winter.2016

A publication of the Cooperative Credit Union Association, Inc.

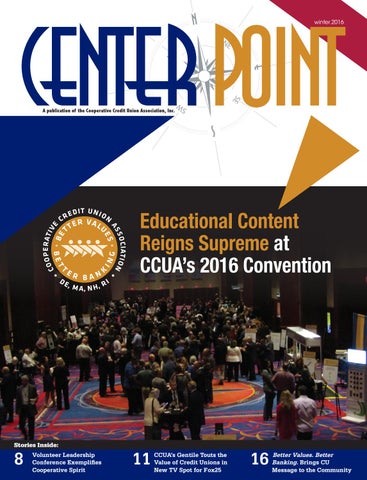

Educational Content Reigns Supreme at CCUA’s 2016 Convention

Stories Inside:

8

Volunteer Leadership Conference Exemplifies Cooperative Spirit

11

CCUA’s Gentile Touts the Value of Credit Unions in New TV Spot for Fox25

16

Better Values. Better Banking. Brings CU Message to the Community

Available in your le nding area January 1, 2017

The Express Lane for Home Equity Lenders

Title Search, Valuation, and Flood in 30 Seconds

THE FIRSTCLOSE REPORT • Title Search • Valuation • Life of Loan Flood Certification • Property Tax Status • Photos of the Property • Lien Protection Insurance • Copy of the Deed

LEARN MORE

Educational Content Reigns Supreme at CCUA’s 2016 Convention

Cooperative Credit Union Association, Inc. www.ccuassociation.org 800-842-1242 Paul Gentile, President/CEO

EDITORS: Donna M. Bevilacqua Walter Laskos Cynthia Lepore CONTRIBUTORS: Robert Delaney Bonnie L. Doolin William F. Nagle Charlotte Whatley

12

Table of Contents PUBLISHED BY

4 MESSAGE FROM THE PRESIDENT/CEO 6 CUNA MUTUAL GROUP ADVOCACY AND STATE-RUN RETIREMENT PLAN

The Warren Group

Design / Production / Advertising custompubs@thewarrengroup.com 280 Summer Street, Boston, MA 02210 Phone: 617-428-5100 Fax: 617-428-5118 www.thewarrengroup.com

©2015 The Warren Group Inc. All rights reserved. The Warren Group is a trademark of The Warren Group Inc. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: The Warren Group, 280 Summer Street, Boston, MA 02210. Call 800-356-8805.

7 CREDIT UNION NEWS – CCUA Partnership with SiriusXM® Enhances Credit Unions’ Used-Auto Loan Offerings – Volunteer Leadership Conference Exemplifies Cooperative Spirit – Financial Fraud Trends in Delaware: Beware the ‘Felony Lane Gang’

08

– Hike the Hill Delivered a Strong Message to Lawmakers – CCUA’s Gentile Touts the Value of Credit Unions in New TV Spot for FOX

16 IN YOUR NEIGHBORHOOD – Better Values. Better Banking. Brings the Credit Union Message to the Community – CCUA Debuts Video on ‘15 Reasons to Bank Only at a Credit Union’

17 COMMUNITY INVOLVEMENT – –

10

DEXSTA Federal Credit Union and Naveo Credit Union Jeans Days Benefit Children’s Miracle Network Hospitals Massachusetts Credit Unions Sponsor and Raise More Than $29K for the Homeless

– Credit Unions Of Rhode Island Present Special Olympics Rhode Island with $90,900 Donation

19 CREDIT UNION PEOPLE 21 CALENDAR

18 winter.2016 | centerpoint | 3

M E S S AG E F RO M T H E P R E S I D E N T

| By Paul Gentile

MEMBER ENGAGEMENT: AN INVESTMENT IN CREDIT UNIONS AND ONE ANOTHER Member engagement comes in many shapes and sizes. From newsletters and commercials on radio and television, to the hearty handshake that occurs in countless branches day in and day out, member engagement is the foundation on which credit unions build relationships. And it’s no wonder since the credit union motto is “People Helping People.” At the Cooperative Credit Union Association, member engagement is no different. It too takes on a variety of shapes and sizes, from network meetings and educational workshops, to the Daily CU Scan and our Video Conference Network. But, nowhere is member engagement more pronounced than at our annual meeting and convention. This year’s gathering, certainly a celebration of who we are as CCUA, took member engagement to new and exciting heights. Not only did we engage minds with creative insights and thought-provoking ideas presented across a spectrum of topics featured during breakout sessions and the general assembly, we also engaged one another – whether it was seeking out the best possible products we can provide to our members from a host of expert service providers, or time spent in grateful reflection for all we accomplished, both as an association and as credit unions devoted in service to our members. We welcomed new colleagues from Delaware, reveled in the popularity of our consumer advocacy campaign, listened attentively to stories of victory and outstanding success made possible by our spirit of generosity, and celebrated the accomplishments of eight credit unions for delivering excellence in advocacy and social responsibility. The time we spent together at Mohegan Sun was a worthwhile investment, energizing our cooperative spirit in ways that we’ll only fully understand as we work together in the days and months ahead, Hiking the Hill, advocating for our industry, supporting each of our state’s charities, and sharing our time and thoughts on the many ways we can grow and safeguard our credit unions and the services they provide. Member engagement – it’s at the heart of your credit union as well as the heart of your association. Your support, your feedback and your participation in our annual meeting and convention, CU Accelerate, our “In Your Neighborhood” gatherings, the Governmental Affairs Conference, golf outings, committee meetings, and open forums, to name a few, makes everyday an exciting and crucial investment in our credit unions and the thousands of people they serve. And, for all of this, I am most grateful! Paul Gentile, president, Cooperative Credit Union Association

4 | centerpoint | winter.2016

Solutions Get Results Teller Tools for Money Handling Automation

Your People are Your Best and Most Under-Utilized Assets The Right Solutions Will Give Your Tellers the Tools They Need to Get Results

Self-Service Coin Centers

Currency Recyclers

Currency Dispensers

Contact a Magee Consultant Today 800-347-1414 ext. 336 · tconklin@mageecompany.com · www.magner.com

© 2016 Magner Corporation of America. All rights reserved.

