2023

JUNE/JULY

Welcome to the latest issue of Convenience & Impulse Retailing magazine, your trusted source of insights and trends in the fuel and convenience retail sector.

As always, the June/July edition is one of the most hotly anticipated reads of the year, as we invite industry representatives, key retailers, and category leaders to share their valuable insights, highlight their achievements, pinpoint the challenges they feel need addressing, discuss how they have adapted to changing consumer demands, and how they view the immediate future for convenience.

Overwhelmingly, the feedback is that the future looks bright, which is also outlined in our five-page snapshot of the 2022 AACS State of the Industry Report, compiled by CMA, and graciously shared by Theo Foukkare, CEO, AACS. Moreover, we explore the current state of vaping regulation in Australia and the everthriving Hot Coffee category.

As the regulatory landscape surrounding vaping continues to evolve, we investigate the current state of vaping regulation in Australia. With growing concerns about the impact of vaping on public health, authorities have been taking measures to ensure responsible and safe consumption, recently announcing its most significant smoking reforms in a decade by imposing a ban on the importation of all non-prescription vaping products, including those that do not contain nicotine. Join us as we examine the latest legislative developments, industry responses, and the implications for convenience retailers and the thriving black market.

Lastly, we turn our attention to the Hot Coffee category, an ever-popular staple of convenience retailing. Despite the rise of specialty coffee shops, convenience stores have managed to carve out a significant share of the market by offering convenience, affordability, and quality. We delve into the strategies employed by successful retailers to maximise the potential of this category, exploring the latest trends, customer preferences, and innovative approaches. Discover how you can transform your hot coffee offering into a customer magnet that drives footfall and enhances profitability.

As the convenience and impulse retailing sector continues to evolve at a rapid pace, staying ahead of the curve is essential. With the Industry Leaders Forum, the State of the Industry Report, and our insightful category features, Convenience & Impulse Retailing magazine is your compass in this dynamic landscape. We hope that the knowledge and inspiration found within these pages will fuel your drive for success and empower you to make informed decisions that shape the future of your business.

Cheers, Deb

Jackson

Jackson

74

06 FACE TIME Kellie Struth, Head of Category and Marketing, APCO 10 STORE REVIEW Mood Food Kempton, Tasmania 14 AACS STATE OF THE INDUSTRY REPORT Theo Foukkare, CEO, AACS, shares insights from the 2022 AACS State of the Industry Report prepared by CMA 20 LEADERS FORUM Industry leaders share their thought on the state of the convenience and roadside retail industry 44 VAPING A look at the laws and regulations around the sale of nicotine vapes in Australia 48 HOT COFFEE The importance of providing a hot coffee offer in P&C 52 PRODUCT RANGING We bring you all of the latest new product launches 62 OPINION Theo Foukkare, AACS; Darren Park, UCB Stores; Andrew Poore, Pacific Optics 68 INTERNATIONAL STORE REVIEW TXB Stores 70 INDUSTRY NEWS 7-Eleven; Viva Energy; MilkRun; Metro Petroleum; 7-Eleven; The Distributors Conference 78 PETROL NEWS APA Group; Coles Express; APCO Service Stations; Ampol 54 EDITORIAL CONTENTS June/July 2023

4 June/July 2023 | C&I | www.c-store.com.au

Safa de Valois Alyssa Coundouris James Wells

Thomas Oakley-Newell

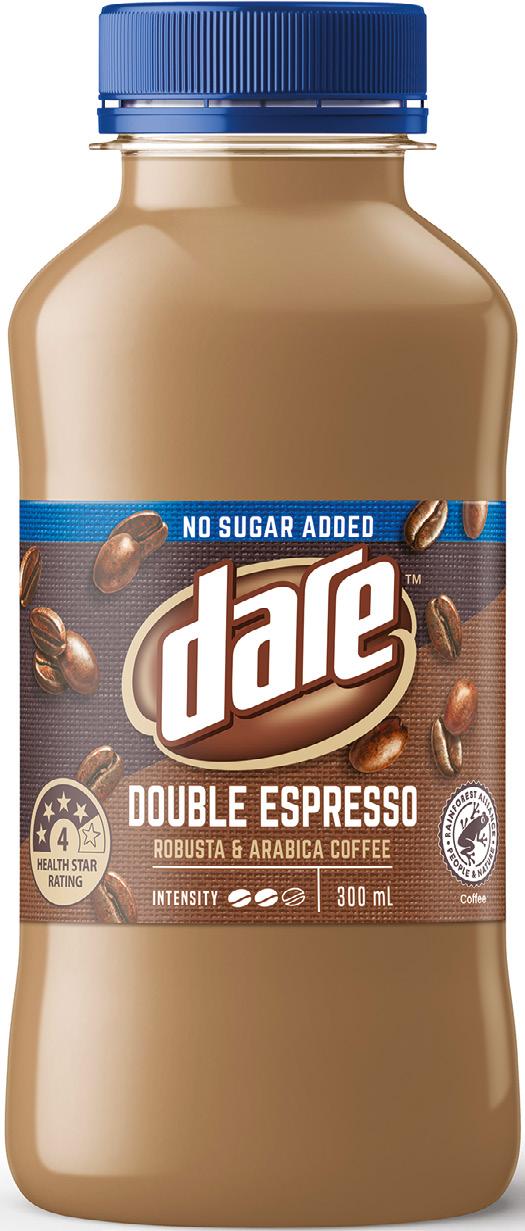

TONIK PRO – The best protein RTDs in

Australia

TONIK is the solution for ‘on-thego’ Aussies who are determined to live a healthier and happier life.

The typical consumer of TONIK RTDs sits in the ‘Active and Lifestyle’ category, which makes up around 49 per cent women, and 51 per cent men. Consumer ages range from 18 right through to 60+ for both men and women, a total of 75 per cent of lifestyle/active consumers have bought and consumed RTDs.

The Halo in-house Product Development Team created their own Proprietary Protein Blend, then developed the six delicious flavours we see today – Chocolate, Choc Honeycomb, Banana, Strawberry, Coffee, and Vanilla.

They have natural flavours and colours, are high in protein, natural fibre, low carbs, low sugar, low fat and are gluten free and GMO free.

Proper Crisps’ BIG new range

Proper Crisps has launched a new range of crisps called Big Cut, which includes four flavours; Cracked Pepper and Sea Salt, Dill Pickle and Apple Cider Vinegar, Marlborough Sea Salt, and Smoked Paprika.

Made using golden unpeeled potatoes grown in Yarra Valley, Big Cut crisps are cooked for twice as long as a regular chip.

Duncan Kerr, Commercial Manager Australasia at Proper Crisps, said: “Our commitment to using locally sourced ingredients and our focus on delivering a superior snacking experience has resonated with Australian consumers.”

Proper Crisps’ Big Cut range is stocked nationwide including at IGA, Ritchies, Romeos, Woolworths Metro, and Coles Locals, and retails for $6.50 for a 140g bag.

Published by C&I Media Pty Ltd

(A division of The Intermedia Group) 41 Bridge Road (PO Box 55)

Glebe NSW 2037

Tel: 02 8586 6292

Fax: 02 9660 4419

E: magazine@c-store.com.au

IPL adds flowers to its range

IPL Retail Group has recently introduced a new category for gifting – flowers.

Flowers have long been associated with expressing emotions, from love and affection to sympathy and gratitude. IPL Retail Group’s flowers and gifting selection features a wide variety of blooms, from traditional roses to the cutest teddy bears.

The new category is a testament to IPL Retail Group’s commitment to meeting the diverse gifting needs of their customers and providing them with an exceptional shopping experience. By offering an extensive range of high-quality flowers and gifting options, IPL Retail Group aims to help its customers create meaningful and lasting connections with their loved ones.

For more information, please visit iplretail.com.au.

A Toatl Category First

With oat milks growing almost 10 times faster than the total plantbased milk category*, the launch of Toatl flavoured oat milk is set to shake up the flavoured milk shelves across the country.

Smooth, creamy and 100 per cent delicious, Toatl comes in three flavours – Chocolate, Caramel, and Strawberry. Made with Aussie oats, high in calcium, and packed with essential vitamins A, B2, B12 and D, Toatl is the plant-based flavour hit your customers have been looking for.

For more information, contact The Distributors on 1800 989 022.

*Source: Nielsen AU GR Scan, Total AU Grocery, 52 weeks to 01/03/2022. Nature, Sanitarium Dairy Free Milks U&A, Sept 2021.

Group Publisher: C&I Media Pty Ltd Safa de Valois

Commercial Director: Safa de Valois

The Intermedia Group takes its Corporate and Social Responsibilities seriously and is committed to reducing its impact on the environment. We continuously strive to improve our environmental performance and to initiate additional CSR based projects and activities.

As part of our company policy we ensure that the products and services used in the manufacture of this magazine are sourced from environmentally responsible suppliers. This magazine has been printed on paper produced from sustainably sourced wood and pulp fibre and is accredited under PEFC chain of custody.

PEFC certified wood and paper products come from environmentally appropriate, socially beneficial and economically viable management of forests.

