Thriving food-to-go retailers share their recipes for success and plans for 2025.

+ BREEZER

FEVER

Canny retailers cash in ABOVE & BEYOND AWARDS

Judges preparing shortlist

2 MINUTES Global Brands’ Daniel McPherson talks RTDs

Raj and Manish Suchak Coldean Convenience 02, Brighton

“To know that our wonderful customers voted for us gives us tremendous pleasure.”

Voted for by the public, our winning stores have been recognised for going above and beyond to support their local communities.They have each won £5,000 in cash plus a Social Value store makeover worth £20,000!

Natalie and Martin Lightfoot Londis Solo Convenience, Glasgow

“It’s lovely when other people recognise something you’re so passionate about.”

06 Property Christie & Co reports a 20% year-on-year rise in the number of convenience stores sold.

07 Off-Trade Canny retailers cash in as Scotland is gripped by Bacardi Breezer fever.

08 Wholesalers JW Filshill offers mental health training to KeyStore retailers to mark its 150th birthday.

09 Sustainability Three-quarters of Scottish shoppers are open to reuse and refill solutions.

10 News Extra Business Costs With staff wage and employers’ National Insurance Contributions hikes set to take their toll, price increases are on the horizon.

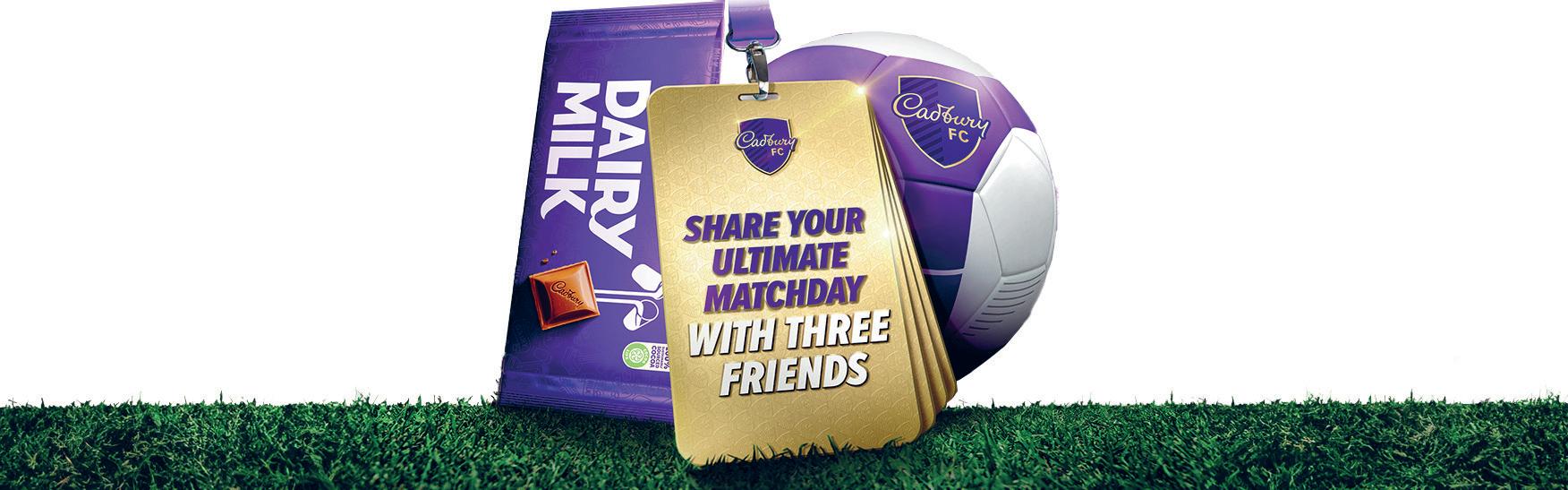

18 Product News Walkers and Cadbury both kick off footballthemed promos, and popchips signs singer Tom Grennan.

20 Off-Trade News As low and no alternatives grow in popularity, Heineken finds there’s 0.0 reasons needed to go alcohol free.

22 SLR Awards Our annual search for Scotland’s local retailing stars is gathering pace and the clock is ticking if you want to enter this year’s SLR Awards.

24 2 Minutes Of Your Time Daniel McPherson Global Brands’ National Account Manager for Scotland discusses the booming market for RTDs.

26 Above & Beyond Awards Judges are busy drawing up what is promising to be a spectacular shortlist for the Above & Beyond Awards 2025.

28 Hotlines The latest new products and media campaigns.

46 Under The Counter Crisps and nuts are caught in the Curmudgeon-in-Chief’s crosshairs this month.

30 Forecourts SLR looks at the growth of the forecourt sector and explores key areas of investment.

36 Impulse Essentials Suppliers explain how to maximise unplanned purchases in key impulse categories.

Aldi Scotland to invest more than £40m Aldi Scotland will open three new stores in 2025 – in Arbroath, Baillieston and Kirkintilloch – as part of a £40m two-year investment. In addition to the new stores, the discounter will extend or refurbish six existing sites over the next two years, with an extension for Galashiels, refurbishments for Linlithgow, Glenrothes and Stirling, and further upgrades in Hamilton and Carluke.

Tech launched to tackle underage vaping

Age and biometric verification platform IKE Tech has developed a solution that could help prevent underage vape use. The solution makes it possible for each vape on sale in the UK to include secure Bluetooth Low Energy technology, which acts as a ‘child lock’ to prevent under-18s from using devices. Only vape users who can continuously prove they are over the age of 18 would be able to activate and use the devices.

Nisa appoints Head of Partnerships

Nisa has grown its Retail & Sales Leadership Team with the appointment of ex-PepsiCo Sales Director, Paul Webster, as Head of Partnerships. Webster will take on management of the company’s largest corporate accounts and strategic partnerships. He will help develop and deliver Nisa’s strategic sales plan, driving collaboration across the Co-op’s wholesale business unit and unlocking longer term growth.

Tesco subsidiary One Stop has launched a fundraising and educational initiative called Fruities & Veggies, which supports UK food redistribution charity FareShare. Fruities & Veggies characters are available on a range of keyrings for £2.50 – with 45p for every keyring sold being donated to FareShare.

Convenience stores remain a robust investment opportunity, with the number of stores sold by Christie & Co (C&C) last year up 20% compared to 2023, according to its annual Business Outlook report.

