TRAINING: COMPETENCY-BASED TRAINING COMES TO BIZAV

OEMS: THE ACT THAT REVITALIZED GENERAL AVIATION

ROTORCRAFT: SHINING A LIGHT ON NIGHT-VISION GOGGLES

Special Report: Product Support Survey

TRAINING: COMPETENCY-BASED TRAINING COMES TO BIZAV

OEMS: THE ACT THAT REVITALIZED GENERAL AVIATION

ROTORCRAFT: SHINING A LIGHT ON NIGHT-VISION GOGGLES

Special Report: Product Support Survey

14 AIN Product Support Survey: Bombardier rises to the top of product support rankings

50 Learning to fly with night-vision goggles

Safety benefits with competency-based training

4 Bizav attorney: IRS audits are ‘going to be very intense’

6 FAA to change Part 380 operations, exploring special category

8 Gulfstream's flagship G700 rapidly picking up validations

10 U.S. business jet accident fatalities unchanged in first half

12 Expert Opinion: Don’t let the autoflight bring you down

24 Pilot Report: Flying Piper’s turboprop-single M700 fury

44 Remembering GARA 30 years later: The law that changed the industry trajectory

Wherever your destination, Gulfstream Customer Support has you covered. With an extensive force of experts around the world, we offer responsiveness matched only by our devotion to detail. It is our pleasure to serve you.

BY KERRY LYNCH

The Internal Revenue Service (IRS) has begun a half-dozen audits of what will be an initial tranche of 50 into the use of business jets. Based on the first few, “it’s going to be very intense and it’s going to be something that the industry hasn’t seen on this level,” warned David Shannon, a partner with and chair of the business aviation practice for Lewis Brisbois, during NBAA’s June Regional Forum in New York.

In February, the agency revealed plans to launch “dozens” of audits on business aircraft use to ensure that large corporations, partnerships, and high-income taxpayers are properly allocating between personal and business use for tax purposes. Additional funding received from the Inflation Reduction Act enabled the IRS to increase staff so it could “closely examine this area, which has not been closely scrutinized during the past decade,” the agency said.

“The IDR [the IRS Information Document Request] we received…is twice as long as some IDRs are and the things they’re asking for are extremely thorough,” Shannon said. “We’re at the stage where we need to treat this with the level of seriousness that the situation requires.”

Noting that there is a small pool of

aviation attorneys and accountants with experience in this area, he added: “We don’t have the capacity as an industry to handle those 50 audits that are going to come [initially]. After these initial 50 audits for the large businesses, the algorithm that they’re using is going to be modified and then you’re going to have hundreds and hundreds of audits. Our industry cannot handle hundreds and hundreds of audits.”

He urged the audience to prepare now and go through a mock audit. “You have to go through all of your documentation now because when you get the phone call or when you get your notice in the mail, it’s not going be the only one that goes out. There’s going to be dozens of these that are going to keep coming out.”

In addition to the normal corporate documents and minutes, the IRS is seeking a lengthy list of documentation on a range of items. If a company is unclear on the documentation, it is leaving the determination of the flight in the hands of the auditor. “I want everyone to understand that those flights need to be documented thoroughly because that’s what they’re coming after,” he said. z

An 18-day strike that brought Global 5500, 6500, and 7500 assembly to a halt at Bombardier’s production facility at Toronto Pearson Airport ended July 10. The 1,350 unionized plant workers, represented by Unifor Locals 112 and 673, ratified a three-year collective agreement that provides a 12.5% wage increase over that span. It also increases pension contributions and ensures better jobs. Bombardier opened this new $500 million aircraft production facility in early May.

Wheels Up laid of 11% of its pilots in late June, citing a “stafng imbalance” caused by “a sharp decline in our pilot attrition rates in the first half due in part to a reduction of pilot hiring at the airlines and pilots choosing to stay at Wheels Up.” Layofs were reportedly concentrated to King Air flight crewmembers and pared its estimated pilot ranks from 950 to 850. Wheels Up reported a $487 million loss last year, and a $97 million shortfall in the first quarter.

Benjamin Schwalen, NBAA general counsel and corporate secretary; Kristi Greco Johnson, NBAA senior v-p of government afairs; and David Shannon, partner with Lewis Brisbois, host a session at the NBAA

Regional Forum in White Plains, New York, on a range of tax issues, including the recent IRS audits.

The European Business Aviation Association (EBAA) has joined Dassault Aviation in taking legal action against the European Commission’s Taxonomy Delegated Act, which it says discriminates against the industry. On July 4, industry attorneys told the European Union General Court that it is intervening with assistance in the Dassault case filed earlier this year. The EU Taxonomy identifies approved sustainable economic activities to help companies and investors make decisions over sustainable investments and “green” financing. EBAA secretary general Holger Krahmer said the European Commission excluded business aviation on ideological grounds.

JSX was swept into the debate surrounding the Part 380 public charter regulations.

BY KERRY LYNCH

The FAA is moving forward on a rulemaking to alter the definitions of “scheduled,” “on demand,” and “supplemental” as it seeks to tighten the requirements for operators flying under the Department of Transportation’s Part 380 public charter economic authority. In addition, the FAA plans to form a Safety Risk Management Panel (SRMP) to discuss the potential for a new operating authority for scheduled Part 135 operations in 10- to 30-seat aircraft.

Following up on a notice issued last August about the potential changes, the agency in June said it plans to issue a notice of proposed rulemaking (NPRM) expeditiously and the rulemaking and panel are designed to address the rapid expansion and increased complexity of public charter flights in recent years.

“Part of the safety mission of the FAA is identifying risk early on, and that’s exactly what we’re doing on public charters as usage expands,” said FAA Administrator Michael Whitaker. “If a company is e ff ectively operating as a scheduled airline, the FAA needs to determine whether those operations should follow the same stringent rules as scheduled airlines.”

Noting its original request for comments on a potential for a rulemaking drew

some 60,000 responses, the agency said the NPRM would solicit further input on an effective date that would enable industry to adapt to any change.

As for the SRMP, the agency further said: “Because of our dedication to expanding air service to small and rural communities, we will explore opportunities to align aircraft size and certification standards with operational needs for small community and rural air service.” The SRMP will be tasked with digging into data to explore risks.

In addition, the FAA is coordinating with the Transportation Security Administration to review security requirements for passenger screening involving public charter flights.

When first announcing the change last year, the FAA said a rulemaking could push some Part 135 operators into 121. The change comes at the behest of certain airlines and pilot unions, which argue that Part 380 companies are effectively Part 121 operators flying under Part 135 and are allowed to bypass certain safety and security requirements. Business aviation groups have pushed back, saying the FAA is jumping into competitive issues rather than safety issues, and that the data do not support changes. z

EASA test pilots have started certification flights with the AW09 helicopter being developed by Leonardo subsidiary Kopter. The company is aiming to complete type certification under CS-27 rules in 2025. Kopter is using a pair of preproduction models, PS4 and PS5, for flight testing and expects to start flying the first production version, PS6, at the end of this year. In September 2022, it retired the earlier PS3 prototype after logging 387 flights.

Universal Hydrogen has abandoned its eforts to convert regional airliners to run on liquid hydrogen, with the U.S. startup acknowledging that it is closing the business. “While we have been pursuing new capital for some time and evaluating various strategic options, we have been unsuccessful in closing any new investment,” chairman and CEO Mark Cousin said in a written statement. In February, Universal Hydrogen reported that it had conducted a first ground test run with its megawatt-class fuel cell powertrain using its proprietary liquid hydrogen module to supply the fuel.

Just Stop Oil protestors broke into London Stansted Airport early June 20 and damaged a pair of business jets parked by Harrods Aviation. Police arrested Jennifer Kowalski and Cole Macdonald soon after the attack, which happened 24 hours after the same group sprayed the UK’s Stonehenge World Heritage Site with orange powder. Protestors cut through Stansted’s security fence and crossed a pair of live taxiways and apron areas to reach the parked jets. Police at Stansted have since mobilized additional resources to protect airside and landside areas.

BY KERRY LYNCH

Gulfstream Aerospace’s G700 program has been picking up steam since FAA certification on March 29, accumulating type validations from eight nations along with the European Union Aviation Safety Agency. The Savannah, Georgia airframer listed Mexico among the latest nations to approve the 7,700-nm business jet.

After receiving the U.S. nod at the end of March, Gulfstream delivered the initial copies in April. Ahead of Gulfstream’s July 24 quarterly earnings call, industry observers estimated the airframer had handed over eight by early July—lagging initial expectations—with others at the time pending a believed modification.

