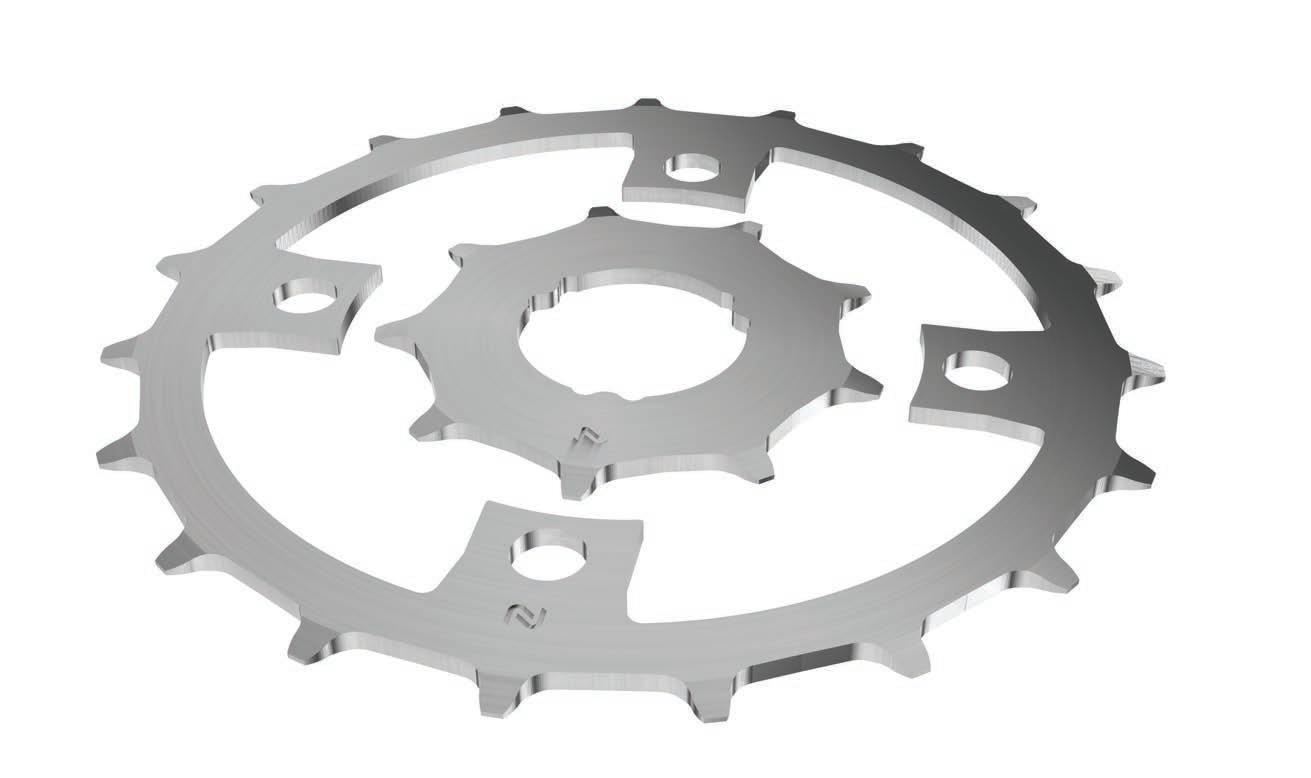

4600 lumens • Handlebar mounted • Reflex technology

Built for ripping through the trails or single track, a combination of 3 spot lenses launch light far down the track and a spread beam highlights the trail edge. REFEX ++ automatically provides the perfect output for any change in speed or terrain. The Maxx-D is backed up with 4600 measured lumens to be at one with any terrain.

Diablo Mk14

Maxx-D Mk15 2000 lumens • Helmet mounted • TAP technology

Exposure Lights most popular Helmet Light the triple LED’d Diablo creates a wide beam, combined with fast mode changing TAP technology, the Diablo’s increased lumen output is now at a measured 2000 lumens and will enable the rider to rapidly adapt lumen outputs to the trails with a TAP to pin the trails. With a lightweight, CNC engineered aluminium body the Diablo gives you licence to raise hell on the trail!

FOR STOCK CALL: 01798839300 OR EMAIL: INFO@USE.GROUP

BoostR ReAKT 150 lumens • Blaze ReAKT 150 lumens • TraceR ReAKT 120 lumens

Rear Mounted • ReAKT & Peloton Technology • Daybright Pulse

Rear lighting that flares up automatically under braking. It can also intelligently adapt to the surrounding ambient light conditions to maintain maximum contrast and visibility, for example brightening for street lit areas and moving into sunlight from shade.

This mode enables rear lights to automatically dim down when the front light of the rider behind is detected, preventing dazzling in the chain gang, it then flares up at the back of the pack for maximum safety.

Bespoke pulse pattern designed for daylight use which is more conspicuous than a regular pulse and visible from over a kilometre away, even in the brightest conditions. DayBright mode will get you noticed. Be Seen Be Safe.

FOR STOCK CALL: 01798839300 OR EMAIL: INFO@USE.GROUP

GETTING INTO YOUR CUSTOMERS’ HEADS

“WHEN your average customer walks into a bike shop, they can be blinded by all the product on offer.”

Like yourselves no doubt, we spend quite a lot of time trying to get into the heads of cycle consumers. Second guessing the tricky blighters is quite the challenge, but one that virtually all of us in the industry (and those of us that watch it) have committed to answering, in some way.

But it’s not even as easy as that, we’re also trying to get into the heads of those who are not yet cycle customers but could be. In a way, that’s easier. That initial quote, about being intimidated by a vast array of product (see page 32 of this issue), applies to both current cycle customers and future ones too. Where do they start when they come into a shop? Good signage, helpful advice, decent packaging… all these things and more, to which the independent bicycle dealer is well placed to offer.

Getting future customers into a bike shop in the first place is also part of the challenge.

Our market data, gleaned from the UK’s independent bike dealers, tells us that the over50s and cycle commuters are among the biggest demographics with potential to grow the market in the near term (page 8). A few pages on, one senior cycle industry exec points out that very few cycle brand’s websites currently have many images of the over 50s on bikes (page 12). That’s a conundrum and needs addressing – or we can just keep doing things the way we’ve always done them.

Is the replica football kit industry worried about not having ads featuring the over 50s? Probably not, but is it bothered about selling football replica kits to the over 50s? Also, possibly not. Is the cycle industry bothered about selling to the over 50s? That’s for you lot to decide, but it’s a safe bet that you are.

The cycle market is vastly different to the replica football kit market (it was a stupid comparison to choose, I’ll be honest) and it is vastly larger too, or should be. With products seemingly tailor-made to appeal to a wider demographic, it feels like there remains huge opportunities ahead of the cycle market which, we hope, will be grasped. And getting better at standing in the shoes of future and existing customers is going to help convert those opportunities.

Publisher Jerr y Ramsdale jerr y@cyclingindustr y.news

Editor Jonathon Harker jon@cyclingindustr y.news

Staff Writer Simon Cox simon@cyclingindustr y.news

Head of Sales Frazer Clifford frazer@cyclingindustr y.news

Head of Produc tion Luke Wikner production@cyclingindustr y.news

Designers Dan Bennett Victoria Arellano

Jonathon Harker

Published by Stag Publications Ltd 18 Alban Park, Hatfield Road St.Albans AL4 0JJ t +44 (0)1727 739160 w cyclingindustr y.news

@CyclingIndustry Cycling Industry Chat

www.cyclingindustry.news

EDITOR FROM

AVAILABLE NOW > GET YOUR LICENCE FOR THE LATEST REPORT MARKET DATA 2023 TO PURCHASE A LICENCE FOR THE 2023 MARKET DATA, PLEASE CONTACT FRAZER@CYCLINGINDUSTRY.NEWS

THE

©2023 Stag Publications No part of this publication may be reproduced stored in a retrieva system, or transmitted n any form or by any means without the prior permission of the publisher The Publisher cannot be held responsible or in any way liable for errors or omissions during input or printing of any material supplied or contained herein. The Publisher also cannot be held liable for any claims made by advertisers or in contributions from individuals or companies submitted for inclusion within this publication. The opinions expressed are not necessarily those of the Editor or of Stag Publications Ltd.

jon@cyclingindustr y.news

TOUGH TIME? WHAT TOUGH TIME?

Are inventory levels normalising? How have retailers managed with supplies while some distributors have sadly gone out of business? We quiz retailers on how they’ve negotiated what are, arguably it seems, tough trading conditions…

IS IT STILL HARD TO GET HOLD OF CERTAIN CATEGORIES/PRODUCTS DESPITE THE GENERALLY OVERSTOCKED SHELVES?

Gavin Hudson, Owner, Butternut Bikes

In general, we’ve been really responsive in making sure that we carry stock of parts, probably too much in many cases, which is a hangover from founding the business during the pandemic. We never ran out of cassettes or chains in nearly any combo, but are now running stocks down a bit to let distributors hold stock. Where we do struggle is proprietary parts that are not profit-making items for distributors, so they don’t invest in stock. Specific bearing sizes, headsets, or small spares to repair items for example.

Len Simmons, Highway Cycles

It is harder to get hold of certain products, but it is improving every month.

IN YOUR VIEW, IS THE MARKET’S NOTORIOUSLY HIGH INVENTORY BEGINNING TO NORMALISE?

Gavin Hudson, Owner, Butternut Bikes

We are seeing bike brands move away from model years. They say that it’s in order to manage inventory, but then also model years create demand and give them something to talk about, so I’m sure that will come back when it’s best for them. Don’t be afraid to resist brands who put pressure on you to hold too much stock, and support the ones that support you.