DISCLAIMER

This publication is published by C&I Media Pty Ltd (the “Publisher”). Materials in this publication have been created by a variety of different entities and, to the extent permitted by law, the Publisher accepts no liability for materials created by others. All materials should be considered protected by Australian and international intellectual property laws. Unless you are authorised by law or the copyright owner to do so, you may not copy any of the materials.

The mention of a product or service, person or company in this publication does not indicate the

Associate Publisher: Deb Jackson

Editorial Director: James Wells

Deputy Editor: Thomas Oakley-Newell

Graphic Designer: Alyssa Coundouris

Production Assistant: Natasha Jara

Prepress: Tony Willson

Publisher’s endorsement. The views expressed in this publication do not necessarily represent the opinion of the Publisher, its agents, company officers or employees. Any use of the information contained in this publication is at the sole risk of the person using that information. The user should make independent enquiries as to the accuracy of the information before relying on that information. All express or implied terms, conditions, warranties, statements, assurances and representations in relation to the Publisher, its publications and its services are expressly excluded save for those conditions and warranties which must be implied under the laws of any State of Australia or the provisions of Division 2 of Part V of the Trade Practices Act 1974 and any statutory modification or re-enactment thereof. To the extent permitted by law, the Publisher will not be liable for any damages including special, exemplary, punitive or consequential damages (including but not limited to economic loss or loss of profit or revenue or loss of opportunity) or indirect loss or damage of any kind arising in contract, tort or otherwise, even if advised of the possibility of such loss of profits or damages. While we use our best endeavours to ensure accuracy of the materials we create, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication.

Copyright © 2023 - C&I Media Pty Ltd.

Average Total Distribution: 20,747 AMAA/CAB Publisher Statement Period ending 30/09/2022

MEMBERS OF:

INFORMATION PARTNERS:

June/July 2023 | C&I | www.c-store.com.au 5

PROUD

PRIME TIME

KICKING GOALS

From a small coastal town in Victoria, to becoming the Head of Category and Marketing at APCO, Kellie Struth has a passion for the P&C industry while balancing her love of sports, family, travel, and her toy cavoodle. This is her story…

Igrew up in the small coastal town of Warrnambool, Victoria, with my Mum, Dad and two younger sisters –Kim and Jess. Growing up in a smaller town afforded me quite a bit of freedom and my childhood weekends were filled with sports and friends.

I was fortunate enough to try my hand at many sports, from tennis and volleyball to hockey and swimming. I even became one of the first female footy umpires.

My first job was as a pharmacy dispensary assistant, however, it didn’t end up being such a great fit for me. The requirement to wear a white coat, court shoes, and bright red lipstick definitely wasn’t my thing. I quickly got out of there and landed a job at Target when I was 15 and even managed to organise a transfer to Melbourne so I could continue working with them while pursuing my university studies.

In my 20s, as many young Australians do, I went on a Contiki trip that broadened my horizons beyond the confines of my small town. Over the course of my career, I have been lucky

enough to have some amazing jobs that allowed me to travel extensively, particularly in my role as a buyer. I travelled to countries such as China, Hong Kong, India, Vietnam, Thailand, and Indonesia to develop and source new products.

My work also took me to the US and UK on retail study trips, where I visited fantastic stores in Los Angeles, London, and Paris. On many occasions I was able to tack on personal time in a few of those countries to catch up with old friends and have some wonderful adventures, particularly in the UK.

Just last year I was fortunate to attend the Australian Association of Convenience Stores (AACS) International Study Tour, where I was able to see a few places I’d never been before. I’m very much looking forward to this year’s trip and ticking a few more places off my bucket list.

Over my career, I’ve worked my way from a junior to senior category manager, working across many different categories over the years and have been involved in everything from buying and planning to supply chain and replenishment.

“ I am the Head of Category and Marketing at APCO, a position

I consider a privilege because I get to work with some of the most genuine, caring, and considerate people.”

– Kellie Struth

6 June/July 2023 | C&I | www.c-store.com.au FACE TIME

Kellie Struth with the APCO leadership team

After having kids, I transitioned into an analyst role that gave me a broader understanding of business by working across various departments and helping with business process transformation. Working as an analyst taught me how to interpret data and use it to effect change.

Currently, I am the Head of Category and Marketing at APCO, a position I consider a privilege because I get to work with some of the most genuine, caring, and considerate people. As a team, we have experienced many highs over the last couple of years, particularly our Wangaratta store, which picked up NACS Asia Pacific Convenience Retailer of the Year, AACS Store of the Year, and AACS Independent Store of the Year. It was pretty special.

Another highlight was joining the APCO Foundation Board, which has accomplished incredible work over the last decade. I am proud to be part of their efforts. In the next five years, I hope to still be at APCO, continuing to make a difference and gaining a deeper understanding of the fuel aspect of our business.

If I had to give any advice to retailers, I would say not to get complacent. The pace is fast in our industry, and the ability to be agile and evolve is more important than ever. For suppliers, it is essential to make it your business to understand the retailer’s business and show that you are invested. Spend time in their stores, listen, understand what is important to them, and then make it as simple and easy as you can for them to work with you.

Away from work, I have my partner Prouty, my three kids –Charlie, Tobie, and Ruby – and our toy cavoodle Milo. Our life is pretty hectic, so in any spare time, I love nothing more than a walk on the beach with Milo, getting to the gym for a pump class, or playing tennis with friends. C&I

“ I was fortunate enough to try my hand at many sports, from tennis and volleyball to hockey and swimming. I even became one of the first female footy umpires.”

– Kellie Struth

Kellie with her mum and two sisters, Kim and Jess

Kellie and her three lovely children Kellie and Milo

June/July 2023 | C&I | www.c-store.com.au 7 FACE TIME

Kellie pictured with her family

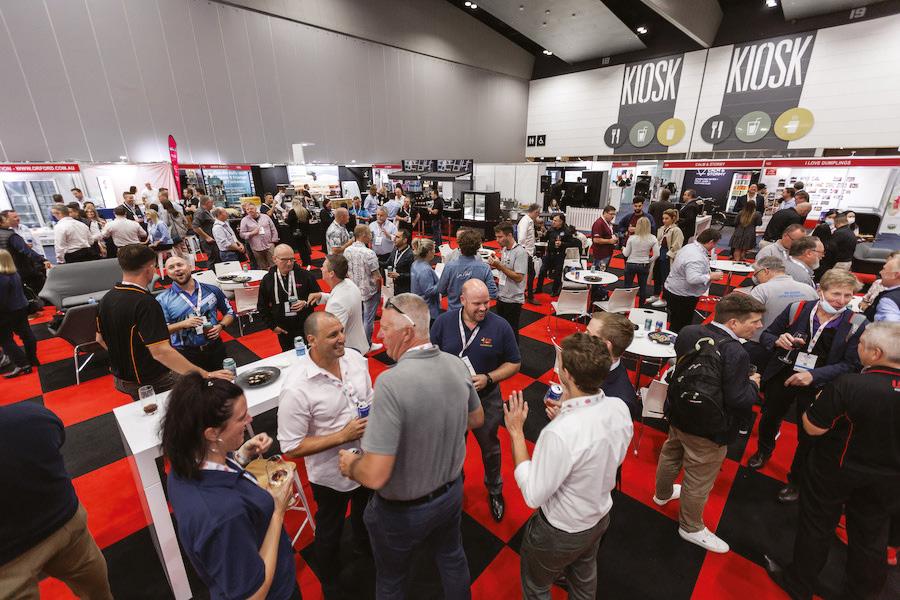

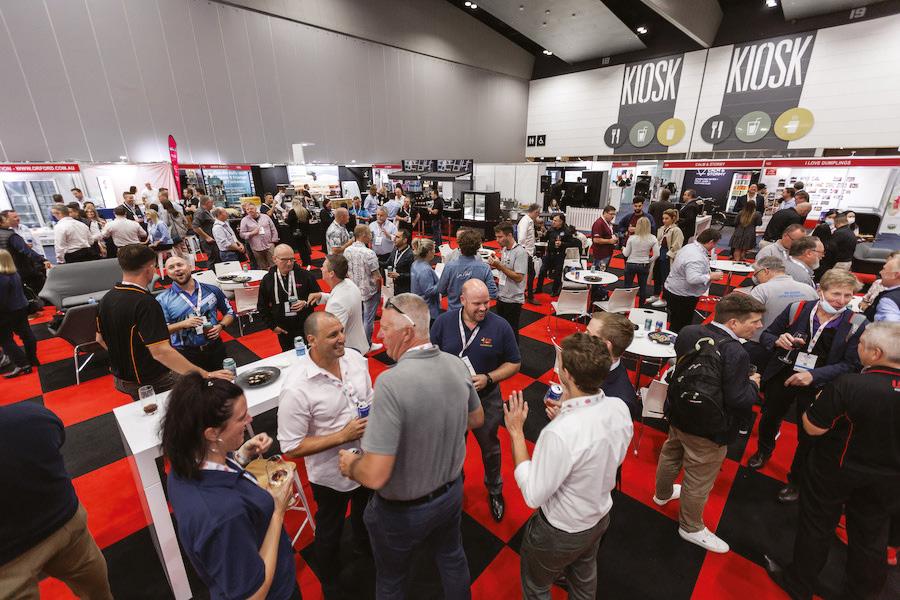

Australia’s largest and most important trade event for Convenience retailers. Unique in this industry, the expo is open to retailers and suppliers from all banners and brands, and ensures a valuable two days of business building and development.

