GOVERNMENT: CHANGE COMING WITH NEW ADMINISTRATION

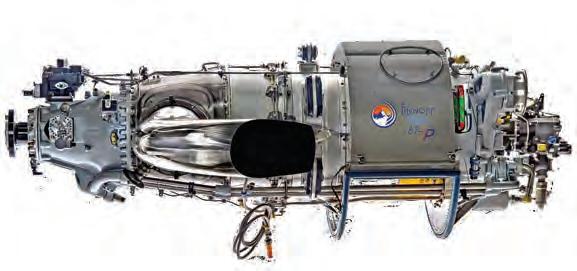

MODS: FINOFF PUTS THE POWER IN THE LEGACY PC-12

SAFETY: NTSB'S CONCERNS WITH PART 135 SAFETY

ROTORCRAFT: NEWS FROM EUROPEAN ROTORS

GOVERNMENT: CHANGE COMING WITH NEW ADMINISTRATION

MODS: FINOFF PUTS THE POWER IN THE LEGACY PC-12

SAFETY: NTSB'S CONCERNS WITH PART 135 SAFETY

ROTORCRAFT: NEWS FROM EUROPEAN ROTORS

The G700 entry into service is just one of the highlights of a fascinating 2024

Finno Aviation bundles Pilatus PC-12 upgrades into Elite Performance Package

Special Report: Finish line still eludes AAM rush

European Rotors 2024 focuses on vertical flight future

6 Washington to see aviation policy shift 8 SAF flow to reach Northeast U.S. FBOs

10 Perfect storm thwarts G700 delivery ramp up in 3Q

12 Eclipse flight tests Daedalean visual awareness system

Special Report: Laying foundation of future in 2024 14 Aircraft in 2024: Bigger, better, bolder 20 Business jet market stable heading into 2025

A year of partisanship and change, a year of bipartisanship and stability

Avionics move into the future

Stepping up on mental health

Connectivity market sees shakeup

2024 brings major leadership changes

NTSB probes top safety concerns in Part 135

Rotorcraft | 46 On the Ground | 48 MRO

As we go to press, conditions in the U.S. suggest that we have a so-called Goldilocks economy. All major indicators are just right—not too strong and not too weak—and you could say the same about the business aviation field.

Of course, things could turn on a dime, especially given the wars in the Middle East and Ukraine. The results of November’s U.S. election might also negatively impact the economy, though historically we’ve often seen a strong rebound after a presidential election regardless of which party has won.

The business aviation market settled down this year, following unsustainable increases during and right after the pandemic. The boost in activity, particularly among first-time charter users, was unsustainable. Still, the net e ect was positive in that the pandemic brought people into our industry who had not previously used business aviation.

A lingering negative of this surge is that entrepreneurs entered business aviation thinking they were smarter than those running the companies already entrenched. The newcomers learned quickly—the hard way—that this is a tough field in which to make money. The adage is true: a good way to wind up with a million dollars is to invest $10 million in business aviation.

It has been two years since our company celebrated its 50th anniversary. That’s when we announced that AIN Media Group would continue to be owned by the Leach family but with a non-family member overseeing day-to-day operations.

I am pleased to report that Ruben Kempeneer, now finishing his second year as AIN’s president, has done an outstanding job of taking over those operations. Dave Leach is our board chair, and Jennifer Leach English is managing personnel and Business Jet Traveler while helping to lead the company.

Businesses, and particularly small ones, need to be nimble and adjust to changing times. Marketing can’t operate with an on/o switch. It is a dynamic and fluid part of the business world, an intangible that is often di cult to measure.

AIN Media Group understands this and has responded to today’s marketing needs with a variety of developments and engagements.

I am so proud that we have adapted to the digital world with o erings such as our daily AINalerts newsletter, which remains one of the most valuable products in the business aviation community. It continues to enjoy an open rate of more than 20 percent, which, to my knowledge, is unmatched by any other newsletter in any field.

Meanwhile, we’re continuing to deliver our industry’s bestread print products—the monthly AIN and the annual Business Jet Traveler Buyers’ Guide, as well as our show dailies. All these award-winning publications are also available digitally, but it’s important to note that we remain committed to print. Independent research confirms that it’s virtually impossible to successfully brand a product without it.

This past October, Ed Bolen and his team produced an NBAA event that was as good as any in recent memory, and my congratulations go to all involved.

I am constantly asked my opinion about the future of domestic and international aviation shows. My answer: because marketing will always be essential, so will these

events. Like everyone in charge of running business enterprises, the organizers of trade shows around the world will need to make adjustments. Those who do not will lose market share and potentially fail. Those who create new forums and means of engaging buyers with sellers will win. Speaking of engaging buyers with sellers, part of our growth here at AIN has involved the introduction of two-day events called Corporate Aviation Leadership Summits (CALS). These under-the-radar, invitation-only gatherings put identified buyers and sellers face-to-face in a focused, intimate, and confidential setting. These so-called “hosted buyer” events feature concise, engaging, and e ective programs that are producing results for our clients. Keep an eye out for future CALS events in Europe and beyond.

Another exciting AIN event offering for 2025 is our first annual FBO Awards Dinner and Gala, to be held March 27 in New Orleans. At this event, we will unveil our rankings of the FBOs worldwide that scored highest in our exclusive annual survey of pilots, flight schedulers, and dispatchers.

AIN Media Group is poised for sustainable growth into the foreseeable future. We are a focused, evolving, up-to-date media company that is staying ahead of the power curve— and enjoying every minute of it. We love the industry, we love the people, and we thank you all for your continued vote of confidence. It keeps us going every single day.

Sincerely,

Wilson S. Leach Founder & Chair Emeritus

Here are a few of the queries I’ve been hearing lately from folks in the business aviation field, along with the consensus answers from industry experts:

Are labor costs stabilizing?

They certainly appear to be, but they’re not headed in the direction OEMs would like.

Are those new to private lift since 2020 staying?

Some frequent travelers are, but not the “family weekend in Aspen” bunch.

Will OEM order backlogs remain at current levels?

No, and we don’t want them to. Who wants to wait more than two years for a new jet?

Have used aircraft inventories leveled out?

Perhaps. For-sale inventories now represent 6 to 9 percent of fleets, depending on the category. That seems right versus 14 percent pre-Covid and 2 percent during the pandemic, but who knows?

Is the pilot shortage over?

It has moderated, but owners need to accept that the working world has changed.

Has the supply chain been fixed?

No, but parts of it are improving.

Amid all these changes, one constant is that AIN continues to invest in its products to deliver awardwinning independent journalism while serving as a trusted marketing partner. We remain committed to o ering unparalleled return on investment with ways to reach your customers in print, online, and in person.

Ruben Kempeneer President

BY KERRY LYNCH

January is poised to bring changes to aviation policy in Washington, with former President Donald Trump returning to the White House after a four-year absence. However, how far those changes may go remains to be seen.

The most immediate change will be in personnel running key agencies. Unless he chooses to leave, FAA Administrator Michael Whitaker will remain in place essentially for the duration of the incoming Trump Administration, confirmed to the post for a five-year term just last year. However, other key agency and department officials are more likely to be replaced, beginning with the Secretary of Transportation, a post currently held by Pete Buttigieg.

At press time, among the candidates reported as floated for that role was House Transportation and Infrastructure Committee Chairman Sam Graves (R-Missouri). Changes could go further downstream as Trump seeks to shore up his support within the administration. Shortly before leaving office in his first term, the former president issued a “Schedule F” executive order that essentially stripped policy officials within the federal government of certain civil

service protections, meaning they could be fired over different policy views or actions. Estimates have been that Schedule F could apply to up to 50,000 employees. This does not necessarily mean they will be fired, but it gives the president more power to exert control over agency actions.

The FAA, and largely the Department of Transportation, tends to remain more bipartisan so it’s too early to say how vulnerable career agency officials would be.

