Why is Southern Cal's destination city in the doldrums?

California is large and in charge. That’s why there’s California Broker magazine. We cover the nation’s biggest mortgage market, and the state with more originators than anywhere else in the country. It’s the industry leader, and so is California Broker magazine.

Debuting January 2023.

Texas is one big state, and it takes a mortgage origination pros in the game. the job done. We roundup the data, Texans win the mortgage rodeo.

Debuting February 2023.

Debuting March 2023.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR David Krechevsky

EDITOR

If 2022 has one big lesson to teach 2023, it’s this: Bold innovation will win the day.

Too many companies went into the start of last year with expectations of a three-peat. Some tempered their outlooks out of caution over slightly higher interest rates. But it’s hard to find anyone who was planning for the largest and fastest rate hikes in history.

Suddenly, lenders found themselves with no refi business and in a tough slog for purchase originations. Alternative products offer some reprieve, but while consumers may be interested in Non-QM or private lending loans, the investor community is too shell-shocked. That leaves those niche providers with borrowers but few buyers.

There are a lot of predictions for what is to come this year, many contradictory. But here’s the clear part: Companies without the ability to reinvest and those who continue to approach the market with the same techniques are the ones least likely to see the start of 2024. What’s needed are “innocent eyes,” untainted by past expectations and ready to see the world anew. We need to look at reality as it is, not as it was and not as we wish it to be. And then, the winners will be those who take action, not those who hunker down.

So throughout this year, we’ll be looking at innovators and visionaries. We’ll be profiling the confident and the accomplished. And we’ll be bringing out the techniques and commitment that result in success in a market that’s marked by doom and gloom.

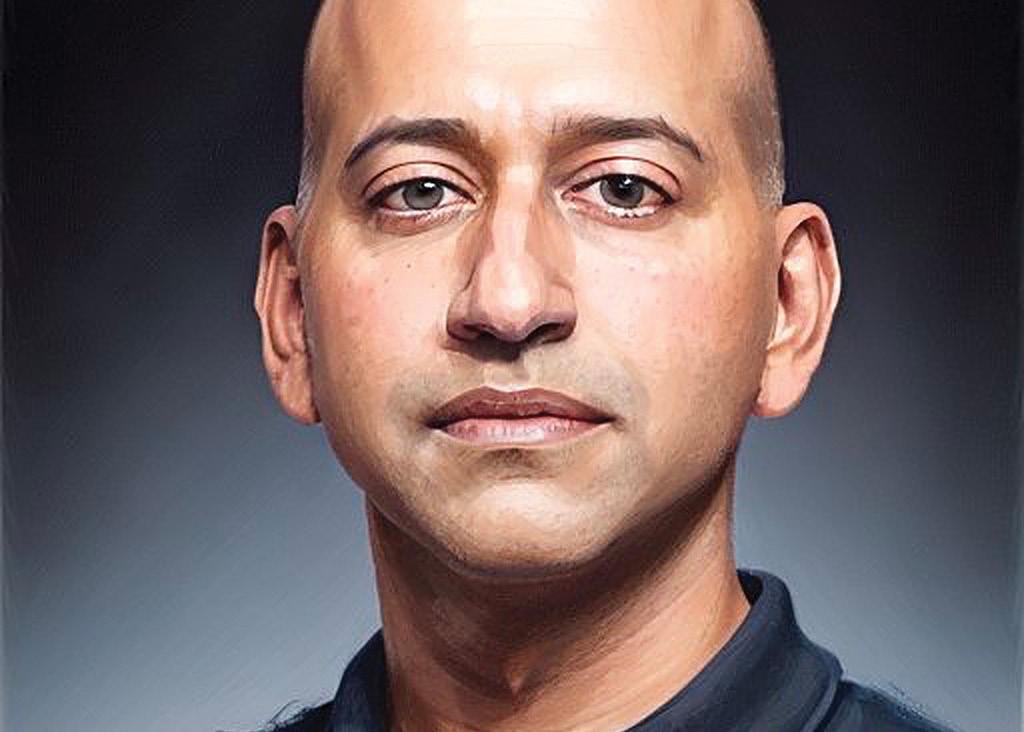

We’re starting with Pavan Agarwal. He’s not the kind of mortgage executive who gets a lot of press, not the guy who gets his name in all the news stories. But he’s building on the philosophies that guided his father, who started Californiabased Sun West Mortgage nearly 40 years ago. And since Pavan took over running the company during the Great Recession, he’s proven that compassion and competitiveness can work together.

But he’s also looking to the future, and he sees tech being the great accelerator. That’s why he founded Celligence, a tech startup based in Puerto Rico. It’s developing new systems for the mortgage industry, leading off with a program called Morgan that threatens to upend traditional loan-application processing and underwriting. He’s looking to transform a process that takes days or weeks to one that takes minutes or hours.

There’s a lot of work to do here. But Pavan and his family see the challenge as an opportunity, a chance to take big steps.

Eyes wide open, he’s looking to push into a stronger future. It’s a lesson worth learning. n

VINCENT M. VALVO Publisher, Editor-in-Chief

Keith Griffin SENIOR EDITOR

Gary Rogo SPECIAL SECTIONS EDITOR Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Douglas Page, Sarah Wolak

STAFF WRITERS

Rob Chrisman, Dave Hershman, Erica LaCentra, Nick Roberson, Lew Sichelman, Mary Kay Scully

CONTRIBUTING WRITERS

Nicole Coughlin, Nichole Cakirca

ADVERTISING ASSOCIATES

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael

PROJECT MANAGER Meghan Hogan DESIGN MANAGER

Stacy Murray, Christopher Wallace GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS William Valvo

UX DESIGN DIRECTOR Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise

MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Joel Berman

FOUNDING PUBLISHER

Submit your news to editorial@ambizmedia.com

If you would like additional copies of National Mortgage Professional Call (860) 719-1991 or email info@ambizmedia.com www.ambizmedia.com

© 2022 American Business Media LLC. All rights reserved. National Mortgage Professional magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991 info@ambizmedia.com

There is no doubt that planning for the future is difficult in this industry because we never know what a year will look like.

No one predicted the pandemic, and certainly, no one predicted that our industry would boom if there were a pandemic. Though many predicted that the good times would end, few

made predictions as dire as the end turned out to be during the second half of 2022.

Planning for the future becomes even more critical in such a changing world. Many loan officers got lost in 2022, and they need a solid plan. It is a manager’s job to coach and guide them in developing such a plan. Though we have touched on elements of this plan — we think the timing is right to put

some of these concepts together to help managers in this regard:

Go back. You must go backward to go forward. Your plan for the future must include some perspective of where you are now. You don’t plan with a blank slate. Let me start with an important question — if you had the ability to do 2022 over, what would you do differently? The answer to this question will give you a basis as to what you need to change for next year. Make a list and see how these factors apply to your future endeavors.

Set specific goals. You can’t arrive at your desired destination if you don’t know where you are going. Saying you want to improve is way too generalized an objective. You must be more specific. Sure, you may want to earn more next year. How much more? What level of production will get you there? Where is that production coming from (targets)? What actions will you need to take to make this happen?

Start Now. These are not new year’s resolutions. These are specific goals you want to achieve in your business. How many times in the past have you said to yourself, “I am going to accomplish this in ___?” And it never happened. If you start the activity now, you will have the equivalent of a running start. This running start will

provide momentum into the new year.