C&C advised on more than 930 stores in 2024, with a combined value of c.£200m. More than 130 (14%) of these were in Scotland, with a combined value of c.£20m.

e report notes that in 2024 retail deal activity continued in the same strong vein as in H2 2023, and that C&C’s retail price index rose by 7.3%. e average sale price of a convenience store increased 21% to £315,000.

e rm reported an average of 10 viewings per convenience store

and a 47% increase in the number of convenience store exchanges between 2023 and 2024.

Despite operational challenges including rising retail crime rates, and increasing restrictions on products such as vapes, tobacco and unhealthy food items, C&C noted that there had been increasing opportunities created for independent buyers in 2024.

Steve Rodell, C&C’s Managing Director – Retail & Leisure,

claimed that the ever-increasing operator cost base was causing the multiples to increase the turnover threshold for pro table stores, inevitably presenting opportunities for independent buyers.

Demand for petrol lling stations remained strong with buyers continually outnumbering sellers, and by the third quarter of 2024 C&C had sold more sites than in all of 2023. e group observed that many operators have made signi cant investments in their real estate to attract customers to the forecourt. Signi cant market changes included MFG’s acquisition of 337 Morrisons forecourts for £2.5bn and EG on the Move’s purchase of 34 Asda sites for £228m.

Racetrack, which comprises 11 stores in and around Glasgow, has used its own CCTV and facial recognition system to stop a con artist in his tracks.

The system, installed and maintained by Nitro Solutions, is able to recognise individuals that may have previously attempted thefts or abused staff and also identifies their car number plates.

A man who had previously visited Racetrack’s Coatbridge store pretending to cash out Paysafe vouchers was picked up on the system when he entered the firm’s Ibrox site.

“He was always targeting younger staff who he was able to confuse by showing a fake text to claim they had to pay him,” explained co-founder Vikas Sud. “Staff have not only given him the voucher for £100 but paid out a further £100.”

But upon entering the Ibrox store last month, the system instantly recognised the scammer and staff refused to serve him.

“Action taken by our loyal staff has prevented another theft and will hopefully deter this individual,” said Vikas, adding that police failed to attend when contacted.

He said: “Retail Crime is a daily occurrence for us all, but nothing is done so we have to take our own action. We have one of the IT team doing CCTV requests daily from the sites and we – as a small group –have over 600 individuals banned in our estate.”

WHOLESALE Better pricing aids members

Both Nisa and mainland Costcutter retailers have had their fuel levy charges dropped as wholesale groups look to help their members tackle rising operational costs.

To further support its retailers, Nisa has extended its Mega Deals pricing campaign beyond Christmas, giving access to weekly market-leading prices across footfalldriving products.

Meanwhile, Bestway announced an investment of more than £2.5m to reduce the cost price of more than 11,000 bestselling branded products across all categories. e changes are designed to help retailers make more margin, whilst enabling them to better compete with large multiple convenience operators by driving footfall and customer loyalty.

Switched-on Scottish retailers who have managed to source Bacardi’s Breezer drinks are selling out in record time as consumers go wild for the alcoholic RTDs. e original Bacardi Breezers were hugely popular in the 90s, but were discontinued in the UK in 2015. ey have since been rebranded as Breezers and have a strong following in other parts of Europe, so when the opportunity came to import them, indies acted quickly.

Londis Solo Convenience has already placed a second order having sold a pallet’s-worth of stock (that’s 1,584 bottles at £2.99 each) in less than 24 hours. “Breezers are another example of nostalgic trends that have taken o ,” said Natalie Lightfoot, who runs Londis Solo Convenience with husband Martin (pictured). “ e day [they landed] ended up being busier than our busiest-ever Christmas Eve and

Independent report reveals

the [sta ] are a little bit traumatised about it!”

Mace Dreghorn in North Ayrshire knew it was onto a winner when its rst Facebook post about the product received over 700 comments. “It’s been crazy,” said the store manager. “Within four hours of trading I’d sold nearly a pallet load!

“I don’t know if it will be long term. Sometimes you get items that go viral for a month or two and then no one’s interested. But if they

keep selling, I’ll get them in. So far, so good!”

Sunny’s Premier in Stirling has also caused a stir with the rumbased bottles. e store created a video about the new stock on its TikTok account, which amassed over 160,000 views and nearly 2,000 likes in just four days.

“It’s been mental the last few days,” said manager Ha z Ahmed. “No other shop in Stirling has it yet. We’ve almost sold a full pallet in three days.”

e Scottish Grocers’ Federation’s (SGF’s) Go Local Programme has seen monthly sales of fresh and healthier Scottish products rocket 44% at participating stores, according to a new report.

Now entering its h year, 127 stores from Shetland to Dumfries & Galloway have participated in the project. e average convenience store on the programme is delivering 31% of their total sales from Scottish products (when tobacco and news are excluded).

e report also highlighted a signi cant multiplier impact and boost for the local economy, with expected increases of around £169,000 per store per annum.

e Go Local Programme provides individual grants for retailers to invest in developing a dedicated space for local products (£5,500 in 2024) with a bias towards fresh and healthier lines, and has a particular focus on facilitating ‘meet-the-buyer’ events linking up local retailers with producers in their area. On average, each store

increased its dedicated Scottish space by an additional 26.4 metres.

Rural A airs Secretary Mairi Gougeon said: “We have seen the number of people wanting to support local producers continue to grow, and this independent report shows the real impact that the Go Local Programme has had in getting more and more of our fantastic local food and drink on the shelves of convenience stores –a vitally important sector.”

Castle Douglas in Dumfries and Galloway is one of the first Co-op stores to trial YEEP! parcel lockers after the Co-op signed an agreement with the supplier, which will see lockers installed at 30 of the retailer’s stores.

The move is part of a wide growth strategy within convenience, which saw the group recently reveal plans to open 75 new stores across the UK this year. These include 25 stores operated by Co-op and up to 50 franchise outlets, while up to 80 further Co-ops will undertake major refurbishments in 2025.

Booker donates more than 20 million meals

Thanks to its ongoing partnership with FareShare and Olio, Booker has donated the equivalent of more than 20 million meals to charities and local communities. Donations are delivered or collected direct from Booker’s 190 branches, 11 distribution depots and Best Food Logistics business. In 2024 alone, Booker donated more than seven million meals to FareShare charities.

Allwyn develops new prize payment solution

National Lottery operator Allwyn has revealed that players who play in-store can now opt to receive their prizes via direct bank payments for the first time. In a partnership with payments provider, Bottomline, Allwyn has created an online claim process that will see mid-tier retail prizes of between £500.01 and £50,000 paid more quickly than before.

