NEW TECHNOLOGIES HEAT UP THE COLD CHAIN

Here’s how the cold chain navigates the unpredictable while innovating for the future.

For t hree dec ades, ID Label has lef t i t s mar k on warehouse opera tions by developing innova tive labeling solu tions to meet t he needs of today ’ s smar ter warehouses. Here’s to anot her 30 years of stic k ing around!

Stoecklin

FOR

WOMEN IN SUPPLY CHAIN

When I created the Women in Supply Chain award five years ago, it was during COVID-19 when my two kids were e-learning from a shared space we created in our loft area (what was then my home office). Juggling my Teams meetings amid their Zoom classes and all of the hiccups in between posed quite the challenge. But I launched the award anyways, in hopes that it would provide hope, awareness and recognition to those wonderful supply chain females fighting the good fight.

Although we’re past the pandemic present day, the true women in supply chain continue to shine—building, innovating and making sure everyone—both men and women alike—can be a part of an industry that values perseverance, safety, tenacity and all of the qualities that make us unique and human.

This year’s winners showcase how mentorship, collaboration and self-advocacy pave the way for future female leaders. And, as I reminisce about the day when I launched the award, and I am humbled knowing that years later, even in the dark, there can be light.

The Women in Supply Chain award, sponsored exclusively by Let’s Talk Supply Chain podcast and Blended Pledge, continues to celebrate the real movers and shakers of the supply chain industry. From truck drivers to CEOs, this award provides a safe space for women to support other women, for men to support their female counterparts and for women to even advocate for and support themselves.

And this year’s applications were especially profound. These women are doing remarkable things for their communities, organizations and teams. They are doing things that make a difference. From mentoring young professionals and creating diversity, equity and inclusion (DEI) programs to optimizing and streamlining networks and instilling a positive company culture, this year’s winners exemplify the future of supply chain.

Congratulations to all of this year’s winners.

Scan the QR code to learn more.

https://foodl.me/ mvi6kgip

And, hope to see you in Atlanta Nov. 12-13 for this year’s Women in Supply Chain Forum. This year’s theme, “Shattering Glass Ceilings: A Woman’s Impact on Supply Chain,” will bring together leading logistics experts to discuss mentorship, self-advocacy, collaboration, closing the gender gap and what it takes to move the needle and pave the way for future female leaders in logistics. Head to www.WomeninSupplyChainForum.com to learn more.

EDITORIAL

Editor-in-Chief Marina Mayer mmayer@Iron.Markets

Managing Editor Alexis Mizell-Pleasant amizell@Iron.Markets

AUDIENCE

Audience Development Manager ...............................Angela Franks

PRODUCTION

Senior Production Manager Cindy Rusch crusch@Iron.Markets

Art Director Flatworld Solutions

ADVERTISING/SALES

Brand Director Jason DeSarle jdesarle@Iron.Markets

Account Executive Brian Hines bhines@Iron.Markets

Account Executive Jay Gagen jgagen@Iron.Markets

Account Executive Mark Pantalone mpantalone@iron.markets

IRONMARKETS

Chief Executive Officer.......................................................... Ron Spink

Chief Revenue Officer Amy Schwandt VP, Finance Greta Teter VP, Audience Development Ronda Hughes VP, Operations & IT Nick Raether VP, Demand Generation & Education Jim Bagan

Corporate Director of Sales Jason DeSarle

Brand Director, Construction, OEM & IRONPROS Sean Dunphy

Content Director Marina Mayer Director, Online & Marketing Services Bethany Chambers Director, Event Content & Programming Jess Lombardo

CIRCULATION & SUBSCRIPTIONS

P.O. Box 3605, Northbrook, IL 60065-3605 (877) 201-3915 | Fax: (847)-291-4816

circ.FoodLogistics@omeda.com

LIST RENTAL

Sr. Account Manager Bart Piccirillo | Data Axle (518) 339 4511 | bart.piccirillo@infogroup.com

REPRINT SERVICES Brian Hines (647) 296-5014 | bhines@Iron.Markets

Published and copyrighted 2024 by IRONMARKETS. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage or retrieval system, without written permission from the publisher.

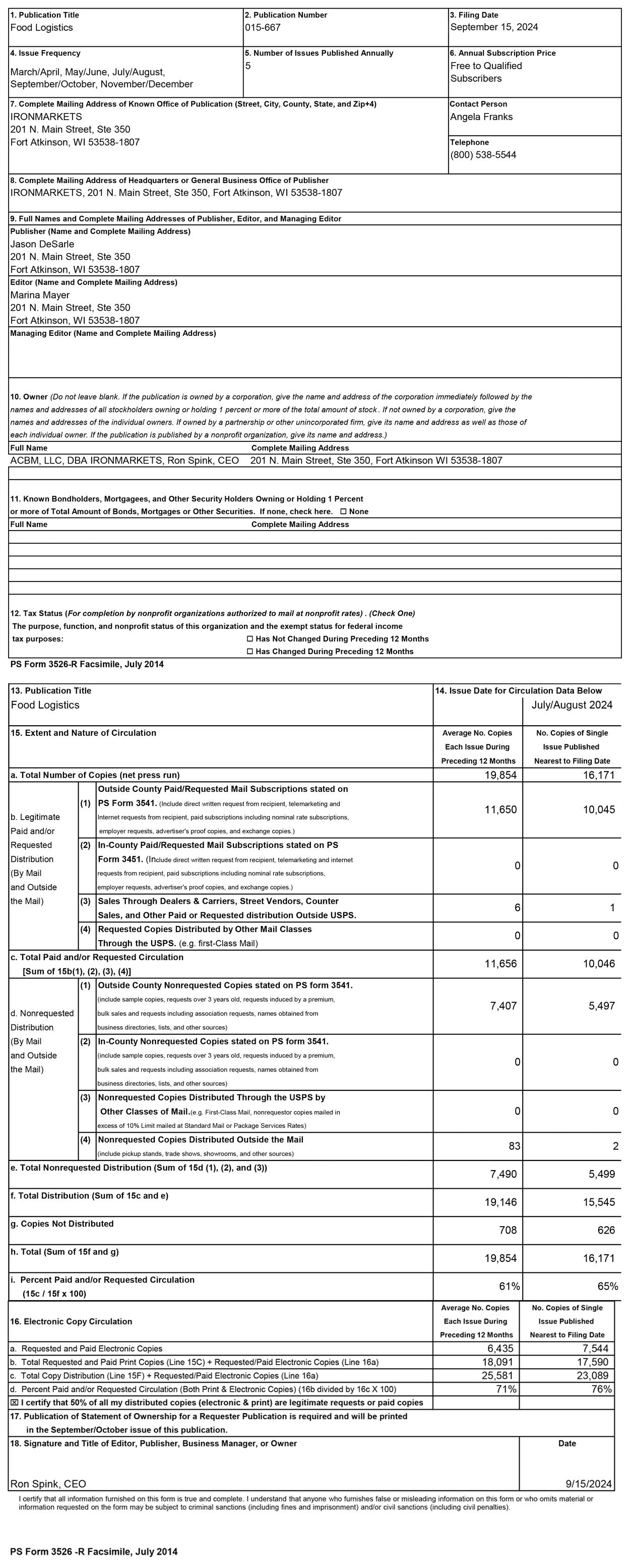

Food Logistics (USPS 015-667; ISSN 1094-7450 print; ISSN 1930-7527 online) is published 5 times per year in March/April, May/June, July/August, September/October, and November/December by IRONMARKETS, 201 N. Main Street, Fort Atkinson, WI 53538. Periodicals postage paid at Fort Atkinson, WI 53538 and additional mailing offices.

POSTMASTER: Send address changes to Food Logistics, P.O. Box 3605, Northbrook, IL 60065-3605. Subscriptions: U.S., one year, $45; two years, $85; Canada & Mexico, one year, $65; two years, $120; international, one year, $95; two years, $180. All subscriptions must be paid in U.S. funds, drawn from a U.S. bank. Printed in the USA.

by IRONMARKETS

201 N. Main Street, Fort Atkinson, WI 53538 (800) 538-5544 • WWW.IRON.MARKETS

Where Efficiency Meets Legacy – Over 35 Years of Unmatched Integrity and Customer Loyalty. Driving Excellence in Transportation & Logistics - Delivering Innovation, Reliability, and Success Nationwide.

For over 35 years, Genpro has delivered on our promises with cutting-edge logistics solutions. As a leading 3PL provider, we specialize in temperature-sensitive multi-pick and drop freight to optimize your networks. Whether you’re navigating last-minute shipments or expanding into new lanes, our 24/7 support guarantees reliable, seamless service. Let us drive your business forward—today, tomorrow, and into the future.

Cloud-Based Traceability Platform

Antares Vision Group launched its new food safety solution, a cloudbased platform designed to ensure regulatory compliance, precision traceability and supply chain transparency for food and beverage brand owners.

The system was developed by ACSIS technology, part of Antares Vision Group, and allows manufacturers and distributors to track raw materials, manage purchase orders, and obtain status updates on subcontractor deliveries, while providing a labeling solution with all required attributes to meet regulatory compliance, particularly those involving the FDA’s Food Safety Modernization Act (FSMA).