Currency Counters Coin Counter/Sorters Coin Counter/Packagers

C R E D I T U N I O N S E RV I C E S

CUNA MUTUAL GROUP ADVOCACY AND STATE-RUN RETIREMENT PLAN By Megan Collins Balogh, manager, CUNA Mutual Group Corporate & Legislative Affairs A growing national trend seeks to change the way Americans save for retirement. As research continues to indicate a majority of Americans are not saving enough for a financially secure retirement, state and local officials are introducing plans to expand the public retirement system. In 2015, at the urging of President Obama, the U.S. Department of Labor adopted rules to remove regulatory barriers that previously prevented state-sponsored retirement plans. Soon after, more than 30 states introduced legislation to establish or research state-run plans for private sector workers not participating in an employersponsored plan. Now, short of state action, even large cities are looking for ways to address the savings gap. For example, in Pennsylvania, there wasn’t a state-sponsored plan or pending legislation for one, so in June the Philadelphia City Council adopted a resolution to create a task force on Retirement Security for Private Sector Employees in Philadelphia. The resolution cited a study commissioned by the city council, which they found 48 percent of Philadelphia workers ages 25-64 have access to an employer-sponsored retirement plan and only 37 percent of those employees actually participate. As a provider of retirement products and services to credit union members and system employees, CUNA Mutual Group is aware of the retirement savings gaps in all states across the country and is committed to empowering hardworking Americans to achieve financial security. To that end, CUNA Mutual Group advocates for state retirement initiatives that promote private sector savings through education and collaboration with the private sector as well as federal initiatives which complement the private sector. But not all state-run retirement plans are created equal. Some of the plans introduced in states may provide only limited flexibility for credit union members and employees looking to save for retirement, while other state plans may not allow contributions for these individuals at all. Generally, there are three state-run retirement models gaining momentum in states: the Marketplace, the Prototype and Multiple Employer Plan, and an auto-enrollment IRA. Following is a description of the three plan options and CUNA Mutual Group’s advocacy position to enable maximum savings for credit union members and system employees. THE MARKETPLACE Under a Marketplace approach, states establish and facilitate a forum for private sector plan providers to sell retirement plans to individuals and small businesses. Currently, Washington is working to implement a marketplace – plans available include target and balanced funds as well as the government’s myRA. There are no stated minimum contributions and an employer match is available; though, these plans are subject to additional employer requirements under 6 | centerpoint | winter.2016

ERISA. As employees leave a job, the marketplace option allows individuals to move with their plans and roll retirement savings into a new plan. CUNA Mutual Group strongly supports legislation to implement marketplace plans that are open to private sector retirement plan providers and improve savings access for all credit union employees and members. THE PROTOTYPE AND MULTIPLE EMPLOYER PLAN Multiple Employer Plans (MEP) allow businesses to pool resources and increase the number of participants in a group policy, despite multiple policyholder employers. The MEP combines investment returns into a single asset pool; employers set contribution rates and individuals maintain their own accounts. While substantially similar, a prototype plan allows only a single plan design. In MEP states, the state is the plan fiduciary and responsible for policyholder communications, selection of service providers and assumes liability for the plan. While achieving economies of scale, MEPs compete with the private market and generally fail to provide wider-reaching savings vehicles to employees without access to retirement plans. In addition, MEPs feature few plan options and enjoy incentives and exemptions not available to the private market. Given the limited availability and unleveled playing field with the private sector, CUNA Mutual Group opposes MEPs and prototype plans. AUTO-ENROLLMENT IRA States where auto-enrollment IRA plans are approved establish mandatory savings programs for most employees without access to an employer-sponsored retirement plan. Plan offerings usually include only Roth IRAs and traditional IRAs, employees must choose to opt out of the plan and no employer match is permitted. Additionally, employers must provide plan administrative support. CUNA Mutual Group supports auto-enrollment plan legislation as a means to increase overall retirement savings so long as such legislation is tailored to assist small employers not currently served by the private sector. CUNA Mutual Group’s advocacy goal is to increase access to retirement savings opportunities throughout the credit union movement. As states develop and adopt state-run retirement plans, CUNA Mutual Group will continue to support plans to increase overall retirement savings.

C R E D I T U N I O N N EWS

CCUA PARTNERSHIP WITH SIRIUSXM® ENHANCES CREDIT UNIONS’ USED-AUTO LOAN OFFERINGS As the Cooperative Credit Union Association (CCUA) continues to seek new ways to deliver value, its partnership earlier this year with SiriusXM has been a winner, giving credit unions a “sweetener” for their used-auto loan programs while giving members an exciting reason to think of their credit unions first when it comes to borrowing. “The used-auto loan market has historically been a key loan category for credit unions. That has never been more true than today,” said CCUA President Paul Gentile. “Used autos make up 21 percent of the system’s loan portfolio with an annual growth rate of more than 13 percent. We believe this program can add to credit unions’ strong performance in used autos.” Credit unions that enroll in the program can offer qualified used-car borrowers a free, three-month trial of SiriusXM radio’s AllAccess package. SiriusXM offers a premier satellite radio experience with more than 150 channels, including commercial-free music, at CCUA. Additional help is also available by calling the plus sports, news, talk, and entertainment. SiriusXM Credit Union Program Information Hotline: “SiriusXM Radio is a highly recognized, well-liked service that 1-888-686-2550. many auto owners have on their wish lists. For eligible borrowers this is a way, through membership in their credit union, to fulfill that wish,” said Gentile. Meanwhile, SiriusXM has embraced the new partnership and was a big contributor to the excitement at the CCUA’s 2016 Annual Meeting and Convention. SiriusXM not only exhibited and sponsored the banquet, but also streamed music into the venue, introduced attendees to the credit union program For a limited time, we’re offering members zero-percent Classic Advances website and gave away an autographed guitar to create or preserve jobs in their communities. signed by Grateful Dead guitarist Bob Weir. Additionally, Radhika Giri, SiriusXM’s VP of Our new program, Jobs for New England, will award up to $5 million in interest-rate subsidies every year through 2018. A maximum of $250,000 affinity partnerships and database marketing, in subsidy is available per member each year. At current rates, $250,000 enthusiastically described the company’s can leverage up to $30 million in one-year advances. commitment to working with credit unions To find out more about Jobs for New England, contact Fatima Razzaq at on behalf of their members in an interview 617-425-9564, or fatima.razzaq@fhlbboston.com. with CU Broadcast’s Mike Lawson (www. cubroadcast.com). But don’t delay. These funds won’t last forever. The SiriusXM Credit Union Program See what your cooperative can do for you! is available to credit unions throughout the United States. CCUA has made it easy to learn even more about the program with its scheduled information sessions held weekly Tuesday afternoons at 2:30 pm EST. Each intro session lasts Federal Home Loan Bank of Boston • 800 Boylston Street Boston, MA 02199 • www.fhlbboston.com approximately 45 minutes. To learn more about this offering, contact Bonnie Doolin

Free money. First-come, first served. Really.

FHLBBoston

winter.2016 | centerpoint | 7

C R E D I T U N I O N N EWS

VOLUNTEER LEADERSHIP CONFERENCE EXEMPLIFIES COOPERATIVE SPIRIT

L-R: John Bratsakis, president, MD|DC Credit Union Association, Lt. Colonel Robert J. Darling, USMC (Ret.) and Paul Gentile, president, Cooperative Credit Union Association.

Although Hurricane Matthew loomed on the horizon, more than 150 credit union volunteers, committee members and key staff descended on Ocean City, Maryland, in early October to attend the 20th Annual Volunteer Leadership Conference. Hosted by the Cooperative Credit Union Association (CCUA) and the MD|DC Credit Union Association, the event provided unique educational experiences, along with the opportunity for attendees to network with their peers from Delaware, MD, Virginia, New Jersey, Pennsylvania, and Washington, DC. Speaker Meagan Johnson got the party started with a lively discussion on the challenges of a multigenerational workforce. She noted that recognizing and utilizing an emotional connection is key to having multiple generations work together successfully in the workplace, rather than merely peacefully co-exist. Johnson said every generation is shaped by “generational signposts” that create a unique environment and mold their expectations for others.

