MORE PRIVATE DORM DEVELOPMENTS MAKING THE GRADE

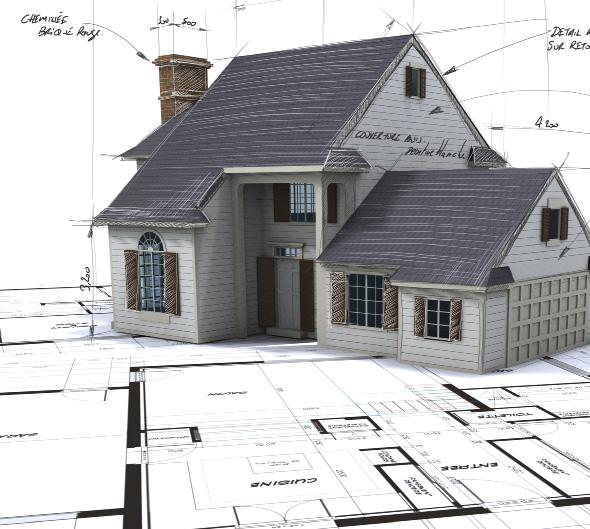

Northeastern’s second partnership with student housing developer American Campus Communities will add 1,240 student beds in a 23-story tower on Columbus Avenue.

Northeastern’s second partnership with student housing developer American Campus Communities will add 1,240 student beds in a 23-story tower on Columbus Avenue.

BY STEVE ADAMS BANKER & TRADESMAN STAFF

rivate developers are eager to build student housing in Boston. And city officials continue to press local colleges to add more dorms and rein in the off-campus population estimated at more than 38,000 students citywide.

It might seem like a win-win proposition, except for the public opposition that frequently arises among residents wary of a dorm being built in their neighborhood.

As Northeastern University and a private

developer prepare to break ground on their second project in Roxbury in 2025, some observers see waning resistance to the private dorm model in Boston.

“What they don’t like to see is the private student housing unaffiliated with colleges or universities,” said Matthew Kiefer, a real estate lawyer at Goulston & Storrs. “They are afraid it’s going to be ‘Animal House’ and they won’t be adequately managed and supervised.”

Boston’s zoning code doesn’t allow private dorm-style housing that’s not affiliated with a local school, as was originally proposed by developer Scape at 1252 Boylston St. in the Fenway in 2019.

And private developers partnering with colleges have to thread the needle of complex zoning, financial and legal issues

when considering partnerships on dorm projects.

But the model is playing out at Tufts University and Merrimack College, which are partnering with private developers on a pair of student housing projects that would create a combined 1,207 new student beds.

Town-and-gown tensions are part of the landscape in Boston. Approximately 38,000 college students live off-campus, according to the 2023 student housing trends report issued by the Boston Planning Department. Nearly two-thirds of the off-campus population lives in the Allston-Brighton, Fenway and Mission Hill neighborhoods.

Continued on Page 10

By James Sanna |

Timothy M. Warren Jr., Chairman of the Board

David B. Lovins, President and CEO

ESTABLISHED 1872

Published by The Warren Group

PUBLISHING

Associate Publisher: Cassidy Norton

Managing Editor: James Sanna

Associate Editor, Commercial Real Estate: Steve Adams

Finance and Data Reporter: Sam Minton

Contributing Writer: Scott Van Voorhis

Senior Customer Support Specialist: Sarah Ahlgren

Advertising Account Manager: Caitlin Bobe

Graphic Designer: William Samatis

DATA SOLUTIONS

Communications Manager: Mike Breed

Executive Account Manager: William Visconti

Senior Account Executives: Caitlin Bobe, Mark Carey

Client Service Specialist: Mike Sweeney

Sales Development Representative: Matthew Griffin

INFORMATION SERVICES

Director of Operations & Product Strategy: Samantha Bullock

Data Operations Manager: Tammy Dandurant

Data Quality/Key Accounts Manager: Ellen Gendron

Data Quality Auditor: Katherine Snow

Key Accounts Coordinator: Amy Guenthardt

Parcel Acquisitions Manager: Christina Doucette

Transaction Acquisitions Manager: Wally Bullock

INFORMATION TECHNOLOGY

Software Development Manager: Michael Paul

Senior Applications Developer: Joe Chan

Systems Developer: Nicholas Rens

Junior Developer: Matt Paul

Cloud Computing Specialist: Tyler North

Database Support Specialist: Joey Roundtree

FINANCE & ADMINISTRATION

Controller: Janeen Silvestri

Assistant Controller: Olga Khalaydovsky

Accounts Recievable Specialist: Valarie Wickey

Human Resources Generalist: Nesima Bartlett

BANKER & TRADESMAN (ISSN 0005-5409) Volume 205, Number 53 Published each Monday.

©2024 The Warren Group LLC, 2 Corporation Way, Suite 250, Peabody, MA 01960. All rights reserved. No part of this publication may be reproduced without the written consent of the publisher. Banker & Tradesman and The Warren Group are trademarks of The Warren Group LLC.

Subscriptions to Banker & Tradesman:

• According to an affordability index maintained by real estate data firm ATTOM, median-priced single-family homes and condominiums remain less affordable in the fourth quarter of 2024 compared to historical averages in 98 percent of counties around the nation with enough data to analyze.

• In Suffolk County, the affordability index sat at 78 for the fourth quarter. Any score below 100 is less affordable than the historical average. Hampshire County suffered the least degradation in its affordability, with an index reading of 81, and Essex County suffered the most, with an index reading of 69.

• Wage growth is also leading to affordability issues. Yearover-year price changes have outpaced changes in weekly annualized wages during the fourth quarter of 2024 in 429, or 75.8 percent, of the counties analyzed in the report.

• The all-cash deal sees the Massachusetts credit union expand its footprint outside of the commonwealth for the second time. The lender’s only out-of-state branch is at the McLean, Virginia office of defense contractor MITRE, whose co-headquarters is in Bedford. Hanscom also said the deal will let it expand its business offerings via The Peoples Bank’s insurance agency subsidiary, Fleetwood Insurance Group.

• “[W]ith this enhanced geographic reach, and proximity to Washington D.C., we expect to further support our founding mission by bettering our ability to serve all individuals that serve our nation,” Hanscom CEO Peter Rice said in a statement.

• The Peoples Bank serves 20,000 customers in three largely rural counties on the eastern shore of the Chesapeake Bay with seven branches. Hanscom will have total assets of approximately $2.1 billion and 115,000 members after the conclusion of the deal.

• The new owner of the TTorren Flats is Kanden Realty & Development, an Osaka, Japan firm that has invested in apartment and condominium projects in Los Angeles, New York, Seattle and Washington, D.C. in recent years.

• The development broke ground in 2019 on a property formerly occupied by a former ambulance dispatch center at 44 North Beacon St. The complex contains 30 apartments in a 5-story, 34,580-square-foot building. The Allston project received $14.5 million in mortgage financing from Cambridge Trust in 2021.

BAKER

• Newton-based Wingate Acquisitions acquired the 133unit historic complex at 1220 Adams St. in Boston’s Dorchester Lower Mills neighborhood from Chartwell Holdings of Needham.

• The property previously traded for $35.2 million in 2018, when Newton-based Chartwell Holdings acquired the historic mill complex from Fairfield Residential.

• The property’s residential conversion, designed by The Architectural Team of Chelsea, received a National Historic Preservation Award in 1988.

• Law firm Ropes & Gray extended its office lease for onethird of the Prudential Center tower in Boston’s Back Bay through 2041, landlord BXP announced.

• The 1.2 million-square-foot Prudential Center tower was nearly 93 percent leased at the end of 2023 with average rents per square foot of $72.45, according to an SEC filing.

• Back Bay’s office market continues to attract premium rents, with class A tenants paying an average of $75.30 per square foot, according to CBRE.

• Atlanta-based Wood Partners acquired an Abington parcel for $4.65 million that’s approved for a 198-unit housing development near an MBTA commuter rail station.

• The 9-acre site on Summer Street was approved for the Abington Station project under Chapter 40B, the state affordable housing zoning law. The development will consist of a 5-story, 277,186-square-foot building.