Just this week we’ve had Frog announce that they are selling bikes to Fraser Group and cutting some margins to 10%, vs Marin who lowered prices, offered to credit dealers holding stock who were affected by this and in general have awesome and transparent communication rather than just paying lip service. If brands have too many bikes, offer to hold a demo bike for them. It might as well be in your shop as in a warehouse.

Len Simmons, Highway Cycles

There are indications that OEM stock is reducing with certain products.

WITH A FEW DISTRIBUTORS SADLY LEAVING THE MARKET THROUGH ADMINISTRATION, HAS THAT HAD A KNOCK ON EFFECT, MAKING IT HARD TO GET HOLD OF SPECIFIC PRODUCTS – OR HAVE OTHER DISTRIBUTORS STEPPED IN?

Len Simmons, Highway Cycles

It seems that other distributors have stepped in the cover most products if there is a market demand.

STAY IN THE LOOP ASK THE PROFESSIONALS SCAN QR CODE > TO RECEIVE OUR BI-WEEKLY NEWS UPDATES

THE PANELLISTS

Gavin Hudson Butternut Bikes Len Simmons Highway Cycles

TOUGH TIME? WHAT TOUGH TIME?

Gavin Hudson, Owner, Butternut Bikes

Having attended Eurobike, there are still quite a few good products out there that don’t have distribution in the UK. It would be good to see distributors looking at that, rather than just trying to nick brands off each other or the fallen distributors. We miss Moore Large for a good range of products (particularly their own branded stuff), but in general it seems to have worked out OK. It’s good when smaller distributors get brands, as they really seem to care about them and put effort in, rather than just slinging them onto a B2B. Have a look at how Cyclorise really put effort into explaining their (pretty niche) products to the trade and customers. Big brands and distributors could take note! We are seeing more and more distributors selling direct to the public, and that is a vicious circle. IBDs aren’t going to invest in a product to compete with their own distro, as a result the IBD channel becomes less important for the distributor, and they invest more in selling direct. With some distributors it’s cheaper to buy from their eBay store than it is from the B2B, and it’s not like we don’t notice that. Support the distributors that support you.

ARE CERTAIN CATEGORIES BUCKING THE DOWNTURN? WE HEAR THAT GRAVEL BIKES, EBIKES AND THE HIGH END/EXPENSIVE PRODUCTS CONTINUE TO BE POPULAR DESPITE TOUGHER TIMES ALL-ROUND. HAVE YOU FOUND THAT TO BE THE CASE, OR ANY INDICATIONS OF THAT?

Gavin Hudson, Owner, Butternut Bikes

Yep, as in life, plenty of people have got plenty of money, they use excuses to not be parted from it, it’s identifying those people and then also doing your best to help those who can’t afford it which is tough. Cycling is still an affordable way to get around and overall is booming. We are doing great with eBikes for family transport, and looking to grow that too. We are lucky as we are in a hilly area of North London, so our market is right on our doorstep. A few years ago the responsible parent would drop their kids at school in a huge SUV. These days you’d be a pariah and also stuck walking them about as far from the school as your house is. We also sell bikes via bike fits, I can’t imagine holding

If you are an independent retailer and would like to take part in future issues, e-mail: Jon@cyclingindustry.news

a £10k road bike in stock these days just in case someone walks through the door.

Len Simmons, Highway Cycles

Overall, there is still demand for those products, but it has decreased compared to the previous year. Our entry-level products, however, have a lower level of interest.

I KNOW YOU WON’T WANT TO GIVE AWAY ANY TRADE SECRETS, BUT IF YOU HAVE ANY INSIGHTS/ADVICE TO OTHER SHOPS AND WORKSHOPS TRYING TO GET THROUGH THIS TOUGH TIME THEN IT WOULD BE GREAT TO HEAR IT.

Gavin Hudson, Owner, Butternut Bikes

Tough time? What tough time? The workshop is busy, cycling is as popular as it was at any time in the last 20 years, people are normalising £5k for a mid-level bike! In the workshop we have had a laser-focus on profitability. We aren’t a charity. If you come in with your 12 spd Canyon wanting “just a DOT fluid replacement” then it’s gold level service for your first visit. Odd jobs will happily be done in the future once we’ve got to know you and your bike. When a customer walks out saying “that’s too expensive” it really hurts, but it happens far fewer times than you think. Having a good relationship with most local shops has been good too, there’s no point in competing on price with each other. Other advice is to build good relationships with distributors and suppliers, we didn’t need to go to Eurobike, but we did. We make sure we chat to all the staff at distros and brands, and when we need a favour (or eg to be able to supply a bike where we’re not a stockist) we generally get a good response. We’ve got a great relationship with nearly every distributor in the UK and we’re working on the other one :)

Len Simmons, Highway

Cycles

It’s a challenging market at the moment and only those who adapt quickly to changes will survive.

ASK THE PROFESSIONALS BIKE JOBS + RECRUITMENT BASIC, FEATURED AND ANNUAL PACKAGES ARE AVAILABLE TO BIKE BUSINESSES LOOKING TO REACH A TRADE-ONLY AUDIENCE. VACANCIES START FROM £150 PER MONTH WITH THE OPPORTUNITY TO FEATURE ON CI.N’S BI-WEEKLY EMAIL DIGESTS. TO ADVERTISE YOUR COMPANY’S BIKE JOBS, PLEASE CONTACT MARK@CYCLINGINDUSTRY.NEWS SCAN QR CODE > TO VIEW JOBS PAGE

BECOMING A PANELLIST

STUNNING NEW BRITISH DESIGNED E-BIKES FROM THE UK’S LEADING E-BIKE SPECIALIST

• Powered by powerful and reliable motor systems

• Quality branded integrated battery technology

• Class leading design

URBAN SERIES

URBAN 2

RRP £1599

URBAN 3

RRP £2499

URBAN 5 RRP £2799

• Quality build

• High value

Well thought out function and classic styling

• Fully equipped with mudguards and lights

• Ideal for commuting and leisure riding

• Roadster/Lowstep and trapeze frame styles to suite all rider sizes, abilities and budgets

STREET SERIES

Designed to ride like a fullsize bike

ADVENTURE SERIES

MTB DNA, with off road capability

EBCO Ltd, 5 Pegasus House, Olympus Avenue, Warwick, Warwickshire, CV34 6LW United Kingdom. t: 01926 437700 Full range details www.ebco-ebikes.co.uk

WHAT WOULD YOU LIKE TO SEE FROM MANUFACTURERS, BRANDS AND SUPPLIERS?

WHAT YOUR CUSTOMERS WANT: BIKE RETAILERS HAVE THEIR SAY ON WHAT THEY NEED MORE OF FROM BRANDS, MANUFACTURERS AND SUPPLIERS. AND WHAT DEMOGRAPHICS SHOULD THE TRADE BE TARGETING TO CONVERT NEW CUSTOMERS? CIN’S MARKET DATA REPORT REVEALS THE ANSWERS

08 cyclingindustry.news

BIKE NOW, ROWASH LATER

Advanced eco-friendly cleaning

Reduce waste

Improve servicing efficiency

Save money, make money

0121 514 0607 WWW.ROZONE.CO.UK

WHAT WOULD YOU LIKE TO SEE FROM MANUFACTURERS / BRAND SUPPLIERS?

ANALYSIS

It’s about model year churn, of course it is. A regular bugbear, this topic has been pushed ever further up the priority list at a time when high inventory is being exacerbated by the need to clear stocks ahead of new model years arriving. It’s such a problem that we hear stories of certain manufacturers holding back product launches as they can foresee their new products aren’t going to get a good crack at the market thanks to current conditions.

But the broader issue is, of course, much of the market is also about the excitement of new product which is better, faster, shinier, swankier than last year’s boring old model. So, we’re not suggesting this is an easy challenge to overcome.

WHICH DEMOGRAPHIC DO YOU BELIEVE HOLDS THE GREATEST OPPORTUNITY TO GROW CYCLING IN THE NEAR TERM?

ANALYSIS

We hear a lot about the potential eBikes hold for the market and that message and view is replicated at the front line of the cycle industry. Most dealers – almost three quarters – believe that those drawn into cycling by electric assistance is the second largest demographic likely to grow cycling in the here and now. Good news for eBike makers, brands and retailers. So what is perceived to be an even larger driver of market growth? Commuters seeking cheaper or cleaner transport.

‘Really?’, you might be tempted to ask?

That doesn’t seem to be reflected in the headlines and articles circulating in the cycle press, you might argue. The commuter market is rarely perceived to be as sexy as cycle sport or as exciting as electric but the nation’s bike dealers, famed for having their own perspective, see commuters as an alluring bunch, and likely with good reason. You also might reasonably argue that commuters and eBikers aren’t exactly mutually exclusive. Likewise the over 50s – the third most likely demographic to grow cycling, according to bike dealers – are another group that plays to the eBike sector. That poses a question – when was the last time you saw someone over 50 on a bike advert? In an editorial article, maybe, but likely not in an advert or a cycle website home page. Here there are marketing questions for the cycle brands to address. Are they reaching out to the over 50s? How would they go about that?

So, leaving aside that vast conundrum, other ‘asks’ from dealers include making product easy to service. It probably depends on the brand on how much of a priority ease of service is, but if something is easy and fast to fix then it’s a boon for shops, workshops and customers too, benefitting the whole cycle eco-system (and maybe even keeping products in operation instead of languishing in landfill).

More recyclable packaging is also high on the list of priorities, whether for ecologically and/or practical reasons. Interestingly, demands for greater packaging protection for products was far less of a priority. Tighter control on grey imports remains a worry for dealers, listed fourth most important requests of brands from dealers – interesting as some of the grey import market was defeated when Brexit finally took place. Enhanced quality control was the next major demand – a partly concerning point. Are dealers concerned about on-shoring and servicing investment, yes, but not above all else.

