WASHINGTON CPA THE

SPRING 2024

Beyond Borders: The Complexities of CPA Mobility

Navigating Leadership: Insights from WSCPA Emerging Leaders

Updating and Future-Proofing Washington Accountancy Act

Volume 67, Number 4

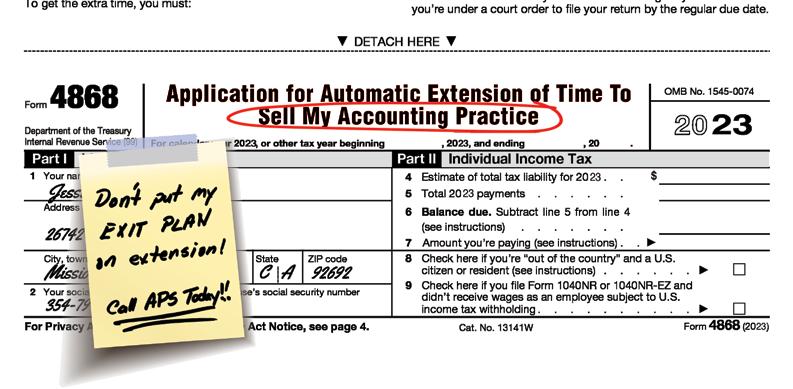

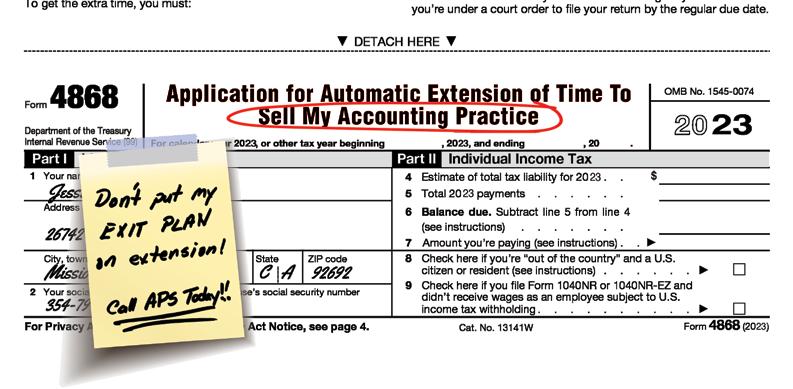

Delivering Results - One Practice At a time GREATEST # of Listings GREATEST # of Buyers UNMATCHED RESULTS! $ 1.5 billion+ in Deals Closed! Our Best-in-class Brokers will help you achieve YOUR goal!

Sherif Boctor Sherif@APS.net 888-783-7822 www.APS.net Scan Here

www.wscpa.org • memberservices@wscpa.org

Tel 425.644.4800

170 120th Ave NE Ste E101 Bellevue, WA 98005

BOARD OF DIRECTORS

Andrew Brajcich Chair

Sarah Funk Vice Chair

Ed Ramos Treasurer

Writu Kakshapati Secretary

Sara Bailey Immediate Past Chair

Kimberly D. Scott President & CEO

Richard Burger Mackey Ursula Perkins

Norman Haugen Bryce Rassilyer

Courtney Hirata Liz Redmond

Jamie Hueners Jillian Robison

Kelly Nelson

Joel Williams

CHAPTER BOARD CHAIRS

Charles Meyerson Everett Area

Marcie McAllister Everett Area TBD Seattle/Bellevue Area

Kairi Roberts Spokane Area

Nick Braun-Lopez Tacoma Area TBD Tri-Cities Area Canada Segura Yakima Area

Wade Helms Yakima Area

MAGAZINE PRODUCTION Jeanette Kebede Editor Jennifer Johnson Art Direction The Washington CPA is published by the Washington Society of Certified Public Accountants for its members. Views and opinions appearing in this publication are not necessarily endorsed by the Washington Society of CPAs. The products and services advertised in The Washington CPA have not been reviewed or endorsed by the Washington Society of Certified Public Accountants, its board of directors, or staff. The Washington CPA is published quarterly by the Washington Society of Certified Public Accountants, 170 120th Ave NE Ste E101, Bellevue, WA 98005. $12 of members’ annual dues goes toward a subscription to The Washington CPA Periodicals postage paid at Bellevue, Washington and additional mailing offices. Cover Graphics illustrations: © iStock/Iconic Prototype, © iStock PeterPencil, © iStock/DvdArts, © iStock/FireflyLight back photo: © iStockAlmaje POSTMASTER: Send address changes to The Washington CPA, c/o WSCPA, 170 120th Ave NE Ste E101, Bellevue, WA 98005. THE

Meet the WSCPA Board of Directors Nominees CPAPAC Conbributors Membership News Washington CPA Foundation Contributors WSCPA Peak Firms Upcoming CPE Classified Ads Spotlights Departments 4 12 18 26 30 8 24 Beyond Borders: The Complexities of CPA Mobility Navigating Leadership: Insights from WSCPA Emerging Leaders Updating and Future-Proofing Washington Accountancy Act The Journey Toward Solving the Pipeline Crisis On the Cover 6 14 20 22 @WashingtonCPAs CONTENTS 3 www.wscpa.org The Washington CPA Spring 2024

WASHINGTON CPA SPRING 2024

Pipeline Survey: Help Shape the Accounting Profession

A career in accounting offers tremendous stability and unlimited opportunities. However, the profession’s talent pipeline has been shrinking, and we need your help to prioritize potential solutions. The National Pipeline Advisory Group (NPAG) is now seeking feedback that will help shape potential talent solutions. By taking one of the quick but critically important national surveys, you can help the advisory group prioritize and refine a holistic pipeline strategy. Visit wscpa.org/pipelineblog

Check out this free benefit for WSCPA members!

Verifyle and the WSCPA have partnered to offer all members access to Verifyle Pro™️, Verifyle’s premium, ultra-secure online file sharing and messaging service (a $108 value) at no cost to WSCPA members

Verifyle is an extremely simple-to-use cloud storage and sharing tool that offers:

• The most powerful encryption technology available on the web (Cellucrypt®️)

• A polished and professional way to present yourself to existing and prospective clients

• Digital signatures capability for requesting clients sign, date and initial documents inside Verifyle

To take advantage of this free benefit:

Sign up at verifyle.com/wscpa using the email on your WSCPA member account.

4 The Washington CPA Spring 2024 www.wscpa.org MEMBERSHIP NEWS

WSCPA Membership Summit 2024 | June 12 | Bellevue | 8 CPE credits

WSCPA Annual Meeting Webcast (Membership Summit Opening Sessions) | June 12 | 3 CPE credits

Join us on June 12 for the WSCPA Membership Summit! This exclusive, FREE event is an opportunity to connect with fellow accounting professionals, exchange ideas, and gain valuable insight into the latest happenings affecting the profession.

Throughout this event, you will have the opportunity to engage with your peers and participate in interactive educational sessions while earning complimentary CPE.

Multiple sessions throughout the day will include:

• Annual meeting

• State and national updates

• Professional issues update

• Artificial intelligence

• Student pipeline round tables

• Fraud schemes that effect clients

• Building resilient teams

• Art of influential conversation

Don’t miss out on this chance to network with like-minded peers and celebrate the accounting profession. Sign up today and join us for the WSCPA Membership Summit! Space is limited. Visit wscpa.org/summit2024

Kick off your Membership Summit experience with the Members Only Experience on June 11. Details forthcoming.

5 www.wscpa.org The Washington CPA Spring 2024 MEMBERSHIP NEWS

photos: Shelly Oberman Photography

The Complexities of CPA Mobility

Andrew Brajcich, CPA, JD, LLM

CPA mobility is increasingly in the spotlight. Mobility gives CPAs the ability to practice in jurisdictions outside of the jurisdiction(s) in which they are licensed. For example, as a Washington CPA I can provide services in California without being required to apply to the California Board of Accountancy. As a profession, we are fortunate to have mobility across all 55 jurisdictions except one, Hawaii. This is possible through a concept known as substantial equivalency. That is, each jurisdiction has agreed to accept all other jurisdictions’ CPA licensure requirements as substantially equivalent to their own.1 Thus, a licensed CPA from any jurisdiction has met the standards of nearly all other jurisdictions. Or at least something close to their standards. There are variations in rules across jurisdictions, such as when a candidate can begin taking the CPA exam, years of experience required, specific educational courses required, and hours of ethics needed.

1 This determination is made at the jurisdiction level. In Washington, our State Board of Accountancy makes decisions around this.

Generally, to become licensed as a CPA, a candidate must complete 150 semester credits, pass the uniform CPA exam, and work for a year. This is often referred to as the “universal pathway.” According to some, this is the cornerstone of substantial equivalency and without it, mobility collapses. Without mobility, many CPAs will be restricted from practicing across state lines at potentially economic and professional risk. There are, however, currently some circumstances that still qualify as substantially equivalent without requiring a candidate to obtain the 150 credit hours.

