SAFETY: THE SECRETS OF FLYING WITH 'LOGIC KNOWLEDGE'

AVIONICS: HONEYWELL RAISES THE BAR WITH ANTHEM SUITE

SHOWS: NBAA-BACE TAKING CENTER STAGE IN VEGAS

SAFETY: THE SECRETS OF FLYING WITH 'LOGIC KNOWLEDGE'

AVIONICS: HONEYWELL RAISES THE BAR WITH ANTHEM SUITE

SHOWS: NBAA-BACE TAKING CENTER STAGE IN VEGAS

Garmin scores a win with its new head-up display in the Citation Longitude

Scan the QR code to see the mission

Shuts Down Connectivity Network

6 OpsGroup releases GPS spoofing workgroup report

8 Business aviation groups seek European leaders' support 10 GAMA: Bizjet deliveries, billings up in first-half 2024 14 Flying Garmin’s new HUD in the Citation Longitude

Vegas takes center stage for NBAA-BACE 22 AIN Product Support Survey: Engines

Here’s a better idea: Avoid the autoflight fistfight in the first place

Product Support: Above & Beyond

BY MATT THURBER

After spending years and hundreds of millions of dollars building an air-to-ground (ATG) airborne connectivity network to compete with Gogo, SmartSky Networks announced that it “has ceased business operations effective August 16, 2024.” A company statement blamed lack of additional financing for the shutdown.

Like most in the industry, an aviation manager in New York was taken by surprise by the shutdown. His company had installed a SmartSky system in the principal’s airplane in February at a cost of $150,000. “[The] system performance is great,” he posted on Facebook. “[It] blows away Gogo L5. [I’m] not looking forward to this conversation with the owner.”

The SmartSky service promised faster connectivity compared to Gogo’s original ATG. SmartSky’s network went live at the end of 2021 and into early 2022. The service had been delayed for many years as SmartSky built a network of towers in the U.S. and fought court battles over the network technology’s patents, including complaints against Gogo. But installations in turboprops and business jets seemed to pick up as more dealers signed up and supplemental type certificates were approved for SmartSky equipage.

Employing patented “beamforming” technology, SmartSky claimed that each aircraft using the network would have its own beam and switch from beam to beam, maintaining high-speed bandwidth for that aircraft instead of having to share it with others.

Two sizes of equipment were available, SmartSky Lite for smaller aircraft, and the Flagship system for midsize jets and larger. The Lite system, with sustained speed of 3 to 6 Mbps and peak over 15 Mbps, was priced at about $60,000. Flagship sold for about $120,000 and delivered speeds of 5 to 10 Mbps, peaking over 20 Mbps. Service plans included Lite at $995 (hourly) to $3,495

(unlimited) and Flagship: $3,495 per month for 5 GB, $299 per GB overage, with unlimited plans topping out at $9,995 per month.

None of the dealers or others contacted by AIN could confirm how many SmartSky installations had taken place. However, some details provided suggests installations never reached a significant number.

Fleet operator Volato had planned to equip its HondaJets with SmartSky. “Luckily, we only had the first one installed,” Volato co-founder and CEO Matt Liotta told AIN “We had five more scheduled for this year, but aircraft [delivery] delays saved us.”

One dealer said it had installed one SmartSky system. Another said, “We had just been added to the dealer network for SmarkSky within the past two weeks. We had never even quoted a single job or ordered any parts. We did have one customer who was interested in the system but again, we had not progressed past the discussing phase.”

Another large MRO facility said it had not installed any SmartSky systems since becoming a dealer. The same was the case for a large MRO company with multiple bases, which told AIN, “There wasn’t a lot of interest in it.”

Davinci Jets had plans to equip its entire fleet with SmartSky systems and had accomplished some installations, but the company did not respond to AIN’s queries. SmartSky co-founder and president Ryan Stone was previously chairman, CEO, and co-founder of Davinci Jets, and he told AIN he couldn’t comment on the shutdown.

AIN tried to contact the email that was published on the SmartSky website after it announced the shutdown, but there has been no reply. AIN also asked Honeywell about its relationship with SmartSky and plans for customers but received no reply. Honeywell Forge was the customer support provider for SmartSky. z

Business jet OEMs reported strong order intake and a nearly 2% backlog growth in the second quarter, while flight operations rose by 6% quarter over quarter and departures remained 14% above second-quarter 2019 levels, according to Global Jet Capital’s (GJC) latest Business Aviation Market Brief. “Due to the industry’s inherent value proposition… there has been a systemic expansion of the user base with a substantial proportion of these new users continuing to utilize business aviation in 2024,” GJC stated. As supply chain and labor issues continue to resolve post-pandemic, airframers increased production and revenues, causing the industry-wide book-to-bill ratio to about 1:1.

Pilatus Aircraft is significantly scaling up its presence in the U.S. under an agreement to develop a “flagship” sales and service facility at Sarasota Bradenton International Airport (KSRQ) in Florida. Long-term plans also include having an aircraft assembly plant at the location. Under the agreement, Pilatus will develop 17 acres on the north side of the airport. Slated to open in mid-2026, the initial facility plans include 54,000 sq ft dedicated to maintenance, spare parts distribution, and new aircraft deliveries, plus 17,000 sq ft of workshops, o ce, and administrative space.

The U.S. Army selected Sierra Nevada Corp. (SNC) as system integrator for the High Accuracy Detection and Exploitation System (Hades) program. Hades aircraft are based on the Bombardier Global 6500. This month, Bombardier will hand over the first aircraft, which will then undergo systems integration at SNC.

BY MATT THURBER

After forming a workgroup to study the issue of GPS/global navigation satellite system (GNSS) spoofing, flight operations support provider OpsGroup has released its GPS Spoofing Final Report, identifying key issues and mitigation efforts.

Spoofing occurs when a GPS/GNSS receiver is tricked into calculating a false position by equipment transmitting from the ground. This can show the aircraft in a different location than its actual position and prompt the navigation system to send the aircraft off the desired course.

According to the OpsGroup report, “The greatest safety concern is the degraded functionality of the ground proximity warning system. The system does not operate correctly after spoofing, even if GPS coverage is restored. The number of false alerts is astounding. There is an increasing normalization of risk.”

Once a GPS receiver is spoofed, it could be contaminated with false data, the group warned. “This places doubt on the use of GPS at any point after spoofing, especially RNP [required navigation performance]

approaches, and RNP en route use.”

OpsGroup has noted a 500% increase in spoofing this year, now affecting an average of 1,500 flights per day, up from 300 per day in the first half of the year. A major concern is that flight crew aren’t being provided technical information about “GPS involvement in aircraft systems” and they are receiving “conflicting crew guidance and incomplete or insufficient procedures, all leading to misunderstandings and knowledge gaps.”

While OpsGroup acknowledged that there are “no quick and easy solutions…The key focus in the short term is on mitigation, crew awareness, guidance, and training. In the longer term, the workgroup identified potential solutions to hardware, avionics, and system components…Consideration must be given to the potential for a deepening of the GPS vulnerability problem. In mid-2024, we are already seeing a major increase in both spoofing and impact to aircraft.”

The group did note that “the over-reliance on GPS for primary navigation places great importance on preserving a sufficient network of conventional ground-based navaids.” z

Bombardier is projecting stable deliveries of 150 to 155 business jets per year for the foreseeable future, with the mix remaining even between its super-midsize Challengers and ultra-long-range Globals, the company said last month at the Je eries Global Industrials Conference. The even mix of products comes with the order momentum for the Challenger 3500 and the model’s better supply-chain environment. Bombardier anticipates delivering the initial Global 8000s next year, transitioning fully from its 7500 predecessor in 2026. Je eries is forecasting 35 to 40 Global 8000 deliveries annually.

The U.S. Department of Justice (DOJ) seized Dassault Falcon 900EX S/N 007—registered as T7-ESPRT—that it claims was owned and operated for the benefit of Venezuelan president Nicolás Maduro Moros and persons a liated with him. According to the DOJ, the trijet was seized in the Dominican Republic and transferred to the Southern District of Florida at the request of the U.S. “based on violations of U.S. export control and sanctions laws.” According to the U.S. investigation, in early 2023 persons a liated with Maduro allegedly used a Caribbean-based shell company to conceal their involvement in the purchase of the 900EX from Floridabased aircraft broker Six G Aviation. Six G did not respond to AIN’s inquiries.

DirecTV Inflight and Satcom Direct are bringing live television to business aircraft equipped with low-earth or geostationary orbit satellite connectivity. The DirecTV IPTV content includes sports, news, weather, and other entertainment programming. Aircraft operators can purchase IPTV as part of Satcom Direct connectivity service plans.

We were meant to fly.

BY CHARLES ALCOCK

The European Business Aviation Association (EBAA) and the General Aviation Manufacturers Association (GAMA) are demanding action from governments and regulators to help the industry achieve its goal of net-zero carbon emissions by 2050. In a joint letter published on September 9, the industry groups spelled out their key lobbying points for the 2024 to 2029 European Union (EU) legislative period.

Among the main calls to action is for the incoming European Commission and Parliament to reform the ReFuelEU regulation to include “a reliable, fraud-proof” book-andclaim system for sustainable aviation fuel (SAF) that would be recognized by the EU’s emissions trading scheme. According to EBAA and GAMA, this would “send strong market signals” to SAF producers and help to reduce “currently excessive” SAF prices and create a single market for the fuel.

