0% CHANCE OF MISSING OUT THIS JULY.

0%* alcohol. 100% flavour.

0%* alcohol. 100% flavour.

Welcome to the June issue of National Liquor News, and my last full issue as Editor.

It’s time for me to say goodbye to this magazine, and to you awesome readers, after four years. It has been an absolutely incredible journey to edit these past 30 issues and a pleasure to bring you all the top industry news, insights and analysis to help your business be the best it can be.

This role has taken me around the country and the world, giving me the opportunity to meet so many of the amazing people that make this industry so great around the world (this month that happened to include the pictured Chris Fletcher, Master Distiller at Jack Daniel’s). Australia’s liquor and hospitality industry as a whole is just incredible – what I have seen, learned, (and tasted) in this role has made for the best of experiences, made me a lifelong industry supporter, and of course, a passionate reader of NLN from here on out.

Looking to this issue itself means looking to the end of something else – the financial year. At this time of year, we always check in with the leaders of Australia’s key independent banner groups, to hear about how they are going, what they’re working on, and what trends they are seeing in the market. You can find Seamus May’s interviews with eight banner groups starting from page 26.

June does mark the start of something too –winter. As the season brings the slowing of social occasions, this can present a low-pressure chance to try some beverages other than alcohol. There are also a few ‘abstinence occasions’ on the calendar in

coming months (think Dry July and OcSober, for example). Caoimhe Hanrahan-Lawrence reviews the current state of the no and low alcohol market from page 44, so your store can be well equipped to cater to the needs of these consumers.

Rounding out this issue is our annual bumper Shiraz tasting, with almost 100 wines tasted by our expert panel. Their top picks in three price brackets are listed from page 54. And as usual, you’ll find all the latest news and insights throughout the rest of these pages, including informative articles from regular contributors such as Retail Drinks Australia, Strikeforce, Wine Australia, Independent Brewers Association, eLease Lawyers, the Liquor Stores Association of WA and Circana.

I’ll be around for a little while longer after this issue goes to print, but before I go I want to give a final thanks to the wonderful humans at The Intermedia Group. Shoutout to all of the wider team who I’ve worked alongside over the years, with a special thanks for the guidance of my editorial mentors Andy Young, Vanessa Cavasinni and Deb Jackson, commercial guru Shane T Williams, design genius Kea Thorburn and supportive Publisher Paul Wootton.

It’s time to sign off for the last time, but don’t be a stranger – feel free to find me on LinkedIn and stay in touch. All the best!

PUBLISHED BY:

Food and Beverage Media Pty Ltd

A division of The Intermedia Group 41 Bridge Road GLEBE NSW Australia 2037 Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au

Editor: Brydie Allen ballen@intermedia.com.au

Journalist: Seamus May smay@intermedia.com.au

Journalist: Caoimhe Hanrahan-Lawrence chanrahanlawrence@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –Liquor and Hospitality: Kea Thorburn kthorburn@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

1yr (11 issues) for $70.00 (inc GST)

2yrs (22 issues)for $112.00 (inc GST)

– Saving 20% 3yrs (33 issues) for $147.00 (inc GST)

– Saving 30%

To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au

Brydie Allen, EditorDisclaimer

This publication is published by Food and Beverage Media Pty Ltd (the “Publisher”). Materials in this publication have been created by a variety of different entities and, to the extent permitted by law, the Publisher accepts no liability for materials created by others. All materials should be considered protected by Australian and international intellectual property laws. Unless you are authorised by law or the copyright owner to do so, you may not copy any of the materials. The mention of a product or service, person or company in this publication does not indicate the Publisher’s endorsement. The views expressed in this publication do not necessarily represent the opinion of the Publisher, its agents, company officers or employees. Any use of the information contained in this publication is at the sole risk of the person using that information. The user should make independent enquiries as to the accuracy of the information before relying on that information. All express or implied terms, conditions, warranties, statements, assurances and representations in relation to the Publisher, its publications and its services are expressly excluded save for those conditions and warranties which must be implied under the laws of any State of Australia or the provisions of Division 2 of Part V of the Trade Practices Act 1974 and any statutory modification or re-enactment thereof. To the extent permitted by law, the Publisher will not be liable for any damages including special, exemplary, punitive or consequential damages (including but not limited to economic loss or loss of profit or revenue or loss of opportunity) or indirect loss or damage of any kind arising in contract, tort or otherwise, even if advised of the possibility of such loss of profits or damages. While we use our best endeavours to ensure accuracy of the materials we create, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication.

Copyright © 2023 - Food and Beverage Media Pty Ltd

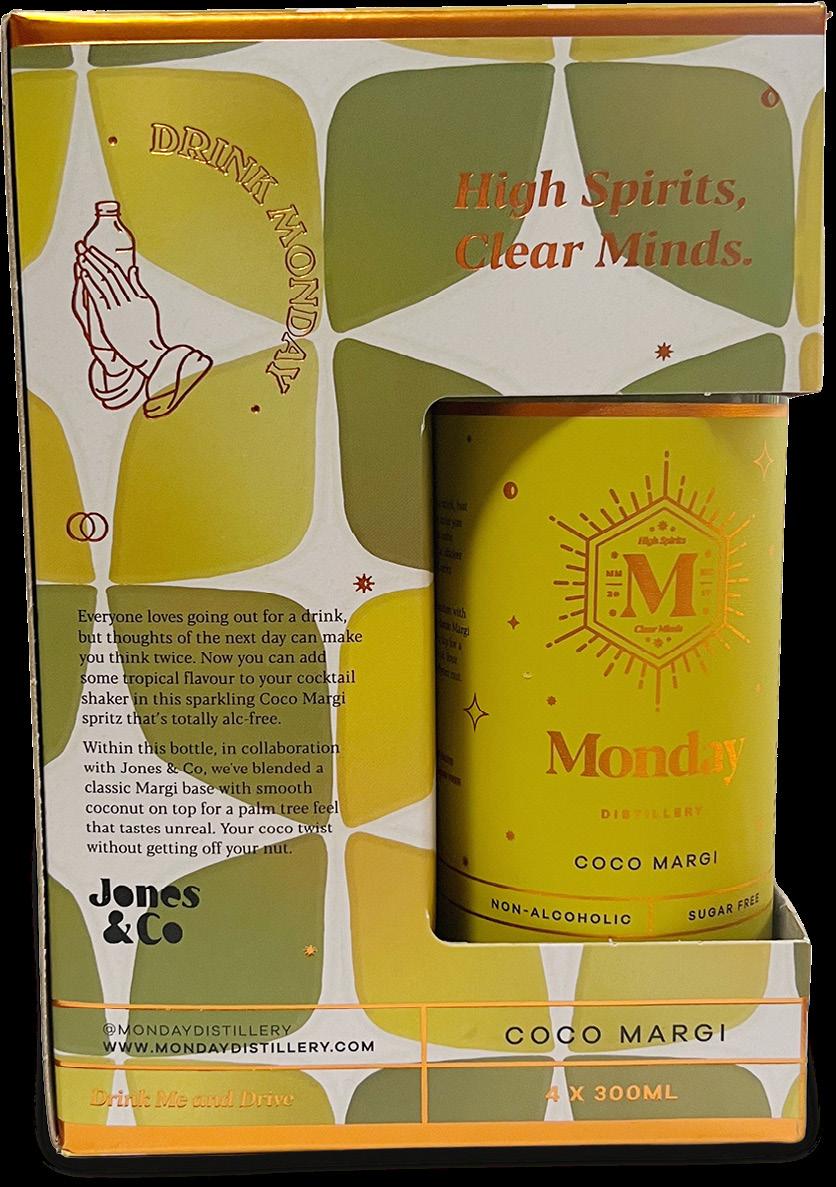

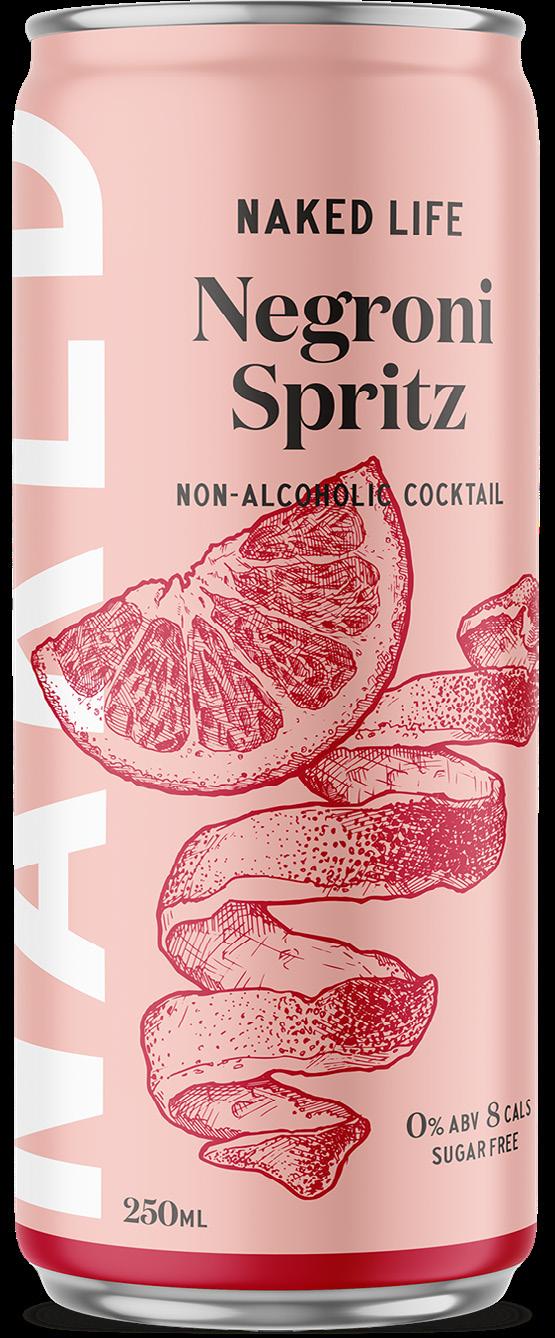

At Naked Life, we’re passionate about moments worth celebrating and believe that you should be able to do so without compromising on taste. That’s why we artfully distill botanicals with quality ingredients, creating beautifully crafted cocktails. Non-alcoholic, sugar-free and low on calories.