Scan the QR code to learn more.

https://foodl.me/2ax39u0q

Waste Management to Sustainable Opportunities

When it comes to ways to dispose of used cooking oil at restaurants, recycling is always preferable as it helps conserve resources, reduces landfill waste and may generate revenue. Used cooking oil, the waste product that was once disregarded, is now in high demand as it is one of the most important raw materials to produce biofuels and help combat climate change.

Restaurants and hotels across the United States produce about 3 billion pounds of used cooking oil annually, according to the Environmental Protection Agency (EPA). That’s a staggering amount of waste, but there’s potential for positive change, explains Peter Zonneveld, president of Neste U.S.

Scan the QR code to learn more https://foodl.me/c40qtf08

PHT Invests in Post-Harvest Cold Chain

PHT Investment Group launched a new fund to transform the post-harvest infrastructure sector. PHT Growth Fund LP is a new investment vehicle established to make strategic acquisitions and investments in temperature-controlled food supply chains, with a mission to support the movement of fresh produce from field to table.

“The post-harvest infrastructure sector is long overdue for improvement; right now, globally, over a trillion dollars of food goes to waste each year,” says Jim White, founder and CEO of PHT Investment Group LLC, the general partner of PHT Growth Fund. “Our new fund will dramatically reduce that wastage through the changes we are making in the industry. Investing in a carefully selected portfolio of cold storage infrastructure assets and mission-critical logistics will increase productivity, increase shelf life, increase the nutritional value of fresh produce, and reduce waste. All of this will result in savings at the retail level as well as profits to growers and investors.”

Scan the QR code to learn more https://foodl.me/93hrjx86

Top Tech Startup Award Opens

Nominations are open for Food Logistics’ and Supply & Demand Chain Executive’s 2024 Top Tech Startup award, which highlights top software- and technology-based startups in the supply chain and logistics industry.

This award honors startups in the supply chain and logistics space, who have launched a viable product and are revenue generating.

Winners will also be considered for further special promotional opportunities at Manifest Las Vegas 2025. Manifest will choose three of the Top Tech Startup winners to be featured on the Manifest Innovation Stage and given the opportunity to give an 8-minute demo.

Scan the QR code to learn more https://foodl.me/0zdweq3q

Reporting System to Improve Railroad

Norfolk Southern Corporation (NS), the American Train Dispatchers Association (ATDA) and the Federal Railroad Administration (FRA) announced joint participation in the FRA’s Confidential Close Call Reporting System (C3RS), a pilot program designed to enhance communication and transparency to help improve railroad safety.

Under the one-year pilot, dispatchers at NS can report safety concerns with the certainty that such reports will not result in discipline. Submitted safety concerns are de-identified by NASA and provided for review by a joint committee of NS, ATDA, and FRA representatives, who will identify and recommend corrective actions to improve safety.

Scan the QR code to learn more https://foodl.me/lxyloprx

Entry Type 86 Enhances F&B

With the U.S. Customs and Border Protection’s recent scrutiny of the ACE Entry Type 86 Test program, several customs brokers have had their licenses suspended. This program allows the flow of shipments, worth under $800, into the United States, exempted from duties and taxes.

Classified as informal entry, this type of filing enables shipments to cross borders more swiftly. However, Siddharth Priyesh, VP of CrimsonLogic, says findings of counterfeit goods, illegal substances, forced labor products, misclassification of shipments and inaccuracies in filing data prompted the governmental crackdown on these low-value e-commerce parcels.

Scan the QR code to learn more https://foodl.me/aoyzrvn8

Supply Chain Visibility Fights Recalls

Matt Heerey, president, manufacturing division at ECI Solutions, explains regulatory bodies such as the FDA, FTC, and CPSC will continue to scrutinize the quality of products, putting additional pressure on manufacturers to ensure quality. The trend of increasing fines and regulatory actions can be expected to persist, emphasizing the critical importance for companies to prioritize quality control measures across all aspects of their operations. Through an ERP solution and a culture of proactive innovation, manufacturers can navigate current turbulence and position themselves to thrive amid evolving market dynamics, emerging stronger and more resilient than before.

Scan the QR code to learn more https://foodl.me/tc14o9pj

Advocacy Group to Strengthen Supply Chains

The Supply Chain Council , a new bipartisan advocacy group, launched a first-of-its-kind group dedicated to bringing business and labor together to protect American jobs, invest in domestic infrastructure and safeguard the supply chain and economy from global instability.

“The U.S. supply chain is the backbone of our economy. Its strength determines the strength of every industry and job in our country,” says Supply Chain Council CEO Josh Wood. “The Supply Chain Council will provide a unique voice at the local, state and federal level and we’re excited about working with partners in the public and private sector to ensure the national supply chain is both strong and resilient.”

Scan the QR code to learn more https://foodl.me/ws5pkr21

Tackling FSMA Rule 204 Challenges

Association of Food and Drug Officials, FMI – The Food Industry Association (FMI), GS1 US, Institute of Food Technologists (IFT), International Foodservice Distributors Association (IFDA), International Foodservice Manufacturers Association, International Fresh Produce Association and National Association of State Departments of Agriculture joined forces to form the Food Industry FSMA 204 Collaboration to enhance industry-wide awareness of the U.S. Food and Drug Administration’s (U.S. FDA’s) Food Traceability Rule, which implements Section 204(d) of the U.S. FDA Food Safety Modernization Act (FSMA).“As state and local agencies, AFDO members are often on the front lines, receiving critical information during foodborne illness outbreaks,” says Steven Mandernach, executive director, AFDO. “We are committed to collaborating with all partners, including industry, to successfully implement FSMA Rule 204 traceability requirements. By working together, we can enhance food safety, ensure efficient traceability and protect public health across the entire supply chain.”

Scan the QR code to learn more https://foodl.me/rr4yagyl

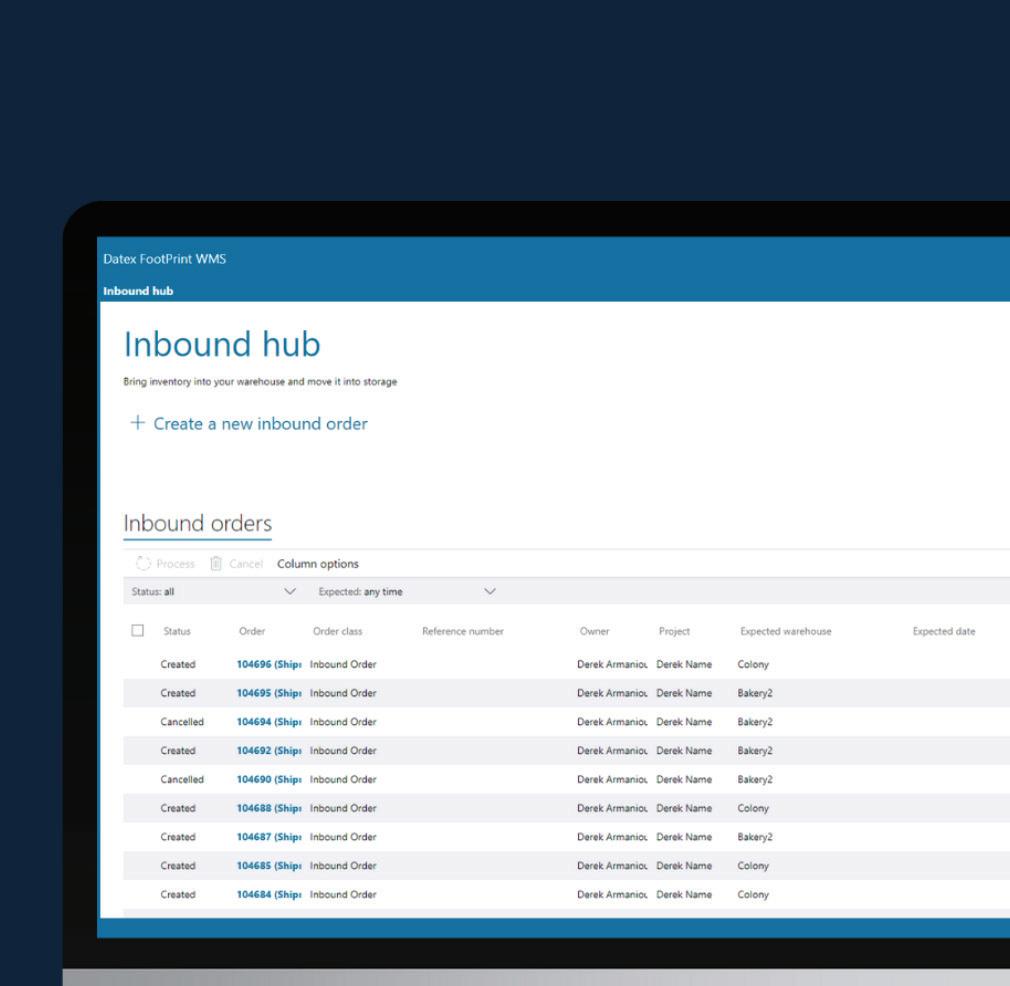

Avetta, National Safety Council Launch Safety Index

Avetta partnered with the National Safety Council (NSC) to launch the Safety Maturity Index (SMI), a systems-based approach to target health and safety weaknesses within the supply chain to help avoid serious injuries and fatalities.

