FINTECH

Gives Banks A Run For Their Money In Home Equity Race

It’s Time To EVALUATE EFFECTIVENESS Of Legacy Products DON’T GET CAUGHT In The Dust of New Data Privacy Slipups

SMART BEATS HAPPY Make Funding Pitches Focus On Expertise, Not Enthusiasm

Get Your Toilet Paper and a Mortgage

A PUBLICATION OF AMERICAN BUSINESS MEDIA

INSIDE THE BIG BOX

THINKING

Justin Demola Lenders One

©2022 First Horizon Bank. Member FDIC. Know-how that wastes you forward. no time moving Our commercial banking team can help you map the cash moving in, through and out of your business with next-level know-how. So, no matter which way it moves, you can be sure it’s moving you forward. Let’s find a way. firsthorizon.com/capital Commercial & Specialty Lending Commercial Real Estate Treasury Management

REGULATORY CORNER

CFPB PROPOSES RULE TO ESTABLISH PUBLIC REGISTRY OF TERMS AND CONDITIONS

The Consumer Financial Protection Bureau (CFPB) proposed a rule to establish a public registry of supervised nonbanks’ terms and conditions in “take it or leave it” form contracts that claim to waive or limit consumer rights and protections. Under the proposed rule, nonbanks subject to the CFPB’s supervisory jurisdiction would need to submit information on terms and conditions in form contracts they use that seek to waive or limit individuals’ rights and other legal protections. That information would be posted in a registry that will be open to the public, including to other consumer financial protection enforcers.

Many companies’ financial products and services require consumers to sign lengthy form contracts. The companies write the form contracts as well as define any choices offered, and consumers cannot negotiate. Some companies slip terms and conditions into their form contracts that try to take away consumer protections, try to limit how consumers exercise their rights, or try to quiet consumer complaints or criticism, and more broadly, the terms and conditions potentially undermine consumer financial protection law. There is often little choice for consumers except to sign these form contracts due both to their market pervasiveness and the critical role the products and services play in people’s daily lives.

Some examples of terms and conditions that would be included:

• Waive servicemembers’ legal protections: The Military Lending Act (MLA) and the Servicemembers Civil Relief Act (SCRA) set limits on the cost of loans for military families and include numerous other important consumer protections. The MLA broadly prohibits waivers of legal protections and arbitration agreements, and the SCRA limits waivers of its protections.

• Mislead consumers by using unenforceable waivers in mortgage contracts: CFPB examiners have regularly identified deceptive acts and practices committed through mortgage lenders’ use of waivers and limitations that are inconsistent with the Truth in Lending Act’s restrictions on the use of waivers and limitations in such transactions.

FTC PROPOSES RULE TO BAN NONCOMPETE CLAUSES

The Federal Trade Commission proposed a new rule that would ban employers from imposing noncompetes on their workers, which it calls a widespread and often exploitative practice that suppresses wages, hampers innovation, and blocks entrepreneurs from starting new businesses. By stopping this practice, the agency estimates that the new proposed rule could increase wages by nearly $300 billion per year and expand career opportunities for about 30 million Americans.

The FTC is seeking public comment on the proposed rule, which is based on a preliminary finding that noncompetes constitute an unfair method of competition and therefore violate Section 5 of the Federal Trade Commission Act.

“The freedom to change jobs is core to economic liberty and to a competitive, thriving economy,” said Chair Lina M. Khan. “Noncompetes block workers from freely switching jobs, depriving them of higher wages and better working conditions, and depriving businesses of a talent pool that they need to build and expand. By ending this practice, the FTC’s proposed rule would promote greater dynamism, innovation, and healthy competition.”

Companies use non-competes for workers across industries and job levels, from hairstylists and warehouse workers to doctors and business executives. In many cases, employers use their outsized bargaining power to coerce workers into signing these contracts. Noncompetes harm competition in U.S. labor markets by blocking workers from pursuing better opportunities and by preventing employers from hiring the best available talent.

“Research shows that employers’ use of noncompetes to restrict workers’ mobility significantly suppresses workers’ wages—even for those not subject to noncompetes, or subject to noncompetes that are unenforceable under state law,” said Elizabeth Wilkins, director of the office of policy planning. “The proposed rule would ensure that employers can’t exploit their outsized bargaining power to limit workers’ opportunities and stifle competition.”

The evidence shows that noncompete clauses also hinder innovation and business dynamism in multiple ways—from preventing would-be entrepreneurs from forming competing businesses, to inhibiting workers from bringing innovative ideas to new companies.

To address these problems, the FTC’s proposed rule would generally prohibit employers from using noncompete clauses. Specifically, the FTC’s new rule would make it illegal for an employer to:

• enter into or attempt to enter into a noncompete with a worker;

• maintain a noncompete with a worker; or

• represent to a worker, under certain circumstances, that the worker is subject to a noncompete.

MortgageBanker

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Christine Stuart EDITORIAL DIRECTOR

David Krechevsky EDITOR

Keith Griffin

SENIOR EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Sarah Wolak STAFF WRITERS

Rob Chrisman, Nir Bashan CONTRIBUTING WRITERS

Gary Rogo

SPECIAL SECTIONS EDITOR

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael

PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Nicole Coughlin, Nichole Cakirca ADVERTISING ASSOCIATES

Lydia Griffin

MARKETING INTERN

Submit your news to editorial@ambizmedia.com

If you would like additional copies of Mortgage Banker Magazine Call (860) 719-1991 or email info@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Mortgage Banker Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com

2023 Already… Now What?

By ROB CHRISMAN, CONTRIBUTOR, MORTGAGE BANKER MAGAZINE

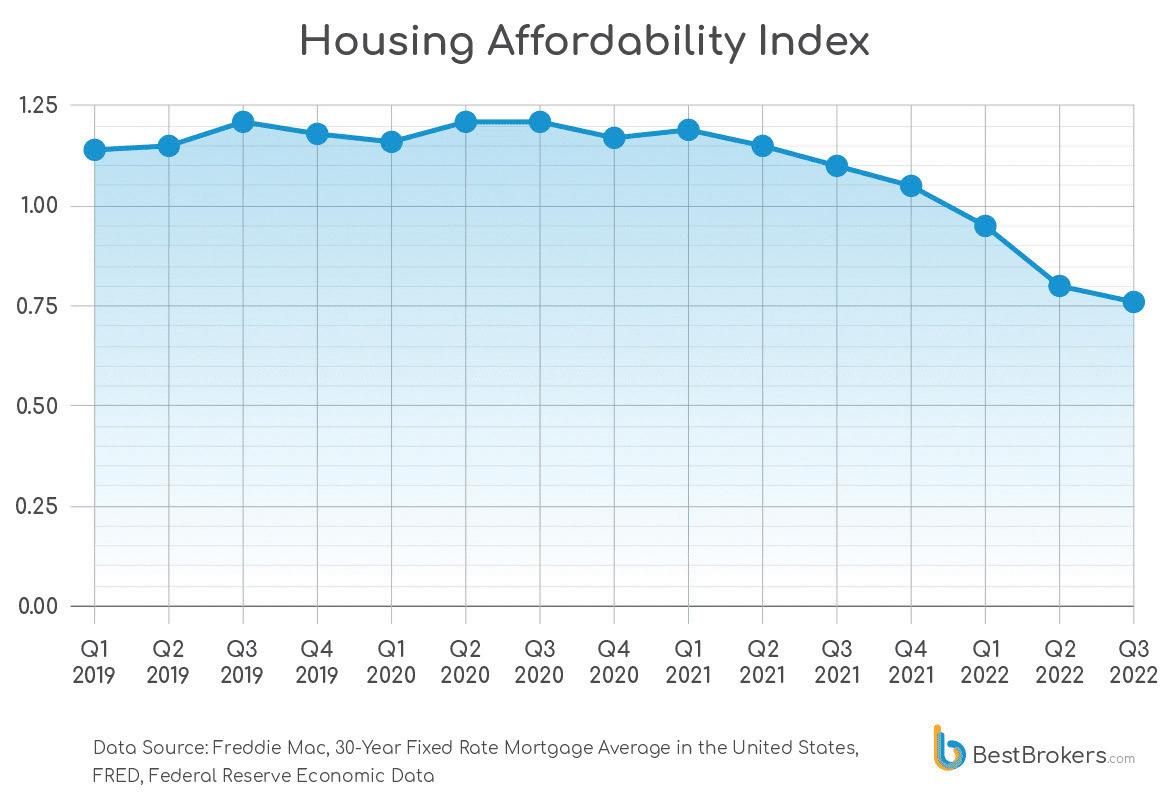

At the beginning of 2020, prepandemic, all the “experts” thought that rates were going to go up. Who predicted a pandemic, and its impact on mortgage rates and housing market? When 2022 began, many were predicting higher rates, but not at the speed at which mortgage rates shot higher. And now economists are predicting interest rates to sag somewhat, and that we may have seen the high for 30year mortgage rates.

We are reminded time and time again that if someone is going to predict an interest rate in the future, not to put a date on it, of if they’re going to put a date on it, don’t put a number on the interest rate. What if everyone thought we were going to see higher mortgage rates, and we didn’t? Remember that this is exactly what happened several years ago when the Federal Reserve Open Market Committee raised overnight Fed Funds in December of 2016, after which long-term rates dropped and stayed low for the next 10 months.

After the 2016 presidential election, the financial markets pretty much began assuming long-term rates, including mortgage rates, would be higher in 2017. Donald Trump’s potential agenda, which included big tax cuts, infrastructure spending, and broad hiring, certainly seemed to point toward higher rates.

Trump’s stated goals during his campaign implied that rates would be higher in a couple years, especially with the pressures from wage increases nudging inflation higher. But stimulative fiscal policy from the Trump administration faced an equal and opposite tightening of monetary policy by a Federal Reserve. (Remember that monetary policy involves changing the interest rate and influencing the money supply. Fiscal policy involves the government changing tax rates and levels of government spending to influence aggregate demand in the economy.)

As we forge ahead with 2023, the Fed, through the actions that the Federal Open

Market Committee makes, is expected to continue to raise short-term rates initially, but then slow or stop the rate increases as their impacts on inflation and economy are felt. Among other actions, the Fed conducts “the nation’s monetary policy by influencing money and credit conditions in the economy in pursuit of full employment and stable prices.” The U.S. central bank will continue to seek to prevent too much inflation from breaking out in an economy it believes is getting close to operating at its full potential.

