Close the Loop sale to Adamantem terminated P05

The company is now back on the market

Label Power buys new Bobst P06

Aims for growth with the new machine

Omni Group appoints new MD P06

Jonathan Salisbury named as the new MD

Amazon Australia axes singleuse plastic delivery bags P08

Replaces them with recyclable paper and cardboard alternatives

Esko, Fiery, and HanGlobal/ HanLabel collaborate P08

The companies come together to deliver a customised DFE for the LabStar series

Koenig & Bauer restructures P10

Focuses on high-growth packaging market

Visy gets new solar panels P10

Partners with two solar energy companies to install solar panels on select sites

A/NZ PIDAs winners in WorldStar Packaging Awards P11

A/NZ companies receive the fourth highest number of wins at the WorldStars

Highcon and Hybrid Software ink collaboration P12

The companies come together for digital die cutting workflow efficiency

Detmold Group outlines new global sustainability goals P12

The move ensures its customers make responsible and informed packaging choices

Fivestar Print buys an Epson SurePress digital label press P13

Fivestar Print has installed an Epson SurePress L-4533AW digital label press at its Auckland site, supplied through FBNZ

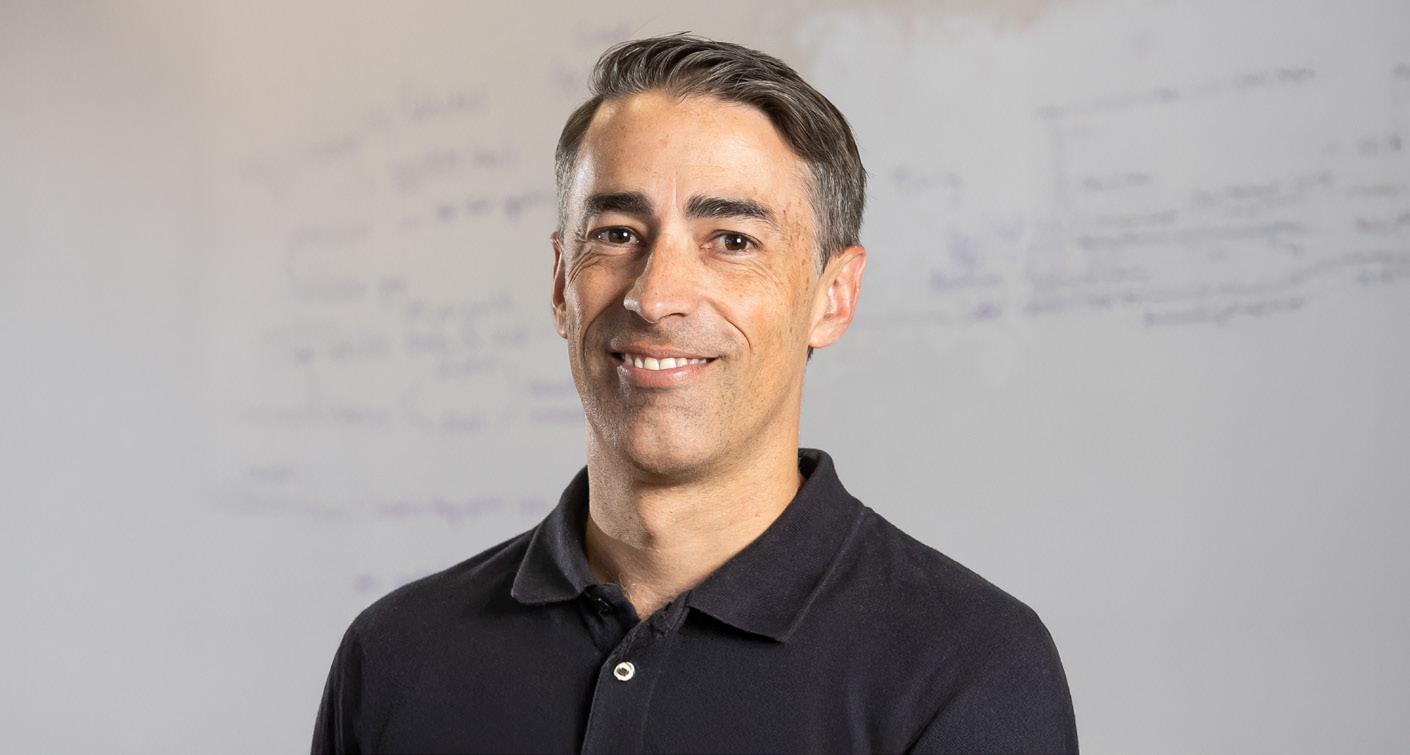

Affinity Print invests to become bigger, bolder and better P14-15

The company is at the top of its game with a new, bigger site

Ali Farid and Shaleen MacGregor take the company from strength to strength

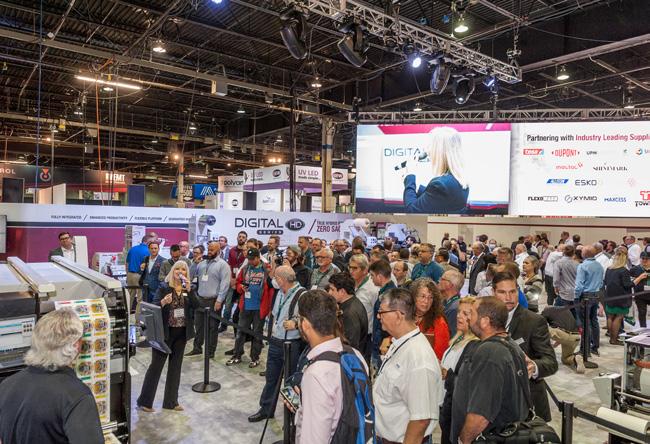

Packaging Leaders Forum P17-36

Thought leadership from: 18 Currie Group

Durst Oceania

Hybrid Software

Jet Technologies

Detmold Group 27 Immij Print & Packaging

28 Impact International 29 Kuhn Corp

in label production P37

Digitalisation and automation fuel its growth

Packaging reform in Australia P38

Packaging industry reform is critical for the industry, but must work for Australia

Dantex innovative digital label printing is available now P40

Dantex launches the PicoColour HD and PicoJet 1200 models MPS EF Symjet digital hybrid label printing boosts efficiency P41 The machine sets a new benchmark for efficiency, versatility, and print quality The evolution of barcodes P42-44 A new chapter in barcode evolution is unfolding, unlocking a world of data

A guide to the upcoming events locally and internationally

Note

Welcome to the first issue of ProPack.pro for 2025. As always, the start of the year is one of reflection and planning for the months ahead. Although the industry faced some challenges in 2024, it was generally a positive one for most and the early adopters of trends flourished. 2025 looks to be favourable for the industry too. As mentioned by thought leaders in the Packaging Leaders Forum within this issue, the year will be led by innovation, sustainability, and driving customer value. Have a read of what these executives had to say.

This issue also highlights Affinity Print’s recent move to a bigger facility, and the plans its owner Steven Todisco has for the business. We also profile Ali Farid and Shaleen MacGregor, the duo behind PakPro.

We hope you enjoy the read.

Close the Loop (ASX:CLG) recently issued a statement on the ASX, updating its shareholders that the proposed sale of the company to private equity firm Adamantem has been terminated, leaving the company operating as a standalone entity and open to offers from other interested buyers.

The sale to Adamantem ceased as the binding transaction documentation between both companies was not executed and the indicative proposal involved “considerable complexity”, resulting in both parties unable to reach alignment on the commercial terms.

Founded in 2016, Adamantem manages assets in Australia and New Zealand across both private equity and, through Melior Investment Management, public market strategies. It already has a foot in the packaging space, having invested in Australian national distributor of sustainable packaging and serviceware products, Pac Trading, in July 2023.

Close the Loop announced to the ASX on 19 November 2024 that it had entered into a transaction process deed, granting Adamantem an expedited period of exclusivity, allowing it to undertake due diligence and negotiate a binding Scheme Implementation Deed to acquire all of the shares in Close the Loop.

On 18 December 2024, Close the Loop extended the exclusivity period to 20 January to allow for

finalisation of due diligence and negotiation, and signing of binding transaction documentation.

However, on 21 January, Close the Loop issued a statement saying the exclusivity period for the transaction had ended, even though Adamantem continued to progress its due diligence and discussions with Close the Loop.

At the time, Close the Loop said, “There is no certainty that the parties will enter into binding documentation nor that a transaction of any kind will materialise”.

As Close the Loop anticipated, the deal has now fallen through, with the company stating it “remains confident of delivering on its strategic plan as a standalone entity, including capturing the significant global growth opportunity in IT refurbishment. Notwithstanding, the board is committed to maximising shareholder value and as such will continue to assess any future change of control transaction proposals if received”.