A key initiative that Trump had indicated during the election season was a desire to impose 10% to 20% tariffs on imports. This might affect business aviation goods, such as jets, engines, and other components. Most of the primary OEMs have some presence in the U.S.—and some with assembly or another form of production—so again, it is unclear how such a proposal would apply. Other changes could affect the sweeping audits that the Biden Administration launched in a range of areas—including on business aircraft use—in a quest to close loopholes and make sure companies and individuals are “paying their fair share.” The new administration may be less amenable to such efforts. z

Bombardier delivered 30 business jets in the third quarter—one fewer than in the same year-ago period—but still posted a 12% increase in revenues as shipments of Globals edged up, pricing remained strong, and its services business continued to expand. Company president and CEO Éric Martel cited the supply chain as the reason for the decrease, but said it remains on track to meet guidance of 150 to 155 deliveries this year. In the first nine months, Bombardier delivered 99 jets (45 Challengers, 44 Globals) versus 82 (39 Challengers, 43 Globals) in the same period last year. Revenues in the quarter reached $2.073 billion, while profits rose to $117 million.

Wheels Up is modernizing its jet fleet through a plan to consolidate jet types to primarily two models: the Embraer Phenom 300 and Bombardier Challenger 300/350. As part of the transition plan, Wheels Up will sell its 13 Citation Xs, gradually retire its fleet of light and midsize jets, and retain some Beechcraft King Air twin turboprops. It also announced a $332 million credit facility from Bank of America. In addition, Wheels Up has acquired GrandView Aviation’s entire fleet of 17 Phenom 300s and 300Es, along with some maintenance assets, for $105 million.

Aircraft winglet technology company

Aviation Partners is collaborating with aviation sustainability firm 4Air to o er emissions footprint assessments to its clients. Aviation Partners will provide clients with 4Air-certified sustainability tracking for one year following winglet installation. These assessments will give operators detailed insights into their carbon footprint.

SAF is poised to become far more available as providers such as Jet Aviation, Signature, and Avfuel significantly increase their supply of the fuel.

BY CURT EPSTEIN

Jet Aviation, Signature Aviation, and Avfuel are greatly expanding the footprint of sustainable aviation fuel (SAF). These efforts include finally bringing the renewable fuel to business aviation hubs in the Northeast.

Beginning January 1, Jet Aviation will more than double the number of its FBOs that carry SAF through a partnership with World Fuel Services. The company’s facilities at Dallas Love Field (KDAL) and Houston Hobby Airport (KHOU) in Texas, along with Palm Beach International (KPBI) in Florida will all carry continuous supplies of blended SAF.

That’s in addition to its FBOs at Boston Hanscom Field (KBED) and New Jersey’s Teterboro Airport (KTEB).

These five locations will join Jet Aviation’s existing SAF distributors at California’s Van Nuys Airport (KVNY); Bozeman, Montana (KBZN); and Scottsdale, Arizona (KSDL). The company also plans to stock SAF at its under-construction facility at Miami-Opa Locka Executive Airport (KOPF) once it opens in third-quarter 2025. Likewise, Signature—through an agreement with fuel supplier Valero Marketing and Supply—will add six new locations to its SAF network in January: KDAL; Washington Dulles International Airport (KIAD); Miami International (KMIA), KOPF, and KPBI in Florida; and KTEB.

Signature recently passed the 40-milliongallon mark of blended SAF pumped since 2020. This expansion will increase the number of Signature locations that carry SAF to 23, including eight of the top 10 largest business aviation markets in the U.S.

Meanwhile, Avfuel will expand its distribution of SAF across the Southeastern U.S, through a distribution agreement with Valero Marketing and Supply. The new multi-year deal will greatly increase Avfuel’s volume and geographic access to SAF.

According to the Ann Arbor, Michiganbased company, it will make the SAF produced by Diamond Green Diesel—using used cooking oil, fats, and greases in the HEFA pathway—more accessible to its customers, with an emphasis on Florida business aviation operations to start. Avfuel is focused on establishing area logistics, with the first FBO delivery expected in the coming months.

GAMA president and CEO Pete Bunce hailed the expansion of SAF into new territories. “I think [this] will send a message to our operator community that ‘Okay, there are no impediments, I don’t have to go through a process of book-and-claim. I can actually just give word as I am inbound to the FBO and say we want SAF.’” z

Third-quarter revenues at Berkshire Hathaway’s aviation services, which includes NetJets and FlightSafety International (FSI), soared 10.4% year over year, echoing second-quarter numbers, and marking a 9.8% increase in the first nine months. However, pre-tax earnings for aviation services fell 17.5% versus third-quarter 2023. This revenue growth was primarily driven by fractional provider NetJets, which continued to benefit from increased flight activity and demand for private aviation. Despite rising operating costs, including those for maintenance, personnel, and fuel, NetJets and FSI have been key contributors to the growth of Berkshire’s aviation division.

The 41 Cessna Citation deliveries in the third quarter outpaced the 39 business jets shipped by Textron Aviation in the same period a year ago, despite a four-week strike of its aircraft production workers. Textron Aviation also delivered 25 turboprops in the quarter, down from 38 a year ago. However, this manufacturing disruption will translate into fewer deliveries in the fourth quarter, Scott Donnelly—chairman, president, and CEO of parent Textron Inc.—said. He wouldn’t discuss how many fewer aircraft that will be but said the strike will result in about a $500 million reduction in forecast revenues this year at Textron Aviation.

Bombardier’s Challenger 3500 has set a new speed record: the fastest in the super-midsize category to reach 100 unit deliveries. On October 31, the Canadian aircraft manufacturer handed over the 100th Challenger 3500 to an unnamed customer just two years after the aircraft model entered the market.

For 12,000 Part 91 operators, CAA membership means more savings, more freedom, and more control. We negotiate the best jet fuel prices from more than 275 preferred FBOs throughout the US and beyond. You even get to vote on which FBOs we include — and recommend your favorites.

BY CHAD TRAUTVETTER

A confluence of events caused Gulfstream G700 deliveries to lag by 11 units in the third quarter, according to Phebe Novakovic, chairman and CEO of Gulfstream Aerospace parent General Dynamics. As a result, planned overall Gulfstream deliveries this year have been contracted from 160 to 150. Forecast G700 shipments fall from 52 to 42. In the first nine months, the company handed over 89 jets (76 large cabin models and 13 super-midsize G280s), up from 72 (57 large cabins and 15 G280s) a year ago.

Novakovic said during the company’s third-quarter investor call on October 23 that only four of the planned 15 G700 deliveries occurred during the quarter. She explained that this was due to paint rework as engine delivery delays led to aircraft being painted before engines were installed, as well as additional type

certification procedures due to complex interiors, a quality escape from a vendor that required replacing 16 parts on each aircraft, and four lost workdays after Hurricane Helene.

The revised schedule going forward called for deliveries of 27 G700s in the fourth quarter, with Novakovic breaking it down by month: five in October, nine in November, and 13 in December.

Despite the G700 delivery challenges, General Dynamics’ aerospace division— which includes Gulfstream and Jet Aviation—saw third-quarter revenues climb year over year by 22.1%, to $2.482 billion, and earnings up 13.8%, to $305 million. For the first nine months, aerospace revenues soared by 27.7%, to $7.506 billion, and earnings rose 19.9%, to $879 million, from a year ago. z

Embraer Executive Jets logged a record third quarter, delivering 41 aircraft, up more than 45% year over year (YOY). Revenues at the division rose by 65% over the same period. Through the first nine months of the year, the OEM has delivered 86 business jets—20 more than last year—and is well on its way toward meeting its forecast range of 125 to 135 aircraft this year. Business jet segment’s backlog stood at $4.4 billion for the quarter, an increase of 3% YOY but a 4% quarter-over-quarter decrease due to a “seasonally slower period for sales.”

Gulfstream Aerospace has completed a ground-test program on its G700 using various fuels, including 100% sustainable aviation fuel (SAF). The goal of the tests was to understand the environmental characteristics of di erent fuels with a focus on unblended SAF. Using SAF produced by World Energy, personnel measured the gaseous and particle emissions from the G700’s Rolls-Royce Pearl 700 engines. Preliminary data showed minimal to no sulfur contamination and a decrease in non-CO2 greenhouse gas production, demonstrating the potential of 100% SAF for improving the air quality near airports and possibly lessening the formation of contrails.

