POST OFFICE PAYDAY

Postmasters set for £250m pay hike

DRS HITS NEW SNAG

Wales opts out of UK scheme

MOTORING AHEAD

MFG completes £40m upgrade

Postmasters set for £250m pay hike

DRS HITS NEW SNAG

Wales opts out of UK scheme

MOTORING AHEAD

MFG completes £40m upgrade

Retailers react to Labour’s first Budget in 14 years

06 Deposit Return Scheme Widespread consternation as Wales backs out of a UK-wide scheme.

07 Business Costs Changes announced in the Budget could cost retailers tens of millions of pounds, warns SGF.

08 Forecourts Sector spend grew by more than 50% last year, according to the 2024 ACS Forecourt Report.

09 Post Office Postmasters are set to receive a £250m income boost under the PO’s five-year Transformation Plan.

10 News Extra Retail Crime Staff reveal the contemptible and entirely unacceptable behaviours they are forced to endure.

18 Product News Pepsi’s EA Sports promo returns and CocaCola gets set for Christmas.

20 Off-Trade News There’s a rash of new RTDs, as both WKD and Four Loko unveil fresh flavours.

22 SLR Awards We launch our 2025 search for Scotland’s local retailing stars.

24 Above & Beyond Awards Don’t delay in honouring your superstar staff members and get your entries in now.

26 Community Local retailers across Scotland sent spirits soaring this Halloween.

28 Store Profile West Kilbride Village Store James Morgan of Vertex takes on his biggest project yet – his own store.

30 Hotlines The latest new products and media campaigns.

42 Under The Counter When is a truck not a truck? When the Auld Boy gets a bee in his bunnet, of course.

32 Christmas Drinks From fruity RTDs to premium beers, a strong alcohol line-up means everyone can celebrate this special time of year in style.

38 Christmas Treats With the countdown to Christmas well and truly underway, consumers are looking for affordable ways to treat themselves, their friends and loved ones.

40 Low And No As consumers’ drinking habits change, the market for alcohol-free and low-ABV drinks is expanding rapidly.

Lords call for immediate action on shop

The UK’s Justice and Home Affairs Committee has published a letter to the Minister for Policing, Crime and Fire Prevention, Dame Diana Johnson MP, recommending a range of measures to deal with the epidemic of shop theft facing retailers. Measures in the report from the Lords Committee included phasing out the use of the word ‘shoplifting’ and prioritising community-based interventions aimed at reducing reoffending and rehabilitation.

Aldi opens three more Scottish stores

Discounter Aldi expanded its Scottish footprint last month with the launch of two new stores on Oakwell Road in Castle Douglas, Dumfries & Galloway and Straiton Road in Loanhead, Midlothian. A third Scottish site on Duff Street in Macduff, Aberdeenshire is set to open its doors before Christmas.

Buying groups Confex and Fairway Foodservice have merged to create The Wholesale Group, which will officially launch on 1 January 2025. The Wholesale Group will be the only UK buying group to offer an extensive retail and foodservice range and expertise, alongside logistics efficiency via central distribution. It will be the largest delivered buying group and the second-largest retail buying group in the UK.

Former Nisa CEO, Michael Fletcher, has been appointed as the new Managing Director of Spar UK and will take up the role on 22 November 2024. Fletcher spent 22 years at Tesco, where he held numerous senior commercial roles in the UK, Ireland and Asia. He joined Coop Retail in 2013 where he held the position of Chief Commercial Officer before moving on to become CEO of Nisa, a role he held until 2022.

Delivering the Deposit Return Scheme (DRS) by October 2027 will be even tougher for Scottish retailers and their English and Northern Irish counterparts, following the announcement that Wales will not proceed with a UK-wide initiative. Its decision to abandon the latter in favour of running a separate DRS scheme has been met with disappointment and concern by the UK’s retail and food industries.

e announcement means that there will be two separate schemes set up in the UK, working on di erent timelines and management systems. Under the Welsh scheme, there will be a greater focus on the reuse of materials.

Association of Convenience Stores (ACS) Chief Executive

James Lowman said: “We are extremely concerned that the Welsh Government is doubling down on insisting on a di erent approach to a DRS than the rest of the UK.

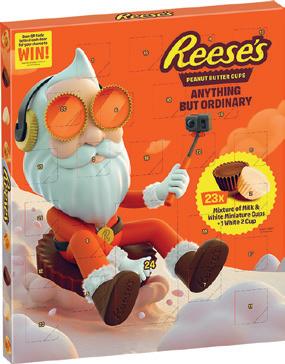

“ e Welsh Government’s separate approach will be confusing for everyone involved and disruptive to the delivery of DRS across the rest of UK.”

e British Retail Consortium, e Food and Drink Federation, ACS and e Industry Council for Packaging and Environment stated: “ e decision by the Welsh Government to step away from the four-nation approach to the Deposit Return Scheme (DRS) is extremely disappointing. With industry preparing to invest billions in a UK-wide DRS system, on top of new costs arising from the

Chancellor’s Budget, it is essential that any approach to DRS is aligned across all four nations and delivers improved recycling rates and a reduction in litter across the UK.

“ e announcement will only increase uncertainty for the scheme and cause confusion among consumers, who may feel cheated by their inability to redeem a deposit and perplexed by the inconsistent approaches just a few miles across the border.”

The Scottish Retail Consortium (SRC) has pushed for the Scottish Government to abandon plans for a new levy on disposable cups.

In a response to the government’s consultation, which closed on 14 November, SRC argued:

Q The levy will change whether consumers buy drinks, not whether they choose reusable alternatives;

Q The levy will impact on the least affluent consumers most heavily;

Q Many retailers and hospitality businesses will not be able to administer the levy, nor practically offer reusable alternatives;

Q There will be a discrete impact on food-to-go

businesses already under significant pressure from weak sales and increasing costs;

Q The Government should instead focus on improving recycling infrastructure and collection alongside supporting the wide range of industry initiatives.

Ewan MacDonald-Russell, Deputy Head of SRC, said: “Scotland’s shops, cafés, and restaurants are already taking significant steps to reduce waste, increase reuse and recycling of cups, and help move to a more circular economy. A cup charge will do very little to help that, whilst hitting both businesses and consumers in the pocket.”

Dan Brown and his family have acquired Lothian Stores, trading as Pinkie Farm, from the Sands family.

A former President of the Scottish Grocers’ Federation, Dan was involved with Pinkie Farm when it opened in 2014, and was appointed Managing Director in 2018. He now runs the business alongside his partner, Nicole.

Dan said: “I am incredibly thankful to the Sands family for their support and mentorship over the years. is store has been close to my heart since I rst became involved, and it’s a true privilege to lead it forward with my family. We’re excited about the next chapter for Pinkie Farm.”

e eye-watering increases to employer National Insurance contributions (NIC) announced in the UK Budget, in addition to the National Living Wage (NLW) rise, could cost Scotland’s local retailers tens of millions of pounds that they can ill a ord, the Scottish Grocers’ Federation (SGF) has stated.

Convenience sta across Scotland worked almost 500 million hours last year, said SGF, which reckons that the changes could add around £2,400 to the cost of employing a full-time member of sta in 2025/26. What’s more, of the 55,000+ people employed across the Scottish convenience sector, nearly a third of sta work between 17-30 hrs/wk (18% less than 17 hrs/wk). is means that thousands more c-store employees will require employer NICs. Combined with the 77p

COSTS Retail industry warns of job losses

increase to the NLW, the extra costs could run into tens of millions, even taking into account the planned upli in Employment Allowance relief from £5,000 to £10,500, said SGF.

A recent survey conducted by the trade body for its annual True Cost of Employment Report, shows that 74% of retailers are now working more than 65 hrs/wk, just to keep sta costs down.

SGF Head of Policy & Public A airs Luke McGarty said: “ ere is no doubt that local stores employing local sta will have to think twice before taking on anyone new or increasing sta hours. In some cases, it could be the nal straw pushing retailers to reduce sta or even close the doors for good.

“Most local retailers simply won’t be able to absorb the extra cost and will either have to pass them onto customers, or reduce annual pay rises for hard working and long serving sta .”

e Scottish Government will publish its budget on 4 December, and SGF is calling on ministers to act cautiously on any proposals that could put small businesses under additional pressure.

To read more about the impact of the cost increases on independent businesses, see p14.

e CEOs of more than 80 retailers, including Spar Scotland, Scotmid and One-O-One, have signed a letter to Chancellor of the Exchequer Rachel Reeves, expressing their concerns over the Budget’s impact on in ation, employment and investment.

e industry leaders highlighted all the new costs impacting them in 2025 would amount to £7.06bn. e letter, which was also signed by the heads of Spar UK, the big four, SGF and BRC, stated that “the sheer scale of new costs and the speed with which they occur create a cumulative burden that will make job losses inevitable, and higher prices a certainty”.

e 15% rate increase in Employers’ National Insurance Contribution would cost £0.57bn, while the threshold change would equate to an extra £1.76bn, claimed the letter.

e National Living Wage increase would account for a further £2.73bn, while the Packaging Levy would add costs of £2bn.

