INSIDE : BILL 23 THE BOLD HOUSING PLAN ONTARIO NEEDS Dec. 3–31, 2022 Greater Toronto Area Greater Toronto’s COMPLETE CONDO GUIDE LOWER HOME PRICES CREATE OPPORTUNITY TO BUY 5 things you need to know about buying a home

The most desirable address. The most natural neighbourhood. The most connected community. National Developments is coming to the North Shore of Burlington on Plains Rd. East, introducing a rare opportunity to live where LaSalle meets the Harbour. Walkable amenities. Minutes to the GO Station. Surrounded by nature. When you live on the North Shore, you’ve arrived.

MODERN CONDOS COMING SOON TO BURLINGTON

Follow your own course LAND ON THE NORTHSHORE MY NORTHS HO RE .CA REGISTER NOW TO FOLLOW

Brokers are protected. Davie Real Estate Inc. Brokerage. Prices and specifications are subject to change without notice. Rendering is Artist’s Concept. E. & O. E. SOLMAR .CA OR SCAN QR CODE Experience upscale living in Brampton’s newest luxury residential condominiums with elegant suite designs, sophisticated lifestyle amenities and refined finishes. Live connected to everything in the heart of downtown Brampton with GO train and transit right around the corner. STEPS TO GO, VIA RAIL, RAPID TRANSIT, ALL MAJOR HIGHWAYS AND BRAMPTON’S WORLD-CLASS INNOVATION DISTRICT 1 bedroom, 1 bedroom plus den, 2 bedroom & 3 bedroom designs starting from the $500’s COMING SOON REGISTER NOW BRAMPTON’S TALLEST CONDO TOWERS

DON’T MISS THE LAUNCH. REGISTER TODAY AT BRANTHAVEN.COM COMING SOON. REGISTER NOW. Birch Condos at

Village will be

Discover distinctive architecture, spacious suites, hotel-inspired amenities and the attainable luxury design-forward features and finishes Branthaven is

for. Step out and enjoy the endless greenspaces and vast waterfront

of

High Style, Boutique Condo Living.

LAND MEETS THE LAKE OAKVILLE 2 & 3 Storey Townhomes COMING IN 2023 TO LAKEVIEW VILLAGE, MISSISSAUGA.

Lakeview

a rare boutique condo located in the visionary Lakeview Village waterfront community.

renowned

playground

Mississauga’s most transformative new home community - all on the shores of Lake Ontario. MISSISSAUGA

WHERE THE

Branthaven.com FIND OUT MORE & VISIT US ONLINE All renderings are artist’s concept. Prices, sizes and specifications are subject to change. E.&O.E.

CONTENTS YOU NEED TO KNOW ABOUT BUYING A HOME 5 THINGS DEPARTMENTS 8 Editor’s Note More policies likely to follow 10 Contributors 11 In The Spotlight New home market sees small increase in activity in October; more news on page 12 26 Maps & Amenity Charts 33 Advertisers Index Want more information? Just ask — and you could win a prize COLUMNS 13 Stat Chat Stability on the horizon 14 Real Estate Pro Today’s buyers benefit in many ways 15 Personal Finance Getting ready to buy in 2023 18 Home Realty Recent government action set to boost housing supply 19 Legally Speaking Why you should get a Will and Power of Attorney 34 Industry Report Bill 23 the bold housing plan Ontario needs PROPERTY PROFILES 20 Lambton Towns Dunpar offers rare lowrise living in vibrant St. Clair Avenue West 22 NorthShore Condominiums National Homes brings modern urban sophistication to Burlington DEC. 3–31, 2022 COVER STORY 16 6 condolife magazine | Dec. 3–31, 2022

If your new home or condo was purchased within the past 12 months, tell us about your experience and you could WIN! HOUSEWARMING CONTEST! YOU COULD WIN A $100 GIFT CARD! Did our homebuyer guides help you find home? HOW TO ENTER: nexthome.ca myhomepage.ca travel & leisure | home & garden | technology & finance beauty & wellness THE BEST COLLECTION OF NEW 4 SEASON HOMES in the Georgian Bay area nexthome.ca myhomepage.ca Dec. 5, 2020–Jan. 16, 2021 Greater Toronto’s COMPLETE CONDO GUIDE WHERE MORTGAGE RATES ARE HEADED IN 2021 condolife DEC. 5, 2020–JAN. 16, 2021 condo in Vaughan launching soon LIVING IN THOROLD! Fabulous WEST COMMUNITY NEW PHASE COMING SOON! DISCOVER SINGLE FAMILY HOMES AND SPACIOUS TOWNS! nexthome.ca myhomepage.ca INSIDE: WHERE MORTGAGE RATES ARE HEADED IN 2021 HOMEBUYER INTENTIONS STILL STRONG: SURVEY Toronto’s Finest NEW HOME GUIDE Scan the QR or visit nexthome.ca/corporate/contests for full contest details & rules

MORE POLICIES

LIKELY TO FOLLOW

Barely one day had passed (at time of writing) since the Ontario government’s More Homes Built Faster Act was approved, and the criticism began to mount. Designed to tackle the housing supply crisis and get 1.5 million homes built over the next 10 years, the bill, not surprisingly, faced strong opposition.

More Homes Built Faster is intended to remove unnecessary costs and cut through red tape and other bottlenecks that stand in the way of new homes being built. Seems like a pretty worthwhile goal, except to those who are fortunate enough to already own a home, and fear development in their area or an increase in property taxes. Such NIMBYism, however, doesn’t do much for actually resolving the housing supply and affordability issues which affect us all – renters, homeowners and prospective homebuyers.

“We are in the middle of an unprecedented housing crisis, and it is critical that we take immediate action to speed up construction of new homes and remove obstacles to residential development,” says Richard Lyall, president of the Residential Construction Council of Ontario. “Removing development charges for affordable and non-profit housing, one of the items in the legislation, is the right thing to do as it will spur new residential construction. These hefty fees are out of control and can result in a project being shelved. Municipalities have become dependent on them, and an alternative must be found.”

WAYNE KARL EDITOR-IN-CHIEF Condo Life Magazine

EMAIL: wayne.karl@nexthome.ca

TWITTER: @WayneKarl

As the days and weeks roll by and critics of the Act perhaps become more vocal, it’s important to look beyond political rhetoric and think big picture, long term. Controversial though it may be, Ontario needs such action, and it’s an important start.

In addition, we might as well get used to more government involvement and policies on housing, not just in Ontario but across the country.

“To overcome these affordability challenges, we need a range of government policies and investments stemming from several sources, notably the private and public sectors,” says a new report from Canada Mortgage and Housing Corp. Deputy Chief Economist Aled ab Iorwerth. “The scale of the challenge is so large that the private sector must be involved – governments cannot do this on their own.”

The housing system is interconnected, he says, so fixing Canada’s affordability challenge requires a suite of policies to affect the entire system. A suite of policies, and the open minds to facilitate them.

EDITOR’S NOTE

+ get social Interact with us on social media: nexthome

8 condolife magazine | Dec. 3–31, 2022

tridel.com

PERSONAL FINANCE | JESSE ABRAMS

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm based in Toronto. thinkhomewise.com

HOME REALTY | DEBBIE COSIC

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

REAL ESTATE PRO | BARBARA LAWLOR

Barbara Lawlor is President and CEO of Baker Real Estate Inc., and an indemand columnist and speaker. A member of the Baker team since 1993, Barbara oversees the marketing and sale of condo developments in Canada and overseas. baker-re.com

STAT CHAT | BEN MYERS

Ben Myers is President of Bullpen Consulting. Ben provides pricing recommendation, product mix, and valuation studies on new residential housing developments for builders, lenders and property owners. bullpenconsulting.ca

LEGALLY SPEAKING | JAYSON SCHWARZ

Jayson Schwarz LLM is a Toronto real estate lawyer and partner in the law firm Schwarz Law Partners LLP. He can be reached by visiting schwarzlaw.ca or by email at info@schwarzlaw.ca or phone at 416.486.2040.

BILD REPORT | DAVE WILKES

Dave Wilkes is president and CEO of the Building Industry and Land Development Association (BILD), the voice of the home building, land development and professional renovation industry in the GTA. For the latest industry news and new home data, follow BILD on Twitter at @bildgta or visit bildgta.ca

CHIEF REVENUE OFFICER Jacky Hill jacky.hill@nexthome.ca

EXECUTIVE MEDIA CONSULTANT Michael Rosset

EDITOR-IN-CHIEF – NATIONAL REAL ESTATE Susan Legge susan.legge@nexthome.ca

EDITOR-IN-CHIEF – GREATER TORONTO AREA Wayne Karl wayne.karl@nexthome.ca

MANAGING EDITOR Rise Levy rise.levy@nexthome.ca

CONTRIBUTORS

Jesse Abrams, Debbie Cosic, Barbara Lawlor, Ben Myers, Jayson Schwarz, Dave Wilkes

SENIOR VICE-PRESIDENT, SALES, NEXTHOME Hope McLarnon 416.708.7987, hope.mclarnon@nexthome.ca

DIRECTOR OF SALES, ONTARIO, NEXTHOME Natalie Chin 416.881.4288, natalie.chin@nexthome.ca

SENIOR MEDIA CONSULTANTS Amanda Bell 416.830.2911, amanda.bell@nexthome.ca

VICE-PRESIDENT, MARKETING – GTA Leanne Speers

SENIOR CLIENT RELATIONS SPECIALIST – GTA Sonia Presotto

MANAGER CUSTOMER SALES/SERVICE Marilyn Watling

SALES & MARKETING CO-ORDINATORS Gary Chilvers, Vi Nguyen

HOME SHOW MANAGER & NEWSPAPER CIRCULATION – GTA Josh Rosset

DISTRIBUTION distributionteam@nexthome.ca

ACCOUNTING INQUIRIES accountingteam@nexthome.ca

DIRECTOR OF PRINT MEDIA Lauren Reid–Sachs

VICE-PRESIDENT, PRODUCTION – GTA Lisa Kelly

PRODUCTION MANAGER – GTA Yvonne Poon

GRAPHIC DESIGNER & ASSISTANT MANAGER Alicesa Pullan

GRAPHIC DESIGNER & PRE-PRESS COORDINATOR Hannah Yarkony

GRAPHIC DESIGNERS Johannah Lorenzo, Jean Fay Rodriguez, Mike Terentiev

Published by nexthome.ca

Advertising Call 1.866.532.2588 ext. 1 for rates and information. Fax: 1.888.861.5038

Circulation Highly targeted, free distribution network aimed at real estate buyers using street level boxes, racking and Toronto Star in-home delivery.