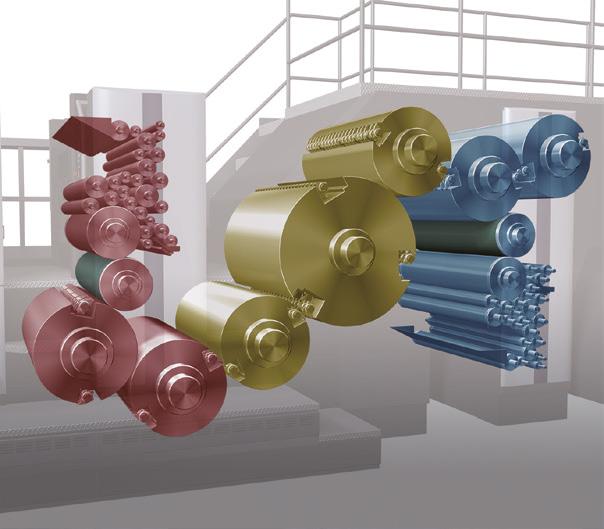

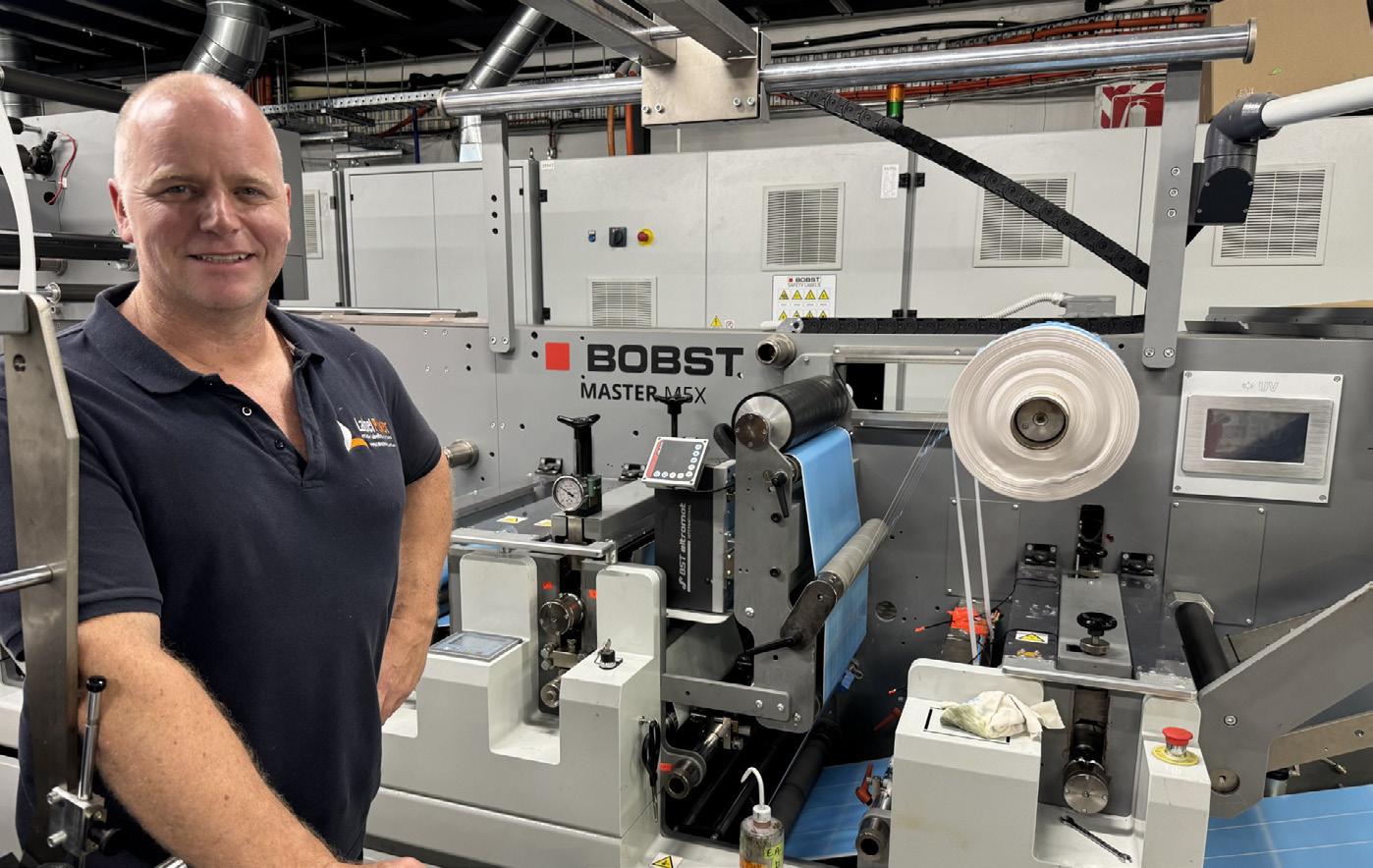

Label manufacturer and printer supplier Label Power has increased productivity following the recent installation of a Bobst Master M5 UV 430 flexo label and coupon press.

James Malone, founder and CEO of Label Power, told ProPack the Bobst Master M5 was chosen for its automation, versatility, and ease of use.

“We purchased the Bobst Master M5 for its ability to produce multi-layer coupon labels and the ability to perforate and sheet with its three die stations. In addition, the 430mm web width offers us better productivity than our 340mm wide presses, while still being easy to work with,” Malone said.

The Bobst Master M5 can print a variety of labels, as well as flex pack and light cardboard, delivering exceptional performance in terms of quality and productivity.

Installed at Label Power’s Brisbane facility, the Bobst Master M5 will be used for high quality label and film printing, peel and reveal coupon labels, as well as labels supplied in sheets following the introduction of a servo sheeter/stacker to the press.

“Previously, the widest label we could print flexo was 340mm wide; now we can print 430mm wide and print up to 10 colours in one pass. We have added a lot of strings to our bow with this new machine,” Malone said.

The Master M5 includes several automated features that take flexo printing to the next level in terms of productivity and quality, while reducing downtime and waste.

For Malone, one of the standout features of the press is the Print Tutor system that automatically handles set up and register, using a mark-to-mark detection camera on every printing unit, thereby allowing real-time monitoring and adjustment of print registration for enhanced accuracy, reduced waste, and faster job changes.

“The Print Tutor system is amazing and allows quick setup with very little waste, especially when combined with the short web path,” he said.

The Master M5 is also oneECG ready and equipped with the well-known flower technology for an easy, quick, and reliable job changeover.

The Bobst Master M5 is not the only recent addition to Label Power’s fleet – the company also recently installed a new 530mm wide 8 colour Omet Kflex with water cooled GEW LEO LED UV curing, which is understood to be the first in Australia. At Label Power’s Melbourne facility, the team also recently installed a MPS EF330 UV Flexo press and an additional ABG Series 2 Digicon that it moved over from its Brisbane plant.

“We are continually investing in extra capacity to serve the market,” Malone said.

Founded in 1996, Label Power has grown from a small startup into a leading name in the label printing industry. In addition to growing its production fleet, Label Power has also expanded its footprint in recent years. In 2024, Victoria-based label converter Action Labels & Nameplates was rebranded as part of Label Power. The move followed Label Power’s acquisition of Action Labels & Nameplates in 2020. At the time of the acquisition, Malone said clients would get a much more seamless service and the ability to deal with just one business, as well as an increased range of products and services.

“This merger will also allow businesses with access to a much wider range of label and tag stocks, materials as well as in-house label printing and cutting solutions. Our combined operations from Melbourne and Brisbane will ensure faster production and delivery. We are now a national company, so depending on where our clients are, we could dispatch either from Melbourne or from Brisbane. And we have stock of common dispatch labels and things in both locations so it’s quick for us to supply no matter where our clients are,” Malone said.

With the installation of the new presses Label Power is also looking for qualified flexographic label printers to join their team.

“The plans for Label Power are to continually grow the business and invest in more machines. There’s plenty that industry can expect from us in the near and far future.”

The Jet Press FP790 digital press could be considered to be three presses in one, able to:

•Print digitally, with all the benefits of digital production

•Print mainstream flexo jobs

•Print rotogravure quality jobs

To discover more, scan below:

Amazon Australia has stopped packing products in single-use plastic delivery bags and envelopes, replacing them with recyclable paper and cardboard alternatives.

Coupled with Amazon’s existing suite of recyclable boxes and tape, this means customers are now receiving orders from Amazon Australia’s distribution network in a recyclable box, bag, or envelope that can go straight into the household recycling bin, or with no added delivery packaging.

This includes items sold by Amazon Australia and third-party selling partners that use Fulfilment by Amazon (FBA).

The company said it has right-sized packages to match the products using less material overall and increased the amount of recycled content that goes into making them.

However, Amazon said there are still a few instances where customers in Australia may receive packages in plastic packaging:

• While Amazon controls the packaging for items shipped to customers direct from its own fulfilment centres, third party sellers can ship directly to

Integrated software and hardware solutions provider, Esko, innovator of digital front ends (DFEs) and workflow solutions, Fiery, and digital printing solutions provider HanGlobal/ HanLabel have come together to deliver a customised DFE for the LabStar series inkjet digital label presses.

This strategic collaboration integrates Esko’s colour management expertise, Fiery’s Impress DFE technology, and HanGlobal/ HanLabel’s digital label printing technology.

Together, the companies are addressing the evolving needs of label converters with an end-to-end solution that streamlines production workflows, enhances colour precision, and accelerates time to market.

The companies say the partnership’s centrepiece is the optimised compatibility between the LabStar series digital label presses and the combined Esko-Fiery solutions. This integration aims to empower label converters with superior automation,

customers themselves, in which case Amazon does not control the packaging. Amazon shares its expertise on alternative packaging options and encourages sellers to use them.

• Plastic preparation material such as bubble wrap may still be used where necessary, for example to protect fragile items like glass or to seal liquid products such as shampoo and soaps.

• When a product comes in a single-use plastic bag from the manufacturer and the bag is suitable, Amazon will deliver the product to the customer in the manufacturer-supplied bag. This avoids

the addition of extra packaging.

In 2021, Amazon Australia replaced singleuse plastic air pillows with recyclable paper filler to protect goods during shipping, and in 2023 it reduced box weights by 25 per cent and label sizes by 50 per cent, to minimise waste.

Amazon Australia country manager Janet Menzies said moving to 100 per cent recyclable delivery packaging in Australia is a major milestone for the online retailer.

“We have removed all single-use plastic delivery bags and envelopes from our local distribution network. Customers are now able to easily recycle all their Amazon delivery packaging by placing it in their recycling bins.

“This project has been almost two years in the making, following a rigorous process of product development and testing to ensure the paper envelopes can also withstand the delivery process and customer orders arrive safely.

“We are proud of this progress but it’s just the beginning and we will keep innovating to improve our packaging.”

As part of its ongoing commitment to reduce packaging, Amazon Australia recently invested in three automated paper packaging machines that pack single products in paper bags that are made on demand for the item.

These machines scan items such as video games, kitchen gadgets, sports equipment, and office supplies – which were previously sent in boxes or plastic padded envelopes –and securely pack them in a paper bag from a selection of three different size options.

colour accuracy, and seamless connectivity, redefining efficiency and performance in digital label printing.

