EXORDIUM

FROM THE PUBLISHER

WELCOME TO ISSUE 139 OF SUBTEL FORUM, OUR SPECIAL DATA CENTERS & NEW TECHNOLOGY EDITION FEATURING A PREVIEW OF PTC ‘25 AND CELEBRATING 23 YEARS OF SUBTEL FORUM!

Last month, I ran my 31st marathon. This time, I trained harder than I have in years—pushing myself with better splits, shedding a good chunk of weight, and starting the race armed with a clear strategy. The results? Mixed. My half split was faster than any I’ve clocked in the past five years, but as the miles piled on, so, too, did the pace. My overall time was my best since before Covid, but it wasn’t quite as fast as I’d hoped. Age, it seems, is an uncompromising force. Yet, I can’t help but hope I’ll be that guy 30 years from now, still pounding the pavement with determination. Only time will tell.

In many ways, my marathon journey feels like a metaphor for SubTel Forum itself. Over the past 23 years, we’ve pushed hard, adapted, and grown—driven by strategy and resilience. This issue is a testament to that progress. Here’s a look at what we’ve been working on:

13TH ANNUAL SUBMARINE TELECOMS INDUSTRY REPORT

Earlier this month, we released our 13th Annual Submarine Telecoms Industry Report , highlighting over $15.4 billion in active new projects. Of these, $8.2 billion in contracts are already in place, with $6.3 billion worth slated for completion in 2024 alone. We’re also honored to feature a foreword from Doreen Bogdan-Martin, Secretary-General of the International Telecommunication Union, who shared her insights on the ITU’s submarine cable initiatives. Haven’t had a chance to dive in yet? Click HERE to access the report.

ANNUAL INDUSTRY SENTIMENT SURVEY

Thank you to everyone who participated in our Annual Industry Sentiment Survey! Your feedback, reflected in the

report, provides critical insights into the mood and direction of our industry.

2025 SUBMARINE CABLE MAP

We’re hard at work on the 2025 Submarine Cables of the World wall map, set for release early next year. This map will be distributed at key conferences like PTC ‘25, Submarine Networks EMEA, and Submarine Networks World, ensuring your brand remains front and center on walls around the globe. Want your logo included? Click HERE to secure your spot!

PTC ‘25 CONFERENCE

We’re thrilled to be heading to Honolulu in January for the PTC ‘25 Conference . The Pacific Telecommunications Council always delivers a stellar event, and we look forward to reconnecting with industry friends while exploring the latest innovations.

SUBTEL FORUM: 23 YEARS AND COUNTING

When Ted Breeze and I launched SubTel Forum in 2001,

the industry was in a dark period. With little more than a severance package, some borrowed software, and a lot of determination, we took a leap of faith. Our first issue featured eight articles and seven complimentary ads—a humble beginning during challenging times.

Now, 23 years later, we’ve grown beyond anything we could have imagined. We’ve embraced new approaches, redefined our mission, and reaffirmed our commitment to our founding principles:

• To provide a wide range of ideas and issues.

• To incite, entertain, and provoke in a positive manner.

This year’s progress reinforces our core belief: education and communication remain vital to our industry’s success.

A HEARTFELT THANK YOU

To our more than 100 sponsors and 725 authors—thank you for helping us reach this milestone. A special thanks to this issue’s advertisers: Fígoli Consulting, Ocean Networks, AP Telecom, PTC ‘25, Submarine Networks EMEA, Trans Americas Fiber System, and WFN Strategies. And, of course, don’t miss our fan-favorite feature: Where in the World Are All Those Pesky Cableships?

We hope SubTel Forum continues to be your go-to destination for submarine cable industry news and analysis. As always, we’re here to illuminate, educate, and inspire.

Good reading – Slava Ukraini , and save me a seat at the Mai Tai Bar… STF

Wayne Nielsen, Publisher

A Publication of Submarine Telecoms Forum, Inc. www.subtelforum.com | ISSN No. 1948-3031

PRESIDENT & PUBLISHER: Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

ANALYTICS: Kieran Clark | kclark@subtelforum.com | [+1] (540) 533-6965

SALES: Nicola Tate | ntate@associationmediagroup.com | [+1] (804) 469-0324

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

DEPARTMENT WRITERS:

Andrés Fígoli, Brian Moon, Ella Herbert, John Maguire, Kieran Clark, Michael Brand, Nicole Starosielski, Philip Pilgrim, Syeda Humera, Carolyn Pohl, and Wayne Nielsen

FEATURE WRITERS:

Bill Burns, Devon A. Johnson, Fernando Borges Azevedo, Joel Ogren, José Amaro, Kieran Clark, Kristian Nielsen, Mark Englund, Raj Jayawardena, Stewart Ash, and Tony Frisch

NEXT ISSUE: January 2025 – Global Outlook and Submarine Networks EMEA Preview

Submarine Telecoms Forum, Inc. www.subtelforum.com/corporate-information

BOARD OF DIRECTORS: Margaret Nielsen, Wayne Nielsen, Kristian Nielsen and Kacy Nielsen

Contributions are welcomed and should be forwarded to: pressroom@subtelforum.com.

Submarine Telecoms Forum magazine is published bimonthly by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers.

Liability: While every care is taken in preparation of this publication, the publishers

cannot be held responsible for the accuracy of the information herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

New Subscriptions, Enquiries and Changes of Address: 21495 Ridgetop Circle, Suite 201, Sterling, Virginia 20166, USA, or call [+1] (703) 444-0845, fax [+1] (703) 349-5562, or visit www. subtelforum.com.

Copyright © 2024 Submarine Telecoms Forum, Inc.

FORUM IN THIS ISSUE

ISSUE 139 | NOVEMBER 2024

6 QUESTIONS WITH BRIAN MOON AND PTC PREVIEW

Talking Submarine Cable Industry with PTC's CEO

RETHINKING SUBMARINE CABLE CYBERSECURITY IN THE AGE OF SMART CABLES TECHNOLOGY AND THE NIS2 EU DIRECTIVE

40 60 48 64 52 68

WET-PLANT: INNOVATION AND SPECULATION

Exploring subsea cable innovations and future trends

By Tony Frisch

Enhancing cybersecurity for SMART subsea cables under NIS2 By José Amaro

THE EVOLUTION OF CABLE LANDING STATIONS: POWERING THE NEXT WAVE OF SUBSEA AND TERRESTRIAL NETWORK INTEGRATION

CLS evolution pivotal in global data connectivity By Joel Ogren

INTO THE FUTURE: QUANTUM TECHNOLOGIES AND THE IMPACT ON THE RESILIENCE OF THE SUBSEA CABLE SYSTEM

Exploring quantum technology's impact on subsea resilience. By Devon A. Johnson

SINES, PORTUGAL, EMERGES AS THE EUROPEAN ATLANTIC HUB

Portugal’s Sines emerges as a key connectivity hub By Fernando Borges Azevedo

WHAT HAVE THE BRITISH EVER DONE FOR US? PART 2

By Bill Burns and Stewart Ash

By Kristian Nielsen

By Kieran Clark

By Raj Jayawardena and Mark Englund

INSIDE THE WORLD OF SUBTEL FORUM: A COMPREHENSIVE GUIDE TO SUBMARINE CABLE RESOURCES

TOP STORIES OF 2019

The most popular articles, Q&As of 2019. Find out what you missed!

NEWS NOW RSS FEED

Welcome to an exclusive feature in our magazine, where we explore the captivating world of SubTelForum.com, a pivotal player in the submarine cable industry. This expedition takes us on a detailed journey through the myriad of resources and innovations that are key to understanding and connecting our world beneath the oceans.

mapping efforts by the analysts at SubTel Forum Analytics, a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

DISCOVER THE FUTURE: THE SUBTEL FORUM APP

CONNECTING THE DEPTHS: YOUR ESSENTIAL GUIDE TO THE SUBTEL FORUM DIRECTORY

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

PUBLICATIONS

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analy sis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

CABLE MAP

In our guide to submarine cable resources, the SubTel Forum Directory shines as an essential tool, providing SubTel Forum.com readers with comprehensive access to an array of vetted industry contacts, services, and information. Designed for intuitive navigation, this expansive directory facilitates quick connections with leading vendors, offering detailed profiles and the latest in submarine cable innovations. As a dynamic hub for industry professionals, it fosters community engagement, ensuring our readers stay at the forefront of industry developments, free of charge.