Canadian subscriptions 1 year = 13 issues – $70 (inc. HST). Canada Post – Canadian Publications Mail Sales Product Agreement 40065416.

Copyright 2022 All rights reserved. All copyright and other intellectual property rights in the contents hereof are the property of NextHome, and not that of the individual client. The customer has purchased the right of reproduction in NextHome and does not have the right to reproduce the ad or photo in any other place or publication without the previous written consent of NextHome.

Terms Advertisers, Editorial content are not responsible for typographical errors, mistakes or misprints. All prices are correct as of press time.

Editorial Submissions from interested parties will be considered. Please submit to the editor at editorial@nexthome.ca.

CONTRIBUTORS Official Media Partners: r

æ Sign up to receive digital editions & newsletters to your inbox!

10 condolife magazine | Dec. 3–31, 2022

NEW HOME MARKET SEES SMALL INCREASE IN ACTIVITY IN OCTOBER

The GTA new home market picked up slightly in October, though activity remained below levels that are typical for the month, the Building Industry and Land Development Association (BILD) reports.

Total October new home sales of 2,007 units were down 53 per cent from October 2021 and 49 per cent below the 10-year average, according to Altus Group, BILD’s official source for new home market intelligence. It was the lowest level of new home sales for October since 2008.

Sales of new condominium units, including units in low-, medium and highrise buildings, stacked townhouses and loft units, with 1,601 units sold, were down 50 per cent from October 2021 and 40 per cent below the 10-year average.

Single-family homes, including detached, linked and semi-detached houses and townhouses (excluding stacked townhouses), accounted for 406 units sold, down 64 per cent from last October and 67 per cent below the 10-year average. It was the lowest October for single-family home sales since Altus Group started tracking in 2000.

“As demand for housing begins to reassert itself, our region’s lack of supply will continue to constrain consumers’ ability to find the homes they need,” says Dave Wilkes, BILD president and CEO. “That’s why we support the Ontario government’s new housing plan, the More Homes

Built Faster Act, which will make it easier to build new homes more quickly, reduce costs, cut red tape and enable the building of the 1.5 million new homes Ontario needs in the next decade.”

“New home sales remain well behind last year’s level but are much improved from the past two months,” adds Edward Jegg, research manager at Altus Group. “Buyers are returning as they become acclimatized to the new market realities of higher mortgage rates and softening prices.”

Benchmark prices eased somewhat in October, compared to the previous month. The benchmark price for

new condominium units in October was $1.14 million, up nine per cent over the last 12 months, and the benchmark price for new singlefamily homes was $1.81 million, which was up 9.6 per cent.

Total new home remaining inventory, at 12,588 units, saw little change from the previous month, and lagged behind the 10-year average by 40 per cent. Remaining inventory included 10,773 condominium apartment units and 1,815 singlefamily lots, representing five months and four months of inventory, respectively. A balanced market would have nine to 12 months of inventory.

IN THE SPOTLIGHT

SOURCE: ALTUS GROUP REGION 2022 20212020202220212020202220212020 Durham 114 4574420308494134765538 Halton 93 26098255 112238 348372336 Peel 25354241317 253 3932707951,513 Toronto 1,104 1,5131,1351 26 321.1051,5391,167 York 37 430794113 414 719150844 1,513 GTA 1,601 3,2022,484406 1,113 1,876 2,0074,315 4,360 HIGHRISE LOWRISE TOTAL OCTOBER NEW HOME SALES BY MUNICIPALITY The One Stop Shop for Builder Storytelling mcouatpartnership.com nexthome.ca 11

AVERAGE SELLING PRICES LEVEL OFF IN OCTOBER: TRREB

Despite the continued housing market transition to a higher borrowing cost environment, the average selling price in the GTA found some support near $1.1 million since the late summer.

GTA home sales continued to adjust to substantially higher interest rates in October 2022, both on an annual and monthly basis. However, new listings are also down year-over-year and month-over-month. The persistent lack of inventory helps explain why the downward trend in home prices experienced in the spring has flattened over the past three months.

GTA realtors reported 4,961 sales through the Toronto Regional Real Estate Board’s (TRREB) MLS System in October 2022 – a similar number to September 2022 but down by 49.1 per cent compared to October 2021. Year-over-year sales declines were similar across major market segments.

New listings were down by 11.6 per cent year-over-year and reached an October level not seen since 2010. New listings were down on an annual basis more so for mid- and highdensity home types, which helps to explain why prices have held up better in these categories compared to detached houses.

“With new listings at or near historic lows, a moderate uptick in

demand from current levels would result in a noticeable tightening in the resale housing market in short order,” says TRREB President Kevin Crigger. “Obviously, there is still a lot of short-term economic uncertainty. In the medium-to-long-term, however, the demand for housing will rebound. Public policy initiatives like the recently introduced provincial More Homes Built Faster Act and strong mayor provisions will help ensure we see more homes being built to affordably meet the needs of new households.”

The MLS Home Price Index (HPI) Composite Benchmark was down by 1.3 per cent year-over-year in October 2022. The average selling price for all home types combined, at $1.08 million, was down by 5.7 per cent compared to October 2021. The monthly trends for both the MLS HPI Composite and the average selling price have flattened in recent months following steeper declines in the spring and early summer.

“Home prices in the GTA have found support in recent months because price declines in the spring and summer mitigated the impact of higher borrowing costs on average monthly mortgage payments,” adds TRREB Chief Market Analyst Jason Mercer. “The Bank of Canada’s most recent messaging suggests that they are reaching the end of their tightening cycle. Bond yields

GTA RESALE AVERAGE PRICES,

Detached

dipped as a result, suggesting that fixed mortgage rates may trend lower moving forward, which would help affordability.”

“The housing sector has certainly been impacted by rising borrowing costs, and so too have other sectors of the economy with linkages back to housing,” says TRREB CEO John DiMichele. “Housing-related spin-off benefits to the GTA economy, which average $70,000 per transaction, will be down by close to $3 billion this year. Associated jobs and government revenue streams will suffer as well. This illustrates the balancing act the Bank of Canada will be dealing with in the months ahead. It will also be incumbent on policymakers to ensure that inflation is not being furthered by price gouging at the retail level.”

$1.60M (-9.9)$1.28M (-11.8)$1.37M (-11.0)

Semi-detached $1.21M (-7.6)$964,193 (-6.3)$1.07M (-6.2)

Townhome

Condo

$1.00M (-2.2)$895,665 (-4.0)$919,903 (-3.9)

$740,374 (0.0)$669,434 (5.7)$716,515 (1.8)

IN THE SPOTLIGHT

OCTOBER 2022 (YR/YR % CHANGE) 416 905 Total

SOURCE: TRREB

12 condolife magazine | Dec. 3–31, 2022

STABILITY ON THE HORIZON

ONE EXPERIENCED DEVELOPER SEES LIGHT AT THE END OF THE TUNNEL

end of the 1990s downturn, and the 2017 bubble.

BEN MYERS

Due to the rapid increase and subsequent decrease in house prices in Ontario this year, pundits are often incentivized to make quick observations and generate oversimplified views on the future of the market. This is especially true for so-called experts with little or no experience in analyzing the future of the pre-construction housing market.

One of the most important factors that people need to consider when it comes to analyzing the market is the lack of a comprehensive understanding of the past. Having a good dose of context can help people get a deeper understanding of the current market.

The past isn’t a perfect predictor of the future, but it’s a good starting point. I recently sat down with real estate veteran Leona Savoie on the Toronto Under Construction podcast to discuss her career, and how the development industry dealt with periods of slower sales.

Savoie started in the real estate world in the late 1990s, and worked for some of the industry’s biggest players, such as Rockport, Tridel, Daniels and Hullmark, before her current position at Dorsay Development Corp. She’s weathered the storms, having been there for the 2008 financial crisis, the tail

When it comes to the current real estate conditions, Savoie admitted it is a challenging market: “The government wanted to slow down the industry, and that’s what they did…” The market started off red hot in 2022 and prices entered bubble-like territory. Following the interest rate hikes, new condo sales softened, with less than 300 new condo sales in September, according to the Altus Group. However, Bullpen is forecasting 1,600 to 1,700 sales in October, just below the long-run average.

Zonda Urban is also tracking new condo sales and noted that activity was blistering to start the year, with 9,446 sales in the first quarter. In Q2 2022, sales were more modest at 6,842. Strong demand and rising construction costs pushed price appreciation during the first half of 2022, but the interest rate hikes will take a bite out of that growth moving forward.

Savoie started her career in 1990 when interest rates were quite high compared to today, and noted during the podcast that current interest rates “aren’t that crazy,” and that once they stabilize, consumer confidence will return to the market.

Continuing with a measured voice of optimism, she further noted that the recently proposed Bill 23 by the Ford government will support development moving forward. “The government fees, development charges and parkland charges are a huge hit to the industry,” and Bill

23’s proposed changes will help get more housing built.

With the Toronto city council approving a nearly 50-per-cent increase in developer charges, developers are estimated to be paying $25,000 to $45,000 higher in additional costs per unit, slowing down production and resulting in those costs being passed onto buyers. Bill 23 proposes phasing in those increases in a more reasonable manner.

