Inside: Hydrogen Valley | Sustainable mining | Alternative agriculture | EV Evolution | Energy investments | Job creation THE RENEWABLE REVOLUTION

9 NATIONAL DEVELOPMENT PLAN

The National Development Plan sets ambitious targets for transforming South Africa’s energy sector, but is it still feasible?

15 HYDROGEN VALLEY

A deep dive into the plan to establish a “hydrogen valley” anchored in the platinum group metals-rich Bushveld geological area

18 THOUGHT LEADERSHIP: THE NEW ENERGY ACTION PLAN

Government’s new energy action plan sends a positive message to the market, industry and private investors looking to invest in renewable energy

19 THOUGHT LEADERSHIP: DIGITALISATION AND ENERGY

Digital technologies are set to make energy systems around the world more connected, intelligent, efficient, reliable and sustainable

21 LEVERAGING LITHIUM

Despite having almost no lithium reserves, South Africa has the potential to play a major role in global lithium-ion battery production

Contents

24 MINING AND ENERGY EFFICIENCY

Mining is a power-intensive business, but recent efforts by the sector are proving to be important catalysts for energy efficiency

28 THOUGHT LEADERSHIP: MINING’S TRANSITION TO RENEWABLES

In order to overcome the ongoing power crisis, mining companies are actively diversifying their energy mix

29 THOUGHT LEADERSHIP: DOUBLING INVESTMENT IN THE GREEN ECONOMY

Nedbank explains why it is vitally important that efforts are made to double financing efforts within the green economy

30 ALTERNATIVE AGRICULTURE

The agricultural industry was an early adopter of alternative energy sources, but how much of this sector’s power can realistically be obtained from them?

32 GOING SOLAR

Everyone wants off the grid, but what is the real feasibility of implementing comprehensive renewable energy solutions in residential areas?

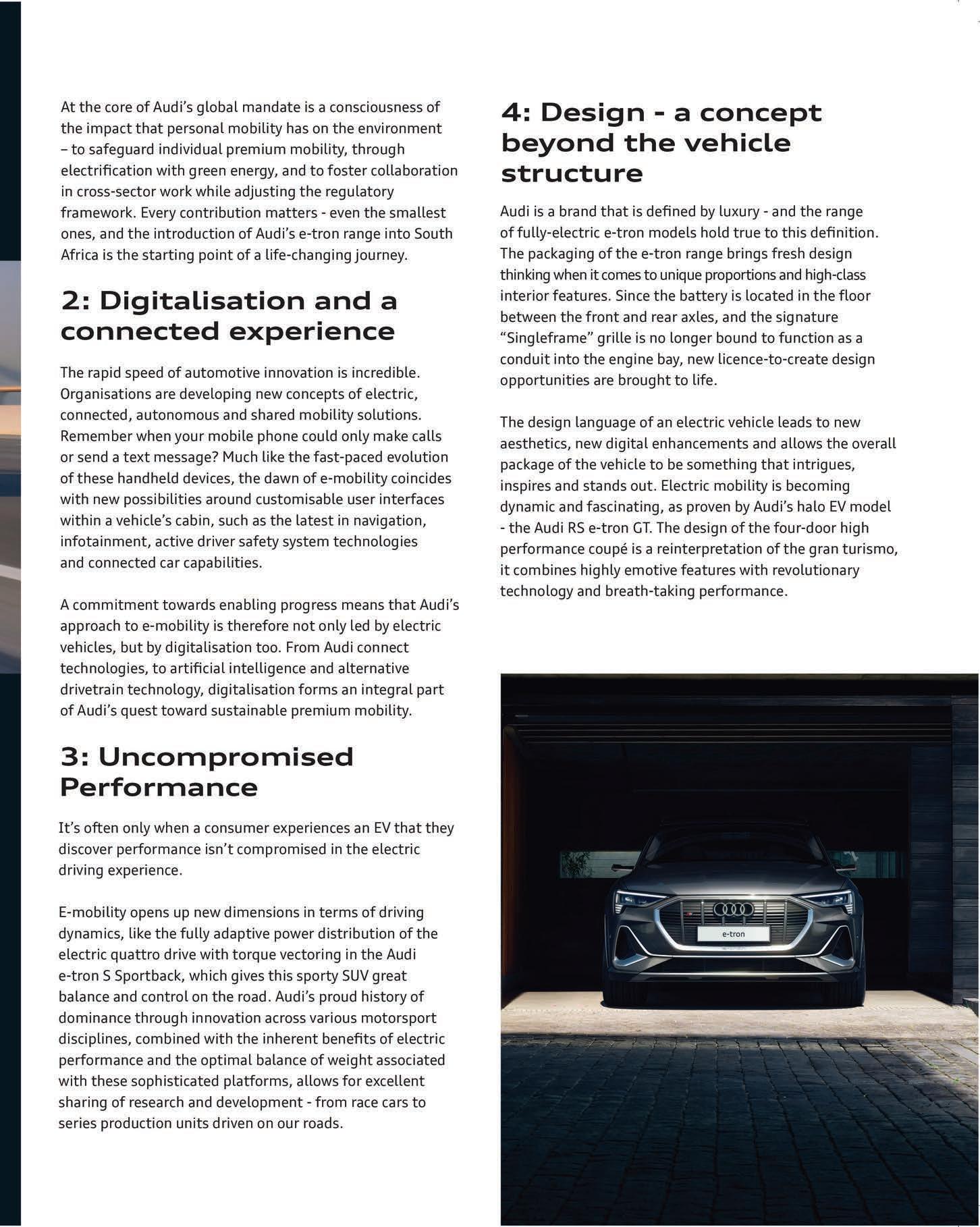

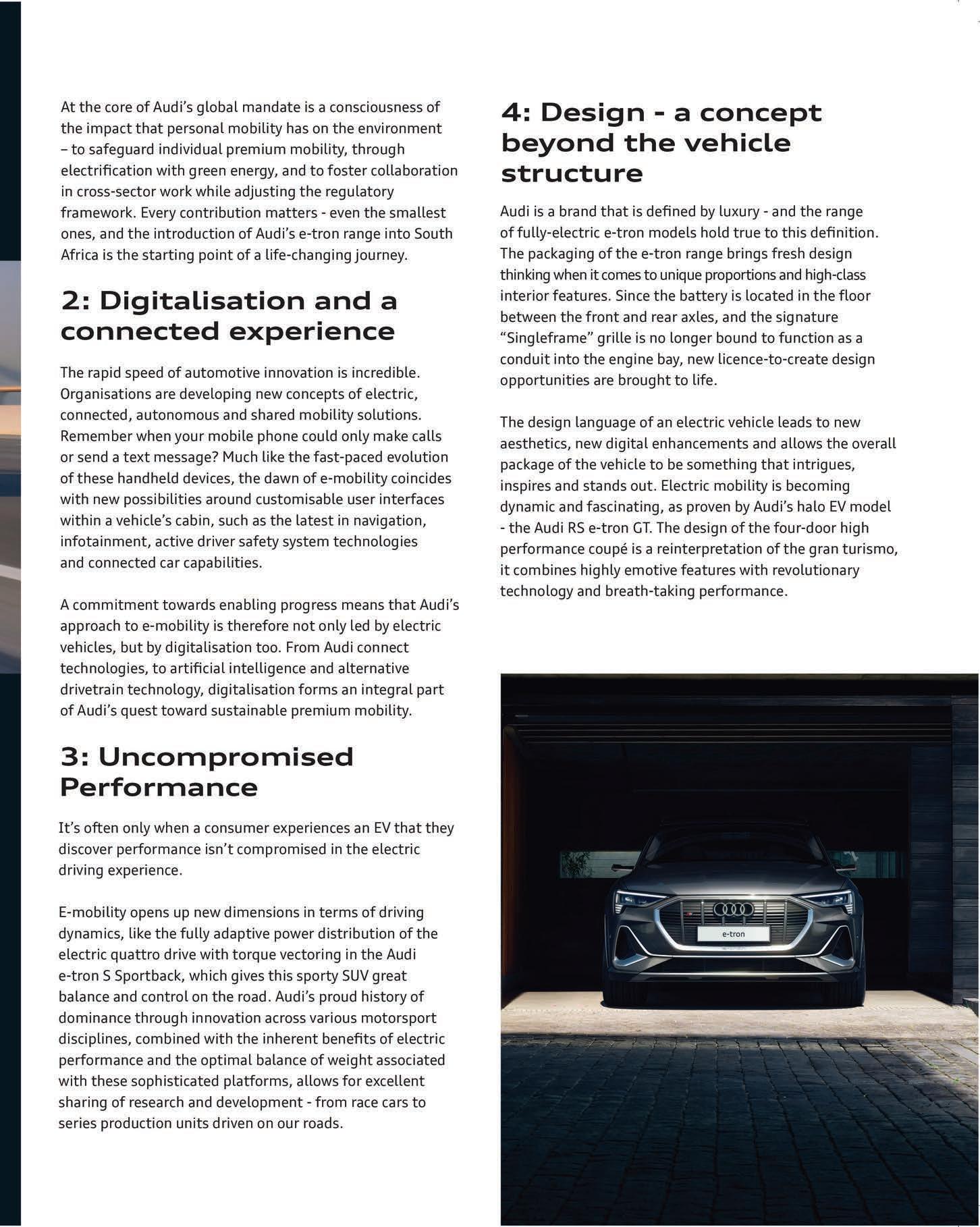

36 ELECTRIC VEHICLE EVOLUTION

Unpacking the current state of South Africa’s electric vehicle market in light of skyrocketing fuel prices driving greater demand

43 INVESTMENT IN ENERGY

Investment in the renewable energy sector is vital, but questions remain around how to obtain funding

45 THOUGHT LEADERSHIP: BID WINDOW 6 AND THE LAW

The legal ramifications around the increase in maximum contracted capacity, the way bidding consortia are assembled and the decommissioning of power plants

48

GENDER EQUALITY

The transition to clean energy offers the industry a clearer chance of discarding its male-dominated image and embracing gender equality

51 JOB CREATION

The emerging energy sector holds enormous potential for job creation and economic development – but is not without challenges

52 THOUGHT LEADERSHIP: RENEWABLE ENERGY BUSINESS SOLUTIONS

There is great potential for SMEs across the value chain to benefit from the growing demand for sustainable and renewable energy solutions.