Announcing the collaboration on the first day of Labelexpo South China at the Shenzhen World Exhibition & Convention Center, Esko global partner ecosystem development director Dries Vandenbussche said, “By combining the strengths of Esko, Fiery, and HanGlobal/HanLabel, we are delivering unprecedented value to the label printing industry. Our integrated solution enables converters to achieve exceptional results faster and more efficiently than ever before”.

Fiery marketing and sales vice-president John Henze said, “Fiery’s industry-leading

DFEs deliver exceptional image quality, including precise rendering of any object – from barcodes to fine lines to text.

“The seamless integration of Esko’s colour management technology into our awardwinning Fiery Impress DFE enables Hanglory to unlock the full potential of the Labstar series, providing unmatched control, performance, and output integrity.”

HanGlobal and HanGlory Asia general manager and Jeak Wu said, “HanGlobal/ HanLabel is excited to partner with industry leaders Esko and Fiery to revolutionise digital label printing. Together, we are equipping businesses with tools to meet the highest standards of precision and efficiency”.

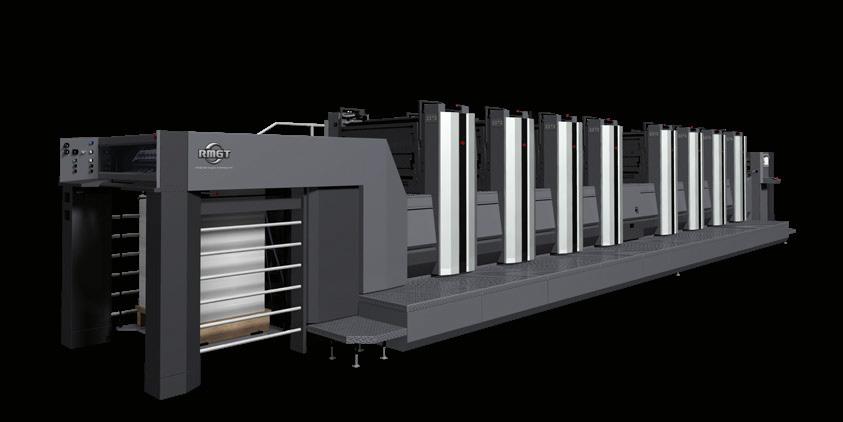

Koenig & Bauer is continuing on the path that it adopted in 2014 to transition from a unitary to a divisional group and is positioning itself in 2025 with a new segment structure.

It has initiated a group realignment, which includes the downsizing of its business segments, the exit of COO Michael Ulverich, and the appointments of Christian Steinmaßl to group management and Markus Weiss as CEO of the Paper & Packaging Sheetfed Systems (P&P) segment following the retirement of Ralf Sammeck.

The company said as a result of the “leaner structures”, the number of its segments will be reduced from three to two, namely P&P and Special & New Technologies (S&T). It added that its focus will remain on the high-growth packaging market.

Within the P&P segment, all the previous activities of the sheetfed segment will be consolidated within this division. In addition, the corrugated cardboard activities for the Chroma series bundled under the Celmacch joint venture, which were previously assigned to the Digital & Webfed segment, will be allocated to this segment due to the close

Visy, an Australian integrated recycler and re-manufacturer, recently partnered with two solar energy companies to install solar panels on select sites across Australia.

Visy worked with Energy Aware in Victoria to install a combined 2,400 KW of solar panels across six sites, including: Wodonga (food can), Shepparton (food can), Truganina (cardboard packaging), Kilsyth (branded cardboard packaging), Wodonga (cardboard packaging), and Dandenong (cardboard packaging).

In Queensland, Visy worked with 1K5° Commercial to install a 2,100 KW system on its Yatala beverage can factory – Visy’s largest solar system to date. The system was completed in December 2024.

Visy said the project will cut how much electricity six Visy sites take from the Victorian electricity grid by seven per cent and slashes the Yatala beverage can site’s consumption in Queensland by 23 per cent.

technological and customer overlap between folding box and corrugated cardboard producers. The activities of the Koenig & Bauer Durst joint venture will continue here.

This segment will be specialising in end-toend solutions for the high-growth folding box and corrugated cardboard box markets, addressing all aspects such as the preprint stage, printing with an integrated digital workflow and post-print processing.

Koenig & Bauer CEO Dr Andreas Pleßke said, “The group’s top priority is to align itself with its customers and markets and to streamline decision-making paths within its business units”.

As for the S&T segment, it will consolidate

the previous activities of the special segment (banknote and security printing, systems for industrial marking and coding and special systems for metal and glass/hollow container direct printing), as well as the remaining activities of the former digital & webfed segment. This includes the special packaging printing applications, primarily web digital and flexo web printing.

Likewise, the partnership forged between Koenig & Bauer and the Volkswagen subsidiary PowerCo for the development of dry coating for battery cell production will be integrated in this segment.

New applications (inspection systems and protection technologies) will be spun off from security printing into an independent Vision & Protection business unit.

The restructuring of the Koenig & Bauer group will also result in changes to central responsibilities for operations as well as crosssectional functions. The company said some of these will be re-assigned to the segments to address the individual requirements of the various markets more effectively.

Consequently, the previous role of a central group COO has been removed –Ulverich has stepped down from the executive board. In addition, Koenig & Bauer has hired Christian Steinmaßl, who brings more than 25 years of experience in the paper and packaging industry, in a key role within the new S&T segment. He will be holding responsibility for production, the Vision & Protection and Kyana (formerly Digital Unit) business units and operational shared services within the group.

Visy general manager of energy Ryan Santowski said the company is always looking for ways to innovate and improve the sustainability of its products.

“While many of our products have up to 100 per cent recycled content – made from household and business recycling – we’re

always looking for ways to further reduce our environmental impact and energy footprint,” he said.

“Installing solar panels on our sites is one of the many ways we continue to invest in green power and improve the sustainability of the food and beverage packaging we make.”

The World Packaging Organisation (WPO) has named the winners of the WorldStar 2025 Awards, with Australia and New Zealand companies receiving the fourth highest number of wins in the world behind Japan, Germany/Austria and India.

ICEE Technology Group, Integrated Plastics, and Caps & Closures were recognised across multiple categories.

In addition, Mars Foods & Wellman Packaging and Thermocup and BioPak were recognised for two separate products.

The 2024 WorldStar Packaging Award winners for Australia and New Zealand are:

Packaging Materials & Components

• Woolworths Pad-free rPET meat trays with ‘Leave Attached’ film for kerbside recycling (Pact Group, Woolworths, Hilton Foods, and Cleanaway)

• IMH PET Integrally Moulded Handle (Integrated Plastics)

• Home Compostable Container range (BioPak)

Food

• Naked Rivals

• Costa Group Premium Grapes paper bag (Costa Group & The Packaging Hippie)

• Don Deli Cuts (George Weston Foods)

• Cryovac Flexprep Portion Dispensing Pouches for McDonald’s Australia (Sealed Air)

• Masterfoods Squeezy rPET sauce bottles (Mars Foods & Wellman Packaging)

Household

• Green Action Dishwashing Liquid (Trendpac)

• Thankyou EzyPour + Refill (Caps & Closures)

Health & Personal Care

• Only Good Hand & Body Wash (Apex Brands) New Zealand

• Thankyou EzyPour + Refill (Caps & Closures)

• 100% Paper Packaging Film for Broc Shot (Close the Loop Group)

E-Commerce

• bouncee Reusable Insulating crates (ICEE Technology Group)

Labelling & Decoration

• The Art series and Indigenous Art series BioCups (BioPak)

Some of the winning entries from A/NZ

Non-Alcoholic Beverages

• Thermocup (Wellman Packaging)

• IMH PET Integrally Moulded Handle (Integrated Plastics)

Transit

• bouncee Reusable Insulating crates (ICEE Technology Group)

The 2025 round of WorldStar Packaging Awards attracted 560 entries from 40 countries, with 40 judges determining 230 winners.

The Australasian Institute of Packaging (AIP) executive director Nerida Kelton said, “This is the fifth year in a row that the A/NZ region has maintained a top five spot against some very tough competition from extremely large countries.

“What makes this global recognition even sweeter is that 50 per cent of the packaging

that was recognised was from first-time entrants into the WorldStar Packaging Award program including Naked Rivals which is a start-up, Only Good Hand & Body Wash (Apex Brands) from New Zealand, Green Action Dishwashing Liquid (Trendpac), bouncee Reusable Insulating crates (ICEE Technology Group), Costa Group Premium Grapes paper bag (Costa Group & The Packaging Hippie), IMH PET Integrally Moulded Handle (Integrated Plastics) and Don Deli Cuts (George Weston Foods).

“We are extremely pleased that A/NZ PIDA Winners have been internationally recognised with 18 awards across eight categories including: Packaging Materials & Components, Food, Household, Health & Personal Care, E-Commerce, Labelling & Decoration, Non-Alcoholic Beverages and Transit.

“As only winners from the Australasian Packaging Innovation & Design (PDIA) awards are eligible to enter the prestigious global WorldStar Packaging awards, the global recognition is a testament to the strict criteria and judging process of our annual PIDA Awards program and the supporting work undertaken by the AIP to ensure that our winners enter the WorldStar Packaging awards each year.

“We look forward to celebrating the winners on the 30 May at the WorldStar Packaging Award ceremony which will be held alongside of Ipack Ima, Milan Italy.”

During the award ceremony, WPO will also announce the winners of the special categories, including the President’s Award, Sustainability Award, Marketing Award, and the Packaging that Saves Food Award.

“The incredible number of entries and winners in this 2025 edition reflects the credibility of this global award, the high level of the competition, and the exceptional quality of the packaging solutions submitted from around the world,” WPO president Luciana Pellegrino said.

“The participating packaging also showcases the profound evolution of the global packaging industry, driven by innovation, creativity, technology, marketing, digital transformation, and sustainability. It is evident that our industry has embraced current challenges and is prepared to grow continuously and sustainably, meeting the expectations of the modern, connected consumers.”

Developer of productivity tools for labels and packaging, Hybrid Software, and digital cutting and creasing systems developer, Highcon, have inked a collaboration for digital die cutting workflow efficiency.