C&I Expo provides unparalleled networking opportunities while giving visitors the chance to sample new products to bring more customers through the door. Learn from industry experts with years of experience growing their businesses and meet directly with suppliers who are actively addressing problem areas for store owners.

Exhibitors and retailers are encouraged to attend the C&I Industry Symposium, held on both mornings prior to doors opening, and the complimentary Networking Drinks on Thursday afternoon.

Why Exhibit

C&I Expo is the premier event for the Australian Convenience channel, open to all banners and brands

C&I Expo’s reputation and longevity attracts a high quality, decision-maker audience

Inquisitive buyers are looking for new products and innovation

Access to independent operators who may not be receiving adequate representation

Access to the major corporates, independent chains and multi-site operators

THE Calendar

“This show has been quality over quantity and having really good in-depth conversations with great retailers. I feel like I have done a dozen mini-range reviews here on the floor of the exhibition - it saves everyone’s time. It is a great opportunity to get a lot of work done and see a lot of people all at once. The buyers are inquisitive and looking for new products and inspiration.” Calm & Stormy

Thursday 19 October 2023

9:00am – 11:00am C&I Industry Symposium

11.00am – 5.00pm C&I Expo Day 1

5.00pm – 7.00pm Networking Drinks

Friday 20 October 2023

10.00am – 12.00pm C&I Industry Symposium

12.00pm – 4.00pm C&I Expo Day 2

Exclusive Expo & Symposium Sponsor

C&I INDUSTRY Symposium

Listen and learn from the industry’s best at the C&I Industry Symposium. Delivered in two morning sessions before doors open to the expo, the Symposium features keynote addresses from the brightest minds leading the convenience industry today. Tickets can be purchased at the time of registration.

98.5% OF ATTENDEES WOULD RECOMMEND THE C&I INDUSTRY SYMPOSIUM TO OTHERS

FOR Retailers

A national event compressed into two days, showcasing best industry practice and cutting-edge innovation

A diverse range of essential suppliers in one place

Taste, touch and smell the latest in convenience products and category trends

Premium industry education at the Industry Symposium

Network with major retailers and suppliers

Convenient hours, weekday timing at a central location, close to public transport and accommodation

register now

“The 2022 expo has been the most successful I have ever been to. If you want to kick-start your business, this is the place you want to come.” Adverto & Pump TV Global

Networking DRINKS

Networking is one of the key reasons visitors attend the expo and the complimentary cocktail function is a highlight of the expo program. An exceptional opportunity to make new connections and also unwind, this year's drinks are proudly sponsored by Coco-Cola Europacific Partners.

To register for free to visit C&I Expo 2023, to buy tickets for the Symposium, or to enquire about exhibiting, visit CANDIEXPO.COM.AU

Networking Drinks Sponsor

Networking Drinks Sponsor

IN THE MOOD

In a small, historic village in Tasmania, Mood Food Kempton has achieved big success with its unique homestead style site and fresh food offering, writes

Mood Food Kempton, owned by Bennett’s Petroleum, already had a strong belief in the quality of its offerings. However, being named the Australian Association of Convenience Stores’ (AACS) 2023 Overall Store of the Year, as well as 2023 Independent Store of the Year, was a wonderful acknowledgement of its success.

“It was a confirmation that our company’s direction was the correct one, which was to build a spacious integrated structure that blends into the physical environment, while cooking and preparing quality fresh food for the travelling market,” explained Troy Bennett, CEO of Bennett’s Petroleum Supplies.

For Bennett, winning the award gave him confidence that he was making more correct decisions than wrong decisions daily.

“I’m absolutely thrilled and couldn’t be happier for all concerned employees, suppliers, and Tasmanians.”

The open-planned colonial-style homestead service station effortlessly integrates the local environment into its design, with a dog run, football field, basketball and netball rings, all incorporated into Mood Food Kempton’s footprint.

“The site offers a sense of freedom, peace, and vacation for the travelling market, while still offering a local café for the community to gather. There are many comfortable seats to talk, share a bite to eat or drink, and relax internally and externally.”

Thomas Oakley-Newell.

Located in the small colonial town of Kempton, which is registered as a classified historic town, about 40 minutes north of Hobart, it is a perfect place for travellers looking to explore a beautiful place littered with architectural delights.

While those travellers explore, they need somewhere to refresh, wind-down, and maybe do a bit of exercise, and with Mood Food Kempton offering 20 parks in front of the store and 50 behind it, there is ample space for customers who want to enjoy what Mood Food and Kempton have to offer.

“Customer needs and wants are always shifting. They want the freshest, cheapest product as quickly as possible, with the least resistance as possible.”

Bennett explained that while healthy options are popular, particularly from females, the bottom line is that when people are travelling, they generally want comfort food, which means Mood Food attempts to provide for as many tastes and cravings as possible.

Food for the mood

Being in the heartland of Tasmania, a state that has some of the best and freshest produce in the country, it’s no surprise that Mood Food Kempton takes advantage of that unique positioning.

A wide range of both hot and cold foods are on offer, from fried foods to salads, to roasts and doughnuts, to hamburgers and fish, Mood Food caters to all tastes.

10 June/July 2023 | C&I | www.c-store.com.au STORE REVIEW

Mood Food Kempton's architecture incorporates the historic feel of the town

“All of our roasts are cooked on-site, and therefore all of our sandwiches and rolls have fresh meats inside. Our fish is all battered by hand and our hamburgers are made by hand using fresh mince. The chickens are all free-range from Tasmania and our coffee is also roasted here in Tasmania, which is paired perfectly with our doughnuts, made freshly each day.”

Featuring three point of sale registers, booth seating at the front of the store to catch the morning light, and gas-flamed heating inside, there is a place to sit, relax and enjoy your meal or beverage no matter the weather.

Lending itself to the colonial style of the town, Mood Food is somewhat of a throwback to a time when people were more connected to each other than their mobile phones, something that Bennett is well aware of.

“People need face-to-face connections. As the world becomes more automated, people will seek out these connections from as many sources as possible. Therefore, convenience stores will play a leading role in not only providing essential services and products, but also providing the communication and care that humans need.”

New Sunrise

As part of the New Sunrise network, Mood Food Kempton benefits from the services and support it provides. But Steve Cardinale, Managing Director of New Sunrise, also recognises the tireless work that its members put in.

“They are often first to open and last to close, particularly in times of distress in their communities. They continue to inspire, innovate, and support their communities every day. They have demonstrated to be true leaders of the industry, and looking back on a challenging retail landscape, particularly over the last 24 months, they have been agile, nimble, and led with strong food and coffee offers, which has set them in good stead for future growth.”

Bennett also recognised the importance of having New Sunrise in being able to help Mood Food Kempton improve its standard and offer over the past 15 years, with the team working hard to ensure Mood Food offers the best quality price as well as best quality service.

“New Sunrise has been really important for us because we are seen as a regional area in Tasmania, and therefore we aren’t necessarily able to negotiate with suppliers as well as some companies in major cities can. But through New Sunrise, being a national program, we get the benefit of what big city convenience stores get by piggybacking off the back of great negotiations by the New Sunrise team.” C&I

“

Customer needs and wants are always shifting. They want the freshest, cheapest product as quickly as possible, with the least resistance as possible.”

– Troy Bennett, CEO, Bennett’s Petroleum Services

The high ceilings offer a sense of freedom and space

Catch the morning light at the booth seating

June/July 2023 | C&I | www.c-store.com.au 11 STORE REVIEW

L-R: Kosta Soldatos, Jasmin Bennett, Troy Bennett, and Steve Cardinale

and Minions is the highest grossing animated franchise of all time MINION POWER YOUR SALES! NEW *IRI, Confectionery UK, 52 & 12wks data to 07.08.2022 YEARS OF CONSISTENT & RELIABLE SUPPLY TO THE INDUSTRY! Squashies is the #1 sweets brand in UK *

Contact CTC Australia at sales@ctcaustralia.com Scan for more Swizzels fun!

CONVENIENCE RETAIL SALES HIT $10.1 BILLION IN VALUE

Theo Foukkare, CEO, Australian Association of Convenience Stores, shares insights from the 2022 AACS State of the Industry Report, prepared by CMA Consulting.

Convenience in-store merchandise sales growth $10.1b

Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements

Ongoing Challenges

Staffing

Our ‘3 Pillars’ remain extremely relevant for our industry and they are: –

Continual battles to get staff and then keep them, with Staff turnover at record numbers and less operational hours remaining in the channel

Supply Chain

Ongoing Supply Issues with the Convenience channel hit hard by Supplier out of stocks, causing range rationalisation in some categories

Convenience in-store

WPerformance

e started 2022 with significant challenges as Covid cases skyrocketed and ran through the community as borders opened and we were able to move freely again. Then came the floods, which placed significant pressure on many parts of the country and affected confidence, while supply chain disruptions and labour shortages continued to plague most industries.

