BEST

about

precise combination of high-quality natural ingredients;

essential vitamins and minerals. Nourish your dog with the tailored nutrition they need to bring out their best everyday.

with real meat,

Welcome to the October/November issue of Convenience & Impulse Retailing magazine. What a pleasure it was to be able to hit the road for a few days with the AACS Down Under Study Tour in Sydney and learn all about the latest innovations in convenience retail at some really remarkable stores, and of course, to catch up with a few friendly faces.

It really makes me proud to be part of an industry that, despite tumultuous events across the world that have rippled into our own, is united and eager to both learn and share insights with each other.

Speaking of sharing knowledge, in this issue

we look into banner groups and how being part of such an organisation can help its members develop strategic plans to develop and grow their business into a more successful operation.

We also take a dive into the impressive rise of the functional beverages category and how retailers and suppliers alike can capitalise on the growing movement of healthconsciousness amongst consumers.

As always, we are grateful to have our regular columns from Theo Foukkare, CEO, AACS and Darren Park, CEO, UCB Stores, and Dan Armes, Founder, ServoPro, and Skye Jackson, General Manager Merchandise, Ampol.

To our readers, the team at C&I had a ball putting this issue together, and hope that you get as much joy out of reading it.

Indulging Australians for more than 20 years, Signature Desserts’ singleserve cheesecakes are optimally designed for impulse purchases and easy on-the-go snacking.

The innovative packaging for the 100g cheesecake wedge was designed by Trevor Hansen when he was selling his cheesecake from an industrial snack bar, and even includes a spoon.

With an attractive starting RRP of $2.99, the single-serve desserts enable retailers to capitalise on the escalating fast-food market and meet the consumer demand for innovative, readyto-eat desserts.

Tic Tac has announced its latest flavour innovation, Tic Tac Tropical Mix, just in time for summer.

Tic Tac’s iconic breath-freshening mints in a signature flip-top box have been made in Lithgow, Australia since 1976.

Always surprising customers with fresh taste sensations, Tic Tac has grown to become one of the world’s leading brands in pocket confectionery with a wide range of minty, fruity, and original flavours.

The latest flavour to join the range, Tropical Mix, features a combination of juicy pineapple, zesty passionfruit, and delicious mango, bringing together a burst of vibrant tropical fruit flavours.

Tic Tac Tropical Mix will be available in 24g packs across Australia and New Zealand.

Scan the QR code for more information

The Intermedia Group

additional

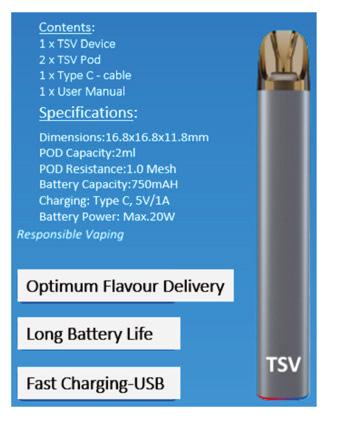

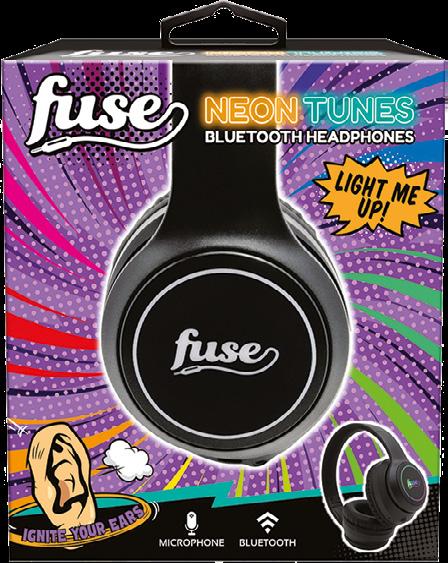

TabSol Australasia has developed TSVT – Tribal Spirit Vape with Cannabis Derived Terpene (CDT) as its base flavour, providing consumers a legal choice and access to better alternatives.

TSVT – Tribal Spirit Vapes with CDT meets all legal guidelines. The terpene is of superior quality and does not contain any CBD or THC – the active ingredients that create the ‘high’ that people experience when they use cannabis and therefore is legal for retailers to sell. TSVT is available in four flavours; Natural, Blueberry, Classic Virginia, and Grape.

TabSol Australasia has also launched the TSV Vape device that is specially calibrated for the TSVT e-liquid. The rechargeable pod system comes with two refillable/replaceable pods. The CDT vapes will soon also be available in a convenient disposable vape format.

To Order the TSVT E-Liquids and the TSV Vape pod system contact the TabSol team on 02 9037 1478, 0413 690 069, email at info@tabsol.com.au.

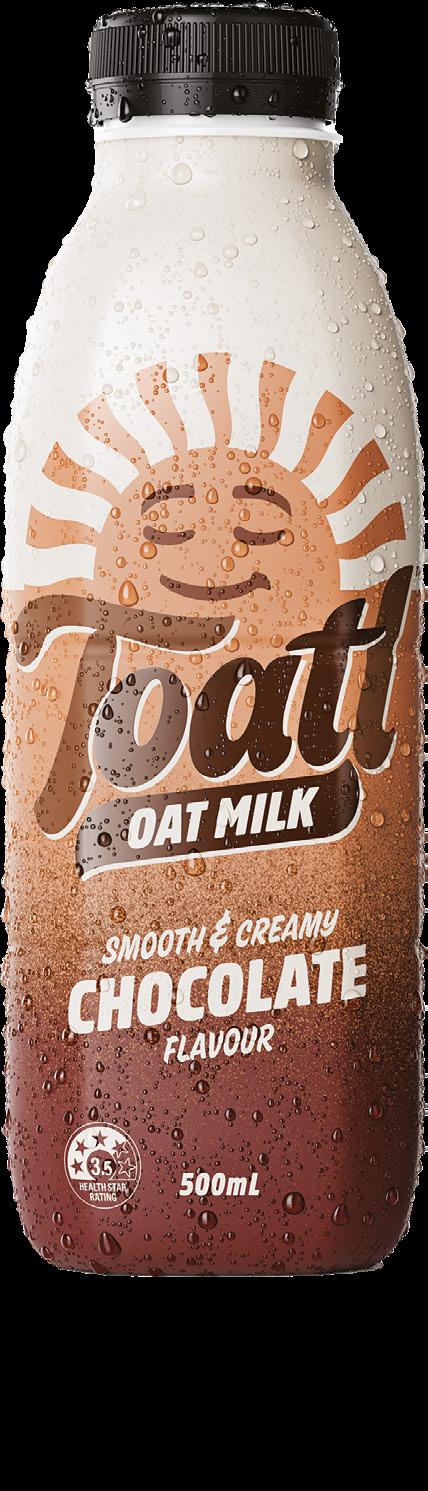

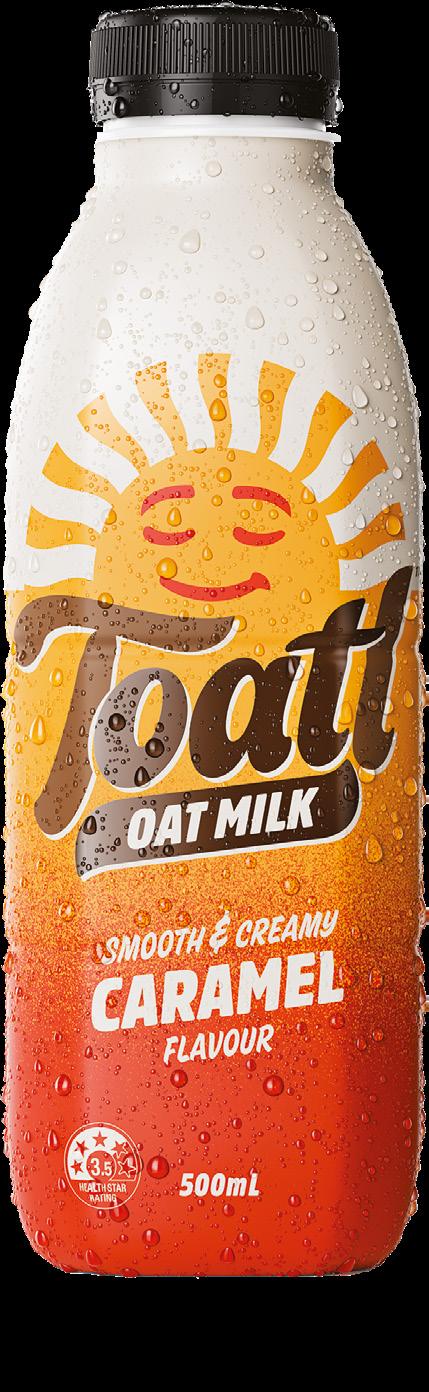

With oat milk growing almost 10 times faster than the total plant based milk category, the launch of Toatl flavoured oat milk is set to shake up flavoured milk shelves across the country.

Smooth, creamy and 100 per cent yum, Toatl comes in three delicious flavours – Chocolate, Caramel and Strawberry.

Made with Aussie oats, high in calcium and packed with essential vitamins A, B2, B12 and D, Toatl is the plant based flavour hit your customers have been looking for. It launched in September 2022 in various P&C outlets nationally.

based

and activities.

As part of our company policy we ensure that the

and

and

The mention of a

used

or

are sourced from

and

been

produced from sustainably

and is

PEFC certified wood and paper products come from environmentally appropriate, socially beneficial and economically viable management of forests.

The wrapping used in the

DISCLAIMER

process of this

is

recyclable.

This publication is published by

(the

Materials in this

have been created by a variety of different entities and, to the extent permitted by law, the

accepts no liability for materials created by others.

materials should be considered

by

by

The

expressed

not

company officers or employees. Any use of the information contained in

of the person using that information. The user should make independent

is

property laws. Unless you are

or the

and

owner to do so, you may not

any of the materials.

