National Homes is proud to announce that we have been honoured with five prestigious North American awards at the very highest level in our industry, the National Association of Home Builders awards in Las Vegas.

· Best Email Marketing & Best Digital Media for DUO, Gold Award.

· Best Presentation Centre for NorthShore, Gold Award.

· Best Realtor/Broker Program for NorthShore, Silver Award.

· Best Graphic Continuity for DUO, Silver Award.

· Best Signage for DUO, Silver Award.

This recognition from our peers is a clear reflection of the teamwork, innovation, and collaboration of the talented people here at National, our consultants, trades and the homebuyers who inspire our vision. We thank you all.

Condo Life Magazine

EMAIL: wayne.karl@nexthome.ca

TWITTER: @WayneKarl

You may recall in our Outlook 2024 special report in the Feb. 10 issue of Condo Life, there were early signs that 2024 is shaping up to be a much better year than its predecessor. Housing supply, interest rates, inflation, government policy and other issues were a cause for concern last year, but there was relief already on the horizon.

(And if you happened to missed that issue, you can find the updated version of the story on nexthome.ca.)

“I see 2024 bringing a stronger real estate market,” says Deena Pantalone, managing partner and chief innovation officer at National Homes. “The fundamentals are all there. The job market, population growth and income are all healthy and, with the lower sales of last year, there is so much pent-up demand. Remember the old adage, ‘When is the best time to buy real estate? Yesterday.’ All we need is downward movement on interest rates – even a slight lowering – and sales will start to rise again.”

More good news came on Feb. 14, when the Canadian Real Estate Association said there are signs the recovery may already be underway.

“Sales are up, market conditions have tightened quite a bit, and there has been anecdotal evidence of renewed competition among buyers,” says Shaun Cathcart, CREA’s senior economist. “However, in areas where sales have shot up most over the last two months, prices are still trending lower. Taken together, these trends suggest a market that is starting to turn a corner, but is still working through the weakness of the last two years.”

Then on Feb. 20, Statistics Canada released the Consumer Price Index for January, showing that inflation is trending down – to 2.9 per cent on a yearover-year basis, from 3.4 per cent in December.

With such important signposts providing hope, we now await Bank of Canada’s action on interest rates. High inflation was the main reason BoC maintained higher rates than a few years ago, holding its target for the overnight rate at five per cent on Jan. 24.

Most experts were expecting rates to begin declining in spring, so this progress aligns perfectly with the Bank’s rate announcement on March 6 (just after press time). Rate relief might more likely on the following announcements on April 10 or June 5 – but it’s clear conditions are improving.

Strong fundamentals, more homebuying activity, pent-up demand –and hopefully very soon – lower rates will spur all kinds of activity on the homebuying and building fronts.

Use this time, then, to prepare and plan your homebuying move, so you’re ready to take advantage when the opportunities arise.

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm based in Toronto. thinkhomewise.com

WESTERN VIEW | MIKE COLLINS-WILLIAMS

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association. westendhba.ca.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

SENIOR VICE-PRESIDENT, SALES, NEXTHOME

Hope McLarnon 416.708.7987 hope.mclarnon@nexthome.ca

DIRECTOR OF SALES, ONTARIO, NEXTHOME

Natalie Chin 416.881.4288 natalie.chin@nexthome.ca

EDITORIAL DIRECTOR

Amanda Pereira

EDITOR-IN-CHIEF – GREATER TORONTO AREA

Wayne Karl wayne.karl@nexthome.ca

CONTRIBUTORS

Jesse Abrams, Mike Collins-Williams, Debbie Cosic, Sara Duck, Barbara Lawlor, Linda Mazur, Ben Myers, Jennifer Pearce, Lisa Rogers, Jayson Schwarz, Dave Wilkes

EXECUTIVE MEDIA CONSULTANTS

Jacky Hill, Michael Rosset

VICE-PRESIDENT, MARKETING – GTA

Leanne Speers

MANAGER, CLIENT RELATIONS

Sonia Presotto

MANAGER CUSTOMER SALES/SERVICE

Marilyn Watling

REAL ESTATE PRO | BARBARA LAWLOR

Barbara Lawlor is President and CEO of Baker Real Estate Inc., and an indemand columnist and speaker. A member of the Baker team since 1993, Barbara oversees the marketing and sale of condo developments in Canada and overseas. baker-re.com

Ben Myers is President of Bullpen Consulting. Ben provides pricing recommendation, product mix, and valuation studies on new residential housing developments for builders, lenders and property owners. bullpenconsulting.ca

Jennifer Pearce, TRREB President, is a Broker and Owner with ReMax Rouge River Realty Ltd., a family owned and operated brokerage. She is a secondgeneration realtor and has been licensed since 2000. trreb.ca

Jayson Schwarz LL.M. is a Toronto real estate lawyer and partner in the law firm Schwarz Law LLP. He can be reached by visiting schwarzlaw.ca or by email at info@schwarzlaw.ca or phone at 416.486.2040.

BILD REPORT | DAVE WILKES

Dave Wilkes is president and CEO of the Building Industry and Land Development Association (BILD), the voice of the home building, land development and professional renovation industry in the GTA. For the latest industry news and new home data, follow BILD on Twitter at @bildgta or visit bildgta.ca

Sign up to receive digital editions & newsletters to your inbox!

Official Media Partners:

SALES & MARKETING CO-ORDINATOR

Gary Chilvers

BUSINESS DEVELOPMENT MANAGER

Josh Rosset

DISTRIBUTION distributionteam@nexthome.ca

ACCOUNTING INQUIRIES accountingteam@nexthome.ca

DIRECTOR OF PRINT MEDIA

Lauren Reid–Sachs

VICE-PRESIDENT, PRODUCTION – GTA

Lisa Kelly

PRODUCTION MANAGER – GTA

Yvonne Poon

GRAPHIC DESIGNER & ASSISTANT MANAGER

Alicesa Pullan

GRAPHIC DESIGNER & PRE-PRESS COORDINATOR

Hannah Yarkony

GRAPHIC DESIGNER

Mike Terentiev

Published by nexthome.ca

Advertising Call 1.866.532.2588 ext. 1 for rates and information. Fax: 1.888.861.5038

Circulation Highly targeted, free distribution network aimed at real estate buyers using street level boxes, racking and Toronto Star in-home delivery.

Canadian subscriptions 1 year = 13 issues – $70 (inc. HST). Canada Post – Canadian Publications Mail Sales Product Agreement 40065416.

Copyright 2024 All rights reserved. All copyright and other intellectual property rights in the contents hereof are the property of NextHome, and not that of the individual client.

The customer has purchased the right of reproduction in NextHome and does not have the right to reproduce the ad or photo in any other place or publication without the previous written consent of NextHome.

Editorial Submissions from interested parties will be considered. Please submit to the editor at editorial@nexthome.ca.

Terms and Indemnification Advertisers and contributors:

NextHome is not responsible for typographical errors, mistakes, or misprints. By approving your content and/ or submitting content for circulation, advertisers and contributors agree to indemnify and hold harmless

NextHome and its parent company from any claims, liabilities, losses, and expenses (including legal fees) arising out of or in connection with the content provided, including but not limited to any claims of copyright infringement, unauthorized reproduction, or inaccuracies in the content. Advertisers acknowledge that they have the necessary rights, permissions, and licenses to provide the content for circulation, and they bear full responsibility for the content’s accuracy, legality, and compliance with applicable laws upon approval. Contributors acknowledge NextHome reserves the right to omit and modify their submissions at the publisher’s discretion.

GTA new home sales were expectedly soft in January, down slightly from January 2023 and up marginally from December 2023, the Building Industry and Land Development Association (BILD) reports.

There were 578 new home sales in January, which was down three per cent from January 2023 and 68 per cent below the 10-year average, according to Altus Group, BILD’s official source for new home market intelligence.

“Given interest rates and the expectation of moves by the Bank of Canada later this year, January new home sales were as expected with prospective new home buyers remaining on the sidelines,” says Justin Sherwood, senior vicepresident communications and stakeholder relations at BILD. “With (the recent) report, if you extract housing related costs we are basically at the two-per-cent rate for inflation. We anticipate that market activity will pick up in the spring with potential rate changes on the horizon. The present inventory levels provide a great degree of selection and choice for new home buyers.”