The new European Business Aviation Manifesto also calls for business aviation to be admitted to the EU’s Sustainable Finance Taxonomy to give the industry access to financing required for fleet renewal with newer, cleaner, and quieter aircraft. In July, EBAA joined Dassault in legal action against the European Commission, which excluded business aviation from this legislation.

EBAA said the exclusion from the so-called EU Taxonomy classification system for identifying approved sustainable economic activities makes it harder for companies in the sector to access sustainable investments and “green” financing.

According to EBAA secretary general Holger Krahmer, business aviation was excluded on ideological grounds and served to discourage investment in decarbonization.

“We stand ready to engage with all stakeholders and continue being the bridge

between the European business aviation industry and policymakers,” he said. “By focusing on our three key policy pillars, we look forward to advancing discussions on solutions that will facilitate our members’ uptake of SAF and ensure a fair, nondiscriminatory playing field for business aviation, granting equal access to airports and financing to develop net-zero propulsion technologies.”

The EBAA and GAMA lobbying alliance is also focused on opposing the threat of “severe taxes,” and operating restrictions.

More specifically, the manifesto urged caution to ensure that any planned reporting obligations for non-CO2 emissions are both technically feasible and do not place an undue administrative and logistical burden on aircraft operators. The groups insisted that distinctions need to be made between small and large emitters when it comes to settling the methods for data collection.

The business aviation lobbyists expressed concern that the anticipated rules covering measurement, reporting, and verification of non-CO2 emissions could be used as the basis for an additional tax on these emissions. They argued that this would be unfair on the grounds that there is no scientific consensus on either the impact of non-CO2 emissions or the most appropriate measures for mitigating them. z

Duncan Aviation last month completed the first installation of a Gogo Galileo HDX electronically steered antenna on a Bombardier Challenger 300, and flight testing of the lowearth-orbit satellite communications system is now underway. Galileo, which will launch commercially later this year, runs on the Eutelsat OneWeb satellite network. HDX, the smaller of two antennas that Gogo will o er, will be available in the first half of 2025. Service speed for the HDX system is up to 60 Mbps download and 11 Mbps upload, while the larger FDX antenna will allow 195 Mbps download and 32 Mbps upload.

FlyExclusive inked a deal to take over the management services for Volato’s fleet, as well as much of the fractional ownership and charter provider’s business. FlyExclusive will manage flight operations, sales, and expenses of Volato’s 13 fractional aircraft, eight leased aircraft, and four managed aircraft. Volato has operated the largest HondaJet fleet in the U.S. and recently added the Gulfstream G280 to its fractional fleet. FlyExclusive plans to transfer Volato aircraft to its operating certificate and in the interim is executing flights for Volato.

AOPA is warning general aviation aircraft operators of the prospect of new landing fees in Florida that could take e ect this month. The state has contracted with Virtower to collect aircraft movement data at airports using ADS-B. Virtower has partnered with Vector Air Systems to use the Virtower data to provide automated invoicing—a capability being marketed to airports in the state. AOPA is weighing options against Vector’s proposal, which is under consideration by several Florida airports.

STEER CLEAR OF STORMS WITH AUTO MODE ON THE GWX ™ 8000 STORMOPTIX ™ WEATHER RADAR. AVAILABLE ON SELECT GTN ™ XI AND TXI ™ -EQUIPPED AIRCRAFT.

BY CURT EPSTEIN

Business jet deliveries rose by nearly 9% year over year (YOY) in the first half of 2024, while total airplane billings increased by more than 24%, to $11.3 billion, according to the second-quarter 2024 delivery report released in September by the General Aviation Manufacturers Association (GAMA). At the same time, however, rotorcraft shipments dipped by 5.1% and billings dropped by 10.2% in the first six months of the year.

Among the jet manufacturers, Gulfstream Aerospace saw the largest improvement overall. Deliveries from the Savannah, Georgia-based airframer increased by more than 35% YOY, led by its large-cabin segment that handed over 52 twinjets in the first half of 2024, 17 more than a year ago. This came as Gulfstream began to ramp up on its recently certified ultra-long-range G700. Dassault—which does not specify deliveries among its models—delivered three more Falcon jets this year, equating to a 33.3% boost of its first-half 2023 tally.

Bombardier experienced a nearly 16% bump YOY, handing over nine more Challengers against one fewer Global. Embraer Executive Jets delivered 45 aircraft in the first six months, an increase of seven units from a year ago. It handed over 10 more of

its Phenom 300 light jets in the period versus a year ago.Swiss manufacturer Pilatus Aircraft handed over 18 PC-24s in the first half, unchanged from last year.

Meanwhile, Textron Aviation delivered one fewer Cessna Citation—79 this year versus 80 in the first half of 2023—with minor decreases across all models except the Latitude and Longitude. Cirrus also delivered 43 SF50 Vision Jets, one fewer than in the first half of last year.

Honda Aircraft had the largest yearover-year erosion, moving from 10 deliveries in the first half of 2023 to just four this year. Eclipse Aerospace, which shipped two EA-550 very light jets in the half of 2023, had none this year.

That was reversed by Airbus and Boeing in the bizliner class. Neither manufacturer had a delivery in the first half of last year, but they handed over an ACJ320Neo and a BBJ737-8, respectively, in the first six months this year.

Piston airplane deliveries also showed a year-over-year gain of 7.3%, with 761 aircraft shipped in the first half.

But the news wasn’t all positive for propeller airplanes. The turboprop segment saw 10 fewer deliveries this year, a decline of

The U.S. sustainable aviation fuel (SAF) industry is on track to meet the Biden Administration’s SAF Grand Challenge to reach annual production of three billion gallons of neat SAF by 2030, o cials said last month at the North American SAF Conference and Expo in St. Paul, Minnesota. “When we initially set it, there was a lot of discussions about whether that was too ambitious,” Alejandro Moreno, an o cial with the DOE’s O ce of Energy E ciency, said. “We are now on track at the low end to meet it and even exceed it.” In 2021, the U.S. produced five million gallons of SAF, and in just the first six months of 2024 that jumped to 52 million gallons.

AMAC Aerospace has begun work to expand its MRO facility at Milas–Bodrum Airport (LTFE) in Turkey, with completion set for 2026. The Swiss-based aircraft completions and MRO group has secured an additional 32,000 sq m (eight acres) of land at LTFE to build hangars that can handle widebody aircraft, as well as technical and administrative facilities. AMAC conducts cabin completions and MRO services for multiple aircraft types. It also has an MRO facility at Turkey’s Istanbul Atatürk International Airport.

Airshare is expanding its fractional aircraft and jet card programs to all customers throughout the continental U.S. This move complements its aircraft management and charter solutions, which the company has already been providing nationally. The expansion completes the company’s strategic plan launched five years ago, with recent entry into the U.S. Upper Midwest, Southeast, and Northeast. Going forward, Airshare will not charge repositioning costs for any flights that begin or end within the continental U.S.

3.4%, while the higher-end pressurized subset fared slightly better, with its 109 deliveries representing a 2.7% fall off from last year.

Epic Aircraft nearly doubled the number of its single-engine E1000GX, with its 11 deliveries equating to a better-than-83% rise YOY.

Daher boosted its output of TBM 960s, adding six of the aircraft to its total from first-half 2023 against one fewer TBM 910. Textron had a nearly 17% improvement in deliveries in its King Air family, almost doubling the amount of King Air 360s handed over for the first half.

As it ramps up the deliveries of its new flagship M700 Fury, Piper Aircraft’s delivery total dipped from 22—including 18 M600s—in the first six months of 2023, to just 13 in the same period this year. While the number of M600s handed over in the first half of this year dropped to two, the OEM delivered its first seven M700s.

Normally very consistent in its delivery numbers, Pilatus was o ff by eight PC-12s YOY, a more than 20% decrease from its first-half 2023 total. Fellow European airframer Piaggio had no deliveries of its Avanti Evo turboprop twin in the first six months of either year.

The results also were mixed in the rotorcraft segment with the decline in overall shipments driven by a slide in turbine deliveries from 339 in the first half of 2023

Through the first half of 2024, we continue to see robust demand for new aircraft, as indicated by the impressive backlogs and plans for facility expansion by many of our OEMs...

to 313 this year. That drove down billings by $200 million in the first half, from $1.9 billion a year ago to $1.7 billion through the first six months of the year. However, piston helicopter deliveries ticked up by 2.7% to 115, marking an improvement of three. In all, rotorcraft OEMs handed over 428 helicopters in the first half.

Airbus Helicopters saw its deliveries dip by 19 units to 119 in the first half with H125 shipments o ff by 12 to 47 and H145 shipments dipping by four to 25. Airbus doubled its deliveries of the H160 medium-utility model to six, but also halved its shipments of its heavy-lift H225 to three.

Bell further reported a seven-unit drop in deliveries to 50, with a slight decline across all of its models, most notably handing over three fewer 429 light twins in the first half for a total of four. Leonardo also saw its deliveries dip by five units to 74 in the first six months of 2024. The Italian manufacturer handed over seven fewer of its light single-engine AW119 in the first half for a total of 26 and deliveries of its AW169 medium twin dropped by six units to 10.

