IS COPPER BECOMING THE NEW LITHIUM? Biggest Lithium Mines in the World Illegal gold Miners Accused of Destroying a Sacred Mountain in Venezuela Volume: 112. Issue.1. January 2023 www.skillings.net

BIG RESULTS SMALL TEAM Optiro is a resource consulting and advisory group. Our 5 core services are Geology, Mining Engineering, Corporate, Training and Software. In eleven years, our team has travelled the world providing expertise to improve, value, estimate and audit the world’s minerals. Pound for pound we think you’ll find no-one delivers greater value –and BIG results. +$15 BILLION DEALS/ VALUATIONS >780 MILLION oz Au RESOURCE AUDITS >64 MILLION oz Au RESOURCE ESTIMATES >3,000 CLIENTS +2,000 PEOPLE TRAINED 24 COMMODITIES 53 COUNTRIES >4,300 MILLION lb NICKEL >5,100 MILLION lb COPPER +5 IRON ORE BILLION TONNES www.optiro.com contact@optiro.com +61 8 9215 0000

06 Sustainable Mine Design Begins With A Cultural Change 12 Chinese Managing Cobalt Mines In DRC By Remote Control 14 Iron Ore to focus on Stimulus, Shrugs Off China’s Rising Covid-19 Concern 19 Copper Prices Will Remain Under Pressure Due To Macro Headwinds 21 Rise in European Demand Hits Coal Mining in Turkey 23 Wobbly Coal Production Sparks Resilience for Coal Mining Jobs in the US 27 Pegmatite Identified At Forrestania Resources’ New Calypso Prospect 28 RC Infill Drilling Completed at Burke Graphite Deposit 29 Employment and wages in the mineral mining industries 32 Drilling In Process at Lynn Lake Nickel Sulphide Project 33 Experts from Virginia Tech Tapped to Explore Impact of Gold Mining in Virginia, USA 34 Biden Failing To Support US Miners? 34 US Arm of Komatsu Opens Job Roles in Finance 34 Nuclear Site Could Replace Lost Mining Jobs In Nottinghamshire 34 Finance-Related Jobs in Mining 35 New Technology Transforms Old Gold Mine To A Source Of Future Employment 38 Canada’s New Critical Minerals Strategy 39 Western Lenders Restrict Financial Services to Coal Miners Content 08 Biggest Lithium Mines in the World 36 Earth AI Starts Field Work at Fontenoy 30 Illegal gold Miners Accused of Destroying a Sacred Mountain in Venezuela 25 Demand for Battery Materials Skyrockets as Net-Zero Emission Goals Penetrate Australian Industries 16 Is Copper becoming the new Lithium? 19 Copper Prices Will Remain Under Pressure Due To Macro Headwinds www.skillings.net 3 January 2023

CUSTOMER SERVICE/ SUBSCRIPTION QUESTIONS:

For renewals, address changes, e-mail preferences and subscription account status contact Circulation and Subscriptions: subscriptions@Skillings.net Editorial matter may be reproduced only by stating the name of this publication, date of the issue in which material appears, and the byline, if the article carries one.

SKILLINGS MINING REVIEW

(ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284 Phone: (888) 444 7854 x 4. Printed in the USA. Payments & Billing: 350 W. Venice Ave. #1184, Venice, FL 34284.

Periodicals Postage Paid at: Venice, Florida and additional mail offices. Postmaster: Send address changes to: Skillings mining review, 350 W. Venice Ave. #1184 Venice, Florida 34284. Phone: (888) 444 7854 x 4. Fax: (888) 261-6014. Email: Advertising@Skillings.net. www.skillings.net

UNITED STATES $72 Monthly in US Funds $109 Monthly in US Funds 1st Class Mail OUTSIDE OF UNITED STATES $250 US Monthly for 7 - 21 day delivery $335 US Monthly for Air Mail Service SUBSCRIPTIONS SKILLINGS MINING REVIEW NEWS ROOM Digital Monthly Magazine SMR Americas Monday Global Skillings Wednesday Skillings Equipment Gear Friday All funds are monthly $4.95 USD per month IS COPPER BECOMING THE NEW LITHIUM? Biggest Lithium Mines in the World Illegal gold Miners Accused of Destroying a Sacred Mountain in Venezuela Volume: 112. Issue.1. January 2023 www.skillings.net publisher CHARLES PITTS chas.pitts@skillings.net managing editor SAKSHI SINGLA sakshi.singla@skillings.net editor-in-chief JOHN EDWARD john.edward@skillings.net creative director MO SHINE mo.shine@skillings.net contributing editors ROB RAMOS AALIYAH ZOLETA MARIE GABRIELLE media production STANISLAV PAVLISHIN media.team@cfxnetwork.com media administrator SALINI KRISHNAN salini.krishnan@cfxnetwork.com director of sales & marketing CHRISTINE MARIE advertising@skillings.net profiles in mining mining.profiles@skillings.net general contact information info@cfxnetwork.com 2023 JANUARY VOL.111. NO.1 Skillings Mining Review of CFX Network LLC, publishes comprehensive information on global mining, iron ore markets and critical industry issues via Skillings Mining Review Monthly Magazine and weekly. SMR Americas, Global Skillings and Skilling Equipment Gear newsletters.

ME Elecmetal Comminution Solutions Innovative Solutions - Proven Performance Solutions to positively impact priority KPIs www.me-elecmetal.com ME Elecmetal Minneapolis, MN • Tempe, AZ 763-788-1651 • 480-730-7500

support,

tools

develop

your needs.

Visit us at the Denver, Colorado Feb 26 - March 1, 2023 Booth 1701

ME Elecmetal o ers innovation,

custom designs and valuable

to

a total grinding solution speci c to

We are on the ground with our customers — setting common goals and providing timely responses based on e ective collaboration. ME Elecmetal will help you optimize processes, extend the lifespan of wear parts, reduce operational risks and increase pro tability.

Sustainable Mine Design Begins With A Cultural Change

By Marie Gabrielle Laguna

Mining companies that have ambitious sustainability goals might be running out of time when it comes to proving their commitment.

Mine operators recognise that stakeholders want to see good returns in order to overcome negative historical perceptions. These returns are based not only on financial performance but also on the triple bottom line of planet, people, and profit. There is a growing consensus that companies with a strong triple bottom line are more adaptable and make for more reliable investments.

It is now time to deliver on the promises made by these companies which will require the assistance of mining development and growth technical teams. This is because design innovation contains some of the most significant opportunities to improve environmental, social, and governance (ESG) performance.

Engineers and designers must look beyond their technical disciplines to embrace whole-system complexities posed by sustainability challenges in order to realize the full potential of future mines and improve current operations.

However, this does not imply that they have to abandon their core design values of safety, dependability, and cost-effectiveness. Teams must now simply take into account ESG factors as well. The good news is that these traditional values and relatively newer ESG considerations can coexist peacefully. For example, environmental improvements such as reduced energy use or material movement save money. Engineers can assist mines in achieving win-win scenarios by using innovative approaches. The question is how does one bridge the gap between where the company is now and where they have promised to be? A good place to start might just be company culture itself.

Recognizing The Risks

To align design teams with ESG goals, an organization must first understand the direction in which it wishes to move the needle and why. According to a White & Case 2022 market sentiment survey, the top concerns among investors and regulators are community impact, emissions, tailings management, and water usage. While the ever-expanding body of ESG frameworks and governing authorities can be overwhelming and complex, this simplified data provides design teams with practical guidance. Concentrating on these top concerns is easier to handle than becoming an expert in everything ESG. Equipping design teams with the necessary tools, knowledge, and resources for these focus areas directs creative energy towards the areas where they will have the most positive impact.

Communicating Measurable Objectives

Once ESG risks have been identified, measurable targets should be communicated to all levels of the organization. Design teams must be clear about what they are aiming for. John Doerr’s book “Measure What Matters” highlights the importance of setting and communicating clear, measurable goals for driving performance.

This is what people wish to see in mining firms. For instance, all members of the International Council on Mining and Metals pledged to achieve net-zero carbon emissions by 2050 or earlier. While decarbonization is the most widely discussed topic in the world of sustainability, miners publish a wide range of other measurable targets. Consider BHP’s goal of achieving gender balance by 2025, starting from a 2016 baseline of 17%. †

6 January 2023 www.skillings.net

FloLevel Technologies

Biggest Lithium Mines in the World

By John Edward

In a recent article, Mining Technology listed a few lithium mines which are in the running for becoming the top producers of the metal in the world. Here’s a look at the top six of these lithium mines on the basis of their proven or probable reserves:

2.

