HOW WILL SUSTAINABLE BECOME THE STANDARD?

DAY 2 JUNE 20, 2023 AINONLINE . COM PARIS AIRSHOW NEWS

Advertisement

Reducing CO2 emissions is more than our priority—it’s our passion. That’s why we’re reinventing aviation with more efficient engines and hybrid-electric propulsion. It’s part of our commitment to meet net-zero emissions and safeguard our environment.

Visit Raytheon Technologies at Pavilion C2

MASSIVE A320/321 ORDER FOR AIRBUS

by Cathy Buyck

EVTOLS PREEN IN PARIS

by Charles Alcock

The eVTOL aircraft upstarts breezed into the French capital this week demonstrating at the 2023 Paris Airshow that their time has come. The attention-grabbing new electric vehicles that promise to revolutionize the way people and things move around truly claimed their place on the aerospace world stage, with Volocopter’s 2X model silently opening the daily flying display.

The two-seat air taxi, which the German company intends to bring to market as the VoloCity, is due back in Paris next year for the 2024 Summer Olympic Games as part of the Re.Invent Mobility

exercise, which will see it used for flights connecting Charles de Gaulle Airport and the Media Village hosted at Le Bourget Airport. It might also be pressed into emergency medical services, with Germany’s ambulance group ADAC announcing today a partnership with Volocopter that could see it add up to 150 VoloCity vehicles to its fleet.

Step into Hall 5 in Le Bourget and you’ll find what is to date the largest concentration of eVTOL vehicles in one venue. Archer’s four-passenger Midnight turned heads by making its international debut after a long trip from California.

Indian low-cost carrier IndiGo on Monday placed a firm order with Airbus for 500 A320 family aircraft, providing the European aircraft manufacturer with an auspicious start on the opening day of the Paris Airshow and setting the record for the largest-ever single aircraft purchase by any airline with Airbus. Deliveries will begin in 2030 and run through 2035.

The order consists of a combination of A320neo, A321neo, and A321XLR twinjets. “The exact mix is still open,” IndiGo CEO Pieter Elbers told AIN . Elbers stepped down as CEO of Dutch flag carrier KLM early last year and started his role as chief executive of the Indian low-cost carrier in September. The engine selection for the order remains undecided.

IndiGo operates a fleet of 264 Airbus aircraft—62 A320neos, 79 A321neos, 21 A320ceos, and two A321 freighters. It has placed previous orders totaling 480 aircraft, which are due to be delivered by the end of this decade. “The order book continues on page 20

DAY 2 june 20, 2023 ainonline.com PARIS AIRSHOW NEWS

Learn more at www.supernal.aero We’re building new roads in the sky. DAVID M c INTOSH continues on page 45

Volocopter 2X

The future is our starting point

Every day, we’re working to help move the world forward. Today, and for generations to come. The future of flight starts now.

Hydrogen bizjet aims to green private aviation

by Charles Alcock

by Charles Alcock

A hydrogen-electric midsize business jet could enter service around 2030 if Beyond Aero can implement the plans it unveiled at the Paris Airshow on Monday. The French start-up said the new BYA-I aircraft will carry four passengers on trips of just above 800 nm at speeds of 310 ktas.

Over the past 18 months, Beyond Aero has built and tested an 85-kW subscale technology demonstrator of its hydrogen fuel cell-based powertrain. The Toulouse-based team will now start work on the 1-MW class propulsion system that will include a pair of electric-powered ducted fans on the rear of the fuselage.

Initially, the BYA-I will run on gaseous hydrogen loaded in tanks installed below the cabin. However, Beyond Aero already plans to switch to liquid hydrogen at a later date. Company founder and CEO Eloa Guillotin told AIN that, for now, it bills the jet as a reduced-carbon aircraft because supplies of completely green hydrogen cannot be assured worldwide. She said that pink hydrogen, produced from nuclear power, would present a desirable fuel source for aviation.

On Wednesday, Beyond Aero will announce strategic partnerships for fuel supply with airports in France and several other European countries. Later, the company, which is a member of the Alliance for Zero Emission Aviation, aims to establish similar arrangements with airports in the U.S. The BYA-I would be capable of operating from 2,800-foot runways.

The BYA-I design features a half-moonshaped air inlet to the rear of the fuselage that will cool the powertrain. That feature represents one of two patents held by Beyond Aero, with the other being the concept for placing the fuel tanks in a fairing under the fuselage to avoid compromising space in the cabin, which can seat up to eight passengers. The company aims to certify the aircraft under EASA’s existing CS-23 rules.

Beyond Aero, which was founded in December 2020 and has so far raised around $10 million, will now look to attract further investments. It is part of the Y Combinator start-up accelerator and has received backing from the France 2030 government fund and the Ami-Maele program of the country’s Occitanie region.

The company said it has signed letters of intent covering possible orders for 72 of the new aircraft, collectively valued at $580 million (implying a base price of $8.1 million). It has declined to identify the prospective customers, indicating that they might include existing business aircraft operators looking to decarbonize their fleets.

The availability of a hydrogen-powered business jet could prove a significant step in countering negative attention on private aviation from activists who have identified it as a primary cause of environmental damage. At the EBACE business aviation trade show in May, protestors from several groups broke into the static display, locking themselves to aircraft and causing some damage. z

Beyond

De Havilland makes a Classic move

De Havilland Aircraft of Canada (DHC) unveiled a new variant of its turboprop-twin short takeoff and landing (STOL) DHC-6 Twin Otter—the Classic 300-G—at the Paris Airshow on Monday. The company has already secured purchase agreements and letters of intent for 45 examples of the fifth-generation Twin Otter. Aircraft leasing firm Jetcraft Commercial is the launch customer, taking the first ten 300-Gs, with deliveries set to start next year.

“For over 50 years, the DHC-6 Twin Otter has stood alone as the most reliable and versatile aircraft in its class,” commented DHC CEO Brian Chafe. “After extensive consultation with our customers, we are poised and proud to take this iconic aircraft to new heights with the new DHC-6 Twin Otter Classic 300-G.”

The DHC-6 Twin Otter Classic 300-G retains the rugged airframe of its predecessors but incorporates new Pratt & Whitney engine technology for enhanced performance. DHC said it reduced the aircraft’s basic weight by 400 to 500 pounds, allowing for more payload or longer range. The Classic 300-G features a redesigned cabin interior, and its flight deck features the Garmin G1000 NXi avionics suite and GFC 700 autopilot with envelope protection. C.B.

4 Paris Airshow News • June 20, 2023 • ainonline.com

Aero plans to bring to market a hydrogenpowered business jet called BYA-I in 2030.

De Havilland CEO Brian Chafe (left) with Jetcraft president Raphael Haddad.

DAVID

M c INTOSH

Performance enhancing solutions for simpler and safer operations.

CAE Civil Aviation is a global leader in both commercial and business aviation training solutions, delivering premier programs that elevate the human learning experience to provide pilots and maintenance personnel with the knowledge, skills, tools and confdence they need to ensure your business operates safely. Today we are creating ever better, smarter, and more future-minded training solutions, with our broader and more digitally-immersive offering, through the world’s most expansive training facility network, and via aviation training joint ventures that seed new growth and opportunities both regional and global.

Visit us at chalet C369 | www.cae.com

CIVIL AVIATION

AIA chief warns about ongoing labor shortage

by Cathy Buyck

The aerospace industry faces an array of challenges, but geopolitical instability, persistent strains on supply chains, and concerns over the commercial aviation industry’s capability to decarbonize won’t prevent Aerospace Industries Association CEO Eric Fanning from heading to the Paris Air Show with optimism. “There is tremendous excitement that American manufacturers are able to return to Paris, the world’s largest air show, after four years…after four rough years,” Fanning told AIN in an interview ahead of the event at Le Bourget. In 2019, North American manufacturers accounted for 18 percent of the more than 2,450 companies exhibiting their products. On a per-country basis, the U.S. took the lead with some 340 high-technology manufacturers and suppliers from across every sector and tier of the civil and defense industry.

Fanning acknowledged that stressed supply chains will make for a major topic of discussion at this year’s show. “The good news is that air travel is picking back up,” he said. “Memorial Day weekend travel exceeded pre-pandemic levels. Demand on the civil side is looking good.” Demand on the defense side also remains high, owing mainly to Russia’s attacks on Ukraine. OEMs and their suppliers can’t keep pace with the resulting demand. The historical counter-cyclical environment of defense and non-defense is gone, Fanning remarked. The civil and defense industries largely share a supply chain, which, said Fanning, “is not built for a simultaneous resurgence of demand of the two sides of the aerospace industry.”

Fanning sees three major concerns that could slow resolving the supply chain difficulties and hamper AIA members’ growth: inflation, access to skilled workers, and geopolitical tensions—including the changing relationship with China—affecting accessibility to trade, minerals, and materials. Attracting and

retaining talent with critical or niche skillsets presents “the real long-term issue,” he asserted. “The issue is not limited to the aerospace industry but it is probably the number-one strategic concern of the industry. It is going to take some creative solutions [to solve it],” he explained.

The European aerospace industry and the broader air transport ecosystem are experiencing a similar shortage of the skilled workers needed in part due to the perception of its nature as a polluter, which has led to a decline in its appeal and dissatisfaction with working conditions.

