TRADE FINANCE TALKS NOV 2022 PAY TO PLAY OVERCOMING CHALLENGES IN THE PAYMENTS SECTOR FEATURED THE HIGHS AND LOWS OF B2B PAYMENTS

THANKS TO

ALAN KOENIGSBERG

RISHIKESH TINAIKAR

JIM REGAN

ENNO-BURGHARD WEITZEL

SCOTT WELLCOME

PRADEEP NAIR

MICHELLE KNOWLES

GEORGE WILSON

GAYANE MIRZOYAN

CHYNARA ALYBAEVA

ANDY ROMANOV

VLADISLAV BEREZHNY

TULKIN YUSUPOV

DALTON LEE

PAUL WOLLNY

GORDON CESSFORD

RICHARD RAWLINSON

MARTIN GRUNEWALD

ANASTASIA MCALPINE

JOSH KROEKER MARK BORTON

TFG EDITORIAL TEAM

DEEPESH PATEL

ANASTASIJA KOVACEVIC

HOFFMAN

© Trade Finance Talks is owned and produced by TFG Publishing Ltd (t/a Trade Finance Global). Copyright © 2022. All Rights Reserved. No part of this publication may be reproduced in whole or part without permission from the publisher. The views expressed in Trade Finance Talks are those of the respective contributors and are not necessarily shared by Trade Finance Global.

Although Trade Finance Talks has made every effort to ensure the ac curacy of this publication, neither it nor any contributor can accept any legal responsibility whatsoever for the consequences that may arise from any opinions or advice given. This publication is not a substitute for any professional advice.

2 TRADE FINANCE TALKS

12 14 19

PHOTOGRAPHS

FREEPIK

ADDRESS 2ND FLOOR 201 HAVERSTOCK HILL BELSIZE PARK LONDON NW3 4QG TELEPHONE +44 (0) 20 3865 3705

CARTER

LAYOUT JERRY DEFEO

AND ILLUSTRATIONS

COMPANY S.L.

BEN ELLIS Global Head of Visa B2B Connect Visa

Barry Tooker Principal Transaction Banker

ANDRÉ CASTERMAN Founder and Managing Director Casterman Advisory

3 CONTENTS

6

7

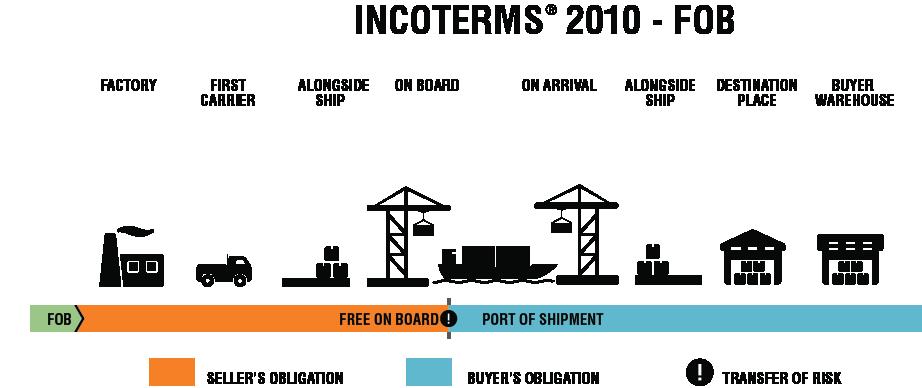

1 FOREWORD 4 1.1 Pay to play: overcoming challenges in the payments sector 6 2 FEATURED 10 2.1 Visa: the highs and lows of B2B payments 12 2.2 How ISO 20022, RTP, CBDCs, and other industry initiatives are changing the payments ecosystem 14 2.3 What a strong US dollar means for the world 17 2.4 The evolving payments landscape: how data-sharing makes all the difference 19 3 EMERGING MARKETS 22 3.1 ESG evaluation: how can we contribute to achieving the SDGs? 24 3.2 ESG: ING gives the green light 26 3.3 Commerzbank on standardisation: the key to sustainable trade finance 29 3.4 Auf wiedersehen fossil fuels: Germany’s route towards LNG adoption 35 4 DIGITISATION 54 4.1 One small bill for parliament, one giant leap for trade digitalisation 44 4.2 Digitising trade: fraud, fintechs and the future 46 4.3 Blockchain, ESG, and data standards driving changes in the trade finance banking sector 48 4.4 The African payments landscape: COVID-19, interoperability, SMEs 50 4.5 Digitising Trade:The solution is in plain sight 52 5 SHIPPING AND SUPPLY CHAINS 54 5.1 Blockchain in bridging trade finance with climate commitment of the shipping industry 56 5.2 Double redundant—Standard Chartered discusses supply chain duplication and deep-tier financing 59 5.3 The most misunderstood Incoterms® in relation to terminal charges . 62

PODCAST 66

ABOUT TRADE FINANCE GLOBAL 68 CONTENTS

1

FOREWORD

DEEPESH PATEL Editorial Director Trade Finance Global

1.1

Pay to play: overcoming challenges in the payments sector

Fire tests gold, adversity tests adaptability.

Trade finance finds itself at a crossroads; a vast and multifaceted sector, it is an industry that continues to participate in extremely archaic processes.

For many, it can feel as if the ecosystem is in a constant tugof-war between technological advancement and 19th-century practices.

Some may refute that trade finance, as the oldest domain of international finance, warrants its arcane methods; after all, many industry practices, such as the bill of exchange (BL), emerged in the Middle Ages.

But increasingly, large market players are finding that this is not enough of an excuse.

COVID-19 served as a catalyst for

many things, but, in part, it served as a wake-up call for the trade finance industry.

It narrowed people’s attention to the inefficiencies associated with shipping procedures, banking relationships, and sustainability measures.

This edition of Trade Finance Talks will explore these topics but also how, in an increasingly digital world, the payments industry has found itself evolving at a rapid pace.

In this new reality, where businesses are now expected to embrace 24/7 realtime payments and market innovations, those that fail to keep up may find themselves paying the price.

6 TRADE FINANCE TALKS www.tradefinanceglobal.com

ANASTASIJA KOVACEVIC Junior Editor Trade Finance Global

Trade finance digitisation: troughs and triumphs

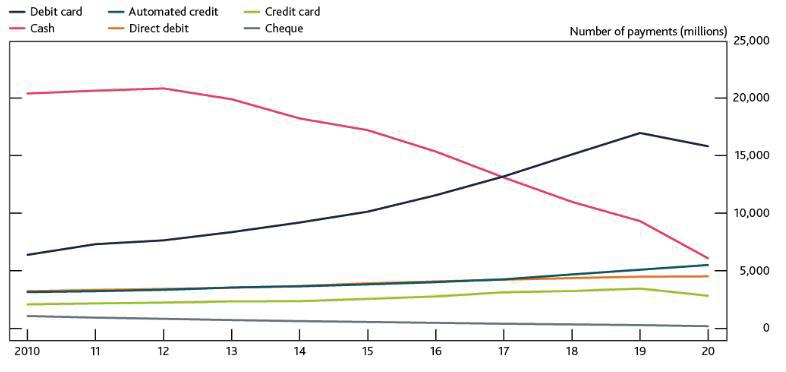

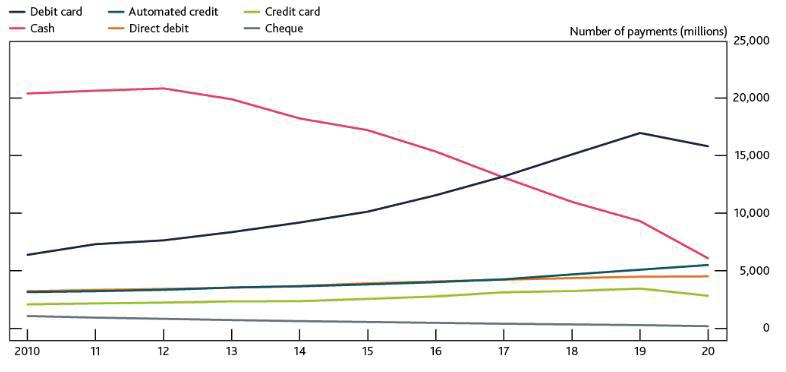

Cash is king, they say.

This may have been true a decade ago, but transactional cash use has fallen from over 50% of payments in 2010 to only 17% of all payments in 2020.

SOURCE: BANK OF ENGLAND

Digitisation has played a large part in increased payments accessibility; and this is not the only capacity in which it has helped progress.

The digital sector represents a wealth of opportunities. In 2019, the tech space contributed approximately £151 billion to the British economy alone.

Despite the world of opportunity presented, it can often be a long road until large market players, like banks, take any real interest in accommodating digitisation of processes.

This could stem from varying reasons, but an overarching reality seems to be the lack of high quality and reliable data

on a real-time or near-real time basis.

Fraud and payments: every action has an equal and opposite reaction

Data. An asset that could potentially solve many barriers to frictionless payments. In the same breath, conversations around data––and more poignantly, data sharing––can invite a few furrowed eyebrows.