Thacker Pass Lithium Project – 179.4Mt

The Thacker Pass lithium project is said to be the second biggest lithium mine in the world and is located in Humboldt County, Nevada (US). It is 100% owned and operated by Lithium Americas. The mine is estimated to contain proven and probable reserves of 179.4Mt containing 3.1Mt of lithium carbonate equivalent (LCE) and is expected to have a life cycle of 46 years.

1.

Sonora Lithium Project – 243.8Mt

The Sonora lithium project is located in Sonora (Mexico) and is touted as the biggest lithium deposit in the world. The lithium mine is being developed by Sonora Lithium (SLL) which is a joint venture of Bacanora Minerals (77.5%) and Ganfeng Lithium (22.5%).

The mine is estimated to hold proven and probable reserves of 243.8Mt, containing 4.5Mt of lithium carbonate-equivalent (LCE). According to the bankable feasibility study for the La Ventana concession, which is expected to account for 88% of the mined ore from the project, the estimated mine life will be around 19 years.

Sonora is expected to be an open-pit operation which is likely to be developed in two stages. The first stage is expected to have a production capacity of 17,500 tonnes per annum (TPA) of lithium carbonate, while stage two is expected to double the production capacity to 35,000tpa.

The pre-feasibility study (PFS) for the project was completed in August 2018 and proposed a two-phase mine development plan using open-pit methods. Phase one was expected to be commissioned in 2022 with a production capacity of 30,000tpa of battery-grade Li2CO3, while phase two is expected to increase the capacity to 60,000tpa with a commissioning date of 2026.

8 January 2023 www.skillings.net

Lithium Project –151.94Mt

The third largest lithium mine in the world is said to be the Wodgina lithium project which is also located in Western Australia. The mine is 100km southeast of Port Hedland and was earlier fully owned by Mineral Resources. However, the company entered an agreement with Albemarle Corporation in August 2019 to form a 60:40 joint venture in order to develop the mine. The open-pit mine is estimated to contain probable reserves of 151.94Mt grading 1.17% Li2O.

Industrial General Contractor Specializing in Equipment Installation and Maintenance crmeyer.com 800.236.6650 Offices: Byron, GA Escanaba, MI Muskegon, MI Coleraine, MN Tulsa, OK Chester, PA Oshkosh, WI Green Bay, WI Rhinelander, WI Millwrighting Piping Ironwork Concrete Electrical Building Construction Design/Build Offices Nationwide l l l l l l l Boilermaking l

Wodgina

3. www.skillings.net 9 January 2023

4.

Pilgangoora Lithium-Tantalum Project –

108.2

Mt

Situated in the Pilbara region of Western Australia, the Pilgangoora lithium-tantalum project is 100% owned and operated by Pilbara Minerals. It is said to be the fourth biggest lithium mine in the world. The proven and probable reserves of the mine are estimated to be 108.2Mt grading 1.25% Li2O and 120 parts per million (ppm) Ta2O5 and 1.17% Fe2O3. After a planned second stage expansion, Pilbara Minerals expects to increase the production capacity of the mine to 5Mtpa, allowing it to produce 850,000tpa of 6% spodumene concentrate.

1.5% Li2O. The mine is owned by Kidman Resources (50%) and Sociedad Química y Minera de Chile (SQM, 50%) under a joint venture named Covalent Lithium. Upon commissioning in 2020, the mine was expected to produce 411,233t of spodumene concentrate a year over its 47-year mine life.

5.

Earl Grey Lithium Project – 94.2 Mt

Also known as the Mt Holland lithium project, the Earl Grey lithium project is located in the Forestania Greenstone Belt in Mt Holland (Western Australia). It is allegedly the fifth largest lithium mine in the world and is estimated to contain proven and probable reserves of 94.5Mt grading

6.

Greenbushes Lithium Project – 86.4Mt

The Greenbushes lithium project is said to be the sixth-largest lithium mine in the world and is located in Greenbushes (Western Australia). It is owned by the Chinese mining company Tianqi Lithium and operated by Talison Lithium. The latter is 51% owned by Tianqi Lithium. The mine is estimated to contain proven and probable reserves of 86.4Mt grading 2.35% Li2O.

The Greenbushes mining operation has three processing plants – one producing technical grade lithium concentrates and the other two producing chemical grade lithium concentrate. Ore containing Li2O is fed into the processing plants, which upgrade the lithium mineral, using gravity, heavy media, flotation and magnetic processes, into a range of lithium concentrates for bulk and bagged shipments.

10 January 2023 www.skillings.net

†

HALCOR PRODUCTS

Copper tubes with or without lining or industrial insulation for applications in:

• Drinking water and heating networks

• Underfloor heating and cooling

• Gas and medical distribution networks gases

• Cooling and air conditioning systems

• Solar energy applications

• Various industrial applications

Chinese Managing Cobalt Mines

In DRC By Remote Control

By John Edward

In order to secure cobalt supplies for producing electric vehicles, China is using smart sensors, high-speed communication tech, and live streams to control cobalt mines in the Democratic Republic of Congo.

According to an article by Stephen Chen for the South China Morning Post, Chinese mine operators monitoring cobalt mines in Africa can remotely control on-site activities in real time from their mobile phones or laptop in China. Engineers at the state-owned company that runs these cobalt mines have unprecedented instant access to production data. This is made possible through the use of cutting-edge information technology, which is helping China secure supplies of cobalt. It is important to note that Cobalt is an essential element in the electric car industry. The mineral boosts the energy storage density, life cycle, and safety of lithium-ion batteries.

The Democratic Republic of Congo (DRC) produces roughly 70% of the world’s cobalt. According to industry estimates, more than 80% of the cobalt mines in Congo are now owned by Chinese companies.

In recent years, China has pushed for immediate access to operational data from on-site equipment in these cobalt mines – most of which are in remote areas – with the large-scale application of smart sensors and high-speed communication technology. A manager in Beijing can,

for instance, determine the position, speed, and load of each truck with their smartphone.

Cui Bing, a senior engineer who is overseeing the construction of digital mining infrastructure with the North Mining Limited company (also known as Norine), added in a paper published in the domestic peer-reviewed journal Mining Technology last month that the system “also streams live video feeds collected by cameras at critical locations back to headquarters”.

Beijing give direct orders to local executives in the cobalt mines

Using these live video streams, management in Beijing can give direct orders to local executives on the basis of what’s happening on-site. The company is headquartered near the Forbidden City and is a subsidiary of Norinco –China’s largest arms exporter. It has made one of the largest investments in DRC’s cobalt mines. “We have maintained distance-free contact with the mines overseas,” Cui and his colleagues said.

China is the world’s largest producer of lithium batteries and has almost no cobalt reserves of its own. According

12 January 2023 www.skillings.net

to a study conducted by the country’s natural resources ministry, the international trade volume of cobalt-related minerals between China and the DRC was already at 95% of the world’s total in 2020. This was undoubtedly driven by the electric car boom.

According to a study published in Acta Geoscientica Sinica journal on December 2, “If the overseas supply of upstream raw material is cut off, the advantages of midand-downstream products will no longer exist. Under the background of increasing tension between major powers and the West’s attempt to ‘de-Sinicise’ the global industrial chain, it can severely restrict the development of strategic emerging industries in our country.”

In the DRC, some critics have accused Chinese companies of overexploiting the country’s natural resources. To combat the same, the government in Kinshasa has imposed new taxes on foreign mining companies. Lawmakers are also mulling new laws to regulate mining activities.

Needless to add, these restrictions mean an increase in the cost of cobalt for Beijing. They could also affect the mass production of lithium batteries.

The central African country has witnessed decades of war between the government and resistant forces. Armed robberies are fairly common. Increasing productivity in such a highly unstable environment poses a massive challenge for Chinese companies.

In the past, information systems in African mines were largely separate from Chinese headquarters. Most data were collected by local employees and processed manually before being sent to Beijing, according to Cui’s team.

“Each mine operates like an isolated island,” they said in a paper. This is in stark contrast to China, where many mines employ new technology such as AI and 5G to automate operations. The equipment in the cobalt mines can include ore excavators and automated machines for selection and fine processing. †`

Proud to be your reliable partner.

