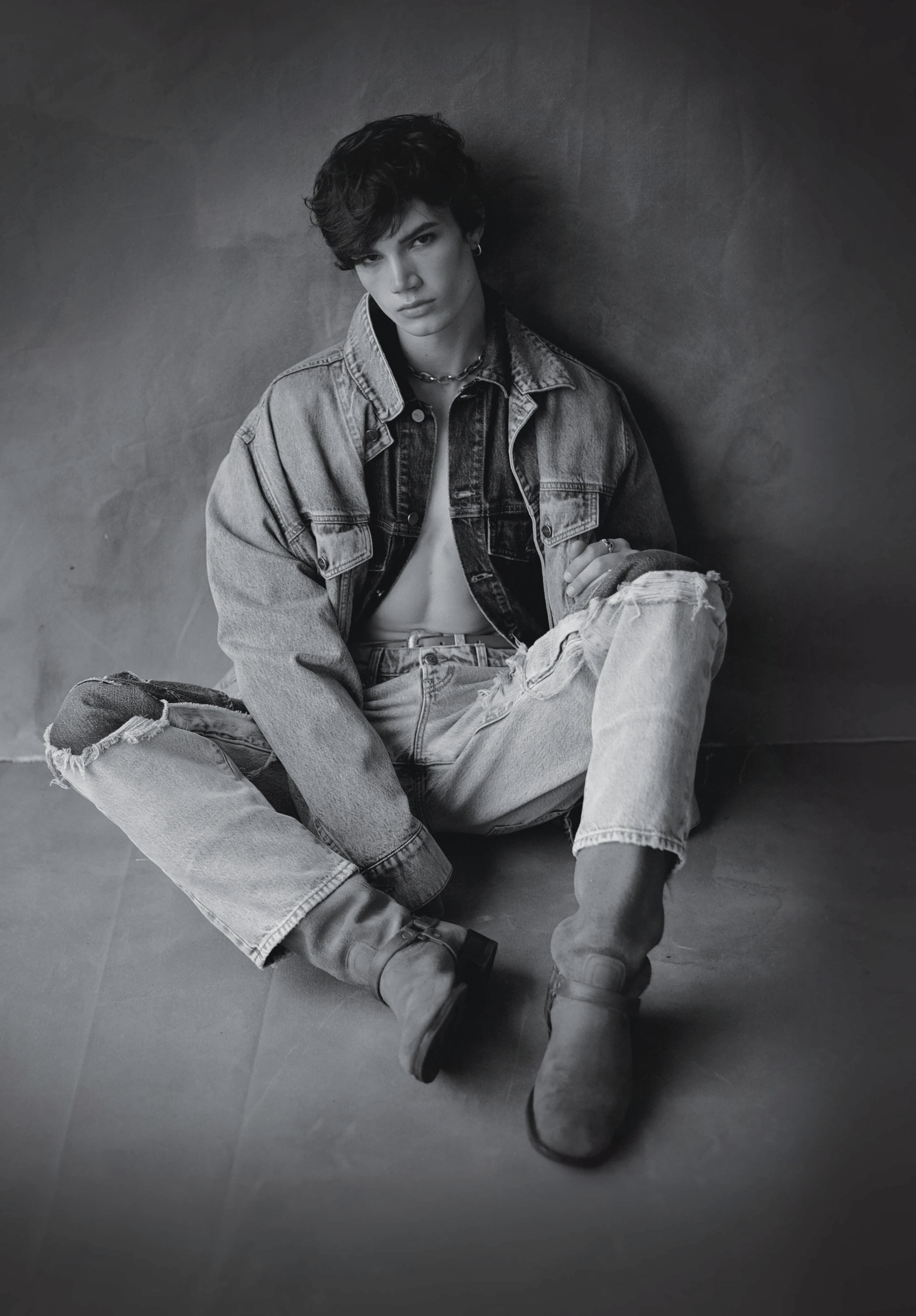

MODEL REINVENTION

IAN JEFFREY NAVIGATES THE FASHION WORLD.

SOURCING JOURNAL • WWD NUMBER 24 • SUMMER 24 FABRIC TRENDS • MEN’S DENIM REPORT • KONTOOR TURNS 5

So that’s the content . Take out Lycra and revise the last line

LYCRA FitSense® is a trademark of The LYCRA Company.

LYCRA FitSense® is a trademark of The LYCRA Company.

EDITORIAL

Peter Sadera Editor in Chief, Sourcing Journal

Angela Velasquez Executive Editor, Rivet

Alex Badia Style Director, WWD

Vicki M. Young Executive Financial Reporter

Jasmin Malik Chua Sourcing & Labor Editor

Kate Nishimura Senior News & Features Editor

Leigh Nordstrom Eye Editor, WWD

Luis Campuzano Senior Market Editor, Men’s, WWD

Emily Mercer Women's Market Editor, WWD

Thomas Waller Senior Fashion Market Editor, Accessories, WWD

Ryan Williams Associate Photo Editor, WWD

Glenn Taylor Business Editor

Meghan Hall Business Editor

Alex Harrell Staff Writer

Lauren Parker Director, SJ Studio

Sarah Jones Senior Editor, Strategic Content Development

Andre Claudio Staff Writer, Strategic Content

DESIGN

Ken DeLago Art Director

Logan Case Senior Designer Erik Pak Senior Designer

Trinity Krakora Designer

SOURCING JOURNAL ADVERTISING

Rebecca Goldberg VP, Strategy & Business Development

Eric Hertzman Senior Director, Sales & Marketing

Deborah B. Baron Advertising Director

Allix Cowan Manager, Audience Development

Darren Dort Media Coordinator

PROD UC TION

Anne Leonard Production Manager

Adeline Saez Production Manager

Therese Hurter PreMedia Specialist

ADVERTISING

Amanda Smith President

Hillari Lazzara Senior Vice President, Sales

Amanda Boyle Beauty Director

Amy Macauley West Coast Director

Jennifer Petersen Fashion and Luxury Ad Director

Sam Rumsky Ad Director, Footwear

Katherine Hogan Account Director, Tech

INTERNATIONAL OFFICES

Olga Kouznetsova European Director, Italy

Giulia Squeri European Director, Italy

Elisabeth Sugy Rawson European Director, France

MARKETING

William Gasperoni Vice President

Christine Staley Senior Director, Marketing and Fairchild Studio

Alexa Dorfman Senior Marketing Manager

Kayla Gaussaint Associate Integrated Manager

Sara Shenasky Head of Client Activation

Barbra Leung Director, Integrated Marketing

OPERATIONS

Ashley Faradineh Director of Operations

Rosa Stancil Media Planner

Emanuela Altimani Senior Sales Coordinator

EVENTS

Julianna Cerchio Executive Director

Joy Chernus Senior Director

Elizabeth Hernandez Senior Associate, Events

Gregory Pepe Manager, Events

Sophie Guzmán Events Coordinator

Lauren Simeone Director, Audience Development

Trish Reidy Attendee Sales Manager

EVENT PROGRAMMING

Caroline Daddario Executive Director, Head of Programming

Alice Song Senior Manager, Programming and Special Projects

HALF TIME

where did the first six months of 2024 go?

One of the side effects of following a seasonal calendar for work and thinking about fall collections in February and 2026 fashion in 2024 is that you tend to lose sight of days, weeks and months. It’s hard to believe that we’re one season out from a U.S. presidential election and two seasons away from starting the cycle all over again.

Summer is a chance to slow down (a little) and take stock of the year so far. In the denim world that means reviewing the innovations coming from the supply chain, and fine-tuning design and merchandising strategies to tap into emerging trends. For this reason, with so much new news out there, we decided to print Rivet’s summer issue versus making it online-only as we’ve done in the past. You will find it at Denim PV, Kingpins New York and Bluezone as well as Pitti Uomo and Chicago Collective.

RIVET IS OWNED AND PUBLISHED BY PENSKE MEDIA CORPORATION

Jay Penske Chairman & CEO

Gerry Byrne Vice Chairman

George Grobar Chief Operating Officer

Sarlina See Chief Accounting Officer

Craig Perreault Chief Digital Officer

Todd Greene EVP, Business Affairs & Chief Legal Officer

Celine Perrot-Johnson EVP, Operations & Finance

Paul Rainey EVP, Operations & Finance

Tom Finn EVP, Operations & Finance

Jenny Connelly EVP, Product & Engineering

Ken DelAlcazar EVP, Finance

Debashish Ghosh Managing Director, International Markets

Dan Owen EVP, GM of Strategic Industry Group

Brian Levine Senior Vice President, Revenue Operations

Brooke Jaffe Senior Vice President, Public Affairs & Strategy

David Roberson Senior Vice President, Subscriptions

Doug Bandes Senior Vice President, Partnerships PMC Live

Frank McCallick Senior Vice President, Global Tax

Gabriel Koen Senior Vice President, Technology

Jessica Kadden Senior Vice President, Programmatic Sales

Judith R. Margolin Senior Vice President, Deputy General Counsel

Ken DelAlcazar Senior Vice President, Finance

Lauren Utecht Senior Vice President, Human Resources

Marissa O’Hare Senior Vice President, Business Development

Nelson Anderson Senior Vice President, Creative

Nici Catton Senior Vice President, Product Delivery

Adrian White Vice President, Associate General Counsel

Andrew Root Vice President, Digital Marketing

Andy Limpus Vice President, Executive Search & Head of Talent Acquisition

Anne Doyle Vice President, Human Resources

Ashley Snyder Vice President, Associate General Counsel

Brian Vrabel Head of Industry, CPG and Health

Constance Ejuma Vice President, SEO

Courtney Goldstein Vice President, Human Resources

Dan Feinberg Vice President, Associate General Counsel

Denise Tooman Vice President, Marketing, Strategic Solutions Group

Eddie Ko Vice President, Advertising Operations

Greta Shafrazian VVice President, Business Intelligence

Jamie Miles Vice President, eCommerce

James Kiernan Head of Industry, Agency Development

Jennifer Garber Head of Industry, Travel

Jerry Ruiz Vice President, Acquisitions & Operations

Joni Antonacci Vice President, Production Operations

Karen Reed Vice President, Finance

Karl Walter Vice President, Content

Katrina Barlow Vice President, Business Development

Kay Swift Vice President, Information Technology

Keir McMullen Vice President, Human Resources

Matthew Cline Head of Automotive Industry

Mike Ye Vice President, Strategic Planning & Acquisitions

There are plenty of new technologies to make the denim-making process more efficient—if brands are willing to invest in it. In “Building Blocks” (pg. 44), we dive into the Fall/Winter 2025-2026 fabric constructions and fiber technologies laying the groundwork for more durable, sustainable and performance-driven products. In “Variety Show” (pg. 36), you can hear from men’s denim brands and analysts about the category’s growth opportunities.

