HOW GUILD MORTGAGE PLAYED ITS CARDS RIGHT

BROKEN HOMES, NEW LOANS

LEADS FROM LAWYERS CAN BUILD A NEW BOOK OF BUSINESS SUPPORT IN DARK TIMES

THE MORTGAGE WORLD MAKES THE MOST OUT OF PINK SLIPS

SCRUPLES ARE SWIRLING DOWN THE DRAIN

MAY 2023

A PUBLICATION OF AMERICAN BUSINESS MEDIA

Vol. 15, Issue 5 $20.00

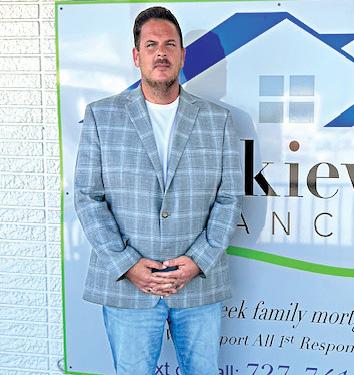

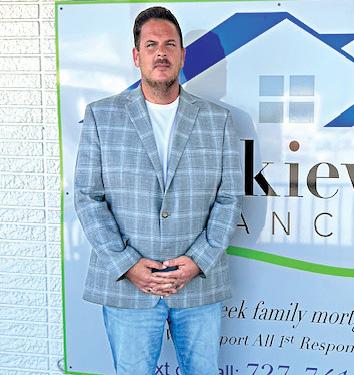

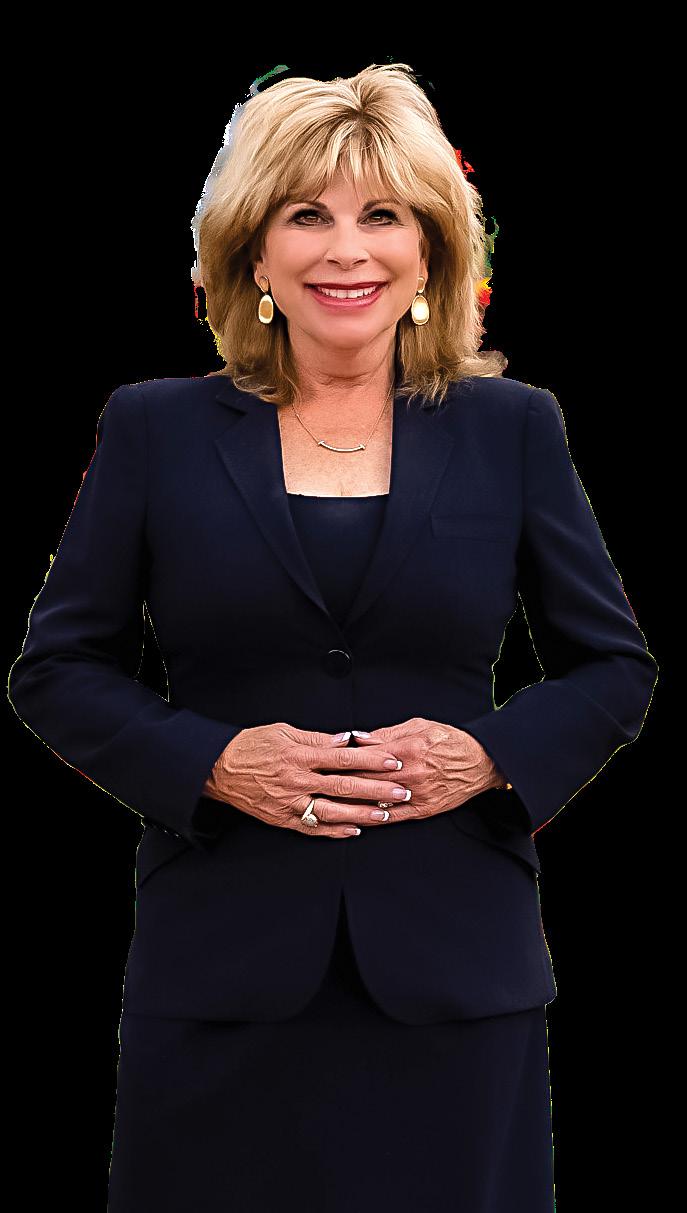

Terry Schmidt, incoming CEO, Guild Mortgage Co. is betting on continued success.

INFO@RCNCAPITAL.COM RCNCAPITAL.COM 860.432.5858 GET READY TO FLIP, NOW LENDING NATIONWIDE! ©RCN Capital, LLC. 2023 All Rights Reserved. NMLS #1045656. RCN Capital, LLC is licensed in AZ (License #: 0932325), CA (Loans made or arranged by RCN Capital, LLC pursuant to a California Finance Lenders Law license # 60DBO-46258), MN (MN-MO-1045656), and OR (ML-5571). This is not an offer to lend. All offers of credit are subject to due diligence, underwriting and approval. Not all borrowers will qualify and not all borrowers that qualify will receive the lowest rate or best terms. Actual rates and terms depend on a variety of factors and are subject to change without notice. ROCK STAR RATES HARD-CORE CUSTOMERSERVICE ELECTRIC LEVERAGES RAISE THE ROOF ON YOUR NEXT RENOVATION!

HOW GUILD MORTGAGE PLAYED ITS CARDS RIGHT

BROKEN HOMES, NEW LOANS

LEADS FROM LAWYERS CAN BUILD A NEW BOOK OF BUSINESS SUPPORT IN DARK TIMES

THE MORTGAGE WORLD MAKES THE MOST OUT OF PINK SLIPS

SCRUPLES ARE SWIRLING DOWN THE DRAIN

MAY 2023

A PUBLICATION OF AMERICAN BUSINESS MEDIA

Vol. 15, Issue 5 $20.00

Terry Schmidt, incoming CEO, Guild Mortgage Co. is betting on continued success.

4 Winning Hand Guild’s not bluffing when it comes to expansion. 6 Forecasts Are Murky This is no year for confident predictions. 8 Prioritze For Success Use your time wisely to get ahead. 10 Bring Back Ethics Too many are skirting the law — or outright breaking them. 17 People on the Move See who the movers and shakers are in the mortgage industry. 18 Build-A-Broker Thinly Capitalized Nonbanks bear watching for potential problems. 22 Build-A-Broker: Be An Equity Standout Speed will set you apart. 24 Build-A-Broker: Fighting Against Discrimination Federal appraisal standards are outdated 26 Your First Million Dollars: Feel Lucky, Not Fearful Don’t shoot for mediocrity. 28 Benchmarks & Best Practices: Winners Stretch Build a team for a better reach. 30 Non-QM Lender Resource Guide 32 My Best Deal: Helping A Baker’s Dozen Hard work finds a home for family of 13 34 Data Bank 37 Wholesale Lender Resource Guide Private Lender Resource Guide 38 When The Pink Slip Hits Have a network ready if bad news happens. 42 Appraiser Pushes New Values Jillian White is not your typical appraiser and she wants to change that. 60 Non-QM Lender Directory 61 Wholesale Lender Directory Originator Tech Directory Private Lender Directory AMC Directory 62 Facebook Thoughts: Break (fast) Dancing nationalmortgageprofessional.com MAY 2023 Volume 15 Issue 5 CONTENTS nationalmortgageprofessional.com COVER STORY PAGE 54 Guild Doubles Down While others fold, this lender grows by grabbing others. ILLUSTRATION | MEGHAN HOGAN, NMP SPECIAL ADVERTISING SECTION PAGE 15 AMC Showcase AMC SHOWCASE PAGE 46 Bountiful Breakups Divorces have a silver lining for smart MOs. NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 3

Keep Your Head In The Game T

he headlines are stark. Mortgage lender after mortgage lender are closing their doors. Employee layoffs are skyrocketing. The cost of being in the mortgage business, right now, is just too high. So, many industry players are simply folding, or at best are staying pat.

Then there are the high-stakes players. They’re the ones who’ve been careful with their chips when they won. They hoarded their winnings, careful not to bet cavalierly. And now they’re betting big. Because in a year when players across the board are bemoaning the hand they’ve been dealt, the high-stakes players understand that every gamble has the opportunity to bring in stacks of cash.

It’s natural for companies to want to leave the table when the action is against them. But true card sharps don’t do that. They know the game has ups and downs, and they know that if they are strategic in their play, the odds long term will be in their favor.

UPPING THE ANTE

So for those in our industry who think the best bet is to fold and come back to the game at a better time, we say just look at the participants who are instead bulking up, getting ready to be powerhouses when the cards turn. Mutual of Omaha Mortgage grabbed Keller Williams Mortgage and is quickly positioning itself as a bigger power. CMG pulled in the entire retail side of Homebridge Financial. Crain Mortgage Group surrendered and is now part of Legacy Bank & Trust.

But the company winning hand-over-hand appears to be Guild Mortgage. The publicly-traded company was a regional retail powerhouse all on its own. But with good capital reserves and savvy leadership, it’s been on a tear expanding its national footprint and growing its talent ranks. In just the past six months, it raked in New Mexico-based Legacy Mortgage, then midwest legend Inlanta Mortgage, and just a few weeks ago capped off its winning streak by sweeping up Cherry Creek Mortgage.

Guild takes pride that it’s C-Suite is predominantly female. But it’s been proving that in the M&A world, gender doesn’t impede aggressive action. Guild’s story is one that has a simple premise: those who planned before and are strong now will be strongest tomorrow.

Ante up, they say.

VINCENT M. VALVO Publisher, Editor-in-Chief

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Keith Griffin

SENIOR EDITOR

Gary Rogo

SPECIAL SECTIONS EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Sarah Wolak

STAFF WRITERS

Rob Chrisman, Dave Hershman, Erica LaCentra, Harvey Mackay, Lew Sichelman, Mary Kay Scully

CONTRIBUTING WRITERS

Nicole Coughlin, Nichole Cakirca

ADVERTISING ASSOCIATES

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael

PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Stacy Murray, Christopher Wallace

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Joel Berman

FOUNDING PUBLISHER

Submit your news to editors@ambizmedia.com

If you would like additional copies of National Mortgage Professional Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. National Mortgage Professional magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com

