FEATUREDARTICLES:

TheevolutionofSupplyChainFinance:Frombankstodistribution

5commonmythsaboutcarbonaccounting:Isitreallyworthit?

HowMRPAsarepavingthewayforcollaborationinTradeFinance

ISSUE18

TRADEFINANCEGLOBAL.COM

RYANHOLLAR-GREGORY ManagingDirectorandHead ofDistribution,SupplyChain Finance MUFG

FreepikCompanyS.L. Canva ADDRESS 201HaverstockHill SecondFloor London NW34QG

TELEPHONE +44(0)2071181027

©TradeFinanceTalksisownedandproducedbyTFGPublishingLtd(t/aTradeFinanceGlobal) Copyright©2022 AllRights Reserved.Nopartofthispublicationmaybereproducedinwhole orpartwithoutpermissionfromthepublisher Theviewsexpressed inTradeFinanceTalksarethoseoftherespectivecontributorsand arenotnecessarilysharedbyTradeFinanceGlobal

AlthoughTradeFinanceTalkshasmadeeveryefforttoensure theaccuracyofthispublication,neitheritnoranycontributorcan acceptanylegalresponsibilitywhatsoeverfortheconsequences thatmayarisefromanyopinionsoradvicegiven Thispublication isnotasubstituteforanyprofessionaladvice

ANDREWROBERTS HeadofEMEA RightShip

SARAHMURROW CEO AllianzTradeUK&Ireland

2 2.6 3

StanCole AdamHearne GillesGoaoc AndrewRoberts GeoffWynne ShaneRiedel ColleenOstrowski HarrySmorenberg

RetaJoLewis SarahMurrow StevenBeck MichelleKnowles VeronicaFernandez PatrikZekkar MariyaGeorge TomFitzgerald DeepaSinha

Enno-BurghardWeitzel OferEinBar

BrianCanup CarterHoffman TammyAli DuyguKarakuzu KirtanaMahendran

THANKSTO RyanHollar-Gregory

MichealSalmony

IainMaclennan

TFGEDITORIALTEAM DeepeshPatel

PHOTOGRAPHSANDILLUSTRATIONS

2 www.tradefinanceglobal.com

CONTENTS

Fragmented,butnotbroken:Theinternationaltradeworldin2023

TheevolutionofSupplyChainFinance:Frombankstodistribution

Istradeandreceivablesfinancethenewhomeforprivatecredit?

Decodingcross-borderpayments:Frominitiationtosettlement

5commonmythsaboutcarbonaccounting:Isitreallyworthit?

HowcansuretycarriersalignwithESG?

Fromstarboardsurprisestoportsideperils:Inherentrisksintheshippingindustry

HowMRPAsarepavingthewayforcollaborationinTradeFinance

Rethinkingcorrespondentbanking:Therealimplicationsofde-risking

Thetimeisnowtounlockthefutureofcross-borderpayments

ThegamechangerinOpenBanking:B2Bintegration

Levelingupexporters:HowtheExport-ImportBankoftheUnitedStatessupports Americancompaniesandtheiroverseascustomers

Internationalexpansion:Leveragingtradecreditinsuranceinapost-Brexit, post-pandemicworld

ADBReport:Tradefinancegapgrowsto$25t,andsustainabilityremainsakeystrategy

Bridgingthetradefinancegap:Absa'sdigitaljourneyinAfrica

Q&A:Visa'sVeronicaFernandezonmovingfromtraditionaltoseamless consumerexperienceswithembeddedfinance

Interoperability:thewayforwardtodevelopdigitaltrade!

Future-proofingtradefinance:ThedigitaltransformationjourneywithClearEye

Navigatingthefutureofdigitalpayments:Efficiency,security,andcompliance

Industrycollaborationisacatalystfortrulydigitaltrade

Thefutureofdigitaltradefinance:Anin-depthQ&AwithSurecomp

4 62 3 36 2 8 x 1 4 5 92 FEATURED FOREWORD PARTNEREVENTS Anindustrywithoutbordersorbarriers NavigatingtheDigitalFrontier:Efficiency,Collaboration,and InclusioninModernTrade 2.2 2.1 1.1 10 12 18 20 24 28 32 38 42 46 50 52 54 58 64 68 72 76 80 84 88 6 3.1 3.2 3.3 34 3.5 36 3.7 4.1 4.2 43 44 4.5 46 4.7 2.3 2.4 2.5 2.6 2.7

Thepowerofallies:navigatingLGBTQ+inclusionintrade,treasury,andpayments

3 www.tradefinanceglobal.com TradeFinanceTalks

1 FOREWORD

4 www.tradefinanceglobal.com

5 www.tradefinanceglobal.com Foreword

1.1

Fragmented,butnot broken:Theinternational tradeworldin2023

Theneedforcollectiveactionhasneverbeen morecritical,andwhySibosrepresentssuchan importantchancefortheindustrytocome togethertosharelessons,ideas,andsolutions.

Theinternationaltradeworld isinherentlyspreadapart Thereare7continents,and 195countries,with360million squarekilometres(139million squaremiles)ofoceanand38 timezonesspanningtheglobe.

Withallofthebarriersthatexist, theindustrysimplycannot physicallycometogethervery often Butonceayear,Sibos allowsustodoexactlythat

Thisyear,theconferenceis embracingthisveryidea.We arecollectivelytacklingthe themeof“Collaborativefinance inafragmentedworld”,andit isatimelythemeaswell Theworldisstillpiecingitself togetherfollowingtheCOVID-19

disruptions,acollective breakdownintheglobalsupply chain,geopoliticalturmoil inalmosteverycornerofthe world,andthestartofaviolent warinUkraine.

TheAsianDevelopmentBank releasedareportshowingthat thetradefinancegaphas increasedfrom$17trillionto $25trillion Despitethebest effortsbytheindustry,thegap continuestowiden,withno clearplanforhowtoreverse thetrend.

2024mightbringaseismic shifttotheglobalsystemas well Upwardsof31countries arehavingpresidential,prime minister,orchancellorelections

6 www.tradefinanceglobal.com

DEEPESHPATEL EditorialDirector TradeFinanceGlobal(TFG)

TradeFinanceTalks

BRIANCANUP AssistantEditor TradeFinanceGlobal(TFG)

inthenextyear,upto31ifyou counttheUK’selectionin January2025

That’swhytheneedfor collectiveactionhasnever beenmorecritical,andwhy Sibosrepresentssuchan importantchanceforthe industrytocometogetherto sharelessons,ideas,and solutions

Eventhoughtheworldseems togodownmultipledivergent paths,therealityisn’tasbleak asitmayseem.Theindustryis increasinglycomingtogetherto findnewsolutionstonew problems

Astraditionallenderspullback inthefaceofrisinginterest ratesandeconomic uncertainty,alternativesources offundingareemerging,and supplychainfinancehas movedbeyondtheconfinesof traditionalbankingmodels

Cross-borderpayments,atopic thatwillundoubtedlygarner attentionatSibos,havealso undergoneaseismicshift The complexitiesthatonce hinderedbusinessesare graduallybeingreplacedby streamlined,transparent

systems.Thistransformation isatestamenttotheindustry's collaborativeeffortstodecode andsimplifytheintricaciesof globalpayments

Theurgencyofclimatechange isatopicthatnoonecan ignore.Butthisurgencyhas sparkedcollectiveactionwithin thetradefinanceindustry,from expandingcarbonaccounting toaligningsuretywithESG efforts

Climatechangeisn’ttheonly aspectofESGthatisbringing peopletogether TFG hostedan“LGTBQ+inTrade, Treasury&Payments”tobring upasubjectthatisignoredfar tooofteninourindustry.People intheLGBTQ+community, specificallyininternational trade,areforcedfartoooften tohidewhotheyare,forfearof losingtheirjobs Butthispanel broughttogethersomeofthe leadingfiguresinTTP,offering insightsandpersonalstories thatwecanalllearnfrom.

Andfinally,theelephantinthe roomhasbeenandwillbefor theforeseeablefuture,the emergingdigitalfrontier Itis thedrivingforcebehindmany oftheinternationaltrade

developmentsin2023andwill bethemaintopicofdiscussion atSibos2023

Thetransitiontodigital platformsisacollectivejourney, requiringconcertedeffortsfrom allstakeholderstobridgegaps inconsumerexperiences, interoperability,andsecurity

Andthistransformationhas started TheUKrecentlypassed oneofthemostimpactful piecesoflegislationinrecent memoryforinternationaltrade. On20September,theElectronic TradeDocumentsActwill becomelaw,creatingaclear pathwayforindustry-wide digitaltransformation

Asyoudelveintothisedition, consideritacalltoaction a precursortothecollaborative dialoguesthatwilltakecentre stageatSibos2023 The challengeswefaceare monumental,buttheyare notinsurmountable.

Asalways,TFGwouldliketo thankallofoursponsors andindustrypartnersfortheir thoughtleadershipand collaborationinputting togetherthecontentthat drivesthismagazine.

7 www.tradefinanceglobal.com

Foreword

8

9 Featured

2.1

heevolutionofSupply ChainFinance: rombankstodistribution

epopularityofSCFprogrammesamong vestorsstartedtoriseintandemwithglobal interestrates,drivenbythefactthattheseare short-term,uncommitted,self-liquidating assetsthatallowaninvestortoridetherisein rates.

Overthepastseveralmonths, corporateshaveincreasingly beenaskingfordetailsona bank’sdistributioncapabilities whendecidingwhichfinancial firmtoworkwith.

Althoughreceivablesand payablesfinancingprovidesan alternativesourceofliquidityto companieswhileallowingthem toimprovetheircashflow metrics,sometimesthese programscanvarygreatlyin size–anywherefrom$10million to$10billion

Whentheprogrammes becomethatlargeandno singlebankhasthecreditlines tosupportthem,distribution becomesavaluabletool.

Distributionprovidesseveral benefitsforparticipatingbanks andcorporations Distributionof supplychainfinance(SCF)and workingcapitalassetsallows onebanktoleadaprogram andworkwithotherbanksas participatinglendersinthe program

Additionally,distribution allowsbankstoleadalarge programmethatmayexceed availablelimits,collectfees fromdistribution,andenhance returnsonaprogramme.

Forthecorporates,thebenefits includehavingonepoint-ofcontactbanktointeractwithon theprogrammeregarding documentationorquestions, usingdistributiontoshare walletsharewiththeirbank group,andhavingtheability toremoveoraddbanksasthe programmesizechanges

EvolutionoftheSCF

investorbase

Whendistributionstrategies firstappearedintheearly 2000s,theinvestorbasewas onlybanks.Overtime,asset managers,hedgefunds, insurancecompanies,and othernon-bankentitiesstarted tolookatthesupplychainas anassetclassandinvestin theseprogrammes

RYANHOLLAR-GREGORY

10 www.tradefinanceglobal.com TradeFinanceTalks

ManagingDirectorandHead ofDistribution,SupplyChain Finance MUFG

Currently,themarkethas bifurcatedintothebankand non-bankmarketsegments withminimaloverlap.Typically, banksaremoreinterestedin investmentgradecorporates, andthenon-bankshavebeen moreinterestedinthehigher yieldingnon-investmentgrade options.

