COST OF

www.propack.pro February 2023 People Technology Business ALSO INSIDE... Sustainable strategies A FOCUS ON: The environmental impact of products Electronics companies are making all the right moves to enhance their circularity models A disruptive digital transformation Durst’s Martin Leitner explains how digital is about to accelerate Fibre-based drives a better future Innovations in fibrebased packaging will improve its use

THE REAL

SUPPLY CHAIN WASTE

Please pass on our thanks to the team for the quality and service for both prints this week. Arrived on time and in good shape which is a pleasant change from some of the jobs we have received from other places.

Kevin

Thank you for having this order completed so promptly, the print quality is faultless and the blind shipping is very much appreciated

Donna

Great job on the books - client is stoked! Thanks again for suggesting the extra laminate -it really made a huge difference! Appreciate it!

James

I just wanted to say thank you for rushing those 2 banners through for me, I really appreciate how quickly you made that happen, pretty amazing service.

Kelly

The postcards were delivered to them this morning and the client is impressed bordering on disbelief. Not sure exactly how you and the team did it all so fast but thank you.

Tom

Loving the magnetic boxes the velvet cards come in, a great way to present the card to the client.

Sarah

‘CUSTOMER IS KING AT HERO PRINT’ ...AND IT SHOWS

o Queen ^

AUSTRALIA’S BEST TRADE PRINTER

In the blink of an eye, 2022 has passed and the new year has set in. What an amazing year it has been for ProPack. From building our online presence to making strategic moves to enhance the magazine, the year has only been one of growth for the brand.

2023 will be no different as we continue to establish ourselves as one of the leading business portals for the packaging industry. This will involve having a bird’s eye view of the year that was and assessing the best plans for action to take as we set the foundation for the rest of this year.

This is probably the stage that everyone else in the industry is currently at as they embark on the process of creating plans for their businesses in the new year.

But considering the chaotic social environment that the industry is facing right now – from global freight related issues to labour shortages to local challenges like REDcycle temporarily pausing its soft plastics collection program – there are several roadblocks to get through.

Not forgetting that we’re getting closer and closer to Australia’s 2025 National Packaging Targets, which means that big steps need to be taken by everyone within the packaging supply chain to truly create a circular economy.

As such, we can all agree that the most important innovations to come out of the packaging industry are the ones that have a strong sustainability agenda, with attention to things such as design for zero waste and improved recyclability.

The other focus for the year will be automation. Some of the bottlenecks faced by the industry can be alleviated through the adoption and use of these technologies. The practical benefits of augmented reality and virtual reality are being realised by many, and trailblazers are already incorporating these technologies into their packaging designs.

With many tradeshows such as Interpack scheduled for this year, there’s plenty for the packaging industry to be excited about. We can’t wait to bring you the latest as they unravel. All the best for 2023 and sending good vibes your way.

Hafizah Osman | Editor hosman@intermedia.com.au

Ph: +61 431 466 140

Ph: +61 431 466 140

Australia or the provisions of Division 2 of Part V of the Trade Practices Act 1974 and any statutory modification or re-enactment thereof. To the extent permitted by law, the Publisher will not be liable for any damages including special, exemplary, punitive or consequential damages (including but not limited to economic loss or loss of profit or revenue or loss of opportunity) or indirect loss or damage of any kind arising in contract, tort or otherwise, even if advised of the possibility of such loss of profits or damages. While we use our best endeavours to ensure accuracy of the materials we create, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication. Copyright © 2023 — Charted Media Group Pty Ltd

www.propack.pro 4 ProPack.pro February 2023 EDITOR’S LETTER Stay informed… visit www.propack.pro and subscribe to receive the latest packaging industry news and views ProPack.pro is published by Printer Media Group, registered in Australia ABN 47 628 473 334. This publication may not be reproduced or transmitted in any form in whole or in part without the written permission of the publishers. While every care has been taken in the preparation of this magazine, it is a condition of distribution that the publisher does not assume any responsibility or liability for any loss or damage which may result from any inaccuracy or omission in the publication. Having the best plans

action

Industry

Managing Director & Publisher: James Wells Editor: Hafizah Osman News Editor: Piotr Wnuk Sales Manager: Carmen Ciappara Production Manager: Jacqui Cooper Pre-Press Manager: Tony Willson Design: Sarah Vella Printed by: Hero Print, Alexandria, NSW 2015 Mailed by: D&D Mailing Services DISCLAIMER This publication is published by The Intermedia Group Pty Ltd (the “Publisher”). Materials in this publication have been created by a variety of different entities and, to the extent permitted by law, the Publisher accepts no liability for materials created by others. All materials should be considered protected by Australian and international intellectual property laws. Unless you are authorised by law or the copyright owner to do so, you may not copy any of the materials. The mention of a product or service, person or company in this publication does not indicate the Publisher’s endorsement. The views expressed in this publication do not necessarily represent the opinion of the Publisher, its agents, company officers or employees. Any use of the information contained in this publication is at the sole risk of the person using that information. The user should make independent enquiries as to the accuracy of the information before relying on that information. All express or implied terms, conditions, warranties, statements, assurances and representations in relation to the Publisher, its publications and its services are expressly excluded save for those conditions and warranties which must be implied under the laws of any State of

for

ProPack

Supporters

Hafizah Osman

IN THIS ISSUE...

How to create a sustainable strategy in NZ

Five ways to create value from your sustainability initiatives through effective marketing communications

Riding the global digital transformation wave

Durst product manager for label and flexible packaging Martin Leitner explains why the digital transformation trend will accelerate

COVER STORY: The real cost of supply chain waste

P6

interpack is back!

P14-16

After six years of absence, interpack returns in May with 18 halls, targeted exhibition areas, new speciality shows, forums and a few exhibitors from the region

Labels & Labeling: Opportunities in Asia-Pacific

P18-20

The Asia-Pacific region tops innumerable market growth projections. It is a robust economy that quickly defeats challenges and seizes opportunities

P8

Fibre-based drives the future of packaging

Taking responsibility for the environmental impact of

products

P28-29

Many electronics companies are making all the right moves to enhance their circularity models

Collaboration is the key for a circular economy

P30-31

Aquapak Polymers CEO Mark Lapping addresses the plastic waste problem and what’s needed in the industry for a circular economy

P22-24

Countless technological developments will see fibre-based packaging disrupt the future of the packaging market

P10-12

Avery Dennison’s latest report shows that making waste reduction part of a company purpose can benefit the planet, people and the bottom line

Aarque pairs Durst and GM for label production solutions

European precision label printing and converting technology arrives in New Zealand through Aarque

THIS ISSUE SUPPORTED BY

P26-27

AIP OP-ED: In search of the ever-elusive qualified packaging technologist

P32-33

Packaging Design and Technology is a science that requires the appropriate higher education and training in the discipline , says AIP’s Nerida Kelton

Pack diary

A guide to the upcoming events globally

P34

www.propack.pro February 2023 ProPack.pro 5 CONTENTS

P14-16

P32-33

P10-12

How to create a sustainable strategy

Business sustainability consultant Jo Pearson offers five ways to create value from your sustainability initiatives through effective marketing communications

communications objectives to support this. Under each objective define the supporting evidence or messages.

4. Think about your packaging

Packaging is a very effective communication tool, especially where you don’t have a big above-the-line marketing communications budget.

You can use well-designed packaging to attract and acquire sustainability conscious consumers at point of sale. Take a look at other product categories and you’ll note there are some very strong calls to action with regard to sustainability.

Many New Zealand alcohol brands are proactively implementing sustainability practices within their businesses. They’re committed to being environmentally-conscious and socially-just, yet they’re not effectively showcasing what they do. Is this an opportunity missed?

Consumers today are looking for sustainable brands, and customers are extending their ranging with a focus on sustainable brands or looking to underpin their own brand by offering drinks lists aligned with green or socially-conscious credentials.

Traditionally, many liquor brands have created a premium through their production processes. Things such as French oak barrels, interesting flavour additions, co-fermentation, botanicals, or perhaps it’s even the personality behind the brew that were the focus of marketing and brand strategies.

As we look to creating brands fit for today and into tomorrow, sustainability needs to have a much greater focus. How can you effectively communicate your sustainability initiatives to grow your brand?

1. Embed sustainability into your business strategy

By embedding sustainability into your business strategy, it will define how you do business. It will also outline what you are going to do and what your long-term aspirations are regarding sustainability.

This provides rich story telling content which easily lends itself to being a key pillar of your marketing communications.

