Share your snaps and be in to win!

Share your snaps and be in to win!

Welcome to our special Leaders Forum edition, carefully curated to bring you and your team helpful tips and strategies for the year ahead. Turn to page 11-19 for insights from respected industry experts, including the NZ FGC, Circana, Foodstuffs and Business NZ.

Budget restraints and economic uncertainty resulted in many households focussing on value and essential goods in recent months. This year, shoppers are also redefining their priorities, including health and wellness and products that align with their personal values. This means that transparent product content, such as detailed nutritional information, a clear ingredient list, and country of origin, can help to build trust and empower consumers to make informed decisions.

Brands and retailers will need to consider pricing strategies and embrace innovation, to meet the changing needs of health-conscious, value-driven, and tech-savvy shoppers.

Also in this issue, we find out what’s new in specialty breads, eggs and easy meals, and take a close look at the major flavour trends for 2025. Plus recruitment tips, packaging insights, legal advice and much more.

Keep an eye on our daily online updates for breaking news and more industry highlights. If you’d like to receive our weekly e-news, please subscribe over at www.fmcgbusiness.co.nz where you can also access FMCG services and events.

We’d love to hear from you if you have new product launches or other exciting news to share. Please keep in touch and join our daily conversations on LinkedIn, Facebook, or Instagram.

Tamara Rubanowski trubanowski@fmcgbusiness.co.nz www.fmcgbusiness.co.nz

PUBLISHED BY

C&I Media (NZ) Ltd PO Box 109 342

Newmarket, Auckland 1149

MANAGING DIRECTOR

Simon Grover

GROUP PUBLISHER AND COMMERCIAL DIRECTOR

Safa de Valois safa@c-store.com.au

EDITORIAL DIRECTOR

James Wells james@intermedia.com.au

HEAD OF CONTENT

Tamara Rubanowski

trubanowski@fmcgbusiness.co.nz ph: 027 278 4761

MEDIA SALES MANAGER

Bridgit Hannigan bhannigan@fmcgbusiness.co.nz ph 022 1505 473

GRAPHIC DESIGNER

Leanne Hogbin leanne@intermedia.com.au

PRODUCTION MANAGER

Jacqui Cooper jacqui@intermedia.com.au

DIGITAL AND PRINT

COORDINATOR

Eclypse Lee elee@intermedianz.co.nz

C&I Media takes its Corporate and Social Responsibilities seriously and is committed to reducing its impact on the environment. We continuously strive to improve our environmental performance and to initiate additional CSR based projects and activities. As part of our company policy we ensure that the products and services used in the

FMCG is printed on FSC®-certified MIX paper from well-managed forests and other responsible sources. SCG print using BIO-inks that contain materials that are

on renewable resources including

Hellers is set to transform the frozen food category with the launch of its Frozen Pork range, a standout innovation hitting supermarkets soon. Read the full story on pg 9.

resin (rosin,

and vegetable oils, linseed oil and soy bean oil. This magazine is printed by SCG, an ToitŪ enviromark gold certified printer.

ISSN 2382-1663 (print) ISSN 2624-4802 (online)

FMCG Business is audited and verified by ABC.

New Zealand’s biggest new supermarket, the $100 million Highland Park Pak’nSave, is opening on February 25th.

The 6391sqm East Auckland store is located at 503 Pakūranga Rd, formerly known as the Highland Park Shopping Centre. The new supermarket has 329 car parks and is next to an existing Woolworths store.

Owner/operators are Wade and Diana Brown who are now managing their third supermarket. They bought into the Foodstuffs North Island co-operative in 2013 via New World Kawerau in the Bay of Plenty. In 2017, they bought New World Kumeū.

Foodstuffs North Island General Manager of Retail & Property, Lindsay Rowles said: “We’re excited to be bringing the latest generation PAK’nSAVE format to Highland Park, featuring ample space for customers and efficient behind-the-scenes operations, all designed to keep costs down. Highland Park is a vibrant community and opening a new PAK’nSAVE demonstrates our

commitment to investing in the local area. With an expected 250 new jobs providing a range of employment opportunities, we’ll also be contributing to the local economy.”

“The new supermarket also underscores our commitment as a 100% NZ-owned co-op to keep investing in every region and providing a worldclass grocery offering for all.”

Situated on a 15,000sqm site, the new PAK’nSAVE will become a flagship location for the Highland Park community, with specialised departments catering to customer preferences such as a seafood servery, butchery, bakery, and deli. The new store will also include a dedicated drive-through area for customers collecting online orders, as well as lockers for click and collect orders.

The site will also include six additional retail spaces available for lease, offering exciting opportunities for specialty businesses to thrive alongside the new PAK’nSAVE.

For the New Zealand Government, 2025 will bring a relentless focus on unleashing the growth we need to lift incomes, strengthen local businesses and create opportunity, said Prime Minister Christopher Luxon in his recent Statement to Parliament.

“Just over a year ago this Government was elected by the people of New Zealand with a mandate to change course. Since then, we have made big changes and we are seeing promising signs of success, with inflation dropping and remaining low, interest rates starting to fall, and wages continuing to rise,” Luxon said.

“Business and consumer confidence is rising and average mortgage interest rates have now fallen for the first time in more than three years. Wages are rising faster than inflation, supporting a recovery in household incomes. Growth is also expected to resume, reaching 2.1 percent in 2025 according to Treasury’s latest

forecasts in the Half Year Economic

“We need to act now to strengthen growth and productivity – both in the very near term and over the years to come.

“In 2025, we will take action to end the culture of no – whether that’s through Fast Track, comprehensive RMA reform, rewriting our health and safety laws, enabling more mining, allowing our farmers to grow their businesses with much less red tape, or other changes designed to promote more growth and investment.

“In this Government’s first year in office we made tough decisions to ease the cost of living and laid the foundations for a stronger economy, rising incomes and more opportunities for New Zealanders to get ahead.

“This year we will continue to build on this early progress to make sure these green shoots of recovery grow into lasting improvements that benefit all New Zealanders,” Luxon said.

Woolworths Group has announced that Woolworths New Zealand Managing Director, Spencer Sonn, will be leaving the Group at the end of March.

Spencer joined Woolworths Group in 2021 and is originally from South Africa. He is returning to South Africa to take up a role with Woolworths Holdings Limited.

Spencer Sonn said: “I’d like to thank our incredible team members and the New Zealand community for welcoming me so warmly. I’ve been lucky to see a lot of this beautiful country and meet many local customers over the last few years, but also to spend time with our team, growers and local suppliers, and see first-hand the passion and care they demonstrate every day.”

Woolworths Group CEO, Amanda Bardwell, said: “Over the last

four years, Spencer has played an instrumental role in leading our New Zealand team with care for customers and team through many challenging

“Some highlights of his time leading our New Zealand business include the rebranding of Countdown to Woolworths, the introduction of Everyday Rewards, the transformation of FreshChoice and our fresh food journey including the refresh of our cold chain. I’d like to thank Spencer for helping make us Better

Together and wish him all the best for the future.”

Spencer will continue to lead Woolworths New Zealand until the end of March 2025, and Sally Copland has been appointed as the new Managing Director, Woolworths New Zealand.

Apple is once again the world’s most valuable brand, according to Brand Finance. The brand valuation consultancy values Apple’s brand at USD574.5 billion, ahead of second-placed Microsoft (USD461 billion).

According to Brand Finance’s research, four out of the five most valuable brands in the world are technology brands:

• Apple: brand value of USD574.5 billion, up 11% from 2024

• Microsoft: USD461.1 billion, up 35%

• Google: USD413.0 billion, up 24%

• Amazon: USD356.4 billion, up 15%

• Walmart: USD137.2 billion, up 42%

The Brand Finance Global 500 report for the year 2025 ranked Costco in 26th place and Coca Cola was 28th.

193 American brands are among the 500 most valuable in the world for 2025, collectively contributing over half of the total. China and Germany follow as the second and third most valuable countries, with 69 and 27 brands respectively, accounting for 15% and 6% of the total brand value.

Across sectors, banking leads with 78 brands contributing 13%, followed by retail with 45 brands at 11%. Media ranks third, with 24 brands representing 10%.