The reality of the situation is that, though interpoperabitlity could serve as real solution for many businesses it also introduces an increased threat of fraud.

Fraud remains an everpresent looming shadow and,

unfortunately, continues to cause long-lasting issues for businesses. It is suggested that fraud tactics such as double financing are costing the industry as a collective up to £5 billion.

Inevitably, it is near-certain that this threat will always be a reality of the landscape, but the question remains: can we find a durable solution for mitigating this risk?

The ICC’s recent paper on fraud reduction shed some light on the situation. The paper included some recommendations on development of common message formats, data exchange protocols, and standardised data.

Additional notes circled around the need for regulators to take

7 www.tradefinanceglobal.com FOREWORD

note of the G20 roadmap to enhance cross-border payments.

Pay-ving the way: SMEs reaping the benefits of digitisation

Thanks to trade digitalisation, cross-border payments processes are now faster, more efficient, and less expensive. Not only has this improved transaction accessibility, but it has also bolstered emerging trading markets.

More specifically, it has allowed small- and medium-sized enterprises (SMEs) to better support their businesses.

Mpho Sadiki, head of realtime payments at BankservAfrica said, “If we can shift from a world where an SME waits for payments during the week––getting no real payments over the weekend––to a world where the payment happens instantly…they will be able to have cash flow available immediately.”

eBL adoption: all hands on deck

Since the creation of Model Law on Electronic Transferable Records (MLETR), only six states and seven jurisdictions have adopted its framework as law.

In October 2022, the UK became the next potential name to be added to the list, with the Bill beginning its journey through government.

According to Catherine LangAnderson, partner at Allen & Overy, the new law will create more comfort and legal certainty for banks around what they are able to do in a digital sense, further driving efficiency and potentially unlocking risk appetite in other areas.

Lang-Anderson is not alone in this sentiment.

ITFA Chairman Sean Edwards separately said, “The Bill will also break psychological barriers by emboldening market players to consider doing something they would never have before.”

Shipping, supply chains, and sustainability

Over 80% of the volume of international trade and goods are carried by sea.

Freight and forwarding is therefore an integral part of the trade finance eco-system. But shipping and logistics fall into a wider network––one heavily effected by macroeconomic fallout over the last few years: supply chains.

The increased acceptance of eBLs will no doubt aid significantly in many ways, but helping shipping become more a more sustainable industry is one of its bigger advantages.

ESG compliance: Hail Mary or greenwashing magnet?

In a field such as trade finance––one almost defined by borders––it is rare for the industry to face a unifying problem such as global warming.

There’s more carbon dioxide in our atmosphere than at any time in human history, and this global crisis will persist if not addressed.

The UN’s 17 Sustainable Development Goals (SDGs) adopted by all member states in 2015 seemingly set the stage for active change in the industry.

Seven years later, the Earth is 0.13 degrees Celsius hotter and no closer to net zero.

Unfortunately, trade finance is a very culpable aggravator in this context. Supply chains, for instance, account for more than 90% of CO2 emissions.

In response to the very relevant concerns about climate change was borne environmental, social and governance (ESG). ESG refers to a set of standards or criteria that measures a company’s actions and how they affect the environment.

Instead of people turning to leading government bodies to solve this larger societal issue, they have, en masse, looked to private companies for answers.

Accordingly, recent polling shows that a large majority of the public believe it is companies who should be responsible for paying for the growing cost of climate mitigation.

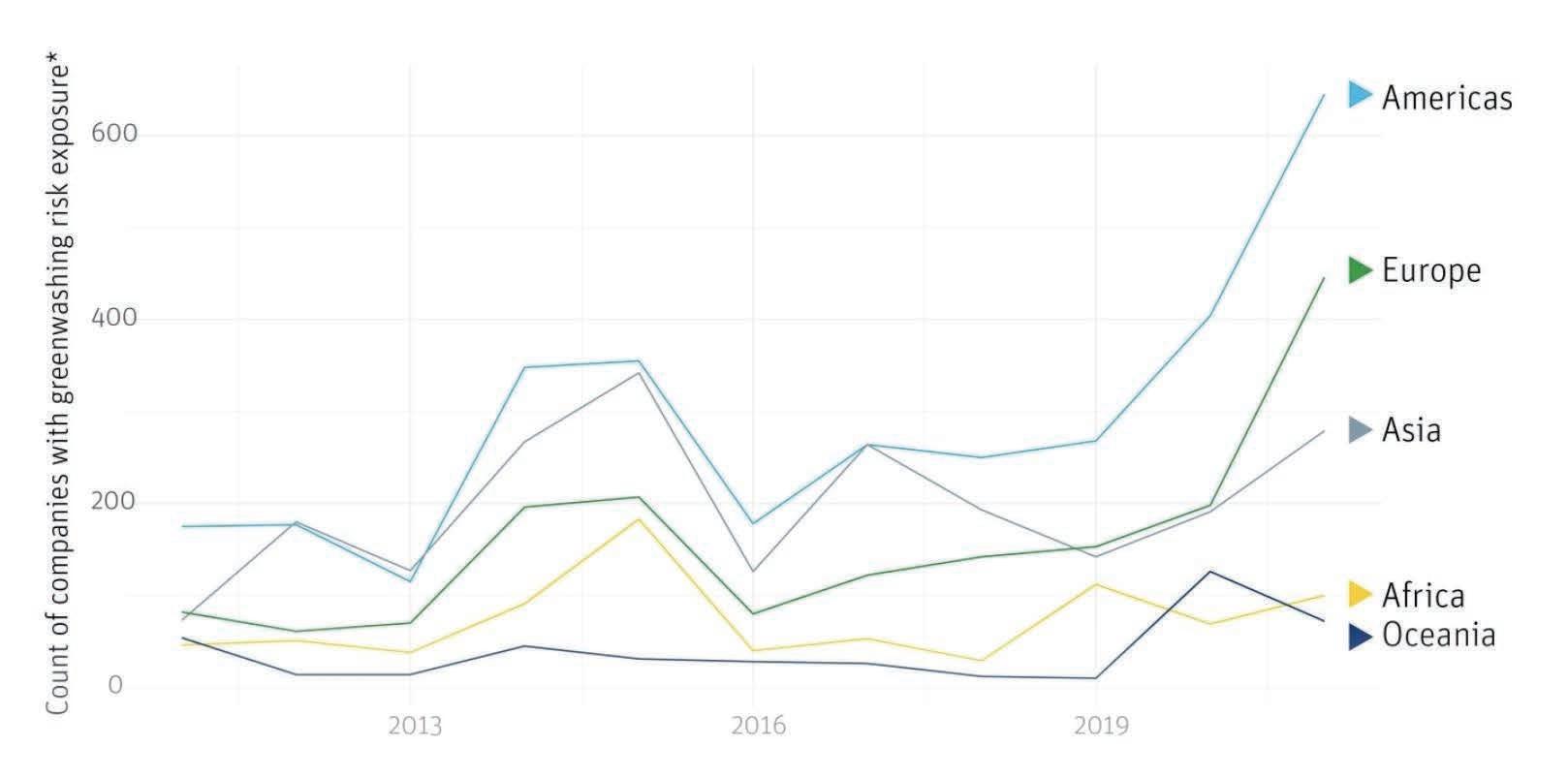

Nevertheless the ESG system has divided the trade finance industry; one side professes its importance, and the other warns against greenwashing.