GROWTH AHEAD

Looking to grow your database? Spend time adding a certain number of contacts each day. Looking to learn a technology? Take the class now and practice. Want to get active on social media from a business perspective? Stop perusing junk and start posting and sharing valuable information. Don’t’ start next week — start today. Add Synergy. Now we will add the last tip. From my book, Maximum Synergy Marketing, you can guess that I consider synergy important. Basically, you are already doing many things which are working — at least somewhat. Instead of trying several new things, why not make what you already do more effective by adding several doses of synergy? Adding completely different activities causes you to go in different directions and makes you less effective. In essence, you are spreading yourself too thin. Instead, go deeper with what you are already doing. For example, you are already closing transactions. Why not find more opportunities to market within the process of closing your deals? For example, if your customer has an accountant — meet that person instead of letting your processor talk with them.

When you assess everything you are doing, by opening your eyes wider, you will see additional opportunities every time. Most of them are right under your nose. Stop moving in 10 different directions and stand still with your eyes open. For example, if you go to an office every day, who else is a tenant in that building? Perhaps an attorney who could be an excellent referral source. Just go up one floor and introduce yourself. That is what synergy is all about

There are many additional tips I could present — but if you start with these, you will give your loan officers a good foundation for planning. The last thing you want to do is give them 20 different fundamentals. These four will provide a good basis for their improvement in 2023. n

Senior Vice-President of Sales for Weichert Financial Services, Dave Hershman is the top author in this industry with seven books published as well as the founder of the OriginationPro Marketing System and the OriginationPro Mortgage School — the online choice for mortgage learning and marketing content. His site is www. OriginationPro.com and he can be reached at dave@hershmangroup.com

With my professional milestone of 10 years in the mortgage industry rapidly approaching in February, it’s only natural that I started to reflect on the humble beginnings of my career

take a hard look at this issue and make a shift towards a better future. Why in the year 2023 does the mortgage industry continue to fall behind and allow sexism, misogyny, and gender bias to still pervade our space?

I recently had the experience of attending an industry conference that had a separate women’s luncheon. This luncheon was put on by a women’s industry group which had been formed within the last year in an effort to connect women in the industry so that we could find mentorship, mentor others and ultimately work to address the issues women continue to face in our space. I viewed this as a great opportunity to network, hear from a notable female speaker and simply enjoy the chance to get to know my female industry

peers over a nice meal.

When I arrived at the luncheon, small giveaway “swag” items had been provided by the various companies that had sponsored the event. One of these was a pocketsized container of pepper spray that bore the phrase “supporting women in private lending.” While I’m sure the intention of this item was good, it was hard not to feel uncomfortable due to the fact that someone thought it was not only a good idea but potentially necessary for female attendees to receive pepper spray while at an industry conference, where, like our male counterparts, we are just trying to do our jobs.

Receiving pepper spray set off an ah-ha moment for me as to why the mortgage industry has not been able to make bigger strides toward fighting misogyny and sexist behavior in our

space. Rather than focusing on creating a safer environment for women and holding men accountable, the onus is on women to protect themselves. And it’s true, one of the biggest issues preventing the mortgage industry from moving forward is we refuse to truly hold the bad actors responsible for their actions.

Over the last decade, I’ve witnessed my fair share of sexist behavior and outright scandals in the mortgage industry. So many instances of individuals exhibiting vile behavior towards women that simply should not be tolerated. But for some reason, while immediate backlash is typical, so is the incident getting glossed over after the initial outrage subsides. These individuals have been welcomed back into the mortgage industry time and time again after a slap on the wrist.

It’s no wonder that sexism, misogyny, and gender bias continue to exist in our industry.

When there are no real long-term repercussions, it signals that this behavior is OK and women don’t deserve the same level of respect or support because heaven forbid a man’s career is ruined over “one little incident.” Simply put, the mortgage industry has more to do in these situations before we see more permanent change.

While the mortgage industry has certainly improved over the last decade for women, we can still do better, and that change has to start at the top. It’s time for our industry leaders to stop ignoring the impact that sexist and misogynistic behaviors are having. Leadership in the mortgage industry needs to start implementing clear policies within their companies against gender inequality and sexism in the workplace with swift and lasting punishments. No more sweeping incidents under the rug or turning a blind eye, it’s time to weed out the bad actors once and for all.

Also, men need to be better allies to their female peers. It’s not just up to the women experiencing misogyny and sexism to have to speak up and hope it is dealt with appropriately. It’s up to men AND women in the industry to stop tolerating this bad behavior. Having been in uncomfortable situations before, there is nothing more validating than when someone else observing the situation steps in and echoes your sentiment; that what is happening is wrong. And as more people continue to speak up, it can cause more permanent change for the better.

Finally, it’s time the mortgage industry truly created safe spaces for women, and by that, I don’t just

mean creating women’s groups. While women’s groups create great opportunities for women to network, why can’t workplaces, events, and conferences just be safer overall? Women shouldn’t feel like they need to hide within a group to be safe.

Take reports of harassment, sexism, and discrimination seriously, and create lasting repercussions for the offenders. One of the reasons why so many women in the industry brush off harassment at events is because they feel like they have no one to really report it to, and even so, who is going to do anything about it? There is a good chance you’ll see that person at your next event, so it can be infinitely easier to try to ignore those interactions and hope you can avoid that person in the future. Women should have the ability to report offenders without fear of nothing being done and potential retaliation.

There are so many seemingly small things that can be done that will make a big impact on this problem in the mortgage industry. As I continue on my journey in this space, I truly hope these changes can be made, even if just gradually, so that when I look back after another 10 years, I can say, “Look how far we’ve come.” n

Erica LaCentra is chief marketing officer for RCN Capital.

Rather than focusing on creating a safer environment for women and holding men accountable, the onus is on women to protect themselves.

irror, mirror, on the wall, who’s the fairest of them all?” Not Blacks, at least not when it comes to housing finance.

I know the wicked queen was talking about beauty when she uttered those famous words in the Disney classic “Snow White.” But taking editorial license, let’s twist the meaning a bit to be fair, as in evenhanded. And when it comes to Black home buyers, the fair meter in that context barely registers 50%.

Yes, 2021 was the fairest year for finding financing since the 2008 housing crisis for Black home buyers, according to a new report. But fairness was no better in 2021 than it was in 1990, according to the report from FairPlay. And if the past is prolog, the fairness meter is likely to drop in the

near future if it hasn’t already.

That’s what happened during the Great Recession, when Fairplay’s mortgage fairness metric, which it calls Adverse Impact Ratios, took a nose dive for Blacks. And the signs already are present that it could happen again — credit card utilization is going up, average credit balances are rising right along with it, and credit scores are tanking.

Overall, however, neither Blacks nor Hispanics nor Native Americans have made any headway over the previous three decades compared to their white counterparts, the study found. And another report, this one from a group of Black realty agents and brokers, reinforces FairPlay’s finding.

According to the National Association of Real Estate Brokers’ “State of Housing in Black America,” the percentage of Blacks securing loan approval has been stuck

at 7% since 2019. In 2008, it was just 6%, so it’s a tick better. But Blacks represent 12% of the U.S. population!

The two studies, which dropped the week after Thanksgiving, both base their findings on data collected from lenders under the Home Mortgage Disclosure Act, the most comprehensive publically available source that identifies race, ethnicity, and gender for mortgage applications.

FairPlay, an AI tool that identifies fairness-as-a-service solution for financial institutions reviewed all HMDA mortgage application data, including almost all mortgage applicants, from 1990 to 2021 — some 350 million transactions in all. And its 27-page “State of Mortgage Fairness” evaluated how much mortgage fairness has changed — or not — in the past 30 years.

STUCK IN NEUTRAL NAREB’s 100-page document is an annual endeavor, with this year’s study

using 2008 as its base year “so we can better understand Black homeownership progress since the height of the foreclosure crisis and the damage of predatory lending,” President Lydia Pope, who operates two real estate firms in Cleveland, explained in the report’s forward. The group isn’t widely known, but it has been active for 73 years.

