Issue 8; 2023 All Markets

In this issue:

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns

Titanium, Aerospace eye Recovery in 2023; Prepare to Embrace ‘Optimistic Turbulence’

Titanium H Grades Win Approval For ASME Boiler and Pressure Vessel Specifications

Japan Titanium Society marks its 75th anniversary

Titanium Industries Strengthens Facilities with Investments

T.I. kicks off 2023 With Improved Productivity & Enhanced Processing Capabilities

Titanium Industries closed out our 50th anniversary year in 2022 with much success, and 2023 will be even more exciting with new equipment additions in several U.S. facilities. As always, T.I.’s aim for these improvements and investments is to ensure increased productivity and logistic success, which translates to added value for our customers.

Titanium Industries is always a step ahead of the competition when it comes to being able to fulfill our customers’ current and anticipated needs.

T.I.’s improvements will ensure increased productivity and logistic success as we continue to strive to stay up to date with the latest metal cutting customization machinery. We will continue to be the go-to, one stop metal supply solution choice while maintaining and updating our facilities to keep up with all our client's needs.

The new plate saw that arrived in Titanium Industries’ Plymouth, Michigan facility is ready to service all Midwest and central US customers.

NJ

water jet machine installed in our headquarters in Rockaway, NJ will enhance our cutting capability and capacity.

The expansion of our rack storage system in Jacksonville, Florida has been completed. This enhancement dramatically increases the overall rack capacity in Jacksonville allowing for increased utilization of the space.

It also supports future growth and further expansion of product breadth, not just for the Jacksonville region, but also for the entire T.I. global distribution network.

RACK EXPANSION JACKSONVILLE, FL

NEW PLATE SAW PLYMOUTH, MI

RACK EXPANSION JACKSONVILLE, FL

NEW PLATE SAW PLYMOUTH, MI

SPECIALTY METALS SUPPLY SOLUTIONS AEROSPACE | DEFENSE | MEDICAL| INDUSTRIAL | OIL AND GAS TITANIUM.COM | SALES@TITANIUM.COM

NEW WATER JET MACHINE ROCKAWAY,

TITANIUM TODAY 3 Editorial Published by: International Titanium Association www.titanium.org 1-303-404-2221 Telephone ita@titanium.org Email Editor & Executive Director: Jennifer Simpson EDITORIAL OFFICES International Titanium Association PO Box 1300 Eastlake, Colorado 80614-1300 USA DISTRIBUTION LIST Join this free distribution by emailing us at ita@titanium.org www.titanium.org All Markets EDITION CONTENTS Meet the ITA 4 Editorial: Titanium, Aerospace eye Recovery in 2023; Prepare to Embrace ‘Optimistic Turbulence’ . . . . . . . . . . . . . . . . . . . . . . 8 Titanium H Grades Win Approval For ASME Boiler and Pressure Vessel Specifications 10 Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns 14 Japan Titanium Society marks its 75th anniversary 54 From the Wire 58 In Memoriam 62 ITA Member Roster 2023 63 Advertiser Index 64

MEET THE ITA

Board of Directors

Executive Committee

Dr. Markus Holz Professor, ITA Academic Member Education Committee Co-Chair

Titanium Europe Conference Chair

ITA President 2022-2024

Dr. Markus Holz is currently Professor at University of Applied Sciences Anhalt starting from 2020. There he is the program director of Logistics Management, teaching Operations Management and is currently involved in several national and international research programs in the field of sustainability and digitization in the industry.

Dr. Holz graduated in Aerospace Engineering in 1986 and earned his PhD in 1992. Following his 10 years of service in the German Airforce, Dr. Holz began his career with ThyssenKrupp in 1992, where he assumed several executive positions mainly in the stainless steel and special metals branch. In 1999, Dr. Holz became Managing Director of ThyssenKrupp Titanium GmbH (formerly Deutsche Titan GmbH) and in 2002 he was appointed Managing Director of ThyssenKrupp Titanium S.p.A. (formerly Titania S.p.A.). Furthermore, he was responsible for Tubificio di Terni, Italien, from 2004 through 2007. From 2007 to 2009 he was CEO of the ThyssenKrupp Titanium Group (Germany and Italy). In January 2010 he joined the Managing Board of Hempel Special Metals, Oberhausen, Germany. After joining as MD the ALD Management Board in October 2011, Dr. Markus Holz was the President of AMG’s Engineering Systems Division and CEO of Vacuum Technologies GmbH from 2012 to 2019.

Martin Pike VP of Global Commercial Strategies

Martin Pike VP of Global Commercial Strategies

ATI Specialty Materials

ITA Vice President 2022-2024

Martin Pike is the Vice President - Commercial for ATI Specialty Materials with responsibilities which include international product management, sales, and long-term agreements with customers. Martin joined ATI in August 2001 and held several positions with increasing responsibility including Titanium Rolled Products, Product Manager and Director of Sales. Prior to joining ATI, Martin worked in manufacturing where he held various commercial positions including Regional Vice-President of Sales. His educational background includes a Bachelor’s Degree from the University of North Carolina at Charlotte.

Sam Stiller Vice President – Commercial Howmet Structure Systems

ITA Secretary/Treasurer 2022-2024

Sam Stiller is Vice President, Commercial for Howmet Aerospace. All Sales, Marketing, and Customer Service, globally, is led by Sam’s commercial team..

Frank L. Perryman President and Chief Executive Officer Perryman Company

Frank L. Perryman President and Chief Executive Officer Perryman Company

ITA Past President 2022-2024

Mr. Perryman graduated from Millikin University in 1986 with a Bachelor of Science in Industrial Engineering. In 1988 he co-founded Perryman Company with his father and brother. Since December of 2008 he has held the position of President and CEO of Perryman Company. Perryman Company is a fully integrated supplier of specialty titanium products. From melting through finishing, founded in 1988, Perryman Company is headquartered in Houston, Pennsylvania, with office locations in Philadelphia, Los Angeles, London, Zurich, Tokyo and Xi’an. Perryman is an integrated titanium producer from melting of ingot to finished products. The company’s product portfolio includes ingot, bar, coil, fine wire, net shapes, and hot rolled products. The Forge and Fabrication group offers medical device contract manufacturing in a range of materials including plastics and titanium. A titanium global leader, Perryman supplies and services customers in the aerospace, medical, consumer, industrial, recreation, additive/3D printing and infrastructure markets worldwide.

4 TITANIUM TODAY

Phil MacVane

Vice President, the Americas PCC Metals Group Global Sales

John J. Scherzer

Vice President – Medical Markets Carpenter Technology Corporation

Michael Marucci Chief Technology Officer Kymera International

Edward Sobota Jr. President TSI Titanium

Brett Paddock President and Chief Executive Officer Titanium Industries, Inc .

Jennifer Simpson Executive Director Ex-Officio Member of the Board International Titanium Association

Safety Education

Robert G. Lee President Accushape Inc

Industrial Applications

Robert Henson Manager, Business Development VSMPO-Tirus, US

Women in Titanium

Holly Both Vice President of Marketing Plymouth Tube / Plymouth Engineered Shapes Medical Te chnology

Eric Baum

Senior Business Development Manger Laboratory Testing Inc

6 TITANIUM TODAY

ITA Directors

Ti Today Contributor

ITA Committee Chairs

Michael C. Gabriele

(+1) 610-693-5822 rai.sales@kymerainternational.com www.kymerainternational.com Master Alloys & Titanium Powders for Critical Applications

Titanium, Aerospace eye Recovery in 2023; Prepare to Embrace ‘Optimistic Turbulence’

By John Byrne

By John Byrne

Aerospace and titanium go hand in hand and the turbulence of the past three years has been difficult for both industries. Now the question is: where we go from here especially for the titanium industry?

While past downturns may provide for some future insights of what can be expected as the recovery takes hold, the situation going forward will be much different than in past recoveries. It is a function of what has happened over the past three years, program shutdowns, the Covid pandemic and geopolitical unrest.

Over the past three years, four major shocks have impacted the commercial airplane industry just as the industry ramped up to record production rates in 2018. First was the Boeing 737 MAX program stoppage; second Covid; third the 787 program stoppage; and finally the war in Ukraine. These impacts resulted in the aerospace supply chains, including the titanium producers and fabricators, being more dislocated and out of synch than at any time since the beginning of large scale airplane production.

The best analogy to use would be a 200 hundred car long freight train moving down the track at a constant speed, each car carrying a prescribed type and amount of cargo, when that train delivers there is an identical one right behind it. That was the production system for commercial airplanes before the impacts. Now picture that same train being decoupled into 50 smaller trains all moving at different speeds on

different tracks and with unreliable types and quantities of cargo aboard, this is more representative of the commercial airplane production system today. Now the challenge is to reconnect all those smaller trains into a single train moving at the same speed and with reliable types and quantities cargo, which is no easy task for OEM supply chain management teams.

The resulting chaos affected the titanium industry by creating a significant inventory overhang and a decoupling of the consumption from demand. Combined with the historically poor forecasting for titanium the environment is challenging. To underscore let’s follow a simple example from ABC machine shop that produces a 737MAX part from titanium plate and a 787 part from a titanium closed-die forging. When the MAX program stoppage began, ABC was kept at a rate of building 52 parts per month, six months later they were asked to begin lowering their rate but it was still at a level that allowed ABC to maintain staff and be economically viable. Then Covid hits ABC struggles with shut downs and supply disruptions and begins to have economic impacts, they are able to access PPP (Paycheck Protection Program) funds to continue to operate the business.

