SALUTES THE 2023

A HOME FOR ALL

WHY THE MORTGAGE INDUSTRY PROVES POPULAR WITH IMMIGRANTS

GET ON BOARD WITH BUYDOWNS

The savings are better than price cuts

KEEP THAT PIPELINE FLOWING A TIP A DAY FOR SOCIAL MEDIA

5 TO MAKE YOU THRIVE

NMP

SALUTES THE 2023

A HOME FOR ALL

WHY THE MORTGAGE INDUSTRY PROVES POPULAR WITH IMMIGRANTS

GET ON BOARD WITH BUYDOWNS

The savings are better than price cuts

KEEP THAT PIPELINE FLOWING A TIP A DAY FOR SOCIAL MEDIA

5 TO MAKE YOU THRIVE

Broker business is built here.

In California, brokers, originators, and support staff love the California Mortgage Expo. The show, which is available in Irvine, San Diego, Oakland, and Pasadena, offers educational sessions, product showcases, networking opportunities, and more (we can’t forget to mention the hors d’oeuvres, open bar, and networking parties). Attendees also have the chance to renew their NMLS license with the class the following day. Plus, the show is free for NMLS licensees* with our code NMPFREE.

No brainer? We think so.

MAY MAY

04 05

Thursday, May 4, 2023

California Mortgage Expo

Friday, May 5

NMLS Renewal Class

Look The Other Way I

t’s a tumultuous year. Refinances have dried up like the Great Salt Lake. Purchase mortgages look like they’re hovering at the same level as Lake Mead. So loan originators are all wondering how to stay afloat, how to expand their market base, how to diversify their business offerings.

Perhaps the answer isn’t so much in paying attention to new products, but in new people. Specifically, tapping into diverse markets that have been previously overlooked.

It’s not hard to see that ours is an industry that often reaches for low-hanging fruit. That means well-qualified borrowers, easily underwritten, who check off all the conforming boxes. Push those apps through processing and underwriting, and move on to the next deal. But the next deal may not be out there waiting where most LOs are looking.

Patty Arviello at New American Funding built her entire company on the truism that few mortgage lenders were giving more than lip service to the Hispanic community. She looked at culture, community and competition, and decided that she could be the best lender serving all three. That’s the kind of ranking that’s hard to objectively affirm, but the shelves of awards from those communities speak loudly about the appreciation for her approach, and the high volume of business New American does in minority neighborhoods speaks to the value of her business acumen.

It’s hard, though, to be a lending force in a community where you don’t have any real connection. An all-White brokerage team, for instance, may not be wildly successful in a predominantly Black city. That’s why even the smallest brokerages should be looking at the demographics around them, and then take a good hard look at their staff. If your market has been traditional middle-class borrowers, mostly caucasian, and you can see that there are a lot of Asian residents in or near your market, building a staff that understands those borrowers is in everyone’s best interest.

In this issue, we have some great tips for social media marketing. And we’ve got expert advice on non-traditional loan products that originators should be offering. That’s all good information. But execution is the proof, and success there will be built by people who know how to connect with audiences that you may not yet be reaching — or understanding. Don’t ignore or underestimate a great business base that may be in front of you just because that opportunity doesn’t look the way you expect it to.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Keith Griffin

SENIOR EDITOR

Gary Rogo

SPECIAL SECTIONS EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Douglas Page, Sarah Wolak

STAFF WRITERS

Rob Chrisman, Dave Hershman, Erica LaCentra, Nick Roberson, Lew Sichelman, Mary Kay Scully

CONTRIBUTING WRITERS

Nicole Coughlin, Nichole Cakirca

ADVERTISING ASSOCIATES

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael

PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Stacy Murray, Christopher Wallace

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise

MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Joel Berman

FOUNDING PUBLISHER

VINCENT M. VALVO Publisher, Editor-in-Chief

The Essential Element — Conducting Status

Don’t let management of your pipeline curtail production

BY DAVE HERSHMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

An often-overlooked essential part of a loan officer’s job is the successful management of their pipeline. Poor pipeline management will essentially keep a loan officer

from reaching their potential in the long run. Every day there will be issues coming up on loan files, conditions or stipulations returned by underwriters, delayed settlements, and more.

The process of managing a pipeline can be totally encompassing for anyone who maintains a mediumto-heavy load of production and even derails lower producers. Without a way

to organize the many, many tasks that must be accomplished, it can also lead to the curtailment of future production or recruiting if the producer is also a manager. Or many times in this industry it has led to burnout.

I know this because I have not only witnessed the inefficiencies and burnout, but I have also managed a pipeline of over 100 cases before the era

A manager is responsible to make sure that they are helping their sales force develop these skills to contribute to the growth of their personnel.

of automation. I had to learn by trial and error. The truth of the matter is we have spent little time helping loan officers learn what it takes to effectively manage a pipeline. In my experience, there are basically two types of loan officers:

• First, those who throw their loans into the office and say — see you to collect my paycheck after the loan is closed.

• Second, those who hover over the processor — trying to micromanage the process and growing cobwebs in the office (or at home).

You can understand that either style is not effective. There needs to be a balance. This is why I have always advocated the conducting of status.

WHAT IS STATUS?

Status is a regular meeting between processor and loan officer. This meeting goes over the pipeline and determines what tasks must be accomplished to make sure the customers are served.

HOW OFTEN IS STATUS ACCOMPLISHED?

There is no set rule, but generally it is more effective to status one time per week. One time per month is not often enough and conducting status every day is exactly what we are trying to avoid.

WHAT DAY OF THE WEEK IS MOST EFFECTIVE?

This will also vary. I tried to hold status on the same day we had our sales meeting. That way, theoretically, the loan officers were in the office only one day each week — assuming they and processors are not remote.

WHAT IS ACCOMPLISHED DURING STATUS?

During status, you are determining what needs to be done on each file. For example, some loans need to be submitted to underwriting, others need to be locked, and still others need a conversation with the applicant(s).

WHAT RESULTS FROM STATUS?

Status should result in more than a list of items that need to be accomplished. Status will also result in agreement as to

who is going to accomplish each task. You should note that the determination of who will be accomplishing each task might vary from week to week. For example, if the processor has a heavy load one week, the originator may help with some phone calls. If the pipeline is light, the processor should be doing everything possible to take the burden off the originator.

the task is finished. It will not eliminate all verbal communication — but it should help organize the task, and that is what pipeline management is all about.

WHAT IF PROCESSING IS REMOTE?

Remote processing will call for remote status as well. This could be over the

There should also be no general rule in place that covers all circumstances. For example, perhaps the processor procures all conditions. But there may be some conditions that are so important they need to be discussed with the applicant, and the loan officer is the proper person to conduct that discussion. Perhaps the condition is a larger down payment. Do you want the processor calling to say that we need an extra $50,000 down?

THE RULES OF SYNERGY AS APPLIED TO PIPELINE MANAGEMENT.

As always, we try to integrate the rule of maximum synergy marketing. It might seem that procuring tax returns is a very simple condition. But should the loan officer take this opportunity to meet the accountant? This could be a major contact that could help further the goals of production. Remember, every action could have a second objective. And some targets are more effective than others!

WHAT HAPPENS AFTER STATUS?

After the status list is produced, each participant should know what his/her job entails more specifically. At this juncture, the actor can keep the other person updated via email, letting them know that

phone or even video conferencing. What makes status quite impossible is the spread of one loan officer’s caseload over several processors — sometimes referred to as rotational processing. I personally am not a fan of this setup, but it does have the advantage of more even distribution of the numbers. No large producer wants to be dealing with four or five processors.

Again, management of a pipeline is a key skill that can make or break a loan officer. A manager is responsible to make sure that they are helping their sales force develop these skills to contribute to the growth of their personnel. It also grows the capacity of operations — something very important when mortgage companies are trying to increase efficiencies. n

Senior Vice-President of Sales for Weichert Financial Services, Dave Hershman is the top author in this industry with seven books published as well as the founder of the OriginationPro Marketing System and the OriginationPro Mortgage School — the online choice for mortgage learning and marketing content. His site is www. OriginationPro.com and he can be reached at dave@hershmangroup.com

Status is a regular meeting between processor and loan officer. This meeting goes over the pipeline and determines what tasks must be accomplished to make sure the customers are served.

