AVIATION INTERNATIONAL NEWS

TECHNOLOGY: BATTERY BREAKTHROUGHS ON HORIZON

MX: DOBSON'S DELIGHTFUL CACHE OF PLANE PARTS

OPS: MANDATORY SMS FOR CHARTER, NOW WHAT?

Special Report: Avionics Support Survey

TECHNOLOGY: BATTERY BREAKTHROUGHS ON HORIZON

MX: DOBSON'S DELIGHTFUL CACHE OF PLANE PARTS

OPS: MANDATORY SMS FOR CHARTER, NOW WHAT?

Special Report: Avionics Support Survey

Qatar's Emiri Air Force Boeing F-15QA shreds the air while taking off for an airshow demo

Scan the QR code to see the mission

30 Dodson keeps business aviation flying

12

@EAA AirVenture: Blackhawk's TBM

Skyryse simulator demonstrates future of flight control

4

6

8

10

Kompass Kapital plots new course with Airshare buy

Rolls-Royce reports progress with Pearl 10X turbofan

Dassault Falcon deliveries rise, backlog grows slightly

@EAA AirVenture: GE Catalyst turbine prepares for year-end FAA approval

14 AIN Product Support Survey: Avionics 24

@Farnborough Airshow 2024 highlights innovation, progress

New challenges for charter and air tour operators with FAA’s SMS mandate

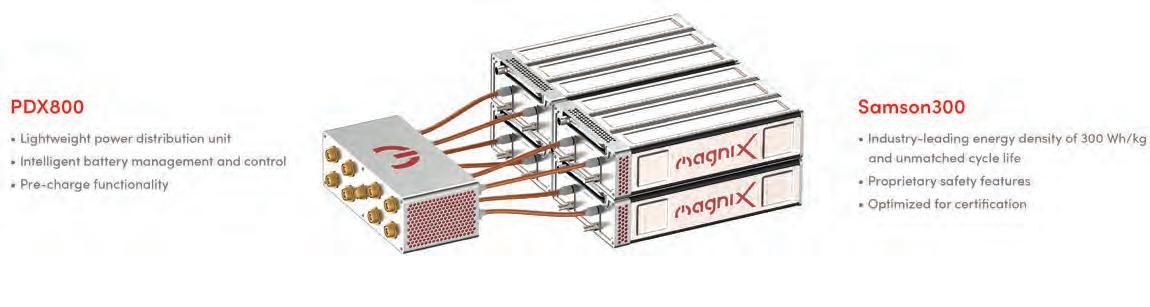

Electric aircraft developers prepare for battery breakthroughs 41 Book-and-claim crucial to SAF expansion

BY SARAH ROSE

Private equity group Kompass Kapital made a strategic investment in private aviation company Airshare; both businesses are headquartered in Kansas City. Kompass Kapital now leads the Airshare ownership group, with previous investors maintaining an active role with considerable equity positions. Terms of the transaction were not disclosed.

“We are thrilled to have Kompass Kapital join the Airshare ownership group and strongly believe its investment will have a material impact on our future,” said Airshare CEO John Owen. “When we made the decision to raise capital in support of our strategic goals, we were diligent in defining the ideal partner for us, both professionally and culturally.

“We immediately received considerable interest, but it quickly became clear we had the perfect match just down the road in Kompass Kapital. Kompass’ reputation is impeccable, and their track record in helping businesses flourish is well known. Additionally, they have already demonstrated great success in partnering with our legacy

ownership group through other investments. The confidence they’ve shown in Airshare is extremely validating.”

Kompass Kapital managing partner Bradley Berger said he is “very excited” about the partnership. “We invest in people, and when evaluating the potential of any opportunity, we start with company leadership. The executive team at Airshare is outstanding, and they inspired us with their vision to strategically expand the company’s geographic footprint, fleet, and customer base. The growth prospects are very encouraging, and we believe the company is uniquely positioned to further capture market share,” he noted.

The companies have called the investment part of a “transformative year for Airshare.”

Following the company’s acquisition of the Wheels Up aircraft management business in September, Airshare doubled in size to nearly 600 employees while operating a fleet approaching 150 aircraft, becoming one of the largest fleet operators in the U.S. z

Second-quarter aircraft deliveries soared by 54% year over year (YOY) at Gulfstream Aerospace, to 37 aircraft (six super-midsize G280s and 31 large-cabin jets). While G280 handovers were flat from a year ago, the large-cabin jet shipments climbed by 72%, mostly driven by 11 deliveries of the recently certified G700. First-half deliveries rose nearly 36% YOY, to 61 jets (nine G280s and 52 large cabins), putting it on pace to reach parent company General Dynamics’ forecast of about 150 this year, including 50 to 52 G700s. Revenues at General Dynamics’ aerospace division ascended 50.5% YOY, to $2.94 billion, in the quarter, while earnings rose 35%, to $319 million.

Bombardier’s revenues jumped 32% in the second quarter to $2.2 billion as deliveries reached 39 business jets, a 34% increase from a year ago. Also helping that revenue bump was Bombardier’s services business, which topped $500 million for the first time in quarterly results. As for deliveries, they weighted more toward Challengers, with 20 handed over versus 15 in second-quarter 2023, while Global deliveries reached 19, compared with 14 last year. For the first six months, Bombardier delivered 32 Challengers and 27 Globals.

Embraer’s executive aviation division improved on its first-quarter deliveries, handing over 27 Phenoms and Praetors in the second quarter of the year for a total of 45 business jets (31 Phenoms and 15 Praetors) in the first half—a more than 18% increase over the first half of 2023. The division ended the first half with a $4.6 billion backlog and expects to deliver 125 to 135 business jets this year.

Garmin is proud to now offer an industry-leading all-Garmin retrofit solution for the CJ2. Adding incredible new capabilities such as auto mode radar with the GWX™ 8000 weather radar and VNAV capabilities with the GFC™ 600 autopilot and GTN Xi navigators, you’ll drastically reduce pilot workload and increase the lifespan of your aircraft.

BY CHARLES ALCOCK

The Pearl 10X turbofan Rolls-Royce is developing for the Dassault Falcon 10X business jet has logged more than 2,500 flight hours and 7,700 cycles on the UK aircraft engine manufacturer’s Boeing 747 testbed. In a media briefing ahead of the 2024 Farnborough International Airshow in July, Rolls-Royce business aviation director Dirk Geisinger said the 18,000-pound-thrust engine is already “smashing” projected performance targets, having surpassed targeted thrust levels since the first test run.

Rolls Royce’s Pearl 10X features the Advance2 engine core combined with a high-performance low-pressure system that the company said will deliver its highest-thrust turbofan to date for business aircraft applications. It also has a 5% improvement in specific fuel consumption compared with earlier-generation engines.

Pearl engines also feature combustor tiles that Geisinger said have delivered 20% more efficiency in cooling the walls and temperature reductions to improve the performance of the high-pressure turbine. The additive-layer manufacturing techniques

used for these tiles have reduced the design and manufacturing time by 75%.

Geisinger also reported that the entry into service of Rolls-Royce’s Pearl 700 engines on Gulfstream’s G700 business jet has been “flawless.” As of July 11, he said the 12 G700s delivered at that point had flown 750 hours, including a nonstop flight from New Zealand to New York City-area Teterboro Airport, taking full advantage of the jet’s 7,750-nm range.

Meanwhile, Rolls-Royce is supporting Gulfstream’s efforts to complete type certification of the 8,000-nm G800 to allow it to enter service later this year. The manufacturer has started to ramp up production of the Pearl 700 turbofans for this program.

According to Geisinger, 75% of new Rolls-Royce engines for business aircraft are now enrolled in its CorporateCare power-by-the-hour maintenance program. The support is provided to operators through more than 85 authorized service centers worldwide, 10 parts stores, and more than 75 on-wing services technicians. More than 250 engines and nacelles are also available for lease under the program. z

Vista America, the U.S. operating partner of charter operator Vista Global Holding, on August 6 said it is shifting away from “legacy aircraft models” and will thus sell its Cessna Citation Ultra and X fleets. The U.S. branch comprises charter and aircraft management providers Jet Select, Red Wing Aeroplane, Western Air Charter, and XOJet Aviation, and they will serve customers with the remaining core fleet of Bombardier and Gulfstream jets, as well as midsize Citation XLSs. At press time, pilots afected by the fleet rationalization plan were being reassigned to other aircraft models at the company.