For all practical purposes the 737 program stops but ABC decides

to continue to build out all the raw material and WIP (Work in Progress) to keep the shop operating. Then they get schedule adjustments for the 787 forging part, again to continue the viability of the business they ship completed parts to their customers. Finally, covid has waned and the airline traffic has recovered and the OEM’s are now trying to ramp their production rates back to 2019 levels. But because ABC is cash strapped and now is facing labor shortages and other inflationary pressures they delay or under purchase raw material.

Meanwhile, lead times are starting to increase for raw material and they now have a new forging supplier due to the exiting of VSMPO over the Russian invasion of Ukraine. ABC machine shop will be very challenged to figure out how much titanium plate to buy and when, and the same for the forgings, the odds of success are not good. This scenario is playing out across dozens of ABC type suppliers, and there are several more types of disruption in the supply chain that increase the complexity and magnitude of the problem which is to figure out how much material is needed when and where. And then get it to the fabricators on time.

While the titanium industry’s customers are faced with unprecedented challenges, there are considerable issues for the mills

8 TITANIUM TODAY

John Byrne

as well. Labor shortages resulting in many new workers, inflationary pressures, equipment failures and extended lead times in their supply chains all loom on the horizon. Most likely the lead times to the OEMs from the titanium mills will increase just as the OEMs are trying to stabilize their production systems and increase build rates. This will only complicate the inventory burndown and managing the inflection point when demand starts to converge on consumption.

An additional twist that everyone must deal with is the war in Ukraine. Boeing has ended its supply agreement with VSMPO and Airbus has recently signaled that it will decouple over the next several months. This will put pressure on the supply of everything from ingot to forgings. Finding new sources for the forgings that came from VSMPO and getting those new suppliers ramped up and stabilized will be the most difficult challenge. Most likely additional support from plate and block will be required to provide the machine shops alternate raw material in lieu of forging delays. Double orders and schedule changes

will put and pressure on ingot and billet supply.

There is also the question of hard sanctions for titanium from Russia. While Russian titanium is not currently sanctioned, the continuing support of the U.S. government and E.U. to Ukraine increases the likelihood of sanctions. Currently some aerospace suppliers are still using the Russian titanium, other industries such as medical are using Russian metal, while this could be justified from a business perspective it would be hard to justify it morally or patriotically. The Ukraine conflict is depleting defense stockpiles and the longer the war drags on the more material will be required to support restocking and equipment transfers. This will add additional demand not seen in past recoveries.

The commercial air travel recovery is well under way, domestic travel

all around the world has recovered to or is near pre-pandemic levels. While international travel still has a long way to recover most likely it will recover faster than forecasted. Recent changes in China on restrictions and large aircraft orders, like the recent 787 order by United Airlines, are all positive signs. The airlines need new planes and are pressuring the OEM’s for delivery. The OEM’s are working to increase the production rates as fast as they can but are constrained by their supply chains. There have been delays in planned rate increases and disruptions to the assembly lines from shortages, these will continue for at least the next 12-18 months. The situation will affect the demand quantities and timing for titanium flowing into the supply chains.

There will be a “Catch 22” as we move forward over the next 12-24 months. Recovery is taking place and there will be opportunities for the titanium industry. However, the industry’s performance will play a key part in the size and timing of those opportunities. Past performance of the titanium industry would lead one to expect poor on time delivery execution and increased lead times. This will hurt the OEM’s plans and the entire supply chain. Combine that with challenge of managing the inflection point on the inventory overhang and challenges from the conflict in Ukraine, the situation can only be described as “optimistic turbulence!”

(Editor’s note: John Byrne, a former executive with Boeing Commercial Airplanes, currently serves as an advisor at Pasayten Advisors LLC, Auburn, WA. He was a distinguished speaker at the ITA’s North American conferences in 2013 and 2014. Byrne joined the Boeing Co. in 1987 and retired in November 2017. He is a frequent guest contributor to TITANIUM TODAY.)

TITANIUM TODAY 9

Titanium, Aerospace eye Recovery in 2023 (continued)

While the titanium industry’s customers are faced with unprecedented challenges, there are considerable issues for the mills as well. Labor shortages resulting in many new workers, inflationary pressures, equipment failures and extended lead times in their supply chains all loom on the horizon.

Titanium H Grades Win Approval For ASME Boiler and Pressure Vessel Specifications

The ITA Global Industrial Applications Committee of the International Titanium Association (ITA) recently released the following announcement:

ASME’s Section VIII Division 2, titanium H Grades Case #3059

Approval Date: September 6, 2022

Approval Process Began in 2019

The Global Industrial Applications Committee of the ITA, in 2019 launched a collaborative project composed of Chemical Processing Industry (CPI) companies, titanium fabricators and other interested parties to work together to develop a “Code Case” for titanium “H” alloy grades to be included in the ASME’s Section VIII Division 2.

The motivation to pursue this project was based on the desire to improve efficiency in the use of titanium to fabricate pressure containing process equipment and thus reduce the overall cost of the equipment, according to the ITA’s Applications Committee.

Having won approval, the ITA’s Global Industrial Committee is now looking to establish an alliance among the association such as metallurgists, chemical

companies (end users who would specify titanium Grade 2H or the other H grades, for pressure vessels) and fabricators (who would design and fabricate using these alloys in Division 2).

Rob Henson, chairman of the ITA Global Industrial Applications Committee acknowledged the project was deeply indebted to our ASME champion Bill MacDonald for taking the lead and guiding the H Grade Code Case through the various stages of the ASME approval process.

This Code Case verifies that titanium H Grades have higher mechanical properties as their non-H counterparts listed in current ASME Division 2 specifications for pressure vessels, and would develop the “design allowable” stress levels at the various temperatures of use—up to 600o F.

The ASME Boiler and Pressure

ASME’s Section VIII Division 2, titanium H Grades

Case No. 3059

Approval Date: September 6, 2022

Unalloyed and Palladium or Ruthenium Enhanced Titanium H grades with 400 MPa (58 ksi) MPa Minimum UTS, UNS R50400, UNS R52400, UNS R52402, and UNS R52404; Section VIII, Division 2

• The maximum allowable stress values, Section VIII, Division 2, Class 2.

• All other rules for Section VIII, Division 2 applicable to titanium shall be met.

• This Code Case number shall be shown on the Manufacturer’s Data Report.

Vessel Code (ASME BPV) allows for the use of 17 different titanium alloys in Section VIII Division 1, including titanium Grade 2 and Grade 2H. These grades are CP titanium alloys with differing levels of interstitial oxygen, iron and carbon in the metal structure, with clearly defined (and different) tensile strengths of 50 ksi and 58 ksi, respectively.

In this ASME Code Section, there are also several other titanium grades, based on titanium Grade 2 chemistry with Grade 2 mechanical properties that have an “H” grade designated. The list includes titanium Grades 7 and 7H, 16 and 16H and 26 and 26H (all of these grades are already included in ASTM specifications).

Michael Stitzlein, ITA Global Industrial Applications Committee member and president of Tricor Metals, said the ability to use the titanium “H” grades for the design and fabrication of ASME Code vessels would “allow for fabricators to potentially offer thinner wall vessels at a potentially lower cost to the Chemical Processing Industry.” The possibility of also offering Division 2-designed vessels as an alternative to titanium clad vessels also exists and could result in lower cost as well as shorter lead times for vessel fabrication.

10 TITANIUM TODAY

Leading Titanium Manufacturer

Premium Quality, Stability and Reliability. One-Stop titanium alloy production and service.

ABOUT US

A dozen years of titanium alloy production and research experience, with more than 100 patents and achievements to its credit, mastering a number of core technologies; Accredited with Nadcap non-destructive testing certificate and AS9100D, ISO14001, ISO 45001 and other certifications;

CORE PRODUCTS

Titanium bar/billet

Size range: Φ15-500mm

Grade: Ti6Al4V, Ti-6242, Ti-6246, Ti-38644, Ti-15333, etc.

Titanium wire rod coil

Size range: Φ1.0-20.0mm

Grade: Ti6Al4V, Ti6Al4V ELI, Ti-38644, Ti-6242, Ti-6246, Ti-15333, Ti-422, etc.

Titanium forging

Size range: customized, disc, bar, ring, etc. L(max):14m, W(max):4m, H(max):4m.

Grade: Ti6Al4V, Ti6246, Ti6242, Ti662, Ti38644, Ti15333, Ti1023, Ti422, etc.

For more information, please visit www.tcae.com/en/

—TC

Aerospace

Shaanxi TianCheng Aerospace Co., Ltd.

+86-29-33336000 tc@tcae.com No 3, Gaoke 3rd Rd, Qindu District, Xianyang, Shaanxi, China. 1 2 3

Higher Minimum Ultimate Tensile Stress

Titanium H grades are a class of CP grades that have a higher minimum ultimate tensile stress than non-H titanium grades. The ASME BPV is the standard that regulates the design and construction of boilers and pressure vessels, and requires that construction materials used in pressure vessels must be approved by the society and be in the material standards.

