CBN Directs Banks to Lift Restrictions on 440 Accounts

Apex bank resumes enforcement of LDR policy, urges banks to comply With subsidy gone, FX Unified, MPC raises MPR to 18.75% to curb inflation Shonubi insists rate hike helping to moderate prices Says FX volatility driven by pent-up demand, low supply

James Emejo in Abuja and Nume

Ekeghe in Lagos

The Central Bank of Nigeria (CBN), yesterday ordered banks to vacate a Post-No-Debit (PND) restriction earlier imposed on bank accounts

of 440 individuals and companies.

This was just as the CBN yesterday communicated to banks that it would resume the enforcement of the Loan-to-Deposit Ratio (LDR) policy effective July 31, 2023.

However, citing key policy reviews

particularly the recent deregulation of petrol price and transition to a unified and market-determined exchange rate - with the attendant inflationary concerns, the CBN’s Monetary Policy Committee (MPC), yesterday resolved to increase the

Monetary Policy Rate (MPR), also known as the benchmark interest rate by 25 basis points to 18.75 per cent from 18.5 per cent.

A PND refers to all debit transactions, including ATMs and cheques, on the accounts, have been blocked

but can receive inflows. It is one instrument through which the CBN gives powers to stop customers from operating their bank accounts, with the permission of the courts.

vacation of restriction in circular, dated July 25, 2023 which was signed by A.M. Barau, on behalf of the CBN Director, Banking Supervision Department, and addressed to all banks.

The central bank conveyed the Continued on page 10

After Ousting Them, Tinubu Meets Adamu,

Omisore at State House US embassy, anti-graft group urge president to unveil masterplan for corruption

for Nigeria.

Tinubu, who is the national leader of the ruling APC, boasts

Continued on page 10

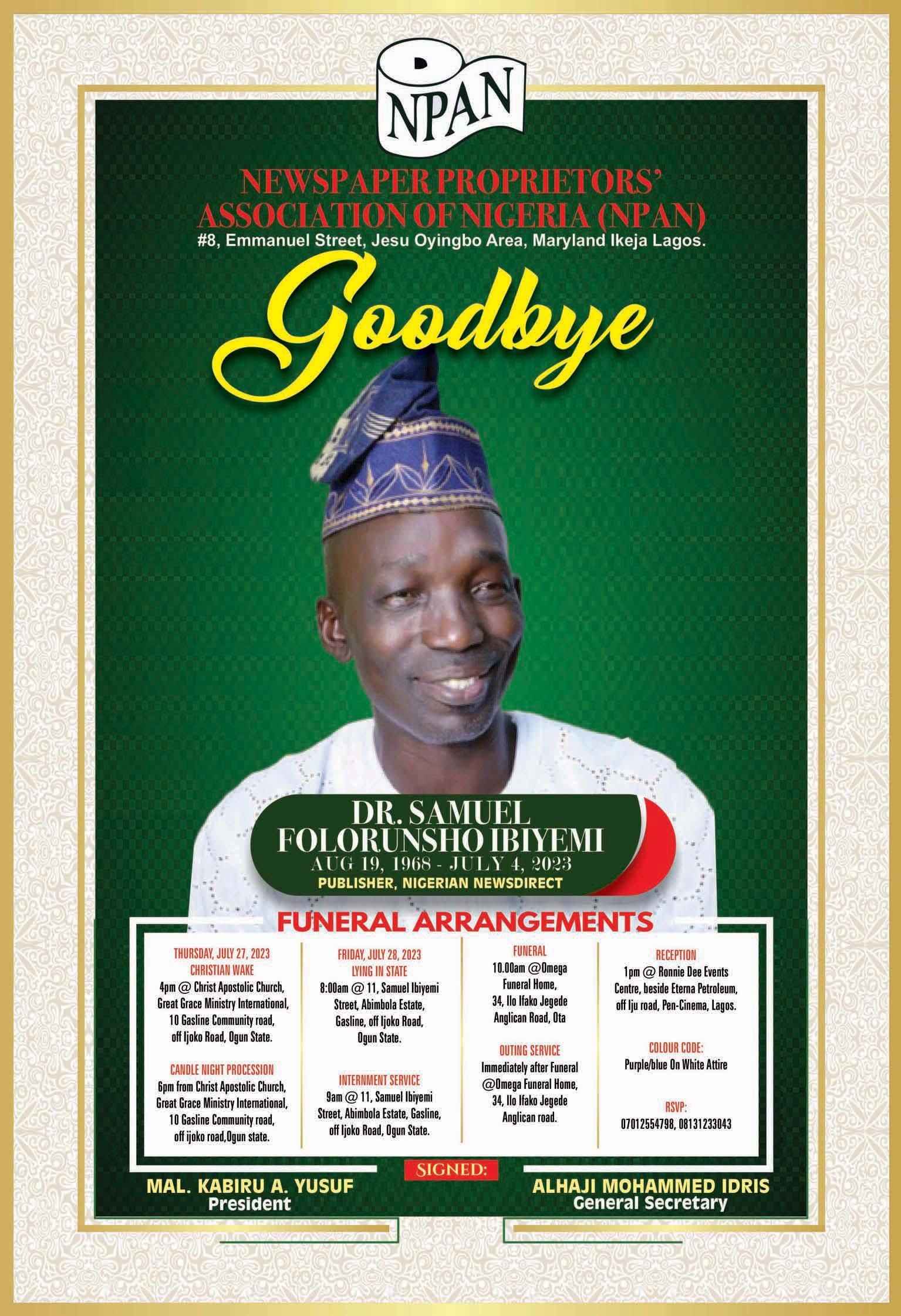

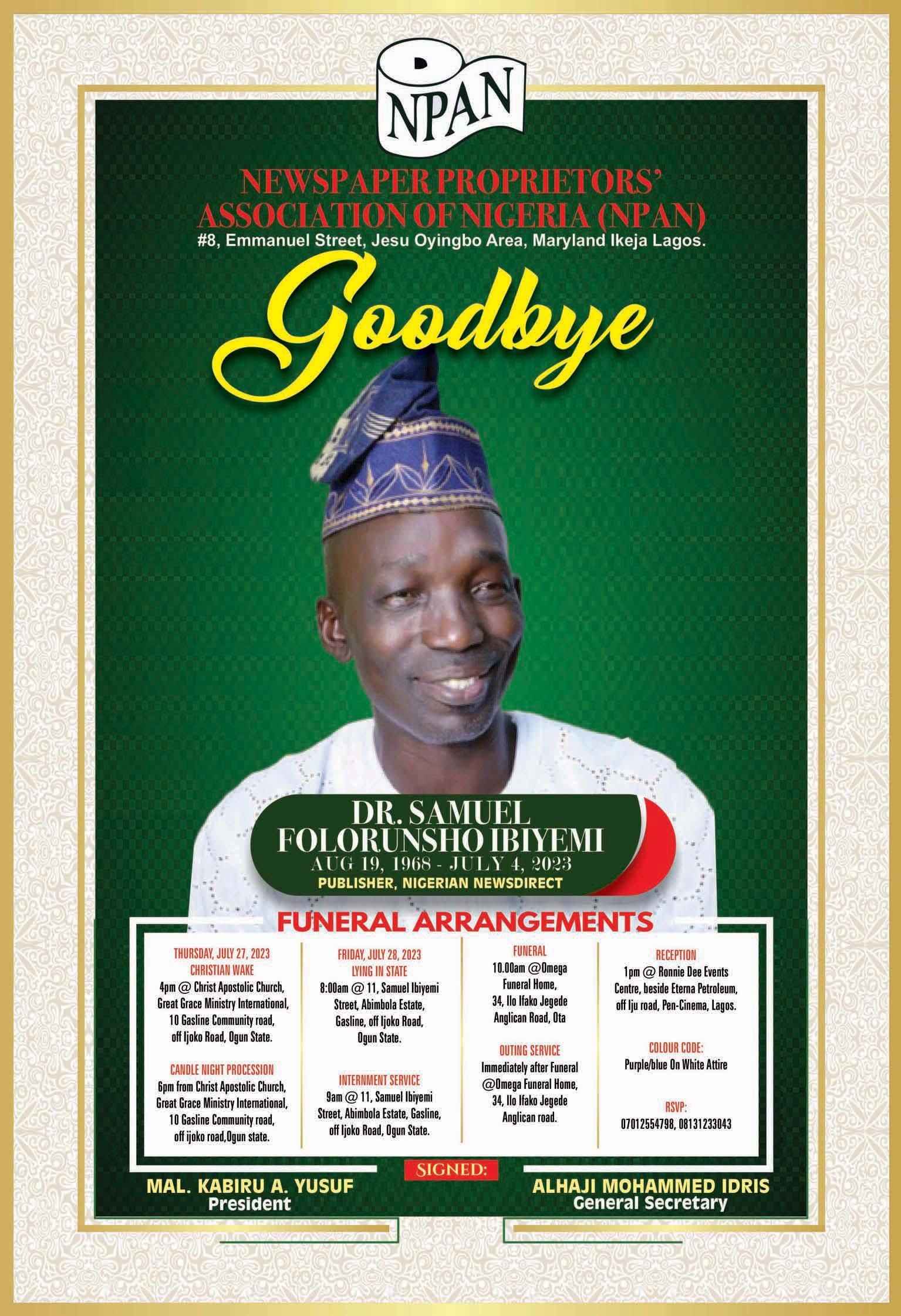

DSS Disobeys Court Order, Beats up Correctional Officers, Re-arrests Emefiele

CORRECTIONAL OFFICER BEING MANHANDLED BY DSS...