David Haigh, Founder & CEO, Brand Finance, commented: “Our analysis of what brands have grown the most since 2020 reveals that technology companies do not have a monopoly on sustained brand growth. This also reinforces another global trend: how Chinese brands like TikTok, Pinduoduo, and BYD lead the charge by creating value and challenging established brand leaders.”

e& is the world’s fastest growing brand value, posting an eight-fold increase following consolidation of brand architecture.

WeChat is the strongest brand, with a Brand Strength Index score of 95.2/100.

Global economic growth is expected to remain stagnant at 2.8% in 2025, mirroring 2024 and falling short of the 3.2% pre-pandemic average, according to United Nations forecasts. In contrast, the world’s 500 most valuable brands are thriving, with their total value rising 10% year-on-year, from USD 8.6 trillion in 2024 to nearly USD 9.5 trillion in 2025, according to Brand Finance data. This brand value growth trend is likely to be strengthened by easing cost pressures on consumers and businesses.

Source: Brand Finance

Hellers is set to transform the frozen food category with the launch of its Frozen Pork range, a standout innovation hitting supermarkets on 3rd March 2025. This exciting product line responds to a significant gap in the freezer aisle, offering a delicious pork-based alternative to the chicken-dominated category.

The frozen food market in New Zealand, valued at $280 million, is experiencing rapid growth, with +14.3% dollar growth in the past year alone. However, it remains saturated with chicken products, leaving little diversity for consumers seeking quick and nutritious meal options. Hellers’ new range fills this gap with three irresistible offerings: Katsu Pork Burgers, Sweet Chilli Pork Tenders, and American BBQ Pork Poppers.

These products are designed with Kiwi families in mind—providing quick, flavourful solutions for meals, snacks, and entertaining. With convenient pack sizes, they’re perfect for busy parents or teenagers looking for an easy, tasty option. Backed by a $1 million marketing investment, including national advertising, in-store demos, and consumer promotions, this launch is positioned to create significant buzz and elevate the Hellers brand even further.

This is more than just a new product—it’s a bold step into a growing market and the biggest launch for Hellers in 2025.

This year, Hellers proudly marks 40 years of bringing quality meats to Kiwi tables. From its humble beginnings as a local butcher to becoming the country’s most trusted name in smallgoods, Hellers has remained committed to crafting products that deliver on flavour, quality, and innovation.

“Visit hellers.co.nz to explore our full range of products and celebrate this journey with us.”

Over the past four decades, Hellers has continued to grow, responding to the changing tastes and needs of New Zealand families. From classic sausages and bacon to innovative products like the new Frozen Pork Range, Hellers has always strived to offer something new and exciting for consumers. This innovation, combined with the brand’s reputation for consistency and quality, has solidified Hellers as a household name.

“As we celebrate this milestone, we reflect on the trust, loyalty, and love from Kiwi families who have made Hellers part of their lives. With big launches, like our Frozen Pork Range, and continued dedication to excellence, we’re looking forward to serving generations to come,” says marketing Manager Brydon Heller.

in place. Forecasting the year ahead it’s almost certain weather and biosecurity vigilance will continue to present challenges along with ongoing unpredictable international geopolitical shifts.

There seems to be agreement that we need to make some serious inroads into lifting our productivity and attracting more capital to support the economy, though winning strategies to achieve this have alluded successive governments. Reducing red tape is one lever available and NZFGC supports this so long as it maintains access to some highly regulated trade partners for export.

What ‘thriving in 2025’ looks like will be a little different to

iStockphoto.com/Nuthawut Somsuk

is underway, we will be pushing hard to get a clear picture for members, industry, and consumers in this space.

Developing our talent pipeline also remains paramount. Over the summer we saw top University talent working in our leading FMCG companies through the FMCG Futures Intern programme. But we need many more employers to provide places for these bright sparks next summer, who contribute as much as they learn. So here’s a new year’s challenge: can your company accommodate a smart and dynamic intern next summer?

Here’s to 2025, NZFGC will continue to champion FMCG –and if you want to join us in this work, get in touch!

Head of Retail, Solutions & Innovation Circana

We made it! We’ve survived until 2025— fingers crossed for a fresh start. It’s a new year, offering a chance to reset after the economic hardship many New Zealanders felt in 2024. But will 2025 truly be a year of recovery, or will we continue to face the slow grind of economic uncertainty?

Economic realities: a slow recovery

The Reserve Bank’s strategy of curbing inflation through higher interest rates may have been successful, but it came at a significant cost. Kiwi households have been squeezed, and the most recent Stats NZ retail volume sales indicate that 10 out of 15 retail industries saw a decline in the September quarter. Those hoping for a spending boost over the Christmas period were likely disappointed, with early indicators suggesting a decline in festive spending.

One diet gaining traction is the Mind Diet, which targets the reduction of cognitive decline.

Avoiding foods and drinks perceived to be detrimental to health is another strategy Kiwis are adopting. Gluten-free products, for instance, have seen strong growth in both value and units across supermarkets. Sugar-free products have also risen, now valued at $32.7 million. Furthermore, protein products are gaining ground, as consumers increasingly view protein as a key component in achieving their fitness and health goals. Protein can now be found in a wide range of products throughout the supermarket, and its popularity continues to soar.

“There’s growing potential for innovations that make it easy to enjoy health-conscious meals without compromising on convenience.” iStockphoto.com/YelenaYemchuk

The good news is that interest rates are now starting to decrease, which should give households a bit more spending power. However, with predictions of further job losses and higher unemployment rates, 2025 is unlikely to be the flourishing year many had hoped for. While we expect some economic recovery, it will likely be slow and drawn-out.

As a result, many of the economising strategies that were prevalent in 2024 will likely persist throughout 2025. Private label products, a big winner in 2024, are expected to remain popular throughout the year. This, along with a sluggish recovery in hospitality, signals a continued focus on home-cooked meals—particularly in the centre aisles of supermarkets, which we expect to thrive.

While the state of the economy is on the minds of many, consumers are also increasingly focused on their health and wellbeing. With an aging population, Kiwis are placing a stronger emphasis on preventative health measures to improve longevity. We are seeing a growing market for supplements known to rejuvenate aging cells and support immune health, alongside an increased focus on diet.

A significant societal shift is also underway in the beverage sector: a growing move away from alcohol-based drinks. With the increasing awareness of the damaging effects alcohol can have on health, it’s no surprise that sales of spirits and RTDs (ready-to-drinks) dropped by 12.5% in the 12 months leading up to October, according to Spirits New Zealand. On the flip side, non-alcoholic alternatives surged by 30%, as reported by Circana MarketEdge for grocery.

Another key trend for 2025 is the ongoing demand for convenience. The rise of air fryers is just one example of how Kiwis are prioritizing convenience in the kitchen. The frozen food category, particularly frozen meat and frozen potatoes, continues to see strong growth. However, the challenge remains that many consumers perceive convenience as being in conflict with health.

This presents an opportunity for manufacturers to redefine “healthy convenience” and offer products that meet both demands. There’s growing potential for innovations that make it easy to enjoy healthconscious meals without compromising on convenience.

While 2025 may not offer the economic boom many had hoped for, there are still opportunities for growth in New Zealand’s grocery market. Manufacturers who can adapt to consumers’ evolving needs—whether through offering affordable, healthy, or convenient options—are more likely to succeed. As we navigate a slow recovery, there’s room for innovation that aligns with the ongoing trends of health-consciousness, value-seeking, and convenience.

enhance service delivery. By combining the strengths of both co-ops, we can achieve greater speed, consistency and simplicity.

For our suppliers, we aim to create a supply chain that is both resilient and responsive to market demands by increasing transparency, streamlining processes and improving communication. These improvements help lower costs and free up resources for reinvestment in innovation and growth.

As an industry, we must embrace change and challenge traditional ways of operating. To remain strong, New Zealandowned businesses owe it to consumers to continuously evolve and improve.

We’re committed to delivering outstanding experiences both in-store and online. Our e-commerce platforms, including New World and PAK’nSAVE, have grown by 25% year-on-year. We’re expanding delivery capacity, improving speed, and introducing new features to meet rising demand for convenience. Our suppliers are crucial in helping us meet these challenges. From developing groundbreaking products to improving processes, their contributions help us provide customers with the most innovative ranges. Initiatives like the Emerging Supplier Programme and events like Foodstuffs Emerge highlight our commitment to supporting new and established suppliers.