• Caroline Ligotti, Linda Redeker and Emily McGranaghan of Boston City Group Inc. at Coldwell Banker Commercial procured the buyer and represented the seller, Abington Crossing LLC of Weymouth.

MA 01960 Phone: 617-428-5100.

www.bankerandtradesman.com

Periodicals Postage paid in Boston, MA USPS #536710 and additional mail offices.

Banks and CUs Look to Leverage Changing Customer Perceptions

BY SAM MINTON BANKER & TRADESMAN STAFF

Large financial institutions charge their customers hundreds of millions of dollars in fees, but some of Massachusetts small and or regional banks see room to earn new deposits by going in the other direction.

A new consumer survey backs them up.

BAI Banking Strategies recently polled American bank customers and found that, across all generations, consumers most often selected a new primary financial institution because it charged the lowest fees.

Bank fees have historically been instituted to cover operational costs as well as provide another source of revenue and means to mitigate risk. But over time, they’ve become a key part of some financial institutions’ revenue streams.

As of Sept. 30, TD Bank has earned $654.65 million in bank fees this year, or 57.9 percent of its non-interest income according to financial statements filed with the FDIC.

Traci Michel, chief operating officer and chief strategy officer at Chelsea-based Metro Credit Union believes that there has been a major shift in consumer expectations over the last four to five years that can be attributed to the actions of larger institutions.

Subscription services are becoming more prevalent in the market, as well as across the economy, she added.

“For a lot of people, having time back in their life and having peace of mind that they aren’t going to be nickel-and-dimed for something is really important to them,” she said. “It’s really top of mind. So, we’ve been shifting our focus into: How can we simplify? How can we give members back time, and how can we give them peace of mind?”

“For a lot of people, having peace of mind that they aren’t going to be nickel-and-dimed is really important to them.”

– Traci Michel, COO, Metro Credit Union

By comparison, Arlington-based Leader Bank only took in $222,000 dollars in service charges – less than one percent of its NII. While Hudson-based Avidia Bank’s service charges make up 19.1 percent of its NII, the same amount as M&T Bank, Avidia made $2.56 million in service charges while M&T Bank raked in $269.43 million.

Michel added that the bank is shifting to provide positive reinforcement to its customers, instead of negative reinforcement. Instead of charging fees for physical statements, for example, Metro instituted a rewards program where members can receive points for signing up for electronic statements.

Reading Co-Operative Bank also shifted its thinking towards fees including the reduction of its NSF fee. Instead of charging $30 per item, the fee was capped to $15 per day. Additionally, a bank account will not be charged for being overdrawn unless the negative balance eclipses $100. Bank executives said they also eliminated some other fees.

Overdraft fees, in particular, have come under scrutiny from federal regulators. As part

BY SAM MINTON BANKER & TRADESMAN STAFF

Older Americans are more likely than younger Americans to buy homes in places with significant climate risk. according to a new report from Redfin.

Redfin economists analyzing housing data found 36.9 percent of home purchases made by people 65 and older last year were in counties with high risk of extreme heat. while 32.3 percent of home purchases made by people under 35 contained extreme heat risk.

Additionally, 13.3 percent of purchases made by people 65 years and older were in counties with a high risk of flooding, compared with 9.8 percent of purchases by those under 35 years old.

The study found 96.2 percent of homes face high heat risk in the counties where 65 and older buyers took out the largest share of mortgages last year, on average according to Redfin. That compares to 59.2 percent of homes in the counties where buyers under 35 took out the largest share of mortgages.

retire. For example, Arizona is a retirement hot spot but is prone to extreme heat. Younger homebuyers are described as gravitating towards job centers such as Boston or Chicago.

“Retirees understand the risks of moving to Florida, but many believe the pros still outweigh the cons,” Rafael Corrales, a Redfin real estate agent, said in a statement. “When I explain to buyers that they can get more bang for their buck and lower flood risk a little further inland, they often tell me, ‘Rafael, we came to Florida for the waterfront views.’”

Redfin’s report credited the risky buying to the locations where older individuals tend to

In Suffolk County, 100 percent of homes contain a high heat risk according to the analysis of First Street climate risk scores along with HMDA data. Additionally, 22 percent of homes contain a high-flood risk.

of President Joe Biden’s anti-“junk fee” campaign across many sectors of the economy, the CFPB recently finalized a rule limiting overdraft fees banks can charge.

The rule states that banks may charge a flat overdraft fee of $5, a fee that covers their costs and losses or banks can charge any fee so long as they disclose the terms of the overdraft loan the way they would for any other loan, typically expressed as an annual percentage rate or APR.

With the increase in digital banking and the overall negative consumer sentiment towards fees, the banking industry is trending towards a landscape where fees are minimized if not eliminated, executives say.

Brian Canina, president and chief operating officer of Holyoke-based PeoplesBank, said that it is increasingly difficult for banks to charge fees as customers are searching out feefree banking.

“We can feel that pressure in the market,” he said.

Numerous banks large and small eliminated NSF fees in 2022. And Metro eliminated its return deposited item fee in 2024.

Michel noted that consumers have very little to no control over the transaction and the credit union felt that members shouldn’t be charged for that transaction. Additionally, this was a transaction that was typically a “heavy lift for financial institutions.”

BY BERNICE ROSS SPECIAL TO BANKER & TRADESMAN

Every year most people make at least one or more New Year’s resolutions. The most common one you’re most likely to break is to take better care of yourself. You intend to exercise regularly, drop those holiday pounds, or spend more time with your loved ones, but those goals get pushed aside as business and personal obligations get in the way. As we move into 2025, self-care needs to be more than just a resolution – it’s a necessity that should be your priority every day.

If you’re ready to start putting your self-care first in 2025, start with scheduling your self-care and recharge time prior to scheduling anything else

Realtors are no strangers to burnout. The real estate business demands long hours, constant availability to clients, and high stakes negotiations, often at the expense of your personal health.

The most common mistake realtors make is failing to schedule their personal time off and then treating those time slots the same way they would treat a listing appointment. In other words, you don’t cancel that appointment time with yourself unless there’s an emergency or some other urgent situation.

When a buyer or seller attempts to cut into your family or personal time, there’s no need to justify or explain what your appointment is. Remember, “No” is a complete sentence.

Recharge Physically

Recharging physically is one of the most effective ways to start your self-care journey. Good physical health results in increased stamina, improved mental

clarity, plus greater resilience.

It’s important to prioritize sleep. Lack of it is linked to burnout, stress, and lower productivity. Set a nonnegotiable bedtime and aim for at least one “sleep-in” morning each week to let your body recover fully.

For a lot of us, we don’t move our bodies enough every day. But while changing that might seem daunting, remember that movement doesn’t have to be intense to be effective. Try short, daily walks, yoga sessions, or even an at-home workout routine that aligns with your schedule. Many realtors find that moving their body daily helps reduce stress and keeps them sharp when working with clients.

Realtors are no strangers to burnout.

Nutrition is important to pay attention to, as well. Real estate can be a grab-and-go job. Planning quick healthy snacks and meals in advance, can help you stay energized throughout the day without having to jack yourself up with caffeine or sugar.

In a business that revolves around serving others, real estate agents often put their clients’ needs before their own, leaving little emotional energy for themselves. Mentally recharging involves finding ways to quiet your mind and shut out what’s stressful in your life.

First, stop multitasking. It’s important to realize that effective concentration only happens when the mind is focused on a single task. Your conscious brain (frontal lobes) can only concentrate on one thought at a time.

The truth is that when you think you’re multitasking, you’re really task shifting. Task shifting not only requires more time, but also decreases the quality of the work that you manage to complete.

Helping others is also a proven way to nourish your spirit. Whether it’s volunteering in your community, mentoring a child in school, or simply being a helpful resource to your clients, acts of kindness and generosity result in a sense of purpose and fulfillment. When you give back to others, it always comes back to you, often in unexpected ways.

And if you take one idea away from my column, remember: One of the most important things you can do is schedule regular time with family and friends and make an effort to be fully present. Research shows that spending quality time with loved ones not only reduces stress but also increases life satisfaction.

Once you’ve mapped out your recharge plan, the next step is integrating it into your daily life. The best place to begin is by blocking your self-care time just as you would for any other appointment. Treat it as a commitment, not an option.

