11 minute read

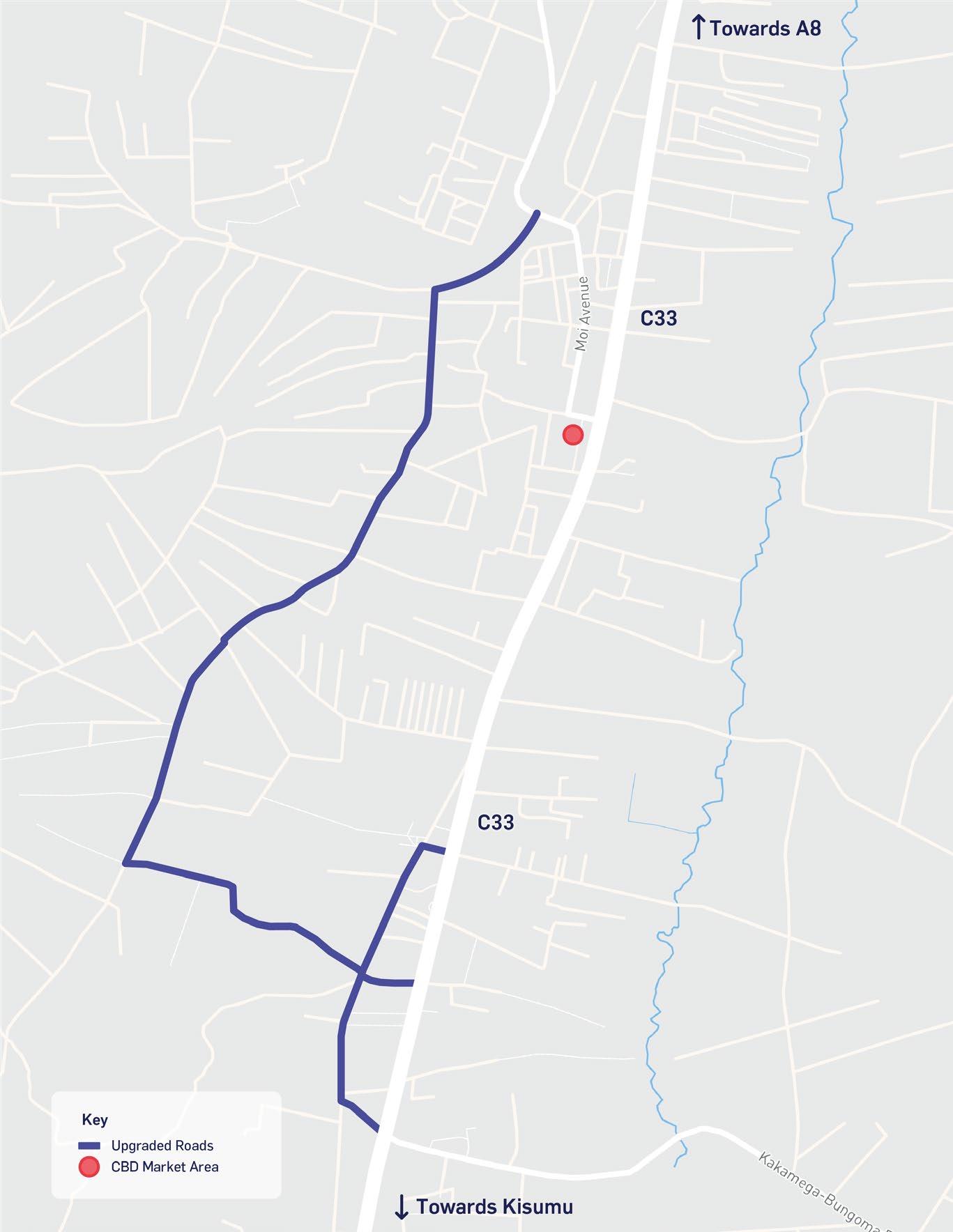

Figure 4-4 – Bungoma County existing and proposed collection centres

The above localised aggregation centres would feed into a larger aggregation centre in Webuye industrial site for value addition. Webuye is well connected to all of the named local collection centres along Bungoma’s key feeder roads. All of these key locations and the related transport links can be seen in Figure 4-4.

