BIG BEATING THE

BANKS

Top MLOs share their secrets

25 YEARS OF SUCCESS

How a Small But Mighty Brokerage Makes It Work

PANDEMIC PANIC

Home Appraisals Decrease

At Alarming Rates

In Asian Neighborhoods

Top MLOs share their secrets

25 YEARS OF SUCCESS

How a Small But Mighty Brokerage Makes It Work

PANDEMIC PANIC

Home Appraisals Decrease

At Alarming Rates

In Asian Neighborhoods

California is large and in charge. That’s why there’s California Broker magazine. We cover the nation’s biggest mortgage market, and the state with more originators than anywhere else in the country. It’s the industry leader, and so is California Broker magazine.

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky EDITOR

Keith Griffin

SENIOR EDITOR

Gary Rogo

SPECIAL SECTIONS EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Douglas Page, Sarah Wolak STAFF WRITERS

Nicole Coughlin, Nichole Cakirca ADVERTISING ASSOCIATES

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Stacy Murray, Christopher Wallace GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise MULTIMEDIA SPECIALISTS

Melissa Pianin MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Submit your news to editors@ambizmedia.com

If you would like additional copies of California Broker magazine Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. California Broker magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991

info@ambizmedia.com

It was just about a half decade ago that our company launched the California Mortgage Expo. Our first edition was in Commerce, next to LA, followed by new editions over the years in the Bay Area, then San Diego and Pasadena. We now do two events in Irvine, including a hugely popular holiday event. This amazing show for the state’s origination community now reaches more than 6,000 live registrants each year, and we deliver free NMLS license renewal classes to more than 1,500.

Of course, we love California. And so does the mortgage world, which counts the Golden State as the nation’s top market for home lending.

That’s why we decided it was time to go above and beyond. Our conferences deliver great education to the attendees, including information on new products and services to expand your lending opportunities, as well as insight into regulations and economics that will change the way you make a living.

But only so many folks can make it out in person. We want to be sure that all originators and mortgage pros in the region have a chance to keep fully informed, and to get access to stories of your compatriots who are conquering the market.

That’s why we launched California Broker, the only magazine looking at the mortgage origination market in California. You’ll get stories on interesting industry participants, details on alternative lending products that can keep you in the game, and regulations that will affect your business practices. We’ll have hands-on practical advice on how to manage your business and your career, and all focused specifically on California.

This quarterly magazine is brought to you by the same people who produce National Mortgage Professional magazine, Mortgage Banker Magazine and Mortgage Women Magazine. These publications are created, written and edited independent of any association or sponsor, so the only allegiance is to our readers. Complimentary digital editions are provided to every active NMLS licensee in the state, and hard copy editions are available at our California Mortgage Expo shows and via subscription.

We’re looking forward to having the eyes of the Land of Milk and Honey on us. As always, we’re here to write the story of your success.

VALVO CEO, Publisher, Editor-in-Chief vvalvo@ambizmedia.com

30

Four of California’s top originators pull back the curtain and share their weapons for succeeding in a tough mortgage market.

6

Golden State News Nuggets

A look at news of interest to mortgage originators across California

10

14

18

Blacks and Latinos have been in the news for appraisal bias. Turns out it’s an issue dramatically affecting AsianAmericans.

Higher rates are squashing housing affordability. Only 1 in 6 Californians earn enough to purchase a median-priced home. Other stats aren’t encouraging either.

A look at those people in the California mortgage industry who are seizing new employment opportunities or promotions.

OUTSIDE THIS ISSUE

MAY

4

The California Department of Financial Protection and Innovation puts the burden on managers when it comes to loan originators working from home.

A Napa Valley mortgage broker focuses on what made it successful as it marks its silver anniversary. Family plays a role!

40

Our Data Bank whittles down the important stats about the California housing market.

California Mortgage Expo

May 4 — May 5, 2023

Hilton Irvine/Orange County Airport

California Mortgage Expo

Thursday, August 10, 2023

Marriott La Jolla, San Diego 10

17

August 17–20, 2023

Planet Hollywood, Las Vegas

After distributing nearly $300 million in assistance to eligible homeowners statewide, the California Mortgage Relief Program is expanding to provide additional assistance and expand eligibility to help even more homeowners who have struggled with housing payments due to the impact of the COVID-19 pandemic.

The program is expanding in four ways according to businesswire:

Previously awarded homeowners who are still eligible and need more assistance can return for additional funds with a maximum of $80,000 in total assistance

Assistance is now available for homeowners with partial claim second mortgages or loan deferrals taken during or after January 2020

The delinquency date for assistance with past-due mortgage and property tax payments was reset - applicants must have missed at least two mortgage payments or at least one property tax payment prior to March 1, 2023

Homeowners with a primary residence that includes up to 4 units on the property may now be eligible

With this expansion, the program will now include grants to reduce or eliminate COVID-related partial claim second mortgages and loan deferrals. While many homeowners took action during the COVID-19 pandemic to restructure their mortgages in order to save their homes, they now face large payments at the end of their mortgages. Those who took a partial claim second mortgage or loan deferral during or after January 2020 may now be eligible for assistance.

In addition, the program has reset the delinquency date for households seeking assistance for past-due mortgage payments or unpaid property tax payments. Homeowners must have missed at least two mortgage payments or at least one property tax payment before March 1, 2023, to be eligible. Delinquency dates do not apply to

homeowners seeking partial claim second mortgages or deferred loans assistance.

Assistance is now available to homeowners whose property has up to four units. Eligible properties, which must be the applicant’s primary residence, may include houses, condos, permanently affixed manufactured homes, ADUs, duplexes, triplexes or fourplexes.

California saw a 14.3% increase in median down payments during the COVID-19 pandemic.

Researchers at Construction Coverage calculated the percentage change in median down payment from 2019 to 2021. Only conventional home purchase loans approved in 2019 and 2021 were considered in the analysis. The data used in this analysis was from the Federal Financial Institutions Examination Council.

14.3%

> increase in median down payments during the COVID-19 pandemic

The research found that the total change in median down payment in California from 2019 to 2021 rose by $20,000. The median down payment in 2021 was $160,000 compared to $140,000 in 2019.

These figures suggest that buyers were using more of their own cash and personal savings to finance purchases during the pandemic.

Idaho saw the largest increases in down payment size (relative to home price) 66.7% from 2019 to 2021.

Homebuying’s crash in Los Angeles and Orange counties pushed sales down 43% in a year to the slowest January on record.

The Daily Breeze reported that home purchases totaled 4,388 in the two counties — down 3,293 from January 2022, according to data from Irvine-based CoreLogic, which provides financial, property and consumer information.

So, just how slow was it?

It was the worst January for sales in records dating to 1988.

It was the smallest sales total for any month in CoreLogic’s database.

The percentage sales drop ranked No. 2 largest over 35 years.

Sales were 48% below the average January pace since 1988.

Across the six-county Southern California region, sales also fell to an all-time low.

Economic skittishness, especially soaring inflation, plus pricier home loans have frozen the housing market. Surging mortgage rates cut buying power by 28% in a year, making Southern California’s high home prices even more unaffordable.

Across the six-county Southern California region in the past year, sales fell 43% to 9,938 as the median sales price fell 0.1% to $670,000.

Madera, the largest city in Madera County of Central California, is the eighth fastest growing city in the U.S., according to a study by Quicken Loans.

The Quicken Loans study looked at census population data with consideration for new residential buildings, GDP and employment rates to identify the top growing cities with

A look at the news that’s important for the mortgage industry across the state of California.

economic prosperity and hot real estate markets to accommodate their growth.

Madera ranked fifth for residential building permits with a 46% increase in 2021, and ranked 30th or higher for all other study metrics. Madera’s population increased 2.1% to 67,944 residents in 2021. The city’s metropolitan area GDP grew 1.3% in 2020. Madera ranked 30th in the study for employment rate growth at 6.2%.

Roseville, the only other California city in the study’s top 20, is ranked 10th.

Roseville, part of the Sacramento metro area of Northern California, had a population increase of 2.3%, to 151,901 residents. The Sacramento metro area awarded 29% more single-unit building permits in 2021 than the previous year, for a total of 9,390. Roseville’s employment rates increased 7.2% in 2021.

San Diego home prices continued their downward trend in December, declining by 1.3% for the seventh straight monthly pullback, according to the authoritative Case-Shiller Index released Feb. 28.

Local home prices are now just 1.6% higher than a year ago, with the possibility of further declines in the months ahead, the Times of San Diego reported. The average decline nationwide in December was 0.8% and prices remain 5.8% higher than a year ago.

“The cooling in home prices that began in June 2022 continued through year end,” said Craig J. Lazzara, managing director of S&P Dow Jones Indices, noting that prices fell in all of the 20 largest metropolitan areas.

“The prospect of stable, or higher, interest rates means that mortgage financing remains a headwind for home prices, while economic weakness, including the possibility of a recession, may also constrain potential buyers,” he said. “Given these prospects for a challenging macroeconomic environment, home prices may well continue to weaken.”