“Pent up demand continued to accumulate with buyers taking a wait-and-see attitude,” adds Edward Jegg, research manager with Altus Group. “Affordability gains from future interest rate declines will

be threatened by price jumps the longer the pool of buyers builds on the sidelines.”

Condominium units, including in low, medium and highrise buildings, stacked townhouses and loft units, accounted for 233 units sold in January, down 44 per cent from January 2023 and 60 per cent below the 10-year average.

There were 345 single-family home sales in January, up 92 per cent from January 2023 and 78 per cent below the 10-year average. Single-family homes include detached, linked and semi-detached houses and townhouses (excluding stacked townhouses).

Total new home remaining inventory decreased compared to

the previous month, to 19,829 units. It included 16,677 condominium apartment units and 3,152 singlefamily dwellings. This represents a combined inventory level of 10.5 months, based on average sales for the last 12 months. This remains one of the highest inventory levels for new homes seen in the last decade. Benchmark prices decreased in January for single-family homes and increased for condominium apartments compared to the previous month. The benchmark price for new condominium apartments was $1.05 million, down seven per cent over the last 12 months. The benchmark price for new single-family homes was $1.57 million, down nine per cent.

The resale housing market showed signs of resurgence in January 2024, with sales rising over January 2023 levels, according to the Toronto Regional Real Estate Board (TRREB).

The annual increase came as some homebuyers started to benefit from lower borrowing costs associated with fixed rate mortgage products. New listings were also up year-overyear, but by a lesser annual rate compared to sales. The resulting tighter market conditions when compared to the same period a year earlier, potentially points toward renewed price growth as we move into the spring market.

“We had a positive start to 2024,” says TRREB President Jennifer Pearce. “The Bank of Canada expects the rate of inflation to recede as we move through the year. This would support lower interest rates which would bolster homebuyers’ confidence to move back into the market. First-time buyers currently facing high average rents would benefit from lower mortgage rates, making the move to homeownership more affordable.”

There were 4,223 sales reported through TRREB’s MLS system in January 2024 – an increase of more than one-third compared to January 2022. The number of new listings was also up year-over-year, but by a lesser annual rate of approximately six per cent. Stronger sales growth relative to listings suggests buyers experienced

tighter market conditions compared to a year ago.

On a month-over-month seasonally adjusted basis, both sales and new listings were up. Sales increased more than listings which means market conditions tightened relative to December 2023.

“Once the Bank of Canada actually starts cutting its policy rate, likely in the second half of 2024, expect home sales to pick up even further,” says TRREB Chief Market Analyst Jason Mercer. “There will be more competition between buyers in 2024 as demand picks up and the supply of listings remains constrained. The end result will be upward pressure on selling prices over the next two years.”

The MLS Home Price Index Composite in January 2024 was down by less than one per cent yearover-year in January. The average selling price was down by one per cent year-over-year to $1.02 million. On a month-over-month seasonally adjusted basis, both the MLS HPI Composite and the average selling price also trended lower.

“While housing market conditions are expected to improve with lower borrowing costs, there are still a number of policy issues that need to be addressed,” says TRREB CEO John DiMichele. “At the federal level, more reflection on the Office of the Superintendent of Financial Institution mortgage stress test is

required, especially to its application at different points in the interest rate cycle. The focus for the province needs to remain on building 1.5 million new homes. At the municipal level, raising property taxes without consistent support from the federal and provincial governments won’t eliminate Toronto’s structural deficit. Helping first-time homebuyers get into the ownership market will ease movement across the entire spectrum and relieve pressure on the rental market.”

Introducing High Line Condos, an intimate six-storey condo next door to Churchill Meadows’ protected forest and moments from Erin Mills Town Centre. With stunning architecture, an impressive array of stylish suites, panoramic rooftop terrace and abundance of surrounding greenery - this is the carefree condo lifestyle and attainable luxury you’ve always wanted.

Following a weak second half of 2023, home sales over the last two months are showing signs of recovery, according to the latest data from the Canadian Real Estate Association (CREA).

Home sales activity recorded over Canadian MLS Systems rose 3.7 per cent between December 2023 and January 2024, building on the 7.9-per-cent month-overmonth increase recorded the month prior. While activity is now back on par with 2023’s relatively stronger months recorded over the spring and

summer, it begins 2024 about nine per cent below the 10-year average.

“Sales are up, market conditions have tightened quite a bit, and there has been anecdotal evidence of renewed competition among buyers,” says Shaun Cathcart, CREA’s senior economist. “However, in areas where sales have shot up most over the last two months, prices are still trending lower. Taken together, these trends suggest a market that is starting to turn a corner but is still working through the weakness of the last two years.”

National gains were once again led by the Greater Toronto Area (GTA), along with Hamilton-Burlington, Montreal, Greater Vancouver and the Fraser Valley, Calgary and most markets in Ontario’s Greater Golden Horseshoe and cottage country.

The actual (not seasonally adjusted) number of transactions came in 22 per cent higher than January 2023, the largest year-over-year gain since May 2021. However, with current activity still running at below-average levels, the double-digit gain was more reflective of the base effect from the comparison to January 2023, which

was the worst start to almost any year in the past two decades.

“The market has been showing some early signs of life over the last couple of months, probably no surprise given how much pent-up demand is out there,” says Larry Cerqua, chair of CREA. “There’s a consensus that the market will probably look quite a bit different this year compared to 2022 and 2023, so if you’re hoping to buy or sell a property in 2024, contact a realtor in your area and get your game plan ready today.”

The Aggregate Composite MLS Home Price Index (HPI) fell by 1.2 per cent on a month-over-month basis in January 2024. This represents an acceleration from the 1.1-per-cent decline recorded in December.

Price declines of late have been predominantly located in Ontario markets, particularly the Greater Golden Horseshoe and, to a lesser extent, BC.

The Aggregate Composite MLS® HPI was up 0.4 per cent on a yearover-year basis in January 2024, little changed from readings over the last six months (0.4 to 1.1 per cent).

The GTA housing market will improve in 2024, supported by strong economic fundamentals, according to the Toronto Regional Real Estate Board (TRREB) in its 2024 Market Outlook and Year in Review report and interactive digital digest.

“Demand for ownership housing in the GTA will start improving in 2024,” says TRREB Chief Market Analyst Jason Mercer. “Record population growth, a resilient economy, low unemployment and declining mortgage rates in the second half of the year will result in increased home sales compared to 2023. This will be the start of a multi-year recovery as some households will still face affordability challenges, even as borrowing costs begin trending lower. As the demand for housing picks up, it will be equally important to see a rebound in the supply of homes for sale and an uptick in new home construction.

“Tighter market conditions will see the average selling price move

closer to $1.2 million this year,” adds Mercer. “The second highest mark on record, but still below the 2022 peak.”

The Market Outlook and Year in Review report also takes an in-depth look at the impact of the housing crisis on the mental and physical health of residents, and the need for more housing supply in response to record population growth driven by immigration.

“It’s clear that our regions will only see sustained relief on the affordability front once we remove the roadblocks standing in the way of progress and get shovels in the ground faster,” says TRREB President Jennifer Pearce. “In the wake of a growing population, policymakers cannot lose sight of planning ahead, and avoid applying band-aid solutions that often result in larger issues than the problems they are attempting to solve.”

“We need to rapidly increase our supply and assist first-time

homebuyers with relief on the significant upfront land transfer tax,” adds TRREB CEO John DiMichele. “Prioritizing missing middle housing will provide more diverse and affordable housing options –something we have long called for. All levels of government need to work together and ensure the right incentives are in place for developers to build more housing across the spectrum.”

Economic factors, including the high cost of living, high interest rates and the price of housing, are prompting one-third of Canadians (32 per cent) to explore alternative ways of entering the housing market, according to a Leger survey commissioned by ReMax Canada.

A new ReMax report titled Alternative Home Ownership Models: Trends in the Canadian Housing Market examined 22 cities across Canada and assessed trends in non-traditional homeownership models, including co-ownership with friends and family, rent-to-own scenarios and purchasing homes with additional units or suites for income potential, as opposed to more traditional avenues.