Pratt & Whitney Canada (P&WC) has secured FAA approval for its PW545D turbofan, checking of another key milestone as Textron Aviation works to bring the Cessna Citation Ascend to market next year. The certification came just two months after Transport Canada’s nod. Rated at 4,218 pounds of thrust, the PW545D will provide a 1,900-nm range, 441-knot maximum cruise speed, and a 30-minute time to climb to FL450 maximum altitude for the Ascend. The PW545D sports Fadec, enabling integration of autothrottle, and an enhanced three-stage compressor.

Metrojet Haite Business Aviation has completed the sale of its stake in Chinese aircraft operator Funian Aviation to Southern Star Aviation. The Hong Kongbased company, which is a joint venture between ExecuJet Haite and business jet operator Metrojet, said the transfer of its remaining shares in the company was completed on July 26. ExecuJet Haite and Metrojet Hong Kong Commercial Aircraft acquired Funian in 2022.

We were meant to fly.

Our engines power flight.

A love of flight powers us.

BY SARAH ROSE

Dassault Aviation delivered 12 Falcons in the first half, up from nine in the first six months of last year, and took in net orders for 11, one fewer than a year ago, the company said on July 23. It reported total revenues of €2.538 billion ($2.78 billion) in the first half versus €2.295 billion in the same period last year, with its Falcon business jet unit accounting for €980 million, up from €827 million in first-half 2023. Dassault’s defense business—largely Rafale fighter deliveries—accounted for the majority of revenues, at €1.558 billion.

Falcon backlog grew by about € 110 million, to € 4.758 billion, in the first six months, covering 83 Falcons, down one unit since the end of last year.

Meanwhile, Dassault is keeping its sights on supply chain delays and a shifting global political landscape, including elections in the U.S. and France and the ongoing war in Ukraine.

“The global context in this first half-year remains marked by the war in Ukraine and the state of war in the Middle East. In France, the President of the Republic, as head of the armed forces, wrote to defense manufacturers urging them to step up

their efforts in the context of a war economy. In response to this call, I instructed Dassault Aviation employees to prioritize Rafale production, for both France and for export,” said chairman Éric Trappier.

The company signaled that supply-chain problems are continuing to create issues into 2024, including shortages at all stages of production and suppliers facing financial difficulties and capacity shortages. It said the situation has also affected its customer support bandwidth. But the company is hoping to counter supply issues through its participation in an investment fund dedicated to supporting the French aerospace supply chain and monitoring actions to anticipate the risks of new supplier inefficiencies.

Dassault has also given priority to the production of Rafale jets and export at the request of the French government and has delivered six Rafales to the country.

On the Falcon side, the company touted its expansion, including a new service center in Malaysia, as well as increased production capacity in Brazil and Florida. It also reiterated its commitment to being carbon neutral by 2050. z

LABACE 2024

The LABACE show held last month at São Paulo Congonhas Airport was the last at this venue, according to Flávio Pires, CEO of Brazil business aviation association and LABACE organizer ABAG. Next year, the annual Latin American bizav show will be held at Campo de Marte Airport. The underused area at Congonhas that has been ceded yearly for LABACE will no longer be available as airport operator Aena reconfigures the field to handle more airline trafc. Pires sees great potential in the move to Campo de Marte, including the possibility of adding a fly-in and demo flights.

Brazilian aviation ofcials praised business aviation for its humanitarian eforts and ability to expand access during LABACE 2024. ANAC director Ricardo Bisinotto Catanant made special note of the Transplantar program that waives fees and eases rules to facilitate organ transport. Meanwhile, Tomé Franca, Brazil’s secretary of civil aviation, pointed out that airlines “serve 2% of Brazil’s cities, while general aviation serves them all—more than 3,000 cities. General aviation lets Brazil grow for everyone, and the government should be alongside it.”

Brazilian fractional aircraft provider Avantto now has three Epic E1000 turboprop singles in service and expects three more to join the fleet by year-end. The aircraft are part of Avantto’s plan to take its fractional share program to Brazil’s Central-West region, which company CEO Rogerio Andrade said is moving apace, noting a base has been established in Goiânia. He told AIN at LABACE that E1000 share sales are brisk and customers are pleased with the aircraft.

BY MATT THURBER

GE Aerospace’s Catalyst turboprop engine is meeting and exceeding its targeted performance numbers and is on track for FAA certification by year-end, the company said at EAA AirVenture 2024. The engine powers Textron Aviation’s Beechcraft Denali single- engine turboprop, which is set for certification next year. Both were on display at AirVenture, although this was the first time the GE display hosted the actual engine instead of a mockup.

Engines in the flight-test program have logged more than 2,100 hours and 900 flights, which “gives a lot of confidence in the performance,” noted Paul Corkery, head of GE’s Catalyst program. Compared to other 1,300-shp powerplants, he said the GE engine burns 18% less fuel while producing 10% more power at altitude.

The $6.95 million Denali first flew on Nov. 21, 2021, and certification was planned for 2023, but delays in the Catalyst program pushed that to 2025. According to Corkery, “We faced tough new regulations that were more challenging than expected.” These had to do with ice crystal and super-cooled liquid droplet mitigation. “We had to bring in very experienced folks to get those [requirements] over the line,” he said. “Those were big headwinds. But we feel we’ve mitigated the risk to get certification by the end of the year.”

A Catalyst engine on display at AirVenture.

We expect all that testing to be wrapped up by the end of the third quarter, then we’ll be finalizing and submitting the final reports.

— Paul Corkery Head of GE’s Catalyst program

Catalyst’s Fadec engine controls, adapted from systems on larger GE turbine engines, are integrated with the Denali’s Garmin G3000 avionics and autothrottle, enabling Textron Aviation engineers to design a single-lever power control. This simplifies the workload for the pilot and protects the engine from exceeding critical parameters.

For FAA certification, the Catalyst had to complete 23 key engine-level tests, and 19 of those are done. The remaining four— covering endurance, vibration, blade-out, and compressor operability—are underway in four separate test cells. “We expect all that testing to be wrapped up by the end of the third quarter,” Corkery said, “then we’ll be finalizing and submitting the final reports.”

Meanwhile, GE is standing up its service infrastructure to support the Catalyst once the Denali begins shipping. The production readiness phase is also underway, and GE has already built 35 engines. “We’ll deliver what Textron Aviation needs,” he said. “We’re aligned with their schedule.” z

The Aerospace Center for Excellence in Lakeland, Florida, will be the first aviation education organization to install Redbird Flight’s new mixed-reality flight training platform. Combining a virtual reality headset with proprietary software, the mixedreality platform will serve as a foundation for future add-ons to new and existing Redbird training devices, the company said. Integrated into the company’s core simulation engine, the platform gives pilots a view of simulation graphics through the headset.

Continental formed a strategic partnership with sustainable aviation solutions provider APUS Zero Emission at EAA AirVenture. Germany-based APUS Zero Emission—whose goal is “to make air trafc 100% emission-free and uncompromisingly climate-neutral”—is a pioneer in the hydrogen-powered and hybrid-electric flight arena. Announced during AirVenture, the collaboration is focused on exploring sustainable, cutting-edge piston engine technology to significantly reduce general aviation’s climate impact. The joint efort will focus on developing innovative power plant solutions for current and future aircraft owners.

Cirrus Aircraft has reached a production milestone with the delivery of its 10,000th SR-series piston-single airplane. The company handed over the first SR20 in 1999 and in the intervening 25 years, it has gone on to become the best-selling aircraft in its class, with the latest being the seventhgeneration (G7) editions. To celebrate, the manufacturer unveiled a one-of-a-kind 10,000th SR series airplane, an SR22T G7.

BY MATT THUBER

To celebrate the 60th anniversary of the Beechcraft King Air series, Textron Aviation created a special Crimson Edition of the turboprop twins. Announced at EAA AirVenture Oshkosh, the Crimson Edition will be available for 2025 King Air deliveries and features a “striking new interior and a vibrant red and silver exterior paint scheme.”