ENERGY 3 IMAGES: SUPPLIED, BLUE PLANET STUDIO/ISTOCKPHOTO.COM

24 15 36

SUPPORTING RENEWABLE ENERGY

With fuel prices at unprecedented highs, ongoing load shedding from Eskom and the effects of climate change becoming more apparent by the day, the need to transition to renewable and sustainable forms of energy has never been greater.

While government’s new energy action plan has received praise, industry and the private sector need to make increasing efforts to support renewable energy too. Agriculture, for instance, was an early adopter of renewables. Looking at it from an investment point of view, says Simon Grier on page 30, renewable energy ticks every box for the agricultural sector. Mining is fast becoming a leader in energy effi ciency as well. On page 24, the Minerals Council South Africa shares how mining companies are moving towards sustainable, renewable sources of energy to reduce their carbon footprint and ensure the minerals they produce are globally acceptable. They also add that there is a strong element of reducing exposure to electricity sourced from Eskom, which generates more than 80 per cent of its electricity from coal, bringing with it carbon tax, and social and environmental consequences. Financial institutions like Nedbank are also seeking to double their fi nancing efforts in this sector.

There is much discussion around South Africa’s plan to invest in a “hydrogen valley” to support the development of hydrogen as a new type of energy, as well as plans to gain traction in the lithium value chain amid the growing demand for electric vehicles.

There are many other facets to renewable energy too. It offers the energy industry a chance to embrace gender equality more

Page 18: “The planned battery energy storage to supplement Eskom’s capacity represents a multifaceted approach to the energy crisis, opening up the energy storage market to private investment.”

– Janice Foster

Page 21: “South Africa is currently the only country in the world, outside of China, that refines battery-grade manganese.” Gaylor Montmasson-Clair

effectively, it holds the potential to create jobs on a scale not seen before, and the digitalisation of the sector will drive signifi cant improvements in effi ciency.

Of course, everyone who has suffered power outages has considered going “off-grid”, so we take a look at the ins and outs of this process, and whether it is even feasible in South Africa.

We also take a look at how the repurposing of good fuel cells from discarded electric vehicles batteries, for the stationary energy storage market, plays directly into the circular economy, and investigate the legal implications around the sixth and latest Renewable Energy Independent Power Producer Procurement Programme bid window.

While South Africa is no doubt faced with energy struggles for the foreseeable future, the incisive articles in this edition demonstrate that there is certainly a light at the end of the tunnel – a renewable one that won’t be subject to load shedding!

Rodney Weidemann Editor

PUBLISHED BY

Picasso Headline, A proud division of Arena Holdings (Pty) Ltd Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Editor: Rodney Weidemann

Content Manager: Raina Julies

rainaj@picasso.co.za

Contributors: Lindi Botha, Trevor Crighton, Mike Davis, Janice Foster, James Francis, Gareth Griffiths, Raghemah Hendricks, Dale Hes, Amber Kardamilakis, Corne Louw, Minnette le Roux, Nicolas Marsay, Robin Melville, Jackie Midlane, Itumeleng Mogaki, Anthony Sharpe, Benjamin van der Veen, Roland Verwey

Copy Editor: Anthony Sharpe

Content Co-ordinator: Vanessa Payne

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Advert Designer: Bulelwa Sotashe

Cover Image: bombermoon/istockphoto.com

SALES

Project Manager: Gavin Payne

GavinP@picasso.co.za | +27 21 469 2477 +27 74 031 9774

Sales: Corne Louw, Brian McKelvie

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat, fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt

General Manager, Magazines: Jocelyne Bayer

Copyright: Picasso Headline.

No portion of this magazine may be reproduced in any form without written consent of the publisher.

The publisher is not responsible for unsolicited material. Energy is published by Picasso Headline.

The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for and therefore do not carry any endorsement by the publisher.

FROM THE EDITOR 4 ENERGY

www.businessmediamags.co.za

Planning for more power

years. So yes, meaningful progress has been made in this regard.”

After nearly a decade-and-a-half of load shedding, it seems almost trite to say South Africa faces a power crisis. Crisis, emergency, disaster – whichever word you choose to describe the picture, it is dire, and it’s getting worse. In April this year, Eskom cut 1 054 gigawatt-hours of power, compared with 2 521 gigawatt-hours for all of 2021. The scale of those cuts was blamed on a strike at the power utility, but that spontaneous event occurred against a backdrop of steady mismanagement, vandalism and lack of maintenance.

It wasn’t meant to be this way. The National Development Plan (NDP), drafted in 2012, set out ambitious economic growth targets, along with steps towards honouring South Africa’s commitment to reduce carbon emissions below a baseline of 34 per cent by 2020 and 42 per cent by 2025. The NDP was developed in line with the Integrated Resource Plan (IRP), promulgated in 2011. However, according to Climate Action Tracker data, from 2012 to 2020, the country managed just a 9.2 per cent decrease. Without coal, unfortunately, the country stands little hope of keeping the lights on, and Eskom burns 9 million litres of diesel daily to offset plant outages.

In the meanwhile, the National Planning Commission (NPC), an advisory body to government on development and policy, has called for 10 000MW of solar and wind power, along with 5 000MW of battery storage, to be built within the next three years.

How do we get this plan back on track? Has government made any meaningful progress towards solving our energy and environmental problems?

Watt has happened so far

According to Prof Sampson Mamphweli, director of the Centre for Renewable and Sustainable Energy Studies at Stellenbosch University, there has been progress. “A lot has happened in terms of implementation of the IRP to bring in new generation capacity from mainly wind and solar sources,” says Mamphweli. “Government has introduced further measures to open up the electricity production space to allow for the involvement of more independent power producers. These efforts will result in a lot more new generation capacity coming online in the next three to four

The sentiment is echoed by Niveshen Govender, CEO of the South African Wind Energy Association. “Although coal has been the primary source of power in South Africa due to the low raw material cost, and will continue to feature in the country’s energy mix in the short to medium term, government has put policies and initiatives in place to ensure a transition to a more diverse, lower-carbon energy mix,” says Govender. “Given the commitment to the Paris Agreement, South Africa has been on the road to reducing its emissions for the past decade through various mechanisms.”

Govender says that much has been achieved in terms of the renewable energy targets, with 6 323MW of power successfully implemented through bid windows 1 to 4 of the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP). He adds that a further 1 995MW was procured under the Risk Mitigation Independent Power Producer Procurement Programme and 2 583MW under REIPPPP bid window 5.

“This brings the total so far procured under the government’s procurement processes to nearly 10 000MW. This does not yet consider the 5 400MW expected in REIPPPP bid window 6 and the distributed generation projects.” ›

Prof Sampson Mamphweli

NATIONAL DEVELOPMENT PLAN ENERGY 9

The National Development Plan sets ambitious targets for transforming South Africa’s energy sector. But, asks ANTHONY SHARPE , is it still feasible?

“Government has introduced further measures to open up the electricity production space to allow for the involvement of more independent power producers.” Prof Sampson Mamphweli

Niveshen Govender

Keeping the plan on track

Much has changed in the past decade, from decreases in the costs of renewable energy installations to the unexpected catastrophic impacts of COVID-19 on the economy. All of which begs the question of whether or not the NDP is still valid.

“The NDP is such a large and complex plan because it looks at so many different elements around a sustainable future for the country,” says Dr Karen Surridge, acting general manager of the South African National Energy Development Institute, which conducts research in order to inform government policy around energy. “It addresses environmental sustainability, reducing emissions and moving to alternative energy sources, which will create redundancies in the fossil fuel space. But things shift over time, and the energy crisis is one of the things forcing a shift.

That’s why President Ramaphosa called the family meeting on energy. Government is reacting to the situation.”

Of course, the wheels of government turn slowly, especially when there are so many different departments involved, as there are with a situation as complicated as the one South Africa faces. This is one of the key challenges facing policy implementation around energy, says Govender.

“There remains a disconnect between energy policy and political will with regards to energy. Investor confidence require long-term policy certainty and political stability.”

Govender adds that our complex regulatory environment has not been conducive to the quick establishment of new generation capacity. “Environmental authorisation, permit applications, connection and regulatory processes remain long and tedious. There’s also a lack of coordination between key stakeholders: interdependency between different

“There remains a disconnect between energy policy and political will with regards to energy. Investor confidence require long-term policy certainty and political stability.” Niveshen Govender

DECLARING A CRISIS

One of the recommendations by the National Planning Commission (NPC) was that government implement emergency measures to deal with the energy crisis. These included removing the 100MW licensing ceiling, scrapping overly onerous registration processes through the National Energy Regulator of South Africa (Nersa) and replacing them with an online registration procedure for database purposes, streamlining environmental and water use approvals, and pausing local content restrictions.