What Does Your Company Stand For?

The Importance of Establishing Core Values for Your Organization

, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

If someone asked you what principles does your company operate under, would you be able to answer easily? How about if they asked your employees or colleagues? Would they have the same response? If you are struggling to answer this question or if you and your colleagues’ answers just aren’t matching up, it’s probably time that your organization developed and implemented core values.

WHAT ARE CORE VALUES & WHY DO THEY MATTER?

According to YourDictionary.com, core values are defined as “the fundamental beliefs of a person or organization” (https://examples. yourdictionary.com/examples-ofcore-values.html). Companies typically create core values either when they are founded or as they start to grow to ensure there is some sort of guide for how the organization should be operating, what common goals they

should be working toward, and what sets them apart from competitors.

Core values may need to be tweaked or adjusted over time as a company continues to grow. Having them from the early stages of your company ensures that your entire organization is working and operating under a shared vision.

From how your company makes decisions, to how you treat clients, to the types of individuals you look to hire, and so much more, core values dictate how your organization functions long term. If you do not define and own your company’s core values, your company’s values may be assumed or evolve on their own, which may be to the detriment of the organization. In this case, you run the risk of your organization becoming fragmented with employees having different ideas of what does and doesn’t matter, which can lead to employee dissatisfaction and your overall brand suffering.

HOW TO DEFINE CORE VALUES

So, knowing that core values are important to the future of your business, if you haven’t defined them yet, it can be a somewhat daunting undertaking. However, don’t overthink the process, it doesn’t have to be complicated. First, pick someone to lead the effort. This individual will oversee and guide this process and keep things on track. They will need to get input

from employees and the executive team, and, most importantly, articulate every step of the way why this effort is happening and why it’s important to your organization.

From there, your point person should assemble a team of key individuals from your organization, founders, executives, and long-time employees who understand the general vision of the business and future plans of your organization. This group will be critical to helping sort through ideas and ultimately choose your company’s core values.

Once your team is assembled, have them identify what they believe are the company’s values, or what values they feel the organization currently embodies. Ask this team pointed questions such as “where are the organization’s strengths?”, “what behaviors or traits do employees display that improve the organization?”, “what differentiates us from competitors?”, and “what would our customers say distinguishes us as a company?” Asking questions like these will stop your team from throwing out vague buzzwords and allow for the creation of more well-defined core values that will truly be unique to your organization.

Once you have a general list from your team, it’s just a matter of condensing that information and refining it until you have your final list of core values. While there is no perfect number, keep

in mind that you want your core values to be simple to understand and easy to remember. Keep your core values short and sweet, preferably under 10 words per value, because in this instance less is usually more. While you may not get complete consensus from your team, having most of the team agree on your values should be considered a success. Any values that are more widely contested can be left off your final list or even revisited at a later date.

You will want to take stock of our core values at key junctures of your business, such as expansion, to ensure they still align with your business. So whomever is leading the effort to create your core values should be sure to keep notes throughout the process to make any revisions in the future easier. But once you have a strong list of agreed-upon values, you can consider your efforts a success, and then it’s just a matter of incorporating them into your company.

LIVE YOUR CORE VALUES

Defining your company’s core values is not the end of the process. In fact, what comes next is arguably more important than selecting them in the first place. These core values need to be embedded in the company to ensure they succeed. Weave them into your corporate culture. Make sure your employees not only know what your core values are but how they can embody them within your organization every day. Display them, create initiatives and rewards around them, and get creative. Your employees should be reminded of your core values every day. When done properly, employees should feel more connected with your organization because they will know what is expected from them as employees. This leads to everyone being on the same page, working toward the mission your company is trying to accomplish, and strengthening your company as a whole for long-term success. n

Erica LaCentra is chief marketing officer for RCN Capital.Don’t overthink the process, it doesn’t have to be complicated.

While there is no perfect number, keep in mind that you want your core values to be simple to understand and easy to remember.

Buydowns Vs Price Cuts: We Have A Winner

Mortgage originators need to make sure they tout benefits of buydowns

BY LEW SICHELMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Home builders are using the hell out of mortgage rate buydowns to bring would-be buyers to the table. Individual sellers, not so much.

The latest study from the National Association of Home Builders shows that one in four builders is buying down the rate for customers who sign on the dotted line. But John Burns Real Estate Consulting says that percentage is much higher among its builder clients. In a recent national survey, three out of four confirmed they are paying lenders to lower their buyers’ loan costs to make their payments more affordable.

But in what is perhaps an offhand comment in a recent newsletter, the Irvine, Calif.-based marketing firm noted that “few sellers are offering these savings to prospective buyers.” Why this phenomenon is occurring wasn’t noted. But it seems to me there are plenty of culprits to go around.

Start with real estate agents, both those who list houses for sale and those who bring would-be buyers to sellers’ doors. It seems to me that both subgroups should be advising their clients about the benefits of a buydown — to the seller who might need a little help finding qualified buyers and to the buyer who might need a little help making his house payments, at least when he’s starting out.

TOUT FROM THE TREETOPS

Next on my list of perps are mortgage brokers and funding lenders, both of which should be touting temporary buydowns to would-be borrowers from the treetops. That is, their first-year payments for interest and principal can be made substantially lower. Perhaps even their second-year payments can be reduced as well. And maybe, if the seller is willing, the borrower’s monthly outlay can be lowered for the entire term of the loan.

That last one’s a stretch, admittedly. But according to the Burns firm, about a third of the surveyed builders are buying down buyer’s mortgage rates for a full 30 years. To do that, they’re paying the roughly 5 to 6% of the sales price up front to the lender, effectively prepaying the interest on the loan. A slightly lower percentage are opting to reduce the rate for the first two years of the mortgage, while the remaining were identified as offering a one-year buydown or another, less common form of alternative financing.

With a 2-1 buydown, a builder would pay roughly 2% of the loan amount. That would bring the rate down from, say 6.5% to 4.5% in the first year of the mortgage. In the second year, the rate would bump up a notch to 5.5%. And then, starting in the third year and lasting for the duration, the rate would return to 6.5%.

So, assuming a conventional mortgage with 20% down, a 2-1 buydown would cost 2% of the sale price, the Burns firm says. On a $340,000 house, the cost, then, would be $6,300. But the drawback is that, for the most part, borrowers still have to qualify at the highest rate. Those who can gain “some breathing room.”

HELP FOR THOSE WHO NEED IT

For those who can’t qualify, builders are switching to full-term buydowns so their customers can make the grade. To do so, though, is expensive. To cut the rate on the $340,00 house in the example used above, the cost is $16,300. On a $590,00 house, it would be a whopping $28,300.

“Builders love buydowns,” says Kevin Parra, CEO of Plaza Home Mortgage in San Diego. “They always have.”

It’s doubtful many individual sellers are willing to donate twenty grand or so of their profits to the strangers buying their homes. But the cost of the shorterterm buydowns is much more palatable.

I asked Parra and his team at Plaza to work up a few examples for a house selling for $375,000. Assuming a 20% down payment, the loan amount would be $300,000. At Plaza, a wholesaler that works through both the broker and correspondent channels, the cost to the seller on a 2-1 buydown would be 2.2 percent, or $6,600.

The savings to the buyer, though, is considerable: $366 a month in the first year before dropping to $188 monthly in the second. A one-year buydown would save the borrower $188 a month, but the cost to the seller is just 0.75% of the loan amount.

