13 minute read

VI. ROLLOUT FEASIBILITY

VI. ROLLOUT FEASIBILITY

Having established the major advantages and disadvantages that solar feeders might have over solar pumps, and vice versa, it is critical also to know whether either model for solarization can actually be implemented. In Rajasthan, the most obvious barriers to implementation are potential bottlenecks in the supply chain; namely, the supply of capital, hardware, and support services. Waste management is not currently reflected in the KUSUM guidelines, or anywhere in India’s central planning. Though not an immediate threat to rollout, waste management is a critical element of the infrastructure life-cycle that should not be forgotten.

SUPPLY OF CAPITAL

Implications: Scaling Up Solar Feeders

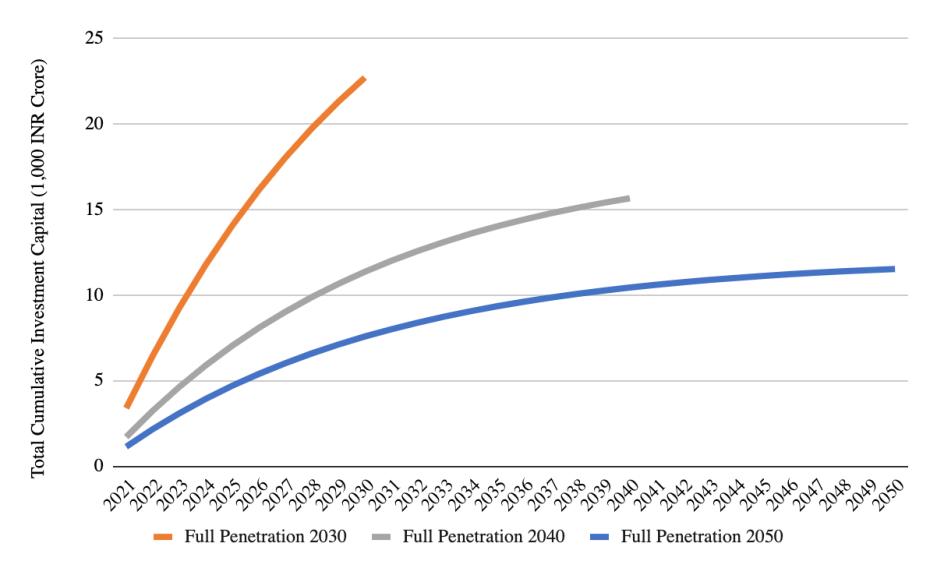

The discounted cashflow analysis presented in this section estimates total capital investment capital that must be mobilized for full penetration of Rajasthan’s solar feeder capacity. “Full penetration” is defined as the 6,121 MW of identified capacity if solar feeders are limited to a maximum size of 2 MW (as identified by RREC and noted in KUSUM A tender documents). Figure 7 illustrates the investment capital mobilized over time to reach 6,121 MW of solar capacity by 2030, 2040, and 2050, respectively. Overall, the longer the rollout, the lower the required capital investment in real terms. This is largely due to the assumption of falling module and panel costs over time and discounting of expenditures that can be delayed. While based on historic trends, these cost reductions are not guaranteed. Rollout by 2040 of the 6,121 MW capacity would require ₹15,642 of developer capital.

Figure 7: Total Cumulative Investment Capital Mobilized Over Time, KUSUM A (6,121 MW) (2020 ₹ crore) The scale-up analysis for solar feeders under KUSUM A demonstrates the impact of different scale-up paces on the total investment capital to developers. Quicker timetables substantially increase the total real expense to developers.

If full penetration of 6,121 MW were achieved via net-metered pump solarization by 2040, the total cost of the 60 percent subsidy Governments of India and Rajasthan are committed to provide would be about ₹13,767 crore. This implies a total capital cost for the project of ₹22,945 crore, much higher than the ₹15,642 crore provided under KUSUM A.

SUPPLY OF PV HARDWARE

Because of the domestic content requirement (DCR) for all solar cells, solar modules, and balance of systems used in KUSUM projects, short supply of any of these component or holdups at any point along the supply chain could constrain Rajasthan’s ability to achieve its KUSUM targets. Supply chain challenges may be especially pronounced if KUSUM accelerates quickly and Rajasthan is forced to compete with other states for access to indigenously manufactured components. This analysis considers how changes in supply chain capacity growth or prioritization of KUSUM in Rajasthan could impact GoR achieving its KUSUM targets.