In New York, candidates with 15 years of experience can bypass the 150-credit hour rule and take the exam. In Ohio, candidates do not need to complete 150 credit hours if they score 670 or higher on the Graduate Management Admission Test (GMAT). Also in Ohio, 60 credits with a two-year degree will suffice if the candidates have four years of experience and score at least 670 on the GMAT. In South Carolina, candidates serving

illustration: © iStock/hurca 6 The Washington CPA Spring 2024 www.wscpa.org

in the military can count executive education toward their 150 hours. And in Nebraska, candidates can use experience “in lieu of” college degrees.2 The question that begs to be answered here is, why haven’t these exceptions torpedoed substantial equivalency already? Alternatively, why would an alternative pathway similar to that proposed in Minnesota3 be any different than these long-established exceptions?

In response to the CPA pipeline crisis, the AICPA formed the National Pipeline Advisory Group (NPAG), of which our very own President & CEO Kimberly Scott is a select member, and NASBA formed the Professional Licensure Task Force. Both groups’ work continues, with plans expected from NPAG in May and NASBA’s task force in October.

NPAG is examining the licensure model as well as larger pipeline issues, while NASBA's task force is only addressing the licensure model. NASBA’s response is meant to be just-in-time/rapid or reactive response to what is happening legislatively around the US at this moment, while NPAG is looking at broader, long-term solutions. There is potential for the two groups to align around the licensure model process. While many have expressed that the

2 Nebraska Revised Statute 1-136.04.

3 https://www.mncpa.org/involvement/legislative/broadening-pathwaysto-cpa/

work is reactive and late to the table to fix issues, I am hopeful when I hear Kimberly state that all potential solutions are on the table and robust, meaningful discussions are happening.

I hope that the solutions or outcomes proposed from the group or task force look beyond the issue of keeping everyone happy and work toward creating outcomes that will modernize the licensing process and make it more appealing to the next generation. This is a noble and worthy profession, and we need to attract and keep talented people.

Chair of the Board of Directors, Andrew Brajcich, CPA, JD, LLM, is the Jud Regis Endowed Chair of Accounting, Graduate Accounting Director, and Professor of Accounting at Gonzaga University. You can contact Andrew at brajcich@gonzaga.edu.

Learn More

• Read more about CPA mobility in Mike Nelson's advocacy article, Updating and Future-Proofing Washington Accountancy Act, on page 20.

• Kimberly Scott writes more about CPA pipeline initiatives in her article on page 22, Turning What Ifs into Reality: The Journey Toward Solving the Pipeline Crisis.

7 www.wscpa.org The Washington CPA Spring 2024 LEADERSHIP LENS

In accordance with Article VI of the bylaws, all nominees will be declared elected by the secretary at the annual meeting unless other nominations, supported by at least one percent of membership, are received by April 1, 2024. If a contest for one or more positions develops, an election for those positions will be held at the meeting. The 2024 Annual Meeting is scheduled for June 12, 2024.

Meet the Incoming Chair:

Sarah Funk, CPA, CGMA

Term: 2 years

Becomes Immediate Past Chair 2025-2026

Board Service: since 2020

Sarah Funk, CPA, CGMA, has more than 20 years of multi-national financial, operations, technology and telecommunication experience spanning accounting, budgeting and finance, compliance, audit, system implementations, transaction activities, money transfer services and public accounting. She is the Chief Financial Officer at Ben Franklin Transit. Sarah is an active member of various civic and community revitalization efforts. In her free time, Sarah enjoys spending time with her family and being outdoors.

What advice would you give to a newly licensed CPA? Raise your hand, get involved and stay involved in your community and the profession. The opportunities you pursue early on in your career outside of work will accelerate building your leadership tool kit and pave the way to a bright future.

What trend do you hope makes a comeback? Technology-

Vice Chair:

Joel Williams, CPA

Term: 3 years, becomes Chair 2025-2026

Board Service: since 2022

Joel Williams, CPA, is a Senior Manager in KPMG’s Global Mobility Practice in Seattle. He has more than 20 years of experience in the global mobility industry. Joel has had the benefit of living and working in Riyadh, Saudi Arabia; London; and Houston during his career and has served clients primarily in the energy, financial and technology sectors. In addition, Joel is a leader within KPMG’s Global Mobility Services Innovation team, an interdisciplinary group of professionals that develops and delivers emerging technologies and creative solutions to help solve our clients’ challenges.

Tell us about a time when you felt like a hero at work. I won a national award in our practice for being a culture champion this past year and I was completely surprised that I won. It was great to be recognized for the effort I make daily to have a positive impact on the firm’s culture.

8 The Washington CPA Spring 2024 www.wscpa.org BOARD OF DIRECTORS

Treasurer:

Ed Ramos, CPA

Term: 1 year (second term)

Board Service: since 2022

Ed Ramos, CPA, is a shareholder at DP&C, a local CPA firm in Tacoma, with more than 24 years of public accounting experience. He attended Wilson High School, Highline Community College, and transferred to Eastern Oregon University. His practice primarily focuses on auditing and accounting for various organizations in the not-for-profit, construction, electric co-op, and employee benefit plan industries. Ed co-founded and served as the past treasurer for the Seattle Chapter of the Association of Latino Professionals in Finance and Accounting (ALPFA). He has served on various non-profit boards as a treasurer or finance committee member, including the WSCPA Foundation Board of Trustees and Grants Committee. Ed is an alumni of the 2011 AICPA Leadership Academy and previously served on the AICPA National Commission on Diversity and Inclusion. Ed is currently a board member at MultiCare Health Foundation. He enjoys traveling, running, and spending time with his family.

What is one organizational tool that you cannot live without? Outlook—I would not know what to do next without it!

How do you handle stress? I spend some time at least once a week to organize and prioritize my work as much as possible. I know it will not all get done, but visualizing that it’s possible helps.

Secretary: Richard Burger

Mackey, CPA, CIA

Term: 1 year

Board Service: since 2023

Richard Burger, CPA, CIA, has 20 years of financial, compliance and assurance experience and has demonstrated proficiencies in executing governance, risk, and control design reengineering across a diverse product/service portfolio involving a multitude of business functions. An experienced and trusted advisor, Richard can engage various stakeholders for managing risk governance. Prior to serving as a Senior Investigator at Microsoft, Richard served as a Compliance Program Manager and Audit Manager; and previously served the Boeing Company as an Auditor and Senior Analyst. Richard graduated from Seattle University with a Bachelor of Arts in Business Administration and Accounting and completed internal audit graduate coursework at Seattle University. Richard is a CPA and an Institute of Internal Auditors Certified Internal Auditor (CIA).

In your opinion, what is the best type of cheese? Emmentaler (Swiss) cheese! It’s so versatile; it can be dressed up or down. It’s great when served simply, or it can complement a fancier spread like fondue. Emmentaler goes along nicely with everything.

Are you a collector of something? If so, what? I became a collector of movie DVDs as the technology becomes more difficult to find. Call me sentimental for history, arts and culture.

RETURNING LEADERS

These leaders currently serve on the Board of Directors and will continue serving on the Board.

Chair | Sarah Funk, CPA, CGMA

Immediate Past Chair | Andrew Brajcich, CPA, JD, LLM

President & CEO | Kimberly Scott, CAE

9 www.wscpa.org The Washington CPA Spring 2024 BOARD OF DIRECTORS

Director:

Jerrilyn Bogart, CPA

Term: 3 years

Jerrilyn Bogart, CPA, is the Sr. Finance Program Manager for Seattle Children's Hospital System. Graduating with her B.S. in Accounting from Western Washington University, Jerrilyn went on to earn her Master of Accounting (Taxation) degree from the University of Washington. Since starting her career at PricewaterhouseCoopers, she has held various roles gaining experience in private and non-profit organizations. In her spare time, Jerrilyn enjoys spending time with her son, cooking and being outdoors.

What advice would you give to a newly licensed CPA? I would advise new CPAs to understand your priorities and set boundaries. Get comfortable standing up for yourself in a professional way.

Are you a collector of something? If so, what? I’ve become an accidental collector of outdoor accessories. If there’s something that looks handy for camping or hiking, I probably have it.

Director:

Michaela Kay, CPA

Term: 3 years

Michaela Kay, CPA, has more than 15 years of professional accounting experience, providing audit and tax services to the Greater Seattle area. Currently, she serves as the practice leader for the BDO Seattle office’s Government and Nonprofit practices.

Michaela is one of BDO's Audit Quality Directors (AQD). As an AQD, Michaela is actively involved in staff training and the other quality control measures. In addition to internal training at BDO, she regularly teaches courses on single audits and other nonprofit accounting and auditing topics for the WSCPA and Thompson Grants.

In her free time, Michaela spends time with her husband, two daughters, and two dogs.

What is one organizational tool that you cannot live without? My Outlook calendar! I put everything I need to do on my calendar. I am completely reliant on my calendar to tell me what to do each day.

In your opinion, what is the best type of cheese? Yum!!! Cheese!!! I really enjoy cheese in general, but I think the best cheese is the classic Beecher’s cheese. I love that I can buy it at Costco or the airport or at Pike Place Market. Beecher's is the best because it is delicious just to eat plain or with crackers and it also makes amazing grilled cheese sandwiches.