Dollar Sales $10.095b 7.4% +2.0% in 2021

for work, holidays and getting back to normal routines, with the full 2022 calendar year delivering +7.4 per cent growth on 2021, delivering incremental retail sales of $693m.

For the first time, the industry broke through the $10bn retail shop sales, which was a big milestone.

$ Value Increase $693m +$182m in 2021

Immunisation rates climbed quickly, and we were all finally able to start living in the new normal, albeit with big changes through the adoption of work from home policies now a part of how we work.

Our ‘3 Pillars’ remain extremely relevant for our industry and they are: – Advocacy –

Food and Beverage ended the year with growth of +16.7 per cent delivering an extra $769m in sales, while Non-Food declined -1.6 per cent or -$76m led by Tobacco, which dropped three per cent or -$107.4m.

Against this backdrop of uncertainty, rising business operating costs, and changing consumer behaviours, the channel had a tough first half of the year declining by -0.9 per cent. This coincided with the beginning of the end of free money, as interest rates started to increase to tackle rising inflation.

Dollar Sales (Excluding Tobacco) $6.597 13.8% +5.8% in 2021

Foodservice and Beverages continue to shine as retailers invest heavily in these offers, together delivering incremental sales of +$570m over the 12 months.

Convenience in-store merchandise sales growth

The second half of the year saw convenience retail sales rebound as consumers increased their mobility

Average Transaction Value $10.74

7.4%

Foodservice has now achieved double-digit growth for six years running, now contributing almost $1.2bn to be the fastest growing category. We continue to build momentum and provide everyday Australians with great quality food to keep them recharged and rehydrated.

Snackfoods

Connection – Knowledge

14 June/July 2023 | C&I | www.c-store.com.au

Advocacy – Connection – Knowledge

Store growth continued, adding 102 stores for the year to finish at 7,180 stores, up +1.4 per cent. This was mainly driven by the independent retailers, with new to industry stores being rolled out at record numbers.

After a concerning start to 2022, and ongoing speed humps throughout the year while operating in a very challenging environment, the industry has delivered a strong retail sales performance.

Major category shifts: The winners

After breaking through $2bn for the first time in 2021, the Beverage category has once again had an above average performance, hitting $2.5bn in sales value. All subcategories apart from Tea Drinks experienced growth, while six of the nine delivered double-digit growth, led by Protein Drinks at +29.8 per cent and Energy Drinks +26.3 per cent. Energy Drinks continued to represent a higher share of the category value and now sits at 33 per cent.

Convenience in-store merchandise sales growth

The snacking category within convenience, which includes confectionery, snackfoods and ice cream, collectively delivered $1bn in sales. Within this, snackfoods was the fastest growing category growing at +29 per cent.

$10.1b

Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements

Ongoing Challenges

Staffing

Energy Drinks had another outstanding year of growth with +26.3 per cent delivering an extra +$184m in value for a total value of $840m. Over the last two years, Energy Drinks has jumped +$261m in value or 45 per cent of total Packaged Beverage value growth.

Our ‘3 Pillars’ remain extremely relevant for our industry and they are:

The Foodservice category was the second fastest growing category achieving +21.4 per cent growth, its sixth consecutive year of double-digit growth. Foodservice now contributes almost $1.2bn in sales. The growth over the past two years alone has equalled $319m in value or +36 per cent. Every subcategory had strong growth with both Food Savouries +24.1 per cent and Take Home Food +21.9 per cent, driving the overall category value. Meanwhile, Prepared Food had the largest percentage increase of +25.8 per cent.

Continual battles to get staff and then keep them, with Staff turnover at record numbers and less operational hours remaining in the channel

Supply Chain

Dollar Sales $10.095b 7.4% +2.0% in 2021 $ Value Increase $693m +$182m in 2021

Other categories that delivered strong growth in 2022 included Hot Dispensed Beverages up more than +17 per cent. Grocery delivered another strong performance growing by +11.7 per cent on the back of two years of growth, demonstrating that some of the traction achieved through 2020 has translated into a regular purchase. Confectionery also grew at +9.9 per cent and added $55m in incremental sales.

Major category shifts: The losers

Ongoing Supply Issues with the Convenience channel hit hard by Supplier out of stocks, causing range rationalisation in some categories

Global Oil Price

Continually higher Fuel prices with over $2 per litre for the first time in Australia, causing Fuel Theft to jump by 85% in 2022

VIVA Energy Purchases the Coles Express Retail business from Coles for $300m which was approved in Janaury 2023.

7 Eleven Announces new concept Johnny’s Deli. Expansion of 15 stores in North Queensland for first time. Extends fuel partnership with Mobil until 2033 Ampol Announces it is buying Z Energy in New Zealand. Launches AMPcharge EV charging rollout.

EG On 9 December 2022, RACV announced it was partnering with EG Australia to offer RACV members a discount of 5.0 cpl.

The single biggest negative in 2022 was in the Tobacco category, declining by -3.7 per cent or $107m. The sale of illicit tobacco is now claimed to account →

Dollar Sales (Excluding Tobacco) $6.597 13.8% +5.8% in 2021

Convenience in-store merchandise sales growth

7.4%

What Makes Up The Retail Price Of Petrol

BP Announces deal with Tritium to supply EV Fast Chargers at sites. Announces Global partnership with Uber to provide delivery services.

OTR Expand outside of South Australia with stores in Regional Victoria.

Average Transaction Value $10.74 0.2% Average Merchandise Transactions per day 355* 2.9% Margin 35.2% 1.3pp 33.9% in

Frucor Suntory Announces $400m build of Beverage processing, packaging, warehousing & distribution facility in Queensland.

OTR Purchases 17 Puma branded service stations to enter the Northern Territory. Granted permission to sell alcohol through the OTR app.

Snackfoods

29.0%

Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements

Litres per transaction 1.1%

“ After a concerning start to 2022, and ongoing speed humps throughout the year while operating in a very challenging environment, the industry has delivered a strong retail sales performance.

”

– Theo Foukkare

–

–

–

Advocacy

Connection

Knowledge

Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements * Number reflected to include all stores not just provided numbers Performance Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements Non Food 2022 $ Sales

-$76m

-4.0% -$198m Food & Beverage 2022 $ Sales $5.368b 16.7% +$769m 2021 +9.0% +$380m Source: Company and ASX announcements Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements Non Food 2022 $ Sales $4.727b 1.6% -$76m 2021 -4.0% -$198m Food & Beverage 2022 $ Sales $5.368b 16.7% +$769m 2021 +9.0% +$380m Source: Company and ASX announcements Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements Non Food 2022 $ Sales $4.727b 1.6% -$76m 2021 -4.0% -$198m Food & Beverage 2022 $ Sales $5.368b 16.7% +$769m 2021 +9.0% +$380m Source: Company and ASX announcements Price Growth

2021

$4.727b 1.6%

2021

23.5%

store

Source: AACS Retailer Submissions, ACCC Report on Australian Petroleum Market December Quarter / Vehicle Care Performance Sales Performance 22.36b litres 4% +860m 2021 +4% +860m

Petrol Theft 81.4% $185 per

per week

Breakdown of the average petrol

December

largest cities GIRDS* 12.8cpl Retail Value $33.0b Source: ACCC Report on Australian Petroleum market – December 2022 *GIRDS are the difference between average retail petrol prices and the indicative wholesale prices before associated costs 182.7 cpl PETROL 16 29.8 cpl % Performance

price in the

quarter across the five

Announcements

June/July 2023 | C&I | www.c-store.com.au 15

$10.74 0.2% Average Merchandise Transactions per day 355* 2.9% Margin 35.2% 1.3pp 33.9% in

Our ‘3 Pillars’ remain

for up to one in five packets sold in Australia, which continues to add more pressure to legitimate retailers. Further adding to pressure on this category is the illegal sale of nicotine containing vapes by illegitimate retailers as consumers are looking for a transition out of smoking.

and they are:

Other categories that suffered predominantly, driven by changes in consumer behaviour, were Communications, Printed Materials and Travel tickets.

What of 2022?

With Covid running rampant throughout the community in January as Australians started moving around freely again and the last of the borders were opened, high vaccination rates and overall increased confidence meant that the lockdowns that restricted so many of us were finally over and hopefully never to be seen again. The sales increases in high performing categories continued for the first half of the year and in a lot of cases, the channel was able to deliver even more growth in categories like Grocery, Foodservice, and Coffee.

Labour shortages, supply chain challenges, and the lack of international students and travellers added new complexity to an already difficult operating environment. Covid cases were now higher than ever during the height of the pandemic, however we had finally accepted that we could live with it and get on with life.

Work from home was adopted into most organisations as standard policy, which led to significant changes in consumer behaviour and new trends that we had to learn to adapt to.

Industry

With consumer mobility returning to more normal levels both on the road and in the air, so did retail fuel volumes. The hangover of supply chain constraints was exacerbated further through the tight labour market and difficulty in finding staff right across the board.

