We were meant to fly.

Our engines power flight. A love of flight powers us.

The Airbus A321XLR arrived at Farnborough yesterday, two days after receiving its EASA certification.

We were meant to fly.

Our engines power flight. A love of flight powers us.

The Airbus A321XLR arrived at Farnborough yesterday, two days after receiving its EASA certification.

By Charles Alcock

Two years on from the Covid bounce-back of 2022, the great and the good of the global aerospace and defense industry will file through the Farnborough gates eager to see whether the historic airshow has gotten its power and influence back.

Farnborough Airshow veterans will recall epic past shows where Airbus, Boeing, and other airliner makers battled for bragging rights over who announced the biggest boosts to their order backlogs while performing captivating face-offs between combat aircraft.

major exhibitors have changed, with what appears to be a more pragmatic—and less braggadocious—set of priorities.

Take Boeing, for instance. Beyond a cross-section mock-up of a 777X cabin interior, the U.S. airframer has not brought a commercial aircraft to Farnborough, candidly acknowledging that its focus on implementing the safety and quality action plan the company has promised to execute as it works to restore trust in the wake of fatal accidents and serious technical failings.

DEFENSE Navy trainer debut

U.S. Navy shows off Beechcraft King Air 260 multi-engine training system | 04

Freighter conversions

Embraer debuts its first E190F, a passenger jet converted for cargo operations | 06

WORKFORCE

ATC staffing shortage

Ongoing drought of air traffic controllers prompts new approach to training | 08

Hydrogen power

Jekta taps ZeroAvia’s hydrogen fuel cells to power its amphibious seaplane | 26

However, in the second decade of the 21st century, the context for global airshows appears to have shifted. The motivations of

Airbus is in a different place, albeit still grappling with ongoing supply chain and productivity issues that continue to challenge the industry. The European group graces this year’s Farnborough show with no fewer than 11 aircraft, including continues on page 37

By Charles Alcock

Four months into her demanding new role as interim president and CEO of Boeing Commerical Airplanes, Stephanie Pope has taken strength from extensive feedback from employees as they strive to roll out the safety and quality plan critical to restoring the airframer’s bruised reputation. On the eve of this year’s Farnborough Airshow, she told a Presidents Panel briefing in London that the input from colleagues is what gives her confidence they can achieve their goals in terms of simplifying procedures, reducing defects, and improving build plans, while at the same time embedding a profound safety culture throughout the company.

“It’s all about culture, and employees know

they have a responsibility to speak up if they see something that’s wrong. It’s all about empowerment and accountability,” Pope told reporters. She also serves as chief operating officer of The Boeing Company.

“Our customers realize this is transformational change and we have to also be able to have predictable deliveries at scale,” she added. “I’m clear that it isn’t safety and quality versus the schedule. We have to do it all; those items aren’t competing.”

At the same time, Boeing is also focused on restoring production rates for both the 737 and 787, which it had to slow when it initiated the FAA-mandated safety and quality plan. Pope reported that the manufacturing flow on the

Embraer’s Super Tucano is at Farnborough on the hunt for sales. The light attack turboprop is close to securing an order from Paraguay to bolster counter-narcotics efforts, as the type’s country customer list nears 20.

Addressing Boeing’s Presidents Panel in London on Sunday were (left to right) Stephanie Pope, president and CEO of Boeing Commercial Airplanes; Ted Colbert, president and CEO of Boeing Defense, Space & Security; and Chris Raymond, president and CEO of Boeing Global Services.

737 lines is improving as the company seeks to get rates back to 38 units per month, while it still strives to get 787 output back above five aircraft per month.

Boeing started certification flight testing its new 777X twinjet after the FAA last week issued the type inspection authorization it needs to begin that phase of development. Pope said the company has learned a lot about regulatory changes that will affect the process of bringing the new widebody to market.

Away from the limelight of the Farnborough show, BCA’s airline customers continue to converge on its Seattle hub, where Pope said they are spending hours reviewing the details of the safety and quality plan and how it will impact them. “This industry is safe because we make mistakes and learn from them,” she concluded. “Some of our customers have shared their own stories with us, but that doesn’t take away the reality that we’ve disappointed them.”

On the military side of Boeing’s business, Ted Colbert, president and CEO of Boeing Defense, Space & Security, acknowledged headaches inflicted by problems with some large fixed-price development programs, including the KC-46 Pegasus tanker and the T-7A. “This quarter you will see that we continue to be significantly challenged on these,” he told the briefing. “It will be like what we saw in the third quarter of last year and, once again, we’ll get through it by investing in our workforce.” z

Every second, an aircraft powered by our technology takes fight, bridging cultures and economies and helping travelers reach new destinations. With our lighter materials, more efficient engines and zero-touch airport solutions, we reduce delays and make air travel more comfortable, connected and secure.

Visit RTX at Pavilion C631

By David Donald

Textron Aviation’s Beechcraft King Air 260 multi-engine training system (METS) is making its international debut this week at the Farnborough Airshow. Last year the U.S. Navy selected the aircraft to fulfill a requirement to replace the aging King Air 90-based Beechcraft T-44 Pegasus.

The company will deliver up to 64 King Airs to Naval Air Station Corpus Christi in Texas to support pilot training for the multi-engine fleets of the Navy, Marine Corps, and Coast Guard, including the V-22 Osprey. An initial $113.1 million contract covers 10 aircraft, with full procurement of 64 expected to cost $677.2 million. Textron Aviation handed over the first aircraft on April 22 this year, and instructor training has started.

Designated T-54A in U.S. Navy service, the METS aircraft is based on the standard King Air 260 that the FAA certified in March 2021. The King Air 260 is an improved and updated version of the popular King Air 200.

Inheriting a modern avionics and navigation suite from its commercial stablemate, the T-54A has been adapted to the Navy’s METS requirement with commercial off-the-shelf items. It features a cockpit that seats three (handling/non-handling pilots and instructor), each with radio and full-face oxygen mask provision. There is no cockpit divide, so passengers can view the flight deck operations.

The T-54 can have TACAN navigation and V/UHF radios, and it’s the first King Air variant to feature an angle-of-attack monitoring/ warning system—an important requirement for a military multi-engine trainer. Another feature—an optional datalink that transmits aircraft data to the ground—allows for real-time maintenance tracking. This, in turn, streamlines and accelerates the process of responding to maintenance issues, including those encountered when the aircraft is operating away from its home base. The

downlinked data, along with imagery from cockpit video cameras, can also replay sorties during post-mission debriefs.

In May, Canada announced that it had chosen the King Air 260 METS to answer the multi-engine/asymmetric power training element of the Royal Canadian Air Force’s Future Aircrew Training requirement. Seven aircraft are to be supplied via the SkyAlyne consortium led by CAE and KF Aerospace.

Canada’s “T-54 Plus” aircraft will feature some additional specific capabilities, including compatibility with night vision goggles and anti-icing, the latter required in the Canadian climate. The additions highlight Textron’s ability to tailor aircraft to customer requirements through a range of commercially available factory options.

The U.S. Navy’s adoption of the T-54 has generated considerable interest in the King Air 260 METS, and the aircraft is being shown at Farnborough to military delegations. There is considerable scope for the type in Europe, where several air arms want to replace aging multi-engined trainers, and where a growing roster operates King Air-based special missions aircraft, for which the 260 METS would serve as an ideal training partner. z

Liebherr Aerospace has adopted the motto “transform. develop. sustain.” to highlight its presence at the 2024 Farnborough Airshow and demonstrate how it addresses the biggest challenges facing the aviation industry.

The French family-run company asserts it invests “far above” the industry average in research and technology—including electrification, 3D printing, and hydrogen power—and “makes a significant contribution” to rendering air transport more environmentally friendly and efcient.

Liebherr designed several components of the Boeing 777X’s novel folding wingtip mechanism, which is on display at the Liebherr booth. The display also highlights the additively manufactured housing of a secondary locking actuator. According to in-depth tests, the aviation-certified housing weighs less and performs to the equivalent of a conventionally manufactured component.

As part of its ongoing research and work on the electrification of aircraft, Liebherr is showcasing its electromechanical actuators and a hologram of its high-efciency power pack. C.B.

