Lilium revealed the first full-scale model of its eVTOL yesterday afternoon here at EBACE. Formore onthenewaircraft,seepage46.

Business aviation continues to navigate a path through a political minefield in which enemies and frenemies alike seem determined to impede or even halt its growth. That is essentially the assessment of Holger Krahmer, the new secretary general of EBAA, as he and his U.S. colleagues from NBAA open EBACE 2024 today in Geneva.

For the second year running, the industry’s enemies will be on hand at the show, with climate change activists expected to call for a ban on all private aviation. Groups including Extinction Rebellion, Scientist Rebellion, and Stay Grounded are expected to protest outside the main entrance to the Palexpo convention center tomorrow.

And as the business aviation lobby strives to demonstrate that it is part of the climate change solution, rather than

being the crux of the problem, it continues to face what it regards as unwarranted discrimination from the European Commission (EC). EBAA is pushing back against legislation that it says undermines its contribution to the aviation sector’s net-zero carbon objective.

“Business aviation is hated on one side [the activists] and neglected on the other side [the EC],” Krahmer told AIN on the eve of the show. “We don’t want to be helped by politicians, we just want to be respected as part of Europe’s aviation landscape.”

The EC’s decision to exclude business from its formal definition of sustainable economic activity is potentially problematic for business aviation companies because it could diminish the industry’s standing with the financial community. For this reason, business jet maker Dassault is continues on page 45

BIZJET MARKET

Annual forecast

Global Jet Capital expects the bizjet market to reach $193B in the next five years | 6

FBOs

Bizav in the UAE Dubai-based Jetex is targeting a growth rate of 15% in 2024 | 14

SUSTAINABILITY

Contrail reporting EU mandate requiring aircraft operators to report contrails goes into effect in 2025 | 18

ENGINE UPDATES Global 8000 power

GE Aerospace’s Passport engine, which powers the Global 7500, is being updated for the Global 8000 | 20

Dassault Aviation is moving ahead on development of major assemblies for what will become its flagship Falcon 10X—a 7,500-nm, Mach 0.925 aircraft that is set to enter service in 2027. The company brought a full-scale mockup of the 10X to its booth in the exhibit hall, providing a glimpse of the flight deck and

53-foot-long cabin.

The company had previously confirmed the delay, but chairman and CEO Eric Trappier told reporters yesterday at EBACE, “We are now confident that [2027] should work.”

He explained that the complications surrounding work during the pandemic, coupled with supply-chain issues that still plague the industry, pushed back the timing. Dassault evaluated the 10X’s progress late in the year once the company had certified the Falcon 6X and decided on the new timeline.

As far as progress, Trappier noted that the first examples of major assemblies—including the all-composite wings, fuselage, and empennage sections—have been built at Dassault and its partner factories. Final assembly is expected to begin later this year at Dassault’s facility in Bordeaux-Mérignac.

In addition, the Rolls-Royce Pearl 10X engine that will power the ultra-long-range aircraft has begun flight testing on a Boeing 747 “and is performing well,” Trappier said. Roughly 10 flights have been completed. The engine has completed about 2,500 hours of ground tests and 7,700 cycles and has already run in a test cell with 100% SAF. “With the increasing availability of SAF, flying this airplane with a small CO2 footprint will be possible,” he said.

Carlos Brana, executive v-p of civil aircraft for Dassault Aviation, further reported that “We have been testing for years now the systems in the airplane,” accruing some 4,500 hours in areas such as the hydraulics, landing gear, and brakes.

Once certified, the 19-passenger 10X will be the largest purpose-built business jet with a cabin that is 6 feet 8 inches (2.03 m) tall and 9 feet 1 inches wide. The cabin is designed with a modular approach that will enable customers to select zone lengths to accommodate an expanded dining/conference center, an entertainment area with a large-screen monitor, and/ or a master suite with a private stand-up shower. Its range will enable city-pair connections such as London to Buenos Aires, Los Angeles to Jeddah, or Geneva to Singapore.

The twinjet’s Honeywell Epic-powered Easy IV flight deck will support new safety features such as touchscreen displays, a single-lever Smart Throttle, and automatic recovery mode. z

CAE’s use of Virtual Reality in Maintenance Training is accelerating the development of new technicians to secure a sustainable future in aviation while maintaining a top technician workforce.

Today and tomorrow, we make sure you’re ready for the moments that matter.

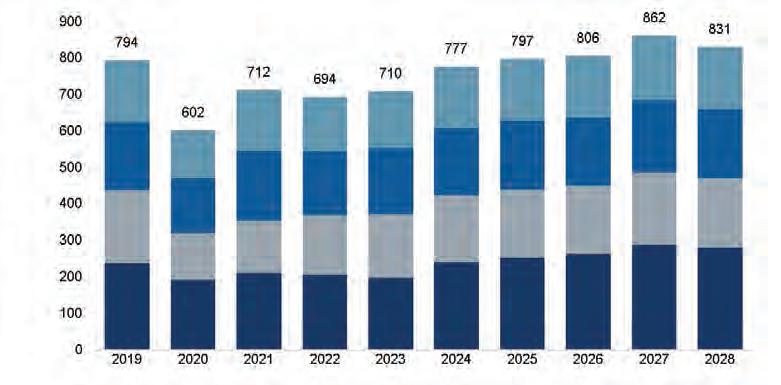

Global Jet Capital (GJC) forecasts that the business jet market will reach $193 billion in total new and preowned transactions between 2024 and 2028. Releasing its annual Business Jet Market Forecast on Monday at EBACE, GJC also anticipates that the market will grow again this year after two years of total market decline.

After reaching nearly 4,000 aircraft trading hands in 2021, the volume dipped to 3,545 in 2022 and 3,021 last year. But it is expected to increase to 3,181 this year. Dollar volume this year should approach the 2022 high of $36.6 billion and surpass that beginning next year before climbing to an estimated $40.3 billion by 2028.

“New deliveries should increase to serve the large backlogs OEMs have accumulated over the past two years, while the preowned market is back to more normal levels and should restart a long-term trend of steady growth,” said GJC chief marketing officer Andrew Farrant.

New deliveries are projected to grow by 9.4% this year and settle at an average annual rate of 3.2% over the next five years, peaking in 2027. Preowned volume is anticipated to increase by 4% this year, while transaction values are predicted to rise 2.2%. Average annual growth rate of volume through 2028 is expected to continue

at 3.8%, with dollar volume creeping up by 2.3%.

GJC anticipates that the market overall will experience a 4.4% compound annual growth rate with transactions expected to increase at an average annual rate of 3.6% and dollar volume at 4.4% over the next five years. For 2024 alone, transactions are anticipated to grow by 5.3% and dollar volume by 10.7%.

GJC CEO Vivek Kaushal told AIN that this year’s update to its forecast is “reinforcing the key theme that we’re seeing across the market right now, which is one of stability.” While stressing that the market is no longer in the “go-go times” right after the pandemic, “backlogs are strong, production is increasing—but gradually—and we’re seeing that client interest remains solid.”

Replacement patterns have returned to usual patterns, as has new growth that is driven by wealth creation, Kaushal added. For young aircraft, “the demand is very much there. Our clients are looking to replace or to upgrade aircraft.”

On the preowned side, the market “had a big, nice run through 2022,” but Kaushal explained, “That was driven, in our opinion, by a market that repriced after a long period, and it’s going to be a bit smaller than the peak that was back in 2022.”

The preowned market will be a little more muted, particularly on the dollar side. “But

again, you’re coming off a couple of blistering years that restored balance in the market and put a nice foundation from which it is going to grow.”

Overall, he characterized the forecast not as seeing any significant change but as a reinforcement of the market. “You see markets generally normalized after the upheaval of the pandemic. We continue to see that customer need for business jets and to be used as a business tool, and we don’t see any reason that should change anytime soon.”

The strength of backlogs, he said, “gives you forward visibility in a way that this market hasn’t enjoyed. When we were looking at last year, we were wondering whether that level of order activity would persist into the future. Fast forward into the second quarter of 2024, and industrywide book-to-bill is still about one…so we see the persistence.”

