NEW MATSO’S

100% AUSTRALIAN OWNED

Vodka Citrus RTDs make up 49% of all Vodka RTDs growing at 250% - one of the fastest growing segments in liquor!*

Matso’s is one of the only RTD brands to have 2 iconic spiritual homes (Broome & Sunshine Coast), driving local provenance and depth of consumer engagement.

*Source: Summit data 6 months ending 25/06/2024 |

Matso’s is a premium brand (the most premium Ginger Beer of scale in Australia*), allowing you to charge a premium.

Matso’s has strong unisex appeal and will bring new drinkers to the category (66% of current Matso’s drinkers are females**), in a way which can complement the male skew of Hard Rated and -196.***

Editor’s note

Welcome to the September issue of National Liquor News, your go-to source for the latest trends, insights, and innovations in Australia’s retail liquor industry.

In this issue, we share a wrap of the 2024 Independent Brands Australia Trade Workshop and hear about how the retail network is winning the market with a shopper-focused strategy.

In terms of category insights, this month we take a look at organic drinks, gin, and we’ve put together a guide of beers to stock for summer.

Aligning with health and environmental values, Australian consumers are increasingly gravitating towards cleaner, more sustainable choices across various industries, and liquor is no exception. Organic alcoholic beverages are no longer a niche, but their expansion into mainstream liquor stores relies on a better understanding of the growing market segment, as Molly Nicholas explores from page 44.

And for this month’s Trade Buyer’s Guide, we take a look at opportunities in gin. Following the category’s boom in recent years, the market for gin has matured and consolidated. Caoimhe Hanrahan-Lawrence looks into what today’s gin consumers are seeking out.

We also share our regular articles from Retail Drinks Australia, DrinkWise, Wine Australia, New Zealand Winegrowers, the Independent Brewers Association, Peter Hall and eLease Lawyers. Thank you to all of our contributors.

We hope you enjoy reading this issue as much as we enjoyed putting it together!

Cheers, Deb

Deb Jackson, Managing Editor 02 8586 6156 djackson@intermedia.com.au

PUBLISHED

Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au

Managing Editor: Deb Jackson djackson@intermedia.com.au

Senior Journalist: Molly Nicholas mnicholas@intermedia.com.au

Journalist: Caoimhe HanrahanLawrence chanrahanlawrence@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –Liquor and Hospitality: Kea Thorburn kthorburn@intermedia.com.au

Prepress: Tony Willson tony@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

1yr (11 issues) for $70.00 (inc

To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au FOOD & BEVERAGE

A STORY IN EVERY BOTTLE

Contents September 2024

10 Cover Story: Ampersand Projects maximises RTD category performance

14 News: The latest liquor industry news for retailers around Australia

18 Marketplace: Brand news and promotions Industry Focused

30 Retail Drinks Australia: The rising threat of illicit alcohol

32 Wine Australia: Do retail wine sales trends align with 2024 vintage results?

33 New Zealand Winegrowers: A boost for New Zealand cellar doors

34 Marketing: Industry Consultant Peter Hall explores successful marketing strategies

35 DrinkWise: Supporting sports fans to minimise alcohol-related harm

36 Leasing: Tenant’s due diligence for retail leases

37 Independent Brewers Association: 2024 Independent Beer Awards wrap up Special Features

12 Independent Brands Australia: 2024 IBA Trade Workshop

38 Summer Beer Retailing: Brews to stock for the sunnier months

44 Organic Drinks: Retail’s green opportunity

49 Trade Buyer’s Guide: The maturation of the gin category

For more information contact your Casella Family Brands representative.

Ampersand Projects maximises RTD category performance

With an agile and responsive approach to market trends, Ampersand Projects has seen consistent growth in the strong RTD category.

The RTD category has seen consistent growth in recent years, and Ampersand Projects continues to capitalise on the opportunities within the category through a focus on consumer-led innovation and responsiveness to market trends.

This understanding of the category has allowed the brand to release on-trend products, which Marketing Manager Alex Bottomley said has led to consistent yearon-year growth.

“With the RTD category continuing to experience value and volume growth, we’ve seen Ampersand’s value surge in the last MAT at +37 per cent, with Vodka Soda Pine-Lime adding a refreshing 12 per cent boost. At just four per cent ABV, it taps into the growing ‘better for you’ segment where we know consumers are seeking high-quality, great-tasting options. Our growth strategy has always been centred around consumer-focused innovation and introducing new products like Vodka Soda Pine-Lime ensures we meet both customer and consumer needs,” he said.

Founded in 2018 by Marcus Kellett, Shaun Rankins and Alex Bottomley, Ampersand

Projects began with its popular flagship product Vodka Soda &. The portfolio has since grown to encompass more than 30 products, including the innovative pack format of Sunset Series Vodka Soda &, and the summer-ready Vodka Soda PineLime. Ampersand Projects has also recently diversified into the spirits category with its Vodka & 500ml, bringing an affordable and Australian made option to spirits shelves. The brand’s growth has been supported by Australian Beer Co (ABCo), a subsidiary of Casella Family Brands, which acquired Ampersand Projects late last year.

Ampersand Projects’ careful attention to consumer preferences and market trends allows the brand to align with areas of growth within the RTD space, releasing new products when consumers are most interested in that category segment.

These releases are further supported by a diverse and innovative marketing strategy, which spans ATL and BTL initiatives and includes in-store displays, influencer gifting, social media tactics, launch events and instore tastings. These strategies, developed over the Ampersand Projects team’s years

of experience in the liquor industry, build brand awareness and encourage consumers to choose an Ampersand Projects product.

The Ampersand Projects portfolio of products has appeal for a broad range of consumers, with dark and light spirit RTDs, cocktail flavours, and a range of ABV options. Alongside the trend towards better-for-you products, which is supported by lower ABV products such as Vodka Soda Pine-Lime, the growing demand for higher ABV products is met by releases such as the nine per cent Vodka Soda & range. Furthermore, Ampersand Projects does more than just follow trends, and releases products that push category boundaries, such as Pink Gin Soda &, which pairs wildberry flavoured pink gin with soda in lieu of the traditional tonic.

With a proven understanding of the category, and now reaching its first year as part of ABCo’s portfolio of brands, Ampersand Projects is well-positioned to continue to lead growth in the RTD category, with a diverse existing portfolio and a long track record of effective new product development. ■

Be a part of Australia’s largest Liquor Cooperative, servicing the industry since 1975.

IBA builds a future-fit liquor market

Molly Nicholas attended the 2024 IBA Trade Workshop to hear how the retail network is winning the market with a shopper-focused strategy.

Last month, Metcash Liquor CEO Kylie Wallbridge welcomed delegates to the 2024 IBA Trade Workshop, with representation from over 700 stores and 130 supplier partners descending on the Gold Coast to share valuable industry insights and feedback and build meaningful relationships.

The workshop opened with a drinks reception at The Star on Monday 12 August, followed by a warm welcome from Wallbridge and General Manager Merchandise and Operations John Barakat at the Gold Coast Convention & Exhibition Centre on Tuesday.

Wallbridge acknowledged the contributions of former CEO Chris Baddock, before reflecting on her own experiences since her appointment in January. Recognising current economic challenges, Wallbridge highlighted her commitment to continuous improvement, fueled by feedback, connection and idea exchange.

“There’s a lot that’s working really well in our business, and there’s a lot to be proud of. It may not feel that way every day, because business is tough and people’s pockets are tight, but we are winning. IBA is the largest independent retail network in the country,” she explained.

“Most recently, IBA has been outperforming the market and growing share. What you’re doing every day in your

stores across the country is making a positive difference and resonating with shoppers.”

Retailers take centre stage

Over the course of the week several business sessions took place, the first of which invited five retailers to discuss what it takes to manage an independent business, in a panel hosted by Adrian Ricci, ALM General Manager NSW/ACT.

Sharing anecdotes of the experiences that define their stores were Ainslee Hill of Cellarbrations, Craig Waldron of IGA, Scott Armstrong of Maeva Hospitality Group, Jay Shah of Cellarbrations and Porters, and Tony Innes of The Bottle-O, representing NSW/ACT, VIC, QLD, WA and SA/NT.

The retailers shared insights into navigating the post-Covid landscape, effective pricing and promotions management and diversifying revenue streams.

IBA business leaders were proud to share the stage with retailers for the first time in the conference history, with attendee feedback also favouring the new panel format.

A new benchmark for independent retail

Barakat and Katherine Johnstone, General Manager Northern Region, shared the successes of the warehouse move to Truganina, Victoria which holds an

additional 25,000sqm to the previous Laverton facility with systemised layer picking and efficient design.