2024 marks a groundbreaking era for SubTel Forum with the launch of its innovative app. This cutting-edge tool is revolutionizing access to submarine telecommunications insights, blending real-time updates, AI-driven analytics,

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of

and a user-centric interface into an indispensable resource for industry professionals. More than just a technological advancement, this app is a platform fostering community, learning, and industry progression. We encourage you to download the SubTel Forum App and join a community at the forefront of undersea communications innovation.

YOUR DAILY UPDATE: NEWS NOW RSS FEED

Our journey begins with the News Now updates, providing daily insights into the submarine cable sector. Covering everything from the latest technical developments to significant industry milestones, this feed ensures you’re always informed about the latest trends and happenings. It’s an essential tool for professionals who need to stay on top of industry news.

THE KNOWLEDGE HUB: MUST-READS & Q&AS

Dive deeper into the world of submarine communications with our curated collection of articles and Q&As. These insightful pieces offer a comprehensive look at both the history and current state of the industry, enriching your understanding and providing a broader perspective on the challenges and triumphs faced by submarine cable professionals.

IN-DEPTH PUBLICATIONS

• Submarine Cable Almanac: This quarterly treasure trove provides detailed information on global cable systems. You can expect rich content including maps, data on system capacity, length, and other critical details that sketch a vivid picture of the global network.

• Submarine Telecoms Industry Report: Our annual report takes an analytical approach to the industry, covering everything from current trends to capacity analysis and future predictions. It’s an invaluable resource for anyone seeking to understand the market’s trajectory.

VISUALIZING CONNECTIONS: CABLE MAPS

• Online SubTel Cable Map: An interactive tool mapping over 550 cable systems, perfect for digital natives who prefer an online method to explore global connections.

• Printed Cable Map: Our annual printed map caters to those who appreciate a tangible representation of the world’s submarine fiber systems, detailed in a visually appealing and informative format.

EDUCATIONAL OPPORTUNITIES: CONTINUING EDUCATION

SubTel Forum’s commitment to education is evident in our courses and master classes, covering various aspects of the industry. Whether you’re a seasoned professional or new to the field, these learning opportunities are fantastic for deepening your understanding of both technical and commercial aspects of submarine telecoms.

SCAN

FIND THE EXPERTS: AUTHORS INDEX

Our Authors Index is a valuable tool for locating specific articles and authors. It simplifies the process of finding the information you need or following the work of your favorite contributors in the field.

TAILORED INSIGHTS: SUBTEL FORUM BESPOKE REPORTS

• Data Center & OTT Providers Report: This report delves into the evolving relationship between cable landing stations and data centers, highlighting trends in efficiency and integration.

• Global Outlook Report: Offering a comprehensive analysis of the submarine telecoms market, this report includes regional overviews and market forecasts, providing a global perspective on the industry.

• Offshore Energy Report: Focusing on the submarine fiber industry’s oil & gas sector, this report examines market trends and technological advancements, offering insights into this specialized area.

• Regional Systems Report: This analysis of regional submarine cable markets discusses capacity demands, development strategies, and market dynamics, providing a detailed look at different global regions.

• Unrepeatered Systems Report: A thorough examination of unrepeatered cable systems, this report covers project timelines, costs, and operational aspects, essential for understanding this segment of the industry.

• Submarine Cable Dataset: An exhaustive resource detailing over 550 fiber optic cable systems, this dataset covers a wide range of operational data, making it a go-to reference for industry specifics.

SubTelForum.com stands as a comprehensive portal to the dynamic and intricate world of submarine cable communications. It brings together a diverse range of tools, insights, and resources, each designed to enhance understanding and engagement within this crucial industry. From the cutting-edge SubTel Forum App to in-depth reports and interactive maps, the platform caters to a wide audience, offering unique perspectives and valuable knowledge. Whether you’re a seasoned professional or new to the field, SubTelForum.com is an indispensable resource for anyone looking to deepen their understanding or stay updated in the field of submarine telecommunications.

SUBTEL CABLE MAP UPDATES

BY KIERAN CLARK

The SubTel Cable Map, built on Esri’s ArcGIS platform, offers a dynamic and interactive way to explore the global network of submarine cable systems. This essential resource provides detailed information on over 440 current and upcoming cable systems, more than 50 cable ships, and over 1,000 landing points. Directly connected to the SubTel Forum Submarine Cable Database and integrated with our News Now Feed, the map gives users real-time insights into the industry, allowing them to view current and archived news related to each cable system. Submarine cables are the backbone of global communications, carrying over 99% of the world’s international data. These cables connect continents and enable the seamless connectivity we rely on for everything from daily communications to critical business operations. Without this vast network, fast, efficient communication between countries and continents would not be possible. Our analysts work diligently to keep the SubTel Cable Map up-todate with data from the Submarine Cable Almanac, along with valuable feedback from users. This ensures a comprehensive and accurate view of the industry, highlighting both the latest deployments and key updates. As the year draws to a close, updates to the map may slow slightly as we move into the holiday season, but our commitment to delivering timely, reliable information remains as strong as ever.

Submarine cables are the backbone of global communications, carrying over 99% of the world’s international data. These cables connect continents and enable the seamless connectivity we rely on for everything from daily communications to critical business operations.

We’re also excited to highlight ACS Cable Systems for their continued support as the official sponsor of the SubTel Cable Map. ACS, a leader in wholesale carrier services, proudly displays their logo on the map, linking directly to their offerings at Alaska Communications. This ongoing sponsorship reflects our shared commitment to global connectivity and reliable infrastructure. Known for their dependable services, ACS Cable Systems is a trusted partner for international carriers, offering top-tier customer service and connectivity solutions worldwide.

We invite you to explore the SubTel Cable Map and gain a deeper understanding of the vital role submarine cable systems play in our interconnected world. As always, if you are a point of contact for a system or company that requires updates, please email kclark@subtelforum.com

Below is the full list of systems added and updated since the last issue of the magazine:

We hope the SubTel Cable Map proves to be a valuable resource for you, offering insight into the continually evolving submarine cable industry. Dive into the intricate network that powers our global communications today. Happy exploring! STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Do you have further questions on this topic?

NOVEMBER 18, 2024

UPDATED SYSTEMS:

• Chile Antarctica

• Hawaiian Islands Fiber Link (HIFL)

• Humboldt Cable System (HCS)

• Philippine Domestic Submarine Cable Network (PDSCN)

• Proa

• Saudi Vision Cable

• Taiwan-Philippines-United States (TPU)

SUSTAINABLE SUBSEA NETWORKS ATTENDS SUBMARINE NETWORKS WORLD 2024

BY ELLA HERBERT AND MICHAEL BRAND

Subsea cable leaders from around the globe gather in Singapore each year at Submarine Networks World, an annual event dedicated to the industry. Key industry members come together to discuss crucial issues impacting the sector — this year including AI, cable security and protection, cable maintenance, and new technologies. This conference provides a rare opportunity to meet some of the most important figures in the subsea industry in person. Therefore, you can imagine our excitement when we were given the chance to represent Sustainable Subsea Networks, an initiative of the SubOptic Foundation, and present on the topic of PUE at the Cable Landing Station alongside our colleague Hesham Youssef from Telecom Egypt.

As undergraduate students, our journey into the industry has been largely shaped by observing discussions at industry conferences. Starting at the Pacific Telecommunications Council (PTC) Conference in January of 2024, we were amazed by the scale of the discussions happening — it felt as if a significant change in the digital infrastructure space was happening before our eyes. The ability to be part of that change by presenting on energy efficiency metrics at the

Cable Landing Station felt surreal. Our invitation to the conference also demonstrates the eagerness for young voices in the industry.

