SP’s

Copyright © 2022 SP GUIDE PUBLICATIONS

All rights reserved. The information published herein is for the personal use of the reader and may not be used for any other activity. No part of this book may be reproduced, stored in a retrieval system or transmitted in any form by any means – digital, electronic, mechanical, photocopy, recording or otherwise – without the prior written approval of the Editor-in-Chief.

For copyright permissions, please contact: The Editor-in-Chief

SP’s Civil Aviation Yearbook

A-133, Arjun Nagar, Opposite Defence Colony

New Delhi 110003, India.

E-mail: editor@spscivilaviationyearbook.com

The publisher shall not be liable in the event of incidental or consequential damages in connection with, or arising out of, the furnishing or use of the information, associated instructions/claims of productivity gains.

Concept founded by SHRI SUKHDEO PRASAD BARANWAL in 1965

Published by JAYANT BARANWAL SP GUIDE PUBLICATIONS

New Delhi, India

Designed by SP Guide Publications Team

ISBN: 978-81-941599-2-6

Printed in India at Kala Jyothi Process Pvt Ltd, Hyderabad

CORPORATE OFFICE: SP GUIDE PUBLICATIONS PVT LTD

A-133, Arjun Nagar Opposite Defence Colony New Delhi 110003, India.

Tel: +91 (11) 24644693, 24644763, 24658322

Fax: +91 (11) 24647093

E-MAIL: info@spscivilaviationyearbook.com

ORDER: order@spscivilaviationyearbook.com

WEBSITES: www.spguidepublications.com, www.spscivilaviationyearbook.com

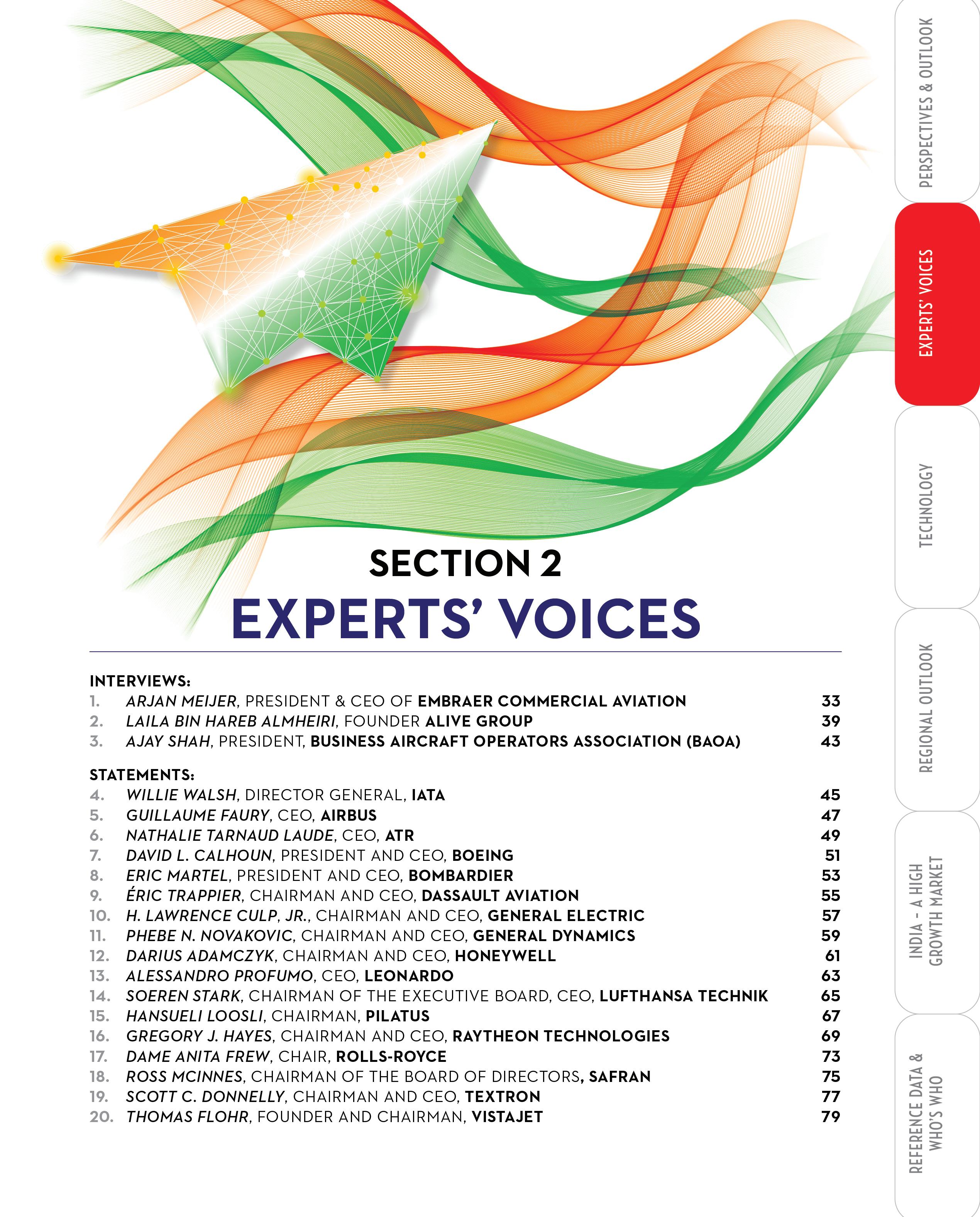

CONTENTS

SP’s Civil Aviation Yearbook 2021-2022

Aviation Industry –The Phoenix Rises from the Ashes

The COVID-19 pandemic had a huge impact on the airline industry in 2020 due to travel restrictions and a decimation in demand among travelers. This resulted in massive losses for the airlines and the entire aviation sector. Planes were grounded and millions of workers worldwide in the aviation sector lost their jobs. However, after nearly two years of being in a critical condition and barely surviving, the year 2022 marked a significant turning point for the global civil aviation market as it emerged from the depths of the COVID-19 pandemic. With the gradual easing of travel restrictions and the growing desire to explore the world again, air travel experienced a resurgence.

CONSUMER DEMAND AND SPENDING

In 2022, consumer spending in the civil aviation sector was bolstered by low unemployment rates and accumulated savings during the pandemic. The pent-up demand for air travel, combined with improved economic conditions, fueled a robust growth in passenger numbers. Despite a global macroeconomic slowdown, the strong consumer sentiment towards air travel remained evident throughout the year.

INTERNATIONAL AND DOMESTIC TRAFFIC

The recovery of international air travel outpaced domestic travel in 2022. Domestic passenger traffic experienced a 12 per cent increase compared to 2021, but still remained 20 per cent below pre-pandemic levels. Conversely, international passenger traffic surged by approximately 175 per cent but was still 30 per cent lower than the equivalent figures in 2019. However, the growth differential between international and domestic traffic is expected to narrow in 2023.

TOTAL GLOBAL TRAFFIC FORECAST

Based on projections, total global passenger traffic (measured in Revenue Passenger Kilometers - RPKs) witnessed a remarkable 70 per cent increase in 2022, followed by an additional 20 per cent growth in 2023 as per IATA forecast. However, the recovery of the Chinese and Asia Pacific markets remains uncertain and holds significant implications for the overall outlook. Travel restrictions lifting and pent-up demand being unleashed, especially in China, is anticipated to drive the resumption of travel from mid-2023 onwards.

FINANCIAL PERFORMANCE AND REGIONAL OUTLOOK

Despite facing unprecedented challenges, the air transport industry exhibited resilience in 2022. The air transport industry posted a loss of nearly $7 billion in 2022 and is expected to deliver a profit of $4.7 bil-

Set of kind words from Dr S. Radhakrishnan, Second President of India, addressed to our Founder Editorin- Chief, in March 1966 in the context of our first Yearbook - the ‘Military Yearbook’ launched in 1965, and now known as SP’s Military Yearbook. This very long-established background of the Yearbook has been the foundation of SP’s Civil Aviation Yearbook.

Following the path of the first Yearbook, SP Guide Publications had introduced SP’s Civil Aviation Yearbook in the year 2018 to fill the vacuum of such a detailed reference document on civil aviation industry covering not just India but the countries across Asia. SP’s Civil Aviation Yearbook strives to remain the leader in Asia after having become the first mover in the space of civil aviation reference document.

lion in 2023. This is a remarkable performance given the $138 billion loss seen in 2020. Traffic is projected to experience a record growth rate during the year, with a slightly slower pace expected in 2023 and beyond. Financial performance across different regions has shown signs of improvement since the substantial losses incurred in 2020. North America leads the way in terms of profitability, while Europe and the Middle East are anticipated to return to profitability in 2023. Latin America, Africa, and Asia Pacific may require additional time to achieve sustainable profitability.