Kaushal pointed to the expansion of products in the heavy jet side over the past couple of decades as helping fuel the growth. In the mid-2000s, there wasn’t the same supply available. “This market is mature. It’s a much larger and installed base of super-mid and

continues on page 26

Qatar Executive (QE) is displaying one of its brand-new Gulfstream G700s this week at EBACE 2024, just days before the company makes its debut as the world’s first commercial service operator of the ultra-long-range twinjet. The air charter group’s G700 fleet will enter commercial service with four aircraft in mid-June, Qatar Airways Group CEO Badr Mohammed Al-Meer said during an unveiling event of the company’s first two G700s— MSN 87009 (tail number A7-CHA) and MSN 87012 (A7-CHB)—in Doha on Wednesday.

QE’s typical G700 passenger cabin consists of four individual living areas, including a dedicated private rear stateroom, with 15 seats and a capacity of up to seven beds—three double beds and four singles. A7-CHB, which is on display at EBACE, has a one-off more luxurious configuration with 13 seats, turning into three double and three single beds.

The private charter subsidiary of Qatar Airways Group became the international launch customer for the G700 in October 2019, with an order for 10 of the Rolls-Royce Pearl 700-powered business jets. Deliveries

were due to start in 2022, but a protracted certification process by the FAA put shipments on hold.

Gulfstream’s flagship G700 obtained FAA certification in March and received EASA validation earlier this month. The Qatar General Civil Aviation Authority’s approval followed soon after, allowing the twinjet to be delivered to and operated by QE.

Qatar Executive plans to have seven G700s in its fleet by year-end and all 10 in 2025. “We are discussing to finalize the delivery of the remaining six with our partner now and seeing if they can deliver sooner,” Al-Meer said.

Gulfstream is in the process of seeking G700 validation by numerous other national aviation authorities, including China, Canada, and the UK, Gulfstream president Mark Burns told AIN. Al-Meer, who became CEO of Qatar Airways Group in November following more than 10 years as COO of Doha Hamad International Airport, described the technologically advanced aircraft with its quiet cabin, bespoke leather interior, and high-speed performance as “the pinnacle of business aviation excellence.”

“With a range of up to 7,750 nautical miles

Qatar Executive’s fleet of four G700s will begin nonscheduled commercial service in mid-June.

and flying at a record-breaking speed, these G700s will quickly connect economic hubs and key destinations such as Doha-New York or San Francisco-Tokyo,” Al-Meer pointed out.

In addition, the G700 meets the group’s sustainability goals by delivering “outstanding environmental efficiency [and] promoting sustainable business aviation,” he said. The ferry flights from Gulfstream’s facilities in Savannah, Georgia, to Doha used a sustainable aviation fuel (SAF) blend. Qatar Airways Group has set a target of 10% SAF use by 2030. QE is already taking advance expressions of interest from clients to charter the G700s, Al-Meer said, adding that demand for Qatar Executive services is “very high.” This demand has increased since the pandemic and “comes from all over the world,” he noted. QE operates a floating fleet and most of its aircraft are based outside of Doha.

“I would like to be as humble as possible, but I don’t know—maybe we understand this high-level business better than our competitors. We have built a very loyal customer base,” Al-Meer said.

The fly-by-wire G700s are an addition to— not a replacement of—QE’s fleet comprising 15 G650ERs, two Bombardier Global 5000s, and a pair of Airbus ACJ319s. “The G650s are still new aircraft, and we will continue flying them for the next two to three years,” Al-Meer explained. “Maybe at a later stage, we will consider upgrading the G650 to either G800s or maybe another order of G700s.” z

Our training goes beyond checking regulatory boxes. By collecting and analyzing critical data, we ensure pilots train more efectively for the right safety risk areas—and enhance overall industry safety.

Holger Krahmer, the new secretary-general of the European Business Aviation Association (EBAA), spoke with AIN in the trade body’s office in Brussels, Belgium, just ahead of the EBACE 2024 show. The former German member of the European Parliament has worked as an economist in the banking sector and as a lobbyist in the car industry. Now he’s ready to address key issues including carbon neutrality, the creation of a European book-and-claim system for sustainable aviation fuel, how to gain recognition for business aviation’s environmental record, and the future of the world’s second-largest industry trade show.

You are new to the industry. What are your first observations since assuming your role as EBAA secretary-general in January?

The first months were exciting and a big learning curve. I have 20 years of experience in European Union [EU] regulatory a ff airs in Brussels, including 10 years as a member of the European Parliament and nearly a decade of public affairs in the automotive industry. Some things are not new. The European car and aviation industries are comparable on several fronts, but what is special about business aviation is that it accounts for a relatively small part of the [air transport] market.

In the first months, I observed that this big EU regulatory machine does not very often reflect the specific needs of smaller sectors like business aviation. Of course, the industry needs to be properly regulated but we simply cannot follow the same rules as commercial aviation. We need regulation tailored to business aviation’s very specific operations.

You said the car and aviation industries have a lot of things in common. How so? The automotive industry has had a journey that includes a very harsh reputational crisis. Like aviation and business aviation specifically, the car industry was and is a politically challenged industry. It’s all about the environmental and climate footprint i t has.

There is also the issue of freedom of movement and mobility, which is a very European discussion. Freedom of movement is a value in itself, but access to cities by cars and access to airports for business aircraft is increasingly questioned. Freedom of movement is [incorporated] in the Treaty of the European Union, but it is [no longer] a given by nature. We find ourselves waking up approximately once a week to news from somewhere in Europe about an airport discussing bans or restrictions on business aviation.

Business and general aviation are excluded from the updated EU taxonomy criteria and are not considered green economic activity in contrast to commercial aviation. Why is it treated differently?

From my point of view, the EU Commission decided to exclude us specifically from the list for ideological reasons. Some people there maintain the sector can’t ever be sustainable.

Many in the industry agree this exclusion is discriminating and unfair, and yet only Dassault Aviation has mounted a legal challenge in the Court of Justice of the EU. Why has EBAA not joined Dassault in this lawsuit?

We’re considering joining them. However, no decision has been made. I’m thrilled that one OEM took the step to dare to challenge the EU Commission’s decision in court. I think that must be followed by a strong signal from the sector. This issue isn’t just about Dassault; the entire business aviation sector is affected. We’re contemplating joining the appeal as a political statement to the EU Commission, signaling that the last word hasn’t been spoken.

The wider public and climate activists portray business aviation as socially exclusive and polluting, accusing it of not taking steps to reduce its carbon footprint. Are you developing a strategy to try to change this perception or do you say, “Forget it, it’s a debate we can’t win?”

No, we cannot ignore this debate. My view after being here for a couple of months is that business aviation operators and the whole private aviation ecosystem tend to hide their business. I believe we should say loud and

clear why business aviation is needed and why it is an essential part in Europe’s aviation system. To that message belongs the message that this sector has been an innovation driver and has a robust plan to reach net-zero carbon dioxide [CO2] emissions by 2050.

Some of the stakeholders, especially green NGOs and radical campaigners, see us as the biggest polluters because they calculate CO2 emissions per passenger. This is completely irrational reasoning. Bizav represents between 7 percent and 9 percent of the traffic in Europe and business aviation flights account for 0.04 percent of global man-made CO2 emissions. If business aviation were grounded tomorrow, approximately 374,000 jobs in Europe and €87 billion in economic output annually would be lost, with little to no significant impact in terms of its climate effects.

How do you shift negative public perception?

In my opinion, the issue lies in communication. In this digital age, we must repeatedly emphasize facts and rationality to move forward. That’s why I advocate for transparency—we as an industry need to stop hiding.

An EU-wide blending mandate for sustainable aviation fuel starts next year. Is the industry ready?

We support the SAF uptake obligation and, as EBAA, we have outlined measures to encourage operators to adopt SAF at a higher rate than what is mandated.

