IN the run-up to Ghana’s 2016 general elections, Africa Briefing published an op-ed by the then opposition leader Nana Addo Dankwa Akufo-Addo headlined, The Ghanaian economic paradox.

Publisher

Jon Offei-Ansah

Editor

Desmond Davies

Contributing

Editors

Stephen Williams

Prof. Toyin Falola

Tikum Mbah Azonga

Justice Lee Adoboe

Chief Chuks Iloegbunam

Joseph Kayira

Zachary Ochieng Olu Ojewale

In the op-ed, Akufo-Addo took the John Mahama administration to task for “throwing away the economic credibility of the nation.” Mahama’s handling of the economy had raised serious questions that needed answers, he wrote. According to Akufo-Addo, government borrowing was at an all-time high and the NDC regime had been on a debt binge, which would result in a serious economic illness if the country continued down that path. “Despite more money in the economy than any time since independence, wealth inequality has increased as rising inflation continues to burn holes in our pockets. To put it simply – since our country’s independence, a breath-taking 66 percent of all government debt has occurred under the Mahama regime. But we should be experiencing a golden time for our nation,” he said adding, “It beggars belief that in a time of plenty, the poorest are becoming poorer and the rich friends of the current administration continue to profit.”

Jon Offei-Ansah Publisher

Desmond Davies Editor Angela Cobbinah Deputy Editor

Oladipo Okubanjo Corinne Soar Kennedy Olilo Gorata Chepete

n 2018, six of the 10 fastest-growing economies in the world were in Africa, according to the World Bank, with Ghana leading the pack. With GDP growth for the continent projected to accelerate to four per cent in 2019 and 4.1 per cent in 2020, Africa’s economic growth story continues apace. Meanwhile, the World Bank’s 2019 Doing Business Index reveals that five of the 10 most-improved countries are in Africa, and one-third of all reforms recorded globally were in sub-Saharan Africa.

What makes the story more impressive and heartening is that the growth – projected to be broad-based – is being achieved in a challenging global environment, bucking the trend.

IThe NDC, he said, could not have been more reckless in their management of the nation’s economy and for the sake of “our future we need to take action.” Based on his campaign promises of free high school education, one factory and $1 million for each district in the country, Akufo-Addo and the New Patriotic Party (NPP) won the elections by a sizeable majority and assumed office in January 2017. “We in the NPP will strive for double digit growth, create new job opportunities and drive down the cost of doing business. We will create an agenda for change that will have a lasting legacy for all Ghanaians,” he promised Ghanaians.

Contributing Editor

Stephen Williams

Michael Orji Director, Special ProjectsContributors

Designer

Simon Blemadzie

Country Representatives

South Africa

Edward Walter Byerley

Top Dog Media, 5 Ascot Knights

Now in his second and final four-year term in office, Ghana’s current economic situation makes the gloomy picture he painted of his predecessor’s era look like paradise. What was recently one of the world’s fastest-growing economies is now a cautionary tale of how tens of billions in foreign investment and infrastructure prospects can evaporate so suddenly.

In the Cover Story of this edition, Dr. Hippolyte Fofack, Chief Economist at the African Export-Import Bank (Afreximbank), analyses the factors underpinning this performance. Two factors, in my opinion, stand out in Dr. Hippolyte’s analysis: trade between Africa and China and the intra-African cross-border investment and infrastructure development.

Much has been said and written about China’s ever-deepening economic foray into Africa, especially by Western analysts and commentators who have been sounding alarm bells about re-colonisation of Africa, this time by the Chinese. But empirical evidence paints a different picture.

Justice Lee Adoboe Chuks Iloegbunam Joseph Kayira Zachary Ochieng Olu Ojewale Oladipo Okubanjo Corinne Soar

47 Grand National Boulevard Royal Ascot, Milnerton 7441, South Africa

Tel: +27 (0) 21 555 0096 Cell: +27 (0) 81 331 4887 Email: ed@topdog-media.net

Ghana

Akufo-Addo’s administration has been riddled with numerous corruption allegations. The country is saddled with huge debts, which some economists say are the highest in the country’s history. Inflation has run away to an all-time high. After constantly ridiculing the Mahama administration for seeking an IMF bail out and vowing never to go that route, the government has gone tail between the legs to the multilateral lender with its begging bowl for a $3 billion bailout.

Gloria Ansah DesignerDespite the decelerating global growth environment, trade between Africa and China increased by 14.5 per cent in the first three quarters of 2018, surpassing the growth rate of world trade (11.6 per cent), reflecting the deepening economic dependency between the two major trading partners.

Empirical evidence shows that China’s domestic investment has become highly linked with economic expansion in Africa. A one percentage point increase in China’s domestic investment growth is associated with an average of 0.6 percentage point increase in overall African exports. And, the expected economic development and trade impact of expanding Chinese investment on resource-rich African countries, especially oil-exporting countries, is even more important.

South Africa

Edward Walter Byerley Top Dog Media, 5 Ascot Knights 47 Grand National Boulevard Royal Ascot, Milnerton 7441, South Africa

Nana Asiama Bekoe Kingdom Concept Co. Tel: +233 243 393 943 / +233 303 967 470 kingsconceptsltd@gmail.com

Nigeria

Ghana’s hopes for a futuristic, 5,000-seat national cathedral have been dashed as the nation’s currency is the world’s worst this year and the project’s price tag has quadrupled from $100 million, say analysts at Bloomberg

The resilience of African economies can also be attributed to growing intra-African cross-border investment and infrastructure development. A combination of the two factors is accelerating the process of structural transformation in a continent where industrial output and services account for a growing share of GDP. African corporations and industrialists which are expanding their industrial footprint across Africa and globally are leading the diversification from agriculture into higher value goods in manufacturing and service sectors. These industrial champions are carrying out transcontinental operations, with investment holdings around the globe, with a strong presence in Europe and Pacific Asia, together account for more than 75 per cent of their combined activities outside Africa.

Tel: +27 (0) 21 555 0096 Cell: +27 (0) 81 331 4887 Email: ed@topdog-media.net Ghana

Credit rating agencies have downgraded Ghana into junk status and the World Bank projects the country’s total public debt will hit 105 percent of GDP by the end of this year.

Nana Asiama Bekoe Kingdom Concept Co. Tel: +233 243 393 943 / +233 303 967 470 kingsconceptsltd@gmail.com

It needs to repay $3.5bn in loans and bonds in 2023, according to data compiled by Bloomberg — a little more than it is asking for from the International Monetary Fund.

A survey of 30 leading emerging African corporations with global footprints and combined revenue of more than $118 billion shows that they are active in several industries, including manufacturing (e.g., Dangote Industries), basic materials, telecommunications (e.g., Econet, Safaricom), finance (e.g., Ecobank) and oil and gas. In addition to mitigating risks highly correlated with African economies, these emerging African global corporations are accelerating the diversification of sources of growth and reducing the exposure of countries to adverse commodity terms of trade.

Nigeria

Nnenna Ogbu #4 Babatunde Oduse crescent Isheri Olowora - Isheri Berger, Lagos Tel: +234 803 670 4879 getnnenna.ogbu@gmail.com

Kenya

Patrick Mwangi

Aquarius Media Ltd, PO Box 10668-11000 Nairobi, Kenya

This makes me very bullish about Africa!

So, have Ghanaians been hoodwinked by the Akufo-Addo administration? The Ghana airwaves, print and social media are dominated by discussions on the sorry state of the economy. Even some die-hard supporters of the ruling party see the current administration as deplorable and rue their decision to vote them in for a second term in the 2020 elections. To say the current situation is a damning indictment on the government is an understatement.