The “smartest guys in the room” might be wrong with their forecasts. The era of very low rates came to an end in late 2021. But presidential administrations and agendas do make a difference. The Trump agenda began with a very vocal bang but packed less of a growth punch than some had imagined. If so, you would expect the same cautious approach to rate increases from the Fed. Or decreases should it come to that.

The day after Donald Trump was elected, stocks rallied and bonds sold off/rates went up. Trump’s major tax cuts would tend to, it was believed, create a short-term boost in economic growth and higher interest rates. But Republican lawmakers who actually have to pass any changes to tax law, especially those in the Senate, were wary of tax cuts that would increase the budget deficit as much as Trump’s campaign plan would have.

Regarding infrastructure spending, Trump had been short on details, and the details matter a great deal for how much an infrastructure plan could lift growth. For example, tax credits that make the finances of building toll roads more favorable are less likely to create a huge boost in activity than spending on upgrading physical infrastructure outright. Then, as now, on both tax cuts and infrastructure there’s no guarantee that the actual scale of stimulus will every match postelection talk.

Recently, and in the future, even if the U.S.

economy does start growing faster, any administration appointees could change their tune on the desirability of higher interest rates. Politicians, once in office, tend to learn that they like low interest rates, and during the Trump administration some pushed for cheaper money and the Fed attempting to hold the line to prevent inflation. We will see what happens with the remaining years of the Biden administration, although so far it seems to have kept its hands off of Fed direction.

Critics say that some elements of Trump’s economic policy wound up being a drag on growth, such as a trade war with China or Mexico, immigration restrictions that limit the supply of labor, or geopolitical disputes. This is still being played out to some extent.

For the past few administrations, presidents have stayed away from weighing in on monetary policy and let the Fed act independently. Trump had described himself as a “low interest rate person” but attacked Fed Chair Janet by name during the campaign. Biden has been letting the Federal Reserve handle things, for better or worse.

Looking ahead to 2023, even if the Fed kept its short-term interest rate targets high to combat elevated inflation levels, longterm interest rates, which are determined by the supply and demand of the bond market, may remain stable or actually drop. Trump didn’t feel bound by the traditions that have governed how recent presidents have acted, but Biden seems more predictable. The future of United States interest rate policy is always uncertain – like everything else in the future – but no one should be sure that long-term rates mortgage are destined to move dramatically higher if at all.

4 MORTGAGE BANKER | FEBRUARY 2023

MARKETS

ROB CHRISMAN

Discover Where Your Competitors Stand In The Mortgage Market

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Mortgage MarketShare Module

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Loan Originator Module

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

GET A FREE MORTGAGE COMPETITOR ANALYSIS

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

BENEFITS

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

NEED MORE DATA?

Inquire about our NMLS Data Licensing and LO Contact Database options.

MORTGAGE BANKER | FEBRUARY 2023 5

Entrepreneurs Should Emphasize Expertise Over Enthusiasm

FUNDING PITCHES WORK BETTER WHEN EMOTIONS DON’T COME INTO PLAY

By GEORGIA INSTITUTE OF TECHNOLOGY, SPECIAL TO MORTGAGE BANKER MAGAZINE

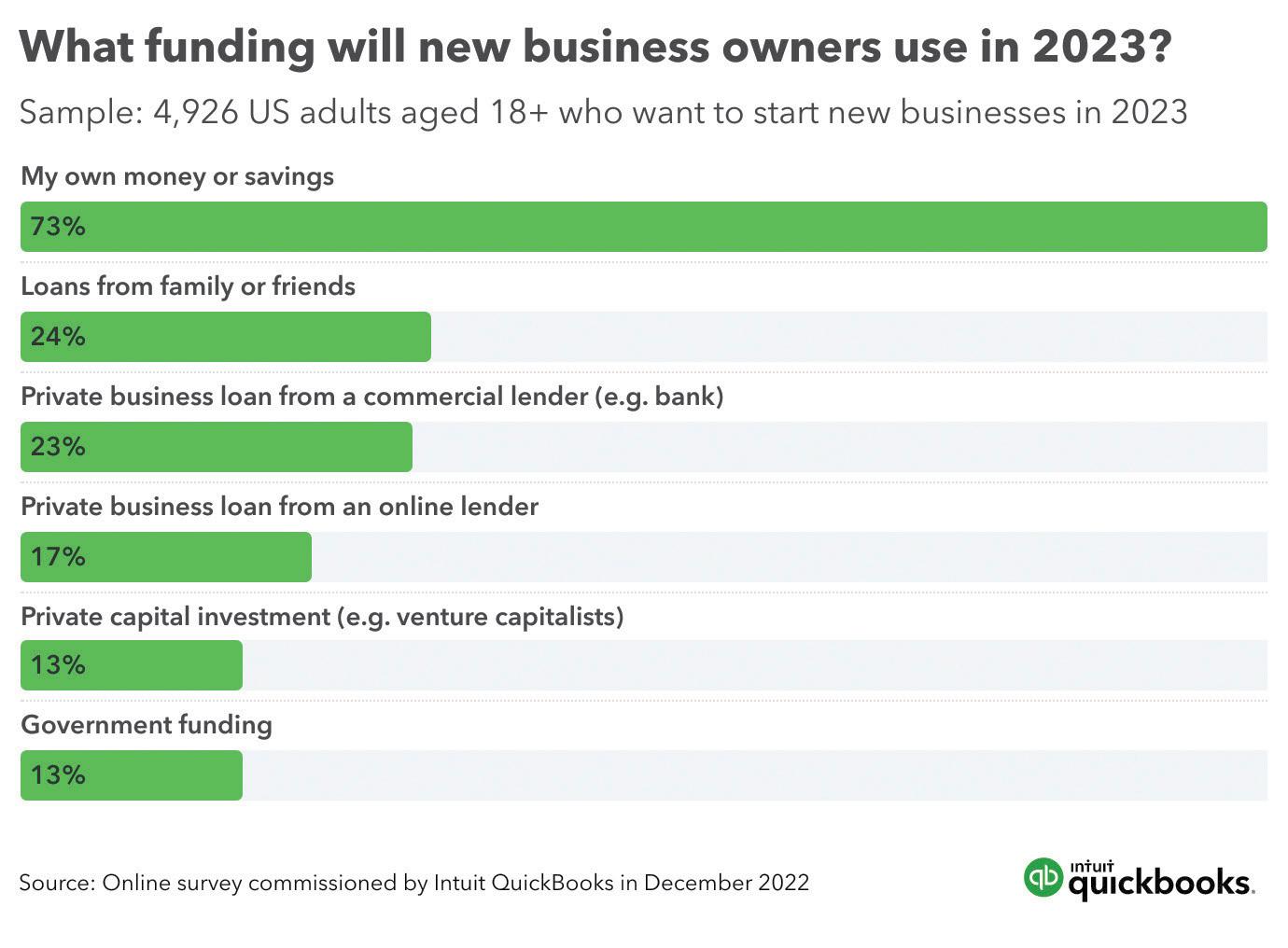

Many entrepreneurs believe the more enthusiastic they can be in their pitches, the more likely they are to get funding. But it turns out that being too emotive in a pitch can make investors feel manipulated and dissuade them from giving money.

This finding comes from the latest research out of the Georgia Institute of Technology’s Scheller College of Business. Researchers interviewed investors and then conducted an experiment with crowdfunding platforms to determine which pitches were successful.

“They don’t trust the displayed enthusiasm or passion by entrepreneurs,” said Dong Liu, a professor of organizational behavior at Georgia Tech.

Instead, entrepreneurs with expertise in their areas and demonstrated competence were more likely to receive funding. Once expertise and competence are evident, entrepreneurs can effectively use

enthusiasm to win over investors.

The researchers presented these conclusions in “The More Enthusiastic, the Better? Unveiling a Negative Pathway From Entrepreneurs’ Displayed Enthusiasm to Funders’ Funding Intentions” in the journal Entrepreneurship Theory and Practice.

PITCH BREAKDOWN

Although research conventionally suggests that enthusiastic entrepreneurs engage investors, in interviews investors said they often see emotional pitches as impression management, or trying to create a positive impression on an audience.

“When people feel your behaviors are triggered by impression management motives, they feel you are not reputable and what you’re proposing isn’t rigorous,” Liu said. “So, they really doubt the value of your presentation.”

To test if this was the general opinion of investors, the researchers surveyed 1,811 potential investors looking at a random sample of 182 videos on the popular crowdfunding website, Kickstarter. The site is an ideal testbed because most participants don’t know each other, making the pitch video their main interaction. About 10 participants viewed each video.

The researchers eliminated bias by running a second study with 273 random participants and hired an actor to give the same pitch with and without enthusiasm (as determined by facial expression, body language, tone of

voice, and vocal pitch). Before watching the video, the researchers offered participants different background information on the entrepreneur, either indicating they had a lot of experience or none in the area they were pitching.

Participants in both studies were asked if they would fund it or buy the advertised product using a seven-point Likert scale from “very unlikely” to “very likely.” Finally, they were asked about their general impressions of the entrepreneurs’ enthusiasm, expertise, and their projects using a similar Likert scale.

PITCH PERFECT

The findings showed that enthusiasm is a double-edged sword. Strong emotions can appear manipulative when an entrepreneur seems inexperienced.

“Funders are more likely to be positively influenced by entrepreneurs’ enthusiasm when they saw those entrepreneurs are actually very capable of completing the project and have a strong expertise in the field,” Liu said.

The researchers believe these findings also could apply to job interviews and plan to study that next. For now, Liu shares the research with his students.

“It’s definitely good to show enthusiasm, but don’t forget, at the beginning of their presentation, they need to show their expertise,” he said. “Otherwise, their passion and excitement about the job may even backfire.

6 MORTGAGE BANKER | FEBRUARY 2023

MARKETS

Dong Liu GEORGIA TECH

“WHEN PEOPLE FEEL YOUR BEHAVIORS ARE TRIGGERED BY IMPRESSION MANAGEMENT MOTIVES, THEY FEEL YOU ARE NOT REPUTABLE AND WHAT YOU’RE PROPOSING ISN’T RIGOROUS.”

