TRADE FINANCE TALKS OCT 2022 FEATURED VISA–B2B CROSS-BORDER PAYMENTS: IMPROVING EFFICIENCY, SPEED, AND TRANSPARENCY TIME’S TICKING FOR TECH

THANKS TO

ALAN KOENIGSBERG

RISHIKESH TINAIKAR

JIM REGAN

ENNO-BURGHARD WEITZEL

SCOTT WELLCOME

PRADEEP NAIR

MICHELLE KNOWLES

GEORGE WILSON

GAYANE MIRZOYAN

CHYNARA ALYBAEVA

ANDY ROMANOV

VLADISLAV BEREZHNY TULKIN YUSUPOV

DALTON LEE

PAUL WOLLNY

GORDON CESSFORD

RICHARD RAWLINSON

MARTIN GRUNEWALD

ANASTASIA MCALPINE JOSH KROEKER MARK BORTON

TFG EDITORIAL TEAM

DEEPESH

ANASTASIJA KOVACEVIC CARTER HOFFMAN

PHOTOGRAPHS AND ILLUSTRATIONS

FREEPIK COMPANY

© Trade Finance Talks is owned and produced by TFG Publishing Ltd (t/a Trade Finance Global). Copyright © 2022. All Rights Reserved. No part of this publication may be reproduced in whole or part without permission from the publisher. The views expressed in Trade Finance Talks are those of the respective contributors and are not necessarily shared by Trade Finance Global.

Although Trade Finance Talks has made every effort to ensure the ac curacy of this publication, neither it nor any contributor can accept any legal responsibility whatsoever for the consequences that may arise from any opinions or advice given. This publication is not a substitute for any professional advice.

2 TRADE FINANCE TALKS

10

ALAN KOENIGSBERG

SVP

and Global Head of Treasury and Working Capital Solutions Visa

13

RISHIKESH TINAIKAR

Global

Head of Corporates and Trade Go To Market SWIFT

27

MICHELLE KNOWLES

Pan African Head of Trade Finance Product Absa Corporate Investment Banking

PATEL

S.L. ADDRESS 2ND FLOOR 201 HAVERSTOCK HILL BELSIZE PARK LONDON NW3 4QG TELEPHONE +44 (0) 20 3865 3705

1 FOREWORD

1.1 Time’s ticking for tech

2 FEATURED

2.1 B2B cross-border payments: improving efficiency, speed, and transparency

2.2 SWIFT thinking: how the global payments system can help digitalise trade finance

2.3 Digitisation in transforming the trade landscape

2.4 Driving sustainability in global trade with digital collaboration

2.5 Can Europe be the first carbon-neutral continent?

2.6 Data standards: a key to a truly sustainable trade

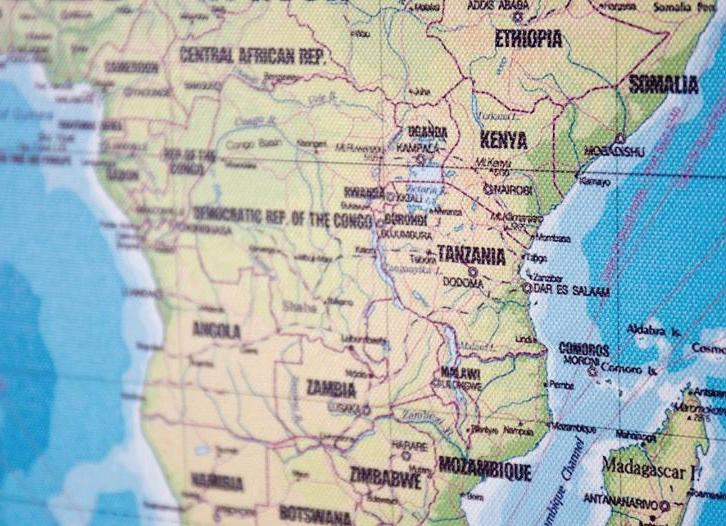

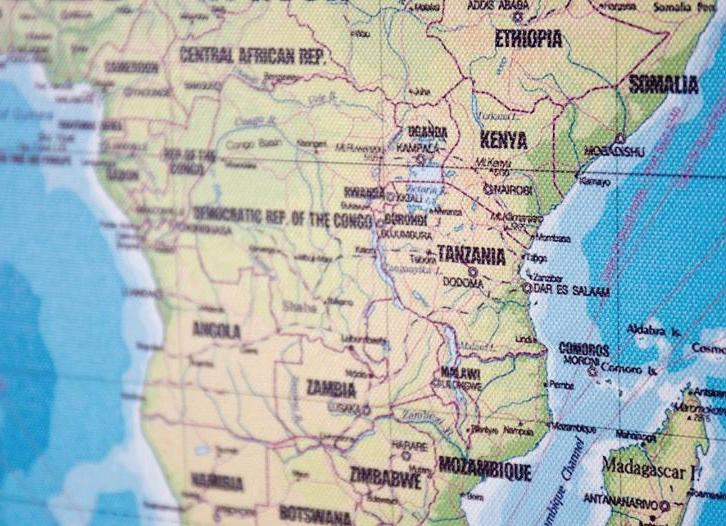

2.7 African trade finance enters an exciting new phase

3 EMERGING MARKETS

3.1 African access to trade: SMEs, FX, and sustainability

3.2 International trade, sustainability, digitisation in Armenia

3.3 Banking in the Kyrgyz Republic, Optima Bank OSJC

3.4 Trade finance in Ukraine: a rallying call for industry members

3.5 Uzbekistan’s largest oil and gas company on digitisation, ESG, geopolitics

3.6 Emerging markets roundtable: understanding and addressing trade finance challenges for SMEs

3.7 Correspondent banking in the Caribbean: the impact of ‘derisking’ on the real economy

4 TRADE CREDIT INSURANCE

4.1 The changing risk landscape of trade credit insurance

4.2 GreenStars’ Paul Wollny on the world of credit insurance

4.3 Atradius on political risk, emerging markets, digitalisation

4.4 Resilience, technology, and risk appetite: credit insurance experts weigh in on current trend

5 FINTECH

5.1 A different type of KYC: lessons from the sub-saharan Africa mobile phone market

5.2 Procure to pay in a global economy: how businesses can acknowledge FX in their processes

5.3 How connected payments impact Africa

5.4 Interview: Why ‘ecosystem play’ is important for digital trade

5.5 Driving a digital agenda for trade: how the ICC is setting the standard

3 CONTENTS

4

5

8

10

13

16

18

22

25

27

30

32

34

37

41

44

47

51

54

56

58

61

64

66

68

71

75

78

82 8 TFG PARTNER CONFERENCES AND EVENTS 86 9 PODCAST 90 10 ABOUT TRADE FINANCE GLOBAL 92 CONTENTS

FOREWORD

1

DEEPESH PATEL Editorial Director Trade Finance Global

Time’s ticking for tech 1.1

ANASTASIJA KOVACEVIC Junior Editor Trade Finance Global

Greek philosopher Heraclitus’ words, written more than 1000 years ago, ring truer today than ever before.

Change can come at any point and can be catalysed by any manner of things. Trade has proven no exception to the rule. US inflation is at a 40-year high, sovereign debt is soaring all around the world, and there’s no end in sight with the devastation between Russia and Ukraine.

At the World Trade Organisation’s (WTO) Public Forum this month, we heard Director general Dr Ngozi Okonjo-Iweala admit that the world is heading towards a global recession due to a “collision of poly-crises around security, climate, energy, [and] food prices”.

“The world cannot afford to do business as usual,” Okonjo-Iweala said.

Yet, the counter-cyclical nature of trade against sluggish economic growth is creating an urgency toward affordable, inclusive, and resilient trade.

Digitisation has once again come first place in the trending trade top of the pops, with murmurings of electronic bills of lading (eBLs), non-fungible tokens (NFTs) and legal reform also joining the party.

It’s all quite overwhelming.

Taking a step back though, there have been pockets of success

at impressive speeds around many innovations seizing the market, scale is now key. To name a few detailed in this issue; Visa B2B connect, SGTraDEX (with Veridapt), SWIFT’s messaging standards, and African payments developments have all catapulted trade, treasury, and payments.