Also at AirVenture, Textron Aviation unveiled an improved cockpit for the Cessna Caravan and Grand Caravan EX. New features include black instrument and cockpit panels, and the Caravan is now equipped with electroluminescent lighting, matching the configuration of the Grand Caravan EX.

Both Caravan models are also upgraded with a wider cockpit boarding ladder, making it easier for pilots to climb into the left seat. For in-flight comfort, the two rectangular cockpit air vents have been replaced with four circular adjustable air nozzles. The lower center pedestal now has two USB-C charging ports instead of the previous 12-volt power adapter, and

the right-hand subpanel on the right-seat pilot’s side has two USB-C charging ports. For more flexibility to power headsets, LEMO jacks were installed next to the two general aviation headset jacks. Finally, headset hooks were installed underneath the cockpit glare shield.

All of these new features will be standard on 2025 Caravans and Caravan EXs. z

Blackhawk Aerospace is developing a supplemental type certificate (STC) to re-engine the Daher TBM 700 series with 150 more shaft horsepower, in partnership with sister company and TBM-authorized sales and service center Avex Aviation. The STC will replace the 700-shp Pratt & Whitney Canada PT6A-64 on the TBM 700A, 700B, and 700C2 with the 850-shp PT6A-66D.

Performance of the re-engined TBM 700 will be boosted to that of the TBM 850, according to Blackhawk. Time to climb to FL310 for the PT6A66D-powered TBM 700 drops to 14 minutes from 16 minutes 39 seconds, and maximum cruise speed ranges from 287 to 307 ktas, improving overall efciency and adding to safety margins.

EAA AirVenture attendees were able to check out N590JL, the TBM 700C2 that Blackhawk is modifying, at the company’s exhibit. Avex’s Camarillo, California team has already

refurbished this TBM with a new interior and LED interior lighting, and a full panel of Garmin avionics, along with fresh paint by ArtCraft Paint.

“The XP66D engine upgrade exemplifies The Blackhawk Group’s commitment to pushing the boundaries of innovation in the aviation industry,” said Edwin Black,

president of Blackhawk Aerospace. “By partnering with our sister company Avex, we are able to combine its vast expertise in all things TBM with Blackhawk’s extensive knowledge of STC development to offer an unparalleled upgrade for our mutual customers.” M.T.

BY MATT THUBER

On the 20th anniversary of its founding, Aspen Avionics unveiled a partnership with engine instrumentation manufacturer Electronics International to bring engine instruments to Aspen displays. The move fits with Aspen’s long-time goal of enabling customers to keep updating their displays to add functionality.

“We have kept with the hardware that can be used and reused,” said Aspen president and CEO John Uczekaj. “We haven’t succumbed to the bright shiny object avionics world where you’re constantly changing platforms and forcing the customer to swap out for new hardware. We will continue to stay true to our roots, which is our Aspen platform.”

Aspen demonstrated a beta version of the engine instrumentation at its EAA AirVenture booth and expects to receive FAA certification for the upgrade in mid-2025. No modifications other than a software upgrade are required for the Aspen Evolution MFD500 Max and MFD1000 Max multifunction displays to show the engine instruments.

At EAA AirVenture, Uczekaj also announced that Aspen has increased its factory warranty to three years from two for the Evolution Max and E5 displays. This includes unlimited transferable coverage and covers all system components regardless of hours accumulated. z

The MRO business appears to have rallied from the problems wrought by the Covid pandemic and subsequent supply chain constraints, according to assessments among the companies that participated in this year’s avionics support survey. Although still not completely recovered, members of the industry expressed far more optimism about the pace of growth and the gradual improvement in parts supply since last year.

Efforts to relieve the pressure took several forms among the respondents, including more communication and hands-on help for suppliers, increasing inventory levels, and maintaining closer ties with teardown

BY GREGORY POLEK

agencies to help supplement parts inventory.

However, the storm clouds that gathered over the industry in the form of a short supply of qualified mechanics appear no less threatening and continue to affect timely access to MRO services. Stepped up recruitment efforts have helped, but an answer to the need for a more enduring solution has proved elusive.

Maintenance shops continue to work toward clearing backlogs within the limitations of the mechanics’ shortage, all the while improving the quality of their support offerings, as evidenced by sector leaders such as Garmin.

The Olathe, Kansas-based supplier took the top slot among flight deck suppliers and airborne connectivity providers with a 9.0 and 9.1 score, respectively. The company secured at least a 9.0 rating in five of the eight categories measured both in the flight deck avionics and airborne connectivity categories, including a 9.3 in overall reliability in both.

Among cabin management systems suppliers, the starkest change involved Lufthansa Technik and its Nice system, which vaulted to the top with an 8.2 average, tying for the top spot with Honeywell, which climbed significantly from a 6.9 rating last year. z

N/A*: Did not draw enough responses for inclusion in results.

AIN ’s annual Product Support Survey aims to quantify and rate through statistical analysis the product support functions of business aviation manufacturers over the past year. The survey, whose respondents include operators of business jets, pressurized turboprops, and turbine-powered helicopters, endeavors to encourage continuous improvement in airframe, engine, and avionics product support throughout the industry.

For the third year, AIN conducted the survey via a questionnaire developed in partnership with Rolland Vincent Associates, a Texas-based consultancy focused on aviation market research, strategy, and forecasting. Designed to provide improved ease of use and to encourage more participants to complete the entire questionnaire, the survey tool included Spanish and Portuguese versions along with clearer language and imagery around the categories and evaluation scale. Finally, it asked respondents to evaluate one full aircraft at

a time, including airframe, engines, and avionics.

AIN emailed qualified readers a link to the password-protected survey website active from late April to mid-June. It asked respondents to rate individual aircraft and provide the tail number, aircraft age, and primary region of service. The survey also asked respondents to rate, on a scale from 1 to 10, the quality of service they received during the previous 12 months in the following avionics categories: Cost Per Hour Program; Parts Availability; Cost of Parts; AOG Response; Warranty Fulfillment; Technical Manuals; Technical Reps; and Overall Avionics Reliability.

In total, 679 unique respondents, representing 2,221 aircraft, from 62 countries completed the survey. While slightly above last year’s total, AIN did not receive enough responses to verifiably report on Universal Avionics in flight deck avionics, Collins Aerospace in airborne connectivity, and Textron Aviation in cabin management

systems. Textron Aviation was included in last year’s results. Rolland Vincent Associates reviewed the data to ensure accurate and valid responses. It also compiled the final survey results in close coordination with AIN

AIN’s analysis of the survey showed that scores slightly improved this year despite several challenges faced by product support organizations:

» Flight hours started to level between the May 2023 to May 2024 survey period but flying still exceeded pre-pandemic levels. More flying leads to more maintenance demand.

» Supply chain disruptions created longer lead times for parts acquisition and have shown little sign of easing.

AIN has published its 2024 Product Support Survey results for avionics, cabin electronics, and airborne connectivity in this issue; next month will feature engine manufacturers, the final report in this series for 2024.

For the 15th year in a row, Garmin reached the top ranking in the flight deck avionics category and this year also ranked first in the airborne connectivity category, finishing with composite scores of 9.0 and 9.1, respectively.

The flight deck avionics score represented an improvement from the company’s top-ranking 8.7 in 2023. However, the company did not draw enough responses in the airborne connectivity category for inclusion in that area in the 2023 results.

In the flight deck category, Garmin managed to reach at least a 9.0 rating in five categories, namely cost-per-hour programs, parts availability, warranty fulfillment, technical reps, and overall avionics reliability.

In airborne connectivity, it finished with a score of 9.0 or above in five categories as well, registering an 9.3 in AOG response, 9.5 in warranty fulfillment, 9.0 in technical manuals, 9.5 in technical reps, and 9.3 in overall reliability. Its 9.5 score in technical reps ranked as the top score among all companies and categories.

The top ranked vote-getter in AIN ’s product support survey last year managed to improve by three points in 2024, as it added new instructor-led classes and training customized to meet the needs of several popular owner/ pilot associations.