—DONG LIU

MORTGAGE BANKER | FEBRUARY 2023 7

8 MORTGAGE BANKER | FEBRUARY 2023 Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. www.ultimatemortgageexpo.com Produced By ORIGINATORCONNECTNETWORK.COM JUL 13 2023 The Gulf Coast’s ultimate gathering for mortgage pros. We’ve brought together the best in the business to create a top tier event specifically designed for mortgage origination pros. Lone Star LO Magazine readers like you can attend for free by using the code LSLOFREE. NEW ORLEANS

Nice Guys Can Finish First

BEING A GOOD PERSON ON THE JOB CAN MAKE WORK PLEASURABLE

By NIR BASHAN, CONTRIBUTOR, MORTGAGE BANKER MAGAZINE

One of the most overlooked yet powerful things you can do to get ahead in your career may surprise you. It’s not necessarily having a ton of knowledge in your field. It’s not necessarily having the best or latest equipment or processing technology. And it’s not having the latest and greatest marketing campaign or outreach.

It is being easy to work with.

Often above all else, being easy to work with is critical in not only getting to that next level at work or earning that new account, but it can also mean a work life that is actually pleasurable and even rewarding. When we use creativity to look at being easy to work with, we unlock secrets that no amount of money can buy. So here is a list of three things that can make you easier to work with and more pleasurable to be around. And the benefits may go further than just your work life:

1. JUST BE COOL

Work is sometimes stressful. At other times it can be downright dreadful. But no matter what, things that happen are out of your control. But what you can control – always – is the way you react to adversity. If you are the type that flies off the handle at even the slightest provocation, then you are not easy to work with.

As I write that last sentence, I think of many past co-workers who fit that description, as I’m sure you do, too. If you are quick to judge – thinking that you may know why someone is getting so stressed at work and therefore losing their cool – think again. Many times, when people get stressed, there are external factors that you may not be aware of like a difficulty at home or personal debt – the list goes on and you have no real insight.

So, what can you do? Simply be cool.

Know that you can’t control the ups and downs of everyday work stress, but you can control how you react. If you can, take a moment as things come at you and realize that they are only temporary. Know that nothing lasts forever, and the only thing we really can control is our reaction.

So, choose to react with kindness. Be cool. Measured in your response not to

escalate the issues and instead try and moderate them. That one single switch that you can do today – right now – at work may pay dividends in your career aspirations – and in your personal life as well.

2. SAY YES

Try to say yes sometimes at work. I know this runs contrary to all the self-help books out there today, which encourage you to draw boundaries around your time by saying no – but I argue to become easier to work with. We need to say yes sometimes.

Saying yes allows you to be easier to work with. If a client needs something – say yes. Even if it may be out of scope. If a co-worker needs you to cover for them while they are on their, say, river cruise in Europe, say yes (even though you wish you were on that cruise instead – and how does that guy take some much time off without getting fired?). The point is that none of that matters. Just say yes.

When we say yes when we otherwise would say no, we get out of our comfort zone. And when we are out of our comfort zone, wonderful creative and innovative things end up happening. We learn something new. We discover that we really are ok with that thing we were dreading. We discover that perhaps – yes – we do like to help.

When we end up saying yes to something we otherwise say no to, we create an opportunity to experience something new, different, and novel. And when that happens, we learn and grow and explore. All of which make us easier to work with and humbles our outlook. Speaking of humble …

3. WIN HEARTS AND MINDS

You may have a PhD in economics, 30 years of experience in your given field, and a Harvard MBA. But here’s a little secret you may not know: No one gives two shits about what you know. Trust me. No one cares. Folks may care eventually if they know that what you know may help them in some way.

While that may sound harsh, if you are able to win hearts and minds instead of trying to bulldoze over people with your

knowledge – then guess what? You’re being easy to work with. And being easy to work with is the surefire way to generate creativity and innovation in all that you do.

When we try to win hearts and minds instead of trying to show everyone how smart we are, we take the humane path in our career. We take the path of empathy. The path of collaboration. The path of teamwork. Now, after you have won some hearts and minds by showing that you care, then you can use your knowledge base to affect change.

So much has been written and said about acquiring knowledge and going to the right university and having the right career history, but seldom do we talk about the soft skills that are critical in the furtherment of our career or business. If we are not dialed into winning hearts and minds, we will never get where we need to go at work. And this may also become a stumbling block to getting where you need to go in your personal life as well. Win the hearts and minds before you show someone how much you know. It’s an effective way to be much easier – and more pleasant – to work with.

I am confident that the above three rules from the book of creativity and innovation are helpful to you on your journey to get more accounts, grow your business and ultimately create more impact in your career or business. Too often we are busy chasing false prophets in the name of improvement or efficiency or optimization. Because at the end of the day, just simply making the choice to be easier to work with is far more powerful than the alternative. One more thing: When we learn how to become easy to work with, we then unleash a magnetism that makes us attractive to do business with. And that attraction is something no amount of dollars we spend can generate.

Nir Bashan is an all-time Top 100 nonfiction book author and speaker. He helps folks become more creative at work.

MORTGAGE BANKER | FEBRUARY 2023 9

C SUITE STRATEGIES

NIR BASHAN

Is Fintech a Threat to Home Equity Business As We Know It?

MORTGAGE BROKERS NEED TO DETERMINE IF LEGACY PRODUCTS CAN COMPETE

By KEN FLAHERTY, SPECIAL TO MORTGAGE BANKER MAGAZINE

Relationships are more like journeys than they are destinations. In romance and in business alike, staying connected and continuing the exchange of resources is an obvious choice when the needs of all parties are fulfilled. However, much like the relationship between traditional home equity lenders and borrowers, when one grows complacent as the other evolves, challenges arise, making other options appear more attractive.