CARGO MARKET PERFORMANCE

The cargo market has outperformed the domestic and international passenger sectors. Although cargo tonne kilometers (CTKs) have moderated, the associated revenue is expected to surpass 2019 levels due to the rebound in global trade. Despite the pressure on yields as belly capacity returns, the share of cargo in airlines’ total revenue increased significantly from 12 per cent in

2019 to 40.3 per cent in 2021. In 2022, cargo account for nearly 27.7 per cent of airlines’ total revenue.

AIRCRAFT DELIVERIES AND ENVIRONMENTAL SUSTAINABILITY

Aircraft deliveries to airlines experienced a sharp decline in 2020 due to the pandemic and have yet to fully recover to pre-pandemic levels. However, as passenger air travel gradually rebounds, a resurgence in aircraft deliveries is expected, reaching 2019 levels by 2023. The industry’s commitment to environmental sustainability and the reduction of carbon emissions is reflected in the adoption of a collective long-term global aspirational goal (LTAG) to achieve net-zero carbon emissions by 2050.

GLOBAL SUPPLY CHAIN

Air transport also plays a vital role in global supply chains, particularly for international trade in manufactured goods. Over the course

of Air Travel:

of this year, trade flows have been impacted by the softer global economy, in addition to the conflict in Ukraine and the various Covidrelated restrictions in Asia Pacific – a major manufacturing hub for the world’s goods. The WTO forecasts world trade will slow sharply in 2023 to just one per cent (from 3.4 per cent previously), as a result of the various headwinds in the global economy.

INDIAN MARKET

The Indian civil aviation market experienced a transformative year in 2022, marking its recovery from the pandemic’s aftermath. Airlines focused on expanding passenger counts and destinations, resulting in a mix of established carriers, newly privatised airlines, and emerging players that shaped the industry landscape.

The most significant development was the successful privatisation of Air India, the country’s flag carrier. After a two-year process, the airline transitioned to the Tata Group, bringing rapid changes despite initial challenges. Air India improved the passenger experience, addressed service and scheduling issues, and set its sights on global expansion under the leadership of Campbell Wilson. The Air India privatisation had an effect on other Tata Group-owned airlines, leading to the merger of Vistara and AirAsia India, operating as a budget carrier, with Air India.

A significant development was Air India’s historic order for 470 aircraft, impacting the Indian aviation sector and providing an economic boost to Western countries. Air India’s fleet expansion aims to support its ambitious growth strategies, positioning it as a strong competitor in the Indian market. Delivery of the first aircraft is expected by the end of this year, marking a significant step in Air India’s transformation into a world-class airline.

New players also emerged, with Akasa Air entering the market as an ultra-low-cost carrier aiming to connect Tier-2 and 3 cities to major hubs. The airline made a significant impact with its order for 72 Boeing 737 MAX aircraft and plans for international expansion in 2023. Jet Airways faced challenges in its revival plans, delaying its relaunch until 2023 due to obstacles from creditors, employees, and banks. Safety was a prominent focus in 2022, with SpiceJet facing temporary flight schedule reductions but later regaining full compliance.

The Ministry of Civil Aviation had a remarkable year in 2022,

Role of Air Cargo:

Cargo and supply chain operations facilitated the movement of goods and ensuring seamless connectivity, supporting the recovery and growth of global travel

achieving significant milestones and implementing key initiatives to enhance the aviation sector in India. One of the notable achievements was the commencement of 50 new Regional Connectivity Scheme (RCS) routes. These routes have played a crucial role in improving regional connectivity and accessibility, benefiting travelers and boosting economic growth. Additionally, the Ministry awarded 140 new RCS routes under the UDAN 4.2 and 4.3 schemes, further expanding air connectivity to underserved areas of the country.

India’s re-election to the International Civil Aviation Organization (ICAO) Council for the 2022-2025 term was a significant diplomatic achievement. It reaffirmed the country’s standing in the global aviation community and provided an opportunity to contribute to international aviation policies and regulations.

The Directorate General of Civil Aviation (DGCA) played a pivotal role in the issuance of Commercial Pilot Licenses (CPL) in 2022. The year witnessed the highest number of CPLs issued in the last decade, indicating the growing interest and demand for aviation careers in India. This achievement reflects the DGCA’s commitment to maintaining high standards of aviation training and safety.

One of the key initiatives launched by the ministry was Digi Yatra, aimed at providing a seamless and hassle-free airport experience for travelers. By eliminating the need for multiple ticket and ID verifications at various touchpoints, Digi Yatra streamlined the check-in process and enhanced passenger convenience. This digital transformation initiative showcased the ministry’s focus on leveraging technology to improve the overall travel experience.

The ministry also took significant steps in regulating drone operations in the country. The introduction of the Drone Certification Scheme, Drone Import policy, and Drone (Amendment) Rules, 2022 demonstrated the government’s commitment to ensuring the safe and responsible use of drones. These regulations have laid the foundation for the growth of the drone industry in India while addressing security concerns.

Under the Krishi Udan 2.0 scheme, the ministry expanded air connectivity to agricultural regions by adding five more airports. With a total of 58 airports now included in the scheme, Krishi Udan has facilitated the efficient transportation of agricultural produce, benefitting farmers and contributing to the development of the agricultural sector.

Sustainablility:

As the production of SAF increases, it will become a more affordable and viable option for airlines to reduce the environmental impact of air travel

Overall, the Ministry of Civil Aviation’s performance in 2022 showcased its commitment to enhancing connectivity, ensuring passenger safety and convenience, and promoting the growth of the aviation industry in India. Through strategic initiatives and successful implementations, the ministry has played a vital role in transforming the country’s aviation landscape.

LOOKING AHEAD:

The global civil aviation market demonstrated resilience in the face of the COVID-19 pandemic, with 2022 marking a significant rebound. Despite the challenging environment, the industry showcased a strong recovery in passenger numbers and cargo performance. As we move into 2023, the sector is poised for continued growth, albeit at a slightly slower pace. The path to recovery remains dynamic and contingent on factors such as vaccination rates, travel restrictions, and economic stability. Nonetheless, the revival of air travel presents opportunities for stakeholders to adapt to the evolving landscape and explore new avenues for sustainable growth.

The Indian aviation market expects increased demand and airlines aim for sustained profitability, while passengers can expect expanded travel opportunities. As the industry continues to evolve, the Indian civil aviation market holds limitless potential.

I hope you enjoy reading the Yearbook! We look forward to your feedback as well.

Clarifications:

Data has been collated and analysed from various sources in each listed country including their official websites of Ministry of Civil Aviation, Directorate of Civil Aviation, Airports Authority and various airlines. Some of the other sources used are various business aviation association websites, IATA, ACI, Wikipedia and OEM websites. Despite this, variations are possible.

Suggestions for improvement will be appreciated and carried out to the extent possible.

Aviation in India:

As one of the largest aviation market in the world, reflecting the country’s burgeoning economic growth, India has the potential to shape the future of global aviation

ACKNOWLEDGMENTS

Several distinguished authors and industry experts have contributed to make this edition of SP’s Civil Aviation Yearbook an indispensable reference document that attempts to surpass international standard and quality. We at SP Guide Publications convey our sincere thanks to all of them for their contributions.

As usual, our research team comprising of Bharti Sharma, Rimpy Nischal, Survi Massey and the design team that includes Vimlesh Yadav, Sonu Bisht, did a splendid job under the guidance and supervision of Rohit Goel. It is their dedication and the hard work that has enabled an enormously updated edition. An edition that is not only comprehensive in its data and analysis, but also presented in a very easy-to-understand format.

Jayant Baranwal Editor-in-ChiefIndianOil Corporation

IndianOil Achieves Another ‘First’ for Atmanirbhar Bharat: Indigenous ‘AVGAS 100 LL’ Aviation Fuel

From being country’s first producer of AVGAS 100 LL to now an exporter, the journey of IndianOil has been incredible and brings Atmanirbhar Bharat mission in words & deeds

In September 2022, IndianOil made a significant impact on the aviation fuel industry by launching its indigenously made aviation fuel, ‘AVGAS 100 LL’, contributing to the Atmanirbhar Bharat initiative. IndianOil, India’s leading Oil & Gas major, a Fortune Global 500 company and the nation’s largest PSU Oil Marketing Company, has developed this specialised aviation fuel through its inhouse research.