But there’s a somewhat hidden benefit to buydowns most people fail to consider. If rates come down and

the same time, 29% are paying their buyers’ closing costs and 27% are offering options or upgrades at no or reduced costs. In Texas, Ben Caballero, the Guiness world record holder for residential real estate sales, tells me 95% of the sales by builders in the four major Lone Star State markets come with $20,000 to $30,000 in buyer incentives.) But the benefit to the buyer by lowering the price is minuscule compared to the savings generated through a buydown. In our example above, dropping the price $5,000, from $375,000 to $370,000, saves the buyer just $24 a month, an amount that hardly makes a difference.

Plaza was one of the first to market buydowns. Connecticut-based Planet Home Mortgage also is a long-time player. Now, others are starting to find the market. Most recently, I’ve noticed that LoanStream Mortgage in Irvine, Calif., is offering 2-1 and 1-0 buydowns on both conventional and FHA loans.

the borrower refinances before the buydown period comes to an end, Parra points out, the prepaid interest — that’s what a buydown really is, prepaid interest — what remains in that escrow account is returned to the borrower, not the seller.

LOWER PRICES NOT AS GOOD?

Now let’s look at how the above example stacks up against lowering the price, say, by $5,000. Lowering prices to attract more interest is a familiar tactic, of course. Even builders are dropping prices in the current market. About 30% are trimming prices or reducing their margins, the NAHB reported recently. (Actually, builders are pulling out all stops these days, the NAHB found. Either instead of cutting prices or at

Meanwhile, Hollywood, Fla., based A&D Mortgage is offering 3-2-1 buydowns. And United Wholesale Mortgage has expanded its buydown program to include prime jumbo borrowers.

Now it’s time, it says here, for brokers and real estate agents to get in the game. n

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country. He also has been real estate editor at two major Washington, D.C., dailies and spent 30 years on the staff of National Mortgage News, formerly National Thrift News.

It’s doubtful many individual sellers are willing to donate $20,000 … of their profits to the strangers buying their homes. But the cost of the shorter-term buydowns is much more palatable.

PEOPLE

BUILD A BROKER Rise Above The Rest

7 Social Media Strategies

YOUR FIRST MILLION DOLLARS

Mellow Those Harsh Words

BENCHMARKS & BEST PRACTICES

Fight The Power Of Fraud

CAREER TICKER People On The Move

> Union Home Mortgage, an independent mortgage banking company based in Strongville, Ohio, has hired Erin Stark as its new regional manager for Texas.

> Colliers Mortgage, the debt financing arm of Colliers | U.S., hired Matthew Rocco as its president.

> NexBank, the largest privately held bank based in Texas, announced that Brian Ralston has been promoted to executive vice president, chief mortgage banking officer.

> Flyhomes has appointed Andrea Collins as chief marketing officer. Collins will lead the Flyhomes mortgage and closing businesses.

> Union Home Mortgage, an independent mortgage banking company based in Strongville, Ohio, has hired Erin Stark as its new regional manager for Texas.

> Colliers Mortgage, the debt financing arm of Colliers | U.S., hired Matthew Rocco as its president.

> NexBank, the largest privately held bank based in Texas, announced that Brian Ralston has been promoted to executive vice president, chief mortgage banking officer.

> Flyhomes has appointed Andrea Collins as chief marketing officer. Collins will lead the Flyhomes mortgage and closing businesses.

5 Loan Products That Will Make You Thrive In 2023

How to rise above the rest in what is bound to be a distressed market

BY JOE CAMERIERI, SPECIAL NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Given the current mortgage loan volume predictions we’ve been seeing the experts relay, it’s clear that you will either grow in 2023 or face the very real possibility of being forced out of the business. There simply won’t be enough new mortgages next year to satisfy the revenue demands of the lenders still in the business, to say nothing of

meeting their growth objectives. To make matters worse, many lenders are still paying the high overhead expenses of overcapacity.

But in every market, even those that seem the most distressed, there will be leaders who rise above the rest and grow in spite of everything.

To win in 2023, lenders will have to do a number of things right, including:

• Right-sizing their organizations to staff

appropriately;

• Streamlining their operations for efficiency to do more with less;

• Refocusing their process for better borrower and employee satisfaction;

• Reducing overall origination costs by better leveraging their tech stacks;

• Making any required corrections to their existing compensation plans;

• Closing every loan faster.

But none of those will matter if lenders don’t do a good job of getting new loan applications into their pipelines.

Some of that will depend on good marketing to the business referral partners, homeowners, and new homebuyers living in the markets they serve. But a lot of it will depend upon offering the loan products that borrowers need now.

If lenders can’t meet the actual needs of the borrowers their business referral partners bring them in 2023, they won’t grow. They may not even survive.

Here are five loan products — in addition to the plain vanilla agency paper that everyone sells — that should be on every lender’s menu going into the new year.

NON-QUALIFIED MORTGAGES (NON-QM)

Rising interest rates and high home values have left many borrowers feeling priced out of the market. When borrowers see the monthly payments that result from agency loans, they feel homes are too expensive. That’s not really the case. At the same time, inflation has caused more consumers to fall back on credit cards, which reduces their credit scores. Product innovation,

predominantly in Non-QM lending, can help both types of borrowers and the lenders who serve them.

In fact, Non-QM lenders are finding strong demand for their products right now. We work with hundreds of lenders who originate loans for their own portfolios, as well as some of the largest independent portfolio lenders in the country, and they are still aggressively promoting Non-QM loans to their applicants and serving more borrowers.

Some have put the size of the total addressable market for Non-QM lending somewhere between $175 billion and $200 billion. That might be on the low side.

Inflation aside, a strong job market is keeping consumers optimistic. We’re seeing consumer spending increase, which could lead to more demand for HELOCS in the future.

While loan balances are lower and few borrowers traditionally tap their entire line of credit, it’s a loan product we expect to see borrowers requesting more often next year.

Banks used to predominantly deliver this product, but there are options for IMBs to get into this mortgage segment as well.

REVERSE MORTGAGE LOANS

After years of consumer education by a number of large players in the reverse

HOME EQUITY LINES OF CREDIT

Cash-out refinances don’t make sense for most existing homeowners today, and they won’t for some time. This doesn’t mean consumers won’t have a need to tap their existing home equity.

The Home Equity Line of Credit (HELOC) is a good solution if the lender can make qualification easy and funding quick.

mortgage space, we’re beginning to see more interest from aging borrowers for these loan products. People seem to understand what this loan product is for and how to use it.

Higher interest rates make these loans less attractive to some borrowers because it limits the amount of equity

CONTINUED ON PAGE 16

> Ncontracts, a provider of integrated compliance and risk management solutions to the financial industry, announced the promotion of Cathy Guthrie to chief human resource officer. > Trinity Oaks Mortgage announced the promotion of John Picinic from sales manager to executive vice president, production. > Sales Boomerang and Mortgage Coach announced the appointment of Shelli Holland to the role of chief people officer. > Churchill Mortgage has hired Kisha Weir as VP of Sales for the Pacific Northwest region.If lenders can’t meet the actual needs of the borrowers their business referral partners bring them in 2023, they won’t grow. They may not even survive.

5 LOAN PRODUCTS

CONTINUED FROM PAGE 15

homeowners can pull out of their homes through these products. Even so, reverse mortgages can be more attractive than home equity loans for paying end-of-life expenses.

Add to that the demographic data that shows how quickly the U.S. population is aging and you can see how important it is that lenders offer these products.

Leaning into this product is not an easy lift, but more and more forwardlooking lenders are adding this capability to their platforms.

ADJUSTABLE-RATE LOANS

Many who have only been working in this industry for a decade or so may be operating under the erroneous assumption that adjustable-rate mortgages (ARMs) caused the financial crisis. That’s not true.

These loans can make sense for borrowers who qualify but want a more affordable mortgage. Given that most people will not remain in their homes for very long before moving, trading up or downsizing their residence, ARM loans can make a lot of sense.

HOME IMPROVEMENT LOANS (FIXED BALANCE HOME EQUITY)

If buying a new home is too expensive, as many Americans are finding it to be today given home prices and current mortgage interest rates, a good alternative is to take out a home equity loan to make adjustments to the homeowner’s existing property. Again, the smaller loan balances may

lead some lenders to discount these products, but each loan adds to the lender’s overall loan volume. Besides, with the right technology, these loans can be fast, easy, and very affordable to originate.