Speak to your local Craft Revolution sales rep or major wholesaler about kickstarting a non-alcoholic offering with our internationally awarded and Australia’s #1 selling range of fifteen RTD cocktails.

info@craftrevolution.com.au

19 Strikeforce: Challenging times

23 LSA WA: A positive first half of the year

26 Banner Groups: Rallying through adversity

58 Retailer Profile: Wine Experience

21 Independent Brewers Association: Revised 10-year roadmap to meet new challenges

22 Wine Australia: Alternatives in Australian wine

24 Circana: The why behind the buy

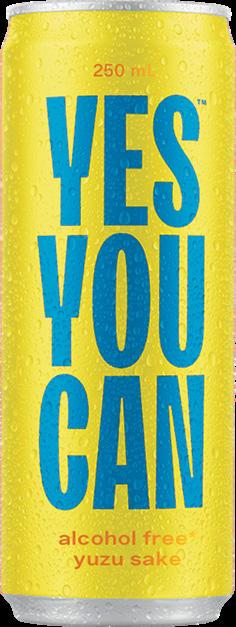

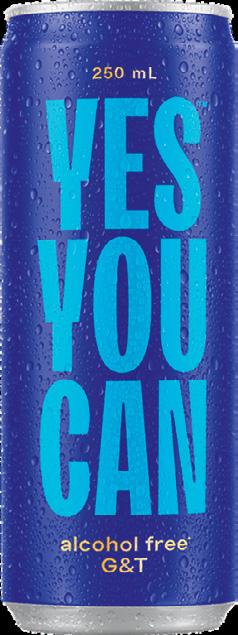

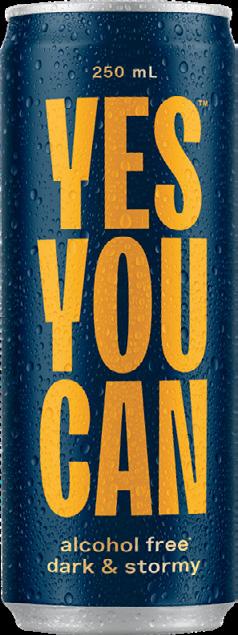

44 No and Low Alcohol: Keep it on the NOLO

52 Brew Review: Top beers

54 Wine Tasting Review: Shiraz

JOIN US FOR THE

Friday 18 August 2023

Lunch 12.30pm

Grand Ballroom Hyatt Regency

Sydney

$195 (WCA members)

$225 (non-members)

Full table $1941 (table of 10)

Giesen Group is expanding its range of zero per cent New Zealand wines with a sparkling offering to come later in the year, and heavy investment in technology.

There’s no doubt about it, the no and low alcohol category is booming around the world, with the IWSR reporting that the category hit US$11bn in key markets (including Australia) in 2022, up from US$8bn in 2018.

According to the 2022 Mindbody Wellness Index Australia, more than 60 per cent of people are also more focused on health and wellness, suggesting a vast latent market of potential purchasers.

Thankfully, Giesen Group has a full range of high quality zero alcohol wines that can immediately allow retailers to appeal to this wide subsection of non-alcoholic drinkers. Plus, Giesen’s non-alcoholic wines are only 14 calories per 100ml serving, allowing retailers to further cater to those consumers behind the ‘better for you’ trend.

The Giesen 0% range boasts five varietals: Pinot Gris, Riesling (a Gold Medal winner at the 2023 World Alcohol Free Awards), Rosé, Merlot, and a non-alcoholic rendition of Marlborough’s world-famous Sauvignon Blanc. And the brand is further widening its appeal, with the addition of Giesen 0% Sparkling Brut to come in late 2023.

Duncan Shouler, Director of Winemaking at Giesen Group, said the new product will give consumers more opportunities to enjoy great tasting wines. It further bolsters a compelling range for retailers to stock, leveraging the strong qualities of New Zealand’s wine industry.

“The Giesen 0% Sparkling Brut is a super exciting addition to our non-alcoholic wine range,” Shouler said.

“We love being able to offer wine consumers a zeroalcohol option for all occasions, and the Sparkling Brut really brings another dimension to the range –especially celebrations.

“New Zealand wine lends itself extremely well to sparkling wine styles, due to the purity of fruit flavour and great natural acidity. As such, we can’t wait to get our delicious, fruity and playfully sparkling zero alcohol example into the market.”

Giesen Group’s range also includes the award-winning Ara Zero line, featuring Ara Zero Sauvignon Blanc (which recently picked up a Gold Medal at the World Alcohol Free Awards) and the recently launched Ara Zero Rosé.

A key point of difference for Giesen across both zero alcohol ranges is its technology. A leader in non-alcoholic innovation, Giesen employs spinning cone technology to gently remove alcohol from the wines at low temperatures, creating a higher quality final product, made from real wines that have undergone the traditional production process.

Giesen is adding to its capabilities in this space too, investing in another spinning cone device that will increase production ten-fold, and also allow for further boundary-pushing innovation.

“We have seen fantastic growth in the zero alcohol wine category, and have become leaders in this space now,” Shouler said.

“The SCC10,000 spinning cone machine will give us the ability to increase our production, and also increase our innovation with the product range.

“It will free up more time for research and development work to continue to really push the boundaries of what’s possible in the zero alcohol wine space, and to really drive wine quality.” ■

To find out more about how your store could benefit from ranging Giesen 0% and Ara Zero, contact Brand Ambassador, Dan Chorley at dan.chorley@giesengroup.com.au

May was a busy month for announcements coming from online drinks companies, with BoozeBud announcing it was going into voluntary administration, and Gintonica going up for sale.

Early in the month, online retailer BoozeBud stopped accepting orders and laid off all staff, as Michael Brereton and Sean Wengel of William Buck were appointed as Voluntary Administrators by the director of BoozeBud Holdings Ltd and the director of Pocko Pty Ltd (trading as BoozeBud).

At the time, Brereton said the Administrators were undertaking an urgent assessment of the businesses’ financial position and exploring a sale of the business and assets or the recapitalisation by way of a Deed of Company Arrangement.

Within a fortnight came the announcement about Gintonica being placed up for sale by Founder, David Box. The company was known for its gin tasting packages, monthly gin subscription service and advent calendars, all featuring miniature bottlings, and had also recently branched into whisky to do similiar under the WhiskyRocks name.

The Gintonica sale would include the business names, databases, websites, stock and media content.

Box said: “The team and I are proud to have contributed to the promotion and rise in popularity of Australian gin and, more recently, whisky, but now it is time to hand over the reins to new passionate gin lovers who, I am sure, will take it to the next level.”

From here, Box said he will focus on distillery services under the name ‘Spirited Bottlers’, which will be a contract filling, capping and bottle labelling service, as well as a supplier of bespoke packaging and Gintonica’s exclusively sourced 30ml and 50ml bottles.

Last month, Kaddy Group announced it had gone into voluntary administration, appointing Rajiv Goyal, Chris Johnson and Joseph Hayes of Wexted Advisors as the administrators to undertake an urgent assessment of the group. The news came after Kaddy Group has been in a trading halt on the ASX since February, requesting extensions for a voluntary suspension pending an announcement “in relation to capital raising.”

The wider Kaddy Group includes many arms, with the Fulfilment division shut down with the administration announcement, but the Marketplace division continuing to operate as normal. While it has not yet been announced what would happen to the rest of the company (at the time of writing), there has been good news for this Marketplace division, thanks to a new partnership with Lecca, a leading Singapore based food and beverage focused investment company.

This new partnership will see a revamped business model known as Kaddy Reborn, which promises to offer a simpler business model, refreshed management team, wider range of products, more competitive pricing and improved application features for its suppliers and customers allowing the seamless delivery of product.

The initiative will be led by Lecca alongside Kaddy CEO, Steve Voorma, who said the move fills both entities with “confidence and excitement.”

“We have actively listened to the market and implemented a range of initiatives to enhance our offerings. With Lecca’s expertise, support and funding we have significantly strengthened our market position,” Voorma said.

“This collaboration, coupled with our simplified yet enhanced business model, will enable us to deliver an unparalleled market offering, setting the industry standard for both suppliers and buyers.”

More information about what to expect from Kaddy Reborn is available via The Shout here: https://bit.ly/KaddyReborn

Two leading drinks companies have announced new Australian leadership in the past month, with key appointments announced at BacardiMartini Australia and Coles Liquor.

Bacardi Limited announced Luiz Schmidt as Managing Director of the company’s Australian and New Zealand operations, returning from Panama after serving as Regional Marketing Director for Bacardi in Latin America and the Caribbean. A highly specialised FMCG marketing professional, Schmidt has over two decades of international experience across a range of roles, with a reputation for outstanding long-term strategy development, new product development, team building, innovation, and growth within the global premium spirits market.

Meanwhile, Coles has announced Michael Courtney has been promoted to the role of Chief Executive Coles Liquor Group, replacing Darren Blackhurst who is returning to the UK to be with family. This new role for Courtney comes after leading Coles Express for four years, where he delivered a winning strategy and oversaw a successful transition to Viva Energy.

