Optiro is a resource consulting and advisory group.

Our 5 core services are Geology, Mining Engineering, Corporate, Training and Software.

In eleven years, our team has travelled the world providing expertise to improve, value, estimate and audit the world’s minerals. Pound for pound we think you’ll find no-one delivers greater value –and BIG results.

24

53

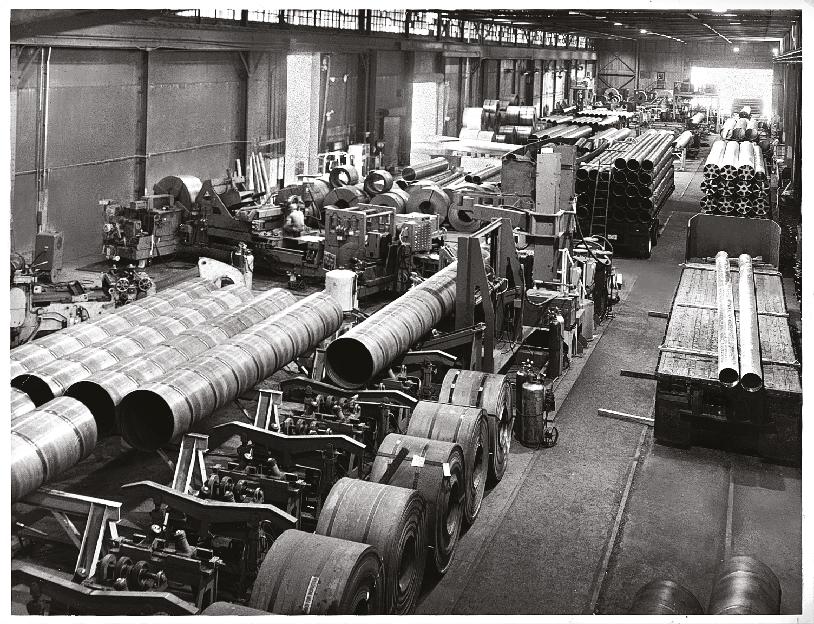

The worldwide iron ore mining business is seeing substantial growth, with numerous major projects in the works or just launched. Here are some crucial details about these initiatives.

Experts in the fast-paced field of mineral processing are in great demand. Process engineers, metallurgists, mill superintendents, process control engineers, and mineral processing technicians will all play more and more important roles as long as global industries depend significantly on minerals and metals.

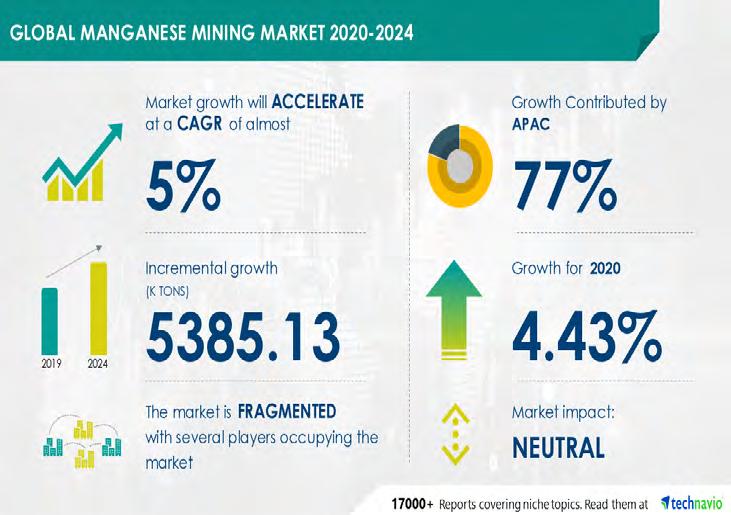

The manganese market is experiencing a significant price surge, drawing attention from industry stakeholders. The recent boost in manganese prices has prompted Jupiter Mines to release a comprehensive update on the current landscape of the manganese market.

Skillings Mining Review of CFX Network LLC, publishes comprehensive information on global mining, iron ore markets and critical industry issues via Skillings Mining Review Monthly Magazine and weekly. SMR Americas, Global Skillings and Skilling Equipment Gear newsletters.

Skillings Mining Review (ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284. Phone: (888) 444 7854 x 4. Printed in the USA.

Payments & Billing: 350 W. Venice Ave. #1184, Venice, FL 34284.

Periodicals Postage Paid at: Venice, Florida and additional mail offices.

Postmaster: Send address changes to:

SKILLINGS MINING

Digital Monthly Magazine 12 issues

Paywall-free website experience

Digital archive back to 1912

Skillings video stories and podcasts

Subscriber-only newsletter

Rich multimedia contentData, Photographs and Visuals

Access paperless reading across multiple platforms. Portable, carry with you, anytime, anywhere

UNITED STATES

$72 Monthly in US Funds

$109 Monthly in US (Funds 1st Class Mail)

OUTSIDE OF THE U.S.A.

$250 US Monthly for 7-21 day delivery

$335 US Monthly for Air Mail Service All funds are monthly

Skillings mining review, 350 W. Venice Ave. #1184, Venice, Florida 34284. Phone: (888) 444 7854 x 4.

Fax: (888) 261-6014.

Email: Advertising@skillings.net.

PUBLISHER CHARLES PITTS chas.pitts@skillings.net

EDITOR-IN-CHIEF JOHN EDWARD john.edward@skillings.net

CONTRIBUTING EDITORS ROB RAMOS AALIYAH ZOLETA MARIE GABRIELLE

MEDIA PRODUCTION STANISLAV PAVLISHIN media.team@ cfxnetwork.com

MANAGING EDITOR SAKSHI SINGLA sakshi.singla@skillings.net

CREATIVE DIRECTOR MO SHINE mo.shine@skillings.net

DIRECTOR OF SALES & MARKETING CHRISTINE MARIE advertising@skillings.net

MEDIA ADMINISTRATOR SALINI KRISHNAN salini.krishnan@ cfxnetwork.com

PROFILES IN MINING mining.profiles@skillings.net

GENERAL CONTACT INFORMATION info@cfxnetwork.com

CUSTOMER SERVICE/ SUBSCRIPTION QUESTIONS: For renewals, address changes, e-mail preferences and subscription account status contact Circulation and Subscriptions: subscriptions@Skillings.net. Editorial matter may be reproduced only by stating the name of this publication, date of the issue in which material appears, and the byline, if the article carries one.

Skillings Mining Review is supported by these leading providers of materials, services and supplies to the mining industry. Please patronize them whenever possible and let them know you saw their advertisement in Skillings.

MRC Recruiting is a family-run corporation with 40 years of global search experience, from entry to board levels.

MRC Recruiting was founded to provide resource companies with experienced and leading high-potential candidates to build a sustainable workforce. It is a family-run corporation with a global network of experienced recruiters. They bring their expertise directly to hiring managers in a collaborative effort to achieve their immediate recruitment goals. The company specializes in clear and specific communications, employing a fee structure that works with their clients' budget, and implementing a hiring process that has been proven through years of successfully building quality, high-performance teams.

MRC Recruiting possesses extensive knowledge of the resource/mining space and strives to provide suitable candidates for every position. Their expertise in human capital development and organizational development ensures that clients receive only top, qualified candidates.

ۗ Your team of skilled Recruiters who’ve developed long-standing relationships with clients and candidates to ensure the best fit possible between the two.

ۗ A blend of Human Resource and Mining backgrounds who understand the nuances of the mining and resource industries.

ۗ With a successful history of working across commodities with exploration through major companies, consulting firms, private equity, mining technology and OEMs.

For over 40 years, CR Powered by Epiroc has been a trusted partner supplying hardware and technology to miners worldwide. They have you covered, whether you need cast lips, GET, wear protection, or GET loss detection technology.

Why have CR as your one-stop shop for bucket protection?

1. Simplified inventory: CR supplies cast lips and GET for excavators, wheel loaders, and rope shovels, wear protection solutions, and GET loss detection technology. A single supplier, aligned with your specific maintenance schedule, makes for a smoother day-to-day operation.

