Zero Carb. Great Taste. How Good.

*<0.5g carbs per serve.

*<0.5g carbs per serve.

Welcome to the October issue of National Liquor News, your go-to source for the latest trends, insights, and innovations in Australia’s retail liquor industry.

Last month we were pleased to be able to join the Independent Liquor Group on its international Study Tour in South Korea. In this issue, Shane T Williams provides a recap of the trip and insights from CEO Paul Esposito, who reflects on ILG’s recent growth and future plans, emphasising member support, innovative marketing strategies, and preparations for ILG’s 50th anniversary in 2025.

Meanwhile, I headed to sunny Brisbane with Thirsty Camel Victoria, and in this issue I share insights into the group’s member-first focus, unique consumer value proposition, and innovative loyalty initiatives.

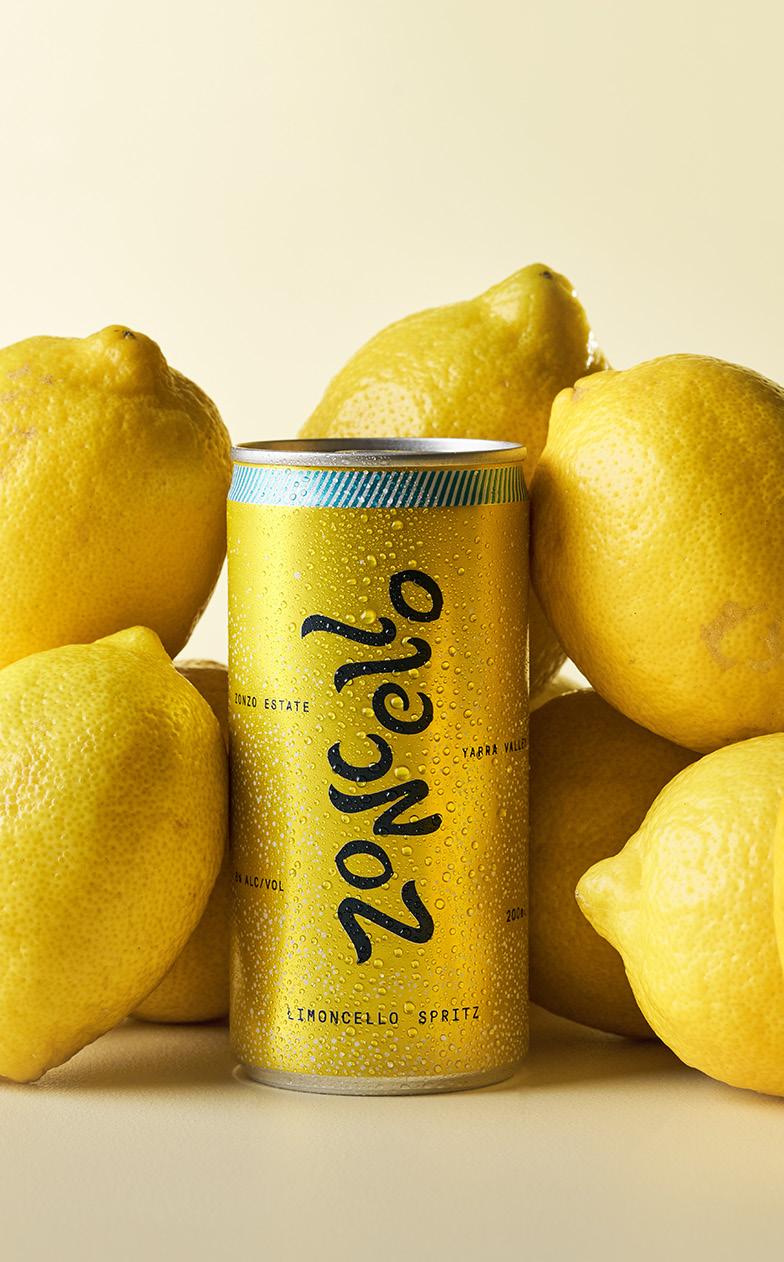

With summer approaching, now is the time to stock up on the freshest drinks of the season, and the months ahead are all about enhancing those long, sunny days and laid-back barbecues. To help you stay ahead of the trends, we’ve rounded up the top summer drinks that are sure to be a hit over the warmer months, from fruit-forward gins

to zesty Spritzes, RTDs and Australian aperitifs, we’ve got a round-up of what to stock for the warmer months.

We also share our regular articles from Retail Drinks Australia, Strikeforce, Wine Australia, New Zealand Winegrowers, eLease Lawyers, and Circana. Thank you to all of our contributors. Finally, we’d like to say a very special congratulations to NLN’s former editor, Brydie Allen, who married her long-time partner Harry Lawrence in a beautiful ceremony last month. Congratulations to the happy couple!

We hope you enjoy reading this issue as much as we enjoyed putting it together!

Cheers, Deb

Deb

Jackson, Managing Editor 02 8586 6156

djackson@intermedia.com.au

Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au

Managing Editor: Deb Jackson djackson@intermedia.com.au

Senior Journalist: Molly Nicholas mnicholas@intermedia.com.au

Journalist: Caoimhe HanrahanLawrence chanrahanlawrence@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –Liquor and Hospitality: Kea Thorburn kthorburn@intermedia.com.au

Prepress: Tony Willson tony@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

1yr (11 issues) for $70.00 (inc

To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au FOOD & BEVERAGE

With its commitment to innovation and responding to consumer trends, XXXX has released XXXX Ultra Zero Carb*, a fresh and approachable zero-carb beer set to disrupt the beer category.

Iconic Australian beer brand XXXX is investing in innovation and making a play for the zero-carb space with XXXX Ultra Zero Carb*. Leveraging the trust and heritage of the Queensland brand, the new beer breaks down barriers to beer consumption and appeals to a new generation of healthconscious beer drinkers.

A guilt free and easy drinking lager with less than 0.5g of carbs per bottle serve, XXXX Ultra Zero Carb* is brewed at the historic Castlemaine brewery, featuring Rho hop and a low bitterness profile. Along with the approachable flavour profile, XXXX’s new release is an appealing option for beer drinkers who may otherwise be turning away from the category in search of more mindful consumption options. Part of Lion’s Ultra category of ultra-low carb beers*, XXXX Ultra Zero Carb* represents the brand’s commitment to producing innovative and high-quality beer.

Pat Donohue, Field Sales Director, XXXX, said that the brewery has a strong track record of responding to consumer demand.

“Over our 146-year history, XXXX has continued to evolve to meet changing consumer tastes. We are excited to introduce XXXX Ultra Zero Carb* to our loyal consumers and a new generation of beer drinkers. Having pioneered the midstrength category with XXXX Gold, we now aim to revolutionise the market once again with our new zero-carb offering and we can’t wait for Aussies to try it,” he said.

With Lion and Pureprofile market research reporting that two-thirds of Australians are feeling fitter and more mindful of their lifestyle choices over the last five to 10 years, the demand for lighter and less filling alcohol options is clear.

Kerry Appathurai, Lion Australia Sales Director, said that XXXX Ultra Zero Carb* provides consumers with a ‘better for you’

choice that still delivers on flavour.

“This new product not only aligns with the broader cultural movement towards mindful consumption but also ensures that enjoying a great beer doesn’t mean compromising on taste or quality. XXXX Ultra ZeroCarb* is part of our wider Lion ‘Ultra category’ where we have released zero carb beers from Hahn, Tooheys and Byron Bay Brewery. This Ultra play also reflects our commitment to innovation that empowers Aussie drinkers to make choices to suit their lifestyle. We’re pumped to launch it,” she said.

XXXX Ultra Zero Carb* is available to liquor retailers nationwide, packaged in a 330ml bottle and sold in both six-pack and 24-pack formats. RRP starts from $51.99 per case and $20.49 per pack.

Contact your Lion representative to discuss stocking XXXX Ultra Zero Carb*. ■ * Less than 0.5g of carbs per bottle serve

Be a part of Australia’s largest Liquor Cooperative, servicing the industry since 1975.

CUSTOMERS

The Independent Liquor Group (ILG) reflects on its recent growth and future plans during a successful 2024 Study Tour in South Korea, emphasising member support, innovative marketing strategies, and preparations for its 50th anniversary.

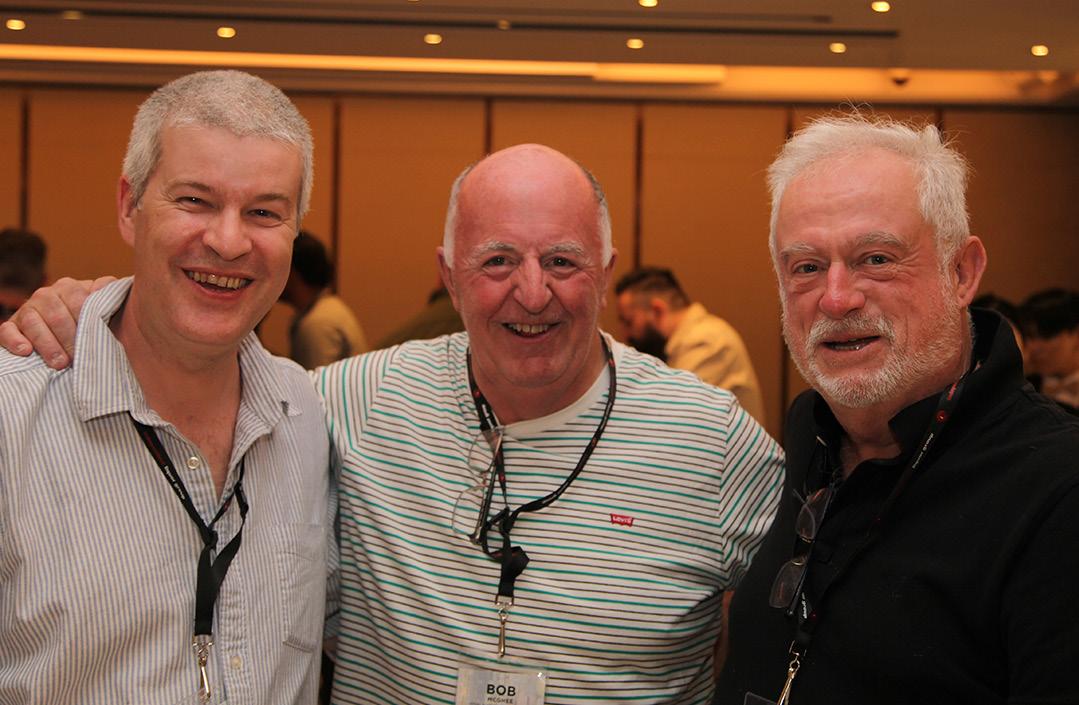

Last month, around 100 Independent Liquor Group (ILG) delegates travelled to South Korea for its 2024 Study Tour. Members enjoyed the best of South Korean culture and hospitality while networking with both new and old friends.