The AdBlue shortage early in the year sent shockwaves through the transportation and fuel distribution networks given the dependence of industry on diesel fuel. This resulted in the Government stepping up and starting the process for additional local manufacturing capability to future proof future supply constraints of AdBlue.

The war in Ukraine introduced a completely new perspective into an already difficult operating environment, which resulted in retail fuel prices skyrocketing and hurting everyday Australians in their hip pocket. This volatility settled down in the second half of the year, however retail fuel prices on average are still sitting well above 2021 levels.

Future fuels

The question of when this will start to impact the channel is still relevant today. In 2022, 3.1 per cent or 33,410 of all passenger cars sold in Australia were EVs (up from 2.1 per cent in 2021), so at this stage the impact is still minimal.

Globally the number was 14 per cent led by China and Europe, although the USA picked up pace as the government has introduced new standards and is investing heavily in infrastructure development, along with mandates for the stopping the sale of traditional internal combustion engine (ICE) vehicles.

Convenience in-store merchandise sales growth Snackfoods

7.4%

– Advocacy – Connection – Knowledge Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements 29.0% Dollar Sales

in 2021 $ Value

Dollar

Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements * Number reflected to include all stores not just provided numbers Performance

extremely relevant for our industry

$10.095b 7.4% +2.0%

Increase $693m +$182m in 2021

Sales (Excluding Tobacco) $6.597 13.8% +5.8% in 2021 Average Transaction Value

2021

– Theo Foukkare Store Numbers 7,249 1.4% Source: AACS Retailer Submissions, IRI Market Edge, Company Websites Performance Retail Segment Growth Total Retail 7.4% Convenience 7.4% Food Retailing 6.8% Online 8.4% Cafe, Restuarants & Catering 25.4% Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements, ABS Retail Segment Growth Total Retail 7.4% Convenience 7.4% Food Retailing 6.8% Online 8.4% Cafe, Restuarants & Catering 25.4% Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements, ABS 16 June/July 2023 | C&I | www.c-store.com.au

“ AACS continues to strongly advocate for a regulated consumer model of nicotine vaping products, with strict product, ingredient, packaging, and safety standards to provide consenting adults with a choice to access regulated products.”

The reality is EVs are coming, however, it is important to note that this will form only one part of the future energy types available to consumers, commercial transport, and heavy industry. Biofuels, zero emission fuel options and hydrogen are also seeing significant investment both globally and in Australia.

In 2022, Ampol launched its consumer electricity brand AmpCharge, along with bp launching its global charging brand BP Pulse in Australia.

The Federal and State Governments in Australia have started to divert investment into charging equipment through their ARENA program as well as various Federal and State grants to entice consumer uptake, however infrastructure investment to support fast charging to keep Australians moving is still significantly lacking.

Convenience and fuel retailers need to start planning on their network strategy to transition to future energy, however with demand being so concentrated in major capital cities, the focus must continue on developing their retail offers in foodservice, grocery, beverages, loyalty and in-store experiences.

Tobacco and e-cigarettes

Tobacco remains an important category to the Convenience Channel. The decline in sales has been mostly affected in 2022 through the explosion in consumers switching to illegal unregulated nicotine vaping products, as well as the continual sale of illicit tobacco by illegitimate operators.

Illicit tobacco now accounts for one in every five packets sold in Australia. This, combined with the vaping black market selling unregulated products, will continue to impact the category until the Federal Government takes a common sense approach to strict product regulation, the introduction of a licensed retail framework and harmonised Federal and State legislation that gives police the powers to clamp down on all illegal operators.

Fast facts:

• Total retail shop sales broke through $10 billion

• Store numbers grew +1.4 per cent, adding 102 new stores to finish at 7,180

• Overall margin improved by +1.3 per cent to 35.2 per cent. This was driven by the improvement in sales performance, mix of category sales & promotional activity.

• The split of business between Food and Beverage and Non-Food has now switched to see Food and Beverage being the largest segment delivering 53 per cent of total sales, having grown by +16.7 per cent and delivering an additional +$769 million in sales.

Research commissioned by AACS through Roy Morgan confirms that there are now more than 1.3 million adults regularly vaping. Unfortunately, the Federal Governments prescription only model is only being used by 12 per cent of adults (Source CMA Consulting).

AACS continues to strongly advocate for a regulated consumer model of nicotine vaping products, with strict product, ingredient, packaging, and safety standards to provide consenting adults with a choice to access regulated products. Retailers have successfully supported the government over decades to eliminate tobacco access to children. A responsible retailing framework, backed by a strong licensing model for retailers and wholesalers, will again support the government in restricting access of nicotine vapes to our youth.

AACS continues to be at the forefront of Federal and State Government engagement on the illicit tobacco market and the impact to the Convenience Channel.

We have been leading the need for greater enforcement from authorities at state level and introducing more streamlined processes and regulatory frameworks to enable taskforces and boots on the ground to shut down this illegal activity. Working in collaboration with the Department of Home Affairs, Treasury, State Health Departments and State Enforcement Authorities has seen significant progress made in key states and traction made at federal level for the introduction of a National Illicit Trade Strategy to be implemented. →

Sales Performance

22.36b litres

4% +860m 2021 +4% +860m

GIRDS*

12.8cpl

Retail Value $33.0b

Source: ACCC Report on Australian Petroleum market – December 2022

*GIRDS are the difference between average retail petrol prices and the indicative wholesale prices before associated costs

What

What Makes Up The Retail Price Of Petrol

Breakdown of the average petrol price in the December quarter across the five largest cities

182.7 cpl

16 29.8 62.6 90.3 34 49

International

of refined petrol (Mogas 95) Taxes

GST) Other costs

margins

retail) Performance 2018 2019 2020 2021 2022 0 5 10 15 20 -5 Food & BeverageNon Food Channel Average +5.1% +3.0% +4.5% +1.9% +5.6% +2.0% +9.0% -4.0% +2.4% +6.0% -1.0% +2.1% +7.4% +16.7% -1.6% Trend Chart 7 AACS Retailer Submissions, IRI Market Edge, ASX Announcements Source: 2018 2019 2020 2021 2022 0 5 10 15 20 -5 Food & BeverageNon Food Channel Average +5.1% +3.0% +4.5% +1.9% +5.6% +2.0% +9.0% -4.0% +2.4% +6.0% -1.0% +2.1% +7.4% +16.7% -1.6% Trend Chart 7 AACS Retailer Submissions, IRI Market Edge, ASX Announcements Source: Sales Performance 22.36b litres 4% +860m 2021 +4% +860m

Source: ACCC Report on the Australian Petroleum Market (2022) Note: Percentages in the chart do not total 100% due to rounding

PETROL

cpl %

cost

(excise and

and

(wholesale and

Petrol Breakdown of the average petrol price in the December quarter across the five largest cities GIRDS* 12.8cpl Retail Value $33.0b Source: ACCC Report on Australian Petroleum market – December 2022 *GIRDS are the difference between average retail petrol prices and the indicative wholesale prices before associated costs Source: ACCC Report on the Australian Petroleum Market (2022) Note: Percentages in the chart do not total 100% due to rounding 182.7 cpl PETROL 16 29.8 62.6 90.3 34 49 cpl % International cost of refined petrol (Mogas 95) Taxes (excise and GST) Other costs and margins (wholesale and retail) Performance June/July 2023 | C&I | www.c-store.com.au 17

Makes Up The Retail Price Of

Packaged alcohol

Convenience retail’s opportunity to enter the competitive landscape of packaged alcohol remains one of the largest opportunities on the horizon, estimated to be $1bn in retail sales per annum. AACS has a clearly defined nationally agreed responsible approach to packaged alcohol that is actively being discussed in key states. Strong advocacy is progressing with all state government stakeholders, liquor regulators, small business ministers and potential opponents.

Traditional retailers of packaged alcohol have capitalised on the emergence of online delivery platforms and direct to boot or home services. Restaurants and cafes have also captured part of this market in some states as Covid specific exemptions for takeaway services have now been adopted into legislation in various states.

AACS believes that convenience retailers should be permitted to compete on an even playing field with other retailers in a responsible retailing framework, providing convenience of location to adult consumers in a competitive packaged alcohol environment.

What will 2023 bring?

In 2023, while labour challenges remain and the hangover in some areas of supply chain shortages continue to plague retailers, business confidence is strong and we will see continued investment in new stores and offer development, product innovation and loyalty initiatives. Investment into new technologies to support efficiencies and free up staff time to focus on the customer experience will continue to be a major focus for all businesses.

Foodservice will likely see its stellar six years of growth continue, as well as continued investment into better quality freshly prepared food to keep customers recharged not only on the go but in their homes or workplaces.

The new Industrial Relations Laws passed by the new Federal Government that came into effect in June 2023 will add another level of complexity to the already challenging IR environment.

We expect that consumer migration away from traditional tobacco products into illicit nicotine vaping will continue to grow, which will again place enormous pressure on our largest category and impact customer frequency and the loss of associated purchases.

As a channel, convenience and mobility retailers will continue to invest in being business fit for the slow but eventual transition to future energy needs. This focus will deliver better retailing experiences for consumers both in-store and online.