➤ Euromonitor reveals the megatrends influencing consumer behaviour

➤ Think outside the box with cask wine

➤ Australian brewers win big at global beer marketing awards

Sign up to our fortnightly Newsletter by going to this URL: https://theshout.com.au/ national-liquor-news/ subscribe/

BAM Wine Logistics has announced the establishment of new operations in WA after acquiring the WA operations of Kaddy Fulfilment after the arm went into administration. With this, BAM entered into a long-term agreement to lease the Forrestfield site previously occupied by Kaddy Fulfilment, acquiring critical operational assets in the process and also offering employment to many former Kaddy staff members

Daniel Van Vemde, General Manager of BAM Wine Logistics, said: “We are committed to being the premier wine storage and logistics provider in the country, and expansion into Western Australia was a logical next step. We pride ourselves on providing exceptional service to our clients and their customers. We look forward to developing our WA network and offering for many years to come.”

BAM is an independently run but integral part of the Joval Group of companies, which has been operating for over 40 years across all areas of the wine industry.

Tim Menting, CEO of Joval Group, said: “We have always been committed to setting a new service standard in everything we do, and view wine logistics as critically important to the distribution chain. We see BAM’s entry into the Perth market as being both a great strategic move for our group, as well as the right thing to do for an industry in turmoil following Kaddy Fulfilment’s sudden collapse.”

“We hope that by making this swift acquisition, we are able to help get things back on track in WA and minimise the pain being felt by countless wine and beverage producers, distributors, retailers and hospitality venues.”

BrightSide Executive Search is the only dedicated drinks recruitment specialist nationally and has been a trusted advisor to the industry for well over a decade. Through accessing its wide-reaching network of potential candidates, BrightSide takes the hassle out of recruitment for drinks businesses of all sizes, advising how they can stay nimble and competitive in a tight market to attract the absolute right person for each role. The latest BrightSide success stories below showcase their capability to manage volume recruitment projects, ensuring businesses like Fever-Tree have full teams of qualified talent as they transition to a direct model.

Ben Asby is loving being back in drinks, bringing a wealth of experience to his new role as National Sales Manager at Fever-Tree.

Richard Irwin is looking forward to utilising his extensive international drinks experience as BDM QLD for Fever-Tree.

Francesco Casarotto is thrilled to be representing a brand he knows and loves again, as BDM QLD for Fever-Tree.

Dean Adams’ passion, experience and enthusiasm will see him hit the ground running as BDM NSW with Fever-Tree.

Adam Hunter comes with strong drinks experience and entrepreneurial flair to his new role as BDM NSW with Fever-Tree.

Callie Raymond is excited to utilise her industry experience and passion for spirits in her new role as BDM VIC with Fever-Tree.

Andrew Grech brings a unique combination of horticultural and hospitality experience to his new role as BDM VIC with Fever-Tree.

Evan LeBlanc comes with extensive drinks experience and passion for spirits to his new role as BDM SA for Fever-Tree.

Lindsay Cardno will use her established relationships and experience as Key Account Manager WA with Fever-Tree.

Steve Carr’s energy, experience and passion is a huge asset to the Sydney team as Trade Marketing Manager for Fever-Tree.

For more information go to www.brightside.careers or to look for current opportunities check out the BrightSide LinkedIn page: www.linkedin.com/company/bright-side-executive-search

Edinburgh Gin got in the spirit of fun last month, becoming the official spirit of the Sydney Comedy Festival after being a long-standing spirit partner of the Edinburgh Fringe Festival. The Sydney event included shows featuring local and international acts at venues across the city, allowing the brand to introduce itself and its commitment to the Australian market. To celebrate the partnership, Edinburgh Gin activated a special takeover of the Factory Theatre courtyard, which was dubbed the Edinburgh Gin Wonderland and included the presence of Global Brand Ambassador, Philip Kingscott from Scotland.

Kentucky’s Maker’s Mark Whisky has teamed up with Australia’s Beechworth Honey on the Goldrush Experience, paying homage to their respective ‘liquid golds’. The collaboration was born from the shared values of both companies, with generations of expertise and knowledge at the core of both sides. Sustainability is also incredibly important to both companies, with Maker’s Mark one of the largest B Corp certified distilleries in the world and Beechworth working to create a healthy and sustainable environment. The Goldrush Experience event took place at Hinchcliff House in Sydney, where guests were treated to both a tasting of Maker’s Mark and Beechworth Honey, also brought together in a special Goldrush cocktail. Throughout the night, the event inspired attendees to honour tradition and heritage alongside positive innovation and collaboration, in order to create a better future.

Barossa winery Peter Lehmann has celebrated 30 vintages of its iconic Stonewell Shiraz wine, stretching from 1987 to 2017. Throughout all 30 (and the unreleased vintages set to follow), the brand has kept a core goal of sourcing the most exceptional intense and robust flavoured fruit, in partnership with its network of highly trusted growers. The milestone 30 year occasion was marked by the team touring to a few select locations to showcase some of the key vintages along the way, that illustrate the development of the wine throughout time and the impact that vintage conditions can make each year. At each event, guests tasted a range of Stonewell vintages, led by Chief Winemaker Nigel Westblade, Viticulturalist Jade Rogge and Brand Ambassador Malcolm Stopp.

The Barossa’s Krondorf Wines has unveiled its next release, with five extraordinary wines selected from the highly anticipated 2021 vintage. The brand has said these wines continue the Krondorf legacy that has been developed over the years to now sit under Paragon Wine Estates, a collection of high quality wineries that are owned by Endeavour Group. Krondorf launched this latest selection of red wines at an intimate event in Sydney, where guests tasted across all SKUs, including the 2019 King’s Mantle Shiraz, 2021 Kingship Cabernet Sauvignon, 2021 Old Salem Barossa Shiraz and 2021 Stone Altar Shiraz and Grenache wines. Head Winemaker Nick Badrice took attendees through the tasting, describing his aim to take a minimalist approach and let the wines express themselves in the glass.

Renowned British chef, restauranteur and television personality, Gordon Ramsay, has launched his own range of wines in Australia. This is the first country outside of the UK to receive the Gordon Ramsay Italian Collection, which was created in partnership with winemaker Alberto Antonini.

The range includes three blends – the Bianco, Rosso and Rosato. These wines combine Ramsay’s passion for the very best ingredients with Antonini’s reputation for contemporary winemaking, resulting in a pioneering decision to create the wines with fruit from two different regions (Tuscany and Abruzzo).

After launching the wines in the UK in 2021, Ramsay discussed why he chose Australia as the next destination for them.

“Just like Italy has a special place in my heart; I have spent some incredibly happy times in Australia and many of those moments were made even better by a beautiful glass of wine, so it was only natural I chose to bring my collection here,” he said.

The Gordon Ramsay Italian Collection is distributed locally by Oatley Fine Wines, with Sales and Marketing Director, Rob Hassan, noting: “We feel very excited to have such an esteemed global chef as Gordon Ramsay joining our portfolio with his new selection of wines. We look forward to sharing the range with wine lovers around the country and developing a wonderful reputation for this collection that captures the heart and soul of Italian winemaking.”

For the first time in eight years, Lion has unveiled a new packaging design for the entire Tooheys line. The aim was to give the iconic brand a fresh, modern look, while still paying homage to its 154-year history.

Also in the redesign, Tooheys Old has changed colour from maroon to the original all-black colour scheme. Tooheys Extra Dry has become even more distinct in its clear glass bottle, with brightened colours and the established date replaced with a product descriptor.

Chris Allan, Head of Core Beer Marketing at Lion, said: “Tooheys is a brand that has over a century and a half of stories under its belt – so there is a challenge in moving too far away from the past and our rich legacy. We feel the new packaging pays tribute to our proud heritage as well as modernising in a way that allows the core brand assets to shine.”

The new packaging was designed by creative agency Weave, which worked collaboratively with Lion on the project.

Mick Boston, Head of Design at Lion, said: “It is such a fine line refreshing an iconic brand like Tooheys, retaining all the well-loved memory structures whilst setting the brand up for the future. We’re confident we have created a look that honours our impressive past but keeps the brand moving forward.”

Dan Cookson, creative director at Weave, agreed, and said: “This wasn’t about throwing yesterday away. We needed to both respect the past and have the courage to move forward, reintroducing it to a new audience while also rekindling the love held by existing Tooheys fans.”

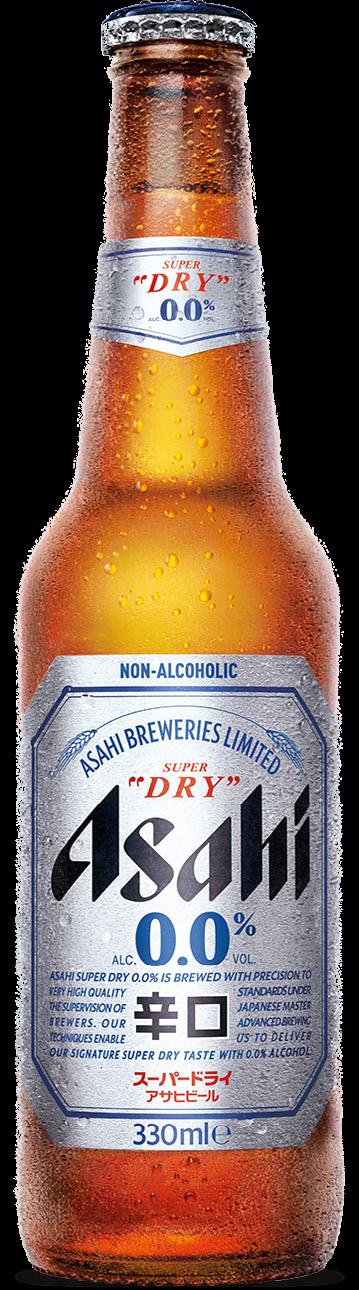

A non-alcoholic version of Asahi Super Dry has arrived in Australia. Asahi Super Dry 0.0% is part of Asahi Beverages’ range of no, low, and mid-strength beers, from which the company garners around 30 per cent of its beer sales.