On 25 July, President Ramaphosa announced five actions to address the situation, including improving the performance of Eskom’s current power stations, accelerating new generation capacity procurement, increasing private investment in capacity generation by removing the licensing ceiling for embedded generation, reducing some environmental requirements, and incentivising households and businesses to adopt rooftop solar. Prof Sampson Mamphweli says that acknowledging

the crisis and declaring these actions won’t necessarily make a difference; what matters is the implementation of the plan as announced by the president. “I am aware that there are various teams working on implementation of the plan through drafting of implementation strategies. The main issue will be whether South Africa has money to implement the plan.”

Ramaphosa said that government will take “a pragmatic approach” to local content requirements for new renewable capacity builds. Mamphweli believes that scrapping these requirements is a missed opportunity. “The opening of the electricity supply market would have brought a lot of investment in local manufacturing, which would have resulted in job creation.”

Niveshen Govender, of the South African Wind Energy Association, says that although localisation and industrialisation are key for the sustainable growth of the renewable energy industry, there have been major challenges implementing the local content requirements of previous

government departments is an obstacle to obtaining timeous responses.”

Mamphweli agrees that policy uncertainty remains an issue. “We had a break in the implementation of the IRP 2010 in 2014/15 when Eskom refused to sign the 27 REIPPPP projects that had been given preferred bidder status by the Department of Mineral Resources and Energy. That led to delays in the introduction of new generation capacity, and now we are catching up with the implementation of the IRP 2019 through various intervention measures announced by the president.”

Surridge says that while things don’t always move as quickly as industry and the public might want them to, the reality is that if the steps along the way aren’t carefully followed, there can be unintended consequences.

“Government is stuck between a rock and a hard place. Some aspects of the NDP are working, but people don’t see those as successes. Because when your lights are out during load shedding, you want an immediate response; you want someone to blame.”

She acknowledges that people are frustrated, but also emphasises that steering a whole country in a new direction will take time.

“Changing course requires all the players to be agreed on the same course. That doesn’t happen easily anywhere in the world. It’s not human nature.”

Renewable Energy Independent Power Producer Procurement Programme rounds. “A more inclusive strategy to achieve industrialisation needs to be considered.”

Local content will remain a contentious issue in a country that desperately needs industrial investment and job creation, says Karen Surridge, of the South African National Energy Development Institute. “Try telling locals where these projects are being built that you’re bringing in foreigners and paying them in dollars to do the work, and see what kind of reaction you get.”

Surridge emphasises that while everyone wants to see things happen faster, the correct procedures still need to be followed. “Nersa registration isn’t simply about filling out a form and filing it. They take that information and seeing how many projects are being registered in a particular area, and whether or not the grid can handle them all, and if not what needs to be done to accommodate projects. It’s not a box-ticking exercise; it’s to understand the broader context.”

NATIONAL DEVELOPMENT PLAN 10 ENERGY IMAGES: ANNASTILLS/ISTOCKPHOTO.COM, SUPPLIED

Dr Karen Surridge

GREENING AND GROWING THE REGIONAL ECONOMY AND LOCAL COMMUNITY

As a green industrial park housing manufacturers of green technologies, the ASEZ presents itself as an important role player in the broader enabling ecosystem of renewable energy projects.

ASpecial Economic Zone (SEZ) is typically defined as a geographic area in which the regular rules and policies applying to industry are different. This can take the form of incentives – in South Africa, one of these is a 15 per cent corporate tax rate – special conditions and/or other types of policies or programmes to attract investment and create jobs. In South Africa, the SEZ programme has typically been used to target development in underserved areas and communities. As a general rule, however, special economic zones are best used when a country wishes to pilot or test specific industrial policies that it is not ready to apply across the economy (policy testing), or, for various reasons, wants to limit to specific locations (spatial targeting). The SEZs in China, for example, were originally designed to test and apply a

more liberal, market-orientated approach to manufacturing and production within the context of a communist state, among other things.

The top priority for the Atlantis Special Economic Zone (ASEZ) is to work with the local community and government stakeholders to attract job-rich investment linked to growing the green economy. It is a combination of spatial targeting (Atlantis and surrounds) and targeting of greentech manufacturing within an eco-industrial park that promotes sustainable and green manufacturing practices. That is a lot – but right now, our focus is on jobs and local impact to build momentum for longer-term growth.

BENEFITS FOR THE COUNTRY

The SEZ aims to benefit the country from an economic, manufacturing and job creation perspective and will do so on several fronts

The top priority for the Atlantis Special Economic Zone is to work with the local community and government stakeholders to attract job-rich investment linked to growing the green economy.

– but two are worth emphasising. First, there is a strong emphasis on exploring how we can support the just transition to a green and sustainable economy. That means a heavy focus on building local skills and enterprises geared towards the green economy. Working with the local community to build shared value is also central to our value proposition. Second, we are targeting the development of a greentech manufacturing cluster. Our vision is to be Africa’s leading green manufacturing zone. Green manufacturing is no longer a nice-to-have – with increasing consumer awareness and growing requirements for low-carbon, resource-efficient goods and services (in some cases moving to law), it is the future of all manufacturing.

As a green industrial park housing manufacturers of green technologies, the ASEZ presents itself as an important role player in the broader enabling ecosystem of renewable energy projects and the roll out thereof. Components destined for these projects need to be manufactured in a suitable location that provides them with sophisticated green infrastructure, a level of energy security, and a green precinct rating, which further improves the manufacturer’s global competitiveness.

As a priority of all three tiers of government, the Atlantis Special Economic Company (ASEZCo) is well-positioned to provide rapid access to development approvals and one-stop-shop support. Benefits derived from clustering manufacturers together is another way in which the ASEZ presents value to renewable energy or other green technology component manufacturers.

12 ENERGY ADVERTORIAL ATLANTIS SEZ

The Atlantis Special Economic Company’s MATT CULLINAN , infrastructure executive; JARROD LYONS, business development executive; and MICHAEL WEBSTER , community integration specialist, explain what a SEZ is and chat about the skills development and community engagement that forms part of this initiative

Matt Cullinan

Jarrod Lyons

Michael Webster

FOCUS ON COMMUNITY ENGAGEMENT AND SKILLS DEVELOPMENT

We place a strong focus on community engagement and providing access to employment.

Community engagement has become more than a tick-box exercise. It involves stakeholders from multiple sectors with different viewpoints who enter into dialogue to ensure communities’ burning issues are highlighted. Traditional methods of the past have, in recent times, given way to a more direct, rooted approach that ensures that communities are at the forefront of projects. This approach allows the ASEZCo to work alongside the community, enabling our stakeholders to own part of the process, which creates effective partnerships.

Enabling and equipping community members with relevant skills is critical to their wellbeing and ensures residents have access to employment opportunities within the industrial area.

Some of the efforts being made in respect of training, internships and skills development include:

• Renewable Energy Workshop Assistant Training (and work placement).

• Technical Training opportunities.

• Early Childhood Development.

• Annual Career Expo.

• Mechanical Fitting Training.

Enabling and equipping community members with relevant skills is critical to their wellbeing and ensures residents have access to employment opportunities within the industrial area.

• Ikamva Youth multiyear afterschool tutoring programme for Grade 10s to Grade 12s. The 2021 academic year has been completed, and the programme is ongoing in this current academic year.

• Business Communication Training programme.

• Food Security and Ecosystem programme.

• Green Economy Workshops.

• Small, medium, micro and macro enterprises (SMME) support – involves knowledge sessions, including power hours.

GOING GREEN FOR SUSTAINABILITY

Green manufacturing is increasingly central to economic competitiveness in the context of growing consumer demands for sustainable goods and services. These demands are increasingly backed up by government

Green manufacturing is increasingly central to economic competitiveness in the context of growing consumer demands for sustainable goods and services.

regulations and targets around things such as the carbon content of goods. Having an SEZ with specific targets around net-zero carbon, net-zero water (positive water balance), net-zero waste to landfill, and working with nature, ensures that we are laying the foundations for truly green and sustainable production. A focus on inclusivity and building skills and enterprises off the manufacturing base also leads to social stability and resilience. These are all the cornerstones of what we believe must be the future of manufacturing.

economic zone

Scan this QR code to go directly to the Atlantis Sez website.

For more information: 087 183 7000 info@atlantissez.co.za www.atlantissez.com

ENERGY 13 ATLANTIS SEZ ADVERTORIAL special

➔

Land is available for investors to locate their manufacturing facilities in a globally competitive destination, the Atlantis Special Economic Zone.

GREEN ECONOMY INVESTMENT WILL DRIVE DEVELOPMENT AND JOB CREATION

THE ATLANTIS SPECIAL ECONOMIC ZONE for green technologies aims to harness the green economy for growth and increase job opportunities by driving sustainable development and job creation.

The Atlantis Special Economic Zone (SEZ) is a key element in the Western Cape government’s Economic Recovery Plan and the scheduling of the company as a provincial business enterprise bodes very well for its role as a game changer in the renewable energy sectors of the Western Cape’s economy.

The eco-industrial park seeks to attract investors that embody the elements and ethos of green technology manufacturing.

The Atlantis SEZ is run on green-economy principles, reduction of carbon, and promotion of resource-effi cient business activities, culminating in a socially-inclusive economy.

With the Atlantis Special Economic Company (ASEZCo) forming part of a mature and effective investment ecosystem in the Western Cape, any investment in the SEZ is sure to offer benefi ts.

GROWING THE REGIONAL ECONOMY

Atlantis presents itself as the ideal location from which to compete in Africa and the world’s green technology markets by offering green infrastructure, a strong support base from government, and fruitful business relationships for investors, as they work closely with the locals and help uplift the community. Green skills development and growing technical capabilities within the Atlantis community are part of the ASEZCo’s strategic objectives, aligned to the legislative requirement of the Special Economic Zones Act to grow the regional economy and drive socioeconomic impact.