As we invest in digital transformation and operational efficiency, these partnerships will be more important than ever. The merger with Foodstuffs South Island will give us the scale and agility to stay ahead of industry changes.

a healthy supply ecosystem. To ease pressure on all sides, we are relentless in our pursuit of efficiency. Reducing complexity, avoiding double handling, and cutting duplication are daily priorities. In a business of our scale, every second saved and every step removed adds up to big improvements.

Our commitment to efficiency is the driving force behind the proposed merger with Foodstuffs South Island. This merger is a significant opportunity to streamline operations, reduce costs, and

Our mission is clear: to be our suppliers’ most valuable partner, the most customer-driven and productive New Zealand business. This is the only place we operate. We’re Kiwis serving Kiwis, reflecting the needs of our people and working hard to make a difference. Together, as New Zealand’s grocery team, we can tackle future challenges and seize new opportunities for innovation and growth. Thank you for your continued collaboration and dedication. Here’s to another year of shared success, efficiency, and delivering for Kiwi communities.

“We’re prioritising technology and innovations to ensure that our supply chain is not only resilient but also capable of evolving with the times.”

Katherine Rich Chief Executive, BusinessNZ

Business leaders and everyone involved in business are looking for a great trading environment in 2025.

Last year was uncomfortable for many. High inflation and high interest rates made shoppers cautious with their spending, something that impacted the FMCG sector as well as many others.

During 2024 it took several months to pull back the inflation that had been boosted by government overspending during the Covid pandemic.

With shoppers reluctant to open their wallets, a number of businesses found it hard to make sales and pay their bills.

However, I believe we are now returning to brighter days.

Inflation is being managed down, interest rates are receding, and business and consumer confidence are definitely rising.

Tourism numbers are starting to improve. The summer growing season, so important to NZ producers, is contributing to a hoped-for level of growth in 2025.

Growers, suppliers, retailers and others in business - all of us want a vibrant economy where consumers feel confident about spending, businesses can thrive, and new businesses can emerge.

I should say that during the last couple of years, the resilience of many Kiwi businesses has been exceptional.

making needed changes to unwarranted financial regulation, and modifying employment relations rules that have been making it hard for employers to run a business. The result is a business environment that is gradually improving, holding promise for a much more productive and prosperous future.

Also positive are the outcomes from two new free trade agreements negotiated recently, with the United Arab Emirates and the Gulf States.

The UAE deal is set to eliminate tariffs on nearly all NZ exports going to the UAE - dairy, meat, and horticultural and industrial productssaving our exporters millions of dollars and increasing their profitability.

“The Government is making significant reforms, such as reducing the unnecessary red tape that is affecting many industries”

Their ability to hold on, make necessary changes, and keep their eye on future growth has been impressive.

Actions by the current Government have also been positive.

Responding to many of the policy initiatives advocated by BusinessNZ, the Government is making significant reforms, such as reducing the unnecessary red tape that is affecting many industries,

The free trade deal with the Gulf States - which include UAE as well as Saudi Arabia, Kuwait, Bahrain, Oman and Qatar – is also a major step forward, reducing tariffs significantly for NZ exporters, and helping them sell more into these wealthy markets.

The results from these deals, which were many years in the making, will greatly benefit the NZ economy. I am grateful for the amazing work that has been done by the NZ Government and our trade negotiators off-shore, representing the interests of New Zealand exporters.

There are many things to celebrate in our business environment.

On a personal note, I am delighted to see how many businesses that are members of the BusinessNZ Network are continuing to grow, prosper, and give back to their communities.

My visits to many of these enterprises, small and large, confirm to me that business in New Zealand is focused, positive, and in good heart.

I am looking forward to a 2025 that is great for business and great for New Zealand.

Lance Dobson

Recent NielsenIQ data has revealed that while many countries in the APAC region started feeling a little more optimistic with their expenses in 2024 compared to 2023, New Zealand might be seeing a different trajectory.

The number of consumers that consider themselves to be struggling in New Zealand (experiencing financial insecurity) has doubled from 12% in 2023 to 24% in 2024.

As consumers face uncertainty with respect to the cost of living, how they feel and how healthy they are can have significant effects on how they spend. Understanding these trends can help retailers and manufacturers better serve their market.

Before considering how the FMCG sector can thoughtfully navigate a marketplace where spending is under greater scrutiny, let’s take a look at some of the health and wellbeingrelated survey data collected by NIQ recently.

believe the barriers to healthier lifestyles are and how they would like to see retailers and manufacturers respond.

When NIQ recently asked what prevented New Zealanders from being healthier, 53% said cost was a key factor, 40% acknowledged habits as a barrier, 32% cited motivation and 21% said time.

While a majority of surveyed New Zealanders (85%) believe consumers are responsible for their diets, governments were seen as accountable by 24% of consumers, and retailers by 22%. 35% of Millennials and Gen Z are more likely to place responsibility on governments and retailers for diets.

So, what do New Zealand consumers want manufacturers and retailers to do? 74% said they’d like to see the industry ‘make healthy more affordable’, 71% want clearer labelling and 48% would like to see brands innovate with new healthier products.

“74% said they’d like to see the industry ‘make healthy more affordable’.”

NIQ survey data from 2024 identified that sleep, nutrition, and mental health were the most important factors for New Zealanders’ wellbeing.

According to the University of Auckland, 40% of New Zealanders have less than seven hours of sleep per night, and that short sleep was consistently linked to problems ranging from psychological distress to poorer sense of health, self-esteem and life satisfaction.

Mental health concerns like depression and anxiety remain concerning ailments in New Zealand households, however, they did drop slightly from 2023 levels of 28% to 25% in 2024.

The country currently leads APAC in overweight and obese adults, and has an estimated annual sugar consumption of around 55.5kg per capita - third highest behind Australia and Hong Kong. Between 2023 and 2024, the reported occurrence of high cholesterol as an ailment went up from 23% to 25%, while high blood pressure remained stable at 33%.

The New Zealand health and wellbeing landscape presents challenges, but consumers have been forthcoming with what they

FMCG companies can start to act on consumers’ cost concerns by bringing more attention to more affordable healthy alternatives. The industry can also do things to help inform consumers through better health guidelines on labels, given that 51% of New Zealand consumers believe that health guidelines can improve public health.

When it comes to consuming food and beverage products in 2024, New Zealanders have some preferences that are worth FMCG retailers and manufacturers taking note of.

Through NIQ’s best-in-class insights platform BASES, a recent report identified the top traits that New Zealand consumers want in these categories. These traits include:

1. Is made with real ingredients

2. Provides a good balance of taste & health

3. Is made with natural ingredients

4. Has a great taste

5. Made with 100% New Zealand ingredients.

FMCG retailers and manufacturers who consider the data above to cater to cost- and health-conscious New Zealanders are better positioned to maintain customer trust and loyalty in uncertain times.

What lies ahead for New Zealand’s convenience sector in 2025?

With shifting consumer expectations, emerging technologies, and ongoing external challenges, I predict a year where adaptability, modernization, and a customerfirst mindset will set businesses apart.

Consumers will increasingly demand speed, quality, and innovation from convenience stores. Time-poor customers are looking for more than just essentials—they want accessible, high-quality offerings and solutions tailored to their busy lifestyles.

Customers expect convenience retailers to go beyond the basics. Modern offerings, diversification, and a focus on quality will be key.

alike. It drives efficiency and delivers the fast, seamless experience customers will be expecting.

Modern, inviting retail spaces will remain central to meeting consumer expectations. Reinvestment in physical stores will become a priority across the sector, ensuring businesses remain relevant and appealing.

Stores that fail to evolve risk falling behind.

Recent store upgrades across the market reflect a broader push toward improving retail spaces, with businesses recognizing the value of creating environments that keep customers engaged.

Stay customer-focused, embrace change, and invest in innovation.”

Additionally, the rise of delivery services is expected to continue shaping the market. Platforms like DeliverEasy, DoorDash, and Uber Eats are bringing convenience stores directly into customers’ homes, and this trend will only gain momentum.

Delivery will continue to be a major growth driver in 2025. Last year’s expansion into smaller markets revealed strong demand for these services, giving more customers additional options for how they purchase and receive goods.