However, I think that the [SAF blending] quota that the regulator provided within the ReFuelEU regulation alone will not lead to success. We need more instruments to push up production in Europe, where SAF production capacity is still very low, and also instruments to make it available everywhere across the EU. The main instrument that we need is a book-and-claim system that would allow operators to purchase SAF even if it is not available in their refuel location.

Some of the regulatory stakeholders in Brussels believe a book-and-claim is a tool that will lead to misuse or fraud.

That is for sure not our intention. It is a flexibility tool that is essential because business aircraft operators also fly to smaller airports where the availability of SAF is simply

not a given. Our operators are willing to pay more for sustainable fuels because the price sensitivity in our sector is probably not as high as in, for instance, the low-cost carrier segment. That’s why we can play the role of an early SAF adopter.

Also, we live in a digital age and it should be possible to make a system [like book-andclaim] safe and secure.

One last thought on SAF: there is currently much more energy going into the discussion than there is fuel in the tanks. We need to overcome this situation.

Illegal charter is a long-standing problem tainting the industry. What will it take to stop it?

There’s only one sentence in response: every market participant, whoever it is, must follow the law and be fully compliant. There is no discussion about that. I don’t know how large a problem illegal charter is; it is difficult to quantify.

EBAA has elected a Luxaviation Group executive to its board. Notably, Luxaviation has been a vocal critic of the EBACE show and, for the fifth consecutive year, will not be exhibiting at this year’s event. Could this signal potential changes in the show format? Bombardier has followed Gulfstream’s lead and will also not exhibit

We are incredibly happy to have Luxaviation, a big operator with a big economic footprint in Europe, back on board. It is truly a reconciliation between the two parties, and I expect a very constructive and close cooperation. They are very supportive of EBAA, and being on the board was for them also a way to show their support.

As regards EBACE, it has been a tremendous success story for 24 years. But we cannot rest on our laurels. I have witnessed a lot of changes in the automotive industry with many large international shows taking a different direction or disappearing because of digitization and manufacturers adopting new ways of product placement. We need to discuss with the OEMs, with the operators, and with the community about how to move forward and the character of the show. That is totally normal. It’s part of doing business. z

Our mission is simple: to transform a potentially complicated and timeconsuming transaction into a seamless, customized financing solution that meets your unique needs. Our decades of experience provide an unmatched level of expertise—and the ability to craft solutions for virtually any challenge—with speed and confidence. And our global footprint gives you access to on-the-ground expertise wherever you’re operating.

So, bring us your challenges. And we’ll show you the art of what’s possible.

844.436.8200 \ info@globaljetcapital.com globaljetcapital.com

After flat traffic levels at the company’s VIP terminal at Al Maktoum International Airport (OMDW) last year, Dubai-based global FBO and ground handling provider Jetex is now targeting a growth rate of 15% in 2024 over the 10,900 movements it handled at the facility in 2023.

“Why not? People are hungry; they are coming here, buying aircraft and basing them here,” said Jetex founder and CEO Adel Mardini ahead of this year’s EBACE show.

Last November, Jetex opened its new FBO at Al Bateen Executive Airport (OMAD), in the UAE’s capital Abu Dhabi, to coincide with the Formula 1 race taking place at Yas Island. This, combined with its flagship terminal in Dubai, gave the company a powerful presence in one of the Middle East’s most prominent markets.

“Business is growing,” said Mardini. “We do handling for both the VIP and VVIP Terminals, the latter being government-managed. We have 80 staff onsite. We have to have manpower there because we are the exclusive operator.” Recently, Jetex handled 35 flights in a single day at OMAD.

Discussing the new FBO’s launch, Jetex said that expansion work was completed at

the airport in 2022, involving resurfacing and widening of the existing 10,500-ft runway to accommodate widebody aircraft, upgraded ground lighting, and enhanced signage and landscaping to meet safety, compliance, and accreditation requirements. The secure apron and hangar parking facilities can accommodate up to 50 aircraft of various sizes, o ff ering a wide range of ground handling services.

Mardini also anticipates additional throughput at the Dubai FBO with the eventual relocation of flag carrier Emirates to OMDW as part of the expansion of scheduled facilities at the new airport.

“We know very well that they will build more runways here because we now only have one,” he said. “Emirates moving here will take time.” Expansion at Riyadh’s King Salman International Airport (OERY, pending a new designation) in Saudi Arabia will involve six runways. “For sure, there’s competition in the market. But I don’t think that this will affect the business in the UAE because the infrastructure here is very strong.”

Jetex still has ambitions to extend its operations to Saudi Arabia but is awaiting

confirmation about how local officials might permit new facilities to be developed at the airports in that country. “They have yet to release a tender,” Mardini explained. “They are developing the strategy and talking about direction. Saudia Private Aviation is the main player. We are keen to enter the Saudi market. We are in communication with them, but until now there has been no action. They’re taking their time.”

Mardini believes the Saudi Arabia business and private aviation sector has yet to achieve its full potential, and there are opportunies for growth, especially with younger new entrants to business aviation. “To be honest with you, in the past couple of years, we saw a big drop in Saudi travelers, who don’t seem to want to fly privately,” he said. “Recently, however, every day one or two flights are coming [to Dubai] from Saudi Arabia—a new generation of Saudis are flying privately.”

Today, Jetex has 38 FBOs and three operations centers worldwide, and the company continues to expand with new FBOs and handling sites. Its new facility at Capitán FAP Renán Elías Olivera Airport (SPSO) in Pisco, Peru—146 miles south of the capital, Lima—is a handling station. The group also hopes to open new Asian FBOs in Indonesia, Thailand, the Philippines, and Malaysia.

ForeFlight’s industry-leading solutions for business aviation bring increased operational efciency and safety and support to your flight department. From an all-in-one dispatch system with runway analysis and weight and balance to intelligent flight tracking and everything in between.

Experience next-gen operations and visit us at Stand A61 to take your flight department to the next level.

Atlas Air Service and Gogo Business Aviation are jointly developing EASA supplemental type certificates to install the Gogo Galileo HDX communications antenna on both the Cessna CitationJet and Embraer Phenom 300. The companies said the STCs will be the first for the broadband system in Europe. This week at EBACE, Gogo is demonstrating the Galileo HDX system onboard a CJ1+ at the static display. Initially, Germany-based MRO Atlas Air Service is focusing its efforts on completing the STC for the CitationJet series. The Phenom 300 STC is being developed in parallel, with the expectation that various international air safety regulators will validate the EASA approvals. According to Gogo, the STCs will apply to more than 2,600 aircraft in operation worldwide today, including some 1,850 Citations and 750 Phenom 300s.

Gogo’s Galileo system will operate on the Eutelsat OneWeb low-earth-orbit satellite network, which is fully deployed. Following ground tests and verification work now being

conducted, the U.S. manufacturer intends to flight test the prototype HDX terminal in the next few months.

“For the first time ever, a true global broadband service will be available to thousands of aircraft operators in Europe and around the world,” said Radu Grigore, deputy director of MRO commercial for Atlas Air Service. “For many years our customers have been asking for a small and affordable broadband solution for their aircraft. We wanted to be among the first to partner with Gogo to develop these STCs and bring true broadband inflight Wi-Fi

Previously available to aircraft owners and operators in the Americas, the Garmin Navigation Database is now available in Europe as well, offering customers a more cost-effective way to update aviation navigation information. New options include single updates, annual bundle options, and OnePak subscriptions for compatible Garmin avionics, including integrated flight decks, navigators, flight displays, and portable units.

“The expansion of the Garmin Navigation Database to include European data has been a

multi-year goal of ours, and we are thrilled to now offer European customers an all-Garmin database solution for their Garmin avionics systems,” said v-p of aviation sales Carl Wolf.

According to Garmin, the expanded navigation database product provides foundational information needed for precise GPS navigation throughout the departure, en route, arrival, and approach segments in Europe. Coverage is available in more than 35 countries and more than 3,400 airports, including en route and airspace data, instrument procedures, frequencies, and airport information.

Single device bundles and OnePak annual

for every segment of business aviation.”

At the end of 2023, Gogo reported that 7,205 business aircraft are now flying with its airto-ground systems onboard, including 3,976 using the Gogo Avance L5 or L3 units. There are also 4,341 aircraft fitted with the company’s narrowband satcom technology.