DSS officials assaulting Mr. Tunde Kuye, Officer in Charge (OC) of Ikoyi Prisons, following a heated altercation between the Service and Nigeria Correctional Service (NCoS) operatives at the Federal High Court in Lagos regarding who should take custody of the suspended Central Bank of Nigeria Governor, Godwin Emefiele … yesterday

www.thisdaylive.com Wednesday 26 July, 2023 Vol 28. No 10332. Price: N250 TRUTH & REASON

Deji Elumoye and Emameh Gabriel in Abuja President Bola Tinubu, yesterday, met with the ousted former National Chairman of All Progressives Congress (APC), Senator Abdullahi Adamu, and erstwhile National Secretary, Senator Iyiola Omisore, at State House, Abuja. The purpose of the meeting, which ended about 1.30pm remained unclear, coming about a week after their forced resignations, announced during the National Working Committee (NWC) meeting of the party on July17. In another development, the United States Embassy in Nigeria, together with a leading anti-craft civil society organisation (CSO), African Network for Environmental and Economic Justice (ANEEJ), called on the president to launch a holistic anti-corruption architecture Suspended CBN governor pleads not guilty, granted N20m bail Ezekwesili, HURIWA blast DSS over former apex bank governor’s arraignment Resident Doctors Commence Indefinite Strike Nationwide ... Page 8 Atiku to Tribunal: Don't Encourage Violation of Our Constitution... Page 12 Story on page 10

WEDNESDAY JULY 26, 2023 • THISDAY 2

WEDNESDAY JULY 26, 2023 • THISDAY 3

WEDNESDAY JULY 26, 2023 • THISDAY 4

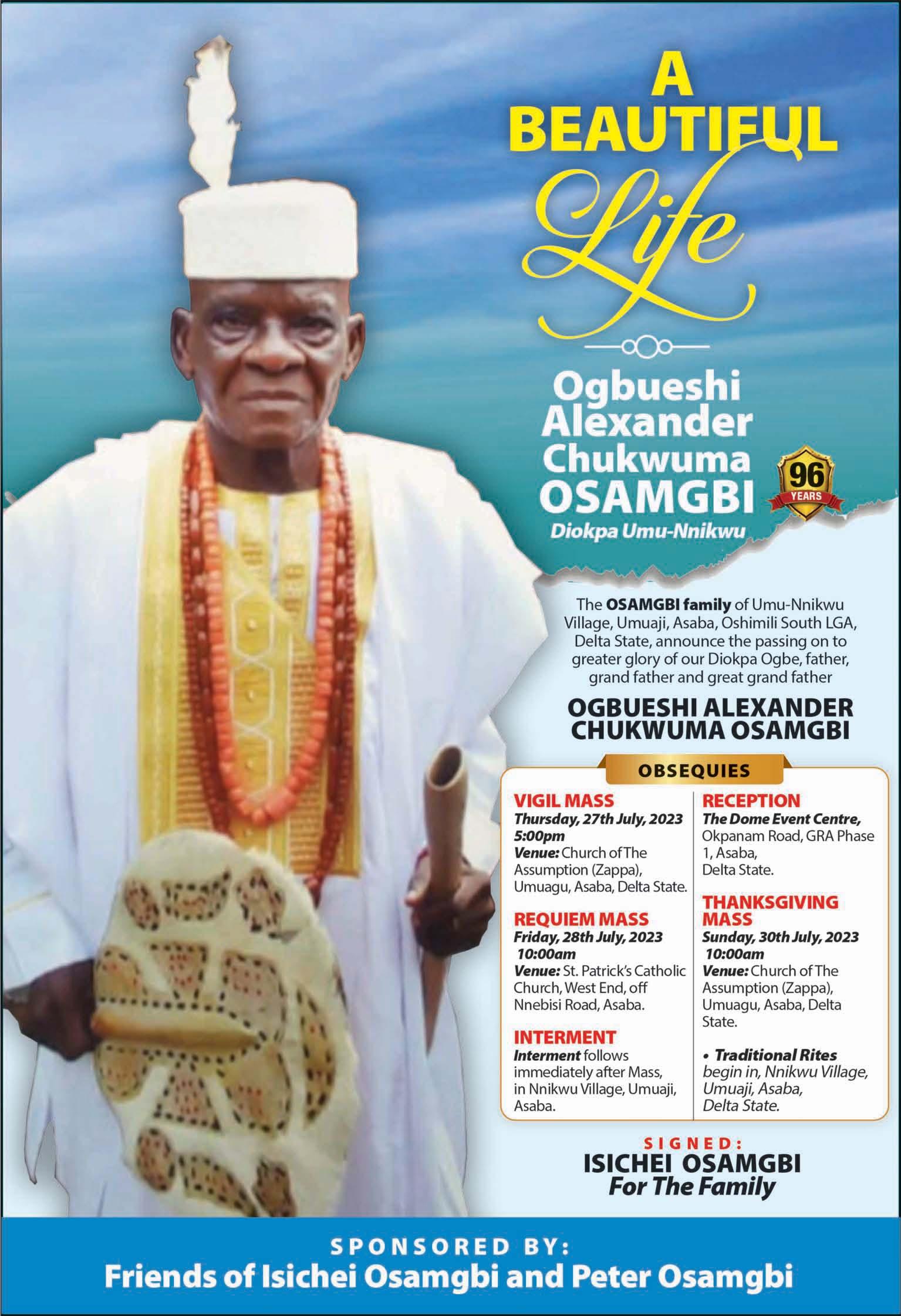

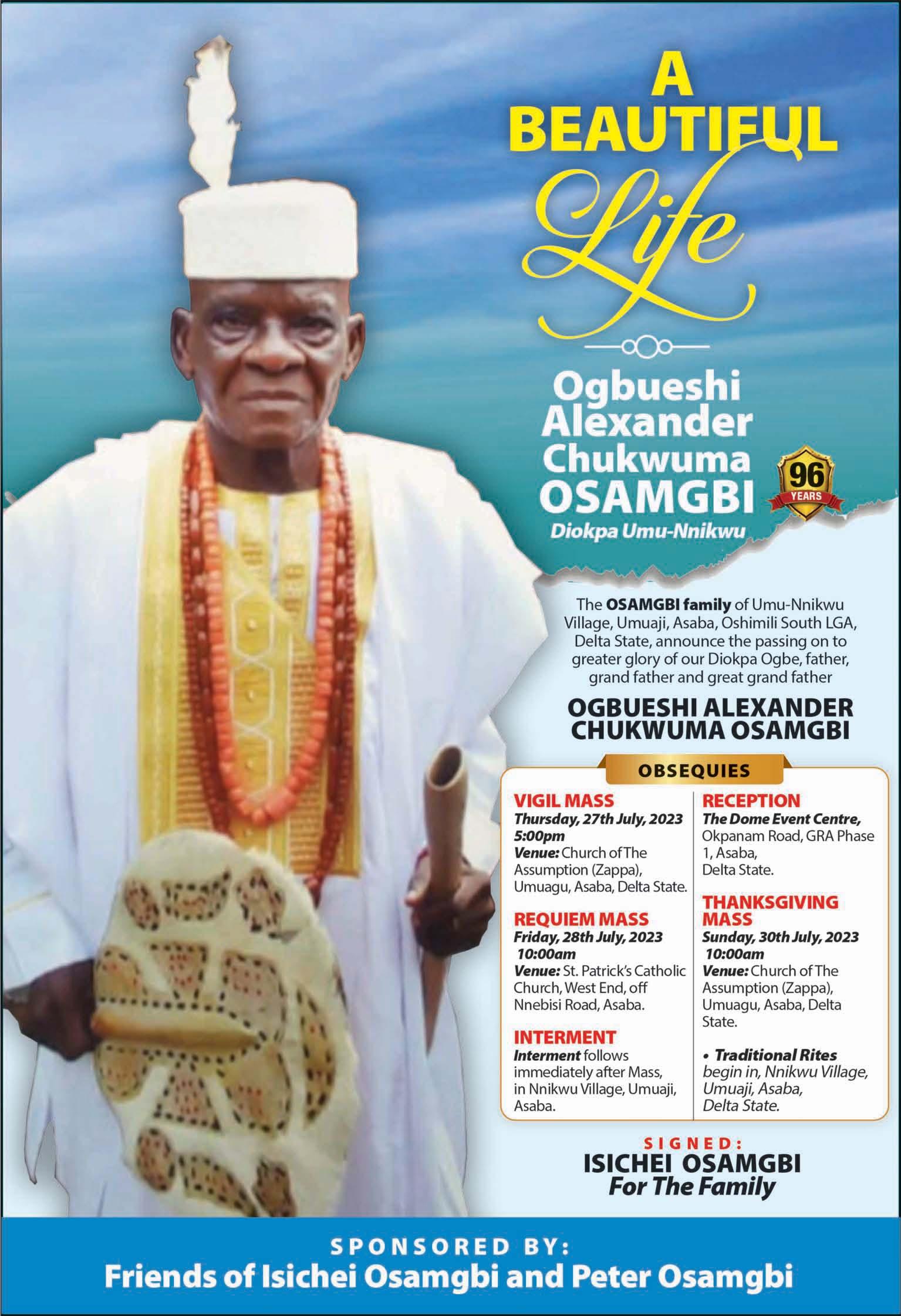

SHETTIMA MEETS ITALIAN PRIME MINISTER...

IMF Retains Nigeria’s 2023 Growth Projection at 3.2%

Ndubuisi Francis in Abuja and Nume Ekeghe in Lagos

The International Monetary Fund (IMF) has maintained its 2023 growth forecast for Nigeria at 3.2 per cent and three per cent for 2024, same figures it had projected for the country in April 2023.

The Washington-based institution made the projections in its latest World Economic Outlook (WEO) released yesterday. In the report titled, ‘Near-Term Resilience Persistent Challenges’ it also predicted that Sub-Saharan Africa (SSA) would experience a decrease in growth, projected at

3.5 per cent in 2023, followed by a recovery to 4.1 per cent in 2024.

Similarly, it estimated that Nigeria's growth prospects for 2023 and 2024 were anticipated to gradually decline, aligning with the projections made in April, primarily due to security concerns in the oil sector.

It states: “In sub-Saharan Africa,

growth is projected to decline to 3.5 per cent in 2023 before picking up to 4.1 per cent in 2024. Growth in Nigeria in 2023 and 2024 is projected to gradually decline, in line with April projections, reflecting security issues in the oil sector.

“In South Africa, growth is expected to decline to 0.3 per cent

FG: Workers’ Pay to Be Based on Performance from 2025

Olawale Ajimotokan in Abuja

The federal government has said it plan to implement performancerelated pay system in the federal civil service from 2025.

The Head of Civil Service of the Federation, Dr. Folasade Yemi-Esan, disclosed this yesterday, while briefing journalists on activities of the 2023 Civil Service Week.

She also stated that Permanent Secretaries have been informed that promotion in the civil service would be based on workers’ performance, adding the Office of the Head of Civil Service of the Federation also plans to professionalise human resource management in the federal service by 2024.

The HoS stated that the office has successfully attended to all training requests from MDAs, while progress report on the year 2022 approved training programmes indicated that over 16,000 officers were trained at core MDA level.

Yemi-Esan, also disclosed that the service detected 1,618 fake/illegal employment letters while it had continued to suspend several errant officers from IPPIS platform for not uploading their records.

She said following the initiatives in accelerating the roll-out of the HR Module of the IPPIS, 69,854 officers across the core MDAs in FCT and the six geo-political zones were verified and enrolled into the payroll.

The HoS also disclosed that 205,411 non-core civil servants affiliated to government agencies and

parastatals have also been verified. The next stage, according to her, was to transfer those workers to the IPPIS. She said by the end of 2024 the process will be completed.

She also added that 3,657 officers were investigated by ICPC for not being present for verification audit while the verification exercise for 3,465 officers recruited from 20172019 and those absorbed into the mainstream had been completed.

She added that the educational certificates, birth certificate/ declaration of age record of workers are to be uploaded to ensure that only duly employed workers are uploaded into IPPIS.

Yemi- Esan stressed that under Structured Mandatory Assessmentbased Training Programme (SMAT-P) and following the successful conduct of Training Needs Assessment (TNA) and development of Standard modules across the three levels of basic, intermediate and advanced, the office had trained 6,007 officers on Salary Grade Levels 07-17.