2. In-depth understanding of your mine: Their bootson-the-ground approach means they spend time with you in the field to understand your goals and pain points. Their customized approach allows miners to achieve better productivity, profitability, and safety while reducing emissions.

3. Uninterrupted supply: CR’s team of forecasting experts plans for ongoing replacement parts based on your scheduled maintenance, minimizing machine downtime. Their outstanding customer service, allied with their global supply chain, ensures supply is continuous and inventory is kept up to date.

With lips and GET that are lighter and stronger than plate lips, you’ll improve penetration while reducing dig energy. CR’s wear protection range, Domite®, extends your bucket wear life by up to six times, and with GET Trakka™, you get rapid and reliable alarms with the ability to find lost GET.

Innovative Solutions - Proven Performance

ME Elecmetal goes beyond simply providing mill liners. We offer a comprehensive package that includes innovation, extensive support, customized designs, and valuable tools to deliver a fully tailored comminution solution that meets your specific needs. Our approach involves being present and engaged with our customers, working together to establish shared objectives and offering timely responses through effective collaboration. Drawing on over a century of experience and utilizing cutting-edge technologies, our goal is to optimize processes, extend the lifespan of wear parts, mitigate operational risks, and ultimately improve profitability for your operations.

With over a century of experience as a trusted supplier and strategic partner in the mining industry, we are proud to o er our customers worldwide innovative and superior end-to-end solutions.

Historically, ME Elecmetal has been a visionary company. Founded in 1917, it truly revolutionized the industry and market by utilizing the latest technology innovation — the electric arc furnace. This was clearly a technological advance that shaped the way we tackled the market, seeking constant, ongoing innovation, which is how we continue to approach the business today. In the 1960s, the company started selling steel castings to manufacturers of railroad machinery, trucks, pressure valves and mining companies. Seven years later, the company successfully manufactured the rst mining mill liner, catapulting the company in a new strategic direction where it began to focus and specialize in the production of impact- and abrasion-resistant wear parts for ore processing — speci cally mill liners and crusher liners.

Today, ME Elecmetal has ve foundries in the United States, Chile and China, with a combined annual production in excess of 134,500 metric tons. With our joint-venture facilities, ME Elecmetal has an annual grinding media installed manufacturing capacity that exceeds 590,000 metric tons of forged grinding balls for SAG and ball mill grinding, in addition to steel rods for secondary grinding.

ME Elecmetal Minneapolis, MN • Tempe, AZ

763-788-1651 • 480-730-7500

Mill Liners: ME Elecmetal sets the global industry standard for excellence in the design and supply of highly engineered mill liners and comprehensive liner solutions for SAG, AG, ball, tower, and rod mills.

ME Elecmetal is renowned for its expertise in designing, manufacturing, and supplying the highest quality forged steel grinding media for SAG, ball, and rod mills.

ME Elecmetal o ers an extensive range of high-quality wear parts designed to optimize the performance and longevity of all makes and models, including primary, secondary, tertiary, and pebble crushers.

ME Elecmetal also o ers 3D laser scanning, liner design and engineering services, discrete and nite element modeling, and mill and crusher optimization services as part of our extensive technology portfolio.

At ME Elecmetal, we recognize that continuous improvement is essential for driving success in the mining industry. That's why we've developed the ME FIT System® programs, which focus on Research + Development + Innovation, led by a diverse team of professionals collaborating closely with our clients. These programs encompass various initiatives designed to address challenges and uncover opportunities that positively impact our clients' key performance indicators, including productivity, reliability, availability, safety, e ciency, and energy consumption.

We take a comprehensive approach to understanding the factors a ecting grinding processes. This involves collecting operational data such as processed tonnage, available power, downtime, load levels, and other relevant information about our customers' mill operations. By analyzing how long media and liners last, production levels achieved, and potential areas for improvement in the comminution process, we gain valuable insights to optimize performance and enhance e ciency.

At ME Elecmetal, integral solutions aren't just about meeting expectations – they're about exceeding them — delivering outcomes that enhance competitiveness, pro tability, and sustainability.

The Invest in African Energy (IAE) forum is set to commence its second edition on Tuesday, May 14th, in Paris, bringing together key stakeholders from the African and global energy sectors. Over the course of two days, participants will engage in discussions, networking sessions, and explore lucrative deal-making opportunities aimed at advancing Africa’s energy agenda.

The forum will feature the active participation of energy ministries, national oil companies (NOCs), service providers, and regulators from prominent African nations including Angola, Nigeria, Egypt, South Africa, and more. These countries will showcase various projects open to private sector involvement, ranging from licensing rounds to farm-in opportunities, highlighting Africa’s immense potential for energy development.

A series of panel discussions will delve into key topics shaping Africa’s energy landscape, such as future-proofing the gas and LNG industry, financing renewable energy projects, unlocking investment in midstream and downstream sectors, and exploring emerging opportunities in high-growth markets across the continent.

These discussions aim to foster collaboration and innovation in addressing Africa’s evolving energy needs.

A highlight of the event will be a ministerial panel on the second day, focusing on Africa’s role in the global energy transition. Against the backdrop of evolving energy priorities and international environmental policies, this panel will map out Africa’s trajectory in embracing a just energy transition, ensuring sustainable development and energy security for the continent.

IAE 2024 has garnered significant attention from global investors, attracting a diverse array of participants including operators, exploration and production companies, technology providers, and financial institutions from the Middle East, Europe, the U.S., and Asia. This international presence underscores the sustained interest in leveraging Africa’s abundant energy resources to enhance energy security both locally and globally.

Sandra Jeque, Event & Project Director at Energy Capital & Power, the forum’s organizers, extended a warm invitation to energy industry stakeholders to participate in IAE 2024. Emphasizing its significance as a premier showcase of African energy projects outside the continent, Jeque encouraged attendees to seize the opportunity for fruitful discussions and deal-making in the vibrant city of Paris.

As the Invest in African Energy Forum 2024 prepares to kick off in Paris, anticipation is high for two days of dynamic engagement, networking, and collaboration among industry leaders. With a diverse range of participants from Africa and across the globe, the forum promises to be a catalyst for advancing Africa’s energy agenda and driving sustainable development across the continent.

Metso, a leading provider of equipment and services for the mining and aggregates industries, has launched its groundbreaking Lokotrack EC range, ushering in a new era of efficiency and sustainability in crushing operations.

At the heart of the Lokotrack EC range is a revolutionary shift towards electric power transmission, marking a significant departure from traditional hydraulic systems. By harnessing electric power, these units drastically reduce the reliance on hydraulic oil, resulting in more sustainable crushing operations. Notably, all Lokotrack EC range units are adaptable to external electricity sources, offering flexibility and environmental benefits.

Metso proudly unveiled the inaugural offerings of the Lokotrack EC range at the prestigious Lokolaunch event held in Tampere, Finland. The first two products introduced are the Lokotrack LT400J and LT350C, designed to meet the diverse needs of primary, secondary, and tertiary crushing applications.

The Lokotrack LT400J, a robust 68-ton mobile jaw crusher, is engineered for the primary crushing of hard rock and recycled aggregates. Meanwhile, the Lokotrack LT350C, weighing in at 50 tons, stands as a formidable mobile cone crusher tailored for secondary and tertiary crushing tasks. Both units boast seamless integration capabilities with each other and with Lokotrack mobile screens, enabling the production of high-quality aggregates with ease.

Jarmo Vuorenpää, Director of New Lokotrack Offering at Metso, emphasized the efficiency and sustainability benefits of the Lokotrack EC range. When external electricity is available, the electric power transmission delivers high capacity while minimizing operational costs and CO2 emissions. In instances where external power is unavailable, onboard diesel gensets ensure maximum independent operation time, further enhancing operational flexibility. Additionally, auxiliary units such as mobile screens and stackers can be powered from the same gensets, optimizing energy usage across the entire plant.

The Lokotrack EC range embodies a new modular architecture, streamlining componentry and offering scalable solutions tailored to various applications and capacities.