Kontoor Brands CEO and president Scott Baxter knows a thing or two about identifying opportunities. In “High Five” (pg. 20), find out how reinvesting in two leading heritage brands—Wrangler and Lee—is leading to new product categories and a flourishing women’s business.

Summer is also a chance to relax and recharge for the remainder of the year. Find out how to stay cool in denim in “Hot Stuff” (pg. 40). We curate the ultimate travel wardrobe in “Vacation Mode” on pg. 4, and we check in on the artists and athletes ready to entertain us in “The Zeitgeist” on pg. 13.

In between our summer vacations, the editorial and events teams will be busy preparing for the inaugural Sourcing Journal x Rivet Sustainability LA event on Sept. 26. Themed “Sea Change,” the full-day conference will present case studies and actionable insights showing how to propel environmental and social responsibility forward. I hope to see you there!

ANGELA JEAN VELASQUEZ avelasquez@sourcingjournal.com

01 • RIVET MASTHEAD EDITOR'S LETTER

▲ Wrangler brings denim to the beach. COURTESY

PENSKE MEDIA CORPORATION

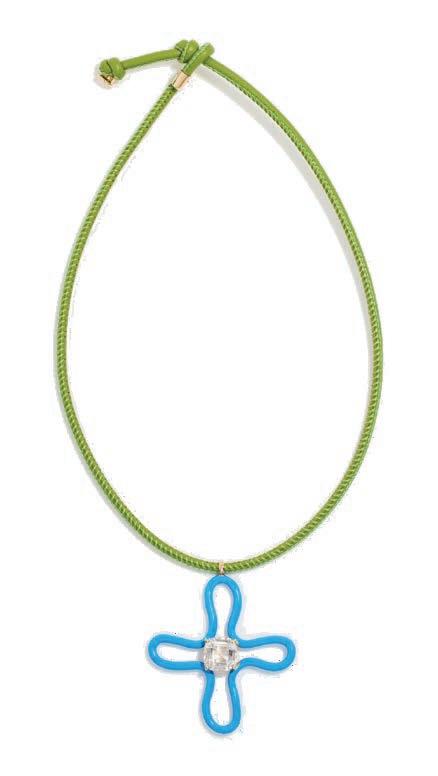

2 • RIVET CONTENTS THERE’S NO ONE I CAN REALLY COMPARE MY CAREER TO.” Ian Jeffrey Cover: Dries Van Noten trench coat, Dior Men shorts, Kenzo gloves.; This Page: Khaite denim jackets, Diesel jeans, Maximum Henry belt, Title of Work necklace, Model’s own boots. Photographs by Matthew Tyler Priestley 05 NOW BOARDING Fashion essentials for the summer’s hottest destinations. 13 THE ZEITGEIST The upcoming albums, movies and TV shows to have on your radar. 16 ALL THAT JAZZ Born out of a love for jazz and Japanese denim, Blue In Green remains focused on delivering quality and community. 18 GLOW UP Area co-founder and creative director Piotrek Panszczyk on elevating denim. 20 HIGH FIVE Kontoor Brands CEO Scott Baxter reflects on the company’s fifth anniversary. 24 MODEL MUSE Ian Jeffrey navigates the modeling world. 36 VARIETY SHOW Denim brands see new opportunities as male consumers try different fits. 40 HOT STUFF The denim industry prepares for another summer of record-breaking temperatures. 44 BUILDING BLOCKS Denim mills focus on color, circularity and alternative materials for Fall/ Winter 2025-2026. 50 FANTASY FABRIC Denim gets its fairytale moment.

2-4 JULY 2024

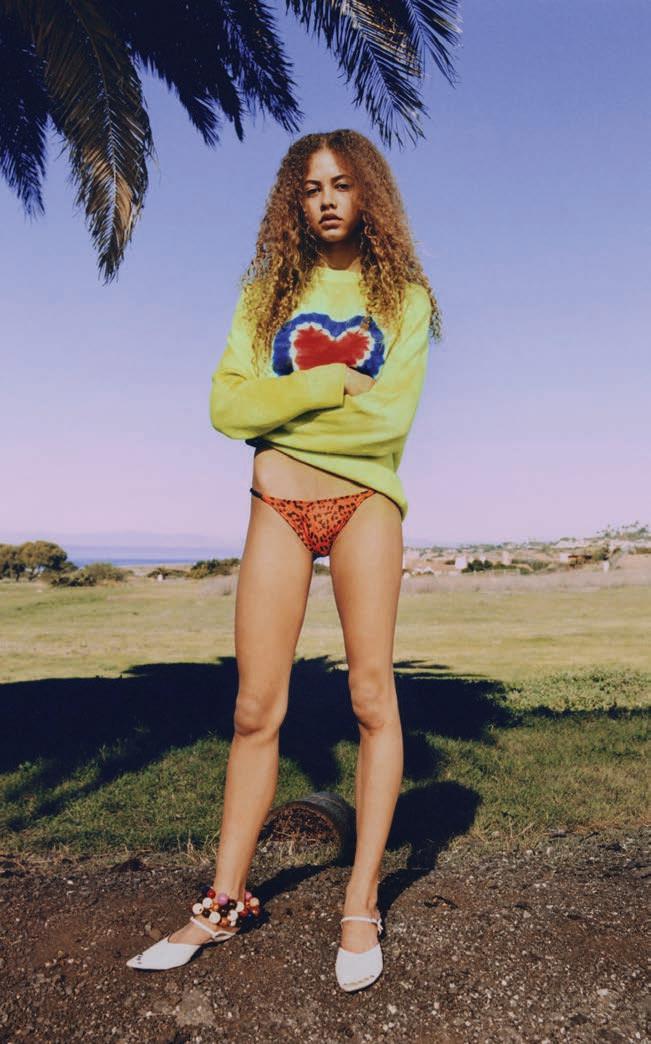

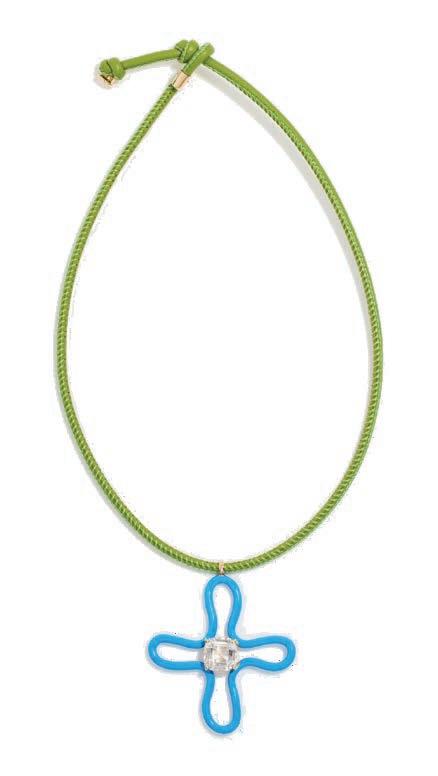

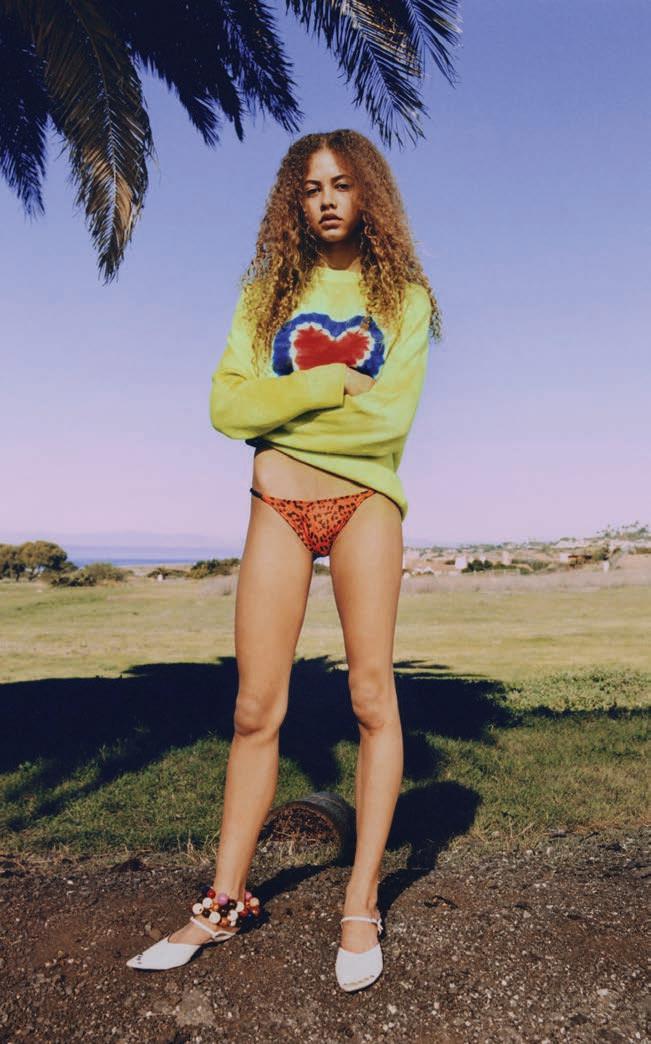

NOW BOARDING

The fashion essentials for summer’s hottest destinations. PULSE

RIVET 5 GREG VAUGHAN FOR WWD ▲ DENIM & SUPPLY RALPH LAUREN VINTAGE JEANS, SPEKTRE SUNGLASSES

Pack your party clothes for this Spanish hot spot.

PULSE

6 • RIVET COURTESY IBZ

▲ ISABEL MARANT SNEAKERS

▲ HELMUT LANG JEANS

▲ ARNETTE SUNGLASSES

AND

THE ELDER STATESMAN LOOK ► EUGENIA KIM SEQUIN BUCKET HAT

▲ IBIZA BOHEMIA ASSOULINE ▲

DIESEL TANK

SHORTS ▲

MAISON IREM BEADED NECKLACE

▲

ISLΛNDS

Soak up the sun in artisan details and organic motifs.

PULSE

Λ N COURTESY ▲ COACH SUNGLASSES ASSOULINE BE BONGIASCA NECKLACE ▲ AL É MAIS JACKET ▲ AMIRI SHIRT ▲ AL É MAIS DENIM SKIRT GR ▲ SANDRO BUCKET HAT ◄ SCOTCH & SODA JACKET

GRΣΣK

BOH Σ MI

@coterie_showwww.coteriefashionevents.com

SEPTEMBER 22-24, 2024

From emerging to established labels, observe the evolution of denim and shop a blend of advanced contemporary and contemporary women’s fashion. YOUR DENIM GUIDE FOR FW24 READ MORE

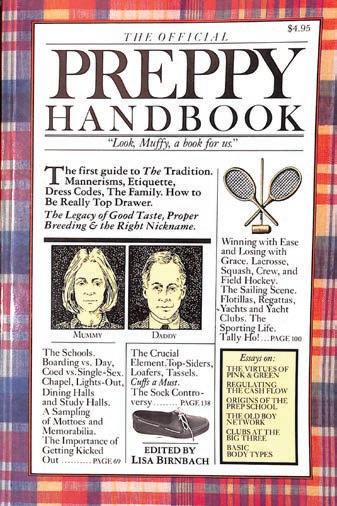

Hamptons Prep

PULSE Cool down in old money

looks.