“Stuck in neutral” is how the FairPlay study describes mortgage fairness — or better perhaps, the lack of same — for African Americans. That’s especially true in five Southern states — Alabama, Arkansas, Louisiana, Mississippi, and South Carolina — where persistent discrepancies in loan approvals are “deep and persistent” no matter how strong the macro-economic environment is.

The FairPlay study suggests an “alarming drop in mortgage fairness” for Native Americans and Latinos as well. The fairness meter has improved only for women. (Its Adverse Impact

NAREB says the “most direct route” to accomplish its goals is to release the GSEs from conservatorship and re-charter them.

Ratios, which are borrowed from an employment context, measure the rate of approval for protected status applicants for the control group, in this case lucre.)

“Our analysis shows that decades of policy interventions and economic reforms to equalize lending opportunities have largely failed to reduce the gap in loan approvals” between most minorities and Whites, the report maintains. While last year’s slight increase in underwriting fairness is an encouraging sign, we believe the persistent disparities in mortgage lending for Black and Native American borrowers deserves policymakers’ attention.”

NAREB has some thoughts on that score. The Marylandbased group’s recommendations are comprehensive. But, according to its study, “they recognize that significant actions must be taken to genuinely offer” Blacks a shot at the brass ring, otherwise known as the American Dream.

The report lists six changes it deems necessary to put Black home buyers on an even playing field. But above those, fixing “the broken housing finance system itself” by turning Fannie Mae and Freddie Mac into the federal corporation structure is Job One.

NAREB says the “most direct route” to accomplish its goals is to release the GSEs from conservatorship and re-charter them as a single and independent federal housing and community investment corporation that would eschew lucre and focus on expanding affordable housing. “Rather than profits,” the group says, “the new agency could lower borrowing costs for all consumers by eliminating fees and risk-based pricing.”

Here are the other changes NAREB would like to see:

• Eliminate loan level price adjustments — Assessing higher

costs to those who are weaker financially is counterintuitive, NAREB maintains, because it makes financing less affordable and increases the risk of default. “LLPAs unfairly and disproportionately penalize the populations that were principal victims of exploitive lending.”

change that so SPCPs could “ultimately provide an alternative and productive lending channel to meet the credit need” of underserved markets.

• End discriminatory and abusive appraisal practices — Here, the group simply says more needs to be done to address what it calls “the pervasive racial bias” in home valuations and “undermine the major source of wealth” in Black communities.

• Fix the broken and out-of-date housing finance system — Noting that today’s housing finance system was built in the 1930s on “powerful discriminatory pillars,” the report says it is not equipped to address the housing needs in older urban communities, nor what it designed to address the racial economic disparities that exist today.

• End fees to access downpayment assistance — Some lending programs charge as much as 1.5 points for help with the downpayment because it is considered a risk element. But that’s “unfair and irrational,” the group argues because it contradicts the purpose of aid, which is to lower the cost to borrowers and decrease the overall risk. “Helping borrowers increase the down payments improves mortgage accessibility and sustainability.”

• Recalculate the impact of student loan debt — Also a contradiction is the treatment of deferred student debt as part of the borrower’s debt-to-income ratio, NAREB maintains, because it ignores the possibility of greater income in the future. “If borrowers cannot receive credit for future earnings increases, why should they be penalized for not-as-yet required education loan repayments?” the report asks.

• Leverage special purpose credit programs — SPCPs have been around for years as a way of meeting the credit needs of historically disenfranchised populations. But they have not become a significant vehicle for supporting affordable housing. NAREB, along with the National Fair Housing Coalition, which is leading the charge, would

“America needs a 21st Century housing finance system that has adequate capacity and flexibility to innovate and create affordable homeownership programs that can create millions, not hundreds, of new Black homeowners,” the report contends.

Given the historic level of systemic, federally sanctioned, and enforced discrimination, the report concludes, it is impressive that African Americans have achieved any meaningful level of homeownership and speaks to their tenacity. But the time is long overdue for change.

White households did not achieve 65 percent ownership rates without substantial federal assistance, NAREB points out. Now, more than ever, minority buyers need the same. n

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country. He also has been real estate editor at two major Washington, D.C., dailies and spent 30 years on the staff of National Mortgage News, formerly National Thrift News.

Acra Lending Lake Forest, CA

acralending.com sales@acralending.com (888) 800-7661

Non-QM / Jumbo

DESCRIPTION OF PRODUCTS

OR SERVICES: Acra Lending is the leader in Non-QM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

STATES LICENSED: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

Angel Oak Mortgage Solutions Atlanta, Georgia

angeloakms.com info@angeloakms.com (855) 631-9943

Angel Oak Mortgage Solutions is the leader in non-QM.

DESCRIPTION OF PRODUCTS OR SERVICES: We offer alternative mortgage solutions for originators throughout the country helping borrowers who don’t fit Agency guidelines. We are pioneering a fresh approach to today’s mortgage lending challenges helping partners to grow their business.

STATES LICENSED: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WA, WV, WI, WY, Puerto Rico, U.S. Virgin Islands

Arc Home LLC Mount Laurel, NJ

business.archomellc.com sales@archomeloans.com (844) 851-3600

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions.

DESCRIPTION OF PRODUCTS OR SERVICES: When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

Champions Funding Gilbert, AZ

champstpo.com Wholesale@ChampsTPO.com (949) 763-9494

Mission Driven Non-QM + CDFI Wholesale Lender

OR SERVICES: Champions

Funding, LLC is a privately-owned wholesale lender providing NonQM loan options for mortgage brokers and their customers. As a Community Development Financial Institution (CDFI), Champions Funding, LLC empowers its Broker Partners to fulfill the dreams of their diverse homeowners as well as realize the mission of serving low-income and underserved communities.

STATES LICENSED: AZ, CA, CO, CT, DC, FL, GA, HI, IL, IA, MD, MI, NJ, NC, OR, PA, SC, TN, TX, UT, VA, WA

Global Integrity Finance LLc McKinney, Texas

globalintegrityfinance.com toby@globalintegrityfinance. com 2145485190

DESCRIPTION OF PRODUCTS

OR SERVICES: As a direct, private lender, Global Integrity Finance takes a common-sense approach to underwriting, with all approvals made in-house. We are dedicated to providing quick responses to timesensitive loans, often times with the ability to close in as few as 3 business days. At Global Integrity Finance, we value referrals and our brokers are protected. We are committed to the highest level of customer service, because our success thrives in building relationships.

STATES LICENSED: AL, AR, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NH, NJ, NM, NY, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VT, VA, WA, WV, WI

Impac Mortgage Corp. Irvine, CA impacwholesale.com wholesale@impacmail.com (949)4756284

DESCRIPTION OF PRODUCTS OR SERVICES: Impac is a national leader in B2B lending with a long heritage of building successful relationships. We’re committed to great pricing, fast decisions, and sensible alternative products, like our comprehensive Non-QM suite. It’s why we opened our doors in 1995 and why they’re still open today.

STATES LICENSED: AL, AK, AZ, AR, CA, CO, CT, DC, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI,

STATES LICENSED: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

LoanStream Mortgage Irvine, CA

loanstreamwholesale.com (800) 760-1833

DESCRIPTION OF PRODUCTS OR SERVICES: LoanStream partners directly with mortgage brokers to provide access to a variety of home loan programs directly to their clients including Non-QM, Government and Conventional loan programs. Including propriety loan loan programs exclusive only to LoanStream mortgage.

