POWERFUL. TRUSTED. FAST.

FEBRUARY/MARCH 2023

Welcome to the February/March issue of Convenience & Impulse Retailing magazine.

2023 is off to a flying start with the UCB Conference just around the corner on the Gold Coast, and the AACS Connect 23 Summit also quickly approaching. It’s so wonderful to be able to reconnect with the industry at events like these to engage with our peers, learn about new release products and industry trends, and celebrate retail excellence.

We were fortunate enough to join the Dib family and Metro Petroleum team in the Hunter Valley at the end of 2022, and we’d like to congratulate the entire team on putting on such a fantastic event, filled with education, networking opportunities, as well as plenty of fun and games. We’ve put together a few of the highlights, so turn to page 54 to see what we got up to.

Speaking of Metro, in this issue we look at an innovative partnership between Metro Petroleum and Frucor Suntory, who have unveiled an Australian first V Energy concept store at Greenacre. The new store features vibrant V Energy branding both inside and outside the petrol station with the impressive brand experience starting as soon as customers pull into the pumps.

Also in this issue, we take a look at how global supply chain disruptions have caused countless headaches for retailers and suppliers alike, and we ask how we as an industry can navigate these murky waters.

We also examine the vibrant categories of confectionery and general merchandise and take a look at the growing plant-based milk category.

As always, we are grateful to have our regular columns from Theo Foukkare, CEO, AACS and Darren Park, CEO, UCB Stores, and Dan Armes, Founder, ServoPro, along with a special opinion piece from Marianna Idas, Principal at eLease Lawyers. We also share our first opinion piece from Andrew Poore, General Manager Sales ANZ, Pacific Optics, who will become a regular contributor to C&I moving forward.

To our readers, the team at C&I had a ball putting this issue together, and hope that you get as much joy out of reading it.

Cheers, Deb

Jackson

54

06 FACE TIME Glenys Tristram, National Marketing Manager, NightOwl Convenience 10 STORE REVIEW Metro Greenacre 14 CONFECTIONERY Accessibility, visibility, and excitability are pivotal in driving consumer engagement 18 SUPPLY CHAIN Global supply chain disruptions have caused countless headaches for retailers and suppliers alike 22 GENERAL MERCHANDISE A less traditional approach to retailing general merchandise 26 PLANT-BASED MILK Australians are making the switch from dairy to plant-based milk in their droves 30 PRODUCT RANGING We bring you all the latest new product launches 46 OPINION Theo Foukkare, AACS;

Park, UCB Stores; Andrew Poore, Pacific Optics; Marianna Idas, eLease Lawyers 54 INDUSTRY NEWS Metro Petroleum; Morsl; NightOwl; OTR; Coles; Sugar Tax, Ampol 60 PETROL NEWS Dan Armes, ServoPro; Caltex; Chevron; Ampol; bp 14 EDITORIAL CONTENTS February/March 2023

Darren

Safa de Valois

Keith Berg James Wells

4 February/March 2023 | C&I | www.c-store.com.au

Thomas Oakley-Newell

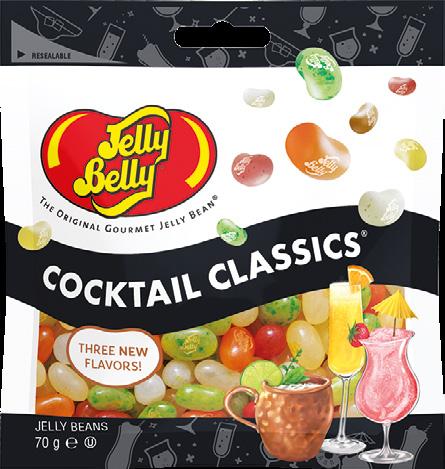

Jelly Belly launches new flavours

Jelly Belly is excited to introduce two brand new flavour mixes to the Australian range of 70g Pouches.

Cocktail Classics is sure to be a hit with every at home barista, and features crowd favourites such as Gin & Tonic, Margarita, Mimosa, Pina Colada, Strawberry Daiquiri, and Moscow Mules.

American Classics delivers some deliciously recreated flavours from the USA, ready to ride the wave of sweet lovers looking for US Candy. The mix includes S’mores, PB&J, Lemon Meringue Pie, Choc Covered Banana, and Blueberry Muffin.

Please contact your local The Distributors partner for more details or call 1800 989 022.

M&M’s new limited edition flavour

Mars Wrigley has released a new limited edition flavour of coconut M&M’s in an homage to the classic Bounty chocolate bar.

The new M&M’s Coconut sees a delectable coconut flavoured chocolate housed in M&M’s signature crispy coloured candy shell.

Ben Hill, Marketing Director at Mars Wrigley, said they saw how passionate the Australian market is about Bounty and all things coconut, so decided to create the bitesized, chocolate-covered love note to Bounty.

Made in Mars Wrigley’s Ballarat factory, M&M’s coconut is available in leading supermarkets and independent retailers for RRP $5.

Published by C&I Media Pty Ltd

(A division of The Intermedia Group)