Greens raises £5,000 for Heat & Eat appeal

Scottish convenience chain

Greens Retail has raised £5,000 in support of Fife Gingerbread’s Heat & Eat appeal through Nisa’s Making a Difference Locally (MADL) charity. The funds contributed significantly to the charity exceeding its £20,000 fundraising target, enabling it to provide critical support to families across Fife facing hardship.

SGF updates its guidance on vapes

The SGF has updated its guide for retailers selling vaping and tobacco products ahead of the ban on single-use vapes on 1 June. Retailers are provided with detailed information on vape product compliance; retailers’ responsibilities; and how to identify a disposable vape. The guide also includes updated advice on complying with Waste Electrical and Electronic Equipment (WEEE) regulations.

The Scottish Wholesale Association (SWA) has announced that its Annual Conference will take place in Ardoe House Hotel & Spa in Aberdeen on Thursday 5 June. Previously a weekend event, the new one-day conference is centred around Kaizen, a Japanese business philosophy, which means “change for the better”.

Retail technology company, Jisp, has unveiled a data and insights division called Jisp Intelligence, to help shed light on the behaviours, needs, and preferences of convenience shoppers. The firm claims shopper data is a goldmine for retailers and brands, allowing them to understand purchasing patterns, preferences, and trends.

Spar has launched a Frozen Fortune customer campaign with four £10,000 prizes up for grabs through its four wholesalers in Great Britain, as well as more than 400,000 instant rewards on big brand products. Frozen Fortune offers a daily Ice Breaker game. After playing this three times, players unlock the Fortune Maker game, where they can spin a wheel to win a guaranteed reward.

While significantly lower than 2023’s 4.1% growth, consumer card spending increased in 2024, up 1.6% compared to the previous year, according to Barclays, which has highlighted a rise in affordable treat purchases. The bank revealed that essential spending grew just 0.9% last year, down from 3.9% in 2023, as spending on fuel fell while supermarket growth slowed. Non-essential spending increased 1.9% but still lagged behind 2023 levels (4.2%).

150 KeyStore retailers will receive training to become mental health ambassadors as part of JW Filshill’s 150th anniversary celebrations.

e wholesaler is marking its big birthday with a ra of activity based around the theme ‘Delivering Success’ that champions community, wellbeing, innovation, and sustainability.

e company, which began as a confectionery manufacturer in Glasgow’s Gallowgate in 1875, now spans ve generations and is based at a purpose-built 120,400sq distribution centre at Westway Park near Glasgow Airport.

To mark its milestone anniversary the rm aims to raise £150,000 for six charities, which represent large demographics of the communities it serves, as part of its anniversary celebrations. Chosen by Filshill sta , the charities are CHAS (Children’s Hospices Across Scotland), Dementia Scotland, Cancer Research UK, MND Scotland, SSPCA and GroceryAid.

On 27 April in Glasgow, 150 Filshill directors, colleagues, customers, suppliers and family members will take part in the Kiltwalk, Scotland’s largest mass participation walking event

with over 178,000 people taking part since 2016. e company’s involvement will represent the Kiltwalk’s largest-ever corporate attendance.

In terms of Filshill’s sustainability goals, the company had pledged in 2020 to cut its carbon emissions by 50% by 2030. However, it has revealed that it has reached this target ve years early, boosted by its relocation to the new Renfrew site, signi cant investment in electric HGV vehicles, solar panels, and transitioning to HVO fuel for all diesel-powered operations at Westway.

During 2025, the wholesaler will also ramp up its commitment to corporate technology within the business and seek innovative solutions to boost e ciency business, including AI. e company has also committed to investing in a so ware platform that will assist greatly in tracking Scope 3 emissions. e celebrations will culminate in a 150th Anniversary Celebration Dinner in Glasgow on 9 October.

As Bestway Wholesale enters its 50th year of business, the firm has kicked off celebrations with its flagship ‘Thank You’ event.

The ‘Thank You’ promotional campaign, which runs until the end of the month, has been a tradition for the Bestway business for over 10 years. It rewards customers for their continued loyalty and runs across the 60+ depots nationwide, as well as online for all retail and catering customers.

The business, which was founded by Sir Anwar Pervez who established his first wholesale depot in 1975, has created a striking in-depot display featuring a golden celebratory LED lit arch. Customers are welcomed through the glittering archway where they can then access Buy One Get One Free (BOGOF) offers and Buy Two Get One Free offers from many top brands across leading categories and key footfall drivers.

Online, the campaign has executed a full homepage takeover, directing customers through to a landing page where all the deals are featured.

Bestway Wholesale Group Trading Director, Kenton Burchell, said: “This campaign is not only a chance to thank all of our customers for their incredible support over the last 50 years but it’s a powerful opportunity for us to set the tone for the year ahead.

“We know that retailers have been affected by economic volatility and Bestway is here to support them. Our aim is to provide our retailers outstandingvalue offers that deliver relevant support to drive the best possible start to 2025, whilst also thanking them for their loyalty during 2024.”

Scottish consumers are leading the UK in their willingness to adopt re ll and reuse systems, reveals new research from re ll solutions provider GoUnpackaged.

ree-quarters of Scots said they were likely to make reuse and re ll a regular part of their weekly shop if supermarkets made it easier –that’s 10% higher than the UK as a whole where only 68% are on board with the concept.

What’s more, Edinburgh was the UK city with the highest number of consumers (82%) expressing a readiness for the sustainable shopping habit.

e research also found younger shoppers were more willing to change, with 77% of UK consumers aged 18-34 open to the idea.

GoUnpackaged also discovered that half of consumers polled (50%)

SALES Lottery ID checks peak

actively preferred to shop with brands who implement reuse and re ll systems, and 45% said they would choose retailers prioritising reuse over those that don’t.

e group claimed that if every UK household reused just one item per week, it would eliminate over 1.4 billion items of singleuse packaging per year (based on an ONS gure of 28.2 million households in the UK in 2022).

Allwyn, which operates the National Lottery, has claimed that the rate of retailers correctly asking for ID as proof of age for lottery sales is at its highest level since National Lottery mystery shopping visits started more than two decades ago.

As part of its new Operation Guardian scheme, Allwyn organised more than 8,200 mystery shopper visits in 2024 to check retailers were challenging players who appeared under the age of 18. e nal results show that a record-breaking 92.3% of National Lottery retailers correctly asked for ID as proof of age on their rst visit.

