“These

are magnificent, old wines - crafted to last. Savour and enjoy a glass of Australian wine history.”

WEDNESDAY 30 OCTOBER 2024

THE STAR EVENT CENTRE SYDNEY HOSTED BY NETWORKING BARS

OFFICIAL MIXER OFFICIAL AFTER PARTY AWARD & DRINK SPONSORS

“These

are magnificent, old wines - crafted to last. Savour and enjoy a glass of Australian wine history.”

WEDNESDAY 30 OCTOBER 2024

THE STAR EVENT CENTRE SYDNEY HOSTED BY NETWORKING BARS

OFFICIAL MIXER OFFICIAL AFTER PARTY AWARD & DRINK SPONSORS

Welcome to the August edition of National Liquor News, your go-to source for the latest trends and insights in the Australian liquor retail landscape.

In this issue, we dive into the enchanting world of Loire Valley wines. Renowned for their diversity and terroir, these French classics are increasingly capturing the palates of Australian drinkers. Our comprehensive report unpacks the unique characteristics that make Loire Valley wines stand out, providing you with invaluable knowledge to elevate your store’s offerings and satisfy your customers’ growing interest in this distinguished region.

We are also thrilled to present our extensive Pinot Noir Trade Buyer’s Guide. After tasting more than 130 wines, we bring you a curated selection showcasing both Old World elegance and New World innovation. Whether your customers are connoisseurs of classic Burgundy or enthusiasts of contemporary expressions, our guide will help you to make informed selections that will resonate with your customers.

Additionally, we explore the dynamic world of South Australian drinks, spotlighting the distinct

qualities that set them apart in the market. This issue also delves into the rise of dark RTDs and the rum renaissance, providing a comprehensive look at these exciting categories and ensuring you’re ahead of the curve in offering the latest and greatest to your patrons.

And finally, in preparation for the upcoming Father’s Day, we offer a carefully curated selection of things to stock for this key occasion.

We also share our regular insights from Retail Drinks Australia, Wine Australia, New Zealand Winegrowers, Strikeforce, Snooper, and we’ve got all the latest industry movements from the team at BrightSide. Thank you to all of our contributors.

We hope you enjoy reading this issue as much as we enjoyed putting it together!

Cheers, Deb

Deb Jackson, Managing Editor 02 8586 6156

djackson@intermedia.com.au

FOOD & BEVERAGE

PUBLISHED BY: Food and Beverage Media Pty Ltd

A division of The Intermedia Group 41 Bridge Road GLEBE NSW Australia 2037 Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au

Managing Editor: Deb Jackson djackson@intermedia.com.au

Senior Journalist: Molly Nicholas mnicholas@intermedia.com.au

Journalist: Caoimhe HanrahanLawrence chanrahanlawrence@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –Liquor and Hospitality: Kea Thorburn kthorburn@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au

August 2024

8 Cover Story: McWilliam’s fortified legacy continues to triumph

10 News: The latest liquor industry news for retailers around Australia

18 Marketplace: Brand news and promotions

Industry Focused

26 Retail Drinks: Retail Drinks outlines key priorities

27 Strikeforce: Consumer driven evolution

28 New Zealand Winegrowers: Celebrate International Pinot Noir Day

29 Wine Australia: Rising popularity of white wines reflected in 2024 vintage

30 Snooper: Unlocking the potential of displays in stores

14 Loire Valley Wines: A symphony of diversity and terroir

32 Father’s Day Retailing: Here’s to Dad

36 South Australian Drinks: A sip of the south

40 Dark RTD: Dark and stormy

44 Rum: The rum renaissance

47 Trade Buyer’s Guide: Pinot Noir – the agony and the ecstasy

With decades of experience in fortified wine and now under leadership from the Calabria Family Wine Group, the McWilliam’s range of fortified wines continues to impress.

McWilliam’s has a long history in creating fortified wines, and Calabria Family Wine Group has built on this legacy throughout the past three years of its ownership of the McWilliam’s brand.

With a focus on relaunching the McWilliam’s Hanwood Estate fortified range, Calabria Family Wine Group invested $300,000 into growing McWilliam’s fortified presence, including an enhanced packaging revamp and undertaking a three-year consumer-focused advertising campaign.

These efforts were vindicated by the 2023 IWSR Brand Health Tracker report, which ranked McWilliam’s at number 13 for brand awareness in the Australian market. The McWilliam’s brand remains at the forefront of the Australian landscape, with sales up 11 per cent on +$15 brands.

All the while, McWilliam’s continues to be celebrated for its quality, upholding a five-star Halliday rating and winning the Best Fortified Wine trophy for the Hanwood Estate 20-Year-Old Rare Tawny at the 2023 Melbourne Royal Wine Show.

Senior Winemaker Russell Cody, who has been the custodian of the McWilliam’s

fortified wine range for more than two decades, spoke to the importance of the Hanwood Estate range to McWilliam’s.

“The company has always been synonymous with the McWilliam’s Hanwood 10-year-old Tawny, which has been around since the 1960s. We also have such a great library of Tawny wine styles that we are able to utilise,” he said.

While sweetness is always a factor in fortified wines, Cody has been shifting the McWilliam’s Tawny range towards a drier style over the last five years, similar to Portuguese or Spanish fortified wines.

“Compared to the Portuguese, a lot of Australian Tawny styles are much sweeter, and they can be difficult to drink,” he said.

The gradual reduction in sugar content over the years and balancing acid finish makes for a clear point of difference for McWilliam’s within the Australian fortified wine market.

“I haven’t necessarily made the wine massively dry, but I’m just adding more of a savoury edge,” Cody said.

McWilliam’s has seen an increased interest in its premium fortified wines,

with consumers recognising the quality of the products.

“Our Tawny sits in barrel for 10 years, and 30 per cent of the liquid is evaporated from those barrels over time. The wine is concentrated down, and we prepare it for bottle.

“Savvy buyers are starting to understand the beauty of these wines and how much work goes into them,” Cody said.

In addition, Australian consumers are becoming more aware of the world class position of Australian fortified wines, further bolstering the category.

“Sometimes we need to dig into our own backyard a bit more, and do more research, rather than buying something from Spain or Portugal because at least you know it will be good. There are fortified wines made here in Australia that are of magnificent quality, and value for money,” Cody said.

With their appealing sweetness and warming higher ABV, fortified wines are particularly popular in the colder months, and are a premium gifting option for Father’s Day.

Explore the range at mcwilliams.com.au. ■

The partnership follows an extensive tender process and will see Fortitude Group’s 16 retail outlets rebranded to the Cellarbrations banner.

Independent Brands Australia (IBA) has been selected as the new retail partner for Fortitude Group’s Queensland operations, following an extensive tender submissions process.

Fortitudo Group operates five venues in Southeast Queensland, including the Iconic QA Hotel in New Farm and Treetops Tavern Burleigh, with 16 liquor retail outlets all of which will be rebranded under the IBA Cellarbrations and Cellarbrations Superstore banners.

Katherine Johnstone, ALM/IBA QLD General Manager, said the long-term partnership will see IBA help to elevate and grow Fortitude Group’s retail performance.

With strong alignment on how the Fortitudo Group liquor retail business will continue to grow and evolve over the coming years, the partnership will leverage the scale of Australian Liquor Marketers (ALM) and IBA to help drive wholesale efficiencies and retail shopper lead programs.

“Together we will create fantastic retail experiences for shoppers seeking out trusted brands and value when shopping for liquor.”

Neil Anderson, IBA Business Manager

“We are delighted to partner with Fortitudo Group as their wholesale and retail banner partner in Queensland. Fortitudo Group have fantastic venues in Southeast Queensland, and we are looking forward to working closely with Andrew, Robina and the team to help grow their business and deliver our ‘Best Store in Town’ retail promise,” says Johnstone.

Through the Cellarbrations banner, Fortitudo Group will have access to best-in-class marketing campaigns and activations, rich shopper and market data and insights, a comprehensive and relevant core range, and a strong promotions program to drive shoppers through their doors.

Neil Anderson, IBA Business Manager added that the IBA Queensland team is very much looking forward to partnering with Fortitudo Group.

“Through the process we have found there is great alignment between the businesses in what we hope to achieve, and we have already established

a strong working relationship between the teams,” he says.

“Already in progress is partnering on improving each outlet’s store design and enhancing their retail offering across the Group’s network. Together we will create fantastic retail experiences for shoppers seeking out trusted brands and value when shopping for liquor. I am looking forward to expanding the ways in which they can talk to their shoppers with the roll out of Q-comm, E-comm and loyalty services.”

Fortitudo Group’s CEO Andrew Prothero, added: “We look forward to working with ALM and IBA across our retail outlets and believe we have the beginnings of a great partnership.

“Cellarbrations is a perfect brand fit for our network with strong shopper awareness and competitive value perception and with a collaborative team they will help us continue to strengthen and grow our liquor operations.” ■

Partnered article with Australian Liquor Marketers

“Cellarbrations is a perfect brand fit for our network with strong shopper awareness and competitive value perception and with a collaborative team they will help us continue to strengthen and grow our liquor operations.”

Following months of speculation surrounding Mighty Craft’s debt, divestment and restructuring efforts, the brakes were put on the craft industry accelerator as it entered voluntary administration on 22 July.

Over the past year Mighty Craft has sold its Mismatch and 78 Degrees brands, appointed a new Managing Director, who subsequently stood down, and appointed a new NonExecutive Chair. The company also reported revenue declines, unsustainable levels of debt and a focus on merging with Better Beer.