Robinson deliveries, however, improved by nine units in the first half for a total of 170, largely thanks to the seven-unit increase in deliveries of its R66 single turbine to 69.

MD Helicopters delivered three aircraft in the first six months of 2023 but none this year, Guimbal shipments improved by one to seven, and Enstrom delivered two in the first half versus none at the same time last year. Sikorsky, conversely, delivered no helicopters this year versus a sole S-92 medium lift model last year, and Schweizer delivered one S300C this year compared with none last year.

“Through the first half of 2024, we continue to see robust demand for new aircraft, as indicated by the impressive backlogs and plans for facility expansion by many of our OEMs,” said GAMA president and CEO Pete Bunce. “Our constraints continue to be ongoing supply chain and workforce recapitalization issues, which are routinely compounded by unacceptable turn times in terms of responsiveness and lack of decisionmaking by the FAA specialists on such things as issue papers, certification plans, and regular correspondence.”

z

Experience comfort never before offered in this class of aircraft. Or the class above it.

BY MATT THURBER

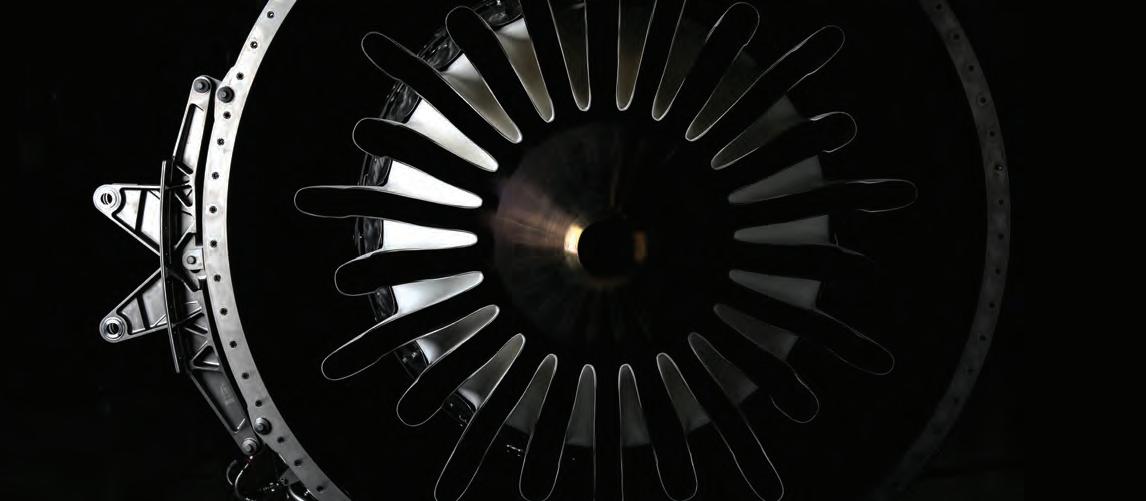

Garmin’s GHD 2100 head-up display adds a new layer of safety to the Cessna Citation Longitude.

Aircraft manufacturers have a new choice for sourcing a head-up display (HUD) for their business jet flight decks, Garmin’s GHD 2100. Certified on Textron Aviation’s Garmin G5000-equipped Citation Longitude, the GHD 2100 is a fully capable HUD matched to an Elbit multi-sensor camera system and offering traditional HUD as well as enhanced, synthetic, and combined vision system imagery.

The HUD landscape has been dominated by Collins Aerospace, which bought Head-up Guidance Systems manufacturer Flight Dynamics in 1999 and manufactures HUDs for aircraft equipped with its avionics and for Gulfstream jets with Honeywell Epic-based flight decks.

Elbit also manufactures HUDs, and Dassault is the primary business aviation customer, having been first to market with a combined vision system (CVS) overlaying synthetic vision system (SVS) and infrared enhanced vision system (EVS) imagery on the HUD.

The GHD 2100 includes CVS as do some modern Collins systems installed on Bombardier and Gulfstream jets.

There is also the SkyLens wearable HUD developed by Elbit’s Universal Avionics subsidiary, and this has distinct advantages for aircraft where there is no space to install a fullsize HUD projector or for operators that want more functionality than a traditional HUD. While Honeywell made its own HUD many years ago, that product never took off, but the company recently purchased HUD assets from Saab and is now developing a new line.

HUDs, which have been a mainstay in military aircraft for decades, have grown in popularity in the business aviation market since Gulfstream pioneered installations in its large-cabin jets. It was first to offer EVS, in 2001, which eventually enabled enhanced flight vision systems (EFVS), and then was followed with SVS imagery on the HUD.

A business jet HUD allows pilots to view flight information on the combiner glass mounted in their forward view while also

enabling them to look through the combiner at the outside world and focus on everything except the glass in front of their face.

This eliminates the need to look down at a primary flight display (PFD) and then back up through the windshield, and HUDs are especially helpful during final approach, with EFVS enabling approaches to lower minima by helping pilots see runway lights earlier than with the naked eye.

On the GHD 2100, pilots can see conformal attitude and flight path information, navigation data, autopilot modes, and master warning/caution annunciations.

Garmin’s HUD is an option for the Longitude, available either standalone or as part of an EFVS when the Elbit camera is installed. Most buyers will likely select this option, which is priced at $668,700, and the take rate has thus far been about 25% of non-fleet Longitude buyers.

While designing the complex optical elements is a significant challenge, Garmin engineers were able to keep the HUD

projector that mounts on the cockpit ceiling above the left-seat pilot relatively slim, so it doesn’t impinge on headroom.

The HUD’s field of view is 30 degrees horizontal by 24 degrees vertical. Like all HUDs, it does require careful positioning of the seat to keep the images on the combiner glass clearly in view. I didn’t find it difficult to set up for my viewing comfort.

The GHD 2100 was certified as part of the Longitude’s type certificate in 2023. Textron Aviation is seeking up to 50% visual advantage approval, allowing landings with lower visibility—cutting it from a half to one-quarter of a mile. With EFVS, the GHD 2100-equipped Longitude can already descend to 100 feet above touchdown-zone height.

Textron Aviation manager of flight operations Rip Lee flew the demo flight with me and, sadly, the weather didn’t cooperate; it was clear blue skies in Wichita, Kansas, so I wouldn’t get to experience the HUD in poor weather. Luckily, we were able to schedule some time in Textron Aviation’s Longitude iron bird engineering simulator, which precisely replicates the flight deck and control feel of the real airplane. The simulator would allow us to set some lousy weather so I could see how the HUD performed in adverse conditions.

Peter Fisher, senior engineering test pilot and the head of the HUD certification

program, walked me through the HUD demonstration in the engineering simulator. After taking off, I did some airwork including steep turns, then he had me climb steeply to see the arrows on the HUD pointing down and showing me which way to move to recover. I tried the same in a steep 80-degree turn to the left, and arrows pointing to the right popped up on the HUD.

With a precision approach dialed in, I hand flew to landing with weather set to one-quarter-mile visibility and using the Longtitude’s autothrottles. This was the first time I saw Garmin’s new lead-in line chevrons with their associated mile markers, a great improvement to the G3000/ G5000 avionics suite and viewable on the HUD or PFD.

Pilots can choose which mode to view on the HUD using a dual concentric knob mounted just to the right of where the combiner hinge is attached to the projector. Turning the small knob switches between EVS, SVS (Garmin calls it synthetic vision technology), and CVS. The large knob is used to adjust brightness. More options are available on the Garmin touchscreen controller’s PFD settings. One includes the ability to switch off SVS terrain so obstacles around the airport or in the foreground are still visible but distant terrain isn’t depicted. This offers a cleaner view, but I like seeing the terrain so I probably wouldn’t use this too often.

The CVS mode superimposes EVS and SVS, but there is a cutout that eliminates SVS on the runway and approach lights. I found that this helped me focus on where the approach lights should appear, and during the low-visibility approach, I could see the lights on EVS well before my eyes could see them without EVS. With this system, the HUD can detect LED lights that are becoming more widespread on runways, thanks to the multi-spectral sensors of the Elbit camera.

To help pilots through the landing, the HUD automatically declutters when approaching the runway, eliminating the horizontal situation indicator when gear and flaps are lowered, and it pops up flare cues (plus signs) to help the pilot achieve a smooth and accurate touchdown.

Fisher repositioned the simulator over Geneva, Switzerland, where I flew toward mountains until a TAWS alert told me to pull up. Flying an approach into Geneva, we couldn’t get vertical guidance to work but this just demonstrated one of the HUD’s benefits; I just put the flight path vector in the HUD over the aim point on the runway, resulting in a perfectly stable approach.

I’ve flown the Longitude twice before, so it was somewhat familiar. But this was the first time with the HUD. Sitting in the Longitude’s left seat, I didn’t find that the HUD projector impinged my headroom. In any

Airport security should go well beyond the passenger screening for commercial flights. Keeping controlled-access places secure within a facility depends on general and business aviation travelers and operators, as well. Know your security procedures – and those of the airport – and make sure everyone follows them. You and your crew will help keep these busy, important centers of commerce and travel thriving safely.