“We don’t see the same loss of attractiveness here [the U.S.] as in Europe,” he said. “The West, and certainly the U.S., has under-invested in developing a technical workforce. Part of globalizing high-tech manufacturing and complex products was influenced by factors such as cheaper labor but also labor availability.”

Last month, the AIA and PwC released a study highlighting the labor market dynamics facing aerospace and defense companies. The A&D industry will continue to experience “serious challenges to fill its workforce ranks over the next several years,” concluded Scott Thompson, PwC’s Global Aerospace & Defense Leader. “Given these challenges, it is especially important for the industry to change course in how it engages with top talent,” he wrote. “Perhaps the most urgent need is to redouble efforts to promote the industry as one that can offer exciting and meaningful careers developing and producing some of the most innovative technology that exists in any field.”

The AIA’s head, a former Pentagon official and the only person to have held senior appointments in all three U.S. military departments, categorically rejects the notion that the Boeing 737 Max debacle and the recent series of runway incursion events have weakened the historic leadership of the U.S. in civil aviation in terms of safety and image. “The world still looks very much to the U.S. in terms of certification. Flying has never been safer,” Fanning pointed out. “Our greatest risk, for the moment, is the political environment.” Political wrangling between the Republican and Democratic parties could, among other things, affect the ongoing five-year FAA reauthorization, including its policies and funding.

Regarding the industry’s drive to become more sustainable, Fanning said he believes the U.S. is equally committed as its European counterparts despite the EU’s headlinegrabbing programs and regulations such as the Green Deal, Fit for 55, and ReFuelEU. “Everyone is in on this,” declared Fanning. “It is the right thing to do. Moreover, delivering increased sustainability is a very clear market demand.” z

6 Paris Airshow News • June 20, 2023 • ainonline.com

“The [talent] issue is not limited to the aerospace industry but it is probably the numberone strategic concern of the industry. It is going to take some creative solutions [to solve it]...”

Eric Fanning , Aerospace Industries Association CEO

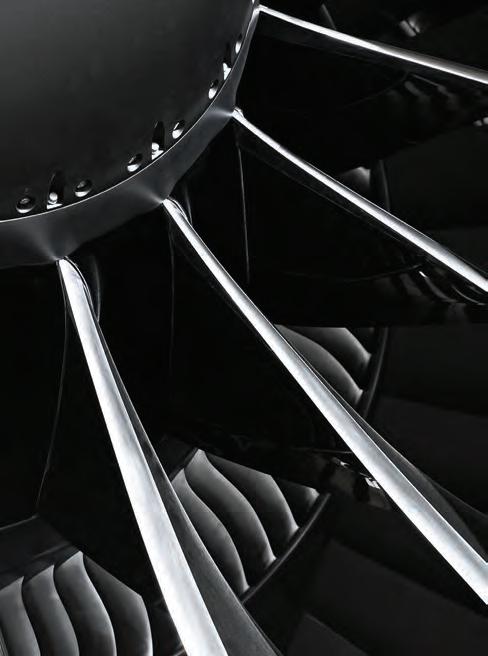

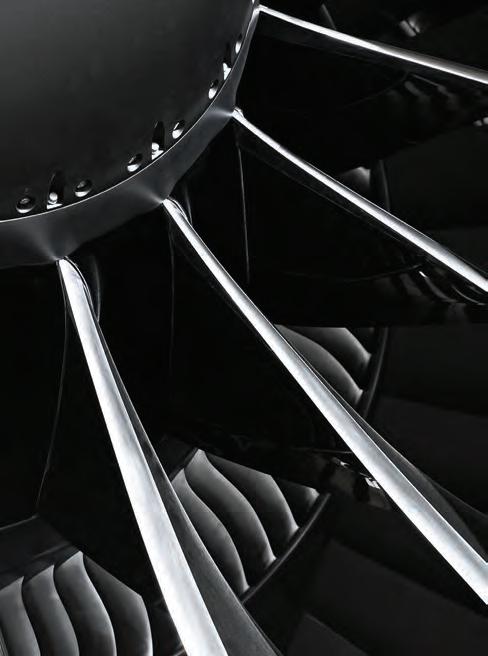

Delivering best-in-class fuel consumption, noise and emissions, the IAE V2500® engine powers nearly 3,500 aircraft serving passenger, cargo and military missions. With over 250M ight hours and counting, we’re meeting customer needs with expanded service offerings, setting the standard for reliability. Visit Raytheon Technologies at Pavilion C2

LIKE?

WHAT DOES PROVEN PERFORMANCE LOOK

offered

IAE International

The V2500 engine is

through

Aero Engines AG, a multinational aero engine consortium whose shareholders comprise Pratt & Whitney, Pratt & Whitney Aero Engines International GmbH, Japanese Aero Engines Corporation and MTU Aero Engines.

Collins stakes claim on future of ATM

by Aimee Turner

Building and deploying reliable airspace modernization advances that overhaul communications, navigation, surveillance, and air traffic management (ATM) systems has served as a core element of Raytheon’s Technologies business. Now, Raytheon’s corporate reorganization into three business units will see its Intelligence and Space division’s civil traffic systems business absorbed into Collins’s Connected Aviation Solutions, whose ambitious team aims to stake a claim on the future of ATM.

Raytheon Technologies systems currently manage two-thirds of the world’s air traffic. It operates in more than 60 countries and supports the FAA in overseeing more than 45,000 flights across more than 29 million square miles of airspace.

Jen Schopfer, president of Collins Aerospace’s Connected Aviation Solutions division, told AIN that the reorganization allows for better alignment with customers’ priorities, ensuring more effective coordination and collaboration across its businesses.

The realignment consolidates Raytheon’s Connected Ecosystem of flight data and management into Connected Aviation Solutions’ strategic business activities. The company sees the move as particularly significant at a time when some industry insiders say Raytheon has fallen behind in developing automation outside its domestic market in the U.S.

Schopfer said that once the realignment takes place in July, Collins’s Connected Aviation Solutions will harness the existing capabilities of Raytheon Technologies to find new ways to apply the huge amount of data generated by modern aircraft and manage the predicted growth in aviation. The latest forecast by Airports Council International shows that passenger traffic worldwide will reach 19.3 billion

by 2041, so advanced automation systems, surveillance tools, and navigation, communications, and networking technologies will prove essential to meeting future airspace needs.

Connected Aviation Solutions’ partnership with UK air navigation services provider NATS and FlightAware, which Collins acquired in 2021, serves as one example of finding innovative ways to apply operational data. In March, Collins and NATS announced plans to work together to explore how the use of aviation data could drive airspace efficiencies. The so-called data-centric approach to air traffic management uses predictive analytics, artificial intelligence, and machine learning to streamline the overall travel experience and improve the management and flow of traffic.

She added that Collins’s Foresight Uplink combines FlightAware machine learning intelligence and ArincDirect datalink capability to provide the crew en route with a more accurate arrival time prediction via their flight management system, providing up to 50 percent less estimation error even compared to onboard flight management system estimated arrival times (ETAs).

Another Collins product, called AirPlan, allows airports to manage resources such as gates, check-in desks, and baggage belts from a single application on any computer or mobile device connected to their network. With the recent addition of FlightAware’s Foresight predictive data, airport customers will receive a more accurate picture of their operations, including both flight ETAs and taxi-out duration predictions, which increases the accuracy and efficiency of airport resources to ease congestion and cut turnaround times.

Such air traffic flow management (ATFM) techniques and intelligent digital communications that connect aircraft with ground systems could effectively help shape future air travel. With ATFM in place, air traffic controllers can see aircraft position and location data, offering a more accurate view of the airspace at any point in time. And when air traffic controllers can digitally sequence aircraft arrivals and departures, passengers will benefit in terms of reduced taxi times and flight duration.

“Integrating FlightAware’s cutting-edge machine learning intelligence into Collins’s portfolio provides a host of new functionality, enhancing the operations of our customers,” said Schopfer.

In terms of uncrewed aircraft systems (UAS), Collins uses FlightAware data to integrate new aircraft tracking and alerting features into the company’s WebUAS digital platform. By integrating FlightAware’s global flight tracking and ADS-B flight status data feed, WebUAS provides ANSPs and UAS operators with a high-fidelity picture of active flight operations.

“Being able to incorporate their ongoing technologies with the FlightAware ADS-B data feeds—crowdsourced data blended with satellite ADS-B—and the other Collins data and data management systems can make it look, and probably be, something more relevant and aligned with SESAR/Next-Gen ATM modernization initiatives,” said a senior Collins ATM executive. “This is all part of the move towards a more connected aviation [landscape], which could then increase automation and remove expensive legacy techniques and technologies.” z

8 Paris Airshow News • June 20, 2023 • ainonline.com

Raytheon Technologies systems manage twothirds of the world’s air traffic.

READY FOR A NY THIN G We train you to stay sharp, fine tune, and always be prepared This empowers you with unwavering calmness and composure needed for all situations, from the everyday to the unusual. For this reason, FSI training is reserved for the sky’s most elite. FSI. Nothing short of excellence. Call +1.201.584.8262 today or visit FlightSafety.com

Europe aviation faces €820B net-zero costs

by Cathy Buyck

by Cathy Buyck

Europe’s airlines worry that environmental regulations and their resulting costs will hinder the sector’s competitiveness and, ultimately, its decarbonization efforts.