The partnership aims to elevate the digital die cutting workflow for packaging and display converters by integrating Hybrid’s renowned PACKZ software, offering full PDF support, into Highcon’s Digital Die Cutting Workflow Package (DWP).

The Detmold Group has launched its new global sustainability goals, scaling up its targets to source more forest-certified fibre, increase recyclable content in products, maximise recycling and landfill diversion, source increased renewable electricity, and achieve net zero emissions.

It said the new sustainability goals ensure the group continues to support customers in making responsible and informed packaging choices by providing both immediate and longer, further-reaching commitments to sustainability globally, with staggered targets from 2025 to 2050.

Detmold Group CEO Sascha Detmold Cox said the new sustainability goals focus on four key pillars:

• Climate: Reducing emissions aligned with global targets

• Nature: Protecting plants, animals, habitat and human health

• Circularity: Reducing waste and operating in a circular economy to eliminate landfill

• Governance: Ensuring transparency and accountability for performance

“Sustainability has been a cornerstone of the Detmold Group and our Detpak and PaperPak brands for more than 75 years, supporting our purpose of making a positive impact for our people, partners, and our planet. The Detmold Group’s commitment to sustainability, including reducing waste and designing packaging ranges to be reusable, recyclable and compostable, underpins our dedication to creating a better future and supporting our customers to make sustainable choices,” Cox said.

This partnership also aims to deliver more streamlined processes, increased precision, and enhanced workflow integration, empowering operators across production sites.

At the core of this collaboration is a custom-designed version of the PACKZ Engine for Highcon, introducing a fully integrated PDF workflow tailored for the digital die-cutting process.

As part of the new sustainability goals, the Detmold Group undertook its first Carbon Disclosure Project (CDP) environmental performance disclosure in September 2024.

Annual CDP reporting, along with implementing environmental management systems across the group, will drive continuous improvement and support the integration of its environmental strategy.

Cox said the Detmold Group had worked with strategic customers to increase recycled content in products, continued to invest in research and development including its laboratory testing capabilities; and progressed towards its target of producing 95 per cent of its stock range as reusable, recyclable or compostable.

Aligned with its new sustainability goals, the Detmold Group has also flicked the switch to solar energy at its largest production facility in Heshan, China. As its first international solar project, the Detmold Group has installed around 1,000 solar panels over 2,200 square metres, which will generate more than 574 MW of electricity annually. The Heshan installation has closely followed the installation of rooftop solar at the Regency Park manufacturing site, aligning with its goal to source 30 per cent of its electricity from renewable sources by 2033 and reduce Scope 1 and 2 carbon emissions by 55 per cent.

By advancing artwork handling, highquality previews, and automated XML export capabilities, this collaboration enables packaging converters to seamlessly integrate Highcon’s digital solutions into their workflows, simplifying setup while accelerating production timelines.

“Our partnership with Highcon is all about empowering the packaging industry,” Hybrid Software chief commercial officer Bert Van der Perre said.

“Finishing is a vital step in packaging production, and this collaboration streamlines the process, delivering greater efficiency and precision for our customers.

“With Highcon’s digital die-cutting systems deployed worldwide, this collaboration with Hybrid Software enables production teams to achieve faster setups and top-quality output. Together, we’re optimising production workflows for digital die cutting,” Highcon product vice-president Haim Veig said.

The Detmold Group 2025-2050 sustainability goals, in detail, are: Climate: Reducing emissions aligned with global targets

• Reduce carbon emissions (scope 1 & 2) by 55 per cent by 2033 (2023 baseline and targets to be SBTi approved by 2026)

• 30 per cent of electricity from renewable sources by 2033

• Net zero emissions by 2050

Nature: Protection of plants, animals, habitat and human health

• More than 95 per cent of fibre sourced from FSC or PEFC certified sources or certified recycled content by 2030

• No deforestation and forest degradation across its supply chain by 2030

• Reduce waste use across operations YoY

• 100 per cent of products with no intentionally-added PFAS Circularity: Reducing waste and operating in a circular economy to eliminate landfill

• More than 95 per cent of stock range designed to be reusable, recyclable or compostable

• More than 50 per cent recycled content in packaging by 2030 (by weight in nonfood grade primary, secondary & tertiary packaging)

• 10 per cent reduction in waste generated by 2030 (2023 baseline)

• More than 95 per cent of waste (by weight) diverted from landfill Governance: Transparency and accountability for performance

• Annual CDP performance disclosure and progress reporting against these goals

• Group environmental management system certified to ISO 14001 across all sites globally

• Full compliance with packaging and environmental legislation in markets in which Detmold operates

• Raw materials procured from noncontroversial sources.

Since taking the helm at Aucklandbased Fivestar Print in 2012, Rajesh Mudundi has steadily built the company into a diverse business offering a range of services including design, marketing, printing, and installations.

The company’s team of 10 staff produces a range of print from small format and large format digital to digital labels and packaging solutions.

Recently, Fivestar Print installed an Epson SurePress L-4533AW digital label press, supplied through Fujifilm Business Innovation (FBNZ).

Rajesh said, “This installation is the next logical step in our label printing journey. We had begun with a second-hand machine, also an Epson, the SurePress L4033 digital label press, and it served us well. While we have been patient in growing the business, we needed to step up our labels production and the Epson SurePress L-4533AW digital label press is proving the ideal solution. Our production has increased, and it is great to have this label press that has the capability to handle short, medium, and long-runs.

“With the Epson SurePress L-4533AW digital label press, we can be more creative. It offers us a white ink option that changes our label production. For example, we can now complete a greater variety of jobs. So, it means more work,

especially for jobs like specialty labels, wine labels and labels with metallic stocks.

“The speed has also increased but our ink volumes have shrunk compared to the previous machine. Epson has changed the ink system. I think we are the first company in the country using this new ink system and it is making a substantial difference. Another benefit is the greatly improved colour gamut. The Epson SurePress L-4533AW digital label press gives us 10 colours. Epson quality is well known across the industry. We can achieve over 90 per cent of Pantone colours.

“Maintenance is also easier with cleaning more automated. It performs a threeminute self-clean and that saves production time and ink. The new RIP is excellent. We changed out our old third party RIP for the Epson software, which is bundled with the machine. It has made a significant difference and is delivering excellent results.”

Rajesh appreciates his partnership with FBNZ. He said, “I have known Paul Thomas since 2011 and Fivestar’s relationship with FBNZ goes back to 2012. We have shared our journey with them.

“Our relationship with FBNZ has helped change the dynamics of this business and boosted the company to reach the next

level tier of clients. As we have installed progressively superior technology and solutions, we have been able to successfully compete for higher jobs. Each investment we have made has given me the confidence to make these steps in our business.

“We installed an Iridesse in 2019 and with FBNZ support, we have grown the company through smart digital printing and their excellent technology and support. FBNZ has always had our best interests at heart.

“From our Iridesse and our large format to our labels and packaging production, we have developed our capability to complete niche work, and we proudly call ourselves a digital printing company. We can renew our contracts with our customers because of the quality of jobs we are doing. We are growing, but without the label press we would not be able to retain those contracts.”

Paul Thomas, graphic arts account manager at FBNZ, said, “Fivestar invested in its business through the COVID-19 pandemic. It has been impressive to see Rajesh and his team grow Fivestar from the small shop in Dominion Road to these large premises.”

Fivestar Print focuses on continuous improvement and is always customerfocused. Having added a design studio and enhanced its portfolio with corporate clients, the business recently changed its logo and branding to reflect change.

Rajesh added, “There are a lot of companies that can print but they can’t help their customers with marketing and design. We can deliver initial value to them with the speed and quality of our work, and we can add even more value to them by showing them how they can stand out. To make that happen, we need to do more than sell labels; we need to make a difference to their business.

“Diversifying our business, not sticking to the same thing, means we will do jobs of all sizes. With labels, we sit in a niche market, especially in terms of volume. With the Epson SurePress L-4533AW digital label press, we can do small-runs and for timeline efficiency, we can do fast turnarounds.”

