DO I NEED AN ADVISOR?

If you have to ask, you probably do

FOSTER CARE FOR TEENS

PART III : It Takes A Village series

SOMETHING TO CELEBRATE

Revealing the benefits of revelry

If you have to ask, you probably do

PART III : It Takes A Village series

Revealing the benefits of revelry

America’s consumer warrior discusses his hands-on approach to healthy finances!

Recognition for Leesburg Regional Medical Center continues to grow. HealthGradesTM has awarded the hospital its 2014 Patient Safety Excellence Award. The distinction places Leesburg Regional within the top 5% of all hospitals in the U.S. for its excellent performance in safeguarding patients from serious, potentially preventable complications during their hospital stays. And while we’re undeniably proud of the recognition, we’re most proud to provide our community with the highest quality of care, year after year.

LeesburgRegional.org

SPECIALIZING IN JOINT RECONSTRUCTION & SPORTS MEDICINE

► Exclusively uses muscle sparing techniques on ALL primary joint replacements

► Makoplasty/resurfacing same day surgery

► Perioperative pain control system consistently yields low pain control scores well above the national average

► Arthroscopic Rotator Cuff Repair

I’ve developed a proprietary approach to knee joint problems that involves an integrated combination of minimally invasive surgical procedures, pharmaceutical intervention and pain management. This results in faster healing times, fewer complications and less pain.

— Donald Perry MD

— Donald Perry MD

At ICE we beleive primary care is your first line of defense for your husband’s office full of sniffling, sneezing co-workers. Our primary care physicians are there for everything from regular check-ups and treating common ailments, to promoting wellness programs like weight loss or smoking cessation. We’re also excellent at heading off illness’ before they have a chance to take hold…Becky brought Ted in on Friday and they both got a flu shot. Ted made it through the week without a single sniffle.

At Promise Hospital, our Admissions team consists of both in-house and field members. Everyone’s role and ability to work as a team is crucial not only to the success of our department, but to Promise Hospital overall. We have recently expanded into the Orlando market with plans to further expand into the Gainesville area. Our goal is to make sure our community and surrounding communities know all their options when it comes to long-term acute care hospitalization. Knowing it is a patient’s choice where they receive health care services, we strive to be the top choice for our expanded community. With the advantages of our advanced wound care program, outstanding pulmonary & respiratory care results, including ventilator weaning, our in-house critical care unit coupled with the easy access to our facility and open visiting hours, we aim to be your #1 choice should your loved one need the acuity level of care we provide.

SCAN THIS CODE WITH YOUR SMARTPHONE TO LEARN MORE ABOUT PROMISE HOSPITAL!

Seated on desk: Heidi Price, Carol Carlton; Middle: Susan Flynn, Suzann Turner, and Debra Koske; With Clipboard: Suzi Gillespie

SCAN THIS CODE WITH YOUR SMARTPHONE TO LEARN MORE ABOUT PROMISE HOSPITAL!

Seated on desk: Heidi Price, Carol Carlton; Middle: Susan Flynn, Suzann Turner, and Debra Koske; With Clipboard: Suzi Gillespie

America’s consumer warrior doesn’t love money. Really, he doesn’t. He’s just crazy about saving it. WRITER: GARY CORSAIR

The buck starts here! Investment tips you can take to the bank! WRITER: JAMES COMBS

Finding foster homes for teenagers can be a challenge, but with patience and love these children blossom into successful adults who are forever grateful to parents who stepped up and made a difference. WRITER: MARY ANN DESANTIS

WRITER:

Once every second or so, a dimesize bundle of cells in the upper chamber of the human heart produces an electrical pulse that keeps the organ beating.

TO KNOW ”ROSIE“

There’s a big difference between a healthy glow and signs of rosacea

WRITER: RUTH ANN BYRD

RECIPE

52 SPRING SALMON

Satisfying meal throws starchy carbs overboard

FATTY ACIDS

53 “FATTY” ISN’T ALWAYS A BAD WORD Omega 3 and Omega 6 are essential for healthy skin

TINA NESSELROTE

— Corita Kent and Jan Steward, authors of Learning By Heart, Teaching To Free The Creative Spirit

MORTGAGES

64 GOING IN REVERSE

Many seniors use equity in home to generate income

WRITER: JAMES COMBS

ASK DAVE

66 INSURANCE: UMBRELLA POLICY

It’s just about the biggest bang for your buck.

WRITER: DAVE RAMSEY

One of the health benefits of salmon is it helps you achieve adequate amounts of sleep, due to the tryptophan, but did you know that the cherry salmon has an average length of around 20 inches, w while the Chinook sal s mon has been known to reach almost 5 feet.

G Go o ood night, Irene!

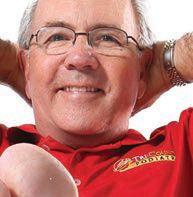

Clark Howard is as happy and enthusiastic in real life as he appears to be on TV.

Just thought I’d get that out of the way right off the bat since people always ask, “Is he really like that?” when they find out I interviewed a celebrity.

I’m happy to report that Clark Howard, is indeed, the real deal.

No subjects were off limits during the 90 minutes we spent together; he freely answered questions about his cheapness, his political aspirations, failure of his parents to save money, his father being fired and his father’s death. He even discussed viewers and listeners who think he stinks.

I left Howard’s $4 million Atlanta home feeling like I’d visited with an old friend.

Still, a tiny part of my brain (or do I mean a part of my tiny brain?) wondered if I’d witnessed a performance.

That itsy voice has since been silenced by the fabulous photo fiasco.

We planned to use an image from ClarkHoward.com on our cover, but the photo of Clark stretching a dollar didn’t have enough resolution, bytes, pixels or some such thing.

So we asked Clark’s people to send us the original. Unfortunately, they couldn’t locate it.

So Clark’s ultra-efficient assistant Kate Moore emailed us a batch of wonderful photos.

The photos were okay … but … we really, really wanted the shot of dollar-stretching Clark. Sorry Kate.

I expected her to suggest that I jump in a lake. Instead, she promised to rush over to the studio and take some quick shots of Clark before he headed to the airport for a trip out of the country.

A day later, we had our photo. Or so we thought. Kate hadn’t had time to retrieve her professional camera gear. The photos Clark graciously posed for were not cover quality.

When I told Kate, I expected her to say, “Well, at least we tried.” Instead, she promised to take high-quality shots when Clark returned. I was flabbergasted. Clark would agree to a second inconvenience? My experience with celebrities is that you don’t ask them to do something twice.

Pen runs out of ink while they’re signing an autograph? Tough. Camera flash doesn’t go off? Too bad. Can’t wait for your camera to recharge, gotta go.

So yes, I’m pretty sure Clark Howard is the real deal. Our cover is proof he doesn’t consider himself more important than people he lives to help.

Gary Corsair Executive Editor

“I expected her to suggest that I jump in a lake.”

a lake.

April is here and that means tax time.

Hopefully you aren’t waiting until the last minute to file, but if you’re one of those special people who enjoy the thrill of rushing to the post office as the clock ticks toward midnight on April 15, then more power to you!

If you filed early, and already have your refund, take a bow. Take two bows if you banked or invested the money.

Many people feel like they have to splurge on themselves after cashing their refund check, but this month’s Healthy Living has me thinking that perhaps we should resist the urge until we figure out how to maximize our windfall.

I like to spend as much as the next person, but this month’s interviews with consumer warrior Clark Howard and retired financial planner Joe Dykes has me rethinking the I-have-to-run-outand-buy-something-big-because-Ideserve-it! approach.

I’m guessing that Clark would find a way to make the money go twice as far by buying used or off brands, or by negotiating the best deal possible on what he has his eye on. And who am I to argue with his frugal ways? The guy is worth $15 million!

And Joe Dykes would invest –conservatively.

Both experts would tell you to make your money work for you.

Do you have a budget? A retirement savings program? Are you paying yourself before you pay bills?

If you answered “no” to any of those questions, you should rethink your approach to money. Saving as little as $50 from each paycheck could impact your life for the better. In a year or two, it could mean a down payment on a car, a nice vacation, a gift for someone in need or the foundation of a financial portfolio.

Here’s hoping we’ll all get smarter with our hard-earned money. Please take time to read our profile of Clark Howard and Joe Dyke’s views on working with a financial planner.