8 TRADE FINANCE TALKS www.tradefinanceglobal.com

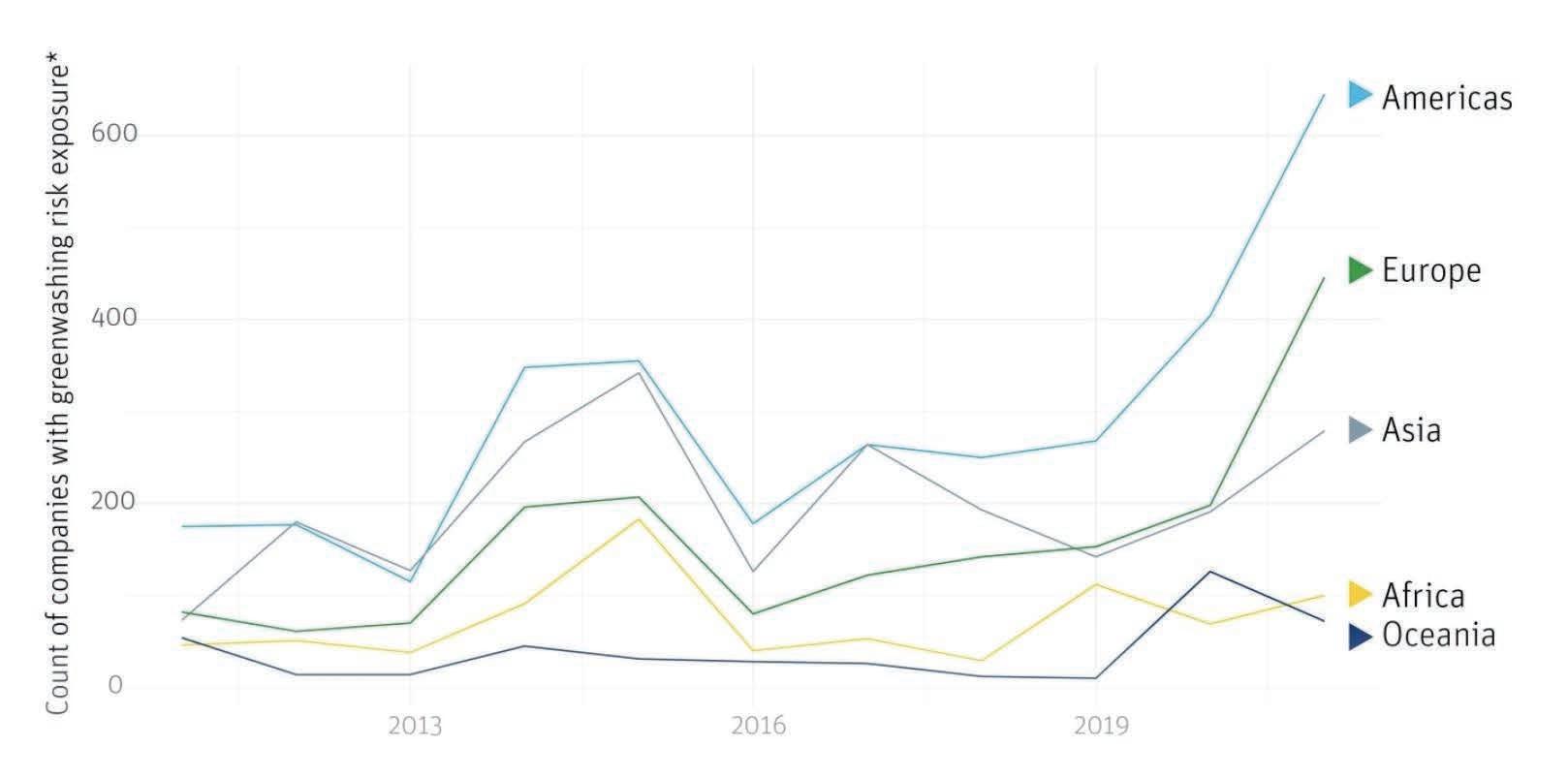

SOURCE: REPRISK

Pierre Bollon, who serves on the European Economic and Social Committee (EESC) and is a general representative of AFG, the French Asset Management Association, said, “Companies are being asked by investors to produce more and more information on ESG as this becomes more mainstream, but

there is no standardisation of this information.

Data providers are now a key part of the financial chain and I do not see why this key part isn’t under scrutiny.”

The issue of compliance and how it interweaves with climate-

conscious practices continues to unravel in different ways. But one thing appears certain, enforcing standards could be trade finance’s saving grace.

9 www.tradefinanceglobal.com

FEATURED 2

CARTER HOFFMAN Editorial Assistant Trade Finance Global

2.1

Visa: the highs and lows of B2B payments

To learn more about the cross-border B2B payments landscape, Trade Finance Global (TFG) interviewed Ben Ellis, global head of Visa B2B Connect.

Cross-border B2B payments landscape

It is important to note that a concise overview of cross-border B2B payments will not fully encapsulate the space and its multi-jurisdictional intricacies. In addition to the complexities of having multiple markets involved, business transactions naturally need to be able to convey additional data—such as which invoice is being paid—alongside the payment itself, something consumer payments do not need to consider.

According to Ellis, “It’s one of the more complicated business challenges.

“We did some research a short while back, and one of the things we discovered is about 70% of corporates have pain points tied to cross-border B2B payments.”

The research referenced was conducted by East & Partners on behalf of Visa Inc. in June 2019, looking at cross-border payments across 20 countries.

Many of these pain points Ellis mentions tie back to the unpredictability of the transaction.

Businesses often do not know where they are along the route, when they will arrive, or if there will be extra fees attached.

All these unknowns can make it difficult for the ultimate importer and exporter to confidently pass the full value of their offering along the supply chain.

Ellis added, “I think the industry is responding terrifically well.

“One of the things I think the industry is really good at is listening to clients—both financial institutions and their corporate clients—and working to innovate and to come up with ways to solve some of these pain points.”

One of these innovations is Visa B2B Connect.

Visa B2B Connect

When Visa began to examine some of these pain points, some of the aspects of a solution became clear.

Ellis said, “It takes good technology; it takes a good set of rules so that banks know what to expect when they engage; it takes an organisation that’s used to working with banks in a

12 TRADE FINANCE TALKS www.tradefinanceglobal.com

BEN ELLIS Global Head of Visa B2B Connect Visa

very structured and regulated environment; it takes a company that can do this at scale.”

These elements led Visa to create a network called Visa B2B Connect—a multilateral network where banks can send B2B crossborder payment data to other recipients on the network.

By applying many of the same rules and infrastructure as its traditional business, Visa can help drive secure, predictable, and efficient cross-border payments around the world.

One of many: the issue of standardisation

Any conversation about trade or financial digitalisation would not be complete without a nod towards the challenge that standardisation—or a lack thereof—provides and some solutions for how to overcome it. Ellis said, “Standardisation is absolutely an issue, and one of the ways we address it is by building flexibility.”

For Visa, this means remaining open to the array of different messaging formats and standards that clients are currently using.

The world may be moving towards ISO 20022, but if a particular bank is not yet prepared to send a message in that format, there needs to be

another approach they can take in the meantime.

Ellis added, “What we try to do is to build optionality into how things connect, so the standards that clients are using—whether it’s the ISO standard or the MT (messaging types) standards that folks may already have in place—that we can do the translation and make sure that it all flows through.”

By avoiding rigidity in these processes, organisations like Visa can help foster that 20% growth rate that the industry hopes to achieve throughout the remainder of the decade.

To watch the full interview, go to tradefinanceglobal.com

13 www.tradefinanceglobal.com

FEATURED

2.2

How ISO 20022, RTP, CBDCs, and other industry initiatives are changing the payments ecosystem

The payments ecosystem is made up of various participants interrelating throughout the process of a payment transaction.

This myriad of parties can be financial institutions, messaging and payment gateways, and third-party service and application providers, each playing unique and specific roles in a payment processing workflow and lifecycle.

New transaction banking initiatives are changing traditional payment processing paradigms. Innovative methods of payment and receipt, new currencies, and payment formats are altering payment, compliance, and liquidity management policies, practices, and procedures.

These new initiatives impact banks of all sizes, from the largest global banks to the smallest local credit union.

In order to keep pace, these banks’ payment ecosystem faces certain challenges and the need for change.

ISO 20022’s role in payments

The global adoption of ISO 20022 is changing the language of payments, and therefore the way payment messages are sent,

received, and mapped. This common standard enables more interoperability between the network participants dealing with cross-border and domestic payments and workflows. There can be as many as 200 internal bank systems affected by ISO 20022.

The new SWIFT MX message types can contain up to seven times the number of characters of the former MT message.

This new messaging standard incorporates more structured, robust, and comprehensive data. These innovative elements enhance speed and efficiency, improving cash recognition and account reconciliations.

The new SWIFT MX messages introduce a new field and party names, requiring the retraining of many payments, customer service, and compliance personnel.

A bank’s back office system(s) and applications were not designed to support ISO 20022––in some cases, even the ISO formats can be different––rather,

14 TRADE FINANCE TALKS www.tradefinanceglobal.com

Barry Tooker

FEATURED

Principal Transaction Banker

they use a number of legacy systems and applications. All of these will have to be updated to support ISO 20022.

The recently announced delay in the global rollout of ISO 20022 until March of 2023 by SWIFT and most of the in-country payment market infrastructures only shortens the implementation gap. In countries like the United States, this is still an issue as The Clearing House will implement ISO 20022 on their CHIPS system later in 2023, and The Federal Reserve will not implement ISO 20022 on Fedwire until sometime in 2025.

In the United States, this requires a prolonged period of coexistence support for both the former SWIFT standard and the new ISO 20022 MX standard. This period will last for at least two years, whereby banks will have to support existing MT standards and the new MX standards and be able to map messages between them.

This will require considerable due diligence to ensure that data being truncated because of the larger MX formats can be properly translated and mapped, accurately accounting for any data trimming.

Real-time payments

The proliferation of realtime payments means that the traditional batch-based processes are no longer adequate to meet the immediate payments processing time mandates.

Real-time payments can be initiated and received 24/7, 365 days a year. This means that financial institutions need to provide access to the rails that can offer instant payments all year round, and their internal systems and applications must be available to process these payments.

The need for continuously available payment processing requires a rethinking of end-ofday cycles and introduces the need for stand-in processing for the times when host applications are down for end-of-day cycles or unavailable due to system outages or maintenance. Liquidity must be managed 24 hours a day to ensure the availability of funds for both customers and the bank’s real-time payments, alongside clearing and settlement systems.