Figure 4-4 - Bungoma County existing and proposed collection centres

Source: Atkins, 2022

As well as aggregation, there is potential to utilise these collection centres as points for dispersing inputs and support for farmers. Smallholder farmers selling to the collection network could be supported, for example, through the provision of produce-handling material such as appropriate bags and crates, farming advice, market information and timely payments of supplied goods. At the collection centre, post-harvest storage solutions are needed, such as warehouses with cold storage facilities, solar-powered cold storage units, on-site water harvesting, and on-site waste management will also be required. The provision of receiving, sorting, grading, storing and dispatching facilities will support the undertaking of some form of pre-processing. Since many agricultural products are perishable, transport to the processing plant and final markets will need to be adapted to provide refrigeration for products prone to damage.

These actions could be complemented with a digital communication strategy to reach smallholders, in particular SIGs, to access information about scheduled collection services, availability of storage facilities, and technology. This strategy could also be used to communicate market opportunities, short-term and seasonal weather forecasts, and training opportunities, with communication in formats and languages accessible to all. A8 - Support the production of animal feed in Bungoma

One input that is in high demand in Bungoma is animal feed, where farmers are forced to buy this from Uganda. This drives up costs to the farmers where feed is expensive. There is potential for producing feed in Bungoma, however, farmers are reluctant to invest in crops where there isn’t a clear demand. To support the production of feed in Bungoma there will need to be an initial demand for the inputs. In the short-term, small-scale production could take place at the existing Bungoma cotton ginnery which would create a market for the farmers and confidence to grow sunflower, sim sim, yellow maize and other inputs required.

In the longer term when there is an established supply, there would be potential to explore infrastructure for a fodder/feed mill to increase the production. A9 - Create a PPP friendly environment

There is a small existing private sector in Bungoma. The private sector is motivated primarily by profit and therefore tends to operate supply chains and value addition activities more efficiently. It is incentivised to support supply chains through timely payments to farmers, supplying inputs, funding, and organising transportation and aggregation. There are a number of newly built facilities available for PPP in Bungoma, however, the current process for private investors to take over these facilities is arduous and off-putting; recognition of these limitations is an important step to creating a PPP friendly environment in the County. Bungoma County government have the opportunity to streamline these processes and create a transparent plan for offering PPP ventures. It needs to clearly identify the purpose of the facilities available for PPP, and undertake official audits of the assets the county owns, and their value. The County government also needs a clear plan for how it will assess proposals from private organisations who wish to operate on the site. The County government needs to make sure that the project is ‘shovel ready’, and all the government stakeholders are ready to mobilise. One way to ensure this would be a stakeholder group or steering group that can work with the private sector for every PPP they present. When implementing this action, it would be important to facilitate and encourage the participation of SIGs-owned businesses and ensure there is no discrimination against their participation in any way.

A10 - Improved access to finance for farmers

Private businesses in Bungoma don't have the capital to support their suppliers, instead they need funds from donors or banks so that they share the risk of investing in their supply chains.

Bungoma Chamber of Commerce is currently working to take off the Bungoma microfinance management institution, with the aim of ensuring funding makes it to the right investors, through monitoring the spending as it happens and bringing the expertise of money management and financial management. The Chamber of Commerce also identified the need for a supporting body, “a micro finance institution,” as part of this so that farmers will have the right education and financial literacy to put together a business plan and a bid for the funding available to them. Kenya’s Agricultural Transformation and Growth Strategy also suggests a vehicle to support access to finance through accelerators and financiers – this guidance could be used to support the development of this supporting body.