I was ready for a new personal challenge – to test myself in a new industry and extend my retail leadership capabilities.”

Fiona Hayes grew up in Melbourne as one of six children. Now, as the new General Manager Channel at 7-Eleven, she is working to change the face of convenience retail.

Igrew up in Melbourne in a very busy household with six kids, my Mum and Dad. With four older brothers and a younger sister, our family was lots of fun, family-oriented, and quite busy! We always had a full house with friends visiting regularly.

Growing up, we all played a lot of sport – for me it was basketball, tennis, and netball, and that kept me busy. Holidays often involved trips to regional Victoria to visit grandparents and cousins or we would go camping over summer at the beach.

My first job was delivering the local newspaper, and then when I turned 15, I began a part time job at Red Rooster. All but one of my brothers worked at Red Rooster along with many other teenagers across our neighbourhood. It was a great training ground in customer service and food service.

I have always been a big traveller and during Year 10 I went to the US as an exchange student. I also travelled to New Zealand thanks to the savings from my part time job – that got the travel bug going. Since then, it’s been numerous trips to the US, Europe, Asia, and New Zealand. I have also worked in the Philippines and travelled to India multiple times as part of my

previous roles. Essentially, I travelled overseas every year, or even multiple times a year, until the pandemic closed the borders.

My husband Glenn and I have two young boys in primary school. Glenn previously worked in the shipping and logistics industry but over the last eight years he has been running the household.

I went back to work when my youngest was 10 months old and Glenn left his role at the same time to take over the day to day running of the family. We are very fortunate to have one of us at home full time to do all the necessary caring duties as well as take on extra roles like basketball coach, footy coach, and caring for family members.

I have just started in a new role as General Manager Channel at 7-Eleven Australia. Prior to joining 7-Eleven, I had enjoyed a rich and varied career over 26 years with Telstra. I joined Telstra in a frontline customer service position and built a breadth of experience and capability by being regularly challenged with new roles and promotions. Over the last 12 years, I was a member of the Telstra executive team and during this time I led two of the large channels to market for Telstra – the Global Contact Centre business and Telstra’s Retail and Regional business.

Fiona and members of the 7-Eleven Channel teamWhile I have worked in a range of different positions, I have always been drawn back to ‘channel’ roles. Personally, I love the direct connection with customers and people. I find it very motivating and rewarding to see the direct impact of the work you’re doing in real time, through the direct and regular feedback from customers and our team members. You know you are alive when you run a channel team!

I was very attracted to the General Manager Channel role at 7-Eleven as it has all the attributes I was looking for. Specifically, being part of a leadership team that is committed to leading the market with a culture of innovation. It provides a channel to lead and the direct connection with customers and team members, as well as some big strategic opportunities to get stuck into.

It’s energising to be part of a team that’s committed to changing the face of convenience retailing by going above and beyond traditional food offerings, introducing new formats and expanding our digital capability and digital engagement with our customers. I am really looking forward to delivering our strategy and growing the business.

Over the course of my career, the main highlight has been establishing a career as a Channel Executive. From the early beginnings as a frontline team member to now leading large channel teams and being part of the strategic leadership of Telstra and now 7-Eleven. It’s not one specific moment, but a series of opportunities and experiences over my career that have led me to where I am now.

I have always been a very grounded leader – by that I mean ensuring I am connected with customers and the people that are delivering for customers every day. The relationships I have with the people who are frontline with customers, and the insight they provide, have meant I have been able to engage, lead, and enable my teams to deliver significant change and transformation to benefit our customers.

In my spare time, I like to exercise and stay fit. That involves sessions at the gym, walks and playing tennis. I played lots of basketball and tennis growing up and have gotten back into tennis again over the last couple of years. It’s a good way to catch up with friends and get some exercise in.

Another interest is cooking. Feeding a crowd is a favourite pastime and comes very naturally. After growing up in a big family I often find it easier to cook for 10 rather than for two. I also like heading out to see live music – it’s been great to be able to do that again after all the lockdowns. And travel! I can’t forget about travel.

I have never been one to have a five year plan, I do however have goals and objectives for how I want to live and the work I will get involved in that I reflect on. For me, this is less about the line in the sand moment of five years from now and more about continuing to expand my tool kit of skills and capabilities, while being part of organisations that can make a difference in the lives of Australians.

I left Telstra as I was ready for a new personal challenge – to test myself in a new industry and extend my retail leadership capabilities. C&I

It’s energising to be part of a team that’s committed to changing the face of convenience retailing by going above and beyond traditional food offerings.”

Fiona checking in with members of the Telstra team in Darwin

C&I EXPO 2023 WILL BE STAGED at the world class International Convention Centre in Sydney. Perched on the edge of sparkling Darling Harbour, ICC offers a CBD location with accommodation for all budgets and proximity to convenient transport services. To book your stand or request an exhibitor prospectus, contact Safa de Valois at safa@c-store.com.au or +61 (0)405 517 115

“It has been good to meet a bunch of new potential customers, including multi-site operators in Victoria, New South Wales, and Queensland. It is great that stores are looking for new buying options, such as ranging toys or our range of mobile phone accessories for example, rather than relying on existing suppliers as they are looking for a point of difference.” - Tal Avraham, Smooth Wholesales

"At this stage, the response so far at this year’s C&I Expo has been far better than we have ever had before. The amount of people that have shown interest and we are not talking about the normal one or two site owners. Yesterday we had more than 12 enquiries and this morning on the second day we have already had six - so I would have to say that this year’s Expo has been the most successful I have ever been to. If you want to kick-start your business, this is the place where you want to come.”

Vern BrickmanAdverto & PumpTV Global

“Today we have been run off our feet with quality enquiries with a lot of interest from our target market. This has been due to an excellent show combined with excellent advertising in C&I as we have relaunched our product with new branding that is more suitable to our target market. We have seen multi-site operators, service stations, groups who own 300-400 stores as well as food service buyers. All I have to do is to transfer them from enquiries to sales and I’ll be a happy chappy.”

-Trevor Hansen, Signature Desserts

“This show has been quality over quantity and having really good in-depth conversations with great retailers. I feel like I have done a dozen mini-range reviews here on the floor of the exhibition - it saves everyone’s time, and I can get cans in hands on the spot. We have seen multi-site operators from the convenience banners - one has 600 stores up the Eastern seaboard. It is a great opportunity to get a lot of work done and see a lot of people all at once. The buyers are inquisitive and looking for new products and inspiration.”

- Murray Raeburn, Calm & Stormy

- Murray Raeburn, Calm & Stormy

Liberty Oil was established in 1995 by founding partners David Wieland and David Goldberger, whose names might be familiar as they were the founders of the giant that was Solo service stations in the 70s and 80s.

Wieland and Goldberger started Solo in 1974 and built it into the largest independent fuel retailer and distributor in Australia. The Solo chain was a part of the Australian Council of Trade Unions (ACTU) project that aimed to sell petrol across Australia through independent operators at significantly lower prices.

Liberty Oil Convenience at Ferntree Gully offers great coffee, great value, and even greater service. Transparency and collaboration are key to ensuring that the store keeps up with the market and consumer needs.”

– Leigh McCullochThe chain was later sold to Ampol, and Wieland and Goldberger took some time out of the industry due to a non-compete clause. But in 1995 they decided to start again with a renewed vigour and focus, founding Liberty. Now, almost 30 years on, Liberty has more than 85 convenience stores across Australia and is growing.

Liberty Ferntree Gully is one of the newest sites to open and has been trading for just under one year. The store has a truck canopy, barista and self-serve coffee, and an eatery area for customers to enjoy their coffee or a selection of hot food.

Leigh McCulloch, Retail Manager at Liberty Oil Convenience, tells C&I that the experience the store is looking to give its customers, comes down to high-quality products at great value, and a good variety of food for travellers on the move.

“Transparency and collaboration are key to ensuring that the store keeps up with the market and consumer needs,” he says.

According to Evan Badlee, Liberty's National Food Manager, most stores are built with their own onsite kitchen. This enables the stores to create fresh cooked and prepared food every day.

“Our trained store operators can create their own special offers while their menu is based on a core range that you will find in most stores across the nation. This way our customers will be familiar with our offer from store to store, and they will be able to trust our brand and know what to expect,” he says.

“At Liberty, we are very passionate about delivering the best cup of coffee to our customers using the best German and Swiss Super Automatic Coffee Machines trusted by the world’s coffee roasters for their reliability and durability,” says Adriana Ivtingioski, National Coffee Manager.

“Barista-made coffee is also available at selected stores across Australia. Our staff are passionate and trained baristas who take pride in delivering that perfect cup of coffee to start your day or as an afternoon pick-me-up.”

Ivtingioski says that a key priority is that customers know they can come to Liberty Ferntree Gully, and in fact any Liberty Oil Convenience store, and know that they will receive a consistent, high quality cup of coffee.

“Our coffee is roasted in one of the largest and most advanced coffee roasters in Australia. Every bag of coffee has been crafted by a team of coffee experts with decades of experience. Our roaster sources the green beans ethically and roasts only the best.

“After months and months of taste testing, we at Liberty have chosen a blend that suits our customers, featuring Arabica, medium roast, earthy with spicy dark chocolate notes with a rich hazelnut crema.”

McCulloch has noticed there has been a change in consumer expectations of convenience retailers and a growing demand for stores to supply things like home delivery. Furthermore, there’s been an increase in the merging of e-commerce with in-store retailing to enhance customer journeys.

One way that Liberty Oil Convenience has been working to enhance its customer’s journey is through its loyalty program, which help its customers to save on fuel and in-store products.

“Our Liberty Loyalty programs allow our customers to save as they drive using our Mate Cards and Liberty Loyalty cards. We have three Mate cards that offer fuel and in-store credits,” says McCulloch.