10 cyclingindustry.news

cyclingindustry.news 11 ACCESS THE FULL CI.N MARKET DATA 2023 REPORT TO HELP YOUR BUSINESS ADAPT TO MARKET CHANGES BY CONTACTING FRAZER@CYCLINGINDUSTRY.NEWS

Cristóbal Pérez

THE BIG QUESTIONS

For many businesses in the cycling industry, getting through this market mired in overstocks and inflation may seem challenge enough. Yet there are equally (if not larger) questions to tackle ahead, not least moving the industry to be ready to punch through to new customers –the kind who will never consider themselves a cyclist. Those familiar with Cristóbal Pérez, former Accell Group’s Country Manager for Spain and Portugal, will already be familiar with his enthusiasm for tackling these big questions and CIN managed to pin him down for a one-toone interview on how to break down some of these big challenges…

You’ve said that most of the business for the bike industry in coming years will be thanks to newcomers to the market. I think this point is broadly acknowledged in the industry, but it has been a struggle to turn that into practical action. Do you think that’s fair to say?

Absolutely. Bikes are one of the strongest contributors to a healthier and cleaner environment, especially in cities. People will come from the car and public transport to join cycling and use bikes as a tool. You will not find cyclists among the newcomers, but bike users for practical, healthy and environmental reasons. They’ll have no interest in Tour de France, but in cycling daily as a solution. Of course, we need a proper framework that includes infrastructure, but also regulations, incentives and the support of

governments at all levels. We in the industry – more clearly in some geographical areas – use, promote and make sports bikes. So, the bike approach is traditionally sporty. The share between sport and other diverse bike usage will shift dramatically. Society seems to run ahead of us in that. We must speak the same language as those in whom we will find the upcoming business.

You see so many race-orientated products. If you hit any of the big brand’s websites right now, you will see a guy riding in the Tour de France, or you will see a bike with a big fork and big tyres… they would show you other kind of bikes as a product option but the communication or the language is not adapted to that new user, who has no clue about cycling. It is clear that we need to catch up.

12 cyclingindustry.news INTERVIEW

“THEY WILL BE BIKE USERS FOR PRACTICAL, HEALTHY AND ENVIRONMENTAL REASONS. THEY'LL HAVE NO INTEREST IN TOUR DE FRANCE, BUT IN CYCLING DAILY AS A SOLUTION.”

A wish list of features, with no superfluous tech.

Connect to the app to customise your light characteristics, use the wireless remote to move between settings on the bike, and monitor battery levels easily on the fly.

Learn more about the ultimate nightriding upgrade.

glowormlites.co.nz

Stock due in time for night riding season, Hotlines have launch pricing available now.

Speak to your account manager or drop us a note to receive details.

A demo kit is available for group rides. Let’s get out for some night riding thrills.

Email: info@hotlines-uk.com www.hotlines-uk.com

Cristóbal Pérez

Do you think part of the problem is that it’s easier to reach out to existing types of customers, rather than reach out to new ones or risk alienating existing customers?

I would fine-tune this assessment. When we say new clients, we can distinguish between new ones in the same category or new ones in a different category. For instance, phone carriers usually offer the best benefits to chase new clients, forgetting their existing ones. Big mistake. Our case is somehow different. We need to chase a new user, a new profile, but without forgetting the current existing ones. We need to provide bikes and services for those we’re aiming for, but it does not mean that we have to forget those already in the house. You can keep making products in sports cycling, but you also have to pay attention to those who will be your business source for the coming years. We don’t have the right framework for that to happen.

The share of each category will change and so our production, language and approach should as well. We need to adapt ourselves to our clients, not the other way around. You need to prepare the right atmosphere. They are interested in fixing their problems. And maybe the solution is a bicycle. We need to change our state of mind to be able to grab their attention.

You’ve mentioned that there are potential lessons to learn from the car industry, can you elaborate on that?

In places where the bike is prominent or will become prominent, many who are stuck in a traffic jam will consider hopping on a bike because it will fit his/her new needs.

We have to consider that those coming from cars have well-implemented brand and service concepts in their purchasing and user mindset. We need to be ready to

offer a similar landscape. Just an example: when you buy a car, there is a question that constantly comes up: when should I service it? The dealer has a clear maintenance plan they can share with you or the car will warn you when to do it. So, those leaving the car behind in favour of bikes will come to our dealers with the same requirements and questions, but with a lot more hesitation because it is quite likely that they do not know that bikes have sizes or gears. We have to prepare our network and communications for this new outlook. We have to prepare ourselves to fulfill these new demands. We need to be ready for those conversations.

It’s a blessing for us that the car industry has given customers this clearly structured mindset. The car industry tells you when you need to go to the workshop for servicing. We need a clear and understandable message. In a bike shop there’s usually a mix of brands, which is different. We must remember the new client is not a cyclist and never will be.

The UK cycle industry is typically seen as sports-orientated, rather than focused on utility cycling/cycling as transport – unlike other north European markets. How do south European cycle markets compare?

In Spain, we all drive like Fernando Alonso and ride like Contador! This is us, this is in our DNA. Perhaps it comes from the favourable weather and our geography. You have more chances to ride all year long and find challenging places to do it. Italy is quite similar. But the future proposal is not to quit sporty bikes or sport bike stuff, but to have a range that covers all of the kinds of demands. We should adapt our bike offer to the users’ wishes and its diversity. Period. This diversification will bring new oppor-

14 cyclingindustry.news

INTERVIEW

“YOU CAN KEEP MAKING PRODUCTS FOR SPORTS CYCLING, BUT YOU ALSO HAVE TO PAY ATTENTION TO THOSE WHO WILL BE YOUR BUSINESS SOURCE FOR THE COMING YEARS.”

Diversification will bring new opportunities to the sector

The age old premise of someone stuck in a traffic jam and considering a change remains a powerful springboard into cycling

tunities for our sector. Phone screen size and car category options ranging from urbanite cars to massive e-SUV proved to be the way to gain a new clientele. Why shouldn’t we?

Looking at the short term, the market is obviously in a difficult place; We see companies struggling and there are overstocks. There is a lot of discounting going on to try and work through the stock… how long will we be feeling the impact of this? Are companies reacting to these challenges in the right way? Will there be long term consequences of this, even when the overstocks are over (eg will we see a lot more caution in terms of purchasers in the medium term?)

Companies face a situation for which nobody was ready. I read about other sectors such as computers in similar situations to ours. The rolling coasting demand was unpredictable and unprecedented. We are now diving into deep stocks in the makers’, distributors’ and dealers’ warehouses. The channel is stuck. I know that the bike industry did not wish to be in this situation, but this is something we all have to go by. Since we had no idea of what was coming, it makes it really difficult to cope with the situation.

So, aiming to keep everything afloat, drastic decisions are being taken regarding discounts, staff, MY24, MY25, etc. The coming times will be anything but easy. So, big problems, big solutions. I am not in a position to guess the day and hour in which all of this will have ended and there will be a more favourable ratio between

stock/sales, but it is going to take time and funding muscle. People keep on buying bikes, but it seems not to be the only solution to clear the cycling industry skies. I hope that we all learn from this and that concepts such as seasonality, and production plans, among others, will be reconsidered to avoid stumbling twice across the same stone.

Can we talk a little about Accell too? You joined during a disrupted time in the market. What are some of the challenges facing Accell South Europe at the moment? Accell is a great company. With the money from KKR [an investment group that acquired most Accell shares in mid-2022] and the clear ideas Accell shows, I am positive about its preponderant position in the cycling industry worldwide in the coming years. No doubt. It does not mean that Accell will skip the tough times we are going across. But if there is someone doomed to succeed, it is Accell.

Accell obviously has a great range of brands to service both the cycle sports markets and the utility cycling/transport cycling markets. So, it is well placed to grasp the opportunities to grow the transport cycling side of things? Is that fair to say? Yes. Clearly. If my memory serves me well, Accell runs nearly twenty brands. Some are more sport-oriented, some are more clearly on the commuting/ trekking/utility side, and some others are global brands to offer a comprehensive proposal. Accell also owns the most powerful P&A companies that working

Pérez advocates a switch around for the market: “We should adapt our bike offer to the users’ wishes and its diversity”

Is customers simply buying more bikes enough to clear the cycling industry skies? Or is a more fundamental rethink required?

cyclingindustry.news 15

“IT IS A BLESSING FOR US THAT THE CAR INDUSTRY HAS GIVEN CUSTOMERS THIS CLEARLY STRUCTURED MINDSET. THE CAR INDUSTRY TELLS YOU WHEN YOU NEED TO GO TO THE WORKSHOP FOR SERVICING... ”

along with the bike side will be able to cover any need, including the cargo bike demand with their dedicated brands. I am convinced that Accell will optimise their brands and their ranges to be ready for the times to come.

Diversity in the cycle industry’s personnel is a challenge that is potentially linked to some of the topics we’ve talked about –including how to reach out to non-traditional customers eg the aging population. In your view, is diversity something that is on the agenda in the cycle industry? When we discussed these newcomers heading to our dealers or websites, keep in mind that they are a vast amount of people of any social, age, gender or situation. So, we should be thinking of how to satisfy them with products and services.

If you look at France, UK or New York, the Netherlands… it proves that bikes are happening in many places. We also have to factor in how happy we would be if we could ride daily as our commuting solution, according to the data in Shimano’s State of Nation. So, it means

that our society wants to make it happen. We, as an industry, have to catch up with the times and adapt to the new landscape. There are cases in which some bike brands saw it coming and reacted. Some others still have to go through that perception process. Nevertheless, we cannot forget about the situation in which we are, that might favour putting things on hold and focusing on.

If you distill the big topics that the cycle industry needs to tackle, how would you summarise them?