Inthelastthreetofiveyears, morenon-bankshaveentered SCFandtheworkingcapital market

Theseassetmanagersand hedgefundstypicallysource theirdealsfromfinancial technology(fintech)firms, banks,ordirectlyfrom lower-ratedcorporates

Historicallytheoperational intensityassociatedwith purchasingandmanaginga largenumberofinvoiceskept non-banksoutofthemarket, butfintechshavestartedto providetechnologythatallows non-bankstoeffectively monitorandmanagealarge numberofinvoices

Whythesuddeninterest insupplychainfinance?

ThepopularityofSCF programmesamonginvestors startedtoriseintandemwith globalinterestrates,drivenby thefactthattheseareshortterm,uncommitted,selfliquidatingassetsthatallowan investortoridetheriseinrates

Tenyearsago,therewere almostnonon-bankinvestors interestedinSCF.Today,some ofthelargestassetmanagers, insurancecompanies,and hedgefundshavefunds dedicatedtoSCFandworking capitalassets Inadditionto theaforementionedbenefits,

ThefutureofSCF distribution

theriseoftechnologyto accommodateoperational needs,andthehistoricallylow defaultrateswithinSCFhave contributedtotheassetclass’s popularity.Asthemarket becomesmoretransparent, standardised,andeasierto access,weexpecttheinvestor basetogrowalongwith increasedadoptionbya diversegroupofcorporations. Weseeseveralfactorsthat willimpactthefutureofthe SCFmarket.

TheFinancialAccounting StandardsBoard's(FASB)new supplierfinanceregulationswill requirethatcompanies discloseiftheyhaveaSCF programmeinplace.

Theeffectofthisincreased transparencyisstilltobe determined,however,more corporationsmayimplement SCFprogrammesbecausethey willnowhavevisibilityintotheir competitorsthathavealready implementedthem.

Secondly,banksthatsell asignificantamountofSCF areusingsimilarparticipation agreementsanddistribution processes.Thiswillmakeit easierforinvestorstosignup andbuyfromseveraldifferent banks

Lastly,moreinnovative legalstructures–suchas IrrevocablePayment Undertaking(IPU)andDrafts (i.e.BillsofExchange)–are makingiteasierandmore efficienttooriginateSCF programsinvarious jurisdictions

Acatalystforgrowthforthe distributionandorigination ofSCFwillbemore standardisationand transparency

Banksthathaveexperienced anddedicateddistribution teamswillbeabletocapitalise onthegrowthofthemarket andbeinapositiontoinfluence thedevelopmentoftheinvestor market

Featured

11 www.tradefinanceglobal.com

ManagingDirector,GlobalHead ofTrade&ReceivablesFinance TradeFinanceGlobal(TFG)

Istradeandreceivables financethenewhomefor privatecredit?

AsTFGcontinuestoevolve,wearecommitted tobridgingthegapbetweendemandand capitalrequirements,therebyintroducingmore effectiveandtransparentfinancingsolutions

Thefinanciallandscapehas undergoneaseismicshiftin recentyears.Fromzeroor negativeinterestratestothe COVID-19pandemicand geopoliticaltensions,theworld hasseenitall Amidstthis backdrop,theroleofprivate credithasevolvedsignificantly.

Thequestionnowis,hastrade andreceivablesfinance becomethenewhomefor privatecredit?

returns,astraditionaldeposits wereofferingzerooreven negativeinterestrates

Fastforwardtotoday,and thescenariohaschanged dramatically.Theinfluxof cheapcapitalfromzeroboundratesandpandemicerastimulusledtoalooser investmentstandard Theindustryknewthiswould notlast,andrecentmarket trendshaveshownthisera hasended.

Twoyearsago,treasurers andfinancialdirectorswere scramblingtofindinvestment avenuesthatcouldyield

Risinginflation,stemmingfrom thequantitativeeasingpolicies andsupplychainproblemshas ledmanycentralbanksto increaseinterestrates

2.2

TradeFinanceTalks

MARKABRAMS

12 www.tradefinanceglobal.com

Theshiftinglandscape

TheUSFederalReservehasset ratesata22-yearhigh,at5.255.5%,andtheBankofEngland hassettheratesat5.25%,with expectationsofanotherhalfpointriseinthefuture In August,TheCentralBankofthe RepublicofTürkiyeincreased ratesto25%.

Allofthesefactorshaveled toareasonableconcernthat theglobaleconomieswillsee varyinglevelsofdeclineinthe nextfewyears

Inotherwords,thisisnota regionalshift,itisamajorshift intheglobalmarket.Andthis hasledtoamorecautioned, reasonedapproachto investments

Peoplearenowlookingfor sensible,low-riskavenues toparktheircapital.

Inthisevolvinglandscape, privatecredithasemerged asaviableoption Itinvolves fundingrealassetsinaworld wheretheyarenotlisted, offeringauniqueproposition forinvestors.

AtTradeFinanceGlobal(TFG), wehaveobservedagrowing interestfrominstitutional capital,particularlyintradeand receivablesfinance

Tradeandreceivables finance:Alow-risk alternative

Tradeandreceivablesfinance linesaretypicallylow-risk, self-liquidatingfacilities.They involvefinancingthesupply chain,buyingatonepriceand sellingatahigherone,typically withinashortdurationof90to 180days.

Weareincreasinglystartingto seeaninterestintradefinance asanassetclass,andthis makessensegiventhe directionofthemarket Inour view,thisismainlybecause pricingtracksunderlyingrates (whicharerising),alongwith thepositivemargincomponent; representinganattractiveasset vs USTreasuries,asan example

Tradefinanceasanassetclass ishighlyscalableandoffers

strongreturns Itisnotlinkedto certainmarketfluctuationsbut istiedtoreal,livetrades.

Thishasledtoincreased interestfrommid-market banksandinstitutional investorslookingtodiversify theirportfolios.

GovernmentsandExport CreditAgencies(ECAs)are alsoencouraginginvestments intradefinancetostimulate economicactivity Thishasled tonewplayersenteringthe market,whoareattractedby thenewstructuresof guaranteesthatarepresenting themselves.

Butitisn’tasblackandwhiteas simplyinvestingintrade finance

Tradefinanceinvolvesahigher levelofcomplexitydueto variousfactorslikedifferent jurisdictions,sectors,andmore nichetopics,likeissuesof perishability However,itoffers aleveloftransparencythatis oftenmissinginotherasset classes.Understandingthe

13 www.tradefinanceglobal.com

Featured

specificitiesofthetrade,and demandsofborrowersare crucialfordetermininghow theyintendtoutilisethecapital, andwherecapitalisbeing deployed

TFG'sevolvingrole: IntroducingTFG DistributionFinance

Historically,TFGhasbeenthe largesttradeandreceivables originator,connectinglenders withbuyers,usingourdeep industryknowledge.

However,thegrowingdemand forcapitalinthetradeand receivablesfinancingspace hasledustoevolveourrole Wesawagapinthemarket andrealisedthatitneededa new,innovativesolution.

EnterTFGDistributionFinance.

Thisnewprojectwillhelpbuild assetbooksforexistingand newfunders Thisallowsusto matchthespecific requirementsofborrowerswith therightkindofcapital,thereby creatingawin-winsituationfor allpartiesinvolved

Thoughmanypeopleare startingtoacknowledgethe potentialofinvestingcapital intotradefinance,itcanbe adifficulttaskwithouta dedicatedteam.TFG

Distributionistheemerging solutiontothisproblem

UsingTFGDistributionFinance, largelenderscanputtheir capitaltousewithouttheneed tocreateadedicatedteamof tradefinanceexperts.Lenders willseepositivereturns,and SMEscanaccessnewcapital

Capitalrequirements: Bridgingthegap

Oneofthebiggestchallenges inthetradefinancemarketis themismatchbetweenwhat capitalexistsandcurrent demand

TFGDistributionFinance aimstobridgethisgapby understandingthegranular requirementsofbothborrowers andlenders.Thisisessentialfor scalingtradeandreceivables financeandbringingnew liquidityintothemarket

Theeconomicuncertainties ofrecentyearshaveledto arenewedfocusonsensible, low-riskinvestments.

Tradeandreceivablesfinance offersapromisingavenuefor privatecredit,providing scalability,diversification, andalow-riskprofile.AsTFG continuestoevolve,weare committedtobridgingthegap betweendemandandcapital requirements,thereby introducingmoreeffectiveand transparentfinancingsolutions

Inaworldwhereeconomic stabilityisfarfromguaranteed, tradeandreceivablesfinance offersanewandpromising avenueforprivatecredit It's notjustaboutfinancinggoods flowingacrossborders;it's aboutcreatingamorestable andtransparentfinancial ecosystemforallstakeholders involved.

s c i T i b i t G A e t e t m t g t B s f T l v j n p a o c g

14 www.tradefinanceglobal.com TradeFinanceTalks

15 www.tradefinanceglobal.com Featured

2.3

Decodingcross-border payments:Frominitiation tosettlement

Internationalwiresareasecureandrelatively simplewaytosendlarge-valuetransactions internationally,asSWIFTdoesnotlimitthe paymentamount.However,wirestaketimeto clearandsettle,andtherearefeesinvolved.

Anybusinessparticipating ininternationalcommerce normallyneedstomake paymentsinforeigncurrencies tosuppliers/sellersoverseasfor goodsand/orservicessourced fromothercountries.

Telecommunications)playsin facilitatingsuchtransactions

HeadquarteredinBelgium, SWIFTisaglobalmemberownedcooperativeofc.11,000 financialinstitutionsspanning over200countriesand territories,andistheworld’s leadingproviderofsecure financialmessagingservices

Internationalwire transfers

Therearemanydifferent methodsofsendingmoney globally Transferringmoney electronicallyisbyfarthe dominantmethod,although somepaper-basedcashways topaystillexist(e.g.cheque, bankdraft,moneyorder). Aninternationalwiretransfer (hereinafter,“international wire”)isacross-border serviceofferedbybanksfor transferringfundsoveran electronicnetworkfromabank accountinonecountryto anotherbankaccountina differentcountry

Internationalwiresare practicallysynonymouswith SWIFTtransfersduetothe pivotalroletheSWIFTnetwork (SocietyforWorldwide InterbankFinancial

Internationalwiresusingthe SWIFTnetworkarethemost commonmethodworldwideto transferfundsfromonebank orfinancialinstitution(FI)to another

Thereisacommon misunderstandingabout whatSWIFTdoes.Itisneither aclearingnorasettlement network.SWIFTisafinancial messagingsystemwhichsends globalpaymentordersinitiated byfinancialinstitutionstobe processedbyaclearingor settlementsystem.