Additional real-time payment services are being implemented, such as Request to Pay/Request

for Payment, and this will change the way payment requests are received, validated, and authorised.

CBDCs and cross-border payments

The number of Central Banks exploring Central Bank Digital Currencies (CBDCs) continues to grow. According to the Atlantic Council, there are 112 countries representing over 95 per cent of the global gross domestic product (GDP) exploring a CBDC.

CBDCs have the potential to streamline and simplify existing cross-border payment channels. Today, cross-border payments use a correspondent banking model. unds move through a series of banks based upon established relationships of the parties in payment and the payment’s final destination.

A payment made using a CBDC could be sent directly to another bank using a distributed ledger, negating the need to go through a correspondent bank network.

This reduction in parties a payment passes through could result in lower costs and a reduction in the overall timing of an end-to-end payment.

15 www.tradefinanceglobal.com

CBDCs have the potential to reduce the current high fee and foreign exchange (FX) charges and improve the tracking of a payment.

This reduction in the number of parties a payment passes through could result in lower payment costs and a reduction in the time it takes to complete an end-to-end payment.

Using a CBDC model for crossborder transactions could impact current banking relationships and related revenues. Payment method selection, alongside liquidity management policies and practices, could also be affected.

Open banking and APIs

Open banking allows customers to control their own financial data. Using application program interfaces (APIs) customers can now permit authorised thirdparty organisations to access their data at their respective financial institutions.

Using APIs, banks can authorise third-party access to financial information needed to develop new applications and services. This will also provide account

holders with greater financial transparency options.

This new approach is changing the way banks and their customers interact with one another, allowing the customer to have ownership rights and privileges over their transaction data instead of their banks.

Ultimately, this requires changes to the bank’s core systems by allowing authorised third-party access to previously walled-off applications.

How AI is changing the banking ecosystem

The use of data and artificial intelligence (AI) is impacting every component of the banking ecosystem.

Banks and credit unions are rethinking how to integrate information, analyse data and use data insights to improve decision-making.

While there are benefits such as reduced costs and enhanced customer experiences, the challenges of disparate and siloed data and formats must be overcome. New access methods and metrics must be created.

The future of payments

A financial institution’s payment ecosystem has evolved over many years. There is a need to continuously adapt and change for new technologies, new industry initiatives, mandates, and regulatory and compliance directives. The pace of these changes has only accelerated and will continue to do so.

This requires a constant review by all internal and external stakeholders responsible for ensuring a smooth and efficient payments workflow as well as an assessment of the impacts on the entire payments ecosystem.

16 TRADE FINANCE TALKS www.tradefinanceglobal.com

FEATURED

2.3

What a strong US dollar means for the world

In a world rattled by broad geopolitical tensions, shrinking liquidity, and record-high inflation rates, investors have turned to the US dollar.

With the traditional 60/40 portfolio currently on track to record its worst year since the 1970s, the dollar has been one of the few assets holding its ground as a diversifier.

The trade-weighted US dollar index rose to a 20-year high in the third quarter of this year and has appreciated against all but eight out of 50 currencies Western Union Business are tracking.

But unlike the 1980s, when the G5 nations decided to coordinate a weakening of the US dollar in the Plaza Accord, the US is now welcoming the appreciation of its currency.

A stronger currency does not only offset rising import prices, but it also helps tighten financial conditions, aiding the Fed in its fight against inflation. But that which has helped the Fed doesn’t necessarily bode well for the rest

of the world, which is struggling with an energy crisis and rapidly shrinking FX reserves.

How US currency affects the domestic trade landscape

It is important to note that a strong dollar has negative side effects for the United States as well, as it affects corporate profits.

S&P500 companies make about 40% of their sales outside the US, which might partially explain why stocks of domesticallyoriented companies have so far outperformed more global businesses this year. However, domestic problems pale in comparison to what USD strength is doing to the rest of the world.

For starters, the dollar is negatively correlated with world trade, which is mainly explained by the fact that around 40% of global commerce is priced in USD.

Based on the dollar’s performance and other leading indicators, world trade growth is expected to turn negative in the fourth quarter of this year.

17 www.tradefinanceglobal.com

Boris Kovacevic

FX & Macro Strategist

Western Union Business Solutions

The strength of the US currency has amplified already existing headwinds for the world economy. But while central banks have kept up the fight to protect their currencies from depreciation, a USD reversal is something only the Fed will be able to engineer.

The damage extends to emerging markets (EM) as well. Central banks have tried to defend their currencies against the US dollar by running down foreign currency holdings.

This year, the fight against depreciation has already drained their FX reserves by more than $400 billion. This has raised the possibility of currency crises in selected countries with a large share of dollar-denominated debt and is one reason international investors have fled emerging market stocks and bonds at the fastest pace since 2005.

Looking into the next year, investors are starting to wonder how much room the dollar has for the upside.

Despite some recent losses, the Greenback is still up 19% since May 2021.

However, following leading economic indicators and macroeconomic uncertainty indices, it becomes clear that a large part of the dollar’s uncertainty- and volatilitydriven strength has passed; the currency is already pricing in a majority of the expected global economic slowdown.

The peak uncertainty theme,

however, does not mandate a fall of the dollar, but simply changes the dynamics driving the Greenback.

The future of USD

Going forward, the dollar will need to draw its strength from other factors, such as the currently unaccounted-for weakness of the global economy. Alternate options include continuing to reprice US interest rates higher. or.

Given the vulnerabilities of other major currencies, it would be possible for the dollar to remain at elevated levels while not reaching new highs in 2023.

The global energy crisis is still impacting currencies like the euro, pound and yen in a negative way and monetary policy will continue to favour the dollar in 2023.

A turnaround of the US currency would be welcomed by financial markets but is primarily dependent on three critical conditions:

1. Geopolitical tensions and commodity prices would have to ease, helping the energyimporting countries’ currencies recover some ground.

2. The Fed would have to signal an end to its tightening cycle and show a willingness to cut rates next year if policy easing is needed to support economic activity.

3. A sustained fall in market volatility would facilitate capital rotation away from the US dollar into riskier currencies, yielding more interest.

While we see inflation and, therefore, volatility starting to peak in most countries, a return to the environment before the pandemic or even 2022 is unlikely to occur next year.

Even though periods of extreme uncertainty are short-lived, above-average volatility caused by a shortage of liquidity, can be sustained for some time.

Peaking inflation might limit the scope of central banks to raise interest rates any further next year but being less hawkish does not translate into being dovish. The threshold for central banks to start buying bonds again has clearly been raised in a highinflation environment. This sets a new regime.

The financial world is hoping to see a triple peak in inflation, interest rates and the US dollar. But will we hit the trifecta next year?

18 TRADE FINANCE TALKS www.tradefinanceglobal.com

FEATURED

ANDRÉ CASTERMAN Founder and Managing Director Casterman Advisory

Continued innovations in crossborder payments

Cross-border payments have transformed over the last six years like never before.

Around a decade ago, new entrants prompted SWIFT to find a way to increase visibility by tracking global payments processed by correspondent banks. And so, SWIFTgpi was born.

More recently, the growing adoption of––and concerted industry migration to––ISO 20022 in the cross-border and highvalue payments space promises to be valuable. This, as well as the ISO norm, will improve data structures and allow richer data to be embedded in instructions and statements.

It is a long overdue move, as ISO 20022 launched two decades ago. This fact alone presents various operational challenges for banks, as older IT systems are not designed to handle data-rich formats––such as ISO 20022.

SWIFTgpi and ISO 20022 provide much-needed incremental

improvements to the traditional cross-border payments space but aren’t moving the needle far enough.

Thankfully, transformational innovations have emerged and are being adopted.

These advancements have been built on borderless 21st-century technological foundations and enable payments to be seamlessly embedded into commercial transactions, thereby reducing settlement risk.

New technologies such as distributed ledgers offer a way to bring such improvements to person-to-person remittances, micro-payments, and small- and medium-sized enterprises (SMEs) payments.

Various payment and securities processes are already moving on-chain to remove frictions, increase transparency on endto-end transactions, and combat fraud (e.g., public blockchains).

The openness of policymakers (e.g., UK, EU, UAE) to digital assets and tokenisation

19 www.tradefinanceglobal.com

The evolving payments landscape: how datasharing makes all the difference

2.4

will definitively

The evolution of cross-border payments is more exciting than ever. However, for banks, the priority is to use the payment data for compliance and differentiation. So, get your data in order.

act as a catalyst in institutional segments.

Moving on-chain will facilitate Delivery versus Payment (DvP) settlement of tokenised assets, whilst increasing transparency and immutability of data.

Hint #1: whether you like it or not, there is no escape to tokenisation and digital assets. It’s a natural evolution of the Internet.

Increased complexity for transaction banks

Incremental and transformational innovations demonstrate the continued appetite for the industry to achieve cheaper, faster, more transparent, and more accessible cross-border payments.

These industry-wide advancements show a drive to deliver on the vision outlined by the Financial Stability Board (FSB) in its G20 cross-border payments roadmap.