Through our experience at the conference, we had the opportunity to learn from the panels and presentations given by an array of speakers on hot topics and trends. As for the other conferences we have attended, we tried to absorb as much information as we could and learn more about the industry as a whole, seeking out advice and information that could contribute to our mission of making digital infrastructure more sustainable.

In this month’s column, we will provide an overview of our presentation at SNW. We will also share our key sustainability-related takeaways

which include a significant focus on carbon emissions, a surge in discussions about the power used for AI and its implications for sustainability, and the growing need for industry and policymaker alignment.

SPEAKING TO AN INDUSTRY AUDIENCE: PUE AT THE CABLE LANDING STATION

At SNW, our team tackled the topic of sustainability metrics at the Cable Landing Station, specifically focusing on PUE. First, we gave a brief overview of the paradigm between the necessity of metrics to quantity sustainability progress and the oversimplification that metrics can cause which hinders sustainability goals.

Then, we elaborated on this discussion by bringing up one of

the most popular metrics in the data center industry, Power Usage Effec tiveness, also known as PUE. We explained that its simplicity as a ratio has many pitfalls that can lead to its misuse, which highlights the need for a broader suite of metrics. PUE is now being used at Cable Landing Stations which currently have no sustainability framework or standards. The activities of the SubOptic Global Citizen Working Group’s Cable Landing Sta tion team were highlighted, especially their work on the first-ever global sustainability survey of Cable Landing Station facilities.

With Hesham Youssef, a Senior Transmission Engineer at Telecom Egypt, we gave an in-depth overview of PUE calculation at the Cable Landing Station and pointed out avenues for improvement. Finally, an overview of Telecom Egypt’s sustainability efforts was provided, including their monitoring of PUE at Cable Landing Stations. Overall, we concluded that PUE should be used within the context of CLS operations; however, it only makes sustainability sense if used in conjunction with other metrics.

With this presentation, we were happy to bring discussions of sustainability to SNW, but also observed many interesting trends and ties to sustainability in panels and presentations during the event.

CARBON EMISSIONS: A SUSTAINED FOCUS FOR ENVIRONMENTAL ACTION

At this conference, sustainability was spotlighted with a dedicated Keynote Panel on the topic. The assembled panel included industry executives Carlos Casado Gallardo from Telxius and Aurelien Vigano from Orange. They were joined by Aileen Chia, from the Infocomm Media Develop-

ment Authority (IMDA) under the Singapore Ministry of Digital Development and Information, and Michael Logan who is on the advisory board of Sustainable Subsea Networks.

The very first question of that session focused on carbon footprints and carbon neutrality, and both the Orange and Telxius representatives came forward with strong plans to reduce

Ella Herbert, Michael Brand, and Hesham Youssef presenting “P.U.(E.), Does something smell fishy?” Photograph by Submarine Networks World

Keynote Panel: “Sustainability and Subsea- threat or ally?” Photograph by Submarine Networks World.

their CO2 footprint. Vigano stated that Orange was committed to going carbon neutral by 2040 and reiterated how they incorporate emissions impact into their decision-making as a business. Gallardo echoed similar goals of reducing carbon usage by using more renewable energy and looking towards innovative solutions such as drones for quality check commitments and investing to make data centers more efficient. Additionally, Ms. Chia emphasized the commitment of the Singapore government to reduce their carbon footprint to about 60 million tons by 2030 and reach net zero emissions in 2050. Carbon savings continued to be a central theme of the sustainability discussion across the panel.

It was clear even in the first five minutes of this panel that sustainability commitments are becoming increasingly serious and have evolved into clear emissions goals that are backed up by strong actionable plans to reduce carbon usage. However, it remains to be seen if other companies will follow suit in this trend and follow through on strong carbon reduction commitments as well. While some large corporations have already done so, many in the industry are not yet advancing planning for emissions reductions. However, if this conversation continues, and carbon emissions reduction continues to become the standard rather than a fleeting trend, there could be even more significant, industry-wide change.

Another perspective on reducing carbon emissions manifested in discussions about the possibility of deploying a green cable fleet. When asked about possible challenges in implementing ESG inclusions,

Gallardo from Telxius said that there was a need to work towards evolution in the cable ship fleet by the owners of the vessels. This conversation was also brought up in a panel about cable laying in a complex operating environment. The panel was asked about the business case for making cable ships greener, and Didier Dillard, the CEO of Orange Marine, brought up customer buy-in as the biggest challenge. He said that many customers were not willing to engage in the trade-off of reduced speed or higher cost for fewer emissions. He suggested asking first how to replace the fleet. Electric vehicles and alternative energy solutions were suggested by the other panel members briefly, but it appeared the consensus was that it would be a difficult business case to make since it requires increased cost and investment.

A greener fleet for cable ships would be an enormous advancement

towards sustainability goals, but more collaborative efforts and substantial investment would be needed to make it a reality.

In short, carbon emissions remained at the center of sustainability discussions at SNW, and many promising commitments were stated by key industry players and markets. There appear to be clearer plans for reaching those goals, and hopefully, this is a trend that continues across the industry. However, it is also clear the business side of sustainability improvements is very complex and requires further collaboration across the industry to develop paths forward.

AI AND POWER: A HOT TOPIC WITH SEVERE SUSTAINABILITY IMPLICATIONS

AI was a consistent topic at each of the presentations at SNW this year. It seemed to come up in every discussion in which people were looking toward the future, and it

“Escaping the Matrix: AI and Submarine Cables” Alan Mauldin, TeleGeography Photograph by Submarine Networks World.

seemed that everyone had a different opinion about how they think AI will impact the market. Jürgen Hatheier of Ciena argued in a session about the AI revolution that there was unprecedented growth in data center capacity and that in the Asia Pacific region, capacity was expected to more than double in the next two years. AI also came up in a session about collaboration in the industry with Fergus Innes of Crosslake Fibre saying it would increase bandwidth by 120%. AI was also a central topic of the talk given by Walid Wakim, CTO of Infinera. He claimed with AI applications, we could expect to see zettabytes of traffic monthly by 2030. Overall, there was a clear consensus that AI would dramatically increase capacity and bandwidth demands.

With this increased capacity and bandwidth comes an increasing struggle for power grids to keep up with data center growth. This issue will be exacerbated by the growth of AI. Industry members have continuously discussed data center growth following power availability, especially in relation to green power. During the sustainability panel, both Aurelien Vigano from Orange and Carlos Gallardo from Telxius agreed that AI was a challenge to sustainability advancements. They were concerned about the power needed for data centers and the subsequent impact on emissions. Depending on the power sources, AI could set back advancements in emissions reductions for the industry as a whole. Alan Mauldin of TeleGeography dedicated his keynote presentation to AI and tied this trend to bandwidth demand. A key point he made was that attempting to shift the workload of AI among data centers to optimize power affordability and car-

bon usage would boost the long-haul demand for AI.

Overall, in regards to sustainability, AI could lead to increased motivation to seek out renewable energy sources and also lead to data center expansion in locations that offer affordable and green energy sources. However, it could also lead to a disastrous spike in carbon emissions from the data center sector that threatens sustainability advancements in subsea. The potential spike in demand following AI that was frequently discussed at SNW will put the industry at a crossroads for choosing power sources that will shape the development of sustainability for many years to come.

INDUSTRY AND POLICY ALIGNMENT: A NEED FOR COMMUNICATION, COLLABORATION AND CERTAINTY

Across the conference, many presentations called for more regulatory certainty from governments. In light of an ever-changing geopolitical landscape, industry members are increasingly concerned about regulations designed to tackle security challenges. For example, there was a full keynote panel dedicated to geopolitics and digital sovereignty where Kent Bressie, International Cable Law Advisor at the ICPC, covered the developing digital sovereignty regimes in China, the European Union, and the United States which were all out of alignment. Government policies focused on security and privacy may force cable layers to avoid certain areas, drastically altering optimal subsea cable routes. Without advance notice, these regulations may require route alterations or cause massive delays for cable layers increasing permitting costs.