41 Bridge Road (PO Box 55)

Glebe NSW 2037

Tel: 02 8586 6292

Fax: 02 9660 4419

E: magazine@c-store.com.au

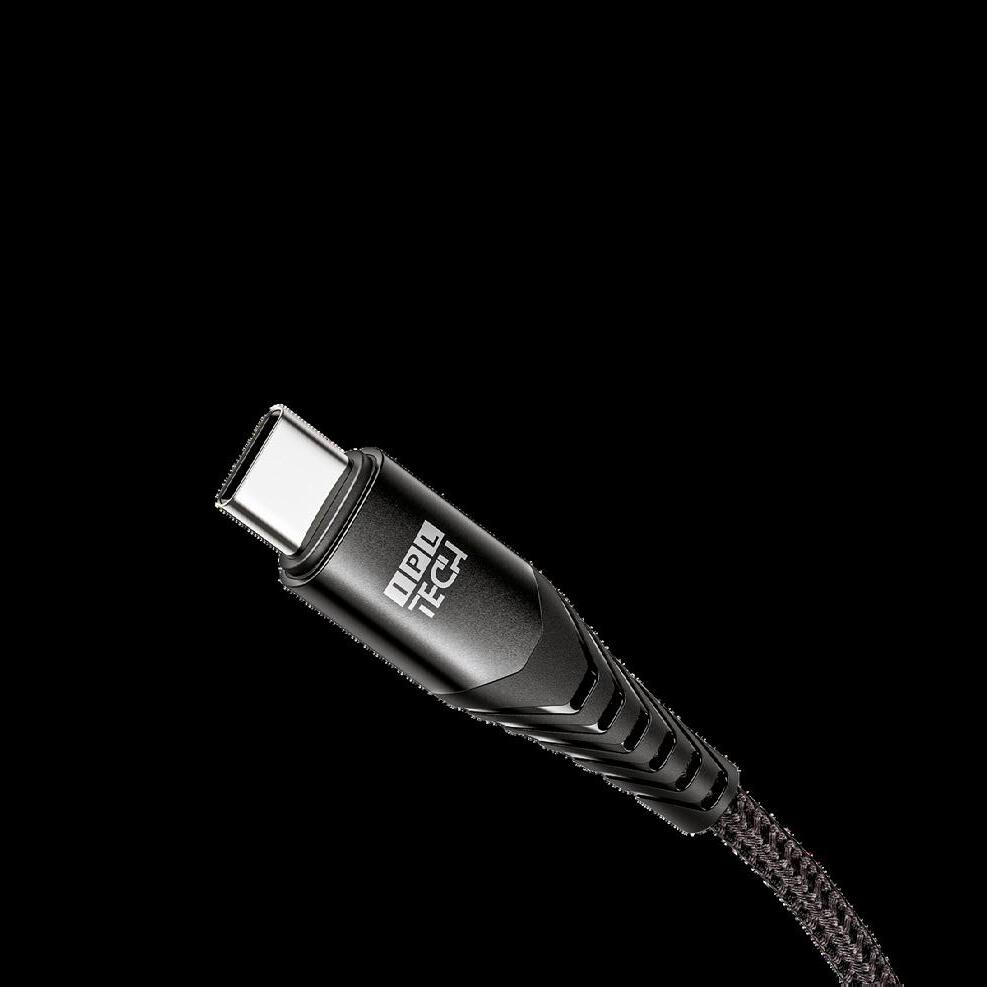

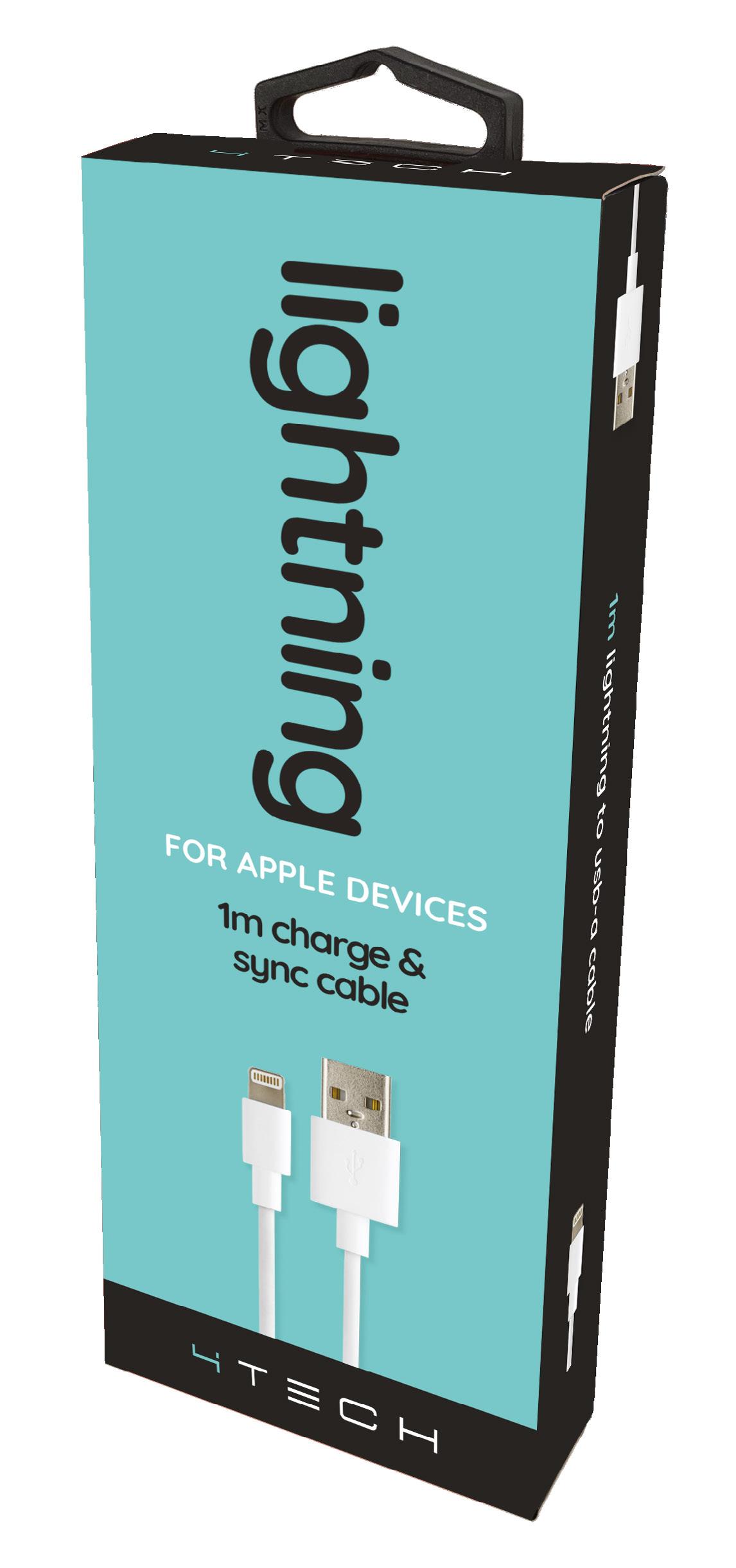

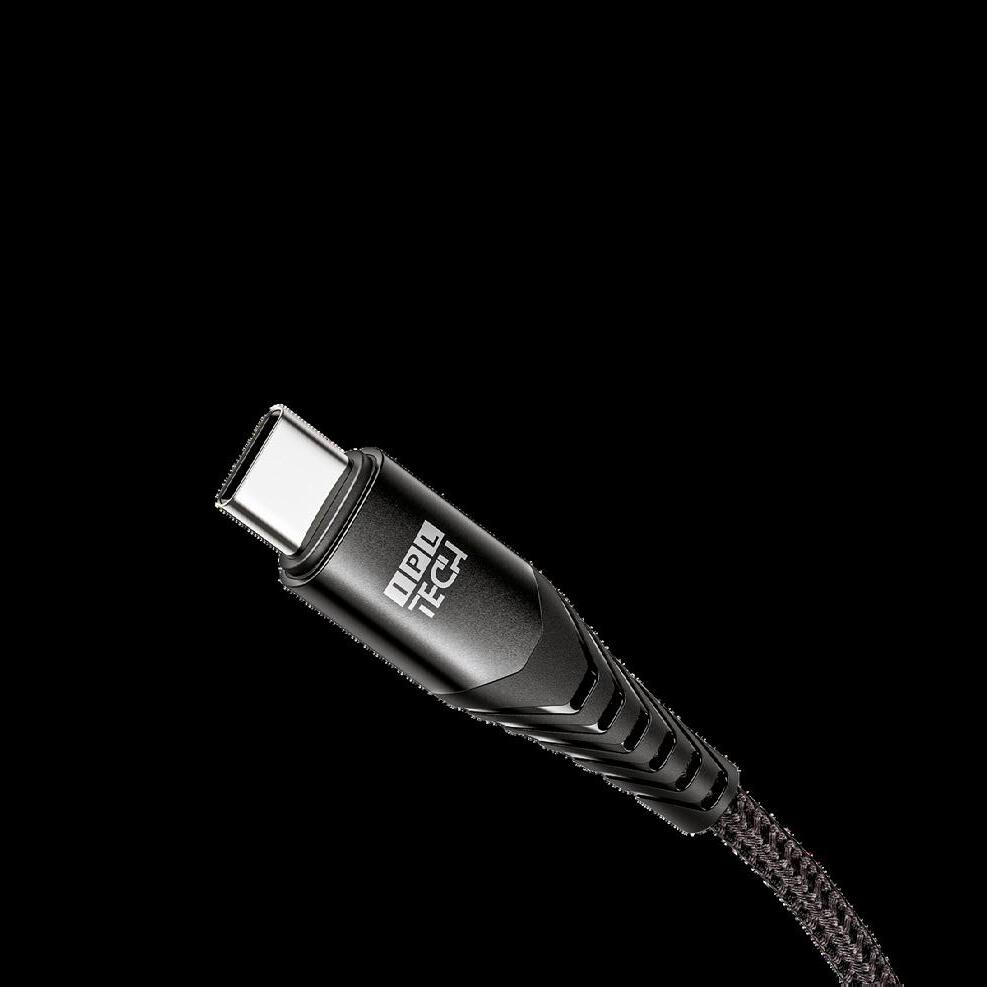

IPL introduces new tech range

IPL Retail Group has recently unveiled its new IPL TECH MFI Fast Charge and Sync Cable 1.2m, designed to provide a robust connection for all tech needs. This state of the art cable supports iOS devices with max output up to 2.4A, allowing for data transmission up to 480 Mbps. The high durability nylon braided construction offers outstanding reliability and longevity, with the ability to withstand more than 10,000 bend tests and 10,000 plugging and unplugging tests. Don’t worry about tangled or broken lines either as the 1.2m tangle free durable tough braiding ensures the cable will have a long lifespan. Enjoy 200mm more length with better value than other competitors. For more information visit iplretail.com.au.

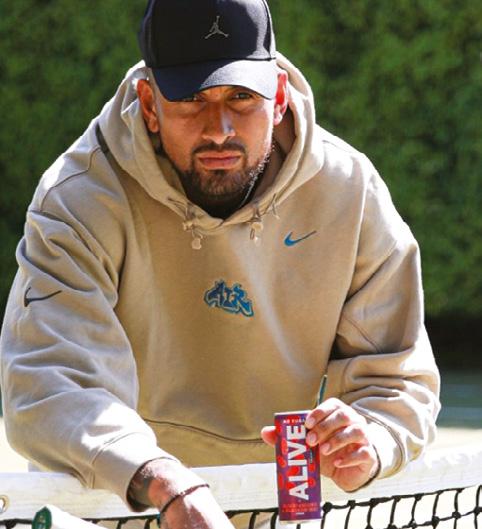

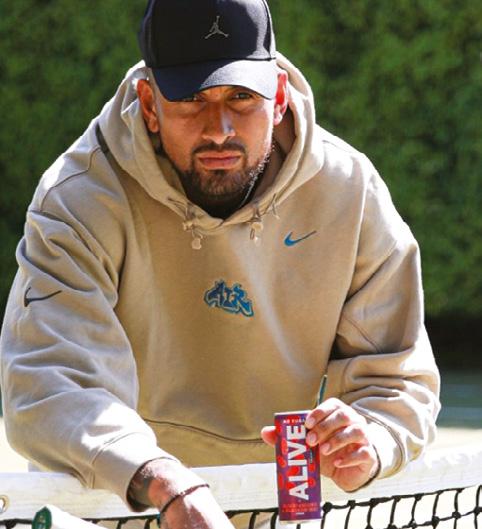

Nick Kyrgios takes on soft drink market

Nick Kyrgios has partnered with Gen U Brands to enter the beverage market with the launch of Australian-made nosugar soft drink, Alive.

Each can of Alive contains one billion live probiotics and prebiotics and is available in eight flavours –blood orange and passionfruit, ginger, lemonade, lemon lime and bitters, orange, passionfruit, and pink grapefruit and raspberry.

Kyrgios, 2022 Wimbledon finalist, said he wanted to make a difference to people’s health with a product that tastes great and delivers.

Alive is currently available in selected IGAs and Coles Express’, with distribution set to expand significantly in Australia and overseas in coming months.

Deputy Editor: Thomas Oakley-Newell Group Publisher: C&I Media Pty Ltd Safa de Valois

Commercial Director: Safa de Valois

to initiate additional CSR based projects and activities.

As part of our company policy we ensure that the products and services used in the manufacture of this magazine are sourced from environmentally responsible suppliers. This magazine has been printed on paper produced from sustainably sourced wood and pulp fibre and is accredited under PEFC chain of custody.

PEFC certified wood and paper products come from environmentally appropriate, socially beneficial and economically viable management of forests.

DISCLAIMER

This publication is published by C&I Media Pty Ltd (the “Publisher”). Materials in this publication have been created by a variety of different entities and, to the extent permitted by law, the Publisher accepts no liability for materials created by others. All materials should be considered protected by Australian and international intellectual property laws. Unless you are authorised by law or the copyright owner to do so, you may not copy any of the materials.

The mention of a product or service, person or company in this publication does not indicate the

Associate Publisher: Deb Jackson

Editorial Director: James Wells

Editor at Large: Keith Berg

Journalist: Rachel White

Graphic Designer: Alyssa Coundouris

Publisher’s endorsement. The views expressed in this publication do not necessarily represent the opinion of the Publisher, its agents, company officers or employees. Any use of the information contained in this publication is at the sole risk of the person using that information. The user should make independent enquiries as to the accuracy of the information before relying on that information. All express or implied terms, conditions, warranties, statements, assurances and representations in relation to the Publisher, its publications and its services are expressly excluded save for those conditions and warranties which must be implied under the laws of any State of Australia or the provisions of Division 2 of Part V of the Trade Practices Act 1974 and any statutory modification or re-enactment thereof. To the extent permitted by law, the Publisher will not be liable for any damages including special, exemplary, punitive or consequential damages (including but not limited to economic loss or loss of profit or revenue or loss of opportunity) or indirect loss or damage of any kind arising in contract, tort or otherwise, even if advised of the possibility of such loss of profits or damages. While we use our best endeavours to ensure accuracy of the materials we create, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication.

Copyright © 2023 - C&I Media Pty Ltd.

Average Total Distribution: 20,747

AMAA/CAB Publisher Statement Period ending 30/09/2022

February/March 2023 | C&I | www.c-store.com.au 5

INFORMATION PARTNERS: PROUD

OF: The Intermedia Group takes its Corporate and Social Responsibilities seriously and is committed to reducing its impact on the environment. We continuously strive to improve our environmental performance and

Nick Kyrgios has launched no-sugar soft drink, Alive.

MEMBERS

PRIME TIME

A POSITIVE FORCE MAKING AN IMPACT

Glenys Tristram is the National Marketing Manager at NightOwl Convenience. She’s a passionate musician, marketer, animal lover, and mother of two teenage boys living in Queensland. This is her story…

Ihave nothing but fond memories of my childhood. I was born in Brisbane and went to a private high school in Ipswich along with my younger brother and sister. At home, my parents always made sure we had one or two dogs around to complete our happy family.

Always an extrovert, my two great loves in high school were music and Girl Guides. I spent an inordinate amount of time camping, going on excursions, and working towards my badges. As I’ve grown, my love of camping has dimmed slightly, but my love of music has stayed with me my whole life, even now, I’m looking to join a local choir.

Throughout my school years, I tried my hand at the piano, violin, and even flute for a while, but it was singing that gave me the most joy. Encouraged by Mum, in Year 11 I auditioned for, and was accepted into, the Queensland Youth Choir and followed that with a Bachelor of Music at the Queensland Conservatorium of Music after finishing high school.

Once I graduated, I spent some time travelling through parts of Africa and backpacking around much of Europe, eventually coming home to work as an audio engineer touring Australia and New Zealand with musicals through the 90s.

It was a calling and career that I loved, but when it came time to start a family of my own, the semi-chaotic life of a travelling freelancer didn’t seem to fit anymore, so I had to rethink my next move.

I descend from a couple of generations of soft drink manufacturers and the family business, Trisco Foods, played a big part in my life growing up. The original company was called Tristram’s Soft Drinks and Trisco and still manufactures wet food products today.