What’s more, reviewed annually you can track your progress, or even better, publish a sustainability report to house on your website and share through your digital marketing channels either as a whole, or broken down into bite-sized chunks.

2. Provide sustainability context in your communications

Frame up the impacts you are making within a wider sustainability context. This will communicate to people how what you are doing contributes to greater community and global goals.

You might link your goals to government targets, for example net zero emissions by 2050, or underpin them with relevant Sustainable Development Goals, such as climate action or gender equality.

When doing this, take care not to make environmental or social claims that mislead or exaggerate and be sure that you have the evidence to back up your claims, if ever anyone were to ask.

3. Repeat, repeat, repeat

If you want to strengthen your sustainable brand positioning, then repeat your sustainability messaging often and across all your marketing communications channels in a consistent and straight forward way.

Use different examples of what you are doing, to ladder back up and underpin your sustainability goals. You can do this by developing a communications plan that outlines your sustainability communications goal and three core

Consider incorporating iconography or infographics on your label, QR codes or investigate the latest in AR technologies to communicate your sustainability stories, claims or certifications right on your label or carton.

Many people don’t know what alcohol brand they are going to buy until they are in the shop – so give them a reason right at the point of purchase.

5. Be authentic and be you

Be honest and authentic about things that you know aren’t perfect, things you know need to change or areas that you could do better. Very few businesses are 100 per cent sustainable. Let people know it’s in the plan to address these items and what small steps you might be taking to head in that direction.

By being open and honest, you build trust with both your consumers and your customers, and you stay in control of your own authentic sustainability story.

Globally, sustainability awareness and demand are growing – so head into 2023 by effectively communicating your initiatives. Develop a strong sustainable brand platform and set yourself up for future growth well beyond.

Jo Pearson is the owner/ director of The Collective Impact Limited, working with companies to develop business and sustainability strategies that strengthen brand value and contribute to the financial sustainability of the organisation. For more information, visit www.thecollectiveimpact.co.nz.

www.propack.pro 6 ProPack.pro February 2023 FOCUS SUSTAINABILITY IN NZ

www.gd90.de

Riding the global digital transformation wave

Durst product manager for label and flexible packaging Martin Leitner explains why the digital transformation trend will accelerate in the next few months

Q: In your opinion, what are the most important arguments to start as regards the digital transformation?

ML: The advantages associated with the digital world have not changed in the last years, but the COVID-19 pandemic, the resulting supply chain crisis and the associated inflation are accelerating the label business towards a more digital production.

In particular, the ease of use and less men-power needed, the quick setup and production resulting in a quick delivery time, combined with a lower amount of waste and therefor lower environmental impact are key arguments to convince customers to invest in the digital transformation.

Q: The Tau RSC series has been developed as the most productive and reliable inkjet solution. What can you tell us about Durst’s strategy and innovations to fit the current and future market needs?

Customers produce tubes, car plates, shrink sleeves, sachets, booklet labels and many other applications. Often, customers try to push the boundaries of what we expected to be possible and it is extremely interesting and rewarding to follow these developments.

Q: Is there any special application in which the customer’s technical expertise played a decisive role?

ML: There are a few but what really astonishes me are some projects in the security field. Variable codes and variable micro text, combined with variable colours on special materials to create special holographic effects which are counterproof, is just one example.

Durst product manager for label and flexible packaging Martin Leitner

To mark the start of the new year, Durst product manager for label and flexible packaging Martin Leitner shared his views on the global digital transformation.

Q: Could you explain what transformation stage – from conventional to digital – the European label market is in, and at the worldwide level?

Martin Leitner (ML): In my opinion, the European label market is already in a very advanced transformation stage, but still transforming very quickly. This development does not only apply to Europe, but can also be seen on a worldwide basis.

The main reason is that today’s digital production systems are at an extremely high level in terms of quality and offer a very competitive Total Cost of Ownership (TCO). That is precisely why in today’s context, more and more customers are shifting jobs from conventional to digital, and substitute flexo presses with our TAU printing presses. I expect this trend to continue and even to accelerate in the next months and years.

ML: Our vision is to accelerate the change towards a digital and resource-saving label industry, while respecting the economic goals of our customers, providing highquality printing systems.

Our RSC platform stands for the highest quality (native 1200x1200 dpi, high opacity and ink resistance, up to nine colours and 95 per cent Pantone coverage), best productivity (up to 510 mm, up to 100 m/ min, operator-friendly E2E process) and future-proof TCO (ink and energy reduction, minimum production waste, optimised 360-degree software support). The combination of these three core aspects makes Durst the number one provider in inkjet label printing solutions.

Q: The digital world offers a high level of versatility. What kind of special applications have been produced by customers around the world?

ML: Our customers never cease to amaze me. I travelled a great deal after the COVID19 pandemic and it is satisfying to see that they use our technology in a lot of different ways. Starting from self-adhesive labels for all kind of applications, to special security projects, which our customers can only produce due to the quality and productivity of the RSC platform.

Moreover, if such projects are not just for a few thousands, but repeatedly for millions of labels, then I know the client really found themselves a unique spot with our technology. In this case, the customer in fact created a new category, something which does not exist with other printing technologies and the goal to success is their deep understanding of the perfect combination of prepress, colour management and Durst’s RSC printing technology.

Q: Durst is working to increase the application possibilities of Durst Tau RSC. Are there any news about the IML or sleeves applications that could be announced to the market?

ML: Over the past few months, we have continued our work with selected customers and soon, we will be able to announce another milestone. For applications such as shrink sleeves and in mould labelling, printing is only one small element in the production of the final product.

If we consider, for example, in-mould labels, it is important to understand the material behaviour during printing and converting, the influence of the diecutting and, last but not least, the moulding process, which has a big influence on the final result. We are confident that in 2023 we are opening up to a few more applications which will provide our customers even more possibilities and which will make them extremely competitive.

FOCUS DURST Q&A www.propack.pro 8 ProPack.pro February 2023

REACH & SVHC COMPLIANT HEAVY METAL FREE VOC FREE BS5609 SECTION 3 COMPLIANT For more information, please visit durst-group.com/label Industrial scalability 330 / 420 / 510 m m print width Jumbo winders Flexo-like productivity Competitive ink pricing Low ink consumption Print quality 1200 x 1200 dpi @ 2 pl Up to 95 % P antone coverage BEST IN CLASS COMPETITIVE EDGE SCALABILITY TAU RSCi INNOVATES YOUR BUSINESS

The real cost of supply chain waste

Avery Dennison’s latest report shows that making waste reduction part of a company purpose can benefit the planet, people and the bottom line

Going green is a big selling point for consumers and businesses alike, with many moving away from companies that don’t share their sustainability values. As people demand demonstrable climate action, there’s an urgent need for brands to respond with more transparent and eco-friendly supply chains that effectively reduce waste.

As such, Avery Dennison conducted a study to better understand the global supply chain waste challenges that companies face and explore the innovative ways these issues are being tackled. It assessed the state of global supply chains, focusing on several core segments – food,

beauty, apparel, automotive, healthcare and pharmaceuticals.

The scale of what it uncovered is worth paying attention to. Global organisations are overproducing and exacerbating the supply chain crisis – estimating that on average, eight per cent of their stock perishes or is discarded annually, which is approximately US$163 billion worth of inventory.

The data found that while companies are acutely aware of the problem, they are not yet investing the budget required to fix it.

Of those surveyed, an average of 29 per cent say that their organisation’s overall

sustainability impact comes from supply chain operations. However, three quarters of businesses are investing five per cent or less of their technology budget to supply chain sustainability improvement.

With cost and quality being the highest priorities for consumers globally when it comes to buying products, the data has also revealed that sustainability still has a long way to go to make it into customers’ immediate priority lists, with just 16 per cent of consumers putting sustainability in their top three considerations for buying products.

www.propack.pro 10 ProPack.pro February 2023

Global organisations are overproducing and exacerbating the supply chain crisis, according to a study by Avery Dennison

Avery Dennison A/NZ labels and packaging materials commercial director Cath

COVER STORY AVERY DENNISON REPORT

Sustainable products produced with the circular economy in mind are built to last

Cornaggia said this is because of a reluctance to change due to brand loyalty, consumers being unable to make informed decisions due to a lack of detailed information on the sustainability of a product, and consumers still thinking that being sustainable will cost more.

“Unfortunately, consumers are mostly still in the mindset that shopping for sustainable products is more costly. While that is true in some cases, and consumers are likely to remain responsible in the current economic climate, eco-friendly options are becoming more competitive in price,” she said.

