The Australian International Movie Convention Powered By Vista Group (AIMC) is incredibly proud and appreciative to return to the Gold Coast for our 77th AIMC.

Delegates have universally favoured the Gold Coast venue in all surveys, and the Gold Coast in October is the perfect venue to celebrate the industry’s prior year successes and showcase what will be releasing during the important December/January holidays and into the coming year.

In 2024, the AIMC program is exceptional, capitalising on feedback from 2023 and exceptional distributor and industry support. Leveraging the success of the Australian Feature Film Forums led by Sue Maslin, in 2024 the AIMC will host our first Screen Australia Filmmaker Masterclass, bringing some of Australia’s leading directors, producers and publicists to the Gold Coast.

Thanks to the generous support of Screen Australia, Screen Queensland and the Gold Coast Film Commission, Australian filmmakers will have the opportunity to engage with some of the countries most experienced and talented practitioners, along with presentations from leading Australian exhibitors and distributors, all with the collaborative industry goal of bringing more Australian stories to Australian cinemas.

Historically Australian local box office has annualised at about 4.6 per cent of total box office, reaching heights of 7.2 per cent ($88.1 million) in 2015. Our industry needs to align behind the collective goal of driving Australian local box office consistently to $100 million or at least 10 per cent of total box office annually, and the Cinema Association Australasia is committed to bringing the industry together to collaborate and learn from local and international best practice.

The Federal Government is providing appealing production incentives, and the industry has everything required to meet that 10 per cent target.

The Cinema Association Australasia will continue to engage with all stakeholders to support the objective of celebrating more Australian stories in the most enjoyable environment possible - in an Australian cinema.

The program for the 2024 AIMC will additionally feature:

• A Cinema Australia luncheon showcasing four yet to be released Australian films, supported by Q&As with filmmakers and cast.

• Presentations from Screen Australia, Screen Queensland and the Gold Coast Film Commission.

• Content presentations from sixteen of the region’s leading distributors.

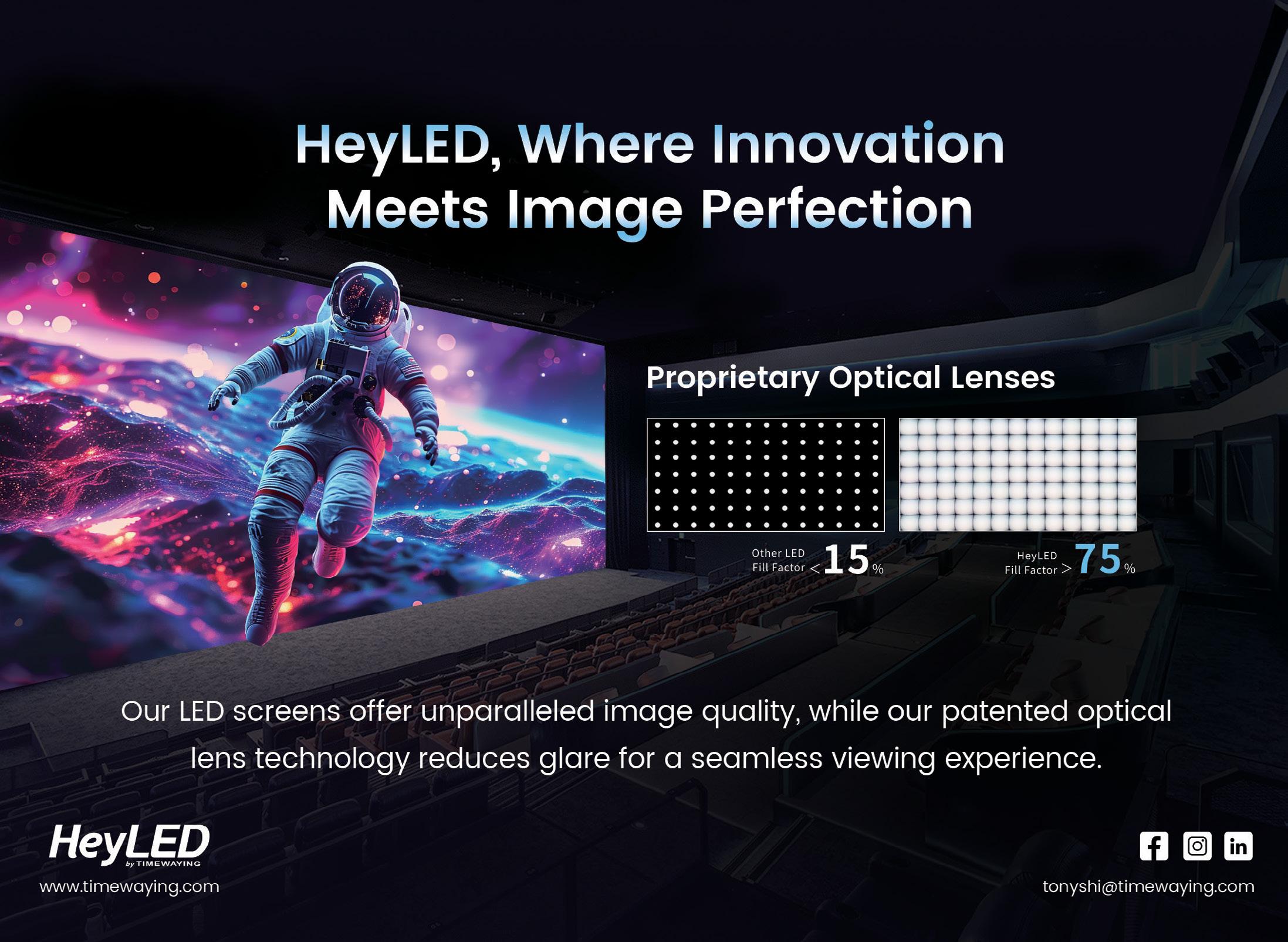

• Keynote presentations from global industry leaders including Vista Group, Asahi Lifestyle Beverages, IMAX, Christie, CJ 4DPLEX and Dolby.

• Four yet to be released feature films, including Q&As with leading filmmakers.

• Several networking opportunities (aka industry parties) that the AIMC has become renowned for.

The Australian International Movie Convention (AIMC) Powered by Vista Group is the only cinematic event in the southern hemisphere to provide opportunities to network with local and international executives from cinema exhibition, distribution, the filmmaking community, and technology and cinema equipment suppliers.