It was only natural to go to work for the family business after I decided to leave my audio engineering career. I started looking after various elements of marketing there and took to it immediately.

Marketing quickly became my new passion, so I enrolled in a Master of Business (Marketing) at the Queensland University of Technology. Then, moving on from the family business, I started at NightOwl when I graduated in 2020.

Starting out just as the disruptions of COVID-19 set in was a challenge. Still, I thrived in the company and about a year and a half after starting as the Marketing Coordinator at NightOwl, I was offered, and gladly accepted, the role of National Marketing Manager.

6 February/March 2023 | C&I | www.c-store.com.au FACE TIME

One of my proudest career moments came to fruition just recently with NightOwl’s first ever wall token donation program, through which we were able to donate more than $36,000 to the Children’s Hospital Foundation.”

– Glenys Tristram

One of my proudest career moments came to fruition recently with NightOwl’s first-ever wall token donation program, through which we donated more than $36,000 to the Children’s Hospital Foundation.

It’s a cause I passionately championed to actively bring to life the core NightOwl value of community-mindedness. I’m very proud of the execution and results we achieved as a team.

In today’s business environment, it’s more important than ever to show your customers, through concrete actions, who you are as a company and what steps you’re willing to take to back your values.

Customers have high expectations regarding company values, and it’s a career highlight for me to have introduced this level of social responsibility to our franchise.

Outside the office, I love to spend my time with friends, singing, reading, hanging out with my sons, and relaxing with our extended furry family. I grew up with dogs, so when we started fostering animals through the RSPCA during the pandemic, I wasn’t expecting to end up with a cat.

However, due to the kids, we had a massive foster failure with a cat called Mouse, now a permanent and well-loved family member. I’ve always been a big dog person, so this new life with a cat still makes me laugh.

Regarding my career, it’s hard to say what the future holds. If the pandemic has taught us anything, it’s that nothing is certain, but still, having a solid direction is important to me.

Leadership roles are of interest to me, as it’s an area where I can make a positive impact. I completed the Australian Institute of Company Directors (AICD) ‘Company Directors’ course in early 2022, and I aim to put everything I learned to good use.

One thing I know for sure is that I absolutely love the franchise business model, so when I’m ready for a new challenge, it’s likely I’ll move sideways into another franchise-based company in some capacity. C&I

“

Glenys with Owlando, NightOwl’s company mascot at the 2022 NightOwl Conference.

Leigh Bartlett, Head of Partnerships, Children’s Hospital Foundation with Glenys Tristram.

February/March 2023 | C&I | www.c-store.com.au 7 FACE TIME

Glenys Tristram and her sons on holiday in Tasmania in 2021, taken at Ocean Beach, Strahan while watching the sunset.

B NEV a It’s our

BETTER VER

Dare fix has

beans that make the difference

out more at ra.org

B a

our

Find

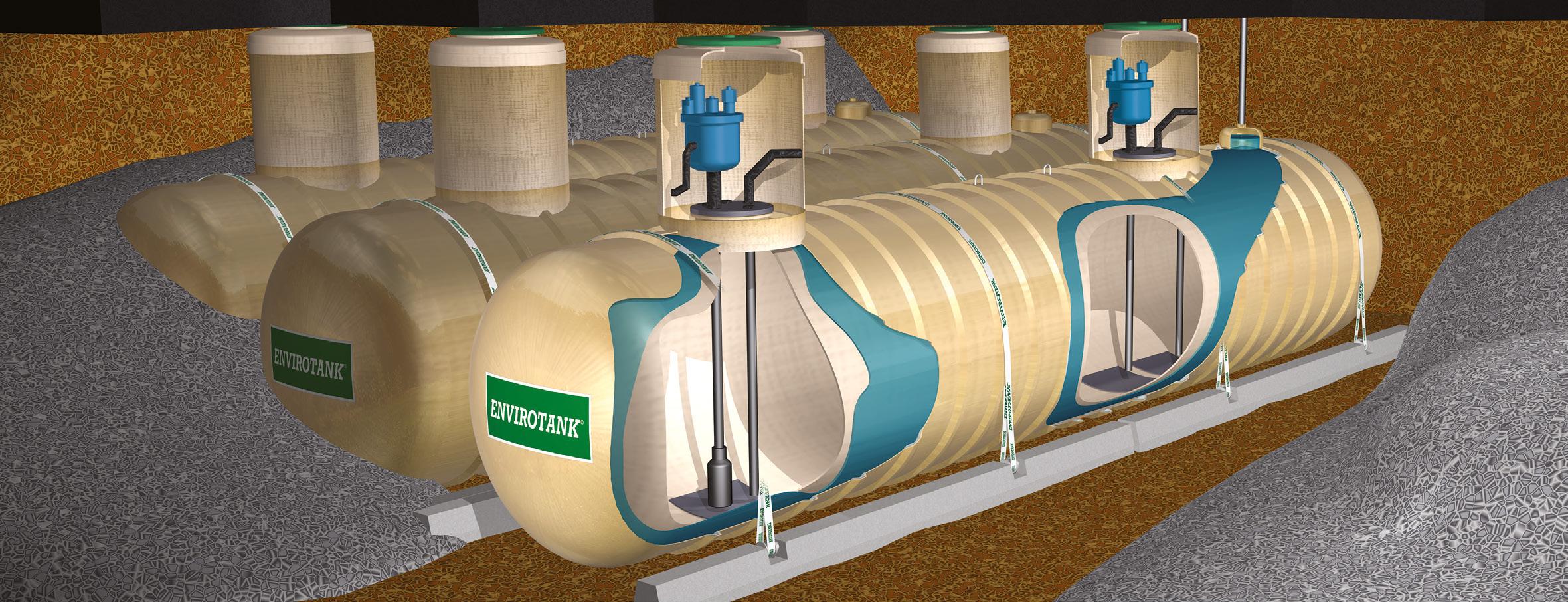

METRO BRINGS THE ENERGY

Frucor Suntory and Metro Petroleum have partnered to create Australia’s first V Energy Concept store in Greenacre.

Featuring a vibrant green exterior, synonymous with V Energy cans, Australia’s first ever V Energy Concept store at David Street, Greenacre is hard to miss.

In a first-of-its-kind partnership, Frucor Suntory has teamed up with Metro Petroleum to create the impressive new store, featuring prominent V Energy branding both inside and out.

Once customers have passed through the vivid forecourt, they’re greeted with dynamic digital signage, which is exclusive to V Energy products, that wraps around the perimeter and advertises the different varieties and promotional offers available across the V Energy range.

Deborah Cooper, Head of P&C at Frucor Suntory, said the idea came about following a collaborative planning session with Metro at the start of their three-year partnership.

“The Metro team were opening a new store, so it was an opportunity for us to partner with a new store opening in an area where we sell a high volume of V Energy.”

Currently within P&C, energy drinks make up 35 per cent of beverage sales*, with that number expected to increase to 40 per cent by 2026, which makes it an attractive category for retailers.

“From a P&C perspective, we know beverages are really important to retailers. So when you think about what’s driving growth in petrol and convenience, beverage is one of the key categories.”

Cooper explains that since the opening of the store, initial month sales are up in both energy and beverages as a whole.

Chris Burgon and David Fullerton, Frucor Suntory.

10 February/March 2023 | C&I | www.c-store.com.au

V Energy branding is visible as soon as customers pull into the forecourt of Metro Greenacre.

STORE REVIEW

“

“Metro would be really pleased with that. There’s really great momentum behind the beverage category and of course energy where we’re continuing to find growth. It’s great to see different ways we can partner with our customers in this area and the early signs are proving to be really successful.”

Green tick of approval

The thought process behind the store is also impressive, recognising the strong performance of beverages in the channel and tapping into that consumer demand.

Energy continues to lead total beverage growth and has experienced 12.3 per cent growth in the latest MAT, with V Energy performing even better than the category average with growth of 14.4 per cent.

This growth has been fuelled by a rise in energy drink consumption among consumers, boosted by the launch of new product lines including V Energy’s low-calorie, sugarfree V Refresh line.

V Refresh has achieved the highest level of trial of any energy drink NPD during the past 12 months since its launch in August and has demonstrated to be 30 per cent incremental to the overall energy category.

John Dib, Managing Director of Metro Petroleum, said he cannot wait to see how their customers connect and embrace with the V Energy experiential execution.

“As the energy category continues to grow and expand within the petrol and convenience sector, Metro Petroleum is proud to be partnering with Frucor Suntory on a first of its kind concept store for both businesses.”

Speaking at the opening of the store, Chris Burgon, Sales Manager – Australia, Frucor Suntory Oceania, said it’s an exciting time to put their vision of a concept store into reality.

“The V Concept store is a testament to the strong relationship and shared values that Frucor Suntory has with Metro Petroleum.”

Cooper agrees with Burgon on the success of the collaborative partnership with Metro and said that they will continue to explore opportunities together.

“From having an idea in a meeting room to seeing it come to life probably about three months later is a great success story of two businesses working really closely together.” C&I

As the energy category continues to grow and expand within the petrol and convenience sector, Metro Petroleum is proud to be partnering with Frucor Suntory on a first of its kind concept store for both businesses.”

- John Dib, Managing Director, Metro Petroleum

Chris Burgon and David Fullerton, Frucor Suntory with Lola Dib, Metro Petroleum.

The Frucor Suntory and Metro Petroleum teams officially opening the Metro Greenacre site.

February/March 2023 | C&I | www.c-store.com.au 11 STORE REVIEW

Chris Burgon, Frucor Suntory with Elie Dib, Metro Petroleum.