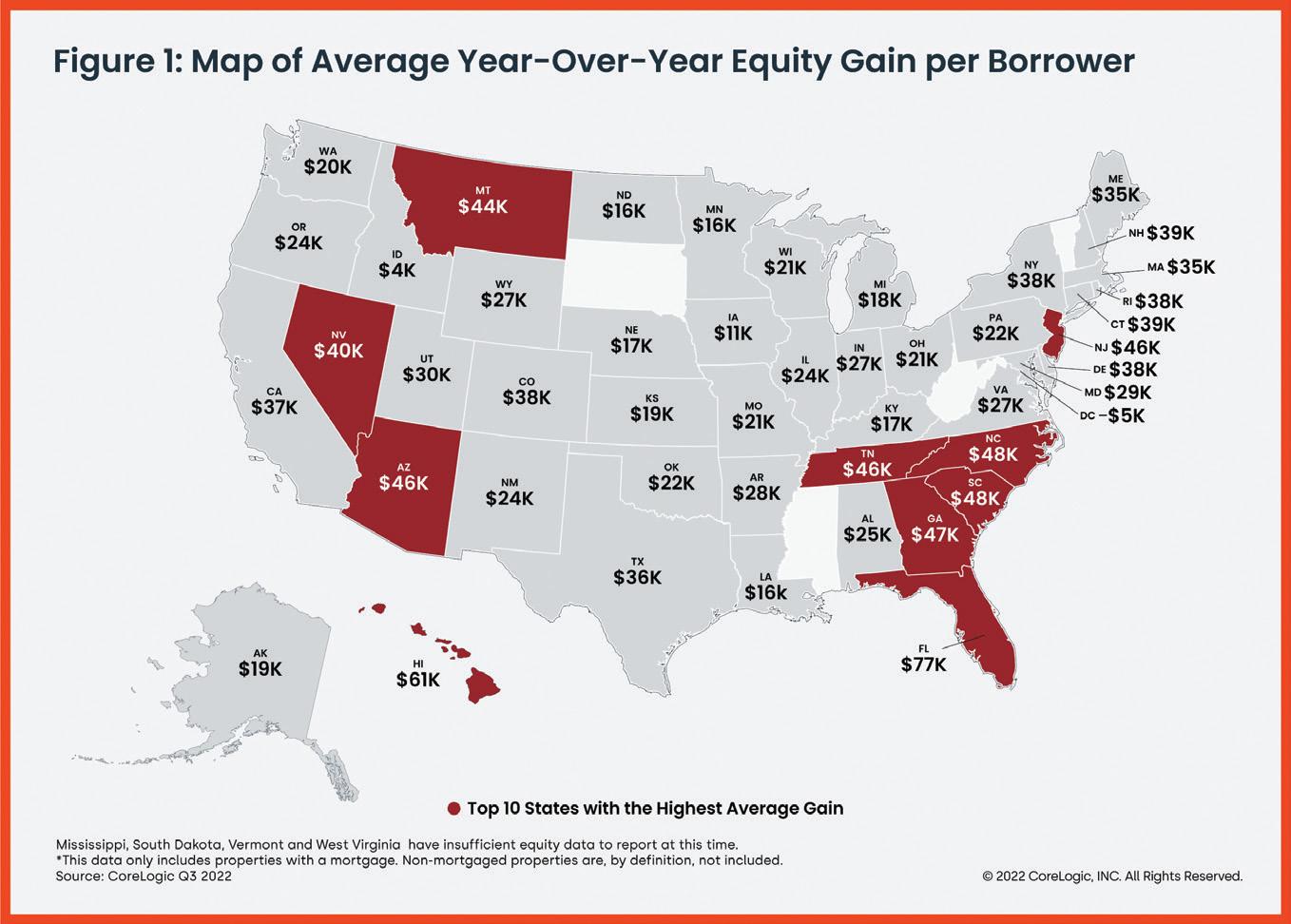

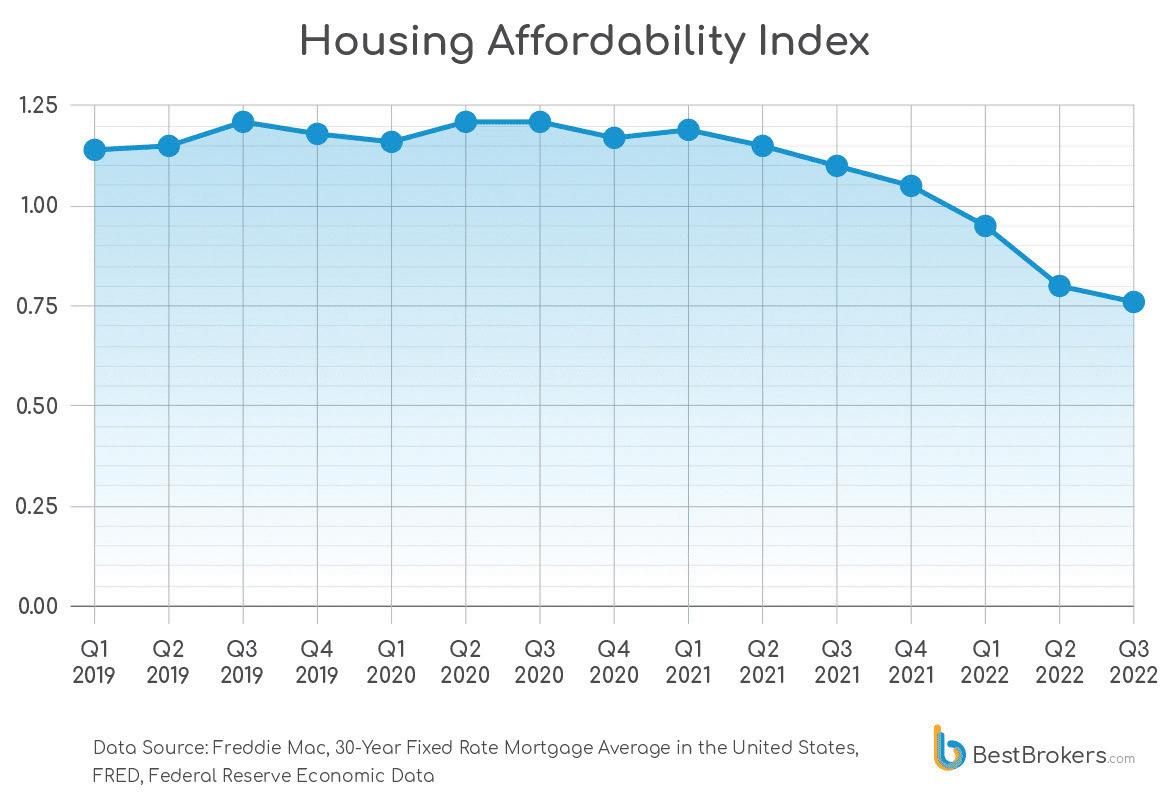

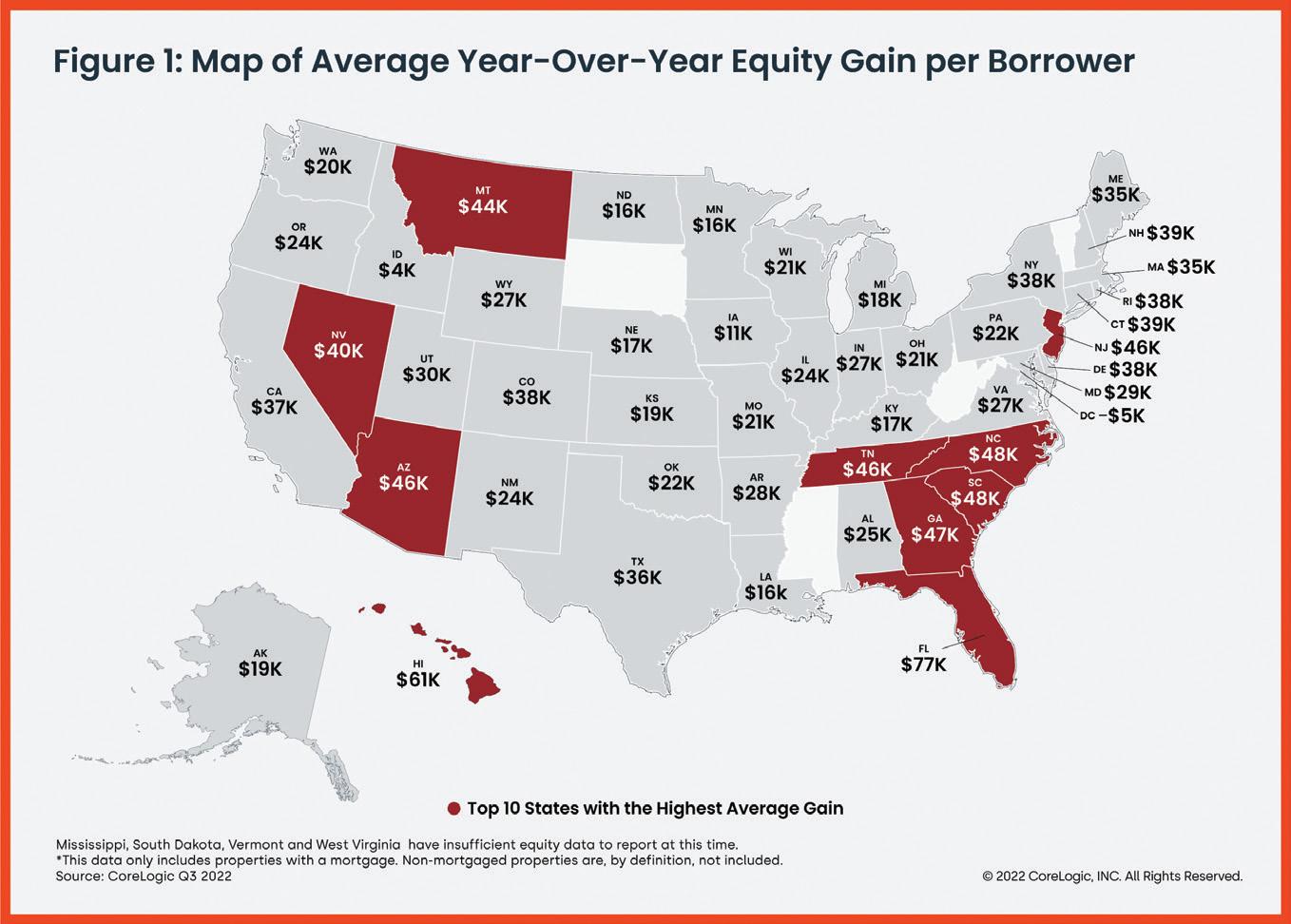

As the home equity boom continues, bringing the total average equity per borrower to $300,000 with a 25% growth in tappable equity year over year, more homeowners are choosing to tap into their home’s value as a low-cost way to borrow large sums of money.

While gravitating

toward home equity products makes sense in the recent rate environment, doing so could come with an unnerving feeling of delayed gratification. Against the backdrop of today’s fast-paced lending market, the traditional home equity process can seem lengthy, demanding, and complicated.

There is a seismic shift in borrower behavior that is priming this market for disruption. It was once assumed that banks would continue dominating the home equity space due to their longstanding relationships with customers; but this certainty has given way to inertia, allowing new fintech organizations with better marketing, sleeker interfaces, fully digital capabilities, faster processing speeds, and differentiated product options to enter the scene.

The current landscape now demands traditional financial institutions to determine if their legacy products and services can endure the growing appeal of fintech and digital lenders.

WHEREVER THERE’S CHANGE,

THERE’S OPPORTUNITY Tappable homeowner equity hit record highs

in 2022 with a $2.3 trillion increase that brings the total value to $11.5 trillion.

After a period of being out of favor among lenders, it is possible that a generational unfamiliarity with home equity could make it challenging for a rapidly growing demographic of first-time homeowners and young finance professionals to have the succinct discussions needed to identify a customer’s needs and make the right recommendations. In the event of a large purchase or sudden need for financing, customers who have never used home equity may be inclined to prioritize speed and choose an unsecured loan, the quickest and easiest option, where a home equity product would be the better long-term solution.

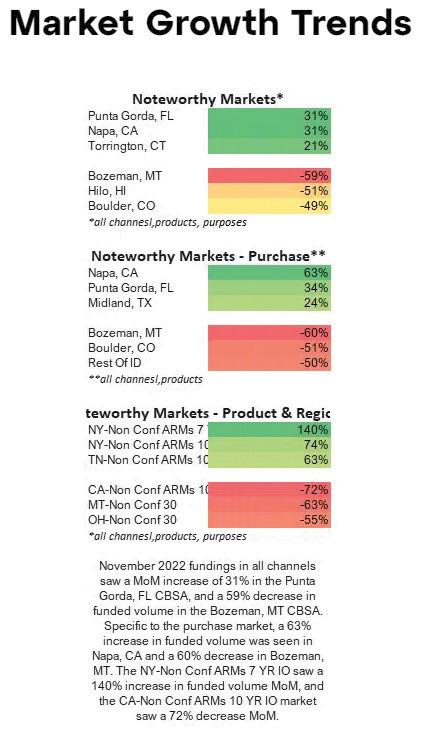

Unsecured lending is a big space for fintech organizations. They have perfected the process and are outpacing traditional lenders, with some up 141.3% year over year Borrowers sitting on low first mortgage rates and excessive equity will undoubtedly turn to unsecured loans or home equity products for their financing needs. The problem remains that tapping into home equity is still a very long and painful ordeal, and this plays

10 MORTGAGE BANKER | FEBRUARY 2023 TECHNOLOGY

KEN

FLAHERTY

right into the hands of fintech lenders.

On average, it takes traditional financial institutions 50 to 60 days to close home equity loans, which means customers could wait up to a few months to get approved and receive funds. Fintech is entering the space with a competitive strategy of speed and convenience. Boasting 5-minute loan approval times and dispersing funds in as little as 5 days, digital lenders have all the necessary ingredients to create a ripple in the industry because of how fast they can get their product into consumers’ hands.

SEEKING SIMPLICITY

Today’s consumer is accustomed to streamlined processes and same-day deliveries across industries. Technological

advancements that support ease and speed are shifting the consumer mindset, creating a greater need to stay in touch with what they think and how they behave. Borrowers increasingly expect simplicity in applying for a loan, immediacy in loan decisions, and seamless delivery of funds.

Fintech organizations also offer alternative solutions to outdated home equity products. The rapid increase in mortgage rates over the past year has opened up a variety of new financing opportunities. Some are similar to a traditional home equity line of credit and others start from scratch, rethinking the product entirely.