Atlas Air Service has headquarters in Bremen and other bases in Augsburg and Altenrhein in Switzerland. It provides support for operators of business aircraft manufactured by Embraer, Textron Aviation, Gulfstream, Daher, Pilatus, and Cirrus. z

European aircraft operators now have a more cost-effective option to update their Garmin aviation databases.

subscriptions offer a simple, cost-effective option to update navigation data and other databases such as terrain, obstacles, airport directory, SafeTaxi, and FliteCharts.

Europe annual device bundles start at €544 for GNS and €686 for GTN-series navigators, while OnePak subscriptions for Europe start at €1,086 and €1,373 with FliteCharts terminal procedure charts. z

The AW169 ofers more than just transport - it’s a reflection of your unique lifestyle. With seamless performance and bespoke design, it efortlessly takes you to your destination in comfort and speed.

Step into the bright and spacious cabin and enjoy your favourite entertainment in a welcoming atmosphere.

Let every flight experience be a moment of connection with your loved ones and appreciate the view from the sky.

Visit us at EBACE, Stand U58

4Air is gearing up for aircraft contrail reporting under a 2025 EU mandate that will require aircraft operators to “report once a year on the non-CO2 aviation effects.” This includes emissions of nitric oxides (NOx), soot particles, oxidized sulfur species, and effects resulting from water vapor.

The EU will use this data to determine if contrails will be integrated into the EU Emissions Trading Scheme (ETS) by the end of 2027—in other words, potentially taxing a non-carbon emission under an existing carbon tax scheme. The cumulative net warming impact of contrails is somewhere between 100% and 500% of the warming impact of CO2 alone, depending on time of day.

In the last two years, 4Air helped offset more than 2.5 million metric tons of CO2 from more than 550,000 flight hours. The company helps private aircraft operators worldwide calculate and offset their impacts on the environment through its four-level rating system. The company also can connect users with available sustainable aviation fuel (SAF) with its live mapping tool, which currently shows verified locations where it can be obtained and gives carbon ratings to aviation facilities.

For customers attempting to navigate the minefield of the rapidly growing volume of aviation environmental legislation and regulation, including the potential for the integration of contrails into the EU-ETS, 4Air provides regulatory monitoring and compliance programs. This is particularly useful in Europe, where the related landscape is changing rapidly, according to Kennedy Ricci, 4Air president.

While the EU-ETS has been in place for nearly 12 years, additional policies are springing up on a national, local, and even individual airport basis, according to Ricci, creating an ever-changing and confusing regulatory landscape.

“EU countries are setting their own benchmarks and mandates for blending SAF and [imposing] carbon taxes or reporting obligations—all the way down to specific airports introducing their own blending mandates or carbon reporting requirements,” Ricci noted. Overall, he calls the European market “very nuanced” when it comes to emissions policy, citing regulations that either don’t accept book-and-claim carbon offset when it comes to SAF or only accepts it on a very limited basis.

of consolidating regulation, so unfortunately we’re going to keep seeing more and more localized regulation to support each country’s own [environmental] ambitions, even down to the level of individual airports with their own visions,” Ricci said. “It is adding a lot of complexity that just didn’t exist two years ago in Europe at all, much less five years ago before Covid.”

Ricci believes Eurocontrol eventually will take primary responsibility for vectoring traffic around airspace where environmental conditions are ripe for contrail formation and that ADS-B will be used to assess whether a particular aircraft traversed the area and for how long.

He likened it to rerouting to avoid known areas of severe turbulence or icing but added that, like those two conditions, contrails come

4Air is meeting the multi-layered, multi-jurisdictional regulatory challenge by developing an automated system that makes it easy for operators, both in Europe and elsewhere, to maintain compliance. “We’ve got programs designed to help you,” Ricci said. In Europe, 4Air maintains staff to monitor emergent policies and engage with rule-makers and operators.

With regard to contrails, official reporting guidance should be out within the next few months, Ricci said. Overall, he doubts this quilt of regulation is going to be streamlined any time soon.

“I think we are in an era of growing and emerging new regulation rather than an era

4Air is helping aircraft operators navigate the maze of new environmental regulations, including the contrails reporting mandate that takes effect next year in Europe.

in degrees of severity, and traversing some areas of potential contrail formation will have little or no impact. But Ricci added that the result likely will be less disruptive than it sounds.

“We can help reroute some of those big hit flights, but it’s not like we have to do this for every single contrail-forming flight. In fact, I think for some of the data we looked at, it’s fractions of a percent of the total number of flights that enter these types of [contrail-producing] zones. So it’s a small number of flights that we have to look at and they’re usually very thin adjustments— on the order of a 2,000-foot vertical adjustment,” he said. z

Entering service in late 2018 on the Global 7500, GE Aerospace’s 19,000-pound-thrust Passport engine is prepping for its next iteration on the ultra-long-range aircraft’s speedier successor, the Global 8000. That update will help enable a boost in speed and range for the Global 8000 to Mach 0.94 and 8,000 nm, up from the 7500’s Mach 0.925 and 7,700-nm range.

Jennifer Ratica, president of Passport and CFE for GE Aerospace, noted that the update does not involve “turbo-machinery” changes but rather software alterations. However, she said those changes “are going to unlock some potential that we had already designed into our engine.”

According to Ratica, GE Aerospace is working with Bombardier on the final engine designation. As for the performance enhancements, she said, “We’re really excited to see the ability that it will allow in increased thrust. It will improve our

[specific fuel consumption], which will enable the aircraft to go 8,000 nautical miles.”

While Ratica did not specify final numbers, she noted that “as with all GE engine programs, we build in additional thrust capability, and [the] engine’s specific fuel consumption has continued to exceed our expectations since entry into service.” The aircraft has already passed the supersonic mark in testing, which was necessary for a certified speed of Mach 0.94.

The potential for the enhanced performance was already built into the Passport design and had the margins to meet the objectives on speed and range, Ratica said, noting that the changes entail a “plug” for the software. “From an engine perspective, the changes are minor,” she said, pointing out that the Global 8000 program will involve a few other upgrades unrelated to the engine.

However, the software changes will require

More than 350 Passport engines are currently in service, logging some 300,000 flight hours on about 160 aircraft.

certification, Ratica said, and GE has teamed with Bombardier on that work. “We’re in lockstep,” she noted. “We meet with them every week to talk about certification. We’ve got a few gates associated with the software that we’re working through.” The Global 8000 is on target to enter service in 2025.

While this is ongoing, GE Aerospace has been maturing the Passport engine. “After six years of service, it really feels like the Passport engine is catching its stride and demonstrating in the market,” Ratica said. “We’ve got more than 350 Passport engines that are in service today supporting about 160-plus aircraft flying, with 300,000 hours flown over about 100 operators. So we feel like we are moving out of that entry-into-service phase and into this more mature space or life cycle, so to speak, of this engine.”

The engine has marked a 99.9% dispatch availability, but she added that on the rare occasion something has gone wrong, the field support team has been right on top of it. Ratica noted that its team just attended its latest Global advisory committee meeting in April “and feedback from operators is amazing—very positive around the engine’s performance reliability and any product support associated with it.”

A key to the smooth service entry is that GE Aerospace leveraged the core architecture of the CFM Leap engine, which has some 30 million flight hours of experience, she said. “Coming from that as a solid core gives us a good starting point,” Ratica said. “We’ve had minor blips here and there [such as] with

sensors that were a little bit too sensitive that we had to redesign and that type of thing. But overall, really no major issues for this engine.”

Particularly satisfying to Ratica, this ramp-up has been ongoing during the pandemic. Bombardier, meanwhile, has been steadily increasing Global production as it targets the delivery of 150 aircraft across its lines next year. The Montreal-headquartered airframer said the planned increases will lean towards Globals next year. In preparation, Ratica said GE has upped Passport production by 20% last year and expects “the same type of increases going forward.”

This includes working through supply-chain issues that continue to arise throughout the industry with geopolitical situations such as that in Eastern Europe, since Russia has been a big supplier of titanium.