Sendinganinternationalwire involvestwodifferentprocesses –clearingandsettlement

16

STANCOLE Advisor UNITEGlobalAS

www.tradefinanceglobal.com TradeFinanceTalks

Clearing

Internationalwiresareinitiated inonecountryandsettlein another Whenabank’s personalorbusinesscustomer initiatesaninternationalwire–viaonlinebanking,anapp,by phoneorin-personata branch–theyneedtoprovide informationaboutthepayment destinationandrecipientbased onSWIFTmessagingstandards, ie acommonlanguagefor paymentdataacrosstheglobe

Thesender’sbankensures sufficientfundsareavailablein thesender’saccounttocover thepaymentandapplicable fees,debitsthecorresponding amountfromthataccountand initiatesthefundstransfer bymessagingapayment instruction/ordertothe recipient’sbankviathe SWIFTnetwork.

Clearingcoversthetransfer andconfirmationofpayment informationbetweenthe sendingandreceivingbanks.

Whenthereceivingbank receivestheSWIFTmessage withalltherequired information,itdepositsthe paymentamountintothe recipient’saccountusingits reservefunds.Atthispoint,the paymenthasbeencleared,and theclearingphaseis completed

Nophysicalmoneyis transferredbetweenthetwo bankswhenconductingan internationalwire.Onlythe paymentinformationincluded intheSWIFTmessageis passedbetweenthebanks

Settlementisthefinalstep inmakingapaymentand involvescollectingthefundsfor thepaymentorderprocessed duringtheclearingphase.

Bankscanbegintheexchange offundstosettleapayment rightafterclearinghastaken place(fundsdepositedinthe recipient’saccount)orlater. Oncethesettlementhas occurred,thepaymentis complete.

Paymentscanbesettledeither onanetorgrossbasis

Settlement:Netvsgross Netsettlement:

Whenbanksaggregate transactions(debitsand credits)throughoutthedayand settleinbulk,bysending afinalsettlementwireatthe endoftheday.

17

www.tradefinanceglobal.com Featured

Whenindividualpaymentsare processedandsettledinstantly basedonindividualtransaction datareceivedinreal-time

Unlikeclearing,onlya settlementnetworkcan facilitatesettlement.The clearingsystemthathas handledatransaction,eg CHIPS,willsendthepayment informationtoasettlement networktosettleit,eg Fedwire Interbanksettlementsystems arerunbycentralbanks.If bothtransactingbankshave asettlementaccountwiththe centralbankinthecountry,the centralbankdirectlydebitsthe sendingbank’saccountand creditsthereceivingbank’s account(bothincentralbank money).

Oncethefundshavebeen transferredtothereceiving bank’saccount,thesettlement phasehasbeenexecutedand theinternationalwire completed.

Akeydifferenceisthatclearing determinesthecommitment ofthefundsandsettlement ishowbanksdothefunds reconciliationwitheachother.

Settlementinvolvesthe exchangingoffundsbetween thesendingandreceiving banks,whileclearingnormally endswithoutmovementof fundsbetweenthebanks.

Timingisanotherdifference.

Theclearingprocesstakes placefast,andistypically finishedwithinminutes,

whereasthetimingof settlementismoreflexible, asthepaymentrecipientcan alreadyaccessthefundsin theiraccountbytheendofthe clearingphase

Otherconsiderations

Internationalwiresareasecure andrelativelysimplewayto sendlarge-valuetransactions internationally,asSWIFTdoes notlimitthepaymentamount However,wirestaketimeto clearandsettle,andthereare feesinvolved.

Shouldthebankofthesender notprovidethecurrencyfor payment,orifitlacksadirect

accountconnectionwiththe recipient'sbank,theuseof intermediarybanksin correspondentbankingwill benecessary

Thislengthensthepayment chainandaddstimeandcost. AninternationalSWIFTwirecan touch2to5banksonrouteto therecipient,andmaytakeup to5businessdaystoclearand settleforlow-volumepayments inexoticcurrenciesinvolving additionalintermediariesalong theway.

Internationalwirescanbe expensive Sendingbanks typicallychargeaflatservice feeforissuingwires,usually$10

Grosssettlement:

18 www.tradefinanceglobal.com TradeFinanceTalks

Differencesbetween clearingandsettlement

to$50pertransaction.

Whenintermediarybanksare involved,eachcanalsolifttheir ownfees,unknowntothe senderinadvance

Moreover,therecipient’sbank maydeductafeeforreceiving theincomingtransfer(“benededuct”),usuallybetween$10 and$20butashighas$40in somemarkets Highercost makesinternationalwires suitablemostlyforlargervalue cross-bordertransfersbut uneconomicalforlowervalue, masspayments.

Nowadays,thereare alternativestointernational SWIFTtransfersforsending commercialpayments cross-border

New,innovativefinancial marketinfrastructures(FMI) areemergingthatreimagine thebusinessofmovingvalue acrossborders,whichcan enablelow-costreal-time paymentswithinstant settlementonaglobalscale

19 www.tradefinanceglobal.com Featured

5commonmythsabout carbonaccounting:Isit reallyworthit?

Totweakanoldproverb,thebesttimetostart measuringemissionswas20yearsago.The secondbesttimeisnow,asregulationtightens andmoreopportunitiesintradefinanceand productdifferentiationemerge.

Whileagrowingportionof theindustrystartstoseizethe opportunitiesofmeasuring andmanagingemissions, manycommoditytradersstill hesitate Whyundertakethe complexprocessofcarbon accounting,ifit’shard,ifit’s notalegalrequirement,and ifitonlydrawsattentiontotheir high-carbonproductsrather thantheircompetitors?

Therearefivecommonreasons forwhysomeperceivecarbon accountingasnotworththe effort.

Butifweaddressthemone byone,itbecomesclearthat carbonaccountingiscrucial forfuture-proofingsupply chainsandunlockingrewards fromcustomersandbanks Moreover,today’stechnology canmakethecomplexparts ofmeasuringemissions surprisinglyeasy

Myth1: There’snomandate, solet’sjustwait

“Wedon’thavetoreport emissions,solet’snotwaste timeormoneymeasuring them Untilregulatorsand legislatorsforceuswith incentivesorpenalties, carbonaccountingisabad

ADAMHEARNE

CEO

CarbonChain

2.4

www.tradefinanceglobal.com TradeFinanceTalks 20

investment”Thereality: Carbonregulationisalready hereandspreading. Companiesinanumberof jurisdictionsare(orwillsoon be)legallyrequiredtoreport theiremissions,including Canada,Chile,NewZealand, Japan,theUK,Australia,US, Singapore,China,Franceand Switzerland.

Ontopofthat,thenewEU CorporateSustainability ReportingDirective(CSRD)is settoquadruplethenumber ofcompaniessubjectto mandatorycarbondisclosure.

Some60%oftheworld’s emissionscomefromglobal tradesupplychains So, commoditytraderswhohaven’t yetfelttheshocksofcarbon pricingandreportingruleswill soonbeunabletoescape them.

Shipsarenowsubjectto InternationalMaritime

Organizationcarbonreporting andratingrules,whilethe upcomingEUCarbonBorder AdjustmentMechanismwill forceimporterstoreportand payapriceonhigh-polluting imports Bidenrecently announcedthattheUSwill requireallmajorFederal supplierstodisclose greenhousegas(GHG) emissionsandsetsciencebasedtargets.

Therewillbewinnersand losers Companiesthatgettheir houseinordernowcanensure properandsmoothcompliance whennewregulationshit. Carbonaccountingnotonly enablestraderstomeasurethe impactofcarbonpricing schemes,butcanhelplower costs,byidentifyingand modellinghowtoreducepriced emissions.

Thetimetostartisnow.Over halfoftheworld’scompanies bymarketcaparealready

gettingaheadandvoluntarily measuringandreportingtheir emissionsthroughCDP.

Myth2:Toolongto complete;toohardto getright

“Carbondataisinshortsupply. Sometimes,wecan’teventrace alloursuppliersandproduct origins We’veheardthere’s hugeroomforerrorwhen followingaverage-based methods,sowhat’sthepoint?”

Thereality:Carbonaccounting isindeedachallengefor unpreparedbusinesses, especiallyforcalculating supplychainorScope3 emissions,whicharethemost significantsourceofatypical business’semissionsand carbonrisks sometimes asmuchas90%

Suppliersoftendon’tmeasure ordisclosetheircarbon information,andthescant informationreportedcanbe incomplete,unverifiedand hardtocompare.

However,businessesdon't needtolookfarfortheright tools Carbonaccountingcan becompletedaccuratelyand ontimeusingtheGHG Protocol'sgloballyaccepted methodsforvariouscarbon footprints,includingsupply chainemissionsestimation whenprimarydataismissing TheycanalsoutiliseCDP’s provenmechanismfor requestingsupplierdisclosure.

21 www.tradefinanceglobal.com Featured

Manycommoditytraders andproducersareturning tospecialistsoftwareand machinelearningtofillassetlevelcarbondatagaps,allthe wayfromsourcetoshipment Forexample,thyssenkrupp MaterialsServicesEastern Europehasadoptedadigital carbontrackingsolutionto measureemissionsacross itsmetalssupplychainsand createstandardsforsupplier transparency

Theprocessofgetting carbonaccountingrightisan investment,butonetostart assoonaspossibleandto keepimproving.ThenewISSB SustainabilityDisclosure Standardsprovidecompanies withagraceperiodofoneyear tostartreportingtheirScope3 emissions,acknowledgingthat thesearethehardestto accountfor.

“Weneedtofocusonserving ourcustomers,generating valueforstakeholders,and accessingtradefinance,not onoptionaladd-ons Especially notinatimeofsupplychain disruption”

Thereality:Business expectationsarechanging. Moreandmorecustomersare requestingthecarbonintensity oftheirpurchases,andare findingwaystosourcelowercarbonproductsinorderto meettheirownnet-zerotargets andregulatoryrequirements.

81%offinancialinstitutions assesstheirportfolio’s exposuretoclimate-related risks,and77%arerequesting climate-relatedinformation

fromtheirclients.Buildingtrust inbusinesshasneverbeen moreimportant Itmeansbeing abletosharethecarbon footprintoftheproductsyou tradeandsourcinglowercarbonoptionstosupport customers’sustainabilitygoals, likeinthecaseofmetalstrader ConcordResourcesLimitedand leadingaluminiumrollingmill NicheFusinaRolledProducts (Fusina)

Whenitcomestotradefinance, buildingstrongpartnerships withbanksinvolvesresponding to,orpreempting,requestsfor carbonreporting Thiscan unlockimmediatebenefitslike interestratediscountsand sustainability-linkedloans (SLLs).

Forexample,SocieteGenerale hassignedmajordealswith twoleadingmetalscommodity merchants,topilotaccess toSLLstiedtoemissionsreductionKPIs

“Theprevailingstandards aren’tdecidedyet Wedon’t havetimetonavigatethe myriadofreportingstandards withalltheiracronyms.If they’renotuniform,thenwe’ll beduplicatingwork,and customerswon’tbeableto easilycompareourdata withcompetitors”

Thereality:Untilrecently,the existenceofmultiplecarbon reportingstandardsand frameworkshasbeenblamed forsomeindustryinertia

However,therehaslong beenonemaingo-toglobal standardforcarbonaccounting (theGHGProtocol)whichisthe keyreportingframeworks (TCFD,CDP,SASB,GRI)align with,evenifcompaniesvary inwhich

Myth3:Wefocuson stakeholders,not nice-to-haves

22 www.tradefinanceglobal.com TradeFinanceTalks

Myth4:There’sno singlestandard:it’san alphabetsoup!

frameworkstheyfollowand howcomprehensivelythey report.Therealityisthata futureupdatetoareporting standardisn’tgoingto materiallychangewhatis requiredwhenitcomesto reporting Allthedata collection,verification,baseline settingandtargetsettingwill allbeverysimilar,sodon’t usethatasanexcuse togetstarted.