Guard against weak links in your security chain. Mount the poster where it can serve as a visual reminder to keep access points and aircraft secured. Need more? Download free copies at usaig.com.

Find out more about our coverage, our Performance Vector safety initiative or Performance Vector PLUS good-experience returns program. Contact us and we’ll connect you with an aviation insurance broker in your area.

John Brogan President and CEO, USAIG

SECURITY DEPENDS ON YOU

Crucial centers of business and movement, airports require everyone’s vigilance to keep travelers safe and property secure. Security protocols and perimeters are only as strong as their weakest element. Play your role to help lessen risks when in controlled-access environments.

Double-check to ensure unattended access points are secure. Leaving one open once is a risky mistake; doing it habitually creates a huge vulnerability.

Respectfully engage unrecognized people in controlled areas to verify credentials.

Ask yourself if something is out of place. Then, 1) what is it, 2) who else needs to know, and 3) have you told them?

Lock and fully secure aircraft when unattended.

case, it is mounted behind where the pilot’s head should be once the seat is adjusted.

Spotting a HUD-equipped (EFVS) Longitude is easy: just look for the camera mounted on the upper nose. It is carefully positioned to line up with where the leftseat pilot is looking to eliminate parallax. The GHD 2100 is fully conformal, which means that what you see in the combiner glass accurately matches the outside world.

With Rip Lee in the right seat and Textron Aviation chief pilot Shane Reese in the cabin, I used the Longitude’s tiller steering to taxi to Eisenhower National’s Runway 19L, maintaining the proper taxi pace by referring to the groundspeed displayed on the HUD. After pushing the go-around button to set the flight director for takeoff, I taxied onto the runway and advanced the throttles until the autothrottle system took over. Once in the air, I set the nose attitude to match the pitch box in the HUD and climbed to 12,500 feet for some airwork.

After getting used to the feel of the Longitude again, I flew some steep 180-degree turns, which are even easier with the HUD; just put the flight path vector on the zeropitch line, far simpler when looking through the HUD and windshield compared to having to look down at the PFD.

I then slowed down for some low-speed maneuvering. In clean configuration, I slowed straight ahead, then in a left bank, followed by straight ahead with landing

gear and flaps in landing configuration. Each time, I watched the Garmin autopilot engage the autothrottles, advancing power and lowering the angle of attack to prevent a stall. I was using the HUD almost the whole time and rarely let my eyes range over the flight and multifunction displays.

We dialed in the RNAV (GPS) 13 approach at Hutchinson Regional Airport where I hand-flew, following the guidance on the HUD with CVS on, all the way to touchdown using the flare cue. The landing was smooth but we did touch down left of the centerline, which may have been due to watching the HUD imagery and not looking through the HUD at the actual runway.

After taking off, I kept the Longitude low and turned left toward some tall towers so I could see what they looked like in the HUD’s CVS. The synthetic vision system painted them clearly so they were easy to spot.

For the second landing at Hutchinson, Lee input the visual approach to the runway. This time I tapped the CLR button on the yoke to remove the SVS and EVS imagery from the HUD so it just had the flight information. With the flight path vector on the aiming point, the Longitude descended steadily to the runway and another smooth landing using the flare cue.

For our final approach to Hutchinson, I headed north after takeoff and then lined up for the Runway 22 approach, using the GPS overlay with lateral and

vertical guidance instead of the plain VOR approach. I wanted to try an autopilot go-around, so I let the autopilot fly the approach. With landing gear and flaps down, at about 300 feet, I pushed the go-around button on the power lever, and the autopilot disengaged while the autothrottles advanced the power. I followed the flight director guidance on the HUD as Lee retracted the landing gear and flaps and then set flight-level change and heading modes on the guidance panel.

Returning to Wichita, we were lined up for a right base to Runway 19L so we set up a visual approach and selected approach mode, which provided lateral and vertical guidance. I was flying a little nose-high on short final, but the flight director guidance was spot on as I matched the flight path vector on the flight director donut by pushing the nose down, and then it was time to follow the flare cue for a landing that was almost right on the centerline.

So far, Textron Aviation hasn’t announced other jets that might be equipped with the GHD 2100 HUD. Garmin is offering it to other aircraft manufacturers as well, and the HUD can be integrated with non-Garmin avionics.

Slowly but surely, Garmin has paved its way into larger aircraft with sophisticated integrated avionics systems, and the addition of a capable and relatively space-saving HUD is a significant accomplishment. z

There are a lot of sports metaphors used to inspire our best performances, but the one I like most when it comes to fighting is from the Greatest himself:

“The fight is won or lost far away from witnesses—behind the lines, in the gym, and out there on the road, long before I dance under those lights.”—Muhammad Ali

In August, I wrote in this space: “Nobody has ever won a fistfight with the autoflight.” It might be that this piece should have come first—a discussion of how crews, both veterans and novices, can prevent an undesired aircraft state, a sort of fistfight for pilots. If you’re going to avoid going down in this kind of fight, just like the Greatest suggests, you better put in the work in advance.

When we organized the (book) Automation Airmanship: Nine Principles for Operating Glass Cockpit Aircraft , we decided that our focus would not be on the mistakes that crews had made in the last 30 years and the accidents that have resulted. Instead, we turned the spotlight on what the very best crews in the profession do to avoid these large system failures at all.

We wanted to share our insight into what makes up a kind of superpower that some pilots demonstrate: a special “knowledge reserve” that makes a few pilots perform consistently better when given the same set of in-flight conditions as their peers.

While engaged with organizations of all types and sizes, military and civil, fixedwing and rotary, we kept seeing this quality on display at about the same rate, no matter where in the world we were being employed to devise robust flight protocols for the cockpits of new fleets.

BY CHRIS LUTAT MANAGING PARTNER, CONVERGENT PERFORMANCE

There was—always—one or more pilots (usually at least two in any given flight department) that could explain the systems better and more thoroughly and operate with more relative ease during flight operations, regardless of the fact that they had nearly the same training and experience with the new technology as their peers.

In the end, we fit all of the qualities of this small group into the last of our Nine Principles: Logic Knowledge . It was the definitive “missing piece” in distinguishing “good” from “great” when evaluating individual pilots. It continues to be so today and might even play an even more important role as aircraft become even more reliant on digital control systems and software.

It explains how crews operating the same make and model of aircraft in similar flight conditions can experience the same system casualty and have completely opposite outcomes—one tragic, and the other so routine it barely meets reporting criteria. (We talk about this in Automation Airmanship by describing what the crews of two other nearly identical aircraft did to overcome an almost identical system failure as the ill-fated crew of Air France 447 in June of 2009, just months apart in that same year.)

Better performing crews on the advanced flight deck are those who know that they are part of what engineers and analysts have named a “tightly-coupled” system. They take every opportunity to know all they can about the technology and other forces that they control to minimize the likelihood that, when forces align in just the right way, they won’t be the source of failure. (Tight coupling is a mechanical term meaning there is no slack or buffer or give between two items. What happens in one directly a ff ects what happens in the other.)

These individuals go beyond what their training has required of them, by forming detailed mental models of how aircraft systems work and interact based on their deep knowledge of the systems themselves. (I think the reason why there are normally at least two pilots in any organization that demonstrate this extra quality is that when someone discovers an insight into how a system works, part of their learning is to explain it to others as simply as they can, and this usually takes at least two people.)

In Working Minds: A Practitioner’s Guide to Cognitive Task Analysis , one prominent group of human factors researchers describes in the clearest terms what the most modern aircraft cockpits demand of each pilot:

“Flight management systems require pilots to engage in sensemaking to fit the FMS analysis with the instrument data. Pilots depend heavily on their mental models of the logic driving the FMS.”

This is not news to most pilots—even if training organizations spend increasingly less time on explaining and demonstrating system logic than they do on the

performance of rote procedures that bring out of the technology the desired flight path control for the respective phase of flight that the crew and aircraft are in at the time.

It leaves a performance gap that is present in nearly every flight department— between what the very best are doing and what everyone else accepts as good enough.

But knowing just a few of these skills could enable every pilot to perform at an elite level. Our challenge was to extract as much of the visible evidence of this skill from our observations as we could and explain it in clear and certain terms that every pilot could understand so that they could each reach the next level of personal airmanship.

Here are some of the things these pilots know beyond what they learned in transition training:

1. The basic laws and phase of flight logic their aircraft is designed around;

2. Altitude level-off logic (during climb, cruise, descent, approach, and go-around);

3. Descent logic (from cruise to alert— or decision height or altitude);

4. Autopilot and autothrottle connect and disconnect logic;

5. The indirect mode-change logic that results from delegating tasks to the automation;

6. Operator authority limits that are intended to maintain the aircraft flight path within design maneuvering limits;

7. Feedback mechanisms (color changes, word changes, etc.) that display mode states.

There are more, but pilots who are determined to bring their knowledge to the next level can start here to have the most immediate impact on their personal performance.

Here is a personal case study . On a recent flight leg from the U.S. to a busy Asian destination, my crew and I were in our initial descent as cleared by the

controller—still in RVSM airspace—with a crossing restriction ahead issued by ATC that we had just programmed into the FMS. The flight guidance was coupled to the autopilot and the autothrottles were on, per SOP.