Homes in California are slightly less expensive than they were one year ago — but only very slightly, Bankrate writes in its overview of the state’s housing market.

According to data from the California Association of Realtors (C.A.R.), the median single family home sold for $777,500 in November 2022, compared to $782,480 in November 2021. Today’s significantly higher interest rates make that already-high price feel even less affordable.

The total value of San Francisco homes fell 6.7% year over year to $517.5 billion in December (a $37.3 billion decline) - the largest drop in percentage terms than any other major U.S. metropolitan area, according to a new report from Redfin.

Next came two other Bay Area markets: Oakland (-4.5%) and San Jose (-3.2%).

The good news for Bay Area buyers is that home prices are down and competition remains far lower than it was during the pandemic homebuying boom. San Francisco’s median home sale price dropped 9.4% year over year to $1.3 million in January - the second biggest decline in the country. The good news for sellers is that the steep decline in prices has lured some buyers back.

This does not hold true across all areas of the state. For example, Fresno, Los Angeles and Orange County saw equally slight increases year-over-year, while the wine-country regions of Napa and Sonoma saw more significant increases.

Homes are also taking longer to sell, C.A.R. reports. In October 2021, homes spent an average of 11 days on the market before selling. A year later, that number had more than doubled to 23 days on the market.

Bankrate acknowledges that while it is hard to predict housing markets and exactly how future trends will impact prices, it writes most experts see no sign of an imminent crash. Recent trends indicate a slight weakening of the California market, with prices falling by small amounts and homes taking longer to sell, per Redfin data.

Redfin reported that the total value of U.S. homes was $45.3 trillion at the end of 2022, down 4.9% ($2.3 trillion) from a record high of $47.7 trillion in June. That’s the largest June-to-December drop in percentage terms since 2008. While the total value of U.S. homes was up 6.5% from a year earlier in December, that’s the smallest year-overyear increase during any month since August 2020.

The California Association of Realtors on Feb. 22 issued a statement of support in response to the Housing and Urban Development's announcement to reduce the annual mortgage insurance premium on Federal Housing Administration (FHA) insured loans.

"Today's move by HUD and the FHA to lower the annual mortgage insurance premium on FHA loans by 30-basis points will help increase homeownership opportunities throughout California, especially for first-time homebuyers and working Californians who rely on

> In Nov ‘22, the median single-family home sold for $777,500

FHA financing," said C.A.R. President Jennifer Branchini, a Bay Area Realtor. "HUD and FHA play a pivotal role in providing housing opportunities for families throughout California, and for years, C.A.R. and NAR have asked the FHA to lower the mortgage insurance premium to ensure that homebuyers using FHA loans are not overpaying for their mortgages."

The FHA's premiums and reserves have been very high for many years, which many believed was necessary due to the pandemic; however, now that the COVID crisis is waning, reducing the FHA mortgage insurance premium is the right decision.

In 2022, California originated the third highest number of FHA loans in the nation. Last year, one in 10 California homebuyers used an FHA loan, and 16 percent of first-time buyers in the state purchased their home with an FHA loan. Additionally, more than one in five Black and Hispanic/Latino homebuyers (firsttime and repeat buyers) used an FHA loan in 2022 to purchase a California home. Therefore, the reduction in the premium will result in tens of thousands of California homebuyers saving money when purchasing a home.

The share of homes valued at $1 million or more is falling quickest in the Bay Area as the overall housing market cools, according to a Redfin report.

Just over 80% of San Francisco homes are worth at least $1 million – the biggest share of the 99 most populous U.S. metros, but down from 86.3% a year ago. Oakland, where 44.8% of homes are worth $1 million or more, down from 50% a year ago, experienced the nextbiggest decline. San Jose experienced the fifth biggest decline, to 79.2%, down from 81.7%.

Nationwide, just over 7% of U.S. homes are worth $1 million or more. That’s down from June 2022’s all-time high of 8.6% and essentially unchanged from a year ago – but it’s up from 4.2% just before the pandemic began.

The Bay Area has seen outsized drops because home prices there have dropped more than in other places. San Francisco’s median sale price fell 9.4%

year over year and Oakland’s fell 7.8%, two of the three biggest declines in the U.S.

“Home values are coming down from their peak and fewer sellers could fetch seven figures – but that doesn’t mean buyers are getting a break,” said Redfin Economics Research Lead Chen Zhao.

“The typical homebuyer’s monthly mortgage payment is even higher than it was when home values peaked in the spring because rates are so much higher and although home prices have come down, they certainly haven’t crashed. Now isn’t the time for buyers who need to take out a loan to get a good deal: Buying an $800,000 home today would cost more per month than buying a million-dollar home a year ago.”

California had 1.73 million homes valued at $1 million or more in 2021, No. 1 among the states. This collection of seven-figure residences is 41% of the 4.2 million counted nationally, according to the Orange County Register.

The Register analyzed recently released 2021 housing data from the American Community Survey by the Census Bureau for the 50 states and the District of Columbia.

Next was New York with 390,238 million-dollar homes, and then Washington at 214,955, Florida at 204,092 and Texas at 166,306.

Consider California’s wealth concentration this way: Take the 49 other states plus D.C., and then subtract Florida, Washington and New York. The Golden State has more million-dollar homes than those 47 states and D.C. combined.

Consider that 23% of all California homes are worth $1 million or more. That’s also No. 1 among the states.

New data reveals that if not a buyer’s market, then the San Francisco Bay Area is a more buyer-friendly market. Homes are, relatively, cheaper — and a similar pattern may be manifesting in Los Angeles, according to the Los Angeles Times.

The Bay Area already had notoriously high home prices when mortgage rates bottomed out during the COVID-19 pandemic, which threw gas on the fire as borrowers snapped up cheap loans. By spring 2022, the average sale-to-list ratio, which compares the average sale price to the average list price, was over 113%.

But now a changing economic climate and disruptions in the tech industry have cooled the housing market; in December, San Francisco’s sale-to-list ratio dropped to 99.8%, indicating that more buyers were beginning to pay below the asking price. It was the first time that San Francisco’s sale-to-list ratio had dipped below 100% in Redfin.com’s data set, which began in 2017.

The trend seems to have hit Los Angeles as well but at a smaller scale since prices never jumped as high as they did in San Francisco. In Los Angeles, the sale-to-list ratio peaked at 105% in April. That has fallen to 98.5%, Daryl Fairweather, chief economist for Redfin, told the Times. The last time the ratio was that low in L.A. was January 2019, according to the Redfin data.

San Jose and San Diego are two of the four American cities that Goldman Sachs warns should gear up for a seismic decline in home prices compared to that of the 2008 housing crash.

In a note to clients in January, Goldman Sachs forecast that San Jose, San Diego, Austin, Texas, and Phoenix will likely see boom and bust declines of more than 25%.

Such declines would rival those seen around 15 years ago during the Great Recession. Home prices across the United States fell around 27% at the time, according to the S&P CoreLogic CaseShiller index.

Goldman credits these cities as having the lowest prices in the coming year because they got too detached from fundamentals during the pandemic housing boom.

Mortgage rates have spiked from 3% to 6% in 2022 — setting off the second significant home price correction of the post-WWII era.

BY KATIE JENSEN, STAFF WRITER, CALIFORNIA BROKER MAGAZINE

BY KATIE JENSEN, STAFF WRITER, CALIFORNIA BROKER MAGAZINE

Asian American appraisal bias is on the rise. Black and Hispanic appraisal bias may have been the hot topic over the past few years, but new studies show disparities increasing at a faster rate in Asian American neighborhoods. A new report, “Appraised: The Persistent Evaluation of White Neighborhoods as More Valuable

Than Communities of Color,” uses the Uniform Appraisal Dataset (UAD) from Fannie Mae and Freddie Mac to evaluate neighborhood racial inequality in appraised values. It found that disparities in home appraisals increased for Asians during the pandemic.

Journalists from around the nation have told stories of Black and Hispanic families who have had to whitewash

their homes to get a fair appraisal. Although appraisers are called out from time to time for not conducting diligent and fair appraisals, when looking at cases of appraisal bias, most of the blame is put upon the legacy of segregation and historic redlining practices.

Yet, historic redlining practices cannot explain the widening appraisal gap between white and Asian

communities. Perhaps, appraisers’ racist stereotypes play a bigger role than previously believed.

The breakout of COVID-19, or the “Chinese Virus” as former President Trump called it, caused resentment to stir up against the Asian community. Hate crimes skyrocketed. Between the onset of the pandemic and June 2021, more than 9,000 anti-Asian incidents were reported, according to national coalition Stop AAPI Hate.

According to Human Rights Watch, government leaders and senior officials in other countries have directly or indirectly encouraged hate crimes with anti-Chinese rhetoric. In Malaysia, authorities carried out mass raids to detain refugees and migrant workers, suggesting without proof that the migrant community and Rohingya refugees were responsible for the spread of COVID-19.

Evidence from the Appraised report shows this discrimination has seeped into the appraisal industry with data showing that East Asian neighborhoods decreased relative to their white counterparts during the

Junia Howell, a report co-author, was shocked to see this bias develop investigate this effect even further.