MAY 2023

Volume 15, Issue 5

LETTER FROM THE PUBLISHER

4 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023

Faulty Predictions Make Planning More Difficult

This spinning crystal ball called 2023 poses many challenges

BY DAVE HERSHMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

BY DAVE HERSHMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

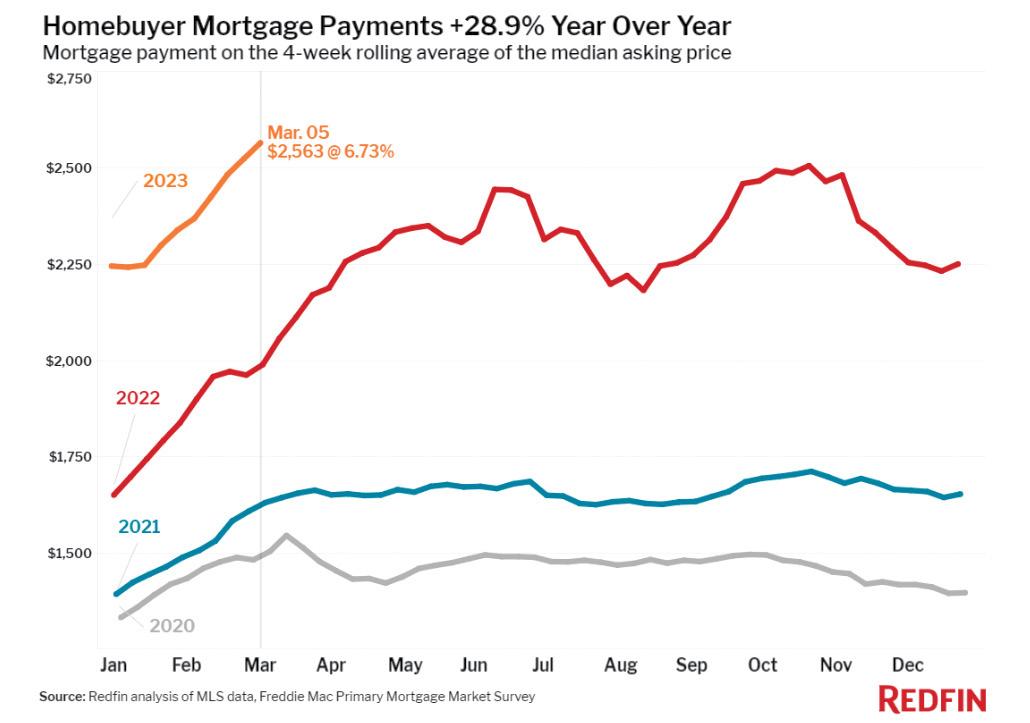

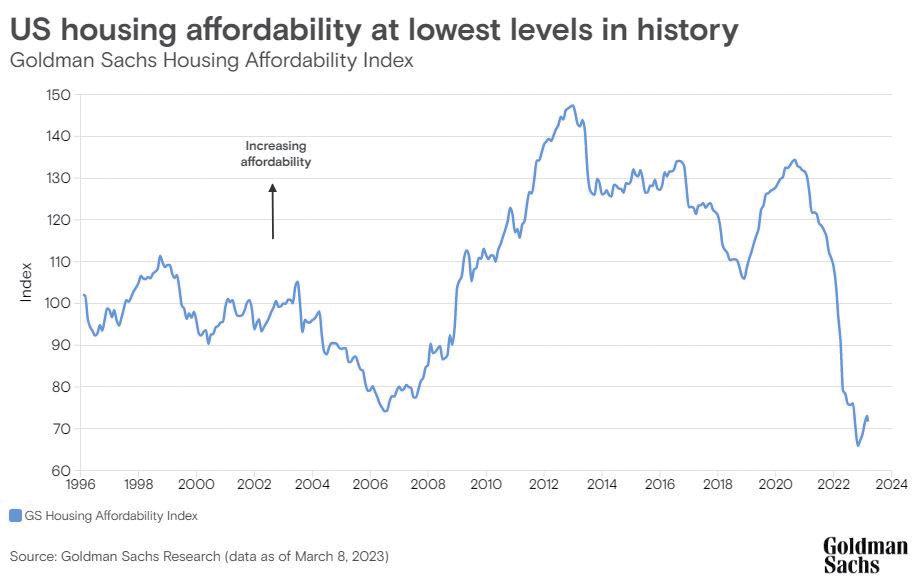

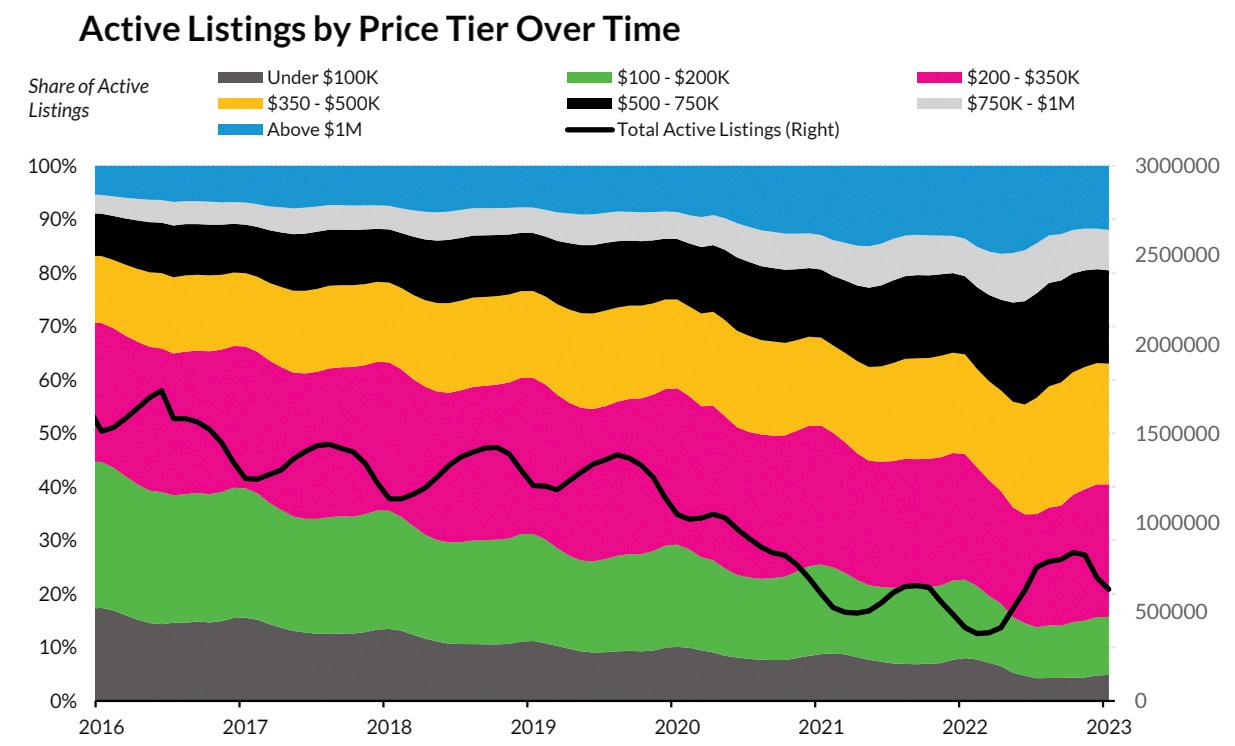

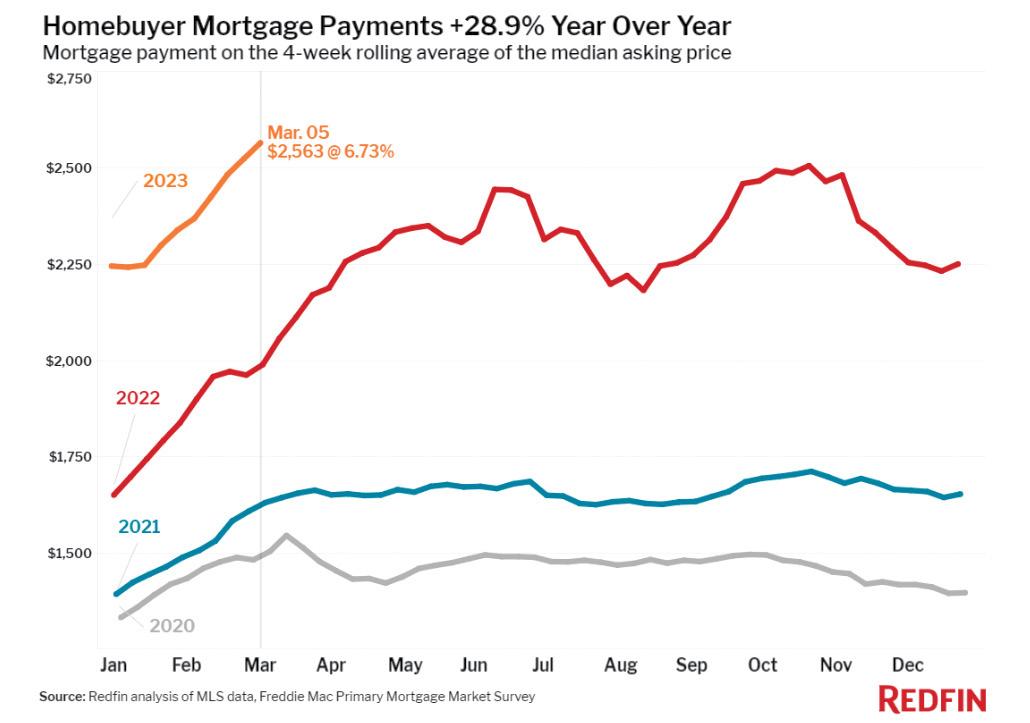

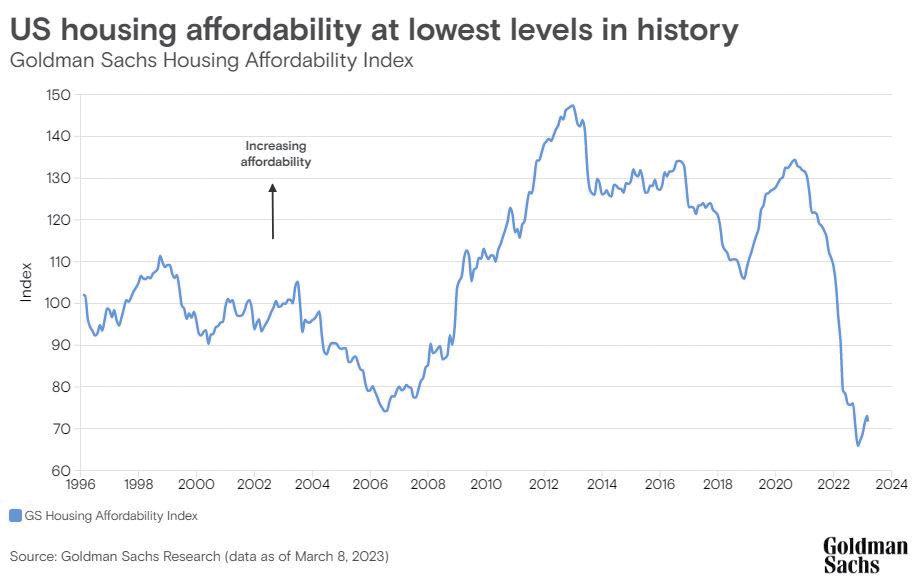

At the beginning of the year, I wrote a column about helping your loan officers plan for 2023. While the concepts are still valid, we need to acknowledge how hard it is to plan in this industry because the future is so uncertain. For example, we expanded our staffs exponentially in the period from 2019 through the first part of 2022.

If someone could spell the word processor or underwriter, we hired them and paid quite a premium. Everyone knew that eventually, these good times would end — and they did. Few predicted they would stop on a dime as they did. Thus, we spent most of the rest of 2022 shedding those hires. Lean and mean has become the key phrase of 2023. Yet, now rates have come down a bit (a few times) and the Spring has brought some buyers out.

DAVE HERSHMAN 6 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 RECRUITING, TRAINING, AND MENTORING CORNER

With staff pared, pipelines are quickly filling up. Should we start hiring again? Hard to know what the answer is when you can’t predict what is going to happen next month, let alone next year. Certainly, the average employer is gun-shy at this point. And if it is hard to predict what we should do, how do you think our loan officers feel? Should they bring back their assistants? Will you help them? What if things die back in the summer?

CHANGING FORECASTS

We are now over one-third of the way through the year, and you can see the forecasts that came out just a few months ago are already being revised. For example, Fannie Mae predicted a recession to start in the first quarter of this year. After the economy produced 800,000 jobs in the first two months of 2023, they shifted the forecast to a slight recession during

the second half of the year.

Since the economy is stronger than predicted, mortgage rates should have risen higher than forecasted. Yet, the Realtor.com housing forecast predicted average mortgage rates of 7.4% in 2023, with a peak during the first half of the year. In reality, mortgage rates have not risen to these levels, so unless they spike from here, we are not likely to reach these heights.

In addition, we went back and did a review, but did not see many predictions of a banking crisis and certainly did not see a specific warning about the largest bank that went down. Silicon Valley Bank was the second-largest banking failure in history. Some are now predicting that the concerns in the banking sector are what may finally tip the economy into recession.

Time and time again, we have indicated that predicting the future is futile. If any of these high-paid

prognosticators could actually predict the future with some accuracy, they would be investing in financial futures and making a fortune.

BEAM ME DOWN

So, let’s go back and misquote Star Trek — predictions are futile. No one predicted the pandemic. No one predicted the pandemic would cause the biggest real estate and refinance booms in history. And few foresaw the party stopping on a dime. The ability to plan in an ever-changing environment is a key to our success and a key to the success of our loan officers. It is a skill that we must convey. Our leaders should not be always asking — what are you doing to produce today? Our leaders, at times, must be asking — what are you going to do if ____ happens?

Welcome to the world where change is the only constant! n

Dave Hershman is a top author in this industry with seven books published as well as the founder of the OriginationPro Marketing System and the OriginationPro Mortgage School. He can be reached at dave@hershmangroup.com.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 7

Welcome to the world where change is the only constant!

Your Time Matters: What To Prioritize At Work To Ensure Success

Take the time to define — or even redefine — what your workflow looks like

ERICA LACENTRA, COLUMNIST, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

n the real estate industry, seasons matter, and with spring in full bloom, more folks are likely listing their homes or looking for homes. As the weather gets warmer, this is typically the point in the year when the mortgage industry starts ramping up. Also, as volatility in the industry starts to die down and rates start to settle a bit, you’re likely (and hopefully) noticing that work is picking up and you’re busier than you were during the winter months. However, as your workload picks up, it can often be difficult to prioritize and determine where you should be focusing your attention to make sure you are making the most of your working day. So in an

industry where time is truly money, what can you do to make sure you are spending that time on efforts that really matter?

IDENTIFY YOUR MOST IMPORTANT TASKS AND RETHINK YOUR WORKFLOW

While it may seem like a no-brainer to identify your most important tasks and prioritize them, that is often easier said than done. It can also become increasingly difficult to determine where to focus your attention when you experience a growing client base or an increase in loan volume. These circumstances are particularly challenging because your tasks haven’t necessarily changed, you just have more to handle overall.

Rather than getting overwhelmed by work piling up, this is the perfect time to look at your existing workflow, figure out where you can

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 RECRUITING, TRAINING, AND MENTORING CORNER ERICA LACENTRA

make improvements, and even cut out areas of inefficiency. Take a look at all of the tasks you are completing on a daily, weekly, and monthly basis and determine where they fall on your priority list based on importance and urgency. Chances are, you are prioritizing items that often don’t need to be, which is an easy way to knock certain tasks lower on your to-do list.

Then, take the time to define or even redefine what your workflow looks like. Set general expectations and deadlines for yourself, and your clients when they are involved, based on the list of tasks you have already identified. Plan to stick to the timelines you have set for yourself for a specific amount of time, think two weeks to a month. Use tools like to-do lists, your calendar, or even a project management software like Monday. com or Trello to set firm or floating deadlines so you can easily track how well you are sticking to them.