The challenge for many in the industry is surviving, crossing this desert. We need to focus on it, we need to be cold-minded and survive. But I guess that we need to clear stocks and survive with profits in mind. Not easy.

No matter how it sounds, at the same time, we have to prepare ourselves for the new society’s demands in which bikes will play a starring role. It means product, distribution network and communication. Supply and delivery should also be improved, even if it means shifting the

16 cyclingindustry.news INTERVIEW

Cristóbal Pérez

“THE CHALLENGE FOR MANY IS SURVIVING... WE NEED TO FOCUS ON IT, TO BE COLDMINDED AND SURVIVE... AT THE SAME TIME, WE HAVE TO PREPARE OURSELVES FOR THE NEW SOCIETY’S DEMANDS IN WHICH BIKES WILL PLAY A STARRING ROLE.”

Throwing open the doors to those who won't consider themselves 'cyclists' will likely also broaden the diversity of the industry

®

fabrication from far away to Europe or USA so that you can control everything, reduce costs, pollution and the dependence on third party risks.

Bike seasons need to be considered –bringing out a new bicycle with a new colour so that you have to wipe out existing stock with future discounts… this is not something acceptable.

So, we need to reconsider what worked in the past. We need to think ahead about not only bicycles but also about distribution. B2C, D2C, C2M… what’s the role of the traditional shop? We should keep all this in mind, because all of these counts. What counts the most is the user – they are the ones who decide. We need to integrate all this in a new approach coming from the market. It’s not that you want to sell to that channel, or that model or that colour… the market will tell you where to go. We must use the tools we must adapt to the new reality and the new reality comes from the user experience.

Finally, the integration between the actors in distribution seems mandatory. Makers, distributors, and dealers should

consider the others as partners, not only providers or sellers. We have to work as one and select with whom we want to link our future.

But any movement should be planned having into account our existing network. We need to work sharply to optimise demand, stocks, and availability with the best benefit for all the involved as a goal… I am sure that I am not discovering Newfoundland here.

I also think the vast majority of the business will come to rely on eBikes or any size, profile, usage, whatever. There’s a lot of evolution in the bike industry regarding eBikes. They next 3-5 years we will have completely different eBikes, able to satisfy any kind of clients, either cyclists or non-cyclists. In Germany in 2022, 90% of MTBs were eMTBs. At the moment, brands making seven versions of an enduro, non-eBike makes no sense to me. You should cancel all of those crazy projects and put your money where the business will be. www.linkedin.com/in/c41/

18 cyclingindustry.news INTERVIEW

Cristóbal Pérez

“YOU SHOULD CANCEL ALL OF THOSE CRAZY PROJECTS AND PUT YOUR MONEY WHERE THE BUSINESS WILL BE.”

“There’s a lot of evolution in the industry regarding eBikes, they

will

have completely changed in the next

3-5 years...”

*Minimum stock purchase required LEDIVISION.COM 01484 66 5 0 5 5 HECYCLEDIVISION.COM • Disc brake pads • Rim brake blocks • Hydro systems • Disc brake pads • Rim brake blocks • Hydro systems • Pulley wheels • High precision sealed bearings • Cable parts • Outer cables & more to come... • Free issue work • Sturmey Archer build easily accommodated • Sealed bearings • Rapid turnaround and delivery • All wheels hand finished, labelled and bagged • Cassette ratios from • 11-40T to 11-50T • Full SunRace range in stock! 1x SOLUTIONS AVAILABLE for 10sp, 11sp & 12sp 80+ RANGE OF TOOLS SMARTER WORKSHOPS FREE Workshop displays* HANGERS TEAM OF EXPERIENCED WHEEL BUILDERS Vast range of stock COMPREHENSIVE RANGE OF PRODUCTS FREE Grease Bars* • Outstanding quality The award winning, workshop friendly P&A Distributor to the cycle trade

Often set against each other for the purposes of political points or online hits, bicycles and cars are rarely considered two parts of the solution to the big mobility challenge which (whisper it) they almost definitely are. IAA MOBILITY made waves when it invited cycling to its automotive-centric event of many decades. CIN speaks with IAA MOBILITY Director Christine von Breitenbuch about joined up thinking…

The world of trade shows has been disrupted, to say the least, and the really bold ones took the opportunity of the pandemic to switch things up. Eurobike did the unthinkable and parted with Friedrichshafen and then the automotive-oriented IAA show blew the proverbial doors off by opening its doors (the ones still attached) to the cycle industry, for the first time in 100 years.

“We took a bold step in 2021, presenting mobility to our visitors and exhibitors, for the first time and as a completely new concept,” Christine von Breitenbuch, IAA MOBILITY Director tells CyclingIndustry.News

“We totally changed the concept from Frankfurt to Munich, with the content, but also with the concept of the show. And at the time, we were, of course, very curious

to see how the concept would be received.”

…Which we imagine is a bit of an understatement. But the move to Munich and to include cycling proved successful, with visitors from 95 countries visiting, in numbers approaching more than 400,000. And, lest we forget, that was with the tricky conditions of the pandemic and full travel restrictions still in place for the likes of China.

“So, we were happy. We brought the experience to the people, we had 9,000 test drives, with cars, bicycles, scooters… with everything.”

IAA MOBILITY´s media reach also cemented the show’s success, with a potential 137 billion international media reach. To put that in perspective, that was third behind the Olympics and the European Soccer Championships worldwide.

20 cyclingindustry.news INTERVIEW Christine von Breitenbuch I IAA Mobility

“IF WE ONLY LOOK FROM ONE PERSPECTIVE, WE WON’T OVERCOME OUR CHALLENGES”

“IT’S ONE OF THE BIGGEST CHALLENGES, WHEN EVERYONE ONLY LOOKS FROM THEIR PERSPECTIVE AT THE PROBLEM AND LOOKS FOR A SOLUTION ON THEIR OWN.”

STUNNING NEW BRITISH DESIGNED E-BIKES FROM THE UK’S LEADING E-BIKE SPECIALIST

• Powered by powerful and reliable motor systems

• Quality branded integrated battery technology

• Class leading design

• Quality build

STREET SERIES

STREET 2

RRP £1699

STREET 3

RRP £2299

STREET 5

RRP £2699

Designed to ride like a full-size bike

• 20 inch Performance large volume tyres

• Hydraulic braking system

• Ideal for fast commuting

URBAN SERIES

Well thought out function and classic styling

• High value

ADVENTURE SERIES

MTB DNA, with off road capability

EBCO Ltd, 5 Pegasus House, Olympus Avenue, Warwick, Warwickshire, CV34 6LW United Kingdom. t: 01926 437700 Full range details www.ebco-ebikes.co.uk

CONTENT TO TAKE HOME

You can also get a good sense of the scale of IAA MOBILITY by the conference element (“The heart of the summit,” Von Breitenbuch tells CI.N), which sounds like a logistical challenge likely to keep show organisers up at night. Circa 500 executives are brought together over three stages to speak on hot topics in mobility. So naturally, it would be impossible for a single show visitor to soak up all that expert opinion and debate in person, but IAA has that covered too.

“Content is so important, bringing people together to talk about the visions, the strategic goals they have, and also the challenges they want to tackle. We are very pleased about the big mixture of executives that are coming to our event, but we broadcast it and publish highlights to our platforms on YouTube or LinkedIn, Insta and all the channels we're using [which readers can catch up with if they didn’t make it to the show]. And also our partners from the conference and also from the whole show are broadcasting different highlights. So it will be visible for everyone who can't join our event.”

JOINED UP THINKING

There’s a multitude of mobility challenges facing the planet, whether that’s working out how to move people or goods around increasingly population-dense cities and towns, coping with the mete-

oric rise of delivery services or ensuring that air quality doesn’t decline even further. With city bosses like London Mayor Sadiq Khan utilising a number of different methods like London’s cycle hire and ULEZ, the capacity we have to tackle these big challenges are not limited to a single channel. Or, to put it another way, there are a combination of ways to tackle big challenges. Happily for IAA MOBILITY, that kind of joined up thinking plays directly into its whole ethos.

“It’s one of our main goals,” explains von Breitenbuch. “There are these different industries, which worked for a long time on their own, not really connecting. In the meantime this has changed. Automotive suppliers are active in the bike business, car manufacturers produce bicycles or enter into partnerships. Our goal is to create a mobility community, which is facing these challenges, like everyone is facing supply chain challenges worldwide, circular economy, sustainable mobility, etc. they are similar for cycling and automotive and technology and public transport. We’re making this more visible, and to help show the different perspectives, and maybe find the solution would be the best way to move forward. We also have the attention of politicians worldwide.

“It’s one of the biggest challenges, when everyone only looks from their perspective at the problem and looks for a solution on their own. Together we’ll find a solution. If you, for example, want to develop living

22 cyclingindustry.news

INTERVIEW Christine von Breitenbuch I IAA Mobility

“ONE OF OUR MAIN GOALS IS TO CREATE A MOBILITY COMMUNITY... HELPING SHOW THE DIFFERENT PERSPECTIVES.”

Bosch’s multi-modal businesses are a good fit for IAA, with the firm back at this year's event

IAA Mobility’s relevance to politicians has helped cement its importance to the mobility world

Christine von Breitenbuch I IAA Mobility

spaces, how can we make our cities more livable? How can you change them?

“If everyone is working against each other, and fighting for their perspective, it won't work. So, I think this is one of the main topics, why we should have a mobility community. But if we want to have climate friendly solutions and C02 neutral mobility we also have to work together. Also, it’s not just the industries but with the politicians with the deciders of the city of the country, that they understand what's the topic and how they can all work together.”

That cross-industry approach could pay dividends for one of the other big challenges facing multiple industries including cycling – of making the industry (and its products) appealing to a more diverse range of people.