Subsequently, the company celebrated the first anniversary of the Garmin Aviation Dealer Academy website, where it hosts short-format training videos at a rate of one new video per week. The videos provide authorized installers with the latest tips to maximize installation quality and efficiency for Garmin customers.

According to Garmin director of avionics product support Lee Moore, the company continues to expand self-service options with a growing library of “knowledge articles” in its frequently asked questions database.

Moore added that Garmin continuously improves chat availability and call-back options to reduce customer hold time, including a new option to reserve a date and time for a call-back.

Garmin also implemented an auto-renewing purchase system for aviation database and Garmin pilot subscriptions. Finally, the company added what it calls its expert, pilotrated staff to help support more calls, emails, and chats from end customers.

Some examples of improvements the company has registered over the past year include Citation CJ2 avionics with Garmin G600 equipment following receipt in July of an FAA supplemental type certificate (STC).

The upgrade features two G600 TXi touchscreen displays specific to the CJ2, including stabilized approach monitoring and aural V-speed alerting during takeoff, as well as Garmin’s engine indication system. Two GTN Xi navigators enable vertical navigation (VNAV) using the GFC 600 autopilot, including coupled VNAV descents and coupled go-arounds.

Meanwhile, a Citation XLS+ and XLS Gen2 upgrade will allow owners to install the G5000 avionics, offering features such as touchscreen displays, synthetic vision technology, and advanced weather radar. It also includes automatic dependent surveillance-broadcast (ADS-B) Out compliance and allows for future growth and expansion through software updates.

Connect anywhere on any business aircraft

Beyond speed: key considerations when choosing an inflight connectivity provider

New broadband Low Earth Orbit (LEO) satellite networks are ushering in a new era of inflight connectivity for business aviation operators on a global scale.

With new LEO networks in place, business aviation aircraft owners and passengers no longer have to worry about the availability, performance, cost or geographic coverage of the network. And LEO enables new antenna technology that is smaller, lighter, and more affordable to operate than ever before.

When a passenger is flying with a LEO system onboard, they’ll enjoy an inflight internet experience that will make them forget they’re flying at 40,000 feet, and at a fraction of the installation and service cost of traditional GEO (geosynchronous) global satellite services.

When considering an inflight connectivity solution and provider, Sergio Aguirre, Gogo Business Aviation’s president and COO, gives a fresh perspective on what actually is important versus what sounds important. Fast peak speeds are impressive, but when you need predictability and consistency in your flight operations and an excellent in passenger experience, there’s more to consider.

“When you’re making the kind of investment to add inflight connectivity to your aircraft, you need to be sure you make the right choice. You need to ask: Is the company committed to business aviation for the long term? Is there a foundation of trust and reliability? And what kind of customer support will you get?” said Aguirre. “Gogo does one thing – inflight connectivity for business aviation, and we do it very well. Your inflight connectivity is our only concern.”

Throughout its 33-year history, Gogo Business Aviation has continually evolved as new networks, antennas, and hardware and software technologies got faster and more efficient. Simply put, innovation is in Gogo’s DNA.

Today it’s not a question of LEO versus GEO but instead, which LEO service provider is best positioned for business aviation? Virtually any LEO satellite provider can fulfill the promise of fast, low-latency inflight Wi-Fi, but there are many other critical components to consider. And the question operators should be asking is, ‘Do I want to get it right now or get it right?’ because with inflight Wi-Fi you’re making a long-term commitment.

“Gogo Galileo and LEO satellite connectivity is revolutionizing business aviation inflight connectivity

like never before by delivering a solution for aircraft of all sizes, especially small aircraft which currently have no broadband options if they operate outside of North America,” said Aguirre. “Our HDX antenna is small enough to fit on any size business aircraft from turboprops on up which is something no one else is offering.

“We are currently completing installation of the HDX antenna on our Challenger 300, which will serve as the Gogo Galileo testbed, and flight testing will begin late this summer. Everything is progressing as we expected,” he added.

A few aspects of Gogo’s business help it stand out from the rest of LEO crowd.

› A singular commitment to business aviation: Gogo only serves business aviation, it’s the company’s sole focus which means Gogo understands the unique needs business aviation operators have and the expectations of the industry’s discerning customer base.

› Reliability and performance: Gogo’s technology was designed for business aviation to deliver reliable connectivity and high performance even in challenging environments such as during bad weather or over remote areas, like the polar regions. This reliability ensures uninterrupted connectivity throughout any flight.

› World-class customer support: Gogo provides dedicated customer support from a team of people who are experts in business aviation connectivity, and they are available 24/7/365, including every major holiday. This helps ensure a smooth and hassle-free inflight connectivity experience and the assurance of a quick resolution if an issue does arise.

› AVANCE: If you already have a Gogo AVANCE system (SCS, L3 or L5) installed in your aircraft, the cost and downtime to upgrade to Gogo Galileo is significantly less compared with adding a non-Gogo system and starting from scratch. AVANCE helps future proof your investment because AVANCE was designed so you can easily add satellite with air to ground for redundancy and increased bandwidth, as well as any future

networks and technological advancements. With AVANCE you’re always on the path to the next best solution.

› Gogo Vision: The industry’s only inflight entertainment service offering hundreds of movies and TV programs, a premium 3D moving map, 30 leading magazines titles in digital format, and business news.

› Over-the-air software updates: Keep all Gogo AVANCE LRUs updated and with the latest technology, which is done for you automatically, for one aircraft or an entire fleet, from anywhere in the world, with no down time required.

› Global coverage: The network powering Gogo Galileo spans the globe, ensuring connectivity regardless of your flight route.

When you’re making the kind of investment to add inflight connectivity to your aircraft, you need to be sure you make the right choice.”

SERGIO

› Customizable solutions: Gogo offers customizable connectivity solutions tailored to the specific needs of business aviation operators and passengers. Whether it’s for a small business jet or a large global aircraft, Gogo provides two antenna options that fit the full breadth of aircraft sizes and requirements. It’s two options for one perfect fit.

› Cybersecurity: Gogo prioritizes the security of its inflight connectivity services, implementing robust measures to safeguard data transmitted over its network. This commitment to security is crucial for business users who need to exchange sensitive information during their flights. With Gogo, security is built into every system.

› Superior partner network: Gogo is partnering with Hughes Network Systems to manufacture the HDX and FDX (larger, best in class) antennas, a trusted name in aviation. And Gogo’s network of choice is Eutelsat OneWeb, the only LEO satellite operator today with a fully deployed global satellite network. And, it’s an enterprise-grade network with guaranteed service levels, not one designed for millions of consumers with high levels of variation in performance.

LEO satellite networks represent a paradigm shift in the way we connect and communicate. The advantages LEO satellite networks provide to business aviation operators compared to the more traditional GEO satellite networks are significant: superfast broadband Wi-Fi, low latency, smaller on-board hardware and antennas, affordability, true global coverage even over polar routes, and the ability to scale with new technologies as they emerge, to name just a few.

Gogo Galileo will leverage the power of LEO technology to bring broadband inflight connectivity to the entire breadth of business aviation. It’s the first time business aircraft worldwide, regardless of the size or mission of the aircraft, can get true broadband service on their aircraft. When coupled with AVANCE, Gogo Galileo enables customizable solutions that are proven, reliable, and secure, with an award-winning team of dedicated customer support professionals. That’s why Gogo has been, and remains, the preferred choice for thousands of business aircraft operators including all the largest business aviation fleet operators, corporate flight departments, OEMs and individuals.

The second-place finisher in flight deck avionics with an 8.6 rating, Collins Aerospace improved by 0.5 in its overall average from 2023. The avionics manufacturer did not draw enough responses to be included in the airborne connectivity category.

In flight deck avionics, Collins’ 9.0 score in both warranty fulfillment and overall reliability boosted its overall score from 8.1 in 2023.

Collins Aerospace continues to invest in people, processes, infrastructure, and technologies as the RTX subsidiary develops digital tools to more quickly resolve issues and respond to customer information requests faster.

Examples include the addition of warranty personnel for processing claims faster and service center capacity to ensure the company’s preparation for fleet growth and mandates.

“Additionally, as the industry faces new challenges and embraces new technologies, we are collaborating and innovating with our customers to bring big ideas and new products to life, as well as drive continuous improvement and support to our existing products,” said Peter Tuchel, senior director for customer support and avionics at Collins Aerospace.