“Canadians from coast to coast are grappling with affordability challenges, but at the same time, their desire to achieve homeownership remains strong,” says Christopher Alexander, president of ReMax Canada. “This is prompting many to seriously consider alternative ways to get their foot in the door, where it might not be feasible under the traditional ownership model of a single person or couple purchasing with between five and 20 per cent down.”

According to Leger research commissioned by ReMax in late 2023, the majority of Canadians believe homeownership is the best investment they can make (73 per

cent). This sentiment has remained consistent with a 2022 survey, indicating that despite economic turbulence, Canadians still see value in homeownership.

“With high interest rates plateauing, and potentially lowering in the latter half of 2024, now may be a good time to consider getting into the market, especially for those who have been taking a ‘wait-and-see’ approach,” says Benjamin Tal, deputy chief economist of CIBC World Markets Inc. “Despite some interest rate reprieve in 2024, Canada is still dealing with an affordability crisis due to a lack of inventory and increasing demand, which will persist until the country addresses the problem adequately. Considering this, creative solutions like co-ownership may be an option for many Canadian homebuyers looking to achieve the dream of homeownership.”

would purchase under a rent-to-own scenario; 21 per cent would consider co- ownership with a family member that isn’t a spouse or partner; and 17 per cent would consider purchasing a home intending to be the primary tenant and renting out a part of the home to someone else.

1. Research, research, research: Research realtors, lenders, lawyers and mortgages brokers with experience in non-traditional homeownership agreements. Get informed on the benefits and drawbacks of non-traditional homeownership models before you begin your buying journey.

Non-traditional homeownership models are also emblematic of a new, modernized chapter in what it means to be a “homeowner,” an identifier more often associated with an individual or a couple. “But creativity in the homebuying process is a workaround, not a solution to Canada’s affordability crisis. Like modern, innovative homebuyers, our governments must be more strategic and visionary in how we can use existing lands and real estate to drive our housing supply to allow for a greater diversity of housing for all Canadians,” says Alexander. “Despite ongoing affordability and supply crises, Canadians still dream of homeownership, and as they wait for governments to come together to create a cohesive, national housing strategy, they’ve become innovative and resourceful in achieving this dream.”

According to the survey, 48 per cent of Canadians would consider purchasing a home using an alternative model. Among Canadians, 22 per cent

2. Understand the tax implications: Non-traditional homeownership models often include different tax impacts and benefits. Consult a tax professional and weigh the taxes you may or may not be subjected to prior to entering into any non-traditional models of homeownership.

3. Choose the right form of homeownership for you: For anyone looking at rent-to-own, structure the agreement and the monthly payments such that the lender will accept it to fund a mortgage utilizing that as your down payment in the future. This is the most common way that rental buyers lose their money, sometimes negligently by the seller or landlord, and sometimes intentionally setting them up to fail to keep their cash.

4. No one-size-fits-all: While demand for secondary suites has seen an increase in many Canadian regions, and does offer potential income benefits, buyers should take caution that these suites come with barriers to entry, specifically timing. It may take owners a while to break even on the income potential of secondary suites.

The Residential Construction Council of Ontario (RESCON) is recommending that the federal government rebate the HST to first-time buyers who purchase a new home and bring back initiatives from years ago to encourage reinvestment by builders.

“Immediate action is needed as we are in a crisis that is likely to get worse. First-time buyers are leaving our cities in droves because they’ve been priced out of the market,” says RESCON President Richard Lyall. “The measures we are suggesting would boost supply and help homebuilders construct housing that is financially viable and affordable. We cannot simply sit on our hands and hope for the best as

the challenge facing our industry is formidable.”

RESCON’s suggestions were made in a 2024 federal budget submission to Finance Minister Chrystia Freeland. The submission outlined three specific practical measures the federal government can take to address housing supply and affordability.

To support the creation of new housing stock, RESCON is recommending that the government implement an immediate and full rebate of the HST on new home purchases for first-time buyers and also re-introduce measures such as limited dividend programs and tax deferral policies from the 1960s, 1970s and 1980s that encouraged re-investment by builders.

Lanterra Developments has announced that renowned British architecture firm Tonkin Liu, led by partners Anna Liu and Mike Tonkin, will create their first permanent sculpture in Canada as part of a new public art project integrated in Lanterra’s master-planned community development, Notting Hill, at 4000 Eglinton Ave W. As one of Lanterra’s largest sites, Notting Hill is located in Toronto’s coveted West End at Royal York and Eglinton. The sculpture is expected to become a significant cultural beacon for the area and is currently in early development phase. The sculpture is slated for installation in early 2026.

Lanterra has also partnered with OCAD University and the Etobicoke School of the Arts to fund a mentorship program led by Anna Liu and Mike Tonkin. This will allow students to work closely with Liu,

seeing through the Notting Hill public art project from start to finish.

“Lanterra is committed to upholding the cultural and social value that public art brings to not only our condominiums but the city of Toronto at large,” says Mark Mandelbaum, chairman of Lanterra Developments. “We were moved by Tonkin Liu’s proposal with their unique take on bringing inspiration from her roots in London, England to Toronto’s very own Notting Hill. We are honoured to commission their very first Canadian project.”

“First-time homebuyers have been disproportionately affected by the housing situation,” says Lyall. “High interest rates and increased material and labour costs, along with exorbitant taxes, fees and levies have pushed up home prices and are preventing them from entering the housing market. Major policy changes are needed in the budget to help first-time buyers.”

RESCON is also suggesting that the feds activate surplus crown and crown agency land for residential housing and support the ability of municipalities to build the infrastructure required to encourage more housing construction. Meanwhile, with many construction workers set to retire, RESCON wants the government to further reform the immigration system and increase targets for workers with the specialized skill sets to build homes and condos.

“These are desperate times as sales of new homes have literally ground to a halt, yet our population continues to increase,” adds Lyall. “The practical measures we are suggesting would help boost housing supply and contribute to ensuring affordability issues are addressed.”

In related news, Canada Mortgage and Housing Corp. confirmed on March 1 that it was discontinuing the First-Time Home Buyer Incentive program.

Catch

Why this could be the year of the rebound

Last year might not exactly have been a walk in the proverbial park for the housing market, but 2024 is shaping up to be something altogether different, with relief –and belief – in sight on most issues.

The shifting landscape of Toronto’s condo market

In the past 25 years, the GTA’s new condominium market has undergone a profound evolution, marked by shifting investor sentiments, regulatory adjustments, and changing market dynamics. Where is it headed now?

3 things prospective homebuyers can look forward to in 2024

Canadians have several reasons to be cautiously optimistic about 2024, given the shifting economic landscape. With rates held relatively steady since July 2023, there is a sense that rate increases could finally be easing, with the potential for modest declines on the horizon.

or check us out on

The benefits of purchasing a condo in a master-planned community Condominiums have become increasingly popular housing options, especially in master-planned communities which offer a unique blend of convenience, comfort and community living that can be truly enticing for potential homeowners.

Gupta family donates $1 million to Toronto Metropolitan University

Dr. Steve and Rashmi Gupta have donated $1 million to Toronto Metropolitan University’s Ted Rogers School of Management and its students through The Gupta Family Foundation. The gift provides endowed financial awards to the school’s MBA students in hospitality and tourism management, as well as crucial unrestricted support.

Visit nexthome.ca

The condominium apartment market in the Greater Toronto Area has softened considerably since April 2022, especially over the last six months. New condo sales were down about 35 per cent annually in the GTA in 2023 and about 55 per cent from 2021.

As a result of the COVID-19 pandemic and its fallout, we experienced rapid inflation and the Bank of Canada’s response – higher interest rates. Higher borrowing costs have shifted the current landscape from what Toronto real estate investors have been accustomed to, consistent upward trending prices.

Each quarter, Bullpen Research and Consulting, puts together our GTA High-Rise Lands Insights Report, which includes looking at new condo prices as they relate to land value. As potential new condo buyers, you should know that the most successful launches in the GTA recently have come to market at summer 2021-level pricing. If you’re actively looking for a new unit, make sure to hire an experienced real estate agent who understands where the current market value is, and avoids overpriced projects where developers have not adjusted to this new high interest rate real estate climate. There is room to negotiate on incentives, as well.

Bullpen continues to underwrite numerous development opportunities on behalf of developers and lenders, many builders remain bullish on the long-term prospects of the GTA highrise market, and many investors

foresee a long-run housing scarcity. Based on the slow sales over the last 20 months, a housing deficit in 202627 will be evident. This will further drive up rents and cause resale prices to rise rapidly.