The Atlantis SEZ has positioned itself as a world-class eco-industrial park and Living Lab. The responsibility of running the park on green-economy principles lies with the Infrastructure and Integrated Ecosystem (IES)

Driving growth through green economy innovation and sustainable job opportunities remains at the heart of what the ASEZCo does. These principles will contribute towards growing the regional economy in a meaningful and impactful way.

team. The IES team supports the Atlantis community through skills and enterprise development, coupled with community integration. The aim is to enable the Atlantis community, and particularly its youth, to tap into growing job opportunities, especially opportunities in the buoyant green economy.

Driving growth through green economy innovation and sustainable job opportunities remains at the heart of what the ASEZCo does. These principles will contribute towards growing the regional economy in a meaningful and impactful way and enabling the regeneration of Atlantis to become a leader in green economy manufacturing within an eco-industrial park that puts sustainability and social inclusion at the top of its agenda.

special economic zone

Scan this QR code to go directly to the Atlantis SEZ website.

For more information: 087 183 7000 info@atlantissez.co.za www.atlantissez.com

14 ENERGY ADVERTORIAL ATLANTIS SEZ

➔

Hydrogen power: driving a just energy transition

of around 400 ultra-class mine haul trucks. Included in the agreement is the provision of critical supporting infrastructure such as refuelling and recharging stations, along with facilitation of hydrogen production.

As a starting point, 40 hydrogen-powered haul trucks at the mining giant will be converted from diesel fuel, to replace diesel vehicles at the company’s Mogalakwena Mine.

“Due to our decarbonisation approach through renewable energy infrastructure, Anglo American is well positioned to benefit communities and small to medium enterprises through new economic opportunities arising from decarbonisation initiatives, via our Impact Catalyst in the Northern Cape and Limpopo provinces,” says Smith. “Our Future of Work and Enterprise Development initiatives –through our Zimele company initiative – also provide opportunities for supply chain and skills development linked to the transition to a low-carbon future, securing future livelihoods for communities.”

A2021 study spearheaded by South Africa’s Department of Science and Innovation (DSI) found that establishing a “hydrogen valley”, anchored in the Bushveld geological area, which is rich in platinum group metals (PGMs), could add more than R56.8-billion to the country’s GDP by 2050, while creating more than 14 000 jobs per year.

The DSI, in partnership with Anglo American, Bambili Energy and ENGIE, has been looking into opportunities to transform the Bushveld complex and larger region around Johannesburg, Mogalakwena and Durban into this hydrogen valley.

In line with government’s intervention, hydrogen project will be leveraged to kick-start the local hydrogen economy. It it intended to lead to cost savings through shared infrastructure investments, improving the cost competitiveness of hydrogen production through economies of scale, enabling a rapid ramp-up of hydrogen production within a given territory and acting as an incubator for new pilot hydrogen projects.

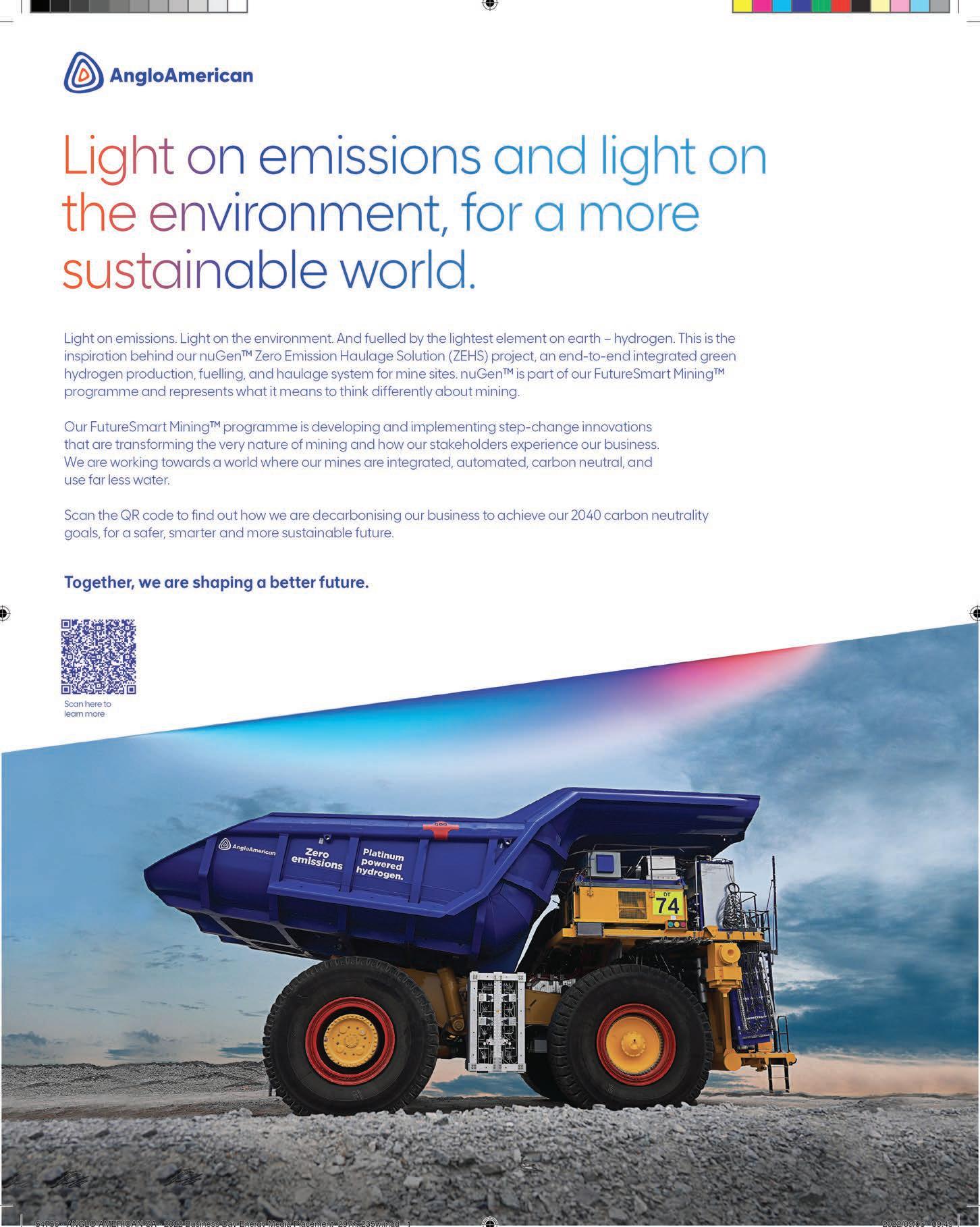

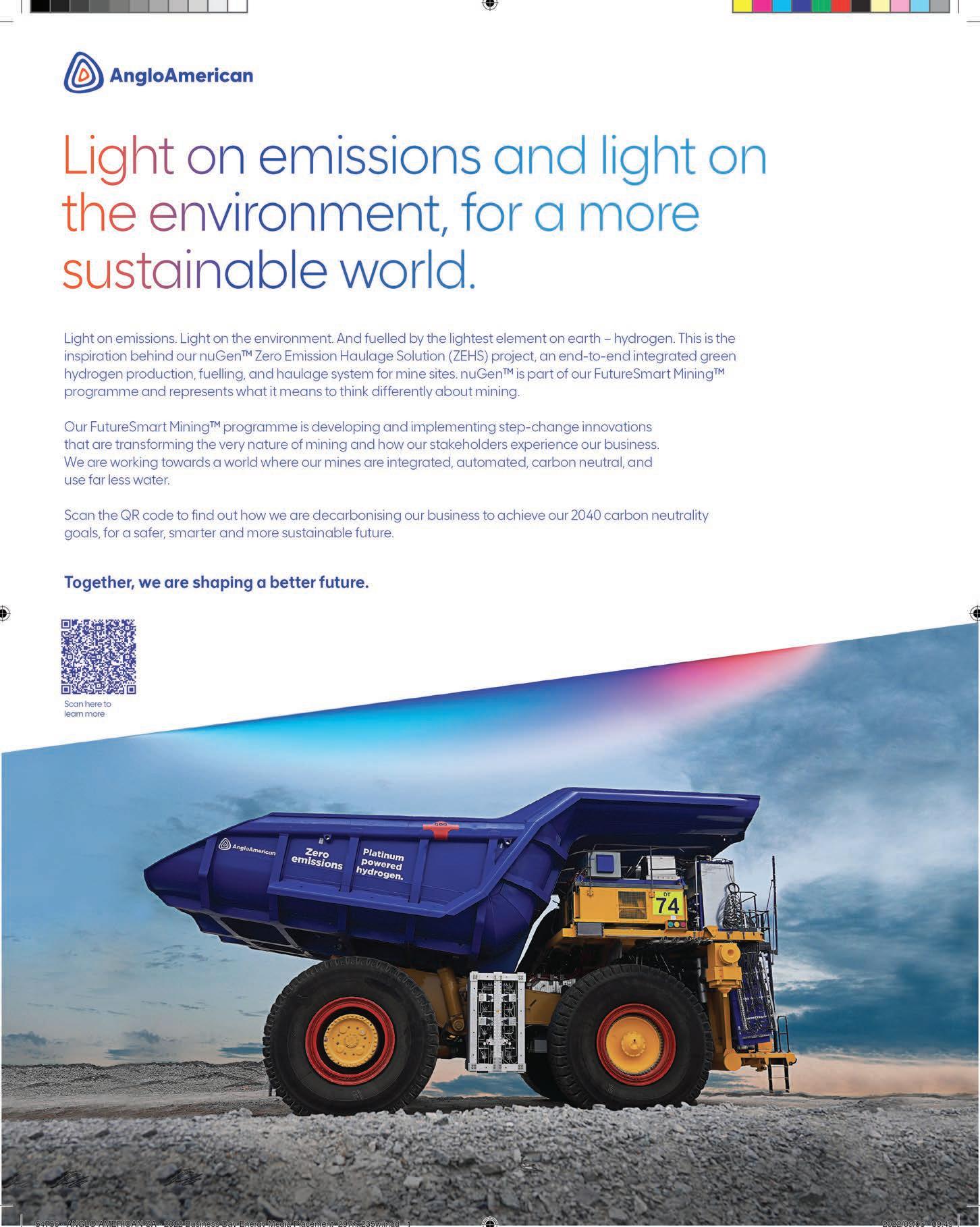

“Conceived as part of Anglo American’s FutureSmart Mining programme, the nuGen Zero Emissions Haulage Solution pilot is an end-to-end solution,” says Fahmida Smith, market development principal at Anglo American.