This issue of Trade Finance Talks aims to deconstruct the tenets facilitating change in the landscape.

Emerging markets face the most challenges

As the youngest continent in the world, with immeasurable levels of untapped wealth, industry leaders’ heads have been turned toward one region in particular: Africa.

Traditionally the African subcontinent has faced many obstacles to accessing trade finance and US dollar liquidity.

This issue has been intensified by inflation hikes and supply chain strains. And African smalland medium-sized enterprises (SMEs)––who provide a bulk of employment––are the ones feeling the brunt of this.

The $120 billion trade finance gap remains a big problem in the African eco-system. This figure is set to rise on account of geopolitical, social, and economic turmoil since.

6 TRADE FINANCE TALKS tradefinanceglobal.com

“There is nothing permanent except change.”

Though the facts present themselves in bleak hues, the fact remains that the large and majority-untapped African market has much to offer.

Elsewhere, there has been a growing trade finance problem in emerging markets.

The current risk landscape has led to dwindling correspondent and respondent banking relationships, whose effects have been farreaching.

Rather unsurprisingly, this has disproportionately affected smaller economies, with credit departments becoming more apprehensive about allocating limited capital to ‘risky’ investments.

TFG spoke to the Caribbean Association of Banks (CAB) about seeking correspondent banking relationships as far as Pakistan. As TFG heard at EBRD’s Trade Facilitation Programme in Istanbul last month, the same issues are being faced across central Eastern and European nations.

The effects of ‘derisking’ are extremely damaging to local communities, who rely on dollar or euro imports. Elements such as inflation and the inability to clear payments in local currencies have brought additional challenges.

Access to healthcare, travel, and education are all placed in the firing line once large banks start to retract support.

Every cloud

Risk is at an all time high, which permeates around all areas of trade and export finance.

This has mostly manifested as a retreat up the credit curve, with BBB+ businesses and below feeling the blow the most.

Does the umbrella open when it rains? TFG invited leaders from the CPRI industry to discuss risk appetite, changes within the credit insurance market and innovations during these challenging times.

New regulatory constraints such as Basel III reform and European Commission amendments to the Capital Requirement Regulations (CRR) have only heightened the issue, hindering banks to lend more to SMEs.

Perhaps innovations in securitisations, or tokenising pools of trade finance assets to open the industry up to new institutional investment could be key.

Of course, we must not forget the power of tech in this matter.

Sure enough, increased operability and efficiency, thanks to artificial intelligence (AI) and new data solutions, have significantly aided in client relations––but these are not the only means in which digitisation has bolstered the trade industry.

Tick, tick, tech Technology. A double-edged sword whose powers for good and nefarious are often times equally balanced.

Anti-money laundering (AML) and know your customer (KYC) may not be the first thing that comes to mind when technology is mentioned, but it is an issue frequently cited in the field.

Digitisation of documents also comes with pitfalls. Duplicate financing fraud is another subgenre aggravating the trade finance industry and the trade finance gap in its wake.

It is difficult not to focus solely on the negative aspect of technology, especially when the repercussions of certain elements have far-reaching ramifications.

However, the realm of tradetech has brought about deep-running and tangible positive effects, most keenly felt––in rather a full-circle affair––in the emerging markets sector.

Accessibility to platforms facilitating cross-border payments has alleviated problems long faced by developing economies. And in many ways, new digital initiatives have levelled the proverbial playing field.

Indeed, technology has allowed a myriad of positive changes to take place, not least helping lessen sustainability consequences generated by a paper-based industry.

It is safe to say that issues surrounding digitisation are not so black and white; whether the advancement of tech is a ticking time bomb, or trade’s saving grace, remains to be seen.

Time’s ticking for tech.

Once again, we thank all of our sponsors, associations and partners for their support to Trade Finance Global.

7 tradefinanceglobal.com

FOREWORD

FEATURED

2

2.1

B2B cross-border payments: improving efficiency, speed, and transparency

Cross-border payments innovation as a priority for everyone

When it comes to innovations in business-to-business (B2B) payments, the marketplace is, and not for the first time, taking its cue from consumers.

The advancement of consumer payments has largely been driven by demand for a better customer experience.

Additionally, the acceleration of cross-border commerce makes cross-border B2B payments even more of a focus. Banks are responding to businesses that are keenly interested in leveraging emerging technologies to improve transparency, expand optionality, and lower costs associated with cross-border payments.

Considering the difficult environment banks and businesses are experiencing globally, transparent, simple, efficient, and tailored payment solutions are now more important than ever.

Development on an international scale

As global business expands, so too does the volume of crossborder payments.

There are currently $120 trillion in global B2B payments processed annually, with at least $10 trillion supporting cross-border trade.

In the face of this growth, banks are left to deal with these highly complex transactions dependent on correspondent banking relationships, offering limited visibility into the status of payments, costs, and certainty.

The traditional payments process leaves receiving banks with little predictability of when payments will arrive, or the amount they will receive after currency exchange calculations and various fees are deducted.

Know your customer (KYC) and anti-money laundering (AML) regulations are also adding to the necessity for new approaches.

10 TRADE FINANCE TALKS tradefinanceglobal.com

ALAN KOENIGSBERG

SVP and Global Head of Treasury and Working Capital Solutions Visa

It is time to modernise cross border payments, and collaborative innovation is the only way to do it.

Complying with regional AML rules can result in transaction delays, which fosters greater uncertainty in an already unpredictable process and a business landscape fraught with volatility

Partnerships can tackle rising challenges and deliver greater transparency

With accelerating global business growth comes increased opportunities for innovation across the cross-border landscape.

Banks are in an excellent position to take advantage of dynamic changes using emerging technologies, such as distributed ledger technology (DLT), artificial intelligence (AI), and cloud capabilities. The rise of cutting-edge solutions, designed to reshape B2B crossborder payments, will enable savvy banks to meet the shifting demands of clients.

Fintechs and other innovative players are bringing their digital expertise to the fore, looking to create a more transparent ecosystem.

As a result, financial institutions (FIs) have a unique opportunity to partner with these innovators, combining resources to

overcome B2B cross-border payments challenges. Another benefit of such innovation is the ability to gain access to important data.

Ultimately, the importance of listening to business customers should not be overlooked.

This is especially true in challenging times, where customers need as much data as they can get. This enables them to make smart, strategic decisions which can have a huge impact on their business.

If emerging solutions hold the potential to deliver the critical data that businesses need, their implementation should be a nobrainer.

How new multilateral networks can help improve cross-border payments

Innovative solutions are emerging that reimagine how B2B crossborder payments are made.

These evolving solutions are offering important advantages to banks and their customers— providing greater optionality, improved transparency, increased predictability, enhanced compliance, and better access to vital data.

Cost savings remains another important benefit of adopting a multilateral crossborder payment solution, as expenditures associated with managing intermediary bank relationships are eliminated.

Look no further than Nostro accounts, for example. The average annual cost of maintaining these accounts among global banks can amount to $1.5 billion, while maintaining just one of these accounts costs a US bank $27,270 each year.

A centralised, permissioned network where all participants are known, will enable payments to be processed securely and directly, thus minimising the expense of maintaining Nostro accounts.

With ongoing market-led innovation and new technologies, the future of B2B cross-border payments promises to be simpler, secure, lower cost, and more transparent.

Geographic barriers will gradually be eliminated in this rapidly evolving global payment ecosystem.

11 tradefinanceglobal.com

FEATURED

Banks can be expected to partner with fintechs and other innovative players to bring new technology to the space, tapping into their expertise as digital natives, with the goal of strengthening customer relationships.

An era of modernisation is dawning for cross-border payments, benefitting all parties involved.

Visa’s solutions for cross-border payments

Visa continues to provide leading edge cross-border services

that can deliver near real-time services for FIs.

Visa B2B Connect, first launched in 2019, is a cross-border payments network focused on the challenging B2B buyer/ supplier payments––which are typically high in value–– and data payload requirements.