Barakat and Johnstone spoke about network growth and logistics, with ALM now housing 17,000 SKUs across its warehouses, and improved service levels.

Demonstrating ALM’s commitment to feedback-based improvement, Johnstone introduced the new Net Promoter Score program and a streamlined claims process.

Johnstone told retailers that the program is “a really important tool to help us understand customer sentiment, drive growth and foster a customer-centric culture. It helps us identify areas where we must continuously improve our levels of retailer engagement, and how we’re performing against the benchmark”.

National Merchandise Manager Craig Payens, Head of Digital Raff Palermo and Head of Marketing Clare Adamiak explored strategies for a future-fit liquor market, building an engaged, shoppercentric network and catering to different demographics in the digital age.

Not only did they demonstrate how IBA is winning in the market with marketing and digital initiatives, but also how the shopper is at the centre of the strategy.

With IBA already growing ahead of the market, Adamiak highlighted the ongoing

focus: “We have strong promotional programs, market-leading digital platforms, communications and media choices which are resonating with our shoppers and driving them in-store and online.

“We have a multi-channel approach – discover, research and purchase online – and with your passion for your store, your flair, your personality, it’s a strong, winning formula. But how do we get closer to our shoppers? Ensure they’re the heart of every decision we make, while driving scale and personalisation through data and insights.”

Linda Boswell, General Manager ALM Western and Central Region, and Dianne Rooke, Head of Operations, discussed shopper behaviour, maximising product visibility and leveraging in-store execution programs to grow basket size and profitability.

As the organisation drives shopper-focused growth and efficiencies, Barakat and Rod Pritchard, General Manager Strategy and Transformation, gave an update on the Platinum program, which was announced at last year’s conference.

Capitalising on IBA’s momentum, Platinum allows retailers to benefit from a collaborative ecosystem and create a true omnichannel shopping experience that inspires shoppers of the future, while unlocking the potential of IBA’s loyalty program.

Pritchard called out four key areas of the program: POS, ranging, execution and digital programming, explaining: “We’re seeing new capabilities in the market, and many of you are taking those opportunities, but we’re looking to take this next quantum step, and Platinum gives us that capability to package it up and create a new benchmark for the independent retail channel.”

After the success of the first pilot wave, the attendees were pleased to hear details of an upcoming planned rollout.

Keynote speakers Craig Woolford, David Shukri and Andrew Gerrard also shared the stage to provide insights on retail, category and shopper trends, followed by an audience Q&A facilitated by Simon Cleave, Head of Vendor Partnerships.

Closing the first day of conferencing, retailers attended the IBA Trade Festival, where 48 suppliers showcased their offering and shared exclusive deals.

State-based excellence

On Wednesday, the program began with Five Star Awards ceremonies in state breakout sessions, celebrating the stores and operators demonstrating retail excellence in each state.

State sessions shared localised updates on IBA performance, store security, digital catalogues and key campaign periods – looking ahead to the Black Friday and Christmas trading periods – while VIC and NSW workshops closed with discussion about tobacco legislation.

The group came together one final time for a gala dinner hosted by MC Shane Jacobson, celebrating national Five Star Awards winners and fundraising for Children’s Cancer Institute. ■

The

News

For retailers around the country

Coopers unveils whisky distillery and microbrewery at new facility

Last month, Coopers Brewery swung open the doors to its new visitors centre, microbrewery and whisky distillery, situated alongside the existing brewery at Regency Park, South Australia.

The new, world-class facility has been designed to offer a unique and immersive experience for local, national and international tourists, celebrating the 162year legacy of the brand.

Now, the home of Coopers comprises a restaurant, three bars and an expansive outdoor plaza, alongside a dedicated tasting room and interactive history displays.

For the first time in the history of the business, Coopers will expand its realm into the world of whisky using the new on-site whisky distillery, positioned alongside a new microbrewery which will allow Coopers to produce small-batch experimental beers.

Almost 20 months since construction began at the Regency Park site, the $70m development was unveiled at an official opening event, officiated by South Australian Governor, Her Excellency the Honourable Frances Adamson AC and attended by the Cooper family and more than 300 industry professionals.

Speaking at the official opening, Coopers Managing Director Dr Tim Cooper said: “This new visitors centre is about celebrating our history and our originality with an emphasis on what makes Coopers different. We’re still standing and still independent at a time when brewery ownership is becoming increasingly concentrated.”

Premium wines shine at

Royal Sydney Wine Show

The Royal Sydney Wine Show has taken place once again, with the 2023 Bream Creek Vineyard Pinot Noir taking out the coveted Tucker Seabrook Perpetual Trophy for Best Wine of Show.

The wine is the youngest red to win the acclaimed title for over 24 years and is the first Pinot Noir to claim Best Wine of Show since 2015. It is also the first Tasmanian wine to win since 2016.

Sydney Royal Wine Show Chair of Judges, Sarah Crowe, said that young reds were a standout.

“The young Pinot class was a real highlight for our judges this year, and this standard of quality can be reflected in our 2024 Wine of Show winner, the 2023 Bream Creek Vineyard Pinot Noir,” she said.

Across the 52 classes judged during the Sydney Royal Wine Show, the 2024 and 2023 Chardonnay class claimed the highest medal count with 118 medals awarded, nine of which were gold medals. Evans & Tate won Best White and Best Chardonnay with the 2022 Evans & Tate Redbrook Reserve Chardonnay, and Silkman Wines claimed Best Small Producer with the 2023 Silkman Wines Silk Chardonnay.

“Chardonnay is at the top of its game and Australian producers are consistently delivering a world-class wine that rivals any international competitor,” Crowe said.

Other award winners included Calabria Saint Petri 2022 Shiraz Carignan winning the Arthur Kelman Perpetual Trophy for ‘Best Shiraz Dominant Blend’, Yalumba Sanctum Cabernet Sauvignon 2021 named Best Cabernet Sauvignon, and Tasmania’s House of Arras Grand Vintage 2015 crowned as Best Sparkling White for the second year running.

Robert Stein Rieslings took home three awards, with the 2017 winning the Douglas Lamb Perpetual Trophy for Best Riesling, the 2023 named Best NSW Wine and the 2024 named Best Current Vintage White.

Melbourne Royal Australian Distilled Spirits Awards winners named

In the awards’ 10th year, winners at the 2024 Melbourne Royal Australian Distilled Spirits Awards were announced in a ceremony at the Victoria Pavilion at Melbourne Showgrounds.

South Australia’s St Agnes Distillery celebrated the biggest achievement of the night, scooping the prestigious title of Champion Australian Distiller, as well as a Consistency of Excellence medal, the Best Brandy trophy, which the distillery continues to dominate year-on-year, and multiple medals for its Blind Tiger Organic Gin and Camborne Single Malt Australian Whisky.

Richard Angove, fifth-generation family proprietor, commented on the achievement: “We are immensely proud to receive these awards. The Australian spirits category has gone from strength to strength in recent years and it has been an exciting time to be part of this industry.”

Other key trophy winners include Backwoods Distilling Co from Yackandandah, which was presented the award for Champion Victorian Distiller, while Madecon’s Travelling While Standing Still clinched the title of Champion Victorian Gin and Best London Dry Gin for its Australian Dry Gin.

The newest Melbourne Royal Australian Distilled Spirits Awards category is Ready To Serve Cocktail or Pre-Mix, which welcomed more than 50 entries, and was won by Reed & Co Distillery’s Yuzu Chuhai.

TWE to divest commercial brand portfolio

Treasury Wine Estates (TWE) has announced its intention to divest its commercial brand portfolio, which includes Wolf Blass, Yellowglen and Blossom Hill, which the company said accounted for less than five per cent of TWE’s gross profit in FY24.

The decision to sell the brands came as part of TWE’s assessment of the future operating model of its global portfolio of premium brands. TWE announced that review as part of its FY24 half-year results and included the non-cash impairment charge of $354m ($290m after tax) for the commercial brands in its FY24 full-year results announcement.

TWE has previously stated its intention to focus on its premium brands, having recently announced the integration of its Global Revenue Growth (GRG) function into its TPB division.

At the time, TWE CEO Tim Ford said combining GRG and TPB would help the business to unlock future opportunities for the strong consumer brands within the Premium business.

“When you consider our Premium portfolio, this is a unique offering with an unrivalled global footprint and brands that resonate strongly with consumers. Integrating our GRG capabilities within TPB will enhance our ability to strengthen these brands, foster cutting-edge innovation and deepen our engagement with consumers and customer partners,” he said.