“It aims to decarbonise heavy-duty transport and includes hydrogen production, on-site storage, ultra-heavy-duty refuelling, and hydrogen-battery hybrid powertrains to replace incumbent fossil fuel technology.”

A prototype haul truck launched at Anglo American Platinum’s Mogalakwena Mine in May is one of the anchor investments in the proposed hydrogen valley. The truck is huge, weighing 510 tonnes fully loaded. Typically, diesel-powered units consume 900 000 litres of fuel a year, so the carbon emission reduction from switching to green fuel is enormous.

An agreement with Seattle-based engineering firm First Mode means that Anglo American will decarbonise its global fleet

Blended green technology

Green hydrogen is produced in a climate-neutral fashion, which is of critical importance in reaching carbon reduction targets by 2050. Anglo American aims to make the hydrogen on site using a process called electrolysis, powered by renewable energy sources.

A dedicated 100MW solar photovoltaic plant at the Mokgalakwena Mine will power the conversion process of water into hydrogen using a catalyst named Impact. The process involves running electricity through water in the presence of a catalyst, to yield hydrogen and oxygen.

The hydrogen-generation solutions are provided by ENGIE, a French low-carbon energy player on the international stage, with Anglo American providing the truck and overall project ›

GREEN HYDROGEN ENERGY 15

Amid the growing clamour for renewable energy, hydrogen offers a credible answer. GARETH GRIFFITHS reports on the use of hydrogen on South Africa’s road to a just energy transition

“The nuGen Zero Emissions Haulage Solution pilot aims to decarbonise heavy-duty transport and includes hydrogen production, on-site storage, ultra-heavy-duty refuelling, and hydrogen-battery hybrid powertrains to replace incumbent fossil fuel technology.” – Fahmida Smith

Fahmida Smith

coordination, management, integration, and design. Fuel cells are supplied by Bambili Energy. Being modular in nature, hydrogen fuel can be deployed rapidly and scaled up easily as the need arises, and maintenance cost is relatively low. Containerised hydrogen fuel cells can be deployed at short notice to provide a clean source of energy, even when the need is only temporary. One example is a COVID-19 field hospital run by 1 Military Hospital in Pretoria, where hydrogen fuel primary power was provided in line with the government’s response to the pandemic.

Caution and hope for investors

What of the risks associated with getting involved at the greenfield stage of commercialising projects in this new economy? Leading global law firm Allen & Overy has project-managed the establishment of three of the largest green hydrogen projects in the world, and says green hydrogen is seen as the darling of the energy transition

by developers, financiers, investors, sellers, buyers and governments. However, as the global appetite for giga-scale projects develops, the business risks associated with getting this promising young industry off of the starting blocks are considerable.

“Notwithstanding the fact that the water-based fuel, which is generated with the help of renewable sources of electricity, is still one of the most expensive and infrastructureintensive fuels on earth, a real lack of expertise on how to produce clean power successfully at scale is still holding the industry back,” says Alessandra Pardini, a Johannesburg-based Allen & Overy partner. “Lack of expertise about how to get giga-scale hydrogen projects off the ground is a big problem in the industry that could lead to painfully expensive mistakes.”

VEHICLES AND SCALED APPLICATIONS

• The mine trucks in the test application are huge. Anglo American engineers have retrofitted an existing mine haul truck, previously powered by diesel engines.

• The prototype is a hybrid. Hydrogen fuel cells provide roughly half of the power, with the balance coming from batteries. The battery option allows energy recovery from when the driver uses the brakes on the truck, known as regenerative braking, to recharge the batteries.

• The performance of the hydrogen truck is expected to be at least the same as its diesel equivalent.

• The power plant module was assembled in Seattle and transferred to South Africa.

• Projects for smaller scale applications such as passenger cars are also underway. In the United Kingdom, two Toyota Mirai hydrogen fuel cell cars have been taken into service at a polyhalite mining site, as part of the Tees Valley Hydrogen Hub scheme.

• In Australia, a feasibility study is being undertaken by Anglo American and Aurizon, the country’s largest rail freight operator, around introducing hydrogen-powered trains for bulk freight.

Pardini and her colleague Alexandra Cluver both believe green hydrogen has the potential to transform many sectors, including shipping, aviation and power generation. This is thanks to its long-distance transportability from warm and windy locations like South Africa to energy-hungry markets such as Europe, which are at the forefront of exploring its potential as a climate-friendly energy source.

ECONOMIC BENEFITS TO THE SECTOR

•

•

that in the low-case scenario, 14 000 jobs could be created annually by 2050, rising to 32 000 new jobs in the company’s high-case scenario.

• Jobs are stimulated right across the value chain, from product and logistics to research and development, engineering/maintenance, training and people-related programmes.

• Fuel cell investment programmes may further contribute job creation way beyond the above figures, in a parallel industry.

• Platinum group metals, long an important group in South Africa’s resource-based economy, should see a “marginal increase” in demand due to the new project. Platinum for the fuel cell and electrolyser manufacturing is not expected to place a supply constraint on existing market demands globally.

• Anglo American’s high-case scenario indicates that the incremental usage of platinum could contribute R1.2-billion to the local industry by year 2030.

Source: Anglo American

Source: Anglo American

“The recent passing of the Inflation Reduction Act in the United States, which allows for generous tax credits for green hydrogen production, is a big positive step for the development of the green hydrogen economy and by extension the environment,” says Cluver.

Cluver adds that with a combination of abundant renewable energy sources, such as solar and wind, and as the world’s largest producer of PGMs, South Africa should see hydrogen as a strategic priority. It presents a significant opportunity for economic development, including the creation of new jobs and the development of the PGMs sector, while also contributing to the country’s decarbonisation objectives. “We thus continue to work closely with the South African government and other industry partners to unlock this sector, to the benefit of the country. The hydrogen valley is only one example of this work,” she concludes.

GREEN HYDROGEN 16 ENERGY IMAGES: PETMAL/ISTOCKPHOTO.COM, SUPPLIED

A feasibility study shows that the proposed hydrogen valley could potentially add R65.9–R148.7-billion to South Africa’s GDP.

The study indicates

“With a combination of abundant renewable energy sources, such as solar and wind, and as the world’s largest producer of PGMs, South Africa should see hydrogen as a strategic priority.” Alexandra Cluver

nuGenTM Solution, Anglo American’s zero emissions haulage solution.

GOVERNMENT’S ACTION PLAN TO ADDRESS THE ENERGY CRISIS

1. Improve the performance of Eskom’s existing fleet of power stations

2. Accelerate the procurement of new generation capacity

3. Massively increase private investment in generation capacity

4. Enable businesses and households to invest in rooftop solar

5. Fundamentally transform the electricity sector and position it for future sustainability

Source: https://www.gov.za

Government’s energy action plan sends a strong message

The action plan recently announced by President Cyril Ramaphosa to address the country’s energy crisis sends a positive message to the market, industry and private investors looking to invest in renewable energy. By JANICE FOSTER, market managing director for energy at Zutari

What is important about the president’s speech is that he has opened the energy challenge to a shared solution, with opportunities for everyone to have an impact, no matter how small. The simple acknowledgement that the country faced an electricity shortage of 6 000 megawatts (MW) is important, because a problem cannot be fixed until it has been identified.

Obviously, the large-scale renewable projects mooted will take time and require buy-in from multiple stakeholders, but there is confidence that the action plan sets us up to make the right decisions and move in the right direction.

A highlight of the plan is doubling the new generation capacity for wind and solar power for bid window 6 of the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) from 2 600MW to 5 200MW. Another significant step is removing the threshold for embedded generation capacity entirely.

Raising the threshold to 100MW last year had already unlocked a pipeline of more than 80 confirmed private-sector projects with a combined capacity of over 6 000MW. The removal of the threshold offers a significant increase in capacity for private offtakers, which we expect to see starting to come online in the coming months.

We do, however, need to ensure that preferred projects in bid window 5 are prioritised, as these have already been awarded and in theory would be the quickest to get online, if we can overcome the obstacles to those achieving financial close. However, bid window 6 projects are anticipated to factor these constraints into their costing and delivery.

Another important move by government is the announcement of an Eskom feed-in tariff for small-scale embedded generation. This is a real signal of incentive to Eskom’s commercial users and private residential customers, indicating that they can also contribute and support their own needs at the same time. While municipalities like Cape Town are already forging ahead in this regard, it only applies to utility customers at present.

It is also positive that the government is reaching out to the private sector to assist with expertise and skills. While consulting firms like Zutari can provide that support, there are also potentially individuals who have left the industry who can be attracted back, in order to add value.

A multifaceted approach to a global problem

The planned battery energy storage to supplement Eskom’s capacity represents a multifaceted approach to the energy crisis, opening up the energy storage market to private investment. The addition of battery energy storage systems will support the grid by catering for peak shaving, providing network stability. These systems will enable greater penetration of renewables into the future.