It’s hard to say how Bill 23 will impact the supply of new housing, especially with high interest rates taking a bite out of demand and affordability. However, developers continue to launch projects, albeit at a slower pace, developers continue to buy land for future projects as well. Experienced developers such as Savoie see the light at the end of the tunnel, and with record immigration, demand for shelter will remain.

Everyone needs a roof over their head. When buying a property, do your own research, surround yourself with an experienced team, and good luck.

Ben Myers is the President of Bullpen Consulting, a boutique residential real estate advisory firm specializing in condominium and rental apartment market studies, forecasts and valuations for developers, lenders and land owners. Contact him at bullpenconsulting.ca and @benmyers29 on Twitter.

+MORE CONTENT ONLINE nexthome.ca

ADVICE | STAT CHAT

nexthome.ca 13

RELATIVELY SPEAKING

EVEN WITH HIGHER PRICES THAN IN THE PAST, TODAY’S BUYERS BENEFIT IN MANY WAYS

I have been thinking a lot about the new home and condominium industry, and the fact that everything is relative. For example, current mortgage interest rate rises may seem steep, but when I entered the industry more than 30 years ago, the rate had peaked at 22 per cent. Yes – 22 per cent. And yes, homes and condos were far less expensive then, but people made a lot less in wages and salaries.

Those homes have increased in value tremendously over the years, so even if the home or condo you’re considering seems pricey, you will also get a lot more for the home you’re selling. Media reports indicate home prices are falling, but remember that during the pandemic years, they increased by 40 to 50 per cent, which was unheard of. Even if they go down 20 per cent, that still leaves a huge amount of money on the table.

Think about designs as well. Decades ago, homes and condo suites were divided into individual small rooms. Today’s designs are airier, with open-concept spaces where families can spend time together. Condo amenities are gorgeous, light-filled common areas rather than simply a pool situated in a dingy basement area. In fact, decades ago, the condominium market was comprised mostly of seniors and empty nesters. Today, young professionals and growing families are opting for condos as well, for their more attainable

price points and for the lifestyle conveniences they offer.

Today’s kitchens are so beautiful that they are a welcome part of the open area, with superb cabinet colours and rich-looking countertops. Modern designs are also far more efficient than those of the past. Price points have dictated more compact square footages, especially in condos, yet the layouts provide more usable space that is not eaten up by stairways and hallways as in so many lowrise homes. In addition, standard features are now what used to be upgrades, so even homes that come with standards are more beautiful, as well as more efficient.

Another way to look at the relative benefits of buying new is that regardless of price, today’s GTA purchasers get the benefit of the latest in building techniques and materials as dictated by the ever-changing Ontario Building Code (OBC). This adds tremendous value to your new home purchase. Updated every few years, the OBC criteria for things such as energy-

saving features are more stringent than ever before. For example, in January of 2022, new building code requirements related to stair dimensions, guards and handrails came into effect.

The point is that even though it has become a cliche, everything is relative. If you are shopping for a new home or condominium suite, think about the big picture and all the benefits you get with today’s selection. Do your homework, compare fairly and shop wisely. Oh, and be thankful you don’t have to pay 22 per cent interest on your mortgage loan.

+MORE CONTENT ONLINE nexthome.ca

ADVICE | REAL ESTATE PRO

Barbara Lawlor is CEO of Baker Real Estate Inc. A member of the Baker team since 1993, she oversees the marketing and sales of new home and condominium developments in the GTA, Vancouver, Calgary and Montreal, and internationally in Shanghai. baker-re.com

BARBARA LAWLOR

Above Condo

14 condolife magazine | Dec. 3–31, 2022

GETTING READY TO BUY

IN 2023 WITH LOWER HOUSING PRICES

JESSE ABRAMS

As we reach the end of 2022, most Canadians have almost gotten used to the rising interest rate announcements. Yes, inflation is taking its toll on the rising cost of living, but if you’re a potential homebuyer, the current environment is showing some silver lining. Between August and September, home prices in Canada fell 3.1 per cent – marking the largest monthly decline since 1999. By the first quarter of 2023, some experts expect prices to dip close to 20 per cent. So, although rates are on the rise, housing prices across Canada are declining in the buyer’s favour – which means a buyers’ market is expected to be on the horizon for 2023.

SAVING FOR A DOWN PAYMENT JUST GOT A LITTLE EASIER

When it comes to buying a home, the heaviest lifting for many Canadians is coming up with a down payment. With the price of homes dropping monthly, along with many pundits expecting a further decline in the coming months, buyers today need less money to make a down payment.

Further, there are federal government programs and incentives available to help buyers save for a down payment. A good one in particular is the Home Buyer’s Plan, which allows you to withdraw up to $35,000 tax free from your Registered Retirement Savings Plan (RRSP) when you buy or build a home. If you’re buying a home with another person who’s eligible, the

two of you can both take advantage of this incentive and withdraw up to $70,000 tax free from your RRSPs. While you eventually have to pay that money back to your RRSP, it’s still a great way to increase your down payment without impacting your savings long term.

GET PRE-APPROVED AND LOCK IN A RATE

A mortgage pre-approval gives you a general understanding of what kind of mortgage you’ll be eligible for and the size of down payment you’ll need, helping you set realistic expectations for what you can afford. Not only does this simplify the homebuying process, but it also provides an overview of your buying power before you jump into the market.

When you apply for a mortgage pre-approval, the lender will offer you an interest rate that you can lock in for up to 120 days. Rates look like they may continue to increase, so doing this would be extremely useful in the current environment.

BE MINDFUL OF YOUR BUDGET

With conversations of a recession on the way and the cost of living inching higher, it’s important to ensure you’re not spending beyond your means –that goes for your home, too. Setting a clear budget, assessing your income and factoring in other daily household expenses is essential to ensure you can comfortably afford the home over the short and long term.

This is where the stress test becomes useful. CMHC introduced the mortgage stress test as a measure for lenders to determine a buyer’s home affordability, and their ability to remain stable in the face of unemployment or rising interest rates.

SHOP AROUND DIFFERENT LENDERS

Most Canadians still make the mistake of going directly to their bank for a mortgage without shopping around. It’s a really outdated and inefficient way to finance one of your biggest investments, and minimizes your chances of potentially saving thousands of dollars.

Outside of the banks, there are other lenders such as credit unions and monoline lenders that also offer strong mortgage products and features that may be more suitable to your needs. For instance, our team at Homewise has found that many firsttime buyers will break their mortgage before the end of their five-year term. What’s important to point out here is that some lenders will charge large penalties for doing this – but most buyers aren’t aware of this fee when signing their contract.

While rates and the cost of living are rising, some housing prices are declining and creating an entry opportunity for many buyers. So, if buying a home is a goal for 2023, it’s best to get prepared sooner rather than later.

The key to a successful mortgage and homebuying process is to be fully informed of your options and financially ready to make this milestone investment.

+MORE CONTENT ONLINE nexthome.ca

ADVICE | PERSONAL FINANCE

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm. thinkhomewise.com

nexthome.ca 15

5 THINGS YOU NEED TO KNOW ABOUT BUYING

A HOME

by WAYNE KARL

Buying a home at the best of times is serious business. But as we approach 2023, with the worst of COVID in our rearview mirror, we’re now dealing with higher interest rates, concerns about the economy, inflation, demographic trends… It’s all very serious stuff, and for some, perplexing and even intimidating. It’s a lot for homebuyers to consider.

Let’s take a look at five key factors you need to be aware of.

1. INTEREST RATES AND INFLATION

The Bank of Canada has increased its influential overnight rate target a number of times over the last year, in an effort to curb high inflation. It seems to be working, but the rate increases have imparted a sense of caution among many buyers, and therefore a cooling effect on homebuying activity.

Many experts believe BoC may introduce another rate hike in its next announcement on Dec. 7, but following that, say the second quarter of next year, we could see an end to this trend.

“At that point, I think you will see the Bank of Canada pause and evaluate the impact on the economy in the following months,” Ted Tsiakopoulos, economist, best-selling author and sought-after speaker, told Condo Life.

As rates begin to decline, and combined with the limited housing supply, we could see a correction to the price softening we’ve seen over the last year.

2. HOMES ARE A LITTLE CHEAPER – FOR NOW

The biggest challenge for many prospective homebuyers is saving

for a down payment. With some home prices experiencing downward pressure, buyers today need less money to make a down payment. With the minimum down payment for homes of less than $1 million being five per cent, a home that was $600,000 in February may cost $540,000 today. That five-per-cent down payment, previously $30,000, is now $27,000.

“So, although rates are rising, housing prices are steadily declining, which means saving for a down payment has become easier for potential buyers in the current market,” says Jesse Abrams, cofounder at Homewise, a mortgage advisory and brokerage firm.

Key message is – for now –we still face a well-documented shortage of new housing in the province that will take time to

COVER

STORY

16 condolife magazine | Dec. 3–31, 2022

address. And this leads us to our next point…

3. MORE HOMES BUILT FASTER

On Nov. 28, the More Homes Built Faster Act was given royal ascent, supporting the government’s efforts to tackle the housing supply crisis and get 1.5 million homes built over the next 10 years. Controversial though it may be, More Homes Built Faster is intended to remove unnecessary costs and cut through red tape and other bottlenecks that stand in the way of new homes being built.

Key actions in the plan include:

• Freezing and reducing government fees to support the construction of new homes and reduce the costs of housing, particularly affordable and not-for-profit housing, inclusionary zoning units and purpose-built rentals.

• Creating a new attainable housing program to drive the development of housing across all regions of Ontario.

• Protecting new-home buyers by increasing consumer protection measures, and consulting on ways to help more renters become homeowners.