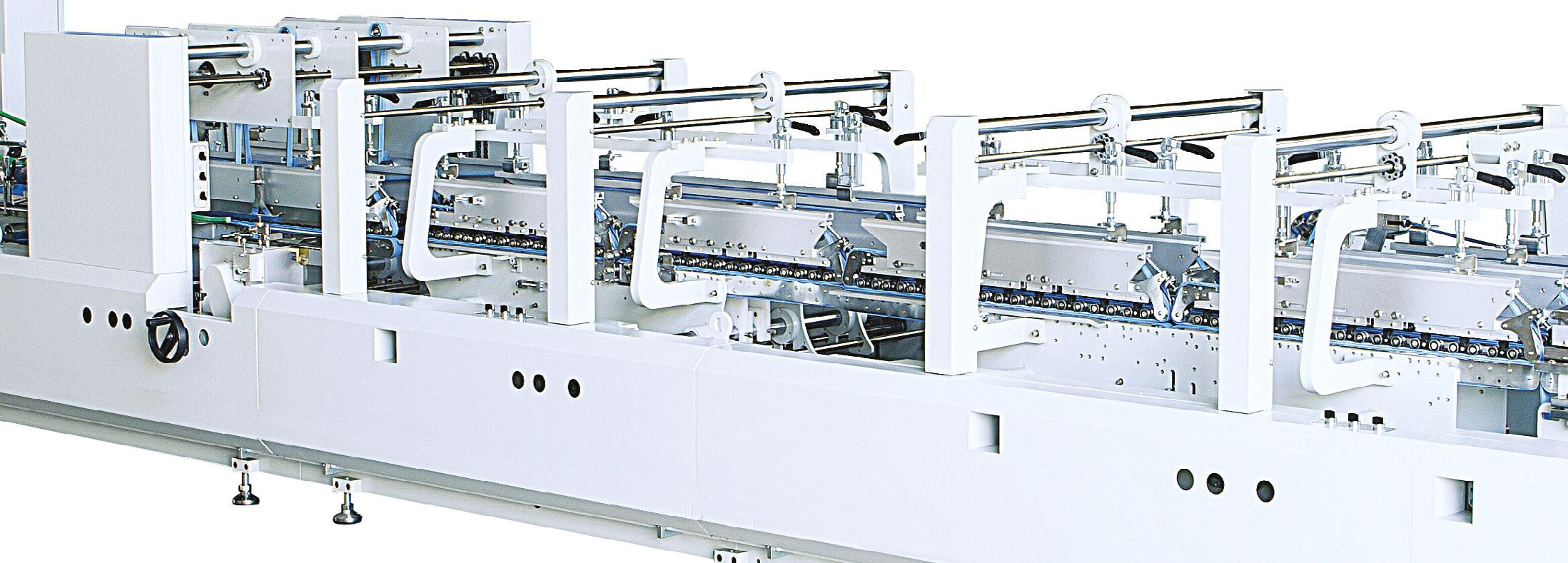

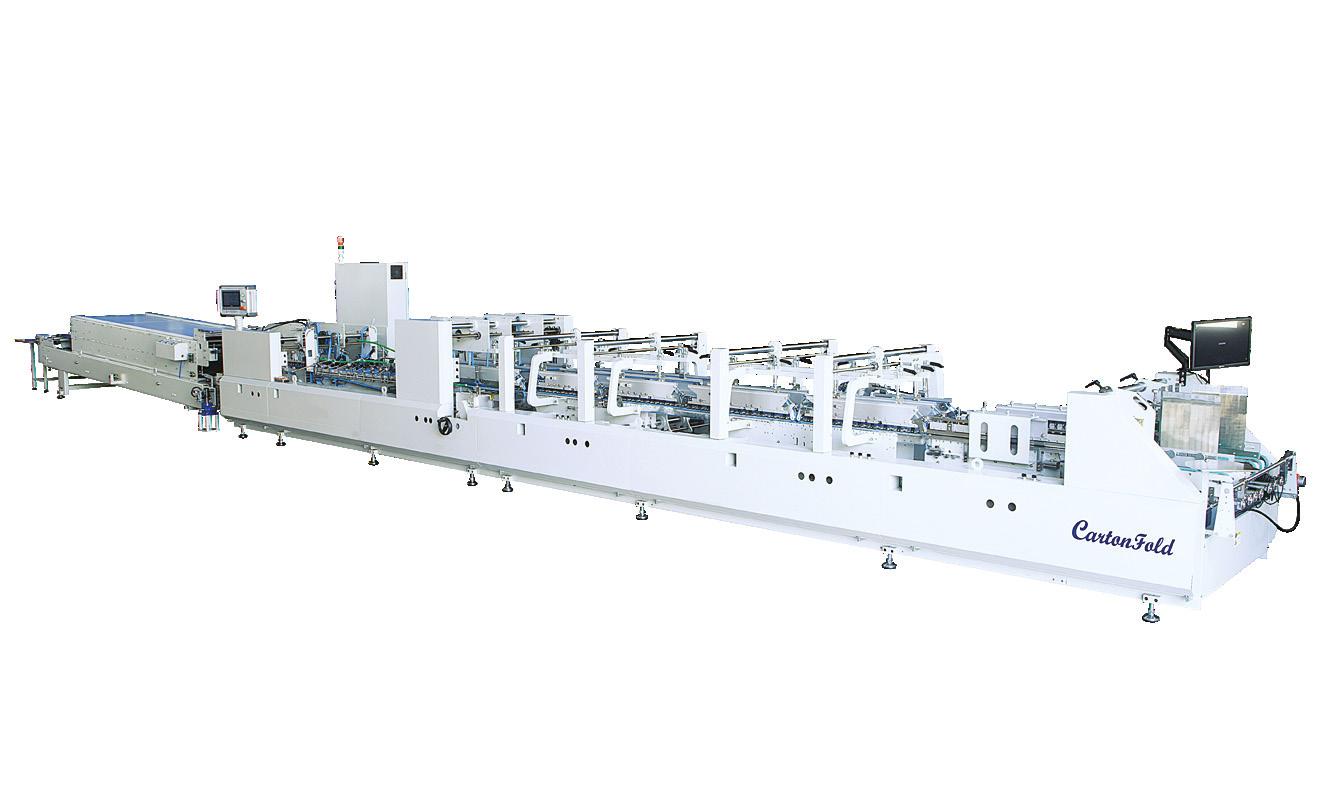

The company is at the top of its game with a new, bigger site and a multi-million dollar investment in machinery, and has more planned for the business in 2025

Steven Todisco, owner of Victoriabased Affinity Print, has great plans for his company, and has been executing them one step at a time.

Most recently, the company celebrated 50 years in operation, and a move into

a new, larger facility which houses modern investment in folding carton machinery.

Affinity Print is a packaging company that provides its clients with a point of difference, out of the box thinking, and quality excellence in offset and digital packaging.

With a full end-to-end-solution, it specialises in fast turnarounds and short-run, high-end packaging, by running on digital, offset, and UV printing complemented by a full bindery.

The company states its point of difference is its ability to offer embellishing and finishing services in-house. It is also proud of its environmental accreditation and impact on the environment, having been certified with Eco Warranty EMS.

Some of its more prominent areas of play are in the beverage, pharmaceutical, and beauty packaging segments.

Todisco himself is no stranger to the printing and packaging industry. He comes from a family that has a long history in print, and great expertise in the trade.

As a second-generation printer, Todisco started his career at Cleveland Printing, which was owned by his father, Ralph Todisco.

Fast forward to 2005, and after stints in several other printing companies, Todisco

decided it was time for him to stand on his own two feet – he became the owner of Affinity Print, which was created in 1973.

“I have more than 30 years’ of experience in the print industry, having worked at several different companies. I have gone from working for my family’s print business to running my own,” Todisco said.

“Affinity Print’s first owner, Terry, had passed on and the two people that took over it pretty much ran it into the ground. I then bought Affinity Print from the duo in 2005, and we went from printing one business card order a week to becoming a high-end boutique packaging company.”

From commercial to packaging

The transition from commercial printing into the packaging space was a natural transition for Todisco and the team at Affinity Print.

“Packaging was a market that we knew could be our expertise. Moving into this space was a natural progression for us –the commercial market was shrinking year-on-year, so we made the decision to get into packaging. We’ve been in packaging ever since, and our growth has just been consistent and continuous,” he said.

“Affinity is one of the few printers in the country to run a full in-house packaging solution, with foiling, embossing, coating, and UV capabilities.”

Affinity Print, which employs 20 staff, excluding casuals, is also one of a few companies that produces bedding labels in the country.

“That segment has become one of the areas of our specialisation, and we have brought new technology in to modernise that space – it used old-school offset printing methods which we have now modernised with digital printing and foiling,” he said.

The company also amped up its specialisation in UV printing, especially bumper labels and printing on plastics, with the purchase of Cain Colour in July 2020.

“We bought Cain Colour as an add-on –to have UV capabilities for our packaging.

Cain Colour ran offset presses, but in its case specialised in UV printing. Having Cain Colour in our fold has boosted Affinity Print’s capacity and capabilities,” he said.

Just four years after the acquisition of Cain Colour, Affinity Print has been subject to growth on a tremendous scale, and as a result, needed to move into a bigger premises.

“When we started, we had a small, 300 sqm factory. Today, we’ve moved into an 1800 sqm factory that’s 10 minutes down the road from our old factory in Cranbourne West,” Todisco said.

“We were on the hunt for a bigger factory for some time, as we needed a unit that was of a particular size and had the power to keep our machines going. What this new factory also meant, was it allowed us to upgrade our machinery expand our inventory in packaging.”

The scale of projects that Affinity Print has been able to produce has also improved.

“One of our biggest clients, for example, came to us with a concept and a few containers, and we ended up putting spot UV on it, in addition to gloss, foiling and shape cutting. And it also had a specialised closure on it. This client – a multi-national company – was very impressed with our capabilities,” he said.

“We’re also in the midst of creating some interesting packaging projects for a Singapore-based company and will be shipping it over soon – we’ve got plenty of clients worldwide to keep Affinity busy.”

And now, having turned 50 years old this year, Affinity Print is celebrating its many

milestones, with Todisco saying there are more to come and that the industry can definitely expect more from the business.

“While the industry is slowing, we are growing. This factory is a new place for us to call home for the next chapter, and it’s very exciting times for the business,” he said.

“Turning 50 is a huge milestone for us, because not many businesses reach that stage these days. That’s because they don’t keep up with technology, or they don’t move forward with time. Businesses turning 50 years of age, these days, are going to be few and far between – other than the big multinationals.

“We want to enhance our customers’ experience with us, and this forms an integral part of our continuous improvement to quality assurance. We are also actively managing our impact on the environment in key areas including resource usage, landfill and greenhouse gas emissions, as our commitment is to reduce our environmental footprint,” Todisco said.

“Our size and investment in state-of-the-art equipment means we can offer our clients fast quote turnarounds, client focussed account management, high levels of project understanding, on-time delivery, online ordering, and electronic or hard proofing.

“We also have a solution for the provision of online services, and the process efficiencies this provides in the areas of web-to-print, ordering, warehousing and distribution of collateral.

“What we can offer the market is of the same level, if not better, than some of the ‘big boys’, which is fantastic for a family-run company.”

Ali Farid and Shaleen MacGregor, the duo behind PakPro, have a goal to take the NSW-based packaging business from strength to strength in the coming years

Ali Farid and Shaleen MacGregor, the business partners behind PakPro at Silverwater, NSW, are testing their transferrable skillsets by recently becoming entrepreneurs in the packaging industry. Having recently taken ownership of PakPro at the end of 2023, the duo has a strategic plan in place to scale the business to new heights.

PakPro, formerly known as Packaging Processors, has been a trusted name in the packaging industry since the 1980s. Over the four decades that it has been in operation, despite the change in ownership, it has provided – and continues to provide – a high level of service to customers and has maintained a strong reputation within the industry.

PakPro’s focus remains on delivering trade finishing by providing a diverse and high expertise in cutting, folding, and gluing services. This includes die cutting, window patching, folding and gluing (straight line, sleeves, crashlock, pillow pack, wallets, and folders), as well as machine double sided taping.