EH 10 • RIVET EDITED BY ALEX BADIA LUIS CAMPUZANO EMILY MERCER + THOMAS WALLER COURTESY ▲ 3.1 PHILLIP LIM DENIM TOTE ▲ STAUD LOOK ▲ CASABLANCA DRESS ◄ ZIMMERMANN ESPADRILLE ▲ POLO RALPH LAUREN SOCKS ▲ HAMPTONS PRIVATE ASSOULINE ▲ JENNIFER ZEUNER GOLD EARRINGS

THE ZEITGEIST

The upcoming albums, movies and TV shows to have on your radar. by Andre

MOVIES

BAD BOYS RIDE OR DIE

Will Smith and Martin Lawrence return to the screen as Detective Mike Lowrey and Detective Marcus Miles Burnett for the highly anticipated “Bad Boys 4.” In theaters on June 7, the duo finds themselves in Miami and on the opposite side of the law. It is the fourth installment of the Bad Boys franchise, which began in 1995.

THE BIKERIDERS

Written and directed by Jeff Nichols, “The Bikeriders” transports viewers to the 1960s Midwestern biker scene. The film follows Benny (Austin Butler), a member of the motorcycle club the Vandals, as the group is lured into organized crime.

DEADPOOL AND WOLVERINE

Hugh Jackman returns to his iconic X-Men role, Wolverine, for the first time in seven years in “Deadpool and Wolverine.” In theaters July 26, the action film finds Wolverine

recovering from his past injuries when he’s recruited by Ryan Reynold’s sarcastic Deadpool character to save the world.

INSIDE OUT 2

Movie goers will be in their feelings when Disney releases “Inside Out 2” on June 14. A sequel to the 2015 hit that introduced Joy, Fear, Anger, Disgust and Sadness to the children and Disney adults alike, Inside Out 2 will feature new characters that are bound to resonate with audiences in 2024, including Anxiety voiced by Maya Hawke.

MUSIC

CHARLI XCX, “BRAT”

Charli XCX is back with a fresh set of club bangers. On June 7, the 31-year-old British avantpop and electronic star will release her sixth studio album, “Brat.” The album follows up her 2022 album “Crash,” which was her most successful to date. The new 15-track album features her hit Y2Kinspired single “Von Dutch” with influencer Addison Rae, along with “Brb,” “Sympathy is a Knife,” “360” and “Club Classics.” Charli XCX is taking the songs on the

road in June starting a global tour that will take her across Europe and the U.S. It will conclude in Glasgow in December.

NORMANI, “DOPAMINE”

Since parting ways with girl group Fifth Harmony in 2018, fans have been vocal about waiting six years for Normani’s solo debut album. The 27-year-old “Motivation” singer is in on the joke too—the website for her highly anticipated debut album is whereisthedamnalbum. com. Fans won’t have to wait any longer when “Dopamine” drops on June 14. Said to represent “liberation and freedom,” the album will show a new side of Normani. The first single is the R&B-infused track “1:59” featuring rapper Gunna.

TYDE LEVI, “A THOUSAND WAYS TO SAY NOTHING AT ALL”

From YouTube sensation to pop star in the making, 24-year-old Australian singer and songwriter Tyde Levi is gearing up for the

▲

Denim and leather hit the big screen in “The Bikeriders.”

▼

Diane von Furstenberg’s story comes to Hulu.

release of his debut album this month. Titled

“A Thousand Ways to Say Nothing at All,” Levi said the album was born from the “rollercoaster of emotions” following a breakup and subsequent fling. The 8-track album was a way for Levi to navigate through the chaos and reflect on the love he’d lost and found along the way.

“In my past [relationship], I don’t think I was being completely honest with myself and the people around me. I might have been saying one thing but thinking another,” Levi told Rivet. “Making this album was like being alone in my bedroom, allowing myself to

express these thoughts and feelings, putting them on paper and into melody. It helped me gain clarity and be honest with myself, something I wasn’t doing with others.”

STREAMING

THE BACHELORETTE

Get ready for another wild journey to find love when “The Bachelorette” returns on July 8 on ABC. Season 21 of this guilty pleasure will center on 25-year-old Floridian and the first Asian-American lead, Jenn Tran. Known for her charming and bubbly personality, Tran first caught viewers’ attention on Joey Graziadei’s season of “The Bachelor” and has now been brought back for her own quest for love.

DIANE VON FURSTENBERG:

WOMAN IN CHARGE

Diane von Furstenberg is the latest designer to get the documentary treatment. The trailblazing designer reflects on her life and work in the Hulu documentary out June 25. The film looks at how von Furstenberg challenged industry norms while being at the center of New York’s cultural scene.

EMILY IN PARIS

The Netflix’s hit series “Emily in Paris” returns in two parts, with the first installment premiering Aug. 15 and the second dropping on Sept. 12. While details about the plot remain tightly under wraps, it’s anticipated that viewers will witness the long-awaited romantic sparks between Emily (Lily Collins) and Gabriel (Lucas Bravo), especially now that Camille (Camille Razat) has called off the wedding. ■

RIVET 13 THE BIKERIDER: KYLE KAPLAN/© FOCUS FEATURE/COURTESY EVERETT COLLECTION • DVF: ROSE HARTMAN / CONTRIBUTOR CHARLI XCX: HARLEY WEIR

Claudio

Charli XCX’s “360” is an early contender for song of the summer.

“I DON’T THINK HEALING IS EVER LINEAR OR A SMOOTH PROCESS. IT CAN BE BEAUTIFUL AT TIMES AND SUPER PAINFUL AT OTHERS.”

FINDING FLETCHER

Pop star Fletcher on the healing powers of making music. by

Andre Claudio

● Initially conceived as a quest to heal from heartache and loss, Fletcher’s sophomore album “In Search of the Antidote” delves into the complexities of self-discovery and embracing the highs and lows.

“I was navigating a lot, health-wise, so I didn’t really have the energy or desire to put on any facade,” the 30-year-old American pop star told Rivet. “I just created the music as an outlet, a true space of healing, and it ended up being my favorite album yet.”

Though Fletcher, who stepped into the spotlight in 2015 with her debut single, “War Paint,” said the journey to heal has “been full of challenges,” she has found the silver lining.

“I don’t think healing is ever linear or a smooth process,” she said.

“It can be beautiful at times and super painful at others.”

One way Fletcher set out to find peace was through silence.

“I deleted social media, went away for a while and things got quiet,” she said. “But then,

Q&A

What is your favorite pair of jeans? Right now, I’m obsessed with my Re/Done jeans. They’re all I have on tour with me.

Who is your fashion inspiration?

Gwen Stefani and early Madonna.

What’s one thing you must bring on tour with you? I have a couple of staples, but my skincare products are an absolute essential.

I noticed all the other thoughts and emotions that got really loud. I allowed it all to surface and learned more about who I am outside of any of the external validation. And from the self-discovery, my album [was born].”

Since its release in March, “In Search of the Antidote” has debuted at No. 3 on Billboard’s Top Album Sales chart giving the singer her highest-charting set yet on the tally. Building on this momentum, Fletcher is hitting the road this year with a tour that has already taken her to South America and Europe. The Australian and New Zealand legs will commence on July 16 in Perth. She’ll hit the U.S. with 14 shows this fall.

While touring can be strenuous on the mind and body, Fletcher is finding motivation through her fans.

“The support from the fans has been incredible. Getting to travel around the world right now to scream these songs with all of them has been such a dream,” Fletcher said, adding that there’s nothing like hearing new songs sung back to you for the first time. “They’ve been on this journey with me for a while so just getting to be together again has been such a celebration of the album.” ■

What are your big astrological three?

Pisces sun, Libra rising, Gemini moon (yikes, I know).

What is your vice of choice? I don’t know that I have a vice. Maybe looking at exes’ Instagram pages when I need to feel something.

What trend are you currently obsessing over?

Billie Eilish’s new album.

What can fans expect on tour, style-wise? I’m always switching things up. Right now, I’m really channeling classic black and white and keeping it simple—with an edge, of course.

Gwen Stefani and Avril Lavigne are forever the reference.

What keeps you up at night? “Karma” by Jojo Siwa. I think about that song daily.

14 • RIVET FLETCHER: SEBASTIAN FAENA MADONNA & BILLIE: GETTY • ASTROLOGY: ADOBE STOCK THE ZEITGEIST

BREAKING BOUNDARIES

Jeffery “B-Boy Jeffro” Louis can’t wait to make heads turn at the 2024 Paris Summer Olympics. by

Andre Claudio

● Though the Olympics has been around for more than 3,000 years, the 2024 Paris Summer Olympics (July 26-Aug.11) will shatter the mold as breaking—the dance style born in the Bronx in the 1970s—becomes an official sport.

Described by the Olympics as a sport characterized by acrobatic movements, stylized footwork and the inclusion of a DJ and MC (master of ceremonies) during battles, breaking is widely known for its deep roots in youth and hip-hop culture. The competition at the Paris 2024 Olympic Games will include a men’s event and a women’s event where 16 B-Boys and 16 B-Girls will face off in solo battles. The athletes will use a combination of

I KNOW SOME PEOPLE SEE BREAKING AS JUST DANCERS DOING HEAD SPINS, BUT IT’S SO MUCH MORE THAN THAT.”

iconic breaking moves like windmills, the 6-step, and freezes as they improvise to the beat of the DJ’s tracks.

Jeffery “B-Boy Jeffro” Louis, the 2022 FISE Montpellier World Series champion, 2022 Breaking for Gold Montreal champion and fifth-ranked B-Boy in the world, will represent Team USA in the competition.

Hailing from Houston, Texas, 29-year-old Louis—

whose signature move is the “switch away,” an illusion where he moves one way and does a flip the other way—began breaking in middle school. “My brother was the one that got me into breaking when I was 10 years old,” Louis told Rivet. “He was enrolled in a program during high school and would come home after and show me the moves he learned. That’s really where my love for the sport stems.”

Besides competing, Louis has turned his passion into a business to help others. In 2019, he launched FitBreak, a training program that combines hip-hop’s full-body movement with fitness exercises.

While Louis said he never dreamed that he’d make a career out of breaking,

SPORTY SPICE

The Olympics serve as the pinnacle of athletic competition, but some athletes approach the games with more style than others. Here’s a look back at some of the most fashionable moments in Olympic history.