Visa B2B Connect streamlines the entire process; it provides same-day payment services and removes the friction associated with multiple banks in the process chain to deliver direct payments from the buyer’s bank to the

supplier’s bank in one step. It provides ‘identify’ and ‘wallet’ services to ensure all participants are known to each other to reduce risks.

Visa has also acquired capabilities and integrated them to round out solution sets; the recent Currencycloud acquisition will help us continue to deliver global services, including foreign exchange (FX) and embedded finance solutions to FIs worldwide.

12 TRADE FINANCE TALKS tradefinanceglobal.com

2.2

SWIFT thinking: how the global payments system can help digitalise trade finance

While the COVID-19 pandemic had devastating impacts, it is difficult to deny that it was instrumental in exposing digital weaknesses around the world.

Businesses and industries that were unprepared for a quick transition to a digital economy were hit hard during the early months and subsequent years.

Trade finance was one of these industries.

Trade Finance Global (TFG) spoke with Rishikesh Tinaikar, global head of corporates and Trade Go to Market at SWIFT, to further explore the pandemic recovery and how lockdowns are accelerating trade finance’s push toward digitalisation.

International trade crucial for pandemic recovery

It is clear that trade has a critical role to play in the overall pandemic recovery.

“Trade is central when you’re talking about global economic growth,” Tinaikar said.

“When you are dealing with goods, you’re dealing with money and economics. The better and faster that you trade, the faster you can grow, innovate, [and] improve productivity.”

However, the complexities of the global trade landscape, which includes myriad stakeholders and key players from disparate specialisations, may make it more difficult for practitioners to simply call on the industry in its present state to facilitate the recovery.

“In my view, rather than asking the question of how trade can aid in economic growth and the pandemic recovery, our thoughts should be around how global trade digitisation can help in that direction,” Tinaikar added.

This is not a new conversation topic for the trade finance space but is one that experienced a mindset shift in light of COVID-19.

Tinaikar said, “The industry has been talking about trade digitisation with respect to the operating environment for a long time.

“But with the pandemic, suddenly it became less about the operating environment and more about digitisation as a matter of business continuity and risk management.”

13 tradefinanceglobal.com

RISHIKESH TINAIKAR Global Head of Corporates and Trade Go To Market SWIFT

FEATURED

DEEPESH PATEL

Editorial

Director

Trade

Finance Global

Trade finance digitalisation

There are many reasons why trade digitalisation will boost efficiency for trade finance and subsequently aid in the pandemic recovery.

“Digitisation has the potential to reduce processing time, costs, risks, and friction, while also increasing transparency,” Tinaikar said.

“Hand in hand with that is richer data, which gives great insight into supply chains and how trade and finance are happening around the world. With this insight, country-central banks will have more visibility into how economic growth is happening.”

This added insight and visibility allows governments to make data-driven decisions on how to change policies to promote both trade and recovery.

SWIFT’s role in promoting trade digitalisation

SWIFT had a key hand to play in keeping finances flowing during the early pandemic uncertainty.

“SWIFT actually facilitated over $2 trillion in documentary trade financing in 2020, which was at the height of the pandemic,” Tinaikar said.

“What we saw was that the use of messaging standards like the MT 799 was relatively less affected, suggesting that SWIFT did serve as a broader means of secure communication even during the pandemic.”

The bank to corporate messaging channel, MT 798, also saw significant growth through 2020, a further sign that the pandemic was inducing a strong shift to digital.

SWIFT did not just rely on pre-established operations to promote digitalisation; the organisation also rapidly adapted and sought unfamiliar ways to help businesses that suddenly found themselves thrust into a remote world without the appropriate toolkit to deal with the challenges.

“We published a guideline on how our network could help facilitate the digital transmission of trade documents,” Tinaikar said.

“That was a significant step towards the industry commercialisation of what we now call the eUCP rules under the International Chamber of Commerce (ICC).”

While all of these steps have helped, there are still some troublesome challenges that remain for trade digitalisation.

14 TRADE FINANCE TALKS tradefinanceglobal.com

Three stubborn challenges

The three biggest hurdles standing in the way of trade finance digitalisation are a lack of standardisation, unfriendly regulations, and industry fragmentation.

Standardisation

The largest challenge according to some experts is a widespread lack of standardisation.

“Trade is an extremely complex ecosystem covering multiple actors, multiple ecosystems, and multiple platforms,” Tinaikar said.

“This means that the operating standards that get developed only set out to solve point problems in those individual domains.”

Over time, if this development continues to happen in silos, it leads to the proliferation of the

digital island problem, which severely limits the amount of rich data that practitioners can collect.

Regulation

Many of the regulatory challenges facing trade digitalisation stem from legal definitions, concepts, and rights that vastly pre-date the advent of digital technology.

“When you then talk about digitisation, the question is if those rights still apply when a document is an electronic form,” Tinaikar said.

For most jurisdictions around the world right now, the answer to this is a resounding no. However, there has been considerable movement on this front over the past several months, and many experts anticipate that lawmakers will enact revisions in the coming years.

Given the nature of international trade, involving multiple jurisdictions at a time, the full benefits may not come until even further down the road.

Fragmentation

“The fragmentation could be around technology -- with some dabbling in blockchain and others using artificial intelligence,” Tinaikar said.

“Some fragmentation could be in terms of who is operating the technology -will it be governments, private enterprises, or some other type of organisation? But at the end of the day, these little digital islands will create different processes and different types of data.

15 tradefinanceglobal.com

FEATURED

2.3

Digitisation in transforming the trade landscape

Digitisation as a catalyst for collaboration, transparency, and operability.

The digital revolution that is changing the way commodities are traded, stored, collateralised and sold is giving birth to a culture of collaboration and transparency that previously did not exist among counterparties.

Indeed, the central theme at this year’s Sibos conference in Amsterdam, the blue-chip gathering of the world’s top executives in banking and finance organised by SWIFT, focuses on how to best embrace digital transformation while mitigating risk and elevating sustainability.

In over 150 Sibos sessions, speakers will address the ability of financial services to identify, adapt, scale forward-thinking innovations, and manage risk in an uncertain world.

In a move underscoring the shift toward greater collaboration among counterparties, heavy hitters in commodities trading, banking, and storage recently injected investment capital into Singapore Trade Data Exchange (SGTraDex).

SGTraDEX is a governmentbacked not-for-profit platform based in Singapore, created to streamline and secure trade flows, which was recently supported by Veridapt, a leading digital commodities hardware/

software monitoring solutions company.

Digitisation of trade finance transactions via platforms such as Veridapt’s provides counter parties—typically, but not limited to, banks, traders, and terminals— with a one-stop collaborative tool.

This, in turn, ensures trade flow information is secure and accurate, illustrating how these new initiatives are the architects of the digital revolution.

Veridapt CEO David Thambiratnam said, “Veridapt is a technology company, and we believe if you create the right solution, the world will beat a path to your doorway, and adoption will happen.”

In a nutshell, digitisation means greater reliance on the interpretation of common data to make decisions. This means successfully putting everyone who is part of a deal on the same page.

Antoine Cadoux, CEO of SGTraDex Services, said, “When we talk about trade digitisation, it’s a team sport.”

16 TRADE FINANCE TALKS tradefinanceglobal.com

JIM REGAN

Commodity Freelance Journalist Veridapt

Elsewhere, recent high-profile cases of commodities fraud across oil, agriculture, and metals are pushing security to the top of the sector’s ‘must have’ list.

“Digitisation is of paramount importance to us,” Loh Wei, CEO of Jurong Port Universal, the largest independent terminal in Asia-Pacific, told a conference in September.

Wei added, “The first thing about inventory positioning is to assure our customers, primarily traders, that their confidential inventory position is safe with us, whether it is us taking custody of their oil or the data that is associated with this oil.”

Indeed, there is growing recognition that the transparency of information that flows between counterparties is the oxygen that drives the sector.

Thambiratnam said, “The need for security in all aspects of commodities has never been greater.

“One of the benefits of collaborations such as the one between Veridapt and SGTraDex is that counterparties now have verification every step of the way, greatly mitigating risk of double financing and other fraudulent behaviour.”