Much like the philosophy of the old Solo service station chain, Liberty Oil strives to provide high quality of service and value for the customer through initiatives like the Liberty Loyalty program as well as its exceptional fresh food and barista made coffee. C&I

The perfect spot to enjoy barista-made coffee

An impressive range is on offer

The menu is based on a familiar core range

The perfect spot to enjoy barista-made coffee

An impressive range is on offer

The menu is based on a familiar core range

Tonik Nutrition is a sports nutrition brand, part of 100% Australian-owned and ASX-listed, Halo Food Co, Australasia’s largest Sports Nutrition manufacturer. With 25 years of local and international contract manufacturing experience, Halo is the go-to contract manufacturer for health and wellness products in Australia.

There has been a boom in pet ownership across Australia, but has the P&C channel capitalised, asks Thomas Oakley-Newell.

With roughly 30.4 million pets in Australia, higher than the number of people, it makes sense that pet care products should be as accessible as possible.

Research by Animal Medicines Australia (AMA) shows that dog and cat owners spend on average $3,237 and $2,074 per year on their pet, bringing the total spend for dog and cat owners nationally to $20.5 billion and $10.2 billion respectively, meaning there are opportunities abound for the P&C channel to capitalise on this spend.

Ben Stapley, Executive Director of Animal Medicines Australia, said Australia has had a boom in pet ownership like we’ve never seen before.

“We estimate there’s now 4.6 million dogs in Australia, meaning there are four legged friends in 47 per cent of all Australian households.”

Samantha Davies, Account Manager of Mass and Impulse at Purina Petcare, said over the past 18 months she has experienced how important the P&C channel is in regard to pet care.

“Our objective is to grow the category further by providing retailers and consumers more choice and accessibility to our strong performing brands. There is significant opportunity within this channel for further growth and Purina will continue supporting the P&C channel by providing optimised product ranges ideal for smaller format and independent convenience retailers.”

Purina Petcare is the producer of one of the strongest performing products in P&C – Supercoat Dry Dog Food, which is the top ranked brand in the dry dog food category in grocery. It has 70 per cent brand awareness and high penetration, with one in three shoppers purchasing the product. Supercoat has also just been relaunched.

“The Supercoat relaunch spreads across four key areas and will be heavily supported with media campaigns. The four areas include product reformulation; enhancing the formulation and adding additional kibble shapes to meet the needs of all breeds. In terms of packaging, Supercoat is available in a 2.8kg bag size, and the specialised nutrition products have changed to 2.6kg.

“Purina has also refreshed the design of the pack ensuring that the key product benefits are in a stronger focal position, enhanced the Supercoat logo and refreshed the lifestyle image on pack. Enhanced colour coding for variants will ensure easier shopper navigation. And lastly, recyclability: The Purina Care logo has been added, highlighting the recyclability of the pack as well as Purina’s sustainability initiatives.”

Davies said that the wet cat food segment is another strong performing segment in P&C.

“Fancy Feast continues to deliver growth and is a significant contributor to growth across the wet cat food category. Felix is another wet cat food brand that has continued to accelerate and helps premiumise the wet cat food category.”

Darach de Búrca, Portfolio Marketing Director of Care and Treats at Mars Petcare, says consumers now have more choices than ever on where and how they get their groceries – pet care products included.

“We want to make sure that our brands are available to pet parents whenever they need them, and the 24-hour availability of the P&C channel can be a lifesaver if you realise your fussy cat is out of Whiskas at 7am.”

Just as the better for you trend is a growing segment in the human market, de Búrca says that also rings true for pets.

“Additionally, we’ve noticed that as we’re paying closer attention to our own health, we’re also increasingly examining what’s in our pets’ bowls. Pet parents are looking for products they see as fresh and healthy; that utilise strong scientific claims; and those that are doing the right thing when it comes to sustainability.”

Making the most of the impulse nature of the P&C channel, de Búrca believes that up to 70 per cent of care and treat purchases are impulse or unplanned.

“The category is highly expandable, so there is a huge opportunity to increase the physical availability of these products.”

De Búrca said Mars Petcare has a lot of innovation coming out of the care and treat category this year to help continue to meet the needs of parents, serve more pets, and, of course, to delight and excite pets.

“A personal favourite of mine is our new BBQ range of Schmackos, for that lip-schmacking flavour. We’re also finding new ways to showcase our values to shoppers, with activations that direct funds towards causes they care about, like coral reef restoration with Dine cat food, and wildlife conservation with our Lion’s Share partnership.”

As people are spending more and more time at home with their pets, giving treats and snacking at the same time as your pet is a growing trend.

“The care and treats categories have seen sustained growth over the past two years, suggesting that we’re snacking with our pets while we work from home. Additionally, the rapid embrace of online shopping across the grocery and specialist channels has seen consumers experiment with their shopping habits, including with subscription models,” explained de Búrca.

Noting consumer trends, Davies says that the pet treat category is one to keep an eye on as it is the fastest growing category and the second largest contributor to overall pet care growth.

“Purina’s best performing treat is Lucky Dog Bones Original 800g. This product is the best performing product in the Dog Treat snacking segment and is available to P&C customers through The Distributors.”

Davies also recognised that shopping for pet products in the P&C channel is commonly a less planned purchase.

“For this reason, it is important to disrupt shoppers to remind them of your pet food offering. This can be implemented with off locations, in-store offers, and point of sale to draw attention to the category.”

– Samantha Davies, Account Manager of Mass and Impulse, Purina Petcare

It is important to disrupt shoppers to remind them of your pet food offering. This can be implemented with off locations, in store offers, and point of sale to draw attention to the category.”

The 24-hour availability of the P&C channel can be a lifesaver if you realise your fussy cat is out of Whiskas at 7am.”

– Darach de Búrca, Portfolio Marketing Director of Care and Treats, Mars Petcare

Ben Whyatt, Founder of Doggylicious, a brand that produces dogfriendly peanut butter and cookies, and who has previously had his products stocked in OTR, said his biggest learnings from venturing into P&C is that impulse purchases are pivotal to the channel.

“I don’t think any dog owner would go into an OTR or 7-Eleven to top up on dog treats or dog food. It has to be an impulse purchase. They go in to top up their petrol and buy themselves a chocolate bar or maybe a coffee and get out, even if the dog is in the car.”

Whyatt believes one of the biggest challenges facing pet care in P&C is making the consumer aware that the store stocks pet products and thinks that stores need to make themselves known as a dog-friendly.

“Instead of leaving the dog in the car, can they welcome dogs into the store? Are there dog washes at the site? There needs to be things that make it known that the store is dog friendly, so that the customer gets the perception that they can bring their dog in and treat them.”

Pulling the pet products out of the dark corners of the store is something Whyatt says is needed to help increase the opportunity for an impulse purchase.

“Take away a SKU that maybe isn’t performing as well but is in a prime location and replace it with a dog-friendly treat. So that when you’re buying yourself the chocolate bar, you think here’s a treat for my dog that’s sitting in the car. That kind of incremental purchase is needed as now there are far more people with a dog in the car, whether they’re on holidays, weekends away, or just a trip to the park.”

Davies said that the display of pet food options is vitally important and recommends three key planogram principles to focus on.

“It helps to cluster different animal groups, for example, dog and cat as this will aid in shopper navigation. Secondly, ensure fair share of shelf – adequate space allocation for each subcategory focusing on categories of growth, for example wet cat food and treats. And thirdly, follow a good – better – best flow to allow trade up into higher $/kg brands.” C&I

The smart choice for the right nutrition

As one of the fastest growing categories, functional beverages has had a positive impact on not only consumers’ minds and bodies, but also the channel, writes Thomas Oakley-Newell.

As

people pay greater attention to what they’re consuming, the desire for products that yield a positive impact on both mind and body is growing.

In the AACS State of Industry Half Year Report 2022, it was reported that functional drinks was the fastest growing category within packaged beverages, growing an impressive 12 per cent.

Jake George, Australian Sales Manager at Arepa, said they’ve noticed that more and more people are making conscious choices when it comes to their beverage selections.

“Consumers are taking the time to research exactly what they are drinking and the benefits the beverage will provide them. Convenience shoppers are increasingly looking for healthy alternatives to the traditional beverages we associate with P&C. As a company, we’ve worked to make the science and research behind our products readily accessible, so consumers have the ability to educate themselves and make informed decisions at the point of purchase.”

Kristian Johannsen, Managing Director and Founder of Bobby, a company that produces healthy ‘unconventional’ soft drinks, agrees that within the functional beverage category there is a consumer expectation that products must embrace a holistic approach and deliver goods that genuinely fulfil ‘better for you’ brand promises.

“Major players in the food and beverage space have got away with buzzwords and asterisks for far too long, consumers are now more educated than ever and can recognise when big brands are trying to health wash products.”

Johannsen believes that moving forward we can expect to see changes in governance around health benefit claims, more sustainable business practices, and an increase in demand for natural ingredient-based products.

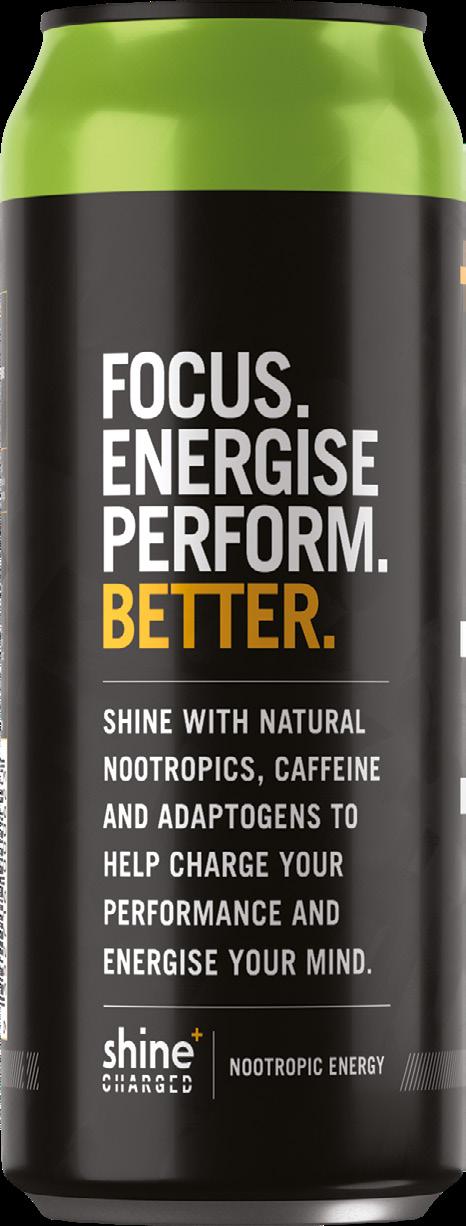

James Noakesmith, Brand Manager ANZ of Shine+, agrees that in recent years the pandemic has affected the whole world in numerous ways.