Once the amount of time you set has passed, you can evaluate what is and isn’t working, refine deadlines to be more accurate based on your experience, and ultimately become more efficient at your job. As you refine your workflow, be sure to look for repetitive and recurring tasks as you may be able to employ a technical solution to automate many of these areas, freeing yourself up for more important efforts.

ELIMINATE DISTRACTIONS

One of the major obstacles to productivity in your job is distractions and they can come in many forms. While external distractions like noise or being interrupted by a colleague can be easy to counter, there are many internal distractions that you don’t even realize are severely hampering your productivity. So, to eliminate distractions, start by figuring out what the biggest culprits are.

If your problem is external distractions like a loud workspace, you can wear noise-canceling headphones or set up a quiet space to be more productive. However, if you think internal distractions are your biggest problem, this may require more creative solutions. For example, if you are constantly being interrupted by

messages from other colleagues or unscheduled phone calls, you may want to set your work messaging system and phone to do not disturb as a quick fix. Or maybe your problem is you feel overwhelmed by your inbox and a need to respond to requests as they come in. In this case, you may want to take the time to set up email rules to send emails to specific mailboxes, which you can check at specified intervals during your day. You can also use time blocking on your calendar to your advantage.

Block out time during your day that you can dedicate to certain tasks. This can allow you to focus specifically on the task at hand while tuning out distractions.

DELEGATE TASKS

While it may seem challenging to hand off tasks to other people, especially if you are used to having full control over tasks within your organization, being able to delegate is critical for several reasons. First, it will free up your time so that you can focus on your most important tasks. If you are a manager within an organization or an owner, there simply isn’t enough time in the day to involve yourself in smaller dayto-day tasks. Delegating these tasks to other team members will allow you to focus on bigger-picture items and ensure you aren’t bogged down in the minutiae. Also, by delegating, you are developing the skills and expertise of other members of your team so that they can also grow within the company.

If you aren’t sure how to best go about delegating some of your tasks to get them off your plate, start by looking at the tasks you handle. Routine or recurring tasks are often some of the easiest to delegate as they are easier to train other team members on. Also, if you have tasks that you feel are outside of your area of responsibility and there

is someone in your organization that is better suited and more qualified to handle them, those are also tasks that can be easily delegated.

Once you have identified what you want to delegate, make sure you identify team members that have the skills, experience, and bandwidth to be able to handle these tasks. It can be counterproductive to try to delegate tasks to team members that are too busy or ill-equipped to handle them, as they will likely end up back on your plate.

Meet with the identified team members and set clear expectations and training for the tasks as you hand them off. Be prepared to initially provide support and feedback and be available to answer questions.

However, once they are trained on these tasks, you will have one less thing to worry about and can focus on more pressing and important tasks.

TAKE TIME FOR BREAKS

It may seem counterintuitive to take breaks in your workday if you are trying to increase productivity, however, factoring in time to step away from your work periodically can lead to greater efficiency. Taking regular breaks has been shown to increase productivity and creativity while reducing stress levels and potential burnout. So if you start feeling overwhelmed or unfocused, take some time to step away for a short walk or even just take some deep breaths to clear your head and get back on track.

In times when volume picks up, it can certainly be stressful trying to adjust to everything that comes your way. However, it is important to do just that and adjust to improve efficiencies and be as successful as you can be. n

Erica LaCentra is chief marketing officer for RCN Capital.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 9

Look for repetitive and recurring tasks … to employ a technical solution to automate many of these areas.

What Happened To Ethics?

A disturbing trend of disappearing values

BY LEW SICHELMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Years ago, I attended a session on ethics at a National Association of Realtors convention. It was eye-opening. The audience filled the room, which in and of itself was surprising, being that real estate agents have a terrible reputation. This is despite the fact that I truly believe most are hard-working souls trying to do right by their clients. That aside, when the speaker asked how many had seen another agent violate NAR’s highly touted Code of Ethics,

every hand shot up. Every one! But when they were asked if they had ever violated the code, nothing. Not one hand was raised. Not one!

I bring this up now because there seems to be something of a trend in the housing sector where companies and/or their leaders or employees are allegedly violating the rules, not to mention perhaps the law. Where are these people’s scruples?

Recently, for example, four women from the eXp Realty in California have charged two men with drugging them and then sexually assaulting them while at industry and company

10 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 RECRUITING, TRAINING, AND MENTORING CORNER LEW SICHELMAN

conferences. One of the men is a former eXp agent; the other still hangs his license there.

According to the complaint, the two alleged miscreants participated in an “ongoing venture to entice women to travel in interstate commerce, recruit enthusiastic real estate agents with the promise of career advancement and coaching, and use their considerable influence in the real estate industry on these other real estate agents(‘) behalf, knowing that they would use means of force, fraud, or coercion to cause these women to engage in a sex act.”

WHAT DID LEADERS KNOW?

The complaint describes in fairly graphic detail — I won’t bore you with the specifics — several incidents in which the plaintiffs maintain they were drugged, then woke up naked in bed with one of the defendants.

Worse, they charge that when they brought the incidents to the attention of eXp’s founder and its former CEO, the company leader did nothing about it.

Specifically, the complaint accuses both company leaders of knowing about a “pattern and practice of predatory sexual conduct” by the two defendants but not doing anything to help the woman. If true, has this company no moral compass?

Next, I give you Celebrity Home Loans, which stands accused of laying off more than 90% of its employees just three days before they expected to be paid. Even Silicon Valley Bank paid its workers their annual bonuses — bonuses they earned in 2022 — just hours before the financial institution collapsed.

Yes, the timing of the bank’s incentives seems a tad shady, especially since the officers had to know they were on the brink of failure. But they weren’t paid to just the top guys. They were paid to everyone. Also, according to news reports, bonuses have always been awarded on the same day every year, and the payments had been in the works for days.

And yes, there does seem to be some shadier — more shady? — dealings among leadership. Reportedly, several officers sold stock they owned in the bank to SVR’s parent company, pocketing millions for themselves, just before the bank went under.

PAY WITHHELD

But Celebrity, if the suit proves true, denied employees timely compensation for the pay period immediately prior to their termination. “For many,” the suit alleges, “the outstanding pay included salaries, wages, and commission earned during the entire month of January and the first half of February.” According to the lead plaintiff, they weren’t paid for accrued paid time off and vacations, either.

Come on, guys. These are the people who brung you there. Where’s your sense of right and wrong? At least Homespire Mortgage has agreed to pay 12 former loan officers the full amount they were due for working overtime and off the clock. It took a lawsuit to get Homespire to step up, but it finally did.

Citing violations of the Federal Fair

Labor Standards Act, the Homespire suit sought to recover unpaid overtime, minimum wages, and commissions as well as attorneys fees and court costs. According to the suit, the plaintiffs were individually owed between $9,500 and $42,960, including both total wages owed and liquidated damages. The loan officers were said to be compensated through a baseline hourly wage plus commissions on loans they closed. The amount of the commissions depended on a number of factors, such as the number of loans closed, loan size, and the loans’ interest rates.

POACHING

And then there’s the less-than-ethical practice of pouching the other guy’s employees. Here, PrimeLending is suing First Community Mortgage for raiding 100 of its employees last September, stripping it of about 10 percent of its workforce and $30 million in annual revenue. And earlier last year, LoanDepot sued CrossCountry Mortgage for purportedly poaching at least 32 of its New York employees, taking with them thousands of confidential documents.

Actually, CrossCountry also has been accused by two other lenders, Guild Mortgage and Caliber Home Loans, of raiding their workforces. In Caliber’s case, the company alleges that CrossCountry snatched more than 80 employees who were responsible for more than $2.3 billion in annual originations.

“We see cases like this all too frequently,” says mortgage banking consultant Joe Garrett of Garrett, McCauley & Co. “So here’s our advice: Anytime you’re thinking of hiring more than two or three employees from a competitor, talk to your attorney first to make certain you do it in a way that will avoid a lawsuit.”

And how about junk fees? Call them legit if you want, but to me, it’s outand-out thievery. And the Consumer Financial Protection Bureau agrees. In March, the watchdog agency identified them as “illegal fees old and new ways that mortgage servicers attempt to run up” the tariff on homeowners.

Among the controversial fees: Charging the maximum late fee allowed by relevant state laws, even when

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 11

Thankfully, there’s some justice in this hocus-pocus, switcheroo world.

owners’ mortgage contracts capped late fee amounts below state maximums. Charging for property inspection fees for every visit even after addresses were known to be incorrect. Charging for mortgage insurance premiums that were not owed. Failing to waive late fees for borrowers entering certain loss mitigation options that precluded late fees from being charged while in forbearance.

And that’s not all! Last year, the CFPB reported finding servicers that charged borrowers who paid by phone “sizable” fees, even though consumers were not made aware of the pay-byphone penalties. Have these robbers no consciences?

PREYING ON THE MILITARY

I could go on and on. A Calfornia lender shut down by the CFPB for repeatedly advertising to military families — our soldiers and sailors — that illegally indicated it was affiliated with the U.S. government. A Florida-based loan

officer accused of concocting child support documents for kids that didn’t exist, creating fake income statements and forging judges’ signatures in order to qualify borrowers for financing for which they didn’t otherwise qualify. A large national bank accused of welching on its commitment to increase its lending in low and moderate income communities.

Thankfully, there’s some justice in this hocus-pocus, switcheroo world. To wit, the California couple who sued an appraiser of undervaluing their property because they were Black. The appraiser valued their place at $998,000. But with a White friend posing as the owner, a second appraisal came in at $1.48 million.

The parties have since settled out of court for an unspecified amount. But the deal comes with a unique and justifiable caveat: The defendant and others who work for her company were compelled to watch a documentary about appraisal bias and

featured the plaintiff’s experiences. That film, “Our America: Lowballed,” was produced by ABC News.

And speaking of Justice, four realty firms have now settled with New York Attorney General Letitia James in the infamous Long Island case in which agents were found to be steering Black clients away from White neighborhoods. Said James, “Discriminating against people because of race is not just shameful — it is illegal. Housing is and always will be a human right, and my office will continue to address these pervasive and discriminatory practices statewide.”

Amen! n

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country.

RECRUITING, TRAINING, AND MENTORING CORNER

12 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. www.utahmortgageshow.com PRODUCED BY SALT LAKE CITY, UT Sheraton Salt Lake City Hotel Register for FREE with promo code MBMFREE MAY 10 Utah’s top gathering for mortgage pros. Innovate. Educate. Motivate.

Discover Where Your Competitors Stand In The Mortgage Market

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Mortgage MarketShare Module

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Loan Originator Module

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

GET A FREE MORTGAGE COMPETITOR ANALYSIS

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

BENEFITS

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

NEED MORE DATA?

Inquire about our NMLS Data Licensing and LO Contact Database options.

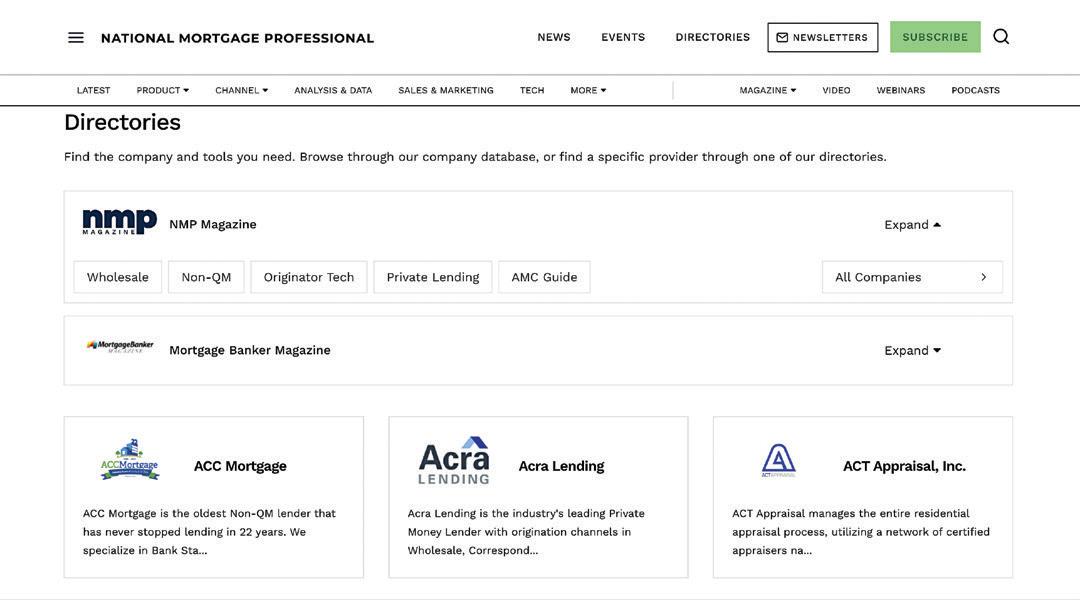

ACT Appraisal, Inc. East Dundee, IL actappraisal.com

Ron@actappraisal.com

(888) 377-8901

AREA OF FOCUS: ACT Appraisal is a nationwide AMC focusing on residential appraisals

DESCRIPTION OF PRODUCTS OR SERVICES: ACT Appraisal manages the entire residential appraisal process, utilizing a network of certified appraisers nationwide, to complete assignments from an array of mortgage lending institutions. Please contact us for more info.