It is difficult to think that far out, but this situation has occurred previously. We saw this same lagged response to poor absorption activity occur in 2017, as new condominium sales were very slow in the preconstruction market in 2013, which translated to extreme undersupply four years later. Prices and rents were rising so rapidly in Toronto, the Liberal government at the time expanded rent control, added a foreign buyer tax and undertook several other measures to cool the market.

To avoid the slow pre-sale condo market and attempt to time their occupancy with the undersupply projected for 2027-28, many developers are trying to better understand the rental market, with Bullpen conducting many rental studies intended for use in their CMHC financing applications. We’re likely to see more rental starts in 2024, but fewer condo apartment starts. There is a clear opportunity to capitalize on deals where developers are very close to getting the sales

they need to finance their project. Research not only the prices, but the developer and their ability to deliver a project.

There were some positive resale figures released for January, but continued poor new home sales figures. Buyers of both existing and new homes continue to grapple with uncertainty, with a spectrum of positive and negative factors to weigh. With many developers still planning spring 2024 launches, these new openings will tell us a lot about investors’ outlook on the market and developers’ confidence in securing the necessary sales to qualify for construction financing. If you do your homework, there are still wise investments to make. Good luck.

NATURE-INSPIRED COMMUNITY IS RISING IN THE BAYVIEW VILLAGE NEIGHBOURHOOD

The Residences at Central Park is a vibrant, master-planned, mixeduse condominium community that is receiving rave reviews. Located in the east end of the prestigious Bayview Village neighbourhood on Sheppard Avenue, Central Park is a nexus between the urban and natural worlds – residents enjoy proximity to a range of urban conveniences and also have direct access to the East Don Parkland’s sprawling, forested ravine that embraces the property in lush nature.

The development is one of the largest residential projects currently under construction in Toronto. The first residential building in this 12acre, environmentally sustainable community is sold out. Buyers are responding with enthusiasm for a variety of reasons, including Central Park’s excellent location, forwardthinking green features, and an array of indoor and outdoor amenities offering lifestyle opportunities for all ages.

The Ontario Home Builders’ Association (OHBA) has awarded Central Park with the coveted Project of the Year Award – People’s Choice. This highly sought-after award recognizes project excellence and is given to a company that exemplifies outstanding professionalism and integrity with their business, their community and the industry at large. “Our project team includes a group of talented consultants including CORE Architects Inc. and II BY IV Design,” said Amexon’s Executive Sales Manager, Jason Shiff.

Central Park is just down the street from Bayview Village Shopping Centre, offering everything from upscale restaurants and retail to lifestyle and wellness venues.

Loblaws, Pusateri’s Fine Foods, and Oliver & Bonacini Café Grill are just a few of its popular destinations. And getting around the city, the GTA and beyond will be incredibly convenient – the Leslie subway station and relocated Oriole GO station are situated at Central Park, so residents have public transit available right at their front door. In addition, Yorkdale, Fairview Mall, golf courses, parks and other destinations are within easy reach with Highway 401, the 404 and Don Valley Parkway close by.

At the heart of the community, is the award-winning Central Park Common – a landscaped, 3-acre urban park that will resemble a traditional village green. Destined to become a social hub to meet with friends and neighbours, this park will feature pedestrian-friendly streets lined with bike paths, casual dining venues, fountains, reflecting pools, and year-round programming that will include a farmers’ market and iceskating rink. Other highlights include retail space, restaurants, and services including on-site daycare facilities.

The East Don Parkland’s 500 acres of lush, urban forest embraces

Central Park, making nature a neighbour and elevating an active lifestyle in this prime Toronto location. According to Jason Shiff, Executive Sales Manager, “Central Park is a nature-inspired, upscale community unlike anything else in Toronto. Central Park will be a quiet oasis in vibrant urban surroundings, where outdoor lovers are going to be able to immerse themselves in nature all year long. The ravine is part of the Don River Valley parklands where there’s a network of walking and cycling trails to explore that lead all the way downtown. And the trails are beautiful during all four seasons, so residents can enjoy outdoor pastimes to the fullest, like hiking, biking, birding and cross-country skiing. The opportunities for a high quality of life in this upscale community are exceptional.”

Environmental sustainability is high on the priority list, and the entire community will be constructed to Amexon’s Green Development Standard™ incorporating industryleading green features. Setting a new standard in the sustainability arena, Central Park is the first largescale project of its kind in Canada to include EV charging stations in all parking areas for residents, visitors and office tenants, as well as retail patrons for the restaurants

and cafes. All in all, there will be more than 1,500 charging stations installed. Additionally, there will be on-site auto- and bike-share options available. The towers’ design features reflective solar panels that supplement the building’s energy needs, and green roofs that reduce energy consumption. Thermal building envelopes minimize energy usage and next-generation mechanical systems incorporate advanced airflow and filtration.

The visionary design of Central Park is another attraction for prospective residents. Amexon enlisted an award-winning team to craft what is sure to become a local landmark. CORE Architects has created a striking exterior for the condominium towers that focuses on an intimate connection with nature – the façades feature an organic leaflike design in a continual interplay of sun and shade, and 6-foot-deep balconies offer inspiring views of the Toronto skyline and meandering East Don Parkland ravine through floor-to-ceiling windows. Central Park’s design features an elegant, hotel-inspired, port-cochère entry, with an artisan-designed fountain, original art installation and lush landscaping by renowned Cosburn Nauboris Landscape Architects. These architectural highlights express a

harmonious coexistence between sparkling glass and nature, setting this condominium residence apart as something truly visionary.

Suite and amenity interiors by II BY IV DESIGN are both warm and sophisticated, with modern features and finishes grounded in natural materials and earthy colours. The focus was on capturing the allure and comfort of nature, uniting a love of the outdoors and creative living. The effect is new and fresh, evoking a conception of classic modernism.

All Central Park residents will have the use of 55,000 square feet of fitness, wellness, leisure, and social amenity space. A highlight is The Park Club®, where fitness enthusiasts can access indoor and outdoor saltwater pools, a state-of-the-art fitness club and half-court basketball. Families are sure to make great use of the screening room/theatre, ice-skating rink, piano lounge, bowling alley, private event space, hobby studio and kids’ club. Guest suites will be

available to accommodate friends and family members.

Among the other leisure-inspired amenities will be rooftop zen gardens, barbecue areas, golf simulator, a yoga studio, recording/media studio and pet daycare/grooming facilities. The Park Club® will include a spacious 5,000-square-foot coworking space that will foster networking and productivity for either a hybrid work model or growing your own business, with smart technology, meeting rooms, hot desks, and a business centre – giving new meaning to “working from home.”

The community will eventually encompass over 1,500 suites in oneto three-bedroom + den layouts, in sizes from 439 to 1,200 square feet. Features and finishes include 9-foothigh ceilings and European-inspired kitchen cabinetry by II BY IV DESIGN. Best of all, these living spaces incorporate flow-through layouts that make the most of spectacular views from the floor-to-ceiling windows

and generous outdoor balconies. Prices begin from the $700,000s.

Amexon Development Corporation is one of Toronto’s most prominent and innovative real estate developers, building their reputation as a multiaward-winning firm by delivering superior-quality properties. The firm owns and manages an impressive portfolio of office, retail, industrial, hotel and residential properties.

The Residences at Central Park is a world-class destination that offers a five-star experience and sets new standards in the condominium industry. Amexon’s must-see 10,000-square-foot, all-glass Central Park Presentation Centre is located at 1200 Sheppard Avenue East, Toronto. Indulge in gallery-like surroundings that include kitchen, bathroom and walk-in closet vignettes displaying many of the high-end appointments that come standard here.

Call 416 252 3000 or visit centralparktoronto.com.

In today’s market, with high interest rates and volatile inflation, the mere thought of making a home purchase on your own might seem out of reach. However, with home prices dropping, rates holding steady since July, and fixed rates lowering, the path ahead is looking a lot brighter for homebuyers, especially those entering the market for the first time. If you are planning on purchasing a home this year on a single income, there are four key things you can do to be prepared, in spite of this economic backdrop.