There are several types of aviation fuels designed to meet the specific needs of the global aviation industry. The majority of aviation fuel is Aviation Turbine Fuel (ATF), also known as Jet Fuel (Jet A1), which is used in large, commercial aircraft.

In contrast, AVGAS 100 LL is used to fuel smaller aircraft and those with turbo-charged reciprocating piston engines, primarily utilised by Flying Training Organisations (FTOs) and defence forces for training pilots.

With this significant achievement, IndianOil has become the first company to produce AVGAS 100 LL in India, enhancing self-sufficiency in this crucial aviation fuel, replacing imports, and conserving valuable foreign exchange.

Manufactured at IndianOil’s cutting-edge Gujarat refinery in Vadodara, AVGAS 100 LL has been tested

and certified by the Directorate General of Civil Aviation (DGCA), which is responsible for regulating civil aviation in the country. This high-octane aviation fuel not only meets product specifications but also offers superior performance quality standards compared to imported grades.

Air travel is no longer a luxury and is becoming increasingly popular in both large metropolitan areas and smaller cities. India is currently one of the largest domestic and civil aviation markets globally, and poised for a brisk growth in the coming years.

The growth in civil aviation, spurred by the UDAN scheme and the Government’s pragmatic vision to accelerate civil aviation, has led to an increased demand for pilots. The number of airports in the country has risen from 74 to 140 over the past eight years, with projections for it to reach 220 by 2027. The indigenously produced AVGAS 100 LL will reduce flight training costs for pilots in India, with the domestically available fuel’s lower costs facilitating the establishment of more flight training institutes in the country.

Already a dominant player in Jet A1 fuel, IndianOil has now also become a pioneer in AVGAS 100 LL fuel in India, fostering further rapid growth of civil aviation in the country.

ALAN PEAFORD, EDITOR-IN-CHIEF, FINN, REVIEWS SP’S CIVIL AVIATION YEARBOOK

“Guide to Asian aviation in one book. 2019 edition has expanded its reach to cover the various sub markets across the whole of the Asian continent from Saudi Arabia in the west to Japan in the East.”

Alan Peaford

Editor-in-Chief FINN (Farnborough International News Network), Editor of Arabian Aerospace, African Aerospace and UK’s ADS Advance

Alan Peaford is a former national newspaper journalist and the current President of the UK’s Institute of Internal Communications. He has also edited Flight International’s Flight Daily News for 17 years and has won an Aerospace Journalist of the Year award on five occasions. He has been writing for many newspapers and trade magazines. Alan has also appeared on BBC news channel for aerospace related talks.

Key extracts of the Review:

• Guide to Asian Aviation in one book.

• 2019 edition has expanded its reach to cover the various sub markets across the whole of the Asian continent from Saudi Arabia in the west to Japan in the East.

• The authors – led by Editor-in-Chief Jayant Baranwal – provide a series of op-ed articles on subjects ranging from the world of turboprops to electric aircraft and concerns over capacity crunch.

• The Yearbook is a stamp in time, a broad snapshot of the civil aviation industry.

• More than half of the Yearbook is devoted to data including organisation charts of various government departments or the names of the key personnel across airlines and airports.

Trust Diamond

Diamond today has more than 50 aircrafts flying in the Indian Sky with various FTOs, private owners, that’s because Diamond efficiency, high reliability, safety, modern design, luxury, single piston engine aircraft, and twin engine aircraft, with larger interior space and performance, durable fully composite airframe, modern high end avionics system and Austro engines with unique options (Thrust you can trust).

Diamond aircraft’s models vary from 2 seater aircraft to 7 seater luxurious aircraft. The DA62 is known as the “SUV of the sky” because of its ultimate looks, large interior space and high performance and the DA50 “sportscar of the sky” known for its luxury, high performance and comfort.

A capability to provide for extremely economical operation in flying on Jet A1fuel. Also allows for appropriately longer training hours as it can fly longer without any need to frequently refuel in FTO applications. Thus, it has the lowest cost of operation in its class.

• Fly smoother, quieter and with less emissions

Cutting edge design: Dual power levers offer jet- like thrust control and provide for a simple operation to reduce pilot fatigue and therefore the “ best flying experience”

“Finance options also available” *conditions apply

“with Diamond reliability is forever” Ideal for Flying Training Organizations Hobbyists and adventure specialists Point to point Air Operations

For more information please contact:

Austro Engines

One stop solution for Power, reliability and aviation combined.

Kasstech Aerospace Pvt LTD offers a comprehensive range of power solutions for every aviation need. Together, Austro Engine GmbH and Hirth Engines GmbH form an unparalleled synergy, delivering a complete aviation solution that surpasses expectations. From performance enthusiasts to industry leaders, our engines are trusted by those who demand the best.

The Austro engines - Jet A1 Aviation piston & wankel rotary engines are crafted with meticulous attention to detail, these engines utilize state-of-the-art technology to maximize power, reliability, and efficiency, These engines range from 50 hp to 180 hp.

Hirth Engine

While achieving the highest in power-to-weight ratio. Hirth offers the most reliable two-stroke engines which not only gives lighter engine but superior power and minimal fuel consumption while boosting reliability and performance .

The models range in power from 8 horsepower (hp) to over 50 hp.

Kasstech Aerospace

Embracing Challenges of New Technologies in Aerospace

Kasstech Aerospace, led by Managing Director Vivek Saxena, is a prominent solution provider in India’s aviation sector. With a strong background in various industrial sectors, including aviation, Saxena recognized the immense growth potential in the aviation industry and established Kasstech Aerospace in 2019. The company aims to contribute to the industry’s progress by offering technical solutions, product support, and services to India.

As a DPIIT registered company, Kasstech Aerospace has been successfully meeting the technical solution requirements of India’s aerospace industry. The company specializes in unique integrations to address industry challenges and also provides maintenance and repair services for indian aircraft engines.

Kasstech Aerospace acts as the sales representative for Diamond Aircraft Industries in the Indian market. Additionally, it serves as a distributor for Austro Engine GmbH, Hirth Engines GmBH, thermal OEM Cores from Teledyne FLIR systems, Dynamic Propeller balancer systems from DSS, and Oxygen and Nitrogen generator/plants from Oxywise. Kasstech Aerospace also operates a CAR- 145 approved MRO.

One of Kasstech Aerospace’s key connections is with Diamond Aircraft, the world’s leading manufacturer of single and twin-engine aircraft in general aviation. Diamond aircraft are renowned for their superior design, build quality, comfort, safety, and low operating costs, making them the preferred choice for private pilots and flying training institutes worldwide. Equipped with Austro Engines (the Jet A1 piston and wankel rotary engines), known for their exceptional power-to-weight ratio and low operating costs, the models range in power from 50 hp to 180 hp. Diamond aircraft offer the best value in the market.

In India, Diamond aircraft are being utilized by various flying training organizations (FTOs) and are playing a crucial role in pilot training. Saxena aims to change the current

trend of training pilots abroad by providing contemporary training aircraft within India.

Kasstech Aerospace acknowledges the challenges that arise in the aerospace industry and is dedicated to finding innovative solutions. With extensive experience in strategic planning, technical and commercial management, marketing, and leadership positions in complex and high-technology businesses, Saxena brings confidence and expertise to the company’s operations.

Recently, Kasstech has also collaborated with Hirth Engines as its distributors. These engines offer the most reliable two stroke engines with less moving parts, superior power, minimal fuel consumption and boosting reliability performance, hirth produces models that range in power from 8 horsepower (hp) up to 60 hp, Kasstech now provides a complete solution for aircraft engines.

Kasstech Aerospace operates a CAR145 certified Maintenance, Repair, and Overhaul (MRO) facility in Narnaul, Haryana, catering to the maintenance needs of Diamond aircraft and Austro engines. Their team of trained engineers handles repairs and maintenance of airframes and aircraft engines. Furthermore, Kasstech has partnered with Dynamic Solution Systems (DSS micro) Inc. to distribute and service dynamic microvib propeller balancer systems. They also serve as the calibration center for rotor balancing on helicopters. DSS and the MicroVib II System are trusted within the aviation industry for helicopter track/balance, dynamic propeller balance, and engine/airframe vibration analysis.

Kasstech Aerospace’s commitment to embracing challenges, coupled with its technical expertise and strategic partnerships, positions the company as a reliable and innovative solution provider in India’s aerospace industry. With its comprehensive range of services and dedication to advancing aviation technology, Kasstech Aerospace continues to contribute to the growth and development of the sector.