Changes in store for Australian Vintage

Australian Vintage Limited (AVL) has announced a change in strategy, as well as a Board renewal, with acting CEO Peter Perrin stepping down with immediate effect following a recent cancer diagnosis.

In a statement to the ASX regarding Perrin’s resignation, AVL said: “The Board thanks him for his dedication and service and supports his need to focus on his health and treatment, wishing him well on his road to recovery.”

James Williamson, who was recently appointed to the Board, will take on an interim Chair and interim CEO role with the CEO search underway. Elaine Teh and Michael Byrne will also join the Board as new members alongside Williamson.

A spokesperson for the Board said: “The appointment of Mr Williamson, Ms Teh and Mr Byrne continues the Board renewal process. Mr Williamson will be Interim Chair, Ms Teh represents a key strategic partner to further drive growth across key Asia markets and Mr Byrne brings leadership and technical expertise within the logistics, supply chain and retail sectors.”

In terms of the new strategy, AVL said it is targeting a free cash flow of +$20m per annum by the end of FY27 and a ROCE of eight per cent in the same time frame. Two-thirds of AVL’s revenue currently comes from export related markets, and one-third comes from its premiumisation and innovation program. Amid strong market competition, AVL has identified the importance of accessing currently unexploited revenue growth opportunities in those two segments.

Spirits tax rises again

Spirits tax in Australia rose again on 5 August to $103.89, hitting the whole industry and consumers, with businesses and people already struggling with cost-of-living increases and other economic headwinds.

Australia’s spirits tax is already the world’s third highest, having risen by more than 20 per cent since the onset of the pandemic, and has been increased 75 times since Paul Keating introduced automatic indexation in his first Budget as Treasurer in 1983.

When Keating introduced the policy Australia had two distilleries, there are now more than 700 and Australian Distillers Association chief executive Paul McLeay says their prospects depend on urgent intervention by the Federal Government.

“The continued Government inaction on this issue is incredibly frustrating for our industry, which already contributes $15.5bn in added value to the Australian economy and supports more than 100,000 jobs,” he said.

Craig Michael, director of Bellarine Distillery in Drysdale, Victoria, said the tax is now $25 per litre higher than when the company began operations in 2015.

“These six-monthly increases are becoming increasingly difficult for our business to sustain, and they are impossible to plan for. How can we accurately undertake financial modelling and make business decisions if we don’t know what tax rate we will be paying in six months’ time?”

Marketplace

Brand news and promotions

New era for The Glendronach with brand redesign

The Glendronach has unveiled a new visual identity and creative direction, speaking to a new generation of whisky drinkers with its clean, pared-back bottle design and an updated illustration, blending the distillery’s rich heritage with modern luxury.

Depicting the bramble and rooks that surround the distillery, the illustration is a contemporary homage to The Glendronach brand’s namesake, derived from the Scottish Gaelic Gleann Dronach, which means valley of the brambles.

The new packaging also highlights the combination of Highland spirit and Spanish flair in The Glendronach Single Malt, distinctly honouring the rare Pedro Ximénez and Oloroso casks from Andalucia in which the whisky is matured.

The Glendronach Master Blender Rachel Barrie says: “For me, The Glendronach is a surprise, a revelation and a flavour crescendo.

“At first taste, it has this amplification that’s so much richer than your expectations, and our philosophy is just that – to raise expectations in Single Malt by creating the most exceptional sherried whisky. And we are now setting a new standard to match the exquisite nature of the spirit with reimagined visuals.”

The transformation will first roll out across The Glendronach core range, which includes the 12-Year-Old, 15-Year-Old and 18-Year-Old Single Malts, available to liquor retailers nationwide from late November 2024. Distributor: Brown-Forman

2024 Atmata vintage boasts refreshed pack design

Prioritising healthier lifestyle choices and environmental stewardship, Atmata crafts a range of 100 per cent certified organic wines designed for the modern palate with minimal environmental impact.

The 2024 vintage, set to hit the market later this year, features the latest release with a refreshed pack design. Symbolising Atmata’s deep connection to the land and dedication to maintaining it for future generations, the new design has been inspired by nature.

The packaging uses lightweight glass bottles to help reduce Atmata’s carbon footprint, with the label printed on 100 per cent recycled paper featuring an on-pack QR code linking customers to its sustainability initiatives.

Appealing to the environmentally conscious consumer, the most popular SKU in the Atmata range is the Sauvignon Blanc. Sourced from family-owned vineyards in Currency Creek, the 2024 Atmata Organic Sauvignon Blanc tasting notes describe grapefruit citrus, tropical fruits and gooseberry on the nose, with a light medium-bodied palate with a soft and zesty mouthfeel.

The Atmata range also includes Rosé, Shiraz, and Sparkling SKUs and is available at independent retailers.

Distributor: Casella Family Brands

Ampersand offers summer-ready nostalgia with Vodka Soda & Pine-Lime

Ampersand Projects’ Vodka Soda & Pine-Lime four per cent ABV is a fresh-tasting, guiltfree twist on the classic Aussie Splice. This ready-to-drink beverage offers a perfect balance of crisp vodka and the nostalgic, tropical flavours of Pine-Lime, delivering a refreshing taste that’s hard to resist.

With no carbs, no sugars, and no gluten, it’s made for those who want a ‘better for you’ option without compromising on taste. Australian made and owned, this drink captures the essence of summer in every sip, making it the perfect companion for any occasion.

Spritz

Calabria BÉLENA expands with exciting ready-to-drink

Calabria B É LENA, the brand synonymous with innovation and bespoke quality, proudly introduces the B É LENA Orange Prosecco Spritz [Arancia].

Known for making waves in the market and currently ranked as the 12th top-selling brand, Calabria BÉLENA continues to captivate with its latest offering.

Established in 2021, the BÉLENA range pays homage to Bill and Lena Calabria, second-generation owners of the Calabria family business, with the latest addition of BÉLENA Orange Prosecco Spritz catering to growing demand for light, citrusflavoured beverages.

BÉLENA Orange Prosecco Spritz is a delightful blend of refreshing Prosecco with a zesty orange twist, perfectly balanced with sweet citrus flavours and a vibrant finish. Pour over ice with a sprig of mint and it is ready to enjoy this summer season.

The Calabria family is committed to driving trial and looking ahead to releasing two more Spritz flavours this season: Passionfruit Spritz and Prosecco Limoncello Spritz.

Distributor: Calabria Family Wine Group

Whether you’re at a backyard BBQ, beach outing, or simply unwinding at home, Ampersand’s Vodka Soda & Pine-Lime delivers a light, enjoyable experience with all the flavours and none of the guilt.

Distributor: Australian Beer Co.

Grant’s Triple Wood shines at IWSC as highest scoring blended Scotch whisky

With more than 135 years of history and heritage, Grant’s is the brand that started William Grant & Sons. According to IWSR data, Grant’s is the second-largest Scotch whisky brand by volume in Australia and the fourth largest Scotch whisky brand globally.

Aged in three woods for one smooth taste, Grant’s Triple Wood whisky is matured in three casks. Virgin Oak cask provides spicy robustness, while American Oak lends subtle vanilla smoothness and Bourbon refill offers brown sugar sweetness, resulting in a smoother, richer, mellower taste.

Receiving 98 points at the 2024 International Wine & Spirits Competition (IWSC), Grant’s Triple Wood was the highest scoring blended Scotch whisky. With more than 50 years of experience, the IWSC is one the of the largest and most influential spirits awards globally.

Scoring 98 out of 100, Grant’s Triple Wood received the highest rank of Gold Outstanding, with judges highlighting the “harmonious blend of sweet pear, balanced by a touch of smoke”.

Distributor: William Grant & Sons

Winesmiths rewards shoppers with chance to win $50,000

Winesmiths has launched a new Australian competition, rewarding shoppers with the chance to win a $50,000 cash prize, plus daily instant win gift cards.

From September through to December, shoppers will have the chance to win from a pool of 480 Prezzee gift cards up for grabs, each worth $25.

Winesmiths Marketing Manager, Lisa Antoney, said: “With cost-of-living pressures on everyone’s mind, we felt $50,000 was the best prize on offer, enabling one lucky shopper a chance to pay off some of their mortgage or put it towards a much-needed expense.

“The $25 instant win gift cards will also take the pressure off, with shoppers able to win these daily throughout September, October, November and December.”

Shoppers can enter online by uploading their receipt, with the chance of an instant win. At the end of the promotion period, one lucky entrant will win the opportunity to play the game for a chance to win the $50,000 cash prize.