The UK government will impose a 50% hike to air passenger duty for most business aircraft charter flights beginning April 2026, under plans announced in its annual budget statement. The new Labour administration has also launched a consultation over more fundamental reforms to how the duty applies to what it categorizes as private jets in a process that will run through January 2025.

We were meant to fly.

Our engines power flight.

A love of flight powers us.

BY MATT THURBER

Eclipse Aerospace has begun flying Daedalean AI’s visual awareness system in an Eclipse 550 twinjet, testing the system’s artificial intelligence (AI)-based capabilities for detect-and-avoid traffic deconfliction. Ultimately, Daedalean’s visual awareness system will offer the traffic capability, as well as landing guidance and navigation in GPS-denied environments.

Although this project is in the early stages of testing and not yet on a certification track, Daedalean is pursuing an FAA Part 23 supplemental type certificate (STC) for its PilotEye visual traffic detection system in partnership with Avidyne. The company is also developing a similar traffic system, Ailumina Vista, for Part 27 rotorcraft and is working on an EASA STC.

The visual awareness system relies on cameras mounted on the aircraft and employs machine learning, which Daedalean explained is a form of AI that “leverages increased computer power to do more efficiently what until now could only be done by people.” The technology uses Daedalean’s “situational intelligence,

the ability to understand and make sense of the current environment and situation and anticipate and react to potential threats.”

For the Eclipse testing, the 550 jet is equipped with two cameras, one forwardfacing and one looking downward. The tests are being conducted in Albuquerque, New Mexico, where Eclipse is headquartered. According to Daedalean, “The focus is to evaluate Daedalean’s system capabilities for detect-and-avoid in critical phases of flight and provide the pilot with information needed to capture, identify, and deconflict with both cooperative and noncooperative traffic.”

A certified system would use more cameras, with the two nose-mounted cameras facing forward and downward, and one camera on each wingtip, covering a full field of view of 226 degrees. All of this camera input would ultimately serve the three visual awareness system functions: detect-and-avoid traffic deconfliction, landing guidance, and navigation in GPS-denied environments. z

CAE is purchasing a majority of Simcom shares from Volo Sicuro for $230 million, leaving joint venture partner Flexjet with a minority stake in the training provider. According to CAE, this investment will further solidify the company’s presence in its core business aviation training market, increase recurring revenue streams, and reinforce its commitment to delivering training solutions in this market segment. Additionally, CAE and Simcom will each extend their respective exclusive business aviation training services agreement with Flexjet and its a liates by five years, to 15 years.

A HondaJet crashed during takeo from Falcon Field (KFFZ) in Mesa, Arizona, on November 6, seriously injuring one occupant and resulting in the death of four people and one person on the ground in a vehicle.

According to an FAA preliminary report, the twinjet ran o the end of the runway during takeo and struck a vehicle o airport property before erupting in a post-crash fire. The NTSB is investigating the accident, which is the first HondaJet mishap to involve fatalities.

Textron Aviation’s machinist union members agreed to a new five-year contract on October 20, ending a four-week strike that halted aircraft production at the company’s Wichita headquarters. Among the key points of the new labor agreement are maintaining major manufacturing operations in Wichita, a 31% salary increase over the five-year contract, a guaranteed $3,000 annual lump sum payment per employee, and a higher 401(k) company match.

Despite the ongoing disruptions of a persistently uneven supply chain, labor constraints, geopolitical roils, and uncertainties surrounding elections, aviation took significant steps forward this year while seeing a “normalization” overall. Aircraft production increased, flight activity ebbed but only slightly, long-term FAA reauthorization passed, a regulatory basis for advanced air mobility was established in the U.S., and new and substantial advancements in avionics were unveiled. On the aircraft front, the fiercely competitive ultra-long-range category continued to progress with models in development and notably the long-awaited certification of Gulfstream’s new crown jewel: the G700.

BY MARK HUBER

The 2024 Honeywell Aerospace forecast predicts the delivery of 8,500 new business jets over the next decade. But how will these aircraft differ from today’s aircraft in terms of features and performance, and which trends have emerged? Airframers took several steps into that future with key advancements this year.

GULFSTREAM’S NEW FLAGSHIPS

Perhaps the most notable advancement in 2024 was the U.S. certification of Gulfstream Aerospace’s G700 in late March. That milestone had followed two years of delays largely stemming from more extensive reviews and stricter certification requirements that followed in the wake of the Boeing Max crashes.

Upon completing certification, Gulfstream president and CEO Mark Burns declared: “We have successfully completed the most rigorous certification program in company history with the G700.”

Importantly, not only did the approval clear the way for the 7,750-nm twinjet to reach market in the U.S., but certification

also opened the door to a stream of international validations; within a little more than 100 days, Gulfstream had already accrued eight international approvals along with a nod from EASA that came in midMay. Those validations have continued to expand. Deliveries have begun to pick up pace as well, but not at the rate originally anticipated, with plans to ship the first 52 out the door this year scaled back to 42.

G700 nod also clears the plate, to an extent, for focus on certification of the even longer-range G800. The 8,000-nm

sibling, which first flew in June 2022, was anticipated to trail G700 approval by six to nine months. However, Gulfstream has been quiet on any update to that.

Gulfstream’s new flagships build on its wildly successful G650/ER. The G700, however, adds a 10-foot cabin stretch yielding up to five separate living zones and an overall interior length of 57 feet.

While the G700 offers many cabin layouts and seemingly endless finer details, what makes it a true luxe long-hauler is the available “Grand Suite” in the aft fuselage.

It’s the closest thing to a five-star hotel room in a production business jet. It can be equipped with a curved-edge, queensize bed opposite a full-size dresser.

The G700’s Symmetry digital flight deck was first introduced on the G500 and G600. Based on Honeywell’s Primus Epic system, the avionics of all three are so similar that G500/G600 pilots can qualify to fly the G700 with transition training.

Power comes from a pair of Rolls-Royce Pearl 700 engines that each deliver 18,250 pounds of thrust. The G700 has a range of 7,750 nm at Mach 0.85 (6,650 at Mach 0.90) and maximum operating Mach number is 0.935.

Meanwhile, the G800, which was unveiled in 2021 alongside the smaller G400, shares a wing, tail, fuselage cross-section, flight deck, and Rolls-Royce Pearl 700 turbofans with the G700. The follow-on to the G650ER, the longer-legged aircraft, however, is 10 feet shorter than the 700, akin to its predecessor aircraft.

Meanwhile, Gulfstream’s busy R&D schedule continues to hum along with the G400, which marked its first flight on August 15, flying for almost three hours, reaching a top speed of Mach 0.85 and an altitude of 41,000 feet.

Powered by a pair of Pratt & Whitney Canada PW812GA engines, the G400 will be able to fly 4,200 nm at Mach 0.85. It features the advanced high-speed wing and winglet design as used by its G500 and G600 siblings, along with the Symmetry flight deck and predictive landing performance system.

Dassault Aviation this year has been working to spool up production and begin a flow of deliveries of its clean-sheet wide-cabin offering, the Falcon 6X. At the same time, it is increasing activity around its entrant in the ultra-long-range category, the 7,500-nm 10X.

The first 6X model entered service late last year after EASA certification and FAA

validation in August 2023. “The 6X is arriving,” declared Dassault Aviation CEO Éric Trappier during the company’s half-year results release in July. “It went through a certain number of delays because the certification was postponed, and the first deliveries are not easy because of the problems in the supply chain.”

Even so, the aircraft is proving to have a smooth entry into service. This year, the airframer brought the aircraft on a world tour, involving 400 flights and 600 hours. The results, according to Trappier: “a very good reliability.”

Introduced in February 2018, the 12to 14-passenger 6X has pushed Dassault into a new cabin class with the largest cross-section of any—currently—in-production, purpose-designed business jet: 8.5 feet wide, 6.5 feet high, and just over 40 feet long yielding 1,843 cubic feet of volume.