Bill MacDonald, director, technical sales for Titanium Metals Corp. (Timet), speaking at the Corrosion 2021 TEG 120X Reactive Metals Conference held in Houston, provided insights and context on titanium H grade Code Case for ASME Section VIII division. MacDonald began his presentation by stating that, in the 1990s, the Materials Technology Institute (MTI), based in St. Louis, and the ITA, sponsored a study to investigate improved properties in CP titanium. It was determined that, if changes could be made in the ASME BPV code, it would “significantly impact” the cost of titanium pressure equipment such as piping, tanks and heat transfer equipment, according to MacDonald.

The Industrial Applications Committee hosted the TCI Reactive Metals technical exchange forum during the AMPP Annual Conference on Sunday, 19 March 2023. Click here to view proceedings.

12 TITANIUM TODAY Titanium

(continued)

H Grades Win Approval For ASME Boiler and Pressure Vessel Specifications

The ASME Code Case verifies that titanium

H alloys have higher mechanical properties as their non-H counterparts listed in current ASME Division 2 specifications for use in industrial pressure equipment such as piping, tanks and heat transfer components, and would develop the “design allowable” stress levels at the various temperatures of use—up to 600°F.

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns

By Michael C. Gabriele

Despite the widespread damage caused by Hurricane Ian, the International Titanium Association (ITA) moved forward and held its 38th annual TITANIUM USA conference and exhibition Oct. 9-12 at the Rosen Shingle Creek Golf Resort in Orlando, FL. The resort suffered no major damage from the storm, and over 580 registrants attended the event.

But there were other ill winds on the minds of conference attendees caused by economic and geopolitical storms. Russia’s invasion of Ukraine, rising trade disputes and hostile language between the United States and China, the threats of global inflation and a possible recession, and the hangover from Covid-19 supply chain snarls, have contributed to a sense of unease among people who conduct business in the international titanium sector.

In contrast to all this uncertainty, the commercial aerospace industry, the showcase end-use market for titanium, reported upbeat business conditions, according to information from the International Air Transport Association (IATA). The titanium industry closely monitors commercial aerospace business conditions as an early indicator for near-term, and long-term, titanium demand.

The IATA, in an October 6, 2022 press release posted on its website (https://www.iata.org), stated that the peak travel season ended on a high note in August, and that the commercial aerospace industry has continued to make progress from the Covid-19 downturn.

“The International Air Transport Association (IATA) announced passenger data for August 2022 showing continued momentum in the air travel recovery. In August 2022 (measured in revenue passenger kilometers or RPKs) was up 67.7 percent compared to August 2021. Globally, traffic is now at 73.7 percent of (Covid-19) pre-crisis levels.”

Asia/Pacific airlines had a 449-percent rise in August traffic compared to August 2021. “While the region experienced the strongest year-over-year growth, remaining travel restrictions in China continue to hamper the overall recovery for the region.” For European carriers, August traffic climbed 79 percent versus August 2021. North American carriers saw a 110-percent increase in traffic in August versus the 2021 period.

“The Northern Hemisphere peak summer travel season finished on a high note,” Willie Walsh, IATA’s Director General, said.

“Considering the prevailing economic uncertainties, travel demand is progressing well. And the removal or easing of travel restrictions at some key Asian destinations, including Japan, will certainly accelerate the recovery in Asia. The mainland of China is the last major market retaining severe COVID-19 entry restrictions.”

‘Good Reasons for Optimism’

Tom Captain, managing director, Captain Global Advisory LLC, in his presentation “Aerospace Industry: Tailspin or Recovery,” also was optimistic on the state of the commercial aerospace industry as it continues to recover from the dark days of Covid-19. “We expect by 2025 to see global aircraft OEMs to produce over 1,600 aircraft annually. Thus, it will have taken five years for the industry to recover to the (pre-Covid) 2019 levels of economic activity. However, he did note several concerns or “interruptions” on this

14 TITANIUM TODAY

YOUR SPECIALTY METALS SOLUTIONS CENTER COIL SHEET STRIP PLATE BAR NEAR NET SHAPES 888.282.3292 | www.upmet.com | sales@upmet.com NICKEL TITANIUM STAINLESS STEEL COBALT PRODEC® ALLOY STEEL CCM ALUMINUM DUPLEX AS9100D — ISO 9001:2015 — ISO 13485 DFARS COMPLIANT UNITED PERFORMANCE METALS HEADQUARTERS — 3475 SYMMES RD, HAMILTON, OH 45015 OAKLAND, CA | LOS ANGELES, CA | HARTFORD, CT | CHICAGO, IL | GREENVILLE, SC INTERNATIONAL — BELFAST, NORTHERN IRELAND | BUDAPEST, HUNGARY

progress, such as pilot and labor shortages, rising fuel costs, and inflation’s impact on aerospace.

“Inflation is not theoretical concept, but a real one for the aerospace industry,” Captain declared. “Prices of labor for pilots, mechanics, and suppliers are rising. The prices of new and used aircraft, maintenance, repair and overhaul (MRO) services, supply chain parts and systems are rising. The price of jet fuel is rising. This in turn translates into higher prices for airline tickets. Moderated demand for travel, for goods and services in the general economy, causing recession concerns.”

“With the interruptions as described above to the recovery from the pandemic, the aerospace industry is facing a delay, not a backward step,” Captain continued. We do not foresee a nosedive, but rather a halting and delayed recovery moving in a positive direction. After all, there is an insatiable appetite for family, business and leisure passenger travel, and for air cargo due to the internet shopping and the ‘Amazon’ effect. The pandemic itself was an interruption, as was the subsequent fuel price increases and labor shortages, not to mention the Ukraine war, and production delays on the Boeing 737 MAX and the 787 programs, plus the

possibility of a recession in 2023. The industry is resilient and will not only survive but eventually thrive on the long-term demand for air travel. It always has, and that’s a good reason for optimism.”

Aerospace Updates

Jeff Carpenter, senior director, Boeing Commercial Airplane Supply Chain Category Management & Contracts Director for Material and Standards, provided a market outlook and observations on the titanium supply chain. Carpenter said airlines will need 41,170 new airplanes over the next 20 years and 19,575 new airplanes over 10 years, while the freighter fleet to grow 80 percent by 2041

“Aviation has proven resilient over and over again,” he said, noting that airline fleets are stabilizing and replacement opportunity is evident. The airline industry is becoming increasingly competitive, while pandemic disruptions boosting nearterm freighter demand.

Carpenter listed accumulated savings, rising employment and wages, and business investment as three key headwinds for commercial aerospace, while he saw a high rate of inflation, supply chain challenges and financial market volatility as three headwinds.

Boeing’s titanium market outlook sees order cancellations and aircraft production cuts from Covid-19 as having created a reduction in titanium demand, but this could turn around over the next two to three years as the global aerospace market gradually regains altitude. Carpenter listed Boeing’s titanium market observation as including a price decline on all titanium products. “Sponge and scrap prices had a quick recovery. Inventory across the supply chain is high. Lead times

16 TITANIUM TODAY

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

are finally starting to stabilize. Near term Russia/Ukraine metal units unlikely to return. Prices are expected to climb towards the end of the year. Participant forecast data indicates inventory burndown for titanium will continue through 2025. Boeing has discontinued procuring Russianorigin titanium and is implementing more conservative inventory draw down to mitigate potential risk.”

He said Boeing has suspended major operations in Russia, including the purchase of titanium (geopolitical risk mitigation started in 2014) and is developing alternate titanium sources to support production. He added that Boeing’s “Forging

Aggregation Strategy” will be a key driver of production stability and improved performance. The strategy will involve improved traceability to support reclamation, an increase in the recycling of titanium and aluminum scrap, an increased use of nesting software to reduce scrap, and lead-time reduction, forecasting, capacity planning.

Laurent Jara, vice president, metallic material procurement for Airbus, said the European aerospace giant’s titanium demand will recover to its pre-Covid 2019 volumes by 2025. Part of that recovery in procurement will be tied to trends in the wide body aircraft market. “The

return to operations of the A350 (wide-body jet) is calling the titanium industry to anticipate Airbus demand post-2025. International traffic recovery is calling for A350 efficiency,” Jara said, noting that the aerospace market is recovering more rapidly than expected from Covid boosted by demand of fuel and costs efficient new generation aircrafts. “Airbus leadership and strong orders backlog is calling for a robust production ramp-up to the highest rates in the aerospace history until 2030 and beyond.”

Even though titanium demand is expected to be robust, the Covid crisis plus the fraught geopolitical situation has brought business uncertainties. As a response to this, Jara said Airbus’ E2E supply chain system would provide resilience strategies for companies in the titanium supply chain. He pointed out that the Airbus titanium E2E supply chain revolves around a “holistic” resilience and flexibility supply strategy by securing “quality first, collaboration and anticipation.” In addition, Jara said Airbus will improve its closedloop titanium recycling operations, “for which Airbus is engaging into a transformation of its scrap/swarf policy.”

Separately, Guillaume Faury, the chief executive officer of Airbus, interviewed by Reuters in London on Oct. 12, reaffirmed a target of delivering 700 aircraft in 2022—a task he said was necessary to reach a separate monthly production target of 65 narrow-body jets in early 2024. Reuters reported that a recent decision to delay the recovery of monthly A320-family production to 65 by six months, to early 2024, eased pressure on suppliers, though some small suppliers in Europe have had to pause plans due to high energy bills, according to Faury.