In a statement to the ASX, Mighty Craft said the proposed merger with Better Beer was fundamental to its ongoing divestment and restructuring program.

While Mighty Craft’s senior lenders and the shareholders of Better Beer had been working on an agreement, Mighty Craft said: “It now appears unlikely that an agreement will be reached between MCL’s senior lenders, Better Beer and Mighty Craft that is acceptable to all parties.”

Subsequently, Mighty Craft was placed into voluntary administration to determine the appropriate way forward. In the meantime, operations continue on a business-as-usual basis, with Better Beer CEO Nick Clegg confirming that this decision will not impact the brewer.

Online craft beer retailer Beer Cartel and its gifting subsidiary, Brewquets, has been acquired by Just Wines, indicating a continued diversification strategy following the recent acquisitions of Sans Drinks and Liquor Loot.

Richard Kelsey, who co-founded Beer Cartel in 2009, says: “We started our e-commerce beer business before Dan Murphy’s was online, before people were buying online in large numbers, and before craft beer was a real thing. That is something I’m really proud of.”

Just Wines Founder Nitesh Bhatia says the success and popularity of Beer Cartel made the business an appealing asset.

“We recognise the success Beer Cartel has had within the online craft beer space over the past 15 years. It has been an industry leader, as evident from winning Beer & Brewers’ Best Online Retailer award five times, and the numerous other awards the business picked up.”

Bhatia doesn’t plan to make any major changes to the Beer Cartel or Brewquets businesses and will welcome its diverse craft beer range, including the Beer Advent Calendar.

Market data analyst Kantar has identified the world’s 20 most valuable alcohol brands, representing a combined total brand value of US$232,743m.

Chinese spirit Moutai topped the charts for best performing alcohol brands globally, with a brand value of US$85,565m.

After Moutai, it was beer that dominated the top five most valuable alcohol brands in the world, with Corona in second place, Budweiser third, Heineken fourth and Modelo fifth.

Beer brands were the only ones that saw gains, accounting for much of the alcohol category’s growth, and much of this success was attributed to beer’s value proposition.

The remainder of the top 20 saw a mix of beers and spirits, with Moët & Chandon being the only wine to place in 20th position with a brand value of US$3,290m.

The report outlined stronger and more varied offerings in the RTD category, and with beer and RTD competing for market share, both beverage types have found success in category crossover, collaboration and innovation.

The Loire Valley, renowned for its rich history and diverse terroirs, offers a captivating range of wines, showcasing a spectrum of flavours and profiles that highlight both traditional French charm and modern appeal, writes Deb Jackson.

The Loire Valley, stretching through central France from the Atlantic Ocean to the heart of the country, is one of the most diverse and celebrated wine regions in the world. Known for its rich history and stunning landscapes, the Loire Valley’s wine production is marked by an impressive range of grape varieties, an array of soil types, and a climate that influences the character of its wines in distinctive ways. For Australian wine enthusiasts, the Loire Valley’s offerings present a refreshing contrast to the more familiar New World styles, with an array of wines that offer complexity, elegance, and a sense of place.

There is an abundance of diversity and a great richness of history in the wines of the Loire Valley. From dry or sweet whites, fruity or structured reds, to dry or tender rosés, and delicate white and rosé sparkling wines, the range of Loire wines reflects the richness of the region’s terroirs and grape varieties. In a changing consumption landscape, Loire wines captivate both the curious with their freshness and connoisseurs with the complexity of their aromatic palette.

Figures confirm the Loire’s position as an essential wine force in France and globally. Internationally, the Loire distinguishes itself as the leading wine region for the production of Cabernet Franc, Chenin Blanc, and Melon Blanc, and second for Sauvignon Blanc. In France, the Loire is the top region for the production of sparkling wines (excluding Champagne PDO).

One of the most compelling aspects of Loire Valley wines is the diversity of grape varieties grown across the region. Unlike regions that focus on a few predominant varietals, the Loire Valley boasts an extensive palette of grapes, each contributing its own character to the wines.

Chenin Blanc: This is arguably the most celebrated grape of the Loire Valley, particularly in the AnjouSaumur region and Vouvray. Chenin Blanc is known for its versatility, producing a range of wine styles from dry and crisp to lusciously sweet. Its ability to reflect different terroirs and its potential for aging make it a favourite among wine lovers. Chenin Blanc’s high acidity and distinctive flavours of honey, wax, and stone fruit can create wines with both freshness and depth.

Sauvignon Blanc: Found predominantly in Sancerre and Pouilly-Fumé, Sauvignon Blanc from the Loire Valley is renowned for its bright acidity and expressive flavours. The wines often feature notes of citrus, green apple, and flinty minerality. The cool climate of the Loire Valley helps preserve the grape’s vibrant acidity and aromatic qualities, offering a refreshing counterpoint to the often-riper styles of Sauvignon Blanc from warmer regions.

Melon de Bourgogne: This lesser-known varietal is the cornerstone of Muscadet wines from the western part of the Loire Valley. Melon de Bourgogne is

celebrated for its crisp, clean flavours and its ability to pair exceptionally well with seafood. Often aged on its lees, Muscadet can develop a delightful creaminess and depth while retaining its characteristic freshness.

Cabernet Franc: In the red wine category, Cabernet Franc stands out in regions like Chinon and Bourgueil. This grape produces wines with red fruit flavours, herbal notes, and a characteristic green peppercorn nuance. The Loire’s cooler climate allows Cabernet Franc to maintain a balanced acidity and a lighter body compared to its more robust counterparts from other regions.

Gamay: While more commonly associated with Beaujolais, Gamay also finds a place in the Loire Valley, particularly in the region of Touraine. Gamay wines from the Loire are known for their bright red fruit flavours, light body, and approachability, making them an excellent choice for casual sipping.

The Loire Valley’s diverse soil types contribute significantly to the complexity and character of its wines. From limestone and clay to schist and gravel, the soil composition across the valley creates a unique tapestry of terroirs.

Limestone: In regions like Sancerre and Pouilly-Fumé, the presence of Kimmeridgian limestone – a sedimentary rock formed from ancient marine deposits – imparts a distinctive flinty minerality to the wines. This type of soil contributes to the bright acidity and crispness of Sauvignon Blanc, enhancing its aromatic intensity and freshness.

Clay and Silica: In the Anjou and Saumur regions, clay and silica soils are prevalent. These soils help retain moisture, which is crucial for Chenin Blanc, especially during the hotter

periods of the growing season. The resulting wines often exhibit a rich texture and a balanced acidity.

Gravel and Sand: In the Muscadet region, the presence of gravel and sandy soils is ideal for Melon de Bourgogne. These soils promote good drainage and a cooler growing environment, which helps maintain the grape’s crisp acidity and clean flavours. The sandy soils also contribute to the wine’s characteristic mineral edge.

Schist: In the Vouvray region, schist soils, which are metamorphic rocks formed from volcanic activity, provide excellent drainage and warmth. This helps Chenin Blanc grapes achieve optimal ripeness while maintaining their vibrant acidity and complex flavour profile.

The Loire Valley’s climate varies significantly from west to east, adding another layer of complexity to its wines. The region experiences a range of climatic influences, from maritime to continental, which affects the growing conditions and the resulting wine styles.

Maritime Climate: The western part of the Loire Valley, including the Muscadet region, benefits from a maritime climate influenced by its proximity to the Atlantic Ocean. This climate brings moderate temperatures and high humidity, which can be beneficial for the freshness and minerality of the wines. The cool, moist conditions help preserve the acidity in Melon de Bourgogne, resulting in wines with a crisp and refreshing profile.

Continental Climate: As one moves further inland, the Loire Valley transitions to a more continental climate with greater temperature fluctuations between day and night. This is particularly evident in regions

“You can find a glass of Loire Valley wine for every single hour of the day, and it really is that simple. Because our wines are so diverse.”

Vins de Loire brings together 3,000 winegrowers, merchants and cooperatives from France’s third largest region in terms of Protected Designations of Origin Wines. It accounts for 80 per cent of Loire total wine production by volume.

In 2023, total French wines exportations were affected by the tense geopolitical environment, the inflation rising and the cost increases.

Nonetheless, in this not supportive global macro-economic context, Loire wines gained market share in volume in 2023 among the total exportations of French wines. In terms of value, the ex-works price continues to grow in 2023 (three per cent). This made 2023 among the top three best years in terms of export sales in value, reaching 190 million euros, since 2000. The 10 main markets for Loire wines exported volumes are Germany, USA, UK, Belgium, Canada, the Netherlands, Australia, Sweden, Japan, and Denmark.

Loire wines notoriety is definitely growing bigger and bigger, and Loire wines consumption abroad as well. Loire wines do have a huge potential to unleash, thanks to the great assets Loire wines have, including the diversity in the offer (colours, grape varieties, types of wines), wine profiles of Loire wines fully in line with the trend (freshness, fruitiness, moderate alcohol degrees), the fabulous heritage of Loire wines (2000 years of history).

like Sancerre and Vouvray. The cooler nights help preserve the acidity and aromatic qualities of Sauvignon Blanc and Chenin Blanc, while the warmer days support optimal ripeness and flavour development.

Transitional Climate: The central parts of the Loire Valley experience a transitional climate that combines elements of both maritime and continental influences. This creates a balanced growing environment suitable for a wide range of grape varieties. The varied conditions contribute to the versatility of wines from this region, allowing for a broad spectrum of styles and profiles.