The co-operative family spent time in both the mega city of Seoul and the beachside port city of Busan. Highlights included visiting the Demilitarised Zone (DMZ) with North Korea, experiencing the nightlife and culinary delights of Seoul, and attending a spectacular Gangnam Style gala dinner to conclude the trip.

National Liquor News seized the opportunity to sit down with CEO Paul Esposito to get a comprehensive read on how ILG is performing in the current economic environment. The insights reveal a nuanced understanding of consumer behaviour, market challenges, and future plans for growth.

ILG has experienced growth in both value and volume in the last quarter, despite a challenging year overall. Consumer buying patterns have shifted significantly, reflecting the pressures of the current cost-of-living crisis. Suppliers have also adjusted their pricing strategies to adapt to this new trading environment.

“It’s been a tale of two halves,” Esposito explained. “In the first half of the year, we saw double-digit growth, but then we started to see a slowdown around Christmas. There was a marked change in buying patterns, with more discounted brands being sold. We noticed a fall in the average basket size as consumers moved towards value wines.”

Esposito elaborated on the suppliers’ response to the changing market conditions, saying: “Spirits companies adjusted their pricing to keep some 700ml spirits under

$45 and one-litre options under $60. RTD cubes, which were previously over $100, were brought back down under that mark,” he said.

In the last quarter, ILG was slightly above last year’s figures but short of budgeted targets.

“Overall, we finished with 5.4 per cent growth in value and 3.3 per cent growth in volume, which is a commendable metric considering the prevailing cost-of-living pressures,” Esposito said.

By channel, ILG has observed a decline in business from the on-trade, particularly in clubs, with many restaurants and bars closing. However, retail has shown resilience, particularly in metro and regional areas, suggesting that consumers are still eager to make purchases, albeit with a more cautious approach.

“There’s a bounce back in retail,” Esposito

noted. “So, I’m pretty optimistic that as we move into summer and head towards Christmas, we should start seeing a bit of recovery.”

Even amid these challenging trading conditions, ILG’s footprint has expanded significantly along the east coast. Membership numbers are on the rise, with a new property in Ipswich set to start trading in September 2025.

“The benefit for us is that our footprint in Victoria is expanding. Nationally, membership has increased to 1,700, with 70 applications pending approval. That’s fantastic news,” Esposito said. “We also have ambitious plans for Queensland, with a new 17,000sqm property scheduled to be operational by September 2025. The site will be purpose-built for ILG.”

This new decentralised approach aims to improve support for members at the grassroots level.

“While our head office is in New South Wales, we’ll be adopting a more state-based approach,” Esposito explained. “We’ll have dedicated member service and accounts personnel in both Queensland and Victoria, alongside a greater focus on tele-sales. This way, our members will know exactly who they can contact, either face to face or by phone.”

In a bid to enhance member support, ILG Trading Manager Tony Oliverio discussed current marketing initiatives that have been put in place.

“Occasions remain a big part of the promotional landscape,” he said. “We continue to drive promotions across both print and digital catalogues to benefit our members.”

The launch of fortnightly digital catalogues has proven successful, enabling members to view products on apps and download them from ILG’s portal for use on their own websites.

“These catalogues essentially showcase our best value products from each promotion,” Oliverio said. “Customers can access these via an app on their mobile devices, and they’re also loaded onto each banner’s website.”

Oliverio also mentioned that the promotional landscape has been tailored around major occasions, which are still significant drivers of foot traffic.

“We recently had footy finals promotions across all three banners, and we’re preparing for a spring carnival promotion as well. We believe there’s a real opportunity for our members to take advantage of these occasions.”

To further boost sales, ILG is introducing a digital rewards program that offers instant rewards to consumers.

“Once customers join the program, they can see a selection of marked products in-store that they can scan for an instant reward,” Oliverio said. “This means that irrespective of the point-of-sale system used, members can offer these instant rewards easily.”

Oliverio provided further insights into which liquor categories retailers should focus on, particularly in light of the current economic environment. He expressed optimism about trading conditions as the industry moves towards summer and the Christmas period.

In the spirits category, he noted that consumers are increasingly looking for value, with Tequila remaining a hot and resilient market segment.

“The growth within the spirits category is coming from Tequila,” Oliverio said. “Premium and super-premium Tequila buck the trend, with consumers willing to spend more despite cost-of-living pressures. We ensure we have one or two premium offers within Tequila, all coming from Blanco.”

While he acknowledged that gin may have peaked, he affirmed that traditionally made gin is still performing well.

“Gin may have had its honeymoon, but traditional gins remain in play, whereas flavoured gins are declining,” he said.

The trend towards value also manifests in the increasing popularity of larger formats and smaller sizes.

“We are seeing growth in one-litre formats, as well as smaller sizes like 50ml, 200ml, and 500ml. Brands like Fireball, Sheepdog, Screwball, Jim Beam, Jack Daniel’s, and Smirnoff are leading this smaller format growth,” Oliverio explained.

In terms of RTD products, 10-packs are currently trending.

“ILG’s MAT (Moving Annual Total) 10-pack growth has been 21.7 per cent. Even if you exclude Hard Rated, which has taken the market by storm, our growth remains in double digits at around 11 per cent. This is great from a member perspective because there’s greater margin to be gained.”

The beer category continues to face challenges, particularly with the craft segment experiencing a decline.

“What we’re seeing is a real shift towards 30-packs,” Oliverio said. “Our top four SKUs are 30-packs and are all showing growth.”

He explained that consumers are looking for cost per unit value, much like grocery shoppers assess cost per 100 grams.

“ILG’s promotional program allows consumers to get a 30-pack for less than $60, which equates to less than $2 a can,” he added.

Conversely, the wine category is also under pressure, with consumers looking for value-driven options.

“Wine has been on a volume decline for some time,” Oliverio noted. “However, we are seeing growth in multi-buys, casks, and Prosecco. Consumers are keen on promotions like two for $10, two for $15, and two for $20.”

“Red wine is in decline, while white wine, particularly lighter styles like Sauvignon Blanc, Rosé, and Pinot Grigio, are performing better,” he said. “The other significant movers in the wine category are casks and Prosecco. With cost-of-living pressures, consumers are increasingly drawn to value options in wine, such as two-litre, four-litre, and five-litre casks.”

ILG Chair and Fleet Street Pittwater Cellars owner Damien Bottero believes that ILG is well-positioned to navigate the current economic conditions.

“I am thankful for what ILG, the Board, and Esposito have done in the past,” Bottero said. “We have a solid foundation that will see members through these

challenging times. We own our own warehouse, and being a co-operative, we have a reliable and proven system.”

Bottero also emphasised the importance of a unified Board, saying: “There is great harmony among the directors. Each director brings their unique experience, but we all share the vision of helping our members. We engage in constructive discussions, distilling our ideas down to collective strategies.

“The joy of being a co-operative is that our focus is always on our members. Even in hard times, ILG is doing well because people are realising the benefits of our co-operative structure. Everything we do is for the members,” he added.

Bottero likened the Study Tour to a family reunion, saying: “Each ILG Study Tour is a chance to catch up with new people and old friends. Some members are on their first ILG trip and are loving it. People are already expressing interest in next year’s trip, which will be huge as it’s our 50th anniversary,” he said.

The ILG family is excited for next year, which marks the co-operative’s 50th anniversary, with Esposito revealing plans for the 50th anniversary ILG Study Tour.

“The ILG Study Tour for 2025 will be significant,” he announced. “We will visit Spain and Portugal, starting in Barcelona and enjoying the best of those countries’ rich traditions.”

He shared that a committee has been formed to organise events throughout the year to celebrate the milestone.

“Throughout the year, we will be celebrating our history and honouring the people and successes that have shaped ILG. This is a milestone worth celebrating.”

Esposito sees his role as a custodian, focused on ensuring ILG lasts for another 50 years, saying: “I always say I’m a custodian at ILG. It’s not about me; it’s about the collective. We are here to ensure ILG continues to flourish and serve its members well into the future.”

Delegates left South Korea with a renewed sense of purpose, reflecting on the cultural experiences, the knowledge shared, and the relationships forged during the study tour.

ILG’s Deputy Chairman, Chris Grigoriou, emphasised the importance of these tours for members.

“They allow members to connect with each other and senior management in a relaxed environment,” he said.

C-INC’s Retail and Procurement Manager Steve Clark echoed these sentiments. “It’s a well-earned break that balances work and social life,” he said.

With a clear focus on growth, innovative marketing strategies, and unwavering member support, ILG is poised for continued success as it approaches its landmark 50th anniversary in 2025.

The commitment to adapting to market conditions and fostering connections among its members will ensure that ILG remains a leading player in the liquor industry for years to come. ■

At the recent Thirsty Camel Forum, the group shared insights into its member-first focus, unique consumer value proposition, and innovative loyalty initiatives.

Thirsty Camel Victoria welcomed its members to Brisbane for its Thirsty Camel Forum in August, where the group discussed its key strengths and how it makes a difference for both members and consumers.

For General Manager Adrian Moelands, Thirsty Camel’s biggest strength lies in its highly engaged membership base. This was clearly demonstrated throughout the week with 260 members and suppliers in attendance at their annual forum, which was aptly themed ‘Stronger Together’.

“We all understand that getting a promotional program right is a must, but I believe it’s much more than just that. It’s all about engaging. It’s about being part of the membership. It’s about execution and most importantly, it’s about bringing our community together with events, resulting in buy-in to our programs.

“I’d say that this is one of our biggest strengths, our membership is genuinely engaged,” he said.

In tumultuous times for retail liquor, Thirsty Camel’s results this year have been up two per cent in value, and down five per cent in volume. Alongside financial results, Moelands emphasised the importance of the strong member engagement during this period.

“We’re bringing in the right members. It’s not a numbers game for us, and this year will be no different. We want people that want to be part of

“If we all join forces, we can achieve better results. So, how do we lean on our past experiences to drive us to the future? The answer is, we’re better together and stronger together.”