Growth Scenarios

Given India’s currently limited manufacturing capacity of solar cells and solar modules (3 and 11 GW per year, respectively) these components pose a potential source of supply-chain constraints on the way to meeting KUSUM targets. To evaluate that risk, low, medium, and high growth scenarios for domestic solar cell manufacturing capacity were analyzed:

• Low Growth: 5 percent annual growth • Medium Growth: 2 GW annual growth • High Growth: 5 GW annual growth

The 5 percent growth scenario was used as the low-growth scenario because it achieves significantly less manufacturing growth than is expected based on over 10 GW of existing and upcoming solar cell manufacturing contracts in India while setting a useful baseline for comparing other, more ambitious scenarios.112,113,114 The 2 GW/y and 5 GW/y growth scenarios denoted as medium and high-growth respectively, are based on these existing and upcoming manufacturing contracts, as well as reports from MNRE and other authorities assessing growth potential in the domestic solar manufacturing sector. 115,116 Of particular importance for Rajasthan was also an August 2020 announcement by ReNew Power of their intent to set up 2 GW of solar cell and module manufacturing in Rajasthan which would be the first solar cell manufacturing plant in the state.117 Additionally, in November 2020, GoI approved a financing package that included over ₹45 billion for investment over five years to support the domestic development of high-efficiency PV modules, further indicating GoI’s priority for expanding its domestic PV manufacturing capacity. 118

Access Assumptions

There are deep uncertainties regarding how much access to domestic manufacturing capacity Rajasthan will have and of that capacity, how much they will allocate toward KUSUM projects. Thus, wide bands of uncertainty are used to identify how sensitive GoR’s ability to implement KUSUM projects is to their access to domestic manufacturing constraints.

• Assumption 1: 30 percent (+20/-10 percent) of Indian-wide domestic manufacturing capacity will be accessible to Rajasthan. Because schemes like KUSUM are implemented at the State level, and States like Rajasthan have set their own independent solar power targets, it is likely that state boundaries will play a role in how much access GoR has to India’s overall domestic solar cell manufacturing capacity. According to MNRE, Rajasthan accounted for approximately 30 percent of all newly installed solar power capacity across India in the last 2.5 years.119 Rajasthan’s overall solar power target (30 GW) is also 30 percent of the national target (100 GW). Lastly, as discussed earlier, there is a current proposal to build the first-ever solar cell manufacturing plant in Rajasthan with 2 GW of manufacturing capacity. 120 Thus, this analysis assumes Rajasthan will have access to roughly 30 percent (+20/-10 percent) of Indian-wide domestic manufacturing capacity.121 • Assumption 2: 70 percent (+/- 20 percent) of the domestic solar cell capacity Rajasthan has access to will be directed toward KUSUM projects. There are currently three Indian-wide solar programs with a DCR for PV cells, of which KUSUM’s 30.8 GW target comprises 70 percent of their combined target. 122,123,124 Because Indian-manufactured solar cells are typically more expensive than imported solar cells, it is unlikely that projects with DCRs for solar cells will have to compete for these products with other projects without DCRs, since these other projects can utilize less-expensive imported solar cells.125,126 Based on these assumptions and their associated sensitivity bounds, every GW of increased Indian solar manufacturing capacity would supply Rajasthan with 100 MW of new KUSUM projects in lowaccess scenarios, 210 MW in medium-access scenarios, and 450 MW in high-access scenarios

Results

Domestic content requirements may constrain India’s ability to achieve its KUSUM targets.

To consider the impact of DCR on KUSUM projects across all of India, the three growth scenarios were analyzed in conjunction with how much GoI might prioritize KUSUM projects compared to other DCR PV projects (Assumption 2 above). Figure 8 displays the cumulative potential domestic solar cell manufacturing in India over time and shows that Indian domestic solar cell manufacturing could be a constraint for GoI to achieve its 30.8 GW KUSUM target by the end of 2022. Of the growth scenarios considered, even the high growth scenario with a high priority of KUSUM projects fails to achieve sufficient capacity to meet India’s KUSUM targets. Despite the possible constraint on GoI achieving its KUSUM goals, however, GoR’s targets could be more achievable