For example, fintech lenders have recently introduced equity-sharing programs as an alternative to conventional home equity

lending. While foregoing traditional loan approval processes and repayment terms, homeowners can sell portions of equity in their home, sharing the value increase of a property, whereas traditional financial institutions have heavily regulated systems in place that make it challenging to offer alternative products.

Even if banks are not interested in investing in equity, it is worth acknowledging that there are other customers whose usage patterns have shifted beyond the classic equity loan format. In recent years, borrowers’ needs have become more shortterm. The odds are a borrower may not need a 30-year product. A 2-year product is more appropriate today as borrowers’ peak usage rates are apparent well before the loan ages even 12 months. And, while old products may work, they do not meet borrowers’ short and long-term needs.

FLEXIBLE SOLUTIONS

The beauty of fintech organizations is their focus on innovating around one use case. They are not full-service financial institutions but often perform significantly better in the spaces they occupy. Digital lenders offering flexible solutions make it vital for traditional lenders to better understand and align themselves with consumers.

Banks have historically been slow to adopt new home equity products and technology. Market changes offer the perfect environment to embrace innovation and invest in technological advancements that create a more customer-centric, streamlined approach to their origination.

Digital lending companies are entering and disrupting a very mature market by simply meeting customers where they are. Now is the time to leverage data to measure what is happening and reassess the product instead of applying a one-size-fits-all approach. Traditional home equity lenders won’t be closing their doors and going out of business tomorrow, but if forced to choose, it should come as no surprise that borrowers are willing to roll the dice on the new guy in town.

MORTGAGE BANKER | FEBRUARY 2023 11

Ken Flaherty is the senior consumer lending market analyst at Curinos, a provider of data, technologies, and insights that enable financial institutions to make better and more profitable decisions faster.

AGAINST THE BACKDROP OF TODAY’S FASTPACED LENDING MARKET, THE TRADITIONAL HOME EQUITY PROCESS CAN SEEM LENGTHY, DEMANDING, AND COMPLICATED.

MORTGAGE BANKER | FEBRUARY 2023 13 Telling the story of your success. Your daily news, industry insight, and professional advice is now streaming. Tune in to Mortgage News Network to discover everything you need to know to be a better mortgage professional. LISTEN WATCH nmplink.com/TheInterest nmplink.com/ThePrincipal nmplink.com/BABTJ nmplink.com/GC Watch or listen at mortgagenewsnetwork.com

PROFIT. AT THE PUSH OF A BUTTON.

Transform Your Tech Strategy, And Outpace Your Competition

The turbulent mortgage market is creating an opportunity to upgrade how we originate mortgages. The answers all revolve around technology and enhancing the origination experience. New tech will lower personnel costs, speed loan delivery, capture application data faster with greater accuracy, and allow more effective marketing including post-close communications.

That’s why you need to be part of the incredible OriginatorTech Live conference. Built off of more than three years of impressive online events, OriginatorTech Live now gives the power players in the field a chance to come together, understand the forces changing the marketing, sales, and delivery channels, and see in-depth hands-on demonstrations of the most compelling products on the market today. You will also hear case studies from origination experience lenders sharing the impact of tech on their organizations.

Mortgage banking executives, broker-owners, top producers, CIOs, and more will walk away from this gathering with more tools, more insight, and more ability to outpace the competition.

We’re at the fun and exciting Linq Hotel and Casino in the heart of the Las Vegas Strip. Join us March 22-23 for the one conference sure to show you a path to the ultimate origination experience.

March 22-23, 2023

The Linq Hotel + Experience, Las Vegas originatortech.live Register for FREE with promo code MBMFREE

Find more events through the Originator Connect Network. originatorconnectnetwork.com

Banks Have an Opportunity to Win Market Share from Non-Banks

Market conditions today likely give banks an edge over non-banks when it comes to offering certain mortgage products, according to an analysis by Jim Cameron, senior partner for mortgage advisory firm Stratmor Group. In fact, the conditions are favorable for leading banks to win back some mortgage market share lost to non-banks during the refinance boom, Cameron writes in his article, https:// www.stratmorgroup.com/press_releases/ stratmor-banks-have-an-opportunity-towin-market-share-from-non-banks/ “In Times Like These, It’s Good to be a Bank.”

“HMDA data shows that bank share has dropped from 76% in 2010 to 37% in 2021, and there are many reasons for this shift,” said Cameron. “But in today’s extremely challenging market, banks may have an opportunity to regain some market share from non-banks by leveraging their liquidity and capital to offer products that non-banks are simply not able to offer.”

There are a variety of factors that tilt the scales in favor of banks, according to Cameron. Key factors include the level of interest rates, the trend line for rates, the regulatory environment, capital requirements, and the mortgage servicing rights market, just to name a few. Cameron identifies several products that create advantages for banks in the current market. In many cases, banks are just better positioned to deliver the loan products customers need now.

“In times like these, it is normal for lenders to look to additional product categories to find ways to increase loan production volume. When thinking about the different product choices out there, whether it is HELOCs, non-QM, construction, ARMs or non-core non-agency loans, banks have real advantages over non-banks,” Cameron said.

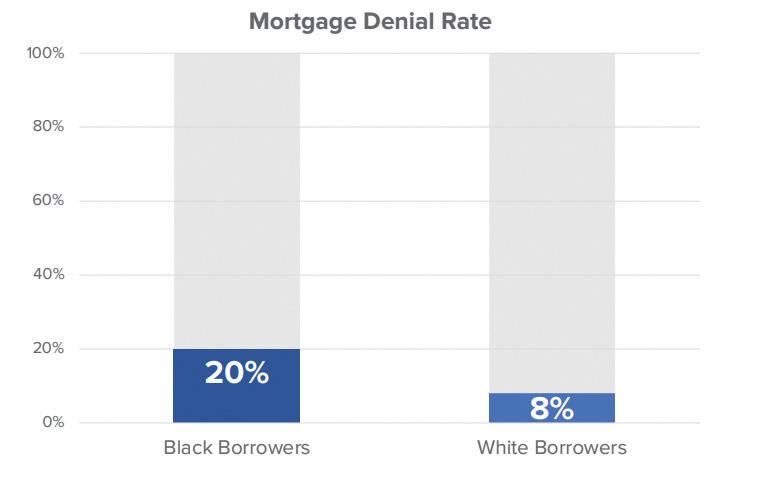

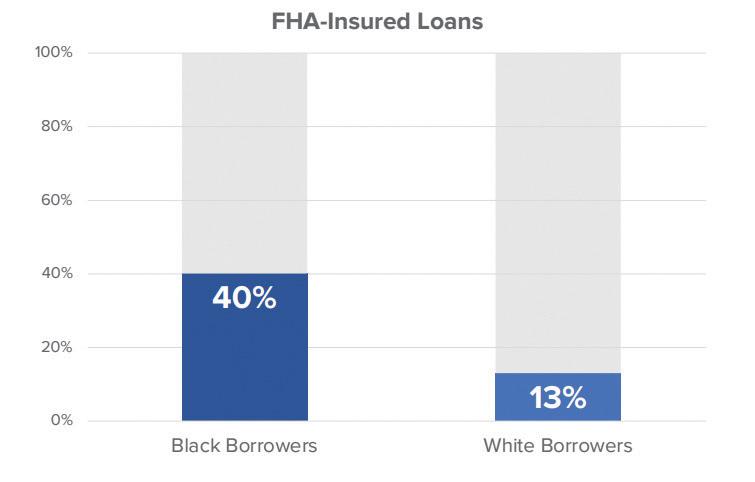

But Cameron also notes two factors negatively impacting bank lending. First, many banks have avoided FHA lending, as the seemingly random enforcement of the False Claims Act creates unquantifiable, and therefore unacceptable, risk for many

financial institutions. This does not help banks when they are competing for their fair share of the first-time homebuyer market.

Second, Cameron says banks have all but abandoned the wholesale channel as they are generally not comfortable that they can manage the risks. While that is perfectly understandable, it negatively impacts banks’ market share as the wholesale channel has been trending up, driven by a handful of large nonbank lenders.

In his insight report, Cameron said, “Volatility and illiquidity are the key factors driving the Non-QM market today. Non-banks are having trouble finding investors who would be willing to purchase the product at a reasonable price. Investor demand for private label securities backed by NonQM loans has been greatly reduced due to market volatility and uncertainty about the future direction of rates and the economy in general.

“So, unless they are backed by a deeppocketed private equity investor with an appetite for the loans and an ability

to manage risk, non-banks are at a real disadvantage. Non-banks have been burned by fickle investors who quickly exited the market (e.g., during the outset of the pandemic) and others who abruptly shut down, such as Sprout and FGMC.”

Even with their advantages in the current lending environment, Cameron stops short of suggesting that banks might suddenly overtake non-banks in market share.

“That’s not likely,” he said. “But by leveraging their natural advantages in certain product segments, banks may be able to regain at least a modicum of lost market share from non-banks in the near term.”

MORTGAGE BANKER | FEBRUARY 2023 15

C SUITE STRATEGIES

HOWEVER, THERE IS SOME SKITTISHNESS ON FHA LENDING AND WHOLESALE

‘WE’RE ALL VERY OPTIMISTIC, ESPECIALLY IN TODAY’S CHALLENGING MORTGAGE ORIGINATION ENVIRONMENT. PUTTING OUR MEMBERS IN PLACES WHERE BORROWERS OR POTENTIAL BORROWERS WILL BE REALLY GOOD.’

—JUSTIN DEMOLA

COVER STORY 16 MORTGAGE BANKER | FEBRUARY 2023

LENDERS ONE SEES A FUTURE WITH WALMART

By DOUG

By DOUG

Starting in high school and continuing through his collegiate years, there were few opportunities for Justin Demola to engage in usual adolescent and student behavior like sleeping in or slacking off. Instead, during vacations and breaks, he was put to work in his uncle’s mortgage business, Walsh Securities/Equity Rewards, in Parsippany, N.J.

“I was held hostage,” said the 48-year-old Demola, who now leads the mortgage cooperative Lenders One, when asked about his upbringing. “My family was in the business and during my high school and college breaks I was working for the family company.”

In fact, as Demola describes family life, there wasn’t much of a choice when it came to a career.

“My mom worked with my uncles,” he said. “My cousins were in the business. My sisters (who are eight and nine years his senior, respectively) were also in the business like my brothersin-law. Everyone in the family was in the business.”