“Some consumers are also reluctant to make the switch because of brand loyalty. If you have been using a brand for years, and it works well for what you need it for –of course it makes sense that you would stick by that brand. However, as we know, sustainable products produced with the circular economy in mind are built to last, and will save you money in the long run as they will not need replacing as often.

“There is also some confusion for consumers around accurate information. Greenwashing is rife and something we are seeing in the news cycle more and more. The combination of this, and lack of transparency from some businesses, creates a perfect storm where consumers are unable to make informed decisions about a product – for example the carbon footprint, the recyclability and traceability.”

However, the research points to a shift in the desire for durable products, with durability ranked by almost half of global consumers (48 per cent) as a top five concern – suggesting there is an opportunity for businesses to shape the future of sustainability by putting a greater focus on product durability.

Cornaggia said suppliers and manufacturers need to consider durability, recyclability and circularity in the design stage.

“Not only is it necessary to think about recycling and reuse after the product’s end-of-life, but the entire life cycle has to be built into the design from the beginning,” she mentioned.

“Product durability is a key facet of a successful circular economy, and suppliers and manufacturers must consider this at the design stage. This means considering the entire life cycle of a product right from the start and thinking about what will happen to the materials, and how they can be reused or repurposed, after the product’s end of life.

“Here at Avery Dennison, this is exactly what we envision when we consider the future as a ‘regenerative economy’. We look at new products, new technology and alternative supply chains and business models that actively replenish rather than remove from our planet.

“For businesses to drive this change, those further in their journeys must empower others to do so. For this reason, we have created AD Stretch, the first programme in the labels industry aimed at partnering with start-up innovators to solve key challenges and create new opportunities within sustainability, customer experience and value chains.”

Future-proofing the supply chain

According to AD Global Supply Chain Research in 2022, global industries saw supply chain disruptions soar from 3,700 in 2019 to 11,642 in 2021, due to the pandemic and its ongoing impact.

However, with other global challenges such as increasing geopolitical risks, inflationary pressures, labour shortages, spiralling energy and fuel costs, and the impact of climate change on production as well as shipping, manufacturers are bracing themselves for an even more volatile future.

Avery Dennison’s research found that one in five global companies said these global forces are driving supply chain disruption. The increased cost of transportation was said to be the single most disruptive factor impacting supply chain operations.

But consumers still expect businesses to act. The report found that whether it’s for food, fashion or beauty, half of consumers expect sustainable manufacturing and distribution.

New waste-free processes are seen as the top way for businesses to make an impact on addressing climate change, followed closely by the use of sustainable and renewable materials. According to the report, 81 per cent of people believe businesses have a significant role to play

in addressing the climate crisis, and 51 per cent say they aren’t acting fast enough.

Avery Dennison said eliminating supply chain waste is key to addressing both the needs of businesses and consumers as effectively navigating volatile demand increases margins, reduces environmental damage and gives businesses an opportunity to divert the recouped losses back into better materials, increased worker wages and investment into corporate social responsibility.

In the process, it also offers an opportunity to build connections with consumers who are looking for ways to close the valueaction gap.

“While Australia and New Zealand is ahead of much of the developing world in terms of our sustainability journey, there is still much more businesses can do to ensure future prosperity. The first being matching up environmental, social and governance goals (ESG) with supply chain investment –this can help greatly to reduce waste and improve margins,” Cornaggia said.

“Secondly, boosting the visibility of supply and demand can lead to less waste and foster consumer satisfaction. Visibility and transparency are a key foundation for consumer trust.

Five key opportunities to reduce waste now

1. Money talks

Matching up environmental, social and governance (ESG) goals with supply chain investment can help reduce waste and improve margins.

2. Balance the stock

Boosting the visibility of supply and demand can lead to less waste and more contented consumers.

3. Considerate consumption

Offering more durable products to consumers not only reduces waste but also addresses their need for affordability and quality.

4. Trust in data

Transparency in the supply chain can help to reduce waste and profit loss caused by damage and strengthen partner and consumer trust.

5. Human truths

Helping consumers make wastefree purchasing choices through education and transparency.

www.propack.pro February 2023 ProPack.pro 11

COVER STORY AVERY DENNISON REPORT

“Offering more durable products to consumers not only reduces waste, but addresses their need for affordability and quality – this is key in attracting those consumers who are on the fence about whether to switch from a brand they trust, to a more sustainable one.

“Further to this, educating consumers in a productive way, through transparency, to make waste-free purchases is a winwin situation for all.”

Increase profits and benefit the environment

In the midst of the climate crisis, Avery Dennison has identified that many businesses have adopted solutions and initiatives to curb their environmental impact – 67 per cent are using more sustainable materials (such as recycled materials or lower emitting products) and 66 per cent are increasing the efficiency of energy use (for instance, improving the energy efficiency of buildings).

physical work, therefore reduced accidents), and creates less waste.

products either at the pallet, case or item level.

“We believe that RFID tagging these products presents the most effective solution to increasing supply chain visibility,” she said.

“RFID technology enables much faster and more efficient and accurate item level tracking with hundreds of items being able to be read accurately at checkpoints across the supply chain within seconds (without direct line of sight to the product on the pallet or in the carton).

“At Avery Dennison we use atma.io to help track the environmental footprint of an item by creating a digital twin that is trackable online. atma.io is a platform that unlocks the power of connected products by assigning unique digital IDs to everyday items, providing unparalleled end-to-end transparency by tracking, storing and managing all the events associated with each individual product — from source to consumer and beyond to enable circularity,” she mentioned.

Improved inventory visibility is another way that Cornaggia said reduces waste and keeps items in stock for customers as the report identified that an average of 3.4 per cent of inventory, amounting to US$64.5 billion, is wasted per year due to overproduction.

“Avery Dennison and our partners can support the necessary infrastructure (hardware and software) and suitable RFID tags to enable near real time visibility of their products across their supply chain. Typically, we would start with a small pilot to help demonstrate and validate the benefits of RFID before rolling out across their sites.”

Key takeaways to minimise waste

• Item-level visibility of inventory end-to-end negates the need for safety stocks: Overproduction occurs due to a lack of clarity on the amount of stock already being produced, distributed and purchased. Therefore, item-level visibility and accurate forecasting can provide this clarity and prevent problems before they occur.

According to Cornaggia, businesses should be investing in technologies that can improve visibility across their supply chains to clearly identify where products are sourced (transparency) and reduce overproduction by ensuring inventory levels more closely matches consumer demand.

“Investing in technologies that can improve visibility across supply chains is extremely beneficial. Utilising technology to identify where products are sourced fosters transparency, and can also reduce overproduction by ensuring inventory levels reflects consumer demands –ultimately driving less waste reduction while also providing the grounds for increasing consumer loyalty,” she said.

In addition, she said adopting RFID or sustainability minimises unnecessary labour (digital track and trace), ensures safety (minimised labour translates to less

“Improved inventory visibility helps track items that are lost and ensures vendors are only ordering what is necessary at the time and prevents overproduction. For example, with food and beauty products, having visibility to products sitting in inventory that are about to expire ensures these items can be sold rather than disposed of,” she said.

“It is also a win for consumers – knowing which stores have what inventory items ensures that they can access real time, accurate information and can find their products.”

But keeping on top of distribution and inventory tracking end-to-end is no easy task. Better visibility requires enabling supply chain practitioners to improve their forecasting accuracy and pinpoint the optimal amount of stock for their business; enough to prevent consumers from experiencing scarcity of essential items and not so much that it leads to excess waste.

To enable more visible supply chains, Cornaggia said companies should work towards assigning unique IDs to their

• Consumers need reassurance and open communication about the availability of goods: Consumers don’t like feeling the effects of scarcity or low stock levels, they want reassurance that they can get their hands on the essential items they need day-today. Food companies especially should aim to dial up reassurance when communicating with customers due to scarcity fears being strongest in this category.