Renaud Lapointe, Senior Vice President of Metso’s Products business line in the Aggregates business area, highlighted the agility and efficiency facilitated by this innovative approach to product development. The modular architecture enables quicker responses to changing customer needs and facilitates more efficient support for the machines, with fewer parts required and easier upgrades of new features.

Metso’s commitment to reliability and safety is evident in every aspect of the Lokotrack EC range. All components are meticulously designed and rigorously tested to perform optimally in demanding conditions, ensuring maximum uptime for customers. The LT400J and LT350C models are engineered to meet the latest safety standards while prioritizing user-friendliness. Furthermore, the incorporation of new digital tools enables operators to safely control the units from excavators and swiftly transition from transport to operation mode.

In a significant move towards sustainability, Petra Diamonds has signed longterm power purchase agreements (PPAs) with Etana Energy to procure wheeled renewable energy for its Cullinan and Finsch diamond mines in South Africa.

Petra Diamonds, a prominent diamond producer, has entered into landmark long-term PPAs with Etana Energy, a licensed South African energy trader, to source renewable energy for its Cullinan and Finsch diamond mines. This agreement marks a critical milestone in Petra’s journey towards sustainable mining operations. Etana Energy specializes in providing cost-competitive clean energy primarily from wind-based projects.

Under the terms of the PPAs, Etana will supply between 36% and 72% of the expected energy load requirements for Petra’s operations starting from the 2026 financial year. This significant shift to renewable energy will enable Petra to achieve its ambitious target of reduc-

ing Scope 1 and 2 greenhouse gas (GHG) emissions by 35% to 40% against its 2019 baseline well ahead of the 2030 deadline.

“This will result in a considerable reduction of our GHG emissions, well ahead of our 2030 target, and will further strengthen the sustainability credentials of our diamonds,” Petra CEO Richard Duffy said. “We consider this to be an important facet, alongside the traceability and provenance of our diamonds, in differentiating Petra’s product offering.”

Beyond environmental benefits, the renewable energy sourced from Etana is expected to contribute to predictable energy costs and significant cost savings over the duration of the PPAs. Petra’s CEO highlighted that the secured tariff would lead to a sustained reduction in energy supply costs, thereby lowering

fixed costs at their South African operations. “The tariff secured is expected to lead to sustained reduction in our energy supply costs, which will further reduce fixed costs at our South African operations,” Duffy noted. He further expressed optimism about achieving net zero emissions for Scope 1 and 2 by 2050, with a potential to reach this goal as early as 2040.

The collaboration with Etana Energy represents a strategic partnership aimed at creating shared value. Petra’s commitment to sustainability is reinforced through this agreement, demonstrating how the company creates value through partnerships that benefit both the business and the broader community. “These agreements with Etana also demonstrate how Petra creates shared value through partnerships and we look forward to embarking on this long-term collaboration with them,” Petra stated.

Etana Energy, on its part, views this agreement as a crucial step towards accelerating the deployment of new renewable energy capacity in South Africa. Reyburn Hendricks, Etana’s director, emphasized the positive impact of this initiative on the country and the planet.

SOUTH AFRICAN MINING INDUSTRY

The South African mining industry is experiencing a significant transformation as an increasing number of women join the traditionally male-dominated workforce. This shift presents a promising opportunity for diversification and economic empowerment.

However, a critical barrier persists: the lack of equitable access to gender-appropriate PPE for women. Addressing this issue is essential for creating an inclusive and safe work environment for all.

Despite the growing demand for women’s safety wear, significant hurdles remain. One of the primary challenges is awareness. Traditional PPE suppliers often focus on high-volume sales of generic, male-oriented safety wear, leading to a lack of

awareness about women’s PPE options among procurement officers in mining companies. This oversight often results in the procurement of unisex alternatives, which are not a cost-effective solution.

Ill-fitting PPE can lead to discomfort, reduced productivity, and safety hazards, making the wrong PPE just as dangerous as no PPE.

Cost is another obstacle. Gender-appropriate PPE can carry a higher price tag due to lower production volumes. However,

the investment in properly fitting PPE is crucial for ensuring the safety and well-being of female miners. The cost of not providing appropriate PPE can be far greater in terms of productivity loss and workplace accidents.

A significant step forward occurred in July 2023 when the Department of Mineral Resources and Energy introduced a new guideline for a Mandatory Code of Practice (COP) for PPE selection specifically for women in mining. This code mandates that employers consider women’s specific needs, including proper sizing and footwear. It also emphasizes the importance of ongoing evaluation of PPE for appropriateness and user comfort.

While these guidelines represent progress, achieving lasting change requires collaboration between PPE suppliers, industry leaders, health and safety officers, and worker unions. Efforts must be made to educate these stakeholders about the benefits of women’s PPE and the legal requirements for its provision.

Raising awareness about the limitations of male-oriented safety wear is crucial. Prioritizing PPE that fits the female form—featuring a defined waist, hips, and a wider range of sizes—ensures greater mobility, comfort, and safety. Properly fitting gear eliminates restricted movement and hazardous gaps, allowing women to perform their jobs with confidence and efficiency.

Footwear is another critical component. Women’s feet have specific biomechanics that require footwear with a narrower heel and a smaller footprint compared to men’s boots. Such designs offer stability and support, reducing fatigue and the risk of injuries. Beyond the core protective function, women’s PPE should incorporate additional design elements to enhance safety and comfort, such as breathable fabrics, strategically placed seams, and ergonomic features.

Providing anatomically appropriate PPE goes beyond safety; it is about making women feel safe and empowered in the workplace. Properly fitting gear fosters a sense of professionalism and belonging, enabling women to perform their jobs on par with their male counterparts. It also reduces the risk of long-term health issues, contributing to a more sustainable and productive workforce.

To truly transform the South African mining industry and create an inclusive environment, the provision of gender-appropriate PPE must be prioritized. Companies have a legal and moral obligation to ensure the safety and well-being of all workers, including women. By investing in proper PPE, companies can enhance productivity, reduce workplace accidents, and foster a culture of equality and empowerment.

The introduction of the Mandatory COP for women’s PPE is a step in the right direction, but more work is needed. Continuous collaboration and education among all stakeholders are essential to ensure that the industry moves towards a more inclusive and safe future.

Ultimately, the correct PPE is not just about safety—it is about dignity, respect, and creating a workplace where everyone feels valued and empowered. As the South African mining industry continues to evolve, addressing the need for gender-appropriate PPE will be a crucial factor in its success and sustainability.

The manganese market is experiencing a significant price surge, drawing attention from industry stakeholders.

The recent boost in manganese prices has prompted Jupiter Mines to release a comprehensive update on the current landscape of the manganese market.

According to the cross-commodity price reporter Fastmarkets, manganese prices have shown a marked increase. As of May 28, 2024, the prices for 37% manganese ore content are $6.29 per dry metric tonne units (dmtu) on a cost, insurance, and freight (CIF) basis at the Port of Tianjin in China and $5.43/ dmtu on a free on board (FOB) basis at the Port of Elizabeth in South Africa.

This is a substantial rise from the prices on April 30, 2024, which were $4.80/dmtu on a CIF basis and $3.92/dmtu on a FOB basis, as noted in Jupiter Mines’ March quarterly update. The highest previous price recorded was $7.96/dmtu in November 2016.

The significant rise in manganese prices is primarily attributed to recent supply disruptions. Jupiter Mines’ head of marketing, Tracey Cloete, highlighted that the supply interruptions are a result of Cyclone Megan, which severely impacted the Groote Eylandt Mining Company (GEMCO) operations in northern Australia. South32, the parent company of GEMCO, suspended operations indefinitely in March due to the cyclone.

“We are expecting manganese prices to be higher than the historical average for the coming months,” Cloete stated. “This is mainly due to supply disruptions as a result of Cyclone Megan which impacted the GEMCO operations.”

The reduction in supply from GEMCO has led to a decline in inventory levels since November 2023. Producers in South Africa had already begun to cut back on export volumes,

Source: Businesswire

further drawing down available inventory. This decrease in supply has created a tight market situation. “Typically, as inventory levels decline, prices are supported because there is less material in China that can be consumed by plants,” Cloete explained.