STATES LICENSED: AZ, CA, CO, CT, DE, DC, FL, GA, HI, IL, IN, KY, LA, ME, MD, MA, MI, MN, MT, NV, NH, NJ, NM, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA, WA, WI

Luxury Mortgage Corp. Irvine, CA

luxurymortgagewholesale.com tpomarketing@ luxurymortgage.co (949) 516-9710

Non-QM, Wholesale, Delegated Correspondent, Non Delegated Correspondent

DESCRIPTION OF PRODUCTS

OR SERVICES: The Simple Access® Non-QM suite of products was built around the idea that it doesn’t have to be complicated to finance a home. We have created a diverse selection of borrower friendly programs that are simple, innovative, and flexible. For more information on our Correspondent division, visit www.

luxurymortgagecorrespondent. com

STATES LICENSED: AL, AK, CA, CO, CT, DC, DE, FL, GA, IL, LA, ME, MD, MA, MI, MN, NV, NH, NJ, NM, NY, NC, OH, OR, PA, RI, SC, TN, TX, UT, VA, WA, WI, WY

Civic Financial Services Redondo Beach, CA www.civicfs.com carolyn.pham@civicfs.com (877) 472-4842

CIVIC delivers fast, honest, simple lending for real estate investors.

Description of your products or services.

DESCRIPTION OF PRODUCTS OR SERVICES: CIVIC Financial Services is a private money lender, specializing in the financing of non-owner occupied residential investment properties.

CIVIC provides Mortgage Brokers and Real Estate Investors with a fast and cost effective funding source for their real estate investment needs.

STATES LICENSED: AZ, CA, CO, FL, GA, HI, ID, IL, IN, LA, MD, MA, MI, MN, NV, NJ, NC, OH, OK, OR, PA, SC, TN, TX, UT, VA, WA, WI

Deephaven Mortgage Charlotte, North Carolina

deephavenmortgage.com info@deephavenmortgage.com (800)983-0457

Founded in 2012, Deephaven is a national, Non-Agency/Non-QM mortgage provider.

DESCRIPTION OF PRODUCTS OR SERVICES: A full-service innovator in the Non-Agency/Non-QM mortgage space helping millions of Americans unable to qualify for a traditional, governmentbacked mortgage to achieve their dreams of homeownership. Available through both wholesale and correspondent channels, our differentiator is our borrower-centric culture and service delivery model. Particular strengths include our own in-house underwriting and collaborative teams that directly support our national network of independent mortgage brokers and loan officers.

STATES LICENSED: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WI, WY

Finance of America Mortgage Conshohocken, PA

FOAmortgage.com customerrelations@ financeofamerica.com (800) 355-5626

Flexible mortgage solutions designed with unconventional borrowers in mind

DESCRIPTION OF PRODUCTS OR SERVICES: Are you looking to help a wider range of borrowers? Finance of America Mortgage offers loan options outside of standard conventional guidelines. Our Two-X Flex Suite of mortgage solutions was specifically designed with unconventional borrowers in mind. It redefines qualifying borrowers without the use of tax returns and with as little as 12 months of self-employment. Join the team at Finance of America Mortgage to offer your borrowers more flexibility. Visit joinFAMtoday.com to apply now.

STATES LICENSED: Puerto Rico U.S. Virgin Islands All U.S. States

First National Bank of America East Lansing, MI www.fnba.com/wholesale requests@fnba.com (800) 400-5451

DESCRIPTION OF PRODUCTS

OR SERVICES: With over 65 years of lending experience, First National Bank of America specializes in Non-QM loans, nationwide.

• Alternative Income Documentation Options

• 12 months only of income history

• Self-Employed/1099

• ITIN or SSN

• Recent Credit Events Our alternative mortgage solutions are designed to help people turn homeownership dreams into a reality in the Retail, Wholesale or Correspondent space visit: www.fnba.com/wholesale www.fnba.com/correspondent www.fnba.com/mortgage

Equal Housing Lender

STATES LICENSED: All U.S. States

PCF Wholesale Tustin, CA pcfwholesale.com Marketing@pcfwholesale.com (714) 955-5700

DESCRIPTION OF PRODUCTS

OR SERVICES: Build your 2022 pipeline with PCFWholesale. com , the home of the EZ DSCR and Alt Choice Non QM Products. We make NonQM E-Z. Direct Wholesale Lender Licensed in 38 States. We love 1-4 and 5-8 unit properties. Ask about our Preferred Lender Program and our on time closing commitments to you!

STATES LICENSED: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, NV, NH, NJ, NM, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA,

Quontic Bank New York, NY

quonticwholesale.com sschnall@quonticbank.com (888) 738-9016

No Ratio & Lite Doc - Owner Occupied & Investor

DESCRIPTION OF PRODUCTS

OR SERVICES: Our unique Community Development Loan programs help historically excluded borrowers look beyond income documentation to help make homeownership dreams a reality. Quontic is exempt from Dodd Frank’s ATR requirements. This enables us to offer our unique Owner Occupied - No Ratio (no income stated & no DTI calculated) and Lite Doc (borrower prepared P&L) loans to credit-worthy borrowers. Quontic also offers a Fast Track underwriting process. Get started growing your business with Quontic Wholesale.

STATES LICENSED: All U.S. States

Stratton Equities

Pine Brook, NJ

strattonequities.com info@strattonequities.com (800) 962-6613

DESCRIPTION OF PRODUCTS

OR SERVICES: Stratton Equities is the Leading Nationwide Direct Hard Money & NON-QM Lender that specializes in fast & flexible lending processes. • Fix and Flip • Soft Money Loans • Cash Out — Refinance

Fixed Commercial Loans

Commercial Bridge Loans

Bridge Loans

Stated Income/No-Income

Verus Mortgage Capital Washington, DC

verusmc.com sales@verusmc.com (833) 862-3863

Full-service correspondent investor offering residential nonQM and investor rental programs

DESCRIPTION OF PRODUCTS

Rental Loans

Verification Loans

Foreclosure Bailout Loan • NO-DOC • Blanket Loans

Fixed Rental Programs • Multi-Family Loan

No Upfront Fees! No Junk Fees! No Tax Returns!

STATES LICENSED: All States except for: AK, ND, NV, SD, UT

OR SERVICES: Verus is the nation’s largest issuer of securitizations backed by nonQM loans. We’ve purchased over $15 billion in expanded, nonagency and offer correspondents an array of expanded non-prime solutions for residential and business purposes. Our flexible lending guidelines, underwriting and pre-purchase diligence tools, and training help correspondents confidently move into non-QM. It’s all we do, and we do it extremely well.

STATES LICENSED: Continental U.S.

In California, brokers, originators, and support staff love the California Mortgage Expo. The show, which is available in Irvine, San Diego, Oakland, and Pasadena, offers educational sessions, product showcases, networking opportunities, and more (we can’t forget to mention the hors d’oeuvres, open bar, and networking parties). Attendees also have the chance to renew their NMLS license with the class the following day. Plus, the show is free for NMLS licensees* with our code NMPFREE. No brainer? We think so.

> FirstClose Inc., a provider of data and workflow solutions for mortgage and equity lenders, announced that James Bolger is its new chief financial officer.

> Movement Mortgage, the nation’s sixthlargest retail mortgage lender, welcomes Lyra Waggoner as chief information officer.

announced that Michelle Amato has joined the company as chief

>

announced its expansion into the Mid-Atlantic region. The new group of

Similar to any viral TikTok phenomenon, the trend of “quiet quitting” has caused its fair share of confusion and controversy. Why is it called “quitting” if you’re still working? Is a quiet quitter lazy or just drawing healthy boundaries?

label can be a damaging self-fulfilling prophecy. If people come to view you as a quiet quitter, you’ll get fewer opportunities to have mastery and grow in your job, experiences key for employees to feel engaged at work.