• With supply chain visibility brands can better implement FIFO policies: The world continues to be intricately interconnected by the global supply chain. While demand volatility is impossible to eliminate, it is possible to manage. With greater stock visibility, brands can better implement “first-in, first-out” (FIFO) policies – meeting consumer desires for reduced waste, while maintaining levels of stock that can cater to unforeseen disruption.

www.propack.pro 12 ProPack.pro February 2023

Overproduction can be reduced by ensuring inventory levels reflect consumer demands

COVER STORY AVERY DENNISON REPORT

atma.io tracks the environmental footprint of an item by creating a digital twin that is trackable online

real

Overproduction and waste are exacerbating the supply chain crisis and hitting businesses as nearly 8% of stock perishes or is discarded. This loss amounts to $163.1 billion worth of inventory. Is your brand ready to take the next step? Download the report at supply-chain-waste.com aus.sales@ap.averydennison.com The Missing Billions

The

cost of supply chain waste

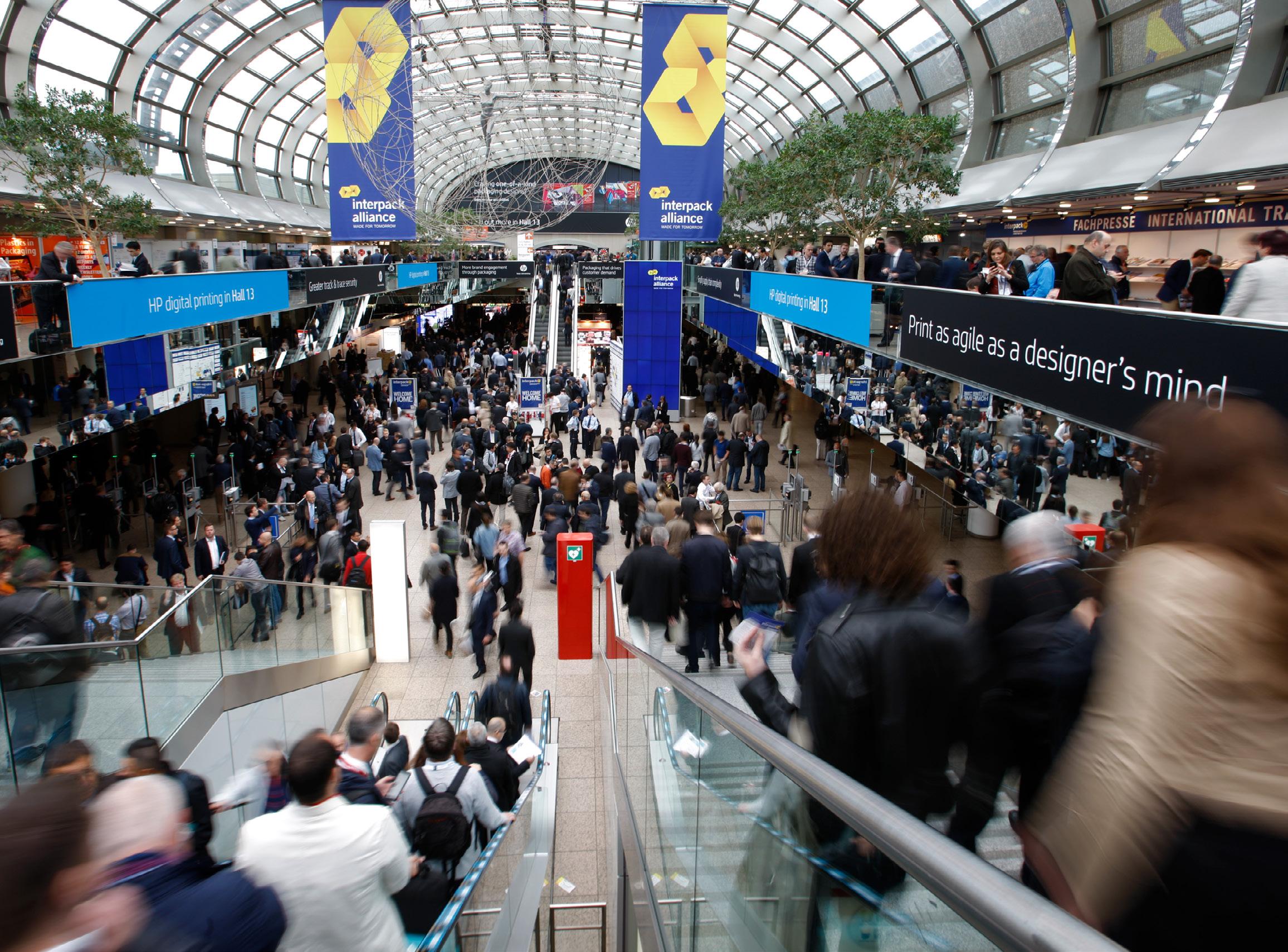

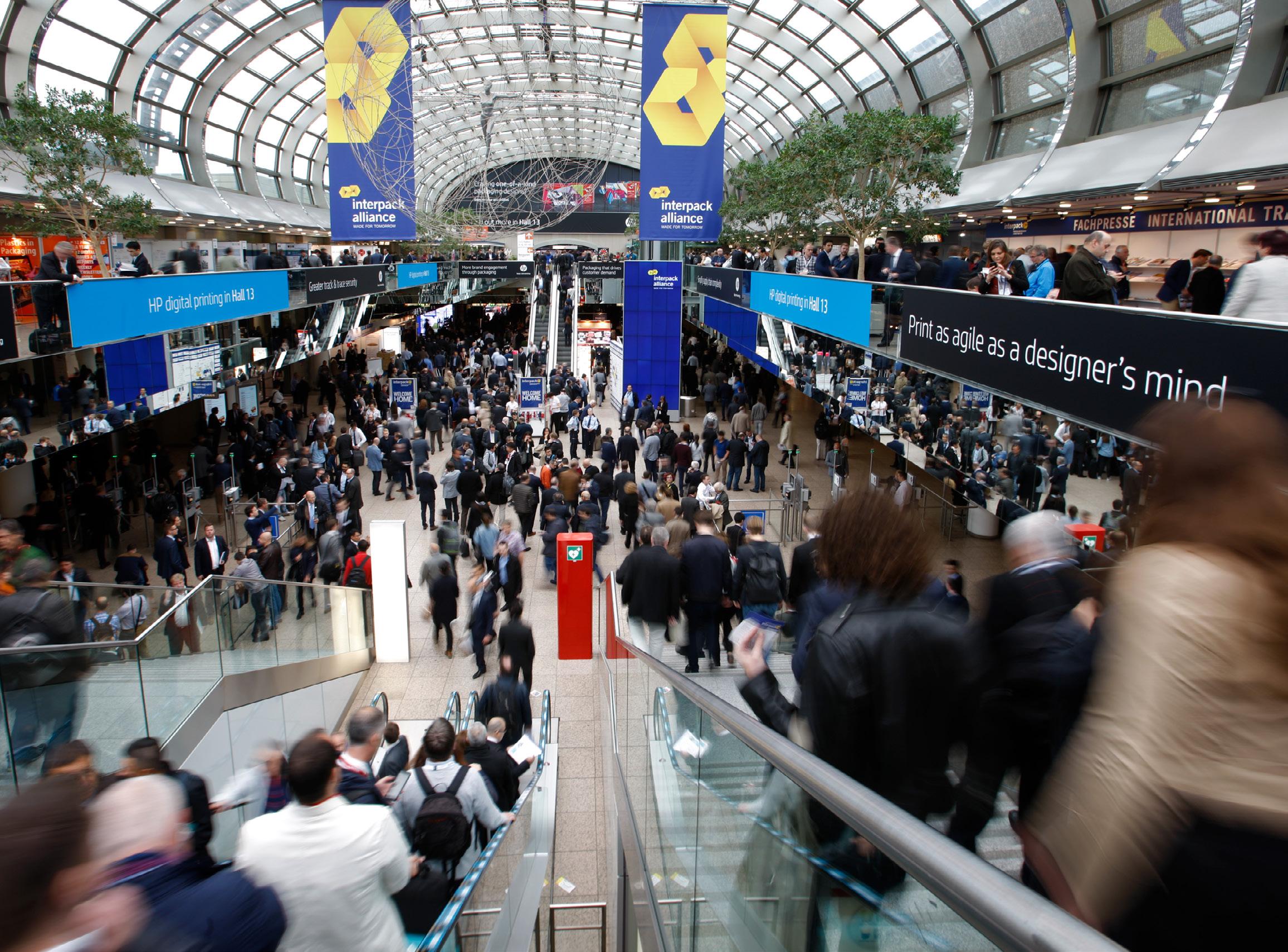

interpack is back!

After six years of absence, interpack returns in May with 18 halls, targeted exhibition areas, new speciality shows, forums and a few exhibitors from the region

According to feedback from the industry, the pandemic showed that digital alternative events were seen as a plus that provided added value, but meeting in person at a trade fair is irreplaceable in terms of generating new contacts and building trust, which is massively important.