COOL JEANS

Burton paid tribute to American jeans with its design for the U.S. snowboarding team during the 2010 Vancouver Winter Olympics. The snowboard brand partnered with Gore-Tex to make the athletes technical pants that resembled vintage denim.

DOUBLE DENIM

Team Canada sported Canadian tuxedos to the 2020 Tokyo Olympics closing ceremony. Canadian retailer Hudson’s Bay orchestrated the outfits by partnering with U.S.-based Levi’s to make the team unisex Trucker jacket and white jeans—Levi’s 502 tapered jeans for men and white 721 high-rise skinny jeans for women.

The jacket was boldly decorated with spray painted Tokyo and Canadian flag motifs.

GRILLS AND GILLS

let alone earning a place in Team USA, he plans to make the most of his Olympic moment by showing the world the level of commitment, passion and energy that makes breaking a magnetic sport to watch.

“Breaking is a party, and I’m ready for it to shock the world,” Louis said. “I know some people see breaking as just dancers doing head spins, but it’s much more than that.”

“To me, breaking’s inclusion in the Olympics is a chance to educate on its true essence as a cultural movement,” he added. “By participating in this momentous moment, I’m looking forward to educating the world on breaking and showing young breakers what’s possible when you put in the hard work.” ■

Gold medalist swimmer Ryan Lochte shocked the Olympic world when flashed his all-American smile at the 2012 London Summer games. The Team USA star infamously wore a $25,000 star-spangled-inspired grill to collect his gold medal.

COWBOY COOL

For the 1980 Lake Placid Winter Olympics, Levi’s outfitted Team USA in a 30-piece collection would fit in with the current Western fashion trend. The collection included jeans for men and denim skirts for women, wool sweaters, plaid shirts, shearling jackets, cowboy hats, boots and more. Valued at $1,200 in 1980, the collection would be worth approximately $4,500 today.

RIVET 15 JEFFERY LOUIS: COURTESY • SHAUN WHITE & 1980 TEAM USA: GETTY

▲

▲

ALL THAT JAZZ

for nearly 20 years , Blue In Green’s detail-obsessed staff has served up indigo-loving New Yorkers and in-theknow visitors with rare and premium denim brands.

While the name may seem like a nod to the boutique’s beloved hue (blue) and its prime location in New York City’s SoHo nabe (Greene Street), real denim heads know the moniker is an homage to Miles Davis, specifically a tune from the jazz musician’s famed 1959 “Kind of Blue” album.

Jazz and jeans are how Blue In Green founders Gordon Heffner and Yuji Fukushima initially connected in 2006, bonding over a mutual interest in men’s wear and melodics. With a penchant for Japanese selvedge denim, their store quickly became the Japanese denim destination in the U.S.

The 900-square-foot store was initially stocked with small-scale brands like Samurai and Studio D’Artisan that Heffner packed into his suitcase during his trips abroad. At the time there wasn’t much of a denim scene but that changed as more consumers learned about the products’ backstories and how they were made.

In the nearly 20 years since Blue In Green opened, the owners have expanded their vision. Geoffrey Chorbajian joined the fold, sharing the title of owner with Fukushima, while Heffner exited in 2019. A second store was opened last fall in Denver. Social media is a growing priority, and there’s more brands, accessories and knickknacks by labels like Beams Japan to peruse.

New York buyer Naoki Hamano—who came on board around the same time Heffner left—has expanded the shop beyond just denim, with Blue In Green now carrying clothing brands inspired by heritage and utility like Engineered Garments and Lite Year.

Though Hamano can identify the differences between any two selvedge jeans in the store, the average consumer just sees a sea of blue, he said.

“Denim and jeans all look the same,” he said. “Most people, you know, don’t see the difference. And we have a lot of jeans from different brands. They all look the same. I want the customer to be excited.”

16 • RIVET

Born out of a love for jazz and Japanese denim, Blue In Green remains focused on delivering quality and community. by Alex Harrell

Natural sunlight fills the back of Blue In Green’s space in SoHo.

JAPANESE PEOPLE REALLY WANT TO

DIVIDE DENIM AND FASHION—BUT THIS IS NEW YORK.” Naoki Hamano, Blue In Green

When Hamano was working at a clothing store in Tokyo, a designer once told him to make his own style. Don’t just buy brands. He’s taken that to heart at Blue In Green by stocking a variety of fashion brands so customers can curate their own look.

“I want to give the customer more options, more interesting items,” he said. “Japanese people really want to divide denim and fashion—but this is New York.”

Premium denim remains Blue In Green’s bread and butter. The store stocks brands like Oni, Orslow, Kapital and Fullcount. The retailer still hems any pair of purchased jeans for free with a Union Special 43200G chain stitch machine from the 1950s.

Despite the store’s evolution, maintaining its point of view for the past 18 years has been relatively simple: it’s all about community.

One way of fostering this family is through Instagram. Run by Victoria Vasquez, the store’s social media coordinator, 34,000 followers flock to Blue In Green’s page for the scoop on new arrivals as well as product highlights.

“I think there’s two audiences that we speak to because every day, we’ll have someone come in and it’s their first time,” Vasquez said. “But, more than anything, it’s people that are very well aware of who we are and what we carry. We have a lot of loyal customers, especially with denim; they’re very locked in.”

JEAN GEMS

NEW YORK CITY IS A DENIM GOLD MINE. DIG THROUGH RIVET’S TOP PICKS.

Self Edge ▲

157 ORCHARD STREET, NEW YORK, NY 10002

Husband-and-wife business partners Kiya and Demitra Babzani opened Self Edge in 2006 after falling in love with Japanese brands producing vintage American-style garments. Nearly 20 years later, Self Edge has six stores and the largest selection of Japanese selvedge denim, offering over 200 different styles. Don’t forget to get Self Edge’s fridge magnet with care instructions. The store gives first-time clients the momento to help demystify how to take care of denim.

Standard & Strange

238 MULBERRY STREET, NEW YORK, NY 10012

From classic selvedge jeans by Ginew, Mr. Freedom and Fullcount to W’Menswear’s patchwork flight pants and Black Sign’s 1900s-inspired waist overalls, Standard & Strange is full of welcomed surprises. Taking its slogan “own fewer, better things” to heart, the Oakland, Calif.-based retailer works exclusively with vendors and brands that manufacture ethically and design garments built to last.

The Vintage Twin

However, in a city of 8.3 million people, don’t underestimate the power of IRL interactions.

“I know online is the ‘thing’ right now but real connection—like inperson—is very important to make community,” Hamano said, noting that one way to strengthen Blue In Green’s community is through events and brand collaborations.

“I’ve been working here for over 10 years, and I always felt like we didn’t have enough connection between brands or customers and that’s why I’m wanting to—little by little—work with brands and have more events,” he said. “And I think it’s been successful so far. Now more people are paying attention to Blue In Green; years ago, very few people were paying attention.” ■

597 BROADWAY, NEW YORK, NY 10012

The Kaia Gerber-approved SoHo store makes finding the right vintage jeans a breeze. The store’s sales associates take pride in their ability to find customers their size, often on the first try. Come here for faded Wranglers and Levi’s 501s, Marithé Francois Girbaud cargos from the ’90s, Y2K jeans by Dollhouse and heaps of novelty T-shirts and sweatshirts.

Brooklyn Denim Co.

338 WYTHE AVE, BROOKLYN, NY 11249

The Williamsburg store has dressed heritage-loving locals with a curated selection of American-made labels and raw denim since 2010. While the store has evolved with its trendy neighborhood—it added the BDC Café serving La Colombe coffee in 2021—it continues to tap into denim head culture by providing mending and tailoring services and stocking quality brands like Blackthorn Denim, First Standard Co. and its eponymous house label.

RIVET 17 COURTESY RIVETING RETAIL

GLOW UP

since 2014 , Area co-founders Piotrek Panszczyk and Beckett Fogg have been carving out a special space in the fashion industry for their quality craftsmanship, textile development and creative embellishments. The result is ultra-innovative, high fashion garments—with clever, often humorous winks. → Thanks to its cult-like following from celebrities and consumers alike, Area’s creative director, Panszczyk, has expanded the brand’s unique take on beauty beyond its megawatt crystalized occasion dresses, performance fashions and couture styles. An expanded range of everyday wardrobe silhouettes like humble blue jeans are imbued with Area’s signature playful glamour.

18 • RIVET

Area co-founder and creative director Piotrek Panszczyk on elevating denim. by Emily Mercer

▲ Area co-founder and creative director Piotrek Panszczyk.

► Head-to-toe denim and glitz.

► The Spring 2022 collection was inspired by showgirls.

◄ ▼ Jumbo crystals decorated denim pieces in Area’s Spring 2024 collection.

◄ Some of Area founders’ favorite denim pieces.

► Crystals and cutouts are house signatures.

I WAS NEVER THE TYPE IN SEARCH FOR THE PERFECT DENIM, FOR ME DENIM WAS A TOOL FOR SELF EXPRESSION.”

Take for instance Area’s Resort 2024 collection, which Panszczyk said was about “doubling down on everyday wardrobing, the Area way.” → Here, Panszczyk shares his denim-filled mood board of inspirations, Area fashions and a behind-the-scenes look of his design process.

Rivet: What’re your biggest inspirations when designing new denim styles?

Piotrek Panszczyk: I usually try to approach denim from two different angles: on one hand thinking of innovative ways to play with material and or shape, and on the other as an item that will both stand out and blend into your everyday wardrobe.

Rivet: Any particular or iconic denim, fashion or era references?

PP: The ongoing recontextualization of denim within culture is always a point of reference within my work.

Rivet: What words do you associate with your designs?

PP: Innovative, iconic, expressive.

Rivet: How do you personally wear your denim, or how would you style Area denim from dayto-day?

PP: Personally, I like to wear tromp l’oeil denim styles, so textiles that mimic the look of denim but are actually fabrics like leather or viscose—something that to the eye seems casual, but in reality, is something very special.

Rivet: Do you have any nostalgic or specific memories regarding denim throughout your life?

PP: I remember going to Antwerp and finding these hyper-shredded Margiela jeans that I couldn’t afford, so I re-created them myself by studying the technique and creating the look myself with a vintage pair. I was never the type in search of the perfect denim, for me denim was a tool for selfexpression. There was something so accessible about it but also unique depending on how you style it, so my first ways of expressing myself through fashion a lot of times were rooted in denim. ■

RIVET 19 MOOD BOARD

20 • RIVET

HIGH FIVE

vf corp. completed the separation of VF’s Jeanswear organization into the independent, publicly traded company called Kontoor Brands, Inc. on May 23, 2019. → The horizon was bright and blue for the thennewly minted parent company of legacy denim brands Wrangler and Lee. Buoyed by a strong foundation and new freedom, the Greensboro, N.C.-based company set ambitious goals to reclaim its position as a leader in denim. At the time of the spin-off, Kontoor announced five strategic priorities: scaling the denim business; growth in high-value segments channels and regions; new custom acquisition; margin expansion and improving capital efficiency; and creating an engaged and performance-driven team. → Covid-19 stalled some of these efforts but compared to other companies in their infancy when the pandemic struck, Kontoor was in a unique position in that it had the heritage of century-old brands and an experienced team on its side. → “I think that we’ve taken on a leadership role in a short period as a company, as far as doing the right things,” said Scott Baxter, Kontoor Brands president, CEO and chair of the board. “And we’re going to continue to do that going forward.” → Here, Baxter discusses the challenges and opportunities ahead for Kontoor and how tapping into new categories is creating “a lot of heat around the heritage brands.”

