EDITORIAL:

INJI SHABRAWISHI - Events & Marketing Manager

EGYPTIAN-BRITISH CHAMBER OF COMMERCE

TELEPHONE: +44(0)20 7499 3100

WEBSITE: theebcc.com

WEBSITE: theebcclibrary.com

GRAPHICS DEPT.

STUART TURNBULL - Studio Manager

RACHEL RILEY - Designer

PUBLISHED BY:

WPL CONTRACT PUBLISHING

46 HENEAGE ROAD, GRIMSBY

NORTH EAST LINCOLNSHIRE

DN32 9ES

TELEPHONE: 01472 359036

E-MAIL: contact@wplcontractpublishing.com

WEBSITE: waltonspublications.com/home/ wpl-contract-publishing/

TWITTER: FACEBOOK: @EgyptChamberUK /EGYBRITCHAMBER

All rights reserved. No part of the EBCC Trade Report magazine may be reproduced or stored in a retrieval system or transmitted in any form, electronic, mechanical or photocopying, without prior written permission of the publishers.

The publishers do not accept responsibility for views expressed, or statements made, or in those reproduced from any other source. No responsibility is borne by the publishers for any errors made in any advertisement, or for claims made by any advertiser which are incorrect. The publishers cannot be held responsible for any breach of copyright arising from any material supplied. This includes copy, design and/or images.

02 FOREWORD – A MESSAGE FROM IAN GRAY, OBE, CHAIRMAN 03 DETERMINING THE SHAPE AND PACE OF ENERGY MARKET 04 BEBA/EBCC NOVEMBER BUSINESS FORUM 08 EGYPT IS FACING A FOREIGN-EXCHANGE CRUNCH 12 HSBC OPPORTUNITY EGYPTTHE ROAD TO GREEN ECONOMY 16 FIDO SIGNING AN MOU WITH VODAFONE AT COP27 18 CARGO X, NAFEZA & ACI UPDATE 20 CRCICA LAUNCHED IN AUGUST 2021 ITS DISPUTE BOARD RULES 22 INFRASTRUCTURE COMMITTEE MEETINGS 24 THE ROAD TO GREEN ECONOMY 26 NETWORKING EVENTS 28 BREAKFAST BRIEFING WITH THE MINISTER OF FINANCE 30 MINISTER OF ELECTRICITY AND RENEWABLE ENERGY VISIT TO THE UK 32 SIR MAGDI YACOUB INAUGURATION AT THE BUE 34 UPCOMING EVENTS 36 TRADE STATISTICS REPORT 38 CONTENTS ISSUE 23.01

04 18 26 34 Copyright © 2023 All Rights Reserved.

FOREWORD A message from Ian Gray, OBE, Chairman

Over the recent 36 months, The Egyptian British Chamber of Commerce has seen a discontinuity in business and economic patterns with some businesses struggling to survive or failing during the European lockdowns whilst others, in an opportunistic manner, shifted their focus and activities into supplying personal protective equipment or expanding their capabilities to profit greatly from the pandemic.

The comparison was often made of similar patterns only usually seen during times of war.

As much of the World came out of the economic challenges from managing the pandemic, the war in Ukraine brought new challenges impacting differently in different countries. The disruption of the supply of grain to many African countries created the same effect as the disruption of the supply of energy to many western European countries.

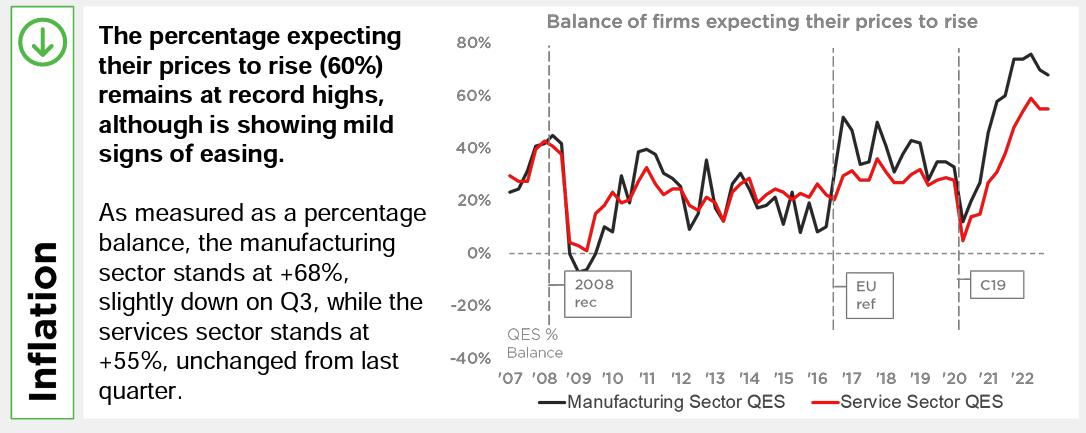

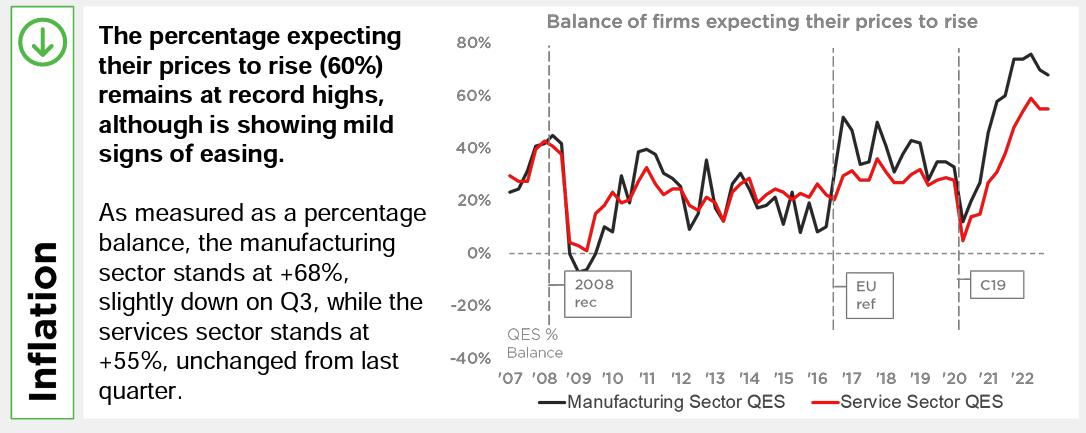

For both the UK and Egypt a rise in inflation and a squeeze on living standards has created great uncertainty in the business outlook. But insightful investing or expansion when others avoid the risks offers high rewards. The successful operators will be those bravely making the best choices from informed decisions.

“For both the UK and Egypt a rise in inflation and a squeeze on living standards has created great uncertainty in the business outlook. But insightful investing or expansion when others avoid the risks offers high rewards. The successful operators will be those bravely making the best choices from informed decisions.”

The Chamber took around 20 UK companies to COP27 in Sharm el Sheikh in November with almost all developing new contacts and some even using the event as the catalyst to sign agreements. Most of these companies see real opportunities in the near and medium term with their focus on sustainable operations. One of the learnings from

COP27, contrary to current politically correct rhetoric, was that innovation to eliminate the impact of fossil fuels will deliver benefits to the planet sooner than an exclusive focus on eliminating fossil fuels.

This issue provides an understanding from Logic Consulting both on the fundamentals behind the devaluation in the Egyptian pound and a view of the likely shape and pace of the energy market. As ever we include an overview of global trends and UK export performance.

Ian Gray OBE, Chairman

We hope to keep you informed and inspired.

Ian Gray OBE Chairman

03

Egypt:

Determining the Shape & Pace of Energy Market

Referring to the latest publication by LOGIC Consulting, the regional leading management consulting firm that provides multidisciplinary services including strategy, governance, organization development and digital transformation for both the private and public sectors in multiple industries, their featured article on “Egypt Energy Outlook” tackled how Egypt is in a good position to make a significant contribution to energy security regionally & globally.

04

The global energy landscape is experiencing huge transformation. Countries are exploring sustainable substitutes to current energy generation methods, diversifying their investments and pouring funds into the development of renewable technology. Also, governments are putting energy security at the forefront of their agendas. While this has meant efforts to diversify the energy mix away from fossil fuels and towards renewable energy, it has also driven countries to diversify the sources of their energy imports. This has placed Egypt in a good position to make a significant contribution to energy security regionally & globally.

LOGIC Consulting Energy Outlook Report tackled 4 main questions that will be discussed thoroughly in the following pages:

1. Why is Egypt a Potential Regional Energy Hub?

2. What Could Egypt Export?

3. To Which Countries?

4. How Could Egypt Boost its Energy Export?

Egypt has been racing to become a Regional Energy Hub, but Chances are Getting Higher, Why?

1. Abundant Natural Resources

A. Natural Gas

Egypt is the third largest dry natural gas producer on the continent following Algeria and Nigeria. According to the Oil & Gas Journal (OGJ), Egypt held proven natural gas reserves of 63 trillion cubic feet, as of January 2021. Egypt achieved self-sufficiency of natural gas 3 years after discovering the Zohr gas field in 2015, representing 40% of Egypt’s total gas output. Yet, the natural gas in Egypt still requires exploration efforts. The country’s gas exploration plan for the fiscal year 2022/2023 is expected to add 150 million cubic meters to gas production per day.