“There was an enormous rise, as crimes in this time period because of the associations that were being made politically between COVID-19 and the Chinese population,” Howell said. “Obviously, there were some very high-profile shootings, high- profile

muggings, and all sorts of really horrendous things. And it's very, very interesting that it’s reflected in this seemingly very distinct industry of housing appraisals.”

Prior to the pandemic, East and Southern Asian neighborhoods were appraised at levels comparable to their white counterparts. These communities were assumed to be more wealthy, because when East and Southern Asians were finally allowed to immigrate to the U.S., only

workers with high education levels, socioeconomic status, or skills deemed highly valuable by the government were granted visas. This fostered racialized assumptions that these Asian communities were successful and therefore their neighborhoods were similar or higher in value than white neighborhoods.

The assumption that Asian Americans belong to a wealthier class than other ethnicities is a negative stereotype that prevents them from receiving necessary help, according to Hope Atuel, executive director of Asian Real Estate Association of America (AREAA).

“It’s like the movie ‘Crazy, Rich Asians’ has perpetuated this. I love the movie, but must say we might all be crazy, but we’re not all rich,” Atuel said.

What is particularly shocking is once the pandemic set in, home values in East Asian neighborhoods decreased relative to their white counterparts. Although the report neglects to mention how much appraisal values have dropped off or where this has taken place, data on the website suggests this was most prevalent within Californian metros such as San Jose, Los Angeles, Sacramento, San Diego, and Riverside. The report states that racist stereotypes negatively affected home prices in East Asian communities in ways they had not prior to the pandemic.

“They're assuming buyers are going to be less likely or willing to move into East Asian communities,

Prior to the Fair Housing Act of 1968, governmentenforced redlining and discriminatory housing practices encouraged higher valuations and investment in white communities while communities of color suffered from a lack thereof. Although these practices are banned today, appraisers are required to use past sales prices to determine property values without adjusting for past injustices.

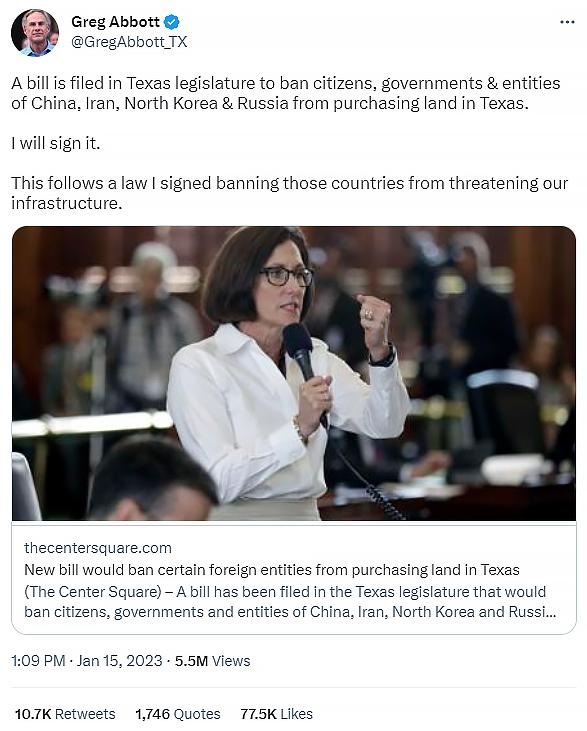

AREAA Executive Director Hope Atuel points to a more recent national example of Asian hate demonstrated through Texas Senate Bill 147, which would make it illegal for citizens of China, North Korea, Iran and Russia to buy property in Texas, including homes. It does not make any exceptions for legal permanent residents, visa holders, or dual citizens.

Atuel said this will not only hurt the current population of Asian residents in Texas, but those who have plans to migrate there in search of more affordable housing.

Despite the fact hundreds of Texan residents across the state have taken to the streets to protest the bill, Republican Gov. Greg Abbott tweeted in January, “I will sign it.”

Listen by following the link or by subscribing wherever you get your podcasts:

and they're making that a part of their assessment,” Howell said. “It probably had less to do with appraisers saying, ‘Oh, I don't like this area as much’ and more to do with recognizing the general push against certain communities and reflecting that in their appraisals. But, I would still call that a racist assessment.”

Other subcommunities, such as Southeast Asian and Pacific Islanders, have dealt with discrimination and progressive devaluing of their land for generations. The Appraised report shows, on average, homes in these communities are appraised at $305,000, yet houses in white neighborhoods in these same metropolitan areas are appraised more than four times as much at $1,268,000.

“In the United States the creation of wealth is driven by homeownership, so if values of the homes are degraded, then it's furthering the problem of wealth disparity,” Atuel said. “There’s already a disparity in homeownership rates amongst certain Asian subcommunities and that’s being layered with lowered appraisals, so it creates more of a wealth gap.”

This is the opposite of what’s happening in Hispanic communities. The Mortgage Fairness report shows that the higher the concentration of Hispanic residents, the fairer the mortgage market is to Hispanics. Saleh believes this may have to do with the upward economic mobility that the Hispanic community has exhibited over the last 30 years, but also that there are more likely to

be mortgage brokers and originators owned by Hispanic proprietors serving those communities.

Evidence from the appraiser study also shows the appraisal gap between white communities and all underserved communities is accelerating. From 1980 to 2015, the neighborhood racial gap in appraisals expanded by $6,000 a year. Yet, in this last decade, this gap grew by $18,000 a year.

As more researchers uncover these hidden biases, they are also proposing solutions to counteract them.

The fact is that the current system for evaluating a borrower’s readiness to acquire a mortgage is not applicable to certain communities who have dealt with historical injustices and negative stereotypes. Or, their cultures are not aligned with how the mortgage industry evaluates borrowers’ eligibility. For example, Islam forbids its followers from paying or charging interest in transactions, so many cannot get a mortgage even if they are financially eligible. Except for only a few banks in America, most do not offer product solutions for these people (see Gated Communities episode: Financing According To Faith).

For the betterment of the mortgage industry and the country’s overall economy, it would be wise to make mortgage eligibility inclusive to as many people as possible. It’s a simple notion: The more eligible borrowers there are, the more potential for higher origination volume.

Howell has proposed a unique solution to the appraisal gap problem this country is facing that may just remedy the problem for all underserved communities. But it does involve overhauling the way appraisals are conducted..

Instead of relying on past

valuations and improvements done on the house, Howell recommends using all the important components of a house to come up with a valuation.

“The approach is a componentbased approach that looks at each piece of the physical structure of the dwelling. So the windows, the framing, the roof, the foundation, those are the components,” Howell said.

able to take a picture or a video of the house structure and help estimate all the answers.

“It's a really radical way of rethinking how we're sharing this cost and how we're passing it along,” Howell said. “But what it does is enable the majority of the cost of housing to shift from paying for a mortgage towards paying for the upkeep of the house. Now you’re looking at what it actually costs to live somewhere.”

Unfortunately, these issues don’t come with a simple solution. But those companies who pioneer the way to change and offer alternative solutions to those who have been ignored or discarded by the rest of the industry will become very valuable.

The appraiser would then analyze the cost and durability of these materials to determine the value. For example, when was this put in place? How much did it cost when it was actually put in place? Was that a 100 years ago or five years ago? How much did it cost then for both the labor and the natural resources as well as the infrastructure to get it there? How long do we expect it to last?

There are questions to consider when conducting an appraisal with this method, but Eruka is working on pairing this method with technology that has object identification to be

“Ensuring unconscious bias doesn’t play a role in appraisals and seeking broader solutions to DEI [diversity, equity and inclusion] in housing is a priority for the Appraisal Institute,” said Appraisal Institute President Craig Steinley. “Creating a more equitable housing environment in this country will take solutions advanced by real estate brokers/ agents, banks, government agencies, appraisers and others.”

The Appraisal Institute has been amplifying and accelerating diversity, equity and inclusion (DEI) initiatives and partnerships to bring about positive change, Steinley said. The organization is also creating a Practical Applications of Real Estate Appraisal program (AI PAREA), which provides an alternative to the traditional supervisor and trainee model for experience, and they are creating a seminar on valuation bias.

“All of these stereotypes you start uncovering, it's like peeling an onion, right? As you get closer to the core, you're crying,” Atuel said.

“All of these stereotypes you start uncovering, it's like peeling an onion, right? As you get closer to the core, you're crying.”