The 6X can use runways as short as 3,000 feet and deliver a range of 5,500 nm (eight passengers, three crew, and a cruising speed of Mach 0.80). It has a top speed of Mach 0.90. Fitted with a next-generation fly-by-wire flight control system and the new EASy IV cockpit, based on Honeywell’s Primus Epic avionics, the 6X is powered by a pair of Pratt & Whitney PW812D engines that deliver 13,500 pounds of thrust each.

With the 6X completed, Trappier added, the company is now turning its research and development funding resources into the 10X. The even wider cabin model, however, has suffered from similar supply chain issues, prompting Dassault to push off the market entry target by two years to 2027.

Even so, production on the model has progressed throughout the year. During EBACE, Trappier noted that the first examples of major assemblies—including the wings, fuselage, and empennage sections— have been built at Dassault and its partner factories. Final assembly was expected to begin this year at Dassault’s facility in Bordeaux-Mérignac. And notably, Rolls-Royce confirmed in October that it has completed the flight test campaign for the Pearl 10X turbofan powering its Falcon namesake.

The 10X has a 2,780-cu-ft cabin that sets it apart from competitors, supplanting the 6X with the largest cross-section of a purpose-built business jet with an interior width of 9 feet 1 inch and height of 6 feet 8 inches.

Leveraging experience from the Rafale fighter jet, the 10X’s highly swept wing will be made of carbon fiber composite materials. A big change on the 10X is the T-tail configuration of the empennage, a switch away from the distinctive-looking cruciform and downward-canted horizontal stabilizers on earlier Falcons.

Meanwhile, upping its own ante and keeping the top end of the market highly competitive, Bombardier is progressing with the certification of the Global 8000 anticipated next year. As the testing program for Bombardier’s new flagship Global 8000 nears completion, the Canadian airframer announced during NBAA-BACE in October that it has begun construction of the first production model. Modified Global 7500s were used for the test program. By late October, the program approached 300 hours of testing.

The successor to the 7,700-nm Global 7500 will feature a range of 8,000 nm at a long-range cruise speed of Mach 0.85. Top speed will be Mach 0.94.

A retrofit kit will be available for Global 7500 customers looking to bring their aircraft to the 8000 standard.

Through a variety of upgrades and enhancements, Cessna’s Citation Excel/ XLS series of midsize jets is deep into its third decade of production, and Textron Aviation is determined to keep the platform relevant after more than 1,000 deliveries. The latest variant, the Citation Ascend, is in flight testing, and deliveries are expected to start next year.

Announced during the 2023 edition of EBACE, the Ascend features a revised cabin with a standard flat floor, improved seating, more in-cabin storage, a wireless cabin management system, larger cabin windows, and enhanced cabin sound insulation.

Garmin G5000 avionics include synthetic vision that supports approach minima as low as 150 feet. Power comes from a pair of Pratt & Whitney Canada PW545D engines with autothrottles. Performance targets include a 441-knot cruise speed, a 1,900-nm range (four passengers) at high

cruise power, and the ability to climb direct to 45,000 feet.

In October, Textron Aviation unveiled the Gen3 models of its popular Cessna Citation M2, CJ3, and CJ4 light jets. All three will be equipped with Garmin Autoland and the avionics in the CJ4 will be upgraded to the new Garmin G3000 Prime system with interactive multi-touch technology, larger secondary displays, and fewer buttons.

CJ4 Gen3 will enter service in 2026 and the other two models in 2027. All three will be equipped with Garmin autothrottles, runway occupancy awareness, and 3D Safe Taxi. Owners of Gen2 M2s with autothrottles and CJ3 Gen2s will be able to incorporate Autoland via service bulletin once Gen3 aircraft are certified.

Individual model upgrades on the CJ4 Gen3 include True Blue Power lithium-ion batteries, new winglets and winglet lighting, new cockpit lighting, and better cabin acoustics.

With seating for up to 10, the CJ3 Gen3 adds 4.5 more inches of pilot legroom, swiveling single executive passenger seats, and RGB accent lighting.

The M2 Gen3 adds new interior styling, ambient lighting, remastered and illuminated cupholders, an optional folding side-facing seat, wireless charging, and USB A and C ports at each seat.

Pilatus Aircraft began delivery of its upgraded PC-24 earlier this year. Unveiled just before NBAA-BACE in 2023, the upgrades include a 600-pound increase in payload (for a maximum of 3,100 pounds), boosting range to 2,040 nm, and a new 6-foot, 6-inch side-facing divan that can convert into a bed.

Payload was increased with refinements in the wing and fuselage structural elements.

Other interior refinements included a reduction in ambient noise levels, and new cabinets designed to optimize space, and upgraded Lufthansa Technik cabin management system.

Honda Aircraft officially greenlit development of its new, longer, and longer-range light jet last year and has been working toward first flight, anticipated in 2026, followed by entry into service in 2028.

Honda already claims letters of intent for more than 350 of the aircraft. It builds

on the design of the shorter HA-420, which posted its 250th delivery earlier this year.

Compared with the HA-420, the new model will sport a fuselage that is 4.5 inches taller and 1 inch wider, and an interior that is 25.4 feet long. With one pilot and four passengers, the aircraft has a maximum range of 2,625 nm and a top cruising speed of 450 knots.

The avionics suite is built around the Garmin G3000 system with Autoland, autobrakes, and autothrottles. Power comes from a pair of Williams International FJ44-4C turbofans.

The FAA certified Piper’s new $4.15 million M700 single-engine flagship in March and FIKI (flight into known icing) approval

followed in May. Foreign certifications are ongoing, and by mid-year, the company had delivered the first seven to customers. Certification came just a few months after Piper unveiled the top-of-the-line M-Class turboprop single in February.

The aircraft comes standard with the Halo safety system, featuring Garmin Emergency Autoland. It also features the G3000 avionics suite with autothrottle.

Powered by a Pratt & Whitney Canada PT6A-52 700-shp engine, the M700 has a maximum cruise speed of 301 knots, a max range of 1,852 nm at a 206-knot cruising speed, and a standard useful load of 2,320 pounds.

Delays with GE’s fuel-efficient Catalyst engine have pushed the anticipated certification for Textron Aviation’s new $6.95 million turboprop single into next year. But

the airframer continued to make strides in its development including kicking off certification flight testing earlier this year.

GE hopes to have the new 1,300-shp engine certified by the end of this year. Preliminary performance numbers for the Denali include a maximum range of 1,600 nm, maximum cruise speed of 285 knots, and full fuel payload of 1,100 pounds. The flat-floor cabin can accommodate up to nine passengers and can be reconfigured for all-cargo or combi operations, facilitated by an oversized rear door.

The aircraft’s single executive cabin seats, which will meet the latest FAR Part 23 standards, were developed specifically for the Denali. Garmin G3000 avionics in the Denali are integrated with Autoland, autothrottle, and single-lever power control in a cockpit designed to ease pilot workload. z

AIN staff contributed to this report

E xperience comfort never before offered in this class of aircraf t. Or the class above it.

BY CURT EPSTEIN

As the business aviation industry continues to recover from the post-Covid era, the major forecasts are seeing growth ahead for the industry. Yet some near-term hurdles forced a slight downgrade in the predicted yearly delivery totals from the OEMs.

“We have adjusted our JetNet iQ business jet delivery forecast downwards for the year 2024 to reflect slower-than-planned [Gulfstream] G700 shipments and the strike impacting Textron Aviation,” said Rolland Vincent, president of Rolland Vincent Associates and founder/director of JetNet iQ. “Together, we estimate that a total of 33 jets will now slip out of 2024 and into the next year. Whereas we had been predicting an 11% year-over-year increase in jet shipments in 2024, we now estimate that jet shipments will be approximately 775 units.”

That total—the highest amount since pre-Covid 2019—still represents a 6% increase over 2023’s 730 jet deliveries across the entire spectrum, ranging from light jets all the way to bizliners, Vincent noted.

“If there is ‘good news’ out of these shipment delays, it is that we believe the outlook for 2025 has improved—we have bolstered next year’s shipments as we do not believe that these delays are causing customers to cancel their orders,” he told AIN. All the major OEMs are expected to finish the year with book-to-bill ratios at or above 1:1.

While the supply chain issues that plagued assembly lines over the past several years are easing, they are still not entirely resolved—a situation that continues to temper the pace of production.