“New work environments have been established, health and immunity have been a household topic driven by the uncertainty stemming from multiple lockdowns, positive case numbers and much more.”

Discussing the changes in society from the impact of Covid, Noakesmith believes that this shift has influenced the way individuals value convenience.

“Although the pandemic created physical boundaries, at the same time it created new opportunities for individuals to engage with their local communities like never before. P&C,

which was traditionally an impulse interaction, has begun shifting towards a consumer destination for dry goods, meals, snacks, fresh produce, and Shine+ of course.”

Noakesmith continues that P&C is an incredibly influential channel in the functional beverages category and for Shine+.

“It plays a significant role in helping people think, feel, and do better at scale. P&C is at the roots of Shine’s shift from what was in the early days an initial focus on independents to ‘BigCo’. Through independents and e-commerce, Shine+ built brand loyalty, velocity, and proof of concept, which later provided the strong data that administered our first national ranging.”

Santino Luciano, General Manager of Sales and Marketing at Remedy, said both P&C and independent grocery play an important role for Remedy as it looks to continue to convert new drinkers to its range of better-for-you drinks.

“P&C plays a huge role in capturing people on-the-go during key beverage consumption moments to encourage trial, making it a key channel in our drive to make Remedy more accessible to more consumers. We know our P&C retailers are also very focused on increasing their range of healthier options. We believe we can convert a lot more people to choose a Remedy over another fizzy drink filled with sugar or artificial ingredients.”

The channel, along with independent grocery, has allowed Arepa the opportunity to reach an entirely new customer base.

“Typically, customers who shop via these channels are on the go and are looking for specific products to suit an immediate need. By having our product readily available in these channels, especially as Arepa’s brand presence grows across the country, consumers will have easy access to a scientifically backed, healthy brain food when they need a boost in their mental performance,” explains George.

While for Johannsen, the P&C and independent grocery channels form a vital part of Bobby’s growth strategy and are key in enabling them to access on the go customers.

“As we’re just starting out, ‘number of doors’ is a vital metric for us and the initial support we’ve received from these channels has been overwhelming.

– Jake George, Australian Sales Manager, Arepa

“We currently have a mix of data from independent grocery and multi-site P&C retail partners for our current range, which show Cola as the most popular flavour; with that said, we’re primarily seeing an even spread of sales across our core range, which is really pleasing.”

As businesses realise the growth potential within the category, an increasing number of players are entering, and George says that the category is becoming more saturated with new products.

“The challenge we face is making our product known and front of mind when consumers are purchasing such beverages, particularly if they don’t often delve into these beverage categories. To further uphold integrity and legitimacy of our products, we are conducting more clinical studies across Australia and New Zealand.”

Lisa Schilling-Thomson, National Sales Manager at Halo Food Co, producer of Tonik protein-based RTDs, said the brand is launching in both EG Australia and OTR later this year, while it already has new ranging in 7-Eleven, as well as independents.

“Independents offer a new brand like Tonik the opportunity to be introduced to their customers from a ground level, enabling organic growth without the massive capital investment required by the majors.”

Staying ahead of the game in a fast-growing category is incredibly important, and Level Beverages is doing just that with its latest innovation – Level Lemonade and Cola.

Chrish Graebner, Founder of Level Beverages, said the new drink is low in sugar, high in vitamin C and Magnesium, and tastes just like a soft drink.

“Cola is the largest flavour segment in carbonated soft drinks. But the real last innovation in that area, attracting the mainstream appeal, was low sugar – but that was about 30 years ago. In many channels, the low sugar Cola versions outsell the normal sugar versions.”

Convenience shoppers are increasingly looking for healthy alternatives to the traditional beverages we associate with P&C.”

Graebner said that when blending the new flavour, they’ve created a ‘functional Cola’, and the amount of vitamin C and Magnesium means it is a formulated supplementary sports drink.

For Shine+, its latest innovation is the Shine+ Charged 500ml cans, which come in five flavours: Wild Tropical, Grape, Blood Orange, Mixed Berry, and Yuzu Lemonade. The initial launch of the Shine+ Charged range saw Grape sold exclusively in 7-Eleven nationwide for a short time, and Mixed Berry into Ampol sites across Australia.

“Early signs of positive velocity regardless of Shine+ being on or off-promo proved the range’s feasibility to ‘stick’. The standouts among the Charged range to date, have been Grape and Mixed Berry, which are among some of the top sellers in the overall energy category right now.

Shine+ made the decision to be shelved within the energy space, which Noakesmith said has been pivotal to awareness and building brand loyalty.

“Shine+ has prioritised physical positioning within the energy space, firstly to ensure that we are playing within the space that is most relevant to the solution that we are solving, but more importantly, to educate the energy/functional beverage consumer that there is not only a better substitute for bad energy that will help you think, feel, and do better but one that tastes amazing without the compromise on health.”

The emergence of a better-for-you segment within energy is a trend that Remedy has also identified. Luciano says there are both major existing and new energy players bringing innovation this space, including Remedy.

“The opportunity in this space can be seen in the data for our Remedy Shots performance in P&C, where our energy SKU leads the way versus Immune+ performing best in grocery.

“We have also just launched Remedy K!CK, a tasty all-natural, no sugar, energy drink that delivers a caffeine kick without the sugar crash. Remedy K!Ck is designed to appeal to those who are looking

P&C which was traditionally an impulse interaction, has begun shifting towards a consumer destination for dry goods, meals, snacks, fresh produce, and Shine of course.”

– James Noakesmith, Brand Manager ANZ, Shinefor a mental boost but would prefer to avoid drinks full of sugar and artificial ingredients. We are super excited for this launch and its potential to expand, led by P&C and independent grocery.”

Arepa recently launched Arepa Brain Shot for Protection to the Australian market for the first time, sold exclusively in Woolworths.

“The shot features Arepa’s patented formulation of Neuroberry blackcurrant juice with the addition of a new superpower ingredient, Bacopa Ayurvedic herb, Bacopa is clinically proven to have properties that positively impact cognition and memory, as well as having neuroprotective effects through its antioxidant and anti-inflammatory mechanism,” explained George.

Schilling-Thomson said that functional beverages have evolved over the past six years as key ingredients change constantly.

“This provides innovation to the category when range reviews come around, but is it innovation that keeps your customers coming into sites and repeat purchasing? Generally, not. What consumers are looking for are great tasting products, with key functional ‘clean’ ingredients that really are a step to living a better, healthier life.”

C&I

Over the past few years, Australia, and the global community, has witnessed a change in the way consumers are enjoying tobacco, with the introduction of e-cigarettes or vapes.

While other countries embraced the change and regulated the new products, the Morrison Government’s response was to ban such products being sold in Australia, leading to a highly profitable black market, or money being forced out of the local economy and being spent overseas as consumers legally imported products.

Theo Foukkare, CEO of the Australian Association of Convenience Stores (AACS), says that the effect of policy failings across the board in containing and eliminating both illicit tobacco and illicit e-cigarettes is having a negative effect on population health and the degeneration of legitimate retailers.

“The illegal sale of illicit tobacco and nicotine vapes continues to add downward pressure on tobacco sales and the associated loss of bundled purchases by the tobacco consumer.

“A recent KPMG report on illicit tobacco has the current rate of sales at 19.3 per cent, an increase from 2020 of 2.4 per cent (16.9 per cent). The black market for nicotine containing e-cigarettes has exploded since prohibition was put in place in October 2021.

“Products are readily available in illegitimate retail outlets, taking away valuable foot traffic from legitimate retailers, therefore decreasing overall basket sizes, and having a major impact on all categories, just not tobacco sales.”

Foukkare says that a recent Roy Morgan study released by AACS estimates there is now 1.1 million adult nicotine vapers in Australia, and that the illegal nicotine vaping industry could be worth upwards of $1.5 billion per annum in Australia.

The impact is being felt across the board, with Pradeep Kumar, Director of TabSol Australia, stating that the prevalence of illicit tobacco and nicotine vapes is the biggest challenge facing the industry right now.

The introduction of new smoking products has seen a radical shift in the way people are purchasing and consuming nicotine, but how will the industry react, asks Thomas Oakley-Newell.

“The widespread availability of illicit tobacco and nicotine vape products is impacting the whole industry. Due to the lack of enforcement of regulations and control at our borders, nicotine vapes and illicit tobacco products are hitting our streets at an alarming rate. Nicotine vapes are so easily obtainable, consumers and the illegal traders are treating it as normal and acceptable.”

TabSol, which wholesales zero-nicotine Tribal Spirit Vapes, has always followed the legislation that has been in place and ensure they only distribute legal non-nicotine vapes.

“We have commissioned independent tests to ensure there is no nicotine nor any banned chemicals. It is the lack of enforcement of the legislation by the authorities that is concerning and impacting all law-abiding businesses.”

Kumar says that unless the authorities take serious action to control the illegal nicotine vape sales, legal suppliers such as TabSol will suffer.

“Our distribution of TSVo - Tribal Spirit Vapes (Zero Nicotine) has slowed down due to the widespread availability of nicotine vapes. Due to the flood of nicotine vapes, the only legal alternative – zero nicotine vapes, sales are slowing down.”