Both analyst Baird and Hagerty Jet Group had made that assessment, but Hagerty pointed to a “dozen or so” aircraft that had been lined up on the tarmac in Savannah missing horizontal stabilizers, which it said were believed to be undergoing modification at the behest of the FAA.

Even so, Gulfstream reported the inservice fleet has already topped more than 700 flight hours, showing a maturity in the program.

“We planned for a seamless entry into service for the G700, and this incredible start is a testament to both the maturity of the program and the dedication of the Gulfstream team,” said Gulfstream president Mark Burns. “Thanks to the investments we made across our business, from research and development to manufacturing and completions, the G700 program is exceeding customer expectations—they are flying their aircraft around the world immediately upon delivery, and the feedback we are hearing is outstanding.”

Along with accruing hours, the model continues to rack up city-pair speed records, including from Paris to Montreal in 6 hours 16 minutes and São Paulo to White Plains, New York, in 8 hours 46 minutes. Both flights averaged a speed of at least Mach 0.90.

The flights are pending National Aeronautic Association and Fédération Aéronautique Internationale recognition as world records.

These will bring the total number of record flights for the ultra-long-range model to nearly 60. z

GE Aerospace is working with NASA to make hybrid-electric, high-bypass turbofan engines. The work will build upon the partners’ ongoing collaboration on the NASA Electrified Powertrain Flight Demonstration program.

GE Aerospace and NASA are modifying GE’s Passport 20 engine with hybrid-electric components for testing under NASA’s Hybrid Thermally Efcient Core project, which seeks to reduce fuel burn through the development of small core engine technologies.

Global Jet Capital saw a continued normalization in the business aircraft market in the first quarter with flight operations and transaction volumes declining year over year, available inventory levels increasing but still low, and OEM backlogs growing. While flight operations were down 2% year over year in the first quarter, they were still 16% above 2019 levels. Supply chain and labor issues still hampered new aircraft deliveries, but demand remained high with OEMs reporting a book-to-bill of 1.3:1 in the quarter. Preowned available inventory increased in the first quarter.

Leonardo has confirmed plans to add a second final assembly line for the AW609 tiltotor at its Grottaglie production facility in the province of Taranto in southern Italy. This would be in addition to the primary AW609 assembly line in Philadelphia. The decision marks a strategic shift for the aerospace and defense group, which said it is diversifying the use of the Grottaglie site that had been mainly intended to build aerostructures for Boeing 787s. Leonardo is also pausing 787 composite center fuselage barrel production to match reduced manufacturing and delivery rates at Boeing.

We invent them. We design them. We build them.

We were meant to fly.

And one day, we let them soar

BY GORDON GILBERT

The number of fatalities from U.S. business jet accidents in the first half of this year was unchanged from that of the first half of last year despite fewer accidents in the recent six-month period. According to preliminary information researched by AIN, three N-registered bizjet accidents took the

lives of nine persons in the first half of 2024, compared with nine deaths from four accidents in the same timeframe of 2023.

The NTSB preliminary report on the Feb. 7 fatal accident involving a Beechcraft Hawker 900XP sheds little light on

CAE inaugurated its first business aviation training center dedicated to Gulfstream business jets in Savannah, Georgia. Located near Gulfstream Aerospace’s headquarters, the center began operating earlier this year with a G450/G550 fullflight simulator. The next flight simulator to come online is for the G280, anticipated to be ready for training shortly. The center has the capacity for four simulators. In addition, the facility is ofering maintenance training for the G650 and G500/600 ultra-long-range models.

European renewable fuel production pioneer Synhelion has inaugurated DAWN, the world’s first industrial solar fuel plant, in Jülich, Germany. Founded in 2016, the company has expanded its technology from a mini-refinery on the roof of the public research university. Synhelion has worked since then to apply its sun-to-liquid process on an industrial scale. The pilot plant will produce several thousand liters of synthetic crude oil a year, which can then be processed into fuels including sustainable aviation fuel. Next year, the company expects to begin construction on its first commercial plant in Spain.

Elevate MRO has opened its new business aircraft maintenance center at Rocky Mountain Metropolitan Airport in Denver. The expansion includes increased staf and maintenance teams to support the existing clients and boost service availability. The 17,000-sq-ft facility provides hangar and ofce space, allowing Elevate to expand its maintenance and management capacity. It will also introduce avionics services.

BY CHRIS LUTAT

In all of my years of flying, whether as an instructor/evaluator or simply a member of the crew, I’ve never seen a pilot win a fistfight with the autoflight.

As I was nearly done writing this article in early May, the NTSB issued its preliminary report on the fatal accident involving a Daher TBM 700, N960LP, near Truckee, California, on March 30, 2024.

In the headline of his report on the release, Gordon Gilbert wrote for AIN that, “the preliminary accident report shows a series of autopilot engagements and disengagements” just prior to the accident.

Here’s the set-up: The airport was closed for VFR traffic; the weather was IMC with ceiling and visibility requiring an instrument approach. The PIC was reported by the NTSB to have had 250 hours flying the aircraft. The preliminary report gives few facts beyond these initial findings, and we may never know why this series of apparent actions in the cockpit were taken.

Initial indications suggest that the pilot made several attempts to connect the autoflight while maneuvering the aircraft close to the ground in an area of high terrain, at night, in weather. Drawing irrefutable conclusions from this information will be a challenge for the NTSB, but its final report will be one that many pilots will be anxiously awaiting. It had the effect of immediately reinforcing for me how important the topic of this article is to contemporary aviation safety.

Inevitably, whether new to flying or a weathered veteran with thousands of hours, every contemporary pilot will confront new technologies designed to increase safety margins and contribute to efficiency and productivity. We all generally agree that those are good things—and wouldn’t have it any other way.

LUTAT MANAGING PARTNER, CONVERGENT PERFORMANCE

But unless we work for an organization that has the resources to deal with these advances systematically through training and evaluation programs supported by a rigorous standardization team, many crewmembers are mostly on their own when it comes to smoothly blending traditional airmanship with contemporary automation. Whether adapting to enhanced flight vision systems like synthetic vision systems augmented with a head-up display or to the latest mandated communications-navigation-surveillance systems and protocols, the amount of knowledge that flight crews need to understand and become proficient with is not going to diminish in the coming years.

Yet few training programs—even the best in our industry—recognize the need to develop a balanced approach to airmanship blending proficiency with advanced flight guidance, autoflight systems, and the stickand-rudder skills that got many pilots their first flying job.

If you stay committed to a flying career long enough, eventually you will encounter conditions that require autoflight and flight guidance systems to take a backseat to maintain control of the aircraft along a safe flight path. Yet real-world practice opportunities can seem scarce when the aircraft and crew are in revenue operations.

If you’re reading this and saying to

yourself, “Yeah, this isn’t a problem,” it may be because you haven’t yet experienced the collision of practical airmanship with onboard automated systems designed to control the aircraft flightpath. Sources of aviation safety are plentiful, but you need to go no further than NASA’s Aviation Safety Reporting System (ASRS) to assess for yourself the prevalence of incidents and reports of airborne flight crews working out their own understanding of their autoflight systems in real time (just about the worst time to do it).

I recently searched the ASRS database for just one type of situation where disconnecting and manually flying the airplane would be a very safe and wise option—altitude excursions. I put in just two of the many search criteria available on the site.

After selecting “Excursion from assigned altitude” plus “Human Factors/HumanMachine Interface,” my request generated 648 hits. Apparently, at least 648 times after an altitude excursion, crews felt compelled to write about it in a NASA report.

It may not be the most demanding airmanship challenge of our time, but it can ruin an otherwise fine flying day. It’s representative of a problem that has been plaguing our industry for decades—one that we should all be able to eliminate (mostly, that is) if we work to refine the relationship between the hardware (the aircraft and all of its integrated systems) and the wetware (that’s you and me).

Of course, I am not the only pilot thinking these thoughts—they are indeed shared by many other pilots and now, it seems, they have the attention of the research community and some regulators as well.

The International Civil Aviation Organization is in the final stages of a yearslong study on the waning of “hand flying”

(otherwise known as “manual handling” in some circles). It’s one industry study that I’m looking forward to when it is finally published, perhaps later this year. But the gist of the research was reported by Aviation Week & Space Technology.

After studying 30 years of accidents and major incidents, researchers focused on 77 flightpath-related accidents and more than 300 incidents—finding that 36% had evidence of automation dependency, and the percentage appears to be climbing. In the two decades from 1990 to 2010, the figure was 22%, but it rose to 49% in the decade that followed.