Australian wine drinkers often appreciate wines that offer a sense of place and a unique character. The Loire Valley, with its diverse grape varieties, varied soil types, and intricate climate influences, provides an array of wines that can be both distinctive and approachable. Here are some reasons why Loire Valley wines might appeal to Australian consumers:

Variety and Versatility: The Loire Valley’s broad spectrum of grape

varieties and wine styles provides something for every palate. From the zesty Sauvignon Blanc of Sancerre to the rich, honeyed Chenin Blanc of Vouvray, Australian wine lovers can explore a range of flavours and textures that may differ from the more uniform styles found in New World regions.

Food Pairing: The Loire Valley’s wines are renowned for their versatility in food pairing. Whether it’s the crisp Muscadet with oysters, the aromatic Sancerre with goat cheese, or the structured Cabernet Franc with grilled meats, these wines offer excellent matches for a wide range of cuisines. This versatility makes them appealing for those who enjoy experimenting with different food and wine combinations.

Elegance and Balance: The Loire Valley’s cooler climate and diverse terroirs contribute to wines with a sense of elegance and balance. The crisp acidity, minerality, and nuanced flavours of Loire wines can provide a refreshing contrast to the fuller-bodied, often fruit-forward wines typical of Australia. This balance makes Loire wines particularly enjoyable for those who appreciate subtlety and finesse in their wine selections.

Speaking to Pierre-Jean Sauvion, President of the Communications Committee of Vins de Loire, about Loire Valley wines, he put it quite simply, saying: “We’re the best region in the world.”

He said: “You can find a glass of Loire Valley wine for every single hour of the day, and it really is that simple. Because our wines are so diverse.”

Australia is a growing export market for Loire Valley wines and rosé is currently the top export. Rosé wines from the Loire Valley offer a captivating blend of elegance and freshness, distinguishing themselves with a unique expression of the region’s diverse terroirs.

Known for their vibrant acidity and delicate fruit profiles, Loire Valley rosés often showcase aromas of ripe strawberries, cherries, and hints of citrus, balanced by a mineral edge that reflects the region’s varied soils. Whether crafted from the Grenache, Cabernet Franc, or Pinot Noir grapes,

these rosés embody the Loire’s signature finesse and are celebrated for their versatility, making them an ideal choice for a wide range of pairings – from light salads to grilled seafood. Their bright, refreshing character and charming complexity not only highlight the Loire Valley’s rich viticultural heritage but also resonate with the evolving tastes of modern wine enthusiasts.

In Australia, Sauvignon Blanc and sparkling are the other key varietals already in our market. But there is still a huge opportunity within the Australian market to explore all that the Loire Valley has to offer, including its vibrant reds.

Sauvion says: “Australian people have knowledge about wine and while there is unbelievable wine produced in Australia, it is very different to the wines of the Loire, which is very good, because our wines are very complementary, and every day is a day to discover a different wine.

“The Loire Valley produces the perfect wine for your food, for your weather, just try it, drink it, and you will adopt it,” he says.

François Lieubeau, Winegrower and Vins de Loire Vice-President, says that the Loire Valley has never been so trendy.

“Our cool climate region brings fresh, fruity, friendly and fair wines. Our new identity shows how openminded, alive and welcoming we are. Loire has never been bringing so many high-end wines to the customers.”

The Loire Valley’s rich tapestry of grape varieties, diverse soil types, and unique climatic influences combine to create a captivating array of wines. For Australian wine drinkers, the Loire Valley offers a delightful departure from familiar styles, providing a taste of French tradition and a refreshing exploration of new and intriguing flavours. ■

Founded in the Yorkshire Dales in 1827, Theakston is one of Britain’s oldest established family brewing companies and is famed worldwide for its wide range of premium ales brewed in a historic Victorian tower brewery.

The brewery is guided by founder Robert Theakston’s passion for quality ingredients and brewing and is still managed today by the fifth generation of direct family descendants.

Theakston is renowned as a brewing innovator, brewing a wide range of small batch cask conditioned and premium keg draught ales, as well as bottled and canned beers for the UK and export markets.

Having employed coopers since the founding of the company, Theakston is proud of its continued coopering tradition, being one of the last remaining breweries in the UK to still have an in-house cooperage.

Theakston’s hero brew is the legendary Old Peculiar Beer, which is exported to many countries and widely admired as an iconic beer style. The range of classic English beers also includes Best Bitter, Theakston Pale and XB Ruby Ale. Distributor: Empire Liquor

Y Series is excited to announce a new shopper competition launching this September, offering three dreamy holidays and instant prizes for Australian consumers. Crafted for lively, feisty, and fancy moments, Y Series is perfect for today’s adventurous individuals.

In keeping with the brand’s ethos, participants have a chance to win one of three $10,000 holiday vouchers, enabling them to book the adventure of a lifetime. Additionally, 200 lucky winners will instantly win a 35mm Co Film Camera, the perfect companion to capture life’s everyday moments.

To enter, consumers need to purchase any wine from Y Series at their local retailer or on-premise and submit their details on the competition website. Running from 1 September to 31 December, Y Series invites consumers to ignite their sense of adventure and embrace their unique individuality.

Explore wines that transform moments into occasions, celebrate distinctive individuality, spark adventure, and inspire exploration. Discover the essence of Y Series.

Distributor: Samuel Smith & Son – 1300 615 072 / info@samsmith.com

Jack Daniel’s, the world’s number one whiskey, is excited to announce the launch of its newest innovation: the Jack & Cola 250ml MINI four-pack.

This exciting addition to the Jack family is designed to make the iconic and popular Jack and Cola serve more accessible than ever before. Perfectly mixed and ready to enjoy, the Jack & Cola MINI premix captures the great taste of the world’s most beloved bar call in a convenient and accessible format at one standard drink per can.

At a promotional price of $20 for a four-pack, it stands as the most affordable entry in the Bourbon premix category to recruit new drinkers. Available from mid-September 2024, whiskey enthusiasts and new to category consumers alike can find this new offering at major retailers across the country.

Whether it’s a backyard barbecue or a beachside picnic, the Jack & Cola 250ml MINI is your answer to a refreshing and perfectly mixed drink you can enjoy with friends all summer long. Distributor: Brown-Forman

Calabria Family Wine Group has announced a new partnership with Whitehaven, teaming up with the New Zealand winery to bring the internationally acclaimed Whitehaven wine portfolio to Australian shores.

Sustainably grown and crafted in Marlborough, the Whitehaven wine range has already enjoyed overseas success, becoming the fastest growing New Zealand Sauvignon Blanc in the United States, and is now available in Australia exclusively through Calabria Family Wine Group.

After the continued success of Hahn Super Dry low carb beers, Lion has unveiled Hahn’s first zero carb beer in partnership with AFL legend Lance ‘Buddy’ Franklin.

Catering to a growing sector of consumers seeking healthier alternatives to traditional beer options, Hahn Ultra Zero Carb has less than 0.5g of carbs per bottle and just 87 calories.

Hahn Ultra Zero Carb is described as a crisp, easy-drinking beer with low bitterness, marking the first release in Lion’s new Ultra Category, which will comprise a range of zero carb beers.

Sammy Russo, Hahn Marketing Manager – Lion Australia, said: “With the launch of Hahn Ultra Zero Carb beer, we anticipate continued expansion and success for the Hahn brand, as we cater to the evolving preferences of our conscious consumers.”

Franklin added: “While kicking footies has always come naturally to me, kicking carbs can be a little trickier which is why it’s so good that the experts at Hahn have managed to create a delicious beer that not only tastes great but has zero carbs – how good?” Distributor: Lion

Showcasing the distinct terroir of Marlborough, characterised by longer sunshine hours and cool crisp winters, Whitehaven Marlborough Sauvignon Blanc 2023 is the icon of the portfolio.

The Sauvignon Blanc has aromas of grapefruit lemongrass and crushed herbs, with hints of tropical fruits and gooseberry. On the palate, the wine has flavours of grapefruit, white peach, lemongrass and citrus, with a medium body and lingering finish.

Enjoyed young and fresh, Whitehaven Marlborough Sauvignon Blanc 2023 is the perfect accompaniment to oysters and fresh seafood, Japanese cuisine, summer salads, light poultry and goats cheese. Being Appellation Marlborough Wine accredited means that provenance, quality and sustainability are all guaranteed.

Distributor: Calabria Family Wine Group

Taking inspiration from French-style rums which use fresh sugarcane juice as the primary ingredient, Husk Distillery Farm was established in 2009, when Husk began crafting rum from Australian cultivated sugarcane.

Combining the complexity of fresh cane juice with the rich smoothness of cane honey, Husk Rare Blend is a modern Australian rum which captures the character of the land on which it is made.

Sub-tropically aged in small barrels at Husk Rum Distillery, Rare Blend combines seasonal 100 per cent single estate cane rum juice, Husk’s signature style, and rum made from Tweed Valley cane honey.

The result is a dark rum with flavours of ripe fruit, honeysuckle, vanilla, Asian spices and toasted oak, perfect for sipping, or served in a Cuba Libre or Old Fashioned.

Quentin Brival, Head Distiller at Husk Distillers, says: “While the Australian rum category is built on products that use molasses in production, Husk is the only brand in Australia which has a farm-to-bottle ethos.