Effortsnowtomoveearly willnotbeinvain

That’swhytherecent publicationoftheISSB standards,whichaimtounify allothers,isabigsteptowards aglobalbaselinefor sustainability-andclimaterelatedfinancialdisclosure

ourportfolioismetals anyway.”Thereality:Unless theyquantifytheirtrade emissionsfromendtoend, commoditytraders(andtheir financiers)don’ttrulyknow theirhigh-carbongoods Therecanbehugevariations inso-called‘high’carbon productemissions;atonneof aluminiumcanbebetween320tonnesofcarbondioxide equivalentpertonneof aluminiumincarbonintensity Oronecopperrefinerymight emitlessthananother,butit mightsourcefroma significantlymorecarbonintensivemine.

2026,andsharingyourproduct orcorporatecarbonfootprint, evenifitishigh,isbetterthan itbeingexposed.

Thecarbonfootprintingprocess allowstraderstofindwaysto loweremissionsandmanage theimpactsofcarbonpricing (forexamplebyscreening suppliersandratingassets againstindustrybenchmarks liketheIMOCarbonIntensity IndicatorandthePoseidon Principles)

It’salsothemostfundamental toolforavoidingthekindof greenwashingthat’scaused bymakinglow-carbonclaims withoutverifiabledata.

“Weknowoilcontributes moretoglobalwarmingthan aluminium,butwe’renot responsibleforwhat happensafterwesellit,orfor ourcustomers’choices Divingdeeperintotheexact emissionswilljustexposeusto reputationalrisk,andmostof

Sometradersfearthatopting forthemostrobust methodologyoutofthe recommendedoptionswillonly makeacompetitor’sproduct lookunfairlylower-carbonif thatcompetitortakesaweaker approach.

However,reputationalconcerns aboutcarbondisclosurepalein significancenexttothedanger offailingtoidentifycarbonrelatedrisksaheadoftime. Environmentalriskscouldcost supplychains$120billionby

Countingcarbonputs youincontrol

Totweakanoldproverb,the besttimetostartmeasuring emissionswas20yearsago Thesecondbesttimeisnow, asregulationtightensand moreopportunitiesintrade financeandproduct differentiationemerge. Today,toolsareavailablethat makeitpossibletoaccurately andpainlesslyaccountforand reporttradeemissions,while pinpointingcarbonrisks.

Putitthisway:forevery businessthatdelays,another competitorisreadytoseizethe emergingfinancialincentives andmeetcustomerdemand forlow-carbonproducts

Myth5:Wealreadyknow ourhigh-carbongoods

www.tradefinanceglobal.com 23 Featured

Howcansuretycarriers alignwithESG?

Suretycarriershaveauniqueopportunityto supportthegreentransition,growemerging industries,andpromotesustainablefinancing practices.However,challengesmustbe addressed.

Suretybondsplayavitalrole inmanagingrisksacrossmajor projectsbyprovidingfinancial guaranteesthatensure delivery,andmitigateagainst potentiallosses Astheworld acceleratesitsfocustoward sustainability,thesurety industrymustkeepupand makeapositivecontributionto financingamoresustainable andresilientworld.

Whilstthereisgrowing recognitionacrosstheindustry oftheneedforsustainable practices,formanysurety carriers,doingsoposes

challenges Theindustry's abilitytoadaptanddevelop suitablebondproductswill bepivotalinsupporting sustainablefinancing andachievingtheUN’s Environmental,Social,and Governance(ESG)goals

Carriersneedtogenuinely supportsustainableand emergingindustries,promote corporateinvestmentinnetzerodecarbonisation,and embedESGpracticestoensure thesuretybondindustry maintainsarelevantvalue propositionintothefuture.

GILLESGOAOC

SuretyBusinessManagerEMEA& APAC,SubjectMatterExpert

Tinubu

GILLESGOAOC

SuretyBusinessManagerEMEA& APAC,SubjectMatterExpert

Tinubu

2.5 24 www.tradefinanceglobal.com TradeFinanceTalks

Toincreasetransparencyand boostenvironmentalandsocial responsibilityacrossthe financeindustry,theEuropean Union’sSustainableFinance DisclosureRegulation(SFDR) mandatesESGdisclosure obligationsforassetmanagers andotherfinancialmarket participants

AsofMarch2021,banks, insurers,investmentfirms,and otherfinancialinstitutionsmust reportsustainableinvestment practicesinastandardised formatsoinvestorscanmake informeddecisions NoncompliancewiththeSFDRcan haveadverseconsequences, suchasdisciplinaryactionfrom localfinancialauthorities,and negativesignallingtocurrent andprospectiveclientsand investors

Giventhatapproximately50% ofsuretybondsareforthe financingofmajorconstruction projectssuchasrail,road,and marineinfrastructure,thereis aclearneedfortheindustryto supportsustainable infrastructure.Theconstruction industryismovingtowardsnetzero,focusingonlow-carbon materials,circularbuilding methods,wastereduction,and regulatorycompliance Surety carriersmustadapttosupport thesechanges.

Adaptingandaligningsurety underwritingpracticeswill meanshiftingfocusfromthe traditionalassessmentof financialstatements,to assessingprojectsthrough aholisticlens,considering factorssuchasclimate resilience,andtheviabilityof innovativetechnologies.

sustainableandresilient projectsthatcanwithstand futureenvironmental challenges.

Somecarriersaresetting targetsforresponsible underwritingandinvestment, andhaveannouncedfuture planstophaseoutcoveragefor certainactivitiessuchasfossil fuelsprojects.

Balancing innovationrisks

Withsuretycarriersaimingfor zerolosses,theystillshow hesitationtowardsfinancing renewableprojectssuchas solarenergyorwindfarms

Theirreluctancetoissuebonds forprojectsinemerging industriesorthoseinvolving innovativetechnologiesstems fromthedifficultyinassessing theassociatedrisks.

Itismoreimportantthanever thatsuretycarriersintroduce productsthataretailoredto helptheirexistingclients pursuemoresustainable initiatives.

Forsometimenow,surety carriershaverecognised climatechangeasamajorrisk thatwillimpacttheir underwritingpractices.They increasinglyincorporateESG intoriskassessmentsand recognisethestrengthof

Contrastingly,inestablished sectorswheresuccessis proven,carrierscanconfidently calculatetheriskthrough historicaldataandexperience. Often,newerindustriesinvolve start-upsthatinvestin transformativetechnology,but lackatrackrecord Thiscauses carrierstohesitatetoissue bonds,makingitdifficultfor projectstogoaheadwithout exposuretorisk.

Withoutaccesstobonds,these innovatorsresorttousingtheir availablecapital,andtakeon largerrisks–inturn,limiting theirabilitytogrowandrealise thefullpotentialandimpactof theirinnovations.

Emergingindustriesalsocome withtheriskofdelays,which canbelengthy,resultingin contractorbankruptcies

Reportingrequirements Movingtowardsnet-zero

Featured 25 www.tradefinanceglobal.com

OnesuchexampleistheEDF nuclearreactorinFlamanville innorth-westernFrance,which startedconstructionin2007 buthasyettobecompleted.

Theprojectwasexpectedto takefouryearsandcost€3 billion However,arangeof issueshavecauseddelays ofoveradecade,withEDF currentlyexpectingnuclearfuel loadingtobescheduledinearly 2024,withcostscontinuing tomount

Inamorepositivesign,some progressisoccurringas renewableenergybecomes moremainstreamandis increasinglybackedbylarger corporations Whilstthis encouragessuretycarriersto participate,progressisslower thanthepacerequiredtomeet transitiongoals.

Asinnovationextendsbeyond solarandwindfarmstonew industries,thecycleofriskand uncertaintywillalsocontinue togrow

Toaddressthis,suretycarriers mustadapttheirunderwriting approachtoincludeabetter understandingofthebusiness modelsandrisksassociated withemergingindustries

Onemajorchallengelies inestablishingacommon understandingacrossthe industryofsustainability.

Differentstakeholdershave varyingdefinitions,making itchallengingtoapply aconsistentapproach

Aggregatingvarioussources ofdataandimprovingaccess toinformationthrough digitisationformoreaccurate informationcangivecarriers theinformationtheyneedto assesssustainabilityandrisks moreaccurately

Collaboratingwithexternal experts,suchasengineersand industry-specificconsultants, canalsohelpassessviability.

Theemergenceofcarbon creditmarketshascreated opportunitiesforsurety companiestoissuebonds thatcovercarboncredits, supportingcompaniesintheir decarbonisationefforts.

Companiesarestrivingto meettheirnet-zerotargets, necessitatingthepurchaseof carboncredits.Weseethis incompaniessuchasTotal Energiesandotherpetroleum giantswhoarebuyingcarbon creditstodemonstratetheir commitmenttoreducing emissions

Issuingbondstocoverthese creditscouldensure accountabilityandprovidea securefinancialmechanismto supportdecarbonisation.Whilst suchbondsdonotyetexist, increasingdemandforcarbon creditscouldsecureanew marketforthesuretyindustry toplayacrucialrolein providingthenecessary financialguaranteestoensure marketintegrity.

Whilstsuretybondscan supportthegreentransition, carriersmustgobeyondsimply shiftingsupportfromcoalto renewableenergyprojects,and assesstheirownoperations Majorsuretyplayerslike Atradiusareproactively aligningwithESGprinciples.

26 www.tradefinanceglobal.com TradeFinanceTalks

Newcarbonmarkets

Aninternalview

Theyareimplementingpolicies toachievenet-zerotargets, adoptingdigitalizationto reducepaperusage,and enhancingefficiency.

Bydigitalisingtheirinternal processes,suretybondcarriers cantransitiontoe-bonds, eliminatingtraditionalpaper bonds,whichstillaccountfor around95%ofbonds worldwide.

Theseeffortssignalthe industry’sgrowingcommitment tosustainabilityand demonstratethepotentialfor suretycarrierstoadaptand aligntheirpracticeswith sustainability.Notonlydoes digitalisationreflectamore sustainableapproach,butit comeswithorganisational

benefitssuchasspeed, efficiency,accuracy,and competitiveness.

Whilsttheenvironmental aspectofESGhasdrawn attention,acomprehensive approachthatincludessocial andgovernancefactorsisalso important.However,thesurety industryisnotcurrentlya frontrunnerinthisarea,and moreworkisneeded.