“For any retailer, large or small, it will not be possible to absorb such signi cant cost increases over such a short timescale,” stated the letter. “ e e ect will be to increase in ation, slow pay growth, cause shop closures, and reduce jobs, especially at the entry level.”

e retailers proposed a meeting to discuss their concerns and to work together on a solution, which would involve changing the timings of some of the changes to allow businesses time to adjust and “greatly mitigate their harmful e ects on high streets and consumers”.

Former Asda Acquisitions Manager, Daniel Arrandale, has joined Glenshire Group as its new Property Director.

Starting in the newly created role last week, Arrandale brings a wealth of industry experience to the business, including a previous position as Development Manager at EG Group.

As part of Arrandale’s remit, he will oversee acquisitions, development, and growth for Greens Retail, Pizza Hut, and wider Glenshire Group property development and investment interests.

“I’m looking forward to working with the existing development team to maximise the opportunities within our current estate, whilst also growing the business further with the acquisition of new sites,” he said.

Sainsbury’s extends Aldi Price Match to c-stores Supermarket giant Sainsbury’s has extended its Aldi Price Match (APM) initiative into its convenience estate. Sainsbury’s Local outlets will house up to 200 APM products, with a focus on the go-to items households buy most often, including daily staples like milk, bread and butter. The news follows a recent reset of Sainsbury’s convenience experience, in which the retailer updated store layouts and product ranges.

Co-op redevelops three Scottish stores

Co-op stores in Biggar, Aviemore and Shotts all reopened last month after major refits. The upgraded stores offer improved chilled produce ranges, strong food-to-go and meal deals, and a range of parcel services.

Allwyn gives out £40,000 to retailers

National Lottery operator, Allwyn, has awarded 22 National Lottery retailers with prizes totalling £40,000 in its two latest Site, Stock, Sell online quarterly prize draws.

Two National Lottery retailers took home a whopping £10,000 each, while a further 20 retailers won a £1,000 runnerup prize, including Asif Hanif of North Berwick Newsagents in East Lothian and a retailer in Portgordon who wished to remain anonymous.

October saw Post Offices across the UK handle £3.69bn in cash deposits and withdrawals – the highest monthly total since July 2024. Scotland saw total cash deposits climb to £186.8m in October, up 6.6% MOM and 14.8% YOY, the highest increase in the UK in percentage terms. Meanwhile, total cash withdrawals in Scotland stood at £250.7m, up 5.4% MOM and 8.4% YOY.

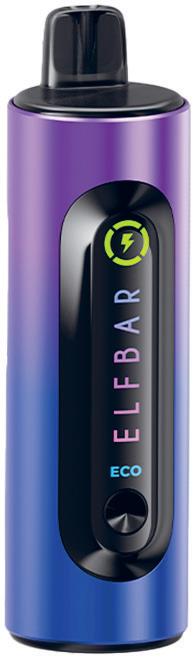

e Scottish Government has con rmed that the sale of disposable vapes in Scotland will be banned from 1 June 2025. e new date is in line with similar legislation in England and Wales.

In a bid to help retailers transition away from disposable vapes ahead of the ban, the Association of Convenience Stores (ACS) has released an extended version of its ‘Selling Vapes Responsibly’ guide, produced with Bucks and Surrey Trading Standards, as assured advice.

e new guidance outlines the features that vapes need to have to be legal for sale from 1 June, as well as what to do with any disposable vapes that are unsold when the ban comes into force. Vapes that are legal to sell from 1 June must be chargeable and re llable, as opposed to disposable vapes which are intended for a single use and are limited to 2ml of vape liquid.

Anyone selling disposable vapes from 1 June 2025 could be subject to a £200 xed penalty notice, followed by further enforcement action if illicit activity continues.

ACS Chief Executive James Lowman said: “ e introduction of a ban on disposable vapes next year will mark a major change for thousands of retailers that currently stock these products. We have produced this guide to help retailers with the transition and ensure that nobody falls on the wrong side of the law on 1 June. It is important that any retailer selling vapes not only prepares themselves for the change, but also communicates with customers on the implications of the ban to avoid any potential confrontations or ashpoints in store.”

Lowman added: “By having this advice assured as part of our award-winning scheme with Bucks and Surrey Trading Standards, retailers can have con dence that following this guidance will see them operating legally and without fear of prosecution.”

Millions of disposable vapes are thrown away every week. ese products contain lithium batteries which are important to recycle, not just because they are a limited resource but because they are a potential re risk if sent to land ll.

Since the start of 2024, retailers who sell vapes have been required to provide a takeback service for customers on a minimum of a ‘one for one’ basis. e ACS guide sets out all of the requirements on retailers when taking back used vapes, storing them in their business and arranging for regular collection so that they can be recycled.

e 2024 ACS Forecourt Report has revealed that the UK’s petrol forecourt retailers have invested almost £19,000 on average per store last year, compared to less than £12,000 in the previous year.

e Forecourt Report provides an overview of the 8,347 forecourt sites in the UK, the products and services they o er, and the customers they serve.

Highlights from the 2024 Forecourt Report include:

Q

e UK forecourt sector creates over 89,000 jobs, with one in four colleagues (26%) being in the business for more than 10 years;

Q e value of sales in the forecourt sector has reached £5bn in the last year (excluding fuel);

Q 84% of forecourt retailers are active in their communities, raising money for local

charities, getting involved with local projects, and donating to food banks;

Q Petrol forecourts were ranked as the hmost-essential service on local high streets, behind banks and ahead of pubs/bars;

Q 17% of UK forecourts now have pay-at-pump facilities, with 6% providing EV charging points.

e Forecourt Report also highlights trends in electric vehicle charging and new car sales. Compared to last year, signi cantly more charging points (59%) are now categorised as ‘slow’ chargers, as battery and charging technology improves and ultra-rapid chargers are getting faster than ever before. ere are now almost 1.2m fully electric vehicles and around 680,000 plug-in hybrid vehicles registered in the UK.

ACS Chief Executive James Lowman said: “Forecourt retailers have made signi cant investments in improving their o er to customers over the last year, spending money on futureproo ng their stores through new technology and refrigeration, as well as into services like parcel collection points and click and collect for groceries.”

Leading independent forecourt operator, Motor Fuel Group (MFG), has completed its initial £40m upgrade of Morrisons forecourts, following the acquisition of 337 Morrisons petrol forecourts, as well as more than 400 sites across the UK for ultra-rapid electric vehicle (EV) charging in April 2024.

The forecourt group, which has over 50 Morrisons Daily sites in Scotland, including outlets in and around Aberdeenshire, Inverness, Ross and Cromarty, Fort William, Ayrshire, Lanarkshire, Dumfries, Edinburgh and Glasgow, worked closely with Allwyn as part of the upgrade. The National Lottery operator achieved its largest terminal installation project to date after equipping all 337 Morrisons Daily petrol sites.

The next stage of MFG’s plans will target investment into valeting services and the installation of Ultra-Rapid EV charging infrastructure. MFG is targeting the installation of 800 Ultra-Rapid 150kW EV chargers, in hubs, within the first five years.

Further expansion of convenience retail will continue, with MFG’s goal to become the number-two convenience store operator in the UK. MFG has a strong track record of investing its profits into its business, as well as delivering returns for its investors. Since the pandemic, MFG has spent millions of pounds on its entire network of convenience retail stores, with a further £50m per year committed to improve its retail, food to go, and valeting offer to the consumer.

William Bannister, CEO, MFG, said: “We are now looking ahead to the next phase of our investment into the Morrisons forecourts, which will focus on further upgrades across the sites, as well as the implementation of our EV charging strategy.”

Postmasters are set to receive a quarter of a billion pound boost to their income by 2030 as part of the Post O ce’s (PO’s) ve-year Transformation Plan. Meanwhile, the group is looking to o oad its Directly Managed Branches (DMBs).

PO Chair, Nigel Railton, set out plans to deliver a ‘New Deal for Postmasters’ that signi cantly increases their total annual income through revenue sharing and strengthens their role in the direction of the organisation.

e PO hopes to double average annual branch remuneration by 2030, and postmasters can expect up to £120m in additional remuneration by the end of the rst year of the Plan – a 30% increase in revenue share.

COMMUNITY Caring retailers get royal recognition

Railton also highlighted the need to “have an honest conversation about the loss-making parts of our network and our Directly Managed Branches”. 115 DMB branches are at risk of closure, including nine in Scotland, based in: Edinburgh City, Glasgow, Haddington, Inverness, Kirkwall, Saltcoats, Springburn Way, Stornoway and Wester Hailes.