The article states that the study found: “Technical advances in flight deck systems are not being supported with sufficient training or best-practices guidance, leaving many pilots too reliant on automated systems and deficient in fundamental hand-flying skills.”

Our own research and fieldwork bear this out, and in 2013, Convergent Performance stated in our book "Automation Airmanship " that pilots and the organizations they fly for should as a matter of routine build mandatory hand-flying or manual-handling opportunities into standard operating procedures (SOPs). For example, something as simple as requiring an SOP that departures be flown manually

as opposed to mandating autopilot engagement at 500 or 1,000 feet could contribute to more balance between proficiency with the autoflight and proficiency with manual flight. How to achieve an optimum balance

is open for debate and should be handled by individual flight departments taking many considerations into account (such as prevailing flying conditions, experience levels, and other safety factors). Policy changes like this can have a real payoff; follow-up and fine-tuning are key to any policy change.

Our observations and the experiences of veteran pilots everywhere show that the decision to “fly the airplane first” is made (and briefed) long before a conflict over control between the pilot and the autoflight forces the choice. z

Chris Lutat is managing partner of Convergent Performance, a B777 captain, and co-author of "Automation Airmanship: Nine Principles for Operating Glass Cockpit Aircraft."

The opinions expressed in this column are those of the author and not necessarily endorsed by AIN Media Group.

BY GREGORY POLEK

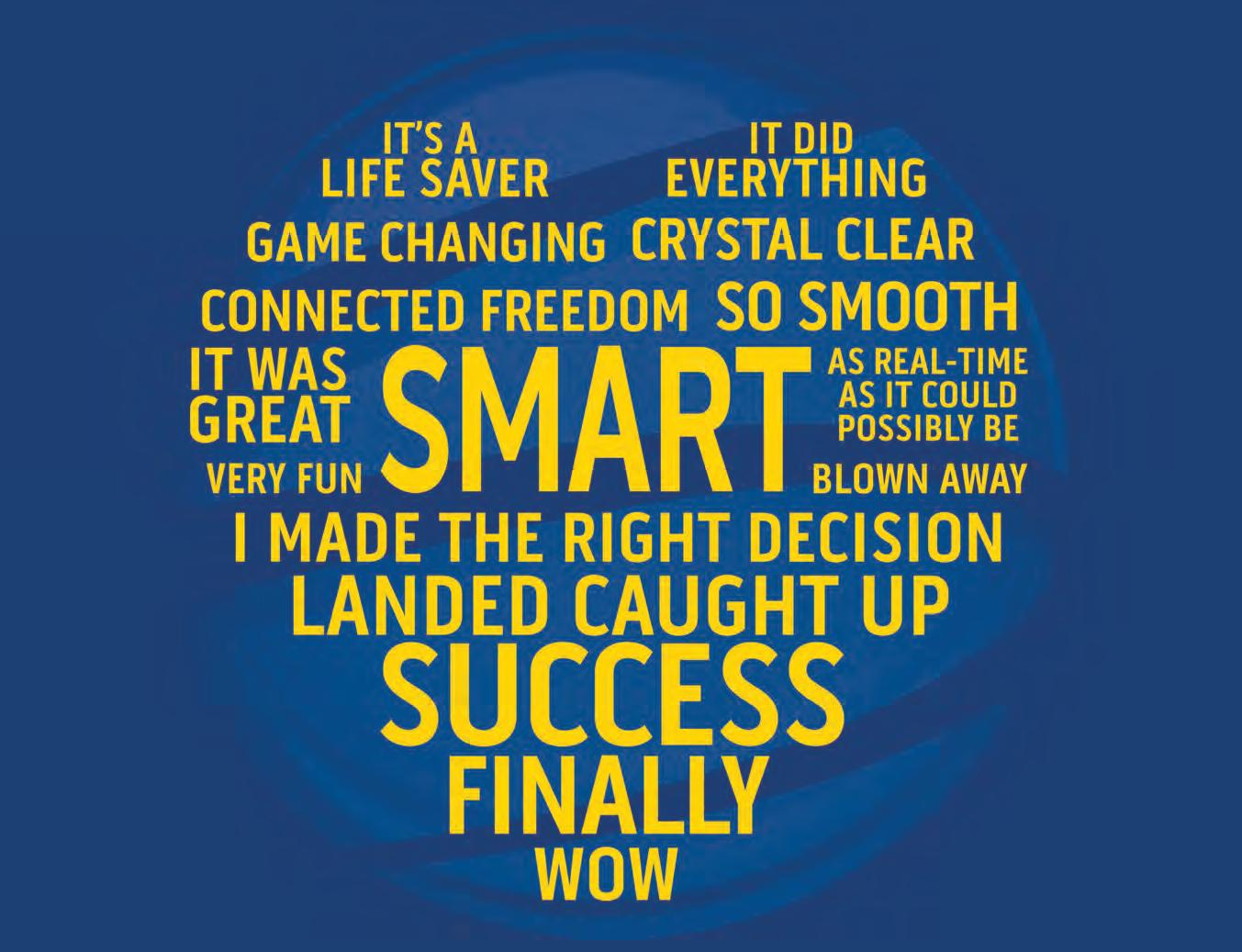

AIN’s product support survey for 2024 saw Bombardier rise to the top of all manufacturers with a full point improvement from 2023, when it ranked last in the business jet sector with a score of 7.6. The company’s 8.6 rating this year resulted from a strong showing in several categories, including a tie for first place with Dassault in warranty fulfillment with a score of 9.0.

Also seeing gains in support rankings in 2024 were Embraer and Dassault, with each improving by 0.4 points in the overall average from 2023. Both had strong service center ratings, reflecting their concerted effort to grow support capacity.

Atop the turboprop ratings, Pilatus continued to score among the highest overall in the survey. However, its 8.4 rating tied Embraer’s in the overall average, two

points behind Bombardier.

While virtually every company surveyed last year reported negative effects of supply chain constraints, several reported some improvement in that area in 2024. Efforts to relieve the pressure took the form of better communication and hands-on help for suppliers, increasing inventory levels, and maintaining closer ties with teardown agencies to help supplement their parts inventories. Finally, continued pressure from increased demand for MRO services saw companies add still more square footage for MRO operations and parts warehousing.

However, cost of parts continued to be a sticking point for many of the OEMs in the survey. As with last year, that category brought in the lowest scores.

Rolland Vincent of Texas-based Rolland

Vincent Associates—the data provider for the AIN survey—noted that improved competitive conditions and easing of supply chain constraints accounted for much of the overall improvement in scores.

Finally, while staffing shortages broadly accounted for adverse effects, some of the OEMs reported more success in recruiting technicians than others.

First-place finisher Bombardier, for example, benefitted from apprenticeship programs at facilities in London, Singapore, and Melbourne, Australia, to ensure a flow of new hires trained to address any workforce shortages. A new program in Wichita supported with grants by the state of Kansas promises further capacity, as has its direct development of needed infrastructure.

AIN ’s annual Product Support Survey aims to quantify and rate through statistical analysis the product support functions of aircraft manufacturers over the past year. The survey, whose respondents include operators of business jets, pressurized turboprops, and turbine-powered helicopters, endeavors to encourage continuous improvement in aircraft product support throughout the industry.

For the third year, AIN conducted the survey via a questionnaire developed in partnership with Rolland Vincent Associates, a Texasbased consultancy focused on aviation market research, strategy, and forecasting. Designed to provide improved ease of use and to encourage more participants to complete the entire questionnaire, the survey tool included

Spanish and Portuguese versions along with clearer language and imagery around the categories and evaluation scale. Finally, it asked respondents to evaluate one full aircraft at a time, including airframe, engines, and avionics.

AIN emailed qualified readers a link to the password-protected survey website active from mid-April to mid-June. It asked respondents to rate individual aircraft and provide the tail number, aircraft age, primary region of service, and whether they used factory-owned or authorized service centers, or both. The survey also asked respondents to rate, on a scale from 1 to 10, the quality of service they received during the previous 12 months in the following categories: Factory-owned Service Centers; Authorized Service Centers; Cost Per Hour Program; Parts Availability; Cost of Parts; AOG Response; Warranty

Fulfillment; Technical Manuals; Technical Reps; and Overall Aircraft Reliability.