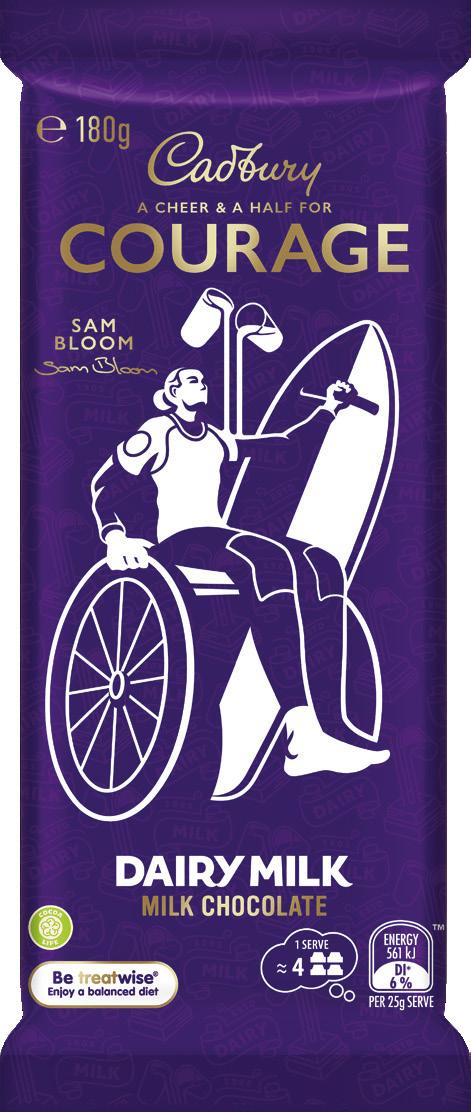

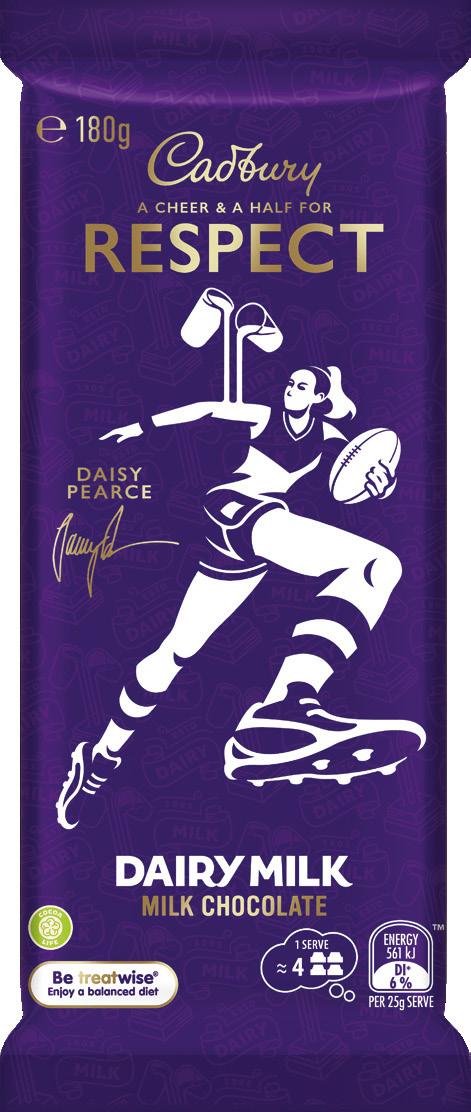

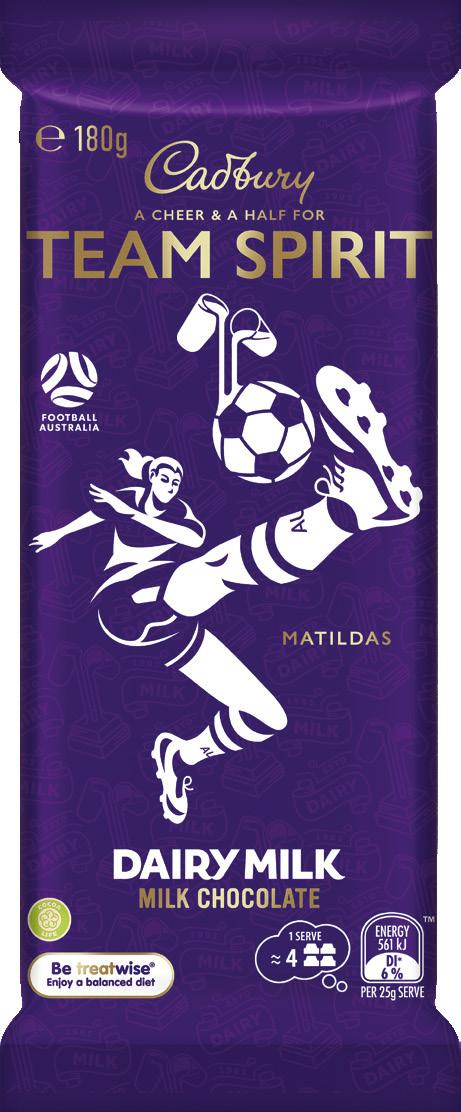

• TEAM SPIRIT • RESPECT • COURAGE • MATE • LEGEND • • INSPIRATION • LEADER • MATE • PURPOSE • RESPECT •

THE EQUIVALENT OF A GLASS AND A HALF OF FULL CREAM MILK IN EVERY 200g OF CADBURY DAIRY MILK MILK CHOCOLATE. DAIRY MILK, THE GLASS AND A HALF DEVICE AND THE COLOUR PURPLE ARE TRADE MARKS USED UNDER LICENCE. PICK UP A SPECIAL EDITION PACK TODAY SUPPORT LOCAL SPORTS CLUBS, BUY A SPECIAL EDITION PACK TO FIND OUT HOW OR SCAN THE QR CODE • TEAM SPIRIT • RESPECT • COURAGE • MATE • LEGEND • • INSPIRATION • LEADER • MATE • PURPOSE • RESPECT •

THE SWEET TOUCH

Accessibility, visibility, and excitability are pivotal in driving consumer engagement of the confectionery category within P&C, writes Thomas

One category that continues to excite and delight consumers is confectionery. You’d be hard pressed to find a category that has such a broad customer base, from parents with kids on the way home from school, city workers at lunch time, to tradies at knock off, there aren’t many consumers that don’t like a sweet treat.

Despite the category’s overwhelming popularity, it suffered a slight drop in performance in the first half of 2022, revealed in the AACS 2022 State of Industry Half Yearly Update, which showed a decline of 1.3 per cent.

This drop was on the back of strong growth of 11.4 per cent in the first half of 2021, with several factors including record fuel prices slowing down the co-buy of confectionery with fuel purchases and the 10 per cent decline of gum and mint.

Guy Bennett, Brand Manager at GC Brands, capitalised on this shift in consumer behaviour and identified that across the Covid period, they saw a stagnation of the gum and mints category as consumers opted for flavour and sweet afternoon rewards over fresh breath, leading to the launch of Hi-Chew.

“Launching in Australia in 2020, having swept Asia, USA, and New Zealand, Hi-Chew has been perfectly placed to fill a need as a gum alternative bursting with flavour. Hi-Chew has

Oakley-Newell.

enjoyed enormous growth of 68 per cent MAT vs LY in 2022 with another national petrol retailer the latest to jump on board with ranging of Cola and Grape kicking off in Q1 2023.”

The growth of Hi-Chew isn’t the only high-performing brand at GC, with Bennett revealing that the company’s entire confectionery portfolio enjoyed exceptional growth in 2022.

“As a supplier of international products, we anticipate this to accelerate in 2023 with Nerds and Hi-Chew in particular expected to grow significantly within P&C on the back of strong supply and significant brand investment into the Australian market.”

For CTC Australia, Lisa Pushkin, Brand Manager, says that their best performing product is the Aussie Drops 70gm Eucalyptus.

“The Distributors Group (TDG) supplied us sales data, which showed the Aussie Drops 70gm as our number one SKU. Even outside of the winter months, this product continues to sell well and is appealing all year around to comfort and sooth.”

Although depending on the retailer, Pushkin has also seen CTC’s Fini Pencil and Cups ranges perform well due to the brand offering something different and unique.

14 February/March 2023 | C&I | www.c-store.com.au CONFECTIONERY

Kevin Pan, Channel Manager – Convenience and Impulse at Nestlé, said their best performing SKUs include KitKat Share Bar 65g, KitKat Chunky Share Bar 70g, Allen’s Snakes Alive 200g, Allen’s Party Mix 190g, and KitKat Medium Bar 45g, but they have also seen growth elsewhere.

“The medicated category has grown significantly in 2022 compared to previous years, impacted by a strong flu season.”

Skye Jackson, General Manager of Merchandise at Ampol, said the snacking and confectionery categories are showing a strong compound annual growth rate (CAGR) of four per cent, and identified the trends behind this.

“Trends that are driving this growth are continued innovation within flavour and texture profiles combined with strong collaborations across trusted brands and traditional sensorial tastes and flavours.”

Sweet innovation

Even with the growing health and wellness trend, confectionery still occupies a large amount of prime positioning, but Pushkin has noticed an emerging trend amongst independent P&C retailers.

“Independent P&C accounts are offering more unique lines and moving away from the major brands, such as offering bigger novelty bays, plus USA lines.”

Pushkin believes it is important that retailers be openminded when looking at what to range and that they offer unique confectionery products to both drive new sales opportunities and as a point of difference to competitors.

“Many of the majors are all so similar and lack any creativity. It’s good when retailers are open to trying new products and offering off location opportunities to smaller brands. Once given an opportunity, CTC products, sell very well.”

This heightened interest in unique and foreign products has been recognised by Bennett, who says he has seen an explosion of international novelty confectionery, and in particular, US candy.

“Brands such as Jelly Belly and Nerds are becoming the centrepiece of very broad ranges. GC enjoys exclusive partnerships with some of America’s largest candy companies and will be significantly broadening the range of US candy we distribute in Australia in 2023 with the guarantee of compliant packaging we provide on our entire portfolio.”

In addition to expanding the US candy range, in 2023 GC will also commence supply of chocolate in the P&C channel with Nomo Vegan and Free From (which contains no nuts, dairy, gluten, soy) chocolate.

“The brand is the UK’s number one in the category and is built to bridge the gap between specialty health and a mainstream audience as the market develops. Being able to distribute the brand cost effectively with temperature-controlled freight within a fractured channel will be a significant challenge until we can bring scale to the brand, however, leading national accounts have already shown great interest with health becoming more of a focus in convenience ranges.”

“ Trends that are driving this growth are continued innovation within flavour and texture profiles combined with strong collaborations across trusted brands and traditional sensorial tastes and flavours.”

– Skye Jackson, General Manager of Merchandise, Ampol

CONFECTIONERY February/March 2023 | C&I | www.c-store.com.au 15

When looking at category decisions, Jackson said Ampol reviews who the customer is and what product is engaging, connecting, and exciting them to pick up and add to their basket while fuelling up at an Ampol site.

“We also review what the supplier support is for the activation in the market, but also what differentiated support plan we can execute with Ampol. Overall asking — do we have the right product range to drive total category growth and profit?”

Convenience still king

The accessibility of P&C makes it one of the most desirable channels for the confectionery category, allowing suppliers to test the waters with NPD.

Bennett said that the channel makes up a large percentage of revenue for GC’s confectionery portfolio, making it a significant factor in top line results.

“Aside from sales results, the fragmented nature of the channel means that there are significant opportunities to partner with retailers of all sizes to build brands incrementally and seed new products to consumers to demonstrate their potential. This is often not possible in other channels dominated by a small number of large retailers.”

Nestlé also sees the benefit of selling certain products primarily in P&C, which is evident in the recent introduction of KitKat Gold Cookies in a 65g share bar format, a twist on fan favourite KitKat Gold, which was the number one

“The P&C channel is a focus for Nestlé. We’ve recently launched KitKat Gold Cookies available exclusively in a share bar (65g), which will primarily be ranged in this channel,” said Pan.

CTC views P&C as extremely important to its brand, as it is their second biggest channel behind major retail.

“It offers us space with plenty of walk-in traffic and loads of opportunities for our unique range of products,” explained Pushkin.

Despite Pushkin recognising the benefits of having space on the P&C shelf, she says arriving at that outcome can often prove challenging.

“It is difficult in major P&C, as their ranging is predominantly from the major suppliers who offer more rebates and spend more on promotions and off locations.

“Future opportunities will include offering products that are not mainstream so they can give their consumers a unique experience in-store. Things like our Pencils and Fini Gum range 60gm fall into this. Also, we need to tailor our offer to each customer. They are all looking for something different and to stand out from their competitor.”

Jackson identified that customers in the channel are not compromising experience and flavour, with continued love and purchases in trusted brands.