By offering the loan products that more borrowers want, lenders will naturally have an advantage over their competitors with the consumers in the geographies they serve.

One important key to success with a broader menu of mortgage loan products is having a single technology platform that can originate anything the lender sells to a borrower. When additional technology is required to expand the business into new lines, the overall profitability of the strategy is reduced.

Fortunately, there are loan origination platforms that can originate all of these products and more. Even better, these next-generation LOS platforms can also deliver most of the other success requirements mentioned at the beginning of this article. There will be no silver bullet or magic elixir for success in the year ahead, but doing more of these things right will set some lenders up to grow, even in 2023. Those with broader product menus will likely get the first shot at new business. n

Discover Where Your Competitors Stand In The Mortgage Market

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Mortgage MarketShare Module

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Loan Originator Module

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

GET A FREE MORTGAGE COMPETITOR ANALYSIS

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

BENEFITS

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

NEED MORE DATA?

Inquire about our NMLS Data Licensing and LO Contact Database options.

Get Lucky With These Top 7 Social Media Marketing Tips

Follow these strategies to achieve greater overall business success in 2023

BY SCORE, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL MAGAZINESocial media is an everchanging landscape, ripe with possibility. In 2023, in order to best leverage social media for your business, you’ll need to prepare for what’s on the horizon.

According to multiple published sources, 30.57 million businesses in the U.S. alone used social media for marketing in 2022, and that number is only expected to increase in 2023. How can you best utilize social media marketing in the new year to stand out from the other 30 million businesses? How can you be certain you’ll be prepared for the changes 2023 brings with social media? Whether you have created an account on every social media platform already or you’re just

starting out, the following tips will help you achieve success with your social media marketing efforts in 2023.

1. AUDIT YOUR CURRENT SOCIAL MEDIA PLATFORMS

It may be time to do an inventory of the platforms you are using. Many companies think they need to make accounts on every social platform, giving them all equal attention. If that sounds like your company, take stock of performance on each platform over the last year. For example, if you’ve been posting tweets on the company’s Twitter account consistently but have seen no indication of growth, engagement, or sales from Twitter, it may be time to phase that out and redirect that energy and attention to a

platform that is actually working for you. It’s OK not to be everywhere all at once, all of the time. Prioritizing the best platforms for your business can help you free up the time and energy to make content that will actually convert.

According to a 2022 study by Sprout Social, platforms like Facebook and Instagram tend to be more popular with millennials, gen-X, and baby boomers and see slightly more males than females using those apps. Meanwhile, TikTok’s users skew younger, with 25% being between the ages of 10-19, and a whopping 61% of users are female. Dig into the numbers of each platform and see if this aligns with your customer base before determining how much attention to give it.

2. PRIORITIZE VIDEO CONTENT

At the forefront of your content planning should be video content, short-form, or long-form. Every social media platform has video capability, and with TikTok speedily rising in the ranks to become the most popular app, all other social media platforms are trying to follow suit. On Instagram and Facebook, Reels are being pushed to users above all other types of content, and in 2023 we can expect to see this continue. This year, brands overall earned nearly 40% more engagement using Reels on Instagram than they did with other types of posts.

We know that video ads consistently

However, doing so may be a mistake that’s costing you. If you’re posting on social media for your business, you need to be consistently using social media on a personal basis.

Many businesses are missing the mark when it comes to successful social media, and the key reason is that they are approaching it like traditional marketing and not from the viewpoint of the user. Anyone on your team that has the power to influence your social media marketing must interact with social media personally daily. You would never sell a product that you yourself haven’t used and can attest to its value; why would you create content

average use time being around 90 minutes a day. With impressive statistics like this, it’s surprising that many businesses are slow to make the jump over to TikTok for their marketing efforts.

Brands are seeing immense growth on TikTok and are even tapping into new audiences completely organically. In fact, it’s likely you may already have supporters on TikTok, who are ready to support and engage with your content as soon as you join. While TikTok is a favorite of Gen-Z, they are not the only users of the app. In fact, the vast majority (73%) of users are between the ages of 18-35.

Nearly half of Gen-Z is using TikTok for search instead of Google, according to Google’s own data. On top of that, not only is TikTok’s algorithm powerful, but its SEO is huge with tens of millions of searches per day. By simply having a presence on TikTok, your brand awareness could increase exponentially, bringing with it more valuable and genuine social listening than you’ll even know what to do with!

outperform static ads, and the same can be said for organic content. However, with short-form content gaining so much traction over the past two years, we may see people growing fatigued with 10-second videos and instead opting for things that are 3 minutes or longer in length. Recently, TikTok updated its maximum video length from 3 minutes to 10 minutes, and other platforms may follow suit. If it makes sense for your business to use long-form video as a marketing strategy, you may want to consider producing content like this. Either way, video content will still be more popular and effective in 2023 so long as the algorithms continue to prioritize it.

3. USE SOCIAL MEDIA PERSONALLY

As a businessperson, you may feel that you don’t have time to engage with social media on a personal level, and you only interact with it while using it for marketing purposes.

if you’re not a content consumer as well? Pencil in time to unwind on Instagram or TikTok and try your best to approach it with a consumer mindset, not a marketer’s mindset.

In using social media apps, you will not only keep up with trends that your company could follow, but you will also be able to gain priceless insights from your customer base by seeing how they interact with competitors or even other businesses in different industries. Your algorithm will become personalized the more you use these apps. With that, you will pick up on what makes social media marketing successful. You’ll soon begin to notice how bad social media marketing sticks out like a sore thumb. Finding success on social media can sometimes be as simple as jumping in at the right time or understanding the hard-to-describe “it” factor.

4. MAKE THE JUMP TO TIKTOK

TikTok has over 1 billion monthly active users and counting, with the

Do you have to dance to be on TikTok? Absolutely not. In 2023, social media is trending toward being more about the value it brings to the consumer rather than purely entertainment factor. This means that you could create content that highlights your products, your brand story, and behind-the-scenes footage of your facilities without anyone on your team ever having to learn a single dance move. That being said, keeping your finger on the pulse of what is trending will give you a leg-up on TikTok, but that doesn’t mean you have to participate in every single trend, either.

5. USE THE RESOURCES YOU HAVE

You may be a small operation, but when it comes to marketing on social media if you want to do it well, it might be all hands on deck. A few years ago, a small business could easily manage

Prioritizing the best platforms for your business can help you free up the time and energy to make content that will actually convert.

7 SOCIAL MEDIA TIPS

CONTINUED FROM PAGE 19

and maintain its social media accounts with just one person handling it parttime. In 2023, social media marketing is likely going to require more energy and brainpower than before. The best way to tackle this challenge without getting overwhelmed is to utilize the resources you already have.

Now that you’re ready to start making video content, you might realize it can be a big undertaking. If filming video content seems daunting to you, try and use the resources available to you to simplify it. Use your phone to film and don’t worry about doing any flashy editing to start off with. Contrary to popular belief, your content does not have to be perfect or polished to be worth posting, especially when you’re just starting out. People will find less-thanperfect content to be more authentic and relatable anyways, so don’t let that stop you from getting started.

Maybe you already have product photos or instructional videos that you’re using. Great! You can repurpose those in a new and fresh way on social media. No need to go through the process all over again if you already have assets that can be refreshed. This will also help free up the time it might take for thinking up new content.

If your business is more than just you, try and get your other team members involved to help think of ideas and create. Even if you don’t have other team members, you could always try and involve friends, family, or even your VIP customers! You’d be surprised by the valuable ideas people can offer or even how willing they might be to help you. A video of a customer’s testimonial can be a really powerful marketing tool.