Whilst such moves offer attractive options to end customers, they also drastically increase the complexity for banks’ IT, operations and compliance teams.

This is the natural fallout of new channels, systems, and data

structures being introduced within their technology infrastructures.

Stephen Wojciechowicz, senior principal, product management at BNY Mellon, recently confirmed this, saying, “The challenge [with ISO 20022] is going to be that the underlying source data applications need to be able to communicate that.

For example, in our static data for address, there isn’t a separate data field for the street. So, we will have to be able to change things to accommodate that structured data format.”

Hint #2: payment standardisation will be centred around ISO 20022, and those semantics will be supported by a mix of closed and open communications technologies.

Getting your data in order is more important than ever

Long considered a purely technical function, archiving transaction data was previously only a concern for the bank’s IT people to take care of.

That was about 15 years ago. The need to access data archives was fairly limited and mostly linked to ad-hoc operational needs and client requests.

Since the 2008 global financial crisis, however, regulatory requirements revealed the importance of this very function, as accessing transaction archives suddenly got on the compliance officers’ priority list.

Subsequently, being able to demonstrate record keeping of transactions and to report promptly on payments––whether archived or in production––became top priorities.

Access to payment data is also important––in an automated way––for front-office operations teams (e.g., offering online access to transaction details for clients via portals) and for backoffice operations teams (e.g., to get real-time alerts on failed transactions).

Furthermore, business and compliance functions are combining payment data with AI-driven algorithms to gain deep and contextual insights never achieved before.

While having a single central database of all payment transaction data would be ideal for accessibility, experience has shown that this is unrealistic for financial institutions. This incompatibility stems from the many disparate data sources,

20 TRADE FINANCE TALKS www.tradefinanceglobal.com FEATURED

geographic locations, specialised internal systems and channels in use.

However, applying data management technologies to link, correlate, track, report, and alert on end-to-end flows helps financial institutions tackle the data accessibility challenge.

Hint #3: If you take away one piece of advice from this article, get your payment data in order. Now.

Payment data to comply and differentiate

Compliance and competition remain the two imperative objectives for financial institutions.

Whichever payment innovation becomes relevant for your financial institution, the granular data derived from payment flow is the actual ingredient to make it happen.

Hint #4: While many new payment options need more time to gain traction, investing in data technologies will be a safe investment for financial institutions.

The following table highlights the many use cases where payment data is either critical for operations and compliance, or gets elevated to a strategic level for competitive differentiation.

Leveraging data for competitive advantage requires a significant data management overhaul.

That includes identifying and assessing the value of existing data, designing a scalable data platform, and developing a longterm data strategy to help the organisation achieve impact at scale.

It also requires an up-front investment in data management technologies, as well as skilled teams.

Data technologies fill the gap

Keeping up with the pace of innovation in cross-border payments can be a challenge for most transaction banks, given the number of available new options and evolving client expectations.

Going forward, those financial institutions with the best data systems will develop a competitive advantage, given how transaction data can help with compliance and increased commercial differentiation.

21 www.tradefinanceglobal.com

©Casterman Advisory 2022

EMERGING MARKETS

3

3.1

ESG

Environmental, social and governance (ESG) has been a hot topic for private and public credit insurers.

At the end of the day, ESG is just a rating system derived from corporate social responsibility (CSR) reporting. In practice, it is difficult to assess what changes it has brought.

Shouldn’t credit insurers shift their focus towards improving their contribution to the United Nations’ (UN) sustainable development goals (SDGs)? How can they contribute and how can digitalisation help them increase their impact?

The ESG rating challenge

There are many valuable ESG rating initiatives around the globe––from various players––and this is clearly a reason to be optimistic.

Yet we are no longer naive. There is no equivalent to International Financial Reporting Standards (IFRS) when it comes to ESG, and rating providers may be tempted to look kindly upon those who pay them.

We all know what the consequence of this is: greenwashing.

It would be easy to blame rating providers, but it is not so black and white. There are no standards governing the evaluation criteria or what should be evaluated.

As a result, and at best, corporate entities approach ESG as a compliance issue. At worst, it is used as a way to gain customers and investments without truly intending to have an impact.

ESG rating approaches may be based on company, product, or transaction assessments––all of which are valid and valuable.

However, they are rarely combined because such a comprehensive approach would be very complex. Unfortunately, it is probably the only way to avoid a company’s attempt to improve the process having adverse impacts elsewhere.

Developing standards for each dimension could certainly help everybody cope with this complexity.

Through its short, medium, and long-term credit insurance and surety offers, the industry has a broad vision, understanding, and

24 TRADE FINANCE TALKS www.tradefinanceglobal.com 24

evaluation: how can we contribute to achieving the SDGs?

THOMAS FROSSARD Head of Innovation & Surety Products Tinubu Square.

MARC MEYER Senior Vice President and Subject Matter Expert Insurance

Tinubu Square

control of project finance and trade transactions in the world.

So, it could be more prominent in promoting virtuous companies and trades.

Incentivise good ratings

In addition to their involvement in renewables, social infrastructure and waste and water treatment projects, credit insurers have quite a unique view on supply chains via their short-term products.

They could lower premium rates for such projects and make sure that the ESG analysis and monitoring is as comprehensive as possible since they are involved in the whole lifecycle of these assets from pre-shipment to decommissioning as part of their product portfolio. By sharing data, they can provide a 360-degree view, which is key to success in this area.

More practically, it is through operational processes that this general green movement must be implemented. It will require the following:

Automation of processes and standardised use of project/ transaction assessment criteria (in addition to the usual risk assessment).

Automated monitoring of criteria used in the initial underwriting phase for each project. This will remain a foundational element during the whole life of the contract.

However, there is a cost related to ESG measures, and in order to consider discounting premiums for suitable projects, insurers must find ways to absorb them.

Digital data and standardisation can certainly help in achieving this, provided that:

They provide secure recording and tracking of all actions during the whole life of the covered/ insured project or transaction.

They render these complex new processes cost-effective.

Promote impact

Beyond a static picture, we must also assess the objectives that the insured set for themselves and the progress they make over time.

Thanks to their buyer-centric underwriting approach, credit insurers have the means to develop business intelligence on companies’ supply strategies.

They also have the potential to contribute to a proper assessment of the efforts a company makes to render its business more sustainable.

Progress could (and should) be the most important criterion rather than evaluating the nature of an activity. Given the current context, it is obvious that some are not green by nature but essential to communities, and it would be unfair to rate them solely on their carbon footprint.

As an industry and an ecosystem, we must also challenge the status quo.

It is certainly difficult to maintain the high level of collaboration between export credit agencies (ECAs) during troubled geopolitical times.

It is obviously more challenging to improve further collaboration with multilateral development banks

(MDBs). Yet if our common goal is to enable project materialisation and end-to-end monitoring, it is a must.

We need to go out of our comfort zone. Technology is available to allow information sharing but nothing will happen without business and legal alignment.

In conclusion, we all saw Alok Sharma crying in his concluding remarks of COP 26. It was a sad moment and it occurred before the Russia-Ukraine conflict and the energy crisis. From an SDG point of view, the situation has worsened.

However, as Bob Marley said, we should get-up, stand-up and not give up the fight. One thing we have too little explored is how to think out of the box. In order to help us do so, we should be more diverse and consider hiring more people who have experience outside of our industry.

Shadow boards have proven to be efficient in very traditional industries such as the luxury industry not because they were hidden, but because they assigned tasks that had not been solved by experts for decades to people with a fresh perspective on the matter. Trade finance and infrastructure finance gaps could certainly fall in this category.

25 www.tradefinanceglobal.com

EMERGING MARKETS

ESG: ING gives the green light 3.2

The responsibility for sustainability falls on everyone, everywhere. It should unite us. We all need to work together, but how do we achieve such a big collective goal?

Following the Sibos session on ‘Accelerate Sustainability in Trade’, speaker Achraf Abourida, head of trade at ING Bank, discussed trade’s role in sustainability and its global importance in an exclusive interview with Trade Finance Global (TFG).

Sustainability has become a buzzword for the trade industry, but what does tangible change mean and how do we avoid greenwashing?

We don’t just want Lewis Caroll’s Alice in Wonderland vision of painting the roses ‘green’––to enact reform, we need to be open in our thinking, to innovate, to collaborate and to be ambitious. And we need to do it now.

Tying in sustainability with social responsibility––the ING way

The United Nations (UN) 17 Sustainable Development Goals (SDGs) set global targets for 2030, but how will they be met?

Achraf said, the answer lies in, “a sense of urgency.”

ING focuses on four of the UN’s SDGs: decent work and economic growth (8), reduced inequalities

(10), responsible consumption and production (12) and climate action (13).

This, as Achraf deems, is where sustainability ties in with social responsibility, reflective of ING’s two core pillars; clients (the people) and sustainability (the planet).

Achraf said, “One of the most important things for us, especially in trade, is responsible consumption and production.”

ING’s sustainability commitment is evidenced through their sustainability targets, supporting companies, both corporates and small- and mediumsized enterprises (SMEs), in different ecosystems and different industries transforming themselves to become more sustainable.