Many of us had to tighten our belts when the economy sputtered and now that things are better, we’re ready to reward ourselves. And that’s okay, but maybe we should splurge a little less and save a little more.

Let’s all be “Clark Smart” and “Dykes Decisive.”

And let’s not neglect the other pillars of a happy life – mind, body and spirit. Read a book, join a gym, set goals and surround yourself with people who will help you attain them.

Now that’s Healthy Living!

KENDRA AKERS publisher/editor-in-chief kendra@akersmediagroup.com

DOUG AKERS vice president doug@akersmediagroup.com

JAMIE EZRA MARK chief creative officer jamie@akersmediagroup.com

SABRINA CICERI associate publisher sabrina@akersmediagroup.com

EDITORIAL // DESIGN // PHOTOGRAPHY

GARY CORSAIR executive editor gary@akersmediagroup.com

JAMES COMBS staff writer james@akersmediagroup.com

MATTHEW GAULIN staff photographer matt@akersmediagroup.com

RHEYA TANNER designer rheya@akersmediagroup.com

STEVEN J. CODRARO creative director steve@akersmediagroup.com

JOE DELEON senior art director joe@akersmediagroup.com

JOSH CLARK senior designer josh@akersmediagroup.com

MICHAEL GAULIN production director michael@akersmediagroup.com

CONTRIBUTING WRITERS//PHOTOGRAPHERS

RICHARD T. BOSSHARDT, M.D., FACS RUTH ANN BYRD MARY ANN DESANTIS FRED HILTON

TINA NESSELROTE SCOTT PERKINS DAVE RAMSEY RON VANDEVANDER

SALES // MARKETING

TIM MCRAE vice president of sales and marketing tim@akersmediagroup.com

MIKE STEGALL senior account representative mike@akersmediagroup.com

MELANIE MELVIN director of client services melanie@akerscreative.com

DEB MATLOCK account coordinator deb@akerscreative.com

HEIDI RESSLER account representative heidi@akersmediagroup.com

DAVID COTÉ account representative david@akersmediagroup.com

ADMINISTRATION

TINA MORRISON office manager tina@akersmediagroup.com

SAMANTHA KURK receptionist samantha@akersmediagroup.com

DISTRIBUTION

SCOTT HEGG distribution manager scott.hegg@akersmediagroup.com

Local residents experiencing vein disease need not worry. The team at Cardiovascular Associates of Lake County possesses the necessary credentials, experience and background to provide top-notch, comprehensive care.

“We have a team of invasive cardiologists who are used to treating heart problems and peripheral artery disease,” says Dr. J. Henry Lesmes, a cardiologist in Lake County for 22 years. “Treating veins is a continuation of our skills we’ve developed in residency and throughout our careers.”

The team conducts a thorough medical history and performs ultrasound to rule out other problems, such as osteoarthritis or neuropathy. Conservative treatments like making lifestyle changes or wearing compression stockings are the first line of treatment.

If symptoms persist, the team at Cardiovascular Associates of Lake County can utilize an in-office procedure called radiofrequency ablation. During this non-surgical, outpatient procedure, a thin catheter is carefully inserted into the diseased vein. Then, radiofrequency energy is applied to help seal the vein.

As one of the oldest and most experienced private cardiology practices in Central Florida, at Cardiovascular Associates of Lake County, we are dedicated to bringing innovation in cardiovascular care to our patients. Since 1992, we are your partners for life.

WRITER: SHEMIR WILES

Healthy Living last visited Bill Miller in November 2011 and learned about his triumphs as a quadriplegic.

It’s safe to say the Leesburg resident continues rolling through life—literally. In February 2012, Bill set a new world record in dynamic wheelchair bowling with a score of 255 at Spanish Springs Lanes in The Villages. His bowling group, affectionately named the “Quad Squad,” typically bowls twice a month. This group of quadriplegics has ramps attached to their wheelchairs, and a bowling ball is placed atop the ramp. They direct their chair toward the foul line, and when they stop the ball is released down the lane.

In 2013, Bill completed a master’s degree in entrepreneurship online from Western Carolina University and now serves as a teaching assistant for two courses in the same program.

The excitement of Leesburg Bikefest returns this month as man and machine roar into the Lakefront City. Follow these simple rules to ensure nobody becomes injured.

these rules to ensure becomes needlessly

ROADS ARE BUSIER THAN ANY OTHER TIME OF THE YEAR. DRIVE SLOWER TO ACCOUNT FOR TRAFFIC AND SUDDEN STOPS.

DON’T TAILGATE. MANY MOTORCYCLE ACCIDENTS OCCUR WHEN INATTENTIVE RIDERS REAR-END A MOTORCYCLE AHEAD OF THEM.

WEAR SAFETY GEAR— HELMETS, LEATHER, GLOVES AND BOOTS.

IF YOU HAVE A PASSENGER, MAKE SURE HE OR SHE HOLDS FIRMLY AGAINST YOU OR ONTO THE MOTORCYCLE’S HANDHOLDS.

“… LIFE CAN STILL BE GOOD, DESPITE SEEMINGLY OR LEGITIMATELY DIFFICULT CIRCUMSTANCES.”

You’ll have several opportunities to support the quest for a cure for cancer this month at local Relay for Life events. The 18-hour celebration of survivors

features participants walking around a track to raise funds for cancer research and create awareness about this deadly disease. Proceeds benefit the American Cancer Society.

This year’s Relay for Life events in Lake and Sumter counties are as follows:

Procee Americ Society Thi ev Sumte follows

children die each day because of child abuse.

14%

5 36%

of imprisoned men were abused as children.

of imprisoned women were abused as children.

HERE’S THE SKINNY. YOU ARE WHAT YOU EAT SO DON’T BE FAST, CHEAP, EASY, OR FAKE.

68% of child sexual abuse victims are abused by a family member.

3.6

million child abuse cases are reported each year in the U.S.

If you’d like to take control of your health through nutrition, consider reading the best-selling book “Living Foods for Optimum Health.”

SOUTH LAKE: April 17 at South Lake High School

LEESBURG: April 18 at Leesburg High School

EUSTIS/TAVARES: April 24 at Ferran Park

THE VILLAGES: April 29 at New Covenant United Methodist Church

SUMTER COUNTY: May 1 at Sumter County Fairgrounds

MOUNT DORA/ SORRENTO: May 2 at Christian Home and Bible School

NORTH LAKE: May 16 at Umatilla High School

FOR MORE INFO, CALL 352.326.9599.

The book was authored by Brian R. Clement, who serves as director of Hippocrates Health Institute in West Palm Beach. The institute is the country’s leader in the field of natural and complementary health care.

The book explains how natural food helps people achieve optimal health by keeping their bodies strong and vigorous. Readers will enjoy 100 healthy, delicious recipes, as well as shopping tips, recommended exercises and ways to maintain strong mental health.

When you’re ready to shift from feeling old to feeling like your old self again, call the caring professionals of FMI.

e with a brand new knee. I’ve ands

ding the knee

Knee pain can create a vicious cycle of lopsided body mechanics and inactivity, leading to more pain and dysfunction. But before you resign yourself to being parked on the sidelines, consider what your life could be like with a brand new knee. I’ve performed thousands of knee replacement surgeries, including the unicompartmental knee replacement procedure. It has put countless patients back on the road to active, healthy living.

cement It has put less back on the road to e,

H. ANDREW HUNTT, MD Board Certified Orthopaedic Surgeon

You don’t retire a classic just because a part is worn out...

Using principles from Dave Ramsey’s Financial Peace University, Mark and Lisa began paying off the rental home first because it was their smallest debt. Although the monthly mortgage was only $600, they began making monthly payments of $800 in 2011. Once it was paid off, the $800 they had been paying toward the rental home—as well as the monthly rent they received— was now being used to pay off the mortgage on Lisa’s home.

WRITER: JAMES COMBS

WRITER: JAMES COMBS

In June, Mark and Lisa Coffman will embark on a two-week vacation to Italy. While traveling with several other married couples, they’ll see the ancient architecture of Rome, picturesque waterways of Venice and stunning artwork in museums throughout Florence.

Both Mark and Lisa are understandably excited about seeing Italy for the first time. But the best part of their adventure is that they won’t have to worry whether the vacation will break the bank.

their 30s, especially considering we live in a world where impulse buying, piling up credit card debt and living well beyond our means is commonplace.