@gorodenkoff.stock.adobe.com

The SMI goes beyond traditional metrics by identifying, assessing, and surfacing the maturity of the contractor’s organizational use of their safety management systems to ensure a safer working environment. The index further focuses on risk management, enabling a comprehensive and accurate safety evaluation to verify a contractor’s safety management system.

Scan the QR code to learn more https://foodl.me/slcidglt

AutoStore Introduces Multi-Temperature Solution

AutoStore introduced new Grid capabilities: the AutoStore MultiTemperature Solution, an expanded 18-Level Grid, a Motorized Service Vehicles and enhancements to the cube control software.

@andei310.stock.adobe.com

“AutoStore is shifting to a regular cadence of product announcements, focusing on innovation and execution to better serve our customers. This fall, our new products directly address the challenges our customers face, while providing them with new tools to improve operational efficiency,” says Mats Hovland Vikse, CEO of AutoStore.

The Multi-Temperature Solution allows multiple temperature zones within a single AutoStore cube. It is designed for frozen and chilled environments with a temperature range of -13°F in the frozen section to 42.8°F in the cooled areas. The picking of frozen products occurs at the ports in the chilled area to eliminate picking of items within extreme frozen temperatures, thus creating a better working environment for operators.

This safety tool provides an easier way to maneuver on top of the Grid when performing routine maintenance tasks.

Scan the QR code to learn more https://foodl.me/g3e38azq

Mexico-to-U.S. Imports Reach Record Year

New data from Motive shows 2024 to be a record year for Mexican imports to the United States.

AI-Driven Load Scheduling

Qued, Inc. launched a new feature to its AI-enabled smart workflow pattern that enables carriers and shippers to use a simple email request to automatically schedule and confirm load appointments.

“With this new functionality, we are applying machine learning and natural language processing tools to generate request emails, read and understand an emailed response from the shipper or consignee, and then update the trucker’s dispatch or operations management system with the scheduled appointment,” says Prasad Gollapalli, Qued’s chairman and CEO. “It’s a significant advantage that streamlines workflows and relieves Qued’s customers from manually dealing with what can be dozens of emails daily.”

Scan the QR code to learn more https://foodl.me/oj8x86ev

“675K trucks crossed the U.S. Mexico border, bringing $32.5 billion in goods with it in May of this year, representing a 7.2% increase yearover-year despite the volatility of shipping during that period. These numbers represent all-time records for Mexico-to-U.S. imports and underscore the new normal for U.S. supply chains: Mexico is now firmly established as the country’s largest importer. The country has imported more goods than Canada by truck for the last 22 months consecutively. With Chinese imports down 19.9% year-over-year since May 2022, it’s clearer than ever that U.S. companies are adopting nearshoring from Mexico as a primary resourcing strategy,” according to Motive.

Scan the QR code to learn more https://foodl.me/k10e1l7v

Cargo Theft Soars 49% in 2024

Freight hubs and major cities across North America are witnessing an alarming surge in cargo theft, with incidents skyrocketing by 49% in the first half of 2024 compared to the same period last year, Overhaul’s United States & Canada H1 2024 Cargo Theft Report.

The surge in theft incidents has been accompanied by a dramatic rise in financial impact. The average loss per incident skyrocketed to $115,230, marking an 83% increase from the same period last year. This trend underscores the growing sophistication and ambition of cargo thieves, who are systematically targeting high-value shipments. California remains the epicenter of this crisis, accounting for 45% of all reported cargo thefts, followed by Texas at 14%. Particularly concerning is the Southern California Red Zone, defined as the first 200 miles of travel for shipments departing from this area, which alone concentrated an alarming 36% of all cargo thefts in the country, averaging 58.6 thefts per month, nearly two each day. Remarkably, this region experiences as many cargo thefts as Texas, Tennessee, Illinois, Georgia and Arizona combined.

Scan the QR code to learn more https://foodl.me/u3orw7ox

@Christina

Cautious Optimism Amid Market Uncertainty

Supply chain professionals express cautious optimism regarding revenue growth in Q4, despite an increasing awareness of potential risks, according to data released by BlueGrace Logistics.

“The data underscores the need for adaptability and resilience among our customers,” says Adam White, VP, marketing at BlueGrace Logistics. “As market dynamics evolve, our goal is to help our customers remain agile and resilient.”

The rise in negative sentiment among customers indicates that businesses may need to focus more on mitigating risks and maintaining strategic flexibility as they navigate these uncertainties. When it comes to inventory management, the Q4 data reflects that customers are finding a balanced approach, with a decline in negative sentiment and a rise in neutral perspectives. This suggests that businesses are adopting more flexible inventory strategies, preparing for both potential surpluses and shortages.

Scan the QR code to learn more https://foodl.me/oi8ognr2

AMX Trucking Intros Flatbed Division

AMX Trucking, Inc. is expanding its fleet with the addition of a new flatbed specialized division.

“We are excited to launch this new division, which will enhance our ability to meet diverse customer needs with increased flexibility and efficiency. This expansion reinforces our commitment to providing top-tier logistics solutions and positions AMX for ongoing growth and success,” says Collins White, coowner, president, and COO.

“This new division allows us to better serve our customers and continue providing quality jobs in our community. We are thrilled to expand our capabilities and support the growing needs of our valued customers,” adds Taylor White, co-owner and CPO

Scan the QR code to learn more https://foodl.me/z7ett6h6

Maintenance Dashboard for PM Schedules

Carrier Transicold introduced a new Maintenance dashboard for its Lynx Fleet telematics platform, where users can create customized preventive maintenance (PM) schedules for their transport refrigeration units based on performance data collected and communicated in real time.

“With the Maintenance dashboard, Lynx Fleet users can proactively schedule preventive maintenance based on what the equipment tells them instead of relying on calendar alerts and manual checks of TRU controllers,” says Scott Blair, senior digital program manager, Lynx Fleet Telematics.

Scan the QR code to learn more https://foodl.me/afwgcds6

FedEx Intros Global Visibility Solution

FedEx launched FedEx Surround, an intelligent solution for monitoring and intervention to elevate logistics and supply chain management by enhancing control and visibility of shipments for customers.

“At FedEx, we are constantly innovating to meet the evolving needs of our customers. With data backed intelligent solutions and the introduction of FedEx Surround, we are building smart logistics for our customers. The tools are not just about tracking; it’s about smartly intervening in real-time to ensure that shipments are not only monitored but also actively managed to mitigate risk,” says Kawal Preet, president, Asia Pacific, FedEx.

Scan the QR code to learn more https://foodl.me/r2lcq1rb

Women in Supply Chain Winners Embrace Collaboration

Concern About Tariff Increases on the Rise

Significant bottlenecks are continuing to occur in Asia for U.S. imports, especially in Southeast Asia. For transpacific trade lanes being shipped to North America, the lack of vessel space and container availability continues to increase spot rates by almost 10 times from earlier this year. The recent closure of Ningbo Beilun’s Phase III Terminal due to an explosion on Aug. 9 is also expected to have a significant impact on the main transpacific trade lanes out of Asia as well as the overall supply chain globally, according to research released by ITS Logistics. While China was the main priority for tariffs during Trump’s first term, a new term may place more emphasis on the European Union and the UK. Regardless of which countries become the focal point should Trump become president again, economists are warning that such actions could very likely become inflationary.

Scan the QR code to learn more https://foodl.me/xxjog1k1

Food Logistics and Supply & Demand Chain Executive announced the winners from this year’s Women in Supply Chain award. Four overall winners were selected from the new sub-categories: Rising Stars; Trailblazers; DEI Pioneer; and Workforce Innovator, along with four Outstanding Acknowledgements from each of the four sub-categories, whose applications made it nearly impossible to select just one winner.

“These women are doing remarkable things for their communities, organizations and teams and are paving the way for future young female leaders to be a part of an industry that’s making a difference. This year’s applications were superb. Not only did these winners go above and beyond what’s expected in their jobs, but they also were able to articulate their many initiatives and achievements in a way that told their story, that explained their journey, that described why mentoring young professionals, creating DEI programs and instilling a positive company culture is so important to all female logistics leaders,” says Marina Mayer, editor-in-chief of Food Logistics and Supply & Demand Chain Executive

Scan the QR code to learn more https://foodl.me/mvi6kgip

AI Dashcam Helps Fleets Enhance Safety

EROAD announced Clarity Edge AI Dashcam, a three-in-one video-based solution to help fleets enhance safety and fleet management programs and proactively increase fleet safety and reduce risk.

“Our easy-to-use and intuitive video portal lets managers see driver behaviors at-a-glance, while enabling them to investigate further with automated tagging and event timelines for rich context,” says Akinyemi “AK” Koyi, president, product and strategy at EROAD. “In parallel, configurable in-cab alerts help drivers stay focused in real time. Using Clarity Edge in concert with our suite of telematics offerings provides the ideal platform to streamline driver safety and coaching programs.”