10 The Washington CPA Spring 2024 www.wscpa.org BOARD OF DIRECTORS

Director:

Scott Rodgers, CPA, MST

Term: 3 years

Scott Rodgers, CPA, MST, is a sole practitioner who entered the profession working for large local CPA firms in Bellevue, Washington. He started up his own practice in 1999 and has provided tax compliance and consulting services to a wide range of business clients. Scott is a co-founder of the Sole Practitioners Resource Group which has hosted monthly meetings since 2011. He is also an active member of the International Tax Resource Group. Scott served as treasurer of the Eastside Nihon Matsuri Association, a Japanese cultural arts nonprofit. Scott and his wife enjoy challenging home improvement projects and spend their free time traveling in Japan.

What advice would you give to a newly licensed CPA? Do more than the minimum CPE hours. Go in person, bring your business cards, and make the effort to meet people outside your network. So many opportunities begin with a casual meeting at a CPE event.

Describe your perfect sandwich. For me, pulled pork on a brioche bun is the ultimate sandwich. A light touch of BBQ sauce and a topping of red cabbage slaw make this the perfect combination.

Director:

David Togami, CPA

Term: 3 years

David Togami, CPA, is a Senior Manager in Armanino’s Growth Office, Data & Analytics group. Born and raised in Honolulu, Hawaii, David moved to Washington to attend Gonzaga University. Throughout his career, David has worked in a range of industries, including public accounting, aviation, intermodal operations, information security, and DevOps. Outside of work, David is an adjunct instructor at Gonzaga University and trains at a local Thai boxing gym.

What is one organizational tool that you cannot live without? The calendar on my phone. It keeps me on track for just about everything from dinners to deadlines.

Describe your perfect sandwich. It’s all about the bread. It needs to be light and crispy, but sturdy enough to hold whatever fillings and sauces you choose. Meatball subs or spam, egg, and cheese (don’t knock it until you try

RETURNING DIRECTORS

These members currently serve on the Board of Directors and will continue serving on the Board.

Jamie Hueners, CPA

Writu Kakshapati, CPA, CGMA

Kelly Nelson, CPA

Ursula Perkins, CPA

Liz Redmond, CPA

Jillian Robison, CPA

11 www.wscpa.org The Washington CPA Spring 2024 BOARD OF DIRECTORS

illustrations: © iStock/serkorkin, © iStock/DTvector

We extend our deepest gratitude to our Washington CPA Foundation contributors. As a donor, you are a valued partner. Your contribution enables us to continue our vital work of investing in the future of the accounting community.

As an organization, we remain steadfast in our commitment to promoting awareness and accessibility to the CPA profession, and we are proud that our efforts have yielded positive results. Thanks to the generous support of individual and firm contributors like you, we have been able to provide scholarships to aspiring CPAs and grants to local organizations dedicated to creating a more diverse pipeline of future CPAs.

As we embark on another year of service to our community, we recognize the essential role that each of you play in making our work possible. We look forward to another year of being able to carry out this important work for our profession.

NAMED SCHOLARSHIPS & ENDOWMENTS

$5,000+

Bill Reed Family Black Accounting Scholarship

Clark Nuber PS

DP&C Black Accounting Scholarship

EY Accounting Scholarship

George J Waterman Memorial Scholarship

Roy J. Polley Memorial Endowed Scholarship

KPMG Diversity Scholarship

Moss Adams Accounting Scholarship

PwC Accounting Scholarship

Rich Jones Accounting Scholarship by Deloitte

Sambataro Family Accounting Scholarship

Shimer Family Foundation/Deloitte Accounting Scholarship

Danielle Lyndes Legacy Scholarship by employees of Baker Tilly

NAMED SCHOLARSHIPS

$2,000+ (ASSOCIATE)