When he graduated from Skidmore College in upstate New York, his family pooh-poohed his Wall Street job offer, persuading him to join the family business, instead.

“My family was like, oh, just come back, you know, for a couple of months and see how it is. And so, to make a long story short, I’m still in this industry.”

“One of my first jobs,” he continued, “was using Lotus 123 to evaluate weighted average coupons and weighted average LTVs on large portfolios of loans that we were looking to purchase.”

TODAY’S CHALLENGES

While he describes himself as “groomed from day one to learn every aspect of the (mortgage) business,” today, Demola likely faces some of his most intimidating and strenuous professional challenges, ones that will put his experiences and background to the acid test.

The first is leading Lenders One, a cooperative with multiple stakeholders – more than 240 “banks, credit unions, independent mortgage banks and real estate/builder-affiliated firms”

that originate between $25 to $50 billion a year in mortgages, says the organization’s website.

The second might be more daunting: Seeing to it that Lenders One aces its test with the country’s largest retailer, Walmart. The Bentonville, Ark., behemoth is testing whether its customers are apt to pick up a mortgage from Lenders One in a few, preliminary locations.

WALMART & LENDERS ONE Lenders

One worked with Walmart for nearly two years before finalizing the relationship.

“Essentially we were able to sign a master lease with them for the ability to open up locations wherever we want as long as there are vacancies and Walmart approves the location,” Demola said.

But something like this was tried earlier by another retail giant, Costco, and it stopped in 2022. So why does Demola think the outcome of his plan with Walmart will turn out better than what happened with Costco?

“The Costco offering was online only, and it was not personal with four members reaching out to the potential

It says in-person is the difference between it and failed Costco attempt

PAGE, STAFF WRITER, MORTGAGE BANKER MAGAZINE

MORTGAGE BANKER | FEBRUARY 2023 17

customer,” he said.

While Lenders One is currently in three locations, two in New Jersey and another in Orlando, Fla., the plan, Demola said, is to pilot this program in three other states, South Carolina, Texas and California.

“We chose these locations based on membership demand and concentration,” he said. “We are looking to add additional states and having the legal reviews for branch licensing done there.”

“Our initial pilot is in 10 stores,” Demola said. “The second phase of the pilot is to be in 20 more stores” over the next six to 12 months.”

As for his views on the test, he said, “We’re all very optimistic, especially in today’s challenging mortgage origination environment. Putting our members in places where borrowers or potential borrowers will be really good.”

And, he adds, Walmart is bullish. “They would like to see us in a lot more than that,” Demola said.

ACTUAL FOOT TRAFFIC

Whenasked if the foot traffic for a Lenders One member is better at Walmart than in their own offices, he said, “The foot traffic in Walmart (millions of customers) makes it much better to originate loans than the majority of standard mortgage offices.”

But he adds caution to that statement.

“It’s too early to have enough of sample size to report on the metrics,” Demola said.

While recent statistics are hard to come by on how many customers visit one of Walmart’s 5,300 locations in the United States each week, six years ago the retail giant said 140 million Americans visited its stores in person or online weekly.

As to who’s picking the spots where Lenders One will set up shop, Demola said,

“The members are picking the locations based on the available locations provided by Walmart.”

In addition, Demola said, there is an exclusivity arrangement. “We only allow one member per (Walmart) location,” meaning that only one member of the Lenders One cooperative is allowed space in a Walmart store.

GOOD CUSTOMER STATS

According to one study, nearly 30% of all Walmart shoppers have an annual income between $50,000 and $99,900. In addition, the study says, more than 20% of its customers were born between 1982 and 2002.

Demola says those Lenders One members with space in a Walmart may visit their customers and potential borrowers off-site, too.

“That depends on what the borrower wants,” he said. “There is nothing prohibiting them from meeting off-site, which is common for business.”

As for how mortgage originators affiliated with Lenders One for this program are compensated, Demola said, “That’s up to each individual member strategy/policies and applicable employment law in their states.”

Of course, that Lenders One is able to set up shop in Walmart prompts scrutiny. For example, what does one of the country’s most successful businesses get in return?

Demola provided his view of the relationship.

“Walmart is only leasing us space,” he said. “They’re the landlord, we’re the tenant. They’re not making any money on a per unit basis or anything like that. They are a complete landlord, and we’re paying them monthly (for the space).”

When asked if there was anything

140 Million

special or unique about the arrangement, Demola said, “One of the things they did to vet us was ask about how we can help create value for their customers, whether it’s on the cost side, the service side or on the education side.

“We’re going to give the Walmart customer the best deal we can give them for their particular situation,” he added. “We’re also going to educate them and given an exceptional level of customer service.”

AND WHAT DOES THAT MEAN?

“One of the things Walmart requested is homebuyer and credit education for their consumers,” Demola said. “So that’s part of what we’re doing. We’re working with them (Walmart consumers) to understand credit and the way credit reporting works, how to purchase a home, how to save for a home and how to maintain a home.

“This is boots on the ground, face-to-face, true personal relationships to help them get into homes,” he said.

But as Michael Moebs, who 40 years ago started Lake Forest, Ill.-based Moebs Services, a financial services consulting firm, and has worked with Walmart executives, sees it, there’s another reason the retail giant is interested in working with Lenders One.

“Walmart’s thrust has always been cost reduction,” Moebs said. “They’re costconscious and they want to bring this (the cost of a mortgage) down.”

When told about Moebs’s view on the Walmart arrangement, Demola demurred.

“I can name 15 different characteristics that affect pricing of a mortgage transaction, so it’s very hard to say specifically, yes, there’s going to be a cost advantage to a (Walmart) consumer. It may be. It may not be. I’ll tell you if go to Quicken, you’re not getting the best rate. But their service, their technology, their marketing and their advertising gets them some of their deals.

“I know I’m being a little cagey on it, but there’s a lot that goes into a mortgage transaction,” Demola continued. “So, while it’s about cost for Walmart’s regular products, mortgages do not necessarily fit into the same bucket as the hard goods they sell.”

MEASURING SUCCESS

But how will Lenders One measure success with Walmart?

“It’ll be based upon the number of mortgage applications and closings and, like any business, our members need to make

18 MORTGAGE BANKER | FEBRUARY 2023

> Number of Americans who visited Walmart in person or online weekly six years ago.

money,” he said.

Demola did mention that consumers in some Walmart locations may need more help than at others, which has been explained to those companies making up the Lenders One cooperative.

“These may be higher touch transactions,” he said. “This is not someone calling in one time, giving an application and closing 30 days later.

“This could be three, four, five, six or 10 conversations (with the same person) over a six- or 12-month period,” he continued, “before someone is ready to pull the trigger and be mortgage-ready.”

Demola says they’ll need to know the consumer demographics of each Walmart store.

“Obviously, Orlando may be a little different than somewhere in the middle of Texas,” he said. “We’ll probably have some FHA and USDA loans come through the system.”

NO DETAILS

Whenasked if the contractual details with Walmart allowed the cooperative to only place Lenders One locations in their stores, Demola refused to answer the question, saying, “I’m not going to discuss any details on the deal.”

As to how the arrangement with Walmart and Lenders One came about, he said, “Walmart had an [request for proposal] out there and we were brought together by a third party,” which he wouldn’t disclose.

Walmart would not return phone calls and emails inquiring about its relationship with Lenders One.

DEMOLA’S BACKGROUND

In 2000, after his tenure with the family business, Demola started his own mortgage origination business, The Hills Mortgage and Finance Company, which he merged into MLB Residential Lending in 2017, briefly serving as the chief operating officer of the merged organization. It was at MLB that he learned about Lenders One.

He joined Lenders One in May 2019 as its vice president for sales and became its president just under two years later, in February 2021.

As for the challenges he faces now, Demola said, “There are a lot of different stakeholders. We have our members, who have one set of priorities. We have our shareholders. We have our employees. And, ultimately, it’s about navigating to make sure we’re creating value for everyone.”

Is he forcing his children, now in high school, into the mortgage business?

“My younger one has a numbers brain but keeps saying she wants to be an attorney. My older one wants to be a special ed teacher,” Demola said.

MORTGAGE BANKER | FEBRUARY 2023 19

Major Changes To Consumer Data Privacy Regulation In 2023

CALIFORNIA AND VIRGINA HAVE NEW COMPREHENSIVE LAWS; OTHER STATES COULD SOON FOLLOW

By WEBB ARTHUR, SPECIAL TO MORTGAGE BANKER MAGAZINE

Little time remains for businesses to prepare for significant chances to consumer data privacy laws in the US. The nation’s first comprehensive consumer data privacy law, the California Consumer Privacy Act (CCPA), was set to undergo significant updates on January 1. Regulations are still being updated, so compliance efforts will continue into the new year. Additionally, the second comprehensive state law, in Virginia, will be effective and enforceable.

The law is similar to the CCPA, but not identical, and impacted businesses will need to separately consider compliance with both laws. While these laws contain exemptions for financial services providers, all businesses directly subject to the laws will need to ensure that their data is inventoried to consider the impact on data sets like website data, marketing data, and data on employees.

CALIFORNIA INSPIRED

First, major changes are coming to the CCPA by way of the California Privacy Rights Act (CPRA), a 2020 ballot initiative. California residents will have new rights with regard to their personal information, including the right to opt out of the sharing of their personal information for cross-contextual advertising, the right to limit the use and disclosure of sensitive personal information (a new subset of personal information), and the right to correct their personal information.

The CPRA also adds new notice content requirements, requires businesses to pass on deletion requests to third parties to which they have transferred personal information, and imposes data security requirements. Further, the law adds new requirements when managing service providers and will require contracts to transfer (or ”sell”)

personal information to third parties. In implementing new requirements, business will need to take particular care to consider the impact of the law on information passively collected or processed by a website or identified with regard to a device, a focus of the regulator.

The CCPA’s limited exemptions related to employment and B2B context information are also expiring. With this development, California-resident employees and other individuals acting in commercial contexts will now have CCPA rights, and businesses will have to amend disclosures to cover this information. Otherwise, the CCPA’s exemptions remain intact.

