BY PETER KATZ Pkatz@westfairinc.com

The New York City Department of Environmental Protection (NYCDEP) is seeking approval from Yonkers to move ahead with a $141 million portion of an approximately $2 billion long-term plan for improvements to the Hillview Reservoir, which has a street address of 100 Central Park Ave. in Yonkers. The entire project includes covering of the reservoir before 2050, which would comply with a settlement agreement reached in 2019 between New

York City and the federal government to ensure water quality. The reservoir holds about 900 million gallons of water and is concrete-lined. It was built between 1909 and 1917, According to Matthew Valade of the engineering rm Hazen and Sawyer, which specializes in dealing with water projects, the Hillview facility handles approximately 50% of the water supply for the city of Yonkers and and up to 100% of New York City’s drinking water.

Reservoir Project 6

Robeks smoothie chain plans further expansion across Connecticut

BY PHIL HALL Phall@westfairinc.com

Among the grab-and-go eateries that populate Connecticut’s strip malls and commercial districts, the Robeks chain is not the most ubiquitous – there are eight stores in the state, with six based in Fair f ield County. The chain’s nationwide presence is also relatively modest, with more than 90 locations

open and 50 in development across 13 states and the District of Columbia.

Of course, Robeks has a different focus than the other establishments serving up burgers, pizza slices, tacos and hot dogs. With its mix of smoothies, fresh pressed juices, acai bowls and premium toasts, the chain emphasizes a healthier alternative to traditional fast food mix.

And while it may not be rivaling McDonald’s and Dunkin in terms of the

quantity of Connecticut locations, the Robeks management is very happy with the quality of performance in the state. The Business Journals’ Fair f ield County Bureau Chief Phil Hall spoke with Todd Peterson, chief development of f icer for Robeks, about the company’s place within Connecticut. Robeks recently announced that it was planning a further expansion across Smoothie chain 6

westfaironline.com May 15, 2023

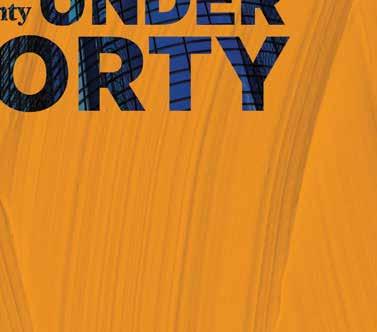

A teen version of 'Shark Tank' featuring real sharks

BY JUSTIN MCGOWN jmcgown@westfairinc.com

It’s one thing for an entrepreneur to pitch a concept in a “shark tank”-style environment, but it’s quite another thing to have real sharks present.

The 2023 Norwalk Leadership Institute (NLI) cohort recently sponsored an event in the Maritime Aquarium at Norwalk inspired by the popular TV show “Shark Tank.” The NLI and the Youth Business Initiative of Norwalk (YBI) partnered to provide the contestants – mostly students from underprivileged backgrounds – with the opportunity to put forth their ventures in competition for a grand prize of $1,000 and a second-place prize of $500.

The winners were selected by a panel of judges consisting of Brian Brumit, the owner and president at the HealthCare Subrogation Group; Shenton King, the vice president of marketing and commercial operations at King Industries; and George Perham, the president of Visionary Interiors Architecture.

Unlike the television show that inspired the event, participants were not cutting deals with investors and would not have f inancial obligations at the end of the night. Instead, the judges asked questions after each presentation and conferred with each other to decide on which businesses would benef it the most from the investment.

The winning pitches were Jadon Washington’s SureHouse Studios in f irst place and Arleny Abreu’s Mindful Couture in second.

Washington has already established a brick-and-mortar location for SureHouse Studios, which aims to provide creators across disciplines with a space for creating music, networking with fellow artists and supporting engagement strategies.

“My business exists to give power to artists who otherwise would not have the opportunity to be heard,” Washington said. “There are so many unheard voices in our area, so many unseen painters and designers in our area that just don’t get the shine that they deserve. We will use the money to help us get more equipment

so that we can serve more artists and those artists can in turn serve the community.”

During his presentation, Washington shared a song he wrote and produced at SureHouse, performed by a friend he met through the process of launching the business. Washington said he plans to put the funds towards a new computer to help facilitate production.

Arleny Abreu earned second place with her pitch for Mindful Couture, a clothing line with a message of self-actualization and improvement. Earning the award was part of her own concerted effort to realize her brand’s ethos.

“Honestly,” Abreu admitted, “the hardest part was probably commitment. Because there were some days where I was like, ‘I know I want this but what if I’m not good enough?”

She credited the YBI with providing the training and supportive environment she needed to succeed in front of a crowd containing business leaders as well as friends and family.

Abreu plans to put the money she earned towards ordering a shipment of shirts designed to her specif ications from a manufacturer in China that will help establish her brand and grow an audience for the social engagement aspect of her business.

“I’ve been going to [YBI] Shark Tanks every Monday since January, I really have been putting my all into this, showing up, doing the work, doing the research, and really just putting my passion into this project,” Abreu said. “It takes practice, a lot of nights where I went to sleep late, but I know that this is what I want to do so I’m going to f ight for it.”

Military recruit claims Rockland lender illegally seized his car

BY BILL HELTZEL Bheltzel@westfairinc.com

ARockland automobile f inance company allegedly seized and sold a serviceman’s car while he was on active duty, according to a lawsuit, in violation of a federal law.

Dosyear White of Buffalo accused New City Funding Corp., Stony Point, of violating the Servicemembers Civil Relief Act, in a May 3 complaint f iled in U.S. District Court, White Plains.

New City Funding did not reply to an email asking for its side of the story.

The Act was signed into law by President George W. Bush in 2003, the complaint states, in part to ease economic and legal burdens on military personnel called to active duty status in Operation

Iraqi Freedom. The law revised the World War II-era Soldiers and Sailors Civil Relief Act and builds on protections for the armed services that date back to the War of 1812.

Personal property, including cars, may not be repossessed without a court order, according to the complaint, where a deposit or installment has been paid before the individual entered military service.

In April 2022, when White was a civilian, he bought a 2012 Jeep Compass from SG Used Autos in Tonawanda, New York.

He signed a retail installment contract, according to the complaint, and the contract was assigned to New City Funding.

White claims he made several payments on the Jeep.

Then he signed up for the Air Force last September, of f icially enlisted on

Oct. 18 and reported to basic training in Tampa on Oct. 19.

A service member does not have to notify a creditor about his or her active-duty status, according to the complaint, but White says he did discuss his status with New City Funding representatives by email and telephone.

But ten days after he enlisted, New City Funding allegedly had the car repossessed, without obtaining a court order, and later sold it at auction.

White is demanding unspeci f ied damages, including consequential and punitive damages, and a court order directing New City Funding to delete negative credit information on f ile with major credit reporting agencies.

He is represented by Asbury Park, New Jersey attorney Yitzchak Zelman.

2 MAY 15, 2023 FCBJ WCBJ Westchester County Business Journal (USPS# 7100) Fairfield County Business Journal (USPS# 5830) is published Weekly, 52 times a year by Westfair Communications, Inc., 44 Smith Avenue, Suite #2, Mount Kisco, NY 10549. Periodicals Postage rates paid at White Plains, NY, USA 10610. POSTMASTER: Send address changes to: Westchester County Business Journal and Fairfield County Business Journal: by Westfair Communications, Inc., 4 Smith Avenue, Suite #2, Mount Kisco, NY 10549. © 2022 Westfair Communications Inc. All rights reserved. Reproduction in whole or in part without written permission is prohibited. A MEMBER OF MAIN OFFICE TELEPHONE 914-694-3600 OFFICE FAX 914-694-3699 EDITORIAL EMAIL Phall@westfairinc.com WRITE TO 4 Smith Ave., Suite No. 2 Mount Kisco, NY 10549 Publisher Dee DelBello Co-Publisher Dan Viteri Associate Publisher Anne Jordan NEWS Fairfield Bureau Chief & Senior Enterprise Editor • Phil Hall Copy and Video Editor • Peter Katz Senior Reporter • Bill Heltzel Reporters Pamela Brown, Georgette Gouveia, Peter Katz, Justin McGown Research Coordinator • Luis Flores ART & PRODUCTION Creative Director Dan Viteri Art Director Diana Castillo Marketing Coordinator Carolyn Meaney ADVERTISING SALES Manager • Anne Jordan Metro Sales & Custom Publishing Director Barbara Hanlon Marketing & Events Coordinator Natalie Holland Marketing Partners •

Lobo AUDIENCE DEVELOPMENT Manager • Daniella Volpacchio Research Assistant

Sarah

ADMINISTRATION Contracted CFO Services Adornetto & Company L.L.C.