Encouragingemployee engagementcancontribute tothesocialgoalsofESG,and whilstmanycarriersengagein thesepractices,theycanalso considerhowtobettersupport thesocialaspectsofthe projectstheyunderwrite

Thiswouldgosomewayto addressinggrowingpressure fromemployeeswhowant toworkforcompaniesthat prioritiseallESGfactors,aswell asexternalpressuresfrom banks,clients,andstakeholders

Suretycanplayavitalrolein financingandsupportingnet zeroinseveralways,withthe futureofsuretyintertwinedwith sustainabilityprinciples

Carriershaveanopportunity tosupporttheirclients’ decarbonisationefforts,while alsoadaptingtheirown practicestoalignwith sustainabilitygoals By introducingnewbondproducts thatpromotedecarbonisation, andbyinvestinginemerging industries,suretycarriers cancontributetoamore sustainablefuture.

However,tofullyembrace sustainability,theymust overcomechallengesin assessingprojectrisks,change theirunderwritingperspectives, anddiversifydatasources.By doingso,thesuretyindustry canplayavitalrolein supportingthetransition

Featured

Aninternalview www.tradefinanceglobal.com 27

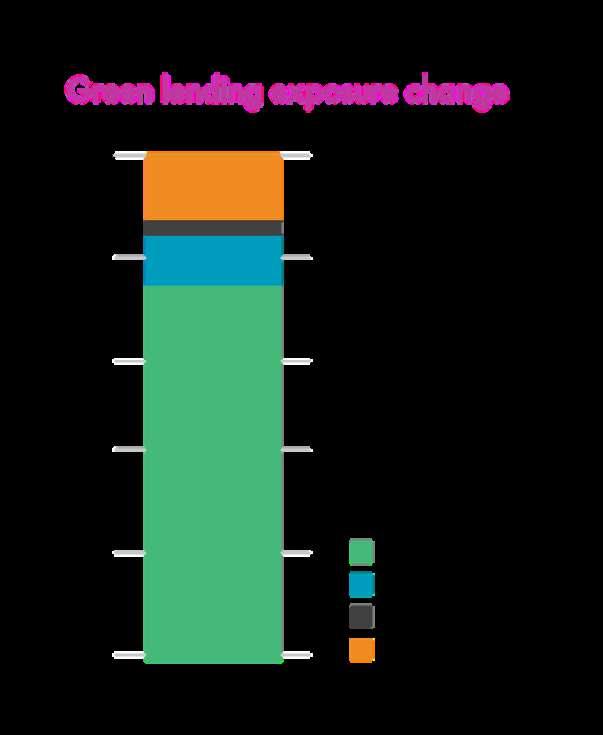

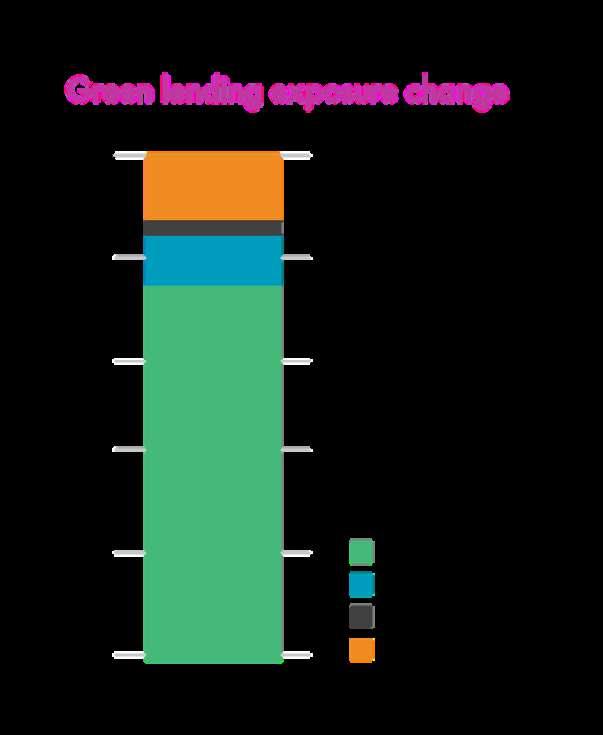

2.6

Fromstarboardsurprisesto portsideperils:Inherent risksintheshipping industry

Atamacrolevel,shippingisataninflection pointwherecircumstancesareelevatingthe potentialrisksfortraders.

90%ofworldtrade–frombulk rawcommoditiestobreakbulk andfinishedgoods–ismoved onapproximately60,000 tradingships,crewedbyabout 1.5millionseafarers.Tomost traders,thepotentialrisks associatedwithanyoneof thesevesselsisanunknown Howcanyouensurethatthe shipsyou’reevaluatingfor supplychainactivityareatan acceptablestandard?Howcan youmitigatethepotentialrisks associatedwithocean-bound vessels? Atamacrolevel,shippingis ataninflectionpointwhere circumstancesareelevating thepotentialrisksfortraders. Onesuchriskistheincreasing averageageoftheglobalfleet Thistrendisdrivenbyanumber offactors,includinghesitancy toordernewvesselswhile newtechnologiesarebeing developed.Additionally,an increaseinvesselvalueis associatedwithprolonged operationallifetimes

Volatilemarketconditions canalsoimpact

themaintenanceregimesof ships,reducingthequalityand reliabilityofassetsasvessels canbetradedharderinbullish marketsandmaintainedmore conservativelyinbearish markets.

Inadditiontothesefactors, COVID-19changedthereality ofshipping During2020and 2021,seafarerskeptglobal trademoving.Theywerenot, however,properlyrecognised askeyworkersand“nocrew change”clausescombined withlocalportandglobaltravel restrictionsrestrictedtheability torepatriatecrew

Thisresultedinmanyseafarers servingwellinexcessof12 monthsonboardvessels withoutrelief.Travelrestrictions duringthepandemicalso limitedtheabilityofshorestaff andthird-partyorganisations toundertakeroutine inspectionsofvessels.

Anumberofshipownersfound thecostofmaintainingtheir vesselswastoogreat,sothey optedtoabandonthemand theircrewswithoutanyfurther consideration

ANDREWROBERTS HeadofEMEA RightShip

28 www.tradefinanceglobal.com TradeFinanceTalks

Overviewofrisksin shipping

Assuch,2022sawthe highestnumberofseafarer abandonmentcasesever recorded.

Theseissueshavebeenfurther compoundedbytheongoing Russia-Ukrainewar,andmany experiencedseafarersare leavingtheindustryasaresult. Thisincreasestheworkloadon remainingcrews,givingriseto agreaterriskofincidents,and threateningthecontinuityofthe industry

Thisisatatimewhenthe industryneedsaninfluxof talenttomeetindustry

demand,managerisksfrom newfuelsandtechnologies,and maintainpacewitharapidly changingworld.

Recenttrendsand inherentrisks

Thispictureofheightenedrisk isreflectedinthedatafrom incidentsandportstatecontrol deficienciesanddetentions whichshowanobservable increase

In2022,4,604incidentswere registeredbyRightShip,withdry bulkvessels,cargovessels,and chemicaltankershaving

thehighestincidentnumbers Incidentsoccurredonyoung andoldvessels,with46 incidentsinthepasttwoyears occurringonvesselsonlyoneyear-old Ofthese46,25%of theincidentswereRightShip CategoryB,thesecond-most severekindofincident (includesinjury,significant vesseldamage,severe structuraldamage,explosion, fire,flooding,etc)

Tragicallywithinthese4,604 incidents,193liveswerelost,113 crewmembersreported missing,and86seafarers sufferedseriousinjuries.

Ro-RoCargoLPGTankerLNGTankerRefrigeratedCargo NA 1.1K 0.8K 0.7K 0.4K 0.4K 0.3K 0.3K 0.3K 0.1K 0.1K 0.0K 0.0K 0.0K

BulkCarrierGeneralCargo Other/Non-CargoCarryingChemicalTankerContainerCrude&ProductsTankerPassenger/CruiseRo-Ropassenger

Featured www.tradefinanceglobal.com 29

Incidentsbyvesseltype

Impactofincidentson tradersandtrade:the microview

Timeisacriticalfactorfor mosttraders,whichmeans importantdecisionsonvessels canbemadewithverylimited informationathand

Shipscanoftenbechosen basedontheircompliance withminimumrequirements suchasbeingregistered underaflagstate,classified byaclassificationsociety, andadequatelyinsured

Someoperatorsmightalso prefernewerships.However,

thesecriteriaonlyprovidea verynarrowperspectiveof aship'sassociatedrisks

Poorqualitytonnage,poor operationalqualityanda historyofincidentscan generateabroadrangeof potentialrisksandimpactsfor traderswhichcanresultin significantconsequential damage.

Intheexamplebelow,wehave twovessels.Bothvesselsare ofasimilarage,andbothare flagged,classed,andinsured Yetthegapinquality betweenthetwovessels–andtherefore

thedifferenceinpotentialrisk–isvast

Therangeofconditionsand risksthatcanimpactavessel isbroad:fromsimplereduced maintenance,whichcanlimit theperformancecapabilityof vessels;tounplanned machinerybreakdownand stoppages,whichcancause significantsupplychain disruption;toevenmoreserious incidentssuchasgroundings, fires,explosions,andother significantevents,whichcan resultinseriousenvironmental impactor lossoflife

Theresultingpotentialimpacts onatraderrangefrom inconvenienttosevere:from delays,performanceclaims, andmisseddeadlines,to breachofcontractualsaleand purchaseprovisions,damage toorlossofcargo,lossof avessel,significantpecuniary costs,andreputationalimpact

ThereisalsoanadditionalESG dimensionthatcanimpacta trader’spotentialriskscenario, withGHGemissionsand

extensivesocialrisksinvolving seafarerscomingintoplay, whicharebecoming increasinglycommonwiththe introductionofnewsupply chainsocialduediligence legislation

Thefrequencyofthese incidentscansurprisethose notwell-versedinmaritimerisk: RightShipdatashowsthat 10.4%ofvesselsfacesome sortofdetentionatportsand terminals,wheretheaverage

durationofdetentionis5.4 days Thesedetentionscanbe theresultofhullandmachinery damage(whichaccountsfor nearly18%ofallincidents recordedbyRightShip)and disruptionoroperational incidentshavethepotentialto causesignificantimpactonthe broadersupplychain–aswe sawinanextremeexamplewith theEverGivenintheSuez Canal.

30 www.tradefinanceglobal.com TradeFinanceTalks

RightShip’svisionisazeroharmmaritimeindustry.Over 22years,wehavehelped charterersandtradersgain greaterassuranceofthe vesselsusedintheirsupply chainactivitiesthrough,inter alia,duediligenceprocesses thatgobeyondbasic compliancewithstatutoryand regulatoryrequirements.

TheRightShipVesselTrade Checkisadigitalsolutionused bytraders,tradefinance institutions,andinsurers,to gainaninstantevaluationof avesselagainstasuiteof customisableduediligence criteriathatexceedbasic statutoryandregulatory requirements

andincludesadditionalcriteria suchasevaluationofClass SurveyStatusreports,and incidentsreportsforsuitable preventativemeasuresforall recentincidentsorevents.