18 TITANIUM TODAY

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

Eyeing demand for its single-aisle jets, Airbus wants to go beyond this output to 75 jets a month. Airbus was likely to achieve this in 2025 as planned, Reuters reported. “We think that 75 is the right place to be for the second half of the decade. There is more demand than 75, but 75 is a robust place to be from the demand side,” Faury said. He added that Airbus was still forecasting a global traffic recovery between 2023 and 2025, but that 2023 now looked less probable amid ongoing

travel restrictions in China.

ATI addressed commercial aeroengine trends and demands, saying that, for the near term, the growth of current-generation engine fleet will increase titanium demand. For the long term, next-generation, lowemission demonstrator engines will be tested in 2020s. “In the 2030s, new engine architectures for single aisle and twin aisle aircraft will enter service. The industry is at a crossroads, driving the need for ‘disruptive’ technologies.” The Rolls Royce UltraFan, the CFM RISE, the Next-Gen GTF, the PW127XT, the Pearl 700 and Pearl 10x, and the ZA2000 are among the next generation of aerospace engines, according to ATI. Technology innovation will include geared turbofans, composite/titanium fan blades and more components produced via additive manufacturing.

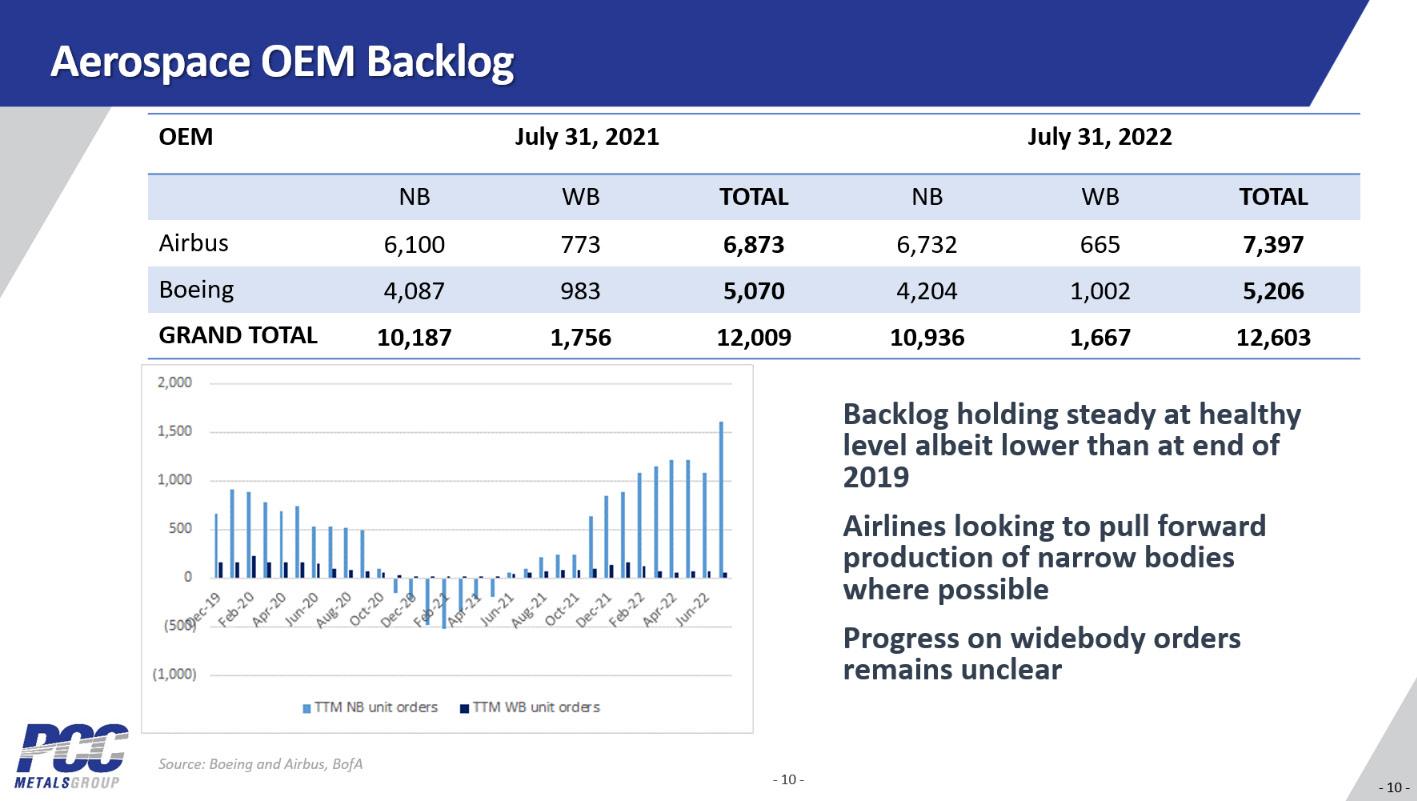

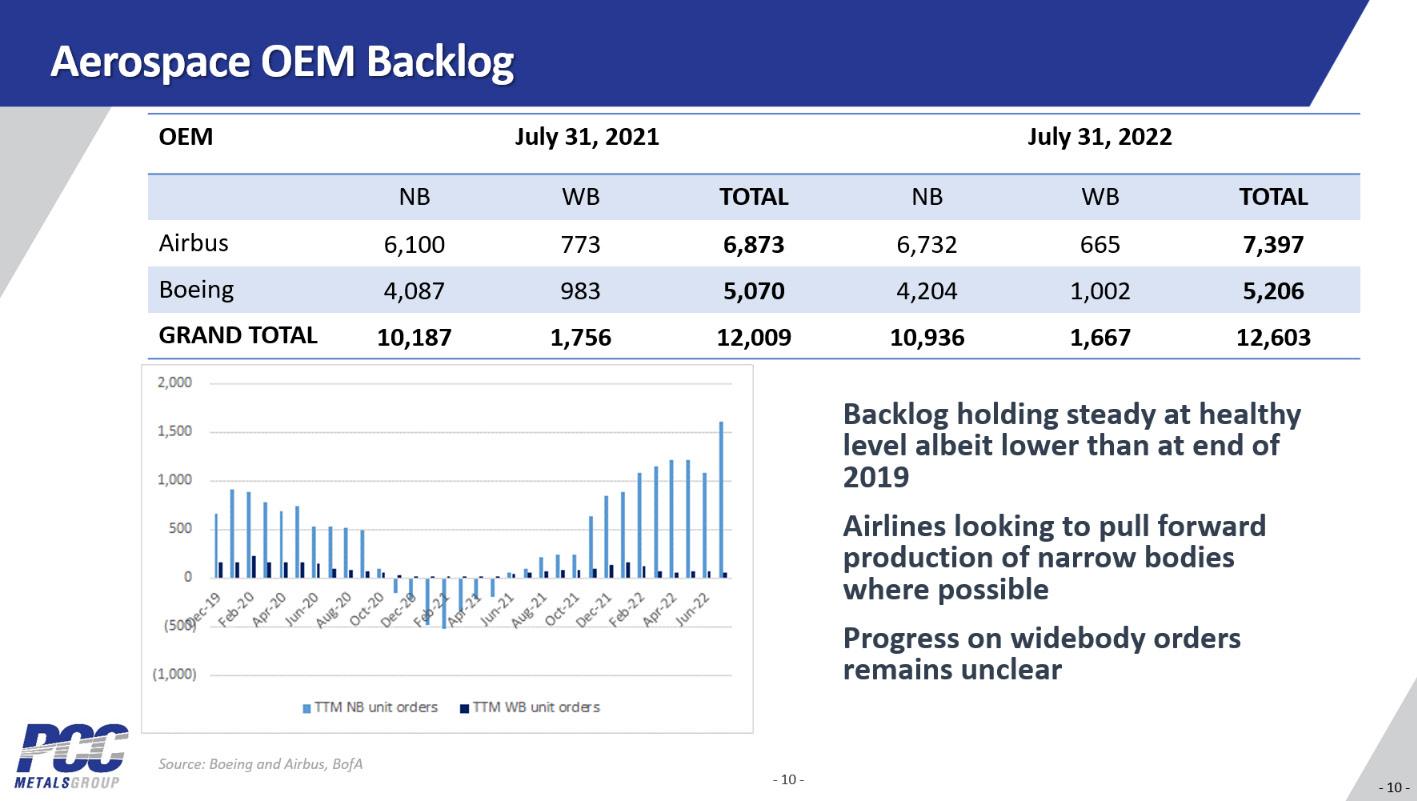

Stephen Fox, Timet/PCC Metals Group, considered the topic of “global demand trends for aerostructures.” The forecast, according to Fox, shows a shift towards single-aisle planes that will continue to impact titanium demand through 2025. “The forecast

20 TITANIUM TODAY

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

Positioned to Respond.

Our continued investment and expansion has us in the right place to meet your needs.

Our capacities and resources are aligned. We are prepared and well positioned to supply a full range of products including ingot, centerless ground bar, precision coil, additive wire, premium fine wire and shapes – all at competitive lead-times.

We are expertly equipped to address the growing demands of the aerospace, medical, recreation, infrastructure, and industrial markets worldwide. We understand the ever-changing factors of the industries we serve and are committed to supporting the growth of your business.