Ken Tracy Accounting Scholarship

Roberts Family Accounting Heroes for Military & Spousal Service

Sam L. and Elvera A. Heritage Scholarship

FIRM CONTRIBUTIONS

Johnson Stone & Pagano PS

Newman Town PLLC

Rekdal Hopkins Howard PS

VWC PS

Willett Zevenbergen & Bennett LLP

Williams & Nulle PLLC

SENIOR EXECUTIVES CIRCLE

$1,000-$2,500

Jacqueline L. Davidson, CPA, CGMA

EXECUTIVES CIRCLE

$500-$999

Sara E. Bailey, CPA

Pat L. Bohan, CPA, CGMA, CGFM

Sarah K. Funk, CPA, CGMA

Richard D. Greaves, CPA

Norman Haugen, CPA, CCIFP

Sandra J. Moss, CPA

Gilberto Plascencia, CPA, CFE

LEADERS CIRCLE

Dr Andrew M. Brajcich, JD, LLM, CPA

Richard F. Burger Mackey, CPA, CIA

Christina J. Gehrke, CPA, CIA, CrFA

Courtney Hirata, CPA, MPAcc

Mark A. Hugh, CPA

Ya J. Liu, CPA

Dr Gerhard G. Mueller, PhD

Ursula A. Perkins, CPA

Ed E. Ramos, CPA

Elizabeth L. Redmond, CPA

Jillian M. Robison, CPA

Leslie A. Sesser, CPA

$250-$499

12 The Washington CPA Spring 2024 www.wscpa.org

Louise C. Andrews, CPA, MBA

Carol S. Appleton, CPA, CGMA

Sonjia Barker, CPA

Diane Bingaman, CPA

Jennifer L. Bixel, CPA

Adele B. Bolson, CPA

Kai F. Bottomley, CPA

Rustin P. Brewer, CPA

David A. Brown

Suzanne C. Chaille, CPA

Joseph H. Choe, CPA

Jolene G. Cox, CPA

Bonnie L. Curran, CPA

Wesley L. Delaney, CPA

Randy A. Farrell, CPA

Leon F. Ficker, CPA

Zenaida D. Fletcher, CPA, MBA, CFP

Brian G. Gosline, CPA, JD

Dean A. Granholm, CPA, CGMA

Maureen P. Gummersall, CPA

Charles E. Hallett IV, CPA, CGMA

Patricia A. Hernandez, CPA, CGMA, MBA

Gregg D. Jordshaugen

Michael J. Kander, CPA, CIA

David E. Katri, CPA, MBA

Marla D. Lockhart, CPA, MAFM

John F. Lynch, CPA

Mark E. Martinez, CPA

Anoop Mehta, CPA, CGMA

Louis H. Mills, CPA

SUPPORTING CONTRIBUTORS $1-$99

Leonard L. Almo, MBA

Todd S. Arkley, CPA

John P. Baker, CPA

Allison Benabente, CPA

Robert C. Best, CPA, JD

Mr Bruce E. Bixler

Justin J. Blanchet, CPA

Gregg W. Blodgett, CPA

Sidney H. Boles, CPA

J B. Bradshaw, CPA

Megan Y. Brady, CPA

Christine B. Brunner, CPA

David I. Calvo, CPA

Vincent E. Cataldo Jr, CPA

Rebecca A. Cates, CPA

Chloe F. Claiborne, CPA

Jay F. Cramer

Alan R. Dance, CPA

Stephen G. Dashiell, CPA

Joseph P. Deacon, CPA

David E. DeGroot, CPA

Justin P. Dix, CPA, MBA, CFE

Thomas G. Donaghy, CPA

David A. Dorn, CPA

David C. Fitzpatrick, CPA, MBA, MA

Clifford M. Frederickson, CPA, CGFM

Chris A. Gates, CPA

Pamela S. Geiger, CPA

Richard N. Ginnis, CPA

Bert R. Golla, CPA

Michaela M. Gould, CPA

Alan L. Gray, CPA

Gerald L. Greer, CPA

Robert B. Gulrajani, CPA, CGMA, CEA

Michael P. Hart, CPA, MPAC

Katherine H. Hasegawa, CPA

Wayne E. Hays, MBA

Sandra J. Heffernan, CPA

Jacqueline J. Henry, CPA

Mary E. Howe, CPA

Flynn X. Huang, CPA

Michael K. Hutchinson, CPA

Cindy L. Isaacson, CPA

Kraig A. Jones, CPA

Arthur Y. Kageyama, CPA

Raad T. Kattula, CPA

Jo A. Kelly, CPA

Kristin L. Knopf, CPA, MBA, MPAcc

Jennifer S. Korten, CPA

Kahoua M. Koudou

Marcella M. Kulland, CPA

Stroud W. Kunkle, CPA

Frank J. Kuntz, CPA,PS

Rhona H. Kwiram, CPA, CGMA

Irene R. Laible, CPA

Carol M. LaMotte, CPA

Joann E. Lee, CPA, MSTax

Luellen H. Lockwood, CPA, MBA, EA

Robert B. Loe, CPA, MBA, CFE

Peter L. Madison, CPA

Carrie A. Martin, CPA

James W. McKean, CPA

Bruce I. Mitchell, CPA, MBA

Annette M. Moore, CPA

David S. Nelson, CPA, CTRS

Terence V. O'Keefe

Fred S. Peck, CPA

Hwan J. Perreault, CPA

Kristine T. Nelson, CPA, MPAcc

Thomas P. Nicholas, CPA

Bradley C. Patton, CPA

Candice A. Pfluger, CPA

Stephen J. Reddaway, CPA

Bill Reed, CPA, CGMA, MBA

James J. Rigos, CPA, JD, CMA

Thomas P. Sawatzki, CPA

Julleen J. Snyder, CPA, CGMA

Duy-Linh Ta, CPA

Nancy L. Voelckers, CPA

Dorothy R. Wagsholm, CPA

Lorina Person

Jack B. Person, CPA

Michael C. Plato, CPA

Christina A. Polf, CPA

Gregory M. Railsback, CPA, MBA, CFP

Christopher P. Rasmussen, CPA

Leslie H. Redd III, CPA

Margo D. Reich, CPA

Donald L. Rodman, CPA, MBA

Harvey J. Rothschild III, CPA, MBA

Richard H. Russell

Craig S. Ruthford, CPA

Susan J. Sanders, CPA

Morgan L. Schulte, CPA, CMA

John A. Sciuchetti, CPA

Jay T. Shilhanek, CPA

Ralph Siegel, CPA

Janis H. Simpson, CPA

William J. Smith, CPA, CFE, CIA

Cathy L. St John, CPA

Samuel Steel, CPA

Monique S. Stevens, CPA

Linda M. Teachout, CPA

Susan L. Thomson, CPA

Timothy A. Throckmorton, CPA, MAcc

Mark E. Ulloa, CPA

Benjamin J. Warren

Mike C. Watne, CPA

Donald G. Watts, CPA

Sarah E. Whitaker, CPA

Azucena A. Wingard

Michael S. Zwink

SENIOR CONTRIBUTORS $100-$249

13 www.wscpa.org The Washington CPA Spring 2024 WASHINGTON CPA FOUNDATION

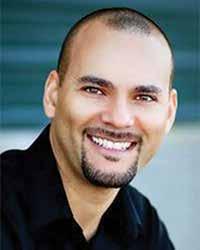

Helen Erven, CPA, is a Senior Accountant in Ship Operations at Holland America Lines. Helen enjoys playing music as well as singing various gospel songs and different music genres. Helen also enjoys cooking in her spare time and trying out new recipes.

Hanna Fleming, CPA, is a senior in Clark Nuber’s Audit and Assurance Services Group. Hanna graduated cum laude from Eastern Washington University in 2020 and began her membership with the WSCPA in 2021, obtaining her CPA license in 2023.

Kaitlynn Gilmore, CPA, is a Staff Accountant at Archer Halliday, P.S. She is a member and board member of Whatcom Women in Business and a board member of the Whatcom Literacy Council. She loves to read, travel, and learn about new cultures.

Carrie Ommen, CPA, is a manager on the Business Solutions Team at Mahoney CPAs and Advisors. She graduated from Hamline University with a BBA in Accounting in 2017. She obtained her initial CPA licensure in Minnesota in 2019 and obtained CPA licensure in Washington in 2022. Carrie enjoys yoga, hiking, traveling, eating at new restaurants, cooking new recipes, and taking leisurely meanders around farmers markets.

Amanda Schaffer, CPA, is a Supervising Senior Audit Associate at SingerLewak, with four years of public accounting experience focusing mainly on not-for-profit organizations, as well as, some privately held companies and funds. Outside of work, Amanda enjoys reading, musicals, and spending time with her friends and family. Amanda is also on the Gonzaga Accounting Young Alumni board.

Alexis Vergara is a Tax Associate at Baker Tilly. She became a member of the WSCPA in 2022 and immediately joined the Emerging Leaders Committee. In addition to her committee leadership and involvement, Alexis serves as the co-chair of Tacoma Chapter Board. Alexis loves a good trashy reality TV show and collecting Starbucks and Stanley tumblers.

14 The Washington CPA Spring 2024 www.wscpa.org

Photo: © iStock/Glenn Pettersen

Navigating Leadership Insights from WSCPA Emerging Leaders

Daniel Fleming

The WSCPA Emerging Leaders Committee (ELC) is a dynamic group of aspiring CPAs and recently-licensed professionals—each with a passion for propelling the accounting profession forward. Their mission? To create a community brimming with engaging opportunities tailored for young professionals, while also leveraging their knowledge and experience to be the next wave of industry leaders. Meet key leaders of the committee and hear about their vision for the profession's future, how they manage work-life balance, and the support they've received from the WSCPA on their professional journey.

As an Emerging Leader with the WSCPA, how do you engage and empower fellow young professionals to become more active and influential contributors to the organization's mission and goals?

H. Fleming: As an Emerging Leader working at a mid-size firm, I am fortunate to have a wide pool of young professionals to engage with and inform about events put on by the WSCPA and ELC. Through mentorship programs and word of mouth, I do my best to share the benefits that result from involvement in various events. The world is ever-changing, and obstacles and opportunities are constantly arising, which makes it that much more important to set an example and encourage peers and colleagues to attend these networking events and stay involved. Once you attend one, you realize the accounting world is not all a scary place, and it can actually be really fun!

A. Vergara: I do my best to speak to everyone in the room. I love to seek out those that stay seated during networking breaks and make it my goal to hear their story. I also make sure to share my story and explain to my fellow young professionals the importance of getting active and the power of networking. I cannot stress that enough! Get involved, get networking, get connected!

In your opinion, what are the most pressing issues or trends facing the accounting industry today, and how do you see young leaders contributing to address these challenges?

K. Gilmore: One of the most pressing issues has been the decline in interest in the public accounting profession. There are so many benefits to having a background in accounting that extend beyond working in public accounting that I feel get overlooked, especially by young students trying to decide on a career path. The advantages of having this background and understanding your company’s financial statements as someone who may be applying for a CEO position or starting their own business are immense. This has also created a demand that

exceeds the supply of accounting firms willing to take on new clients. I think young leaders can be advocates for the industry and really stress those advantages that come along with that kind of background which will in turn help to reduce the stress that the demand has placed on the industry.

A. Schaffer: In my opinion, the decline in people entering our industry, coupled with increasing regulatory requirements, has resulted in a crisis of audit/accounting quality. Young accountants will be instrumental in modernizing firm processes, bringing their unique experience of growing up in the Digital Age to help find technological efficiencies critical to reducing workloads.

How has your involvement with the WSCPA contributed to your growth as a leader, and what unique opportunities have you found through your affiliation?

H. Erven: WSCPA is a great organization to be affiliated with. My involvement in WSCPA committees has positively contributed to my growth as a leader. In my opinion, a good leader is someone who has integrity, self-awareness, courage, respect, compassion, resilience, and gratitude. Being involved with WSCPA committees has boosted my confidence greatly in areas that I am passionate about, such as helping other young professionals to achieve their dreams of becoming a CPA and connecting them with other professionals in the accounting industry as well as collaborating with other leaders in the industry to come up with new ideas to attract college students majoring in accounting to become future CPAs.

C. Ommen: Being involved with the WSCPA has been integral in helping me feel more connected to a larger community after moving halfway across the country, and I’d say the WSCPA’s biggest influence on my growth in leadership has come from the chance to meet and learn from other members. I’ve never known a professional existence outside of public accounting, and, especially as a committee member, it’s beneficial to be able to connect and engage with people from other areas of

15 www.wscpa.org The Washington CPA Spring 2024 MEMBERSHIP

the profession and practice more meaningful communication around issues that affect us all―—everyone from students to CEOs to retirees.

H. Fleming: My involvement with the WSCPA has opened several doors to attending training sessions, planning events through the ELC, volunteering in various capacities, and much more. I was honored to speak on a panel with two other professionals, sharing insights and tips with others preparing for, or in the process of, obtaining their CPA. Participation with the ELC has also provided valuable networking opportunities and helped me to learn about different industries within the accounting world. These experiences and involvement with the WSCPA have been instrumental in advancing my professional development and personal growth.

A. Vergara: I wouldn’t be where I am today without the WSCPA. Everyone involved with the WSCPA has made it their goal to make sure each member feels empowered and has the tools to advocate for themselves no matter what. I would not have the skills nor the growth as a leader if I had not been so actively involved with the WSCPA. I thought I was going to be forever stuck working bookkeeping jobs even after I finished school and got my CPA license. Yet here I am working at such an amazing firm, on the ELC, co-chairing the WSCPA Tacoma Chapter Board, and with the resources to continue after my license and career.

How do you balance the demands of leadership roles with maintaining a healthy work-life balance, and do you have any tips for other young professionals striving for similar equilibrium in their careers?

K. Gilmore: It is a constant challenge for me, but I’ve found that setting clear boundaries for yourself is a good way to combat the demands of personal and professional life. When I get off work, I may receive work-related emails throughout the evening, but those can wait until the morning. I’m also fortunate to have bosses that understand the various challenges that come along with work and life demands. It is something that I prioritized in finding a job. I want to be successful and knowledgeable in my industry but not at the risk of my health. I think finding an employer that aligns with your own outlook on work-life balance is key.