In total, 679 unique respondents representing 2,221 aircraft, from 62 countries completed the survey. While total responses were above last year’s total, AIN did not receive enough ratings to verifiably report results for Daher, Honda Aircraft, Airbus Helicopters, and Bell. Rolland Vincent Associates reviewed the data to ensure accurate and valid responses. It also compiled the final survey results in close coordination with AIN

AIN has published its 2024 Product Support Survey results for aircraft in this issue; next month will feature avionics, cabin electronics, and airborne connectivity products; and engines will follow in the October issue.

After finishing last among the five business jet makers appearing in 2023’s survey, Bombardier became the toprated OEM in the airframer category this year as it jumped to 8.6. Bombardier ranked first in cost-per-hour programs with an 8.3 rating, placing it six-tenths of a point ahead of the second-place vote-getter Gulfstream. It also had a strong showing (9.0) in aircraft reliability.

Supporting an in-service global fleet of some 5,170 aircraft, Bombardier continues to work toward ensuring that operators consider the OEM their “first choice” for maintenance, modifications, and parts. In a recent interview with AIN, Bombardier v-p of product support Anthony Cox said achieving that objective starts with building the company’s network footprint with an ever-expanding team of 1,800 technicians.

‘We clearly have to focus on the customers where they need us, when they need us,” he explained. “So, we do a lot of studying of the demographic worldwide, and we consider our aircraft movements and our installed base. We study the maintenance requirements that are upcoming, and the parts that our customers may need. Those studies allow us to address each market with a suitable infrastructure, human resources or human capital, and any other technical abilities that we may need.”

Cox noted that Bombardier no longer su ff ers from the staffing shortages that virtually every maintenance provider experienced before the Covid pandemic took hold.

“Two years ago, I think we would’ve been pleased to see around 150 aircraft in maintenance throughout the network,” said Cox. “Typically, today, we have anywhere from 280 to 300 aircraft in work. So, in terms of market share, we continue to improve that. Market share is a result of the customers having a good experience, word of mouth, our expanded

capabilities, our expanded footprint, and full OEM support.”

Cox further reported that supply chain constraints have begun to loosen for Bombardier and generally industry-wide. However, some of the smallest sub-suppliers continue to suffer from a shortage of raw materials, for example.

“We still have some difficulties with a couple of partners who are catching up on raw material, but none of it [is] affecting our production line,” explained Cox. “The in-service market where we struggle is just with a couple of suppliers who make unique parts. They require certain equipment; they require finesse in the supply chain.”

“We’re working with those partners. We have about a hundred intervention specialists that we’ve deployed out to our various vendors. And their role is to assist the vendors in any shortages, make sure that we have a line of balance to support our aftermarket needs.”

Cox also noted that its proprietary Smart Link application has yielded significant returns, allowing for what he called a visualization of the aircraft health monitoring system. In a Global 7500, for example, the application generates thousands of parameters per millisecond to analyze potential problems ahead of landing, giving technicians alerts to ensure they have access to the needed parts.

Finishing with an overall average score of 8.4, Embraer saw its results improve by four-tenths of a point from last year’s showing, leaving it in a close second place behind

Bombardier. The Brazilian manufacturer saw some of its strongest category rankings in technical manuals (9.1), technical representatives (9.2), and overall aircraft reliability

Embraer continued (9.1), all of which placed it among the top of the individual scores. Among all the scoring categories, only a fourth-place finish in parts availability (7.2) weighed on the overall result.

Characterizing its focus on customer experience as essential to its entrepreneurial success and a core aspect of its business strategy, Embraer Services & Support highlights its Executive Care program as a way to help navigate a healthy expansion of the business and to budget aircraft maintenance costs.

Executive Care rolls together planning, budgeting, and support under a fixed monthly fee, along with an hourly charge for flight hours flown to render a straightforward and simple program for customers to manage. The program freezes costs for scheduled and unscheduled maintenance items upon enrollment.

Important improvements over the past year include technical services at no cost for up to five hours and reduced rates thereafter, as well as carbon offsets of the first 25 flight hours for newly delivered aircraft. Although the program does not cover parts, Embraer offers up to a 10% discount over the standard list price, as well as a 10% discount for new enrollments in landing gear overhaul add-ons. Finally, operators get a special price for select service bulletins and Phenom STC special coverage.

To ensure operational excellence, Embraer is concentrating on guaranteed spare parts availability and optimized inventory turnover to minimize downtime and enhance

cost-effectiveness, as well as footprint expansion and synergy to streamline operations across locations to eliminate redundancies, foster collaboration, and improve overall efficiency. Embraer doubled its maintenance service capacity in the U.S. to support the continued growth of its customer base with the addition of three Executive Aviation MRO facilities at Dallas Love Field, Cleveland, and Sanford, Florida. In support of the expansion, Embraer Services & Support increased its mobile response network by 28 teams and added access to interior services, paint, and component repairs. Embraer Services & Support also said it intends to move its facilities at Paris–Le Bourget Airport to a new maintenance building capable of accommodating more capacity, while committing to low-carbon construction and energy self-sufficiency. The company expects the new executive aviation maintenance facility to more than double the unit’s capacity.

Finishing just a tenth of a point lower than second-ranked Embraer at 8.3, Dassault saw an overall rating improvement of four-tenths of a point compared with its 7.9 showing last year. The company’s highest individual scores in warranty fulfillment (9.0) and technical representatives (9.3) both helped maintain its buoyancy. However, lower scores in cost-perhour programs (7.1) and AOG response (7.7) helped keep it from ascending any higher than its third-place finish.

Dassault Aviation’s opening in late March of a purpose-built 149,500-sq-ft MRO facility in Kuala Lumpur further supports

the company’s plan for developing a wider global aftermarket footprint with modernized and expanded facilities to support the growing fleet and product line of its Falcon family. Operating under the ExecuJet brand, the service center can support 10 to 15 aircraft at one time, including Dassault’s largest aircraft, the Falcon 6X, which recently entered service, and the larger 10X, scheduled to reach the market in 2027.

The acquisition of the global maintenance activities of Luxaviation’s ExecuJet subsidiary and the European-based MRO activities of TAG Aviation five years ago cemented Dassault’s plan to command a worldwide Falcon maintenance network and bring support capability closer to customers.

“Over the last half decade, we have more than doubled our global support capacity and considerably modernized our MRO capability,” said Jean Kayanakis, Dassault Aviation senior v-p for worldwide customer service. “We now have more than 60 service locations and 15 parts distribution centers around the world, along with the go-teams necessary to support aircraft in the field 24/7 wherever they may be. This is part of a strategy aimed at keeping us as close as possible to our customers and offering all the services needed to maximize the up-time and value of their Falcon fleets.”

Further expansion will hinge on the opening of several more facilities, including a new U.S. flagship MRO in Melbourne, Florida, to support Falcons operating in North and South America, in 2025. Further added capacity in the U.S. will take the form of another authorized service center (ASC), Pro Star Aviation, located near Boston.

Dassault also opened a third authorized facility in India, Indamer in New Delhi, adding to the two ASCs in Mumbai. Dassault said all the activity reflects a need to stay ahead of fleet growth and provide more service. The company has 40 factory service centers, 21 ASCs, and 15 parts distribution centers.

Meanwhile, Dassault’s relocation of its facility in Sorocaba, near São Paulo, Brazil, anchors Catarina International Executive Airport’s maintenance offering.

Last year, the company opened a major new ExecuJet MRO center at the Dubai World Central airport.

Finally, the company continued to encourage more customer use of Dassault’s online parts ordering system. Now, its customer base places 70% of orders online while Dassault continues to improve its customer portal and add eCommerce platforms. Last year, it increased parts inventory by 13% amid gradually improving supply chain constraints and high fleet utilization.

After ranking in a tie for the top spot with Textron last year, Gulfstream saw its total score fall by one-tenth of a point in 2024. However, with the improvements made this year by Bombardier, Embraer, and Dassault, an 8.0 overall score lowered Gulfstream’s position to the number-four spot. Gulfstream’s lower rating in cost of parts (5.9) and factoryowned service centers (7.8) weighed on its total score.

Gulfstream continues its pursuit of a plan for facility modernization and expansion to ensure consistent service across all its service centers.

In April, the company continued the expansion of its Savannah-based MRO facility, already one of the largest dedicated business aviation maintenance facilities in the world. Once complete, it will provide more than 200,000

sq ft of workspace, allowing Gulfstream to expand scheduled and unscheduled inspections as well as maintenance, avionics upgrades, and interior refurbishments.

The company followed the Savannah announcement with a new repair and overhaul shop that opened at its Farnborough Service Center. In Mesa, Arizona, the company began work on expansion in the fall of 2022 in anticipation of completion of its new 225,000-sq-ft facility later this year. In the Dallas-Fort Worth area, progress continues on a new component repair and overhaul facility where Gulfstream plans first to concentrate on wheels, brakes, and landing gear and then increase o ff erings to support aircraft structures, avionics, and other components.