Adrian Moelands

the Thirsty Camel community. If you’re a part of the membership, it means you come to the forums, you come to the conferences, you come to the road shows because connection builds consistency,” he said.

Moelands said that Thirsty Camel’s members are the foundation of the group, truly setting the stage for future growth.

“If we engage with the members and suppliers to find mutually beneficial outcomes, then we all win. If the members believe in our strategies and are driven to execute them, we will grow,” he said.

Thirsty Camel’s commitment to its members was represented by the theme of the 2024 forum, Stronger Together. Moelands explained that the theme reflects the group’s original ethos, as well as pointing to a path forward.

“If we all join forces, we can achieve better results. So, how do we lean on our past experiences to drive us to the future? The answer is, we’re better together and stronger together,” he said.

This year’s forum saw 73 per cent attendance across the membership. Moelands explained that events such as the forum allow an opportunity for members to learn lessons through seminars, and most importantly, each other.

“You learn 50 per cent in the classroom, and then the other 50 per cent comes from social settings, like over drinks at a bar after meeting a new member. Whether it’s on a walk, whether it’s on a boat, it doesn’t have to be just presentation after presentation,” he said.

Importantly, Thirsty Camel also recognises the efforts of its members, such as Adriana Thomas, who won the 2024 Member Appreciation Award at this year’s forum.

“Adriana has had 36 years in the industry, in the same hotel group. She worked in the front bar, before transitioning to liquor and becoming a manager. She became a buyer for the four bottle shops that the group owns, and 36 years later, at 65, she’s still doing it,” Moelands said.

The winners of the Member Milestone Award are presented with Thirsty Camel’s ‘Green Jacket’, a symbol of their expertise. Each year, ‘Green Jacket’ alumni proudly return to Thirsty Camel events, wearing their jacket with pride.

For consumers, Thirsty Camel offers two key points of difference, through its on-the-go focus and unique Hump Club loyalty program.

Moelands explained that Thirsty Camel focuses on on-the-go consumers rather than convenience, because what consumers consider convenient can be subjective.

“We want people to think, ‘I’m going somewhere, I’m on the way home, I know that I can get a convenient offer from Thirsty Camel’. If you have a look at our range, from an RTD point of view, we focus on four-packs, six-packs, and 10-packs. If you look at our beer range, we focus on 10-packs and six-packs, versus cases. For the member, there’s more money in selling a 10-pack than there is selling a 24-pack, so our promotional program is really focused on those products, which is a point of difference,” he said.

When it comes to loyalty, Thirsty Camel has been enhancing its Hump Club program, reaching $2m in loyalty revenue in July, compared to $400,000 18 months ago.

“Loyalty is a big priority for us. It’s a way for us to win in the current market,” Moelands said.

“I think we do loyalty well, and we’re constantly working on new innovations to offer our Hump Club members more value.”

Moelands attributes this increase in loyalty revenue to a renewed focus on its members through the Store of the Year incentive program.

“While we’re always focused on growing Hump Club awareness in the Victoria market, we also understand there’s a big opportunity to incentivise our members to drive the program in their stores. With the Store of the Year program, we can reward members for reaching their Hump Club targets. If they hit their targets, they unlock rewards like free tickets to our annual forum. Instead of just focusing on how we market to consumers, we’re also focused on how we market to our membership,” he said.

Thirsty Camel’s Store of the Year incentive program extends beyond Hump Club metrics.

“If you buy from outside of the group, then you don’t receive points. To win, members would have hit all the criteria for store standards. They would have received 100 per cent compliance in core range, uniform, execution of promotions and more. They would be a part of our e-commerce program, and they would hit their Hump Club loyalty targets,” Moelands said.

For transparency, and to drive a competitive edge, members can see how they compare against other stores with a leaderboard on the member portal, MILIE, which indicates each store’s performance as of the last quarter.

For Moelands, Thirsty Camel both empowers its members to optimise their businesses and creates a supportive community among members and the group.

“If you want to be a part of an engaged, fun community, and you also want to do really good business, then we’re for you.”

Continuing to innovate with its loyalty program and customer engagement strategies, Thirsty Camel Bottleshops is exploring gamification as a new way to reach consumers, following a successful trial of the Can Smash Footy Finals digital game.

While member exclusive deals and points-based rewards systems are important elements of building consumer loyalty, Thirsty Camel is thinking beyond transactional behaviours when considering consumer loyalty.

Rachel Brown, Loyalty and Digital Marketing Manager, Thirsty Camel, said that gamification is one way the group is engaging with its consumer base on a different level.

“This isn’t about transactional behaviours or getting our members to spend money. It’s about getting them to engage with the Thirsty Camel brand and Hump Club program in a more meaningful way,” she said.

Thirsty Camel’s digital games are exclusively available to Hump Club members, inviting consumers to sign up or sign in to play for bonus product, merch or vouchers to spend in-store or online.

“By completing a certain level, you’ll get automatic My Offer vouchers into your Hump Club account. What we’ve seen in our trial game, Can Smash, is an uplift in signups and engagement. What we tracked here was engagement, traffic through to the game, and people returning to play again to try and earn that reward,” Brown said.

Brands that incorporate gamification into their strategies see a 47 per cent increase in engagement, and the response from Thirsty Camel consumers has

Stores of the Year: Settlers Tavern, Tawonga; Esplanade Hotel, Inverloch; Nepean Highway Cellars, Mornington

Supplier of the Year: Carlton United Breweries

Rising Star Award: Good Drinks Australia

Member Milestone: Adriana Thomas, Gladstone Park Hotel

certainly confirmed this statistic. The group’s first digital game, Can Smash, exceeded the brand’s expectations whereby the benchmark for a successful digital game is an average of two to three plays per user and Can Smash surpassed that number significantly with a reported 20 plays per user.

For Brown, the Thirsty Camel brand is uniquely suited to this innovative style of engagement.

“Considering our brand is a talking camel, we’re allowed to have fun with it. We can play in a space that’s cheeky and irreverent and we have a great advantage in being able to be agile and try new, innovative things to see if they work for the program,” she said.

Following the initial success of Can

Smash, Thirsty Camel aims to launch new games for other key purchase occasions.

“We’ll be working on building a custom digital game into every national campaign moving forward so that we can support with genuine Hump Club engagement,” Brown said.

As well as building loyalty, digital games such as Can Smash offer new avenues for Thirsty Camel to communicate with its customers.

“What’s great is that there is also the opportunity to build in additional features to the games. To reset and try again, players have to watch a video or complete a survey. This is valuable data for us to better understand our loyalty customer and be able to provide them with best experience,” Brown said.

Now in the seventh year of its loyalty program, Thirsty Camel has 250,000 Hump Club members across the eastern states. This makes a significant difference to member stores’ bottom line, with the average Hump Club customer spending $55 per transaction, compared to $40 per transaction for a non-loyalty customer.

Like Thirsty Camel’s General Manager Moelands, Brown emphasised the importance of the Thirsty Camel membership in ensuring the success of its innovative loyalty initiatives.

“None of these innovations count without engagement from our members. We’re counting on them on the front line to believe in the program and encourage their customers to join,” she says. ■

“If you want to be a part of an engaged, fun community, and you also want to do really good business, then we’re for you.”

Adrian Moelands

Thirsty Camel celebrates AFL finals with free drive-through tattoos

In celebration of the AFL Finals, Thirsty Camel partnered with Good Marks Tattoos to offer a free drive-through tattoo activation for fans wanting to wear their love for their footy team on their sleeves.

Thirsty Camel Grandview Hotel was transformed into a one-day-only drive-through tattoo studio, with the Good Marks Tattoos team offering one of 18 designs featuring the mascots of the AFL teams. A special Thirsty Camel design was also on offer, with customers who opted for the Thirsty Camel tattoo gifted with a voucher valued at $50.

Customers were able to get a free tattoo with a purchase of $20 or more, excluding tobacco products.

Winners of the inaugural Sydney Royal Distilled Spirits Show and 2024 Sydney Royal Beer & Cider Show were unveiled on 17 September at an awards ceremony held in Sydney.

Across both shows a total of 25 trophies were handed out, made up of 14 spirits champions and 11 beer and cider trophies, which included nine new trophies introduced under the revamped beer and cider award structure.

Speaking about the decision to introduce nine new champion trophies, as a means of better reflecting trends in the Australian brewing industry, Ian Kingham, Sydney Royal Beer & Cider Show Chair said: “I think what has come out of that is a very deserving range of champion winners who are producing quality products that can be enjoyed by a wide demographic.”

Scooping the top awards were St Agnes Distillery, which won the inaugural Best Distilled Spirit of Show for St Agnes XO Grand Reserve, and Esker Beer Co, which claimed the coveted Champion Beer or Cider trophy for its Esker Citrus Gose.

Of the 270 Sydney Royal Distilled Spirits Show entrants, 88 per cent received a medal, with regional towns dominating the champion prizes. Entries for the 2024 Sydney Royal Beer & Cider Show were received from a total of 206 exhibits across Australia, 83 per cent of which scored either a gold, silver or bronze medal.

Coles Liquor has uncovered the next phase of its transformation, announcing a pilot program that will see select Vintage Cellars and First Choice Liquor Market stores adopt the Liquorland brand.

Over the past four years, the Liquorland transformation has converted more than 600 stores to its black and white format, with customers enjoying more spacious store layouts, clearer in-store signage and more locally relevant ranges.

Building on the success of the early phases of the transformation, all nine stores in South Australia, along with a small number of stores in Victoria and Queensland, will adopt the Liquorland brand. Selected Vintage Cellars stores will be rebranded as Liquorland Cellars, while participating First Choice Liquor Market stores will become Liquorland Warehouse.

Coles Liquor Chief Executive, Michael Courtney, told National Liquor News: “It starts with the customer. We know that First Choice Liquor Market and Vintage Cellars stores get a very strong rating from customers in terms of NPS, but they also suffer from low brand awareness.

“By extending Liquorland as our strongest and most well-known brands to those locations, we think it’ll help drive footfall into those locations, in what we know is already a strong shopping experience for customers.”

Due to commence in November, the pilot program has not only been informed by extensive customer research, but it also capitalises on the momentum building around the Liquorland banner after the continued success of the black and white conversions, which is now 75 per cent of the way through the Liquorland network.