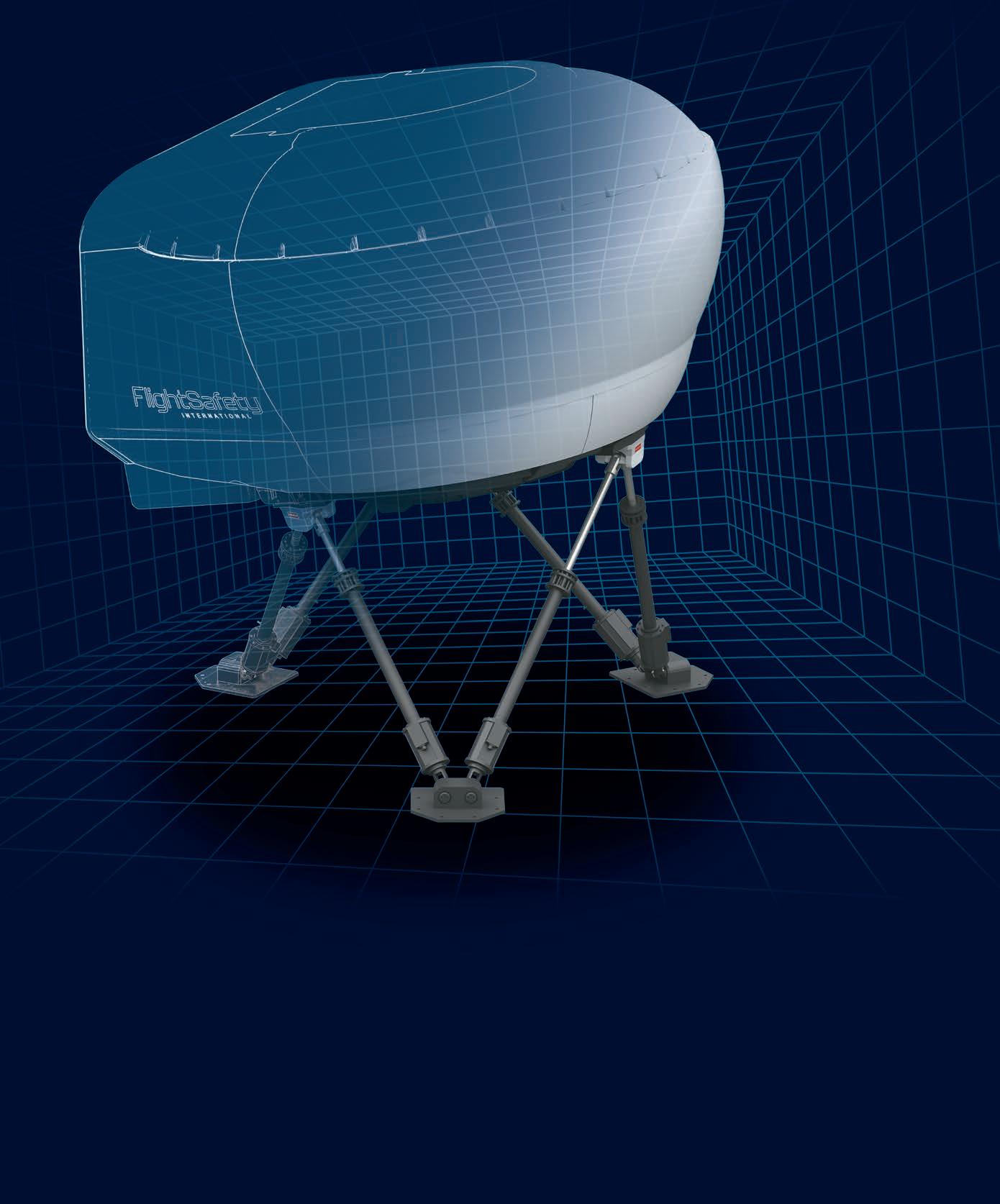

CAE has 75+ years experience in developing ever more effective fight training tools, with the XR Series equipment suite as its crowning achievement to date. Built for lower ownership costs and increased reliability, the 7000XR FullFlight Simulator (FFS) provides the highest simulation fdelity exceeding Level D standards. With the highest screen density on the market, the 7000XR FFS provides outstanding levels of realism and fexibility designed to enhance your airline’s operational excellence.

Today and tomorrow, we make sure you’re ready for the moments that matter.

By Peter Shaw-Smith

Embraer’s new E-Freighter, the E190F, is making its first public appearance at Farnborough this week and headlines the company’s activities at the air show this year.

The E190F, which performed its maiden flight earlier this year, is a converted passenger jet. Embraer launched the E-Jet freighters (E190F and E195F) in 2022 to meet the changing demands of e-commerce and modern trade, which require fast delivery and decentralized operations.

The Brazilian OEM’s lineup at the show also includes a portfolio of commercial and defense aircraft, featuring the E195-E2, which Embraer claims ranks as the world’s most efficient and quietest narrowbody; the aforementioned E190F; the C-390 Millennium multi-mission military tactical transport; and the A-29 Super Tucano multi-role aircraft, which Embraer calls the “gold standard” for

a broad range of missions such as light attack, aerial surveillance and interception, and counterinsurgency. The C-390 Millennium and the E195-E2 will also take part in the flight display, the OEM said.

“I’m sure this will be another great air show for Embraer,” said company president and CEO Francisco Gomes Neto. “Farnborough is the main stage of the aviation industry, and we look forward to meeting with our customers, partners, and many other stakeholders as we kick off our 55th-anniversary celebrations.”

The Embraer chalet showcases several features of the company’s efforts in innovation, new technologies, and its roadmap to sustainable aviation, which includes the Energia future aircraft concept. Embraer subsidiary Eve Air Mobility is presenting updates on its eVTOL aircraft and Vector urban air traffic management software at the show, including a full-size eVTOL cabin mockup and a virtualreality flight experience. z

Qatar Airways plans to lift the veil on its latest business class product, the “Qsuite Next Gen,” at the Farnborough Airshow this week.

The airline hopes the new design, which appears at the Qatar Airways Discover Lounge, underlines its claims as the “world’s best airline” and the “world’s best business class.”

Qsuite Next Gen brings further advancements in comfort, collaborative and social design elements, and an improved passenger dining experience, the airline says.

“We are highly anticipating this year’s Farnborough International Airshow, and as the best airline in the world, we are confident that the reveal of our latest business class offering will be a huge draw for the global aviation community,” said Qatar Airways Group CEO Badr Al-Meer.

Airshow visitors can also explore the airline’s Boeing 787-9 Dreamliner to learn more about its products and services, and experience “ultimate luxury and aircraft performance” with Qatar Executive’s Gulfstream G700. Qatar Executive is the world’s first commercial carrier to operate the aircraft type. P.S.-S.

By Charles Alcock

Air navigation service providers (ANSPs) around the world still struggle to recruit, train, and retain air tra ffi c controllers as staffing levels have not recovered from Covid-era layo ff s and retirements. In the U.S. alone, the FAA needs to fill about 3,000 vacancies in a situation that appears to mirror the pilot shortage.

Aviation training group CAE offers to remedy the challenge through its new Air Traffic Services (ATS) program, which will launch in October with NavCanada. Between then and the end of 2028, the Montreal-based company expects to prepare more than 500 students in a process beginning with between three and six months of initial training before their assignment to on-the-job training positions at NavCanada facilities around the country.

meet the specific needs of each ANSP, which might include recruiting instructors. In some cases, recruits from one part of the world could serve roles in another region.

U.S. air navigation service providers need another 3,000 controllers, according to the FAA.

NavCanada has been investing in its recruitment process, expanding its presence at trade shows and student fairs. It uses questionnaires to assess the potential of prospective candidates who likely have little or no exposure to aviation. “They tend to be very cerebral and scenario-based in how they think,” Cloutier explained. “We need very calm people.”

“One of the things we think we can bring to this situation is our global footprint and the access we have to a talent pool,” Marie-Christine Cloutier, CAE’s vice president of civil strategy, performance, and marketing, told AIN. “We are looking to form partnerships with ANSPs and help them to be more efficient to ramp up [staffing levels] quickly. There is a lot of competition [for recruits] and this is a very demanding job.”

Marie-Christine Cloutier is vice president of civil strategy, performance, and marketing

at aviation traning group CAE.

CAE provides classroom training and devices to simulate a control tower with a 360-degree view of aircraft operations, with elements such as weather presented to students. “We need to make it interesting and we’re also trying to make the process more efficient, because currently there is a high rate of remedial training needed for students who don’t pass [the course] the first time,” Cloutier said. “We want the pass rate to increase and we’re looking at different things we could apply.”

BAE Systems and the UK Ministry of Defence plan to begin inflight trials of the Advanced Tactical Augmented Reality System (ATARS) developed by U.S. company Red 6 later this year, using a Hawk T.Mk 2 trainer. The RAF is considering using augmented reality (AR) as part of future aircrew training.

ATARS enables pilots to “see” virtual adversaries in their visors in air combat scenarios, as well as synthetic support aircraft such as a wingman. The threats are programmed to act as they would in combat, providing a realistic training environment without the need for real-world adversary aircraft. AR ofers the potential to save costs and maximize the training benefits of each hour of a trainee’s flight time.

The ATS training offering can adjust to

The company already uses a tool called Rise for grading students and provides analysis of training data to identify areas where changes might be needed to improve outcomes. z

“Exploitation of novel technologies is an essential part of ensuring the RAF is able to sustain our combat edge and succeed on operations against a constantly evolving adversary,” said Air Commodore Rob Caine, the RAF’s head of flying training. “This latest development is a very exciting proposition and opportunity, and we are all looking forward to seeing the outcomes.” D.D.