Taiwo Adedoyin MV Noble, Press House, 3rd Floor 27 Acme Road, Ogba, Ikeja, Lagos Tel: +234 806 291 7100 taiadedoyin52@gmail.com Kenya Naima Farah Room 22, 2nd Floor West Wing Royal Square, Ngong Road, Nairobi Tel: +254 729 381 561 naimafarah_m@yahoo.com

Africa Briefing Ltd 2 Redruth Close, London N22 8RN United Kingdom Tel: +44 (0) 208 888 6693 publisher@africabriefing.org

Tel: 0720 391 546/0773 35 41 Email: mwangi@aquariusmedia.co.ke

©Africa Briefing Ltd 2 Redruth Close, London N22 8RN United Kingdom Tel: +44 (0) 208 888 6693 publisher@africabriefing.org

African labour migration in the Gulf States

Discussing removal of term limits is a distraction

The multiple downgrading by the international credit rating agencies have had their negative impact on the economy, as Ghana lost access to the international capital market where it could borrow to support budget implementation and debt substitution, writes Justice Lee Adoboe

As debt soars, Ghana must take ownership of its financial troubles, starting with slashing public expenditure, Jon Offei-Ansah reports

Ghana battles economic headwinds Will another bailout solve Ghana’s economic crisis? Challenging times for demobilising rebels

More than 200,000 combatants have been shuffled through different demobilisation programmes over the years, making the process one of the world’s largest and longest-running, write Sam Mednick and Claude Muhindo Sengenya

The new Kenyan leader has taken aim at a variety of laws, regulations and programmes that were central to the administration of his predecessor by starting to dismantle them, writes Kennedy Olilo

Africa—the most demographically dynamic region of the world—has been making headlines for the massive investment potential it offers, and yet has been stubbornly ignored, some analysts say

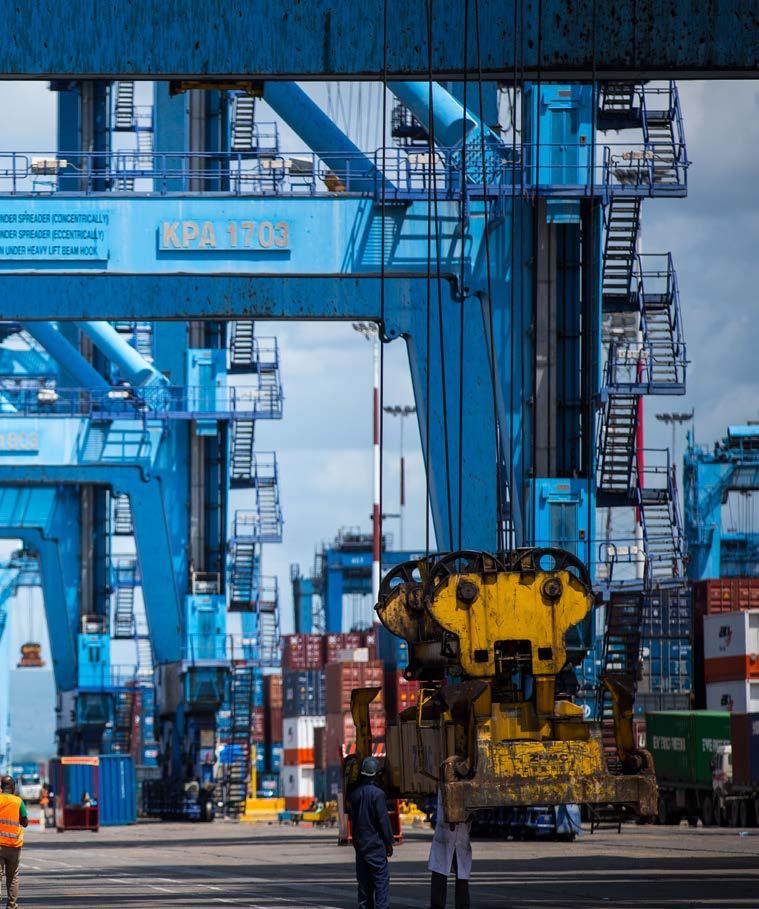

From the Horn of Africa on the strategic Red Sea to the buoyant ports of Mozambique, East Africa’s ancient “Swahili Coast” provides a logistical nexus between Africa’s massive population centres and other continents. Foreign direct investment is driving expansion and rehabilitation of existing seaports, while entirely new facilities are also being rolled out. Ports that shun partnerships with experienced foreign investors are set to lose out as competition for market share intensifies, says a new report by boutique business advisory firm GBS Africa

Established in 2002, Shanghai Grand International Co., Ltd. offers a variety of shipping and transportation options via air, sea and ground. Our company is based in Shanghai, China, with branches across the nation. Ranging from customs declaration, warehouse storage, containers and consolidated cargo shipping we have a large array of options to meet your needs.

In addition to being approved and designated by the Ministry of Transportation of China as a First Class cargo service provider, we have also established excellent business relations with major shipping companies including Maersk, CMA, ONE, SM line, and

EMC over the past 15 years. In addition we have also built long term business relations with major airline cargo departments. In order to expand our global operation, we are looking for international partnerships to work together in this industry.

Should you ever import any goods from Peoples Republic of China please ask your exporter and shipper to contact us. We will provide our best service to you.

Room 814, 578 Tian Bao Lu, Shanghai, Peoples Republic of China E-Mail: felix@grand-log.net phone: 86-13501786280

Mr, Felix Ji

Mr, Felix Ji

THE ongoing World Cup in Qatar has presented the rest of the world with the opportunity to scrutinise human rights in a country that is seen as autocratic – just like other countries in the Gulf. For Africans, the main issue has been the droves of migrants from the continent who have travelled to the region in search of jobs but who have mainly had a raw deal.

Recently, the Kenyan government took up the case of the 400,000 Kenyan workers who are in the Gulf, especially in Saudi Arabia where there are 210,000 migrant workers from Kenya.

The government announced that 89 Kenyans died in mysterious circumstances in Saudi Arabia. As at November this year, the government said another 23 of its citizens had died in the Gulf State.

The poor treatment of these migrant workers is not just confined to Kenyans, but also to others from the continent. It is just that the Kenyan government has taken a robust stance on this grave violation of the human rights of Kenyan migrant workers in the region.

The International Labour Organisation has regularly highlighted cases of exploitation by recruitment agencies and employees that often create considerable hardship for workers in basically medieval societies. For instance, the admission and employment system implemented by most countries in Arab and Gulf States is based on restricted rights and limited duration of employment contracts and visas, known as the Kafala (sponsorship) system.

Employers and/or sponsors often have both liability for the conduct and safety of the migrant they bring into the country, as well as control over that migrant’s movement and employment. The ILO points out that while in some cases employers may welcome the responsibilities of the Kafala system and treat the worker well, the inherent imbalance in the rights and responsibilities of each party can create a situation which is exploitative of the worker.

The ILO has noted that “the kafala system may be conducive to the exaction of forced labour and has requested that the governments concerned protect migrant

workers from abusive practices”.

It is high time that the African Union takes a more serious approach to deal with the matter. We know that African governments seldom show much interest in the way their citizens are treated abroad. But this has to change from the perspective of the governments and the AU itself.

Of course, the AU regularly pays lip service to tackling the problems facing African migrants in the Gulf but nothing concrete has ever come out of this. During the pandemic, a virtual meeting explored the human costs of migration policies in Africa but the underlying issue was that because the Gulf States and Arab nations were “undemocratic” not much could be done.

This is a defeatist position. African

the domestic work sector, the protections afforded are often inferior to those provided in the labour law; limited access to justice, weak and inefficient dispute settlement mechanisms and absence of compensation schemes; and limited or no freedom of association in some countries and inability of migrant workers to bargain collectively.

Given these severe restrictions, African migrant workers in the Gulf states are at the mercy of their employers who take full advantage of the lack of protection for their “employees”. It is not uncommon to hear of “employers” withholding salaries of their workers or not even bothering to pay wages that had been agreed earlier. Physical abuse is also rampant.

It would seem that the human cost

governments naturally argue that because of the unregulated manner of migration – and the unscrupulous nature of some Africa-based employment agencies – it is difficult to regulate the flow of their citizens to the Gulf States,

According to the ILO, in addition to abusive and fraudulent recruitment practices and the high costs associated with labour migration, other issues and challenges facing migrant workers in the region include: poor conditions of work and substantial occupational safety and health deficits combined with weak labour inspection in migrant-intensive sectors such as construction and domestic work; non-inclusion or only partial inclusion of certain categories of migrant workers, such as domestic workers, in labour laws –while a number of countries in the region have adopted separate laws regulating

of migration far outweighs the financial benefits that these migrants were expecting so that they could help their families back home. Human rights must take precedence, as the Kenyan government has now done by informing migrant workers of their rights.