Their concerns stem largely from elements of the European Green Deal, under which the European Commission has actively developed policies in the areas of energy, transport, and taxation with the objective of achieving climate neutrality for the European Union (EU) by 2050. Among its arsenal of initiatives, the “Fit for 55” package consists of a set of legislative proposals designed to curb net carbon dioxide (CO2) emissions by at least 55 percent by 2030 compared with the levels recorded in 1990.

On paper, Europe’s aviation sector supports the EU’s ambitious blueprint for sustainable growth and in 2021 mapped its own sustainability initiative, Destination 2050, which will see all flights within and departing the “EU+”—the 27 EU states, UK, and the European Free Trade Association countries—realizing net-zero CO2 emissions by 2050. But many industry leaders question what they consider the one-sided approach regulators have taken toward achieving the goal.

A study conducted by consultants SEO Amsterdam Economics and the Royal Netherlands Aerospace Centre, released in March, calculated that the European aviation industry faces €820 billion ($900 billion) in “premium” expenditures—or spending exclusively on sustainability—to achieve net-zero emissions by 2050. That comes on top of the €1.1 trillion in “business as usual” expenditures over the 32-year period from 2018 to 2050 considered in the Price of Net Zero study. “Business-as-usual expenditures alone will not generate on-time decarbonization,” the researchers noted. Expenditures involve investments in assets such as new aircraft and infrastructure as well as costs of developing alternative aviation fuels—including drop-in sustainable aviation fuel (SAF),

hydrogen, and electricity—and technologies aimed at removing carbon from the atmosphere to achieve “negative emissions.”

Total expenditures to yield on-time netzero amount to €1.9 trillion, or €59 billion per year. Of the total, €820 billion will go towards new aircraft and fleet renewal, representing the largest expenditure at 43 percent. With a projected cost of €751 billion over the 32-year period, sustainable aviation fuels stand as the second largest expenditure, accounting for a 40 percent share, while €152 billion (19 percent) will go toward carbon pricing and economic measures, including emission trading and negative emission technologies.

long-promised reform of Europe’s fragmented airspace—has shown little sign of progress. According to European commissioner for transport Adina-Iona Valean, implementing the Single European Sky reform proposals would ensure “CO2 savings of around 10 percent through more fuel-efficient routes.”

According to a research report commissioned by the European Parliament’s transport committee, implementing the Fit for 55 measures for the aviation sector would lead to a 10 percent decline in demand for flights within the European Economic Area (EEA) and a 1.4 percent reduction in demand for flights beyond the EEA, provided consumers bear that the entire cost increase.

The researchers pointed out that the reduction in demand would disproportionally affect EU carriers, at least until regulators implement comparable policies in other regions. They also noted that decarbonization policies with an EU scope could affect the competitiveness of EU

While the U.S. concentrates on incentives for reaching CO 2 goals, European airlines complain about the EU’s focus on mandates.

“There is a new currency in town, CO2,” remarked Lufthansa Group CEO Carsten Spohr, speaking during the recent A4E Summit in Brussels. He criticized European policymakers’ lackluster approach toward incentives to increase production and the consumption of SAF. “We see [SAF] blending mandates for a product that does not exist,” he lamented. “There is global competition for green investments. Europe has to be careful; we might lose the [clean energy] race,” he said, warning that the U.S. Inflation Reduction Act (IRA) will drive SAF investments to the US. The IRA earmarks $370 billion in federal funds to assure the U.S. remains a global leader in clean energy technology, manufacturing, and innovation.

Much to airlines’ frustration, an important contributor to achieving net zero—the

airports through the “hub-switching effect.” Specifically, they predict a 2.7 percent decrease in the number of passengers traveling to nonEEA destinations, either directly or through an EEA hub, by 2030. Additionally, the number of intercontinental passengers traveling through non-EEA hubs would rise by 1.9 percent.

The study did not consider measures to proactively reduce demand, to curb CO 2 growth. For Valean, demand management or limitations measures contemplated across the region represent “some worrying trends.”

“I, myself, do not see flight bans or caps as a viable option,” she added. “They will only serve to restrict citizens’ right to free movement, damage regional connectivity, and hamper aviation’s ability to invest in its decarbonization.” z

10 Paris Airshow News • June 20, 2023 • ainonline.com

THE GULFSTREAM DIFFERENCE

Your success is our inspiration. Every investment we make—in advanced technology, sustainability innovation, precision manufacturing and worldwide customer support—is an investment in you.

RIGHT NOW. RIGHT FOR THE WORLD AHEAD

The world has changed. Industries have changed, and aviation has more than any other. Embraer has also changed.

We are now more efficient, agile, and ready for growth.

We have a clear vision of the way forward, driving new business and revenue with an entirely new product portfolio and focus on innovation and ESG.

We are on a journey that will make us bi er and stronger, driven by a unique passion for creating the best products and services and prepared for the opportunities of this emerging world. We are right for the world ahead. Right Now.

embraer.com

Boeing Global Services charts profitable path

by Cathy Buyck

Anyone participating in a Boeing results or investors’ presentation can’t fail to notice that the company’s global services segment gets barely any attention. Yet with revenue of $17.6 billion and positive earnings from operations, Boeing Global Services (BGS) accounted for nearly 30 percent of the U.S. aerospace giant’s total revenue and nearly all its operating profits last year.

BGS’s financial performance clearly outshines that of its more well-known peer segments, Commercial Airplanes (BCA) and Defense, Space, and Security (BDS). In 2022, BGS reported a 15.5 percent operating margin while both BCA’s and BDS’s operating margin ended in negative territory, specifically 9.2 percent and 15.3 percent, respectively. With a 17.9 percent operating margin in the first quarter of this year, the services segment exceeded pre-pandemic margins and again represented Boeing’s only profitable business segment. BGS received $4 billion in orders during the quarter and the backlog stood at $19 billion. Revenue totaled $4.7 billion, up 9 percent year-over-year.

“We’re set up very well to deliver a mid-singledigit revenue growth business with mid-teens margins and a high cash flow conversion,” commented Boeing CFO Brian West. “We get more and more confident about that business and the team that’s running this, so I think it’s going to accrue to our benefit over the next several years. We love the service business, right? It’s a franchise, it goes on for years and years and years.”

BGS formed in 2017 with the integration of the OEM’s commercial, defense, and space services capabilities. Its global portfolio spans parts and distribution services, engineering, modifications and maintenance, training support, and digital analytics. The parts and distribution business remains the largest revenue contributor, but the digital solutions and analytics business has increasingly expanded, owing to the growing need to collate, share,

and integrate data across subsegments, BGS executives told AIN during a briefing at the company’s offices in Frankfurt, Germany, ahead of the Paris airshow.

BGS employs some 450 staff at the Frankfurt site, which formerly printed up to 1 billion Jeppesen navigation charts a year. That same building now serves as home to BGS’s largest Digital Solutions & Analytics Lab.

“Jeppesen stands as one of the first successful digital transformations in the world,” remarked Brad Surak, BGS vice president of digital aviation solutions. For Surak, Jeppesen—which Boeing acquired in 2000 for $1.5 billion in cash—is the “Google Maps of aviation navigation,” offering a 99.92 percent accuracy. Almost 80 percent of pilots use the so-called “Jepps” regardless of the airframe they fly. Users have downloaded Jeppesen FliteDeck Pro, the navigation app providing digital charts, maps, and documents, on more than 350,000 mobile devices.

The transition from paper charts to the Jeppesen electronic flight bag (EFB) serves as a perfect example of BGS’s “double bottom line” approach, noted Surak. “We are not just aiming to improve financial results but want to achieve an outcome that enables airlines to make strides in operational efficiency and their sustainability targets,” he explained. Since its launch in 2012, the Jeppesen EFB enabled more than 40,000 paperless flights and removed 6.3

million kg of paper from airplanes, resulting in 271,500 tonnes of fuel savings and avoiding almost 900,000 tonnes of CO2 emissions.

Following its success in establishing a seamless paperless flight deck, BGS has expanded its digital aviation products to help airlines transition to a fully integrated operations center. “The operations center is the nerve center of the airline, but we see that [legacy] airlines often have seven to 10 different solutions, and these systems operate in silos,” according to Surak. Integrating the systems for core capabilities such as flight planning, flight scheduling, tail assignment, crew management, communication, and operations control in one inter-connected digital suite will improve the integrity of day-to-day operations and enable airlines to quickly recover from disruptions, he maintained.

In a subsequent step, the Boeing Integrated Operations Center (IOC) will join with maintenance, Surak said, highlighting that the IOC suite is fleet agnostic and customizable based on the airline’s operational requirements.

Data analytics also is improving pilot training and aviation safety, asserted Chris Broom, Boeing Global Services’ v-p of commercial training solutions. The Boeing 737 Max crashes prompted the airframer to move towards competency-based training and assessment (CBTA) for instructors and pilots. “We are rolling out a five-year plan to move all our fleets to CBTA,” Broom said. Some 20 aviation safety regulators have approved the CBTA flight training manuals and programs for the airframer’s single-aisle 737 family—excluding the Max 7 and 10 variants, which remain in the process of winning FAA approval—and two have approved the Boeing 787 program. z

14 Paris Airshow News • June 20, 2023 • ainonline.com

Users have downloaded Jeppesen FliteDeck Pro, the navigation app providing digital charts, maps, and documents, on more than 350,000 mobile devices.

WHY IS THE FUTURE OF AVIATION ELECTRIC?