B. Renewable Energy:

Egypt enjoys an abundance of renewable energy resources – solar, wind, biomass and hydro. Egypt is leading the Arab world in terms of operating wind and solar power which reached a capacity of 3.5 gigawatts (GW).

Graph- Capacity of operating wind and solar power in Arab Countries- 2022

C. Nuclear Power:

Regarding the leaps that have been taken in nuclear power, the GoE, in partnership with the Russian Company Rosatom, is working on the construction of a nuclear power plant in Al-Dabaa in Matrouh Governorate (northwest). The first unit of this project is planned to enter force in 2026.

2. Global Energy Changes are in our Favor

A. Global Energy Crisis

Following the Russian-Ukranian war, European countries have been facing an energy crisis, with Russia dropping supply by up to 60% in gas deliveries since June 2021. Europe is now in a race against time to find a replacement for Russia’s natural gas. The impact of the current energy crisis will not be limited to Europe alone. Rises in gas prices are already being felt hard on low-income energy importers in Africa, Southeast Asia, and Latin America. Also, although the MENA region is a major energy producer, many of the MENA countries are struggling to meet growing domestic energy demand. So, the energy crisis is an opportunity for other gas exporters around the world, including Egypt.

Besides, JP Morgan’s research shows a $400 billion oil underspend to 2030 and paints a grim picture in which all energy investment- in

both fossil and non-fossil fuels- needs to grow at a faster rate than the prevailing investment implies.

B. Green Direction

Most green plans are still in their infancy, but the direction is clear. Although Fossil fuels still account for more than 80% of global energy production, cleaner sources of energy are gaining ground. The International Renewable Energy Agency (IRENA) estimates that 90% of the world’s electricity can and should come from renewable energy by 2050. Renewable energy is actually the cheapest power option in most parts of the world today. Prices for renewable energy technologies are dropping rapidly. According to a UN report, the cost of electricity from solar power fell by 85% between 2010 and 2020. Thus, Egypt could benefit from emerging synthetic fuel markets and profit from energy carrier exports to neighboring countries.

C. Increasing Energy Demand:

According to BP (2019), the Middle East will face an annual increase in energy demand of around 2% until 2040. The power, transport, industrial, and non-combusted sectors are mainly responsible for the high increase in final energy consumption. Energy demand is increasing due to the installation and expansion of seawater desalination capacities in most MENA countries. Besides Mena Region, global electricity demand is projected to triple by 2050 as sectors electrify and hydrogen and hydrogenbased fuels increase their market share due to decarbonization, according to McKinsey Report “Global Energy Perspective 2022”.

What Could Egypt Export?

I. Green Hydrogen & Green Ammonia

Egypt has recently adopted a vision to be a global and regional hub for green hydrogen production, storage and export. In fact, Egypt’s green hydrogen project plans currently amount to almost 12 GW, equivalent to more than 1.57 million tons of green hydrogen. Not only do these projects rank Egypt among the top 3 green hydrogen pipelines globally, but if implemented fully, they could provide one-sixth of the 10 million tons of green hydrogen the EU plans to import by 2030. Besides, Egypt is the world’s seventh largest ammonia producer, just behind Saudi Arabia, which is the largest producer in the MENA region. Already a major ammonia producer, Egypt could utilize part of its existing ammonia storage and transportation infrastructure for green ammonia. As such, green ammonia is likely to form a central part of Egypt’s low carbon hydrogen strategy for both domestic use and exports

05

II. Electricity:

Egypt is trying to make use of its power surplus. The total capacity produced by Egypt is about 59,200 MW and the maximum consumption on the electrical network is about 33,000 MW. Egypt, which has achieved an electricity surplus of more than 25%, is implementing electricity linkage projects with African and European countries to enhance the sector’s reliability and allow for the exchange of generated electricity at the subregional level. The country has already linked its electrical grid with Sudan, Libya and Jordan, with a scheduled plan to establish more power linkages with other Arab and African countries

III. Natural Gas:

Natural gas consumption has remained relatively flat, allowing Egypt to export some of its surplus natural gas via pipelines and as Liquefied natural gas (LNG). LNG exports witnessed significant growth, reaching 6.5 million tons in 2021, compared to 1.5 million tons in 2020. Exporting natural gas, instead of consuming it locally, would raise the government’s earnings. Natural gas is sold by the ministry of petroleum to the ministry of electricity for the purpose of local consumption for only LE3 per Mbtu. If exported, it could be sold for $30 in the European market. Egypt has a relatively large natural gas export infrastructure, but it’s underutilized. With a total length of 7,485 km of transmission grid and 38,000 km of distribution grid, Egypt has the largest infrastructure in the East Mediterranean area. Thus, with new discoveries, the presence of significant natural gas reserves in Egypt, as well as the availability of export infrastructure, gas supply expansion shall be feasible.

To Which Countries?

1. Europe

Europe is a net importer of natural gas, with demand far exceeding the region’s total proven reserves, resulting in a greater reliance on natural gas from other supplying countries. Egypt is well-positioned to profit from the present energy crisis in Europe and might soon get to be a major energy exporter to the EU if it is able to sell LNG in large quantities to the EU .

2. Africa

African countries — especially Nile Basin countries — have acute electricity shortages. In December 2019, President El-Sisi announced that Egypt was prepared to export 20% of its surplus electricity to African nations. Beyond Libya, Egypt is poised to contribute to the electrification of sub-Saharan Africa where access to electricity averages under 50%. Also, through Libya and Sudan, Egypt could

theoretically export electricity to neighboring countries such Chad whose 2018 access to electricity rate stood at only 12%. Egypt also turned to Djibouti & Burundi, where agreements were done to increase Egyptian investments and to allow Egyptian companies to contribute to infrastructure projects and electricity projects.

3. Arab Countries

Power demand in the Arab region is expected to grow by 3.3% each year until 2035 while populations are increasing at an even faster rate. With this growing demand, IHS expects that the Middle East will need 277 gigawatts (GW) of additional capacity to boost installed capacity to 483 GW by 2035. The demand for electricity in the region is expected to increase due mainly to economic development and population growth, combined with increasing needs for water desalination and air conditioning. Other countries such as Jordan, Lebanon, Morocco, the Syrian Arab Republic and Tunisia are net importers whose domestic energy mix has historically been more diversified, though it remains heavily dependent on imported fossil fuels. Besides, some countries’ energy demand is rapidly outpacing supply, like Iraq.

How Could Egypt Export More and Make Sustainable Gains from The Current Changes in The Energy Markets?

1. Focus on Domestic Gas Supply

Egypt needs to focus on domestic gas supply, displacing the use of the still widely used diesel, which is putting a heavy burden on the government as Egypt imports about 25 –30% of its needs of petrol and diesel fuel. The Zohr field has been producing less than initially expected, and fresh offshore exploration is slowing down. Also, Egypt appears to rely on re-exporting gas imported from its regional neighbors, leaving it with the possibility to profit only from transit and liquefaction fees. It has also retained the right to use Israeli gas imports domestically if its own demand increases, which could be translated into less exploration efforts. On the demand side, gas demand in Egypt may rise very rapidly. Egypt is already the largest gas consumer in Africa and there is strong potential for further growth, especially in the power sector where gas is the dominant fuel. So, Egypt should work on accelerating exploration and diversifying investors to ensure energy security and sustainable exports’ growth over the long-term.

On the side: Importing LNG doesn’t necessarily mean that Egypt would become an all-year-round importer. It so happens that domestic power demands are stronger in summer when demand in Europe is low and while it’s coincidentally quite the opposite in winter times. This means that Egypt could opt for a seasonal export model.

2. Attract Investments in Gas Exploration, Renewables & Green Hydrogen Facilities

Discovering a new natural gas field does not happen overnight. It needs investments of billions of dollars by international oil companies (IOCs). Moreover, extra foreign direct investment (FDI) should be pumped into the oil and gas industry to secure high production levels of natural gas in the future. Unfortunately, FDI in the Egyptian oil and gas sector registered net outflows of $ 1.7 billion during the first nine months of FY2021/22, according to the CBE. Also, there is now a huge importance of attracting foreign investment in green hydrogen as Egypt is seeking to attract more cooperation and investment in green transformation projects.

3. Develop Infrastructure

Countries with infrastructure for oil and gas, like Egypt, could build on their experience in handling gas and liquid fuels. The share of renewable energies in the installed capacity – including variable solar PV and wind energy – will increase in the medium to long term. This is expected to present the grid with a variety of technical challenges. Also, Egypt also needs to maximize the efficiency of its liquefaction complexes so that they better process additional Egyptian gas or surplus gas from Egypt’s regional partners such as Israel and Cyprus. These two countries have agreed to liquefy their surplus gas in Egypt for export to European and Asian markets. It is possible that Iraq and Greece, which currently lack significant capabilities to liquefy gas, could be potential new partners with which Egypt might conclude such agreements.

06

07 www.lekela.com

DAY 1: Opening Session:

The Business Forum included a keynote speech from H.E. Dr. Hala El Said Egyptian Minister of Planning and Economic Development who stated the government’s commitment to green projects; so far the national investment in green projects is 40% mainly in transport and water sectors aiming to reach 50% by 2024/25. The minister gave an overview of the government’s key polices to help support the business community in its transition, a set of environmental and sustainability guidelines to help entities in their transition is now available.