We were arriving in the terminal area at the end of an eight-hour leg, at the airport’s peak arrival period; the controller was doing an excellent job of managing her workload, and we were in compliance with our clearance. After an “expedite descent” instruction from ATC, our TCAS display showed proximate traffic ahead and to our right, converging and also descending, probably heading for the same waypoint we had in our FMS.

In this complex, fast-moving, and tightly coupled system, we each knew without saying it that whatever we did was going to factor in the outcome the controller was seeking—to deconflict traffic while keeping the arrivals in sequence and above all avoid a loss of separation. Seconds after we had increased our descent to around 4,000 feet per minute by extending full speed

brakes, with an altitude capture mode indication on our FMA (due to our high rate of descent), we were issued an immediate level-off by ATC, at an altitude 2,000 feet above the FMS target.

Unable to communicate with the converging traffic to revise their clearance, the controller did the next best thing and issued an urgent instruction to an aircraft she was in communication with (us). Our challenge was to execute an immediate level-off that was in conflict with the commanded flight mode (from the previously programmed constraint, already in capture mode) and do it within the next few seconds. I was flying—so I can say exactly what the pilot flying was thinking: “Here’s a conflict between the commanded flight guidance and our clearance, and the risk to the ATC system is real. The best solution is the smooth disconnection of the autoflight and autothrottle, retraction of the speed brakes, followed by an immediate manually flown level-off from a high rate of descent, then a reconfiguration of the FMS and flight guidance to comply with the new clearance, and

ultimately, reconnection of the autopilot and autothrottle.”

It all went off like clockwork, but the mental representation of what the aircraft autoflight was commanding versus what we wanted and needed was the key to a smooth transition to another flight mode without compromising aircraft or ATC limits. The system worked as planned, and our aircraft passed safely over the conflict aircraft without so much as a TCAS alert.

ATC thanked us for our assistance and switched us to the next sector as though it was all in a day’s work. Which it was, right? In our debrief just before deplaning, each member of my crew shared their perceptions of the situation and their takeaways, which when taken together demonstrate just how many systems were interacting together, and how important it is to know the logic of the systems we control so that we could play our part.

In short, we avoided a fistfight with the autoflight because we knew how it was configured (the airplane’s systems), how that was in opposition to what the bigger system required (the airspace system), and exactly the steps that were required to resolve the conflict.

The safety industry continues to find new ways to prove that the human remains the “weakest link” in the complex, tightly coupled system we all work in. It’s up to us as individuals to take every possible step to reduce the likelihood that we will be the source of failure on any given day when, unexpected and unwarned, forces align to challenge the limits of the tightly coupled system we live in and the knowledge that it depends on. z

Chris Lutat is managing partner of Convergent Performance, a B777 captain, and co-author of “Automation Airmanship: Nine Principles for Operating Glass Cockpit Aircraft.”

The opinions expressed in this column are those of the author and not necessarily endorsed by AIN Media Group.

BY MATT THURBER

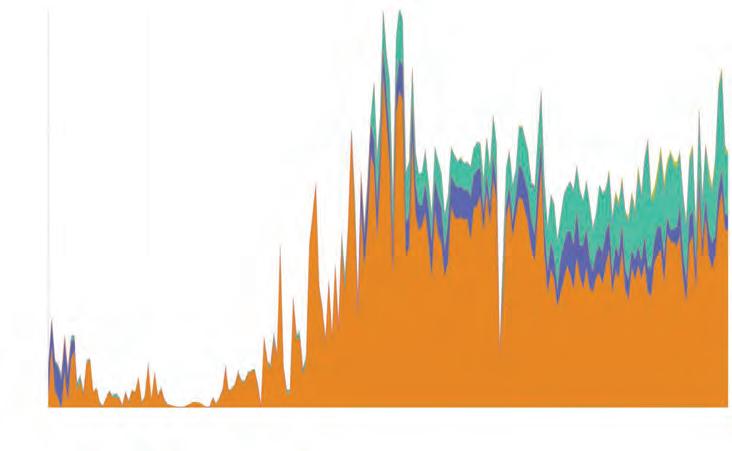

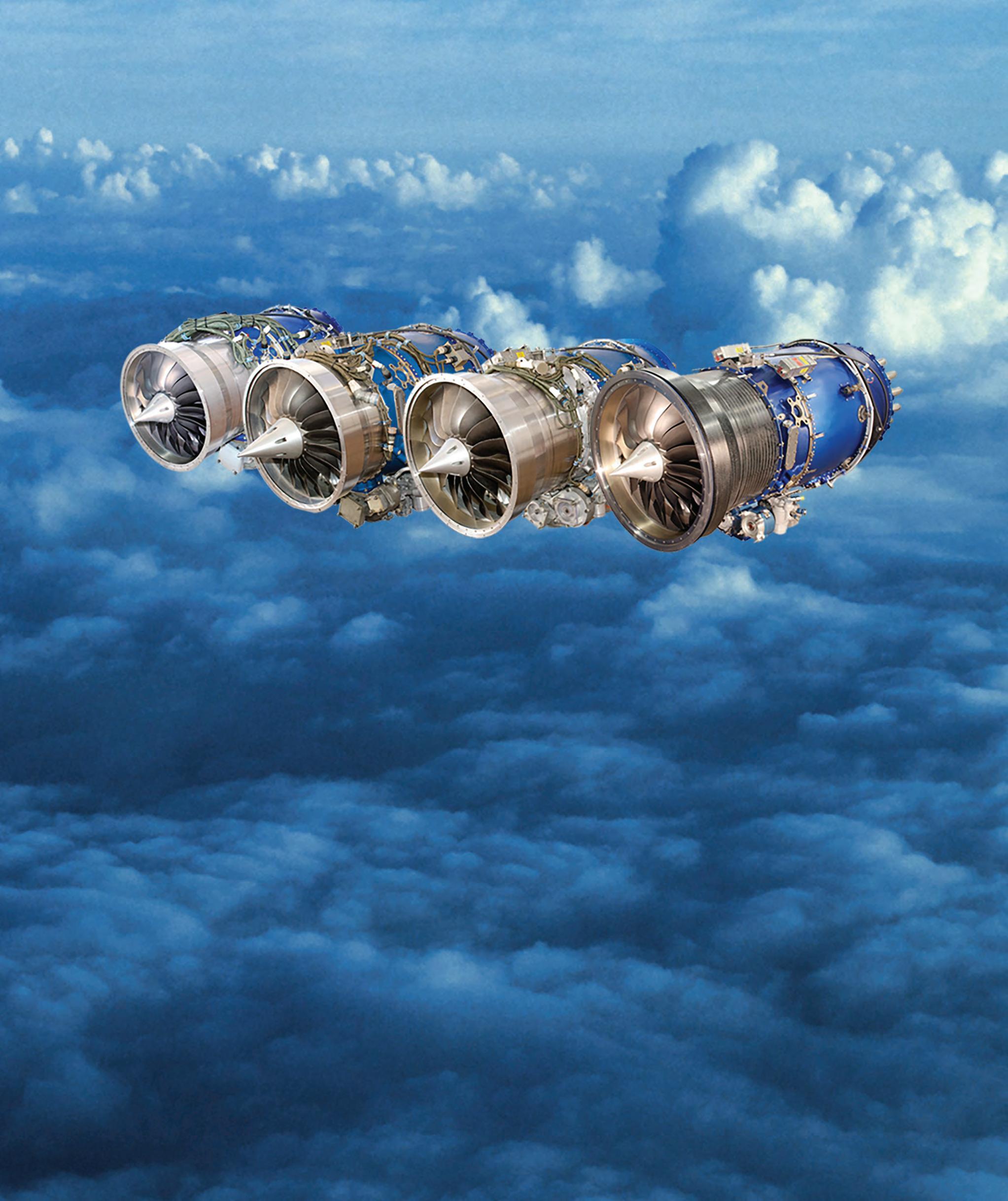

AIN overall average reader ratings for turbofan engine product support during the past year climbed for three engine manufacturers, with GE Aerospace topping the chart at a 9.1 rating, up the most—by 0.4—from last year. Rolls-Royce’s 8.6 rating remained the same as last year, putting it in second place, while Williams International, with a rating of 8.5, climbed 0.1 and came in third. Pratt & Whitney Canada (P&WC) declined by 0.1 to 8.3, while Honeywell saw the second-largest gain of 0.3 to a 7.9 rating. In the turboprop category, Honeywell topped the chart with a 9.1 overall average, followed by P&WC, which climbed 0.3 points to an also very strong 8.9. Pratt & Whitney’s overall average dropped to 8.6 from 9.1 for turboshaft engines. RollsRoyce and Safran weren’t included because they received insufficient ratings.

As for the individual engine ratings, most of the turbofan models saw increases in support scores even as it was more of a mixed bag on the turboshaft front. GE Aerospace’s Passport and CF34 turbofans came in with 9.2 and 9.0 overall averages this year, leading the pack. Honeywell’s TPE331 led in the turboprop/turboshaft category with its 9.1 rating.

Overall engine reliability generally drew the strongest ratings with nearly all scores edging above 9.0, while predictably, cost of parts was among the lower scores for both the company and individual models.