Winesmiths will be advertising the competition with onpack promotions, as well as a digital campaign, designed to bring interest to the wine-on-tap category.

“Not only will this engage new consumers, but people will appreciate the quality of the wine inside and the convenience that the 2-Litre pack offers,” Antoney added.

“Our packs can be kept in the fridge and enjoyed over several weeks, so there’s no wastage from not finishing a bottle or feeling compelled to have more than one glass”. For more information, please contact your local Samuel Smith & Son representative.

The latest release of celebrated Peter Lehmann Master’s Collection

Peter Lehmann Wines has released the latest iteration of its Master’s Collection, comprising the 2017 Wigan Riesling, the 2017 Margaret Semillon, the 2021 Mentor Cabernet Sauvignon, and the 2021 Eight Songs Shiraz.

Since the first release in the early 1990s, the Peter Lehmann Master’s Collection has been recognised for its quality with numerous awards and accolades. In particular, the Wigan Riesling has consistently won awards throughout the years, notably winning the IWSC award for Best Riesling in the World six times.

The Master’s Collection celebrates the people who influenced the Peter Lehmann winemaking journey and drove the winery’s passion to craft the finest possible Barossa wines. Representing the best of the Barossa, the Master’s Collection highlights the region’s traditional varietals.

Peter Lehmann Wines sources its fruit from a diverse and highquality selection of more than 800 hand-tended vineyards across all 14 Barossa subregions, from the valley floor to the elevated sites of the Eden Valley. The winemaking team’s more than 100 years of collective vintage experience allows them to find a balance between remaining contemporary and respecting the unique Peter Lehmann house style.

All wines in the collection will cellar exceptionally under the right conditions and are released with bottle age: a minimum of five years for whites and a minimum of two for reds.

With an RRP of $50 each, the latest Master’s Collection release is expected to hit the market this month.

Distributor: Casella Family Brands

https://theshout.com.au/national-liquor-news/subscribe

NED enters flavoured whisky category with Golden Bickie

Building on the success of its canned RTD range, NED Australian Whisky has unveiled its first flavoured whisky, Golden Bickie.

Described by NED as a “quintessentially Australian entrant into the growing flavoured whisky category”, the Australian whisky liqueur blends the warmth of whisky with the sweetness of golden syrup, creamy coconut and oats.

Trent Fraser, CEO at Top Shelf International, which produces NED and Golden Bickie, says the flavoured whisky is a flavourful and versatile addition to the portfolio.

“We wanted to create a whisky liqueur that was truly Australian in character. Golden Bickie captures the essence of Aussie comfort – sunshine, good company, and a touch of indulgence. It’s fitting of our mission statement to create world class spirits with an Australian accent and playfulness.”

Inspired by the nostalgia surrounding classic Australian biscuits and cake sales, tasting notes describe a familiar vanilla aroma, reminiscent of golden biscuits straight out of the oven. On the nose, the liqueur also has hints of syrup, oats and pastry.

Distributor: Top Shelf International

Reed & Co. Distillery releases premium shochu RTD, Yuzu Chuhai

Recognising that most ready-to-drink shochu cocktails on the market were not to the makers’ own standards, Reed & Co. Distillery aims to bring the quality flavour of an authentic honkaku-style shochu to the RTD market with its new canned cocktail release, Yuzu Chuhai.

Reed & Co Distillery’s artisanal, single-distilled shochu is crafted from Australian-grown biodynamic Tachiminori Rice. The shochu, which retains more of the rice flavour than multiple-distilled and cheaper korui shochu, is paired with yuzu fruit from Ovens Valley, Victoria.

As well as winning the trophy for Best RTD Cocktail or Premix at the Royal Melbourne Australian Distilled Spirits Awards, Coowner Rachel Reed said that Yuzu Chuhai has wide appeal.

“We know that people love a citrus cocktail like a Tom Collins or a sour, our Yuzushu and NEO gin are popular for that reason. Rice shochu and yuzu pair perfectly. Once you add carbonation to the equation, you get a highball that is simply delicate and delicious,” she said.

Distributor: Direct

Red Mill Rum: The revival of a family-owned rum brand

Red Mill Rum has announced the release of its first bottling, the Red Mill Classic Rum, a style of rum and packaging that proudly reflects the history of Red Mill Rum.

David Fesq, Red Mill Rum Founder, says the label was first created by his great-grandfather after the depression, growing into an iconic Sydney brand in the post-war years before being sold.

Fesq began making the rums again in 2020 and describes the latest release as “our expression of the old and the new”, packaged with a tropical label that is a rework of an original Fesq & Company liqueur label from the 1940s.

Merging a story of the past with a vision for the future, Red Mill Rum Classic blends a selection of casks that were approximately 50 per cent ex-whiskey casks with 50 per cent ex-wine casks, settled in older American oak for six weeks before bottling by hand at 40 per cent ABV for a versatile style.

Red Mill Rum is already enjoyed in more than 150 bars and venues around Sydney, now expanding its presence across retail. Classic Red Rum is available at an RRP of $90.

Distributor: Direct

House of Arras unveils 2024 Vintage Collection

Marking the winery’s 18th consecutive vintage release, the House of Arras 2024 Vintage Collection will be available from late October, showcasing the highly anticipated 2016 vintage.

House of Arras Chief Winemaker Ed Carr says the Vintage Collection release is the most important date in the House of Arras calendar, and an opportunity to share fine Tasmanian sparkling with the world.

“I am excited by the creativity and forward-looking outlooks of the House of Arras team and our amazing grape growers. Our aspiration has always been to produce some of the world’s best sparkling wines that resonate the purity and taste of Tasmania.

“This can only be done through collaboration, attention to detail and investment in time. This 2024 collection highlights that we are achieving this goal and that we can give sparkling wine lovers something unique, delicious and memorable to drink.”

The 2024 Vintage Collection includes the House of Arras Grand Vintage 2016, House of Arras Blanc de Blancs 2016, House of Arras Rosé 2016, House of Arras E.J. Carr Late Disgorged 2009, and a limited allocation of the House of Arras E.J. Carr Late Disgorged 2008 Magnum.

Distributor: DMG Fine Wines

Fourth Wave Wine unveils mid-strength range, In the Middle

Family-owned winemaker Fourth Wave Wine has demonstrated its confidence in the market for low-alcohol wines with the launch of its latest range, In the Middle.

The no- and low-alcohol category has seen significant growth in recent years, with the IWSR attributing a boost in low-alcohol consumption to a wave of NPD in wine, beer and spirits.

Wine is the strongest performer in the low-alcohol marketplace, and Fourth Wave Wines’ latest release comprises five mid-strength wines, a Pinot Noir, Prosecco, Pinot Grigio, Rosé and Chardonnay, each ranging between six and seven per cent ABV.

Fourth Wave Wine Marketing Manager, Indeya Passfield, says: “Working with innovative winemaking techniques to preserve each varietal’s regional characteristic, our In the Middle winemaking team are able to bridge flavour and have them meet in the middle, creating five delicious wines that are lighter but with the depth and vibrancy of bigger wines.”

Distributor: Fourth Wave Wine

Island Gin creates quintessentially New Zealand gin

Featuring Manuka bush honey sourced from an apiary near the distillery, the flavours of Island Gin reflects its home of Great Barrier Island, located five hours off the coast of Auckland. In addition, its distinctive bottles are modelled after kina shells, which wash up on the island’s shores.

Head Distiller Andi Ross said that the hyperlocal botanicals are an important point of difference for the brand.

“We wanted to make a product that was quintessentially New Zealand, so Manuka bush honey is our key ingredient.

“It’s very local, and given that the bee population is in decline, it’s important to support that. We could have used kawakawa, or one of the other native botanicals, but other brands are already using those in their gins. We wanted to do something that is quite unique,” she said.

Island Gin has been widely awarded, including winning the New Zealand Best in Country award at the 2024 World Drinks Awards in London, and two consecutive gold medals at the 2022 and 2023 San Francisco Spirits Competition.

Distributor: Direct

Dasher + Fisher debuts refreshed packaging

Award-winning gin brand Dasher + Fisher has unveiled a new look, paying homage to its deep Tasmanian roots with an enhanced bottle, new brand colours and redesigned labels.

The new-look core range, Ocean Gin and Mountain Gin, features blues and greens to reflect Tasmania’s natural landscapes, with Sloe Gin and Raspberry Gin also updated to reflect the bold flavours within.

The new bottle shape features a longer neck with a wooden closure replacing the former screw top, and the map of Tasmania embossed onto the base of each bottle.