CHAPTER 1

Travellers to Reach 4 Billion in 2024 – IATA

Excluding the deeper impact of the ongoing Russia-Ukraine conflict, the passenger number is expected to exceed the pre-COVID-19 levels in the next two years

BY AYUSHEE CHAUDHARYTwo years ago, the novel coronavirus took over the entire world and was declared as a pandemic. The travel landscape has not been the same ever since. Multiple waves of the virus taking over the world, various travel restrictions, and additional hassles changed the passengers’ behaviours, travel frequency, and just how the world moves. However, the restrictions are gradually easing, and passengers are starting to move again following the successful vaccination drives and the lowered rate of the disease’s spread.

Noting this rising sun over the travel industry, the International Air Transport Association (IATA) stated that the passenger number is expected to exceed the pre-COVID-19 levels by 2024. IATA expects overall traveller numbers to reach 4.0 billion in 2024 (counting multi-sector connecting trips as one passenger). According to IATA’s long-term forecast, in 2021, overall traveller numbers were 47 per cent of 2019 levels. This is expected to improve to 83 per cent in 2022, 94 per cent in 2023, 103 per cent in 2024 and 111 per cent in 2025. Additionally international traveller numbers in 2021 were 27 per cent of 2019 levels. This is expected to improve to 69 per cent in 2022,

82 per cent in 2023, 92 per cent in 2024 and 101 per cent in 2025. The expectations for the shape of the near-term recovery have somewhat shifted, given the evolution of government-imposed travel restrictions in some markets. Yet, the overall picture presented in the February update to the forecast, remains unchanged from what was expected in November, prior to the Omicron variant.

Towards the end of 2021 and the beginning of 2022, the Omicron variant made headlines but the impact was not felt in equal severity as it was during the Delta variant. IATA’s Director General, Willie Walsh, said, “The trajectory for the recovery in passenger numbers from COVID-19 was not changed by the Omicron variant. People want to travel. And when travel restrictions are lifted, they return to the skies. There is still a long way to go to reach a normal state of affairs, but the forecast for the evolution in passenger numbers gives good reason to be optimistic”.

IATA has been constantly emphasising on the following:

y The removal of all travel barriers (including quarantine and testing) for those fully vaccinated with a WHO (World Health Organisation)-approved vaccine.

“People want to travel. And when travel restrictions are lifted, they return to the skies. There is still a long way to go to reach a normal state of affairs, but the forecast for the evolution in passenger numbers gives good reason to be optimistic,” said IATA’s Director General, Willie Walsh

CHAPTER 2

2022 – An Aerospace Year for the Books

With changed behavioural patterns, new business models, and ambitious goals, the aerospace industry rolled out of 2022 and entered 2023 with an optimistic outlook

BY AYUSHEE CHAUDHARYAs the world got back from the pandemic blues and travel resumed, the aerospace industry took off on a high note with many new announcements, launches, new airlines making entries on the block alongside some collaborations, consolidations and some closures. Here’s us looking back at some of the major moments that the aerospace industry witnessed.

AIRCRAFT MANUFACTURERS

Airbus

European aerospace manufacturer Airbus delivered 661 commercial aircraft to 84 customers in 2022 and registered 1,078 gross new orders. Airbus’ end December 2022 backlog stood at 7,239 aircraft. An Airbus H225 performed the first-ever helicopter flight using 100 per cent SAF in both of its Safran Makila 2 engines. Part of Airbus Helicopters’ test campaign, this flight attempted at understanding the impact of SAF use on the helicopter’s systems. Airbus, for the first time, also performed an A380 flight powered by 100 per cent SAF in one of its RollsRoyce Trent 900 engines. The aim was to certify the use of 100 per cent SAF in Airbus airplanes and rotorcraft by 2030. The Airbus A321XLR successfully completed its first flight, powered by the CFM LEAP

engine. The extra long-range aircraft will be able to carry 180-200 passengers for more than 10 hours of flight time, while consuming 30 per cent less fuel per seat than the previous generation of aircraft. Airbus also launched a 1,000-hr, four-aircraft flight-test programme for the A321XLR long-range narrowbody airliner. In another milestone, Airbus delivered its 500th A350 alongside unveiling its new Production Standard 2022. With this milestone, the A350 Family stood at 225 million passengers, more than 900 routes and over 400 orders in the backlog.

ATR

Regional aircraft manufacturer ATR received certification from the European Aviation Safety Agency (EASA) for its ATR 72 and 42 aircraft powered by the new Pratt & Whitney Canada PW127XT-M engine. ATR also launched a new engine variant during the Singapore Air Show that in the future will become standard on ATR 42 and 72 aircraft. The PW127XT will bring down fuel burn and engine maintenance costs even further – respectively by three per cent and 20 per cent.

ATR, Swedish airline Braathens Regional Airlines and sustainable aviation fuel (SAF) supplier Neste collaborated to enable the first ever 100 per cent SAF-powered test flight on a commercial aircraft.

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

After the pandemic, travel resumed and the aerospace industry thrived, showcasing new announcements, launches, airline entries, collaborations, consolidations, and closures

CHAPTER 3

Airlines to Return to Profit in 2023 – IATA

Even though the road to recovery is still long, turning the corner towards profitability is a significant feat considering the scale of the financial and economic damage caused by the pandemic

BY AYUSHEE CHAUDHARYThe airlines have survived the COVID-19 crisis donning the badge of resilience. 2022 almost became synonymous with a comeback for the industry as travel restarted. Building on that, financial recovery for the airlines is expected in 2023, further making way for the first industry profit since 2019. That is a significant feat considering the scale of the financial and economic damage caused by the pandemic. However, the road to recovery is still long. “Many airlines are sufficiently profitable to attract the capital needed to drive the industry forward but many others are struggling for various reasons. These include inconvenient regulation, high costs, inconsistent government policies, inefficient infrastructure and a value chain where the rewards of connecting the world are not equitably distributed,” said Willie Walsh, Director General of the International Air Transport Association (IATA).

In 2023 IATA expects the airline industry to tip into profitability. Airlines are anticipated to earn a global net profit of $4.7 billion on revenues of $779 billion (0.6 per cent net margin) in spite of growing economic uncertainties as global GDP growth slows to 1.3 per cent (from 2.9 per cent in 2022). “Despite the economic uncertainties, there

are plenty of reasons to be optimistic about 2023. Lower oil price inflation and continuing pent-up demand should help to keep costs in check as the strong growth trend continues. At the same time, with such thin margins, even an insignificant shift in any one of these variables has the potential to shift the balance into negative territory. Vigilance and flexibility will be key,” Walsh added.

The main drivers of this profit identified by IATA include:

y Passengers: The passenger business is expected to generate revenues of $522 billion as passenger demand is expected to reach 85.5 per cent of 2019 levels over the course of 2023. Despite the uncertainties of China’s Zero COVID policies, which are constraining both domestic and international markets, passenger numbers are expected to surpass the four billion mark for the first time since 2019, with 4.2 billion travellers expected to fly. Passengers are taking advantage of the return of their freedom to travel. A recent IATA poll of travellers in 11 global markets revealed that nearly 70 per cent are traveling as much or more than they did prior to the pandemic. And, while the economic situation is concerning to 85 per cent of

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

A recent IATA poll of travellers in 11 global markets revealed that nearly 70 per cent are traveling as much or more than they did prior to the pandemic

CHAPTER 4

Air Cargo Softens in 2022

After a stellar 2021, the weaker air cargo demand in 2022, is a result of multiple headwinds including inflation, Russia-Ukraine war disruptions, and the unusual strength of the US dollar

BY AYUSHEE CHAUDHARY2021 had proved to be a stellar year for the air cargo industry showcasing a strong performance. Following its lead, 2022 did start alright for cargo, maintaining stability for half of the year and showing resilience for most of the second half. However, September onwards the demand began to soften. The International Air Transport Association (IATA) released data for November 2022 global air cargo markets showing that cargo demand softened as economic headwinds persisted.

From a year-to-date (YTD) perspective, the global air cargo industry has achieved 229.4 billion cargo tonne-kilometers (CTKs). Although this is 7.4 per cent lower than the same period in 2021, it still tracks close to the pre-pandemic level with only a 1.1 per cent contraction YTD compared with the same period in 2019. The weaker air cargo demand is a result of multiple headwinds. Inflation remains high, curtailing the spending capacity of households. The ongoing war in Ukraine disrupts trade flows, and the unusual strength of the US dollar makes commodities traded in US dollar more expensive in local currency terms. Although global goods trade growth remained positive, air cargo’s relative growth performance softened.