“We were a little hampered between 2020 and 2023 because of supply chain constraints,” said Kevin Schwab, a systems engineer with Honeywell and lead analyst on the company’s recently released annual business jet operators survey. “We’re

seeing some improvements in the supply chain, and that is enabling the OEMs to have these production rate increases.”

Ron Epstein, a managing director with Bank of America Merrill Lynch Global Research, noted that the situation is not just limited to business aviation. “It’s not just this industry; the entire aerospace and defense industry is constrained,” he said. “You have an industry that is constrained from a labor point of view, and you’ve got multiple constraints in the supply chain, so I guess the good news is nobody can overproduce.”

It is that situation that led the General Aviation Manufacturers Association (GAMA) to issue its Aerospace Supply Chain Resiliency Task Force Report to Congress last month. The report determined that, among other factors, the U.S. aerospace supply chain “is vulnerable to labor shortages, obstacles in critical materials, and the health of supporting infrastructure,” adding, “Investment in these three areas, well beyond today’s current levels, will be needed to ensure that the

aerospace supply chain is able to operate in the presence of supply chain disruptions.”

The report noted that while global workforce shortages have been on the horizon for decades, the Covid-19 pandemic, the “great resignation,” a constantly expanding industry, economic cycles that encourage early retirement, and retention challenges have served to exacerbate workforce issues, leading to pressure throughout the supply chain.

“For us in Germany, it’s not necessarily labor,” said Frank Moesta, senior v-p of strategy and future programs with RollsRoyce Deutschland. “We have got the mechanics; we have got the equipment; it’s just when you can’t get parts, you can’t build engines.”

Despite, or as a result of, these headwinds, Vincent noted that the industry backlog has stood at approximately $50 billion for the past three years. “We’re not clearing out the backlog, but the good news is the backlog is holding,” he stated.

In the third-quarter JetNet iQ survey, Vincent noted a great deal of pessimism among its recipients, with the industry’s

net optimism score the lowest since the start of the Covid pandemic in the second quarter of 2020. North America had led the plunge, likely due to pre-election jitters in the U.S. Based on the survey’s historical data, uncertainty was seen in the third quarter in each of the past two election years but rebounded after the election results were certified.

For this year’s annual 10-year forecast, JetNet predicts deliveries of 8,600 business jets worth a total of $262 billion. In the same decade outlook, the forecast added 4,300 turboprops at $25 billion through 2033.

Honeywell Aerospace’s latest forecast, released in October at the start of NBAABACE, was slightly more conservative, calling for the delivery of 8,500 new business jets worth $280 billion over the next decade and cracking the 900-units-a-year delivery threshold for the first time since 2008 at the tail end of the forecast window.

“The business aviation industry is in a prolonged period of healthy growth, and we don’t see that positive trend changing any time soon,” said Heath Patrick, Honeywell Aerospace Technologies’ president for the Americas aftermarket. “Business aviation continues to see more users and, as a result, manufacturers are ramping up production to keep pace with growing demand, a trend we expect to continue for the foreseeable future.”

Next year, the company predicts 16% more business jet deliveries than in pre-Covid 2019. Over the next half decade, Honeywell’s survey anticipates that large-cabin jets will account for one-third of the delivery total and two-thirds of the total revenue value.

In terms of where deliveries are anticipated over the next five years, North America is expected to receive two-thirds of the total, followed by 13% to Europe, 10% to Latin America, 7% to Asia Pacific,

and the remaining 3% to the Middle East. While the preowned aircraft market has cooled somewhat since the record low inventories of 2021 and 2022, Honeywell noted that used jet values remain strong compared with those of the previous decade. The report predicted that while the inventory should continue to slowly rise, prices should remain stable. Operators in the survey noted that they expect to rely more heavily on the preowned market to expand their fleets than in previous years. Vincent noted continued stabilization in the preowned jet market as some young aircraft have begun to appear on the market for the first time in several years. “The market is moving, and it’s normalizing back up to 7 to 8% of the fleet [availability],” he said. “We want to start seeing numbers like that because with two-year backlogs, [preowned] is another way to get people into the industry.” z

This has been a pivotal year for aviation policy, setting in motion the foundation for the FAA’s activities over the next several years. Further, the release of the long-awaited safety management system (SMS) is pushing operators and companies into action that until then may have adopted a wait-and-see approach.

However, 2024 also ratcheted up the bureaucracy on top-tier corporate operators who may have been swept into the populism of “paying their fair share,” and on charter operators who may have been pulled into the Part 380 wars.

But perhaps most importantly was the outcome of the November elections that will bring in a new administration and Congress.

As November concluded, Washington was readying for the changes that will come with the new administration, as former President Trump returns to the White House following a four-year absence. In the immediate aftermath of the elections, several names were named for key positions.

Absent from that immediate first tranche was transportation secretary, which undoubtedly will turn over after Pete Buttigieg held the post for the past four years. However, House Transportation and Infrastructure (T&I) Chairman Sam Graves (R-Missouri) has been floated for the role and has said he would be honored to be considered.

The changes also bring uncertainty for others within the DOT, but FAA Administrator Michael Whitaker likely will have the option to remain in place throughout the new administration; he was confirmed just

BY KERRY LYNCH

a year ago to a five-year term.

Lawmakers also are preparing for the new U.S. Congress with a shift in power that will follow Republicans taking control of the Senate. With Senator John Thune (R-South Dakota) set to become majority leader, Senator Ted Cruz (R-Texas) is next in line to chair the Senate Commerce Committee. Cruz, who won reelection in November, is the current ranking member of the committee. But it is unclear whether he’d remain or look for a different assignment on another committee.

In the House of Representatives, Graves is bumping into a leadership term limit on T&I but has applied for a waiver to remain at the helm of the committee (that is if he doesn’t move over to the Cabinet). Also, House aviation subcommittee Chair Garret Graves (R-Louisiana), a key contributor to writing the FAA reauthorization bill, has opted to retire. So it’s possible

the committee will see new leadership in both places.

At the same time, the FAA is putting pieces in motion for hundreds of new mandates that came with the massive reauthorization bill that was signed into law on May 16.

The cornerstone 1,000-page aviation package, which included both FAA and NTSB reauthorization, passed with overwhelming support in the House and the Senate even if it took four short-term extensions of the FAA’s authorization to get it passed. By congressional terms, however, that was relatively quick compared with the lengthy delays and numerous extensions required in the past bill.

But importantly for the industry, the bill set a clear foundation of priorities in Washington for aviation: airport funding, consumer protections, safety workforce, security guardrails, and advanced air mobility and future technologies among them. In

a first for an FAA bill, Congress also sent a strong signal on the importance of a vital general aviation industry by giving the sector a full title in the bill dedicated to it.

Rep. Rick Larsen (D-Washington), the ranking Democrat on the House Transportation and Infrastructure Committee, noted during the 2024 NBAA-BACE Convention that, while much work remains to be done to implement the bill, its overwhelming passage set a mandate regardless of who came into power.

“Presidents come and go; Congress is forever,” Larsen joked during a Newsmakers Luncheon at the 2024 NBAA-BACE ahead of the November elections. “In this sense, we passed the bill 387 to 26 out of the House of Representatives—and I know where those 26 people live—and with 88 to four out of the Senate. It sends a bicameral, bipartisan message about the bill that we passed. So, regardless of which administration comes in, they’re not going to be able to come to us and say, ‘Well, you didn’t mean to do that.’”

What it does mean is the first significant funding increase for airports—aside from the pandemic aid—in years: $4 billion per year, in fact, with more money headed towards general aviation airports. And it addresses many key issues for the business aviation community such as protecting operator data privacy, clearing out the certification backlog, establishing a Part 135 aircraft conformity working group that recommends improvements in the aircraft conformity processes, stepping up implementation of runway safety equipment, providing more access to better weather information, supporting workforce initiative programs, probing cybersecurity risks, and so on.