C. Ommen: For me, it involves a lot of setting boundaries and trying to hold myself accountable to them, mostly because I find it very easy to give too much weight to the “work” side of the spectrum. Practicing things like keeping consistent work and personal times, shutting off work-related message notifications, and taking all my PTO each year really help me reset, refresh, and maintain a healthier middle ground. I also consider myself incredibly fortunate to work for a firm where employees are encouraged to seek their own best version of work-life balance―—I’m positive I wouldn’t be able to successfully

sustain mine without the invaluable support of my mentors and team.

A. Schaffer: I’ve always been a “yes” person, like many people in our industry, so healthy work-life balance is never easy. However, I can say that I’ve only accepted leadership roles that I was truly excited about, and that I am always careful about looking at my calendar and not overcommitting. Sometimes balance isn’t trying to fit everything into one day but being more flexible with your time—―accepting that one day/week/month may be work focused, and the next more people/relationship focused.

Want to learn more about getting involved with the Emerging Leaders Committee? Connect with me, at dfleming@wscpa.org.

Learn More

Attend the Women's Leadership Summit on May 16 in Newcastle. Register at wscpa.org/leadership24

“The Women’s Leadership Summit offers an invaluable platform for personal and professional growth!” - Alexis Rodriguez

Daniel Fleming is WSCPA Manager of Membership. Contact Daniel at dfleming@wscpa.org.

Daniel Fleming is WSCPA Manager of Membership. Contact Daniel at dfleming@wscpa.org.

16 The Washington CPA Spring 2024 www.wscpa.org MEMBERSHIP

17 www.wscpa.org The Washington CPA Spring 2024

WSCPA PEAK FIRMS

The WSCPA Peak Firm program recognizes and awards special benefits to firms that sign up 100% of their eligible staff for WSCPA membership. Being a Peak Firm establishes you as a leader in the profession and provides an array of discounts and benefits.

Learn more and enroll your firm at wscpa.org/peak-enroll

CURRENT PEAK FIRMS

Affinity Group CPAs & Consultants

Alegria & Company PS

Baker Tilly LLC

Brantley Janson Yost & Ellison

Clark & Associates CPA PS

Cordell Neher & Company PLLC

Dwyer Pemberton & Coulson PC

Eide Bailly LLP

Falco Sult & Co

FBCPA Group PS Inc

Finney Neill & Co PS

Greenwood Ohlund PS

Hauser Jones & Sas

Hellam Varon & Co Inc PS

Hunt Jackson PLLC

Hutchinson & Walter PLLC

Jacobson Jarvis & Co PLLC

James Russell PLLC

Johnson & Shute PS

Johnson Stone & Pagano PS

King & Oliason PLLC

Kovarik & Kim PLLC

Larson Gross PLLC

Lodder CPA PLLC

Martin Bircher Thompson PC

McDevitt & Duffy CPAs

Moss Adams LLP

Nicholas Knapton PS

Norris Lutkewitte PLLC

Northwest CPA Group PLLC

Opsahl Dawson PS

Rekdal Hopkins Howard PS

Ryan Jorgenson & Limoli PS

Shannon & Associates LLP

Smith & DeKay PS

Starr & Leaf CPA Group PLLC

StraderHallett PS

Sweeney Conrad PS

The Doty Group PS

The Myers Associates PC

Vine Dahlen PLLC

Werner O'Meara & Co PLLC

Willet Zevenbergen & Bennett LLP

Your Financial Solutions LLC

© iStock/lightphoto

Photo:

18 The Washington CPA Spring 2024 www.wscpa.org PEAK FIRMS

Thank you for being a WSCPA member! Don't miss out on all the wonderful things planned as the WSCPA begins another new exciting chapter. WSCPA Membership Renewal $300 VISA Gift Card Drawing! Questions about renewing or your member benefits? Contact us at memberservices@wscpa.org or 425.644.4800. To enter, renew your WSCPA membership by midnight on May 31st. We’re giving away THREE $300 Visa Gift Cards! Renew your membership today by visiting wscpa.org/dues 19 www.wscpa.org The Washington CPA Spring 2024

Updating and Future-Proofing Washington Accountancy Act

Mike Nelson

For the first time in 23 years, the Washington Accountancy Act (the Act) underwent significant updates on March 7, with the signing of House Bill 1920, sponsored by Representative Eric Robertson, and signed by Governor Jay Inslee. The bill passed unanimously from both the State House of Representatives and Senate before reaching the governor’s desk and will be effective June 6.

During the past few years, the WSCPA collaborated with stakeholders around the state and nationally to update and streamline the Act in Washington. The Act governs the requirements for becoming a CPA, outlines the standards of work completed by CPAs, and identifies the specific acts requiring a CPA license. The last major update to the Act occurred in 2001 with the introduction of the framework for CPA license mobility and reciprocity in Washington. Since then, minor changes have been made to address specific issues, but these led to complexities and language misalignment with the Uniform Accountancy Act (UAA). The UAA serves as the model language that all states aim to follow to allow the profession to maintain individual and firm mobility throughout the states, while establishing standard practices on which the public can rely. After more than two decades, it was imperative to simplify the Act in Washington.

The bill made several changes, such as simplifying redundant language for CPA firm licensing and reorganizing the sections on prohibited and non-prohibited practices for enhanced readability and understanding. In addition, the legislation adopted longstanding UAA language concerning firm ownership and acts discreditable, among others.

The most substantial change in the bill is granting the Washington State Board of Accountancy (WBOA) greater flexibility to evaluate and accept qualifications for CPAs from other jurisdictions to practice in Washington under mobility. This flexibility arises from removing the statutory requirement of obtaining 150 semester hours of education, passage of the CPA exam, and one year of experience and replacing it with the term “substantial equivalency” as determined by the WBOA. The WBOA now has the flexibility to make the determination of substantial equivalency for CPAs from a state that may no longer be deemed substantially equivalent by NASBA who still wish to practice in Washington.

This flexibility is a great asset for Washington as national trends are leading toward a period of at least temporary loss of mobility in some jurisdictions. Several states have introduced and are attempting to pass legislation that would create an alternative pathway to initial licensure. For instance, Minnesota introduced legislation that would allow two pathways to CPA licensure. Both

20 The Washington CPA Spring 2024 www.wscpa.org ADVOCACY

the paths would include passing the CPA exam with different combinations of experience and education. One path would keep the existing requirements to have 150 hours of education and one year of experience, while a second option would require 120 hours of education and two years of experience. The National Association of State Boards of Accountancy (NASBA) and American Institute of CPAs (AICPA) have stated this approach would break mobility.

"The most substantial change in the bill is granting the Washington State Board of Accountancy (WBOA) greater flexibility to evaluate and accept qualifications for CPAs from other jurisdictions to practice in Washington under mobility."

While Minnesota and other states consider these changes for incoming CPAs, the issue of how to treat existing CPAs has become a larger concern. Based on the UAA, nearly every state, including Washington, maintains two paths through which individual CPAs obtain license mobility. Either a) the other state has standards that are substantially equivalent to initial licensing requirements in the home state, or b) an individual licensee has met substantially equivalent standards. If a state changes their initial licensing standards and loses consideration under option a, then a licensee’s only path would be determined based on their individual circumstances. At the time that mobility was introduced, the existing CPAs who had met the previous 120-

hour education requirements were granted mobility based on the state’s standards. Prior to Washington’s Act being updated this year, with Washington’s old law requiring the individual to obtain 150 hours of education, a licensee from Minnesota who was licensed in the 1990s under the old rules of 120 hours of education would not be eligible today to practice under mobility in Washington. The flexibility given through this bill to the WBOA allows them to maintain mobility for existing CPAs from states that may move to change their licensing requirements.

As individual states consider altering their requirements, both the AICPA and NASBA established task forces and work groups to consider national proposals for changes to the licensing process that will hopefully maintain mobility or only temporarily and partially lose it in some states depending on the changes proposed. Those recommendations are expected in the summer or fall. Granting the WBOA the authority and flexibility to set rules for all aspects of CPA licensure in Washington positions our state to adopt potential new national standards seamlessly whenever they arise.

The cleanup of the existing Act and the flexibility for Washington to adapt to a changing national landscape will enable more proactive regulatory response and a smoother transition for future changes.

Mike Nelson is Manager of Government Affairs. Contact Mike at mnelson@wscpa.org.

Pictured here with Governor Inslee are (l. to r.) Michael Nelson, WSCPA Manager of Government Affairs; Rep. Eric Robertson; Lisa Thatcher, WSCPA Lobbyist; Jennifer Sciba, Washington State Board of Accountancy (WBOA) Deputy Director; and Mike Paquette, CPA, WBOA Executive Director.

Mike Nelson is Manager of Government Affairs. Contact Mike at mnelson@wscpa.org.