Alongside the remuneration plans for postmasters, the Post O ce is establishing a new Postmaster Panel where serving postmasters will help the business to improve the support and training it provides to postmasters.

A new Consultative Council will also be established to work with the Post O ce on the delivery of the Transformation Plan, and to challenge and feed back to ensure

Falkirk retailers Asiyah and Jawad Javed were praised by King Charles for their incredible community work when they attended a Local Heroes event at Holyrood this autumn.

“We were very happy and shocked to be invited,” Asiyah told SLR. “King Charles said thank you for all that we had done in the community.”

Michelle omson, MSP for Falkirk East who nominated the couple to attend the Scottish Parliament event, said: “Based in their expanding retail premises at Alloa Road Stenhousemuir, the Javeds have assisted many in the community through relentless activity over many years. It was really pleasing to hear that they had such an enjoyable day at Parliament.”

postmasters’ interests remain front and centre.

Railton outlined a number of challenges that must be addressed to deliver change for postmasters and learn the lessons from the Horizon IT public Inquiry.

He said: “ e Post O ce has a 360-year history of public service and today we want to secure that service for the future by learning from past mistakes and moving forward for the bene t of all postmasters.”

Nick Russell back at Bestway Retail as Head of Symbol

Former Head of Independent Franchise and New Business at Morrisons Daily, Nick Russell has rejoined Bestway Retail as Head of Symbol and will lead the independent Bestone and Costcutter estates.

Up until 2021, he worked for Costcutter in the field before heading up the New Business Team.

Bestway is also welcoming ex-Parfetts Head of Retail

Tobacco and Vapes Bill introduced

The Tobacco and Vapes Bill, introduced in the UK Parliament last month, will phase out the sale of tobacco products to anyone aged 15 or younger this year, and will also include powers to introduce a licensing scheme for retailers to sell tobacco, vape and nicotine products in England, Wales and Northern Ireland. Legislation in Scotland will be extended to include goods like non-cigarette nicotine and herbal products.

FedPlus members’ discount scheme unveiled Members of The Federation of Independent Retailers (The Fed) can benefit from an exclusive new scheme called FedPlus, which offers discounts on goods and activities. The scheme covers areas including health and wellbeing; home and car essentials; food and drink; and technology.

Orkney Islands see highest lottery grants in UK National Lottery players have contributed £504m towards good causes this year, with the Orkney Islands seeing the largest lottery grants per capita. A total of £1.69m in grants was allocated to Orkney this year. With a population of 22,020, this equates to £76.73 per person. More than half of this (£41.52 per head) went to sports-related causes, while heritage projects attracted funding worth £33.45 per person. The remainder went towards arts.

Asiyah and Jawad, who recently changed their store name to A&J Alloa Road Shop as part of a switch from Day Today to Spar, spent thousands of pounds creating care packages for the elderly and vulnerable during the pandemic, and they still give out more than 100 food packages on a weekly basis to those in need.

Customer Margaret Wilson said: “No one deserves this award more than you both for everything you do for the community.”

While local Robert Beagley described them as “a truly remarkable family who have become a rock in the middle of the local community”.

Steve Moore and former Spar Appleby Westward New Business Lead Rodney Tucker. Moore takes on the role of Regional Controller for Costcutter and Best-one, leading the Midlands and South Wales team.

Tucker will drive recruitment of New Business in the Southwest and South Wales in his role in the New Business and Acquisitions Team.

Pamela Scott named Chair of Scotland Food & Drink Scotland Food & Drink has appointed Pamela Scott as its new Chair. With an extensive career spanning nearly 30 years in the consumer goods sector, including key leadership roles in drinks manufacturing, quality assurance, and sustainability, Scott brings a wealth of expertise to the role.

Scottish Grocers’ Federation

Many retailers were reeling after gut-wrenching increases to employer NI contributions and the National Living Wage were announced in the UK Budget. Bottom line, the tax hike could add around £2,400 to the cost of employing a fulltime member of staff next year (for staff on the NLW).

Our sector proudly employs more than 55,000 people in Scotland, providing essential local jobs and flexible working hours. Alongside a plethora of local services that benefit both the surrounding community and other nearby businesses.

However, with around half of the Scottish convenience workforce employed on a part-time basis, the drop to the employer NI threshold from £9,100 to £5,000, on top of the 77p increase to the NLW and the rise in NIC from 13.8% to 15%, could add even more pressure to many businesses that are already struggling to make ends meet.

While the planned uplift in Employment Allowance from £5,000 to £10,500 will provide a welcome relief, it will only mitigate some of the extra cost of employing staff, next year.

There is no doubt that local retailers will have to think twice before taking on anyone new or increasing staff hours. Many simply won’t be able to absorb the extra cost and will either have to pass them onto customers through more price rises, or reduce annual pay rises for hard-working and long-serving staff.

Either of which will worsen the cost-of-living crisis. Now is not the time to be penalising small business for creating much-needed local jobs.

The Scottish Government will publish its budget on 4 December, and SGF is calling on ministers to act cautiously on any proposals that could put small businesses under additional pressure.

Retail staff reveal the utterly contemptible and entirely unacceptable behaviours they are being forced to endure, as Usdaw fights for Freedom from Fear.

Retail trade union Usdaw has shared Scottish shop workers’ experiences of violence and mistreatment, as it launched shocking statistics showing that 69% of retail sta have su ered verbal abuse.

e stats, which featured in Usdaw’s annual survey, released during this year’s Respect for Shop Workers’ Week (11-17 November), also showed that 45% of shop sta had been threatened by a customer, while 17% had been assaulted.

Seventy per cent of these incidents were triggered by shopli ing and two-thirds of those were linked to addiction, stated Usdaw, which has interviewed over 4,000 shop workers over the past 12 months.

e group revealed a selection of Scottish voices from the frontline:

Central Scotland:

Q “Punched in the shoulder and verbal abuse – being called names and sworn at.”

Q “Customer tried to grab my face.”

Q “Colleague got stabbed with screwdriver.”

Q “I get deliberately misgendered.”

Glasgow:

Q “Daily verbal abuse even when asking customers to scan their bags.”

Q “Held up at knife point.”

Q “Couple stole jars of co ee, asked for them back and they smashed a jar of co ee on my head.”

Highlands and Islands:

Q “ reatened with a bottle a er customer stole beer.”

Q “Aggression over being asked for ID, unwanted sexual attention.”

Q “Customer came behind cash desk and was in my face.”

Lothian:

Q “Racially abusive statements made to me and about me.”

Q “Grabbed by the scru of my work jacket and shook me whilst yelling I had ruined their son’s Christmas because we were out of a speci c chocolate.”

Q “Being called a bitch.”

Mid-Scotland and Fife:

Q “Men following to the car.”

Q “Customers being volatile when you will not sell them age-restricted items due to no ID.”

North East Scotland:

Q “ e and threatening behaviour towards myself or my colleagues is a daily occurrence. Worst I have experienced.”

Q “Customers shouting at you pushing trollies into you.”

South Scotland:

Q “Kick up the bum by customer.”

Q “Customers grabbing my waist, pulling my hair, grabbing my shoulder/arms/legs, telling me they stalk me, telling me to meet them a er work, making sexual comments toward me.”

West Scotland:

Q “Called an f**king moron because I was pulling a trolley on the shop oor.”

Q “Drunk football fans – alcohol purchase rejection –backed against wall poked in the eye – grabbed by others in the group preventing me from alerting security.”

Tony Doonan, Usdaw Regional Secretary for Scotland, said: “Shop workers deserve far more respect than they receive and these experiences from Scottish retail workers make very di cult reading. It is shocking that over two-thirds of our members working in retail are su ering abuse from customers.

“Violence and abuse is not an acceptable part of the job and much more needs to be done to protect shop workers. We were delighted to have won the campaign for a protection of workers law in the Scottish Parliament, but that is the beginning not the end. We have to ensure that the legislation is central to tackle a growing wave of retail crime.”

To all the retailers who entered and for your support throughout the last 200 years.

Retailers have been sharing their Great Retailing Ideas with Cadbury to help celebrate the brand’s landmark 200th year, with winning ideas receiving prizes.

RON AND ARUNA PATEL, RON’S NEWS DROITWICH

“After over 35 years as a self-employed retailer, I’ve found that learning customers’ names and greeting them personally creates bonds that foster loyalty and respect. Our motto is, ‘We don’t have customers; everyone who enters is a friend because we’re always pleased to see them.”

To read all the great retailing ideas, visit SnackDisplay.co.uk or scan the QR code

Labour’s first Budget in 14 years or so was always going to make for interesting viewing. Watching it live on Budget Day, I can’t have been the only guy to find the way that Chancellor Rachel Reeves delivered it a little curious. It was peppered with smirks and snide comments and came across as fairly self-satisfied and smug. Not exactly the approach we’d been hoping for.