Hypersonic weapons travel at more than fve times the speed of sound, and we stand ready to stop them. With advanced sensors and interceptors, our solutions combine vision and precision to arm warfghters and protect lives. It’s just one of the ways we create a safer world.

Visit RTX at Pavilion C631

By Gregory Polek

As Embraer emerged from what it might want to consider a forgettable period in its history when a deal to sell 80% of its commercial airplane division to Boeing fell apart four years ago, the Brazilian company soon turned its attention to restoring the forward-looking trajectory of the entire business. Today, as its U.S. nemesis struggles, the OEM appears to have rediscovered its mojo, to which its controlling interest in eVTOL developer Eve Air Mobility, the resilience of its business aviation division, and the market momentum achieved by its C-390 military transport attest.

Since entering service with the Brazilian air force in 2019, the C-390 program has seen strong demand from Europe, where Portugal (five aircraft), Hungary (two), Netherlands (five), Austria (four), and the Czech Republic (two) have placed orders or entered final negotiations for the type. The twin turbofan model has presented viable competition to both the Lockheed Martin C-130 and Airbus A400M aircraft.

Hungary’s first example flew for the first time this past February and took delivery of the medium-size transport in April. That same month Embraer signed a memorandum of understanding with Saab to explore partnership opportunities, including pitching the C-390 to Sweden as a replacement for aging C-130s.

Other recent customers include South Korea, which in December signed for an undisclosed number of C-390s as part of the country’s Large Transport Aircraft (LTA) II public tender. Now, talks with India led to an MOU signed in February between Embraer and Indian conglomerate Mahindra to collaborate on the country’s Medium Transport Aircraft (MTA) procurement project under the auspices of Prime Minister Narendra Modi’s Make in India policy.

These initiatives apart, Embraer has not abandoned its ambitions in the air transport sector. Group CEO Francisco Gomes Neto told reporters at a mid-June briefing in Brazil that the group’s E-Jet line up of narrowbodies now

holds a commanding position in the 76- to 150-seat commercial jet segment benefitted further from “delivery constraints” haunting larger narrowbodies.

“We have a great opportunity, a great solution for airlines to add capacity more quickly to their fleets,” he said. “The E175 is the workhorse in the regions of aviation in the United States. It is a very robust and mature product, carrying more than five million passengers every month. From LaGuardia in New York, one of four flights is performed with our E175. And since they entered into service, our teams have been able to improve fuel burn by 6.4%.”

Neto expressed particular satisfaction with the most recent sale of its E175s, which comply with the scope clauses in the U.S. pilot labor market. “We were very happy with the big order in early March from American Airlines covering a firm order for 90 E175s plus 43 purchase rights,” he noted. Having collected orders for the E175/E190 families from 18 airlines, Embraer plans to deliver the first of American’s 76-seat jets next year, added Neto.

Embraer is introducing improvements to its E175 twinengine jet airliner during the Farnborough Airshow. continues

With passion and purpose, our team works to solve the world’s most complex problems. By leading the way in advanced materials, advanced sensing, advanced propulsion and more, we push the boundaries of known science—and fnd new ways to protect and connect our world.

Visit RTX at Pavilion C631

Also speaking at Embaer’s main facilities in Sao Jose dos Campos, Embraer Commercial Aviation marketing vice president Rodrigo Silva e Souza issued a preview of plans for improvements to the E175 to be introduced at the Farnborough show. Already leading the 76-seat regional jet category, the E175 has managed to remain so even as mainline pilot unions refuse to allow an increase in the weight limitations, foiling Embraer’s attempt to market an E2 version of the airplane. Silva said its latest plans call for interior improvements, the addition of further connectivity options, and more avionics functionality.

“This we see as a key platform for commercialization and we want to keep it competitive,” he explained.The company’s pair of E2 models, the E190 E2 and the E195 E2, have regained sales momentum around the globe and now operate in every continent, noted Silva.

Operators have deployed the E2s in two key areas—first, as a vehicle to add capacity to regional fleets and, second, to complement large narrowbodies. “They use the E2 together with large narrowbodies, either to increase frequency or to expand the network to feed the hub, for instance,” reported Silva.

On the long-term reliability problems that have emerged on all variants of the Pratt &

Whitney geared turbofans, the PW1900Gs powering the E2 jets haven’t felt some of the worst wear effects experienced by the Airbus A220 and A320neos due to the Embraer jets’ lower weight and thrust requirements, according to Silva.

“I wanted to emphasize that most of the issues will have the solutions addressed this year,” he reported. “We will have, let’s say, addressed them all for normal operation. We have a solution in place that extends the time on wing by 75%. In terms of inflight shutdowns, which is critical, we have experienced 15 times [fewer] events than our competitors. So the experience of issues of GTF on the E2 is a lot less impactful, let’s say, than in other platforms.”

Of course, the company’s business jets are also impactfully holding their own, with Neto claiming the entry-level Phenom 100 as the “most popular jet” in its category. With the launch of the 100EX model late last year, new customers will benefit from an interior that weighs 190 pounds less than the base Phenom while featuring upper tech panels, wider seats, increased use of more sustainable materials, and flush-to-the-wall tables. It also makes standard the previously optional side-facing fifth seat and a belted lavatory.

Neto also took note of the market

performance of the Phenom 300E, calling it the most-sold light business jet for 12 years in a row. Gaining market share “year after year,” Embraer has delivered more than 730 of the light jets over the past decade.

Separately, Embraer hopes its work in the advanced air mobility (AAM) market will yield a similarly impressive sales performance by the eVTOL concept under development by publicly-listed Eve Air Mobility, in which Embraer is the dominant shareholder. Eve CEO Johann Bordais told reporters that while the program remains on schedule, exactly when first flight takes place hinges in part on a “general alignment” of the various certification authorities, namely the FAA, EASA, and Brazil’s ANAC.

“I think it’s just for the best,” Bordais said of the focus on the alignment of regulatory approvals. “When it comes to safety, we’re really talking about putting people in the air in an air taxi operation… this is what we’re looking at. All of us have these interests because we’re creating something new. And, by definition, you want to make sure it works from the very beginning. So we’ll do all it takes to make sure it will be a safe operation. I think this is the key word of the whole [discussion].”

Acknowledging the pressure on Embraer’s schedule as other eVTOL developers appear closer to realizing the ultimate goal of entry into service, Bordais also stressed the need to take the time to ensure operational readiness.

“It’s not about being the first one. I think it’s about being the right one,” he said. “And by being the right one, we just need to do it at the right time…You don’t want to rush anything.

“By the way, this schedule and the timeline that we gave is the same one that we gave back in 2017, when the spino ff of Eve out of the Embraer-X incubator [took place],” added Bordais, “We want to make sure that we deliver the right product safely and also right for the operator. Let’s not forget the operator. He’s going to have to learn how to operate a 100% electric [powered vehicle] and how he puts it in a new operation or a current operation.” z

By Hanneke Weitering

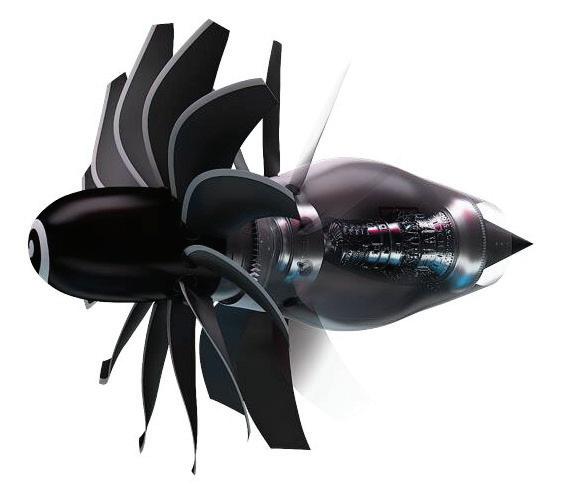

Development work for the Rise open-fan engine has shifted from the design phase to an extensive ground testing campaign as CFM International prepares to begin flying a technology demonstrator in the coming years.

CFM launched the Revolutionary Innova tion for Sustainable Engines (RISE) program in 2021 to develop a successor to the ubiqui tous Leap turbofan engine, which powers the Airbus A320neo, Boeing 737 Max, and Comac C919 airliners. It could support the next generation of single-aisle air craft that airframers such as Boeing and Airbus aim to introduce in the 2030s.

Pierre Cottenceau, executive vice resident of engineering and R&T for CFM partner Safran Aircraft Engines, updated AIN on the project’s many technical advances. “We have made significant progress in our testing plan, which confirms the benefits of the open fan propulsive system for the next generation of single-aisle aircraft,” he explained. “We successfully completed key tests on fan acoustics, aerodynamics, and blade ingestion, and the high-speed, low-pressure turbine, while advancing hybrid electric tests for our suite of pioneering technologies.”

from wind tunnel tests. Safran conducted the tests earlier this year in collaboration with the Onera aerospace research agency at its wind tunnel facility in Modane, France.