This level of uncertainty exists within emerging environmental policies

as well. On the sustainability panel, Michael Logan noted with the Biodiversity Beyond National Boundary Jurisdiction agreement moving forward there may be multiple implications for the subsea cable industry not just from the agreement itself but also the increased awareness about sustainability issues. For example, there may be more restrictions in route selection with the development of high seas marine protected areas or more countries may choose to call for environmental impact assessments during the permitting process. There remains a massive amount of uncertainty surrounding how governments will shape environmental regulations for subsea cables in the future. Logan notes that this is causing some companies to choose non-optimized routes to “take into account any regulatory issues known today, unknown or future” potentially resulting in higher costs and more carbon emissions from the ships laying the cables.

Industry and policy alignment is essential for creating secure and sustainable subsea networks. Sonia Jorge, Founder and Executive Director of the Global Digital Inclusive Partnership, noted in her keynote presentation that “regulatory certainty is essential” to facilitating an inclusive and equitable internet. She furthered that achieving this requires coordinating with policymakers so they “understand how the sector is evolving and the needs of the sector.” Across the conference, speakers noted a handful of cases where government policies may be helpful for the industry — cable protection zones, subsidies for recovering outof-service cables, internal government information sharing to reduce redundant studies and permits among them — but for any of them to be actualized

SUBSEA

requires communication and collaboration between industry members and policymakers.

A SUBSEA CABLE DOCUMENTARY

In addition to the conference itself, we were lucky enough to interview a handful of industry leaders for a new Sustainable Subsea Networks film project. Led by recent UC Berkeley graduate Sebastian Johnson-Deal, our team is developing a 15-minute documentary encapsulating the lifespan of a subsea cable — portraying the cable itself as an integral part of a dynamic, living system. Through a combination of animation and live action, the film spotlights researchers and industry

professionals working to make digital infrastructure more sustainable.

During the conference, we interviewed several industry experts gaining a wide range of perspectives on the intersection of sustainability throughout the processes of laying, maintaining, and recovering a subsea cable. We discovered that everyone has slightly different definitions of sustainability, which impacts what actions they prioritize the most. Some interviewees were primarily concerned with the end-of-life aspect of cable recovery, some prioritizing carbon emissions, and some most concerned about the sustainability of the industry itself, regarding the importance of hiring young profession-

als. Overall, the interviews illustrated the importance of collaboration in sustainability, so that initiatives in each of those separate areas can come together to shape improvements across the industry.

LOOKING TO THE FUTURE

At the confernce, we were delighted to see more young voices in the room. Youssef pointed out that one of the key highlights at SNW was “the involvement of talented young professionals in the industry.” Adam Ball, General Manager of Terrapinn (event owner and organizer of SNW) enthusiastically echoed this sentiment. , reflecting that the “new wave (of young professionals) will bring

Sebastian Johnson-Deal, Ella Herbert, and Michael Brand Interviewing Gabriel Jack. Photograph by Submarine Networks World.

new ideas, an outside eyes looking in approach and possibly an alternative way of thinking.” Similarly, Youssef explained that engaging with these emerging professionals not only brings fresh perspectives but also offers “opportunities for experts in subsea cables to both learn and teach,” which strengthens sustainability efforts across the board. As the industry evolves, Youssef noted, “sustainability is becoming central to our activities.” He emphasized that collaborating with research teams like Sustainable Subsea Networks and other industry initiatives “can meaningfully extend and enhance those efforts.” Inspired by this collaborative spirit, our team is excited to continue connecting the next generation with industry professionals, fostering innovation and sustainability.

Researchers connected to Sustainable Subsea Networks are also visiting the SubOptic Foundation’s WAVE Symposia on subsea cables over the course of this fall. Tochukwu Egesi, a Ph.D. student in Computer Science at the University of Cape Town, presented at the Wave Symposium in London, England earlier in October. Egesi reported back from the symposia: “Participating in the WAVE Conference as a panelist on “The Economic Impact of Submarine Cables in Africa” was a pivotal opportunity to shed light on how digital infrastructure, particularly submarine cables, plays a transformative role in driving economic growth across the continent. Our discussion explored how these cables are not just technical achievements but also engines of economic development, fostering new business opportunities, enhancing connectivity, and accelerating innovation. I had the chance to

emphasize the importance of building robust, sustainable infrastructure to ensure long-term benefits, particularly for underrepresented communities in Africa. The insights shared during the panel highlighted the need for strategic investments in submarine cables as part of a broader digital ecosystem that can bridge the digital divide and support economic resilience in Africa.”

In terms of sustainability, Egesi found that “sustainability was at the core of many discussions at WAVE. Conferences like this provide a critical platform for the exchange of ideas and the formation of industry collaborations that focus on creating long-term, environmentally conscious solutions. In the context of submarine cables, sustainability takes on a dual meaning: it’s about reducing environmental impact during deployment while also ensuring that these technologies are sustainable in terms of their social and economic benefits. Engaging with industry leaders and experts at WAVE reaffirmed the importance of integrating sustainability into every aspect of our digital infrastructure planning, not only for the health of our planet but also to ensure that these systems are inclusive, accessible, and beneficial for all.”

Over the course of November, two of our academic researchers will be presenting our team’s sustainability work. Isabel Jijon, a master’s student at Sciences Po in France, will present on sustainability in subsea networks at the WAVE Symposium in Paris, and Iago Bojczuk, a PhD candidate at Cambridge University, will share the team’s work at a symposium at Portugal’s Regulatory Agency for Communications (ANACOM), in Lisbon.

When we entered UC Berkeley as college students a little over a year ago and joined the Sustainable Subsea Networks project, neither of us expected to find ourselves traveling across the world meeting with industry leaders, let alone presenting at prominent industry conferences. Our growth as researchers would not have been possible without the support of an industry that is truly invested in supporting the development and viewpoints of the next generation. At every single conference, we have felt welcomed, valued, and encouraged to share our ideas. We look forward to continuing our journey at PTC’25 where we will be, as always, eager to document how sustainability is being discussed across the industry. STF

This article is an output from a SubOptic Foundation project funded by the Internet Society Foundation.

ELLA HERBERT is an undergraduate student at UC Berkeley pursuing her B.S. in Environmental Science. She is currently a research assistant for the SubOptic Subsea Sustainable Networks research team, focusing on data center sustainability by exploring metrics, industry trends, and publications within the field of telecommunications.

MICHAEL BRAND is an undergraduate student at UC Berkeley studying Environment Economics and Policy. He is also a research assistant on the SubOptic Foundation’s Sustainable Subsea Networks research team. His research focuses on the intersection of behavioral economics, environmental policy, and public communication for the development and regulation of digital infrastructure.

ANALYTICS

IClick here to view the entire 2024-2025 Industry Report

n SubTel Forum’s 2024/25 Submarine Industry Report, a comprehensive examination sheds light on the current landscape and emerging trends within hyperscale data centers and their interdependence with submarine cables. This report delves into the transformative role of Hyperscalers, such as Google, Amazon, and Microsoft, as they increasingly invest in and own critical subsea infrastructure, reshaping data connectivity and data center expansion worldwide. Hyperscalers are driving new cable deployments to ensure greater control over data capacity, latency, and cost structures, fundamentally altering the dynamics of global connectivity. The report further highlights how Hyperscalers’ investments are fostering edge computing, expanding internet access in underserved regions, and prompting traditional telecom operators to adapt to an evolving market. Technological advancements, regulatory challenges, and the imperative for sustainable growth underscore the report’s forward-looking perspective, positioning these developments as crucial to the future of global internet infrastructure.