Pictured here with Governor Inslee are (l. to r.) Michael Nelson, WSCPA Manager of Government Affairs; Rep. Eric Robertson; Lisa Thatcher, WSCPA Lobbyist; Jennifer Sciba, Washington State Board of Accountancy (WBOA) Deputy Director; and Mike Paquette, CPA, WBOA Executive Director.

illustrations: © iStock/cgdeaw, © iStock/GreenTana, © iStock/ Oleksandr Hruts

21 www.wscpa.org The Washington CPA Spring 2024 ADVOCACY

Turning What Ifs into Reality: The Journey Toward Solving the Pipeline Crisis

Kimberly Scott, CAE

Last June a couple hundred members joined together for our first Membership Summit. During this event members were invited to share their feedback on professional issues like pipeline and the profession’s image. While opinions were varied, one theme was consistent and clear: something needs to be done to address these challenges.

One of the discussed issues continues to be in the newsfeeds, and that is pipeline for the profession. In July, I had the honor of being appointed to the National Pipeline Advisory Group (NPAG—I obviously did not get assigned to the group with the cool acronym). NPAG was established to start the work described in a resolution passed by AICPA Council members in May of 2023. The resolution reads in part: "This collaborative process, convened by and through the AICPA, should result in a continuous research-driven national pipeline strategy that, among other things, addresses the image of the profession in the eyes of students as well as educational and experience

requirements, and outlines short and long-term initiatives and actions that result in measurable outcomes to address the profession's ongoing and evolving human capital needs and priorities."

Since July, our group of 22 and a facilitator (for details, please visit https://www.accountingpipeline.org) have maintained a robust working schedule of in-person and video-conference meetings multiple times a month. As a data-driven group, we have absorbed many research papers, articles, surveys, and have hosted meetings with various organizations and state society leaders and created our own surveys to glean perspectives and needs. We created a thoughtful process to give us direction on the main areas of focus along the pipeline path. Our facilitator likes to call these “the biggest leakage points.” These include precollege, college, licensing, and first five years after license. Sub-committees were established to assist with the process of identifying solutions.

BRIGHT IDEAS

22 The Washington CPA Spring 2024 www.wscpa.org PIPELINE INITIATIVES

I am excited to participate on the Substantial Equivalency committee, or the licensing committee. What thrills me the most about this committee are the objectives we generated at our first meeting, which are as follows:

“A successful output of the substantial equivalency working group is a bold and broadly accepted proposed solution to modernizing licensure while protecting substantial equivalency and mobility, addressing cost barriers, and upholding the integrity of the CPA license.

Ultimately, the proposed solution should appeal to a diverse and broader group of people and be created with input from key stakeholders.

Additionally, the working group will work to establish a transparent process by which input can be provided to the UAA (Uniform Accountancy Act) on a regular basis.”

As we started our ideation process, we collectively decided that all ideas would be considered. Although our report will not be released until the AICPA May Council meeting, I am confident you will be inspired by the “What Ifs” we explored and adhered to during our solutioning process.

“What IF we could modernize the licensure system while still protecting the public?

What IF license pathways for the profession could be future-proofed against changes both in and outside of our control.

What IF instead of being reactive we were proactive?

What IF pathways were developed that provide equitable access to CPA candidates?

What IF licensure pathways had a built-in methodology of enabling transparent and ongoing evaluation?

What IF licensure could align with how business is done now while being nimble and adaptable?”

We strongly believe that we can turn all of these What IFs into reality. If we fail to address these questions, we believe we will not genuinely resolve the issues that we have been tasked to tackle.

Join us in person on June 12, 2024, at the Membership Summit in Bellevue to get the latest updates from the AICPA Council’s May meeting. Summit registration is free for members, though space is limited to 500 attendees. I look forward to sharing and discussing this important issue with you.

Learn More

• Read more about accounting pipeline initiatives on page 6, Beyond Borders: The Complexities of CPA Mobility.

• Attend the WSCPA Membership Summit 2024 on June 12 in Bellevue. Register at wscpa.org/summit2024

• Take a survey from the National Pipeline Advisory Group (NPAG). Details and links to the survey are on the WSCPA blog >> wscpa.org/pipeline

illustrations: © iStock/PeterPencil, © iStock/Iconic Prototype

Kimberly Scott, CAE, is President & CEO of the WSCPA. You can contact Kimberly at kscott@ wscpa.org.

23 www.wscpa.org The Washington CPA Spring 2024 PIPELINE INITIATIVES

Thank You, Contributors

With your generous contribution to the Certified Public Accountants PAC we have continued to provide a strong voice for the profession and develop vital relationships with legislators.

As the only professional association advocating for CPAs in Olympia, your contribution ensures that the profession has a seat at the table as legislation moves forward. As many WSCPA members are tax policy experts, we have also provided a valuable resource to legislators as they consider the implantation and impacts of various tax proposals.

These contributors donated to the CPAPAC between March 2023 and February 2024.

FIRMS

Clark Nuber PS

Deloitte LLP (Seattle)

Ernst & Young LLP

Hagen Kurth Perman & Co PS

Hellam Varon & Co Inc PS

Johnson & Shute PS

KPMG LLP (Seattle)

Lodder CPA PLLC

Moss Adams LLP (Admin Office)

PwC LLP (Seattle)

Sweeney Conrad PS

VWC PS

AMBASSADORS CLUB $500+

Sara E. Bailey, CPA

Sarah K. Funk, CPA, CGMA

Jennifer B. Harris, CPA, MS

Kelly Nelson, CPA

Kate L. Anderson, CPA

Carol S. Appleton, CPA, CGMA

Bryan Avery, CPA

Kai F. Bottomley, CPA

David A. Brown

Anthony J. Cook, CPA

Jolene G. Cox, CPA

Wesley L. Delaney, CPA

Rodney K. Fujita, CPA

Merle R. Gilmour, CPA, CFP

Dean A. Granholm, CPA, CGMA

Norman Haugen, CPA, CCIFP

Courtney Hirata, CPA, MPAcc

Mark A. Hugh, CPA

Kathryn L. Lapin, CPA

John F. Lynch, CPA

Mark E. Martinez, CPA

Kristine T. Nelson, CPA, MPAcc

Thomas P. Nicholas, CPA

Bradley W. Orser, CPA

Bradley C. Patton, CPA

Ursula A. Perkins, CPA

Susan B. Queary, CPA

Jillian M. Robison, CPA

William J. Smith, CPA, CFE, CIA

Julleen J. Snyder, CPA, CGMA

Duy-Linh Ta, CPA

Ronald L. Tilden, CPA, CMA, MBA

Marianna J. Willey, CPA

Joel H. Williams, CPA

Cheryl K. Woods, CPA, CGMA

ADVOCATES CLUB $100-$499

photo: © iStock/cosmonaut, illustration: © iStock/Bigmouse108

24 The Washington CPA Spring 2024 www.wscpa.org

Todd S. Arkley, CPA

John P. Baker, CPA

Robert C. Best, CPA, JD

Diane Bingaman, CPA

Bruce E. Bixler

Pat L. Bohan, CPA, CGMA, CGFM

Bart Bradshaw, CPA

Dr Andrew M. Brajcich, JD, LLM, CPA

Christine B. Brunner, CPA

Jerome P. Burnett, CPA

Vincent E. Cataldo Jr, CPA

Rebecca A. Cates, CPA

Jay F. Cramer

Stephen G. Dashiell, CPA

Chris A. Davies, CPA, CMA

Joseph P. Deacon, CPA

David E. DeGroot, CPA

Thomas G. Donaghy, CPA

David C. Fitzpatrick, CPA, MBA, MA

Zenaida D. Fletcher, CPA, MBA, CFP

Chris A. Gates, CPA

Bert R. Golla, CPA

Sidney H. Boles, CPA

Alan R. Dance, CPA

Clifford M. Frederickson, CPA, CGFM

Michael P. Hart, CPA, MPAC

Jennifer S. Korten, CPA

Carmen Aguiar

Bea Nahon

Sara Bailey

Alicia Banasick

Lindsay Chuang

Adam Cline

Dani Espinda

Michael Ferguson

Sarah Funk

Mark Hawkins

Darcy Kooiker

Lowel Krueger

Dan LaFree

Craig Landes

Rick H. Graham, CPA

William J. Graham, CPA

Alan L. Gray, CPA

Suzanne Heidema, CPA

Patricia A. Hernandez, CPA, CGMA, MBA

Teresa A. Herrin, CPA

Navzer R. Hormazdi, CPA, MSTax, MT

Flynn X. Huang, CPA

Christopher J. Hugo, CPA, MS

Michael K. Hutchinson, CPA

Cindy L. Isaacson, CPA

Arthur Y. Kageyama, CPA

Kristin L. Knopf, CPA, MBA, MPAcc

Stroud W. Kunkle, CPA

Frank J. Kuntz, CPA, PS

Irene R. Laible, CPA

Peter L. Madison, CPA

Bruce I. Mitchell, CPA, MBA

Mark J. Morrissette, CPA

David S. Nelson, CPA, CTRS

Terence V. O'Keefe

Douglas M. Oord, CPA

Robert B. Loe, CPA, MBA, CFE

Christopher P. Rasmussen, CPA

Ralph Siegel, CPA

Timothy A. Throckmorton, CPA, MAcc

Jack B. Person, CPA

Michael C. Plato, CPA

Ed E. Ramos, CPA

Elizabeth L. Redmond, CPA

Bill Reed, CPA, CGMA, MBA

Donald L. Rodman, CPA, MBA

Keenan A. Roylance, CPA

Craig S. Ruthford, CPA

Susan J. Sanders, CPA

Thomas P. Sawatzki, CPA

Daniel J. Schroeder, CPA

Stephanie M. Seamans, CPA

Kevin R. Sell, CPA

Jay T. Shilhanek, CPA

Janis H. Simpson, CPA

Alyson C. Stage, CPA

Shane M. Summer, CPA

Linda M. Teachout, CPA

Susan L. Thomson, CPA

Mark E. Ulloa, CPA

Carol A. Woo, CPA

Laura Kapuscinski

Sherry Ma

Moses Man

Peter Miller

Tom Neill

Kelly Nelson

Kimberly Nelson

Jessica Packer

Cody Parrish

Ursula Perkins

Liz Redmond

Rachel Roberson

Scott Schiefelbein

Mike Schlect

Blaise Sinclair

Julleen Snyder

Bob Underhill

Joel Williams

CPAPAC MEMBER $50-$99 ADVOCACY VOLUNTEERS We'd like to extend a special thank you to these individuals who went above and beyond to assist with PAC and Hill Day efforts.