Amongst other commitments, ING has set a target to provide at least €1 billion of new sustainable financing to SMEs and midcorporates by 2025.

Achraf is clear that banks do not need to make a profit as the aim when providing incentives for companies is to become more sustainable, but they do

26 TRADE FINANCE TALKS www.tradefinanceglobal.com

NATASHA ROSTON Head of People and Growth Trade Finance Global

need to make this change. It is this transformation where collaboration needs to be industry wide.

Achraf said, “Of course, a commercial business needs to make money, but what people don’t always see is that sustainability, like with any investment, is investing in tomorrow. This is both a financial, and a social investment.

“This is not because ING, or other banks feel obliged by the SDGs, but because they know it’s the way to make a true impact.

“It has to be done. In the same way that if you were investing in a fintech, knowing that you wouldn’t see a return for the first few years. Banks need to believe in sustainable initiatives and make it happen. Then, once achieved, everyone will have more.”

Incentivising green behaviour: the right approach?

Incentives. One approach is that when banks provide financial incentives for companies to put sustainability first, the industry could move forward to a greener future.

ING has created a framework whereby they can help clients obtain sustainability ratings based on certain data points. So a supplier would aim to improve its rating, or apply for one, in order to get benefits in their pricing on base, so that their financing costs go down.

Is supply chain finance the lowhanging fruit?

Achraf said, “Supply chain finance, for instance, is lowhanging fruit. We can reap the benefits sooner than other trade finance products that need more work to be done.

“A big buyer wants to create awareness within the supply chain which obviously links to financial benefits, as well as enhance the end-to-end supply chain from a sustainability perspective.”

On a positive note, sustainable supply chain finance already shows a substantial pickup, largely driven by industry leaders, which helps to show exactly what we can achieve.

Actions speak louder than words

Sustainable development is one of the biggest responsibilities that the banking industry has. However, community involvement is essential for its success.

People don’t just need to believe in the actions taken by banks, and the motives behind them––they need to trust them.

27 www.tradefinanceglobal.com

EMERGING MARKETS

No Poverty

Affordable and Clean Energy

Climate Action Life Below Water Life on Land Peace, Justice and Strong Institutions

Partnerships for the Goals

Decent work and Economic growth

Reduced InEqualities

Sustainable Cities and Communities Responsible Consumption and Production

Industry, Innovation and infrastructure

Zero Hunger Good Health And Well-Being

Quality Education

Gender Equality Clean Water and Sanitation

However, as banks disappear from the high streets, they lose their presence and connection to local communities, leading to a feeling of separation and distance.

Achraf is adamant that banks need to restore faith from the public. They need to remind them that, like with any successful relationship, they are honest, they are clear, and that they work hand-in-hand.

When banks fund local community initiatives in their home markets, such as through sports teams, playgrounds, and youth clubs, they are earning their trust. They are showing their understanding of the symbiotic nature between the people’s perception and the banks’ practice.

Why is trust important for sustainability? We can’t move forwards if we’re not together.

Patience is a virtue

They say patience is a virtue. And none more so for banks than setting sustainability Key Performance Indicators (KPIs) for years to come, knowing that the full impact may not be felt until the next generation.

But for the world to truly change, we have to be prepared for slow progress. It is key to not be disheartened. As long as we’re still moving forward, this momentum will build.

For some, it’s not fast enough. Many don’t understand the reasoning behind why banks are still investing in fossil energy, for example.

The reality is that the industry will not be able to transform overnight, else the social coherence will be disturbed. There needs to be a plan.

Companies with CO2 emissions need support for a period of time in order to convert to either a climate neutral or diverted business model. For its part, the industry will be open and transparent.

A green light for sustainable trade.

28 TRADE FINANCE TALKS www.tradefinanceglobal.com

SVEN OLAF SCHMIDT Regional Head Europe & Americas Trade Finance Operations Commerzbank

3.3

Commerzbank on standardisation: the key to sustainable trade finance

The world of trade is changing. Increasingly, the topic of environmental responsibility is taking centre stage, with discourse specifically circling around how the finance industry can implement sustainability measures more effectively.

At Sibos 2022, Trade Finance Global’s (TFG) Annie Kovacevic spoke with Sven Schmidt (SvS), regional head of trade finance operations in Europe and Americas at Commerzbank––a trade financier for the German Mittelstand (medium-sized companies).

Sven is also a Steer Co-member of the Working Group on Sustainable Trade Finance at the International Chamber of Commerce (ICC).

What does sustainability mean to you, Commerzbank, and the banking sector?

Commerzbank has also issued its own Environment, Social, Governance (ESG) framework, delineating what we consider to be sustainable and how we apply ESG principles to our business.

The framework clearly states all the key cornerstones of our sustainability strategy, making our sustainability concept transparent to all stakeholders.

KOVACEVIC Junior Editor Trade Finance Global

SvS: The sector as a whole is taking action. The International Chamber of Commerce (ICC) has published its sustainable trade finance framework, which will foster and incentivise sustainable trade globally.

Commerzbank supports the ICC’s work by participating in various working groups and joining the minimum viable product (MVP) to test the framework starting in November this year.

In particular, it governs which products are considered sustainable. Amongst others, it describes the criteria for sustainable lending and the reduction targets for CO2intensive sectors. Social criteria are also taken into account, and the criteria for exclusions are defined.

Sustainability metrics are now key performance indicators for our company, accelerating our sustainable transformation.

We have a very holistic approach to ESG. In practice, this means not only looking at individual transactions but rather looking at the whole supply chain––our

29 www.tradefinanceglobal.com

AG

ANASTASIJA

EMERGING MARKETS

clients and our client’s clients––to see if they fulfil certain minimum standards.

For example, under the MVP now launched by the ICC, for a client in the textile industry, we will check whether they comply with the ICC’s and ITC’s approved standards regarding the production of goods, fair wages, no child labour, and so on.

How much has the conversation around ESG changed in the last few years?

SvS: The client conversations have become much more frequent and intensive.

When we started client conversations two years ago, I would say about 90% of our clients were interested and excited about ESG as a new topic to begin exploring. Increasingly, clients now want solutions and proposals regarding what we, as a bank, can do to assist them and manage their transactions. In many companies, this desire for change has reached the C-suite level, which is very

important because that is where the momentum to really drive change comes from.

Our role has shifted too––from offering an interest-based exploratory capacity to being an active participant in clients’ transformation journey.

In terms of standards and interoperability, how do you think the industry can come together and collaborate and overcome hesitancy to share data?

SvS: Among a variety of industry initiatives, the ICC also has an important role to play as a promoter of standardisation and a catalyst for change.

It is the organisation that sets many of the standards, for example, the Uniform Customs and Practice for Documentary Credit (UCP 600), which is the framework banks refer to for letter of credit transactions.

What the sector needs now is to accelerate its efforts––that’s why I really like that we are going out with an initial MVP now

rather than waiting until we have covered every sector and every eventuality.

This, of course, necessitates extensive collaboration between banks, corporates, and technology providers at every step of the way.

How will having standards, frameworks, and scoring systems incentivise traders to take the first step towards more sustainable trade?

SvS: It’s a very good first step to showcase that certifications and standards matter. It’s important for everyone in the ecosystem to be involved––from the smallest buyers and suppliers all the way up to the massive corporates and their banks.

Standardisation would ultimately pull everyone in the industry towards more sustainable practices. Market players will quickly see that if they don’t take ESG seriously, they will be left out of the market and have trouble selling their goods or providing their services.

30 TRADE FINANCE TALKS www.tradefinanceglobal.com

What does the ideal world look like to you in terms of sustainability and trade helping to reach the UN’s Sustainable Development Goals (SDGs)?

SvS: In an ideal world, trade would serve as an accelerator, promoting and ultimately helping businesses reach the SDGs. This is not just a vision of the future, though; it is becoming a reality today.

I’m a big fan of making use of technology, and that’s why I really appreciate that the ICC also has a technology working group.

I’m optimistic that the solutions it develops will be workable. At Commerzbank, we are also developing a technological solution that will make clear strides towards sustainability to create awareness and start reducing carbon emissions in trade finance.

31 www.tradefinanceglobal.com EMERGING MARKETS

TOD BURWELL President and Chief Executive Officer BAFT

3.4

The role of banks in developing more sustainable trade practices

Trade Finance Global (TFG) spoke to the president and CEO of BAFT at Sibos 2022 about the role that banking organisations can play in developing environment, social, governance (ESG) and sustainability best practices within global trade.

COVID-19 has changed a lot of things, for better and for worse.

On the one hand, the knock-on effects of the pandemic, including supply chain delays, have been a significant contributing factor to the economic downturn and difficult trading circumstances the world currently finds itself in.

lot of emerging energy around ESG and sustainability. “There were a couple of things that I’d say sort of went silent a little bit for a while, but it re-emerged. One of them is the implementation of the Basel Framework, with several jurisdictions now going through their implementation process.”