“We believe that mobility knows no channel boundaries, so we invite all enthusiasts to join us. Yet we do see a gap in the share of women when working in this industry.” Elements of IAA MOBILITY like its Open Space programme – have managed to bridge the gap and attract a broader range of visitor. Free to attend, Open Space takes place in Munich’s inner city, giving opportunities for visitors to experience diverse, sustainable transport options in famous locations. “They expe-

rience it and they get excited. If I remember correctly, we had about 40% of women among the visitors in the Open Space.

“I think if you get into the topic and get inspired, you begin to think about it in the context of your profession – maybe it could be an industry I can move to? We also partner with Women in Mobility in the context of the conference and try to bring a lot of women on stage. So, this is also a topic we are interested in. We try to make it visible and help attract women to this market.”

Is it too early to talk about IAA MOBILITY in 2025? (the show runs every two years). The IAA team are already laying the groundwork for the show: “We want to build this community, so we have a continual exchange in the lead up to the 2025 event with clients.

“Not only that, but to keep the relevance we are looking at a mobility platform, that will be open even to those not yet exhibiting. This perfect blend will make this a world-leading mobility platform, taking in sustainability as well and bring everyone together.

“This is a transformation. We all know transformation takes time, but we are working hard for it and we have a longterm plan.”

www.iaa-mobility.com

24 cyclingindustry.news INTERVIEW

Speaking to different markets: IAA Mobility

“WE PARTNER WITH WOMEN IN MOBILITY IN THE CONTEXT OF THE CONFERENCE AND TRY TO BRING A LOT OF WOMEN ON STAGE. WE TRY TO MAKE IT VISIBLE AND HELP ATTRACT WOMEN TO THIS MARKET.”

MOTUL BRINGS ITS EXPERTISE TO THE CYCLING MARKET

Probably best known for its leading line of motorcycle lubricants and care products – in which it is the UK market leader – Motul has now turned its attention to the bicycle market and is bringing across its expertise in lubricants and vehicle care. Eight consumer products will kick off the range off, as well as a partnership with Orange.

170

YEARS’ EXPERIENCE

Celebrating its 170th birthday this year, Motul has been at the cutting edge of lubricant innovation over the last three quarters of a century. A long line of innovation has seen it produce Multigrade motor oils in the ‘50s, Semi-Synthetic oils in the ‘60s and in the ‘70s, the world’s first Fully Synthetic Oil – Motul 300v. The brand has now launched the next major step forward: NGEN, which offers a fully recyclable, sustainable lubricant, featuring regenerated oil, which offers top performance.

There’s a good deal of cross-over from motorcycles to bicycles, in terms of experience and technology, eg two different chain lubricants use innovative ester technology - originally developed for motor sports - to guarantee exceptionally long-lasting lubrication with a particularly stable molecular structure.

WHY MOVE INTO CYCLES?

Motul product manager Rebecca Ramos explains how growing demand and the trend for people switching to new types of mobility helped bring about the move: “We thought it was a good opportunity as it’s a growing market and allows us to get into more diverse products. After our market research, we decided to target hobby cyclists, especially people who are really passionate about their bikes and want to gain some efficiencies.”

“The bicycle market is a fantastic mix of enthusiasm and embracing a very modern, efficient way to travel, to move, to exercise and much more,”

explains Callum Goodland, Motul UK Country Manager.

THE NEW MOTUL RANGE:

The Motul Bike line comprises a highly effective and environmentally friendly range of products.

“We wanted to be the experts for performance and sustainable productsto mix both,” continues Callum Goodland. “Some of our competitors are really good on the performance side of bicycle products but are lacking in sustainability. Others are strong in sustainability but not on performance. So, we see that sweet spot as a good market for us, as we offer both qualities.”

This new range answers the four most important and essential needs for bicycle users: degreasing, cleaning, lubricating and providing preventive maintenance. This new range initially comprises eight products:

CLEANING:

Motul Frame Clean, Motul Dry Clean, Motul Chain Clean, Motul Brake Clean. LUBRICATION AND PREVENTION: Chain Lube Dry, Chain Lube Wet, EZ Lube, Tubeless Tire Sealant.

PERFORMANCE WITH SUSTAINABILITY – THE SCIENCE

All Motul Bike Care products are sustainably produced and packaged, employing biodegradable care and maintenance fluids wherever feasible and all contained in 100% recycled packaging or made from bio-source plastic.

The Cleaners have been developed with the best materials for great performance, yet specially formulated not to damage either the health of the user or the planet.

The results are unique formulas, making use, as with the Chain Lubes for instance, of Motul’s experience with Ester technology, which it introduced to the automotive world, having seen its benefits in aircraft lubrication, to offer

the highest protection and optimal chain functioning, whatever the conditions.

“With our chain lubricants we rely on a variation of the innovative ester technology used in our engine oils. But the extra effort in production certainly pays off later on,” explains Motul UK Technical Specialist, Has Tahier. “Lubricants with ester technology retain their excellent lubricating properties even after a long period of use and provide optimal protection, especially for the hardestworking components such as gears, chains, or sprockets. This means they surpass the performance of existing chain lubricants, such as those which use PTFE. All bicycles are ideally protected against wear with these new products, no matter whether it’s a road bike, MTB or eBike.”

“We see a lot of synergy between the arenas of Powersport, Motorsport and bicycles,” comments Motul UK Sales and Marketing Manager, Andy Wait. “Professional riders and race drivers invariably train on bicycles. These products are for really passionate people who love using their bikes, and who also look after them well. The feedback, internationally, has been fantastic!”

PARTNERSHIP

Partnerships with OE manufacturers are a key part of Motul’s global activities and in the automotive sector include the likes of Suzuki, Subaru, Honda, NISMO, MV Agusta and Caterham. Moving into the bicycle sector, Motul has also been looking to establish partnerships with manufacturers and so the brand is delighted to be able to announce an OE tie-up with leading manufacturer of premium sports and mountain bikes, Orange.

For further details of Motul’s Bike Care Range, other Motul products, its history and partnerships, and the latest Motul news: www.motul.com

Or email: enquries@uk.motul.com www.motul.com

cyclingindustry.news 25 ADVERTORIAL MOTUL

“WE ARE STILL IN A VERY GOOD POSITION”

During a visit to the SRAM headquarters in Chicago, CEO Ken Lousberg gave us an in-depth look at the state of the bicycle industry and how the renowned bicycle component manufacturer weathered the Covid-19 pandemic.

With more than 5,000 employees and 16 locations worldwide, SRAM is one of the world’s most important manufacturers of bicycle components. During a visit to the company’s headquarters in Chicago, we sat down with SRAM CEO Ken Lousberg and spoke with him about the current business developments at the US manufacturer, the effects and consequences of the Covid-19 pandemic, and the general status quo of the bicycle industry.

Mr Lousberg, you have been with SRAM for six years. What were the most critical challenges during this time?

I joined SRAM from outside the bicycle industry. But since I have always been an avid bike enthusiast, the first years felt more like a passion than a job – especially since the company’s overall development was pretty smooth. However, when the pandemic struck, that was when the situation shifted. That period marked the first time I had to make some really tough decisions. No one was prepared for such a situation, and we surely had to adapt and navigate through many unexpected situations. It was quite a journey, but we managed to make it through.

26 cyclingindustry.news INTERVIEW Ken Lousberg I SRAM

“I HAVE ALWAYS BEEN AN AVID BIKE ENTHUSIAST – THE FIRST YEARS FELT MORE LIKE A PASSION THAN A JOB.”

Can you take us back to that time when Covid-19 started?

One difficulty for us was that we are a global company with locations all around the world. Another one was that no one in the industry had an idea of the economic consequences of a pandemic. After the first weeks, we went through various scenario planning exercises, predicting how long the pandemic would last and its potential impact. We planned for scenarios ranging from a 20% downturn for 4-6 months to a worst-case scenario of a 50% downturn for a year. To make it short: None of these scenarios was even close to being correct. I remember very well a meeting with our German office in April 2020. They told me a sentence I will never forget: “Bicycles are the new toilet paper.” Instead of a decline in sales, there was a massive surge in demand. This was, of course, very positive for us and the entire industry –despite challenges such as lockdowns, etc. that came with the pandemic.

How did your business adapt to the increasing demand?

We have expanded our capacities – in

Taiwan, Portugal and North America. But we were also constantly aware of the fact that the sudden demand surge was a pandemic-induced phenomenon and wouldn’t last forever. So that is why we acted with some restraint and accepted slightly longer delivery times at the peak.

A situation that then also occurred last summer...

Exactly. We already started talking about the so-called “bullwhip effect” already over a year ago, even though things were still pretty positive at that time. That’s why we waited until the demand started to decrease before adapting and reducing our production volume. That means: We were prepared. But, of course, no one wants to believe that such a boom could end.

How would you describe the current status quo at SRAM and in the cycling industry after the pandemic?

What we all in the bicycle industry have recently been facing is a typical example of the “bullwhip effect”. Due to the consequences of the pandemic, inflation, supply, demand, supply chains, etc. were entirely out of balance. Nevertheless,

“WE PLANNED FOR SCENARIOS RANGING FROM A 20% DOWNTURN FOR 4-6 MONTHS TO A WORST-CASE SCENARIO OF A 50% DOWNTURN FOR A YEAR.”

cyclingindustry.news 27

SRAM’s global footprint includes production in North America, Taiwan and Portugal

While the jury is still out on Covid-19's long-term impact, SRAM is currently expecting a 20-30% drop from the pandemic peak, but still up on pre-pandemic levels

many have continued to operate bullishly for too long, resulting in overstock situations in many places. After a period of excessive growth in 2021 and 2022, we are also seeing a slight decline. However, this is complaining at a high level. Compared to 2019, we are today still above the prepandemic level. This is also the reason why I am generally very optimistic about the future, despite the current overstock situation and the cautious buying climate.