–Hope Atuel, executive director of Asian Real Estate Association of America

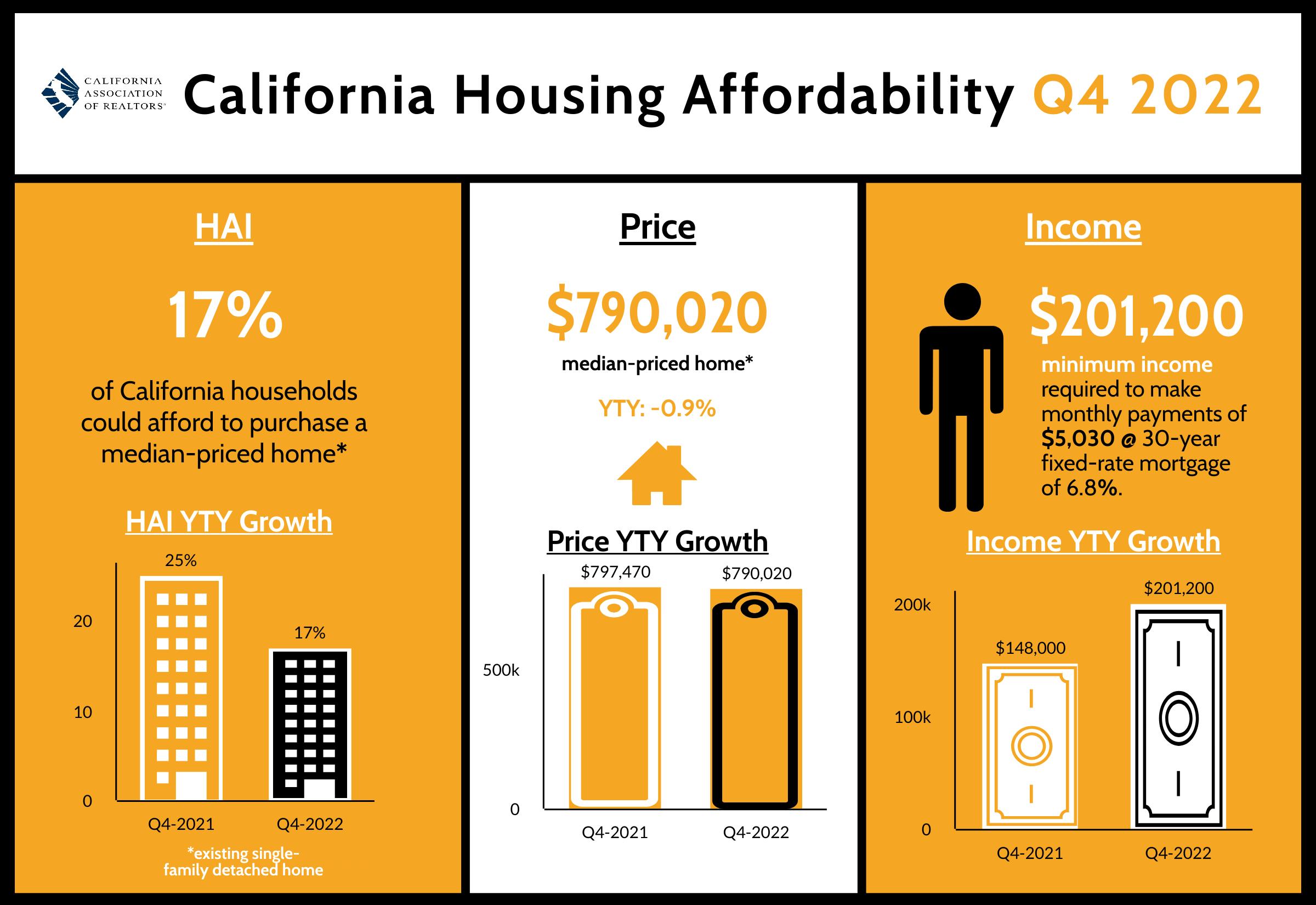

Arapid rise in mortgage interest rates depressed housing affordability in California during the fourth quarter of 2022 and pushed the statewide affordability index for an existing, single-family home to 17 percent, just above the 15-year low of 16 percent recorded in the second quarter of 2022, the California Association of REALTORS (C.A.R.) said.

The percentage of homebuyers who could afford to purchase a median-priced, existing single-family home in California dipped to 17 percent in fourth-quarter 2022 from 18 percent in the third quarter of 2022 and was down from 25 percent in the fourth quarter of 2021, according to C.A.R.’s Traditional Housing Affordability Index (HAI). California hit a peak high affordability index of 56 percent in the first quarter of 2012.

C.A.R.’s HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. C.A.R. also reports affordability indices for regions and select counties within the state. The index is considered the most fundamental measure of housing well-being for homebuyers in the state.

A minimum annual income of $201,200 was needed to qualify for the purchase of a $790,020 statewide median-priced, existing single-family home in the fourth quarter of 2022. The median income in California is $84,000. The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $5,030, assuming a 20 percent down payment and an effective composite interest rate of 6.80 percent. The effective composite interest rate was 5.72 percent in the third-quarter 2022 and 3.28 percent in fourth quarter 2021.

A minimum annual income of $201,200 was needed to qualify for the purchase of a $790,020 statewide median-priced, existing single-family home in the fourth quarter of 2022.

While the cost of borrowing was the highest in over two decades, recent encouraging inflation data has allowed the Federal Reserve to scale down its rate hikes to 25 basis points in its latest February Federal Open Market

CONTINUED PAGE 16

Seventeen percent of California households could afford to purchase the $790,020 median-priced home in the fourth quarter of 2022, down from 18 percent in thirdquarter 2022 and down from 25% in fourth-quarter 2021.

A minimum annual income of $201,200 was needed to make monthly payments of $5,030, including principal, interest and taxes on a 30-year fixed-rate mortgage at a 6.80 percent interest rate.

More than one in four (26 percent) California homebuyers were able to purchase the $610,000 median-priced condo or townhome. A minimum annual income of $155,200 was required to make a monthly payment of $3,880.

• Compared to the previous quarter, housing affordability in the fourth quarter of 2022 improved in 10 counties, remained unchanged in 13 counties and declined in 28 counties. Not one single county saw an improvement in affordability from a year ago, although Tehama and San Mateo counties remained unchanged on a year-overyear basis.

• In the nine-county San Francisco Bay Area, affordability declined from the previous quarter in Solano and Sonoma, increased in Napa, and remained flat in the other six counties.

• In the Southern California region, housing affordability fell in four counties from third-quarter 2022 and remained unchanged in two counties. San Bernardino County was the most affordable in the region at 29 percent of households able to purchase the $458,000 median-priced home.

• In the Central Valley region, Glenn and Kings counties were the most affordable at 35 percent, and San Benito was the least affordable at 18 percent.

• In the Central Coast region, Santa Cruz County was the most affordable at 13 percent, and Santa Barbara County and San Luis Obispo were the least affordable at 11 percent.

• For the state as a whole, Lassen (54 percent) remained the most affordable county in California in the fourth quarter of 2022, followed by Tehama (40 percent) and Shasta (39 percent). These three counties were also the only counties

whose affordability index was higher than the national index of 38 percent. Lassen also had the lowest minimum qualifying income ($59,200) of all counties in California to purchase a median-priced home and was the only county in the state with a qualifying income less than $60,000.

• Mono (7 percent) and a two-way-tie between Santa Barbara and San Luis Obispo at 11 percent, were the least affordable counties in California, with each of them requiring a minimum income of at least $210,000 to purchase a median-priced home in the respective counties. San Mateo County continued to require the highest minimum qualifying income to buy a median-priced home in fourthquarter 2022 and was one of four counties in California — all in the Bay Area — that required a minimum qualifying income of more than $400,000 in the fourth quarter of 2022. Other counties with a minimum qualifying income over $400,000 include Marin ($402,400), Santa Clara ($401,600) and San Francisco ($401,200).

• On a year-over-year basis, housing affordability declined the most in Kings County, falling 18 points from fourthquarter 2021 to fourth-quarter 2022. Del Norte and Lake followed closely behind, with each county dropping 15 points year-over-year in the last quarter of 2022. The surge in mortgage rates, along with elevated home prices, continued to be the primary factors for the plunge in affordability in these counties.

Nationwide housing affordability also slipped in fourth-quarter 2022.

38% of the nation’s households could afford to purchase a $378,700 median-priced home.

Committee meeting. In anticipation of the Fed’s less aggressive push on rate increases in the last couple of months, the market has had less upward pressure on yields, which resulted in the average 30-year fixed-rate-mortgage (FRM) trending down since it peaked at just over 7 percent in late October/early November.

The statewide median price of an existing single-family home in California dipped on a year-over-year basis in the fourth quarter of 2022 for the first time in 11 years. It also experienced the second largest quarterto-quarter decline since the first quarter

of 2011. Home prices are expected to soften further in the upcoming quarter as rates remain elevated, which will continue to put some downward pressure on housing demand.

Despite a moderate quarter-toquarter drop in the median condo/ townhome price, the share of households in California that could afford to buy a median-priced condo/ townhome continued to slide from last year as the cost of borrowing remained on the rise. Twenty-six percent of California households earned the minimum income to qualify for the purchase of a $610,000 median-priced

condo/townhome in the fourth quarter of 2022, which required an annual income of $155,200 to make monthly payments of $3,880. The fourth quarter 2022 figure was down from 36 percent a year ago.

Nationwide housing affordability also slipped in fourth-quarter 2022. Compared with California, 38 percent of the nation’s households could afford to purchase a $378,700 median-priced home, which required a minimum annual income of $96,400 to make monthly payments of $2,410. Nationwide affordability was 51 percent a year ago.