The energy crisis is not unique to South Africa. Globally, we see different countries facing energy challenges that might look different but are based on some of the same fundamental issues. One of these is the “just energy transition”, which the government is tapping into to invest in the grid and repurpose power stations that have reached the end of their viable lifespans.

It is a global imperative for the world to reduce its reliance on carbon-intensive energy solutions, and this is a problem likely to be with us for the foreseeable future. In South Africa, we face both an energy security challenge and the need to reduce the carbon footprint of our energy supply.

Therefore, a just energy transition is probably the most important consideration from a local perspective. As we transition away from fossil fuels, we need to ensure there are opportunities for all stakeholders to participate, especially the thousands employed in the coal-mining industry. Our energy crisis is a relatively solvable problem from a technical standpoint, but the number of social and institutional challenges it brings are equally, if not more, important.

The planned battery energy storage to supplement Eskom’s capacity represents a multifaceted approach to the energy crisis, opening up the energy storage market to private investment.

THOUGHT LEADERSHIP: THE NEW ENERGY ACTION PLAN 18 ENERGY

Janice Foster

IMAGES: EKYSANTI23/ISTOCKPHOTO.COM, SUPPLIED

The digitalisation of the energy sector

Digital technologies are set to make energy systems more connected, intelligent, efficient, reliable and sustainable. By ROLAND VERWEY, control and automation manager at Saryx Engineering Group

Although oil and gas are highly competitive industries, oil majors and other fossil-based energy sources are coming together more to collaborate on how best to tackle the challenges and opportunities that digital technologies provide. In an area that is particularly critical for all of them, these experts are discussing how new technologies and digitalisation are transforming health and safety in this space. Saryx Engineering Group, for example, has created an as-a-service solution that utilises top technologies to deliver measurably improved health and safety compliance.

Network infrastructure, communication service development, information technology industry development and digital technology innovation all offer some degree of positive contribution to energy efficiency. There are thus numerous important discussions currently taking place around the world related to this subject.

Jennifer Hartsock, vice president and CIO at Baker Hughes, moderated discussions at the Offshore Technology Conference in Houston in 2019, where opportunities were presented to improve offshore safety, make processes rigid and help workers do the right thing.

The Gulf Research Programme, which was established with the settlement funds paid as a result of the 2010 Deepwater Horizon disaster – the largest offshore oil spill in US history – is focused on enhancing offshore energy system safety, human health, and environmental resources in the Gulf of Mexico and other United States outer continental shelf regions, through the use of advanced technologies like cloud computing and the Internet of Things (IoT).

Data-driven decarbonisation

Decarbonisation is mission critical for the planet, and the global energy landscape will change more in the next 10–15 years than it did in the previous half-a-century. This is especially true in South Africa, as global energy trends move away from fossil fuels towards renewable energy sources.

During this transition, it should be obvious that the efficiency and economics of these new energy projects will be driven by data, inextricably linking digital transformation with the transition to renewable energies. One only needs to consider how the rise of new and advanced digital technologies – including artificial intelligence (AI) and machine learning,

The efficiency and economics of these new energy projects will be driven by data, inextricably linking digital transformation with the transition to renewable energies

high-performance computing, robotics and automation, remote sensing, and blockchain – have the ability to improve an organisation’s capability to monitor, optimise and automate operations, and pull the right levers to reduce greenhouse gas emissions.

Getting smart about solar

South Africa has one of the highest levels of solar radiation in the world. The solar radiation of South Africa ranges from around 1 450 kilowatt-hours (kWh) per m2 to about 1 950kWh/m2 per year, according to the Solargis resource map 2021, compared to Europe which on average has 1 000kWh/m2 per year.

In most renewable energy plants, the most important requirement is to follow the local grid policies, which is particularly important with regard to South Africa’s fragile energy grid. The only way to do this is to ensure that the selected technologies for the power plant controller (PPC) conform to the grid code. The software in the PPC ensures that stable energy, generated from multiple energy sources that have different energy-driven characteristics, nonetheless works in harmony at a site that is connected to the national grid.

The Net Zero Emissions by 2050 Scenario shows an average annual generation growth of 24 per cent between 2020 and 2030, which corresponds to 630 gigawatts of net capacity additions in 2030. With this kind of growth, South Africa must now put in place methods to dispose of old solar panels responsibly, without causing major pollution.

Here again, the importance of digital technologies, notably IoT, AI, advanced analytics, cloud computing and blockchain, comes to the fore, even at the end of the value chain. Implementing these technologies at the start of that chain will allow users to track panels from the time of manufacture, record the performance of each panel during its life cycle, and then ensure the proper disposal of each individual panel at end of life.

THOUGHT LEADERSHIP: DIGITALISATION AND ENERGY ENERGY 19

Roland Verwey

IMAGES: LEOWOLFERT/ISTOCKPHOTO.COM, SUPPLIED

© iStockpeshkov www.businessmediamags.co.za THE SA PROFESSIONAL’S PORTAL TO INDUSTRY INSIGHTS @businessmediaMAGS @BMMagazines Business Media MAGS BUSINESS MEDIA MAGS FEATURES SECTORS INCLUDING: Mining Infrastructure Health Architecture Green Local Government Business ICT Construction & Engineering Skills Development Travel Textiles business_media_mags

IMAGES: SUPPLIED

Building lithium partnerships across the continent

Despite having almost no lithium reserves, South Africa has the potential to play a major role in global lithium-ion battery production.

By TREVOR CRIGHTON

Lithium is a mineral with many uses in products, from ceramics to glass. The most prominent, however, is as the key chemical component in batteries for mobile phones, laptops and electric vehicles (EVs).

While South Africa has almost no lithium reserves, the country is well positioned to play a major role in the production of lithium-ion batteries, if we partner smartly with our Southern African Development Community neighbours. We already have a developed battery assembly industry, with enclosures, battery-management systems and other components manufactured locally, but battery cells are imported from elsewhere – usually the East.

“There’s plenty of hype around lithium-ion batteries, but it’s important to understand that there are many different types of such batteries with different chemistries, some of which are better suited to particular applications,” says Gaylor Montmasson-Clair, senior economist for sustainable growth at Trade & Industrial Policy Strategies. “They’re all classed as ‘lithium-ion’ because lithium is the common denominator.”

Hiten Parmar, director of the uYilo Electric Mobility Programme, says: “If we start looking at value-chain analysis, sub-Saharan Africa is endowed with lots of minerals that are essential to the production of lithium-ion battery packs.

The Democratic Republic of the Congo has the world’s largest reserves of cobalt, Zimbabwe has the fifth-largest global reserves of lithium, South Africa has 85 per cent of the world’s manganese reserves and Zambia has significant reserves of copper. Forming partnerships within the region and producing battery cells to complement the assembly process could have major local and export implications for our country.”

EV power shift

Montmasson-Clair says that a key driver for the growth of the already booming lithium-ion battery industry is the automotive sector, with no real competitor to lithium-ion battery power for electric vehicles. “In South Africa, we have a role to play in the battery value chain, but we need to be careful what that role is. South Africa is currently the only country in the world, outside of China, that refines battery-grade manganese. It has a tiny share of the market, but as one of only two facilities, has massive expansion potential.”

Parmar concurs: “Pre-COVID, the automotive industry contributed close to

FAST FACT

It is projected that between 2020 and 2030, the global demand for lithium-ion batteries will increase elevenfold, reaching over two terawatt-hours in 2030. Much of this growth can be attributed to the rising popularity of EVs.

Source: Statista

seven per cent of South Africa’s GDP, and 60 per cent of those vehicles were exported to the EU. With EU markets closing to internal combustion-engine vehicles from as soon as 2025, our manufacturers stand to lose their principal export markets if we don’t make a rapid change to producing EVs.”

A just lithium transition

As the demand for lithium-ion batteries has grown, the industry has been forced to evolve into developing more sustainable methods of operation. The “second life” market for batteries has developed, as batteries from EVs are able to be repurposed and recycled for use in other, smaller products.

“The Department of Forestry Fisheries and the Environment has introduced ‘extended producer responsibility’, which means that every manufacturer, importer and distributor of electrical components that include batteries is liable to ensure that the life cycle of a battery is managed responsibly from start to the end of life,” notes Parmar. “This has promoted the improvement of the technology to the extent that up to 90 per cent of the battery components can be recovered, meaning that there’s feed stock for manufacturing of related products that doesn’t rely on natural resources. In fact, it’s theorised that the recycled materials from a lithium-ion battery will fetch higher prices in the commodity market than the raw materials.”

Parmar believes that setting up lithium-ion battery manufacturing facilities in South Africa is a “no-brainer” because of our needs in terms of the just energy transition, sustainability and energy security. “While we’ve fallen behind in terms of global technology, the real low-hanging fruit is in partnering with international powerhouses to inbound-license their technology and scale up local manufacturing. We can put our hands up and invite them to build facilities in South Africa. We have the frameworks for our industrial development zones and incentives for manufacturing; now we need to push,” he concludes.

BATTERIES ENERGY 21

“South Africa is currently the only country in the world, outside of China, that refines battery-grade manganese.” – Gaylor Montmasson-Clair

Hiten Parmar

uYilo Smart Grid Ecosystem

DRIVING MINING’S LOW-CARBON FUTURE

South Africa is one of Africa’s leading industrialised economies, endowed with enormous natural resource potential, which is critical to enabling life as we know it and helping decarbonise the world’s energy and transport systems.