By checking out, you neither accept your working situation — flaws and all — nor make moves to change what isn’t working. So, while checking out can make you feel less negative toward your job, it’s unlikely to make you feel as positive as someone who is fully engaged in their job.

So here are four things you need to do before quiet quitting:

While quiet quitting covers a range of worker mindset and behaviors in response to unhappiness at work, at its worst, quiet quitting is checking out. The most extreme quiet quitters work only as much as needed to keep from being fired, and often feel very negative or passive aggressive toward their work, colleagues, and employers.

While reducing your workload can curb burnout, checking out doesn’t solve many other issues that lead to burnout, such as poor leadership, unreasonable deadlines, or failure to be properly recognized for your work.

Additionally, the “quiet quitter”

> Planet Home Lending, a national mortgage originator and servicer, has promoted Kathryn Edelen to eastern divisional manager.

First, understand why you’re feeling burnt out and think quiet quitting will help.

Some workers check out to avoid

hustle culture. A study by UK marketing company Impero found that less than half (45%) of Gen Zers equate career and money to success. And a middleschool English teacher notes that more of his past students are now prioritizing travel or finding a job they enjoy after college. These trends show that younger generations are more likely to view work as simply a means to their desired life, and not a purpose-giving endeavor that should be allowed to detract from their time or mental health.

Other factors leading to burnout include heavy workloads, long hours, feeling underappreciated, finding no meaning in work, and dealing with challenging colleagues or bosses. In other cases, the person might not be a good fit for the role — for example a salesperson who doesn’t like interacting with people.

Alternatively, some workers may be

> National mortgage lender Waterstone Mortgage Corp. has named Chik Quintans as the company’s new director of digital marketing.

> Jim Janczy joins NewFed Mortgage as executive vice president-chief production officer. He will be responsible for sales and marketing.

> Opteon USA, an international provider of valuation, advisory, and property services, has promoted Lee Trice to managing director.

Once you understand your motivations for quiet quitting, propose actionable and reasonable changes your boss could implement to help reduce your burnout.

tempted to follow coworkers who’ve already jumped on the quiet quitting trend. Whether resentful or admiring, for many workers it doesn’t make sense to do more work while others are doing the bare minimum.

As you brainstorm your reasons for quiet quitting, identify which factors are within your control. Did you work overtime because of bad time management or because your boss assigned you work right before a deadline? Are you confused about your role because you volunteer to help other departments or because other teams give you work? Record the details of your burnout experiences to both help you and your manager better understand the problems and identify solutions.

Ideally, employees want to give 100% while at work, including doing as much high-quality work as they can. However, to make working like this sustainable, you need to become comfortable setting and sticking to boundaries with yourself, coworkers, and bosses. Here are three tips to help you avoid wanting to check out at work:

Avoid taking on work outside your role

By being assertive, avoid work not directly related to your job. For example, don’t volunteer for tasks just because you’ve done them in the past and others have come to expect you’ll do them. Only accept assignments that fall within the scope of your work, interest you, or provide a growth opportunity for you.

If working overtime has led to

your burnout, improve your time management skills to work more efficiently, including avoiding distractions, streamlining processes, and using technology. Prioritize the tasks that are most urgent and important to your role, accepting that some to-do items won’t get done. If possible, increase how much work you delegate to others. But be wary that optimizing your time management skills can only save you so much time, especially if many aspects of your work system fall outside of your control. For example, if you rely on a coworker to provide the data for a report, how quickly they finish their work will determine how much time you have left before the deadline.

Stick to your work-life boundaries

Avoid answering emails or taking meetings after you leave work. Additionally, try not to worry about work during off-hours. Although not worrying is easier said than done, actively focusing your attention on hobbies or interests outside of work can help. If exhaustion is contributing to your burnout, ensure you get enough good sleep. Try to take the full number of vacation days

> Nations Lending, a fullservice national mortgage lender, announced the onboarding of Capt. (retired) Eric Flores, a 29-year lending veteran and Indiana’s #1 VA

originator.

> Cenlar FSB announced that Nayda McKain has been promoted to vice president, human resources business partner.

> Granite Mortgage of Champlin, Minn., has hired Brian Fritz as its first president.

> Planet Home Lending, a national mortgage originator and servicer, has named Lynette Hale-Lee its western divisional manager.

employer. For example, you may look for jobs that have certain benefits helpful for avoiding burnout, such as flexible working arrangements or mental health days.

you’re allowed, even if doing so makes you feel uneasy or is frowned upon at your company. Equally crucial to taking time off is commiting to not working during your vacation.

Once you understand your motivations for quiet quitting, propose actionable and reasonable changes your boss could implement to help reduce your burnout.

Solutions can include more recognition, more growth opportunities, better pay, flexible working arrangements, or removal/management of the stressful aspects of your job. For example, if you’re constantly given work outside of your specialty, ask that assignments be commissioned to the appropriate team instead.

Use popular psychology tool the DEARMAN technique to help you approach the conversation with your manager. Here’s how:

• Describe your problem

• Express your feelings

> Homestar Financial Corporation, a privately held mortgage lender, announces Gurp Bhandal as executive vice president of national production.

• Assert what you need

• Reinforce gratitude towards the opposite party

• Mindfully stay on point

• Appear confident

• Negotiate as needed

Additionally, keep in mind that having a solutions-oriented conversation is a win-win. If your boss is receptive, you can improve your situation. If your boss doesn’t respond well, that will help confirm that you don’t want to work for this employer anymore.

If the steps outlined haven’t successfully reduced your burnout, it may be time to quit. Ultimately, quitting and finding a job more aligned with your interests and lifestyle will improve your short- and long-term happiness more than quiet quitting at your current job will.

Keeping in mind your reasons for quiet quitting will help you determine what you’re looking for in your future

Alternatively, you may focus on choosing a workplace with a healthy company culture, which you can determine by talking with past or current employees at the target company. Also, when interviewers ask if you have questions for them, you can use behavioral questions to probe how employees are treated. For instance, if your current boss never acknowledges your work, you can ask potential employers how they view or reward employees who’ve successfully completed their work.

It’s normal to want to do as little work as possible for your current employer while you search for a new job. But make sure you don’t check out or act in a passive-aggressive way that catches your boss’s attention. Maintaining amicable connections with old employers increases the likelihood they’ll think of you for other job openings or be willing to write you letters of recommendation in the future. Additionally, you don’t want to be “loudly fired” if you haven’t yet secured a new job and aren’t prepared financially. n

Rebecca Tray is a content writer and researcher at Resume Genius, a careerfocused website known for its AI-powered resume builder, free resume templates, and job search resources.

> Nations Lending opened its newest branch in Summerville, S.C., and hired native South Carolinian Hunter Jackson as branch manager.

> Union Home Mortgage announced the hiring of Kimberly Evers as branch manager for its Fayetteville, N.C., location.

Submit the information to Keith Griffin at kgriffin@ ambizmedia.com for possible publication. Announcements should include a headshot.

You either get “it” or you don’t … It sounds crass, but it’s really not. It’s more about self-awareness than anything.

“Leadership has been innate in me since I was on the playground with my friends, I’d be the first one to say, “hey, we’re going to do this, we’re going to jump off the side of the slide, let’s go do it.” It wasn’t my job to be a follower, I am a leader.” DeLory explained

Kevin went on to explain that one of the strongest lessons he has learned in business is authenticity. He believes that when you are working or dealing with someone who is inauthentic that those who are real will see right through it. Kevin built his success by being in the trenches, putting the time in, and learning as much as he could. As an Account Executive he earned the trust of his brokers, never asked of his underwriters anything he wouldn’t do himself, and always set the proper expectations; he likes to say, “bad news is a dish best served hot.”