After the minister’s keynote speech H.E. Gareth Bayley Ambassador to the UK in Egypt revealed that the UK is the biggest foreign investor in Egypt. The ambassador emphasised the importance of investing in green projects sooner rather than later ‘Our mission is to support the re-imagination of investment portfolio and green partnerships between UK and Egypt,’ said the ambassador. The

opportunities in green projects in Egypt are immense in solar, wind and green hydrogen.

Ben Wreschner Economist and Public Affairs Officer for Vodafone highlighted that the road to green economy is the road to digital economy. Higher returns could be achieved by companies which invest in green projects. There are of course some barriers, which are around three main principles: shifting time horizon, avoiding fragmentation and exporting innovation from Africa to Europe. Vodafone managed to sign a renewable energy deal with the Egyptian government, it is the start of a long-term investment in renewable energy and hopefully to other companies too.

Sarah Howard MBE, BCC Chair, discussed that following on from COP26 and through the BCC’s daily engagements with over 53 chambers across the UK, it was made clear that larger firms are more likely to transition to net zero than smaller ones. The BCC has a large network through which it has been conducting in-depth research which lead to the richest insights into what businesses

need to transition to net zero. The role of the BCC is to pass these findings to the government and to business leaders, specially in times where SME’s are facing numerous challenges in the current global economic situation. The BCC is keen to show how vital it is to see businesses from every corner are brought together and experience the power of partnerships between public and private sectors, which should be the way forward.

Plenary Session I:

This was followed by ‘Transition between Trade and investment to Circular economy and sustainable projects and procedures. The speakers for this session were, H.E Waleid Gamal MSc, Suez Canal Economic Zone, Basel El Hini, Chairman Misr Insurance Holding Group, Shevaun Haviland, Director General BCC Chambers of Commerce and Bobbie Mellor, Global Head of ESG at Vodafone Group. This session was moderated by Caroline Ray, Regional Director East Africa, Arup Group. >>>

09 INTERNATIONAL TRADE REPORT

In this session, the speakers discussed their entities efforts to commit to net zero; the Suez Canal has already launched its first pilot green Hydrogen project and many more will follow in the near future. Vodafone revealed their plans for a new refurbishment project of old phones in its attempt to cut e-waste and at the same time create more job opportunities. The speakers also discussed the trade and investment opportunities to move into a circular economy in different sectors as well as the challenges facing SMEs in their transition to green economy and how partnerships between public/ private sectors and government/ private sectors could help support net zero economy while trying to deal with post pandemic effects as well as other major issues in the world.

Plenary Session II:

Plenary Session II ‘Green Finance / Enabling conditions including Behavioural Changes to achieve Climate targets’ The speakers for this session were Vikas Aggarwal - Regional Head of Public Affairs – Europe, Eurasia, the Middle East and the Americas - ACCA Global, Faisal Eissa-General Manager-Lekela Egypt, Boutrous Klink-CEO Middle East and BahrainStandard Chartered Bank and Dr Sofia G. Vaz –Programme Director, Environmental Engineering, NOVA Cairo Branch- The Knowledge Hub. This session was moderated by Magued Ezzel DinCountry Senior Partner and Deals Leader - PWC

The Green finance session discussed the immense funds needed for green transition

and the financial burdens faced by SME’s to help them reach green targets especially in emerging markets. Many initiatives have been taken by various countries to help with the green transition like the issue of green bonds in Egypt and Saudi Arabia. This transition to green finance will require many entities to collaborate including governments, multinationals and the private sector in order to achieve the essential targets especially in developing countries who are significantly affected by the climate change.

A networking lunch was next on the agenda where all delegates, speakers and attendees got to exchange ideas where they used the Forum’s networking app to identify their relevant matches. The delegates were then free to

EGYPTIAN-BRITISH CHAMBER OF COMMERCE 10

Continued from page 09...

Egypt is Facing a

Foreign-Exchange Crunch

Referring to LOGIC Insights, the research arm of LOGIC Consulting, Egypt is currently facing a foreign-exchange crunch akin to that face back in 2016. Egypt devalued the pound in March, and then again by 18% in late October on the same day that it announced the IMF deal. During 2022, the EGP has lost more than 50% of its value against the dollar. For 2023, The EGP dropped to a fresh record low against the US dollar (USD) on 5 January, which is the largest one-day decline since the government reached a deal with the IMF.

What’s Happening in Egypt?

Why Is Egypt’s Currency Falling Faster Than Previous Projections?

1. Growing Financing Gap: According to Fakhri Al-Feqi, head of the parliamentary planning and budget committee, Egypt’s financing gap amounts to about $25bn, of which $15bn are installments and debts were due during 2022, and the rest is from the deficit in the balance of payments, which is largely due to the weakness of domestic savings, which represent only 13% of GDP.

2. Rising Debts: A report released by the World Bank at the beginning of July, 2022 indicated that Egypt’s foreign debt had reached unprecedented levels of nearly $158 billion as of the end of March, 2022. Egypt has committed to repaying $33 billion in foreign debt in a one-year period, from March 2022 to March 2023, according to the report (which accounts for almost the country’s foreign currency reserves, estimated now at $33.5 billion as of December 2022).

3. Foreign Outflows: The country has seen about $22 billion in foreign outflows after investors in local debt exited. When the Fed

raises interest rates, hot money speculators shift their dollar, or hard currency, investments from Egypt to US treasury bonds in search of higher returns. Currently, the Fed offers higher interest rates than the central banks of most of the world’s large economies.

4. New IMF loan: Egypt has reached an agreement with the IMF for a $3 billion in October 2022 to implement comprehensive economic policies and reforms for a 46-month period during Egypt’s ongoing economic struggles. Devaluing the EGP was among the reform policies as Egypt shifts to a flexible exchange rate regime.

12

It’s Not all Gloomy on the Economy Front:

• Promising GDP Projections: The GDP is projected to record above EGP 9 trillion in FY 2022/23 and to continue to grow to hit EGP 16.3 trillion in FY 2026/27, according to Maait. Also, he noted that the government adopts a plan to decrease the debt to GDP ratio to 71.9% in FY 2026/27, down from the current 87.2%.

• More Investments from the Gulf: Saudi Arabia, the UAE and Qatar have pledged to invest as much as USD 22 bn in Egypt this year, providing a vital source of foreign currency. Gulf investors are showing interest in the series of planned privatizations of state-owned companies. Moody’s expects the government’s privatization strategy — which aims to bring in USD 40 bn in fresh investments over the next 4 years — will help “bolster Egypt’s FX reserve buffer in the future.

• Surplus Achievement: The initial surplus in FY 2021/22 jumped to EGP 100 billion compared to EGP 93.3 billion in FY 2020/21, making Egypt among the few countries all over the world that achieved a primary surplus of 1.3% of GDP, while most of the emerging market reported a primary deficit of 4.7% in the same period.

• Egypt’s External Debt is still within Safe Levels: Egypt’s external debt represents about 30-35% of the GDP, as the size of Egypt’s external debt is about $158bn. As long as it is less than 50% of the gross domestic product, it remains at safe levels.

Is Egypt the Only Country in MENA Region Suffering from Currency Devaluation?

It is true that Egypt’s economy has been hit severely by the war, but it is also important to examine the global context. Egypt is certainly not alone. The IMF revised its previous estimates of the growth rate of the global economy for the years 2022 and 2023, as well as reduced its forecasts for growth rates in about 143 countries in the April 2022.

The April 2022 issue of the World Bank’s “Commodity Market Outlook” indicates that the increase in energy prices over the past 2 years can be considered the largest since the 1973 oil crisis and that the recent increases in the prices of food commodities and fertilizers are the largest since 2008. The World Bank noted that the RussianUkrainian crisis had prompted a change in trade, production, and consumption patterns and prices are expected to remain at those high levels until 2024.

Yet, according to Bloomberg and subsequent to the Ukrainian crisis, the EGP was the most devalued currency against the US$ among the “Emerging Markets”.

IMF Loan, Was It the Biggest Driver Behind Devaluation? And Was It Inevitable?

An inflexible exchange rate policy could have further delayed agreement on a new IMF program. Adopting a flexible exchange rate policy was part of IMF’s conditions before it agrees to extend another multi-bn USD loan to Egypt. Another USD 6 billion could follow, and it’s divided into a USD 5 billion multi-year financing package to be triggered for the fiscal year 2022/23, which “reflects broad international and regional support for Egypt,” and a USD 1 billion pending finance request to the IMF’s newly created Resilience and Sustainability Facility. Egypt is considered the second-biggest debtor to the IMF after Argentina and this is its fourth loan agreement since 2016.