Supply chain has continued to plague some of the engine manufacturers, with conflicts including that involving Russia and Ukraine vexing areas such as access to titanium. However, in parts availability, some manufacturers have had more

success than others—reflected in the range of scores from 7.4 to 9.1.

That spread was even greater for individual models, reaching 9.2 for GE’s Passport, a relatively new model that is still expanding in the marketplace, and 6.9 for the venerable Honeywell TFE731, a more legacy model that has been in production since the early 1970s with more than 13,000 produced.

Despite the challenges of supply—in material, parts, and labor—the high scores for engine reliability across the board are particularly notable in light of the uptick in flying over the past several years. While first-half activity is generally down in North America and Europe, it has been up in other parts of the world and largely still surpasses 2019 activity, according to analysts such as WingX and Argus.

The FJ33 and FJ44 family of engines won’t let you down. Our Total Assurance Program (TAP Blue) covers all engine maintenance for a fixed cost per flight hour, scheduled and unscheduled, including all service bulletins plus whatever nature throws at you. TAP Blue is the only engine maintenance program that covers foreign object damage (FOD) including bird strikes and lightning strikes. Simple, predictable, and affordable – you can rely on TAP Blue.

To sign up now for the highest levels of maintenance coverage ever o ered, contact us at www.williams-int.com, by e-mail at WIproductsupport@williams-int.com, or by phone at 1-800-859-3544 (continental US) / 1-248-960-2929 (other).

AIN ’s annual Product Support Survey aims to quantify and rate through statistical analysis the product support functions of business aviation manufacturers over the past year. The survey, whose respondents include operators of business jets, pressurized turboprops, and turbine-powered helicopters, endeavors to encourage continuous improvement in airframe, engine, and avionics product support throughout the industry.

For the third year, AIN conducted the survey via a questionnaire developed in partnership with Rolland Vincent Associates, a Texas-based consultancy focused on aviation market research, strategy, and forecasting. Designed to provide improved ease of use and to encourage more participants to complete the entire questionnaire, the survey tool included Spanish and Portuguese versions along with clearer language and imagery around the categories and evaluation scale. Finally, it asked respondents to evaluate one full aircraft at

a time, including airframe, engines, and avionics.

AIN emailed qualified readers a link to the password-protected survey website active from late April to mid-June. It asked respondents to rate individual aircraft and provide the tail number, aircraft age, and primary region of service. The survey also asked respondents to rate, on a scale from 1 to 10, the quality of service they received during the previous 12 months in the following engine categories: Factory-owned Service Centers; Authorized Service Centers; Cost Per Hour Program; Parts Availability; Cost of Parts; AOG Response; Warranty Fulfillment; Technical Manuals; Technical Reps; and Overall Engine Reliability.

In total, 679 unique respondents, representing 2,221 aircraft, from 62 countries completed the survey. While above last year’s total, AIN did not receive enough responses to verifiably report on all manufacturers in all categories and on

several engine models. Rolland Vincent Associates reviewed the data to ensure accurate and valid responses. It also compiled the final survey results in close coordination with AIN

AIN’s analysis of the survey showed that scores slightly improved this year despite several challenges faced by product support organizations:

» Flight hours remained elevated between the May 2023 to May 2024 survey period and flying exceeded pre-pandemic levels in all business aviation segments. More flying leads to more unscheduled maintenance and demand on support teams.

» Supply chain disruptions created longer lead times for parts acquisition but these are finally showing signs of easing.

AIN’s 2024 Product Support Survey will be conducted from late April to mid-June next year. Recognition of personnel who went Above & Beyond on behalf of their customers follow this article.

GE Aerospace’s Passport and CF34 engines rocketed to the top of the ratings for individual engine models with a 9.2 and 9.0, respectively. Neither drew enough ratings to be included in the 2023 survey results. For the Passport, which powers the ultra-long-range Bombardier Global 7500, ratings topped 9.0 in all categories except cost-per-hour programs and cost of parts. Even in the latter category, the Passport led the panel with an 8.8 rating. It also led in areas including AOG response with a 9.5.

The company’s overall engine reliability—crossing all its rated engines—scored a high 9.5, matching that of Rolls-Royce. GE also received high scores for factory-owned service centers (9.4), authorized service centers (9.2), cost-per-hour programs (8.6), parts availability (a relatively high score of 9.1), cost of parts (a surprisingly high 8.6 for this category), AOG response (9.3), technical manuals (8.9), and technical reps (9.2).

Operators flying aircraft powered by GE Aerospace engines continue to fly more after the Covid pandemic, and this has spurred growth of GE Aerospace business jet MRO activity through its OnPoint product support program.

Since 2023, the fleet of aircraft powered by GE engines grew by 10%. Just in business aviation, GE’s CF34-3 engine fleet recently climbed over the 15-million-hour mark. The GE Passport has surpassed 300,000 flight hours.

The full-service OnPoint risk-reduction program for business aviation continues to focus on the “four essential elements,” according to GE: “comprehensive, transparent, transferable, and global.” Supporting customers through OnPoint means investing in growth globally, improving spare parts availability, and providing prognostic information via GE’s digital data analytics. This includes adding logistics personnel and emphasizing strategic global spare parts warehouses to improve the processing and delivery of parts.

“The result has been a 20% year-over-year growth in the volume of mobile repair jobs supported and a 10% increase in proactive analytics developed to minimize operator disruptions with over 68% of Passport disruptions caught prior [to] occurrence,” GE explained.

“The OnPoint program balances our OEM design expertise and the use of genuine parts and repairs to give our customers superior operational reliability and peace of mind,” said Melvyn Heard, general manager of business aviation at GE Aerospace. “This streamlined support means no time wasted so you have less downtime and more time in the air.”

Rolls-Royce maintained its overall average score of 8.6, as well as its position of second of five turbofan providers listed in the survey, similar to 2023. The company’s highest rating in the survey was for overall engine reliability at 9.5, matching that of GE Aerospace. The engine maker also scored a strong 9.0 in factory-owned service centers and

8.8 in authorized service centers, along with 8.9 in warranty fulfillment.

While its Tay series did not garner enough responses to be included in this year’s survey, its BR700 series improved in ratings from the top-ranked 8.6 last year to 8.8 this year and led the pack in overall engine reliability at 9.6. However,

its AE3007 saw a notable dip in the ratings from 8.6 in 2023 to 7.9 this year with drops below 7 in the cost-per-hour programs and cost-of-parts categories.

Rolls-Royce’s Business Aviation Aircraft Availability Center has helped the engine manufacturer achieve a return to service for AOGs of fewer than 24 hours and a more than 99% averted missed trip rate for customers all over the world.

During the past year, Rolls-Royce has added to its authorized service center network, which now has more than 85 locations. These are supported by 10 parts depots, including the newest, a 10,000-sq-ft AOG support storage facility in New York for CorporateCare customers based on the East Coast.

More than 50% of CorporateCare-covered engines are now on CorporateCare Enhanced, which includes “full coverage of both the engine and nacelle plus all labor and mobile response team travel time,” according to Rolls-Royce, as well as covering “unlimited corrosion and erosion.”

To help owners of “mature Rolls-Royce-powered business aviation aircraft,” the company introduced CorporateCare Flex, a power-as-a-service program that lowers the cost of ownership while helping increase aircraft availability.

Other developments include Rolls-Royce’s new technical publications platform; strengthening engine and nacelle lease assets with more than 250 on hand; and 25 customer managers and more than 75 on-wing services technicians dedicated to business aviation. This year, Rolls-Royce is

launching a new customer portal “where you will find everything you need to manage your Rolls-Royce assets in one convenient location.”

Williams International’s score inched up a tenth of a point to 8.5 this year, placing it in the middle of the overall average ratings for turbofan providers and just below Rolls-Royce. The company received the highest rating for warranty fulfillment at 9.7, also the highest rating of any category for any of the turbofan providers.

Its FJ44 engine drew an 8.5, pushing above 9.0 in warranty fulfillment, authorized service centers, and technical representatives.

During the past year, Williams International said it “worked to identify areas of improvement to minimize turnaround time in our repair station and expedite the engine delivery process.”

Since 2020, Williams has faced challenges with downtime and rental engine availability, but the work to improve these areas has resulted in customers experiencing greater aircraft availability and an increase in

the number of available rental engines. Customers in the Williams TAP Blue service program were able to receive expedited maintenance, the company explained, so no loaner engine was needed, thus eliminating having to make a return trip to the service center for a loaner engine exchange.

Another important e ff ort has been upgrading the Williams service network to full capabilities approval. “We understand the need for our service centers to be fully equipped to support operators’ maintenance needs,” the company noted, and the added capabilities at authorized service centers have helped prevent engine removals and also sped up the work because there was no need to wait for dispatch of trained technicians. Plans call for all authorized service centers to have the enhanced capabilities “in the near future,” but 70% have already reached that level.

“We are passionate about supporting our customers and believe in providing the best products and services available,” the company said.

Pratt & Whitney Canada’s (P&WC) turbofan support rating dipped slightly to 8.3 this year, but the engine maker drew a strong 9.0 in authorized service centers and 9.2 in engine reliability. At the same time, in the turboprop segment, P&WC’s rating improved by 0.3 to 8.9 with scores topping 9.0 in six categories: factory-owned service centers, authorized service centers, AOG response, technical manuals, technical representatives, and overall engine reliability. As for its turboshaft position, P&WC experienced a 0.5 drop to 8.6 but still scored 9.0s in both service center categories and 9.2 in engine reliability.