“We’re turning the corner; I feel really positive about where we’re headed,” she said.

The twin-spool axial engine is designed with a 5.6:1 bypass ratio and a 45:1 overall pressure ratio at max power. Incorporating GE’s

18-blade titanium blisk technology at the front and a high-efficiency tail mix at the back. “We put all of that together to allow for the most efficient architecture,” Ratica said.

The results make the engine a leader in energy extraction, fuel efficiency, emissions, and noise, according to Ratica. The Passport’s fuel efficiency is 3% better than others in its class, GE said.

Its blisk technology “is really exciting,” she added. “We’ve got one piece there that increases the airflow with a smaller diameter, which minimizes the leakage, the wear, the vibration, and maintenance.”

GE further provides a fully integrated propulsion system, including the nacelle, which she said optimizes the complete system. While a little more complex on the company’s end, the integrated system is a direction Ratica sees airframers headed in the future and one that helps with durability, reliability, and ease of maintenance.

On the sustainability front, GE Aerospace said the engine has a 13.6 dB cumulative noise

margin from Stage 4 requirements. Ratica added that it has been tested on 100% sustainable aviation fuel “with great results.”

As far as the future of the Passport family beyond the Global 7500 and 8000, she said, “I think there’s still going to be some margin after we get through.” While used at nearly 19,000 pounds of thrust, the engine can grow to 22,000 pounds or be downrated to 16,000 pounds while maintaining the core, she said.

“It was designed to be able to create different variants, assuming that the industry goes that way and maybe an airframer wants a little bit bigger or a little bit smaller,’’ she said.

While not discussing specific applications, Ratica said, “There are always discussions around new opportunities within business aviation, for sure.”

She added: “But if you look at the entire business aviation spectrum, I think probably a little smaller is going to be the next opportunity,” she said, noting that this could be something akin to the size of a Bombardier Challenger 650. z

Based on CAE’s 2023 Aviation Talent Forecast, more than 8,000 pilots and 10,000 technicians will need to be recruited and trained for European business aviation operations in less than 10 years. The company expects the worldwide business aircraft fleet to grow 18% by 2032, “with up to 26,000 business jets in service and the need for more than 100,000 new business aviation professionals to be recruited.”

CAE continues to build more aircraft simulators and open training facilities around the world to help meet the growing demand for business aviation pilots and technicians. “All we do is based on where we see demand,” said CAE business aviation division president Alexandre Prévost.

Last year, CAE said it will open a dedicated business aviation training facility in Vienna, Austria, that initially will house simulators for the Bombardier Global 6000 and 7500 and Challenger 3500, as well as the Embraer Phenom 300. This center is set to open in the second quarter of 2025.

“This is the first expansion in business aviation in Europe in many years,” Prévost said; it complements additional centers opened in the past two years. This includes CAE’s Singapore facility equipped with a Gulfstream G650 simulator; the Las Vegas center, which began operations in late 2022; facilities in Savannah, Georgia; and the CAE-Simcom training complex in Lake Nona, Florida, which opened late last year.

In addition to building aircraft simulators and opening training facilities, CAE is creating data-driven training programs to meet the business aviation industry’s growing demand for pilots and technicians.

Additionally, a Phenom 300 simulator has just come online at CAE’s Burgess Hill training center in the UK. “These are all based on growing demand for pilot training and CAE’s expanding closer to where the customer needs us to be,” he said.

Adding simulators and facilities isn’t the only way CAE is meeting demand. “We’re focusing on building training programs that are data-driven,” Prévost explained.

This helps CAE improve not only training quality but also efficiency. “Aircraft are a lot more technological and they’re more complex to fly, but at the same time a newer generation of pilots are coming in,” he said.

CAE captures data from the simulator and measures how trainee pilots are performing, and the company is now working with aircraft manufacturers to gather operational insights from their fielded aircraft fleets. Realtime data from training events helps inform debriefing sessions but also serves to highlight trends on specific aircraft platforms that can help improve the training process for the individual pilot and the operator.

“We’re still continuing to expand that network,” Prévost said. “As with everything with data, we continuously learn as we gather more of it. The data-driven program helps us deliver better-quality training.”

Another area of expansion is CAE’s

remote ground school. While regulators have allowed online ground school for recurrent pilot training, its use in initial training courses had been constrained. But CAE is now able to offer FAA-certificated pilots some online computer-based training for initial courses.

“It used to be all in the training center,” Prévost said. Now pilots can complete some training days remotely and then finish ground school at the center along with the simulator portion. “This reduces the number of days they have to be in our facility.”

For maintenance technicians, CAE has expanded its use of virtual reality (VR) tools and is also testing combined VR and augmented reality. “We see a real benefit,” he said. “It makes it easier to do practical training and have people in different locations interact with each other in a VR environment.”

Students can practice tasks and build muscle memory, he explained, and there is an added benefit of reducing the risk of causing damage to a real aircraft. CAE is adding maintenance training at its Vienna training center when it opens in 2025, as well as at the Burgess Hill center.

CAE hasn’t expanded VR training to pilots yet. “We’re looking into it,” Prévost said. “We’re always looking at how to leverage new technology.”

According to Will Robson of Aviation Pride UK, EBACE 2024 is providing another opportunity for his organization and the larger National Gay Pilots Association to advocate for the LGBTQ+ community. Both organizations are co-exhibiting this week at the European business aviation show.

“We’re continuing to just promote who we are and share that with the industry,” Robson said. “It’s important because one of the things we do is...regular training and support for the industry. The other part of our tagline is making aviation more inclusive, accessible, and safer for all.”

“What we’re trying to do is share our name,

let people know that we’re here. Whether you are just an individual member, or whether you are an organization that’s looking to get support, that’s exactly what we’re here to provide and help you with. We’re just happy and want everyone to come say hello to us, just find out a little bit more information, have a chat.”

Robson said that Aviation Pride UK’s mission is to be a wide-ranging resource for the community and a broad organization of advocacy and support.

“We’re part of a worldwide LGBTQ+ aviation community. Our tagline is ‘to build, support and unite’ the LGBTQ+ aviation community, worldwide. And that’s sort of what we do through many different avenues, whether

Aviation Pride UK and the National Gay Pilots Association are co-exhibiting at EBACE 2024 this week and advocating for the aviation industry’s LGBTQ+ community.

it’s through social events, networking, mentoring, scholarships, advocacy events, whistleblowing industry training, and a bunch of other things as well,” he said. z

www.aviavip.com * Coming Soon

Germany-based air service provider Flyvbird has formed a partnership with travel planning company Moove. Under the agreement, Flyvbird will integrate Moove’s technology to showcase its options for what it calls “faster, more sustainable, direct air travel solutions.”

The first 50 travelers who register on the Moove app will receive a voucher for a free flight on any future Flyvbird route, usable within one year after the launch of operations. The launch is anticipated in the first quarter of 2025.

“We are excited to partner with Moove. Utilizing its intuitive visualization tool will help us attract a brand-new segment of the market as travelers quickly see the benefits. It will play an important role in the early phase of our operation,” said Flyvbird CEO and co-founder Anton Lutz.

“We are delighted Flyvbird is adopting our tool to help make its air travel product become more tangible. We strive to lower the entry barriers to on-demand aviation, creating a market for exciting new airline ventures like Flyvbird. It’s an attractive partnership as we create a bridge between private and commercial aviation,” said Moove CEO and co-founder Arthur Ingles.

Moove announced its launch at EBACE two years ago and is returning to showcase it at EBACE 2024. Ingles is hosting a panel called “UAS Forward Discussion on AI and Technology” today at 11 a.m. at Booth B51. z

Over the weekend, exhibitors were busy assembling booths and displays at Palexpo for EBACE 2024. Here, workers put together a scale model at the Boeing Business Jets booth.

continued from page 6

heavy aircraft, which is the kind of airplanes that our clients like to be in and so that gives it some really good balance to go through, both down as well as up cycles,” he said.