“It’s very freeing and humbling when you’re not weighed down by financial burdens,” says Lisa, a 34-year-old ultrasound technologist.

Mark and Lisa know about being burdened. After marrying in 2006, the Coffmans moved into Lisa’s home. Her monthly mortgage was $1,100. In 2009, they purchased a home in foreclosure and used it as a rental home. They were now paying two mortgages.

Nocedtcaddebt.

The Eustis couple is completely debt-free. No mortgage payments. No automobile payments. No credit card debt.

quite a feat for a marr

That’s quite a feat for a married couple in

See Mark and Lisa’s tips on how to become debt free, below.

Mark and Lisa do not spend money foolishly. “When it comes to money we are both savers,” Lisa says. “Unless we absolutely need something we’re not going to buy it. We’re even getting rid of cable because it’s insane to pay for all those channels we never watch. Everybody can get out of debt. The key is saving money instead of spending it on things you do not need.”

When Mark and Lisa came into money — $85,000 in a period of three years through inheritance and a stock option — they exercised restraint. Many people would have used the money to purchase a luxurious home or exotic sports car, but Mark paid off debt.

“I had the choice to use the money for something else or use it toward our mortgages,” says Mark, a 37-year-old software developer for a credit card processing company. “It was really an easy decision for me. As a result, we do not have to

stress over finances every month. Being debt-free really gives you peace of mind.”

According to a Federal Reserve Board study, 43 percent of American families spend more than they earn.

“I was walking a mile by the end of the week and by week three I was riding my bike. Now I’m living my life again!”

MEDICARE & OTHER INSURANCES ACCEPTED!

Over 30,000 patients treated & 13,000 surgeries performed.

WRITER: FRED HILTON

When I was about 20, I was killing time at a store’s magazine section, checking out the Playmate of the Month when a fellow nearby crumpled to the floor. His eyes rolled back and his arms and legs began wildly thrashing in the air. We all knew he was having some kind of violent seizure but no one had the slightest idea what to do. The mood in the store ranged from sheer panic to absolute hysteria. Finally, one wise-looking man yelled out: “Put something in his mouth or he’ll swallow his tongue!”

One of the store’s clerks quickly dashed to the back room and returned carrying a big paintbrush, which he promptly stuffed into the mouth of the poor fellow having the seizure. A minute or two later, the man returned to normal

DID YOU KNOW?

and the flailing stopped. He hadn’t swallowed his tongue and seemed no worse for the ordeal, other than a touch of Sherwin-Williams’ cherry tomato red paint on his teeth.

Now older and presumably wiser, I realize the man was never in danger of swallowing his tongue. It can’t be done and the experts all agree. “Contrary to popular belief, it is not possible to swallow your tongue,” according to Science Myths. The article adds the cutesy qualifier that it can happen only if you cut your tongue off and swallow it.

The New York Times concurs: “Swallowing the tongue is virtually impossible. In the human mouth, a small piece of tissue called the frenulum linguae, which sits behind the teeth and under the tongue, keeps the tongue in place, even during a seizure.”

The Times cited Ryan Brett, the director of education for the Epilepsy Institute in New York, who said people witnessing a seizure often reach for a wallet, a spoon, or a dirty object to stick in the person’s mouth. “The only thing that happens when something is put in the mouth is you end up cutting someone’s gums or injuring the teeth,” Brett said.

The best way to help is to roll the person on one side to drain fluids from the mouth and cushion the head to prevent cranial injuries. And seek medical help if necessary. Don’t try to restrain a person having a seizure. Move objects away from them so they won’t injure themselves.

Save your paint brush to put a coat of cherry tomato red paint on that icky bathroom wall.

In the U.S. epilepsy takes as many lives as breast cancer. cases of epilepsy are diagnosed each day in the U.S. 500

WRITER: GARY CORSAIR

WRITER: GARY CORSAIR

The gangly gent adjusts eyeglasses bought on the Internet for the price of a large pizza as he talks on a Chinese phone while sitting at a conference table he found on Craigslist.

When posing for a photo, he doesn’t say “cheese,” he sings “cheeeeaap.”

Go ahead, laugh. Clark Howard is guffawing all the way to the bank.

America’s consumer warrior is worth $15 million from spreading the gospel of “save more, spend less and avoid rip-offs” in 10 books he’s authored, on 200 radio stations, Turner Broadcasting’s HLN and the Internet.

Clark obviously knows how to make money. But – surprise – he’s not nutso about greenbacks. Clark Howard would rather save a buck than make one.

That’s why he wears glasses purchased at ZenniOptical.com for $37, talks on ZTE Zmax cell phone (no annual contract!) and bought a $2,000 conference table off Craigslist for $175.

There’s a big difference between loving money and hating to waste it.

“People automatically assume before they really know me that I’m one dimensional, and that everything is about money. And that’s not the case at all,” Clark says from the living room of the $4 million Atlanta home he shares with wife Lane and their three children.

“You can’t be. You’d be pretty lonely and lead a pretty dull life if everything was about money.

just crazy about saving it.

Study after study has found that money can make you unhappy if you don’t have any, but once you reach the point that you can cover the basics, money as an identifier of happiness trails off really quickly.”

Clark’s basics have been covered since he arrived on June 20, 1955.

“I grew up, what I call a child of privilege,” he says matter-of-factly. “We had lived a very, very nice life. My parents were in a country club. They were living a very high life.”

And then … now pay attention, because this is when the pied piper of pennypinchers was born.

“My father worked 30 years

for his father-in-law’s business. When his father-in-law died, the business hit a rough patch and he got laid off,” Clark recalls. “I had no clue there wasn’t a lot of money around. I didn’t know they hadn’t saved any money until I came home from college.

“It was very solemn in the house. I thought my dad was going to tell me he was dying. Because it was that gloomy in the house. After dinner, he asked me to stay at the table. And I was like, ‘Okay, this is it, he’s going to tell me what he’s dying from.’ And instead, he told me he had been fired from his job. And I started smiling and he’s like, ‘What are you smiling about?’ And I said, ‘Well, I thought you were

dying.’ And then he laughed.”

The smiles and laughter didn’t last long.

“And then he said, ‘I don’t know how much longer I can pay for your college.’ And I was like, ‘What?’ Because I just thought my parents just had an endless trough of money, which I think a lot of kids think their parents do. So that was a key defining moment in my life.”

Clark responded by moving out of the dorm on the American University campus (in Washington, D.C.) and registering as a night student. Next, he moved into a rundown apartment building (“My apartment rent was $257 a month – Not that I remember.”), got a full-time

and later, his calling as a consumer advocate.

“That was the best thing that happened to me,” he says. “I became obsessed with not spending money.”

Clark’s frugality allowed him to bank every other paycheck. After graduation he moved back to Atlanta and opened a travel agency.

job as a bill collector for IBM and rode the city bus to and from work.

“My days started very early and I fi nished school at 10 o’clock,” Clark says.

He was not a typical college student.

“Animal House came out either while I was in college or right afterward, and I saw the movie and I didn’t understand why it was funny. Because I didn’t have any of those experiences at all.”

While other kids partied, Clark developed a selfdiscipline and work ethic that would lead him to fortune,

“I started that when I was 25 years old. And it was the right business at the right time because the airlines had just been deregulated. Before that the government decided what the prices would be, who would fly the route, what time of day they could fly, how many times a day they could fly. It was like a straightjacket so only the wealthy privileged flew,” he says. “Before deregulation the percent of people who flew was teensy tiny. And now it’s huge.”

Within five years, Clark was one of the wealthy privileged.

“I retired the first time when I was 31,” Clark recalled. “I had expanded my travel agency into five offices. I opened a new office about every 18 months.”

And then he sold.

Clark the retiree unwound at the beach, rode his bike 20 miles every day, swam another two miles and watched reruns on TV.

“I had worked so hard in that business for six years, that when

“People automatically assume

I sold it I was like, relieved … so I was here doing really nothing, except my athletics.”

And then, another “key defining moment.”

“I got a call on a Friday afternoon in the fall of 1987 from a producer at WGST Radio. They used to have a weekend lineup of how-to shows, self-help shows, and they had a travel show and their guest expert had cancelled for Sunday. And the producer asked if I could come in. Well, my schedule was so busy I said, “Sure.” Everything that happened to me in broadcast, happened because of that one guest appearance.”