To validate the open-fan engine performance and noise levels, GE Aerospace has used supercomputers to run simulations before compar-

artificial intelligence platforms like OpenAI, according to Ali.

Last year GE Aerospace became the first business to use the U.S. Department of Energy’s new Frontier supercomputer. Located at Oak Ridge National Laboratory in Tennessee, it is the fastest supercomputer in the world, carrying the capacity to process more than a quintillion (one million trillion, or 1018) calculations per second.

Noise testing of the open fan design began last year at an Airbus facility in Hamburg, Germany. Those tests “validated that we can achieve lower noise with an open fan than today’s Leap [engines],” Ali said.

The joint venture between GE Aerospace and Safran Aircraft Engines looks to achieve a 20% reduction in fuel burn and carbon dioxide emissions compared with the most efficient jet engines available today—a goal that GE Aerospace vice president of engineering Mohamed Ali says he feels increasingly confident it will achieve, and possibly overshoot.

During a media briefing before the Farnborough International Airshow at GE Aerospace’s Cincinnati headquarters last month, Ali said his team recently received some promising results

Noise and wind-tunnel tests of the Rise openfan engine architecture yield promising results.

ing calculations with real-world test results.

With the power to process trillions of calculations per second, supercomputers are shortening the product development cycle “and enabling us to get accurate results faster,” Ali said.

GE Aerospace is one of the largest consumers of supercomputing capability in the world, and the company now uses about the same amount of computational power as prominent

At the 2022 Farnborough show, CFM and Airbus announced plans to begin flight-testing the open-fan technology demonstrator on an A380based testbed. Earlier that year, the two companies signed a separate agreement to collaborate on a hydrogen demonstration program.

Airbus and CFM plan to install a modified GE Passport turbofan combustion engine on an A380 testbed filled with liquid hydrogen tanks and fly it by the end of 2026. Separately, GE is collaborating with NASA to modify a Passport engine with c components.

After it successfully demonstrates the hydrogen-combustion technology with Airbus, CFM intends to produce a hydrogen-powered variant of the Rise engine, which will initially be compatible with ordinary jet fuel and sustain-

This hydrogen demonstration also contributes to Airbus’s ZeroE program, which aims to introduce a hydrogen-powered airliner capable of carrying around 200 people up to 2,000 nm by 2035.

So far the CFM Rise team has conducted more than 100 tests to validate various aspects of its engine technology. Ali called the results measuring durability and the capability of the open fan “quite encouraging.”

“We actually are increasingly feeling confident about our ability to achieve 20% fuel burn improvement,” he concluded. z

Pratt & Whitney’s F135 Engine Core Upgrade (ECU) is ensuring the F-35 Lightning II will remain the most advanced fghter for decades to come. Easily retrofttable with all F-35 variants, the ECU delivers the durability and performance needed to fully-enable next generation weapons systems, sensors and power and thermal management capacity for Block 4 and beyond.

Visit RTX at Pavilion C631

By Charles Alcock

Sierra Nevada Corp. (SNC) has contracted with GE Aerospace to help overhaul and upgrade the GEnx-2B engines for the Boeing 747-8 that the U.S. Air Force has chosen as the platform for its Survivable Airborne Operations Center (SAOC). The companies will modify the widebody airliner under the $13 billion Pentagon contract SNC won in April to replace the current E-4B Nightwatch aircraft, now powered by GE’s CF6 engines.

Expected to run into the 2030s, the SAOC program calls for SNC to take responsibility for developing and integrating the capability the Air Force needs. According to GE, the GEnx engines will deliver up to a 15% improvement in fuel efficiency compared with the current CF6 turbofans while running 30% quieter and reducing emissions of nitrogen oxides and other gases.

As it seeks to tap defense export markets, GE Aerospace has shifted much of its attention to making its propulsion systems more affordable for U.S. allies. Platforms it hopes to power include South Korea’s KF-21 Boramae fighter and Turkey’s TF-X. It has previously enjoyed export success with engines on Apache helicopters for Poland and F-16 fighters for Greece.

According to Amy Gowder, president and CEO of GE Aerospace Defense & Systems, remaining competitive in export markets means shifting design practices to achieve what she described as “affordable mass for multiple buys.” She said the group’s footprint in Asia, where the company operates engineering centers in Japan, India, and Korea, will help support prospects in other export markets.

In June, GE unveiled its Time Sensitive

Networking Digital Backbone computing platform, which it developed to control multiple systems and avionics for civil and military aircraft. The open architecture platform, which can work with multiple different systems to facilitate modifications, already forms the core computing system for Boeing’s 787 airliner. The U.S. Army also chose the system for the V-280 Valor future military tiltrotor.

“The U.S. Army is very excited about this because it is truly open and modular, so they can upgrade avionics, integrating new electronic warfare capabilities by adding network nodes and building new circuit cards,” Gowder told AIN.

In the longer term, GE continues to invest in the rotating detonation combustion technology it believes could power future Mach 5 hypersonic aircraft. In December, it demonstrated a subscale dual-mode ramjet test rig and is working toward running a scaled-up version later this year.

Another research-and-development priority is the adaptive cycle engine with an advanced thrust control system GE has in mind for future military platforms. “We want to have the cruise and fuel efficiency of an airliner to be able to loiter longer, but when we needed there would be the thrust and maneuverability to operate like a fighter,” Gowder explained. “Another advantage is that it will have a third stream of air for more cooling that comes.” z

RTX business Pratt & Whitney and SR Technics have announced the induction of the first Geared Turbofan (GTF) engine at the MRO service provider’s Zurich facility, where it will provide full disassembly, assembly, and test capability for the engine company’s PW1100G, which powers the Airbus A320neo family.

Pratt & Whitney intends to expand GTF MRO capacity to support growing aftermarket demand. In 2023, it announced three GTF MRO facility expansions and six shop activations to support the growing GTF fleet.

SR Technics, which joined Pratt & Whitney’s GTF MRO network in 2022, marks the

network’s 17th active location and its seventh facility in Europe.

“With the first induction of the GTF engine, we are fulfilling our strategy to expand our capabilities continuously,” said SR Technics CEO Owen McClave. “In maintaining the GTF engine, we will not only be able to support more global customers, but we are also adding to the skillset of our talented employees in Zurich.”

Pratt & Whitney said its EngineWise program provides operators with a range of aftermarket services to promote long-term, sustainable value. P.S.-S.

Entrust your most sensitive missions to Gulfstream. With more than five decades of high performance, flexible platforms and proven reliability, there is no other choice for civilian and military operations over land and sea.

Request your private consultation

By Hanneke Weitering

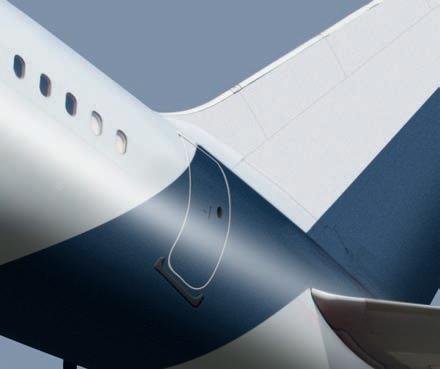

Boeing has returned to the Farnborough International Airshow with a cross-section mockup of its new 777X cabin, but the aerospace giant’s commercial airliners are notably absent from the static and flying displays this year.

At the previous Farnborough show in 2022, Boeing debuted its 737 Max 10—the largest member of the 737 Max family—in the flying demonstrations, along with a flight test example of the 777-9, the larger of the two planned 777X variants.

This year, however, Boeing opted not to spend time and resources orchestrating overseas flight demonstrations with its latest airliner models. Rather, the Boeing Commercial Airplanes (BCA) division has turned its attention to a comprehensive safety and quality action plan the FAA ordered the company to devise following several high-profile accidents

with its 737 Max family of airliners.

After the January 5 incident in which a midexit door plug blew out of an Alaska Airlines 737 Max 9—causing rapid depressurization shortly after takeoff from Portland, Oregon—the FAA launched an investigation into reports of systemic quality-control deficiencies in Boeing’s 737 Max production lines. In February the FAA ordered Boeing to devise an action plan to systematically address the issues, incorporating findings from the agency’s production-line audit and an expert review panel report.

Boeing has since begun to overhaul its quality-control processes, not only at the 737 production line in Renton, Washington, but in all of its manufacturing facilities. The plan calls for simplifying processes, investing in more robust training and mentoring programs, and increasing oversight of its suppliers. The company also has asked for feedback

from employees and encouraged them to openly report safety and quality concerns.

At the Renton factory, the production line now shuts down for an hour every week to allow employees to discuss safety concerns and needs with their supervisors. The meetings allow employees to report any issue ranging from noncompliant manufacturing work to basic needs such as better lighting or taller ladders, Katie Ringgold, v-p and general manager for Boeing’s 737 program and Renton site leader, told reporters last month during a tour of the facility.