Allwyn also carried out 4,000 ‘excessive play’ visits to ensure stores could provide support information to players requesting help with their play if needed. Towards

the end of the year, this also incorporated a smallerscale mystery shop exercise for the new 10 scratchcard per purchase limit, which Allwyn o cially launched in October 2024. e nal part of Operation Guardian, a ‘knowledge check’, encompassed 4,000 visits which assessed store sta ’s knowledge around preventing underage play and minimising excessive play. Retailers were tested using six core questions, and 85% of retailers answered ve or more questions correctly.

Despite consumer appetite, there are still barriers stopping shoppers from making these simple changes, as over half (54%) of UK consumers struggle to nd reuse or re ll options at their regular supermarkets, and 47% nd these schemes confusing or di cult to navigate.

In fact, 69% of Scots said there was very little information online for customers to nd out more on reuse and re ll.

Catherine Conway, Director at GoUnpackaged, said: “Retailers have a limited window to act. Supermarkets that embrace reuse and re ll systems now can establish themselves as leaders in sustainable retail, while those that wait risk falling behind in a market that’s increasingly intolerant of wasteful practices.

Retailers looking to capitalise on growing demand for vegan, local, free-from and sustainable foods have the chance to check out Greencity Wholefoods at Scothot 2025 in Glasgow SEC from 26-27 February.

Exhibiting at stand 631, the Glasgowbased wholesaler of fine food and drink supplies businesses in Scotland, the northeast of England, and Ireland with more than 5,000 vegetarian, vegan, organic, locally sourced, Scottish, Fairtrade, freefrom, ethical and eco-friendly products.

A workers’ co-operative, Greencity endeavours to treat customers, suppliers, the community and its workers with fairness and respect, and champions co-operative working as a successful alternative business model.

InPost’s UK parcel deliveries up 58% in Q4 Rapid network expansion, coupled with improvement in logistics has enabled InPost to end its Q4 UK trading on a high with 27.2 million parcels delivered, a year-on-year increase of 58%. In 2024, InPost delivered 93.2 million parcels in the UK, doubling 2023 volumes, while globally, it surpassed one billion parcel deliveries and added over 11,500 automated parcel machines.

Baker recalls bread rolls Glasgow-based McGhee’s Family Bakers recalled packs of 6 Scottish Brown Rolls because of undeclared soya, last month. The recall, which was issued by Scottish Food Standards, stated that, due to a packaging error, several packs included white rolls which contained soya, meaning that the product was a possible health risk for anyone with a soya allergy.

Keep Scotland Beautiful calls for litter pickers

In a bid to beat its 2024 record of 45,000 participants, Keep Scotland Beautiful is on the hunt for 50,000 people to get involved with its biggest Spring Clean ever from 21 March – 21 April. The environmental charity’s latest report ‘How clean are our streets?’ revealed that 72% of all sites surveyed were littered. And the 2024 Scottish Litter Survey highlighted that 87% of people agree litter is a problem across Scotland.

C-Store Collective partners with SOLUM

Convenience channel

consultancy C-Store Collective has teamed up with SOLUM, a provider of electronic shelfedge labels (ESELs). The firm claimed that ESELs are a smart, time-saving solution that enables retailers to update prices across their entire store in seconds without the need for printing and swapping tags.

Scotland is home to a plethora of world-class food and drink produce, so linking up local retailers with nearby producers is a no brainer.

Customers can get the best quality local goods, and there’s an important boost to the local economy. Meanwhile, producers and retailers get direct access to their local market while improving sustainability and cutting out long-distance transport costs.

So, SGF is delighted to have published a comprehensive report on its hugely successful joint project, the Go Local programme, now in its fifth year.

Run by SGF with the support of the Scottish Government and Scotland Food & Drink, Go Local provides grants for retailers to invest in developing a dedicated space for local products (£5,500 in 2024) and has a particular focus on facilitating ‘meet-the-buyer’ events – linking up retailers with producers in their area.

Originally set up to support the economic recovery of Scotland’s food and drink sector from Covid-19, the programme has gone from strength to strength. The figures highlighted throughout the report speak for themselves.

Across the 127 stores now participating in the programme, representing communities from Shetland to Dumfries & Galloway, the average growth in sales of goods sourced from local producers is a staggering 44%. The report also shows a significant multiplier impact and boost for the local economy, with expected increases of around £169,000 per store per annum.

The ‘Go Local Project Report 2024’ is available on the SGF website, and we look forward to another successful year, in 2025.

With staff wage and employers’ National Insurance Contributions (NICs) hikes set to take their toll, price increases are on the horizon.

has the potential to cause in ation,” said Managing Director – Retail & Leisure, Steve Rodell. “However, as convenience stores are needsdriven, consumers will accept price rises or seek out value for money.”

When asked how they would be responding to the increases in employers’ NICs, two-thirds (67%) of retailers stated that they would increase prices, according to a British Retail Consortium (BRC) survey of Chief Financial O cers (CFOs) at 52 leading retailers.

A concerning 70% of respondents were either ‘pessimistic’ or ‘very pessimistic’ about trading conditions over the coming 12 months, while just 13% said they were ‘optimistic’ or very ‘optimistic’.

Around half said they would be reducing the ‘number of hours/overtime’ (56%), while 46% were looking to reduce ‘stores headcount’. Almost onethird said the increased costs would lead to further automation (31%).

e impact of the Budget on wider business investment was also clear, with 46% of CFOs saying they would ‘reduce capital expenditure’ and 25% saying they would ‘delay new store openings’. A similar number (44%) of respondents expected reduced pro ts, which will further limit the capacity for investment.

e CFOs also predicted that shop price in ation, currently at 0.5%, would rise to an average of 2.2% in the second half of 2025. is would be most pronounced for food, where in ation is expected to hit an average of 4.2% in the second half of the year.

Property advisor Christie & Co has acknowledged that retailers will continue to face rising costs as a result of measures outlined in the Autumn Budget, and predicts this will a ect wages in particular. “ is

Food-to-go prices have been negatively impacted at the Broadway Convenience Store near Edinburgh. “We’ve just had to put the lunch special up to £4.50 because of rising costs; it was at £4 for as long as I can remember,” says Sophie Williams, who runs the store with parents Linda and Dennis. However, the special remains popular and Sophie points out that the large portions and highquality ingredients still o er excellent value for customers.