Kym Bonollo, Head of International and Craft at Asahi Beverages, said: “Asahi Super Dry is an internationally recognised premium beer brand and Japan’s leading beer. Now, Australian beer lovers looking to moderate their alcohol consumption can enjoy Asahi Super Dry’s signature crisp and refreshing taste without the alcohol.

“As demand for alcohol-free alternatives grows, we’re seeing more people seek out brewed adult beverages such as non-alcohol beers that don’t compromise on taste or quality. Developed through extensive research and trials, Asahi Super Dry 0.0% is an elevated option,” Bonollo commented.

The Australian launch will be supported by a multi-platform advertising campaign. Asahi Super Dry 0.0% will be sold in bottle format nationally, with cans exclusively available through Endeavour Group at Dan Murphy’s and BWS.

Mighty Craft has continued its efforts in championing local small-batch distillers by entering an exclusive distribution deal with Mark Watkins from Mt Uncle Distillery. The new partnership will see Mighty Craft bring the distillery’s Agave Australis and FNG Rum Co. beverages to consumers nationwide.

Mighty Craft Director, Mark Haysman, said: “We had a look at some of the cocktail and beverage trends happening right now and there’s been a real resurgence in the popularity of rums and in tequila and mezcal.

“These spirits are world class and are an important addition to the Mighty Craft portfolio.”

The Agave Australis range includes three products: unaged Agave Australis Silver; Agave Australia Rested (matured in red wine barrels for two months); and Agave Australis Aged, which has been in reconditioned, ex-red wine American Oak barrels for two years. These products are made with blue agave plants Watkins first planted in 2012, after visiting Jalisco in Mexico in 2010, and noticing the similarities between it and his home in the Queensland tropics.

The FNQ Rum Co. brand includes Iridium Australian Rum, aged for five years in reconditioned American oak barrels that held red wine; Iridium X, aged for 10 years and available in limited quantities; and an unaged Australian cane spirit called Platinum.

This new partnership with Mt Uncle Distillery comes after Mighty Craft secured investor commitments to raise $5.2 million in equity, partly aimed at accelerating the growth of the company’s spirits portfolio.

Wolf Blass has launched its latest annual Luxury Collection, releasing five wines across three price points that reflect the label’s history of quality wines. Founded in 1966 by Wolfgang Blass, the winery is a highly celebrated Australian label in the Treasury Premium Brands portfolio.

Chris Hatcher, Wolf Blass Chief Winemaker, said: “Wolf forged a new path in luxury Australian wines, always setting a much higher standard amongst his peers and this philosophy remains as relevant today to the 2023 Luxury Collection as when he first began over 50 years ago.

The wines of the 2023 Wolf Blass Luxury Collection are: Grey Label Piccadilly Valley Chardonnay 2022; Grey Label McLaren Vale Shiraz 2021; Grey Label Langhorne Creek Cabernet Shiraz 2021; Black Label Barossa, Langhorne Creek, McLaren Vale Cabernet Shiraz Malbec 2021; and Platinum Label Medlands Vineyard, Barossa Valley Shiraz 2021.

“Individually and collectively, these wines have been consistently recognised the world over. Sophisticated and multi-layered, they are equally traditional yet contemporary, showcasing the Wolf Blass hallmarks of power and elegance,” concluded Hatcher.

Australian distiller Husk Rum has released its new creation, Rare Blend, a prime example of how the brand is redefining the rum category.

Husk Head Distiller, Quentin Brival, said the new rum uniquely reflects the terroir of the coastal land between Queensland and NSW, where the Husk Farm Distillery lies.

“As Australia’s only farm to bottle rum distillery, we make Husk Rum using fresh cane juice grown on our farm and have focussed on creating a flavour profile reflective of our local region, the Caldera Coast,” said Brival.

“Rare Blend is a made from two styles of rum. The first is a seasonal 100 per cent single estate cane juice rum, our signature style which is dry and adds complexity and depth to the final product. The second is a rum made from Tweed Valley cane honey, which is evaporated cane juice. Cane honey is sweet, rich, and pure which creates a very smooth and round rum with fruity and floral notes.”

Paul Messenger, CEO of Husk Rum, adds that this latest creation is driven by the evolving tastes of Aussie consumers in the rum category.

“As rising consumer interest and the emergence of premium brands expand the category, modern perceptions of rum extend well beyond the traditional rum and coke. New styles and flavour profiles present opportunities to showcase the versatility of rum in high-end cocktails and new consumer trends elevating the category and educating consumers,” he said.

There’s a new local player in the aperitif market, bringing together a love of the traditional Italian aperitivo occasion with Australian native ingredients.

Ragazzi e Succo Aperitivo was created by Tom Hoff after 25 years in the hospitality industry. The product aims to be beautifully balanced to the tastes of consumers, masterfully blending 26 sustainably sourced botanicals, with classic amaro foundations harmonising with wattle seed, river mint, rosella flowers and more.

“During the development process, I kept in mind that many aperitivos focus solely on being either bitter or sweet, and so I turned my effort to delivering what consumers enjoy,” Hoff said. Ragazzi e Succo Aperitivo comes in 750ml bottles, with tasting notes describing mandarin, pink grapefruit, lemon and bitter orange alongside robust spices and a herbaceous bittersweet finish. Hoff’s serving suggestions include both as a substitution in classic cocktails, or with lemon juice and tonic over ice, which is the mix found in Ragazzi e Succo Aperitivo’s RTD can too.

Maritime Tasmanian whisky distiller, Waubs Harbour, has just launched its official first release whisky range. The family run distillery was founded by husband and wife team, Tim and Bec Polmear, in partnership with Tim’s brother Rob Polmear, previously Head of Production at Lark Distillery and Head Distiller at Overeem Whisky. The team’s first official releases have been eagerly awaited since the distillery’s preview series, launched in early 2022.

“The launch of our official first release whiskies is momentous for Waubs Harbour. While we have been established for over five years, due to the time it takes to set up a premium distillery production facility and to make and mature hundreds of casks of whisky, this is really just the beginning for us,” said Tim.

The new Flagship Series is a core range of three single malt whiskies – Waubs Original (43 per cent ABV), Port Storm (48 per cent ABV) and Founder’s Reserve (62 per cent ABV). For two weeks prior to the launch, Waubs Harbour auctioned off bottle number one of the Founder’s Reserve SKU via Whisky Auctions Tasmania, raising $4800 for the Great Southern Reef Foundation.

The launch was celebrated at the official opening of the distillery, complete with a ribbon cutting ceremony by Tasmanian Premier, Jeremy Rockliff MP. Big names of the Tasmanian distilling and tourism industries gathered for the occasion, including Bill Lark (Lark Distillery), Patrick Maguire (Sullivans Cove), Casey Overeem (Overeem Whisky), Sarah Clark (Tourism Tasmania), and Grace Keath (East Coast Tourism).

University of Oxford’s leading sensory academic, Professor Charles Spence, has collaborated with award-winning String Musicians Australia, to create a music track that’s scientifically proven to enhance the bold flavours of Jack Daniel’s Bonded.

The track includes melodic piano to enhance notes of caramel, low-pitched brooding cello to enhance notes of oak, and high tempo sharp violin to enhance notes of spice.

Professor Spence says: “The Sound of Bonded is built on years of research exploring the surprising connection between sound and taste… The research suggests that when you listen to the track while sipping Jack Daniel’s Bonded whiskey, the flavour notes will come to life in an even bolder, more enjoyable way.”

This innovation expands on the recent launch of Jack Daniel’s Bonded, the first super-premium release from the brand in 25 years. The whiskey has been created with select barrels that add more depth and character to the 50 per cent ABV liquid.

Jack Daniel’s Tennessee Whiskey Master Distiller, Chris Fletcher, says: “We’re constantly looking for new ways to elevate the tasting experience of our whiskey. Jack Daniel’s and music have always had a special connection, and what a better way to bring the two together than with a tailored piece of music that’s proven to bring out the bold and exceptional flavour notes of Bonded.”

The Sound of Bonded was launched in Australia during a visit from Fletcher. Music and whiskey lovers can recreate the experience at home with instructions and music via the Jack Daniel’s website: https://bit.ly/3okxf6m

One of the most marked trends in liquor retailing in recent years has been the pivot towards online alcohol sales and delivery. Whilst this trend was accelerated during COVID-19, the online alcohol sector is projected to continue growing over the coming years. As these services have expanded in popularity, governments have demonstrated an increased desire to pursue regulation in complement to the Retail Drinks Online Alcohol Sale and Delivery Code of Conduct.

The Code continues to enhance compliance in the responsible online sale and delivery of alcohol since it was first launched in July 2019. We know this because of the nearly 20,000 compliance audits conducted on signatories, which comprise well over 80 per cent of all online alcohol sales.

The Code also continues to help inform and shape the development of e-commerce regulation across Australia. The Queensland Government is currently examining regulations regarding online alcohol sales and deliveries, following on from similar consultations in New South Wales in 2020 and Victoria in 2021. Despite the sector receiving increased media scrutiny in Queensland, these regulatory reforms have been in the pipeline for several years with the Palaszczuk Government committing to undertaking a regulatory review as a direct result of Retail Drinks’ advocacy. In participating in this consultation, we will be aiming to ensure close alignment between the Code and the eventual regulatory framework in Queensland.