8 | centerpoint | winter.2016

Despite strong loan and membership growth, credit unions are facing tremendous regulatory headwinds and the system is showing strong trends toward a “have and have-not” system. Paul Gentile, CCUA president, and John Bratsakis, MD|DC CEO, joined forces to present a credit union system update. This engrossing session gave attendees the “lay of the land” of the system in terms of data, regulatory challenges, legislative opportunities, and technology trends impacting how credit unions serve their members. Demonstrating the true cooperative nature of credit unions, Gentile and Bratsakis, along with a panel of credit union CEOs and board chairpersons, also led a lively exchange of ideas, information and questions. This popular session provided a unique opportunity for a peer-to-peer sharing of perspective, experience and knowledge. Other educational opportunities included aligning risk management with business strategy;compliance; board and committee duties and responsibilities; revenue strategies in a changing economy; an update on FASB’s CECL; and Bank Secrecy Act Training. The event drew to a close with “24 Hours inside the President’s Bunker, Sept. 11, 2001,” a moving presentation on crisis leadership from Lt. Col. Robert Darling, USMC (Ret.). Darling took attendees on a behind-the-scenes journey of events that unfolded during the attack on America, emphasizing how preparation and training provide structure necessary to overcome extreme adversity. He noted that, during a time of crisis, what you do to get back to normal is crisis management; who you turn to is crisis leadership. Darling shared how utilizing a three-step process (assess, decide, act) can prepare individuals to lead with courage and resolve when faced with unforeseen circumstances. He noted that during a time of crisis, the person with authority to act is looked to for action and will be “forgiven for doing the wrong thing; but not for doing nothing.”

C R E D I T U N I O N N EWS

FINANCIAL FRAUD TRENDS IN DELAWARE: BEWARE THE ‘FELONY LANE GANG’ Michael Lawson, CFCI, president of the Delaware Association of Bank Security (DABS), provided insight into different fraud trends in Delaware to 14 attendees from eight of the state’s credit unions. During the presentation this fall. Lawson, who also is vice president at Artisans’ Bank, shared best practices in fighting account-based fraud, noting that account takeover can involve any type, including government benefit accounts, wireless phone contracts,

BE THE FIRST TO KNOW.

The Banker & Tradesman delivers breaking news and essential insights to real estate and financial professionals every day. Get subscriber-only access to the stories behind the headlines and to password-protected transactions – information you need to get ahead. Arm yourself with the latest updates on movers and shakers, legislation, major sales, foreclosures, liens, bankruptcies and acquisitions, trends and more.

SUBSCRIBE TODAY! Call 617.896.5388 or email subscriptions@thewarrengroup.com

mortgage loans, checking accounts, credit cards, and e-commerce accounts. He also focused part of the discussion on what he called the “felony lane gang,” a group of thieves originating in Fort Lauderdale, Florida, which has been in “business” for over a decade, causing hundreds of millions of dollars in losses. The gang typically breaks into vehicles with purses in plain view to scavenge driver licenses, checkbooks, credit and debit cards, and social security cards. Using prostitutes, the homeless and drug addicts, the gang uses the stolen cards to immediately buy sustainment items. They then outfit their “helpers” to closely resemble the stolen IDs and direct them to make withdrawals on the stolen accounts, using the drive-up lane farthest from the teller’s window. Cautioning citizens to be proactive when leaving their vehicles, Lawson also urged the credit unions to be extra observant of people using distant teller lanes and look for heavy tinting on the rear windows of vehicles. He also asked credit unions to notify police immediately if there is any suspicion of this sort of activity.

The best things in life are free. Especially money. We’re offering members zero-percent Classic Advances, on a first-come, first-served basis, to create or preserve jobs in their communities. Our new program, Jobs for New England, will award up to $5 million in interest-rate subsidies every year through 2018. A maximum of $250,000 in subsidy is available per member each year. At current rates, $250,000 can leverage up to $30 million in one-year advances. To find out more about Jobs for New England, contact Fatima Razzaq at 617-425-9564, or fatima.razzaq@fhlbboston.com. But don’t delay. These funds won’t last forever.

See what your cooperative can do for you!

FHLBBoston Federal Home Loan Bank of Boston • 800 Boylston Street Boston, MA 02199 • www.fhlbboston.com

WWW.BANKERANDTRADESMAN.COM

winter.2016 | centerpoint | 9

C R E D I T U N I O N N EWS

HIKE THE HILL DELIVERED A STRONG MESSAGE TO LAWMAKERS The Cooperative Credit Union Association (CCUA) hosted its members in Washington, DC, in September as part of its annual Hike the Hill program. With more than 30 credit union executives in attendance, and led by CCUA President Paul Gentile, the group started at Credit Union House on Capitol Hill for a comprehensive legislative, political and regulatory briefing in partnership with CUNA. Hike the Hill produced ample opportunities to voice concerns and recommendations to lawmakers and their staffs, on a wide variety of topics that are challenging the ability of credit unions to serve their members. Credit unions from Delaware, Massachusetts, New Hampshire, and Rhode Island held approximately 20 meetings with members from both Houses of Congress. Some of the key messages covered during the afternoon meetings addressed: REGULATORY BURDENS ON CREDIT UNIONS The regulatory burden under which credit unions must operate stifles their ability to fully and efficiently serve their members and leaves the financial system underserved. Since 2008, credit unions have been subjected to more than 190 regulatory changes from 15 federal agencies. In 2014, the cost of regulatory burden on credit unions amounted to $7.2 billion, according to a study commissioned by CUNA. This level of regulation limits credit unions’ ability to serve their members. Regulatory change prompts certain upfront costs, including staff time and credit union resources being applied in order to comply with the change; forms and disclosure changes; data processing systems reprogramming; and staff retraining. A case in point is mortgage lending. Credit unions are overwhelmed with the unprecedented amount of regulations that are now required for mortgage lending (HMDA, TILA/RESPA, appraisal rules, loan officer compensation rules, servicing rules, qualified mortgage/ability-to-repay rules, etc.). These 10 | centerpoint | winter.2016

The Cooperative Credit Union Association hosted 35 member credit union executives in Washington, DC, during its 2016 Hike the Hill advocacy program.

Senator Elizabeth Warren (MA) and CCUA President Paul Gentile (back row, fourth from left) and CCUA Board Chair Bernie Winne (back row, third left) with members of the MA CU delegation.

regulatory changes have brought greater compliance and legal risk to credit unions. More concerning, many of these rules are forcing credit unions to stop offering certain products and services; and, in turn, are limiting consumers’ options for credit. A prime example of regulatory burden is the new HMDA Regulation C data reporting requirements. There are several problematic provisions for credit unions, including the gross under-estimation for the exemption threshold. Under the final rule, a depository institution is required to collect and report data if it originated 25 or more closed-end mortgage loans in the prior year. Setting the exemption threshold at only 25 does not accurately reflect the current mortgage market, or go nearly far enough. STOPPING MERCHANT DATA BREACHES When merchant data breaches occur, credit unions and other financial institutions bear the

actual costs of the breach that includes not just fraud, but the expenses of helping the consumer. Credit unions are already strictly regulated with regard to data security and notification of data breaches to affected members by the requirements under the Gramm-Leach-Bliley Act (GLBA). Merchants who accept cards for payment should be held to the same standards as the credit unions that issue the cards. RESTORATION OF BUSINESS LENDING AUTHORITY Credit unions have historically been a reliable source of lending to small businesses but are limited by a statutory cap on business lending; the current cap on credit union lending to small businesses should be eliminated or raised and certain other loans should be exempt from the cap. Eliminating the cap or raising it to 27.5 percent would increase lending to small Continued on next page

C R E D I T U N I O N N EWS

CCUA’S GENTILE TOUTS THE VALUE OF CREDIT UNIONS IN NEW TV SPOT FOR FOX The Cooperative Credit Union Association (CCUA) President Paul Gentile was under the studio lights recently as he participated in an interview for “Around Town,” which airs during the morning news on Boston’s WFXT Fox25. Michele Lazcano, host of the popular segment, interviewed Gentile about the key qualities that make a credit union a credit union, the safety of credit unions and the many ways credit unions give back to the community. The recording was part of CCUA’s Better Values. Better Banking. consumer awareness campaign. More than 30 executives representing credit unions within the Fox25 broadcast footprint gathered in early December for a lunchtime presentation to view the debut of a new TV commercial touting Better Values. Better Banking. The group also received a sneak preview of the “Around Town” segment.