African governments must provide an enabling situation that will regulate the flow of their citizens to the Gulf States. They must ensure that young women are properly protected because of the sexual abuses that many have undergone.

But because wealthy Gulf States provide funding to aid African governments, the continent’s leaders tend to turn a blind to abuses of their citizens in the Gulf. This should no longer be the case. The AU should take the lead in developing migration governance policies to halt the ill-treatment of African migrants.

‘ ’

NOT long after President William Ruto took over the reins of power in September for an initial term of five years, a member of his United Democratic Alliance in parliament, Salah Yakub, shot from the hip. Without careful consideration of the feelings of Kenyans who have been reeling under economic pressure, Yakub was more focused on presidential term limits.

He hinted that the UDA intended to remove these limits and replace them with age limits. So, instead of a president stepping down after two terms of five years each, Yakub would like to see this changed to a president going on until he or she is 75.

This is rather uncalled for, coming at a time when Ruto and his new administration are trying to set things right after yet another acrimonious presidential election. The new Kenyan president is 55, so an age limit would serve him well.

But he was quick to slap down Yakub’s

charge since 1979, was re-elected for a sixth term with 94.9 per cent of the votes. But there was scarcely opposition of any substance to challenge him.

On the economic front, people in the oil-rich country are struggling to make ends meet. But this has not stopped Obiang’s son, Teodorin, Equatorial Guinea’s Vice President, from frittering away the country’s wealth on luxury goods and pristine properties in Europe.

In Uganda, Museveni’s soldier son is said to be being prepared to take over from his father. Museveni might deny this, but let’s wait and see.

When term limits were introduced in the wake of the second wave of democracy in Africa in the 1990s, the argument was that they would stop tyrannical leaders and usher peaceful transition of power from one president to the next. But in Kenya, for instance, this has not worked, as the outcomes of the last three presidential elections have been hotly disputed by the candidates, with the courts being the final

in power for a third term by manipulating a referendum that extended his stay as president.

The soldiers disapproved and he was ousted. The sad thing about this was that Conde ought to have known better. Having being in exile for ages because of tyrannical rule in Guinea, one would have thought that he would play by the rules.

Leaders like Conde and others who have removed term limits in Africa have clearly done so for self-serving reasons. It had nothing to do with them seeking the interests of their citizens.

However, removing term limits is not a problem in itself. What matters most is that the electoral process must be transparent and free from encumbrances that would stop voters from exercising their democratic rights. Then, if a leader does not deliver, there would change.

In South Africa, a recent survey by the Brenthurst Foundation showed that for the ANC, which has been in power since 1994, its share of the vote among those who will cast their ballots will fall to 46.7 per cent in 2024 from 57.5 per cent in the 2019 election.

suggestion to amend the Constitution. He said the UDA should stop “pushing for selfish and self-serving legislation like changing the Constitution to remove term limits”.

Indeed, what’s with African politicians and their fascination with removing term limits? Let’s face it, can’t a leader deliver in two terms lasting 10 years?

Take, for example, Yoweri Museveni of Uganda, who has been in power since 1986, and the world’s longest serving president, Teodoro Obiang of Equatorial Guinea? Have they really delivered for their people during their time in power?

Recently, Obiang, who has been in

arbiter. This, though, does not mean that Kenya should abandon term limits.

Two years ago, the Open Society Initiative of Southern Africa, in partnership with the National Democratic Institute, the Open Society Initiative for West Africa, and the Kofi Annan Foundation, hosted a Term Limits conference. Such was the uproar over the issue that a gathering of this nature was needed to look at how African leaders play games with their citizens when it comes to power.

The conference heard that from April 2000 to July 2018, limits were changed 47 times in 28 countries, with at least six failed attempted changes. In 2021, Alpha Conde in Guinea attempted to continue

Dr Greg Mills, Director of the Brenthurst Foundation, noted: “The results of this survey clearly show that South Africans are ready for change. South Africa is on the cusp of change, but it is up to political leaders to listen to voters and start working on ways to fix the country.

“They see the country in crisis and want leaders to work together to fix it. While more will vote for the ANC than any other party, it is revealing that the vast majority want to see a coalition governing South Africa.”

This could be said for the rest of the continent. Africans want their leaders to provide jobs, fight corruption and help create economic prosperity. They do not want politicians who use the issue of removing term limits as a distraction from dealing with the real issues at hand. AB

Desmond Daviespresidential term limits is just a self-serving exercise by African leaders

’

THREE years after exiting the International Monetary Fund (IMF)’s Extended Credit Facility–backed programme, Ghana is at the crossroads again with debt sustainability crisis weighing down heavily on the country’s economy.

Finance minister Ken Ofori-Atta conceded during the reading of the 2023 budget statement late November that the economy continued to reel under the

adverse impact of the challenging global and domestic environment.

Despite the monetary and fiscal policy interventions deployed by the government, the economy is buffeted by the rapid exchange rate depreciation, high inflation, an unsustainable debt burden, fiscal stress and external sector shocks.

Moreover, revenue performance between January and September, 2022,

according to Ofori-Atta, had experienced shortfalls, leading to a budget deficit of 7.4 percent, compared with a programmed 6.4 percent for the period. The government had to resort to borrowing from both domestic and external sources to finance the deficits.

To bridge the resource gap in budget implementation, the West African cocoa, gold and crude oil exporter resorted to borrowing, increasing total public debt provisionally to GH¢467.37 billion ($48.8

The multiple downgrading by the international credit rating agencies have had their negative impact on the economy, as Ghana lost access to the international capital market where it could borrow to support budget implementation and debt substitution, writes Justice Lee Adoboe

billion per official exchange rate) or 75.9 percent of Gross Domestic Product (GDP) as of the end of September. The comparable figure was about GH¢ 122.6 billion at the end of 2016.

“Ghana’s Debt Sustainability Analysis shows a moderate rated debt carrying capacity and an overall risk rating of high risk of debt distress and unsustainable due to the negative effects of exogenous shocks on the economy which worsened existing vulnerabilities,” the finance minister stated.

The minister attributed Ghana’s external and public debt vulnerabilities to “the perennial high fiscal deficits of the past,” and the rapid exchange rate depreciation, which the budget statement estimated had added GH¢ 93.8 billion to the stock of external debts which had increased to 58.1 percent of GDP from 48.4 percent of GDP over the same period in 2021.

Meanwhile, credit rating agencies responded swiftly to the challenging macroeconomic environment, with inflation soaring far above the mediumterm target band of 8±2 percent and rising budget deficit among other indicators in Ghana.

Fitch, Moody’s and S&P had at various times in the year downgraded the country’s credit rating, with dire consequences on the country’s ability to use the Eurobond market to raise the badly needed funds to support budget implementation.

As late as November 30, Moody’s further downgraded the Ghanaian government’s long-term issuer ratings to Ca from Caa2, changing the outlook to

stable.

“The Ca rating reflects Moody’s expectation that private creditors will likely incur substantial losses in the restructuring of both local and foreign currency debts planned by the government as part of its 2023 budget proposed to Parliament on November 24 2022,” the agency said in a statement on its website.

On its part, the government outlined various measures in the 2023 budget to deal with the debt situation while restoring macroeconomic stability.

first three quarters of 2022. The debt management strategy implemented in 2022 resulted in increasing the cost and risk indicators of the public debt portfolio,” he said.

The government has also taken due cognisance of the underperformance of revenue, especially during a period when the doors to the external financial market have been shut to Ghana .

The government, therefore, seeks to undertake fiscal adjustments with revenue and expenditure measures to improve debt

Chief among these is the proposed and yet to be defined Debt Exchange strategy which is linked to the proposal by President Nana Addo Dankwa Akufo-Addo at COP 27 in Egypt, urging rich countries to allow debt-laden African countries to swap their debts for Climate Action.This is to ensure Ghana’s public debt returns to sustainable levels.

This new debt-swapping, has is being dreamed up because the debt substitution method used so far, according to OforiAtta had fraught with challenges.

“The recent global and domestic macroeconomic developments have had adverse effect on the implementation of government financing strategy for the

sustainability and restore macroeconomic stability and fast-track discussions with IMF.

Moreover, the Akufo-Addo-led administration also seeks to pursue macro-critical structural reforms to address structural bottlenecks in the economy to deal with some of the critical and potential sources of financial liabilities on the state.