Names New CEO

Guild Mortgage, a growth-oriented mortgage lending company originating and servicing residential loans since 1960, has named Terry Schmidt as its new CEO, effective July 1.

Schmidt, Guild’s current president, will succeed Mary Ann McGarry, who will retire following a career of almost 40 years.

In addition, David Neylan, who joined Guild in 2007 and now serves as executive vice president and chief operating officer will replace Schmidt as president and continue as Guild’s COO.

Schmidt has been president and a director of Guild Holdings Company since August 2020. She has served in a number of leadership positions at Guild Mortgage, including controller from 1991-97 and chief financial officer from 19972000. She joined Guild as a member of its internal audit department.

She is a member of the California Mortgage Bankers Association, an association representing the California residential and commercial real estate finance industry, a member of the board of directors of the Guild Giving Foundation, a nonprofit organization, and a member of the Mortgage Bankers Association, an association representing the real estate finance industry.

Prior to joining Guild, Neylan managed the local branch, regional and national origination divisions at CMG Mortgage Inc., a provider of mortgage banking, where he began his career in the mortgage banking industry in 1997.

Guild, with its home office in San Diego, oversees 70 branch offices in 11 western states.

Terry Schmidt

Tom Wight

Amber Jaurequi

Nick Roberson

Jennifer Lawrie

William Chang

Terry Schmidt

Tom Wight

Amber Jaurequi

Nick Roberson

Jennifer Lawrie

William Chang

Hozoro Mortgage, a leading provider of residential mortgage services, announced the appointment of Nick Roberson as vice president of business development & acquisitions.

With over 30 years of experience in the financial services industry, Roberson brings a wealth of expertise and knowledge to Hozoro Mortgage. Throughout his career, he has developed a proven track record of successfully growing businesses through strategic partnerships and acquisitions. His ability to identify opportunities and execute on growth strategies will be a valuable asset to the Hozoro Mortgage team.

In his new role, Roberson will be responsible for leading business development and acquisition initiatives, as well as identifying and pursuing new business opportunities. He will play a key role in advancing the company’s growth plans and helping to position Hozoro Mortgage for long-term success.

“We are thrilled to welcome Nick to the Hozoro Mortgage team,” said Joseph Dio, President/CEO of Hozoro Mortgage. “His experience and insights will be invaluable as we work to expand our reach and enhance our offerings. We are confident that Nick will make a significant impact in his new role, and we look forward to his contributions to the company’s continued growth and success.”

KeyBank Real Estate Capital named Tom Wight vice president of mortgage banking in Northern California as part of the Northwest expansion of its commercial mortgage group.

The San Francisco-based executive will be responsible for originating multifamily loans and report to Jon Reible, senior vice president and regional production manager at KeyBank Real Estate Capital.

Wight brings almost a decade of experience in commercial mortgage banking to his new role.

Before KeyBank, he was vice president of debt and equity at Northmarq, where he was responsible for sourcing clients with a pipeline of debt and equity transactions, negotiating terms with capital providers, and leading a team of analysts and closers to execute transactions.

Additionally, Wight is a past president of the Bay Area Mortgage Association and an active member of several local and national real estate groups, including the California Mortgage Bankers Association, the Berkeley Real Estate Alumni Association, NAIOP, Urban Land Institute, and the Mortgage Bankers Association.

Jennifer Lawrie joined Kind Lending as a producing branch manager in December, a role she serves at Kind’s new branch

office in Brentwood.

Kind, an independent residential mortgage lender headquartered in Santa Ana, opened the office on Feb. 1.

Lawrie has been in the mortgage business since 2002. She says that firsttime homebuyers are her specialty, according to her profile on kindlending.com

Before joining Kind Lending, she was a branch manager for Supreme Lending at Brentwood location for six years. Previous to that, she was a branch manager at both First California Mortgage Company in Brentwood and at WJ Bradley Mortgage Capital LLC in Walnut Creek, according to her LinkedIn profile.

Geneva Financial named Amber Jaurequi mortgage branch manager of its Cameron Park office.

Jaurequi is Veteran Affairs certified and has been doing VA loans for over 25 years. She also works with Homes for Heroes, which is a program designed strictly for first responders. She said, “A helping hand for our veterans and our first responders is the least we can do.”

She appreciates that Geneva Financial shares her passion for veterans and first responders and that it continuously introduces new ways to help.

Jaurequi has the loan industry in her DNA and began working for a mortgage company as an intern at age 16. She knew this was the career for her

and got her real estate license as soon as she legally could at age 18.

Jaurequi helps clients through the entire homeownership journey and beyond, and will work with them to make them ready to purchase a home.

“The answer is never no, you don’t qualify to purchase. … it’s just a matter of when,” she says.

Geneva Financial is a national mortgage lender with branches across the United States.

PennyMac Financial Services and PennyMac Mortgage Investment Trust appointed William Chang senior managing director and chief capital markets officer for PFSI and chief investment officer for PMT.

Chang joined Pennymac more than 10 years ago and has a successful track record in various management positions across the company, including in corporate finance, business development, investor relations, and capital markets. Most recently Chang served as deputy chief investment officer for both PFSI and PMT. Prior to joining Westlake Village-based Pennymac, Chang served in the Mergers & Acquisitions Group at Credit Suisse for over a decade, where he advised boards of directors and management teams on more than $100 billion of public and private transactions across a range of industries.

The California Department of Financial Protection and Innovation (DFPI), in recognition of the end of the COVID-19 State of Emergency on February 28, and the status of remote work options, issues the following guidance regarding remote work under the California Residential Mortgage Lending Act (CRMLA).

The CRMLA does not expressly prohibit employees of a licensee from working at a remote location, such as an employee’s home. A licensee may authorize an employee to perform limited functions at a remote location that is not considered a branch office, provided that the location does not have the indicia of a branch office and is not advertised to the public as a business location.

In instances where a mortgage loan originator (MLO) or another employee is working remotely, a branch manager must continue to supervise the employee. In accordance with Rule 1950.122.6 of the CRMLA (Cal. Code of Regs., tit. 10, § 1950.122.6), the DFPI will continue to examine the supervisory activities of a branch manager to ensure that the branch manager is adequately supervising each MLO and employee regardless of whether they are working at a remote location or a branch office.

The following are considerations for a licensee when determining whether a location is adequately supervised, or whether it has the indicia of a branch office:

1. Only one employee or multiple employees who reside at the location and are members of the same immediate family work at the remote location.

2. If confidential physical files are accessible at the remote location, and whether the remote location contains secure storage that protects confidential physical files.

3. The MLO is assigned to a designated branch office, and such designated branch office is reflected on all communications to the public by the MLO.

4. The employee’s communications with the public are subject to the licensee’s supervision or a designated communication person.

5. Electronic mail is through the licensee’s electronic email system.

6. All loan processing is reviewable at the main or branch office.

7. Written supervisory procedures pertaining to supervision of loan origination and lending activities conducted remotely are maintained and enforced by the licensee.

8. A list of the remote locations is maintained by the licensee.

9. All records can be accessed by the DFPI at the main or branch office location.

10. Written supervisory procedures contain specific provisions regarding cybersecurity and a virtual privacy network (VPN) or other secure system at the remote location, including:

a. Multi-factor authentication,

b. Back-up system and data recovery system, and

c. Protocols in the event of a cybersecurity incident.

The DFPI is committed to working with licensees to ensure adequate supervision of employees working from remote locations while recognizing the increased desire and ability of their employees to perform work functions remotely.

Questions regarding this guidance may be directed to CRMLA.Inquiries@dfpi.ca.gov.

1 of 10 considerations for a licensee when determining whether a location is adequately supervised:

If confidential physical files are accessible at the remote location, and whether the remote location contains secure storage that protects confidential physical files.

Your daily news, industry insight, and professional advice is now streaming. Tune in to The Interest to discover everything you need to know to be a better mortgage professional.

Airs Monday - Friday.

Watch or listen at nmplink.com/TheInterest

ProMortgage’s website boasts that it provides “Everything the Big Banks Offer and Everything They Can’t.” It’s a broad statement from a small San Rafael-based company, which just celebrated 25 years in the industry at the tail end of 2022. But that’s not all: ProMortgage secured the spot as Marin County’s Top Mortgage Brokerage Firm for 2021 and completed $153 million in originations during 2022. An interview with Brenda Cantu and David Rubinstein proves that they’re not losing steam anytime soon.

Q: ProMortgage is celebrating 25 years with a refreshed logo and tagline. What other ways are you keeping your business fresh?

A: Daily, the principles are participating in mortgage industry educational opportunities and utilizing the latest technology to streamline our business. Specific examples are:

• New product webinars presented by lenders.

• Housing and economic updates presented by industry leaders.

• Best marketing practices for social media, videos, and in-person homebuying workshops.

• Participate in a government affairs committee to best understand state and national legislation affecting the mortgage industry.