When the pandemic brought the aviation industry to a halt, cargo aviation had emerged to the forefront, handling the situation of constant transporting of medical aids and stranded passengers across countries. Many commercial airlines had

also transitioned their carriers for cargo purposes. Though the demand for cargo had its moments of fluctuations through the time, 2021 had turned out to be an outstanding year for Air Cargo with a strong performance in December 2021 that witnessed the YoY going up 18.7 per cent. The data released by IATA for global air freight markets showed that full-year demand for air cargo had increased by 6.9 per cent in 2021, compared to 2019 (pre-covid levels) and 18.7 per cent compared to 2020 following a strong performance in December 2021. However, the global demand, measured in CTKs, fell 13.7 per cent in November 2022 compared to November 2021 (-14.2 per cent for international operations). Capacity (measured in available cargo tonne-kilometers, ACTK) was 1.9 per cent below November 2021. This was the second year-on-year contraction following the first last month (in October) since April 2022. International cargo capacity decreased 0.1 per cent compared to November 2021. There was a lesser decline in overall demand (-10.1 per cent) compared to preCOVID-19 levels (November 2019), but capacity was down 8.8 per cent.

Airlines’ reduced air cargo capacity was mainly a response to the supply imbalance that has emerged as demand had fallen year-onyear (YoY) since March. The industry seasonally adjusted (SA) cargo load factor (CLF) in November was 47.2 per cent, marking the fourth monthon-month decline in a row. Therefore, it is likely

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

Airlines’ reduced air cargo capacity was mainly a response to the supply imbalance that has emerged as demand had fallen year-onyear (YoY) since March

CHAPTER 5

Latest Trends in MRO

The increasing digitalisation of MRO to improve efficiency and reduce aircraft downtime is the key factor expected to fuel the growth of the digital MRO market

BY SUKHCHAIN SINGHMRO is an ecosystem of interconnected supply chain and repair stations to perform heavy maintenance, line maintenance, aircraft repairs & modifications, interiors, paint, component repairs, part-out, teardown, and recycling. MRO is the backbone of the aviation industry’s systematic operation be it in general, commercial, or defence sectors.

MRO Industry Forecast & Trends, an IATA

Maintenance Cost Conference in Geneva details exhaustive pattern in the civil aviation trends. It has opined that OEM facilities temporarily closed during the pandemic have created shortage of parts and the scarcity of labour & raw materials has slowed the post-pandemic recovery. Increased trade wars and tariffs driven by growing anti-globalism, nationalism, in addition to other geopolitical issues have resulted in aviation and aerospace company pursuing new strategies to minimise supply chain risk. This will result in Globalisation 2.0 which is More Dual Sourcing & Near-Shoring. Also, commercial airlines worldwide were successful in offsetting pandemic losses leveraging the “preighter” aircraft. The sales of new freighter aircraft are making a strong come back and demand for Passenger to Freighter (P2F) conversions are increasing. Engine and airframe MROs are benefitting from additional MRO demand from the very old, maintenance intensive aircraft due to their delayed retirement.

While the consequences of the pandemic were intense for the industry, they also offer a time for consolidation and innovation. Technologies such as digital twins, real-time monitoring of aircraft condition, and predictive maintenance, could be a handle for service providers to cope with the reduced MRO budget of airlines. Digitalisation plays an important role in improving service efficiency. However, such innovation would require changes not only in the industry culture but also from the safety regulators. According to a global newswire report the digital MRO market is projected to grow to $4.7 billion by 2030. The increasing digitalisation of MRO to improve efficiency and reduce aircraft downtime is the key factor expected to fuel the growth of the digital MRO market. However, limited budgets restrain the adoption of digital MRO which is a major hurdle in the development of this market.

SMART EQUIPMENT TECHNOLOGY

Prior to the introduction and widespread use of sensors and smart equipment, maintenance followed a predictable routine. Now, as sensors and Internet of Things (IoT) technology becomes more accessible and inexpensive, manufacturers are better able to track equipment performance and maintenance needs, vastly reducing or eliminating the cost inefficiencies of outdated routines. Digitisation and smart technology produce vast amounts of data. This data is used to analyse supply chain

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

Technologies such as digital twins, real-time monitoring of aircraft condition, and predictive maintenance, could be a handle for service providers to cope with the reduced MRO budget of airlines

CHAPTER 6

Upscaling SAF – Key for Sustainable Aviation

The aviation industry has started taking steps towards reaching net-zero carbon emissions, however, the pressing need is to further support SAF R&D and adopt globally recognised sustainability standards

BY AYUSHEE CHAUDHARYAviation is responsible for around 2.5 per cent of global CO2 emissions, with most aircraft powered by jet gasoline. While the number may seem small, the impact can be severe and to do its part, the aviation industry has started taking steps towards reaching net-zero carbon emissions. In line with that, 2022 has been an important year for sustainable aviation marked by the adoption of the Long Term Aspirational Goal (LTAG) for Net-Zero by 2050 at the 41st International Civil Aviation Organization (ICAO) Assembly, as a result of which all countries now share the same goal of decarbonising aviation and an interest in Sustainable Aviation Fuel’s (SAF) success. Led by the World Economic Forum (WEF), the Clean Skies for Tomorrow coalition also started its journey from ambition to action. The Clean Skies for Tomorrow Coalition is a global initiative to facilitate the transition to net-zero flying by 2050 - by accelerating the deployment of SAF. The coalition of more than 100 companies is aiming to power global aviation with 10 per cent SAF by 2030.

ICAO had led two weeks of negotiations involving 184 nations to agree on CO2 emissions reduction measures. These include ramping up innovative aircraft technologies, “streamlining” flight

operations and the increased production and use of SAF. “States’ adoption of this new long-term goal for decarbonised air transport, following the similar commitments from industry groups, will contribute importantly to the green innovation and implementation momentum which must be accelerated over the coming decades to ultimately achieve emissions-free powered flight,” said the President of the ICAO Council, Salvatore Sciacchitano.

As of December’s first week, over 4,50,000 commercial flights operated using SAF, noted the International Air Transport Association (IATA). Additionally, around 40 offtake agreements have been announced. SAF has been recognised as a significant enabler to reach net zero CO2 emissions. IATA highlighted that according to current projections, SAF will be responsible for 65 per cent of the mitigation required for this, necessitating a production capacity of 450 billion litres per year in 2050. IATA estimates a 200 per cent increase in SAF production in 2022 on 2021 production of 100 million litres.

“There was at least triple the amount of SAF in the market in 2022 than in 2021. And airlines used every drop, even at very high prices! If more was available, it would have been purchased. That makes it clear that it is a supply issue and that market forces alone are insufficient to solve

SAFs can reduce emissions by 80 per cent according to IATA, however, high production costs and limited supply has slowed its adoption

CHAPTER 7

The Slow Fade of the Four-Engine Airliner

With its four high-powered turbofan engines and up to 480 all-economy passenger capacity, the Boeing 747 jumbo jet transformed the economics and reach of passenger aviation

BY JOSEPH NORONHATime was when a four-engine jet airliner was everybody’s idea of the perfect way to reach a dream destination on another continent. Well-heeled travellers loved the ample space and the lavish cocktail lounges and restaurants on the double-decker Boeing 747. First class Emirates passengers on the gigantic Airbus A380 – of which the Dubai-based carrier has the world’s largest fleet of 118 aircraft – could even enjoy an inflight shower.

In fact when the jet age began in 1952, it was with four-engines all the way. The de Havilland Comet, the world’s first jet passenger aircraft, may have been a safety nightmare. But the Boeing 707 that followed in 1958 proved that jetliners could be both safe and successful. All through the 1960s, four-engine airliners or “quads”, such as the Douglas DC-8 and Boeing 707, dominated both the domestic and long-haul airspace because they were seen as safer than twinjets. In fact, United States (US) Federal Aviation Administration (FAA) regulations required twin-engine aircraft to have a diversion airport available within 60 minutes flying time throughout their route. This made them impractical for transoceanic journeys. In the 1960s and 1970s, three-engine planes or “trijets” were popular since they were more economical than quads and their operation was not as strictly limited as that of

twinjets. The Boeing 727 trijet introduced in 1964 was highly successful and 1,832 were built.

BOEING’S BIG BET

However, the real revolution in air travel came when Pan Am’s legendary founder Juan Trippe asked Boeing to produce a much larger airliner. When the Boeing 747 “jumbo jet” entered service in January 1970 it was a true game-changer. With its four high-powered turbofan engines and up to 480 all-economy passenger capacity, the hump-backed “Queen of the Skies” transformed the economics and reach of passenger aviation. By collecting travellers from several smaller planes into one huge airliner, it helped relieve the congestion at major airports around the world.