17 tradefinanceglobal.com

FEATURED

2.4

Driving sustainability in global trade with digital collaboration

ENNO-BURGHARD WEITZEL

Senior Vice-President of Strategy and Business Development Surecomp

While the environmental, social, and governance (ESG) agenda is clearly front-of-mind at the moment and a crucial element of sustainability, the topic is more nuanced than it might first appear.

In order to be truly sustainable, trade needs to be accessible to not only the largest corporates but also mid-sized corporates, small- and medium-sized enterprises (SMEs), and even micro-SMEs.

What’s more, it needs to be free of difficulties, disruption, and costs brought on by fraud.

That’s not to minimise the importance of ESG. Today’s trade finance technology needs to also provide ESG tracking of individual trade finance transactions.

Surecomp has been involved in the International Chamber of Commerce (ICC) Sustainability Working Group’s recent sustainability positioning paper, which outlined the need for an ESG rating of the buyer, the seller, the goods, and the transport.

Likewise, today’s trade finance users need to be able to incorporate ESG ratings into their trade finance transactions as quickly and easily as possible.

Combatting fraud

While ESG is important, we’re also thinking about sustainability much more broadly, particularly when it comes to minimising fraud in trade finance.

Ultimately everyone pays for fraud because banks have to take higher margins as a buffer against any fraud-related losses.

Trade finance, in particular, is still heavily paper-based, which leads to considerable vulnerability, as illustrated by a high-profile $284 million metals fraud case that was perpetrated by forging warehouse receipts.

The reality is that in today’s world, we can’t trust paper—so Surecomp wants to enable everyone to use digital documents, taking paper out of the system.

Surecomp is also advocating ways to combat fraud––for example, to prevent duplicate invoice financing while remaining fully compliant with bank secrecy regulations.

18 TRADE FINANCE TALKS tradefinanceglobal.com

ESG may be front-of-mind, but how can the wider implications of sustainability help different areas of trade?

Opening trade finance to everyone

So, how can trade finance technology enable all participants to trade more effectively while supporting sustainability and fostering collaboration across the trade finance ecosystem?

Thinking big

In today’s market, trade finance technology vendors are largely all focusing on the same small group of potential customers.

As a result, the number of companies currently served by trade finance technology in Europe may only be around 1,000. This represents an enormous

unrealised opportunity: there are around 24 million corporations in the EU, 8 million of which could arguably benefit from trade finance solutions.

So, how can trade finance vendors add value to more of these potential customers? While there is much discussion about application programming interface (API) and MT798s, the reality is that most corporations aren’t concerned with the technicalities of how to connect to a trade finance ecosystem––they just want to use the service as easily as possible.

That’s why Surecomp is focusing on solutions that have a mass market appeal that provide a seamless user

experience alongside increased accessibility––users are able to simply download an app on their mobile phones.

For example, vendors that incorporate legal entity identifiers (LEIs) into trade finance software can enable users to validate the identity of their trading partners more easily, thereby enhancing data quality and trust within the system.

Likewise, integrating data providers into trade finance technology can enable banks to carry out compliance checks on data such as container information and shipping information.

19 tradefinanceglobal.com FEATURED

Expanded ecosystem

Surecomp believes that trade finance technology should be open to everyone; this includes a vast group of corporates, from small businesses to multinational corporations, as well as banks, non-bank financial institutions (FIs), insurance companies, investment funds and asset managers.

Insurance companies, for example, can act as providers of finance or security to trade finance transactions.

Under Basel IV, banks will need to set aside more capital for their trade finance commitments––but insurance companies, which are managed under Solvency II, won’t be subject to the same requirements.

By including insurance companies on the platform, vendors can provide support for smaller companies that might struggle to find a bank to finance their guarantees.

There’s also much to be gained by bringing together buyers and sellers of trade finance assets.

Many investment funds and asset managers are looking to invest in trade finance assets––so why not include these funds in trade finance platforms? By doing so, trade finance vendors have an opportunity to reduce transaction costs for smaller banks that lack the balance sheets needed to fund trade finance assets and hold them to maturity.

Additionally, if trade finance technology is to be accessible to everyone, cost must not be a barrier. One way to overcome this is by adopting ‘freemium’ business models so that any bank or corporate can take advantage of a free plan to access trade finance technology.

Collaboration

Last but not least, modern trade finance solutions need to enable parties to collaborate more effectively with each other.

For example, guarantees are often held up by inaccurate data, not least because these are typically sent as PDF attachments by emails.

The resulting inaccuracies lead to delays and extra work for the bank, particularly if guarantees have to be replaced or amended.

But what if a platform could enable the applicant and beneficiary to collaborate on the details of a guarantee right at the beginning of the process? Those details could then be agreed upon before the bank even gets involved––making the process easier for everyone involved.

The way forward

In conclusion, we believe in enabling sustainable and seamless trade in any way we can.

Next-generation trade finance technology needs to incorporate everything from ESG tracking and fraud prevention to collaboration tools and a freemium business model. Moreover, embracing software as a service (SaaS) delivery will mean that participants can access their platforms without needing to fulfil any technical requirements.

20 TRADE FINANCE TALKS tradefinanceglobal.com

Driving sustainable global trade with digital collaboration

Surecomp® is the market leader in digital trade finance solutions for banks and corporations.

An industry pioneer for over thirty years, we provide a cost-effective and holistic, digital experience across trade finance operations. Our customers apply, track, finance and collaborate to enhance operational efficiency and drive growth through sustainable, global trade.

For more information please visit surecomp.com or email marketing@surecomp.com

2.5

Can Europe be the first carbonneutral continent?

SCOTT WELLCOME Director, Grains Mills Management GoodMills Group GmBH

A lot has changed since the European Commission unveiled the European Green Deal in December 2019.

The aim of the strategy - to “make Europe the first carbonneutral continent” - was always ambitious. The question now is whether the events over the last 30 months have put the targets out of reach.

Part of the Green Deal is the Farm to Fork Vision, which was unveiled in May 2020 and briefly outlines the following main objectives:

• To reduce the use and risk of chemical pesticides by 50% by 2030

• To reduce the use of more hazardous pesticides by 50% by 2030

• To reduce nutrient losses by at least 50% while ensuring no deterioration of soil fertility

• To reduce fertiliser use by at least 20% by 2030

• To achieve 25% of total farmland under organic farming by 2030

Since those announcements, Europe and the world have had to deal with a global pandemic that caused unprecedented worldwide lockdowns and travel

restrictions, Russia’s invasion of Ukraine, rising inflation, growing interest rates, and geo-political instability not experienced for many a decade.

Is the European Green Deal still achievable within the original time frame?

Probably, but it will be a massive challenge that will require a lot of sacrifices.

Sacrifices that the West may not be ready to make given our reliance on low food prices, cheap energy, and nearcontinual availability of most produce.

A significant reason for this overreliance is the policy decisions made by the organisation now pushing for the Farm to Fork initiative: The European Union.

The EU

For decades, governments within Europe supported the development of a food system that was bad for the economy, society, the environment, and people’s health - all intending to keep food prices low for the consumer.

22 TRADE FINANCE TALKS tradefinanceglobal.com

The Green Deal is supposed to drive sustainability in the EU, but are the objectives feasible in a tumultuous environment?

This myopic approach meant many animal feeders and food manufacturers needed to find ways to keep costs artificially low in the short term - preventing the investment needed to find sustainable solutions for the long term.

In some ways, the current situation in Europe - with record high gas prices, underperforming crop yields, and supply chain bottlenecks - may be the wakeup call we all need.

This remains a complex challenge, and while the Farm to Fork strategy gets a lot of things right, the devil is in the detail, and its design may be choosing to ignore two inconvenient truths: money and consumer preferences.

Money

The EU Green Deal will need a great deal of money.

While the cost of organic farming is 10% lower than that of conventional agriculture, average yields of organic grains are between 35-40% lower than those of traditional grains, leading to higher prices for raw materials.

Furthermore, in its proposal on 27 May 2020, the European Commission mentioned spending over €348 billion on agriculture.

This proposed expenditure, however, was before the additional costs from the COVID-19 crisis, the conflict in Ukraine, energy relief efforts, and higher inflation and interest rates.