Rivet: How did the five strategic priorities hold up?

Scott Baxter: They went according to plan, some a little bit better than others. The key was making sure that we continued to focus on our core business because that’s what pays the bills at the end of the day. That was what we had as our crown jewel when we spun off. We needed to make sure that we grew that, and we have done that.

As we thought about the business, there were other segments and opportunities for us to grow, like in our outdoor business, T-shirt business, workwear business, and recently, we just announced our golf business. About a year and a half ago to two years ago, we announced our Wrangler Angler, our fishing business. There were categories that we weren’t playing in that we needed to that were important for us. And then those bring in a new set of consumers and new channels of distribution. They just bring a little bit of heat to our brands in addition to our licensing business. We didn’t have a big licensing business at the spin, but we’ve put a lot of focus on it. Now it is a much bigger licensing business than we were

at that point in time with the right partners and right products.

As far as reaching new customers, we’ve become a more global company. We have our own infrastructure versus being part of a parent company in South America. We’ve got our own licensing and distribution business down there. We have our own go-to-market teams and headquarters in Europe and in Asia. It’s a more complex business but bigger and much more branded and more forward facing.

We also have a strong directto-consumer business in a lot of those markets I mentioned too. We talk a lot about gross margins and that’s from running a good business and creating products that people want to buy at full price through the direct consumer channel, e-commerce channel and with our big wholesale partners. From a capital standpoint, we have very low levels of debt, and we invest a lot of money into our people and our brands.

It takes a while to create culture because when you spin off another company, you kind of bring that culture. It’s clone and go on so many points so that you get the spin off done quickly and efficiently because that’s what everyone wants in the beginning.

I think over the time we’ve been spun from them, and become our own company, we have created a good performance driven culture.

Rivet: In hindsight, would you change any of the decisions made during the pandemic ?

SB: We made the right decisions. As a company, we cut spending across the board, which at that point in time was a really significant decision. We pulled what I would call the controllable levers to protect the company because, as you know, people stopped spending right away and companies and retailers closed. It was a very scary time, but I think the decisions we made at that point in time were right, and part of the reason for that was that we had a very experienced team. From the standpoint of folks like me who had the financial crisis of 2000s still fresh in our minds, we remembered how difficult that period was. That was still fresh in my mind and some of the things in the playbook that we had from back then we just kind of dusted off and used. So, I was proud of the decisions, and I was proud of the speed at which we did those decisions. We moved very quickly. We would have gotten things done

IT'S A MORE COMPLEX BUSINESS BUT BIGGER AND MUCH MORE BRANDED AND FORWARD FACING.”

▲ Scott Baxter, Kontoor Brands president, CEO and chair of the board.

◄ Women's denim is a key growth opportunity for Kontoor's Wrangler and Lee brands.

even faster. Without the pandemic, we would be a year or two ahead of where we are now related to our culture and related to the ERP.

Rivet: What is Kontoor’s biggest achievement since the spin off?

SB: Creating a new culture, which is very difficult to do, is probably the biggest achievement. Creating a culture of winning, a culture of excellent brands with tremendous people helping drive them. I think the fact that we resurrected two brands that were great brands but had not been invested in for many years is the achievement of the whole team—supply chain, merchandise, sales, finance. The team resurrected those brands from a real place of struggle in that they had lost that top of mind conscious with the consumer. We brought them back in five years, what I would say is a short period of time especially with a pandemic thrown in.

COURTESY RIVET 21 CEO Q&A

Kontoor Brands CEO Scott Baxter reflects on the company’s fifth anniversary. by Angela Velasquez

Rivet: How has Kontoor’s wholesale business changed?

SB: One of the things that we talk about a lot, and that’s been a key advantage for us, is that our wholesale partners are the best in class. If you think about Walmart, Target, Boot Barn, the different folks relative to who we do business with, they’re in really good shape. They’re important customers of ours and we feel really good about the people that we do business with and the people that we have really long-standing partnerships with. There’s no question that we’re going to continue to support wholesale in a very big and strategic way. It’s an important business, a core part of our business and a business that’s going to be very important for us going forward around the globe.

Rivet: What about Kontoor’s direct-to-consumer business?

SB: We’re building stores in all regions. One of the biggest things that we’re doing here is we think there’s opportunity for us in North America for a bigger footprint. We really don’t have that many marketplaces this size. And it’s a little bit of the same in Europe, we’ve been building full price stores and that’s going well. In India, we have a licensing and

distribution model. We have partners that build stores that are local operators, and they know the marketplace and the consumer really well. We have a similar story at China, where we are going to refurbish quite a few of our stores over the next 24 months and we've already started. During the pandemic, China was closed a little longer than us, so they opened up a little later. So now we’re getting the chance to go ahead and invest back in those stores that have been closed for a long time.

Rivet: How is Kontoor keeping up with the innovation happening in denim?

SB: We’ve leaned heavily into water savings in our plants and with a foam dyeing process that we have with mills. Denim can consume a lot of water during the process of dyeing and now we’ve gone to a foam dyeing process which uses much less, in some cases, almost no water usage. That has been really strategic with the mills that we’ve done that. Then we focused on a reduction of energy and clean energy in our

13,000+ Number of employees

141 MILLION number of finished goods manufactured or sourced in 2023

10 BILLION LITERS amount of freshwater saved since 2008

185 number of suppliers

$631 MILLION Q1 2024 revenue $2.57 BILLION TO $2.63 BILLION expected revenue for 2024

own factories and distribution centers. We spent a lot of time [innovating] ourselves and also with our partners and suppliers.

Rivet: What have been the most effective ways to reach new consumers?

SB: Everybody goes back to how they’re utilizing social marketing and different things like that, but I have a different opinion. The single most effective thing we’ve done is we built a really great product with a great design and merchandising team. People want to wear and show up to events in our product. That’s the differentiator for us. After that, most of the excitement from the consumer—the consumer wanting to pull that product into their universe— comes from creating good brand platforms, marketing platforms, social media platforms and collaborations. But it starts with product and ends with product, and I think that’s how you get the consumer involved and get them excited.

You’ve got to sell product to start creating profit to go ahead and have a company, obviously. Our big differentiator is that we went from a company that, for a long time prior to the spin, wasn’t developing and building great products. We curtailed that; we hadn’t given

the investment to our people that they needed to do that. Once we opened that box up and gave them the investment to go ahead and design and build great products, that excited consumers. That’s where everything took off for us. So as far as how we’re attracting new consumers, we’re attracting them because they’re going to our website, they’re going into our e-commerce sector, seeing our product at our wholesale partners and they’re saying “holy cow, I love this product, I love this fabrication, I love this decoration, I love the flares, I love the skinnies, I love the jean dresses”—whatever it may be its product that people want to wear and that’s where it all starts for us.

Rivet: Are you reaching more female consumers?

SB: One of the things that’s a little bit different about us than from when we spun off, is we’re building a really good female franchise. I’d be remiss if I didn't mention the work that we’ve done with Lainey Wilson. She’s a powerhouse. Wrangler was a little bit too skewed to the male category five years ago, and now that there’s a really big opportunity with the female category. They love Wrangler just as much as male consumers.

Rivet: What do you make of the current Western fashion trend?

SB: From a Western standpoint, we continue to be the leader and have been since 1947. It’s a lifestyle…and we think that there’s just a lot more fun to be had there, more product to build there and the consumer just loves playing in that space.

Rivet: What are the next opportunities for Kontoor?

SB: Kontoor will become much bigger if we focus on the big markets that matter to us. So, a real maniacal focus on North America, Europe and China. There’s huge opportunity in the outdoor space with that category becoming a $200 million business over a very short period. Our workwear business has opportunity…Our consumer insights team is doing some really good work thinking about where the next categories are, so there’s no end in sight for us relative to growth, relative to product placement around the globe. But I think that it just goes back to focusing on our core and then supplementing it with those categories that are top of mind to the consumer, that being outdoor, T-shirts and workwear. We want to become a broader consumer lifestyle company than what we’ve done in the past.■

22 • RIVET COURTESY CEO Q&A

FROM A WESTERN STANDPOINT, WE CONTINUE TO BE THE LEADER...”

Consumers are learning about Wrangler's cowboy heritage as they search for Western fashion trends.