We are incredibly appreciative of our major sponsors for their support in uniting the Australasian industry on the Gold Coast this October.

Cameron Mitchell Cinema Association Australasia

– Executive Director

The Gold Coast’s star continues to shine with our city’s screen industry a ‘box office success’.

Latest figures show the industry is generating 4500 jobs across the coast and injecting more than $500 million into the economy.

Hold on for the next chapter in our screenindustry-storybook with a massive state-ofthe-art facility planned in the north of our city. Global powerhouse Shadowbox Studios has been selected as the preferred proponent to develop this world-class screen hub with 10 sound stages, workshops, office spaces, a backlot and training facilities part of the masterplan.

As mayor, I welcome delegates to the Australian International Movie Convention here at The Star. You have arrived at an exciting time with all three tiers of government strongly backing the screen industry’s evolution.

Hosting this convention is a testament to our city’s dedication to the screen industry’s growth and success. Enjoy your time here and seize this opportunity to forge new partnerships, foster creativity and make screen magic happen on the Gold Coast.

Tom Tate Mayor

Cinemas are finding new ways to attract audiences, but quality content remains the key. Brendan Swift takes a closer look.

Cinema owners have had more than their fair share of challenges over the past few years.

But not even a pandemic, US industrial action, the rise of streaming platforms, and the collapse of release windows can derail the unique cinema experience that keeps audiences coming back.

When asked about how optimistic they were about the ongoing popularity of cinemagoing, Australian audiences rated the future 7.5 out of 10, according to a QUT audience survey on behalf of Palace Cinemas.

“We know that it does touch people really deeply,” says Palace Cinemas CEO Benjamin Zeccola. “It is a very special communal experience but there are all the challenges. You have so many more screens and ways to consume content: tighter windows, streaming.”

He says cinemas simply need more quality content. It has been hit by a lack of studio blockbusters after the 2023 US actor and writer strikes, as well as the rise of streaming platforms. The planned theatrical release of Wolfs, starring George

Clooney and Brad Pitt, in September was curtailed by Apple in favour of its own platform.

“It hurts us deeply that Wolf was removed from the release schedule,” he says.

“That’s something that we could have really done well with, and it’s going straight to streaming. There’s a theatrical model for so many films that that will do better when they stream as a result of having the word-of-mouth and the marketing push that comes with a theatrical release.”

However, the pipeline of blockbusters is finally starting to look healthier. Hoyts CEO Damian Keogh says the industry needs more consistent solid releases after a patchy first half of 2024. The second half is expected to bring the annual total back up to around last year’s $1 billion mark.

“I don’t think we’re going to go back to – dare I say it – the good old days of 2015 to 2019 so therefore, we really focus at Hoyts on how do we influence and control the things that are in our control? And that is the experience in our cinemas.

“It’s increasingly the way we market, the way we develop our loyalty and reward schemes and talk to our customers - the kind of experiences we can give them in cinema that makes them want to come back and that have a memorable experience.”

It was the comprehensive rollout of recliner seats from 2015 to 2019, which required significant capital investment and reduced the total number of seats in each auditorium, that boosted audiences. Keogh says Hoyts market share lifted from around 19 per cent in 2016 to 29 per cent in 2024.

For example, Hoyts offers a range of options such as its extra-large Xtremescreen, immersive D-BOX motion recliner seats, and its LUX premium dine-in cinema experience.

Dendy/Icon CEO Sharon Strickland says audiences continue to demand premium experiences that involve more than a movie. Dendy Cinemas this year announced plans to open its first IMAX screen in Canberra.

“People are willing to pay for a richer, more immersive experience,” she says. “I truly believe the future is bright and

cinemas will continue to be a beloved and essential part of our communities.”

Event Cinemas’ “premiumisation” strategy has also flowed through directly into higher average spend per head (up 51.4 per cent on pre-Covid levels (2018-19) levels last financial year) and average admission price (up 26.6 per cent on pre-Covid levels).

“These are really good results considering the change of film mix with a greater proportion of box office from world, family and mid-tier films which generally deliver less spend per head,” EVT CEO Jane Hastings said at the group’s annual results.

Event Cinemas analysed Commonwealth Bank customer expenditure data at the time Barbie and Oppenheimer were ruling the box office in mid-2023 – a period which followed the fastest interest rate hikes in history.

“Our category was increasing as other categories were shrinking,” Hastings said. “People come to the cinemas about four times a year. It’s a treat. And still, in terms of relative cost to other entertainment

experiences – even though our premiumisation strategy is in place – it’s still more affordable competitively.”

With a lack of blockbusters, other content such as documentaries, concerts, and foreign films are attracting an even wider array of people to the cinema. At Event Cinemas, world content comprised a record 8.8 per cent of its 2023-24 Australian box office and 11.8 per cent of its New Zealand box office revenue.

Audiences are also flocking to film festivals, including foreign-focused events such as the Palace-run Spanish Film Festival, the German Film Festival, and the Italian Film Festival.

“They’re all performing very strongly,” Zeccola says.

Palace says its audience aged under 30 is at record highs while its audience aged 50 to 65 is stable and growing. However, individuals over 65 are returning in fewer numbers although the issue comes back to the type of films being released.

“The problem is not thought to be related to that cohort’s general reluctance to venture out of the home, nor a change in culture or behaviour as a result of the virus. The problem faced by the industry is the reduction in the number of films being released, particularly the number of titles targeting or appealing to that demographic has reduced versus 2019.”

While the cinematic experience continues to be refined and tailored for more segments of the population, it will always remain tied to the quality of content. And with a stronger pipeline, the future looks healthy.

“We’re not subscribing to the fact that cinemas are in danger long term,” Keogh says.

“There is an argument that we’re structurally challenged in some areas at the moment, and that’s why we’re focused as a business on how we can attract more people. The more we do that then, and as the content improves, the better the cinema industry is going to be long-term.”

Ahead of this year’s AIMC, Sean Slatter speaks with Cinema Association Australasia (CAA) executive director Cameron Mitchell about the varying fortunes of the domestic and global box office so far and the challenges facing the industry.

We may only be just over three-quarters of the way through 2024, but it has already been a year of two halves for the domestic and global box office.