Despite the current challenges facing the industry, the P&C and independent grocery channels are still of great importance to many brands in the category.

Phoebe Tacon, National Business Manager P&C at Imperial Brands, whose portfolio includes JPS, Davidoff, and L&B, says that the two channels combined represent more than 8,500 single and multi-store operators across Australia.

“Most of these stores provide a comprehensive range of tobacco products and accessories to consumers, with great customer service at competitive price points.

“Shoppers are responding positively to the category offer in independents and convenience and share of trade has been strong. Grocery independent has grown from 14.3 per cent in 2019 to a high of 17.0 per cent in 2022, whilst P&C has remained solid at 11.5 per cent. This means almost one in every three tobacco sales in Australia are made in these channels.”

For the independent grocery channel, Tacon believes their share of trade will be challenged by the tobacconist and grocery organised channels once return to work has normalised and shopper behaviours return to pre-Covid routines.

“However, this also provides a great opportunity for Independents and Convenience to continue the improvement and consistency of the shopper experience they have delivered to date.

“Imperial Brands is committed to partnering with Retailers to develop solutions that drive footfall and category penetration in your stores.”

The P&C channel is one of the priority channels for TabSol, explains Kumar, as the convenience channel tends to overindex on tobacco and associated goods sales compared to some other channels.

“TabSol offers quality tobacco and e-cigarette products at value for money prices, therefore convenience stores are a focus. The sheer number of stores, their national coverage, and their mostly organised nature makes the convenience channel good and easier to deal with.”

Recognising the role that Imperial Brands play in reducing the harm caused by combustible tobacco products, Gary Dickson, Regulatory and Legal Compliance Manager at Imperial Brands, says they understand society’s concerns about the health risks of smoking and as a result, are increasing their attention on nicotine alternatives.

- Theo Foukkare, CEO, Australian Association of Convenience StoresThe illegal sale of illicit tobacco and nicotine vapes continues to add downward pressure on tobacco sales and the associated loss of bundled purchases by the tobacco consumer.”

TabSol offers quality tobacco and e-cigarette products at value for money prices, therefore convenience stores are a focus. The sheer number of stores, their national coverage, and their mostly organised nature makes the convenience channel good and easier to deal with.”

- Pradeep Kumar, Director, TabSol

“Imperial Brands Australasia does not currently market or sell any Next Generation Products (NGPs) in Australia. We are committed to making a meaningful contribution to tobacco harm reduction and our global portfolio includes a range of NGPs including vapour, heated tobacco, and oral nicotine.

“Many regulators and public health bodies have concluded that NGPs, including vape products, are less harmful alternatives to smoking, and therefore have a positive role to play in reducing smoking-related disease. We encourage the Government to recognise the reduced risk potential of NGPs and to develop balanced regulation and fiscal policies that support tobacco harm reduction.”

Foukkare says that AACS is calling for a National Summit on the issues that have developed since the current prescription model policy was introduced by the Therapeutic Goods Administration (TGA), which includes designing cost-effective enforcement measures, abolishing the prescription scheme which is not being accessed by consumers, and identifying ways to disrupt the unruly syndicates that are driving black market trade.

“AACS would also like to see the TGA support immediate age limits on sales, the implementation of a national licencing scheme for all retailer sellers of vaping products, underpinned by a national product accountability tracking scheme, and to limit sales of nicotine vaping products to licensed, responsible retailers.”

Kumar believes the in-action by authorities is making Australia a sanctuary for criminals who engage in illegal nicotine and tobacco trade.

“The tough regulations on tobacco products as well as vapes has made the illegal trade quite lucrative.

“The in-ability by authorities to enforce the regulations is cultivating a culture of acceptance of the illicit trade. Retailers overwhelmed by the widespread availability of illicit tobacco and vape products are succumbing to the high demand and huge profits and engaging in the retail of illicit cigarettes, tobacco and vape products.”

Dickson echoes Foukkare’s belief that the current prescription model has failed and does not provide adult smokers with an effective transition path away from combustible cigarettes.

“The burgeoning illicit disposal vape market highlights the urgent need for more effective regulation which strikes a better balance, encouraging NGP uptake by adult smokers and limiting the ability of minors to access nicotine products.

“Products available on the illicit market are entirely unregulated, meaning that there are no product standards and are often sold to underage consumers. Legitimate manufacturers, retailers, and the Government are deprived of what could be legitimate revenue.” C&I

TabSol Australasia has partnered with

The key elements that distinguish TSVo from other vape products are:

• Best Quality legal Vape device – TSVo has classy light polished metal encasing that makes it look elegant compared to other plastic options.

• Available in more than 20 popular flavours – Zero nicotine vapers seek tasteful flavours.

• Leak proof functionality – the manufacturer’s sealing technology minimises any leaks during distribution and usage.

• Available in 600 and 1800 puff options.

• Responsible retailing – all packaging comes with ‘WARNING: Strictly for 18 years and over’ – being the first vape brand to have this warning. Despite being nicotine free we believe that will remind retailers to only sell to adult consumers. TSVo packaging contains all required contact details including phone for consumers and retailers.

• The disposable pod comes with extra-long battery

Banner groups are a pivotal cog in the wheel of convenience retail and help provide their members with strategic plans and the skills to learn, develop, and grow their business into a more successful operation.

Darren Park, CEO of United Convenience Buyers (UCB), believes that while retail buying groups can’t pretend to have every single answer to every single situation, as the business world becomes increasingly competitive and complicated, they do offer a safe harbour within which like-minded retailers can seek support, assistance, and understanding.

“What UCB believe is that with our members, trade partners, and UCB all working together we all go faster, save management time, and achieve more than any of us could on our own.”

Park explains that one of UCB’s key strengths is to look for situations where flexibility and nimbleness allow them to respond to opportunities or manage issues with pace.

“The key strength for UCB is what allows us to be nimble at store level and that strength is our business managers - those dedicated UCB employees who are on the road, in our member stores, day in and day out. Helping our members no matter how

big or small, to maximise their trading opportunities. Layouts, trade partner liaison, and instore execution are just some of the areas our field team cover.”

Steve Cardinale, Managing Director of New Sunrise, said New Sunrise prides themselves on the true partnership and honest collaboration with their strategic partners.

“We adopt a ‘one size does not fit all’ approach to the market, where others do not. We recognise that two stores, in the same suburb, but on different sides of a road, can have largely differing shopper missions. We offer a tailored program, which has been premiumised and has the ability to be customised.

“Our passion is the success of our retail members. We work with our members to assist them in setting the store up for success. This includes floor plans, hosting product files, customising in-house built planograms, aligning with over 120 suppliers, providing retail training, providing hardware support, access to qualified chefs and baristas, providing a help desk to assist in invoice issues, provide a benchmark category analysis by store and category management to optimise return on working capital. We go far and beyond providing just the ‘buying’ function, which is only the tip of the iceberg,” explains Cardinale.

in-depth look into how being part of a banner group can be beneficial to your business, writes Thomas Oakley-Newell.UCB offers access to banners such as fast&ezy

Glenys Tristram, National Marketing Manager at NightOwl Convenience, believes banner groups provide a level of security to the new business owner.

“The owner is certainly their own boss and with NightOwl there is flexibility in all areas of business management. However, having the full support of a company like ours with a head office full of dedicated experts in their fields means the new owner isn’t trying to wear all the hats in the business at once.

“The NightOwl support office provides training and support to the individual owner, and then there’s the economy of scale when it comes to marketing, buying, and supply chain needs. Why wouldn’t you join a banner group? The benefits give an owner a tangible business advantage.”

A c-store customer is looking for a retail offer that sits between a fully-fledged supermarket and traditional convenience store. They want to shop all they want, how they want, and at fair price, explains Kellie Struth, Head of Category and Marketing at APCO.

“That is the reality of our shoppers’ expectations today, there’s so many options and choices for the shopper, so APCO is committed and consistently evolving to deliver this retail box mix.”

The introduction of online retailing is having a big influence on convenience retailing, says Struth, for both good and bad reasons.

“It is here to stay and APCO is investing significantly in IT infrastructure, systems and processes to meet these future trends.”

The digitisation of the industry is something that Matt Elliott, VP mobility and convenience ANZ at bp, has also noticed.

“Online ordering, payment, and delivery is booming with a strong demand for delivered convenience. As an example, bp’s Couchfood branded home delivery service now operates from more than 200 stores and our in-car mobile fuel payment app, BPme, saw a 29 per cent increase in use last year.

“Our convenience business is constantly expanding and adapting as our customers’ needs change. From home deliveries through our partnership with Uber Eats, to a trial of checkout-free technology and a reimagined ‘food for now’ offer.”

Park recognises that demographic changes are under way across the country and are sending new waves of shoppers into stores.

“Shoppers have different wants and needs at different ages. For example, teenagers likely aren’t as interested in buying health care products as older adults might be. Similarly, older customers may be more concerned with price, while younger shoppers may be more interested in appearance and brand… they want to Tik Tok everything!

“We are also seeing more attention on brand purpose, what are brands and retailers doing for the environment and my community? We are addressing these through knowledge sharing, for example when we make a ranging change, why are we doing it? Is there a demographic reason for example or some other marketplace factor at play?”

Cardinale believes we will see continued movements into robotics at front and back of house, particularly in QSR and restaurants, which will see improvements in speed of service and variety of range. He also sees it entering convenience, and that food and coffee orders of the future may look quite different.

“But what won’t change is that people will still be on the move and while they are moving, they will need to eat, drink, and use bathrooms. No amount of technology can replace the ‘now’ especially when it comes to a providing the energy they need to get on with their day.”

What UCB believe is that with our members, trade partners, and UCB all working together we all go faster, save management time, and achieve more than any of us could on our own.” - Darren Park, CEO, UCB

Inside a NightOwl store A Bowser Bean fit-outOur passion is the success of our retail members. We work with our members to assist them in setting the store up for success.” - Steve Cardinale, Managing Director, New Sunrise

Haydn Tierney, Managing Director of Bowser Bean, said the past 12 months have held some impressive changes for the business including the launch of its biggest greenfield location to date, Bowser Bean Echuca, and the refurbishment and relaunch of sites at Violet Town, Strathmerton, and Euroa.