To be fair, not much of what she said though was particularly surprising. Most of it had been trailed beforehand. And, if you were being generous, you could broadly label it “well intentioned” but as is so often the case with politicians, having good intentions only gets you so far if you don’t have a very deep and thorough understanding of what you’re actually legislating or budgeting on.

Ask farmers or the hospitality trade if they feel Ms Reeves truly understands their sectors, for example.

But for retail it was largely as expected, if a little heavier handed than most of us had hoped for.

Having spoken to a load of retailers for this issue’s cover story, it looks broadly like the extra wage and NIC costs are going to add around £16k or so of cost for a typical smallish store. Depending on what margin you’re operating on, that means that most stores are going to have to find an extra £70k or £80k of sales just to stand still.

Bigger stores like Billy Gatt’s Premier in Whitehills are more likely to take a hit in the region of £25k. So he’s looking at having to make an additional £100k or more just to stop himself going backwards.

The inescapable conclusion is that something is going to have to give. It’s just not possible to carry on business as usual. Billy has already cut his store’s hours which could have a negative impact on trade in various ways. Craig Duncan in Falkirk says he can’t see any other way forward than raising prices or cutting staff hours.

It’s also impossible to see how the Budget won’t lead to job losses. For a Budget that was trumpeted as one that wouldn’t cost workers a penny, it has all the hallmarks of a Budget that’s going to cost workers a lot more than a penny – it could cost them their jobs.

That’s not to say any retailers have an in-principle problem with paying staff better wages. The problem lies more in how things were done. A hike in the minimum wage and a hike in employers’ NIC was a very crude and very blunt way of attempting to tackle a complex and delicate issue.

It has echoes of some SNP policies where business was treated with contempt, ignored, excluded from conversations and consultations then simply told to ‘deal with it’ after the latest bit of extremely ill-considered legislation was implemented.

Retailers will indeed deal with it, but this time around many – or most? – will have no choice but to deal with it by laying off staff. Not quite the goal the Chancellor was aiming for.

ANTONY BEGLEY, PUBLISHING DIRECTOR

EDITORIAL

Publishing Director & Editor

Antony Begley abegley@55north.com

Deputy Editor Sarah Britton sbritton@55north.com

Features Editor Gaelle Walker gwalker@55north.com

Web Editor Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director

Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager Cara Begley cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 22 22 100. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100 Fax: 0141 22 22 177 Website: www.55north.com Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher.

All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

©55NorthLtd.2024 ISSN1740-2409.

The recent Budget threatens to inflict untold damage on the vital local retailing sector. We speak to retailers to find out how they have been impacted and what measures they are taking to manage the extra costs.

BY SARAH BRITTON

When Chancellor of the Exchequer Rachel Reeves delivered the Autumn Budget on October 30, it sent shockwaves through the convenience industry. A rise in Minimum Wage was always on the cards, but when the government also announced that employer National Insurance Contributions were rising from 13.8% on employees’ earnings above a threshold of £9,100 a year, to a rate of 15% on earnings above £5,000, local retailers were le reeling.

“Taxing the costs of small privately owned businesses so aggressively and without any warning, whilst not seeking any productivity improvements from the ine cient public sector and the huge pay settlements these charges are funding is a new low, for a government of any hue,” rages Craig Duncan of Keystore Maddiston in Falkirk.

“Many of the businesses most impacted by these changes are the last men standing within their communities and the lifeline services they provide to a wide range of stakeholders will be severely impacted.”

e changes will mean a £16,000 increase for Craig’s business and he predicts that managing such steep cost rises will have a devastating impact on the whole sector. “At worst, it will lead to closures, or less scrupulous operators developing or expanding illegal employment practices,” he warns. He’s talking about incidents of hybrid contracts with o cial hours reduced and balance paid in cash ‘o books’, or paying cash in hand at below National Minimum Wage (NMW) levels to bene t claimants or workers with no right to work in the UK. He is also concerned about the potential for an increase in tax evasion strategies, such as smuggling, duty evasion and VAT evasion.

Even Craig’s best-case scenario paints a miserable state of a airs. “At best, it will force operators to signi cantly increase prices and cut employee jobs or hours and outlet operating hours to cover the costs associated with the changes,” he says. “Every operator I know is undertaking these exercises right now and expecting operators of any size to just absorb these costs is stunningly naive.”

Despite having only been trading for two and a half years, Fraserburgh-based Julie-Ann Whyte has already picked up several accolades for her contribution to convenience retailing, including the SLR Awards’ Unsung Hero in 2023 and Community Hero in 2024. But the cost hikes have le the owner of Whytes of Pitsligo questioning her career choices. “It’s pretty disappointing, to be honest,” she says. “You should be giving small businesses the opportunity to grow, and it just makes you reconsider whether you actually want to be in business.

“Where are you going to nd another £16,000 in my business to accommodate all the changes that are happening?”

Although workers’ pay is going up, Saleem Sadiq, who owns ve convenience stores, as well as nurseries, wonders how bene cial the changes will really be for employees. “Whether the employees get extra money in their pocket, I’m not 100% convinced because something needs to give at the end of the day for us to balance the books.

“We’re the ones creating jobs and I can actually seriously see us having to cut hours back to try and make some savings somewhere. We employ over 250 people and nancially, it’s going to be very di cult for us to carry on as we are because it a ects our bottom line.”

Q National Living Wage (age 21+) rises from £11.44 to £12.21 in April 2025;

Q National Minimum Wage (age 18-20) rises from £8.60 to £10 an hour in April 2025;

Q Employer National Insurance Contributions rate rises from 13.8% to 15%;

Q Threshold for employer National Insurance Contributions to fall from £9,100 to £5,000 per year.

Ban -based Billy Gatt has had to take immediate action to protect his business by reducing Premier Whitehills’ opening hours.

“We reckoned it was going to cost us an extra £25,000,” he told SLR. “So we did not feel we had any option but to take action and I didn’t feel we could wait until April.” He had already recently changed the store’s closing time from 10pm to 9pm and has now pulled it back to 8pm. “We’ve also taken back our online delivery from a seven o’clock nish to six o’clock,” he says. “It will just generally mean a tightening of the belt.”

He claims that sta are disappointed about the reduction in hours, especially in the run up to Christmas. “I’m led to believe some of my café sta are maybe looking for alternative employment or additional shi s,” he claims. He is hoping to send a few extra shi s their way as other members of the team use up annual leave, but accepts that some people may go elsewhere. “It might mean one or two folks here retiring or nishing and then if they do, then those hours will become available to the existing sta . I really don’t want to lose any of my sta . A lot of them are long standing – over 10 years.”

Julie-Ann is also reducing sta hours in order to save money. “I’ve already started saying to them that they’re going to get less hours next year, and I just think that’s shocking,” she says. “ ere’s already someone who says that they will be leaving because of their hours being reduced. She’s going to go back into caring because they’re in need of people and they’re willing to pay.”

Saleem, too, is thinking about cutbacks.

“Currently, say we employ ve sta in a shi , we might have to think about employing only four.”

He claims that single store retailers will end up increasing their own hours to keep costs down. “ ey’ll have to work more themselves, take no holidays, have no family life because people can’t a ord to employ people. I think the government has not thought this through properly.” is is a harsh reality for Julie-Ann. “We’ve always had two people on a shi , but now it will be one person and me, which then distracts from the whole strategic thinking of a business,” she says. “It was a er 11 o’clock last night when I came o the laptop, and then I’m back in here to do an opening because I’ve started reducing the hours already. Really, the work I was doing last night, I should be doing today, but I can’t do it today because I’m in the shop.”

Family members are also being roped in to help out. “My husband retired in April and this week he’s doing 22 hours,” says Julie-Ann. “He won’t get paid so that’s 22 hours we’re saving, but he should be enjoying his retirement.”

In another bid to save money, Julie-Ann is also making di cult choices over price. “I’ve looked

at putting up prices but everyone’s struggling just now so if you put up your prices, then your sales go down. It’s a vicious circle.”

However, she has still upped the prices of certain items. “I didn’t want to, but I’ve had to,” she sighs.

In-store deals may also su er. “I am actually considering not doing any of the [Nisa threeweekly] promotions,” she says. “It’s really disappointing because we’ve always done the promotions and advertised it.”

Billy is considering upping his prices too. “ ere might be a small room for manoeuvre on general shop pricing,” he says, though he is keen to remain competitive.

Premier Whitehill’s popular Auntie Meg’s o ering, which comprises an in-store café, as well as take-home ready meals, pies and pastries all prepared in the on-site kitchen, will also be impacted. “We’ll change the price of our Auntie Meg’s brand in April,” he says, but he is reluctant to change the café prices. “ ere was a long time my café didn’t get a lot of trade and then it got busy and I’m wary to knock up our prices and then knock the business.”