On digitilisation the head of service said open government across MDAs and minimum of 50 per cent of functional official email addresses was created in the Service by 2025 while minimum of 40 per cent automation of ministries’ work processes, minimum of 60 per cent access to government’s services online and provision of clean, reliable, affordable and sustainable power supply to guarantee the optimisation of the digitalisation policy is attained.

“By the grace of God, it is our

pledge as a Service to remain focused and committed to formulating and driving the policies of government for sustainable development of our beloved country. Hence, the Office will continue to forge stronger alliances and continue to re-engineer the service to be able to attain this aspiration,” Yemi-Esan said.

She also expressed government sensitivity to the plight of workers who are finding it difficult to commute daily to work in the light of the high transport fares caused by the removal of fuel subsidy.

She said a committee is working

at recommending minimum wage for workers, providing buses for workers as well as looking at a stop gap in on the amount of money they have to pay as transport for workers.

“It is a working committee that has not finished its work. It will look at amount of money to pay for six months. It is even looking at the conversion of vehicles for workers instead of buying PMS with their cars. I am sure in a week or two, the committee finish its work and we hope the workers will smile home,” she said.

in 2023, with the decline reflecting power shortages, although the forecast has been revised upward by 0.2 percentage point since the April 2023 WEO, on account of resilience in services activity in the first quarter.”

Responding to the impact of climate change in Sub-Saharan Africa as well as its growth prospects for SSA during a briefing yesterday, the Chief Economist and Director Research Department IMF, PierreOlivier Gourinchas said: “For the whole region, we have growth that is slowing a bit from 2022 to 2023 from 3.9 per cent to 3.5 per cent. That's a very mild downward revision for 2023 about 0.1 percentage points.

“So, this is a gross number that is kind of on the low side. I was talking earlier about the fact that this is not an environment that has very strong robust growth. And this is certainly one of the regions where we see that it's very different from emerging Asia, for instance.”

On climate change, he added: “It's certainly the case that we're seeing more extreme climate events. And some of these can have strong macroeconomic consequences we've seen and talked about the drought in Argentina, we can think about the floods in Pakistan, and we can think

about the impact of temperatures rising on agricultural yields in general and agricultural production.

“So, this is certainly something that is very important, especially for countries that have very little fiscal space, very small buffers with which they can address some of that volatility in food prices. And that's causing in many of these countries situations of food insecurity that were particularly acute last year.

“They are a little bit less acute now because food prices have been coming down, but that remains an important risk going forward. And climate change is certainly something that is aggravating that phenomenon.”

It also stated that global inflation was projected to decline from 8.7 per cent in 2022, to 6.8 per cent this year, indicating a 0.2 percentage point decline, and 5.2 per cent in 2024.

According to the IMF, the global economy was on track but not yet out of the woods, adding that economic growth showed near-term resilience amid persistent challenges.

The IMF said the global economy continues to gradually recover from the pandemic and Russia’s invasion of Ukraine, stressing that in the near term, the signs of progress are undeniable.

Women, Girls Becoming More Exposed to Gender-based Violence, Group Insists

Laleye Dipo in Minna

As the World marks this year's World Population Day, it has been asserted that women and girls are becoming more exposed to gender based violence as a result of climate change.

Other groups more vulnerable to negative effects of climate change include the physically challenged, people living with disabilities and youths.

Speaking at an event to mark the World Population Day in Minna, Niger State, with the theme, "Safeguard the Health and Rights of Women and Girls Now," the Executive

Director of Esteemedhub Foundation, a Non-Governmental Organisation (NGO), Doosugh Agbadu, noted that the category of people were also vulnerable to conflict-related sexual violence, human trafficking, child marriage, and other forms of abuse.

Agbadu, added that Niger State has also experienced climate changerelated challenges including flooding, which she said had resulted in the loss of lives, farmlands, property, and livelihoods.

She, therefore asked the state and local governments to take urgent steps to address the challenge, especially now that the rains have peaked in several parts of the state by providing

lasting solutions to flooding in the state, and better conditions for IDPs.

"No person (especially women, the youth and the vulnerable) should be made to bear the uneven burden of the environmental hazards resulting from climate change while others remain protected and even unaware that anything is happening,” she added.

As an activist for climate justice, Agbadu recommended that a deliberate effort should be made to ameliorate the challenge in order to protect those who suffer unnecessary negative effect of climate change.

She stressed that, "women in agriculture are working hard to

put in place measures to sustain their livelihood and provide income and resources for their families and should therefore not be made to suffer the negative effects of climate change.”

She lamented that, "For years, Niger State has experienced climate change-related challenges such as flooding, which has resulted in the loss of lives, farmlands, property, and livelihoods," saying efforts should be made to check the trend.

The United Nation set aside July 11, every year to be observed as the World Population Day, to reaffirm the human right to plan for a family among others.

WEDNESDAY, THISDAY 5

Vice President Kashim Shettima meets with the Italian Prime Minister Giorgia Meloni during the UN Food Systems Summit in Rome ,Italy ... yesterday.

NEWS Group News Editor: Goddy Egene Email: Goddy.egene@thisdaylive.com, 0803 350 6821, 0809 7777 322, 0807 401 0580 Predicts 3% for 2024, forecasts Africa’s growth to decline to 3.5%