RightShip’sdatashowsthatthe detentionratiodropsto8.5%for vesselswhichhavebeenvetted byRightShip’sOperationsteam, againstthosewhichhavenot beenvetted(11.3%detention ratio)

Theduediligenceprocessalso evaluatespotentialESGrisks, includingenvironmentalrisks andtheextensivesocialrisks thatcanbepartofshipping (suchascrewwelfareand seafarerabandonment) Even asidefrommoralreasons,such riskscanimpacttraders becauseofahigherpotential forincidents,asindustrydata

showsastrongconnection betweencrewwelfareand incidentlikelihood.

Third-partyduediligence shouldbeconsideredan essentialpartofatrader’s process.Forourpart,asan ESG-focusseddigitalmaritime platform,RightShipprovides flexibleandcontinuoussupport fortradersbasedonqualitative data-driveninsights Understandingandreducing therisksassociatedwithvessels benefitsnotjustthetrader, butallinvolvedinthe transportationofoceanboundcargo.

Featured

No.ofInspections No.ofInspected ships AvgNo,of Deficiencies AvgNo.ofdays detained (minimum) Detention Ratio with>=1deficiency with>=1deficiency anddetention

Increasingassurance

throughvesseltrade checkandvetting

www.tradefinanceglobal.com 31

206,393 38,759 1.7 5.4 10.4% 85,081 4,877

ManagingDirector,GlobalHead ofTrade&ReceivablesFinance TradeFinanceGlobal(TFG)

2.7

HowMRPAsarePavingthe WayforCollaborationin TradeFinance

ThestandardisationofMRPAsplaysanotable roleinreducingthetradefinancegapand promotinginclusionwithintheindustry.MRPAs provideastandardisedmethodoftransferring risk,makingiteasierforparticipantstoevaluate andjointransactions.

Thetradefinanceindustry offersadiverserangeof instruments,structures,and mechanisms,allaimed attransformingtrade opportunitiesintotangible realities Onesuchmechanism employedbyfinancial institutionsistheutilisation ofMasterRiskParticipation Agreements(MRPAs).

Theseagreementsenable activeriskparticipation, allowingfinancialinstitutions toeffectivelymanageand distributerisks,safeguarding theinterestsofallparties involvedwhilepromotinga resilientinternationaltrade ecosystem

MarkAbrams,Managing Director,GlobalHeadofTrade &ReceivablesFinanceatTrade FinanceGlobal,spokewith GeoffreyWynne,Partnerand headofSullivan'sTrade& ExportFinanceGroup,toexplore theevolution,significance,and futureprospectsofMRPAs

RiskParticipationAgreements (RPAs)areameansofsharing riskintradefinance transactions,whichoriginated primarilybetweenbanks These agreementsenablefinancial institutionstotransferaportion oftheirtransactionalriskto otherpartieswhilemaintaining

GEOFFWYNNE

MARKABRAMS

Partner Sullivan

GEOFFWYNNE

MARKABRAMS

Partner Sullivan

evolutionandfunction ofMRPAs 32 www.tradefinanceglobal.com TradeFinanceTalks

Understandingthe

acustomer-facingrole.As Wynneexplained,"Whenabank wantedtostayforwardfacing tothecustomerwhileit transferredpartoftheriskof thattransactiontoanother party,participation agreementswereagreat wayofdoingit."

Inaddition,Wynnehighlighted thetwomaintypesofrisk participation:fundedand unfunded

Infundedriskparticipation,he noted,"Fundedriskparticipation iswheretheselleroftheriskis fundedbytheparticipanton dayoneandthenpaysthe moneybackwhenit'spaid back"

Thistypeofparticipation ensuresthattheparticipantis directlyinvolvedinfinancing thetransactionfromthe beginning Ontheotherhand, unfundedriskparticipation coverstheriskwithout immediatefunding.The participantisobligatedtopay onlyintheeventofadefault,

earningareturnforassuming therisk.Thistypeof participationallowsforrisk transferwithouttheneedfor upfrontfunding

Furthermore,theneedfor standardisationinrisk participationagreements becameapparentwhen variousbanksindependently draftedtheirownsetof agreements Thelackof consistencycoupledwiththe complexnatureoftrade financepromptedagroupof bankstotakeactionand initiateastandardisation process

Thiscollaborativeeffortledto theintroductionofMRPAs, includingthewidelyrecognised BAFTMRPAs,in2008.The standardisationofMRPAshas establishedanindustry-wide frameworkforbanksandtheir counterpartiesintheglobal tradefinancemarket It simplifiedtradefinance transactions,streamlined negotiations,andenhanced transparency.

Thechallengesand considerationswhen engaginginMRPAs

recognisethestrengthof sustainableandresilient projectsthatcanwithstand futureenvironmental challenges

Somecarriersaresetting targetsforresponsible underwritingandinvestment, andhaveannouncedfuture planstophaseoutcoveragefor certainactivitiessuchasfossil fuelsprojects

DealingwithMRPAsinvolves navigatingchallengesand considerationsthatrequire strikingabalancebetweenthe interestsofboththesellerand participantwhileadheringto regulatoryandcompliance obligations

Wynneemphasisedthis balance,stating,"Wetriedto balancethepositionbetween theselleroftheparticipation andtheparticipant Theseller saystotheparticipant:here areallthedocuments,ifyou acceptmyoffer,thenyou're inthetransaction"

Evidently,companiesshould carefullyreviewtheprovided documentation,assesstheirrisk exposure,andalignthetermsof theMRPAwiththeirobjectives andriskappetite

Alongsidetheneedforbalance, regulatoryandcompliance considerationscomeintoplay. Thecoreobjectiveistoensure theeffectivetransferofrisk fromthesellertothe participant Wynnepointed out,"Fromaregulatoryand legalpointofview,theidea istomakesurethattherisk istransferredfromtheseller

www.tradefinanceglobal.com 33

Featured

totheparticipant"Sellersseek assurancethattheriskis successfullytransferred, whetherthroughsellingor funding,toremoveitfromtheir books.

Conversely,participantswant toascertaintheirrightstothe underlyingtransactionand understandtheirobligations, particularlyiftheyarefunded. ItisessentialtoaligntheMRPA withregulatoryrequirements, ensuringtransparency, accountability,andclear delineationofrightsand responsibilitiesforall involvedparties

Unlockingtradefinance opportunities:Theimpact ofMRPAsonthetrade financegapanddriving inclusion

ThestandardisationofMRPAs playsanotableroleinreducing thetradefinancegapand promotinginclusionwithin theindustry.MRPAsprovide astandardisedmethodof transferringrisk,makingit easierforparticipantsto evaluateandjointransactions AsWynnesaid,"You'vegota standardwayoftransferring risk Consequently,itmakeslife

aloteasier"TheuseofBAFTbasedMRPAsasanindustrystandardframeworkhas enhancedtransparencyand facilitatedmoreefficient participationintradefinance transactions,"Sincethe transactionwillbebasedon BAFT,theparticipantalready hasaprettygoodideaofhow it'sgoingtobecomeinvolved init,"Wynneadded.

Besidesfacilitatingrisktransfer, MRPAsopendoorsfornon-bank originatorsandinvestorsto enterthetradefinancemarket BysigninganMRPA,these entitiesgaindirectrights

www.tradefinanceglobal.com

TradeFinanceTalks 34

andincreasedconfidencein theirparticipation

Wynneunderscoredthe simplicityofthisapproach, stating,"IfyousignthisMRPA, youaregettingdirectrights againstthepartypaying Itis thatsimple"

Theinclusionofguaranteesor creditinsurancefurther mitigatescreditrisksand reinforcesconfidenceamong non-bankoriginatorsand investors Moreover,MRPAs demonstrateversatilityin accommodatingdifferent marketparticipants While

originallydesignedasatwowaydocumentforsellersand participants,Wynneexplained thatthecurrentusageoften involvesone-wayagreements tailoredtospecificneeds

Henoted,"Alotoftheworkwe donowisoneway,whichis exactlyright."Thisadaptability allowsforvariationsin structuresandarrangements, offeringflexibilitytomeetthe diverserequirementsofmarket participants.

Lastly,theadoptionofMRPAs promotesaccessibilityfor smallerbuyersandsellers whohavehistoricallyfaced challengesinaccessingtrade financeinstruments AsWynne stated,"Ifyoureallywanttobe inthismarketplaceandare preparedtosignapromissory notethatsaysyouwillpayin90 days'time,whileyoucanget thefundingtothesellerinten days,there'sarbitrage,and there'sthemarketplace"

Throughstreamliningthe fundingprocessandexpediting accesstofunds,MRPAscreate athrivingmarketplacethat welcomesparticipantsofall sizes

ThefutureofMRPAs: Addressinginvestor needsandevolving dynamics

ThefutureofMRPAsinthe tradefinancelandscapeis propelledbythecommitment tomaintaintherelevanceand accessibilityofMRPAsforawide arrayofmarketparticipants Reflectingontheevolving dynamicsofMRPAs,Wynne pointedouttheimportance ofrefinementsandupdates,

suchastheremovalofLIBOR.

However,heemphasisedthat thekeyconsiderationliesin therelationshipbetweensellers andparticipants,traditionally dominatedbybanks.Tofoster inclusivityandexpandaccess totradefinancethrough participation,addressing investorconcerns,suchas cumbersomedocumentation, becomesparamount Wynneexpressedhis confidence,stating,"Therewill bechangestomeetthe investor'sneeds That'swhere Iseethisgoing"

www.tradefinanceglobal.com 35 Featured

36

37 Anindustrywithoutbordersorbarriers

3.1

Thepowerofallies: navigatingLGBTQ+ inclusionintrade,treasury, andpayments

Thispowerthatalliesbringisatestament totheirabilitytoofferunwaveringsupport. Fromwearingsymbolicitemslikerainbow lanyardstoattendingevents,alliesshowup visibly,creatingapowerfulshowofsolidarity, whichcanmakeanimpactfuldifferencefor somecommunitymembers.

Theinternationaltrade, treasury,andpaymentsspace isaboutremovingbarriers, bridgingdivides,andfinding commongroundtokeepthe worldconnected.

Attheheartofitall,there'sa humanelement:unseenbut everpresent

Creatinganinclusive environmentonamacroscale requiresthecreationof environmentsforaninclusive society Onamicroscale, everydaypeoplemustcome first

Afirstfortheindustry,Trade FinanceGlobal(TFG)has partneredwithseveralmajor organisationsinthetrade, treasury,andpaymentsspace tocometogetherandspeak openlyaboutanoften overlookedyetinvaluable segmentintheindustry:the LGBTQ+community.

LGBTQ+isanabbreviation forlesbian,gay,bisexual, transgender,queeror questioning,andmore.These termsareusedtodescribea person 'ssexualorientationor genderidentity.

Awomanwhoseenduring physical,romantic,and/or emotionalattractionisto otherwomen

Theadjectivedescribespeople whoseenduringphysical, romantic,and/oremotional attractionsaretopeopleofthe samesex.