We have long supported the region’s mining industry by providing safe, reliable and competitively priced electricity. In 2021, half of the energy we provide to all of our customers will come from renewable sources. Together, we power northeastern Minnesota’s economy.

mnpower.com/EnergyForward 19260

www.skillings.net 13 January 2023

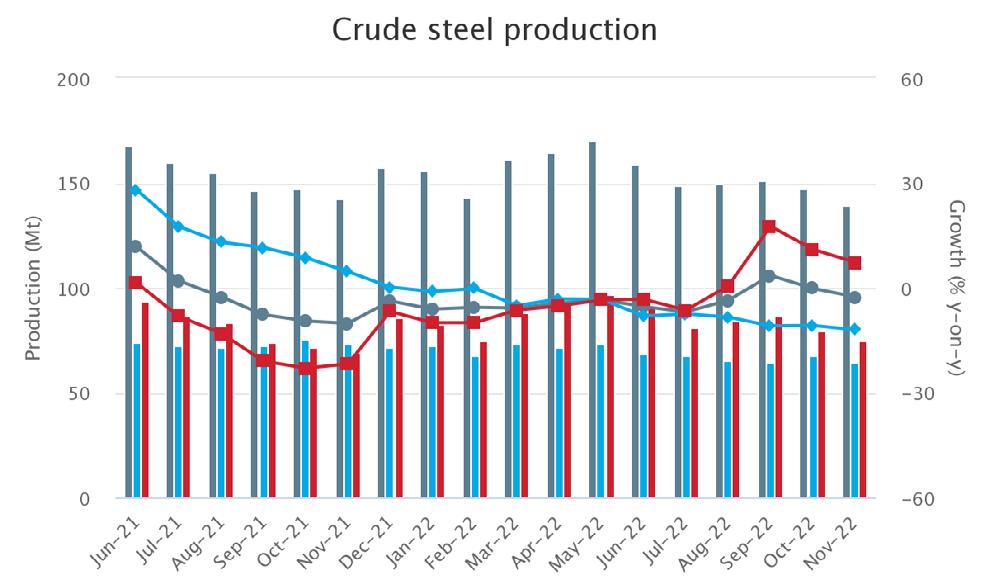

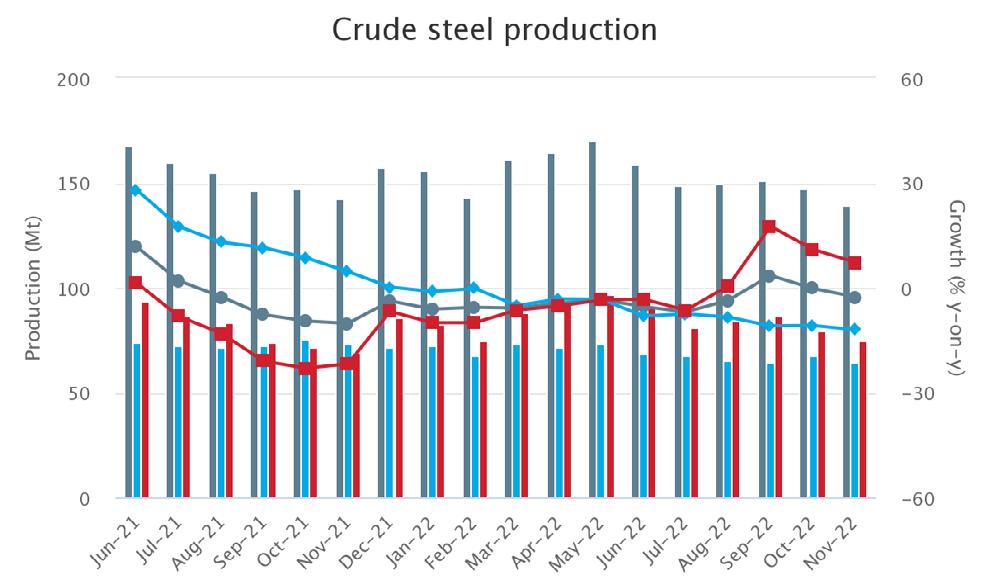

Iron Ore to focus on Stimulus, Shrugs Off China’s Rising Covid-19 Concern

By Robel Ramos

The iron ore market has opted to concentrate on China’s efforts to stimulate its property sector rather than on the rising issues over the potential economic fallout due to the increasing number of COVID-19 cases in the country and public anger at efforts to control the outbreaks.

at 753.50 Yuan ($104.65) per ton on Monday. The price was a gain of 2% from the close on November 25, 2022. The slight dip in the global prices of spot iron ore and the modest gain for the main Chinese domestic price shows the various perceptions held by traders in those markets. A lot of international traders may be more concerned by the country’s adherence to its very strict zero-Covid measures than China’s domestic investors.

However, the overall message from the price action seems to be that the rising cases of Covid-19 and the street protests against the government’s adherence to its stern zero-Covid strategy are insufficient to change the entire positive outlook for iron ore.

Protests against the country’s policies on Covid-19 took place over the weekend in different cities, with analysts saying they were the biggest since the violent 1989 Tiananmen Square protests.

The impact of any ongoing street demonstrations may become more vital if they continue, persist, and escalate or if they lead to either even stricter measures against the Covid-19 virus or easing restrictions in a bid to appease public opinion.

The spot price of benchmark 62% iron ore for delivery to north China dropped slightly on November 28, 2022, to end at $98.60 per ton from the previous close of $99.25. The figures have been assessed by the commodity price reporting agency Argus.

The recent dip was matched by the December iron ore futures traded in Singapore, which dropped to $98.14 per ton from $99.15 on November 25, 2022. However, iron ore contracts traded on Dalian Commodity Exchange ended

Outside of the uncertainties brought about by the Covid-19 virus, the picture nonetheless looks brighter for iron ore as the country, the biggest buyer of the steel raw material in the world looks determined to revive its ailing property sector. China’s biggest commercial banks reportedly pledged to provide at least $162 billion in new credit to property developers last week, the latest in a series of steps taken to restore confidence in the housing sector. The question for the market, however, is whether or not

14 January 2023 www.skillings.net

the efforts to stimulate the housing construction and infrastructure sectors are enough to encourage steel demand or if a slowing global economy cuts demand from areas like those in the manufacturing sectors.

Positive Signals for Iron Ore

There are a lot of positive signals for iron ore with China’s port inventories below levels prevailing at the same time a year ago even though they have been going up in recent weeks.

Stockpiles were at 138 million tons in the seven days to November 25, up from 135.45 million a week prior, but below the 150.90 million in the same week a year ago.

Iron ore inventories will typically pick up in the northern winter as steel mills build up stocks ahead of the strong demand for steel in the coming spring. In February 2022, iron ore inventories peaked at 160.95 tons, hinting that there is scope for them to keep building in the coming months.

The country’s iron ore imports appear to be going for a relatively strong outcome in November, with Refinitiv estimating the seaborne arrivals at 106.8 million tons, while commodity analyst Kpler expects a slightly lower but still strong 99.13 million tons.

For the month of October, official customs data for iron ore imports are at 94.98 million tons. Thus, it is more likely that November’s outcome will be relatively stronger.

The vessel-tracking data and customs numbers do not align completely due to the difference as to when cargoes are assessed as having been landed and cleared but the tracking data gives valuable information about the direction of imports.

While stimulus efforts are increasing both in size and scope, the market stays at risk from the global health scare situation. †

SOLVING YOUR MOST COMPLEX CHALLENGES. With SEH, you are a true partner and collaborator. Engineers | Architects | Planners | Scientists 800.325.2055 | sehinc.com/subscribe

www.skillings.net 15 January 2023

Is Copper becoming the new Lithium?

16 January 2023 www.skillings.net

Norway, Sør-Trøndelag region, Røros, UNESCO World Heritage Site, old mining town, Olavsgruva old copper mine

The International Energy Agency or IEA presented data portraying a roadmap for increasing demand for the metal in the future. The report, The Role of Critical Minerals in Clean Energy Transitions, predicts that 45% of the highly conductive metal will be used up by the energy sector in 2040 under its “sustainable development scenario.”

By Robel Ramos

The global mining industry, especially investors looking for inflation-beating returns, has experienced many peaks and troughs in 2022. Those with investments in a specific commodity have performed better than other pockets of the business. However, 2022 may not go down as a victorious year for some metals.

The IEA also revealed that high levels of mineral concentration could mean the system is prone to disruptions –usually caused by geopolitical activities, pandemics, natural calamities, or even shutdowns due to unfavorable environmental, social, or political incidents. Policy strategies have to be in place to safeguard the market against supply disruptions.

Unlike lithium, the price of copper –which was predicted to strengthen – went south throughout the year. In quantifiable terms, the price of lithium has ballooned and has gone up by more than 100%. In the case of copper, a chunk of this highly conductive metal is going for 15% less. The stark contrast between the two minerals has played out despite lithium and copper being seen as likely to benefit from the electrification trend.

tain new record highs and could even reach a high price of US$11,000 per ton. Its bullish forecast does not come without reason. The broker is estimating a 178,000-ton copper deficit by 2023.