In addition to the Code, Retail Drinks, in partnership with Frontier Economics, has produced

the most comprehensive research report on the Australian online alcohol delivery sector to date. This report is based on transactional data as provided by Retail Drinks members, which has never been seen. The report addresses key knowledge gaps across the sector, including the times and locations of deliveries as well as the typical demographic characteristics of consumers. The report will provide another valuable resource to policy makers in attempting to gain a greater understanding of the sector as regulatory frameworks are considered. This report is far more detailed than other reports on the sector as it is based on millions of verifiable sales transactions.

Lastly, we will also be undertaking a two-year review of the Code later this year. As part of this process, all potential updates to the Retail Drinks Code will be vetted by a select committee consisting of major industry representatives, including small and large retailers, as well as delivery companies. The purpose of the review process is to ensure the Code remains a robust, best-practice and fit for purpose framework accounting for the rapid changes occurring in in the online alcohol sales and delivery sector. Previous changes to the Code have included widening its remit to capture sales by third-party marketplaces.

Retail Drinks is immensely proud of the thoughtleadership role we have played in the online alcohol sale and delivery space over several years and we look forward to continuing our contribution to important regulatory processes concerning the sector in the future. ■

CEO, Michael Waters, discusses the organisation’s focus on the online sector.

CEO, Michael Waters, discusses the organisation’s focus on the online sector.

Michael Waters

CEO

Retail Drinks Australia

“Retail Drinks is immensely proud of the thoughtleadership role we have played in the online alcohol sale and delivery space over several years.”

Retail Drinks continues to inform and shape development of online alcohol regulatory frameworks

What should the range on offer be? What products are on trend, and which are not? Which products are driving sales and margin? How much inventory should I be carrying?

These are just some of the questions that retailers ask themselves almost every day.

The much-reported inflationary pressure that households and retailers are facing makes informed decisions even more important. Shoppers are forced to modify their behaviour as savings built up over the past few years are depleted by higher mortgage payments, rents, grocery, fuel, and energy bills.

Typically, households will attempt to offset costof-living increases by eating more at home, trading down for cheaper products, and shopping at retailers they perceive to be doing better at managing prices.

While it is tempting to go down the lowest price route, margin erosion and the increased cost of doing business make this approach untenable in the long term.

It is worth noting that during times of economic uncertainty households also trade up based on occasion. For example, a portion of the savings they make by eating in instead of dining out is allocated to rewarding themselves, creating an opportunity for retailers to upsell. With this in mind, a balanced range of value, mid-tier, and premium offerings is a must.

So, what else are retailers doing to sustain their customer base and cash flow?

There is a plethora of options that include, but

are not limited to, lowest price guarantees, exclusive member offers, and curated offers based on an individual’s previous purchases.

Product offerings and ranges are being curated using demographic information to best match the store’s local catchment area and purchasing behaviours.

Bundling seems to be back in vogue, which encourages shoppers to increase their spending in return for savings.

Retail brands continue to invest in store refreshes to generate latent interest and encourage shoppers through their doors.

With their online presence, retailers offer express delivery to time-poor shoppers, free shipping over a set purchase amount, digital gifting, and leverage their sustainability credentials.

Finally, suppliers always seek to increase their sales share in every retail outlet. This provides an opportunity to create an ‘event’ or ‘occasion’ to generate an incremental sale or attract new shoppers into the store.

Allocation of space and rotation of promotional products in that space, in a highly visual area of the store, keeps the offer fresh and interesting.

Ultimately, there is no single approach or magic formula to guarantee success. ‘Right product, right place, right time’ is the common thread that underpins any strategy to entice shoppers in the door, build loyalty and grow revenue. ■

“‘Right product, right place, right time’ is the common thread that underpins any strategy to entice shoppers in the door, build loyalty and grow revenue.”

Stephen Wilson Category & Insights ManagerStrikeforce Stephen Wilson, Category and Insights Manager at Strikeforce, suggests how operators can navigate current economic pressures.

Before signing a commercial lease, it’s essential for tenants to be aware of the costs that can increase the overall expense of leasing.

Some of the main hidden costs in commercial leases include:

• Maintenance and repairs: Commercial leases often require tenants to maintain the leased property and cover the costs of any repairs needed during the lease term. These costs can be significant and unexpected, especially if there is significant wear and tear on the property over time. Before signing a commercial lease, it’s essential to discuss the maintenance and repair requirements with the landlord and negotiate a fair agreement that takes into account the age and condition of the property. It is advisable to try and avoid repair due to fair wear and tear, structural and capital expenses.

• Common area fees: These fees are the costs associated with maintaining and repairing common areas, such as hallways, parking lots, and elevators. While these fees can vary significantly, they are often a percentage of the tenant’s total rent payment. Tenants need to negotiate these fees to ensure that they are either capped or that major items such as capital expenses are covered by the landlord.

• Operating expenses: In addition to rent, tenants may be responsible for a portion of the property’s operating expenses, such as property taxes, insurance, and utilities. It’s crucial to understand the full scope of these expenses and negotiate a fair agreement. If the lease is a retail lease, then you should obtain a Disclosure Statement that outlines the outgoings payable in detail.

• Renewal options: Many commercial leases include renewal options that allow tenants to extend the lease term beyond the initial agreement. However, these renewals often come with increased rent payments and additional fees including legal fees.

• Security deposits: Commercial leases typically require tenants to provide a security deposit upfront, which can be a significant expense.

• Improvements and alterations: If a tenant wants to make any improvements or alterations to the leased space, they may be required to cover the costs themselves. It may also be possible to obtain a contribution from the landlord to decrease this cost to the tenant.

In conclusion, commercial leases come with several additional costs that businesses need to be aware of before signing any agreement. These costs can add up quickly and significantly increase the overall expense of leasing, making it crucial to negotiate and understand all terms upfront.

By carefully reviewing the lease agreement and discussing any potential expenses with the landlord, businesses can make informed decisions and ensure that leasing remains a cost-effective option for their needs.

It is also advisable to obtain legal advice from a lawyer who specialises in leases to provide you with guidance. They should be able to help negotiate to decrease these costs by capping them, removing prohibited outgoings and negotiating the removal of other items to provide a fairer and more costeffective lease. ■

Marianna Idas

Principal eLease Lawyers

“Commercial leases come with several additional costs that businesses need to be aware of before signing any agreement.”

Marianna Idas, Principal at eLease Lawyers, details some key things for commercial leaseholders to watch out for.

As we here at the IBA read The Shout and National Liquor News religiously ,we know that times are once again challenging for the alcohol industry. Like all associations we have been working on trying to understand the breadth and depth of the issues that our members and industry are facing, and to crystal-ball gaze on what the future might present.

While our 10-year plan, Future Brew – Tapping the Potential remains highly relevant, market conditions since its completion have evolved, and the mindsight of the IBA and members has changed from one of driving rapid growth to short-term member stability; solidifying the market share gains of the last decade; continuing to drive long-term macro advocacy agenda, and appropriately resourcing the IBA and tightening the focus of our agenda/remit.

Last month IBA Chairman Richard Watkins announced that we had revised our priorities into a three-year plan with a focus on advocacy, Independent Seal marketing direct to consumer, business sustainability and IBA health – ensuring we survive to continue to support our nearly 600 members.

While we will continue to advocate and respond at a ‘local’ level, our renewed focus will be to try and find solutions for the myriad of challenges currently facing Australian brewers. Here’s just a taste of what breweries are currently having to navigate:

1. The ongoing struggle of carrying an

excise debt. It was great to defer excise during the height of the pandemic but in many instances the payback options are not sustainable as well as keeping up with current obligations.

2. The beer excise is linked to the Consumer Price Index (CPI) and automatically raises twice a year in August and February. Pegged to inflation, the hikes amounted to almost eight per cent in 2022.

3. We already pay the fourth highest tax on beer in the world, sadly, soon to be the third highest.

4. Cost of red tape regulation, for example: pregnancy warning labelling, licensing, permits etc.

5. Cost and ease of development.

6. Increase in the costs of doing business, power, consumables, ingredients, packaging, freight etc.

7. Less disposable income due to the rising cost of living.

8. Labour and skills shortages and therefore demands for higher wages.

9. Reduced distribution points and greater competition for shelf space.

10. The ‘alcohol opposition’ are well funded and have a focused agenda. On a lighter note, we launched our first ever direct to consumer marketing campaign which aims to raise awareness of the Independent Seal and what it stands for – more than ever

we want to capitalise on the hyper local trend.

The national campaign is going very well with over 11M impressions as a direct result of the ad and over 5,000 people clicking through to the Ask For Indie websitewww.askforindiebeer.com.au

Once there, they can find out what independent beer is, why it’s important to buy independent and most importantly where to find it.

This is the first phase of a three year campaign and is giving us some great insights into where our consumers like to be in the digital world.

There are no surprises that smartphones are the best performing devices or that Sunday, when consumers are relaxing and enjoying their down time, is when they are clicking through.

We recently chatted to our pals at the Brewers Association in the USA to understand their journey of the Independent Craft Brewer Seal and they agreed that ensuring consumers understand what it means is one of the most important things an association can do for its members. It is our point of difference, and we need to keep educating, not only to consumers directly but via the trade.

Some of our trade partners have really gotten behind the buy local, buy independent message, but we look forward to broadening those conversations. ■

There are well over 120 varieties of winegrapes currently grown in Australia*, of which the top 10 reds and top 10 whites account for more than 95 per cent of all wine produced.

That leaves around 100 varieties to make up the ‘alternative’ landscape – together accounting for just five per cent of Australia’s wine production. So, if you’re interested in alternative variety wines, how can you possibly choose between them?