To better organize the production line, Boeing implemented a new digitized system that tracks parts and tools while automatically documenting any unfinished work at the end of a shift. The company stores the items on a so-called “work in progress” (WIP) rack monitored by an attendant, and each airplane travels down the assembly line with its own designated WIP rack.

The new WIP rack ensures that no parts removed from the aircraft get left behind when it moves down the assembly line—a simple mistake that may have contributed to the door plug fallout.

The door plug incident in January marked the latest in a series of problems with 737 Max airliners involving Boeing and its supplier Spirit Aerosystems, which assembles the model’s fuselages in Wichita, Kansas, before shipping them to Boeing’s Renton factory. The supplier, which Boeing expects to acquire next year, has come under fire in recent years over manufacturing defects and potentially non-compliant parts it supplied to Boeing.

Following a “comprehensive and methodical” 20-month review of Boeing’s processes in the aftermath of the twin crashes of 737 Max jets in 2018 and 2019, the FAA cleared the Max to fly again in November 2020. At the time, Boeing CEO Dave Calhoun promised the company had addressed the resulting safety concerns. “The lessons we have learned as a result have reshaped our company and further focused our attention on our core values of safety, quality, and integrity,” he insisted.

Nearly five years later, Boeing echoed those

60,000

It starts with a portfolio that has no equal. With our three market-leading businesses, world-class operations and investments in research and development, we offer capabilities no one else can. First in our industry for new patents granted, we continue to pioneer advanced technologies that will transform the world. Visit RTX at Pavilion C631

t or 60+ opratrs fo th trus yo plac in CFM –

in or popl and in or proucts – eery singl day.

We have an amazing hitry tgthr; a lot ha hapend

in th pat 50 years. Our promie t yo fo th nxt

50 i that CFM wil aways deliver th l vel o supot

and inoation that ha earnd that trus.

Gaël Méhus

P resident & CEO, CFM Intrnationa

sentiments in response to the door plug fiasco. This time, the situation differs in that the focus has shifted from engineering to manufacturing, argued BCA senior vice president of quality Elizabeth Lund. “When this accident came along, it gave us a chance to look at a different area,” she explained “This was really the manufacturing side of the house, not the engineering side of the house,” Lund told reporters during a pre-Farnborough media briefing on June 25.

Last September, while the aircraft equipped with the suspect door plug underwent production at the Renton factory, Spirit AeroSystems employees had to replace some faulty rivets on the fuselage, and Boeing mechanics temporarily removed the door plug to grant access to those rivets. Investigators found that when they subsequently mounted the plug, they failed to install four retaining pins that held it in place.

In a perplexing turn of events, Lund said in the briefing that the mechanics who closed the door plug following the repair are not to blame for the missing pins. Rather, Boeing believes that someone failed to file critical paperwork when workers opened the plug in the first place.

“We believe there was a non-compliance to our processes at that point by having the plug open without the correct documentation and paperwork,” Lund said. “There was documentation and paperwork on the actual rivets. Those got removed and replaced. That was stamped off. That was appropriate.”

After mechanics addressed the rivet problem, the airplane was ready to roll outside. “We have a team that we call the move crew,” said Lund. “Before an airplane rolls out of the factory on line-move night, they come in and they just button the airplane up for the weather. We know the move crew closed the plug. They did not reinstall the retaining pins. That is not their job. Their job is to just close it and they count on existing paperwork.

“The paperwork goes with the airplane,” she continued. “In this case, because we believe the paperwork was never created, there was no open paperwork that traveled with the airplane… The fact that one employee could not fill out one piece of paperwork in

this condition and could result in an accident was shocking to all of us.”

Lund’s comments prompted a strong rebuke last month from the U.S. National Transportation Safety Board (NTSB), which leads the investigation into the door plug incident. As a participant in the probe, Boeing may not release any investigative information without the NTSB’s express approval, Tim LeBaron, director of the NTSB’s Office of Aviation Safety, explained in a letter to Boeing president and CEO Dave Calhoun.

Elizabeth Lund, BCA senior vice president of quality claims missing paperwork played a major role in the door plug incident.

LeBaron alleged that Boeing blatantly violated the terms of its party agreement with the NTSB. “[The company] released non-public investigative information and made unsubstantiated speculations about possible causes of the January 5 door-plug blowout, which is directly at issue in the ongoing investigation,” said LeBaron. “Some of the information Lund discussed in the June 25 briefing “was either inaccurate or unknown to the NTSB,” he added.

The rebuke marked the second time in one month that the NTSB reprimanded Boeing for publicly discussing an active investigation without permission. On June 18, Boeing chief engineer Howard McKenzie testified in a U.S. Senate hearing that a “Dutch roll” incident in May involving a Southwest Airlines 737 Max 8 had “nothing to do with design

or manufacturing.” LeBaron countered that notion. “The NTSB has not made any such determination, and our investigators have not yet ruled out design or manufacturing issues as contributing to this event,” he said.

In response to Boeing’s mishandling of the door plug investigation, the NTSB rescinded the company’s access to “investigative information the NTSB produces as it develops the factual record of the accident,” LeBaron said.

Furthermore, he noted, the NTSB intends to subpoena company witnesses, including Lund, to appear at an investigative hearing in Washington, D.C. in August, adding that the NTSB had notified the Department of Justice about Boeing’s unauthorized release of investigative information.

While Boeing addresses claims of safety deficiencies and possible criminal charges, the company continues to struggle with delays in the certification programs for the 737 Max 7 and Max 10 models, as well as the 777X. According to Boeing, increased regulatory scrutiny since the Max crashes has contributed to ongoing certification delays.

BCA decided not to bring its new airliners to the Farnborough Airshow this year to concentrate on minimizing the program delays.

The U.S. aerospace giant also opted to leave its latest commercial jets behind for the Singapore Airshow in February, instead bringing the 777X cross-section to showcase in the exhibit hall. Originally scheduled for certification in 2020, the 777X likely won’t enter service until 2026.

The 777-9 test fleet has accumulated more than 3,500 flight hours during 1,200 flight tests as of June 2024, according to Ted Grady, chief test pilot for the 777X program. Grady said the flight test team has “gone through almost all of the Boeing testing we’ll do before we get into certification [testing].”

Boeing has suffered a series of setbacks in certifying the Max 7 and Max 10 derivatives since the Max 8 and 9 entered service in 2017. Boeing continues to work on a fix for a faulty anti-icing system and now expects the Max 7 and 10 models to gain certification in the latter half of 2026.

The Bahrain International Airshow returns this November to continue its journey, providing an unrivalled platform for innovative and personalised commercial networking. A valuable and unmissable opportunity facilitating international trade and leveraging opportunities.

13-15 November 2024

Sakhir Airbase, Kingdom of Bahrain

By Charles Alcock

Collins Aerospace has completed the preliminary design review (PDR) for the European Union Clean Aviation HECATE program, which is working on high-voltage distribution technologies that could apply to future hybrid-electric aircraft. HECATE, which stands for hybrid-electric regional aircraft distribution technologies, is now progressing toward demonstrating a 500-kilowatt (kW) powertrain to achieve the TRL5 level of technology readiness in 2025.

A consortium that includes engine-maker Safran, Airbus Defence and Space, Leonardo, and several universities conduct the work.

Collins leads the project’s steering committee, while Safran serves as technical coordinator.

The PDR has wrapped up for both the power conversion and secondary distribution system developed by Collins. Safran has reached the same stage for the demonstrator’s primary distribution, power management, and cabling.

Airbus and Leonardo provide input on airframer requirements and help with validation. According to the partners, the main project requirements, including electrical distribution architecture, will reach TRL4 status and a critical design review by the end of this year.

The latest achievements with HECATE constitute part of a trio of announcements from Collins and RTX group siblings this week about progress with the propulsion technology. The company has invested heavily in research and development that could lead to the 20-megawatt (MW) class powertrain needed for next-generation single-aisle airliners.

Airbus Helicopters has asked Pratt & Whitney Canada (P&WC) and Collins to provide a hybrid-electric propulsion system for the PioneerLab technology demonstrator. The European aerospace group uses the twin-engine H145 rotorcraft, which has flown with other systems on board since 2023, to develop performance and safety improvements that could appear on new and existing helicopters.

One target of the PioneerLab is a 30% improvement in fuel efficiency and reduced CO2 emissions. P&WC will replace the H145’s Safran Arriel 2E turboshafts with a derivative of the PW210 engine, which will work in tandem with a pair of Collins 250-kW electric motors and controllers through a common gearbox. It will deliver the motors to Airbus next year.

water-injecting turbofan (SWITCH) programs have guided the engine company’s preparation of the PW210 turboshaft. Phill Godfrey, Collins’s chief sustainability officer, told media ahead of this week’s air show that RTX is combining expertise across the group to accelerate cuts in carbon emissions with improved propulsion efficiency, better power management, and lighter, more efficient aircraft systems.