However, despite the absence of the physical show, interpack has been supporting its exhibitors and visitors in different ways.

“On our digital channels, we continuously accompany the industry, share valuable knowledge and initiate discussions,” interpack project director Thomas Dohse said.

“We also provide business and communication platforms in key growth markets and regions.”

According to Dohse, more and more people worldwide are buying more and more packaged products. This demand must be met and is the basis for growth. The industry is, therefore, highly relevant.

“Added to this are changing consumer habits, for example, in e-commerce, which positively impacts economic expectations. But of course, it’s not that simple because the packaging industry is facing a profound transformation,” Dohse said.

“The year 2022 was marked by the effects of the Ukraine war, disruptive supply chains,

the energy crisis and inflation. Added to this is the major issue of sustainability. For example, brand owners and the packaging industry are increasingly focusing on the goal of climate neutrality, sustainable packaging, and resource conservation. This is also about technological advances. Without digital technologies, change cannot be shaped.”

Over the past six years, Messe Düsseldorf had the opportunity to host some interpack alliance trade shows. Most recently, in Egypt in December 2022 with Food Africa and pacprocess MEA – which attracted over 25,000 visitors – took advantage of the excellent investment climate and, together with the exhibitors, took important steps into a significant sales market on the African continent.

FOCUS INTERPACK 2023 www.propack.pro 14 ProPack.pro February 2023

Messe Düsseldorf estimates that around 2,700 exhibitors will take part

“Here, too, it became clear in many discussions that despite all the challenges facing companies, the opportunities for growth are great. This applies to developing regions as well as saturated markets. Processing and packaging are significant industries of the future,” Dohse said.

Messe Düsseldorf estimates that around 2,700 exhibitors from around the world will present leading technologies at this year’s edition of interpack and showcase packaging trends from the entire value chain accumulated within the last six years of forced absence during the pandemic.

The entire exhibition was booked out already a year ago, with other interested companies registering for the waiting lists.

“We are delighted that we are once again “fully booked”. This year’s interpack has an extremely high status. There has never been more need to meet. Since the last

interpack in 2017, the market, political and social conditions, and above all, technological progress have changed drastically,” Dohse said.

“We look back on a long tradition and have always been as close as possible to the industry since 1958. This is incredibly important in helping to drive the packaging and processing industry forward.

“interpack is the central place where the industry comes together from all continents. Here, the industry takes advantage of the opportunities offered by a leading trade show to demonstrate the industry’s capabilities, discuss current trends and set the course for the future.

“Here, you can see machines and complete process technologies live in action. If you’re not here, you’ve definitely missed out. I like to compare it with the Olympic

Games, which every athlete marks in the calendar years in advance.”

To live up to its status as the flagship of the global processing and packaging industry trade shows, interpack has introduced a new slogan, “Simply Unique”.

Dohse said, “interpack is the flagship of the global processing and packaging industry. It is unique in terms of its dimension, diversity, innovative strength and internationality.

“Nowhere else do you meet the entire industry in one place, and nowhere else do you have this density of innovations and premieres. “Simply unique” is our selfimage, claim and promise to our exhibitors, visitors and partners.”

Interpack is always rounded up by its special themes that pick up on the trends for the coming years. According to Dohse, in 2023, sustainability and all of its facets will be even more significant than it has been in years past, which means that this year, interpack will be tackling this set of themes in cooperation with its partners.

“The two major megatrends of our time are undoubtedly digitalisation and sustainability, which have a major impact on the processing and packaging industry. Both will determine interpack 2023,” Dohse said.

“Let me briefly touch on the sustainability issue. In addition to the social movement, we are also talking about a central economic factor here. Europe is to become climate-neutral by 2050. This goes hand in hand with a resource-efficient and competitive economy.

“The circular economy is one of the most important building blocks. How can recyclability be improved? How can we produce in a climate-neutral way? How can we increase the amount of content to be recycled? Which materials are suitable for which products? interpack exhibitors have answers.”

In the past, interpack’s special themes have always grabbed the public’s attention, for example, Save Food, which aimed to reduce food waste, or the concept of the innovation parks, which demonstrate smart solutions and approaches for specific issues, which are now a firm favourite at the other international trade fairs held by the interpack alliance.

“We focus on highly relevant trend and future-oriented topics for our target groups, for example, with our spotlight talks and trends lecture forum, which features presentations, case studies and interactive sessions with top experts and industry pioneers,” Dohse added.

FOCUS INTERPACK 2023 www.propack.pro February 2023 ProPack.pro 15

interpack 2023 returns after six years of absence

Many major megatrends surface during interpack

“We have the theme of co-packing and packaging innovations with several award ceremonies at the show. And we are looking forward to our first TV studio with live reports and talk shows from interpack. Save Food also continues because it is really close to our hearts. The processing and packaging industries are important players in the fight against global food losses.”

With still a few weeks to go, exhibiting companies started presenting their businesses individually and introducing their contacts and product innovations in the exhibitor and product database, which is now available on the interpack’s website.

“Companies need to present their businesses and products optimally, not only in the trade fair halls but also online.

The new exhibitor profile makes this possible,” Messe Düsseldorf CEO Wolfram N. Diener said.

“We are increasingly focusing on platforms that we can offer our customers in both physical and digital form. On our online portals, our trade fairs run 365 days a year. They are the first points of contact for their respective industries. In order to offer our customers the greatest possible benefit, we stay in regular contact with them and continuously develop our digital services such as the online portals.”

The database gives visitors a better overview of exhibitors offering the option of convenient sorting of products, filtering according to personal interests and making contact before the trade fair. In the run-up to interpack, the platform also offers the feature of saving preferred exhibitors, products and events in the “myOrganizer”. Five Australian companies are already listed in the catalogue.

Dohse said, “When exhibitors from the other side of the world come to us, it is always something very valuable. At interpack 2023, we are looking forward to no less than five exhibitors from Australia: Composite Materials Engineering, Glory Tins Australia, Heat and Control, ICEE Containers and tna solutions. In addition, there were around 500 trade visitors from Australia and New Zealand at the previous interpack trade shows.

“We will see many new things, for example, production worlds with more efficient machines and higher levels of automation, resource-saving processes, optimised supply chains, new digital services, material innovations and countless more. We are excited about all the announced premieres and the next step into the future.”

interpack will take place in Düsseldorf, Germany, from 4 to10 May, 2023. Further up-to-date information on the trade fair is available at www.interpack. com. The exhibitor and product database is now available at: https://www.interpack. com/en/Exhibitors_Products_2023/ Exhibitors_interpack_2023/Search_ for_Exhibitors.

www.propack.pro 16 ProPack.pro February 2023 FOCUS INTERPACK 2023

According to the industry feedback, meeting in person at a trade fair is irreplaceable

interpack introduced a “Simply Unique” slogan for this year’s edition of the show

At interpack 2023, there is expected to be no less than five exhibitors from Australia

interpack 2023 was booked out a year ago, with other interested companies registering for the waiting lists

PACKAGING AND DISPLAY EQUIPMENT

KOLBUS AUTOBOX

The original and leading complete custom box machine manufactured in Germany and the UK, since 1979 with 60 plus units installed in ANZ.

14 - 16 March 2023, Munich, Germany

Visit the Graffica team on the Kolbus Stand 2740, see the new latest generation Autobox maker to be launched. We will also be on the Century Die Cutters Stand 2935

THE BOXER

As demonstrated at PacPrint and sold to APC Innovate, AKL, NZ

Box making systems incorporating inline digital printing

MULTI-NOVA

Large format, straight line crash-lock box gluer

AMEIDA CUTTING TABLES

Fast, efficient with various tooling 2500mm x 1600mm unit with cut/crease and v-cut options

CENTURY LARGE FORMAT DIECUTTERS

Leading large format diecutter in Australia

Sizes Available:

1050/1300/1450/1650/1850/2100 & 2300

Flute/Solid Fibre/Corflute/Polyprop etc

Full & Semi auto; various feeding options

With or without stripping

DATIEN CUTTING MACHINE

High speed, heavy duty, sizes from 115cm to 300cm

Graffica Pty Ltd Phone +61 477 200 854 I Email grafficapl@bigpond.com I Visit Us www.graffica.com.au

Opportunities in Asia-Pacific

The Asia-Pacific region tops innumerable market growth projections. It is a robust economy that quickly defeats challenges and seizes opportunities

By Piotr Wnuk

Asia-Pacific is showing strong economic growth again and is listed as one of the fastest-growing mar-kets globally

Asia-Pacific is undoubtedly a rising market with great potential. Although the pandemic has negatively influenced its economy, the region is showing strong economic growth again. It is listed as one of the fastestgrowing markets globally, with indicators way above other more mature markets like North America or Western Europe.