Any hope of maintaining momentum from last year’s Barbenheimer doubleheader was dashed in the wake of the US actor and writers’ strikes, which played havoc with studio release schedules. The release of tentpoles such as Mission: Impossible - Dead Reckoning Part 2 and Captain America: Brave New World were pushed to 2025.

Adding to the uncertainty, titles carrying expectations at the start of the US summer were met with a decidedly lukewarm response, with action comedy

The Fall Guy only managing US$27.7 million over its opening weekend, while fellow Australian-shot blockbuster Furiosa: A Mad Max Saga only just edged past The Garfield Movie to top the Memorial Day box office with US$32 million. Those results contributed to the worst figures for the holiday weekend in three decades.

The downward trend was confirmed in June with the Australian box office down about 12.8 per cent year-on-year.

However, reports of an early death for theatrical releases proved to be greatly exaggerated.

The June release of Disney Pixar’s Inside Out 2 showed there was still a strong appetite for cinematic viewing, with the film becoming the highestgrossing animated film in Australia and New Zealand markets with more than $55 million. It was then surpassed by Disney stablemate Deadpool & Wolverine, which has taken more than $65 million in Australia, and reached US$1.3 billion globally.

It is against this background of renewed hope that this year’s Australian International Movie Convention will be held on the Gold Coast, offering

insights on emerging cinema trends and the theatrical landscape for Australian filmmakers.

Speaking ahead of this year’s event, Cinema Association Australasia (CAA) executive director Cameron Mitchell offered a succinct summation of the current environment.

“Cinemas need more films,” he tells IF.

“Cinemas globally continue to demonstrate that well-made, well-marketed content, backed by exceptional cinema experiences, drives attendance to cinemas and box office. The industry is aligning around the value of longer windows, streamers are dedicating sizable production budgets to films that are released in cinemas first, and aside from once-ina-decade strikes and pandemics, the industry is well placed for the exciting next chapter.”

This will be Mitchell’s second AIMC leading CAA, having overseen the event’s return to full capacity at The Star last year.

It comes on the back of the Australian box office’s best year since the pandemic, exceeding an estimated $985 million, 4.6 per cent higher than the previous year according to Numero data.

Cinemas had an estimated 58.1 million visits throughout the year. In comparison, 19.5 million for the top five sports (AFL, NRL, soccer, cricket and basketball) over the same time.

While the box office total was still well below the 2016 record of $1.259 billion, Mitchell believes 2023 must now be used as the new benchmark in place of pre-pandemic comparisons.

“It’s now time to put references to the pandemic behind us and refocus on supporting our partners in distribution in optimising every release,” he said.

“Australian cinema has a proud 128year heritage and comparisons to 2016 are unproductive.

“Restaurants are competing with online dark kitchens, taxis are competing with Uber, petrol cars are competing with electric cars, and print with online. Yes, the world continues to change, and all industries and businesses are evolving but our industry remains better equipped than most to continue to pivot, innovate, and grow because we have so many positive indicators to rely on.”

Like restaurants, taxis, Ubers, and petrol, going to the cinema has become more costly in the past few years amid rocketing inflation.

Screen Australia data indicates that the price of tickets increased from $14.23 to $16.26 in the two years to 2023, while ice cream or snacks went up 21 per cent and 15 per cent respectively since 2020, according to ABS data.

However, Mitchell notes that Australian cinema prices remain competitive globally.

“When dividing the average ticket price in Australia [$16.96] by the minimum wage of $23.23 [Fair Work], Australian cinema tickets are calculated to be one of the lowest globally from an affordability perspective, with an Australian required to work about 73 per cent of one hour to afford an average ticket from the minimum wage,” he said.

Cinema owners have faced a range of one-off challenges in recent times, yet one structural challenge has remained consistent through the years: piracy.

The industry appeared to be winning the fight. Film piracy more than halved between 2015 and 2018, reaching a low of 21 per cent according to a survey by the Attorney-General’s Department. However, it has since climbed back up to 28 per cent.

“We know that it’s a much tighter economic environment for Australian consumers,” says Creative Content Australia (CCA) chair Chris Chard. “We’re hoping that in that environment they don’t revert to piracy.”

While it may be one factor in the recent upswing, CCA research also shows pirates are overwhelmingly younger, male,

WHY DO PEOPLE WATCH CONTENT ILLEGALLY?

• The lure of ‘free’ content.

• People don’t appreciate the costs of TV, film and sports rights.

• The impact on the economy and jobs from piracy is not widely understood.

• Consumers aren’t aware that pirate sites have strong ties to organised crime.

high-income earners and well-educated. They are huge content consumers and even visit cinemas more than non-pirates.

Tackling the problem is not simple. It requires multiple avenues including enforcement, legislation, education, and wider access to content.

CCA this year launched its first national consumer advertising campaign since 2018.

Three television commercials highlighted the risky nature of illegal streaming sites and the scale of cybercrime issues for Australians. They were screened by cinema, free-to-air TV, and outdoor digital marketing including by FOXTEL, Val Morgan, Seven Network, SBS, Network Ten, ARN, Fetch, QMS, oOH, Optus Sport, Flicks and Just Watch.

Distributors reveal their thoughts on the year we’ve had, the year ahead, and the distribution landscape.

MIKE BAARD

Mike Baard, managing director, Universal Pictures International Australasia

The box office has been significantly down this year. What films are on your slate that will help arrest the decline?

For Universal, our release volume has not been overly impacted by the strikes and we have been able to retain our big releases for the year. In particular, the success of our animation slate from Illumination Entertainment and DreamWorks Animation (Trolls Band Together, Migration, Kung Fu Panda 4, Despicable Me 4, The Wild Robot) has delivered over $100 million box office in Australia alone.

Looking ahead, Universal has 40 titles slated for release in 2025. It’s not about quantity, rather commercial appeal, but we are certainly confident that we will bring both scale and range to cinemas and help keep the momentum going, in particular with successful franchise entries such as Jurassic World: Rebirth, How To Train Your Dragon, Bridget Jones: Mad About the Boy, Five Nights at Freddy’s 2, Downton Abbey 3 and Wicked to name a few.

For Warner Bros, the studio has had a very strong slate with the likes of Wonka, Aquaman and the Lost Kingdom, Dune Part Two, Godzilla X Kong, Furiosa, Twisters (in partnership with Universal) and Beetlejuice Beetljuice all delivering blockbuster business. We still have the likes of Joker: Folie a Deux, Red One and Lord of the Rings: The War of the Rohirrim to come this year.