Goldman Sachs had previously forecast a 169,000-ton surplus, betting on new supply coming online. However, forecasts are suggesting that there might not be any additional supply. Any such falling off in supply could boost prices if demand for copper holds steady or increases. This scenario is what copper investors would be happy to see – especially in light of its rather poor performance this year.

Some experts believe that this scenario might change next year, and this will benefit the global mining industry in general. Supply and demand play a vital role in all commodity prices. It is for this reason that Goldman Sachs is expecting great things from copper by next year.

The International Energy Agency or IEA presented data portraying a roadmap for increasing demand for the metal in the future. The report, The Role of Critical Minerals in Clean Energy Transitions, predicts that 45% of the highly conductive metal will be used up by the energy sector in 2040 under its “sustainable development scenario.”

Some experts believe that this scenario might change next year, and this will benefit the global mining industry in general. Supply and demand play a vital role in all commodity prices. It is for this reason that Goldman Sachs is expecting great things from copper by next year.

Goldman Sachs predicts that this metal will probably at-

Under these conditions, operating (current) and under-construction (future) supply will fall short of demand by 2025. The report also depicted that the gap between supply and demand is expected to widen for the foreseeable future. However, if the metal enjoys a rise that is similar to lithium in 2022, the returns from ASX copper shares could be considerable. After all, some of the best-performing investments on the Australian market this year have been in lithium.

www.skillings.net 17 January 2023

Some of the biggest lithium names in 2022 include the following:

• Rio Tinto Limited (ASX: Rio) up 18%

• Mineral Resources Ltd (ASX: MIN) up 65%

• Pilbara Minerals Ltd (ASX: PLS) up 47%

• Allkem Ltd (ASX: AKE) up 36%

Some of the biggest ASX-listed mining companies with exposure to copper are BHP Group Ltd (ASX: BHP), Newcrest Mining Ltd (ASX: NCM), IGO Ltd (ASX: IGO, and also Rio Tinto Limited.

Currently, China accounts for 87% and Malaysia 12% of rare earth processing capacity for certain minerals and fossil fuels used in climate technologies. For lithium, Chile follows China with 29% while Argentina accounts for 10%. China also leads in the Cobalt share with 65% – Finland is second with 10% and Belgium pegged at 5%.

In Nickel and Copper processing, China is ahead by 35%, and 40% respectively. Nickel and Copper are the most vital raw materials in renewable energy solutions. Completing the list in Nickel processing are Indonesia with 15% and Japan with 8%. Chile and Japan followed China with 10% and 6% respectively in Copper processing.

Despite these figures, China is not the top producer of many of these critical raw materials. In the case of Lithium, for example, Australia accounts for a 52% market share followed by Chile with 22%, and China with only 13%. Cobalt extraction on the other hand is dominated by the Democratic Republic of Congo with 69% while Russia and Australia account for 4% each.

For nickel, two Southeast Asian nations top the list – Indonesia leading with 33% followed by the Republic of the Philippines at 12%. Russia comes in close with 11%. Copper is extracted the most in Chile which has a 28% share, Peru accounts for 12%, and China only contributes 8%. Graphite, however, is extracted the most in China which accounts for a 64% market share. The case is similar for rare earth with China contributing a 60% share.

IEA Reports: Processing of Critical Minerals Dominated by China

In related news, vital minerals used for clean energy are reportedly being dominated by China, accounting for 58% of Lithium processing. The International Energy Agency or IEA earlier said, minerals and metals used to produce clean energy technologies are being dominated by China. These raw materials are most vital in the manufacturing of climate control technologies such as renewable power, carbon capture, battery solutions, E-Vehicles, hydrogen production, and more. The IEA’s Critical Minerals Policy Tracker said that if the supply of these materials does not meet the demand, prices for energy transitions could skyrocket or even delay the transition and make it less efficient.

Antimony, arsenic, germanium, gold, hafnium, iridium, iron, magnesium, niobium, and tungsten as minerals were also largely dominated by at least one country. These minerals, however, are not needed in large quantities for the energy transition at the moment.

One of the leading examples of international collaboration structures that expressly target the security of supply is the Minerals Security Partnership or MSP. This partnership was convened by the United States in June 2022 in order to protect the supply chain of critical minerals.

The Minerals Security Partnership has brought on board mining leaders like Australia, Canada, Finland, France, Germany, Japan, Korea, Sweden, the United Kingdom, and the European Union. It aims to strengthen the supply chain by encouraging countries to share information and promote larger investments. The partnership is also looking into the creation of recycling technologies. †

18 January 2023 www.skillings.net

Processing Plant at Lithium Mine in Western Australia. Mechanical processing used to refine lithium spodumene concentrate.

Copper Prices Will Remain Under Pressure Due To Macro Headwinds

By Marie Gabrielle Laguna

By Marie Gabrielle Laguna

Copper has lost its gains this year as inflation, interest rates, and energy costs continue to rise. The red metal’s short-term demand outlook remains bleak owing to recession fears, China’s slowdown, and slowing global manufacturing activity.

Copper Fails To Maintain Its Gains

LME prices are now down approximately 30% from their peak in February, following Russia’s invasion of Ukraine, when the three-month LME copper price reached $10,580/t. Despite the fact that copper’s fundamentals appear to be supportive, the red metal has struggled to hold onto its gains as global slowdown fears stay high.

China Continues To Be A Major Question Mark

Covid-19 lockdowns in an already decelerated Chinese economy have persisted in dampening the red metal’s demand perspective, with the country’s property industry remaining a big question mark for the copper market in the future. For nearly two decades, the development of the property sector in China and the country’s rapid urbanization have been the primary drivers of growth in copper demand, which accounts for nearly a quarter of total demand.

The country’s GDP grew 3.9% year on year in the third quarter of 2022, faster than the consensus forecast of

3.3% YoY and 0.4% YoY in the second quarter, but real estate contracted 4.2% YoY due to unfinished projects that slowed activity in the industry from land bidding to housing starts. However, hopes have increased re-

cently that new stimulus initiatives will boost demand for the red metal following moves to shore up the country’s property sector and ease Covid restrictions. The loosening of China’s Covid-related quarantine measures

www.skillings.net 19 January 2023

shortens the quarantine period for incoming travelers and close contacts of those who test positive. Furthermore, secondary contacts will no longer need to be tracked down. The government also stated that it would increase vaccinations among senior citizens, though it refrained from issuing mandates to help raise inoculation rates.

Even so, while these policy changes are taking place, China is also experiencing the highest number of daily Covid cases since April. Beijing recently saw the country’s first Covid deaths in six months as the city tightened its restrictions. Guangzhou has sealed off its largest district as the number of reported crimes continues to rise. Reports of Covid protests in China will also likely harm general sentiment.

The recent relaxation of quarantine requirements is certainly a move in the right direction, but the market will almost certainly require further relaxation if this enthusiasm is to be sustained.

China has also recently introduced 16 property measures to assist the weak property sector. Some of these measures include debt extensions for the industry and lowering deposit requirements for homebuyers. These could possibly increase the use of industrial metals like copper. Civil and building construction accounts for about 23% of China’s copper end-use.

Caught Between Falling Demand And Shrinking Supply

Supply disruptions in South America remain a concern for copper. According to the most recent International Copper Study Group data, Chile’s mined copper production fell by 6% in 2022 through July due to low ore grades, labor issues, and water scarcity.

Chilean output fell by 1.84% year on year last year, to 5.73 million tonnes, the lowest since 2017. The country’s ore quality has also been steadily declining. Copper mining grades averaged 1.41% in 1999 but are now around 0.60%.

Protests by local communities in crucial mining areas in Peru have also continued this year. Recently, the Las Bambas copper mine in Peru, owned by Chinese miner MMG and accounting for 2% of global copper supply, has begun to reduce operations due to recent roadblocks. MMG cut its annual copper production forecast at Las Bambas to 240,000 tonnes in August.

Imports of both metal and ore fell to their lowest point in over a year in October, as factory activity slowed. Concerns about China’s economy are likely to continue to exert pressure on copper till the government eases Covid-19 restrictions further.

For the time being, the country’s uncertainty about Covid-19 restrictions weighs on demand for the metal.

Imports of both metal and ore fell to their lowest point in over a year in October, as factory activity slowed. Concerns about China’s economy are likely to continue to exert pressure on copper till the government eases Covid-19 restrictions further.