On the eve of this year’s Farnborough International Airshow, RTX reported that it has validated the sustained operation of the thermal engine for STEP-Tech, as well as the electrical generator, battery system, and propulsors to demonstrate how energy

The RTX group partners aim to start test flights with the configuration in 2027 from the Airbus Helicopters facility in Donauwörth, Germany. The team plans to evaluate how the electric motors provide high torque capability during flight phases, including takeoff and landing, and how to optimize the overall performance of the hybrid powerplant.

Collins is developing the 250-kW motors and controllers at its Electronic Controls and Motor Systems center of excellence at Solihull in the UK. The UK government-backed Aerospace Technology Institute has supported the work to bring a family of products to market that can scale up or down for a variety of aircraft.

Learnings from Pratt & Whitney’s involvement in the RTX Hybrid-Electric Flight Demonstrator, Scalable Turboelectric Powertrain Technology (STEP-Tech), and sustainable

Collins and Pratt & Whitney push for progress with multiple hybrid-electric applications.

gets transferred between the components through the high-voltage electrical network. The modular demonstrator program will evaluate prototypes for distributed propulsion concepts in the 100- to 500-kW class that could scale upward to 1MW and higher for applications such as eVTOL and blendedwing-body aircraft.

In work conducted at the RTX Technology Research Center in East Hartford, Connecticut, each of STEP-Tech’s components underwent testing. The program team conducted a first engine run at partial power and checked the integration of electrical systems. The company said it has validated the program’s battery system and is ready to start running the powertrain demonstrator’s thermal engine and use electrical power produced by the turbogenerator to charge the batteries used to drive the propulsor motors. z

By Charles Alcock

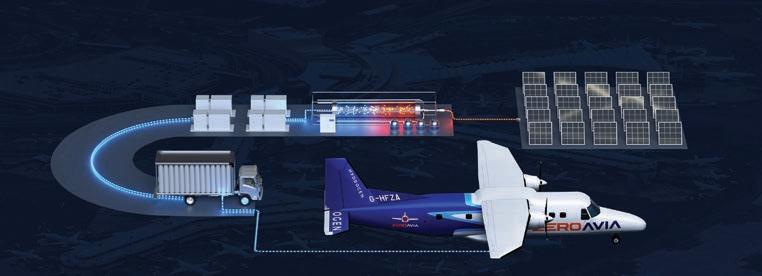

Jekta has chosen ZeroAvia’s fuel cell power generation system as the basis for its planned PHA-ZE 100 hydrogen-electric amphibious aircraft. The Swiss start-up, which announced the agreement on Monday at the Farnborough International Airshow, intends to bring the latest version of the 19-passenger seaplane to market after it wins certification of an initial battery-electric model.

The hydrogen-powered version of the PHA-ZE 100 will fly to a range of up to around 326 nm. Jekta aims to build a full-scale prototype in 2027, by which time the company believes that improved battery technology means it could deliver improved performance. The company plans to gain EASA type certification in 2029.

According to Jekta CEO George Alafinov, his engineering team is advancing design work on the PHA-ZE 100 despite uncertainty over a decision on battery packs. He pointed out that MagniX’s recent surprise launch of its Samson battery, which offers an energy density of 300 watt-hours per kilogram (Wh/kg), is evidence of the fast-changing technology environment. “That was a real curveball because it would deliver around 30% more than what is available now,” he told AIN

Jekta’s agreement with ZeroAvia calls for the two companies to jointly develop and certify the power generation system for the PHA-ZE 100, including the inverters, electronic components, and a hydrogen tank and fuel system. ZeroAvia has already flown its 600-kilowatt ZA600 powertrain on a Dornier 228 testbed aircraft as part of its plans to convert multiple regional airliners to hydrogen.

ZeroAvia also is working on a 2-megawatt powerplant that could power a larger aircraft carrying up to 80 or 90 passengers. The company has developed a range of low- and high-temperature proton exchange membrane fuel cell systems for various applications.

“By working with ZeroAvia and defining a suitable fuel cell system, we can offer our potential operator clients the choice of two fuel systems,” Alafinov said. “The hydrogen system delivers a viable alternative to electric battery power that promises a significant increase in the range of the PHA-ZE 100, which will suit operators serving longer regional routes. In contrast, the battery power option will suit short-range missions and operators flying in locations where electric power is more cost-effective and accessible.”

Jekta sees demand for its new-generation seaplane from prospective operators in Asia and the Middle East. z

U.S. aerospace supplier Harlow Aerostructures will sign a letter of intent to commence production on two new aerospace-related contracts with Turkish Aerospace at the Farnborough Airshow this week. A ceremonial signing is scheduled for July 23 at the Greater Wichita Partnership chalet.

“These two long-term contracts are producing jobs in the Wichita region and generating crucial new revenue streams for our company,” said Harlow Aerostructures chief operating ofcer Jim Barnes.

Established in 1954 and located in Wichita, Kansas, Harlow supplies a range of aerospace manufacturing components, from large bulkheads, spars, chords, and stringers to small bushings, bolts, and bearings.

Since 2008, it has participated in the Farnborough and Paris airshows after an invitation from the Greater Wichita Partnership. The events have facilitated meetings with aerospace clients leading to multi-million-dollar contracts with companies in France, Turkey, and Brazil, which have increased the headcount at Harlow by 10.

“The support of the Greater Wichita Partnership, the State of Kansas, and the City of Wichita in our participation in international airshows and fostering connections within the global aerospace industry has allowed us to capture work from other countries,” said Barnes. “Our diversified operations across multiple platforms contribute to a more stable workforce.”

Barnes will be accompanied at the signing ceremony by Wichita mayor Lily Wu, as well as high-ranking Turkish Aerospace ofcials.

“Strengthening our local economy is crucial for our city’s future,” said Wu. “The new contracts between Harlow Aerostructures and Turkish Aerospace highlight Wichita’s highly skilled workforce and global competitiveness.” P.S.-S.

By Charles Alcock

E

fforts to reduce carbon dioxide (CO2) emissions appear at the top of the engineering agenda at every major aircraft engine maker. The air transport industry also confronts the need to mitigate the environmental damage from other emissions from engines, including contrails formed by water vapor, nitrogen oxides (NOx), sulfur oxides, carbon monoxide, soot, unburned hydrocarbons, aerosols, and traces of hydroxyl compounds.

The complexity around how OEMs can reduce and mitigate the various non-CO 2 emissions has meant that, for now, they are not covered by legally binding mandates. Still, they remain on regulators’ list of priorities. While increased use of sustainable aviation fuel (SAF) forms part of the solution, manufacturers continue to focus on design changes to engines and possible adjustments to the operational profile of flights, including altitude, that could drive down emissions.

In March, the FAA announced plans to work with Pratt & Whitney, the Missouri University of Science and Technology, Aerodyne Research, and the Environmental Protection Agency to better understand and reduce the environmental impact of such emissions as part of the agency’s Ascent program. The work will measure emissions from a Geared Turbofan (GTF) combustor rig test stand using conventional jet-A fuel and a 100% blend of SAF based on hydroprocessed esters and fatty acids synthetic paraffinic kerosene.

In June, results from the ECLIF3 study, involving Airbus, Rolls-Royce, Germany’s DLR aerospace research agency, and energy group Neste, showed a 56% reduction in contrail-forming ice crystals from an A350 aircraft with Trent XWB turbofans powered by unblended SAF. Simulations conducted by the DLR projected a 26% reduction in the climate impact of contrails from engines running on SAF instead of jet-A.

According to Timothy Snyder, Pratt & Whitney’s aerothermal chief engineer, the scientific community now seeks more accurate data from flight evaluations to assess factors such as contrail formation, rather than depending on data generated purely from ground-based evaluations. The studies have involved the deployment of chase aircraft to witness contrail formation at different altitudes.

“Now we are looking at the contributors to contrail formation, which are mainly

quench lean combustors—can minimize temperatures and thereby reduce both NOx and VPM emissions. According to Pratt & Whitney, the GTF engines already in service have reduced NOx emissions by 50% and nVPM by more than 100-fold.

“When it comes to future plans, we have a full annular combustor rig that we plan [to use] to take emissions measurements at inflight conditions to quantify the benefits of low-sulfur SAF,” Synder told AIN “We will use this emissions data to estimate the reduction in contrails and then validate them once we acquire inflight engine emissions data. Based on this data, we can then make further changes to the engine and/or combustor to minimize both ground and cruise emissions.”

non-volatile and volatile particulate matter (nVPM and VPM),” Snyder explained. “These come from sulfur in fuel, incomplete combustion, and lubrication oils. What happens when these contributors are combined with the water-rich exhaust plume is what we are trying to understand. So we measure these emissions and the number of ice crystals to determine if, for example, sulfur is reduced to zero and how much have ice crystal numbers reduced.”

Even before scientists completely understand the mechanism behind the reductions, clearly improvements in combustor technology—such as lean staged and advanced rich

Pratt & Whitney engineers use a combustor test rig to measure emissions at inflight conditions. The engine maker aims to reduce non-CO2 emissions from aircraft.