▲

KONTOOR BY THE NUMBERS

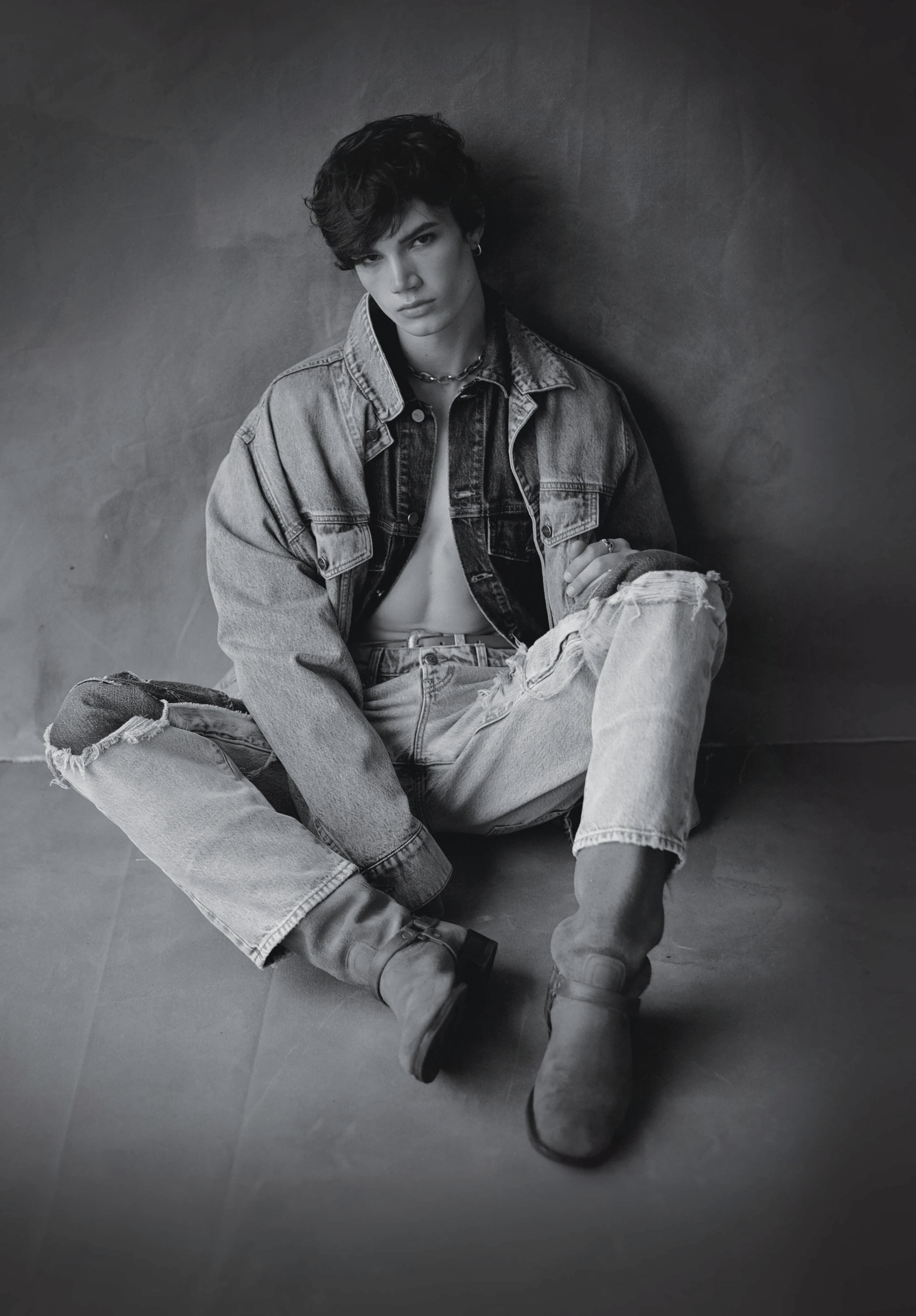

MODEL MUSE

24 • RIVET

YouTuber turned model Ian Jeffrey is charting his own course. by Leigh Nordstrom

STYLED BY ALEX BADIA • PHOTOGRAPHS BY MATTHEW TYLER PRIESTLEY

26 • RIVET

“there’s no one I can really compare my career to,” says Ian Jeffrey. “Or even anyone to ask ‘Hey, do you have any advice about this?’ Even my agents are like, ‘No, this is a new situation for us.’ ”→The rising 22-year-old model, who is signed with IMG, is talking about his desire to blend into the modeling world as seamlessly as any other breakout male model and leave his influencer past behind.

Most models in today’s era are, of course, interested in the reverse: building a following online to help grow their careers as models. Yet Jeffrey moved to New York five years ago to shift entirely from a YouTuber into a top male model.

Jeffrey, who is the brother of beauty influencer James Charles, grew up in Albany, N.Y., and relocated to Los Angeles while in the 10th grade specifically to do social media—mostly “get ready with me” videos and Q&As. Thousands of fans soon followed, but it soon started to lose its appeal to him.

“I quickly realized that I was growing a following and was popular, but it wasn’t what I wanted to do,” he says. “I was always interested in clothes and fashion, and I realized that L.A. is not the place to be for that.”

Jeffrey also struggled with understanding why exactly people were following him, and what he should do with his popularity. When he moved to New York and started going out for modeling jobs, he felt that casting agents didn’t know what to make of him, either.

“Because I was so known at the time when I moved here, it was ‘why do you have this following?’ It’s like, ‘Well, they just think I’m a cute 16-year-old kid. I’m not a chef. I’m not a basketball player. But I was trying to transition to something else,’” he recalls.

Even now, Jeffrey said the casting experience can be tricky. “I’m not getting booked per se because of my following, and I’m still going to castings like everyone else, but I’m at the casting and they’re like ‘Oh, you’re Ian.’ And I’m like, ‘Yeah, but we’re trying out for the same job.’ I think [my following] definitely helps, but I think it also does the exact opposite at some points, too. I am a face in a sense, but I’m not a face in the modeling industry.”

Jeffrey’s foray into the world of fashion was seeing Virgil Abloh’s debut at Louis Vuitton. At the

◄ ◄ PREVIOUS

HELMUT LANG JEANS, BALMAIN BOOTS, TITLE OF WORK NECKLACE (WORN THROUGHOUT).

◄ MARINE SERRE TANK TOP AND BELT, WILLY CHAVARRIA JEANS.

time, he was big into streetwear, and seeing that reflected in high fashion had him thinking to himself “holy shit, this is a thing.”

Moving to New York introduced him to “fancier clothes,” and now he cites Maison Margiela, Acne Studios and Glen Martens at Diesel as favorites. New York is also where he’s developed his love of thrifting. When not modeling, he spends his time at estate sales or flea markets and sells the vintage finds out of his apartment.

He also dreams of making his own clothes one day, “because there isn’t one brand that I’m obsessed with,” he says.

“I would love to eventually have a cut and sew line, but based around vintage materials where it’s military duffle bags that are cut and sewn into tote bags or hats or using vintage materials to rework into something more modern,” he says.

The last five years have included highlights like walking Abloh’s Louis Vuitton show in Miami, held days after his death, as well as Alessandro Michele’s Gucci Love Parade show. Still on the dream board is to walk a Balenciaga show, as well as a Margiela couture show.

“I’m very content with my modeling career for the last five years,” he says. “There’s obviously so much that I could still do and want to do.”

Though social media gives him “terrible anxiety,” Jeffrey is starting to embrace the medium again, this time in a way that feels in tune with his fashion career. “I don’t promote [myself] as someone, I want to be just like anyone else going on the casting,” he says.

He’s also working on embracing his unique situation in the modeling world.

“I’m at a point where I’m like, whatever happens, happens. I’ve been shooting a lot of editorials and a lot of covers recently, which is amazing,” he says. “But when I’m talking to agents, it’s like, why am I shooting covers if I’m not getting paid work at the same time? It’s kind of contradicting for most people’s careers, but at the same time, do I really question [it]? That’s what I’ve realized over the years. Just go with the flow.” ■

RIVET 27

28 • RIVET

RIVET 29 ◄ ◄

◄

FENDI SWEATER, LAPOINTE JEANS, BALMAIN BOOTS.

DRIES VAN

NOTEN TRENCH COAT, DIOR MEN SHORTS, KENZO GLOVES, BODE SHOES.

30 • RIVET

RIVET 31

◄

LUAR SHIRT AND JEANS, VITALY NECKLACE.

▲ BALMAIN JEANS, PAUL STUART BOXER SHORTS.

32 • RIVET

RIVET 33 ◄ KENZO VEST AND FENDI LEATHER PANTS. ▲ ACNE STUDIOS T-SHIRT AND JEANS. ▪ MODEL: IAN JEFFREY AT IMG GROOMING: ASHLEIGH CIUCCI ASSOCIATE PHOTO EDITOR: RYAN WILLIAMS SENIOR MARKET EDITOR AND CASTING: LUIS CAMPUZANO FASHION MARKET EDITOR: EMILY MERCER FASHION ASSISTANT: ARI STARK, KIMBERLY INFANTE

FROM THE

For F/W 24-25, men’s designers balance ’90s baggy fits with utility silos and raw denim looks.

DSQUARED2

34 • RIVET

LOUIS VUITTON

KENZO

BALMAIN

OFFICINE GENERALE

Y/PROJECT

BLUEMARBLE

DRIES VAN NOTEN

ANDERSSON BELL

RUNWAY

by Alex Badia

RIVET 35

VALENTINO

JUNYA WATANABE

KIDSUPER

LOEWE

SANKUANZ

AMI

RHUDE

MEN'S REPORT

EGONLAB

DIOR

VARIETY

Denim brands see new opportunities as male consumers try different jean fits. ◄ ► G-Star Raw sees demand growing for looser fits and fabric innovation.

36 • RIVET

SHOW

by Kate Nishimura

men’s denim is on the upswing, according to industry insiders. While a post-pandemic return to work could have signaled a downturn for jeans, male shoppers are still clinging to casual looks— but seeking more versatility and polish than the athleisure styles they came to favor throughout recent seasons.

Jeans continue to represent a men’s wardrobe staple, experts say—but they won’t settle for basic. While male consumers are historically less driven by of-themoment trends, they crave new, technical fabrications that promise performance, as well as ultrafunctional styling.

“In the U.S. we see a growing demand for denim innovation in terms of design details, fabrics and finishes, but also in fits,” according to Willeke Hendriks, chief product officer G-Star Raw.

“Skinny and slim fits have been leading in the U.S., but we see more and more appetite for looser fits and bootcuts, first mostly reflected in our early adopter audience, but now we see the share of these fits increasing in our overall sales.”

“When it comes to men’s denim, the biggest opportunity for us is comfort and scaling new fabric franchises in order to achieve this,” said Kyle Sweeney, senior vice president of men’s design and merchandising at Rag & Bone.

“Our fabrications range from the Aero stretch, which is our lightest weight, stretchiest fabrication to the Authentic stretch, which is still a comfort stretch but more of a mid-weight,” he explained.

“Rigid and selvedge jeans remain a small portion of the business but are growing in popularity due to the authentic nature and origin of denim—rigid workwear.”

Currently, the New York Citybased label’s slim-fitting Fit 2 style is its best-selling for men “because of its versatility,” and the brand is building upon that success to offer something new to its male audience.

“Being that we are a quiet luxury, aspirational brand, our customer is looking for a style they can dress up or down which is exactly what you can achieve with Fit 2,” Sweeney added. Most often purchased in classic, traditional indigo hues and dark-washed grays and blacks, the group’s Minna wash—a proprietary dark indigo overdyed wash effect—is among the most popular.

But like women’s denim, fits are becoming baggier. “Additionally, we’re seeing looser-fitting silhouettes trending,” he said, from Fit 3, Rag & Bone’s most athletic fit to Fit 4, its straight leg. These options “are becoming more relevant as of recent,” Sweeney said. Meanwhile, Fall 2024 will see the debut of the Stride men’s style, which “merges the world of comfort and denim using loopback

RIVET 37 MEN'S REPORT

OUR GROWING DENIM SUCCESS

HAS SHED LIGHT ON WHAT MEN SEEK—COOL, COMFORTABLE PANTS.”

construction similar to your favorite sweat pant.”

Giving consumers a range of options—from silhouettes to fabric weights and stretch content—has been a winning recipe for the brand. “We continue to see denim growth in double digits year over year for the past several years,” Sweeney said, noting that Rag & Bone “still only see[s] continuous improvement in our denim sales.”

BUILDING A DENIM WARDROBE

Coresight research analyst Sunny Zheng said athleisure has been an “important driver that has changed the fabrics and the styles of denim because consumers want comfort and they want jeans that can be worn on different occasions including work.”