Fully Integrated Titanium Manufacturing

| www.perrymanco.com

724.746.9390

shows deliveries lighter than previously expected in 2022 due to multiple supply constraints,” Fox said. “When widebody build rates return, demand has potential to increase significantly. Geopolitics, oil, and interest rates have an impact, but historically nothing like the impact of Covid. The disruptive effects from pressure to decarbonize the airline industry may accelerate. The industry must be prepared to innovate

throughout the supply chain and drive to expand titanium usage by delivering the most cost-effective solutions for the airlines.”

Fox examined various factors for titanium use in aerospace. The pre-Covid mix of aircraft deliveries was 75 percent single aisles and 25 percent twin aisles. Forecasts indicate that deliveries will be 80 percent single aisles. He said that, historically, the industry average of titanium per plane is 30 metric tons, but it’s expected that there will be an overall shortfall in titanium per plane through 2025 as deliveries of narrowbody jets will dominate. However, increases in built rates for the Boeing 787 and 777, and an increase in sales for the Airbus A350 rates would begin to correct this mismatch in titanium demand. Fox indicated that the 2022–2026 forecast demand remains robust, “but there are headwinds.”

Sam Stiller, vice president, commercial, for Howmet Engineered Structures, (a division of Howmet Aerospace Inc.), addressed “Titanium Demand Trends in Defense Aerostructures.” Stiller began by citing increasing utilization of

22 TITANIUM TODAY

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

Harness our leading-edge vacuum technology to help assure your flight-critical parts go the distance.

Aerospace Vacuum Heat Treating Services

Advantages

• Bright, clean, scale-free surfaces with minimal distortion

• Furnace capacities up to 48 feet long and 150,000 lbs

• Full line of major aerospace approvals

• Titanium and high nickel alloys

solaratm.com

1-855-WE-HEAT-IT

Eastern PA • Western PA • California • South Carolina • Michigan

Annealing • Degassing • Creep Forming and Flattening • Stress Relieving • Brazing Solution Treat and Age (STA) • Homogenizing • Sintering • Hydriding/Dehydriding

Solar Atmospheres heat treated the titanium manifold weldment used on the Orion Launch Abort System for the NASA Artemis I Program.

titanium aerostructures across programs of record: higher titanium content in current generation aero platforms; demanding operating environments; affordability pressures driving demand for cost effective materials/parts and improvements in manufacturing productivity. “Product and process innovations are aiding growth in titanium optimized structures and high-temperature alloys.”

He described titanium-intensive F-35 jets as being increasingly popular among NATO member countries. Volumes remain fully funded by U.S. government and supported by increased foreign military sales to Canada, Finland, Switzerland, Germany, Czech Republic, and Greece, more anticipated. Overall for NATO, there’s been the replacement of legacy long-range precision fire systems, radar, and air and missile defense systems; significant investments in air superiority programs, like F-35; and increasing focus on critical materials supply chains, with an industrial base policy focused on “on-shoring, re-shoring, and friend-shoring.”

Titanium Sponge Outlook

Takeshi Nakashima, Toho Titanium Co. Ltd., discussed titanium sponge demand outlook for the near term. Nakashima said titanium sponge demand is recovering from Covid-19 and keeps increasing. “Air passenger recovery and growth helps aerospace demand increase. Industrial demand for commodity sponge has already recovered and demand for high-end products is also recovering. Global titanium sponge demand in 2021 exceeded prepandemic demand level due to the increasing demand in China. At the moment, a shortage of titanium scrap requires more sponge consumption in

melting.”

The outlook, according to Nakashima, is that global sponge capacity can cover total sponge demand. “Chinese suppliers are

eager to expand sponge capacity.” The Ukrainian war reduces CIS (Commonwealth of Independent States) titanium sponge/products supply for aerospace in 2022 and

24 TITANIUM TODAY

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

YOUR ONLINE SOURCE FOR AEROSPACE GRADE TITANIUM QUOTE, BUY, TRACK... IT’S THAT EASY @ ROLLEDALLOYS.COM 24-7 Instant pricing! • TITANIUM • NICKEL • STAINLESS • DUPLEX • COBALT • WATERJET • LASER • PLASMA • PLATE SAW • AND MORE! ADDITIONAL PRODUCTS & SERVICES

2023. Ukrainian titanium feedstock supply has been reduced since the war, which results in titanium sponge production decrease in CIS countries that relied on Ukrainian feedstock supply. Japanese sponge suppliers, who mainly supply titanium sponge for aerospace, have suffered from titanium sponge’s low profitability. At the moment, the sponge price for industrial customers appears to be more attractive than for aerospace.”

Regarding the sponge production cost outlook, titanium sponge production cost is increasing. “The increasing demand for titanium dioxide, which occupies 90 percent of titanium feedstock usage, and the shortage of titanium feedstock supply, keeps pushing feedstock prices

up. Titanium sponge production consumes a lot of electricity. The hike in (the cost of electricity) influences sponge production. Other material

costs like coke and magnesium also are rising.”

Matt Schmink of AmeriTi Manufacturing, offered thoughts on the outlook for titanium scrap. “We are facing a volatile market for titanium scrap in the near to medium term. Regional imbalances and logistics bottlenecks will either sharpen or soften the peaks and troughs. On a macro level, the market should remain relatively stable; from a micro-view, however, we could see substantial instability.” The global titanium scrap availability forecast indicates that scrap levels will exceed 240,000 metric tons by the year 2025.

Nicholas D. Corby, III, vice president, Titanium Products and Services, for ELG Utica Alloys, also addressed titanium scrap trends. ELG Utica Alloys processes, sources and supplies high-performance alloys and metals for our customers across the globe. According to Corby, using scrap as the primary source of raw materials for the production of titanium ingots will reduce the energy consumption and related carbon dioxide emissions by 95.4 percent.

“Most of the melting capacity for titanium scrap is concentrated in the North America (largest capacity worldwide) with new projects in

26 TITANIUM TODAY

Commercial

Altitude Despite Inflation and Supply Chain Concerns (continued)

Aerospace Trends Gain

The project funded by Innovate UK

Epoch Wires is pleased to announce their involvement in an Innovate UK research project as part of the “NATEP helping SMEs innovate in aerospace - Autumn 2021” competition. The project entitled “NanoTi - Grain refinement of Ti-6Al-4V wire to enable Aerospace DED AM” is led by Epoch Wires and supported by TWI.

The project aims to design novel-alloy wire chemistry to minimise the grain growth in Ti6Al4V alloys deposited by Additive Manufacturing. In this work, Epoch Wires will produce new wires with a nanoparticle injection, forming equiaxed grains to enhance the mechanical properties of Ti6Al4V alloys. TWI will be depositing the wires using laser, plasma, and electron-beam additive manufacturing techniques. Epoch Wires will be utilising it’s proprietary technology of producing metal-cored wires using continuous laser-seam welding technology, designed for titanium alloys.

The NanoTi project has received funding from Innovate UK under grant agreement No. 10030392.

Nano Ti Wires

Innovative and cost-effective titanium wires for the aerospace industry

Laser-seam welded Ti6Al4V wire

Ti6Al4V material deposited using Nano Ti wires, with laser additive manufacturing technology (image courtesy of TWI)

Contact

Serdar Atamert (CEO)

serdar.atamert@epochwires.com

+44 (0) 7414 866801

Epochwires.com

info@epochwires.com

Unit 8, Burlington Park, Cambridge, CB22 6SA, UK

Europe, Japan and China,” Corby said. “Scrap has to be sourced globally but supplied locally. Sophisticated logistic solutions are needed to secure scrap volumes generated emerging manufacturing clusters

Vanadium Trends

Terry Perles of TTP Squared Inc. reported that the global use of molybdenum in the first quarter of 2022 rose 9 percent to 153.8 million pounds when compared to the previous quarter, but fell 2 percent compared to the same quarter of the previous year. Global production of molybdenum was 581.4 million pounds in 2021, a 3-percent decline from 602.4 million pounds in 2020, according to figures released by the International Molybdenum Association (IMOA). Global usage in 2021 rose 14 percent to 614.3 million pounds from 539.7 million pounds the previous year. Figures released by the IMOA show that the global production of molybdenum fell by 4 percent to 138.4 million pounds the first quarter of 2022 when compared to the previous quarter—a fall of 7 percent when compared to the same quarter of the previous year.

In a guest article earlier this year, published by

TITANIUM TODAY, Perles wrote that global vanadium production and consumption have shown high rates of growth in recent years. From 2016 to 2021 consumption of vanadium globally grew from 71,700 metric tons pure vanadium (MTV) to 120,375 MTV for a compound annual growth rate (CAGR) of 10.2percent. Vanadium production over this period has grown from 76,530 MTV in 2016 to 115,667 MTV in 2021 for a CAGR of 8.6 percent. Pre-Covid-19 titanium alloy production consumed approximately 4 percent of the vanadium produced each year. During Covid-19, production of titanium alloys was drastically affected and in recent months production of titanium alloys as started to recover and we expect that by 2023 titanium alloy production will return to pre-Covid-19 levels.

“Vanadium has been classified as a critical mineral by the European Union, the United States and other jurisdictions,” Perles wrote. “High-purity vanadium is critical for various national defense applications including jet engines, airframes, ballistic missiles, and as a coating for night vision goggles. Vanadium is critical in the production of many basic chemicals and petrochemicals and as a

28 TITANIUM TODAY

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

Titanium Mill Products: Sheet, Plate, Bar,Pipe,Tube,Fittings, Fasteners, Expanded Sheet & Ti Clad Copper or Steel.