Gulfstream has invested heavily in spare parts storage and distribution, concentrating its effort on locating warehouses near key airports such as Atlanta Hartsfield-Jackson Airport in Georgia and Schipol Airport in Amsterdam. Meanwhile, Gulfstream has increased its investment to more than $2 billion in ready-to-serve parts inventory, helping

the company mitigate ongoing supply chain constraints. The company’s in-house repair and overhaul (R&O) capabilities aid an effort to gain more control over the supply chain. R&O capabilities also align with sustainability goals, allowing for extension of aircraft life cycles while reducing the need for raw materials and manufacturing of replacement goods.

The manufacturer also has increased the strength of its workforce by identifying and establishing new roles to enhance customer service, where teams have grown by more than 500 employees in just the past year. The company now employs more than 5,000 people at a dozen MRO locations across the Americas, Europe, and Asia.

Finally, the company continues preparations for entry into service of the G700, on which the customer support team has already completed extensive training for deliveries of the aircraft.

The only business jet airframer to have scored below an overall 8.0 rating, Textron Aviation registered a score of 7.9, a drop of 0.2 from last year. A 6.5-point showing in cost of parts beat Gulfstream’s placement in that category. The company did see respectable scores in overall reliability at 8.8 points, placing it a tenth of a point above Gulfstream, while a 7.5-point showing in cost-per-hour programs placed it above Dassault’s 7.1 score.

The manufacturer of Beechcraft and Cessna aircraft has spent what it calls a significant investment in support over the past year. During the past year, Textron added resources and employees in Europe and the Asia-Pacific region, boosting support outside its U.S. stronghold. The expansion included a third member of its 1CALL team based in Spain for unscheduled maintenance support along with a technical support team in Australia.

Technology investments saw the addition of Textron Aviation’s service management app, helping ease the process for customers to review and approve work and connect with a service center. A Textron rulemaking change request would allow Part 91 owners of single-engine

turbine-powered airplanes to perform a “current inspection program recommended by the manufacturer” in lieu of annual or 100-hour inspections,” effectively increasing inspection program options and reducing maintenance costs.

The expansion of the company’s parts distribution facility at its Wichita headquarters adds 180,000 sq ft of space, ensuring a ready supply of parts for both new and existing models.

Among the two OEMs to appear in the rankings of turboprops still in production, Pilatus with its PC-12 outscored Textron’s King Air support by an average of 0.5. However, the Swiss manufacturer saw its own composite score fall by twotenths of a point compared with last year’s showing of 8.6.

The company’s standout scores of 9.1 or better in four distinct categories proved remarkable. Its highest result of 9.3 in both overall reliability and factory-owned service centers helped counter its weaker results in parts availability and cost, with 7.4 and 6.2, respectively.

Pilatus has seen its fleet of more than 2,090 PC-12s account for 10.6 million flying hours, while some 360 PC-12NXGs amass about 210,000 flying hours. About 260 PC-24 light jets now in operation have collected 230,000 hours in the air.

Pilatus held five customer-oriented operators conferences around the world in the past year. During that time, it entered an agreement to acquire the Pilatus-focused MRO business from Aero Centers Epps in Atlanta.

A major revision to the company’s service center policies and procedures improved spare parts availability and

allowed for faster response times. Along with that e ff ort, Pilatus developed a real-time service center analytics suite, allowing greater cooperation between the OEM and its authorized service centers to further standardize “Pilatus Class” service.

Pilatus obtained approval for engineering design work under its Stans DOA at Pilatus Business Aircraft in the U.S., obtained Pilatus FOCA/EASA approval for Pilatus PC-24 maintenance training, and opened a second maintenance training classroom at Pilatus Business Aircraft USA.

Textron Aviation’s King Air turboprop matched its composite score of 7.9 from last year in the turboprop sector as well as among the company’s three business jet models, cementing its finish in both groupings. While finishing behind Pilatus by half a point in the turboprop category, the King Air posted relatively high scores in companyowned and authorized service centers, where it finished ahead of Pilatus by two-tenths of a point. Also finishing ahead of Pilatus in technical manuals, the King Air’s support apparatus scored overall aircraft reliability of 8.6.

See the summary of Textron Aviation’s improvements on page 19.

Daher did not draw enough responses to post a valid sample of scores.

Daher has shown progress on several elements of its maintenance offering, most notably the consolidation of the Kodiak Care and TBM support networks under the umbrella dubbed Kodiak & TBM Care. The company now boasts 55 service centers, just four of which are factory-owned. In North America, customers have access to 28 TBM centers, 14 Kodiak locations, and eight that now serve both airplanes. What Daher calls the Prestige package for the purchase of a new TBM 960 includes the TBM Total Care Maintenance Program, which covers scheduled maintenance for five years or 1,000 flight hours. The company offers a similar program for TBM 910 customers. For a new Kodiak 100 or Kodiak 900, the Kodiak Care maintenance program covers four years or 1,000 hours.

Since 2018, Daher has developed the use of data

transmission systems on TBM models. The systems enable full-flight engine and aircraft data recording and wireless transmission to the relevant server. In-house experts continue enlarging its list of high-value features, reports. The same data feed the Daher-developed Me & My TBM app, which generates individual flying assessments and debriefs of pilot owners/ operators.

Out of production since 1986, the Mitsubishi MU-2 nevertheless continues to rank as high or higher than any of the newer designs in several categories covered by AIN’s product support survey. Backed by Mitsubishi Heavy Industries America (MHIA) at its facilities in Dallas and five MU-2 authorized service centers, more than 220 of the turboprop twins still fly worldwide, thanks largely to its support apparatus.

Registering no lower than 9.0 in eight categories including its overall rating, MHIA finished with a perfect 10.0 in warranty fulfillment and a 9.4 in overall aircraft reliability. Its lowest rating—a 7.2 in cost of parts—placed the company more than a full point ahead of the two other turboprops in that category.

Consisting of spare parts sales, engineering, field support, quality assurance, flight safety, and customer support, the company’s support organization helped attract many new members to the MU-2 community over the past 12 months, it said. MU-2 owners and operators actively engage with each other to take advantage of the experience gained over many

years of flying the MU-2. The MU-2 Flyers Association, organized by MU-2 owners and experts, plans to host a safety seminar in Smyrna, Tennessee, this coming September. The seminar will cover operational tips, analysis of past accident scenarios, and enhancements for some of the onboard safety specific to MU-2.

MHIA supports the seminar and encourages all MU-2 pilots to attend and share their experience and operational tips among pilots.

Posting a strong 8.4 composite rating in this year’s survey, Leonardo nevertheless scored three-tenths of a point lower this year than it did in 2023. The only helicopter maker to have drawn enough responses to post a valid sample of votes in this year’s list, the company took the top slot in the helicopter sector by default. Nevertheless, it finished with better than an 8.0 in eight of the 10 groups. Technical representatives accounted for its highest score at 9.2.

A plan Leonardo formulated last year to strengthen the level of support through 2025 has already boosted the company’s global service network, including digitization and enhancements in supply chain management. Leonardo further reinforced its service center and logistics support network through closer proximity to operators’ bases. Present in all continents, the company reinforced its network in Europe with Leonardo Belgium’s service growth and Yeovil’s single-site logistics hub. Other focus markets include Australia, Malaysia, the U.S., Brazil, South Africa, Saudi Arabia, and the UAE.

Digital advances include Leonardo’s Sesto Calende, Italy-based Diagnostic Service Tower, which supports data gathering and analysis for more than 1,400 connected helicopters. Benefits include fleet management and operational efficiency gains, data-driven training, spares, and logistics management.

In the field of logistics, the company increased critical items stock availability and logistics output to respond to its growing in-service fleet. Critical stock availability (fill rate) improved by 150% in 2023 versus 2022, and the company registered a more than 50% logistics output ove r 2022.

Bell’s new customer service facilities include Chinook Helicopters, established this year as an authorized Bell

505 dealership serving Western Canada. As an authorized Bell 505 dealership, Chinook Helicopters will execute aircraft demonstration flights and work to promote the aircraft to Western Canada private operators. Bell also signed an agreement to grant Bell customer service authorization to Abu Dhabi Aviation and provide service for Bell 212, Bell 412, and the Subaru Bell 412EPX helicopters.