Examples include flight deck upgrades to meet next-generation modernization requirements, enhanced situational awareness, and connectivity for the cockpit and cabin. Business jet cabin management system upgrades allow for installation of 4K monitors, improved maps, support for third-party peripherals, and control of cabin functions onto mobile devices.

Collins has launched an airport ground monitoring system that provides real-time tracking and recording for aircraft and ground equipment movement. According to the company, its Airport Surface Awareness System (ASAS)

will provide a holistic view of on-field operations that can enhance efficiency and help reduce the risk of ground incursions and improve airport surface safety.

The system uses three components to generate an accurate picture of airport operations, including aircraft tracking with ADS-B and radar feeds both for arriving aircraft and those on the ground; real-time tracking of motorized and non-motorized ground equipment; and an interactive map application with geofencing to allow operators to set location and speed restrictions for different assets with alerts for any violations.

Collins also recently introduced a “smart monitor” for its Venue cabin management system (CMS), allowing aircraft owners and operators to install the monitor as a standalone inflight entertainment (IFE) system or as part of a Venue CMS. Buyers can start with a smart monitor and build a CMS in a phased approach, according to Collins. The smart monitor allows integration of IFE products such as Airshow moving maps and Stage on-demand entertainment and it is upgradeable via software updates.

Honeywell remained at the bottom of the rankings among flight deck avionics makers this year and saw its score in that grouping fall two-tenths of a point from its 7.7 showing in 2023. However, it performed significantly better in cabin management systems, where it tied for first with an 8.2 score and in airborne connectivity, where it posted a

relatively strong result of 8.4, which nevertheless placed it in a last place despite the 0.5 increase.

Among the three groupings, the company saw its biggest progress in support of cabin management systems with a 1.3-point improvement from its 2023 score. Within that grouping, it registered a mainly middling performance,

scoring its highest tally in warranty fulfillment with an 8.7 and its lowest in parts availability with a 7.6.

Last year’s MRO laggard among flight deck avionics makers in AIN’s survey, Honeywell saw its score in that category fall still further this year by two-tenths of a point. However, the company sees a path to improving on those numbers with a new technical publications portal that tackles the deficiencies of a 15-year-old system.

Honeywell Aerospace vice president of technical support Malcolm Fleming explained that the old portal’s problems left it at a serious disadvantage compared with other big OEMs.

“That was really what was preventing us from moving into the current century,” explained Fleming. “We did go live with a new technical publications portal at the end of last year. It was a completely re-architected back end of the system into a modern format. We’ve already seen improved download speed. We’ve done continuous enhancements over the first six months of this year, and I think some of the key things we want is the availability of integrated electronic technical manuals by the end of this year.”

While several companies reported a measure of progress in addressing supply chain constraints, Fleming and Honeywell Aerospace vice president of customer and product support Todd Owens described the state of the supply chain as somewhat improved but still an impediment.

“The delivery performance of our avionics product lines is improving steadily,” reported Owens. “One of the things we’re still challenged with is just the unprecedented demand. As we’re recovering, our OE demand is very high, which puts additional strain on our constrained supply chain.”

Owens conceded that Honeywell had fallen short in terms of transparency with customers. To help address the shortcoming, it committed to communicating more effectively with what Owens called a distressed product line document that will appear in its updated portal.

“Then we’ll also share with our customers as we’re meeting with them, to let them know where we’re investing in our supply chain, let them know where we’re dual sourcing and, in some cases, triple sourcing…to improve our supply chain delivery performance,” said Owens. “So, we’ve actually shared a few drafts of those with some of our airline customers, and we’re going to share a couple of drafts with our business aviation customers to get some feedback to make sure that we’re not missing the mark.”

Addressing one important area where Honeywell believes it can tackle some of its volume challenges, Owens explained that the company has begun to move its business aviation support processes toward something akin to an airline model for large fractional operators such as NetJets. “We have to think of new spaces in business aviation that we really haven’t ventured in to before, so having rotable pools, exchange pools, hardware at repair stations for our fractional customers,” he said. “So that’s an exciting space for us that also points back to [the need] to continue to be diligent.”

Universal Avionics did not draw enough survey responses for inclusion in the final results.

As Universal Avionics (UA) continues to leverage the use of its remote tools technology, the company’s technical support

team in Arizona recently loaded new InSight software in a Hawker 800XP for UA dealer Redimec in Buenos Aires. Similar tools, including Universal-deployed HoloLens virtual reality technology, have improved the team’s efficiency, saving travel time and overall cost for UA, its dealer, and the end customer. This year UA began moving away from paper with digital

downloads of all its technical publications. The company also began developing requirements for authoring in S1000D—a modern standard for producing and distributing technical publication—and for automating service information communications to customers.

Finally, in the field of training, UA continues to add innovative content to its online learning center, UA Academy. It has also developed a ClearVision simulator specifically for its new 737 program, which has received positive feedback from the FAA’s Aircraft Evaluation Division (AED) and the company’s integrator. Finally, the company has begun expanding the use of scenario-based learning in its training curriculum and software.

After failing to draw enough responses for inclusion in AIN’s 2023 cabin management systems survey, Lufthansa Technik (LHT) rose to a tie for first place in this category. Recording an 8.2 overall rating in 2024, the company saw its network integrated cabin equipment (Nice) exceed an 8.0 rating in all but one category—namely, cost of parts, where it posted a score of 7.6. LHT‘s best score came in the warranty fulfillment category, where it finished with an 8.7 rating, again placing it in a tie with Honeywell for the top position in that category.

Lufthansa Technik’s Nice customer support team has kept busy over the past 12 months working on several improvements and initiatives, including the introduction of field unit testers that give customer service agents the ability to update aircraft component firmware at the customer site. The company expects the program to result in lower component removals, increased reliability, and reduced aircraft downtime for its customers.

Separately, the MRO provider expanded its repair network for Nice components by introducing them to Lufthansa Technik’s cabin electronics repair shop in Frankfurt, which almost exclusively handled components for commercial aircraft. The company expects the resulting increase in the company’s repair capacity to reduce the turnaround times for

repairs, especially for time-critical components of the system. Access to well-trained personnel represents another key aspect of its customer support services. Consequently, Lufthansa Technik also increased Nice training of maintenance personnel, air crew, and aircraft owners in the past year.

The company’s Original Equipment Innovation (OEI) unit expects to introduce the next generation of its Nice platform next year and has begun to install cabin systems

on the latest additions to the Embraer Phenom 100EX.

With each evolution of the Nice platform, LHT plans to facilitate further upgrades to the capabilities of the in-flight entertainment and cabin management systems. “The core system doesn’t have to be changed, and you can deliver new benefits at the software application level,” explained Wassef Ayadi, the company’s senior director for customer relations with the OEM & Special Engineering Services unit.

A year after finishing in a tie for first place among cabin management system suppliers last year, Gulfstream saw its two-tenths of a point decline this year place it last in the category for 2024. Its best showing came in technical representatives with an 8.9 rating, giving it a clear lead in that category among the four companies that drew enough survey responses for inclusion in the ratings. However, customers paid handsomely for parts, as Gulfstream scored well below its competitors with a 6.2 rating, placing it dead last in that category. Otherwise, its performance changed little from its first-place overall showing in 2023.

The certification of the G700 business jet has given Gulfstream’s CMS personnel the opportunity to work with the company’s cabin development team to provide in-cabin access to the technology on the all-new aircraft. The company’s CMS team has produced what Gulfstream calls the latest cabin innovations in the industry, including upgraded lighting system control, all-new circadian lighting sequences, and new ways to monitor flight information and cabin control. Bluetooth audio receivers and transmitters have become the company’s top customer-requested CMS products, prompting Gulfstream to explore more opportunities for product enhancements. The new advancements provide passengers with a “robust experience” streaming onboard content to personal devices. Gulfstream also modernized its cabin charging ports and optimized HDMI input to support High-bandwidth digital content protection.

Connectivity remains an essential aircraft component, and further development of the technologies help

operators leverage multiple network sources to deliver the best possible coverage, performance, redundancy, and service flexibility.