Understanding what you can afford before starting your home search is one of the most important steps you can take, especially if you’re buying on a single income. A mortgage pre-approval, which is less formal than securing an actual mortgage, is when a lender assesses your financial situation to determine how much you can borrow and an estimate of what your monthly payments will be. If granted, the lender will commit to loaning you a specific amount of money over a 120-day period. However, this is not 100-per-cent set in stone and may not convert to an approval when you’re ready to buy. While a pre-approval is not mandatory, it offers several advantages to prospective

homebuyers. It ensures financial preparedness, it offers meaningful insights into your affordability so that you can set a realistic budget to guide your home search, and it eases the stress of the process. If you’re making this investment on your own, extra steps like a pre-approval can help you to understand your finances better as well as where you might need to improve to make your home purchase with confidence.

Before making any sudden moves, it’s crucial to get your finances in order, starting with any outstanding debt you may have. Your debt-to-income ratio, which is the comparison of your monthly debt payments to

your monthly gross income, is a significant factor lenders look at when reviewing your mortgage application. By clearing your credit card debt and paying down loans, whether they’re student loans, auto loans or other types, you not only improve your chances of getting approved for a mortgage but ensure your financial stability to manage the additional expenses that come with homeownership.

It’s also essential to avoid taking on any large purchases or additional debt before you’re approved for a mortgage. This can significantly impact your debt-to-income ratio and credit score, potentially affecting your loan terms or your ability to qualify for a mortgage at all.

When it comes to making a home purchase on your own, a down payment can feel like one of the biggest financial hurdles to overcome. And while it is important and can help to reduce your monthly mortgage payments, it’s one of the many costs associated with buying a home. In addition to your down payment, homebuyers on a single income also need to budget for closing costs, property taxes, maintenance, the cost of furnishing the home and CMHC home insurance if you make a down

payment that is less than 20 per cent. A well-thought-out budget will ensure you’re not stretching yourself too thin so that you can enjoy your new home without financial stress.

When shopping for a mortgage, many Canadians typically default to their home bank without exploring other options. However, when making such a significant financial commitment, it’s important to shop around and understand what’s available in the marketplace before making a decision. At Homewise, we work with more than 30 banks and lenders, including credit unions and monoline lenders, which often provide more competitive rates and features than traditional banks. Given that everyone’s financial situation and goals vary, finding a mortgage that aligns with your unique needs and goals is crucial. This includes understanding the specifics of prepayment privileges and penalties, which are essential for adapting to life’s changes.

For instance, if you’re buying a home on a single income and later enter into a relationship with the desire to make a lump sum payment on your mortgage, your ability to do so is dependent on the terms of your mortgage contract. This underscores the importance of reading the fine

“

It’s also essential to avoid taking on any large purchases or additional debt before you’re approved for a mortgage.

print and fully understanding the details of your mortgage agreement to ensure it not only fits your current needs but also potential future scenarios.

Regardless of the economic environment we’re in, buying a home on your own is possible and a goal within reach if you are financially prepared, leverage the proper tools available to you, and seek advice from mortgage professionals such as those on our team at Homewise.

Are you interested in purchasing a pre-construction condo? Whether you are a first-time purchaser or a seasoned home buyer, the Home Construction Regulatory Authority (HCRA) is here to help. The HCRA licenses and regulates the people and companies who build and sell new homes in Ontario and protects the public by enforcing high professional standards for the homebuilding industry.

There are many things to consider when considering a pre-construction condo, and the HCRA has several excellent resources available to help new-home buyers through the purchasing process. The HCRA is highlighting some of the key resources from the Steps in the Home Buyer’s Journey on its website, hcraontario.ca/journey.

The Ontario Builder Directory Before buying a pre-construction condo, the HCRA always

recommends homebuyers do their homework and research builders on the Ontario Builder Directory (obd. hcraontario.ca). The Builder Directory provides comprehensive information on more than 6,500 licensed builders in Ontario to help new-home buyers make informed, confident decisions when selecting a builder.

Each profile on the Builder Directory provides information on builders such as the number of years active, number of homes built and any conduct concerns including charges and convictions. Importantly, the Builder Directory will indicate if a builder is licensed – never purchase from an unlicensed builder (also known as an illegal builder).

Once purchasers have done their research and selected a builder, the next step in purchasing a preconstruction condo is reviewing and signing an Agreement of Purchase and Sale (APS). An APS

contains essential information about homebuyers’ rights under the agreement, the builder’s rights, and information about the unit and the project.

Understandably, many homebuyers may not understand the terms and conditions they are signing on to. It is always encouraged that purchasers have their APS reviewed by a lawyer who is experienced in preconstruction condo transactions, and builders should also encourage their purchasers to seek this legal advice.

An important feature that is specific to a condo APS is the Condominium Information Sheet. Builders are required to attach this sheet to condo purchase agreements, which outlines some of the potential risks of buying a pre-construction condominium such as potential early termination conditions, construction financing risks, and permit and approval risks.

The sheet also highlights an important feature for condo buyers – a 10-day cooling off period. Under

the Condominium Act, 1998, the 10-day period allows purchasers who have signed an APS to cancel their purchase, terminate the agreement, and receive their deposit back. In addition, licensees must abide by the rules and conduct expectations around changes to signed agreements as noted in the HCRA Advisory (hcraontario.ca/Advisory11) concerning price escalations and contract terminations.

Conduct expectations

The HCRA regulates licensees’ conduct, and licensees are required to meet ethical conduct principles under the Code of Ethics. The Code of Ethics (hcraontario.ca/ethics) is a set of 20 clear principles for how builders are expected to behave, and what is considered ethical and acceptable conduct for their profession.

Builders are expected to adhere to these standards, ensuring a level of professionalism that inspires trust and confidence in homebuyers. Clear communication, competent service and honouring the terms of agreements of their contracts are all things purchasers can expect from their builder. As a purchaser, it is important to understand what to expect from licensees throughout the construction process – especially considering this relationship can extend up to seven years during the post-occupancy warranty period.

Another thing for condo buyers to be mindful of is construction delays. The pre-construction process is complex, so delays are common; however, since a condo project requires more time to complete than a single-family home, the potential for construction delays is much higher. This means

that the occupancy date to move into the condo may change, and the builder will set a Tentative Occupancy Date.

In the event of a delay and a Tentative Occupancy Date, purchasers should review the addendum attached to their APS to understand when they can terminate their agreement because of delay and if they are eligible for compensation due to the delay. In a recent Advisory (hcraontario.ca/Advisory11) to licensees, the HCRA outlined the rules and conduct expectations around changes to signed agreements –including price adjustments and attempts at early termination of the APS.

This is the moment that all condo buyers look forward to – move in day. While it is exciting to move into a new home, it is important to understand the concept of the Interim Occupancy Period. While the unit may be fit to live in, construction may be ongoing within the condo and other parts of the building. In this case, purchasers cannot take ownership until the entire project is completed and registered with the municipality.

During interim occupancy (which can last anywhere from a few months to more than a year) purchasers will be required to pay a monthly fee to the builder that covers three things: Interest on the unpaid balance of the unit, estimated municipal taxes for the unit and maintenance expenses.

While most purchasers have positive experiences with their builders, there are exceptions. In cases of professional conduct concerns, issues with builder competency, financial viability or instances of building or selling without a license (which is illegal in Ontario), condo buyers can turn to the HCRA for assistance. Visit the HCRA blog, The Home Front (hcraontario.ca/blog), to learn more about the types of complaints the HCRA manages, and the website (hcraontario.ca/complaints) for more information on how to submit a complaint to the HCRA.

The HCRA is dedicated to ensuring that purchasers feel confident and informed throughout their home buying journey – visit its website for more information and resources specific to new condo buyers.

The HCRA is here to help condo buyers stay informed, purchase smart and confidently navigate the path to new homeownership.

Over the past few years, we have experienced unprecedented challenges in the new construction real estate industry. The pandemic, supply chain issues and interest rate increases have all taken their toll, not only through potential purchasers waiting for rates to settle and the market to pick up, but also through owners of large single-detached homes doing the same. If you own a large, detached home and have been sitting on the sidelines when you might have otherwise sold and moved into more suitable accommodations, now is a great time to assess your situation and act on your decision.