Today, radio is just a small part of the Clark Howard empire.

“In 1987, there was no Internet. Personal computers were basically glorified word processors and accounting machines,” he says. “I’ve never stopped morphing in how I reach people. The information is the sun, radio is one planet and TV another, but the big planet today is digital. People accessing me on their phones is the fastest growing way people access me.”

He’s doing pretty well on social media too. Clark’s Facebook page has 434,000 likes. By comparison, CNBC financial advisor Suze Orman

has 416,00 likes and NBC Mad Money host Jim Cramer has 58,855.

Which begs the question, “What does Clark have that other high-profile money managers lack?” For starters, humility.

“For me, the information is the star,” he says. “It’s not about me, it’s about the information.”

You have to love a guy who lets — make that encourages — people to criticize him on his own show. In fact, Clark is thrilled that “Clark Stinks” has become the most popular feature on his radio broadcast.

“I’ll tell you how ‘Clark

Stinks’ came about. Years ago there were all these websites that people registered, like ClarkHowardsucks, and several competing ones that were just piling on,” he recalls. “And I thought, ‘If people really feel that way about me, we should let them say it in our own house.’ It started off as a one-time thing. We got feedback, and people loved it … I say we’re all in it together and that I shouldn’t have the last say. And I mean it. I’m a flawed human being, I might be wrong. So I’m giving people a chance to let off steam.”

Still think Clark Howard is

just about money?

By now, it should be clear that Clark’s stayed on top for 28 years because he’s about Bens and Bonitas, not Benjamins.

“I just believe that the greatest joy in life is doing things for others. That’s what brings me the greatest satisfaction,” he says.

But one person can only do so much, so Clark opened Team Clark Howard’s Consumer Action Center, which he staffs with volunteers who provide advice and problem resolution — free of charge — to callers.

“We care about people and

before they really know me … that everything is about money…

we all want people to have better lives,” says Clark, who opened the center 22 years ago.

Clark also gives back to the community by sponsoring (40 so far) and helping build Habitat for Humanity houses in and around Atlanta.

In this, his 20th year as a Habitat volunteer, he’ll help build “57 to 62.” And he’s in his 14th year as a volunteer in the Georgia State Guard.

“The charities and the community activities I’m involved in are central and core to who I am,” Clark says. “We as Americans

at the end of the

think we identify by what we do for work, but the reality is, at the end of the day, what really matters is who we are as people.”

oward has been

comfortable with himself since he began working for people instead of a paycheck. And the more he gives of himself, the happier he gets.

happy. I believe experiences make you happy,” Clark says. “The things that really matter to me, are obviously my family, and then doing what I can to make the

1 // ATTACK THE MONTHLIES. And any kind of subscriptions. People have subscriptions to stuff they don’t even remember. They might have signed up for Netflix, which is a great thing, but they might never watch it. I like people to look through cre card statements and bank statements to find monthlies that they never use.

credit

2 // GET A LITTLE SPIRAL NOTEBOOK – not an app on the phone … and any time you spend money, write it down. What happens is amazing. Because you have to physically take the pencil out and write everything down, it starts a whole new wave of thinking: ‘Do I really need that? Should I be buying that?’ It really does make you stop and think. It only takes two weeks doing that for people to see there’s a lot of money they’re throwing away that they don’t need to spend.

3 // A LOT OF PEOPLE FEEL THAT THE DEBIT CARD IS THE ANSWER spending money you already have. But if someone has a problem using plastic, I like them to go to a cash allowance. Decide how much cash comes out of every pay period and live on that amount of cash for everything you do walking around for 15 days, a month, two months. What happens is you see the cash dwindle. You don’t have that perception with a piece of plastic. Maybe you normally don’t think about spending $6 or $7 for lunch, but if your cash is really getting light and you’re several d from the next draw of cash, maybe you make your lunch that day and take it with you. It’s all about changing behaviors.

sh is really getting light and you’re several days about

And that’s not the case at all.”

88 years and counting.

Dr. Herman Flink Radiation OncologistInterCommunity Cancer Center is coming together for coordinated cancer care at a single location in our Lady Lake, Florida, facility.

Leading Radiation Oncologist Dr. Herman Flink, who has cared for patients in our community for several decades, will continue to provide cancer care at the Lady Lake location, only minutes from Leesburg.

Coming together at one location will allow us to provide even more options for advanced technology to you, our patients. InterCommunity Cancer Center will continue to provide evidence-based, radiation therapy treatment ensuring the use of best practice guidelines in our patients’ cancer treatment.

Together we can provide powerful outcomes for you.

Any bank will gladly accept your money, but how many will give you their time? At First National Bank, we take the time to get to know you and your goals so we can provide service tailored to your needs. After all, we can’t expect you to be loyal to us unless we prove our ongoing loyalty to you.

When you want a bank that does more, come to one that cares more. First National Bank.

The people you know, the bank you trust.

922 Rolling Acres Road | Lady Lake, FL 32159

855.403.2519

www.icccvantage.com

HEALTHY LIVING MAGAZINE PRESENTS ITS INAUGURAL

JOIN US FOR A GALA EVENT ON JULY 17

AS WE HONOR THE PEOPLE WHO TAKE CARING TO A WHOLE NEW LEVEL.

Nominate a local nurse for the Nightingale, Barton or Whitman awards!

THE NIGHTINGALE AWARD

This award recognizes a lifetime of dedicated service in the field of nursing. The recipient exemplifies the spirit of Florence Nightingale, who laid groundwork for modern nursing by founding the Nightingale School of Nursing in 1860, and devoted her life to reforming her country’s health care system. The award is presented to a special individual who spent at least 20 years making a difference in numerous lives and leaving a lasting legacy of compassionate care.

THE BARTON AWARD

This awards pays tribute to a caregiver who has spent at least 10 years contributing to the wellbeing of others. He or she will have a record of going above and beyond the call of duty, just as Clara Barton did during the Civil War when she volunteered to bring medical supplies to the front lines and stayed to administer to sick and wounded soldiers.

THE WHITMAN AWARD

This award is presented to a unique person who has been involved in nursing or a related field for less than 10 years and is well on their way to leaving an indelible mark on society. Like, Whitman, who visited more than 100,000 wounded soldiers during just three years as a volunteer nurse during the Civil War, the recipient of the award bearing his name will have accomplished great things in a short time.

There’s never been more advice available, yet most people remain in the dark about how to achieve fi nancial goals.

A good fi nancial planner can show you the necessary steps to meet all your fi nancial goals, yet only three in 10 American families have a comprehensive fi nancial plan, according to a 2012 report by the Consumer Federation of America.

Does that mean 70 percent of us don’t need professional help? In a word, no.

Everyone can benefit from a financial advisor, according to Joe Dykes, a financial advisor of 13 years who recently retired from Edward Jones in Leesburg. Here’s his take on who should enlist the help of a financial planner:

ANYONE LIVING PAYCHECK TO PAYCHECK. “Many people living paycheck to paycheck put very little, if any, money away for savings. How do you expect to retire? It makes no sense not to put some money away every month for your future.”

RECENT COLLEGE GRADUATES OR YOUNG PEOPLE ENTERING THE WORKFORCE. “The school system does a very poor job when it comes to teaching our children about managing finances. Young people love to have fun, which is understandable, but they simply

don’t understand the importance of savings. If they begin saving young, they can accumulate wealth and retire at a reasonably young age.”

PEOPLE CHANGING JOBS:

“A career change means a different level of income and benefi ts. It also means that you don’t want to leave any retirement accounts you had at your previous job behind. That’s a lot to manage for someone with no experience in financial planning.”

RECENTLY MARRIED COUPLES:

“Newlyweds are now merging their

finances and their financial goals and spending habits will now change considerably. They will need help reorganizing and formulating new goals. Plus, they need to be financially stable if they plan on having a baby.”

RETIREES: “I’ve had people in their 60s and 70s come in my office with very little savings. In situations like those, having a financial advisor is extremely important to keep them from going broke. Retirees who are financially secure need a financial advisor to ensure they do not outlive their assets.”

YOU’VE DECIDED YOU NEED A FINANCIAL ADVISOR TO NAVIGATE THIS COMPLEX FINANCIAL WORLD. ACCORDING TO DYKES, THERE ARE FIVE IMPORTANT QUESTIONS YOU SHOULD ASK BEFORE HIRING A FINANCIAL ADVISOR.