HYPERSCALERS AND DATA CENTERS: A Snapshot Of Where We Are And Where We Are Headed

[Reprinted Excerpts from SubTel Forum’s 2024/25 Submarine Industry Report]

HYPERSCALERS, DATACENTERS, AND THE EVOLUTION OF SUBMARINE CABLE OWNERSHIP

Perspectives of Alex Vaxmonsky

Submarine cables, the fiber optic systems lying on the ocean floor, have been the lifeblood of global communication for decades, facilitating over 99% of international data traffic. Traditionally, these cables were owned and operated by telecom consortia, but in recent years, Hyperscalers (massive cloud and tech companies like Google, Amazon, Meta, and Microsoft) have transformed the landscape of submarine cable ownership. This shift has also significantly influenced data center expansion and integration. In this analysis, we explore how Hyperscalers have

disrupted the traditional subsea cable industry and how the evolution of submarine cable ownership has catalyzed new growth patterns in the data center market, fundamentally reshaping global connectivity and infrastructure.

Hyperscalers have increasingly taken control of the physical backbone of the internet by investing directly in submarine cables.

HYPERSCALERS AND SUBMARINE CABLE OWNERSHIP

The Rise of Hyperscalers, which include major cloud providers and internet giants, operate at an unprecedented scale, managing massive volumes of data across global networks. The rapid growth of cloud computing, social media, and data-intensive

services like video streaming, AI, and IoT has driven the need for more efficient and extensive global infrastructure. In response, Hyperscalers have increasingly taken control of the physical backbone of the internet by investing directly in submarine cables. This shift started around the mid-2010s, with companies like Google leading the way. Historically, telecom operators and consortiums dominated submarine cable ownership, but Hyperscalers now account for a significant share of new cable projects. For example, Google owns or co-owns over a dozen submarine cables globally, including high-profile systems such as the Curie cable connecting the U.S. and Chile and the Grace Hopper cable linking the U.S., U.K., and Spain.

MOTIVATION FOR HYPERSCALERS’ INVESTMENT IN SUBMARINE CABLES

The primary driver for Hyperscalers’ direct investment in submarine cables is control over network capacity, latency, and costs. By owning their own cables or having substantial shares in cable systems, these tech giants can bypass traditional telecom carriers, ensuring their global infrastructure is optimized for their own services. This reduces the reliance on third-party carriers, allowing for better predictability in cost structures and network performance. Additionally, Hyperscalers are incentivized to reduce latency—the time it takes for data to travel from one point to another across the globe. Latency is critical for services such as cloud computing, real-time communication, and video streaming. By owning submarine cables, Hyperscalers can lay cables along the most direct routes, minimizing latency and improving user experience for their customers. Moreover, as data demand explodes with AI, edge computing, and 5G rollouts, Hyperscalers’ strategic investment in submarine cables positions them to meet future bandwidth needs. Ownership also gives them more flexibility in negotiating capacity with other network operators and partners.

sortium that includes Microsoft and Meta, as well as Telxius. This new model of ownership allows Hyperscalers to pool resources and reduce costs, while still maintaining control over critical infrastructure.

DATA CENTERS AND CHANGING STRATEGIES

The

growth of submarine cables is also tied to the rise of edge computing, where data processing happens closer to end-users to reduce latency. Submarine cables enable edge data centers to flourish in previously underserved regions, transforming coastal cities and developing markets into data hubs.

The shift in submarine cable ownership has had profound effects on data center expansion and integration. Hyperscalers, with their direct investments in submarine cables, are now building out massive, globally distributed data centers, often located near the cable landing stations. Historically, data centers were concentrated in key metropolitan hubs with proximity to major population centers and traditional telecom infrastructure. However, the rise of hyperscale ownership of submarine cables has shifted this paradigm. Now, we see a growing trend of data centers being strategically located in coastal areas or close to key cable landing points. For example, Google’s investment in the Curie submarine cable, which connects the U.S. to South America, also coincided with their expansion of data center facilities in Chile. This demonstrates how submarine cables are closely integrated with Hyperscalers’ global data center strategies.

EDGE COMPUTING AND REGIONAL DATA CENTER GROWTH

HYPERSCALER-CENTRIC CONSORTIA

While some Hyperscalers build and own their cables outright, others form consortia with telecom operators or other tech companies. These hyperscale-centric consortia are different from traditional telecom consortia because the tech firms generally drive projects. For example, the Marea cable, which connects the U.S. to Spain, is owned by a con-

The growth of submarine cables is also tied to the rise of edge computing, where data processing happens closer to end-users to reduce latency. Submarine cables enable edge data centers to flourish in previously under-served regions, transforming coastal cities and developing markets into data hubs. By improving connectivity and reducing latency in far-flung regions, Hyperscalers are able to expand their services globally and push more data-processing capabilities to the network’s edge. For instance, submarine cables landing in Africa and Southeast Asia are fostering new data center investments in these regions, providing local populations with faster access to cloud services and encouraging economic growth. The rollout of subsea cables such as Google’s Equiano cable, which connects Europe to Africa, is driving this trend. This cable system, when coupled with local data centers, allows Hyperscalers to expand their reach and serve growing markets with highspeed, low-latency infrastructure.

INTERCONNECTION AND INTEGRATION OF DATA CENTERS

The role of submarine cables in fostering greater interconnection between data centers cannot be overstated. Hyperscalers’ submarine cables link their global data center networks, creating an intercontinental web of high-speed data highways. This increased interconnectivity allows Hyperscalers to offer services with minimal latency and seamless global integration. For example, Google’s private subsea cables, such as Dunant (connecting the U.S. and France), serve to link their global data centers, ensuring faster and more reliable data flows across continents.

The development of multi-tenant data centers, where different cloud providers and enterprises co-locate their servers, has also been influenced by submarine cable routes. By collocating near cable landing stations, data centers can offer their tenants superior connectivity, driving the demand for interconnected infrastructure. This interconnectedness is crucial for cloud services, CDNs, and the broader Internet ecosystem to function optimally.

The growing role of Hyperscalers in submarine cable ownership also presents new geopolitical and regulatory challenges. Submarine cables are critical infrastructure, and their ownership and control can raise national security concerns.

operators have responded by partnering with Hyperscalers in cable consortia or focusing on providing value-added services like managed cloud solutions or local fiber networks. Others have diversified into data center ownership, attempting to capture a share of the cloud infrastructure market by building facilities near cable landing points or offering interconnection services to cloud providers.

NEW GEOPOLITICAL AND REGULATORY CHALLENGES

IMPACT OF GLOBAL CONNECTIVITY AND INDUSTRY DYNAMICS

Democratization of Global Internet Access Hyperscalers’ investments in submarine cables are having a democratizing effect on global internet access. Regions that previously lacked affordable, high-speed international bandwidth are now benefiting from new submarine cables. These cables reduce the cost of international internet traffic, making it easier for local ISPs to offer affordable services to their customers. For instance, in Africa, new cables like Google’s Equiano and Meta’s 2 Africa have the potential to drastically reduce the price of bandwidth, improving internet penetration and allowing millions of people to access digital services for the first time. This helps narrow the digital divide and promotes economic development.

DISRUPTION OF TRADITIONAL TELECOM OPERATORS

The rise of Hyperscalers as major submarine cable owners has disrupted the traditional telecom-centric model. Telecom companies, which previously dominated the submarine cable market, are now competing with Hyperscalers for control over key international routes. This has led to increased competition, driving down prices for bandwidth and forcing telecom operators to rethink their strategies. Some telecom

The growing role of Hyperscalers in submarine cable ownership also presents new geopolitical and regulatory challenges. Submarine cables are critical infrastructure, and their ownership and control can raise national security concerns. Governments may become increasingly wary of allowing foreign tech companies to control cables that land in their territories, particularly as tensions rise around issues of data privacy, cybersecurity, and digital sovereignty. Countries like China, for instance, have shown interest in building their own cable systems to reduce reliance on Western infrastructure. Meanwhile, the U.S. government has blocked Chinese firms from investing in U.S. connected submarine cables due to security concerns. This dynamic could lead to a fragmentation of the global internet, with countries building parallel infrastructure to avoid reliance on foreign-owned cables.