Key features include capture of critical events in high-definition and easy video sharing; customizable driver behavior monitoring options; real-time alerts to drivers with in-cab voice alerts and configurable coaching; sophisticated risk management through manager notifications and escalation options; and a streamlined review process with automated behavior tags

Scan the QR code to learn more https://foodl.me/e3y6thq8

Administration Provides Millions to Boost Trucking

The U.S. Department of Transportation’s Federal Motor Carrier Safety Administration (FMCSA) announced awards totaling nearly $3.5 million to 27 colleges and other commercial driver’s license (CDL) training programs through the agency’s Commercial Motor Vehicle Operator Safety Training Grant Program. These grants will help improve roadway safety by providing additional training for current CDL holders and creating new pathways for career opportunities as drivers in the commercial motor vehicle industry

“The Biden-Harris Administration’s investments in training and support for Commercial Driver’s License holders will help meet the nation’s growing demand for truck drivers and better prepare for the future,” says U.S. Transportation Secretary Pete Buttigieg. “The funding we’re announcing today is an important part of this Administration’s Trucking Action Plan to strengthen America’s supply chains and support the workers who keep our economy moving.”

Scan the QR code to learn more https://foodl.me/i09d25g9

Labor Strikes on U.S. Container Imports

September is traditionally one of the busiest months for U.S. containerized imports, driven by the peak shipping season as businesses prepare for the holiday rush. However, this year presents an unprecedented combination of challenges that could heavily impact supply chains. Potential labor strikes, natural disasters, and tariff uncertainties are converging, creating a highly volatile environment for global trade.

In August, U.S. container cargo imports surged by 12.9% year-over-year, with major ports handling nearly 2.5 million TEUs. While this reflects strong freight demand, it also intensifies concerns as labor strikes loom on Oct. 1, according to Container xChange.

The International Longshoremen’s Association (ILA), representing more than 85,000 dockworkers on the East and Gulf Coasts of the United States, faced a contract expiration Sept. 30. The uncertainty of negotiations is compounded by the fact that the duration of these strikes is unclear.

Scan the QR code to learn more https://foodl.me/47dhw0v5

NEW TECHNOLOGIES HEAT UP THE COLD CHAIN

The cold chain transportation industry continues to experience a shift. A growing market fused with a move toward electrification is expected to keep the industry innovating.

But the nature of unpredictability continues to plague the cold chain industry, presenting a host of challenges and even setbacks.

That’s why a host of new solutions and technologies are pertinent in keeping the cold chain market moving forward. From telematics to traceability and everything in between, new technologies and software solutions are in position to keep temperature-controlled

products moving through the cold chain safely and efficiently. Here’s a breakdown of how this looks.

Current market outlook

The North America cold chain market size is expected to reach $333.96 billion by 2030, registering a CAGR of 17.1% from 2023-2030, according to ResearchAndMarkets.

Spot truckload rates, for example, rose in June despite declines in the number of loads moved, according to research collected by DAT Freight & Analytics.

“The month ended strong for dry van freight, with nearly 25% more vol-

ume moving during the final week of June compared to last year,” says Ken Adamo, DAT chief of analytics.

The 2024 State of Logistics Report, produced for the Council of Supply Chain Management Professionals (CSCMP) by Kearney and presented by Penske Logistics, shows that U.S. supply chains pressured by global economic volatility, including inflation, climate change and geopolitical conflicts, are enhancing their capabilities to accelerate resilience, agility and flexibility to navigate current and future disruption.

Data from Truckstop and FTR Transportation Intelligence for the week

A host of new solutions and technologies are pertinent in keeping the cold chain market moving forward.

says Tom Nightingale, CEO of AFS. “Carriers, on the other hand, continue to step up the sophistication and nuanced defenses of their revenue streams, with subtle and frequent ancillary price increases.”

ending Aug. 30 shows sharp increases in broker-posted spot rates for refrigerated van and dry van equipment during the week before Labor Day. Dry van spot rates were not as strong in relation to historical performance but rose by the most week-over-week since International Roadcheck week in May.

However, flatbed spot rates were down for an eleventh straight week to their lowest level since July 2020. The increase in total load postings was the first in five weeks. Coupled with a sizable drop in truck postings, FTR’s Market Demand Index increased to 57.4, the highest level in four weeks.

On the other hand, the latest release of the TD Cowen/AFS Freight Index from AFS Logistics and TD Cowen shows the uneven effects of continued demand and capacity imbalances playing out across multiple transportation modes. While less-than-truckload (LTL) carriers are holding the line with pricing discipline, parcel rates are showing the effects of aggressive discounting and excess truckload capacity continues to suppress a pricing recovery.

“The current state of freight markets empowers shippers to wield pricing power and re-evaluate how to best make use of logistics networks,”

Although there have been a couple of negative readings for FTR’s Shippers Conditions Index, it’s been mostly positive, Avery Vise, VP of trucking for FTR Transportation Intelligence, detailed in Food Logistics’ SCN Summit: State of the Supply Chain webinar. Scan the QR code to watch in on-demand: https://foodl.me/0ero8s3c

“The negative readings have been primarily due to brief surges and diesel prices that we’ve had. And it’s probably going to still be negative for most of the rest of the year. Now, in general, both of those indexes are moving toward neutral territory. In fact, they’re likely going to slip to swap places by the time we get to the beginning of next year. So, in other words, the trucking index will turn positive, and the shippers index will turn negative,” Vise says.

Overcoming the main challenges

Disruptions such as cargo fraud, ever-changing regulations and an imbalance of supply and demand continue to present their own set of challenges for cold chain companies. But, compliance remains the top challenge many of today’s cold chain companies face.

There is “extreme rigor being placed on understanding, documenting and maintaining chain of custody. That’s just table stakes, and it makes sense— it’s a business that’s all about risk management and risk recovery,” says Andy Dyer, CEO, AFS Logistics. “Imagine, for instance, that we identify a tainted item that’s gotten into the food supply chain. The producer or distributor needs to know where it went. Did it go to grocery stores, or into restaurant or foodservice? They have to be able to find and pull it from circulation before it gets to consumers. None of this is new. But the technologies that

support it are becoming increasingly complex and efficient. The good news is that it’s easier today than it was 20 or 30 years ago. There used to be a paper trail. Now, there’s a digital trail. The bad news is that, as the technology improves, regulatory bodies tend to shift the burden to companies to keep track of that trail.”

Another challenge pertains to the cost of equipment, as a result of inflation and elevated interest rates.

ing, and controls. This has a direct impact on operating cost and upward pressures on compensation due to scarcity in the labor pool,” says Brad Nuffer, SVP, transportation at CJ Logistics Freight America.

Volatility in volumes and labor availability also continue to pose as great challenges to the cold chain transportation market. For instance, the industry faces unpredictability in both production and international shipping and fluctuations in consumer demand.

“Refrigerated trailers cost 40-50% more than dry trailers, they require more routine maintenance, and they are more scrutinized because they are often hauling food. Additionally, while less of a constraint, the employee pool is limited because of specialized requirements in this mode. While this isn’t unsolvable, understanding the equipment and requirements requires more investment in training, re-train-

However, as inflation declines and consumer confidence rebuilds, there is reason to be optimistic, according to Shane Brennan, SVP for global communications, Global Cold Chain Alliance (GCCA).

“The structural challenges relate to long-term decisions on infrastructure and equipment. With significant regulatory pressure led by the State of

California to phase out combustion engines, businesses are dealing with uncertainties over how and when to transition investment into non-combustion vehicles. For heavy freight, the cost and availability of fossil fuel alternatives remain highly prohibitive, despite subsidy support in some cases. However, the core problem is the persistent range and charging infrastructure challenges. It is incredibly hard to choose zero-emission heavy freight today for all but the most localized low-distance use cases,” says Brennan. “Similar issues present with alternatives to power vehicle refrigeration systems. However, there are more reasons to be optimistic about the innovation curve, with battery electric and hybrid solutions increasingly available across the market and far less prohibitive charging challenges. The critical question is how far businesses go in decarbonizing their

One challenge plaguing the cold chain is the rise in cost of equipment to maintain temperature, ensure worker safety and more.

One of CJ Logistics’ customers, with whom we have been working for decades, has seen millions of dollars in savings over the years by taking advantage of our FTZ-approved warehouse in ELWOOD, ILLINOIS.

THANKS TO CJ LOGISTICS’ FTZ STATUS, OUR CUSTOMER CAN MAINTAIN FLEXIBILITY AND WILL ONLY PAY TAXES WHEN THEY DECIDE WHAT’S BEST FOR THEIR PRODUCT DISTRIBUTION PLAN. We currently have space available. Scan here for more:

Learn all about FTZs

Foreign trade zones (FTZs) offer significant benefits for businesses engaging in international trade. Download our latest white paper to learn:

• The history of FTZs and their impact on the economy and trade.

• The various ways that businesses can see value when using FTZs.

• How CJ Logistics America helps customers utilize FTZs in their supply chain operations.

fridges before they tackle the main vehicle engine.”

What’s more, while nearshoring and localization are deemed an opportunity, for others, it requires a complete revamping of the end-to-end supply chain.

Mexico, for instance, has become the U.S.’ largest trading partner, and Laredo, Texas, is dubbed the top international trade port in the United States. Record truck border crossings and ground import volumes cement Mexico as No. 1 U.S. importer amid declining Chinese imports, according to Motive.

“675,000 trucks crossed the U.S. Mexico border, bringing $32.5 billion in goods with it in May of this year, representing a 7.2% increase year-over-year despite the volatility of shipping during that period. These numbers represent all-time records for Mexico-to-U.S. imports and underscore the new normal for U.S. supply chains: Mexico is now firmly established as the country’s largest importer. The country has imported more goods than Canada by truck for the last 22 months consecutively. With Chinese imports down 19.9% year-over-year since May 2022, it’s clearer than ever that U.S. companies are adopting nearshoring from Mexico as a primary resourcing strategy,” according to Motive.