69,845 verified individuals on payroll

Says

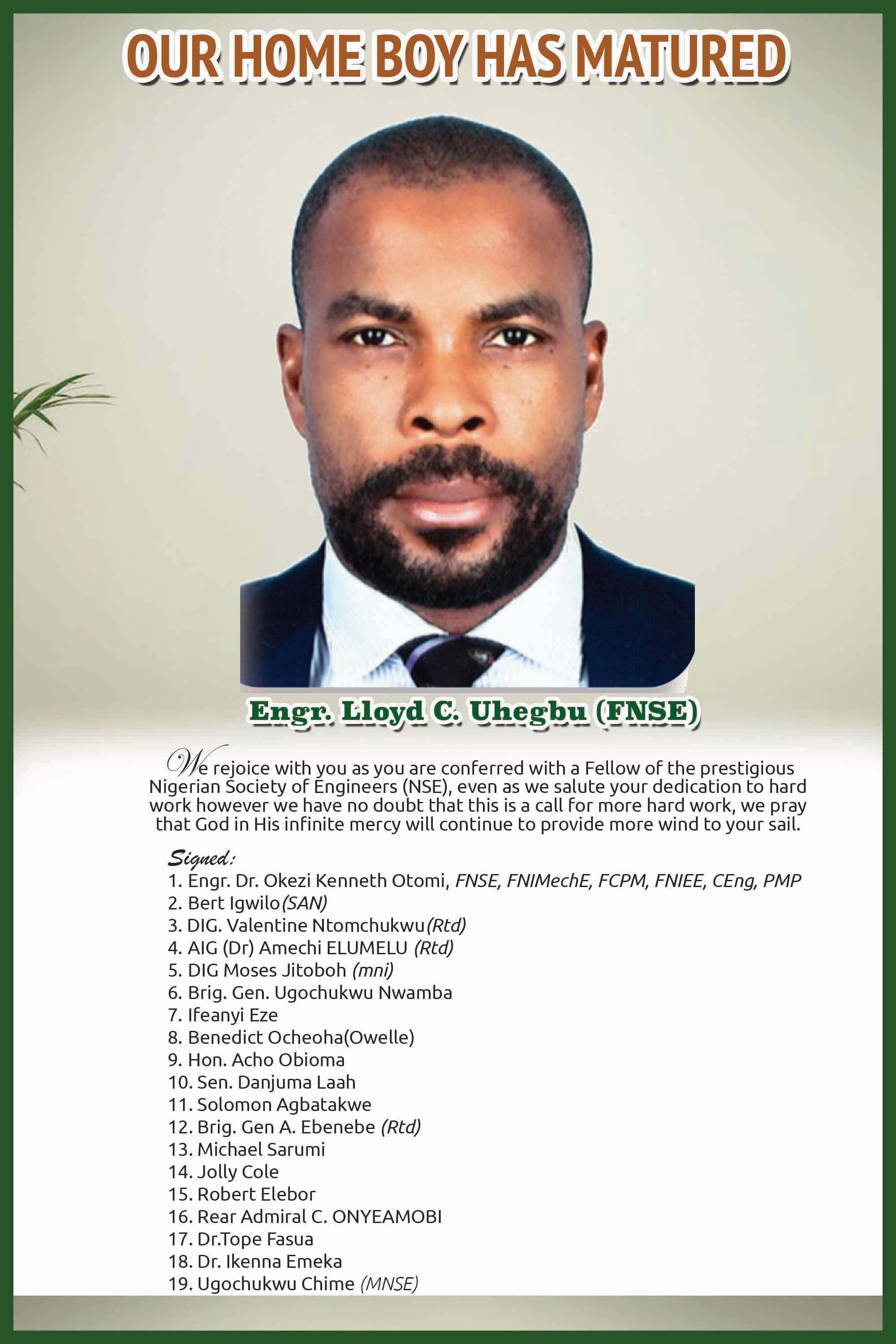

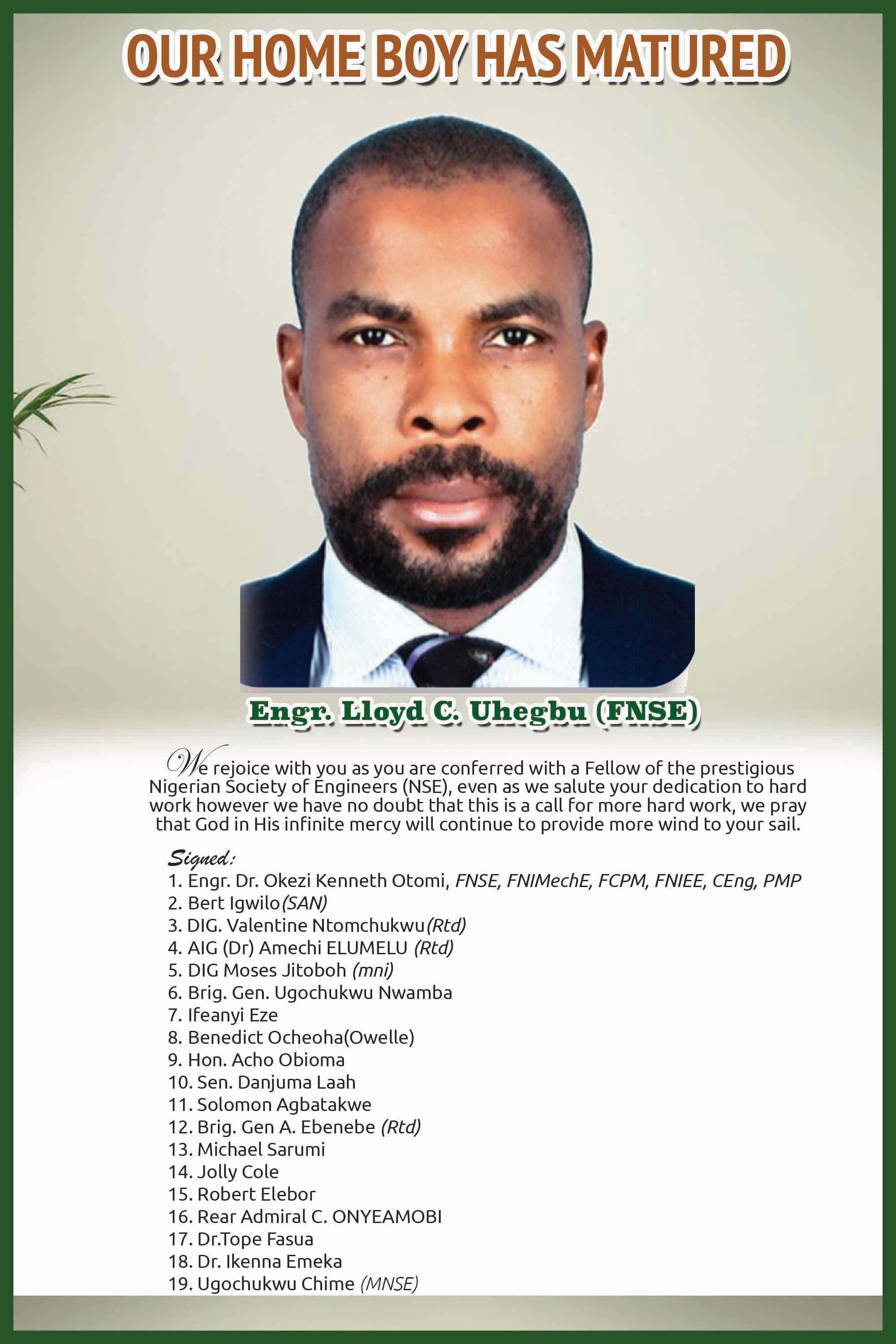

THISDAY MD’S DAUGHTER BAGS FIRST CLASS IN CHEMICAL ENGINEERING...

NDPHC: $1.2bn Spent on Power Distribution Assets, 374 Projects Executed to Boost Supply

Emmanuel Addeh in Abuja

THIS DAY Managing Director Eniola Bello with his daughter Bukola, after she was awarded First Class in Chemical Engineering, Aston University, Birmingham, United Kingdom... yesterday the issues being dealt with by the NDPHC.

The Niger Delta Power Holding Company Limited (NDPHC) has said about $1.2 billion has been spent so far to boost its distribution network in the power sector.

Speaking at the 8th Nigeria Energy Forum in Lagos, NDPHC Executive Director, Networks, Ifeoluwa Oyedele, noted that over 374 projects in the power distribution space of the Nigerian Electricity Supply Industry (NESI) had been executed.

Ifeoluwa, who spoke on the theme: 'Maximising National Integrated Power Projects', noted that the benefiting electricity Distribution Companies (Discos) were expected to refund the NDPHC, stressing that the projects had been handed over to the utilities.

On transmission, the executive director disclosed that the company had also undertaken over 121 transmission lines and substation projects, while expansion works were carried out in 34 Transmission Company if Nigeria (TCN) substations across the country.

"These accomplishments led to a complete transformation of the hitherto radial Nigerian grid into what it is today: a substantially looped grid that provides substantial redundancy to power flow around the grid. This was completely unavailable prior to NIPP," he said.

The National Integrated Power Projects (NIPP) was initiated in 2005 in response to the deplorable state of the power infrastructure in Nigeria

and the inappropriate framework for private sector investment.

It mainly gets its funding from the Excess Crude Savings Account, with capital funding to the tune of $8.46 billion since inception.

On power generation, the NDPHC stated that total planned capacity remains at approximately 5,000 MW, with an estimated 4,000mw already completed.

According to Oyedele, seven gas pipelines and metering stations projects had been concluded and were waiting to be transferred to the Nigerian Gas Company (NGC).

He disclosed that 20,000 Solar Homes Systems (SHS) were deployed in the first phase of its renewable energy programme explaining that in the phase two, 100, 000 SHS would be distributed to 12,000 off-grid rural communities.

“NDPHC has installed capacity of about 4000MW which are mostly available, except for maintenance outage, but is dispatched at about 700MW on average by the System Operator(SO) for reasons ascribed to load rejection by Discos,” the NDPHC added.

On key lessons learnt in the sustainability of national energy infrastructure projects, he listed way leave issues and right of way acquisition for transmission lines and project management structure and use of project and design consultants as some of them.

In addition Oyedele mentioned the adequacy of financial oversight of offshore project funds drawdown by EPC contractors and overconcen-

tration of too many projects with an EPC contractor as some of the things that needed improvement

He disclosed that inadequate dispatch grossly affects NDPHCs revenue generation capacity as well as irregular dispatch (Disco load rejection), System Operator’s frequent start up and shut down instructions of the units for reasons

also ascribed to load rejection issues, causing increased maintenance cost of the units.

Besides, he stated that three power plants on the eastern axis of the Niger Delta have full gas but constrained by dispatch challenges.

“Five power plants on the Western axis of the Niger Delta have major insufficient gas supply.

As at today, gas requirement is 560 mmscf/day while 60 mmscf/day is available,” he noted.

Furthermore, Oyedele said that low revenue generation due to poor dispatch, low remittance from the market and high maintenance cost due to frequent shut down and start up instructions by the system operator remain some of

He also listed shortage of spares due to paucity of funds to stock spares, inability to execute gas contract with Take or Pay (ToP)/ security and constraints in the execution of transmission and distribution projects as some of the challenges the NDPHC faces.

Tinubu Promises to Involve Nigerians in Diaspora in Policies’ Formulation

Michael Olugbode in Abuja

President Bola Tinubu has promised to involve Nigerians in the Diaspora in the designing, implementation and review of public policies as well as plans and programmes.

Tinubu, disclosed this yesterday, while giving his remark at the 2023 Diaspora Day celebration in Abuja, with the theme, "“Consolidating Diaspora engagement for national development."

The president, who was represented at the event by his Chief of Staff, Hon. Femi Gbajabiamila, said the government was not unmindful of the contribution of the Nigerians in Diaspora to the economy.

He said: "It is a great delight to address our over seventeen million Nigerians in the Diaspora as the President and Commander in Chief of the Armed Forces of Nigeria for

the very first time on this auspicious occasion of the celebration of our National Diaspora Day 2023. The National Diaspora Policy 2021 prescribes July 25th annually as a day to celebrate Nigerians in the Diaspora by recognising their contributions to National Development and networking them to Ministries, Departments and Agencies (MDAs) of government, State Diaspora Focal Point Officers (SDFPOs) and Civil Society Organisations (CSOs) in Nigeria.

"The theme for this year’s celebration, ‘Consolidating Diaspora Engagement for National Development,’ is apt giving the fact that it births the new dawn in our political journey with the aim of strengthening our development in policies and programmes with our Diaspora Community across the globe for national development.

"Let me reiterate that government has held our Diaspora in high esteem and has worked hard in uplifting our engagements with them.”

He added that: " It is worthy of note that this year’s Diaspora Day celebration is a special one owing to the new initiatives by the Nigerians in Diaspora Commission (NiDCOM) to further celebrate the amazing contributions of our Diaspora Champions with the introduction of the maiden edition of National Diaspora Merit Awards.

“This initiative will not only serve as a morale booster for the Diaspora community but will also encourage Diaspora engagement and participation for national development.

"Let me commend NiDCOM for its dynamic engagements with the Diaspora community especially in coming up with laudable pro-

Commissioner Accuses FCC Chairman of Dodging House Committee Job Racketeering Probe

Committee summons Chairman, 36 commissioners

Juliet Akoje in Abuja

The House of Representatives investigating personnel recruitment, employment racketeering and gross mismanagement of the Integrated Payroll and Personnel Information System took another turn yesterday, as a Commissioner of the Federal Character Commission (FCC), Moses Anaughe, accused his boss, the Chairman of the Commission, Muheeba Dankaka, of lying to a House Committee to avoid being probed.

Anaughe, who represents Delta

State, during the Ad-hoc Committee’s investigative session, accused his boss of lying to the Committee that she was sick to avoid the investigation, adding that at the time of the investigative hearing, the Chairman was in her office.

Dankaka, had sent a team of Commissioners led by Armaya'u Abubakar, the Taraba State Commissioner, to represent her at the probe with the excuse that she was indisposed and had an appointment with her doctors.

Anaughe, who came in after the proceedings commenced, raised his

hand to be identified and when he was acknowledged, bluntly told the committee that the Chairman's representatives were lying and that she was in her office.

He further accused the Chairman of always giving excuses whenever she was called for a probe, but that, "If she wants to collect 10 per cent of employment from MDAs, the Chief Executive will go, so why is she not here?"

Anaughe questioned.

Subsequently, one of the Commissioners who came in with Abubakar, said they never said she was in

the hospital, but that she had a doctor's appointment as she was ill.

However, the Chairman of the Committee, Yusuf Gagdi, demanded that the Chairman should appear today, following day, Wednesday, with all 36 Commissioners for the probe.

Consequently, the Commissioners were put under oath by the Committee before proceeding continued.

Abubakar, after the oath appealed that the committee give them till next Monday, for the Chairman to appear in person.

But Gagdi insisted they must appear on Wednesday, and accused Abubakar of being a liar.

The Accountant General of the Federation, Oluwatoyin Madein, disclosed to members of the Committee that they did not have the nominal roll of staff on the IPPIS in the Ministries, Departments and Agencies (MDAs).

The Accountant General, who was represented by the Director, IPPIS, Mr. Emma Deko, at the investigative hearing, said they only had the nominal roll of staff of the IPPIS.

grammes for Nigerians in Diaspora to invest at home. I believe in the years to come, these programmes will impact tremendously on our economy by catalysing our developmental efforts. May I therefore encourage you to key into these programmes for our mutual benefits.

"May I also let you know that this new democratically elected government is a Diaspora friendly one, which will provide an enabling platform for effective policies for the Diaspora with the view to galvanising support for the new administration and concretizing our democracy, setting a good example for other African countries to emulate.

"Let me also let you know that we will look at the Challenges NiDCOM has enumerated with a view to ameliorating the same so that we will maximise the benefits of our engagements with our Diaspora for national development."

The Secretary to the Government of the Federation, Senator George Akume, on his part, advised all Nigerians to key into the federal government development agenda.

He stressed that all Nigerians, "both at home and Diaspora should key into our development agenda as only Nigerians can develop Nigeria. This includes both those at home and those in the Diaspora."

In her welcome remark, the Chairman/CEO, NiDCOM, Abike Dabiri-Erewa, called for the review of the Act setting up the Nigerians in Diaspora Commission.

She noted there is the need to review the Act setting up NiDCOM to streamline its activities by setting up a smart board and a sustaining funding mechanism for its activities.