However, the Chinese government is likely to stick to its zero-Covid policy through the winter and will consider relaxing some of the restrictions after the National People’s Congress in March or April next year. Preferential policies on property developer financing might limit the growth of unfinished residential projects. China’s condition will probably get better but remain sluggish until 2023, with its zero-Covid strategy likely to stay in place until then.

Despite the high level of interruptions, global mine production grew strongly in the third quarter of this year. CRU predicts that global development will reach 3.2% year on year in 2022.

The ramp-up of Ivanhoe Mines’ Kamoa-Kakula mine in the Democratic Republic of the Congo, as well as Anglo-American’s newly-commissioned Quellaveco mine in Peru, are both contributing to the growth.

Near-Term Headwinds But Upside Threats To Dominate Long Term

Recession fears, China’s slowdown due to Covid-19 constraints, and the Fed’s interest rate hike path will continue to drive copper’s short-term price outlook, but tightening supply must keep the red metal’s price support above $7,500/t through 2023.

Copper prices will stay under pressure until the global growth outlook improves. Tight supply will then become the market’s main focus, supporting prices above $8,000/t in the fourth quarter of 2023. †

20 January 2023 www.skillings.net

Rise in European Demand Hits Coal Mining in Turkey

By John Edward

In an article for Middle East Eye, Naomi Cohen states that the ban on Russian oil coupled with remarkably cold winters across Europe, have forced the continent to turn towards traditional energy sources in an attempt to fight power shortages. In effect, this means that coal mining in Turkey is back on the agenda despite pledges to reduce reliance on the same.

Several European countries – including France, Germany, Austria, the Netherlands and Greece – are reactivating their coal-fired power plants. Poland is reviving its practically defunct coal production and even opening new coal mines. Concurrently, individual households which cannot afford more expensive heating options are turning towards coal furnaces.

With Russian coal no longer in the picture, there simply isn’t enough coal in Europe to meet this rapidly increasing demand. The continent is buying the mineral in bulk from non-European countries, thereby shaking up an entire industrial sector. In fact, sales by major coal producers – like Indonesia, South Africa and Australia – have broken records in 2022. Coal exports by Turkey, the 11th-largest producer of coal in the

ZONGULDAK, TURKEY - APRIL 05: Coal is seen after being brought to the surface at a a small mine on April 5, 2017 in Zonguldak, Turkey. More than 300 kilometers of coal mineÕs riddle the mountains of Zonguldak. The coal-mining city in the Black sea region of Turkey was established in 1849 as a port city and mining hub. However the province with a population of more than 500,000 is facing an uncertain future. As the coal mining industry globally sees a steady decline, Zonguldak and surrounding towns are also at a cross roads with coal miner numbers dwindling from some 60,000 in peak years to now just over 6000 working in the city. Steady population decline, Turkeys current economic crisis, cheap coal imports from Columbia and Russia, as well as a series of mining disasters, such as the 2014, Soma mine fire, which forced parliament to adopt a new code to improve safety conditions, which raised some mine operating costs by 50 percent, have all contributed to a decline in profit and have pushed many mining companies into financial difficulty. However with TurkeyÕs Minster of Energy and Natural resources pushing new policies focusing on domestic resources and reducing TurkeyÕs energy import dependence, many companies and miners hope that they will see a revitalized industry in coming years. (Photo by Chris McGrath/Getty Images)

world, increased nearly seven-fold in May 2022 after the European Union announced a ban on Russian coal.

Even this figure pales in comparison to the nearly 12 times increase of Turkish coal exports in August 2022

In the backdrop of the global energy crisis and supply chain disruption, coal mining in Turkey is having trouble keeping up with local and European demand.

www.skillings.net 21 January 2023

when Russia cut natural gas exports to Europe through Nord Stream 1. The effects of these unprecedented sales are sending shockwaves across a hitherto fading sector in the country, thereby triggering a potential supply and demand crisis. “All of our reserves are depleted,” claimed Erhan Altay of the sales department of the state-owned Turkish Coal Enterprises. The company mines the majority of Turkey’s lignite coal and has been scaling down its production over the past three years.

It is important to note that hard-coal production had been reducing for decades in Turkey. Much of the stock was kept in anticipation of a time when coal would be more scarce and valuable – like what it has become this winter.

Without any reserves to fall back on, Turkey is finding it difficult to meet rising demand. This is especially true because coal has been the country’s major energy source since 2018 despite lower production figures. The mineral accounts for more than a third of all electricity generation in the country – up from 23 per cent a decade ago.

Bridging the gap

Turkey has attempted to address this increase in demand by importing coal that is cleaner and of a higher calibre than local variants. However, rapidly rising European demand has caused coal prices to double, thereby pushing lower-income countries out of the market.

The Turkish Lira suffered a rapid fall in value this year. Thus, imported coal has become practically unthinkable as a cheaper energy alternative in Turkey. Even though local coal continues to remain available, it has become much more expensive.

This increase in demand, coupled with the energy crisis, has both coal mining companies and suppliers in Turkey scrambling for potential solutions. They have the onerous task of not only addressing the supply gap for their regular clients – including thermal power plants and the cement, iron, and steel industries – but also combating near-triple-digit inflation and soaring electricity bills. The latter especially has pushed more households towards coal.

In some cities, demand has increased by as much as 200 per cent, according to Mahmut Kayahan, assistant secretary of the Chamber of Commerce and Industry of Zonguldak – the province that holds all of Turkey’s hardcoal reserves. Since Turkish Coal Enterprises only serves

the public sector, the country is increasingly being forced to turn towards private mining companies to meet the load.

Even though coal production figures have been down until this year, the Turkish energy ministry is trying to expand mining fields in an attempt to wean the electrical grid off coal imports. On this front, it is important to note that – due to high costs and shifting public opinion against coal-powered thermal power plants – only a handful of the 80 planned thermal power plants have been installed in the country.

Better days ahead?

The coal boom of 2022 might just make investment in the sector more attractive. Even though the cost of coal is increasing with inflation, revenues are increasing at an even faster rate. As an illustrative example, coal which previously sold at 2,000 Turkish liras ($107) per ton last year now sells between 4,000 and 7,000 liras depending on its quality, Kayahan told MEE.

Hard-coal mining needs heavy machinery and a significant number of personnel – costs that have multiplied this year. However, companies are still earning more than last year, he highlighted. Lignite mining, which is less costly, has

22 January 2023 www.skillings.net

been “extremely profitable” according to Kayahan. “Most will invest it,” he said. “Where they invest the profit is left up to the manager’s initiative.” A few mining companies are planning ahead for the energy transition and exploring the possibility of branching out into cleaner alternatives, said Kayahan. While nothing currently binds their investments in Turkey, some private banks are still interested in keeping their money in the fossil fuel industry.

As a nation, Turkey wishes to be an active participant in the global transition to clean energies. However, it is still promoting domestic coal mining in Thurkey and seeking financing anywhere it can find it. “There was never a well-coordinated policy,” adds Tok.

Tok does not expect the current coal rush to last long term as financial and political pressure is likely to push private companies away from fossil fuels for good. However, as profits from fossil fuel rise and Ankara does not commit to distance itself from coal, short-term calculations might just win out.

“While there is a climate policy around the world that works against domestic coal mining and thermal power plants, Turkey is pushing in the opposite direction,” concluded Tok. †

Wobbly Coal Production Sparks Resilience for Coal Mining Jobs in the US

By Randy Molejona

The US Bureau of Labor and Statistics has released a report showing that approximately 381,000 people are employed in the coal mining industry. But with recovering economic growth, the number of employed coal miners has an enormous potential to increase.

In October 2022, the United States Energy Information Administration (US-EIA) released its annual coal report which showed a staggering 577 million short tons of coal production in 2021, generating around US$261 billion in terms of total economic activity brought by coal operators in the US. The state of West Virginia accounts for 13.6% of this national coal production.

According to West Virginia University, based on the fiveyear economic outlook from 2021 to 2025, around 99,000 additional jobs are estimated to be generated by the economic impact of coal production in the US. This number is separate from the 37,300 direct coal mining jobs that will be expected by the end of the year, garnering a total employment impact of 136,300 jobs in the coal mining industry. However, these figures do not necessarily mean that coal production has been stable throughout the years.