Regulatory changes, particularly around products like tobacco and vapes, will be a key challenge for the sector. Businesses must remain agile and proactive to navigate tightening rules while maintaining strong customer offerings.

Staying ahead of regulatory changes is vital for long-term success. Businesses that adapt quickly will be in the best position to thrive.

Technology will also play a pivotal role in improving operations and enhancing customer experiences. Investments in self-service kiosks, loyalty apps, and streamlined supply chain systems are no longer optional—they are essential.

Technology simplifies processes for staff, suppliers, and customers

The difference between a modernized store and one that hasn’t evolved will ultimately be measured in profitability. Customers who have a positive experience in updated retail spaces, even during a brief visit, are more likely to return and become loyal customers over time.

While urban areas remain a cornerstone of convenience retail, regional New Zealand is emerging as a significant area of opportunity. Strong performance in the South Island and renewed confidence in smaller towns highlight the untapped potential of these markets.

As demand for modern convenience grows, regional areas present exciting opportunities for expansion. Communities want access to the same quality and innovation seen in urban centres.

My advice for businesses in 2025 is this: stay customer-focused, embrace change, and invest in innovation.

Success in convenience retail comes down to understanding and meeting the customer’s needs. Businesses that stay agile and reinvest in their future will be the ones to watch.

With ongoing advancements in technology, the expansion of delivery services, and opportunities for growth in regional markets, 2025 promises to be another transformative year for the convenience sector.

Chris Foord Partner, Argon & Co New Zealand

As we look forward to 2025 the outlook for business and New Zealand is improving. Many businesses in 2024 were focused on the “survive till 2025” mindset, controlling costs and avoiding discretionary spend. Very few though forgot about the consumer/ customer and the need to continue to serve, surprise and delight with excellent product, service and pricing. Most FMCG businesses will be looking to return to better margin positions in 2025 and indications are favourable that this is achievable.

The inflation beast has been tamed, so interest rates have fallen and are predicted to drop further (albeit not by a huge amount) through 2025. Business sentiment is on the rebound. Consumer confidence is at its highest level for two years, which in turn improves business confidence. Whilst the signs are positive, navigating from the survival mindset to a thrive mindset doesn’t happen without intent.

survival mindset to a thrive mindset doesn’t happen without intent.”

So, what are some helpful tips to consider as FMCG businesses transition into what should be a period of growth, and importantly how to create value and embed sustainable profitability. Here are some areas to consider and explore:

• Align operations to execute your business strategy

• Plan to drive profitable growth

• Unlock, deliver and celebrate quick wins

• Create and embed a continuous improvement culture

• AI: Proof of value

Operations is where the rubber hits the road for your business strategy. Are your operational teams involved in the key decisions as you launch new products, drive innovation, review range, pricing and promotional plans? If not, they should be. They operationalise strategy, plans and tactics into reality. Get them onboard early and you will realise value faster and more effectively.

Continue your focus on productivity. 2024 taught most to drive efficiency through their existing business operating model as very few invested in capital options due to the cost of borrowing. With more capital projects likely in 2025 remember and retain the behaviours that got you through 2024. Growth should be profitable, but if not done correctly it can cost you as bottlenecks, capacity constraints, people/process/system capability get challenged.

Plan it out, assess your readiness to change, model outcomes, test and learn and integrate your teams to ensure success is embedded and sustained.

With large scale transformations and major capital projects (infrastructure, digital, automation) likely back on the cards for 2025 don’t forget to capture value on the way through. There is no better way to drive and sustain a transformation than getting runs on the board early, celebrating the success and showing yourselves, your teams and your customers that you are driving change in the right way.

Adopt lean techniques and tools, adapt them to your business, your team and ways of working. They are proven globally over many decades and stand true today as fundamental to value creation and growth mindsets. Build and nurture this capability in your leaders and teams – and most importantly don’t stop….it is called continuous for a reason.

Is it possible to write an article on trends and predictions for 2025 without referencing AI? Probably not. It is here, it is real, and it can and should be super valuable. It can also be daunting to know where to start and some have spent lots of money or time for little benefit. Our recent survey of the Food & Grocery sector told us that 74% of businesses have invested, or are planning to invest, in Generative AI over the next three years. AI adoption is no longer polarised by age group – we are all giving it a go. Get clear on your use cases for AI, where and how it can add value, reduce repetitive tasks, provide deeper more holistic insights. Start small, build it, proof the value, then keep going.

Here’s to 2025.

Think outside the plastic box and let Huhtamaki help transition your business to one of the most sustainable packaging solutions available, paper.

Paper containers are currently among the highest performing packaging solutions in terms of consumer protection, hygiene and food safety.

Reduces the depletion of fossil fuels and improves your packaging carbon footprint.

Maintains performance with an improved environmental profile.

Sustainable and certified fibres with certified home compostable options available.

Paperboard does not get brittle at low temperatures meaning no risk of breakage - reducing glass / plastic contamination in both manufacturing and retail environments.

Paperboard acts as a thermal insulator. When chilled and frozen it is much more comfortable to the touch than plastic.

Lighter weight to transport reducing freight costs.

We work with you to help find the consumer packaging that best suits your specific requirements.

Wide variety of sizes and lid options

Multiple coating options

High quality photographic print

Versatile and adaptable to multiple categories

Dairy, honey through to confectionery

Supporting your brand protecting your business

Allan Managing Director www.weareonfire.co.nz

“Make it simple, but significant.” – Don Draper, Mad Men.

One of fiction’s best copywriters emphasises the power of words, an apt introduction to the undervalued power of a distinctive brand language.

Design attracts, copy connects. Retail environments are busy, so your brand’s design’ (shelf-facing) needs to attract and shout on the shelf. But beyond that, when the consumer is perusing within your range of products, or has picked up your product to investigate further, copy and how you speak come into play and leverage your (hopefully!) distinct personality. There is the chance to explain why your brand is chosen and not the one sitting next to yours. Of course, a retail brand is just as much digital as it is physical, so this tone of voice will probably have already been encountered through other digital channels. This is where a unified approach to tone, style and messaging are essential to build brand recognition and nurture connection with a consumer.

To get to grips with brand language, it is easier to break it down into three levels. The upper level is the overall narrative, providing a sense of the world you want to create, which is essential

for your brand. Consider what your brand or product stands for, and why a consumer needs it in their daily life.

Next level down, we start to inject a sense of personality: quirky, deadpan, informative, conservative… this is your brand’s human traits coming to the fore and connecting with the consumer. The bottom level is productcentric, highlighting flavour, taste, health and lifestyle identifiers.

All three levels are consistent in tone, sentence structure, use of adjectives and turns of phrase. These are not used on pack all at the same time; instead, they are strategically deployed across packaging (short back-of-pack story while the front of the pack has product-specific callouts), website (long-form story), social media and other consumer communications (brand phrases and comments).

While doing this work, it is essential to consider what your product is, does and delivers for the consumer and stay authentic to that, differentiate from your competitors and keep in mind brevity. Shorter is better and twice as engaging.

At Onfire, we become lovers of each project we work on and deep dive to understand each one in detail. This way, we write and create a brand language with heart – if we love it, it is much easier to convince others to love it, too. For example, Hubbards is the definitive Kiwi-made success story. Starting with Dick Hubbard in the late 80s through to today, the brand is famous for its breakfast staples, quirky NPDs and New Zealand communityminded spirit, and above all else is its inventor mindset. The brand language is just as distinctive as the packaging. Each range has a definitively Kiwi, excitable and imaginative story to tell on the back of pack. Each story aims to get Kiwi minds ready for each day. This comes through on frontof-pack callouts; simple messages using wordplay and positivity. This tone of voice is deployed cohesively across all consumer touch points.

“Design attracts, copy connects.”

Living and breathing your mission is a must for any brand owner. But when you are really ‘in it’, it’s too easy to have tunnel vision. As creative partners, we go the extra mile to understand your brand while keeping a healthy distance. This allows us to not be led by what others are saying. Whatever stage you are at, working with an experienced brand narrative and copy team is an integral part of the creative process.

Want to know more about how we can help ignite your brand?

Call Sammo on: 021 608 204

email@sam@weareonfire.co.nz www.weareonfire.co.nz

Onfire’s history catalogues a range of clients who changed, not for the sake of change, but to drive action.