Right-sizing after spending decades in a large lowrise home is a big decision, but also a freeing one. You might find yourself an empty nester or senior rambling around in a home that is just too big for your needs. Maybe you prefer to move into a smaller detached home, or even a townhome or semi, so you still have a yard for gardening. For a lot of mature buyers, taking care of a yard and garden are important pastimes. You could look for a bungalow for easier one-level living in a community located close to amenities, perhaps even some within walking distance.

Then again, you may be ready for a condominium lifestyle for the benefits of having a vertical community that fits your needs. Again, one-level living is easier to maneuver, plus you enjoy having exterior and common area maintenance handled for you. If you

are able to finally travel the way you have dreamed, locking your suite door and leaving is a breeze, feeling confident that your home is being looked after while you are away. Today’s condos are built close to local amenities, and many even have some retail spaces in the lobby. Gardeners take note: You may even find a condo that offers rooftop gardening spots. Many right-sizers choose boutique condominiums that are more intimate than highrise towers. It’s all a matter of preference.

Whichever lifestyle is your cup of tea, remember that buying new brings with it numerous perks, including Tarion warranty coverage. This adds a level of confidence that brings welcome peace of mind to mature buyers. So, how can you prepare for your move? First start decluttering your decades worth of “stuff.” Remember that today’s adult children do not want the same number of knickknacks their parents and grandparents likely own. Spring is around the corner and is the perfect time to hold a yard sale or use consignment stores for more valuable items. Your cast-offs may be someone else’s treasures.

Then consider carefully where and how to shop for a new home or condo. Location, location, location is first on most people’s lists. Perhaps you can move farther away from an urban area, or maybe you live on a rural property and want to relocate to a place where you can walk to amenities. Either way, you can find houses or condominiums that will appeal.

One thing we have all learned is that we do not know what the future will hold. Right now, you can start making plans to right-size. The resale market needs your lowrise home. You will know when the timing is right to realize your new housing dream.

As the world navigates through unprecedented shifts in work dynamics, the GTA housing market finds itself at the epicentre of a significant transformation. The rise of remote work, accelerated by global events, has fundamentally altered traditional notions of the workplace and, consequently, the demand for housing. This article examines the evolving relationship between workfrom-home (WFH) arrangements and the demand for pre-construction housing in the GTA.

The GTA, renowned for its bustling urban landscape and robust job market, has historically attracted droves of professionals seeking career opportunities. However, the onset of the COVID-19 pandemic triggered a seismic shift as employers swiftly embraced remote work models to ensure business continuity. This transition liberated workers from geographic constraints, prompting many to reassess their living preferences and seek properties that enhance their quality of life, productivity and overall well-being.

One of the most notable repercussions of the WFH revolution is the heightened demand for suburban and exurban housing. With commuters no longer tethered to city-centre offices, individuals and families are increasingly gravitating towards spacious, affordable properties outside the urban core. This trend has translated into a

surge in interest in pre-construction developments in suburban enclaves across the GTA.

Moreover, the newfound flexibility afforded by remote work has spurred a revaluation of housing priorities. Homebuyers now prioritize features such as dedicated home offices, outdoor spaces and proximity to recreational amenities over traditional urban conveniences such as proximity to the workplace. Developers are swiftly adapting to meet these changing preferences by incorporating versatile living spaces and modern amenities into their preconstruction projects.

However, while WFH has fueled demand for suburban housing, its impact on urban markets is more nuanced. While some professionals relish the convenience and vibrancy of urban living, others are rethinking their allegiance to city life in favour of more spacious and affordable suburban locales. Consequently, developers are recalibrating their urban projects to cater to changing preferences, emphasizing proximity to greenspaces and recreational facilities.

Additionally, the WFH phenomenon has engendered a paradigm shift in housing design and urban planning. With remote work poised to

become a permanent fixture in the professional landscape, municipalities and developers are exploring innovative approaches to create livework communities that seamlessly integrate residential, commercial and recreational spaces.

The proliferation of remote work has catalyzed a seismic shift in GTA housing dynamics, redefining the demand for pre-construction properties. While suburban markets experience unprecedented growth fueled by newfound flexibility and changing preferences, urban centres are undergoing a metamorphosis to adapt to evolving lifestyle trends. As the WFH revolution continues to unfold, the GTA housing market stands at the cusp of a transformative era characterized by innovation and adaptability.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

+

The real estate market is constantly evolving in a bustling metropolis such as the GTA. Staying ahead of the curve is crucial for both seasoned real estate professionals and prospective homebuyers and sellers alike. With the release of TRREB’s Market Outlook and Year in Review Report, there is no better time to explore the current housing market trends.

Enrich your understanding of the new homes and resale real estate market and tune into insights straight from the experts on TRREB’s Ready to Real Estate podcast.

Hosted by Jason Mercer, TRREB’s chief market analyst, Ready to Real

Estate delves into pressing topics and showcases compelling conversations with changemakers, trailblazers and thought leaders. Each episode allows you to access valuable knowledge to better inform your real estate decisions. Whether you’re looking to buy, sell, rent or simply stay informed, our podcast is your go-to resource for all things real estate in the GTA.

On a recent episode, Sean Simpson, vice-president of Ipsos Public Affairs, talked about consumer buying and selling intentions. He shared the shifts in buying intentions to the impact of mortgage rates on market conditions. On the same episode, Mercer was joined by Ray Wong, vice-president of data operations at Altus Group, to explore the pre-construction residential housing market in the GTA. With more than 30 years of experience in the sector, Wong offered a deep dive

into market activity, housing types, and the effect of interest rate cuts on the new homes market.

Looking for more? You can also check out our monthly Market Watch. We break down home prices, sales, and new listings each month with an easy to glance report. Visit trreb. ca to explore the latest look into the housing market. Plus, connect with a TRREB member realtor and search listings in real-time on any device.

Jennifer Pearce, TRREB President, is a Broker and Owner with ReMax Rouge River Realty Ltd., a family owned and operated brokerage. She is a secondgeneration realtor and has been licensed since 2000. trreb.ca