We’re driving the development of electrified aircraft today, so flights tomorrow are safer, smarter and more sustainable—all to help civil aviation work toward net-zero carbon emissions. From the 1 megawatt motor to environmental control systems, for more than 20 years, we’ve been revolutionizing what it means to be electric.

Visit Raytheon Technologies at Pavilion C2

Rapid Dragon is a stand-up stand-off

by Reuben F. Johnson

A cooperative program between the U.S. defense industry and several of its military customers called Rapid Dragon is revolutionizing the ability of foreign air forces to deliver long-range munitions from non-combat aircraft. The result will give nations the capacity to conduct deep strike missions without the requirement for a stealthy fighter design or a long-range bomber as the delivery platform.

Rising lethality of air defense systems across the globe and increasing ranges and probability of a kill of the latest active-homing air-to-air missiles have prompted most modern air forces to arm their fighters with stand-off weapons, thereby keeping the aircraft launching the weapon well outside the engagement envelope of most threat systems.

One of the leading designs in the category is the Lockheed Martin AGM-158 JASSM (joint air-to-surface stand-off missile). A lowobservable air-launched cruise missile with a 1,000-pound warhead first designed for the U.S. Air Force, it also is in service with the air forces of Australia, Finland, and Poland.

Japan, Germany, and The Netherlands will become JASSM customers in conjunction with their acquisition of the F-35. They and existing foreign customers of the weapon plan to procure the modernized AGM-148 JASSM-ER model.

That version nearly triples the range of JASSM from 230 to 620 miles but retains “backward compatibility” with the original AGM-158 design. Reports by the U.S. Government Accountability Office state the -ER version has 70 percent hardware and 95 percent software commonality with the original AGM-158 model.

JASSM o ff ers “distinct advantages over other ALCMs that are launched from a fighter,” explained a Lockheed Martin representative who spoke with AIN. “Most other stand-off weapons are terrain-following missiles that fly a low, nap-of-the-earth profile from launch point to the target.

“This keeps the missile out of harm’s way from ground-based air defense systems, but that kind of a maneuvering flight profile involves many twists and turns. That consumes energy-maneuverability capacity of the missile and burns up the rocket motor faster and thereby limits the range of the weapon,” he continued. “In comparison, JASSM is a stealthy design that is difficult for any air defense radar to detect. This missile flies way up in the proverbial ‘thin air,’ which maximizes the range of the propulsion system and gives the missile the deep interdiction capability the original requirement called for.”

“experimentation campaign exploring the feasibility and operational advantages of airdropping long-range palletized munitions from existing airlift platforms, such as the C-130 and C-17, without aircraft modifications.”

The first live-fire test of Rapid Dragon took place in 2021, followed by the first multiple launch module tested off Norway in November 2022 using an MC-130J as the launch platform.

Palletized munitions deploy from a cargo aircraft by airdrop using a specially designed launching rack. This JASSM launching package is designed to be roll-on roll-off for rapid fielding. It requires no modifications to the cargo aircraft because the targeting data are all programmed into the individual missiles using a laptop.

“A target is selected and a strike request is made, routing and retargeting coordinates are confirmed and/or updated,” according to an AFRL presentation. Once the launching package deploys, operators follow standard airdrop pro-

Foreign users of JASSM are limited to employing the missile on a fighter aircraft, which can carry a maximum of two of the JASSM missile. The limitation never posed an issue for the USAF, explained one of the Lockheed Martin executives charged with marketing the weapon, but it has with the foreign operators of the system. “For the USAF, the first-choice platform for a JASSM strike mission is the B-1B bomber because it can carry so many of them,” he explained. “The U.S. air war plan does not depend on fighter aircraft to launch JASSMs, but this can be a limiting item with foreign customers.”

The solution is Rapid Dragon—an initiative led by the U.S. Air Force Research Laboratory (AFRL), specifically the Strategic Development Planning and Experimentation office. Officials describe Rapid Dragon as an

cedures. The multiple JASSMs are “stabilized under the parachute [and] weapons are systematically released. The released weapons ignite, pull up, and proceed normally to the target.”

The Rapid Dragon program offers two palletized packages—a six-JASSM configuration for the C-130 and nine-JASSM configuration for the C-17. The next step involves increasing the set of options for the program with new configurations to allow for adaptation for other platforms.

Deployable, palletized munitions system like Rapid Dragon allows an air force to “saturate the airspace with multiple weapons and effects, complicate adversary targeting solutions, help open access for critical target prosecution, and deplete an adversary’s air defense munitions stockpile,” according to the same AFRL presentation. z

16 Paris Airshow News • June 20, 2023 • ainonline.com

A standard cargo version of the palletized munition deployment system drops from a C-17A.

©2023 GE Additive. All Rights Reserved. MACHINES | POWDERS | SOFTWARE | CONSULTING A metal additive partner you can trust. Improve product performance, simplify the supply chain, and reduce production lead time with proven metal additive solutions. Ready to accelerate your path to full metal additive production? GE Additive has the products, solutions, and expertise to help. Get started at ge.com/additive/fasterpath On the shop floor and in the skies.

MTU to produce H2 fuel cells for regional flyers

by Charles Alcock

MTU Aero Engines this week launched plans to develop a hydrogen fuel cell propulsion system for commuter and regional aircraft. The German aircraft engine manufacturer unveiled its Flying Fuel Cell (FFC) concept on Monday at the Paris Airshow, confirming that it now will increase its 100-strong team of engineers as it works toward getting the system into commercial service in 2035.

According to MTU senior v-p for engineering and technology Stefan Weber, the company expects to increase the performance of the liquid hydrogen FFC to allow it to support short- and medium-haul flights in larger aircraft by 2050. “The FFC reduces the impact [of flying] on the environment by as much as 95 percent, so it’s practically zero,” he said.

The electric motor for the FFC is being developed by EmoSys, which since April

has been a subsidiary of MTU. The German company’s motors already are used in applications such as automotive, car racing, rail, and medical science. The motor has a diameter of just 300 millimeters (12 inches) and weighs around 40 kg (88 pounds). The company designed it to produce a continuous output of 600 kW and an energy density of 15 kWh/kg.

MTU’s chief engineer for the Flying Fuel Cell, Barnaby Law, said that “the motor has extraordinarily high efficiency at continuous takeoff power and produces relatively low thermal loads.” The fluid-cooled motor can operate at temperatures of up to 85 C and can be installed in multistack configurations.

Work on the FFC project has received backing from Germany’s DLR aerospace research center. A Dornier 228 twin turboprop aircraft owned by DLR serves as a technology platform and flight demonstrator.

The partners plan to replace one of the aircraft’s two turboprop engines with a 600 kW powertrain using energy from MTU’s new fuel cell. Ground testing will accelerate between now and the middle of the 2020s, when the FFC team expects to start flight testing.

MTU already started discussions with EASA to establish the approval requirements for the propulsion system. The Munichbased group is entering a sector that so far has largely been addressed by start-ups such as ZeroAvia and Universal Hydrogen, which are working to convert existing regional airliners to electric propulsion. z

AIN team captures four Aerospace Media Awards

Aviation International News won four trophies at the Aerospace Media Awards (AMA) held at L’Aero-Club de France in Paris on Sunday night. In an honor given to a colleague who remains sorely missed, a posthumous lifetime achievement award went to Jerry

Siebenmark for his aviation journalism career.

“All of us at AIN are so proud of our team members’ Aerospace Media awards and appreciate the industry’s continued strong support for aviation journalism,” said editor-in-chief Matt Thurber. “The lifetime achievement award for our late colleague Jerry Siebenmark was especially meaningful.”

Freelance journalist Colleen Mondor won best business aviation submission for “SIC Logging is Focus of FAA Investigation into Boutique Air,” which discusses the role of second-in-command pilots flying single-pilot airplanes in charter operations.

New York’s James Wynbrandt came out on top in the passenger and crew well-being category for a piece titled “Mental Wellness Gets Post-Covid Safety Focus.”

Along with Siebenmark’s honors, Thurber accepted the awards on behalf of Mondor and Wynbrandt, who did not travel to Paris.

In recognition of his tireless work on the future of flight technology beat, UK-based senior editor Charles Alcock won for “Advanced Air Mobility Pioneers Embark on Another Decisive Year.” P.S.-S.

18 Paris Airshow News • June 20, 2023 • ainonline.com

MTU’s EmoSys unit is developing electric motors for the Flying Fuel Cell project.

From seabed to space, we help create connections no one else can. With solutions that range from full-scale to mission-speci c, we’re delivering in every domain of the connected battlespace. Visit Raytheon Technologies at Pavilion C2

HOW WILL MULTIPLE DOMAINS ACT AS ONE?

Airbus order

now of almost 1,000 aircraft will bring us well into the next decade and serve the needs of the Indian aviation market, which is one of the fastest-growing markets in the world,” remarked Elbers. India is the world’s fifth-largest economy by nominal GDP and projections call for it to become the third-largest by 2030. The country’s strong economy, the changing demographics with rising demand for air travel, and the government’s support for expanding the aviation ecosystem and infrastructure underpin IndiGo’s confidence in its strategy and placing the new aircraft order, he explained. IndiGo started operations only 16 years ago and now operates on average 1,800 flights a day.

Airbus CEO Guillaume Faury expressed confidence the airframer will fulfill the order from 2030 onwards. “We will be at rate-75 [per month] at that time,” he said. “We know we have challenges on the short-term ramp-up [of narrowbody production]. These are

short-term. In the meantime, our friends here [at IndiGo] remind us that the aircraft they have on order need to be delivered on time.”