With manganese prices expected to continue their upward trajectory, industry players have a window of opportunity to fill the gap left by GEMCO’s reduced output. Notable companies poised to benefit from this situation include ConsMin, which operates the Woodie Woodie manganese mine in Western Australia, and OM Holdings, owner of the Bootu Creek manganese mine in the Northern Territory.

Jupiter Mines‘ update indicates a bullish outlook for the manganese market in the near term. The combination of supply disruptions and declining inventory levels is expected to keep prices elevated above historical averages. This presents a promising opportunity for other producers to ramp up their operations and meet the increased demand.

The battle for dominance in the electric vehicle (EV) market is intensifying as North American graphite miners lobby the US government to impose tariffs on Chinasourced graphite products.

This move aims to counter Beijing’s monopoly on a crucial material used in automobile batteries, adding to existing tensions between the two economic powerhouses. Here’s a closer look at the escalating trade dispute and its implications for the global EV industry.

North American graphite miners are urging the US government to impose a 25% tariff on three graphite products imported from China. These tariffs are intended to address concerns about China’s control over key materials vital for EV production, particularly graphite used in battery anodes.

China currently dominates the global graphite market, accounting for 70% of global output. This dependence on Chinese graphite poses significant challenges for North American miners, who struggle to compete with lower-priced imports.

OEMs, the main customers of graphite manufacturers, often opt for cheaper Chinese graphite, undermining the viability of offtake agreements and hindering capital raising efforts for North American miners.

The proposed tariffs could escalate trade tensions between the United States and China, further straining diplomatic relations. The Section 301 tariff, introduced by former US President Donald Trump, targets China’s unfair trade practices related to technology transfer and intellectual property. However, China has denounced these tariffs as discriminatory and retaliatory.

The push for tariffs has divided the EV industry, with OEMs opposing the measure due to concerns about supply chain disruptions and increased costs. Without a credible supply

chain from North America, OEMs argue that they are forced to depend on Chinese imports to remain competitive against Chinese auto makers.

The dispute over graphite underscores the strategic importance of critical minerals in the global energy transition. As countries seek to reduce their reliance on China for these key materials, trade protections and domestic production become imperative for ensuring supply chain security and national interests.

In response to growing international scrutiny, China imposed controls on

graphite exports last year to safeguard national security and interests. This move reflects China’s efforts to maintain control over critical minerals and protect its dominant position in the global market.

The North American Graphite Alliance, a coalition of Canadian and American graphite producers, advocates for trade protections to counter China’s ability to manipulate global markets.

Erik Olson, a spokesperson for the alliance, emphasizes the need for tariffs to address China’s overproduction of graphite and ensure a level playing field for North American miners.

The push for tariffs on China-sourced graphite products highlights the growing competition and geopolitical tensions surrounding the EV industry.

As North American miners seek to secure their position in the global market, the outcome of this trade dispute will have far-reaching implications for the future of EV production and the broader clean energy transition.

In conclusion, the battle over China-sourced EV materials underscores the urgent need for strategic measures to safeguard supply chain resilience and protect national interests in the face of increasing global competition.

The worldwide iron ore mining business is seeing substantial growth, with numerous major projects in the works or just launched. Here are some crucial details about these initiatives.

The Simandou iron ore project in Guinea, one of the world's largest undeveloped high-grade iron ore reserves, has received $15 billion in financing for the development of railway and port infrastructure. This project, which is expected to be operational by the end of 2025, will be the world's largest new mine with the greatest iron ore content, contributing approximately 5% to global marine iron ore reserves.

Magnetite Mines' Razorback Iron Ore Project in Australia has experienced a significant rise in Probable Ore Reserves and Mineral Resources to 2 billion and 3.3 billion tonnes, respectively. The company has completed optimisation studies for a redesigned project scope with an initial production scale of at least 5 million tonnes per year, capable of producing highgrade and Direct Reduction (DR) grade iron ore products.

Fortescue Metals Group's Iron Bridge project, a premium-grade magnetite operation, is ramping up production, despite a setback caused by a ruptured water pipe. The company sees Iron Bridge as vital to the energy shift, offering diversification potential and a product ideal for green iron manufacturing.

Iron ore production in the United States is predicted to increase by 2% each year between 2022 and 2026, with ArcelorMittal leading the way. The country's iron ore exports, largely to Canada, are also expected to grow at a 2% CAGR during the same time period.

Global iron ore production is expected to increase marginally at a CAGR of 1.9% throughout the projected period, reaching 3,002.8 million tonnes in 2030, with Brazil, China, Russia, India, and Australia contributing to the growth.

Western Australia, known for its tremendous mineral richness, is preparing to host one of the largest iron ore projects currently underway: the Onslow Iron Project. This gigantic project, led by Mineral Resources, aims to liberate billions of tonnes of iron ore resources while simultaneously setting new benchmarks in sustainable mining techniques and innovative technologies.

The Onslow Iron Project is a joint venture between Mineral Resources, which owns 40%, and Red Hill Iron Joint Venture partners Baowu, AMCI, and POSCO, which own the remaining 60%. This collaboration brings together a wide range of experience and resources, ensuring that the project capitalizes on the strengths of all stakeholders.

Mineral Resources will be in charge of all parts of the project, including mining and infrastructure, crushing, haulage, and port/transshipment services.

The Onslow Iron Project, which is expected to ship roughly 35 million tonnes of iron ore per year, has the shortest pit-toport distance at 150 kilometers. Autonomous road trains will transport ore to the Port of Ashburton via a dedicated, sealed haul road. There, the ore will be loaded into transhippers and transported to capesize vessels anchored 40 kilometers

offshore. With a projected mine life of more than 30 years, this project will be a key contributor to the world iron ore market for many decades.

Innovation is central to the Onslow Iron Project. The project will use the world's largest autonomous 320-tonne road trains to improve both safety and efficiency. These road trains will initially run on diesel, but there is a clear plan to shift to electric autonomous road trains, resulting in huge carbon reductions.

Furthermore, the project will use enclosed transhippers, which allow export without the requirement for a deep-water port, reducing environmental effect. The NextGen modular crushing plants will contribute to sustainability by reducing dust and noise emissions.

Mineral Resources is strongly committed to sustainability. The switch from diesel to electric road trains is just one illustration of the project's efforts to

minimize carbon emissions. Another option is to combine sustainable solar power generation with energy storage technologies to charge these road trains. The initiative seeks to reach net zero operational emissions by 2050 by electrifying and using alternative fuels. These actions demonstrate the project's dedication to environmental stewardship and decreasing its carbon impact.

The project, which includes resort-style towns designed to improve living conditions for workers and their families, sets new standards for workforce housing. A 500-room village on the Ken's Bore mine site and a 250-room village in Onslow town will provide apartment-style rooms that are three times larger than normal fly-in, fly-out (FIFO) accommodations. These facilities will contain a variety of amenities to provide a comfortable and supportive atmosphere for the personnel.

The Onslow Iron Project is Mineral Resources' largest ever capital investment, valued at A$3.7 billion. Over its first 30 years of operation, the mine is estimated to produce more than A$10 billion in royalties for the Western Australian government. The

project will also provide around 3,000 construction jobs and 1,000 permanent operations positions, creating considerable employment prospects while encouraging local and indigenous company engagement.

Environmental management is a primary focus, with tight plans in place to limit the impact on local flora, fauna, heritage monuments, and the marine environment. Greenhouse gas control, water efficiency, and site rehabilitation strategies all contribute to the project's dedication to long-term sustainability.

Looking ahead, the Onslow Iron Project has the ability to increase output capacity to 50 million tons per year by duplicating current infrastructure. Mineral Resources has additional iron ore resources in the region, making the project a possible hub for developing other stranded deposits.

The Onslow Iron Project is more than just a mining project; it represents a comprehensive approach to sustainable and innovative resource production.

It demonstrates Mineral Resources' commitment to leading the way in responsible mining, while also providing major economic and environmental benefits to Western Australia. As the project moves forward, it promises to solidify the region's position as a worldwide iron ore powerhouse.