Village Savings and Lending Associations (VSLAs) are another method to improve access to finance for farmers. This is particularly important for marginalised groups such as women, youth and PWDs, who can benefit from improved access to market information and finance. A VSLA, often referred to as ‘chamas’, is a group of individuals (between 20 and 30) who come together with the aim of making savings and taking small loans from those savings. After a certain period, the accumulated savings and the loan profits are distributed back to members. This provides opportunities for farmers who would otherwise have no access to conventional banking services that require collateral for credit accessibility. Several NGOs across Kenya have recognised the value of VSLAs in providing poor communities with a secure place to save, as well as the opportunity to borrow on flexible terms and access affordable basic insurance. As such, several organisations are now supporting VSLAs by equipping members with the skills required to operate their groups effectively (see case study), with the potential for the once-established cooperatives highlighted above to collaborate with such groups in future.

To improve social inclusion within the sector, it will be critical for cooperatives to promote collaboration among SIGs and provide information on available funds, such as the Uwezo Fund, the Women Enterprise Fund and the Youth Enterprise Development Fund30. Based on the GeSI findings, it is also recommended to incorporate funding options that require alternative forms of collateral. Specialised FBOs are well-placed to strengthen their role in climate action and as a result gain better access to climate finance which will increase the options available to communities to adapt to climate change. Farmers in Bungoma are already experiencing the impacts of climate change as increasing temperatures and unreliable rainfall affect food production and supply. Climate finance provides opportunities to enhance farmers' resilience to climate change through increased capacity for adaptation activities, for example, by providing funds for investment in ‘climate smart’ agricultural projects.

There is a growing landscape of climate finance investment and tools which can be utilised as a source of funding for the projects in this report. Consideration will need to be given to the eligibility criteria of each source and it may be necessary to blend sources to meet the projects' expenditure requirements. Potential funding sources include The ACUMEN Resilient Agriculture Fund (ARAF), the Special Climate Change Fund (SCCF) and the Kenya County Climate Change Fund (CCCF) Mechanism.

30 Chamasoft, Table Banking: The Concept of Table Banking (2015) Available at: https://blog. chamasoft.com/table-banking-the-concept-of-table-banking/ (Accessed: 28/10/2021).

4.2.2 Priority VC 1 – Poultry Farming

This VC is aimed at developing a fully integrated poultry industry in Bungoma, building on the existing farmers, distribution and collection networks, and processors, and filling in the gaps and improving overall efficiency.

The key outcomes of this VC include:

> Reducing the overall cost base for the sector - improving competitivity; > Improving the quality and size of the County flock; > Supporting the switch to better breeds (e.g. the KALRO improved Kienyeji); > Improving the incomes for poultry keepers; > Providing a base for promoting local production and distribution of feeds; > Improving supplies to Chwele and other slaughterhouses; > Building on the strong poultry sector and value chain being promoted by the County government; and > Creating direct employment for around 60 full-time employees, with high potential for employing special interest groups (SIGs) and people with disabilities (PWDs).

Key to supporting these outcomes, will be the soft interventions around capacity building, supporting key organisations and aggregation. 4.2.2.1 Base Assessment

Demand for poultry meat and eggs is growing in Kenya, and Bungoma is well-placed to capitalise on this growth. Poultry farming is undertaken across the County, and the poultry industry in Bungoma has all the elements of a successful industry:

> Large flock size: there are reportedly around 2.5 million chickens in the County, mostly indigenous varieties31 (though discussions with key stakeholders indicate that the actual number may be significantly lower than this); > Significant egg production: the County produces around 2 million trays of eggs per year (4% of the Kenyan total)32; > Modest but growing meat production: the County produces around 0.4 million tonnes of poultry meat per year (less than 1% of Kenyan production) with this volume set to expand as a result of the abattoir; > Following some delays the Chwele abattoir is now operational, managed by Shiffa Chicks, with a capacity of up to 10,000 chickens per day (20,000 per day with a double shift); > Established hatcheries: several are located in the County including KenChick, Bungoma