PCV Murcor Pomona, CA

pcvmurcor.com

sales@pcvmurcor.com

(855) 819-2828

AREA OF FOCUS: Nationwide Real Estate Valuations Management — Appraisal Management Company

DESCRIPTION OF PRODUCTS OR

SingleSource Property Solutions LLC Canonsburg, PA

singlesourceproperty.com

marketing@singlesourceproperty.com

(866) 620-7577

AREA OF FOCUS: Appraisals, BPOs, AVMs, Hybrid Valuations, and Value Reconciliations

DESCRIPTION OF PRODUCTS OR

Home Base Appraisal Management

Sandy, Utah

HomeBaseAMC.net

Michael@homebaseamc.net

(801) 449-9200

AREA OF FOCUS: Apprasial Management Company — We Care — INC 5000 Fastest Growing 5X

DESCRIPTION OF PRODUCTS OR

SERVICES: From a Regional powerhouse to a national INC 5000 fastest growing company five years running. Home Base Appraisal Management has put their stamp on the Apprasial industry and brought service levels to all new heights. All of this without a marketing team!? This company truly breaks the mold with their different approach to the industry of real estate appraising.

SERVICES: From our in-house experts offering customized strategy with you at every step, to our nationwide panel of independent appraisers working in the communities you invest in — PCV Murcor brings a wealth of experience to your business — immediately. Our mission is to help clients and their customers, nationwide, make their real estate needs happen through accountability, connectivity, and performance. Visit pcvmurcor.com/products to learn more about residential valuations, commercial valuations, hybrid valuations, and value reconciliations. We strive for accurate and timely property valuations. Assessing the quality and promptness of a valuation is something we take to heart. We only succeed when our clients and their customers do. We’ve ensured that our order procedures implement precise knowledge of local resident markets to provide timely, accurate residential valuations to our clients. Our quality control system is engineered to combine a manual review with automated checks to search for and exclude errors on orders before client delivery. This helps to reduce requests for any revisions, saving our clients valuable time and money. Our proven processes are designed to mitigate your financial and reputation risk — without missing important deliverables. While our processes and technologies have evolved over the past 40 years, our focus on excellent customer service remains the same; to develop and maintain strong engagement and collaboration with our clients.

SERVICES: SingleSource Property Solutions (SingleSource) is a nationwide service provider to many of the largest mortgage origination and loan servicing companies. Our wide range of product and service offerings can be categorized into five lines of business: Property Valuations, Title and Settlement, REO Asset Management, Field Services, and Document Management. With over 20 years of experience, SingleSource has delivered over 5 million valuation reports and has maintained a 97% client retention rate by delivering quality reports along with dependable and helpful customer service.

SingleSource’s approach to fulfilling valuation needs ensures our customers receive customized, accurate and quick valuations services. We understand the valuation is a critical piece to the success of your process. We are committed to providing the highest level of quality and care to your business and customers by utilizing industry-leading tools that include: a proprietary scoring model that grades every valuation report, MLS tools that verify data points in delivered products, use of robotic process automation (RPA), and staff field appraisers in key markets nationwide. SingleSource is a fully compliant national AMC, able to manage residential appraisal assignments in all 50 states. We offer a full suite of property valuation products, from appraisals to BPOs, hybrid valuations, AVMs, and value reconciliations. We are committed to being a vendor partner of choice to the real estate lending industry, including banks, credit unions, mortgage originators, loan servicers, government agencies, real estate investment firms, and other companies involved in mortgage finance.

SPECIAL ADVERTISING SECTION AMC

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 15

SHOWCASE

HOW

BUILD A BROKER

Nonbanks Need Watching

After Your Pink Slip Between Mediocrity & Success Never ‘Under’ Reach

YOUR FIRST MILLION DOLLARS

Don’t Feel Fear — Feel Lucky BENCHMARKS & BEST PRACTICES

Make That Stretch CAREER TICKER

People On The Move

> Superus Careers, a recruiting agency based in Sykesville, Md., has named Mo Oursler its executive vice president, Mortgage Career Exchange.

> Anchor Loans, a provider of financing to residential real estate investors and entrepreneurs, announced that Rayman “Ray” Kaur Mathoda has been named CEO.

> Cenlar FSB, a national mortgage suberservicer, said that Pete Johnson has joined the company as vice president of special products in loan operations.

> Steve Meirink, formerly leading compliance solutions, is the new CEO of Wolters Kluwer Financial & Corporate Compliance.

PEOPLE ON THE MOVE //

NMP’S MONTHLY SECTION OF HANDS-ON PRACTICAL ADVICE

SPONSORED BY NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 17

Why Nonbank Mortgage Companies Bear Close Watching

Lenders are thinly capitalized without much federal oversight

BUILD-A-BROKER

> Churchill Mortgage announced two key personnel moves: Jesse Vazquez as vice president of talent acquisition and promoting Kelly Lee to executive vice president of national production.

> Mr. Cooper Group announced two new executive leadership appointments. Kurt Johnson has been appointed chief financial officer, while Christine Paxton has been named executive vice president and chief risk and compliance officer.

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

PEOPLE ON THE MOVE //

18 | NATIONAL

MAGAZINE | MAY 2023

MORTGAGE PROFESSIONAL

BY CLIFFORD ROSSI, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

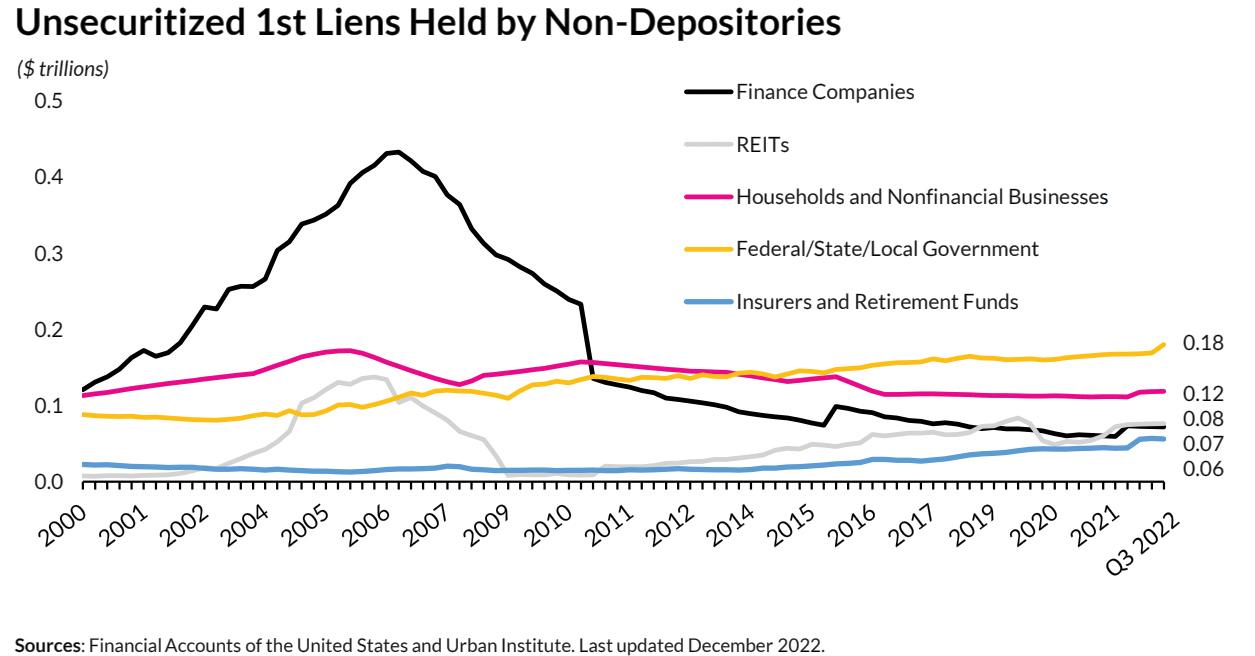

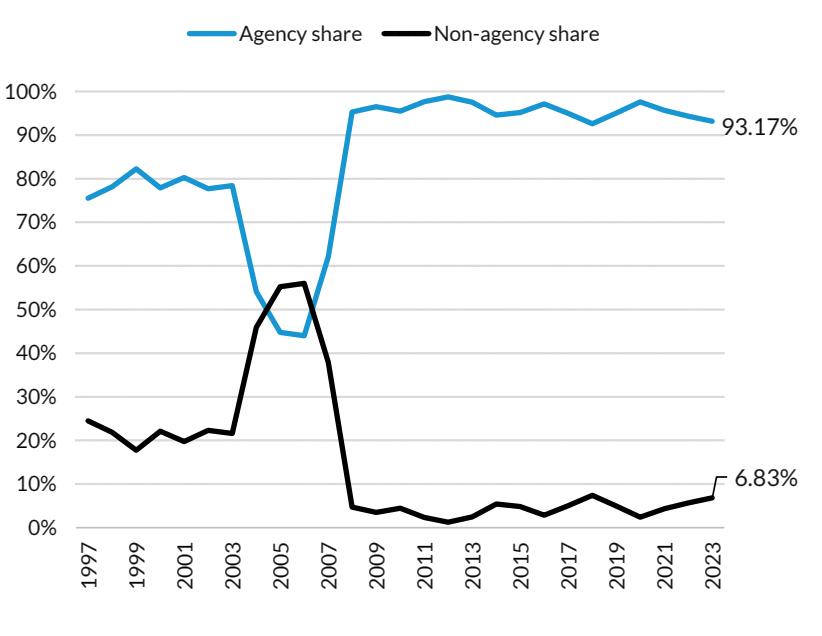

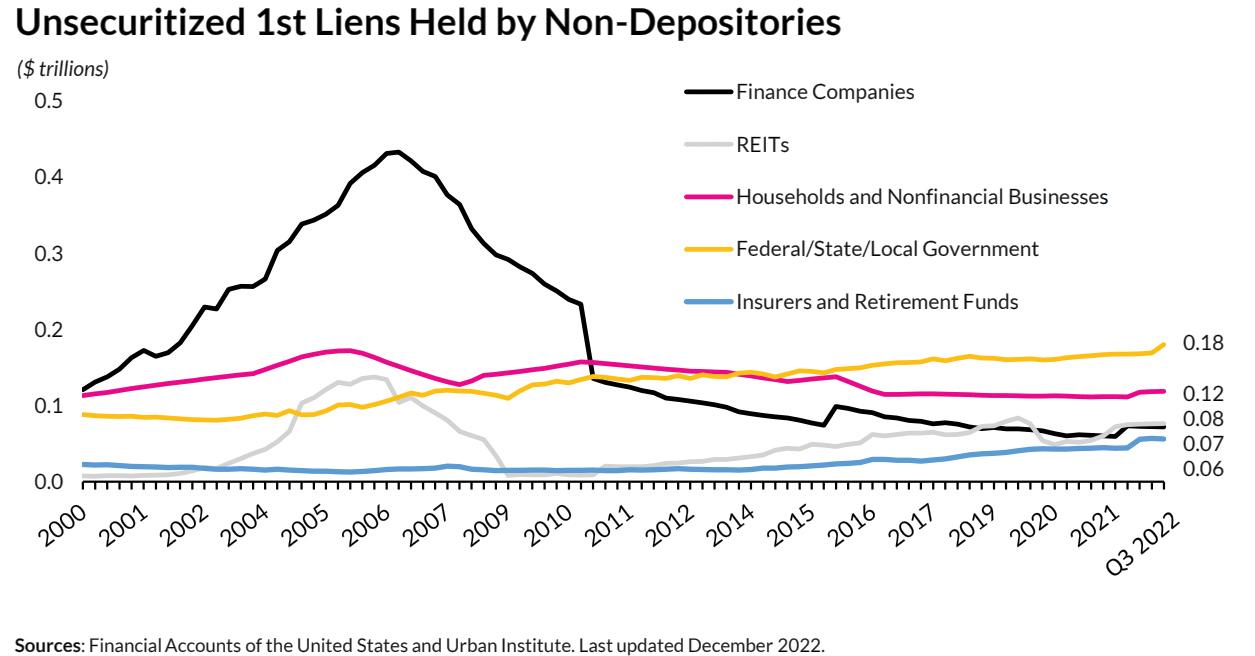

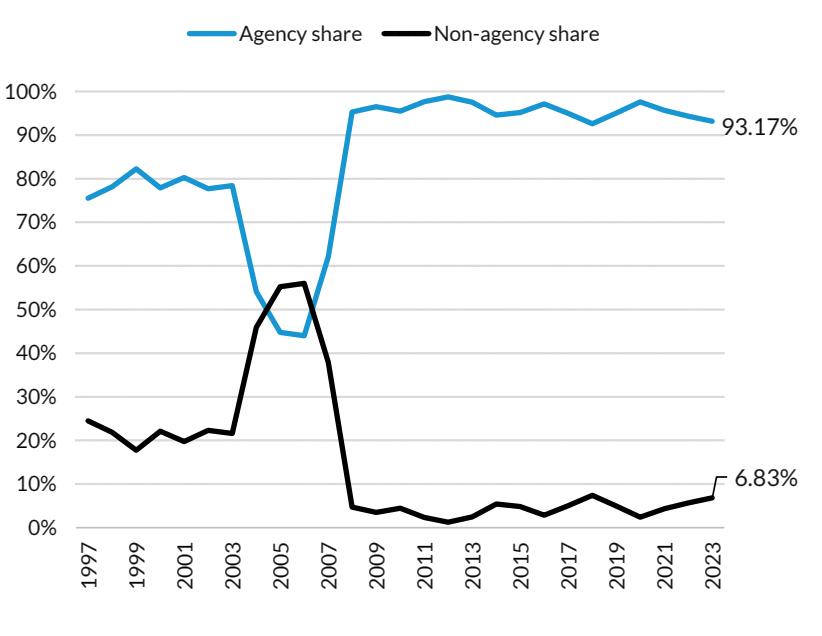

Recent SVB and Signature Bank failures notwithstanding, the financial industry’s stability for surviving a major downturn could depend on large, nonbank mortgage players. These entities are thinly capitalized, have high leverage, are subject to no federal safety and soundness oversight and sit on top of large exposures to highly volatile assets. They’re prone to excessive risk-taking.