1) ARE YOU A FULL-SERVICE ADVISOR AND WHAT PRODUCTS DO YOU OFFER?

“You need a diverse portfolio to truly meet your fi nancial needs. Make sure your advisor sells stocks, bonds, mutual funds and annuities, as well as insurance.”

2) WHAT’S YOUR FEE STRUCTURE?

“It’s important that your advisor provides you with a written estimate of the fees and charges you will pay on an ongoing basis. The advisor should also thoroughly explain those costs to you. Be sure you understand these costs because there are advisors out there who will sell you anything for a commission, whether it’s right or wrong.”

CENTS-LESS SPENDING

Many people throughout the world view Americans as materialistic and wasteful spenders. Based on the following numbers, their perception may not be far from reality.

3) WHAT WILL YOU DO IF THERE IS A CONFLICT OF INTEREST IN INVESTMENT STRATEGY?

“For example, if you’re semi-conservative with your money, your advisor should not make a risky investment just because it gives him or her a high payout. Conversely, when clients desired to make an investment I felt was wrong for them, I had them sign a letter that the investment went against my advice.”

4) WHAT KIND OF LICENSES DO YOU HAVE?

“Make sure they have both a Series 7 and Series 66 license. Having these ensures they are fully rounded financial advisors who can sell stocks, bonds, mutual funds, insurance and other types of financial products.

5) WHAT’S YOUR EXPERIENCE?

“Ask them if they have any special designations, such as certified financial planner or chartered financial consultant. Also, ask if they receive any ongoing training or education so that they’re up to speed on the latest changes and trends in the financial industry.”

$66.5 BILLION

HOW MUCH AMERICANS SPENT ON LOTTERY TICKETS IN 2011

According to CNN

$1,092

HOW MUCH REGULAR COFFEE DRINKERS SPEND ON COFFEE EACH YEAR

According to a survey by Accounting Principals

PHOTOS: karenfoleyphotography; Shutterstock.com

PHOTOS: karenfoleyphotography; Shutterstock.com

Sure, buying stocks can be risky business, especially if you are ultra-conservative with your finances. However, if you decide to take a leap of faith and invest in the stock market, here are the ones industry experts feel are the best bets in 2015.

nance/2014/03/24/20-ways-we-blow-our-money/6826633/; newportinternationalgroup.com/ glossary.html; keplergroup.co.nz/glossary-of-common-fi nancial-terms/; businessdictionary.com/defi nition/bond html; investorwords.com/4725/stoc k.html; money.howstuffworks. com/personal-fi nance/fi nancial-planning/dow-jones-industrial-average.htm; kiplinger.com/slideshow/investing/T052-S003-25-best-s tocks-for-2015/index.html

We hear financial terminology being tossed around frequently, but most of us really have no idea what those words really mean. With the help of this mini-glossary, perhaps you won’t sound as phony as a three-dollar bill next time you discuss finances.

Annual percentage rate (APR): The interest rate charged on the amount borrowed.

Annuity: A contract sold by an insurance company that guarantees holders a series of payments at fixed intervals.

Bear market: A declining market.

Bull market: An advancing market.

Dow Jones Industrial Average: The market average of 30 large, industrial stocks from companies such as General Motors, Goodyear and IBM.

NASDAQ: An automated network, or electronic stock market, used for trading over-the-counter stock, with an emphasis on high-tech and developing companies.

New York Stock Exchange: The world’s largest organized securities market, founded in 1792 and located on Wall Street.

Headquartered in San Francisco, this company makes software to enhance relationships between businesses and their customers.

52-week high: $67

52-week low: $48.18

Annual revenues: $5.07 billion

Projected 2015 earnings growth: 35 percent

Google, one of the most popular websites in the world, earnings has been growing at more than 20 percent each year.

52-week high: $615.05

52-week low: $511

Annual revenues: $67.91 billion

Projected 2015 earnings growth: 18 percent

This popular social media company has 284 million active users, and its revenues double every year.

52-week high: $74.73

52-week low: $29.51

Annual revenues: $1.17 billion

Projected 2015 earnings growth: 240 percent

Apple is famous for its computers and computer software. In September 2014, the company enjoyed its strongest revenue growth rate of the past seven quarters.

52-week high: $118.77

52-week low: $70.51

Annual revenues: $182.80 billion

Projected 2015 earnings growth: 20 percent

Who wants to be a millionaire? Okay, put your hands down. Achieving this feat will take careful budgeting on your part, but its possible. Here’s how much you would have to save each month to become a millionaire by age 65.

Age 40: $1,435.83

SOURCES: usatoday.com/story/money/personalfi

Portfolio: A combination of holdings that include stocks, bonds, managed funds or other types of securities.

Securities: Transferable investment products represented by certificates or documents of ownership.

Stock: A share of a company held by an individual or group. Corporations raise capital by issuing stocks and entitling the stock owners (shareholders) to partial ownership of the corporation.

$400 HOW MUCH THE AVERAGE AMERICAN LOSES EACH YEAR TO GAMBLING

A large aerospace and defense company, Lockheed Martin has boosted its dividend for 12 straight years.

52-week high: $192.94

52-week low: $135.39

Annual revenues: $44.6 billion

Projected 2015 earnings growth: 3 percent

$859.6 BILLION AMOUNT AMERICANS OWE ON CREDIT CARD DEBT AS OF JAN 2014

$117 BILLION HOW MUCH AMERICANS SPEND ON FAST FOOD EACH YEAR

Age 20: $361.04

$7 BILLION THE TOTAL AMOUNT OF ATM FEES IN THE U.S. IN 2010

What does The Smith Prevatt Monteith Group at Morgan Stanley do?

We proactively serve a select group of families with the distribution phase of their retirement by offering rigorous, relentless discipline seeking to bring a higher level of predictability.

How does your group achieve that?

With financial planning tools and discretionary portfolio management, we build plans based on our client’s risk tolerance. As portfolio managers, we manage our clients’ portfolios on a daily basis and guide their objectives, which range from developing a health care strategy to attending to estate planning needs.

How do you help your clients achieve their objectives?

Focusing our attention on our clients’ financial details means working toward their goal of living the lifestyle they have always envisioned. Having the resources in place to enjoy the next stage of their lives is

important in achieving those goals. Perhaps they want to master a new language or travel to see family. Moving financial worry away from the front of their minds can put big concerns to rest.

What specific strategies do you offer your clients?

Our focus is on financial planning which includes retirement planning, retirement income planning, estate planning, college education planning, custom portfolio management, 401k rollovers, traditional and Roth IRAs, tailored lending, alternative investments, long-term care and life insurance planning.

What makes your group passionate about what you do?

Our clients have spent their working years building a legacy. We enjoy helping them build the next phase of their lives. Having an advisor who can walk that path with them can mean the difference between living, and enjoying, their retirement.

It’s not easy being a teenager. Peer and social pressures, school work, worries about the future and other tribulations make growing pains very real. Add an unstable family situation and the emotional tolls tally up even quicker.

Many licensed foster parents are often reluctant to tackle the challenges of raising a teenager, especially ones with a lot of emotional baggage. But those families who do open their doors to these often hard-to-place minors are rewarded immensely.

Ashley and John Kennen of Leesburg wanted a family, but Ashley had a double lung transplant in 2010 and was unable to get pregnant. After becoming licensed foster care parents through Kids Central, the Kennens welcomed their first foster child — Rachel, a 14-year-old who had

already been in several group homes.

“Everyone saw potential in her and knew if she was placed with the right family, she’d be okay,” says Ashley. “We were very comfortable about taking her and had no apprehension at all about her being a teenager.”

Rachel recently turned 17 and is preparing to graduate from high school in May. She plans to stay with the Kennens and continue her education until she is 18.

“Rachel is thriving because she got the attention she needed,” says Rosey Moreno-Jones, who is in charge of foster parent recruitment for Kids Central, Inc., a nonprofit community-based agency that works with the Florida Department of Children and Families.

Kids Central tries to fi nd the right match for foster parents and children.

Counselors are encouraged to focus on the attributes of the child, not the age, when placing a child.

Moreno-Jones knows fi rsthand how that works. She took in a 15-year-old foster child more than 20 years ago and eventually adopted him. Like many other foster parents, she had preconceived notions about fostering teenagers.