Mary Connor, Larissa

•

Kimmer

business.

No matter what business you are in, we’re into

your

Jadon Washington makes his prize-winning presentation for ShureHouse Studios while a shark photobombs his presentation. Photo by Justin McGown.

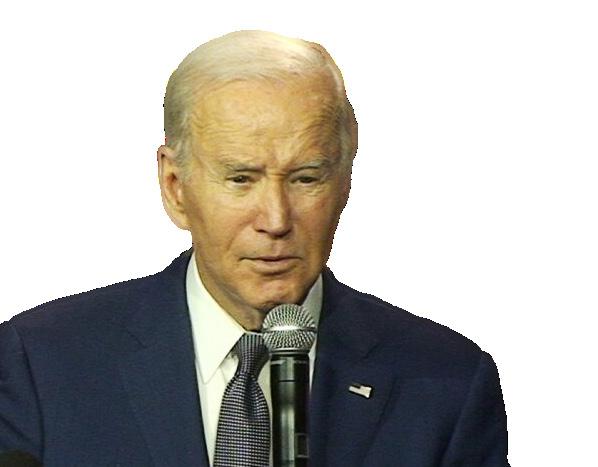

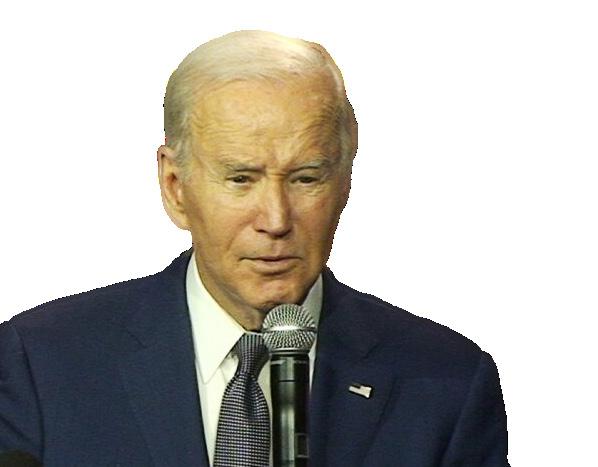

Biden slams Republicans on debt ceiling in Westchester appearance

BY PETER KATZ Pkatz@westfairinc.com

BY PETER KATZ Pkatz@westfairinc.com

Westchester played a role in President Biden’s May 10 speech at Westchester Community College (WCC) and not just because of his visit to the county. He presented examples of what would happen in Westchester if the Republicans succeed in forcing a 22% cut in the proposed federal budget as the price for their agreeing to raise the debt ceiling so the U.S. doesn’t default on its debts.

“According to estimates, the Republican bill would put 21 million people at risk of losing Medicaid, including 2.3 million people here in New York State and 78,000 people right here in Westchester County,” Biden said. “It’s devastating. It’s not right.”

Biden said that Republican cuts would force the shutdown of 375 air traf f ic control towers, including at the Westchester County Airport and four more in New York state because there wouldn’t be enough personnel.

Biden described he WCC campus as “one beautiful community college. The property here is amazing.” He then explained that students at WCC would be affected because of forced cuts in the size of Pell Grants and the elimination of the grants for 5,000 New York students.

“You know, here’s what’s happened if MAGA Republicans get their way: America defaults on our debt; higher interest rates for credit cards, car loans, mortgages; payments for Social Security, Medicare, our troops, and veterans could all be halted or delayed,” Biden said. “According, again, to Moody’s, eight million Americans would lose their jobs, including 400,000 New Yorkers alone. Our economy would fall into

recession. And our international reputation would be damaged in the extreme.”

It was standing room only in the theater at the Hankin Academic Arts Building on the WCC campus in Valhalla for Biden’s appearance. The White House at f irst announced that he would be making a speech on the debt ceiling in the Hudson Valley without disclosing the actual location.

Biden’s speech was designed, in part, to put additional pressure on Republicans in

advance of the scheduled May 12 meeting on the debt ceiling at the White House. Republican House Speaker Kevin McCarthy had said after the May 9 White House meeting involving himself, Biden, House Minority Leader Hakeem Jeffries and Sen. Mitch McConnell and Sen. Chuck Schumer that there was no forward movement.

Biden had arrived at Westchester County Airport shortly after 12:45 p.m. on board the helicopter Marine One. He had

come from John F. Kennedy International Airport after a flight from Washington on board Air Force One. Biden was greeted at the Westchester airport by Gov. Kathy Hochul and Westchester County Executive George Latimer. Traveling with Biden were Sen. Kirsten Gillibrand and Rep. Jamaal Bowman, both of whom had flown up from Washington with him.

While at WCC, President Biden participated in a photo event with local leaders. According to the White House, Biden was photographed with Mayor Tom Roach of White Plains, New York State Senate President Andrea Stewart-Cousins, Chairman of the State Democratic Party Jay Jacobs, leaders of WCC and local union members and of f icials.

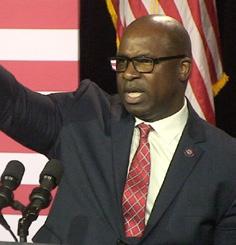

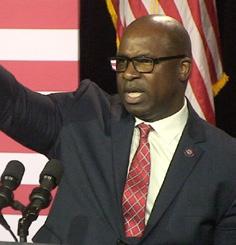

The event was reminiscent of a campaign rally at the start, with Hochul, Bowman and Gillibrand blasting Republicans for playing politics with the national debt, the creditworthiness of the U.S., and the global economy. Hochul introduced local elected of f icials who were at the event and each stood up to loud applause and cheers.

Bowman, in a f iery speech, raised the issue of recent mass shootings and gun laws.

MAY 15, 2023 FCBJ 3 WCBJ

Biden speaking at WCC. Photo by Peter Katz.

A view of the theater at WCC set up for Biden's speech. Photo by Peter Katz.

Rep. Jamaal Bowman speaking at WCC. Photo by Peter Katz.

Preident Biden, right, thanks Brian Sullivan for his introduction. Photo by Peter Katz.

“They’re OK with our children dying everyday from gun violence because they won’t do a damn thing about it,” Bowman shouted as the audience reacted loudly. “We need a ban on assault rifles. We need universal background checks. We need universal red flag laws,” Bowman said.

Biden had been introduced by Brian Sullivan, a seventh grade science teacher at the White Plains Highlands Middle School.

Biden began his speech by saying that

it’s good to be back in Westchester, having appeared in the county just before the 2022 election at an event for Hochul at Sarah Lawrence College. He gave a special acknowledgement to Republican Rep. Mike Lawler who was at the WCC the event.

“Mike’s on the other team but you know what? Mike is the kind of guy that, when I was in the Congress, was the kind of Republican I was used to dealing with,” Biden said. “He’s not one of these MAGA

Republicans. I don’t want to get him in any trouble by saying anything nice about him.”

The speech at WCC was being followed in f inancial as well as government circles around the world as evidenced by the presence of reporters from foreign f inancial journals and other overseas news media.

“There’s a big debate going on in this country about protecting America’s hardearned reputation as the most trusted, reliable nation in the world, about how we f ix

the long-term f iscal health of this nation, a debate with enormous implications for the American economy and quite frankly for the world economy,” Biden said. “It’s important for the American people to know what’s at stake.”

Biden said that it’s not a theoretical debate that’s going on in Washington.

“The decisions we make are going to have real impact on real peoples’ lives,” Biden said. “The MAGA Republicans have taken control of the House. They’re doing to the best of my knowledge what no other political party has done in the nation’s history. They’re literally, not f iguratively, holding the economy hostage by threatening to default on our nation’s debt, a debt we’ve already incurred over the last couple of hundred years, unless we give in to their threats and demands.”

Biden was in Westchester until about 3:45, when the helicopter Marine One flew him to Manhattan where he was scheduled to attend a number of political fundraising events.

Greenwich Hospital receives an 'A' grade for safety

BY JUSTIN MCGOWN jmcgown@westfairinc.com

BY JUSTIN MCGOWN jmcgown@westfairinc.com

Greenwich Hospital has earned an “A” grade for patient safety from the Leapfrog Group, a nonprof it watchdog group that rates many aspects of hospital quality across the country.

Leapfrog works on a scale from A to F and analyzes more than 3,000 hospitals, using a judging scale based on their performance across 30 different metrics that impact patient safety.

“Receiving the A made us all feel very proud here at the hospital,” said Dr. Karen Santucci, chief medical of f icer for Greenwich Hospital. “Being part of this voluntary survey means that we’re being recognized for our work related to patient safety. It includes markers like how our physicians and our nurses communicate with our patients, avoiding preventable infections, and things like focusing on being the safest environment we could possibly be.”