6 WEDNESDAY, THISDAY NEWS

WEDNESDAY JULY 26, 2023 • THISDAY 7

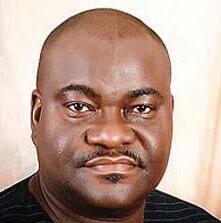

MPC MEETING AT CBN HEADQUARTERS...

Construction of Ondo Oil, Gas Park to Begin Soon, NCDMB Assures Govt, Investors

Olusegun Samuel in Yenagoa

Construction of a low-cost manufacturing hub for equipment components and spare parts used in the oil and gas industry was set to begin in Ondo State soonest, according to the Nigerian Content Development and Monitoring Board (NCDMB).

Located at Ilaje, Ilaje Local Government Area of the State, the facility is one of six being built in different parts of the country under NCDMB’s Nigerian Oil and Gas Park Scheme (NOGAPS) in furtherance of its corporate mandate to develop in-country capacity in the oil and gas industry.

A statement signed by Esueme Dan Kikile, Manager, Corporate Communications, made available to THISDAY, in Yenagoa, said NOGAPS, at Odukpani, Cross River State, and at Emeyal 1, Bayelsa State, are at 99 per cent completion.

NCDMB’s Director, Monitoring and Evaluation, Mr. Akintunde Adelana,

told a gathering of top government functionaries, including Ondo State Acting Governor, Mr. Lucky Aiyedatiwa, industrialists and investors as well as representatives of the United Nations Development Programme (UNDP) and the European Union (EU), that the agency was conceived to provide, “a springboard to galvanise different sectors of the Nigerian economy.”

He remarked that the oil and gas industrial parks, developed by the Board in conjunction with Shell Petroleum Development Company, ExxonMobil and Nigerian Agip Oil Company (with particular reference to NOGAPS, Emeyal 1 and NOGAPS, Odukpani) consist of manufacturing shop floors and factories, warehouses, training centres, mini estates, fire stations, truck parking and holding spaces, hostels and administrative blocks.

They were intended to eliminate importation of equipment components and spares required in oil industry

operations.

Speaking on Day 1 of the ongoing, “Develop Ondo 2.0 Investment Summit,” in Akure, Adelana stated that in line with the core mandate of the Board, which revolves around, “domesticating and domiciling value-adding activities in the oil and gas industry,” regulations on utilisation of home-grown resources, that is, local manpower, technical services of indigenous firms, goods manufactured locally as well as raw materials available in the country, have been rigorously enforced.

With specific reference to Ondo State, he emphasised that NCDMB wants, “to align with the State Government, support the State to ensure that her dreams and aspirations come to reality.”

He said Information and Communication Technology (ICT) Centres have been built in parts of the State to facilitate digital education and thus equip the youth with appropriate skills for gainful employment and

self-development.

On the Board’s role in facilitating access to energy, Adelana, who represented the Board’s Executive Secretary, Engr. Simbi Kesiye Wabote, said an effective way of doing it was by building capacities, which NCDMB has done consistently since its creation in

2010 through trainings for manpower development, equity participation in companies like Waltersmith Modular Refineries, blending plants and cylinder manufacturing companies, as well as strategic interventions in funding to indigenous companies through the Nigeria Content Development Fund,

Earlier in a welcome address, the Acting Governor, Mr. Lucky Aiyedatiwa, expressed appreciation to the organisers and assured industrialists and prospective investors that Ondo remains resource-rich and investment-friendly.

Resident Doctors Commence Indefinite Strike Nationwide

Resident Doctors under the aegis of the National Association of Resident Doctors (NARD) have declared an indefinite strike over dispute with the federal government on salary and welfare matters. A former president of NARD, Dr. Godiya Ishaya confirmed the development to THISDAY, last night, in a telephone message.

"It's true NARD has declared a total and indefinite strike action," he said.

The association is insisting that the government should address all its six point demands, failing which it would no longer guarantee industrial harmony in the health sector nationwide.

In the communique issued at the end of its recent National Executive Council (NEC) meeting, the doctors had resolved, "to further extend her already expired ultimatum issued to the government by two weeks with effect from Wednesday July 5, 2023."

The two weeks elapsed on July 17.

Education Reforms’ Success Story

Edo Only Sub-national at Africa Heads of State Summit, Obaseki Shares

Governor celebrates business magnate, Uanseru at 65

Reforms to transform Edo’s education sector and tackle learning poverty in the State took centre stage at the Africa Heads of State Human Capital Summit (HCS), as the Edo State Governor, Mr. Godwin Obaseki, was said to have impressed African leaders and policymakers at the confab, sharing his government’s achievements in the State’s basic education system as well as the entire education ecosystem over the past six years.

According to a statement yesterday, Edo was the only sub-national invited as a state to the Africa Heads of State Summit and continued to stand out as a sub-national demonstrating strong political will and action to accelerate investments in learning and human capacity development.

The Summit, taking place in Tanzania's port city of Dar es Salaam between July 25-26, has in attendance over 1200 delegates, including African leaders, policymakers, and other development stakeholders from over 30 African countries.

Obaseki, who is a panelist at the Summit spoke on the theme, “From Strategy to Implementation in Education,” sharing insights on how the government’s bold and strong institutional reforms have translated to improved learning outcomes, identifying ongoing efforts

to accelerate and sustain the gains recorded in the State’s education ecosystem.

According to the governor, “Edo State has become a reference on how a sub-national can undertake massive transformation and significantly improve learning outcomes in the public school system.”

He further noted, “We have over the past six years deployed significant resources to improve teaching and learning outcomes, focusing on the basic education sector with over 380,000 students from various public schools across the State currently benefiting from the State’s Basic Education Sector Transformation (EdoBEST) Programme. With the success recorded in the basic sector, we are expanding the programme to capture secondary schools and tertiary institutions in the State.

“As a government, we understand the need for quality manpower in the overall development of our State and are investing aggressively in this regard, building the capacity of our people and ensuring a massive transformation throughout the entire educational system, from basic education to senior school, technical colleges and tertiary institutions, to guarantee highly-skilled graduates that can compete in the global workforce.”

Meanwhile, Obaseki, has felicitated

business mogul and President/Chief Executive Officer of GCA Energy Limited, Mr. Greg Uanseru, on his 65th birthday celebration, hailing his contribution to the growth and development of the country.

In a statement, the governor lauded Uanseru for his tenacity and entrepreneurial excellence, noting that his exploits which have elevated

the nation’s business landscape to enviable heights are a testament to the indefatigable spirit of hard work and resilience common with Nigerians.

Obaseki said, “I heartily felicitate with the President and Chief Executive Officer (CEO) of GCA Energy Limited, Mr. Greg Uanseru, on his 65th birthday celebration.

Among the demands of the doctors were the immediate payment of the 2023 MRTF as contained in the approved 2023 budget in line with various agreements reached with the government.

The agreement was that the government should without further delay, pay all outstanding arrears owed members including the hazard allowance and the skipping arrears of 2014-2016, and the arrears of consequential adjustment of minimum wage, arguing that there was no justifiable reason to keep owing the arrears and allowances.

NARD is also demanding

the immediate release and the implementation of the guidelines on one-for-one replacement of clinical staff to cushion the effect of the massive manpower shortage in various hospitals nationwide. Additionally, the resident doctors are asking the Medical and Dental Council of Nigeria to discontinue the downgrading of the membership certificate issued by the West African Postgraduate Medical and Surgical colleges.NARD further demanded the immediate payment of all Salary Arrears, implementation of the CONMESS salary structure and new Hazard Allowance and domestication of the Medical Residency Training Act and payment of the Medical Residency Training Fund to our members in the State Tertiary Health Institutions nationwide.

The NEC of NARD insisted on the immediate implementation of minimum of 200 percent increment in the CONMESS salary structure and upward review of the associated allowances as requested in her previous letters on the subject matter, adding that the current economic realities in the country cannot justify the continued payment of CONMESS as it is at the moment.

Nigeria, South Africa Forge Ties to Enhance Fight against Drug

Michael Olugbode in Abuja

Nigerian and South African antinarcotics agencies have met to forge stronger operational ties that would enhance the war on drug syndicates operating between the two countries.

A signed press statement yesterday, by the spokesman of the Nigerian anti-narcotics agency, Femi Babafemi, noted that as part of efforts to combat illicit drug trafficking between Nigeria and South Africa, senior officials of the National Drug Law Enforcement Agency (NDLEA) held a two-day meeting with their South African counterparts in the Directorate of Priority Crime Investigation popularly known as HAWKS, to forge stronger operational ties that would herald tough times for drug syndicates operating between the two countries.

Speaking during the start of the meeting at the NDLEA national headquarters in Abuja, recently, Chairman/ Chief Executive Officer, Brig. Gen. Buba Marwa (Retd), who was represented by the agency’s Secretary, Mr. Shadrach Haruna, said the deliberation which was a follow up to a virtual one held in April 2022, would, “bridge the gap and rekindle our efforts by deepening collaboration in line with the principle of common and shared responsibility in tackling the global drug problem.”

According to him: “Among other expected outcomes of this visit is the need to have a collaborative Memorandum of Understanding to combat drug trafficking and related crimes between the NDLEA of Nigeria and the Directorate for Priority Crime Investigation (DPCI) HAWKS, of South Africa.

“This will provide a framework for enhanced information exchange, and Joint Operations/Joint Airport Interdiction; all promising dividends that will benefit our two organisations and countries greatly.” Marwa, while emphasising the increasing sophistication of drug trafficking cartels, particularly the proliferation of methamphetamine laboratories and the emergence of fentanyl production facilities, which pose grave threats to the safety and well-being of citizens in both countries, said this demands swift action through the seamless exchange of intelligence and technical expertise. He added that: “This will not only help to halt the spread of illicit production of these deadly illicit drugs but also prevent locally produced ones from being smuggled between both

countries.

“The need for collaboration became urgent given the volume of trade and social interactions between the two countries leading to a corresponding trade in illicit drugs. Another expected outcome of this visit is the expectation of an agreed mechanism that would lead to the dislodgement and disruption of major drug trafficking syndicates operating between the two jurisdictions.”

In his response, leader of the South African delegation, Lt. Gen. Senaba Mosipi stressed that the collaboration between the two countries was necessary because criminals operating in the drug trade recognise no borders, or geographical boundaries, noting that to effectively combat their criminality, proactive measures within the arm of the law are imperative.

8 WEDNESDAY, THISDAY NEWS

L-R: Central Bank of Nigeria (CBN) Deputy Governor, Financial System Stability, Aishah N. Ahmed; Acting Governor, Folashodun A. Shonubi; Deputy Governor, Corporate Services, Edward Adamu, and Deputy Governor, Economic Policy, Dr. Kingsley Obiora, during a press conference on the outcome of the MPC meeting, at the CBN headquarters in Abuja ... yesterday PHOTO: KINGSLEY ADEBOYE and sundry initiatives.