CONCLUSION

The evolution of submarine cable ownership, driven largely by Hyperscalers, has ushered in a new era of global connectivity and data center integration. As Hyperscalers invest directly in submarine cables, they are transforming not only the subsea cable industry but also the broader data center landscape. By strategically integrating cable routes with data center expansion, these tech giants are reshaping the future of global internet infrastructure, fostering faster, more affordable, and more widespread connectivity. This shift also presents challenges for traditional telecom operators and raises new questions about the geopolitical implications of hyperscale-owned infrastructure. As submarine cables continue to play a critical role in global communication, the power dynamics between tech companies, telecoms, and governments will likely evolve, with long-term implications for global digital economies and internet governance. STF

HYPERSCALER ANALYSIS

7.2.1 CURRENT SYSTEMS IMPACTED

Since 2016, the ownership and development of submarine cable systems have steadily shifted toward Hyperscalers like Google, Amazon, Microsoft, and Facebook, who increasingly find it more efficient to own their own infrastructure rather than relying on leasing capacity from traditional telecom companies. This trend has continued as these companies seek to support their massive data needs, which are driven by global cloud services and content delivery across vast distances.

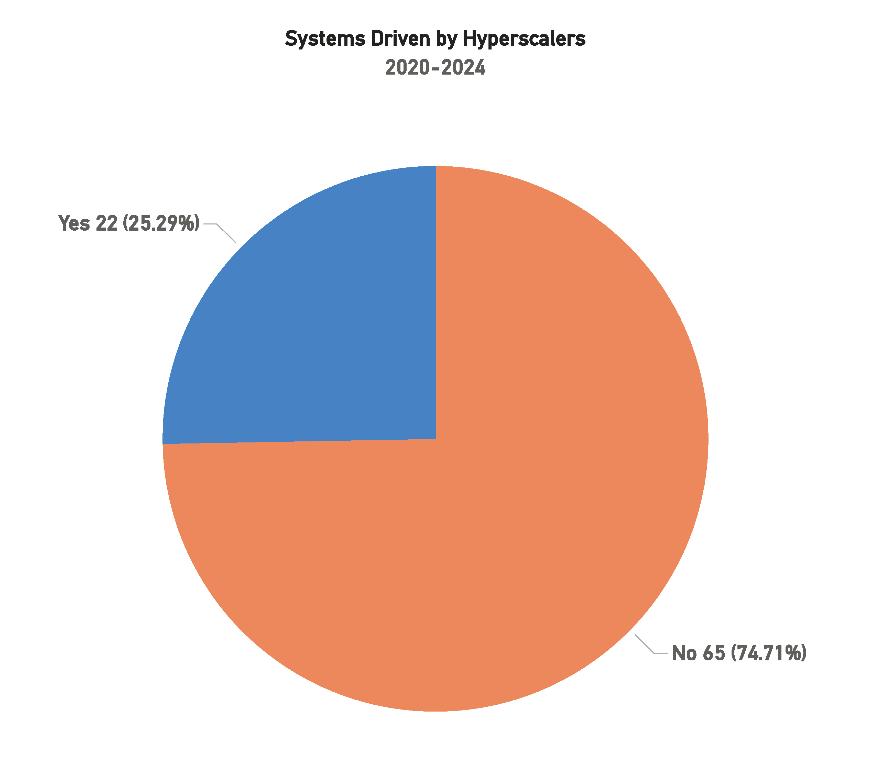

For the period from 2020 to 2024, Hyperscalers were responsible for driving 22 systems, representing 25.29% of the 87 total systems that went into service during this period. This shows a slight increase in the percentage of systems driven by Hyperscalers compared to the 2019-2023 period, where they were behind 24 systems, accounting for 23.5% of the 102 systems that were put into operation. While the total number of systems involving Hyperscalers decreased by two, their proportional influence has grown. This indicates that, despite the fluctuating total number of systems being built, the importance and involvement of Hyperscalers in the global cable market have continued to expand.

new cable projects as they continue to seek greater control over their connectivity infrastructure.

The continued involvement of Hyperscalers is driven by several key factors. The increasing need for higher bandwidth between their global data centers is one major driver. In addition, the desire to secure greater control over their infrastructure, improve the efficiency of their networks, and avoid potential bottlenecks or supply constraints in the traditional leasing model are all factors that continue to push these companies toward building their own systems.

The data shows that the role of Hyperscalers has not diminished but has instead become more strategically important. While there was a slight drop in the number of systems attributed to them, their influence relative to the total number of systems being developed has grown. This suggests that Hyperscalers continue to prioritize infrastructure investments that meet their specific needs for greater control and flexibility, reflecting their long-term commitment to managing their global connectivity requirements independently.

Looking at 2024 in isolation, Hyperscalers have been the driving force behind 22 systems, which is a significant portion of the total systems that have gone live in that year. This continues the trend seen in previous years, with 2023 seeing 14 systems, 2022 seeing 11 systems, and so on. This steady increase illustrates the growing role that Hyperscalers play in

The exponential growth of Hyperscalers continues to drive increasing demand for bandwidth, which is now outpacing the capacity available from traditional carriers. In the past, these companies would have purchased bandwidth from existing telecom providers, but the rapid pace of their growth has made this approach inefficient. As a result, Hyperscalers are now opting to build their own submarine cable systems, which offers several key advantages.

Figure 1: Systems Driven by Hyperscalers, 2020-2024

First, it provides them with greater control over their infrastructure, allowing them to manage and allocate bandwidth based on their specific operational needs. This direct control also reduces their reliance on traditional carriers, eliminating the need to compete for limited capacity on existing circuits. Owning and operating their own infrastructure streamlines the process of increasing capacity. Previously, acquiring additional circuits could take weeks or months; now, Hyperscalers can activate additional bandwidth within days.

The trend of Hyperscaler involvement in submarine cable systems has steadily grown year over year. In 2020, only 5 systems were driven by Hyperscalers out of a total of 20 systems. However, by 2024, Hyperscalers are driving 22 systems out of 65 total systems, marking a significant increase in both their absolute involvement and their share of total systems. This trend shows consistent growth: in 2021, Hyperscalers were involved in 8 systems out of 31 total systems; in 2022, they accounted for 11 systems out of 43 total systems; and in 2023, they were behind 14 systems out of 50 total systems.

The continued involvement of Hyperscalers in submarine cable systems is driven by their increasing need for higher bandwidth between global data centers, as well as their desire for greater control over their infrastructure. Owning their own systems allows these companies to improve network efficiency and avoid potential bottlenecks and supply constraints associated with the traditional leasing model. This strategic approach enables Hyperscalers to manage their global connectivity requirements with greater flexibility and efficiency.

Despite a slight drop in the total number of systems attributed to Hyperscalers, their influence relative to the total number of systems being developed has grown. This highlights a long-term strategy aimed at securing more control over the global connectivity landscape. With the rise of cloud computing, data storage, and global data transfers, controlling infrastructure has become increasingly critical for these companies.

The financial implications of this shift are substantial. While the initial investment in transoceanic cable systems can exceed $100 million per route, the long-term potential revenue generated from controlling these vast networks is significant. Hyperscalers can also benefit from lower operational costs relative to the substantial gains they achieve through improved scalability and reliability. These infrastructure investments not only meet their current bandwidth needs but also ensure their ability to sustain future growth as demand for global data connectivity continues to rise.

7.2.2 FUTURE SYSTEMS IMPACTED

For the upcoming period of 2024 to 2028, 26.47% of the 34 planned systems are expected to be driven by Hyperscalers, a noticeable increase compared to 14% of the 56 systems projected in last year’s report.

This growth demonstrates that, despite recent internal restructuring and market challenges faced by companies like Facebook and Google, Hyperscalers remain significant players in the development of submarine cable infrastructure. Several factors likely contributed to this change. Although

Figure 2: Systems Impacted by Hyperscalers by Year, 2020-2024

challenges like the global chip shortage and COVID19’s lingering effects impacted technological develop ment across industries, Hyperscalers have maintained strong financial positions, enabling them to continue investing in infrastructure projects. The chip shortage, which began in 2020, is expected to resolve soon, likely accelerating technological progress and investment in new systems (J.P. Morgan, 2022). This could explain the higher percentage of systems driven by Hyperscal ers moving forward.