Airbus also announced that Saudi airline Flynas placed an order for 30 A320neo-family aircraft and that Air Mauritius confirmed an order for three A350s to expand its network in Europe and South Asia. z

The IndiGo order for 500 jets sets a record for Airbus and is the largestever single aircraft purchase agreement by any of its airline customers.

Pannoramix satcom antenna captures multiple frequency bands

France-based Greenerwave has unveiled a multibeam ground antenna that can communicate simultaneously with several satellites. Called Pannoramix, the new antenna can communicate with all types of satellite constellations in various orbits and can easily integrate into fixed and moving platforms.

Greenerwave said that Pannoramix was “born from the world of physics…a cavity antenna that integrates revolutionary micromirrors to direct waves.” It claimed that existing electrically-pointed antennas are large and only work on one frequency band, making them ill-suited to the mass markets targeted by the new low-earth orbit mega-constellations. Greenerwave’s technology features low power consumption and low cost, and Pannoramix can maintain a stable and continuous connection in both densely populated and isolated areas, according to the company. C.P.

20 Paris Airshow News • June 20, 2023 • ainonline.com

French President Emmanuel Macron took a tour of the Paris Airshow on Monday, making the typical stops at traditional and mostly French aircraft companies and also taking in the likes of new entrants such as France’s Aura Aero, which makes training aircraft and plans to implement electric power.

DAVID M c INTOSH

continued from page 1

DAVID M c INTOSH

Thanks to our experience and R&D network, we are developing innovative technologies for the next generation of propulsion systems to support commercial and military aviation.

We are the European partner of choice for military and commercial propulsion.

We are helping shape a more sustainable future of flight.

Embraer’s KC-390 Millennium utility/ tranport aircraft maneuvers in a steep climb during validation flights in preparation for the Paris Airshow flying displays.

Embraer aims to triple revenue in next 5 years

by Matt Thurber

In the midst of the Covid pandemic, in 2020, Embraer leadership pulled together a group of 50 people to develop a strategic plan for the company’s future, called “Fit4Growth.”

“Remember that in 2020 we had to face two different crises—the pandemic that affected all of us and the termination of the deal with Boeing,” said Embraer CEO Francisco Gomes Neto at a pre-Paris Airshow media briefing at its Ogma facility in Lisbon, Portugal. Boeing had agreed to purchase 80 percent of Embraer’s commercial aircraft business for $4.2 billion but backed out of the deal in April 2020. “The [Fit4Growth] plan was created to help us to survive that difficult moment and also to prepare the company for a prosperous future,” he said. The plan’s targets include reaching $8 billion in revenue in 2027, up from $4.5 billion in 2022.

Fit4Growth rests on five pillars to help increase revenues and improve profitability: incremental sales for Embraer’s existing products; focusing on efficiency; strategic partnerships; innovation; and environmental, social, and governance initiatives.

“In 2022, we were profitable in all the business units,” Neto said. “From 2023 onwards, we see it as a growth period, to capture the full potential [of Embraer].”

The efficiency plan hinges partly on the Ogma subsidiary, of which Embraer owns 65 percent and the Portuguese government the remainder. Ogma has a long history, manufacturing various aerospace products since 1918, and now serves as a key part of Embraer’s growth strategy, both in manufacturing and MRO services.

“We have a huge facility here,” said Neto. Ogma manufactures wings for the C-390 Millennium utility/transport aircraft and composite parts for other programs. Key product lines for Ogma’s 60 MRO customers include military and civil maintenance, while Embraer serves as an authorized service center for Rolls-Royce and Pratt & Whitney engines. A new Ogma facility is nearly ready for advanced repairs and with a new test cell for the Airbus A220’s PW1500G geared turbofan.

“Ogma is a very important subsidiary and will play a very important role in our growth in the future,” said Neto.

“Flight safety…is the most important thing

in our company, and quality and of course, enterprise efficiency,” said Neto. “We have robust initiatives that we have been working on very hard since 2020.” Those efforts include reducing the production cycle time of new aircraft by 30 percent, a target hampered by supply chain problems. “Even then we see we have seen a lot of improvements by reducing the production cycle time of our aircraft,” he said.

A team focused on maximizing the use of Embraer assets led to the sale of the company’s plant in Évora, Portugal, to Aerrnova Aerospace in 2022. Embraer also closed its MRO facility in Connecticut in 2021. “All of this is to maximize the use of the assets in our organization and with a focus to improve the cash generation,” Neto explained.

Meanwhile, Embraer’s first KC-390 simulator has begun training pilots at the Embraer Academy in São José dos Campos, Brazil. The company will use the level-D simulator, built by Rheinmetall, to train pilots from Brazil, Portugal, and Hungary.

On June 16, Embraer delivered the sixth C-390 and the first in the full operational capability (FOC) configuration to Brazil’s air force (FAB), although all of the FAB’s C-390s can fly aerial refueling missions under the KC-390 designation. The company will upgrade previous C-390s delivered to the FAB to the FOC configuration. The sixth C-390 will operate with the First Troop Transport Group based at Anápolis air force base. z

22 Paris Airshow News • June 20, 2023 • ainonline.com

DAVID M c INTOSH

CAN MATERIALS

5 ,000 ° F? When it comes to thermal management, our expertise is unmatched. Using advanced alloys, ceramic composites and carbon-carbon technology, we’re engineering exceptional new materials that can handle the harshest extremes. Visit Raytheon Technologies at Pavilion C2

BE DESIGNED TO WITHSTAND

92% asset availability

LEADERS AREN’T BORN. THEY’RE ENGINEERED.

Another reason to say LEAP. By example.

*Compared to 83% for competition, per third-party data.

That means fewer spare aircraft and more flights, which helps profitability climb.

LEAP-powered aircraft are achieving the highest days flown ratio* for their thrust class.

LEAP turns heads in the boardroom.

cfmaeroengines.com

French MALE UAV debuts at Paris

French aerospace and engineering group Turgis & Gaillard unveiled a new medium-altitude, long-endurance (MALE) UAV at the Paris Airshow. Known as the Gaillard ASA 1204 Aa’rok, the UAV is a 5.5-tonne platform for surveillance and attack missions. The company plans to fly the vehicle later this year.

China operator signs LOI for 100 Lilium Jets

by Hanneke Weitering

Lilium now plans to introduce its Lilium Jet eVTOL aircraft into the Chinese market. During the Paris Airshow on Monday, the German start-up announced its first purchase agreement with a Chinese operator, as well as plans to open a regional headquarters in China.

Chinese business aircraft operator and helicopter service provider Shenzhen East General Aviation (Heli-Eastern) has agreed to purchase 100 Lilium Jet eVTOL aircraft, which it intends to operate throughout China’s heavily populated Guangdong-Hong Kong-Macao Greater Bay Area.

“With Lilium’s premium cabin design and innovative electric jet technology, our customers can travel throughout the Greater Bay Area and beyond quickly and sustainably,” said Heli-Eastern chairman Zhao Qi.

As part of the agreement, Heli-Eastern and Lilium will also explore a possible future partnership on ground infrastructure. The two companies might work together to identify potential locations and partners for vertiports

within the region.

Lilium’s new Asia-Pacific headquarters—its first regional headquarters outside of Germany—will be located in the Bao’an District of Shenzhen in China’s Guangdong province, Lilium announced on Monday. The Bao’an district municipality and Lilium have signed a memorandum of understanding for the joint development of eVTOL services using the Lilium Jet in the Asia-Pacific region, with an initial focus on the Guangdong-Hong Kong-Macao Greater Bay Area.

According to Lilium CEO Klaus Roewe, China could potentially account for up to 25 percent of the global eVTOL air taxi market. “We see significant potential for Lilium’s eVTOL network in the Greater Bay Area, both to reach this important premium market, as well as to offer the sustainable, time-saving benefits of the Lilium Jet to as many people as possible,” Roewe said.

Following the new order from Heli-Eastern, Lilium says it now has collected an order backlog of 745 Lilium Jet eVTOL aircraft from customers in Europe, the U.S., South America, and the Middle East. z

Although a Pratt & Whitney PT6A turboprop will power the prototype, the production Aa’rok would use a Safran Ardiden if the fixed-wing version of that engine gains qualification or the GE Catalyst if it does not. The 22-meter-wingspan drone has underwing hardpoints for the carriage of four Safran AASM guided bombs or up to 16 Hellfire, Brimstone, and MBDA’s Akeron-LP anti-tank missiles. Payload totals 3 tonnes and maximum endurance extends to about 24 hours, depending on loadout. With four AASMs carried on twin launchers from two heavy-duty pylons, it can fly for around 10 hours.

The Aa’rok can be fitted with a variety of sensors from a number of suppliers. The preferred electro-optic/infrared turret is the Safran Euroflir 610, which will be retractable to reduce drag during transit. The Searchmaster from Thales is a lead candidate for a search radar.

Aa’rok is being pitched to the French armed forces, o ering a rapidly available all-French solution for a flexible armed surveillance UAV. The air force has encountered certain operational restrictions while using the U.S.-supplied Reaper, which would be removed by using a French sovereign system.

Turgis & Gaillard wants to point out that Aa’rok does not compete with the 11-tonne quadrinational Eurodrone program being pursued by Airbus, Dassault, and Leonardo to meet the needs of the French, German, Italian, and Spanish forces. D.D.