We aim to make brands more visible, more differentiated, more competitive – on time, on budget and on fire. Ignite your brand now. Call Sam Allan, Managing Director, on 021 608 204 or sam@weareonfire.co.nz.

weareonfire.co.nz

Shoppers are looking for new and exciting bread products that are tasty and versatile. Wraps and bagels are popular for breakfast, lunch and even dinner.

Better-for-you ingredients are also trending this year, such as super seeds, keto-friendly and gluten-free variants.

The gluten-free segment is worth $28.4M and is growing at 2.9% in value and 2.0% in units for MAT 29/12/24, reveals the Circana team.

Rebel Bakehouse wraps up awards and Cottage Lane gets social

Breadcraft includes the Rebel Bakehouse and Cottage Lane brands and has grown by a phenomenal 35%*, cementing its position as the clear number two player in the overall Bakery/Smallgoods category, says Belinda Bonnor, Head of Marketing at Breadcraft.

Rebel wraps have taken out numerous Healthy Food Guide

awards, with Low Carb Everything and Gluten Free Sourdough & Super Seeds wraps winning the Lunchbox awards and new Wholemeal Snack wraps winning the Heart Healthy and Best Bread Alternative. Wraps awards are great endorsements from nutritionists and a clear reason for people to buy Rebel.

“As consumers look for more exciting meal solutions and ways to feed large households it’s about getting the flavours and pack formats right”, says Bonnor.

“Our launch of Capsicum & Roasted Garlic and 10 pack Snack pack and Family pack wraps has been the primary driver of the more than 10-point share jump to 22.2%**, a result we’re very happy with,” says Bonnor.

“Our fully-sliced Rebel bagels have firmed up their position in the market at a steady 23.1% share***, with innovation on the way set to boost this.

“And it doesn’t stop there, our Cottage Lane Artisan handcrafted, stone-baked bread range continues to win favour with in-store bakery teams. Being able to bake it off from frozen in under 25 minutes is a game-changer, saving time and money and making it super easy to serve customers fresh artisan bread throughout the day. And Cottage Lane has got more social, our new website and recent activation of social platforms not only shows people new ways with artisan bread but means they’ll more easily recognize our products in store, stimulating purchase.

“We plan to keep identifying opportunities for innovation in the market so we give consumers what they’re looking for, while driving category growth through our brands success,” says Bonnor.

Bake well, eat well, live well.

For more information contact sales@bwl.co.nz or visit www.rebelbakehouse.co.nz www.cottagelanebakery.com

Circana Scandata, NZ Grocery:

*Bakery Smallgoods,

“Our Cottage Lane Artisan handcrafted, stone-baked bread range continues to win favour with in-store bakery teams”

denotes value AND unit growth > +2%

Continuing to dominate as market leader in the wraps category with 69.3% share (Circana data to 24/11/24), Farrah’s has expanded its keto friendly lineup with a game-changing new product – Ultra Keto Wraps, pushing the boundaries of low carb innovation even further with only 1.4g carbs per wrap.

Farrah’s Low Carb Wraps continue to contribute exceptional growth to the low carb wraps category, driving 64.1% growth (Circana data MAT to 22/12/24).

With Ultra Keto Wraps now the lowest carb wraps on the market, Farrah’s is excited to keep driving incremental growth in this category while still delivering the exceptional taste and quality the brand is known for.

“We already had the lowest carb wraps on the market, but we couldn’t just stop there,” says Jasmine Currie, Head of Marketing at Farrah’s.

“We challenged ourselves to go even lower. But they had to taste and perform just as good, if not better, than our existing wraps. So that’s exactly what we did, without compromising.”

Just three months since launching into market, Farrah’s Ultra Keto Wraps have seen rapid success, soaring to the Top #5 wrap in New Zealand. This early success signals that it’s only the beginning, with this

product on track to revolutionise the wraps category as more consumers discover this low-carb innovation.

As more Kiwis embrace low-carb eating, Farrah’s Ultra Keto Wraps provide exciting new meal opportunities without compromising on taste or texture – from wrap burgers, to samosas, to ice cream cones, the possibilities are endless! They won’t crack or split when rolled and are proudly flame-baked in Upper Hutt.

Farrah’s Ultra Keto Wraps are available at Foodstuffs and Woolworths supermarkets nationwide. For more information contact your Twin Agencies representative or visit www.farrahs.co.nz.

For over 22 years, Venerdi has led the way in specialty dietary baking, revolutionising specialty dietary breads with incredible taste and texture. Breaking away from traditional baking norms and crafting breads that nourish the body and delight the senses.

“Every loaf we create is designed to offer the ultimate eating experience—from the first bite to the last mouthful. We focus on taste, texture, and how our breads make you feel long after you’ve eaten,” says Marketing Manager Sam Kelly.

“Venerdi’s two signature ranges—Venerdi Gluten Freedom and Venerdi Pure Foodie—are a testament to our commitment to excellence. Venerdi Gluten Freedom celebrates what gluten free eaters can eat, not what they can’t. With artisan style, sourdough based, breads, buns, bagels, English muffins, long rolls and pizza bases that burst with dynamic flavours.

“Venerdi Pure Foodie celebrates food the way it used to be. With ancient ingredients and processes that blend pure goodness, with purely delicious flavour. Proof that you can eat more wholesome and natural, without compromising on taste or texture.

“Our products are 100% gluten, dairy and soy free, but you wouldn’t know it and that’s the point. Venerdi is for those of you who believe you deserve better. The taste and texture speaks for itself – unrecognizably gluten free.” info@venerdi.co.nz , www.venerdi.co.nz

“Our products are 100% gluten, dairy and soy free, but you wouldn’t know it and that’s the point.”

Sam Kelly, Marketing Manager at Venerdi

The FMCG Business team endeavours to produce a monthly snapshot of category news and highlights, based on information from participating clients, plus a table of the freshest data available at time of print. If you wish to contribute news for upcoming category reports, please contact trubanowski@fmcgbusiness.co.nz

100% Gluten, Dairy & Soy Free

For those of you who believe you deserve better

Look out for exciting new arrivals in the supermarket chiller, from flavoured chicken for easy BBQ meals, to cold cuts and ready sliced ham and chicken for filled rolls, salads, pizzas and pastas. Brydon Heller, Marketing Manager at Hellers says: “We are seeing some good growth in our chilled chicken products, especially our Craft sliced range. So tasty, easy to use and versatile. Similar to the

sliced ham that is enjoyed all year round. The long shelf life and good pack size means it can go a long way.

“And what would the world be without bacon. It just keeps on going and we get such good feedback on ours. A little bacon goes a long way. So in today’s environment with cost considerations, it can add a great boost of flavour, some protein to the meal and is liked by the whole family.”

New BBQ products from Waitoa

Waitoa Free Range Chicken have teamed up with The Four Saucemen – a premium BBQ rub brand here in New Zealand to bring you convenience for dinner this summer. With three pre-marinated BBQ products: Hot Honey Chicken Wings, and ‘The Chicken Rub’-flavoured Drumsticks and Butterflied Chicken, there is something for everyone.

Created with the iconic Kiwi summer nights in mind, this range makes it easier than ever to fire up the BBQ and serve up something extraordinary. Waitoa is all about helping Kiwis spend less time in the kitchen and more time enjoying those quality moments with family and friends.

This innovative range isn’t just about convenience – it’s about making summer meals truly unforgettable. Backed by Waitoa’s unwavering commitment to sustainability and animal welfare, these products are sure to tempt loyal fans and new customers alike.

So, whether it’s a classic butterflied Chicken, something from the freezer, or premarinated fresh chicken you are after, Waitoa Free Range chicken will have you covered.

For more information or to order, please contact your local sales representative or contact us here: www.waitoafreerange.co.nz/contact-us/

“Waitoa Free Range Chicken have teamed up with The Four Saucemen – a premium BBQ rub brand here in New Zealand to bring you convenience for dinner this summer”

The new frozen range from Hellers is ready in minutes.

Check out the full range. In store now!

Eggs are a staple in New Zealand households, playing an essential role in our diets and nutrition. Not only are they affordable and packed with protein, but they also provide nearly every vitamin and mineral needed for a healthy lifestyle. New Zealand is fortunate to have some of the highest standards of freshness and quality in the world, ensuring that every egg reaches consumers in peak condition. These high standards reflect a commitment to providing nutritious, high-quality food that supports the health and wellbeing of families nationwide. Eggs are nutritious, delicious, versatile and make for a quick and easy meal, from salads to omelettes, breakfasts and desserts. We consume more than 200 eggs per person every year (on average), which means millions of eggs are eaten each year in New Zealand.