“Fresh sugar cane juice is grown at the distillery, harvested and instantly fermented and distilled to create rums which are fresh, vibrant and complex due to its unprocessed nature.” Distributor: Proof and Company

As wine enthusiasts around the globe prepare to raise their glasses on 30 August for International Cabernet Sauvignon Day, there’s one region that stands out among the rest, Coonawarra. Nestled in South Australia, it is renowned for producing some of the finest expressions of Cabernet Sauvignon in the world.

Among the many stellar examples from this region is Brand’s Laira Blockers Cabernet Sauvignon. Named in honour of founder Eric Brand, one of the original ‘Blockers’ (landholders who sold their grapes to larger wineries in the 1950s and 60s) the wine is made in true Coonawarra style, where the unique terroir plays a pivotal role in shaping the character of our wines.

Brand’s Laira Blockers Cabernet Sauvignon is the perfect combination of rich fruit, complexity and elegance. The 2018 vintage presents a deep garnet red colour, accompanied by aromas of dark classic berry fruits with subtle oak displaying cashew nut and vanilla aromas. On the palate, Intense dark fruits are wellintegrated with cashew nut and vanilla flavours derived from time spent in barrel. It displays elegance and structure, with powerful finegrained tannins and a long finish.

On 30 August, you’re invited to join in a toast to the legacy of Coonawarra with a glass of Blockers. The balance of fruit and tannin makes it a versatile companion at the table, pairing beautifully with hearty dishes like roasted lamb or aged cheeses, yet also capable of standing alone as a contemplative sipper.

Distributor: Casella Family Brands

After the success of its Zoncello Spritz and recent reformulation of Bellina, Victorian winemaker Zonzo Estate has introduced its latest creation, a first-of-its-kind bottled Pistachio Spritz named Cicchio.

Given the recent exponential rise of the pistachio industry, and the roots of the pistachio nut in Italy, Zonzo Estate Director Rod Micallef saw an opportunity to create a new beverage concept that was ahead of the curve.

“The idea was a fun exercise in imagination and experimentation at first, but it has completely evolved into a refined, delicious, real-life product that we’re hugely proud of,” he says.

Cicchio Pistachio Spritz features a pistachio spirit blended with Zonzo’s awardwinning Prosecco Di Aria. On the nose, Cicchio has aromas of melon, citrus, honey and pistachio, with a creamy texture on the palate.

“This is a beautiful creation by our team, from an aesthetic standpoint, and on the flavour profile. We are quite literally nuts about Cicchio and feel incredible excited to unveil this tipple to the world,” added Micallef.

Distributor: Contact wine@zonzo.com.au

Hailing from Sydney’s Northern Beaches, Coastal Stone Whisky has announced its expansion into the RTD category with the unveiling of its new canned premix range.

Comprising Coastal Stone Whisky & Dry and Coastal Stone Whisky & Cola, the new range has been crafted with premium ingredients and each can features the distillery’s double grain whisky, expertly crafted for the Australian palate.

Dave Richards, Coastal Stone’s Distillery Manager, says: “I’m thrilled about the launch of Coastal Stone Whisky’s new ready-to-drink Whisky & Cola and Whisky & Dry, made with our award-winning double grain Whisky Xplore, right here in sunny Sydney.

“This whisky has already revolutionised the realm of affordable Australian whisky, and we believe all Aussies deserve to enjoy their whisky in every way possible, making it accessible to all.”

Both flavours are available in 330ml can format at 5.3 per cent ABV, now rolling out to retailers nationwide.

Distributor: Direct – contact sales@manlyspirits.com.au

Award-winning Monkey Shoulder whisky, the 100 per cent malt whisky made for mixing, is revealing a fresh new look and feel to its bottle, the first major change to the brand’s hero bottle since it started shaking up the traditional whisky category in 2005.

The lowdown on the slimdown: The new and improved Monkey Shoulder bottle is more than just a glass reduction. Refreshingly light, the new look includes a longer neck for an easier pour, for both bartenders and consumers making whisky cocktails at home.

A premium look for a premium whisky: The label design has been optimised for maximum impact, to improve shelf appeal and stand out on the back bar, in-store and online. Monkey Shoulder’s distinctive brand asset – the ‘three monkeys’ icon – features pride of place on the new label. The ‘three monkeys’ badge maintains its position on the new design, and the debossed three monkeys remain on the wooden cork for a premium feel.

Everything remixed but the recipe: Inside the bold new bottles is the same award-winning liquid loved around the world. Made with single malt whiskies from the Speyside region, selected in small batches then married together, Monkey Shoulder Original Malt Whisky retains its rich, smooth, and fruity flavour.

Distributor: William Grant & Sons Australia – 02 9409 5100 / wgsa.customerservice@wgrant.com

Clare Valley winery Taylors marked the 55th anniversary of its founding day with the unveiling of its 2024 Family Flagship Release, a capsule collection featuring 11 of Taylors’ finest wines.

Comprising wines from four of Taylors ranges, the release showcases vintages spanning from 2017 to 2024, and for the first time includes a museum release, St Andrews Riesling 2020.

Taylors Chief Winemaker Adam Eggins says: “The spread of vintages and the selection of varieties showcased in this release is a capsule collection of what Taylors has been known and celebrated for more than 50 years. I’m incredibly proud to share the 2024 Family Flagship Release and look forward to sharing these wines with wine lovers worldwide.”

The collection includes three of Taylors’ pinnacle wines, each named in honour of the founding principles and individuals who have made lasting contributions to the winery over the years.

This includes The Pioneer Shiraz 2018, The Visionary Cabernet Sauvignon 2018 and The Legacy 2017.

Completing the collection are new vintages from Taylors Masterstroke and St Andrews ranges, including a selection of Riesling, Chardonnay, Shiraz and Cabernet Sauvignon from the Clare Valley, Coonawarra and McLaren Vale regions.

Distributor: Direct

Seeking to appeal to a new generation of whisky drinkers, The Glendronach has unveiled a new creative direction, refreshing the design of its core range.

While commemorating the rich heritage of the Scottish distillery, the new visual identity speaks to modern luxury, incorporating timeless, pared-back packaging and an updated illustration.

Depicting the bramble and rooks that surround the distillery, the new illustration is a contemporary homage to The Glendronach brand’s namesake, derived from the Scottish Gaelic Gleann Dronach, which means valley of the brambles.

The new packaging also highlights the combination of Highland spirit and Spanish flair in The Glendronach Single Malt, honouring the rare Pedro Ximénez and Oloroso casks from Andalucia in which the whisky is matured.

Speaking about the relaunch, The Glendronach Master Blender Rachel Barrie said: “For me, The Glendronach is a surprise, a revelation and a flavour crescendo.

“At first taste, it has this amplification that’s so much richer than your expectations, and our philosophy is just that – to raise expectations in Single Malt by creating the most exceptional sherried whisky. And we are now setting a new standard to match the exquisite nature of the spirit with reimagined visuals.”

The transformation will roll out across The Glendronach permanent range, including the 12-Year-Old, 15-Year-Old and 18-Year-Old Single Malts, available to liquor retailers nationwide from late November 2024.

Distributor: Brown-Forman

De Bortoli has announced the release of its latest product, Limoncello Spritz. Citrus-flavoured products are currently dominating the RTD market, and Innova Market Insights reports that they comprise 32 per cent of the overall beverage market. A refreshing combination of De Bortoli Prosecco and lemon flavours, Limoncello Spritz provides a ready-to-serve spritzer option for wine consumers.

Although traditionally consumed as an aperitif, Limoncello Spritz is equally suited to a pre-dinner occasion, paired with a meal, or on its own. De Bortoli suggests elevating the drinking experience by serving Limoncello Spritz with a sprig of fresh mint and a slice of lemon. In addition, with an ABV of nine per cent, Limoncello Spritz offers flavour to consumers who may be looking to moderate their alcohol consumption.

Distributor: Direct

To celebrate its 30th anniversary, Robert Mondavi Private Selection is modernising with a new name and new modern look: Robert Mondavi Private Selection Vint. This new name represents the next chapter in the Robert Mondavi story, one that is committed to crafting and producing the wine you know and love with a refreshed and modern look. Robert Mondavi Private Selection was launched in 1994 with Robert Mondavi’s vision of bringing high-quality wines from California to every family table. Since its inception, the brand has fulfilled this vision.

This new pack clearly calls out the varietal and the sought after Californian appellation to assist customers in easily identifying their favourite wine on shelf. Despite a modernised design, customers can feel confident knowing this is only a pack refresh and the liquid in each bottle has not changed.

All four varietals will be refreshed throughout 2024 with Buttery Chardonnay transitioning on shelf first, followed by Bourbon Barrel-Aged Chardonnay, Bourbon Barrel-Aged Cabernet Sauvignon and Rum Barrel-Aged Merlot. Distributor: Contact dean.kornman@cbrands.com

BrightSide Executive Search is the only dedicated drinks recruitment specialist nationally and has been a trusted advisor to the industry for well over a decade. Through accessing its wide-reaching network of potential candidates, BrightSide takes the hassle out of recruitment for drinks businesses, advising how they can stay nimble and competitive in a tight market to attract the absolute right person for each role. The latest BrightSide success stories below show the strong abilities of the recruitment agency in partnership with drinks businesses of all sizes, country-wide.

Charlotte O’Brien is loving her new role working cross functionally as Trade Activity Manager with Joval Wines in Sydney.

Hayley Ferry’s strong hospitality and event experience is highly regarded in her new Brand Ambassador role for Archie Rose QLD.