Looking ahead, Hyperscalers’ financial strength ensures that systems they back are more likely to reach implementation. While non-Hyperscaler proj ects often struggle to secure the necessary funding and prove viable business cases, Hyperscaler-driven projects benefit from significant financial support and reduced risk. As more Hyperscaler-backed projects are announced over the next few years, the percentage of systems they influence may rise further. However, the trend currently indicates that Hyperscalers will play a major role in nearly a third of the upcoming submarine cable systems, reflecting their continued expansion into this critical infrastructure.

In terms of financial investment, Hyperscalers are expected to contrib ute $2.65 billion, or 36.32%, of the total projected investment of $7.29 billion over the next several years. This represents a notable increase in both total investment and share compared to previous years. While Hyperscalers may not be the sole owners of every system they invest in, their contributions are vital to ensuring these projects move forward. Hyperscal ers’ financial backing often determines whether a system reaches completion, and their participation is a major factor in sustaining the overall health of the sub marine cable industry.

It is also important to note that while general industry statistics indicate that only about 52% of announced cable systems eventually go into service (Clark, 2019), Hyperscaler-backed systems have historically been more successful in this regard. These systems are typically not announced until they have achieved the critical Contract in Force (CIF) milestone, meaning they are highly likely to be implemented. This reinforces the dominant role Hyperscalers are expected to play in shaping the future of the submarine cable industry, both in terms of system count and financial investment.

Lastly, while no new Hyperscalers have announced plans to enter the submarine cable market, the existing leaders like Google, Amazon, and Microsoft are expected to maintain their investments in upcoming systems. Their ongoing involvement ensures that the submarine cable industry will continue to grow, driven by the need for ever-greater global data connectivity and the associated infrastructure. STF

Figure 3: Systems Driven by Hyperscalers, Future

Figure 4: System Investment Driven By Hyperscalers, Future

DATA CENTER EXPANSION AND STRATEGIC GROWTH PROJECTIONS

Data center providers have become increasingly integral to the submarine telecommunications ecosystem over recent years. A major trend is the strategic positioning of data centers and colocation facilities near submarine cable landing stations to enhance interconnection and optimize network services. This trend is driven by the need for low-latency, high-speed data transmission, and closer proximity to cable landing stations can dramatically reduce network latency. Additionally, hosting data centers near cable landing stations simplifies network infrastructure by minimizing the number of hops required for international data transmission.

Such configurations are especially advantageous for cable landing stations that support multiple submarine cables. These data centers can tap into a broader range of customers, providing them with extensive interconnection opportunities. For instance, Marseille, France, has become a key interconnection hub due to its strategic cable landing facilities, which accommodate 13 international submarine cables. This makes the city a gateway for high-speed connectivity across Europe, Africa, the Middle East, and Asia. Data centers in Marseille benefit from the city’s role as a global interconnection point, providing easy access to backhaul services and interconnection options.

such as artificial intelligence and machine learning. In particular, Equinix and Digital Realty have continued to grow their data center portfolios near key cable landing points, providing high-density interconnection platforms that are critical for cloud service providers and enterprises seeking low-latency connections to global markets.

With data center capacity projected to expand by over 5 GW by 2025, the submarine cable and data center industries are set to grow even more interdependent. This symbiotic relationship will likely spur additional investments in both infrastructure types, further solidifying the role of data centers as pivotal components in global telecommunications.

Moreover, the cost of establishing data centers remains substantial, with construction costs ranging from $7 million to $12 million per megawatt (MW), depending on the location and scale of the facility. This investment is further justified when considering the demand for low-latency, high-performance networks, particularly in locations with multiple cable systems. As these landing stations become critical interconnection points, they offer access to broader customer bases, interconnecting carriers, and service providers. This has incentivized carriers like Equinix and other non-Hyperscaler providers to invest in strategic markets close to these landing points, enhancing their competitiveness.

With data center capacity projected to expand by over 5 GW by 2025, the submarine cable and data center industries are set to grow even more interdependent. This symbiotic relationship will likely spur additional investments in both infrastructure types, further solidifying the role of data centers as pivotal components in global telecommunications.

The rise in data center investments has been particularly strong in regions like North America, Europe, and Southeast Asia. According to Energy Monitor, global data center capacity is expanding rapidly, driven by the need for increased processing power and storage to support new technologies

The global data center market is experiencing remarkable growth, with hyperscale data centers driving much of this expansion. Hyperscale facilities, which are primarily operated by large cloud providers such as Amazon, Microsoft, and Google, surpassed 1,000 globally in early 2024. These

massive infrastructures continue to play a critical role in supporting the growing demand for cloud services, AI workloads, and large-scale data processing. Over the past four years, hyperscale capacity has doubled, and experts project that this trend will continue, with capacity expected to double again within the next four years. (McKinsey & Company, 2023) (Synergy Research Group, 2024)

The increasing reliance on hyperscale data centers is largely attributed to the exponential rise in data generation and the growing adoption of artificial intelligence (AI). AI workloads, which are highly compute-intensive, are reshaping the infrastructure requirements of data centers. Hyperscale operators are responding by scaling their facilities, increasing rack power density, and enhancing cooling technologies to support the massive power consumption driven by AI and cloud computing. Furthermore, the geographical distribution of data centers is also expanding, as companies prioritize proximity to end users to reduce latency and improve efficiency. This is evident in the rise of smaller, strategically placed data centers that complement the larger core facilities. (Synergy Research Group, 2024)

In the U.S., which currently houses 51% of global hyperscale capacity, there are ongoing efforts to expand data center infrastructure across several key regions. Northern Virginia remains the dominant player, contributing nearly a third of the nation’s capacity. However, other regions, such as Texas, Georgia, and North Carolina, are emerging as important hubs for data center development. This diversification is driven by several factors, including power availability, favorable tax

incentives, and increased demand for connectivity across different parts of the country. (Synergy Research Group, 2024)

Globally, the future of data center expansion looks equally robust, with over 440 hyperscale projects currently in various stages of development. These projects are expected to come online over the next few years, further cementing the critical role that hyperscale data centers play in global IT infrastructure. The rise of cloud services, e-commerce, social networking, and AI-driven applications is a key contributor to this rapid growth, pushing both existing hyperscale operators and new entrants to continually expand their capacity to meet demand. Additionally, data centers are increasingly focusing on improving energy efficiency and sustainability as they scale up. The power-hungry nature of data centers has prompted operators to invest in renewable energy sources and advanced cooling techniques to reduce their environmental footprint. Regions like Scandinavia and the Pacific Northwest have become attractive locations for new data centers due to their access to renewable energy and favorable climate conditions that reduce cooling costs. These developments underscore the growing importance of sustainability in data center operations. (Synergy Research Group, 2024)

The combination of rising infrastructure investments, a growing pipeline of projects, and the increasing adoption of AI and cloud technologies suggests that the data center market will continue to expand at a rapid pace. This growth will likely reshape the global landscape, with key regions and hyperscale operators driving forward the next generation of digital infrastructure. STF

Figure 5: Data Center Cluster Map

The 2024/2025

INDUSTRY REPORT READ IT NOW!

MAIN TOPICS FOR THIS Y EAR’S REPORT INCLUDE:

• Global Overview

• Capacity

• System Ownership

• Supplier Analysis

• System Maintenance

• Cableships

• Market Drivers and Influencers

• Special Markets

• Regional Analysis and Capacity Outlook

WHERE IN THE WORLD ARE THOSE PESKY CABLESHIPS?