Innovation is key—rather than sticking with the traditional denim recipe of 98 percent cotton and 2 percent elastane, “Denim brands are launching more stretchy, lighter, moisture-wicking fabrics” that prioritize easy wear.

“There’s a big movement from slim and straight, or more traditional styles, to more modernized styles with comfort and elasticity,” Zheng added. “We are definitely in a denim cycle of baggier, looser styles since the since the pandemic, and we’re still in the casualization trend,” she added. Relaxed bootcut silhouettes are especially en vogue, and while slim styles “aren’t fading away— they are losing some momentum.”

According to Coresight’s research, macroeconomic trends are also impacting shoppers’ appetites.

“We’re seeing the outperformance of the value segment, especially this year, and in the second portion of last year,” Zheng said. “Because of high inflation, consumers are cutting spend on discretionary items including apparel, footwear and jeans,” and consequently, “Companies are reporting they’re seeing lower tier jeans are selling better than luxury jeans.”

Within the mass market, the most popular selling price for jeans “sits comfortably in the $40 to $60 range, followed by $80 to $100,” according to EDITED retail analyst Krista Corrigan. Growth in the $100-plus range was also noted, up 4 percent from the same period last year.

“Traditionally affordable brands are experimenting and having success with more premium prices,” Corrigan said, pointing to a $149 pair of jeans in H&M’s collaboration with Rokh, which sold

Jake Danehy, Fair Harbor

out a majority of SKUs in just one week. Fast fashion titan Zara is also selling jeans under the luxury label Massimo Dutti, upping the average sale price for a pair of denim.

“Looking at the average price of jean assortments, it’s clear that brands see promise in the category and are raising prices,” Corrigan asserted. H&M’s denim prices grew 4 percent over last year, and 13 percent over two years. Zara saw similar pricing trends, with denim up 7 percent year over year and 12 percent from two years ago.

The proof of denim’s staying power is in the sell-through data.

“More jeans are selling out at mass retailers in the past three months compared to last year as the category continues to flourish,” Corrigan said. Products that pair well with denim are also on the rise, from graphic T-shirts to linen button-downs.

The trend toward baggier fits is also growing across generational cohorts, with wide-leg men’s styles taking over Gen Z favorites like Pull&Bear, Asos and Zara. “Loose fits are outselling slim fits almost 2 to 1 and skinny jeans nearly 6 to 1 as the customer gravitates toward baggy fits,” the EDITED analyst said.

Western styling, too, is gaining ground in the men’s denim market, from denim button-downs to snap-front shirts. “Boxy denim worker jackets are also bubbling up, fueled by demand for the streetwear aesthetic,” she added.

“Jean shorts will also be a major category this summer, a silhouette retailers shouldn’t omit from their ranges this year,” Corrigan said.

“This season, we’re seeing extremely oversized and much baggier fits selling well,” she added, like skate-inspired styles that have sold out at Pull&Bear, Urban Outfitters and PacSun. The popularity of ’90s fashion endures, with nostalgic grunge aesthetics influencing men’s purchases, manifesting in “acid washes and ‘dirty denim’ looks,” along with “grubbier dark washes to nostalgic light-wash denim.”

When it comes to hues, “Blue still dominates the color wheel across jeans at 45 percent of sell outs over the past three months, but black and grey are rising in the ranks at 27 percent of the total,” she added.

DEFYING TRENDS

“I am also seeing a solid revitalization of 90’s style and denim, in particular, is making a huge comeback,” said Jake Danehy, Fair Harbor co-founder and CEO.

While post-pandemic male shoppers seemed to gravitate to synthetic styles like Lululemon’s ABC Pants “to stay comfortable but remain put together for work,” the chief executive said jeans are again on the rise. “I honestly see denim as being in demand and trending up.”

Looking ahead, the chief executive said the New York-based lifestyle brand sees “significant opportunities in the men’s denim market.”

While Fair Harbor trades mostly in casual staples that straddle the line between athleisure and fashion, “With the rise in the denim trend, we wanted to offer an authentic aesthetic with modern comfort that our customers have grown accustomed to,” Danehy said. “Our growing denim success has shed light on what men seek—cool, comfortable pants.”

Danehy believes in “denim that defies trends”—meaning that the brand is keeping its assortment tight with three washes that designers believe will stand the test of time: Beach, a medium indigo, Deep Sea, a dark indigo and the palest Light Wash.

“The Beach Wash is our consistent best seller, but we’re excited to see how our new Light Wash will do in warmer weather,” Danehy said, noting that the brand’s modern, straight fit with classic five-pocket styling has proven versatile enough for work or weekend wear. Each jean features “classic stitching, heritage details, and traditional hardware.”

When it comes to fabrications, the brand’s Ultra-Stretch Driftwood denim has hit the spot with comfort-driven shoppers. The “incredibly soft” fabrication “looks like authentic heritage denim, but feels more like sweatpants,” Danehy said. A blend of 69 percent organic cotton, 29 percent recycled polyester, 3 percent rayon and 2 percent spandex is Fair Harbor’s secret sauce, balancing “stretch, softness, sustainability and durability.”

According to Danehy, denim is a category with the potential for extensive growth. The brand is planning to launch a new wash in the fall, along with a denim shirt, “to address our customers’ evolving needs” and heighten interest. “We’d like to maintain a year-round denim business, ensuring we stay in stock and meet the demand consistently,” he said. ■

INFLUENTIAL MEN

From a brooding Marlon Brando in the 1950s to a Gucci-fied Harry Styles in the late 2010s, men’s style icons are often a reflection of youth culture. Add to it the glow-up of professional athletes and the massive reach of Instagram and TikTok influencers, and there are more influential stars in men’s fashion than ever. Here’s a look at four guys with style power.

Shai Gilgous-Alexander

Oklahoma City Thunder’s Shai

Gilgous-Alexander is following in the footsteps of NBA greats like LeBron James and Russell Westbrook, both with his on-thecourt prowess and his head-turning street style and pre-game fits. Though he made his tunnel debut with distressed and patchwork skinny jeans, he favors wide-leg dark washes now, styled with designer tops and jackets.

Jacob Elordi

Known for his smoldering portrayal of Elvis Presley in “Priscilla” and his embodiment of an angsty teen on “Euphoria,” It-guy Jacob Elordi spends much of his time off screen time in denim. Channeling the male version of quality luxury, Elordi is often seen in ’90s-inspired baggy (but neat) jeans and a simple knit top.

Eitan Broude

Australian sustainable streetwear and denim designer Eitan Broude has been generating buzz among Gen Z shoppers on TikTok. Known for eye-catching styles like the Squiggle Jean and the Plumber Pant, Broude’s genderless designs are both chic and whimsical.

Lewis Hamilton

British Formula One racecar driver Lewis Hamilton is known as much for his performance behind the wheel as his sartorial style. Instagram fan accounts track the Tommy Hilfiger collaborator’s every fashion move, showing that Hamilton—a fan of double denim looks— gravitates as much to independent designers as haute couture.

38 • RIVET RAG & BONE, FAIR HARBOR: COURTESY; SIDEBAR: THE HAPA BLONDE/GC IMAGES, RAYMOND HALL/GC IMAGES, EIITANBROUDE.COM, QIAN JUN/MB MEDIA/GETTY IMAGES. MEN'S REPORT

▲ Fair Harbor is tapping into '90s denim looks.

▲ Rag & Bone is growing its stretch denim franchises.

EEBRU OZAYDIN, global strategic marketing director, denim, woven and RTW, explains The LYCRA Company’s latest innovations on fit, durability and sustainability.

RIVET: Consumers come in all shapes and sizes. How is LYCRA FitSense® Denim working to help customize and personalize fit?

Ebru Ozaydin: Bodydiversity culture and apparel personalization is changing the paradigm of consumer fashion. According to our consumer survey conducted in April 2023 (Denim Study, Walnut, Inc.) among 1,204 women, there is still an unmet demand for the “perfect pair of jeans.” LYCRA FitSense® denim technology is our next game changer, with invisible targeted shaping achieved through a combination of fiber, fabric and garment processing technology. The flexible new yarn and garment processing technology supports the specific parts of the body that women in research said they wanted shaped—tummy, thigh, bum, leg and waist—without changing the look and feel of the denim.

What are some solutions for other pain points?

E.O: LYCRA® Anti-Slip fiber helps prevent seam (elastane) slippage and improve garments quality in denim applications.

LYCRA® XFIT fabric for double beam technology offers new design opportunities in bi-stretch denim. Unlike conventional bi-stretch constructions that require core-spun yarn in the warp direction, LYCRA® XFIT fabric works with any kind of warp indigo yarn and weft yarn to create fabric with high recovery and low growth. Additionally, fabrics developed

THE LYCRA COMPANY OFFERS NEW FIT AND SUSTAINABILITY GAMECHANGERS

“ACCORDING TO OUR CONSUMER SURVEY, THERE IS STILL AN UNMET DEMAND FOR THE ‘PERFECT PAIR OF JEANS.’”

EBRU OZAYDIN global strategic marketing director, The LYCRA Company

with LYCRA® XFIT technology exhibit less compression compared to traditional bi-stretch jeans, give jeans an authentic vintage look and soft feel while avoiding the unwanted gummy touch of traditional bi-stretch denim and enable two-layer denim for added warmth.

LYCRA® ADAPTIV fiber technology helps consumers find great-fitting jeans and woven bottoms across a wider range of body shapes and sizes. This revolutionary polymer proactively adapts its unique chemistry to a wearer’s functional needs, at rest or in motion.

For hot-weather summer denim, COOLMAX® fiber offers great performance in absorbency, wicking, fast dry rate and thermal resistance. Specially channeled cross-sections wick moisture away from the body, this fiber (it’s not a finish) lasts and gives durable cooling performance. We also offer COOLMAX® EcoMade technology, with fiber made from 100 percent recycled PET bottles or 100 percent pre-consumer textile waste from cutting rooms. The COOLMAX® brand is widely recognized as a leading cooling fiber technology among consumers worldwide who associate it with the key comfort feature of cooling.

LYCRA® DUAL COMFORT fabric technology with LYCRA® T400® A fiber comprises a multitude of small loops on the surface of the yarn. These numerous filament crimps and the unique fiber cross-section shape of the bi-component fiber offer a yarn with excellent, durable moisture management for wovens such as bottom weight pants, shirts and dyed garments.

How are LYCRA® fibers offering better durability?

E.O: To meet today’s consumer sustainability demands for long-lasting apparel, LYCRA® lastingFIT technology creates fabrics with a range of stretch levels, an authentic denim look and feel, and long-lasting recovery for extended use. Our EcoMade versions are partly made with at least 50% recycled materials. Additionally, LYCRA® XFIT technology reduces bag and sag for a better fit and enhanced wearing experience. LYCRA® XFIT technology denims control fabric stretch level, allowing to easily control the fabric dimension and the size consistency.