The series of policy tools deployed so far — allowing a fall in the currency, restricting imports, and attracting Gulf investments — have done little to ease the external pressures. A fresh program could provide additional funding and give extra >>>

13

15 TO REDEFINE THE BOUNDARIES OF AMBITION Mace Egypt 10 Obour Buildings, Apt. 10, Salah Salim St, Cairo, Egypt T +2 (02) 2405 46870 E: mace.egypt@macegroup.com Mace UAE 2104 Aspect Tower, Business Bay, Dubai, United Arab Emirates T: +971 (4) 4470 207 E: mena.enquiries@macegroup.com

The Road to COP27 HSBC Opportunity Egypt:

The EBCC in partnership with HSBC Egypt, have organised a breakfast briefing on Thursday 7th of July 2022. The event aimed to discuss the current and future opportunities, strategies and goals for the Egyptian Economy and how they might be of interest to your business. Furthermore, with COP27 being held in Sharm El Sheikh in November 2022, the speakers provided updates on Egypt’s climate strategy, sustainable investing, and net-zero alignment of the financial sector.

Stuart Tait, Head of Commercial Banking HSBC UK, introduced corporate banking by stating ‘With so many locations, vibrant companies HSBC sit at the Crossrail of world commerce, and share insights when we speak with you, we operate 80% of FTSE 100 companies in the UK and 80% in FTSE250 in Tech, leading bank in innovation and trade’. With Egypt hosting the COP and its commitment to net zero economy, HSBC provides funding and advise to enable businesses to where they want to be, the entrepreneurial spirit that brings the whole process all together to discussion on how UK and Egypt can do more business together.

The keynote speech was given by H.E. Sherif Kamel Egyptian Ambassador to the UK. H.E. started his speech by stating how HSBC is a leading bank and has a long presence in Egypt and the formula between the financing and companies coming into Egypt using this for the transformational change that Egypt has been seeing in the last 7 years. HSBC has played a great role in this change as well as the reform program which the government has applied

and funded by the IMF strong program creating lots of subsidies to water, electricity and Petrol helping Egypt to reach major transformation in terms of implementing mega infrastructure, 12 new cities, new administrative capital, working on energy generation, changing situation from a deficit in 2015 into a surplus in 2019 and to export electricity not only to neighbouring countries but also to European countries like Greece. Also increasing agriculture target into export and in achieving that, Egypt is always looking for new partners within the private sector in Egypt and there is always a lot of interest in working with the UK government and private sector. Two trade missions between UK and Egypt took place this year as well as the launch of the association council between the two countries based on the signed trade agreement and to introduce the opportunities Egypt offers to the private sector. Egypt has a very young population, very eager and capable of upgrading its skills, it is a gateway to Africa as well as its connection to the Arab world and the EU through different trade agreements, it has the Suez Canal being one of the most important trade canals in the world allowing for

manufacturing and logistical services around the canal. The business environment in the country also encourages a very promising business start-up culture among its youth. Egypt is also hosting the COP27 in Sharm El Sheikh to raise awareness in terms of climate issues, as a potential for renewable energy as Egypt aims to become one of the energy hubs in the world, so many opportunities in Egypt.

This was followed by a presentation from Simon Williams, Chief Economist, CEEMEA Region, HSBC Research and his views on the Egyptian economy in the context of the difficult global backdrop and inflation and how global growth is slowing. Egypt enjoys many compelling factors in the long run including a growing population by 2% yearly adding to the workforce as well as Suez Canal which brings so much potential for logistical services, broader primary sector is oil and gas waiting to be developed, potential for green energy around Suez Canal with wind and solar sources. The tourism industry in Egypt, is quite developed however it needs to be even more, with the development of infrastructure new roads, new airports and the new museum all of this speaks in

16

recognition and the importance of manufacturing and export which are all keys for bilateral trade and economic growth for up to 6%, one of the largest growths in any emerging market.

Egypt also faces some challenges including COVID, Russia-Ukraine war, inflation and there will be strains on public finances, however Egypt doesn’t face those problems alone. These are short term pressures which should be eased soon through the international funding agencies supporting Egypt like the IMF, World Bank, EBRD or Africa Development Bank who are engaged with Egypt, recognising its importance and how critical it is to transition smoothly.

Richard Simon -Lewis, Director & Head of Business Development, UK Export Finance

started his presentation with giving an overview of export credit agencies with an emphasis on the close relationship between the UKEF and the Egyptian government leading up to the COP27. The Export Credit Agencies (ECA) are demand led and usually gravitate around mature sectors like aviation and oil and gas. However, UKEF is reimagining the role of an ECA, the work UKEF does alongside HSBC by expanding the sectors breadth with an emphasis around clean growth.

In terms of what UKEF provides, it is embedded with the UK government roadmap, UKEF is keen to bring in new projects of net zero map and the main key objectives now are to provide export finance guidance and insurance to UK companies to recover from COVID-19 and responding to ministerial priorities, continuously

adapt and focus on sectors and companies that would benefit the exporters across all sizes and across all the UK and improve awareness of UK companies, banks and insurers about export finance available from UKEF.

Richard has also demonstrated UKEF’s commitment to clean growth by showcasing Ankara-Izmir’s sustainable railway and Taiwan’s offshore wind. He also demonstrated UKEF’s financing of the Monorail in Egypt, the first mass transit to connect Greater Cairo with the Metropolitan areas while saving on fuel and reducing on pollution.

This was followed by Q&A to the panel which included Todd Wilcox CEO HSBC Egypt, Martin Horgan CEO Centamin and moderated by Ali Taqi Head of Commercial Banking HSBC Egypt.

17

FIDO signing an MOU with Vodafone at COP27

FIDO AI stepped into the green zone at COP27 to put water at the heart of the agenda. An issue which is so often overlooked or overshadowed. But without water, humanity will cease to exist and all the topics which traditionally take centre stage will become irrelevant.

The noble aim of ‘achieving net zero’ is not going to be achieved in our lifetime if we do not address the issue of Day Zero – the day the world runs out of water. It is already happening, and more and more communities will be affected unless we change our attitude towards water scarcity.

In 2017 Cape Town faced Day Zero, and the country had to rapidly inject 60 billion dollars into its water infrastructure for its own people to survive. Even now South Africa is expected to have no water by 2030. This is the reality all nations across the globe are going to face. By acting now Day Zero can be prevented.

https://www.nationalgeographic.com/ science/article/partner-content-southafrica-danger-of-running-out-of-water

“At COP27 I contributed to a panel discussion on smart cities and data. Cities know they need to invest to prevent crises, the dilemma is what to prioritise first. With water, the answer is simple, invest in protecting what you already have. The world loses 40% of the clean water it produces through leaky pipes, so there is a huge global opportunity to recapture that valuable resource and prevent water scarcity.”

Open data is a key prevention tool. Globally we need to be collaborative and more honest. At FIDO we bring together the brightest and the best in a non-partisan or tribal way, harnessing the greatest technology to stop this threat of water scarcity and insecurity. FIDO is here to help.

Already FIDO is partnering with corporations whose attitudes and missions align with FIDO’s own. Our latest signed partnership is with Vodafone Egypt – signed at COP27. FIDO AI’s leakage reduction programme is being rolled out across Egypt’s water network. The nationwide project has initially begun in Sharm El Sheikh. FIDO AI sensors have been deployed

across the city as the first stage of the longterm FIDO process to tackle leakage and water scarcity across Egypt. It was evident very clearly from the Egyptian government as they took over the presidency of COP27 that the word “implementation” is for them, more than just a word; it is a call to action. Clear vision, well articulated and backed with an action agenda and desire to share best practise are key to delivering transformational results as we tackle the devastating effects on climate change.

We are not stopping there; our global mission is only just beginning.

At COP27 I was proud to represent FIDO and the incredible team back in the UK and the US. Our mission is to rid the world of water scarcity and we invite all to embrace true open data collaboration and join with us. Water scarcity is climate change and I extend my gratitude to the EBBC for embracing the FIDO mission and inviting us to COP27. What an instrumental effect FIDO will now have in Egypt and hopefully, the rest of the world will listen.

18

22

23

improving operational services and strengthening the sector’s framework at the national level. This plan consists of desalination projects, expansion of water waste management plans and expansion of the rural sanitation program.

The meeting was opened by Mr Gareth Bayley OBE, British Ambassador to Egypt. Ambassador Bayley said: “I am delighted to see the DIT/ EBCC Infrastructure Committee initiative continuing successfully with this second meeting, strengthening UK-Egypt bilateral cooperation and our partnership in construction and water management. Our commercial ties are truly growing; only last year, UK company Hydro Industries secured a contract worth up to $200 million to build a world class water treatment plant on Egypt’s Red Sea Coast, helping to safeguard one of the world’s most precious ecosystems. The UK is keen to see these ties grow yet further, and I look forward to many more UK-Egypt partnerships in the booming infrastructure sector.”

The meeting was attended by major UK companies operating in the Construction and Water sector, including Mott MacDonald, Blue Water Bio, Hydro-industries, and Mace.

Alfred Assil, Co-Chair of the DIT/EBCC Infrastructure Committee and CEO of Menarail Transport Consultants said “Egypt is embarking on a new era in regard to long term sustainable infrastructure projects, specifically in the water sector; great collaboration potential could be foreseen between UK and Egyptian companies that we are keen to present and follow up through these infrastructure committee meetings held by the chamber’

Gordon Turley, Co-Chair of the DIT/EBCC Infrastructure Committee and Major Projects Director at Mott MacDonald said ‘This Forum is an exciting opportunity to hear and understand firsthand about the major upcoming developments in this sector and the openings they provide for UK businesses. We are grateful to the Ministry and Embassy for their contribution to this event.