• Active board members for mortgage industry trade associations North Bay California Association of

Mortgage Professionals (North Bay CAMP)

• Fully paperless office utilizing the newest LOS technology (Arive)

• Keeping in touch with our database through the latest technologies, to ensure they have access to financing answers at their fingertips

• Attending industry events organized by NAMB or AIME

We stay in the know [about] what is happening in the industry all the time. We have weekly meetings with our loan originators to make sure they are aware of all the products available in the market.

Q: How did you weather the 2022 market?

A: Back to basics! We embraced our roles as educators for the real estate community. We made presentations to Realtors about the evolving mortgage

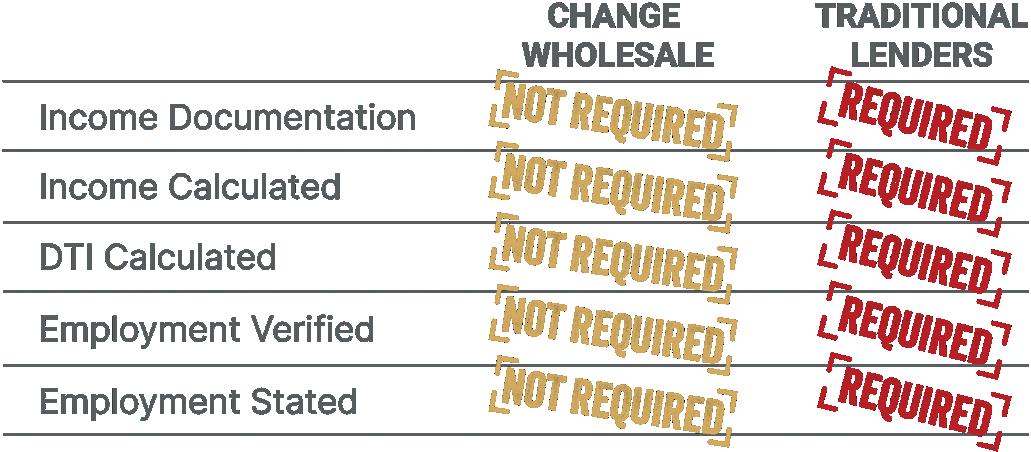

product environment. We gave presentations to consumers about buying their first home in this challenging market. When interest rates began to rapidly increase, the products that worked best for most homebuyers in 2020 and 2021 were no longer the best fit in 2022. We educated our Realtor partners about the products that were leading to successful outcomes for homebuyers and homeowners. Our expertise with NonQM loan products helped get deals closed in a challenging market.

A lot of our resilience in this market can be attributed to being a true mortgage broker. Borrowers often pay fewer costs, experience more transparency in the process and work with someone local in their community when they hire a mortgage broker.

Q: You held the title of Marin County’s top Mortgage Brokerage Firm in 2021. How are you staying on top?

A: Our loan agents are doing the hard work of growing their referral network by getting out in the field to meet with Realtors, making presentations in real estate offices about new mortgage products, conducting seminars for first-time homebuyers, and visiting open houses among other activities. We are passionate about helping our clients build wealth through real estate acquisition. We want to help everyone we can achieve this goal. Our knowledge and experience are invaluable to a client just getting started in the homebuying process.

We introduced products aimed at increasing homeownership through

“Our shared vision is to be great at what we do and help our loan agents take their practice to the next level.”

Brenda Cantu ProMortgage co-founder

down payment assistance from the state, more lenient underwriting guidelines, and alternative ways to verify a borrower’s ability to repay their mortgage. More options for financing result in happier homebuyers.

Q: Since family is a big part of ProMortgage, what are some challenges that come with working alongside relatives?

A: We have never really experienced any challenges in this regard. We take a lot of pride in helping family members start and grow their careers at ProMortgage. We all share the same goal of achieving the best outcome for our clients and our business. Our shared vision is to be great at what we do and help our loan agents take their practice to the next level. The family dynamic provides plenty of advantages in our business. There is built-in trust with interests aligned. We are all working toward a common goal and making sure we protect the business and continue to help our community. We can rely on each other unequivocally.

The family environment permeates the company. We are active in each other’s lives outside of work, celebrating birthdays and milestones, [and] relying on each other for advice and support.

Q: Also, on the subject of working with relatives, how do you separate work from family?

A: We try not to discuss business out of the office as much as possible, but this is sometimes hard to do. If someone is working on a special project or has a new idea they want to discuss, it is not unusual to talk after hours or on the weekends about the business. We don’t consider this a burden as it is always all about making the business better.

Q: What have been some of the biggest changes over the past 25 years in the California mortgage market?

A: We have seen product guidelines expand to unsustainable risk-taking through subprime lending preceding the great recession; then contract so dramatically that it was near impossible to get a mortgage during the great recession. What we learned is that change is inevitable and that we can’t rely on any current market to grow a sound business. We have learned to stay nimble, diversified, and forward-looking to survive the ever-changing mortgage market given prevailing economic conditions.

Q: What are some of the unique challenges of the California market? How do you overcome them?

A: The increase in property values since the Great Recession recovery and through COVID has created negative externalities for families trying to buy homes. We stay current on federal, state, and local programs designed to help: first-time homebuyers, certain household income levels, and certain census tracks to buy a home. Knowing what programs are out here and guiding our clients to the programs that may benefit them is how we meet the unique challenges of the California real estate market. Another challenge unique to California is the short time frame of our purchase contracts. In other parts of the country, 30-45 days to close a transaction is common. In California, especially the Bay Area, most contracts are prepared with a closing time frame [of] less than 30 days, often as short as 21 days. We have partnered with various funding sources that ensure quick and smooth closings, fully underwriting borrowers prior to identifying a property, and making sure we are available to work late nights, weekends, and holidays.

We are a creative bunch and work together, as a company, to find solutions for our mutual clients. We treat the Mortgage business as a team sport, relying on the strengths of all team members to create the best experience for our clients.

Q: Would you recommend others working with family members to start businesses?

A: Yes! Absolutely! We love sharing what we know with the next generation and seeing them use that knowledge to craft [a] practice and thrive! Mutual respect and trust are paramount to working with family. We cover for each other and are understanding when personal situations come up. We each can focus on our strengths and trust the rest of the team will carry their fair share.

Q: Is there something about the mortgage business that makes it a better environment for working with family members?

A: Our clients frequently refer their grown children to ProMortgage when they want to buy a home. In the same way, loan agents can pass on their book of business to the next generation. There is a level of consistency that gives our clients comfort when they have been ProMortgage customers, and we know them from generation to generation.

“We treat the Mortgage business as a team sport, relying on the strengths of all team members to create the best experience for our clients.”

David Rubinstein ProMortgage

OCN MODESTLY PRESENTS:

In 2022, we had a record turnout for our best event … yet. Let’s just say, you won’t want to miss this year’s Originator Connect and these exclusive programs:

Free NMLS Renewal * Build-A-Broker

Non-QM Summit

Private Lender Forum & so much more!

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility.

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility.

BY KATIE JENSEN, STAFF WRITER, CALIFORNIA BROKER MAGAZINE

BY KATIE JENSEN, STAFF WRITER, CALIFORNIA BROKER MAGAZINE

California’s leading independent loan originators are bringing in dollar volume comparable to originators at big banks — in a tough market, no less. What are their methods? California Broker Magazine spoke with four of the top loan originators in the Golden State. See what they have to say on topics like secret success strategies, lead generation, fighting retail banks, and the best social media tools for bringing in business.

According to Modex, the top five lenders were retail banks, but these independent loan originators are generating dollar volumes that meet or beat dollar volumes originators at retail banks.

Their secrets are revealed on the following pages.

Loan Originator and President of United American Mortgage Corporation

Modex reported 2022 Volume:

$294.28 million

Your voice is the best tool you have to capture attention and command respect. Smiling and soft-spoken, Hensling seems to have a calming aura about him. He’s also well-established within the Southern California market as a non-delegated banker. As someone who defines himself as a problem solver, this approach conveys the message to his clients that everything is going to be OK and, for his referral agents, that he can handle even the messiest of loans.

What kind of market are you anticipating in 2023?

Ithink you're going to see a lot of individuals try to enter the marketplace. There are still some very innovative strategies from a financing standpoint. Some of the buydown programs we've established and some relationships with some proprietary lenders that

are very focused on Community Reinvestment Act (CRA) lending. So, they're affording belowmarket rates to help stimulate home ownership. I think you're gonna see a fair amount of firsttime homebuyers coming into the marketplace. A lot of individuals believe the rates they see today are somewhat temporary, and ultimately rates will come back down. So, some people are willing to take a leap of faith and get into a product that will be comfortable. It’s a little bit of a stretch right now with the hope that in the future rates will come down and it'll become an opportunity to potentially refinance.

Is there any strategy you consider your secret weapon?

The secret weapon is to always remain calm. A lot of the Realtors that are in the marketplace don't really have a tremendous sales skillset or people skills. Not all but a lot of them want what they want when they want it, and they don't try to develop relationships. There always has to be an adult in the room. As long as you can stay calm, be the voice of reason, always tell the truth, and always provide answers when people need them in an efficient fashion, you're going to be successful.