The Boeing 747’s market entry came even as longer routes were being opened up – routes that only big four-engine planes could serve due to the 60-minute rule. Dozens of airlines snapped up the 747, including Air India. Airbus tried to challenge Boeing’s dominance in the long-haul market; but its A380 “Gentle Green Giant” finally entered commercial service only in October 2007, by which time the slow fade of the four-engine fleet was beginning.

FALL FROM GRACE

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

Fast forward to today, both the Boeing 747 and the

Engine power has also increased tremendously. This makes it possible to operate large widebody airliners with just two engines.

CHAPTER 8

Single Crew Airliner –Dynamics

Could developments in Artificial Intelligence and onboard computers in the civil arena make the Co-pilot and eventually perhaps the Captain, redundant? There are some pilots who feel that even with two pilots in the cockpit, sometime situation can get complex.

BY ANIL CHOPRAApassenger plane of the 1950s used to have the cockpit crew of nearly five consisting of two pilots, a radio operator, a navigator and a flight engineer. Over the years, advances in avionics, cockpit displays, navigation, radio communications and autopilots have helped reduce the number to two pilots by late 1980s. There is a global debate in the aviation community on whether it is time to relieve the first officer and leave just the captain in the cockpit. The logic that expensive military aircraft have been having single pilot since military aviation began and that mastering of unmanned aerial systems for decades, is being quoted. The emergence of the urban air mobility sector, not to mention driverless cars, has nudged the concept of autonomous transport higher up the agenda. Could developments in artificial intelligence and onboard computers in the civil arena make the co-pilot and eventually perhaps the captain, redundant? But passenger confidence and safety issues remain.

TRANSITION CHALLENGES

The first step would be to greatly increase automation in the cockpit by handing over more tasks

to computers. Simultaneously, some tasks will need to go from the cockpit to the ground support crew. Many technologies for ground control already exist in unmanned aerial vehicles (UAV). Undoubtedly, to switch to single crew airliner will mean significant operating cost savings while still maintaining safety levels similar to conventional two-pilot commercial operations would be essential. The initial experiments would have to be on a cargo aircraft. Yet there are some pilots who feel that even with two pilots in the cockpit, sometime situation is complex and both get saturated with tasks.

TRAINED PILOT ON GROUND

NASA has suggested that a trained pilot on the ground could simultaneously oversee a number of flights. He could even take over the aircraft fully if the pilot was to get incapacitated. This pilot could also specialise in a specific airport. Such options have been tested on special simulators created on ground. All ground pilots could safely land the planes, but the studies showed “significant increases in workload” compared to regular twocrew operations. Visual cues from the second pilot were considered important.

Undoubtedly, to switch to single crew airliner will mean significant operating cost savings while maintaining safety levels similar to conventional two-pilot commercial operations would be essential

CHAPTER 1

In an extensive interview with Jayant Baranwal, Editor-in-Chief, SP Guide Publications, Arjan Meijer, President & CEO of Embraer Commercial Aviation talks about how Embraer has created a niche for itself as an aircraft manufacturer and its plans for the future

Jayant Baranwal (Baranwal): Can you take us through the journey of Embraer Commercial since its inception and its evolution?

Arjan Meijer (Meijer): Embraer is the market leader in commercial jets up to 150 seats, and it is also a significant player in Executive Aviation, Defence & Security, and Agricultural Aviation. Founded in 1969, Embraer’s first aircraft was the Bandeirante, a turboprop plane designed for both civilian and military purposes, with the capacity to transport between 15

and 21 passengers. From the APAC perspective, the first Bandeirante, and by extension Embraer’s first aircraft in the region arrived in 1978 and was operated by an Australian airline.

TO

READ THE COMPLETE ARTICLE

GET YOUR COPY NOW!

Looking from a commercial aviation perspective, following the Bandeirante, the ERJ family of jets entered into service in 1997 and was crucial in developing regional connectivity especially in North America and other parts of the world, including Europe and South America.

“We work hand in hand with our customer support team to provide our customers the very best service and support”

“Embraer is committed to developing aircraft that deliver best-in-class reliability, performance and operating costs”

CHAPTER 2

Regulator should Act as a Parent to the Industry”

Laila Bin Hareb Almheiri has spent over 10 years with UAE General Civil Aviation Authority (GCAA). As a forward-looking and an enterprising woman, she founded Alive Group which offers solutions across multiple disciplines including aviation and cyber security. SP Guide Publications Editor-in-Chief Jayant Baranwal caught up with her for an interview after a BizAv Talks event that was anchored and presided by Laila during the MEBAA 2022 in Dubai.

AVIATION REGULATIONS

SP Guide Publications (SP’s): As you have spent over ten years in UAE General Civil Aviation Authority (GCAA), what do you think about the regulatory bodies’ role in aviation sectors? What all should be the most crucial roles on the part of regulatory bodies through your eyes supporting aviation industry and ensuring the desired level of growth creating win-win situation?

Laila Bin Hareb Almheiri (Laila): People have misinterpreted the role of a regulator. I believe that the role of a Regulator should be altered to ‘facilitator and enabler of sustainable industry growth’ rather than viewing them solely as the police of the industry. A regulator should act as a parent to the

industry. They should provide wisdom and foster a flourishing environment while advising on harmful risks that may arise.

In order to do that, regulators should have a triad of people:

y Individuals who have gathered a plethora of experience throughout their careers.

y Young and hungry people who understand and who can relate to the current era of technological advancement, and facilitate digital and innovation dynamics to create a future-ready regulator.

y Thirdly, data scientists specialised in behaviour and economics who will work with the first two groups to bring positive and well-accepted change to the industry. In the past, being a regulator marked the end

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

“A

“I believe the role of general aviation in rural and urban connectivity will increase tremendously in the coming years”

CHAPTER 3

Speaking exclusively to SP Guide Publications in his First and Exclusive interview, Ajay Shah, BAOA’s President shares his insights about the industry and how BAOA can contribute to the continued growth of the GA/BA industry in India

SP Guide Publications (SP’s): What would be your top three goals as the BAOA President?

Ajay Shah (Shah): BAOA is more than a decade old organisation now and since inception its functioning and ethos is based on democratic and transparent values. The goals of BAOA are driven by the requirements of the GA/BA industry. Our three top priorities are:

y Keeping the interests of operators, members & GA/BA industry in the forefront of everything we do as an association;

y Collaborate with the Ministry of Civil Aviation and the Regulators to find optimum solutions to the issues faced by the industry;

y Create a better understanding amongst all the members for issues affecting the industry as a whole.

SP’s: What kind of support does the industry require from the Government at this stage?

Shah: We are all aware that the Government is taking numerous proactive steps to address the needs of the aviation industry. A number of ‘Advisory Groups’ have been formed by the Ministry to this effect. It is our opinion that there is a need for these advisory groups to function in a coordinated manner through collaborative mechanism involving the regulators via ‘Joint Working Groups’. This will help accelerate decision making and issue of executive directions by the Ministry.

SP’s: How can we balance the unreasonable charges that sections of the industry have to bear with, whether it’s the import duties, the ground handling charges, the parking charges, etc?

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

“We foresee fractional ownership as a gamechanger”

“Since aviation is yet to develop to its full potential in India, as a national policy, we are aiming for net-zero emission by 2060”

CHAPTER 4

IATA – Keeping the World Connected

Statement of Willie Walsh, Director General,

Aviation is resilient and on the rise. After the worst downturn in our history, we have turned the corner on the COVID-19 pandemic. Industry losses are expected to reduce to $9.7 billion in 2022; down from $42.1 billion in 2021. That is a huge improvement from losses of $137.7 billion in 2020.

In growing numbers and with rising excitement and enthusiasm, people are again enjoying the freedom to travel, to connect with one another, and to see the world. By the end of 2023, most regions will be at—or exceeding—pre-pandemic levels of demand.

PANDEMIC LESSONS

Looking back at the pandemic, we can point to our service with pride. Where permitted by governments, airlines kept the world connected. Airlines kept vital supply lanes open to deliver life saving vaccines and medical supplies. And they operated to the highest levels of safety throughout. Over and over, the aviation workforce rose to the occasion.

In fact, the importance of aviation was made absolutely clearby the pandemic restrictions. People recognised that their quality of life deteriorated and economies suffered.

This pandemic will not be the last. It is vital, therefore, that we draw the correct lessons so that we can be better prepared next time. Top of the list of lessons learned is that travel restrictions did little to contain the spread of COVID-19. The World Health Organisation (WHO) said this from the beginning, but far too many governments ignored their sound advice. Governments must do better next time.