Finally, Bell has named Boeing as an authorized and endorsed supplier of used serviceable material products for Bell 212 and 412 customers and maintenance providers. The agreement allows Bell to expand its Boeing- supported rotable pool with USM parts including airframe, main transmission, avionics, main rotor head, main rotor blades, tail rotor blades, and gearboxes.

AIRBUS HELICOPTERS

Airbus Helicopters did not draw enough responses to post a valid sample of scores.

Evidence of the effectiveness of Airbus Helicopters’ innovation in product support comes with advances in HCare

offerings since the program’s launch in 2022. Last year, the company saw the number of Airbus helicopters covered by

one of the three versions of HCare global contracts—namely HCare Initial, HCare In-Service, and HCare Lifetime—grow by 4%, reflecting their flexibility and ability to meet customer expectations throughout the life cycle of their fleets.

Meanwhile, Airbus’ investments to address supply chain constraints yielded a €400 million increase in working capital over 2019. The company also managed to increase the supply of spare parts with end-of-life management, extending the life of serviceable components and creating more opportunities to lower prices with helicopter buy-backs and dismantling complete helicopters.

Airbus has begun using a new multi-purpose test bench for those components installed last year at Airbus Helicopters in Grand Prairie, Texas, resulting in decreased turnaround time for customers and more than a two-fold capacity in testing capacity for main gearboxes.

BY MATT THURBER

After flying Piper Aircraft’s new turbopropsingle M700 Fury, it’s clear that this is the airplane that customers have been waiting for. A larger engine with 100 more shaft horsepower boosts performance, yet it’s still possible to fly as efficiently as the previous model, the M600 SLS.

I flew the M700 in May with Piper manager of engineering flight test Joel Glunt at Piper’s Vero Beach, Florida headquarters. Coincidentally, Piper had just received FAA flight into known icing approval for the airplane. The remaining certification

item is unpaved runway approval, which is expected shortly.

The main difference between the M600 and M700 is the latter’s Pratt & Whitney Canada PT6A-52 engine and five-blade composite Hartzell propeller, the latter of which was optional on the M600. To accommodate the more powerful engine, the M700’s intake plenum was redesigned for improved ram air recovery and the exhaust stacks have a flatter design that maximizes residual thrust. There are no changes to the airframe and equipment;

both have six seats and Garmin touchscreen-controlled G3000 avionics with autothrottle and Autoland.

The M700 adds Garmin’s PlaneSync 4G LTE cellular datalink, which allows owners to check fuel quantity, aircraft location, oil temperature, battery voltage, and Metar weather report at the M700’s location and download databases wirelessly and remotely. Its more powerful engine delivers better performance during climb and at high altitude, and significant improvements in takeoff and landing distance.

At the 6,000-pound maximum takeoff weight, climb rate is 2,048 fpm, a 32% improvement over the M600. Climb to FL250 takes 13.9 minutes, a 34% improvement. The M700’s takeoff distance is 1,994 feet and landing distance is 1,968 feet, compared with the M600’s 2,635 and 2,659, respectively. Landing performance is without prop reverse, just using beta mode. Its empty weight is 80 pounds greater than the M600 because of the larger engine, so payload with maximum fuel of 260 gallons is 565 pounds versus the M600’s 658 pounds. But the extra power boosts the maximum range to 1,852 nm, up from 1,658 nm for the M600. What owners will like most is the higher maximum cruise speed of 301 ktas, 27 knots faster than the M600.

It’s hard to compare the M700 to other single-engine turboprops because it is the second-lowest-cost pressurized singleengine turboprop available. At just over $4 million (typically equipped for about $4.3 million), the M700 is less expensive than the Epic E1000 GX ($4.45 million) and TBM 960 ($5.3 million) and much lower than the Pilatus PC-12 ($6.2 million) and upcoming Beechcraft Denali ($7 million).

But the M700 is also in a different class in terms of cabin size and performance. Piper is still offering the M500 turboprop single, so that is its entry-level, highperformance single, but the M700 has a lot to offer and is just as easy to fly as the M500—maybe even easier with the autothrottle and safer with Autoland—so it won’t be a surprise to see buyers lining up for the M700.

In comparing these models, it may be helpful to begin with their engines and their flat-rated output. The M700’s PT6A52 delivers 700 shp. The TBM 960’s PT6E66XT provides 850 shp. The PC-12 NGX is powered by a PT6E-67XP with 1,200 shp, the same output as the Epic E1000’s PT6A67A. The Denali is the only airplane in this group that is not powered by a Pratt &

Whitney Canada engine, and its GE Cata lyst will provide 1,300 shp, the most in this class.

In terms of basic performance specifications, the M700’s new 301-knot top speed at FL250 brings it into the competitive sphere of these airplanes: TBM 960, 330 knots at FL280; PC-12 NGX, 290 knots at FL220; Epic E1000 GX, 333 knots; Denali, 285 knots. Range has been a complaint for Piper turboprop buy ers, but the M700’s maximum range of 1,852 nm at 206 knots or 1,149 nm at 301 knots (with 45-minute reserve) gives it new longer legs. By compar ison, the TBM 960 can fly 1,440 nm at 326 knots or 1,730 nm at 252 knots (45-minute reserve). The PC-12 NGX at long-range cruise can fly 1,803 nm (100nm alternate). Epic publishes a maximum range of 1,560 nm. And the Denali’s published figure is 1,600 nm.

load databases and view aircraft data.

To achieve maximum range, the airplane has to be loaded with as much fuel as it can carry, which limits the payload. At the standard empty weight, the M700 can carry 565 pounds of payload. The TBM 960’s maximum payload is much higher at 1,446 pounds, while the PC-12 NGX can carry even more at 2,236 pounds. The Epic E1000 GX’s maximum payload is 1,100 pounds, the same number as the Denali.

Apart from the important aspect of performance capability, the other key determinant for the person writing a big check to buy one of these airplanes is the size of the cabin. The M700 is typical of Piper’s M-class airplanes, ranging from the piston M350 to the M500 and M700, and they share the same cabin dimensions: length, 12.25 feet, width 4.1 feet, and height 3.9 feet. The TBM 960’s cabin isn’t much larger than that of the M700: length,13.3 feet; width, nearly 4 feet; and height 4 feet.

The manufacturers of the larger airplanes like to point out the narrow aisles in the M-series and TBM, and moving from back to front does take a little wriggling.

Pilatus’ PC-12 NGX is unique (as will be the Denali) in that it has a massive rear baggage door. Its cabin’s length is 16.9 feet, width 5 feet, and height 4.8 feet. Textron Aviation is clearly targeting the PC-12 with the Denali, which has a cabin that is 16.75 feet long, 5.25 feet wide, and 4.8 feet tall. Epic’s E1000 cabin measures 15 feet long, 4.6 feet wide, and 4.9 feet tall.

All of these airplanes have the most modern avionics with autopilot envelopeprotection features and in the M700, TBM 960, and Denali, Garmin’s Autoland technology, which enables safe recovery of the airplane in case of pilot incapacitation.

Four of the airplanes have Garmin avionics, four have touchscreen controls: the M700, TBM 960, Denali, and PC-12 NGX. The Epic E1000 GX has Garmin’s keyboard interface, while the PC-12 NGX has a Honeywell Ace avionics suite. Another differentiator is the engine control. The M700 and E1000 GX have a traditional PT6 control system. TBM 960, PC-12 NGX, and Denali pilots might find their single power levers simpler to operate.

Climbing into the left seat of the M700 takes me back to the familiar feel of a Piper

cockpit, and the M700 is still an easy airplane to manage with excellent, straightforward handling.

The Garmin touchscreen-controlled G3000 avionics make running the avionics much simpler than the G1000 system on the M500 and other airplanes, and the autothrottle adds an extra dimension of precise control. It also adds safety: during an autopilot-coupled go-around, letting the autothrottle manage power can be much safer, helping the pilot avoid radical maneuvers close to the ground. It was necessary to pull the prop back into beta to keep the M700 from going too fast while taxiing.

Glunt reminded me before taking off from Vero Beach’s Runway 12R that while the M700 has an autothrottle, the engine isn’t digitally controlled, so the pilot needs to advance the power just enough—to about 800 foot-pounds of torque—for the autothrottle to engage and not advance the throttle all the way.

The 700-shp PT6 accelerated the M700 rapidly to the 75-knot rotation speed, and I pulled the nose up and then up and up some more, trying to keep to the 95-knot best rate of climb speed. We were loaded with 1,055 pounds of fuel, not quite two-thirds of the

260-gallon max fuel capacity, and our takeoff weight was just under 5,400 pounds, well below the 6,000-pound mtow.