An emphasis on hand washing when entering and exiting any room, organizational rules in place to ensure reliability, and having systems for staff members to share their thoughts and concerns are all key parts of the process that earned the hospital the coveted A grade, according to Santucci.

“We call it 200% accountability,” Santucci added. “This is what we do every day here at Greenwich hospital. So, it is really nice when we’re recognized outside the hospital for these values that we uphold on a daily basis.”

Santucci emphasized that the dedication to patient safety applied to all staff members who worked to hold each other accountable. She noted that she has been gently reminded by other staffers to put a mask on, which is still required outside of of f ices within Greenwich hospital out of an abundance of caution and as a counter to diseases besides Covid.

While allowing that the A rating was a “major triumph,” Santucci indicated that

the award itself will not be allowed to foster a lax attitude about safety measures.

“My CEO, Diane Kelly, will say ‘We will celebrate that for about 30 seconds and then get back down to work.’ Because nothing happens accidentally, it has to be very purposeful and also just in the moment,” Santucci said. “We need to be reminding each other that we have to be hypervigilant working every day towards our goals with each and every patient, but also for bigger projects.”

Santucci described efforts to continually improve both the patient experience and hospital safety as central to continuing to receive high ratings and recognitions. She noted the hospital has been designat-

ed a Magnet Hospital by the American Nurses Credentialling Center, a distinction which only 8% of hospitals nationwide can claim, but she noted this was important because it adds value, attracting nurses interested in providing the highest levels of service.

Earning the award has also required the implantation of new technolog y, such as a fall monitoring system. According to Santucci, cameras are used to keep an eye on patients who are at risk of hurting themselves through falls or may be in distress from conditions like dementia. When the system’s operator spots one of these patients trying to get up, they can let them know that assistance will arrive shortly or dispatch a nurse immediately in urgent cases.

Above all else, Santucci said the most important part of ensuring that Greenwich Hospital remains able to not only earn top marks such as the Leapfrog’s safety rating is a focus on listening to patients.

“We always have our eye on the ball. We have surveys that are submitted for all of our encounters at the hospital, and we read 100% of every single comment that comes back to the hospital,” Santucci said. “If somebody had a less than optimal experience, we delve into that. If it’s not an anonymous survey, we reach out to the patient to f ind out how we could have done better.”

4 MAY 15, 2023 FCBJ WCBJ

Photo by Noroton / Wikimedia Commons.

From left: Rep. Jamaal Bowman; Sen. Kirsten Gillibrand; Gov. Kathy Hochul. Photo by Peter Katz.

Biden used a handheld microphone and walked around the stage . Photo by Peter Katz

Mirror mirror on the wall, whose is the fairest trademark of all?

BY BILL HELTZEL Bheltzel@westfairinc.com

APeekskill company that makes glassless mirrors is accusing an Irvington competitor of reflecting poorly on its business.

MirrorLite Mirror Inc. accused LiteMirror GMM Inc. of trademark infringement in a April 25 complaint f iled in U.S. District Court, White Plains.

LiteMirror’s alleged infringement “has become progressively more signif icant,” the complaint states, and has “made consumer confusion inevitable.”

MirrorLite, owned and operated by Janet Reith, claims that it has been using MirrorLite® since 2008.

The Peekskill company uses flexible, metal-coated plastic f ilm that is shatterproof and much lighter than glass, according to its website, and sells the glassless mirrors to f itness and dance studios, theaters and other performance spaces, and trade shows and exhibitions.

The LiteMirror trademark uses the exact same letters, the complaint states, “merely flipping the words mirror and lite.”

Both businesses sell the same kind of products, the complaint states, marketed through the same sales channels, and pur-

CONNECT WITH westfair communications

chased by the same types of customers. Consumer confusion, MirrorLite claims, is inevitable.

Recently, for example, a customer of a MirrorLite dealer who was paying for services mistakenly delivered the check

to LiteMirror. Then LiteMirror allegedly cashed the check, “prof iting off of the consumer confusion created by its own infringement.”

MirrorLite is accusing its purported doppelgänger of trademark infringement,

false advertising, and unfair competition.

It is asking the court to order LiteMirror to stop using its trademark or any deceptively similar combination of words; turn over materials that use the trademark; account for its prof its and pay unspecif ied damages, including treble damages for willful infringement.

“LiteMirror denies the allegations of the complaint and looks forward to defending itself in court,” company president Rick Powers said in an email.

MirrorLite is represented by Ossining attorneys Jeffrey A. Lindenbaum and Jess M. Collen. LiteMirror is represented by White Plains attorneys Peter Sloane and Cameron Reuber.

Today we welcome thousands of Signature clients and employees to the Flagstar family. Together we will thrive. Strength. Stability. Security. For generations Flagstar has been dedicated to the success of our clients, our employees and our communities. Welcome to a new energy in nance. Equal Housing Lender | Member FDIC agstar.com

westfaironline.com

“The Hillview Reservoir facilities control the incoming flows from the upstate water supply reservoirs and manage water pressure entering the water distribution system,” Valade said. “The chemical systems at Hillview Reservoir provide the last point of chemical treatment for a majority of the water supply before water enters New York City’s drinking water distribution system.”

The current Hillview Reservoir Improvements Project includes two major components: construction of new chemical addition facilities and Hillview Reservoir Campus upgrades; flow-control improvements and additional facility upgrades.

The f irst component includes construction of two new chemical addition facilities, the New North Facility and New South Facility, which would increase on-site chemical storage capacity. Upgrades to the existing north and south facilities include installing two new electrical service feeds and associated distribution equipment, new flow measurement systems, a new Supervisory Control and Data Acquisition system, and upgrading the existing North Entrance and adding a new police booth.

The second component would see the installation of new chemical feeding and monitoring systems along with additional upgrades to existing systems. New access

roadways would be constructed. Once new chemical facilities were operational demolition of older facilities would take place.

In March, the Yonkers Zoning Board of Appeals approved variances that were needed for the project that dealt with building heights and the number of required parking spaces. NYCDEP said it did not need all of the 147 parking spaces that would be required based on square footage to be built and did not anticipate that more than the current 56 workers would be accessing the site. It said it only needed 77 parking spaces and that 17 of them would be equipped with electric vehicle charging stations. NYCDEP also was asking for a variance so that if it became necessary construction work could take place outside of the normal hours permitted by Yonkers.

NYCDEP now is seeking site plan approval from the Yonkers Planning Board.

NYCDEP pointed out that while it has acted as lead agency for the environmental review of the project it also has reached out to the residents of the surrounding community. The agency said there were town hall meetings hosted by Yonkers Councilman John Rubbo and that it met with the Hyatt Association and other community groups in the neighborhoods near the reservoir. NYCDEP issued a negative declaration of environmental impact for the project.

“The New York City water system is based on a 2,000-square-mile watershed the size of the state of Delaware. The vast majority of water that serves Yonkers, New York City, almost all of Westchester, many communities in the four counties just

north of here, all comes from the Catskills,” John Milgrim, director of outreach for the NYCDEP water supply system said. “All of that water from the main water supplies ultimately ends up in Hillview.”

Milgrim described Hillview as a very critical piece of infrastructure.

“It’s what we call a balancing reservoir,” Milgrim said. “It’s used to create the pressure in the municipal systems. It’s always at the same level, within inches. It’s monitored carefully 24/7. There’s a long, good safety record at the facility.”

Milgrim described the Hillview Reservoir as being in a unique situation since it is closely surrounded by residential and business areas whereas most of the other NYCDEP water facilities are in rural locations.

“We worked with the community intensively -- listened to their concerns. We believe that we have addressed the vast majority of their concerns in a positive way with providing green space they can use throughout, continue to allow them to use space that is New York City property that abuts to the backyards, to ensure that have somebody that they can reach out to who is in a decision making capacity, who they can work with and reach pretty much any day of the week.”

NYCDEP anticipates that there would be about 450 construction jobs created by the current project.

Connecticut. Has this been a lucrative market for your company?

As a matter of fact, it’s been a very successful market for us. We’ve been in Connecticut for some time – I believe we opened up in Stamford in 2004 – and we’ve been growing consistently. The average volume for our units – in Connecticut, there are eight currently – is generally higher than our average unit volume. There’s obviously a lot of a lot of af f inity for the brand and we want to continue to sort of pursue growth, within Fair f ield County in particular.

I used to live down the street from a Robeks and would see it every day. But I don’t recall seeing very much in the way of either TV advertising or social media advertising for Robex. How you get the word out regarding your Connecticut stores.