The raft of measures to enable the government to cut expenditure and boost revenue include a 2.5 percentage point increase in value added tax (VAT). This will bring the total VAT burden, including National Health Insurance Levy, Ghana Education Trust Fund Levy and Covid-19 Health Recovery Levy, to 21 percent.

The government also mulls a freeze on new tax waivers for foreign companies and a review of tax exemptions for free zones and extractive industry players.

The government also seeks to place a cap on salary adjustment of SOEs to be lower than negotiated base pay increase on Single Spine Salary Structure for each year; and “Negotiate public sector wage adjustments within the context of burdensharing, productivity, and ability to pay; with a freeze on new employments in the public sector.

"It has become even more urgent to mobilise domestic revenue especially in times like this when our access to the international capital market is largely closed," said the finance minister as he announced the intention of the government to impose a debt limit on non-concessional

financing among other reforms.

Under the circumstances, the government expects economic growth to slow to 3.7 percent in 2022 and 2.8 percent in 2023, after a 6.7 percent growth in 2021.

“We expect 2023 to end with an inflation rate of 18.9 percent, primary balance on commitment basis of a surplus of 0.7 percent of GDP, and gross international reserves to cover not less than 3.3 months of imports,” the minister told parliament.

Meanwhile, the government is seeking approval to spend GH¢205.4 billion ($14.1 billion) in the 2023 fiscal year, against projected revenue and grants of GH¢143.9.

A deal with the IMF

"The government and the IMF have agreed on programme objectives, a

preliminary fiscal adjustment path, debt strategy and financing required for the programme," he said, adding he hopes “to reach a deal very soon.”

The minister added that the objective was to fast track negotiations with the Fund to conclude these negotiations by year-end.

The multiple downgrading by the international credit rating agencies have had their negative impact on the economy, as Ghana lost access to the international capital market where it could borrow to support budget implementation and debt substitution.

As a direct consequence of the downgrading, and also due to the high import bill of petroleum products among other external factors, Ghana has recorded a significant decline in reserve buffers,

among other risks to its external sector.

Bank of Ghana governor Ernest Addison said during the 109th Monetary Policy Committee press briefing late November that despite the significant improvement in trade surplus due to higher export receipts from increased gold production and higher crude oil prices, the current account deficit widened.

He added that, “The balance of payments swung into a deficit in the first nine months, from a surplus last year due to continuing large current account deficit and, importantly, significant outflows in the capital and financial account.”

“The significant decline in reserve buffers was due to the loss of market access, significant portfolio reversals, rising petroleum import bill, market reaction to sovereign downgrades by rating

agencies, and increased foreign exchange demand. These have exerted intense pressures on the local currency,” Addison stated.

At the end of October 2022, the governor said the gross international reserves position had declined to $6.7 billion, equivalent to 2.9 months of import cover compared with the reserve level of $9.7 billion (4.3 months of imports) at the end of December 2021.

The net international reserves, which exclude encumbered assets and petroleum funds, were estimated at 2.8 billion dollars as of October 2022.

Ghana’s key source of foreign exchange is the export of cocoa, gold, and crude oil. In addition to these traditional sources are portfolio investments by offshore investors in the local capital market, Foreign Direct Investments, and the sale of bonds in the Eurobond market.

Whereas, the key primary sources performed creditably in 2022, Ghana’s downgrading by global rating agencies affected all the other sources and Addison thinks the country needs a more sustainable way of building foreign exchange.

“Risks to the external sector outlook are on the upside, and measures are being taken to gradually rebuild reserves in more sustainable ways to preserve stability going forward,” Addison added.

Already the bank has begun the purchase of gold from mining companies in the country to boost its gold reserves as a means of strengthening the country’s reserve position.

To deal with pressure from the higher cost of crude, the government also announced a Gold-for-Oil programme, as Ghana ordered large gold-mining companies to sell 20 percent of their products to the central bank, as the government embarks on a plan to barter gold bullion for fuel amid increasing cost of fuel on the international market and foreign exchange depreciation.

The governor said the government had informed the IMF of the “Gold for Oil” initiative and discussions were still ongoing as Ghana is yet to secure a fund programme from the Fund.

He added that when that was done, the pressure to spend foreign exchange to purchase petroleum products from the international market would ease as

gold, rather than dollars would be used in exchange for fuel.

The central bank ramped up its policy rate by 250 basis points to 27 percent to rein in inflationary pressures and local currency depreciation.

“Inflation will likely peak in the first quarter of 2023 and settle at around 25 percent by the end of 2023. This forecast is conditioned on the continued maintenance of tight monetary policy stance and the deployment of tools to contain excess liquidity in the economy,” Addison projected.

He said there were, however, some risks to this forecast that needed monitoring, “including additional pressures from the proposed VAT increase, and exchange rate pressures. Continued vigilance to the evolution of these potential price pressures in the outlook will be key.”

He also hinged the achievement of some of the targets set in the 2023 budget on Ghana’s securing a programme with the IMF.

Ghana took advantage of the Highly Indebted Poor Country (HIPC) initiative to receive debt forgiveness from 2001 when total foreign debt stood at around $6.7 billion.

However, debt has accumulated far beyond the HIPC threshold, putting its debt sustainability in serious doubt.

“The lesson the international community learned in the HIPC Initiative was that most African countries have not learned any good lessons, to the extent that just after exiting that programme, the first thing we did was to go into the Eurobond market to borrow $750 million and the debt keeps piling,” said John Gatsi, Dean of School of Business, University of Cape Coast.

Gatsi said the underlying factors in Ghana’s current debt situation was that, “We have over-borrowed, and are not managing the economy to provide the needed stable environment, so inflation surges, exchange rate is volatile to escalate the volume of the debt if you want to pay in Ghana cedis.”

Gatsi added: “Downgrading is an assessment of your performance, to see whether you are in the position to pay your debt. So it is an objective activity, and if government has a different record to indicate, the government would have

shown that record by now.”

Seeking a new IMF programme just three years after exiting the previous ones, Gatsi said was an indication that Ghana should have stayed longer in the previous programme.

“Staying a bit longer in the previous programme would have consolidated the gains and helped us manoeuvre when the crisis came during the pandemic. But we were in a hurry to ask for permission to exit the programme. So we were actually not fully prepared to exit, but we chose to exit the programme,” he stated.

Instead of an “unrealistic and uncertain” gold for oil deal, Gatsi urged the government to rather activate the wartime clause in the petroleum agreements, to compel the IOCs operating in Ghana to sell their crude to the country during this difficult era.

“Though this would be at international price, with cedi equivalent paid to them,

it could cut off the transportation cost , so that all the associated cost would have been gone and you’d be able to give the oil to TOR [the Tema Oil Refinery] to refine for domestic use and that will make the price far lower than we have now,” he stated.

Gatsi, however, lauded the government for finally deciding to promote and invest in food crop production, especially for staples such as rice, tomatoes and others to reduce their import burden on the scarce foreign exchange.

Touching on the proposed debt exchange for climate action, the academic did not see its plausibility as Ghana had demonstrated clearly that it could not control illegal mining locally, allowing the practice to wreck havoc on the environment.

“You have galamsey [illegal artisanal mining] here and government is not able to control it, or made any serious commitment

to galamsey, but we go to Egypt and start talking about debt exchange, to swap debts for climate proceeds - it is just laughable when we are not controlling the things that are destroying our environment. That is difficult to appreciate,” he stated.

Gatsi, also a chartered economist and a barrister, projects a difficult year ahead of Ghanaians, considering the tax and labour proposals in the 2023 fiscal policy.

“The budget speaks volumes. The budget says that there will not be any employment in the public sector, which is a huge one. There are all kinds of increases in taxes, including VAT, which will cause hardships, and lead to increase in prices which will cause inflation especially in the first quarter of 2023,” he added.

Since he projected that the international capital market would not open to Ghana any time soon, Gatsi agreed with the central bank’s decision to have a mix of gold and foreign currency as its reserves.

GHANA’S economic woes continue as the country seeks International Monetary Fund (IMF) support for the 17th time. The bailout was necessary after the new electronic transaction levy (e-levy) – a 1.5 percent tax on all electronic transfers above GHS100 –failed to yield the expected results.