Did you know that Better Eggs produces 4.1 million eggs a week? That’s almost one for every Kiwi! Not only that, but almost 30% of sales through major supermarkets come from their sites. Better Eggs and Henergy all carry the SPCA Blue Badge for the higher standard of animal welfare and more recently they gained the first Toitu net Carbon Zero certification for an egg brand in New Zealand.

“At Better Eggs®, we’re not just producing eggs— we’re striving for Better,” says CEO Gareth van der Heyden.

“Better for our animals, our environment, and our shoppers. Every decision, from farm to table, reflects our unwavering commitment to sustainability, animal welfare, and exceptional quality.

“Better Eggs® is a fourth-generation, familyowned farm business proudly supplying New Zealand with top-quality eggs since 1937. With over 200 dedicated staff working across our five sites and on the road visiting stores, we’re passionate about providing nourishment for Kiwi families with eggs they can trust.

“Sustainability is at the heart of everything we do. From reducing our carbon emissions to choosing eco-friendly packaging, we’re committed to minimizing our environmental footprint. We know the choices we make today shape the world we’ll pass on to future generations.

“Animal welfare is equally important to us. As SPCA-certified producers, we adhere to strict standards to ensure our hens live happy, healthy lives. This certification reflects our commitment to compassionate care, providing hens with enriched environments where they can express natural behaviours. We take immense pride in producing all our hens’ feed ourselves. By carefully managing every aspect of our hens nutrition and providing a high level of care, we ensure our eggs consistently deliver the highest quality, taste, and

nutrition possible. For us, it’s simple: happy hens lay Better Eggs®.

“Our diverse range of brands, egg types, and pack sizes caters to every shopper, retailer and foodservice provider. Whether you’re a supermarket, wholesaler, fruit and veggie shop, bakery, or dairy, we have a solution that will meet your and your shoppers’ needs. Look out for our Better Eggs®, Henergy®, and Rise & Shine® ranges - crafted with care to deliver exceptional quality, taste, and freshness,” says van der Heyden.

“Every egg produced at Better Eggs® is the result of generations of striving for better. We believe that great meals begin with the finest ingredients, and our eggs deliver unparalleled value, flavour, and nutrition to egg-cite your customers!”

To learn more about how we’re Champions for Better®, contact us at info@bettereggs.co.nz or visit www.bettereggs.co.nz.

“Better Eggs® is a fourthgeneration, family-owned farm business proudly supplying New Zealand with topquality eggs since 1937.”

Source: Circana MarketEdge Grocery Data MAT to 05/01/25

The FMCG Business team endeavours to produce a monthly snapshot of category news and highlights, based on information from participating clients, plus a table of the freshest data available at time of print. If you wish to contribute news for upcoming category reports, please contact trubanowski@fmcgbusiness.co.nz

As a cooperative of 100% NZ-owned, regionally-based, family farms, Independent Egg Producers Co-op Ltd (IEP) supplies locallyproduced, fresh, quality eggs delivered with reliability and care.

With farms having been in the same family for generations, they exhibit an ongoing passion for time-honoured tradition, coupled with modern farming technology to ensure eggs are not only of excellent quality, but also embodying the attributes of ‘local’, ‘community’ and ‘provenance’ into every single pack.

Not only that, each local farmer has also invested in the ‘Trace My Egg’ stamping technology, ensuring that every New Day free-range and Morning Harvest barn egg is stamped in accordance with the ‘Trace My Egg’ compliance programme (www.tracemyegg.co.nz).

Egg brands supplied by IEP include New Day, Morning Harvest, Sure As Eggs, The Chook Farm and Bowalley. For more information and orders contact info@independenteggs.co.nz or 0800 787 327

Energy anytime anywhere!

Peak Energy Gum is the ultimate sugarfree energy boost. Two pieces equal one energy drink, delivering instant focus and stamina without the crash. Perfect for busy professionals, athletes, students, and travelers—stay sharp and energized anytime, anywhere. Small, powerful, and convenient— chew your way to peak performance with

www.peakenergygum.com

Call +61405323003

New news for Luncheon lovers, NZ’s favourite luncheon is now available in a 500g chub. Country pride luncheon is the #1 ranked SKU in the category and the brand is growing at +17.8% (+$242k), arresting category decline of -5.9% (-$444k) (Circana QTR & MAT data to 29/12/24). Drive your Deli cold shelf sales now! sales@flf.nz or 0800 806 328

If you believe quality, delicious, award-winning products are what your consumers deserve, Little City Kombucha is the drink for you. Brewed in small batches with real ingredients and presented in stylish bottles, LCK is at home on a supermarket shelf, high-end eateries, and your favourite cafe. Unashamedly refreshing, adds a touch of class to your non-alcoholic drinks menu.

www.littlecitykombucha.co.nz

Orders and enquiries kat@ littlecitykombucha.co.nz Ph 021 1101925

Bursting with real fruit and less sugar than a traditional jam, this delicious preserve is easier than ever to enjoy! Available now in a range of four flavours: Strawberry, Apricot & Mango, Mixed Berry and Tropical. Simply squeeze and spread on hot toast or add a dollop to your favourite sweet kitchen creations.

www.barkers.co.nz

Contact your Twin Agencies representative

Bold flavour innovation from CH’I

All the commentators are saying bold eastern influenced new flavour experiences will be on trend in 2025. CH’I Jeera Masala is a fresh take on a traditional salted masala lemonade. Handcrafted cumin and masala spice blend pops with the salted lemon. 250ml cans RRP $3.49

www.chidrinks.com

Although summer is drawing to an end, summer fruit and vegetables remain abundant. Summer salad vegetables such as capsicums, cucumbers, tomatoes and leafy greens will be popular buys with consumers.

New Zealand summer fruit including apricots, nectarines, peaches and plums are all available and great lunchbox fillers.

Hydroponic growing ensures a year-round supply of fresh herbs, allowing you to offer a wide variety to meet the needs of Kiwi shoppers. Popular choices like mint, coriander, basil and parsley are essential, while stocking herbs such as sage, chives, dill, oregano, tarragon and fennel will provide added variety and appeal.

What to look for: Choose herbs with vibrant, bright colours that have a strong, pleasant aroma and good leaf condition.

Storage/handling: Handle with care and display potted herbs in a bright place away from draughts and any refrigeration source. Do not spray them while on display – they will be well watered prior to leaving the greenhouse. Coriander plants should be kept on the top shelf of the display unit as they require light. Pre-cut herbs should be kept refrigerated between 2-7°C.

Cucumbers are commercially grown in greenhouses. Retailers should ensure a range of varieties are available including Telegraph and Lebanese. Telegraph cucumbers are highly perishable unless shrink wrapped in plastic. The plastic used to wrap cucumbers is a thin film that is compostable and biodegradable.

What to look for: Look for vibrant green cucumbers that are firm with even colouring.

Storage/handling: Cucumbers should be refrigerated and left in their plastic wrap. They should be washed prior to use.

Capsicums are grown in hot houses and while they are available year-round, the season peaks in the summer months through until March. Keep a range of colours displayed to meet customer needs.

What to look for: Select capsicums with shiny, smooth skin and green stems.

Storage/handling: Ideally capsicums should be

stored between 11-13 degrees.

Nutrition: Capsicums of all colours provide a good source of vitamin C with one serving of yellow and red varieties offering over 200% of the recommended daily intake.

“Watermelons should be cleaned before cutting and cut watermelon must be kept refrigerated.”

New Zealand watermelons are in good supply throughout February and March. They are grown in various regions across Aotearoa.

What to look for: Watermelons are around 90% water so choosing a heavier one means it will be juicy. Look for straight lines on the melon and a round shape.

Storage/handling: Watermelons should be cleaned before cutting and cut watermelon must be kept refrigerated. Uncut melons can be stored at room temperature.

Nutrition: Watermelon is a source of vitamin C and contains potassium, which supports a healthy nervous system.