The Western Australian Liberal Party has announced its intention to increase protections for retail workers, including introducing Workplace Protection Orders (WPOs), which has garnered support from liquor retail peak bodies.

Employers are able to apply for a WPO to protect their staff and customers from high harm repeat offenders, with the order applying to the whole workplace for a period of 12 months. This differs from a Violence Restraining Order (VRO), which requires the victim of violence in the workplace to apply for the VRO, and only protects the victim rather than the whole workplace.

Following an incident of violence or intimidation in the workplace, the business will be able to apply for the WPO in a similar manner to applying for a VRO. Evidence such as CCTV footage, police reports and witness statements will still need to be provided to meet the burden of proof. Additionally, a WPO cannot be issued for shoplifting, as it is focused on addressing violent offences.

An individual who has been issued with a WPO may be prohibited from entering the workplace, required to remain a certain distance away from the workplace, or subject to conditions under which they may enter the workplace or contact specific individuals.

The announcement has received the support of peak liquor retail bodies, with Liquor Stores Association of Western Australia CEO, Peter Peck, saying the proposed measure protects victims of violence and intimidation by allowing business owners to take charge of applying for WPOs.

“Anything that sets out to ensure the safety of people doing their job or protecting customers from unruly and anti-social behaviour is important, especially for those in a retail setting, including our liquor store members and their staff,” he said.

“It’s a plan that allows employers to do the heavy lifting through the courts and protects their staff. It’s a step in the right direction and another way to ensure community safety.”

Endeavour Group has unveiled its first Trade Supplier Charter, which builds on existing policies and initiatives, and Complete Liquor, established by data and insights company Circana, as a data tool for retail liquor trade suppliers.

Complete Liquor will give liquor trade suppliers access to a free report offering a top-level overview of the beer, wine, spirits and pre-mix categories, providing a clear and comprehensive market perspective.

Endeavour Group CEO and Managing Director, Steve Donohue, said the Trade Supplier Charter and Complete Liquor tool demonstrate Endeavour’s focus on strong partnerships and innovation.

“We have doubled the number of small suppliers we work with since 2018, and now 90 per cent of what we range is sourced from independent, small suppliers. Importantly, some of the most popular drinks we sell today didn’t exist two years ago, which is a testament to their responsiveness to changing customer preferences,” he said.

Paul Hinds, Managing Director, APAC, Circana said: “Circana’s Complete Liquor is designed to help identify opportunities and streamline decision making by offering the most comprehensive view of the market to suppliers and retailers. Combining unmatched measurement capabilities and our deep industry expertise, we are excited to partner with retailers across the liquor sector to provide the first single source of truth for the industry.”

New research from NiQ indicates that beer consumption is back on the rise in Australia, trumping spirits.

Recent consumer trends have been impacted by the pandemic, cost-of-living pressures as well as a desire to moderate consumption and a focus on more sustainable products. These factors have all combined to influence consumer behaviour in terms of managing expenses, becoming more home-centric rather than going out to drink.

According to NiQ, data suggests that consumers are replacing out-of-home occasions with drinking at home, resulting in stable off-premise unit sales and growth in value compared to the previous year.

NiQ said: “Although ‘units per occasion’ has dropped by -3.3 per cent, there’s an uptick in both buyers (+2.1 per cent) and occasions per buyer (+1.7 per cent). This suggests people might be shifting some occasions to at-home consumption, but also purchasing smaller pack sizes more frequently, indicating a move towards occasion-based buying rather than stocking up.”

Beer is the primary beneficiary of this search for value, seeing double-digit dollar value growth and increased buyers.

Consumers in the 55-plus age group show the strongest increase in liquor retail sales growth (34.1 per cent value growth compared to the previous year), while under 35s show the biggest reduction in retail spending on total liquor (-8.0 per cent).

https://theshout.com.au/national-liquor-news/subscribe

Corryton Burge showcases six generations of winemaking excellence

Situated in the heart of the Barossa Valley, Corryton Burge is rooted in history, owned by a family whose legacy dates back six generations and is synonymous with exceptional Australian wines. Led by siblings Amelia and Trent Burge and guided by their parents Grant and Helen Burge, Corryton Burge is the family’s next step in their wine journey.

Last month, the winery celebrated the release of its inaugural Sparkling Collection, a much-anticipated release that captures the legacy of the winemaking family, comprising the NV Sparkling Pinot Noir Chardonnay, 2019 Martha Mae Tasmanian Sparkling Pinot Noir Chardonnay and NV Sparkling Red.

The Sparkling Collection joined the existing Kith and Kin ranges, both inspired by family and friends’ stories. The Kith Range is Corryton Burge’s core group of wines designed to honour provenance with wines that are an accurate representation of the region and variety.

The Kin Range, a premium collection of Chardonnay, Pinot Noir and Cabernet Sauvignon, was crafted as an elegant example of terroir and varietal expression.

Distributor: ALM nationally, Veraison in NSW, Icon Beverages in ACT, Burge Family Wine Estates in SA and NT

From 1 October, the Better Beer range is now available to all retailers across the country. The award-winning range of betterfor-you beers comprises the original Zero Carb Zero Sugar Lager, Ultra Low Carb Middy, lower sugar Ginger Beer, the Ultra Low Carb Pacific Ale, Arvo Ale and Zero Alc. Since its launch, the brand’s first release, Better Beer Zero Carb Zero Sugar has driven category and margin growth.

Better Beer has a track record of continued growth, making $100m in revenue in the first 30 months of trading. It was only launched in October 2021 and is now one of the largest independently owned beer brands in Australia. Additionally, it has strong digital engagement, with more than 220,000 social media followers and a clear appeal to younger adult consumers.

Independent retailers are now able to benefit from the brand’s impressive growth with the expanded wholesale opportunities.

Better Beer has introductory offers available to support the brand’s availability in independent channels.

Distributor: Contact sales@betterbeer.com.au

Spring is here, and so is the perfect weather for spritz filled celebrations. Inspired by the rich history of Venice, La Maschera was crafted to turn any occasion into a celebration. With Prosecco leading growth in Australia’s sparkling wine category, La Maschera Prosecco offers a perfect blend of quality, versatility, and accessibility. Coupled with its stylish Venetian-inspired packaging and activation support, La Maschera Prosecco is an ideal choice for trade buyers looking to tap into the demand for a refreshing and festive sparkling wine.

The new release La Maschera wines are versatile, refreshing, and perfect for the springtime drinking occasion. With the consistent growth of both Pinot Grigio and Prosecco in Australia, customers are increasingly looking for quality wines that are well-balanced, dry, and refreshing. Whether they enjoy them at home as a standalone glass or mix them into a Spritz, La Maschera Prosecco meets these demands with ease.

For many consumers, the La Maschera drinking journey starts on-premise, where the brand is supporting venues with exciting activations, including reusable metal straws, stoppers, and ice buckets to enhance consumer experiences and build brand awareness to support its off-premise strategy. These fun touches help create a festive atmosphere that’s ideal for social occasions, ensuring guests enjoy every sip of La Maschera wines.

This spring, make sure your store is ready to toast to warmer days. Contact the sales team at Samuel Smith & Son today to elevate your wine offering with La Maschera. Let’s celebrate together. Distributor: Samuel Smith & Son

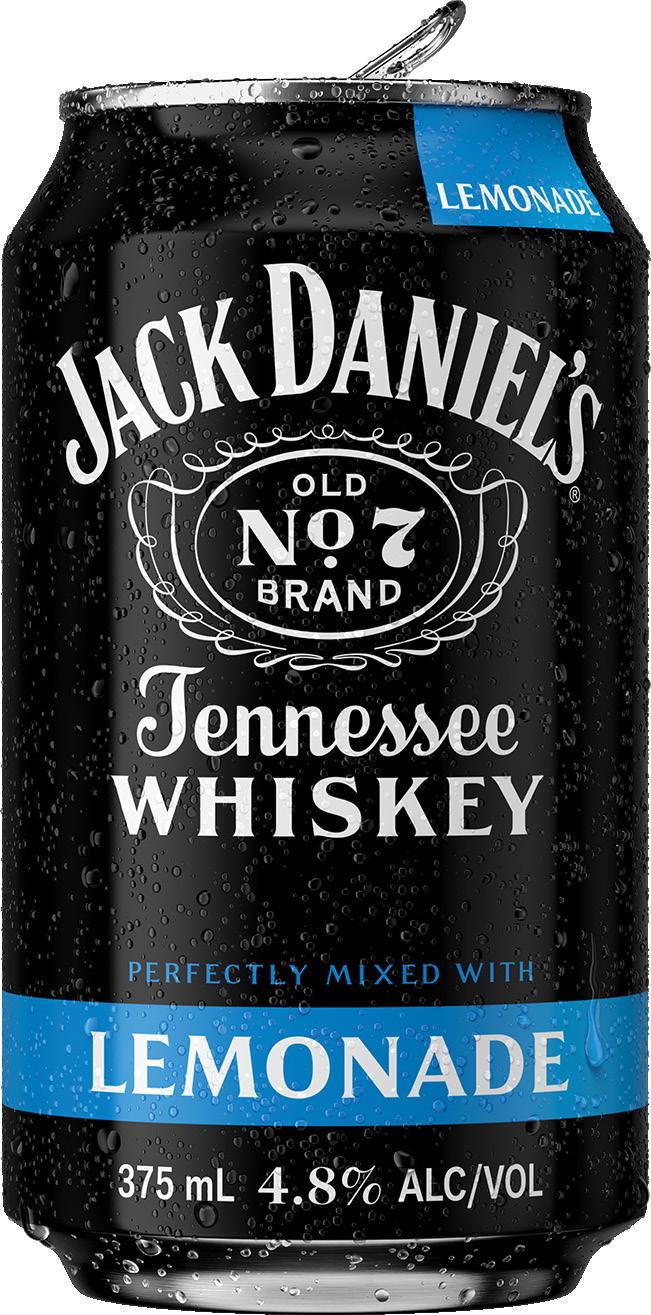

As the warmer months approach, Jack Daniel’s is thrilled to introduce summer’s best kept secret, Jack Daniel's & Lemonade, in brand-new packaging. This refreshing blend is perfect for those sunny days and relaxed evenings, making it the ideal companion for all your spring and summer gatherings.

On the shelf in October, the new packaging not only looks great but also ensures consumers can enjoy the same great taste of Jack and Lemonade on-the-go.