“Suppliers are focusing on fewer launches and making them have bigger impact, this is due to all the supply challenges and inflation pressures over the last 12 months.” C&I

“ Independent P&C accounts are offering more unique lines and moving away from the major brands, such as offering bigger novelty bays, plus USA lines.”

– Lisa Pushkin, Brand Manager, CTC Australia

16 February/March 2023 | C&I | www.c-store.com.au CONFECTIONERY

At 1.5Mbps you can scroll and stream music but is not suitable for HD video. Find out more about speeds at vodafone.com.au/prepaidspeed. $2 SIMs contain no value until recharged. Place your order at sales@lebara.com.au Order Vodafone and Lebara Starter Packs

SUPPLY AND DEMAND

Global supply chain disruptions have caused countless headaches for retailers and suppliers alike, but how do we as an industry navigate these murky waters? Asks Thomas

The past few years have seen massive disruptions to the global supply chain, from shifts in consumer demand to labour shortages to geopolitical situations such as the war in Ukraine and lockdowns in China.

These factors have impacted the day-to-day running of businesses across Australia and the world and have forced companies to pivot and re-evaluate the way their business operates.

Looking at the P&C supply chain, Darren Park, CEO of United Convenience Buyers (UCB), said that across the value chain we collectively expect to buy products ondemand, through preferred partners and suppliers.

“This challenges supply chains to have the right product, in the right place, at the right time, and at a competitive price. This has been generally a stable platform for quite some time, but the world has changed. Australia is part of a globalised supply chain, that includes finished products and raw materials. COVID-19, natural disasters, cybersecurity breaches, inflation, trade disputes and many more events and behaviours continue to take their toll on our supply chains.”

Oakley-Newell.

While these are the obvious and well-known contributors, Park says that what people aren’t talking about is the existing and new market entrants that have accelerated their growth over the past 24-36 months, which have retrained consumers and shoppers to expect on-demand access.

“So, not only have we as retailers been dealing with massive supply chain vulnerability, but we also have shoppers that still behave like every item, is just one click away. That continues to be a challenge to manage.”

Theo Foukkare, CEO of the Australian Association of Convenience Stores (AACS), points to the current labour shortages as being one of the most significant factors affecting the supply chain.

“The challenges from the last two years are still with us and are affecting us all the way through from manufacturing, logistics, and warehouse management. Leading into Christmas, suppliers were constrained by how much they could physically get out the door to customers based on available staff. This is slowly addressing itself, however, I believe that it will still be an issue for at least the first six to nine months of 2023.

18 February/March 2023 | C&I | www.c-store.com.au SUPPLY CHAIN

Above: Supply chain disruptions make it difficult to achieve consistency in store execution and customer availability.

“Supply chain disruptions make it difficult to achieve consistency in store execution and customer availability, not only causing frustration for everyone, but also letting customers down. It also presents retailers with compliance challenges to their planogram range and promotional.”

Kristie Davison, Vice President Sales Asia Pacific, RELEX Solutions, a company that helps retailers improve planning in all functional areas, from forecasting and replenishment to planogramming and workforce optimisation, believes that we’ve had a series of challenging years and that 2022 was no different.

“While the pandemic began releasing its grip somewhat, Russia’s invasion of Ukraine flung us into a wartime economy, bringing steeply rising energy costs, inflation, and materials scarcity, unlike anything we’ve seen in decades.

“These challenges have become more acute within the retail and consumer goods industries, as shown by the rapidly shifting consumer behaviour we’ve seen in many markets. Retailers aren’t alone in feeling the pinch of increased commodity prices and have seen a reduction in consumer buying power as a result.”

This new challenge of reduced buying power as a result of record-setting inflation has imposed a new challenge on business following the years of supply chain disruption.

“Decreased buying power has forced retail customers to make hard decisions about the goods and brands they spend their money on. This need to adhere to a stricter budget comes at a poor time for retailers who find their margins shrinking as the cost of products rise.

“Even though it may be possible in some categories to raise prices and pass along the increases in raw material costs to consumers, it would be unfeasible in many categories. The retailers able to refrain from raising consumer prices seem to be winning in their markets across geographies.”

Dealing with difficulties

While it may seem like there is a perpetual parade of problems affecting businesses across the country, Park believes that recovery will happen, but it will take time, perhaps another 12 to 18 months.

“We need to see normalisation of labour availability (both domestically and internationally) and even though sea freight for example is slowly trending back from its highs, raw materials are still hard to access especially via China, where at the time of writing lockdowns are still in force, impacting manufacturing capacity. There are some other complex issues in play now too such as interest rate increases in Australia, which ironically may impact demand too.”

Looking at UCB, Park says that supply chain difficulties have affected their business through such things as “visible” as not being able to find your favourite energy drink, potato chip, or confectionery snack on shelf, to “less visible” but keenly felt increases in the P&C industry’s cost of goods sold (COGS).

“There are multiple actions we have taken and will need to take into 2023. We must, and we have, adjusted price, it’s a reality. But we need to temper that with the other reality, which is our UCB members are not large multinationals, UCB members make money from buying and selling merchandise and to keep competitive in their local communities, they may not always be able to extract the maximum profit from their merchandise.

“We will need to be more aligned with our trade partners about how we help them sell more, reduce cost, and share fairly in those jointly gained benefits.”

Addressing concerns over disparities between how different retail sectors have been favoured during supply chain disruptions, Park says that if you asked 100 people what they thought, then many will say Retailer X seems to be getting an advantage over Retailer Y, but for Park the answer is a little more sensible.

“If you can track inventory, manage shipping, and keep updated on which items are moving the fastest, in real time or as close to, it can appear that you have an advantage over a retailer that might not have some of that capability.

“ Not only have we as retailers been dealing with massive supply chain vulnerability, but we also have shoppers that still behave like every item, is just one click away. That continues to be a challenge to manage.”

– Darren Park, CEO, United Convenience Buyers

Russia’s invasion of Ukraine flung us into a wartime economy.

February/March 2023 | C&I | www.c-store.com.au 19 SUPPLY CHAIN

Decreased buying power has forced retail customers to make hard decisions about the goods and brands they spend their money on.

“What I will say though, is that many in convenience rely on many trade partners who are logistics experts, and my message is that I will be expecting to see more visibility from them across their business on my members’ supply chain positions in 2023.”

Foukkare acknowledged that he has heard the stories around how some retail channels, particularly organised grocery, are favoured ahead of others, but is not close enough to the supply chain to comment further.

“I believe that all retailers should be entitled to access stock proportionately to their sales and planned activities to ensure fairness.”

Davison believes that until recently a convenience store’s main competition was simply another c-store, but that has now changed.

“Quick commerce businesses have made aggressive moves into the convenience space, promising delivery of small baskets, as we saw this year with the ramp up of Metro60 in Australia. Quick commerce faces very unique supply chain challenges as consumers are increasingly looking for fresh food and food-to-go.”

Retailers looking to stay relevant must improve, streamline, and automate in-store operations to elevate the customer experience, claims Davison.

“C-stores have unique challenges related to their small footprint and high cost per square foot. They must balance high availability with the ever-present risk of waste and lack of backroom space to hold safety stock. They also need to ensure that their customers can find exactly what they want and quickly make a purchase.”

Offering advice to retailers, Davison says promotional planning is more relevant than ever as customer shopping patterns change and that many retailers still use a “copy and paste” method using the previous year’s data to develop their annual promotional plans.

“Considering how quickly customer demand and shopping patterns have changed these days, it is easy to understand why this approach is not the most cost-effective. As such, we found an opportunity in the market to improve how retailers and consumer brands use data and analytics to predict the impact of their promotional plans.”

Looking ahead

While the challenges we’ve faced of late are likely to continue into 2023, Davison says that companies that can react quickly and nimbly are the ones who will make it through challenging times the best.

“I’m confident our solutions will continue to help retailers and consumer goods brands reduce their costs through improved efficiency, accuracy, and transparency throughout their supply chains in the coming year and into the foreseeable future.”

For Foukkare, he believes that great communication with partners will allow stock to flow into their most needed areas.

“While some suppliers can afford to bulk up their stock to satisfy their customer demand, other suppliers aren’t able to be given the shelf life. Some partners are looking at multiple supply/manufacture options and looking at more production locally, however this comes with its own set of challenges.”

Echoing Foukkare’s sentiments, Park agrees that having effective communication between all involved parties is one of the most important aspects of navigating supply chain difficulties.

“For too long, supply chain has operated as an important but rarely spoken about function. Very few trade partners bring supply chain to our table. UCB is a valuable and complex network with a supply chain that mirrors that.

“What can we do together to focus on consistent optimisation? What benchmarks are feasible to aspire to? How do we jointly share savings and also build efficiency and security for all? This is not a trade partner only problem, it’s a joint one and it needs to be treated in a way that supports mutuality of understanding.”

The importance of the power of communication as a vehicle to jointly share issues and look for sensible ways forward is important to Park and UCB.

“From my perspective, I want myself and my team to be involved and aware early, so we can help to decide if we solve issues or live with them.” C&I

We want to hear from you

Are you a retailer who has experienced difficulties in acquiring stock? Have disruptions in the supply chain caused you to change the way you run your business? Reach out to Thomas at tom@c-store.com.au to take part in an article on the challenges currently facing P&C retailers.

“ I believe that all retailers should be entitled to access stock proportionately to their sales and planned activities to ensure fairness.”

– Theo Foukkare, CEO, AACS

20 February/March 2023 | C&I | www.c-store.com.au SUPPLY CHAIN

Raw materials are still hard to access especially via China, where at the time of writing lockdowns are still in force, impacting manufacturing capacity.

©2021 Energizer. Energizer, Energizer Character, and certain graphic designs are trademarks of Energizer Brands, LLC and related subsidiaries.

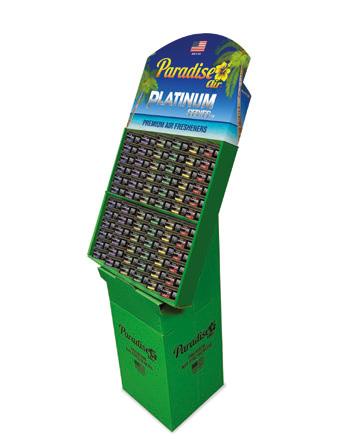

COMPLETING THE PACKAGE

The general merchandise category helps round out the P&C channel as a one-stop-shop for consumers, writes Thomas Oakley-Newell.

Cementing convenience stores as a one-stop-shop wouldn’t be possible without the availability of the general merchandise category. From sunglasses to toys, to smoking and auto accessories, making shoppers aware of the products available is paramount.

As consumers drifted away from heavily populated areas such as supermarkets and shopping centres during the pandemic, they came to the less crowded P&C channel to purchase their everyday items, and in turn witnessed the wide variety of general merchandise available.

Ben Coleman, General Manager of Commercial and E-Commerce at Pacific Optics, said this is a huge opportunity to service customers that have migrated to the channel over the past 12 months, from grocery in particular.

“The challenge with this is making sure they get repetitively led to the channel through above the line marketing, the other challenge is in making sure what they see in advertising comes to life in-store.”