Coinciding with the rebrand, the limited edition range of Blackberry Gin, Whisky Barrel Gin and Coffee Liqueur has also hit shelves nationwide.

Dasher + Fisher Executive Chairman, Stephen Grove, says the new design is more than just a visual update: “This new design is inspired by our past and driven by our future. It represents our unwavering commitment to quality and the rich legacy we continue to build upon.”

Distributor: Southern Wild Distillery

Modern tequila-based beverage Alba lands on Australian shores

New Beenleigh Rum & Pineapple Crush hits the market

Australia’s oldest-operating distillery Beenleigh Rum has launched the latest addition to its RTD portfolio, Rum & Pineapple Crush, crafted with the booming light RTD market in mind.

Will Sullivan, Beenleigh Rum’s Brand Manager, says: “As we approach our 140th anniversary, the introduction of a white rum-based RTD marks a pivotal moment in Beenleigh’s rich history. This launch not only highlights our unwavering commitment to growth and innovation in the rapidly evolving drinks space but also pays homage to our storied past,” he stated.

The new RTD features Beenleigh’s signature Australian white rum, blended with real pineapple juice to create full-bodied flavour. Tasting notes describe a smooth taste layered with notes of tropical vanilla, subtle spices and juicy pineapple, with a crisp, clean and refreshing finish.

At 4.5 per cent ABV, the new beverage is rolling out nationwide via independent retailers, available in a fourpack at an RRP of $24.

Distributor: Beenleigh Rum

New Zealand-owned RTD brand Alba has officially launched in Australia, combining authentic Mexican tequila from the Magdalena Distillery in Jalisco with homegrown New Zealand flavours and ingredients, designed for the next generation of Margarita enthusiasts.

The portfolio appeals to a range of tastes, from the classic Margarita option to a modern mix of flavours including grapefruits, coconuts, hot sauce and even olive brine.

Michael Tutty, Creative Director, says: “We are thrilled to bring Alba to Australia, a place that shares our love for good times and great vibes. Our tequila is carefully produced with the utmost respect for tradition before being blended into a convenient RTD format. We know that Alba offers a unique and authentic experience that will resonate with tequila enthusiasts and newcomers alike.”

Alba’s Dirty Sparkling Margarita, Original Sparkling Margarita, Chilli Sparkling Margarita, Coconut Sparkling Margarita and Grapefruit Sparkling Paloma are available now to Australian liquor retailers.

Distributor: Alba

Corryton Burge portfolio welcomes trio of sparkling wines

Family winemaker Corryton Burge is celebrating the release of its inaugural Sparkling Collection, capturing the legacy of the sixth-generation winemaking family and its dedication to vibrant, elegant wines.

The unveiling of the Sparkling Collection has been a much-anticipated occasion for the Burge family, led by siblings Trent and Amelia Burge.

“The Barossa Valley and Burge family are two integral pieces of the South Australian wine story and we’re so proud to be showcasing them to a new generation of wine lovers through Corryton Burge,” says Amelia.

“We’re only just getting started sharing a new side of our family’s winemaking legacy and we hope Corryton Burge is the epitome of the joy and passion we feel for wine.”

Sitting within the Sparkling Collection is the NV Sparkling Pinot Noir Chardonnay, a rich and balanced wine with a crisp natural acidity; 2019 Martha Mae Tasmanian Sparkling Pinot Noir Chardonnay, aged on lees for three years to create depth; and NV Sparkling Red, crafted from Barossa-grown Cabernet Sauvignon, Shiraz and Grenache.

Distributor: ALM, Verasion Wines and The Wine Agent

Jack Daniel’s launches latest Bonded Series – Triple Mash

Jack Daniel’s has launched the second instalment of its Jack Daniel’s Bonded Series, with Jack Daniel’s Triple Mash – a blend of three straight bottled-in-bond whiskeys.

Featuring 60 per cent Jack Daniel’s Bonded Rye Whiskey, 20 per cent Jack Daniel’s Bonded Tennessee Whiskey, and 20 per cent Jack Daniel’s Bonded American Malt Whiskey, the team describes Triple Mash as “a perfectly well-rounded whiskey with a bold and complex flavour profile of honey sweetness, grain spice and dry oak”.

Jack Daniel’s Triple Mash is bottled-in-bond at 100 proof (50 per cent ABV), with packaging inspired by the original design of the 1895 Jack Daniel’s Tennessee Whiskey bottle.

The Bottled in Bond Act of 1897 stipulates that a bonded whiskey must be distilled by a single distiller, during a single distilling season, matured in a government-bonded warehouse for at least four years and bottled at 100 proof.

Triple Mash is described as the most premium offering to date in the Bonded Series and a 700ml bottle carries a $110 RRP, it is currently available for selected independent liquor stores, with broadscale availability by October 2024.

Distributor: Brown-Forman

Brown Brothers gives Prosecco a mid-strength makeover

Responding to the growing demand for no- and low-alcohol (NoLo) options, as well as the continued popularity of Prosecco in the sparkling wine category, Brown Brothers has launched Mid Strength Prosecco.

Offering the same flavour profile of crisp apple and pear as the full-strength Brown Brothers Prosecco, the Mid Strength contains seven per cent alcohol and 72 calories per serve.

Emma Brown, Brown Brothers Head of Innovation and fourth-generation family member, said that NoLo wines are an important part of the Brown Brothers portfolio.

“As leaders in wine innovation, Brown Brothers is dedicated to expanding our range of low- and no-alcohol options, ensuring that all consumers have access to highquality alternatives. The Prosecco drinkers will be pleasantly surprised by the similarity between Brown Brothers Mid Strength Prosecco and Australia’s favourite Prosecco, Brown Brothers Prosecco NV,” she said.

Distributor: Brown Family Wine Group

Tequila Don Julio brings Rosado to Australia

For a limited time, Australians will have access to Tequila Don Julio Rosado, which joins the brand’s other luxury Tequilas, Don Julio 1942 and Ultima Reserva, as part of a growing superpremium portfolio.

Tequila Don Julio Rosado is a Reposado Tequila which achieves its pink hue from aging in ruby port casks, sourced from the Douro wine region of Portugal. Tasting notes describe flavours of red berries, dried plum, caramel, and cocoa.

Tequila Don Julio Australia Senior Brand Manager, Iven Breneger, said that Don Julio Rosado is well-suited to a variety of occasions.

“A light and deliciously smooth tequila, Rosado is the ideal beverage to enjoy during the day as the temperatures begin to increase. While most people enjoy luxury tequila in the evening, Tequila Don Julio Rosado is an invitation to break the mould and call up your friends to enjoy an unforgettable daytime celebration with a Rosado cocktail in hand,” he said.

Distributor: Diageo

Agnew Wines joins Mezzanine distribution portfolio

Hunter Valley family-owned winery Agnew Wines has announced a new partnership with Mezzanine, part of Joval Wines, for the national distribution of its Audrey Wilkinson and Pooles Rock brands.

The Agnew Wines and Mezzaine partnership commenced earlier this month, owing to Mezzanine’s expertise in the fine wine market. Mezzanine National Brand Manager Cassandra Eyres said she was looking forward to taking the brands national.

“Agnew Wines produces some of the finest wines in the Hunter Valley, with a focus on regional expression, elegance and balance. We are excited to introduce these wines to our customers and to showcase the diversity and quality of the Hunter Valley region,” she stated.

Joval Wines CEO Gary Crawford added: “Both Audrey Wilkinson and Pooles Rock have incredible brand awareness, holding an iconic position in the Hunter Valley with over 150 years of winemaking excellence.

“We understand the brands and their ambition for the next important phase. Agnew being a long-standing family business with strong values is also very important to us.”

Distributor: Mezzanine

Seppeltsfield Rd Distillers puts fizzy twist on classic Gin Sour

Seppeltsfield Rd Distillers has entered the evergrowing RTD market with the release of its new Barossa Shiraz Gin Soda, transforming its Barossa Shiraz Gin into a ready-to-drink cocktail crafted for the summer months.

Described as a ‘fizzy twist on a classic Gin Sour’, the Barossa Shiraz Gin Soda is sweet, sour and spritzy with bright berry flavours, marking the distillery’s first step in portfolio diversification.

Seppeltsfield Rd Distillers Managing Director Jon Durdin says the distillery has been working on the product for a while, investing a lot of time into recipe development.

“For us it was all about the quality of the product. It was important the Shiraz Gin remained the hero and that the end product stayed true to our brand’s reputation for crafting bright, beautifully balanced gins.

“It’s refreshing, bright and damn right tasty and gives people another way to enjoy our iconic Barossa Shiraz Gin.”