Onyebuchi Ezigbo in Abuja

WEDNESDAY JULY 26, 2023 • THISDAY 9

Senate to FG: Halt Planned Electricity Tariff Hike, Don't Increase Nigerians' Hardship

Sunday

Aborisade in Abuja

Senators yesterday, asked the federal government to halt the planned increment of the electricity tariff in order to lessen the burden of the poor masses.

The lawmakers stated this as part of their resolution after a motion sponsored by Sen. Akintunde Yunus Abiodun (Oyo Central), and co-sponsorsed by Sen Asuquo Ekpenyong (Cross River South) and

Sen Abbas, Aminu Iya (Adamatoa Central).

The motion was titled, "Need to Halt the Proposed Increase in Electricity Tariff by Eleven Successor Electricity Distribution Companies (Discos)."

The Senate, in a unanimous decision insisted that Nigerians were now going through hard times as a result of the removal of fuel subsidy.

The red chamber maintained that the price of gas, which was

the major item being used electricity companies to generate power, had not been increased.

It therefore resolved that henceforth, town halls on electricity should be held at the headquarters of the companies.

It added that communities that bought transformers or any electrical appliances should be compensated.

Part of the resolution read, "Senate accordingly resolves to call on the federal government of Nigeria to

intervene and halt the proposed increase in electricity tariff by the Distribution Companies (Discos).

"We urge Nigerian Electricity Regulatory Commission (NERC) to decentralise proposed engagement with stakeholders scheduled for Abuja to the six geopolitical zones of the Federation for effective participation by all.

"We also urge NERC to thoroughly look into the rate review applications filed by the Discos, taking

into consideration the interests of citizens, affordability, and the need for improved service delivery

"We further urge NERC to explore alternative measures to address the financial challenges faced by the Discos, such as improving operational efficiency, reducing technical and commercial losses, and enhancing revenue collection mechanisms.

"We equally urge Discos to henceforth discontinue estimated billing and make available to all

electricity consumers prepaid meters at affordable prices.

"The Committee on Power (when constituted) is hereby mandated to engage with the Federal Ministry of Power, NERC, and other stakeholders to find lasting solutions to the challenges facing the Nigerian electricity sector.

"It should include the need for comprehensive sector reforms. The Senate also resolved that the executive should allow the poor to breath."

DSS DISOBEYS COURT ORDER, BEATS UP CORRECTIONAL OFFICERS, RE-ARRESTS EMEFIELE

Chuks Okocha in Abuja and Wale

Igbintade in Lagos

Operatives of the Department of State Services (DSS) yesterday rearrested the suspended Governor of Central Bank of Nigeria (CBN), Mr. Godwin Emefiele, in the premises of the Federal High Court, Lagos, few hours after he was granted bail by Justice Nicholas Oweibo.

The re-arrest attempt turned riotous when Emefiele came out of the courtroom, led by a squadron commander from the Nigerian Correctional Service (NCoS), but was intercepted by DSS operatives, which caused Emefiele to retreat back into the courtroom.

While Emefiele’s lawyers were busy perfecting his bail conditions, DSS sent for reinforcement. The mood in the court immediately changed, as DSS personnel engaged in fisticuffs over who should take custody of the former CBN governor.

It became a free-for-all, as the DSS officers beat up the NCoS squadron commander, when he tried to resist their attempt to take Emefiele from him. They thoroughly manhandled the correctional officer in whose custody the judge had ruled Emefiele should be, pending perfection of his bail.

The situation became so messy that both the DSS personnel and the NCoS officers corked their guns and were ready to shoot, as court workers and journalists scampered for safety.

However, few hours after the face-off between the two federal agencies, Emefiele reappeared from the court and was led into a waiting DSS vehicle, which took him away about 3:02pm.

One of the operatives of the cor-

rectional service told THISDAY that they decided to withdraw following the directive from the Controller General of the NCoS in Abuja.

Following the directive from Abuja, the correctional officials brought a form for the DSS to sign, effectively handing Emefiele's custody to DSS. But the DSS initially refused to sign, it but eventually signed after some back and forth that lasted about another 30 minutes.

Earlier, the trial judge had granted Emefiele bail in the sum of N20 million for alleged illegal possession of firearms.

Emefiele is standing trial on a two-count charge bordering on possession of a single barrel shot gun, as well as possession of 123 rounds of live ammunition without licence. He pleaded not guilty to the charges. Following his plea, defence counsel, a former President of the Nigerian Bar Association (NBA), Joseph Daudu, informed the court of a bail application filed on behalf of the defendant.

Daudu, who led four other Senior Advocates of Nigeria (SANs), told the court that the bail application had been served on the prosecution, adding that there was a stamp of the office of the Attorney General as proof.

But the prosecutor, a Deputy Director of Public Prosecution (DDPP), Nkiru Jones-Nebo, objected to the bail application on the grounds that she had not been served a copy of the application. Jones-Nebo informed the court that her office had been on the lookout for a possible bail application of the defendant but did not see any.

Alleging that she had just been aware of the application in court, Jones-Nebo requested for time to

respond by way of affidavit, since facts had been deposed.

Besides, Jones-Nebo noted that since there was no sitting Attorney General of the Federation (AGF) at the moment, the defence could not have effectively served same.

But defence counsel told the court that the prosecutor had no excuse not to proceed today in response to the bail application, as same had been duly served on the prosecution's office.

Daudu argued that the office of the AGF was a creation of statute, and so cannot exist in a vacuum.

In his ruling, the judge agreed with the submission of the defence counsel, and urged him to move the defendant's bail application.

Moving the application, Daudu urged the court to admit the defendant to bail as he was not a flight risk, being a reputable former governor of CBN. He told the court that the defendant had been kept in custody for long and had lost so much weight and so required medical attention.

The defence counsel also informed the court that the defendant would be available to stand trial, adding that assuming the prosecutor had produced a witness, the defence would have been ready to proceed.

Daudu urged the court to grant the defendant bail.

In response, the prosecutor informed the court that they were opposed to the bail application of the defendant and alleged that he was a flight risk

Jones-Nebo told the court that the defendant had refused to submit his international passport, which indicated flight risk.

Besides, she argued that Emefiele, being a very influential citizen of

CBN DIRECTS BANKS TO LIFT RESTRICTIONS ON 440 ACCOUNTS

The correspondence read, “You are hereby directed to vacate the Post-No-Debit restriction placed on the accounts of the underlisted bank customers at our instance."

The apex bank further mandated the banks to inform the concerned customers of the vacation accordingly.

Some of the affected accounts included Fortune-K Resources and Investment Nigeria Limited, Voomos Limited, BoxII Limited, OP Amber, KIIPay Limited, Blake Excellence Resort, and Vanu Nigeria Limited. Others were Bakori Mega Services, Ashambrakh General Enterprise, Namuduka Ventures Limited, Crosslinks Capital and Investment Limited, IGP Global Synergy Limited, Davedan Mille Investment Limited and Urban Laundry, Advanced Multi-Links Services Limited, Spray Resources, Al-Ishaq Global Resources Limited, Himark Intertrades, Charblecom Concept Limited, Wudatage Global Resources, Whales Oil and Gas, Mosinox Oil and Gas and A.A. Gwad Ventures.

Those also listed included Treynor Soft Ventures, Fyrstrym Global Concepts Limited, Samarize Global Nigeria Limited, and Zahraddeen Haruna Shahru, FirmCoin Resources and SIBT Acuracy, CrossLinks Energy Limited, among several others.

With Subsidy Gone, FX Unified, CBN Raises MPR to 18.75% to Curb Inflation

The MPC also adjusted the asymmetric corridor around the MPR to +100/-300 from +100/-700, and retained the Cash Reserve Require-

ment (CRR) at 32.5 per cent as well as Liquidity Ratio at 30 per cent.

Addressing journalists after the two-day meeting of Monetary Policy Committee (MPC) meeting in Abuja, the CBN acting Governor, Mr. Folashodun Shonubi, said the modest increase in the benchmark interest rate was targeted at curtailing potential uptick in inflationary pressures resulting from the policy changes.

Shonubi, also clarified that the current volatility witnessed in the foreign exchange market was driven by the fact that the market needs to find its level, adding that there's a pent-up demand which current supply may not be sufficient to satisfy.

He said the floating of the naira and removal of petrol subsidy were likely to sustain upward pressure on domestic prices in the short to medium term especially considering the negative impact the proposed palliatives would have on liquidity.

The acting CBN governor also insisted that previous hike in MPR had continued to make quite a lot of difference by moderating the rate of increase in the prices of goods and commodities.

According to him, without the tightening stance, the headline would have spiraled out of control.

He said the continued uptick in inflationary pressure to 22.79 per cent in June 2023 from 22.41 per cent in the previous month was driven by the moderate increases to both the food and core components.

According to him, legacy headwinds, including security challenges in major food-producing areas; high cost of transportation driven by the rising cost of energy, and inadequacies

Nigeria, could also interfere with the case and evidences intended to be led by prosecution. She urged the court to refuse bail.

In his ruling, Oweibo agreed with the submission of the defence counsel on the grounds that the offence for which the defendant was charged was bailable.

The court held that bail could only be denied where any of the circumstances set out in section 162 of the Administration of Criminal Justice Act was established. The court held that the prosecution did not furnish such circumstances before the court.

The court consequently granted bail to the defendant in the sum of N20 million with one surety in like sum. The court held that the surety must depose to an affidavit of means and have a landed property.

Oweibo urged that the defendant be remanded in custody of the correctional service, pending perfection of his bail, and the correctional service personnel left with Emefiele. The court had earlier adjourned the case until November 14 for trial.

In the charge, the prosecutor told the court that the defendant who resides at No. 8 Colorado Street in Maitama, Abuja, committed the offence on June 15, at No. 3b Iru close, Ikoyi Lagos.

Emefiele was alleged to have in his possession a single barrel shot (Jojeff Magnum 8371) without licence. The defendant was also alleged to have in his possession 123 rounds of live ammunition cartridges, without licence. The offence contravenes the provisions of sections 4 and 8 of the Firearms Act, Cap F28, Laws of the Federation, 2004.

Meanwhile, Emefiele's lead counsel, Daudu, accused the DSS

of affront and disobedience of court order. Daudu stressed that the DSS could not be in disobedience of court order and at the same time use the machinery of the court to torment people.

Daudu stated, "We were in court and the court grated Emefiele bail. We further applied that pending when he will perfect the conditions of his bail, he should be moved from the custody of the DSS to the NCoS.

“The court, in its discretion, granted that he should be in correctional centre until he completes the terms of his bail.

"No sooner that was done, we noticed movements from the men of the DSS to take him back into their custody, despite the pending court order. We then drew the attention of the court to this, and the court was magnanimous to hear us.