In South Africa, Anglo American is actively helping realise this natural potential by sustainably producing many of the metals and minerals essential to realising the globe’s low-carbon future and developing a 3-5GW regional renewable energy ecosystem – in partnership with a global energy partner, EDF Renewables. This system has the potential to draw on the country’s abundant renewable resources, resulting in the construction of a network of on-site and off-site solar and wind farms.

Each of Anglo American’s operations lies within a unique wind, solar, and topographic resource area. One site may be suitable for solar power, while another is better suited for wind power generation. While each mine operation has different energy consumption patterns, when connected into a singular system and as each site’s renewables become optimal, they are poised to deliver around-the-clock energy to all the company’s operations.

TRANSITIONING TO A LOW-CARBON FUTURE

The ecosystem’s goal is not only to provide for Anglo American’s energy demands, but also to supply surplus energy into the grid while opening the door to developing an entirely new renewable energy generation industry and all the services that will support it.

Leveraging its FutureSmart Mining™ programme – bringing technology, digitalisation and sustainability together to make mining more integrated, automated, and carbon-neutral while using far less water

– Anglo American has already secured a 100 per cent renewable electricity supply for all its operations in South America. It is expected that, by next year, 56 per cent of Anglo American’s global grid supply will come from renewables.

As the global mining company progresses towards its 2040 target of neutral carbon operations, its partnership with EDF Renewables is designed to abate the largest single source of its Scope 2 emissions, its current grid energy usage in South Africa.

The transition to a low-carbon future is not without challenges for a country such as South Africa. These challenges cannot be addressed by any single entity, private or public. That is why transitioning to a low-carbon future requires collaboration across institutional lines, joining civil society, communities, private sector, and government in a joint bid to ensure that the move to a low-carbon economy is just and seen to be so by all.

LONG-TERM SOCIOECONOMIC BENEFITS

Anglo American supports South Africa’s just energy transition by placing people at the heart of its initiative. Already, over R5-billion in investment has been made in scalable, long-term economic development, education, and health interventions to help improve the lives of its employees and help build thriving host mining communities.

Through the development and construction of the regional renewable energy ecosystem, Anglo American seeks to generate up to 40 000 new jobs by the end of the project.

The build-out of renewable energy across South Africa will also provide the foundation for developing a hydrogen economy through the production of green hydrogen. Earlier this year, the company launched a pilot of an

The ecosystem’s goal is not only to provide for Anglo American’s energy demands, but also to supply surplus energy into the grid.

end-to-end integrated green hydrogen production, fuelling and haulage system for its mine sites – the nuGen™ Zero Emission Haulage Solution (ZEHS). This ambitious pilot project marks the fi rst time a 220-tonne truck with a 290-tonne payload was converted to run on hydrogen. The truck is a 2MW fuel cell battery hybrid – the best available technology combination for this specifi c use case – with a hydrogen fuel cell providing roughly half of the power required and a battery pack providing the other half, allowing us to recover energy while braking.

Specifi cally, Anglo American expects hydrogen and electricity from renewable energy sources to progressively displace diesel and petrol for vehicles and other machinery. The economic development associated with these changes could also provide the backbone for creating a hydrogen economy in the region – thus helping to drive South Africa’s just energy transition further through employment and economic activity in this supply chain and the construction and services sectors.

In this way, the pathway to Anglo American’s carbon neutrality offers a case for continued investment in South African mining, the catalyst for new economic activity around renewable energy within the region, and supports a nation’s journey towards a just energy transition into the low-carbon economy of the future.

22 ENERGY ADVERTORIAL ANGLO AMERICAN

A nglo American’s regional renewable energy ecosystem is helping the mining industry reduce its carbon emissions and assisting in the South Africa’s energy transition. By ANGLO AMERICAN

Scan the QR code for more information about Anglo American.

IMAGES: SUPPLIED

From culprit to leader in energy efficiency

PROVIDING A CRITICAL BUFFER FOR ESKOM

Member companies of the Minerals Council South Africa indicated, even before the current round of loadshedding began, that they have several thousand megawatts of renewable energy projects, worth an estimated R60 billion, planned. These, when all are built, will relieve pressure on Eskom and go a long way towards meeting the industry’s commitment to achieve net zero carbon emissions by 2050.

Eskom has suggested the utility needs to add an additional 4 000MW to 6 000MW of generating capacity. The mining industry is involved in various stages of building plants, conducting studies, planning and applications for up to 3 900MW of renewable solar, wind and battery energy projects.

Mining is one of civilisation’s oldest activities. Even in the late Palaeolithic period – also known as the Stone Age – hunter-gatherer tribes coveted valuable materials such as obsidian rock, mined and shipped across ancient trade routes. The Bronze Age rose and fell partly on the supply of tin and copper, and the Industrial Revolution started in Britain’s mining heartlands. Southern Africa is home to the oldest evidence of deliberate mining as we understand it now, when humans dug up coal as far back as 40 000 years ago.

Today, mining is a power-intensive business, consuming around 14 per cent of South Africa’s electricity output, according to Eskom. This demand is near-continual, and the industry suffers when supply is intermittent. That adds to a volatile margin that can jump significantly and quickly enter negative territory.

In an average period, these elements are challenging, but the stakes are much higher during an energy crisis, where energy costs are growing by double digits. Add South Africa’s problems with energy politicisation and Eskom,

as well as environmental concerns, and it’s a perfect storm of woes for the sector.

Yet it is also an opportunity. Few groups in modern society can combine motivation, scale and resources as mining can to effect a genuine shift in energy generation.

“Mining companies are moving towards sustainable, renewable sources of energy to reduce their carbon footprint and ensure the minerals they produce are globally acceptable,” says Allan Seccombe, head of communications for the Minerals Council South Africa (MCSA).

“There is a strong element of reducing exposure to electricity sourced from Eskom, which generates more than 80 per cent of its electricity from coal, bringing with it carbon tax, and social and environmental consequences. By having their own sources of renewable energy, mining companies have access to dedicated sources of electricity and are better able to project future costs, something they cannot do with Eskom.”

A future energy champion?

South African mines are grabbing energy by the horns, prompted by the energy crisis,

“There is a strong element of reducing exposure to electricity sourced from Eskom, which generates more than 80 per cent of its electricity from coal, bringing with it carbon tax, and social and environmental consequences.”

– Allan Seccombe

Compared to the planned 1 600MW the industry spoke about during 2020, this is a massive jump of 146 per cent in the number and size of renewable energy projects now underway.

(Source: Minerals Council of South Africa)

environmental pressures and the easing of energy legislation. According to the MCSA, 29 of its members are working on a combined 89 projects totalling 6 106 megawatts (MW) at a value above R97-billion. Those are significant investments that few other sectors could muster.

That total is still marginal compared to mining’s total energy needs. For example, Impala Platinum uses around 3 864 gigawatt-hours (GWh) of energy for all its sites, Seriti’s coal operations consume 750GWh, and Sibanye Stillwater’s needs sit at 6.59 terawatt-hours. Suffice it to say that renewables won’t completely meet the energy demands of the sector, nor are the current options entirely suited to that purpose –especially wind and solar.

“Solar alone is not sufficient, as mining operations operate around the clock and are energy intensive,” says Johan Theron, Impala Platinum’s group executive for corporate affairs

24 ENERGY

Despite its energy-guzzling image, the mining sector is shaping up as an important catalyst for energy effi ciency, writes JAMES FRANCIS

Smaller sites, such as the 100MW Mogalakwena Solar PV Plant in Limpopo, and larger 2000MW+ sites will feed into larger energy ecosystems.

MINING’S ENERGY CONSUMPTION

South Africa’s overall energy consumption:

• Distributors: 42.9%

• Industrial: 21.3%

• Mining: 14%

• International: 7%

• Residential: 5.7%

• Commercial: 5%

• Agriculture: 2.8%

Source: Eskom Integrated report 31, 2021

and strategy. “As a stand-alone technology, solar requires significant energy storage, which is currently cost prohibitive.”

Yet it’s folly to expect renewables simply to replace existing energy generation. In the book How the World Really Works, author Vaclav Smil encourages us to think of energy density as the main benchmark for replacement. For example, an aircraft would have to add significantly more weight in batteries to match the energy density of aviation fuel. If like-for-like transitions aren’t feasible, energy systems will require major redesigns – something the mining sector emphasises out of necessity.

“Renewable energy systems such as wind, solar and hydro power, coupled with energy storage and gas-to-power base-load systems, offer a far better solution,” says Theron. “The trick is to optimise the design so that renewables are maximised, with enough storage, where gas-to-power provides dispatchability and better control.”

Not all interventions are at the generation level. Mines are also chasing energy optimisation. Anglo American is currently piloting its nuGen Zero Emission Haulage Solution at the openpit Mogalakwena Mine in Limpopo, converting heavy haulage trucks into 2MW fuel cell battery hybrids that run on hydrogen. Given mining’s extensive supply chains, these projects can create ripples. For example, Anglo American is collaborating with an Australian rail freight enterprise to study the impact of integrating nuGen beyond mining sites.

Anglo American said in a statement: “We expect hydrogen and electricity from renewable energy sources to progressively displace diesel and petrol for vehicles and other machinery. The economic development associated with these changes could provide the backbone for creating a hydrogen economy in the region, thus helping to drive South Africa’s just energy transition.”

Energy beyond mining

General Electric built the original commercial power generation sites 140 years ago, first in London and then in New York. These were centralised out of necessity, wiring surrounding early adopters directly to the generation sites. In time, electric grids and other standards settled

into place, and the world has run off monolithic and centralised energy systems ever since.

But the status quo is changing. The Center for Strategic and International Studies notes that “decentralised renewable energy models offer an opportunity to circumvent political bottlenecks, provide affordable electricity, and reduce reliance on imported fuel”.