Adapting to the changing nature of consumers drinking habits and preferences, Seppeltsfield Rd Distillers expects to release further new product lines later in the year.

Distributor: Seppeltsfield Rd Distillers

The rising threat of illicit alcohol

Illicit alcohol production is a multifaceted issue posing significant challenges to public health, safety, and the legitimate alcohol industry. It has become particularly pronounced in recent times occurring against a backdrop of high taxation, regulatory barriers, and market demand for cheaper alternatives.

Illicit alcohol production encompasses various activities including the illegal manufacture, distribution, and sale of alcohol, typically circumventing regulatory frameworks and evading taxes and quality controls. Concern is also growing that illicit alcohol is shifting to the same practices witnessed in tobacco over the past five to 10 years, namely, the advent of organised crime and growing violence.

While it’s difficult to quantify, the scale of the problem is significant with recent media articles and data from the ATO suggesting it’s a significant issue with forgone revenue in FY22 of $745 million. It’s important to note that the issue is occurring not only among packaged liquor retailers, but also in on-premise venues such as pubs, clubs and nightclubs. The problem is also widespread across the country, despite the problem

Illicit alcohol production, distribution and sale impacts industry, government and consumers, writes Michael Waters, CEO, Retail Drinks Australia.

appearing to be particularly prevalent in Victoria.

These illegal products can pose significant health risks for consumers who may be unaware that they are drinking an inferior or tainted product. At worst, the consumption may result in severe sickness or even death. Between 2000 and 2020, there were 55 reports of mass deaths worldwide from methanol poisoning associated with illicit alcohol production, distribution and sale. Earlier this year in Victoria, state police uncovered a $1 billion underground operation involving substances such as paint stripper and brake fluid being mixed with various spirit products.

For liquor retailers, key signs to be aware of when purchasing alcohol products are:

• Is it being supplied at a commercially unrealistic price given the excise duty that should apply?

• Does the supplier, manufacturer or importer hold an ATO issued manufacturer or storage licence?

• Is the product labelled correctly, including, but not limited to, country of origin, supplier details, lot identification, barcode, tampered lot codes?

• Is bonus stock offered (or received), in substantial amounts and/or on a regular basis, reducing the overall unit price?

• Does the amount of product specified on the invoice differ to what was delivered?

• Are there missing, vague or incorrect product descriptions on invoices?

• Has the supplier requested to hold or temporarily store product without purchase? In responding to this challenge, Retail Drinks has recently met with various Minister’s offices, regulators and police agencies to raise awareness of the issue and will continue to work in collaboration with the ATO.

As part of our educative role, we have proactively emphasised to members the importance of ensuring that all alcohol products sold through retail channels are done so legitimately and that all applicable excise duties are paid. In doing so, we have sought to amplify the ATO’s messaging around illicit alcohol sales through our communications channels and how retailers should respond if they ever encounter this issue.

Retail Drinks and our members are strongly committed to ensuring that the sale of illicit alcohol products is eliminated from industry. ■

2024

WHEN

Friday 4th October 2024

Tasting 11.30am

Lunch 12.30pm

WHERE

Ridley Centre, Adelaide Showground TICKETS

$199 (WCA Member)

$229 (Non-Member)

Full table $1950 (table of 10)

Do retail wine sales trends align with 2024 vintage results?

Sandy Hathaway, Senior Analyst at Wine Australia, analyses the share of red and white varieties in the 2024 vintage, and how these trends are reflected in retail.

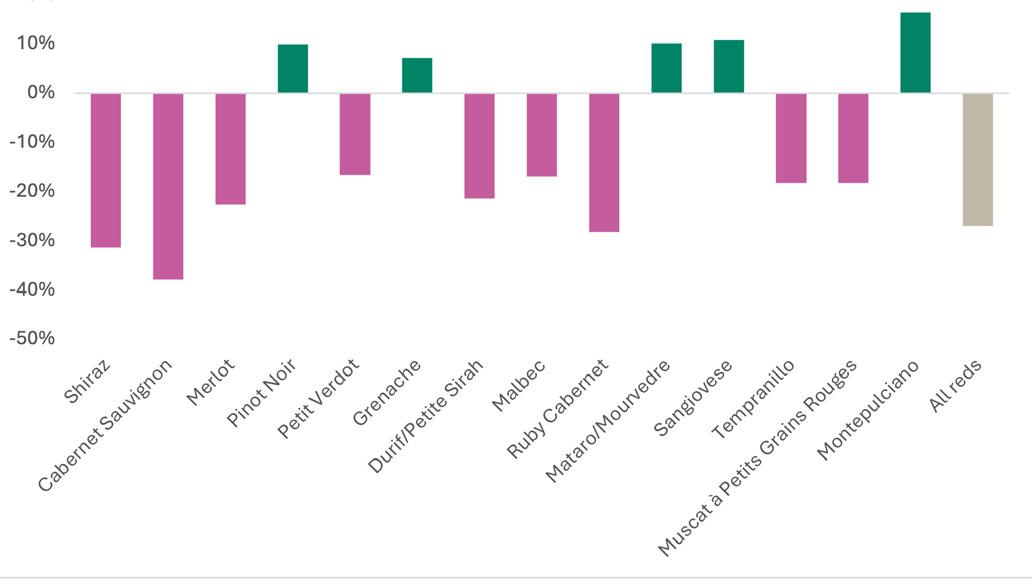

The 2024 Australian wine vintage was most distinctive for the increase in share of white varieties, while red varieties were well down on their long-term average crush. This analysis looks at whether the trends in retail reflect the results of the national vintage. Part one looks at reds, while part two, to appear in the October issue of National Liquor News, looks at whites.

Red varieties and the Australian crush

The crush of red grapes has declined by 27 per cent in the past two years, driven mainly by Shiraz, which was down by 31 per cent nationally in 2024 compared with 2022 (the equivalent of around 10.5 million nine litre cases). Looking at the major red varieties, the ones in growth over the two years were Pinot Noir, Grenache, Mataro (Mourvèdre), Sangiovese and Montepulciano, all of which showed increases in crush size despite the overall decline in the red crush and despite both Shiraz and Cabernet Sauvignon declining by over 30 per cent each across the two years (see Figure One).

On the domestic market, recent retail sales trends are broadly consistent with the crush data in terms of the best-performing varieties.

The only red varieties showing volume growth over the past 12 months are Grenache (up three per cent), Pinot Noir (up one per cent) and Sangiovese (up four per cent) – mirroring the growth in varieties crushed shown in Figure One.

The exception was Mataro/Mourvèdre (down 46 per cent in the retail figures but showing growth in the crush figures) while Montepulciano is not separately identified in the retail sales data. Shiraz was down three per cent, Cabernet Sauvignon (including blends) down five per cent and Merlot down seven per cent (Figure Two).

Rosé has been classified as a red variety in the sales figures but can’t be directly related to a particular variety in the crush data. This category grew by six per cent, consistent with a growing demand for lighter styles of wine.

New law gives boost to New Zealand cellar doors

Amendment to New Zealand Winery Cellar Door Tasting Bill shows strong support for wine tourism, writes Catherine Wansink, New Zealand Winegrowers.

In August, New Zealand Winegrowers welcomed the passing of the Sale and Supply of Alcohol (Winery Cellar Door Tasting) Amendment Bill following its third reading.

“These changes will make a difference,” says Philip Gregan, Chief Executive Officer of New Zealand Winegrowers. “The Bill brings legislation on winery cellar doors into the 21st Century. It recognises the contribution made by winery cellar doors to the tourism offering in New Zealand’s wine regions and enables wineries to charge for providing their tourism experience.”

Gregan said: “It is positive that the legislation will be in force ahead of the busy summer season, which was one of our requests to the Select Committee when hearing submissions on the Bill. We thank them for the timely consideration of the Private Members Bill.”

The changes allow winery cellar doors with an off license to charge for providing samples of wine, which were previously only able to be given away for free, making it difficult for wineries to cover the costs of providing these experiences.

“During the submission process the Select Committee heard directly from our members that this change will help them to cover their costs and encourage other members to open new winery cellar doors that would otherwise have not been an economic proposition. We expect this change will create new jobs and new tourism experiences to encourage visitor growth,” says Gregan.

Winery cellar doors will continue to observe host responsibility practices, including a maximum sample size of 35ml, meeting the new requirements to have snack food available for purchase and for water to be freely available.

“The robust consideration by the Select Committee and Parliament means these changes will have a positive and lasting impact on New Zealand’s regional wine tourism experiences. We welcome all visitors to one of the 250 plus winery cellar doors and wine tourism experiences throughout New Zealand.”