While 2024 may have been looked at as the year of reauthorization on Capitol Hill, it was not the only major action in Washington. Also notable was the FAA’s longawaited release of the safety management

system mandate for Part 135 and many air tour operators, along with manufacturers. That rule, issued in March, has been long expected, and industry groups and private firms had been working to line up programs and resources to help assist the transition for operators, especially the small ones.

The final rule—which applies to nearly 1,850 Part 135 operators and more than 70 air tour operators—drew mixed reactions, with NBAA noting that it reflects comments urging flexibility and scalability to enable SMS programs to be tailored to the size and complexity of operations.

However, NBAA president and CEO Ed Bolen also cautioned: “While the FAA’s new rule appears appropriate in broad brushstrokes, the key going forward will be for the agency and industry to work in collaboration to ensure that rule’s realworld implementation is smooth, scalable, and squarely focused on measures that

demonstrably enhance safety.” In the FAA bill, Congress added language reinforcing that collaboration.

Also on the agenda this year and still ahead are fundamental changes to how Part 380 works. While a DOT economic rule, a couple of airlines and associated pilot organizations put on a full-court press to get this overhauled, making accusations of security and safety weaknesses as they complained of unfair competition.

A gamut of airport groups, community organizations, and nearly the entire general aviation industry pushed back, saying evidence does not support their accusations and competitive concerns should not shape safety policy. Plus, they argued, Part 380 often supports small communities.

However, the FAA in June announced that it was moving forward on a rulemaking to alter the definitions of “scheduled,” “on demand,” and “supplemental” as it

seeks to tighten the requirements for operators flying under Part 380. In addition, the FAA said it would form a Safety Risk Management Panel (SRMP) to discuss the potential for a new operating authority for scheduled Part 135 operations in 10- to 30-seat aircraft.

This drew mixed reactions, with NBAA president and CEO Ed Bolen saying, “We call upon the FAA to step forward with a data-driven basis that explains the need for this change, and detail its intended process for engaging with all voices in a meaningful dialogue about the agency’s approach to public charter policy.” However, industry groups did praise plans for the SRMP.

Meanwhile, tax policy took center stage this year with the Biden Administration rolling out audits on large corporations and high-net-worth individuals to ensure they are properly classifying business use of

aircraft for tax purposes. This was part of a larger effort to make sure these entities and people “pay their fair share.” That effort also included proposals to increase private jet fuel taxes fivefold and to lengthen depreciation schedules. The audits kicked off already and are said to be extensive, but the other tax policies face an uphill battle with the new White House.

While Washington has been busy, so too has Europe. The European Business Aviation Association (EBAA) joined Dassault Aviation in legal action against the European Commission’s Taxonomy Delegated Act on the grounds of discrimination.

The so-called EU Taxonomy is a classification system that identifies approved sustainable economic activities to help companies and investors make decisions over “green”

financing. EBAA secretary general Holger Krahmer said the European Commission specifically excluded business aviation on ideological grounds, discouraging investment in the sector’s efforts to decarbonize.

More recently, the EU further delayed the introduction of its Entry/Exit System (EES), a biometric fingerprint and facial scan check system for non-EU citizens at all EU borders. It was pushed back after Germany, France, and the Netherlands said their systems were not ready. Rather than giving a specific timetable for EES implementation, the EU is now planning to introduce it in phases.

However, since October 6, all visitors to the EU who do not need a visa are required to obtain travel approval through a new European Travel Information and Authorization System (ETIAS). This authorization grants a visa waiver for a stay of up to 90 days. z

BY CHARLES ALCOCK

Advanced air mobility (AAM) is where the space race meets the gold rush, with a dwindling group of start-ups scrambling for the elusive “finish line” marked by type certification and service entry for new eVTOL aircraft.

For these companies and their doubtless impatient investors, 2024 is drawing to a close with some important questions answered, but plenty of remaining doubts as to when the hype will be replaced by a sustainable flow of commercial returns from the billions of dollars that have already been plowed into the sector.

What does seem clearer is that the race is tightening, with just a handful of companies now visibly in contention for what might be seen as the first wave of eVTOL air services. Some contenders that might have seemed viable even a couple of years ago are barely on the radar anymore.

Others, in a group that includes the likes of Hyundai subsidiary Supernal, Embraer spinoff Eve Air Mobility, Boeing subsidiary Wisk Aero, Airbus, and Textron eAviation, have consciously opted out of the race to be first to market. For them, the horizon seems to lie more in the 2030s than the 2020s. They appear to have deep enough pockets, and management teams taking the long view, not to get drawn into the froth around what will or won’t happen in 2025.

But there are other players around which existential concerns have escalated in recent weeks. Lilium, often viewed as one of Europe’s leading AAM contenders, has been forced to seek shelter in the German self-administration process after being refused German federal and state government funding of around $108 million.

As of press time, it was unclear whether the move would lead to further funding being lined up, with the possibility that ownership of the company could change hands and/or some operations could relocate to France.

In the UK, Vertical Aerospace is another eVTOL developer with a future that appears to be hanging in the balance. With a full-scale prototype of the four-passenger VX4 now in flight testing, shareholders Stephen Fitzpatrick and Mudrick Capital Management have been publicly at loggerheads over the terms under which further financing could be urgently raised to keep the program afloat. By contrast, on the other side of the Atlantic, eVTOL developers Joby and Archer are ending the year apparently flush with funds, having boosted their war

chests significantly in 2024. Nonetheless, as of press time, it remained far from certain whether either of these companies would hit their declared target of achieving FAA type certification before year-end.

In fact, Sergio Cecutta whose SMG Consulting firm provides expertise to the AAM sector, believes industry timelines could be moving more slowly than industry promoters would have us believe. He told AIN that the first U.S. and European type certificates might not even be issued by the end of 2025 (see sidebar).

Regardless of when that key milestone is achieved, eVTOL aircraft manufacturers are now rapidly digesting what the newly-released FAA special federal aviation regulation for the “Integration of Powered Lift: Pilot Certification and Operations” will mean for service entry of early use cases such as eVTOL air taxi services. The U.S. regulator earned the industry’s gratitude for apparently taking on board a plethora of concerned comments over an earlier draft version.

The final document makes repeated use of the term “alternative requirements,” supporting the FAA’s willingness to accept a more performance-based approach to compliance in key areas such as energy reserves (governing eVTOL aircraft range) and training and certifying type-rated commercial pilots.

The new year may yet see adjustments to early use cases and plans to launch commercial services as prospective operators, including the likes of Delta Air Lines, come to terms with where and how they will be able to start reshaping public transportation.

It is by no means a given that the “where” will first materialize in the U.S. Joby has suggested that its first air taxi services may very well be in Dubai, where regulators seem determined to fulfill the Emirate’s ambition for another world-first.

CHRIS CLEMENTI CEO AEG FUELS

2024 has been transformative for AEG Fuels as we bring a major focus to building our branded FBO network, providing sustainable aviation fuel solutions to our customers, and cementing our position as one of the largest independent marketers of aviation fuel to the commercial, government and business aviation segments. In a rapidly evolving landscape, we have seen remarkable shifts, from the resurgence of international travel to an amplified focus on sustainability and operational resilience. As CEO of AEG Fuels, I am proud of our team’s ability to navigate these changes, providing seamless service and trusted support to our partners worldwide.

The demand for efficiency and reliability in aviation fuel and trip support services has only intensified, underscoring the importance of agile, customized solutions for our clients. At AEG Fuels, we remain committed to innovating our offerings to address these demands, with notable investments in technology and sustainable aviation fuel (SAF) to support lower-carbon travel.

Looking ahead, we anticipate continued growth driven by partnerships, operational expansion and acquisitions that align with the evolving needs of our clients. We are also optimistic about future developments in sustainable fuel sources and infrastructure enhancements across our network. As we reflect on this year, we are energized by the progress and look forward to an even stronger aviation community in the year to come.

That said, the manufacturer recently indicated it will be late 2025 before the first passenger-carrying flights happen, with operations in U.S. launch cities New York and Los Angeles to follow.

Meanwhile, China provides perhaps a cautionary tale for those struggling to contain their impatience to see the dawn of the eVTOL age. It is now more than 12 months since EHang became the first eVTOL manufacturer in the world to achieve type certification, when the Civil Aviation Administration of China approved its autonomous EH216-S two-seater.