“I never intended to take a teen, but the placement counselors had me sold on him before I knew his age,” she remembers. “From what they were describing, I had a picture in my mind of an adorable Dennis the Menace type kid who had already been in several group homes.”

Her son is now thriving as a 37-yearold successful businessman. “We got through the teenage years just

Finding foster homes for teenagers can be a challenge, but with patience and love these children blossom into successful adults who are forever grateful to parents who stepped up and made a difference.

WRITER: MARY ANN DESANTIS

like biological families do,” says Moreno-Jones.

The Kennens admit that raising a teenager can have its challenges. “We reassure her that it’s okay to have disagreements and that we would argue even if she was our own biological child. It’s human nature,” says Ashley. “I remind her that I treat her just as I would if she were my own daughter and we talk a lot.”

The family also includes 3-year-old Zander, a foster son that came after Rachel, who had been an only child in

her biological family. People often ask the Kennens about raising children with such a wide age span.

“Rachel loves him,” say Ashley. “She shows more responsibility and looks out for him.”

Kids Central believes teens thrive when wrapped in the love of a family and have opportunities to build connections, like the ones the Kennens have provided.

Lake County has an outstanding network of caring foster parents, but it still falls short when matching the

population of children with beds that are already licensed and available. The beds are there (about 350 in-home for Judicial Circuit Five that Kids Central serves), but some foster homes turn away children, simply because of the child’s age. Adolescents and teenagers are the hardest to place because foster families think they are not equipped to handle older children.

Group homes are still necessary, according to Nicole Pulcini-Mason, community affairs director for Kids Central. “It’s not common, but some children need therapeutic homes and would not necessarily thrive in a family situation,” she says. “When most kids fi rst come to us, we want to try to place them with foster families.”

As of Feb. 1, Lake County group facilities had 16 youths. Recent news reports about sexual abuse in a Leesburg group home made the public cringe and brought attention to the plight of not having enough foster families step up to the plate when it comes to taking older kids.

The other alternative is sending youths out of their home counties, which can have just as many disadvantages.

“Every time these kids change schools, they lose ground and their education suffers,” explains MorenoJones. “They lose everything that is familiar to them. All they know is that their home and family are far away. These children have their hearts broken over and over.”

The solution, Ashley Kennen believes, is for foster parents to try it just as she and her husband have done.

“Take one teen and have patience,” she says. “If you want to be a family, you can be a family...and a loving one.”

What happens on that 18th birthday?

“If you want to be a family, you can be a family…and a loving one.”

— ASHLEY KENNEN

Whether your allergy symptoms are seasonal or year-round, our team of board certified physicians, PAs and allergy nurses offer comprehensive diagnosis and customized treatments for seasonal and year-round allergies.

Picture yourself with a bold, fresh image that lets you shine through.

Precision Optics offers an amazing selection of name-brand designer fashion and sports frames for every taste, every age, every member of the family! We feature the latest and most advanced eyewear and sunwear, plus a complete line of specialty lenses, contact lenses and accessories. Our board certified ophthalmologists are on site to provide expert eye exams, and our friendly, experienced opticians are ready to help you find the right style to fit your image and your budget.

In Mary Shelley’s book, “Frankenstein,” there is no specific mention of how the monster made of recycled body parts is brought to life. The book, however, does mention galvanism, the therapeutic use of electricity, and refers to the “spark of life.” In various movie versions, Frankenstein’s monster is brought to life by electricity. Lightning is the source, probably because it is cinematographically dramatic.

There is fact behind the fiction. We are, in a very real way, electrical beings. Years ago, I saw a lady who came to me for a surgical procedure. Her biggest concern was something I had never come across. She wasn’t worried about the anesthesia, infection, bleeding, or any of the usual risks of surgery. Her worry was that the surgical incisions would somehow alter her electrical meridians, fields of electricity surrounding her body and flowing through her which, she felt, were important to her health. I had no answer for that.

She elected to move forward with surgery, and to both my relief and hers, her meridians appeared to be fine afterwards.

More recently, a medical colleague brought up in conversation how much we rely on electricity to power our bodies. It is not something you hear much about.

Since I expect most readers are no more sophisticated about electricity than I am, I will keep this simple. All matter, including you and me, is comprised of atoms, the basic building blocks of our universe. Atoms contain three particles: protons, neutrons, and electrons. Protons have a positive charge and electrons have a negative charge. Neutrons are neutral. What? You want to know what “charge” means? Good

luck with that. No one seems to know. What we do know is that protons and electrons somehow attract and cancel each other out.

Atoms with equal numbers of protons and electrons are stable. Electrons, however, can “hop off ” of one atom and go to another atom. This movement of electrons is called a current and a steady flow of electrons produces an electric current. Now, we may not completely understand how this works, but we can put it to good use, and have. Just look around at how essential electricity is to our daily lives. Without it, we would probably still be living in caves stoking our fires for heat, meals, and protection.

Electricity also animates us. Our nervous system functions due to the flow of electrons along nerve fibers, all of which originate in our central nervous system — our brain and spinal cord. Interrupt this flow and we suffer potentially catastrophic disability, as seen in strokes and a host of neurologic disorders. Many of our diagnostic tests to define our health, or lack thereof, are basically measurements of electricity. The electroencephalogram (EEG) measures electrical activity in the brain. Nerve conduction studies measure this in our nerves.

I use nerve conduction studies to diagnose conditions such as carpal tunnel syndrome. In carpal tunnel syndrome, pressure on a major sensory nerve at the wrist causes pain, numb-

ness and weakness of fingers in the hand. This can be clearly seen by measuring the flow of electricity through the nerve. In carpal tunnel, this slows down dramatically in the wrist.

Electrical activity in our brain is so critical that it is a crucial measure of life itself. One of the legal and medical definitions of death is the absence of any electrical activity in the brain. Such individuals are defined as “brain dead,” a description accepted by all major religions as the end of meaningful life. This is regarded as so certain that we can ethically and morally justify harvesting organs from such individuals for

Once every second or so, a dime-size bundle of cells in the upper chamber of the human heart produces an electrical pulse that keeps the organ beating.

transplantation purposes.

Electricity keeps you alive in other ways. Your heartbeat is the direct result of the flow of electrical signals along very specific pathways in your heart. These cause your heart muscles to contract in a coordinated way so that blood is effectively pumped through your lungs and body. Disrupt this and your heart may beat erratically and/or ineffectively. Most cases of sudden death are due to an abnormality of normal electrical activity in the heart. In a move eerily reminiscent of the Frankenstein story, we use electrical defibrillators to “shock” the heart and restore function when it has stopped beating normally.

Electricity is even present on a cellular level, in our most basic metabolic activities. Movement of nutrients and oxygen into our cells, and elimination of waste products of metabolism all depend on the sustained flow of electrons across our cell

membranes and even with the cells themselves. We can use microscopic probes to actually measure the electrical potential across the wall of cells and inside cell structures. There is, literally, no process in living things that is not, in some way, electrical.

This is all very interesting (at least I find it so) but what does it have to do with health or, more to the point, your health in particular? Well, only everything! Think of the house you live in. Unless you are a hermit in the woods living “off the grid” your house relies on external sources of energy and proper functioning of innumerable electronic devices within it for you to live your best.

Our bodies are electrical marvels, almost miraculous in their own way. We should treat them with reverence and respect. To do otherwise is to risk shortened and/or miserable lives.

Our bodies pretty much run themselves. All they ask is that we provide a few basics and get out of the way — healthy food, sufficient rest, moderate exercise and at least some effort at limiting stress. Attending to our emotional and spiritual well-being are all that is required. Oh, and avoiding toxic substances. Not too much to ask considering that our bodies are our own unique, individual home.

Sadly, instead of taking care of our homes, we do endless things to destroy them. Take smoking. Cigarette smoke contains hundreds of toxic substances. Why would anyone put this stuff in their bodies, their only home? The same goes for trans-fats in high fat, high-sugar processed foods. Physiologically, consuming trans-fats is like dropping countless grenades into a power plant. There is no safe minimal quantity.

Ever racked your brain wondering how you and your spouse can spend quality family time with the kids?

A daytrip to Magic Kingdom. Check. A three-day beach getaway. Check. Dinner and a movie. Check.