June 2022- The meeting included a keynote address from His Excellency Kamel Al Wazir, Minister of Transport for the Arab Republic of Egypt. His Excellency Al Wazir provided an update on major Egyptian transport projects with an emphasis on opportunities in rail, metro and

ports, and ways in which UK companies can get involved.

The meeting was opened by His Excellency Tarek Adel, Ambassador of the Arab Republic of Egypt to the UK and Anisah Dathi, Country Director for Egypt at the British Embassy in Cairo, representing Sir Geoffrey Adams, British Ambassador to Egypt.

Egyptian Ambassador then to the UK His Excellency Tarek Adel said: “I am positive that this Committee will be of great value in further enhancing dialogue and providing project-specific cooperation in the field of infrastructure. Investment in infrastructure projects lies at the heart of our government’s long-term vision for sustainable development because of this sector’s immense potential to transform the economy, create jobs and enhance connectivity. Egypt and the UK share a strong history of cooperation in the transport sector. Today we have many joint projects in different fields, at the forefront is the development of the new electric monorail in Cairo that will transport millions of citizens to and from the new administrative capital every day.”

British Ambassador to Egypt Sir Geoffrey Adams said: “I am delighted to see the launch of the DIT/ EBCC Infrastructure Committee initiative, which aims to promote UK-Egypt bilateral cooperation and partnerships in the infrastructure sector. Egypt has recently witnessed one of the UK’s biggest investment deals in Africa’s infrastructure sector, with the ongoing development of two electrified monorails in the Cairo metropolitan area - a deal worth $4.16 billion. The UK is keen on further strengthening our commercial ties with Egypt, and I am sure that this initiative will be of great help to both British and Egyptian businesses.”

The meeting was chaired on the Egyptian side by Alfred Assil, CEO of Menarail Transport Consultants and on the British side by Gordon Turley, Director of Major Projects at Mott MacDonald. The meeting was attended by major UK companies operating in the transport sector, including Bechtel, Colas Rail, Progress Rail, and the main UK organisations in rail and safety, RSSB, and the Railway Industry Association (RIA).

25

“Egypt is embarking on a new era in regard to long term sustainable infrastructure projects, specifically in the water sector; great collaboration potential could be foreseen between UK and Egyptian companies that we are keen to present and follow up through these infrastructure committee meetings held by the chamber”

Trade Mission to Egypt

The Road to Green Economy

The Egyptian British Chamber of Commerce (EBCC) in partnership with Department of International Trade (DIT) have organised a three-day business mission to Egypt from 27-30 of March 2022. The delegation included delegates from 18 different companies.

As Egypt prepares to host COP27 in November 2022, the mission’s focus on clean growth and sustainable projects in Egypt, to showcase opportunities for joint projects between British and Egyptian companies in key sectors such as infrastructure, energy, and finance.

The delegation started with a morning briefing with HMA Gareth Bayley summarising the

current political and economic situation in Egypt. The ambassador spoke about the resilient economic climate in Egypt, the progress H.E has witnessed since his last visit and how Egypt is a desirable place to invest.

The ambassador has discussed the stable political state Egypt has reached since 2011 and how the current government is keen to create a positive business environment for investment opportunities.

The briefing was followed by an infrastructure committee meeting with the ministry of Housing, Utilities and Urban communities discussing green projects leading up to the COP27. In this meeting, the ministry discussed the different projects for Green Cities and water projects in the pipeline.

The sector development policy will depend on three main pillars: Improving drinking water, improving operational systems and

26

strengthening the sector’s framework at the national level.

In the afternoon, the delegation met with His excellency Eng. Mohamed Shaker minister of electricity and renewable energy where he discussed the ministry’s electrical energy transformation, and show cased the scale of projects that have been accomplished in Egypt in the past period and upcoming investment opportunities.

This was followed by a meeting with Dr Ahmed Kouchouk deputy minister of finance who gave an overview to the delegates and answered their questions about Egypt’s financial plan in the coming period following the latest measures and expected mitigations of any repercussions.

In the evening, a networking reception took place at the residence of the British Ambassador where 120 business leaders from both Egyptian and British companies had a chance to meet, connect and discuss partnerships. The reception started with welcoming remarks from HMA Gareth Bayley to welcome the delegation followed by opening remarks from Ian Gray, OBE Chairman of the EBCC who expressed his gratitude for the in-person meetings after two years of COVID-19 restrictions and how great it is to have many British companies to be part of this delegation. Aden Nguyen, Chief Business Officer at The National Bank of Egypt in the UK, also spoke about the bank’s efforts in supporting sustainable development and plans for continuous support to the new ways of life, he also demonstrated the progress the Bank is undergoing giving examples of their newest products and the upcoming change in the near future.

On the second day, the delegation had the chance to visit the New Administrative Capital to see the latest developments and massive progress that took place in a short span of time demonstrating a perfect example of sustainability and green cities initiatives. The visit started with an overview of the whole project and the latest developments in terms of what has been achieved. The New Capital is a smart city integrating infrastructure to provide many services. This was followed by a tour of the city’s main attractions, the new government’s

“As part of our Green Partnership between the UK and Egypt, we are committed to working together with Egypt to ensure that COP27 builds on the legacy of COP26 and that Egypt realises its ambitious sustainable energy strategy and continues on its path to clean growth. The private sector will be essential to this success. We want to unleash the potential of green finance to engage and support British and Egyptian businesses, including sustainable infrastructure, renewable energy projects and green finance. The Road to Green Economy trade mission by the Egyptian-British Chamber of Commerce is an important step in building bridges between UK and Egypt that will strengthen our trade relationship and drive our mutual clean economic growth.”

headquarters, the highest residential tower in the Middle East, an impressive mosque to cater for thousands of prayers as well as a state of the art cathedral, which is considered one of the biggest in the region.

In the evening, the Chamber organized a reception for B2B meetings where Egyptian companies met the delegation on one-to-

“After over 2 years of COVID-19 restrictions it is great for so many UK companies to have come with EBCC to Cairo looking for partners and opportunities in particular with the private sector. We have all been stopped from traveling and, now that we can, all these executives have put Egypt at the top of their list of countries to visit. I am looking for Egyptian companies to meet us and discover their opportunities! “

Ian Gray, OBE Chairman of EBCC

Ian Gray, OBE Chairman of EBCC

one basis and discussed opportunities for collaboration.

The last day was concluded with a meeting with H.E Kamel El Wazir who welcomed the delegation and discussed collaboration projects that would match with the British know how and expertise. He gave an overview of the opportunities in Egypt leading up to COP27.

27

HMA Gareth Bayley, OBE British Ambassador to Egypt

NETWORKING EVENTS

With the ease of COVID-19 restrictions, the Chamber was determined to make up for the lost time and there is nothing like a networking event, where companies get to meet and interact together. The Chamber aims to organise quarterly networking events as part of our continuous effort to promote bilateral trade and partnerships.

The Chamber in partnership with the National Bank of Egypt has organised a networking event during the month of October, which was hosted at NBE ‘s impressive London premises in Mayfair where an array of canapes and drinks were circulated among guests. Welcome remarks were given by EBCC Chairman Ian Gray, OBE, followed by opening remarks from Dr. Yasser Hassan NBE CEO, who welcomed everyone and talked about the bank’s services. We had a full room of guests, and the atmosphere was vibrant, was very good to see many familiar faces as well as new ones.

In February the Chamber organised its second networking event in partnership with Vanquish Real Estate and the National Bank of Egypt. The evening was hosted in honour of H.E. Sherif Kamel Egyptian Ambassador to the UK. who gave an overview of the business environment in Egypt and how the country is gearing up its resources leading up to COP27.

This was followed by a presentation from Karim Gorgy CEO of Vanquish Real Estate highlighting the latest projects and developments in the UK. The forward thinking, innovative attitude which Vanquish Real Estate offers is designed to offer professional, efficient service on a friendlier level.

Dr. Yasser Hassan CEO of National Bank of Egypt talked about the bank’s continued

support of businesses that wish to trade with Egypt by providing tailored financial solutions. With the recent launch of its Buy to Let Mortgage product, it also helps property investors take advantage of buy to let opportunities.

The event was attended by many people who exchanged ideas and contacts. The atmosphere was buzzing and vibrant, an overall success!

28

29 Harness the full potential of flare gas for your oilfied operations Partner with Aggreko to progress your Energy Transition today Visit: Visit us at aggreko.com to get in touch Visit us at aggreko.com to get in touch AGK_5114_Flare gas Press Advert-Africa-12 22.indd 1 15/12/2022 12:32

Visit Review: Breakfast Briefing with the Egyptian Minister of Finance

Speakers:

H.E. Dr. Mohamed Maait – Egyptian Minister of Finance

Rt. Honourable Sir Jeffrey Donaldson MP, UK Trade Envoy to Egypt & Cameroon & Leader of the Democratic Unionist Party

Moderator: Ian Gray OBE, Chairman – Egyptian British Chamber of Commerce

Sir Jeffrey Donaldson started his opening remarks, by paying tribute to the EBCC for maintaining interest in Egypt during the pandemic through webinars and informative events which was really important to bridge the gap and build bridges for trading connections.