Another five months elapsed before the Chinese company secured the production certificate required to start series manufacturing. More importantly, as of press time, neither EHang nor its prospective customers had the air operator certificate required to launch commercial services.

Keep in mind that AAM is not all about all-electric eVTOLs. Companies like Electra Aero feel they can deliver more value with hybrid-electric STOL aircraft like the nine-passenger model for which it unveiled the first full-scale prototype in November. The Virginia-based company expects its “ultra short” fixed-wing aircraft to be able to operate from patches of real estate barely bigger than a football field, transforming regional air services in the process.

In Europe, effort and investment are going into developing new airliners to meet net-zero carbon imperatives for the air transport sector. Among the pioneers are Sweden-based Heart Aerospace and Maeve in the Netherlands, while ZeroAvia has been making progress with its plans to convert regional airliners to hydrogen-electric propulsion systems.

This article is courtesy of AIN Media Group’s FutureFlight coverage. To read more, please visit https://www.ainonline.com/ futureflight. z

AIN asked independent AAM industry consultant Sergio Cecutta for his perspectives on progress made this year and expectations for 2025. Here are his key takes:

2024:

I think we all expected to be in a more advanced state of development, but this is a result of underestimating how di cult and capital-intensive aerospace programs are. We all thought for a long time that $1 billion was the price tag for the certification of an eVTOL; it is now clear that depending on the level of vertical integration, it will come to about $1.5 billion to $2 billion [in the West]. The development of the regulations has happened as hoped, with the FAA pulling a rabbit out of the hat with the fast turnaround on the SFAR [operating regulations]. While we did not expect it, I think the European eVTOL sector is in trouble with the three champions in dire financial straits, a marked di erence from their U.S. and Chinese peers. For the second wave of AAM aircraft, we wonder where the remaining funding will come from.

2025:

We do not expect any eVTOL type certifications in the U.S. or Europe, except for Volocopter, but for them, the make-orbreak moment is whether they will have the funds to develop the larger [higher payload] VoloCity aircraft. We expect type inspection authorizations to be issued to Joby, Archer, and Beta [giving approval for type certification flight testing to be conducted for full credits].

Beta’s CX300 [conventional takeoff and landing version of its Alia 250 eVTOL] might cross the type certification finishing line before the year is over. The UAE will be getting ready to host its first eVTOL flights in early 2026. I expect to see vertiports in the UAE but not in any other jurisdiction in the world as it becomes clearer and clearer that without government support, closing the business case for vertiports is quite di cult.

The 2025 NBAA Leadership Conference will take you on a transformative journey, starting with the basics. Across three days, engage in interactive sessions centered around effective communication, emotional intelligence, strategic thinking and authenticity.

This event is designed to elevate your leadership skills to new heights, focusing on the foundational elements that foster exceptional leadership growth and development for you and your team so you can lead with clarity and purpose.

While it might seem that avionics design had reached a plateau with few significant advances, this year has seen some interesting developments from new integrated touchscreen flight decks to the practical application of artificial intelligence and the proliferation of autothrottles in smaller airplanes.

Garmin announced its latest integrated flight deck—G3000 Prime—just before this year’s NBAA-BACE in October. For many years, Garmin has employed touchscreens as avionics controllers and more recently has offered touchscreen main displays with its TXi avionics. Now, the G3000 Prime flight deck is bringing touchscreens to integrated flight decks with 14-inch edge-to-edge touch displays in the primary and multifunction display positions and improved pilot interfaces that make the system even easier for pilots to manage.

With G3000 Prime, the screens are now called primary display units (PDUs). The current Garmin touch controllers are replaced by secondary display units (SDUs), and these have 40% more screen area than the original controllers. Now the SDUs are all standby-capable, eliminating the need for separate standby instruments.

On both the PDUs and SDUs, the capacitive-touch displays recognize when a hand is resting on the display and still allow fingers to manipulate the screen simultaneously, which makes interacting with the displays easier in turbulence. There are no knobs on the SDUs, but there is a new Garmin control unit (GCU 315) under each secondary display with physical knobs

BY MATT THURBER

and buttons. The GCU enables navigation through applications, zooming of windows, pane focus on the PDUs, and radio tuning.

Textron Aviation became the first airframer to announce the adoption of G3000 Prime at NBAA-BACE, and this will be in the Citation CJ4 Gen3.

Honeywell’s new Anthem avionics suite made significant progress this year, including logging hundreds of flight hours in the company’s Pilatus PC-12 testbed. Designed for a variety of aviation segments, from Part 23 to 25 general aviation aircraft and commercial airliners to military aircraft, Anthem is a platform that could introduce new pilots flying training aircraft to its new operating philosophy. They might then graduate to different types or larger aircraft equipped with the familiar Anthem interface.

In the flight test PC-12, the Anthem setup includes three touch-display units (TDUs). Two pilot interface display units (PIDUs) are mounted in front of the center console, underneath the center TDU. Each TDU can host a page that looks exactly like the PIDU, called a pilot interface window (PIW), so all the functions that control Anthem are available on any display. Airframers that select Anthem can opt for a cursor-control device as an alternative to all-touch interfaces.

The PIW is the primary interface that pilots will use to manage Anthem, and its touchscreen has all the buttons for operating radios, planning a flight, and pulling up systems synoptics. At the bottom of the PIW is probably the most unique feature of Anthem: the multiple data field or smart scratchpad, which Honeywell calls the predictive user interface.

Scratchpads are a common design feature on FMSs, allowing users to input, say, a frequency and then select which radio will be assigned that frequency. The Honeywell User Experience (HUE) design team took the scratchpad further into the future and made it much more useful. Touching the scratchpad enables the user to input various types of data, and the scratchpad automatically recognizes the data type and prepares it for proper placement.

Recognition of the safety and operational benefits of autothrottles is growing, and airframers are adding these to smaller airplanes. The most recent addition was Honda Aircraft’s HondaJet Elite II, while more of Textron Aviation’s Garmin G3000equipped CitationJets are equipped with or adding autothrottles. Turboprops such as the Beechcraft King Air 260 and 360 include factory-standard autothrottles (made by Innovative Solutions & Support), while the newest versions of the Pilatus PC-12 and Daher TBM 960 are autothrottle-equipped. Many of these airplanes

support Garmin’s Autoland capability, which requires autothrottles.

Eclipse Aerospace has begun test-flying Daedalean AI’s visual awareness system in an Eclipse 550 twinjet, testing the system’s artificial intelligence (AI)-based capabilities for detect-and-avoid traffic deconfliction. Ultimately, Daedalean’s visual awareness system will offer the traffic capability, as well as landing guidance and navigation in GPS-denied environments. Daedalean’s Visual Positioning System uses cameras to determine aircraft position, along with a Visual Motion Unit to calculate the distance and direction that the aircraft is flying, updated by the positioning system’s camera-based visual references.

One of the first products that could result from Daedalean’s AI efforts is a Part 23 supplemental type certificate (STC) for its PilotEye visual traffic detection system in partnership with Avidyne. The company is also developing a similar traffic system, Ailumina Vista (for Part 27 rotorcraft), and working on an EASA STC.

At NBAA-BACE, Universal Avionics demonstrated its AI-driven system that uses external camera inputs, audio capture, and ADS-B In information to paint a picture for the pilot of the situation at the airport while taxiing. The AI system uses Universal’s FAA-certified Aperture visual management system, which delivers video inputs and imagery to flight deck displays and head-up displays (HUDs), including Universal’s SkyLens head-wearable display (HWD).

The AI application for the Aperture product is image content analysis, using data captured from sensors such as Universal’s EVS-5000 multi-spectral camera mounted on the nose for HUDs and HWDs, as well as external cameras, and audio captured from the aircraft’s communications radios. The AI system can isolate and ingest com radio audio and it knows which instructions are for its aircraft.

For example, if a controller clears that aircraft for takeoff, the AI system recognizes the registration number that the controller uses in radio calls to the pilot. Any other communications to other aircraft can safely be ignored because they are for different aircraft. Once the AI captures the controller’s message, it is displayed in text on the upper right side of the display (either head-down on an instrument panel display or head-up on a HUD or HWD). The text annotation is backed up by a graphic depiction on the display showing a line for the taxi route and a flashing white line at the runway threshold to indicate a “hold short” instruction.