nexthome.ca

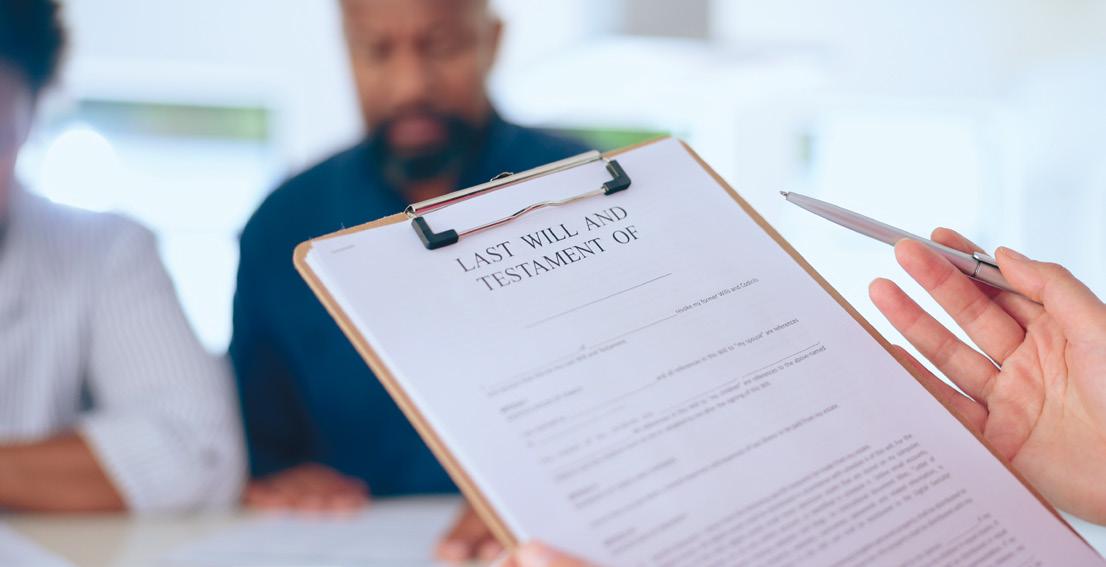

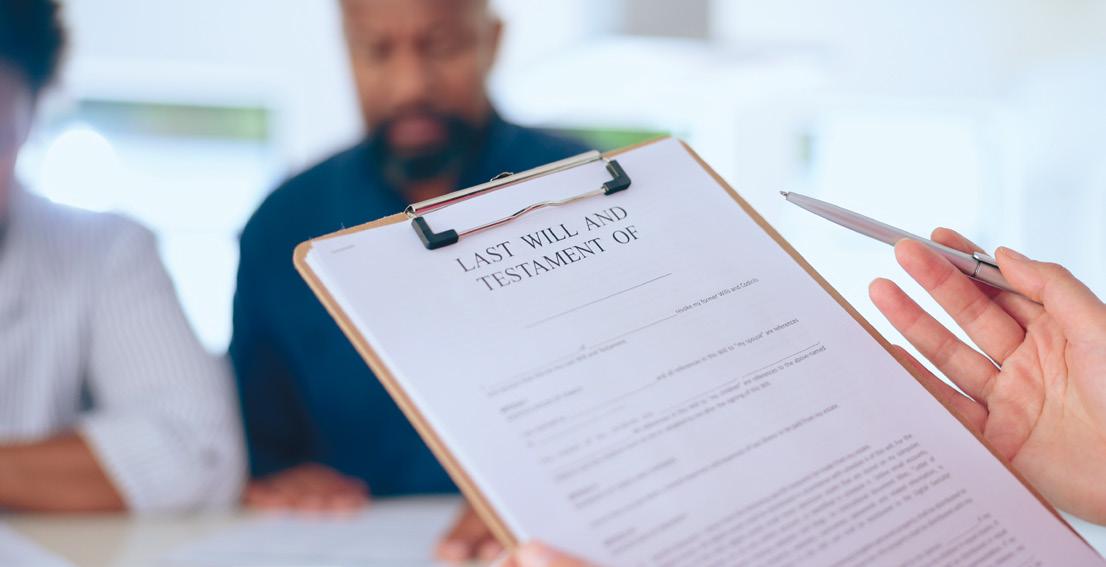

When you die, how does ownership of your assets transfer to your beneficiaries?

With or without a Will, if you own certain types of assets in your name

alone (such as real estate or a bank account), your beneficiaries (the ones you want to get your assets) will have to prove that they should legally be able to give instructions to the proper authority about that asset. In Ontario, this proof is a court order called a Certificate of Appointment of Estate Trustee (CAET). Many people may be familiar with this court order under one of its older names – a grant of

probate or letters of administration. These types of assets are said to “trigger probate” because without the CAET court order, you can’t change the legal title to these assets.

For example, imagine Barbie is only person with her name on a bank account when she passes away. Ken goes to the bank with Barbie’s Will and says “Look, Barbie gave me this bank account.” The bank will say

“Why should I give you information about this account or pay any of Barbie’s bills or transfer any money to you? You aren’t Barbie and I can only do what Barbie says because she’s legally the only owner and because of privacy legislation.” This can create a huge problem with matters such as bills and funeral expenses.

In this case, Barbie took care of things and had a Will naming Ken as her estate trustee, as well as the only heir to her estate – that is to say, Ken is both the estate trustee named in the Will and the sole beneficiary of Barbie’s estate. Ken can then take the will to a lawyer, who will help him apply to court to get a CAET. Ken can then take this CAET to the bank to show that he legally stands in Barbie’s shoes and he is entitled

to the money in the account. The bank will say “We recognize you as Barbie’s legal representative and now we’ll follow your instructions as though you are Barbie.”

This example illustrates why you often need a CAET and how to get one. A lawyer can assist you with filing an application for CAET either with or without a Will. Where there is no Will naming an estate trustee, provincial law determines who in the deceased’s family has the right to apply for a CAET, and in what order of priority. Unfortunately, under this scenario, the person who ends up being the estate trustee (the legal representative of the deceased) or gets the assets may not be someone the deceased would have chosen.

The point is – prepare your will now. It’s too late when you are dead.

A large part of the application is reporting the total fair market value (TFMV) of the estate. Estate Administration Tax (formerly probate fees) is calculated on the TFMV using a formula. The estate trustee is personally financially responsible for reporting the total value of the estate accurately. And filing an Estate Information Return. This return can be audited by the ministry of finance, and errors or omissions are subject to late fees, penalties and a prison term

of up to two years for truly fraudulent reporting, so it is imperative to have your lawyer or accountant help you.

In summary, a CAET is the proof required to sell, transfer or otherwise deal with certain types of assets. These assets are usually things that are registered and regulated by government, such as bank accounts and ownership of real estate, but not always. If you would like to make it possible for your loved one(s) of choice to administer your estate and transfer your property after you die, getting a professionally prepared Will is an important planning step. Hiring a lawyer who has experience in filing court applications for CAET is an equally important decision made by your selected estate trustee, since the applications are very detailed and legal advice is crucial.

Jayson Schwarz LLM is the managing partner of Schwarz Law Partners LLP; Robin Hammond is a lawyer operating the firm’s wills and estates department. Visit online at schwarzlaw.ca or email info@schwarzlaw.ca with your questions, concerns, critiques and quandaries.

The West End Home Builders’ Association (WEHBA) recently held its Annual Industry Luncheon in Hamilton, bringing together more than 320 leaders from the residential construction and renovation industries, to recognize distinguished members and celebrate the bold steps the association has made towards increasing housing affordability and choice in southern Ontario.

Distinguished guests and speakers included Hamilton Mayor Andrea Horwath, Burlington Mayor Marianne Meed Ward, and Dan Muys, MP, Flamborough-Glanbrook. Mayor Horwath spoke about the positives steps Hamilton has made over the past year towards addressing the housing crisis and improving housing affordability. The City of Hamilton has launched a new division called the Housing Secretariat building on her election campaign Action Plan on Housing commitment, has secured more than $97 million through the federal Housing Accelerator Fund and has signed a provincial housing pledge for the City of Hamilton to support the construction of 47,000 new homes over the coming decade.

The association’s 2024 President John Anthony Losani addressed the assembly and spoke from the heart, about his family’s humble beginnings, his experience growing up in the residential construction Industry and the life lessons he received on work ethic and true passion from his role models. “I remember being full to the brim with pride with the work that our

family did. I understood from a young age that being trusted by people and their families to deliver them a home for them to raise their families in was not to be taken lightly.”

The WEHBA president also talked about the current lack of affordability and choice, noting that “homeownership is tougher than it has been in 60 years.” He noted that we need to focus on innovation and adapt new technologies that increase productivity across the whole Industry. “We as an industry have an extraordinary opportunity to help create and execute the solutions that the people of Ontario so desperately need. And to our partners in government, we need you to be part of the solution as well. The time for talk has passed, and the time for action has come. The only way we can implement meaningful change for the good people of our city and province is if we work together.”

At the event, WEHBA also honoured 2024 Hall of Fame inductee, WEHBA Past President – and first WEHBA female president – Bernice Flegg. “As a new board member or serving as president, the support, the seasoned board members and staff provided was very instrumental. As I reflect on my various association involvements over a 30-year span, being part of West End Home Builders’ Association is one that stands out as particularly special, in large part, because of the sense of community afforded me. I’m sure this continues to be true today for current members.”

The event closed with an informative panel discussion on the supply of entry level market housing to meet Hamilton’s housing pledge of 47,000 new units over the next decade. The WEHBA luncheon presents a showcase of

the industry’s strong relationship with our local partners in government and emphasizes the importance of increased communication and collaboration between the development industry and the municipal sector, in finding housing solutions and making our cities welcoming and affordable.

“Canadian cities – especially southcentral Ontario are in the midst of a housing crisis that is impacting all segments of the housing continuum, young people, new Canadians and increasingly all residents from all walks of life,” says Mike Collins-Williams, WEHBA CEO. “We all need to work together to solve this problem – all three levels of government, the nonprofit sector and the private sector, and I believe we are all up to the challenge.”

Introducing Trees. This once-in-a-million-year innovation doesn’t just clean the air we breathe, it has powerful Earth-cooling abilities and can improve our mental health. But in so many places, nature’s inventory is quickly running out.

You can help turn things around. Donate now and join us in increasing the tree canopy in communities across Canada at TreesForLife.ca

Thank you to our sponsors and supporters.