CCUA’S HIKE THE HILL Continued from page 10

businesses, but would not harm bank lending. An SBA study found that 80 percent of additional lending from raising the cap would represent NEW lending. “Clearly we learned that our lawmakers are carefully considering a number of issues important to credit unions. From the need for tighter data security for retailers to the opportunity that one to four non-owner occupied MBL cap relief presents, our credit unions did a terrific job relating the impact of issues like this to their everyday operations,” said Gentile. Members of the CCUA were also able to spend some quality time with NCUA Chairman Rick Metsger and several of his staff during Hike the Hill. Gentile thanked chairman Metsger for recently pushing the reporting date back for the 5300 report, noting that those few days were very helpful to many credit unions. He noted that relief from other regulatory burdens would also be of tremendous help, especially to small credit unions.

There’s no such thing as a free lunch. But money, that’s a different story. We’re offering members zero-percent Classic Advances, on a first-come, first-served basis, to create or preserve jobs in their communities. Our new program, Jobs for New England, will award up to $5 million in interest-rate subsidies every year through 2018. A maximum of $250,000 in subsidy is available per member each year. At current rates, $250,000 can leverage up to $30 million in one-year advances. To find out more about Jobs for New England, contact Fatima Razzaq at 617-425-9564, or fatima.razzaq@fhlbboston.com. But don’t delay. Zero-percent funds won’t last forever.

See what your cooperative can do for you!

FHLBBoston Federal Home Loan Bank of Boston • 800 Boylston Street Boston, MA 02199 • www.fhlbboston.com

winter.2016 | centerpoint | 11

Educational Content Reigns Supreme at CCUA’s 2016 Convention

They came from towns and cities throughout the states of Delaware, Massachusetts, New Hampshire, and Rhode Island, and they were joined by friends, colleagues and professionals from across the U.S. for what was billed as the October place to be – the Cooperative Credit Union Association’s Annual Meeting and Convention at the Mohegan Sun Resort in Uncasville, Connecticut. This year’s monumental gathering not only delivered a stimulating intellectual experience to attendees but also an agenda that ignited the senses and further strengthened the bonds of camaraderie all shared as members of CCUA. With a few taps on the handy convention app, attendees were guided to the appropriate destinations of their choice, whether seeking out the breakout sessions or locating specific vendors on the trade show floor. The convention kicked off on Wednesday, Oct. 12 with a day of customized content for small credit unions and continued to roll out over the next two with a robust agenda and a diverse menu of topics ranging from digital banking and member engagement to payment fraud and the always-hot subject of cybersecurity.

12 | centerpoint | winter.2016

Day One also saw the opening of the trade show with its 80-plus vendors and generous prize drawings throughout its duration. New this year were drawings for two grand prizes – a Royal Caribbean cruise to the Bahamas and an overnight stay in historic Boston. Opening night was capped off with a dessert reception for attendees, guests and vendors that offered wildly decadent delights. Technology also commanded a front-row seat, contributing to this year’s headline sessions by showcasing the CEOs of two major credit unions during a live broadcast on the Internet via Livestream (viewable at livestream.com/CCUA). This year, the convention embraced the topic of CCUA’s consumer advocacy campaign, Better Values. Better Banking., celebrating the many successful aspects of the campaign, from “In Your Neighborhood” gatherings to its series of radio commercials and member interviews, all highlighted during a special four-minute video that premiered on Day Two. That evening, convention-goers filled the resort’s palatial ballroom, donning their finest attire for a celebratory banquet that featured the

L-R: Greg Smith, Paul Gentile, Jim Blaine

conferment of CCUA’s first-ever Awards of Excellence and the presentation by CCUA President Paul Gentile of $1,000 checks to each state’s charitable partners: Children’s Miracle Network, Delaware; Massachusetts Coalition for the Homeless; Make-A-Wish New Hampshire; and Special Olympics Rhode Island. Videos produced by CCUA highlighted the good works of each organization, drawing applause for the success of a Special Olympian and bringing tears to many eyes on hearing a moving account of a young Wish child. Here’s a look back at some of the convention headliners. BRICKS VS. CLICKS – WHAT’S YOUR STRATEGY FOR GROWTH? Jim Blaine, CEO of State Employees Credit Union in North Carolina, and Greg Smith, president of the Pennsylvania State Employees Credit Union (PSECU), appeared center stage for a spirited and humorous debate on strategies each are taking to grow their organizations. The event, hosted and moderated by Gentile, was broadcast live over the internet and captured the attention of several industry reporters. Blaine has built his credit union’s success using the traditional, bricksand-mortar approach. The driving force behind his credit union’s growth from eight branches in 1979 to today’s 256 branches, Blaine has blanketed North Carolina with one of the largest branch networks in the nation. His “boots-on-the-ground” philosophy, he said, provides his members with the convenience of a call center delivered on the local level. His staff are all salaried and trained to provide “CU +1” service, layering an additional level of business expertise from one of seven ancillary businesses the credit union provides. A proponent of online delivery channels – the “clicks” approach, Smith uses his grasp of technology, paired with his quest to improve overall credit union productivity, to position PSECU as one of the leaders in remote service delivery. His credit union serves more than 400,000 members from two branch locations. PSECU, he said, believes in “letting members help themselves, whenever and wherever” their needs arise; and, with almost 20 percent of his staff dedicated to the IT department, Smith ensures those needs are met. During the back and forth between the two, Blaine said his credit union “is a business and is run as a business. The idea is to get a little bit of revenue from all sources, rather than a lot of revenue from a few.” He thinks of his membership as the “not yet wealthy,” a group overlooked and underserved by the big banks. Smith pointed out that using online channels helped to reduce or eliminate the need for “fractional employees,” reducing staffing costs; Continued on next page

L-R: Joel Romaine, president/CEO, Community Powered Federal Credit Union; John “Bernie” Winne, president/CEO, Boston Firefighters Credit Union; Jerry King, president, DEXSTA Federal Credit Union; Brian Hughes, president/CEO, Holy Rosary Credit Union; Robert Cashman, president/ CEO, Metro Credit Union; Ellen Ford, president/CEO, People’s Credit Union; Anabela Grenier, president/CEO, Pioneer Valley Credit Union; David L’Ecuyer, president/CEO, Central One Federal Credit Union; Roland Draper, president/CEO, Somerville Municipal Federal Credit Union; Ronald Covey, Jr., president/CEO, St. Mary’s Bank Credit Union; David Suvall, president/ CEO, Rhode Island Credit Union; Paul Gentile, president/CEO, Cooperative Credit Union Association.