Previous IMF programmes have improved macroeconomic stability in Ghana. Fiscal discipline in the country often depends on these programmes, as self-imposed controls are rare. Nonetheless, the solution to Ghana’s crisis lies with its government and people.

The economy has suffered significantly since early 2022, plunging the country into

a full-blown economic recession. Inflation rose from 13.9 percent in January to 37.2 percent in September, and some analysts believe the actual level is more than twice the official rate – possibly as high as 98 percent. Petrol and diesel prices have jumped by 88.6 percent and 128.6 percent respectively. Most public transport fares have increased by more than 100 percent since January.

Likewise, water and electricity tariffs have risen by 27.2 percent and 21.6 percent respectively this year. According to the World Bank, Ghana has the highest food prices in sub-Saharan Africa, with prices soaring by 122 percent since January.

The country’s interest rate of 30

percent and lending rate of 35 percent are the highest in Africa. Bloomberg says the Ghana cedi is now the worst performing currency globally, and the IMF revised Ghana’s projected growth rate for 2022 from 5.2 percent to 3.2 percent.

Analysts trace the current problems to the downgrading of Ghana’s sovereign rating.

“Problems began when international credit rating agencies downgraded the country to junk status due to its unsustainable and growing debt. The relegation denied access to global capital markets, and prevented the raising of the $2-3 billion Eurobond required to service its debts and support the Ghana cedi, which

As debt soars, Ghana must take ownership of its financial troubles, starting with slashing public expenditure, Jon Offei-Ansah reports

then went into freefall,” says Enoch Randy Aikins, Researcher, African Futures and Innovation, at the Institute for Security Studies (ISS) in Pretoria, South Africa.

Aikins says the major problem now is rising debt, which stands above 80 percent of GDP and is projected to reach 104 percent by the end of 2022. Ghana has been thrust into debt distress as 70 percent of its total revenue must go towards debt servicing. This leaves little room for other statutory obligations or investment in education, health and infrastructure.

Aikins dismisses the government’s claims that Covid-19 and the war in Ukraine are the cause of the current headwinds. “While the government blames the economic crisis on Covid-19 and Russia’s invasion of Ukraine, the political opposition and some civil society

organisations believe state mismanagement is largely responsible,” he says.

In Aikin’s opinion, several structural problems need fixing. “For instance, the country’s inability to produce for export and its reliance on imports for daily consumption has led to a perpetual deficit in its balance of trade. That means the Ghanaian currency is fated to be inherently weak compared to the dollar, leading to high import prices that hit consumers.

“Poor public financial management is also a factor, especially the high levels of unproductive and profligate government expenditure. From 2017 to 2020, Ghana – a small country – had over 120 ministers and 1 000 presidential staffers. These lucrative appointments drained the public purse.

“The crisis was further aggravated by government spending on flagship

programmes that didn’t yield the expected results, such as NABCO (a graduate apprenticeship programme) and One Village, One Dam.”

The 2018 financial sector clean-up cost Ghana about $4 billion in borrowed funds, says the government – a figure experts believe could have been less had implementation been more efficient. Debt was also driven by the 2014 capacity charges agreement that enabled independent power producers to address energy shortages. The government says the country paid $937.5 million in capacity charges between 2017 and 2020.

Ghanaian governments also have a history of large fiscal deficits in election years. In 2020, the deficit was 15.2 percent of GDP compared to the 8 percent average from 2017 to 2019.

Domestic revenue mobilisation is also weak due to tax exemptions for large corporations, government cronies and corruption. The country loses about GHS2.2 billion ($300 million) annually this way. According to the AuditorGeneral, public sector irregularities from 2016 to 2020 amounted to about GHS48 billion (more than $8 billion). And a recent report to Parliament flagged GHS17.4 billion ($3 billion) in financial irregularities in 2021, 36 percent higher than in 2020.

To achieve macroeconomic stability, the government has applied for a $3 billion IMF bailout programme starting in the first quarter of 2023, with discussions focused on debt restructuring to give the government fiscal space but Aikins believes the government can boost public confidence in the economy through other measures in the meantime.

“First, the Fiscal Responsibility Act capping government deficit at 5 percent

The government of Ghana’s proposed debt exchange programme aimed at easing is debt burden kicked in Monday with the launch of the domestic debt exchange amid the ongoing economic crisis.

Ken Ofori-Atta, the finance minister launched the programme (just as Africa Briefing was going to press on December 4) explaining that debt restructuring was inevitable in order to redeem the economy from its current crisis.

Ofori-Atta said the government was inviting eligible holders to voluntarily exchange approximately 137.3 billion Ghana cedis ($9.8 billion) worth of domestic debts “for a package of new Bonds to be issued by the government.”

He said the domestic bond investors would receive new Government of Ghana bonds with 0 percent coupon in 2023 that steps up to 5 percent in 2024, and 10 percent from 2025 onwards.

The minister first announced the government's intention on the debt swap when he presented the 2023 budget to parliament in late November.

of total revenue that was suspended in 2020 due to Covid-19 should be restored. Second, measures are needed to drastically reduce government’s size, including allowances and bonuses. Foreign travel and new vehicle purchases should be banned unless vital. Initiatives such as the Free Senior High School programme must be reviewed to improve their efficiency.

“Third, revenue mobilisation measures are needed. The newly passed tax exemption bill, which has clear eligibility criteria and provides for monitoring and evaluation, should be implemented. The new bill could reduce tax exemptions to at least GHS500 million ($66.7 million).

“Using technology, the government could improve property tax collection, which has been sporadic and low due to poor information about ownership and accurate valuations. The extractive industry could bring in revenue if the tax regime is tightened and properly implemented.

“The Debt Sustainability Analysis of the country’s economy demonstrated that Ghana’s public debt is unsustainable and that the government may not be able to fully service its debt down the road if no action is taken,” the minister stated.

He added that “debt servicing is now absorbing more than half of total government revenues and almost 70 percent of tax revenues. Total public debt, including that of State-Owned Enterprises, exceeds 100 percent of our GDP.”

The minister said the debt exchange would restore the capacity of the West African cocoa, gold, and crude oil exporter to service its debt.

“This domestic debt exchange is part of a more comprehensive agenda to restore debt and financial sustainability. We are also working towards debt restructuring, which we will announce in due course,” added the minister.

He added, “This is a key requirement to allow Ghana’s economy to recover as fast as possible from this crisis and a key requirement to securing support from IMF.”

“We are confident that with these measures and those in the 2023 budget

The government must also seal the leaks at ports to realise more from excise and import duties.”

In addition, Aikins believes that parliament should enact legislation to establish a debt limit and cap government borrowing to prevent the crisis from recurring. Constitutional amendments to limit the number of ministers and appointees in government, abolish exgratia payments and review emoluments to public servants must be considered.

“Finally, Ghana needs a national industrialisation plan anchored in its strong manufacturing sector with links to agriculture. The country must establish import-substitution and export-driven industries based on its comparative advantages. The One District One Factory industrialisation agenda should be reviewed and better implemented. These measures can improve the country’s trade balance and government revenue,” he says.

statement, underpinned by a successful IMF program, Ghana will witness a stable and thriving economy from 2023, with a return to single-digit inflation to ensure that real returns on bonds are protected,” said the minister.

Ghana’s economy has been hit by multiple crises including fiscal deficit, debt overhang, current account deficit, exchange rate depreciation, and galloping inflation, causing international rating agencies to downgrade Ghana’s creditworthiness multiple times in 2022.

The IMF staff team has been in Ghana since December 1, following up on negotiations with the government for a possible support program toward economic recovery.

Moody’s further downgraded the Ghanaian government’s long-term issuer ratings to Ca from Caa2 ,changing the outlook to stable on November 30.

“The Ca rating reflects Moody’s expectation that private creditors will likely incur substantial losses in the restructuring of both local and foreign currency debts planned by the government as part of its 2023 budget proposed to Parliament on 24 November 2022″, the agency said in a statement.

ABTHE Democratic Republic of Congo has been encouraged to accelerate the rollout of a new programme to demobilise rebel fighters amid surging conflict with armed groups, including the M23, which has seized yet more territory in eastern parts of the country.