Shop formats, product ranges, healthier food options, new services, great coffee and exceptional customer service will continue to be a major focus aimed at raising the profile of the channel to engage shoppers on a more frequent basis, and an understanding of localised trends will drive increased engagement with local communities.

Convenience in-store merchandise sales growth $10.1b

AACS will continue to support the industry across all our strategic priorities to ensure we protect the convenience retailers that continue to play a more integral role in the lives of every Australians – keeping them refuelled, recharged and well fed and hydrated. ■

Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements Ongoing

Staffing

Continual battles to get staff and then keep them, with Staff turnover at record numbers and less operational hours remaining in the channel Supply Chain

Ongoing Supply Issues with the Convenience channel hit hard by Supplier out of stocks, causing range rationalisation in some categories

Global Oil Price

Continually higher Fuel prices with over $2 per litre for the first time in Australia, causing Fuel Theft to jump by 85% in 2022

“ AACS will continue to support the industry across all our strategic priorities to ensure we protect the convenience retailers that continue to play a more integral role in the lives of every Australians.”

– Theo Foukkare

Dispensed Hot Beverages Packaged Beverages FoodserviceSnackfoods Confectionery GroceryBreadPrinted Communications Materials +$361m +$211m +$56m +$55m +$54m -$1m -$8m -$15m +$32m Table of value of growth Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements

Challenges

Dispensed Hot Beverages Packaged Beverages FoodserviceSnackfoods Confectionery GroceryBreadPrinted Communications Tobacco Materials +$361m +$211m +$56m +$55m +$54m -$1m -$8m -$15m -$107m +$32m Table of value of growth Source: AACS Retailer Submissions, IRI Market Edge, ASX Announcements 18 June/July 2023 | C&I | www.c-store.com.au

with Sheena Polese

DOWN UNDER STUDY TOUR

Keynote Presentation by Sheena

Leadership & Development Coach

We are pleased to announce our first Women in Convenience event for 2023

We will be joined by guest Speaker Sheena Polese, an experienced Leadership & Development Coach.

Sheena will share her knowledge & experience with the group on how to get the best out of everyone, followed by a question & answer session.

Wednesday 19th July 3-5.30pm | Sydney

Time & Venue Confirmed Upon Registration

The 2023 AACS Down Under Study Tour

The 2023 AACS Down Under Study Tour - a local study tour to visit the latest innovations in convenience stores, service stations, small format grocery & food retailing in and around Melbourne Stay at Crown Metropol, Melbourne and join the group for an exclusive tour dinner and networking event Not only will attendees then get to see stores but will also be hosted by senior executives from the various stores and given insights into the store operations & format development.

Thursday 9th & Friday 10th August 2023

Melbourne

UPCOMING EVENTS Have a question? Reach out to AACS CEO Theo Foukkare on 0423 003 133 or theo@aacs.org.au

M E L B O U R N E 2 0 2 3

Polese,

SCAN TO REGISTER or visit bit ly/3InQFOG SCAN TO REGISTER or visit bit ly/3Wu02SR

2023 INDUSTRY LEADERS FORUM

20 June/July 2023 | C&I | www.c-store.com.au 2023 LEADERS FORUM

From suppliers, wholesalers, and retail groups to industry associations, C&I has spoken with leaders from right across the convenience and roadside retail industry.

CELEBRATING

Despite the many challenges we’ve faced over the past few years, from Covid, to supply chain disruptions, and floods, the convenience channel has shown incredible resilience and for the first time the industry managed to break through $10bn in retail shop sales, which is an incredible milestone.

This achievement highlights the growing prominence and undeniable potential of the convenience channel within the Australian retail landscape.

A key driver behind this success is the food and beverage segment, which continues to dominate the convenience channel. Retailers have recognised the immense opportunities presented by on-the-go food, foodservice, and hot coffee offers, and they have been refining their strategies to capture a larger slice of the pie.

The convenience channel has evolved into a go-to destination for consumers seeking quick and convenient meal options that fit their fast-paced lifestyles. From busy professionals and students to travelers and tourists, the demand for easily accessible and delicious food and beverages on the move has never been higher. Retailers have responded by expanding their product ranges and improving the quality and variety of their offerings.

Gone are the days when pre-packaged sandwiches and mediocre coffee were the only options available. Retailers have

embraced innovation, investing in state-of-the-art equipment, and partnering with local food suppliers to offer fresh, tasty, and diverse choices to their customers.

On the other end of the spectrum, the decline in tobacco continues to hurt retailers, and the black marker for illicit tobacco and vaping products continues to add pressure to legitimate retailers.

In this years annual Industry Leaders Forum, we delve deeper into the latest trends, innovative concepts, and success stories within the convenience channel. We speak with industry leaders to find out the challenges and opportunities our channel is facing and ask them to look into their crystal ball and predict the future of convenience in Australia. Overall, we aim to provide our readers with valuable insights, actionable strategies, and inspiration to help them navigate this dynamic industry and seize the multitude of opportunities it presents.

It’s always a delight to speak with leaders in their fields that share such an unwavering passion and belief for the petrol and convenience industry. And while we don’t actually have a crystal ball to tell us how the remainder of this year will play out, if this year’s Leaders Forum is anything to go by, the future is bright for convenience and through hard work and dedication, we will continue to thrive. C&I

a milestone in the convenience channel

June/July 2023 | C&I | www.c-store.com.au 21 2023 LEADERS FORUM

What have been the main highlights for Nestlé Purina over the past 12 months?

Despite the multitude of challenges facing the industry in relation to supply, logistics and operations, we’ve still managed to deliver growth for the channel and our aspirations to increase the footprint of the Petcare category haven’t lost momentum.

What will be the focus for Nestlé Purina for the remainder of 2023?

Our continued focus on ensuring we support retailers in developing and unlocking the growth potential of the pet category in their stores, with a clear focus on providing category leading insights to support growth driving brands.

What do you enjoy most about the convenience channel?

I love the diversity and multifaceted nature of the channel. One day you could be supporting a remote customer in a mining town in Western Australia, the next it’s focusing on scaling an offer for a metropolitan city store.

What is one challenge you’d like to see addressed in the industry?

Increasing the awareness and education of the power of the pet category through:

• Firstly, our retail partners around the size and impact pet can have on their business.

• Secondly, education to our loyal consumer base around the fact that the P&C channel carries their favourite brands and products.

How do you envisage the next six months for the pet category in the convenience channel?

With the momentum behind the category and strong industry growth forecasts, the size and importance of pet will only continue to increase as it continues to act as a tool for retailers to drive additional revenues outside of the more traditional impulsive categories.

What do you enjoy most about what you do?

Every day I get to come to work and assist in making lives better, not only for pet owners and their pets through offering our portfolio of market leading Purina brands, but through the P&C channel I get the chance to help small, medium, and large business owners or companies to drive additional revenue within a powerhouse category.

Is there anything else happening at Nestlé Purina that you’d like to highlight?

With an estimate of more than 28 million pets in Australia, Nestlé Purina will continue to remain focused on bringing great products and market leading innovation to ensure we help pets live longer, happier and healthier lives, to continue to set up the category for future growth. Our significant investment into new manufacturing capability will help us to realise these ambitions. ■

“

Through the P&C channel I get the chance to help small, medium, and large business owners or companies to drive additional revenue within a powerhouse category.”

– Michael Yassine

Michael Yassine

Senior Customer Business Manager – Independent & Impulse

22 June/July 2023 | C&I | www.c-store.com.au 2023 LEADERS FORUM

Nestlé Purina

®

®

Lisa Schilling-Thomson National Sales Manager

Halo Food Co

What have been the main highlights for Halo Food Co over the past 12 months?

We formally launched TONIK on 1 September last year, following months of brand workshopping, re-branding, and new imagery. We completely turned the brand inside out to understand who the TONIK consumer/shopper was.

Since 1 September, it’s been an absolute whirlwind with 12 new accounts for our bars and RTDs, tremendous brand growth across multiple channels, particularly P&C and grocery. In April, TONIK was represented at the AUSFIT Expo in Sydney, the first trade event the brand has attended, and it was a huge success with thousands of attendees trying TONIK products, and 100 per cent fantastic feedback.

TONIK has experienced more than 65 per cent growth YOY and continues to grow. We expect TONIK to become a leading Australian brand within the next 12 months.

We acquired The Healthy Mummy (THM) brand back in February 2022, which was previously an exclusively online company providing health and wellness products to women all over Australia.

Mid last year we commenced plans to take THM into the Australian retail market. Our initial wins were ranging three SKUs with Woolworths and another three SKUs are ranged and going into stores in a couple of months. We’ve had terrific results in the first eight weeks with our Vanilla Tummy Smoothie ranking number 10 in the whole category. We are also presenting the brand to the pharmacy channel with very positive results currently.

What will be the focus for Halo Food Co for the remainder of 2023?

Halo’s core business has been contract manufacturing for the past 20+ years, and we continue to drive that highly successful part of our business. But now stepping into brand ownership, we have clearly seen the opportunities we have to take to market high quality consumable products, initially to the Australian public, but also entering other global markets with our highly desirable Aussie made products. We’re currently in discussions to take our brands into New Zealand, New Caledonia, South Korea, and Hong Kong.