Egypt has prospects in tackling climate change due to its strong sustainbility plans, however in combination with the Chamber’s outward mission in March more sectors also have great opportunities like healthcare, education and infrastructure. ‘The reform agenda which has been taken forward under the direction of President Sisi in recent years, has shown major improvement

in the investment climate. The refrom agenda has very positive impact on investment and opportunities for making it easier to do business with Egypt and in Egypt Sir Jeffrey added.

H.E. Dr. Mohamed Maait, Egyptian Minister of Finance started his presentation ‘Egypt’s Fiscal Policy Response: A year in review and future

outlook’ by looking at what Egypt has been through during and after COVID-19. H.E. Dr. Maait stated that the government tried to have a balanced approach in terms of safety measures to save lives and making sure the economy kept moving, the government was keen to support vunerable sectors while trying to reduce the negative impact on people’s income.

EGYPTIAN-BRITISH CHAMBER OF COMMERCE 30

The Key pillars for government response were:

• Policies to maintain macroeconomic stability: The government tried to sustain its fiscal and debt position by mobilising additional pro -growth revenue

• Supportive and Targeted measure worth 2% of GDP: The government provided support to the most vulnerable sectors including Tourism, aviation and exporters.

• Secured adequate financing: The government was able to secure adequate financing with two programs Rapid Financing Instrument (RFI) and 12-month Stand By Agreement (SBA) through the IMF at the onset of COVID-19. The government has also issued Green bonds worth $750 million to diversify its investor base.

The government is also supporting its people in dealing with the impact of COVID-19 with the biggest program in the history of Egyptians yet ‘Hayah Karima’ or ‘Decent Life’ aimed at improving more than 60 million Egyptians living standards in the poorest rural areas with a budget of over $50 billion over the next 3-4

years. The program aims at developing basic infrastructure needs in all these villages investing in healthcare, education, and water sanitization.

Egypt was one of the few countries in the world to have growth during the pandemic with a rate of 3.6% while keeping its rating from three different international rating agencies. Egypt also got a positive review from the IMF, European Bank, and the World Bank, which was reflected in a positive employment rate. The government aims to achieve a sustainable growth of more than 6% growth rate in the next few years.

Egypt was successful in bringing down deficit even during COVID-19 which declined from 12.5% in 2015/16 to 7.4% in 2020/21 and the target for this year is to reduce further to be 6.7%.

For the new financial year, Egypt has three main objectives:

• Ensure fiscal & debt sustainability: the overall budget deficit to decrease by 6.7% of GDP while increasing the primary surplus to 1.5% and the target is to reach 2% in the next two years

• Improve efficiency of revenues & expenditures: The government aims to keep annual growth up to 20% and annual expenditure around

• 10%. The revenue growth can be achieved through reducing the gap in tax collection. Egypt has a huge informal sector up to 55% who are not tax registered. The introduction of E-receipt will aim to encourage automation and be able to monitor trade

• Support high jobs rich economic growth: To provide adequate job creation to reduce unemployment rate and create adequate jobs

H.E. Dr. Maait concluded that although there are challenges that face the whole world due to the pandemic and its effects on the economy; however, Egypt is on track with its economic plans and will ensure sustainability of growth. Egypt has huge opportunities that will soon open new markets with neighbouring countries. Foreign investors have current and pipeline opportunities to do business with Egypt in several sectors, whether in education, renewable energy, oil or healthcare.

Following the Breakfast Briefing the EBCC organised three roundtable meetings with British investors for H.E. Dr. Maait where he discussed investment opportunities in Egypt in the field of sustainability and renewable energy as well as education, healthcare, and infrastructure.

31 INTERNATIONAL TRADE REPORT

‘Egypt was the only country in Africa and the Middle East to issue Green Bonds worth of $750 Billion in 2019’

H.E. Dr. Shaker Minister of Electricity and renewable energy visit to the UK

Ahead of Egypt’s hosting of COP27, as part of The Egyptian government’s plans and the commitment to net zero through increasing the supply of electricity from renewable sources like wind, solar and green hydrogen. Egypt has attracted substantial investments in the Green Hydrogen sector especially from the UK.

On Wednesday 18th of May the Chamber participated in site visit with H.E. Dr. Mohamed Shaker Egyptian Minister of Electricity and Renewable Energy to Sheffield which was organized by DIT as part of an Egyptian delegation to the UK. H.E. Dr. Shaker was invited to the Translational Energy Research Centre (TERC), which is one of the largest research and development facilities in Europe for zero-carbon energy, hydrogen and bioenergy. The Centre is a unique pilot scale testing facility to develop ideas and technologies to support sustainable energy systems.

H.E. Dr. Shaker was invited to the Translational Energy Research Centre (TERC), which is one of the largest research and development facilities in Europe for zerocarbon energy, hydrogen and bioenergy.

The minister also visited ITM Power to learn more about the UK strengths capabilities in Green Hydrogen and electrolysers production

as well as R&D. The Egyptian minister became one of the world’s only energy ministers to build an electrolyser first hand. ITM power is a leading manufacturer of electrolysers which help with the decarbonisation process by controlling the power of green hydrogen. Unlike other fuels, the green hydrogen doesn’t remove oxygen from the atmosphere or add more water vapour

which helps retain the earth’s existing water and oxygen balance.

During his 3-day trip to the UK H. E. Dr. Shaker discussed several potential opportunities of collaboration between the two countries over a round table meeting and B to G meetings with several UK companies.

32

CAPRICORN IS ONE OF EUROPE’S LEADING INDEPENDENT UPSTREAM ENERGY COMPANIES, HEADQUARTERED IN EDINBURGH, UK.

We have discovered, developed and produced oil and gas throughout the world. Today, our focus is on growing production through development and exploration and using our strong balance sheet to expand our production base into other attractive markets and to commercialise exploration resources. Always working responsibly, we invest to ensure our portfolio remains competitive through stringent energy transition scenarios. We are committed to net zero carbon emissions by 2040

33

Sir Magdi Yacoub inauguration at the BUE

The British University in Egypt was honoured to install Professor Sir Magdi Yacoub as the University’s first Inaugural Chancellor. The Installation Ceremony was held in the University’s Auditorium and the Medal of Chancellor’s Office bestowed upon Sir Magdi by the Chair of Board of Trustees, Ms. Farida Khamis joined by President and Vice-Chancellor, Professor Mohamed Loutfi. Ms. Khamis said ‘I know that Sir Magdi will support and empower the students and enable and inspire the continued success of the university. Quite simply Sir Magdy is inspiring and remarkable’

The Installation Ceremony was attended by Minister of Health and Population, H.E. Professor Khaled Abdel Ghaffar, the Minister of Planning and Economic Development, H.E. Professor Hala El Said who added ‘ I am honored to have taken part in the inauguration ceremony of the renowned cardiologist Professor Sir Magdi Yacoub’s appointment as the first Honorary President of The British University in Egypt, Dr. Yacoub’s work, legacy, dedication and commitment inspire the world to strive for a brighter, healthier future. The installation was also attended Professor Yasser Refaat, the Minister of Higher Education and Scientific

Research’s Deputy for Scientific Research Affairs. The ceremony was also graciously joined by the British Ambassador to Egypt, H.E. Gareth Bayley who added ‘My thought to the audience was simple: ‘Be Like Sir Magdy’. An inspiring hero for Egypt and the UK.’

The BUE was established in Egypt in 2005 based on 1998 Memorandum of Cooperation between the UK and the Egyptian Governments. The BUE’s vision is to produce graduates of UK standards for key sectors in the Egyptian economy in the the areas of engineering, computer science and business studies.

34

35

UPCOMING EVENTS

Breakfast Briefing – Sustainable Investment in Egypt

As a follow up from the success of COP27 Business Forum in Sharm El Sheikh, The Chamber is holding a breakfast briefing on the 18th of January from 9-11 am. The meeting will feature keynote speeches from H.E. Sherif Kamel Egyptian Ambassador to the UK and H.E. Gareth Bayley, OBE British Ambassador to Egypt. The event will be moderated by Ian Gray, OBE, Chairman of EBCC

The two ambassadors will discuss the opportunities for UK/Egypt business relations post COP27 highlighting various sectors more likely to foresee high level of cooperation between the two countries in the near future.

If you would like to join this event, you can register online on: https://www.theebcc.com/events/

Alternatively, you can email Inji El Shabrawishi on: Inji@theebcc.com

Trading with Egypt Workshop – Cargo X/ ACI

The Chamber organises a trade workshop to all exporters to help them navigate the new ACI system.

This course is a step-by-step guide on how to send your documents using the new system CargoX.

Changes and why they were implemented? CargoX platform - What is it and how does it work?

What is the ACI? Why is it needed?

What does the system do for the Importer and what should the Exporter receive?

CargoX - This will be an end-to-end overview from registering to sending an envelope via the blockchain.

FAQ Q&A

To join the next workshop, check the latest dates on www.theebcc.com/events/

36

H.E. Sherif Kamel Egyptian Ambassador to the UK

H.E. Gareth Bayley OBE British Ambassador to Egypt.

GENERAL TRENDS & DRIVERS OF WORLD TRADE IN 2022

Global core inflation, measured by excluding food and energy prices, is expected to be 6.6 percent.