This steam of expensive events leads many to question whether the promised sum of money will still be readily available for agricultural spending.

Moving forward, however, the EU has a real opportunity to become

a standard bearer for sustainable and healthy food.

To do so, the union must recognise and gradually remove the many subsidies for uncompetitive farming practices and use trade agreements to push for more robust standards around the globe.

Consumer preferences

Another issue facing the EU Green Deal is the current set of consumer preferences.

The volatile climate conditions that the world has experienced in the past few years have seen farmers produce at variable yields.

However, yields must improve to meet the growing demand for food while reducing land used for crops.

23 tradefinanceglobal.com

FEATURED

To do this while meeting all parts of the EU Green Deal - including the call on countries to reduce dependency on pesticides and excess fertiliser use - more resilient seeds and plants need to be developed.

Consumers must be ready to accept more genetically modified seeds and plants and change their dietary habits accordingly.

However, while recognising the need to move to a more plantbased diet with less processed meat, the Green Deal strategy does little to suggest how it will promote the health benefits of these changes.

Far more is needed to promote the importance of healthy diets.

Retailers and consumers have a part to play, but the real onus lies with EU and local policymakers to create a standardised framework for action.

Humankind’s commitment to the future

This EU Green Deal strategy will require massive investment and its deployment will require the mobilisation of a high percentage of public resources.

To meet this deal is not without sacrifice, and that could be a hard sell in the current environment, but one that is ultimately needed to be made.

Policy-makers must increase budgets for sustainable projects, education, and innovation, all while maintaining enough cash to support those citizens at risk of not being able to put food on the table or heat their homes this winter.

But it is not just governments that have a role to play.

Even though a large part of the investment will come from the public sector, the future state of the planet also requires support from the private sector.

Companies must understand the potential of embracing a sustainable economy and begin to prioritise sustainable investments to meet the demands of an increasingly aware society.

The European Green Deal provides opportunities for future generations to meet their needs, for Europe to lead the fight against climate change, and to drive cooperation between countries.

This is our commitment to the future, our children’s children, and beyond.

24 TRADE FINANCE TALKS tradefinanceglobal.com

2.6

Data standards: a key to a truly sustainable trade

PRADEEP NAIR

Companies around the world are almost unanimous in their desire to make their supply chains more responsible, resilient, and futureproof––no matter the sector or the region they operate in.

To better support them in their journey and for this to scale, however, the trade finance sector needs a universal framework for environmental, social, and governance (ESG) data.

Standard Chartered recently surveyed more than 500 C-suite and senior leaders as part of its Future of Trade 2030 report.

Its findings are encouraging: global trade is moving rapidly towards a new, more sustainable and inclusive paradigm.

However, although 9/10 of respondents acknowledged the need to incorporate ESG standards and practices across their supply chains, many do not have a clear view of what they need to do to achieve their goals.

The main reason for this is a lack of definitions around what ESG in trade actually is.

Lack of ESG clarity is a data problem

This is a data problem: there is no uniformity in either the inputs --that is, the metrics used or the data that need to be collected-or the outputs.

As a result, there’s no real way for companies to identify which areas they need to improve upon or benchmark themselves against others.

For banks looking to support their clients on the journey towards creating a more equitable, climate-sensitive, global trading system via sustainability-linked financing, this poses a serious challenge.

If a bank wishes to ascertain the credit risk of a client, it relies on ratings. While the output of each credit assessment, for example, BBB+, Baa1, or P2, depends on the model used, the inputs are governed by accounting standards, meaning they come from the same set of information.

25 tradefinanceglobal.com

Global Head of Structured Solutions and Development Standard Chartered Bank

For sustainable trade finance to scale, the industry needs a uniform model for ESG data that can be used by everybody.

FEATURED

The ESG landscape, in contrast, does not currently have any such uniform standards. Instead, there is a patchwork of different measures covering numerous sustainability metrics––some areas have no standards at all. For carbon emissions, companies can use the GHG Protocol Corporate Standard, but while this covers the accounting and reporting of emissions, it does not provide granularity on how firms should conduct the verification process.

For other environmental and social issues in the supply chain, there are myriad areas to focus on. Each company at present has the freedom to effectively self-select the details that they believe to be material, leaving them open to claims of ‘greenwashing’.

Companies want to be able to understand their ESG risks and have conversations with their banking partners as to what solutions can be offered to mitigate them.

But with hundreds of different assessment techniques, scales, and ways of looking at ESG in trade––each capturing certain metrics and omitting others to give a red, amber, or green ESG score, or a rating of A or 1––every sustainability-linked trade and supply chain finance facility becomes a bespoke deal.

The lack of standards creates challenges for SMEs

This is fast becoming a major problem for SME suppliers, who should be the largest beneficiaries of sustainabilitylinked supply chain finance.

Often, a supplier may be catering to multiple buyers, each with different ESG criteria.

Without clear standards and an agreed-upon format, the amount of work that must go into acquiring the information required is significant, and this can create a barrier to accessing the financing that is needed.

A uniform model requires a collective effort

Through its sustainable trade proposition, Standard Chartered is aiming to address this confusing landscape.

Launched at the beginning of 2021, the proposition embeds measurable metrics that are aligned to external benchmarks across four pillars: sustainable goods, sustainable suppliers, sustainable end-use, and transition industries.

However, Standard Chartered cannot do this alone. For sustainable trade finance to scale, the industry needs a uniform model that can be used by everybody.

This is why the International Chamber of Commerce’s (ICC’s) recent work has been welcomed; they have created the firstever standardised assessment methodology to qualify the sustainability profile of trade transactions, industry-wide.

The opportunity is enormous. The rise of digitalisation in trade and the growing adoption of tools that can be leveraged for the attribution of ESG data at the transaction level are laying the ground for all participants in trade to collect and share information on their sustainability performance, allowing for meaningful change across supply chains globally.

But the data they share needs a framework.

This needs a home.

According to Standard Chartered’s research, global exports will rise from $17.4 trillion to $29.7 trillion over the next decade, with this upward trajectory bringing along new prospects for more inclusive, equitable growth.

An industry-wide model for ESG data will unlock the true power of trade as a force for good, as long as everyone adopts it.

26 TRADE FINANCE TALKS tradefinanceglobal.com

MICHELLE KNOWLES

Pan African Head of Trade Finance

Product

Absa Corporate Investment Banking

2.7

African trade finance enters an exciting new phase

Closing Africa’s $100 billion trade finance gap is going to require alignment across a number of ecosystem elements.

It is often debated whether the reported existing trade finance gap, which over the last 3 years has oscillated between $100 billion and $120 billion, will diminish or whether the nature of illiquid, growth-focused, emerging market economies means that the gap will never truly close.

Before 2020 and the COVID-19 pandemic, there had been some meaningful progress; the trade finance gap had dropped to $81 billion. If we can get back to these kinds of levels, a $20-30 billion injection into the small business sector will be welcomed.

However, 2022 has thus far shown no signs of such a return. The world today looks very different, with geo-political uncertainty in Ukraine, Russia, China, and Taiwan, amongst others.

This, in turn, has seen spiralling input costs and constraints on supply chains. Considering that a lot of emerging market debt is dollar-based, this again puts pressure on the trade finance ecosystem.

This is perfectly highlighted through a case study of a South African client whose core business was disrupted by events in Ukraine.

The steep increase in input costs and the knock-on impact on escalating freight costs meant that the client had to reinvent its business model completely.

Absa increased an import letter of credit facility from 1.8 billion rand (R) in 2021 to R6.5 billion in 2022 in response to the evolving environment.

The result of this was that the client saw a rise in profitability while maintaining its leading position in the South African market, in addition to a growing market share in Mauritius and The Democratic Republic of Congo.

Surging inflation and rising input costs, coupled with the Central Bank tightening, are likely to result in pressure on emerging market businesses that had just begun to rebuild their balance sheets.

Avoiding a situation where banks start withdrawing credit at a time when businesses are cashhungry is paramount, especially when these businesses are only just beginning to take advantage of an economic recovery.