Well, we’re a smaller brand in terms of system size – we’re just under 100 units, but we’ll surpass that sometime in this quarter. So, by virtue of that, we need to rely more on marketing engagement with our franchisees in terms of local schools and other

sorts of key demographics. We do some things locally around social media and, in some cases, radio – it depends on the cost and availability of a particular media.

What is the state of your franchise market? Are you getting a lot of inquiries, not only from Fair f ield County but from around the country for Robeks?

We are, and that segment has really grown in the last 24 months. I think part of that is a byproduct of Covid. We had a tremendous sales increase to 2021 versus 2020, and then another nice year in 2022. Some of it was fundamental elements that we changed or adapted within the business itself, but I think the other piece of it, frankly, was sort of a post-Covid halo around health and wellness.

I think it will continue to be strong. It’s a segment that has been around for many, many years – we started in southern California back in 1996. We’re on a steady growth and there is a lot of awareness and interest in our type of a product.

How do you review the franchise applications and determine who gets the nod and who may not be the best f it?

As you might imagine, there is both a subjective and objective kind of look. One

of the key objective criteria is a matter of f inances – obviously, for someone to be able to build a restaurant there’s a certain f inancial requirement. We’re looking at $300,000 in terms of minimum net worth and $100,000 in liquidity – that typically is the base level.

But beyond that, we engage with a candidate and begin our process to understand if they are good communicators, organized and motivated. We like to see folks that are community minded – it goes to my point earlier around being focused on local restaurant marketing, and that’s a key piece of the puzzle for us.

We are also looking at their involvement in managing young people, because in many cases that is the employee base – for some young folks, it is their f irst job.

What about the Robeks menu selection? How frequently does that get updated? And how many new flavors new foods or drinks are you testing at any given time?

I wouldn’t say there’s a lot of movement as it relates to the menu. We have a very stable juice and smoothie lineup that’s been very successful. We will do limited time offers and if it adds some excitement

and some energ y within the brand, we might be adding it as a menu item.

In 2021, we launched a line of premium toast starting with an avocado toast, and it’s been a tremendous product for us. We added three new premium toasts to that line as a limited time offer, and as we see how those perform as an extension of original avocado toast products we may well retain one or all those three new products.

What about across the state line?

Robeks has a single Hudson Valley store in Carmel – are you planning to do any additional stores in that market?

We’re vetting potential candidates. With the person that opened in Carmel – I guess it was last year – we are talking with him as well about the potential of extending going from one to two additional locations. We see a lot of similarity in those markets, how they look from a demographic standpoint and how we think they perform.

We still have some opportunity in Connecticut – we have two locations slated to open this year, in Bristol and Milford. And I would say Bridgeport is a market that makes a lot of sense. We’re excited about Connecticut.

6 MAY 15, 2023 FCBJ WCBJ

Smoothie chain 1

Reservoir Project 1

Rendering of proposed new South Facility at Hillview Reservoir.

New initiative encourages civic engagement by Connecticut businesses

tion for the CEO program started shortly after she began her Secretary of the State position in January.

could be anything from doing a neighborhood cleanup to running for of f ice or showing up on Election Day.”

to E.N.G.A.G.E., with the acronym def ined through the following activities:

BY PHIL HALL Phall@westfairinc.com

Connecticut Secretary of the State Stephanie Thomas has announced the launch of her Civically Engaged Organization (CEO) program, which is designed to encourage businesses and nonprof it organizations to commit to civically engagement through local community participation or by helping to raise public and employee civic awareness.

In an interview with the Business Journals, Thomas – a former business owner and state representative from Norwalk’s 143rd District – said the inspira-

“When I got here to the secretary’s of f ice, I saw that we have our elections division and our business division, and they felt very separated,” she said. “That got me thinking: what is the commonality? I realized that so many organizations are good civic citizens in their communities, and I thought, ‘Wouldn’t it be interesting if we could take what they’re already doing, and just ask them to do a little more to help educate either their employees or customers about civic engagement?’ – which is one of the major pillars of why I ran for this of f ice.”

Thomas def ined civic engagement as being more than a passive or indifferent observer to how localities and the state operates.

“Basically, the easiest way to def ine it is community involvement,” she continued. “My end goal is to make sure more people are voting. But it’s also about understanding how government works. It’s about understanding your place in the community and how you can help in this notion that we all rise together. So, for me, civic engagement

Thomas envisioned the CEO initiative as “great way to build morale” within companies and organizations, observing that many younger employees are eager to establish “a more thoughtful sort of corporate culture.” Having businesses and nonprof its encourage voter education and participation, both within their organizations and in their communities. is a central focus of Thomas’ CEO program, and she encouraged employers to ensure their staff has time to vote on Election Day.

Thomas added that her of f ice conducted focus groups ahead of the CEO program’s of f icial launch.

“There wasn’t one that said, ‘I hate this idea,’” she said. “What they said was, ‘As long as you make it easy for us, this is great because we want to do this anyway. If you can get us the tools and get us the social media posts and tell us how to do these things, we’re happy to help spread the word.’”

Any Connecticut-based organization can become a CEO by agreeing to pledge

• Email the of f ice’s non partisan “Civics 101” document to staff and/or customers.

• Note dates of elections in the of f ice/ workplace and/or in newsletters.

• Give employees time off to vote on Election Days if their schedules don’t allow for before or after hours voting.

• Announce the organization’s commitment to civic engagement via email and social media.

• Give employees time to volunteer in the community each year.

• Email or post a polling place look-up tool for employees.

Upon pledging to E.N.G.A.G.E., organizations will receive a certif icate and digital badge from Thomas’ of f ice, along with a CEO toolkit that includes a “Civics 101” document and templates for press releases, social media posts, and newsletters. The CEO has, as of this writing, already attracted nearly three dozen companies and organizations that pledged to participate; those interested in participation can f ind more information at CEOPledge.ct.gov.

Carting company tax cheat sentenced to federal prison

BY BILL HELTZEL Bheltzel@westfairinc.com

Aformer carting company executive who cheated on his taxes and diverted more than $800,000 in company funds to pay for extravagant strip club charges and other personal expenses has been sentenced to federal prison for a year and a day.

U.S. District Judge Cathy Seibel also ordered Christopher Oxer, 37, of Darien, Connecticut, to pay a $20,000 f ine and $275,780 in restitution, April 28 in federal court White Plains. He will be put on parole for one year after he is released from prison.

Last year, Oxer pled guilty to three counts of subscribing to false tax returns, in a plea deal with prosecutors.

He was general manager of City Carting of Westchester, a Rye Brook company that held county contracts to operate transfer stations, a recycling center and a land f ill. The company was owned by his father, Robert, and an uncle (or, according to Oxer’s attorneys, his father’ business partner who is like an uncle).

He got caught in 2021 by Kroll Associates, a Manhattan f irm that moni-

tored the company for Westchester County to ensure compliance with civil and criminal laws.

Kroll found credit card transactions for charges at Larry Flynt’s Hustler Club, Prime 333 at Sapphire and Sapphire Times Square in Manhattan that were classi f ied as business expenses for tires, equipment maintenance and tolls.

One strip club visit, according to court records, cost $40,000. Investigators also found charges for escorts, international vacations, clothing and expenses for Oxer’s consulting business, New England Waste Services.

As general manager, Oxer was “uniquely situated” to divert company funds, assistant prosecutor Jennifer N. Ong stated in a sentencing letter to Judge Seibel. He oversaw the bookkeeping and categorized credit charges on the monthly ledger.

From 2017 to 2019, he failed to report $808,753 in credit card charges as income on his personal tax returns, resulting in tax losses of $275,780.

Oxer’s attorneys, Andrew C. Quinn and Steven J. Bushnell, attributed his conduct to addictions, anxiety and poor choices.

Oxer believed he was overworked,

underpaid and underappreciated, according to their sentencing memorandum. He started drinking heavily and using cocaine and descended into a downward spiral.

His actions were not meant to cheat the government, his attorneys said, but to “enrich himself and feed his addictions.”

When he got caught, he freely admitted his misdeeds, accepted full responsibility, and sought treatment for his addictions, the memo states.

The impact of his poor choices was devastating.

“He has brought shame to his name and reputation,” the memo states.

His father and uncle were forced to sell the business. His father repaid the company for its losses, and Oxer is repaying his father “as much as he can.” Oxer has sold his house in Darien to cover restitution payments: $233,134 to the IRS and $42,646 to the New York Department of Taxation and Finance.

But through “hard work and the acknowledgment of his demons,” his lawyers claim, “he had remained sober and successfully turned his life around.”