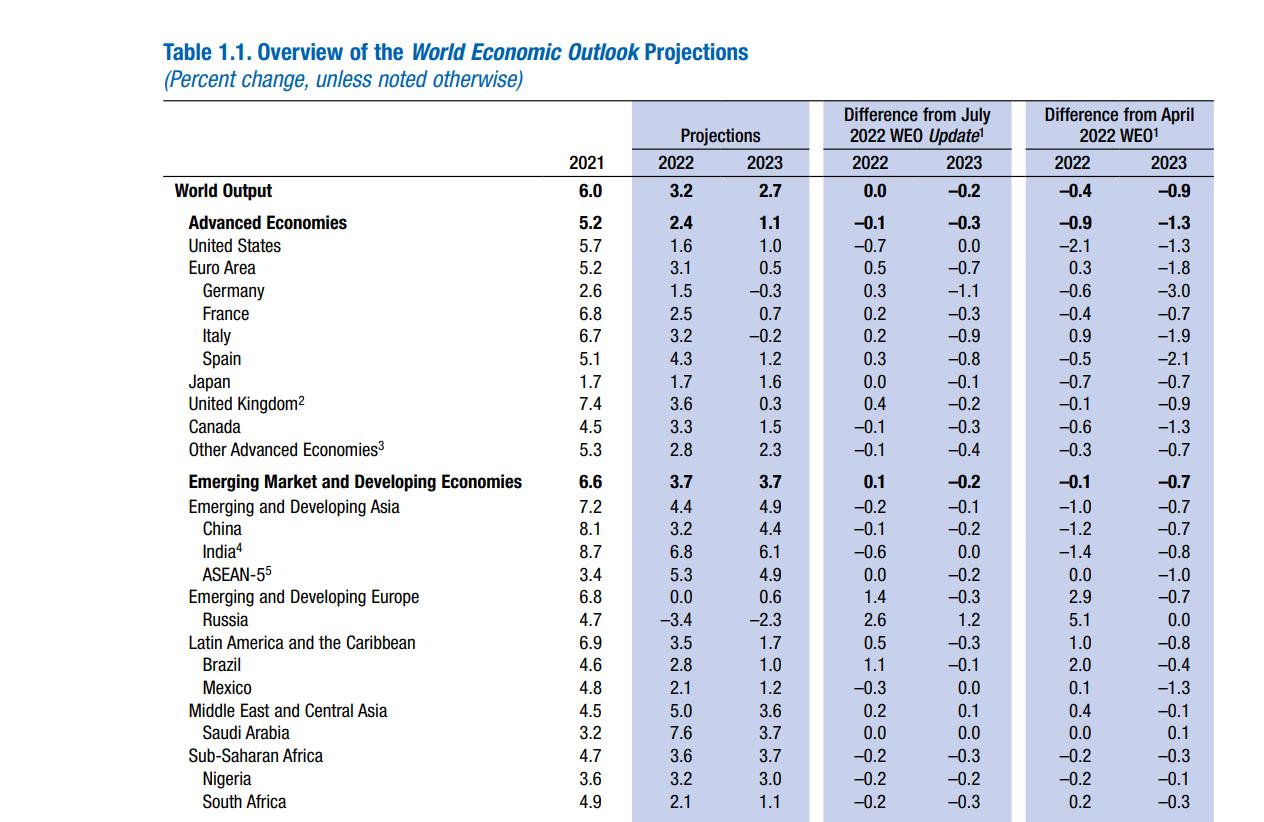

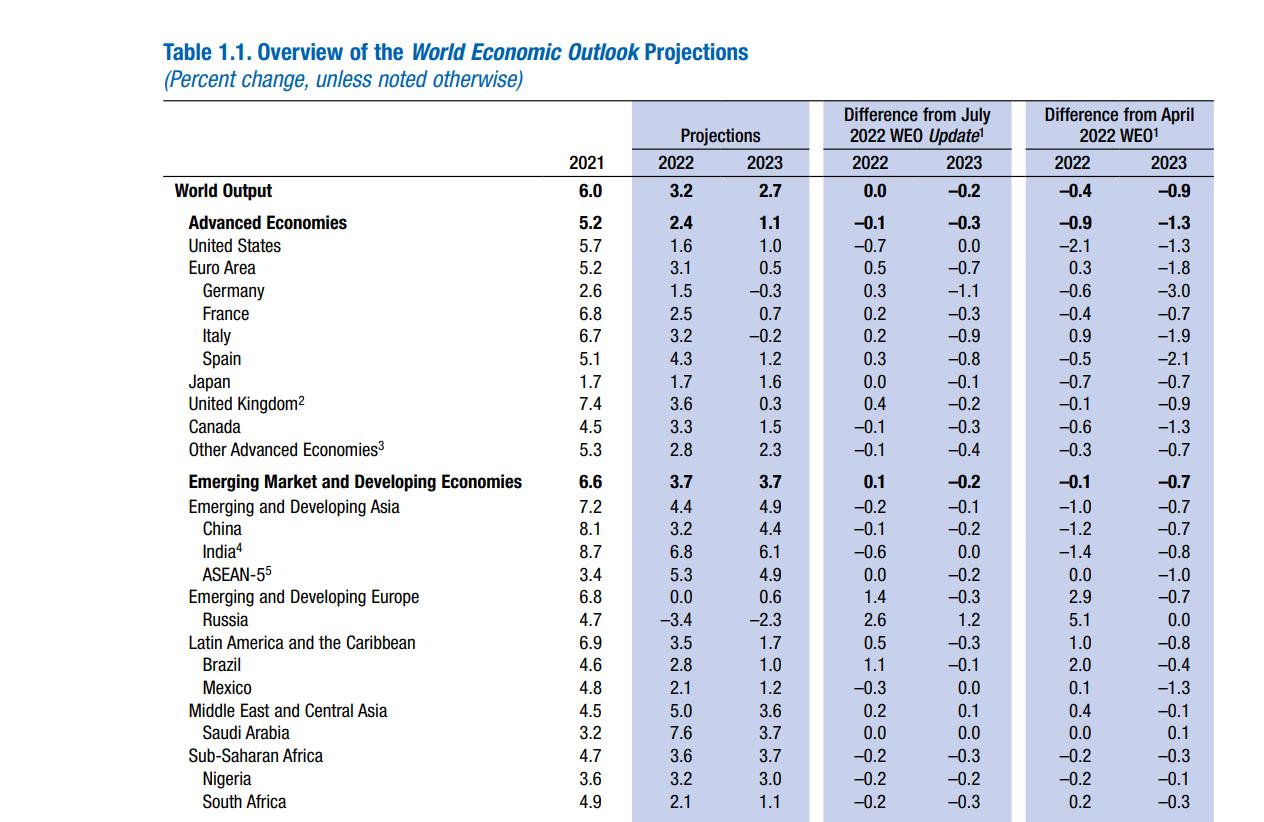

A slowdown in global growth is forecast, from 6.0 percent in 2021 to 3.2 percent in 2022