We've really established ourselves as a solution-based lender, and we get called in oftentimes to fix transactions that have gone awry, maybe at the big bank because they don't understand the complexities or the challenges and/or the solution to those challenges for the particular transaction.

Retail banks dominate the California mortgage industry. How can independent mortgage loan originators get ahead?

Oftentimes the case with the retail banking space, they usually do one product — maybe a couple of products very well — whereas in the broker or mortgage banking space we have the opportunity to participate in more, whether it be Non-QM, government down payment assistance, or up to a $25 million jumbo product. So it just gave us an opportunity to be able to fit the client's needs by having the essential product set. I chose this space because I felt it was a much better opportunity and would be a much better situation for our clients, but also from a financial standpoint, from flexibility.

There may be a lot of moving parts, for example, in a family law case. You may have two individuals that are trying to split assets and then determine what they can purchase. Or there may be a liquidation or a buyout of one individual where it requires a cash-out refinance. That’s when we get called in.

“The secret weapon is to always remain calm.”

–Al Hensling

“Part of going after Realtors is you have to create value for them.”

–Scott Evans

Modex reported 2022 Volume: $261.92 million

Five years ago, Evans was your everyday loan originator, scrambling for leads and new referral sources. That was until he developed a new strategy to get Realtors’ attention. For those loan originators who are nervous for what this year holds, remember panic leads to desperation, and that is not the look you should be going for. Learn how one LO was able to flip the script, and got Realtors to chase after him.

How do you generate leads?

My business has always been based on going after Realtors.

[They] are my customer and my client, uh, that's who I, you know, focus my daily activities after. Part of going after Realtors is you have to create value for them. And the ultimate value proposition is creating business to give to a Realtor.

Is there any strategy you consideryour secret weapon?

Most lenders don't have an ability to create business to give back, and that's what I stumbled across four years ago. So, I started doing these homebuying seminars. A majority of them are VA homebuying seminars, but I also do traditional homebuying seminars. Essentially, I do the marketing, and fill the room to present to all the people coming to the event. The call to action is for them to fill out a loan application and then set an appointment with the Realtor. So now I'm giving the Realtor someone that is motivated to buy a house and that's spelled out in an application to get pre-approved.

I'll have 50 to 100 people sometimes at these events. And I've now taken 'em into different markets. When the pandemic happened, I took this seminar to Texas because California was shut down. We're still doing these events in Texas and doing a loan in Texas in comparison to doing a loan in California, it's the same amount of work.

Now that California's opened up, my plans are to take the homebuying

seminar up the coast of California. I've gone into Orange County and Fresno, and now I'm going into LA. I’m also looking to take them to Bakersfield.

How do you market these events?

It's all from Facebook. We'll select a venue like a Dave & Busters, a local brewery, or something that has more of a well-known name. It is a free event. The hard part is figuring out who's actually gonna come to the event out of the people who are signing up. So when people sign up on Facebook, I have a way to text them to follow up and see if they're coming. The secret sauce is the marketing and getting people to sign up. We do them on a Tuesday, Wednesday, and Thursday after work. We also do a free buffet and free drinks for people to come. We've been doing them for the last four years.

I'm also going after new home builders doing seminars at their model homes. I come in with a value proposition of driving 40 to 50 people to their model home to go on a contract. So it's a tremendous amount of value right now in this market.

SVP Mortgage Lending, OriginPoint

Modex reported 2022 Volume: $249.61 million

Self-proclaimed “Benjamin Button of the mortgage industry,” Kilaru is as competent and articulate as they come. She can underwrite loans in her head. She can give you realistic projections about where the market is headed. She can travel the world and answer all of her clients phone calls without missing a beat. Oh, and she’s one of California’s top producing originators. It’s a mystery whether there’s anything she can’t do — that’s what makes her so valuable.

What kind of buyers do you work with?

I'm in the toughest real estate market in the country, where they are extremely savvy. I would say they're very rate centric. I mean, you name it and that's the demographic I deal with. So, I have a lot of Asians and Caucasians. But I would say they are a very tough group of buyers that pretty much knows what's going on. They know the numbers, they've got spreadsheets, and they've talked to people.

What kind of market are you anticipating in 2023?

Idon't think this is the market that you had in November and December. I think your borrowers have figured out this pricing it's not gonna last. You can already see the trend of inflation is coming down. Your job numbers are still fantastic with 311,000 jobs added in February. So that fear of recession that you've been hearing and that has been scaring buyers, it's really not what the numbers are showing.

I tell my clients that you can't look at what the Fed is doing. It's like driving a car and looking in the rearview mirror. They look at the past to determine the plan for the future. I said that's the wrong way to gauge the U.S. housing market or the economy. The easiest way, if you wanna get an idea where the markets are heading, is looking at stocks. Your stock market is not doom and gloom.

I tell my clients, when that rate dips, you miss the boat. It's like buying the stock at its peak. If you don't see the value of buying it when it's the lowest, then you are not a savvy investor. But the trend is these guys have figured out they can get a house cheaper today. It's still technically a buyer's market, but it can switch on a dime.

It's my background. I always think of myself as the Benjamin Button of the mortgage industry. Truly, because when I started my career trajectory, I started in the foreclosure department, the very end of the loan process. Then, I started managing bankruptcies. After, I started running those departments, then running quality control, then being moved to correspondent where I was handling the buybacks. Later, I began underwriting loans for a company, learning anything and everything about how to structure a loan, how to make it work, and how to make it sellable before finally moving into origination.

I am literally underwriting the loan in my head as I'm talking to them. I know which borrowers could default because I've worked with enough borrowers that have defaulted, been in foreclosure or had bankruptcies. In one conversation I know if this deal's gonna pan out or it's not worth wasting my time.

All of this knowledge and background is rare. It’s very rare you would find a loan officer that's underwritten or ran underwriting or has run so many departments associated with mortgages. Most of them just start originating.

“You can't look at what the Fed is doing. It's like driving a car and looking in the rearview mirror.”

–Risha Kilaru

Modex reported 2022 Volume: $539.07 million

Nguyen has so many clients, he doesn’t know what to do with them. At first, he built a do-it-yourself platform called Moso where borrowers can handle the loan process themselves, which allowed him to complete a record amount of loans in a year. It ended up being so successful for his company that it brought in even more clients. Now Nguyen is swamped. So, now he’s telling other originators to please use his platform.

What are your tips for marketing on social media?

Alot of clients come from social media, and it's the best way to get clients because it's cheap. If you don't have money, you need to go on social media. Use your phone to record a lot of videos with helpful content, and post it online.

If you get involved with Facebook, for example, you need to help other people.

You need to somehow let them know that you are an expert, and then they will come to you.

You have to provide very good advice and share your knowledge. You must answer their questions correctly and precisely. You need to show your product and pricing to the potential clients. So this is a way for you to let everyone else out there know about you as an expert, and that you have a good rate or good service. Ultimately, it's your chance to let other people know about you. Make a lot of noise.

What kind of buyers do you see coming to the market this year?

Mostly the younger generation. They are the ones that are going to buy homes this year. They are more active on social media too, which matches perfectly with my business model.

My model is heavily reliant on technology. We built a platform so good that our clients can come and check rates, apply for a loan, as well as monitor rates, and request us to lock their rate. We can interact online throughout the whole loan process — a 100% technology. And they are

the best segment to do this. They value technology more than the older generations.

What is your secret weapon?

My website is my biggest weapon. I closed 6,600 loans just last year, which comes out to be at least 500 closed loans a month. That means I have to have, on average, a thousand clients in my pipeline. Normally, to help or service 1,000 clients, I have to have an army of staff to help me. But with the Moso Technology, I can handle that amount of volume easily.

When clients hear about us, they go to our website where they can check and monitor the rate themselves. They can say, “Oh, the rate is too high. I’ll wait for the rate to drop a little bit lower before I apply.” They can also use Rate Alert, which is a daily email updating them on the current rate, then they can click on a button to lock the rate whenever they want.

Although we have a huge amount of transactions, nobody complains. We get perfect five star reviews. No other mortgage company in America has that type of reputation.

Don’t worry, Nguyen isn’t gatekeeping this technology from the rest of the industry. Loan Factory opened it up for other brokers to use through a $50 monthly subscription. The company has not been able to promote it yet, because they are swamped with clients. Nguyen said they have over 40 brokers who have been using it for the past four years, and they are loving it.

“My website is my biggest weapon. I closed 6,600 loans just last year, which comes out to be at least 500 closed loans a month.”