To boot, trade flows are changing, requiring a reevaluation of supply chains, says Nuffer.

“To improve outcomes, logistics providers need to prioritize building an end-to-end solution with fewer touches across borders. They need to optimize their approach to routes and strategically invest in warehouses. This is no different in cold transportation, and it is creating the need to invest in partnerships to facilitate these ever-increasing transactions,” Nuffer adds.

And, with ongoing disruptions in global shipping, the value of holding product near to the consumer remains strong, Brennan says.

“This is fuelling the growth in investment in quality cold storage. However, we don’t expect dramatic

change in the balance between local, regional and global food trade flows. It is also vital to remember that security and resilience come from having access to food from a range of suppliers and locations both locally and across the world,” adds Brennan.

New solutions heat up the cold chain

From cargo tracking and enhanced traceability to improving worker safety and overall insights, many of today’s software solutions and technologies are designed to heat up the cold chain.

The adoption of cold chain telematics solutions for refrigerated trucks and containers, for example, is set to grow extensively over the coming years. In fact, cold food chain track-and-trace revenues are expected to surpass $7 billion worldwide in 2032, according to research from ABI Research. These revenues will consist of hardware sales and recurring monthly Software-as-aService (SaaS) revenues.

A third option for accessing trailers is Trailers-as-a-Service (TaaS), where fleet managers can subscribe to trailer capacity based on need, as outlined in this expert column written by Cory O’Brien, VP, marketplace operations, Wabash.

“These changes to how you acquire, operate and maintain trailers all serve a common goal—helping reduce the complexities involved with managing your trailer fleet so you can increase uptime and more easily and efficiently get food products to where they’re needed,” O’Brien says.

For its part, DPL Telematics released the AssetView Stealth Tracking System, an advanced solution for wireless monitoring and remote tracking of any powered or unpowered asset to improve logistics, manage inventory and curb theft.

Tive released Tive Solo Lite, a shipment visibility solution tailored for the needs of logistics service providers and third-party logistics (3PL) providers, food and beverage suppliers, retail grocers, and other key industry sectors.

tracking solution that empowers professionals to actively monitor shipment location, temperature, and light exposure.

ORBCOMM announced the latest generation of its reefer container monitoring solution featuring the CT 3600 device, enabling a new era of intelligent reefer management for shipping lines, container leasing companies and more.

Trucker Tools launched Cold Chain Load Tracking, a load tracking solution that provides monitoring for temperature-sensitive shipments, including perishables. Key features include real-time temperature tracking, customizable visibility and alerts, multi-zone trailer tracking and accessible tracking interfaces.

Carrier Transicold introduced a new

Solo Lite trackers and the Tive cloud platform offer a real-time

NFI Industries partnered with Electrify America to open a state-of-the-art distribution center fast charging facility in Ontario, Calif.

NFI Industries

Maintenance dashboard for its Lynx Fleet telematics platform, where users can create customized preventive maintenance (PM) schedules for their transport refrigeration units based on performance data collected and communicated in real time.

And, Copeland released its new GO real-time 4G/5GNA tracker for shipping products within the cold chain. This next-generation alkaline product leverages Wi-Fi and 4G/5G cellular technology to deliver real-time data for customers shipping high-value products.

To achieve sustainability initiatives, NFI Industries partnered with Electrify America to open a state-of-the-art distribution center fast charging facility in Ontario, Calif. Supporting NFI’s fleet of 50 heavy-duty electric trucks, the project advances the electrification of drayage operations between the Ports of Los Angeles and Long Beach. The new charging facility will feature roughly 7 megawatts of charging capacity shared across a total of 38 chargers, capable of speeds up to 350 kW for capable trucks.

“In July, our ZEVs hit the 3 million zero-emission miles milestone, and we’re on track to hit 4 million by the end of the year,” says Bob Knowles, president, transportation at NFI. “In addition to our drayage fleet, we’ve implemented several diesel emission

reduction practices for our dedicated fleets, including lightweight trailers, aerodynamic fittings, and technology that allows us to monitor our utilization.”

NFI also sees customers inquiring about “multi-temp” solutions, “where they can load both fresh and frozen products within the same trailer, segregated by bulkheads,” Knowles says. “In addition to transportation, we’ve seen more requests for temperature-controlled warehousing, including refrigerated, ambient, and frozen. In addition to the warehouses we already own and operate, we’ve partnered with various customers to build custom temperature-controlled facilities through NFI’s real estate team.”

Maersk Container Industry (MCI) introduced the Star Cool 1.1, a triple refrigerant reefer cooling machine designed to promote sustainable global cold chains.

Market outlook for 2025

Most experts project 2025 to be much

like how it was in 2024—navigating the unpredictable while innovating for the future.

But for the most part, the cold chain industry is booming thanks to changes in consumer behaviors and constrained capacity.

“That’s being reflected in the actions supply chain providers are taking, investments in infrastructure, and regulations around the products themselves,” says Nuffer. “An example of this would be the exponential increase in the number of registered cold chain facilities since 2019. While not all of this is new construction, I think it identifies an increased focus on not only expansions, but also a re-focusing on utilization of existing capacity.”

And, “with so many providers out there, shippers today can be picky when it comes to what logistics company they work with,” Nuffer adds. “They desire an approach centered around them and their unique needs.”

Redundancy and optionality with regard to planning for potential dis-

ruptions are also important in the cold food chain.

“We’ve always lived in a world of diminishing resources, but we’re really starting to feel that now. It’s becoming increasingly important to understand the efficiency of food distribution and minimize food waste while also minimizing the carbon output to transport it,” says Dyer. “In the U.S., temperature-controlled less-than-truckload (LTL) carriers make up somewhere between 5-10% of overall capacity. This makes sense because the demand is lower for temperature-controlled transport, but it doesn’t change the fact that shippers must have redundancy and backup plans in place.”

Brennan likens the expectation in 2025 to be about the continued rebuilding of transport volumes to match declining inflation and returning consumer confidence.

“The X factor will always be geopolitical and other external events, but we can rely on steady demand for quality storage and reliable transportation ser-

The current state of freight markets empowers shippers to wield pricing power.

Pexels

vices into 2025 and beyond,” he adds. What’s more is, the labor market seems to have hit an inflection point.

“We’re seeing a market that is cooling. We’re going to still see a significant gain in jobs, but not certainly what we were seeing in 2021 or 2022,” Vise says. “I think the bottom line is, is that a tight labor market has been an issue, it is not going to get any worse and may get a little bit better. Interest rates are still obviously a challenge and they’re going to continue to be a challenge until they start coming down. Inflation is still sticky. It is cooling, especially for goods, but it is not necessarily cooling on the services sector, especially in housing. Obviously, the hot issue is the presidential election. To be honest, we’ve looked at this issue over time and it’s not proven to have the effect that everybody assumes it does.”

Even so, the supply chain has gone from boom to bust the last couple of

years.

“COVID-19 caused massive growth and expansion to maintain pace with the demand of everyone being at home and having goods shipped directly to their houses. Coupled with the low interest rates at the time that caused a housing boom, more people were even buying bulk items to fill their new houses. Most sectors of the supply chain underwent growth,” as outlined in an expert column penned by Craig Lough, director of strategic planning for A. Duie Pyle. “But like all things— whatever goes up, must come down.”

As the economy has slowed and shipment volumes have decreased, the overcapacity across the supply chain has caused a volatile pricing war that has, in turn, also forced companies out of the market. However, in the last few weeks there has been news surrounding a rebound in the ocean carrier market that is showing an earlier than

normal peak season, renewing optimism about recovery across the entire supply chain. But that doesn’t tell the entire story, especially not in the trucking sector.

While some industry analysts believe that the market is beginning to turn, research such as the Cass Transportation Index Report from June 2024 continue to show a decline in shipments. In fact, taking the economic impact of COVID-19 out of the equation, volume in June was the lowest since 2014. While conditions are improving, it will be some time before we see a significant impact in pricing.

While the nature of unpredictability continues to plague the cold chain industry, presenting a host of challenges and even setbacks, a host of new solutions and technologies are key to keeping the cold chain market moving forward.

BE HONORED FOR YOUR ACHIEVEMENTS!

Annually, Food Logistics showcases individual and corporate leaders in the end-to-end supply chain. Plan now to enter your company - or a cutting-edge client or vendor - in one of these industry-leading recognition programs.

Nominations Open: September 23, 2024

Recognizes influential individuals in the industry whose achievements, hard work and vision have shaped the global cold food supply chain.

Nominations Open: February 10, 2025

Recognizes leading third-party logistics and cold storage providers in the cold food and beverage industry.

Nominations Open: February 17, 2025

Profiles innovative case study-type projects designed to automate, optimize, streamline and improve the supply chain.

Nominations Open: April 7, 2025

Honors female supply chain leaders and executives whose accomplishments, mentorship and examples set a foundation for women in all levels of a company’s supply chain network.

Nominations Open: August 4, 2025

Honors software and technology providers that ensure a safe, efficient and reliable global cold food and beverage supply chain.

Nominations Open: September 15, 2025

Spotlights top software and technology startups in the supply chain and logistics space.