Kevin was a leader without the title in his earlier years in the industry and was privy to real culture and real influence before it was made out to be the “celebrity status” it is today. Now some may even join a culture only for influence and that would be for the wrong reasons. According to Kevin, culture is doing the right thing, respecting each other, lending a hand because you want to see someone get better, not because you’re in it for yourself.

“There’s not much that brings me greater joy than seeing my team do well, some of those include winning the day and the month, being a father, and bringing business to EPM,” says DeLory.

Another rewarding piece of advice Kevin received in his career was to slow down and wait for others to catch up; everyone learns differently. Kevin deems this some of the best leadership advice he has ever received from a late mentor who has since passed away. He has taken that advice in stride and applies it every day to his leadership skillsets.

“I do find that slowing down and working through things to develop a plan is extremely valuable. However, I don’t wait until the end of the month to know if the plan didn’t work. I figure it out weekly. Leaders check in; leaders tweak the plan. Leaders trust their gut; follow their intuition, and know that one misaligned person can burn down any culture faster than an aligned person can build it up.” – Kevin DeLory

Lastly, to lead is to be loyal not because of the word but because of the action. Pay it forward and always put people before the profits, when you do that, more profits come than you could have ever imagined. Kevin is partnered with EPM not only for its values, culture, and belief in their people but their mission to empower PEOPLE more. “Our industry is all about the people” Kevin goes on to say… “When you have a strong community, anything is possible and we aren’t just EPM Wholesale, We Are Wholesale.”

Kevin DeLory has over 20 years of experience in the TPO space. Kevin has a leadership style that always puts him in the trenches working through any problem with his team versus a bird’s eye view from above. Kevin believes in the bottom-up philosophy that the leadership team at EPM has created. Kevin has several internal core values but among them his favorites are accountability, relationships over transaction, and integrity.

This team-oriented sales approach has gained Kevin results that he is very proud of. There is never a day that goes by where Kevin is not watching growth under his guidance, and the results speak for themselves. When Kevin sees a challenge, he jumps on it and is very quick to embrace the conflict head on so no outcome can ever be hindered with unacceptable behavior.

Today, Kevin is the Chief Lending Officer and Partner at EPM (Equity Prime Mortgage) where he thought culture was just a buzzword, and boy was he wrong. Kevin explains his journey at EPM as a complete 180. “Everybody

speaks about culture, but nobody lives it like I have seen in this organization” said DeLory after celebrating his one-year anniversary in August of 2022.

More than anything, Kevin’s experience has left him an eager mentor. The greatest joy in Kevin’s life aside from his daughter is to help his team become the best that they can be. That means both in and out of the office. He learns from his people just as much as his people learn from him and for that he is eternally grateful.

Having been in the industry through its ebbs and flows, Kevin is familiar with the stresses and rewards, and can turn ANYONE into a high performer. His strong sales training ability mixed with his leadership and culture knowledge is a perfect recipe for anyone who walks through his door ready to learn and grow.

Kevin graduated from Rhode Island College and at one point thought he may have been a teacher but after seeing what he could do in the sales force, he never turned back. It is Kevin’s

belief that a leader should: know the way, go the way, and show the way.

You can reach out to Kevin anytime by email at Kevin@epm.net or you can go to epmwholesale.com and fill out any form or see anything EPM’s team is up to there. You can also tune into his podcast, “The Whole Perspective” with his SVP of Lending at EPM and best friend of 30 years, Kenny Phillips. They air an episode every Friday at 11:30AM EST.

When Kevin is not at work or in the field, he truly is living the dream at home in in Rhode Island with his beautiful wife, Dana, their daughter, Brooklyn and as many dogs as they can manage. In his downtime, you can catch Kevin on the golf course, with friends, or with his family.

TikTok is currently the fastest-growing social media platform in the world, with over 800 million active users worldwide.

For a small business or a newly established entrepreneur, TikTok is a great platform for you to expand your brand identity and increase your consumer target audience.

Whilst TikTok has traditionally been used mostly by 16-24-year-olds, it is becoming increasingly popular with older generations, giving businesses a platform to express creativity to a wider audience.

Here are nine ways businesses can upscale and reach wider audiences

using TikTok.

First, you want to establish yourself or your business as a credible, trustworthy authority. This will instantly attract audiences and keep them engaged with your business.

To do so, you need to create videos that bring value to your customer.

Whilst there are plenty of people creating videos of dance challenges and pointing at text bubbles, it is doubtful that this kind of content will help build your business’ credibility. Audiences much prefer to hear a voice behind the business.

Therefore, engage with audiences

by using your voice, whether it be answering questions you are receiving frequently from customers or providing informative content they want to see.

There are several ways you can do this, such as: using the keyboard shortcut tool, demonstrating internal training, or creating educational content videos around what your audience wants to know.

Whether you are the face of your business or your product is the star, a consumer needs to establish who or what clearly can offer them familiarity — and this is all part of building your brand.

This is important because, on TikTok, a user’s default feed is not

the feed containing the people they follow. Instead, it’s the ‘for you’ feed, meaning TikTok algorithms are personally customized for the users watching habits.

Therefore, if you are posting videos of yourself as the face of your business and your journey, you are extremely likely to get put in front of users who have no idea who you are.

This is because TikTok loves to push a business’ success story onto a user’s ‘for you’ feed and share the growth of a company — which is why it is so important to be the face of your brand.

If you are already established elsewhere, whether it be on your own personal website, other social media platforms, or perhaps you have built a podcast, TikTok can actually be a great vessel to promote external projects you

You can do so using the ‘edit profile’ section within the app by simply including links to where your business appears elsewhere across the internet.

Having a link in your bio is extremely important, ensuring it is extremely easy for a user to direct themselves to your business website once landing on your TikTok page.

It is worth remembering that you need a minimum of 1,000 followers to have a link in your bio. However, once that is achieved, it is recommended to have the link to your website in the ‘website’ section, which is below the ‘bio’ section.

In the bio section, you could add a link to “check out more here” with an arrow pointing downwards, which

clearly indicates to your customer where your business’ main website is.

Essentially, having ‘actionable’ links will help you encourage users to navigate themselves away from TikTok, which is how you are going to make your money!

Going live is a great way to get to know your audience in an unscripted, unfiltered kind of way. Customers love to know the person behind a business in a personal way, as it makes them feel more involved in the business and the journey.

To go live, you do, again, need to have at least 1,000 followers. However, once you do, the best way to feel comfortable is to practice on a smaller audience.

Once you have made a few mistakes in front of a smaller audience, you will

Engage with audiences by using your voice, whether it be answering questions you are frequently receiving from customers or providing informative content they want to see.

be a pro by the time you have built up a mass following.

Going live reinforces the point mentioned above: You want to establish yourself as credible and trustworthy. By showing your audience the real you, you are encouraging them to trust you and your business, giving it authenticity.

On TikTok, audio matters, and 88% of TikTok users say that sound is essential to the TikTok experience. Being an essential asset for going viral, brands should learn how to get it right. Therefore, by following the latest algorithms, you can check the “TikTok Viral” tab via the video editor, then select “Sounds” to browse the latest trending audio tracks.

It is important for businesses to be extremely careful when using songs, as they must comply with copyright. As a business account on TikTok, you can only use TikTok commercial sounds. You should also check that the trending sounds aren’t at odds with your brand image, of course.

To jump on the latest trending sounds, take advantage of the Creative Centre, where you can go to see the top performing sounds on TikTok, whether a trend is on the rise, at its peak or starting to slow down.

“Adayinthelife” videos have a staggering 1.4 billion views on TikTok, so jumping on the trending hashtag is a no-brainer for any account wanting to attract attention.

Taking your followers along with you on a typical day as a small business owner is a great way to keep them engaged and involved with your journey and the growth of your business.