A 50-50 partnership between Brockman Mining and Mineral Resources, the Marillana Iron Ore Project is positioned to become a mainstay of iron ore production in the Pilbara area of Western Australia.

Located around 100 kilometers northwest of Newman, this project is unique among the Pilbara's underdeveloped iron ore reserves in that it aims to produce 20 million tonnes of iron ore per year for direct shipping.

The 1.51 billion tonnes of mineral reserve of the Marillana Project is graded at 30.1% Fe. There are 748 million tonnes of proven and probable ore reserves at 30.2% Fe inside this.

Detrital iron deposits and channel iron deposits (CID) make up these reserves, which offer a strong basis for the project's long-term viability, which is expected to last longer than 20 years according to present projections.

Having finished its pre-feasibility investigations, the Marillana Project is now in the feasibility study phase. The current feasibility study covers thorough mine planning, processing

techniques, logistics, and infrastructure development. Targeting first production by 2025, the project is subject to final permissions and investment decisions. The 20 million tonnes of saleable iron ore will be produced by an anticipated plant throughput of 37.5 million tonnes per annum through on-site beneficiation to generate both lump and fine products.

Significantly, the dry processing method simplifies environmental management by doing away with the requirement for a tailings facility.

It takes a strong logistics system to get the ore to market. Along with building vital infrastructure, such as a heavy haul road and an accommodation village, the project calls for a 300km trucking route to Port Hedland and the provision of basic services like water and power. Potentially, a multi-user infrastructure solution could help other miners in the area.

There should be major economic gains from the Marillana Iron Ore Project. Over 900 jobs are expected to be created during the building phase, and 500 permanent operational positions will follow following completion.

Over the course of its first mine life, the project may generate over A$5 billion in royalties and corporation tax payments in addition to giving chances to regional and indigenous companies.

Strengths from Brockman Mining and Mineral Resources complement each other in the joint venture. Australian iron ore exploration and development company Brockman provides its knowledge from the iron ore projects in Ophthalmia and Marillana. Conversely, Mineral Resources, well-known for its resource processing and mining services, has a wealth of project development, mining, and logistical expertise.

Two phases make up Marillana's development plan. An extension to 20 Mtpa (Million tonnes per annum) steady-state production will come after a 10 Mtpa start-up operation to verify the logistical network.

A possible light rail alternative and autonomous road trains are two of the cutting-edge logistical technologies being investigated to maximize ore transportation.

Targeting net zero emissions with the use of electric mining equipment and renewable energy, the Marillana Project is dedicated to sustainable development. With the dry processing technique, tailings management is not only unnecessary but also water consumption is reduced. Together with thorough restoration and closure planning, the project is also looking into sustainable water supply alternatives including remote desalination and aquifer reinjection.

In addition to negotiating the environmental assessment and approvals procedure with regulators, the project includes Native Title agreements with traditional owners. Through this cooperative strategy, the Marillana Project is to be advanced in an ecologically friendly way.

All things considered, the Marillana Iron Ore Project is a major addition to Western Australia's mining portfolio that promises to provide significant economic and employment advantages while upholding strict environmental regulations. Pilbara's position as a global iron ore powerhouse is expected to be cemented as Brockman Mining and Mineral Resources get closer to production.

Tucked up in the isolated, mountainous region of southeast Guinea is the Simandou Iron Ore Project, which is set to revolutionize the iron ore industry worldwide.

Perched atop what is thought to be the biggest unexplored high-grade iron ore deposit in the world, this project has reserves of more than 2 billion tonnes and a 66–68% iron content.

A model of international cooperation, the Simandou project is jointly managed by the Trans Guinean Company (CTG). Rio Tinto, through the Simfer JV, has a 45.05% share; Aluminium Corporation of China (Chinalco) has a 39.95% stake; Winning

Consortium Simandou (WCS) has a 15% stake; and the Government of Guinea has a 15% stake as well. This varied alliance highlights the project's worldwide importance.

The building of a 622-kilometer railway to link the mine to a new deep-water port at Morebaya on the Atlantic coast is one of the largest projects of the Simandou initiative.

Transportation of iron ore to foreign markets depends on this railway and the port facilities built to accommodate the Cape-size boats. The $15 billion estimated infrastructure cost underscores the scope and significance of this undertaking.

April 2024 saw the start of full-scale development of the port and rail infrastructure, which was supposed to be finished by 2025. 2026 is when the first iron ore exports are predicted to start, after the mining activities have developed. Rio Tinto is committed to this enormous project as seen by their budget of about $6.2 billion for the mine development.

With the possibility to reach 100 million tonnes per year (Mtpa) at full capacity, the initial production target is set at 60 Mtpa. The market would be greatly impacted and Guinea would be positioned as a major participant in the mining sector since this output level would contribute about 5% to the world's seaborne iron ore supply.

by more than 5% yearly. Just the building phase is expected to generate around 45,000 employment, with 10,000 permanent ones once the facility is operational. The local economy will be much enhanced by this inflow of jobs and money.

In the center of the Simandou project is sustainability. Planned are rigorous environmental and social management strategies to lessen effects on local populations, water supplies, and biodiversity. Communities near the railway line are having their resettlement action plans created. Rio Tinto is committed to responsible mining as seen by its $700 million commitment to sustainable development projects.

Construction of more than 100 bridges and viaducts as well as multiple tunnels is necessary to build a 622-kilometer railway over difficult terrain.

Over its first 25 years, the project is predicted to bring in over $15 billion in revenue for Guinea, maybe raising the nation's GDP by more than 5% yearly.

Not all of the Simandou project has been without difficulties. Delays have resulted from protracted talks brought on by Guinea's complicated ownership structure, legal issues, and political unrest. Logistically difficult as well are the enormous infrastructure requirements in such a far-off place.

The management of possible impacts on local populations and biodiversity depends on continuous environmental and social impact assessments.

Over its first 25 years, the project is predicted to bring in over $15 billion in revenue for Guinea, maybe raising the nation's GDP

The proposal calls for a specialized fleet of more than 200 locomotives and 16,000 carriages. With 250,000 DWT vessels able to be accommodated by the new port infrastructure, iron ore may now be exported to Europe and Asia.

To power mining activities, a 670MW power plant will be constructed; assessments for combining solar and hydro power sources are now under progress. A steady water supply for the project is guaranteed by the 100 million liters of water that desalination facilities are expected to produce daily.

There are prospects for further development because the Simandou South deposit has an extra 3.5 billion tonnes of iron ore. More general economic advantages are made possible by the multi-user and multi-commodity utilization of the rail and port facilities.

For Guinea, the Simandou Iron Ore Project offers a huge chance to use its abundant mineral resources. Despite major obstacles, the project's effective execution promises the area enormous economic growth, job creation, and sustainable development.

Iamgold has announced a significant financial maneuver, entering into an agreement with a syndicate of underwriters to sell 72 million common shares. This move aims to generate approximately $410 million in gross proceeds, intended for repurchasing a stake in the Côté gold project from Sumitomo Metal Mining.

Iamgold Corporation, in collaboration with a syndicate of underwriters co-led by National Bank Financial Markets, BMO Capital Markets, and RBC Capital Markets, has secured a deal to sell 72 million common shares at a price of $5.70 per share. This strategic initiative is set to yield gross proceeds of about $410 million (US$300 million). To accommodate potential over-allotments, the underwriters have also been granted an option to purchase an additional 10.8 million shares, potentially raising an extra $61.5 million.

The primary purpose of this substantial offering is to repurchase the 9.7% interest in the Côté gold project near Gogama, Ontario, from Sumitomo Metal Mining (TSE: 5713). This transaction will enable Iamgold to regain a 70% ownership interest in the project, enhancing its control and potential returns from the operation.

The net proceeds from the share offering will initially be deposited into an interest-bearing account or utilized to repay drawn amounts on Iamgold’s credit facility.

These funds will remain allocated for the repurchase until the transaction is completed, anticipated by the end of 2024. Iamgold is confident that the combination of the offering’s net proceeds, existing cash, and cash equivalents will be sufficient to facilitate the repurchase.