Check out our new website

Archie Rose welcomes Danielle Dounis as Account Manager to drive brand awareness and sales growth throughout Sydney.

Ryan Thomas joined CBCo as Area Sales Manager bringing strong industry experience to support and drive growth in WA.

Loy Catada brings a wealth of industry experience and sound networks to Proximo Spirits as National Brand Ambassador.

Doozy Drinks is loving the energy and extensive experience Phillip Tasker brings to the team as Area Sales Manager NSW.

For more information www.brightside.careers

Ben Coleman has joined Archie Rose as Key Account Manager NSW to increase brand distribution for their premium spirits.

Daniel D’alessandro brings passion and experience to Proximo Spirits as Area Sales Manager driving growth in Brisbane and Cairns.

All Saints Estate is delighted to welcome Hilary Thomson to the team as Sales Manager to drive brand and sales growth.

Andrew Cossar is excited to utilise his previous drinks and hospitality experience as Account Manager for Archie Rose VIC.

Visit us on LinkedIn

“Retail Drinks will continue to work collaboratively and constructively with the incoming governments to secure positive policy outcomes on behalf of our members and the entire retail liquor industry.”

Michael Waters Chief Executive Officer Retail Drinks Australia

With upcoming elections in the Northern Territory, the ACT, and Queensland, Retail Drinks has ensured that our major policy priorities for and on behalf of members and the broader retail liquor sector have been proactively advocated to the major parties for consideration.

The first cab off the rank is the NT on 24 August. Unlike other jurisdictions, alcohol-related issues play a significant role in Territory politics. Pleasingly, some of our proposed policies have already gained traction and been committed to by both major parties pre-election, including continuation of the Police Auxiliary Liquor Inspectors and BizSecure grants, and we’re confident of more positive outcomes.

It is evident that the NT election will be a tight contest, with one recent poll suggesting less than 0.4 per cent separating the two major parties on primary vote. The next three-year review of the Liquor Act 2019 will also take place in the next term of government, which may result in significant legislative changes for retailers in the NT.

Following the NT, the ACT election is scheduled to take place on 19 October. Retail Drinks already sits on the ACT Government’s Liquor Advisory Board as the representative for off-licences, and the election result will not change this.

A summary report arising out of the ACT Government’s review on same-day alcohol deliveries in Canberra was recently released and one of the key issues on Retail Drinks’ agenda will be the implementation of regulatory changes concerning online delivery in the next term of government. Polling suggests there is unlikely to be a change of Government, however Retail Drinks has put forward several key policy proposals to the major parties.

Lastly, Queensland’s election is due to take place on 26 October with the Labor Party attempting to win a fourth consecutive term in office. Recent polling and results in by-elections suggest that a win for the Liberal National Party may be on the cards. Retail Drinks has put forward several key policies to the major parties in the lead-up to the election, including reforms to the state’s online alcohol sale and delivery sector, liquor licence fees, trading hours and harsher penalties for assaults on retail workers, in particular liquor retail.

Regardless of which party forms government in each of these jurisdictions, Retail Drinks will continue to work collaboratively and constructively with the incoming governments to secure positive policy outcomes on behalf of our members and the entire retail liquor industry – as the voice for liquor retail. ■

Time stands still for no-one, not even the liquor industry, writes Stephen Wilson, Category & Insights Manager, Strikeforce.

I have been reflecting on the state of play of off-premise liquor, now compared to decades ago, when I was fortunate enough to represent one of the major brewers calling on local independent liquor stores.

The trade was largely relationship-based, with retailers and suppliers collaborating and succeeding based on a rudimentary understanding of local customers and their purchasing habits, which were very much driven by the major brands and the prevailing marketing campaign at that point in time.

We used to joke, “if it moved sponsor it, if it didn’t paint a logo on it”.

This led to a ‘stack them high and watch them fly’ philosophy to match demand, with the biggest challenge being to provide enough product initially and then replenish for the duration of the promotion.

Some limited-edition releases were so popular that stores would pre-sell, often taking enough orders from customers to exhaust their allocation even before the stock was delivered.

Fast forward to 2024 and the driving wheel is very much in the hands of liquor shoppers.

The retail landscape is evolving at pace with consumer trends determining how retailers and suppliers react with their

“The retail landscape is evolving at pace with consumer trends determining how retailers and suppliers react.”

Stephen Wilson Category & Insights Manager Strikeforce

brands and how they are positioned to take advantage of prevailing trends.

Non-alcoholic beverages, once confined to the soft drink section of the fridge, are mainstream driven by generational change. Major suppliers are replicating the taste of their flagship brand without the alcohol, understanding demand will continue to grow if they get it right.

E-commerce has fundamentally changed the way shoppers purchase their liquor, the convenience of ordering online and having the order delivered to your door is appealing to many. Consequently, retailers must have an online option or risk losing customers.

Health and wellbeing needs must be catered for, meaning functional beverages with health benefits must be offered to shoppers who centre on their food and beverage intake as part of their overall health and wellbeing regime.

Shoppers remain heavily focused on sustainability and companies demonstrating corporate responsibility for their environmental impact. There is a continued demand for sustainable sourcing, packaging and production practices.

Brands that demonstrate authentic ecofriendly practices are attracting shopper loyalty and these shoppers are prepared to pay a premium for products that align with their values.

These four trends are just the tip of the iceberg and there are many more to consider as off-premise liquor continues to evolve.

In summary, while non-negotiables like customer service, curated ranges of product and understanding your customer base are staples of good retailing, offpremise liquor will continue to innovate and evolve largely dictated by prevailing and emerging consumer trends. Retailers need to be cognisant of these changes at the early-stage new trends emerge and adapt accordingly. ■

Falling in the middle of our winter, International Pinot Noir Day is the perfect time to honour a variety that enjoys a heartwarming history in New Zealand. However, the New Zealand Pinot Noir success story is one that may never have eventuated if not for a twist of fate.

Although first planted in the Wairarapa region of New Zealand’s North Island back in 1883, it wasn’t until the late 1980s that the popularity of the Pinot Noir variety started to bloom. The accolades at local wine shows began to roll in and by the 1990s, things had started to heat up internationally. Gold medals were won in Australia, then London, and murmurings of a potential new Pinot powerhouse began travelling around the globe.

Since then, the rest of the world has woken up to the fact that New Zealand Pinot Noir is something else. It’s fruity, softer, and more expressive than wine produced in the grape’s native home of Burgundy, and thanks to the huge diversity in climates and soils throughout New Zealand’s Pinot Noir regions, there’s also a wide range of styles.

Pinot Noir is predominantly grown in New Zealand’s cooler southerly wine regions including Central Otago, North Canterbury, Marlborough, and Nelson in

the South Island. Wairarapa is the main North Island region, with a climate best suited to the notoriously fickle grape and now, 100 years on from the first planting, there are several boutique, sought-after producers offering some of the country’s best Pinot Noir with texture and depth. The region’s flagship red is richly flavoured and warm, with darker fruit aromas, often with a savoury component.

Still considered the new kid on the block due to its rapid rise to fame, New Zealand Pinot Noir is now the country’s top red wine variety and the second-most exported wine after Sauvignon Blanc. Impressive growth in export sales over the past five years means more than 1.5 million cases of New Zealand Pinot Noir are exported annually.

Palooza

Building on the New Zealand Pinot Noir theme, New Zealand Trade & Enterprise and New Zealand Winegrowers are partnering with Pinot Palooza this year to showcase New Zealand as the feature region at the Sydney, Brisbane, and Melbourne events.

Dan Sims, Head of Revel, commented: “While New Zealand has been a key part

of the festival since inception, it hasn’t been since 2019 that producers have been with us in force. Well, that five-year hiatus is over, and we can’t wait to welcome them back and we know our audience can’t either (heck, they’ve been asking for two years). Being the feature region will fully amplify their triumphant return and showcase the best of what they do; Pinot Noir.”

New Zealand will proudly be featured at the following Pinot Palooza events:

Sydney 4-5 October

Brisbane 15-16 November

Melbourne 22-23 November ■

New Zealand 2025

A reminder that registrations are now open for Pinot Noir New Zealand 2025, an exciting opportunity designed to engage with international wine professionals and passionate, energetic Pinot Noir producers from New Zealand’s diverse winegrowing regions.

Join us in Christchurch 11-13 February 2025

Pinot Noir NZ (pinotnz.co.nz)

Sandy Hathaway, Senior Analyst at Wine Australia examines vintage 2024.