Titanium Forgings and Billet: Staged intermediate ingot & billet to deliver swift supply of high quality forgings in all forms and sizes including: rounds, shafts, bars, sleeves, rings, discs, custom shapes, and rectangular blocks.

Titanium, Zirconium, Tantalum & High-Alloy Fabrication & Field Repair Services: Vessels, Columns, Heat Exchangers, Piping, Anodes, Custom Fabrications, Field & In-House Reactive-Metal Welding & Equipment Repair Services Available 24/7.

Plate Heat Exchangers: Plate Heat Exchangers to ASME VIII Div 1 Design, Ports from 1” through 20” with Stainless Steel, Titanium and Special Metals, Plate Heat Exchanger Refurbishing Services & Spare Parts.

Two Service Centers & Fabrication Facilities in Ohio & Texas with Capabilities in: Waterjet, Welding, Machining, Sawing, Plasma Cutting & Forming.

Serving a Wide Variety of Industries: Chemical Processing, Mining, Pulp & Paper, Plating, Aerospace, Power and others.

Ti sheet, plate, bar, & forgings 6/4,6/4ELI, CP Ti, Welding Wire, & Fabrications tricormetals.com astrolite.com tricoralloys.com Tricor Metals, Ohio Division 3225 W. Old Lincoln Way Wooster, Ohio 44691 Phone: 330-264-3299 Fax: 330-264-1181 Tricor Metals, Texas Division 3517 North Loop 336 West Conroe, Texas 77304 Phone: 936-273-2661 Fax: 936-273-2669 Tricor Metals, Michigan Division 44696 Helm St. Plymouth, MI 48170 Phone: 734-454-3485 Fax: 734-454-7110 Astrolite Alloys California Division 201 Bernoulli Circle, Units B & C Oxnard, CA 93030 Phone: 805-487-7131 Fax: 805-487-9694

pollution control catalyst. Vanadium consumption in these critical applications will continue to grow in the coming years and the supply of high-purity vanadium for these applications will continue to be important from a defense and economic development standpoint.”

A Postcard from Japan

Takashi Hirose, the chairman of the Japan Titanium Society and the representative director and executive vice president of Nippon Steel Corp., offered insights on current titanium trends in Japan. “Japanese sponge producers have increased their shipments of sponge since 2013,” Hirose said. “The shipments of sponge

temporarily decreased in 2020 due to Covid-19, and shortly bottomed out because of the titanium demand recovery. “Hirose noted that Japan

accounted for 16 percent of global titanium sponge production in 2021, but that China has been expanding its production for 14 years and represents 61 percent of the market share.

Hirose said Japan titanium mill product shipments have decreased since 2019, but shipments will increase this year owing to titanium demand recovery.

The Japan Titanium Society, founded in 1952, contributes to the development of the titanium industry in Japan, and is celebrating its 70th anniversary in 2022. The society organizes meetings and trains young researchers and engineers. It also subsidies to develop new titanium applications and contributes grants for technology research program. “The Japan Titanium Society continues to work to promote expansion of new applications in titanium and help nurture the next generation of leaders of our industry,” Hirose said. “We believe that these activities will contribute to expanding titanium demand and developing the titanium industry.”

Manufacturing Technologies

Ron Adams, business development director for QuesTek Innovations LLC, discussed the concept of

30 TITANIUM TODAY

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

“Materials by Design®; Leveraging Integrated Computational Materials Engineering (ICME) Technologies for Development of Improved Performance Titanium Alloys.” He said it takes too much time and too high cost to develop and deploy novel materials and alloys. The QuesTek solution involves technology (software and methodologies) proven to reduce the time and cost, and increase the performance of novel materials.

The goal is to utilize “predictive capability” to assure qualification of minimum design properties for specified performance. Accelerated Insertion of Materials (AIM) methodologies and Integrated Computational Materials Engineering

(ICME) technologies are the keys for addressing the goal. Predictive software links process microstructure

and property performance. This involves Alloy Qualification Tools (AQT) using ICME, leveraging ICME technologies for the development of improved performance titanium alloys.

Adams said that QuesTek takes a holistic approach to fatigue modeling, with separate models to consider various length and time scales, and models combined for total life predictions. “While this application emphasizes AM (additive manufacturing), it can effectively extend beyond to the qualification of various other manufacturing applications. The technology delivers robust, accurate properties predictions with varying processing and test conditions (temperatures, orientations and surface finish, according to Adams.

QuesTek Technology is the “2020 Air Force AM Challenge” award winner as “First Place Top Performer,” and the “AM BENCH 2022 Challenge” as the first place awardee for best modeling results.

Joe Grohowski, the president of Praxis Technology, provided an update on “The State of the Art: Titanium Metal Injection Molding.” Grohowski said Praxis’ TiMIM technology represents years of

32 TITANIUM TODAY

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

investment and development, a titanium-only production facility, custom feedstock that limits binder contamination, and follows ASTM F2885 and F2989 and FDA master file guidelines.

Advantages of metal injection molding (MIM) parts, according to Grohowski, are smooth fillet radii inside and outside, no machining burrs or sharp edges, no residual stresses, added complexity at no extra cost, molded-in positional indication and identification features, compound/complex curvatures, and

the ability to combine assemblies. The challenges for MIM are that titanium is extremely sensitive to contamination; titanium powder is especially reactive, along with adoption challenges for regulated industries.

Professor Martin Jackson of the Henry Royce Institute at the University of Sheffield in the United Kingdom outlined the “Fast Forge of Titanium Alloy Waste for Future Low-Cost Components” being reviewed at his institute. Jackson said the Royce vision for metals involves

the advanced metals processing theme, which aims to build on the UK’s strength in metals processing and provide UK academia and industry with advanced facilities, collaboration opportunities, holistic support and expertise, all of which are needed to deliver innovative metals processing technologies and novel alloy solutions.

“We need to treat swarf (machine scrap waste) as a valuable feedstock,” he said. High-value alloyed titanium swarf is used as a feedstock for the FAST and FAST-forge process, which has the potential for generating near-net shape components in high strength and good fatigue life applications. Jackson said production volumes and cost levels of swarf could find applications in automotive industry and other markets, and would lead to the development of a new UK titanium supply chain. Jackson said the FAST process involves closed-die forging of FAST billets; forging trials prior to committing to batch FAST process tooling; confirmation of simulation analysis before committing to FAST process tooling; confirmation of FAST process tooling design; confirmation of forging tooling design, all of which would ensure material flow is as expected.

In a 2020 online technical journal (www.mdpi.com/20754701/10/2/296), Jackson wrote that forged titanium billets used in the aerospace industry, after being machined, create substantial levels of swarf. “The quantity of waste titanium swarf generated is increasing as aircraft orders, and the titanium components contained within them, are increasing. Cleaned Ti-6Al-4V swarf was fully consolidated using the FAST process at sub-transus and super-transus temperatures, followed by hot forging at sub-transus

34 TITANIUM TODAY

Commercial

Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

Plasma Arc • Electron Beam • Cold Wall Induction • Vacuum Arc Remelting • Atomization US: +1 (716) 463-6400 EU: +48 68 38 20 500 www.retechsystemsllc.com Your Global Leader for Titanium Melting Technologies

temperatures at different strain rates. It was demonstrated that swarfderived Ti-6Al-4V FAST billets have equivalent hot forging flow behavior and resultant microstructures when directly compared to equivalently processed conventional expensive hydride–dehydride powder, and previously reported Kroll-derived melt-wrought material. This demonstrates that titanium swarf is a good quality feedstock for downstream processing.”

Maximilian A. Kaiser, chair of lightweight automotive design for the department of mechanical engineering, Paderborn University, Germany, examined the “Heat Transfer Coefficient Investigation for Hot-Die Quenching Process of Ti 6 AL4V Alloy.” Kaiser said a new, efficient and resource-saving process for sheet metal forming of Ti-6AL-4V is needed. One solution is TISTRAQ: Titanium Solution Treatment and Rapid Quenching, a combination of short-time quenching and forming process with additional annealing.

An online technical paper (https:// www.heggemann.com/news/2020/ aeronautical-research-new-publiclyfunded-joint-project-launched) explained that TISTRAQ is intended to avoid the formation of an oxygenenriched brittle edge layer (Alpha Case). “This process route offers great potential for increasing the efficiency for the production of aviation parts.”

The paper stated that “the main objective of the TISTRAQ joint project is the development of a new forming process for the energyand material-efficient production of sheet metal parts made of α+β titanium alloys with enhanced mechanical properties through process-integrated heat treatment. The project is funded by the German federal government in the context of the aeronautical research program

and it was launched in July 2020. For the first time, the titanium alloys shall be heated very quickly and then

quenched with tempered forming tools. The process-integrated heat treatment increases the potential

36 TITANIUM TODAY

Commercial

Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

Rapid Response. Dependable Delivery.

Exceptional Turnaround From a Proven Partner in Titanium Materials Testing

Product Evaluation Systems, Inc. (PES) is a fully accredited, independent leader in titanium materials testing for aerospace and other applications. With a dedicated, experienced staff and state-of-the-art testing facilities, we offer full-service capabilities for all of your titanium testing needs, including:

• Mechanical Testing

• Metallurgical Analysis

• Chemical Analysis

PES responds to your needs promptly with personal service, customized solutions and expedient turnaround. We work with clients throughout the United States and Europe on projects of all types and sizes.