Jack Daniel’s & Lemonade will bring the lighter side of Jack to those summer drinking occasions of backyard barbecues, heading to the beach, or simply unwinding after a long day, and is the perfect offering to elevate consumers’ drinking experience.

Jack Daniel’s encourages all its valued customers to stock up on this exciting new product. By doing so, you’ll be ready to make the most of the season and offer your customers a refreshing twist on a classic favourite and the opportunity to enjoy Jack & Lemonade in its stylish new look.

Please reach out to your Brown-Forman sales representative for more information, and exclusive deals. Cheers to good times and great drinks with Jack Daniel’s.

Distributor: Brown-Forman

Sydney distillery Hickson House has officially released a small-batch Oyster Shell Gin. Starting with Hickson House’s multi award-winning Classic Dry Gin, the new release features crushed Sydney Rock Oysters and native Australian ingredients. The botanical mix includes old man saltbush, seaweed, tarragon, and bright citrus notes from native finger lime and ruby grapefruit. Oyster Shell Gin offers a smooth and creamy texture with a delicate hint of salinity and vibrant citrus notes.

The new release reflects a heightened demand for artisanal spirits with distinct and unique flavour profiles.

Hickson House Head Distiller, Tim Stones, said that Oyster Shell Gin is a versatile and flavoursome product.

“Gin is a very sociable spirit already, whether you’re celebrating with friends and family or simply enjoying a quiet night at home, it mixes with a lot of things. It really needs to be versatile, but gin enthusiasts are looking for a liquid that transports them beyond the bottle.

“Matching flavour profile, intensity and drinking experience to capture a feeling and place is really what we aimed for with the Oyster Shell Gin, and we wanted to create a sea-to-glass texture and taste. Each of the botanicals are selected from seaside locations across Australia to bring to life this hand-crafted spirit and tell a sensory story of the diversity of flora and fauna that makes our coastline so unique,” he said.

Hickson House suggests serving Oyster Shell Gin in a classic martini or a gin and tonic.

Distributor: Amber Beverages

The fruity wine category is set for a shake up as Brown Brothers releases its latest product, Limited Edition Moscato Mango Swirl, launched alongside permanent flavour favourites Moscato Strawberries & Cream and Cienna Salted Caramel.

Following the success of the top selling Moscato Strawberries & Cream last year, which contributed more than $4m to the category, the Moscato Mango Swirl appeals to those seeking sweeter, fruity options, blending Moscato with hints of mango and coconut.

Cienna Salted Caramel, which combines fruity red wine with a hint of caramel and salt, is also back on shelves after the product enjoyed high demand and sold-out pre-Christmas.

Pushing the boundaries of flavour in the wine category, Tarynn Barrie, Senior Brand Manager at Brown Brothers, hopes the trio of fruity wines will reinvigorate the category and recruit a younger generation of drinkers.

“Recognising that taste is the primary driver of the category, we listened directly to our audience and created flavours we know they will adore. These wines have been meticulously crafted to deliver an exceptional taste experience, and we can’t wait to bring them to our customers and consumers,” she stated.

Distributor: Brown Family Wine Group

Consistent

Mr. Consistent has announced the release of two new mixers, Pina Colada and Mai Tai, the two most requested flavours since the brand launched four years ago.

Made with fruit sourced from local Queensland farms, Mr. Consistent mixers are ready to mix with the desired spirit and be served anywhere, anytime. The release of the Pina Colada and Mai Tai flavours are ready to welcome the sunnier months.

Mr. Consistent Co-founder, Jarrad Bell, said that the new releases are personal favourite flavours.

“Personally, within the brand, we have a deep love for these tiki inspired cocktail flavours, and we wanted to ensure we were delivering a world class experience with these two, which is why it’s been important to keep tweaking until we got these flavours perfect,” he said.

The Pina Colada and Mai Tai have been in development for the past four years to ensure a highquality and accurate flavour.

The new flavours have received immediate demand through retail outlets and the Mr. Consistent website, indicating a promising future for the product in coming months. Mr. Consistent is able to keep up with growing demand with its new bottling facility in Burleigh Heads on the Gold Coast, which can produce up to 20,000 bottles a day.

Distributor: ALM, Paramount, ILG, ClubCo. and Liquid Mix

Lemsecco is the latest, zestiest addition to the Australian Vintage portfolio

The RTD category has seen immense popularity with fruit-forward and citrus-flavoured beverages in the last 12 months, and as we draw closer to summer, this growing trend has made its way into the wine category.

Crafted to resonate with younger consumers who increasingly gravitate towards fun, flavoured beverages, Lemsecco is the latest addition to the Australian Vintage portfolio, set to be a key player in the expanding category of fruit-flavoured sparkling wines in the months ahead.

With one-in-three new wine consumers entering the category through a sweeter or fruitier wine, Lemsecco was designed to meet younger expectations, without being overwhelmingly sweet.

Made with real lemons, tasting notes describe a crisp, effervescent profile, making Lemsecco a refreshing and versatile choice for a variety of summer occasions.

Distributor: Australian Vintage

A new partnership between Calabria Family Wine Group and Ponting Wines will see the Australian wine brand join the Calabria family’s distribution portfolio.

Founded in 2020, Ponting Wines is the brainchild of Australian cricketer Ricky Ponting and winemaker Ben Riggs. The pair came together to curate a portfolio reflective of Ponting’s life, with Riggs’ expertise ensuring flavour, structure and complexity of the highest quality.

Ponting commented: “My family are excited to partner with another family-owned wine business in the Calabria Family Wine Group. We see obvious synergies and clear opportunities for Ponting Wines, as we look to continue our growth. We look forward to working closely with the Calabria family.”

As of Tuesday, 1 October, Calabria Family Wine Group has taken over national distribution of the wine brand, which is currently managed by Saint Wines. The portfolio includes a total of 10 wines of varying styles, all crafted in South Australia and Tasmania.

Distributor: Contact customerservice@calabriafwg.com.au

This summer, Brown Brothers is elevating the Prosecco drinking occasion with the release of Brown Brothers Limited Edition Prosecco and Limited Edition Prosecco Rosé.

Last year, Brown Brothers Prosecco NV was the third largest contributor to overall growth in the wine category, with the King Valley producer experiencing 24 per cent growth year-on-year and leading the Prosecco category. As the festive period draws closer, Brown Brothers hopes to drive category growth with its new range of limited-edition Proseccos.

Monique Brougham, Brown Brothers Brand Manager, says: “We know that special occasions and celebrations are key drivers of the Prosecco category. To drive further penetration, limited-edition Prosecco captures these moments, combining an Australian spirit with the essence of celebration.

“Almost one-in-four bottles of sparkling wine sold in Australia is Prosecco, but there is still significant opportunity for growth with Prosecco penetration at 24 per cent compared to sparkling wine at 37 per cent.”

Both SKUs feature the same easy-drinking style consumers know and love, gift-wrapped in limited-edition labels and available now until sold out.

Distributor: Brown Family Wine Group

launches Angel’s Envy in Australia

Ultra-premium Kentucky Straight Bourbon Angel’s Envy has received a national launch in Australia, marking Bacardi-Martini Australia’s first large-scale whiskey release in the country.

Co-founded in Louisville, Kentucky, in 2011 by Master Distiller Lincoln Henderson and his son Wes Henderson, Angel’s Envy has seen impressive growth in the US, with a 26 per cent five-year CAGR.

Luiz Schmidt, Bacardi-Martini Managing Director for Australia and New Zealand said that the Australian market is showing a keen interest in premium whiskey.

“Angel’s Envy’s success in the US, coupled with Australia’s rapidly growing thirst for premium whiskey and the dynamic spirits market here, makes this the perfect time to propel Angel’s Envy into the spotlight. Since joining the Bacardi-Martini family in 2015, Angel’s Envy has been poised for this moment. We’re eager to elevate the super-premium American whiskey category in Australia and further strengthen our dark spirits portfolio,” he said.

Angel’s Envy Kentucky Straight Bourbon, finished in Port Wine Barrels, will now be available in a larger 750ml bottle for an RRP of $100.

Distributor: Bacardi-Martini Australia

Yalumba

Octavius Old Vine Shiraz 2019 on La Place de

Following the successful release of the 2018 vintage of The Octavius Old Vine Shiraz through La Place de Bordeaux in September last year, Yalumba has now released the 2019 vintage through the prestigious international distribution network.

Additionally, Yalumba is offering a limited museum release of The Octavius Old Vine Shiraz 2009. The Hill-Smith family is celebrating 175 years of family winemaking this year, and The Octavius wines reflect the family’s deep connection to the Barossa’s rich winemaking heritage. The wine is crafted from some of the world’s oldest Shiraz vines, some dating back to 1854.

The Octavius Old Vine Shiraz is a hallmark of Yalumba’s winemaking craft and tasting notes for the 2019 vintage describe aromas of black fruits with fragrant vanilla and spice, with a balanced and rich body.

By releasing through La Place de Bordeaux, Yalumba reinforces its position in the international fine wine arena, as well as the status of the Barossa wine region more broadly.

Distributor: Samuel Smith & Son

With summer right around the corner, Beerfarm has released a thirst-quenching and Australian-made RTD, Hard Lemon. The nostalgic release is inspired by classic homemade lemonade, as well as the high-quality citrus available at this time of year. Hard Lemon is juicy, tangy, and refreshingly carbonated, with naturally lower levels of sugar than many RTD alternatives.

Brewed with gluten-free ingredients and fermented dry, Beerfarm adds Aussie lemon juice and natural sweetening before centrifuging and pasteurisation.

Charlotte Freeston, Innovation & NPD Manager, Beerfarm, said that the release responds to the demands of the Australian market.

“Our team is always searching for pioneering products that strike a chord with the Australian landscape. With Hard Lemon, we’ve used Aussie lemons, and no artificial flavourings to capture that balance of sweetness and lemon zest that Aussies love – perfect for those hot summer days,” she said.