6. GO LIVE

In 2023, social media live streaming is going to continue to be a great marketing strategy for brands. Nearly all social media platforms now have live streaming capabilities including Facebook, Instagram, Twitter, YouTube, and TikTok. Customers love to tune in

to live streams because they don’t want to miss out on something exciting that might be happening, or they might want to use that opportunity to ask questions. For businesses, this is a great real-time feedback system and customer touchpoint.

Live streaming is also great for brand reputation. By going live, you are building trust with your customers. You are also humanizing your brand and showing how authentic you can be. This kind of brand reputation building is hard to come by any other way. You can connect with your existing customers and expand your reach at the same time.

Try planning out consistent times to go live and let your followers know when you’ll be doing it. Use that time for customer Q&A, unboxing new merchandise, or educating customers on a new product or service. You can even surprise your viewers and reward them with a special coupon code for viewing, incentivizing them to join again next time.

7. GO FOR THE SOFT SELL

One of the most important things you can remember is to opt for a soft sell. Consumers are tired of being inundated with ads, and it’s no wonder they feel fatigued when the average American is exposed to anywhere between 4,000-10,000 ads per day. But when consumers don’t want to be sold to and you need to sell, what do you do

so your content isn’t muted?

Today’s consumers are generally distrustful of ads and are growing cynical about the attempts to win their buy. Influencer marketing is dying a slow death as Gen-Z finds these efforts to be fake. In 2023, traditional advertising is going to work less and less, and “sneakier” methods of selling, such as product placements and paid user-generated content (also known as UGC) will leave a bad taste in the mouth of customers. What people are desperate for is brand authenticity. Being straightforward with a soft sell is the most effective way of getting the information out there about your business. People will respect the genuine approach and will appreciate not being hit over the head with your call to action. Focus on using your social media to build your brand awareness, create community among your customers, and provide useful information. It’s a slower pipeline to sales, but it’s one that will make loyal repeat customers. In 2023, brands that connect with their customers on an authentic level will truly see success, and social media marketing is the perfect way in which to do so. n

This article was written for SCORE by CallRail. Since 2011, CallRail has helped more than 150,000 companies and digital agencies worldwide track leads back to marketing efforts.

ACC Mortgage

Rockville, MD

ACC Mortgage is the oldest Non-QM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

ACCMortgage.com

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

Angel Oak Mortgage Solutions

Atlanta, GA

Angel Oak Mortgage Solutions is the leader in the non-QM mortgage space. We offer alternative specialized mortgage solutions for brokers throughout the country helping borrowers who don’t fit conventional guidelines. We are pioneering a fresh approach to today’s mortgage lending challenges helping partners to grow their business.

angeloakms.com

(855) 631-9943

info@angeloakms.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WA, WV, WI, WY, DC and the District of Columbia

Acra Lending

Lake Forest, CA

Acra Lending is the leader in Non-QM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

Change Wholesale Irvine CA

Change Wholesale gives mortgage brokers an unfair advantage to close more loans, faster. Our CDFI certification from the U.S. Department of the Treasury allows us to offer proprietary programs that are tailored to meet the needs of commonly overlooked prime borrowers. Our flagship Community Mortgage requires no income, employment, or DTI documentation. Prime borrowers looking for their dream home or vacation getaway can get approved with just the first page of the bank statement.

ChangeWholesale.com

(949) 255-6085

info@changewholesale.com

LICENSED IN:, AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

First National Bank of America East Lansing, MI

Bio: FNBA is a portfolio lender with over 65 years of experience. We understand that in the Non-QM business, service makes all the difference. That’s why we are committed to providing you with the fastest turn times, exceptional service and loan programs that make growing your business easy!

fnba.com/mortgage-brokers

LICENSED IN: All 50 U.S. States

Harsh Words Are Hard To Heal

Respond rather than react for effective communication

BY HARVEY MACKAY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

One summer night at an all-girls summer camp, the campers were gathered in a circle for their nighttime devotions.

The counselor asked if any of the girls wanted to share something that had happened during the day which impacted them. One camper raised her hand and said a girl from another cabin had said something that hurt her feelings, and she was really upset about it.

The camp counselor went to the bathroom to grab a tube of toothpaste, then took the tube and squeezed out just a bit. She then tried to put the toothpaste back in the tube, but it just created a mess. Then she squeezed the tube even more, pushing more toothpaste out and creating even more of a mess, but none of it would go back into the tube.

The counselor told the campers, “This toothpaste represents the words you speak. Once you say something that you want to take back, it’s nearly impossible and only creates a mess. So think before you speak, and make sure your words are going to

words will never hurt you.” Wrong! I think the saying should be, “Sticks and stones can break your bones, but words can really hurt you.” Words hold tremendous power. They can shatter or make a career, kill or nurture a relationship, or break or heal a heart.

American poet Carl Sandburg said, “Be careful with your words. Once they are said, they can only be forgiven, not forgotten.”

There are all kinds of words: words of wisdom, words of encouragement, fighting words, words to live by, foreign words, simple words, big words, naughty words, strong words, last words. They all serve a purpose. Choose the right words for your situation.

Research has found that the people who talked trash about someone else unwittingly painted themselves with the same brush. On the bright

side: The same is true when the talk is positive.

FREUDIAN ADVICE

It’s much better to heed the advice of Sigmund Freud: “Words have a magical power. They can bring either the greatest happiness or deepest despair; they can transfer knowledge from teacher to student; words enable the orator to sway his audience and dictate its decision. Words are capable of arousing the strongest emotions and prompting all men’s actions.”

In my case, my mother, who was a teacher, set me straight around the tender age of 12. At that time, my idea of a vocabulary upgrade consisted of adding to the string of cuss words I could say without repeating myself. A colorful skill but of limited value in mixed company and it put me at personal risk within the

Mackay household.

Over the years, I have learned the value of using the right words at the right time. I choose words every day. When speaking, writing, requesting, and deciding, I use some words and not others. You do, too. The words we choose create meaning and mission in our lives. Every word and phrase you choose convey mood, tone, and meaning.

Remember, customers and colleagues come in every possible stage of enthusiasm, anxiety, understanding, and confusion. Pay attention! When you are

offering, asking, responding, explaining, invoicing, installing or advising — choose the words you use with care.

“Always keep your words soft and sweet, just in case you have to eat them,” said Andy Rooney, radio and

exacerbated this problem.

2. Be aware of your influence. This is especially true for authority figures such as role models, parents and teachers. Your words mean a great deal. To most people you might be just another person, but to that person you might be the world.

3. Respond rather than react. Too many people just say things off the cuff and then realize they can’t take them back. It’s like trying to put toothpaste back in the tube. If you want your words to work for you, work for your words. The result will pay off big time.

TV personality.

Here are three simple tips to consider:

1. If you don’t have anything positive to say, it’s better to say nothing at all. Take your emotions out. Too often we want to get our opinions out and slam the other person or try to get even. Social media has really

Mackay’s Moral: Your words say a lot about you: choose them wisely. n

Harvey Mackay is a seven-time New York Times best-selling author whose 15 inspirational business books have sold 10 million copies worldwide.

Words hold tremendous power. They can shatter or make a career, kill or nurture a relationship, or break or heal a heart.

The Fight Against Mortgage Fraud

Empower your borrowers with the correct resources for better compliance

BY MARY KAY SCULLY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Did you know that three out of five loans will have a critical error that jeopardizes the chance of referral, according to data from STRATMOR Group? You may be thinking, three out of five doesn’t sound that high, but that’s 60% of your loans. When you put it in perspective of the nearly one million mortgages originated in Q3 of 2022, per ATTOM data, that’s hundreds of thousands of errors. While it may be easier up front, incomplete or inaccurate applications can lead to big setbacks down the road. Let’s talk about audit tips, best

practices, and why they are so important.

GATHERING CORRECT DATA

You’ve probably heard it before, but let me say it again: take a complete application. Make sure you’re getting all the info you need — and that it’s as accurate as possible.