Maiden-Year Accomplishments and an Enthusiastic, Purposeful Look Ahead Mark 2016 Annual Meeting Following the convention’s close on Friday morning, Oct. 14 CCUA’s Annual Meeting got under way with the traditional rap of the gavel. Putting into play the credit union principle of “One Person, One Vote,” registered delegates cast their ballots in uncontested races that resulted in the re-election of all incumbents and the welcoming of two new board members from Delaware. Re-elected to three-year board terms for Massachusetts were John (Bernie) Winne, president/CEO, Boston Firefighters Credit Union; Robert Cashman, president/CEO, Metro Credit Union, Chelsea; and Roland (Ron) Draper, president/CEO, Somerville Municipal Federal Credit Union. During an executive session immediately following the meeting, board members selected Winne to continue to serve as chairman; Ellen Ford, president/CEO of People’s Credit Union as vice chair; Jerry King, president of DEXSTA Federal Credit Union as secretary; and Ronald Covey, Jr., president/CEO of St. Mary’s Bank Credit Union as treasurer. Among the dignitaries addressing members at the morning meeting were Victor Corro, vice president for Member Services, World Council of Credit Unions; Jim Power, executive vice president, Commercial Business, CUNA Mutual Group; as well as the heads of CCUA’s charitable partners representing Children’s Miracle Network Hospitals, Delaware; the Massachusetts Coalition for the Homeless; Make-A-Wish New Hampshire; and Special Olympics Rhode Island. CCUA President Paul Gentile addressed members providing a brief look at the changes and accomplishments of the past year, including important legislative and regulatory victories supporting member credit unions and the industry, in general. “I believe strongly in working cooperatively together for the greater good and we can accomplish great things when we share a common purpose,” he said. winter.2016 | centerpoint | 13

CCUA’S ANNUAL CONVENTION

Continued from page 13

NCUA Board member J. Mark McWatters

Dr. Silva Narendra

and to speed delivery of products and services to members. He did concede that determining eligibility was the biggest hurdle to adding new members online and that perhaps using biometrics as identifiers would be the key to overcoming that hurdle. Both agreed that knowing their members is key to providing products and services no matter what the delivery channel may be. NCUA GIVING FRESH EYE TO PROBLEMATIC ISSUES While attendees were brought up to date on legislative advocacy efforts in each CCUA state, J. Mark McWatters, board member of the National Credit Union Administration (NCUA) delivered a detailed account of the agency’s efforts to improve the regulatory environment for credit unions across the country. A CPA and practicing lawyer for 34 years, McWatters was appointed to the NCUA board two years ago by President Obama and almost immediately, began “stirring the pot,” he said. A novice to the credit union industry, he was able to bring a fresh perspective and specialized skill set to examine and make recommendations on policies and practices he found ineffective and nonsensical, citing the cost-accounting methodology for the overhead transfer rate as an example. “We need to come up with a simpler approach to calculating OTR,” taking into 14 | centerpoint | winter.2016

account industry feedback and staying within the strict confines of the Federal Credit Union Act. “There was, and still is, a lot of work to be done,” he emphasized. “We fight and often lose but dissent is always an opportunity to move forward.” McWatters delved into other issues critical to credit unions, such as fraud loss, field of membership, securitization rule, secondary and supplemental capital, the appeals process, cyber security, vendor oversight, and the ongoing MBL lawsuit. He said the agency is working hard to create a transparent budget and asked for attendees to study and offer feedback on the 2017 preliminary budget prior to its approval in November. Taking the time to applaud Gentile’s successful push for an 18-month exam cycle, he ended the discussion by encouraging those in the room to get involved in issues where their input can help shape policy. DIGITAL BANKING: KEEPING MEMBERS SECURE IS PARAMOUNT As credit unions move toward providing more products and services through digital channels, the need for security becomes critical. Dr. Silva Narendra, CEO of Tyrone, Inc., provided insight into the importance of a secure digital banking strategy and trends in the area, including Secure

Online and Mobile Banking, Billpay/P2P and PFM and Marketing Analytics. Narendra emphasized the need for security to be the focus for credit unions as data compromises continue to grow. He noted the need to “authenticate who the credit union is transacting with as well as what they are authorized to do.” As security evolves, credit unions will need to keep pace with options and the needs of their members. When asked how credit unions need to prepare for the “internet of things,” Narendra noted that physical security will be key. He explained that biometrics, such as a fingerprint, is translated into code and are therefore not as secure as people would think. In the same vein, he added that Apple Pay and Samsung Pay do not have the same security as a chip card because they are programmed over the net, while chip cards are programmed in a secure environment. Narendra noted the benefit of physical security, the need to use a PIN or biometric as well as a chip card. He included the need to ensure increased security when utilizing instant issuance of chip cards. He emphasized the need to make security appropriate to the level of transactional risk, but not to substitute security for convenience. Using a secure token in the convenient form of a CR80 card will allow credit unions to provide the highest level of security to their members.

EIGHT CREDIT UNIONS COLLECT INAUGURAL AWARDS OF EXCELLENCE IN ADVOCACY, SOCIAL RESPONSIBILITY Amid the excitement and grandeur of the convention banquet on Oct. 13 was the announcement of CCUA’s 2016 Awards of Excellence recipients and the winner of the Credit Union of the Year award. “Excellence in advocacy and commitment to social responsibility are two of the core tenets of the Cooperative Credit Union Association,” commented CCUA President Paul Gentile prior to revealing the names. “We have established these awards to recognize member credit unions for excellence in promoting a deeper awareness and knowledge of all credit unions by their commitment to advocacy and social responsibility.” Eight credit unions were named recipients of this inaugural awards program and one, People’s Credit Union of Rhode Island, also took home honors for Credit Union of the Year.

EXCELLENCE IN ADVOCACY: • Delaware Alliance Federal Credit Union New Castle, DE

• Hanscom Federal Credit Union Bedford, MA

• Triangle Credit Union Nashua, NH

• People’s Credit Union Middletown, RI

EXCELLENCE IN SOCIAL RESPONSIBILITY: • DEXSTA Federal Credit Union Wilmington, DE

• RTN Federal Credit Union Waltham, MA

• St. Mary’s Bank Credit Union Manchester, NH

• Navigant Credit Union Warwick, RI CCUA President Paul Gentile presents Awards of Excellence to (Top row, L-R) Dawn Sutcliffe, Delaware Alliance Credit Union; David Sprague, Hanscom Federal Credit Union (Row 2, L-R) Gary Furtado, Navigant Credit Union; Millie Zayas, RTN Federal Credit Union; Ron Covey, Jr., St. Mary’s Bank Credit Union; Maurice Simard, Triangle Credit Union; (Row 3) Ellen Ford, People’s Credit Union, and staff -- Credit Union of the Year Award; (Row 4) Ellen Ford, People’s Credit Union; Jerry King, DEXSTA Federal Credit Union, and staff.

winter.2016 | centerpoint | 15

I N YO U R N E I G H B O R H O O D

BETTER VALUES. BETTER BANKING. BRINGS THE CREDIT UNION MESSAGE TO THE COMMUNITY The Cooperative Credit Union Association’s Better Values. Better Banking. campaign has been in full swing over the last several months, raising consumer awareness in local neighborhoods of the great value credit unions hold in the financial marketplace. During events organized by CCUA known as “In Your Neighborhood,” local credit union representatives greet patrons of locally owned breakfast and sandwich shops and engage them about their banking habits and the many ways credit unions provide a better banking experience. Patrons are given credit union literature, including the popular guide “15 Reasons to Only Bank at a Credit Union.” They also receive up to $5 off their orders, while others also are awarded a $10-dollar gift card to pay the act of kindness forward to a friend or family member. “There are no hard-sells with Better Values. Better Banking. It’s all about education,” said CCUA President Paul Gentile. “We are telling consumers a story of ‘value.’ The value of being part of a not-for-profit cooperative. The value credit unions deliver back to the membership in the form of better rates, lower fees and industry leading member service. We also focus on the value credit unions provide in their local communities in so many ways.” The In your Neighborhood gatherings were held in Massachusetts and, for the first time, in Delaware, following the merger of that state’s league with CCUA.