Following the Group of Seven (G7) forum’s declaration to phase out unabated coal by 2035, global coal organization FutureCoal has urged world leaders to adopt a balanced, pragmatic, and responsible approach to energy policy.

The announcement, made during a G7 Ministerial meeting on climate, energy, and environment matters, has sparked debates over the future of coal and its role in ensuring energy security and reliability.

FutureCoal’s Perspective:

Michelle Manook, CEO of FutureCoal, expressed concerns regarding the clarity and objectives outlined in the G7 statement. Manook highlighted that while several G7 countries, such as Germany and Japan, still rely on coal for baseload electricity, they have emphasized the necessity of coal in ensuring energy security. The G7 statement specifically referred to unabated coal as coal plants lacking carbon capture and storage technology.

In Germany, although legislation calls for a coal phase-out by 2038, uncertainties remain regarding an earlier phase-out. The country’s Finance Minister has dismissed the aim to phase out coal by 2030 if affordable energy alternatives are lacking. Additionally, Germany’s energy regulator has warned about the potential grid problems due to the lack of reliable standby capacity such as coal.

In Japan, a cautious approach to coal phase-out has been adopted, with no specific date set. Japan operates the world’s most efficient coal power fleet, which has served as a crucial component of its electricity supply, particularly following the mass nuclear shutdown in 2011.

Manook emphasized the importance of a balanced approach to energy policy, where affordability, reliability, and security are prioritized. With coal playing a pivotal role in more than 80 countries, FutureCoal advocates for wider leadership

engagement beyond the G7, particularly involving the Global South, to invest in technology solutions, including abated coal, to lower global emissions.

FutureCoal has presented a Sustainable Coal Stewardship roadmap, showcasing existing abatement and commercial opportunities that enable the coal value chain to mitigate emissions in alignment with the Paris Agreement’s goal of limiting global warming to 1.5˚C above preindustrial levels.

Manook highlighted that known technologies could abate up to 99% of coal emissions during combustion, emphasizing the importance of genuine international cooperation in achieving global sustainability objectives.

As the debate over coal phase-out intensifies, FutureCoal’s call for a balanced, pragmatic, and responsible approach to energy policy resonates globally.

Environment Ministers from the G7, which includes Canada, France, Germany, Japan, the U.K. and the U.S., pose for a photo during of Minister’s Meeting On Climate, Energy & Environment on April 29, 2024 in Turin, Italy. | Photo Credit: Getty ImagesAs regulatory frameworks surrounding the social obligations of mining operations continue to evolve, many mining companies are already exceeding these requirements to gain the essential ‘social license to operate’ from local communities. This proactive approach is vital for securing long-term operational success and fostering positive relationships with stakeholders.

Mining companies recognize that obtaining a social license to operate is crucial. This concept extends beyond regulatory compliance, involving the perception and acceptance of mining activities by the host communities. According to ENS Namibia senior associate Stefanie Busch, a social license is about gaining community buy-in and ensuring ongoing approval for mining operations.

Regulations governing the social aspects of mining are becoming more stringent. For instance, the Department of Mineral Resources and Energy in South Africa has introduced guidelines mandating that mining companies address the specific needs of women in the workforce by providing appropriate Personal Protective Equipment (PPE). This move highlights the industry’s shift towards more inclusive and community-focused practices.

Local regulations in African countries now emphasize the social responsibilities of mining companies, although the specifics vary across jurisdictions. ENS South Africa senior associate Zinzi Lawrence pointed out that South African communities are particularly aware of these obligations, which encompass both mitigating negative impacts and generating positive benefits such as employment and skills development.

Despite the regulatory advancements, mining companies face significant challenges in meeting the dynamic and increasing expectations of various stakeholders. ENS Ghana partner Rachel Dagadu noted that while companies have tradition-

ally focused on reducing negative impacts and corporate social responsibility (CSR) initiatives, they are now expected to create substantial social value. The expectations from communities and other stakeholders can be subjective and difficult to quantify, often changing midstream. This makes it challenging for mining companies to set and achieve targets that align with community needs and desires.

Meeting social obligations requires substantial investment from mining companies. For example, in Ghana, draft community benefit regulations mandate that 1% of gross revenue be allocated to local projects through development agreements with the community. ENS Uganda partner Donald Nyakairu emphasized the importance of transparency and accountability in mining operations to ensure they meet these social expectations.

In remote areas, mining companies often face the dilemma of either transporting workers to the site or establishing mining towns. The latter option involves significant responsibilities, including providing essential services such as electricity, water, and sanitation. ENS Namibia senior associate Stefanie Busch highlighted the need for mining companies to plan for the long-term sustainability of these towns, even after mining activities have ceased.

Many mining companies operating in Africa adhere to international standards, setting benchmarks for social benefits. These standards often exceed local requirements and serve as a model for government regulators. Investors and financiers also play a crucial role in driving these standards, as they seek to avoid litigation and ensure ethical operations.

As the mining industry continues to navigate the complexities of social responsibility, the importance of securing a social license to operate cannot be overstated.

A successful takeover of Anglo American by BHP Group could trigger an outflow of $4.3 billion from South Africa, according to a recent analysis by JPMorgan Chase & Co.

This potential outflow, stemming from the proposed deal, poses significant implications for the South African economy and its currency, the rand.

The proposed takeover, which has been rejected by Anglo American but remains under negotiation, involves Anglo distributing its holdings in its South African iron ore and platinum units to shareholders. This distribution could lead to developed-market investor index funds selling the unbundled stocks, resulting in the substantial outflow.

JPMorgan’s South African mining analyst, Catherine Cunningham, emphasized the potential repercussions of such an outflow on the rand. The South African currency has gained 4.4% against the dollar in the past five weeks, the most among the 16 major currencies tracked by Bloomberg. However, the expected outflow from the BHP deal could weaken the rand, reversing its recent gains.

While Anglo American has spurned BHP’s $49 billion bid, it has agreed to discussions with the mining giant. BHP now faces a deadline of May 29 to make a firm offer. Cunningham’s analysis suggests there is a significantly higher probability that BHP will reach an agreement with Anglo American.

“There is now a materially higher probability that BHP will reach an agreed deal,” Cunningham noted in a May 23 note to clients. She also warned of potential downside risks to the share prices of Anglo American’s units, Anglo American Platinum (Amplats) and Kumba Iron Ore, should the deal proceed.

The proposed deal could adversely affect the share prices of Amplats and Kumba, two major players in the South African mining sector. Amplats, with a market value of R192 billion, is nearly 80% owned by Anglo American. Kumba, which has a capitalization of R170 billion, is almost 70% held by Anglo American. Cunningham’s analysis predicts developed-market funds will sell $9.4 billion in stock, while $5.1 billion will be purchased by emerging-market investors, resulting in the net outflow.

“Locals will not sell anything, developed market index funds will sell every share they receive, and DM active and others will sell 90% of what they receive,” Cunningham estimated. “EM active funds will buy 50% of what’s for sale.”

Developed-market index funds would need to divest their shares as Johannesburg-listed stocks do not fit their investment mandates. Active investors are also likely to limit their exposure to single-commodity and single-country stocks. Kumba’s mines are all located in South Africa, while Anglo

Platinum has one small operation in Zimbabwe, with the rest based in South Africa.

Spinning off these companies would also add $14.2 billion to the market capitalization of the MSCI South Africa index, increasing it by about 6%, according to Cunningham’s analysis.

For Anglo American, the decision to distribute its South African holdings and the potential takeover by BHP involves strategic considerations. While the distribution could streamline Anglo’s operations and potentially increase shareholder value, the resulting market dynamics and investor reactions could lead to short-term volatility.

The implications of this deal extend beyond the immediate financial outflow. The weakening of the rand could impact South Africa’s broader economy, influencing import and export dynamics, inflation, and overall economic stability. Additionally, the market responses to changes in the holdings of Amplats and Kumba will be closely watched by investors and analysts alike.

The potential takeover of Anglo American by BHP Group represents a significant event in the mining sector with far-reaching implications.