"We told the court that in the interest of the rule of law, and democratic process in this country, the court should intervene. So, the judge sent for the officer in charge of DSS who was armed to the teeth. The court asked me to repeat what I told him, and I did. However, his (DSS operative) response was that he was under instructions to secure the suspect, in other words he was under the instructions of his boss, the Director General, to bring him.

"He has been brought to court, and has been granted bail. You can see the vehicles of the DSS and that of the Correctional Service. I must tell you that because of the delay in perfecting the bail conditions, the officials of the Ikoyi Prison have legal obligations to take him to Ikoyi Prison.

because the court said take him to correctional centre.”

The SAN added, "He will soon come out; we cannot allow this type of stalemate to continue. You cannot have a warrant when you have come to court with a charge. The only warrant is the one issued by the court to take him to correctional service.

“So, if the DSS takes him into custody by force, then it tells a lot about the new administration. No court will leave you in the hands of your tormentor. It will take you away and put you in the hands of another government institution. What is the big deal with the DSS if not ego? What is the big deal in insisting in keeping him in their custody?”

On whether there was another pending case in Abuja against Emefiele, Daudu said, "In that case a reproduction order will be issued. He is no longer in the hands of the DSS, you cannot be in disobedience of court order and at the same time use the machinery of the court to torment people. The case will never move."

Former Minister of Education, Oby Ezekwesili, yesterday, condemned the arraignment of the suspended CBN governor over alleged possession of a firearm and ammunition.

Reacting to what took place between DSS and NCoS, Ezekwesili, in a post shared on her Twitter handle, slammed the secret security agency over its treatment of Emefiele.

in public infrastructure continued to drive the rise in food and core inflation.

Shonubi, who read the committee’s communique, noted that unfolding dynamics in the monetary policy environment and the resultant passthrough to domestic prices would require greater collaboration between the CBN and the fiscal authority to ensure that macroeconomic stability is achieved.

The MPC’s considerations focused on the persisting rise in inflation and its potential adverse effect on output growth and household income, adding that the continued uptick in inflation (month on month) driven by increase in both the food and core components remained a key challenge.

The committee also expressed concerns that the recent policy decisions around subsidy removal, exchange rate liberalisation and disbursement of palliatives would have pass-through effects to inflation.

The MPC therefore, called for decisive measures by the bank to address the likely liquidity surfeit from these developments, including using appropriate monetary policy instruments.

The committee further prevailed on the monetary and fiscal authorities to sustain collaboration towards addressing the inflationary pressure and incentivise domestic investment to reduce unemployment and boost output growth.

It further enjoined the federal government to continue to explore policies to improve investor confidence in the Nigerian economy and pave the way for foreign and domestic investments.

The acting CBN governor also stressed the need to attract investment, particularly to auto manufacturing, aviation, and rail industries to boost non-oil revenues.

He said key policy mechanisms to shield the Nigerian economy from persisting global shocks and other emerging domestic shocks were urgently required for the economy to continue to post positive growth.

The MPC also commended the several measures put in place by the central bank to boost foreign currency liquidity.

Shonubi said, “Particularly, members were of the view that the recent policy on exchange rate unification would increase market transparency and encourage more foreign capital inflows. It, therefore, urged the bank to leverage on effective policies to attract remittances from diaspora to help moderate exchange rate pressure.

“The committee also commended the CBN’s role in the effective oversight of the banking system, evidenced by the relative stability in key financial soundness indicators and resilience of the sector, despite tight global and domestic financial conditions.”

The MPC, however, noted the likely impact of the recent policy reforms on the valuation of commercial bank assets and called on the central bank to act proactively to ringfence the banking system from any possible second-round effects, as well as sustain its micro-prudential surveillance over the banking system.

Shonubi, pointed out that staff projections showed that output growth recovery in 2023 would

"Ikoyi Prison is not far from the court and it's a federal institution, why they want him into their custody is what beats my imagination. But what is more devastating is the fact that the DSS came to court with two-count charge, and the court in its discretion granted him bail, but you still want to arrest the person,

She wrote, “The DG of @OfficialDSSNG who without decorum publicly advertises that he is a close friend of @officialABAT, obviously thinks the average IQ of sensible Nigerians is as low as that of the politicians he has reduced that agency of @NigeriaGov to serve.

“Stop embarrassing yourselves and tell us the truth of the Emefiele matter jooo. Be guided Continues online

AFTER OUSTING THEM, TINUBU MEETS ADAMU, OMISORE AT STATE HOUSE

huge influence in the party and is expected to have a say in who emerges new party leaders.

Although neither Adamu nor Omisore had openly announced their resignation since it became news, the acting national chairman of APC, who was Deputy National Chairman (North), Abubakar Kyari, told journalists after a meeting of the party's NWC in Abuja that both leaders had resigned.

But yesterday in Abuja at a one-day national dialogue on anti-corruption with the theme, “Enhancing Anti-corruption and Social Inclusive Policy Reform Initiatives in Nigeria Project”, organised by ANEEJ and sponsored by USAID and Palladium, representative of the U.S. Embassy, Deputy INL Director, Walter Quintanilla, pointed out the need for a holistic step to combat corruption in Nigeria. Quintanilla said, "Transparency and accountability were key to win the war against corruption in Nigeria.”

The U.S. Embassy charged CSOs in Nigeria to join the fight against corruption, while appreciating the effort put in by these bodies in the fight to expose corruption in Nigeria. Speaking on the side-lines of the event, Executive Director of ANEEJ, Rev. David Ugolor, said the anticorruption architecture would bring about appreciable results.

Ugolor pointed that there was also need to strengthen the Economic and Financial Crimes Commission (EFCC) and the Independent Corrupt Practices Commission (ICPC), adding that it has become imperative for Tinubu to appoint a substantive Chairman of EFCC to allow room for efficiency.

On the essence of the dialogue, Ugolor explained that one of the reasons was to launch the assessment report tagged, “Report of Assessment of the Implementation of Nigeria's International Anti-corruption Asset Recovery Commitments”, which he said, "ANEEJ has just produced on the London anti-corruption commitment that Nigeria made, and then the Global Forum on Asset Recovery that was held in Washington in 2017, and the report focuses on where Nigeria is on anti- corruption fight."

The Chief of Party, SCALEPalladium, Lydia Odeh, said it was understandable that the "issues of corruption had to be addressed in collaboration with stakeholders, whether from government, civil society, development partners and the media”.

In a goodwill message, former Executive Secretary, Presidential Advisory Committee Against Corruption (PACAC), Professor Sadiq Radda, said the searchlight on anti-graft war should be beamed on states and local governments.

TEN 10 WEDNESDAY, THISDAY

Continued on page 37

WEDNESDAY JULY 26, 2023 • THISDAY 11

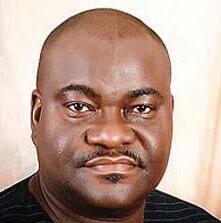

SIGNS OF RAPPROACHMENT?...

Atiku to Tribunal: Don't Encourage Violation of Our Constitution

Insists Tinubu not qualified on account of $460,000 forfeiture, dual citizenship, alleged forged certificate APC urges DSS, police to investigate PDP's alleged foiled attack on ex-VP

Adedayo Akinwale and Alex

Enumah in Abuja

Presidential candidate of Peoples Democratic Party (PDP) in the February 25 election, Atiku Abubakar, has challenged the Presidential Election Petitions Court (PREPEC) to not condone or encourage the violation of the country's constitution.

Atiku argued that by the provisions of the 1999 Constitution, President Bola Tinubu was unqualified to participate in the election, having forfeited $460,000 drug-related money, acquired citizenship of a country other than Nigeria, and presented a forged certificate to the Independent National Electoral Commission (INEC).

But All Progressives Congress (APC) called on the police and the Department of State Services (DSS) to investigate PDP’s allegation about Boko Haram members arrested by the police following their foiled attack on the residence of the former vice president.

However, urging the presidential election tribunal to be bold and take the lead in righting the wrongs in the society, Atiku recalled some of the previous positions of the Supreme Court.

He stated, “This court must take the lead, in righting the wrongs in our society, if and when the opportunity presents itself, as in this appeal. Allowing criminality and certificate forgery to continue to percolate into the streams, waters and oceans of our national polity would only mean our waters are,

and will remain, dangerously contaminated.

"The purification efforts must start now, and be sustained as we seek, as a nation, to now ‘change’ from our old culture of reckless impunity.”

Atiku, in his final written address, appealed to the tribunal to apply the above commendable approach of the courts with equal force to cases of brazen violation of the constitution, as shown in the instant petition.

He said, "The Petitioners in paragraph 16 of their petition, made the non-qualification of the Second Respondent a ground of challenge to the Second Respondent’s return. This complaint on the settled state of judicial authorities remains purely a matter of law, circumscribed around the provisions of section 137 (i) (a)

(d) and (j) of 1999 Constitution (as amended).

"The relevant section provides: 137(i) A person shall not be qualified for election to the office of the president if, ‘a. subject to the provisions of section 28 of this Constitution he has voluntarily acquired the citizenship of a country other than Nigeria or, except in such cases as may be prescribed by the National Assembly, he has made a declaration of allegiance to such other country.

“d he is under a sentence of death imposed by any competent court of law or tribunal in Nigeria OR a sentence of imprisonment OR fine for any offence involving any other dishonesty OR fraud (by whatever name called) OR any for other offence, imposed on him by any

court or tribunal OR substituted by a competent authority for any other sentence imposed on him by such a court or tribunal. j. he has presented forged certificate to the Independent National Electoral Commission.”

Atiku's lead counsel, Chief Chris Uche, SAN, who filed the final address, noted that the above provision was self-executory, being matters that the courts are enjoined to take judicial notice of.

Atiku maintained that Tinubu, having personally admitted and also confirmed by his witness that he forfeited $460,000 to the American government over offence of narcotics trafficking and money laundering, had no basis to contest and be declared winner of

the presidential poll.

Uche stated, "The forfeiture of $460,000 by the Second Respondent to the United States Government, (a competent authority in the instant case), is neither contested nor disputed by any of the Respondents. The feeble response of the Respondents is that there was no arraignment or criminal conviction.

"The verified complaint for forfeiture and the entire records of the United States District Court, Northern District of Illinois, eastern Division dated September 15, 1993, was clearly indicated that the Second Respondent’s funds totalling $460,000, were seized as the funds which constitute proceeds of narcotics trafficking and money laundering.

"The Second Respondent’s sole witness, Senator Bamidele Opeyemi, admitted under cross examination when shown the American court judgement that the proceedings affected the Second Respondent, as his name was reflected in the records of the court.

"It is pertinent to observe that the Second Respondent evaded denying the forfeiture of the said sum of $460,000 U.S Dollars to the United States Government for narcotic trafficking and money laundering activities, but engaged in semantic distinction between civil and criminal forfeiture, as well as the defence that the offence was committed over 10 years."

Subsidy Removal: Ogun to Reactivate Bulk Purchase Programme

The Ogun State Governor, Dapo Abiodun, has disclosed plans by his administration to reactivate the state owned 'Bulk Purchase Program' under its Gateway Trading.