The plan also supports the development of “gentle density,” which will create more rental housing while minimizing the impact on existing neighbourhoods. These changes will give most property owners the right to build up to three units on their land – including a basement apartment or a laneway home – without lengthy planning approvals or development charges.

More Homes Built Faster may not be perfect, and there may still be some opposition even though the bill has been approved, but these are actions we need to address the housing crisis in Ontario.

4. THINK LONG-TERM AND LOCAL

Looking at Royal LePage’s House Price Survey for the third quarter of 2022, home prices are being affected by current economic challenges. The

aggregate price of a home in Canada decreased 4.9 per cent in the third quarter, the second consecutive quarterly decline. However, prices increased 3.3 per cent year-overyear to $774,900.

Royal LePage is also forecasting that the aggregate price of a home in Canada will decline 0.5 per cent in the fourth quarter of 2022, compared to the same quarter last year.

But those are Canada-wide numbers, and when you’re buying a home, you’re not buying a national market. Real estate is local – hyper local, in fact.

The aggregate price of a home in the GTA decreased 5.9 per cent on a quarterly basis, according to Royal LePage – the second consecutive quarterly decline. But on a yearover-year basis, the price increased 2.1 per cent to $1.09 million, in the third quarter of 2022.

The median price of a singlefamily detached home decreased 0.6 per cent year-over-year to $1.34 million, following record-high price gains in 2021. Meanwhile, the median condo price increased 8.7 per cent year-over-year to $701,300.

And remember what we wrote about real estate being local, and looking at the long term? Aggregate home prices in Burlington, for example, are down 9.1 per cent for the third quarter, but up 5.4 per cent year-over-year. Hamilton, down 8.1 and up 4.5 per cent. Vaughan, down 5.2 per cent for the quarter, but up 6.5 year-over-year.

Royal LePage does expect home prices to level off through the remainder of this year, with aggregate prices decreasing 3.5 per cent in the fourth quarter, compared to the same quarter last year.

This all illustrates that real estate is not just about location, location, location. Especially during these times, it’s important to look at your local market over the long term And in this context, the GTA is well positioned.

And for what it’s worth, the Building Industry and Land

Development Association (BILD) is already noting a small increase in activity, with the GTA new home market seeing a slight pick-up in October.

5. HOUSING A PERMANENT ELECTION ISSUE

It may have been the case in some parts of Canada before, but our last round of federal, provincial and even municipal elections proves that housing is permanently on the agendas of our political leaders.

In the Oct. 24 municipal elections, for example. housing supply –specifically, the development approval processes of the province’s 400-plus municipalities – was under the microscope.

Why is this so important?

“Municipal approval timelines for new housing in the GTA are among the worst of major municipalities across Canada, and add significant costs to new home purchases,” according to a municipal benchmarking study conducted for BILD by Altus Group, a market-leading intelligence service provider to the global commercial real estate industry.

BILD estimates the average delay in approvals adds approximately $50,000 in cost to an 800-sq.-ft. condo, and $100,000 to the cost of a single-family home.

“All of us – voters, the industry, municipal governments, the provincial government and other regulatory authorities – must take collaborative action to boldly address housing supply and affordability,” says BILD President and CEO Dave Wilkes. “It’s the only way to fix the housing challenges in our region and our province, secure our economic competitiveness and address generational inequity brought about by our housing crisis.”

Municipal governments really matter when it comes to solving our housing supply issue, and to your bottom line.

And this is where More Homes Built Faster comes in, imperfect though it may be.

nexthome.ca 17

RECENT GOVERNMENT ACTIONS

SET TO BOOST HOUSING SUPPLY

DEBBIE COSIC

Supply and demand determine the economics of any industry. For new home construction, we have been in a serious demand-exceeds-supply situation for far too long, with the result of prices soaring.

If dealing with labour and materials shortages from the pandemic hasn’t been enough, rising development charges, and intricate red tape when it comes to approvals, are only fueling the problem. Unnecessarily complicated municipal approvals processes have stalled far too many new home and condo communities from going forward. Developers have been asking for many years for governments to streamline these requirements.

In the fall, the Ontario government took steps to help ease this issue. On Oct. 25, it was announced that zoning changes would be made in some instances to allow for up to three units to be built on residential lots without bylaw amendments and extra municipal approvals. The object is to open the door to more “missing middle” homes, such as those with basement apartments or in-law suites.

To enhance the action, there will be no development charges or parkland dedication levels for affordable housing, non-profit housing and inclusionary zoning units. In addition, the government announced reducing development charges on family-sized rental units by up to 25 per cent.

It’s all part of the tabled Bill 23, the More Homes, Built Faster Act – something most everyone in the industry applauds. Among the proposed steps the Ontario government is taking toward this goal are changes to conservation authorities, such as streamlining the 26 current groups into a single agency. For an undetermined time, conservation authority fees for development permits will be frozen.

Bill 23 is currently under review with possible amendments. According to the Bill, the Ontario Association of Architects reported that the cost of delays in site plan reviews was between $300 and $900 million yearly. Certainly, any improvements will be welcome by developers and potential homebuyers alike.

In October, the provincial government also raised the nonresident speculation tax on homes bought by foreign nationals from 20 to 25 per cent. The percentage of foreign buyers in Ontario is small (less than five per cent), but this tax increase may make more residences available to Canadian buyers and investors.

If the Conservative government hopes to achieve the goal of building 1.5 million new residences over the next decade, these and other steps will have to be acted upon and not simply announced. Time will tell. Hopefully, future steps will include setting aside more land for highrise development, or at least the approval of smaller lowrise lot sizes to increase density.

In addition to needing more than one million new residences, we need people to build them. There is good

news from the federal government, which is paving the way for more immigrants with much-needed skills such as construction experience to come here. The Federal Skilled Worker Program uses a points system to determine if applicants have the skills and experience to contribute to in-demand occupations – and construction is certainly in demand.

Canada’s population growth rate is the highest among the G7 nations, so demand for housing will continue for the foreseeable future. Increasing supply will help to make new homes and condos more attainable. Government must continue to work with private enterprise for the good of everyone.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

+MORE CONTENT ONLINE nexthome.ca

ADVICE | HOME REALTY

18 condolife magazine | Dec. 3–31, 2022

The Grand

WHY YOU SHOULD GET

A WILL AND POWER OF ATTORNEY

JAYSON SCHWARZ, LLM and GREGORY DUBECKY, JD

When it comes to Wills, while the numbers vary somewhat from survey to survey, one thing about the picture remains consistent: Fewer than half of Canadians have a Will, and even fewer than that have appointed Powers of Attorney. There is a number of reasons why this might be, but there seems to be a few mistakes people make when thinking they do not need a Will or POA.

and delay by having left a properly prepared Will. Most of all, being clear in your Will about how you want your assets divided can save disagreements within families. It is amazing how much trouble a dispute over a prized piece of jewelry can cause. The same can happen with other possessions, including pets.

Another increasingly important area is digital assets; there may be family photos online or privacy considerations that you wish to see addressed.

‘MY

BEST FRIENDS HAVE AGREED TO TAKE THE CHILDREN’

‘I

DON’T NEED A WILL UNLESS I’M OLDER’

In the province of Ontario, you can make a legal Will once you have reached the age of 18, provided you are of sound mind. Unfortunately, we are vulnerable at any age. Accidents, unforeseen health events or other bad things are not restricted to older people; they can happen when least expected.

In Ontario, all parents and legal guardians of a minor child should know that you have the power to name a guardian, should they be left without a surviving parent. What if the grandparents don’t want your friends raising the children? By appointing a guardian in your Will, you can avoid potential disputes.

Power of Attorney: One for Property and one for Personal Care. The appointment of a Power of Attorney is the ability to designate decision making authority to someone other than yourself, often in a situation where you lack the ability to handle your own affairs. You need a Power of Attorney early in life, from 16 years of age and older. It is important. For example, on a financial level, who will handle your tax filings or other obligations and affairs if you are alive but incapable of doing so for yourself? On a physical level, what if a decision needs to be made about life support? Who will be responsible for arranging care for you, and where you will live? What if a decision on a dangerous operation to save your life needs to be made?

Without a Power of Attorney, your loved ones may be left to pursue costly and time-consuming applications through the courts.

If you don’t have Will or a Power of Attorney, now is the time to act. Call or email a lawyer and take that important first step.

‘I

DON’T HAVE ENOUGH ASSETS TO NEED A WILL’

If you have a home, have savings or investments or cars, boats, motorcycles paintings or jewelry, you can have a significant financial impact on the lives of the people you care about, as well as potentially sparing them added costs, complexity

‘MY FAMILY KNOWS WHAT TO DO’ Maybe, but if you don’t have estate trustees (executors), there will be a lot of uncertainty, and it will dramatically slow the process of dealing with your estate – everything from organizing your estate to memorial services.

WHAT ABOUT POWERS OF ATTORNEY?

Why get one? What are they for?

These are common questions. In Ontario, there are two basic types of

Jayson Schwarz, LLM, is founding senior partner of Schwarz Law Partners LLP, and Gregory Dubecky, JD, is lead associate for wills and estates. schwarzla. ca, info@schwarzlaw.ca.

+MORE CONTENT ONLINE nexthome.ca

ADVICE | LEGALLY SPEAKING

nexthome.ca 19

For homebuyers with a wish-list for a walkable neighbourhood, easy access to transit and shopping – plus a beautiful home – Dunpar Homes’ Lambton Towns checks all of the boxes. The collection of 96 luxury back-to-back townhouses, located at 2650 St. Clair Ave. W., provides a rare opportunity to enjoy lowrise living in an up-and-coming neighbourhood. It’s also yet another example of Dunpar continuing its tradition of bringing thoughtfully designed and well-constructed residences to vibrant communities.