Meanwhile, Pratt & Whitney’s RTX group sister company Collins Aerospace is working to detect so-called ice super-saturation regions from data collected during flights to provide guidance to airlines on how they might change altitudes to avoid forming contrails. That said, Snyder acknowledged that, in some circumstances, such changes might increase fuel burn and CO2 emissions.

For now, non-CO 2 emissions are not assessed by the European Union’s emissions trading scheme (ETS), but some in the industry expect that to change. Airline industry group IATA has focused more intently on the issue and has issued a policy document, while member carriers including Delta, Air France, and KLM have participated in pilot studies on emissions avoidance. z

By David Donald

Agile Combat Employment, or ACE, is a term increasingly heard around NATO’s air arms strategy. It is, according to a senior officer with a NATO state’s air arm, “an operational scheme of maneuver designed to improve resilience and survivability while generating air combat power from both home bases and geographically dispersed locations.”

To achieve such a plan, forces have gotten better prepared to move at short or no notice, with reduced, more agile footprints. A key element involves deploying multi-skilled support personnel. Perhaps, though, the most important facet centers on the employment of dispersed operations, particularly for defensive needs.

Operations away from peacetime military bases were a major feature of the Cold War on both sides of the Iron Curtain. With the end of that conflict, dispersed operations no longer held strategic relevance other than for out-ofarea counter-terrorism campaigns.

However, first with the Russo-Georgian war of 2008 and then Russia’s occupation of Crimea in 2014, the specter of potentially fighting from and on NATO soil loomed, and some countries began to revisit dispersed operations. The capability appeared validated during the opening attack by Russia on Ukraine in February 2022: The air force aircraft that had dispersed away from the main bases survived the opening rounds to then provide a stout defense against further attacks, but those that stayed put suffered hits.

This stark reminder spurred NATO into pursuing ACE concepts more aggressively. The alliance and its members became very interested in the way Sweden went about force dispersal. The Nordic country enjoyed a reputation as the world leader in such operations, which had at one time seen jet fighters operating off frozen lakes in winter. They evolved into complex “war base” operations with a disused military airfield or regional civil airport acting as the central hub for a network of highway strips.

During the 1990s, Sweden sporadically employed road-based operations, but in the 2010s they came back into vogue, and today they serve as a routine element of air force training. The operations have evolved to take advantage of advances in communications technology and today permit a very fluid form of warfare that is di ffi cult to detect and disrupt.

That fluidity is the key to survivability. “If you operate from anywhere for long enough, a bomb will eventually find you,” said Adam Nelson, chief of the Swedish air force’s F7 wing at Såtenäs. “You have to keep on the move.”

Each “base” consists of numerous highway strips of a nominal 800-meter length and 17-meter width (0.5 miles by 56 feet). The strips are everyday roads with treatment applied to the surface to prevent damage. Discreet hard standings have emerged alongside the roads, not only to provide parking stands for aircraft but to accommodate trucks and fuel bowsers when not required for combat. Everything is kept small to minimize detectability and enhance survivability. A single strip might only be activated for a short time, the support personnel retreating to the safety of the woods when they are not needed. Local police shut down the highway for only as long as required. Typically a Swedish Gripen will stay on the ground for around 15 minutes between sorties—time for it to be serviced, refueled, and rearmed by a team of just three trained conscripts and one full-timer.

NATO states’ air forces pursue more agile means of going to war to improve survivability.

Aircraft aren’t necessarily allocated to one strip, but will operate from locations near fuel or missile reloads, or strips that align with the wind. Communications between fighters and air traffic controllers working the strip are kept to an absolute minimum, and contact is not normally made until they enter the landing pattern. The controller mainly ensures that ground vehicles do not suffer runway incursions and broadcasts basic runway landing conditions based on portable wind-measuring equipment.

For the pilots, highway ops do not present a major issue, as they train for them regularly. New pilots fly several approaches to a painted highway strip on the main base runway before their first road landing. A steep, 14-degree AoA instead of the normal 12-degree approach is the main difference from landing on a standard runway.

The Swedish Gripen is the only fighter in NATO cleared to operate from such short strips, but other NATO nations—notably Finland—fly larger aircraft from longer road runways, and the basic concepts of agile maneuvering remain the same.

The advent of the Lockheed Martin F-35 as NATO’s primary fighter does pose some issues, however, due to its need for a sizable ground support element. Maintenance requirements—especially for its low observable coatings—prove considerable. The type has demonstrated highway ops in Finland, but the engine remained running throughout. z

Textron eAviation is building the first full-scale technology demonstrator for its planned Nexus eVTOL aircraft.

By Charles Alcock

A new wave of small electric aircraft, mostly with a capacity for between two and six passengers and a range of little more than 100 nm, has become the most hyped aspect of aviation’s precocious advanced air mobility (AAM) sector. The new eVTOL vehicles will vie for attention alongside much larger aircraft at this year’s Farnborough International Airshow, pressing the case for early-stage commercial operations set to launch as soon as 2025.

The pool of viable eVTOL contenders is shrinking, and several of them still in contention continue an urgent search of funding needed to get them to market while investors apply pressure for returns on their capital. The situation has created pinch points, according to Robin Riedel, who co-leads consulting group McKinsey’s Center for Future Mobility. “With the AAM companies at the pre-revenue stage, many of them are too small for private equity [backers] and too big for early venture capital,” he told AIN

At Singapore-based consultancy Alton Aviation, Joshua Ng also sees a crunch point in the competitive environment. “We are starting to see winners and losers, and those who are winning can demonstrate they have a lot of cash in the bank,” he commented. “Those that are not will need to start quickly demonstrating that they have something really exceptional to convince people they are worth investing in.”

That’s not to say the new sector of air transport will create a case of first-to-markettakes-all, and opportunities beyond the initial use cases continue to emerge. “If you have an ambition to be an aircraft OEM, the window of opportunity is closing,” Ng added. “But if you have a strong value proposition in terms of battery technology, propulsion systems, or avionics, you can still do a really good business if you have something that is your own IP, and we will see a lot more of that because you need a really good supply chain behind the OEMs to make the whole ecosystem work.”

UK-based Vertical Aerospace enjoys homefield advantage this week as it works to bring

its VX4 model to market in 2026 with a high-profile list of customers including Virgin Atlantic, American Airlines, Japan Air Lines, and Bristow. Overall, the start-up has reported provisional sales from customers on four continents of about 1,500 aircraft valued as much as $6 billion, implying a unit price of around $4 million.

Vertical’s recently-completed second prototype features more hardware provided by key partners Honeywell, Leonardo, and GKN Aerospace. It also adopted new batteries from the company’s in-house Vertical Energy Centre at its Bristol headquarters and new propellers that Vertical has redesigned since the Aug. 9, 2023 crash that destroyed its first prototype.

The lessons learned from flight testing this aircraft at Kemble Airport in the west of England will apply in the construction of a third prototype that engineers will redesign to earn type certification credits with the UK Civil Aviation Authority, which is following EASA’s process for approving new eVTOL designs. Vertical’s key technology partners

for the program include highly experienced aerospace groups such as Rolls-Royce, GKN Aerospace, Honeywell, and Leonardo.

Based in California and backed by major South Korean automotive group Hyundai, Supernal has made a far longer trip to Farnborough. It plans to unveil a full-scale mockup of its S-A2 eVTOL aircraft, which will carry a pilot and four passengers on flights of up to around 52 nm on a single charge, although many of its anticipated commercial missions will be as short as 22 to 35 nm. Expected to operate at around 1,500 feet at a cruise speed of 104 knots, the S-A2 will use batteries that take less than seven minutes to fully recharge.

The mockup on show in Farnborough features the V-shaped tail, wings, and eight tilting rotors, as well as a reworked cabin featuring new seat frames with upgraded energyabsorbing materials designed for protection in the event of a hard landing. The latest S-A2 design also features new interior lighting.

Unlike rival California start-up Joby Aviation, Supernal hasn’t targeted service entry next year but rather has set its sights on FAA type certification in 2028. The company, which like Joby will initially operate its own aircraft in commercial service, aims to achieve a first flight with a technology demonstrator by the end of this year.

Joby is already advancing plans for series production of its still-unnamed four-passenger eVTOL model, with the establishment of a pilot production

line in Marina, California and the main factory planned in Dayton, Ohio. Like several other AAM pioneers, the company has lately formulated early use cases in markets such as the UAE, where Dubai awarded it an apparent monopoly on air taxi services.

Joby, which enjoys support from Toyota, in June acquired autonomous flight control system developer Xwing. For now, Joby’s eVTOL will be piloted, but the company sees Xwing’s technology under development for conversion of existing aircraft such as the Cessna Caravan as a path towards autonomous operations, which would further transform the economics of the eVTOL air taxi business model.