CCUA DEBUTS VIDEO ON ‘15 REASONS TO BANK ONLY AT A CREDIT UNION’ In light of recent account activities rocking Wells Fargo Bank, the Cooperative Credit Union Association (CCUA) is taking a lead on ways to promote credit unions and their values to consumers during a time when many may be questioning their allegiance to profit-making big banks. One of these channels is a booklet, “15 Reasons to Bank Only at a Credit Union,” authored by CCUA President Paul Gentile. The video version of the booklet made its debut on Livestream before a number of CCUA members during October. Walt Laskos, SVP, strategic communications, produced both the video and Livestream event, appearing live to walk viewers through the clip. “Right now, credit unions have the perfect opportunity to tell everyone the 15 reasons why they offer consumers the best choice in banking and the video is a great tool to deliver that message in a way that’s simple and entertaining,” he said. “Perhaps if we all work together in pushing the video out through our own social media channels, we might even see our message go viral, and wouldn’t that make a statement.” 16 | centerpoint | winter.2016

The 12-minute video can be accessed through the CCUA website at www.ccua.org.

C O M MU N I T Y I N V O LV E M E N T

DEXSTA FEDERAL CREDIT UNION AND NAVEO CREDIT UNION JEANS DAYS BENEFIT CHILDREN’S MIRACLE NETWORK HOSPITALS DEXSTA Federal Credit Union in Wilmington, DE, joined with other U.S. credit unions in “Credit Unions for Kids” to support children’s hospitals affiliated with the Children’s Miracle Network (CMN). On Miracle Jeans Day, Sept. 14, DEXSTA employees raised more than $200 for their local hospital, Children’s Hospital of Philadelphia, by wearing blue jeans. This is the fourth year DEXSTA has gone casual for kids. For the sixth consecutive year, Naveo Credit Union of Somerville, MA, has participated in the Miracle Jeans Day initiative to raise funds for Boston Children’s Hospital, the local Miracle Network Hospital. Naveo joined hundreds of organizations and raised nearly $2,000 from employees and members. Naveo then matched the employee donations. Credit unions are the third-largest sponsor of CMN hospitals.

Rethink & Reshape consumer loan processing.

Built by Lenders

Lending 360 was designed by and for lenders. As such, special focus has been given to each feature to ensure maximum flexibility. Lending 360 is a complete loan origination system, increasing efficiency, loans and membership. Built with the same high standards and commitment to innovation CU Direct is known for, Lending 360 was designed to help credit unions strengthen and grow their loan portfolio.

CU Direct Support

Not only will you gain access to our renowned support group, you’ll have a direct line to the Lending 360 decision-makers.

Seamless Integration

CUDIRECT.COM/LENDING360 (413) 214-2318 «» jennifer.brown@cudirect.com

Lending 360 can integrate with nearly anyone. We have over 100 host integrations in place today!

winter.2016 | centerpoint | 17

C O M MU N I T Y I N V O LV E M E N T

MASSACHUSETTS CREDIT UNIONS SPONSOR AND RAISE MORE THAN $29K FOR THE HOMELESS

Kelly Turley addresses the gathering.

The Massachusetts Credit Unions’ Charity Golf Tournament attracted more than 100 golfers to support their charitable partner, the Massachusetts Coalition for the Homeless, at Juniper Hill Golf Course this past summer. The group appreciated a fun day of golf and fellowship as its generosity raised more than $29,000 from the day’s event. CU Direct Corporation showed its commitment to the cause by sponsoring the tournament lunch. Additional sponsors made generous donations of $750 or more: Balance Sheet Solutions, LLC; Harvard University Employees Credit Union; CUNA Mutual Group; MIT Federal Credit Union; UMassFive College Federal Credit Union; MassMutual Federal Credit Union; Members Plus Federal Credit Union; Digital Federal Credit Union; Synergent; and Tricorp Federal Credit Union. At the awards banquet, golfers heard from Kelly Turley, director of legislative advocacy for the coalition. “We are so grateful to the Massachusetts Credit Unions for the more

than 25 years of support, collaboration and encouragement,” she opened. “Our work is to ensure that everyone in the Commonwealth has a safe and stable place to call home, which is a daunting task for one group, yet achievable with broad community and government collaboration.” Turley shared updates on successful public policy campaigns championed by the coalition to increase funding and access to homelessness prevention resources, to create housing and support services for unaccompanied youth experiencing homelessness and to increase funding for affordable housing programs. The coalition continues to work with the legislature and Baker Administration to advance key initiatives to create a bill of rights for people experiencing homelessness and improve benefits for extremely low income elders and people with disabilities. CCUA President Paul Gentile praised the credit unions and company sponsors for their dedication to the coalition.

CREDIT UNIONS OF RHODE ISLAND PRESENT SPECIAL OLYMPICS RHODE ISLAND WITH $90,900 DONATION

L-R: David Dupere, Paul Gentile, Michael Lucca, and Dennis DeJesus.

18 | centerpoint | winter.2016

The Credit Unions of Rhode Island presented a record-breaking amount of $90,900 to Special Olympics Rhode Island (SORI) at the conclusion of the Rhode Island Charity Golf Tournament this past summer. These funds represented the total amount raised in the year by credit unions, members, sponsors, etc. This donation surpassed the original goal of $80,000 set by the Rhode Island Social Responsibility Committee in September 2015, bringing a 19-year total to $890,000. The scenic Crestwood Country Club located in Rehoboth, MA, played host for the tournament, which was the culmination of a phenomenal fundraising effort. One hundred three golfers and 56 sponsors combined to make the event a great success. Dennis DeJesus, executive director, SORI, and Michael Lucca, SORI Global Messenger, accepted the check for $90,900 from David Dupéré, Rhode Island Social Responsibility Committee chairman, Special Olympics board member and executive vice president/COO, Wave Federal Credit Union; and Paul Gentile, Cooperative Credit Union Association president. DeJesus expressed his heartfelt appreciation to the Rhode Island Social Responsibility Committee, member credit unions and everyone in the room for their efforts throughout the year. “We value the extraordinary partnership we share with the credit unions in Rhode Island and we thank you all for your year round support.”