Distributor: Direct

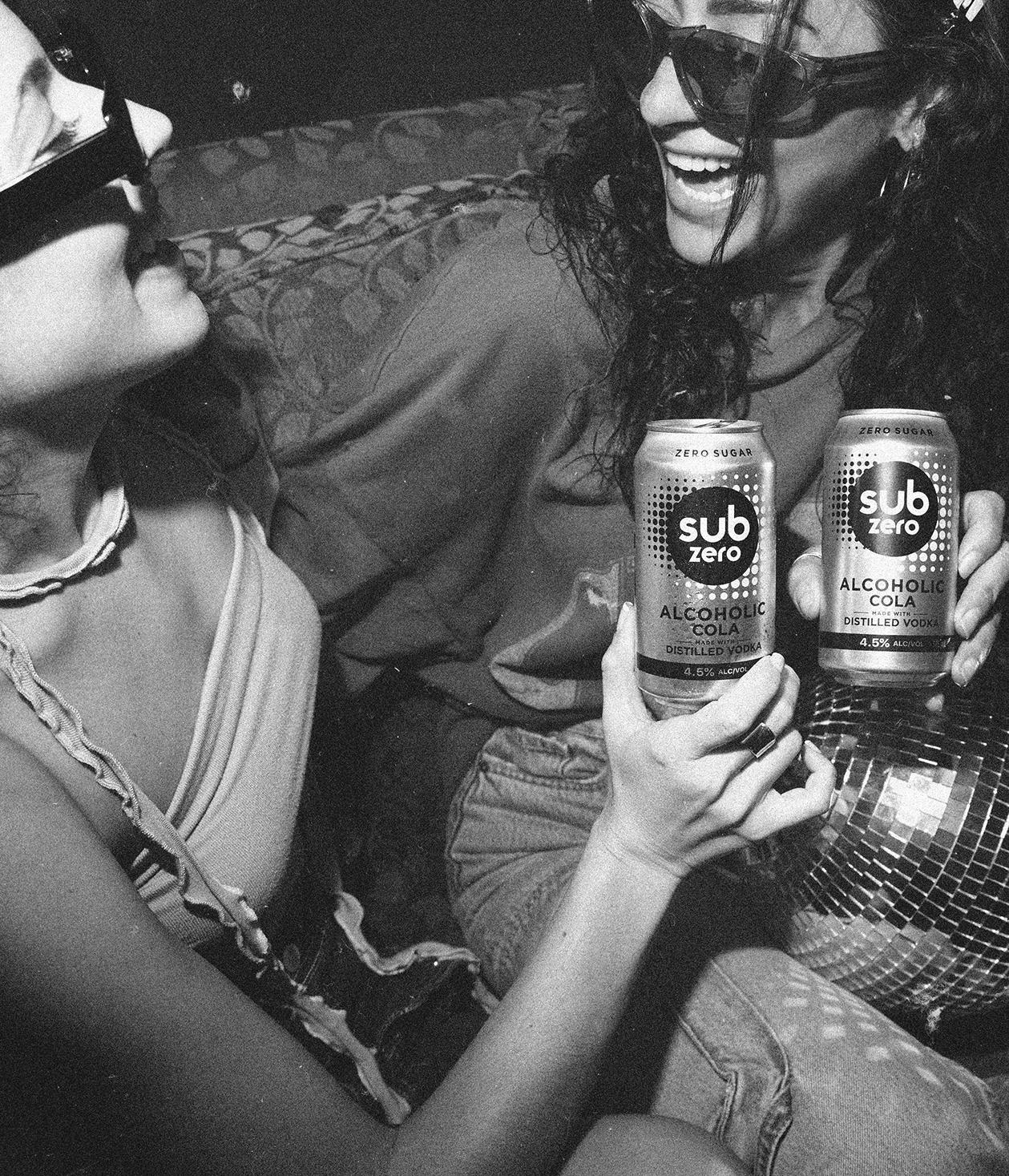

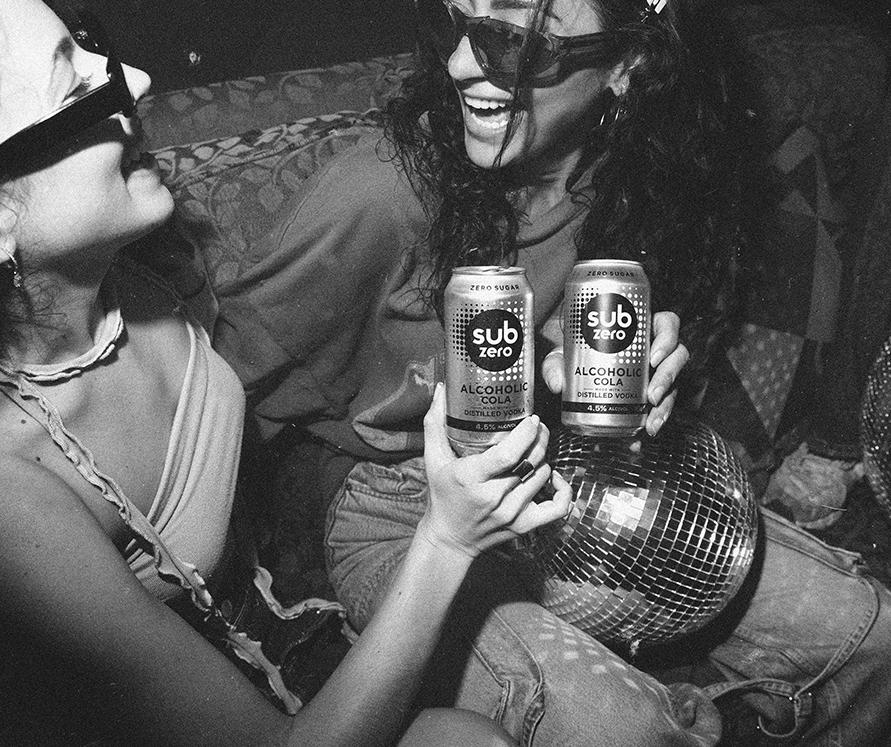

A new era for retro RTD Sub Zero

Exactly 30 years since it first launched, Sub Zero is back on shelves in Australia, reimagined by Carlton & United Breweries to capitalise on the popularity of alcoholic cola drinks among Gen Z.

According to Sub Zero Marketing Manager, Ben Haysman, the original Sub Zero was one of Australia’s first and most popular premixes, pioneering the multimillion-dollar RTD market.

“Despite the popularity of cola among drinkers there are very few vodka and cola premixes, and none with zero sugar. Until now. Sub Zero is aimed at today’s Gen Z – those looking for an easy-drinking zero sugar RTD with an edgy attitude – but it will also pull in nostalgic Subbie fans,” he stated.

Steering away from its original citrus flavour profile, Sub Zero now comprises five-times distilled vodka and zero sugar cola in a refreshing RTD format, crafted at 4.5 per cent ABV and available in four-packs of 375ml cans.

“With no hidden nasties, no sugar and just the right level of fizz, Sub Zero is a great example of how Carlton & United Breweries is innovating to grow the premix category as this re-imagined retro icon is sure to be a favourite for a whole new generation of great nights,” added Haysman.

Distributor: Carlton & United Breweries

Westward Whiskey, Stomping Ground and Proud Mary Coffee have unveiled their latest collaboration, Westward Whiskey Small Batch Selection Strong Ale with Coffee Cask Finish, a new whiskey aged in barrels that held the trio’s last collaboration in 2022, offered alongside Stomping Ground’s ‘Into The Wood’ 2024 release, Whiskey Barrel-Aged Strong Ale with Coffee.

The collaboration began when Westward Whiskey shared its American oak barrels with Stomping Ground brewery, before the two brewed a Strong Ale infused with Proud Mary Coffee to produce the Westward Whiskey Barrel-Aged Ale with Coffee.

Later, the same casks were used to mature Westward Whiskey for 18 months, resulting in the new whiskey offering, Westward Whiskey Small Batch Selection Strong Ale with Coffee Cask Finish, with the barrels repurposed again to brew the 2024 strong ale.

Miles Munroe, Master Blender, Westward Whiskey said: “Though together our collaborations yield delicious results, we’re proud to share so many similarities with our friends at Stomping Ground and Proud Mary – most significant of which are our ethos and desire to innovate.”

This special boilermaker pairing bundle features a 365ml bottle of the whiskey alongside a two-pack of the ale. Distributor: Iconic Beverages

Morris of Rutherglen has launched its newest whisky, 36 South Australian Whisky, which, at RRP $70, aims to provide an affordable and Australian-made option for consumers looking to experiment within the whisky space.

The brand draws its name from the Morris Distillery in Rutherglen, which has a latitude of 36 degrees south. This reflects both the distillery’s geographical location, as well as the distinctive climate that the whisky was matured in. With the extreme seasonal temperatures at this latitude, the whisky has undergone a unique ageing process resulting in a complex flavour profile. Made with Australian wheat and barley and water sourced from the Snowy Mountains, 36 South heroes the natural flavours of southeast Australia.

Tasting notes describe a nose of raspberry jam and toasted cereal, and a palate opening with notes of dried red fruits and charred oak, which opens into hints of honey-glazed pastry, with a lightly spiced, buttery finish.

Distributor: Casella Family Brands

St Agnes Distillery is encouraging retailers to showcase the world-class Australian brandy offering after collecting the champion Best Distilled Spirit of Show trophy at the inaugural Sydney Royal Distilled Spirits Show last month for St Agnes XO Grand Reserve.

The 40-year-old brandy was deemed Australia’s best spirit by judges, also claiming the JJ McWilliam Perpetual Trophy for Best Brandy.

Richard Angove, fifth-generation family custodian of St Agnes, said: “St Agnes is Australia’s oldest continually operated craft distillery, and to win Best Brandy and Best Distilled Spirit tops off a fantastic couple of months for St Agnes, and is just reward for what is a very complex spirit that requires a lot of patience and dedication to craft.”

Aged for four decades in carefully selected small oak casks, tasting notes for St Agnes XO Grand Reserve describe deep notes of dried fruit, vanilla and spice with a velvety smooth finish enhanced by the meticulous ageing process.

The JJ McWilliam Perpetual Trophy marked the third Best Brandy trophy received by the South Australian distillery in just two months, with the Tasting Australia Spirit Awards and the Melbourne Royal Australian Distilled Spirits Awards completing the trio.

Distributor: Angove Family Winemakers

Acclaimed New Zealand whisky, Thomson Whisky, has announced its partnership with The Whisky List (TWL) as its exclusive distributor in Australia.

The partnership comes after recent success at the 2024 New Zealand Spirits Awards, where Thomson’s Manuka Smoke Single Malt took home the New Zealand Innovation Trophy.

Speaking about the partnership with TWL, Co-founder Rachael Thomson said: “We’re thrilled to partner with The Whisky List to expand our footprint into Australia.