“Despite production declines in recent years, coal remains a very important part of America’s economy, as illustrated in our research. Coal continues to support a sizeable share of the nation’s economic output and thousands of high-paying jobs”, said Dr. John Deskins, Director of the West Virginia University Bureau of Business & Economic Research (BBER) reported by the West Virginia Coal Asso-

www.skillings.net 23 January 2023

ciation back in September 2022. Improvement measures are being planned to increase coal productivity in the coming years. In fact, the domestic demand for US coal has already increased by 20 million short tons in 2022 compared to a significant drop during the pandemic. However, the US-EIA Annual Energy Outlook’s coal production forecast states that coal production is expected to fall by 50 million short tons in 2023.

This alleged decline in coal production does not necessarily translate to a broken promise in terms of employment when it comes to US coal miners. America’s Coal Associations assured that with the economic activity generated from previous years, there is enough avenue for the mining industry to leverage US$ 10.6 billion on national wages in the US with 29,674 jobs in West Virginia, 15,852 in Indiana, 13,735 in Texas, 13,418 in Illinois, 12,266 in Kentucky, 7,027 in Utah, and 3,895 in Montana.

“At a time when energy-driven inflation is weighing heavily on all Americans and electricity grids are being stretched to their limits, the coal industry’s significance has never been greater, providing high-paying direct and indirect jobs for Americans, economic benefits for communities across the country, the fuel for affordable and reliable energy, and metallurgical coal for steelmaking.”, remarked Rich Nolan – incumbent President of the National Mining Association.

According to the December 2022 issue of the Bloomberg Law, even though coal power plants are gradually shutting down due to the transition to renewable energy, projects involving the conversion of shuttered coal power plants into nuclear power plants through small modular reactors (SMRs) are now being seen as an alternative to maximize the sites and generate coal mining jobs.

“Coal plant sites have emerged as places to create jobs and avoid having to build as much new infrastructure. Nuclear developers could leverage existing coal plant land use, transmission lines, cooling water availability, and key permits to reduce costs and shorten construction timelines, reduce environmental impacts, and increase community support”, noted a November 2022 report from the Electric Power Research Institute.

According to the December 2022 issue of the Bloomberg Law, even though coal power plants are gradually shutting down due to the transition to renewable energy, projects involving the conversion of shuttered coal power plants into nuclear power plants through small modular reactors (SMRs) are now being seen as an alternative to maximize the sites and generate coal mining jobs.

The US Department of Energy Systems Analysis and Integration estimated that around 80% of the closed coal power plants can still be used as potential sites for the conversion to nuclear power plants. Additionally, each plant would produce an average of 650 permanent jobs which means this impact in employment could generate about 92% more in terms of local tax revenue compared to operating an actual coal power plant. Furthermore, an interesting trend in hiring activity for roles in the information technology (IT) sector is also beginning to emerge which could be the next best-paying job in the mining industry. Administrators and Architects for Database and Networks are some of the most popular roles, consuming 40.23% share in the hiring activity in the mining sector.

In terms of employee compensation, both coal mining and coal-fired power generation are anticipated to give US$43.8 billion, this time including the highest average wages per year compared to all other industries. With this rate, the said industries are obliged to cut US$8.1 billion in order to pay for local and state tax revenues.

If the coal mining industry could adapt to the changing business climate of the energy sector, coal mining jobs could still be seen as valuable, as long as there is evident support to maximize the use of coal in the manufacturing of sustainable materials in the US. †

24 January 2023 www.skillings.net

Demand for Battery Materials Skyrockets as Net-Zero Emission Goals Penetrate Australian Industries

By Randy Molejona

The efforts of the International Energy Agency (IEA) towards the pursuit of a low-carbon future outlined in the Paris Agreement is nudging Australian companies to try to lead the global production of battery materials.

The IEA recently released its global energy outlook model to reveal the expected market growth of minerals to meet the Sustainability Development Scenario (SDS) in 2040. The sectors most likely to be impacted by the anticipated shift to clean energy are Commercial, Residential, and Transportation. Currently, Australia accounts for about 25% of lithium ore reserves globally. This is a

promising opportunity for the country’s economy as the lithium market is expected to grow 42 times to meet the goals of the SDS. A market research by Thomson Reuters named Australia as a major exporter of key minerals in battery materials production. In fact, the Western Australian government has invested a significant amount of money in the last five years in the field.

www.skillings.net 25 January 2023

Stock exchange data reveals that the investment rate of the country is not even remotely close to slowing down, especially with government policies catalyzing the transition of the country towards a green future.

In June 2020, 55 public stock offerings were admitted at the Australian Stock Exchange (ASX), and roughly 74% of these were under the global Metals and Mining industry classification standard. 21 offerings were found to be linked to exploration and/or transition to clean energy and the goal of net-zero emissions. An analysis by Renew Economy Australia showed that strategic trade alliances, especially with North America, are a vital element in securing the country’s position as an important major distributor of highly valued minerals during the critical energy transition.

For instance, the Australian mining company Koba Resources Ltd. – a major player in the cobalt industry –highlighted its goal to align with America’s Clean Energy Plan led by President Biden’s administration. BHP, a global supplier of copper, is currently the leading Australian firm in building strategic investments in North America, investing around US$ 2.46 billion for the expansion of Spence Growth Option with the objective to improve

ore throughput without compromising the lifespan of the mine. On the other hand, Allkem – one of the most diverse lithium suppliers – has also invested in other countries like Canada because of the hard-rock lithium pipeline which serves the upstream production of lithium not only in North America but also in Europe.

Apart from public stock offerings, the mergers and acquisitions (M&A) market also reflects signs that prioritize the transition to green energy of various industry sectors across Australia. Collaborative partnerships among companies show the strong interest of maximizing all possible resources to protect the stability of the mining industry in light of the rapidly increasing demand for materials needed for the energy transition.

Significant developments in this movement include the merger between Kirkland Lake Gold Ltd. and Agnico Eagle Mines Ltd., a gold mining company with operations in Canada, Finland, and Mexico apart from Australia. This partnership was sparked by the goal of becoming the leading firm in terms of energy performance by reducing greenhouse gas emissions significantly during operations. Another bold move in the M&A space is the collaboration of IGO Nickel Holdings Pty. Ltd. And Western Areas Ltd. with the hope of exploring more products that are useful for promoting clean energy in the mining industry and achieving net-zero emissions in the near future.

Meanwhile, the Department of Industry of Australia has taken note of these market drivers and paid attention to IEA’s forecast of higher demand in the production of value-added minerals for battery production. This has been brought about by a surge of developments in electric vehicles (EVs) that require sufficient battery storage. Both the public and the private sector contributed to making Australia home to 9 of the 50 currently leading mineral projects worldwide. As the mining industry adapts to the priority of decarbonization across various industry sectors, Australian mining companies are evidently put in an advantageous position to make use of the value-added supplies currently available.

This is certainly an avenue which will allow the country to meet investment opportunities when stakeholders realize the stability of the country as a trusted battery materials supplier. †

26 January 2023 www.skillings.net

The Pixel Building in downtown Melbourne, Victoria, Australia on a sunny day. It opened in 2010 and was Australia’s first carbon-neutral office building, generating all its own power and water on site, designed by Decibel Architecture.

Pegmatite Identified At Forrestania Resources’ New Calypso Prospect

The prospect is part of the Company’s flagship Forrestania Project which is being explored for potentially significant lithium, gold, and nickel discoveries.

Forrestania Resources Limited (ASX:FRS) recently announced a promising exploration update with respect to the fieldwork completed at its newly identified Calypso prospect. The prospect is part of the Company’s flagship Forrestania Project which is being explored for potentially significant lithium, gold, and nickel discoveries.

The Calypso prospect is located at the southern end of the Forrestania Project on the western side of the tenement package. The Forrestania Project itself is part of the well-endowed southern Forrestania Greenstone Belt. It has a tenement footprint spanning approximately 100km, north-to-south, of variously metamorphosed mafic/ultramafic/volcano-sedimentary rocks host to the historic 1Moz Bounty gold deposit, emerging Kat Gap gold deposit, the operating Flying Fox, and Spotted Quoll nickel mines, and the more recently discovered Earl Grey lithium deposit.

The geology team has completed a reconnaissance field trip to the Calypso prospect with the goal of mapping and infill soil sampling the area. This mapping identified a pegmatite subcrop which correlates with coarse grained or pegmatitic felsic rocks in historic air core drilling and anomalous lithium pathfinder elements (beryllium and rubidium) in soil and rock chip data.