During the 2008 financial crisis, hundreds of nonbank mortgage lenders and servicers went bankrupt. Since they have enjoyed a renaissance of sorts. This rise filled a void left behind by depositories reeling over mounting credit losses, intense regulatory scrutiny, litigation, and reputation damage. However, while market conditions in recent years remained strong, nonbanks have posed significant risk to the stability of the mortgage market when another major downturn inevitably occurs.

Today, the corporate structure and weak regulatory oversight of nonbanks prioritizes short-term business objectives over long-term viability. These factors, moreover, invite weak risk management governance and practices, which at some point will manifest into poor loan-manufacturing quality, resulting

in extraordinary losses for the mortgage industry and another industry shakeout.

According to recent research, between 2007 and 2016 the share of nonbank origination volume rose from 20% to about 50%. These same lenders

in some of the larger nonbank mortgage companies today. However, while such activity permits private capital to flow into the mortgage market, the nature of nonbank regulation — coupled with this type of ownership structure —

today represent three-quarters of loans sold to Ginnie Mae. What’s more, since the crisis, the share of nonbank mortgage servicing rose significantly.

NONBANK MODEL PROMOTES RISK‐TAKING

Given the magnitude of the 2008 crisis and regulatory response, the retreat by traditional banks from the mortgage market and subsequent move by nonbanks to take up market slack weren’t surprising. The timing of this market turnover, with one of the tightest credit environments for mortgage lending in decades, spurred on nonbank participation, as it masked underlying conditions that, in the presence of market stress, place these firms in greater jeopardy than depositories generally.

Hedge funds and private equity firms maintain significant ownership stakes

promotes greater risk-taking by these firms over time relative to depositories. Another risk nonbanks face is from large positions in a highly volatile asset class called mortgage servicing rights or MSRs. The value of these assets is based on a strip of interest earned on each mortgage that is serviced, and so the valuations can fluctuate dramatically depending on the direction and level of mortgage rates. This, coupled with their relatively thin liquidity poses significant risk at times. Nonbank regulatory oversight for the most part occurs at the state level, which translates into significant variability in the quality and consistency of oversight of these firms compared to bank safety and soundness regulation. This in turn provides a perfect environment for nonbanks to take on greater risk.

> Newfi Wholesale announced the addition of John Wise to its executive team as senior vice president of West Coast sales.

> Cenlar FSB, a mortgage loan subservicer, announced that Michelle DeHart has joined the company as vice president of loan operations, escrow.

> Sagent, a Pennsylvaniabased fintech software company, has appointed Perry Hilzendeger as executive vice president of servicing.

SPONSORED BY SPONSORED BY

> Fairway Independent Mortgage Corp., the nation’s third largest retail mortgage lender, announced mortgage veteran Kym Poladsky has joined the company’s Denver region.

The largest nonbanks should be subject to a form of heightened expectations for risk management that is compatible with their corporate structure and governance.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 19

Clifford Rossi

Hedge fund and private equity investors have limited experience with risk governance practices that traditional banks have spent the last decade building, thanks in part to regulatory mandates. This blind spot for risk management, given the acute return-focused nature of nonbank investors, promotes underinvestment in risk management capabilities that lie dormant during benign economic periods, only to emerge when markets unravel.

LOAN MANUFACTURING, MORTGAGE CYCLE AND RISK

The risk infrastructure used by mortgage originators and servicers tends to expand and contract in concert with the mortgage cycle. Boom periods stretch underwriting resources to the limit while default and collections resources slacken. During these periods, greater loan volume — combined with credit risk expansion — puts enormous pressure on the mortgage production risk infrastructure.

Without robust risk controls, processes and governance in place, these systems can fail under the weight of excessive risk-taking. For example, a recent study of mortgage product development found that lenders with relatively high repurchase rates from Fannie Mae or Freddie Mac (an indication of defective loan manufacturing process) tended to experience credit losses that were 1.52.5 times higher than other firms for the 2003-2008 origination years, controlling for other borrower, loan, and property risk factors.

Building on this analysis, I developed a similar statistical model (predicting the probability a loan would become 90 days

past due or worse) to examine the relative risk of depositories and nonbanks. From a random sample of 180,000 mortgages originated between 1999-2016 and sold to one of the GSEs, a model incorporating similar variables as those used in the earlier study was estimated. An indicator variable for whether the firm was a depository or not was included and interacted with origination underwriting periods denoted as pre-boom (prior to 2004); boom (2004-2007) and crisis; and aftermath (2008-2016).

Loans originated by nonbank firms during the boom period were 20% riskier than loans originated by depositories. However, the risk of nonbanks is statistically no different from that of depositories since the crisis. These results support the point that the risk of nonbanks is masked during times when credit standards are tighter.

Under such circumstances, strong borrower and collateral requirements can cover up deficient operational risks in the underwriting and origination process that become more apparent as credit standards relax and production accelerates.

IMPLICATIONS AND PARTING THOUGHTS

Weak regulatory oversight of nonbank mortgage companies requires mortgage securitizers to redouble their efforts to manage counterparty risk exposure to these firms. Nonbanks have three strikes against them in their business model that increase market volatility during stress periods: they tend to be thinly capitalized, their funding sources pose liquidity risk, and their

risk management processes tend to be underdeveloped.

During the 2008 crisis, warehouse lines, asset-backed commercial paper, and tri-party repurchase agreements — major sources of mortgage financing of nonbanks — dried up and helped put many nonbank mortgage companies out of business. The good news is that in the years since the crisis, strong net worth and liquidity requirements have been established by the GSEs and Ginnie Mae. For example, the GSEs took steps to impose a set of rigorous (bank-like) risk-based capital standards on private mortgage insurance companies and Ginnie has done the same for their counterparties including nonbanks as well as added liquidity buffers. However, given the increasing importance of nonbanks to the mortgage industry, their oversight needs to continue to evolve.

In addition to strong liquidity and capital standards, the largest nonbanks should be subject to a form of heightened expectations for risk management that is compatible with their corporate structure and governance. Doing so will ensure alignment of risk-taking between nonbanks and depositories, mitigating another race to the bottom in mortgage underwriting. n

Clifford Rossi (PhD) is a professor of the practice and executive-in-residence at the Robert H. Smith School of Business, University of Maryland, and a principal of Chesapeake Risk Advisors LLC. Prior to his current posts, he was the chief risk officer for Citigroup’s North America Consumer Lending Division.

BUILD-A-BROKER > New American Funding announced that Pat Bolan has been named chief production officer. Prior to joining NAF, Bolan served as a division manager for Guaranteed Rate. > Mortgage insurance company Radian Group Inc. has appointed Sumita Pandit as senior executive vice president and chief growth officer. > Nations Lending opened its newest branch in St. Louis, Mo. Steve Dieckhaus will serve as area sales manager. HAVE A NEW HIRE OR PROMOTION TO SHARE? Submit the information to Keith Griffin at kgriffin@ ambizmedia.com for possible publication. Announcements should include a headshot.

// BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

PEOPLE ON THE MOVE

20 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. www.ultimatemortgageexpo.com Produced By ORIGINATORCONNECTNETWORK.COM JUL 11 2023 NEW ORLEANS The Gulf Coast’s ultimate gathering for mortgage pros. We’ve brought together the best in the business to create a top tier event specifically designed for mortgage origination pros. Mortgage Women Magazine readers like you can attend for free by using the code NMPFREE.