CONTENT SESSIONS

Tuesday, Nov. 12, 2024 | 4:00 PM - 5:00 PM

Opening speaker, Jennifer Kobus, will delve into the importance of culture, advocacy, and the crucial themes of diversity, equity, and inclusion. Prepare to be inspired as we explore these pivotal topics and learn more about Jennifer’s journey.

Wednesday, Nov. 13, 2024 | 9:30 AM - 10:30 AM

Olivia Hu will talk about how the latest technology is going to shape the future of supply chains, increasing efficiency and improving safety for the logistics space.

Wednesday, Nov. 13, 2024 | 1:30 PM - 2:30 PM

Sandhya Pillay will talk about self-advocacy, how to balance being yourself while staying true to culture, what it takes to shatter your own glass ceiling and lessons learned along the way.

FIRESIDE CHATS

Navigating Traditionally Male-Dominated Industries

Wednesday, Nov. 13, 2024

9:00 AM - 9:30 AM

Join us for an insightful fireside chat as we explore the journey of women working professionals in traditionally male-dominated industries such as supply chain and technology. This discussion will highlight the challenges and unique perspectives of female leaders who have promoted collaboration and driven innovation within their fields. Our speakers will share their personal stories, strategies for success, and visions for the future, offering grounded and practical insights for today’s and tomorrow’s female leaders.

Sponsored by:

SPEAKERS:

This year’s theme, “Shattering Glass Ceilings: A Woman’s Impact on Supply Chain,” will bring together leading experts in the industry to discuss mentorship, self-advocacy, collaboration, closing the gender gap and what it takes to move the needle and pave the way for future female leaders in logistics.

Emerging Technologies with Inbound/Outbound Logistics

Wednesday, Nov. 13, 2024

1:00 PM - 1:30 PM

Connected hardware and software solutions are evolving in materials handling to include all aspects of logistics, from digitizing the truck driver checkin process to optimizing loading dock assignments and improving operational efficiency. Join this Q&A session to hear from supply chain professional, Sara Silver, and learn about her experience of incorporating technology into a distribution center’s logistics and streamlining the operations.

Sponsored by:

SPEAKERS:

DATE: NOVEMBER 12 - 13, 2024

LOCATION: RITZ CARLTON - DOWNTOWN ATLANTA, GA

Women in Supply Chain Forum is the industry’s premier networking and educational forum tailored to men and women in executive-level positions to expand their professional network and enhance their businesses through thought-provoking discussion panels.

JENNIFER KOBUS Vice President of Transportation & Logistics at Ulta Beauty

SANDHYA PILLAY Customer Vice President for Coca-Cola Company

OLIVIA HU Head of Autonomous Trucking at Uber Freight

MELISSA O’KEEFE Director of Product Management at myQ Enterprise

SARA SILVER Vice President of Operations of Cheney Brothers, Inc

DAISY JIANG

SULTANA NIAMI

A 3PL’S GUIDE TO THE GROWTH OF TRANSPORTATION MANAGEMENT SYSTEMS

Transportation management systems (TMS) have become indispensable tools in a 3PLs toolbox. Today, third-party logistics (3PL) providers are under pressure to deliver more efficient, transparent and cost-effective transportation solutions, and a robust TMS can address these challenges. By exploring the advanced capabilities that optimize transportation operations, we can dissect the use cases driving TMS adoption and find out how 3PLs can successfully integrate them into their practices.

TMS: Efficiency and effectiveness

TMS platforms are designed to help businesses plan and optimize the movement of goods. For 3PLs, a TMS provides a range of capabilities that enable more efficient and scalable logistics management including route optimization and planning, freight management and carrier selection, real-time tracking, billing automation, data reporting, multi-modal transport management and more.

Sean Gill, VP, business solutions at Arrive Logistics, says implementing a TMS can greatly improve 3PL efficiency and effectiveness by streamlining essential tasks and operations like pricing, load building, capacity matching, tracking and billing.

For example, a TMS optimizes shipments by matching loads with the most efficient transportation modes, ensuring cost-effective freight movement while meeting service requirements.

A modern, successful TMS will provide efficiency, transparency and actionable insights for every aspect of a 3PL broker, explains Dustin Verdin, executive director of business at Zipline Logistics.

“Online loadboards and tender offer/ negotiations communications help a 3PL find the best carrier(s) for the best price and the best on-time delivery outcomes. Integrated freight tracking allows oversight into all active loads and provides alerts for loads that may have issues or are at risk. External-facing dashboards and KPIs allow customers complete visibility to their entire freight spend and provide actionable data

to both improve performance and lower costs. Internal dashboards, KPIs, and widgets provide clarity, efficiency, and priority to operational actions and managerial decisions,” says Verdin.

And from a TMS provider’s view, Kevvon Burdette, chief commercial officer at Princeton TMX, says both shippers and 3PL providers can harness the benefits from a TMS when integrated properly, resulting in process improvements like:

• Enhanced process efficiency. Eliminate manual tasks by automating your end-to-end transportation processes—from creating RFQs, tendering loads, carrier payment, reporting, and more. Improved efficiency is especially important in a tight labor market.

• Cost savings. Reduce transportation costs using a highly configurable system that ranks carriers by cost, service rating, and other business rules.

• Improved visibility. Real-time visibility into inbound and outbound shipments and on-demand access to critical re-

Technology connection web in transportation across the globe.

porting data enables shippers to identify new optimization opportunities and quickly respond to disruptions.

• Better customer service. Access to real-time load data enables shippers to give more timely, detailed delivery information to customers.

Cost consciousness and visibility

When it comes to TMS, in the quest for cost reduction in transportation, it’s not a matter of does it save money; it’s a matter of how does it do so.

“Route consolidation can streamline several smaller LTL loads into a single order, taking advantage of the cost-savings and greater reliability of FTL. Along with facilitating order consolidation, a modern TMS can provide both the 3PL and its customers with cost savings reports and uncover possible consolidation opportunities,” says Verdin. “A successful TMS can provide visibility into the granular details of freight spend. For example, a KPI such as cost per load per day of week shipped can uncover a large cost savings by simply shifting your standard ship date by one day or so.”

According to a Gartner survey, TMS users typically see 5-15% yearly savings. As a practical example, recently a global industrial manufacturer using Princeton TMX’s multi-modal TMS reduced freight rates by 28% in just one year. The company was also able to leverage the Princeton TMX mobile app to track driver checkins more efficiently and reduce overdue payments by 98%.

“Those who rely on manual processes—either partially or entirely—are missing out on the opportunity to utilize the large volumes of operational data available to them to improve efficiency and realize cost savings. A TMS allows shippers to view their entire network in real time, enabling them to quickly identify and address any potential problems while gathering critical data on shipments, carriers, routes and more. All that data can then be put to work to support better operational planning and ongoing efficiency,” explains Burdette.

A TMS should strengthen core activities by matching shippers’ volume

and service needs with carriers who can support them, optimizing pricing and enhancing visibility through reliable tracking. This approach, says Alex Schwarm, VP, data and data science at Arrive Logistics, supports strong service levels (e.g., ontime delivery and pickup) while minimizing costs through consistent performance, around-the-clock support and reducing cost per mile—even supporting customer environmental, social, governance (ESG) goals by reducing environmental impact (lowering annual CO2 emissions).

Integration with other tools

An advanced TMS can integrate with other systems, and that’s a key feature for 3PL consideration. As Verdin explains, this interoperability with other WMS/ ERP systems is a hallmark of successful TMS systems. Integration can take many forms, including EDI, API, data import/ export, and custom implementations and this allows a 3PL, its customers and its carriers to stay informed of and proactively act upon any potential changes that may affect the supply chain.

“Direct communication with WMS/ ERP systems can help ensure freight is ready for pickup at the expected time and ensure a dock and/or appointment is available for the carrier to deliver on time. Integration with accounting and management allows for real-time decision making within the overall supply chain, providing actionable data to improve efficiency and lower costs,” says Verdin.

Integrations result in end-to-end visi-

bility that’s highly sought after in supply chains now. When a TMS can communicate with a WMS to receive real-time data about orders and inventory, that information can be used for load optimization and scheduling.

Ultimately, Burdette says using disparate systems often leads to inefficiencies and increased costs, while creating isolated data environments, making it difficult to get a comprehensive, real-time view of logistics operations. This leads to poor decision-making and the domino effect of a faltering logistics network facing disruption at the drop of a hat, whose greatest tool is often the visibility produces by data and analytics to forecast and plan.

The coveted role of data

The power of data in decision-making is a known fact. As analytics evolves, so does the ability for advancements in TMS capabilities. Schwarm says advanced algorithms and machine learning models provide fast and accurate cost prediction and competitive pricing that enable reps to better support shipper and carrier needs; for APIs and automated load offers, these systems can also support rapid responses for urgent and planned shipments while delivering on service.

“Successful 3PLs constantly make business decisions at all levels, based on data-driven insights. Management will look to high-level financial and operational data for the overall health of the company. Carrier teams are looking at current and historic freight rates, current weather and traffic data, carrier performance

An employee coordinates a shipment.

metrics, and real-time tracking data to make sure the right carrier is found for every load,” says Verdin. “Customer teams are utilizing network analysis and consolidation tools to find opportunities for customers to optimize their freight spend. Deep analysis of both historical and forecasted customer freight data— especially within the CPG industry—is used to improve OTIF performance and greatly reduce associated penalties.”