Boeing’s stake in the AAM sector hinges on its Wisk Aero subsidiary, which at Farnborough will display the sixth-generation eVTOL design it is preparing to start flight testing. The four-passenger vehicle would fly to a range of almost 80 nm and at a speed of 120 knots, but with no pilot on board.

The California-based company, which started flying an eVTOL prototype in 2010, has since logged more than 1,700 flights.

Management insists that only fully autonomous operations can make air taxi services commercially viable. Outside China, regulators have not yet defined a path for approving operations on that basis, but Wisk remains confident it can get what it calls its Gen 6 aircraft certified for use in IFR conditions.

Boeing’s main commercial aviation rival Airbus has taken its own approach to the AAM sector. In March it unveiled the first full-scale prototype of its CityAirbus NextGen eVTOL aircraft and wants to start flight testing from the program’s base at the Airbus Helicopters facility in Donauwörth, Germany. It already has started building a second prototype.

With a 12-meter (40-foot) wingspan, the CityAirbus vehicle features eight propulsion units, with four rotors mounted on the rear side of the wing for vertical lift, a pair of forwardfacing propellers, and two pusher props installed on the tail. It is intended to operate flights of up to around 33 nm at a cruise speed of 65 knots.

Last October, Airbus tested the so-called Millenium stick flight control system for use by CityAirbus pilots on its FlightLab helicopter testbed. The company wants to deploy its Vertex autonomous flight technology, including Wisk Aero, a Boeing subsidiary, has its Gen 6 eVTOL air taxi on display at the Farnborough Airshow. Rival eVTOL developers Joby (below, left) and Airbus (right) are also exhibiting.

a new human-machine interface for the flight deck, to reduce single-pilot workload.

Unlike many eVTOL start-ups that have boldly promised investors commercial returns pegged to very ambitious target dates for type certification, Airbus has not published a program timeline but has indicated it expects to start deliveries by the end of this decade. Also, unlike some of the AAM sector pioneers, the European aerospace group will not operate the aircraft itself.

According to Balkiz Sarihan, CEO of Airbus’s urban air mobility business unit, the first use cases for the CityAirbus will likely center on emergency medical services, tourism flights, and perhaps scheduled passenger routes. “The industry will have to prove itself before air taxi services are viable,” she told reporters in a briefing earlier this year.

Also in Germany, Lilium awaits calls from the federal government and Bavarian state officials to confirm some €100 million ($107 million) in fresh funding to complete ambitions to certify its four- to six-passenger Lilium Jet eVTOL by the end of 2025. To keep the project on track, the company needs to start flight testing for the EASA type certification process by the end of this year. It now is assembling the first production-conforming prototype at its headquarters near Munich.

Unlike most other eVTOL developers, Lilium directly targets wealthy private aviation customers. It recently confirmed a sales agreement with UK-based business jet operator Volare, which will operate up to 20 of the fourseat Pioneer Edition aircraft for private owners and make them available for charter flights. In May, Lilium announced plans with partners to

launch air taxi services across well-healed communities in France’s Côte d’Azur region.

At its headquarters in Wichita, Textron continues work on its first full-scale technology demonstrator for its planned Nexus eVTOL aircraft. The U.S. business aircraft manufacturer’s eAviation division aims to start flight testing the four-seat aircraft in 2025. Performance targets include a range of 100 nm and a cruise speed of 120 knots. The company will conduct flight tests at a new facility that Wichita State University’s National Institute for Aviation Research is building near McConnell Air Force Base.

The Nexus, which draws on expertise from Textron’s rotorcraft division Bell, is not the group’s only gambit in the AAM sector. Based on its 2022 acquisition of Slovenian electric aviation pioneer Pipistrel, the eAviation unit has nearly reached the start of flight testing of its hybrid-electric Nuuva V300 cargo drone.

Embraer-backed Eve Air Mobility now builds its first four-passenger eVTOL prototype at a new facility at Taubaté in Brazil’s São Paulo state. The company has advanced the program with little public fanfare but does claim to hold letters of intent for nearly 3,000 examples of the 52-nm-range aircraft.

Eve, which targets type certification in 2026, last month told reporters it cannot say exactly when it will conduct the first flight of the prototype because the plan hinges on “the alignment” of Brazil’s ANAC aviation regulator, as well as the FAA and EASA. “I think this is for the best,” Eve CEO Johann Bordais said. “When it comes to safety, we’re really talking about putting people in the air in an air taxi operation. All of us [eVTOL developers] have these interests because we’re creating something new. And, by definition, you want to

make sure it works from the very beginning.”

Bordais offered words of caution to rivals rushing to be first to market, suggesting that new operators will need to be well-prepared and have the right infrastructure in place. With Embraer’s backing, Eve has invested time and energy establishing partnerships to underpin the so-called AAM ecosystem, including air traffic management technology for lowaltitude urban flights, which is the focus of the Brazilian group’s ATech subsidiary.

“We want to make sure that we deliver the right product safely and also [that it is] right for the operator,” Bordais said. “Let’s not forget the operator. He’s going to have to learn how to operate a 100% electric vehicle and how he puts this in a new operation or a current operation.”

Also assembled in the AAM presence at this year’s Farnborough, the UK start-up Arc Aerosystems continues work on a modernized version of the 1960s-era Avian Pegasus gyroplane, as well as a nine-seat compound helicopter called the Linx P9. It also has laid plans for a three-seat all-electric rotorcraft called the Linx P3 and the C-600 uncrewed eVTOL cargo aircraft. In June, the company secured an agreement with the Saudi governmentbacked Life Shield for around $400 million in funding for development work and manufacturing capability.

From Spain, Crisalion Mobility is presenting plans for a six-seat eVTOL design called the Integrity, which uses the company’s proprietary FlyFree propulsion and stability system. In June, the company signed a provisional sales agreement with Malaga-based business aircraft operator iJet, which plans to launch air taxi services in the Andalusia region with 10 of the aircraft. z

By Cathy Buyck

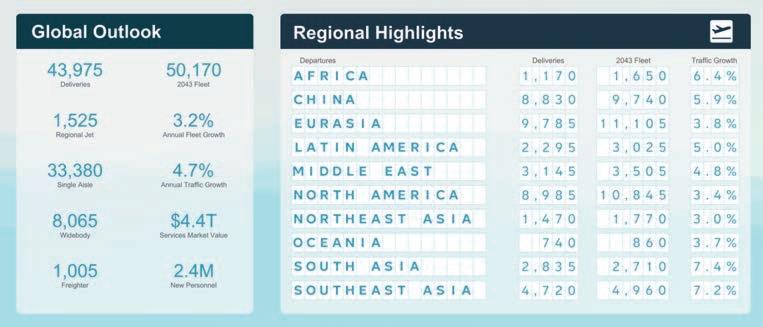

Boeing has upgraded its 20-year demand forecast for commercial jets and now predicts that airlines will need 43,975 new airplanes over the next 20 years.

The revised forecast, released ahead of the Farnborough Airshow, represents an increase of 1,375 aircraft over its previous forecast, which the U.S. airframer attributes to the faster-than-expected recovery of air travel after Covid-19. Four years after the pandemic grounded most of the global fleet, air traffic growth is reconnecting with previous trends and will rise an average of 4.7% annually over the next two decades, according to Boeing’s 2024 commercial market outlook (CMO).

Boeing’s main rival, Airbus, also upwardly revised its industrywide delivery forecast, projecting a need for 42,430 new passenger and freighter deliveries between 2024 and 2043, versus the 40,850 airplanes anticipated in its global market forecast last year.

“This is a challenging and inspiring era for aviation. The return to more typical traffic growth shows how resilient our industry is, even as we all work through ongoing supply chain and production constraints amid other global challenges,” said Brad McMullen,

Boeing’s senior vice president of commercial sales and marketing.

The Boeing CMO projects that the global passenger and freighter fleet will nearly double over the next 20 years to 50,170 planes. Of the new deliveries, 47% (20,565 jets) will replace older aircraft with more fuel-efficient models to improve sustainability, and 53% (23,410 jets) will support growth.

Single-aisle airplanes will account for 71% of the 2043 fleet and 76% of new deliveries (33,380 jets) over the next 20 years. Widebodies will account for 17% of deliveries (8,065 units), while regional jets make up 4% (1,525) and freighters at 2% (1,005).

The world air cargo market demand will top 2,800 freighters by 2043, according to Boeing. The company’s forecast calls for 1,250 so-called standard-body freighters (less than 40 tonnes), 785 medium widebodies (40 to 80 tonnes), and 810 large widebodies with cargo capacities exceeding 80 tonnes. Passenger-to-freighter conversions will boost the cargo fleet by 1,795 aircraft in the 2024-2043 period, said the report.

By region, Eurasia and Asia-Pacific will lead all markets with the most airplane deliveries (22% of total each), with North America (21%) and China (20%) close behind. The Middle East will take delivery of 7% of all new aircraft in the 2024-2043 period, said the report. z

Boeing has updated its commercial market outlook for 2024-2043, predicting accelerating demand for commercial airliners and cargo freighters.