Apersonwhocanform enduringphysical,romantic, and/oremotionalattractions tothoseofthesamegenderor morethanonegender.People mayexperiencethisattraction indifferingwaysanddegrees overtheirlifetime

CARTERHOFFMAN

DEEPESHPATEL

ResearchAssistant TradeFinanceGlobal(TFG)

EditorialDirector TradeFinanceGlobal(TFG)

WhatdoesLGBTQ+mean? Lesbian Gay Bisexual 38 www.tradefinanceglobal.com TradeFinanceTalks

Anumbrellatermforpeople whosegenderidentityand/or genderexpressiondiffersfrom whatistypicallyassociated withthesextheywereassigned atbirth Peopleunderthe transgenderumbrellamay describethemselvesusingone ormoreofawidevarietyof terms includingtransgender ornonbinary

Queer

Anadjectiveusedbysome peoplewhosesexual orientationisnotexclusively heterosexualorstraight This umbrellatermincludespeople whohavenonbinary,genderfluid,orgendernonconforming identities

Transgender Questioning

Sometimes,whentheQisseen attheendofLGBT,itcanalso meanquestioning Thisterm describessomeonewhois questioningtheirsexual orientationorgenderidentity

Source:https://gaycenter.org/ community/lgbtq/

TFG’sDeepeshPatelspoke withindustryexpertsCatherine Lang-Anderson,PartneratAllen &Overy;NatashaCondon, GlobalHeadofTradeSalesat JPMorgan;RobertoLeva,Trade andSupplyChainFinance RelationshipManageratthe AsianDevelopmentBank; RogiervanLammeren, ManagingDirectorHeadof TradeandWorkingCapital ProductsatLloydsBank,and AlanKoenigsberg,SVPVisa CommercialSolutionsatVisa

Overthecourseofthe discussion,theimportanceof allyshiparoseasavitalwayto

breakdownbarriers,find commonground,andpropel LGBTQ+inclusionacrossthe sector Anallyisapersonwhostands insolidaritywithLGBTQ+people, particularlywhenthey themselvesdonotidentify asLGBTQ+

Allyship:Abridgeto inclusivity

Alliesarevitalacrossallparts ofdiversity,equalityand inclusion(DEI),promoting inclusivity,equality,andsocial change

Theymaytakevariouskinds ofaction Theseinclude: educatingthemselvesand othersaboutLGBTQ+issues, usingtheirprivilegetoamplify marginalisedvoices, challengingdiscriminatory behaviour,andworkingto createsaferandmore acceptingenvironmentsfor LGBTQ+individuals.

vanLammerensaid,“It'sreally theallieswhobridgethegap betweenthewiderorganisation orindustryandthesmaller groupsofindividualswithin itwhoareactivelytryingto deliverchange.Havingpeople arounduswhocaninfluence widergroupsofpeoplereally makesadifferencebetween doinganokayjobordoinga reallygreatjobwhenitcomes todiversity,equality,and inclusion.”

Thispowerthatalliesbringis atestamenttotheirabilityto offerunwaveringsupport From wearingsymbolicitemslike rainbowlanyardstoattending events,alliesshowupvisibly, creatingapowerfulshowof solidarity,whichcanmakean impactfuldifferenceforsome communitymembers.

Condonsaid,“Everytimeyou meetsomeonewelcoming, maybethey'rewearingthat rainbowlanyard,youdon't needtoworryabouthaving

Anindustrywithoutbordersorbarriers

www.tradefinanceglobal.com 39

thatconversationorcensoring thepronounyouuseto describeyourpartner You know,it'sgoingtobeokay”

Oneofthepowerfulaspects ofallyshipisthatitisopento anyone:allittakesistheright mindsetandawillingnessto supportthosearoundyou

Lang-Andersonsaid,“Beingan allyispartiallyabouteducating yourselfandknowingthatyou’ll alwaysneedtobeopenand eagertolearn.It'simportantnot toletalackofcomplete knowledgeholdyoubackfrom tryingtovisiblyshowsupport Peoplewillalwaysbehappyto helpyouwhentheycansee yourcommitmenttobeing supportive.”

Sometimes,however,oneofthe bestthingsthatanallycando isprovidespacewhenitis needed

Lang-Andersonadded,“Abig learningpointinmyjourneyas anallyhasbeenknowingwhen tostepback.Somepeoplemay notbeoutatworkoroutinall partsoftheirlives,andit'sreally importanttorespectthatspace aswell”

Alliesinthework environment

Peopleareattheheartofany greatorganisation,andwhen theyfeeltheirbest,they performattheirbest,making aninclusiveandsupportive environmentcriticalfor businesssuccess.

“Alliesareessentialtomake apersonfeelateaseinawork environment Beingunableto relyoncolleaguesasallies wouldbeashardasgoing throughyourpersonallife

withoutfriendsorfamily,”Leva said It’saverybadsituation thatdoesnotallowyoutogive 100% That'showimportant theroleofanallyisinan organisation,”headded.

Butit'smorethanjusthelping othersexcelatwork;embracing allyshipisapowerfultoolfor self-developmenttohelpthe allythemselfgrowandthrivein otherareas

Levaadded,“Embracingthe attitudeofanallyalsoallows someonetogrowtheirlevelof empathyoverall,whichreally goesbeyondjusthelpingthe LGBTQ+communityandcan helpapersongrowandthrive intheirrole.Especiallywhen thatroleinvolvesdealingwith peoplefromdifferent backgroundsorlifesituations.”

Theconceptofallyshipdoes notstopatthewallsofyour organisation Therecanbe countlessopportunities, particularlyforleadersinany industry,tousetheir professionalskillstopromote inclusivityinothersettings

Koenigsbergsaid,“Imade aNewYear'sresolutionone yearthatIwantedtostart givingback,andI'vesince joinedtwononprofitboards.

Betweenopportunitieslike theseandyourdayjob, sometimesmagichappens, andyoucanbringallthat together.

Maybethenonprofitcancome intothecompanyforalunch andlearn,orthecompanycan sponsoragaladinnerevent Allofthatsendsaverypositive messageaboutyourown personalcommitment.”

Throughsharedexperiences, supportiveactions,andgenuine engagement,allyshipcandrive meaningfulchangeandmake theworldoftrade,treasury,and paymentsamoreinclusiveand welcomingspaceforeveryone.

Condonsaid,“It'sanadmirable thingtoadvocateforyourself, butpeoplewhofightforothers whenthere'snopersonal benefittothem,thosepeople arespecial.”

Inarealmwherefinancial institutionsareoften

www.tradefinanceglobal.com TradeFinanceTalks

Fosteringpositivechange

40

associatedwithnumbersand transactions,itisimportantto rememberthattrueprogress transcendsbalancesheets

Allyshipemergesasabeacon ofhopeandtransformation, capableofweavinginclusivity intothefabricofthetrade, treasury,andpayments industry

Asthediscourseonallyship gainsmomentum,itisclear thattheroadtoinclusivity beginswithopen conversations,empathetic actions,andacollective commitmenttofostering positivechange

StonewallLGBTQ+Allies Programme: Acomprehensiveprogramby Stonewallthatoffersin-depth trainingandunderstandingto fosterLGBTQ+inclusionin workplaces:

https://wwwstonewallorguk/st onewall-lgbtq-allies-andtrans-alliesprogrammes/lgbtq-alliesprogramme

HowtobeanLGBTQ+allyImperialCollegeLondon: HowtobeanLGBTQ+allyImperialCollegeLondon:A resourcefulguidefromImperial

CollegeLondonthatprovides insightsandactionablesteps onbeinganeffectiveLGBTQ+ ally,emphasizingthe importanceofcreatingan inclusiveenvironment: https://www.imperial.ac.uk/equ ality/resources/lgbtqequality/how-to-be-an-lgbtqally/

https://wwwwileycom/enus/Allies+and+Advocates:+Cre ating+an+Inclusive+and+Equita ble+Culture-p-9781119772934

AlliesandAdvocates:Creating anInclusiveandEquitable Culture: AbookbyAmberCabralthat offerspracticalstrategies andreal-worldexamplesto promoteinclusionanddiversity, guidingreadersonhowto transitionfromdiscriminatory behaviorstobuilding meaningfulconnectionsacross diversebackgrounds: https://outrightinternational. org/

LGBTQFreedomFund: Afund thatactivelypaysbailtosecure thesafetyandlibertyofLGBTQ individualsinjailand immigrationdetention,while alsoaddressingthe disproportionatelyhighrateof jailingonLGBTQindividualsdue toacombinationof discriminationandpoverty: https://www.lgbtqfund.org/

NationalCenterfor TransgenderEquality: Aleadingadvocacy organizationfocusedon advancingtherightsand well-beingoftransgender individualsintheU.S.,offering resources,knowledge,and actionopportunitiesonvarious issuesaffectingthe transgendercommunity: https://transequalityorg/

www.tradefinanceglobal.com Anindustrywithoutbordersorbarriers 41

Alliesinthework environment

FounderandCEO Elucidate Writer TradeFinanceGlobal(TFG)

3.2

Rethinkingcorrespondent banking:Thereal implicationsofde-risking

De-riskingdisproportionatelyimpacts developingeconomies.Particularlyvulnerable arethecommunitiesthatrelyontheseservices toaccessfinancialresourcesanddollarliquidity fromthedevelopingworldtosustaintheir populations.

Forages,correspondent bankinghasplayedavitalrole intheglobalpaymentssystem Throughcorrespondent bankingrelationships,banks gainaccesstoadiverserange offinancialproductsacross variousjurisdictionsenabling themtooffercross-border paymentsolutionsandservices totheircustomers

Nonetheless,inrecentyears majorbanksaroundtheworld havebeenterminatingtheir long-standingcorrespondent bankingrelationships This phenomenon,commonly knownas‘de-risking’,is fundamentallyreshapingthe globalfinancialservices market.

Whilepredominantlypursued withtheintentionofmitigating riskexposureforfinancial institutionsamidstgrowing regulatorypressures,the consequencesofde-risking extendbeyondthebanking sector.Manycountriesare threatenedbythelossoftheir connectivitytotheglobal financialsystem Forsmaller

developingcountries,de-risking isnotjustabankingconcern, butaconsiderabletradeissue endangeringtheirbasichuman needs.

Todelvedeeperintothekey driversofde-riskinganditsreal

SHANERIEDEL

TAMMYALI

TradeFinanceTalks

42 www.tradefinanceglobal.com

Unveilingthecatalysts behindde-risking

impactonglobaltradeand developingmarkets,Trade FinanceGlobal’s(TFG)Deepesh PatelspokewithShaneRiedel, FounderandCEOatElucidate TheongoingUkraine-Russia conflicthasmagnifiedthe globalregulatoryfocusonthe financialservicessector, particularlyinareasoffinancial crimes,anti-moneylaundering (AML),andcounter-terrorist financing(CTF)regulations.In response,financialinstitutions havenotablycutbacktheirrisk appetite.