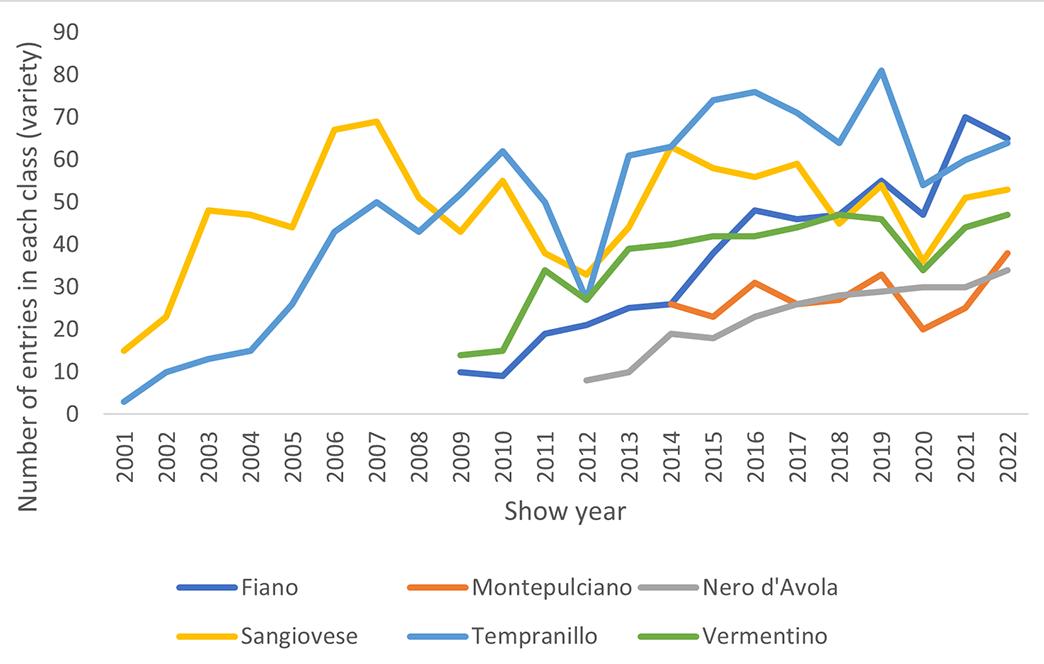

One way to look at which alternative varieties are currently growing in popularity is to look at trends in the number of entries in the Australian Alternative Varieties Wine Show (AAVWS) over time. This wine show – held in Mildura, Victoria, each year for the past 21 years – has seen more than 1200 entries in its long history, all of which are documented in a comprehensive database.

Analysis of the database conducted by Wine Australia indicates that the strongest growing varieties over time have been Tempranillo, Fiano and Nero d’Avola. Montepulciano has shown strong growth in the past two years but does not have a long history in the competition (Figure 1).

Of these, Tempranillo and Sangiovese have the longest history in the competition and have generally dominated in terms of share until being overtaken by Fiano in 2021.

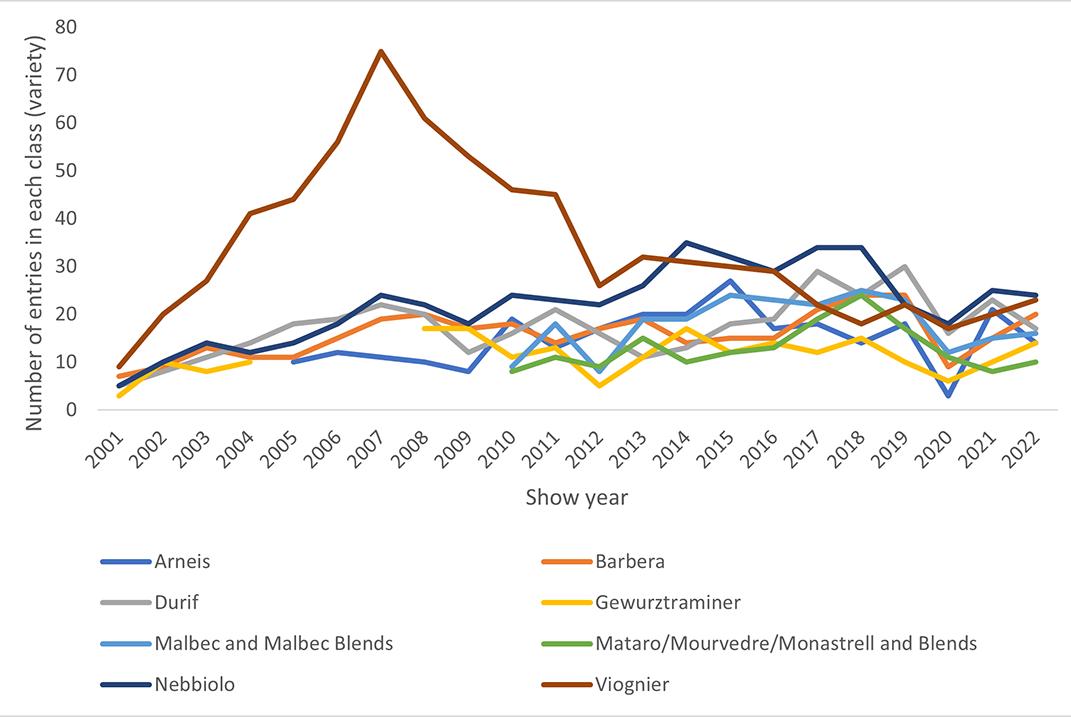

Meanwhile, the varieties that have decreased the most in popularity (measured in terms of number of entries) over the past 20 years include Viognier, Nebbiolo and Mataro/Mourvedre.

Viognier peaked with 75 entries in 2007 (compared with 69 entries for Sangiovese in the same year) but has since declined to 23 in 2022. Nebbiolo peaked at 35 entries in 2013 and declined to 24 in 2022 (Figure 2).

With the exception of Nebbiolo and Viognier, most of these

varieties have retained a similar share of around two to three per cent for the past 10 to 15 years. Nebbiolo peaked at five per cent in 2014 and has since declined to three per cent, while Viognier has declined from a peak of 13 per cent in 2007 to around three per cent in 2022. ■

*According to the Wine Australia National Vintage Survey 2022.

Figure 1: Strongest growing varieties over time in the AAVWS

Figure 2: Varieties declining most over time in the AAVWS

*According to the Wine Australia National Vintage Survey 2022.

Figure 1: Strongest growing varieties over time in the AAVWS

Figure 2: Varieties declining most over time in the AAVWS

It’s been a great first half of the year for the Liquor Stores Association of Western Australia (LSA WA).

The association began kicking goals for its members early in the year, launching a new partnership with Bendigo Bank and Tyro Eftpos Solutions. This exclusive partnership netted significant value for members in the form of highly competitive merchant fees for associated point of sale transactions.

The positivity continued into the following months, with the highly anticipated return of the LSA WA Sundowner on the Swan event on the last day of March.

This is the second time the association has hosted the event and it has again been dubbed a great success. More than 100 people turned out despite the grey weather, with good representation from retailers, suppliers and government officials. This included WA Liberal Leader Libby Mettam MLA and Minister Paul Papalia CSC MLA, who gave an address on behalf of the WA Premier.

This year the event again had OzHarvest WA as its charity partner, and raised enough money to provide 3000 meals for those in need.

Peter Kapsanis, Media and Government Relations Manager for LSA WA, said the Sundowner provided a great atmosphere

for the industry to come together in a laid back setting.

“Overall it was hugely successful, despite the gloomy weather… it gave LSA members the chance to see what the association is doing for the benefit of our 300 members across the state, to broaden our horizons and add more value for them,” Kapsanis said.

“Our aim is to do good and paint the sector in a positive light, and we do that year on year.”

The 2023 Sundowner was supported by LSA WA partners including Lion, Containers for Change, WA Energy and Bendigo Bank.

More recently, the LSA WA has also introduced its new board, with Michael Cartwright joining the team following the tragic loss of former board member Anita Grace last year. The board has now been ratified, with Cartwright joining Chair Lou Spagnolo, Deputy Chair Steve Nicoloff and Treasurer Brent Rudler, and other board members Vikrant Sharma, Chris Dzodzos and Laurie Hurley (honorary board member).

Cartwright comes to the board with over 12 years of hands-on experience in the independent liquor and grocery retail space. He is the Owner Operator of Cellarbrations Port Kennedy and the adjacent PK Fresh

IGA, Stockyard Meats and the Kiwi Shop, specialising in food and beverage products from New Zealand.

Cartwright said he is proud to be joining the board, commending all members as well as Spagnolo and LSA WA Management for their hard work advocating for members so far. This appreciation for the association was one of the key drivers behind Cartwright’s interest in joining the LSA WA board, combined with his true passion around the necessity of independent retail.

“Independent liquor retailers are the conduit to the continued innovation of local producers and the industry players recognise the important role that independents make,” Cartwright said.

“My main purpose for joining the board is to ensure that regulators continue to make decisions in the best interests of the community and the local industry and do not lose sight of the importance of the independent sector to the wider WA local producers.”

More positivity is expected from LSA WA in the second half of the year too, with the date announced for the association’s 2023 Liquor Industry Awards, presented by Lion. Save the date for Friday 13 October, at the Hyatt Regency Perth, and keep an eye out for more information to come. ■

The year has kicked off well for the association, as it continues to advocate on behalf of its members.Circana explores how opportunity can be created in an inflationary economy.