Anila Ali claimed that the employers’ National Insurance contributions would impact pricing at Ali’s Convenience Store in Tranent, East Lothian. “I think slowly, but surely,” she told SLR. “It’s not something that we would just do overnight.

“It’s something we will have to take into account and see where we can [increase prices] without a ecting our customers too much because at the end of the day consumers have a lot of choice – down our high street we’ve got four convenience stores, an Asda and an Aldi. If you’re good at customer service, I think that makes a di erence and sometimes people won’t mind paying a little extra if they’re treated nice and welcomed in the shop.”

Anila believes c-stores everywhere will be doing similar. “I think many convenience stores are probably already putting their prices up. It depends on your good demographics if you can get away with it. When you’re in a residential area, it’s something that needs to be built over months.

“I do think we will see this across the board. I think it’s a game of survival now. You go into survival mode and you will eventually have to look at your gures and see – do I need to cut the hours of my sta or can I keep them on and put the prices up by a little? Eventually, where we can, we will start putting prices up.”

The history of food-to-go in local retailing in Scotland is long, complicated and a wee bit patchy. Once seen as the Next Big Thing and the answer to all of our prayers, the sector quickly found out the hard way that food-to-go is hard to do. Or, to be more precise, it’s hard to do well

When, long before Covid, food-to-go was all the rage, everybody was seemingly piling in but what quickly became clear – to me at least – was that for food-to-go to have a chance of blossoming in a store, it has to be done well. And I mean really well. You don’t have to go full David’s Kitchen on it, but to maximise sales and profits requires a lot of time, money, effort, knowledge, experience and staffing hours.

To win with food-to-go you truly have to commit to it. I’ve spoken to many retailers over the last 10 years or so who told me that “food-to-go didn’t work” in their store. They’d tried it. Customers weren’t into it. To be brutally honest, though, all they’d really demonstrated was that doing food-to-go badly hadn’t worked in their store.

Take a look around, however, and take a look at this month’s cover story, and you’ll see just how well food-to-go can work when done well. It’s all about delivering the right offer for your audience. I’ve had so many retailers tell me that they’re too rural to do food-to-go; there’s not enough footfall. Tell that to Innes MacDonald, whose Spar Scourie store is about as remote as you can get in Scotland. And yet he does £8k a week on food-to-go and coffee.

Then there’s the latest generation of food-to-go retailers who have been doing it for several years now and have learned a lot along the way. Retailers like Linda Williams at Broadway Convenience Store in Edinburgh and Umar Majid at Baba’s Kitchen in Bellshill. Both of these stores decided to give food-to-go a punt and, a few years later, food-to-go is the category that now defines both stores.

It’s hard work, it requires lots of staff hours, it can involve backshifts and even night shifts but if you get it right, the rewards are handsome. Fantastic margins certainly help and becoming famous for food-to-go in your area can make your business a real destination store. With the challenges of April ahead, it’s clearly an opportunity for many retailers to grow sales and margins.

So is 2025 the year when food-to-go really becomes good to go for our sector?

ANTONY BEGLEY, PUBLISHING DIRECTOR

EDITORIAL

Publishing Director & Editor

Antony Begley abegley@55north.com

Deputy Editor

Sarah Britton sbritton@55north.com

Features Editor Gaelle Walker gwalker@55north.com

Web Editor

Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director

Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager Cara Begley cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 22 22 100. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100 Fax: 0141 22 22 177 Website: www.55north.com Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher.

All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

©55NorthLtd.2024 ISSN1740-2409.

Thriving food-to-go retailers share their recipes for success and plans for 2025.

Roofers, bricklayers and landscapers are ocking to Broadway Convenience near Edinburgh to refuel on its wholesome, hearty deli fare. What started as a sideline to give the store a USP has fast become a cornerstone, contributing 15% of the shop’s turnover. “It’s turned into a bit of a beast!” says Sophie Williams, who has taken on much of the running of the store from her parents Linda and Dennis, and is regularly roped in to help with the deli.

A basic hot roll o er was expanded with hot pies from local butcher and bakery, McGills. en Linda, who heads up the deli, started making soups, which turned the store into a destination outlet. “ ey’re really popular because we have a lot of tradesmen working in the cold, and this is proper, homemade chunky soup, full of veg,” she says. “ ey’ll travel quite a distance for it. O the back of that, I thought, ‘I wonder if they’d like lunch too’.” So Linda now whips up daily special dishes like steak pie, mince & tatties, and chicken curry & rice. at’s on top of paninis, toasties, baguettes, pasta pots, sandwiches and lled rolls – the latter of which sell 150 a day.

When it comes to food to go (FTG), knowing your audience is vital, observes Stephen Brown, head of FTG at Spar Scotland. “Di erent locations have di erent needs and wants,” he says, noting that the rm’s various bakery partners help stores to cater to the needs of their local area.

“Bakery products can be quite a parochial thing based on your area, so if you’re brought up in Dunfermline, Stephens Bakery’s Steak Bridies is your go-to. Whereas if you are brought up in Kilmarnock, Killie Pie from Brownings the Bakers would be the famous product that you would recognise.”

Analysing the local o er and whether you can ll a gap in the market is also crucial. “Rural stores are some of our busiest sites,” he states. “For example, for Spar Balmacara in Skye – the nearest McDonald’s is Inverness, so it’s a twohour drive, but we can provide that burger on the road.”

Innes MacDonald, who owns two Spar stores in Inverness and Scourie is certainly making the most of the latter’s location near a campsite on the North Coast 500 route. “Scourie has a population of 200 people, but food to go is absolutely bonkers!” he says. “Even in winter

it more than justi es itself and in summer we do £7,000 to £8,000 a week in food to go plus co ee.”

In winter, the store sells 10-15 breakfast rolls in the morning, plus sausage rolls and pies, and in summer, this shoots up to 30 or 40. e store makes its own sandwiches too.

“We use the labelling that Country Choice gives us,” says Innes. “You invest a bit of time rst thing in the morning pre-packing. If you get a load of cyclists in, or two or three campervans full of tourists, or workers from the local salmon farm, they don’t want to be hanging about while you’re making up rolls.”

He also sells Flatstone pizza, which is hugely popular with the local campers. e pizzas have a 40% margin. “It isn’t as much as it could be, but I don’t want to sting people too hard,” he says. Despite the summer washout, he was averaging 30 a night. “Even though we were down £350/£400 a day, we were still up on hot food 10% year-on-year,” he says.