Many phones have apps that track your steps, sleep, heart rate, and stress levels. Tech tools like Fitbits and Apple watches can also monitor these for you and assess how well your self-care journey is going.

Don’t get discouraged if this all seems like a tall order. Small action steps done consistently can yield major results over time. Some examples include drinking water when you wake up, taking five-minute stretch breaks every hour, or setting an alarm that reminds you to take time to break for lunch, take a walk, or start winding down for the day.

Life changes quickly, especially in real estate. Reassess your self-care plan every few months to ensure it still aligns with your needs and lifestyle. Be flexible and willing to adjust as needed.

Bernice Ross is a nationally syndicated columnist, author, trainer and speaker on real estate topics. She can be reached at bernice@realestatecoach.com.

BY LEW SICHELMAN SPECIAL TO

& TRADESMAN

The Department of Justice has warned buyers not to sign contracts binding them to the agent showing them houses. And maybe they shouldn’t. But sellers should also be leery of signing listing agreements that tie them to one brokerage firm for months at a time.

For example, sometimes a seller finds a buyer on their own, with no help or input from the listing agent. In traditional contracts, the agent has the exclusive right to sell – meaning that they are still owed a commission, even if they didn’t find the buyer.

If you intend to proactively work to sell your place while it is listed in a multiple listing service, you may want to consider an exclusive agency agreement instead. You’ll still work with a listing agent, but if you find the buyer, you’ll have the right to sell without paying a commission.

Sellers also might want to consider the type of deed of conveyance they provide, said Martin Segal, a lecturer at the University of Miami who writes the popular Ask Doctor Law blog.

Rather than warrant the entire chain of ownership, how about a special warranty deed that only guarantees a clear title during the time you owned the place? That gets you off the hook for unknown defects that occurred when you were not the owner.

While it’s doubtful that a buyer would accept it, you can also offer a quit-claim deed, which conveys title without any warranties whatsoever.

Property taxes are the largest discretionary source of revenue for local governments, and tax assessors usually try to maximize the valuations of houses within their purview. But not so when it comes to their own residences, according to a working paper published by the National Bureau of Economic Research.

The “Assessing the Assessor” paper, which has not yet been peer reviewed, finds that assessors tend to rate their own properties “at significantly lower values” than those of their neighbors. Consequently, said authors Huaizhi Chen of the University of Notre Dame and Lauren Cohen of Harvard Business School, their tax bills “grow significantly slower” than their neighbors’ do.

Second, the incoming Trump administration’s vow to deport illegal immigrants could slow builders’ ability to construct houses.

According to the latest Census Bureau stats, the number of immigrants joining the construction industry rose to nearly 130,000 in 2022.

There’s no telling how many of those entered the country illegally. But in a business with persistent labor shortages, kicking out any gainfully employed immigrants will slow down the construction process – probably considerably.

And third, the percentage of “defective” mortgages –those on which borrowers lie or otherwise supply bad information – is low, but rising, according to quality control analytics company ACES.

Less than 2 percent of all approved loans have issues, the company said, but the number is trending upwards.

The paper also finds that the lower the value assessors assign to their own houses, the more likely other homeowners within the county are to sell their homes below their assigned taxation values. In other words, the lower the assessor’s assessment, the less others will profit from the sale of their places.

Finally, the paper documents “a significant connection” between the under-assessment of assessors’ own properties and the tax-maximizing assessment gaps documented in the districts they operate.

Three items caught my eye recently that seem concerning.

First, renter households have formed faster than owner households for the past four quarters, as homebuilders have been unable to keep up with demand.

But even if they could, the cost of buying is rising faster than the cost of renting. Owner households now number 86.9 million, according to data collected by Redfin. But the number of renter households hit a record 45.6 million in the third quarter of 2024.

Most errors in this year’s second quarter were about borrowers’ incomes and employment, but applications with faulty appraisals saw the most significant quarterto-quarter increase.

Ground has been broken outside of Atlanta for what the builder claims will be the largest zero-energy community in the country.

Located in Marietta, Georgia, the GreenHouse community will have 591 houses, all of which will be built to the Department of Energy’s Zero Energy Ready standards. The builder is Beazer Homes, a company that has promised to build every one of its properties to high energy-efficient standards. Based in Atlanta, Beazer currently has 12 projects in various stages of development in the metro area, each of which offers Zero Energy Ready houses.

At GreenHouse, the houses’ renewable energy systems will be so efficient that they could offset most, or all, of the home’s annual energy use, the company said.

Lew Sichelman has been covering real estate for more than 50 years. He is a regular contributor to numerous shelter magazines and housing and housing-finance industry publications. Readers can contact him at lsichelman@aol.com.

Address: 178 Queen Anne Road, Chatham

Price: $9,525,000

Buyer: 178 Queen Anne Road LLC

Seller: Nancy C. Ferry and Thomas R. Ferry

Agent: Maggie Gold Seelig, MGS Group Real Estate

Size: 7,700 square feet on 0.97 acres

Sold: 12/10/2024

Address: 1 Moth Ball Way, Nantucket

$7,999,500

Buyer: Trok Ack LLC

Seller: Galley West LLC

Size: 3,537 square feet on 1.5 acres

Sold: 12/11/2024

The lead home in this week’s Gossip Report deftly manages the tough task of combining new construction with a historic home on the same property. The home in Chatham Center’s main living area is located in a light and airy contemporary addition whose exterior still takes its cues from the original 1820 home. A big guest house-cum-pool-house with a pair of sliding, hangar-like glass doors looking over the pool the Oyster Pond extension of Chatham Harbor.

HAMILTON SOUTH BOSTON

Address: 1373-D Monument St., Concord

Price: $6,500,000

Buyer: Elsfield Manor RT

Seller: Christine M. Paradis and Kenneth J. Paradis

Agent: Kevin Balboni and Emma Dorsey, William Raveis Real Estate

Address: 50 Liberty Drive #5B, South Boston

Price: $6,500,000

Buyer: David C Barsam RET

Seller: Francesco Insolia and Suzanne Y. Thompson

Agent: Skambas Realty Group, Compass

Size: 2,083 square feet

Address: 920 Highland St., Hamilton

Price: $5,263,570

Buyer: Karl-Heinz Maurath and Patrisia R. Maurath

Seller: Elisabeth A. Massey and Mark T. Massey

Size: 8,193 sq. ft. on 8.47 acre Sold: 12/10/2024 4 5 2 1 3

Sold: 12/9/2024

Agent: Lanse Robb and Sophie Soman, LandVest –

Manchester Size: 5,856 sq. ft. on 61.53 acres

Sold: 12/9/2024

THE

■ Showcase your listings alongside The Gossip Report, reaching high-net-worth individuals eager for the latest in luxury real estate.

■ Get noticed with exclusive online banner placements on bankerandtradesman.com, ensuring your name and listings shine bright in the digital sphere.

■ Stand out in Banker & Tradesman’s Weekly Newsletter with native ad property links and images, captivating engaged subscribers.

Contact Caitlin today at 617-896-5307 or cbobe@thewarrengroup.com for more details!

BY JAMES SANNA BANKER & TRADESMAN STAFF

Dressed in a Santa suit, MBTA Chief Operating Officer Ryan Coholan called it “a once-in-a-lifetime Christmas miracle.”

The declaration was in keeping with officials’ celebratory mood in the mezzanine of the T’s North Station subway station early on Dec. 23 as they gathered for a press conference to promote the elimination of all slow zones on the MBTA subway network “for the first time in 20 years.”

The T’s workers and contractors wrapped up the last in a seemingly endless parade of shutdowns on the agency’s subway lines on Dec. 20 with a two-week closure of the Green Line from its northern termini in Somerville and Medford through to Park Street in downtown Boston.

“I want to thank the T riders for their patience and staying with us. When we came in two years ago, we said we were going to deal with this and get after it. And I really credit [MBTA General Manager] Phil Eng. Under his leadership with the team for putting together a plan to remove slow zones and take care of business,” Gov. Maura Healey said, backed by a large crowd of public officials and paperboard cut-outs of reindeer and pine trees that had been decorated with holiday lights.

The 14-month repair campaign repaired or rebuilt large sections of track on the T’s subway lines. The net effect, Healey said, has been to set riders up to save riders 2.4 million

minutes “every day” that they would otherwise have wasted as their trains crawled through a section of track whose speed had been restricted thanks to a track problem that had gone too long without being repaired. Around 200 such slow zones were in place when the Healey administration took office, Lt. Gov. Kim Driscoll said.

Data from the MBTA and data independently analyzed by watchdog group TransitMatters shows MBTA work crews working overnight when trains aren’t running appear to have been effective at removing the small number of slow zones that have popped up in the last month. The T’s own tracker listed eight that had been added since Nov. 23 on the Red, Orange and Blue lines, and 12 removed by the morning of the press conference, including two thorny ones that were eliminated by the Green Line shutdown and a long-running pair on the Red Line.

But other aging pieces of MBTA infrastructure seemed to take the opportunity that morning to remind officials and the public that the job of fixing decades of deferred maintenance at the agency was far from over.

Commuters on the Red Line’s Braintree branch found themselves facing delays of 20 minutes or more as they tried to head in to work due to what the MBTA described on its account on X, formerly known as Twitter, as a “a signal problem near Braintree” followed by another at the JFK/UMass station.

The issue sent delays rippling through the rest of the Red Line. An hour after the T

first announced the problem, a rider posted a photo to the Bluesky social media site showing the countdown clock on the southbound platform of the Downtown Crossing Red Line station. It listed “+50 minutes” until the next train headed towards Braintree would arrive.

The agency later posted that a rail between Quincy Center and Braintree also broke in the cold, forcing northbound and southbound trains to take turns on the remaining track until it could be fixed.

“It sucks. I’m sorry. Anybody who’s waiting right now – it’s cold,” Healey said when asked by a reporter about the problems, “but, you know, we’re continuing to run a train. So from time to time, there are going to be periodic issues that come up.”

Eng told reporters that the crews began replacing antiquated signal systems on the Red and Orange lines this year, with work sched-

uled to be completed before the World Cup comes to Boston in 2026. The T had originally awarded a contract for the work in 2018, but Eng said his agency was speeding up the project’s delivery schedule.

The agency is also trying to upgrade its power infrastructure to make it more reliable and working with troubled train-maker CRCC to get the remainder of its new fleet of Red Line trains delivered. The current Red Line trains are some of the oldest in the country, Eng said.

“Every day, [riders] will see the system getting more and more reliable. And they will see that, from time to time, there are challenges, but you have challenges at all [transit systems],” Eng said. “The system is something I want to be proud of. I want [riders] to use this system and I want to show that we deeply care about making their lives better every day.”

Title: Director of Homeownership, MHP Age: 41

Industry experience: 15 years

BY BY SAM MINTON

BANKER & TRADESMAN STAFF

Massachusetts homebuyers’ ability to afford a home is getting worse and worse, leaving down payment assistance and mortgage discounts as two of the few ways ordinary Bay Staters can land their first home. According to the latest data from The Warren Group, the publisher of Banker & Tradesman, the statewide median single-family sale price hit $600,000 in November. Additionally, the median statewide condominium sale price in November is up to $511,955.

Our partner lenders are coming out with their own portfolio products geared towards low- and moderateincome households.

A ranking by real estate data company ATTOM shows that, between those prices and higher mortgage rates, housing affordability got worse in every part of the state this year. Hampshire County suffered the least, while Essex County suffered the most.

At the Massachusetts Housing Partnership, Elliott Shmiedl is the point person for one of the newest and biggest efforts to try to reverse that trend: the ONE+ mortgage product. Fundedin partnership with the state government, Eastern Bank and The Boston Foundation it combines a heavily discounted, fixed-rate 30-year mortgage with up to $50,000 in down payment and closing cost assistance. First-time homebuyers who utilize the program also don’t need to pay for private mortgage insurance.

The program is available to low to moderate-income first-time homebuyers in the 26 Gateway Cities as well as Framingham, Randolph and Boston. Prospective buyers must complete a homebuyer education class and, if purchasing a multifamily property, participate in a pre-purchase landlord course.

Q: How effective are down-payment assistance and special purpose credit programs in getting people into homes who might otherwise not be able to?

A: It comes down to a math problem. Your average purchase price in Massachusetts has risen something like 30 percent to 40 percent in the last four to five years, and that’s obviously outpacing income growth so these gaps are widening. That’s come at a really inopportune time because while prices have gone up, mortgage rates have gone up too and everybody became a little too comfortable too quickly. So ONE+ mortgage comes with a 30-basis-point discount from the start. It’s just going to mean the difference for that household that doesn’t want to stretch to the point of nearly breaking just to buy their first house.

I look at loan scenarios all the time, and the ones that leave me feeling most uncomfortable are the ones that technically work on paper. They meet all the requirements, but it leaves the household with very little room thereafter. It’s like they’re throwing all their reserves at it. They’re getting in by the skin of their teeth. So, by helping folks with a lower monthly payment, down payment assistance, closing cost assistance, hopefully we’re helping them not just get into the home, but in a way that is sustainable for the future so that they can support that payment going forward.

Q: You might not want competition, in this sense, but do you think that as the state continues to see prices increase and continues to struggle with a lack of inventory, that we’ll see more down payment assistance and mortgage discount programs?

A:

Yes, and I actually think many of our banking partners, they may also participate in the MassHousing [mortgage] program, state-sponsored mortgage products but they’re also starting to come out with more and more of their own portfolio products geared towards low- and moderate-income households. I think we chuckle at the same notion, like, “oh no, competition,” but competition is good and if our banks are putting their best foot forward, offering our product, but also alongside it maybe they’re offering their own affordable product, perhaps with no PMI, some even their own down payment assistance. We think that’s all good, because the same way that we want to promote choice of housing options, we want to promote choice of mortgage options and financing options. So, the broader the menu is for first-time homebuyers, we think that’s better in the long run. It might mean a few less loans for us here and there but ultimately it should be more buyers in their first home.

Q:

Especially in these current market conditions, how important is it to help low to moderate-income households? The American Dream is being able to own your home and be able to kind of pass down that wealth.

A:

It’s incredibly meaningful, because I think it offers opportunity going forward when somebody can fix their housing costs, a 30 year fixed rate mortgage, and not be at the whim of market conditions and landlords raising rent and things like that. It allows them opportunity to put those savings towards other things. Maybe it’s just flat savings, maybe it’s helping put their kids through college, replace an aging car, pay off student loans. Families are hit with probably more expenses today than they used to be. When you couple that with the increasing cost of housing, it’s really put a lot of people in trouble. So every dollar we can save [a borrower] is meaningful, and of course, it unlocks the potential to build equity. Massachusetts is a strong real estate market. We understand that it’s got a very positive trajectory, if you look at the history. So we feel good about putting people in homes and what the future would bring for them.

Q: Looking ahead to the next year, in 2025 how do you feel the market will play out? Do you think inventory and prices will continue to dominate the story, or do you think that we could see some shifts heading into next year?

A:

I’m not super optimistic that we will see like market change in 2025. I think if interest rates can tick down a little, that will be helpful. Of course, there’s a lot of uncertainty there. I do hope that inventory can rise just a little bit, but I don’t necessarily see that happening. So I think it’s important on the financing to continue to be innovative and creative and save people money and create opportunity where we can because it’s just not clear enough that change is on the horizon on this sort of inventory, price, interest rate side.

BY STEVE ADAMS BANKER & TRADESMAN STAFF

Amajor portfolio sale and a reported lease in negotiation are making headlines in the geographic heart of Massachusetts’ biotech industry.

Alexandria Real Estate Equities sold three Kendall Square life science buildings to its archrival BioMed Realty for $250 million in a transaction between the nation’s two largest lab landlords.

Along with the 147,808-square-foot former Foundation Medicine-leased building at 150 Second St., the transaction includes 215 First St., which totals 366,000 square feet and includes the headquarters of Sarepta Therapeutics.

Foundation Medicine has relocated to Boston’s Seaport District at a new tower by WS Development.

Alexandria also assigned its lease at 11 Hurley St. to BioMed, according to a deed filed in Middlesex County. The 67,037-square-foot property is assessed at $39.8 million.

The nation’s largest lab landlord, Alexandria has been divesting properties in eastern Massachusetts and shelving expansion plans since 2022 as biotechs trimmed real estate footprints and lab vacancies steadily rose to historic highs.

This fall, it sold properties in Norwood and Andover for a combined $467 million to Moderna Pharmaceuticals and The Davis Cos., respectively.

Prior to 2024, Alexandria owned over 13

million square feet of life science properties in Greater Boston delivering nearly $821 million in annual rental revenues, as part of its 47.2 million-square-foot nationwide portfolio.

BioMed, meanwhile, has continued its growth strategy with the $361 million acquisition in September of another Kendall Square property. The 750 Main St. building is anchored by The Engine, a climate tech accelerator, and is owned by MIT which ground-leases the building to BioMed.

San Diego-based BioMed owns 5.2 million square feet of lab and office buildings in Greater Boston and 17 million square feet total in the U.S. and United Kingdom.

After nearly a decade with vacancies in the low single digits, East Cambridge’s 16.8 million-square-foot lab market has softened amid the decline in biotech leasing since 2021.

As of Sept. 30, lab availabilities in Kendall Square comprised 16.2 percent of the submarket, including an 8.6 percent direct vacancy rate. East Cambridge has the regions’ highest asking rents of nearly $108 per square foot, according to CBRE.

Biogen is reportedly in negotiations to lease up to 500,000 square feet as the first tenant at MIT’s redevelopment of the Volpe Center property in Cambridge.

The $9.8 billion-a-year drugmaker is in “advanced discussions” on approximately 500,000 square feet of space at the Kendall Square development, the Boston Business Journal reported.

Biogen leases nearly 1.2 million square feet of office and lab space in Massachusetts, with various leases expiring through 2028, according to the company’s 2023 annual report. Its Cambridge footprint totals 808,000 square feet, including the corporate headquarters at 225 Binney St. The total includes 209,000 square feet currently subleased by other companies.

The company also has an expiring lease for 357,000 square feet of office space in Weston, which will not be renewed, and 174,000 of which is already subleased.

MIT acquired the sought after former federally-owned Volpe Transportation Center site

BY STEVE ADAMS BANKER & TRADESMAN STAFF

The Boston skyline may be getting a new signature office tower.

Developer Skanska USA pulled building permits late last week for a $363 million tower at 380 Stuart St. near Copley Square, less than three months after a Massachusetts Appeals Court dismissed a lawsuit by residents of a Back Bay condominium building seeking to block its construction.

The 26-story, 625,000-square-foot tower has been in the planning stages for a decade.

John Hancock Life Insurance originally proposed replacing its 9-story office building on the 380 Stuart St. site with a new office tower, but reconsidered its space needs after the onset of the COVID pandemic. The insurer sold the property to Skanska in December 2020 for $177 million.

”We are confident about the future of office in Boston and are encouraged by recent trends that reinforce the city as our region’s economic

engine. In an evolving market, we are positioning ourselves to be ready to start at the appropriate time so that we can deliver a dynamic building to the Back Bay at 380 Stuart Street. At this time, we have not set a specific start date,” Skanska said in a statement.

In its application materials, the company said the project “should provide clear validation of its belief in the long-term vitality of Boston’s office market. The proposed project will bring jobs and people back to the city with a fresh perspective on what the office environment can and should be.”

Skanska had considered switching to a life science project during the first year of the COVID pandemic, before submitting an updated office design for review by Boston planning officials.

Skanska’s proposal for a 625,000-squarefoot office tower was approved by the thenBoston Planning and Development Agency in March 2022, but was delayed in part by a lawsuit filed by condominium owners in the neighboring Clarendon tower at 400 Stuart St.

Continued from Page 3

“The cost models are definitely changing, and it’s something we have to continuously evaluate,” she said.

However, financial institutions need to strike a delicate balance between fees and their very real expenses. Some transactions or services come with a cost to the bank. So, while small and regional banks might not charge as many fees as larger institutions, it’s hard to get rid of them entirely.

“I think there will always be a place for a service charge for value-added services,” Michel said. “I don’t necessarily see service charging going away, but that concept of negative reinforcement for behavior through fees, you can definitely see that dwindling almost to a near-zero point at this point, especially in terms of what consumers will tolerate.”

Still, Michel believes that financial institutions should be looking to offset the costs of eliminating or reducing some fees.

“I think smaller FI’s need to look at the big picture, calculate those offsets for themselves, and find the areas where they’re either going to save or make money to offset the loss in revenue,” she said. “There’s the relationship factor that the checking account tends to drive a multiproduct service relationship that’s a bit more dynamic, that has payments, income associated

with it – and there’s operational efficiency.”

Michel said overdraft fees are one example of how a fee can actually reduce operational efficiency and customer satisfaction, as call center employees are tied up trying to fix and possibly solve a problem that ends up with the bank reversing the fee. On the other side of the coin, if the charge remains, customers can be left frustrated that they took time out of their day to call and still have to deal with fees.

Canina said that PeoplesBank still charges fees for more specialty services, which could persist even as sentiment towards NSF and overdraft fees grows more and more negative.

“We do charge fees for more specialty services that are more individually driven by customers, the ones that we feel are that value add,” Canina said. “Added services that customers would expect to pay for, and then you just kind of monitor the landscape. It’s really more based on the competition and market.”

As small and regional banks look to compete with larger institutions, marketing their lower fees can be a crucial tool to gather deposits and customers. Canina noted that PeoplesBank markets itself as a “fee-free bank,” while also highlighting how it aspires to make banking simpler.

A lawsuit filed by a dozen neighbors argued the project was improperly approved. The lawsuit challenged the office tower’s height and cited potential adverse effects on the condominiums’ value, noting that the residents live in units below the office tower’s roof line and will experience diminished privacy.

The lawsuit also argued that the BPDA’s approval was motivated in part by the desire to ensure that John Hancock maintains its “substantial corporate presence” in Boston rather than relocating.

for $750 million in February and has approval for 1.7 million square feet of commercial development and 1,400 housing units.

The institute is in permitting for individual buildings within the 14-acre site, including a 16-story, 407,893-square-foot office-lab building at 25 Broadway.

A move to the Volpe site would follow the move of drugmaker Sanofi to another new master-planned campus in East Cambridge. In 2018, Sanofi opted to consolidate its Cambridge-based operations to 900,000 square feet at the new Cambridge Crossing campus, leaving behind its 50 Binney St. headquarters.

The state Appeals Court dismissed the lawsuit with prejudice on Sept. 30.

The 380 Stuart St. project is projected to create 1,500 construction jobs and 3,000 fulltime jobs. The community and public benefits package includes $4.4 million in affordable

housing linkage and a $100,000 contribution to the Friends of Copley Square.

The construction permit comes not quite two months after Boston Properties executives said they were putting their own office tower atop the MBTA’s Back Bay Station on hold indefinitely due to high construction costs outstripping rents being achieved elsewhere in the neighborhood.

“That is what we do to differentiate ourselves from the national and larger regional competitors. They are known to charge more fees,” he said. “They have a much bigger market share in the majority of the markets that they’re in, particularly the larger urban markets. So, when we move into those markets, and look to compete, that is a way that we can differentiate ourselves.

He added that banks use the large market share as a way of charging more fees with the belief that they won’t switch financial institutions. This leaves smaller and regional banks battling to make customers decide that enough is enough.

Shanna Cahalane, vice president and director of marketing at Reading Co-operative Bank, said as the bank markets itself to new customers, it aims to gain trust by discussing its fees. In addition, the bank employs Spanish speakers in areas where the language is common to ensure that Reading Co-operative is living up to its “Banking for All” tagline.

“We talk more about being transparent and making sure that people understand the fees that are out there,” she said.

Email: sminton@thewarrengroup.com

Continued from Page 1

Concerns about off-campus renters overwhelming Boston’s housing stock have only increased amid the skyrocketing housing prices in recent years. Off-campus renters drive up average apartment rents by $200 in neighborhoods with the most off-campus renters, according to a survey by the Mayor’s Office of Housing from 2015 to 2021.

During the same time period, Boston has been gradually loosening its resistance to privately-owned student housing projects.

Capstone Communities developed University of Massachusetts-Boston’s 1,077-bed housing tower and dining commons which opened in 2018. American Campus Communities partnered on a 2019 private housing development at 744 Columbus Ave. in Roxbury, a dorm-style private housing tower known as LightView that contains 825 beds.

Following the initial experiments, city planners last March approved Northeastern’s second partnership with ACC: a 23-story, 1,240-bed housing tower at 840 Columbus Ave. expected to break ground in 2025.

NEU Experiment a ‘Success Story’

The project wasn’t without controversy, stretching more than four years and attracting opposition from Roxbury neighborhood representatives who warned of gentrification and displacement.

The public review process prompted the university to reduce the height and redesign the tower to eliminate academic space. Northeastern will lease the parcel to Austin, Texasbased ACC, which will operate the 21 residential floors.

LightView’s track record may give assurances to city officials and neighborhood groups about the acceptability of private dorms, Kiefer said.

“There was some concern when they initially filed, but it’s been occupied for years now and it’s well-managed. That’s a great success story for everybody,” he said.

In the first year of return to campus after COVID, Northeastern admitted an additional 1,000 firstyear students compared to its recent history, bringing its current undergraduate population to 17,737 students, according to data submitted to the Boston Planning Department.

“More private student housing getting built would free up some of the housing stock,” Kerr said. “Students are looking for a premium product, and they are willing to pay for it.”

Three-quarters of the students live in Boston, including a 41 percent off-campus cohort that equates to nearly 5,550 undergraduates who live in private residences in surrounding neighborhoods.

Northeastern also has increased its residential footprint in Back Bay through a long-term lease of the Sheraton Boston Hotel’s South tower for 856 student beds, under a temporary arrangement in 2018 that was approved for a permanent dorm conversion this year.

But so far, city officials don’t seem keen to loosen the reins on private student housing developers who aren’t directly teaming up with a university.

Gary Kerr, senior managing director for Greystar Development Services, sees these zoning restrictions in Boston and elsewhere as a missed opportunity.

Greystar is expanding its Bay State student housing horizons after breaking ground in September on a twobuilding dorm project on Merrimack College’s campus in North Andover.

The South Carolina firm manages nearly $18 billion in student housing properties near 82 universities totaling more than 110,000 beds. Developments typically are built under a 99-year master lease, giving colleges more oversight by retaining ownership.

four years before breaking ground. Designed by Cube 3 Architects, the project includes a traditional residence hall and an apartmentstyle building for first- and second-year students. Both buildings are scheduled for completion in 2026, adding 540 beds.

Concerns about offcampus renters overwhelming Boston’s housing stock have only increased amid the skyrocketing housing prices in recent years.

“The strategic control remains with the university, which is incredibly important,” Kerr said.

Greystar was in planning and predevelopment with Merrimack College for more than

School Partners with Capstone Communities on 276K SF Project

BY STEVE ADAMS BANKER & TRADESMAN STAFF

Tufts University is proposing its largest-ever dorm project in partnership with Capstone Development Partners.

The project would reduce Tufts students’ presence in the Medford and Somerville rental markets, Tufts officials said. The school’s undergraduate enrollment totals 6,662, an increase of 700 students since before the pandemic.

Designed by Elkus Manfredi Architects, the two buildings would include “apartment-style housing” for juniors and seniors, primarily suites containing four bedrooms with shared kitchen, living and bathrooms.

The project, which Tufts officials said could break ground in spring 2025, has attracted criticism from Medford Mayor Breanna Lungo-Koehn.

In a Dec. 3 letter to the city’s Community Development Board, Lungo-Koehn echoed complaints from residents of the surrounding Hillside neighborhood about the 10-story height of the two dorm buildings totaling 275,800 square feet.

“Reducing the hours of sunlight and increasing the amount of darkness in a community can have substantial side effects, especially on one’s mental health,” LungoKoehn wrote, adding that the project is

Payoffs for private student housing developers are lucrative, according to a recent report by brokerage Berkadia.

Dorm-style housing, with multiple bedrooms sharing kitchens and bathrooms, typically cost less to build than apartment buildings. Private student housing attracts average rents of $902 per bed as of June 30, up 4.6 percent in the previous 12 months. The Northeastern U.S. attracts the highest rents, averaging $1,065 per bed, the report stated citing RealPage data.

Email: sadams@thewarrengroup.com

being proposed under a “rushed process.”

But Lungo-Koehn and other Massachusetts officials have limited powers to block college-sponsored developments under state law. The Dover Amendment exempts nonprofit educational institutions from many land-use regulations.

To comply with the legal requirements under the Dover Amendment, Tufts and Capstone plan to form a nonprofit educational corporation which will ground-lease

the property from Tufts, according to a letter submitted to the city from attorneys Christian Regnier and Patrick Gallagher of Goulston & Storrs, representing Tufts University.

Tufts officials have stated the project would reduce the off-campus student population in Medford and Somerville.

In a statement, Tufts spokesman Patrick Collins noted that the project is shorter than the maximum 12 stories allowed

under Medford zoning and will contribute $3 million in permitting fees, city affordable housing trust payments and a neighborhood improvement fund. Shrinking the project would make the apartments unaffordable for students, Collins wrote in an email.

“The university chose this location because we think it is the best option for achieving the shared goals that the city and university have discussed,” Collins wrote.

Sale in United States Bankruptcy Court for District of Massachusetts of the Following Properties and Minimum Counteroffer Amounts

Property

305 K Street

921-923 East Broadway 595 East Sixth Street

Minimum Counteroffer Amount

$2,362,500

$2,257,500

$1,338,750

Deadline to Submit Qualifying Counteroffers is January 13, 2025 at 4:30 P.M. Case: 921-923 E Broadway, LLC, Chapter 7, Case No. 24-11119-JEB.

For further information, contact:

Harold B. Murphy, Chapter 7 Trustee, at (617) 423-0400; hmurphy@murphyking.com, or Michael Moran, Trustee’s Broker, at (617) 733-7660; Michael.moran@gibsonsir.com

renovated and underwent fire damage repairs and handicapaccessibility upgrades.

IBA will provide education, workforce development and cultural programming to residents. The nonprofit was founded in 1968 to fight displacement in South End during the urban renewal era.

more time to secure financing and move ahead with projects.

Atwo-year permit extension throws multifamily developers a lifeline – but no silver bullet to overcome still-high obstacles to housing projects breaking ground.

A nearly $4 billion economic development measure Gov. Maura Healey signed in November includes a provision aimed at helping developers find

But experts in the multifamily space say it likely still isn’t enough on its own to nudge proposals over the starting line anytime soon.

The economic development bill includes a provision that allows a twoyear extension on any project approved between the start of 2023 and the end of this year. The rationale behind the measure: It buys developers more time to hopefully move forward on projects that don’t pencil out today amid interest rate hikes in recent years and soaring construction costs.

The recent decision echoes a similar measure approved by lawmakers following the Great Recession.

New Challenges Arose

Trade organizations including the Home Builders & Remodelers Association of Massachusetts and NAIOP Massachusetts, a commercial real estate development group, heralded the permit extension measure as a win for the Massachusetts real estate sector.

But there is also sentiment in the local development and finance industries that, after a recent string of rate

BY STEVE ADAMS BANKER & TRADESMAN STAFF

Q: What was The Collaborative Companies’ original business model and where are your growth opportunities?

A: All I did my entire career is the same thing we do now: vertical new construction [brokerage and advisory services]. I never dabbled in resale, so it’s a little unique. In 2008, we went into the auction business pretty heavily because it was a depressed market. We did auctions all over the country. That was the genesis of our analytical research. I’d argue that we do more than anyone in terms of understanding the market.

It’s easy to look in the rear-view mirror. It’s harder to project until you look at where the economy seems to be moving, but also the permits. You can tell what’s going on in terms of how deep the market is, what’s approved and what’s coming out of the ground. We get hired by developers to design the project to give them the right unit distribution and amenities. We’re very active at the early stages to determine the end result from a product and price distribution standpoint.

We’ve got a really good handle on what awaits in the future in terms of new construction. You have to look at the unit sizes and the prices. Because we’ve been doing these buildings for 25 years, we have all the floor plans and the infrastructure and we know the building. Utilizing that history and seeing what’s coming, we can find niches in the market that somebody could fill. A perfect example was COVID. Everybody was getting squeezed into their one-bedrooms [working from home] so the evolution of the one-bedroom-with-den was an example of capitalizing on that need.

Q: What’s your outlook for Boston’s condo pricing given the limited amount of new construction under way, with only one luxury tower opening in 2025?

A:We’ve had an amazing month for [The Ritz-Carlton Residences] at the South Station Tower. That project is really one that needed to be further along for people to appreciate it. It’s such a behemoth and people need to understand where the entry is, and how the commercial interacts with the residential. We’ve been able to get people into it the last few weeks, and it’s going to be ready at the end of [2025]. Boston has always done between

300 and 400 units per year in the luxury market at that pricepoint [$1.5 million and up]. If you look at the new inventory, we’re going to have such a dearth of new supply in another year.

Q:

As the new supply in Boston dwindles, where are the other opportunities for The Collaborative Companies?

A:

Up until 15 years ago, we had a big footprint outside the city. Because of the growth in Boston, we got so busy we stayed in town. We’re now doing projects in New Hampshire, including the condos at Tuscan Village. Our sales there average $780 a foot. That market is terrific and the [Boston] suburbs are a little more prolific with approvals. With the new requirements for MBTA Communities [multifamily zoning law], more cities are embracing it. Most of the new development is right outside the city: Everett and parts of Somerville and Watertown. Improvement of the rail situation and the MBTA Communities law will be much more helpful than trying to evolve the urban core.

Q:According to your quarterly rentals report, the Life Time Living-branded apartment building in Burlington has topped $3,900 in effective rent since opening in 2023. What’s the key to its appeal?

A:

When you rent there, you get an automatic membership to the [adjacent] fitness facility. That’s not a small savings. Nordblom Co. built to a condo-level quality and they attracted a huge number of empty-nesters, much more so than you would expect in a rental community. It’s a very high-end older demographic, and they have a wait list for membership to the fitness club.

Q:

A:

Where do you see the local luxury condo market headed in 2025?

The inventory is going to get eaten up and prices are reasonably stable. There are some opportunity buys for projects looking to sell out the last 10 percent of their building, but not excessive. At that point, most of the debt is already paid for, so people are looking at it as, “This is my profit, this is my last opportunity.” So, this isn’t a fire sale moment. Drops in interest rates do impact the psychology of the consumer. I expect the suburbs to expand and explode.

TITLE: Managing Director, The Collaborative Companies

AGE: 73

INDUSTRY EXPERIENCE: 44 years

Luxury condominium developers rely on The Collaborative Companies not only to deliver buyers, but to advise them on optimal unit mixes and designs years before they receive a certificate of occupancy.

Over the past four decades in Bostonarea luxury brokerage, Sue Hawkes has followed the market’s shifts during upand-down cycles and shifted business strategies accordingly.

Utilizing that history and seeing what’s coming, we can find niches in the market that somebody could fill.

The Collaborative Companies increased its focus on downtown Boston amid the past two decades’ urban resurgence, and added auction services during the Great Recession.

As development slows in Boston, TCC now is eyeing opportunities in multifamily residential development in the suburbs spurred by rezoning under the MBTA Communities law. A former broker with Codman Company, Hawkes founded The Collaborative Companies in 1997 along with Jon Gollinger and Bob Cole, before buying out her partners in 2008.

HAWKES’ FIVE FAVORITE RESTAURANTS IN BOSTON: 1. Amar

Contessa 3. O Ya

Ostra

Woods Hill

State Regulations Set Definitions for Housing Category

BY CHRISTOPHER R. VACCARO SPECIAL TO BANKER & TRADESMAN

Massachusetts residents are familiar with entreaties for production of more “affordable housing” from well-meaning government leaders and housing advocates.

The commonwealth does indeed suffer from a shortage of reasonably priced dwelling units, but before joining the chorus of promoters of “affordable housing,” one might want to consider the meaning of that term, and the consequences of affordable housing initiatives.

The state Executive Office of Housing and Livable Communities (EOHLC) plays a major role in housing development and affordable housing programs. It is responsible for administering local housing authorities and overseeing state-aided housing projects, urban renewal regulations, housing voucher programs, low-income housing tax credits, smart growth zoning and comprehensive permits for affordable housing projects. It also determines whether municipalities are in compliance with the MBTA Communities law.

stricted: 17 percent deed-restricted and another 3 percent set aside for holders of state or federal housing subsidy vouchers.

The Mayor’s Office of Housing (MOH) oversees compliance with Boston’s Inclusionary Zoning ordinance.

Boston Sets Minimum Requirement

In order for affordable housing programs to meet their goals, government agencies, such as EOHLC, MOH and local housing boards, must limit housing prices and rents on affordable units, and determine income eligibility of buyers and renters of those units. These monitoring agencies also must ensure that when affordable units are resold or relet, the household incomes of new occupants do not exceed eligibility limits.

These responsibilities require a lot of effort not only from monitoring agencies, but also from developers, landlords and property managers of affordable units.

Affordable housing in Massachusetts has come to mean not inexpensive housing, but instead pricecontrolled housing.

Housing production is the core of EOHLC’s mission.

EOHLC regulations define “affordable housing” as “homeownership or rental housing which is restricted to occupancy by low- or moderate-income households and for which the sales prices or rents are affordable to such households.” The regulations define “low- or moderate-income households” as those “with gross income at or less than 80 percent of area median household income as most recently determined by the U.S. Department of Housing and Urban Development (HUD) adjusted for household size.”

Area median household income varies throughout Massachusetts, but it is generally in the vicinity of $100,000 per year. These definitions are essential to EOHLC’s affordable housing programs.

The city of Boston and many other municipalities have their own affordable housing requirements baked into their zoning ordinances and bylaws. Boston’s zoning mandate, known as “Inclusionary Zoning,” is particularly aggressive.

It requires new housing projects with seven or more dwelling units, to set aside up to 20 percent of units as income-re-

To set pricing of affordable units and see that affordable units are only owned by or rented to income-eligible households, developers must accept deed restrictions under affordable housing agreements. These pricing and occupancy restrictions generally last for decades.

Developers intending to sell affordable units to homebuyers are expected to assemble and submit to monitoring agencies marketing plans directed at incomeeligible buyers. Developers are sometimes required to give preferences to first-time home buyers, local residents or artists.

The deed restrictions limit resale prices on affordable units, to prevent owners from enjoying profits from a resale, and to verify that buyers meet income eligibility limits. Monitoring agencies must certify that resales meet these requirements.

Similar restrictions apply to affordable rental units. Developers must present marketing plans acceptable to monitoring agencies, with limitations on rents and tenant incomes.

Affordable housing restrictions present interesting challenges.

For example, when properties inevitably require capital improvements or replacements, owners need the ability to recover their expenditures. Restrictions on resale prices and rents must be loosened to accommodate these expenditures, which owners of affordable units must verify with monitoring agencies.

Also, affordability restrictions on rental properties should be tailored to address increases to occupants’ income levels. Individuals who have low or moderate incomes when they first join the workforce often enjoy significant pay increases as they acquire skills, experience and responsibilities. Monitoring agencies should have mechanisms to prevent “over-income” households from enjoying the benefits of affordability restrictions intended for lower-income households.

Keeping track of tenant income, and moving over-income households out of affordable units to make room for income eligible households, can be difficult for monitoring agencies.

Affordable housing in Massachusetts has come to mean not inexpensive hous-

ing, but instead price-controlled housing set aside for lower-income individuals with associated governmental oversight. Imposing affordable housing requirements on developers might be good public policy, if combined with financial incentives that encourage production of more market-rate housing for the general public.

But, if local governments use overly restrictive zoning limitations to force developers to build affordable housing, and their restrictions result in less overall housing production, then it’s time to reevaluate those limitations.

Christopher R. Vaccaro is a partner at Dalton & Finegold in Andover. His email address is cvaccaro@dfllp.com.

2-4 Los Angeles St, Newton

Use: Mixed Use-Prim Res & Comm

B: 2 Los Angeles St Owner LL

S: Residences On The Charles

Date: 11/12/24

Total Assessed Value (2024): $49,447,500

$114,000,000

Lot Size: 148563sf Prior Sale: $13,260,000 (08/20)

41 Jefferson Ave, Nantucket $26,000,000

Use: Mixed Use-Prim Comm & Other

B: Nantucket Is Land Bank

S: Purple Wampum LLC

Date: 11/13/24

Total Assessed Value (2024): $5,212,400

Lot Size: 32234sf

21 Parker Dr, Avon $18,500,000

Use: Manufacturing Building

B: Avon Parker Drive LLC

S: Atlantic Oliver Ii 21 Pke

Mtg: Provident Bank $13,885,000 Date: 11/27/24

2 Executive Dr, Chelmsford $14,500,000

Research & Dvlpmnt Facility

B: Rc 2 Executive Rt & Rc 2 Executive Mgr LLC Tr TR

S: Nv 2 Executive Drive LLC

Mtg: BankNewport $9,327,500 Date: 11/20/24

Total Assessed Value (2024): $12,250,000 Lot

BY SIMON BUTLER, BIRIA ST. JOHN, JOHN MCLAUGHLIN AND BRIAN BOWLER

SPECIAL TO BANKER & TRADESMAN

Boston ranks as one of the top multifamily markets nationally for investors, thanks in large part to its strong underlying fundamentals and dynamic employment market.

Home to some of the country’s top universities and hospitals, Boston has historically been one of the first stops for domestic and foreign capital, and 2024 was no different. Notably, 25 percent of all class A transactions were sold to new entrants into the market; CBRE handled the majority of these sales.

In 2024, the Greater Boston market saw $3.5 billion in transactions over $10 million, up from $3 billion the year prior, amounting to the fourth highest historical sales volume ever. Overall, there were 46 transactions over $10 million in 2024 compared to 35 transactions in 2023, a 31 percent increase.

Among the 2024 transactions, 14 were repeat sales that averaged nearly 30 percent price appreciation over the prior acquisition. CBRE brokered eight of the 14 sales.

Seventy percent of the total sales volume occurred in the second half of the year, compared to 57 percent the same period 2023. With more purchasing opportunities later in the year, pricing was more aggressive.

Cap rates averaged 4.5 to 5 percent in the second half of 2024 compared to 5 to 5.5 percent in the first half. While the compression in cap rates was partly a result of the downward trend in the underlying Treasury markets, investor demand heated up over the summer with the support of strong rent growth and the anticipation of further rate declines.

One notable trend is that many investors in the Boston market are underwriting exit cap rates equal to going-in cap rates, both of which are lower than prevailing interest rates.

The second half of 2024 also saw the return of more institutional investors.

Illustrating the depth of the investment market, CBRE received 15 to 20 offers on two recent coreplus offerings, for which final pricing stretched 7 percent to 10 percent over initial bids.

The market has averaged 4 percent annual market revenue per available foot (M-RevPAF) over the past 15 years, resulting in cumulative rent growth 10 percent higher than the average among the top 50 markets.

Of the 2024 deliveries, only 1,600 apartments were in Boston or Cambridge, the fewest in over 10 years.

In both situations, there were numerous new bidders, as well as bids from groups which had previously been out of the market. This illustrates the importance of running a process and understanding who has the most competitive capital.

Ranked as one of the top apartment markets in the country by Green Street, Boston is able to attract capital and command the lowest yields because of its strong and stable fundamentals.

But Better Energy Policy Could Lower Construction Costs

BY DEMETRIOS SALPOGLOU SPECIAL TO BANKER & TRADESMAN

As we approach the end of 2024, a look back at the previous year’s apartment data reveals that housing supply is still tight and rent prices continue their path upward.

Apartment price growth did decelerate in 2024 to 3.08 percent due in part to slightly increased rental availability. The current real-time availability rate in Boston sits at 1.81 percent, which is still low despite being up by 28.37 percent yearover-year.

The real-time vacancy rate in Boston is also very low at 1.09 percent despite being up 67.69 percent compared to last December.

rental real estate marketplace. Median days on market for Boston apartments is 15 days, which is down seven days yearover-year.

These data points combine to show that demand is still strong in Boston for rental units. The region could easily absorb 15,000 new units per year, and it wouldn’t impact rental pricing.

As we look ahead to 2025, we analyze the market trends both good and bad that have got us here to this point. In the spirit of ending on a positive note, we will start with the bad news first: The supply problem.

Greater Boston could easily absorb 15,000 new units per year, and it wouldn’t impact rental pricing.

This constriction in the supply level of available apartments is primarily due to the failure of new product hitting the

Over the past two years, Boston’s average rent price has increased by a margin of 12.65 percent amidst a historic lack of inventory. Boston’s real-time availability rate bottomed out at a record-low 0.68 percent in September 2022 as we recovered from the pandemic. That led to a severe lack of choices for apartment renters.

Looking forward, MRevPAF growth throughout the Boston market is projected to remain stronger than any of the top 50 markets in the country and nearly two times the average – 3.5 percent annually in Boston compared to just 1.8 percent annual average in the other top 50 markets.

Another significant contributing factor to the historic stability and growth throughout the Boston apartment market is the limited new supply.

With high costs, lack of available sites and restrictive local zoning, Boston is seeing fewer new deliveries compared to other parts of the country.

There were 7,800 new apartment homes delivered in 2024, less than a 2

percent increase to the overall apartment stock and 10 percent fewer new homes than in 2023.

Of the 2024 deliveries, only 1,600 apartment homes were in Boston or Cambridge, the fewest urban deliveries in over 10 years. This downward trend is expected to continue over the next few years, with 21 percent fewer deliveries projected in 2025 and 37 percent fewer in 2026.

CBRE anticipates a significant reduction in deliveries in urban areas where union and high-rise construction costs make very few developments economically feasible.

These strong fundamentals are expected to drive investment activity throughout the Boston market. Until housing production returns and elevates to considerably higher levels, the greater Boston market is going to continue to see outsized rent growth.

Simon Butler, Biria St. John, John McLaughlin and Brian Bowler are members of CBRE capital markets multifamily group in Boston.

When a landlord notices that inventory is low, they can try for a higher price or wait longer before dropping their price to fill their units.

As a result, Boston’s average rent price exploded by double-digit margins. From January 2022 to June 2023, rent prices surged by 20.1 percent, from $2,537 to $3,047.

The Bad: Little New Construction

Greater Boston’s declining new housing development has been a major contributing factor to the inventory shortages we’ve seen over the last few years.

Boston Mayor Michelle Wu was sworn into office on Dec.13, 2021, which ended

a year where the biggest city in Greater Boston saw a record number of new housing units approved for construction. But new housing units permitted declined each year from 2022 through 2024. Rising energy costs, surging inflation, cost of borrowing and onerous affordability requirements in Greater Boston’s core cities have crippled the ability for developers to make new construction projects profitable.

These confluences led to the decline in development we’ve seen over the past three years, and have effectively fanned the flames of surging rents by ensuring low apartment availability.

BY JAY FITZGERALD

& TRADESMAN

New Hampshire’s multifamily housing market faces a murky future heading into the new year, as cautious developers, bankers and investors wait to see how the Fed handles interest rates and how the incoming Trump administration’s policies impact the economy in 2025.

Early bank data indicates that the multifamily lending market improved through the first nine months of the current year in New Hampshire, with multifamily purchase lending jumping by 18.4 percent to nearly $90 million compared to the same period in 2023, according to figures compiled by The Warren Group, the real estate analytics firm and publisher of Banker & Tradesman.

The Warren Group’s data doesn’t cover all multifamily lending in the state through Oct. 31, but the purchase-loan numbers do point to increased investor interest in the multifamily sector in the Granite State, some of it apparently due to the Federal Reserve’s interest rate cut in September.

To some, the higher Treasury yields effectively offset the benefits of the Fed’s fall interest rate cut, leaving the multifamily lending sector – and most other lending sectors – in a sort of limbo, industry figures say.