But Bowser Bean doesn’t plan to stop there, and Tierney expects to see more growth in the coming year.

“Bowser Bean is continually expanding their network of sites, aiming to service more local communities across regional Victoria and NSW. There will be continued improvement on our instore offering, with additional focus on the take-home food offer. We will be enhancing our customer interaction through the upcoming launch of the Bowser Bean app. Bowser Bean is ramping up its social media and marketing channels, in addition to some dramatic branding plans that will create much hype amongst local communities.”

Also looking to evolve their food offer and introducing an app, is APCO.

“I think our Cafe 24-7 foodservice strategy will continue to evolve and amplify over the next 12 months through new product development in our hot and chilled ready to eat range. The launch of our APCO App early 2023 will enhance our on-line delivery business and no doubt scale our reach and performance,” Struth explains.

Elliot said that bp plan to increase its customer touchpoints to more than 15 million a day globally by 2025.

“Our convenience strategy is about creating something distinctive, that really sets us apart from other convenience offers – so we’re trialling, testing and rolling out compelling new offers across our network.

“We’re also upgrading stores to deliver a great in-store experience – delivering clearer signage, more thoughtful store layouts and improved technology.”

Cardinale said that New Sunrise’s priority is to continue to drive retail growth by giving shoppers more reasons to stop at New Sunrise stores.

“The shift in this mindset will move customers from treating convenience as transactional commodity-based visits, to experiential and daily habitual visits. We seek to do this in a number of ways, including the recalibration of the pricing and promotional mix on key categories.

“New Sunrise will support retail members through driving awareness of their stores and locations. We will accelerate our brand love and awareness of the Sunrise Enjoy Local brand and our mascot, Sunny Sunrise. Through both the digital sphere and our above-the-line TV campaigns, we aim to educate and connect with Australian Consumers, so that they know that when they see Sunny Sunrise, they are supporting a locally owned and operated store, offering genuine care for the local community.”

This care includes continuing its brand partnerships with both ‘Heart of the Nation’ and ‘Beyond Blue’, which reinforces the important role New Sunrise sites play in their local communities as they continue to build on their mission of helping people in their communities enjoy life and get on with their day.

Park reiterates that as an industry, if P&C want to thrive and prosper, it must be relatively united in its focus.

“Product inflation control and supply chain continuity are crucial to our success. We are a profitable and brand led channel for many trade partners, and we have millions of shopper missions to solve for each and every day. It’s a team effort.” C&I

APCO’s impressive Café 24/7 food offer A New Sunrise branded store

As summer approaches, what are the best ways to get the most out of your freezer section, asks Thomas Oakley-Newell.

As the warmer months arrive, customers will soon start venturing to the freezers to pick out their favourite iced treat on a hot summer’s day, providing an opportunity for retailers and suppliers to capitalise.

Already the ice cream category has experienced strong growth, with the AACS State of Industry Half Year Report 2022, showing growth of 6.8 per cent in the first half of 2021 and growing 3.1 per cent in 2022.

Interestingly this growth came from ice cream, 3.3 per cent, and icy pole singles, 13.3 per cent, instead of take-home, which saw a decline of 0.7 per cent as consumers have started getting out and about again.

Elliot Ravioso, Head of Sales Petrol and Convenience at Unilever, said with a significant portion of ice cream purchased on the go, the P&C channel is extremely important.

“If we have learnt anything from Covid-19, it is that consumers are living more flexible lives resulting in the merging of once strict occasions such as working, leisure and consumption. Consequently, consumers are driven even more by convenience and fulfilling their ‘need state’.

The ‘needs for today’ mission is the most prolific shopper mission for ice cream, and as such, consumers are favouring quicker shopping trips in nearby convenience channels to instantly satisfy their hunger or craving.

“Unilever sees a great opportunity to leverage the convenient and seasonal locations the P&C channel offers to satisfy the needs of the ice cream consumer. Due to these shifts in consumers’ behaviour, the P&C channel will continue to play an important role in the Australian ice cream market moving forward.”

David Bickle, Category Manager at New Sunrise, said that ice cream is an important part of the convenience market as it speaks directly to the way Australians enjoy the outdoors.

“Australians are out and about, on the move, and enjoying the outdoor lifestyle. Whether it be kids riding their bikes down to the corner store and standing around the freezer or Mums and Dads bringing ice creams home after stopping for fuel.”

Bickle has noticed a trend within the category with the long-term domination of the indulgence segment now being overtaken by snacking as the dominant segment within impulse ice cream.

“Indulgent brands such as Magnum and Connoisseur remain big sellers within our stores, however they have now been eclipsed by snacking, driven by the expansion of brands like Maxibon, Gaytime, Drumstick and the Cadbury’s range.”

Ravioso said Unilever, which produces both Gaytime and Magnum, has consistently seen the iconic Golden Gaytime Original be the number one impulse product in Australian convenience, and this latest quarter is no different.

“Further, due to the highly seasonal nature of the ice cream market, we see the refreshment segment within ice cream greatly over-index in summer where our Calippo Raspberry Pineapple product is the number one product in this segment.”

Unilever’s Ben & Jerry’s brand is also highly successful within the take home market, representing 50 per cent of all take home sales, and is the number one take home brand.

“We are trying to de-seasonalise the ice cream market by driving sales in the winter months largely driven through our popular Ben & Jerry’s products Half Baked, Choc Fudge Brownie, and Choc Chop Cookie Dough.”

Bickle said the take home ice cream product has been a notable change within the ice cream market, with the 437ml to one litre tubs becoming very popular across New Sunrise stores.

“Of the take home range sold, around 30 per cent of convenience purchases are ordered from an online platform to be delivered to home or ordered online to be picked up in-store through apps like the Grab it Local app we utilise.

“Tubs have gone from a couple of lines offered in a convenience store to a full door or perhaps even two doors in our larger stores. This is not at the stage where it rivals impulse products, however its growth is notable and has become a strong factor in planning out the category. The decision to place a larger freezer may be balanced with a mid-sized freezer and an upright for take home.”

Peters has experienced impressively stronger growth than the channel average, reporting 9.4 per cent YTD, coming from both the impulse side and the take away side, explained Parita Parekh, Category Manager Convenience and Specialty at Peters.

“With three of the top five brands in impulse ice cream – Peters ice cream portfolio has an offer to suit all consumers. The biggest brand for Peters is Maxibon, with 15.9 per cent value growth (QTR to 22/05/2022), an offer that strongly resonates with convenience shoppers.”

Ice cream in P&C is highly impulsive –64 per cent of shoppers do not plan to buy ice cream when they enter an outlet.”

- Andrea Hamori, Head of Marketing, Peters Ice Cream

Innovating the biscuit end of the Maxibon is something Parekh says consumers love and proved successful in April 2021 in a collaboration with popular TV show Rick and Morty with the release of a limited-edition flavour – Pickle Rick Mint.

“The flavour featured a mint slab with mint crisps sandwiched between the iconic Maxibon biscuit and half dipped in a Pickle Rick inspired green coloured white choc with cookie crumbs.”

Building on this success, Peters released Maxibon Waffle On in July this year, the innovation sees Maxibon’s iconic biscuit end transformed and upgraded to two big, golden, sugar-dusted waffles.

Andrea Hamori, Head of Marketing at Peters, said they know how much Australians love Maxibon as it has become a staple in so many freezers.

“Maxibon is all about being ‘born different’ and we know our consumers love different and love bold. So, we are extremely excited to be launching Maxibon Waffle On, our biggest innovation to date. Not only have we transformed the biscuit end for the first time ever, but we are pushing the breakfast boundaries giving our fans a Maxibon take on brekkie they can enjoy anytime, anywhere.”

Unilever has also not been resting on its laurels, with the release of new iterations of its popular Golden Gaytime product, including its new Bites range, which Ravioso believes is a major opportunity with potential to build out this segment in the channel.

“We have created an entire new segment this year in shareable snacking. This year we launched shareable ice cream bites in Golden Gaytime, Magnum, Ben & Jerry’s, which steps ice cream into one of the highest growing areas in convenience. Being able to portion control ice cream, or share an ice cream between friends, on the couch, in the car on a road trip, or out after a meal is an entirely new format and one that we are really excited to bring to Australia.”

It has become critical that ice cream performs as a category. Electricity costs have significantly risen, and it takes around three times the power to keep an ice cream freezer running in comparison to a drinks fridge.” - David Bickle, Category Manager, New Sunrise

Another market Unilever has tapped into is the growing plantbased segment with the launch of Golden Gaytime’s new plantbased range, which still features the iconic biscuit coating with a toffee-flavoured creamy centre.

Annie Lucchitti, Unilever/Streets spokesperson, said the plant-based launch is about opening their products to more Australians regardless of their dietary needs or choices.

“Australians have been buying more plant-based products than ever, and we are thrilled we could bring another Aussie classic into this domain too. Golden Gaytime has been around for over 60 years and recreating this iconic product had to maintain the delicious expectations that come with our classic treat.”

Bickle explained that new product development (NPD) plays a factor when New Sunrise is deciding which ice creams to range, as NPD will always provide growth and new lines will constantly draw people to the freezer, but this isn’t the only factor New Sunrise considers.

“Other factors include brand performance and support, it is very important to be aligned to what the ice cream companies, and their brands have worked toward being their key launches, major competitions, or key focuses for the season. Promotions are critical, people will purchase from this category but only if the category provides choice and value.

“Fun; it is important to remember fun and enjoyment are at the centre of the category, the consumer will often be families or children who are perhaps not interested in the decadence of indulgent or the size of a snacking offer. And of course, refreshment, for most regions of Australia, hot summers and an outdoor lifestyle drive the category. The refreshment offers peak in summer but are pretty much enjoyed all year round.”