Initial climb rate was over 3,000 fpm as we headed up to 13,500 feet, and even through 8,000 feet we climbed at 2,500 fpm. After leveling off at 13,500 feet, I reacquainted myself with the handling of Piper’s M-class turboprops. I’ve always enjoyed flying the M500 and M600, and the Fury carries on the familiar Piper feel.

Having learned to fly in Pipers, the M-class airplanes feel just like larger

Cherokees, with crisp response although the pitch control is heavier due to the size and weight of the airplane. Pitch trim is definitely helpful.

Glunt demonstrated some of the M700’s Garmin Electronic Stability & Protection (ESP) envelope protection features. We switched ESP off so I could do some steep 180-degree turns without the nudge to wings level protection, and these were easy to do by keeping the primary flight display (PFD) flight path marker on the horizon line.

Banks at 30 degrees were so smooth it felt like the airplane was on rails. Stalls were benign, with no wing drop and a simple reduction in angle of attack and adding power to recover. With the autopilot on, I steered the M700 back to Vero Beach for a coupled RNAV approach to Runway 12R. With approach mode selected, the autothrottle perfectly set the speed as the autopilot tracked the glide path to the runway.

I watched the PFD as the M700 aligned with the runway, illustrated by centerline chevrons with mile markers leading to the runway end. At 200 feet, I clicked off the autopilot and, heeding Glunt’s reminder that the rudders and nosewheel are directly connected, straightened the rudder pedals just before touchdown in the gusty left crosswind. Pulling the power lever into beta mode slowed the Fury nicely for the turnoff z

Business Aviation Sponsor Showcase

This year’s edition of Solutions in Business Aviation marks its sixth anniversary and will have a different look, appearing as an exclusive sponsored content section within the pages of AIN’s August issue.

This change was made to ensure we keep delivering the superior content that you have come to expect from AIN. This section of the publication is filled with compelling solutions from some of the top companies in the industry.

In addition, our industry continues to face issues regarding the management of generational differences as new graduates enter the market. This topic has been among the most popular roundtables at our Corporate Aviation Leadership Summit events.

To further stimulate this discussion, we asked market leaders how their organization is preparing for the retirement of highly experienced employees and transferring that knowledge to the next generation.

Their responses are included in this edition of Solutions in Business Aviation.

Please enjoy.

Warm Regards

Lisa Valladares Director of Marketing & Client Services lvalladares@ainonline.com

With decades of experience and thousands of installations, the avionics pros at Stevens Aerospace and Defense Systems know that the only way to deliver the performance their customers demand is to pay attention to every tiny detail.

Whether you’re flying a turboprop or large-cabin jet, sooner or later you’ll need to upgrade your avionics. The problem is that any shop can make the front of the panel look great. But it’s the attention to detail behind the installation that truly makes a difference in performance and reliability.

Prioritizing detail is what makes Stevens Aerospace and Defense Systems’ installations stand out from the rest.

As the company’s Director of Aircraft Modifications, Rob Reed, explains, “Over the years, we’ve developed several STCs to alleviate obsolescence issues on many types of aircraft. But no matter the goal, each job starts with our team ensuring every element is done to the highest level of quality and by paying attention to every detail behind the panel. That’s the only

way to guarantee that the systems will provide reliable performance for the life of the aircraft.”

One of the “smaller details” that sets Stevens Aerospace and Defense Systems installations apart is the quality of their wire terminations. It may not seem critical, but after a few hundred hours of vibration, a poorly terminated connector will fail, and so will the unit it’s connecting to.

“The quality supervisor in our Greenville (South Carolina) wiring harness shop has been certified as a trainer for the IPC/Wiring Harness Manufacturing Association A-620 standards,” Jim Williams, Stevens Aerospace and Defense Systems, VP Government Operations, adds. “It includes a robust quality

assurance system that approves every phase of our harness-making and connection termination processes.” This level of quality assurance and harness-building excellence is in place at Stevens’ wire harness facilities in both Greenville and Nashville.

Another detail that sets the company’s installations apart is the craftsmanship of its wiring harnesses. For example, both Stevens’ wire harness facilities have full-size mock-ups of King Air compartments to create pre-contoured harnesses for Garmin G1000 installations.

“Other shops build them on a flat table, and that means the wires and connectors can be strained during installation—which can lead to failures,” says Gary Brown, Stevens’ Nashville sales director. “We pre-contour the harnesses to eliminate all those stress points— and prevent problems.”

Reed adds that the company’s unmatched history of delivering high-end installations is one reason it does so much avionics upgrade work on various U.S. government agency aircraft.

“Our DoD contracts require extremely detailed processes, and we have incorporated many of them into our standard installation practices,” he says. “The result is that we’re bringing even higher quality, reliability, and safety to all of our customer aircraft.”

While the processes have evolved to keep up with changing technologies and customer needs, Williams stresses that it’s still the skills and attention to detail provided by Stevens Aerospace and Defense Systems technicians that makes the difference.

He added that the company is so proud of its technicians’ work behind the panel that it sends photos of the finished work to the aircraft’s owner. Not many shops do that today.

“It comes down to the technicians behind the connections,” Williams says. “They are the ones touching every part of the installation.

It’s their unwillingness to compromise that sets our installations apart.”

That level of quality enables Stevens Aerospace and Defense Systems to cover each of its avionics installations and stand behind the workmanship for “as long as they own the aircraft.”

“In the past four years alone, we’ve completed hundreds of cockpit and cabin avionics installations across our network of locations,” Williams explains. If there is ever a problem a problem with our workmanship, we will stand by it and get you flying quickly.”

“That kind of reliability is why our customers come to us,” he says. “In the end, system reliability is critical to their operational safety.”

» Authorized installer for Collins, Garmin, Gogo, Honeywell, STARLINK, Universal, and others

» From connectors to cut-outs, every detail is completed to the highest U.S. DoD standards

» Stevens’ world-class workmanship warranty - proven by 70-plus years of civilian and government installations and backed by decades of solid proven performance.

For over three decades, CAA’s independent contract fuel program has been the trusted choice for Part 91 turbine aircraft operators, offering not only guaranteed lower jet-A pricing but also discounts on other essential trip and aircraft handling services.

» Independent contract fuel program created specifically for Part 91 turbine aircraft operators

» Average 25% saving o ff retail prices

With the continued popularity of private aircraft travel, pilots and trip planners don’t need the added hassle of trying to find the lowest jet-A prices—and with CAA, they don’t have to.

“Whether they’re operating a fleet of longrange jets or a single aircraft, CAA’s independent contract fuel program guarantees members that they will pay lower prices than any other independent fuel program at participating FBOs,” stated a CAA representative. “We work hard every day to connect our loyal members with some of the best FBOs in the world who share our vision for fair and competitive fuel pricing.”

“We’ve partnered with leading independent and chain FBOs to ensure the price our members pay is at least ten cents a gallon lower than other programs,” they continued. Our members can easily access our pricing via maps on our website and mobile app. In addition, we also work with key fuel pricing locators, including ForeFlight, JetFuelX, and FuelerLinx, to make sure our pricing is easily accessible to our members.

CAA currently provides the guaranteed lowest contract fuel prices at over 260 domestic and international FBOs and handlers at con-

veniently located airports that business and private travelers want to fly to—no more landing at inconvenient airports to save on fuel.

The representative stated that, along with the lowest jet-A prices, CAA members also receive discounts on ramp fees, rental cars, hotel rooms, and even international trip planning through participating partner FBOs and providers.

“The strength of our program lies in our members. We currently have over 12,000 aircraft registered in our program, and we work hard to provide a great value to their operations every day,” they continued. “Our goal is to continue to grow our membership to drive more traffic to our CAA Preferred FBOs and ensure continued competitive pricing in the future.

To those ends, CAA is offering a FREE 90day trial membership to any Part 91 turbine aircraft operator. You can sign up at www. caa.org. After the trial period, operators may choose to join CAA and pay the yearly membership fee of $500 for each enrolled aircraft.

» Turbine aircraft operators can sign up for a FREE three-month trial at www.caa.org

“Since 1994, CAA has grown into the most trusted and respected name in competitively priced jet fuel in the business and private aviation user community,” the representative stated. “And all of our efforts then and now continue to be focused on encouraging the growth of Part 91 operations by bringing together operators and FBOs in a win-win arrangement.”

Engine Assurance Program has amassed a $41M inventory of rental engines and replacement LRUs and complemented that with a large network of dedicated AOG technicians to meet one goal: Ensuring its customers enjoy 99.9% aircraft availability.