Standing Out In A Crowded Home Equity Market

Faster and more accurate valuations among needed changes

BY JEREMY MCCARTY, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

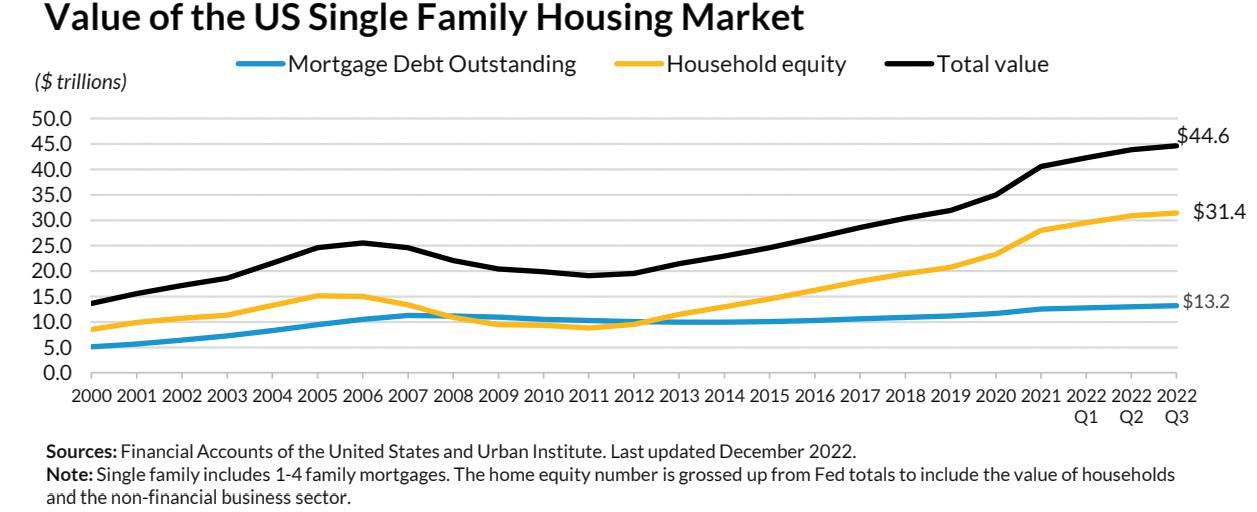

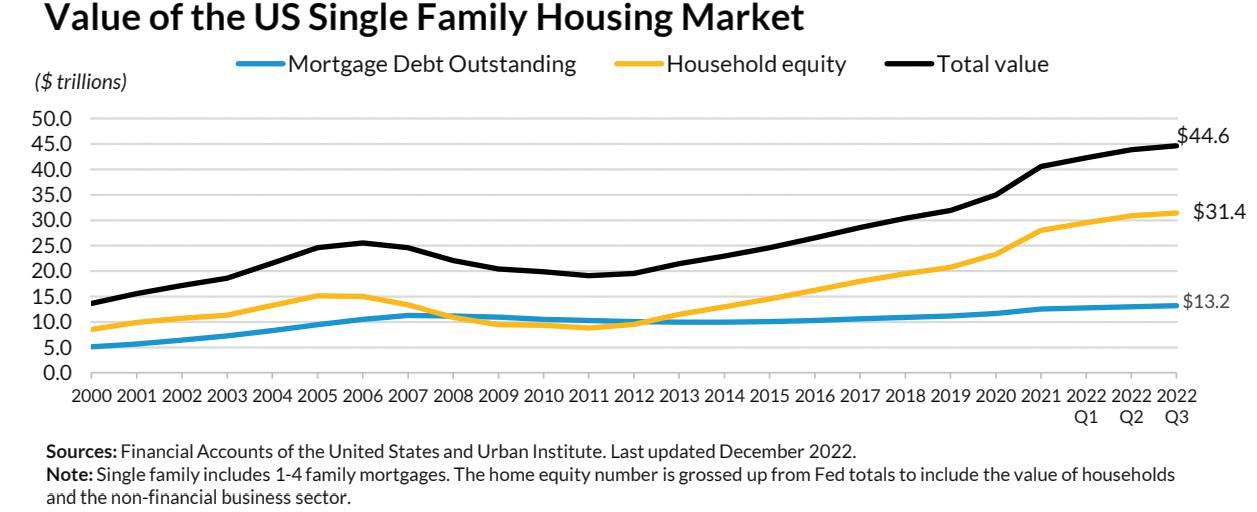

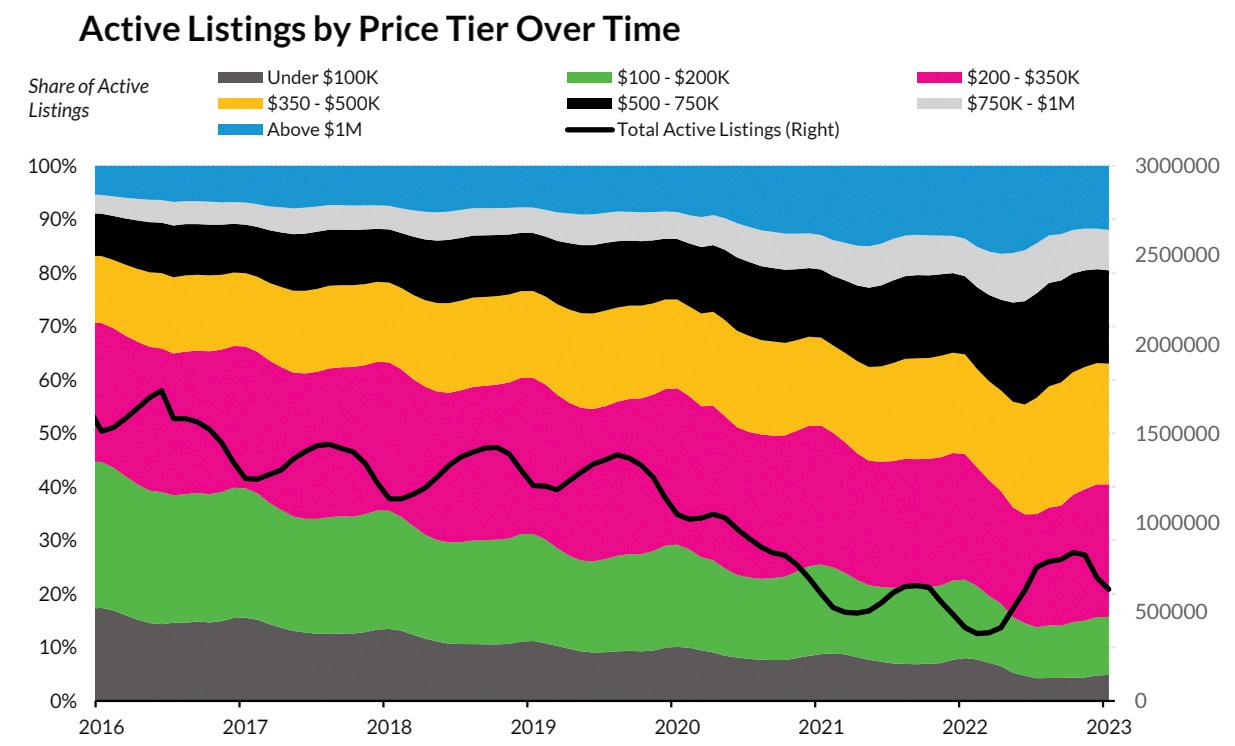

With rising mortgage rates, homeowners in need of cash for remodeling, debt consolidation, or just a rainy-day fund, have increasingly turned to a home equity loan. And, thanks to rising home values over the last decade, homeowners are sitting on more equity than ever. Many homeowners are opting to remodel or add on rather than move, but don’t want to touch their low-interest first mortgage when

tapping into their home equity. A home equity loan is now one of the most viable options to convert equity into cash. Home equity loans are a great option to consolidate debt or used as a cushion to weather the challenging economy.

With this surge in home equity demand, lenders need to re-focus on this market and establish a way to differentiate themselves from the competition.

FASTER VALUATIONS

Home equity loans are often categorized as consumer loans with the credit and title underwriting completed very quickly. Similarly, the property valuation component needs to be expedient for a successful program and to meet homeowner

expectations. The ability to provide an equity loan commitment within a few hours is a game changer for the lender’s competitive abilities and for the borrowers to potentially get faster access to their funds.

ACCURATE VALUATIONS

Often, equity lending valuations are completed through the use of Automated Valuation Models (AVMs) or other valuation tools that utilize only a drive-by inspection of the property. While these tools serve a purpose, they may not show the maximum home value, especially if interior remodeling and amenities are not considered. Furthermore, homeowners are disappointed when the lender’s valuation does not reflect the true value of their home because the chosen

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE BUILD-A-BROKER

22 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023

Jeremy McCarty

tool did not provide a complete view of the property.

TECHNOLOGY

By leveraging new technology to show all the interior and exterior amenities, rather than the antiquated valuation processes focusing only on the home exterior, lenders can be operationally more efficient, and provide the true home value to their borrowers. All of this results in a positive borrower experience.

Additionally, with the right technology, lenders do not have to sacrifice the quality of their valuation. With the proper tools in place, a decision made with the help of technology can be just as thorough and accurate as a full appraisal, at a fraction of the cost.

VIRTUAL INSPECTIONS

A key technology to streamline home equity valuations is the “virtual inspection.” Rather than waiting for someone to drive by the property to do just a front exterior inspection, virtual inspections can be completed within minutes — and the process is much simpler than you would think.

With a virtual inspection, the homeowner connects to the virtual

inspector through a streaming video call to conduct a brief, but thorough inspection of the home’s interior and exterior. The inspection usually takes just 15-20 minutes, and homeowners often enjoy the experience. They appreciate being able to show off their home, being part of the process and knowing that the

the necessary elements for a sound and accurate valuation. The valuation analyst can then provide a strongly supported valuation report within a couple hours after inspection. Technology like virtual inspection helps set lenders apart where the time for loan approval can be measured in hours,

unique qualities of their home have been considered in the valuation.

Within minutes of the lender ordering the evaluation, the homeowner is contacted, and if available, the inspection is conducted on the spot. Alternatively, the homeowner can schedule a time that is convenient for them through an online calendar.

Collecting the property data virtually is a much faster, lower cost, thorough and consistent manner to provide

not weeks. This sets a new standard in home equity lending. Additionally, homeowner involvement in the inspection solidifies their commitment to the loan and vastly improves the borrower experience — reflecting very positively on the lender in the highlycompetitive equity lending landscape. n

SPONSORED BY SPONSORED BY

Jeremy McCarty is founder and CEO of Valligent, an appraisal management company that was recently acquired by Veros.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 23

Technology like virtual inspection helps set lenders apart where the time for loan approval can be measured in hours, not weeks.

APPRAISAL STANDARDS MUST INCLUDE

FEDERAL PROHIBITIONS AGAINST DISCRIMINATION

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

BUILD-A-BROKER

24 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023

CFPB continues to raise concerns with The Appraisal Foundation

BY PATRICE ALEXANDER FICKLIN AND TIM LAMBERT, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Homeownership is one of the best paths for building intergenerational wealth. For some homebuyers and owners, however, a home’s valuation may be skewed by skin color or community demographics. Biased home appraisals can worsen racial inequities and distort the housing market.

The CFPB and leaders from across the federal government submitted a joint letter to The Appraisal Foundation (TAF), the private, nongovernmental organization that sets appraisal standards. The letter urges TAF to revise its draft Ethics Rule for appraisers to include a detailed statement of federal prohibitions against discrimination that exist under the Fair Housing Act and Equal Credit Opportunity Act. We are concerned that some appraisers may be unaware of these prohibitions and, in particular, that the draft Ethics Rule emphasizes that “[a]n appraiser must not engage in unethical discrimination,” implying that appraisers may engage in “ethical” discrimination, a concept foreign to current law and practice.

The letter marks the second time we have raised these concerns with TAF. On Feb. 4, 2022, we urged TAF to provide clear guidance on existing legal standards related to appraisal bias in response to a prior draft of its Ethics Rule included in the Uniform Standards of Professional Appraisal Practice. In a blog post released with the letter, the CFPB noted that we are deeply troubled by the discriminatory statements the Federal Housing Finance Agency

identified in some home appraisals, and the appraisal disparities for communities and borrowers of color described in both Freddie Mac and

Fannie Mae studies. Moreover, the CFPB continues to see reports of appraisers who fail to follow the law and who base their value judgments on biased, unfounded assumptions about borrowers and communities.

For more than 50 years, federal law has forbidden racial, religious, and other discrimination in home appraisals. It is imperative that TAF provide appraisers clear, detailed, and unambiguous warnings about the requirements of federal law covering appraisal standards.

RELUCTANCE?

The Appraisal Foundation, however, appears reluctant to act. Its recalcitrance undermines efforts to rid the housing market of bias and discrimination and threatens the market’s fairness and competitiveness.

We continue to work closely with other member agencies of the Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) to create an equitable path toward addressing the persistent misvaluation of properties owned or sold by families and communities of color. We look forward to engaging with all relevant stakeholders and using all of the CFPB’s tools, in collaboration with our interagency partners, to address these important issues. n

Patrice Alexander Ficklin is the Fair Lending Director and Tim Lambert is Fair Lending Programs Lead and Senior Counsel. This article originally appeared on the CFPB’s website: https://www. consumerfinance.gov/about-us/blog/

BUILD-A-BROKER

The CFPB continues to see reports of appraisers who fail to follow the law and who base their value judgments on biased, unfounded assumptions.

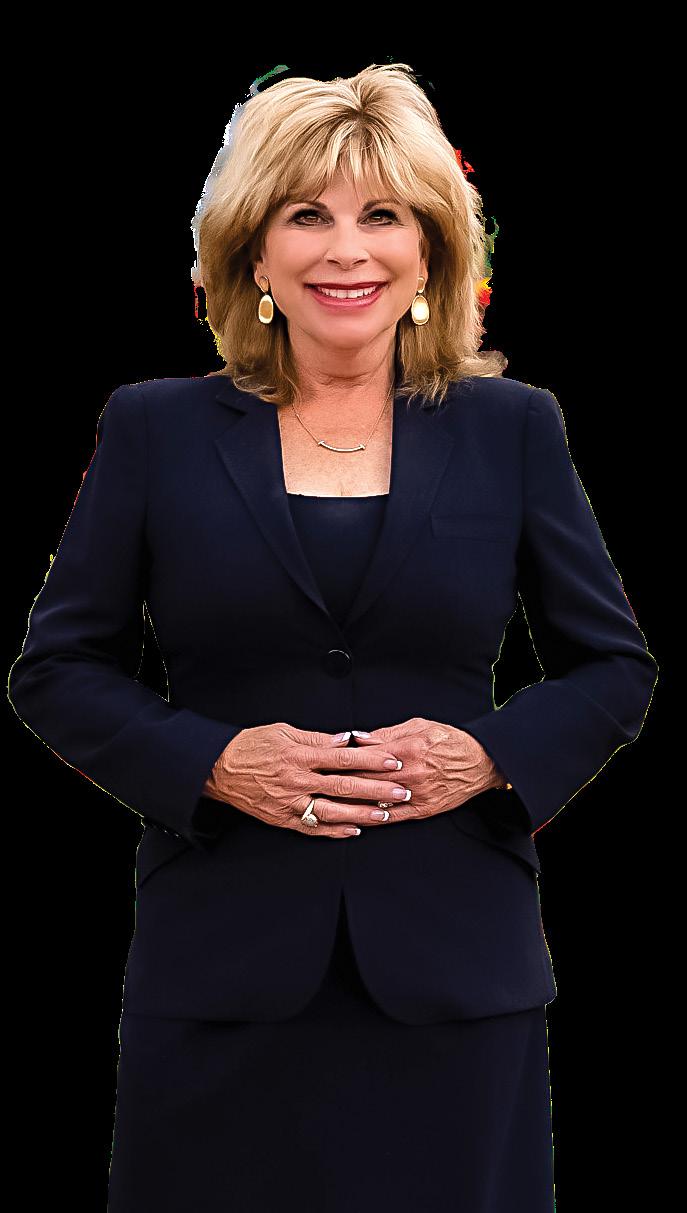

Patrice Alexander Ficklin

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 25

Tim Lambert

Embrace Your Fear Of The Unknown

Taking risks can be the difference between mediocrity and success

BY HARVEY MACKAY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Once upon a time, there was a warrior whose teacher told him he had to battle fear. He didn’t want to because it was scary. But his teacher said he must do it and gave him instructions for the battle. When the day arrived, the student warrior stood on one side and fear on the other. The warrior felt small, while fear was big and wrathful. They both had their weapons, but suddenly the

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE YOUR FIRST MILLION DOLLARS HARVEY MACKAY 26 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023

warrior fell prostrate and asked fear, “How can I defeat you?”

Fear replied: “My weapons are that I talk fast. And I get very close to your face. Then you get completely unnerved and do what I say. If you don’t do what I tell you, I have no power.”

At that, the student warrior learned how to defeat fear.

When things fall apart and you start feeling fear, feel lucky instead. Because only when you feel fear will you have the courage to overcome it. Being courageous and having a great life is all about being intimate with fear. Rather than being depressed or scared about fear, lean into it and see it as an opportunity to learn and grow.

My friend, motivational speaker Les Brown, said, “Too many of us are

not living our dreams because we are living our fears.”

Don’t be afraid to confront your fears. If you are afraid, admit it. We all face fears and anxieties every day, and the only way to overcome them and succeed is to recognize them up front so we can confront them directly.

• Examine your fears by identifying them. Spend some time each morning asking yourself what might happen during the day that you’re afraid of — failure to reach the people you need to talk to, for example, or getting lost on the way to an appointment.

• Take preventive steps. Think of what you can do to prevent your fear from coming true. Be on the lookout for behaviors and thoughts that add to your fear, and train yourself to change your patterns of action and thinking.

• Learn from your fears. You’ll succeed or fail. Either way, use the experience of confronting your fear to overcome new problems.