Billy has also been reviewing his contracts to see where savings can be made. “Back in April this year, I was focusing on savings over the

business by controlling the costs,” he says. “I did three-quarters of the book keeping myself and identi ed some stu we could make savings on contracts.” He intends to ditch his Tango Ice Blast machine as part of the cutbacks. “ e Tango Ice Blast machines spend half their time broken down, so where I’ve signed a lease contract with that, that’ll most de nitely go in a year’s time because it’s a three-year deal.”

Julie-Ann previously saved money by hiring younger sta , but the rise in the NMW means this is no longer viable. “At the weekends we bulk up to try and reduce the wage bill by having students in, but now the students are getting a huge increase so it’s just absolutely pointless,” says Julie-Ann. “ e government has made such a mess of this, it really does make you wonder what they were thinking.”

Saleem is also hindered by the NMW changes. “Going forward, that’s going to seriously a ect us because we employ a lot of young people,” he says. “ is is probably an opportunity for young people to start o their rst job. I think that’s going to be very di cult going forward in years to come because it gives me no incentive to employ somebody who’s 18 versus somebody who’s already mature and has the knowledge of the business.

“In [Spar] Renfrew I have three or four members of sta under the age of 20. Going

If you think the Budget is hard for single site retailers, the challenge is multiplied for multi-site operators like Spar.

“We knew there would be challenges ahead that we had to be prepared for,” says Spar Scotland CEO Colin McLean.

“Wholesalers, independent retailers, and suppliers alike are experiencing rising operational costs, inflationary pressures, changing consumer habits, and supply chain unpredictability. With tightening pressures and increases across the board, driven by factors like the National Living Wage and National Insurance hikes, absorbing these into businesses will be tricky.”

Nevertheless, McLean remains confident that the group can navigate these stormy waters. “Despite these pressures, we have to show incredible resilience and innovation, and as a symbol group we are committed to working even harder to remain agile and proactive in addressing these issues,” he says.

“Spar has proven repeatedly that we can overcome challenges: through collaboration, innovation, sharing insights, offering guidance and strategic planning, to ensure continued success and growth.”

forward, I wouldn’t be inclined to employ somebody who’s just come out of school because why would I?”

Craig agrees. “Any incentive to employ school leavers looking for experience in the world of work is removed,” he says.

He also believes that retailers will have to slow down their investment plans. “As prices increase, volumes will likely reduce and it will also lead to operators reducing capital expenditure, having a knock-on e ect on jobs in other parts of the convenience supply chain,” he says.

Billy had hoped to buy a new van as part of plans to expand distribution of his Auntie Meg’s products. “We supply it to other shops from Whitehills to Elgin,” he explains. “I was going to add another run from Whitehills to Aberdeen. I had a couple of customers [already] and I was looking for others, but I stopped that as a direct consequence [of the budget changes] because I’d need another van and another driver, and I was going to need more hours upstairs in the kitchen and the timing isn’t right for that.”

e budget announcements have also obliterated Julie-Ann’s plans. “It’s going to a ect my great plan to do my expansion next year; I’m not going to do it,” she laments. “I really can’t a ord it, and I need to nd money to cover these changes. So it’s a shame, because there was going to be an opportunity of growing the team and now there’s not.

“I’ve had to tell the joiner, who was going to be doing the expansion, that he’s no longer required. So you’ve got the supply chain a ected, you’ve got all these people hit by these mad decisions.”

Saleem has a similar view on the sacri ces that will likely be made for his business to remain viable.

“It’s going to cost a lot of money – that money could have gone towards a re t in a year’s time, and I’ll need to maybe delay that plan going forward,” he says. “Bonuses for sta need to be cut to make savings somewhere.”

He believes that some businesses won’t survive the increases. “A er Covid, vaping helped convenience stores [to bring in extra money],” he says. “With that diminishing in some way with the new legislation coming in from June next year and with the increase in wages, I think that will bring some businesses under 100%.

“I think there will be more shops closing down unless we come up with a local plan for the Scottish Government to help businesses.

“I’m on the Scottish Grocers’ Federations’ board [of directors]. We do try and speak to local ministers, but there’s only so much they can do – the Budget obviously comes out from central government.

“For now, it looks quite bleak to be honest.”

The power of Biscoff

Sports nutrition bars brand Trek has reported that its retail sales have hit the £30m mark for the first time after another year of double-digit growth (+12%). The brand put much of this success to its Trek Power Biscoff bar, which has seen sales of £2.1m since launching six months ago. Trek is currently supporting the Power Biscoff range with a consumer campaign that consists of paid digital, social media and influencer activities.

Nuts on the up this winter

Nuts and dried fruit supplier Itac has flagged up an opportunity for convenience retailers to tap into a growing demand for natural ingredients. The UK market has seen volumes up for nuts and dried fruits up 5% and 3.4% respectively, as consumers become more aware of the potentially negative impact of ultra-processed foods and seek out healthier options. Itac’s range is available to purchase exclusively from Booker.

Taylors Snacks unveils festive range

Taylors Snacks has launched a seasonal range that includes four new products – Amaretto & Orange toffee coated popcorn; Hot Honey Pigs in Blankets; and Brie, Bubbly & Orange straightcut and Spicy Prawn Cocktail ridge-cut crisps – and the return of Toasted Marshmallow popcorn and Boxing Day Curry straight cut crisps. Special-edition 500g packs of Pigs in Blankets are also available from Costco.

Arla expands yogurt range

Arla Foods has launched three new products. Arla LactoFREE natural yogurt (400g, RSP £1.85) offers all the taste of dairy but with none of the lactose. Arla Skyr Whipped (128g, RSP £1.25) comes in three flavours and layers Icelandic-style skyr over a fruit compote. Arla Protein has also launched a 450g pot (RSP £2.25) in Vanilla and Strawberry flavours that contains 45g of protein per pot.

Pepsi has teamed up with EA Sports FC for the second year running, for a bigger and better on-pack promotion set to give away even more gaming prizes to shoppers across additional Pepsi SKUs and formats.

Shoppers can get their hands on one of 60 game consoles, 3,000 EA Sports FC 25 game copies, and 4 x guaranteed-win rewards packs that can be redeemed in game.

Müller UK & Ireland is switching its Corner yogurt pots from white to clear plastic as it bids to halve the environmental impact of its packaging by 2030.

The move to fully recyclable clear pots means that more than 3,000 tonnes of plastic will be able to be used again within the food sector every year, significantly reducing the need for ‘virgin’ plastic.

The dairy brand also aims to add recycled content into its Clear corner yogurt pots by the end of 2025, as it tries to hit an average 30% recycled plastic packaging content target.

With Müller research finding that 78% of shoppers prefer a clear Corner pot, the company hopes the switch will drive further category growth as well as benefitting the environment.

Live now, the campaign features on all Pepsi 500ml packs and 330ml Pepsi Max cans. Entries close on 30 December 2024.

To enter, shoppers must purchase a promotional Pepsi product and scan the QR code on-pack.

For more information on how the campaign can help drive their sales and pro ts, retailers should visit Britvic’s atyourconvenience. com platform.

Delice de France has unveiled its Christmas range for 2024 alongside a raft of other new products.

Available now from the company’s website, festive treats include a Double Chocolate Santa Muffin, Gingerbread Muffin, Apple Pie Doughnut, Merry Cherry Doughnut and Shortcrust Mince crown, alongside Puff Lattice Mince Pies and Mini Mince Pies.

Meanwhile, Delice’s wider autumn/ winter range is now available via a new digital catalogue. Products include a new Breakfast Sausage Patty and Sausage & Cheesy Bean Slice, which are available for both convenience and foodservice outlets in units of 40.

Coca-Cola has launched a new on-pack promotion as part of its annual Christmas campaign which, this year, is pushing the message, ‘ e World Needs More Santas’.

Between 7 November and 2 January, shoppers can enter a free prize draw via the Coca-Cola app by scanning QR codes on festive-themed cans and bottles of Coca-Cola Original Taste and Coca-Cola Zero Sugar. ey will nd out instantly if they’ve won one of thousands of £50 shopping vouchers.

e new packs feature eyecatching festive designs with Santa graphics and decorations to help create a sense of Christmas magic

in stores. Convenience retailers can dial the fun up further with festive-themed Cokebranded POS materials that are available now from My.CCEP.com.

is year’s campaign will also see the Coca Cola Christmas Truck make a return to TV screens, this time in an updated AI-generated interpretation of the original advert.

e so drinks giant is also rolling out a new festive digital AI experience for shoppers, letting them create a shareable snow globe

CONFECTIONERY Major sustainability move from Mondelez Cadbury has recycling all wrapped up

Mondelez has announced that its Cadbury core range sharing bars are to be wrapped in 80% certi ed recycled plastic packaging.