To request a free quote for your titanium testing needs and to see a full list of capabilities, please visit our website at www.PES-Testing.com or call 724-834-8848.

for lightweight construction by enhancing mechanical properties and reduction of manufacturing costs for sheet-based titanium components by eliminating the need for additional heat treatment process.”

Kaiser said that the development involves a new and unique test stand for Heat Transfer Coefficient (HTC) evaluation, and that the initial requirements were successfully realized. The results included: homogeneous temperature distribution after resistive heating; well controlled and user defined temperature profiles were implemented; and extremely high cooling rates were achieved (cool (900 °C – 500 °C) ≈ 940 K/s). There was no significant dependence of the HTC on pressure without lubricant, and that lubrication has great influence on HTC and cooling rate.

Harald Korbel, Inteco melting and casting technologies GmbH, shared information on the “Development of a New Type of Vacuum Arc, Cold Hearth Skull Melting Furnace and Process.” Korbel describe a cold hearth skull, explaining that it’s a special process phenomena related to water cooled copper crucibles. “Liquid titanium solidifies rapidly in the contact area towards the copper crucible wall while inside the skull/crucible the titanium remains liquid. The physical appearance and properties of the skull are created by the energy balance between provided melting power, latent energies and adjusted heat transfer. The cold hearth skull becomes the prerequisite for effective metallurgical work in vacuum metallurgy, such as removal of metallic inclusions, removal of non-metallic inclusions, and a reduction of interstitial dissolved nonmetallic elements.”

For cold hearth skull melting and casting, Korbel said that any

type of scrap can be used and virgin feedstock can be blended with the scrap. “Scrap is a low gas load feedstock compared to the virgin

sponge raw material. Every common and commercially pure (titanium) grade and alloy grade can be produced. Improved homogenization

38 TITANIUM TODAY

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

of the melt (can be achieved) through a large, turbulent bath volume induced by the electric arc and magnetically induced bath movements. The presence of gravitational segregation effects (force) larger or insoluble particles in the liquid phase to sink and get stuck in the ‘liquid/solid transition zone’ of the cold hearth.”

Inteco’s innovative furnace concept involves intermediate scrap, sponge and alloy additions during the melting & casting process cycles Two Titanium casting techniques are combined in one plant: static casting for ingot, slab, and Investment casting Centrifugal casting by means of a rotary casting table to achieve extended product complexity and properties. The skull melting furnace either acts as primary melter (electrode feedstock) for vacuum arc remelting (VAR) furnaces or final melting and casting plant for investment castings using VAR/EB /PAM electrodes.”

Korbel summarized by saying all other reactive metals and demanding alloys such as (zirconium, nickel, cobalt) Zr, Ni- and Co-based alloys can be melt and cast under vacuum into each any kind of shape and format. “Improved solidification conditions for the cast product can be integrated in the casting chamber concept to control.”

Marcus Lindholm, global purchasing manager-metals for Alfa Laval, spoke about “New Opportunities for Industrial Titanium; Accelerating Sustainable Solutions.” Lindholm said that collaboration and strong, lasting partnerships “are critical for accelerating sustainable solutions and reshaping our economy and the world we share. That is why Alfa Laval works closely with customers and other partners to find new answers to the most challenging questions of our time.”

“We already have the technology,” he continued. “Now it’s time to work together to build a more sustainable future. We want a solid titanium industry (that has) a diverse customer base to safeguard unforeseen events and new technologies; meets customer demands; transitions to green energy sources; (with) increased competitiveness, sustainable materials and a broadened scope of affordable business opportunities.”

Lindholm observed that, going forward, 25 to 30 percent of the titanium volumes sold are used for industrial applications. “The market for industrial titanium is growing, but where is the focus from the titanium community? Buyers of industrial titanium can offer stable

volumes over time. Diversification generates flexibility and spreads the risks.”

Sustainability drives innovation, he said. “(Alfa Laval) makes the existing industry more sustainable. Our technologies and solutions enable the transition to clean energy and circular economy. We continue to build on our legacy and strive towards a sustainable future. Alfa Laval’s purpose is to accelerate success for our customers, people and planet.”

40 TITANIUM TODAY Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

Lindholm described Alfa Laval as a leader within the

SYSTEMS FOR AVIATION INDUSTRIES

SYSTEMS FOR AVIATION INDUSTRIES

NEAR NET SHAPE TECHNOLOGY COATING SYSTEMS

CASTING SYSTEMS

� Leicomelt with Cold Crucible

� VAR Skull Melting

HOT ISOTHERMAL FORGING (HIF)

METAL ADDITIVE MANUFACTURING

� EIGA: Ceramicfree Metal Powder Production

� VIGA: Inert Gas

� EB-PVD SYSTEMS

Electron Beam Physical Vapour Deposition

� EB-PVD SYSTEMS Electron Beam Physical Vapour Deposition (EB-PVD) of Thermal Barrier Coatings (TBC)

HEAT TREATMENT SYSTEMS

� SYNCROTHERM®

Total Integration of Heat Treatment into Component Manufacturing

TITANIUM TODAY 41

SYSTEMS

VIM Master Melting

VAR

ESR

EB Melting � PA Melting

CASTING SYSTEMS � VIM-IC

Leicomelt with

Crucible

VAR Skull Melting HOT ISOTHERMAL FORGING (HIF) METAL ADDITIVE MANUFACTURING

EIGA:

Metal Powder Production

VIGA:

Gas Atomization Equipment

MELTING

�

�

�

�

HEAT TREATMENT SYSTEMS � SYNCROTHERM® Total Integration of Heat Treatment into Component Manufacturing

�

Cold

�

�

Ceramicfree

�

Inert

NEAR NET SHAPE TECHNOLOGY COATING SYSTEMS

Courtesy of SLM Solutions ALD Vacuum Technologies GmbH Otto-von-Guericke-Platz 1 | 63457 Hanau, Germany T: +49 6181 307-0 | info@ald-vt.de ALD Vacuum Technologies North America, Inc. 18 Thompson Road | East Windsor, CT 06088, USA T: +1 860 386 7227 | info@ald-usa.com

www.ald-vt.com www.ald-usa.com

ALD Vacuum Technologies High Tech is our Business

MELTING SYSTEMS � VIM Master Melting � VAR � ESR � EB

Melting

� PA Melting

� VIM-IC

Atomization Equipment

(EB-PVD) of Thermal Barrier Coatings (TBC) Courtesy of SLM Solutions ALD Vacuum Technologies GmbH Otto-von-Guericke-Platz 1 | 63457 Hanau, Germany T: +49 6181 307-0 | info@ald-vt.de ALD Vacuum Technologies North America, Inc. 18 Thompson Road | East Windsor, CT 06088, USA T: +1 860 386 7227 | info@ald-usa.com ALD Vacuum Technologies High Tech is our Business www.ald-vt.com www.ald-usa.com VACUUM SYSTEMS AND TECHNOLOGIES FOR METALLURGY AND HEAT TREATMENT PAM Melting CVD SYSTEMS Chemical Vapor Deposition for non metallurgy applications METAL POWDER PRODUCTION International Titanium Association www.titanium.org 1-303-404-2221 Telephone 1-303-404-9111 Facsimile ita@titanium.org Email BY ADVERTISING IN TITANIUM TODAY you connect with a specific target market unlike any other. Each edition includes: Member Profiles, Timely Editorial, Advertising opportunities, Press Releases, Classified Ads, Calendar Events, Executive Summaries from Titanium Conferences As an ITA member, you have the opportunity to submit press releases, classified ads, and host your updated company profile in the trade publication all INCLUDED in your annual membership .

key technology areas of heat transfer, separation and fluid handling. “With more than 3,700 patents, we provide worldwide solutions in areas that are vital to society both today and for the future. Alfa Laval’s worldwide organization, with over 17,000 employees, helps customers in nearly 100 countries to optimize their processes.”

Titanium Feedstocks

David McCoy of TZMI gave a titanium feedstock market update, focusing on a rutile feedstock supply/demand outlook to 2026. “The global rutile market is experiencing extremely tight market conditions, with a deficit position of 104,000 TiO2 units in 2021, but ‘balanced’ in 2022. Near-term rutile demand has been moderated to reflect the declining supply availability. TZMI has made provisions for greater chloride slag supply during the next few years, on the basis that there is some latent capacity in the supply chain that can be re-commissioned to meet chloride feedstock demand growth. This will displace higher-cost rutile in the TiO2 pigment sector as chlorinator head grades are reduced as pigment demand drops.”

McCoy identified new rutile projects in Australia, such as West Balranald Iluka Resources, Sembehun Sierra Rutile Holdings Ltd., Avonbank WIM Resources, as well as other projects in Norway, Sierra Leone, and Malawi.

Regarding feedstock demand for a sponge outlook to 2026, McCoy said that titanium sponge end use resumed the upward trends since 2016 and peaked at 486,000 TiO2 units in 2019 before Covid-19 impacts; 2022 is expected to be 7.3-percent higher than 2019. “TZMI believes that the strong demand from aerospace and newenergy automobiles will support demand growth for titanium sponge in the foreseeable few years. Industrial market demand may be impacted in the next 24 months.” He also observed that chloride slag is replacing rutile and other high grade TiO2 feedstocks outside of Japan, while China is dominating the production of this feedstock into the metal supply chain. “Metal supply chains that require ‘back to source’ certification for rutile feedstocks might have less leverage on future prices. Sponge producers will be competing for feedstocks against

a growing global chloride TiO2 sector. However, the next 12 to 24 months are forecast to be downcycles for TiO2 pigment demand.”