The business also offers consultation to its customers in optimising packaging design and sourcing tooling, and prides itself in being able to provide fast quoting and conversion turnarounds in the industry.

Its customers are wide ranging – from cardboard packaging suppliers to digital printers offering small volume custom boxes, envelopes and key card holders.

PakPro has had the privilege of working on a variety of impactful projects for its clients – from consulting with complicated designs to streamlining trade finishes, rushed orders and new product launches. At the same time, the business has supported customers during their transitional period of site relocations, resources shortages, peak periods capacity, and regular support.

Farid and MacGregor entered the packaging industry and took over the operations of PakPro after holding director level positions at large FMCG multinationals.

Farid’s background in engineering and more than 20 years of extensive experience in the operations and commercial fields has enabled his engagement with customers,

resulting in business partnerships and quality service commitments.

MacGregor’s finance qualification and more than 20 years of expertise in compliance, financial and risk strategy, legal and compliance, and stakeholder management has enabled the re-engineering of PakPro from being a traditional business into the current operational/commercial environment it is today.

Farid and MacGregor’s immediate focus for PakPro is to bring awareness to the packaging and printing industries of its core and exclusive capabilities and services at a wider scale.

“We want to showcase to the market the reasons for choosing PakPro as their first choice for trade finishing. We also intend to invest in technology and software to increase our response to market,” Farid said.

“Medium- to long-term, we plan to position PakPro as the solution for business continuity planning, making us the business partner and outsourcing and contract manufacturer of choice for printing/packaging companies and brokers in the industry.”

The packaging industry is no different to other industries and is undergoing significant disruption driven by sustainability, technology, and changing consumer preferences. Key trends impacting the operations of PakPro include:

Eco-friendly packaging: With increased consumer and regulatory pressure to reduce plastic and waste, Farid and MacGregor find there is a clear demand for biodegradable, recyclable, and compostable packaging solutions which creative cardboard packaging businesses can continue to thrive in.

“As more businesses prioritise ecofriendly alternatives, we’ve seen an increasing interest in recyclable and biodegradable packaging solutions – a trend we are actively supporting by transitioning from plastic to cardboard containers for food service and retail,” Farid said.

“In addition, the beauty segment has seen new entrepreneurs emerging with innovative, sustainable packaging.”

Smart packaging: The integration of digital technologies such as QR codes, tracking systems, and anti-counterfeit solutions, which is revolutionising the way businesses manage and engage with their packaging.

Automation and efficiency: Businesses are seeking automated packaging solutions to reduce costs, improve productivity, and minimise waste.

E-commerce and cashflow: Many packaging and printing companies continue to operate using traditional business models. By integrating e-commerce platforms and payment gateways, businesses can enhance agility, streamline operations, and significantly reduce outstanding collections, improving overall cash flow efficiency.

“At PakPro, we’re embracing these trends by staying ahead of technological advancements and sourcing sustainable solutions that align with our clients’ goals. We’re committed to helping businesses navigate this changing landscape and aim to implement solutions that will futureproof their operations,” Farid said.

024 was a pivotal year for the labels and packaging sector. We witnessed strong recovery across the board, with demand continuing to grow for sustainable label and flexible packaging solutions.

This was evident in the growth of digital printing press sales we forecast, with customers such as Queensland-based Ultra Labels leading the charge with its purchase of three new HP Indigo platforms to join its existing fleet, including the latest model HP Indigo 200K for the growing digital flexible packaging segment.

A key highlight for the year was the innovation driven by automation and smart technologies, such as AB Graphic International’s ABG Connect software simplifying and automating the label converting process, and HP Indigo’s AI intelligent factory, enabling businesses to improve efficiency and stay competitive.

However, challenges such as supply chain disruptions, rising material costs, and meeting sustainability demands put significant pressure on businesses, compelling them to adapt quickly. Despite these hurdles, our industry continues to demonstrate resilience and innovation, driving growth and meeting the everevolving customer expectations.

To remain relevant, many businesses further embraced digital transformation and automation. Investments in technologies like HP Indigo and smarter, automated

finishing equipment has allowed them to reduce lead times, enhance customisation, and meet shorter production runs.

Collaboration with partners and an increased focus on sustainability, including recyclable and biodegradable materials, also helped maintain a competitive edge.

The packaging landscape in 2025 will continue to be shaped by sustainability and personalisation. Sustainability will continue to dominate as a key trend, with more stringent regulations driving innovation in eco-friendly materials and processes and flexible packaging formats.

Digital printing will play an even greater role in enabling customisation and faster time to market, particularly for brands looking to engage consumers directly. Brands will lean further into digital printing for targeted campaigns and shorter run lengths, keeping pace with changing consumer expectations. As both industry and technology evolves, we will see the drive to shorter runs and digital automation re-shaping the flexible packaging space.

In addition, businesses should explore automation in their workflows to reduce waste and labour costs while maintaining quality. The rise of AI-driven workflow automation will streamline production, enabling better cost efficiency.

Also, the demand for premium and personalised packaging – especially for

e-commerce and luxury goods – presents significant growth potential.

However, challenges such as rising input costs, talent shortages, and the rapid pace of technological change require businesses to remain agile and adaptable. While the spotlight on the US and the volatile Australian dollar may create uncertainty for some businesses to invest, it also creates opportunity for others to get ahead of the game.

We anticipate breakthroughs in sustainable materials, including advancements in compostable and recyclable substrates at this year’s tradeshows. Innovations in digital finishing, such as digitally printed embellishments, and AI-powered workflow solutions are also likely to take centre stage, alongside technologies designed to reduce energy consumption and carbon footprints.

Currie Group’s primary focus for 2025 is to continue to empower our customers with innovative, sustainable, and efficient solutions. We aim to continue expanding our technology offerings while strengthening our partnerships with global leaders like HP Indigo, ABG, OMET and others.

Our business has evolved over time to meet the changing needs of our customers and that means continuing to strengthen our portfolio. This not only means additional brands such as MAAN Engineering (linerless coating solutions) and JetFX for digital embellishments joining our label portfolio, but strengthening our offering in the flexible packaging segment with exciting news to be announced in the first quarter of 2025.

Additionally, we’re committed to supporting customers in meeting their sustainability goals by introducing ecofriendly technologies and processes. We’ll continue to prioritise partnerships with manufacturers that deliver ecofriendly solutions, including reduced waste technologies and energy-efficient systems.

A key focus will be our collaboration with the HP Planet Partners Program and Close the Loop initiatives dedicated to recycling and reusing printing hardware and consumables. We’re also working closely with customers to help them achieve their sustainability goals through education and tailored solutions.

It’s evident that the labels and packaging industry stands at an exciting crossroads. With innovation and sustainability at the forefront, there’s immense potential to shape a future that’s not only profitable but also responsible. By working collaboratively and embracing new technologies, we can overcome challenges and lead the way in creating a sustainable, consumer-centric packaging landscape.

Durst is currently present across a broad cross section of the digital packaging market from labels to flexibles to folding carton and corrugated. In 2024, Durst Oceania continued to grow its install base of labels and packaging machines in Australia and New Zealand.

Converters have chosen Durst because they are forward-thinking, young, modern, and entrepreneurial businesses and they see us as the perfect partner for the future of their fast-growing business. We have found traditional converters remain apprehensive and challenged when it comes to embracing new digital inkjet technology, and this lack of agility represents a potential risk for their businesses.

My advice is for the industry to take the leap and observe the decisions made by your competitors in Australia and overseas who are reaping the rewards that digital inkjet production delivers.

I believe 2025 will be defined as the year when mainstream packaging businesses decide if they will choose to embrace new digital inkjet technology coming to market.

When Durst co-owner and CEO Christoph Gamper spoke at the ProPack Packaging Forum in Sydney last year, he made a very important statement that reinforces this point – digital printing is no longer wearing its baby shoes.

This is now the time for packaging converters to educate themselves and no longer treat digital as just an add-on in their business,

or as a smaller part of their business. Digital inkjet is the future of packaging.

Locally we are seeing strong, profitable, and viable businesses that have digital inkjet printing in both labels, flexibles, and folding carton packaging – this is a massive sea change for the industry.

The cost of print and the cost of ownership has now hit a sweet spot as the demands of customers have changed and so too have the run lengths, which is ideal for digital inkjet production.

My advice is, don’t miss the boat and the competitive advantage that comes with embracing new technology. As your clients find out they can order packaging in a different way, this will progressively become a game-changer.

Traditional large packaging converters have always demanded high volumes as that was previously the most efficient way – normally one design with an incredibly high run and then brands would order from that volume.

However, now with digital technology, customers can print the precise amount on almost a weekly basis. Also, you must bear in mind that this type of digital production has no run-up, which means there is less time in setting up the machine – making it far more efficient to run.

In terms of sustainability, with digital inkjet production there is zero wastage. This is becoming increasingly important for

external customers. More and more major brands want to know what converters have in place in terms of their sustainability plan when it comes to printing.

New laws coming into effect across the European Union will see the introduction of a sustainability audit for every business. At Durst, we have been conducting this audit for the last two years and it is only a matter of time before Australian businesses will be expected to present the same annual documentation and reporting.

Regardless of this, sustainability credentials will be increasingly demanded from end customers, therefore converters will need to have a solution that ticks this box.

Converters will be better off dictating the future rather than following how the industry has operated in the past. Progressive customers are not looking to work with converters or with machinery that is 20 or 30 years old and in this current business environment, replacing like for like with a new machine is no longer a smart option. Don’t work harder, work smarter.