BUILDER PROFILE LAMBTON TOWNS DUNPAR OFFERS RARE LOWRISE LIVING IN VIBRANT ST. CLAIR AVENUE WEST 20 condolife magazine | Dec. 3–31, 2022

As a more affordable option to downtown, many millennials and families are choosing the St. Clair West midtown neighbourhood. The area is undergoing a massive revitalization with many new condo towers. Lambton Towns offers an alternative to highrise living in this pedestrian-friendly neighbourhood rich in amenities and close to transit. The 512 St. Clair streetcar stop is just a six-minute walk away, and other nearby transit options include the Old Mill subway station, TTC buses to downtown, GO Transit and the UP (Union Pearson Express) from Bloor Station. Hwys. 401 and 427 and the Gardiner Expressway are a short drive away. The location is convenient to downtown Toronto, as well as to North York and Mississauga.

Lambton Towns residents will be able to walk to numerous stores, restaurants and services. St. Clair West’s existing retail scene has been enhanced with new boutique shops, specialty grocery markets, salons, fitness studios and gyms, restaurants and cafes as the revitalization continues. Residents will enjoy proximity to major chain stores, such as Loblaws, Shoppers Drug Mart, LCBO and Walmart. There are elementary and secondary schools, as well as childcare centres and recreation facilities for families.

It’s easy to connect with nature, with an abundance of parks and proximity to the Humber River Recreational Trail. Smythe Park is a 15.3-hectare park with biking and walking trails, three ball diamonds, outdoor pool, splash pad and children’s playground. Marie Baldwin Park offers community gardens, summer camps and learning events and it’s adjacent to a leash-free dog park. The Humber River Recreational Trail is a favourite among locals for its walking and biking options. It follows the river and is dotted with benches, small waterfalls and fountains, and provides connection to the Lake

Ontario Waterfront Trail. Malta Park is a small park with beautiful trees that’s a nice place to have a picnic, and James Gardens, a former estate on the Humber River, is renowned for its gardens, stone pathways, spring-fed ponds, streams and mature trees. It’s where people can lawn bowl, cross country ski or enjoy views of downtown Toronto from a scenic lookout.

When they aren’t out and about in the neighbourhood, Lambton Towns residents can relax at home in residences with quality construction and functional floorplans. Dunpar is as discriminating about the design and quality of its homes as it is about the neighbourhoods it chooses to build in. Exteriors are modeled on English Georgian Manors, utilizing genuine Custom Natural Indiana Limestone features and planter boxes

crafted with ledger rock Kingston Hue Stone.

Interiors feature open-concept main-floor layouts at a generous 1,569 sq. ft., with three bedrooms, two baths, a single car parking and rooftop decks.

For more than 40 years, Dunpar Homes has been building superbly designed and architecturally unique homes and communities across the GTA. The company has established a reputation as a premier builder specializing in luxury townhomes. It has demonstrated its ability to adapt to the evolving industry by offering homebuyers comprehensive virtual tools to help them achieve their ownership goals.

For more information or to register for Lambton Towns, visit dunparhomes.com.

nexthome.ca 21

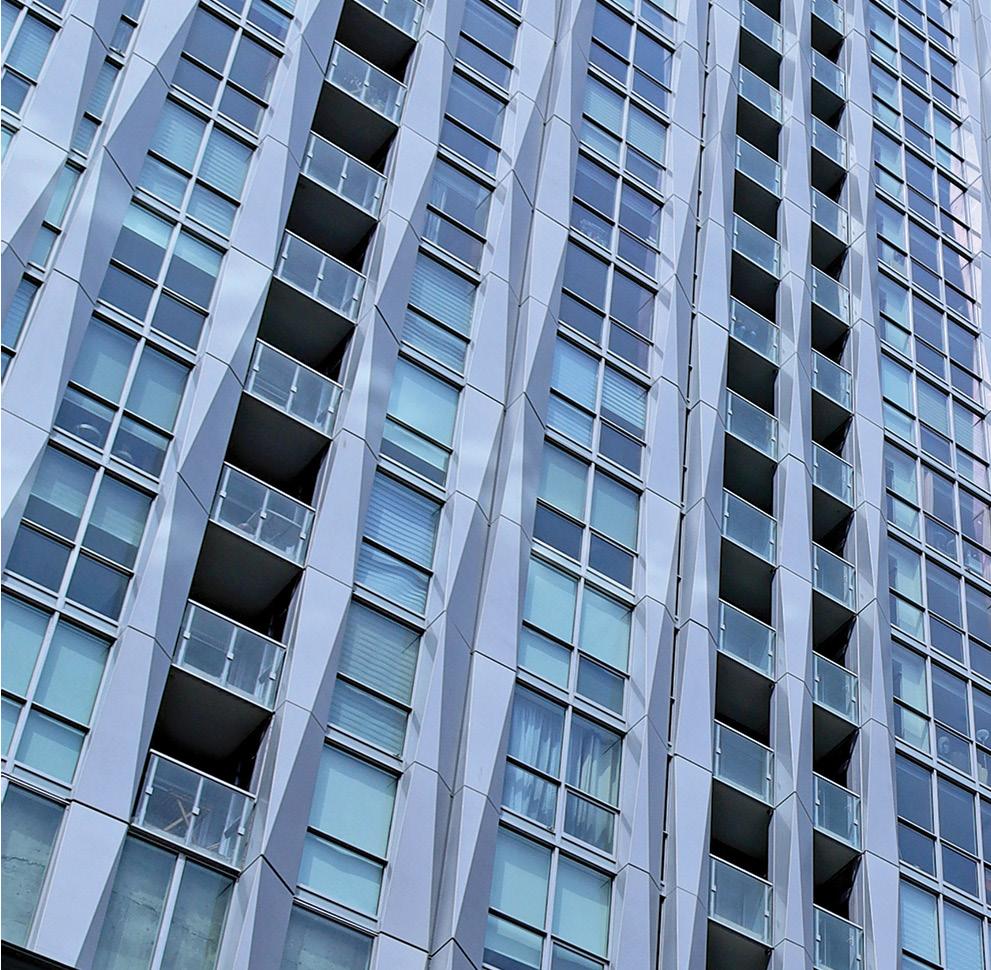

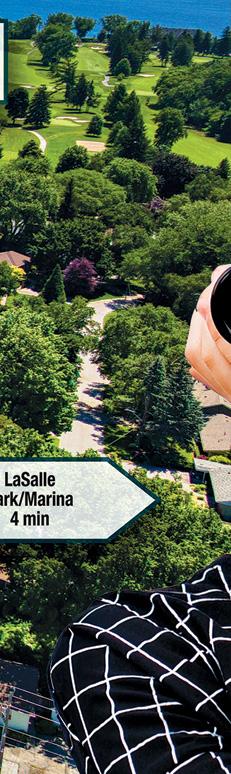

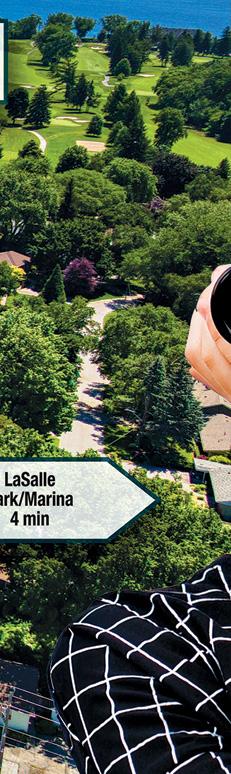

NORTHSHORE

You know where you’re headed, and this is the perfect place to land. Sophisticated modern urban design is coming to Plains Road in Burlington. This is NORTHSHORE, where LaSalle meets the Harbour, overlooking the rolling fairways of Burlington Golf and Country Club.

National Developments is about to introduce two boutique midrise condominiums offering 387 stylishly designed suites. NORTHSHORE

Condominiums will offer just the right blend of amenities, from rooftop patios and lounges to fitness rooms and balconies with stunning views of the golf course.

The stylish, spacious suites will be available from one-bedroom to two-bedroom plus den with refined features and sophisticated finishes. This is modern design at its best, brought to you by National Homes, an award-winning builder with a 30-

year history of satisfied homebuyers. It’s exactly what you’re looking for, in the address you want to call home. Is there a more desirable setting in all of Burlington than the North Shore? This is where LaSalle meets the Harbour at the stunning estate homes along North Shore Boulevard. It’s where streams and woodlands wind their way down to the Lake through the rolling fairways of Burlington Golf and Country Club,

BUILDER PROFILE | BURLINGTON

CONDOMINIUMS NATIONAL HOMES BRINGS MODERN URBAN SOPHISTICATION TO BURLINGTON 22 condolife magazine | Dec. 3–31, 2022

and, above it all, Plains Road pulses with lively local energy. The North Shore is the perfect blend of nature and neighbourhood.

When you live at NORTHSHORE, you know you’ve arrived. Everything is just a stroll away, from local shops and restaurants, to practical amenities such as pharmacies and grocery stores. The golf course is outside your window and the lake is a stone’s throw away. Kids can walk to school. You’re minutes away from downtown Burlington, Burlington Beach, the Burlington Trail, Brant Hospital, Mapleview Mall and La Salle Park and Marina. When you have places to go, you can be on the GO train, QEW and Hwys. 403 or 407 in minutes.

Hamilton is right across the Harbour with its exciting new sense of energy, art and style. Explore restaurants and art galleries. Take a course at McMaster University and cheer for the hometown Hamilton Tiger Cats football team. You’re minutes from the Royal Botanical Gardens and a thousand breathtaking waterfalls in Hamilton, the waterfall capital of the world. When you live

on Burlington’s North Shore, it’s all right at your fingertips, from glorious views on top of the Escarpment to wine country just a few minutes down the QEW.

If the NORTHSHORE sounds like the place you’d like to land, register now at mynorthshore.ca.