Fortunately, Mark and Lisa Coffman of Eustis have a different spin on the matter. For them, spending time with their children—Justin, 6 and Hannah, 4—is inexpensive, fun and healthy.

At least once a week, they embark on a family cycling trip, which promotes a satisfying blend of fitness and togetherness. And unlike running, it’s not nearly as taxing on your bones, joints and spine.

“We ride to a local park or around the neighborhood,” Lisa says. “We all love getting some fresh air and exercising

together. We do this primarily because we want the kids to feel loved and know that they are a priority in our lives.”

For them, cycling has been a popular family activity dating back to when the children were infants. Mark attached a two-seat bike trailer to his mountain bike and took the kids along for a ride. That proved to be a bonding force in their future relationship.

“We’re a close-knit family, and I think one of the reasons for that is we share a common activity,” Lisa says.

Justin can now ride a bike with no training wheels, and Hannah is quickly becoming a natural herself.

“Sometimes we’ll let the kids ride their bike and we will walk or run beside them,” Lisa says. “We plan on cycling more frequently when the kids get older and can keep up with us.”

If you cycle for one hour at a speed of 10-12 miles per hour, how many calories will you burn?

120 pounds: 327 calories

140 pounds: 381 calories

160 pounds: 435 calories

180 pounds: 490 calories

200 pounds: 544 calories

220 pounds: 599 calories

240 pounds: 653 calories

260 pounds: 708 calories

280 pounds: 762 calories

300 pounds: 816 calories

SOURCE: bicycling.com/training-nutrition/trainingfitness/cycling-calories-burned-calculator

BETTER HEALTH: The health benefits of cycling include:

• Increased cardiovascular fitness

• Increased muscle strength and flexibility

• Improved joint mobility

• Decreased stress levels

• Improved posture and coordination

• Strengthened bones

• Decreased body fat levels

• Reduced anxiety and depression

SOURCE: betterhealth.vic. gov.au/bhcv2/bhcarticles.nsf/ pages/Cycling_health_benefits

Before attempting to let your toddler ride a bicycle with pedals, consider an alternative bike. Several years ago, the Coffmans purchased a no-pedal balance bike for Justin. It helped him develop coordination and confidence in no time.

3 things your child can inspect before the ride:

• Check the air in their tires.

• Make sure their chains are oiled and not loose.

• Make sure brakes are working properly. Doing these things will teach your child responsibility and give him or her a sense of ownership in the family activity.

PHOTOS: Matthew Gaulin and Shutterstock.com

WRITER: RUTH ANN BYRD

WRITER: RUTH ANN BYRD

Rosacea is a chronic skin disorder characterized by flare-ups of redness and flushing of the face. The disorder can also extend to the neck, chest and scalp. Symptoms typically appear after the age of 30. Rosacea is more common in women than men and more likely to occur in fair-skinned individuals. Sun damage has been shown to be a contributing factor.

Because of the progressive nature of rosacea, early treatment is essential. Left untreated, rosacea can progress to a chronic ruddiness of the complexion, facial bumps and pimple-like lesions. Swelling and enlargement of the nose can occur in severe

cases and is more likely in men than women. Ocular rosacea, or dry eye syndrome, can develop in some individuals, resulting in chronic redness and irritation of the eyes.

There is no known cause or cure for rosacea, but symptoms can be controlled with oral and topical prescription medications, avoidance of known triggers and proper diet.

The month of April has been named National Rosacea Awareness Month by the National Rosacea Society in order to help the public better understand the disease. To learn more about rosacea, visit www.rosacea.org.

While symptoms and intensity vary from person to person, the most common symptoms of rosacea remain consistent:

• Facial flushing and redness

• Tiny bumps and pustules scattered on the cheeks and forehead

As a licensed aesthetician who sees rosacea on a daily basis, I believe an important key to successful rosacea treatment also involves the following:

• Eat a healthy, anti-inflammatory diet high in antioxidants and fresh organic fruits and vegetables

• Add ginger and turmeric root to your diet. They’ve been shown to have powerful anti-inflammatory effects. The fresh roots can be juiced or taken in supplemental powders or capsules

• Dine on foods high in essential fatty acids, such as

flaxseed, hemp hearts and chia seeds, which help control inflammation and improve skin health

• Consume probiotics to help control small intestinal bacterial overgrowth

• Avoid environmental toxins and pesticides

According to the National Rosacea Society, 16 million Americans suffer from Rosacea, and millions more may be in temporary remission.

What causes flare-ups? Rosacea flare-ups occur when blood vessels in the skin become dilated, causing the face to become red and inflamed.

Below are some of the most common triggers:

• Sun exposure and environmental extremes, such as heat, wind and cold

• Emotional stress

• Alcohol

• Spicy foods

• Certain cosmetics and skin care products

• Inflammatory diet, including high fat, high glycemic foods such as dairy and refined sugars

Because there is no known cure for rosacea, traditional physicians typically recommend lifestyle changes to control the symptoms. This would include avoiding known triggers such as those listed above. In addition, your physician may prescribe topical or oral medications. Light emitting diodes (LED) and intense pulsed light (IPL) have shown success with treating facial flushing and redness.

• Visible blood vessels on the face, especially the nose and cheeks

• Redness and irritation of the eyes and/or eyelids

• Progression of the disease can result in rough, raised patches of skin on the face and skin thickening, especially on the nose

SPRING SALMON

Ingredients:

4 (4-ounce) skinless salmon fillets

1 cup diced tomato

½ diced Hass avocado

1 crushed garlic clove

1-2 tablespoons balsamic vinegar

1 teaspoon extra virgin olive oil

1 cup cooked corn kernels

¼ cup minced Vidalia onion

½ cup chopped fresh cilantro

Pepper to taste

Lime juice to taste

Mrs. Dash® Table Blend to taste

Servings: 4

Directions:

• Preheat oven to 325 degrees.

• Combine everything, except the salmon, into a small bowl. Stir and refrigerate for 30 minutes.

• Bake salmon for 15–20 minutes to cook thoroughly.

• Place salmon on top of mixture. (If you want cold salmon, refrigerate until cool.)

• Top with lime juice.

HEALTH BENEFITS OF SALMON

• A great source of Omega-3 fatty acids

• Contains calcitonin, which helps with bone density

• Improves brain function

NUTRITIONAL INFO:

Fat: 10.2g

Carbohydrates: 12.4g

Calories: 272.4

Protein: 30.5g

• Helps prevent cardiovascular diseases

• Contains tryptophan, which helps you achieve adequate amounts of sleep

WRITER: TINA NESSELROTE

The human body cannot produce essential fatty acids, so it is important to maintain the appropriate amounts of unsaturated fats by consuming specific foods, taking oral supplements and using topical skin care products.

Dry skin affects millions of Americans, but the use of essential fatty acids topically provides light occlusion that helps our skin retain moisture levels. Using essential fatty acids in a skin-care regimen has been shown to improve dryness and reduce inflammation and acne.

Essential fatty acids also have a soothing ability, which is beneficial for inflamed conditions such as rosacea and atopic

Flaxseed and linseed oils both are high in Omega 3 fatty acids and help create a protective film on the skin when applied topically.

Sunflower oil contains high concentrations of Omega 6 fatty acids and helps improve skin barrier function and increases elasticity.

Is high in Omega 6 fatty acids, this oil decreases inflammation and helps reduce redness.

Borage oil is one of the highest sources of Omega 6 fatty acids and also contains Omega 3 fatty acids. It serves as an antiinflammatory and antioxidant.

Soybean oil contains both Omega 3 and Omega 6 fatty acids.

Benefits include antioxidant protection, pigment control, hydration and antiaging properties.

Grape seed oil is an excellent source of Omega 6 fatty acids, as well as polyphenols antioxidants. It acts as a light moisturizer in the skin.

Rose hip seed oil contains high concentrations of both Omega 6 and Omega 3 fatty acids. Rose hip seed oil also contains vitamin E, trans-retinoic acid and polyphenols, making it a superior antioxidant and great choice for calming and healing properties.

dermatitis. They are excellent for fighting free radicals in the skin that lead to premature aging. They also keep the skin hydrated— not only so it can function properly, but so it can maintain a plumper and more youthful appearance. For acne, essential fatty acids help hydration since they are non-comedogenic and will not contribute to any blocking of the follicle. This will help reduce breakouts while giving the skin much-needed hydration.