Next year, Warner Bros will continue to deliver a high volume of major releases such as Superman, A Minecraft Movie, F1, the Untitled Conjuring finale and Mortal Kombat 2, along with a number of original films from high-profile filmmakers such as Ryan Coogler, Bong Joon Ho, Paul Thomas Anderson and Maggie Gyllenhaal to name a few.

How have your marketing and audience plans changed in the postpandemic/streaming era to ensure that cinema remains a must-attend component of the eco-system?

We focus on the core drivers for an audience to see a film in theatres, what makes a film ‘worth seeing at the movies’ versus steaming at home – often it’s the shared experience of

seeing a movie, it’s the social currency and connection that movies provide, and it’s an experience they can’t get in their own home. In addition to driving trailer play and the base awareness levels of a campaign, we implement engagement tactics that address each of these areas to drive ‘urgency to see in theatres’. So for example, creating immersive social sharing experiences like premiere events, stunts, activations or special screenings. Leveraging the power of influencers to drive social noise and create a sense of FOMO around the film. Brand collaborations and talent tours play an important role in keeping cinema at the heart of the cultural conversation and driving that ‘rush out’ for opening weekend.

Ultimately in addition to delivering on the marketing fundamentals to reach our core audience, we need to create enough social buzz and conversation around a movie that audiences feel like they are ‘missing out’ by not seeing the film in theatres.

Theatrical windows continued to shrink in 2023 to around 30 days on average. What is your current approach to release windows and the role of cinemas?

Universal supports the exclusive theatrical window. The window to transact with a film at a nominal fee remains between 60 and 90 days and sometimes longer. A premium window has been created which can vary from 31 days to 45 days or longer. The premium window is transactional at a higher price point and is intended to provide accessibility for those who might otherwise not be able to visit the cinema.

STEPHEN BASIL-JONES

Executive vice-president – head of international marketing, Sony Pictures Releasing International

The box office has been significantly down this year largely thanks to a lack of blockbusters following the 2023 US strikes. What films are on your slate that will help arrest the decline?

It may have started that way, but I feel we have seen a real bounce back and rejuvenation in the business since the US summer. It started with Bad Boys:

JOSH BRIGHAM AND KYLIE WATSON-WHEELER

Ride or Die. We then of course saw some enormously big grosses with Inside Out 2 and Despicable Me 4, a big Deadpool & Wolverine number, and most recently a big exclamation mark with our own It Ends with Us. For the near future for SONY Pictures, it’s all about Venom: The Last Dance on October 24.

How has your marketing and audience plans changed in the post-pandemic/ streaming era to ensure that cinema remains a must-attend component of the eco-system?

We need to make our movies a necessary and compulsory theatrical experience for the defined audience. The shift in support levels and effort to social and digital media platforms, and more user-generated content, to accompany our traditional advertising efforts and materials, are more important than ever to create urgency and social currency, and these are growing in importance every film campaign.

We are also working with talent in different ways – and they are getting more involved in creating non-traditional marketing materials for the campaign – as Anyone But You and more recently

Josh Brigham, general manager, studio, The Walt Disney Company Australia and New Zealand, and Kylie Watson-Wheeler, senior vice president and managing director, The Walt Disney Company Australia and New Zealand.

The box office has been significantly down this year. What films are on your slate that will help arrest the decline?

KWW: Audiences continue to be drawn to blockbusters and quality films across all genres and Walt Disney Studios will continue to make movies that tell amazing stories and create must-see moments on the big screen.

We’re closing out 2024 with two must see event movies with Moana 2 and Mufasa: The Lion King which will be absolute big screen blockbusters for all audiences. It’s eight years since Moana first delighted audiences on the big screen and in 2023 the film was the most streamed movie around the world on any streaming platform.

Deadpool showed so powerfully.

We are also seeing from an audience perspective, with the fragmentation of media, that it is more important than ever to feel ubiquitous and urgent for an audience segment – even if this is a more narrow segment than the previous holy grail of broad four quadrant appeal.

For the 20 million-plus results on Anyone But You and It Ends with Us, we focused our marketing efforts and investment squarely on the female audience, and primarily the under 34 audience.

All films need to be a true cultural event for someone, or they risk not being urgent for anyone.

Theatrical windows continued to shrink in 2023 to around 30 days on average. What is your current approach to release windows and the role of cinemas?

SONY has been the single most resolute studio in respecting and maintaining reasonable windows always – and we’re extremely proud of that position. Our company’s’ purchase of the Alamo Drafthouse theatre chain is testament to our commitment and belief in the theatrical experience and business.

How have your marketing and audience plans changed in the post-pandemic/ streaming era to ensure that cinema remains a must-attend component of the eco-system?

KWW: There’s no shortage of content competing for attention, but our point of difference is our creative excellence. We’re focused on fewer, better movies that are true to our core – the best stories made exceptionally well. We have seen those big theatrical releases, whether it be existing franchises or new IP, continue to excite audiences and draw them in for experiences that are only possible in cinemas.

Theatrical windows continued to shrink in 2023 to around 30 days on average. What is your current approach to release windows and the role of cinemas?

JB: We will continue to take a bespoke approach for each of our releases. Disney has the longest exclusive theatrical window of all the studios in the industry – on average 60 days. In fact, both Inside Out 2 and Deadpool 2 had theatrical windows of greater than 90 days before downstream release.

Vice president and managing director

Australasia, Paramount Pictures

The box office has been significantly down this year. What films are on your slate that will help arrest the decline? We have a really dynamic and exciting lineup for the remainder of our 2024 slate, with appeal for all audiences. Next up, we have the sequel to one of the most successful horror movies of recent years with Smile 2. With Smile, we saw not only a box office hit but also one of the highest audience scores for horror films in recent times. The movie played incredibly well with teenagers, who represented the highest age group during the opening weekend and absolutely loved it. Smile 2 raises the stakes and amplifies all of our worst fears with a story told through the eyes of a pop star.