Figure 8: Cumulative Potential Domestic Solar Cell Installed in India This graph displays the potential cumulative quantity of domestically manufactured solar cells in India over time. The scenarios vary based on two uncertainties: domestic manufacturing capacity growth rate for solar cells, displayed as low (5 percent growth), medium (2GW/year), and high (5GW/year) growth rates varying in color; and how much India’s will prioritize utilizing this domestic output for KUSUM projects vs. other DCR projects, displayed as low (50 percent, medium (70 percent), and high (90 percent) priority varying in line type. India’s KUSUM target of 30.8 GW by the end of 2022 are shown in black dashed lines. All scenarios start at the current annual domestic manufacturing capacity for solar cells of 3 GW and grow assuming all manufacturing capacity is fully utilized year over year. The figure demonstrates that even a high growth scenario that highly prioritizes KUSUM projects may fail to achieve India’s KUSUM target by the end of 2022.

Domestic content requirements should not constrain Rajasthan’s ability to achieve KUSUM targets. Figure 9 displays the cumulative potential installed KUSUM capacity in Rajasthan over time. This figure suggests two findings: First, that lower domestic manufacturing growth and constrained access to that domestic output delay Rajasthan from reaching its 4 GW DG target; and Second, despite delays, only in the low-growth with low-manufacturing access scenario does Rajasthan fail to install 4 GW by 2025. Acknowledging the uncertainties involved in Figure 9, so long as India grows domestic PV manufacturing by a modest rate of at least 2 GW annually, or Rajasthan receives access to at least 210 MW of every 1 GW of India’s PV manufacturing capacity that the state utilizes for KUSUM projects, the industrial supply chain is not likely to constrain implementation of KUSUM in Rajasthan. Even considering the most ambitious timeframe for reaching a full penetration of 6,121 MW by 2030, as discussed in the previous section, the industrial supply chain is not likely to be a serious constraint.

Figure 9: Potential Cumulative Installed KUSUM Capacity in Rajasthan This graph displays scenarios for the potential cumulative installed capacity of KUSUM projects in Rajasthan over time. The scenarios vary based on two uncertainties: domestic manufacturing capacity growth rate for solar cells, displayed as low, medium and high growth rates varying in color; and Rajasthan’s access to India’s domestic manufacturing capacity that the state utilizes for KUSUM projects, displayed as low, medium, and high access varying in line type. Rajasthan’s DG target of 4 GW by the end of 2025 are shown in black dashed lines. The graph demonstrates that only with low-growth and low-manufacturing access may Rajasthan be constrained to reach its 4 GW DG target by the end of 2025.

SUPPLY OF PV SUPPORT SERVICES

Beyond PV hardware, rapid PV deployment relies on routine labor and technical skill that all levels of government would do well to cultivate. That said, this report finds no evidence that a lack of support services would badly constrain Rajasthan’s prospects for solarization of irrigation pumping.

Solar feeders can demand very much, or very little of farmers. If Rajasthan wants only to provide farmers cheaper, more reliable electricity and water, solar feeders do so without explicitly demanding any development input from farmers. 127 Excluding farmers places the burden of design, construction, operation, and management with specialized actors; namely, Discoms and private developers. Where feeders are owned by farmers or by farmer cooperatives, service challenges increase dramatically, as untrained farmers must double as developers, business planners, and construction foremen. Though this model gives farmers maximum ownership over power generation, without support from NGOs, it is rarely entertained.

Solar pump purchases offer farmers comprehensive coverage. If Rajasthan insists on preserving farmers’ ability to sell electricity to the grid, grid-connected, solar pumps provide this capability and, fortunately for farmers, can be installed under KUSUM with extensive support from the implementing agency. Following installation, maintenance needs are met for a limited time by warranties and annual maintenance contracts (AMCs):

Annual Maintenance Contracts (AMCs) cover pump operators’ short-term service needs.

Vendors bidding under KUSUM C must have AMCs for at least five years, establishing service centers and customer helplines in all client communities. 128 Staff must speak local languages and respond to calls quickly: In Rajasthan, vendors must rectify breakdowns within three days of a complaint.129 This rapid-response service enables Discoms in Rajasthan to ensure an 18 percent capacity utilization factor (CUF) for all solar pumps, compensating users for any shortfall at a rate of ₹7.00/kWh.130

Comprehensive maintenance coverage reduces risk and uncertainty for farmers—at least during their first five years with solar pumps. However, with PV systems intended to last several decades, farmers must eventually maintain systems themselves. As such, MNRE requires vendors to train locals in longterm upkeep.131 Publicly available RFPs mention this requirement only in passing, however, directing contractors to “provide training to the locals” without further specifics.132

Warranties cover pump operators’ medium-term service needs.