WORKING WITH GOVERNMENTS

Many governments recognized aviation’s vital role as an economic lynchpin, providing financial relief to numerous airlines. As governments now rebuild their regulatory agendas, it is critical that they continue to focus on regulations that create value. IATA will be vigilant and remind governments that the benefits of regulation must exceed the costs they create.

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

IATA

“This pandemic will not be the last. It is vital, therefore, that we draw the correct lessons so that we can be better prepared next time.”

CHAPTER 5

Airbus –Staying the Course

Guillaume Faury, CEO outlines Airbus’ performance in 2022, including the key operational and financial takeaways. He also discusses the priorities for the Company.

Question: How would you assess Airbus’ year?

Answer: Even though there were some notable successes, 2022 proved to be more difficult than expected. We began the year full of optimism, in anticipation of finally putting COVID-19 behind us. Demand for commercial aviation had rebounded in most parts of the world and airlines had high expectations of Airbus to provide them with the aircraft they needed. However, after two years dominated by a pandemic-driven demand crisis, we faced the opposite challenge: a crisis of supply.

There were various macroeconomic headwinds to navigate, and Russia’s invasion of Ukraine –plus the related sanctions – added to the adverse operating environment. The industry faced many constraints over the supply of labour, raw materials and electronic components against a backdrop of sharply rising inflation and energy prices. The pandemic also continued to cast a long shadow in some parts of the world.

However, we came together as Team Airbus to

address these challenges and make progress on our strategic priorities. This combined effort meant we achieved our financial targets even though we had to reduce our commercial aircraft delivery targets.

Question: What were the main operational and commercial developments?

Answer: The number of commercial aircraft deliveries rose by eight per cent year-on-year to 661, although as stated this was less than we had aimed for. Nevertheless, it was a successful year on the sales front, with the 1,078 gross and 820 net orders reflecting the broad strength, competitiveness and efficiency of our product line.

We set out our A320 Family production plans with an objective to reach a monthly rate of 75 aircraft in 2026. To support this we are modernising and upgrading our industrial set-up globally, including upgrading our A320 Family final assembly facilities to all be capable of producing the indemand A321 model. We established two new entities in the year for our reorganised and streamlined

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

“We want to deliver on our commercial aircraft backlog over the coming years as there is strong demand globally for more fuel-efficient aircraft”

ATR –Set for Growth in 2023

After three difficult years due to Covid and a complex economic and geopolitical environment, ATR is set for growth in 2023. In the context of industry-wide supply chain issues, ATR delivered 25 new and 11 pre-owned aircraft in 2022. Nonetheless the global ATR in-service fleet is now close to pre-Covid numbers with 1,200 aircraft flying, and the current backlog stands at a solid 160 aircraft.

Last year saw 150 new routes created with ATR aircraft. As part of its commitment to decarbonisation, ATR performed the first 100 per cent Sustainable Aviation Fuel (SAF) flight in history with a commercial aircraft, and its brand new PW127XT engine was certified and entered into service. At the same time, ATR successfully advanced the development of its aircraft family, completing the first test flight of the ATR 42-600S (Short Take-Off and Landing) and launching a feasibility study for its next generation EVO concept. These achievements showcase the commitment

to connectivity, sustainability and innovation that ATR stands for.

“The goal for 2023 is to maintain our position as the leading regional aircraft manufacturer, by

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

CHAPTER 7

Transforming Boeing

Statement of David L.

For more than a century, The Boeing Company has been at the forefront of historic innovations that connect people around the world and beyond. Today, our work continues to help chart the course for the future of aerospace.

Every day we work to transform our company to service big defence and commercial needs. There is substantial and growing demand for the products and services we create, with more than $400 billion in open orders. In response to these demands and in light of post-COVID supply chain challenges, a priority is making our aircraft production capabilities more predictable and scalable. We do this work while meeting exacting safety and quality standards that are set by our regulators and customers and reflect our values, and I am incredibly proud of the progress we have made in our journey together.

Our mission—to protect, connect and explore our world and beyond—is supported by our unwavering commitment to strengthening safety through continuous improvement, learning and innovation. We will never forget the lives lost in the 737 MAX accidents. Their memory drives us every day to uphold our responsibility to all who depend on the safety of our products and services.

Despite facing existential challenges in our company’s recent history, there has not been a single year in the last decade when we did not invest substantial time and capital to enhance our capabilities and deliver innovation. We established research and technology centers in Australia, Brazil, China, Europe, the Middle East, India, South Korea and most recently in Japan. We believe the unique local perspectives our teammates bring to the table allow us to collaborate globally to find technology solutions that drive future growth.

Our product portfolio spans an impressive array of commercial and defence products that meet our customers’ needs, including 737-7, 73710, 777X, KC-46, MQ-25 and the T-7A. That includes classified products that serve the U.S. government and NATO allies—which we cannot disclose— along with services platforms that cater to a global customer base.

Boeing is one of the most sophisticated engineering and technology companies in the world. We specialise in creating the world’s leading aerospace and defense products and solutions. Prioritising and expanding large-scale capability investments will help us secure our future.

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

Calhoun, President and CEO, Boeing

“We charted the course of aerospace history through the last century, and we will do the same again over the next one hundred years”

CHAPTER 8

Bombardier –

Executing the Plan

Statement of Eric Martel, President and Chief Executive Officer, Bombardier

It is fantastic to celebrate Bombardier’s 80th anniversary with the performance, passion and pride we witnessed throughout 2022. All our strategic paths were successful, from our footprint expansion to the launch of Bombardier Defense, and unveiling of the Global 8000 aircraft, which sits atop the industry as the fastest and smoothest flying jet. Throughout the year, we accelerated our talent acquisition initiatives and grew our workforce by over 2,000 people, all the while exceeding our financial targets and significantly deleveraging our company.

The year began with Bombardier navigating a booming market as business jet demand and utilisation surpassed expectations. We remained focused on executing our plan and ensuring that the fundamentals of our business remained central to delivering strong margins and overall performance, no matter the market conditions. I am immensely impressed by the Bombardier team’s focus on execution, most notably on seizing

opportunities to significantly grow our backlog and in turn ensure our predictability.

Our sights are firmly set on a future where Bombardier jets continue to lead their categories, our service network continues to grow and bring our jets home in more places around the world, governments increasingly seize the opportunities special-mission business jets bring, we continue to recruit and develop top talent, we deliver exceptional and predictable performance, and above all, lead the charge to a net zero business aviation industry and steward sustainability in all aspects of our operations(1). 2022 saw Bombardier significantly progress each of these elements with focus, energy and determination.

On the product side, the year began with the launch of the Global 8000 jet. When it enters service in 2025, this aircraft will be the fastest flying plane in business aviation with a maximum operating speed of Mach 0.94, or 94 per cent of the speed of sound. To unlock this, testing has begun, and we unveiled a mission in which our test vehicle

TO READ THE COMPLETE ARTICLE

GET YOUR COPY NOW!

“The year began with Bombardier navigating a booming market as business jet demand and utilisation surpassed expectations”

CHAPTER 9

Dassault Aviation –Upbeat about the Future

Statement of Éric Trappier, Chairman and Chief Executive Officer, Dassault Aviation

Question: What was the most exciting development for Dassault Aviation in 2022?

Answer: 2022 will go down as a record year for Dassault in terms of new orders: an all-time high of 21 billion euros. This figure represents 64 Falcons and 92 Rafales, 80 of which were ordered by the United Arab Emirates, in what is the largest contract ever secured by Dassault Aviation. Our order book now stands at 35 billion euros, another all-time high, which amounts to a total of 251 aircraft: 87 Falcons and 164 Rafales. This means we can plan ahead for the next 10 years, which is a rare and enviable outlook in the aviation industry. We will be manufacturing 35 Falcons and 15 Rafales in 2023. This may seem like a low figure, considering the magnitude of the orders mentioned above, but it is important to remember that, on account of the production cycle, it takes at least three years from the time a contract comes into effect until the first aircraft are delivered. Thereafter, we are aiming for a production rate of three aircraft per month. To achieve this ramp-up,we are actively recruiting new

employees, on top of the 1,560 we hired in 2022. We are also working to secure our industrial ecosystem in the face of the fallout from the war in Ukraine: issues such as energy, raw materials, components and inflation are affecting a supply chain that was already underpressure due to the Covid crisis.

Question: What is happening in terms of civil aviation?