How are you outlining progress toward your 2030 sustainability goals?

E.O: Our second annual Planet Agenda Update outlines the initiatives we are pursuing to meet our 2030 sustainability goals. A key highlight is our transition to renewable resources like bio-derived LYCRA® fiber made with QIRA®. ■

RIVET X THE LYCRA COMPANY

HOT

summer officially arrives in North America on June 20, 2024, at 4:51 pm EDT, but rising temperatures are already heating the forecast. The National Oceanic and Atmospheric Administration (NOAA) said there is a 99 percent chance it will rank among the five warmest years on record. → All it takes is one hot day to be reminded of the record-breaking temperatures of summer 2023—the warmest since global records began in 1850—to understand why retailers and brands are emphasizing natural fabrics like linen and cotton this summer. → “When it comes to marketing denim for summer, there’s an even greater emphasis on lightweight fabrics than there was before and this is reflected in the data,” said Kendall Becker, Trendalytics’ fashion and editorial strategy director. Searches for lightweight denim are up 58 percent compared to last year while social engagement around the topic has increased 143 percent in the last three months. → “This has been most prominent amongst contemporary brands, and the Trendalytics platform is marking the style as a ‘top market mover’ for the season,” she explained.

“Even when temperatures heat up, cotton is a comfortable option in the summertime. It’s breathable, comfortable, and doesn’t stick to you like some other fibers will. Denim has a long history as the go-to workwear because of its durability and comfort in all weather conditions,” said Seth Winner, Cotton Incorporated’s technical manager, wovens product development.

“Heatwave or not, August is one of our best-selling months for denim,” said Natasha Ziavras, Dynamite’s director of merchandising.

Cotton is the go-to fiber for denim for the women’s apparel brand. “The fabrics that we use in our denim are year-round fabrics and are mostly in 100 percent cotton or a mix of cotton and spandex for more stretch. “Cotton is a popular choice for summer since it’s naturally breathable and absorbs moisture, so a comfortable fiber to wear in hotter weather,” she said.

The simplest way to make denim more comfortable for warm temperatures is to use lighter fabric, Winner said. Denim fabrics that are 10 oz. or lighter and chambray fabrics woven with warp-dyed indigo and natural filling gives designers many options for tops and bottoms. There are also ways to add more comfort through the construction of the weave itself.

“Seersucker has a long tradition of keeping wearers comfortable in summertime. Seersucker uses differential tension in construction to create stripes of pucker in the fabric. These raised surfaces keep most of the fabric off the wearer’s skin and create channels for airflow,” he said.

Designers can go a step further to enhance denim’s moisture management properties, Winner said. With Cotton Incorporated’s Wicking Window technology,

they can print a pattern of water resistance on the inside of the fabric to help move sweat away from the skin, resulting in the wearer feeling dryer. TransDRY technology is another way to make denim more comfortable via moisture management. “Yarns treated with TransDRY technology are water resistant. When they are used in the filling of denim, the warp acts as a wick, and draws the moisture away from the wearer for more comfort,” he said. The technology also makes the fabric dry faster.

“Summer denim means ultimate comfort and the right combo of fibers, weave fits and fabrics,” said Ebru Ozaydin, The Lycra Company’s global strategic marketing director, denim, wovens and ready-to-wear.

Consumers are aware of branded cooling technologies like The Lycra Company’s Coolmax fiber family. The Coolmax brand is in the top three of the most recognized cooling technologies among consumers worldwide who associate it with the key comfort feature of cooling, she said, adding that 7 out of 10 consumers are likely to purchase garments made with Coolmax technology.

Coolmax and Coolmax EcoMade, a fiber made from either 100 percent recycled PET bottles or 100 percent pre-consumer textile waste from cutting rooms, delivers proven moisture management (absorbency, wicking, fast dry rate and thermal resistance) that helps keep the wearer cool and dry. “Specially channeled crosssections are designed to wick moisture away from the body,” Ozaydin explained. “It’s a fiber, not a finish, so it lasts and gives durable cooling performance.” The Coolmax family aligns with consumers’ growing love for being outside, be it for physical activities or leisure. “Brands use Coolmax

40 • RIVET

technology not only for standard denim bottoms and tops but also in performance denim for extended summer and humid climates,” she said, adding that the technology is “an inevitable part of fabric design” for items like traditional chinos, non-denim woven parachute pants and workwear silhouettes like cargo pants, jackets and overalls.

“Increasingly, non-traditional denim categories are gaining market share over classic jeans, providing new product development opportunities. In recent seasons, there has been a rise in looks featuring unconventional denim pieces beyond five-pocket styles,” said Francisco Ortega, Evlox’s R&D manager.

The Spanish mill is weaving performance into fabrics for these styles. Evlox uses Coolmax technology in in Technim, a fabric collection that incorporates Regenagri-certified cotton. Benefits include moisture management, high tear and abrasion resistance and retaining stretch.

“Without a doubt, customers are looking to add performance to denim,” said Mark Ix, Advance Denim’s director of North American marketing. “They are looking for wicking/moisture management options that keep you cool and dry in hot muggy weather. The key is that these performance denims must have a true vintage character on the face and cooling and drying technologies against the skin.”

China’s oldest denim mill Advance Denim offers several fiber-based solutions. Wafer Technology moves moisture away from the skin by utilizing the fiber’s special hollow core to transport sweat away from the skin. Aircore Denim uses a specially designed fiber that has added channels like a sponge to keep the wearer cool and dry. The technology is especially good for brands that want the look of traditional denim without the weight. The mill also uses Naia Renew fiber for Ecocool Denim, a line of cool-to-the-touch fabrics with wicking properties.

COOL BY DESIGN

Fabric choice is crucial for summer denim collections.

“We have spent decades obsessing over our fabrics, so we really believe we’ve got the perfect fabrication,” said Chelsia Solari, Garage’s senior product manager for denim, woven bottoms and outerwear. The brand uses a loose yet structured weave denim for its core styles, “providing more drape to our garments making them relatively seasonless,” she said.

“We are always inspired by what’s happening in the world, how things are affecting our culture and how people are reacting. Consumers today expect comfort year-round, regardless of

SUMMER DENIM MEANS ULTIMATE COMFORT AND THE RIGHT COMBO OF FIBERS, WEAVE FITS AND FABRICS.”

◄ Baggy and relaxed shorts are key styles in Levi's summer collection.

Ebru Ozaydin, Lycra

the climate,” said Janine ChiltonFaust, Levi’s global VP of men’s design. “We continue to innovate our fabrics and fits, delivering new summer essentials.”

Levi’s is building on its 12.5 oz. cotton/Tencel shrink-to-fit fabric offerings this summer with the 501 90s, 501 Crop and 501 Mid-Thigh Shorts. The Spring/Summer 2024 collection also features a range of denim lifestyle looks featuring indigo cotton/linen blends, chambray and Levi’s lightest denim fabric to date. The lightweight Tencel and cotton fabric is used for women’s High Baggy jeans, Ribcage Bermuda shorts, carpenter shorts and a range of skirts, giving consumers the look of classic denim with a soft and breezy touch.

Chilton-Faust added that the new 6.5 oz. lightweight corduroy fabric is “remarkably soft, drapey and beach-ready.”

The season also marks the global launch of Levi’s Performance Cool line, a technology originally launched in Asia engineered to cool the wearer and wick away moisture. The cooling technology is offered in men’s slim and tapered fits, complementing the new 511 Tech 5-pocket. Modeled after the 511 slim jean, Chilton-Faust said the pant “delivers ultimate comfort in a non-denim knitted fabric” and boast moisture-wicking, quick dry and UV protection properties.

“There’s definitely a natural decline in denim during the hotter months, but that doesn’t mean we’re taking a break. We’re always on the lookout for fresh ideas,” said Mary Pierson, Madewell SVP of denim design. “It’s all about keeping it chill and comfy.”

This summer Madewell launched the Airy denim line, a women’s collection that offers

STUFF

RIVET 41 SOURCING

lighter weight and softer denim fabrics to bring comfort and ease for the hot months ahead. Styles like the Harlow Wide-Leg jeans are made with a blend of cotton and Tencel lyocell woven in a looser construction, resulting in a soft, flowy feel. “Seriously, it’s like you have nothing on,” she added.

Summer denim is something Madewell has been pursuing for a decade. This year marks the 10th anniversary of the brand’s Perfect Summer Jean. The style—a light wash, rigid straight leg— was a bit of an anomaly when it launched in 2014.

“It’s crazy to think back to when I first started at Madewell 11 years ago, and the denim landscape was dominated by stretchy skinny jeans,” Pierson said.

Madewell is celebrating the style’s milestone this summer with a whole Perfect Summer Denim capsule in the original Fitzgerald wash. “Our approach with this collection was all about that livedin feel. We broke down the fabric through washes to achieve that perfectly worn-in look,” Pierson said. The collection includes a

wide-leg crop, ’90s straight crop and low-slung straight jeans, an A-line sleeveless mini dress, a button-front tank, shorts and midi skirt. Some styles are made with 100 percent Regenagri certified cotton; others with a cotton and Tencel lyocell blend.

SUMMER HITS

Consumers are making the connection between loose and baggy and cool and comfy.

Pierson said Madewell is embracing the trend for looser and relaxed fits, especially for summer.

“Our new low-slung straight fit, low-rise boyfriend shorts and relaxed skirts are all about easy, breezy summer dressing,” she said.

A new lightweight stretch denim by Cone is available in the Kick Out Crop Jeans, a mid-rise jean with raw hems that Pierson said will make you “forget you’re even wearing jeans.”

“In the summer, we introduce more wider leg styles, lower waist options and more distressing that’s conducive to warmer months,” Solari said. “Our girl will

THERE’S DEFINITELY A NATURAL DECLINE IN DENIM DURING THE HOTTER MONTHS, BUT THAT DOESN’T MEAN WE’RE TAKING A BREAK.”

Mary Pierson, Madewell

▲ A lightweight chambray twill with Cotton Incorporated's Wicking Windows technology.

◄ Madewell's Perfect Summer Denim capsule is inspired by the brand's first summer jean from 2014.

are up 102 percent in comparison to last year and the market is meeting demand as market adoption from brands and retailers has risen 143 percent to last year.

Ziavras said the summer is a time to expose the ankle and legs, and allow details in hems to be a feature. Crop denim is having a resurgence—be it skinny, wide-leg, classic five-pocket styles or more fashion styling like capris and culottes. “Lengths in shorts and skirts are also being challenged, from micro shorts and skirts to the longer line of culottes. The offering on the market will be much richer than previous summers,” she said.

Jean shorts (a.k.a. jorts) are proving equally important to the baggy trend for men’s and women’s brands this season, especially among Gen-Z-focused labels.