Whether it be the simple things like coffee and breakfast to product launches and marketing events, it is nice for your customers to get to know you, as well as the team that helps to keep your business afloat.

For a business wanting to attract niche audiences, hashtags are a great way to do so. Using relevant hashtags in established TikTok communities such as #WineTok, #FoodTok, #CleanTok or #BookTok can help you tap into users in certain niches.

As a small business, it can be easy for you to be involved with your audience if you don’t have a huge stream of comments. Therefore, you can also connect with audiences in your comment section or answer their questions.

Once any TikTok account attracts followers, they will continue to want to see more.

Therefore, posting rich and valuecentered content around 1-3 times daily is a great way to keep your audience happy.

Short-form videos are an excellent marketing tool, and since TikTok is the home of this type of content, as a business owner, you should take advantage.

Posting more than once every day increases your chances of getting seen by your desired audience and increasing your following. n

Chloe Chai is a spokesperson for Business Name Generator.

Chloe Chai is a spokesperson for Business Name Generator.

ACC Mortgage is the oldest Non-QM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

ACCMortgage.com

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

Angel Oak Mortgage Solutions is the leader in the non-QM mortgage space. We offer alternative specialized mortgage solutions for brokers throughout the country helping borrowers who don’t fit conventional guidelines. We are pioneering a fresh approach to today’s mortgage lending challenges helping partners to grow their business.

angeloakms.com (855) 631-9943 info@angeloakms.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WA, WV, WI, WY, DC and the District of Columbia

Change Wholesale gives mortgage brokers an unfair advantage to close more loans, faster. Our CDFI certification from the U.S. Department of the Treasury allows us to offer proprietary programs that are tailored to meet the needs of commonly overlooked prime borrowers. Our flagship Community Mortgage requires no income, employment, or DTI documentation. Prime borrowers looking for their dream home or vacation getaway can get approved with just the first page of the bank statement.

ChangeWholesale.com (949) 255-6085 info@changewholesale.com

Acra Lending is the leader in Non-QM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

LICENSED IN:, AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

First National Bank of America East Lansing, MI

Bio: FNBA is a portfolio lender with over 65 years of experience. We understand that in the Non-QM business, service makes all the difference. That’s why we are committed to providing you with the fastest turn times, exceptional service and loan programs that make growing your business easy!

fnba.com/mortgage-brokers

LICENSED IN: All 50 U.S. States Find

Arecent international campaign focused on Cybersecurity Awareness Month was led by the Cybersecurity and Infrastructure Security Agency (CISA) and the National Cybersecurity Alliance (NCA). The two groups highlighted four key action steps that everyone can take to better protect themselves against cyber threats.

In this post, we will discuss the four steps and why they’re essential, as well as provide some valuable tips that small and medium business owners can follow to make sure that their businesses and employees are protected.

Phishing is a type of cyberattack in which an attacker tries to trick someone into doing something that they shouldn’t, such as clicking on a malicious link or sharing their username and password. It is a huge threat to businesses because one small mistake by an employee could result in sensitive

company and/or customer data falling into the wrong hands, the installation of malicious software onto company computers, and lots of other serious cybersecurity issues.

Phishing most commonly happens via email. Below are two real phishing email examples that were detected by Trend Micro — a global leader in cybersecurity — recently.

As you can see, the examples above look legitimate. However, there are some commons signs of phishing

scams that employees can be trained to recognize, including:

• Threats or a sense of urgency —

“Your account will be closed in 24 hours if you don’t click this button,” for example.

• A questionable email address — If an email claims to be from a certain company, but the email address domain doesn’t include the company’s name, it’s a huge red flag.

• Suspicious attachments — Cybercriminals will often attach files to emails that when opened will install malicious software.

• Strange requests — Out-of-theblue emails that ask for payment and/ or personal information are almost certainly phishing scams.

• Grammar and spelling errors.

In addition to ensuring that all employees know what to look out for when it comes to the common signs of phishing scams, security software should be installed on all company computers. Look for a product that comes with anti-phishing capabilities — most security software from wellknown companies will include this.

If you or one of your employees receives a phishing email, forward it to the Anti-Phishing Working Group at reportphishing@apwg.org. Phishing scams can also be reported to the FTC at FTC.gov/complaint.

Making sure that all company computers’ operating systems and apps are regularly updated to the latest software versions is essential because software updates will regularly include fixes for known security issues. The use of out-of-date software makes it exponentially easier for cybercriminals to exploit a computer/system.

The global WannaCry/WannaCrypt ransomware attacks in 2017 targeted Microsoft computers running outof-date software that had a known vulnerability that had already been fixed by Microsoft. However, because many computers hadn’t been updated, cybercriminals were able to take advantage of the exploit and install ransomware on them that caused an estimated $4 billion in damages.

If your business employs only a very small number of employees, teach them about the importance of installing the latest software updates and remind them from time to time to

check for new ones. However, if that wouldn’t be practical, consider hiring a person to take care of IT-related issues or give an existing, tech-savvy employee this responsibility.

Using password hacking software, a cybercriminal can crack a 10-character password made up of only numbers instantly, whereas a 14-character password made up of a mix of numbers, uppercase and lowercase letters, and symbols (@, %, &, etc.) would take 200 million years.

However, it’s difficult to remember complex passwords, so it can be

passwords, allowing every employee to have unique, ultra-strong passwords for all their accounts — without the need to remember them all. Many password manager providers offer licenses specifically designed for small and medium businesses, too.

Multi-factor authentication (MFA) — also called two-factor authentication (2FA) — adds an extra layer of protection to accounts by requiring users to provide two separate forms of information to log in.

Conventionally, users log in with

tough to resist the temptation to use suboptimal ones. If only there were an easy way to create strong, toughto-hack, memorable passwords, right? Well, there is! You can create strong passwords from memorable song lyrics, poems, etc. using letters, numbers, and characters to represent words and/or letters.

For example, take the AC/DC lyric “It’s a long way to the top if you wanna rock ‘n’ roll.” This can be converted to a strong password like so: i@ Lw2tTiUwr’n’r (it’s a long way to the top if you wanna rock ‘n’ r). As long as you can remember it, you can get as creative as you want, too. For instance, the dollar sign can be used to represent the letter “S” or the word “money” and parenthesis makes for a good, toughto-guess substitute for the letter “O”.

You can check how strong your passwords are and how long it would take a hacker to crack them by clicking here.

You should also consider purchasing a password manager for your employees. Password managers can automatically generate and store secure

a username and password (the password being the first form/factor of identification). However, MFA requires users to provide an additional factor to prove that they are who they say they are — such as a code sent to a trusted phone number. According to Google, MFA via SMS helps “block 100% of automated bots, 96% of bulk phishing attacks, and 76% of targeted attacks.”

There are several common authentication methods for MFA, including SMS verification, email verification, and authenticator apps. However, no matter which authentication method is used, the improvements to account security are tremendous.

It is strongly encouraged that you enable MFA on all your personal and business accounts and make it mandatory for employees to enable it on all their work accounts. n

Michael Mundell wrote this article https://www.score.org/blog/4cybersecurity-tips-businesses for SCORE. org, which is the website for the Service Corps Of Retired Executives.

One small mistake by an employee could result in sensitive company and/or customer data falling into the wrong hands.

The New England Mortgage Expo returns to the fabulous Mohegan Sun Resort & Casino in 2023! With over 2000 attendees in 2022, you won’t want to miss this opportunity to be a part of New England’s largest and most exciting mortgage event — the largest regional mortgage show in the nation. Join your peers for an exiting day of networking, product showcases, educational sessions, motivational speakers, and so much more!