He is managing his consulting business and helping manage DeYulio Sausage

Company, a 112-year-old enterprise named after his mother’s side of the family.

He intends to move in with his parents, his lawyers said, to take care of them and monitor their health.

The U.S. Probation Of f ice recommended a prison sentence of 30 months, and Oxer agreed in his plea deal that the non-mandatory federal sentencing guidelines called for 30 to 37 months.

His attorney’s asked Judge Seibel to impose no prison time, “to achieve a just disposition,” citing his repentance, dedication as a volunteer f iref ighter, charitable works, supportive family, and low to nonexistent risk of reoffending.

Assistant prosecutor Ong recommended imprisonment within the 30 to 37 month guidelines.

She noted that the f inancial reward of tax fraud is high but the chance of being caught and successfully prosecuted is low.

“A non-custodial sentence here would provide a would-be tax cheat every incentive to orchestrate a tax fraud scheme,” she wrote. “Respectfully, that is not the message this court should send to the public.”

Judge Seibel ordered Oxer to surrender to the Bureau of Prisons on June 15.

MAY 15, 2023 FCBJ 7 WCBJ

From fangirl to boss –the many dualities of Indra Nooyi

BY GEORGETTE GOUVEIA ggouveia@westfairinc.com

Indra Nooyi -- the former chairman and CEO of PepsiCo Inc., who spoke at Mercy College in Dobbs Ferry on Monday, May 1 -- is a woman of fascinating dualities, a word that served as a motif throughout her “f ireside chat” with Eva Fernández, the college’s provost and vice president of academic affairs. (On a cool spring day, the two were ensconced in a cozy setting -- blue backdrop; blue and purple hydrangeas; and a monitor with a roaring f ireplace reminiscent, at least to some of a certain vintage in the audience of 250, of WPIX-TV’s “Yule Log,” which was originally f ilmed in Dobbs Ferry.)

On the one hand, Nooyi is a fangirl -- a self-professed child of the 1960s and ’70s, who grew up listening to The Beatles, The Rolling Stones, Creedance Clearwater Revival, Crosby, Stills & Nash and Jimi Hendrix and played guitar in an all-girl rock band in her native India. Attending a talk by Beatle Paul McCartney at Yale University, this graduate of the Yale School of Management -- the f irst woman to endow a chair there -- couldn’t believe it when she found herself eating pizza with him at Frank Pepe Pizzeria Napoletana in New Haven.

“I don’t think there’s a single Beatles song I didn’t know,” she said.

Her love for the Fab Four is perhaps only exceeded by her passion for the New York Yankees, which is such that this cricketer -- she sits on the board of directors of the International Cricket Council -- can’t bear to read about her beloved Bronx Bombers lest she discovers that they’ve lost a game. Happiness, she said, is a Yanks’ win.

And yet, Nooyi remains very much the strong-minded global leader, one whose name has regularly appeared on Forbes’ annual list of the world’s most powerful women, peppering her remarks with her “P” words -- “performance” (what you bring to the job day-to-day); “purpose” (your longterm civic values and responsibilities); and, above all, “proposition.”

“The most important thing each of us has to know is our proposition to the company,” Nooyi said. “Always ask yourself, How am I going to be a lifelong student so I can learn everything around my job, so that I can offer a proposition to the company -- which I keep improving?....Expand the scope of your job and push to make it better. It’s a very unself ish thing that you have to do.”

She once demonstrated this while she was climbing the corporate ladder at PepsiCo, whose world headquarters is in Purchase, by canceling a glamorous overseas company trip to stay behind to collaborate on improving a project in another division. What you don’t want to be, she said, is a “safe hand” -- someone who knows his/her job, and nothing else.

And while she understands that Covid has created flexibility in the workplace -- flexibility that should afford men as well

as women an opportunity to serve as caregivers, she added – she said that those who work at home shouldn’t expect to be “on the same proposition” as those who put in the work and face time at the of f ice.

Clearly, this fangirl was one rigorous boss.

“She was tough, terrifying, fun and interested in everybody’s lives,” said Mercy Chief Advancement Of f icer Bernadette Wade, who worked for Nooyi at PepsiCo and served as master of ceremonies for

the event. Working for Nooyi, she added, was all about “being present and getting the work done.”

Daughter of India – and America

The duality of which Fernández and Nooyi spoke -- and which threads Nooyi’s book, “My Life in Full: Work, Family, and Our Future” -- has been present since her early days.

“I see through the persona of an Indian,” Nooyi said. “Every aspect of me, I got from India.”

At the same time, she added, “my story could only happen in the United States. I owe my success to what the U.S. offered me.

“I belong in both worlds…I’m true to both. I never tried to be someone else. Never put on a persona.” And indeed she made it clear at PepsiCo that she was never going to be one of those CEOs who golfed and f ished.

What she called her “improbable life” began in Madras (now Chennai), Tamil Nadu, India, where she was born Indra Krishnamurthy eight years after the country’s independence from Great Britain in 1947. It was a world in which not much was expected for women in the workplace, although she said her father and grandfather stressed education and her becoming whatever she wanted. A devout Hindu who neither drinks alcohol nor eats meat, Nooyi was educated in a Roman Catholic convent school, Holy Angels Anglo Indian Secondary School, before earning bachelor’s degrees in physics, chemistry and mathematics from Madras Christian College at the University of Madras and a postgraduate diploma from the Indian Institute of Management Calcutta.

In 1978, Nooyi moved to the U.S. to attend the Yale School of Management where she was a classmate of Connecticut Gov. Ned Lamont and earned a master’s

8 MAY 15, 2023 FCBJ WCBJ

“Fireside chat”: Eva Fernández, Mercy College’s provost and vice president of academic affairs, and Indra Nooyi, former chairman and CEO of PepsiCo, in a conversation on “Breaking Down Barriers: Gender Bias, Inequality and Motherhood in the Workforce,” at the college Monday, May 1. On a cool spring day, they joked about the “roaring fire” between them, reminiscent of WPIX-TV’s iconic “Yule Log,” a Christmas tradition that was originally filmed in Dobbs Ferry, not far from the college.

Students at Mercy College in Dobbs Ferry present former PepsiCo chairman and CEO Indra Nooyi with a bouquet after her May 1 conversation on “Breaking Down Barriers: Gender Bias, Inequality and Motherhood in the Workforce.” From left: Jaid Wazihullah (Class of 2025), Nooyi and Marques McKinney (Class of 2023). Photographs by Alyssa Politi/Mercy College.

degree in public and private management. By then, she was already on her way to a starry corporate career with executive stints at Johnson & Johnson and Motorola, among other companies, before she joined PepsiCo in 1994. Working her way up the corporate ladder, she became the f ifth CEO in PepsiCo’s history in 2006, two years before the Great Recession. It did not stop her from implementing “Performance With a Purpose” -- a company redirection that saw the advancement of healthier subsidiary brands and more sustainable packaging. Out went KFC, Pizza Hut and Taco Bell; in came Tropicana, the Quaker Oats Co. and its subsidiary Gatorade. (A mention of the power drink led to an amusing anecdote about Nooyi’s encounter with a Gatorade consultant, who said he could also improve Nooyi’s wardrobe and invited her to a style makeover at

Saks Fifth Avenue the next day. Intrigued rather than insulted, Nooyi met him and bought a half-dozen ensembles, keeping his fashion playbook to this day. At the event she looked chic in a white-striped black blouse, black pants and black ballet shoes, donning a jewel-toned wrap when she left the building.)

“Performance With a Purpose” was about doing well on the ledger while doing good, Nooyi said. By the time her tenure ended in 2019, the company’s sales had risen 80%.

CEO and mother in chief

Mercy is a school known for its commitment to DEI (diversity, equity and inclusion) throughout its community,https://westfaironline.com/featured/ reaching-out-to-mercy-colleges-community-and-beyond/ and Nooyi also talked about the struggles she encountered as

a female Indian American executive -being in a room where no one looked like her, having male colleagues interrupt her or give her the eyeroll. But there were also mentors along the way, including a German boss who had his driver chauffeur her at times when she was pregnant with her second child. (Nooyi and her husband, Raj K. Nooyi, president of AmSoft Systems, live in Greenwich and are the parents of two daughters.)

It was clear from listening to Nooyi that some of her greatest challenges – and the ones she spoke most emotionally about -- were those involving work and motherhood. It was she and not her husband who got the call if anything went wrong at school, something that will resonate with many working mothers.