Here, it is important to reiterate that, by its nature, trade finance is less risky than other types of financial support for importers and exporters.

27 tradefinanceglobal.com

FEATURED

According to the African Development Bank (ADB), the average approval rate for trade finance transactions was 88% in 2019, while the average default rate on trade finance between 2017 and 2019 was 7.5%, compared to 11% on other types of non-performing loans.

In Southern Africa, this number was as low as 2% over the period spanning 2011 to 2019. This highlights the power of getting liquidity into the right places in the system, showing how economic activity can be unlocked without the burden of excess risk.

Fortunately, we live in a world which is constantly evolving, and countries will continue to both import and export their goods, particularly as the African continent develops economically.

Furthermore, there have been meaningful developments in terms of digitisation, liquidity, financial inclusion, and involvement from Development Finance Institutions (DFIs) to enhance Africa’s growth prospects.

Jeff Gable, the chief economist at Absa, shares this sentiment, saying, “Despite supply-chain and other global challenges, Africa’s trade flows have really accelerated significantly.

“International Monetary Fund (IMF) data show that the dollar value of Africa’s exports to the world have increased by more than a third over the last year and are up by more than half from pre-pandemic levels.

“Africa is showing similarly exciting increases in trade values within the continent as well, with exports up 37% in the first quarter of 2022 as compared to a year ago, and up more than 40% postpandemic.”

Approximately 60% of banks that engaged in African trade finance activities received some sort of support from DFIs.

This highlights just how close the relationships between these parties are and why there is excitement around some of the innovation and interest from the DFIs who are focusing time and resources on this market sector.

For instance, the ADB recently approved a $175 million regional trade finance facility for Eastern and Southern Africa, specifically a “strategic effort by the ADB to support the Africa Continental Free Trade Area’s agenda of reshaping markets and economies across the region by helping to boost output in the services, trade, manufacturing, and natural resources sectors.“

This deal is expected to release $2.1 billion in value over the next 3 years.

Absa believes that increasing access to trade finance represents one of the most critical focus areas, with a potential to unlock significant economic activity at relatively low-risk.

28 TRADE FINANCE TALKS tradefinanceglobal.com

Over 270 banks, funds & alternative lenders partner with TFG to finance transactions

29 tradefinanceglobal.com

in trade, receivables and scf Why don't you? partners@tradefinanceglobal.com

EMERGING MARKETS

3

GEORGE WILSON Head Institutional Trade Finance Investec

3.1

African access to trade: SMEs, FX, and sustainability

African small businesses face considerable FX challenges on their path to exporting, contributing to a widening finance gap.

Developments in the African market have taken centre stage in the trade finance industry lately, but this has not done much to dispel the hurdles that the market faces.

With a global energy and food crisis peaking, alongside hiking inflationary rates and geopolitical tensions, it may seem that the road ahead for the African continent is not as straightforward as one would hope.

Speaking to George Wilson, head of institutional trade finance at Investec, Trade Finance Global (TFG) was able to find out more about the African eco-system.

FX and access to trade finance

have had little in the way of a natural source of US dollars, relying on their exports to sustain central bank reserves and their much-scrutinised FX import cover.

Developing economies simply do not export enough in dollars to provide sufficient FX, and the impact is very real for SMEs that provide the bulk of the employment in Africa.

Wilson said, “African countries don’t export enough in dollars to generate the dollars that they need to pay for their imports.

ANASTASIJA KOVACEVIC Junior Editor Trade Finance Global

Dollars have always been scarce and expensive for banks and businesses on the continent to obtain.

Now, as global central banks hike rates to rein in inflation, and businesses battle with sourcing goods through strained supply chains––exacerbated by the Russia-Ukraine conflict and China’s lockdowns––Africa finds itself with a growing problem: accessing US dollar liquidity. Historically, emerging markets

“There is also a thriving market for structured letters of credit [LCs], which is essentially a method that African countries and African banks can use to import shortterm trade-tenor dollars into their countries.”

Despite the improved liquidity gained from the structured LC and trade refinance markets, the dollar timing and availability to African banks’ treasuries still fall short of what is required to support critical trade finance.

32 TRADE FINANCE TALKS tradefinanceglobal.com 32

Moreover, steep inflation rates have significantly hiked prices of essential imported food and energy commodities, exacerbating issues surrounding dollar shortage.

African SMEs: closing the trade gap

The primary cause of the trade finance gap in Africa is the inability of SMEs to obtain trade credit and FX from their financial institutions.

Furthermore, global banking regulation is the root cause of the unavailability of trade facilities from African banks to their SME clients.

To function at all, these SMEs need access to trade credit and FX from their banks. Still, these local banks have limited access to dollars and high capital costs––largely due to the extraneous Basel regulatory capital and US dollar liquidity. Overall, these facets make it unprofitable for banks to provide trade facilities to their SME clients.

African banks have limited interest in investing their finite dollar liquidity and capital in ‘risky’ SMEs, with the return of equity (ROEs) way below their cost of equity. Instead, it is a much more attractive option to buy government bonds––completely risk-free––and earn a 15% return.

These are commercial banks which must be mindful of shareholder interests, and, thus, the only responsible policy is to avoid trade finance altogether––hence the trade finance gap.

Wilson said, “The trade finance gap…pre-COVID was estimated to

be around $120 billion. It’s almost certainly north of that now [due to] the Russia-Ukraine conflict and the dollar liquidity situation.”

Despite this persistently large trade finance gap, trade remains a key driver of Africa’s social and economic development.

Sustainability: a channel for African SMEs?

There is a danger that wellmeaning international sustainable development goals (SDGs) and environment, social, governance (ESG) requirements may actually heighten the trade finance gap and limit funding even further to African SMEs.

There is an emerging risk that the environmental element of ESG completely precludes and overrides the social and governance aspects, not to mention the United Nations’ (UN’s) 17 SDGs.

The harsh reality is that much of the continent depends on extractive industries for survival, with Africa currently running on diesel and coal––albeit contributing only 3% of emissions globally. Shut these off, and fragile economies won’t just falter and fail, but people will suffer.

Trade is estimated to contribute up to a third of gross domestic product (GDP) growth in developing African economies, SMEs employ as much as 85% of the population, and trade is the ultimate supply mechanism for food security, health, industrialisation, and infrastructure in African economies.

Wilson added, “There are billions, perhaps trillions, of dollars in

the impact and alternative investment market looking for an ESG, or sustainable, home for their investment dollars. It could very elegantly solve the trade gap and provide them with safe, really sustainable, financing opportunities and investments.”

Industry policymakers and traders worldwide can look toward the 2021 ICC Standards for Sustainable Trade and Sustainable Trade Finance positioning paper as a marker of sustainable trade’s parameters.

The ICC’s roadmap to sustainability in the trade sector is a step in the right direction for the developed market, but there needs to be more input from emerging markets and, specifically, African trade finance.

As such, under the auspices of the African Regional Committee, ITFA will soon be releasing a positioning paper on ‘Sustainable Trade Finance and African Trade’, which intends to amplify the African voice in the proposed standards for sustainable trade finance.

This will hopefully help improve delivery on all of the UN’s SDGs through African trade, reduce the trade gap, and leverage the full benefit of the burgeoning African Continental Free Trade Area (AfCFTA) developments.

Watch the full video interview at tradefinanceglobal.com

33 tradefinanceglobal.com

EMERGING MARKETS

ANASTASIJA KOVACEVIC Junior Editor Trade Finance Global

3.2

International trade, sustainability, digitisation in Armenia

TFG interviews Ameriabank about Armenian supply chains, COVID-19 recovery, digital transformations, and more.

The global trade finance industry has seen significant shifts over the last few years.

The pandemic’s impact on the trading landscape acted as a double-edged sword; on the one hand, the adoption of digital tools was expedited, and on the other, supply chains suffered under the strain of lockdowns.

The year 2022 has added to such complications, seeing global food and energy crises, high inflation rates, and geopolitical challenges stemming from the RussiaUkraine conflict.