Hamori agrees that innovation is key in the channel to continue to drive excitement and to attract customers to the freezer, with research showing that shoppers are 76 per cent more highly likely to trial new products in P&C, with 87 per cent of these shoppers repeat purchasing the product1

“Ice cream in P&C is highly impulsive – 64 per cent of shoppers do not plan to buy ice cream when they enter an outlet1 Because of this, point of sale is critical to drive engagement and penetration. The majority of shoppers will buy an ice cream once they get to a freezer.

“Therefore, the key to conversion is getting shoppers to the ice cream freezer, aided by emotive point of sale along their path to purchase. Peters continues to invest in a broad suite of POS and off location freezer solutions that help engage the consumer in-store across the entire path to purchase. This is becoming increasingly challenging for the category, as we compete for real estate against other food and beverage offers in these outlets.”

Bickle also offered some advice when stocking ice cream products.

“It has become critical that ice cream performs as a category. Electricity costs have significantly risen, and it takes around three times the power to keep an ice cream freezer running in comparison to a drinks fridge. Larger freezers and enormous stock holdings are a luxury the category cannot sustain unnecessarily. We are very precise when placing the category into a store. What sales the category will make and what profit will the category return are key to setting up new stores.

“Large freezers were traditionally placed determined by the space available, it is now more determined by sales opportunity.” C&I

Say goodbye...for good....to expensive “Point of Sale” and customer-service downtime. And say ‘Hello!’ to happy employees, happier customers, and repeat business.

How? - By plugging your business into SMARTFUEL. The all-in-one, cloud-based point-of-sale software solution designed to help you maximise the earning potential of your business.

SMARTFUEL is more than just a “versatile” and “intuitive” point-of-sale software solution. Depending on your business needs, the SMARTFUEL system can even be deployed business-wide to cover not only the shop or customer-facing operations but also the back office, head office and even the customer service department:

Create, save & retrieve favourites

Create & use shortcuts to complete routine tasks lightning fast Search for products by name or SKU code

Create, save & retrieve personalised entries

Process payments seamlessly

Calculate & apply fuel discounts in a snap Manage promotional details

Our C&I Choice product for this issue is Bennetto, a carbon zero chocolate brand which produces a range of certified organic, Fairtrade, vegan, and gluten-free chocolates.

Bennetto’s range is also free from additives and preservatives and appeals to both the premium customer and health-conscious consumer. Bennetto is becoming as well known for its beautifully designed packaging as it is for the delicious dark chocolate that lies within.

Bennetto have achieved the ‘do good’ status by creating a valueadded experience for their consumers and maximum impact for the farming producers.

All ingredients are real, whole, and natural. From freeze dried raspberries, toasty hazelnuts, and pure orange oils. Paired only with cocoa from Fairtrade farming communities in the prefect growing regions of Peru, Ecuador, and Madagascar, the result is a chocolate full of punchy flavours, interesting textures, and melt-in-the mouth complexity. And a bar that is uniquely illustrated with quirky birds from the origin to help tell the cocoa story.

With the unique ability to manufacture from single origin organic cocoa beans to scale and without additives, their positioning spans organic premium to super-premium with an ‘eat less, but better’, proposition and considered well priced and accessible to mainstream. Each bar of Bennetto chocolate is a delicious gift on the inside and out.

Contact Lucy Bennetto directly on lucy@bennetto.co.nz or one of four distributors in Australia; Unique Health Products, Cartel and Co, First Ray Distribution, Perth Health.

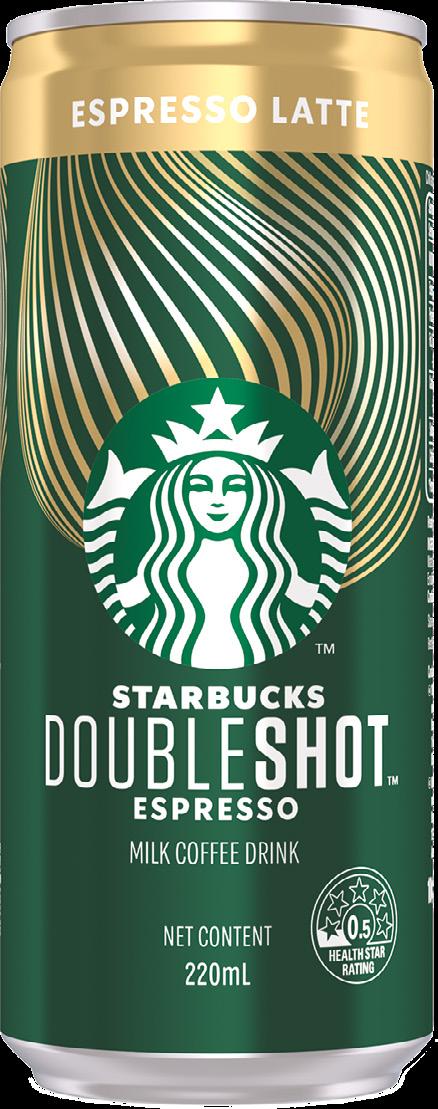

Following the success of Dare Toffee Nut Latte, the Dare team is thrilled to announce the arrival of the latest limited time flavour – Dare Butterscotch Latte. Combining a delicious blend of buttery brown sugar alongside the iconic Dare taste Australians know and love, Dare Butterscotch Latte provides a Dare fix like never before.

Over the last quarter, milk-based beverages have shown seven per cent growth vs YAGO, with the Iced Coffee segment driving this overall category growth.

As Australia’s number one RTD Coffee brand, Dare’s limited time flavours are a must have for retailers across the country. Each flavour rotate performs a key role in bringing new customers into the fridge and ultimately creating incremental sales.

Over the last two years Dare’s limited time offers have represented more than 20 per cent of total Iced Coffee NPD, leveraging their position as Australia’s number one Iced Coffee alongside classic flavour combinations to increase penetration and bring light and lapsed iced coffee consumers back into the category.

Dare Butterscotch Latte is set to reinvigorate the Iced Coffee category, not only bringing in new shoppers with 65 per cent purchase intent, but also creating more value for retailers through growing the overall Milk-Based Beverage category. Flavour rotates such as Dare Butterscotch Latte create a bridge for Flavoured Milk consumers to enter the Iced Coffee segment, increasing their product repertoire and basket size. The combination of Butterscotch and Coffee has become a global trend with Dare Butterscotch Latte leveraging this trend alongside sustainably sourced Rainforest Alliance coffee to deliver on the key consumer desires of taste and sustainability.

Dare Butterscotch Latte is available in 500ml and 750ml pack sizes and will be in market for 12 months. It is available to order via your current customer portals.

Sources:

IRI MarketEdge | Quarter To 31/07/22 vs. YA IRI AU Grocery Scan and Convenience Scan, Iced Coffee, Dollars (000s), MAT 12/04/20 to MAT 11/04/21.

As the old adage goes, life is about balance. However, the reality that we all know is balance can feel impossible to achieve. It’s this enduring challenge of modern life that inspired Tonik Nutrition.

As Australians become increasingly time poor, and yet, maintain an appetite for an active lifestyle and healthy diet, a clear gap emerged for high quality and accessible, on the go nutrition. As nutrient rich as they are convenient, Tonik’s protein drink and bar range also cater for our evolving dietary preferences. Tonik’s RTD plant-based protein range being an Australian-first innovation.

The combination of proprietary plant protein blends, alongside Tonik’s proprietary multi-step cold microfiltration process, delivers a nutrient rich drink that tastes fresher and keeps you feeling full for longer.

This focus on innovation continued with Tonik’s protein and plant-protein bar ranges. In addition to an ever-expanding flavour range, inspired by the tastes of an Australian childhood, Tonik’s unique layering process delivers a smoother taste with a signature contrast of crunch.

Tonik’s innovation and positioning have translated into immediate consumer adoption. With national ranging in Coles, Tonik’s bar ranges are selling at 8-11.5 units per store per week.

Most recently these ranges have been picked up by EG Petroleum and OTR for nationally ranging, further cementing the Tonik range as the go-to nutrition option for on-the-go Australians.

Proudly Australian owned and made, it’s Tonik’s unique insight into Australian life, combined with unrivalled manufacturing innovation and capabilities, that’s allowing Aussies to REPLENISH. GO.

Tonik Nutrition is a sports nutrition brand, part of 100 per cent Australian-owned and ASXlisted, Halo Food Co, Australasia’s largest sports nutrition manufacturer. With 25 years of local and international contract manufacturing experience, Halo is the go-to contract manufacturer for health and wellness products in Australia.