Chairman and interim CEO John Hannaford commented: “The identification of a pegmatite subcrop at the Calypso prospect is an excellent outcome for the geology team at Forrestania. The discovery continues to demonstrate the effectiveness of the company’s planned and ongoing regional infill soil sampling programs to identify and generate new target areas.” Forrestania has initiated the process of obtaining the relevant approvals needed to undertake an initial drilling program at the prospect. Additionally, the company is also in the process of finalising and undertaking regional and targeted exploration programs as it continues to build momentum towards its next lithium

targeted drilling programme at the Forrestania Project. Forrestania Resources is also exploring the Southern Cross and Leonora regions of Western Australia. The Southern Cross Project tenements are scattered within proximity to the town of Southern Cross and located in and around the Southern Cross Greenstone Belt. This belt extends along strike for approximately 300 km from Mt Jackson to Hatters Hill in the south. The Company is of the opinion that the potential for economic gold mineralization at the Southern Cross Project has not been fully evaluated.

The Leonora Project tenements are located within the Norseman-Wiluna Greenstone Belt of the Yilgarn Craton. The Project includes four Exploration Licences and five Exploration Licence Applications, covering a total of around 920km2. The tenements are predominately non-contiguous and scattered over the 200 km length of the greenstone belt.

Prior exploration over the Leonora project area has focussed on gold, diamonds, and uranium. Tenements in the Project have been variably subjected to soil sampling, stream sampling, drilling, mapping, rock chip sampling and geophysical surveys. †

www.skillings.net 27 January 2023

RC Infill Drilling Completed at Burke Graphite Deposit

Lithium Energy Limited recently released an update about the RC Infill drilling program at the company’s highly prospective 100%-owned Burke Graphite Project located in Queensland, Australia.

The Burke Graphite Project is important for the company because it represents an opportunity to participate in the anticipated growth in demand for graphite and graphite-related products.

The Burke Graphite Deposit is in the Burke Tenement (EPM 25443) and currently has a 6.3Mt JORC Inferred Mineral Resource Grade of 16% Total Graphitic Carbon (TGC) which includes a higher-grade component of 2.3Mt @ 20.6% TGC. The objective of the RC infill drilling program

at the Burke Tenement is to upgrade the category of the Burke Deposit from a JORC Inferred Mineral Resource to a higher standard JORC Indicated Mineral Resource. The drilling program consists of a combination of reverse circulation (RC), diamond core and geotechnical holes.

DDH1 Drilling has completed the RC component of the RC Infill drilling program at the Burke Tenement, with 2,306 meters drilled across 23 holes. Samples have been submitted for assaying and the results are expected some-

28 January 2023 www.skillings.net

time around late January-February 2023. If the weather conditions are favorable, DDH1 will initiate the next component of the drilling program at the Burke Tenement around early to mid January 2023. This component is expected to comprise of diamond core and geotechnical holes totaling approximately 600 meters across more or less 6 holes to maximum depths of around 120 meters.

The diamond core will provide representative graphite samples of the Burke Deposit for an extensive metallurgical, Purified Spherical Graphite (PSG), and anode test-work and development program.

Burke Graphite as feedstock material

The upgrade in the resource classification of the Burke Deposit coupled with the metallurgical and PSG optimization test-work will support the planned Engineering Study which will assess the viability of establishing a PSG Anode manufacturing facility. This facility will use Burke Graphite as feedstock material.

Once the RC Infill drilling program at the Burke Tenement is completed in January 2023, DDH1 will mobilize to the Corella Tenement (EPM 25696). The latter is located around 150 km south of the Burke Tenement and the drilling program at the same will test the extent of graphite mineralization in the area.

The mineralization at the Corella tenement was previously identified through sampling and Electro Magnetic (EM) surveys which were conducted with the goal of delineating a maiden JORC Inferred Mineral Resource. Approximately 2,000 meters of RC Infill drilling and around 200 meters of diamond drilling are planned at the Corella tenement. These are expected to provide assays and samples for supporting resource development and metallurgical test-work.

Concurrently, Lithium Energy Limited is also developing its flagship Solaroz Lithium Brine Project in Argentina. This project includes 12,000 hectares of highly prospective lithium mineral concessions located strategically within the Salar de Olaroz Basin in South America’s “Lithium Triangle” in north-west Argentina.

The Solaroz Lithium Project is directly adjacent to or principally surrounded by mineral concessions being developed into production by Allkem Limited and Lithium Americas Corporation. †

Employment and wages in the mineral mining industries

According to a recent report, employment and wages in the mineral mining industries are on the rise. The report, released by the Department of Mines and Petroleum, shows that the number of people employed in the mining sector has increased by 3.5% in the past year.

One of the main drivers of this growth is the increase in demand for resources such as coal, iron ore, and copper. Many mining companies are expanding their operations to meet this demand, leading to an increase in employment and wages. The report also shows that wages in the mining industry have increased significantly in the past year. The average wage for a worker in the mining sector is now $93,000 per year, an increase of 6.5% from the previous year. This is higher than the average wage for all industries in Australia, which is $80,000 per year.

The news of increased employment and wages in the mining industry is welcomed by many workers and industry experts. “This is great news for the mining industry and for workers in the sector,” said John Smith, CEO of the Australian Mining Association. “It shows that the mining industry is a strong and growing sector that is creating good paying jobs for Australians.”

Overall, the report paints a positive picture for the future of the mining industry in Australia. As demand for resources continues to grow, it is expected that employment and wages in the sector will continue to rise. †

www.skillings.net 29 January 2023

Illegal gold Miners Accused of Destroying a Sacred Mountain in Venezuela

By Robel Ramos

Illegal gold miners have been accused of destroying the top of a sacred mountain in Venezuela. Part of a protected national park in the country, the Cerro Yapacana is being stripped off by unauthorized gold miners. Local government officials of Caracas are also being accused of turning a blind eye as authorities allegedly take a cut.

Rising 4,415 feet above sea level, the sacred mountain – a sandstone butte – is located at the country’s corner of the Amazon rainforest. It is home to various wildlife endemic to the area. The indigenous people in South America know its distinct tabletop shape as the “House of God” or “tepui.”

Heavy machinery is invading this sacred place and ripping into the mineral-rich earth. Illegal miners, armed groups, and state troopers have turned Yapacana National park into the biggest illegal mining site in this part of the Amazon. This illegal activity threatens the rainforest which scientists say is vital to mitigating global change.

William, a former miner who still works in the area said, “They’ve turned the sacred mountain into sand.” He further added that “A tree will never be able to grow there.”

Sacred Mountain- a center for illegal gold miners

The area has long been a center for illegal gold miners. New satellite imagery shows just how heavily embedded illegal mining has become – from the foot of the hills up to the hard-to-reach top of the “tepui.” Affected by these illegal gold miners are approximately more than seven square miles of the park. Two advocacy groups, Amazon Conservation Association (ACA) and SOS Orinoco, employed high-resolution imagery to identify at least 8000

30 January 2023 www.skillings.net

mining camps or parts of machinery at the park’s lowlands. The groups found 425 more camps or pieces of machinery at the top of the tepui.

A senior research specialist of ACA said, “What we typically see is a smattering of dwellings and equipment. But when we zoomed in on Yapacana, it was like… What is this?” A post-analysis of separate satellite imagery confirmed the presence of mining camps and machinery. Finer was stunned by the density of the illegal operations. He further added that he had not seen anything like it in a supposedly protected national park. Finer had studied mining at the Amazon.

“It is the lowest hanging fruit, protecting national parks. If you cannot clean up your national parks, you are really in trouble.”

Analysts and locals are saying that the authorities are letting illegal miners and armed groups operate inside the protected national park. Worse, allegedly, some Venezuelan authorities are benefiting from it.

Guerilla groups exploited the area for gold

For years, guerilla groups from the border in Colombia have exploited the area for gold. After the peace accords in 2016, violence between government forces and rebels has reduced, prompting their presence inside the national park to swell, the International Crisis Group (ICG) reported.

Bram Ebus, a consultant to the ICG, said that one rebel group that did not sign the peace accords – the National Liberation Army controls local justice and taxes residents. Ebus added that some of the precious metal is given to authorities who fly in on choppers to get their share. SOS Orinoco’s founder, Cristina Vollmer Burelli, said that since 2018 their group has been warning about the destruction and impact of these illegal activities while the rest of the world concentrates on other parts of the Amazon.

President Maduro, who was at the COP27 Climate Conference in Egypt last month, called for the protection of the Amazon. “Millennia of existence have left an irreparable mark on the Amazon. We believe that it is the original

peoples who should teach us how to save and how to live with nature.” He points out that great damage is being caused to the rainforest due to capitalism.

He did not, however, mention the role the Venezuelan government is allegedly said to have played by allowing illegal gold extraction.