How do you anticipate the pandemic will impact SRAM’s revenue in the long term? It’s a bit too early to predict the long-term changes definitively. We’re currently still working with our key customers to adjust and figure out the new dynamics. I believe we’ll be able to assess more accurately by the end of the summer. My current feeling is that we may see a 20-30% drop from the pandemic peak, but the annual growth compared to pre-pandemic levels will still be significantly higher. But I also have to say that we, as a company that is traditionally rooted in the high-end segment, have been hit less than companies in the lower price segment. There, the overstock situation is more serious. High-performance bikes, however, continue to sell well. There is still quite a bit of channel inventory though, so we expect the current situation to continue for another six months or a bit more.

How important is the British market for SRAM? What specific challenges do you see here besides the aforementioned global challenges?

The British market remains a vital market in terms of rider trends across applications and the associated business it drives for us. It influences specification trends globally and it is clearly an enthusiast market for us. We value the relationships with our bike brand partners and distribution partners across the market. Brexit was a bit of an adjustment for us, but I feel we are in good shape now and will continue to invest in the British market.

That you are sure that demand will remain high in the future is also shown by the fact that you are currently building a new factory in Taiwan. Please tell us more about this latest investment. Please tell us more about the strategy behind that expansion. Taiwan is the country with the most bicycle assemblers. We have also been established here with a factory for more than thirty years. But with an increasing demand, it was time to expand our on-site capacity. This is all the more true as it is part of our strategy to produce as close as possible to our partners in order to avoid long transports by ship or plane. Taiwan was already our primary production location before. We have now strengthened this commitment.

You mentioned the shortening of supply chains. Many companies are getting involved in sustainability these days and the supply chains are a big part of that topic. How are you addressing the subject of sustainability in general? This is an issue that we take very seriously – even before the public began to talk

28 cyclingindustry.news INTERVIEW

Ken Lousberg I SRAM

“I AM GENERALLY VERY OPTIMISTIC ABOUT THE FUTURE, DESPITE THE CURRENT OVERSTOCK SITUATION AND THE CAUTIOUS BUYING CLIMATE.”

THE WORLD’S ONLY DUAL ENGAGEMENT TECHNOLOGY THAT WILL DOUBLE THE LIFETIME OF YOUR EXISTING BICYCLE CHAIN Designed for eBikes THE RIDE WITH TWICE THE LIFE JOIN THE ENDUOTM REVOLUTION TODAY. GO RIDE. sales@newmotionlabs.com www.newmotionlabs.com Here’s what you get with Enduo™ Ride: Enduo™ Ride doubles chain lifetime lasting up to 15,000km. Unbeatable maintenance cost savings for your fleet Less downtime and breakdowns = more time on the road Fully recyclable stainless steel components – no plastic or rubber Sustainability, durability, reliability – for every bike, every day! Compatible with a conventional bicycle chain Award-winning patented Enduo™ Drivetrain Technology DISCOVER ENDUO RIDE AT WORLD OF EMOBILITY 26-27 OCTOBER 2023

Ken Lousberg I SRAM

“30 years ago, the bicycle itself was a symbol of sustainability. Today it is also about acting more sustainably as a bicycle company.”

about it more in recent years. An example is our commitment to the World Bicycle Relief in the area of social sustainability. We also have staff explicitly looking at how we can improve in different sustainability areas. But we also feel that the pressure on the bicycle industry, in general, is increasing. Thirty years ago, the bicycle itself was a symbol of sustainability. Today it is also about acting more sustainably as a bicycle company.

Apart from that: What are the next challenges for SRAM and the bicycle industry in the coming months and years?

As I said before: I firmly believe that the bicycle industry will be well off. Regarding the lead times, we are already experiencing

a normalisation. And as soon as the overstocks are released and the overall buying climate improves again, this will positively impact the entire industry. Ultimately, the pandemic brought millions of new riders into the industry. Although some may leave, many have fallen in love with bikes. So while we might not reach the peak of the pandemic demand again soon, there is undoubtedly a larger customer base. That’s why I believe that we all are still in a very good position. However, companies that thought the boom would never end might suffer during this downturn.

www.sram.com

words by: Werner Müller-Schell

30 cyclingindustry.news

INTERVIEW

“ULTIMATELY, THE PANDEMIC BROUGHT MILLIONS OF NEW RIDERS INTO THE INDUSTRY. ALTHOUGH

SOME

MAY LEAVE, MANY HAVE FALLEN IN LOVE WITH BIKES.”

Production capacity remains an area of investment for SRAM, currently building a new factory in Taiwan

To find out more about KranX contact your area sales manager, email sales@bob-elliot.co.uk or call us on 01772 459887 Consistent self selling packaging across all ranges Excellent dealer margins & partner programmes High turnover & easy to replenish products Low risk investment stocking bob-elliot.co.uk bob-elliot.co.uk/twitter bob-elliot.co.uk/facebook bobelliot-online w

Key componentry for the IBD

INVESTED IN BEING A ‘PROPER DISTRIBUTOR’