The company’s PT6A turboprop received a rating of 8.9, with the turboshaft variants close behind at 8.8.

In the fourth quarter of last year, P&WC announced the selection of Duncan Aviation’s Lincoln, Nebraska MRO headquarters as a designated overhaul facility for PW300 and PW500 turbofan engines that enter into service in the subsequent two years.

The move bolsters P&WC’s global network, which consists of more than 50 company-owned MRO facilities, designated maintenance facilities for line maintenance

and mobile services, designated overhaul facilities, and APU-approved repair facilities located in 25 countries. With more than 600 PT6C-67C engines operating in the Asia-Pacific region, P&WC in February revealed plans

to expand MRO capabilities in Singapore with a new overhaul line. Demand for “advanced maintenance solutions” in that region led to the decision to add the overhaul line, which will include a new modular test cell, according to P&WC. The PT6C-67C powers the Leonardo AW139 medium-twin helicopter, and the new overhaul line and test cell will be fully operational by 2025.

“Maintaining close customer relationships is crucial for planning our customers’ maintenance, repair, and overhaul needs,” said Irene Makris, v-p of customer service at Pratt & Whitney Canada. “With increased flying across all our markets, we continue to work on finding solutions through pioneering repair part

strategies and new provisioning to keep fleets flying.” Supply chain continues to challenge manufacturers throughout the industry, she added, as well as longer turnaround times. This makes it critical to keep communication channels open and make sure front-line teams have all the tools and training that the y need. “It’s also important not to lose sight of the future. Leveraging our engine health monitoring data, automation, and AI delivers proactive solutions. Additionally, efforts are underway to inspire the next generation of maintenance technicians amidst increased service demand, as the industry evolves and innovates,” she concluded.

Honeywell marked a 0.3 improvement in its rating from 2023, reaching 7.9 in turbofans, while maintaining a top rank among turboprop/shaft engines of 9.1 for its TPE331. In the turbofan segment, it received a 9.0 score for authorized service centers and a 9.1 in engine reliability. However, lower scores in cost of parts (6.7) and parts availability (7.4) tamped down overall scores in the turbofan sector.

Meanwhile, in the turboprop segment, warranty fulfillment drew a high of all the scores in this year’s survey—and last year’s, for that matter—with a perfect 10.0 followed closely by a nearly perfect 9.9 in engine reliability.

Like other engine OEMs, Honeywell customers have faced issues obtaining rental engines, so some reorganization has taken place to improve bank engine health, according to Todd Owens, v-p of customer and product support for the Americas. “The engine rental bank team, as well as the specs teams, used to report into a different part of customer product support,” he said. “We made a strategic decision to have those teams…report directly to me so that my team can better prioritize and take back the voice of the customer. The demand for bank engines is only going to increase,” and this applies to the HTF and TFE series engines.

Although the last new TFE731 shipped earlier this year, there are still more than 10,500 TFEs in the field, and supporting them remains a priority. There have been supply chain issues for TFE parts, but Owens and his supply chain vice president are working with channel partners and the Honeywell Aerospace Trading team to source serviceable used parts that can be repaired to keep the engine fleet flying.

“We’re going out and purchasing engines to make sure that the TFE bank health is where it needs to be,” he said. “We have a weekly [meeting] with myself and my peers and the supply chain to make sure that we’re getting the details needed, or we’re dual sourcing those parts, to make sure that we get the customers’ engines out of our shop back and on their airplanes.” This also releases engines back into the rental bank. “We’re making a lot of progress there,” he said.

As the HTF fleet has matured, these are seeing more services affecting the core of the engine. A recent fix for the stator will be incorporated during HTF core access, via a new service bulletin, according to Malcolm Fleming, v-p of global technical operations. Another improvement is availability

soon of a device for wireless downloading to improve monitoring of engine data, identify emerging trends, “or identify removals that need to happen proactively,” he said.

Honeywell has bolstered its AOG team with six new agents who will help provide faster service. Additionally, said Fleming, “We’re looking at how we use digital transformation and generative AI to identify multiple locations or where parts could be available and what’s the fastest way to get the part to the operator. And then providing the operator some options on how they can get the part…to help accommodate potential import-export timeframes, but also looking more holistically where the hardware is available, and giving them options.”

Last year, Honeywell refreshed its technical publications portal, and this will enable a key step, adding interactive electronic technical manuals. These are set to go live on the portal at the end of the year. “We’re also heavily focused on getting the TFE manuals updated and revised to the latest standards,” Fleming said, and this will be followed by AS907 manuals.

“There are still many challenges in our supply chain,” Owens said, and although trends are positive, “we’re not where we want to be. We continue to invest and are looking for opportunities to add additional repair capability.” One big improvement is the development of repair capabilities for TFE ITT harnesses, speeding up engine turn times. “We’re working with our engineering team to develop repair capabilities,” he said. “We’re turning over every rock to try to improve our mechanical throughput, and we invest heavily there. We know we still have a long way to go, but we’re doing everything we can do to improve the mechanical side of our supply chain.” z

AIN Media Group is excited to announce our inaugural

March 27, 2025 | The National WWII Museum | New Orleans, LA

Join us for AIN’s FBO Dinner & Awards Gala, a prestigious event dedicated to celebrating excellence in the business aviation industry, as we announce the top performers from our survey.

The event will take place on Thursday, March 27th, 2025, from 6 pm to 9 pm in the U.S. Freedom Pavilion at The National WWII Museum in New Orleans. This exclusive evening will feature a formal dinner and an awards ceremony.

This event promises to be an unforgettable night of networking, recognition, and celebration among the leaders in aviation.

During AIN’s annual product support survey for aircraft, avionics, and engines, customers highlighted individuals who go above and beyond their call of duty. Below are many of those named and the praise they received.

RANDY ADAMS (TEXTRON AVIATION)

“Randy is willing to answer calls 24/7, immediately works to address AOG and fleet issues. Continues to provide updates and then follows up after the event to identify the action items needed to prevent the AOG in the future.”

GRAHAM ALLAN (LEONARDO HELICOPTERS)

“Very hard working and dedicated.”

TAREK AMIN (PRATT & WHITNEY CANADA)

“Exceptional attention to customer matters. Makes you feel like you are P&WC’s only customer. Amazing support.”

SHAUN APPELL (LEVAERO AVIATION)

“Shaun’s customer-first approach ensures that people are satisfied with their maintenance experience.”

ETHAN AU (BOMBARDIER)

“Always responsive, responsible, and delivers the services…Informative advice and timely response to the operators’ needs.”

CHRISTOPHER BARNES (SMARTSKY)

“After contacting him late on Saturday, he changed his schedule to arrive on a Sunday morning to test the system prior to our departure. He went way above and beyond normal customer support.”

STEPHANE BEAUCHAMP (BOMBARDIER)

“Demonstrates exceptional customer service, agility when it comes to solving problems. Provides high level of service.”

JANET BEAZLY (DUNCAN AVIATION)

“! anet is a great CPM. She’s always helpful, informative, and knowledgeable about my company’s aircraft.”

RICK BEST (TEXTRON AVIATION)

“When we call, he replies and if he can’t help us himself, he gets us in touch with those who can.

Rick is the best I have ever worked with. He’s aways quick to answer. Rick does an outstanding job of helping us resolve issues that we have.”

HANNES BESTER (BOMBARDIER)

“Always available and helpful.”

KEN BLAD (BOMBARDIER)

“Very knowledgeable and always helpful when we need support.”

MIKE BOWEN (BOMBARDIER)

“Exceptional service in every way. The best FSR I’ve used. He was quick to help with an issue when the aircraft was on the road. Mike was extremely helpful in expediting a [service request for product support action] so we could fly the aircraft to a service center. Mike will answer the phone any hour of any day.”

JON BRAIDICH (HONEYWELL)

“Incredibly knowledgeable and always prompt and helpful. We truly appreciate what he does for us.”

JOHAN BRUNO (DAHER)

“After an FBO caused hangar rash incident, !ohan organized a rapid AOG response, working with the Daher factory, Daher engineering, and a local mechanic to get me back flying as quickly as possible, but more importantly, making sure the repairs were executed correctly and safely.”

MARK BURNS (GULFSTREAM AEROSPACE)

“Mark has built the service center network as well as the Lincoln MRO to support the aircraft Fleet. No other OEM has accomplished what Mark has achieved!”

DAVID CAMPBELL (AVEX AVIATION)

“Best customer support. Customer service and availability are outstanding. Responsive, knowledgeable, makes sure it’s done right!”

DENIS CANTIN (BOMBARDIER)

“Great customer service. Utmost commitment to the client.”

ROMAN CARRETO (LEONARDO HELICOPTERS)

“Excellent support and attention.”

JOHN CARY (LEONARDO HELICOPTERS)

“Very hard working and dedicated. Always available to help us find solutions that keep us flying.”

TREVOR CASTLE (BOMBARDIER)

“Trevor has superior knowledge to troubleshoot and diagnose. If he doesn’t know the answer, he is quick to find it, day or night. Lucky to have him at my disposal.”