Fear is the factor that prevents many from taking risks that can mean the difference between mediocrity and success.

Many years ago, I wrote a column about “The Second Ten Commandments.” Commandment two stated: Thou shall not be fearful, for most of the things we fear never come to pass. Every crisis you face is multiplied when you act out of fear. Fear is a self-fulfilling emotion. When you fear something, you empower it. If you refuse to concede to fear, there is nothing to fear.

Companies that make bold moves

rarely do so without some element of fear. Leaders worry every day whether they have acted too soon or are missing some unanticipated obstacles when they introduce new products or services. Have they performed their due diligence? Will their decisions pay off?

Those choices are never easy, but then business is never easy. Successful organizations know how to master their fear and put it in the proper perspective. They know their target markets and customers well enough to predict their chances of winning. They understand that if an idea fails, it most likely will not spell imminent doom.

They understand the difference between confidence and arrogance. I’ve seen plenty of businesses succumb to arrogance when a reasonable dose of fear might have prevented their failure. Fear can be useful when it is used to guide practical decision making.

But fear can paralyze you, preventing you from achieving, even from living. Can you actually die from fear? Most likely not. What fear kills is your spirit, your ambition, your confidence.

A commanding general in the Persian army would go through a rather unusual ritual with captured spies: He would give criminals a choice between the firing squad or going through “the big, black door.”

Most spies decided on the firing squad, with the usual results.

Turning to his aide, the general said, “They always prefer the known way to the unknown. It is typical of people to be afraid of the undefined. Yet, we gave them a choice.”

“What lay behind the big, black door?” asked the aide.

“Freedom,” replied the general, “and I’ve only known a few brave enough to take it.”

Mackay’s Moral: Never be afraid to try something new. Remember, amateurs built the ark, professionals built the Titanic. n

Harvey Mackay is a seven-time New York Times best-selling author with 15 books.

SPONSORED BY NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 27

When things fall apart and you start feeling fear, feel lucky instead.

Expand Your Reach To Expand Your Business

True success comes when you can multiply yourself

MARY KAY SCULLY, COLUMNIST, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

You are only one person. While that seems like such an obvious statement, sometimes we need to be reminded. You can’t be everywhere with everyone at once, and you can’t do everything alone. To truly be successful, you need to multiply yourself. And while cloning machines are still a thing of science fiction, there are ways to achieve this effect in the real world. Many different tools and strategies exist that can help you multiply your efforts without spreading yourself too thin. So, let’s talk about how you can seemingly be everywhere at once.

BENCHMARKS & BEST PRACTICES

28 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE MARY KAY SCULLY

MAIL

Mail may seem like an odd place to start, given the digital world that we live in, but there are a few advantages to using mail to reach out to customers. A study by Redfin shows the average homeowner stays in their home for around 13 years. Mail is a surefire way to get a hold of your existing customers — you know exactly where they are because you helped put them there.

Rather than cutting through a crowded email inbox, classic “snail mail” may grab their attention. Think about it: when was the last time you got good mail? It’s probably been a while — and that’s likely the case for your customers too.

Be prepared to think outside the box with this, as another mail

advertisement isn’t likely to move the needle. However, a short card or personal message can have you top of mind the next time they’re looking for home financing.

EMAIL

Of course, standing out amongst the hundreds of emails someone gets in a week can be a challenge, but leaning in and personalizing your emails can bring a great return. Hubspot reports that personalizing your emails simply by segmenting your customers can increase revenue by up to 760%. Adding interactive elements to your email can help you group users based on their interests or circumstances.

Whatever you do, make sure any email you send is relevant to the customer and, from there, any additional personalization you can add is icing on the cake.

A customer relationship management tool (CRM) can be a great advantage in keeping track of customer information so you can reference it and use it to your — and their — advantage when sending emails.

Make sure you have a CRM and that you’re maintaining it. Update it when their contact info changes, make any important notes about the person, and keep track of when you last contacted them and when you should follow up. This also helps when sending mail — or even making a phone call.

VIDEO

Face-to-face connection is still an important part of the customer relationship, but it’s hard to get in front of everyone you need to contact. Using video helps you bring a more personal element to your communications without having to stand in front of someone.

Canva even reports scientific reasons why our brains respond well to visual marketing. Our brains are hardwired for visual processing, and mediums like video can convey emotion, color and movement, all of which capture our attention.

We’ve talked about this plenty of times before, but it always bears repeating: you need to make sure your videos look professional. You don’t need a full camera and lighting setup — just ensure that you look and sound professional, that your surroundings aren’t distracting, and that you are getting the right message across in a clear and succinct way. There are so many tools that help you easily edit videos and make them look like they were shot by a pro.

IN PERSON

Of course, when you can be in person, it’s a great advantage. Whether it’s with your customers or referral partners, being face-to-face allows you to form a relationship that can’t develop as easily through a screen or a message. You may have many tools that help you be successful when not in person, but don’t write off the valuable time you could be spending in person with someone.

You can’t be everywhere physically, but you can be everywhere you need to be, simply by using different tools and strategies to get in front of your customers and referral partners in as many ways as possible. So, get out there and start connecting! n

Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum.

SPONSORED BY

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 29

Adding interactive elements to your email can help you group users based on their interests or circumstances.

Acra Lending

Lake Forest, CA

Acra Lending is the leader in NonQM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com

(888) 800-7661

sales@acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

Champions Funding

Gilbert, AZ

Mission Driven Non-QM + CDFI

Wholesale Lender

At Champions Funding, we Non-QM all day, every day! It’s our core business, and we live to serve underserved borrowers through our valued broker partners. We put diversity and inclusion into mortgage lending by empowering the mortgage broker community to provide solutions for non-traditional credit profiles and those who cannot get approved with standard financing. Through our highly coveted CDFI certification backed by the U.S. Department of the Treasury, we can offer our flagship neighborhood products and tap into a $1 Trillion market of historically underserved communities in the country.

Focused on speed to closing (in days, not weeks), smooth processes, and userfriendly access to our underwriting and support teams, we offer modern, flexible, and responsible non-traditional lending solutions.

champstpo.com

(949) 763-9494

Wholesale@ChampsTPO.com

LICENSED IN: AZ, CA, CO, CT, DC, FL, GA, HI, IL, IA, MD, MI, NJ, NC, OR, PA, SC, TN, TX, UT, VA, WA

FIND IT.

Civic Financial Services

Redondo Beach, CA

CIVIC delivers fast, honest, simple lending for real estate investors. Description of your products or services.

CIVIC Financial Services is a private money lender, specializing in the financing of non-owner occupied residential investment properties.

CIVIC provides Mortgage Brokers and Real Estate Investors with a fast and cost effective funding source for their real estate investment needs. civicfs.com

(877) 472-4842

info@civicfs.com

LICENSED IN: AZ, CA, CO, FL, GA, HI, ID, IL, IN, LA, MD, MA, MI, MN, NV, NJ, NC, OH, OK, OR, PA, SC, TN, TX, UT, VA, WA, WI

THE COMPANIES AND TOOLS YOU NEED

When searching for products or services to help your business, browse through our Resource Guides, or find a specific provider through one of our Directories.

Originator Tech, Non-QM, Wholesale, AMC. These listings provide quick, easy access to the resources you need, all in one convenient location.

Find

NON-QM LENDER RESOURCE

GUIDE

the company and tools you need. Browse through our directories.

Find

what you’re looking for. Visit nationalmortgageprofessional.com/ directories

Global Integrity Finance LLC McKinney, Texas

DSCR Rental NO DOC Loans

As a direct, private lender, Global Integrity Finance takes a commonsense approach to underwriting, with all approvals made in-house. We are dedicated to providing quick responses to time-sensitive loans, often times with the ability to close in as few as 3 business days. At Global Integrity Finance, we value referrals and our brokers are protected. We are committed to the highest level of customer service, because our success thrives in building relationships.

globalintegrityfinance.com

(214) 548-5190

toby@globalintegrityfinance.com

LICENSED IN: AL, AR, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NH, NJ, NM, NY, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VT, VA, WA, WV, WI

LoanStream Mortgage Irvine, CA

Home loans

LoanStream is dedicated to providing the best combination of wholesale loan products and wholesale loan rates in the industry. We understand that along with your need for excellent service, innovative TPO Portal, and fast turn times, you need loan programs that give you the competitive edge with your customers. With over 70 different home loan products and programs to choose from including Non-QM loan portfolio products, you’ll be sure to find the right product to fit your borrower’s needs. We offer Non-QM, Conventional and Government loan programs. loanstreamwholesale.com

(800) 760-1833 inquiries@lsmortgage.com

LICENSED IN: AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, KS, KY, LA, ME, MD, MA, MI, MN, MT, NC, ND, NV, NJ, NJ, NM, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA, WA, WI

Luxury Mortgage Corp. Stamford, CT

Non-QM, Wholesale, Delegated Correspondent, Non Delegated Correspondent

The Simple Access® Non-QM suite of products was built around the idea that it doesn’t have to be complicated to finance a home. We have created a diverse selection of borrower friendly programs that are simple, innovative, and flexible. For more information on our Correspondent division, visit www. luxurymortgagecorrespondent.com

luxurymortgagewholesale.com

(949) 516-9710

tpomarketing@luxurymortgage.com

LICENSED IN: AL, AK, CA, CO, CT, DC, DE, FL, GA, IL, LA, ME, MD, MA, MI, MN, NV, NH, NJ, NM, NY, NC, OH, OR, PA, RI, SC, TN, TX, UT, VA, WA, WI, WY

NON-QM LENDER RESOURCE GUIDE

Find the full list of Non-QM Lenders cn page 60 TOP OF MIND RECOGNITION Be where they are when they’re looking for you. Take out your Directory Listing in NMP Magazine™ today to be listed among the companies making their services available to our readers. Visit nationalmortgageprofessional.com/purchase-alisting today to get started reaching your audience. through our company database, or find a specific provider through one of BE SEEN.SHORT-TERM VACATION RENTAL FINANCING RATESLIKENOTHING ELSE UNDERTHESUN The Leverage essto Flourish SPECIAL ADVERTISING SECTION: ORIGINATOR TECH DIRECTORY COMPANY AREA OF FOCUS WEBSITE Calyx Loan Origination Software Solutions calyxsoftware.com Capacity AI-powered mortgage support automation platform that connects your entire tech-stack. capacity.com FileInvite: Document Collection on Autopilot Automated document collection and client portal for workflow productivity.fileinvite.com Lender Price Most Advanced Mortgage Pricing & Underwriting Engine On The Market Company lenderprice.com MonitorBase Customer Intelligence monitorbase.com COMPANY SPECIALTY/NICHE STATES LICENSCED WEBSITE ACC Mortgage Non-QM AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA ACCMortgage.com Acra Lending Non-QM / Jumbo AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY acralending.com Angel Oak Mortgage Solutions Non-QM, Non-Agency AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WA, WV, WI, WY, DC angeloakms.com Change Wholesale Helping mortgage brokers close more loans, faster. AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY ChangeWholesale.com First National Bank of America Non- QM All 50 U.S. States fnba.com/mortgage-brokers SPECIAL ADVERTISING SECTION: WHOLESALE LENDER DIRECTORY SPECIAL ADVERTISING SECTION: WHOLESALE LENDER DIRECTORY

A Family Of 13 Children FINDS A HOME

What was your best deal?

My best deal was when I helped a family that didn’t think that they could ever qualify for a mortgage to purchase a home. They had 13 children; some were adopted. They were in a very small home and they outgrew it. They were losing hope, thinking that they could never achieve the American dream. They got turned down by several lenders before I ever met them. They were referred to me by a business associate that highly recommended me. With my knowledge and experience, I was able to guide them on cleaning up their credit and soon after, I was able to get them approved for a home loan and close their escrow successfully. They were in tears of joy and so grateful for all of my hard work and for believing in them and not giving up the way all the other lenders did.

What made it your best deal?

That transaction stays with me in my heart and will always follow me in my career since I saw their stress soon turn into happiness after I funded their loan, and their Realtor handed them the keys to their future. I found out recently that the wife had passed away. I was so saddened to hear since they were like my extended family. And clients like them end up becoming like family going through all the emotions with them throughout the process. I end up building a great friendship with them and not just a business relationship.

What else was interesting about the deal?

The other thing that made the transaction so interesting is that their eldest son wanted to become a chef and he always dreamed of being able to cook meals for his family in a big kitchen at home, but he started cooking in the little home that they were renting before they bought a home. He was in heaven once he was able to see his parents’ big beautiful home with a kitchen island and plenty of counter and cabinet space and a chef stove with all stainless steel appliances! He went on to continue to cook for his family all of his signature dishes and he eventually became an executive chef at a very renowned restaurant.