CONTRIBUTORS $1-$49

25 www.wscpa.org The Washington CPA Spring 2024 CPAPAC CONTRIBUTIONS

A group of advocacy volunteers attend Hill Day 2024 in Olympia. Photo by Shelly Oberman Photography.

Upcoming CPE

A selection of WSCPA CPE events scheduled April-July are listed.

To view the thousands of courses and complete details, please visit the CPE & Event Catalog at wscpa.org/cpe.

International Tax Conference 2024

May 8 | Bellevue and Webcast | 8 credits

The International Tax Conference will highlight the new laws, rules and trends affecting your international tax practice. Recognized experts in this field will share practical information that CPAs, tax advisors, attorneys, financial officers, and other tax professionals need to know to advise clients in today's global economy.

Washington State Tax Conference 2024

June 6 | Tukwila and Webcast | 8 credits

Boost your knowledge of Washington State and local tax topics and gain updates from top- level speakers and tax experts. The WSCPA Washington State Tax Conference provides critical new information that every business advisor needs to share with their clients or employer. This conference is a must for state and local CPAs and other financial professionals.

Women's Leadership Conference 2024

May 16 | Newcastle and Webcast | 8 credits

Empower women, empower others. Walk away from the Women's Leadership Summit inspired, connected and equipped with new leadership tools. Current and future leaders will engage on the topics that matter to professional women like you.

Bottles, Brews & Buds Conference

July 30 | Seattle and Webcast | 8 credits

Working in wine and spirits? Accounting for ale? Curious about cannabis? Let us help you craft your practice by demystifying the risks and rewards of these rapidly growing industries at this half day conference! Our nationally-renowned instructors will distill the latest updates into engaging sessions full of local flavor. Open your mind to bold new possibilities in accounting.

The Washington Society of CPAs is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of group-live and group-internet-based continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org

For more information regarding refunds, complaints, program cancellations or other policies visit www.wscpa. org/cpe/cpe-policies or call 425.644.4800

26 The Washington CPA Spring 2024 www.wscpa.org

Online CPE

DATE COURSE TITLE CREDITS 4/23 Washington Ethics and New Developments 2024 WEBCAST 4 4/24 Examining ASC 842, Leases: More Than Meets the Eye WEBCAST 4 4/24 Member Exclusive: Mentoring Today's Accounting Students WEBINAR 1 4/25 Accounting for Exchange Transactions, Contributions and Gains and Losses in an NFP WEBCAST 2 4/26 Prix Fixe: Sustainable Real Estate Construction and Operating Practices and Hurdles WEBINAR 1 4/30 The Most Critical Challenges in Not-for-Profit Accounting Today WEBCAST 4 5/3 Prix Fixe: Value Pricing: An Essential Step to Staying Competitive WEBINAR 1 5/6 Proven Controls to Steer You Clear of Fraud WEBCAST 4 5/8 International Tax Conference 2024 WEBCAST and IN-PERSON EVENT 8 5/8 Member Exclusive: Mental Health and Burnout WEBINAR 1 5/10 Crucial Real Estate Tax Strategies WEBCAST 8 5/13 Fraud Basics: Protecting the Company Till WEBCAST 4 5/14 Rules, Regulations and Ethics for CPAs in Washington - 2024 WEBCAST 4 5/16 Women's Leadership Summit 2024 WEBCAST and IN-PERSON EVENT 8 5/16 Afterglow: A Sunset Networking Soiree with the Women of WSCPA IN-PERSON EVENT 0 5/16 Internal Controls, COSO, and COVID-19 WEBCAST 4 5/20 Project Management: Tips, Tricks, and Traps WEBCAST 4 5/21 Using Internal Control to Strengthen Security, Efficiency, and Employee Conduct WEBCAST 8 5/29 Innovative Forecasting and Budgeting: Moving Beyond the Traditional Techniques WEBCAST 4 6/6 Washington State Tax Conference 2024 WEBCAST and IN-PERSON EVENT 8 6/12 WSCPA Annual Meeting 2024 WEBCAST 3 6/12 WSCPA Membership Summit 2024 IN-PERSON EVENT 8 7/30 Bottles, Brews & Buds Conference 2024 WEBCAST and IN-PERSON EVENT 8 WSCPA Blue Ribbon CPE Hosted and hand-selected by the WSCPA

27 www.wscpa.org The Washington CPA Winter 2024 EDUCATION AND EVENTS Register at www.wscpa.org/cpe

Online CPE

4/17 Deep Dive into Common Auditing Deficiencies WEBCAST 4 4/17 K2's 2023 Advanced QuickBooks Tips And Techniques WEBCAST 4 4/17 Understanding the "Most Common" Form 990 Schedules: A,B & C WEBINAR 2.5 4/17 Payroll Essentials: Getting to Know Payroll Taxes WEBINAR 2 4/17 Tax Depreciation: Review and Update WEBINAR 2 4/18 SAS 145 - Risk Assessment WEBCAST 1 4/18 What's Changing in A&A for Governmental Entities WEBCAST 4 4/18 K2's 2023 Excel Essentials For Staff Accountants WEBCAST 8 4/18 Employment Law Update: Reducing Employer Liability WEBCAST 4 4/18 The Impact of ESG Matters on Financial Reporting and Audits WEBINAR 2 4/18 Comprehensive Accounting and Financial Reporting Update WEBINAR 4 4/19 Case Studies in Accounting Fraud 2023 WEBCAST 4 4/19 K2's Implementing Internal Controls in QuickBooks Environments WEBCAST 4 4/19 Protecting Digital Data: More Important Now Than Ever Before 2023 WEBCAST 4 4/20 Partnership Tax Updates WEBCAST 2 4/22 Financial Statement Fraud WEBCAST 2 4/22 QuickBooks - Know the Right Version for Your Client WEBINAR 2 4/23 Audit Risk Assessment in Plain English WEBCAST 2 4/23 Multi-State Taxation WEBCAST 8 4/24 The Tax Practitioners Guide to Estate Administration WEBCAST 2 4/24 Networking Works: Build Relationships to Build Your Business WEBCAST 1 4/24 K2'S 2022 An Accountant's Guide To Blockchain And Cryptocurrency WEBCAST 4 4/24 Examining ASC 842, Leases: More Than Meets the Eye WEBCAST 4 4/25 Creating A Coaching Culture in Your Company WEBCAST 3 4/25 What You Can Learn From the Statement of Cash Flows WEBINAR 2 4/25 The Omniverse and Metaverse for Accountants WEBINAR 2 4/26 Introduction to Sustainability Accounting WEBCAST 1 4/26 Audit & Attestation Update: What's Going on at the AICPA 2023 WEBCAST 4 5/2 Inventory, Expense and Payroll Fraud WEBCAST 2 5/2 The SECURE Act 2.0 - Planning Opportunities for Employers WEBCAST 1 5/3 K2's 2023 Technology For CPAs - Don't Get Left Behind WEBCAST 8 5/3 Partnership Tax Updates WEBCAST 2

DATE COURSE TITLE CREDITS 28 The Washington CPA Spring 2024 www.wscpa.org EDUCATION AND EVENTS Register at www.wscpa.org/cpe

Online CPE

Harmony in Numbers | April 24 | Bothell

Get ready to groove to the beat of your favorite tunes, but with a twist! Introducing Singo, the ultimate musical bingo experience tailored for number-crunching aficionados.

Brushes & Best Friends | April 25 | Lakewood

Calling all accountants and pet lovers! Join in for a special Paint and Sip night at Craft Theory where you can unleash your inner artist and immortalize your beloved furry friend on canvas.

The State of the Profession | April 29 | Spokane | 1 credit

Join Okorie Ramsey, CPA and AICPA Chairman, as he discusses transformation within the global accounting function during disruption and change, upskilling and advancing talent within the profession, and innovation and business transformation.