But there was pride and passion in her voice as she spoke about never missing

one of her children’s events or a school board meeting, and when she went out of town on business, she left a letter for each daughter each day she was away, festooned with Pikachu and Teenage Mutant Ninja Turtles stickers. In essentials, Nooyi said, she was always there, adding that “a lot of people who stay at home with their kids are not present.”

She was, she acknowledged, “no saint.” But then, she added, women in particular have to get passed that:

“…Unfortunately, women are born with this perfection gene. We want to do everything perfectly. So we sacrif ice everything about ourselves, which I did. There are struggles all the time, a lot of juggling. You just hope you juggle all these priorities, and the most important ones don’t crash...If you have the courage and the resilience, you can power through.”

How to move (or move on) from your possessions

BY KATIE BANSER-WHITTLE

He has stuff. You have collections. I have treasures.

These are sometimes the comparisons that come to mind when people talk about the things they accumulate in the course of busy lives.

What those things are called doesn’t really matter, until it comes time to sell, bequeath, donate, give away or (maybe) discard them. The process of transitioning material possessions to their next owners has a fancy name in museum-speak -- deaccessioning. For the rest of us, it means deciding what’s what and who gets it.

People often dread this process, because it can be time-consuming, emo-

tionally dif f icult and physically challenging. But it doesn’t have to be that way. Moving possessions, even much-loved ones, to new homes can be liberating, educational and even f inancially rewarding.

The f irst step to a smooth process is to f ind out what you have and what it’s worth. This is best accomplished with the help of experts who are both objective and market-savvy. That support is most readily achieved with the assistance of a full-service auction house with an international presence.

One such resource close at hand is Bonhams Skinner. Part of the global Bonhams network, Bonhams Skinner, the New England auction house, has representatives throughout the area as well as a

robust online presence. This auction house is large enough to tap into the broadest possible market while offering a high level of personalized attention.

As Bonhams Skinner’s regional manager Northeast, I’ve found that often exceptional items are hiding in plain sight in houses that weren’t homes of “collectors.”

People are sometimes surprised to learn that the value of an object doesn’t necessarily depend on its age or its rarity. The souvenir rock from a long-ago Grand Canyon adventure is more than antique; it’s ancient. That handwritten booklet of greatgreat-great grandfather William’s sermons is unique. To the owner, their personal associations are priceless. Neither one of these has much monetary value, because

there isn’t any demand for either item.

At the other end of the value spectrum may be a small painting by an obscure artist, hung in a seldom-used bedroom, or an ordinary-looking porcelain dish most recently used for feeding the cat. An experienced appraiser on a house call is especially attuned to spot outliers, unrecognized items that in the international market could achieve a previously undreamt-of price.

The moral here: Know before you let go. If you’re considering getting rid of his stuff, their collections or your treasures, consult an expert. Because you never know. But Bonhams Skinner does.

For more, contact Katie at Katie.Whittle@ bonhamsskinner.com or 212-787-1114.

MAY 15, 2023 FCBJ 9 WCBJ

Aaron Willard Jr. Thermometer-front patent timepiece, or banjo clock (circa 1815). Sold for $10,000 at Bonhams Skinner. Photographs courtesy Bonhams Skinner.

Red/gold-lacquered bronze figure of Buddha (China, Ming Dynasty-style). Sold for $10,625 at Bonhams Skinner.

Richard Henry Nibbs’ “European Harbor at Dusk,” oil on canvas. Sold for $9,375 at Bonhams Skinner.

10 MAY 15, 2023 FCBJ WCBJ PRESENTED BY: SPONSORED BY For sponsorship inquiries, contact Barbara Hanlon at bhanlon@westfairinc.com or 914-358-0766. For event information, contact Natalie Holland at nholland@westfairinc.com. WestfairOnline REGISTER TO ATTEND AWARDS PRESENTATION REGISTER AT: CHAMBER PARTNERS: Darien Chamber of Commerce | Wilton Chamber of Commerce | Greater Norwalk Chamber of Commerce Fairfield Chamber of Commerce | Greater Valley Chamber of Commerce | Ridgefield Chamber of Commerce | Westport-Weston Chamber of Commerce Greater Danbury Chamber of Commerce | Greenwich Chamber of Commerce | Bridgeport Regional Business Council | Stamford Chamber of Commerce JUNE 15 | 5:30 - 8 P.M. The Point at Norwalk Cove 48 Calf Pasture Beach Rd, Norwalk Meteorologist Co-Host Fox 61 Morning News westfaironline.com/40under40 MATT SCOTT EMCEE STAY TUNED FOR THE WINNERS.

An ice cream shop that screams for beter service

BY JEREMY WAYNE

BY JEREMY WAYNE

Idon’t scream for ice cream because I’m not a baby (although my wife might not agree,) but I do desire, crave and positively need a good ice cream hit a couple of times a week.

True, cream of any kind is my weakness. La Grande Cascade restaurant in Paris, a beloved spot I often visited as a child, still serves desserts with a choice of heavy “pouring” cream, a heavier cream akin to clotted cream and whipped Chantilly cream. If you choose to have all three on your pro f iteroles or even your ice cream, no one turns a hair. Ça c’est normal for the indulgent Parisians and delicious it is, too.

Commercial French ice cream, like the popular Berthillon brand, distinguishes itself by using a greater than usual amount of egg yolks, which give added depth and custard-like creaminess. Here in the United States, Häagen Dazs has long been the gold standard for “luxury” store-bought ice cream, with its egg content relatively high and added air content relatively low, although its dependence on combination flavors, rather than simple, “true” ones has, in my view, somewhat diminished our ability to discriminate.

Which is why, when we go to Italy, or taste gelato (which is simply ice cream by its Italian name,) we recognize the difference. In good “gelato,” there is both purity and intensity of flavor, with less fat and less air than its American counterpart.

Reverting to the French model, I’ve long admired the rich ice cream churned by Pete and Ben Van Leeuwen at their factory in Greenpoint, Brooklyn, and available in markets and their own branded Van Leeuwen outlets throughout the country. There are now 41 of these, from New York to California with many points in between.

Ice cream f iend that I am, I was excited to learn about their latest “scoop shop,” as they call it, in Darien, which opened in the Darien Commons Mall in April, alongside upscale neighbors like Sweetgreen and Warby Parker. With 20 people already waiting ahead of us on line, the new mall’s lack of landscaping or aesthetic appeal clearly wasn’t putting people off the day I visited, with my two tasting helpers. These Van Leeuwen guys must be doing something right, we thought.

Well, up to a point. Out of the four staff members present, one was robotically wiping down a cabinet while staring into space; another was grappling with a

recalcitrant milkshake blender; a third was standing doing nothing, waiting to take sporadic payments; while the fourth was valiantly struggling to scoop -- and to cope.

At the front of the line at last, I asked for an initial scoop of vanilla in a cup -- “a very good place to start,” as Maria von Trapp sings in “The Sound of Music.”

“Sorry, no vanilla,” came the disheartening reply. “We’ve run out.” (Well, vanilla is the most popular flavor of ice cream.) Under pressure and with no Plan B at this point, I opted for vegan PB Brownie Honeycomb. While a little sweet for my taste, it was dense and creamy with a gentle crunch. (“PB” is, of course, peanut butter, although it could just as easily stand for “Pete” and “Ben.”)

Between the three of us we went on to sample four more flavors, with comments faithfully reported below.

Vegan strawberry shortcake: “Overly sweet, bubble gum-forward, clag g y texture.”

Big Face coffee affogato: “Great, authentic coffee flavor, smooth consistency, though it didn’t quite capture the punch of a strong espresso hitting cold vanilla ice cream, as implied in the name.”

Pistachio: “Pale, slightly insipid green color belied a beautifully sunny, ripe pistachio flavor.”

Earl Grey Tea: “Subtly captured real Earl Grey flavor -- black tea with a hint of bergamot -- in a smooth ice cream base.”

As they were also out of regular whipped cream, I tried the vegan whipped cream alternative. It tasted of coconut and processed cheese.

When I asked our overstretched scooper about the bomboloni -- Italian donuts f illed with ice cream that I had seen advertised as being unique to the new Darien shop -- he said he had never heard of them. He suggested an ice cream sandwich instead, two scoops of ice cream between two cookies. Although I did not try it, it is apparently a best seller.

Along with milkshakes and a good selection of toppings, Van Leeuwen sells its ice cream in pints to take out, as well as its own ice cream bars in boxes of six. The bars, which by the way are excellent, are certi f ied kosher. (The ice cream is not).

The day after the visit, I received a text from Van Leeuwen, which had craftily captured my number when I paid my bill.