C R E D I T U N I O N P EO P L E Service Credit Union Selects New President/CEO Service Credit Union in Portsmouth, NH, named David Van Rossum as president/CEO. He served as interim since February. “As a demonstrated strategic executive leader, we have seen firsthand how capable and qualified David Van Rossum is to take on the pivotal role of president/CEO. I know I can speak for the entire board of directors when I say that the future of the credit union and the needs of our members are in good hands with David,” said David Hanchett, board chairman. As chief administration officer (CAO) at Service Credit Union, Van Rossum operated as a liaison between the credit union and the areas it served, cultivating meaningful relationships throughout the community. When appointed as interim president/CEO, he eagerly and eloquently took on the crucial yet demanding role, overseeing all affairs of the credit union with $3 billion in assets, more than 50 locations and more than 230,000 members. Van Rossum was hired in 2015 as CAO and president/CEO of four related credit union service organizations, but his involvement with the Service Credit Union began prior to these roles. He served on its board of directors for 24 years was a member and a past chairman. Prior to his time at the credit union, he held executive positions in the telecommunications, computer hardware, aerospace, and consumer electronics industries. Van Rossum has a bachelor’s in business administration from the University of New Hampshire and obtained his MBA from Southern New Hampshire University. “I am honored and humbled to be given this opportunity,” said Van Rossum on his appointment. “I have cherished the time I have spent at Service Credit Union and look forward to what the future brings.”

Metro Credit Union Names Chief Financial Officer Erik Porter has been appointed as Metro Credit Union’s senior vice president and chief financial officer. He will report to Robert M. Cashman, president and CEO of the Chelsea, MA-based credit union, overseeing accounting and finance. Erik Porter Prior to joining Metro, Porter served as a senior manager and banking practice leader at CFGI, a Boston-based, financial consulting firm, where he provided assistance to various financial institutions as a trusted advisor in a number of specialized areas, including accounting operations and financial planning processes, process improvement and redesign, and strategic matters. Prior to joining CFGI, he held various leadership roles at Cape Cod Five Cents Savings Bank. Porter, a certified public accountant, earned his bachelor of arts in accounting, finance and economics from Western New England College and was an honors graduate of the ABA Stonier Graduate School of Banking. He is the outgoing president of the Boston chapter of the Financial Managers Society. He also served on the board of directors at the Family Pantry of Cape Cod for the past three years. Outside the office, Porter is an avid runner, golfer and beachgoer. He enjoys spending time with his family and two dogs.

Dover Federal Credit Union Names New CIO Dover Federal Credit Union, Dover, DE, has appointed Travis Frey as chief information officer (CIO). He brings more than 20 years of experience within the financial industry, 15 of which have been dedicated to information technology. Travis Frey As CIO, Frey will be instrumental in leveraging the right technology solutions to improve the member experience, while reducing operating expenses and delivering solutions that will align and enable strategic growth and efficiency. Frey’s proficiency is exemplified in his experience working on various CORE systems, Window servers, NCR, and Nautilus Hyosung ATMs, as well as with branch transformation technology. He has executed core conversions, managed the infrastructure transformation for a successful credit union merger, led product and service conversions, and implemented a new branch prototype using Nautlius Hyosung ATM machines with an integrated transformation solution, designed to maximize the member self-service experience. Frey has earned certifications on disaster recovery, Jack Henry Symitar programming and network security. His passion and commitment to members are reflective in his dedication to leverage technology that allows them to have more secure control in a digital environment, while incorporating the personal element to empower the member experience.

Jeanne D’Arc Credit Union Hires New AVP Technology Mark S. Cochran, president and CEO of Lowell, Mass.-based Jeanne D’Arc Credit Union, welcomed Mark Levesque as the new AVP of technology operations. Levesque brings more than seven years Mark Levesque of experience in the information technology management field. His new position marks his first in the financial services industry. Prior to Jeanne D’Arc, he offered his expertise and skill to various positions in health care and the corporate side of retail. His main responsibility at the credit union is to ensure that members and staff have the best technical experience possible. A graduate of Boston University, Levesque holds a bachelor’s in computer systems management. He also holds several professional certifications and is a Cisco-certified network associate.

St. Mary’s Bank Credit Union Announces Promotion Manchester, NH-based St. Mary’s Bank Credit Union announced the appointment of Richard Haney to AVP, senior residential loan officer. Haney joined St. Mary’s Bank in 2012 and has more than 19 years in mortgage origination expeRichard Haney rience. He works to provide NH residents with lending options to meet their needs. “Rich consistently provides members with exceptional service,” said Karen Mayrand, St. Mary’s Bank director of residential lending. “He Continued on next page

winter.2016 | centerpoint | 19

C R E D I T U N I O N P EO P L E

Continued from previous page

builds a rapport with members and goes above and beyond to help individuals reach their goals of homeownership.” Haney works primarily out of the St. Mary’s Bank Mortgage Center located at 20 Trafalgar Sq., in Nashua, NH and at the St. Mary’s Bank Hanover Street branch in Manchester, NH. Haney lends throughout the state.

GFA Federal Credit Union Announces Promotions GFA Federal Credit Union in Gardner, MA, promoted John Colantino to the position of 1st vice president chief technology officer and Pamela Genelli to 1st vice president culture officer. Colantino has been with the credit union for more John Colantino than a year and has more than 16 years of information services and technology management experience. He has professional membership with the Association of Information Technology Professionals, Global Digital Infrastructure Alliance, Technology Leadership Network and Healthcare Information Group. A resident of Peterborough, NH, he has an assoPamela Genelli ciate’s in science from Manchester Community College in Manchester, CT, and is compellent certified storage administrator. Genelli has a long history of leadership roles in human resources. She was previously employed by Wood’s Ambulance in Gardner, MA, where she managed all aspects of the human resources function.

As a senior human resources professional, her extensive experience also comes from previous positions including vice president of human resources at the Edward M. Kennedy Community Health Center in Worcester, MA; director of human resources and administration at Eastern Casualty Insurance Company in Marlborough, Mass., and regional human resources manager for Allmerica Financial/Hanover Insurance Company, Worcester, Mass. She resides in Hubbardston and is a well-known member of her community.

Holy Rosary Credit Union Names AVP of Technology Holy Rosary Credit Union (HRCU) in Rochester, NH, announced the promotion of Kenneth Mauser to assistant vice president of technology. A member of the HRCU family since 2014, Mauser previously assumed the position of IT manager for Kenneth Mauser the credit union. As AVP of technology and senior management team member, one of Mauser’s top priorities is the safety and security of members; particularly, during online transactions. A crucial member of the IT department, he assists with ongoing network testing of the HRCU system, regular reporting on technology updates and threats of banking fraud, and constant monitoring to ensure the utmost security during member transactions. “Ken is a key player in our IT department and truly demonstrates an important part of our mission - to embrace innovation,” said Brian Hughes, Continued on next page

In Memoriam Joseph Nee, Boston Firefighters Credit Union A longtime director and former board chair of the Boston Firefighters Credit Union died Sept. 6 after a year-long battle with cancer. Joseph “Dodo” Nee, a former firefighter with more than 20 years of service to the credit Joseph Nee union, was well known in the Boston-area credit union community with many friends at City of Boston Credit Union, Members Plus Credit Union, Mass Bay Credit Union and Liberty Bay Credit Union as well as others, said Bernie Winne, president/CEO of Boston Firefighters Credit Union. “Joe was very community focused. Everything he did was to make things better. He devoted his life to it,” said Winne. “We will miss him.” Nee leaves behind his wife, children and grandchildren.

Stephen Jones, Jeanne D’Arc Credit Union

Stephen Jones

Steve Jones, VP of community development for Lowell, MA-based Jeanne D’Arc Credit Union died unexpectedly on Sept. 29. A 20year veteran of the credit union, he was loved by his colleagues for his genuine warmth and true appreciation of people.