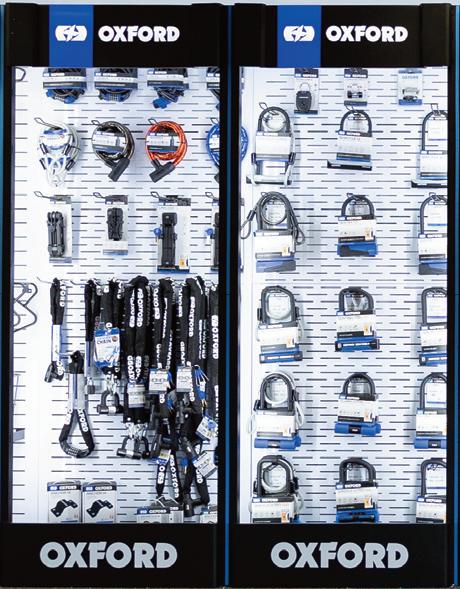

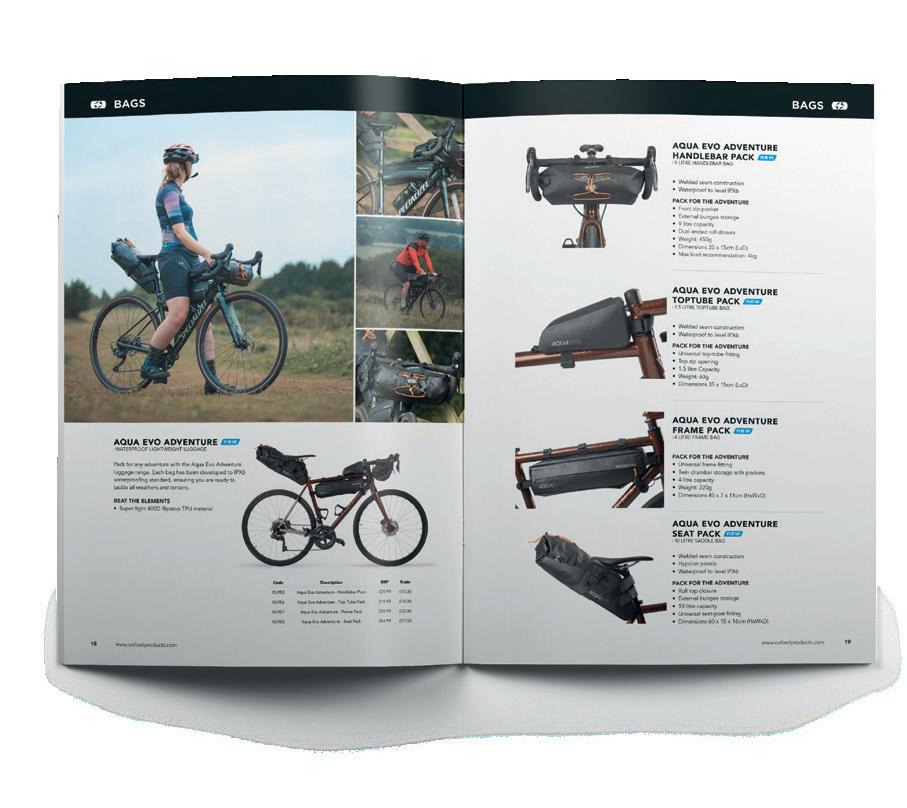

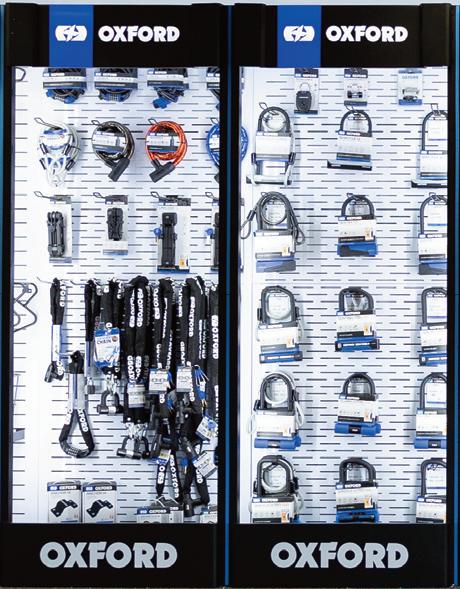

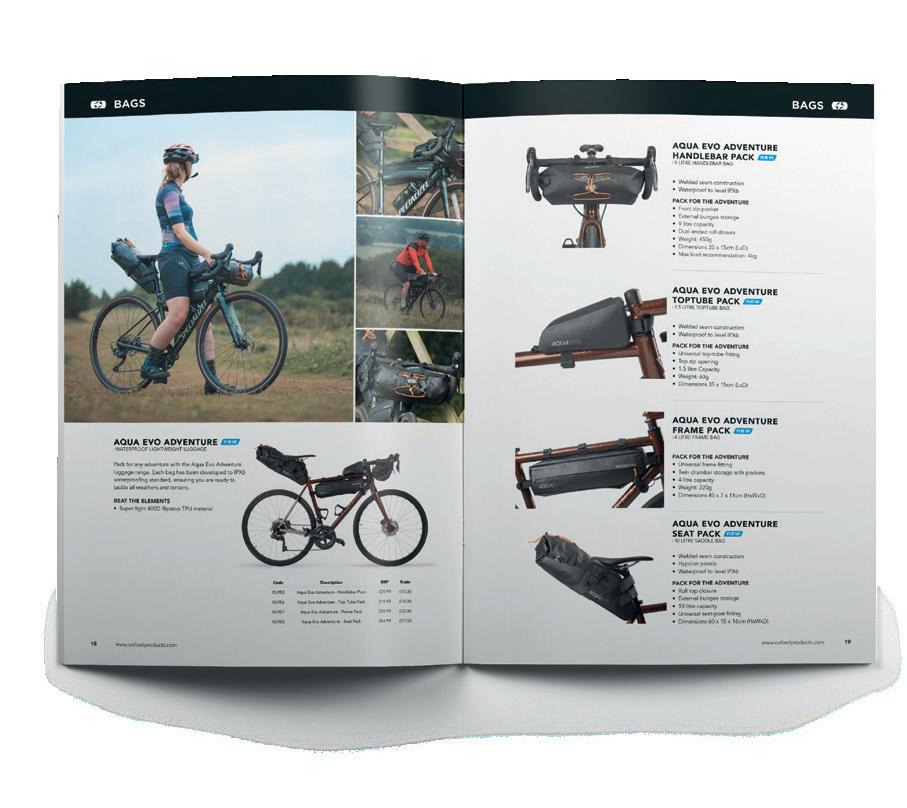

It’s always heartening to see investment at a time when we hear a lot about the woes of the industry, so a trip to see Oxford Products is a bit of a tonic. If you’ve not made the trip recently (or ever) then you can expect to find a vastly expanded warehouse, swathes of showrooms that exhibit product lines and best practice examples for retailers, plus a very well equipped and staffed product research and development facility. It’s all part of what Oxford Products modestly describes as its commitment to being ‘a proper distributor’.

Working with dealers and the trade – and not going direct to consumer – is core for the business, which is vastly experienced in its role, having served the bicycle market for 20 years and the motorcycle business for 50 years, with all the learnings and tricks of the trade accumulated along the way.

The showrooms play a core role for Oxford, not only showcasing new and existing ranges but – just as crucially – showing shops how they can help lift profits significantly.

“We have countless product display options. Some shops have more wall space, some only have floor space to play with… every shop is different. We can help planogram shops to maximise sales,” Henry Rivers Fletcher tells CIN

“When we started to push this into the cycle industry, we met with some resistance and comments like ‘this isn’t how we do it’. But we persisted and those that tried it saw it worked for them. We’ve learnt how to do it very well, from all our years in the motorcycle industry where dedicated POS is the norm.

“When dealers visit us here in Witney, they see how their shop could be enhanced and often come around to the idea of having this kind of well-lit display in the shop. They might try a row of three units and when that goes well they go for more. We have dealers that have enjoyed a 100% jump in sales with a full refit.

“When the average customer comes into a bike shop, he or she can be blinded by all the product held on display. It’s hard for them to know what to go for if there is no form of navigation.

“Impulse purchases are vital for shops. The things the customers didn’t come in intending to buy, help keep a shop profitable. The retail space has to work hard. If you look at Next or Lidl or wherever, everything has been calculated – the whole flow of the shop, the customer journey. We can help dealers with this.”

Packaging has to work hard too, he notes, and showcasing products in the optimum way plays into Oxford’s start-to-finish philosophy of product development, with the same marketeer working on everything from packaging, to sales packs, displays and adverts, helping to bring a product along the journey to the customer.

“We are continuing to invest in these areas, to help dealers sell our products. We see this as part of the deal of being a distributor.”

That deal also includes a team of six nationwide sales reps, as well as another level of staffing support for dealers – ambassadors that traverse the country merchandising and assisting the sales team.

32 cyclingindustry.news

What are the traditional features of a cycle distributor? Offering a retail solution that boosts sales for dealers, avoiding D2C, investing in brands and R&D… Oxford Products ticks all those boxes and more, revelling in dedicating itself to being a ‘proper distributor’. CIN takes a tour of its HQ with Marketing Director Henry Rivers Fletcher

PROFILE Oxford Products

“IF YOU LOOK AT NEXT OR LIDL OR WHEREVER, EVERYTHING HAS BEEN CALCULATED –THE WHOLE FLOW OF THE SHOP. WE CAN HELP DEALERS WITH THIS.”

Shop looking dark and in need of some TLC? Oxford Products aims to help dealers invigorate their displays with some clever solutions

Countless product display options can help lift dealer profits, says Oxford

For more info about our brands, send a message to sales@onewaybike.nl or give us a call: +44 1527 958331 Website: shop.oneway.bike YOUR PARTNER TO HELP YOU BUILD YOUR BUSINESS √ 24 years of experience √ Customer & sales support √ Customized marketing activities √ Delivery from stock √ Place orders 24 hours a day 7 days per week

EXPANDING FOR THE FUTURE

Oxford hasn’t been shy of spending lately, not only mending the roof while the sun is shining, but going considerably further than that and investing for the future. Put it this way; Oxford Products’ recent warehouse expansion might prompt you, if you had a unit on a plot near their HQ, to wonder if you were next.

Oxford Products’ seven acre site includes multiple warehouse units (which are supplemented by off-site warehouses). Oxford typically handles 400 orders a day, including 20,000 items a day. Those are picked from a SKU range of nearly 20,000 items.

“We hold a lot of stock,” Rivers Fletcher explains. “We’re probably overstocked but we’re comfortable with that and it’s coming down.”

Oxford’s turnover this year will be a healthy £50 million at trade, with approximately £26 million currently residing on the shelves.

2018 saw the firm buy a neighbouring block and warehouse (part of which is now a bespoke photography suite for the products marketing team). The most recent warehousing unit, opened last year, features appropriately new technologies that squeeze more efficiencies out of the unit – including a dizzyingly high forklift device that brings the driver up as well as the forks – thanks to which, an extra 20cm has been squeezed from each aisle, so the warehouse can handle more pallets. Efficiencies here will trickle through to Oxford’s older (but not exactly old) warehouses, which will eventually

free up space for a fully automated warehousing area. The likes of which, by our reckoning, are pretty unusual in the UK cycling industry (possibly unique).

As it stands, there is already a degree of automation in the warehouse, with hand barcode scanners in operation. Pickers grab product and scan as they go, then the process is repeated at the packing stage, double checking and minimising the opportunity for mistakes. Automation is likely to go a bit further than that. Once newer efficiencies in the new warehouse are implemented in the new old warehouse, there will be space for an automated warehousing area.

Around 60 staff handle the growing and ever more efficient warehouse portfolio.

“We operate a no quibble return service. We credit returns straight away, saving time for shops. They don’t have to wonder if we’ve issued them a credit not yet, it’s peace of mind for them.”

THE BUSINESS BALANCE

The motorcycle side of the Oxford Products business is by far the larger. For now…

“Cycling should be the largest proportion of the business,” explains Henry Rivers Fletcher. “No more than around one million people in the UK can ride a motorcycle, and a proportion of those don’t do it very regularly or at all. It’s similar in a lot of other nations, like Germany. In contrast, how many people can ride a bicycle? The market should be larger.

“So, why are we bigger in motorcycles? Because we’ve been at it for longer. We’ve had about 50 years doing it. It’s only since 2010 that we’ve been working properly in the cycle world. And in 2016 we started to work directly with independent dealers.”

Oxford’s motorcycle DNA is critical to its success in the cycle market, which might seem a bit of a shocker for dyed in the wool cycle traders, but learnings from operating in the market (and dominating it in many categories) have given the firm a significant leg up and that all-important insight from outside the industry that it can bring in, surely something crucial to the future.

That experience of the UK motorcycle market also offers some tantalising morsels for cycle industry pundits, not least on the topic of broadening cycling’s reach. Rivers Fletcher explains: “When we started out, motorcycle apparel was all leather. It was a mixture of boy racer gear or what rockers used to wear, that kind of thing. Around 20 years ago there was a big shift to textile utility wear and around a decade ago that changed to more everyday fashion-related gear.”

34 cyclingindustry.news PROFILE Oxford Products

Cash has been ploughed into not only fixing the roof when the sun was shining, but also investing in the future of the business

Oxfords' own brands are complemented by high-end third party brands

“OXFORD

TYPICALLY HANDLES 400 ORDERS A DAY, INCLUDING 20,000 ITEMS A DAY. THOSE ARE PICKED FROM A SKU RANGE OF 20,000 ITEMS.”

The style we’re talking here is chinos, jeans, leggings… but all items of PPE that will protect riders on the bike, despite looking like the kind of thing everyday folk would wear on a trip to Costa or Lidl.

“It doubled the sales opportunities.”

That might be ringing some bells for the cycle world, especially those of us looking to bring in more ‘non-cyclists’ –could the cycle market follow the motorcycle market in this way?

R&D

Oxford Products has been developing its own ranges virtually since year one, but it is now taking things to a new level, bringing in expertise and developing a prolific product development team.

Using CAD technology like SOLIDWORKS and the latest visualisation software, the R&D team can completely analyse new products before they get anywhere near the prototype stage –checking tolerances and analysing all aspects of a product, including finishes –even to a photo-perfect visualisation of how the product will look in the flesh. “We can specify every element so there is no guess work, and all details are fixed and specific. Nothing gets lost in translation and samples come back how we asked for them.”