While Innes is enjoying his success with FTG, keeping pace with demand presents numerous obstacles.

“Deliveries are hard – we only get two a week from Country Choice, which is a real pain,” he sighs. His 1,000sq store has a 400sq stock room, which struggles to contain su cient supplies. “Sometimes 100 cyclists come in and clean us out of all our sandwiches. en we’re snookered!” he says. “Trying to hold enough stock in our freezers for that amount of sales, we’re creaking at the seams. We need to do something with back-of-store because we regularly run out of stock. Whether we add an outside storage unit for non-food, something’s got to give.”

Umar Majid of Baba’s Kitchen in Bellshill is also looking to invest further in FTG in order to keep up with customers’ appetite for storemade food. He has already reaped the rewards of a major FTG-focused re t in 2019, which has helped him achieve weekly sales of between £7,000 and £11,000 a week, across the hot food counter and shop-made meals. Comprising chef-prepared dishes, such as Pasta Bolognese, Enchiladas and Chinese Chicken Curry, the store sells between 320 and 350 meals a week, while between 40 and 60 soup portions are served up each day.

With ready meal sales alone almost doubling in the past year, Umar is hungry for another upgrade, but is currently still sizing up the return on investment.

More equipment is needed to cope with soaring demand, he says. “I’d like bigger fryers. We were only doing a 2.5kg bag of chips once a week and now we’re doing anywhere between four and six bags, Monday to Friday, and between eight and 12 bags at the weekend.”

Umar’s also got his eye on a new bain marie to aid e ciency. “With the last re t, I speci cally wanted an open bain marie so that it was easy for our sta to grab the food and put it straight onto a roll. But we found that having no doors meant that it didn’t keep the heat in as well, so sometimes the food wasn’t keeping above 63 degrees. So in the next re t, I de nitely want to have doors so that we’re not having to reheat it.” is would also help save on energy costs, which are a major headache. “Energy is de nitely the biggest di culty right now,” he says. “Our electricity bill was £66,000 last year and this year it is £82,000 a year because of the Russia Ukraine war and obviously the energy prices went up.”

He is currently doing everything he can to cut consumption. “We already have a few energysaving practices in place. For example, we have three fryers; so now we turn one on a bit later.”

Linda can relate. “Energy costs very much a ect us,” she says. “Colleen, our manager, suggested turning the griddle down a notch and start putting the immersion heater o for an hour every now and then. We’re watching the pennies, but it is a massive cost and also the extractor fan is running constantly. But it is the price you pay for fresh food.”

e store is also a victim of its own FTG success, having outgrown its current extractor fan. “What we’ve got is not quite up to the job, so I think we’re going to have to spend a bit of money and get a bigger kit for that,” she says.

e popularity of the deli is taking its toll on Linda too, and she is eager to relieve some of the pressure by taking on a new chef. “It’s getting a little bit much for me, but it’s not easy to nd the right person and until I do, I’m not willing to relinquish it,” she says.

Sophie adds: “Working in the deli is not just about cooking, you also need to have the customer service skills to have that back and forth with the customer, especially with our clientele. Within the deli it’s all tradesmen that call in. ey want a laugh as well as their food.”

Baba’s Kitchen feels most grateful to have “culinary maestro” Bella on board. If he goes ahead with his mini re t, Umar wants to make the most of the passionate chef’s skills to embark on a new initiative. “Bella knows how to batch cook products, so I want to be able to batch cook our soup, or our lasagna and then sell it to other stores.”

Another item on Umar’s agenda for 2025 is cracking the evening dining occasion. “Evening meals is something I’m trying to branch out with,” he says. “We currently have Late ursdays where food can be ordered until 6pm.”

But increased overheads are putting a spanner in the works. “ e issue that I have is that our electricity costs are already so high. I’m trying to gure out the risk calculation if we keep all the equipment on for an extra four or ve hours, how many sales do I need to generate to balance that out and have an extra sta member? From one brief calculation I think I was going to have to increase the revenue by about £1,000 over three days.”

Enticing people into the shop in the evening is also proving tricky. “Right now with where the economies are, the Late ursday experiment is not working,” he says. “We found that within the shop as well a er 6pm it’s really quiet. People just hunker down once they get in from work. ey go on Just Eat and place an order for a takeaway.”

In addition, he feels that his FTG o er requires a revamp. “You need to have a di erent dinner menu because our steak pie isn’t going to sell; people want smash burgers and fried chicken. Meanwhile, the winning combination of Flatstone pizza and an adjoining bar, mean that Innes is nailing night-time FTG at Scourie Spar. But he is on the hunt for a second dish to tempt people. “We need to nd something that we can bang out on menus that’s really easy to do,” he says. “Pizzas are ne because they cook within seven minutes.”

If he gets his FTG o er right, Innes reckons he can grow the category from 20% to 30% of Scourie’s sales.

Spar Scotland’s Stephen Brown is also optimistic about future growth. “In terms of our food to go category, we’re looking for a 20 to 25% growth,” he says. But he is not convinced that an evening o er holds the key. “I’m not saying at some point we wouldn’t want to tap into the evening food-to-go occasion, certainly we would. But at the same time, I think concentrate on your breakfast and your lunch and your daytime o er.”

Innes can’t understand why more people aren’t taking advantage of FTG. “Despite me telling everyone on the northwest ring how good food to go is and that they should go into it properly, they don’t,” he says.

Linda and Sophie advise retailers to proceed with caution. If executed well – as it has been at Broadway Convenience – FTG can be a lifesaver. “It’s been a complete change of the focus of the business, but without it, the shop 100% would not have survived,” says Linda.

FTG lines not only generate the store tasty margins of between 50 and 100%, but deli shoppers are also big spenders. “ e average spend of a deli customer is about three times what the average store customer spends, and if they weren’t coming into the deli, there wouldn’t be enough trade for the shop just on its own.”

Sophie concludes: “It’s a huge, huge undertaking and I don’t think people should go into it lightly. You need to weigh up all of your options, but if you can do it and you can do it successfully, I think it is a massive bene t for your store.”

We’ve got your grocery supply needs covered with a catalogue of 5000+ Organic, plant-based, Fairtrade, free-from lines and FMCGs – including soft drinks, sweet and savoury snacks, dairy-free milks, chilled foods, speciality artisan products and seasonal gifts, alongside a comprehensive range of high-quality kitchen ingredients, store cupboard essentials and eco-friendly cleaning products – all delivered free* to customers in mainland Scotland and the North East of England.