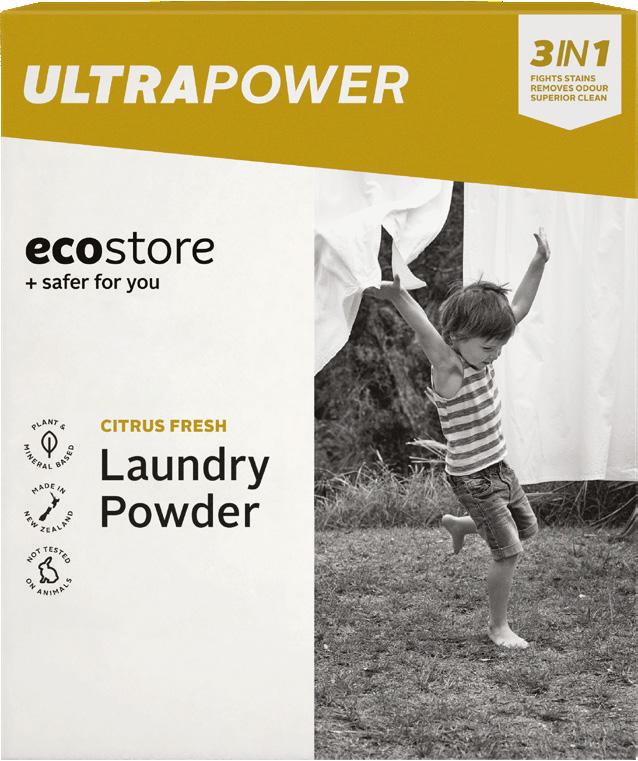

As an FMCG professional, I’ve seen countless trends sweep through the grocery aisles, but few as transformative as the convergence of wellness and sustainability. For FMCG brands, this isn’t just a challenge—it’s a monumental opportunity.

rise of the conscientious consumer

New Zealand’s grocery market reflects a global shift. Shoppers are increasingly scrutinizing not only the ingredient content of products, but also the environmental impact of their production and post-use. Health-conscious buyers prioritize products free from harmful additives, while eco-aware consumers seek packaging that minimizes waste or is responsibly sourced. Greater expectations are driving innovation, compelling brands to consider not just the ingredients and materials they use, but also the long-term footprint their products leave behind.

The cost-of-living crisis has brought affordability and availability back to the forefront. However, that doesn’t mean consumers are abandoning their values. Success at scale lies in giving shoppers a path to caring for their health, reducing their environmental impact, AND staying within budget.

By addressing these needs, brands can build trust and loyalty, even in challenging economic times. Those who do so successfully will not only weather the storm of the cost-of-living crisis, but will emerge stronger as the economic landscape shifts.

To thrive at the wellness-sustainability nexus, FMCG brands need a clear strategy:

1. Prioritize ingredient transparency: Clean-label products aren’t optional anymore. Consumers want to know not only what they’re eating or using but also how it was sourced. Partner with credible certification bodies to build trust.

2. Rethink packaging: Biodegradable, compostable, and refillable options are now key differentiators. Investing in sustainable packaging innovations can open doors with eco-conscious retailers and consumers.

3. Educate and engage: Storytelling matters. Use digital platforms to highlight your brand’s

sustainability journey and health benefits. Authenticity fosters emotional connections, transforming one-time buyers into loyal advocates.

4. Measure and communicate impact: Shoppers want to see real evidence of your brand’s environmental and wellness commitments. Share clear, simple metrics—like carbon footprint reductions, water saved, or sustainably sourced materials—to show the tangible difference your products make. Transparency builds trust and helps consumers feel confident in their choices.

The convergence of wellness and sustainability is reshaping FMCG. Brands willing to innovate and adapt to these evolving consumer demands will emerge as leaders in the next phase of grocery retail. For those lagging, the risk isn’t just losing market share—it’s irrelevance.

Daniel Bourhill Head of Client Strategy and Managing Partner Blueprint

Sales Management. With more than a decade of experience across the ANZ, UK & European markets, Daniel is passionate about helping busy teams at FMCG founder brands with outsourced sales management.

Wellness and sustainability aren’t just buzzwords; they’re the blueprint for the future of FMCG. Brands that embody these values will not only survive but thrive, shaping a grocery landscape that benefits both people and the planet.

Functional products are rising in popularity, from probiotic yoghurts to energy bars and new protein drinks.

Look out for Vanilla Bean Gut Health Kefir from Raglan Food Co, rolling out in a 500ml bottle.

Cathedral Cove Naturals’ new Superfood Coconut Yoghurt has also recently hit supermarket shelves. With a powerful blend of superfood ingredients, it delivers a potent dose of Vitamin C and anti-oxidants for an immune system and nutrition boost any time of the day.

If you are working on launching a new functional product, consider showcasing certifications (like organic, vegan, or similar), explaining functional benefits, and addressing common health concerns.

Brands that provide clear, accessible, and honest product content are better positioned to meet consumer expectations, foster loyalty, and stand out in a competitive marketplace where trust is a deciding factor.

Em’s Power has a fresh new look and improved recipes to enhance the taste and texture of this iconic Kiwi brand. This range is taking it to the next level in delivering delicious, soft and satisfying snacking. The new packaging celebrates the ‘power up your potential’ ethos of Em’s. Designed to deliver nutritious sustenance and energy to go, the wholesome Ems range is perfect for any time you need to get a move on.

All Em’s products are made with quality real ingredients, empowering conscious food choices. Individually wrapped for freshness, convenience and portability – ideal for busy people, busy parents, active kids, sports, work or play.

“Designed to deliver nutritious sustenance and energy to go, the wholesome Em’s range is perfect for any time you need to get a move on.”

Em’s Power is part of the Cookie Time Group, proudly made in New Zealand. Available in three delicious flavours – Chocolate Oat; Cranberry Choc; and Apricot Choc.

Founded in 2018 in Porirua, Wellington, Little City Kombucha was developed as a sophisticated twist on Kombucha that reflected its intent to be a health drink that appealed to adults as a premium on the go offering; and the perfect non-alcoholic alternative for cafes and restaurants. This local brand has quickly gained a reputation for offering unique, handmade low-sugar brews packed with real flavour.

At the heart of Little City Kombucha is Head Brewer Jerome Hughson, at 26-years-old he has an impressive track record in the world of artisan beverages, and has already earned Little City several prestigious NZ Artisan Awards. All of the kombucha is still brewed and bottled by hand on-site, a testament to the brand’s passion for quality and authenticity.

As kombucha resurges in popularity—driven by a growing focus on gut health—Little City is expanding its reach. National Sales Manager, Kat Chandler is focused on propelling their presence in premium eateries and supermarkets across the country, with particular growth in Wellington.

“Like other Wellington brands before us, we think the taste of our product and attention to branding has a wide appeal to consumers, choosing to range a craft kombucha and not a mass produced one speaks to the calibre of the eatery.”

The two newest flavours, Feijoa and Passionfruit & Pineapple, have become fan favourites already. And the ever popular Dry Hopped

Circana defined segments based on lifestyle drinks, dietary food drinks and selected fermented foods.

* denotes value AND unit growth > +2%

brings a refreshing, alcohol-free alternative that still delivers a satisfying hop kick with the bonus of probiotics!

Find out more at littlecitykombucha.co.nz

The FMCG Business team endeavours to produce a monthly snapshot of category news and highlights, based on information from participating clients, plus a table of the freshest data available at time of print. If you wish to contribute news for upcoming category reports, please contact trubanowski@fmcgbusiness.co.nz

So GoodTM proudly introduces New Zealand’s first High Protein Oat Milk, enriched with 10g of protein per serve. Combining high-quality oat and soy protein, it provides a source of complete protein by containing all essential amino acids. Now, you can seamlessly incorporate the benefits of high protein into your daily routine without compromising on texture or taste, easily turning your favourite hot or cold drinks and cereal into a protein boost. If you’re looking for a plant-based milk that has just as much protein and calcium as dairy milk*—this is it.

“We’re incredibly proud to expand our high protein range by launching High Protein Oat Milk.”

Why choose plant-based protein? It’s a key part of maintaining a healthy and balanced diet. Whether you’re powering through a busy workday, hitting the gym, or staying active in your own way, protein plays a vital role in supporting healthy muscles, bones and strength as part of a balanced diet.