Abiodun, who made this known during an interview in Abeokuta, Ogun State, noted that his administration would also introduce an agric and food palliative which according to him would help, "at supporting our farmers so that we can boost food production."

Abiodun noted that the Bulk Purchase Program, would allow

the state government to purchase food items at pre-deregulation prices.

He said, "In terms of food palliatives, we are now going to reactivate our Bulk Purchase Program under the Gateway Trading and through different channels and warehouses in different parts of the state. We will be selling food items like grains and rice that we will be purchasing from the Central Bank of Nigeria at pre-deregulation prices."

The governor also said the introduction of an Energy Transition Plan, which was conceived some months back by his administration would allow the state to migrate

from depending on Premium Motor Spirit (PMS) or diesel to power public transportation to using Compressed Natural Gas (CNG).

Abiodun, noted that the plan of his administration was to convert mini buses owned by individuals in the state at the expense of the state government because of the financial requirements, adding that the first set of vehicles with CNG would be unveiled during the week.

"The Energy Transition Plan is something that we conceived six to eight months ago, and we have begun work in earnest on that.

"The Energy Transition Plan is

a plan that allows us to migrate from depending on PMS or diesel to power public transportation and begin to migrate to using Compressed Natural Gas (CNG).

"I am proud to say that sometime this week, we will be unveiling the first set of vehicles that will be converted from using diesel to using Compressed Natural Gas. That process started some months back.

"The first set of vehicles that we will be unveiling are the state-owned mass transit buses, staff buses, and then we will be converting our mini buses that are owned by different individuals in the state.

Access Bank Donates Office Building to Lagos’Vehicle Inspection Service

Sunday Ehigiator

Access Bank Plc yesterday inaugurated a four-office building it donated to the Vehicle Inspection Service (VIS) Zonal Office located in the Ojodu area of Lagos State, following the destruction of the service’s old building during the 2020 #EndSARS protest

Speaking at the official inauguration and handover event held at the VIS Office, Ojodu, Lagos, the bank’s Executive Director, Iyabo Ojo-Okusanya, said the project was a part of the 'Employee Volunteering Scheme' of the bank.

According to her, “Outside our corporate social responsibility as an organisation, we also encourage our employees to be responsible in the communities that we are operating.

“Therefore, we encouraged them that they must contribute to society. So, this building you are seeing here today is not built by Access Bank,

but by members of the Corporate operations group of Access Bank Plc, out of their private earnings, and it cost them millions of naira.

“It is a fully furnished project, and it would also be brought to a level that we expect public servants to be comfortable in. It is not all the time that private or individuals give due respect to public servants, and the work that they do is already difficult enough. Sometimes, we, the public, make it a lot more difficult.

“We hope that the donation of this building will support the process of making their lives a bit easier so they can serve the community they operate better.”

Appraising the project, Permanent Secretary, Lagos State Ministry of Transportation, Engr. Abdulhafiz Toriola, expressed delight over the completion of the project.

According to him, “You may recall that sometime, in October

2020 an #EndSars protest erupted in our state and part of the resultant effect is the loss of over N3.9 billion investments and the destruction of this building as a result of the arson that accompanied the protest.

“It is, however, a joyful moment for us as a government to witness the birth of this building as part of the recovery process. As a worthy partner, Access Bank Plc took this project very closely to heart and delivered this state-of-the-heart facility to the state government.

“On behalf of the state government and the good people of the state, I'd like to express my heartfelt appreciation to Access Bank plc for their benevolence and unwavering commitment to the present administration THEME agenda and our institutions.

“The commitment and dedication exhibited by Access Bank Plc towards rebuilding the VIS annexe office

complex as part of its employee volunteering scheme are exemplary for the essence of corporate social responsibility.

“Hence, this partnership has not only brought about the restoration of a crucial government asset but has also rekindled the hope in the hearts of Lagosians. It is common knowledge that the VIS is saddled with the primary responsibility to ensure road safety on our roads, especially as it concerns safer vehicles and safer road users.

“Hence, the facility will further enhance the productivity and efficiency of the directorate, and the state government will put it into judicious use by taking full ownership by providing it with the necessary maintenance and protection it deserves.”

She added: “Beyond the bricks and metal, Access Bank Plc's partnership with the Lagos State government

is a shining example of how the government and corporate entities can synergise to holistically address societal challenges and please a positive impact.

“It underscores the notion that we create enduring positive changes when we work together. We appreciate Access Bank Plc once again for this laudable project.”

Also speaking, Director, VIS Lagos State, Engr. Akin-George Fashola, noted that since the building was destroyed during the #EndSARS protest, the zonal office has been having a difficult time executing its mandate.

“Currently, we are sharing with other facilities to engage the public in carrying out our mandate. Access Bank came to us and opted to reconstruct this building for us so that the efficiency of the VIS, especially the Ojodu Zonal office, can be more effective.

"Our plan is to convert these buses at our expense because of the financial requirements that may make it difficult for owners of public mass transit buses to do that conversion. So the state will convert those buses at our expense, and that itself is part of our intervention plan," he said.

Abiodun, also disclosed that an infrastructure initiative would be introduced by his administration that would allow community leaders, market women and religious bodies to identify three roads in their area for immediate intervention such as reconstruction, repair or maintenance.

"We have what we call the Infrastructure Initiative. I have asked that each local government in unison with leaders in that locality, community leaders, market women, religious bodies identify three roads in each local government for us to immediately begin to either reconstruct, repair or maintain," he said.

The governor further noted that the N10,000 allowance for civil servants and pensioners was to cushion the effect of the increased cost of transporting themselves to work, adding that hazard allowance, peculiar allowances and promotion allowances would also be paid.

Abiodun, also disclosed that civil servants have been asked to maintain about 80 per cent presence in their various offices so that not everybody has to come to work every day.

He noted that his administration would be launching its E-mobility program, which he said would allow his administration to retrieve every petrol dependent motorcycle or tricycle and replace them with electricity operated motorcycles and tricycles.

NEWS 12 WEDNESDAY, THISDAY

online

Continues

James Sowole on Abeokuta

L-R: Former National Chairman, All Progressives Congress, (APC) Sen. Abdullahi Adamu; Former APC National Secretary, Sen. Iyiola Omisore, and Special Adviser to the President on Monetary Policies, Mr Wale Edun, during their Visit to President Bola Ahmed Tinubu, at the Presidential Villa Abuja...... yesterday

WEDNESDAY JULY 26, 2023 • THISDAY 13

WEDNESDAY JULY 26, 2023 • THISDAY 14

WEDNESDAY JULY 26, 2023 • THISDAY 15

In this piece, Emameh Gabriel asks if President Bola Tinubu will negotiate with agitators, including the outlawed Indigenous People of Biafra, as he had promised during the campaigns that led to his victory at the February 25, 2023 poll.

Supposed negotiation with all genuine agitators, including IPOB as a way of dousing violence in the South East and other parts of the country was on the front burner of the presidential poll debate as key contenders pledged to utilize negotiation as a means to find solution to the crisis.

President Bola Tinubu, then the flag bearer of the All Progressives Congress (APC) even went further promising to make the South East a new hub of prosperity in the country.

Today, Tinubu is President amid great expectations especially in the area of insecurity as violent non state actors and centrifugal forces continue to mount deadly assault against the natives, public infrastructures and security formations across the country, especially in the South East which has rapidly become the new theater of instability in the country and the resurgence of compulsory sit-at-home.

Insecurity has always been a fundamental factor determining Nigeria’s electorate’s decision when it comes to choosing the occupant of the office of the President, particularly since the deadly Boko Haram phenomenon reared its ugly head on the nation’s political scene.

The insecurity factor has of recent time been exacerbated by the amplification of the farmers - herders crisis in the North Central, the emergence of banditry in the North West and especially the IPOB secessionist agitations in the South East.

While the Northern region as a whole is not new to instability and violent eruptions every now and then, the South East was relatively peaceful and stable hitherto, even when violent agitations of resource control was rocking its sister region of the SouthSouth culminating in the famous Presidential Amnesty Programme (PAP) in August 2009.

While the mayhem in the North have largely been regarded as undefined and indeterminate with no clear legitimate agenda, the agitation in the South East like its counterpart in the South-South hadvsought to wrap itself around international and universal principles and norms in a bid to give it legitimacy.

The emergence of IPOB can be traced to 2015, as a successor to MASSOB, which was until then the vehicle that championed the legacy of the Igbo quest for the realisation of a sovereign state which they were unable to achieve during the 1967 - 1970 civil war that tested the bonds of Nigeria’s federal republic.

Negotiation With IPOB as Election Plank?

Insecurity was a key talking point for all the presidential candidates of the major political parties during 2022 presidential campaigns, debates and town hall meetings.

Tinubu, the then presidential candidate of the ruling All Progressive Congress (APC) during his campaign and engagement with South East leaders promised that he would engage Biafran agitators and negotiate with them if elected president.

Speaking in Abakaliki, Ebonyi state capital, on November 21, 2022, Tinubu said there was the need to come to table with all agitators,

which he described as the best way to end insecurity in the South East region.

He said: “We want peace, we will talk to all the agitators, this thing is not done by conflicts. You can’t get your wishes by conflict but by sitting round the table to complain.

“We don’t want to go backward. We are progressives, we will move Nigeria forward. We will do the right thing. We will make South-east the Taiwan of Africa”.

He also promised to continue the reformation of the transport system, especially the railway sector, embarked upon by the Buhari administration.

IPOB, an outlawed group, has been blamed for the restlessness in the South East, where it declared weekly sit-at-home at the expense of the economy of the region.

The region at the last count has lost an estimated N4 trillion to insecurity in the last two years and this has continued to raise concern among leaders of the region.

The attacks, often linked to the outlawed IPOB, have led to the abduction and killings of several persons, mainly government officials and officers of various security agencies.

Beyond abduction and killing, the facilities of the various security agencies and those of the Independent National Electoral Commission (INEC) have been repeatedly attacked across the region.

The activities of IPOB and its affiliate body, otherwise known as Unknown Gun Men have provoked terror in the South East that many of its elites who supported Nnamdi Kanu at the intital stage of his movement have not only become victims of his sword but have become speechless even in the face of the carnage witnessed in the region almost on daily basis.

Former Minister of State for Labour and Employment, Festus Keyamo, who partially blamed elites of the region recently on his verified Twitter handle, confirmed this when he twitted that “the

simple reason the elites in the South East are finding it difficult to speak out against those killing and dehumanising their own people in the East is the fear of reprisal attacks against their own properties and family members back home by these ‘unknown gunmen’.

He said: “Their silence does not mean support for what is happening there. It is the responsibility of the federal government to restore law and order in all parts of the country and this I am absolutely certain the government of Bola Ahmed Tinubu will do.

“Besides, we cannot isolate a region and its elites in a country where we see ourselves as one. It is our collective responsibility to assist the Federal Government in restoring order nationwide.