In fact, the company worked to incorporate SD Plane Simple Ka-band and Ku-band antenna advancements, and Gulfstream recently received an FAA supplemental type certificate for the Plane Simple Ka-band tail mount terminal for a Gulfstream G650. The advances offer users access to more speed, data, and service flexibility.

Gulfstream’s approach to developing consistent service to all Gulfstream operators led the company to develop its own CMS modernization efforts specifically designed for legacy aircraft. The enhancements allow passengers to control their personal seat preferences and amenities through a mobile device application, doing away with the need for multiple cabin switches. Technicians can now replace physical switches with graphics that support a modern appearance along with reduced cost and installation time.

Textron did not draw enough responses for inclusion in the final survey results. However, in 2023 it had scored an overall average of 8.1, placing it in a tie with Gulfstream for that year.

Textron Aviation supports Beechcraft, Cessna, and Hawker customers throughout their ownership journey by investing in avionics upgrades based on customer feedback. As the original equipment manufacturer of the aircraft, Textron Aviation says it can offer the OEM-certified upgrades that maintain system integrity as originally certified.

Textron Aviation has won repeat FAA Diamond Awards for all U.S.-based airframe and powerplant (A&P) mechanics, product support, and global field support teams. All 11 North American service centers and team members across six field support teams and five technical support teams domestically and internationally received awards.

The plaudits came as Textron Aviation added resources and team members in Europe and the Asia-Pacific region to increase parts and maintenance support for customers

outside the U.S. For example, the company added a third member to its 1CALL team based in Spain to support customers with unscheduled maintenance needs and a technical support team based in Australia.

Satcom Direct posted a respectable second place showing in airborne connectivity this year, maintaining its rating from 2023 at 8.6. This year’s results showed technical reps accounted for the company’s highest score among all categories with a 9.0, while not scoring below an 8.0 in any line item except cost of parts, where it finished in second place with a 7.9.

Over the last 12 months, Satcom Direct has boosted its team of customer support professionals around the globe as it added new connectivity plans, including the rollout of the SD Plane Simple Ku-band tail mount antenna. While seeing increasing numbers of customers opting for customized connectivity services, Satcom Direct promotes its “follow the sun” provision of around-the-clock service, ensuring it rarely resides more than a 12-hour journey from its customers.

Satcom Direct took its Connecting with Customers (CwC) program on tour this year, holding three events on the U.S. West and East Coasts as well as one dedicated to its military-government customers, which have specific connectivity needs. The company held similar events in Basel, Singapore, and London.

The CwC meetings allow SD customers to gather information about the latest connectivity topics and share skills and insights through workshops, presentations, and networking.

Finally, Satcom Direct continues to develop its training

courses to support connectivity, cybersecurity, and the inflight experience. As cyber events become more prevalent, SD continues to train in all aspects of cyber awareness. This year, it has added topics related to “smishing,” which uses fake texts to extract data, and “vishing,” which uses voice-generated AI to create fake voices that sound like familiar ones also to extract information. Meanwhile, SD continues to work on updates to the industry’s only AeroIT-certified program for aviation IT professionals, as an increasing number of customers return to ensure currency in the rapidly changing realm of connectivity.

Finishing just one-tenth of a point below Satcom Direct with an average score of 8.5 in airborne connectivity, Gogo Business Aviation saw its composite increase by two-tenths of a point from 2023’s 8.3 rating. Highlights included a 9.1 in warranty fulfillment and a 9.0 in technical reps, but Gogo’s 7.5 in cost per hour programs tied it for last place among all participants in the category with Honeywell’s 7.5 flight deck score.

Gogo Business Aviation customers have completed more than 1,000 Avance air-to-ground system software updates since enabling its over-the-air (OTA) feature late last year. The upgrades replace the cumbersome process of using a USB device to update each connectivity system manually and cut upgrade time by 83 percent, according to Gogo.

The first of its kind for the inflight entertainment and connectivity industry, Gogo launched OTA last November. The approach gives new and existing Gogo Avance customers worldwide an easier, more convenient, more affordable method for updating system software, doing away with the need for mechanics to go on board to update the system.

“We designed OTA to be a sustainable benefit and value- add to our global customers,” said Todd Krawczyk, senior director of product strategy and marketing for Gogo. “The most popular OTA use we’ve seen is with our large fleet customers operating aircraft positioned around the world. Through OTA, Gogo helps relieve the logistics involved with updating software and makes

access to our most up-to-date features easier tha n ever.”

As Gogo readies for the anticipated launch of its Gogo Galileo Low Earth Orbit (LEO) satellite products, OTA will also expand to support antenna software updates.

Launched in conjunction with Avance software update, version 4.4 and has become the fastest-adopted software update in Gogo’s 30-year history, according the company. Accessible through the Gogo DASH app-based toolkit, the OTA eliminates the need for additional downtime to perform the manual software updates. The system slashes upgrade time by 83 percent when used with a Gogo Cloudport, a device that allows for what amounts to a hotspot in customers’ hangars.

Search by aircraft category from turbo props to large jets, by manufacturers or popular models.

BY CURT EPSTEIN

The eight-engine Bristol Brabazon, which appeared at one of the first Farnborough Airshows in 1949, flies over the famous Cody Tree.

The UK’s Farnborough Airport has always been associated with advancements in aviation and so is a fitting location for the biennial air show staged there. After being the site of the country’s first powered flight in October 1908, it became the headquarters of the Royal Flying Corps (RFC) during the First World War and the site of the Royal Aircraft Factory, which designed and built hundreds of airplanes during the war.

In 1918 when the RFC was renamed the Royal Air Force (RAF), it was thought to be too confusing to have two entities with the initials RAF. And so, the aircraft design and manufacturing facility was renamed as well to the Royal Aircraft Establishment, a name which it would hold for much of the 20th century.

While several successful aircraft came out of the Farnborough facility during the

1914–1918 conflict—the first war in which aircraft played a major role—the British government decided it would change the RAE’s role.

“They said you should leave the building of aircraft to the companies that had emerged to make them,” said Richard Gardner, chairman emeritus and former president of the Farnborough Air Sciences Trust Museum. “They had to make thousands of them, and the RAE would be concentrated on development, evaluation, and testing; all aspects of aviation, basically.”

The successful designs would then be handed over to industry for mass production. “RAE did the initial build in parallel with industry because the RAE had its own designers and they had workshops and the facilities to actually put the engines and the airframes together and test them. It was obvious with the needs of the First World War you had to get the wider industry involved,” explained Gardner. “That

sort of set a pattern and established Farnborough as one of the [...] leading aviation research centers in the world.”

Among the early successes in material sciences developed at the RAE was the creation of anti-incendiary paint coatings for the fabric that covered the early, flimsy airplanes that had previously been easy to set on fire with ammunition. New camera housings that allowed for the easy removal and exchange of film canisters for battlefield intelligence were developed, and pioneering work in aerial radio communications was conducted.

The facility continued to grow with the addition of ever more sophisticated wind tunnels and eventually employed thousands including many of the top scientists and engineers in the industry. “They were developing absolutely everything, from the evacuation of aircraft, survivability of aircraft in ditching, bombing equipment,

radar, and electronic countermeasures, all of these pioneering things were all tested there,” said Gardner.

That pioneering spirit included the first flights of Britain’s first single-engine and twin-engine jets.

By 1945, RAE had more than 100 aircraft based there for research and development and test flying, and the following year, after the Allied victory in World War II, a public display was held at Farnborough with approximately 60 captured German aircraft on exhibit. It would be the first large-scale public aviation display at Farnborough, but certainly not the last.

The ancestor of today’s Farnborough International Airshow was an RAF Pageant held in 1920. It was first held in the north London suburb of Hendon as a gathering of RAF aircraft including a flight display. This continued into the 1930s as a combination of RAF flight displays along with exhibits from the companies that produced the aircraft, showing off their latest designs and innovations.

Organized by the Society of British Aircraft Constructors (SBAC), the event grew and was forced to change venues several times, first to Hatfield, and then to the Radlett Aerodrome in 1946. Initially meant as a showcase for British-built aircraft, it was gradually expanded to include aircraft powered by UK-built engines or equipped with other British content such as avionics. After the war, SBAC began considering a permanent site for the annual show. With convenient access to London by road or rail, and with plenty of available space, the first Farnborough Airshow took place in 1948.