Intel and Insights Specialist at New Zealand Winegrowers, Richard Lee explains the importance of wine tourism and the cellar door experience for Kiwi wineries.

Based on pre-Covid surveys, 25 per cent of inbound tourists visited New Zealand wineries for tastings. Adelaide University research revealed that 54 per cent of cellar door visitors purchased an average nine bottles of wine, 50 per cent indicated they would purchase in the future, 16 per cent who had never purchased a cellar door brand previously began to buy it after their visit, and 33 per cent went on to repeat purchase from retail stores.

Pre-Covid surveys also revealed that New Zealand cellar door visitors highly rated their experience, with an average satisfaction score in excess of nine out of 10. In other words, these consumers are brand advocates, highly likely to make positive recommendations to their social networks.

And indeed, they do. The Adelaide University research showed that more than 80 per cent of consumers who visited a cellar door went on to recommend to friends, family or colleagues within three months, making on average three positive referrals.

Therefore, the opportunity for wine tourism is to target drinkers of New Zealand wine as Active Considerers and convert them to Actual Travellers. When cellar doors continue to provide a wonderful experience at the homes of New Zealand wine brands, they can reconnect with these brand fans, then reactivate them after they have returned home. This will create even more converts to New Zealand wine, and in turn more Active Considerers for travel to New Zealand. It’s not just a return trip, it’s a continuous round trip. If done well, this can cost effectively build a New Zealand Wine Brand Army, because a fabulous experience means brand fans love to spread the word, for free. ■

Marketing: That all-encompassing term

“When you start considering both current and potential customers, and what niches they might be part of, it totally alters our marketing and promotional thinking.”

Peter Hall Industry Consultant

It came to my attention, admittedly a bit late, but, you don’t know what you don’t know. This could relate to many topics in the pantheon of management skills required, however in this case, I’m talking about marketing.

I’d been in business many years and, like many of you, considered marketing to be mainly banner group activities, getting the gondola end displays done and making sure the right posters were out the front. I was right in one aspect as they’re all part of the marketing process but, as I found out over time, they’re only a few of the many aspects to consider when we’re wearing our marketing ‘hat’.

I was introduced by an early mentor to the concept of niche marketing; the idea of segmenting your current and potential market into groups or niches. When you start considering both current and potential customers, and what niches they might be part of, it totally alters our marketing and promotional thinking – one promo doesn’t encapsulate everyone.

Now, going back one step, it’s worth looking at a definition of marketing, if only to tick off the areas where we’re already strong. The broadest definition states that marketing is everything we do in moving goods from supplier to consumer – simple, yet all encompassing.

Not only does marketing involve those daily activities mentioned earlier but also product ranging, pricing, display, staffing, customer interface, POS data collection and analysis, market research and profitability. Now, that’s a day’s work and we’ll do the same again tomorrow.

Once we’ve established the breadth of marketing activities, it’s worthwhile looking again at market

segmentation, the concept of niche marketing. In reality, you already do this every day without putting a fancy ‘management’ term on it.

Let’s develop our wine category for example – who is your current market by age, spend, geographical spread and socio-economic group? Is that the group we believe will grow the category? How can I get a promotional message to more of that group? How will I know if I’ve succeeded or not? Sales? GP%? Customer feedback?

Notice the number of questions; get a marketing guru involved and they’ll ask you more questions than provide answers. Why? Because you know your business best.

In assisting business with business plans, I find simple is always best. Four key strategies for improving sales:

1. Increase the size of your Prime Market Area (PMA). Pulling customers in from further afield requires you to have a point of difference. Don’t have that unique range, promotion, location, car-parking, hours, layout or staff? You won’t drag people away from their current favourite.

2. Increase your market share from within your PMA; be better than your local competition (and I don’t mean just on price).

3. Increase your number of niche markets; get the tradies, premium spirit buyers, local businesses, students, BYO restaurant wine buyers. You can break up your potential market anyway you like.

4. Increase the size of each niche; we’re getting the premium spirit buyers as we’ve got a great range but let’s promote better and get more of them. Food for thought. ■

DrinkWise supports sports fans to minimise alcohol-related harm

DrinkWise CEO Simon Strahan shares an update on the success of the ‘Always respect, always DrinkWise’ campaign.

At a time when statics show improvements in drinking behaviours, it is important that we keep focusing messages and programs on those that may be drinking at risky levels or at risk of alcohol-related harm.

This is why DrinkWise, through the ‘Always respect, always DrinkWise’ campaign, teamed up with the New South Wales Government’s Minster for Women, Jodie Harrison, New South Wales Police Force Assistant Commissioner Brett McFadden, the National Rugby League (NRL), 1800RESPECT, Men’s Referral Service and 13YARN prior to the NRL State of Origin series. It provided a timely and important reminder to fans about the importance of moderating their alcohol consumption and always being respectful towards others – a wholeof-community approach to driving meaningful behavioural change in the community.

The launch took place ahead of game one at Accor Stadium and received significant media coverage across national television news, radio, digital and social media platforms, in addition to featuring across stakeholder and DrinkWise digital channels.

Geotargeted social media messages featuring NSW and QLD NRL and NRLW players James Tedesco, Lindsay Collins, Tamika Upton and Kezie Apps

also emphasised the importance of asking for help if people are having trouble managing their alcohol consumption, or if their behaviour or choices are impacting those around them. DrinkWise promoted the partnership with support services as a strong callto-action for anyone who needed help or support managing their behaviour or alcohol consumption to reach out.

Endeavour Group, Coles Liquor, Retail Drinks Australia members, Flemington Liquor Accord and Accor Stadium helped promote the ‘Always respect, always DrinkWise’ message by displaying materials in their venues and stores throughout the State of Origin series.

With the upcoming AFL, NRL and NRLW Finals series kicking off in September, DrinkWise will further promote this important initiative to remind sports fans about the importance of moderation, respect and seeking support if needed.

To find out how to support the ‘Always respect, always DrinkWise’ campaign initiative, get in touch via info@drinkwise.org.au, or find out more about the work DrinkWise is doing to create a safer and healthier drinking culture in Australia by visiting www.drinkwise.org.au. ■

“With the upcoming AFL, NRL and NRLW Finals series kicking off in September, DrinkWise will further promote this important initiative to remind sports fans about the importance of moderation, respect and seeking support if needed.”

Simon Strahan Chief Executive Officer

DrinkWise

Tenant’s due diligence for retail leases: A comprehensive guide

Marianna Idas, Principal, eLease Lawyers, provides a comprehensive overview of how tenants can secure a lease that supports their business objectives and minimises risks.

Entering into a retail lease is a significant commitment for any business. Conducting thorough due diligence is essential to ensure that the lease terms align with the tenant’s business objectives and financial capabilities.

Understanding the lease agreement

The lease agreement is the cornerstone of the tenant-landlord relationship. It is crucial for tenants to obtain legal advice on this lease. Key areas to focus on include:

Rent and additional costs: Clarify the base rent, frequency of payments, and any additional costs such as maintenance fees, property taxes, and insurance. Understand how rent will be adjusted over the lease term.

Lease term and renewal options: Examine the duration of the lease and options for renewal. Ensure that renewal terms are clearly defined and consider how these terms align with the long-term business plan.

Premises description and use: Ensure that the lease accurately describes the premises, including the square footage and any exclusive use areas. Verify that the permitted use clause allows the intended business operations and check for any restrictions.

Fit-out and alterations: Understand the responsibilities for initial fit-out and any subsequent alterations. Confirm who bears the cost and the process for obtaining landlord approval for changes to the premises.

Financial due diligence

Tenants should assess the overall cost of occupying the space and its impact on the business’s financial health. Key

considerations include:

Total occupancy costs: Including base rent, additional expenses, and any variable costs such as percentage rent.

Security deposit and guarantees: Understand the conditions under which these may be retained or refunded.

Break clauses and exit strategies: Review any break clauses that allow for early termination of the lease. Assess the financial implications and conditions associated with exercising these options.

Legal and regulatory compliance

Tenants should:

Consult legal counsel: Engage a lawyer specialising in commercial leasing to review the lease who will identify potential risks and negotiate favourable terms.

Verify zoning and permits: Confirm that the premises are appropriately zoned for the intended use and that all necessary permits and licenses can be obtained.

Compliance with Retail Leases Act:

Ensure the lease complies with the relevant state’s Retail Leases Act, which offers protections and imposes obligations on both parties.

Market and location analysis

Understanding the market and location is essential to ensure the retail space meets business needs and attracts the desired customer base. Consider the following: Demographic analysis: Analyse the demographics of the area to ensure alignment with the target customer profile.