Getting a complete and accurate application often comes down to empowering your borrowers with the resources they need:

Hand out checklists to make it easier for borrowers to gather all of their documents. Having a simple and clear list of what they need can help them provide the right documents in a timely manner. Be available for questions. Whether you make yourself available outside of regular business hours or you reach

out to see if they have questions, make sure your borrowers know you are there for them. Not everyone will reach out themselves, even if they do have questions, but if you make the first move, they are much more likely to talk things out with you.

Educate your borrowers where they need it. It’s easy to think that education is only necessary for first-time homebuyers, but that’s not always the case. While you may have a borrower that has purchased a home before, they may still have questions or need help through the application process. Our industry is always changing, but the rapid changes over the past few years may leave even experienced buyers guessing. Just because your borrower has done this before doesn’t mean they know it all.

Proactively communicate with

your borrowers frequently during the application process. Beyond being available for questions, reach out to your borrowers and keep them informed with projected timelines, helpful resources, and anything else that you feel would be useful for them to know and keep them engaged.

It is ultimately up to you to guide your borrowers through this process. You can’t assume they know everything or even that they’ll ask questions when they need help.

fraudulent activity than refinances. With this, and current interest rates, in mind, be extra cognizant of any red flags, such as a sudden or drastic change in employment or income. It’s not common that a borrower suddenly goes from making $40k to $80k per year. Drastic changes like this should set off alarm bells. On the other hand, with so many industries experiencing layoffs right now, your borrower may not have that high-paying job with which they started the application. Whatever the case, reverify as close to closing as possible to ensure their income is solid.

Another type of misrepresentation to keep an eye out for is occupancy fraud. With higher down payments, reserve requirements, and financing costs, it’s much easier and more cost effective to buy a primary residence than it is to buy a vacation home or rental property. To avoid occupancy misrepresentation, pay attention to any red flags such as a significant or unrealistic commute distance, or a rental policy listed on the declarations page.

Staying proactive, available, and connected is the best way to ensure their success and yours.

WHY IT’S IMPORTANT

Rather than harping on you to take complete applications, let’s talk about why you should.

Incomplete or inaccurate applications do not have all of the information required to make an accurate credit decision. They also can lead to an increase of declinations, create more work for your underwriter, slow down the process for your borrower, and open the door for misrepresentation and fraud.

Being vigilant and taking some extra steps up-front will reduce a lot of headache down the road — not just for you, but for your underwriters and borrowers as well.

FRAUD TIPS

Beware of misrepresentation. CoreLogic reports that purchase transactions are more susceptible to

This by no means is a comprehensive list of all the misrepresentations that can show up in files, so leverage the many industry resources that are available to help you understand and identify fraud. In addition to the mortgage fraud prevention resources available from Fannie Mae and Freddie Mac, other mortgage partners often have their own resources that lenders can leverage.

Ultimately, it is your responsibility to make sure your borrowers are accurately represented. Be vigilant in spotting any potential roadblocks or red flags that could cause issues for them or your business down the road.

As author and scientist John Andreas Widtsoe once said, “Fraud and deceit are anxious for your money. Be informed and prudent.”

Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum. The statements in this article are solely the opinions of Mary Kay Scully and do not necessarily reflect the views of Enact or its management.

Ultimately, it is your responsibility to make sure your borrowers are accurately represented.

THE KEY TO GROWTH FOR LOAN OFFICERS IN 2023

By Marco Zamudio, CEO, Z Loans Funding

When I started in the industry with Lehman Brothers many years ago, I knew our industry had a problem relating to the immigrants and second generation Americans that made up what was then referred to as emerging markets. I knew that eventually this problem would become very serious for the industry.

With the end of the historically long refinance boom, that time has come. Solving this problem is the key for loan officers who want to grow their businesses in 2023 and beyond.

It’s not that Wall Street didn’t have plenty of front line sales people who could speak Spanish — or German or Armenian. They had those people. The problem was that they didn’t understand the cultures they were selling into.

CREATING A COMPANY THAT CAN SUCCEED IN THE NEW MORTGAGE BUSINESS

When I founded Z Loans Funding with my wife Patricia, we set out to build a company filled with professional loan officers who understood that, “Every Story Matters in Lending.”

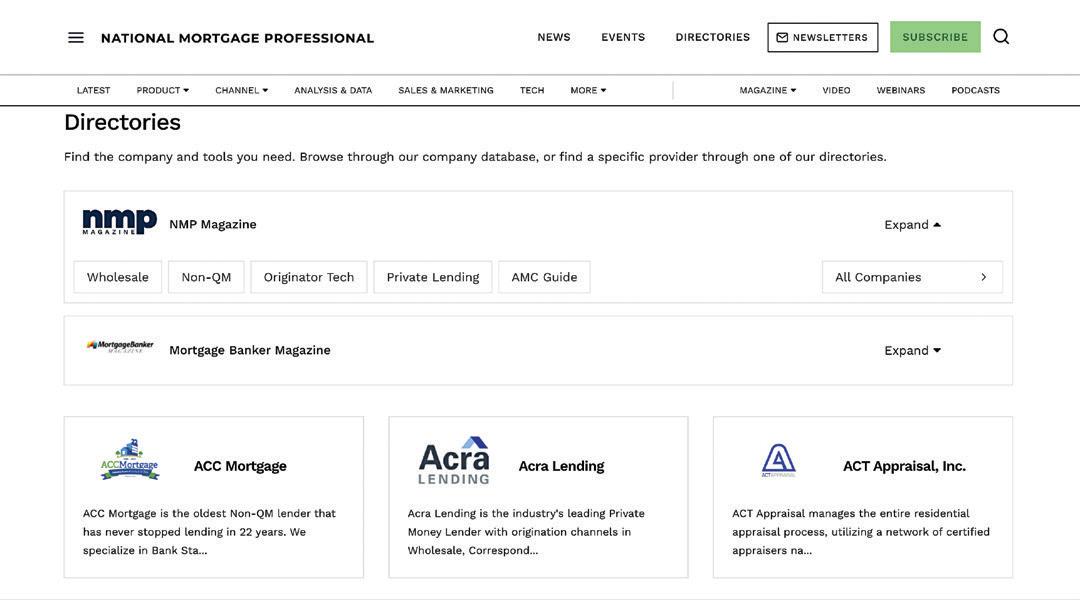

These stories are being told by a new generation of borrowers, many of whom have been traditionally underserved. You don’t have to look far to see how fast these communities are

Every one of them deserves the chance to achieve the American Dream of home ownership. We knew that the lender who could provide the education, guidance and loan products to lead these borrowers to that goal would be incredibly successful.

How could we build a company that would support loan officers who shared this passion?

It starts with Culture at Z Loans Funding

Most lenders understand the power of culture, but few realize it’s not just the culture the founders embrace, but also that of the professional loan officers their company attracts. Virtually everyone work-

ing in our company today is a second or third generation American. They come from Armenia, Guatemala, Mexico, El Salvador, Germany and Spain.

We don’t try to change who they are, we empower them to use what they know in service to borrowers. This is critically important because borrowers can tell if a loan officer really understands their families needs. This is why so many lenders fail in these communities.

Helping these borrowers understand home financing without losing touch with their own culture’s key values is what our loan officers do every day.

A frictionless mortgage operation

You can’t ask a good loan officer to take the lead in helping people achieve home ownership and then make it difficult for them to get that job done. A culture of operational efficiency is very important.

As a mid-sized company, there is nothing standing between our LOs and our CEO. There is no bureaucracy to add friction to the process. This means problems are solved quickly, loans move through the process smoothly and turn times are better, leading to better borrower satisfaction.

The proof is in our high referral rate. Sure, these communities tend to be better at sharing good solutions with their family, friends and neighbors, but a better experience is a vital requirement.

The key to that, and it’s something every LO in our company understands, is always putting the relationship over the short term sale. The relationship is paramount.

Transparency and Vision

Every employee in the company and every borrower the lender serves deserves the answer to any question they ask. Too many companies just push LOs out the door to fend for themselves in the search for new business or pile complicated paperwork on borrowers with limited English proficiency without sufficient guidance. There is no transparency. The short term dollars that may result from these actions cost the company much more in the long run.