The view will also show other objects such as aircraft identified by their call sign or registration number and ground vehicles to help improve the pilot’s situational awareness.

The pilot can still see other traffic on the head-down display, HUD, or HWD, even if it is obscured visually by inclement weather, thanks to ADS-B In, and it is easy to match that traffic with the display of its call sign via incoming radio calls. z

BY AMYWILDER

The issue of mental health in aviation

reached a critical turning point in 2024, with government leaders and stakeholders across the industry coming together to address long-standing barriers that have discouraged pilots, air tra ffi c controllers, and other aviation professionals from seeking necessary care. As such, the past year has seen a series of updates, initiatives, and other collaborative efforts focused on easing the path for pilots and air tra ffi c controllers in need of help.

Notably, a much-anticipated Mental Health & Aviation Medical Clearances Aviation Rulemaking Committee (ARC) report was published in April heralding significant changes in the industry’s approach to mental health.

Formed in December 2023, the ARC was tasked with identifying and addressing the barriers preventing aviation professionals from disclosing mental health concerns. The committee’s report laid out 24 specific recommendations to foster a safer National Airspace System through better mental health support for pilots and controllers.

Key ARC member and NBAA director of safety and flight operations Mark Larsen highlighted the critical need for such changes, pointing out that concerns about culture, trust, stigma, and fear often keep aviation professionals from seeking timely care. “These concerns often stand in the way of pilots and controllers seeking mental health help,” he said in April.

The ARC’s recommendations are divided into key focus areas, including creating non-punitive pathways for disclosing mental health conditions, revising reporting requirements for certain mental health conditions, and expanding peer support programs.

The FAA responded by updating its Guide for Aviation Medical Examiners (AME Guide). Pilots with a history or diagnosis of anxiety, depression, or related

conditions now have clearer, less restrictive guidelines for obtaining medical clearance, provided they meet certain criteria. The new rules allow AMEs to issue unrestricted medical certificates immediately for aviators who have an established medical history of up to two uncomplicated conditions, such as anxiety or depression.

The FAA has also made strides in reducing the time it takes to process medical certifications for pilots with mental health conditions. Historically, the certification process could take months, or even years, due to the complex paperwork and evaluations required. In 2024, the FAA introduced a new AME decision tool to streamline this process, helping to reduce wait times and making it easier for pilots to get back in the air.

However, the progress is not without limitations. The FAA still requires more extensive review for pilots with multiple conditions, recent medication use, or any history of self-harm or suicidal ideation. But the change in policy represents a significant step toward normalizing mental

health care within the aviation industry, signaling that the FAA recognizes the importance of treating mental health at the same level as physical health.

To further support mental health initiatives, the FAA has increased training for AMEs, who are critical in the certification process, as they are responsible for assessing whether a pilot is fit to fly. In 2024, the FAA expanded its training curriculum to include more robust mental health education, including effective interview techniques, mental health literacy, and how to engage in conversations with applicants about sensitive topics.

The goal of this expanded training is to ensure that AMEs are equipped with the tools to identify potential mental health concerns, offer appropriate guidance, and facilitate referrals for treatment if needed. This effort is important in reducing stigma surrounding mental health in aviation, as AMEs play a key role in shaping the industry’s culture of openness and acceptance. While the U.S. has made strides in

improving mental health support in aviation, global collaboration remains essential in creating a universal standard for addressing these issues. The ARC’s recommendations were influenced by the experiences of other international aviation authorities, and the FAA has continued to monitor global best practices.

As the regulatory landscape evolves, industry groups are stepping up with initiatives of their own.

At the NBAA Regional Forum in June in White Plains, New York, Larsen moderated a panel discussion on mental health, focusing on a larger effort to expand peer support programs, which are increasingly seen as essential to mental healthcare in aviation.

Peer support has been shown to be highly effective—80% to 90%—in addressing or preventing many mental health concerns, according to ARC member and Aviation Medicine Advisory Service CEO Quay Snyder, participating in the NBAA panel. Snyder pointed to international studies to support this.

Peer support is unreported to the FAA, offering a confidential means of support for pilots who might avoid seeking help due to the fear of medical certification issues or job loss.

Laila Stein, a CFI who has researched

student mental health, highlighted the University of North Dakota’s pioneering peer support program, which has shown success in addressing mental health concerns among aviation students. “Ultimately,

everyone deserves to be able to talk to someone,” Stein said.

Business aviation presents unique challenges when it comes to peer support programs. Unlike airlines, which can scale to offer robust peer support systems, small flight departments often lack the resources to implement such programs. However, efforts are underway to adapt models that have been successful in other sectors. NBAA, in line with ARC recommendations, is exploring creating an aggregated approach to peer support to ensure that business aviation pilots have access to appropriate resources. Larsen noted this will require creative solutions and cooperation within the industry to overcome the inherent limitations of smaller, dispersed operations.

One company at the forefront of mental health support for aviation professionals is MedAire, which launched a partnership with OdiliaClark in May 2024 to develop a peer-to-peer support network for flight crews. The peer support network allows flight crew members whose employers have contracted with MedAire to access real-time assistance from trained volunteers. The services range from offering a sympathetic ear

to someone who is simply going through a rough patch to providing more intensive support for those dealing with the aftermath of a traumatic in-flight event, such as an onboard medical emergency. According to OdiliaClark sales director Peter Whitten, peer support is particularly effective in aviation because it leverages the shared experience of being part of the same high-pressure, often isolating profession.

MedAire’s model is in direct response to the FAA’s encouragement to expand support networks for aviation professionals, with the goal of intervening before mental health issues escalate into crises. The company’s peer support program has been designed with strict training protocols to ensure volunteers can handle sensitive situations and know when to escalate concerns to professional healthcare providers.

Another new player in the field is MD Onboard, which launched in 2024. Built on the telehealth technology of Northwell Health, MD Onboard’s proprietary app connects commercial airline and business aviation crews directly with paramedics for immediate triage, bypassing the traditional communication delays that often

Aircraft operators and other FBO users can rate FBO service providers they frequent worldwide in five categories—line service, passenger amenities, pilot amenities, facilities, and CSRs—as well as give a shout out to facility sta ers who went above and beyond in providing great service.

The window for rating FBOs for the 2025 survey will close on January 17, 2025.

The results will be announced at AIN’s Inaugural FBO Awards Dinner & Gala on March 27, 2025 and will appear in the April 2025 issue of Aviation International News.

FBO Survey respondents will be entered to win a $250 Amazon gift card.

To access the survey and record your votes, visit ainonline.com/ osurvey

For more information on AIN’s FBO Awards Dinner & Gala visit AINFBOAwards.com

hinder timely medical advice during flights.

The platform also provides mental health support, offering a direct line to professional help for pilots or crew members experiencing stress or other psychological issues on duty.

As we head into 2025, the progress made in 2024 offers a hopeful outlook for the future of mental health in aviation. FAA

rule changes, expansion of peer support programs, and the growing number of services aimed at providing confidential mental health care are all steps toward ensuring that pilots and other aviation professionals have the tools and support they need to stay healthy—mentally as well as physically.

While the stigma surrounding mental health in aviation is gradually decreasing,

it will take continued effort to fully integrate mental health care into the industry’s culture and operational processes. The progress made in 2024 is a testament to the industry’s commitment to addressing mental health challenges head-on, and supportive structures are being put in place to enhance well-being in the skies. z

BY MATT THURBER

This past year has seen extraordinary changes in the airborne connectivity market, with new entrant Starlink making big inroads, SmartSky’s sudden shutdown and resurrection, Gogo buying Satcom Direct, and Viasat consolidating its 2023 purchase of Inmarsat. Competition in the low-earthorbit (LEO) market is heating up with the arrival of Starlink’s aviation service and the imminent launch of Gogo Galileo on Eutelsat’s OneWeb network, and other entrants such as Telesat and Kuiper planning to enter this space.