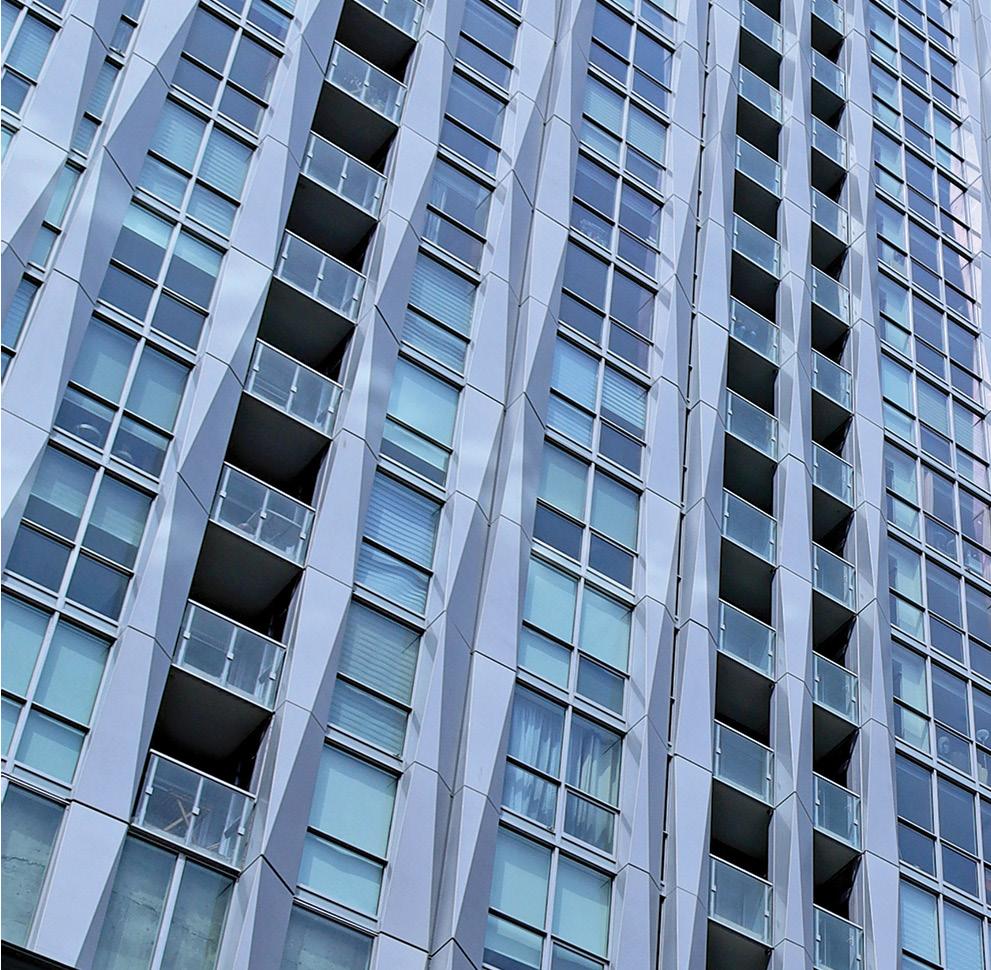

DUO CONDOS BREAKS GROUND IN THE HEART OF BRAMPTON

This stunning new two-tower, 26-storey condominium development is now under construction on Steeles Avenue West near Hurontario Street. The 2.6-acre transit-oriented community, situated at the corner

of Steeles Avenue and Malta Avenue, just west of Hurontario, will consist of more than 800 units connected by an outdoor Euro-inspired piazza and courtyard.

DUO is revolutionizing this remarkable connected neighbourhood. Sheridan College is close by, and the Brampton Gateway Terminal and the new Hazel McCallion LRT Station are only minutes away from DUO and slated for completion in 2024. The LRT will connect residents to Mississauga with 19 stops on the way to the Port Credit GO Station

Parks and schools are within touching distance, and shopping, restaurants, and lush golf course are close by to enrich your life. DUO is desirable, dazzling, distinguished and rising now in Brampton. The first release sold out quickly. Your opportunity still awaits. A new release is coming soon.

Register now at duocondos.ca

MISSISSAUGA – WHITEHORN WOODS, TOWNHOMES ON BRITANNIA WEST

The first release of National’s Whitehorn Woods sold out, but the good news is that a new release is coming soon to Mississauga near the Credit Valley. In this rare infill enclave, National Homes is offering remarkably refined townhomes steps from woodland trails and the river valley. Stylish details, elegant design and a setting next to nature where Britannia meets the river. Minutes from Heartland Centre shopping.

Register now at nationalhomes.com.

DUO Condos, Brampton. By National Developments and Brixen Developments Inc.

DUO Condos groundbreaking. Left to right: Councillor Martin Medeiros (City of Brampton), Deena Pantalone, Jason Pantalone, Matthew Pantalone, Alexander D’Orazio, Andrew Iacobelli.

nexthome.ca 23

CONDO PROFILES

Bristol Place Brampton

NorthShore Burlington

developer: SOLMAR DEVELOPMENT CORP.

style: Highrise size: Starting from 432 sq. ft. features:

• Two 48 storey towers on a podium within a landscaped courtyard

• 1 bed, 1 bed + den, 2 bed, 3 bed

• Steps to Go, VIA Rail, and ZUM rapid transit

• Surrounded by shopping, dining, arts and culture

• Party room, gym, yoga, lounge, outdoor BBQ & dining area, work stations and more contact: solmar.ca location: 199 Main St N, Brampton, ON L6X 1N2

Branthaven

Mississauga

developer: NATIONAL DEVELOPMENTS

style: Mid-Rise size: 8 Storeys, 387 Units features: • 1 bed, 1 bed + den, 2 bed, 2 bed + den, 3 bed

• Lobby, Gym, Co-Working Space, Party Room, Private Dining Room with Catering Kitchen

• Rooftop with BBQs & Party Lounge Area

• Coming soon to Burlington register at: MyNorthShore.ca location: 490 Plains Rd E near Plains Rd. & King Rd., Burlington

Central Park North York

project name: Birch Condos & Towns at Lakeview Village style: Highrise Condos and Towns features: 298 Condos & 59 Towns prices from: TBD features:

• Part of Mississauga’s most anticipated master planned waterfront community, Lakeview Village.

• Waterfront trails, beaches, parks, schools and shops

• Fully furnished indoor and outdoor amenities designed by II BY IV DESIGN

• Rooftop terrace, fitness facility, dining/social lounge, media/games lounge and pet spa

• BH Home TechnologyTM , a Smart Home solution providing integrated building/home access and control system

• 1-3 bedroom condo units

• Located between Port Credit and Long Branch Go Stations contact: Branthaven.com location: Hydro Road, Mississauga

developer: AMEXON DEVELOPMENT CORPORATION

style: Highrise – 12-acre, master-planned community size: 436 - 1,200 sq. ft. prices from: from the $700,000s features: • 1 Bed, 1 Bed+Den, 2 Bed, 2 Bed+Den, 3 Bed+Den

Spacious layouts, terraces/balconies

Located in the Bayview Village neighbourhood

Leslie subway station and GO Transit at your door

Direct access to the East Don Parkland ravine

Central Park Common a three-acre urban park offering year-round, outdoor event programming

55,000 sq. ft. of resort-style amenities including coworking space, skating rink, indoor and outdoor saltwater pools, privately operated childrens’ daycare, EV charging stations in all parking areas contact: centralparktoronto.com • (416) 252-3000 location: 1200 Sheppard Avenue East

•

•

•

•

•

•

M O DERN C ON D O S C OM I N G S O O N T O B U RLI N G T O N

developer: BRANTHAVEN

24 condolife magazine | Dec. 3–31, 2022

CONDO PROFILES

developer: TRIDEL style: Midrise size: 1200 – 1500 sq. ft. prices from: $1,675,000 features: • Immediate Occupancy • South Facing Views • Private outdoor spaces • Convenient location • Lifestyle Amenities – Rooftop Pool, Fitness Centre, Party Room, Smart Home technologies contact: Tridel.com location: Dupont and Howland Order in! Receive your favourite magazines to your inbox. HOMES, Condo Life, Active Life Reno + Decor The ‘best of the best’ coverage in the categories of new home; new condo; adult lifestyle; design, decor and renovation. To get the latest real estate news, renovation ideas, deals and o ers, sign up to our e-newsletters! THE BEST COLLECTION OF NEW 4 SEASON HOMES in the Georgian Bay area INSIDE condo in Vaughan launching soon LIVING IN THOROLD! Fabulous INSIDE STREAMLINE YOUR HOME NOW! 5 TIPS living tru ABOUT RENOS IDEAS SUSTAINABLE To get started visit: nexthome.ca/newsletter Retail Value $249.99 Enter our Clean Like a Pro Contest! www.blackanddecker.ca | @blackanddeckerca For full contest details & rules visit the link above. YOU COULD WIN A BLACK+DECKER™ POWERSERIES™ EXTREME™ PET CORDLESS STICK VACUUM CLEANER TM • Go to renoanddecor.com/contests • Select this contest within the listing and click Enter to Win. Enter Online

Bianca Toronto

HOT PROPERTIES | GREATER TORONTO AREA 1 2 8 9 65 24 25 54 54 56 57 26 27 28 29 30 31 32 33 34 35 36 39 38 40 43 44 45 45 47 53 18 15 17 62 58 59 50 41 42 11 14 4 5 6 19 48 46 51 52 49 7 63 64 16 60 12 26 condolife magazine | Dec. 3–31, 2022

CARTOGRAPHY: MARKETMAPS.COM Match the map numbers with property listings on the following Hot Properties page MAPS 10 22 21 23 37 61 13 20 nexthome.ca 27

Etobicoke Mirabella HR 1926 Lake Shore Blvd. W. mirabellacondos.ca

Etobicoke Westerly HR Islington & Dundas tridel.com

Etobicoke Curio Condos MR 801 The Queensway marlinspring.com

Etobicoke Humberwood Heights CTH/FTH 50 Humberwood Blvd. tributecommunities.com

Etobicoke Cypress at Pinnacle Etobicoke HR 5475 Dundas St. W. pinnacleinternational.ca

Etobicoke Verge MR Islington & The Queensway vergecondos.com

Etobicoke 36 Zorra Condominiums MR 36 Zorra altreedevelopments.com 8.