The head of the National Parks Institute, Hildebrando Arangú, said that the expansion of mining atop the mountain is causing “irreversible damage.”

How these miners are making it to the tepui is unclear. “When I worked there,” Arangú who served the institute from 2004 to 2009 said, “the only way to do it was with the support of the Armed Forces, by helicopters.”

William said that the machines were carried by hand, part by part, by trekking on the mountains for at least 5 hours.

Charles Brewer-Carías, a Venezuelan explorer, identified activity at the top of the mountain in the 80s. During that time, he took a photo of a rare flowering plant, Navia Saxicola. This bromeliad can only be found at the top of the tepui and is probably going to be pushed into extinction.

The demonic poison frog is a small red amphibian that makes it home in the bromeliad and is probably lost forever. Venezuelan herpetologist, Josefa Celsa Señaris said “I wonder if it’s already extinct.” †

www.skillings.net 31 January 2023

Drilling In Process at Lynn Lake Nickel Sulphide Project

Corazon Mining Limited announced that it had initiated the next phase of drilling at its flagship 100%-owned Lynn Lake Nickel-Copper-Cobalt Sulphide Project. The project is located in the province of Manitoba, Canada.

pipeline depending on the results of the initial exploration. Furthermore, a metallurgical drilling program has also been planned to secure samples for further metallurgical test work.

The ongoing geological and resource modelling studies by the Mining Centre indicate that they are a significant number of areas which have not been effectively tested by prior drilling. These studies highlight potential opportunities for discovering additional mineralization and potential resources in and around the existing nickel sulphide deposits and mine infrastructure.

Corazon Mining Limited is an Australian resource company with projects in Australia and Canada. The commodity mix of the company’s projects has put it in a strong position and allowed it to take advantage of the growing demand for metals required for the booming rechargeable battery sector.

In Canada, Corazon has consolidated the entire historical Lynn Lake Nickel Mining Centre in Manitoba. It is the first time Lynn Lake has been under the control of one company since the mine’s closure in 1976. Lynn Lake hosts a large JORC nickel-copper-cobalt resource which has given Corazon a major development opportunity that is becoming increasingly prospective due to recent increases in the value of nickel and cobalt metals. Both metals are also expected to have strong demand outlooks due to their importance for the emerging global electric vehicle industry.

The drilling in Lynn Lake includes an initial priority exploration program comprising six holes for approximately 2000 metres. These holes will test four targets within the Lynn Lake Mining Centre. Additional holes are in the

Corazon has previously conducted successful drilling in the Mining Centre with results including 22.6 metres @ 2.30% Ni, 0.82% Cu, 0.068% Co from 24.4 meters, 4.5 metres @ 1.17%Ni, 0.22% Cu, 0.029% Co from 25 metres and 4.1 metres @ 2.09% Ni, 0.57% Cu, 0.073% Co from 26.9 metres. Samples from the metallurgical drilling will primarily be used for ore-upgrade and ore-sorting studies. The bench-scale test work undertaken recently on upgrading the Lynn Lake mineralization has shown promising results. This work is a critical component of Corazon’s strategy to transform Lynn Lake into a long-life, low-cost, nickel sulphide mining operation.

Apart from Lynn Lake, Corazon is also exploring the Miriam Nickel-Copper Sulphide Project (Miriam) in Western Australia and the Mt Gilmore Cobalt-Copper-Gold Sulphide Project (Mt Gilmore) in New South Wales.

Miriam is a highly prospective nickel sulphide exploration project, representing a strategic addition to Corazon’s portfolio of nickel sulphide assets. At the same time, Mt Gilmore focuses on a regionally substantive hydrothermal system with extensive copper, cobalt, silver and gold anomalism. †

32 January 2023 www.skillings.net

Experts from Virginia Tech Tapped to Explore Impact of Gold Mining in Virginia, USA

By Robel Ramos

Professionals from the globally-renowned Virginia Tech headed by William Hopkins and Robert Bodnar were gathered together recently by the National Academies of Sciences, Engineering, and Medicine or NASEM to provide a concise and detailed report on the potential impacts of gold mining in Virginia, USA.

Together with other technical professionals, the two experts in this field were expected to give their thorough and professional opinion on the subject matter as attention to gold mining at both the new and historical sites in Virginia is starting to pick up.

The sudden increase in interest in the gold mines in Virginia prompted lawmakers to pass House Bill 2213 to the Virginia General Assembly, directing the secretary of natural resources, secretary of health and human resources, and the secretary of commerce and trade to put up a team of experts and professionals to study gold mining.

To create a fair committee and to provide credible reports, NASEM sought out people from diverse backgrounds and disciplines. Each member was nominated and selected through a strict process that included an evaluation of any conflicts of interest and a public comment period.

The team of experts, over the course of more than a year, gathered and interpreted information from various sources. This included presentations and discussions with representatives from the mining sector, academia, community, and both state and federal government. Moreover, stakeholders were also heard during town hall meetings and mining site visits in Virginia and South Carolina. The committee to evaluate whether Virginia has appropriate

for gold mining. Hopkins, who is the committee chair, said, “Our task as a committee was to evaluate if Virginia has the appropriate regulatory structure to safely start gold mining again.”

Hopkins is also a professor in the Department of Fish and Wildlife Conservation and at the College of Natural Resources and Environment.

Aside from Hopkins and Bodnar, the committee has other experts and professionals coming from the mining industry, state government, US Geological Survey, and faculties from the University of California Berkeley, Missouri University of Science and Technology, University of Illinois, University of Michigan, Colorado School of Mines, Johns Hopkins Bloomberg School of Public Health, and Michigan Technological University.

Hopkins has been part of similar initiatives in the past. One of the committees that he had served in earlier addressed concerns related to freshwater resources, mining, management of waste from fossil fuel combustion, and research data quality in federal agencies. He also helps state and federal agencies, industry, and other stakeholders related to the environment and its impact. In a report, Hopkins said that the regulations and oversight should be the foundation of state efforts to lessen the impact of gold mining if it were to resume in the state of Virginia.

“But as Virginia’s laws and regulations currently stand, they are not up to the task of minimizing the risks to Virginia’s communities and the environment by ensuring that industry adheres to modern engineering standards and best practices. Our report points to opportunities to strengthen these systems to minimize the risk of harming water resources, ecosystems, and human health.”

Bodnar, on the other hand, is in charge of providing a detailed description of the geological and geochemical characteristics of the gold deposit found in Virginia, and then extrapolating these data points to identify deposits found in other parts of the world with the same features. †

www.skillings.net 33 January 2023

Biden Failing To Support US Miners?

Daniel Turner, founder and executive director of ‘Power the Future’ admonished the Biden administration for “…creating a demand for these materials and then prohibiting American workers from bringing them to the domestic market.”

The Biden administration has often been accused of delaying, if not outright killing, major mining projects in the US. In January 2022 for instance, the Interior Department canceled two leases for proposed copper and nickel mines in Minnesota. Similarly, the Bureau of Land Management only approved 14 mine plans last year as opposed to the 29 mines approved by the Trump administration in 2018. †

US Arm of Komatsu Opens Job Roles in Finance

As the mining industry continues to evolve and advance in the 21st century, the need for highly trained and skilled Mining equipment operators has become more critical than ever. The opening was for the position of a Cost Accountant and a Senior IT Audit Consultant, as reported on their finance career page. Interns for their Corporate Accounting sector are also welcome to apply if they are pursuing a bachelor’s degree in accounting.

Recently, a Senior Business Analyst position for Komatsu’s subsidiary – Modular Mining Systems Inc. – was also opened on December 18, 2022 for candidates with over three years of experience in the financial planning and analysis sector. Interested applicants can directly apply using the link provided on the company website. †

Nuclear Site Could Replace Lost Mining Jobs In Nottinghamshire

By Marie Gabrielle Laguna

The construction of the UK’s first nuclear fusion site in Nottinghamshire, according to MPs in the county’s former coalfield communities, could replace some of the jobs lost from coal mining.

A national enquiry has been launched to investigate whether job losses in the coal industry have been fully replaced and whether these jobs offer adequate pay and opportunities. A devolution agreement that would grant more power to Nottinghamshire councils has also been mentioned as something that could improve long-term opportunities for people living in former coalfield areas. Since then, studies have shown that people in these former mining areas have a more difficult time finding good jobs than people in other parts of the country. †

Finance-Related Jobs in Mining

As the mining industry is inherently a contract-based one, we find various examples where a single project can put a mining business in jeopardy. This is why mining businesses are always on the lookout for financial experts in specialist job positions.