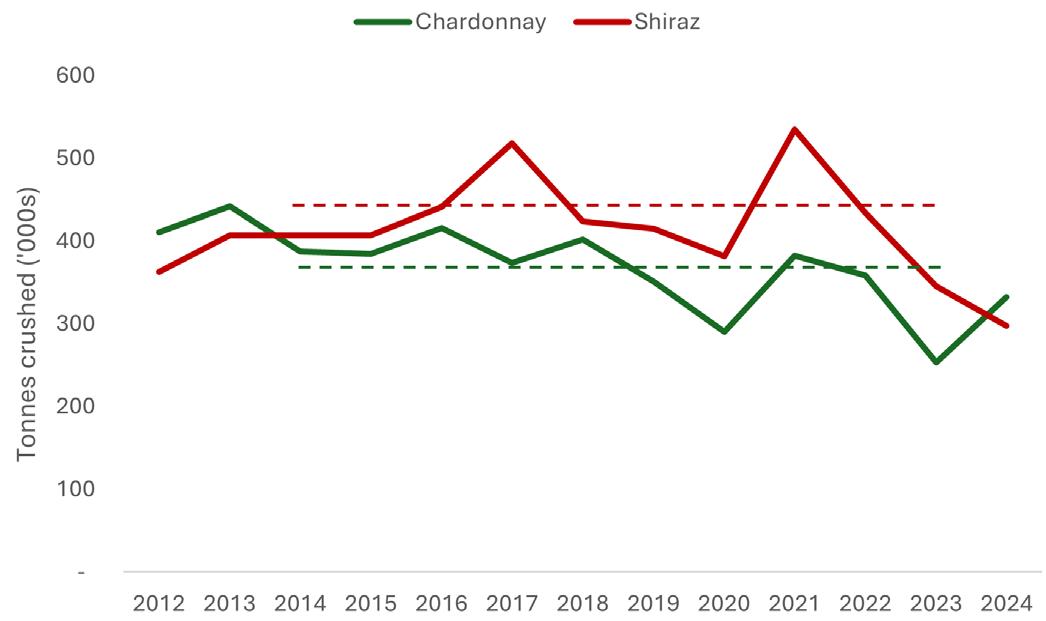

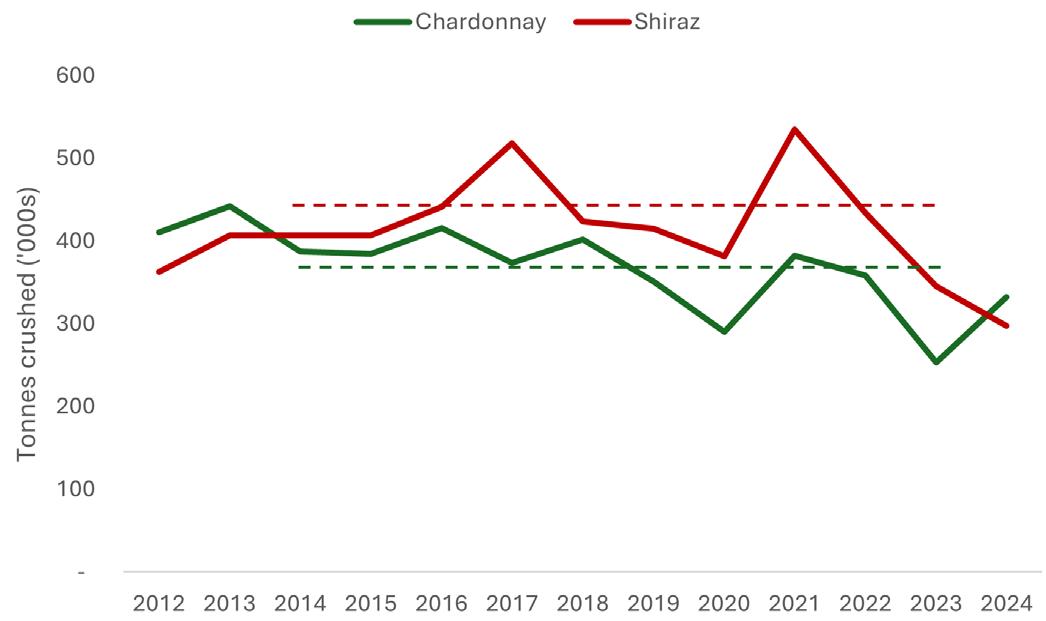

The 2024 vintage was distinctive for two main reasons: it was the second smallest in the past 20 years (after last year recorded the smallest in that time) and the crush of white grapes exceeded reds, for the first time since 2014.

The 2024 vintage was 1.43 million tonnes, which equates to around one billion litres. Around 60 per cent of Australian wine is exported and 40 per cent sold on the domestic market.

The crush of white grapes increased by 19 per cent (over 100,000 tonnes) compared with 2023, while reds decreased by one per cent (5,000 tonnes). The overall reduction in the red crush was entirely driven by Shiraz, which decreased by nearly 48,000 tonnes while most other red varieties increased. In particular, Pinot Noir was up 34 per cent, Grenache up 19 per cent and Mataro (Mourvèdre) up 15 per cent, reflecting changing preferences towards lighter styles and varieties.

The relatively strong showing for whites was mainly driven by Chardonnay, which rebounded strongly from last year’s exceptionally low crush and overtook Shiraz to resume the title of top variety that it last held in 2013 (see Figure 1). Despite this, both Shiraz and Chardonnay were well below their 10-year average crush, largely reflecting adjustments to reduced demand in export markets.

Figure 1: Crush of Chardonnay and Shiraz in Australia since 2012

Source: Wine Australia

The Chardonnay crush increased in 2024 by 31 per cent and all other top 10 white winegrape varieties also increased, especially

Pinot Gris/Grigio (up 27 per cent), Colombard (up 23 per cent) and Prosecco (up 22 per cent).

Prosecco, Fiano, Roussanne and Grüner Veltliner have all shown strong growth in crush over the past 10 years. Prosecco has increased by nearly 700 per cent in tonnes since 2015 to become Australia’s eighth-largest white variety while Fiano is up 71 per cent to reach 15th spot. Roussanne is up 19 per cent and Grüner Veltliner by 116 per cent but both from much smaller bases.

The increasing popularity of white varieties was shown in the prices paid for grapes at the farmgate, particularly in the cool climate regions known for their premium white wines. Stand-outs included Clare Riesling, Margaret River Chardonnay, Adelaide Hills Sauvignon Blanc and Tasmania Chardonnay – all of which saw their highest average value in at least 10 years (Figure 2).

Figure 2: Average value for selected variety–region combinations 2008–2024

Source: Wine Australia

(Note: Rising winegrape prices are based on increased demand, but do not necessarily translate into higher retail prices.) ■

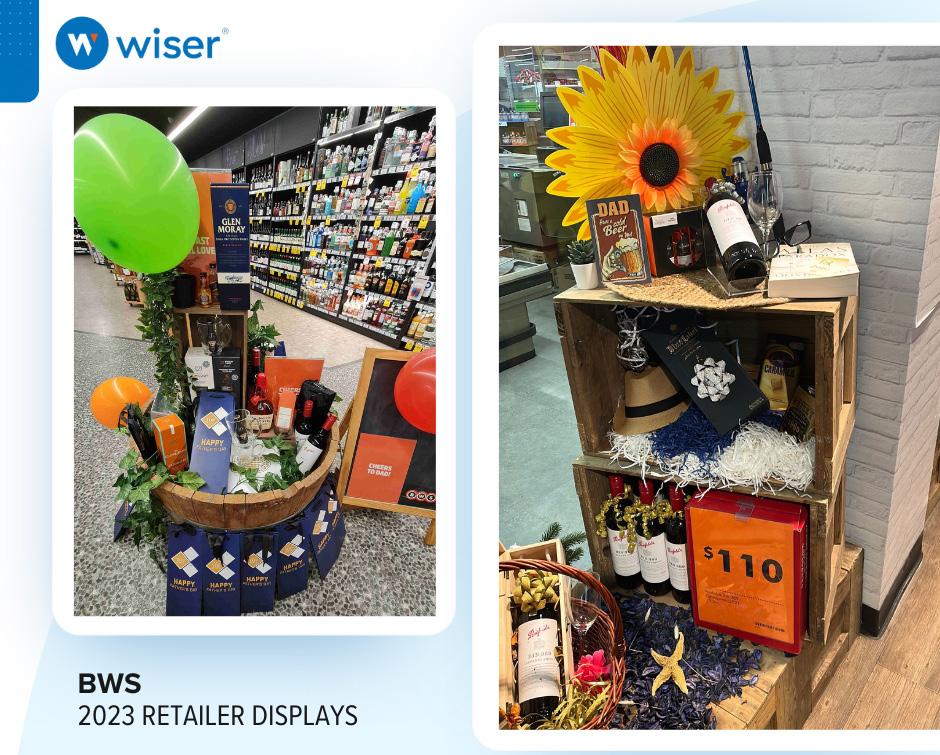

Displays play a vital role in establishing a strong in-store brand presence during key sales periods.

Laurie Wespes, CEO of Snooper, Wiser’s crowdsourcing platform, discovers how emerging trends are transforming the retail landscape.

With 95 per cent of Australia’s alcoholic beverages revenue generated via offline sales channels1, in-store touchpoints and strategic brand activations remain critical sales drivers for both brands and retailers.

Key selling periods present prime opportunities to capitalise on increased in-store engagement. Through its “Share of Display” data series, Wiser helps brands capitalise on these opportunities through proactive monitoring on out-of-aisle activations across various categories and retailers. Here are the main takeaways from the last key sales periods within the alcoholic beverage category.

Within Australia’s alcoholic beverage retail landscape, Liquorland and BWS both employ distinct strategies to attract shoppers during key sales periods. While both retailers clearly utilise gondola ends featuring multiple categories and promotions, their approaches to in-store displays are notably different.

BWS, known for its vibrant and engaging store environments, makes significant investments in the variety and quantity of in-store displays. During the 2023 festive season, BWS stores featured an impressive average of 7.7 displays per store2, marking a 17 per cent increase from the previous year.

By leveraging a combination of branded and elaborately styled displays, BWS aims to maximise sales during seasonal events throughout the year.