26 Paris Airshow News • June 20, 2023 • ainonline.com

Heli-Eastern plans to fly Lilium Jet eVTOL aircraft in China’s Greater Bay Area region.

Our space solutions are essential for global security, space protection and scienti c discovery. From missile defense to weather, navigation and beyond, we deliver mission breakthroughs and advance our way of life. Visit Raytheon Technologies at Pavilion C2 CAN YOU SEE THE FUTURE FROM HERE?

Airbus has increased the maximum payload of the A350F to 111 tonnes, 2 tonnes more than at the launch of the aircraft in 2021.

Airbus increases A350F max payload

by Cathy Buyck

by Cathy Buyck

Airbus is forecasting that airlines globally will need some 40,850 new widebody aircraft over the next 20 years, including 8,220 freighters, a segment where the European airframer claims it has won a significant market share since launching the A350F program in 2021. Airbus has delayed entry into service of the new twinjet from 2025 to 2026, but operators will receive an aircraft with a higher payload capability than initially planned. “We started marketing that

platform at a 109-tonne payload,” said Florent Massou dit Labaquére, head of Airbus’s widebody program. “Now we have progressed so well on the design that we can already offer up to 2 tonnes more, [allowing for] more revenue for the airlines.” Another modification entails the main deck cargo door, which designers have expanded from its initial width of 165 inches to 175 inches and, according to Massou dit Labaquére, establishes it as the largest main deck cargo door available in the market.

Airbus has secured firm orders for 39 A350Fs,

UK pavilion helps start-ups shine

UK aerospace and defense are back in force at this year’s Paris Airshow, with 61 member companies of industry association ADS jointly exhibiting within the national pavilion in Hall 2b. For the first time, the UK pavilion is co-located with a “start-up zone” run by Aerospace Technology Institute and Boeing’s Aerospace Xelerated program.

The new zone includes about 20 small- and medium-sized enterprises in the show’s new “Start Me Up” program that might not otherwise get exposure on the global stage. Exhibiting UK companies include Plyable, Aiber, AireXpert, Datch, Productive Machines, SensaWeb, Signol, Airline Pilot Club, Amygda, Flare Bright, LexX Technologies, Pegasus, To eeAM, Aerosens, Aiir Innovations, Conductor Software, Dessia Technologies, Nabla Mobility, Quasir, and Zetamtion.

According to the latest information published in May by ADS, the aerospace sector contributes £10.9 billion ($13.9 billion) to the UK economy. In 2022, revenues grew by 20 percent from £22.4 billion to £27 billion, while exports increased in value from £15.2 billion to £18.6 billion. C.A.

which it launched to challenge Boeing’s monopoly in the larger freighter segment. “We already gained a 42 percent market share versus the 777-8F. We are very proud of that,” he said. When considering the total widebody market, Airbus claims a 48 percent market share.

The Toulouse-based aircraft manufacturer has not ruled out an A330neo freighter variant, remarked head of marketing Stan Shparberg. “We have no precise discussions on this at the moment,” he said. “If we find enough market interest, we would be eager to do it. The A330neo is a platform that is capable of doing it. We built the A330ceoF,” he said, noting that there are “a lot” of A330 passenger-to-freighter conversions. The new-build A330-200F, however, did not sell particularly well.

Shparberg expressed confidence in the recovery of widebody travel and demand for widebody aircraft, asserting that at some point Airbus will need to “review production rates and increase those.” Last month, Airbus said it targets a monthly production rate of four for the A330 in 2024 and a rate of nine for the A350 at the end of 2025. “We see a very strong demand and this demand is shared across the globe,” he said. “Capacity is not there. We also have an opportunity with a competitive product, [Boeing’s 777X], being delayed.” z

28 Paris Airshow News • June 20, 2023 • ainonline.com

DAVID M c INTOSH

TECHNOLOGY EVOLVES HERE. Leonardo builds a sustainable future through industrial ACCELERATING TECHNOLOGY EVOLUTION Leonardo builds a sustainable future through industrial capability, investing in strategic skills leonardo.com Leonardo is home to the sustainable future thanks to its long-term vision, consisting of engineering expertise, knowledge and skills. It exploits the digital to enhance its legacy businesses, accelerating technological evolution. Visit us at Le Bourget, Chalet 250, Static Area B6

Honeywell offers 737 APU upgrade

by Chad Trautvetter

Honeywell is introducing a high-efficiency mode upgrade for its 131-9B auxiliary power unit (APU) on Boeing 737NG and Max airplanes. The enhancement, which the company will make available in the second half of this year, employs a more efficient diffuser that regulates airflow to the APU, saving fuel and lowering emissions while increasing inspection intervals, Honeywell said.

With an estimated fuel consumption reduction of about a half-gallon per hour, Honeywell said the improved diffuser can reduce CO2 emissions and fuel costs by about 2 percent each. Meanwhile, time-on-wing increases to 1,500 APU running hours.

“Globally, airlines are working to reduce their carbon footprint, and every incremental step will help them achieve their net-zero carbon emissions targets,” said Honeywell president for Americas aftermarket Heath Patrick. “An airline with a fleet of 50 B737s could realize as much as $450,000 [€411,252] in annual fuel savings and reduce its CO2 emissions by up to 1,100 tonnes, depending on operating conditions.”

Patrick also estimated that the higher time on wing can result in fewer service events costing $315,000 per visit. z

Deployable tower puts ATC in remote locales

by David Donald

Saab has partnered with Finnish company Conlog Oy to o ff er a deployable version of its remote tower air traffic management system. The partners developed the r-TWR Deployable system for expeditionary and remote operations as well as disaster relief applications.

Saab is one of the pioneers of remote tower technology, placing a number of remote towers at civilian locations. The NATO air base at Geilenkirchen in Germany also has a Saab remote tower. Now it has packaged the technology into a twin-container configuration that can be transported by land vehicle or in a C-130-sized airlifter.

Conlog has developed the purpose-built containers that accommodate the system. The sensor module features a hydraulically actuated mast that can deploy up to 30 meters in height, allowing the sensor suite to see over trees and other obstacles. Typically, the mast-top mounts six to eight cameras that provide uninterrupted 360-degree

coverage, a pair of pan/tilt/zoom infrared cameras, and a signal light gun. It can also mount communications aerials and meteorological sensors. The module uses an integrated diesel generator and can operate unattended for long periods.

The remote tower control (RTC) module is an expandable container designed by Conlog that offers a comfortable environment for four to five operators. The company can also incorporate ballistic and nuclear/biological/ chemical protection if required. Operators can control up to three mast modules from one RTC module, which proves especially useful in dispersed operations where aircraft might be flying from a number of locations. Three technicians can set up the remote tower systems for operation within an hour of deployment.

The r-TWR Deployable employs the same systems and software as Saab’s civilian products and is fully compatible with the company’s related offerings, including the Giraffe 1X air defense radar and the TactiCall secure communications system. z

30 Paris Airshow News • June 20, 2023 • ainonline.com

DAVID M c INTOSH

The r-TWR Deployable air traffic control tower system consists of two containerized modules, normally separated by a considerable distance.

WHAT IS YOUR ENGINE TELLING YOU?

Pratt & Whitney EngineWise® solutions are backed by OEM experts who harness the power of data to proactively maintain engines. It’s how we enhance the reliability and health of your eet—so you are ready for today and can plan for tomorrow. Visit Raytheon Technologies at Pavilion C2

Airship fans persist with plans for lighter flyers

by Chris Pocock

Lockheed Martin has sold its Hybrid Airship program to a private company led by former program manager Bob Boyd.

Boyd has started AT2 Aerospace to continue the attempt to find a buyer for the 300-foot-long, 21-ton vehicle. Lockheed Martin described AT2 as a transition partner. AIN understands that the transaction was low-priced and that the former owner has taken a stake in the new company.

Here at Paris eight years ago, Lockheed Martin staged an optimistic presentation on what it then called the LMH1. But no customer surfaced, although a Chinese investor nearly came close to concluding a deal. The sale never happened because then-U.S. President Donald Trump imposed a 25 percent tariff on exports of aircraft to China in 2018 as response to the

alleged theft of intellectual property (IP).

Boyd told AIN that Lockheed Martin transferred all the IP to his new company, including a subscale prototype that flew in 2006. He has hired three former colleagues who worked on the airship’s design and engineering.

Last week, British company Straightline Aviation said it signed a letter of intent (LOI) with AT2 for three airships, along with options for a further 12 to be delivered over the first three years of production. Straightline chief executive Mike Kendrick told AIN that the first flight could occur in 14 months, in time for first delivery in 2026. The company claims to be the most knowledgeable airship operator, having operated 19 airships and 200 aerostats in more than 35 countries. It was Lockheed

An artist’s impression offers a glimpse of the bulbous proportions of the hybrid airship now marketed by AT2.

Martin’s preferred operator for the LMH1.

For more than 20 years, the developers of hybrid airships have marketed their unique STOL airframes for a variety of applications, including airlift into remote areas, long endurance surveillance, luxury tourism, and passenger transport. More recently, proponents have stressed the green credentials of airships.

Hybrid Air Vehicles (HAV) of the UK last year claimed a launch order from Spanish airline Air Nostrum. In reality, the deal amounted to another LOI, and the company has long sought a strategic investor to launch production.