Art is often thought of as part of the finishing touches of your decor, a last-minute addition to the space. But is this really the case? Art is more than just a decoration. When it is well curated, it can transform and elevate any room. It can set the tone of the space while also adding to the overall design aesthetic. Art can express your personality, add visual interest, evoke emotion or simply calmly complement the surroundings.

Understanding the role art plays in your space is important. A vibrant abstract can create energy, a subtle landscape can be calm and peaceful. The colours, textures and forms found in your artwork can be complementary to the surroundings of the room, adding not only visual interest but also depth to the design. It can create a focal point in the space, or just add a subtle nuance to a small little corner of a room. It can be the starting point when designing, or it could be that extra layer needed when creating a well-curated room.

Many feel that great artwork should stand alone and really have nothing to do with the finished decor of your space. However, when working with clients, I often find that art always will have a greater impact and look better within the space when the decor supports the pieces in questions.

Whether you are working with original art, prints you fell in love with, photography from your travels or some great vintage pieces you found while thrifting, you need to decide the role these pieces will have within your space. Is art to be used as the inspiration for your designs, a focal point within the space or simply be a piece that accompanies and completes the overall design?

However you decide to incorporate these pieces, know that they will certainly add dimension, richness and interest to the area.

So, the question remains: How do you design a space to highlight your art? One of the more classic and easiest ways to coordinate your art selections within your living spaces is drawing on colour. This is not about having your art “match” everything in the space, but rather developing a palette of colour and texture throughout that will help enhance

the pieces. This could be a simple repetition of some of the colours found within the piece through paint, fabric and accessories which will help to strengthen the visual impact of the art. A coordination and balance of colour, pattern and texture within your decor will draw you into the room and visually highlight the art.

For a more modern approach, the design of a room can be a little more restrained, both in colour and composition, allowing the art to become more of an impactful focal point. With the use of strategically placed directional lighting you can add another element to highlighting your art and truly make it the centre of attention.

When working with impactful or large scaled pieces of art, put some thought in to how you’d like to display these pieces and make the design or decor of your space complement them, instead of just making the art exist. If you are selecting fresh pieces of art for your room, select wisely, both in size and composition. Look to creating groupings, or collages, with some pieces to avoid simply hanging a single piece per wall. While art is subjective and personal, it does need

to vibe with the space it will be in to truly shine.

Art can elevate your interior space. But in the end, artwork should simply make you happy. Make a bold statement with your art selections or create a calm and relaxing environment, whichever suits your personality and style best. Be creative with your selections, and don’t be afraid to play with scale as well. A large piece on a smaller wall can really make an impact in a space, and the same goes for the reverse. Your selection of art is a reflection of you, your life, your history, your travels… have fun with it and don’t be shy to show your true self.

Linda Mazur is an award-winning, nationally publicized designer and Principal of Linda Mazur Design Group. With almost two decades of experience this in demand multi-disciplinary design firm is known for creating relaxed, stylish spaces and full-scale design builds within Toronto, the GTA and throughout Canada. lindamazurdesign.com @LindaMazurGroup

Decorating a small space isn’t really that different from decorating a large one – it just requires some ingenuity and understanding what works in the space and what doesn’t. While your focus will be different when you’re working with less square footage, the basic rules of design are very much the same.

Whether you’re looking to update a rental apartment, condominium or small home, give some thought to these eight tips to optimize your space.

First, if you have plenty of natural light, let it shine through. Keep window treatments airy with sheer fabrics so light can come through easily, and you’re not weighing down your space with heavy curtains or blinds. Add additional lighting throughout your space but avoid any big floor or table lamps – they just add “bulk” – and opt for wall sconces, pendant lights or string lights that don’t take up too much real estate.

If you aren’t blessed with a lot of natural light in a room, mirrors can

add additional light and the feeling of additional space by reflecting back any natural and non-natural lighting you do have. It will give the illusion of more square footage, so think about using one large mirror in your room or arrange a few smaller ones throughout.

When dressing a small space, your furniture has to look light. For example, instead of investing in a sturdy, block of a coffee table, opt for a piece that has legs on it. Why? It helps carry the eye in and around your space, which gives the impression of a bigger room.

I often picked pieces that are multipurpose, such as a high-top table that I put in the kitchen area that acts as a workstation as well as an eating area. You can get creative with storage options, too: Ottomans that can store your linens, or built-in cabinetry under your bed. Nowadays there are so many chic storage options that work double-duty as a piece of decor.

Shelves and nightstands that are built into the walls keep your floor clear of any obstacles and free up some extra space as well.

Believe it or not, you don’t want to skimp on size with your rug. A tiny rug just makes the room feel equally as small, so pick a floor covering that’s large enough so most of the furniture will sit on it or go wall-to-wall.

This feels fairly obvious, but lighter walls give the illusion of a bigger space, where darker walls do the opposite. My favourite hues are

from Benjamin Moore: CC40 or Chantilly Lace. I often use them both in design.

Yes, you can. Use colour for your pillows, bedding, artwork or carpets, but I always caution about going too overboard with really bold patterns of palettes. You want to minimize the “noise,” as it were, so my advice is to add your colour, but keep it fresh, light and harmonious.

Lisa Rogers is Executive Vice-President of Design for Dunpar Homes (dunparhomes.com). Lisa has shared her style and design expertise on popular television programs such as Canadian Living TV, House & Home TV and as a regular guest expert for fashion and image, health and wellness and design on CityTV’s Cityline. Follow Lisa’s blog at craftedbylisa.ca

Elevate your interior aesthetics with the timeless sophistication of a wool rug.

This versatile design element easily blends comfort and style, offering a luxurious tactile experience underfoot. Beyond its plush texture, a wool rug brings a natural warmth to any space, creating a harmonious balance in contemporary or traditional decor schemes. Renowned for its durability, a wool rug not only withstands the test of time, but also resists stains and retains its vibrant colours. Choose from a spectrum of patterns and textures to effortlessly infuse your living space with a touch of understated elegance.

1. DEJRET hand-made rug in beige. $400. ikea.ca

2. STONE TILE rug. From $149. westelm.ca

3. BOVI rug in pearl blue. $399. article.com

4. FINN hand-knotted wool rug. From $1,135. potterybarn.ca

3

4

Farrow & Ball’s latest decor tome, How to Redecorate by Joa Studholme and Charlotte Cosby, aligns timeless advice with current trends, adapting to the demands of the home-working age. This updated edition encapsulates the transformative evolution witnessed in home design over the past decade. From chic city apartments to more spacious country retreats, the book showcases diverse living spaces with inspiration on how to decorate your home with ease. $46. amazon.ca

Pantone has released its colour of the year, and it’s just peachy! Peach Fuzz embodies our desire for selfcare and connection. This gentle, velvety peach tone seeks to enrich mind, body and soul. “In looking for a hue that echoes our innate yearning for closeness and connection, we chose a colour radiant with warmth and modern elegance, a shade that resonates with compassion, offers a tactile embrace, and effortlessly bridges the youthful with the timeless,” says Leatrice Eiseman, executive director at the Pantone Color Institute.

A global leader in innovative and sustainable surfaces, Cosentino has collaborated with acclaimed interior and product designer, Claudia Afshar, to create the Ukiyo collection. Boasting textured and linear fluting, the Ukiyo collection is available in five colourways (from dark gray to cream and terracotta shades) durable, ready-to-install fluted tiles – one of the first offerings of its kind in the industry. cosentino.com

Is it your goal to eat more fruits and veggies this year? I hear you! Boost your fruit and veggie intake with the Easy Clean juice extractor from Hamilton Beach. Create a fresh, healthy juice in seconds with a chute that fits whole foods, cutting down on prep time and making it easier than ever to add more fruits and veggies to your diet for a healthier lifestyle. The machine also has dishwasher-safe parts. $120. bestbuy.ca

PET

Keep your space looking stylish while keeping your fur babies comfy with these cool beds. zarahome.com

developer: NATIONAL DEVELOPMENTS AND BRIXEN DEVELOPMENTS INC.

style: Highrise

size: 26 storeys

features:

• Studio, 1 bed, 1 bed + den, 2 bed, 2 bed + den

• Lobby, Gym, Co-Working Space

• Kids Playroom, Party Room, Private Dining Room With Catering Kitchen

• Rooftop with BBQ’s, Flex Lawn, Dining and Lounge Areas register at: duocondos.ca