Assess factors such as population density, age distribution, and income levels.

Competition and foot traffic: Evaluate the level of competition and the potential for foot traffic. A location with high visibility and accessibility can significantly impact business success.

Future developments: Investigate any planned developments or changes in the area that could affect the business. Future infrastructure projects, zoning changes, or new retail complexes can impact foot traffic and competition.

Operational due diligence

Key points to examine include:

Physical condition of the premises: Inspect the premises to identify any existing issues or necessary repairs. Ensure that the lease specifies the party responsible for addressing these concerns.

Landlord’s obligations: Clarify the landlord’s responsibilities regarding maintenance, repairs, and common area upkeep.

Access and parking: Consider the impact of these factors on customer convenience and satisfaction.

Due diligence is a critical process for retail tenants entering into a lease agreement. By thoroughly understanding the above, tenants can secure a lease that supports their business objectives and minimises risks. Engaging professional advisors and adopting a proactive approach to negotiation can further enhance the outcome, providing a solid foundation for business success. ■

2024 Independent Beer Awards wrap up

Now 10 years in, Independent Brewers Association (IBA) CEO Kylie Lethbridge says the quality of the Independent Beer Awards just keeps getting better.

The 2024 Independent Beer Awards (Indies Awards) were no small feat, with 1028 beers going head-to-head by nearly 50 top tier judges over three days.

In the end, it was South Australia’s Uraidla Brewing Co.’s Vampiric Throne Red IPA that stole the show, first nabbing the title of Champion Amber-Dark Ale and then going on to claim the ultimate prize of Champion Independent Beer.

Max Bowering, the 24-year-old Head Brewer at Uraidla Brewing, has only been in his role for two months, but he’s already making waves. His win represents the future of independent brewing in Australia – young, passionate, and ready to take the industry to new heights.

The presentation ceremony was held at the conclusion of the West Australian Brewers Association conference and trade show with 300 brewers, industry suppliers, and supporters gathered to celebrate 10 years of innovation, growth, and brewing excellence.

The night was full of firsts making it one to remember:

• A Red IPA took the Champion Independent Beer award

• A Western Australia brewery took home the Champion Small Independent Brewery title, proving that big things come in small packages

• A Northern Territory brewery didn’t just win its first gold medal

– it won two

• Boundary Island Brewery, Innate Brewers, Uraidla Brewing Co., Aethon Brewing and Indian Ocean Brewing all walked away with their first Indies Awards trophies.

• Hobart Brewing Co. and Seven Mile Brewing celebrated their first Champion State Brewer Award

• And for the first time ever, the Indies Awards were hosted in Western Australia.

This year, an incredible 87 per cent of all beers entered received a medal – the highest ever, and a two per cent increase over 2023.

And it wasn’t just about the beer, Matt Kirkegaard from Brews News was honoured with the Lifetime Achievement Award for his nearly 15 years of dedication and passion in covering the industry.

The awards once again showcased the creativity, craftsmanship, and pure dedication that define Australia’s independent brewers.

The full catalogue of results and recording of the presentation ceremony can be found online: https://independentbrewers.org.au/ the-indies-awards/winners/2024-winners/ ■

Summer Beer Retailing

With the weather warming up, it’s time to start thinking about what consumers are drinking this summer. We’ve served up a list of new releases and classic favourites for the sunnier months.

Hahn Ultra Zero Carb cuts carbs, not flavour

Hahn, alongside AFL legend Lance ‘Buddy’ Franklin, is encouraging the nation to kick carbs not beer, with the release of Hahn Ultra Zero Carb, the brand’s first zero carb beer, which promises not to compromise on great taste. Boasting zero carbs and only 87 calories per bottle, Hahn Ultra Zero Carb is the first beer being introduced as part of Lion’s brand-new Ultra category, which will soon comprise a range of zero carb beers.

With two thirds of Australians feeling that they’ve become fitter and more mindful in their lifestyle over the last five to 10 years, there has been a shift to lighter and less filling alcohol options. This new beer perfectly caters to the growing sector of consumers seeking mindful choices without giving up on flavour.

Retaining the full beer taste, the Hahn Ultra Zero Carb’s profile result is a perfect balance of flavour and easy drinking crispness, with zero carbs and low bitterness.

Distributor: Lion

“This summer, Lion is reshaping the beer category by launching Ultra (zero carbohydrates) across four brands. We are offering Aussie drinkers four delicious new beers, all with zero carbohydrates. It is an exciting time for the category, and by summer we will have Hahn Ultra, XXXX Ultra, Tooheys Ultra and Byron Bay Ultra beers all on the market.”

Rachel Ellerm, Marketing Director, Lion AU

Matso’s Vodka Lemon Crush offers naturally-flavoured refreshment

Matso’s Vodka Lemon Lime Crush offers a refreshing, natural Australian twist on the growing trend of citrus flavoured RTDs. Crafted with vodka, lime and Australian lemons, it delivers a vibrant, authentic taste that meets the increasing consumer demand for genuine, natural ingredients.

Proudly 100 per cent Australian-owned, Matso’s has two iconic spiritual homes: the original brewery in Broome, WA, and new brewery and distillery in Eumundi, on Queensland’s Sunshine Coast.

The Matso’s brand resonates with a broad audience, appealing to both men and women, with a particularly strong following among women, as 66 per cent of Matso’s Ginger Beer is enjoyed by female consumers. This broad appeal makes Matso’s Vodka Lemon Lime Crush a versatile choice for anyone seeking a delicious, naturally flavoured refreshment.

Distributor: Good Drinks Australia

New convenient pack format for Pressman’s Apple Cider

Pressman’s Apple Cider is now available in a convenient new 10-pack format of 375ml cans, responding to the increasing consumer demand for portability and ease. This cider has earned its reputation for a balanced sweetness, crisp finish, and vibrant apple notes with a hint of tartness. Crafted from premium Australian apples, it delivers an expert blend of sweet and dry flavours.

As the warmer months approach, the 10-pack format arrives at the perfect time, offering a versatile option for various occasions. Whether it’s a backyard BBQ, a post-beach refreshment, or a relaxed gathering at home with friends, Pressman’s Cider was created for the modern drinkers’ occasion needs in mind.

Pressman’s Cider is the ultimate summer companion, available in 375ml 10-pack cans and 330ml six-pack bottles. Its crisp, refreshing taste is ideal for sunny days and balmy evenings, making it the go-to choice this summer.

Distributor: Australian Beer Co.

A sessionable and approachable XPL from White Bay Brewery

Not to be confused with an XPA, White Bay Brewery’s Extra Pale Lager (XPL) is an easy-drinking, crisp and clean lager. The XPL bridges the gap between the old-school and the new-world, meeting people where they’re at, rather than challenging them to be somewhere else.

Built to be incredibly sessionable without being flavourless, and a little bit hoppy without being obnoxious about it, White Bay Brewery’s XPL is a beer that you can have more than two of before your tongue tries to escape your mouth, but won’t bore you to tears either.

White Bay Brewery is committed to making affordable beer at a time where money is tight for the average punter, without compromising on its commitment to quality-first brewing.

Distributor: Paramount or Direct

“Anything that could fit into the category of humidity repellent. For us that means crispy pilsners and lagers, hazy pale ales and fruited sours. We’re releasing a new limited-release beer every 10 days on average so watch this space for some of these styles coming out of White Bay Brewery.”

Jackson Davey, Senior Sales Manager, White Bay Brewery

Coopers provides for lager lovers with Coopers Australian Lager

Refreshing from first drop to last, Coopers Australian Lager is an authentic Australian lager that pairs well with a barbecue on a sunny day. With a bright golden hue originating from Coopers’ own lager malt, the lager features stone fruit and citrus aromas, with a dash of late hopping adding subtle tropical notes.

Released in August 2023, Coopers Australian Lager quickly struck a chord with drinkers across Australia and the beer now takes its rightful place in the permanent portfolio of Australia’s largest independent family-owned brewery. With the lager style representing 85 per cent of beer volume sold in Australia, Coopers has delivered a new premium, great-tasting lager to meet drinker demand across the country this summer and beyond.

Distributor: Paramount, ALM, ILG

“What we’re seeing as being popular this summer is an easy drinking blend of styles that come together in a really refreshing way.”

David Neitz, Co-founder founder, Brewmanity

Great Northern gives Queenslanders a premium option with Long Run

The Great Northern Brewing Co has launched a premium beer exclusively into the Queensland market for drinkers looking to upgrade their celebrations.