Yaniv Peleg, Director of Peleguy Distribution, has also recognised that consumers are visiting smaller, local stores more often instead of big supermarkets and shopping centres.

“We’ve noticed that buyers are exposed to a much wider range of products at P&C stores these days. There’s also a trend of customers spending money happily on things they would not normally get from a convenience store or a petrol station, such as phone chargers with wireless charging technology, bluetooth earphones and gifts, which are usually more expensive than your everyday range.”

22 February/March 2023 | C&I | www.c-store.com.au GENERAL MERCHANDISE

Over the summer, Coleman has noticed an uptick of eight per cent in the sale of sunglasses, most likely off the back of marketing investment and better weather as opposed to previous years.

“During summer, sunglasses and headwear are the best performing products given the season and the sunshine we have had this year. The colourful ‘dopamine inducing’ shades have been really well received, particularly by party and festival goers.”

Also noticing a change in consumer preferences over the summer months is Tal Avrahami, Managing Director at Smooth Wholesales, who said they’ve also seen an unprecedented demand for sunglasses.

“We have been inundated with orders, which I guess comes down to quality and price. The last time I checked, our sunglasses were probably one of the best priced in the market without compromising on quality. So, it’s no surprise they’re popular.

“Other products like USB-powered fans, drink bottles, sunscreen, and beach toys are also proving to be incredibly popular with our customers. The busy bees in the office are already putting together some great deals for when the weather gets colder in the coming months, so I’d keep an eye out for that.”

Avrahami believes that as a wholesaler in the P&C channel it is Smooth Wholesales’ job to understand the styles that shape the industry, while also trying to be trend-setters.

“Consumers aren’t as close-minded to new products as some may believe, with a number of non-traditional categories performing well over the last 12 months such as toys and novelty giftware. The demand for Select Footy Cards is also showing that these timeless collectables are more popular than ever.”

Changing landscape

As the cost of living continues to increase, consumers are looking to tighten their purse strings and while this has no doubt led to changes in purchasing habits, it’s the job of wholesalers and suppliers to attempt to offer value where they can and maintain interest in their products.

“With the cost of living going up and up, consumers are becoming more price conscious with their shopping. This aligns to our core mission at Smooth Wholesales, to help our P&C customers meet the demands of their customers. We go above and beyond to find the best deals, from the best manufacturers to bring the best value to the Smooth Wholesales network,” explains Avrahami.

While offering value is critical, it is also important to understand the consumer and Avrahami says that insights are what help drive their business decisions, and by sharing them with the customer they can help them make better choices.

“We base all our recommendations on observed results, like an approximate increase of 145 per cent of disposable vapes suggesting that P&C consumers are shifting away from traditional tobacco products to newer options.

“Additionally, we’ve also seen an increase of over 40 per cent in the sales of toys and games around seasonal buying periods, which presents as a great opportunity for stores to be convenient locations for consumers to now buy gifts for friends and family.”

For Peleg, their best performing products are phone accessories such as the Vibe USB cables, but he also recently noted an increase in the sale of IGET vapes.

“IGET vapes have picked up pace recently, demonstrating that customers have had enough of traditional cigarettes. Consumers desire a funkier, cheaper, and healthier alternative to cigarettes. IGET vapes are the number one choice by consumers.”

Having effective communication with retailers is important to Peleg, and they spend time educating store managers about which products sell the fastest and advise them to carry back-up stock.

“ The mission we have at Smooth Wholesales is to help store operators and small business owners in P&C by supplying affordable, highquality stock and sharing our vast experience and knowledge to maximise their earning potential.”

– Tal Avrahami, Managing Director, Smooth Wholesales

February/March 2023 | C&I | www.c-store.com.au 23 GENERAL MERCHANDISE

“Some clients are running out of things only a week or two after receiving them, which is rather impressive. We are aware because when clients run out, they call to let us know and then purchase more.”

A trend that Coleman and Pacific Optics have noticed is the introduction of non-MFi (Made for iPhone) products and cheaper technology products into the market, which may be limited in the amount of scrutiny it receives before making its way to a shop shelf.

“We hope this doesn’t devalue the category as a whole for our trade partners or harm the reputation for quality that consumers have learnt is available in the channel. We are also seeing increased demand and acceptance of fast charge and magnetic charging technology as the newer phone models become more common.”

A convenient offer

For Avrahami, P&C is in his blood. His family have been in the industry since the 70s, so it is something he has grown up with his entire life.

“As a company, we pride ourselves on the fact that we’ve been in the same position that a lot of our customers are experiencing, and we understand the difficulties and pain points with running these businesses. It’s the reason we started Smooth Wholesales, because we understand that independent operators and even larger organisations are conscious of the bottom line – that amount that keeps their business going.

“The mission we have here, at Smooth Wholesales, is to help store operators and small business owners in P&C by supplying affordable, high-quality stock and sharing our vast experience and knowledge to maximise their earning potential.”

Avrahami’s father’s words of wisdom; “You don’t know, what you don’t know” are what he would say when he was trialling products at his Liberty sites, and this phrase still rings true for Avrahami.

“He believed that if you bring the right products, at the right prices, then you’ll always find a customer for them. That is something we see time and time again within our

network of customers who are willing to take calculated risks on products they’ve never tried and seeing remarkable outcomes. P&C customers don’t want to see boring stores with the same old stock, they want to see exciting products at reasonable prices and that’s why our customers trust us to help them boost store sales.”

At Peleguy Distribution, the P&C channel is extremely important to them, as it is the largest sector of their business.

“This industry is where we excel and we aim to help our customers make thousands of dollars in revenue every month. We achieve this by having regular store visits and supplying a large range of products that are in high demand,” says Peleg.

Offering advice to retailers in positioning and selling Peleguy products in-store, Peleg said that retailers must make the shelves attractive and eye-catching, while keeping the products neat and visible.

“Make sure you have reasonable prices to be able to become that regular local store that the customers are happy to come back to. Shelves must be full, always stock up on the more popular products to avoid the shelves looking empty. Don’t be afraid to over-stock on fast moving items, you don’t want to be left without stock and having customers asking for sold out items.”

Avrahami believes that the P&C industry is witnessing a dynamic shift in the design and layout of stores.

“I have seen it at a few of Jasbe Petroleum’s new sites in Victoria, which have successfully merged functionality with aesthetics. This raises the question of how to effectively display and sell products. I believe that a key strategy to boost sales is positioning products in prominent spaces and utilising captivating signage to draw customers’ attention. Additionally, making sure prices are clearly visible will inform customers of potential bargains which, in turn, will keep them coming back to your store.” C&I

“ This industry is where we excel, and we aim to help our customers make thousands of dollars in revenue every month.”

– Yaniv Peleg, Director, Peleguy Distribution

24 February/March 2023 | C&I | www.c-store.com.au GENERAL MERCHANDISE

Above: Having eye-catching, neat, and visible shelves is the key to making more sales of general merchandise, according to Peleguy. Bottom right: Peleguy advises stores to keep display shelves attractive and fully stocked.

ORDERNOW! AVAILABLE MARCH 2023 1300 180 770 smoothwholesales.com.au CONTACT US TO SECURE YOURS TODAY STARTER PACK OPENING ORDERS 2 x CARD 36PK CDUs 2 x ALBUM 10PK CDUs INCLUDES Note that 2023 packaging may be different to what is displayed above. *

MILK FOR THE MASSES

Whether for health, the environment, or simply for taste, Australians are making the switch from dairy to plant-based milk in their droves, writes

Where once soy was dairy milk’s solitary competitor, now, there are a plethora of options like oat, almond, rice, coconut, macadamia, pea, potato and even hemp to satisfy a growing demand for dairy alternatives.

Perceived as healthier and greener, data from the Australian Bureau of Statistics (ABS) supports what many companies already know, that demand for animal-free alternatives across the board is growing by the minute.

Paul Atyeo, a health statistics spokesperson from the ABS, said the average apparent consumption of dairy and meat substitutes has risen 29 per cent since the 2018-19 financial year.

“About 17 grams of apparent consumption per person per day came from dairy milk substitutes like soy milk or almond milk. This is equivalent to about half a metric cup per week.

“Consumption of dairy milk substitutes rose four grams per day between 2018-19 and 2020-21, mirroring a four grams per day fall in dairy milk over the same two-year period.

Rachel White.

“Almond milk had a particularly rapid increase in apparent consumption, up 31 per cent in the last two years. Soy milk increased by 16 per cent over the same period,” Atyeo said.

Lauren Chapman, Founder of h.alt, an innovative company bringing hemp milk to the market, says the take-up of dairy alternatives is multi-faceted, with consumers making the change for various reasons.

“Plant milk as a category is growing massively with a generational shift away from dairy. We know that public consciousness and the need for more sustainable options have led to more people choosing to drink plant-based milk.

“Another common and growing reason to believe people are making the switch to plant-based milk is due to allergens, lactose intolerance and digestive issues that often arise from dairy milk,” she said.

Andrew May, Co-CEO of Unigrain, a B2B oat milk supplier, agrees. He said the reason consumers are buying plantbased milk is varied dependent on the individual.

26 February/March 2023 | C&I | www.c-store.com.au PLANT-BASED MILK

“Everyone’s decisions are slightly different. It could be lactose intolerance, it could be environmental sustainability, it could be that it just tastes good. I think there is a whole range of factors,” he said.

Oat on the rise

The newest kid on the block, oat milk, although not the most popular choice currently, is widely predicted to be the plant milk that will overtake other varieties within the next few years.

Appealing for its mild flavour and dairy milk-like qualities, including its pleasing pairing with coffee and ability to be frothed without splitting, many producers are adding oat milk products to their offering.

Sanitarium, manufacturer of Australia’s first dairy milk alternative, So Good, is jumping on the oat milk bandwagon with its newly launched Toatl range designed for the convenience channel.

“Oat milk is the plant milk on the rise,” said a Sanitarium spokesperson. “Our local oat milk manufacturing capability and our successful oat milk launches in grocery and café, meant creating a great-tasting grab-and-go oat milk for convenience customers was a clear opportunity.”

Tim Clarke, Shopper Strategy Manager at Sanitarium, said the flavoured milk segment is an ever-evolving market that thrives on innovation.

“With more consumers at the fridge looking for a plantbased option, Toatl provides the opportunity to convert these shoppers with a great tasting offer. This will bring new consumers into the segment and drive incremental sales. It’s a must have,” he said.

May says at the core of demand for any food or beverage offering is taste, and despite health or environmental concerns, at the end of the day, for a consumer to make repeat purchases, a product has to taste good.

“We can’t forget the fundamentals of food and beverage demand, which is it has to taste good and that’s I think, ultimately where the market has really found its place.

“As a consumer, [a plant milk] has to fit those categories really well, so it tastes good and it works in all the applications you would expect dairy to,” he said.

Above all other plant-based milks, May said the rapid rise in the popularity of oat is because it is a familiar and wellreceived ingredient in Western countries like Australia.

“Oats are a really well-accepted ingredient in Western countries, and I think that makes a real difference in terms of take up of the product, relative to a product such as soy milk,” he said.

Where to next?

Associate Professor Nitika Garg, a researcher in consumer behaviour from the School of Marketing at the University of New South Wales (UNSW), said it’s possible that, in time, plant milk will take over dairy milk in popularity.