Greencity Wholefoods is a wholesaler of fine food and drink founded in 1978, based in Glasgow’s vibrant East End. We operate as a worker co-operative, democratically run by our members, and we endeavour to treat customers, suppliers, the community and our workers with fairness and respect. browse our range and apply for a trade account at www.greencity.coop

or contact our friendly sales team 0141 554 7633 | sales@greencity.coop

Cadbury’s Big Win-Win promotion returns

Cadbury has brought back its Big Win-Win campaign for 2025, giving both local retailers and their shoppers the chance to win cash prizes of up to £1,000 each. To take part, shoppers simply purchase a participating Cadbury product and enter some details online. If they are a winner, they will be asked to nominate their local store to receive an identical prize. The on- and off-pack promotion runs until early July.

Allwyn has unveiled a brand-new annuity-style scratchcard based on its Set For Life draw game. The ‘Set For 5 Years’ scratchcard costs £2 and gives players the chance to win a top prize of £5,000 every month for five years. In-store support for the new scratcher – which mimics a Set For Life draw with players having to match key numbers on the card – includes both Set For Life and Set For 5 Years POS.

Charity candy cups raise more than £18k

World of Sweets has raised a total of £18,498.32 to help support young carers through the sale of its charity candy cups. The confectionery wholesaler and importer launched a new range of Bonds of London Candy Cups, in partnership with The Honeypot Children’s Charity, with 10 pence from each sale donated to the charity, helping to provide respite breaks and ongoing support for young carers.

Starbucks has launched four new products into its chilled ready-to-drink range. Oat Based Cappuccino and Oat Based Caramel Macchiato join the coffee giant’s Chilled Classics range with an RSP of £2, as does limited-edition Blissful Retreat (RSP £2). The brand also unveiled a new limited-edition bottled product: Frappuccino Sip On Sunshine (RSP £2.10).

Walkers Max is giving football fans the chance to win a trip to the Champions League nal in Munich with its latest on-pack promotion.

e competition runs from 20 January until 23 March 2025 across 50g, 70g PMP and 140g promotional packs of Walkers Max.

ere are 1,610 instant-win prizes up for grabs, including 1,330 Champions League hoodies and 280 Champions League footballs.

e grand prize includes two trips for two to the Champions League nal on 31 May, complete with tickets, travel, accommodation and £500 spending money.

To enter, shoppers simply need to purchase a qualifying pack of Walkers Max and follow the instructions provided.

Walkers Max as the ultimate

KP Snacks has named singer Tom Grennan as the official ambassador for its ‘better for you’ popchips brand.

Wayne Newton, the brand’s Senior Marketing Director, said: “ is promotion positions Walkers Max as the ultimate snack companion for all football occasions and adds some excitement to the crisps, snacks and nuts category while helping retailers to increase sales by driving more snacking occasions by attracting new customers and encouraging repeat purchases.”

football occasions and adds helping retailers to increase

Grennan will perform at a special popchips event in May, with tickets available as prizes in a brand new on-pack promotion running across the popchips portfolio until the end of March. Consumers also have the chance to win cash prizes and tickets to UK festivals. The partnership will be supported by a £1m media campaign.

Mondelez unveils first-ever confectionery paper pouch

The new Cadbury Easter Favourites Pouch is the company’s first-ever confectionery pouch made from paper – meaning it can be easily recycled at home. An Easter egg hunt in a bag, it contains Mini Cadbury Dairy Milk Eggs, treat-size bags of Cadbury Mini Eggs, and Cadbury Creme Eggs, for a total of approximately 15 items.

CONFECTIONERY Money-can’t-buy footie experiences up for grabs

Cadbury FC is back with its latest promotion, e Winning Pass, giving shoppers the chance to win an exclusive, money-can’t-buy football experience.

Six winners will get their own personalised match day, each with three friends, at a participating

e promo runs across the entire range of products from brands including Cadbury, Sour Patch Kids, Trebor and Maynard Bassetts.

To enter the competition, shoppers need to buy a participating product, enter the barcode and

batch code online, then select their preferred participating club.

Participating clubs for the top prize are Arsenal, Chelsea, Leeds United, Liverpool, Manchester United and Spurs. Match tickets can also be won for all of these, along with Celtic and Rangers. e campaign runs until 21

Jonathan Kemp heads for Radnor Hills

Former AG Barr Commercial

Director Jonathan Kemp has joined the board of Welsh soft drinks producer Radnor Hills. Kemp’s 21-year stint at Barr’s came to an end last September and it was widely understood he would retire. However, he now joins the Radnor Hills board as a Non-Executive Director. Kemp was presented with an Industry Achievement Award at last year’s SLR Awards.

Urban Eat unveils new street food range

home, social and radio advertising,

For more information and advice, retailers can visit the

CHEESE Lactalis brand supports YoungMinds charity

Natural cheese slice brand Leerdammer has announced the launch of ‘Talk It Out,’ a new mental health initiative in support of the YoungMinds charity.

Talk It Out will use comedy to help parents and young people get talking and have better conversations about mental wellbeing.

Comedian Stuart Goldsmith performed a one-o special stand-up gig at Bristol Grammar School to mark the launch. Leerdammer brand owner Lactalis hopes to roll the initiative out across the UK later in the year, following an initial pilot scheme in January.

KP Snacks has launched Bank of McCoy’s, a promotion offering cash and stock prizes for consumers and retailers.

Running on McCoy’s PMP and Grab Bags, consumers can unlock a £100,000 prize vault via on-pack QR codes, with the chance to win up to £1,000 or free crisps. Retailers also have a chance to win a share of £50,000 by entering via PMP cases. The promotion, live until 13 April, is supported by themed POS materials including dump bins, FSDUs, floor vinyls, and shelf wobblers.

Food-to-go brand Urban Eat has launched ‘Urban Street,’ a new range of limited-edition products in street food-inspired, global flavours that will be replaced every three months. The first three products – which are available until the end of the quarter or until stocks run out – are the Thai Green Chicken sandwich, the Chicken Shawarma flatbread, and the Korean Chicken wrap.

JTI cuts Mayfair Gold price JTI has dropped the price of its Mayfair Gold ready-made cigarettes from an RSP of £13.30 to £12.50 for a pack of 20. This means Mayfair Gold is now JTI’s cheapest readymade cigarette. To find out more about Mayfair Gold, retailers can look out for branded wobblers in wholesale depots, speak to their local JTI UK Business Advisers or call the help desk on 0800 163 503. Retailers can also visit jti360. co.uk for further information.