JPMorgan’s analysis highlights the possible outflow of $4.3 billion from South Africa and the subsequent impact on the rand and local stock prices. As BHP approaches the May 29 deadline to make a firm offer, the market will closely monitor developments, preparing for the potential shifts in South Africa’s economic landscape.

The scene is set for this year’s International Mining and Resources Conference (IMARC) in Sydney next week with the announcement by Australian Prime Minister Anthony Albanese to increase the investment in the Critical Minerals Fund.

Alaska Energy Metals Corporation (AEMC) has announced a strategic acquisition that strengthens its position in the critical minerals sector. The company has entered into an agreement to acquire a 100% interest in the Bambino nickel-copper platinum group element (PGE) property located in the Temiscaming Region of western Quebec.

The newly acquired Bambino property spans 57 claims over 3,320 hectares and is strategically located adjacent to AEMC’s 100%-owned Angliers-Belleterre property, which the company acquired in 2023.

The proximity of these properties allows AEMC to consolidate its exploration efforts and leverage the geological synergies of the combined land package.

The Bambino and Angliers-Belleterre properties are underlain by thick basalt flows interlayered with gabbro sills and komatiite flows. This geological setting is indicative of a mantle plume environment, which is highly prospective for high-grade

nickel mineralization similar to the renowned Kambalda and Raglan deposits.

AEMC’s exploration program for the Bambino property is fully funded and set to commence immediately. The program will include the collection of approximately 4,000 soil samples, extensive prospecting, and a VTEM (Versatile Time Domain Electromagnetic) survey.

Gregory Beischer, CEO of Alaska Energy Metals, expressed enthusiasm about the acquisition and the company’s strategic direction. “Our Nikolai nickel project in Alaska, which hosts the Eureka deposit, already contains one of the largest known nickel resources in the US.

We intend to acquire Bambino so that we can further expand our contribution of nickel and other strategic metals to the rapidly growing lithium-ion battery industry and the long-term energy storage industry in North America,” Beischer stated.

Experts in the fast-paced field of mineral processing are in great demand. Process engineers, metallurgists, mill superintendents, process control engineers, and mineral processing technicians will all play more and more important roles as long as global industries depend significantly on minerals and metals.

The transformation of raw materials into valuable resources that propel several economic sectors is mostly the responsibility of the mineral processing industry.

For those with the appropriate training and credentials, this industry provides a wide variety of employment options, from mining and refining metals to manufacturing industrial minerals and building materials.

We explore the many positions and duties, educational needs, and career options within this fast-paced sector in this post. Whether you are an experienced expert trying to progress your career or a fresh graduate looking for an entry-level job, this thorough guide will offer insightful information on the fascinating and fulfilling prospects in mineral processing.

Experts in the fast-paced field of mineral processing are in great demand. Process engineers, metallurgists, mill superintendents, process control engineers, and mineral processing technicians will all play more and more important roles as long as global industries depend significantly on minerals and metals.

These professionals are essential for the effective mining extraction and processing as well as for promoting sustainability and innovation in the sector.

In the forefront of mineral processing plant design and optimization are process engineers. Strongly trained in chemical, metallurgical, or mineral processing engineering, these experts handle the complex process of planning and directing the metal and mineral extraction from ore. Their knowledge also covers process condition monitoring, cutting edge technology implementation, inefficiency troubleshooting, and maximizing extraction efficiency.

Five to ten years of experience and expertise using simulation programs like JKSimMet, METSim, and HSC Chemistry are typical of a process engineer. Their function is critical to project cost management, operational efficiency enhancement, and the financial sustainability of mineral processing operations.

Metals are extracted and refined in large part by metallurgists, especially those with specializations in hydrometallurgy and pyrometallurgy. These experts create and put into practice cutting edge procedures that yield premium mineral concentrates by testing and researching on the spot.

With advanced degrees in extractive or process metallurgy, metallurgists contribute a plethora of expertise from benchscale test work to full-scale process development. Especially in the handling of tailings and other byproducts, their job is crucial to guaranteeing that mineral extraction procedures are effective and ecologically friendly.

Mineral processing plants run well because of mill superintendents and managers. Having led teams for more than ten years, these experts manage day-to-day tasks like feed rate, operational parameter, and chemical addition monitoring. In charge of overseeing groups of engineers, technicians, and operators, they guarantee a unified and effective workforce.

Processing plants need their knowledge of budgeting, cost control, and productivity enhancements to stay profitable and functioning. They also are essential to creating workforce training programs and operational procedures, which are essential to upholding high standards of efficiency and safety.

High degrees of technical proficiency are brought to the automation and optimization of mineral processing circuits by process control engineers. Having earned degrees in chemical, electrical, instrumentation, or control systems engineering, these experts use sophisticated process control methods and

processing, extractive metallurgy, and data analysis are needed by the sector. Upskilling of geologists and metallurgists to employ specialist tools and techniques is also advancing predictive strategies that link the mining and processing fields.

positions throughout the supply chain, this has created a wealth of employment opportunities.

By 2030, the world's drive for cleaner energy is expected to have increased the demand for lithium by more than 500%. Building of new lithium hydroxide and carbonate facilities to supply battery makers is being driven by this increase. Experts in electrolysis, ion exchange, and acid leaching are in great demand. Moreover, understanding of direct lithium extraction methods from non-traditional sources like brines and clays is getting more and more important.

equipment such as DCS, PLC, and SCADA systems. Encouraging productivity and efficiency in mineral processing processes requires their capacity to tune controllers, optimize control loops, and troubleshoot problems. With the industry moving toward more automated and data-driven methods, their function is growing in significance.

Experts in the field, mineral processing technicians run and maintain a variety of processing machinery, including flotation cells, crushers, and mills. Smooth operations of the plant are guaranteed by their practical abilities and compliance with safety procedures.

These specialists are essential to the regular operations of mineral processing facilities since they give engineers and managers the tools they need to keep performance at its best and safety regulations met.

Strong foundations in mineral processing, extractive metallurgy, and data analysis are needed by the sector, as seen by the necessity for qualified workers in these positions. Highly sought after are advanced degrees, digital proficiency, and cross-functional teamwork. These positions will become increasingly more important in the future as the sector develops and emphasis on sustainable practices and cutting-edge technology increases.

Professionals knowledgeable in processing important battery metals like lithium, nickel, and cobalt are in high demand due to the fast expansion of the energy storage and electric vehicle (EV) industries. In many facets of mineral processing, from process development and plant design to operational

Expertise with solvent extraction, electrowinning, and high-pressure acid leaching (HPAL) of lateritic ores is needed for nickel and cobalt. A developing area of opportunity is also the recycling of used lithium-ion batteries. Deep knowledge of cutting-edge extraction and purification methods is necessary for these positions in order to generate battery-grade metals needed for the expanding electric vehicle industry.

To maximize mineral processing activities, the developing multidisciplinary area of geometallurgy combines geological and metallurgical data. Geometallurgists can develop better predictive models of ore behavior throughout different processing stages including comminution, flotation, and leaching by using geostatistical modeling, chemical analysis, and automated mineralogy. Process control and efficiency are thus improved.

Managers and coordinators of geometallurgy are increasingly needed to supervise the use of geometallurgical methods and data integration. Upskilling of geologists and metallurgists to employ specialist tools and techniques is also advancing predictive strategies that link the mining and processing fields.

Digital technologies being used in mineral processing are revolutionizing the sector. Together with Internet of Things sensors and sophisticated analytics tools, digital twins—virtual copies of actual processing facilities—are becoming essential to raising operational efficiency.

The combination of these technologies calls for experts in advanced process control, machine learning, and data analytics.

Process optimization machine learning models are becoming more and more important. Furthermore, the utilization of

in mineral processing are revolutionizing the sector. Together with Internet of Things sensors and sophisticated analytics tools, digital twins—virtual copies of actual processing facilities—are becoming essential to raising operational efficiency.

Internet of Things systems and big data platforms calls for cybersecurity specialists to guarantee the security of linked operations. The drive for digitalization is generating a need for metallurgists and process control experts that are skilled with digital workflow tools and automation systems.