“Much of the growth to date appears to be consumer-driven, so I would expect the trend to continue to grow.

“As these brands continue to scale up their manufacturing and marketing efforts, there’s a huge opportunity for a true milk substitute to emerge and compete with dairy,” she said.

One possible roadblock is cost, as plant-based milk is generally sold at a higher price point than regular dairy milk, making it unrealistic to assume it will take over completely any time soon.

“ Plant milk as a category is growing massively with a generational shift away from dairy. We know that public consciousness and the need for more sustainable options have led to more people choosing to drink plantbased milk.”

– Lauren Chapman, Founder, h.alt

February/March 2023 | C&I | www.c-store.com.au 27 PLANT-BASED MILK

“We do have an issue with making products such as plant-based milk accessible for everyone. They are more expensive, and some consumers who might want to switch can’t, especially with the cost of living right now where every dollar counts.

“It might be something governments need to explore, to help subsidise in the same way they subsidise the dairy industry,” said Associate Professor Garg.

Professor Johannes le Coutre from the School of Chemical Engineering at UNSW notes another challenge with plant-based products, including milk, comes from the manufacturing process.

“There are challenges when it comes to plant-based products in that they usually destroy a lot of nutritional goodness and require a lot of resources just to mimic a product [milk] that isn’t intended for human consumption in the first place,” he said.

May agrees and said there’s still progress to be made in the manufacturing process of plant-based milk to optimise taste and nutritional value.

“I certainly think there is a long way to go in terms of specific product development,” he said, especially regarding oat milk, which is highly geared towards creating the best experience possible for the coffee consumer.

“Innovation will also be important in terms of other kinds of plant-based mixes whether that be oats, or oat milk produced in combinations with other plant-based ingredients, so there’s certainly still a long way to go,” he said.

Taking things a step further, Professor le Coutre says plant-based milk is just the beginning of a new global food system that will give consumers a wider variety of choices than ever before.

“Plant-based products, existing animal-based materials and, someday soon, cell-based and blended products improve our food choices.

“As we expand our portfolio of products, it enriches the spectrum of offerings in the market to everybody’s benefit,” he said. C&I

“

Everyone’s decisions are slightly different. It could be lactose intolerance, it could be environmental sustainability, it could be that it just tastes good. I think there is a whole range of factors.”

– Andrew May, Co-CEO, Unigrain

28 February/March 2023 | C&I | www.c-store.com.au PLANT-BASED MILK

Alka Power a ‘game changer’ in the water category

With its ultra-hydrating properties, its immunity boosting benefits, and its crisp, refreshing taste, it was hard to go past Alka Power as our latest C&I Choice product, as it leads the charge in the better for you bottled water space.

Alka Power, which is ranged through a variety of channels including grocery, health, and wellness, and at WHSmith nationally, has recently expanded through the convenience channel including at Ampol and will soon be available in Ezymart stores. Managing Director Steve Pettaras explains that Alka Power has a bottling facility located in the Southern Highlands of NSW, with natural spring water drawn directly on-site. The result is the first and only naturally-raised high pH 9-10 alkaline spring water on the market.

“Alka Power is channelling into the mainstream bottled water segment as we believe Alka Power is the best tasting and better for you bottled spring water on the market,” he says.

“We infuse our spring water with unique active ocean sourced minerals, which also have a smooth crisp refreshing taste. Other high pH 9-10 alkaline waters are artificially raised using electrolysis (electrocuting the water molecule).

This method is unstable as once the bottle has been opened; oxidation causes the pH to drop to its original pH value.

“Of course, there are a number of other naturally raised alkaline spring waters on the market, but these are only slightly alkaline and will commonly be found to have a chalky after taste.”

Alka Power has national distribution in Coles, Woolworths, and WHSmith, as well as independent grocers such as IGA, Harris Farm, and is experiencing growth in health food, supplement stores, cafés, wellness centres and many more small retail outlets.

Pettaras concludes: “We’re pretty proud of what we have achieved and the feedback from our loyal customers. Even all our retailers and distributors are so happy with our growth in such a competitive price driven commodity such as bottled water.

“One driving force is brand loyalty and continued growth in major national retailers. The main functionality is how customers are repeat buyers of Alka Power and the feedback from them through socials and emails is how they see results by regularly drinking Alka Power. This gives us great pride.”

Nestlé Purina’s most convenient cat food is now available in P&C

Perfect for fast paced living, Nestlé Purina’s single serve Felix Sensations Jellies are now available at various petrol and convenience (P&C) retailers nationally.

One of the most popular cat food products on the market, Felix Sensations Jellies are individually portioned meals packed with vitamins, minerals and omega 6 fatty acids for a happy and healthy cat. Ready in seconds, Felix 12-pack and bulk varieties are available in multiple flavours featuring tender meaty and fishy pieces encased in a flavourful jelly to satisfy even the fussiest feline critic.

Fan favourites include salmon in tomato flavoured jelly, beef and tomato in jelly, chicken, spinach in jelly and ocean fish in prawn flavoured jelly, mackerel and spinach in jelly and turkey in game flavoured jelly.

The meal-sized portions are designed to be irresistible, while offering a balanced diet that meets all a cat’s daily nutritional needs in a quick and convenient format.

Wet cat food is a fast growing category, accord to Nestlé Purina, which has noted a general shift away from multi-serve cat food products and simultaneous uplift in single serve meal portions.

In line with shopper insights, Nestlé Purina has made its popular Felix Sensations Jellies available in both grocery and P&C channels to cater to busy professionals looking for quick and nutritious meals for their beloved companions.

Nestlé Purina has a longstanding commitment to helping pets live long, happy and healthy lives through proper nutrition.

PRODUCT RANGING 30 February/March 2023 | C&I | www.c-store.com.au

MINT FLAVOURED SWIRLS & CURLS COATED IN CADBURY

DAIRY MILK MILK

THE COLOUR PURPLE IS A TRADE MARK USED UNDER LICENCE.

CHOCOLATE

TRY THIS!

Peroni delivers superior Italian taste with zero alcohol

In July 2022, Peroni relaunched Peroni Nastro Azzurro 0.0% under the Masterbrand of Peroni Nastro Azzurro, continuing to deliver the same Italian passion and flair to customers.

Launching in Europe in April 2022, Peroni Nastro Azzurro 0.0% is crafted using the signature Nostrano dell’Isola maize, grown exclusively for Peroni in the north of Italy, creating the same uplifting Italian taste.

Birra Peroni has implemented technology in its Rome brewery to enable Peroni Nastro Azzurro 0.0% to match the flavour profile of signature beer, Peroni Nastro Azzurro, which has been brewed since 1963. This technology allows the signature base recipe and ingredients of Peroni Nastro Azzurro to be used, and only after the characteristic aroma and taste profile of Peroni Nastro Azzurro is fully developed, is the alcohol gently removed to deliver the crisp and refreshing Italian taste.

Australians still love a drink but are consuming beer in an increasingly responsible way, with Australian alcohol consumption at historic lows. Peroni Nastro Azzurro 0.0% caters to Australia’s evolving tastes, allowing lovers of premium beer to moderate their alcohol consumption while still enjoying the full and distinctive Peroni flavour.

Introducing the ultimate refreshment: Level Lemonade & Cola

Level Beverages, founded by Chrish Graebner, is shaking up the beverage world with its range that seamlessly blends deliciousness and goodness. No more sacrificing one for the other, the Level range has something for everyone. The newest flavour, Level Lemonade & Cola, is the perfect solution for cola fans. Packed with essential vitamins and minerals, this drink is not just refreshing, but nourishing too. And it’s 100 per cent Australian made and owned.

Graebner acknowledges the lack of innovation in the carbonated soft drink market, but Level Lemonade & Cola is here to change that. With its unique blend of flavour and nourishment, this drink will satisfy your cravings and leave you feeling refreshed.

Say goodbye to bland and uninspiring drinks and hello to the ultimate refreshment. Level Lemonade & Cola will be available through leading wholesale partners, including Ampol, EG, Coles Express, New Sunrise, OTR, and Ezymart. Get ready for a new level of refreshment.

32 February/March 2023 | C&I | www.c-store.com.au PRODUCT RANGING

Manufacturing in Australia, can we come back?

What has happened to Australian manufacturing in the 21st century?

Tonik is proudly owned by Halo Food Co, one of the largest, and last major manufacturers of health, sport and diet companies in Australia. Having produced product as a contract manufacturer for more than 20 years, recently the company has stepped into the brand ownership space.

The challenges of operating a profitable manufacturing company are clear; labour costs, increasing ingredient costs, having an experienced team to maintain and run a well-oiled machine costs a lot of money.

This is why manufacturing over the past 20 years in Australia has been dwindling away year on year.

‘Buy Aussie Made Products’, is the call out we hear, but in a market flooded with imported products, how does the consumer clearly define what is Australian made and Australian-owned? These are the questions that Lisa Schilling-Thomson, National Sales Manager for Tonik asks.

Tonik is here now

That’s why Halo entered the market with its own brand Tonik, which produces protein bars, and protein RTDs all made right here, by the hands of Australians. As the call out says, ‘Made by Australians, for Australians’.

“Being the manufacturer, we have complete control over the quality of the final product, which is why we developed our own Proprietary Protein blends for our bars and RTDs, and only select the highest quality ingredients available,” says Schilling-Thomson.

“Our bars and RTDs are without doubt the best tasting in the Australian market, all due to the quality of our products. But without the support of retailers and gaining new ranging we are at risk, just like any other Australian brand.”

Tonik flies the Aussie flag proudly and loudly, and is gaining more, and more success in recent months, notably achieving new ranging in bp, Chevron, Metro Petroleum, New Sunrise Group, UCB, OTR, 7-Eleven, Foodworks, Romeos IGA, and Lloyds IGA.

Watch this space in 2023, Tonik is coming…

R E T A I L USB A - LIGHTNING TYPE C - LIGHTNING Unit 1, 22 Rowood Road, Prospect NSW 2148 Tech F O O T W E A R 1300 176 078 ABN 28632453135 support@iplretail com au www iplretail com au PRODUCT RANGING

SUPERCOAT with SMARTBLEND

A dog’s best life starts with the right nutrition

NOURISH THEIR BEST LIFE

NEW LOOK WITH ENHANCED FORMULA

We believe a SUPERCOAT dog lives their best life and enjoys every day to the fullest! It’s all about them having a great doggy time, whether that’s chasing a ball, playing fetch, going for walks or simply relaxing and receiving cuddles and pats. A dog’s best life starts with the right nutrition. That’s why we developed SMARTBLEND.

22 essential vitamins and minerals

Natural fibres

EVERY INGREDIENT HAS A PURPOSE

SUPERCOAT SMARTBLEND is the precise combination of high-quality natural ingredients; blended with real meat, plus 22 essential vitamins and minerals. Nourish your dog with the tailored nutrition they need to bring out their best everyday.

Omega 3 & 6

Chicken/Beef (protein)

Mars Wrigley releases a world first Maltesers innovation

Mars Wrigley has launched the new Maltesers Gold, bursting with flavours of caramel and white chocolate, with Australians the first to try it globally.