CARTER HOFFMAN Editorial Assistant Trade Finance Global

But on the other, many believe that it has also helped to accelerate several much-needed reforms within trade finance, including the introduction of digital systems to help streamline documentation and fraud monitoring processes, as well as the implementation of more sustainable business practices.

At Sibos 2022, TFG spoke to Tod Burwell, president and CEO of the BAFT (Bankers Association for Financing Trade), a global trade finance association headquartered in Washington DC, about the key issues within the industry.

Burwell said, “That still remains a top priority. There’s also been a

In his view, one of the challenges of introducing key reforms around ESG and digitisation within the finance industry is trying to deal with existing gaps in existing legal frameworks so that they better support the introduction of digital trade documentation.

ESG: sustainability about more than climate

In terms of the connection between digitisation and greener trade practices, Burwell feels that technology has a role to play in making ESG reporting and monitoring a lot easier.

However, as far as the role of banks is concerned, Burwell believes that the banking

32 TRADE FINANCE TALKS www.tradefinanceglobal.com

EMERGING MARKETS

community can help provide the ‘connective tissue’ from a standards point of view.

This is particularly true when it comes to the question of interoperability––a major prerequisite for the rollout of the digital agenda.

To achieve this, you have to introduce international standards––something that large financial organisations have a lot of experience with.

Burwell said, “And so I think a lot of the discussions are going to focus on: where are we in the standards process, with the adoption process of those standards and the like?”

And while they aren’t in a position to help trading companies source, produce, or transport goods sustainably, banks and trade finance organisations can potentially help with the financing of more sustainable supply chains, thereby incentivising

more importers and exporters to adopt sustainable practices.

However, he also feels it is important to gain clarity on what precisely sustainability means to trade organisations.

Burwell said, “The UN has their 17 sustainable development goals (SDGs). But then when you look at the policy community, everything is focused on climate and environment.

“So much of trade actually facilitates SDGs outside of climate change. And so one of the biggest issues for our members is how do you apply the concepts of sustainability across the spectrum of trade, measure it in a way that’s consistent with policy frameworks?”

Legal frameworks: a region-byregion affair

On the issue of legal frameworks, BAFT has teamed up with the legal reform advisory board of

the ICC to try and drive forward the adoption of the Model Law on Electronic Transferable Records (MLETR) region-by-region.

Burwell added, “There are about seven countries that have already adopted MLETR, but there are some major jurisdictions [are] on the cusp of making significant steps forward.

“The UK has an electronic documentation bill that’s under consideration right now.”

Indeed, the Electronic Trade Document Bill which is currently making its way through the UK Parliament has been designed to address a long-term bugbear within English law around the question of legal ownership of intangible items.

Up until now, this has made it hard to address the issue of control, without which it is difficult to develop a reliable document control and verification system. In the US, where BAFT is based,

33 www.tradefinanceglobal.com

recent amendments that were made to the Uniform Commercial Code at a national level still need to be approved by all 50 states before these will apply universally across all major US trade jurisdictions.

When it comes to things like cross-border trade and global payments, the situation is a bit more complex.

Burwell said, “When we look at cash management, particularly on the payment side, we’re trying to focus on the unevenness of regulations and how that’s impacting the disparate faster payment systems around the world: What are the rules, who’s allowed to participate, how is [know your customer] KYC––as well as banks versus nonbanks––being considered?”

Basel and closing the trade finance gap

When it comes to trade finance, BAFT is advocating for ways to encourage more financial inclusion so that the standing trade finance gap doesn’t continue to widen, especially given the current tough trading environment.

Here, Burwell feels it is also important to introduce some basic legislation around capital frameworks in accordance with the Basel Framework for international settlements. This directly impacts how much liquidity banks are able to provide to trade organisations, which in turn, determines their ability to help close trade finance gaps.

Overall, though, Burwell feels that things are headed in a very positive direction, and BAFT is doing all it can to facilitate this process through a mixture of policy advocacy, education and training, alongside global community building.

Burwell said, “You need to collaborate in order to solve those challenges, and they do it through us.”

34 TRADE FINANCE TALKS www.tradefinanceglobal.com EMERGING MARKETS

ANASTASIJA KOVACEVIC Junior Editor Trade Finance Global

3.5

Auf wiedersehen fossil fuels: Germany’s route towards LNG adoption

21 February 2022. The Russia-Ukraine conflict becomes a reality, and the lives of many are immediately impacted.

Though a humanitarian crisis, first and foremost, the situation between the two countries soon spills over to affect the global trading stage.

Fuels the globe to keep spinning

Oil and gas are amongst the highest-demanded commodities in the world.

Leading global producers include; the United States, Saudi Arabia, and Russia. These three countries produced approximately 40 million barrels of oil per day in 2020, with the total revenues for the oil and gas drilling sector coming to approximately $2.1 trillion in 2021.

With the world relying on these countries, who produce 43% of the world’s oil resources, it follows that if one of these countries were to be removed from the equation, access to gas would plummet. As is the case, with sanctions enacted, European member states especially had to find new sources of fuel quickly.

But it was Germany that felt this knock, perhaps more than others.

Russia accounted for 55% of Germany’s gas imports in 2021, a level that has since declined to 26% by the end of June 2022.

LNG port abundance, but supplies lacklustre

In a bid to diversify energy sources and become more ecofriendly, Germany has enacted a grand push toward natural gas. As the least pollutant fossil fuel source, natural gas will play an important role in the transition to a climate-neutral energy supply. Liquified natural gas (LNG) seems to be the way forward in this regard, and Germany has been quickly acquiring new LNG terminals.

By and large, Germany’s efforts have been successful. In May 2022, four floating storage and regasification units (FSRUs) were leased, capable of importing at least 5 billion cubic metres (bcm) of seaborne gas per year each. It is expected that the LNG hub at Wilhelmshaven will become the first to be functional and the second, Brunsbuettel, to be developed by Uniper and RWE AG, respectively.

35 www.tradefinanceglobal.com

In addition to these measures, Germany has also confirmed the chartering of a floating LNG ship for Wilhelmshaven. This is expected to be ready within the first quarter of 2023.

However, despite all the positive steps being taken to facilitate easier access to LNG, there still seems to be a large question mark looming; where will the LNG supplies be coming from?

The German economic ministry has made it clear that a memorandum of understanding exists between the energy companies RWE, Uniper, and EnBW for supplying two new floating LNG terminals beyond 2022. But the selection of suppliers, as well as the conclusion of contracts, will fall as the responsibilities of the companies themselves.

Though a promising avenue, it underlines the uncomfortable

reality that providers of resources are nowhere in sight––the only certified source being a single shipment of LNG to arrive in Germany from the UAE at the turn of the year.

And with Uniper making it known it will only discuss supply contracts once terminal projects are finished, it seems that, for the most part, the question mark will prevail.

Flip of the coin: challenges and advantages of LNG deals

Germany’s challenges regarding LNG continue, most recently facing disagreements over cut supplied of LNG supplies to India. The German state-backed company SEFE has reportedly failed to provide previously negotiated gas supplies to Indian-based company GAIL, due to disruptions since May 2022. The original 2012 deal arranged between SEFE and GAIL stipulated

that GAIL would purchase an average of 2.5 tonnes of LNG annually for 20 years.

Disagreements over the cut in LNG supplies to GAIL have escalated, with diplomats being called to resolve the issue.

India has reportedly suggested that SEFE source alternative supplies from its portfolio to meet contractual obligations whilst looking toward Russia for a solution to fill that gap.

Elsewhere, the picture being painted is slightly more positive.

On 3 November, Germany and Egypt signed a memorandum of understanding to cooperate in producing renewable hydrogen, alongside cultivating LNG trade between the two countries.

Vice Chancellor of Germany Robert Habeck said, “We support Egypt in speeding up the change from fossil to climate-friendly energy.

36 TRADE FINANCE TALKS www.tradefinanceglobal.com

EMERGING MARKETS

“In the short term, closer trading ties with Egyptian LNG help us to diversify [Germany’s] energy imports further and become independent of Russian gas.” Egypt, located above the mammoth Zohr gas field, is indeed developing clean energy resources of its own and has signed a number of agreements for green hydrogen development. Conversations between Germany and Britain have also arisen, specifically a solidarity pact for either country to assist the other in extreme natural gas shortages. The legal realities of Brexit mean that an emergency aid scheme between the two countries no longer exists, but there remains a willingness to cooperate in this manner.

The future for Germany and LNG

Given the nascent stages of Germany’s uptake of LNG, one cannot make too many solidified opinions or assumptions.

The large paces taken to secure LNG hubs, is, however, indicative of the scale and wider projected resource influx of the initiative. Teething problems that have developed in the meantime may provide practical contemporary hurdles, but there is lots of evidence to suggest that these will remain small bumps in the road on the path to a more robust LNG framework.

37 www.tradefinanceglobal.com

CARTER HOFFMAN Editorial Assistant Trade Finance Global

3.6

Tragedy struck at 9:00 AM on Wednesday, 24 April 2013.

Rana Plaza, a building complex in Bangladesh housing five garment factories, collapsed, claiming the lives of 1127 workers and injuring a further 2000.