Starting from 2025, in a phased approach, the project aims to cover approximately 300 million sharing bars across the UK&I Cadbury core tablet portfolio. e move will see the highest percentage of recycled exible plastic used within the Cadbury brand globally.

Furthermore, a new on-pack QR code will tell consumers all about the sustainable packaging journey that the Cadbury brand is taking and will also let them check their local collection and recycling points for a wide range of packaging materials.

the QR code on a Christmas bottle or can of Coca-Cola.

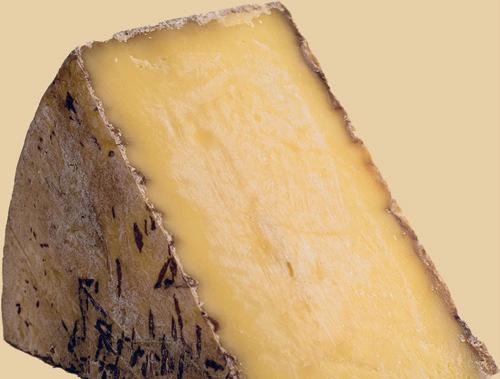

Cathedral City has relaunched its 200g price-marked packs (PMPs) in both its Mature and Extra Mature varieties across the convenience and wholesale channels.

Relaunched packs are price marked at £2.59. Plain packs are also available.

The move follows recent shopper research which found that 66% of consumers are actively seeking ways to extract more value from or reduce the cost of their weekly shopping trips.

Cathedral City cheese is purchased by 43% of UK households.

Walkers Chocolates moves to sustainable packaging

Walkers Chocolates is switching its own-brand Turkish Delight and Mint Cream chocolate bars into a 100% recyclable paper wrapper. Unlike conventional paper packaging which often contains polyethylene, the new wrappers can go for normal kerbside recycling collection. Furthermore, if littered, they don’t release harmful microplastics into the environment when they break down.

Yoplait launches Yop 500g into Booker

Yoplait has launched its Yop 500g Strawberry drinking yogurt into Booker Cash & Carry. The launch comes with the flavoured milk category experiencing huge growth and expected to be worth £671m by 2028. With sales of £262m, the convenience sector accounts for 44% of total category sales. Yop Strawberry 500g has a smooth texture and is a source of protein, calcium and vitamin D.

Fox’s Burton’s unveils chocolatey PMP

Fox’s Burton’s Companies has launched its Fox’s Fabulous Chocolatey Milk Chocolate Shortcake Rounds in a new £2.29 price-marked pack. The 130g PMPs feature crumbly shortcake biscuits coated in a generous amount of smooth, rich milk chocolate. They come with the premium treat segment of sweet biscuits growing by 10.8% year on year and currently worth £383m.

New look for Penn State

KP Snacks has given its Penn State pretzel brand a bolder and cleaner look. The redesigned packs run across the entire range and feature more prominent images of pretzels and highlight the brand’s status as a ‘baked’ snack. The refresh comes with the Pretzel segment soaring, worth £48.3m and growing at +15.8%, well ahead of the overall Crisps, Snacks and Nuts category (+5.4%).

VK Chocolate Orange comes back for Christmas

RTD brand VK has relaunched its limited-edition Chocolate Orange flavour in time for Christmas. It features in the VK Festive Mixed Pack, which has an RSP of £9. The launch of the fan-favourite flavour is supported by a new tongue-in-cheek out-of-home advertising campaign alongside an on-pack promotion that gives shoppers the chance to win one of 70 “money can’t buy” VKbranded Christmas jumpers.

A complaint against a Jam Shed wine point of sale display has not been upheld by the alcohol industry’s Independent Complaints Panel. A member of the public was concerned the slogan ‘wine for drinking, not overthinking,’ would promote irresponsible and excessive consumption. Despite the verdict in its favour, Jam Shed voluntarily removed the display and confirmed it would not use the phrase in future campaigns.

The Macallan concludes bicentenary with new single malt

The Macallan has brought its 200th anniversary celebrations to an end with the launch of the third release in its ‘A Night on Earth’ series. The limited-edition single malt, A Night on Earth in Jerez de la Frontera (ABV 43%), nods to the Spanish region where the sherry-seasoned oak casks The Macallan matures in are made. It is available now with an RSP of £110.

Sassy celebrates 10 years with new calvados French drinks brand Sassy Cider is marking its 10th anniversary with the launch of Sassy 10-Year Calvados, which is made from distilled apple cider matured in French oak barrels. Bottled at 46% ABV, it is a “well-rounded spirit enriched with oak tannins and layered with flavours of baked apples, quince and stewed fruits”. It is available in the UK from In Good Company.

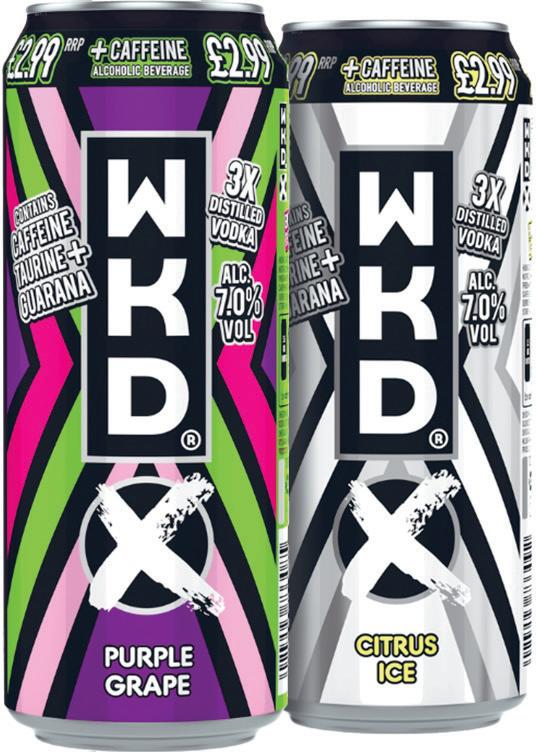

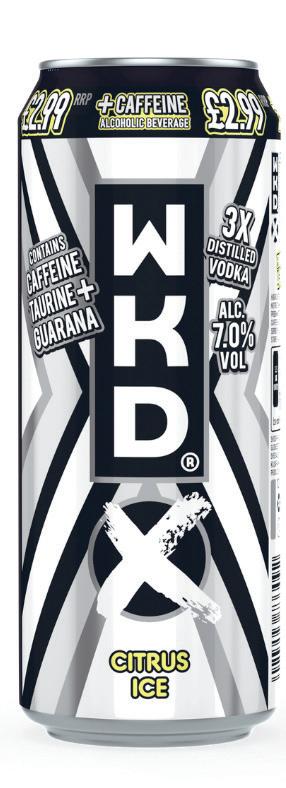

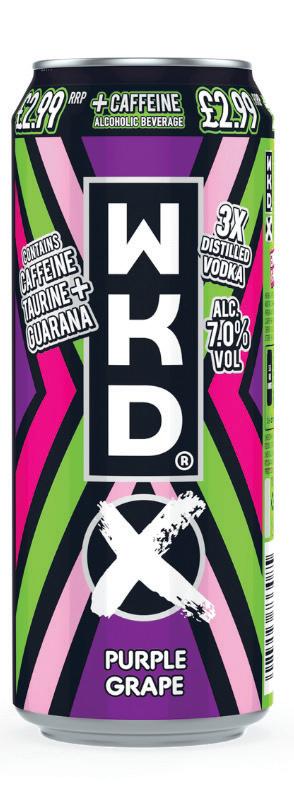

WKD X has added two new avours to its ca eine-containing 7% ABV range and launched its rst-ever media campaign.

e two avours – Purple Grape and Citrus Ice – initially roll out in 500ml single cans, price-marked at £2.99.

e launch coincides with the appearance of the rst-ever ad campaign for the brand (see Media Watch, p35).

e RTD’s sales volumes are currently up 88% year on year and set to bene t from a new listing in 650 Morrisons Daily stores.

Alison Gray, Head of Brand for WKD at SHS Drinks, commented: “WKD X has proven to be a great success since its introduction. e 18- to 24-year-old core target audience has really bought into what the range stands for: a convenient way to get a ca eine x. Consumers are well versed in mixing alcoholic drinks with energy drinks, but WKD X delivers the convenience of a pre-mixed format from a nationally recognised brand that’s known and loved.”

Gordon’s has launched a new TV ad showing consumers choosing to pace their consumption by switching between Gordon’s Pink and Gordon’s Pink 0.0%.

‘Mix It Up’ is the first Gordon’s campaign to bring both Gordon’s Pink and Gordon’s Pink alcohol-free variants together in one advert. It comes with 36% of drinkers currently pacing their consumption with soft drinks and 49% of alcohol-free occasions also featuring alcohol.