As with all good processes, evolution can bring about an increase in quality. Burdette explains this simply: Better transportation starts with better data.

A stronger future

Supply chain leaders predict that the technology behind these features is going to continue to grow in the next

5-10 years, but what does that mean for 3PLs implementing it now? For Gill, TMS capabilities are likely to expand beyond traditional functions and become more deeply integrated with a broader range of business solutions—some we’re already seeing today.

“The biggest evolution of TMS systems (and the logistics industry in general) may come in the form of industry-standardized, API-driven appointment scheduling, with a healthy dose of AI and Large Language Models to automate much of the process. The lack of standard systems and processes for appointment scheduling cause inefficiencies when facilitating new orders, but even more so when trying to recover loads which may have gone awry. Better yet, future systems will be

able to detect loads at risk and make appointment adjustments on the fly to completely avoid the operational and financial consequences of late deliveries,” says Verdin.

Terms like AI and visibility are no longer a hypothetical. In logistics, where speed is a necessity, these tools are full speed ahead and TMS providers are working to invest in developing improvements, which Burdette says include moving toward greater functionality and all-in-one solutions.

TMS capabilities are no secret to 3PL providers. By leveraging the ongoing advancements of the software, 3PLs can navigate the complexities of modern supply chains more effectively no matter how fast and complex the landscape becomes.

TOP 7 FEATURES FOR A TMS INCLUDE:

1. Automating carrier selection by evaluating factors such as cost, service levels and capacity.

2. Identifying the most efficient routes for shipments, considering factors such as delivery windows, fuel costs, traffic patterns and vehicle capacity.

3. Providing end-to-end visibility of shipments, enabling real-time tracking and monitoring.

4. Automating billing and settlement processes to reduce manual errors, accelerate the payment cycle, and ensure that all charges are accurately captured and invoiced, improving cash flow management.

5. Offering powerful analytics tools that analyze key performance indicators (KPIs), such as delivery times, fuel consumption and carrier performance.

6. Capabilities of managing multiple modes of transportation (road, rail, air and sea) under one umbrella.

7. Integrating with warehouse management systems (WMS), enterprise resource planning (ERP) systems and customer relationship management (CRM) platforms.

Abstract image of data and analytics collection.

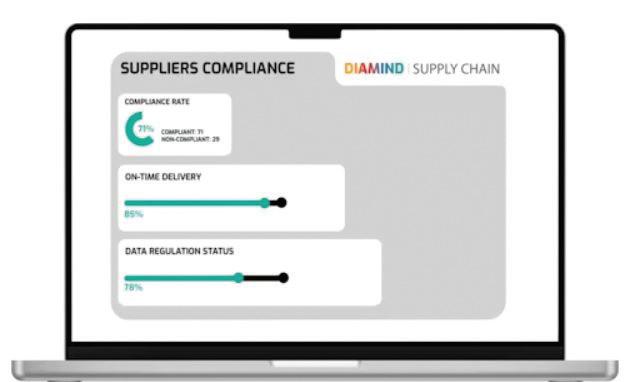

Your “YES” WMS

Footprint WMS will give you confidence to say “YES” to more customer requests, giving your business the ability to grow faster.

Built on a low-code platform, Footprint WMS is crafted uniquely for 3PL, cold storage, and pharmaceutical warehouses. It brings simplicity to complex processes, enabling you to easily handle intricate requests and workflows, ensuring reliable profitability and efficiency for your operations.

Just say “YES” to

• More configurability including an intuitive, role-driven interface.

• Streamline temperature control to avoid spoilage or contamination.

• Easier tracking and reporting to meet strict food safety standards.

• Improved space optimization without compromising product quality.

Take a look at the warehouse management software that will have you saying “YES” –today, tomorrow, and in the future.

HOW AUTOMATION IS RESHAPING

GLOBAL WAREHOUSE SOFTWARE MARKET

Warehouses are extremely complex environments, requiring a plethora of different hardware and software solutions to orchestrate various workflows and activities. Historically, almost all warehouses used paper-based methods of assigning orders and tracking inventory. However, the end of the 20th century saw the introduction of warehouse management systems (WMS), a computational approach to tracking inventory and managing orders.

More recently, we’ve seen the introduction of hardware solutions like automation and robotics, which have further streamlined warehouse operations. These hardware solutions require additional software, on top of the WMS, to coordinate the movements of the mechatronics and robotics.

Sub-ordinate control software is used to control fine movements of the hardware, while warehouse control systems (WCS) and fleet management systems (FMS) provide the movement logic that enables pallets, cases, totes, and other handling units to get from Point A to Point B through an automated system. Execution software, on the other hand, is used to orchestrate order release and task allocation to optimize a given output (e.g. maximize throughput or minimize cost).

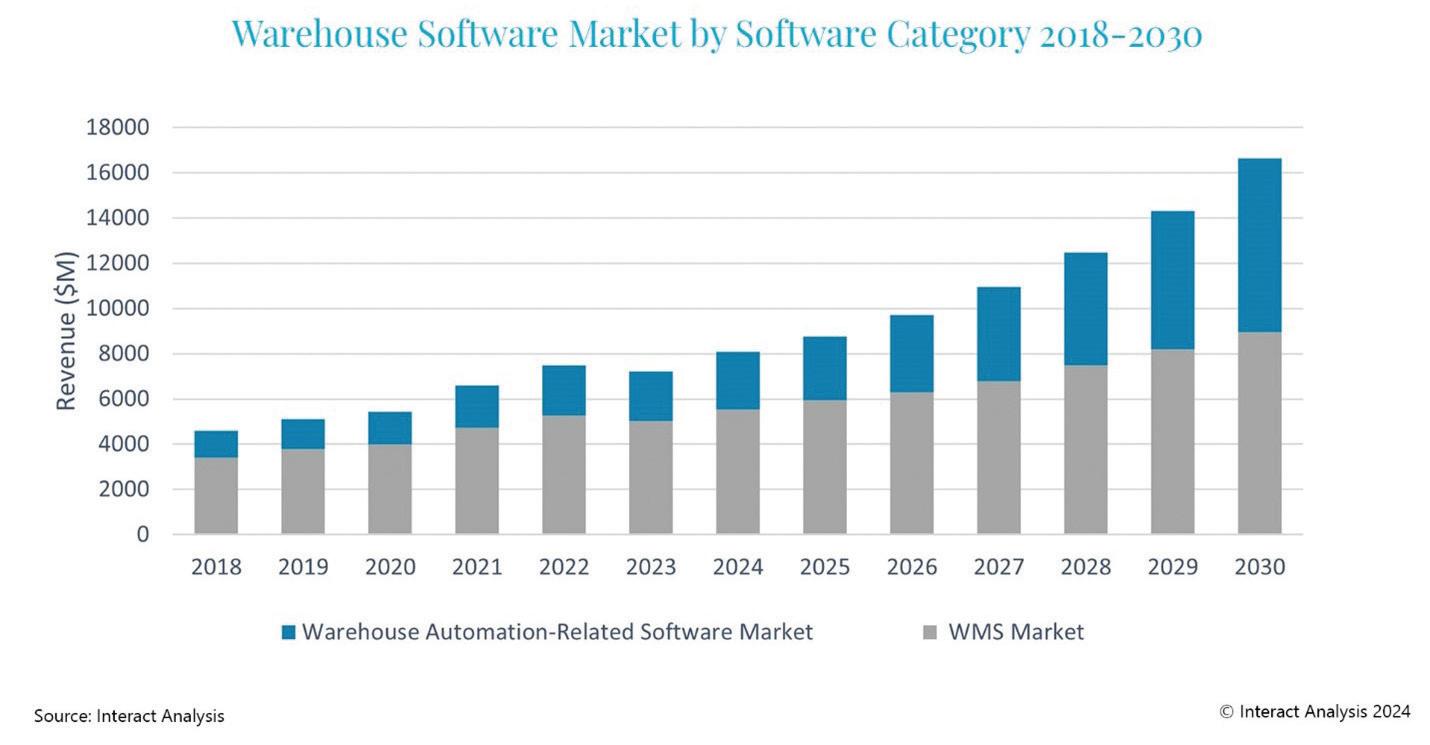

Given the relative maturity of the WMS market, a recent study released by Interact Analysis shows revenue generated from automation-related software solutions growing at a faster rate than warehouse management software. Furthermore, the growth of automation is leading to the blurring of traditional industry boundaries, which is going to lead to significant disruption in the industry over the coming years.

Strong growth in warehouse software, particularly for automation-related software solutions

The market for warehouse software reached $7.2 billion in 2023 and is forecast to increase to $16.6 billion by 2030, growing at a CAGR of 13%. As the complexity of warehouses continues to increase and the need to fine-tune logistical processes grows, expect significant growth in the deployment of

warehouse software solutions.

Breaking the market up into WMS and automation-related software solutions, the market size for WMS-related solutions reached $5 billion in 2023 and is expected to reach $8.9 billion by 2030, growing at a CAGR of 8.6%. Automation-related software solutions, on the other hand, reached $2.2 billion in 2023, with the market anticipated to expand to $7.7 billion by 2030, growing at a much higher rate of 19.5%.