But there are limited funds for the programme – which is yet to begin activities more than a year into its creation – and local analysts and combatants are sceptical it will succeed given the failure of three prior demobilisation schemes to ease violence.

“You can take a thousand fighters out

from armed groups today, but tomorrow they will be able to recruit another thousand people,” said Nene Morisho, director of Pole Institute, a Congolese think tank specialising in conflict prevention and resolution.

The demobilisation scheme – which comes after several years without a nationwide programme – is one of several initiatives introduced by President Félix Tshisekedi, who came to power in early 2019 promising to quell long-running conflict in the east.

Tshisekedi has initiated dialogue with some armed groups and launched largescale military offensives against others.

He has also introduced martial law in two eastern provinces, and approved the deployment of a controversial East African military force.

Yet insecurity has only worsened, as a renewed offensive by the M23 – which Rwanda is accused of backing – uproots nearly 240,000 people. Conflicts involving other armed groups are also flaring, with almost six million Congolese internally displaced overall.

Experts say the new programme must improve on prior schemes in order to reduce violence. Past efforts did not create durable livelihoods for rebels nor address the political factors that drew them into

More than 200,000 combatants have been shuffled through different demobilisation programmes over the years, making the process one of the world’s largest and longest-running, write Sam Mednick and Claude Muhindo Sengenya

armed groups – of which there are now over 120.

But the latest demobilisation initiative has been marked by controversial appointments – its top official, Tommy Tambwe, has prior links to rebel groups, including the M23 – and a sluggish start that has left some questioning the government’s commitment.

Several Congolese officials involved in the programme told The New Humanitarian they do not have funds to implement projects, while a senior diplomat said international donors were not willing to release money until the government put “skin in the game”.

Local residents in conflict-hit areas called for faster action from authorities. “The government needs to disarm people quickly,” said Henri Ngabu, from north eastern Ituri province. “People will restart fighting because they need a means to live.”

The DRC’s first disarmament, demobilisation, and reintegration (DDR) programme began in 2004, following two devastating wars. The conflicts were linked to the 1994 genocide in neighbouring Rwanda and the subsequent exodus of genocidaires into eastern DRC.

More than 200,000 combatants have since shuffled through different demobilisation programmes, making the DDR effort here one of the world’s largest and longest-running. International donors have invested hundreds of millions of dollars in the processes.

Yet some funds have been misappropriated by the state and poor implementation has meant combatants who disarmed often ended up re-joining rebel groups – which have proliferated in numbers in recent years.

Almost a dozen current and former rebels who spoke to The New Humanitarian said they spent several hard years in cantonment camps, waiting to demobilise. Some were so ill-equipped that rebels and their families died of hunger and disease.

Combatants who reintegrated into civilian life, meanwhile, said assistance was scant and poorly tailored. Others were stigmatised by communities, which were left out of programme implementation, and questioned why rebels were the only ones being assisted.

“It’s because [combatants] are not treated well that they re-join groups,” said Joseph Byenda, an ex-rebel who demobilised in 2005, having started fighting in the 1990s. Byenda said he was still stigmatised and struggled to survive on a paltry income.

Despite the failure of past programmes, the absence of a national scheme in recent years led to missed opportunities. For example, a wave of rebels surrendered in 2019 when Tshisekedi came to power, but they then received little support.

Known as the Disarmament, Demobilisation, Community Recovery and Stabilisation Programme, the new scheme differs from past ones in that it will be run from provinces rather than Kinshasa – a measure supposed to decentralise decisionmaking.

There will also be a strong emphasis on sensitising and supporting communities to accommodate ex-combatants, with both parties standing to benefit from job creation schemes such as on farms and in road construction.

“Ex-fighters and the populations will work together in order to create an environment of understanding and trust,” said Joseph Ndayambaje Sukisa, deputy coordinator of technical and operational

matters for the demobilisation programme in North Kivu.

Like past programmes, the initiative will focus on bringing rebels back into civilian life and excludes the wholesale integration of armed groups into the army. Amnesty for serious rights abuses is ruled out too.

“Impunity is the root of all the cycles of violence in [the] DRC," said Stewart Muhindo, of the campaign group LUCHA. “Until now, all the dialogues in DRC seem to consecrate the impunity of militiamen by granting them a general amnesty or integration into the army.”

Still, while some combatants expressed optimism in the new programme, many remained jaded by past iterations and few seemed aware of specific details about the initiative, indicating a lack of communication from authorities.

A slow rollout has also undermined trust. Though Tshisekedi first called for a new DDR programme in 2019, the initiative is not yet operational, even with provincial and national coordinators appointed over a year ago.

“We don’t feel the political will on the part of the Congolese state to actualise this programme, more than a year after facilitators were appointed,” said Xavier Macky, executive director of Justice Plus, a local rights group. “We’re still going in circles.”

Trust is especially low at cantonment sites where surrendered combatants have been waiting for several years to be demobilised. Hundreds tried to leave a camp near Goma, North Kivu’s capital, in July, but were urged by authorities to stay and wait.

“Patience is running out because the conditions aren’t good,” said Sadock Assani, an ex-combatant who has been living at Mubambiro cantonment site near Goma since 2019. “If the programme is delayed longer, there will be a catastrophe.”

Analysts warn the new scheme may face the same problems as past ones. A weak economy, for example, makes it hard to find lasting livelihoods for rebels, while a militarised political system means elites often use armed groups to further their interests.

Unresolved local conflicts and the presence of foreign armed groups may also leave Congolese combatants

wary of disarming. Few have much trust in army soldiers who are poorly paid and regularly responsible for abusing the rights of civilians.

In recent months, meanwhile, the military has been providing support to a number of local and foreign armed groups willing to support its offensive against the M23, raising questions about the force’s commitment to demobilisation.

Earlier this year, even cantoned fighters who were awaiting DDR in North Kivu were asked by the army to reinforce their positions 100 kilometres away, according to a local human rights activist who asked not to be named citing security risks.

“Why would we demobilise when the government needs youth to defend the country, which is under attack?” said Jules Mulumba, spokesperson of a rebel group called the Collective of Movements for Change, which is currently allied against the M23.

Rules around amnesty and army integration may further weaken the motivation of combatants to demobilise. This is especially the case for rebel leaders seeking the same rewards and ranks, which armed groups and commanders enjoyed in the past.

A combatant with the Front for Patriotic Resistance in Ituri (FRPI) told The New Humanitarian that rebel officers who return to civilian life rather than the military are likely to recruit people again.

The combatant, who asked not to be named, was part of a local demobilisation

initiative in 2019 and 2020 that was based on promises of army integration and amnesty. However, the deal fell apart in late 2020 with only a few weapons handed over.

sites, though it does run its own sites in the east.

Daniel Owen, a development specialist at the World Bank – which has spent

“The militiamen were no longer reassured that their demands were taken into account… namely general amnesty and integration into the army with recognition of ranks,” said an employee of a local NGO in Ituri. They asked for anonymity due to security fears.

If the programme does move forward –some analysts fear elections scheduled for next year will get in the way – government officials said combatants will initially be received at the Mubambiro cantonment site near Goma.

Yet this camp already hosts around 1,600 ex-fighters, and officials there worry they would not be able to receive more. When The New Humanitarian visited in September, people were sleeping in shared tents on muddy ground and lacked food and medicine.

A spokesperson for the UN’s peacekeeping operation, MONUSCO, said the mission was not currently providing “life support” to government-run DDR

some $190 million on demobilisation in DRC since 2003 – said the organisation was preparing a new “investment project” focusing on the communitybased reintegration of fighters and “local institutional capacity building”.

However, other donors are reluctant to directly support the government’s efforts. The senior diplomat said the “major donor position” was to only release funds when authorities take tangible steps to support the programme.

If rebels agree to disarm but do not receive benefits and timely assistance, they may commit even more abuses against civilians, cautioned Chober Agenonga, an international relations professor at the University of Kisangani in northern DRC.

“All commitments not accompanied by support are followed by relapses [from the combatants],” Agenonga told The New Humanitarian. “It pushes them to commit atrocities.”