According to the Knowledge Sourcing Intelligence report published in September 2022, the Asia-Pacific (APAC) print labels market was valued at US$15.778 billion in 2020 and is expected to grow at a CAGR of 7.34 per cent to reach a market size of US$25.092 billion by 2027.

Compared with the 3.02 per cent and 3.47 per cent growth prognosis for North America and EMEA, it becomes clear why some of the significant label market players globally increased their presence in the region.

However, several countries in the APAC region were significantly affected by the pandemic. The shutdown of various factories affected global supply chains and negatively impacted manufacturing, delivery schedules and raw material sales. Additionally, sealed borders made it difficult to procure raw materials such

as ink, label stock, plates and dyes.

“The global economic outlook during the pandemic saw a decrease in gross domestic product and supply chain challenges,” Singapore-based Arnon Goldman, general manager for HP in Asia-Pacific, said.

“As a result, the print industry was impacted by lower demand and volume slowdown. We immediately set out focused plans to support our customers and partners aimed at business continuity and the needs of customers.

“Since then, we have seen many of our print service providers (PSPs) demonstrate business agility and a quick reaction to ever-changing market demands by shifting more volume to digital print and leveraging the versatility of our presses to offer new types of products and services.”

“I believe that many companies faced the same issues with longer delivery times beyond their control,” agreed Lena Chmielewska-Bontron, European marketing manager at press manufacturer Mark Andy.

“This meant we all had to change our logistics and supply chains. The advantage

for Mark Andy was that most elements are produced in-house at our factory in St Louis, USA.”

The pandemic affected the regional labels market as consumption and demand plummeted due to government restrictions and businesses closing.

“The impact of the pandemic on business has been a mixed bag, varying by segment and country. In general, we saw a rise in demand in the tag and label sector and flexible packaging,” Roy Schoettle, vicepresident of the Asia-Pacific region at XSYS said.

“This was largely driven by the high demand for pharmaceutical and sanitary products and by the rise in at-home consumption of packaged goods. However, other areas, such as the beverage industry, dropped. From a regional perspective, China performed strongly, whereas India, for example, experienced a decline.”

“In general, our business has remained resilient despite the impact of government lockdowns,” Jane Tan, managing director of Press Systems Group (PSG), a Thailandbased supplier of UV LED systems, said.

“The restrictions on travel led to a downturn in the leisure and tourism sector, and therefore, we’ve seen a divergence in demand trends across different sectors. The hygiene and pharma sectors have been solid and the retail food and drink sector performed better than expected.”

Thai KK, a label and adhesive tape manufacturer, faced a much lower demand for self-adhesive labels for the food industry. However, it could keep a stable volume by supplying more to converters producing labels for the pharmaceutical, home and personal care, and digital advertisement industries.

“A big number of brand owners were supplying labels to specific verticals such as healthcare, retail, home, personal care and education before the pandemic unfolded,” Chawaeng Uvimolchai, CEO of Thai KK Industries said.

“Now, as businesses have reopened, many brand owners are getting more traction and demand on social distancing labels, smart labels, touchless transactions, etc.

www.propack.pro 18 ProPack.pro February 2023

FOCUS LABELS AND LABELING

We were also able to capitalise on this opportunity during the pandemic.”

Challenges and opportunities

“Regional companies will embrace the opportunity for growth and will know that it represents both an advantage and a challenge,” Jake Roberts, sales director of Sandon Global, said.

“The advantage will lie in the increased revenue opportunities, but that will, of course, be countered by the challenges. Elsewhere in the world, we’ve already seen increasing demand for shorter-run work, with fast turnaround expectations and a greater variation in print quality demands.

As the market grows, so do these more exacting requirements and increasing quality standards, all of which require technical know-how and agility to uphold consistently.

“The growth provides a good incentive for companies to invest in the region. The APAC region is characterised by its large population, rising living standards and urbanisation trends,” Tan said.

“These are the principal factors driving consumption across all aspects of the packaging market. Overall penetration of supermarkets and convenience stores

FOCUS LABELS AND LABELING

labor in print can be an enduring crisis,” Goldman said.

“Customers that have adopted digital as part of their business strategy are coming on top of those challenges as they react and change faster. We see increased demand for automation in production and a move to more automated workflows.”

Chmielewska-Bontron added that the challenge now, and going forward is finding the right people with the technical know-how and ability to operate a printing press and be responsible for production.

“This is especially an issue for the flexo sector and is, perhaps, one of the reasons for the growth of digital printing – the presses are easier to learn and operate,” Chmielewska-Bontron said.

“The shortage of printing skills is a global issue facing all converters, irrespective of where they are in the world or which sector they work in. For many major markets, the looming crisis in energy costs will become a critical concern. So strange as it may seem, now is a good time to invest in the latest and most efficient technology.”

is relatively low compared with more mature markets.”

XSYS, on the other hand, warns that high growth also presents various challenges for individual companies, including PSPs.

“The main challenge for regional companies would be staff retention, new recruitment, and staff training and development. Like in the rest of the world, the conditions are tough in the Asia-Pacific region now with severe cost pressures, fast-rising energy costs, supply chain issues and lack of highly skilled staff making life difficult for flexo converters,” Schoettle said.

Material prices have been increasing substantially throughout 2022. Additionally, companies are hit with higher power, logistics and staffing costs. Consequently, there is a great deal of cost pressure across the entire value chain.

HP lists rising costs as the biggest challenge in the region. These costs are going up to the highest prices for decades and has led to inflation forecasts on a macro level.

“In addition, a challenge we learned to plan for is shortages of parts, substrates and raw materials. With only a few new offset workers being trained, any shortage in

Driving the cost curve of flexographic printing down compared to other printing technologies, such as gravure or digital printing, is one of the most significant opportunities for the industry, according to Schoettle.

“This can be achieved by increased machine automation resulting in higher productivity and waste reduction while enhancing quality through a more consistent plate production process, Schoettle said.

Goldman mentioned digital is growing in the region, with ample opportunity appearing in areas such as smart packaging.

“The post-pandemic trends show the world embracing more digital tools. In print and packaging, we are seeing this integration of the best of the physical and digital world for a fuller experience,” Goldman said.

Balancing digital, flexo and hybrid

As print continues to grow and evolve, customer expectations and demands are changing. Successful PSPs are now increasing their focus on growth drivers and progressing their digital acceleration.

“The digital sector is proving popular for smaller runs and niche applications, offering cost benefits and flexibility over flexo. However, we don’t expect digital printing to make big inroads into the core flexo print sector at this time as flexo is still proven to have its cost advantage for mid- to long-run jobs,” Tan said.

www.propack.pro February 2023 ProPack.pro 19

Domino’s facility has been established to support regional sales, sampling and training

Domino opened a Digital Centre of Excellence in Bangkok, Thailand, to support regional growth

FOCUS LABELS AND LABELING

Talking about ratios, Thai KK believes digital printing products will have higher percentage growth in the long run. Although, the company estimates the current balance is only at 10 per cent digital, compared to traditional offset labeling, which is around 90 per cent. The company predicts that digital printing will grow faster in the next five years.

HP is also expecting all technologies to coexist in the market, noting that there is a shift in focus and investment to digital.

“All the trends we discussed here motivate PSPs to redefine their strategy and longterm plans. We are seeing more interest in new business models and offerings largely enabled by digital and HP technologies, services and solutions,” Goldman said.

“We can supply 50 per cent of our energy requirement through photovoltaic solar panels when weather conditions are favorable.”

What does the future hold?

One of the dominant trends in mature packaging markets is M&A activity. The APAC region is no different.

“We are seeing M&A activity changing the customer landscape in the APAC and contributing further to global industry consolidation. There are now fewer small and medium-sized printers active in the market than were present 10 years ago, and this trend is expected to continue,” Tan said.

“It’s higher quality in terms of the overall durability of the ink, which supports a longer shelf-life, and is another advantage. Furthermore, flexo can be used for addon processes such as lamination or cold foiling, which are not supported by a digital press on its own.”

Domino Digital Printing Solutions, which has been present in the APAC market for over three decades, opened a Digital Centre of Excellence in Bangkok, Thailand, with its long-standing partner Harn Engineering Solutions, in June 2021. The facility has been established to support regional sales, sampling and training.