French company Flying Whales is developing a large conventional airship for lifting heavy loads. It is conducting a series of workshops here, at Stand A228 in Hall 2A. z

Structures firm offers temporary storage hangars for Airbus A380

Temporary buildings specialist Losberger De Boer is o ering a semi-permanent hangar for Airbus A380 storage and light maintenance that it can erect and hand over to a customer within four months of placing an order. Measuring 90 by 95 meters and open at both ends, the modular aluminum curved-framed structure can help A380 operators speed service reintroduction of quadjets put into extended storage during the pandemic, according to the company.

The hangar’s PVC roof and polyisocyanurate sandwich panels also protect the aircraft from environmental elements, helping to prevent A380 wing cracks caused by high temperatures and moisture, Losberger De Boer said. It also has overhead fans to cool the air. “Heat and humidity have been identified as leading contributing factors of the reported [A380] wing-spar cracking problem,” noted Paul Machin, the company’s Middle East senior sales manager.

On-site assembly takes about six weeks, with the structure secured to existing concrete ramp space via chemical anchoring, Losberger De Boer said. Once disassembled, the site can revert to its previous state without any remediation required. C.T.

32 Paris Airshow News • June 20, 2023 • ainonline.com

Temporary 90- by 95-meter hangars offered by Losberger De Boer provide a quick-deploy solution for Airbus A380 operators looking to reintroduce quadjets sidelined during the pandemic.

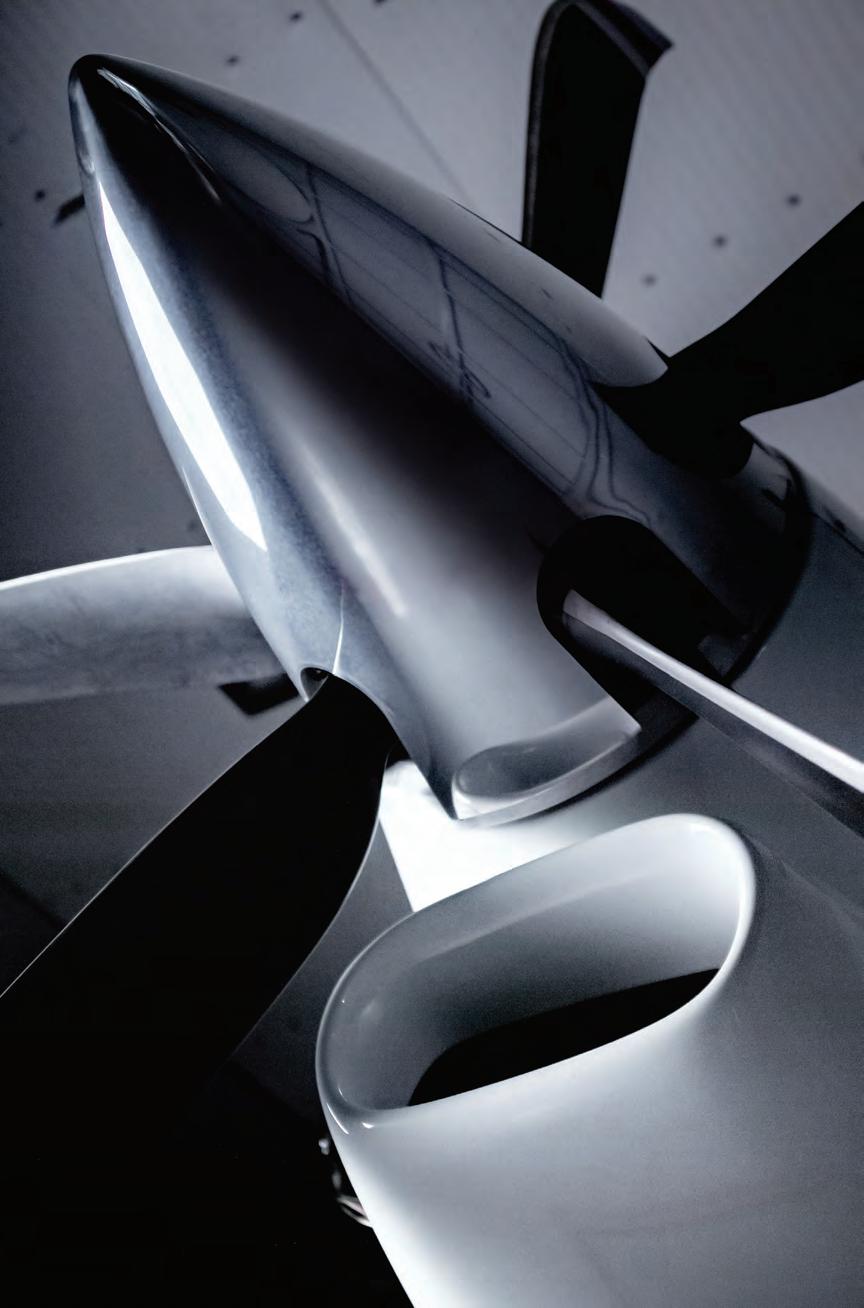

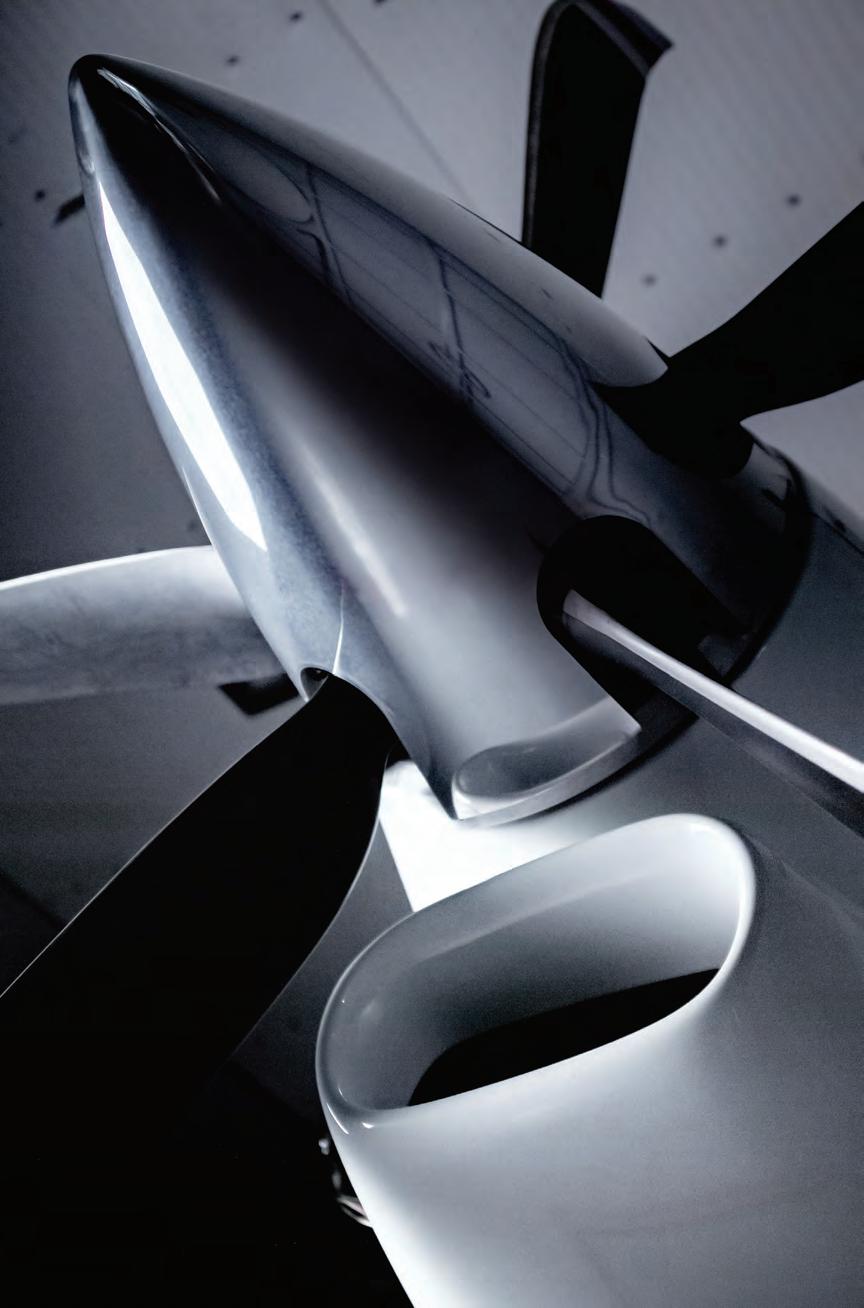

Engineering

Dowty is a leading supplier of electronically controlled, allcomposite propeller systems to the global turboprop market.

We are committed to pioneering next generation propulsion technologies and partnering with customers to be at the forefront of sustainable aviation.

Our drive for technology innovation, and the backing of our global support network, has kept customers flying for over 85 years - and will continue to do so for decades to come.

Propelling the next generation of flight

tomorrow’s technology, today.

BAE systems offers new-technology EW

by Chris Pocock

by Chris Pocock

The Electronic Combat Systems division of BAE Systems is marketing a new airborne digital electronic warfare (EW) protection system for export. Trademarked Storm EW, the company calls it scaleable, modular, fully internal, and platform agnostic. It works across the spectrum and permits third-party software and programming. Its main application would likely be the large number of F-16s in worldwide service, although it can also protect large aircraft such as transports and tankers.