Whether you’re talking about Sam Walton’s two-seat Ercoupe 145c or a global conglomerate’s longrange jet, all aircraft owners have one thing in common: When they need to take off, they want their airborne assets ready to fly.

Unfortunately, engine-related AOGs do happen. When they occur, the Engine Assurance Program (EAP) team has the parts and the technical expertise to get its customers’ aircraft airborne as quickly as possible.

“We are totally focused on supporting our customers and their aircraft,” explains Sean Lynch, EAP’s founder and managing director. “That’s why we’ve invested over $41 million in our inventory of rental engines, replacement oil pumps, fuel controllers, and the like.

“I can’t tell you the last time a customer has been AOG because we could not get them an oil pump,” he continues. “And as of today, we still have a flawless track record of getting rental engines on customer aircraft quickly. I think only Honeywell has a larger stock of TFE731-series engines than EAP.”

Parts are just pieces of the solution. Of course, any business jet MRO would give their “eyeteeth” to have access to EAP’s extensive parts pool, but Lynch knows that parts

aren’t worth much if highly experienced technicians aren’t available to install them.

“We’ve negotiated an exclusive arrangement that gives us priority access to a team of top field service technicians,” he says. “These technicians are basically on ‘standby,’ so when a customer has an AOG situation, the expertise they need will arrive as quickly as possible.

“In my opinion no one else in the business is going to the extent that we are,” Lynch continues. “It’s a huge investment, but it actually saves us time while assuring the high quality of the work. And because the parts and engines come from our inventory (as often as possible), we get the parts faster and at lower overall costs.”

As you might expect, solving AOGs is just one service EAP delivers to its customers. The dedicated field-support relationships can also provide routine inspections and maintenance along with more in-depth services like R&Rs, performance runs, fan balancing, vibration surveys, engine borescoping, and more. “It sounds like a cliché, but everything we do is to benefit our customers,” Lynch stresses.

“Other MROs might not see it today, but ours is a customer-focused business, and our customers care about dispatch reliability.

“We are investing in the parts and people

to help ensure that our customers can use their airplanes when they need to fly,” he says. “We take great pride in helping them do that, and that commitment is the reason we are in business.”

See the list of engines we cover. Visit eap.aero or call +1 (214) 350-0877 for a quote.

» An exclusive network of engine AOG specialists helps achieve a 99.9% aircraft dispatch rate

» Supporting 26 models of legacy CFM, Honeywell, Pratt & Whitney, and Rolls-Royce engines

» Also offering rental engines for MPIs

Duncan Aviation is acquiring the latest in digital design and automated material and foam-cutting tools to help its upholstery artisans continue to deliver the highest-quality cabin finishings while controlling costs and minimizing aircraft downtime.

Like any true art, hand-crafted upholstery takes time. Unfortunately, today’s MROs don’t have any to spare. Every minute counts when a customer brings their aircraft in for interior work.

How do you achieve consistent quality while minimizing downtime? Duncan Aviation’s answer: Upgrade its interior shops with the latest digital design and automated production equipment to help its team of experienced upholsterers continue to provide the extremely stylish and high-quality cabin completions they have been known for since 1981.

“In 2023 alone, we had over 460 interior work orders across our three facilities, and that means we have to strive for efficiency,” explains Duncan Aviation’s Lincoln, Neb., Interior Manager, Jared Stauffer. “Traditional upholstery work would mean significantly longer downtime for those aircraft. To help reduce that downtime, we’ve been upgrading our upholstery shop with automated tools to save time and maintain quality.”

Stauffer says that Duncan Aviation’s evolution to advanced upholstery automation started in the early 2000s when it installed its first CNC machine for leather cutting. The next big step was adding software to create custom seat and divan patterns.

“We’ve eliminated the time and cost of shipping the seats to Lincoln,” he explains. “All we need is a couple of measurements from the seats, and we can start the production process before the aircraft even arrives in our hangar. Or we can cut the leather here and send it to our Provo or Battle Creek facilities for final fitting. That saves a tremendous amount of time.”

Another recent automation addition is a new leather quilting machine, significantly increasing Duncan Aviation’s ability to create unique designs for its discerning customers.

“We were using outside vendors for this work, but that limited our control of the process both from a design and delivery standpoint,” Stauffer said. “Being able to work inhouse is a big plus for us.”

Another big time-and waste-saving technology adopted by Duncan Aviation is the addition of a five-axis CNC machine to cut seat foam to the most exacting design specifications.

“These technologies make it much easier for our technicians to produce top-notch quality and consistency in less time,” he continues. “That leaves more time to concentrate on the finer points like uniform stitching, consistent panel gapping, and the overall high level of final finishing that sets our interiors apart.”

Like so many MROs, Duncan Aviation is faced with the fact that many of its talented uphol-

sterers are approaching retirement. In the past, it would take years to train an apprentice with the skills necessary to maintain the company’s legendary quality. Today’s automation is helping to dramatically shorten that learning curve.

“With routine tasks like material and foam cutting now being done by the CNC machines, we can concentrate on having our experienced craftsmen mentor our less tenured technicians, reducing their training time,” Stauffer explains. “By bringing the new hires up to speed quicker, we will be able to continue to deliver the exceptional quality our customers expect from us.”

While it may seem that advanced automation and digital technologies will replace experience and craftsmanship, Stauffer stresses that this is not the case—not at Duncan Aviation, anyway.

“Just to be clear, there’s nothing the machines can do that our craftsmen can’t. We have a lot of talent and experience under our roof,” he says. The main thing is that the automation enables us to better support our customers’ needs for high finish quality and low aircraft downtime.”

“It’s just one more way for current and future Duncan Aviation customers to see that we are constantly innovating to improve our services and meet their goals,” Stauffer adds. “We are taking steps to continue to do what we’ve done well since 1956: delivering the services our customers want.”

» Over 43 years of experience with high-quality aircraft cabin upholstery and refurbishing

» Talented upholsterers use advanced automation to create unique cabin finishes

» Automation enables new upholsterers to learn skills faster and with greater consistency

“Just to be clear, there’s nothing the machines can do that our craftsmen can’t. We have a lot of talent and experience under our roof... ”

How is your organization preparing for the retirement of highly experienced employees and transferring that knowledge to the next generation?

We strive to hire the best and brightest at CAA. In our customer surveys, we get excellent feedback on our customers’ interactions with our team. In fact, 99% of our customers say they plan to renew their membership—an extraordinary number. We continue to grow our employees and expand their responsibilities to ensure we continue to provide great services and customer experiences in the future. We also provide our team with an education reimbursement program to continue expanding their skills for today’s competitive marketplace. I absolutely love working with this amazing team!

David Scobey, President & CEO

Duncan Aviation has developed excellent partnerships with technical trade schools and high schools with aviation programs. We are also active in the DOD SkillBridge program, which provides opportunities for separating service members. In addition, we have a Department of Labor-certified A&P Apprentice Program to help team members attain the necessary skills for engine and airframe maintenance certification.

Jeff Lake, President

With the entire industry struggling to maintain a qualified workforce today, preparing for tomorrow is a daunting challenge. Along with mentoring the younger members of our team, we collaborate with organizations such as the Love Field Pilots Association and the Independent Falcon Aircraft Operators Association to engage and inspire the next generation of aviation professionals.

Sean Lynch, Managing Director

The Naples Airport Authority strategically addresses succession throughout the year. Employees are offered career path planning, robust training, industry engagement, and professional development opportunities. We are committed to retention by striving to be a best-in-class employer and maintain a formal succession plan.

Chris Rozansky, Executive Director

Covering 99% of the globe, Intelsat’s FlexExec and FlexAir are the only high-speed connectivity solutions “purposebuilt” to meet the rapidly increasing bi-directional throughput needs of today’s data-hungry business, personal, and governmental aviation passengers.

According to a report by Euroconsult Prospects, the connectivity capacity demand for business aviation will increase up to 60 Gbps by 2030. That’s a tenfold jump from today’s usage.

While that number may seem extraordinary, consider that a business aircraft’s data usage is expanding to not only meet increasing passenger needs but also include a growing array of high-demand applications that manage the critical aircraft and engine health monitoring information flowing to and from the airplane.

“Not long ago, higher-down load speeds were the end goal, but today, there’s a greater need for much higher upload speeds,” explains Tuomo Rutanen, Intelsat’s director of business and government aviation. “Video conferencing alone requires much higher bi-directional throughput speeds. Passengers won’t settle for poor network performance just because they’re in an airplane.”