Diageo has unveiled a convenience- rst support plan to bolster the launch of Captain Morgan Original Spiced Gold mixed with Pepsi Max. is kicked o with a teaser campaign, gi ing retailers up and down the country with an exclusive rst look and taste of the new RTD. Retailers were o ered an array of bespoke POS suites alongside free stock to deliver stand-out instore activations and create a buzz on social media. A consumer launch event was also held, where retailers and industry insiders mixed with DJs, Love Island stars and social media in uencers. Retailers who want to add some spice to their own store should register for Diageo One to access marketing advice and bespoke POS solutions.

Premium vodka-based RTD brand

Four Loko has released its latest limited-edition avour, Black.

With notes of kiwi and an ABV of 8.4%, Four Loko Black is said to deliver “a fresh and fruity blast to ‘excite the senses’ as never before,” while the striking black and green can delivers high on-shelf visibility.

Four Loko Black is now available in 440ml cans, RSP £3.49, for a limited time only.

e launch is being supported by the ‘Party in a Can’ campaign, designed to engage the brand’s

target Gen Z audience via highpro le social media and in uencer activities. A range of in-store POS material featuring shelf barkers, wobblers and digital aisle ns is also available.

Clark McIlroy, boss of Four Loko distributor Red Star Brands commented: “With the festive season now upon us, this is the perfect time for consumers to get their hands on this limitededition release and embrace the season with an exciting new taste sensation.”

Jameson has teamed up with sportswear brand Admiral to launch a retro-style tracksuit in the Irish whiskey brand’s signature green colour.

Alongside a stitched Admiral logo, the Jameson ‘J’ features on both the chest and side taping.

Naturally, the brand approached Newport County’s Kyle Jameson (who else?) to model the new trackie, which is available on Jameson’s website.

Jameson has been the English Football League’s main spirits sponsor for two seasons. Kyle Jameson is the only player the brand has ever sponsored personally.

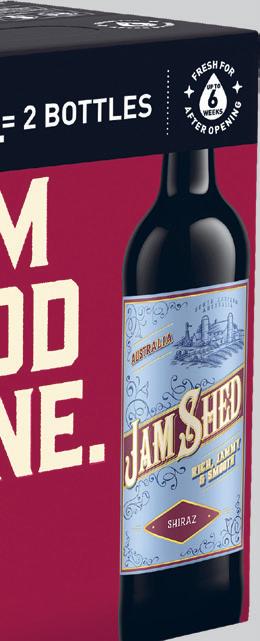

Accolade Wines has expanded its mini boxed wine portfolio with the launch of the Jam Shed Shiraz Mini Box.

The 1.5 litre box holds the equivalent of two bottles of wine (ABV 13.5%), has an RSP of £14 and is guaranteed to keep its contents fresh for up to six weeks.

It rolls out shortly after the launch of Mud House Sauvignon Blanc in Mini Box format.

The format delivers a 26% overall size reduction and a 13.6% cardboard by weight reduction compared to Accolade’s previous 1.5 litre format.

Lapping up luxury

Diageo GB has launched the Diageo Luxury Company (DLC), a new division dedicated to boosting the drink giant’s presence in Britain’s superpremium and premium segments. The DLC will have a clear focus on increasing the role that five of Diageo’s luxury spirit brands – Don Julio, Casamigos, Johnnie Walker, The Singleton, and Ciroc – play in popular culture.

making returns to The Cabrach

Whisky production has returned to The Cabrach – a once-thriving but now sparsely populated area on the northern edge of the Cairngorms National Park – for the first time in more than 170 years. The first distillation from The Cabrach Distillery was marked with a ceremony attended by Deputy First Minister Kate Forbes. There is now a minimum three-year wait while the spirit matures into what can legally be called Scotch.

Kingfisher Ultra arrives in Britain

Kingfisher Drinks has launched Kingfisher Ultra, a superpremium world beer with an ABV of 5%, which is now available in the UK. First launching in India 15 years ago, it is now one of the country’s fastest-growing beers. Made using hand-picked malts for a strong but balanced profile, Kingfisher Ultra is brewed with a six-step filtration process and no additives. It comes in a clear glass bottle with pull-crown lid.

Mangrove brings Spanish spirits to UK

Premium spirits distributor

Mangrove Global has added four brandies and a gin from Spanish producer Osborne to its portfolio. Mangrove will take on UK distribution of the Carlos I Gran Reserva, Carlos I Gran Reserva Pedro Ximenez, Carlos I Imperial Gran Reserva XO, and Veterano Solera Reserva brandies, along with Osborne’s Nordes Atlantic Galician Gin.

This month we launch our 2025 search for Scotland’s local retailing stars as we unveil the SLR Awards 2025. You’ve got to be in it to win it, so set some time aside in the diary now!

We are delighted to announce that our annual search for Scotland’s local retailing stars is now o cially underway.

e SLR Awards will return once more with the awards ceremony taking place in Glasgow on 4 June next year.

It’s been another challenging year for the sector and next year looks set to be more of the same, but we know that Scotland is packed with fantastic, creative, dedicated and successful local retailers –and we want to hear from you.

e SLR Awards presents a fantastic opportunity to share best practice, learn from one another and, of course, have a cracking night out into the bargain.

Deadline for entries isn’t until the middle of February but why not stick an hour or two in the diary sometime soon, or early in the new year, to make sure you give yourself the best possible chance of winning.

Simply head over to SLRAwards.com where you’ll be able to enter as many categories as you like. We’ve ne-tuned our entry forms once again this year, so it’s easier than ever to enter.

Our glittering awards ceremony at the Radisson blu will pay homage to the very brightest lights in our sector and if you think you’ve got what it takes to be there, then we want to hear just how far you’ve come over the past 12 months.

A round table judging session will see a panel of industry experts help to select the very best of the entries in each category. If you make the grade, our on-the-road judges will be visiting your store, and we can’t wait to see what you’ve got to o er.

So please do get involved and we look forward to hearing from you.

Bread & Bakery Retailer of the Year

Confectionery Retailer of the Year

Food-to-Go Retailer of the Year

Forecourt Retailer of the Year

Fresh & Chilled Retailer of the Year

Newstrade Retailer of the Year

Off-Trade Retailer of the Year

Scottish Brands Retailer of the Year

Soft Drinks Retailer of the Year

Vaping Retailer of the Year

Community Retailer of the Year

New Store of The Year

Refit of the Year

Sustainability Retailer of the Year

#ThinkSmart Innovation Award

Team of the Year

ENTRY DEADLINE: 15 JANUARY 2025

TDon’t delay in honouring your superstar staff members and get your entries in now for SLR’s Above and Beyond Awards 2025.

here are some sta who you simply couldn’t do without. e person who always steps in at short notice when you’re up to your eyeballs with a late delivery, or the colleague who’s quick to act in the case of an emergency.

With the Budget changes wreaking havoc on the cost of running a business, awarding pay rises and bonuses is not an option for many employers in the convenience sector. But with the many challenges facing our channel, everyone is most de nitely in need of a li and SLR’s Above & Beyond Awards o er exactly that. is event presents a marvellous opportunity to reward your best assets – those team members who truly deserve celebrating – and what’s more it’s free to enter. So ll in an entry form without delay, telling us all about your unsung heroes and what makes them so special. But be quick – the entry deadline is just a few short weeks away on January 15 and you don’t want your star player missing out!

Perhaps it’s the supervisor who lls nervous trainees with con dence and goes the extra mile to keep everyone smiling. Or the sales assistant who can create showstopping displays that bring in the crowds and bolster basket spend. Whoever that special someone is in your store – or maybe you’re lucky enough to have a whole team of them – we want to know! is is your chance to reward your sta for their sterling performance. Simply knowing that you think they are good enough to be put forward for an award is a super

way to boost morale, and if your sta are lucky enough to be shortlisted, then boy, are you in for a treat! Working closely with our sponsors, we have put together a fantastic event, guaranteed to create memories that will last a lifetime.

Now in their second year, the Above & Beyond Awards will take place at the Corinthian Club in Glasgow on March 13 where nalists will enjoy free a celebratory lunch. During the ceremony, we will sing the praises of each of our amazing winners, giving them the much-needed recognition they have rightfully earned.

New for 2025, e Scottish Sun has been announced as the o cial Media Partner of the Awards. Teaming up with Scotland’s biggestselling newspaper means that the inspiring stories we uncover during the Awards can be shared nationwide with the Scottish public. We hope that this will not only give consumers an even greater appreciation for the important role their local stores play in their communities, but furthermore, it can also help to tackle the retail crime epidemic the country is currently battling. ese are the only awards dedicated to convenience sales colleagues across Scotland, encompassing symbol and franchise store workers, as well as those whose shops are una liated. is incredible event provides a unique opportunity to shine a spotlight on your employees’ many achievements and give them the credit they deserve. So what are you waiting for? Get cracking on that entry and let your sales stars sparkle.