The California Privacy Protection Agency, the new entity that has taken over rulemaking under the CCPA from the Attorney General, is working on updating the CCPA regulations. These regulations, when finalized, will impact notice content, the

20 MORTGAGE BANKER | FEBRUARY 2023

REGULATION

WEBB ARTHER

rules surrounding processing of consumer requests, and the circumstances under which businesses may process personal information secondary to the purposes for which it was collected. Businesses should monitor CPPA rulemaking efforts, as rules related to profiling opt outs and managing online opt-out signals are anticipated.

VIRGINIA SPEAKS UP

In addition to big changes to the CCPA, Virginia’s new data law also became effective on Jan. 1. That law, the Virginia Consumer Data Privacy Act (VCDPA), applies to businesses that control or process personal data on at least 100,000 Virginia residents in a year, or that control or process personal data on at least 25,000 Virginia residents in a year where they derive over 50% of their gross revenue from the sale of personal data. The law comes with similar (but not identical) exemptions to the CCPA. One distinction to note for Virginia is that, in contract to the CCPA, the VCDPA exempts not only personal data subject to the Gramm-Leach-Bliley Act (GLBA) but also ”financial institutions” as defined by the GLBA. Additionally, unlike the CCPA, the VCDPA does not apply to personal data in employment or commercial contexts.

The VCDPA comes with many of the same consumer rights and business requirements as the CCPA, but with a few new and different obligations to note:

Consumers in Virginia will have the right to opt out of profiling in furtherance of decisions that produce legal or similarly significant effects concerning the consumer. Here, ”profiling” means the automated

processing of personal data to evaluate, analyze, or predict personal aspects related to an identified or identifiable natural person’s economic situation, health, personal preferences, interests, reliability, behavior, location, or movements.

Businesses will have to obtain optin consent to process sensitive personal information, not just extend an opt-out right.

Consumers will have the right to appeal denials of consumer rights.

Businesses will have to conduct and document data protection assessments when engaging in certain data activities, like selling data, processing personal data for targeted advertising, engaging in profiling, or any other activity that presents a heightened risk of harm to consumers. These assessments are required to identify and weigh benefits and risks - to the business, the consumer, other stakeholders, and the public - related to the proposed data processing activity, as well as whether risks may be appropriately mitigated by safeguards. Assessments must be written and may be demanded by the Virginia Attorney General as related to an investigation.

Consumer data privacy compliance will continue to be an ongoing effort in 2023, as the consumer data privacy landscape continues to evolve through new laws and regulations.

Laws in Colorado, Connecticut, and Utah are set to take effect later in 2023, and Colorado is currently engaged in rulemaking efforts related to its law. More states will consider next year broad privacy legislation, as well as more targeted proposals, like those related to biometric information, geolocation information, and website information. The FTC is considering broad privacy and data security rulemaking, the CFPB is working on implementing consumer rights to personal financial records under section 1033 of the Dodd-Frank Act, and debate about federal privacy legislation will likely start back up in the new Congress.

Amidst the changing landscape, businesses are strongly encouraged to keep data inventory and mapping efforts up to date and consider the risks - in opportunities - that come out of data collection and processing.

Webb is a partner in the firm’s Washington, DC office. Webb advises a range of financial institutions, consumer reporting agencies, technology and information companies, and others on compliance with data use and privacy laws.

MORTGAGE BANKER | FEBRUARY 2023 21

WHILE THESE LAWS CONTAIN EXEMPTIONS FOR FINANCIAL SERVICES PROVIDERS, ALL BUSINESSES DIRECTLY SUBJECT TO THE LAWS WILL NEED TO ENSURE THAT THEIR DATA IS INVENTORIED.

Blend Announces Strategic And Financial Initiatives To Achieve Path To Profitability

Blend announced a series of specific initiatives that support its previously communicated plan to accelerate its path to profitability.

The initiatives announced today aim to right-size the Company’s cost structure, focus its investments on the highest potential growth opportunities, and realign its leadership to drive the Company’s transition from a product company to a platform company. Specifically, they include:

A 28% reduction in Blend’s onshore employee base impacting Blend Title and corporate operations in R&D, sales and marketing and general and administrative functions. This latest reduction in force and prior savings initiatives are expected to reduce Blend’s annualized cost of revenue and operating expenses by over $100 million in the aggregate on a non-GAAP basis exiting calendar 2023 relative to the third quarter of 2022.

Implementation of planned enhancements to Blend’s goto-market and investment strategies designed to enhance the Company’s product suite, revenue models and gross margins, including:

Allocating an increased portion of operating expenses into Blend Builder, the Company’s configurable software platform, which carries a subscription fee on top of success based transaction fees. This platform is already the foundation of Blend’s non-mortgage offerings, and over time will give mortgage lenders the flexibility and power they need to differentiate from their competitors.

And for Blend’s large mortgage customer base, focusing on helping lenders be even more efficient by implementing the large backlog of features built over the past several years, including Loan Officer Toolkit, Self-serve Prequalification, Blend Income, and Blend Close.

In his role as director of risk quantification, Whitsitt will help inform product direction and lead the new professional services division tasked with getting customers off the ground with risk quantification while avoiding or mitigating common pitfalls.

FinLocker is proud to have the opportunity to private-label the FinLocker mobile applications for Family First Funding and MLB Residential Lending to provide the residents of their communities with financial education and a path to homeownership,” said Brian Vieaux, president and chief operating officer, FinLocker.

Justin Demola, CMB, president, Lenders One, said, “The FinLocker powered private-labeled apps for Family First Funding and MLB Residential Lending will provide prospective homebuyers with the financial education and resources to help them build and monitor their credit and make informed financial decisions while keeping them connected to their lender until they are ready to buy a home.”

Half Of Closings Exposed To Higher Risk

FundingShield’s Q3 2022 Wire & Title Fraud Risk report shared that close to half of the closings it monitored were exposed to higher risk ranging from documentation, compliance, license and background issues leading to vulnerabilities of fraud. Increased cyber security related risks, data breaches, a more challenging real estate finance market resulted in client growth of 63.5% during 2022 while much of the mortgage technology ecosystem is dealing with sizeable double-digit decline in revenues. The firm secured approximately $55 Billion per month on average for $670bn secured in 2022 total.

CEO Ike Suri shared, “The mortgage industry is going through headwinds, and we empathize with our clients going through low volumes, however fraud has only risen as it has an inverse relationship. Cyber security prevention tools and risk automation has helped our clients’ right size while maintaining compliance, review and risk management workflows in this challenged market. The risks are pervasive thus the solutions being leveraged allow clients to save up to $200 per transaction. Our strategic partnerships continue to grow in addition to our partnership with Ice Mortgage technology where we provide a single-click, safe, secure and seamless cyber security and compliance solution out of the box.”

The “Home Hero” app for Family First Funding and the “Secure Home” app for MLB Residential Lending, powered by FinLocker, will support each company’s consumers to achieve a financially stable future with homeownership as the anchor to building wealth by using FinLocker:

Tools to improve their credit score and monitor their credit report, manage their finances, create savings goals and budget to pay down debt and save for a down payment, Personalized journeys to guide them toward mortgage eligibility and sustain homeownership, and

Educational resources to manage credit and credit cards, prepare for the mortgage process, sustain homeownership, and plan for college and retirement.

Ostrich Cyber-Risk Hires

Fannie Mae Cyber Expert

Ostrich Cyber-Risk, a unified cyber risk management company, announced the hire of risk quantification expert Jack Whitsitt, appointed director of risk quantification, to elevate and expand the CRQ offerings of Ostrich CyberRisk and its new professional services division.

Whitsitt joins Ostrich Cyber-Risk most recently from Freddie Mac, where he served as the Information Security Risk Quantification Program Architect, with prior positions held at Bank of America and the Department of Homeland Security.

Whitsitt is a leader in the CRQ community with more than two decades of information security specific experience and has spent the past six years advancing the state of the art by expanding and refining existing CRQ, including Open FAIR, into targeted best practices.

FinLocker

Creates Financial Fitness Apps For Family First Funding And MLB Residential Lending

FinLocker has partnered with two community-focused mortgage lenders, Family First Funding and MLB Residential Lending, to create financial fitness apps that guide prospective homebuyers to achieve mortgage eligibility and sustain homeownership. This partnership comes two months after Lenders One Cooperative, a national alliance of over 240 independent mortgage bankers, announced the opening of its first three Walmart in-store branches in Newton and Boonton, New Jersey, and Orlando, Florida, with the mortgage lenders.

“As a preferred partner in the Lenders One cooperative,

OrangeGrid Enables Mortgage Servicers to Manage Entire Vendor Supply Chain

OrangeGrid, a provider of mortgage servicing software, announces it has released a new environment, GridSource, that connects all vendor types to its default suite of products included in their mortgage servicing platform.

GridSource simplifies vendor management processes, offers additional oversight of vendor’s task load to ensure they are completing assigned tasks on schedule, and provides easy access to archived data and documents submitted by vendors in a single environment. Due to OrangeGrid’s unique architecture, there is no limit to the vendor types that can be added. The current list of vendor types already includes property preservation and inspection companies, valuation providers, law firms, real estate brokers, and title companies.

Vendors have their own logins where they can review open tasks and outstanding items via workflow queues. Becoming a GridSource vendor is on an invite-only basis based on client requirements, but once a part of the OrangeGrid vendor marketplace they can be easily added to other existing client processes.

“GridSource offers mortgage servicers greater insight and control in the way they manage their relationships with vendors, which provides enhanced collaboration and coordination of activities with each other.” Said Todd Mobraten, CEO and founder of OrangeGrid. “Our customers create operational foundations via OrangeGrid’s product suite and are seeing even more data centralization and process optimization by bringing in their vendors.”

22 MORTGAGE BANKER | FEBRUARY 2023 TECHNOLOGY

ROUNDUP

MAGAZINE

MortgageBanker

Scott L. Luna Partner

sluna@ravdocs.com

469-730-4607

Scott Luna’s practice is focused on real estate law with an emphasis on mortgage document preparation and land title issues. Scott managed a successful multistate highvolume title and document preparation business for over 20 years before joining RAV and is recognized throughout the real estate legal community for his expertise. As a past President of the Oklahoma Land Title Association, Scott’s ongoing involvement in the industry adds to his wealth of title-related knowledge. Scott received his Juris Doctor degree from the University of Tulsa College of Law in 1991 after receiving his Bachelor of Science degree from Texas A&M University. Scott is currently licensed in Texas, Oklahoma, Missouri, Minnesota, Nebraska, and Kentucky.