Some lenders promise full transparency, but when loan officers ask about the company’s vision they don’t have much of a story to tell. We have a great story about a company with a mission to serve the fastest growing home buying demographic in the country and a vision to guide us there.

While most lenders are telling stories now about a down market, layoffs and cutbacks, Z Loans Funding is growing. We’re planning, hiring, training, and getting ready for the next wave of home purchases. This is serious business, but it’s also a game we are prepared to win.

Are you ready to join a team that will continue to grow in 2023? Then grow with us! Let the games begin!

The Principal AS HEARD ON T

he Principal™ is the daily podcast of Mortgage News Network™. Hosted by Mike Savino, director of multimedia, the podcast takes an in-depth look at the major issues of the day in the mortgage industry. Here are some of the highlights from recent episodes.

“It doesn’t help that there’s some big bank with some big headline every couple of months saying they denied African Americans the right to credit or to own a home, or evaluate their house at value.”

– Ready Life Founder and CEO Ashley Bell, on why Black customers distrust banking institutions.

“We are focused on making sure that the enterprises are doing everything that they can to be helpful in these very challenging economic times.”

– HFA Director Sandra L. Thompson, on leveraging Fannie Mae and Freddie Mac to improve access to affordable housing.

“When I exited the military, I didn’t understand this program at all. I didn’t know anything about it. Even the people that I asked — they didn’t know anything about it.”

– loanDepot Branch Production Manager David Smith, on the need to educate mortgage professionals about the VA loan.

“I also thought that, like, getting the business was as simple as just walking into a real estate office and saying, ‘hey, I do mortgages,’ and people were just going to start using you.”

– Direct Mortgage Loans Branch Manager Caleb Hiester, on what he expected when he entered the mortgage industry at 23 years old.

“I really feel that we’re headed toward 5% on mortgage rates, and I really feel that we’re headed there in the first half of 2023.”

– MLS Highway CEO Barry Habib, on where he sees mortgage rates going.

BIG Something is on the horizon(s).

Texas is one big state, and it takes a big reach to keep its mortgage origination pros in the game. Only Lone Star LO gets the job done. We roundup the data, insight, and products that let Texans win the mortgage rodeo.

Debuting February 2023.

When Sunshine State brokers and lenders need information and opportunity, Florida Originator magazine is there for them. It’s the only mortgage publication that criss-crosses all of Florida, and the only one that lets industry pros from Miami to Jacksonville, from Destin to Key West know it all.

Debuting March 2023.

California is large and in charge. That’s why there’s California Broker magazine. We cover the nation’s biggest mortgage market, and the state with more originators than anywhere else in the country. It’s the industry leader, and so is California Broker magazine.

Debuting April 2023.

Civic Financial Services

Redondo Beach, CA

CIVIC delivers fast, honest, simple lending for real estate investors. Description of your products or services.

CIVIC Financial Services is a private money lender, specializing in the financing of non-owner occupied residential investment properties.

CIVIC provides Mortgage Brokers and Real Estate Investors with a fast and cost effective funding source for their real estate investment needs.

civicfs.com

(877) 472-4842

info@civicfs.com

LICENSED IN: AZ, CA, CO, FL, GA, HI, ID, IL, IN, LA, MD, MA, MI, MN, NV, NJ, NC, OH, OK, OR, PA, SC, TN, TX, UT, VA, WA, WI

Global Integrity Finance LLC

McKinney, Texas

DSCR Rental NO DOC Loans

As a direct, private lender, Global Integrity Finance takes a commonsense approach to underwriting, with all approvals made in-house. We are dedicated to providing quick responses to time-sensitive loans, often times with the ability to close in as few as 3 business days. At Global Integrity Finance, we value referrals and our brokers are protected. We are committed to the highest level of customer service, because our success thrives in building relationships.

globalintegrityfinance.com

(214) 548-5190

toby@globalintegrityfinance.com

LICENSED IN: AL, AR, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NH, NJ, NM, NY, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VT, VA, WA, WV, WI

FIND IT.

Luxury Mortgage Corp.

Stamford, CT

Non-QM, Wholesale, Delegated Correspondent, Non Delegated Correspondent

The Simple Access® Non-QM suite of products was built around the idea that it doesn’t have to be complicated to finance a home. We have created a diverse selection of borrower friendly programs that are simple, innovative, and flexible. For more information on our Correspondent division, visit www. luxurymortgagecorrespondent.com

luxurymortgagewholesale.com

(949) 516-9710

tpomarketing@luxurymortgage.com

LICENSED IN: AL, AK, CA, CO, CT, DC, DE, FL, GA, IL, LA, ME, MD, MA, MI, MN, NV, NH, NJ, NM, NY, NC, OH, OR, PA, RI, SC, TN, TX, UT, VA, WA, WI, WY Find

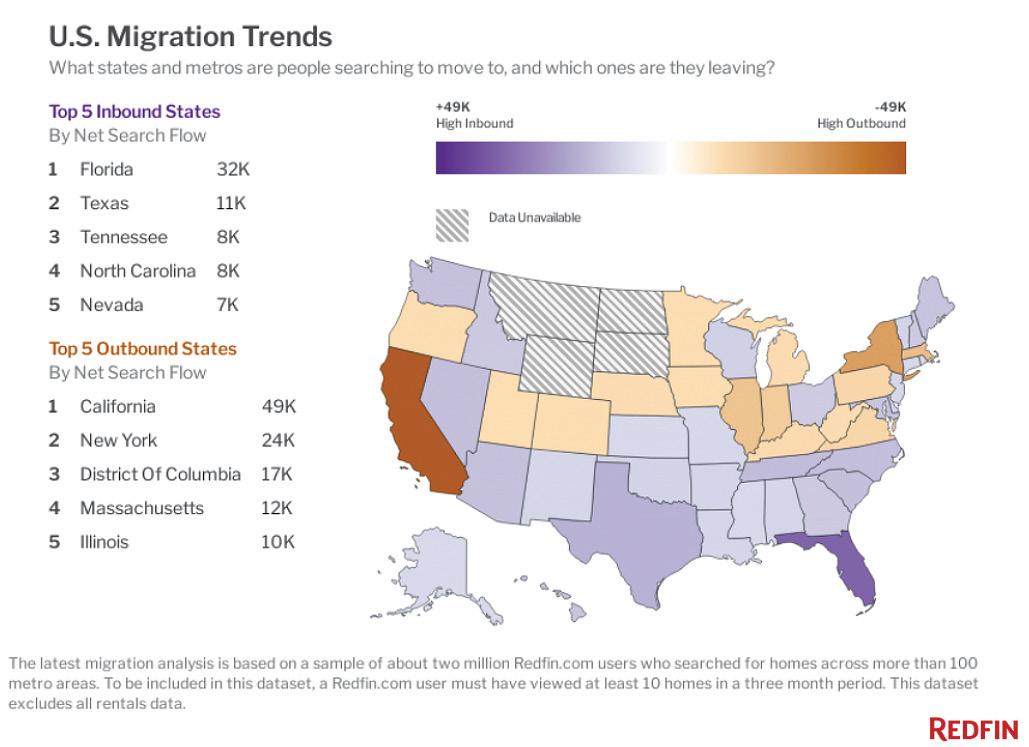

THE COMPANIES AND TOOLS YOU NEED

When searching for products or services to help your business, browse through our Resource Guides, or find a specific provider through one of our Directories.

Originator Tech, Non-QM, Wholesale, AMC. These listings provide quick, easy access to the resources you need, all in one convenient location.