“Digital inkjet printing is gaining momentum in the Asia-Pacific for label printing and for the increased use of variable data printing witnessed since the pandemic struck,” Paul Myatt, Domino Digital Printing Solutions APAC regional service and support manager said.

Schoettle mentioned that the install base of digital presses is growing, but these technologies are still complementary to flexography.

“Digital does play a role, however, particularly in the tag and label market where we are seeing many printing companies investing in multiple technologies, but in other markets, such as flexible packaging where high-speed printing and long job runs are required, it is still not economically viable,” he said.

Chmielewska-Bontron said flexo is and will be for some time the major technology in narrow web, and it is important that converters see the two as complementary, not as direct competitors.

“Each has advantages and limitations, so we carefully evaluate each customer’s requirements before recommending which technology they should invest in,” Chmielewska-Bontron said.

Beyond eco-friendly materials

Sustainability is on everyone’s agenda, and while before, it was mainly just a topic for debate in the APAC region, legislation is now being introduced to reduce the impact of packaging on the environment. The region is proving its maturity when it comes to eco-friendly approaches.

“People and companies who still see the Asia-Pacific region as a dumping ground for inferior products will have difficulties finding clients, as the converters in the region are supplying high-end quality packaging and continuously improving conditions and the quality of their output,” Schoettle said.

“Sustainability has become a key requirement for the packaging industry across the board, with everyone from global brand owners to local startups making pledges to lower their impact on the planet.”

Roberts thinks that sustainability may have been less of a priority during the early stages of the pandemic as hygiene and safety rose in consumer concern. But now companies are operating again at full strength, everyone is far more conscious of sustainability when purchasing products, both in their professional and personal lives.

“Print and packaging businesses can become an integral part of the solution and offer a digital-first mindset in manufacturing with reduced waste, a lower carbon footprint, circularity commitments and new sustainable materials,” Goldman added.

Broader environmental, social and governance subjects have also become a significant priority for customers and businesses in the APAC region in recent years.

“As a responsible business ourselves, the new Sandon Global facility is only fractionally away from being carbon neutral,” Roberts said.

“For us, it presents both challenges and opportunities. Challenges are associated with the need to meet global best practices of customers and additional requirements on product consistency across different regions. Ultimately for PSG, this has led to longer testing and trailing periods for some products and additional cost and supply chain pressures.”

As Domino see it, the future lies in inkjet as it offers local businesses to operate more flexibly, efficiently, cost-effectively, sustainably, and with shorter lead times, ultimately driving up their return on investment and digital product development and growth.

“We strongly believe that the APAC region will adopt hybrid technology in a big way, which means that we will have to stay very close to our customers and partners to help them choose the right solution for their specific needs,” ChmielewskaBontron said.

Schoettle, on the other hand, thinks that introducing higher levels of automation into the production process can help alleviate some of these issues, which will no doubt continue to trouble the region, and the world, over the next few years. He thinks that minimising waste, removing manual intervention, and reducing the total cost of ownership is now conditional to successfully operating in the packaging industry and future -proofing businesses.

Perhaps the best future trends conclusion comes from Goldman, who thinks that there are several categories at tipping points for our industry, like digital adoption, sustainability, automation, personalisation, e-commerce and growth in packaging.

“Print is positioned at the intersection between many interesting segments of big logistics and operations and the rush for more creative solutions where our PSPs can plan key roles with new business models,” he said.

www.propack.pro 20 ProPack.pro February 2023

XSYS sees a rise in demand in the tag and label sector and flexible packaging in the region

03—05 May 2023

Durst HQ, Brixen, Italy

DURST BEYOND OPEN HOUSE LABEL

Following the success of the past few years, we are once again organising our Open House in 2023, the biggest to date. An exclusive event where customers and partners from around the world will meet at our headquarters in Brixen, South Tyrol, and get the chance to take a look BEYOND the surface and into the future of the label printing world.

For more information, please visit www.durst-group.com/en/ digital-printing-technologies/durst-beyond

Fibre-based drives the future of packaging

From diversifying materials use to improving recycling properties, countless technological developments will see fibre-based packaging disrupt the future of the packaging market

By Piotr Wnuk

In 2018, Australian environment ministers established the 2025 National Packaging Targets to increase the use of recycled content in packaging. The ministers worked, and are continuing to work, with the Australian Packaging Covenant Organisation (APCO) to achieve four ambitious goals in the next two years – for 100 per cent of packaging to be reusable, recyclable or compostable; for 70 per cent of plastic packaging to be recycled or composted; for 50 per cent of average recycled content to be included in the packaging and lastly, to phase out problematic and unnecessary single-use plastic packaging.

As such, replacing the problem plastics in packaging with completely renewable fibre-based materials is the sustainable alternative that consumers are both demanding and actively seeking. Those materials can be easily recycled into new products and are naturally biodegradable. Therefore, the market is witnessing a boom in fibre-based packaging, which, according to the latest Smithers report, was valued at US$425.4 billion in 2022 and is expected to reach US$503.4 billion by 2027.

Wood is more sustainable than many others when adequately managed through growing and responsible harvesting

“Wood fibres are the best renewable raw material,” said Mandi Alaterä, senior vice-president of communications and marketing of packaging materials at Stora Enso, a Finish manufacturer of pulp, paper and other forest products.

“Paperboard is a best-of-both-worlds solution: it is a circular and decidedly reliable material that does not sacrifice product protection and appearance for sustainability. It allows brand owners to offer a low-carbon and recyclable package that supports the most demanding and sensitive applications.”

Huhtamaki A/NZ sustainability and public relations manager Jano Crema added, “The production of fibre-based packaging encourages the growth of renewable resources that capture carbon rather than the extraction of materials.

“Fibre-based packaging is also typically recyclable, with a very high resource recovery rate in Australia. Fibre materials are also more easily composted and biodegraded.”

Indeed, fibres can be recycled up to 25 times and are an important raw

material for new packaging. Because they partially lose their strength in the process, they need to be refilled with fresh fibres to maintain their quality. This often leads to misconceptions about the use of trees. However, this raw material is more sustainable than many others when adequately managed through responsible harvesting.

“Sustainable forest management is the integral first step of the paperboard production process; at Stora Enso, for example, its virgin raw material is sourced from 100 per cent sustainably managed forests as is covered by internationally recognised certification schemes, like PEFC and FSC,” Alaterä said.

“We use every part of the tree smartly and avoid waste, use recovered fibres where possible and seek to expand their use, build circularity into our materials to ensure they can be recycled.”

“Growing trees sequesters carbon from the atmosphere – in fact, production trees continue to be the best, most efficient and only commercially-viable approach to do this at the scale we need to achieve

FOCUS FIBRE-BASED PACKAGING www.propack.pro 22 ProPack.pro February 2023

a circular economy,” Australian Forest Products Association (AFPA) acting CEO Victor Violante said.

“Our opportunity is to use the fibre resource in as many ways as possible to add value and solve complex challenges such as plastic pollution in the environment. Fibre-based products are already replacing single-use and problematic plastics in our supply chains, supermarkets, homes, cafes and more. Paper and cardboard already have the highest rates of recovery and recycling of any material.”

the material’s recyclability as it needs to be separated from the paperboard during the recycling process. For this reason, most food packaging is now predominantly plastic, and its recycling rates are relatively low. While fibre-based packaging is currently widely recycled for non-food uses, the recent Smithers’ study indicates that by 2040 it will approach full circularity as technical developments broaden its suitability for food packaging.

“The packaging industry will focus research and development efforts to meet increasing consumer and regulatory demand for more recyclable and compostable packaging,” UPM Specialty Papers vice-president of strategy Maria Saloranta said.

“As a result, we expect the share of fibrebased food packaging to grow, accelerated by breakthroughs in barrier properties and use of smart technologies that help relay information to consumers quickly and easily.”

Amcor agrees that the most significant challenge is developing products with the necessary barrier properties and food contact properties to fulfil productsecurity needs at the high level that other materials, like plastic, can achieve.

Jumping over the barrier’s barrier

One of the disadvantages of fibre-based packaging is the main obstacle to eliminating plastic in packaging. The challenge is the need for barriers that protect the inside of the package to maintain the freshness of the food and preserve its nutrients while providing essential functionalities.

“In the realm of flexible packaging for retail food, there are many challenges with using paper and bio-based plastics, the highest of which is performance,” O F Packaging marketing manager Jessica Ansell said.