“We hope you enjoyed your visit as much as we enjoyed your visit,” said the rather glib message. That sentiment felt a little hollow, since there was no obvious sign that anyone behind the counter had enjoyed our visit. Indeed, I think the young and hopelessly undertrained staff would have been happier had we not been there at all.

On the one hand, I continue to enjoy the Van Leeuwen brand -- and, old sap that I am, I’m crazy for its packaging by the way -- but I do think socks can be pulled up. On the other hand, with that line snaking into the parking lot, the customers seemed happy enough, so perhaps I’m just talking out of my ice cream cone.

For more, visit vanleeuwenicecream.com.

MAY 15, 2023 FCBJ 11 WCBJ

Customers throng to the new Van Leeuwen “scoop shop” in the Darien Commons Mall

The Van Leeuwen motto. Photographs by Jeremy Wayne.

Ice cream – and shorts – season is upon us.

What to do if you missed the tax deadline

If you haven’t f iled your 2022 tax return, it’s not too late.

Gather the information related to your income and deductions and call your tax preparer ASAP. If you are owed money, the sooner you f ile, the sooner you will get your refund. If you owe taxes, f ile and pay as soon as you can, which will stop the interest and penalties you owe.

Some taxpayers f iling after the deadline may qualify for penalty relief. Those charged a penalty may contact the IRS by calling the number on their notice and explaining why they couldn’t f ile and pay on time.

For 2022 tax returns due April 18,

2023, some taxpayers automatically qualify for extra time to f ile and pay taxes due without penalties and interest, including:

• Some disaster victims. Individuals living or working in a federally declared disaster area have more time to f ile and pay what they owe.

• Taxpayers outside of the country. U.S. citizens and resident aliens who live and work outside the U.S. and Puerto Rico, including military members on duty who don’t qualify for the combat zone extension, may qualify for a twomonth f iling and payment extension.

• Members of the military who served or are currently serving in a combat zone may qualify for an additional extension of at least 180 days to f ile and pay taxes.

• Support personnel in combat zones or a contingency operation in support of the armed forces may also qualify for a f iling and payment extension of at least 180 days.

Military members can also f ile their taxes using MilTax, a free tax resource offered through the Department of Defense. Eligible taxpayers can use MilTax to f ile a federal tax return electronically and up to three state returns for free.

What If You Don’t File?

Every year, more than

1 million taxpayers choose not to f ile a return and miss out on receiving a refund due to potential refundable tax credits. The most common examples of these refundable credits are the Earned Income Tax Credit and Child Tax Credit. For example, the IRS estimates nearly 1.5 million people did not f ile a tax return for 2019 and missed out on an estimated average median refund of $893.

Taxpayers usually have three years to f ile and claim their tax refunds. If they don’t f ile within three years, the money becomes the property of the U.S. Treasury. However, the three-year window for 2019 un f iled returns was postponed to July 17, 2023, due to the Covid-19 pandemic.

How To Make a Payment

If you owe money but cannot pay the IRS in full, pay as much as possible when you f ile your tax return to minimize penalties and interest. The IRS will work with taxpayers suffering f inancial hardship. Taxpayers with a history of f iling and paying on time often qualify for administrative penalty relief.

Taxpayers usually qualify if they have f iled and paid promptly for the past three years and meet other requirements. However, if you continue to ignore your tax bill, the IRS may take collection action.

There are several ways to make a payment on your taxes: credit card, electronic funds transfer, check, money order, cashier’s check or cash. If you pay your federal taxes using a major credit card or debit card, there is no IRS fee for credit or debit card payments, but processing companies may charge a convenience or flat fee. It is important to review all your options. The interest rates on a loan or credit card could be lower than the combination of penalties and interest imposed by the Internal Revenue Code.

to pay as much as possible. By paying as much as possible now, the interest and penalties owed will be less than if you pay nothing. Based on individual circumstances, a taxpayer could qualify for an extension of time to pay, an installment agreement, a temporary delay, or an offer in compromise.

For individuals, IRS Direct Pay is a fast and free way to pay directly from your checking or savings account. Taxpayers who need more time to pay can set up either a short-term payment extension or a monthly payment plan.

Most taxpayers can set up a monthly payment plan or installment agreement that gives them more time to pay. However, penalties and interest will continue to be charged on the unpaid portion of the debt throughout the duration of the installment agreement/payment plan. You should pay as much as possible before entering into an installment agreement.

Individual taxpayers who do not have a bank account or credit card and need to pay their tax bill using cash can make a cash payment at participating PayNearMe Company payment locations (places like 7-Eleven). Individuals wishing to take advantage of this payment option should visit the IRS.gov payments page, select the cash option in the “Other Ways You Can Pay” section, and follow the instructions.

It’s important to understand the ramif ications of not f iling a past-due return and the steps that the IRS will take. Taxpayers who continue not to f ile a required return and fail to respond to IRS requests for a return may be considered for various enforcement actions, including substantial penalties and fees.

This column is for information only and is not advice. Always consult a qualif ied tax professional if you have questions.

What

to do if you

cannot pay in full Taxpayers who cannot pay the full amount owed on a tax bill are encouraged

Norman G. Grill is managing partner of Grill & Partners LLC, certif ied public accountants and consultants to closely held companies and high-net-worth individuals, with of f ices in Fair f ield and Darien.

12 MAY 15, 2023 FCBJ WCBJ CONTRIBUTING WRITER | By Norman G. Grill

Image by sentavio on Freepik.

PANELISTS Jonathan Gertman Senior VP The NRP Group SPONSORED BY GOLD SPONSORS BRONZE SPONSORS westfaironline.com/RealEstate2023 Martin Ginsburg Katherine Kelman Principal Managing Director Ginsburg Development Co. LMXD R. David Genovese Founder

Properties PRESENTED BY Thursday, June 8 11:30 a.m. to 1:30 p.m. $40 per person For event information contact Natalie Holland at nholland@westfairinc.com For Sponsorship inquiries contact Anne Jordan at anne@westfairinc.com CV Rich Mansion 305 Ridgeway, White Plains HOSTED BY: MODERATOR: REGISTER: EVENT: ATTENDANCE: The Conversion of Commercial Properties: What are the Creative Options? Eon S. Nichols Partner Cuddy & Feder LLC

Baywater

NYC mayor's plan to bus migrants to Hudson Valley is blasted

BY PETER KATZ Pkatz@westfairinc.com

BY PETER KATZ Pkatz@westfairinc.com

Orange County Executive Steven M. Neuhaus and Rockland County Executive Ed Day are among the elected of f icials who have been vehemently opposing plans by New York City Mayor Eric Adams to bus immigrants seeking asylum in the U.S. from the city to locations in the Hudson Valley.

Neuhaus issued an executive order to block hotels in Orange from housing asylum seekers. Neuhaus said that Adams went back on a promise he made not to send more than 60 adult male immigrants to hotels in Orange County.

Day declared a State of Emergency in Rockland County after learning that Adams planned to send 340 or more immigrant single men to stay at a hotel in Orangeburg.

During a May 8 news conference at the Rockland County of f ices in New City, Republican Rep. Mike Lawyer urged elected of f icials to show up on May 10 when President Biden was due to visit Westchester Community College to deliver a speech on the debt ceiling and other economic matters. Lawler said they need to demonstrate their opposition to Adams’s plan to send immigrants out of New York City that Lawler said the Biden Administration supports.

“New York City is a sanctuary city. Rockland County is not,” Lawler said. “We will not pay for the foolish policy decisions made by a city council that has been led by radical socialists.”

Orangetown Supervisor Teresa Kenny said that all of the immigrants would be single men and she charged that none would have been vetted for possible criminal records.

Kenny said that she talked with Adams and he failed to provide answers to many of the questions she raised and members of his administration have not been forthcoming with her about the plan.

“You are bringing upwards of 340 men into the hamlet of Orangeburg,” Kenny said.

“It’s a little over three square miles with a population about 4,600 people. It’s a residential suburban community and you’re going to bring 340 single men that we don’t know if they have criminal records.”

Day complained that the Adams administration noti f ied New York state of its plan long before Rockland became aware of it.

“We went and did our own due diligence. That’s how we found out about the plan,” Day said. “If someone’s going to tell you, the working press, that we were informed -- that’s utter nonsense. We were not informed. We had to f igure it out ourselves.”

Adams had previously proposed sending immigrants to SUNY’s Sullivan County campus. They initially were supposed to be Ukrainian families who had fled the war zone. SUNY of f icials had agreed to house them in dorms that had plenty of vacant space. However, it was discovered that Adams did not plan to send Ukrainian refugees and instead was planning to send about 100 single homeless men from various countries. Sullivan County of f icials accused Adams of trying to get away with a “bait and switch” scheme.