Find

NON-QM LENDER RESOURCE GUIDE

PRIVATE LENDER RESOURCE GUIDE

PCF Wholesale

Tustin, CA

Build your 2022 pipeline with PCFWholesale.com , the home of the EZ DSCR and Alt Choice Non QM Products. We make NonQM E-Z. Direct Wholesale Lender Licensed in 38 States. We love 1-4 and 5-8 unit properties. Ask about our Preferred Lender Program and our on time closing commitments to you!

pcfwholesale.com

(714) 955-5700 Marketing@pcfwholesale.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, NV, NH, NJ, NM, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA,

Alpha Tech Lending

West Hempstead, NY

DSCR Rental NO DOC Loans

Alpha Tech Lending is a trusted direct lender, with over a combined 30 years of experience in the private lending sector. We offer a variety of loan programs for non-owner-occupied residences that are customizable to suit your real estate investment needs. From fix and flips, long term rental, new construction, commercial bridge, and more. We lend to both new and experienced real estate professionals throughout the country. We value long term relationships built on trust. Our brokers are protected.

alphatechlending.com

(888) 276-6565 info@alphatechlending.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Stratton Equities

Pine Brook, NJ

Stratton Equities is the leading Nationwide Direct Hard Money & NON-QM Lender that specializes in fast and flexible lending processes. Our Hard Money and Direct Private Money loan programs support the following investment projects:

• Fix and Flip

• Soft Money Loans

• Cash Out — Refinance

• Fixed Commercial Loans

• Commercial Bridge Loans

• Bridge Loans

• Stated Income/ No-Income Verification Loans

• Rental Loans

• Foreclosure Bailout Loan

• NO-DOC

• Blanket Loans

• Fixed Rental Programs

• Multi-Family Loan

No Upfront fees! No Junk Fees! No Tax Returns!

strattonequities.com

(800) 962-6613 info@strattonequities.com

LICENSED IN: All States except for: AK, ND, NV, SD, UT

Why Do Immigrants Gravitate To The Mortgage Industry?

There’s an appeal to being rewarded for a strong work ethic

BY SARAH WOLAK, STAFF WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINEThe American workforce, especially the mortgage industry, is finally starting to reflect the melting pot that is this country. With immigrants making up nearly 17% of today’s labor force, more are flocking toward sales and business-related jobs, which are abundantly available in the mortgage industry.

Many efforts have been dedicated to diversifying the industry as a whole, such as Fannie Mae’s Future Housing Lenders (FHL) program, the Asian Real Estate Association of America’s homeownership efforts, and the National Association of Minority Mortgage Bankers of America’s initiatives.

Within the mortgage industry, there is a pool of first-generation immigrants who have found sustainable, successful careers.

INSPIRED BY PERSONAL CHALLENGES

Shashank Shekhar is one of these industry superstars who has found not only success but confidence as well. Shekhar immigrated to the United States from New Delhi, India, in the early 2000s, just before the 2008 financial crisis. His father worked in financial services and encouraged Shekhar to pursue a business degree in India. Shekhar worked handling loans for what was formerly known as GE Consumer Finance. In early 2007, Shekhar was transferred from a small startup to Mountain View, Calif., as director of product management. The company soon shut down just as the housing market came to a crash.

Similar to Shekhar, Thuan Nguyen got his first taste of the industry during the tumultuous early 2000s. Nguyen immigrated to the United States from

Vietnam at the age of 19 unable to speak English and no plans of being a part of the mortgage industry. After buying his first home in 2004, Nguyen said that the experience of buying a home and the smooth transaction interested him in the market.

He recalled that his broker earned a hefty commission, which enticed him as well. “It got me curious about what is this kind of job,” he said. “I realized the potential of this career and saw that I could help people I know buy homes, too.”

Nguyen started as a data analyst at Morgan Stanley, but quit due to what he describes as a difficult and strict work environment. Following that, he became a mortgage broker in 2006.

“I studied online and did it all myself,” Nguyen said. “I didn’t ask anyone for help. It’s crazy that I didn’t have guidance from anyone. I didn’t

have any experience or clients. When I became a broker, it was a bad time [in the market]. I was discouraged from even joining the industry because of the competition. I believed that I could be successful, though.”

Nguyen said that at the start, he didn’t know any mortgage terminology. He operated as a solo broker for a few years, founding Himark Loans — now known as Loan Factory — in 2006.

Like Nguyen, Andres Munar had no plans of pursuing a mortgage-related career. After immigrating to Miami, Fla., from Bogota, Colombia, at the age of 4, Munar says that he grew up living in a single-wide trailer for most of his childhood. When he was 12, his parents bought their first home.

“I never forgot that feeling of ‘oh wow, I have a home’ as an immigrant,” he said.

“In middle school, I grew up around

middle-class to upper-class people and so I’d always be embarrassed to have my friends come over because we lived in a trailer. I finally felt that feeling of ‘we made it.’”

Munar says that his parents ended up losing the house when he turned 16. Being the only English speaker in his household, Munar said that he was the main contact with his family’s real

estate agent. That relationship gave Munar a glimpse of what it would be like to pursue work in real estate.

But instead of gravitating to the housing industry, Munar became a server at a local restaurant and described becoming “obsessed” with the hustle and bustle of his job. Following

“I have always felt like being an immigrant is an opportunity and an advantage in the sense that the country is full of immigrants, probably 20% of people.”

– Shashank Shekhar, founder and CEO, InstaMortgageShashank Shekhar, founder and CEO, InstaMortgage Thuan Nguyen, founder, Loan Factory

IMMIGRANTS

high school graduation, Munar attended the Pennsylvania Culinary Institute. It wasn’t until postgraduate life that Munar was intrigued enough to pursue a job in the mortgage industry.

“I moved to the Penn State area [in 2006] to be closer to my then partner, who was a real estate agent,” Munar said. “His friend who was a broker hired me to be his assistant.”

Munar says that the same hustle and bustle he experienced while managing restaurants was prevalent in the brokerage office. He was able to work the traditional 9-to-5 shift while still keeping up with the same hustle culture to which he had become accustomed.

A SERIES OF ONE-MAN BANDS

As Shekhar, Nguyen and Munar navigated being immigrants in a whitedominated industry, they each turned to solo operations to get on their feet.

Following his layoff, Shekhar started Arcus Lending in 2008, operating as a one-man band. That first year, he barely closed seven loans. He only knew three people in all of the United States and his closest relative lived in Canada. At first, Shekhar says that he looked forward to returning to India after working for some time in the U.S.

“Now, we have no plans to go back,” he said.

Finding it hard to attract clients, Shekhar says he used his “sphere of influence” to write loans, especially during the 2008 crash.

“I struggled for the first 12-18 months because I couldn’t find clients,” he said. “I realized that I needed a new business model to survive. I started looking into where consumer trends were finding information.”

Nguyen draws parallels to Shekhar’s story, as he started off being a solo broker and sole owner of Himark.

“It was tough at the beginning and finding staff,” Nguyen said. “I went from a one-man band to licensed in 43 states. I run a [much] bigger operation now, but it wasn’t until after seven or eight years that I was able to expand.”

Just like Shekhar and Nguyen, Munar decided to bridge the gap between being a broker’s assistant and an actual broker and go off on his own in 2007. In

2014, he opened Munar Mortgage and subsequently, merged businesses with Megan Marsh, another broker, in 2015, renaming it Keystone Alliance Mortgage. In 2021, the dynamic duo rebranded to Co/LAB Lending. Today, Co/Lab has closed over $500 million in loans and services in multiple states and Puerto Rico.

SUCCESS STORIES

Shekhar credits his success in the industry to his writing. After having trouble finding business, Shekhar turned to blogging to get his voice heard. He’s become a trailblazer for mortgage blogging, writing an average of one blog post per week for the last 11 years.

“I decided that I wanted to build a business where people come to me versus me chasing them,” Shekhar said. “I wanted to build a brand around education to get leads, so I started blogging. I was probably one of six in the industry who

“You have a community and potential clients that you can rely on,” he said. “It gives you a huge motivation to be successful in America.”

– Thuan Nguyen, founder, Loan Factory

were blogging at that time.”

Nguyen, on the other hand, almost gave up on the industry altogether. After becoming discouraged due to low customer volume, Nguyen decided to put brokering on the back burner and work as a software engineer. However, as rates shifted downwards, Nguyen’s broker business caught speed.