To gain an insight into how this affected the banking terrain in Armenia, Trade Finance Global’s (TFG) spoke with Gayane Mirzoyan (GM), head of the payment instruments and escrow division at Ameriabank. Mirzoyan’s expertise extends to letters of credit (LCs), bank guarantees, documentary collections, escrow services, and import and export financing.

Can you tell us a little bit more about Ameriabank?

GM: Ameriabank is the largest financial institution (FI) in Armenia, offering corporate, investment, and retail banking services.

In 2021, Ameriabank was the first in the market by key financial performance indicators with the following market shares: assets (15.6%), liabilities (15.9%), loans (16.9%), equity (14%), and net profit (23.4%).

In recent years, Ameriabank has continued efforts toward digital transformation, improving efficiency during the pandemic and increasing demand for digital services.

Driven by growing consumer demands, the bank has developed and launched a digital ecosystem covering virtually all banking services.

34 TRADE FINANCE TALKS tradefinanceglobal.com

GAYANE MIRZOYAN

Head of the Payment Instruments and Escrow Division Ameriabank

What does the current trade and supply chain finance landscape look like from an Armenian perspective?

GM: The Armenian trade and supply chain finance market is represented by banks with a full spectrum of products in line with international rules, regulations, and local legislation.

Armenia is primarily an importing country but has seen rapidly growing export levels in recent years; larger local companies have become more informed, actively using trade and supply chain finance tools to facilitate their operations.

The demand has also been growing among small- and medium-sized enterprises (SMEs) that use such tools for transactions with new counterparts, receiving better trading terms and financing in more convenient conditions.

Armenian banks support SMEs by offering services tailored to their unique needs.

How do you think that COVID-19 impacted banks and trade finance in emerging markets?

GM: In general, COVID-19 and the Russia-Ukraine conflict have negatively impacted banks in emerging markets.

COVID-19 introduced restrictions worldwide, raising concerns about the timely delivery of products and services.

Lockdowns imposed by governments caused companies to bear tremendous losses, disrupting operations and supply chains.

However, Armenia saw the introduction of several governmental programs to help companies cope with the consequences of the lockdowns and delays.

These new measures, combined with the support programs adopted by local banks, allowed the most vulnerable companies to overcome challenges. In turn, banks began to look for ways to revise and diversify their trade finance business.

Despite the pandemic, in 2021, Ameriabank sustained strong results, with the bank remaining the Armenian trade finance market leader.

Additionally, Ameriabank is actively involved in trade facilitation programs with all major international FIs, including European Bank for Reconstruction and Development (EBRD).

In addition to its issuing bank status with many international FIs, Ameriabank is the first Armenian bank to receive confirming bank statuses under the EBRD’s Trade Facilitation Program (TFP) in 2013 and under the Asian Development Bank’s (ADB’s) TFP in 2018.

What is your view on the impact of the recent Russia-Ukraine conflict on banks and trade finance in your market? How has this impacted clearing, access to foreign exchange (FX) services, and settling international payments?

GM: From a trade finance perspective, the main difficulty in Armenia is blocked transportation routes. Companies have been bearing additional costs to change usual routes and bypass conflict regions.

Simultaneously, with the introduction of new sanctions on Russia, intermediary banks took a somewhat evasive approach to transactions for parties related to, or routes involving, Russia--irrespective of whether such parties or goods fell under sanctioned lists.

The same situation happened with international companies covering the Armenian region, with offices in Russia. Here, once again, the intermediaries would reject such transactions.

This catalysed a shift wherein businesses considering trade finance products looked for alternative business opportunities with new partners, via new routes and in new countries.

Ameriabank has provided continuous support to its clients and worked out quick solutions to maintain the business continuity of client operations.

How can digitisation help innovate in cross-border payments and escrow banking?

GM: As international e-commerce is growing exponentially, crossborder payments have become well-integrated into the daily operations of businesses.

Digitalisation and innovation have become pivotal components for improving the customer experience. The primary focus on improvement is to secure seamless, instant, and cheaper cross-border payments for the banks to remain competitive among peers and keep pace with technological change in the global marketplace.

35 tradefinanceglobal.com

EMERGING MARKETS

Some of the latest technologies --such as machine learning, artificial intelligence (AI), application programming interface (API) connectivity in payments, virtual account management, and digital escrow––are considered the directions the banks are leveraging.

All of these features are aimed to ensure visibility and transparency of payments and decrease risk exposure and process complexity.

Beyond the customer experience and retention benefits, digitalisation of the transactions allows FIs to expand into new markets and ultimately achieve a better return on investment (ROI).

What are your thoughts on CBDCs?

GM: The rapid spread of cryptocurrencies issued by private businesses has prompted central banks worldwide to adopt their own central bank digital currencies (CBDCs).

The primary rationale behind this is a desire for better control over the currency. Like many central banks, the Central Bank of Armenia has considered a concept of its own digital currency, but not much progress has been made in this direction yet.

Some of the benefits of central banks issuing digital money include better-regulated options for using digital currencies, reduced inefficiencies, and shortened payment value chains.

Central banks can also offer better-controlled options for using digital currencies to reduce inefficiencies and shorten the payments value chain.

It is clear that CBDCs make transactions straightforward and offer financial inclusion for people without physical access to banking.

However, most concerns and ongoing debates are focused on the high volatility and risks associated with digital currencies issued by regulators, particularly privacy risks for citizens and security issues.

What does the future of banking look like in Armenia? Where are the growth areas?

GM: Armenia has a strong and relatively stable financial system dominated by well-capitalised banks.

Tested against COVID-19 and post-pandemic economic shocks, this assured stability will be integral for further development.

Among other challenges, banks are facing changing consumer behaviour. The digitalisation of financial services allows banks to embrace new technology, rapidly integrate new digital services, and shift to a more flexible organisational structure, including governance and risk management policies.

As the leading bank in the country, Ameriabank, for several years now, has invested considerable financial and human resources in its digital transformation.

This includes upgrading all of the components mentioned above and creating seamless digital solutions across a range of financial products, all to secure a leading position in the technologically-enriching banking industry for the coming years.

36 TRADE FINANCE TALKS tradefinanceglobal.com

3.3

Banking in the Kyrgyz Republic, Optima Bank OSJC

TFG interviews Optima Bank to learn about the economic challenges facing banks in the Kyrgyz Republic and strategies for overcoming them.

The world of trade finance has experienced significant fluctuations as of late. Whether it be the after-effects of COVID-19, the geopolitical climate, or rising inflation rates, the trade industry has seen many changes as a consequence of all these elements.

In preparation for the 2022 EBRD TFP Trade Finance Forum, held in Istanbul, Turkey, Trade Finance Global’s (TFG) Annie Kovacevic sat down with Chynara Alybaeva (CA), head of global transaction banking department at Optima Bank OJSC, to learn more about the banking sector in the Kyrgyz Republic.

Alybaeva’s role spans documentary operations and correspondent relationships, allowing for a comprehensive overview of the banking network on a national level.

Could you expand a little bit more on Optima Bank? Where do you operate?

CA: Optima Bank is a universal commercial bank operating in the Kyrgyz Republic. The bank has recently strengthened its position in the Kyrgyz Republic market, gaining a reputation for garnering

reliable partners, and holding both client and shareholder interests in high regard.

The main priority of Optima Bank is high-quality banking services and dynamic development.

Over the last 30 years, Optima Bank has maintained strong foundations as a financial institution (FI), sustaining a sound balance sheet structure, a diversified credit and deposit portfolio, and well-balanced geographical coverage throughout Kyrgyzstan.

Can you give us an overview of the transaction banking landscape in the Kyrgyz Republic? What are the key challenges and risks?

CA: Currently, the main activities of Kyrgyz commercial banks are;

• Increasing the amount of deposits

• Settlement and cash services

• Loans (consumer, mortgage, business development etc.)

• Foreign exchange (FX) transactions

• Cross-border payments

• Documentary operations

37 tradefinanceglobal.com

CHYNARA ALYBAEVA Head of Global Transaction Banking Department Optima Bank OJSC

ANASTASIJA KOVACEVIC Junior Editor Trade Finance Global

EMERGING MARKETS

Optima Bank’s current strategic trajectory is to ensure free access for the population to banking services, not only in cities but also in rural and isolated areas of the Kyrgyz Republic.