20 | centerpoint | winter.2016

Jones worked tirelessly to support community efforts and gave his time to many non-profits throughout the area. At the time of his passing, he sat on the boards of the Cultural Organization of Lowell, Whistler House Museum of Art, My Father’s House, Greater Lowell YMCA, Lucy’s Love Bus, Town of Chelmsford Scholarship Committee, Chelmsford Youth Basketball League, and Jeanne D’Arc CU’s We Share a Common Thread Foundation. An avid golfer, he enjoyed playing many courses throughout New England and celebrated an unprecedented hole in one in August 2012 at the Advent Care Golf Tournament at The International Golf Club in Bolton, MA. He extended his love of golf by serving on the Merrimack Valley Food Bank Golf and Fundraising Committees and Big Brothers Big Sisters Golf Committee. Jones was an advocate for the credit union movement since 1976 and particularly believed in the philosophy of people helping people. He shared this enthusiasm through his role as president of the Tri County North Chapter of the Massachusetts Credit Union League for many years. He “hiked the hill” with the Cooperative Credit Union Association (CCUA) to advocate for credit union causes and he also served on CCUA’s Social Responsibility Committee. In 2011, Jones was recognized by Community Teamwork, Inc. of Lowell with its community service award for his dedication to the region and to helping his fellow man. The Cooperative Credit Union Association extends its sympathies to the Nee and Jones families.

C R E D I T U N I O N P EO P L E

Continued from previous page

president/CEO. “His knowledge of network management, as well as his vigilant nature when dealing with the sensitive data of our members, is a true asset to HRCU.” Mauser graduated from New Hampshire Technical Institute in Concord in 2005. He currently lives in Rochester, NH.

Direct Federal Credit Union Announces New Board Member Direct Federal Credit Union of Needham, MA, named Robert J. Gill of Brookline to a three-year term on its board of directors. Gill, a managing partner at the Gill Realty Group, Keller Williams Realty International, has been a Direct Federal Credit Union member for 49 years. He was employed by the Polaroid Corporation as its corporate new product development process owner for 30 years. Prior to that, he served as managing director of Intermarix PDP, a global strategy consulting firm. A graduate of Northeastern University with a bachelor’s degree in engineering, Gill has his MBA from Suffolk University. His former board experience includes service as board chair of the Product Development Management Association, board member of the PDMA Research Foundation and board member of the American Society of Mechanical Engineers. Gill and his wife Ginny have three sons and six grandchildren. David Johnson, chairman of Direct Federal Credit Union, said, “It’s a pleasure to announce Bob to the board of directors. His leadership skills, knowledge and commitment to the communities we serve are certain to make him a valuable member of the board.”

Bellwether Community Credit Union CEO Honored as Good Samaritan

New Hampshire (PCS). The annual award recognizes individuals who have pursued extraordinary measures to strengthen communities and improve life in the state. L’Ecuyer received his award from Calvin Genzel, PCS director of clinical services, and David Reynolds, PCS executive director.

Dover Federal Credit Union VP Receives High Honors The Credit Union Executive Society (CUES) recognizes credit union executives every year who have established a standard of educational excellence in the CU, through a three-part graduate-level program. Dover Federal Credit Union’s Vice President of Business Services Lynne Schaefer earned the title of certified chief executive (CCE). Schaefer completed the program equipped with new tools, resources and education that will allow her to contribute additional insight, planning and successful execution techniques to complement the strategic goals for Dover Federal Credit Union. With a refreshed and enhanced perspective of the financial industry as a whole and the role that credit union’s play, Schaefer will continue to make a positive impact not only in the organization, but in the community as well.

Credit Union Rock Stars Hailed by Credit Union Magazine

Jennifer DeMoe

Michael L’Ecuyer, center, CEO of Bellwether Community Credit Union in Manchester, NH, was the recent recipient of a Good Samaritan Award given by Pastoral Counseling Services of Michael L’Ecuyer

Credit Union Magazine has recognized Pioneer Valley Credit Union’s Jennifer DeMoe and Faith Perreault as Credit Union Rock Stars. DeMoe, VP of finance, has been with Pioneer since 2011. In her role, she has helped to oversee the increased technological advances of the credit union. Loan manager Perreault joined the Pioneer community in 2008. A certified credit union financial counselor, she helps to oversee the functions of the lending and collections area.

Faith Perreault

rePRINTS Positive coverage helps drive business. Put your coverage to work with a reprint from CenterPoint Magazine.

To learn more about rePRINTS: http://bit.ly/CenterPointMagazine

winter.2016 | centerpoint | 21

C R E D I T U N I O N C A L E N DA R SPECIAL EVENTS

CONFERENCES AND CONVENTIONS

BetterValues. Better Banking. Night at the Dunk January 27, 2017 ............ Dunkin’ Donuts Center, Providence, RI

CU Accelerate April 21–23, 2017 ......... Wentworth by the Sea, New Castle, NH

Credit Union High School Basketball Championships March 17-19, 2017 ................ Ryan Center, North Kingstown, RI

Cooperative Credit Union Association Annual Meeting and Convention October 11-13, 2017 ....................Mohegan Sun, Uncasville, CT

Rhode Island Governmental Affairs Day January 12, 2017......................... RI State House, Providence, RI

Strike for Gold Charity Bowling Tournament March 29, 2017 ........ East Providence Lanes, East Providence, RI Richard Mahoney Charity Golf Tournament June 8, 2017 .................. Candia Woods Golf Links, Candia, NH

CUNA Governmental Affairs Conference (GAC) February 26 – March 2, 2017 .......................... Washington, DC

Cooperative Credit Union Association Hike the Hill October 18-19, 2017........................................Washington, DC

MA Charity Golf Tournament June 29, 2017....... Juniper Hills Golf Course, Northborough, MA RI Charity Golf Tournament July 17, 2017................ Crestwood Country Club, Rehoboth, MA Cooperative Credit Union Association Annual Golf Tournament August 31, 2017 ...... The International/Pines Course, Bolton, MA

Please visit the Cooperative Credit Union Association’s website for additional calendar events, webinars, meetings dates and times. www.ccuassociation.org.

Call Innovative Business Systems to get your IT project done right, on time and within budget. Server and desktop virtualization, enterprise storage, networking… we get it done.

Call 800.584.4279 or visit www.for-ibs.com today. Smarter Technology. Better Banking.

Easthampton, MA | Marlborough, MA

22 | centerpoint | winter.2016

The Value of Partnership

Integrated Solutions and Support

What our Credit Union Partners are Saying

Maximize Your Core

Partner with a CUSO Owned by Credit Unions One partner, one call. Access Symitar’s

“We saw opportunity...” Rosemary Shields

Episys® Core Processing and a world of best-of-breed solutions with a single point

Chief Operating Officer, HRCU

of contact. Spend your time where it “We really trusted Synergent’s recommendations...”

matters most — with your credit union and your members.

Adam Sheehan

Executive Vice President, Maine Highlands FCU

For more information, contact:

“The future is bright for us...” Joseph Soldano

Member Service Officer, Palisades Credit Union

Fred Barber, Account Executive fbarber@synergentcorp.com 800-341-0180 ext. 593

synergentcorp.com/core-processing

Technology Services, Providing Symitar’s Episys Core Processing Platform Payment Services Direct Marketing Services Professional Services

INNOVATION AT WORK

Coming Soon!

Experience the difference

Bank Design | Architecture | Project Management

905 South Main Street, Bldg B Suite 201, Mansfield, MA 02048 • 508-339-6600 • www.nes-group.com • www.drlarchitects.com