32 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023

linkedin.com/in/bernadine-torres-3224a447 instagram.com/fernieandbernie

ATIONAL MORTGAGE PROFESSIONAL MAGAZINE WANTS TO FEATURE YOU!

hat is the best deal you ever made? We know biggest isn’t always best. Did you help a single mom get the house of her dreams? How about the couple that finally found the one home they could afford — almost, that is, until you found a way. Was it the first deal you ever closed? A deal that turned your life around?

ubmit your story using the link, and your deal could be featured in a future Best Deal column!

nmplink.com/bestdeal

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 33

2.3%

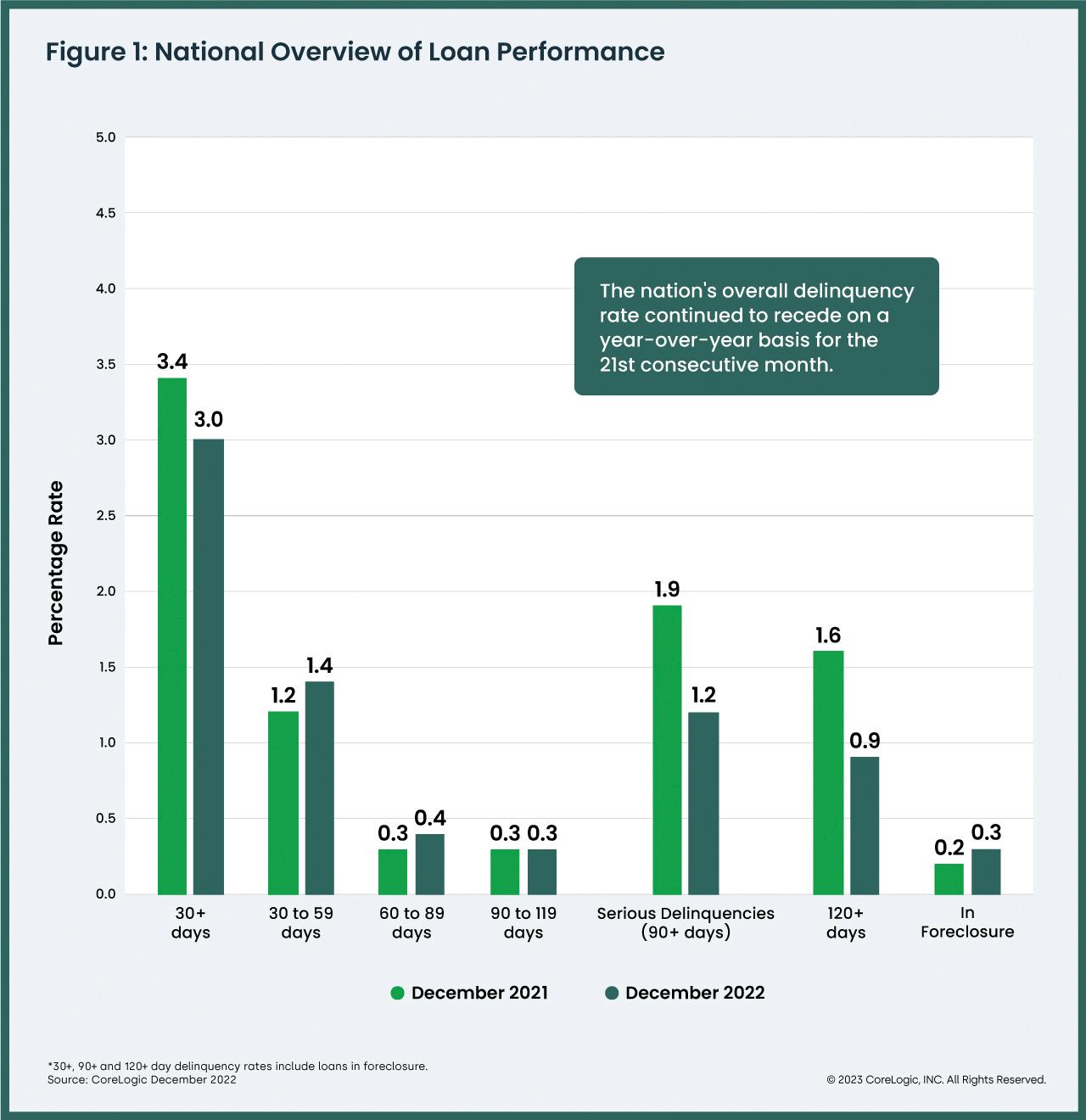

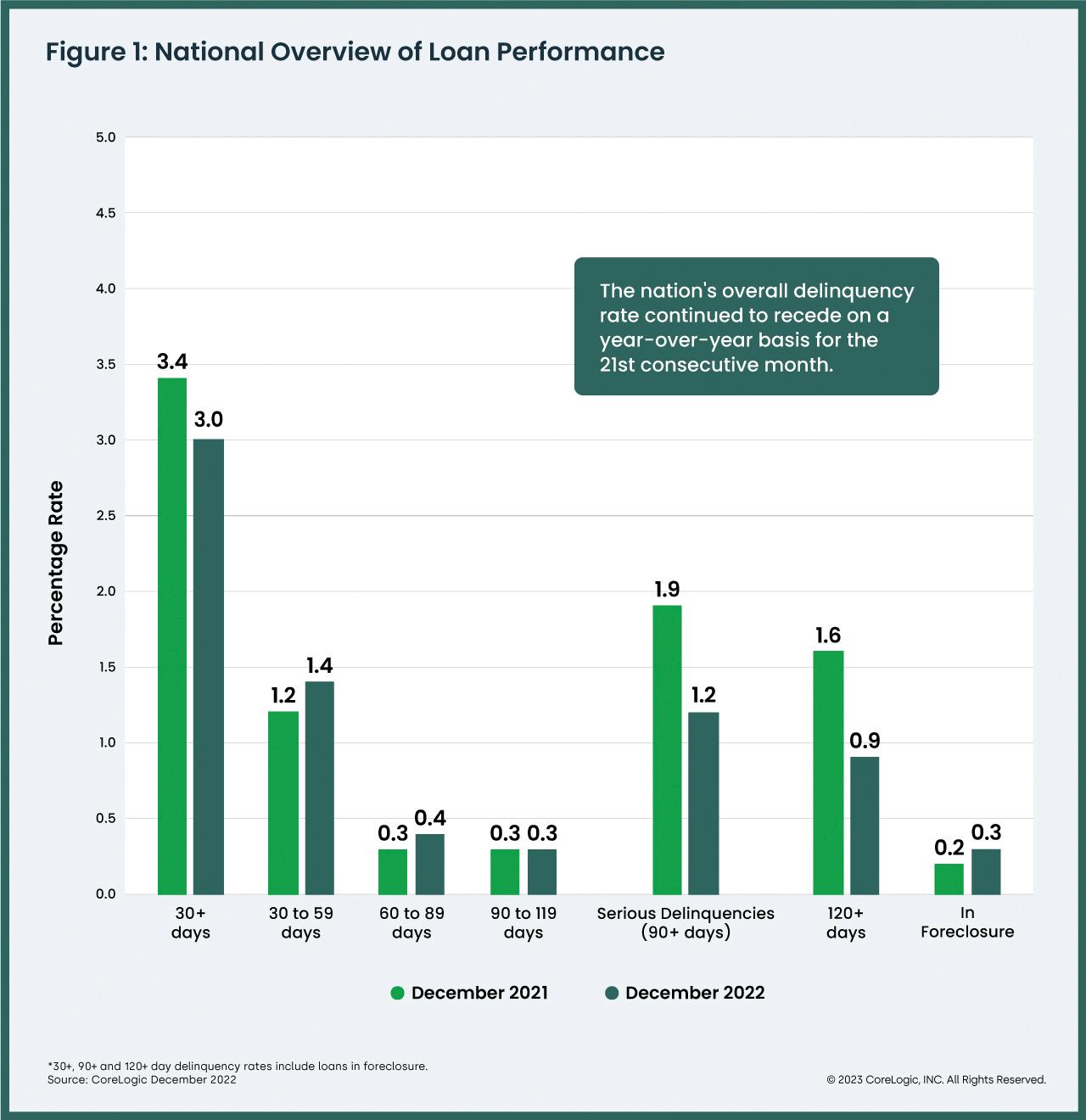

FEBRUARY NATIONAL STATS

RATE LOCK VOLUME

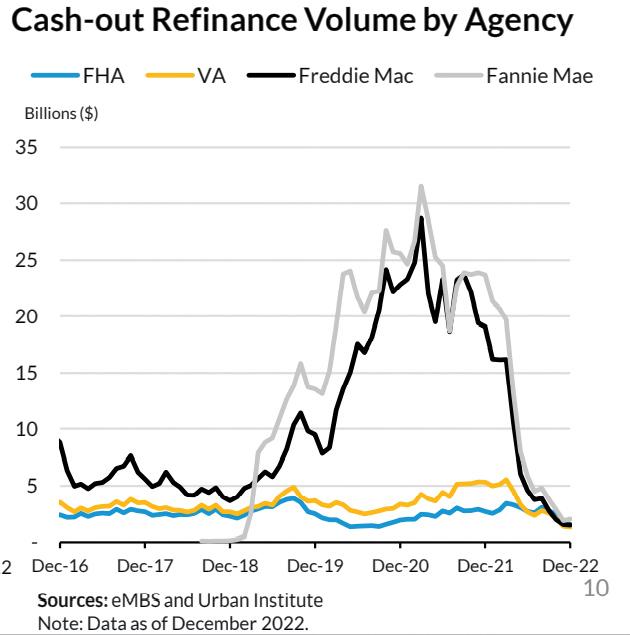

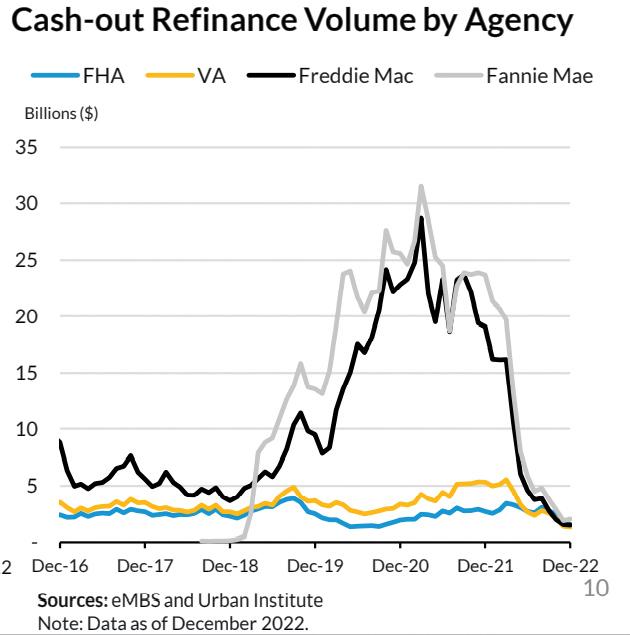

Purchase locks edged up 4%, cashouts fell 11% and rate/term refis held at record lows

MARKET MIX

14% Refi 86% Purchase

AVERAGE LOAN AMOUNT

$349K

The average loan amount rose by $9K in February

6.68%

Refi share of the market mix returned to a record low in February

MONTH-END C ONFORMING RATE

Our Optimal Blue Mortgage Market Indices tracked a 52 bps rise in 30-year rate offerings throughout February

34 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023

DATABANK NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2023 | 35

Veterans, when you’re struggling, soon becomes later becomes someday becomes ...when?

Don’t wait. Reach out .

Whatever you’re going through, you don’t have to do it alone.

Find resources at VA.GOV / REACH

We

WHOLESALE LENDER RESOURCE GUIDE

PRIVATE LENDER RESOURCE GUIDE

ACC Mortgage Rockville, MD

ACC Mortgage is the oldest Non-QM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

ACCMortgage.com

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

Change Wholesale

Irvine CA

Change Wholesale gives mortgage brokers an unfair advantage to close more loans, faster. Our CDFI certification from the U.S. Department of the Treasury allows us to offer proprietary programs that are tailored to meet the needs of commonly overlooked prime borrowers. Our flagship Community Mortgage requires no income, employment, or DTI documentation. Prime borrowers looking for their dream home or vacation getaway can get approved with just the first page of the bank statement.

ChangeWholesale.com

(949) 255-6085

info@changewholesale.com

LICENSED IN:, AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY Find

Hands-On Advice

Find

Industry Insights

Don’t

— understand it. Find insightful articles from leading industry voices to help digest all the changes in the industry.

Stratton Equities

Pine Brook, NJ

Stratton Equities is the leading Nationwide Direct Hard Money & NON-QM Lender that specializes in fast and flexible lending processes. Our Hard Money and Direct Private Money loan programs support the following investment projects:

• Fix and Flip

• Soft Money Loans

• Cash Out — Refinance

• Fixed Commercial Loans

• Commercial Bridge Loans

• Bridge Loans

• Stated Income/ No-Income Verification Loans

• Rental Loans

• Foreclosure Bailout Loan

• NO-DOC

• Blanket Loans

• Fixed Rental Programs

• Multi-Family Loan

No Upfront fees! No Junk Fees! No Tax Returns!

strattonequities.com (800) 962-6613 info@strattonequities.com

LICENSED IN: All States except for: AK, ND, NV, SD, UT

Find

the full list of Wholesale Lenders on page 61 KNOW IT ALL. Way more than a magazine. Stronger Stories

discuss the issues in the industry others may be too wary to touch, and we never let advertise relationships affect our stories.

actionable advice from professionals across the industry with tips to further your career, grow your business, and more.

just read the news

nmplink.com/subscribe

the full list of Wholesale Lenders on page 61