The external environment requires the banking system to be more dynamic. Implementation of the state program and alternate measures to optimise monetary circulation will ensure:

1. Increase in the percentage of non-cash payments, reduction of the shadow turnover of cash in the economy,

2. Anti-money laundering (AML); legalisation of financial transactions,

3. Further development of the legal framework for banking legislation and supervision.

However, a considerable hurdle for the financial development of commercial banks in the Kyrgyz Republic is the current global geopolitical terrain––namely, the Ukraine-Russia conflict.

The economy of the Kyrgyz Republic depends on external

financial support, including the Russian market. This new landscape has created an environment where FIs are now especially careful when working with new customers and counterparties.

Other knock-on effects include; a longer execution period for foreign currency payments due to a decline in international correspondent banking relationships. This has led to an additional layer of tightening requirements for cross-border payments.

What impact has COVID-19 and the current Russia-Ukraine conflict had on banks, more specifically, banks in the Kyrgyz Republic?

CA: One of the main impacts of the coronavirus pandemic on the banking system is the relative deterioration in the quality of loan portfolios.

Whilst a difficult burden to manage, it was not entirely unexpected with quarantine measures and border closures creating derivable negative

effects on businesses and on the income of borrowers (legal entities and individuals).

In addition, the turnover of goods and services decreased significantly against the backdrop of a moderate reduction in money transfers and private capital inflows, while increasing payments on obligations.

In 2022, sanctions against Russia led to uncertainty. There were significant after-effects, notably the freezing of Russia’s dollar assets and an increase in energy prices, which ultimately caused strong volatility in the FX markets, including in Kyrgyzstan.

Despite the worldwide negative repercussions of contemporary global economic instability, political risk, and volatility of foreign currencies (the dollar, ruble, euro and tenge), there has been a rapid growth of the banking sector’s profits.

At the end of June 2022, the net profit of commercial banks in Kyrgyzstan increased 4.4 times compared to last year. This increase was attributed to

38 TRADE FINANCE TALKS tradefinanceglobal.com

exchange operations with foreign currency, enabling commercial banks to receive most of their income.

How has Optima Bank helped local businesses to gain better access to finance?

CA: The Ministry of Finance of the Kyrgyz Republic disburses concessional loans through commercial banks, including Optima Bank, to support the production industry and the agriculture sector.

We understand that one of the successful indicators of the bank’s activity is a wide client base, which is growing every year, as well as a constantly expanding range of services.

Therefore, Optima Bank conducts regular loan/credit card promotions for its customers. In order to provide additional support to local entrepreneurs, Optima Bank provides deferrals for loan repayments, offering flexible repayment schedule if necessary.

What impact has the cutting of correspondent banking relationships had on Optima Bank’s clearing, access to FX services, and settling of international payments?

CA: Kyrgyz banks hold most of their correspondent accounts with Russian banks, using both the euro and the dollar.

Given the current situation, banks have had to transfer resources from state-owned banks in Russia to private banks, which are not yet under sanctions.

Taking into account longterm cooperation with foreign partner banks, Optima Bank has subsequently developed direct correspondent accounts in Europe and Asia. This allows the bank to provide uninterrupted clearing services to clients in foreign currency.

However, on a more general scale, the situation has been quite complicated. As mentioned previously, there has been a trend of declining international correspondent relationships, with the forecast for Kyrgyz correspondent accounts looking to suffer a similar fate.

The US government has included most of the Commonwealth of Independent States (CIS) in the list of transit countries, through which sanctioned goods may enter Russia.

In case of violation of sanctions, secondary sanctions will follow. Therefore, the Compliance Control Department has tightened vigilance over opening accounts for new customers.

What can multi-laterals such as the EBRD do to support your banking efforts?

CA: Optima Bank is open to mutually-beneficial cooperation with multi-lateral institutions.

The European Bank for Reconstruction and Development (EBRD) is one of the key partners of Optima Bank. Most collaborations fall under the field of lending, co-financing, and trade finance.

Optima Bank is also a participant of the EBRD’s KyRSEFF program––a program backed by the EBRD seeking to finance sustainable energy in Kyrgyzstan.

39 tradefinanceglobal.com

EMERGING MARKETS

The Russian Kyrgyz Development Fund (RKDF) provides financing for those projects. Aside from the commercial benefits for the owners, this initiative will have a positive impact on the overall economy, creating more jobs, increasing tax payments, improving imports and exports, and positively impacting the development of local communities.

Particular emphasis has been given to the projects aimed at propelling rational use of resources and energy, waste reduction, processing, regeneration of resources, and using environmentally friendly technologies.

With half of the micro-finance sector’s credit sources coming from international donors, how can we be sure to support SMEs in this current economic climate?

CA: Small- and medium-sized businesses (SMEs) are a powerful factor in the country’s economic development. They occupy about 60% of the client base of banks and, accordingly, the banks are interested in financing such clients as they are highly profitable.

The main priority areas for SMEs in the Kyrgyz Republic are agriculture, industry, trade, car repair, hotels and restaurants, transport and communications, financial activities, real estate transactions, education, healthcare, alongside social and personal services.

Kyrgyzstan is a member of more than 70 international organisations. These international organisations also support and finance SMEs in Kyrgyzstan and play an important role in the development of SMEs in the state.

What steps have been taken to introduce green finance or green financial products?

CA: Optima bank always supports the loans with a “green clause” placing them as a priority. With the support of EBRD (KyRSEFF program) and RKDF, Optima Bank implements energy and heat saving projects in apartments/ houses, lighting and sewerage improvement systems in hotels, planting of trees, and the modernisation of excised hydroelectric power plants.

One notable example is the treeplanting project in the Issyk-Kul region, amounting to the planting of 17 thousand Paulownia trees.

Paulownia trees are famous for their fast growth; an added bonus comes in the form of their leaves, as they can be used as animal feed.

Reaching a maximum height of 15-17 metres, this tree lives up to 70 years. Paulownia also processes ten times more carbon dioxide than any other tree and therefore releases more oxygen.

Paulownia’s wood is valued all over the world for its durability and lightweight.

What does the future of transaction banking look like in the Kyrgyz Republic?

CA: A few years ago, it seemed impossible for us to pay for purchases by attaching a smartphone to the terminal. COVID-19 and quarantine measures have undoubtedly accelerated digitalisation.

The new digital reality and highly competitive environment are forcing banks to move to the client side. It has increased user accessibility, allowing clients to choose the most convenient bank with the best online banking platform without much effort.

The digitalisation of banking services will optimise processes and facilitate the access of the population to banking services, including those regions in the country where banking penetration is insufficient.

It will additionally provide an opportunity to increase online operations, as well as simplify access to banking services and develop distance sales channels.

Therefore, along with the development of digitalisation of banking services, commercial banks need to modernise their automated banking systems in accordance with the requirements of international standards.

40 TRADE FINANCE TALKS tradefinanceglobal.com

ANDY ROMANOV Deputy Head of Trade Finance Ukrgasbank

3.4

Trade finance in Ukraine: a rallying call for industry members

VLADISLAV BEREZHNY Director of Trade and Structured Finance Credit Agricole

The humanitarian and economic war between Russia and Ukraine has sent ripples all around the world, with practitioners, financiers, and governments urgently stepping in to try and help.

Boosting and restoring trade exports will be key for Ukraine, as well as ensuring a safe entry route for trade imports.

The European Bank for Reconstruction and Development (EBRD) has been one such organisation, actively stepping up to support the country which has become one of its top investment destinations, second only to Turkey.

To gain insight into the trade and structured finance landscape of Ukraine currently, Trade Finance Global’s (TFG) Deepesh Patel sat down with Andy Romanov, deputy head of trade finance at Ukrgasbank, and Vladislav Berezhny, director of trade and structured finance at Credit Agricole.

Both Romanov and Berezhny will be speaking at EBRD’s flagship Trade Facilitation Programme (TFP) conference in Istanbul.

TFG are a proud media partner of EBRD.

The changing trade and trade finance landscape in Ukraine