“We’re incredibly proud to expand our high protein range by launching High Protein Oat Milk,” says Anna Antunovich, Senior Brand Manager NZ.

“It has been in the works for a long time and now we get to share it with Kiwis across the country. At Sanitarium™, we’re passionate about creating products that are tasty and nutritious, that’s why we have 8 essential vitamins and minerals in our newest product, including iron.” Available in New Zealand supermarkets from late February. For more information, visit www.sogood.co.nz.

*When compared to 250mL fresh standard and lite cow’s milk (New Zealand Food Composition Data)

The changes are part of a nationwide programme that kicked off in 2022 and will continue until 2026, which will see Z retail sites across the motu get a fresh new look. But along with adding contemporary stylings to the stores, Z is also focused on more fundamental changes in the way Kiwis come and go – both now and into the future.

“With our highly mobile population, busy lifestyles and increasing desire for fresh and convenient food and drink, service stations are becoming as much about fuelling people as they are about fuelling vehicles. We also make multitasking easier, by grabbing lunch and extra grocery items for later,” says the team.

But at the heart of it all sits one key beverage that us Kiwis are very particular about. “A lot of people design their mission around where they’re going to grab that cup of coffee,” explains Z’s Head of Retail, Tim Bailey, “So we’ve got professionally trained baristas with our distinctive orange group handle coffee machines across New Zealand – and our coffee business has grown really well off the back of that.”

have also been expanded so staff can whip up treats with ease.

Transforming several of our sites has been a massive multi-year project, so before work even began we looked beyond our shores to identify best practice. “A good market for us to look at overseas is the Irish market,” explains Tim. “They have a similar population to us and it’s a piece of work that they’ve done really well, in the way their convenience model is working.”

Another shift is the introduction of more EV charging stations at select Z sites, which means some customers are likely to spend more time at stores while they plug in. The light, bright contemporary feel of the new design is also helping to make the environment inviting and enjoyable for staff and customers alike.

In order to streamline the customer experience, layout and logistics have been key considerations in the renovations. Designated zones within the store help people home in on exactly what they’re after, and

In terms of getting the refit right we checked out businesses closer to home.

“We looked at other retailers that had done this well in the last couple of years and how they’d gone about it.”

Tim continues, “The challenge has been getting the programme working at scale across the country, but the team has found a really good rhythm now.” Meanwhile, the positive results are already evident.

“As we’ve rolled out more of these sites, we’ve had more of our customers head in-store which has been really great to see”.

As customer habits continue to evolve, Z is prepared for what comes next. “We’ve made sure that the spaces are fit for us to grow the offer as well,” adds Tim. “We’ve used a modular design so we can put it in pieces and take them out – things like making sure you’d have space to put in different oven capacity if you need to and so on.”

“We’re thinking about where we want to be in New Zealand going forward and making sure we’ve got the right sites, the right stores, the right look and feel, and that we can provide quality and convenience. We’re getting the work done now.”

Fonterra is taking another significant step toward its climate goals and operational resilience with $150 million in investments in electrification projects across the North Island over the next 18 months.

Investments into electric boilers at the Cooperative’s Whareroa, Edgecumbe and Waitoa sites, along with further fleet decarbonisation, marks further steps in renewable energy supporting the Co-operative’s sustainability targets* while future-proofing operations.

Fonterra aims to build enduring, cost-efficient assets while enhancing energy security across its manufacturing operations and ensuring a sustainable energy supply.

Fonterra’s Chief Operating Officer, Anna Palairet, says the investments are a significant step for the Co-operative’s future operations.

“Last year we turned off the last coal boiler in the North Island, meaning manufacturing operations in the North Island are now coalfree. These investments are the next step in creating enduring assets that are fit for the future, as we look to reduce our reliance on gas.

“Choosing the right energy solutions is about striking a balance between affordability, security of energy supply and reducing our environmental footprint, and the new electric boilers are crucial to navigating this challenge.”

“These electrification projects are at the heart of ensuring efficient operations with a reliable energy supply for our manufacturing sites and to support the long-term sustainability of our business. It also represents a commitment to our farmer owners that we are building a resilient, future-ready Co-operative.”

Investments announced are:

Whareroa: The site will undergo a staged energy transformation with the first stage including the installation of two electrode boilers. The

$64 million investment is expected to reduce the site’s annual emissions by an estimated 51,000 tonnes – the equivalent of removing around 21,000 cars from New Zealand roads – and contribute a 3% reduction** towards Fonterra’s overall 2030 Scope 1 and 2 GHG emissions reduction target.

Edgecumbe: The site will transition from the use of steam and electricity generated through a co-generation plant, to a reliable source of renewable energy with the installation of a new electrode boiler. The $57 million investment is expected to reduce the site’s annual emissions by an estimated 28,000 tonnes – equivalent to removing around 11,000 cars from New Zealand roads – and contribute a 1.5% reduction** towards Fonterra’s overall 2030 Scope 1 and 2 GHG emissions reduction target and reduce the Co-op’s overall natural gas reliance by approximately 8%***.

Waitoa and Waitoa UHT: Following the closure of its last coal boiler in November 2024, the Co-op is investing a further $18 million in installing two Resistive Element Boilers to boost heat production, while providing a secure and reliable energy source allowing for future growth in UHT processing.

Fleet decarbonization: The next step in looking for more economical solutions for the future includes a pilot of six EV tankers and associated infrastructure later in the year, expected to provide an approximately 60% annual reduction in fuel costs per tanker, along with environmental benefits.

*The Co-operative’s target is 50.4% absolute reduction of Scope 1 & 2 GHG emissions by 2030 from a 2018 baseline.

** From a 2018 baseline.

*** An approximate 8% reduction from the Co-op’s average annual natural gas usage from FY23 and FY24.

Consumers around the world are seeking adventurous new taste profiles and bold flavours inspired by Asian, Indian and Middle Eastern cuisines.

Kerry, a global leader in taste and nutrition, has launched its 2025 Taste Charts, a comprehensive resource on developing trends designed to guide food and beverage innovators worldwide. The charts are a must-have consumer insights tool, with every prediction grounded in market reality and projected innovation.

Taste is the ultimate non-negotiable for product development. In a rapidly evolving industry, challenges such as nutritional optimisation, sustainability and consumer demand must all be addressed without sacrificing taste. This year’s edition features a carefully curated selection of tastes and trends, blending global insights with the expertise of top flavourists and scientists to help brands anticipate market shifts and create impactful products. The 2025 Taste

Charts provide the insights needed to meet consumer demands, empowering brands to lead with bold, sustainable innovation.

“The 2025 Taste Charts underscore the power of innovation in shaping the future of taste, with trends that are a testament to the dynamic preferences of consumers across Asia Pacific, Middle East and Africa. The rise of premiumisation, reimagined heritage flavours and street food, fusion fare, healthier foods, and innovative food formats highlight an industry thriving on creativity and connection. As consumers embrace diverse cultures and cuisines, brands have a remarkable opportunity to create unique, authentic taste experiences using our data-driven Taste Charts to meet changing consumer preferences. By blending global flavours with regional traditions, we can delight evolving palates and bring exciting products to market,” said Claire Sullivan, Vice President, Marketing, Kerry Asia Pacific, Middle East & Africa.

The Kerry Taste Charts reveal these major flavour trends for Australia and New Zealand in 2025.

• Elevated street food: Food trucks, market stalls and restaurants are taking traditional street food to a new level of sophistication and flavour, where the casual essence of street food is retained while merging its excitement with the finesse of gourmet cooking. Think maple caramel belly pork skewers, ramen popcorn, and crispy black bean tacos with zesty coriander & lime sauce.

• Global influences: Australian chefs and brands are increasingly experimenting with fusion cuisine, combining traditional Australian and New Zealand flavours with international influences from Asia such as matcha, and the Middle East, like harissa and za’atar. This has resulted in a diverse range of dishes and launches that cater to a wide range of tastes.

• Healthy hedonism: Functional ingredients continue to be popular as consumers desire food and beverages that taste as great as it makes them feel. There’s a growing demand for nutritious, wholesome, and sustainable food options. Think protein puffs with cheese flavour, no sugar adaptogenic sparkling coconut and pineapple flavoured drinks. Along with this, turmeric, acai, ginseng, guarana are leading the region’s trending flavours and ingredients for 2025.