“Most of the UK industry had been geared up for wartime production, but by 1948, they realized there was a slowly growing civil market that could do with new designs,” Gardner told AIN. “There were some very radical aircraft for that time being considered, big airlines with the possibility of powering them with jet engines

or turboprop engines, and SBAC was very keen to show them off.”

The formula of what became the typical Farnborough show solidified the following year. “You had an industry banquet to start it off and the SBAC had the list of VIPs to invite, which would be the chief executives of the major companies, and invited foreign guests, and then they widened it out to include what were then the dominions Australia and Canada, which also had sizable aircraft industries at the time,” Gardner explained. “In 1949 they decided to make more publicity about having a flying display at the end of this exhibition week, and 275,000 visitors came on the last two days.”

The 1950s saw the heyday of the UK aircraft industry with new aircraft of all categories emerging every year, and SBAC built a 67,000-sq-ft exhibition hall at Farnborough to house company stands. “There was more of a development of high technology from the late 1950s onwards, and although the aim of SBAC remained to sell British aircraft and equipment, the show was also huge— what we now call a networking opportunity,” Gardner said. In those pre-internet days, if your company was producing a component to go on an airplane, you could just walk a few yards to speak with a key person from Boeing or de Havilland.

In addition to the stands, exhibitors would also tow hospitality trailers up to the hill terraces above the runway where the rows of corporate chalets stand today. It was that view that made the site an iconic airshow venue.

“You were so close to the runway and you had such a good overall view of everything because you were on the hill, only a hundred yards from the runway,” explained Gardner, “whereas if you were down by the flight line, you were only just beyond the wing tips actually, incredibly close which made it very popular on the public days.”

While safety rules have limited the maneuvers demonstration pilots can perform, the displays were designed to amaze. The RAF’s Black Arrow demonstration team showed up one year with a routine involving 22 Hawker Hunters, while the Royal Navy pilots performed a stunt where two Supermarine Scimitars landed and folded their wings as they taxied down the runway while a third Scimitar landed between them in the opposite direction. In another year, nine Hawker Seahawks landed simultaneously in a diamond formation.

“That really reached a climax in the 1960s where you had a lot of competition between the navy and the air force,” said Gardner. “The RAF and navy had whole series of staged mock attacks on the airfield, with multiple aircraft one year, where virtually everything the air force had they threw at it, and that sequence was about an hour of continuous flying.”

Yet, as airframers consolidated in the post-war years, it slowed the number of new aircraft arriving on market and diminished the need to have an annual show, particularly when the rival Paris Air Show was taken into consideration.

“Farnborough was traditionally in September, and the Paris show was always late May or June, and it was very expensive for the exhibitors to basically repeat the show for Farnborough,” Gardner explained, adding that Farnborough organizers in 1962 made a decision that they wouldn’t have a show the following year. “The next one would be in ’64, and it was established that it would be biennial thereafter and would alternate with Paris so they didn’t duplicate things.”

One of the most exciting moments at the show was always the first demonstration of a new aircraft, but Gardner noted that the most recent Farnborough debut on the civil aviation side was the Airbus A350 a decade ago, with Boeing’s 787 Dreamliner arriving on the scene in 2010.

Given the current backlogs held by the two leading civil manufacturers stretching for years, he believes it might be a while until the next one. “I suspect we won’t see all new serious aircraft emerging for at least another decade,” he said. “If an airline wants to stay in business, it’s got to have aircraft that make money. As long as airlines want to buy sort of bulk standard A320s and 737s, [the airframers] will keep doing it.”

Yet Gardner still describes the show as a must-go event for the industry even as the focus shifts with the emerging emphasis on new technology such as urban air mobility and sustainability.

On the military side, he expects to see some changes among the exhibit stands due to the recent geopolitical situation and the development of future air combat systems. “We’ve had almost three

decades where all the combat experience has been in anti-terrorism in the Middle East and Afghanistan, and now we’ve got what would have been unthinkable until a few years ago, that sort of stateon-state threats, China, North Korea, Iran, and Russia,” he said. “With the Ukrainian war underway, a lot of lessons are being learned with what you can and can’t do.” z

In recent years, demand and scope for using business aircraft as platforms for a wide array of special missions has been rising. Leading manufacturers in the sector—namely Embraer, Gulfstream, Bombardier, Dassault, and Textron—are all now vying for contracts covering applications ranging from electronic warfare to transportation for government leaders and emergency medical services.

A pair of recent orders from authorities in the Nordic region represents a prime example. Finland’s coast guard chose Bombardier’s Challenger 650 jet for its MVX airborne surveillance requirement, while Sweden exercised an option to acquire a third example of the Canadian company’s Global 6000-based S 106 GlobalEye airborne early warning (AEW) platform.

Over the years, Gulfstream has delivered more than 200 business jets to customers in over 40 countries, including all branches of the U.S. military. According to Leda Chong, the company’s vice president of worldwide government sales, it is currently engaged in projects with air forces in the U.S., Australia, and Italy.

End users can choose from Gulfstream’s several in-production aircraft, ranging in size from the G280 to the latest long-range, large-cabin G700 and upcoming G800 models. Alternatively, pre-owned examples of the G550 jet can be adapted as well.

Last year, L3Harris started delivering the first of a new generation of electronic attack platforms to the U.S. Air Force. The EC-37B is based on a G550 airframe, and Gulfstream is part of the Compass Call Rehost program team, which also includes BAE Systems.

Selecting the airframe is just the start. Gulfstream handles the extensive modification work in-house with a dedicated team of engineers who work closely with end users and the manufacturers of the advanced systems that need to be fitted for the various roles, including leading defense prime contractors. Customers select the mission equipment, often as part of a wider defense acquisition process.

Among the factors that draw special missions customers to today’s larger business

jets are their extended range and ability to quickly reach higher altitudes. Chong highlighted factors such as an unrestricted field of view and flight endurance as important factors too.

Cabin sizes are well suited to accommodating equipment required and can be more cost-effective options than larger airliners. Beyond North America and Europe, demand is also strong in the Middle East, the Indo-Pacific region, and Latin America.

At the 2024 Farnborough Airshow, visitors viewed the U.S. Navy’s new training aircraft for the first time. Textron Aviation’s Beechcraft King Air 260 multi-engine training system is replacing the earlier King Air 90-based Beechcraft T-44 Pegasus. C.A.

L3Harris worked with Gulfstream and BAE Systems to convert the G550 business jet into an electronic attack platform for the U.S. Air Force.

BY CHARLES ALCOCK

The RTX Technology Research Center is testing STEP-Tech propulsors as one of the group’s hybrid-electric powertrain development projects.

The existential threat to the air transport industry if it fails to achieve net-zero carbon emissions and the mounting dangers from military conflicts around the world were hard to ignore at the Farnborough Airshow this year.

Threats faced by the aerospace and defense industries beg for answers in the form of technology, technology, and yet more technology. This year the show has proved light on major product reveals, but the event has been packed with tidings of technological progress for the next decade and beyond.

Air transport’s challenge is simple to define but much harder to execute, requiring a mix of short- and long-term sustainability solutions. For the defense contingent, the emphasis seems to be on pooling an array of complex technologies, including artificial intelligence, to make warfare simpler.

Engine makers stand on the front lines of the war on carbon. Pratt & Whitney, Rolls-Royce, and the CFM International partners GE and Safran are all working on improving fuel and energy e ffi ciency for their respective legacy turbofans in the GTF, Trent, and Leap families.

Even incremental progress can make a positive contribution when scaled up over large fleets, such as the 1% improvement in fuel burn e ffi ciency Rolls-Royce is preparing to introduce on its Trent XWB-84 turbofan for the Airbus A350-900 with modifications to the compressor system.

For the past three years, CFM has advanced its planned Revolutionary Innovation for Sustainable Engines (RISE) program for the long-envisioned, nextgeneration single-aisle airliners meant to replace the ubiquitous Boeing 737s and Airbus A320s. The objective is to be ready with a propulsion solution whenever the airframe behemoths show their hand.