Hatcheries, Shiffa Chick and Mama Mikes; > Increasing numbers of small-scale poultry farmers in the County supplying traders and the abattoir; and > Established commercial farms: several medium-scale operators including Shiffa, Ratigan and Melpa Poultry

Farm with a flock of 45,000 birds, all providing a solid core for the sector, as both a source of information and strong demand base for feed production and/or bulk purchases. Case Study

Shiffa Chicks

Shiffa Chicks is the main business involved in value addition of poultry in Bungoma, currently operating from a site in central Bungoma. At this site are basic provisions of offices, a hatchery, incubators, and a feed store. Shiffa Chicks is also operating the abattoir at Chwele under a leasing agreement. From its site in Bungoma CBD Shiffa is working with larger, established poultry farmers to provide them with guidance, appropriate feeds, and chicks to rear. Farmers then transport their chicken to the slaughterhouse where there are resting pens to de-stress the chickens before they are processed. Shiffa has a number of butcheries across the County where it sells to local customers, as well as refrigerated vans to transport their dressed poultry produce to Nairobi, Kisumu, Eldoret, Naivasha and other key economic centres. Shiffa has plans for rolling out its business model to small farmers as well as establishing a feed mill, but these initiatives are at an early stage and would benefit from the support provided by this VC.

31 FAO, Africa Sustainable Livestock 2050 (2019). Available at: http://www. fao.org/3/ca5369en/CA5369EN.pdf, (Accessed: 18/02/2022). 32 Ministry of Agriculture, Livestock and Fisheries, agricultural datasets (2022),

Available at: http://kilimodata.developlocal.org, (Accessed: 18/02/2022).

Despite this strong base, the poultry sector in Bungoma faces a number of issues:

> High (delivered) feed costs due to a combination of limited local processing and growing of feed crops, and poor road networks and lack of regular collection/delivery services; > High cost of sending old layers and mature cocks to market due to poor roads and services; > Substantial dependence on unimproved varieties, limiting eggs and meat productivity; and. > High (delivered) cost of day-old chicks of improved strains (e.g. KALRO improved Kienyeji).

The combined impact of these issues is that the sector in Bungoma has difficulties competing on price (especially in the face of cheap imports from Uganda) and the Chwele slaughterhouse is having problems sustaining the supply of chickens.

To combat these challenges and to support the Bungoma poultry sector in achieving its potential, this VC would focus on improving linkages across the sector by providing logistics services, supplies and financial support and advice (proposed soft interventions are presented in 0). This approach is in line with the model being developed by Shiffa Chicks to support out growers and increase supplies of birds to the Chwele slaughterhouse, and there may be potential for this VC integrating with the Shiffa system. The key components of this VC would then include:

Logistics: scheduled delivery and collection services for:

> Supplies of day-old chicks to out growers; > Collection of poultry for slaughter or market; > Collection of eggs for aggregation and dispatch market; and > Supply of feeds and other inputs to farmers.

Hatchery: an additional hatchery would be established to accelerate the move to improved breeds.

Feed: promote the development of a local feed mill focussed on the demands of the poultry sector together with local production of key feed crops (soya, sunflower, etc.)

Finance: support to out growers and egg producers, (supporting investment in improved stock, better husbandry techniques and additional capacity), either through micro-credit or production share arrangements, and/or insurance.

Advice: poultry-focused extension service for existing and new farmers aimed at improving husbandry and business management skills. Development of the poultry value chain is supported by:

> Bungoma CIDP: promotes the development of the poultry sector to increase employment, raise farm incomes and improve food security; > Big Four Agenda: prioritises food security and nutrition as well as the manufacturing sector which includes poultry meat processing; > KALRO: promotes improvements in knowledge, information and technology in the poultry sector aimed at raising productivity and value added; and > Strategic Plan for Livestock: the Ministry of Agriculture,

Livestock and Fisheries five-year plan supports development of the poultry value chain for both eggs and meat, and improvements in production volumes and quality.