Find a mortgage event near you. For mortgage brokers, originators, processors, underwriters, and anyone looking to grow within the industry. originatorconnectnetwork.com/events

Do you have what it takes to be the best?

TITLE SPONSOR

TITLE SPONSOR

This show — part of the Originator Connect Network lineup of shows — provides an exceptional opportunity to showcase your solutions, while networking with hundreds of mortgage industry leaders, brokers and lenders. And all of them are there because they want to improve their business practices — the best environment for you to show them how you can help them succeed!

Ashopkeeper was dismayed when a brand-new small business, much like his own, opened next door on his left and erected a huge sign which read BEST DEALS.

He was horrified when another business competitor opened on his right, and announced its arrival with an even larger sign reading LOWEST PRICES.

The shopkeeper panicked until he got an idea. He put the biggest sign of all over his own shop. It read MAIN ENTRANCE.

There is no substitute for creativity. That shopkeeper could have spent a year’s profits on an ad campaign, mailings, giveaways, you-name-it, and probably wouldn’t have made as large an impact. A stroke of brilliance kept his business humming.

There is no correlation between IQ and creativity. Every single person has the potential to become more creative than they think they are. The key is developing a mindset that enables them to look at things from new perspectives. Creativity and innovation

these factors into account: Money. Creativity and innovation can’t breathe in an atmosphere of budget cuts and downsizing. You may produce creative ideas to get around a lack of funds, but in the long run, you won’t get many practical ideas unless you’re willing to spend cash on developing and testing them.

Elbow room. Cramming people into tight little cubicles is no way to get their imaginations working. Give them room to move around: conference rooms to spread out, windows to stare out, and the freedom to work in different environments that spark innovative ideas and insights. In this age of working from home, be open to allowing people to escape the distractions of the office to do some brainstorming outside the confines of the workplace.

Freedom. Part of this is related to the space issue — freedom to work in nontraditional surroundings. But more important is freedom to suggest

changes and question assumptions. Don’t challenge people to think creatively only to squash their ideas with “But that’s not how we do things around here.” Keep your eye on the prize and consider innovative ways of reaching that goal.

Risk. Remember how many times Thomas Edison tested his first light bulb? You can’t generate creative thinking if people don’t feel comfortable taking chances and failing. You should tolerate intelligent risk — and even celebrate failure — if people are acting in good faith while trying to help the organization grow. Failure is not fatal; it’s just proof that there’s another solution out there.

Advertising genius Alex Osborn, considered the “father of brainstorming,” devoted his life to promoting and teaching creative thinking. He believed the fiercest enemy of creativity was criticism: “Creativity is so delicate a flower that praise tends to make it bloom, while discouragement often nips it in the bud.

Any of us will put out more and better ideas if our efforts are appreciated.”

Make creativity a core value. There is no business that cannot benefit from creative thinking. Talk about the power of ideas and the benefits of innovation.

model creative thinking. If your staff hears you express not-so-traditional ideas, they will be more inclined to share their thoughts.

A real estate tycoon from New York City visited a Miami bank and said his

“Well, I’ve got a brand-new Cadillac outside.”

The banker jumped all over it and took the Cadillac. A week went by, and the New Yorker returned and paid off the $3,000 note and $25 interest for the week.

The banker said, “I don’t understand, sir. I looked at your application and called New York City. You’re a very successful real estate operator. Why did you have to come into my bank and borrow a paltry $3,000?”

“Can you think of a better place to keep my car for seven days for $25?”

Provide training that hones people’s thinking. Reward creative efforts, even when they fail, to reinforce the value you place on imagination and creative thought. Sometimes a minor tweak can make a major difference.

As a manager, it’s critical that you

wife wanted to fly over to the Bahamas, so he needed a fast $3,000. The banker said, “I don’t know who you are.”

He said, “I have a very successful real estate office in New York City.”

The banker said, “That doesn’t matter. I’d have to have some collateral.”

Mackay’s Moral: A spark of creativity can ignite a blazing business success. n

Harvey Mackay is a seven-time New York Times best-selling author whose 15 inspirational business books have sold 10 million copies worldwide.

It’s a new year, so it’s time to reset. What better time for new habits, a new mindset, and more? And I’m not talking about the new year’s resolution you’ll probably be done with by the time you read this. I’m talking about lasting changes — not the two weeks you’ll devote to your Peloton before it starts collecting dust.

According to Johns Hopkins Medicine, there is a link between positivity and wellness, most likely due to a reduction in inflammation that is caused by stress. Regardless, their study found that people with a positive outlook — whether they had a history, other risk factors or not — were less likely to have a cardiovascular event.

With a sense of gloom pervading the industry for what feels like years, let’s work to break through the negativity and focus on the good news for the industry. I’m not disputing the validity of market concerns on home price appreciation, higher interest rates, or inventory constraints, but there is still plenty of good news for the market as we begin the new year. Let’s concentrate on these four:

Rates may be high compared to recent levels during and prior to the pandemic, but they are still historically low, according to a historical mortgage rate chart from TIME. It’s so easy to get caught up in the here and now that we forget to bring current rates into perspective.

Homeownership continues to help Americans build wealth for their futures. The National Association of Realtors (NAR) reported that single-family homeowners typically accumulated $225,000 in housing wealth over 10 years. The NAR also reports that average monthly rents increased by more than 14% year-overyear in December 2021 and the Federal Reserve Bank of Dallas forecasts that year-over-year rental price growth will

reach 8.4% by May 2023.

With rent prices soaring, homeownership is not only a great wealth-building tool for the future, but it could be the more affordable option for the here and now. While it seems like a big commitment upfront, buying a home could potentially offer a lower monthly cost, while allowing buyers to start building equity that will pay off in the long run.

Another study from the NAR found that homeowners see a lot of social benefits, too. For one, homeowners tend to be more involved in their communities. The study showed that they are more likely to vote in elections and volunteer at local charities, because of the stake they have in the community.

Homeowners also form social bonds with neighbors and feel a sense of attachment to where they live. They

also have more incentive to deter crime and can even see positive health benefits, much like those that come with positivity.

Supply chain issues are finally subsiding. Sea-Intelligence, a supply chain research and analysis firm, reports that 50% of supply chain congestion has been resolved and that a “full reversal to normality” could come in March 2023.

Lumber prices also are coming down. Quartz reported that lumber prices are near pre-pandemic levels and expected to continue falling into 2023. With many of the challenges that faced new construction now easing, builders can better address the inventory issue the market has been facing for quite some time. Better inventory can help bring prices down and remedy many of the

challenges we’ve been seeing this year.

The bottom line is no one knows what 2023 will hold. Whatever events we may encounter, your attitude will play a large role in your success this year — or any year, for that matter.

Lucille Ball is quoted as saying, “One of the things I learned the hard way was that it doesn’t pay to get discouraged. Keeping busy and making optimism a way of life can restore your faith in yourself.” Start 2023 off with

your head held high and try to keep the good in perspective, it may pay off better than you think. n

Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum. The statements in this article are solely the opinions of Mary Kay Scully and do not necessarily reflect the views of Enact or its management.

I’m not disputing the validity of market concerns on home price appreciation, higher interest rates, or inventory constraints, but there is still plenty of good news.

“ It is truly an honor to work in this industry with such an amazing team!” - Twyla

Lake Forest, CA

Acra Lending is the leader in NonQM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com (888) 800-7661 sales@acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

We offer alternative mortgage solutions for originators throughout the country helping borrowers who don’t fit Agency guidelines. We are pioneering a fresh approach to today’s mortgage lending challenges helping partners to grow their business.

angeloakms.com (855) 631-9943 info@angeloakms.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WA, WV, WI, WY, DC and the District of Columbia

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions.

When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com (844) 851-3600 sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY