Raises Tenure Limit for Banks’ Chief Executives to 12 Years

James Emejo in Abuja

The Central Bank of Nigeria (CBN) has increased the tenure of the Managing Director/Chief Executive of banks to a maximum

of 12 years from 10 years.

This was disclosed in a circular on the new, “Corporate Governance Guidelines for Commercial, Merchant, Noninterest and Payment Service

Banks in Nigeria.”

The circular dated July 13, 2023, was signed by CBN Director, Financial Policy and Regulation Department, Chibuzo Efobi, and addressed to commercial,

merchant, non-interest, Payment Service Banks and Financial Holding Companies (FHCs).

The central bank also increased the tenure of Deputy Managing Director (DMD/Executive Director

(ED) of a bank to a maximum period of 12 years.

NNPC Upstream Plans 40bn Barrels Reserves by 2030, Seeks Investment in Pipelines Network...Page 6

principles, recommended practices, and responsibilities contained in NCCG 2018; outline industryspecific corporate governance Monday 17 July, 2023 Vol 28. No 10323. Price: N250

Senate: $800m Not Loan, It's World Bank Support for Vulnerable Nigerians...

On

Votes Can Lead to Anarchy

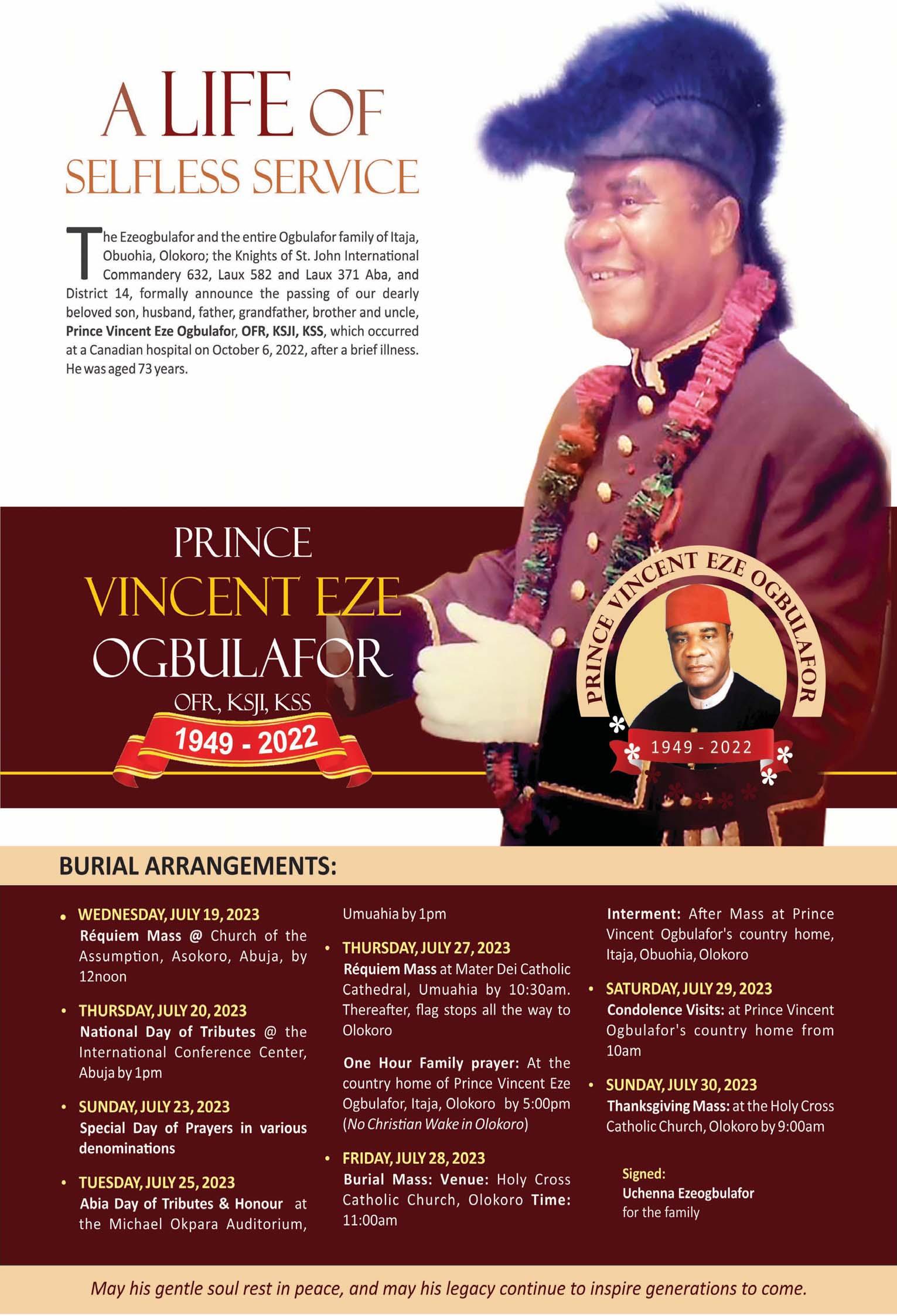

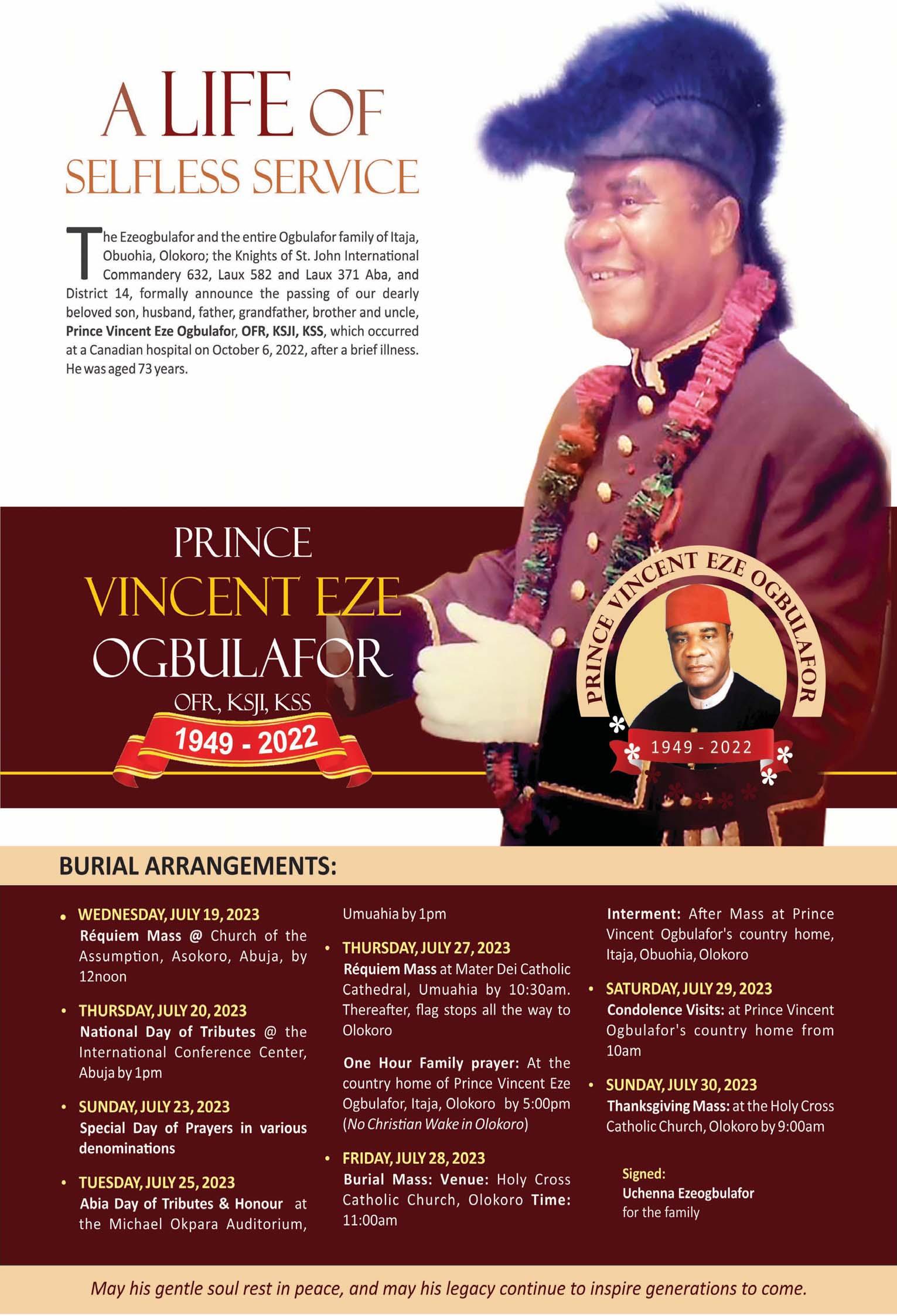

L-R: UNDSG, Amina Muhammad, President Bola Ahmed Tinubu, Egypt President, Abdel Fattah El-sisi, Gabon President, Ali Bongo, Chairperson of the African Union, Azali Assoumani, Kenya President, William Ruto, Djibouti President, Israel Omar Guelleh, Senegal President, Macky Sall, DR Congo President Felix Tshisekedi and Primer Minister of Libya , Abdul Hamid Dbeibeh at the 5th Mid-Year Coordination Meeting between the African Union, Regional Economic Communities (RECs) and Regional Mechanisms (RMs) in Nairobi, Kenya... yesterday

www.thisdaylive.com TRUTH & REASON

The CBN stated that the objectives of the guidelines are to among other things provide additional guidance on the Continued on page 5 Page 8

Claims Obi, Atiku’s petitions unfamiliar with electoral law Says their petitions failed to prove alleged non-compliance Puts actual votes scored at 8,800,369

President’s Alleged Order, Adamu, Omisore Resign Continued on page 5 Adedayo Akinwale in Abuja The duo of National Chairman of the ruling All Progressives Congress (APC), Senator Abdullahi Adamu, and National Secretary, Senator Iyiola Omisore, have resigned from their positions ahead of today’s National Working Committee (NWC) meeting of the party, allegedly on the orders of President Bola Tinubu. Their resignation would be formally announced today at the NWC meeting. This might have deepened the internal crisis plaguing APC, as the fate of the duo would be further sealed at the National Executive Committee (NEC) meeting scheduled to hold on July 19, where their resignation would be accepted and during which a midterm elective convention of the party would be proposed to fill current vacancies. Adamu had fixed the NWC meeting for July 17, preparatory to the July 18 and 19 Caucus and APC may propose midterm elective convention at NEC

New governance code emphasises gender diversity on companies’ board Sets cumulative tenure limit of directors of the same bank to 24 years Mandates banks to disclose risk management policies in annual financial statements

CBN

FCT

Tinubu: Misinterpreting the Law on

25%

5TH MID-YEAR COORDINATION MEETING BETWEEN AFRICAN BODIES…

MONDAY JULY 17, 2023 • THISDAY 2

MONDAY JULY 17, 2023 • THISDAY 3

MONDAY JULY 17, 2023 • THISDAY 4

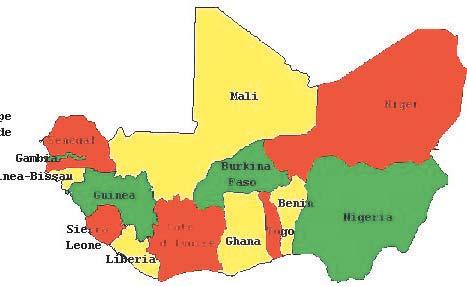

Shettima: Military Solutions Can’t Solve Nation’s Insurgency

Says Tinubu’ll soon unveil initiative on security, poverty Troops kill 22 terrorists, destroy 22 illegal refineries

Deji Elumoye in Abuja and Ahmad Sorondinki in Kano.

Vice President Kashim Shettima has explained that military solutions cannot end insecurity and Insurgency in the country, especially in the north. Shettima stated this yesterday at the Kano Government House while responding to questions from newsmen.

The vice president disclosed, at another forum, that the President Bola Tinubu government would in the coming weeks unveil an initiative to address insurgency and poverty, among other challenges facing Nigerians, especially those living in the north. Shettima’s comments came as the Defence Headquarters (DHQ),

weekend, said 22 terrorists were killed across theatres of operations in the north, while 240 insurgents and their families surrendered to troops in the region within one week.

The troops also destroyed 22 illegal refining sites discovered in the Niger Delta within the same period.

Answering questions from journalists at the Kano Government House, Shettima said, “Unless we want to engage in an endless war of attrition, there cannot be a military solution to the crises in the North-west.”

He said Tinubu was determined to redefine the meaning and concept of modern governance, which would address the root causes of banditry and insurgency in the country. Shettima stated, "The president is

determined to redefine the meaning and concept of modern governance. And the crises we have in the Northwest, further associated with poverty and social exclusion, is something that the president is determined to confront.

“In the coming weeks, he is coming up and is going to unveil the 'Fulaku' solution. Unless we want to engage in an endless war of attrition, there cannot be a military solution to the crises in the North-west. There has to be a kinetic and non-kinetic solution.

"President Bola Tinubu, in the next couple of weeks, will unveil the 'Fulaku' solution, which will address the grievances and the social exclusion of our Fulani cousins in the North-west. He was addressing the root causes of all the banditry

and insurgency in the region," Shettima, who was accompanied by Deputy Senate President, Senator Barau Jibrin to commiserate with the government and people of Kano State over the demise of elder statesman, Alhaji Abubakar Galadanci, noted, “The social exclusion is also something that the president is determined to frontally confront and in the coming weeks he is going to unveil the Fulaku solution.”

The vice president was received by Kano State Governor Abba Yusuf, before proceeding to the residence of the Emir of Bichi, HRH, Alhaji Nasiru Ado Bayero, where he commiserated with him on the passing away of the late Imam Galadanci, and expressed Tinubu’s condolences.

From the Emir of Bichi's residence,

TINUBU: MISINTERPRETING THE LAW ON 25% FCT VOTES CAN LEAD TO ANARCHY

President Bola Tinubu has warned the Presidential Election Petition Court (PREPEC), that misinterpreting the law as provided for in the constitution on the25% of lawful votes cast in the Federal Capital Territory (FCT), Abuja, could “lead to absurdity, chaos, anarchy and alteration of the very intention of the legislature.”

Tinubu also told the PREPEC that the two petitions filed by candidates of the Labour Party (LP), Mr. Peter Obi and his Peoples Democratic Party (PDP) counterpart, Atiku Abubakar, seeking the nullification of his victory were not only novel but not familiar with the country’s electoral laws.

The president, whose submissions were contained in his final written address against the two petitions pending at the PREPEC, further stated that the petitions of his opponents failed to prove alleged non-compliance and therefore put his actual votes scored at 8,800,369.

The five-member panel had on July 5, given the respondents in the two separate petitions 10 days to file their written address, while the petitioners were given seven days to reply.

Led by Justice Haruna Tsammani, the panel gave the order shortly after, Tinubu, Shettima and the All Progressives Congress (APC) closed their defence in the two petitions.

Mahmood Yakubu, had on March 1, returned Tinubu as the winner of the February 25 elections with 8,794,726 votes while Atiku Abubakar and Peter Obi of were recorded to have scored 6,984,520 votes and 6,101,533 votes, respectively.

Aside faulting the figures, which they claimed were incorrect because the collation of results was still ongoing, when Mahmood returned Tinubu as the winner, the petitioners also claimed that Tinubu could not be said to have won the election, having not scored 25% of the lawful votes cast in the Federal Capital Territory (FCT).

The two petitioners argued that Tinubu ought not to be on the ballot because of an alleged United States District Court judgment that ordered his forfeiture of 460,000 US dollars suspected to be proceeds of drug trafficking.

Another ground for seeking his disqualification was the alleged double nomination of Shettima, who according to them, was already a senatorial candidate for the APC in the Borno Central senatorial district election conducted the same day and time with the presidential poll.

not a petition stricto senso, familiar to our electoral jurisprudence, as the petitioners are not, this time around, complaining about election rigging, ballot box snatching, ballot box stuffing, violence, thuggery, vote buying, voters’ intimidation, disenfranchisement, interference by the military or the police, and such other electoral vices.

“The crux of their grouse this time around is that while the presidential election was peacefully conducted all over the country (as corroborated by their primary witnesses) and the results accurately recorded in the various Form EC8As, some unidentified results were not uploaded electronically to the INEC Election Result Viewing (IREV) Portal.

“The other remote contention of the petitioners is that the 2nd respondent did not score 25% (or one-quarter) of the votes recorded in the Federal Capital Territory, Abuja (FCT); while the petitioners have also alluded to the respondent’s non-qualification, without any fact known to law,” Chief Wole Olanipekun, SAN, counsel to Tinubu pointed out in the final address dated July 14.

election to the office of President shall be deemed to have been duly elected where there being more than two candidates for the election.

“(a) He has the highest number of votes cast at the election; and, (b) he has not less than one-quarter of the votes cast at the election each of at least two-thirds of all the states in the Federation and the Federal Capital Territory, Abuja.”

According to the INEC results Tinubu was only able to garner 19% of votes in the FCT.

But the president has argued that it was erroneous for the petitioners to call for the nullification of the entire election based on the FCT results.

“While we have premised this issue on the combined reading of sections 134 and 299 of the Constitution, and section 66 of the Electoral Act, in the course of our arguments … it is apt to submit right from get-go that election is about votes and voters, and when votes and voters are mentioned in any part of the world, there is no superiority of votes or voters as all votes and voters are equal,” he said.

the Shettima proceeded to the family compound of the late Alhaji Abubakar Imam Galadanci, where he was received by Professor Shehu Galadanci and Air Vice Marshal Nura Imam (rtd), on behalf of the extended family.

Meanwhile, a statement by the Directorate of Defence Media Operation (DDMO), said 67 terrorists, economic saboteurs, their informants and logistics suppliers were also apprehended within the period.

It stated that over 120 kidnapped civilians were rescued while caches of arms and ammunition were also intercepted across all theatres of operations in the country.

The statement said, "Due to the offensive by the troops against the Boko Haram/Islamic State of West

listed the 36 States by their respective names, the sidenote reads thus: “States of the Federation and the Federal Capital Territory, Abuja.”

Section 299, for ease of reference and clarity, he claimed provided thus: “The provisions of this Constitution shall apply to the Federal Capital Territory, Abuja as if it were one of the States of the Federation…” The phrase ‘as if’ has been defined in Corpus Juris Secundum, page 298 as connoting “in the same manner and to the same extent.

“May we draw the attention of the court to the fact that there is no punctuation (comma) in the entire section 134(2)(b) of the Constitution, particularly, immediately after the ‘States’ and the succeeding ‘and’ connecting the Federal Capital Territory with the States.

Africa Province terrorists, a total of 240 terrorists and their families, comprising 24 adult males, 79 adult females and 134 children, surrendered at different locations within the theatre of operation with five AK47 rifles, 13 AK47 rifle magazines, 36 rounds of 7.62mm special ammunition, one dane gun, one hand grenade, amongst other item."

The statement disclosed that within the week in review, troops recovered nine AK47 rifles, 20 AK47 rifle magazines, 104 rounds of 7.62mm special ammo, two dane guns and one hand grenade.

Others include 15 pairs of new slippers, three gallons of premium motor spirit, four cartons of dry fish, food stuff, clothing, three motorcycles, four bicycles and the sum of N15, 200.

as exemplified in a host of decisions, including but not limited to Nafiu Rabiu v. State (1980) 12 NSCC 291 at 300-301, Marwa v Nyako (2012) 6 NWLR (Pt. 1296) 199, 306 – 307, ADH Limited v AT Limited (2006) 10 NWLR (Pt. 986) 635, 649, Awolowo v. Shagari (supra), Abraham Adesanya v. President, Federal Republic of Nigeria (1981) 12 NSCC 146 at 167-168; A.G Abia v. A.G Federation (2002) 6 NWLR (Pt. 763) 265 at 365.

“The petitioners themselves admit this much in paragraph 107 of their petition, where they listed the FCT as the 37th state, after listing the states mentioned in section 3(1), as numbers 1 to 36. Again, the maxim, res ipsa loquitur applies to the petitioners.

“Coincidentally, these sections of the Constitution were considered by the Supreme Court in the celebrated case of Buhari v. Obasanjo (2005) 13 NWLR (Pt. 941) 1 at 105 and the apex court held thus:

Besides, the Independent National Electoral Commission (INEC), had closed its case a day earlier.

However, before closing his petition, Atiku called 27 witnesses including INEC’S Presiding Officers and experts, while Obi on the other hand, called in 13 and tendered a plethora of documents including over 18,000 blurred results sheets on which INEC based its declaration of Tinubu as the winner.

Both Atiku and Obi had claimed INEC breached Section 134 of the Constitution when he announced Tinubu who did not score up to 25% of votes cast in the FCT in line with the law.

Section 134(2)(b) of the Constitution provides that: “A candidate for an

He added that there was no superiority between the votes from voters secured in either Lagos or Kano, which are the most populous states and Bayelsa, Ebonyi and Ekiti, which are the least populous states.

Olanipekun, in his argument, further argued that, while Section 3(1) of the Constitution specifically

“In essence, the reading of the subsection has to be conjunctive and not disjunctive, as the Constitution clearly makes it so. Pressed further, by this constitutional imperative, the Federal Capital Territory, Abuja, is taken ‘as if’ it is the 37th State, under and by virtue of section 299 of the Constitution.

“With much respect, any other interpretation different from this will lead to absurdity, chaos, anarchy and alteration of the very intention of the legislature. Our courts have always adopted the purposeful approach to the interpretation of our Constitution,

“This provision appears clear to me. Where a candidate wins the highest number of votes cast in at least two-thirds of the 36 states in the Federation and the Federal Capital Territory Abuja, he is deemed to be elected ...I do appreciate any ambiguity in the provision and even if there was one, this court is bound to adopt a construction, which is just, reasonable and sensible.

ON PRESIDENT’S ALLEGED ORDER, ADAMU, OMISORE RESIGN

Both Atiku and Obi, alongside their respective parties, had dragged the INEC before the PREPEC for declaring Tinubu and the APC winner of the presidential election.

Amongst the reliefs they sought was the nullification of Tinubu’s election on the grounds that INEC did not substantially comply with the guidelines and regulations for the conduct of the 2023 election and the relevant electoral laws.

INEC’s Chairman, Professor

Although INEC, Tinubu, and the APC had interrogated the validity of the witnesses and documents to the petitions and asked the court to discountenance them, Tinubu, Shettima, and the APC in the individual written final address have asked the court to dismiss the two petitions because the grounds upon which they were built were not familiar to the country’s electoral laws.

“The petition in issue in this address is very novel in the sense that it is

NEC meetings, respectively.

It was expected that the NWC would present the party’s financial report and also seek approval for those nominated as members of the APC National Advisory Council (NAC).

But Adamu would no longer get a chance to preside over the meeting, as his resignation and that of Omisore are no longer in the realm of speculation.

Inside sources told THISDAY that the president had met with some governors of his party and given them an express order to remove Adamu and Omisore, after detailing his displeasure, especially with the national chairman, who recently confessed to having supported a different candidate for the party’s presidential ticket in the person of Ahmad Lawan, a former Senate President.

CBN RAISES TENURE LIMIT FOR BANKS’ CHIEF EXECUTIVES TO 12 YEARS

Also, in line with the Nigeria Code of Corporate Governance (NCCG) 2018, the apex bank further stipulated that no board of a bank shall consist of only one gender.

Hence, to achieve gender diversity and promote a gender inclusive board, banks shall take a practical approach to women’s economic empowerment in line with Principle 4 of the Nigerian Sustainable Banking Principles (NSBP).

The apex bank explained that the guidelines followed the pronouncement of the Financial Reporting Council of Nigeria (FRCN) for sector regulators to issue sector-specific guidelines on corporate governance for institutions under their regulatory purview.

The CBN has therefore, adapted the principles and recommended practices of NCCG 2018 in developing the new guidelines

for affected entities, taking into account, the peculiarities of the sub-sectors.

The central bank said the regulation was issued pursuant to the provisions of Section 2(d) of the CBN Act 2007, and Sections 56(2) and 67(1) of the Banks and Other Financial Institutions Act (BOFIA 2020).

Essentially, the regulation noted that where an ED becomes a DMD, a cumulative tenure of 12 years applies and shall not be extended.

Also, Non-Executive Directors (NEDs) (with the exception of Independent NEDs) of a bank shall serve for a maximum of 12 years comprising three terms of four years each.

The CBN stressed that to qualify as a NED in a bank, the proposed NED shall not be an employee of a financial institution except where the bank is promoted by that financial institution and the proposed NED is representing the interest of that financial institution.

The guidelines further stated that an executive (ED, DMD or

MD/CEO) who exits from the board of a bank either upon or prior to the expiration of his/her maximum tenure, shall serve out a cooling period of two years before being eligible for appointment as a NED in the same bank, subject to applicable cumulative tenure limits.

It stated that where an executive (ED, DMD or MD/CEO) of a bank is appointed to the board of its FHC in any role, a cooling-off period of two years shall apply.

The central bank added that the cumulative tenure limit of directors (ED, DMD, MD and NEDs) on the board of the same bank is 24 years. The cumulative period is calculated from the date of first appointment to the board of the bank.

The regulation among other things, stipulated that banks shall disclose a summary of their risk management policies in their annual financial statements, adding that in the case of a publicly quoted bank, such summary shall be hosted on its website.

NEDs inclusive of the Chairman (excluding INEDs) of an FHC shall serve a maximum tenure of three terms of four years each.

Consequently, the cumulative tenure limit of a NED in an FHC or any other FHC shall be 12 years and shall have unfettered access to corporate information from the MD/CEO, company secretary, internal auditor, and heads of other control functions with direct/indirect reporting lines to the board, while access to other senior management shall be through the MD/CEO.

Furthermore, Independent NonExecutive Directors (INEDs) in an FHC shall have sound knowledge of the operations, relevant laws, and regulations guiding the business of its subsidiaries in the relevant subsectors. The INED shall also have proven skills and competencies in his/her field.

However, the term of office of an INED shall be four years and may be renewable only once for another consecutive term of four years.

Armed with a presidential order, a powerful force, including some serving and former governors, members of the party's NWC and some party chieftains began the plot to remove the chairman and the secretary, but first by approaching them to honourably resign.

After some back and forth, THISDAY gathered that the duo acceded to resign, knowing the directive was the president’s. They had since last night handed their letters to Chairman of the Progressive Governors’ Forum and Governor of Imo State, Senator Hope Uzodinma.

One of the sources, who confirmed the resignations, said a list of Adamu's "sins" had been prepared, as instructed and forwarded to Tinubu, who was in Kenya on official assignment and was expected to return to the country today, Monday.

Another party source revealed that a team of party faithful had already met with Adamu last night and persuaded him to resign rather than being shown the exit door at the NEC meeting scheduled for Wednesday, a situation they reckoned might be too embarrassing.

The source said, "The truth is that some bigwigs in the party are no longer comfortable with Adamu. They are bent on removing him and the national secretary. They have compiled their sins, presented them to President Bola Ahmed Tinubu, and are ready to send them out of office during the NEC meeting on Wednesday.

"But in order to mitigate the impact such removal could

have on the party and the new administration, a group of party stalwarts met with the chairman tonight (last night) to advise him to resign rather than being shown the exit door at the NEC meeting slated for Wednesday and he agreed.”

Yet, another source claimed that having seen the handwriting on the wall, Adamu and Omisore decided to throw in the towel ahead of the NWC meeting slated for noon today, to avoid complicating the situation.

Continued on page 36 standards for banks; and promote high ethical standards amongst operators, while enhancing public confidence.

The source explained, "A meeting of NWC has been called for Monday at the instance of the national chairman. As usual, no agenda is on the notice of the meeting. The feelers I am getting included the fact that the chairman has been advised to throw in the towel. The truth is that the whole matter is enveloped in a lot of secrecy."

One other source said the APC leadership had since identified a replacement for Omisore, but what delayed the change in leadership, including the postponement of the caucus meetings slated for penultimate week, was the choice of replacement for Adamu. This further confirmed the fact that their removal was a done deal.

It was also gathered that the NEC meeting was likely to approve a timetable for a midterm elective convention to fill party vacancies.

The source added, "You know we lost the National Welfare Secretary, Deputy National Publicity Secretary resigned, and if the chairman and the secretary are made to resign, the NEC will have to approve a midterm elective national convention of the party to fill the vacant positions."

THISDAY • MONDAY, JULY 17, 2023 PAGE FIVE

5

Alex Enumah in Abuja

With Eyes on Major Oil Fields in N'Delta, Nigeria Expects 1.8m Barrels Per Day Production by 2024 OPTS, IPPG: Finance Act 2022 diminished benefits of PIA for oil sector IPPG tasks FG on policies to increase investments, competition in

Peter Uzoho

Nigeria through the state oil firm, the Nigerian National Petroleum Company Limited (NNPC) is looking up to a number of oil blocks and fields in the prolific Niger Delta basin to ramp up national oil production to between 1.7 million and 1.8 million barrels per day (bpd) between this year and end of 2024.

The Executive Vice President, Upstream, NNPC, Mr. Adokiye Tombomieye, gave the hints during a presentation at the just-concluded Nigeria Oil and Gas (NOG) Energy Week held in Abuja, with the theme: "Powering Nigeria's Sustainable Energy Future".

This was just as the multinational oil firms and the Nigerian independent producers under the aegis of Oil Producers Trade Section (OPTS) and Independent Petroleum Producers Group (IPPG) have condemned the Finance Act 2022, saying the Act has diminished the benefits brought by the Petroleum Industry Act (PIA) 2021.

However, represented by NNPC's Upstream Business Advisor, Mr. Igandan Olanrewaju, during a panel session with the topic: "Defining the Roadmap for the Future of Nigeria's Upstream Sector," Tombomieye stated in a pre-panel presentation that the new production targets would be achieved through a couple of measures including asset integrity, production ramp up, well interventions, new drillings, alternative crude oil evacuation and improved security architecture.

He explained that NNPC in collaboration with its partners had resumed crude oil production in earlier challenged areas like the Oil Mining Leases (OMLs) 29, 18, and 24 and that they expect to ramp up to about 80,000 bpd with its joint venture (JV) partners by the third quarter (Q3) 2024.

Tombomieye said, "First oil to tank was achieved in NNPC E&P, former NPDC, OML 13 field of 25,000bpd and we expect to fully monetise that by the end of Q3 2023.

“Obodo field in OML 150 PSC is expected to bring up about 20,000bpd in late Q4 2023. Development in OMLs 71 and 72 is expected to add about 20,000 to 30,000bpd to national production by late Q3 2023.

“Within the deep water space we are concluding the Aboe turn around maintenance which will bring back about 10,000bpd, additionally within OML 130 we are opening up two injector wells and we expect that that should bring up another 10,000bpd

Q3 2023.

"Kalaekule field development in OML 71/72 with West African Exploration and Production (WAYEP), our JV partner is expected to have about 20,000 to 30,000 barrels in national production possibly by late Q3 2023.

"We have Madu field in First E&P OML 85, which will have about 20,000 barrels by Q1 2024.

"Within the Deepwater space, we're concluding the Aboe turnaround maintenance and that will bring out 10,000 barrels. Additionally, within OML 130, we're hooking up two injector wells and we expect that that will bring another 10,000 barrels by Q3 2023.

"We're streaming some of the Bonga wells and we expect to deliver additionally about 7,000 barrels from that." Noting that upstream opportunities exist in the deep water space, the EVP explained that NNPC was working with its partners to achieve Final Investment Decisions (FIDs) on key major projects including the Bonga North field that would add 120,000bpd to national production.

He listed some of the projects as the Shells's Bonga North field, saying the field was estimated to deliver 120,000 bpd production which would be tied back to the Bonga Floating Production, Storage and Offloading (FPSO) facility.

He added that the Bonga Southwest Aparo was like a 150,000 bpd development field.

For TotalEnergies, Tombomieye said the Preowei tie-back in OML 130, where the Egina and Aboe fields are located was like a 60,000 barrels tie-back to Egina.

For Chevron, the NNPC EVP maintained, "We have Agbami gas development in OML 127, which helps to increase compression capacity by 150 million scuf per day and monetise that gas."

As relating to ExxonMobil, he explained that further opportunities exist in the Bosi gas development in OML 133 Production Sharing Contract (PSC) as well as the Owowo field development in OML 154 and 139, all operated by the American oil major.

In addition, Tombomieye, who also mentioned the Nwaduru field development in OML 129 and 135, said NNPC would take on all of those projects in collaboration with its partner to shore up production.

He stressed that realising the full potential of the projects listed above requires a conducive Investment

climate, saying that was where the new NNPC structure comes into play.

Established under the auspices of the PIA, he said NNPC aimed to announce the oil and gas sector's transparency, accountability and efficiency.

He added that by separating the regulatory and commercial functions of the sector, NNPC structure creates a level playing ground for investors, mitigates conflict of interest, and fosters a conducive environment to attract local and foreign investments.

Tombomieye said, "The streamlined governance and increased operational autonomy of NNPC will undoubtedly bolster investor conference and drive sustainable growth in the sector.

"Now, addressing the PIA's impact on investor appetite for upstream development is very essential as the PIA represents a landmark reputation that will reform and revitalise the Nigerian oil and gas sector. While any significant regulatory change can create uncertainties, the PIA's long-term benefits outweighs the

oil sector

short-term challenges.

"The Act introduces a progressive fiscal framework that provides a fair and competitive investment environment. Moreover, it promotes the development of host communities, local content participation and technologies transfer. These measures contribute to a more stable investment climate, attracting traditional players as well as new entrants in the upstream sector."

OPTS, IPPG: Finance Act 2022 Diminished Benefits of PIA for Oil Sector

However, the NNPC EVP also pointed out that the multinational oil firms and the Nigerian independent producers under the aegis of Oil Producers Trade Section (OPTS) and Independent Petroleum Producers Group (IPPG) had submitted a petition regarding clarifications around specific sections of the Finance Act 2022, saying the Act would diminish the benefits of the PIA 2021.

"Lastly, ease of doing business,

OPTS and the IPPG submitted a petition recently regarding clarifications around specific provisions of the 2022 Finance Bill following its passage by the National Assembly and presidential assent.

“They noted that these factors would diminish the benefits of the PIA implementation and reduce competitiveness of Nigeria's oil and gas industry by introducing uncertain investment conditions," Tombomieye said.

But to ensure sustainable delivery of benefits, he said putting in place enabling regulations were indispensable, noting, however, that it was essential to establish explicit and consistent framework that promotes stability, predictability and openness. He added that by establishing a solid legal framework, Nigeria could creditably reduce investment risks and maximise the value of its hydrocarbon reserves.

IPPG Tasks FG on Policies to Increase

Investments, Competition in Oil Sector

Meanwhile, the IPPG has called on the current Bola Tinubu-led government to pay priority attention to key areas in order to increase investments and competition in the nation's hydrocarbon industry.

The group also declared its commitment to the development and growth of the oil and gas sector in alignment with the visionary goals of the new administration.

The Chairman of IPPG, Mr. Abdulrazaq Isa, made the call while delivering his keynote speech at the just-concluded 2023 Nigeria Oil and Gas (NOG) Energy Week in Abuja.

Represented by the Executive Vice Chairman of ND Western Limited, Dr. Layi Fatona, Isa stressed the need for a laser-focused delivery of key priorities to unlock Nigeria's energy potential, fuel economic growth, diversify the economy, and enhance energy security sustainably.

ICAN to Partner with NFIU, FRC, SCUML to Fight Corruption

Dike Onwuamaeze

The Institute of Chartered Accountants of Nigeria, (ICAN) has pledged to partner with the Special Control Unit Against Money Laundering (SCUML), the Nigerian Financial Intelligence Unit (NFIU), the Financial Reporting Council of Nigeria (FRC) and other stakeholders to checkmate corruption in the country.

The pledge was made by the President of ICAN, Institute, Dr. Innocent Okwuosa, in Lagos, during the weekend, at a retreat of the governing council of the ICAN that was attended by representatives of the SCUML, NFIU, FRC and the big four accounting firms in Nigeria.

Okwuosa, explained that the retreat was organised to review the ICAN's processes in view of its current poise to deepen its advocacy and thought leadership in Nigeria's national development, among other initiatives.

He appealed to SCUML to review some of its operational processes that have made direct registration difficult and constraining stakeholders to register through consultants.

He also promised that the ICAN

would leverage the template received from SCUML to implement market entry control checks on licensed firms.

In his response, the representative of SCUML, Mr. Matthew Enu, who stood in for Mr. Daniel Isei, a director at SCUML, stated that self-regulatory bodies like ICAN should take the necessary measures to prevent criminals, or their associates, from being professionally accredited or hold a significant, controlling interest or management function in accounting firms.

Enu, further urged ICAN to always partner law enforcement agents or relevant authorities in conducting background checks on intending licensees.

Similarly, the Executive Secretary of the FRC, Ambassador Shuaibu Adamu Ahmed, traced the origin of the council to ICAN’s establishment of the then Nigerian Accounting Standards Board (NASB) that later metamorphosed to Financial Reporting Council.

Ahmed commended the ICAN for its immense roles and collaboration with FRC.

He said: “A good cordial relationship with relevant stakeholders in the accountancy

profession is important for growth and development of the profession in our country.

"The FRC is, therefore, urging the professional accountancy bodies in the country to work with it for the good of the profession and the country at large."

Similarly, the Head of Sanctions, NFIU, Mr. Chinedum Odenyi, pointed out that the Designated NonFinancial Business and Professions (DNFBPs) are the most crucial and vulnerable to money laundering and terrorism financing.

Odenyi, therefore, solicited for more interaction with ICAN to strengthen compliance with the relevant Anti Money Laundry/ Combating the Financing of Terrorism/Counter Proliferation Financing (AML/CFT /CPF) laws, regulations and guidelines to ensure there is clear understanding of obligations.

He also recommended the establishment of an effective system to identify ML/TF risks and have measures in place to mitigate those risks, and file Suspicious Transaction Reports (STRs) to the NFIU.

He said these were part of the requirements for Nigeria to exit the

Financial Action Task Force (FATF) grey-list.

Odenyi further urged Financial Institutions and Designated NonFinancial Business and Professions (DNFBPs) to develop and implement robust processes and procedures for implementation of AML/CFT/ CPF obligations with particular emphasis on risk assessment on money laundering and associated predicate offences, standalone Counter Financing of Terrorism (CFT) risk assessment, and establish measures for effective detection of politically exposed persons/their family members/close associate, among others.

At the end of the retreat, SCUML and NFIU sought the institute's collaboration in ensuring that Nigeria exits the grey listing by the Financial Action Task force (FATF)

The immediate past Country Partner of PwC, Mr. Uyi Akpata, in his submission assured that the Institute of PwC’s partnership would promote high accounting standards, enhance the competence of accountants’, discourage proliferation of accounting bodies and strengthen the profession's role in national development.

6 THISDAY • MONDAY, JULY 17, 2023 NEWS Group News Editor: Goddy Egene

Continued online

L-R Director, Nigerian Exchange Group Plc (NGX Group), Mrs. Ojinika Olaghere; Group Chief Executive Officer, NGX Group, Mr. Oscar N. Onyema; Group Chairman, NGX Group, Dr. Umaru Kwarainga; Group Company Secretary, NGX Group, Ms. Obehi Ikhaghe and Director, NGX Group, Dr. Okechukwu Itanyi during the 62nd Annual General Meeting held at Nigerian Exchange Group House, Lagos on Friday,

MONDAY JULY 17, 2023 • THISDAY 7

ACCESS BANK SIGNS AGREEMENT WITH STANDARD CHARTERED…

Senate: $800m Not Loan, It's World Bank's Support for Vulnerable Nigerians

Says register of beneficiaries scrutinised before approval Vows to monitor implementation of approved N500bn Group faults N8,000 monthly palliatives

The Senate has clarified that the $800 million World Bank postpetrol subsidy removal facility was not a loan, but an assistance from the multilateral institution, to help vulnerable Nigerians who are currently finding it difficult due to the challenges that came with the petrol subsidy removal. The clarification from the government came just as Human rights lawyer, Mr. Femi Falana, described as “callous and insensitive,” the decision of members of the National Assembly to provide N110 billion for themselves in the 2023 Supplementary Appropriation Bill. Also, the United Action Front of Civil Society yesterday faulted the N8,000 monthly approved for vulnerable Nigerians.

Falana: N110bn palliative for N'Assembly members callous, illegal

Commenting further on the postpetrol subsidy removal World Bank facility, the red chamber also said data for the disbursement of N8,000 to 12 million poor families for six months, was thoroughly scrutinised before it gave approval to the President Bola Tinubu's administration to access the facility.

Chairman, Senate Committee on Media and Public Affairs, Senator Yemi Adaramodu, gave the explanation while briefing journalists in Abuja.

Adaramodu, also stated that the $800 million facility was different from the N500 billion the federal government had set aside to provide palliatives to Nigerians in order to cushion the effects of the fuel subsidy removal.

He said the 9th Senate, following public outcry, had refused to give its approval to former president Muhammadu Buhari's government

to access the fund because it was a few days to the expiration of the administration.

He said, "It is a World Bank facility. It has been on before the advent of this government.

"It is not borrowing, it is for the national social safety net. It is very different from the palliatives targeted specifically at Nigerians which would be sourced among Nigerians. It is not borrowing, it is not a loan.

"We are not approving a loan for the federal government; It is a World Bank assisted facility that has been there before the 10th Senate.

"It is just that the National Assembly has to legislate upon any money that is either coming from outside or that is being taken out of Nigeria. That is what we did with the approval given."

Adaramodu, further explained that the N500 billion meant for fuel subsidy palliatives was a

different arrangement from the disbursement of $800 million to 12 million vulnerable homes.

He said, "The N500 billion palliatives which the president asked for is to cushion the negative effects of the fuel subsidy removal on the common Nigerians.

"Definitely, that may not be enough because there are many other aspects which the government can delve into especially as we learnt that the government has been having talks with the organised labour.

"I think the federal government is going to do something in that area. However, in the meantime, it is the stopgap for the dependent Nigerians so as to lift them up before other palliatives come.

"We feel their problems too, and that is why we believe that the average Nigerians must be assisted because we are running a human face government.

Obaseki: Nigeria’s Dysfunctional Educational System Stalling Desired Transformation of Education Sector

Says Edo closing 50% gap in education via reforms, programmes

Edo State Governor, Mr. Godwin Obaseki, has said one of the nation’s biggest challenges was its dysfunctional educational system, noting that the state has set up parameters to play its part in closing the 50 per cent education gap in the country.

Obaseki, who noted that the government was emphasising strengthening foundational learning and improving learning outcomes, said, “The drop in the ratio between primary six and SSS1 is 50 per cent and until we focus on that we will continue to have problems in education.”

Speaking recently, the governor said the gap was as a result of the lack of communication and close relationship between primary and secondary schools.

He said, “For us, it is about people, focusing on talents. We realised that foundational learning was very weak and we saw this when we had to deal with the issue of human trafficking.

“We have invested hugely in the past six years to strengthen foundational learning because without

that you can't build anything else in terms of developing talents.

“We’ve looked again at the entire educational policy. The biggest challenge we have today is a dysfunctional educational system. 25 years ago, we changed our educational policy but we didn’t realign that change with reality.”

He further said Edo State was supporting vocational training and partnering with various companies in the area of technology, training children on technology and entertainment.

The governor added, “For us, it’s about less certificates, more handiwork as we're focusing on technical education. So, we have revamped our College of Agriculture, College of Nursing Sciences, Technical College and Colleges of Education.”

“We are supporting vocational education because there is a large population of young people who have fallen through the cracks but they are talented. So, we are partnering with various companies in the area of technology. We have a programme with Decagon to train

youths on software development and engineering.

“In terms of entertainment, we are working with a number of producers and this year alone, we are shooting in excess of 30 Nollywood movies in Benin City because we have created

20

"When we are running a human face government, then everything that will be done must be targeted at Nigerians.

"That is why we expeditiously acceded to the request of Mr. President because appropriations belong to the National Assembly.

"It took us time to pass it because we have all pointers that this palliative is going to yield result. It is going to touch those people that it supposed to touch. So, that is why it was passed."

He added: "On the issue of $800 million, it is like a social security scheme, which the federal government had sourced, because we know that the N500 billion cannot do the magic.

"So the $800 million will follow in and assisting Nigerians to overcome the economic hardship in the country. So, that is why we approved these requests by Mr. President.

"We were not part of the previous palliatives, and for this 10th Senate, so we asked questions because we were not part of any previous palliatives and we are not concerned about what was given before.

for the yet to be disclosed (or otherwise covertly selected) 12 million poor and vulnerable households."

In a statement by its Head, National Coordinating Centre, Olawale Okunniyi, the United Action Front of Civil Society, said, "It is no longer in doubt that the N500 million approved by the House of Representatives on Thursday 13, 2023 as part of the amendment to the 2022 supplementary appropriation Act for the provision of palliative would be funded through an additional $800 million World Bank loan approved by the Senate.

"It is therefore worrisome that the new administration is treading in the erroneous indebtedness of its predecessor. The United Action Front of Civil Society however laments the reality of making the same poor citizens of Nigeria take the bitter pill of repaying a wrongheaded loan supposedly being acquired in their interest in the nearest future," it added.

the infrastructure for artists and producers to come and succeed.

“Today, we are investing in communities, giving them resources and we have drastically reduced crime rate and acts of violence,” Obaseki said.

Meanwhile, the United Action Front of Civil Society had expressed concern over the approval of the sum for palliatives by the Bola Tinubu-led administration of the All progressives Congress (APC), after what it described as the arbitrary hike in petrol price.

The group decried as another grand deceit, "the N8,000 monthly handouts proposed by government

The group said it was also beyond doubt that the meagre monetary palliative could barely feed a family of two for five days considering the fact that the fuel price hike in the name of subsidy removal had deepened the proportion of multi-dimensional poverty in the country.

Accordingly, the group said, "The leadership of the organised civil society therefore considers the supposed intervention as erroneous and a poorly conceived

Continued on page 37

Nigerians Depart for Sponsored University Education in India

Michael Olugbode in Abuja

Twenty Nigerians are to depart the shores of the country between midJuly and early August for university education in India, which is fully sponsored by the Government of India.

The Nigerians are mostly going in for MBA, B.sc or M.sc (Zoology, Chemistry, Physics, Geology, Space Science, etc), Phd in Pharmacy, Engineering, Economics, Agriculture, IT, Cyber Security, among other.

The Indian government has yearly since 1958 been sponsoring Nigerians to study at various Indian university under the Indian Council

Cultural Relations (ICCR) Scholarship Programme which has seen several thousands of student worldwide and over a thousand Nigerians benefiting from the scheme.

The Indian High Commissioner to Nigeria, Mr. Shri Balasubramanian, while speaking at an orientation programme for the 20 beneficiaries, asked them to be good ambassadors of Nigeria to India by being well mannered and facing their studies. He equally advised them to make sure they return back to Nigeria and involve in their homeland socio-economic growth.

He said India was counting on them to be promoters of Indo-Nigerian

relationship as they were going to be accustomed to the two cultures, which noting that both Nigeria and India were multicultural and share many things in common.

India is well known as an education hub attracting international students from all over the world.

India’s robust education system, in the backdrop of its rich diversity and vibrant culture and history, affords a broad range of options for students.

And as a rapidly growing country with a leading technological edge, studying in India has much to offer, whether it is Engineering, Computers, Arts, Philosophy, Political Sciences or Classics etc.

Indian Council for Cultural Relations administers various scholarship programs annually and awards about 3000+ scholarships under 21 different schemes to foreign students from about 180 countries.

Amongst the 21 schemes, six were funded by ICCR from its grant and others were administered on behalf of MEA and Ministry of Ayush.

The courses offered for studies are for Under-graduation, Post-graduation and Ph.D. levels. Each academic year, ICCR has about 6000+ of its foreign scholars who are studying at various Central/State Universities, Institutes, NITs, and Agricultural Institutions etc.

NEWS

Chuks Okocha, Sunday Aborisade in Abuja and Wale Igbintade in Lagos

8 THISDAY • MONDAY, JULY 17, 2023

L-R: Roosevelt Ogbonna, Group Managing Director, Access Bank Plc, and Sunil Kaushal, Regional CEO, Africa & Middle East, Standard Chartered Bank at the signing of agreements for Access Bank’s acquisition of Standard Chartered’s shareholding in its subsidiaries in Angola, Cameroon, The Gambia, and Sierra Leone, and its Tanzanian Consumer, Private & Business Banking business in London…recently

SEND-OFF DINNER FOR LOSADA…

NNPC Upstream Plans 40bn Barrels Reserves by 2030, Seeks Investment in Pipelines Network

Emmanuel Addeh in Abuja

The Nigerian National Petroleum Company Limited (NNPC) has said with all the ongoing upstream projects, it plans to meet its 40 billion barrels crude oil reserves target by 2030.

The Executive Vice President, Upstream, Adokiye Tombomieye, who spoke during the just-concluded Nigerian Oil and Gas (NOG) week in Abuja, stated that the company would also need massive investments

to revamp part of its over 5,000 kilometres pipelines nationwide.

The EVP who was represented by the Upstream Business Advisor, Olanrewaju Igandan, said that with existing proven crude oil and condensate reserves of 36.966 billion barrels as well as 208.83 trillion cubic feet of natural gas, it was important to ramp up the country’s stock of the commodity.

Tombomieye, stated that the NNPC had been active within the inland basin and has partnered with

PTAD Assures Pensioners Prompt Payment, Improvement in Documentation, Computation

David-Chyddy Eleke in Awka

The Executive Secretary of Pension Transitional Arrangement Directorate (PTAD), Dr. Chioma Ejikeme, has assured pensioners that the directorate would do well in ensuring prompt payment of their pensions.

The directorate, which is an arm of the National Pension Commission, stated this at the weekend, during a South-east stakeholders’ engagement forum, which held in Awka Anambra State capital.

Ejikeme, who addressed stakeholders recalled the difficulty in accessing pensions and gratuity by retirees, the haphazard documentation and the wrongful computation of pensions that used to be the order of the days.

She assured that: "PTAD’s determination to change the narrative as far as pension administration under the Defined Benefits Scheme (DBS) in Nigeria is concerned is irrevocable.

"We have intentionally and consistently been working on achieving positive and sustainable change in the DBS Pension management for the almost 10 years of our operation.

"You may recall that the Defined Benefit Scheme in the past was fraught with allegations of fraud, corruption and inefficiencies prior to the establishment of the Directorate. “However, the processes and controls that have been put in place since the establishment of PTAD have contributed immensely to the change being witnessed today in the management of the Defined Benefit Pension scheme." Ejikeme, listed some of her achievements in office, saying the directorate aims at repositioning matters regarding pension in the country, and make it even more

seamless for pensioners to access their hard earned money.

"Our journey from field verifications, mobile verifications, to putting together a solid database of pensioners, benefit computation, ensuring the regular payment of monthly pensions and paying long overdue pension arrears to pensioners, has been a progressive one filled with creativity, dedication, commitment, persistence and resulting in milestone achievements.

"It is not yet a perfect situation, but PTAD is committed to continuing to make giant strides.

"Since our last Stakeholders Forum for the South-East held in Enugu, Enugu State in January 2022, PTAD has carried out a series of activities which include:

“Complete payment of arrears arising as a result of the consequential adjustment to pensions as a result of the increase in minimum wage of April 2019 to the four operational departments in the Directorate.

"Complete liquidation of the 126 months outstanding liabilities due to ex-workers of Nigeria Reinsurance Corporation, complete payment of the 219 months of inherited liabilities to Ex-workers of New Nigeria Newspaper Limited, complete payment of the 100 months of inherited liabilities to Ex-workers of NICON Insurance, complete payment of the 96 months of inherited liabilities to Ex-workers of Delta Steel Company (DSC), among many others."

She added that PTAD had also commissioned a mechanised filing system, put in place to safely store pensioners’ physical verification and departmental files. She said securing and archiving the documents would make it faster and easier to recall pensioners’ files to reconcile and resolve complaints.

TotalEnergies for the discovery of the Ntokon field in Oil Mining Lease (OML) 102, with the discovery of large volumes of the commodity.

He stated there was the need for a conducive investment climate to operate, highlighting the critical role of the Petroleum Industry Act (PIA) in creating a transparent and efficient sector.

“As one of Africa's leading oil and gas reserves holders and producers, we will continue to attract significant investments albeit under the right investment climate.

“NNPC limited has made commendable exploration forays into the frontier basins. Following our success in the Kolmani River prospects in the Upper Benue

trough, NNPC has increased its activities into the middle Benue trough with the spudding of the Ebenyi well.

“We have also progressed the Chad basin with the spudding of the Wadi B well. All this is geared towards achieving the 40 billion barrel reserves mark by 2030,” he said.

He noted that the issue of insecurity remains a significant barrier to the company’s realisation of its vision for the upstream sector, lamenting that in August 2022, for instance, it was so severe that the NNPC production dropped to less than 1 million barrels of crude oil only.

To address the issue, Tombomieye

stated that the NNPC in collaboration with its partners, devised a new security architecture for the entire industry and has since then seen an upward trend in its production so much that in February 2022, it went to as high as 1.69 million barrels of crude oil and condensates.

“We have separated the regulatory and commercial functions and so that provided a level playing ground and an environment that is conducive to attract both local and foreign investment.

“A significant amount of our deferred production is as a result of infrastructure issues. At least 40 per cent of our main pipeline infrastructure systems are over 30

to 40 years old and they must be replaced.

“Assets integrity issues have created issues such as deteriorating of the pipelines, hydrocarbon spills, postponement and shutdowns. We will need enormous investment to replace aging infrastructures,” he stressed.

According to him, many exploration companies now invest more in digital oilfield technology to increase production efficiency and reduce operating cost.

He disclosed that efforts to integrate hardware, software data analysis techniques, digital oilfield technologies to collect data in real time so that decisions can be made in real time were ongoing.

UN: 3.3 Billion People Live in Countries Spending More on Debt Service Than Education, Health

African countries borrow at rates four times higher than US Outlines roadmap to tame global burden

Ndubuisi Francis in Abuja

ANo fewer than 3.3 billion people live in 48 countries that spend more on servicing their debts than on education or health, a new report by the United Nations Conference on Trade and Development (UNCTAD) has indicated.

Titled, "A World of Debt:

A Growing Burden to Global Prosperity," the report submitted that developing countries were dealing with an international financial architecture that exacerbates the negative impact of cascading crises on sustainable development.

The burden of debt on development, it stated, was intensified by a system that constrains developing countries' access to development finance and pushes them to borrow from more expensive sources, increasing their vulnerabilities and making it even harder to resolve debt crises.

According to the report, in 2022, global public debt – comprising general government domestic and external debt reached a record $92 trillion, with developing countries owing almost 30 per cent of the total, of which roughly 70 per cent was attributable to China, India and Brazil.

Public debt has also spiked more than five-fold since 2000, the report added.

The report submitted that countries

were facing impossible choice of servicing their debt or serving their people, adding that a world of debt disrupts prosperity for people and the planet.

It revealed that African countries borrow on average at rates that are four times higher than those of the United States and even eight times higher than those of Germany.

It stated that high borrowing costs make it difficult for developing countries to fund important investments, which in turn further undermines debt sustainability and progress towards sustainable development, adding that interest payments were growing faster than other public expenditures.

It acknowledged that public debt could be vital for development, as governments use same to finance their expenditures, to protect and invest in their people, and to pave their way to a better future.

"However, it can also be a heavy burden, when public debt grows too much or too fast. This is what is happening today across the developing world. Public debt has reached colossal levels, largely due to two factors.

"Financing needs soared with countries’ efforts to fend off the impact of cascading crises on development. These include the COVID-19 pandemic, the cost-ofliving crisis, and climate change.

"An unequal international financial architecture makes developing countries’ access to financing inadequate and expensive.

"The weight of debt drags down development. Debt has been translating into a substantial burden for developing countries due to limited access to financing, rising borrowing costs, currency devaluations and sluggish growth.

“These factors compromise their ability to react to emergencies, tackle climate change and invest in their people and their future.

"Countries are facing the impossible choice of servicing their debt or serving their people. Today, 3.3 billion people live in countries that spend more on interest payments than on education or health.

"A world of debt disrupts prosperity for people and the planet," the UNCTAD report explained.

Public debt around the world has been on the rise over the last decades. Cascading crises in recent years triggered a sharp acceleration of this trend.

As a result, global public debt has increased more than five-fold since the year 2000, clearly outpacing global GDP, which tripled over the same time.

The UNCTAD report lamented that developing countries are dealing with an international financial architecture that exacerbates the

negative impact of cascading crises on sustainable development.

The burden of debt on development was intensified by a system that constrains developing countries access to development finance and pushes them to borrow from more expensive sources, increasing their vulnerabilities and making it even harder to resolve debt crises, it added.

Noting that borrowing from foreign creditors increases exposure to external shocks, the report stressed that developing countries’ total public debt increased from 35 per cent of Gross Domestic Product (GDP) in 2010 to 60 per cent in 2021.

Similarly, external public debt, the part of a government's debt owed to foreign creditors, increased from 19 per cent of GDP to 29 per cent of GDP in 2021.

According to UNCTAD, comparing debt levels to developing countries’ ability to generate foreign exchange through exports showed that their ability to generate sufficient revenue to service their external debt obligations has also been deteriorating.

"The share of external public debt to exports increased from 71 per cent in 2010 to 112 per cent in 2021. During the same period, external public debt service as a share of exports increased from 3.9 per cent to 7.4 per cent.

NEWS 9 THISDAY • MONDAY, JULY 17, 2023

L-R: Former Director General of Nigerian Maritime Administration and Safety Agency(NIMASA), Dr. Dakuku Peterside; Publisher, The Abuja Inquirer, Dan Akpovwa; Consul General Spanish Embassy, Lagos, Mr. Daniel Losada; Former Minister of Transports, Hon Rotimi Amaechi and Managing Director/Chief Executive Officer of Central Securities Clearing System (CSCS) Plc, Haruna Jalo-Waziri, during a private send off dinner for Mr Losada held at Capital Club Lagos... yesterday. : KUNLE OGUNFUYI

NBA-SBL 17TH ANNUAL INTERNATIONAL BUSINESS LAW CONFERENCE…

Onaiyekan: 2023 Elections Worst in Nigeria's History

Highlights potential for judicial intervention, urges proper scrutiny of presidential poll results

Criticises politics, religion for fostering divisions, violence

Bishop Emeritus of the Archdiocese of Abuja, Cardinal John Onaiyekan, has criticised the 2023 elections, particularly, the presidential polls, labeling them as the worst in Nigeria's democratic process.

Speaking at a virtual town hall meeting organised by the Rebuild Nigeria Initiative (RNI) with the theme 'Nigeria-Pathway to National Peace and Reconciliation,' Onaiyekan expressed his regrets over the deep divide and violence in Nigeria, caused by the intertwining of politics, religion, and the activities of Boko Haram.

"It is true that there is nowhere in the world where elections are perfect, but does that justify the

foolish acts we witness during elections?" queried the Cardinal.

He emphasised that while many aspects of the 2023 elections were being challenged in court, individuals were also being sworn into office, giving the impression that, "nothing will come out of the court proceedings.

“But I do not believe that because the court has addressed electoral grievances in the past, as we have seen governors being removed from office following court proceedings. There have been previous instances of flawed elections, but what we witnessed in the last election is unparalleled. We have never experienced anything like this before.

Abiodun Eulogises Wife

James Sowole in Abeokuta

The Ogun State Governor, Prince Dapo Abiodun has praised his wife, Bamidele Abiodun, for her continuous support and role at ensuring the successful implementation of his administration’s ISEYA program, saying her determination at ensuring his success as Governor of the state had helped in filling in the gap as he serves the people of the state.

Abiodun, poured encomium, during the 57th birthday thanksgiving of his wife held at the Government House Chapel, Oke-Igbehin, and charged the congregation and the people of the state to deliberate and live a life that touches others.

He said, "I want to thank you for filling in the gap as I serve the good people of Ogun State. I want to thank you for your consistent prayers, may the Lord Almighty continue to protect and keep you under his shadow.

"Today is a special day of thanksgiving because my beautiful and adorable wife has added another year, we are here to celebrate what the Lord has done for us.

"I want to pray that God continues to give you Bamidele unspeakable and everlasting joy, may you fulfill your destiny," he said.

Abiodun, who also noted that days like his wife's birthday thanksgiving was indeed worthy of celebration, saying, "Days like these are indeed worthy of celebration, but at the same time, they are

reminders that we have added one extra year and we have one less extra year left on this earth."

The State Governor who also urged the people of the state to ask themselves of what reason God has created them, said that occasions like birthday thanksgivings are created not to only number our days, but to also give thanks to God.

In her remarks, the celebrant and wife of the Ogun State Governor, Mrs. Bamidele Abiodun, who thanked God for giving her a good health and sound mind, thanked God for holding her hands even in times of tribulation.

Bamidele, while noting that she would be intentional about how she lives her life from now on, thanked her husband for being her greatest supporter.

In his message titled, "Unquantified Thanksgiving," the South-west Chairman of the Organisation of Africa Instituted Churches(OAIC), Jacob Adetokunbo Adeaga, who read from the book of Psalm 103, disclosed that no man could ever quantify the level of the love of God in their life, saying that it is good to always thank God for his love in our lives.

Adeaga, who also urged the first lady, to continuously thank God for his love in her life, charged her to continue to do more for God, the people and the state.

Adeaga who also thanked the husband of the celebrant, for his wonderful performance in his first term, charged him to surpass the performance of his first term as he started his second term.

"INEC promised us a standard election, but what transpired in the presidential election fell short of our expectations. We should not resign ourselves to accepting elections that lack credibility. These leaders claim to have been elected by us, yet, we know we did not elect them. Even taking oaths with the Bible and Quran has become so common among politicians that they no longer have any moral compass.

"There are ongoing cases in court that have yet to be resolved. We have a president, whose election is being challenged, and the court is handling the matter. It is not enough to attribute Nigeria's problems solely to leadership.

“Why do we allow these same leaders, who have not denied being corrupt, to continue leading us? We do not need to legitimise it; what is wrong is wrong. They owe us the responsibility to wield the power acquired from public office judiciously."

Onaiyekan also discussed the historical collaboration between Christians and Muslims in Nigeria, highlighting a time, when the nation was on the path to becoming a model country, characterised by peace and harmony.

He lamented that, "In recent years, we have witnessed a shift in this trajectory, a downward spiral,

as religious fanatics have strained the relationship between the two religions.

"The emergence of Boko Haram caused significant damage, as it was perceived as an attack on Christians. Fanatics believe that anyone practicing a different faith is in error. This is incorrect. We should assume that everyone is sincere and convinced of their own beliefs. That is why it is wrong for anyone to speak ill of any religion.