On November 14, hitting theatres is the follow up to one of the most beloved and critically acclaimed movies of all time with Gladiator II. Upon its release in 2000, the original Gladiator was a box office juggernaut that overperformed in Australia. Like Top Gun: Maverick, Gladiator II is a sequel long worth the

wait with appeal not only to nostalgic audiences in Australia but also a whole new generation of fans. It is truly the perfect sequel to the perfect movie, and for this production, the studio basically rebuilt the Colosseum to scale in order to capture the scope and grandeur of this incredible story. There’s no better way to see this movie than on the big screen to truly immerse yourself in ancient Rome. It is a movie like no other this year, with the masterful director Ridley Scott back in the director’s seat and a fantastic cast, including Paul Mescal, Pedro Pascal, Denzel Washington, and Connie Nielsen who returns for the sequel.

Finally, we have Sonic the Hedgehog 3, a franchise that continues to grow in Australia. This time, we meet Sonic’s biggest and baddest nemesis—someone everyone has been waiting to see make his big-screen debut: Shadow. Jim Carrey also returns, this time in a dual role playing not only the hilarious Dr. Robotnik, but now his grandfather as well. We anticipate Sonic’s latest

adventure being one of the biggest Boxing Day hits in our market.

How have your marketing and audience plans changed in the post-pandemic/ streaming era to ensure that cinema remains a must-attend component of the ecosystem?

The audience behavioural shifts post-Covid accelerated technological changes and created more variety in terms of content and ways to consume it. But it also brought back the realisation that there’s nothing like sharing experiences with other people, especially entertainment options. The cinematic experience represents one of the best, if not the best, social entertainment options. However, with audience attention more segmented and greater competition with other forms of entertainment, we have been promoting our movies as “must-see now” cultural experiences – content you can’t miss if you want to be part of the conversation. And that goes for both an all-audience

film like a big four-quadrant blockbuster, as well as a smaller-scale movie that is a huge draw for a specific niche audience. Now more than ever, it’s important to start with the consumer – understand who they are, what they value most, and where they are – and align these elements with each movie’s DNA. Social media has also become the new identity, especially for tweens and teens. For them, the gratification of seeing a movie is not enough; they need more value for their money but, most importantly, for their time. They need to be part of that conversation when it is relevant so they can be part of the larger conversation and, most importantly, gain value through their social media identity – growing their personal social following.

How do you reach the older cinemagoer that may be more interested in upscale and auteur-led films? What strategies are working to support films that are not traditional blockbusters? For all of our audiences, we need to find

out where they are, who they are, and what they are doing. I think it’s a matter of psychographics rather than demographics. A gamer can be a teenager but also a 40-year-old. People who like “upscale” movies could be university students as well as someone about to retire. We have seen this in the audience data.

So, we need to understand, for every movie, who the most valuable audience is not only from an age perspective but also from a behavioural perspective, using tools like trailer reactions to see who is reacting the most or best to a specific trailer launch.

This facilitates our efforts to reach that particular audience in the best possible way – not only through the right message that creates engagement but also around environments they frequently visit. And, of course, in-cinema trailering is always high on the list as one of the most influential mediums to reach potential audiences for cinema visitations, especially for those types of olderskewing movies.

Vista Group chief product, innovation, and marketing officer, Matthew Liebmann, tells Sean Slatter about how cinema owners can more deeply understand audience trends.

MATTHEW LIEBMANN Chief product, innovation and marketing officer

IF: You noted last year that a comparison between 2019 and 2021 had shown that those who came to the cinema less frequently were less likely to come back post-Covid and those who were active pre-pandemic were almost back to their normal standards. What have been the predicators for attendance in the past couple of years?

Matthew Liebmann: When we compare 2022-24 to the ‘before times’ (2017-19) we have seen a marked change in moviegoer behaviour. Now, the average moviegoer attends the cinema less frequently but when they do, they make an event of it. They plan their visits rather than just showing up. We see this from increases in pre-sales and online ticket purchases. They come in larger groups, with more visits comprising three or more tickets. Moviegoers are more likely to choose a premium experience, be it PLF or boutique. And they are willing to spend more on food and beverage, no doubt partially enticed by broader menu choices. While we should preserve this ‘eventised’ occasion, the industry also needs to recreate a parallel occasion, restoring moviegoing as an everyday entertainment option.

Can the performance of films such as Deadpool & Wolverine, Inside Out 2, and Despicable Me 4 tell us anything about who the typical cinemagoer is in 2024?

By their nature, these blockbusters only tell part of the story. Comparing the aggregate audience of these three blockbusters to the overall 2024 audience, the blockbuster audience

visits the cinema less frequently (you need to attract couch-dwellers to achieve blockbuster box office). These movies also have longer tails than the average 2024 release. Because two of them are family titles, they outperform in groups of five-plus as well as females because mums are more likely to take the kids. Also, the nature of these three movies means that their average age is younger overall, with those aged 55+ particularly underrepresented.

Do you think on the whole that exhibitors are embracing new technology when it comes to gathering data?

Most exhibitors are doing what’s required to collect rich levels of moviegoer data, but the magic with data is not in its collection but in its timely use. And to be fair, that’s where technology companies like Vista come in. We are committed to making it easy for exhibitors to find the nuggets of gold in their data and action them before the opportunity passes. For example, our Movio product assesses moviegoers based on their propensity to watch each movie shown and, in a matter of minutes, sends communications to demonstrably boost admissions and spend. Our Oneview executive app updates the occupancy of every pre-sales and in theater showtime in real-time, allowing exhibitors to swap houses and add sessions to avoid sell-outs. We are also mindful that many exhibitors are expanding their operations into dining and family entertainment centres and so we continue to enhance our Horizon data warehouse to ingest and export data so that exhibitors can analyse a single view of their guests and business.

In what ways do you think cinema data will evolve going forward?

If I was to summarise how data will evolve, I’d say it will be in the areas of motivation and AI. At present, exhibitors can easily harness transactional data and, via membership programs, demographic and behavioural information. Some capture guest feedback, but it almost always sits in isolation. Very few currently understand why moviegoers behaved as they did, what they thought of the experience, and what they intend to do next. If collected, this will be a powerful predictor of what moviegoers might do next. AI, whilst integrated in our products almost since Movio’s inception, will also become even more prevalent. To me, its key benefit will be to move data from being surfaced in historical reports and some business intelligence to becoming genuine, future-focused decision support at all levels, from point of sale to the executive suite.