“Paper as a film substrate for packaging does not seal to itself without the use of lamination to plastic layers, or when combined with a specialty coating. Paper fibre has a naturally poor moisture barrier and poor physical barrier. It is typically used in a multi-laminate structure with fossil-fuel-based plastics, which can be difficult to separate at the end of life, or with bio-based plastics, which can alter the biodegradability properties of the materials compared to their use individually. These products also contaminate the paper stream at recycling facilities.”

For example, a paper coffee cup needs a thin barrier layer on each side of the fibre to hold liquid and is produced by heat sealing. Using plastic in barriers challenges

‘It is this innovation that Amcor is focused on working toward, innovating for the creation of packaging from alternative materials like paper without sacrificing on the properties necessary to keep the products inside safe and secure,” Amcor vice-president of corporate venturing and open innovation Frank Lehmann said.

“This biggest challenge is also the market’s greatest opportunity. Packaging manufacturers can replace existing applications and move more significantly toward paper packaging. Paper and fibre packaging present an opportunity for a wide range of applications in the packaging industry, including the ability to develop packaging barriers to suit specific needs depending on the product.”

Rapid innovation

The market is now focused on intensive research and development in fibre-based materials and wide-ranging design options, which will help brand owners and converters replace plastic packaging in many more end-uses.

Tetra Pak is testing a fibre-based barrier, claimed to be the first within food carton packages distributed under ambient conditions, in close collaboration with some of its customers. A first pilot batch of single-serve packs featuring this industryfirst material is currently on the shelf for a commercial consumer test.

Tetra Pak vice-president of climate and biodiversity Gilles Tisserand said, “Early results suggest that the package with a fibre-based barrier will offer substantial CO2 reduction when compared to traditional aseptic cartons, together with comparable shelf life and food protection properties.

“Therefore, we believe this development will be a breakthrough in reducing climate impact. In addition, cartons with higher paper content are also more attractive for paper mills; thus, this concept presents clear potential for realising a low carbon circular economy for packaging.”

Huhtamaki is partnering with a major customer to develop paper-based coffee capsules made from wood fibre, responsibly sourced from European forests. They have been independently certified by TÜV – as home compostable and compostable in food waste collection schemes.

“The home compostable fibre-based coffee capsules will initially be piloted with consumers in selected European markets before being more widely introduced,” Crema said.

Huhtamaki sees this technology as a paradigm shift in how it can use renewable wood fibre in complex food packaging. Its high-precision technology can capture the sustainability benefits of renewable wood fibre in an expanding array of packaging solutions that offer superior functionality, keep food safe, and maintain quality.

Back in October 2022, Koehler, a German provider of papers with a “disruptive barrier function for packaging solutions”, launched NexPure Wrap, a paper designed for burger packaging with extremely low grammage.

Now, the company is expanding its portfolio with NexPure OGR, an oil- and grease-resistant, sustainable paper suitable for packaging foods such as fries, sandwiches, wraps and burritos.

FOCUS FIBRE-BASED PACKAGING www.propack.pro February 2023 ProPack.pro 23

APCO published a report outlining the progress towards the 2025 National Packaging targets as of 2019-2020

Tetra Pak is testing a fibre-based barrier, claimed to be the first within food carton packages distributed under ambient conditions

The first AmFiber product is an innovative solution tailored to provide snacks and confectionery customers in a recyclable package that delivers a high barrier from oxygen and moisture

At Amcor, we analyse and consider the sustainability features of every packaging product depending on its intended use, working to find the most applicable, practical and sustainable option,” Lehmann said.

Opal Fibre Packaging is also focused on delivering high quality and unique fibre solutions with the attributes of plastic, but which are a sustainable alternative to plastic and non-recyclable polystyrene. In an Australian first for the salmon industry, Petuna’s Gold Award-winning Ocean Trout and Atlantic Salmon is being transported in new sustainable packaging that will divert more than 150,000 polyboxes from landfill every year.

“Our packaging solution replaces nonrecyclable expanded polystyrene packaging for Petuna’s high-quality salmon and trout products. Using Opal’s patented Photo Surefresh process and functionally coated liners, the packaging also features stunning photographic quality branding,” Opal Fibre Packaging group general manager Brad Hinds said.

“Implementing government regulations and incentives, educating consumers, and developing the needed infrastructure are some strategies which can help overcome the above challenges,” he said.

Alaterä added, “There are some challenges concerning the materials shift, such as material availability and suitability. Given the high demand and specific product requirements, brand owners wanting to switch to fibre-based materials may encounter issues securing the material they need. Depending upon the brand owner’s end-use, plastic can be difficult to replace entirely, and there may not immediately be a suitable fibre-based substitution. To limit obstacles in switching, brand owners should work closely with an expert partner to identify fit-for-purpose materials that will work with the end-use.”

Holmen Iggesund, a premium paperboard company from Sweden, and Yangi, the pioneer of dry forming technology, have entered into a long-term agreement to explore opportunities with a new type of sustainable packaging material. The collaboration focuses on replacing rigid plastics with alternative renewable materials for beauty and cosmetics packaging, such as refills, inserts, testers, and other types of applications within the segment.

“There’s a real sense of urgency to make packaging ever more sustainable and purposeful, and at Holmen Iggesund, we see the benefits of working with others to solve challenges faster,” Holmen Iggesund director of future packaging Hein van den Reek said.

“The collaboration is aimed at helping beauty, and cosmetics brands deliver what their customers are demanding –sustainable packaging. Holmen Iggesund is always interested in the latest ideas and potential new opportunities for purposeful packaging solutions.”

Amcor launched a new platform of paperbased packaging products, AmFiber, in January 2022, aiming to redefine the capabilities of traditional paper packaging, providing snacks and confectionery customers in Europe with a recyclable package that delivers a high barrier from oxygen and moisture.

“A large confectionery brand is currently using our AmFiber. We were able to help this brand use fibre packaging smartly to replace an existing solution without compromising packaging security.

“Another example is Opal’s award-winning 100 per cent recyclable cardboard corrugated dunnage that we developed in collaboration with JBS Australia to replace expanded polystyrene dunnage.”

Will fibre replace plastic?

The industry anticipates the global share of polymer-based packaging will fall by half over the next two decades in sustainable food packaging applications, while fibre-based materials are projected to contribute to over 40 per cent of all materials in use. The Smithers study, which was also conducted in partnership with a material specialist, UPM Raflatac, asked more than 200 global packaging professionals from across the value chain to contribute to the first-ever collective assessment of projected key trends driving sustainability in packaging.

“The survey shows the industry is anticipating a US$20 billion shift from polymer-based to fibre-based packaging by 2040,” Smithers global vice-president of business development Ciaran Little noted.

“The use of polymer packaging will not be eliminated but will focus on robust applications in which high strength barrier requirements and reusability are critical.”

Also, according to Jamie Weller of Kissel + Wolf, in many packaging cases, plastic is still preferable, if not essential, to some food packaging. There is a need to extend perishable food storage, and plastic is perfect for this. Another challenge is the cost and the lack of alternative packaging recycling capabilities.

Huhtamaki sees several significant obstacles to successful and science-based plastic reduction policy in Australia. This includes misinformation about environmental credentials from several manufacturers and suppliers, confusion among consumers on the actual environmental benefits of packaging options, the lack of acknowledgement of the role that packaging plays in minimising food waste and inconsistent policy measures from state to state.

“While each of these issues can be addressed, further investment in processing and consultation with the packaging industry is needed at a federal level,” Crema said.

Alaterä agreed that fibre-based packaging could significantly reduce the amount of plastic that brand owners currently consume, but in some end-uses, a small amount of plastic will be required to achieve the necessary barrier properties. He believes that this will create immense innovation opportunities.

Ansell added, “Fibre and bio-based packaging is only part of the answer. Plastic will continue to play a key role in protecting food and allowing the global market to function for some time”.

“However, reducing plastics in the singleuse or non-food packaging space will require fibre and bio-based products. Removing low performance, excessive plastic packaging from the market used for non-food or short shelf-life applications is key for reducing our reliance on non-renewable materials and reducing waste to landfill.”

Replacing plastics will not happen overnight; however, each step forward opens a myriad of opportunities to create value for consumers while supporting the transition to a more sustainable future.

www.propack.pro 24 ProPack.pro February 2023 FOCUS FIBRE-BASED PACKAGING

Swedish premium paperboard specialist Holmen Iggesund focuses on replacing rigid plastics with alternative renewable materials for beauty and cosmetics packaging

SERIES DIE CUTTER

PRESENTS

SERIES DIE CUTTER

SERIES DIE CUTTER