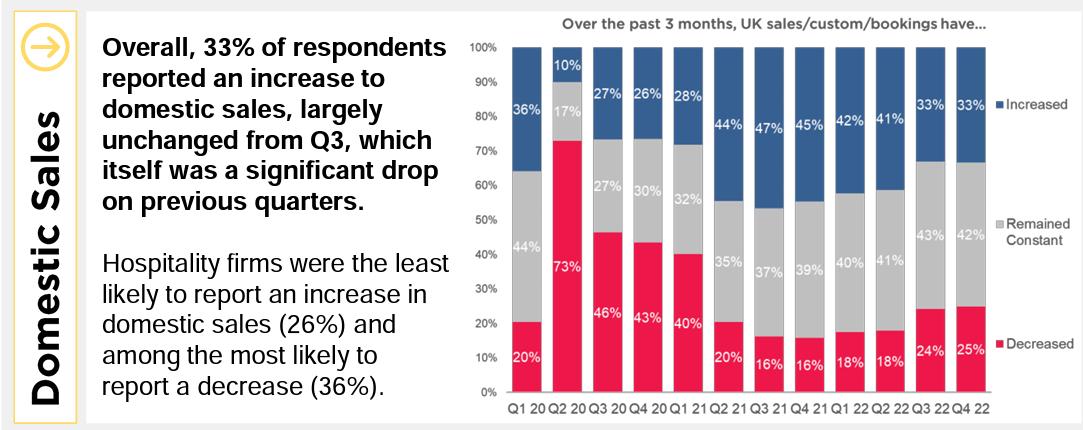

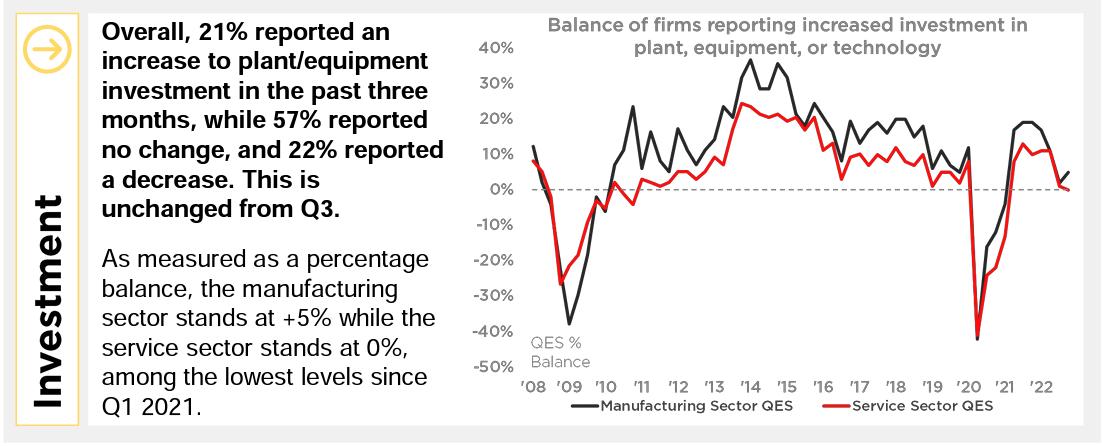

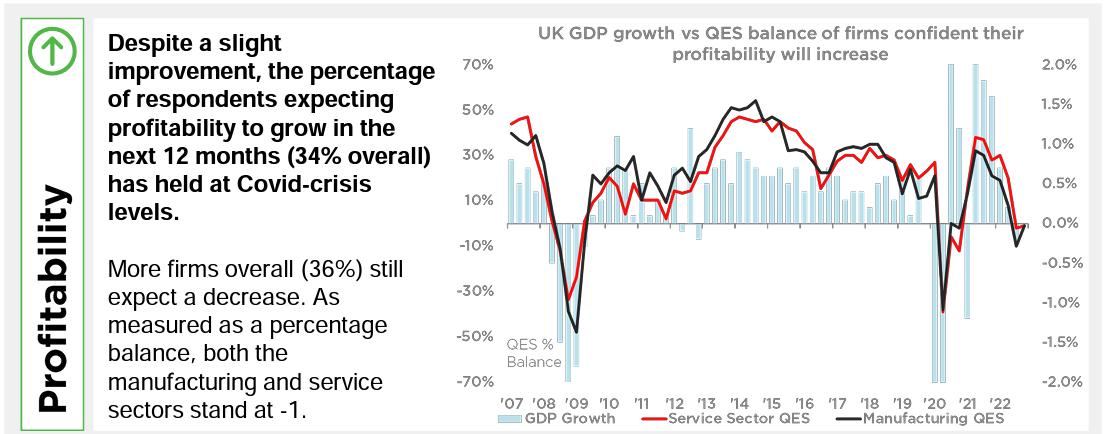

The world is currently facing a very challenging state whether economically, politically or socially. While the world was still recovering from the effects of COVID-19, inflation and cost of living put a lot of pressure on all households with a big squeeze on their disposable income. The Russia – Ukraine conflict has also created disruptions on the geopolitical front, especially in Europe which is most directly affected by conflict with its reliance on gas driving natural gas prices to its highest levels As a result, the global economy is witnessing a slowdown and saw a real GDP contract as shown in (fig.1) although the total GDP has increased in numbers however the increase is only 2.8% compared to 5.7% in 2021.

In its efforts to combat inflation, central banks increase interest rates which is another factor in the slowdown of the economy. With the growing inflation and rise in food and energy prices, poor families are hit the hardest which in turn puts more pressure on governments to give support to the most vulnerable.

2.8%

While the inflation rate of consumer commodities has steadily increased as shown in (fig.2) it has reached its highest to 9.06%, however inflation is expected to decline by end of 2023 to 6.5%.

Source: International Monetary Fund statistics

Source: International Monetary Fund statistics

Source: International Monetary fund

66,485 73,773 75,197 77,366 79,429 74,944 76,211 81,036 86,210 87,654 85,441 97,076 101,561 20,000 40,000 60,000 80,000 100,000 120,000 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Billions in USD Axis Title Chart Title 39

Although the total GDP has increased in numbers however the increase is only 2.8% compared to 5.7% in 2021.

Fig 1. Gross Domestic Product current prices

Fig 2. Inflation rate

1

Outlook for 2023

As uncertainties persist, the outlook for 2023 is looking at a global growth decline. For most economies, the growth is expected to be very slow. The forecast for 2023 is the slowest since the global slowdown in 2001 with the exception of the financial challenges during COVID-19.

The world’s largest economies are expected to significantly slow with tightening of the global financial conditions as well as predictions for further interest rate hikes. A decline in GDP is also expected due to the global recession. Fig 3. shows the projected percentage change for 2023 in different countries.

40

Source: International Monetary Fund

Fig 3.

42 Chapter 2 sources: British Chambers of Commerce Trade Confidence Outlook Q1,2,3 & 4 2022 www.britishchambers.org.uk/media/get/BCC%20QES%20infosheet%20Q4%202022.pdf

Export figures for EGYPT and the UK Product Breakdown

Commodity

Machinery & Mechanical Appliances (16), of which: Of which: Turbojets

Electrical Machinery & Equipment

Base Metals & Articles of Base Metal (15)

Chemicals (6), of which:

Pharmaceutical Products

Transport & Equipment (17)

Medical & Other Instruments & Parts (18), of which:

Vegetable Products (2)

Fruit and Vegetables

Mineral Products (5)

Plastics, Rubber and Articles Thereof (7)

Paper and Paperboard (10)

Live Animals, Animal Products (1)

Prepared Foodstuffs (4)

Miscellaneous Manufactured Articles (20)

Arms & Ammunitions (19)

Textiles & Textile Articles (11)

Articles of Stone, Ceramics and Glassware (13)

Precious Stones, Metals & Jewellery (14)

Arts & Antiques (21)

Wood and Articles Thereof (9)

Fashion Accessories (12)

Leather, Hides & Skins (8)

Animal or Vegetable Fats & Oils (3) Other (22)

All figures are in £ thousand

2021 - Jan-Nov Export from the UK Rank 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 2022 - Jan-June Export from the UK 211,157,763 37,653,979 65,796,081 460,201,585 168,706,915 91,147,810 133,616,548 47,301,892 33,201,233 31,462,817 33,076,854 42,185,620 19,467,595 23,660,094 20,434,023 5,820,038 3,701,340 8,175,502 1,895,896 15,236,209 80,797 527,861 278,368 391,228 90,990 129,362 1,229,337,713 264,469,222 93,783,919 60,672,654 523,417,121 194,228,184 120,090,629 176,431,836 72,418,833 77,878,335 75,054,001 47,206,971 48,093,290 18,260,774 34,419,370 21,942,271 6,319,143 991,173 6,188,447 2,092,836 21,678,732 2,075,377 656,622 311,566 138,223 177,345 107,118 1,519,502,789 25% 149% -8% 14% 15% 32% 32% 53% 135% 139% 43% 14% -6% 45% 7% 9% -73% -24% 10% 42% 2469% 24% 12% -65% 95% -17% 24% % Change Total 43

Commodity

Machinery & Mechanical Appliances (16), of which:

Of which: Turbojets

Electrical Machinery & Equipment

Base Metals & Articles of Base Metal (15)

Chemicals (6), of which:

Pharmaceutical Products

Transport & Equipment (17)

Medical & Other Instruments & Parts (18), of which:

Vegetable Products (2)

Fruit and Vegetables

Mineral Products (5)

Plastics, Rubber and Articles Thereof (7)

Paper and Paperboard (10)

Live Animals, Animal Products (1)

Prepared Foodstuffs (4)

Miscellaneous Manufactured Articles (20)

Arms & Ammunitions (19)

Textiles & Textile Articles (11)

Articles of Stone, Ceramics and Glassware (13)

Precious Stones, Metals & Jewellery (14)

Arts & Antiques (21)

Wood and Articles Thereof (9)

Fashion Accessories (12)

Leather, Hides & Skins (8)

Animal or Vegetable Fats & Oils (3)

Other (22)

44

2021 - Jan-Nov Import to the UK Rank 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 2022 - Jan-June Import

UK 245,680,614 9,367,217 232,013,801 20,065,961 78,085,720 2,138,912 31,603,634 7,855,773 191,111,179 186,748,833 23,320,266 78,094,717 25,736,659 42,426 12,438,225 2,474,337 0 68,528,847 32,808,192 22,253,394 1,438,453 610,706 2,256 22,378 1,899,433 453,962 844,527,132 301,690,444 33,921,434 262,510,050 32,411,664 378,036,222 3,896,264 39,586,622 11,464,608 179,874,769 174,521,110 295,029,880 87,142,276 49,886,116 15,737 27,707,881 2,032,070 0 74,461,557 34,326,836 28,759,156 265,841 541,431 48,022 81,529 5,721,681 444,190 1,549,528,532 23% 262% 13% 62% 384% 82% 25% 46% -6% -7% 1165% 12% 94% -63% 123% -18% 0% 9% 5% 29% -82% -11% 2029% 264% 201% -2% 83% % Change Total Mena Egypt % of MENA Mena Egypt % of MENA Exports to the UK 2021 - Jan-nov 14,510,660,990 1,229,337,713 8.47% Imports from the UK 2021 - Jan-nov 11,228,020,834 844,527,132 7.52% 2022 - Jan -nov 22,231,936,084 1,519,502,789 6.83% 2022 - Jan -nov 24,892,578,764 1,549,528,532 6.22% 53.21% 23.60% 121.70% 83.48% All figures are in £ thousand

to the

Ian Gray, OBE Chairman of EBCC

Ian Gray, OBE Chairman of EBCC