Developing Business in Challenging Times | May 23 | Bellevue | 1 credit

It’s time to talk about the business strategies and tools that can help grow your business even in the face of adversity.

Visit wscpa.org/events

5/6 K2's 2023 Excel Essentials For Staff Accountants WEBCAST 8 5/6 Proven Controls to Steer You Clear of Fraud WEBCAST 4 5/7 360 Budgeting: A Holistic Approach to Process and Solutions WEBCAST 8 5/14 Employment Law 101 WEBCAST 1 5/14 Rules, Regulations and Ethics for CPAs in Washington - 2024 WEBCAST 4 5/15 Audits of Employee Benefit Plans Subject to ERISA WEBCAST 8.5 5/18 K2's 2022's Biggest Security And Privacy Concerns WEBCAST 4.5 5/20 KPI Bootcamp for Small Businesses WEBCAST 5 5/20 Project Management: Tips, Tricks, and Traps WEBCAST 4 5/21 K2's 2023 Case Studies in Fraud and Technology Controls WEBCAST 8 5/21 K2's 2023 Advanced Excel WEBCAST 8 5/22 Tax, Estate and Financial Aspects of Cryptocurrency WEBCAST 4 5/24 10 Ways to Create Delighted Clients and More Referrals WEBCAST 4 5/24 The Tax Practitioners Guide to Estate Administration WEBCAST 2 5/29 Governmental Accounting 101 WEBCAST 2 5/30 K2's 2023 Best Word, Outlook, And PowerPoint Features WEBCAST 4

DATE COURSE TITLE CREDITS

29 www.wscpa.org The Washington CPA Spring 2024 EDUCATION AND EVENTS Register at www.wscpa.org/cpe

Join us for In-Person Chapter Events:

VOLUNTEER OPPORTUNITIES VOLUNTEER OPPORTUNITIES

Interested in using your CPA skills to make an impact in your local community? WSCPA has a list of volunteer opportunities for you to check out!

• Washington Physicians for Social Responsibility

• Community Health Centers of Snohomish County

• Seattle Choruses

• Leadership Eastside

• Seattle Pro Musica

• Northwest Gifted Child Association Shoreline Farmers Market

• Theatre Puget Sound

• Myrina NP

• Juice Box Theatre

• SciAccess

Find or submit an opportunity at: wscpa.org/volunteer-opportunities

Mergers & Sales

IBA Sells Privately Held Companies: Do you represent a client who is ready to retire or has taken a company as far as they want to or can? IBA is the Pacific Northwest’s oldest business brokerage (M&A) firm. We are professional negotiators with over 4,300 completed transactions. Please contact us if we can be of assistance at 425.454.3052, 509.907.9406, or www.ibainc.com.

Have a client / owner ready to explore the business sale process? Business owners are experts on their business. We are experts on the process of selling a business. Call 206.703.3555 for a confidential, no commitment consultation. Check out resources and learn more at wabusinessbrokers. com. Put our experts to work for you! Contact Ryan Hemmert, info@wabusinessbrokers.com or 206.703.3555.

Vancouver and Olympic Peninsula Firms for Sale! With over 19 years of experience, Accounting Biz Brokers specializes in the sale of accounting firms and tax practices. Selling your accounting firm is complex. Let us make it simple. For Sale! Olympic Peninsula, WA Gross $360k. Vancouver, WA Gross $572k. Visit https://accountingbizbrokers.com/ for more information.

Office Space

Sublet comfortable office in University Village area of Seattle: Need a quiet office to get work done? Need a professional office in a professional building to meet with clients? Office space in modern building in thriving area across the street from University Village in Seattle. Large windows with view of trees. Contact Patricia McKee, counseling@pmckee, www.pmckee.com.

Engage with CPAs who share your interests by participating in one of the many resource groups or committees, which are open to WSCPA members. These groups provide a space for you to share your insights and stay aware of developments affecting your specific practice area. Topics include international tax, not-for-profit, sole practitioners, student outreach and more. Visit wscpa.org/resource-group-committees

CLASSIFIED ADS

Join a Resource Group Join us on June 12 for the WSCPA Membership Summit! Visit wscpa.org/summit2024 WSCPA Knowledge Hub - A Free Member Resource! Discover a library of free, downloadable content right at your fingertips. Includes white papers, webinars, product guides, case studies, industry analysis and much more, provided by experts and vendors within the accounting industry. Visit hub.wscpa.org 30 The Washington CPA Winter 2024 www.wscpa.org Advertise with the WSCPA Learn more at: wscpa.org/classifieds Reach Your Target Audience

Profitable Fresno Tax & Accounting Firm (CA 1215): Established in 2012, this Certified Public Accounting practice has established a strong, long-term presence in the greater Fresno area. Since its inception, the Practice has offered a wide range of tax and accounting services to both business and individual clients. The Practice’s service by revenue breakdown is 37% Tax Preparation and Planning, 37% Accounting & Auditing, and 26% Consulting, Forensic & Valuation. Including the Owners, the Practice has twelve (12) staff members serving its ~477 active clients. Over the past three (3) years, the Practice has averaged gross revenues of approximately $1,978,397 (2020-2022). This Practice is poised for growth and increased revenue under new ownership. To take advantage of this exciting business opportunity, call 253.509.9224 or email info@privatepracticetransitions.com.

Highly Rated Methow Valley Tax & Accounting Firm (WA 1205): Over the past 40 years, this Washington tax and accounting firm has offered tax and bookkeeping services to both business and individual clients in Winthrop and surrounding areas. As of March 2023, the Practice has approximately ~671 active clients and has seen great client retention as is evidenced by the increase in client counts year-over-year. The Practice’s service by revenue breakdown is 86% Tax Preparation & Consulting, and 14% Bookkeeping. In 2022, the

Practice brought in $680,566 in gross receipts which was a 14% YoY increase! Including the Owner, the Practice has seven (7) loyal staff members. The Owner is willing to stay on part-time for up to two (2) years if desired. To take advantage of this “turnkey” business opportunity, call us at 253.509.9224 or send an email to info@privatepracticetransitions. com, with “1205 Highly Rated Methow Valley Tax & Accounting Firm” in the subject line.

Highly Profitable Marion County Tax and Accounting Firm (CA 1208): For over 68+ years, this Marion County tax and accounting practice has provided its services to countless clients within the community and surrounding areas. The Practice offers a wide range of services such as Tax Preparation & Consulting, Financial Statements, Payroll, and Bookkeeping. The Practice’s success can largely be attributed to its established name and loyal clients who have grown to trust the services it provides. In 2023, the Practice had impressive gross revenues of over $1.8M. The Practice has thirteen (13) loyal staff members including the Owner, who is willing to assist with the transition to new ownership for a short period of time to maximize the transfer of goodwill and client retention. To learn more about this exciting business opportunity, call us at 253.509.9224 or, send an email to info@privatepracticetransitions. com, with "1208 Highly Profitable Marion County Tax and Accounting Firm" in the subject line.

Discover savings on all things travel with your Passport Corporate card.

Your WSCPA membership includes this free benefit (a $150 value). Access 3,000+ discounts online and in your neighborhood. Great for fitness classes, dining, travel and shopping.

Find your savings today at wscpa.org/passport

CLASSIFIED ADS Visit the WSCPA Job Board! Post your opening and be seen by some of Washington's finest CPAs and finance professionals. Learn more at: wscpa.org/job-board

31 www.wscpa.org The Washington CPA Spring 2024

International Tax Conference

May 8 | Bellevue & Webcast

Women's Leadership Summit

May 16 | Newcastle & Webcast

Washington State Tax Conference

June 6 | Tukwila & Webcast

WSCPA Membership Summit

June 11 | Pre-Summit Event

June 12 | Summit | Bellevue

Bottles, Brews & Buds

July 30 | Seattle & Webcast

Farm Tax Conference

August 22 | Kennewick Register

wscpa.org/spring24 170 120th Ave NE Ste E101 Bellevue WA 98005 Periodicals postage paid at Bellevue WA and additional mailing offices AREA CLEAR

Now!

Daniel Fleming is WSCPA Manager of Membership. Contact Daniel at dfleming@wscpa.org.

Daniel Fleming is WSCPA Manager of Membership. Contact Daniel at dfleming@wscpa.org.

Mike Nelson is Manager of Government Affairs. Contact Mike at mnelson@wscpa.org.

Pictured here with Governor Inslee are (l. to r.) Michael Nelson, WSCPA Manager of Government Affairs; Rep. Eric Robertson; Lisa Thatcher, WSCPA Lobbyist; Jennifer Sciba, Washington State Board of Accountancy (WBOA) Deputy Director; and Mike Paquette, CPA, WBOA Executive Director.

Mike Nelson is Manager of Government Affairs. Contact Mike at mnelson@wscpa.org.

Pictured here with Governor Inslee are (l. to r.) Michael Nelson, WSCPA Manager of Government Affairs; Rep. Eric Robertson; Lisa Thatcher, WSCPA Lobbyist; Jennifer Sciba, Washington State Board of Accountancy (WBOA) Deputy Director; and Mike Paquette, CPA, WBOA Executive Director.