–Thuan Nguyen

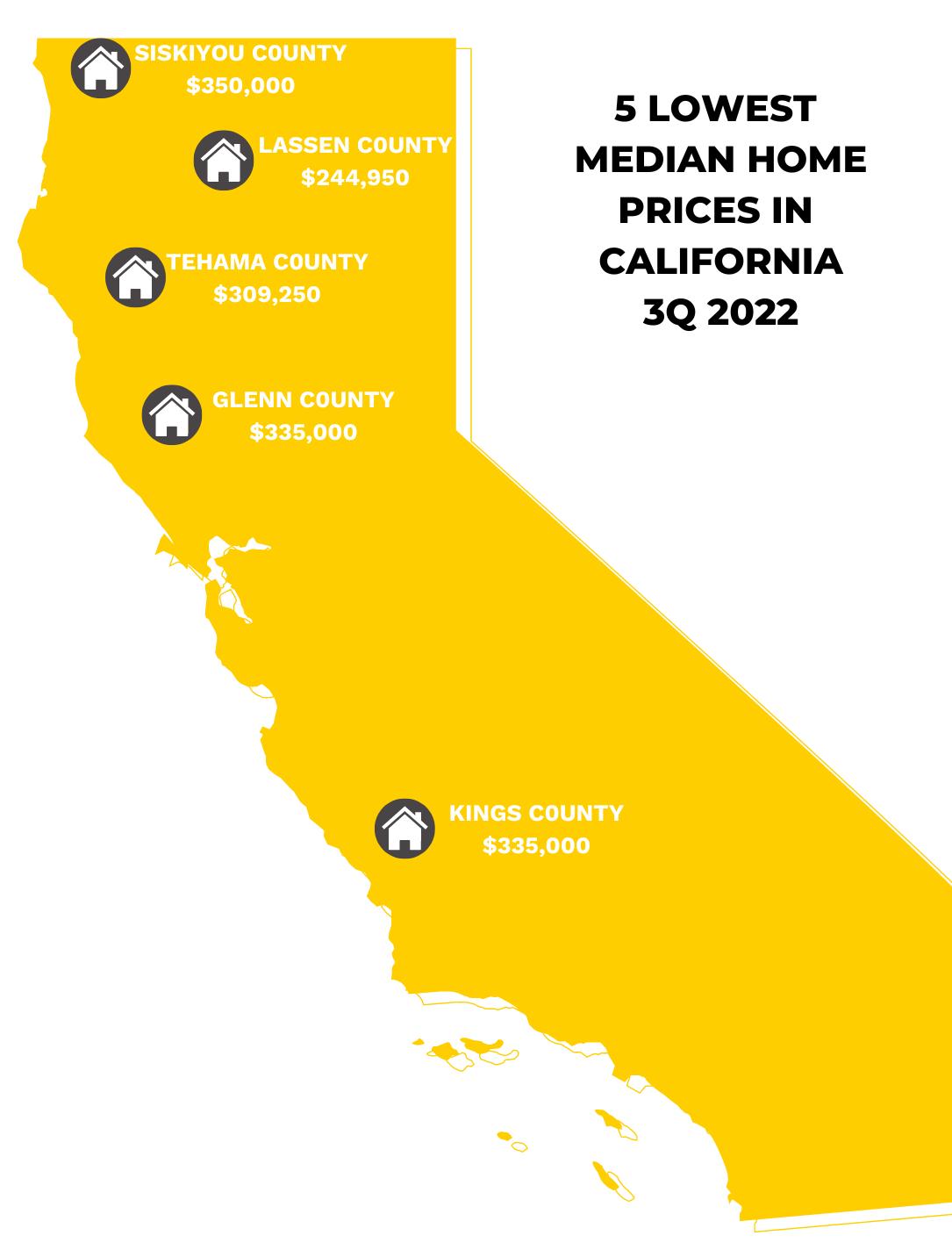

For the State of California

It’s no longer possible for mortgage originators to rely on gut instincts, especially in a market like California that requires being at the top of your game.

To keep you better informed, California Broker Magazine tracks information provided about the Golden State.

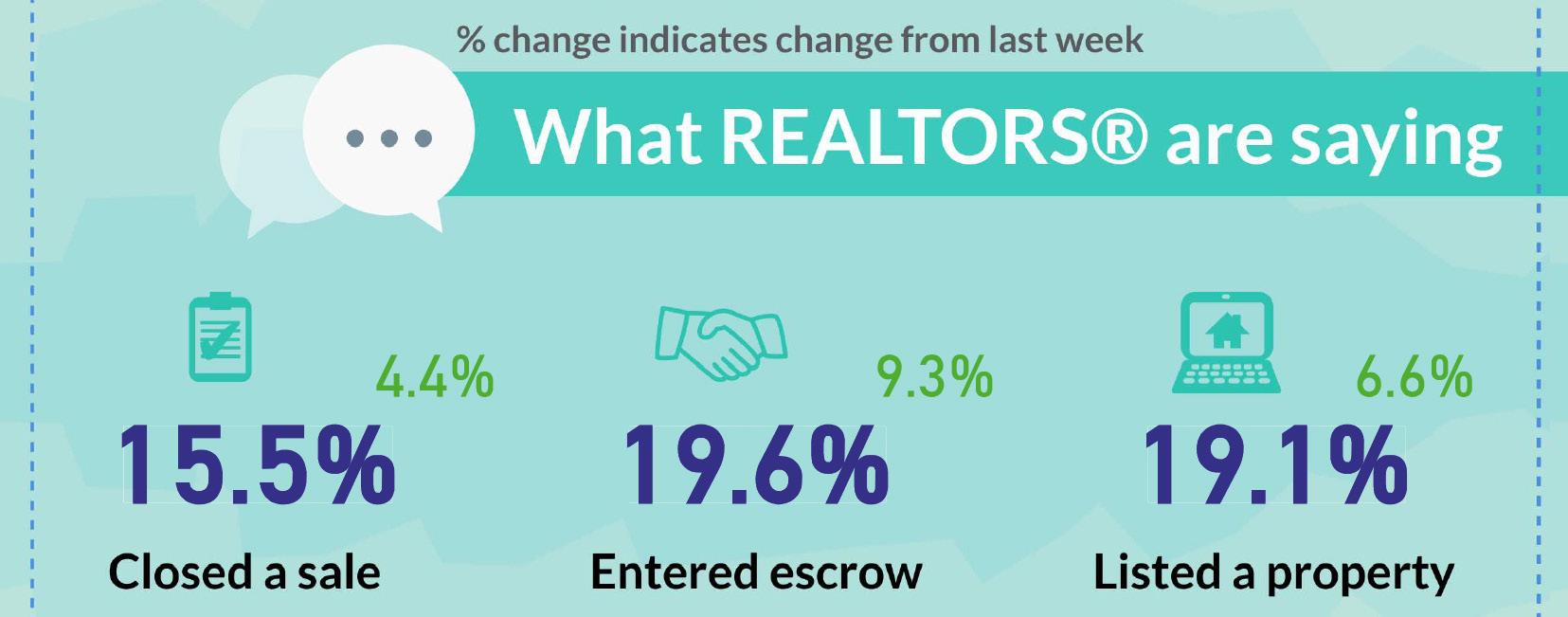

Delve into the data that shows you the mindset of Realtors. Want them to refer business to you? It helps if you know how their business is doing.

Also, data shows where former Los Angeles residents are moving to. While it may seem as if your losing customers, the smart loan originator knows to keep in touch even with customers who have left California. Know what out-of-state markets you need information on. By the way, our sister publication, National Mortage Professional Magazine, helps you track national market trends.

Important to track, too, is where the lowest median home prices are in California. Those markets could be particularly affected

www.car.org

by investors, as well as homeowners who don’t to move because of low mortgage rates and higher housing prices elsewhere. It’s data that helps you form better action plans for growing your business.

Interested in other data? Know other data sources we should be following?

Drop a note to Senior Editor Keith Griffin at kgriffin@ambizmedia.com.

MAY 4–5, 2023

Irvine, CA | www.camortgageexpo.com

California’s largest mortgage events for loan origination professionals, bringing together hundreds of mortgage brokers, loan originators and bank and credit union lending officers from throughout the region for an event full of education, networking and fun. The event will include a broad array of event partners from throughout the mortgage community, multiple educational sessions and top speakers. You’ll be growing your business and your contacts in a setting packed with passion, professionalism and fun!

AUGUST 10, 2023

San Diego, CA | www.camortgageexpo.com

California’s largest mortgage events for loan origination professionals, bringing together hundreds of mortgage brokers, loan originators and bank and credit union lending officers from throughout the region for an event full of education, networking and fun.

AUGUST 18 — AUGUST 20, 2023

Las Vegas, NV | www.originatorconnect.com

Be part of the nation’s largest and most innovative mortgage conference focused solely on the origination community at brokerages, banks and credit unions. A three-day weekend event that motivates originators, drives your business forward with new tools, and energizes and educates on ways to propel volume to new heights.

SEPTEMEBER 12, 2023

San Francisco, CA | www.camortgageexpo.com

California’s largest mortgage events for loan origination professionals, bringing together hundreds of mortgage brokers, loan originators and bank and credit union lending officers from throughout the region for an event full of education, networking and fun.

NOVEMBER 7, 2023

Pasadena, CA | www.camortgageexpo.com

California’s largest mortgage events for loan origination professionals, bringing together hundreds of mortgage brokers, loan originators and bank and credit union lending officers from throughout the region for an event full of education, networking and fun.