Of course, building decentralised generation capacity is still expensive and arduous, and requires a long-term mindset. Mines could be important catalysts in this regard.

“The mining industry is an intensive energy user that requires stable power and often owns large areas of land that could be viable for the development of renewable energy,” says Linda Khuluse, Seriti’s communications, media and brand manager, commenting on the mining company’s recent majority-stake acquisition in renewable energy asset management firm Windlab. “The blending of our existing coal assets with renewable energy assets is not only the first step in our journey to becoming a diversified energy business, but it is also able to provide Seriti with a sustainable self-generation solution.”

This answer reveals two trajectories for mining. Foremost, it needs to develop energy infrastructure that can support stable power and reduce dependence on external providers.

But there is also the opportunity for mines to diversify beyond their core operations. They could even end up selling power back.

“With the most recent policy changes announced by the president, space has further opened for the Impala Platinum group to assess additional renewable energy purchases and the possibility to wheel this across the national grid to our operations in South Africa,” says Theron.

Mines are also realigning their core business to support energy transitions better. Sibanye Stillwater calls this a shift to mining “green metals” that are key for manufacturing energy components such as batteries. It collaborates on initiatives such as the Rhyolite Ridge project, which provides materials for electric vehicle supply chains linked to companies such as Ford.

“Not only is the industry looking at the energy sources it uses to produce minerals, but there is also more focus on which minerals will feed into sustainable energy supplies,” says Seccombe. “In South Africa, we have platinum group metals, vanadium, copper, nickel, manganese, and other minerals that are used for renewable energy and battery applications. Without these minerals and others like lithium, for example, the world cannot achieve its energy transition goals. Mining is a critical part of the energy transition.”

Mining houses are investing R97-billion into 6 106MW of energy generation, primarily renewables such as wind and solar.

ENERGY 25 MINING

IMAGES: SUPPLIED

Anglo American’s zero-emission vehicles hydrogen production, storage and refuelling complex at Mogalakwena incorporates the largest electrolyser in Africa and a solar PV field to support the operation of the haul truck.

“The mining industry is an intensive energy user that requires stable power and often owns large areas of land that could be viable for the development of renewable energy.”

– Linda Khuluse

Mining’s transition to renewable energy

In order to overcome the ongoing power crisis, mining companies are actively diversifying their energy mix. By MINNETTE LE ROUX , environmental specialist, and NICOLAS MARSAY, B-BBEE, economic development and localisation specialist at NSDV

did not have economic value at the time of disposal. However, in recent years, new technologies have been developed that can treat this discarded material, turning it into an economically viable commodity while reducing the long-term environmental impact and rehabilitation cost.

In 2021, the mining industry directly employed more than 450 000 people, with more indirect jobs in the supply chain supporting the industry. The social impact that mines have cannot be underestimated, with many unemployed family remembers reliant on the wages of those employed. With the introduction of the principle of the circular economy, it is possible that the mining sector can increase its positive social impact through job-creation opportunities, while simultaneously reducing its overall environmental impact.

Unlocking new generation

Government has come to the party with the latest presidential announcements removing the 100MW cap for independent power production, unlocking more than 80 confirmed private-sector projects with a combined capacity of over 6 000MW.

The shortage of electricity supply in South Africa is a huge constraint on economic growth and job creation, deterring investment and reducing economic competitiveness within the country and the mining sector. In order to overcome this obstacle, the sector has for the last decade been actively diversifying its energy supply by transitioning to renewable energy.

Mining companies have been engaging renewable energy independent power producers (IPPs) on how to supplement their energy supply and reduce the risk to their operations from

Eskom’s unpredictable electricity supply. Until recently, regulations prohibited large-scale projects from being developed in the standard power project way, where the mine simply purchased energy from the generator. Self-generation was permitted, but this didn’t fit into the business model of IPPs selling power through a power purchase agreement. Likewise, the intermittency of

renewable energy makes load planning a challenge. However, with the cost of energy storage decreasing, on-site storage is becoming more economically viable.

Recently, there have been a number of examples of success stories, such as Sturdee Energy’s 75 megawatt (MW) deal with Sedibelo Platinum Mines and SOLA Group’s 200MW deal with Tronox. However, as an indication of what is to come, EDF has signed a deal to generate up to 5 000MW for Anglo American, whilst Seriti Resources acquired the majority stake in Windlab Africa, which has a renewable energy project portfolio of 3 500MW.

Areas for improvement

Whilst the industry has made great strides on the renewable energy front, there are areas where sustainability is lagging. Mining is of course an extractive industry, which through its efforts permanently changes nature itself.

The ore that contains the targeted mineral also contains other material, which is discarded on mine residue stockpiles and deposits – collectively referred to as MRDs.

The reality is that the material on these MRDs

This move is an excellent step towards ensuring energy security, and will enable private investments in electricity generation to rise to higher levels. There are still challenges to iron out, such as wheeling through the distribution and transmission networks of Eskom and local municipalities, and how to account for tariffs within the National Energy Regulator of South Africa framework. Also problematic is the time it takes for energy projects to receive the necessary approvals.

The presidency, through Operation Vulindlela, has been playing an active role in engaging with all relevant stakeholders to find solutions within the current legislative framework. Special legislation is also currently being tabled in Parliament on an expedited basis, to address the legal and regulatory constraints around new generation capacity.

This includes reducing the regulatory requirements for solar projects in areas of low and medium environmental sensitivity. Just as crucially, it will allow for Eskom to expand power lines and substations without needing to obtain environmental authorisation in areas of low and medium sensitivity, and within strategic electricity corridors.

Government has come to the party with the latest presidential announcements removing the 100MW cap for independent power production.

THOUGHT LEADERSHIP: RENEWABLE ENERGY 28 ENERGY

Minnette le Roux

Nicolas Marsay

IMAGES: BRIANBROWNIMAGES/ISTOCKPHOTO.COM, SUPPLIED

Rewiring the economy fairly

South Africa’s CO2 emissions are double the world average. Alongside extremely high levels of poverty, inequality and unemployment, this puts our country in the unenviable position of being a global outlier. While our developmental challenges have not necessarily arisen from high CO2 emissions, nor can they solely be solved by reducing these, they do share common origins.

The country’s high emissions, poverty, inequality and unemployment reflect the fact that our economy has for too long been structurally extractive and exclusive. It is vital to turn this approach on its head via collaborative efforts focused on creating a regenerative and inclusive economy.

The so-called “just transition” presents opportunities to address these developmental challenges in a systemically sustainable manner. It has the potential to be a new and sustainable engine for growth, as well as a net generator for respectable jobs, which can contribute significantly to poverty eradication and social inclusion.

There is also the significant risk that without such a just transition, South Africa will not achieve the low-carbon, environmentally sustainable economy that is essential to the well-being of future generations. For instance, South Africa’s carbon-intensive economy faces mounting trade risks and decreasing competitiveness.

The Carbon Pathways research undertaken by the National Business Initiative estimates that South Africa could lose 50 per cent of its export value, more than 1 million direct jobs

and 15 per cent of GDP if decarbonisation is not deliberately pursued.

In fact, according to a 2020 report by the World Economic Forum, Why the Crisis Engulfing Nature Matters for Business and the Economy, it is estimated that more than half the world’s total GDP is dependent on a healthy natural environment, with 60 per cent of Africa’s GDP highly or moderately dependent on nature. Yet between 1970 and 2016, the stock of natural capital for African countries fell by an average of 65 per cent.

Additional investment

To address climate change and support and protect biodiversity, Nedbank has made several investments and commitments aimed not just at mitigating environmental risk, but also driving a positive transition that can create jobs and business opportunities. Most notable is how the bank is accelerating its efforts to finance renewable energy solutions, in order to support socioeconomic development and build climate change resilience.

In April 2021, Nedbank became the first bank in Africa to release an energy policy that will see the bank make an orderly exit from fossil fuels over time, while scaling up renewable-energy financing to meet our energy supply needs. For South Africa to achieve net zero by 2050, the energy sector will need to decarbonise fully while many other important sectors, such as transport, will

Mike Davis

need to electrify. The implied financing needs in this transition, and subsequent new business opportunities for lenders and investors, are significant. This presents major opportunities for growth and investment across the country.

Lessening the impact

The impact on jobs and opportunity for job creation is a key part of a just transition, and one that is not without challenges. With regard to coal, South Africa’s strategy is not to eliminate coal entirely, but to see no new power plants built after 2030,and 80 per cent of capacity closed by 2050.

While this will result in fewer jobs in this sector, a recent PwC report entitled What a ‘Just Transition’ Means For Jobs in South Africa identified more than 850 000 job opportunities in the renewable energy sector alone. Mitigating the impact of climate change also protects 400 000+ jobs in nature-based tourism and related areas, as well as 800 000+ agricultural jobs.

Of course – as in any transition – there will be winners and losers. An orderly, just transition seeks to soften the landing for those most-impacted sectors, their employees and related supply chains. The role of financial institutions in rewiring the economy is simple, albeit not easy: to steer capital towards economic activities that support the future we want, and away from activities that do not. The decisions the finance sector makes today, in terms of capital allocation, will help shape the economy of tomorrow. This is a massive responsibility, and one that the sector should not take lightly.

THOUGHT LEADERSHIP: THE GREEN ECONOMY ENERGY 29

It is vitally important that efforts are made to double financing efforts within the green economy, writes Nedbank CFO MIKE DAVIS

IMAGES: GALEANU MIHAI/ISTOCKPHOTO.COM, SUPPLIED

Agriculture’s leap towards the sun

The agricultural sector was an early adopter of alternative energy sources, but although the case for switching to solar gets stronger by the day, how much of the sector’s power can realistically be obtained from the sun, asks LINDI BOTHA