TZMI is a global, independent consulting and publishing company with offices in Australia, the United States, Europe, Africa and China. TZMI consulting services include practical experience in mineral sands, titanium dioxide and coatings industries.

42 TITANIUM TODAY Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

ALPHA RESOURCES™

‘Green Pickle’

Kurt Faller, the president and chief executive officer of MetCon, discussed how “Electrochemical Processing Solves Environmental Pickling Challenges.” Faller said MetCon was founded to commercialize a breakthrough application of electrochemistry: controlled metal surface reactions by applying highly specific electrical signals in specialty electrolytes. He said MetCon’s patents cover a broad range of electrolytes and the company’s industrial scale operation employs a citric acid-based electrolyte.

Faller said MetCon’s “Green Pickle” technology controls surface reactions with specific electrical signals. The system offers consistent, reproducible, digitally controlled reactions. The spent acid is categorized as fully non-hazardous and can be treated in-house with sodium hydroxide to raise pH to local sewer authority specifications. By contrast, he said HF or HF+HNO3 “historically are the only acids used to pickle or chemical mill titanium, and are among the most dangerous acids known.”

MetCon’s modifying rectifier outputs enable range of titanium surface modifications. “Alpha case removal is equivalent to HF-HNO3 pickling, but the reaction controlled by rectifier,” Faller said. “No adiabatic heating; loads run back-to-back without a chiller or cooling period.” The uniform chemical milling can deliver titanium sheet and plate chemical milling into final gauge (12.7 microns), and can operated as a fully automated system. Faller said that the MetCon system has been proven with more than 20 million pounds processed. “MetCon now offering technology licenses and is developed for intermediate conditioning.

Notes on HAMR

Z. Zak Fang, a professor in the Department of Metallurgical Engineering at the University of Utah, presented information on using Hydrogen Assisted Magnesiothermic Reduction (HAMR) of TiO2 to produce high performance, low cost titanium. Fang explained that the challenge for producing high performance low cost titanium is that conventional wrought titanium is too expensive, which conventional powder metal suffers from either a low performance or high cost conundrum. Low cost high performance titanium requires a holistic approach: a low cost primary metal, titanium sponge or powder;

44 TITANIUM TODAY Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

The solutions we create provide value to your business

ARIES Manufacturing is dedicated to the supply of complex airframe structure components, in both titanium and aluminum alloys, to leading manufacturers in the aerospace industry.

ARIES Manufacturing is part of the ARIES Alliance, a group of companies focused on developing innovative technology that creates value for the aerospace industry.

Superplastic Forming and Hot Forming for titanium airplane structural and engine components Panel mechanical pocket milling, drilling and trimming HSF® process technology for titanium airframe components Design vupar.fr ACB Part production facility Nantes - France +33 (0)2 51 13 84 00 DUFIEUX Part production facility Grenoble - France +33 (0)4 76 09 67 44 CYRIL BATH Part production facility Monroe - NC USA +704 289 8531 sales@aries-manufacturing.com wwww.aries-manufacturing.com

low cost parts manufacturing; and a microstructure and mechanical properties that are equivalent to wrought products.

The challenge to achieve the desired results is to use hydrogen, as it destabilizes Ti-O, making the reaction of Mg with Ti-O from being thermodynamically unfavorable to being favorable. Two steps to reduce oxygen (reduction and deoxygenation) ensures low oxygen. Molten salt (MgCl2 bearing salt) is used to facilitate the reaction.

“Our team (at the University of Utah) has developed a novel thermochemical process to extract titanium metal from ore that substantially reduces the cost, energy consumption, and emissions of titanium metal production,” Fang said. The HAMR process is a thermochemical process to obtain titanium metal from titanium oxides. A technical challenge in the production of titanium metal is the formation of oxide impurities. The Kroll process addresses this challenge by converting titanium ore (an oxide) into titanium tetrachloride (TiCl4). This intermediate material is readily purified. It is reduced to titanium metal with magnesium. This technology is capital, energy, and carbon-intensive. One advantage of the Kroll process, and several like it, is that it starts with titanium ores (e.g., illmenite), not a purified dioxide.

Fang said the HAMR technology is a two-step process, starting withTiO2 under an atmosphere of hydrogen gas. The product (TiH2) can be further processed to titanium metal through standard methods. “The reduction of titanium oxides to titanium metal using magnesium does not occur. The novelty of the HAMR process is the inclusion of hydrogen.”

46 TITANIUM TODAY Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

Master Alloys

Vince Rocco, vice president, sales and marketing with AMG Advanced Metallurgical Group N.V., focused his presentation on “Accelerating the Energy Transition – Titanium Master Alloys: the Hidden, Yet Critical Part of the Titanium Supply Chain.” Rocco said master alloys allow titanium producers to add alloying elements into titanium melts. “They contain two or more alloying elements that are needed for a particular titanium grade. The alloying elements enhance the properties of titanium to increase strength, weldability, and temperature resistance.”

The production of master alloys involves an aluminothermic reaction (elemental oxide plus aluminum powder), which yields a master alloy plus Al2O3 slag. “The fuel for the reaction comes from the aluminum powder and the reaction is initiated. An exothermic reaction consumes the aluminum powder and elemental oxide. A metal ingot forms with slag settling on the top, and no external energy is used for the process.”

Regarding vanadium and molybdenum, Rocco said China dominates vanadium production, while Russia is a key player in vanadium production and the aerospace industry uses vanadium from primary ore and secondary production. Vanadium demand is dependent on steel production.

The molybdenum market is expected to grow at a CAGR of 4 percent between the years 2022-2027, according to Morder Intelligence. Molybdenum growth will be fueled by the automotive, aerospace and energy markets. The trend towards electric vehicles could reduce molybdenum consumption, but in the aerospace market, global demand for new jets is forecasted to increase

about 80 percent.

The dynamic for titanium scrap and sponge will involve titanium melters matching the most economical inputs into their formulations, according to Rocco. Reduced aircraft build rates and excess titanium inventory led to titanium scrap shortages in 2021 into 2022. Risk mitigation by titanium consumers is bolstering titanium production in the United States. Sponge and master alloy utilization is increasing.

Rocco summarized his remarks by saying master alloys “are highly engineered products important to the titanium industry. Master alloy

raw materials are sourced from all over the world. Ongoing supply chain issues also affect master alloy producers. (The current, tense) geopolitical environment has added an additional element of risk to the industry.”

The Velta Titanium Process

Andriy Gonchar, technical director, and Artem Yarovinsky, sales and marketing director, Velta Holding US, outlined the Velta Titanium Process. Velta LLC is a feedstock producer and the only privately owned company in Ukraine, which has built a mining and processing complex. Founded in 2006, Velta has

48 TITANIUM TODAY

Commercial Aerospace Trends Gain Altitude Despite Inflation and Supply Chain Concerns (continued)

Butech Bliss delivers excellence in melting equipment repairs

That’s why when it comes to the design and manufacture or the repair and reconditioning of crucibles, molds, and hearths for your ESR, VAR, EBM, or PAM installations, we draw on our more than 130 years of design, engineering and manufacturing excellence to ensure that your copper-based melting equipment is operating at peak efficiency.

A reputation for quality work and on-time delivery.

Our staff of expert millwrights, welders and machinists can tear down, assess, repair and test your valuable melting equipment. Additionally, our manufacturing capabilities are fully supported by our staff of over 50+ engineers. Our services include:

• Machining, welding, straightening, and sizing of stainless steel, copper, nickel, aluminum, bronze, and carbon steel

• Preventative maintenance, including cleaning, re-sizing, straightening and seal replacement

• Crucible diameter and size modifications

• New crucibles, molds, base assemblies, water jackets, etc.

To learn more about our rebuilding and manufacturing services,call (330) 337-0000, visit www.ButechBliss.com or email cu@butech.com.

We Build Things. Better. 550 South Ellsworth Avenue, Salem, OH

650 employees, and 60 percent of its production sold to U.S. customers

The Velta Titanium Process features the implementation of special technology which controls particle size distribution (PSD) for titanium metal powders, resulting in the production of non-spherical, spherical titanium powders and its alloys, with low and extremely low oxygen content. The high economic efficiency of the process allows the production of different types of titanium metal powders (non-spherical and spherical shape) at low cost. The representatives said the cost of titanium powder

from the Velta Process could be lower by two to three times compared to Kroll-HDH powder for commercially pure titanium grades; three to four times lower for Grade 5PM alloy; and three to four times for different types of spherical powders (both pure titanium and its alloys). They said the Velta Process can produce alloys directly through the reduction of titanium-containing raw materials (technical titanium dioxide).

“As a result, a powder of the corresponding titanium alloy is formed without the need for additional stages, as is the case with the Kroll process. These capabilities open the way for intermetallics production and production of a large number of high-quality alloys, especially those that are currently either difficult or even impossible to manufacture in industrial quantities due to engineering constraints or economic inexpediency.” They said Velta is planning to launch a titanium manufacturing facility with a capacity of 10,000 tons of titanium powder and titanium finished parts per year.

Titanium Cladding