Vendors like Adani normally warranty panels against assembly defects for ten years and performance deficiencies for twenty-five years.133 Inverters, likely the most maintenance-prone components of PV systems, are usually warrantied for five years.134 However, warranties are only as good as the vendors that offer them. If a manufacturer becomes insolvent, uninsured warranties cease to exist, leaving buyers to inherit all performance risk.

If MNRE expects farmers to develop, own, and operate solar feeders, accessible training must

be offered to hone requisite skills. As a State Nodal Agency (SNA), Rajasthan Renewable Energy Corporation Ltd. (RRECL) is required to assist farmers with “project development activities including formulation of DPR, PPA/EPC contracts, getting funds from financial institutions, etc.”135 RRECL trainings apparently target vendors, however, and as such neglect farmers’ gaps in business planning, system design, etc.136 SNAs do coordinate with the National Institute for Solar Energy to administer “Suryamitra” trainings in both maintenance and entrepreneurship. Rajasthan has nineteen Suryamitra centers and plans to graduate 2500 technicians over five years.137, 138 While its syllabus is quite thorough, the Suryamitra program is unfortunately ill-suited to farmers. First, Suryamitra is a 600-hour residential program which, though free, would take farmers from fields for inordinate lengths of time. Second, eligibility is restricted to Indian Technical Institute graduates and diploma-holders, 139 a condition most farmers aren’t likely to meet.

Augmenting government trainings are institutions like Amity University, Jaipur, which charges ₹3 lakh for a master’s degree in Solar and Alternative Energy. 140 These programs are also out of reach for most

farmers, but are nonetheless necessary to equip the small, but essential pool of engineers and specialists who must (among other tasks) engineer solar feeders. At the other end of the spectrum are nonprofits like the widely respected NGO Barefoot College, whose headquarters in Tilonia, Rajasthan has already been solarized by program graduates.141 These “Solar Mamas”—women and girls often sidelined from development schemes—might well be employed to install and maintain Rajasthan’s fleet of solar PV, just as Barefoot College might be recruited to train locals in entrepreneurship, financial planning, and other “soft” skills required to develop feeder installations.

Although farmers will not need training in most routine tasks, GoR should train them in water

management and crop selection. With both solar feeders or solar pumps, many jobs require little to no training, such as panel cleaning. Feeder installations might be dusted or hosed every month or so, with greater or fewer cleanings as local conditions demand. Spot-checks using infrared cameras can occur as infrequently as once or twice-annually, with only rare tasks (circuit breaker maintenance, transformer refilling, etc.) potentially requiring outside assistance.142 Where assistance is not provided under warranties or annual maintenance agreements, it would not be hard for several installations (or many farmers with solar pumps) to share in the hiring of one itinerant technician.

The GoR should instead ensure that training efforts are focused on areas where farmers are currently underprepared, including communal water management and selection of water-sensitive crops. Even simple information-sharing interventions have proven effective at conserving water in other parts of India, and initiatives like the Foundation for Ecological Security’s Water Commons Project provide templates for how more advanced trainings might be organized.143, 144

WASTE MANAGEMENT

India currently has no central plan for PV disposal and recycling, but with 100 GW of solar ostensibly on the way (and over 30 GW from KUSUM alone), time is running out to make one. The Energy and Resources Institute (TERI) estimates over 100,000 tons of PV waste will accumulate over just the next two years, much of it toxic, and much of it carcinogenic. 145 Disposing and recycling this waste requires a suite of services not yet incorporated into the supply chain, including panel disassembly, combustion, and etching (the process whereby recyclable glass and metals are recovered).

Rajasthan stands to bear the brunt of this waste issue, given its high prospects for solar development, and should thus encourage investment in a national waste program. The central government ought to embrace this challenge, as an abundance of recycled components would make it easier to satisfy DCRs in solarization schemes currently limited by scarce domestic supply. TERI identifies silicon, cobalt, germanium, and lithium as only the most critical minerals that might be recovered. 146