Answer: As far as business aviation is concerned, we have had to deal with cancellations by Russian customers, as well as a number of support issues and supply chain problems. As a result, our 2022 deliveries are slightly under target. On the other hand, sales have made good progress, with 64 aircraft sold, up from 51 in 2021. The Falcon 6X is scheduled to be certified and to enter into service in 2023. As for the Falcon 10X, our future flagship, its development still has several years to go. These two business jets make us really upbeat about the future. They address our current customers’ needs and are sure to attract

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

“Our aim is to be using 100 per cent SAF blends by the time the Falcon 10X enters into service”

A Year That Propelled GE Forward

Statement of H. LAWRENCE CULP, JR., Chairman of the Board and Chief Executive Officer, GE; Chief Executive Officer, GE Aerospace

Throughout our journey over the past four years—step by step— we have built a stronger GE. Our first priority was to reduce our debt load, and we have done so by over $100 billion since 2018—no small feat. Today our balance sheet is solid, and we are operating from a position of strength. We are also focused on changing the way we work. A lean mindset focuses on safety, quality, delivery, and cost (SQDC)—in that order— and gives us the tools and instincts to make the right decisions and necessary trade-offs.

While developing a lean mindset takes many years, we are gaining ground. At our GE Aerospace site in Greenville, South Carolina, our team performs complex machining operations and detailed inspections on high-pressure turbine blades. With a clear focus on reducing blade delivery lead time, the team created standard lines, which in turn improved part flow. This is just one of the countless examples of effective utilisation of lean across GE.

GE AEROSPACE

At GE Aerospace, we have a tremendously talented team, a highly differentiated product and technology portfolio, leading positions in attractive commercial and military sectors, and a bold vision for the future of flight.

In 2022, nearly 3 billion people flew with our technology under wing. We have nearly 41,000 commercial engines at work in more than 70 per cent of global airlines, and a diverse portfolio of more than 26,000 military engines. We take that responsibility seriously, living our purpose to invent the future of flight, lift people up, and bring them home safely.

It’s now been three years since the start of the pandemic, and the world is eager to travel. The commercial market recovery continues, and we expect total departures to return to 2019 levels in late 2023.

GE Aerospace is uniquely positioned to serve this market as customers expand and upgrade their fleets. Today we have new engines in each market segment that offer double-digit fuel burn reduc-

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

“Today we have new engines in each market segment that offer doubledigit fuel burn reduction, lowering one of our customers’ greatest variable costs”

CHAPTER 11

General Dynamics (Aerospace Division) –Relentless Focus on Innovation

Statement of PHEBE N. NOVAKOVIC, Chairman and CEO, General Dynamics

Our company had another solid year in a difficult environment as the ramifications of the pandemic continued to impact our industrial base in different ways. Our Aerospace businesses had a very strong year. Sales, earnings, margin and backlog all increased nicely. Demand was robust, with a bookto-bill ratio of 1.5-to-1, with orders of $12.6 billion. Aerospace ended the year with a backlog of $19.5 billion. Over the past two years Gulfstream has received over 400 net orders. All said and done, Aerospace backlog was up 20 per cent in 2022 and a staggering 68 per cent since the end of 2020.

Certification efforts with the FAA continue, focused on the G700. We anticipate FAA certification this summer, depending on FAA time and resources. The G800 should be certified approximately six months later.

As we look to the remainder of 2023, our operating performance, strong backlog and free cash flow generation put us in good stead to continue to drive value for our shareholders.

AEROSPACE

We design, manufacture and service the most advanced and reliable family of business jets in the world. Gulfstream’s powerful brand recognition is

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

“We promote the availability and adoption of SAF in support of the industrywide effort to achieve netzero carbon emissions by 2050”

CHAPTER 12

Honeywell –Focus on Innovation

Statement of DARIUS ADAMCZYK, Chairman and Chief Executive Officer, Honeywell

As has been the norm in recent years, 2022 offered its share of opportunities but also its share of unique challenges. In terms of the challenges, our primary focus was on effectively managing the continued supply chain constraints. We developed new skills and tools to manage these challenges, which have been added to our operating system: Accelerator. We demonstrated in 2022 that by leveraging our operating model we can deliver superior results — independent of market conditions. In the last six years, which includes the pandemic year, we have created nearly the same amount of value as we did in the previous 15 years.

ACCELERATOR & DIGITALISATION

Honeywell’s next evolution is the expansion of our operating system – Accelerator – and further advancement of Honeywell digitalisation, which has already brought significant gains in business operations over the last few years.

Within Accelerator, we are developing global design models across various business types (product, project, software, services, etc. to fully standardise how we operate them. This is inclusive of functional processes, IT backbone, and leadership skills to optimise performance. We are also refreshing all Accelerator content and educational instruments, tools, and templates to ensure it fully reflects our operating rhythm. Lastly, Accelerator is constantly expanding with additional processes and tools to enable further business performance enhancements.

Our digitalisation efforts have already generated significant gains in product-level inflation projection, value capture, manufacturing operations, digital finance, and more. Our next phase of the digital evolution is in spanning the value streams such as order-to-cash, budgeting to financial planning, and many others.

STRATEGY UPDATE

TO READ THE COMPLETE ARTICLE

GET YOUR COPY NOW!

We made progress across many of our key objectives in 2022. In 2022, we also added a new strategic

“In 2022, about 60 per cent of our new product R&D investments were directed toward ESGoriented outcomes, while more than 60 per cent of our sales were from offerings that contribute to ESG oriented outcomes”

CHAPTER 13

Be Tomorrow –Leonardo 2030

Statement of Alessandro Profumo Chief Executive Officer, Leonardo

For Leonardo, 2022 was an important year. We have once again achieved, and in some cases exceeded, the objectives set. We have delivered results that further confirm the validity of our strategic path.

Indeed, thanks to the actions undertaken since 2018, Leonardo has strengthened its competitiveness and consolidated its role as a top player. Today we are a more solid, resilient, sustainable, innovative company, ready to face challenges and seize future opportunities.

Orders show significant growth of over 20 per cent compared to 2021, with a value of over €17 billion, increasing our backlog to over 37 billion. There are positive trends in all our business areas, confirming the commercial solidity of the Group and the validity of the diversified offer of products, systems and solutions that meet the complex operational requirements of customers, guaranteeing interoperability and multi-domain capabilities.

The results achieved are even more significant in the light of a general and national economic framework characterised by inflationary pressures on energy and raw material costs: our results demonstrate the solidity of the Group’s industrial strengths and the ability to react and adapt to complex challenges, as already demonstrated during the pandemic period.

In this context, we continued to pursue with determination our objectives in terms of improving our competitive positioning in international markets and the creation of long-term value.

There were also many actions that we implemented in the ESG area, supporting the Business Plan’s priorities, with the aim of “protecting people and the planet, guaranteeing defence and security, with long-term benefits in terms of development technology, innovation and progress”. These were, in fact, some of the topics covered on the occasion of the first ESG Investor Day in which Leonardo presented significant results on decarbonisation, sustainable innova-

“We have further strengthened the decarbonisation journey by announcing a commitment to the Science Based Target initiative”

CHAPTER 14

Lufthansa Technik –Continue to Grow from a Position of Strength

Statement of Soeren Stark, Chairman of the Executive Board, CEO, Lufthansa

Year 2022 was a highly dynamic year in aviation. The industry has emerged from the coronavirus pandemic, with demand for air travel in Europe and the Americas, as well as transatlantic traffic, recovering over the year. Although COVID restrictions – especially though not exclusively in Asia –still heavily impaired air traffic, the strong development of demand in the summer demonstrated how much people around the world longed to be able to travel again. Good prospects as well for companies in the aircraft maintenance, repair and overhaul (MRO) sector.

This dynamism also characterised Lufthansa Technik’s financial year – a year that once again demanded everything from us. At the beginning of the financial year, we did not have enough work for all our employees – and at its end, not enough

employees for all the work that needed to be done. While we have not quite returned to our former greatness, we will continue to grow from a position of strength.

Lufthansa Technik’s revenue grew by 39 per cent and we achieved the best result in the Group’s history. This is also due to our central improvement programme “RISE”, which has enabled us to organise the company much more efficiently, streamline processes and sustainably reduce our expenses. Today Lufthansa Technik is a better company than it was before the COVID crisis – we are well prepared now for the opportunities that lie ahead.

The foundation of our success remains the partnership with our customers. Our efforts to work together through the crisis and our investments in new technologies and offerings such as Mobile Engine Services were rewarded in many

TO READ THE COMPLETE ARTICLE GET YOUR COPY NOW!

Technik

“Lufthansa Technik benefited from the strong demand for maintenance and repair services in the context of the recovery of the global industry”

Pilatus – One of the Best Years Ever