For the remainder of 2023 we will continue to grow our TONIK and Healthy Mummy brands within Australia, focusing on grocery, P&C, independent supermarkets, and the specialty channels.

What do you enjoy most about the convenience channel?

The P&C channel in Australia is always dynamic, ever evolving, and driven to satisfy consumer demands and to develop category trends constantly – it’s an exciting channel that’s always changing.

I love working with category managers and buyers in P&C that are well versed and passionate about their categories. They do the work, they know their core SKUs, the trends coming, the trends ending, they understand the insights, the really great CMs get ahead of the trends coming, and pivot quickly, even outside of their structured annual reviews to change their ranging.

What do you enjoy most about what you do?

Firstly, being the highly competitive individual that I am, I love the challenge with a new brand to gain national ranging, competing, and winning! With TONIK, I’ve achieved national ranging in 12 new accounts in seven months, for Healthy Mummy, national ranging in Woolworths, and several other new accounts about to confirm ranging in the next couple of months.

This time next year I’m expecting TONIK to be one of the top three brands in the country.

I love multi skilling, it enables me to be able to put to good use all of the skills I have learnt in my career over the past 35 years. As I am the ‘sales team’ for Halo Brands Division, I work across all channels with both brands, from route, P&C, grocery, independent grocery, specialty, and pharmacy, so I wear many, many hats. I also do all the brand management, marketing, social media management, and liaise with our manufacturing plants.

Then there are the people I get to work with, collaborate with regularly, the category managers, buyers, business owners, account managers, sales reps, all of which play a major role in taking a brand to market.

I’m lucky that I get to do every day what I love. ■

“

The P&C channel in Australia is always dynamic, ever evolving, and driven to satisfy consumer demands and to develop category trends constantly – it’s an exciting channel that’s always changing.”

– Lisa Schilling-Thomson

24 June/July 2023 | C&I | www.c-store.com.au 2023 LEADERS FORUM

Dean Theouli Director

Confectionery Trading Co

How has the CTC business evolved over the last 40 years?

Confectionery Trading Co (CTC) was founded in 1982 as a small business buying local confectionery and packing it in bulk count bags.

In 1987, the business was acquired by Andrew Theouli and Gordon Ogilvie, and they continued to grow the business, with year-on-year growth of five to 10 per cent.

The company’s first TNA packing machine was bought in 1990, which changed the way CTC packed bulk products. Aussie drops were launched with a mini 25g and a 70g bag and these two lines were very well received in the trade and school markets.

In 1992, a second TNA machine was purchased to pack high speed mini bags. Speeds up to 125 bpm. The company kept growing, and CTC acquired more warehouses.

In 2000, CTC went to ISM where they met Fini and acquired the agency for Australia. CTC imported more than 20 lines in the first year and was the first company to bring in Fantasy belts. This item become CTC’s number one product and still is.

CTC outgrew its facility in 2003 and bought the current premises in Villawood with more than 5,000sqm of warehouse space. I joined CTC in 2003 and brought skills to the business, which took it to the next level. Packaging capacity was as maximum, and a third TNA machine was purchased to pack mini bags. A shift in the business in 2004 saw more retail packs being developed.

For the next 10 years, the business continued to grow. CTC become SQF accredited, which set a high standard to our packing and warehouse business.

CTC is now in major supermarkets, discount stores and P&C stores. We continue to grow our brands and develop products for Private Label.

In Aug of 2022, I purchased the business and now am sole director of CTC. Over the past six months, CTC has purchased two new packaging machines to cope with the new business we have. We have rebranded our biggest growing brand Big Lolly.

CTC continues to find new markets to sell into. We continue to design and develop new products and support all our suppliers worldwide.

It’s an exciting time for CTC. We have a brand plan which is very clear and gives the company direction and growth. With the addition of our two new machines, this will give CTC more packing capacity and fewer delays in delivering products to shelves.

What have been the highlights for CTC over the past 12 months?

The main highlight for CTC has been relaunching our Big Lolly brand – the new look is amazing. Big Lolly as a brand

has grown 55 per cent over the past 12 months and we have also seen growth in our other key brands such as Aussie Drops, Joojoos, Fini, and Swizzels.

For the remainder of 2023, our main focus will be to continue to service all of our customers. We are aiming for a 98 per cent rate of delivery in full on time (DIFOT).

What do you enjoy most about the convenience channel?

I love it when we have the opportunity to set up a Kandy Kingdom stand in a retail outlet. It makes me very proud to see all of our fantastic products on display and available for the kids to purchase.

What has been a personal highlight for you over the past year?

A personal highlight for me has to be purchasing CTC Australia. The love that I have for the business and also for confectionery really gave me no other option but to purchase CTC and keep the business in the family. It has definitely been a massive experience for me, but it was all worth it. The business has been in our family for more than 40 years, so to keep it in the family is very important to me.

What do you enjoy most about what you do?

I enjoy being part of an amazing company. Of course, my background is in engineering, so that pushes me to improve our systems and packaging machines. Developing new products is also very enjoyable.

Is there anything else happening at CTC that you’d like to highlight?

We are currently running an Aussie Drops promotion. It’s the first of its kind for CTC with a QR code and unique codes to enter the draw. The promotion is on our 70g and 150g share pack. ■

“ The love that I have for the business and also for confectionery really gave me no other option but to purchase CTC and keep the business in the family.”

June/July 2023 | C&I | www.c-store.com.au 25 2023 LEADERS FORUM

– Dean Theouli

Martin Best Managing Director Pacific Optics

What

have been the highlights for Pacific Optics over the past six months?

At Pacific Optics, we keep challenging our status quo and setting ourselves new benchmarks for field representation, customer service and delivery metrics.

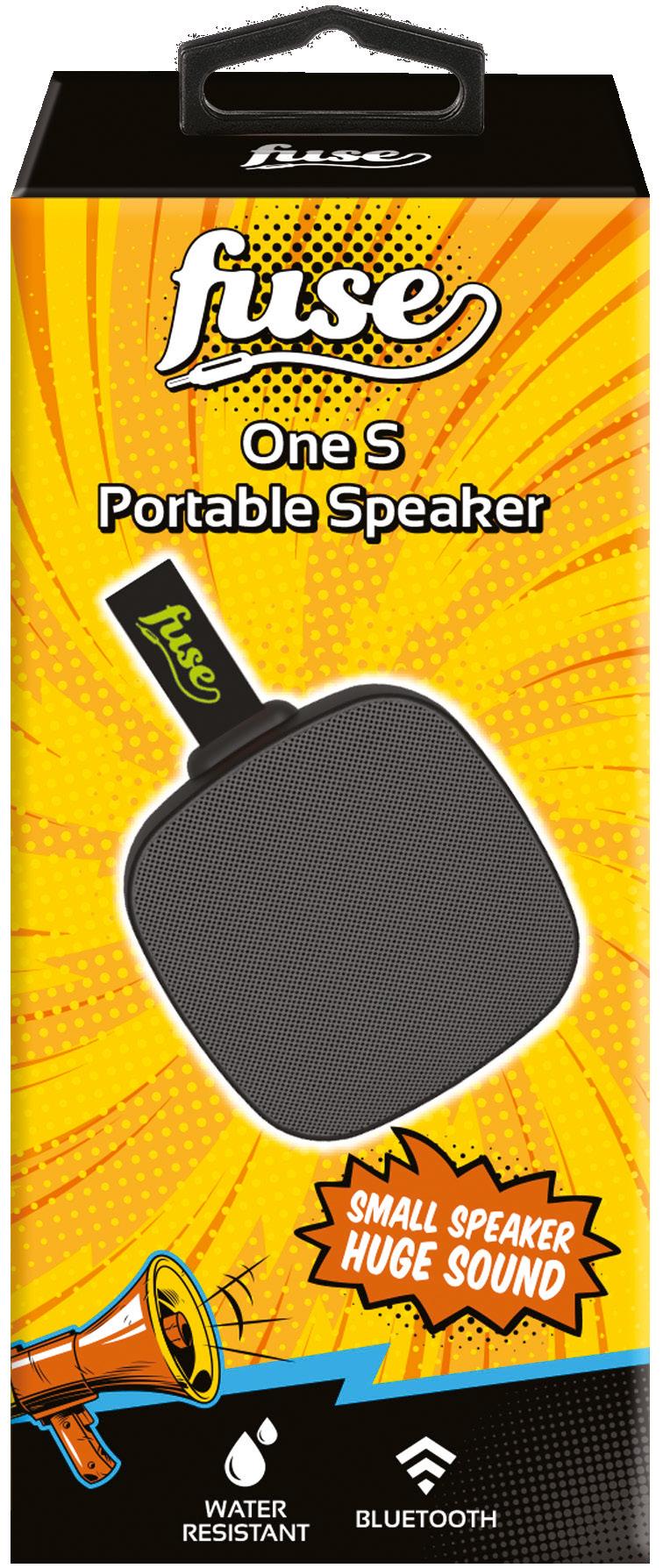

From a product perspective, the relaunch of Fuse Audio has been incredibly successful. The vibrant contemporary packaging and innovative products have significantly increased category sales.