"I do not want it to seem as though we have lost our way as a people because we still coexist. Both religions have not given up on peace. While some individuals strive to create divisions for their own selfish gains, the majority of Nigerians still believe in unity," he added.

The Cardinal emphasised the importance of speaking truthfully about the issues affecting the country, stating, "It is not a matter of being polite; it is about speaking the truth. For example, when I criticise a Muslim brother, it is not to provoke a quarrel but because it is the truth. We cannot refrain from telling the truth without sugarcoating it."

On the role of the politicians in fueling violence in Nigeria, he pointed out that politics played a significant part in the divide. Many

politicians use their positions to make speeches that promote sectional support, based on ethnicity and religion, further exacerbating divisions.

"When a politician wants to win or gain an advantage, they exploit ethnicity and religion, claiming, 'I am fighting for you because you belong to this tribe or because you are a Christian or Muslim.' This has further divided us.

"We complain about politicians manipulating situations, but why do we allow ourselves to be manipulated when the power to elect lies with the people? Moreover, it is challenging to distinguish between political leaders and religious leaders because their speeches blur the line between the two."

Onaiyekan reiterated the need for peace to foster national development, emphasising the necessity of reviewing the national policies, saying, “Accepting things merely for the sake of peace is wrong, instead, the nation should pursue the kind of peace it truly desires.

"When things are not done properly, development stagnates. The immunity clause, which shields wrongdoings, has hindered progress. We should not forget that Nigeria is the only country in Africa capable of making significant strides. If

Nigeria fails, what other country can succeed?

"It is becoming shameful that despite our abundant natural and human resources, we remain at this level. I believe we can achieve more, not overnight, but a four-year term can make a significant difference.

"As a people, I do not believe we are powerless, as the people play an active role while the politicians play a passive role in elections. For far too long, we have placed trust in our leaders. We should no longer trust them, as they have taken us for granted and betrayed our trust. Those who have betrayed us still hold positions of power.

"We strive for peace, but I fear that if the court does not resolve the election petitions in a timely manner, issues may arise. Some of the president's actions are in response to public protests, and we must continue engaging the government to voice our concerns.

"Although we have not seen the ministerial list, it will likely comprise the same old faces. The positive aspect is that no one remains in office forever; there will be an end when officials vacate their positions. We need functional structures in place. When these leaders leave the country, they behave properly, not because they are guarded, but because the system enforces it."

NYSC, Symbol of Nigeria's National Strength, Says Governor Mohammed

Segun Awofadeji in Bauchi

Bauchi State Governor, Senator Bala Mohammed of Bauchi has described the National Youth Service Corps (NYSC) as not just a programme, but a symbol of Nigeria's strength and diversity.

Mohammed, stated this in Bauchi, during the swearing-in ceremony of 1,756 of the 2023 Batch B stream 1 corps members posted to the state at the weekend.

Represented by his Deputy, Mr. Auwal Jatau, Mohammed, added that the scheme brings together young men and women from different ethnic, cultural, and religious backgrounds, uniting them under a common goal so as to contribute to the progress of the nation.

According to him, "In the course of this orientation exercise, you

will undergo rigorous training that will equip you with the necessary skills and knowledge to face the challenges ahead.

"It is an avenue for you to learn, to grow, and to cultivate a spirit of resilience, adaptability, and excellence.

"As young graduates, you are the future leaders and changemakers of our society and your enthusiasm, creativity, and fresh perspectives are invaluable assets that can drive our nation forward."

The governor, however, urged the corps members to seize every opportunity presented to them during the programme, saying it would help shape their personal and professional development.

He also reminded them that the true essence of NYSC lied not only in the skills they acquired but

also in the values they embodied.

"I urge you to embrace the diversity of cultures and traditions that you will encounter during your service year," he advised.

In her address, the state Coordinator of NYSC, Mrs Rifkatu Yakubu, commended their patriotic disposition as demonstrated in their readiness to participate in the orientation exercise.

She said the orientation course was the first cardinal programme of NYSC which was aimed at introducing them to the objectives and programmes of the Scheme.

According to her, it was also designed to prepare them for the tasks of the service year through training on Skills Acquisition and Entrepreneurship Development, leadership coaching, paramilitary drills and other physical activities

as well as sensitisation on topical national issues.

"It is also an avenue that provides the opportunity for you to realise your potential and attain individual feats both during and after the service year.

"I, therefore, enjoin you to take advantage of this golden opportunity to participate in all the camp activities," she said.

The State Coordinator also commended the state government for its avowed commitment towards the realisation of NYSC objectives in the state.

She, however, reminded the state government on the scheme's call for the reconnection of the orientation camp's electricity to the national grid, provision of additional hostel accommodation and expansion of the camp multipurpose hall.

NEWS 10 THISDAY • MONDAY, JULY 17, 2023

L-R:; Communications Manager, Savannah, Nigeria, Okwudili Onyia; Legal Manager, Kofoworola Bamgbose; Head of Human Resources, Yetunde Onabule; Chief Compliance Officer, Titilayo Okoye; and Senior Legal Counsel, Solomon Alo, during the NBA-SBL 17th Annual International Business Law Conference 2023 held in Lagos….recently SUNDAY ADIGUN

MONDAY JULY 17, 2023 • THISDAY 11

UNILEVER IN PARTNERSHIP WITH UNICEF…

At AU Meeting, President Affirms Africa's Unity, Strength

Rejects report of new scramble for continent Says war, violence will impede economic integration African leaders express commitment to integration, cooperation

Deji Elumoye in Abuja

President Bola Tinubu, in his maiden appearance at the African Union (AU) mid-year meeting in Nairobi, Kenya, yesterday, spoke glowingly about the continent and affirmed Africa's unity and strength.

Tinubu rejected the notion of a new scramble for Africa, warning that past plundering and exploitation of the continent should remain in the past and never be repeated.

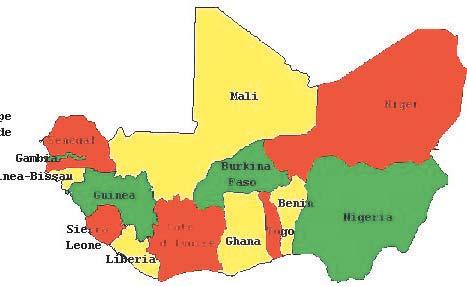

Speaking at the Fifth Mid-Year Coordination Meeting (5thMYCM) of the African Union (AU), the Regional Economic Communities (RECs), the Regional Mechanisms (RMs), and the African Union Member-States, the president announced plans to strengthen the ECOWAS Standby Force to deter coups and combat terrorism in the sub-region.

In his capacity as Chairperson of the ECOWAS Authority of Heads of State and Government, Tinubu highlighted the progress made by ECOWAS in various sectors of its integration process, including trade, free movement of persons, investment promotion, infrastructure development, and security.

In his statement titled, "Address on Status of Regional Integration in ECOWAS," Tinubu emphasised the need for Africa to overcome its challenges and work towards a prosperous future, focusing on inclusive growth, good governance, and leveraging the opportunities provided by the African Continental Free Trade Area (AfCFTA).

Calling for good governance to ensure a prosperous future for Africa, free from the exploitations of the past, the president said, "As Africans, we

forge ahead no matter the barriers thrust before us. The world we inhabit is often unkind and uncertain. Past history and current global difficulties argue against our future success.

''Lessons of the past few years teach us that the world economy can be disrupted in ways that halt progress and invite downturn. Our nations can suddenly find themselves in dire situations if we choose to be passive observers of our fate.

“Such passivity does not commend itself to me. I will not listen to it. Neither should any African. The challenges we face mean that governance will be difficult. They also mean that visionary good governance is necessary. Some observers assert a new scramble for Africa is afoot and it is much like the old scramble that plundered our continent.

"But, here and now, let it be said

to whomever the new scramblers might be that our continent may be old but our spirit is new. And it is strong. The bad that took place in the past must stay there. It shall never be repeated.''

Addressing peace, security, and stability, Tinubu acknowledged the challenges faced by the sub-region, including terrorism and anticonstitutional changes in government.

According to him, “We sit here in meaningful discussion of vital economic matters. Yet, it will be impossible to bring full meaning to what we attempt unless we give due consideration to the instability and conflict that now scar many of our nations.

“The fullness of the integration we seek will elude us as long as several of our nations stand in the mist on violence and war. The trade and

Geregu Stock Price Soars as Investors Cheer PPP Deal, Solid Earnings

Geregu Power stock price may just be marking time and consolidating on its technical patterns before making an explosive move higher as a number of positive catalysts are set to drive its fundamentals for long term growth.

Geregu on Friday, released its second quarter (Q2), financial statement showing a 34 per cent jump in revenue from energy sold, and capacity charge. Its stock trading on the NGX rose 6.45 per cent to a new 52-week high of N330 per share, as investors cheered the announcement of a partnership with the Lagos State Government, the State Grid Corporation of China and the African Development Bank

(AfDB).

According to Moneycentral, an online news platform, for the 3-months period to June 2023, revenue for the energy giant stood at N20.465 billion, while gross profit rose by 48.5 per cent to N11.175 billion.

Other positives for the quarter included a reduction in receivables due from related party Amperion Power Distribution Company Ltd, to just N6.9 billion as a total of N31.58 billion was paid to Geregu Power.