Warehouse software types

The reason for the differential in growth between WMS-related and automation-related software solutions is that most warehouses have a WMS and growth potential is therefore largely limited to renewals and greenfield warehouse developments. On the other hand, the penetration of automation within warehouses is much lower, resulting in a greater opportunity to automate existing brownfield sites.

The blurring of industry boundaries

The development of warehouse automation is also blurring the lines between what were previously well-defined product categories. Traditionally, WMS was typically provided by enterprise resource planning (ERP) or supply chain vendors. However, with the development of warehouse automation, some warehouse automation solution providers have begun offering WMS.

Similarly, traditional WMS providers are getting more involved in the orchestration of automation through the development of execution layers embedded into their WMS plat-

forms. Some software providers are going as far as providing a WCS, where the WMS is then able to connect directly to the PLCs.

In other words, automation vendors are looking to move up the value chain by providing more execution and management products, while traditional software providers are looking to move down into the orchestration space through the development of execution layers embedded into their WMS solutions.

Final thoughts

With the growth of the automation market, expect traditional software providers to capture a slice of the pie. However, different software providers are developing different strategies to capitalize on the growth of automation.

Some software providers are relying on third-party interoperability layers to help connect and integrate with automation. Others are developing an in-house library of APIs that are used to connect directly to robotic solutions. Given the changes the industry is facing, it’s more important than ever to stay ahead of the curve and develop a successful automation strategy.

IRENE ZHANG senior analyst, Interact Analysis.

TRANSFORMING WAREHOUSE SUSTAINABILITY WITH GREEN STEEL

The planet is more vulnerable than ever, according to the World Health Organization (WHO). Climate change is directly contributing to devastating disasters like wildfires, floods, heatwaves, and hurricanes and are only increasing in scale, frequency, and intensity. Research shows that 3.6 billion people are already living in areas highly susceptible to climate change. Global leaders are calling for help to reduce electricity use, reuse items, and protect the environment. This mission has put stress on companies to assess their products, practices, and infrastructures, identify areas for sustainability improvements and implement actions to reduce environmental impacts. Leading companies are already turning to solutions like automation to help improve greenhouse gas emissions through better transport options and reduced food and energy waste.

In fact, automated warehouses offer a number of advantages to improve sustainability. They optimize energy consumption for more efficient processes and enable precise inventory management to prevent overproduction. In addition, automated systems often require less space, which minimizes the need for additional warehouse space and enables more sustainable use of existing facilities. While implementing automation within warehouses is making an impact on improving sustainability, many companies are unaware that the materials used within their infrastructures can actually be setting them back from reaching their sustainability goals.

Steel vs. green steel

A common material used in today’s warehouses is steel. However, traditional steel production involves the use of coal, which is burned to create the high temperatures needed for smelting iron. This process results in significant emissions of greenhouse gasses, including carbon dioxide and methane, and pollutants like sulfur dioxide and nitrogen oxides. The production of steel accounts for about 7% of global greenhouse gas emissions. Additionally, traditional steel production contributes to a significant amount of waste. The process of refining and purifying the iron for steel creates a large amount of slag and

other waste products, which can contaminate nearby soil and water sources.

As the second most commonly used building material next to concrete, steel is a highly sought after material. But, because steelmaking involves processes that release carbon dioxide into the environment, many are exploring sustainable methods like green steel—an innovative manufacturing process that uses hydrogen or electric arc furnaces (EAF) instead of fossil fuels to create.

Currently, North America is dominating the green steel market with a market share of over 60%.

A climate-neutral, or low CO2 emitting material, green steel can significantly help companies around the world reduce environmental impacts. Whether building a new warehouse or integrating into an existing infrastructure, green steel has many benefits, including:

1. Reduced energy and emissions

Green steel production methods, like hydrogen, cut CO2 emissions compared to traditional steelmaking processes. By incorporating green steel into construction, warehouses can lower the overall carbon footprint of their buildings from the ground up, contributing to more sustainable infrastructure. Further, structures built with green steel often feature better energy performance due to advanced manufacturing techniques.

In addition, green steel is produced using renewable energy sources and minimizes waste during the production process. This approach not only lowers overall emissions but also supports a more sustainable and resource-efficient manufacturing cycle. By harnessing renewable energy, like hydrogen, green steel production decreases the reliance on fossil fuels, while improving production techniques and technologies

2. Cost savings

Investing in green steel within a warehousing infrastructure can offer long-term financial benefits, like lower energy costs and potential government incentives for using sustainable materials. Green steel is often more durable and

resilient, leading to longer-lasting structures. This reduces the need for frequent repairs or replacements, which in turn minimizes the environmental impact over the building’s life cycle. As the construction industry moves toward greater sustainability, using green steel can position companies as leaders in innovation, making them more resilient to future changes in industry standards and market demands.

3. Compliance

As regulations and industry standards increasingly focus on sustainability, using green steel is helping companies comply with environmental laws and certifications, potentially avoiding penalties and enhancing their market position. The companies that adopt green steel demonstrate a commitment to environmental responsibility and sustainability, which can appeal to eco-conscious customers, investors, and stakeholders.

By adopting green steel, warehouses and distributors can align with global sustainability goals, reduce operational costs, and future-proof their infrastructures. As the industry moves toward greater sustainability, embracing green steel can position companies at the forefront of innovation, driving positive change and contributing to a more sustainable future.

CMO and VP, Stoecklin Logistics.

ALLEVIATING TRUCK CONGESTION AND BOOSTING EFFICIENCY FOR PERISHABLES

In the intricate world of logistics, where the clock never stops ticking, efficiency is the cornerstone of success, especially in the time-sensitive perishables market

Importance of infrastructure in perishable logistics

The perishable goods industry relies heavily on a seamless, delay-free supply chain. Any interruption or hiccup in delivering or recovering cargo from an airport will add to the overall time in transit; time is the enemy, directly reducing the shelf life of perishables. This is where infrastructure plays a critical role. Adequate infrastructure at airports, seaports, and the roads and highways that connect them are essential to facilitate the flow of perishable cargo, minimize delays, and ensure that perishable items arrive as fresh as the farmer, fisherman, or grower intended.

Advocacy for improved infrastructure

The Airforwarders Association (AfA) is pivotal in advocating for infrastructure improvements that directly benefit shippers and the like. By lobbying for the FAA Reauthorization Act, the AfA aims to address truck congestion and enhance infrastructure at critical junctures such as air and seaports. These improvements are not merely logistical upgrades; they are essential for the seamless flow of perishable goods, which require stringent handling to maintain quality and safety.

Examples of advocacy include the AfA’s efforts to push for better infrastructure by lobbying for Government Accountability Office (GAO) studies to look at the disaster preparation plans and the root causes of delays at airports; all situations that can spell disaster for perishables. The AfA provided instrumental support for the GAO to initiate a study on the economic sustainability of air cargo operations. This advocacy work is a cornerstone for

shippers and the like who rely on efficient logistics to uphold their positions in the perishables market.

Enhancing efficiency through collaboration

The AfA’s role in facilitating collaboration among industry stakeholders is instrumental. By bringing together airforwarders, truckers, and port authorities, the AfA helps create a cohesive network that works toward standard efficiency and reliability goals. This collaboration is evident in the improvements seen in infrastructure and the reduction of truck congestion at key points, which directly benefit the perishable goods market.

With the AfA being based in the Washington, D.C., area, it also gives companies representation and a voice when it comes to speaking to legislators, committees and staff members and collaborating with other private sector stakeholders.

Impact of efficient logistics on the perishables market

Delays in the perishables market lead to considerable financial losses and affect consumer trust. Strategic infrastructure and technological investments can drive success in this sector. But they can only drive so far. Aging airports, crumbling roads, outdated technology, and ineffective disaster preparation takes a harsh toll on the ability of carriers to move cargo seamlessly.

Improving roads and civil engineering saves time and preserves the quality of perishable goods. Quality and freshness are essential in the current market, where consumers are often concerned about the freshness and quality of the food on their plates. For sellers, they want goods to arrive at the maximum freshness with little to no spoilage. Infrastructure improvements drive down the cost of doing business and

road wear for carriers. Better traffic and improved facilities process cargo faster and more securely, allowing for continued investment in groundbreaking refrigeration and icing technologies.

Unifying the approach to perishable logistics

The collaborative efforts between the AfA and other companies underscore the importance of infrastructure in the logistics industry, especially for perishable goods. By advocating for improvements under the FAA reauthorization and fostering industry-wide collaboration, the AfA plays a major role in enhancing efficiency and reducing truck congestion at air and seaports. These advancements are instrumental in ensuring that products reach consumers fresh and in optimal condition.

The continued partnership between logistics companies and advocacy groups like the AfA will be essential in managing the challenges of the perishable goods market, driving efficiency, and enhancing customer satisfaction.

BRANDON FRIED executive director, Airforwarders Association.

3 THEFT PREVENTION STRATEGIES TO CATCH A CARGO THIEF

Over the past several years, the overthe-road (OTR) transport industry has been inundated with a surge in cargo thefts. Industry research reveals that incidents reached epidemic proportions in 2023 when thieves employed more sophisticated robbery schemes in addition to traditional methods. In the face of this escalating threat, stakeholders need to implement tools and technologies to help them protect shipments throughout the supply chain.