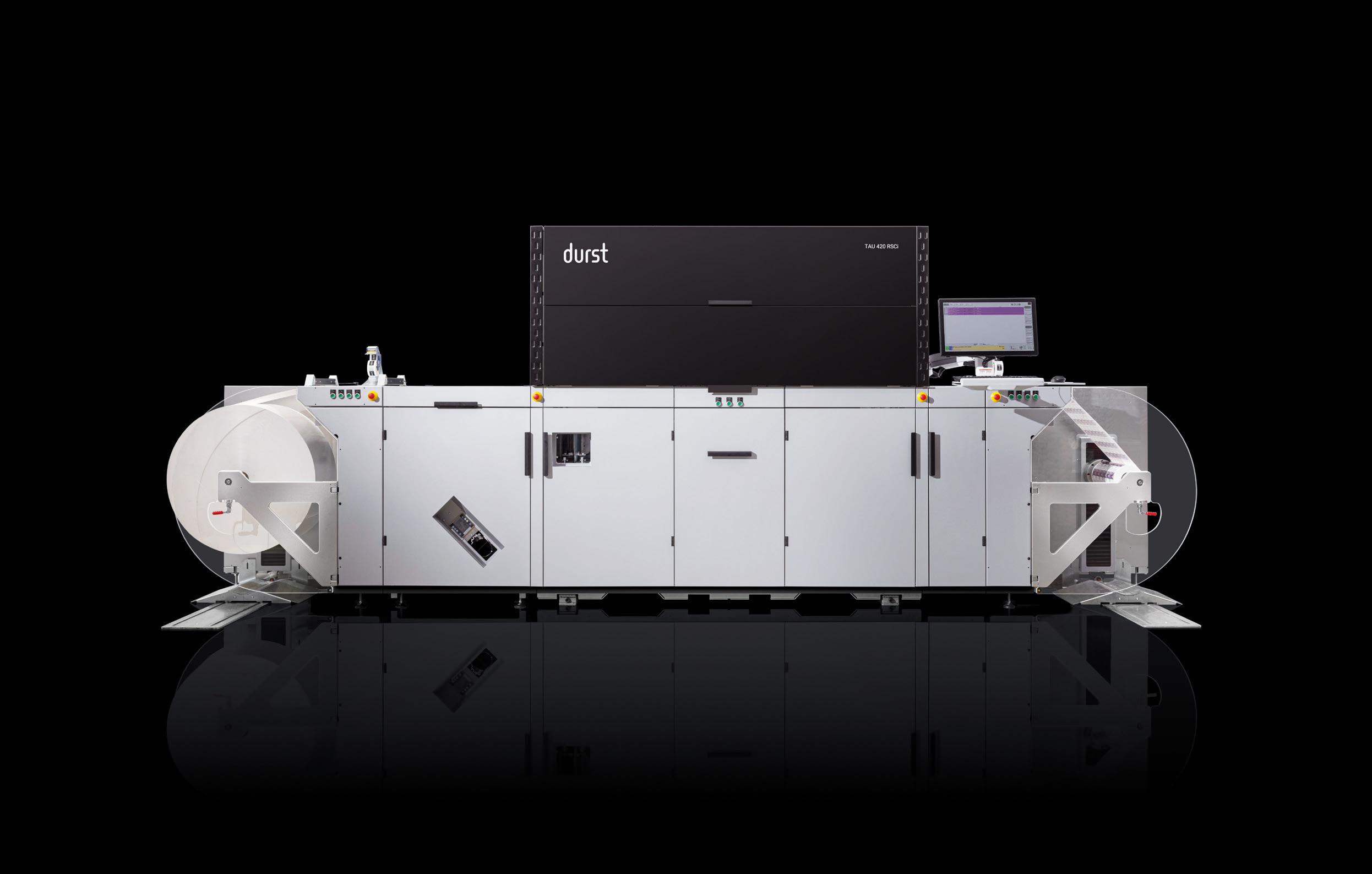

Durst offers products in its labels and flexibles portfolio – from the Tau RSC-E to the Tau RSCi, measuring up to 510mm in width and delivering prints of up to 80m/min at 1200 dpi.

The Durst Omet K-Jet hybrid option offers the same speed and width with flexographic integration.

The Durst folding carton and corrugated portfolio starts with the P5 Pack through to the SPC130 high speed corrugated printer, producing up to 100m/min. And at the top end, we offer the Koenig & Bauer Durst VariJet 106 folding carton machine with amazing speed and water based technology that complies with all global food standards for printing.

Durst is truly a one-stop shop – not only do we have the hardware, but we also have the software to manage a fast-paced packaging operation – with Lift ERP and Workflow solutions through to the B2B Smart Shop software.

Later this year at Labelexpo Europe in Barcelona, we will showcase our advanced hardware and software in the labels category, which will be complemented by several global open house events held at Durst’s head office in Brixen as well as in conjunction with our customers globally.

There will also be specific open house events for folding carton and corrugated customers showcasing the businesses that have taken the step to embrace digital inkjet production with Durst technology.

durst-group.com/label

One of the biggest highlights of 2024 was drupa, as it enabled the industry to showcase the latest innovations and get together to pool ideas and collaborate. The challenge was adapting to the changing market, reminding us we need to be flexible with industry demands and understand that we need new ways to interact with our customers/partners and prospects.

In addition, attracting talent into our industry continues to be a challenge. For the past few years, we have seen a decline in new employees coming into the industry. Finding and retaining the right people to keep business going, throughout my travels and discussions with international colleagues, seems to be not just a local problem but a worldwide one for the industry at large.

Just like last year, consolidation will be rife in 2025 – this is set to continue as many smaller companies get enveloped into larger industry players.

In 2024, we saw the likes of SmirnoffWestrock and Amcor and Berry merging, and we have already seen the news of SGS Co purchase SGK this year. This won’t be the last major transition in 2025.

In terms of external forces, we have seen the economic and political environment reduce in volatility slightly, although they will still pose challenges in 2025 – but I’m looking forward to a more subdued year.

On the upside, we have noticed many more businesses adopting the Cloud as a hosting option. Hybrid Software has always been flexible with hosting platforms for our CLOUDFLOW product but giving the option for a fully hosted SaaS offering via our MYCLOUDFLOW platform has been a worldwide success in reducing the local IT demands and challenges our customers face.

It also enables a centralised and consolidated platform for multi-site operations, which is a significant

positive for our customers in reducing overheads and costs in their business.

In 2025, there are some areas of growth that businesses should be looking to, to navigate through challenges:

1. Customisation and the use of different substrates and packaging options is key

2. The increase in digital solutions goes hand-in-hand with the ability to adopt customised, individual products for the personalisation of small-run or marketing campaigns, which can influence the way consumers behave

3. We see a lot of innovative materials on the market, which means brands can adopt different packaging options, allowing for an increase in flexible packaging solutions.

In terms of technologies of 2025, being a software supplier, AI is a big topic –although AI can be a marketing tool for some companies, the technology is advancing rapidly.

As a software company that strives to find solutions for customers, we have had situations whereby we haven’t been able to tackle complex problems, but a few months later, with AI assistance, we have a solution available which is a complete change in the way we approach the market.

Hybrid Software has also used AI tools to optimise our code for faster run times, better efficiency, and reduced energy usage for all our customers. A simple example we found is, computing 100 divided by two is significantly more intensive on a computer than 100 multiplied by 0.5.

By striving to make our software as efficient as possible, we are committing to improving our sustainability – even though a software company does have the same recycling and waste management issues that other suppliers have, there is a commitment to do our part.

This year, Hybrid Software’s main priority is to further invest in innovation. Hybrid is dedicated to listening to the demands of our customers and bringing forward the most innovative solutions to the market, and the only way we can do that is via R&D investment and solutions engineers to bring those innovations to final products. I have already seen the roadmap for some of our products to be released at Labelexpo Europe 2025.

I would love to say everything will be great and we will face a fantastic 2025. However, there will be challenges, but challenges bring out the best in people, so I am looking forward to 2025 being a successful year for many companies. I hope everyone else is looking forward to this as well.

2024 was a year filled with opportunities, amid rising costs and supply chain disruptions. Jet Technologies not only weathered these complexities, but thrived.

By forging new partnerships with industry leading companies for the market adoption of pioneering technologies, such as our recent affiliation with ACTEGA in 2024, we continued to add significant value to our customers’ businesses and the broader industry in 2024.

As the Australian printing industry faces evolving consumer expectations, rising costs, and increasing environmental pressures, the following three key trends will shape the path towards a smarter and more sustainable future:

Precision, efficiency, and opportunity with print-on-demand (POD): POD will become more prominent in the local printing industry in 2025, offering businesses the ability to produce materials in exact quantities as required. This approach eliminates the inefficiencies of overproduction, reduces storage costs, and significantly minimises waste –addressing both environmental concerns and bottom-line pressures.

The need for custom, on-demand solutions are escalating as businesses work to minimise overproduction and deliver on the growing consumer expectation for personalisation. At the same time, challenges like labour shortages and rising

costs are pushing the industry toward smarter solutions, such as POD, which emphasises waste-free production, eco-friendly materials, and automated workflows to unlock new growth in a competitive marketplace.

The rise of POD is particularly impactful in the packaging sector, where short-run production and rapid turnaround times are critical. For example, beverage companies using POD can create tailored, region-specific packaging for limitededition products tailored towards local events. This strategy can help move stock and create lasting impressions with consumers and help build brand loyalty.

POD also offers businesses new ways to connect with customers through integration with cross-media marketing campaigns. This capability allows businesses to print and distribute personalised marketing collateral – such as QR code-enabled flyers – on a just-in-time basis for limited offers, creating a seamless bridge between physical and digital customer interactions.

Automation transforming workflows: Automation is changing every phase of the printing process, driving efficiency and improving margins in an increasingly competitive market. From automated job submissions and scheduling to AI-driven quality control, businesses are leveraging technology to reduce manual intervention and error rates while optimising output. Automation is critical in addressing the dual pressures of labour shortages and escalating

operational costs. By streamlining processes, it empowers printing businesses to deliver superior results faster, with greater accuracy, and at a lower cost – transforming the way the industry operates and meets customer expectations.

For instance, a printer could integrate automated binding and trimming systems, enabling shorter turnaround times for high-volume book production, while maintaining impeccable quality standards.

Additionally, cloud-based workflow management systems are allowing businesses to operate seamlessly across multiple locations. These platforms provide real-time visibility into job status, inventory levels, and maintenance schedules, empowering teams to make informed decisions and address potential issues proactively.

Sustainability as a core strategy:

Sustainability has evolved from an industry buzzword to an operational necessity. In 2025, printing businesses will lean into eco-conscious innovations such as recyclable, biodegradable, and non-plastic materials. At the same time, energy-efficient technologies, like LED UV curing, are reducing resource consumption without compromising on quality.