INDEPENDENT STORE COLLEAGUE

(SPONSORED BY MONDELEZ INTERNATIONAL)

Open to all colleagues working in independently owned local retailing stores in Scotland that are unaffiliated or members of any symbol group, fascia or franchise.

COMPANY-OWNED STORE COLLEAGUE

(SPONSORED BY CJ LANG/SPAR SCOTLAND)

Open to all colleagues working in CJ Lang company-owned stores in Scotland.

BUSINESS BOOSTER

Open to all colleagues who have materially improved their store’s performance by suggesting or introducing a new concept, product, service, communication method or a change in operational process.

TEAM OF THE YEAR

(SPONSORED BY TENNENT’S)

Open to all in-store teams which have pulled together to make a positive difference to their store’s performance and/or to their community.

UP & COMING STAR

(SPONSORED BY CCEP)

Open to all colleagues aged 25 or under working in any of the store formats detailed above who have shown themselves to be outstanding colleagues with a bright future in the sector ahead of them.

LONG SERVICE AWARD

(SPONSORED BY CADBURY)

Open to all colleagues working in any of the store formats detailed above who have worked in the sector, or a single store or chain, for an extended period of time.

ASTONISHING ACT

Open to all colleagues working in any of the store formats detailed above who truly went Above & Beyond to perform an astonishing act that had a massive positive impact on a customer, colleague or the community.

Communities across Scotland came together for all manner of frightful festivities thanks to their generous local stores who conjured up a spell for success this Halloween.

James Morgan of Vertex has taken on his biggest shop project to date – a store of his own.

BY SARAH BRITTON

As sales and project manager at shop tting rm Vertex, James Morgan has led countless c-store refurbs, but has he got what it takes to pull o the ultimate transformation, and carve out a credible career as a store owner?

Originally from Belfast, James moved to West Kilbride, North Ayrshire, at the age of 15 and had always fancied the idea of becoming a local retailer having worked in a shop as a teen.

A er six years tting out stores with Vertex, and working in store development at Booker prior to that, he nally found himself able to set up shop. He took on an empty outlet in West Kilbride, that had previously operated as a KeyStore, earlier this year and got straight to work on a little makeover magic.

“When I’m doing shop tting for other people, obviously I have a bit of an in uence, but it’s somebody else’s shop, so I’m working to what they want, or speci cations from symbol groups,” he says. “So with my own store I was able to be a bit more creative with it.”

James certainly made his mark with the bold terrazzo ooring, in uenced by the hospitality sector. “I’ve never done it before [in a store],” says James. “It’s an older style that’s become trendy again, so bars and restaurants in Glasgow will have terrazzo tables and oors.”

He also looked outside of retail to add a twist to his counter. “We used uted MDF, which is more common in hotels for bedside cabinets and bars, to make it look a bit di erent,” he explains.

Next, James added a recessed LED strip light around the beer cave to make it more eyecatching at the back of the store. “We branded it ‘the cellar’ to give it a premium feel because West Kilbride is an a uent area,” he explains.

He opted for modern-look dark shelving and refrigeration, whilst also taking energy e ciency

into account. “I looked into energy costs quite a lot, so we double-insulated the ceiling and chose integral panoramic energy e cient chillers to keep the running costs down.”

His experience in the shop tting industry meant he had seen bits of kit tried and tested. “I’ve probably supplied 20 of those chillers to other stores in the last few months. I did one in Haymarket in Edinburgh and the guy came back and said, ‘James, I’ve saved £350 a month on electricity just by swapping this one cabinet’.”

A striking hexagonal light was inspired by another shop. “I put that light in a Premier store at a petrol station in Hartlepool and I quite liked it,” he says. “So we’ve used it as a feature above the counter.”

e reason James was keen to introduce numerous unusual touches isn’t simply to unleash his creative air, but also to give the

store true stand out. “ ere’s quite a lot of competition in the area,” he says. “ e village has a population of about 5,500 and there’s a Co-op and a Spar store as well, both about two minutes’ walk from my store, and slightly further away there’s a Nisa.”

Of course, he knows that it will take more than a few funky ttings to build up a loyal customer base, so he’s gone out of his way to o er a varied selection of products. “ at was why I went with the beer cave to make it a bit di erent,” he says. “We’ve imported a lot of beers from around the world from Spain and Argentina that are selling well. We’re also doing good deals on stu like Tenants and Stella.”

He has also imported American snacks and confectionery, Japanese confectionery and ai so drinks. “ e imported stu has been some of our bestsellers so far,” enthuses James. “We literally can’t keep the American sweets on the shelf! We sell a box of Jolly Ranchers a day!”

Korean Ca e Bene drinks pouches, which are trending on TikTok, are also proving popular. A freezer under the smart Bestir co ee machine is stocked with large cups of ice that the store sells for £1. “People come in and buy a cup and a Korean co ee pouch [to pour in], they’re like avoured iced co ee,” he says. “ at seems to be selling quite well so far, and people are coming in from the other villages to try them.”

Word has spread quickly about the new store and its exciting o er, thanks to Facebook, Instagram and TikTok pages with videos giving customers a virtual store tour and showing the latest products available, including gold bars of trending Dubai chocolate. James sold 300 bars on the rst day of stocking it a er posting a pic on social media!

“Obviously, I’m only just starting o , but if you can be interactive on Facebook in the right way with new products, it de nitely does bring people to your door,” he says.

Another USP are the stunning photos of the area displayed throughout the store. “I was quite heavily involved in the signage,” says James, who is keen to embrace the beauty of the locality. He is also eager to celebrate the rich heritage of the store, which rst operated as a greengrocer more than 200 years ago. “ e village is quite a close community and on the inside of the shop on the windows we’ve got two big window vinyls across the glass with a big story about the history of the shop,” he explains.

James’ ability to create a contemporary outlet, whilst still paying homage to the past, appears to have given the shop universal appeal. “ e kids love it; they pull their parents in on the school run!” he says. “A lot of elderly people come in during the day because we’re cheaper on bread and milk, and at night time, it’s more younger adults coming in for the beer cave, the American stu and iced co ees.

“All the feedback’s been really positive, I’ve only heard good things so far, so hopefully that will continue,” he says humbly.

e biggest challenge, he claims, is that he is still working full-time on shop ts. He ended up overseeing a project 200 miles away in Elgin, Moray, which meant driving the four-and-a-half hours back to West Kilbride a er a day’s work, and then putting in a shi at the store. “I’ve been working 15-hour days, seven days a week,” he says. ankfully, a shop team comprising his partner, family and friends are more than capable of holding the fort.

Having only opened its doors in October, the store quickly clocked up a weekly turnover of £14,000. “My targets were slightly less than that at this stage,” he says. “It’s always tough, especially if you’ve got other competition, we’ve got to give people a reason to come into our shop. You’ve got to break their habits, so I was only expecting to be to do about £12,000. e shop is only 650 square feet, so if I get up to £15£18,000, I’ll be really happy.”

It’s early days yet, but it looks like Vertex won’t be the only peak in James’ career.

Launched as a new cigarette brand that seeks to offer exceptional value without compromising on quality, Paramount features premium, fullflavour Virginia sun-cured tobacco, meeting the needs of the majority of cigarette smokers. Packs have an RSP of £12. However, Imperial is offering additional support to retailers to let them sell at £11.50 or less per pack should they wish to. The brand is available in both kingsize and super king-size formats.

Häagen-Dazs has unveiled its latest Limited Edition Festive Collection, which includes a luxurious version of a much-loved classic flavour: Mint Chocolate. With an RSP from £5.40, it combines refreshing mint and rich chocolate, with added crunchy chocolate pieces and swirls of chocolate mint sauce.

The launch is supported by in-store and social media activities.

Rizla’s new range of king-size slim papers features three designs which, when placed together, form an image based on Michelangelo’s sculpture David. Each limitededition pack contains 32 papers and has an RSP of 99p. The design was chosen from more than 580 entries submitted worldwide for a Rizla competition. Retailers should contact their Imperial Brands sales rep to find out more and order the

new range.

Swizzels has launched its first-ever Christmasthemed Squashies product to keep up with the increasing demand for confectionery during the festive period.

Naughty & Nice Squashies is available now in cases of 12 x 120g packs (RSP £1.15).

Packs contain elf-shaped sweets in two popular flavours, Strawberry Ice Cream and Apple Pie.

The sweets are colour-coded depending on their flavour – red for strawberry and green for apple – with the red elves on the ‘naughty’ list and green ones on the ‘nice’ list.

Swizzels is also bringing back its popular Sweet Shop Advent Calendar for Christmas 2024, which has seen 41% year-on-year growth and features 24 fan favourites.

The brand’s festive range also includes several vegan options:

Q Party Mix (785g, RSP £5)

Q Sweet Treat Tub (600g, RSP £4)

Q Sweet Shop Favourites Carton (324g, RSP £3)