Professional products high in essential fatty acids provide relief from persistent skin challenges and lead to healthy, beautiful skin. As always, please consult with your skin care professional to make sure you’re using the correct products and ingredients for your skin type.

Essential fatty acids are not only healthy for our skin, they also help lower cholesterol and inflammation throughout our entire body. Foods highest in Omega 3 fatty acids include:

Butternuts

a. You’re disappointed, but you understand. You say you’re sorry you won’t be able to meet and you’ll wish for better luck next time. After all, it’s a business trip.

We all repress our negative feelings at times. But it’s not a good idea to speak in a passive-aggressive tone all the time. Sometimes you need to express what you feel in a direct way.

Do you tend to act in a “passive-aggressive” way? The quiz below will answer that question:

1. Your partner comes home at midnight on a weeknight without explaining where he or she was. How do you react?

a. You feel relieved they are back safe and sound, turn over and go to sleep.

b. You give them a piece of your mind for their lack of consideration.

c. You refuse to speak to them for a week; you’re too angry to speak anyway. They need to apologize properly before you can act normally.

2. A work colleague isn’t pulling his weight, causing you to suffer from overwork and stress. What is your strategy?

a. You start looking for another job.

b. You tell your colleague his conduct is unfair, and the company’s productivity is suffering, as is your mental health.

c. You would keep going until you can’t stand it any longer and end up sick. They will realize how much you do when you’re not there to do it.

3. Your neighbor keeps you awake by playing loud music in the early hours. How do you react?

a. You do nothing and see if it keeps happening. There’s no point in souring relations

over one bad night.

b. You knock on the wall and tell them to be quiet. If that doesn’t work, you knock on their front door to complain. It may seem rude, but you are desperate.

c. When you next see the neighbor, you mention how thin the walls are and the problem you have with insomnia. If that doesn’t work, you’ll have to start sleeping in the sitting room.

4. An old friend is in town and you’re excited to see him. But he calls to say there’s no time for you in his busy schedule. He hopes to fit in a meeting next time. What is your response?

Three or more As: You have a philosophical approach to life. You try not to waste energy fighting things you can’t change. When things don’t go well, you adjust your expectations. You need to be careful not to accept the unacceptable.

b. You ask your friend why he couldn’t find time to see you; you go back a long way and it’s just not right to put other things before friendship.

c. You tell your friend you’re sure you must have done something to offend him, and let him know you feel awful about it.

5. You’re first in line at a bus stop in cold weather. As the bus pulls up, everyone pushes to get ahead. When you manage to get on, the driver tells you the bus is full and you’ll have to wait for the next one. What do you do?

a. You accept the situation gracefully: it’s hardly the driver’s fault.

b. You tell the driver you were first in line and refuse to get off the bus.

c. You get off grumbling audibly about selfish people. They know who they are and you’ll leave them to their consciences.

Three or more Bs: You confront your difficulties head on. You have a strong sense of right and wrong, and you don’t hide your opinions. You need to think before you act.

Three or more Cs: When things go wrong, you find it hard to express your frustration. You feel aggrieved, but are unable to assert your point of view. Try not to bottle things up: If something is worth sulking about, it’s worth mentioning. Everyone has the potential to act in a “passiveaggressive” way, but in your case, you really need to watch out for it. You have a right to your point of view, and people around you deserve to know what it is.

No more than two of any answer, with no more than one C: Congratulations! Your personality is well balanced. The chances are you speak your mind when you think it’s needed, but you know how to accept the inevitable.

WRITER: SCOTT PERKINS

1. Closed questions

Questions that elicit a right or wrong response. “Did you finish your homework?”

2. Leading questions

Questions that contain the opinion of the asker that usually lead to a defensive response. “Why is the homework not finished?”

3. Empowering questions

As a coach, I earn a living asking questions that allow clients to experience more fully their potential, personally and professionally.

For anyone who interacts with people — whether in friendship, a leadership role or as a parent or spouse — it’s far easier to tell people what to do. Telling is a demonstration of what you know and also demonstrates that the person doing the telling is in control. In any of the above relationships, telling creates an atmosphere of defensiveness and evaluation.

Developing the ability to ask good, empowering questions gives you the power to direct a conversation and its content. Good questions decrease rigidity and bring life and energy to a relationship.

It’s never too late to begin asking questions. It will take time to develop the ability. Part of the difficulty will be suppressing the comfortable and familiar response of just telling others what you think and why you are right. Once that initial awkwardness is overcome, the ability to ask good questions (and to wait for responses) will have positive impact on all your relationships.

Asking questions requires more self-control, but is a much more powerful way of communicating than telling. There are three general types of questions:

Open-ended questions that seek the perspective of the person being questioned.

“What obstacles have you encountered in trying to finish the homework?”

Questions can shape perspective. Part of the power in asking questions is the ability to provide a different viewpoint the recipient may not be aware of or may have overlooked. One of my most effective is also very simple: “What is the impact of this decision on your family?”

Questions create trust in a relationship. Telling someone what they should do may feel productive, but it builds up resistance and defensiveness in the listener. A good

question communicates that you value the other person’s opinion and insight and also allows that person to process the information.

Questions require you to listen. In a world saturated with social media, people are looking for an outlet to be heard. Asking questions shows a willingness to listen rather than speak, and good follow-up questions demonstrate good listening. Questions build influence. As you demonstrate you are a questioner and demonstrated listener, you also show there is safety in your relationship.

With that increased influence, rather than falling into the trap of telling what you think and would do, there is now the ability to ask questions closer to the heart. Questions develop ownership in the recipient. Solving other people’s problems becomes exhausting, and we sometimes enable when we give quick answers.

Asking questions requires the respondent to take ownership of a situation and think it through. Additionally, the solution is theirs, so the results will fall squarely in their lap.

WRITER: SCOTT PERKINS

WRITER: SCOTT PERKINS

Ours is a culture of progress. From that, we attribute positive identity to people — both our self and others — who produce. One of the drawbacks to this is a continual moving on from one thing to another, whether it is from task to task in our day, or goal to goal in our leadership.

The feeling that we need to produce constantly in order to maintain a sense of

self is very draining. There is pressure inherent in that way of living and leading, and it will eventually wear you, and those around you, down to the nub.

While pursing awareness of motivation and developing soundness of your sense of self are essential to long-term success, having goals and working toward outcomes never stops.

An important discipline to not being

consumed by goal setting and production is the ability to celebrate.

How often do you take time to celebrate milestones? What is your built-in plan to celebrate achieving goals? Part of coaching is directing clients to the importance of personal celebration as incorporating it into their leadership.

Beyond just having fun, there are many positive results involved with celebrating.

1RELEASES STRESS.

In the pressure to achieve, stress and anxiety builds up, often in the background while we are distracted planning and working. Taking time that is not task or goal directed gives the opportunity to release stress in a way that will not be ultimately detrimental to future goals.

In the pressure to

2

CELEBRATION PROVIDES MOTIVATION.

In an obvious way, if you know something good is on the horizon, there is motivation to pursue the carrot on the stick, as when you promise yourself a new pair of jeans for meeting a weight loss goal. Going deeper, celebrating reminds you of why you are pursing your goal in the first place. It is a great way to be reminded of a vision or mission that is ultimately greater than the celebration itself.

We are drawn to the negative. News is negative; our self-talk tends to be negative. Taking the time to celebrate gives evidence of excellence.

4 CELEBRATION SHOWS APPRECIATION AND ACCEPTANCE.

Particularly important when leading a team, taking the time to pause and celebrate shows that you notice and appreciate the contributions that others are making. Want to have people continue to work hard? Let them know that you are not taking them for granted.

5

CELEBRATION BUILDS

ENERGY. Going from task to task, being ruled by deadlines, and knowing you have to produce to meet expectations is draining. Celebrating stands in contrast. It means that the battle was won. Maybe not the war…yet!

6CELEBRATION PROVIDES A TIME OF REFLECTION. In the momentary pause, it becomes possible to look at what went well that allowed the result to be achieved and what could have been done better. Yet, while celebrating, thinking what could be done better is free of condemnation.

INDIVIDUAL WAYS TO CELEBRATE YOUR SUCCESSES—NO MATTER HOW BIG OR SMALL

• Share your exciting news with family and friends.

• Thank everyone who supported you.

• Take a day off from work to relish your accomplishment and recharge your batteries.