‘ ’

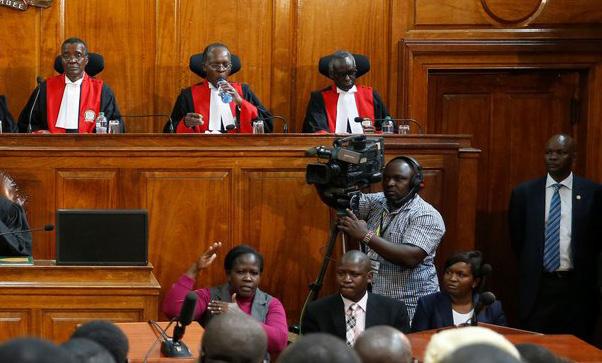

PRESIDENT William Ruto has already begun the process of amending Kenya’s Constitution and the Independent Electoral and Boundaries Commission Act, not long after his inauguration on September 13. Additionally, he has undone important policies, orders and projects earmarked by his predecessor, a move largely perceived as a signal that former President Uhuru Kenyatta made mistakes during his administration.

Immediately after he was sworn in, Ruto appointed the six judges that the Judicial Service Commission (JSC) had recommended but who were rejected by Kenyatta due to purported integrity difficulties after taking the oath of office.

Kenyatta had insisted that he would not be forced to make the appointments in the face of numerous court wrangles over the matter.

“My administration would respect court rulings as we cement the place of Kenya as a country rooted on democracy and the rule of law,” Ruto stated. “This will help to consolidate the place of the judiciary in our constitutional and democratic regime.”

Cuts to the judiciary’s budget in the past had led to vehement complaints from the Chief Justice about how the financial reduction affected the operations of the courts. Ruto has committed to increase financing for the judiciary by $26.4 million a year over five years.

For the 2022/2023 financial year, the judiciary received $155.2 million, only $8 million more than the year before. On the other hand, the judiciary was seeking $324.8 million.

The opposition, led by former presidential contender Raila Odinga, has expressed concern about the Kenya Kwanza Alliance regime's growing ties with the judiciary, warning that it could undermine the courts' independence. According to the opposition, Ruto's public declaration that he will provide additional funds to the judiciary is a “ruse to endear himself to and eventually control the judiciary”.

Next on Ruto’s list was the appointment of the Inspector General of

The new Kenyan leader has taken aim at a variety of laws, regulations and programmes that were central to the administration of his predecessor by starting to dismantle them, writes Kennedy Olilo

Police to the position of Accounting Officer of the National Police Service (NPS). In his inaugural speech, Ruto had promised to give the police service financial independence by removing its budget from the Office of the President and designating the Inspector-General as the accounting officer.

Ruto’s argument was that this arrangement had jeopardised the operational independence and autonomy of the NPS. He often used to refer to this as “political weaponization of the criminal justice system”.

Ruto’s axe then fell on the dreaded Special Service Unit after accusing it of indiscriminately killing Kenyans. He claimed that his administration, following the dissolution of the SSU, now had a plan in place to keep Kenya off the list of countries with the highest rate of extrajudicial killings by the security forces.

On the socio-economic front, Ruto, who campaigned on a platform of lowering the cost of living, immediately repealed the fuel and maize flour subsidies instituted by Kenyatta's administration. He said that the fuel subsidy programme had cost $1.18 billion, while the maize flour subsidy was costing the government $57.5 million in

a month. For many Kenyans, though, the subsidised maize flour was nowhere to be found.

On the removal of the maize subsidy, Ruto said that his administration would focus on interventions to make fertilizer, good seeds, and other agricultural inputs more affordable and accessible. These efforts are seen as long-term, given the uncertainty of the impact of climate change on the continent.

Additionally, Ruto ended the programme that stabilised fuel prices, which led to a litre of fuel being sold at the pump for $1.47. In particular, fuel price inflation has been the main factor influencing consumer prices in Kenya. Ruto thinks that consumption subsidies can be abused, causing market distortion and artificial scarcity.

But he has become unpopular because of the high cost of living in the first two months of his presidency – to the point where thousands boycotted the Heroes’ Day celebrations on October 20. Is this an early sign of things to come for Ruto during his first term?

The battle is already being fought on the electoral front. Ruto’s Kenya

Kwanza Alliance has proposed changing the composition of the team tasked with recruiting new Independent Electoral and Boundaries Commission members. Ruto's allies want the composition of the recruitment panel changed in the new law, which critics say will "favour the Executive”. Kenya Kwanza proposes reducing the number of political party nominees in the IEBC commissioner's recruitment panel from four to two. The proposal seeks to reduce the Parliamentary Service Commission's current allocation, which nominates four of the seven members of the selection panel.

Instead, the new Bill gives one of the slots to the Public Service Commission, which is widely perceived to be under the Executive's tight grip, to nominate one person to sit on the panel. The other slot on the selection panel will be filled by the Political Parties Liaison Committee, whose leadership is currently favouring Ruto's Kenya Kwanza Alliance.

The IEBC commissioners are currently recruited by a team of seven. Two men and two women are to be nominated by the Parliamentary Service Commission, representing the majority and minority sides in Parliament. One person is to be

nominated by the Law Society of Kenya, and two others are to be nominated by the Inter-Religious Council of Kenya.

Odinga's coalition, Azimio la Umoja, has slammed the proposed changes to the Independent Electoral and Boundaries Commission Act, saying this was “the real state capture”.

The battle for control of the IEBC so soon after the August 9 elections is, indeed, underway, with political heavyweights already planning for the 2027 polls. Unusually, the IEBC leadership was divided, with four of the seven commissioners opposing the declaration of Ruto as president. Whether Ruto replaces the commissioners who backed his election victory remains to be seen.

Meanwhile on the economic front, Ruto has relocated port operations and cargo clearance to Mombasa. The previous regime, in which he served as Deputy President, had directed that all onward cargo arriving at the port be transported via the Standard Gauge Railway to the Embakasi and Naivasha inland container depots (ICDs) to increase the use of the railway in order to repay the construction loan.

Importers can now clear goods at ports or ICDs and transport them by road or rail. The directive is likely to hurt the businesses that had been set up in Naivasha after the directive. The Naivasha ICD was at the heart of Kenya’s ambition to become the transport corridor of choice for neighbouring countries like Tanzania, Uganda and South Sudan.

Kenya also launched an upgraded ICD in Nairobi to promote efficient transportation of bulk cargo from the port of Mombasa to the hinterland. The Nairobi ICD that was built by the China Roads and Bridge Corporation (CRBC) was expected to decongest the port of Mombasa while lowering the cost of transporting goods.

On the agriculture front, the government reversed the November 2012 decision prohibiting the open cultivation of genetically modified crops as well as the importation of food crops and animal feeds produced through biotechnology innovations. Opposition politicians have promised to fight the effective lifting of the ban on genetically modified food through legal channels and public awareness campaigns.

They argue that the introduction of genetically modified foods into the country

will jeopardise the country's biodiversity and create health risks. Experts in the sector have alleged that the country will lose its organic seeds to mutated forms of crops.

Ruto has also changed the focus of the National Hygiene Programme, which was established to provide work for young people during the Covid-19 pandemic. He said that it was outdated and was robbing the youth of half of their wages.

The programme now will be transformed into a tree planting initiative in order to help mitigate the negative effects of climate change in the country, with five billion trees planted over the next five years through the Special Presidential Forestry and Rangeland Restoration Programme

In a short space of time, Ruto has been ringing the changes at breakneck speed, giving the impression that he did not approve of the decisions taken by a government of which he was Deputy President. Having now made a bold move to stamp his authority, many Kenyans will be watching with keen interest to see whether Ruto will deliver on his elections promises to make life better for the people.

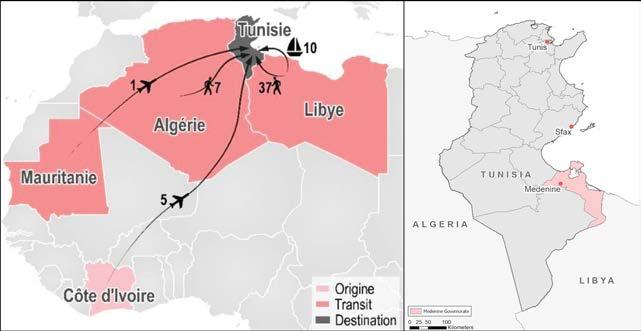

TOURISTES Hors Saison (Off Season Tourists) is the title of a short Tunisian film I watched recently, as part of the 2022 Alyssa Tunisian Film Festival in London. It tells the true story of Hervé, an Ivorian man, who after the political crisis in his own country in 2010, when disputed presidential elections led to widespread violence, decided to leave and settle in Tunisia.