Also driving growth is the array of service options that weren’t available in the past. “The ways in which you can get access to business aviation is now much wider and much richer than it was before,” he said.

As far as customer selections, he noted that after the pandemic, there were new entrants who perhaps didn’t pick the right fit. “You did see people get into aircraft that they perhaps now regret,” he said. “But when you look at the core customer base that we have, they continue to be thoughtful, they continue to think through their requirements and their mission profile.”

However, he did note that people tend to have a bias toward aircraft that can execute all their missions, which favors larger aircraft even if 90% of their needs can be met by smaller aircraft. Heavy jets are predicted to enjoy a 7.2% CAGR during the forecast period.

He anticipates that the U.S. will be “a big chunk” of the growth—GJC forecasted it to account for 76.3% of the total market—with Asia Pacific, India, Europe, and the Middle East regions being additive to that expansion.

Northern Asia and Eastern Europe are a little quieter, Kaushal further said.

As for the Indian market, Kaushal said a consistent economic policy is fostering stability, which in turn has encouraged expansion. “There’s also been a fairly significant buildout of infrastructure, which is greasing the wheels of the economy there.”

He cautioned that there are still significant regulatory hurdles to overcome, and the industry is exploring ways to work within those constraints. “But it takes time.”

For GJC, which is celebrating its 10th anniversary, it has enjoyed rapid expansion along with the market group. “We’ve got a strong brand, a global franchise, and we’ve got the support of an ecosystem that’s seen again and again what this business can deliver,” he said.

Looking forward to the next 10 years, Kaushal added, “We’re really excited about the foundation that we built to get here.”

The company has done $4.4 billion in originations and expects that to grow to $5 billion next year. “We’ve also really raised the profile of business aviation in the capital markets through our securitization program.” GJC completed its seventh securitization issuance last month.

“When I think about where the market is headed and where we’re headed,” he said, he credits the success to not only its partners but also its people. “We are a pure play provider. This is all we do, and that allows us to develop an expertise and hone an expertise and keep it updated. Our clients see that value every day.” z

Comlux has signed a letter of intent to collaborate with Stellar Blu on the integration of the Sidewinder multi-network satcom connectivity platform into the Airbus ACJ TwoTwenty. The agreement builds on Comlux’s partnership with Airbus on ACJ TwoTwenty completions.

Using a “network of networks” approach, Stellar Blu’s Sidewinder system will be adapted to the ACJ TwoTwenty to enable access to multiple service providers ofering global coverage and services via satellite networks in LEO, MEO, or GEO orbit.

The system will support full HD streaming, videoconferencing, and collaborative computing via a resilient broadband connection. Integration into the ACJ TwoTwenty is beginning immediately with the goal of having the system certified on the aircraft by year-end.

“In addition to the already extraordinary cabin experience, this system will further position the ACJ TwoTwenty at the forefront of new technology,” said Arnaud Martin, CEO of Comlux. “Our partnership with Stellar Blu will transform the way our passengers communicate and stay connected during their flights, enhancing their overall inflight experience.” K.L.

It’s a big, bad world out there, and traveling around it in a business aircraft doesn’t provide insulation from these dangers. Security experts gathering at the EBACE 2024 show are urging the industry to make sure it has a solid protection plan.

Airspace safety is increasingly compromised by armed conflict, or the threat of it, from Ukraine’s border with Russia through Israel, Iran, the Caucasus, and across Africa’s Sahel region. With this in mind, Osprey Flight Solutions has joined forces with the European Union Aviation Safety Agency (EASA) to hold the first World Overflight Risk Conference from July 2 to 4.

The agenda for the event in the Polish capital Warsaw features experts from leading airlines, police and security forces, NATO, the European Commission, and EASA, as well as risk management and insurance specialists. UK-based Osprey intends to publish a white paper to summarize the conference’s main conclusions.

The event is being run on a not-for-profit basis, with any profits to be donated to victims associations associated with the Malaysian Airlines flight MH17, which was shot down in July 2014 by Russian-affiliated forces in Ukraine, and Ukrainian International Airlines flight 752, which was destroyed by Iranian air defense missiles

soon after takeoff from Tehran in January 2020.

Health and safety group MedAire sees airspace threats as part of a wider array of security concerns that have fueled a sense of “permacrisis” in which risks appear to constantly morph and escalate. In addition to airspace closures, a recent spate of spoofing incidents to undermine the integrity of GPS navigation systems— and rocket and drone attacks by Iranian proxy forces—are causing operational disruption.

“Charter operators and flight departments are having to reroute flights, and that means additional technical stops that have to be planned for. It means more money, time, and resources,” John Cauthen, security director of MedAire’s aviation and marine division, told AIN. MedAire aims to help clients understand and contextualize the threats they face. “Our security teams try to bring the pieces of the puzzle together and then make risk-based decisions on the basis that everyone has a different appetite for risk,” Cauthen said.

To confront the threat of GPS signal spoofing, as has occurred in Middle East airspace recently, MedAire is providing training for flight crews. This provides guidance as to how pilots can ensure they are not being misled, and how they can fall back on training to make use of traditional charts and ground-based tools as backups. z

Dassault’s 6,450 nm Falcon 8X ultra-long-range jet is featured at the static display, in addition to the Falcon 6X extra-widebody twin that recently entered operation and a full-scale cabin mockup of the ultra-long-range, ultra-widebody Falcon 10X, which is currently in development.

Embraer Executive Jets is in “harvest season” as it gains momentum from the series of updates to its existing product line, according to company president and CEO Michae l Amalfitano.

Addressing rumors about what airplane might be next in its lineup, and whether it would be bigger, he said, “We’re going to do something bigger when we can disrupt it with something differentiated,” pointing to how Embraer migrated fly-by-wire into the midsize business jet class.

Meanwhile, Amalfitano called the momentum the company is experiencing as “pretty strong.” This comes as the market appears to be normalizing from the peak after Covid. “We’re taking advantage of that…we’re still capturing sales.” He pointed out that the Phenom 300 has been the most delivered aircraft in its class for a dozen consecutive years and the most delivered twin-engine jet for four years. It also was the most flown private jet in the U.S. during 2023, he added.

“What’s interesting about that is it displaced the [Cessna] Citation XLS category, which held the position for 10 consecutive years,” Amalfitano said. “So obviously, that’s a big driver in terms of the market momentum. But we’ve seen similar growth in terms of market penetration across all our products.”

The Phenom 100 has grown in market share from 12% to 19%, the 300 has gained an additional point to 34%, and the Praetor 500 has upped its portion of the market from 26% to 33%. The Praetor 600, in the competitive super-midsize category, has remained flat at 19%.

Supporting this is a backlog that has reached what Amalfitano characterized as historically high at $4.6 billion and a book-to-bill that was in excess of 1.3:1 at the end of 2023 and jumped to 2:1 in the first quarter as that ratio has retracted closer to 1:1 at many OEMs.

“So pretty significant in terms of the backlog momentum,” he pointed out.

Embraer is now selling into the second half of 2026 across the Phenom and Praetor lines. For the Phenom 300 and Praetor 600 specifically, the company is looking at the fourth quarter of 2026 and the first quarter of 2027, respectively.

As far as clients, Amalfitano said it is balanced in most aircraft segments, noting that while the fractional market is strong, the Phenom 100 has no such customer. Rather, it is an owner-flown, flight academy, and entry-level jet aircraft. “We were getting a huge traction in terms of the growth of that product line,” he noted, especially with the launch of the Phenom 100EX in October.

Embraer Executive Jets president and CEO Michael Amalfitano

Embraer Executive Jets president and CEO Michael Amalfitano

The Phenom 300 has benefited with steady orders from NetJets and Flexjet, but sales are a mix, he maintained. “We have a strong corporate flight department [business]. We have high-net-worth individuals. We have fractional, and we have fleet customers across the board. So that’s a good balance of trade.”

As for the Praetor 500 and 600, “What’s interesting is the increased adoption of the corporate flight departments to our product line. We have gotten the benefit of the Fortune 50, 100, 500, and customers in the corporate flight departments that have been in a replacement cycle. That replacement cycle has been very strong, not only during the pandemic period but since then even stronger. That has really benefited us.”