Markham/Unionville Panda Markham HR 8200 Warden Ave. lifetimedevelopments.com 9.

Markham/Unionville Varley Condo Residences LR 20 Fred Varley tributecommunities.com 10.

Markham Canvas on the Rouge MR Donald Cousens Pkwy & Ninth Line flatogroup.com 11. Markham Gallery Towers at Downtown Markahm HR 162 Enterprise Blvd. downtownmarkham.ca 12. Mississauga Harbourwalk at Lakeview HR 1260 Lakeshore Rd. East tridel.com 13. Mississauga Perla Towers and Amber at Pinnacle Uptown HR 5044 Hurontario St. pinnacleinternational.ca 14. Mississauga Oro, at Edge Towers HR 24 Elm Dr.W. solmar.ca 15. Mississauga Artform Condos MR 86 Dundas St. E. artformbyemblemdevelopments.com 16. Mississauga Gemma at Pinnacle Uptown HR 5044 Hurontario St. pinnacleuptown.com 17. North York Express 2 MR Tippett Rd./Wilson subway express2condos.ca 18. North York Central Park HR Sheppard Ave. East & Leslie St. amexon.com 19. North York The Diamond HR 5336 Yonge St. diamond.diamantedevelopment.com 20. Oshawa U.C. Condos Tower 3 HR Simcoe St. N. & Winchester Rd. W. tributecommunities.com 21. Pickering Vupoint HR Kingston Rd. & Liverpool Rd. tributecommunities.com 22. Scarborough Pinnnacle Toronto East HR 3260 Sheppard Ave. E. pinnacleinternational.ca 23. Scarborough FourMe HR Markham Rd. & Ellesmere fourmecondos.com 24. Toronto 111 River St. Condos HR 111 River St. lifetimedevelopments.com 25. Toronto Lawrence Hill Urban Towns CTH Don Mills & Lawrence lawrencehillurbantowns.com 26. Toronto 489 Wellington St. W. HR 489 Wellington St. W. lifetimedevelopments.com 27. Toronto 500 Dupont St. MR 500 Dupont St. lifetimedevelopments.com 28. Toronto Aqualuna at Bayside HR 200 Queens Quay East tridel.com 29. Toronto Artistry Condos HR 292 Dundas St. W. tributeartistrycondos.ca 30. Toronto Panda Condos HR Yonge & Dundas. lifetimedevelopments.com 31. Toronto Skytower at Pinnacle One Yonge HR 1 Yonge St. pinnacleinternational.ca 32. Toronto The Prestige at Pinnacle One Yonge HR 1 Yonge St. pinnacleinternational.ca 33. Toronto Tridel at the Well MR/HR Spadina Ave. & Wellington St. thewelltoronto.com 34. Toronto Via Bloor HR Bloor & Parliament. tridel.com 35. Toronto The PJ Condos HR 283 Adelaide St. W. pinnacleinternational.ca 36. Toronto 36 Eglinton Ave. W. HR 36 Eglinton Ave. W. lifetimedevelopments.com 37. Toronto Linx Condominiums HR Danforth & Main tributecommunicties.com 38. Toronto Y&S Condos HR 2161 Yonge St. tributecommunities.com 39. Toronto Burke Condos HR Bloor & Sherbourne burkebyconcert.com 40. Toronto MRKT Alexandra Park MR HR Dundas & Spadina tridel.com 41. Toronto 181 East HR 181 Sheppard Ave. East stafford.ca 42. Toronto Avenue & Park MR Avenue Rd. & Bedford stafford.ca 43. Toronto 50 at Wellesley Station HR 50 Wellesley St. East pureplaza.com 44. Toronto No. 1 Yorkville HR 1 Yorkville Ave. pureplaza.com 45. Toronto Theatre District Residences HR Adelaide & Widmer pureplaza.com 46. Toronto Bijou on Bloor MR 2450 Bloor St. West pureplaza.com

W. at Bathurst oscarresidences.com

Locate properties using the map on the previous page

BUILDERS IF YOU WOULD LIKE TO INCLUDE YOUR PREVIEW REGISTRATION, NEW RELEASE OR SITE OPENING IN THIS FEATURE, JUST EMAIL THE DETAILS TO EDITORIAL@NEXTHOME.CA

HOT

PROPERTIES

+

MAPS

1.

2.

3.

4.

5.

6.

7.

53. Toronto Liberty Market Tower HR 171 East Liberty St. lifetimedevelopments.com 54. Toronto XO Condos MR King & Dufferin lifetimedevelopments.com 55. Toronto The Georgian MR Gerrard & Parliament

56. Toronto The Dupont MR Dupont & Ossington

57. Toronto Bianca Condos MR 420 Dupont St

58. Toronto 225 Jarvis Street Condos HR Dundas St. East & Jarvis

59. Toronto LeftBank HR River St. & Dundas St. East

60. Toronto The Residences of Central Park HR Sheppard Ave. East & Leslie centralparktoronto.com 61. Toronto The Dawes at Main Street HR Danforth & Main St. thedawes.com 62. Toronto Queen Church Condos HR 60 Queen St. East. queenchurch.com 63. Vaughan Park Avenue Place 1 & 2 HR Jane St. & Rutherford Rd. solmar.ca 64. Vaughan The Vincent MR Jane St. & Hwy. 7 thevincent.ca 65. Vaughan The Rose Hill Condos MR 177 Woodbridge Ave. truecondos.com/capital-north-communities 66. Vaughan SXSW Condos HR Islington & Steeles primonthomes.com The latest properties in the Greater Toronto Area to keep your eye on FIND YOUR NEXT HOME MAP LOCATION SITE TYPE ADDRESS CONTACT Legend: HR = High Rise CTH = City Home MR = Mid Rise LO = Loft LR = Low Rise LW= Live Work PH = Penthouse RH = Row Home TH = Townhouse 28 condolife magazine | Dec. 3–31, 2022

47. Toronto The Briar on Avenue CTH 368 Briar Hill Ave. pureplaza.com 48. Toronto One Seventy HR Spadina & Queen St. West pureplaza.com 49. Toronto King West & Charlotte HR King St. West & Charlotte pureplaza.com 50. Toronto Forest Hill Private Residences MR 2 Forest Hill Rd. foresthillresidences.com 51. Toronto Oscar Residences MR 500 Dupont St.

52. Toronto Whitehaus HR Yonge & Eglinton lifetimedevelopments.com

stafford.ca

tridel.com

tridel.com

amexon.com

broccolini.com

HOT PROPERTIES | OUT OF TOWN The latest properties in the Out of Town Area to keep your eye on FIND YOUR NEXT HOME CARTOGRAPHY: MARKETMAPS.COM N w A V N W W W G A H M W d D W C W R b n D w D d A D W M d W A g D S M d MQuayB vd mcoe S S Onta o Stevenson Rd N La k e Drwy W G bbon S Som v l e S t PhllipMurr yA e Wilmot Tr A holSt E QueenS Th c on Rd R o g S D v d S t Wali s D Q u enSt Mai n S HarwoodAve N Manvers/ s u gog Townl ne Rd NMonaghanPky V u am Rd N ScugogLine2 Coat sRdW Chand erDr B ck Rd Mas odRd PalestineRd LindenV l yRd Ram eyRd RamseyRd K l arney B a y Rd R erRd Ba yduffRd H awa h a Line L ndsa y S t S Scugog S t A n geline S t S ConcessionStE King St E ConcessionRoad8 Verulam Rd S WoodvilleRd ConlinRdE ThunderBridgeRd Edgerton Rd Sun g HarbourRd Holt Rd Bethesd a Rd Marsh Rd Hami on Rd 7thLine k ColumbusRdW Howden RdE CottageRd Solanum Way MtPleasantRd OakHill Rd BethelGroveRd PaudashSt StewartLine LarmerLine EnnisRd T araRd Tara Rd BaseLine CavanRd H o t Rd Fleetwood Rd LiffordRd TelecomRd PeaceRd MeadowviewRd 8thLine 7thLine Sherbrooke St LansdowneStW ParkhillRdW Park S t N Olive Ave AdelaideAve E Ri tson Rd S Ar m o u R d ChemongRd A n derson S t Wi l son Rd N Garden S t on Rd Garrard Rd ConcessionRoad 6 Peterborough Byps Count r yL n Dundas St E R a nevscrof t Rd Brock S t S GibbSt Young s PointRd HilliardSt A n geline S t N Baldwi n S N Brock S t N ConcessionRoad 7 Mai n S t C oncession Road 4 Sal e m Rd ColborneSt W Baseline Rd Trul l s Rd OldScugogRd h Townline Rd N W aver y R d Robinson Rd Fif e s B a y Rd Ashburnh am D r TransCanada Hwy Victoria St W Courtice Rd Frank Hill Rd Bensfort Rd KingSt Concession Road 10 Joh n S t Mill St S Concession Road 1 Matchett Line Television Rd Long Beach R d Golf Course Rd C e n lert ne Rd 6thLine Ontari o S t KingSt McGill Dr ConcessionRoad3 Ward St La k e e ld Rd ncession 4 brock CraggRd MyrtleRdW M a pl e Grove Rd Janetvi l l e R d Cedar G l en Rd Emi l y Park Rd T a pl e y Quarter L i ne dEenberryLine Concession Road 5 VimyRidgeRd Old NorwoodRd TelephoneRd oncession 3 brock TownLine Rd BrawleyRdW MacDonald cartier Fwy Trans Canad a Hwy Trans Canada Hwy S i mcoe S S i m c o e S S i mcoe S t S i mcoe S t S icm o e St N GanaraskaRd King St E R tson Rd N Taunton Rd Laker d ge Rd ge Rd Thornton Rd N L bert y S t N Pigeon LakeRd Elm Tree Rd E l m Tree Rd DaleRd DaleRd Lakeshore Rd E l don Rd Eldon Rd Little Britain Rd Hei gh t s Rd Hei gh t s Rd O l d S i mco e R d Harmony Rd N Old ScugogRd OakRidgesDr Nash Rd YankeeLine B ru n ham S t N WallacePointRd CambrayRd Sturgeon Rd GlenarmRd Salem Rd Ashb urn Rd 5th Line dnals R d BloorSt Ski H i l l Rd Porter Rd 4thLine Buckhorn Rd White Rock Rd BoundaryRd Mt Horeb Rd 7thLine Drummond Line LornevilleRd S e wy n Rd Peniel Rd O pmar Rd Post Rd Division Rd Keene Rd 401 115 35 35 7 7 7 7 7A 7A 12 2 2 2 35 36 28 28 46 7 7 7 Dunsford Pontypool Newcastle Sunderland Nestleton Station Ennismore Courtice Blackstock Bethany Hiawatha First Nation 36 Seagrave Janetville Bailieboro Cannington Mississauga's Of Scugog Island Lakefield Douro-Dummer Ashburn Newtonville Lindsay Omemee Fraserville Cavan-Millbrook-North Monaghan Brooklin Kendal Douro Bridgenorth Curve Lake Curve Lake First Nation 35 Cavan Caesarea Cameron Gores Landing Woodville Millbrook Port Perry Sturgeon Point Cambray Hampton Campbellcroft Manilla Reaboro Youngs Point Bewdley Bowmanville Greenwood Haydon Orono Oakwood Little Britain Greenbank Hamilton Twp Smith-Ennismore-Lakefield Port Hope Scugog Brock Peterborough Ajax Clarington Kawartha Lakes Oshawa Whitby nexthome.ca 29