“TWL’s expertise and passion for whisky, combined with their extensive network, make them the ideal partner to introduce Australian drinkers to the unique character of our New Zealand single malts. We look forward to seeing our whiskies on shelves, at whisky festivals, and most importantly in the hands of our fellow whisky drinkers across Australia.”

TWL Co-founder, Oliver Maruda, said: “We are excited to welcome Thomson Whisky into our growing portfolio. Their commitment to craft, quality, and innovation is evident in every bottle. Australian whisky drinkers have shown a growing interest in exploring new and exciting single malts, and we’re confident that Thomson Whisky’s range will resonate deeply with them.”

The partnership will see a variety of Thomson Whisky expressions (all bottled at 700ml) now available in Australia, including Thomson Two Tone Whisky, Thomson Manuka Smoke New Zealand Single Malt Whisky, Thomson South Island Peat New Zealand Single Malt Whisky and Thomson Full Noise Manuka Smoked Australian Exclusive New Zealand Single Malt Whisky.

Distributor: The Whisky List

Michael Waters, CEO of Retail Drinks Australia, provides an overview of what to expect from the 2024 Retail Drinks Industry Summit and Awards.

“Our annual Summit and Awards provides a great opportunity to connect, share, learn and importantly, celebrate the successes of people and companies in our industry.”

Michael Waters Chief Executive Officer Retail Drinks Australia

On Wednesday 13 November, around 500 members and industry colleagues from all parts of the country will come together in Sydney for our annual flagship event, the Retail Industry Summit and Awards, which will be held in conjunction with our FY24 Annual General Meeting at Doltone House Darling Island.

Our annual Summit and Awards provides a great opportunity to connect, share, learn and importantly, celebrate the successes of people and companies in our industry.

To continue to succeed in business, we need the latest information, trends and ideas to help make business decisions. The Summit sees business experts and industry leaders come together to share their knowledge and expertise to reveal key insights and strategies so together we continue to succeed in liquor retailing and help grow business and profits responsibly and sustainably.

This year’s Summit Program kicks off with an overview of the current federal, state and territory regulatory landscape impacting the retail liquor industry, including Retail Drinks’ recent and upcoming policy and advocacy activities and achievements.

Industry partner Circana will then delve into the current state of the industry, bringing together retail liquor market and category performance trends, and the dynamics driving performance around occasion, consumer, and shopper.

Next, a presentation followed by a panel of retail and loss prevention industry experts discussing the latest trends regarding retail liquor crime, safety and security, and the various challenges liquor retailers face on the frontline, how they are responding, and

importantly what else can be done about it.

As an extension to this timely and important theme, delegates will be able to visit our Retail Security and Safety Hub. From finance, insurance, IT, software and hardware solutions, to compliance, training, resources and more, exhibitors will provide hands on, practical and insightful education on how to better understand, and reduce retail security and safety risks.

Lastly, award-winning actor, writer and director Rob Carlton – our official Awards MC – will deliver, through his own lived experiences and real-life stories, a not-to-be-missed keynote presentation, illustrating the importance of organisational culture.

Following the conclusion of the Summit and AGM, guests will return that evening for the Retail Drinks Industry Awards – the peak awards for Australia’s retail liquor industry, where the national winners will be announced across retailer and supplier categories.

We take our Awards Program very seriously, as do our members, which is encouraging to see. It’s a significant investment, run with integrity and professionalism. This year, nominations across all categories grew by 20 per cent on last year, to a whopping 532 in total.

Retail Drinks simply couldn’t run the annual Summit and Awards without the ongoing, enhanced support of our members, partners and sponsors, and on behalf of the Board and Management Team, I sincerely thank all involved in helping to make this year’s event another resounding success.

For more information about this year’s Summit and Awards, or to register, visit www.retaildrinksindustrysummit.com.au. ■

In the ever-evolving landscape of liquor retail, one factor remains paramount: maintaining optimal stock levels on your shelves. As consumer preferences shift and new products emerge, the ability to consistently offer a diverse and well-stocked range can be the difference between thriving and merely surviving in this competitive industry.

Imagine a customer walking into your store, intent on purchasing their favourite bottle of wine or trying out a newly launched craft beer. They navigate the aisles only to discover that the product they’re seeking is out of stock. Frustration sets in, and more often than not, that customer will leave the store empty handed, likely heading straight to a competitor who has what they’re looking for. This scenario highlights the immediate loss of a sale, but the impact runs deeper.

Empty shelves not only result in lost sales but also erode customer loyalty. Today’s consumers expect convenience and reliability, and if a store consistently fails to meet these expectations, customers will take their business elsewhere. In an industry where brand loyalty is hard-won and easily lost, maintaining adequate stock levels is crucial to ensuring repeat business and building long-term customer relationships. The selection of products you offer, plays

In a sector where customer choice is vast and loyalty can be fleeting, the importance of keeping your shelves well-stocked cannot be overstated, writes Daniel Pizzolato, Group Client Service Manager, Strikeforce.

a vital role in customer satisfaction and store performance. A well-curated range that meets the diverse tastes of your customer base can drive sales and enhance your store’s reputation. However, even the best range is ineffective if it isn’t adequately stocked.

The liquor industry is dynamic, with new products and trends emerging regularly. Staying ahead of these trends and incorporating new products into your range can attract a broader customer base and keep your store relevant. However, this strategy only works if these new products are readily available on your shelves.

New product launches often generate significant consumer interest. Capitalising on this buzz by ensuring these products are in stock can position your store as a go-to destination for the latest offerings. Conversely, failing to stock these new products can result in missed opportunities, as customers who can’t find what they’re looking for in your store may turn to competitors who are quicker to adapt to market trends.

To maintain the right stock levels, liquor retailers must implement effective inventory management practices. This includes regularly reviewing sales data to understand which products are in high

demand, forecasting future trends, and adjusting orders accordingly. Developing strong relationships with suppliers can also help ensure that you receive stock in a timely manner, particularly for high-demand or limited-edition items.

Additionally, technology can play a crucial role in inventory management. Automated systems that track stock levels in real-time, trigger reorders when stock is low, and provide insights into sales patterns, which can greatly reduce the risk of out of stock. These tools can also help manage the balance between overstocking, which ties up capital, and understocking, which risks losing sales.

In the competitive world of liquor retail, maintaining optimal stock levels is not just a matter of convenience; it’s a key factor in your store’s success. Investing in robust inventory management practices is essential for keeping your shelves stocked and your customers satisfied, ultimately securing your store’s position in the market.

In a sector where customer choice is vast and loyalty can be fleeting, the importance of keeping your shelves well-stocked cannot be overstated. Make it a priority, and your customers and your bottom line will thank you. ■

The 2025 Wine Sommelier Scholarship is back, allowing global wine professionals to explore New Zealand’s wine regions through exclusive events, writes Catherine Wansink, New Zealand Winegrowers.

In partnership with Sommeliers Australia, New Zealand Winegrowers has reintroduced the 2025 New Zealand Wine Sommelier Scholarship in Australia.

First launched in association with Sommeliers Australia in 2015, the scholarship is now a global initiative with sommeliers from New Zealand, Asia, Canada, UK, and USA set to join the Australian scholars in 2025.

The scholarship provides engaged wine professionals from all over the world with the opportunity to take part in an unforgettable wine experience, discovering the regions, varieties, landscapes, and personalities that make New Zealand wine so distinctly New Zealand.

Scholarship recipients will attend the 2025 Sommit, to be held in Gisborne on 17 and 18 February 2025. The Sommit is hosted by New Zealand Wine and onpremise authorities Cameron Douglas

MS and Stephen Wong MW and attended exclusively by sommelier scholarship recipients. Tailored to their interests, the Sommit event is an all-encompassing celebration of the lesser-known aspects of New Zealand wine.

This programme is a unique and targeted experience for sommeliers to explore the world of New Zealand wine. It provides an unparalleled opportunity to meet and network with fellow sommeliers from around the world and to discover and share their stories and best practices.

Our objective is that the winners of this scholarship will become Australian ambassadors for New Zealand wine, passionately telling the story of New Zealand wine and increasing sales in restaurants within their community.

The winners of the scholarship this year will also be invited to attend Pinot Noir New Zealand 2025 in Christchurch from 11 to 13

February, along with wider wine experiences and tastings in regions across New Zealand.

Candidates are expected to have a strong passion for the wine industry and a keen interest in developing their knowledge of New Zealand wine. The successful sommeliers will be announced in October.

Emma Farrelly, Beverage Manager at State Buildings in Perth, commented: “I was fortunate to be selected for the New Zealand Sommit in 2019. It was an intense and exceptional trip, visiting Hawke’s Bay, North Canterbury, Gisborne and Marlborough. I met many amazing wine professionals from all over the world and forged some great new friendships.

“My understanding of the New Zealand wine industry was solidified over the 11-day itinerary. Not only did we get extraordinary insight into the regions and producers, but also a firm understanding of the history and culture of the country.” ■

Sandy Hathaway, Senior Analyst Wine Australia, analyses the share of white varieties in the 2024 vintage, and how these trends are reflected in retail.

The 2024 Australian wine vintage was most distinctive for the increase in share of white varieties, while red varieties were well down on their long-term average crush. This analysis looks at whether the trends in retail reflect the results of the national vintage. Part one, published last month, looked at reds, while part two looks at whites.

The crush of white grapes has declined by seven per cent in the past two years, whereas the red crush declined by 27 per cent, indicating demand-driven factors as well as seasonal factors, favouring white varieties. However, production of white varieties is still generally in decline after many years of reduced popularity compared with reds.