In contrast, Liquorland opts for a more minimalist approach. During the same festive period, Liquorland featured an average of 1.3 displays per store, focusing primarily on utilising its own displays rather than brand-provided ones.

While BWS attracts shoppers with large, eye-catching displays, Liquorland employs simple displays with focused messages like “Father’s Day landed” or “game days landed” in September 2023, and “cheers” during the 2024 festive season, New Year and summer.

To captivate shoppers and increase off-location visibility, alcoholic beverage manufacturers can deploy a mix of branded and retailer displays, tailored to align with each retailer’s strategy.

One of the best examples of a category that has successfully increased its visibility through in-store branded displays is the RTD category. This category has seen remarkable growth in recent years, capturing a 13 per cent share of the total alcoholic beverages market in Australia3

This surge in popularity was evident at BWS, where branded RTD displays began to appear in 2023, gradually replacing some branded beer displays. Brands like Vodka Cruiser made a significant impact with their strong branded display presence during the 2023 festive and New Year periods and summer 2024 periods.

In addition to the RTD category, spirits were also featured prominently on branded displays during key periods at BWS, showcasing manufacturers such as Diageo, Bacardi, and Campari.

While branded displays certainly capture shoppers’ attention and drive brand awareness, retailer displays still dominate the in-store landscape, playing a crucial role in overall off-location visibility for brands.

Throughout the year, wine frequently takes the spotlight on retailer displays. Nonetheless, the share of display for various categories, and across different retailers, continuously shifts during key selling periods.

For example, wine dominated retailer displays in Liquorland both during the 2023 footy finals and the 2024 New Year and summer season. However, the category’s overall share of display varied significantly, accounting for 45 and 35 per cent respectively.

To compete with the wine category, brands from other alcoholic beverage categories must adopt more innovative strategies. This was seen during the 2023 festive season, where wine failed to command the spotlight on retailer displays in Liquorland.

Instead, the spirits category took centre stage, offering a broad portfolio of gift packs and capturing an impressive 60 per cent share of display. Some leading manufacturers like Diageo and Campari added extra items such as glassware, while others opted for simpler gift packs featuring their products in attractive packaging.

This focus on gift packs extended beyond spirits and was seen across multiple categories including beer, RTD, wine and sparkling. However, Liquorland’s limited display capacity meant only a small selection of gift packs could be featured. In contrast, BWS showcased a larger variety of non-spirits gift packs, thanks to the numerous displays available in their store

With many prime selling periods such as Spring Racing and Father’s Day upcoming, three key lessons emerge for alcoholic beverage manufacturers aiming to enhance in-store visibility and sales:

Decode retailer strategies: Understand and adjust to the distinct strategies of different alcoholic beverage retailers. From the varying assets they leverage to their prioritised categories and brands, grasping these retailer nuances is crucial for strategically positioning your brand in stores and navigating the competitive landscape successfully.

Navigate cross-category dynamics: Track in-store category dynamics and delve deeper than surface trends to identify how emerging (sub-) categories are reshaping the market. Leverage innovative tactics to challenge established leading categories in stores.

Craft creative visibility strategies: Explore innovative approaches like attention-grabbing gift packs, exciting new product launches, and strategic collaborations to carve out a distinct presence and stand out amidst the dominance of competing brands and categories.

Curious about the visibility of your category, brands, and competitors? Visit the Wiser website (www.wiser.com/retail-intelligence/share-ofdisplay) and request your free Share of Display trial today. ■

Sources:

1 Statista Market Insights

2 Data based on a total of 202 store visits during December 2023 (N=129 store visits in BWS and N=73 store visits in Liquorland

3 IWSR

With Father’s Day just around the corner, we’ve compiled a list of premium, giftable products to help retailers make the most of the occasion.

Since 1962, each vintage release of this iconic Barossa Cabernet Sauvignon and Shiraz blend bears the signature and story of an individual who has made a significant contribution to the culture and traditions of Yalumba. For the series’ 50th vintage, Yalumba has dedicated The Signature 2021 to third-generation employee and Packaging and Development Manager, Christopher Gerhardy.

Gerhardy follows in the footsteps of his father, who was also a Signatory of a previous vintage.

“My dad, Colin, worked at Yalumba for 49 years and his father, Herb, for 33 years. I am as proud as punch to be a Signatory and join dad who was the 1988 Signatory,” he said.

Fifth-generation proprietor Robert Hill-Smith announced Gerhardy as the Signatory at the family winemaker’s annual Christmas celebration on the Signature lawns of Yalumba.

“This man is remarkable, and his family have been remarkable contributors for over three generations, serving 145 years cumulatively here at Yalumba.

“The 2021 vintage was near perfect, presenting an impressive wine of balance, style and defined fruit characteristics. It is a very fitting wine for the 50th release,” he said.

Each bottle of The Signature celebrates heritage, innovation, and the enduring pursuit of excellence in winemaking. RRP $70.

Distributor: Samuel Smith & Son

Elevate your shelves for Father’s Day with a truly unique Australian whisky from Archie Rose.

Unlike most distilleries that use just one malt in their Single Malt Whisky, Archie Rose uses six locally grown Australian malts. With an unwavering belief that malt provides a potent and vital contribution to the final flavour profile of our whisky, Archie Rose Single Malt Whisky is distinctly crafted to highlight six malts, each with a unique profile and character. This six-malt mash bill, although incredibly low yielding, provides a rich and expressive flavour, full of distinct regional character.

Matured predominantly in 100, 200 and 300-litre Australian Apera (Sherry) casks, the flavours are complemented by a selection of ex-Bourbon and Archie Rose’s own 36-month air dried ex-Rye Casks, each with a specific balance of both char and toast.

The natural sweetness of these casks complements the savoury charisma of the spirit, revealing fresh herbs, shortbread biscuits, raisins, toffee and dark chocolate on the nose. Meanwhile, the palate is luscious with wellintegrated flavours of sticky date pudding and amaretto, with a final note of espresso.

Distributor: Available from all good wholesalers nationally

Coopers Brewery has launched its annual extra strong brew, the 2024 Vintage Ale, with a tropical twist.

Each year, the Coopers expert brewing team creates an exclusive craft-style ale with a distinctive blend of hops. The heroes of this year’s Vintage Ale are the unique hops; the German variety Solero, and a new hop, Bru-1, from the USA. This pairing offers a blend of pineapple, mango, and passionfruit aromas, herbal and citrus notes, and berry, spice, and melon characters on the palate.

Coopers Managing Director and Chief Brewer, Dr Tim Cooper, said the 2024 Vintage Ale has maintained its reputation as a complex, premium craft beer.

“The hops pairing creates an intriguing balance of tropical fruit and herbal notes while maintaining a pleasant bitterness on the palate. While it’s perfect to drink right away, Vintage Ale can also be stored under cellar conditions to bring its robust, malty characters to the forefront,” he said.

Liquor retailers across Australia are a popular destination for Father’s Day gifts and beer is high on the shopping list. Coopers 2024 Vintage Ale is available in 355ml bottles, six packs and 24-cartons for a limited time only, making it the perfect Father’s Day gift.

Distributor: ALM, Paramount, and Liquid Mix

Proudly independent and family-owned since 1859, Morris of Rutherglen is famous worldwide for its fortified wine, but now also for its whisky.

According to Morris, its Signature Single Malt is the fastest-growing Australian single malt under $100, showcasing a host of international gold awards and making it a must-stock for the whisky season. Presented in a premium gift box, the Morris Signature is perfect for gifting this Father’s Day.

Made with 100 per cent Australian ingredients and crafted in regional Victoria, Morris is one of the only distilleries in the world where whisky is aged and finished in family-owned and award-winning wine barrels.

Father’s Day is a time to celebrate the special men in your life, and Morris suggests pairing a gift of its Signature Single Malt with a road trip to Rutherglen for a one-of-a-kind experience at Morris’ newly renovated cellar door and distillery, nestled in the heart of Victoria’s wine country.

Distributor: Casella Family Brands

“Gifting a bottle of The Signature for Father’s Day is a special way to celebrate this day. Every vintage release we dedicate to an individual who embodies the culture and traditions of Yalumba, and they become a ‘Signatory’, a Yalumba legend. This wine is all about people. Many Signature drinkers connect with a particular vintage, or a Signatory, and have their own memories to share.”

For a limited time only, everyone’s favourite Shiraz from much-loved Barossa winery, Pepperjack, is providing gift givers the perfect solution this Father’s Day. With three different labels: ‘Thanks & Cheers’, ‘You’re the best’ and ‘From me to you’, Pepperjack’s exclusive gifting labels also provide the perfect gift for other key occasions throughout the year, whether you are shopping for family, friends, loved ones or colleagues.

Pepperjack wines are predominantly grown and made in the Barossa, a wine region notorious for world-class Shiraz and Cabernet Sauvignon. Pepperjack wines can be enjoyed now but will also improve with careful cellaring, meaning your gift will stand the test of time.

Available from leading retailers nationally from mid-July to mid-September, unless sold out prior, don’t miss out on gifting dad something he will truly love on his special day. RRP $27.