Overwhelmingly, almost every Australian is ‘somewhat or extremely concerned’ about the effects of inflation (93 per cent), as the cost of living increase bites hard. At the time of writing, we were hit with a 10th consecutive interest rate hike and three quarters of Australians told us they are concerned about the cost of general household bills (72 per cent)and food and groceries (77 per cent). Half are worried about the cost of petrol (54 per cent) and their rent or mortgage payments (46 per cent). And in a fifth consecutive decline, Australia’s household saving ratio fell to 4.1 per cent in the December 2022 quarter.

In fact, value is now overwhelmingly behind why Australians are changing brands. Seven in 10 of us are now likely to make unplanned purchases after seeing products on promotion or discounted (68 per cent) or switch to a new brand if it offers new features or benefits that appeal (69 per cent), while 80 per cent now ‘like to stock up when products are on sale’ and two thirds believe that retailer/own-label products are a good alternative to branded products. After value, sustainability for younger consumers and personal

choice for older people is driving our purchase habits.

As many Australians reduce their spend and gravitate to value brands, you must create a better balance between price and value proposition; and identify and create new revenue opportunities while sustaining shopper loyalty that meets shifting shopper behaviours.

What is clear is that the cost-of-living crisis and skyrocketing interest rates will continue to hike up FMCG prices, and with this, elasticity will return.

To drive profitable growth and create opportunity in an inflationary environment, Ray Florio, Partner, Growth Consulting at Circana, recommends brands build a sustainable pricing leverage over the:

• Short-term (within the next year) – by identifying optimal everyday price points and promotional calendars by channel for each product, ensuring each has the right pack size from the existing portfolio. Capitalising on current pricing leverage stemming from existing brand strengths will help ascertain the right price and promotion structure per channel, the products that must compete, and those that can sustain premium pricing.

• Immediate-term (one to two years) – by strengthening margins with lower impact when the volume trade-off is positive to capture

consumer segments based on price and pack offerings, identifying and driving new occasions through new and changed pack sizes by channel, and cost-effectively meeting key price-per-unit and priceper-volume thresholds. Drive stronger differentiation by improving price realisation within your existing portfolio, influencing preference through refining on-pack communications and promotional messaging and positioning to improve willingness to pay without incurring additional promotional costs.

• Long-term (two to five years) – by tailoring innovation pipelines around brand strengths to deliver the attributes and benefits for which shoppers are willing to pay a premium – especially in an otherwise stagnant category. Identify benefits and attributes to drive a stronger sustained value proposition and efficient options for defending against potential competitor entrants and/or launches.

Successful brands and retailers must differentiate their customer types and quantify their sales contribution to prioritise initiatives. Through understanding the factors influencing or disrupting shopper behaviour, both manufacturers and retailers can more confidently adapt their strategies to better address specific needs and influence shopping behaviours to suit various shopper types on different occasions. Shopper research will enable you to understand the ‘why’ behind the buy. With inflation expected to peak in 2023 – what’s your long-term strategy? Disruption is not going away. It is critical to support your customers through it. But this inflationary environment gives you an opportunity to get organised to springboard towards 2024. Test and trial new tech, new innovations and new launches now. Build loyalty while showing you care during inflation. Get your data and your omnichannel customer experience synchronised. Remember, the consumer is now in the driver’s seat, and you need to meet them where they are. Success requires consistent, memorable experiences delivered through every available channel – ensure your shoppers can use their loyalty privileges and enjoy seamless service and fulfilment, no matter whether they purchase through livestream shopping or walk into your bricks and mortar outlet. Smart data utilisation will amplify your understanding of and dialogue with them.

The future is about using technology in ways that create more time and value – for your company and your customers. That future is already here. Are you ready? As you utilise new channels, fine-tuning the individual customer experience will matter more than ever. ■

“The future is about using technology in ways that create more time and value – for your company and your customers.”

There’s no doubt about it, economic headwinds are swirling. Data released by the Australian Bureau of Statistics in April found that inflation in the consumer price index had grown by seven per cent over the 12 months to March. With staple goods on the up, retailers in all sectors may be concerned that customers might look to lessen spending as budgets shrink and belts tighten.

Thankfully in this environment there is still some positive reading for liquor retailers. Recent research from Compare The Market found that alcohol is one of the top items that Australians are unlikely to give up, with over 12 per cent of those surveyed saying they would continue to purchase even if under cost-of-living pressures.

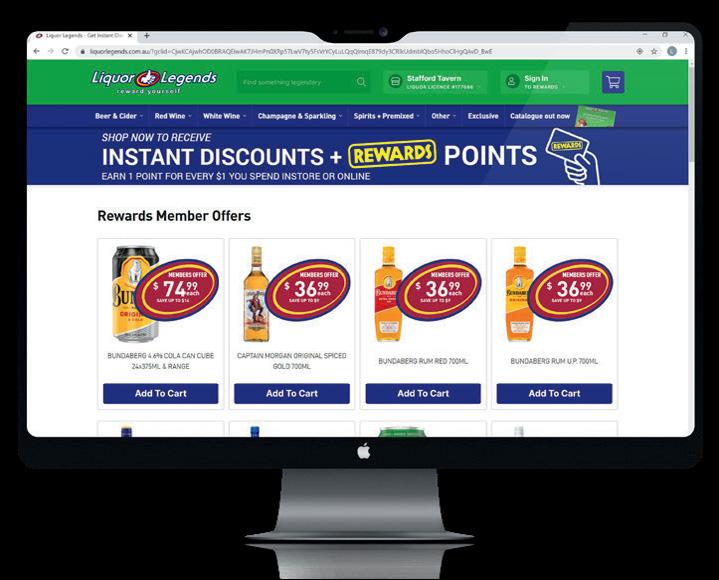

Nevertheless, independent liquor retailers around Australia know it’s important to remain vigilant to respond to the challenges of the market today. One such area that the nation’s banner groups are looking into is how best to approach online shopping. E-commerce has provided a vital lifeline to stores and groups during the darkest period of the lockdown era. But now, there are indications that some e-commerce businesses have suffered as trading conditions changed.

The banner groups in this feature have approached this challenge in diverse ways. But across all groups and any other challenge that arises, one question consistently seeks to be answered - how can banners help give their member stores an edge? During difficult times, it can be reassuring to be part of a larger ‘family’ and have someone in your corner.

In these pages, we hear from the leaders of some of the key banner groups in Australia – Australian Liquor Marketers, Independent Liquor Group, Independent Liquor Retailers, Liquor Barons, Liquor Legends, Liquor Marketing Group and Thirsty Camel Victoria. They share their thoughts on the market and how this has been reflected in their brand’s performance, how trends are making an impact, and how they are developing their strategy this year. ■

Inflation, increased costs and rapid changes to business mix are obstacles that banner groups are overcoming successfully, as Seamus May hears.

Banner group leaders share their thoughts on major trends in the liquor retail sector, and reflect on the ongoing ‘shop local’ movement.

“2023 to date has seen a stabilisation of the market compared with the extreme growth of prior years. The COVID period delivered rapid change in where shoppers preferred to shop and what they purchased. The prior years delivered great growth through premiumisation of products and larger basket sizes, along with shifts in category purchases to RTD and spirits. These trends have stabilised and are being maintained.”

- Gavin Saunders, LMG“The ongoing popularity of low and no-alcohol products continue to rise. We are also seeing a lot of suppliers in all categories introducing smaller pack formats, value packs or focusing on four and six pack formats to soften price shock. ILG has also always been a strong advocate of the ‘support your local’ movement. We are pleased that this has remained strong after the pandemic, and we have continued supporting members involved in their respective neighbourhoods.” -

Paul Esposito, ILG

Paul Esposito, ILG

“Familiar brands are resonating well with shoppers, as is the continued category shift towards spirits and in particular RTDs.”

- Vaughan Peters, Liquor Legends

- Vaughan Peters, Liquor Legends

“We’re still seeing some strong growth in the RTD category especially in light RTD. The lemon refreshment category and flavourful vodka mixes are very much on trend. Also seeing growth continue in the ginger beer space and seeing some surprising uplift in wine, especially local sparkling.” - Corey

“Glass spirits continue to grow as people look to continue making drinks at home. Whiskey and vodka are the main drivers of these categories for us. Shopping local remains highly relevant as consumers have discovered that independent businesses can offer competitive prices while also providing exceptional convenience, particularly through the availability of drive-thru bottle shops.”

- Adrian Moelands, Thirsty Camel VIC

Leeson, ILR

- Adrian Moelands, Thirsty Camel VIC

Leeson, ILR

“With the substantial increase in pricing seen this year, plus rate rises and more, consumers are seriously feeling the pinch and without giving too much away, our next brand campaign will be responding to this.”

- Chris O’Brien, Liquor Barons“Consumers are increasingly looking for ways to support their local businesses, and independent retailers are well-positioned to capitalise on this trend. We’re also seeing a continued increase in spirits and RTD, as innovation in flavour continues to win new consumers into these categories.” -

Nathan Rowe, Sessions Liquor Group

Nathan Rowe, Sessions Liquor Group

“CPI increases, interest rate rises, cost of utilities and living have all led to a shopper who is more aware of their wallet… ALM believes shoppers will be looking for value ads across not only liquor but across all retail categories.”

- Chris Baddock, ALMQ: How have things been going for ALM so far this year?

ALM has spent the first half of 2023 continuing to drive our singleminded strategy of ‘famous, frictionless and sticky’. Famous for the right offer and brands, frictionless in the best core processes and sticky in the value creation for retailers and suppliers.

Most recently we launched ALM Connect, a one stop shop for all ALM customers. ALM Connect gives retailers access to products through their existing ordering processes not available in the warehouse, while enabling suppliers to make available their more local, unique, and tailored products to the entire network base. With on average 50 products being onboarded to the site daily, we believe our retailers and on-premise venues will be able to offer exactly what their shoppers/consumers are wanting.