Thanks to a £100,000 investment, the R&D team also has access to a 3D printing suite, which can turn out product that can be tested on the bike. Laser sintering ensures 3D products come out as solid products (and not the gradated 3D printed results of old). They cannily recycle waste 3D materials (you would too if you knew how much they cost).

Oxford’s big apparel business has seen an influx of talent from other industries, not least the fashion market, which can be working on up to 120 projects at any one time. Garment technologists determine and specify how every stitch, zip and button is put together.

Testing can an expensive business, so ensuring products at prototype stage have already jumped through the hoops of the aforementioned programme is essential. Having spent out on sending product out of house for testing, the firm has brought ever more testing equipment in-house –though it has stopped short of plonking a wind tunnel on the side of its expanding facility… so far.

The test lab aka torture chamber puts products through more stress and extremes than they will reasonably be asked to bear in the real world. Tensile testing exerts huge 5,000 kilo pulling

forces or – for apparel testing – more appropriate levels on clothing materials. One unusual bit of kit is the Q LABS’ accelerated weather testing machine. This Florida-based company knows a thing or two about product exposed to high levels of UV and humidity, and its machines exert 35x or more natural levels of those on products. The firm showed Cycling Industry News its CLIQR phone mount, which had been undergoing high UV and humidity testing in that machine for the equivalent of 102-plus years, amazingly retaining its integrity and colour.

The testing equipment (also including an incubator and multiple multimeters) is used in the QC process too, ensuring that factories continue to use machines that are operating optimally with regular spot checks on products arriving at Oxford Product’s HQ. The machines are also handy for taking apart (sometimes literally) competitor products, analysing what rival brands are getting right and wrong.

UPWARDS TREND

Oxford Products remains on an upward trajectory in the cycle market. At the end of June, cycling was 10.2% up, by July end that number was 13.4%, representing an accelerating growth level.

In the last year alone, Oxford has expanded its dealer number by 122. It is also seeing an upswing in the number of those buying via its B2B site. The door is open to new bike dealers, figuratively and literally (if they wish to visit the showroom).

As part of being a ‘proper distributor’, Oxford complements its vast own label range with a few carefully selected global brands. Most are distributed on an exclusive basis (ACROS components; G-Form protectives; Kali helmets; Sigma lighting & computers; Taya chains), then there are a couple of other popular essentials such as Schwalbe & Weldtite.

Get in touch via email (info@oxprod.com) or phone 01993 862 300.

That’s

“IN THE LAST YEAR ALONE, THE BUSINESS HAS EXPANDED ITS DEALER NUMBER BY 122. IT IS ALSO SEEING AN UPSWING IN THE NUMBER OF THOSE BUYING VIA ITS B2B SITE.”

cyclingindustry.news 35

torn it: The testing lab includes tensile tests that exert extreme forces on products before they reach dealer shelves

RETYRE YOUR RUBBER

reTyre is making a bid to revolutionise the trade’s sustainability credentials one bicycle tyre at a time. CIN met the brand at Eurobike to hear how it’s betting on elastomer-based tyres to offer brands an estimated 82% greenhouse gas footprint reduction in production…

Rubber is one tricky substance to truly recycle. Sometimes it’ll be ground up and scattered on football pitches, but rarely does it have much of a second life; in fact, often tyres are simply incinerated to generate energy, something that isn’t the greenest nor cleanest practice. For your information, it’s estimated that every day in Britain over 100,000 tyres from cars, vans and lorries are removed. Bike tyres only add to the tally.

The scientific reason why rubber is hard to repurpose, if you were curious, is that as an insoluble and infusible thermoset material, it cannot be directly reprocessed. As for those that end up in landfill, they are among the least desirable pieces of waste thanks to the void space tyres create. Often tyres can trap

methane gases, latterly bubbling up and damaging landfill liners designed to keep everything buried. The EU’s landfill directive actually prohibits tyres from entering landfill, which has prompted businesses like Velorim to take the bull by the horns when it comes to recycling. Bike shops up and down the land can now employ this specialist to collect and recycle customers’ used rubber on their behalf.

Rubber is, then, a considerable blight on the bike industry’s supposed green and clean credentials. Efforts from brands like Schwalbe have begun to scratch the surface of the subject of endof-life rubber re-use, but for the most part, one of the most regularly changed bicycle components remains a stain on efforts to use less oil and creates smaller

38 cyclingindustry.news

PROFILE reTyre

“THE SCIENTIFIC REASON WHY RUBBER IS HARD TO REPURPOSE, IF YOU WERE CURIOUS, IS THAT AS AN INSOLUBLE AND INFUSIBLE THERMOSET MATERIAL, IT CANNOT BE DIRECTLY REPROCESSED.”

CEO Paul Magne Amundsen [right] and team at Eurobike 2023

waste piles at the end of a product’s life.

Step in reTyre. You may well recognise the name; it’s the same company that came up with the zip-on tyre replacement idea, admittedly a concept that got mixed reviews in the trade. These are still available on reTyre’s website, should you wish to try switching from road to mountain bike tyres in one ride.

Go on to the brand’s website today, however, and front and centre is talk of revolutionising the bicycle tyre business by bringing to the masses a solution where pneumatic bio-based elastomers replace our rubber tyres.

Speaking to us at Eurobike, where its brief was to capture OEM interest, CEO Paul Magne Amundsen explained why the business is turning heads again.

“Scientists now say that of all ocean pollution is 28% rubber, which is of course not naturally recyclable. In fact, a lot of the time tyres are melted and then shipped around, which compounds their dirty footprint. The vulcanisation process alone is

hugely energy intensive. Extrapolate this to apply to the 1.8 billion tyres disposed of every year worldwide and you get an idea of just how dirty the footprint is. That’s why reTyre is now encouraging an alternative in our patented thermoplastic elastomer material, which itself is 100% reusable and uses no fossil fuel content.”

In the first instance, the brand is starting small. By that, it intends first to target the balance bike market, bike trailer and stroller segments, gradually developing products that fit larger wheels.

“For the kid’s bike industry, in particular balance bikes, we think reTyre could replace the entire rubber supply and we are closing lots of deals here, including some very cool luminescent tyres that shine at night. The manufacturing method is patented and allows us to produce any size. So, it’s definitely not just a small wheel solution, we have a tractor company speaking to us about solutions for some very large vehicles,” says Amundsen.

cyclingindustry.news 39

“FOR THE KID’S BIKE INDUSTRY, IN PARTICULAR BALANCE BIKES, WE THINK RETYRE COULD REPLACE THE ENTIRE RUBBER SUPPLY AND WE ARE CLOSING LOTS OF DEALS HERE, INCLUDING SOME VERY COOL LUMINESCENT TYRES THAT SHINE AT NIGHT.”

Big wheel: The patented manufacturing method can produce any size, even solutions for tractors

Importantly, where rubber can degrade over time, eventually cracking and allowing greater ingress of unwanted grit and grime, reTyre’s elastomer product apparently doesn’t degrade and it may selfrepair too. With rubber tyres a UV blocker is an additive that features, yet that is again not a requirement with reTyre’s product. Such is the firm’s faith in its solution and its recyclability that the business will even buy back material once it is no longer deemed up to scratch.

Of course from both a bike shop and customer’s perspective, the concern has always been how such innovations perform against the tried and tested tyre. Here reTyre again doesn’t flinch, suggesting that the overall weight is comparable to that of conventional setups and that if desired by partners a layer of Fiberguard protection can be added in. “You can’t recognise the performance difference in most applications and there are four separate compounds currently available to ensure compatibility with the terrain,” so says the gathered reTyre team as they introduce the samples at Eurobike.

At the present time, reTyre is making products in Norway, but in the future it sees no reason why the technology cannot be exported, enabling a brand to

produce a white-label product locally. reTyre is convinced that once promoted by brands, the sustainability message will resonate with consumers. It has been shown that younger demographics in particular have warmed to brands with genuine low-carbon credentials and will divert their spending on occasion where viable. KPMG research states that 86% of households consider that sustainability is important and that has a 5% uptick for households with children present. Boardrooms increasingly see the worth too. Research by the Capgemini Research Institute has 69% of executives now stating that sustainability credentials increase brand value, while 77% acknowledge that such kudos can have an effect on customer loyalty. Finally, 63% said that investing in sustainability initiatives has already helped boost revenues.

Amundsen concludes: “If a company wants to quickly cut its emissions and make a dent in its sustainability reporting then tyres are a great place to start; you can immediately cut out a wedge of your footprint just by ditching rubber. Our production methods use 90% less energy overall, plus less water too.”

www.retyre.eco

40 cyclingindustry.news PROFILE reTyre

Tyre pressure: Sustainability-savvy consumers, particularly in younger demographics, are helping push brands towards more eco-friendly product

“IF A COMPANY WANTS TO QUICKLY CUT ITS EMISSIONS AND MAKE A DENT IN ITS SUSTAINABILITY REPORTING THEN TYRES ARE A GREAT PLACE TO START; YOU CAN IMMEDIATELY CUT OUT A WEDGE OF YOUR FOOTPRINT JUST BY DITCHING RUBBER.”

Handlebar Cradle

£64.99

Mount the Handlebar/Front Fork Cradle directly to the handlebar or front of any bike or e-bike. Whether it’s attached vertically or horizontally, the Handlebar/ Front Fork Cradle enables you to bring an additional 5kg without compromising your ride.

Spider Rear Rack

£119.99

The Rack is the base layer of the aeroe system and includes one Cradle to carry your drybag or tent, which can be mounted on the top or sides of the rack. Secure with the built-in straps – no fiddly cables or fiddly attachments. Customise your ride with additional Cradles (up to three), Pods and aeroe accessories.

Spider Rear Cradle

£64.99