While this is more of a North American marketplace phenomenon, he said, “We’ve had equal growth of segments on an individual basis in Latin America and Europe. So lots of opportunity to see our products be served in not only total market share growth but also regional growth in the segments that we serve.”

As far as the new buyers that entered the market during the pandemic, Amalfitano said, “I wouldn’t say that that’s unique like it was during [that] period. It was this boom effect and the pie got bigger. A bunch of folks came in.”

Embraer benefited from that during the pandemic. “Now as the market normalizes, so do the first-time buyers that are buying the aircraft,” he said estimating that those customers have settled to the mid- to high teens as a percentage of buyers. “It’s not phenomenonbased anymore. It’s more stable in terms of its growth.”

But as a result of this growth, the company has been able to build on the brand of parent Embraer, now 55 years old, according to Amalfitano. This is a key part of its pillar of maintaining a customer-centric philosophy, he said.

Amalfitano noted that the supply constraints are going to be a critical focus as Embraer works to meet its guidance of 125 to 135 business jet deliveries this year, up from 115 last year. “We’re very focused on production leveling so that you have the ability to manage the longer lead time that the backlog has served,” he said. This requires long-term investments to maintain the volume increases.

The supply chain in general has recovered, Amalfitano noted, “but when you get specific in certain segments, it’s still very challenging and it has nothing to do with anything unique to Embraer.”

He pointed to windshields as an industry challenge. “Same thing with propulsion, all things engines, all things APUs, all things

compressors.” He also said there may be aircraft-specific challenges such as involving landing gear on one and actuators on another. Amalfitano cited resins as an area that is “systemic,” adding that they are in windshields, tires, and interior parts.

“There’s a lot going on in terms of managing their supply chain,” he said. Embraer has an advantage in talking to suppliers because of its solid backlog.

“There’s no speculative issues with typical supply-chain cycles. They can go all in because you can show them an order book. That allows them to make the investments they need to then ramp up their people, ramp up their tooling, and ramp up their supply base to support that growth. But it takes time.”

The company has an ambitious research and development agenda, focused on exploring a range of sustainable and autonomous technologies. But whatever these solutions, he added, they have to be customer-centric.

“We need to make sure for whatever new product we come up with, these are kinds of pillars that are really powerful in terms of our design characteristics,” Amalfitano told AIN

Any new product has to have “unmatched performance, disruptive technology, superior comfort, and top-ranked leading edge support services,” he said. “We’re actively in conceptual study phases of looking at the markets that we think will best serve those value propositions in each of those value pillars so that when we come to market, we will continue to capture share, be the customer’s first choice, and drive the future of air mobility through innovation.”

But noting the speculation surrounding its next product, he stressed, “We have to recognize that we are reaping. This is harvest season, as we call it; we are harvesting the benefit of leading in the categories we serve.” z

VoltAero’s Cassio S testbed aircraft has completed more than 220 flights and covered a total distance of 10,000 km (about 6,210 miles) to validate the company’s parallel electric-hybrid propulsion system.

Gama Aviation has celebrated a milestone in its development of a new FBO/MRO complex at Sharjah International Airport in the UAE. While the company has been providing aviation services there for more than a decade from a previously existing structure, its space was constrained. Its plans to construct a purpose-built facility had stalled, however, due to a variety of economic factors during the global pandemic and its aftermath.

improve that,” said Tom Murphy, managing director of Gama’s Sharjah location as well as its two UK facilities in Glasgow and the Isle of Jersey. “At the moment, we provide line maintenance to [Bombardier’s] Global series, Challengers, and Gulfstream’s G650, and we’ll be looking to expand on that outside of those airframes.”

Editorial inquiries: Charles Alcock calcock@ainonline.com, +44 7799 907595

Advertising inquiries: Victoria Tod vtod@ainonline.com, +1 (203) 733-4184

The company just completed a new 36,000sq-m (387,500-sq-ft) parking apron at its 80,000sq-m (20-acre) leasehold on the eastern side of the airfield. In the third quarter, it expects to break ground on a climate-controlled 14,000sq-m (151,000-sq-ft) hangar—one of the largest in the region, capable of sheltering bizliners— along with a new VIP terminal. The hangar will house the company’s MRO, as well as provide storage for based and transient aircraft.

“It will give us the opportunity to scale up and review what MRO services we provide and

Following the construction of the ramp, Gama will add a taxiway linking it to the runway, and move its airside services to a temporary facility there starting in September, while shuttling guests to its existing location until its replacement is completed in the second quarter of 2025. The old FBO facility will return to airport control.

“We believe what we will offer in Sharjah will be unique to the other facilities in the region,” said Murphy, adding that the emirate was the site of the UAE’s first airport. “Over 40 years of operational experience has been synthesized into developing a business aviation center that offers a highly personal, tailored experience to discerning owners, their traveling associates, and flight crews.” z

Artificial intelligence (AI) looms large over business aviation’s future, although for now most in the industry have fairly limited visibility as to how life-changing this will be. Early indicators are that the first applications will illuminate a path forward in which, hopefully, humans are still able to do what they do best, only with greater e ffi ciency from autonomous support.

UAS International Trip Support is hosting a discussion about how AI can be made to “work for you” this morning at Booth B51. This will be moderated by James Hardie, founder of the Course Correction consultancy; Daniel Newman, Honeywell’s chief technology officer for advanced air mobility; Arthur Ingles, founder of flight booking platform Moove; and Chris Marich, co-founder of financial software group MySky. They will be joined by no less of an expert than Pepper the Robot from Robots of London.

MySky is tapping AI as part of its quest to help aircraft operators exercise effective revenue management, while also keeping close control of spending. This week, the company is launching an AI-driven Smart Quoting engine to help charter flight providers ahead of the busy summer travel period.

“We’re not looking to replace humans but to empower them with a level of automation for repetitive tasks like capturing invoices,” Marich told AIN. “In our spend system, we can use the AI technology to automatically capture and digitize information so that the operators can focus on producing the final quote and on the relationship with the owner and the charter customer.”

Part of the challenge that AI can ease comes from the fact that operators can receive hundreds, if not thousands, of flight requests and yet are likely to convert only around 1% of these into bookings. The AI technology is

capable of gathering the necessary data to build the first part of the quote and can also give guidance as to how to optimize the operator’s fleet in the process.

“What is very powerful is that, instead of having hundreds of unanswered questions, the system can gather what it needs from previous quotes, such as aircraft types [and their performance],” Marich explained. “It

Web Manuals conceived plans to apply AI to what they offer the industry. To accelerate progress, it acquired a specialist called Manual AI and in April rolled out its Amelia AI system.

For Web Manuals’ clients, AI promises to facilitate the search process. “There are lots of situations where pilots and other operations people need to find very specific information in time-critical moments,” explained CEO Martin Lidgard. The technology supports a more contextual search, rather than just using keywords, and can help pinpoint something specific relating to maintenance activity or some operational issue during a fast turnaround.

also takes into consideration logic around where to reposition aircraft, et cetera. That gives operators a clean slate each morning [in terms of workload] and that could be a competitive advantage.”

According to Marich, AI applications are still in their early stages in aviation and the industry is somewhat behind the finance sector in this respect. “Security has to be taken very seriously, and this is still very much under human control,” he concluded.

In March, the Swiss-based company teamed with digital contract specialist Tuvoli to support quote generation and payments for charter flight bookings. The companies have agreed to integrate the MySky Quote platform with Tuvoli’s digital checkout function.

It was at the EBACE show in 2023 that the team from document management specialist

MySky applied artificial intelligence technology to its process for generating quotes for flight requests and launched an AI-driven Smart Quoting engine this week.

Amelia AI integrates natural language processing that can accelerate the process of understanding factors such as aircraft faults to support decisions over airworthiness. Once initial information from the manuals has been shared, pilots can continue to interrogate the platform to find out more details and assess the responses.