HOT PROPERTIES | SOUTHWESTERN ONTARIO AREA 11

KITCHENER–WATERLOO

LONDON 1 14 5 7 15 4 12 13 11 8 30 condolife magazine | Dec. 3–31, 2022

Hamilton Milton Guelph Waterloo Kitchener Cambridge Brantford

London

CARTOGRAPHY: MARKETMAPS.COM

Welland St

Burlington Oakville

6 17 18 19 20 10 9 21 16 22 23 24 Match the map numbers with property listings on the following Hot Properties page MAPS 2 3 nexthome.ca 31

Niagara Falls

Catharines

Mississauga

1. Ancaster Meadowlands MR/CTH 559 Garner Rd E elitemdgroup.com 2. Brampton DUO Condos HR Malta Ave. & Steeles Ave. duocondos.ca 3. Brampton Bristol Place HR 199 Main St. North solmar.ca 4. Brantford Station Sixty Lofts MR 60 Market St. S. elitemdgroup.com 5. Burlington Affinity Condos MR Plains Rd. E. & Filmandale Rd. rosehavenhomes.com 6. Burlington Millcroft Towns CTH Appleby Line & Taywood Dr. branthavenmillcroft.com 7. Burlington North Shore MR/TH Plains Rd. East nationalhomes.com 8. Burlington NorthShore MR North Shore Blvd. & Plains Rd. mynorthshore.ca 9. Fonthill One Twenty Condos LR Rice Rd. & Highway 20 mountainview.com 10. Fonthill One Fonthill Condominium Collection MR Rice Rd onefonthillcondos.com 11. Grimsby Century Condos HR Main St. East & Baker St. South. desantishomes.com 12. Hamilton 1 Jarvis HR 1 Jarvis 1jarvis.com 13. Hamilton The Design District HR 41 Wilson Street emblemdevcorp.com 14. Hamilton Steeltown City Co. MR/CTH Fennell Ave. E. & Upper Ottawa St. elitemdgroup.com 15. London White Oaks Urban Towns CTH London elitemdgroup.com 16. Niagara Region Lusso Urban Towns CTH Martindale Rd. & Grapeview Dr. lucchettahomes.com 17. Oakville The Greenwich Condos at Oakvillage MR Trafalgar Rd. & Dundas branthaven.com 18. Oakville Synergy MR McCraney St. E. & Sixth Line branthaven.com 19. Oakville The Randall Residences MR Randall St. & Lakeshore Rd. E. randallresidences.com 20. Oakville Upper West Side at Oakvillage MR 351 Dundas St. E. upperwestsidecondos.ca 21. Oakville Greenwich Condos at Oakvilage HR Trafalgar Rd. & Dundas St. branthaven.com 22. St. Catharines 88 James HR 88 James elitemdgroup.com 23. Stoney Creek Casa Di Torre MR 980 Queenston Rd. branthaven.com

HOT

PROPERTIES

The latest

your

on FIND YOUR NEXT HOME MAP

TYPE

CONTACT Legend: HR = High Rise CTH = City Home MR = Mid Rise LO = Loft LR = Low Rise LW= Live Work PH = Penthouse RH = Row Home TH = Townhouse Locate properties using the map on the previous page MAPS

+ 32 condolife magazine | Dec. 3–31, 2022

properties in the Southwestern Ontario Area to keep

eye

LOCATION SITE

ADDRESS

BUILDERS IF YOU WOULD LIKE TO INCLUDE YOUR PREVIEW REGISTRATION, NEW RELEASE OR SITE OPENING IN THIS FEATURE, JUST EMAIL THE DETAILS TO EDITORIAL@NEXTHOME.CA

Enter our Sign-Up to Win Contest! BLACK+DECKER™ 20V MAX* LITHIUM ION DRILL/ DRIVER + 68 PIECE PROJECT KIT ™ www.blackanddecker.ca | @blackanddeckerca BLACK+DECKER™ Prize Value: $149.99 • Go to renoanddecor.com/contests or scan the QR • Select this contest within the listing and click Enter to Win. For full contest details & rules visit the link above. Enter Online ADVERTISER INDEX — Find ads easily inside this edition Bianca – Tridel 25 Birch – Branthaven 4, 5, 24 Black & Decker 25, 33 Brand Factory 12 Bristol Place – Solmar 3, 24 Canadian Appliance Source 35 Central Park – Amexon 24, 36 Harbourwalk– Tridel 9 High Line Condos – Branthaven 4, 5 North Shore – National Homes 2, 24 Partnership 11 West & Post – Branthaven 4, 5 BUILDERS Amexon 24, 36 Branthaven 4, 5, 24 National Homes 2, 24 Solmar 3, 24 Tridel 9, 25 nexthome.ca 33

BILL 23 IS THE BIG, BOLD HOUSING PLAN

THAT ONTARIO NEEDS

DAVE WILKES

DAVE WILKES

Chances are, you have recently come across advertisements by the Building Industry and Land Development Association in support of Bill 23, the More Homes Built Faster Act We have been very vocal about our support for this bold, innovative plan recently introduced by the provincial government because we know it will help Ontario and the GTA overcome a critical lack of housing supply and reduce the cost of housing.

Currently, it simply takes too long to get building approvals and it is too difficult to add gentle density. On top of that, new-home buyers are unfairly burdened with escalating government fees and charges. Bill 23 addresses all of these challenges.

Most importantly, Bill 23 will enable the building of more housing, more quickly, by introducing a culture change that is needed across Ontario, but most especially in many municipalities in the GTA. In conjunction with Bill 109, the More Homes for Everyone Act, 2022, Bill 23 signals to municipalities that they must approve new housing in a timely manner, as required by provincial legislation.

It also encourages parties such as conservation authorities to focus on their own core priorities. It rejects the attitude of “not in my backyard” that preserves the status quo and hinders the addition of new homes.

The new housing plan also makes it easier to add the density needed in our cities. This is currently very

difficult and expensive due to outdated and restrictive zoning. Bill 23 offers new provisions for adding gentle density across existing neighbourhoods and greatly increased density around major transit areas. These measures are the very definition of anti-sprawl, and they enable the highest and best use of land.

Finally, Bill 23 addresses the significant government charges collected on new homes and passed on to consumers. On average, 25 per cent of the cost of a new home in the GTA consists of government fees, taxes and charges. This can add as much as $250,000 to the cost of a typical single-family home and more than half of that is added by municipalities. Municipal fees and charges have been escalating significantly, with development charges increasing between 250 and 800 per cent since the early 2000s. Municipalities in the GTA have more than $5 billion in reserves from development charges, as well as parkland cash-

in-lieu and section 37 payments collected on new homes. Bill 23 adds predictability on government charges, defines what should and should not be paid for by development charges, and limits future increases.

For too long, we have endured a housing supply and affordability crisis in Ontario, centred on the GTA. Bill 23, together with previous legislation, provides the solutions we need to build more homes, reduce the cost of housing and create a brighter future for everyone who lives here.

Dave Wilkes is President and CEO of the Building Industry and Land Development Association (BILD), the voice of the homebuilding, land development and professional renovation industry in the GTA. For the latest industry news and new home data, follow BILD on Twitter, @bildgta or visit bildgta.ca.

+MORE CONTENT ONLINE nexthome.ca

ADVICE | INDUSTRY REPORT

34 condolife magazine | Dec. 3–31, 2022

Shop Our Website Scan Me canadianappliance.ca Whether your style is minimalist or modern LG has innovative intuitive and resource-saving appliances built around the way you live. Shop LG at the Canadian Appliance Source near you. 37 locations nationwide to choose from. We’re open 7 days a week and available 24/7 on our website. Call us now! At 1-877-374-3439 to chat with one of our sales professionals. Shop Our Website Scan Me canadianappliance.ca

DAVE WILKES

DAVE WILKES