ROBERTO CESAR (GULFSTREAM AEROSPACE)

“Very proactive.”

NICOLAS CHABBERT (DAHER)

“Works tirelessly and enthusiastically to support and promote TBM and Kodiak aircraft.”

AGNIESZKA “AGGY” CHRANIUK (BOMBARDIER)

“Bringing the aircraft to a maintenance visit involves a lot of planning, travel, accommodation, airport badges, etc. and she takes care of these things, so I can and have time to focus on technical issues. This is often overlooked but really makes a difference.”

MATTHEW COLBORNE (BOMBARDIER)

“Unwavering dedication, exceptional work ethic, and proactive approach to customer service. Continually demonstrates a positive attitude and a collaborative spirit, inspiring those around them. Outstanding efforts have not only ensured the smooth execution of tasks but have also set a high standard for excellence.”

STEVE COMMODORE (BOMBARDIER)

“Glad to have as my Customer Care FSR. Does an excellent job of supporting my aircraft and me. Quick to respond and help me get the aircraft fixed in a timely fashion.”

RONNIE COOK (BOMBARDIER)

“A leader in the FSR field, Does an excellent job of supporting my aircraft and me. Quick to respond and help me get the aircraft fixed in a timely fashion.”

ROBERT CORRY (PRATT & WHITNEY CANADA)

“Always available and responsive.”

BRIAN COTTON (BOMBARDIER)

“Always available and very knowledgeable.”

ANTHONY COX (BOMBARDIER)

“Listens and finds solutions. Anthony has always tried to do right by the customer–sometimes exploring exotic solutions. Understands support needs worldwide.”

MARIO CRUZ (EMBRAER)

“Mario is always available, whenever we need, to understand and solve every single demand we have, at any time. The field support is amazing! Mario Cruz is a really special guy; he created a synergy with pilots, services centers, and of course, with the technicians.”

MAURIZIO D’ANGELO (LEONARDO HELICOPTERS)

“Always available.”

RYAN DAGES (GE AEROSPACE)

“Ryan is responsive, professional, and always has time for his customers. Thank you, Ryan.”

RANDY DAVIS (TEXTRON AVIATION)

“Field service rep who will answer his phone any time day or night. He will stay on the problem until it is completely resolved! He does this even though he is no longer our field service rep!”

FRANCIS DE GRUCHY

(PRATT & WHITNEY CANADA)

“Exceptional attention to customer matters. Makes you feel like you are P&WC’s only customer. Amazing support.”

SCOTT DILLON (EAGLE CREEK AVIATION)

“Always ready to assist and outstanding knowledge of aircraft.”

MIGUEL DOSKOCZ (BOMBARDIER)

“Great knowledge and dedication.”

RAPHAELE DRUMMOND (BOMBARDIER)

“Best customer account manager out there. She truly cares about the customer and always does her very best to get issues addressed.”

MARCO ESPEJEL-ORTEGA (LEONARDO HELICOPTERS)

“Excellent professional. Easy going person, professional and dedicated.”

ANGELO FAVARO (LEONARDO MALAYSIA)

“Fully supports us.”

LUIS FERNANDO SAUCEDO MÁRQUEZ

(GULFSTREAM AEROSPACE)

“He knows the models very well, is polite and respectful.”

SAMSON FRANKLIN (HONEYWELL)

“Samson goes above and beyond every single day, both for his company and for his customer! Kudos!”

LUCIO GARCIA (BELL TEXTRON)

“Outstanding field support engineer.”

ERIC GARNEAU (GE AEROSPACE)

“Always available and very helpful, every time.”

NICHOLAS GERMANI (BOMBARDIER)

“Troubleshooting support and constant onsite visits this year have been well received and saved time and money with his support. Thank you.”

KRISTI GLASSMANN (GOGO BUSINESS AVIATION)

“Kristi did a great job organizing all levels of support in repairing a very challenging issue with our L5 installation. Top notch service!!”

PETER GRABHAM (JET DILIGENCE)

“Excellent support for our aircraft, always happy to assist and available day and night. Excellent AOG response with a wide network of people he can reach in a short period of time.”

CHRISTOPHER GRINNELL

(AERO STAR AVIATION)

“He knows the product. He responds right away. He cares about customer service…‘THE EXPERT’ for all things Phenom.”

QAIS HAMDAN (ROLLS-ROYCE)

“Always available and helpful.”

OSKAR HAUG (BOMBARDIER)

“Very dedicated person for many years.”

LEE HOGGARTH

(GULFSTREAM AEROSPACE)

“Lee has consistently demonstrated a remarkable commitment to providing exemplary service. His proactive approach, attention to detail,

and willingness to go above and beyond expectations have greatly contributed to the success of our operations. Lee’s expertise and professionalism have been invaluable in resolving challenges swiftly and e!ectively, ensuring minimal disruption to our operations.”

JOE HENSLEY (INTERCONTINENTAL JET SERVICES)

“Excellent in avionics upgrades and service response.”

TONY HULSEBUS (DASSAULT FALCON JET)

“Tony does an exceptional job. He is knowledgeable, friendly, and knows the company’s key people to get my aircraft up and running. He follows up to make sure that all ends well even after a solution is discovered.”

NICOLE JEFFORDS (CAVU AIRCRAFT MAINTENANCE AND AVIONICS)

“Above and beyond in service.”

BRET JONES (BOMBARDIER)

“Is always readily available for any questions and with assistance with a new plane.”

MARK JAMES (INTERCONTINENTAL JET SERVICE)

“Always accessible, bullet-proof reliable, excellent communicator, truly cares for his customers. Extremely knowledgeable and friendly to boot… Sets the example.”

NEIL JAMES (INTERCONTINENTAL JET SERVICE)

“Available 24/7 for troubleshooting and to solve problems with the plane.”

DAVID JENSEN (ACI JET)

“Great customer relations.”

IAN JONES (BOMBARDIER)

“Professional throughout—always available and supportive. Then, there’s a deep product knowledge, too.”

ASHOK KAPADIA (EMBRAER)

“The best tech rep ever! This guy deserves recognition for his support and assistance.”

VIGNESH KASIVISWANATHAN (EMBRAER)

“Excellent technical representative. He is always very active at any point of time for

technical and other matters. Always prompt with response, and extremely knowledgeable. He helps us in every aspect of our operations. Excellent and knowledgeable about the work.”

ALEC KINDRED (NORTHEAST AIR)

“Always goes above and beyond as far as maintenance on aircraft.”

KERRY KINEK (LEONARDO HELICOPTERS)

“Always going above and beyond.”

DEL KIRK (SIKORSKY)

“Above and beyond. Del provides our organization with the necessary parts to keep our aircraft with impeccable service and support.”

AARON KREISSLER (BOMBARDIER)

“Always going above to support and helps our mission with customer service support.”

JEAN-MICHEL LABORDE (DASSAULT AVIATION, FALCON COMMAND CENTER)

“Fast and very detailed precise replies in AOG situations, which also includes a lot of figures, diagrams.”

MARTINE LAPLUME (COLLINS AEROSPACE)

“Excellent support with Collins Venue installation and integration.”

ED LA SALA (DASSAULT FALCON JET)

“Ed has been very helpful when we need parts and is always there to take care of some of the issues on the back end. Very prompt in his responses, and I appreciate the attitude and humor he brings to his job. In short, Ed is able to make things happen for us and does it all while having a good time.”

MIKE LAVER (CAROLINA TURBINE SUPPORT)

“Goes above and beyond for support.”

JEFF LEISEY (DASSAULT)

“Any time day or night he is always ready to help.”

LARS LEMKE (BOMBARDIER BERLIN)

“Lars is always responsive to the customer and makes you feel like you are receiving his personal attention.”

JAMES LIANG (GULFSTREAM AEROSPACE)

“Very knowledgeable, always available, swift responses, always comes up with solution to solve your problem, and get you out of AOG.”

SARAH LINTERN (BOMBARDIER)

“Always quick responses.”

FERNANDO MACHADO (LEONARDO DO BRASIL)

“High knowledge and availability to solve customer problems.”

JULIANO MAIA (EMBRAER)

“!uliano has greatly supported us in terms of parts issues and is always available and with the sense of urgency we need.”

RAPHAEL MAITRE (DAHER)

“He is the most helpful and honest man l know in the industry.”

STEPHEN MARANDOLA (PRATT & WHITNEY CANADA)

“Exceptional attention to customer matters. Makes you feel like you are P&WC’s only customer. Amazing support.”

PETE MARKER (BOMBARDIER

DALLAS SERVICE CENTER)

“Very professional.”

MIGUEL MARTINEZ (BELL TEXTRON)

“Does his best to keep Bell customers satisfied.”

CHUCK MASSANOPOLI (SKYTECH)

“A 35-year veteran who is extremely well-versed and competent over multiple product lines and regs.”

JAVIER MATOS (LEONARDO HELICOPTERS)

“Second-to-none support for the ongoing operation. A large part of the success of our maintenance services is due to the quality and opportunity of support that he and his team provide in a personal and highly qualified manner.”

KRIS MCCANN (BOMBARDIER)

“Exceptional support and communication for required maintenance service events.”

MATTHEW MCCAULEY (BOMBARDIER)