Distributor: Treasury Wine Estates

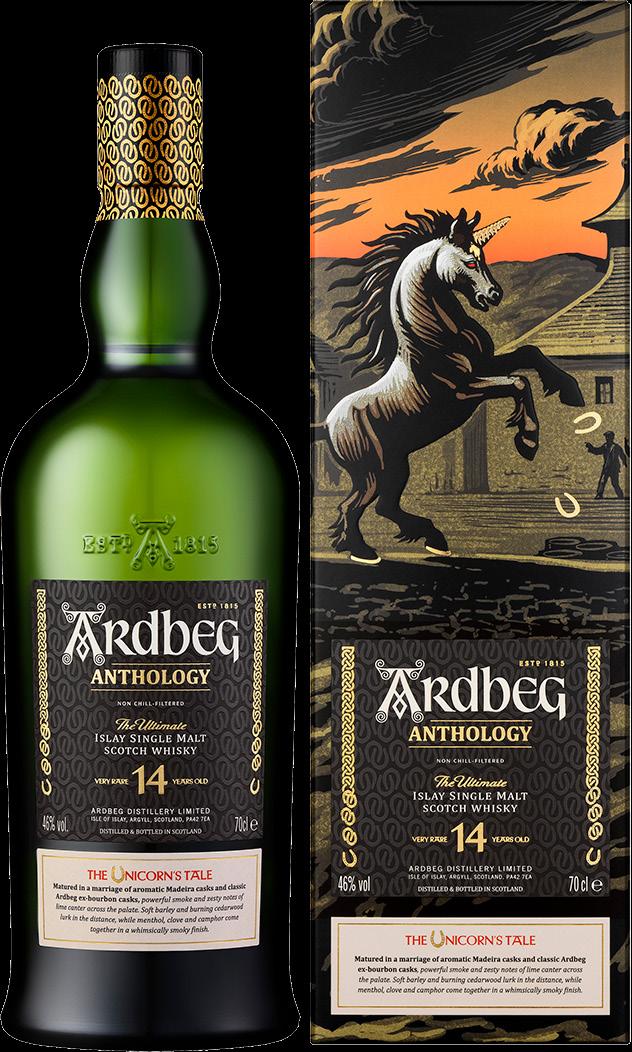

This Father’s Day, delight your smoke enthusiast customers with Ardbeg Islay single malt whisky’s second release of rare and strange single malts in its Anthology Collection.

Aged 14 years, Ardbeg Anthology: The Unicorn’s Tale is Ardbeg’s first whisky matured in a marriage of madeira wine casks and classic Ardbeg Bourbon barrels, to perfectly balance sweetness and smoky complexity.

This limited release offers a unique experience where peat meets sweet, with notes of syrupy sponge pudding and tropical baked fruits, seamlessly intertwined with peat smoke, cedarwood, and camphor.

This exceptional whisky, crafted with precision and passion, is more than a drink; it’s a tale of craftsmanship and tradition showcasing Ardbeg’s love for experimentation to push our spirit’s smoky balance into new worlds and flavours.

Stock the Ardbeg Anthology: Unicorn’s Tale and provide your customers the opportunity to gift an extraordinary whisky that embodies Ardbeg’s awardwinning, smoky heritage this Father’s Day.

Distributor: Moët

Hennesy

Make Father’s Day memorable with a one-of-a-kind Australian whisky from Archie Rose.

To create this truly unique whisky, Archie Rose selectively sourced rare, malted rye and the finest malted barley from progressive malt houses, paired them with virgin American oak casks air-dried for 36 months and let it all mature in the maritime air of coastal Sydney.

Archie Rose’s preference for malted rye over the far more commonly used unmalted rye affords this whisky a point of distinction evident upon the very first sip. Less common but more approachable than raw, unmalted rye, it provides characteristic spice and herbal elements but with more restraint, elegance and complexity than traditional rye.

This layered, aromatic spirit offers notes of spiced custard, ginger, stone fruit and baked apple pie with a fresh herbal finish that lingers on the palate.

Distributor: Available from all good wholesalers nationally

“As a nationally recognised day and given the popularity of Father’s Day as a gift giving occasion annually, it provides liquor retailers with a focused opportunity to boost sales through targeted marketing, create appealing special offers as well as plan ahead for creative collaborations with relevant brands across all categories.”

Nick Powell, Head of Marketing ANZ, Treasury Premium Brands.

Approachable, complex, and Lark’s most awarded single malt, Lark Classic Cask is tradition redefined. A New World whisky with a story to tell, its story begins with Lark, where the whisky rules of old were rewritten to make way for new traditions. Double-distilled and aged in a considered selection of small casks, this is a labour of love steeped in both heritage and curiosity. Each sip of Lark Classic Cask celebrates the time-honoured art of distillation, Lark’s rich legacy and the rebellious spirit of Tasmania.

Handcrafted at the Coal Valley Distillery, Classic Cask 43 per cent is a true labour of love from the second it leaves the stills to the moment the cork is popped. It features the citrus and rich plum pudding of the Lark house style, with a hint of Tasmanian peat. Based on the original recipe from founder and Pioneer Bill Lark, it is a whisky worthy of over 20 awards and international medals. Distributor: Spirits Platform

A tribute to Deen De Bortoli’s passion for crafting exceptional wines that are accessible to all, the Deen collection showcases a variety of delicious wines including Durif, Shiraz, Cabernet Sauvignon, Master’s Blend, Chardonnay, Sauvignon Blanc and the renowned Botrytis Semillon. Each bottle bears a unique Vat number, honouring Deen’s tradition of hand-numbering vats in the early days.

Ideal for gifting, the Deen range stands for quality and affordability, appealing to a wide range of tastes and preferences. From the robust oak-aged reds to the elegant whites and the exquisite dessert wine, every bottle tells a story of authenticity and craftsmanship. The saying “Our Father, everybody’s Deen” reflects De Bortoli’s commitment to celebrating family bonds with quality drops.

For retailers, stocking the Deen range presents a strategic opportunity to cater to Father’s Day shoppers seeking meaningful and high-quality gifts. With its rich backstory and diverse appeal, the Deen range not only honours tradition but also captures the essence of shared experiences. Embrace the spirit of Father’s Day with wines that resonate with both wine connoisseurs and those just beginning their wine journey, making every celebration all the more special.

Distributor: De Bortoli Wines

Home to some of Australia’s most well-known drinks brands and celebrated wine regions, Caoimhe Hanrahan-Lawrence explores the unique appeal of South Australian drinks.

Certainly a gem in the crown of the Australian drinks industry, South Australia is home to a diverse and widely celebrated range of producers, with more than 700 wineries, 50 distilleries, and almost as many breweries. This is matched by quality, with South Australian products continuing to perform on the national and international stage.

The South Australian wine industry is particularly varied, as Bryn Richards, Senior Winemaker, Chapel Hill, explained.

“South Australia crushes approximately 50 per cent of Australia’s annual grape production from a diverse range of regions, encompassing many different climates and geologies. You can find world class examples of every wine style in South Australia,” he said.

This diversity does not stop with wine, and Callie Davis, Advertising and Promotions Manager – Central Region, Thirsty Camel, highlighted the region’s other impressive producers.

“We are spoilt for choice in South Australia and surrounded by a great variety of subregions, many within stone’s throw of metro Adelaide,” she said.

“Although we’re known globally for our wines, we also have well-known, award-winning South Australian brands emerging in other categories such as spirits and beer.”

Due to its high quality, South Australian products benefit from a perception of prestige throughout the

country. In fact, the Department of Primary Industry reports that South Australia produces approximately 80 per cent of Australia’s premium wine.

According to Paul Midolo, Executive Director ANZ Sales, Samuel Smith & Son, consumers are comfortable trading up for premium South Australian wine.

“On average, premium South Australian wine has higher price points than the overall wine category. It encourages wine shoppers to trade up in retail as they see the value in paying more for premium South Australian wine,” he said.

Sean Baxter, Co-Founder, Never Never Distilling Co., said that the renown of South Australian wine has bolstered the state’s spirits producers.

“South Australian spirit producers do a good job of actually using the states wine regions to build more brand awareness. These regions are known for the quality beverages that they produce, and many gin brands in particular are using the region’s varietals in exciting new ways.

“This sometimes extends to the fruit itself, creating Shiraz gins from the Barossa or Grenache gins from McLaren Vale, or even maturing their spirit or cocktails in barrels that once featured the region’s iconic wine varietals,” he said.

However, the South Australian spirits industry is also developing its own prestige.

“I struggle to think of any other state that is dominating the distilling landscape like South Australia has recently. Over the course of the last five

Jack Glover, Executive Director – Marketing & Sales, Hill-Smith Family Estates “In essence, Y Series is a bold, energetic South Australian wine brand made for today’s consumers and the way they enjoy wine.”

years South Australia has emerged as a leader when it comes to generating spirit that is constantly awarded the best in the world, winning either trophies or best in class,” he said.

According to Adam Carpenter, Director, Prohibition Liquor Co., this is especially true of South Australian gin.

“We have a disproportionately high number and calibre of gins coming from South Australia these days. All the producers push each other to continually make better gin, so we all rise together.”

Another factor playing into the popularity of South Australian wine is its heritage.

Matt Redin, Marketing Manager, Angove Family Winemakers, said: “The wine industry in South Australia has a rich cultural heritage, with a history of winemaking dating back to the early 19th century. This history is reflected in the traditional techniques and family-owned wineries that continue to thrive today.”

Shielded from the effects of the phylloxera blight that affected much of the world’s wine producing regions, South Australia is home to some of the world’s oldest vines, despite the regions’ relative youth. In addition, many wineries in South Australia are family owned and run, including five of the 12 members of Australia’s First Families of Wine.

“We are spoilt for choice in South Australia and surrounded by a great variety of subregions, many within stone’s throw of metro Adelaide.”