In 2025, we expect an even stronger emphasis on sustainability, with environmental, social, and governance (ESGs) and sustainable development goals (SDGs) initiatives becoming central to printing and management practices. Print manufacturers and their partners have a unique opportunity to lead in sustainability, helping businesses reduce emissions while ensuring operational excellence. Australian printers who embrace water-based inks and carbon-neutral production processes are strategically positioning themselves to forge partnerships with environmentally conscious retail brands. This approach not only reduces their carbon footprint but also enhances their appeal as a preferred vendor for clients prioritising ESG alignment.

Further innovation is occurring in material reuse, with advancements in circular economy models enabling used packaging materials to be repurposed into new products. This trend is fostering collaborations between the printing and recycling industries, creating a closedloop system that benefits both the planet and profitability.

As the printing industry moves into 2025, trends such as POD, automation, and sustainability are key factors shaping its future. With these innovations at the forefront, Australian printing businesses are uniquely positioned to meet evolving demands, improve efficiency, and lead in environmental responsibility.

The packaging landscape is in a state of evolution. The industry will need to balance cost effectiveness, sustainability, and compliance, with the drive for lower consumer costs impacting the packaging supply chain. This may result in customer-driven trade-offs between packaging performance, raw materials, or product claims and costs.

State legislative requirements are also changing, affecting end- and beginningof-life packaging and environmental claims, with consumers seeking increased transparency around traceability while making more sustainable choices.

The packaging industry needs to work together to help governments and regulators develop and implement environmental packaging policy and regulations which are consistent and workable across jurisdictions, to drive responsible packaging practices while avoiding unreasonable increases in compliance costs, adding to cost of living pressures.

In addition, greenwashing is still prevalent in some parts of the food service packaging market, and companies need to partner with suppliers to legitimise claims. We are hoping to see more uniform decisionmaking regarding federal legislation to minimise state compliance confusion.

However, complying with federal and state-based legislation regarding greenwashing and single-use plastics will be challenging for some industry participants, along with offsetting rising

input costs and industry ‘free-riders’ operating outside of the NEPM/APCO co-regulatory arrangements. Greater sustainability oversight and accountability is essential, including investment in compliance or certification claims, as extended producer responsibility laws gain traction in the future.

In 2025, we expect more functional and user-friendly packaging designs, enhancing aesthetics, and an improved unboxing/brand experience. The debate on eco-modulated fees and their application will continue. There will be a greater focus on health and wellbeing, including eliminating chemicals of concern such as PFAS, compliance with food-safe quality regulations, and addressing CSR issues such as worker safety standards and complying with anti-modern slavery regulations throughout the supply chain.

The shift towards sustainable material choices will persist, with circular packaging options including reusable, recyclable, and compostable options, to minimise waste and align with legislation. Technologies like AI will optimise packaging processes from design and material selection to logistics, improving efficiency, reducing costs, and making advanced packaging more accessible. As a result, in 2025, innovation will continue to be essential, particularly around the rapidly growing range of paper-based packaging raw material technologies, compositions and performance, while designing products to meet customer and brand expectations.

Companies and packaging suppliers need to understand regulatory compliance and what customers want – including high-quality products and accurate sustainability information, while designing for useability and end-of-life, incorporating new technologies, certifications and testing processes to create future-proof, sustainable products.

The Detmold Group has invested heavily in this space with the 2024 expansion of our dedicated in-house packaging design and R&D lab, LaunchPad, which has increased our service offerings and customer base, including directly offering re-pulpability and other testing services to third parties and non-packaging sales customers.

In 2024, Detmold Group also launched its 2025-2050 Sustainability Goals featuring 15 targets across climate, nature, circularity, and governance. Supporting this, we completed our first Carbon Disclosure Project (CDP) environmental performance review and international solar project in Heshan, China, with 956 solar panels generating more than 574 MW annually.

We also expanded globally, strengthening our presence in North America with two new US sales offices and completed a European acquisition. In addition, we launched more than 250 products, focusing on innovative coatings and single-use plastic ban-compliant items.

2024 was a strong year for the group in terms of industry recognition, earning awards including the Full Framework Reporting Award at the 2024 APCO Awards, the APPMA Packaging Design Innovation Award, and the Flynn Group’s Product Excellence Award. We were also recognised by the SA Business Chamber for gender pay parity and equality in manufacturing, and as an Employer of Choice in the Australian Business Awards for the seventh year.

Our key priorities for 2025 are sustainability and design innovation. This includes reducing emissions in line with key customers within globally accepted timeframes, continuing to collaborate with suppliers to prevent deforestation in our supply chain, and enhancing participation in a circular economy. We are improving material optimisation, increasing use of sustainably sourced materials, reducing fossil fuel-based plastics, and introducing more recyclable and compostable packaging solutions.

Our 2025-2050 Sustainability Goals include sourcing more forest-certified fibre, increasing recyclable content in products, maximising landfill diversion, sourcing more renewable electricity and setting greater emissions reduction targets; and continued investment in governance processes to drive accountability, including CDP disclosure and Group ISO 14001 certification.

In 2024, Immij made substantial advancements in solidifying our position within the folding cartons sector in both Melbourne and Sydney, aiming to redefine industry standards and service delivery.

One of the most notable initiatives was the implementation of a flexible one-totwo-week turnaround for our printing and converting services. This innovative approach significantly contrasts with the traditional four to six-week turnaround times typically offered by competitors.

Despite these advancements, we encountered some challenges in maintaining work volume consistency throughout the year.

The variability in demand created periods of both high activity and slower times. This inconsistency was not unique to Immij, but rather reflective of broader trends observed across the industry.

A key highlight for Immij in 2024 was the celebration of employee milestones. We proudly recognised 28 staff members who achieved 15 years of dedicated service, alongside 29 others marking a decade with the company since our establishment in 2008.

One of our main priorities this year is to maintain a significant position within the horticulture and fresh produce sector.

In alignment with our environmental objectives, we are embarking on a strategic initiative to transition both our existing and

new clients from traditional polypropylene labelling material to innovative waterrepellent board alternatives.

Our proactive approach to innovation has led us to develop recyclable cardboard plant labels and fresh produce labels.

These advancements are designed not only to meet the functional needs of our clients but also to substantially reduce the reliance on plastic, thereby minimising the amount of waste sent to landfills and reducing our environmental impact.

We consistently seek methods to assist our clients in making knowledgeable decisions about how their packaging solutions can be repurposed, recycled, or composted.

Earlier, I discussed the areas of green life and fresh produce; in addition, we have recently revamped the packaging for a global pen company by eliminating the blister pack to ensure it is entirely recyclable.

Another significant and well-known brand aims to replace a non-recyclable reflective coating on its secondary packaging. Therefore, we are exploring different materials, finishes, and designs that will still provide a visually striking presence on store shelves while minimising environmental impact.

The packaging landscape is increasingly competitive as more commercial offset printing companies are shifting their product focus towards folding cartons.

This shift is attributed to the stagnation or decline of the traditional commercial print market, whereas the packaging industry is experiencing year-on-year growth.

The silver lining is that there is ample highquality work available, with converting companies that are offering unique advantages best positioned to benefit. I believe conversations about packaging are expected to remain centred on sustainability through 2025.

In packaging design, I hope to see more vibrant and striking colours and the introduction of more embellishments –allowing products to stand out on the shelves.

I have seen this trend begin to emerge in the previously somewhat dull ready-toeat-meal industry, which has now become highly competitive and crowded. Brands are employing bold Pantone colours and spot gloss varnishes to distinguish between different varieties, making the brands themselves more adventurous.

“We consistently seek methods to assist our clients in making knowledgeable decisions about how their packaging solutions can be repurposed, recycled, or composted.”

I believe automation will also reach unprecedented levels this year. Additionally, digital printing capabilities for not only premium packaging, but everyday packaging will become even faster, larger and more impressive.

A major challenge for the industry in my opinion is the current economic situation, particularly in Victoria, which is causing widespread anxiety about expenditure and the significant level of government debt, which is preventing many individuals from taking initiative in their decisions. In 2025, the printing industry might undergo additional mergers and acquisitions.

But it is all not doom and gloom. On a brighter note, with more projects being produced domestically post-COVID, demonstrating a reliable history of consistent delivery will enable companies to expand their businesses further.

As an industry, we are lucky to be involved in a field that is both creative and engaging, and it is important to occasionally pause and appreciate this.

2024 was a tale of two halves. The first six months was extremely busy, with order levels very strong. We then saw a decline in order levels in the second half of the year. Ever increasing costs – especially government-controlled costs – and a lack of skilled staff were two major issues that we had to face in 2024.

No matter how we tried, we could not get the percentage increase to our cost base anywhere near the official inflation rate. Sadly, we continued to see our supplier base shrink in 2024. On the positive side, Impact International installed two production machines in 2024, further adding to our capabilities.

Throughout 2024, we maintained focus on quality and sustainability. Our sustainable forest program remained well supported and we continued to work with our customers to move from non-recyclable packaging formats into packaging that is designed to be recycled.

Back in August 2022, we planted more than 5000 trees at the Impact Forest. These trees are growing well and as a result our carbon capture rates for the forest are increasing. We remain the only packaging company in Australia who operates their

own forestry infrastructure to offset the carbon footprint of the packaging that we manufacture.

We also continued to support the Penrith Museum of Printing, the Zen Tea Foundation, and the Exodus Foundation –all worthy causes close to our hearts. We also communicated regularly with our customers, informing them of the current market conditions and updating them on projects that we were working on.

This year, we will be focusing on further strengthening our position in the market by offering an improved value proposition. We firmly believe that cheapest is not best; however, customers must see clear value in accepting a superior product which comes with a higher price tag.

We will also continue to develop new product offerings in accordance with the guidelines issued by APCO. Staff retention will also remain a priority as will supporting suppliers who manufacture in Australia.

The next 12 months will be uncertain for the broader packaging market. I expect our cost base to continue to increase, and a lack of skilled production staff will remain an area of concern.