Empowering you to create exceptional moviegoer experiences from trailer drop to last show

Audiences have never had so much access to content across so many screens. Brendan Swift looks at how cinema owners can make the big screen experience even more immersive.

The communal nature of cinema has remained largely unchanged for more than a century. But the technical components that create such immersive big screen experiences are constantly in flux.

At the heart of the cinematic experience is the quality of the image and sound, which is constantly improving, although not all innovations take off.

The release of James Cameron’s Avatar in 2009 set off a surge of 3D films. It became the first film shot with 3D digital cameras to win an Oscar for best cinematography.

Peter Jackson took an even bolder step forward with the release of The Hobbit in 2012, shooting not only in 3D, but at double the frame rate to create a sharper and more realistic image.

Unfortunately the resulting highframe rate image was roundly criticised while 3D films today make up a small minority of all major releases.

Those side-steps haven’t stopped the rollout of more popular technologies despite the pandemic and higher interest rates creating a more capital-constrained environment for cinema owners.

One of the most successful technologies to resonate with Australian cinemagoers in recent times has been the IMAX format.

It currently has just two locations – IMAX Melbourne and IMAX Sydney –but their box office per screen average has made Australia the number one IMAX market in the world this year.

IMAX Sydney, which re-opened in October 2023, is the fourth highestgrossing IMAX location worldwide among approximately 1700 IMAX theatres globally.

“Following the very successful opening of IMAX Sydney last year, we spent the past months conducting extensive reviews of the potential target locations that can accommodate IMAX in the territory,” says IMAX Corporation global chief sales officer Giovanni Dolci.

“We’re in active conversations with various cinema operators for multiple locations. You can expect us to announce new projects later this year.”

Event Cinemas will convert two screens to the IMAX format in calendar 2024 and 2025, while Dendy Cinemas is opening its first IMAX

screen in Canberra later this year.

Dendy/Icon chief executive officer Sharon Strickland said it had recently invested in IMAX, describing the format as the “gold standard in cinema”.

“Our decision to invest in IMAX was driven by the increasing demand for high quality, immersive experiences and IMAX perfectly aligns with our strategic focus on innovation and premium entertainment,” she says.

A rising number of films are also shooting specifically for the format, after the success of Oppenheimer, shot with IMAX cameras in 70mm film, and Dune: Part Two, which used IMAX lenses. The upcoming Joker: Folie a Deux and Venom: The Last Dance were both filmed using IMAX-certified digital cameras and have been specially formatted for IMAX.

Experience Queensland’s winning combination of competitive incentives, renowned crews, stunning locations and first-class facilities with Screen Queensland Studios in Brisbane and Cairns.

“We wanted to make a movie about paradise, so choosing Queensland was the perfect location to do so.”

— TIM BEVAN Producer, Ticket to Paradise

Making messages memorable since 1894.

CJ 4DPLEX and B&B Theatres recently opened the largest 270-degree panoramic ScreenX in North America and the first multi-sensory 4DX theater in the Dallas-Fort Worth Area.

The premium cinematic experience has been taken to its most immersive level by Seoul-based CJ 4DPLEX and its ScreenX and 4DX technology.

Australia’s first ScreenX opened in August 2023 at Event Cinemas Robina, allowing audiences to immerse themselves

IF Magazine 2024_Layout 1 04/09/2024 13:52 Page 1

in a 270-degree viewing experience where movie visuals are extended to the side walls of the auditorium.

4DX offers motion chairs and multisensory environmental effects such as wind, bubbles, lightning, fog, water, rain, air shots, and scents work that are synchronized with the on-screen action.

Aditya Singh, head of business development - South Asia, South-East Asia and Oceania at CJ 4DPLEX, says occupancy rates are much higher while cinemas can charge up to 40 to 50 per cent more than screenings shown on standard format

“We have become even more relevant, especially after Covid, because we provide the kind of experiences which cannot be replicated at home. We attract more people because they cannot watch it on a mobile or other type of screen.”

It can take up to two months for a 4DX fitout, including retrofits, he says.

“The major thing in terms of 4DX is whether the cinema or mall where it is located can sustain the load because there will be vibration coming out of the motion from the seat.”

The most popular 4DX films have been Hollywood blockbusters such as Avengers: End Game, Jurassic World, Spider-Man, Top Gun: The Maverick, and Avatar.

To date, more than 790 4DX auditoriums have been built around the world across more than 70 countries.

The World’s First Truly Engineered Screen For Laser Projection

Optically engineered for use with all types of laser projection including RGB, HugoSR creates compelling 2D and deep 3D images With a visually whiter appearance under projected light, HugoSR has built-in speckle reduction, contrast enhancements and an engineered gain profile to support the technical capabilities of laser projection including HDR

ScanPlay is a perfect way to enhance the movie going experience for children. The system is ideal for ‘pre-session’ entertainment and provides added value to customers in the highly competitive space of children's entertainment and amusements.

ScanPlay 2.0 allows children's artistic creations to come to life!

Our cutting edge software transforms scanned 2D images into 3D digital characters with fully independent AI behavior! ScanPlay 2.0 Interactive Colour-In System

Easy Integration. Ideal for cinema foyer video walls and/or projected onto the big screen in the auditorium.

Creations come to life with our new AI brain control. Character behavior is fully random and independent.

Parent Approved! Keep kids off the screens and explore artistic creativity whilst promoting fine motor skills.

Full customisation available! Design your own theme or explore cross marketing promotional opportunities for additional revenue generation...

Australian films continue to struggle at the box office, but times may be about to change. Brendan Swift investigates.

Going to the movies is one of the most popular activities in Australia, yet Australian movies attract just a small proportion of all cinemagoers.

It has been a boom-or-bust ride despite billions of dollars invested in the industry since government support began in the 1970s.

Local films tend to account for just a few percentage points of the total box office each year – as low as 1.3 per cent in 2004 and as high as 23.5 per cent in 1986 (driven by the once-in-a-lifetime success of Crocodile Dundee).

The answers to create more sustained success are varied and myriad, according to industry participants. But all areas of the industry want that success and are working towards it.

“The biggest issue for me with Australian films is, quite simply, we need to latch on to good stories,” Independent Cinemas Australia (ICA) CEO Brett Rosengarten says.

Australian films have historically played particularly well among independent and regional cinemas, which tend to skew

towards older and family demographics, and make up about half of ICA’s members.