BY SYEDA HUMERA

ENHANCING MARITIME OPERATIONS EFFICIENCY: A POWER BI-DRIVEN ANALYTICAL OVERVIEW OF NAVIGATIONAL DATA

In today’s globalized world, maritime operations continue to play an essential role in enabling the smooth flow of commerce, data, and connectivity across continents. The latest 2024 Power BI-driven analysis of Automatic Identification System (AIS) data reveals new insights into the operational trends, vessel movements, and regional activity within the global submarine cable fleet. With advancements in predictive analytics and real-time data visualization, the maritime sector is poised to harness these insights to enhance efficiency, optimize resources, and reinforce global connectivity.

This month’s analysis focuses on updated AIS data, offering a fresh perspective on navigational patterns, vessel types, and zone activity within the maritime industry. The attached charts provide detailed visualizations of vessel speed fluctuations, navigation status distribution, draught-speed relationships, vessel types, and zone-specific activity. Each of these aspects is critical in understanding the broader dynamics at play in submarine cable operations and maintaining a resilient global communications network.

One of the key metrics observed is vessel speed, which reflects the dynamic nature of maritime operations. The line chart details daily fluctuations over recent months, underscoring the influence of environmental conditions, seasonal demand, and strategic positioning on operational speeds. The analysis reveals specific high-activity periods, which likely correlate with increased demand in global data flow and stra-

tegic vessel positioning to support network reliability.

Navigational status offers another layer of insight, with the bar chart showing a breakdown of vessel operations across different statuses. This data highlights the balance between active navigation and stationary periods, painting a picture of how the submarine cable fleet is being utilized. Understanding these patterns enables stakeholders to make data-informed decisions that improve operational efficiency and safety.

The relationship between vessel draught and speed, shown in the scatter chart, further illustrates the diversity of operations within the maritime sector. This plot captures how various vessel classes and cargo weights affect operational speeds and performance, providing a nuanced view of how these ships are navigating the seas under differing conditions.

The donut chart categorizes vessel types based on AIS data, presenting a clear view of the global maritime fleet’s composition. With a significant portion labeled as “Other Type,” there remains an opportunity to refine vessel classifications to improve fleet management. The distribution also highlights the role of specialized vessels, such as those engaged in dredging and underwater operations, underscoring their importance in global maritime infrastructure.

Lastly, the area chart on zone activity maps the global reach of submarine cable fleet operations, showing the most active regions. Key areas such as East Asia, North America’s West Coast, and the North East Atlantic emerge as focal points for submarine cable maintenance, installation, and repair. This regional distribution reflects not only the demand for connectivity but also the strategic importance of these zones in supporting global communication links.

As this report delves into these insights, it becomes evident that the maritime industry is evolving through data-driven strategies, embracing technological advances to meet rising connectivity needs. The integration of AIS data with advanced analytics offers unprecedented opportunities for the industry to adapt, anticipate, and respond to the demands of a digital, interconnected world. With each update, stakeholders are empowered to leverage data for optimized fleet management, sustainable operations, and enhanced global connectivity.

LINE CHART

In this month’s analysis of the line chart detailing the average vessel speeds by day, several notable trends emerge that offer insights into operational dynamics within the maritime industry. The line chart displays daily fluctuations in average speed over September and October, with some significant peaks and dips that likely correspond to varying operational conditions and environmental factors.

September’s data reveals consistent variations in daily speeds, mostly ranging between 3.0 and 5.0 knots. Notably, there is a sharp dip to 1.2 knots on the 13th, followed by an immediate recovery back to a more stable range. This pattern might suggest periods of congestion or specific operational requirements causing temporary reductions in vessel speed. Such dips are indicative of dynamic shifts within maritime

operations, where vessels may encounter constraints due to weather, route congestion, or strategic repositioning.

A particularly prominent spike is observed on September 30th, reaching 11.9 knots, marking the highest recorded speed over the two-month period. This peak likely correlates with operational adjustments, such as strategic repositioning or fast transits across open waters. Peaks of this nature are often a response to urgent logistical demands or favorable environmental conditions that allow for higher speeds. This elevated speed, however, is quickly followed by a drastic decrease at the beginning of October.

The first week of October is unique in this dataset, as multiple days display an average speed of 0.0 knots. This anomaly is due to issues within the data collection process, which led to incomplete or absent speed data for several days in October. Such gaps highlight the challenges in maintaining consistent data accuracy, especially in a large-scale maritime monitoring system where technical disruptions or reporting lapses can occur. This temporary interruption in data collection limits our ability to analyze trends for this period accurately, leaving some uncertainty about the operations occurring during those days.

Beyond the initial days of October, data collection resumed, with vessel speeds showing a return to variable but consistent averages, often ranging from 2.0 to 6.4 knots. Peaks on October 9th (5.2 knots) and October 10th (6.4 knots) reflect potential increases in activity, possibly aligning with favorable conditions or heightened operational demands. Following these peaks, speeds gradually stabilize, suggesting a return to typical operational patterns as vessels maintain moderate speeds in line with standard maritime logistics.

Throughout the rest of October, the data continues to reflect fluctuations, with several dips to lower speeds, such as 1.2 knots on October 22nd. These lows, interspersed with moderate highs, provide a snapshot of how vessels adapt

CABLESHIPS

to the varying demands of maritime operations, possibly navigating restricted waters, adjusting routes, or positioning strategically for upcoming assignments. By the end of October, average speeds appear to settle within a range that suggests regular operations, with the final days displaying values between 2.7 and 4.1 knots.

This analysis of the line chart offers insights into the rhythm of maritime operations, showing how vessels’ average speeds change in response to operational demands, environmental factors, and data collection issues. The noticeable spike on September 30th, coupled with the zero readings at the beginning of October, emphasizes the importance of accurate data collection for actionable insights. Addressing data gaps is crucial for understanding patterns fully, allowing stakeholders to make informed decisions based on consistent and reliable information.

BAR CHART

“Restricted Maneuverability,” with 2.79K entries, captures vessels that are operational but constrained in their movements, possibly due to close-proximity maneuvering in harbors, or maintenance activities. This status provides insight into vessels engaged in specialized operations that require precision and limited mobility, often seen in congested or strategic areas where navigation flexibility is reduced.

The bar chart displaying navigation statuses for September and October offers a comprehensive view of the operational distribution within the maritime industry during this period. Each category reflects distinct aspects of vessel activity, providing insights into how the fleet is utilized, from active navigation to stationary states.

The “(Blank)” status leads with 3.51K entries, signifying instances where vessels either did not report their status or where data gaps exist. This unclassified segment highlights the potential challenges in data consistency, where incomplete or missing entries can obscure a full understanding of fleet operations. Improving data reporting accuracy within this category would enhance visibility into vessel activity and support more refined analysis.

Close behind, the “Moored” status has 3.40K entries, indicating a substantial portion of vessels remained stationary in port or near coastlines. This status suggests periods of inactivity, likely due to docking, loading, or maintenance activities. High counts in the “Moored” category could reflect a combination of routine port operations or even temporary pauses in operations due to external factors such as weather or geopolitical constraints.

The “Under Way Using Engine” category records 2.39K entries, representing vessels actively navigating and making way under engine power. This count provides a direct view into the fleet’s active transit phase, where vessels are moving between destinations. It is a critical indicator of maritime activity levels, as vessels in this status contribute significantly to global logistics and supply chain flows.

The “At Anchor” status, with 0.86K entries, represents vessels that are stationary but not moored to a dock. These vessels may be waiting to dock, positioned in anchorage zones, or holding for further instructions. This status is common in congested port areas or strategic locations where vessels need to wait before proceeding.

In comparison, the “Under Way Sailing” status shows only 0.08K entries, highlighting a minimal segment of vessels navigating without engine power, such as those under sail. This count reflects the limited use of non-engine-based navigation in contemporary commercial maritime operations.

Finally, the “Not Defined (Default)” and “Not Under Command” categories record minimal to zero entries. These categories, which typically represent vessels without explicit navigation instructions or those experiencing a temporary loss of control, show very low occurrence, suggesting that most vessels in the fleet are accounted for under more ac-

tive or stationary statuses.