“New York City Mayor Eric Adams, hear me loud and clear. Rockland will not stand for your administration, which boasts itself as a sanctuary city, diverting busloads of undocumented individuals to our county,” Day said. “This is not about being anti-immigration but as it stands you are only incentivizing illegal immigration, which does nothing to support our infrastructure or the hardworking citizens we are elected to serve. It is only draining taxpayer resources from the families who are already here and struggling, including our homeless, low-income, disabled, seniors and other vulnerable populations.”

The State of Emergency that Day put into effect in Rockland prohibits any hotel or motel from housing migrants without a license from the county. Additionally,

it prohibits municipalities from housing anyone in Rockland without a contract agreement with the county. Violations of the State of Emergency could result in f ines of $2,000 per migrant per day.

“Instead of trying to help our own families the state of New York is using taxpayer dollars to fund up to one year of housing and services for noncitizens to relocate within our state,” Day alleged. He posed a question for Adams and Gov. Kathy Hochul: “Will you be offering all of our low-income families free housing, food, clothing and more for up to a year as the current state of the economy drives the cost of living, home and apartment prices to new record highs?”

In Westchester, County Executive George Latimer said that he was advised by County Attorney John Nonna that he does not have the power to deal with an immigration issue by declaring a State of Emergency. Latimer said that the debate in Washington on immigration that includes whether to build a full-scale border wall and whether to completely end immigration has delayed the country from addressing immigration policy.

“That debate in Washington has frozen us from having any kind of a rational policy,” Latimer said. “And so it falls to state governments and now local governments to deal with the aftermath of that.”

14 MAY 15, 2023 FCBJ WCBJ HUDSON VALLEY

Rockland County Executive Ed Day at May 8 news conference.

Dutchess legislators updated on $70M youth center project

BY PETER KATZ Pkatz@westfairinc.com

BY PETER KATZ Pkatz@westfairinc.com

Work continues on plans to build a youth center for Dutchess County at 35 Montgomery St., in Poughkeepsie, formerly the site of the YMCA. The county purchased the site from the city about two years ago. The cost of the project is now estimated at $70 million.

The plans by designer MASS Design Group include a competitive pool, a family pool, a g ymnasium housing a basketball court and elevated track, an early learning and childcare center, a f itness center, a smart lab, a community room, meeting rooms and a café with teaching kitchen. The new facility has been dubbed YOU, standing for Youth Opportunity Union.

“The YOU will provide a holistic approach that encompasses the entire spectrum of a child’s life; bringing together nutrition and wellness, family learning and social interactions with neighbors and the community at large," said Dutchess County Executive William F.X. O’Neil. "This comprehensive focus will positively impact individual and collective community youth development.”

Members of the county legislature were briefed on the project at a meeting of the Public Works and Capital Projects Committee.

Dutchess County pledged $25 million

toward the project. In April, the county received formal support from Rep. Pat Ryan, who is recommending $3 million in federal funds through the Congressionally Directed Spending program for Fiscal Year 2024. Senate Majority Leader Charles Schumer requested $10 million for the YOU through the Senate Committee on Appropriations. A fundraising effort is currently being developed in partnership with the Dyson Foundation.

The legislators were told that anticipated construction costs have increased as the construction industry deals with delays and higher materials costs in the wake of Covid. No commitment was made on a construction timetable for the new building.

Ulster helps 42 more businesses, nonprofts

BY PETER KATZ Pkatz@westfairinc.com

Ulster County has announced it is giving f inancial assistance to 42 businesses and nonprof its through its CARES II Small Business Grant award program. This is the second round of funding in the CARES program and is designed to support and expand the operations of local small businesses and organizations with 25 or fewer employees and provide much-needed relief from the economic effects of the Covid pandemic.

A wide variety of expenses including rent, payroll, equipment and f ixed assets are eligible for reimbursement through the

program, with a minimum award amount of $5,000 and a maximum award amount of $35,000 provided directly to businesses and organizations.

Ulster County said that more than 270 applications for funding were received. The applications were reviewed by a six-person committee composed of County Legislators John Gavaris, Kevin Roberts, and Chris Hewitt, along with three county employees appointed by the Ulster County Executive’s Of f ice. The Ulster County Economic Development Alliance reviewed the committee’s recommendations and formally approved them.

“I want to congratulate the more than 40 small businesses and nonprof its through-

out the county that received these awards,” said County Executive Jen Metzger. “In the aftermath of the pandemic, the funding will provide f inancial relief and assistance where it is most needed, as well as the opportunity to support the growth and vitality of these businesses and organizations, especially when it comes to creating and retaining jobs throughout the county.”

Hewitt said that the review process revealed local businesses are in need of major support as they recover from the pandemic, and that he and his colleagues would continue working to support these businesses. He also said that the number of applications made it clear that more funding is needed.

“The recipients of the CARES II small business grants demonstrated that the pandemic drastically impacted their businesses,” said Hewitt.”They each have strong plans to keep their businesses and organizations successful into the future.”

The f irst round of the CARES program aid totaled nearly $930,000 and covered eligible expenses from Dec. 23, 2021 through Oct. 31, 2022. It provided direct f inancial assistance to 34 small businesses and organizations, more than half of which were women- and minority-owned. The county said that as a direct result of this funding those businesses added 38 new full-time jobs and 27 part-time jobs while retaining 82 full-time and part-time jobs.

MAY 15, 2023 FCBJ 15 WCBJ HUDSON VALLEY

Rendering of YOU exterior..

Rendering of proposed gym with elevated track.

Can Artificial Intelligence Advance Access to Care?

Find out June 7 at the WCA's next "All Access Healthcare event " AI in healthcare is not a new concept: for years, AI applications have been used to transform the healthcare industry improving patient outcomes and increasing efficiencies Today, as health disparities widen across the country, AI may be able to help close the gap Join us to hear about AI’s potential to improve existing technologies, sharpen personalized medicine, and with a big influx of data benefit historically underserved populations

4

Our talent summit was a huge success, with 150 business leaders attending to share best practices in talent attraction and development An insightful keynote address and robust panel discussion revealed four big takeaways to consider as we tackle today’s pressing labor challenges:

1

Expert speakers include:

Vasco Drecun, Keynoter & Panelist, Vice President, R&D Strategy, Digital Operations Officer, Siemens Healthineers

Mel Donatelli, Moderator, Senior Executive Leader, Slalom

Lindsay Farrell, Panelist, President & CEO, Open Door Family Medical Center

Vishal Sheth, Panelist, Director of Transformation, New York-Presbyterian Register at Westchester.org/events.

2

3

A lack of affordable housing hurts employers' ability to recruit and the housing crisis must be addressed to attract top talent;

Career exploration should start much earlier to expose young people to the diversity of available jobs;

Successful recruitment stems from partnerships between employers, schools, trade organizations, and workforce development programs;

Retention is playing a bigger role; employers must create workplaces where people want to stay.

Career exploration should start much earlier.

16 MAY 15, 2023 FCBJ WCBJ HEALTHCARE | REAL ESTATE & HOUSING | WORKFORCE DEVELOPMENT | DIGITAL CONNECTIVITY | ENERGY & SUSTAINABILITY BUSINESS INTEL NEWS WESTCHESTER COUNTY ASSOCIATION MAY 2023

SAVE THE DATE Thursday, June 15, 2023 C.V. Rich Mansion 305 Ridgeway, White Plains SUMMER NETWORKING

17 W e s t c h e s t e r C o u n t y A s s o c i a t i o n P r e s e n t s in partnership with Thursday, June 1 | 12:30pm - 7:30pm Elisabeth Haub School of Law at Pace University Sustainability Boot Camp for Business Transitioning to a Lower Carbon Footprint Regulatory Developments Tickets: westchester.org/events Sustainable Business Conference Thanks to our sponsors

The phenomenon of hybrid work has resulted in a lot being said in real estate circles regarding of f ice building vacancies, valuations and f inancing. Hybrid work has caused tenants of all sizes to shrink their of f ice space as their leases expire. This will likely continue for years, as there is no regularity to lease terms or lease expiration dates. The adoption of hybrid workforces by businesses will be very detrimental to owners of of f ice buildings.

Tech companies (that are some of the largest users of high-quality of f ice space) have gone through multiple rounds of employee layoffs, following excess expansion during the pandemic. These actions have caused them to put substantial amounts of space on the sublease market, to cancel leases where they have that option, and to pull back on taking new space. The result is obvious: vacancy rates (which pertain only to space that can be leased directly from the building owner) and availability rates (which include space that tenants are paying rent on but are actively marketing for sublease) are both increasing and will continue to increase in the future.