Aerial Sunglasses have launched more than 60 new quality styles catering for the evolving change in fashion. In addition, we have launched a selection of sunglasses that use 100 per cent recycled frame materials.

Our Australian standards compliant sunglasses category has been revitalised and is in a strong growth phase.

I consider our 2023 Aerial Winter Headwear range, including the value Winter Warmers prepacked stand, to be the best value and fashionable range in the market. As with sunglasses, our headwear range is designed by our team in Australia – we do not buy generic products off the shelf.

Pacific Optics has developed and continually invests in cyber security best in class, with a redundancy of less than four hours to regain operations. It is extremely important for trade partners to have confidence that suppliers are taking all practicable measures to insulate them from attacks and will be in a position to keep trading.

We have delivered more than six million digital ads a month supporting Aerial Brand, Walk n Talk and Fuse Audio. These have been targeting consumers to shop with our retail partners. This is key in encouraging consumers to shop within the convenience channel.

Most importantly, we have several new additions to our team across sales, product development and operations. We now have an ideal mix of experience, innovative enthusiasm, and people that contest the norm.

It’s always great for the whole team to receive recognition for their hard work and innovation, and we are proud recipients of the following customer awards:

• BP: Buying Group General Merchandise Supplier of the Year

• UCB: Trade Partner of the Year General Merchandise

• APCO: General Merchandise Supplier of the Year

• Ampol: General Merchandise Supplier of the Year

• NSG: Supplier of the Year Non Food

• AACS: Supplier of the Year Grocery & General Merchandise

What will be your key priorities for the remainder of 2023?

We are launching a new marketing campaign on Walk n Talk Phone accessories. Walk n Talk is Australia’s favourite phone charger brand and is dedicated to supporting the P&C channel.

In addition, we are launching a new range of Aerial Footwear, a whole new toy and games offer focusing on market leading global brands and rolling out our fishing partnership with Tackleworld.

Christmas and peak travel occasions will be huge with exciting new tech stand offers, gifting and outdoor fun products to delight the consumer.

We will also be continuing down the ESG path which is a key corporate objective for Pacific Optics.

We support a foundation charity – OneGirl, which has benefited more than 10,000 girls and boys via education programs across Africa and the Pacific. Each sale from our brand ONEDAY helps fund ongoing education, feminine hygiene and business bursaries programs across Africa and the Pacific Islands.

We also take Modern Slavery seriously and have registered voluntarily to the Australian Boarder force anti modern slavery reporting with a view to ensure we only deal with compliant factories across the region.

What are the biggest challenges facing the convenience industry?

An opportunity exists to improve the overall benchmark in the industry by contesting products that do not meet with applicable Australian and Safety Standards in eyewear, headwear, and phone accessories.

We also see new entrants to the channel, which is great to ensure ongoing innovation and development. The challenging part of this is ensuring that competition is in the best interest of category solutions, category profitability and overall professional business practices and doesn’t mean degradation in any of these key areas that have been built and are appreciated over the last few decades. ■

“ We have several new additions to our team across sales, product development and operations. We now have an ideal mix of experience, innovative enthusiasm, and people that contest the norm.”

– Martin Best

26 June/July 2023 | C&I | www.c-store.com.au 2023 LEADERS FORUM

CHARGES APPLE, SAMSUNG AND ANDROID DEVICES. STAY CONNECTED ON-THE-GO

orders@pacificoptics.com 1300 AERIAL (1300 237 425) www.pacificoptics.com ULTRA COMPACT. ULTRA POWERFUL.

What have been the main highlights for PeleGuy over the past 12 months?

We’ve discovered that not many suppliers offer the same level of service as we do; I’m talking about our reps physically visiting every single store on regular basis, including those located in very remote areas. Apparently, that is not something that comes as a standard to other companies.

This has led to a substantial growth in our customer base, right around Australia, with new independent stores, groups of a few sites, additional service stations, and supermarkets from the groups we are already working with.

We’ve been receiving amazing feedback about the attention each of our customers are getting from us, and this has been very rewarding and motivating.

What will be the focus for PeleGuy for the remainder of 2023?

The market is unpredictable these days and we often see the prices of a few products increasing by around 20 to 30 per cent overnight, but then they can come back down as quickly as they went up. So, we work hard to ensure that we keep our prices as stable as possible, to provide the best value to our customers. This is of course not always in our control, so our team is constantly researching the market to find new sources and contacts, to be able to keep our prices competitive.

What do you enjoy most about the

convenience channel?

Over the past 20 years, we’ve enjoyed watching our customers grow and expand their businesses, opening additional locations around Australia. It’s satisfying to know that we’ve been a part of that growth.

There have been companies that had just one site when they began working with us and now, they’ve grown to more than 60 sites around the country, and we’ve been there with them setting up for the opening of each of these sites.

We also have a direct connection to our consumers and we can react almost immediately to any new trends or products that are hitting the market.

What do you enjoy most about what you do?

As a former sportsman – an ex-superbike racer to be exact –I enjoy moving fast, and that includes being the first to market with the latest gadgets, novelty products, and hot items.

We love turning an average store into a great looking store, with a well-stocked and organised, and therefore a profitable operation.

Having spent best years of my life working hard to beat my best lap time in racing, I know what a good challenge is, and how rewarding it is to overcome it. I will always go out

of my way to close a deal with a new lead that needs a bit of extra attention and will give them all of the information they need in order to understand the benefits of working with us. This is a challenge that I get a real kick out of, and it’s not always an immediate reward. The money can come later but first comes the pleasure of having another satisfied customer on board for the long run.

What is one challenge you’d like to see addressed in the industry?

Staffing has been a huge problem over the past 12 months, and it has been a huge challenge to find good, professional people.

Is there anything else happening at PeleGuy that you’d like to highlight?

We are very excited as we are about to shift to a new ‘top of the range’ sales software that will allow our customers to place orders online in a much more convenient way. They will be able to see all the current offers, create ‘favourite’ lists, view their order history, view popular and best-selling products, see their history of sales – by product volume and value; create a contact request, pay their bill online etc. And our own PeleGuy App will be available to download for Apple and Android users for the smoothest and sweetest customer experience while shopping online with us. ■

“

As a former sportsman – an ex-superbike racer to be exact – I enjoy moving fast, and that includes being the first to market with the latest gadgets, novelty products, and hot items.”

– Yaniv Peleg

Yaniv Peleg Director

28 June/July 2023 | C&I | www.c-store.com.au 2023 LEADERS FORUM

PeleGuy Distribution

Haydn Gearon, National Sales Manager – ANZ, Rich Products

What have been the main highlights for Rich Products over the past 12 months?

Seeing the growth of f’real throughout the ANZ marketplace has been a real highlight for us at Rich Products. Volumes are growing substantially, and we expect that growth to continue for some time.

F’real is a unique offer, which ticks all the boxes. It is convenient – the product is all in the cup, the customer chooses their flavour (and thickness), inserts it into the f’real blender and in a minute, they have a fully formed thick shake or smoothie. Stores love it because the self-serve blender is also self-cleaning, so other than basic housekeeping there is very little store staff interaction required.

Despite being in the relatively early stages of our growth in ANZ, f’real trends quite regularly on TikTok – the brand and the offer seems to resonate with the core customer. We had a recent installation that went viral due to a TikTok video, the site sold more than 1,000 units in three days.

What will be the main focus for Rich Products for the remainder of 2023?

On the f’real side of our business our focus will be in on the development of new products. Our current range sits at six SKUs (by comparison, in the US, where f’real has been a market leader for more than 20 years, we have twice that

amount). We’ll have a couple of new f’real shakes for next summer. Constant innovation and ‘new news’ are critical for the continued growth of the brand.

For the other parts of the Rich Products business, we continue to pursue growth in our toppings and icings product ranges, to the bakery, dessert and beverage segments as we develop our omnichannel approach.

What do you enjoy most about what you do?

When it comes to f’real, I enjoy seeing the growth we are achieving with the brand and the results our customers are getting out of it. We find that with f’real, our customers are getting new users into their sites, that’s incremental business (and good for their business) so it’s a win/win for everyone.

My role at Rich’s is quite varied, so no two days are really the same. From presenting to senior management to going through the basics of f’real blender maintenance at a remote site in Australia or New Zealand, there is never a dull moment.

Is there anything else that you’d like to highlight?

Watch out for us at the C&I Expo of course, come and try a shake and enjoy the f’real experience firsthand. As I mentioned we will have new lines coming through for summer so watch out for that as well. ■

2023 LEADERS FORUM

What have been the main highlights for Fujifilm over the past 12 months?

TPG Store of the Future (STOF) – This is a total rethink for TPG and we have worked with them and their planning team to have more focus on an LED solution in-store. They have gone with one large 2.5m LED Screen and banners above their product bays driving customers in-store. These products have been custom made to suit but also provide TPG with a consistent look and feel to engage with their customers.

What will be the focus for Fujifilm for the remainder of 2023?

We will have further focus on TPG’s STOF but we are really looking forward to working with new customers like Lowes Fuel to further enhance their customer experience in-store.

What do you enjoy most about the convenience channel?