Investigators discovered that the building had been authorised for six stories, yet the owner had built another four stories on top with subpar materials.

Amid the rubble, crews found clothing from major western brands such as Walmart, The Children’s Place, and Mango. While these major brands did not own or operate the factories in the building, the ensuing backlash made it clear that the court of public opinion found them complicit in the catastrophe.

Major brands and multinational organisations are no longer able to hide behind the shield of a long and opaque supply chain in order to avoid environmental, social, and governance (ESG) concerns.

The imbalance of power in global supply chains

Traditionally, many global supply chains have been characterised by a stark imbalance of power.

Large multinational corporations at the top of the chain have been able to place grand demands on their smaller suppliers to deliver large orders under immense time pressure.

To meet these demands, tierone suppliers must often make equally grand demands on their own suppliers. Likewise, these tiertwo suppliers must procure their inputs from yet more suppliers, and so on, down the chain.

While events like the Rana Plaza disaster have imposed multinationals with an increased duty of care and accountability to their top-tier suppliers, the line becomes increasingly blurred the further down the chain you go.

38 TRADE FINANCE TALKS www.tradefinanceglobal.com

Into the depth—deep-tier supply chain finance as a driver for ESG development

EMERGING MARKETS

Deep-tier supply chain finance can be a powerful tool in the ESG toolkit––but implementing this innovative financing approach will require overcoming some key barriers.

To what extent, for instance, can electric carmakers—with their large, geographically dispersed, ‘long-tail’ supply chains—be held accountable for the perilous conditions of a small artisanal cobalt mine in the Congo?

The complex practical and ethical implications of such a scenario cannot be understated. One possible solution could be the very phenomenon that has put supply chains in this mindset: money.

The role of finance

The global financial system is constantly changing.

With access to financial support, businesses can ease the working capital constraints that often prevent them from making necessary investments in themselves and their operations.

Access to affordable financing can also help incentivise ESGaligned activities along the value chain.

If used extensively, this can help promote stability and resilience

in supply chains and bring about much-needed social change.

One example of this in practice is the Better Work Program—a collaboration between the United Nation’s International Labour Organization (ILO) and the International Finance Corporation (IFC) that seeks to improve working conditions in the garment industry.

The program covers 1700 factories in nine countries that employ more than 2.4 million workers.

In an impact assessment report highlighting the program’s findings from 2017 to 2022, it is clear that improving working conditions needs to be considered an investment that will improve firm performance and productivity rather than a burdensome cost.

Unfortunately, for the many small businesses around the world that struggle to access finance, making businessimproving investments often gets deprioritised behind simply keeping the lights on.

The plight of small businesses

In addition to this, despite playing a major role in most economies, particularly in developing countries, small and mediumsized businesses (SMEs) are often poorly served by existing financial processes.

According to an Asian Development Bank (ADB) brief, they often struggle to access support mechanisms, meaning they tend to suffer global and regional shocks more acutely than larger suppliers.

In instances where an SME does have the resources and know-how to navigate the often convoluted financing application process—something that discourages many from even pursuing the option in the first place—they are often rejected or must accept high financing costs.

In a nebulous self-fulfilling cycle, the greater exposure to risks that they experience causes traditional lenders to deem them as riskier investments, increasing their cost of capital.

39 www.tradefinanceglobal.com

This is often the case because SMEs tend to operate in the lower tiers of supply chains, where they are too far removed from the financial power of their ultimate up-chain end customer. A small Congolese mining operation can hardly leverage Volkswagen’s €500 billion balance sheet when applying for finance, even though the cobalt they mine may well be among the 3000 tonnes of the metal that the car company purchases each year for its electric vehicle batteries.

But what if they could?

Deep-tier supply chain finance

Multinational supply chains tend to consist of large “anchor” corporations with strong credit ratings and robust borrowing capacity coupled with many deeper-tier SME suppliers operating within their ecosystems.

Traditionally, only upper-tier suppliers have been able to benefit from a relationship with the anchor corporate. While there is no issue with such a relationship, these suppliers already tend to be quite financially strong and could likely acquire financing from any number of sources.

Deep-tier supply chain finance is a financial solution that seeks to leverage business relationships with this ‘corporate anchor’ deeper into the supply chain.

The aim is to unlock working capital to make financing accessible for suppliers throughout the ecosystem, not just for those in the top tier.

The idea is born out of reverse factoring, a financing technique where a supplier can sell their receivables and receive payment early—albeit at a discount. The discount rate applied in this technique is aligned with the credit risk of the buyer, which will generally have a more favourable risk profile than the supplier itself.

In the past, it has simply not been feasible to translate this into lower tiers of the supply chain; however, advancements in digital technologies are making this degree of transparency and data sharing possible.

To ESG and beyond

Deep-tier supply chain financing can provide a major financing boon to smaller suppliers deep within long-tail multinational supply chains, providing them with easier access to finance.

By putting this financing to use in a benevolent manner, SME executives down the chain will have the working capital needed to make investments into bolstering their processes and improving working conditions.

These paramount ESG improvements will reflect positively on the consumerfacing anchor corporates, renewing their social license to operate. But there are many more potential benefits that deep-tier supply chain finance can bring, most notably added supply chain resilience.

The COVID-19 pandemic showed the world how vulnerable hyperefficient supply chains could be during economic shock.

By creating systems and programs that allow their

deeper-tier suppliers to have easier access to finance, large corporations can help build resiliency in their supply chains by mitigating the risk of a highly specialised supplier going insolvent.

Such programs also provide the corporate anchor with increased visibility over the entire supply chain, giving it a host of data that it can analyse and leverage to make better business decisions.

Financiers also benefit from an outsized opportunity to expand their client base by becoming a strategic partner in the entire global value chain, expanding their reach and revenue in the process.

The benefits are numerous but do not come without a few roadblocks to overtake.

Challenges for deep-tier supply chain finance adoption

The ADB brief on deep-tier supply chain finance outlines several major inhibitors to adoption across the various stakeholder groups.

Fintechs creating the software that can be used to facilitate such programs must contend with a lack of market awareness, difficulty engaging buyers, and integration challenges.

Banks and financiers exploring the program must overcome unclear revenue incentives and integration challenges.

The anchor corporations are faced with potential resource constraints and a lack of government incentives.

40 TRADE FINANCE TALKS www.tradefinanceglobal.com

EMERGING MARKETS

Suppliers that could join these programs need to be comfortable disclosing their business information and working with technology in addition to overcoming their own resource constraints.

On top of this, all of the stakeholders must contend with an ambiguous legal structure and lack of clarity around the regulations and legal precedent for these models and their related technological functions.

Despite the challenges, there is a path forward.

Accelerating adoption

In its brief, the ADB has also established a clear set of actions that each deep-tier supply chain finance stakeholder must take to help overcome these challenges and accelerate its adoption.

Suppliers must encourage their anchor corporates to implement

programs of their own and engage with fintechs to improve their technology offerings by voicing their concerns.

Anchor corporates must engage with their suppliers to understand their demand for financing, and they must begin to run trials using existing fintech programs.

Banks and financiers must raise awareness around successful implementations and work with fintech providers to trial new solutions.

Fintechs must engage with a range of stakeholders to raise awareness and work on clarifying the legal basis of such programs, particularly in a cross-border context.

Governments and policymakers need to raise awareness of the programs, and set key performance indicators (KPIs) around SME lending volumes and ESG reporting. They must

additionally encourage the adoption of legislation enabling trade digitalisation and develop the legal infrastructure that will supply deep-tier financing programs.

Lastly, multilateral development banks must advocate for digital trade legislation, raise awareness, and extend targeted financing programs to include deep-tier options.

By following these calls to action, the industry can grow awareness and devise better technology solutions that will be able to reach a broader audience than ever before.

In due time, this nascent financing tool will be a key enabler of supply chain resiliency and a major proponent of the ESG agenda.

41 www.tradefinanceglobal.com

DIGITISATION

4

CARTER HOFFMAN Editorial Assistant Trade Finance Global

DEEPESH PATEL Editorial Director Trade Finance Global

DEEPESH PATEL Editorial Director Trade Finance Global

4.1

One small bill for parliament, one giant leap for trade digitalisation

On 12 October, the UK officially introduced The Electronic Trade Documents Bill into parliament, the next step in a long road to shred the country’s legally imposed reliance on using paper for trade documents.

The new Bill, which has been anticipated since it was announced during the Queen’s Speech in May, is welcomed by businesses and industry leaders across the country, including the British Chamber of Commerce and the International Trade and Forfaiting Association (ITFA).

“We welcome the changes that the bill will bring about, but this is not just about pure legal change,” ITFA Chairman Sean Edwards said.

“The bill will also break psychological barriers by emboldening market players to consider doing something they would never have before. “More importantly, we now need to make a business out of the new opportunities.”

Age-old trade governed by 19thcentury legislation

Under current legislation, such as the Bills of Exchange Act 1882 and the Carriage of Goods by Sea Act 1992, business-to-business documents like the bill of lading