At the same time, they are placing longer- term bets on a variety of options for new hybrid-electric powertrains that could power aircraft ranging in size from general aviation aircraft to regional airliners, and potentially even single-aisle narrowbodies.

RTX, including Pratt & Whitney and Collins Aerospace, offer a prime example. Through programs including the European Union-backed HECATE (hybrid-electric regional aircraft distribution technologies), STEP-Tech (scalable turboelectric powertrain technology), and SWITCH(sustainable water injection turbofan comprising hybrid electrics), the group is drawing expertise not just in engine-making but in electrical systems to edge up from power ratings of 500 kilowatts to the 20-megawatt class needed for future narrowbodies.

Looking further ahead, Airbus sees hydrogen propulsion in its future. Behind

the scenes, the company is evaluating which of three concepts from its ZeroE program it might pursue to meet the objective of delivering an aircraft capable of carrying 200 people around 2,000 nm by 2035. Rolls-Royce already has started evaluating hydrogen as a fuel in one of its Pearl business jet engines, as it explores options for scaling up the technology.

In the defense sector, the main technological developments are encapsulated in the Global Combat Air Program, a sixth-generation fighter under development by the industries of the UK, Italy, and Japan. A large model of its latest shape was on show in the BAE Systems hall.

Sensors such as radar, infrared, and electronic warfare systems provide a very high level of situational awareness. All of the aircraft’s systems are linked with data fused automatically within the system. Artificial intelligence is ubiquitous, handling the enormous amount of data that the sensors gather on board and presenting the pilot with clear information that is relevant to the mission. z

Major OEMs announced significant sustainable aviation fuel (SAF) financing initiatives at the Farnborough Airshow in a move to wrest control of the fight against climate change away from the major oil companies.

A group led by Airbus and including the Air France-KLM Group, Associated Energy Group, BNP Paribas, Mitsubishi HC Capital Inc., and Qantas Airways, co-invested in a SAF financing fund to accelerate production of the green fuel. The collaborators worked with Burnham Sterling Asset Management to establish the SAF Financing Alliance (SAFFA) investment fund, in which Airbus serves as an anchor investor. Commitments by the seven partners amount to around $200 million.

“Each partner brings experience and financial expertise to the fund with the ambition to accelerate the availability of SAF by investing mainly in technologically mature SAF-producing projects using, for instance, waste-based feedstocks,” Airbus said in a statement issued at the Farnborough Show. “Investments will be diversified across various SAF production pathways and also by region.”

Each partner might then enter into priority contracts to secure SAF oftakes from the various projects in which SAFFA will invest for its allocated volumes. SAFFA’s focus centers on SAF eligible for RefuelEU Aviation or CORSIA (Carbon Offsetting and Reduction

Scheme for International Aviation) certification.

Many believe that the urgency of developing SAF has increased the pressure on the world’s top OEMs to take steps to deliver the fuel type, after demand for cleaner fuels has met with painfully slow progress. In addition, oil and gas companies seem as keen as ever to press ahead with the development of new hydrocarbon wells and resources.

Boeing and Clear Sky, an investment company dedicated to aviation sustainability, are collaborating to accelerate SAF development with an initial project to help in testing and advancing the UK’s Firefly Green Fuels’ technology to increase SAF production in the UK.

“SAF offers the greatest opportunity to decarbonize aviation, and the industry’s collective challenge of bringing it to scale

globally requires new sustainable pathways,” said Brian Moran, chief sustainability o f cer for Boeing.

“Clear Sky combines many years of investment expertise with knowledge on aviation’s decarbonization challenges. Firefly’s technology holds transformative potential as the SAF feedstock, sewage waste, is accessible in all regions of the globe.”

According to Boeing, SAF today represents 0.1% of global jet fuel use. In the UK, the pending mandate to achieve 10% SAF in the jet-fuel mix by 2030 will require 1.2 million tonnes of SAF by 2030.

The new UK Labour Government’s SAF mandate will start in 2025 at 2% of total UK jet fuel demand, increase on a linear basis to 10% in 2030 and then to 22% in 2040. P.S.S.

BY MARK HUBER

On March 5, 2015, actor/pilot Harrison Ford crashed his vintage Ryan ST-3KR monoplane onto a Venice, California golf course following an engine failure. Eventually, the wreckage ended up in the boneyard at Dodson International in Rantoul, Kansas.

Dodson buys and sells used aircraft parts. That includes accident aircraft, those that are no longer airworthy, or others that are worth more parked and parted out. Most were owned by people or entities you’ve never heard of, but there are a few notable exceptions: the late actor John Wayne’s Jet Commander, a Jetstream 31 turboprop once owned by Nascar racing legend Richard Petty, a Gulfstream GIII formerly belonging to Ultimate Fighting Championship CEO Dana White, the Piper Meridian that disgraced financier Marcus Schrenker parachuted from in an attempt to fake his own death in 2009, four Piaggio Avantis from the defunct Avantair, and a Hawker 4000 from that aircraft’s flight test program.

Dodson began as an FBO operator’s side hustle of parting out old Cessna 172s and

Piper Cherokees. Today, it is one of the world’s largest suppliers of business aircraft and turbine helicopter parts. Learjet 30 series and early Cessna Citations are particularly popular, as are vintage Bell JetRanger and model 212 helicopters.

But there are newer business jets on the lot as well, including a late-model Dassault Falcon 7X. Dodson also deals in commuter and some large transport category aircraft, as well as aircraft support vehicles including fuel trucks and tugs.

Drive through the rolling pastures just outside of town on Vermont Road and you’ll find the incongruous sight of a Lockheed JetStar mounted atop a pylon. Go through the adjacent gate and you will come to what was once a giant dirt-floor cow barn that formerly hosted rodeos.

It’s part of Dodson’s nearly 200-acre complex with more than 200,000 sq ft under the roof, home to 18 million aircraft parts including 2,000 fuselages. The latter are neatly placed in the surrounding fields and arranged in groupings by make and model. CEO J.R. Dodson estimates that the

company has recycled 5,000 aircraft since its founding in 1984. J.R. Dodson runs the company with his sons Dilon and Nic and 65 other full-time employees.

Dodson obtains the aircraft and the parts from a well-established network of insurance and other companies. About 70% of its business is from North America. Occasionally, J.R. Dodson, a type-rated jet pilot and Embry-Riddle graduate who once aspired to fly for the airlines, will pilot his Falcon 10 to a site of a prospective acquisition to inspect it. He calls the Falcon a “Ferrari on steroids” and notes that the business he does on one trip often can pay the operating expenses on the 10 for the entire year.

Dodson also has partial ownership of a Falcon 50 and 900. While photos and videos are nice, Dodson said there is no substitute for looking at an aircraft in person.

Some aircraft Dodson dismantles itself, and others are taken apart through contracted FAA Part 145 repair stations. Dodson does not hold a Part 145 certificate but does employ airframe and powerplant mechanics for quality and compliance

reasons. The airplanes arrive on trucks or are flown in by contract pilots, either to a grass strip across the road or the airport in nearby Ottawa, Kansas (KOWI), home to sister company Dodson Aviation. Components that have been recently overhauled or have a good amount of remaining useful life are particularly prized. During AIN ’s visit, Dodson technicians were in the process of tearing down a newer Cirrus SR22 piston single, a medevac Leonardo AW109 twin-turbine helicopter, and a fire-gutted TBM turboprop.

Inputting inventory involves a painstaking process of documentation, inspection, and evaluation, then data entry and bar-coding. The relevant data is stored on triple-redundant servers. The parts themselves are photographed and tagged and

then either capped, bagged, caged, or sealed and then sent to warehouse for retrieval. Dodson uses a program that allows authorized users to access data and photos of any part of its inventory on a cell phone.

Engines, around 20% of Dodson’s business, are stored separately and maintained according to recommended schedules. Vintage avionics also are a hot item and “are very valuable,” said J.R. Dodson. The company’s customers are primarily MROs and individual flight departments, but the continuing Covid overhang supply-chain disruptions have created a new class of customers—the OEMs.

“The inability of manufacturers to provide certain parts has obviously helped us,” he said. “There are a lot of structural pieces and other things that manufacturers