“There is a place for arthouse movies. There is a place for mainstream movies. The mainstream movies are the ones that are going to provide the better return and the better commercial box office. Obviously, because they’re bigger and broader stories, we need to have more of those.”

Government screen agencies have long been criticised for not funding enough commercial films with an obvious audience. Hoyts CEO Damian Keogh says the industry faces structural challenges, such as the rise of streaming platforms, but the funding model is broken.

“Screen Australia funds every kind of production under the sun, and in that process, has got a chook feed mentality. And it’s not conducive to where we are currently with Australian product.”

Over the years, funding has become more stretched across areas and programs as the screen industry has become more fragmented. There is a strong feeling among the industry that the agency prioritised TV and streaming platforms at the expense of local features in recent years – although this is expected to change with new leadership.

Direct government film funding was originally intended to support a more commercial sector, with private funding the key factor to trigger the government agency’s film funding.

Today, Screen Australia has five equally-weighted areas it assesses, including its view of the story and writing quality; the potential to reach an audience; the experience and achievements of the creative team; marketplace attachments and interest; as well as the way the film will amplify inclusivity, diversity and/or gender equity in front of (and behind) the camera. (Filmmakers can still tap into the 40 per cent Producer Offset rebate, which does

not have such creative assessment and diversity criteria.)

But whatever criteria are used, making successful films has never been easy in an industry where most films never recoup their production budgets. Former Film Finance Corporation CEO Brian Rosen was fond of quoting screenwriter William Goldman’s aphorism – “Nobody knows anything” – with good reason.

Screen Australia this year launched an inaugural Audience Design Initiative to help five teams working on late-stage projects improve their understanding of audiences and improve their projects’ marketability.

Screen Australia CEO Deirdre Brennan says key takeaways from the workshop included the importance of timing and collaboration.

“Filmmakers learned to think like distributors, emphasising positioning, exploring audience personas and identifying hooks and potential barriers. Discussions on audience

comping and benchmarking were also particularly insightful.”

Many local distributors will privately say they still see pitches from Australian film producers without a clearly defined audience.

Producer Sue Maslin also says there’s room to improve the performance of Australian films, and better data about what resonates with audiences will help.

“There’re more feature films being released every year now than there was 10 years ago or five years ago, but most of them are self-financed, underfinanced, and don’t have a clearly defined audience,” she says.

Paramount Pictures Australia managing director, Brian Pritchett, says the highest-frequency age group that visits cinemas are between 14–34 years old and that data is crucial to understand all demographics.

Australian films have averaged around a 6 per cent share of the local box office over the past 47 years, according to Screen Australia data. But even that may overstate the level of success given many of the biggest years were posted in the 1980s when the production industry enjoyed unprecedented levels of government support.

Fast-forward to 2023, which was one of the worst on record at just 2 per cent. However, the 2021 share stood at an impressive 11.8 per cent thanks to the success of films such as Peter Rabbit 2, The Dry, Mortal Kombat, and Penguin Bloom, although the Covid pandemic simultaneously put a brake on many Hollywood releases.

Screen Australia’s corporate plan 2023-27 says one of the agency’s key performance indicators (KPIs) for local feature films is a three-year average of 2.7 million cumulative attendances at cinemas.

This equates to Australian films having an approximate 4.6 per cent share of the box office given total cinema attendance was 58.1 million last year.

“We view KPIs as benchmarks, not targets, and are committed to seeing success for local

films at the Australian box office,” a Screen Australia spokesperson said.

“Based on the three-year average per calendar year of 2021, 2022, and 2023 admissions were 2.9 million and the KPI was met. The agency will be conducting a review of its KPIs over the next 12 months as part of its commitment to continuous improvement and meeting the fast-evolving needs of the industry.”

Hoyts CEO Damian Keogh says the lack of box office success needs to be fixed.

“It really scratches a nerve with me as a proud Australian, but also someone running one of the major cinema chains here. We should have a target as an industry, as a country, that is a minimum of 5 per cent box office.”

The Australian Feature Film Forum, which includes exhibitors, distributors, producers and screen agencies, has set a target for Australian theatrical films as a minimum of 6 per cent share of total box office.

“We will continue to strategise to achieve this and more,” says producer Sue Maslin.

CAA Executive Director, Cameron Mitchell, says Australian films should be consistently

achieving $100 million – or at least 10 per cent of the total box office each year. The Independent Cinemas Australia CEO Brett Rosengarten also endorses the 10 per cent target.

It would be a significant achievement given there have been just five years out of the last 47 where it has happened – and four of those were in the 1980s.”

Screen Australia CEO Deirdre Brennan says box office expectations can’t be a one-size-fits-all, especially in a shifting global market.

“To enhance local film performance, we need to focus on delivering engaging, entertaining content that resonates, increased curation, community marketing and tailoredrelease strategies,” she says.

“We should also explore ways to build a stronger connection to Australian screen culture from a younger age.”

Screen Australia says five of the top eight releases in our box office history have been released since 2020, illustrating that Australians continue to embrace stories shared on the big screen despite a volatile economy.

“Within those groups, we need to explore common behaviours (psychographics),” he says. “Once we better understand what these groups value the most, we can start producing movies that resonate with them. Smile, for example, is a movie that connected really well with younger groups as it explores anxiety and depression themes, which are relevant for some of these audiences.”

Filmmakers can benefit by attending the AIMC and speaking to distributors and exhibitors who constantly see how audiences respond to content, according to Maslin.

“Not only does it give you a better sense of what’s really happening at the coalface, but more importantly, when you have a film that’s ready to release, you’ve got a relationship with those exhibitors,” Maslin says.

Maslin has produced successful local films such as The Dressmaker, which stared Kate Winslet and Judy Davis and grossed more than $20 million at the

box office. She is a member of the Australian Feature Film Forum, which is working with the AIMC to boost the Australian feature film sector over the next several years.

Change is already afoot.

She points to initiatives such as the 2022 Road Test initiative which offered ten independent producers the opportunity to pitch their projects to decision makers from independent and major cinema exhibitors. Meanwhile, companies like Mushroom Pictures have included exhibitors in the development process.

“There’s a place for the communal theatrical experience and we’re all really committed to that.”