Q: Are there any exciting projects you’ve been working on to support your members?

Further to ALM Connect, the team has been focusing on shifting from pilot to launch of the loyalty program and have most recently launched My Bottle-O Rewards. The pilot has been a success with basket size for loyalty purchases much higher than the average transaction. With demand from retailers to join and sign up to the loyalty program growing across both The Bottle-O and Cellarbrations, it is just another way retailers are rewarding their shoppers and keeping them coming back.

It’s certainly been a busy start of the year and due to launch later this year is ROSS (Retailer One Stop Shop). However, more importantly, One Stop Shop as it will be available to both retailers and on-premise customers. ALM One Stop Shop is a single channel of communication for all ALM customers, from delivery details, new products and marketing campaigns, all tailored to the individual store or venue.

Q: ALM’s award-winning owned and exclusive portfolio is continuing to grow – how important is this for the company?

CPI increases, interest rate rises, cost of utilities and living have all led to a shopper who is more aware of their wallet. This is why we have spent the past few years building our owned and exclusive portfolio, which not only drives a point of difference for our retailers but offers

a range of products giving great margin and very competitive prices for shoppers.

Products like Cougar RTD launched recently in the value bourbon space and POETS beer is one of our fastest growing beers sitting in the value space. And our wine portfolio was recently awarded eight medals at the International Wine Challenge.

Q: Why is now a great time to be part of your group?

ALM believes shoppers will be looking for value adds across not only liquor but across all retail categories. However, for us it is a strong focus on our promotional programs and more importantly our prices locked programs, rewarding shoppers with consistent competitive prices in market on their favourites.

We know the expansion of our loyalty program, e-commerce online exclusive deals and rewarding shoppers with gift cards will continue to drive shoppers into our member stores.

ALM is set to announce our full year results to the market on 26 June. ■

The biggest wholesaler to independently owned liquor retailers in Australia

We want to help you create the best store in your town

1 Through famous brands with unique character

2 By being frictionless from order to cash

3 By building programs, which create growth for you and your shoppers

Q: How has your performance been so far this year?

Growth in membership has remained steady and favourable for ILG. The co-operative welcomed over 500 new members to the ILG family from July 2022.

Recent member additions include managed groups which has also increased the number of accounts we service. To ensure we maintain acceptable service levels, we have also grown the ILG staff family with new faces in the areas of IT, trading, finance and supply chain. ILG’s half-year results continue to surge across all channels of the business. Revenue grew by 21 per cent compared to the same period last year, while case sales surged by 14 per cent. Profit surpassed last year’s figures by 21 per cent.

Q: You recently introduced the Liquor Co-op Warehouse and the Liquorstop Warehouse – how has their early performance been?

Liquor Co-op Warehouse is doing well. We have a dedicated person overseeing both platforms of Liquor Co-op Warehouse and the Liquorstop Warehouse. ILG has also partnered with the Restaurant & Catering Association which gives us a wider reach to our target market. This is an avenue allowing businesses out there to access our extensive product range at competitive prices.

Q: How would you assess the success of ILG’s Queensland expansion, and is there any further expansion in the works?

We strongly believe Queensland will surpass NSW in volume and revenue within the next two years. Queensland operates with a different model - we supply brewery products to our members, versus the brewery direct model in NSW. We are in the process of acquiring another warehouse in Queensland to accommodate our growth.

Q: How are you making a difference for your members with current cost pressures?

In the face of fuel price increases, ILG continues to offer its members freight neutral benefits. This simply means that ILG absorbs the cost of transport. That’s one unbeatable member advantage. Membership growth comes with better buying power, allowing

us to pass on the savings to our members, savings they pass on to their customers through better retail prices.

Through our business development training, we continue to support members in enhancing their staff’s skill set, grow commercial knowledge, increase morale, and job satisfaction that breed a confident and reliable workforce.

Q: Why is now a good time to be a part of your group?

As a cooperative, we operate differently. The co-operative is owned by the members, it is not simply trading with ILG – it is partnering with fellow members in collectively shaping the future.

All surplus generated from the provision of its’ service is invested back into the business for the benefit of the members, for example, freight and fuel levies. With costs increasing, we have managed to absorb these increases to benefit our members. For those customers who are not part of the cooperative already, and are feeling these pressures, it’s worthwhile having a chat with us.

ILG’s purpose is to future proof independent retailing. Our membership base is diverse. We supply clubs, pubs, bars, restaurants, stadiums, retail and any other organisation providing alcoholic beverages to consumers. We don’t have the same pressures of return of profits to shareholders as we are not a publicly listed company. Our benefits and cost savings go back to members and the cooperative. Now is the time to join. ■

Pay rebates only on selected Core Ranged products?

Force you to take product allocations?

Charge you a shrink wrap fee?

Have their call centre or accounts department located offshore?

Make you pay monthly fees?

Include discounts, point of sale and advertising spend in their rebate calculations?

Make you pay for promotional point of sale and signage?

Have agreed terms with all Suppliers?

Have full control of their logistics?

Restrict you from having greater flexibility to retail and market to your local community?

ILG is Australia’s largest member-owned Liquor Co-operative with over $50 million in assets

ILG means ownership in two and soon to be three distribution centres in NSW & QLD

ILG has six strong banner groups providing choice and flexibility to suit your business needs.

ILG has 1500 members/customers strong in three states.

ILG offers competitive rebates on all package liquor purchases with no exclusions.

ILG offers freight rebates of $1.10 per case inc gst

ILG has NO forced product allocations

ILG offers strong signage to improve street presence free of charge

ILG has a dedicated sales team and member services team to help with day to day needs.

ILG has NO shrink wrap fees

ILG offers a marketing and e-commerce platform free of charge including a complete fortnightly printed promotional kit

Q: How has ILR been going so far this year?

We performed above our expectations in the first quarter of this year. A combination of CPI buy-up, solid marketing plans to pull through stock in February and March and then a great buy-up in late March in the lead up to Easter saw great trading results. Our store count has increased in the first quarter due to continued growth in the Queensland market and increasing our presence in Sydney through to the Central Coast. Our Liquor & Co. banner seems to be appealing to these areas as most of the new stores have chosen this banner.

Q: ILR has a focus on local trends through advertising to appeal to consumers in certain areas – how is this tactic faring?

We’re not only varying the products by local region but reviewing product mix to ensure we are providing the right amount of offers in each category based on location. We have seen this used most successfully in the ACT region. We have continued to grow local craft brewers Bentspoke and Capital which combined now have a higher share of business in the ACT than Coopers. Additionally we have added local wines like Collector, Eden Road and Nick O’Leary to our programs and have seen them grow more than double digits. Canberrans and our stores are very much supporting local.

Q: It’s a difficult economic environment for consumers and retailers alike – how are you helping your members navigate this tough terrain?

We have put a lot of focus on helping businesses reduce their costs. We want to be more than just a banner but a business partner that will help in all areas, not just pricing and marketing. We have partnered with Choice Energy to help reduce electricity prices, partnered with merchant service providers to reduce fees, partnered with insurance companies to reduce insurance and improve their level of cover. All things that add up to some significant savings. But the main focus is how we grow our share. Driving consumers to our members stores by showcasing our great offers. Our move to more digital advertising is driving this change. We still have work to do but providing the right offers to the right shoppers in the right locations is starting to prove fruitful.

We are doing a full business review to ensure we set ourselves up for growth and adapt to changes in the market. We’ll be conducting some strategy sessions to understand where we need to be and what we need to do to be successful. We are already seeing the impacts of inflation and rate rises and we need to ensure our business has a plan to navigate this period to support members and grow our market share. We are asking for members’ feedback to get their buy-in and make sure we take them on the journey.

We are a member-driven group and decisions are driven on members’ needs and not shareholders. Being a profit-share business we return all our profit back to our members. We provide flexibility in ranging to tailor to local markets and reward you for execution, not punish you. We are the local. ■

Q: How has your performance been in the first quarter of this year?

Sales and transaction count for the first quarter of this year have both grown on our 2022 and 2021 figures. Given that this quarter we’ve navigated the largest CPI increase seen since the 80s, exceeding last year’s sales figures is an outstanding result. With sales at three per cent above last year, our margin has also grown both in value and percentage points, increasing profitability for our co-operative members. These numbers reflect our customers are remaining loyal in this difficult economic environment.

We’ve seen our store count increase and I don’t see it stopping any time soon. This year alone we’ve had five new stores join our group in the first quarter, with a sixth store planning to open its doors in June 2023. Our focus is not only on increasing our footprint, but on recruiting members that are the right fit.

Q: The Legit Locals campaign was very successful, what’s next for your marketing?

Liquor Barons’ Legit Locals campaign ended in January 2022 and as restrictions eased and our market changed, we went in a new direction for our 2022-23 summer campaign. The campaign ‘Wines, Beers & Independent Spirit’ was born out of communicating our unique selling proposition in a different way to our previous Legit Locals brand campaign.

As WA’s only 100 per cent locally owned and operated independent liquor co-operative with over 60 stores and counting, ‘Independent Spirit’ was and still is at the very core of the Liquor Barons brand. The challenge was communicating what the benefits of being an independent liquor retailer are to our consumer – that we’re not part of any national chain and their cookie cutter offering! The new campaign was a fresh take on showcasing this point of difference to our local WA community.

Q: How are you managing staffing issues?

Having seen a spike in younger members joining the group in 2022, the co-operative was met with a hard decision to restructure the head office team to meet the needs of the growing group. Liquor Barons underwent the restructure in the last quarter of 2022 to make sure we were equipped to meet the changing needs of our co-operative. We