The world first innovation for Maltesers sees the classic crisp malt centre coated in an indulgent gold white chocolate, adding a decadent twist to the iconic treat.

Ben Hill, Marketing Director, Mars Wrigley, said the product innovation has been consumer-led and the team expects Aussies to be excited by the launch.

“Australians are the first consumers in the world to enjoy our new Maltesers Gold, and we’re really proud to have designed and formulated the recipe and manufactured the product locally in Australia at our Ballarat innovation hub. It’s been a full team effort and we’re incredibly excited to have this product on shelves,” Hill said.

In recent years, Mars Wrigley has invested more than $25 million into its Ballarat site with the ambition to bolster consumer-led product innovation within its Bitesize portfolio.

“Maltesers Gold is not only one of the first product innovations for us this year, it’s a great example of where we’ll be taking the brand over the next 12 to 24 months, so there is a lot for us to be excited about.”

Maltesers Gold sits alongside the full Maltesers range offering, including Milk and Dark, and Honeycomb, Caramel, and Popcorn.

Maltesers Gold will RRP at $5 and will be available from Coles, Woolworths, and leading independent retailers.

The new Smith’s Taste Icons range features iconic restaurant flavours

The Smith’s Taste Icons range will feature five new flavours derived from three iconic restaurants – Subway, Red Rooster, and Mad Mex.

Launching in January, the new range features the following flavours: Subway Crinkle Meatball Sub, Subway Crinkle Pizza Sub, Subway Crinkle Chicken Teriyaki Sub, Red Rooster Crinkle Reds Fried Chicken Burger, and Mad Mex Double Crunch Hot Sauce.

Sam O’Donnell, Marketing Manager at Smith’s, said they are excited with the partnerships and the launch of what is their biggest brand collaboration to date.

“Smith’s is famous for its flavours, so of course we jumped at the opportunity to bring a unique range of flavours to life on our iconic crinkle cut chips.”

Ashley Hughes, Marketing Director at Red Rooster, said when the opportunity to partner with Smith’s came up, they couldn’t refuse.

“To us, nothing sums up the rooster’s call better than our iconic Reds Burger and we can’t wait to share our flavours with Aussies in a new and very craveable way by joining forces with Smith’s and their Taste Icons range.”

Rodica Titeica, Head of Marketing at Subway ANZ, said like Subway, Smith’s has been in the hearts of Aussies for many decades.

“Our freshly baked subs are a delicious and filling meal option for breakfast, lunch and dinner but we know there can be key snacking periods in between and partnering with Smith’s allows Aussies to access the Subway flavours they know and love in another form – in potato chips.”

Clovis Young, CEO and Founder of Mad Mex, said when they were approached by Smith’s to partner on the Mad Mex Hot Sauce infused chip, they jumped at the opportunity.

“We knew that by combining Smith’s product development expertise and our world-famous Mad Mex hot sauce, we would come up with something truly special for our amigos. The end result will impress even the toughest of food critics.”

The Taste Icons range has been available to purchase from Coles, Woolworths, and other independent retailers from January, with Smith’s Subway Meatball Sub flavour available exclusively at Coles.

36 February/March 2023 | C&I | www.c-store.com.au PRODUCT RANGING

Did you know…?

KitKat Gold Cookies is produced locally at Nestlé’s factory in Campbellfield Victoria, where 100 per cent of the electricity is sourced from wind power as of 2021. This same factory has been sourcing 100 per cent sustainable cocoa certified by the Rainforest Alliance® and supplied by the Nestlé

Plan since 2013, supporting cocoa farmers and their communities.

Caramelise your break with KitKat Gold Cookies

KitKat Gold Cookies is available exclusively in a 65g share bar and is sure to be a fan-favourite with KitKat lovers.

KitKat Gold Cookies is a delicious combination of crisp KitKat oven baked wafer fingers, fan favourite KitKat Gold chocolate and dark cookie pieces. By combining two hugely successful and popular flavours that work well in chocolate, KitKat Gold Cookies is a match made in heaven.

In 2018, Gold was the number one innovation launch and has been sustainable in the KitKat range ever since, while cookies continue to be a top performing flavour in the chocolate category year on year. KitKat Gold Cookies is the combination of these two fan-favourites and is available exclusively in a share bar (65g).

Cocoa

38 February/March 2023 | C&I | www.c-store.com.au PRODUCT RANGING

“ KitKat Gold Cookies is a delicious combination of crisp KitKat oven baked wafer fingers, fan favourite KitKat Gold chocolate and dark cookie pieces.”

Get ready to go NUTS!

KitKat’s smooth new flavours feature a spin on a fan favourite and are the first KitKat with real nut filling.

The KitKat team is taking Aussie ‘breaks’ to the next level by launching two new indulgent flavours, KitKat Smooth Hazelnut and KitKat Mint Cookies and Cream.

Set to satisfy all chocolate lovers, KitKat Smooth Hazelnut features KitKat’s iconic oven-baked wafer, filled with delicious, fudge-like hazelnut praline coated in irresistibly smooth chocolate. The new mouth-watering flavour is available in a KitKat block and the much-loved four finger bar.

Pulling out all the stops, the new KitKat Mint Cookies and Cream is a delicious combo of two fan favourite flavours – filled with creamy mint and crunchy cookie pieces, combined with the iconic KitKat wafer and smooth milk chocolate. KitKat Mint Cookies and Cream is available in a block, perfect for sharing.

Nestlé Marketing Manager Confectionery Shannon Wright said: “We’re excited to bring our KitKat fans this new range – to create truly indulgent ‘breaks’. The new Smooth Hazelnut marks the first Aussie KitKat with real nuts and delicious praline filling.

“We know chocolate lovers are seeking more indulgence and these new KitKat flavours offer just that. But don’t worry – we’ve kept the classic KitKat snap fans know and love from the number one chocolate bar*.”

KitKat Smooth Hazelnut Block (170g, RRP $5.50), KitKat Smooth Hazelnut Bar (45g, RRP $2) and KitKat Mint Cookies and Cream Block (170g, RRP $5.50) are now available in-store across supermarkets and convenience retailers nationwide.

*Nielsen Total Australian Grocery Report MAT 6/12/22

“ We know chocolate lovers are seeking more indulgence and these new KitKat flavours offer just that. But don’t worry – we’ve kept the classic KitKat snap fans know and love from the number one chocolate bar*.”

– Shannon Wright, Marketing Manager Confectionery, Nestlé

40 February/March 2023 | C&I | www.c-store.com.au PRODUCT RANGING

Allen’s relaunches a fan favourite taste of summer

Bringing back a fan favourite, this take on a range of classic Aussie ice-block and ice-cream flavours is only here for a limited time.

Frosty Fruits and Drumstick lollies

Allen’s and Peters have partnered once again to bring back the popular Allen’s Frosty Fruits and Drumstick range.

Originally launched in 2018, the range was one of the most popular in Allen’s history. Featuring flavours such as Tropical, Summer Sunset, and Watermelon Slice from Frosty Fruits, and Classic Vanilla, Super Choc, and Boysenberry Swirl from Drumstick, there was something for everyone.

Sapphira Nolan, Marketing Manager at Nestlé, said nothing says summer more than ice-cream.

“So, it makes sense to partner with the experts in this space, Peters Ice Cream, to offer a delicious twist on the popular Aussie treats you love.”

Carla Spadafora, Ice Cream Marketing Manager at Peters, said when they were given the opportunity to bring back these fan favourites, they had to say yes.

“Our collaboration with Allen’s Lollies was so popular when we first launched it back in 2018.”

The Allen’s Frosty Fruits and Drumstick range comes in a 170gm pack at RRP $3.60 and is available at convenience retailers, independent supermarkets, and Coles.

Allen’s Frosty Fruits

flavours include:

Tropical Summer Sunset (Tangy Orange and Pink Grapefruit)

Watermelon Slice (new)

Allen’s Drumstick flavours include:

Classic Vanilla Super Choc

Boysenberry Swirl

PRODUCT

42 February/March 2023 | C&I | www.c-store.com.au

RANGING

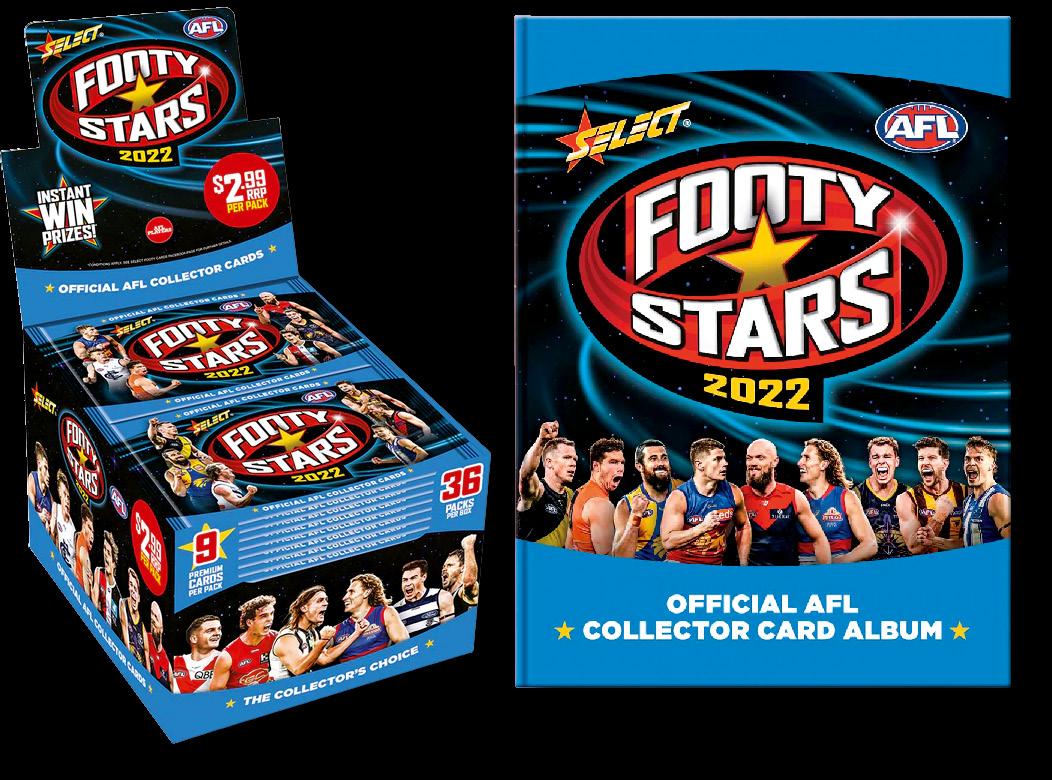

Kick goals with Select AFL Footy Stars

AFL is the most popular sport in Australia, so it’s no wonder that the demand for collectable cards is skyrocketing. With a release date set for March 2023, the Select AFL Footy Stars is the number one choice for footy fans and avid collectors.

Printed on high-quality card stock with full-colour images, Select cards feature the game’s most popular and iconic players from the AFL and AFLW.

“We saw an unprecedented response to the Select Footy Stars in 2022 from our P&C customers,” says Smooth Wholesales Managing Director, Tal Avrahami.