Environmental, social, and governance (ESG) concerns together with tighter laws are making sustainable management of tailings—the waste material left behind after the extraction of valuable minerals—more important. Novel tailings disposal techniques are being researched to lower water consumption

and environmental effect, like paste or thickened tailings systems.

Opportunities in this field include creating rehabilitation plans for site closure and reclamation, putting water treatment systems into place, and constructing and monitoring tailings facilities. Professionals in environmental and digital monitoring are finding jobs as tailings facility management is improved by the use of drones and digital monitoring systems.

All things considered, employment prospects in the mineral processing sector are expanding quickly, especially for those with solid fundamental knowledge combined with emerging area expertise.

Highly sought for are skills in data science, digital technologies, hydrometallurgy, and sustainable processing methods. The requirement for cutting-edge methods and sophisticated skill sets will keep driving demand for trained personnel as the industry develops, guaranteeing that the mineral processing industry will always be a vibrant and essential component of the world economy.

Al Workman, a Mineral Exploration Professional with Watts, Griffis and McOuat Ltd. (WGM) in Toronto, Canada, has an illustrious career that has seen him work extensively across Canada, Saudi Arabia, Yemen, Iran, Indonesia, and China, among other countries. He specializes in mesothermal and epithermal gold deposits, non-sulphide zinc deposits, uranium deposits, and rare earth deposits.

MINING ENGINEER AT TANTALUM MINING CORP. OF CDA LTD

Jining Zhong, a Mining Engineer at Tantalum Mining Corp. of Canada Ltd., brings over 20 years of handson experience in hard rock and coal mining. His career has taken him from China to Canada, where he has overseen numerous mining projects and developed expertise in various mining software and engineering technologies.

Al Workman: "Leadership skills have been moderately important in my career. While technical expertise is crucial, the ability to lead and manage teams effectively cannot be understated."

Jining Zhong: "Leadership is certainly good to have. However, it's essential to keep learning and adapting to new challenges and technologies."

In our recent discussion, we engaged with two seasoned Mineral Exploration Professionals Al Workman and Jining Zhong, who shared their career experiences and insights based on a comprehensive questionnaire.

In this exclusive interview, we speak with two seasoned professionals in the mining and mineral exploration industry, Al Workman and Jining Zhong. Their combined experiences span continents and decades, providing a rich tapestry of insights into the industry's past, present, and future. Their responses provide valuable perspectives on leadership, career advancement, and industry challenges, particularly relevant in today's evolving business landscape.

In our latest industry dialogue.

Al Workman: "My formal education narrowed my focus, allowing me to specialize in specific areas of mineral exploration."

Jining Zhong: "Education is fundamental, but continuous learning and adapting to new situations is just as important."

Both Al and Jining agree: Engendering

commitment is absolutely vital for a successful manager. Building a committed team leads to better project outcomes and a more cohesive work environment.

Both professionals agree: It is important for new employees to fit into the company culture to ensure harmony and productivity within teams.

Al Workman: "Job goals are about the same now as when I first started. The fundamentals of the industry haven't changed much."

Jining Zhong: "The job goals are clear and defined. There's a more structured approach to career progression now."

Al Workman: "There wasn't a clear promotion plan for my career. I've had to carve my own path."

Jining Zhong: "There wasn't a strict promotion plan, but being proactive and seeking opportunities has been key."

Al Workman: "Both technical and managerial skills are required, but technical skills are more important in my view."

Jining Zhong: "Having both skills is better. A balanced approach leads to better management."

Al Workman: "For me, maintaining a life/work balance is very important, especially as I'm on the cusp of retiring."

Jining Zhong: "It's crucial to have a balance between life and work. This balance depends on the individual and their stage in life."

Al Workman: "My biggest challenge is finding replacement staff. My advice to young professionals is to seek opportunities wherever they occur and embrace the challenges of fieldwork."

Jining Zhong: "Improving the industry's image involves engaging the public and explaining the importance of mining. Providing better commuting options for employees could also make a significant difference."

Both Al and Jining emphasize: Engaging the public and providing better understanding of the mining industry's role is essential. Practical steps, like improving commuting options for employees, can also enhance the industry's attractiveness.

Al Workman: "In my view, too many young geologists lack basic field experience. The industry needs to encourage more hands-on training and fieldwork."

Jining Zhong: "To improve our industry, we need to provide continuous learning opportunities and create an environment where employees can balance work with personal life."

Through their careers, Al Workman and Jining Zhong have witnessed significant changes and challenges in the mining industry. Their insights offer valuable guidance for young professionals and highlight the importance of commitment, continuous learning, and balancing technical and managerial skills.

Gold and copper exploration company KEFI has officially launched the Tulu Kapi Gold project in western Ethiopia. The project, spearheaded by Tulu Kapi Gold Mines (TKGM), aims to create around 1,000 direct jobs and foster economic development in the region.

The launch of the Tulu Kapi Gold project was announced by the TKGM Board, comprising representatives from KEFI, the Ethiopian Federal Government, and the Oromia Regional Government. This significant milestone follows the establishment of dedicated site policing and conditional confirmations from the project’s finance syndicate.

The project’s financing structure involves multiple phases. From October 2024 to mid-2025, the focus will be on executing definitive detailed documentation and drawing down equity-risk capital. Following this phase, the project will secure debt capital to ensure its financial sustainability.

The Tulu Kapi Gold project is expected to significantly boost the local economy by creating approximately 1,000 direct jobs. This influx of employment opportunities is anticipated to improve the livelihoods of many residents and stimulate local businesses.

KEFI has detailed a comprehensive plan of early works for the project, scheduled to continue until September 2024. Key activities include:

Community Resettlement Preparations:

Ensuring that the local communities are appropriately resettled in a manner that minimizes disruption and maximizes benefits.

Procurement Engineering:

Securing the necessary materials and services to support the project’s infrastructure and operational needs.

Social Development Consultations:

Engaging with local communities to address social impacts and foster positive relationships.

Recruitment:

Hiring skilled personnel to support the various phases of the project.

Furthermore, the project’s focus on community resettlement and social development demonstrates a commitment to ethical and sustainable practices. By consulting with local communities and ensuring safety and protection systems, KEFI aims to foster a collaborative environment that benefits both the company and the residents.

These activities will be independently monitored to ensure adherence to the schedule and implementation of necessary safety protection systems.

Independent monitoring of the project’s early works is a crucial aspect of KEFI’s approach. This oversight ensures that all activities progress on schedule and adhere to stringent safety standards. By prioritizing safety and transparency, KEFI aims to mitigate risks and build trust with stakeholders.

The launch of the Tulu Kapi Gold project marks a significant step forward for KEFI and the local communities in western Ethiopia. With a structured plan for early works, a robust financial strategy, and a commitment to social development, the project promises to bring substantial economic benefits and foster sustainable growth. As KEFI moves forward with this ambitious venture, the focus on safety, community engagement, and transparent operations will be key to its success and long-term impact on the region.

Container Rotation Systems (CRS), a leader in containerized bulk handling solutions based in Sydney, Australia, has announced the latest innovation in its product portfolio: an electronically managed lid removal and replacement system.

This cutting-edge system, designed to enhance efficiency and safety in bulk handling operations, is a significant addition to CRS’s suite of container management solutions.

The new lid removal and replacement system is a standalone unit intended for installation at processing plants where containers must be loaded in a fully contained and environmentally safe manner. The system simplifies the handling process by automating the removal and replacement of container lids, ensuring that operations are both efficient and compliant with environmental regulations.

Containers are placed in the lid lifting station where the lids are carefully removed. The system then allows for the container to be filled and weighed to achieve the desired gross weight. Once the filling process is complete, the lid is securely replaced, and the container is moved to a marshalling area or directly to transport logistics for shipment.

“This static unit is a modulated system completely manufactured in our state-ofthe-art facility in western Sydney,” a CRS spokesperson told. “It is a pre-tested plug and play design, just fit it to the mount pads, power up, and away you go.”

The system’s design emphasizes ease of installation and use. The plug and play feature ensures that the unit can be quickly operational with minimal setup time, reducing downtime and increasing productivity.