Althoughthedecliningrisk appetiteandtheintensifying AML/CTFscrutinyareoften perceivedasthemainmotives behindde-risking,the underlyingfactorsaremuch morecomplex.FromRiedel's perspective,de-riskingreflects

reflectsareactiontothe multifacetedcommercial realitiesintoday'sfinancial markets

AsRiedelpointedout,"Deriskingisjustaresponsetothe commercialrealitiesofthe market.Theinstancesof genuinede-riskingdueto financialcrimeorcompliance reasons,representan astonishinglysmallpercentage oftheoverallexitsobservedin themarket."

Inaddition,Riedelclarifiedthat theprimaryreasonbehindderiskingliesincommercial decisionsthatarecentred aroundthecostsofregulatory compliance,saying,"Inmost instances,thereasonthat banksareconsolidatingtheir portfoliosisacommercial decision,basedonthecostof regulatorycompliance" Whilstacknowledgingthe significanceofenhancing

complianceframeworks, Riedelcautionedagainst focusingsolelyon implementingadditional compliancemeasures. Rather,hesuggestedexploring thesystemicfactorsthathinder banksfromeffectively evaluatingthecommercial aspectsoftheircorrespondent bankingrelationships

Aimingformorecost-effective partnershipsorinclusive distributionofrisksand costsacrossthemarket,he explained,"Weneedtolook atthesystemicreasonswhy bankscan'tmakethe commercialelementswork andhowtochangethat."

De-riskingdisproportionately impactsdevelopingeconomies. Particularlyvulnerablearethe communitiesthatrelyonthese servicestoaccessfinancial resourcesanddollarliquidity fromthedevelopingworldto sustaintheirpopulations.

Asdollarliquiditydeclines, thechallengeobviously demonstratesthereal intersectionoffinancialmarket dynamicsandbasicsocietal needs

Underscoringthefragilityof sucheconomiesandthe strugglesfacedbythese nationsandtheirSMEs,Riedel added,"Inthesemarkets,fewer opportunitiesarebeingcreated forSMEswhocouldotherwise havebeenmoreinvolvedifthe tradefinancegapwasbetter bridgedorifmoreopportunities forinternationaltradewas availabletothem"

Anindustrywithoutbordersorbarriers www.tradefinanceglobal.com 43

Theeconomicimpactof de-risking

Anotheroftenoverlooked impactofde-riskingisits potentialtotrigger undergroundtransactions Theclosureofbankaccounts mayforceorganisationsand individualstoresorttocash transactions,effectively creatinganenvironmentthat precludesthegoalsof AML/CTFregulations

Riedelnotes,"Whatweare seeingistheevolutionof shadowbanking,entitiesthat arelessregulatedandless transparent.Theimpactofderiskinghasgenerallybeento notonlyremoveorreduce opportunitybutalsotoreduce transparencyinthemarket" Theriseofshadowbankingand theinadvertentpromotionof untraceabletransactions representsastarkparadoxin theglobaleffortstomaintaina securefinancialecosystem

Balancingriskand accessibility

Whiledigitisationhasled tosignificantprogressin correspondentbanking, particularlyinthepayments andtradesectors,operational, compliance,andrisk managementprocesses remainstagnant.

Riedelhighlightedthatwhile thepaymentsandtrade sectorshavesuccessfully integrateddigitisation,risk managementstillreliesheavily onmanualprocesses,suchas manualKnowYourCustomer (KYC)checks,qualitative assessments,andgovernance procedures.

Heexplained,"Themoment yougettotheoperations, complianceandrisksideofthe house,theprocessesarethe

sametodayastheywere10-15 yearsago"Thisdisparitycalls fortheadoptionofdigitisation andautomationintothe compliancedomain,reducing manualprocessesand achievingabalance betweenriskassessment andoperationalefficiency

Riedelasserted,"Theonlyway toaddressthisisbybringing digitisationandautomationto thecommercialside."

Furthermore,partnershipshave thepotentialtoachievea balancebetweenriskand accessibility Riedelillustrated

thispotentialwithareal-world exampleofthecollaboration betweenElucidateand DowJones

Thispartnershipallowsfinancial institutionstoaccessquantified andobjectiveriskscoring, supportingtheircompliance strategies Riedelsaid,"We cantakesomeofthemost cumbersome,qualitative processesandstarttoput valuesagainstthem.”

Similarly,variousfinancial instrumentssuchasLettersof Credit(LCs),canbenefitfrom suchadata-drivenapproach

TradeFinanceTalks www.tradefinanceglobal.com 44

Riedelpointedouthowthis approachcantransformthe traditionalLCprocesses, stating,"Weenablebanksto pre-qualifythoselettersof creditbydeterminingthe riskinessoftheoriginating bank."

Thisrisk-basedapproach helpsbankstoaccelerate theirdecision-makingprocess andenhancesoperational efficiencywithout compromisingduediligence.

Thefutureof correspondentbanking

Withdisruptivemarketentrants suchasdigitalcurrenciesand theintroductionofmulticurrencypaymentplatforms fuelingcompetitionand sparkinginnovativesolutions, thecorrespondentbanking sectorislikelygearingupfor atransformationalchange

Moreover,thecorrespondent bankingindustryiscontinuously adoptingstrategicaggregation modelsandnestingmultiple layersofaggregationto

enhanceoperationalefficiency, albeitwithaddedcomplexity

Asthemarketnavigates complexlayersofpayment clearing,andwheremultiple banksareengagedinasingle transaction,theroleofdata andstandardisationcannotbe overstated

AsRiedelstressed,"Therole ofdataandstandardisation becomesevenmoreimportant toavoidthechaosofnumerous rejectedpaymentsand ultimatelymorede-risking"

Anindustrywithoutbordersorbarriers www.tradefinanceglobal.com 45

3.3

Thetimeisnowtounlock thefutureofcross-border payments

Asglobalconnectivityincreasesandpeople continuetoworkinternationaljobs,the paymentsindustrymustadaptandgrow alongsidethedemand.Itisonthepayments industrytomatchthisgrowingdemandand makecross-borderpaymentsasseamlessas possible.

Cross-borderpaymentscan playaspecialroleforpeople andbusinessesaroundthe world Theyallowustosend moneytoourlovedones,book aholidayofalifetime,orstart abusinessinanothercountry

However,cross-border paymentshavetraditionally beenslow,expensive,and opaque Forindividuals,this couldmeanpayinghighfees andwaitingdaysorevenweeks fortheirmoneytoarrive

Forabusiness,itcouldmean losingoutonanopportunity togrowandexpandintoanew market Andfortheglobal economy,itcandragontrade andinvestment

Forbanks,itcanmean experiencingsignificantdelays andfeesoncross-border payments.

Whilethebankingsystemat facevaluecanbeseenas responsibleforthese

www.tradefinanceglobal.com TradeFinanceTalks

COLLEENOSTROWSKI SVPandTreasurer Visa

46

inefficiencies,itisnotentirelyits fault Banksfacesignificant regulatoryandcompliance hurdlesthatcanhindertheir abilitytocreatesmoother processes.

Thechallengesofcrossborderpayments

Thoughwebelievethatcrossborderpaymentsshouldbe easyandaccessibleforall,we understandthereareinherent roadblocks Today’sworldis smallerandmoreconnected thaneverbefore,butthe realityisthattheinternational financialsystemsunderpinning thisglobalcommunitystillhave theirspeedbumps

Therearemanychallenges,but wewanttohighlightthetop threethathinderprogressin cross-borderpayments: complexcomplianceand regulations,legacy infrastructure,andlackof transparency

Complexcomplianceand regulations

Cross-borderpaymentsare subjecttovariousregulationsin differentcountries,making itdifficultforthetraditional financialsystemtodeliverrapid cross-borderpayments.The sheernumberofhoopsthat needtobejumpedthrough addscomplexityandtime penalties

Inmanycountries,businesses arerequiredtoobtainalicense beforetheycansendorreceive cross-borderpayments.These canvarysignificantlyin difficultytoacquire Inother countries,businessesmaybe requiredtoreportallcrossborderpaymentstothe

government Andinsome countries,theremaybelimits ontheamountofmoneythat canbesentorreceivedcrossborder.

Thislevelofregulatory complexitydoesn’thelp anyone Itcancreatesignificant delaysintheprocessand impactabank’sabilitytoserve itsclient’sneeds.

We’reheretohelpeasesome ofthesepains Banksthatuse oursolutionswillexperiencefar fewerpainpointsduringcrossbordertransactions.

Asbanksexperienceamore seamlesspaymentsprocess,so willtheircustomers,creatinga better,faster,andmorereliable systemforall

Manyofthetechnologies designedforcross-border paymentsthatareinplace todaywerecreateddecades ago

Theselegacyinfrastructuresstill existbecausetheystorevital data,andalteringorupdating themcanintroduceenormous risks Insituationslikethis,banks haveanobligationtoberisk averse andprotectthesystemfor theirclients-ifitain’tbroke,why riskit?

Nevertheless,asother contemporarytechnological offeringscontinuetoadvance, theinefficienciesinthese legacysystemsbecomemore

Anindustrywithoutbordersorbarriers

Legacyinfrastructure www.tradefinanceglobal.com 47

pronouncedbycomparison. AccordingtoaRapydreportin 2023,nearly40%ofbusinesses experienceddelaysofmore thanfivedaysforsendingor receivingcross-border payments.

Whilemulti-daydelaysmay havebeenacceptableyears agowhentheselegacysystems wereconceived,themodern customerexpectsmorefrom theirbankandis notshyaboutaskingforit.

Banksarehesitanttodisregard theselegacyinfrastructures, anditmakessense Butasthe paymentsindustrycontinuesto progress,theindustryisfinding waystointegratenew technologiesintosystems.

Lackoftransparency

Thefeesandcharges associatedwithcross-border paymentscanbeopaqueand difficulttounderstand, potentiallyleadingto unexpectedsurprises.

Thevaryingriskappetitesof intermediarybankscanleadto unexpectedchallengesinthe moneytransferprocess While theoriginatorbankmayhave noissueinitiatingthetransfer, factorssuchastheclient's nameorotherdetailsmay causecomplicationswith anotherbankalongtheway

Thiscanleavethecustomer uninformedaboutanyproblem untiltheyseekanswersfrom theiroriginatorbankregarding thedelayedarrivaloftheir funds.

Inaddition,thefeesassociated withcross-borderpayments canvarydependingonthetime ofday,thecurrencyused,

andthecountryoforiginand destination Thiscancause customerstoreceivealarger finalbillthantheyexpected, andonlytheirbanktodirect anydispleasuretowards.

Whiletheymaybelegitimate reasons,customerscannotsee thebehind-the-scenes operationsandinsteadonly experiencelongdelaysin sendingremittancestotheir familieswhileseeing considerablefeesappliedto theirhard-earnedmoney

TheWorldBank’sRemittance PricesWorldwideQ12023report showsthattheaveragecostof sendingremittancesgloballyis 6.24%,whichis3.4%abovethe UN’sSDGgoals.

Thisisamajorchallengein cross-borderpaymentsbutis onethattheindustryneedsto dealwithinternally.

Itshouldbeagoalforallofus tomaketheseissuesathingof thepast Weareconfidentthat theinnovativemindsinthe industry,combinedwith growingtechnological inventions,willalleviate theseproblems.