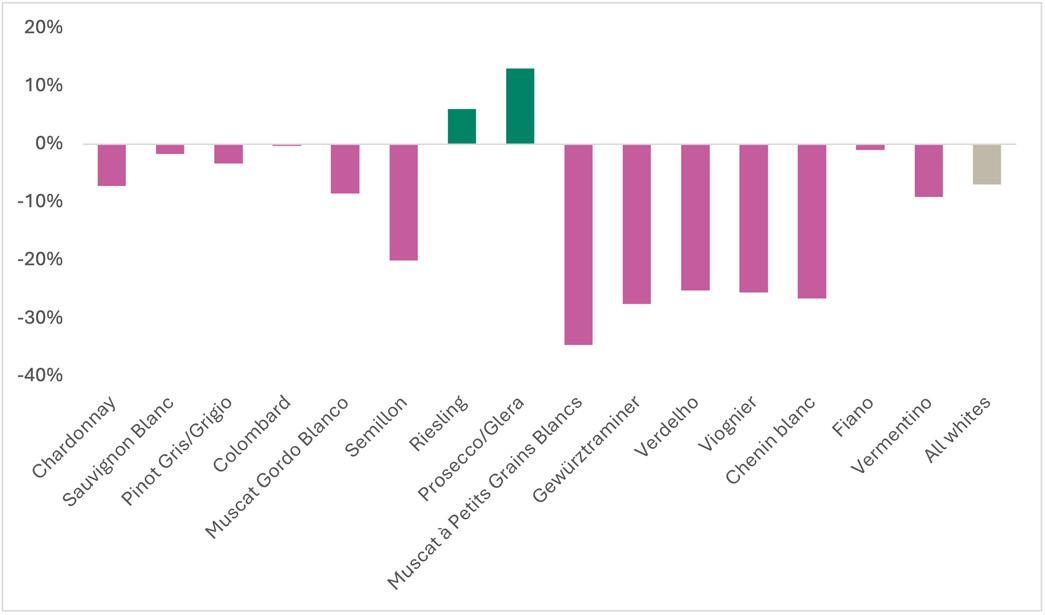

The only white varieties to show growth in the 2024 vintage compared with 2022 (which was an average vintage) were Riesling (up six per cent) and Prosecco (up 13 per cent). However, the declines for Sauvignon Blanc (down two per cent), Pinot Gris/Grigio (down three per cent) and Fiano (down one per cent) are all smaller than the overall figure, indicating a counteracting trend (Figure One).

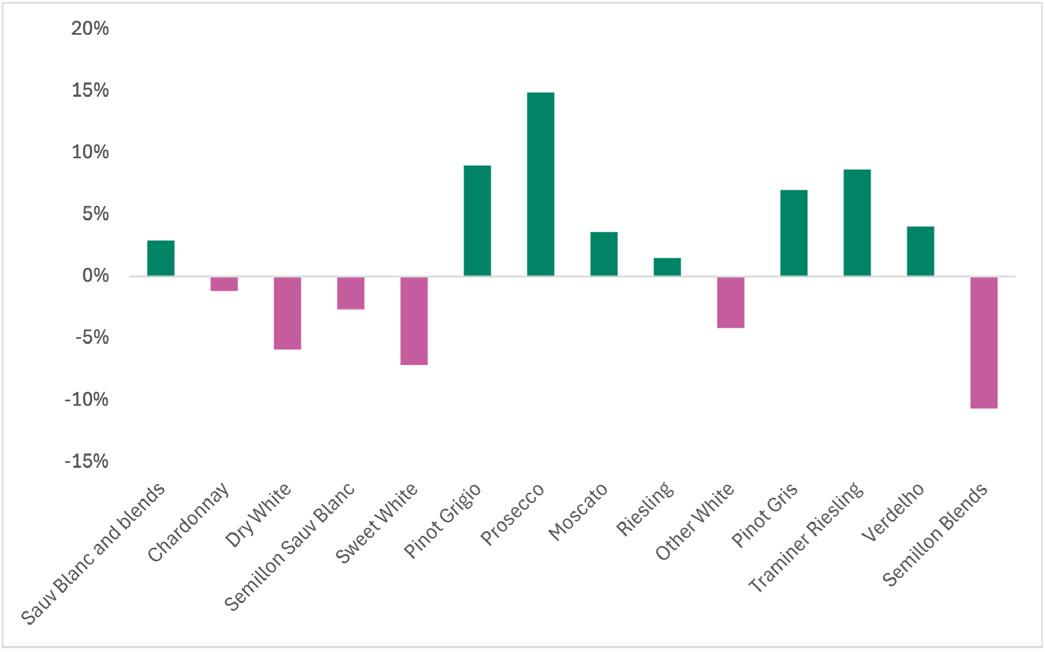

The performance of the white varieties in the retail data was better overall than in the crush data, with more than half of the major still white varieties in growth (Figure Two). As in the case of the crush, Prosecco (up 15 per cent), Pinot Gris and Pinot Grigio (up nine per cent as a combined category), Sauvignon Blanc (up three per cent) and Riesling (up one per cent) were among the best performers.

An exception was Moscato, which grew by four per cent, whereas the crush of the main Muscat varieties (Muscat a Petits Grains Blanc and Muscat Gordo Blanco) was down by 16 per cent overall in 2024 compared with 2022. Traminer Riesling (Gewürztraminer) and Verdelho were other strong performers in the retail figures (up nine per cent and four per cent respectively) where the crush figures did not reflect this growth. ■

1 Wine Australia National Vintage Survey (varieties sorted by crush size in 2024)

2 Circana (varieties sorted by sales volume)

The current retail leasing landscape presents challenges and opportunities, emphasising lease flexibility, suburban growth, and sustainability amid rising e-commerce demands, writes Marianna Idas, Principal, eLease Lawyers.

The economic landscape in 2024 presents a unique blend of challenges and opportunities, particularly for the retail leasing sector. This article explores the current economic conditions and their legal implications for retail leases, providing insights into the evolving dynamics that businesses, property owners, and their leasing lawyers must navigate.

Currently, the economy is characterised by a mix of cautious optimism and persistent uncertainties. The recovery from the Covid-19 pandemic continues to shape economic policies and market behaviours. While some regions experience robust growth, others face headwinds due to geopolitical tensions, supply chain disruptions, and inflationary pressures.

The retail leasing market has undergone substantial shifts in recent years, driven by changing consumer behaviours, technological advancements, and economic conditions. Here are some key legal trends shaping the current landscape:

1. Lease flexibility and renewal clauses: There is an increase in online shopping, prompting many retailers to embrace different strategies. This shift has led to a demand for more flexible lease terms. Legal agreements often include shorter lease durations, renewal options, and exit clauses that allow tenants to adapt to market conditions without long-term commitments.

2. Suburban retail growth and local government regulations: Urban centres, once the epicentres of retail activity, are seeing competition from suburban and secondary markets. The appeal of lower costs, reduced congestion, and improved quality of life has driven consumers and businesses to explore these areas. Care must be taken to ensure tenants and landlords are aware of local government regulations, including zoning laws and land-use regulations, which vary across states and territories and can impact the development and leasing of retail spaces.

3. Focus on sustainability and environmental regulations: Sustainability is no longer a niche consideration but a mainstream demand. Retailers and investors prioritise environmentally friendly buildings. Legal agreements increasingly incorporate green clauses that mandate energy-efficient designs and sustainable practices. Compliance with environmental regulations, such as those set by the Environmental Protection Authority in various states, is crucial for avoiding legal pitfalls and fostering long-term sustainability. Tenants must factor in these increased costs as a result of such compliance.

4. E-commerce: The surge in e-commerce has increased demand for retail spaces that can support product storage and delivery. Retailers are seeking locations that enable efficient distribution to consumers, with a focus on urban fulfilment centres and micro-distribution

hubs. Legal considerations include ensuring that leases allow for these types of uses and that premises are suitable for logistical operations. Additionally, planning permits and compliance with local council regulations are critical.

While the retail leasing sector presents numerous opportunities, it is not without challenges. Inflation remains a significant concern, with the Reserve Bank of Australia closely monitoring and adjusting interest rates to manage inflation. Changes in interest rates directly impact borrowing costs, borrowing ability, customer spending, operating costs, business investment, rental rates, cash flow and, consequently, retail leasing agreements.

Tenants are also concerned about future space requirements to ensure flexible lease tenure. Landlords, therefore, must be agile in adapting their offerings to meet changing tenant needs.

The current economy and retail leasing landscape present both challenges and opportunities for tenants. Navigating the complexities of inflation, interest rate fluctuations, and evolving market conditions requires strategic foresight and adaptability.

In this dynamic environment, staying informed and proactive is key. Tenants who adapt to these changes can not only meet their current needs but also position themselves for future success, ensuring resilience and growth in the market. ■

Social commerce is fast connecting retail opportunities with social media users and is one of the most powerful examples of community e-commerce, which is all about entertaining, creator-driven content featuring brands. By bringing the store to your consumer in their social worlds, social commerce is inspiring more than 70 per cent of consumers to shop, even when they aren’t looking to, with deals and discounts (39 per cent), ease of purchase (33 per cent) and exclusive offers (28 per cent) driving more social commerce purchases globally.

Social commerce allows you to engage with people during the micro-moments when they’re scrolling on their devices and potentially reduce the sales cycle and use social media platforms as an effective revenue stream. It provides a personalised, one-to-one shopping experience at scale 24/7, building authentic connections between consumers and brands – and their ambassadors.

Social commerce can accelerate consumer decision journeys from awareness to purchase almost instantly through inapp or live shopping – the latter reaching highly engaged audiences such as gamers. Live commerce involves highly interactive experiences which combine instant

purchasing of a featured product and audience participation through a chat function or reaction buttons.

The shoppable media channels of the future such as streaming video on-demand, gaming and the evolution of the Metaverse provide endless opportunities to engage and understand your consumer as technology continues to develop. This is an area brands will need to continue to invest in and learn about to ensure they remain competitive in the market.

With trust key to enhancing shopper confidence, a recent study found social media influencers (16 per cent) are in fact not the top drivers of purchase on social platforms, falling behind the influence of family members (20 per cent) and friends (17 per cent). It is critical to look at who your target shoppers trust – are they content creators, influencers or celebrities? Or are they real everyday users?

Shoppers seek out reviews and insights from their online communities meaning your brand presence is critical. They also need to be able to easily contact you via their platform of choice e.g. private message on social media, email, and/or phone call.

Buyer dissatisfaction often comes from a bad website user experience, too

many emails, complex returns processes, fulfilment and delivery delays, and difficulty contacting customer service.

Buyer confidence and satisfaction is key to repeat purchases, brand advocacy and building trusted communities that people turn to for genuine experiences of products and services.

Simply being present on social media isn’t enough; you need to engage in twoway conversations to build consumer relationships. Respond to comments, ask questions and engage with their content, especially if they’re tagging you.

These interactions not only generate buzz and increase visibility of your brand but can also drive sales as people feel more of a personal connection to your brand.

It’s important to identify the right platform to reach your audience and deliver a seamless experience authentically. You don’t need to be present on every social media platform if your audience isn’t there and especially if you don’t have the appropriate content to be shared on that platform.

Social commerce brings your physical shop to the consumer, make sure you consider how social commerce is part of your overarching omni-channel strategy to achieve greater success. ■