Hervé seeks to support himself and his wife by obtaining decent work, but faces major challenges: living and working illegally means he is constantly dodging the authorities, a situation made worse by ongoing prejudice from Tunisians. These issues prevent Hervé from integrating into Tunisian society.

Hervé’s case highlights the precarious situation of thousands of sub-Saharan immigrants, itself a subject rarely covered by the Tunisian media in neither its journalistic nor cinematic outlets.

Ivorians are among other sub-Saharan Africans who once chose Tunisia as a place of study. Up until the mid-1990s, the number of foreign students numbered a few hundred, predominantly coming from the Maghreb and in smaller groups from the Middle East and sub-Saharan countries. Most of the incoming students benefited from scholarships provided either by the governments of their countries or by the Tunisian state within the framework of bilateral agreements.

By the new millennium, this number had started to climb toward the thousands, as the establishment of private universities beckoned in a new generation of students primarily coming from sub-Saharan Africa.

Tunisia presented an attractive

A film by a young Tunisian director pointedly highlights how Africans from south of the Sahara are faring in the North African country. Mounira Chaieb looks at the complex situation facing migrants there

study destination for a combination of reasons. It is geographically accessible for Maghrebian and sub-Saharan students, situated along the North coast of the continent and made even more convenient by the lack of visa requirements for entry into the country.

Such visa exemptions mean visitors from the region can stay in the country for a maximum period of three months. More than 20 African countries, including those in the Maghreb, are on this list.

Even those who come from countries that do not have bilateral agreements with Tunisia can easily obtain a visa as soon as they present proof of their enrolment

in a Tunisian university. The fact that some private Tunisian universities offer programmes delivered in French also played a major role in attracting students

from Francophone Africa, while other universities teach courses in English to attract those from English-speaking subSaharan Africa.

Many other factors contribute to making Tunisia an attractive destination for students from the continent. They include security and stability (especially before the events of 2011, often referred to as The Arab Spring); the relatively developed infrastructure in the capital, Tunis, and in other major cities where private universities are concentrated; the diverse range of disciplines offered by these universities, which provide the students with choices; the international recognition of Tunisian university qualifications; and the low cost of living compared with European countries.

The nature of the sub-Saharan presence in Tunisia has however changed in recent years. At the height of the conflict in Libya in 2011, almost a million Libyans (nearly 10 per cent of Tunisia’s population) crossed the border into the country. Before that year, only a hundred refugees arrived each year.

The volatile situation in Libya also rendered the country too dangerous as a route to Europe and immigrants from subSaharan countries began transiting through and settling in Tunisia in larger numbers. Many others found themselves in Tunisia after being turned back on the other side of the Mediterranean and decided to stay temporarily, while they plan to cross again towards European shores.

Historical ties connect Tunisia and North Africa as a whole with the countries and communities of sub-Saharan Africa. Ifriqiya was the original name of Tunisia and a part of Algeria, from which the continent derived its appellation. The ties were economic through commercial convoys and slavery, religious through

Islam and Sufi currents and historical through European colonialism of the continent.

The country’s location makes it a perfect transit point and the “road to Rome passes through Carthage”, as some say. This means that migrants aspiring to reach Europe can access the penultimate stage, Tunisia, within hours, which buys them time and allows them to avoid the dangers of the desert route.

The small nation, strategically placed between Libya and Algeria, is still considered more accessible than its neighbours and there are several factors contributing to this. For instance, the long coastline and its proximity to European shores and especially the Italian ones. The island of Lampedusa is less than 150 miles away from the southern, central and eastern Tunisian shores.

The island of Pantelleria is only 50 miles away from the Tunisian north eastern shores. This proximity via multiple ports means faster access and lower risks, especially when the means of transportation usually involved is unsafe and not made for long-distance travels.

Another factor is the rigidity of the European Union’s migration policies and the many agreements/deals it has reached with governments of countries of the Maghreb to ensure that they control their borders more tightly and address African migration flows “properly”. At the beginning of the new millennium, Europe and some of its Mediterranean allies started to close all the maritime routes, which the smugglers and irregular immigrants had resorted to.

People smugglers have therefore looked for alternatives. One of their options was the Tunisian-Italian route which was, until the late 1990s, mostly used by Tunisian, Algerian and Moroccan illegal immigrants, known as Harragas.

But while inward-looking Europe exerts pressure on Tunisia to address

Libyans crossed the border into Tunisia

illegal immigration from Africa and wants it to translate this into stricter laws and an enforcement of the security services patrols, the country finds itself struggling alone to accommodate the ongoing complex issue that its neighbours are refusing to deal with.

According to Médecins Sans Frontières (MSF), thousands of immigrants have been deported from Algeria and Libya in recent years, leaving them stranded in the middle of the desert on the border region with Niger. Among those left in the desert are immigrants with physical injuries, as well as survivors of sexual violence and people suffering severe psychological trauma, according to MSF.

Nearly 70 per cent of those cared for by MSF reported being subjected to violence and abuse while stranded on the borders of Algeria and Libya. At least 38 people have also been confirmed dead in the area between 2020 and 2021.

Some groups working with refugees estimate that there are currently around

20,000 African immigrants settling in Tunisia, but official statistics from the General Population and Housing Census put the number at less than 10,000. Citizens from Nigeria, Cote d’Ivoire, Cameroon, Mali and Senegal emerge as the top five among them.

But given the irregular arrival of immigrants to Tunisia, official figures remain in a permanent state of fluctuation. And they only consider those who carry a legal residence permit issued by the ministry of interior.

A great number of immigrant workers from sub-Saharan Africa live in the country without any legal documents, for either a short or long stay and work in the informal sector. Others, such as students, have residence permits which do not allow them to work officially, but they also resort to the informal sector to improve their living conditions.

While migrant flows remain complex and varied, the general trend in Tunisia indicates that an increasing number of

sub-Saharan immigrants are settling and building their lives in major cities: Tunis in the north, Nabeul and Sousse on the coast, Sfax and Medenine in the south. African men tend to work in construction and agriculture; as kitchen porters in restaurants and cafes; or sales assistants in shops. The women often take jobs as household helpers, while others sell African goods in the souks and on the streets.

Without any legal avenues to pursue work in Tunisia, immigrant workers are left vulnerable to trafficking and other forms of smuggling. Their situation also limits their access to social services. To stay lawfully in the country and have the same benefits as Tunisian citizens, individuals must acquire residence permits – a difficult process locked behind a legal maze of its own.

To make matters worse, skirmishes and quarrels between African immigrants and Tunisians are frequent occurrences across several areas, especially those where there is a large immigrant population. The

unresolved tension builds a simmering atmosphere of resentment among local inhabitants, liable to escalate into violence at any given moment for any reason.

For example, the defeat of the national football team by Equatorial Guinea in January 2015, and Tunisia’s subsequent failure to make the finals of the Africa Cup of Nations, led to a wave of attacks against immigrants from sub-Saharan Africa.

In June 2021, more than 100 subSaharan immigrants fought with Tunisian residents of a neighbourhood in Sfax. Security forces intervened to end the clashes. These skirmishes were not the first in the region.

Sfax, being a coastal city, the industrial capital of Tunisia and the second largest city in the country, with more job opportunities, is among the areas with the highest influx of immigrants from subSaharan Africa. Most of them arrive from Libya. It also faces continuous attempts at migration via clandestine boats.

The troubles with the inhabitants have created a social stigma, leading to prejudiced thinking that links sub-Saharan migration to increased crime around the country. Human rights activists, though, often report the contrary; rather than an increase in crime, sub-Saharan immigration has healed a different kind of social ill: unemployment has gone down as the immigrants step in to fill gaps in the labour market that are there because Tunisians are not interested in doing the jobs.

For many Tunisians, the issue of sub-Saharan migration to the country is somewhat surreal. Young and even elderly Tunisians could be seen in long queues outside embassies of European and Gulf

countries, hoping to get a visa. Others, often including entire families, have been embarking on what are called “death boats” heading towards Italian shores almost every day in recent months.