Mitchel H. Kider Managing Partner

kider@thewbkfirm.com

202-557-3511

Mitch Kider is the Chairman and Managing Partner of Weiner Brodsky Kider PC, a national law firm specializing in the representation of financial institutions, residential homebuilders, and real estate settlement service providers. Mitch represents banks, mortgage companies, homebuilders, credit card issuers, and other financial service companies in a broad range of litigation and regulatory and compliance matters. He defends clients in investigations and enforcement actions before the Consumer Financial Protection Bureau, Department of Housing and Urban Development, Department of Justice, Department of Veterans Affairs, Federal Trade Commission, Fannie Mae, Freddie Mac, Ginnie Mae, and various state and local regulatory authorities and Attorneys General offices. In addition, Mitch acts as outside general counsel to smaller companies and special regulatory and litigation counsel to Fortune 500 companies.

MORTGAGE BANKING LAWYERS

Gregory S. Graham

Co-Managing Partner

Gregory S. Graham

Co-Managing Partner

ggraham@bmandg.com

972-353-4174

Black, Mann & Graham CoManaging Partner Gregory S. Graham has practiced in the areas of real estate, litigation, and bankruptcy law since 1989, and is currently licensed in Texas and admitted to practice before the United States District Courts for the Northern and Eastern Districts of Texas.

Mr. Graham is also currently licensed to practice law in Georgia and has been since 2017. He received his Juris Doctor degree from Southern Methodist University School of Law in 1989 after receiving a Bachelor of Arts cum laude from UT Dallas.

Mr. Graham’s affiliations include the Dallas MBA, where he previously served as a Director & Chairperson of the Legislative Committee; DFW Mortgage Brokers Association, where he previously served as Legal Counsel; MBA; NAMB; Texas AMB prior to its closure; and Texas MBA.

James W. Brody, Esq. Mortgage Banking Practice Group Chair

jbrody@johnstonthomas.com

415-246-3995

James Brody actively manages all the complex mortgage banking litigation, mitigation, and compliance matters for Johnston Thomas. Mr. Brody’s experience centers on those legal issues that arise during loan originations, loan purchase sales, loan securitizations, foreclosures, bankruptcy, and repurchase & indemnification claims. He received his B.A. in International Relations from Drake University and received his J.D., with a certified concentration in Advocacy, from the University of the Pacific, McGeorge School of Law. He was a recipient of the American Jurisprudence BancroftWhitney Award. He is licensed to practice law in California and has been admitted to practice in front of the United States District Courts for the Central, Eastern, Northern, and Southern Districts of California. In addition, Mr. Brody has served as lead litigation counsel for numerous mortgage banking and commercial related disputes venued in both state and federal courts, in a direct capacity or on a pro hac vice basis, in AZ, CA, FL, MD, MI, MN, MO, OR, NJ, NY, PA, TN, and TX.

marty.green@ mortgagelaw.com 214-691-4488 ext 203

Marty Green leads the Dallas office of Polunsky Beitel Green, one of the country's top residential mortgage law firms. Mr. Green is an accomplished attorney with more than 20 years of experience in the legal, banking and financial services industries. He is the former Executive Vice President and General Counsel for Dallas’ CTX Mortgage Co. and previously worked with the Baker Botts law firm in Dallas as Special Counsel. In his role as leader of the firm’s Dallas office, Mr. Green advises clients on the latest rules and regulations covering residential lending, in addition to building on Polunsky Beitel Green’s long tradition of delivering loan closing documents with speed and accuracy. Mr. Green is admitted to practice before all Texas state and federal district courts in addition to the U.S. Court of Appeals for the Fifth Circuit. An honors graduate of the University of Texas School of Law, he earned his undergraduate degree at Southern Utah University. Texas Monthly has selected him as a Super Lawyer multiple years.

These attorneys are universally recognized by their peers as setting the highest standard for the legal profession, excelling in all fields — knowledge, analytical ability, judgment, communication, and ethics.

Marty Green Attorney

MORTGAGE BANKER | FEBRUARY 2023 23

24 MORTGAGE BANKER | FEBRUARY 2023

MAGAZINE

MortgageBanker

MORTGAGE BANKER | FEBRUARY 2023 25 DATABANK

NON-QM LENDER RESOURCE GUIDE

Arc Home LLC Mount Laurel, NJ

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions. When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com

(844) 851-3600

sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

Carrington Wholesale Dallas, TX

The Carrington Advantage Series is a full suite of Non-QM Loan solutions that “Delivers More” for you and your borrowers. Ideal for borrowers, like the self-employed, that don’t fit Agency or Government Qualified Mortgage standards based on credit quality, property type, documentation type, income documentation, or other borrower situations.

• FICOs 550+

• Primary wage earners FICO

• DTIs up to 50%

• Bank Statements (personal or business) accepted

• We don’t require disputed tradelines to be removed

With the Carrington Investor Advantage (DCR)

• DCR down to .75

• First-time investors are ok

• Only 48 months seasoning for major credit events

• 1x30x12 mortgage history ok

(866) 453-2400 carringtonwholesale.com

LICENSED IN: 47 States (excluding NH, MA & ND.)

WAREHOUSE LENDING RESOURCE GUIDE

FirstFunding, Inc. Dallas, TX

Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors.

*Ease of use (Support staff, technology an other tools to support mortgage bankers) FirstFunding’s FlexClose Funding program allows our clients to fund outside the Fed wire restrictions. Same day and afterhours funding. Browser-based proprietary platform, customized reporting tools, and a dedicated customer service team.

Conventional Conforming, Jumbo, FHA, VA, USDA, Non-QM

(214) 8217800

firstfundingusa.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

26 MORTGAGE BANKER | FEBRUARY 2023

APPRAISER & AMC RESOURCE GUIDE

PRIVATE LENDER RESOURCE GUIDE

Clear Capital Reno, NV

Clear Capital is a national real estate valuation technology company with a simple purpose: build confidence in real estate decisions to strengthen communities and improve lives. Our commitment to excellence is embodied by nearly 800 team members and has remained steadfast since our first order in 2001.

clearcapital.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

Alpha Tech Lending West Hempstead, NY

DSCR Rental NO DOC Loans

Alpha Tech Lending is a trusted direct lender, with over a combined 30 years of experience in the private lending sector. We offer a variety of loan programs for non-owneroccupied residences that are customizable to suit your real estate investment needs. From fix and flips, long term rental, new construction, commercial bridge, and more. We lend to both new and experienced real estate professionals throughout the country. We value long term relationships built on trust. Our brokers are protected.

alphatechlending.com

(888) 276-6565

info@alphatechlending.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Stratton Equities Pine Brook, NJ

Stratton Equities is the leading Nationwide Direct Hard Money & NON-QM Lender that specializes in fast and flexible lending processes. Our Hard Money and Direct Private Money loan programs support the following investment projects:

• Fix and Flip

• Soft Money Loans

• Cash Out — Refinance

• Fixed Commercial Loans

• Commercial Bridge Loans

• Bridge Loans

• Stated Income/ No-Income Verification Loans

• Rental Loans

• Foreclosure Bailout Loan

• NO-DOC

• Blanket Loans

• Fixed Rental Programs

• Multi-Family Loan

No Upfront fees! No Junk Fees! No Tax Returns!

strattonequities.com

(800) 962-6613

info@strattonequities.com

LICENSED IN: All States except for: AK, ND, NV, SD, UT

MORTGAGE BANKER | FEBRUARY 2023 27

28 MORTGAGE BANKER | FEBRUARY 2023 SPECIAL ADVERTISING SECTION: NON-QM LENDER DIRECTORY SPECIAL ADVERTISING SECTION: PRIVATE LENDER DIRECTORY COMPANY AREA OF FOCUS WEBSITE Alpha Tech Lending Private Lending, Non-QM alphatechlending.com Patch Lending Private Lending for Real Estate Investment Properties patchlending.com Stratton Equities Nationwide Direct Hard Money & NON-QM Lender strattonequities.com COMPANY AREA OF FOCUS STATES LICENSCED WEBSITE Arc Home LLC Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions. AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY business.archomellc.com Carrington Wholesale Private Lending for Real Estate Investment Properties 47 States (excluding NH, MA & ND.) patchlending.com Verus Mortgage Capital Nation’s largest issuer of securitizations backed by non-QM loans. Continental U.S. verusmc.com Mortgage News Network’s mission is to use the power of video and podcasts to compliment the written word and inform, educate, enable and empower mortgage professionals with the most relevant, up-to-date information and advances in the mortgage industry. It is our goal to offer worthwhile information to our viewers while delivering it with the utmost professionalism. MORTGAGENEWSNETWORK.COM And … Action!

SPECIAL ADVERTISING SECTION: ORIGINATOR TECH DIRECTORY

COMPANY AREA OF FOCUS WEBSITE

Global DMS Appraisal Management Software globaldms.com

SPECIAL ADVERTISING SECTION: APPRAISER & AMC DIRECTORY

COMPANY AREA OF FOCUS

WEBSITE

Clear Capital National real estate valuation technology company clearcapital.com

SPECIAL ADVERTISING SECTION: WAREHOUSE LENDING DIRECTORY

COMPANY AREA OF FOCUS

WEBSITE

FirstFunding Inc. Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors. firstfundingusa.com

Independent Bank of Texas

Mortgage warehouse lines of credit, from $2 million to $150 million, and fund over 200 delegated and non-delegated retail originators. Ifinancial.com

nationalmortgageprofessional.com/video

nationalmortgageprofessional.com/ podcasts/principal

nationalmortgageprofessional.com/ podcasts/gated-communities

PRODUCTIONS OF AMERICAN BUSINESS MEDIA

MORTGAGE BANKER | FEBRUARY 2023 29

PROFIT. AT THE PUSH OF A BUTTON. March 22-23, 2023 The Linq Hotel + Experience, Las Vegas originatortech.live LEARN MORE | REGISTER Exploring Exciting Opportunities In B2B Business Building

By DOUG

By DOUG

Gregory S. Graham

Co-Managing Partner

Gregory S. Graham

Co-Managing Partner