Yesterday, Austrian aircraft management and charter company Skyside confirmed that it is the first Web Manuals customer to start using Amelia AI. “Managing a vast array of safety, operational, and compliance documents can be challenging,” said Jonas Conrad, the operator’s electronic flight bag administrator. “With Amelia, we anticipate a significant enhancement in our ability to quickly find crucial information.” In his view, the time savings will allow Skyside’s personnel to focus

on the most safety-critical tasks.

So far this year, Malmo-based Web Manuals has added eight new business aviation customers in Europe, the Middle East, and Africa, taking its total for the region to 102, out of a global client base of 643 companies. “An increasing number of business jet operators are starting to recognize the importance of using a digital documentation system,” said Web Manuals operations director Julia Larsson. “As regulators such as the FAA begin to mandate safety management systems that help identify and assess risks, the role of digitalization has become more central to aviation safety.”

For instance, Amelia AI can help the crew understand whether there are any applicable safety notices or bulletins that are relevant to a particular flight procedure they are working on. The pilots then get a summarized response based on the manuals along with sources referencing relevant content from the documents.

“The problem we’re trying to solve is information overload because pilots are expected to know by heart thousands of pages of manuals,” Lidgard told AIN “Sometimes information overlaps between these, and in other cases, it doesn’t apply in all conditions. This is a way to simplify searches for pilots to support better decision making.”

As part of its security protections, the system only conducts searches within the documentation that is available to the user and relevant to their specific needs. It does not access any external public data. All responses provide specific references to parts of the manuals to ensure that users can validate the search results.

Amelia AI will be released through the Web Manuals Core 2024.3 update, with additional features to be announced later this year. The company has around 70,000 end users in its customer base, including operators.

More hands-on AI applications can be found in Lufthansa Technik’s prototyping room in Hamburg, where the cabin refurbishment and systems specialist is evaluating multiple options. These include an intelligent cabin reading light that automatically moves the beam of the light as the passenger’s head moves. z

DAVID M c INTOSH

The Airbus H160 was moved to the convention center by crane before it was taken inside and reassembled with the blades. Attendees can view the helicopter’s new “Line in Lounge” cabin configuration that reduces fuel burn and is designed to be easy to repurpose for various missions.

Business aircraft service specialist Jet Aviation has been approved by the Swiss Federal Office of Civil Aviation (FOCA) to use automated drone and artificial intelligence technology for general visual inspection (GVI) work. The drones are used to create images of an aircraft’s entire surface, from which a detailed paperless report can be derived.

A GVI is an important, regulated maintenance process that identifies defects in an aircraft’s surface. Drones are more efficient than traditional methods for this purpose and they reduce aircraft downtime. These reports are a valued element of pre-purchase inspections.

“The FOCA approval is a significant milestone for our program as we continue to expand

our automated drone and AI capabilities across our network,” said Vincent Rongier, v-p of business operations support. “As we continue to challenge ourselves to re-imagine business aviation and expand our services, we can provide groundbreaking solutions for even the most challenging inspections and offer innovative services centered around predictive maintenance.”

The global company—which is wholly owned by U.S.-based General Dynamics—introduced drones and AI last year for a number of nonregulated services such as pre-purchase aircraft structure inspections, paint quality checks, and inspections in connection with insurance and warranty issues. Regulated inspections are now available for the Gulfstream G280, G550, and G650, as well as for other larger wide- and narrowbody business aircraft. z

“The business aviation industry is in a unique position, it’s adaptable, it’s nimble, it is an early adopter of innovation, but it’s also in the crosshairs of many environmentalists,” said Sky News anchor Jonathan Samuels, who moderated a panel on sustainability and industry perception yesterday at EBACE.

Leading off the discussion, which featured the heads of several OEMs—Chadi Saade of Airbus Corporate Jets, Joe Benson of Boeing Business Jets; Carlos Brana of Dassault Aviation, Michael Amalfitano of Embraer Executive Jets, and Ron Draper of Textron Aviation—Samuels described the industry’s goal of net zero by 2050 as “a moon shot.” But his question to the panel of whether it was achievable was met with unanimous agreement.

“I think a few years ago, the aviation sector was commonly being described as quite difficult to decarbonize, but things have changed in recent years,” said Saade. “If you ask me what’s behind it, I would mention three things: first is technology, second is collaboration, and the third thing would be regulations.”

He pointed to technology developments that have led to a 25% fuel burn reduction in his company’s aircraft due to engine

advancements; the use of sustainable aviation fuel; and investment into hydrogen research. In terms of collaboration, he explained that no single company can take on this challenge by itself.

Textron’s Draper said the goalposts are 25 plus years away, and he expects the rapidly growing pace of investments to yield benefits.

While noting that there is no single solution to the carbon emissions problem, Embraer’s Amalfitano explained: “Investing in sustainable aviation fuel (SAF) and the creation of additional pathways to bring that fuel to market is going to be what makes the biggest difference between now and 2050.”

It’s not only in the air that improvements in emissions can be realized, according to Brana. “For example, when they land, they have time to be towed electrically to their [parking spot].” He noted that more use could be made from electric APUs to power aircraft on the ground, and that is something Dassault is assessing with the Paris Airport Authority.

“What you are seeing this week is the depth, the breadth, and the imagination that is being brought to bear for us to do something that is really audacious—net-zero emissions by 2050, but we’re an industry that has a track record of that,” concluded NBAA president Ed Bolen. z

Officials from NBAA and the industry welcomed EBAA into the Climbing Fast bizav advocacy initiative.

The European Business Aviation Association (EBAA) has joined NBAA’s Climbing Fast program, a multi-media advocacy initiative that highlights the societal benefits of business aviation, the groups said yesterday at EBACE 2024.

One of Climbing Fast’s key topics is sustainability, as the sector heads towards its commitment to be carbon-zero by 2050. That subject was at the heart of the panel session, which was moderated by NBAA president and CEO Ed Bolen and EBAA secretary general Holger Krahmer.

A major challenge is educating politicians to view the sector as a leader in the drive for decarbonization, and its ability to implement and demonstrate positive changes in a short time. Many of the politicians, opined Krahmer, “underestimate the business needs and business impact” of decarbonization, adding that politicians often “ignore business aviation’s potential” to drive change.

Patrick Hansen, the CEO of Luxaviation, added that “wealthy clients can pay for low-emission flying” and were willing to do so. He also noted that business aviation is a leader in the development of electric and hydrogen-fueled aircraft.

However, for the time being those technologies remain the future, and currently the main effort remains the introduction of sustainable aviation fuel (SAF). “SAF is the key tool to decarbonize commercial aviation and also business aviation, but it needs the right enablers,” said Krahmer. D.D.

The northeast regional forum will bring current and prospective business aircraft owners, operators, manufacturers, customers and other essential industry personnel together for a one-day event at the Westchester County Airport. This event will feature over 100 exhibits, an aircraft display, and education sessions to help introduce business aviation to local officials and prospective owners and operators, and to address any current issues in the region.

Textron Aviation this month held the grand opening of its expanded global parts distribution center in Wichita. With an additional 180,000 sq ft of floor space and state-of-theart package sorting facilities, the company says it will be able to store more airplane parts and ship them to customers faster.

“Being centrally located in the United States, we can pretty much ship a part overnight and have it to a customer first thing in the morning as long as the order comes in

before 6 p.m. the day before,” Brad White, Textron Aviation’s senior vice president of global parts distribution and programs, told reporters during a tour of the facility before the EBACE show.

Also known as P43, the expanded facility now covers a total of 245,000 sq ft and stocks around 150,000 active part numbers for new and existing models of Cessna, Beechcraft, and Hawker aircraft. It ships the parts to more than 170 countries, and the company has satellite warehouses and operations around the world. Textron Aviation’s aftermarket

business accounts for one-third of the company’s total revenues.

“We were running our warehouse out of potentially five different buildings here within Wichita, and we were able to consolidate all of that into one single footprint here,” White said. “That was important for us not only for efficiency…but it was a kind of a multifunctional facility strategy where we now can repurpose those other buildings for other needs that the company has,” such as the new hiring and learning center on its East Wichita campus, he added. z