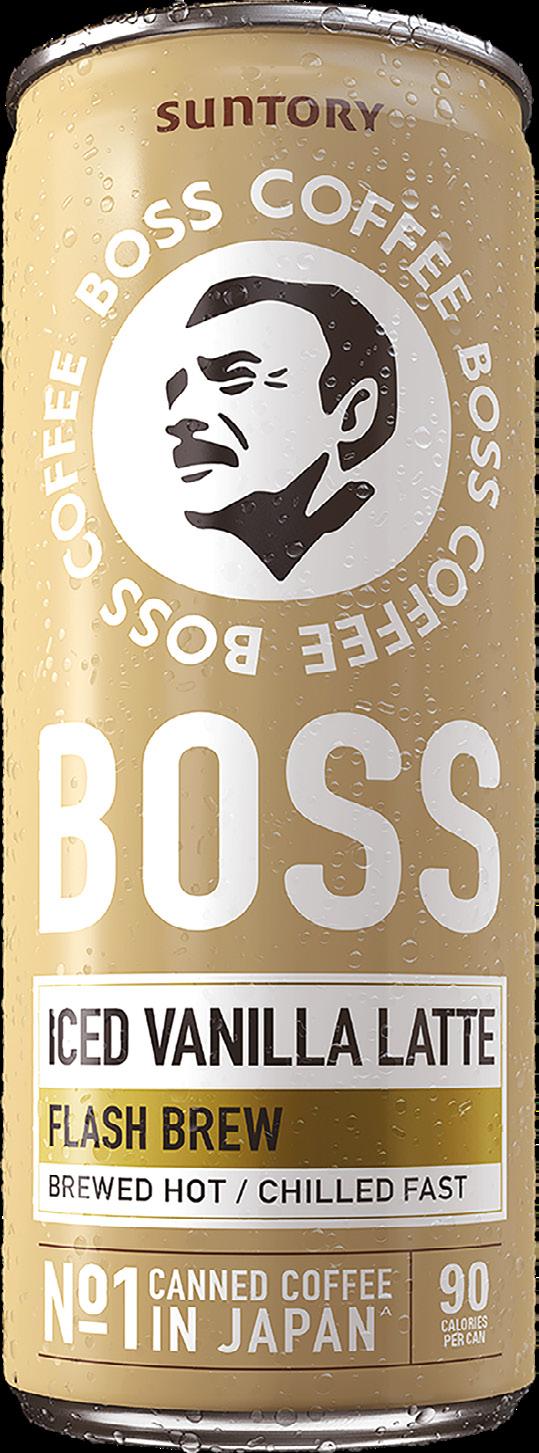

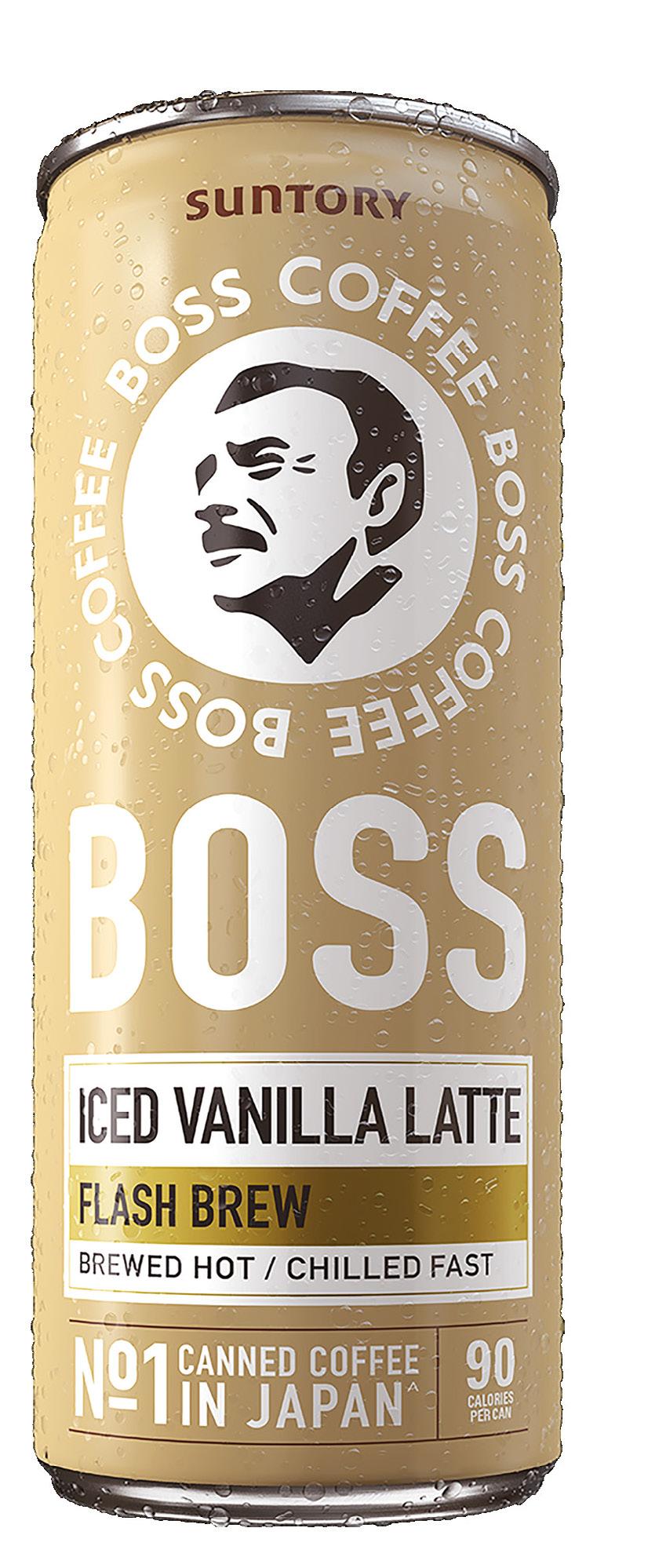

Three years after launching in Australia, Japan’s Suntory BOSS Coffee has added a new blend to its successful canned coffee range, Iced Caramel Latte. It joins the already popular line-up of Suntory BOSS Coffee, including Iced Long Black, Iced Double Espresso, Iced Latte, and Iced Vanilla Latte.

Suntory’s Marketing Manager of Global Brands Shana Khan believes Iced Caramel Latte will help the category continue to grow.

“In Japan there are hundreds of Suntory BOSS Coffee products from Iced Long Black to Café Au Lait ranging with different blends and roasts that cater to the many ways consumers drink their coffee, and we are excited to replicate that across Australia and New Zealand and give consumers a variety of options based on their taste preferences.”

Iced Caramel Latte is a blend that will appeal to those who love the taste of quality coffee but also have a bit of a sweet tooth. The new blend taps into the younger audience’s coffee and flavour preferences and will help recruit new consumers into the category, driving further incrementality.

“We know that coffee is not a one size fits all and the way consumers drink coffee is really interesting and diverse. The variety of coffee consumers choose to drink varies depending on time of day, occasion, and need. Broadening the Suntory BOSS Coffee range will help us grow the category and drive more mainstream appeal with consumers,” says Khan.

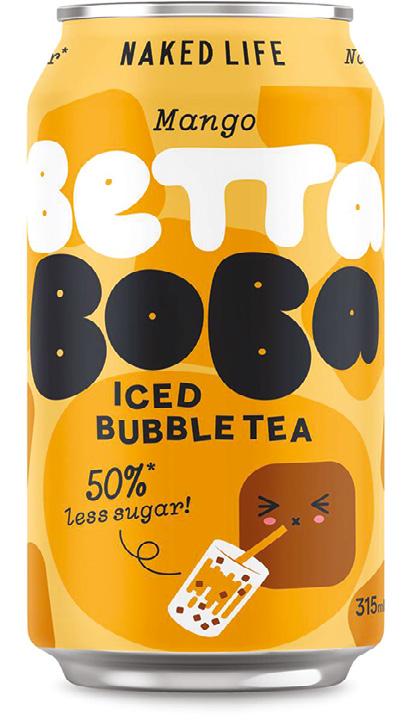

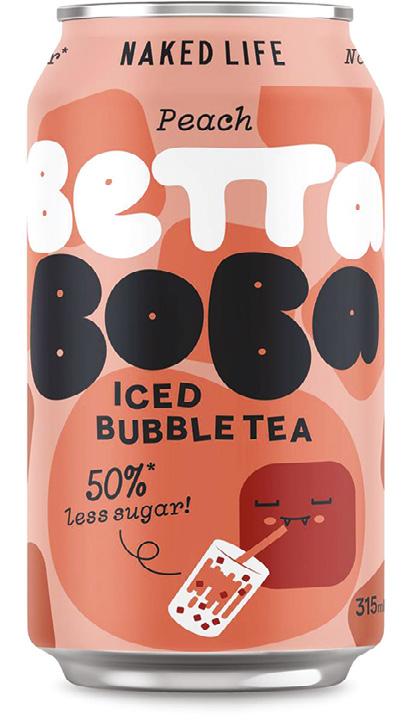

Naked Life, the innovative company behind Australia’s sugar-reduced revolution, has expanded into the bubble tea category targeting Australia’s youth and Asian market.

The Melburnian start-up is looking to make the trendy bubble tea category better for you with its brand new 50 per cent less sugar Naked Life Betta Boba range.

The Betta Boba range is available in four popular flavours: Original Milk, Brown Sugar, Peach, and Mango and contains tapioca and coconut pearls.

David Andrew, Founder and CEO of Naked Life, said the bubble tea category has been growing rapidly with bubble tea shops being the fastest growing QSR outlet.

“However, given the often high sugar amounts in these drinks, we saw a need to bring a format that does not only taste great, but contains 50 per cent less sugar,” he said.

Supporting this, research from a recent Grandview study, states that the global bubble tea market size was estimated to be worth US$2.15 billion in 2019 and US$2.32 billion in 2020 with an expected compound annual growth rate of 8.9 per cent from 2020-2027 reaching a total of US$4.25 billion by 2027.

The latest release from Naked Life comes just after the brand launched a series of nootropic influenced hot drinking chocolates. The company’s dedication to ‘better-for-you’ products are what spurns its R&D team.

“We are dedicated to creating a healthier Australia without compromising the taste or fun of your favourite drinks,” says Andrew.

The range is available in Woolworths nationally, both in fourpacks as well as individual cans. It is also available in WHS stores and has its sights set on the petrol and convenience channel.

Never run out of power with Joyroom Portable Power Bank External Battery Charger 10000mAh D-QP191.

When you’re out and about, the last thing you want to worry about is your phone running out of power. With the Joyroom Star power bank, you’ll never have to worry again. This highcapacity portable battery has two USB outputs and one USB-C input/output, so you can charge up to three devices at once. It also supports multiple fast charging protocols, so your gadgets will be back up and running in no time. Never be caught without power again with the Joyroom Star.

The Joyroom Star power bank has a capacity of 10,000mAh, so you can charge your devices multiple times before needing to recharge the power bank itself. With two USB outputs and one USB-C input/output, you can charge up to three devices at once with this power bank. This is

compatible with QC3.0, PD3.0, FCP, SCP, and AFC fast-charging protocols.