The U.S.-based division of BAE Systems serves as the premier supplier of EW systems to U.S. military aircraft, but it has also sold platforms to more than 65 countries over the years. Major contracts in the U.S. include the Eagle Passive Active Warning Survivability System (EPAWSS) for the new F-15EX and for retrofit to some F-15Es and the EW system for upcoming Block 4 F-35s.

According to Craig Nieman, director of business development for tactical air at BAE Systems, air forces neglected EW upgrades over the past two decades, when forces took for granted air dominance over the skies of Afghanistan and Iraq, for example.

Elsewhere, though, potential adversaries have introduced advanced air defense systems. In particular, surface-to-air missile (SAM) systems have now become highly mobile, feature longer ranges, and operate in broad frequencies, sometimes with passive guidance. Moreover, air-to-air missiles also have increased range and maneuverability, plus anti-jam capability. “The threat rings are expanding, and our defensive systems are lagging behind,” said Nieman.

He explained that the legacy analog EW systems fitted to many military aircraft offer only limited situational awareness and potential to defeat advancing threats. They scan only one quadrant at a time and require a library of tables to identify and counter the threats.

Spectrum warfare, according to BAE systems

Custom electronic warfare (EW) systems have proven their value in battle zones with increased mission e ectiveness and survivability, but their development, implementation, and sustainment costs for individual aircraft platforms can limit their adoption, leaving some fleet aircraft without EW protections and capabilities. This is particularly true for legacy platforms and those with rare combat exposure.

Spectrum warfare suites were developed to provide an adaptable, platform-agnostic approach that makes adding advanced EW defense and attack capabilities to any appropriate aircraft significantly more a ordable, as well as making them easier to field rapidly.

However, spectrum warfare suites are not all alike, the company says. Some manufacturers employ a multi-function approach to EW module design by packaging core EW functions in modular units that provide EW plus several other capabilities for a multi-purpose, all-in-one value proposition. That approach has its downside, however: when some of those other functions are engaged, the EW capabilities can react more slowly than they should, which threatens survivability. Speed is vital in electronic warfare, so BAE Systems specializes in building only dedicated spectrum warfare suites to assure lightning-fast action/reaction times necessary to protect every aircraft. C.P.

In contrast, advanced EW systems are physics-based, offering constant 360-degree detection and rapid response to every radar within the horizon and across the spectrum, including those with new radar waveforms and war reserve modes. They “learn” from every mission, and can continuously be upgraded through software and swappable subcomponent modules. According to Nieman, BAE Systems has invested more than $3 billion in advanced EW over the past two decades.

“We have something that’s real; now it’s an integration issue,” he said. The company forecasts a $5 billion market for Storm EW over the next five years and $15 billion over 15 years. Nieman said that the product is ITAR-controlled but exportable to a wide range of countries, most likely via the foreign military sales route, but with direct commercial sales also possible.

Another key product from this division of BAE Systems is the Common Missile Warning System (CMWS). First fielded in 2005, the EO/IR sensor’s design allows it to detect manportable SAMs so that they can be countered by chaff, flare, and RF decoy countermeasures, as well as laser DIRCM and ATIRCM systems. This system appears on nearly all the U.S. Army’s airplanes and helicopters and has been exported to 17 countries for installation on over 30 different platforms.

The latest versions of the CMWS integrate hostile fire indication, missile warning and data recording capabilities into one unit. A next-generation development named 2-Color Advanced Warning System (2CAWS) features new processors to handle new and emerging threats. z

34 Paris Airshow News • June 20, 2023 • ainonline.com

Mobile surface-to-air missiles like the Russian S-400 are spurring EW technology development.

How AI will transform aerospace, defense

by Hanneke Weitering

by Hanneke Weitering

More than a century after the invention of the autopilot, aerospace engineers are still working to bring more automated processes into aircraft cockpits to enhance safety, increase efficiency, and reduce pilot workload. With the help of artificial intelligence (AI), autopilot technology has evolved from simple devices that maintain an aircraft’s altitude and heading to fully autonomous flight control systems capable of performing gate-to-gate operations without any human input.

One way or another, almost every aerospace and defense company exhibiting at this year’s Paris Air Show increasingly is looking to exploit the potential for AI to improve their aircraft and other systems. This ubiquitous and rapidly morphing technology sphere likely will show a high profile at several forward-looking events during the main show. They include the Paris Air Lab, which concentrates on ensuring aviation’s sustainable future, and the Avion de Métiers sessions, meant to lure young technologists into an industry that stands to learn much about AI from other sectors, such as automotive manufacturing.

But AI isn’t only changing the way airplanes fly—it’s transforming nearly every aspect of aviation on the ground, too. As AI and machine-learning technology have matured in recent years, the aviation industry has explored ways to capitalize on it by making

processes more efficient and often safer.

For example, aircraft manufacturers and service technicians can use AI software and robots, including language learning models like ChatGPT, to streamline assembly and maintenance, repair, and overhaul (MRO) processes. Airlines and other operators can also use AI for fleet optimization, flight planning, and ground operations. Engineers developing aircraft can use AI tools to facilitate and speed the design and certification of products before they even hit the market.

AI isn’t just the way of the future. The aviation industry already has used at least some primitive form of AI technology for years, particularly for manufacturing and MRO. Traditional AI relies on human programmers to define rules and algorithms for pattern-matching and decision-making processes, and it can analyze large datasets much faster than humans. For example, MRO providers might use AI to analyze data from the various sensors onboard an aircraft to predict potential maintenance needs before they arise.

Generative AI Is Changing the Game

Although the aerospace industry already widely uses AI for various applications, it has

only just begun to make an impact. In the coming years, new applications will begin to emerge as companies find ways to take advantage of generative AI—models like ChatGPT that use machine learning and deep neural networks to generate outputs not predefined by human programmers.

“AI is already helping both manufacturing and repair and maintenance users to work with robots much better,” Rishi Ranjan, founder and CEO of GridRaster, told AIN. GridRaster is a software company that specializes in “extended reality” technologies, like augmented reality and virtual reality, that employ AI and spatial mapping software. It provides such tools for the aerospace and automotive industries and works with several top U.S. defense contractors.

According to Ranjan, the U.S. Department of Defense and its top contractors already use traditional AI tools, but generative AI has the potential to make a much bigger impact on defense applications, as well as on the wider aviation industry. “We strongly believe that generative AI will really start helping scale these things to the much bigger aerospace industry in the next two to 10 years,” he explained.

36 Paris Airshow News • June 20, 2023 • ainonline.com

Aircraft manufacturers can use AI software and robots, to streamline assembly and MRO processes.

ChatGPT and other language-learning AI models like it generally are adept at disseminating an astronomical amount of information to yield relevant and—mostly—accurate output almost instantly. It can tell one how to build and certify an airplane, provide tips for improving the aerodynamics of an airframe, and even generate maintenance schedules for specific aircraft.

But the greatest value of generative AI models like ChatGPT will come when aerospace companies begin to verticalize the technology, integrating it with their own intellectual property for internal use, Ranjan said.

AI Makes Faster, Better Digital Twins

While ChatGPT and other generative AI models can access all the information publicly available on the internet, they don’t have access to companies’ valuable, private intellectual property. Giving AI access to that highly protected information would open up a world of new use cases for AI across the industry.

“For the real use, what will happen is that companies will have to pay for an AI model like ChatGPT and start training it—whether ChatGPT enables that or someone will come up with a solution—so that you can take this massively large learning model and now start training it with proprietary data,” Ranjan said. “That will be true for pretty much every enterprise where IT is very important.”

While ChatGPT is a language-learning model that only outputs text, generative AI can also create images and 3D models. In aerospace, that can be particularly useful for generating digital twins.

Aircraft developers and MRO providers alike nowadays often rely on sophisticated virtual models known as digital twins to simulate products, like aircraft and their various subsystems, in a digital environment. Engineers can leverage digital twins to speed product development timelines by reducing the need to physically build and test things, thereby

minimizing costs. MRO technicians use digital twins for predictive maintenance and to detect anomalies by comparing real-world sensor data to the data generated by digital twins.

While digital twins can help to save time and resources, they’re also expensive and time-consuming to create. But generative AI will soon make the process of building digital twins much faster.

“Traditional AI is still very manual, and a digital twin is an extremely manual process to build,” Ranjan said. “Large AI models like ChatGPT, once you can verticalize these for the aerospace industry, can remove a lot of that manual work. They can look at text data and image data and start helping you create a digital twin for these automatically.”

According to Ranjan, generative AI will soon allow companies to build digital twins for just a small fraction of what it costs to do so today. For every $1 spent on building a digital twin with traditional methods, “in another three to four years you’re looking at like 10 cents,” he said. “In another 10 years, it might be one cent.

“Now these expensive solutions will start getting into the hands of more users,” Ranjan added, noting that he expects just about every aerospace company to be using some form of internal generative AI technology within two to three years.

Will AI Take Our Jobs?

As with just about any other industry, the impact that AI will have on the job market is not yet clear. Robots have already taken over some tasks that humans originally performed in the aerospace industry, and new autonomous airplanes will reduce the demand for commercial pilots.

However, AI has the potential to create jobs that didn’t exist before. Those new roles might involve maintaining AI systems for both aircraft and ground operations, developing algorithms, and ensuring that AI gets used ethically and responsibly.