Even Australian films with a strong potential audience face an uphill battle against the might of Hollywood. Blockbusters are often built on preexisting IP or brands and backed by massive global marketing campaigns.

Local films that are able to get their story and execution right must then find smarter ways to cut through to audiences who have never had more entertainment options.

Yet many Australian films over the last 12-18 months have been released without the marketing expertise and backing of a distributor, says ICA’s Brett Rosengarten.

“We have a very strong distribution sector that has significant expertise and know-how to release Australian films and get them to a mass, broad audience,” he says.

“When Australian producers don’t get a distribution deal, the first reaction to that is – is the film not strong enough commercially to get a distributor? When producers try to release those films themselves, they just don’t get the marketing and advertising support that a good Australian distributor can provide.”

One proven marketing strategy that can offset the Hollywood onslaught are special screenings such as Q&As with filmmakers and talent. It was a key

Local and international filmmakers are increasingly choosing Queensland and the Gold Coast to shoot their films. Brendan Swift considers the reasons why.

Queensland’s status as a prime tourism destination is being eclipsed by its growing reputation as a filmmaking hub.

Screen Queensland CEO Jacqui Feeney says the State has two sectors with distinctive characteristics – one caters to the big Hollywood productions its attracts while the other fosters a growing local film industry.

“Increasingly, there is also a hybrid sector where we can our Production Attraction Fund to bring bigger local projects into the State,” she says.

Baz Luhrmann and Catherine Martin’s production company Bazmark was one of 12 Gold Coast screen businesses recently awarded a share in $5 million to grow their businesses. It will use the money to establish a new headquarters.

“When you see companies like Bazmark establishing on the Gold Coast, they’re in this ‘hybrid space’,” Feeney says. “They’re taking all the smarts of their Hollywood knowledge and expertise, but operating from Australia, so they’re able to use Hollywood as the bank to undertake their work in Queensland.”

Major Hollywood films have long been attracted to Queensland’s locations, crews, and Village Roadshow Studios (and its 1200m2 main water tank).

The Location Offset’s recent increase to 30 per cent has also stoked offshore interest. Screen Queensland also offers incentives, as does the City of Gold Coast. It is the only local government in Australia to provide incentives to attract screen productions.

The Gold Coast has recently attracted film shoots including Mark Wahlberg comedy Balls Up, swashbuckler action-drama The Bluff, and Australian thriller Dangerous Animals

part of the success behind veteran filmmaker Bill Bennett’s The Way, My Way, which tracked his walk along the famed Camino de Santiago trail in Spain. The film was unheralded – it didn’t receive Screen Australia funding – yet grossed $1.84 million in Australia.

“The cinemagoers were really thrilled to attend events where there was an introduction or a Q & A and that seeded demand for the film,” says Palace Cinemas CEO Benjamin Zeccola. “I even saw it anecdotally at Palace Brighton Bay where there were people who’d done a Camino walk and then there were others that wanted to do it and were gathering information.”

The biggest Australian film of the year remains George Miller’s Furiosa: A Mad Max Saga – powered by a massive marketing campaign – which still underperformed against expectations with $10.22 million. Nevertheless, hopes remain high that the second half of the year will bring at least one more breakout Australian hit.

By late-September, Australian films had grossed only slightly more than $25 million in total. With forecasts of another near $1 billion box office total across the industry, there remains much ground to recover.

Australia has committed to a Net Zero Greenhouse Gas emissions target by 2050. Brendan Swift takes a look at the options available to cinema owners.

Cinemas represent an escape from the world.

Yet the way they’re run requires significant energy, which contributes to global warming, as well as adding to operational costs.

But there are an increasing number of more sustainable options available such as laser projection, solar panels, batteries, and smarter automation of power use.

A small number of Independent Cinemas Australia (ICA) members have already switched from xenon lamp-based projection to more efficient laser projection as their original digital projectors approach the end of their running life.

“We’ve been working on this initiative for over a year, with support from Christie, analysing our projection fleet’s sustainability,” ICA CEO Brett Rosengarten says.

“If we converted all the remaining projectors, we are talking about ICA members saving thousands of tonnes of CO2 emissions for the environment every year. It’s the equivalent of taking more than one thousand cars off the road every year or more than one thousand homes off the electricity grid every year. It’s not an insignificant benefit to the environment.”

For example, Christie RGB pure laser projection systems use solid-state laser devices that save more than 300 per cent in electricity consumption and CO2 emissions compared to traditional lampbased projectors. Its top-line projector can save an estimated 46,434 kWh in electricity and 33.9 tons in annual carbon emissions, as per the table.

“Christie is dedicated to helping cinemas lower power consumption and reduce carbon emissions, all while delivering outstanding performance,”

says Christie executive vice president for cinema division, Brian Claypool.

“Our projection solutions are designed with energy efficiency and environmental responsibility in mind, ensuring that they not only enhance the cinematic experience but also contribute to a more sustainable future. We remain focused on continuously improving the energy efficiency of our products, reducing our carbon footprint while maximizing performance for our clients.”

However, switching from traditional lamp-based projectors to laser projection involves a substantial upfront investment.

“We’re trying to get some support from government and semi-government bodies to see whether they will assist with this process, given governments at both state and federal levels are trying to reduce CO2 emissions,” Rosengarten says.

Australia has committed to the Paris Agreement, pledging to hold the increase in global average temperatures to well below 2°C of warming. It means Australia’s economy must be dramatically

reshaped to meet legislated targets of a 43 per cent cut in carbon emissions by 2030 before reaching net zero by 2050.

Innovations such as solar and batteries can also help cinema owners to cut greenhouse gas emissions and reduce costs.

Daniel McCabe, business development director of solar energy company GI Energy, says cinemas can optimise their consumption based on their energy profile by pairing solar panels and batteries with smart energy management software.

Batteries can be charged from the grid or solar at zero cost, then cinemas can use this energy after sunset or sell back to the market for more than $1 per kWh –the process is automatically managed.

In addition, Australian government rebates of up to $36,746 through Smallscale Technology Certificates (STCs) for solar installations, along with ongoing incentives for larger systems through Power Purchase Agreements (PPAs), are available to organisations.

Australiaʼs cinema seating specialist.

Experts in Projection & Sound

Trusted by Australian Cinema Brands

Installation, Support, Maintenance & Servicing

Premieres, Festivals & Events

Proud sponsors of AIMC 2024