Yoplait cuts sugar in Petits Filous and Frubes

Yoplait has reformulated the recipes for its Petits Filous and Frubes children’s yogurt brands, which sees the sugar content in Petits Filous reduced from 9.3g to 8.9g and that in Frubes cut from 10.8g to 9.9g. Both figures include naturally occurring sugars from lactose and fruit. Since 2015, Yoplait has reduced sugars across its kids’ portfolio by 25%.

Promotion for Molson’s Whitehead

Phil Whitehead has been appointed President and CEO of the EMEA & APAC division of Molson Coors Beverage Company. Whitehead has been boss of the company’s Western Europe region for the past eight years and prior to this was European Supply Chain Director. He will continue to lead the Western Europe business until a successor is named.

Black and white answer to excessive drinking

Diageo’s latest annual global trends report into how and why consumers will socialise over the next year has predicted a further rise in ‘zebra striping’ –alternating between alcoholic and non-alcoholic beverages during a single social occasion to help moderate alcohol consumption. A quarter of Brits are already zebra striping in the on-trade; it remains to be seen if the practice will gain traction with at-home drinkers.

Innis & Gunn gets on board with Celtic Connections

Craft brewer Innis & Gunn celebrated its headline sponsorship of the recent Celtic Connections festival with an unusual outdoor concert in Glasgow. Folk band Gnoss entertained fans on an open-top bus shuttling between Innis & Gunn’s taprooms on West Nile St and Ashton Lane, with the four-piece also performing sets at both venues.

Holyrood Distillery unveils experimental whisky series

Holyrood Distillery has launched a new series of experimental single malts with the release of Re-Rack #1. Only 227 bottles of the 59.7% ABV whisky are available, with an RSP of £75. Re-racking involves moving the spirit to a second cask during maturation to add in different characteristics. Re-Rack #1 was matured in a first-fill bourbon cask then re-racked in a rum barrique.

More people are drinking low- and no-alcohol alternatives than ever before, according to e Portman Group’s seventh annual survey of the nation’s drinking habits.

e survey found that well over a third (38%) of UK drinkers are now consuming low- and no-alcohol alternatives semi-regularly (12% regularly and 26% occasionally) – compared to 35% in 2023 and 29% in 2022, with a notable rise in regular consumption from 8% in 2023 to 12% in 2024.

Young adults continue to drive the trend as the biggest consumers of low- and no-alcohol alternatives, with 46% of 25–34-year-olds polled considering themselves either an

occasional or regular drinker of alcohol alternatives, compared to 37% in 2023. Forty per cent of 18–24-year-olds also drink these products semi-regularly.

Jameson has teamed up with alcohol harm charity Drinkaware and former England international Jay Bothroyd to promote responsible drinking within British football culture.

Jameson’s new signing, Bothroyd, encourages fans to visit Drinkaware’s website and use its free Drinking Check tool to check whether their drinking habits are putting their health at risk. The Drinking Check is a quick, three-minute online quiz that provides a personalised drinking score. It helps users understand the potential impact of their drinking habits on their health and offers tailored advice and support for those who may need help moderating their consumption.

Trends show that the younger generation also continue to be the most sober age group overall, with 39% of 18–24-year-olds not drinking alcohol at all.

NZ wine enjoys big Christmas presence

Wine from New Zealand had a fine festive season. In the four-week period leading up to 28 December, New Zealand white was the country-of-origin leader in the Still White Wine category, with value growth up 7.3% and volume growth up 9.7% YOY. Nielsen IQ data showed New Zealand whites had an average price of £8.09 per bottle, well above the market average of £6.69. MAT value growth was up 9.2%, with volume up 9.8%. New Zealand reds also did well over Christmas, with an average price per bottle of more than £10.50.

Heineken has launched ‘0.0 Reasons Needed,’ a new global marketing campaign that seeks to normalise alcohol-free drinks.

e campaign includes a series of TV ads that challenge a number of stereotypes around reasons for not drinking alcohol, including dieting or being a designated driver.

e campaign comes on the heels of a worldwide survey of almost 12,000 adults which found that 21% of Gen Z respondents have been criticised for choosing non-alcoholic drinks.

e poll also revealed that more than one-third of Gen Z have felt pressured to drink alcohol in social situations and 38% of Gen Z

men would opt for non-alcoholic alternatives if their friends did the same.

However, half of the participants reported increased acceptability

London-based low and no specialist Nirvana Brewery has launched its rst nitro stout, a 0.5% ABV brew that comes in 330ml cans with an RSP of £3.

e new Nitro Stout is the creation of Head Brewer James Rabagliati. It features roasted avours with notes of co ee, cocoa, and caramel. Goldings hops contribute a subtle earthiness and smooth nish. e stout is designed to be poured vigorously to release the nitrogen, creating a creamy, velvety texture similar to Guinness.

Nirvana founder Becky Kean said: “ ere’s not enough no/low alternatives to this particular style of beer, so we’re looking forward to seeing the reaction.”

of low- or no-alcohol drinks compared to ve years ago, and 20% of drinkers now alternate between alcoholic and non-alcoholic drinks at social gatherings.

Premium drinks importer Love Drinks has kicked off 2025 with the UK launch of Brunette – a small batch, organic cold brew coffee liqueur from France’s Bordeaux Distilling Co.

Brunette is made using 100% naturally organic ingredients and artisan processes to extract maximum flavour and aromatics from sustainably sourced Honduran and Ethiopian coffee beans.

It has zero additives or colourings and is said to contain less sugar than any other coffee liqueur on the market. It is also described as the world’s first certified organic coffee liqueur.

Brunette Cold Brew Coffee Liqueur (ABV 25%) is available now in 70cl bottles with a £29.95 RSP.

Carlsberg completes Britvic buyout

Carlsberg has completed its £3.3bn acquisition of Britvic. The merger creates the UK’s largest multi-beverage supplier – Carlsberg Britvic – which combines Carlsberg’s beer portfolio with Britvic’s soft drinks. The deal strengthens Carlsberg’s partnership with PepsiCo, making it the soft drinks giant’s largest European bottler. The new business is headed up Paul Davies, former CEO of Carlsberg Marston Brewing Company.

Cider maker Thatchers has won its appeal against Aldi over claims of trademark infringement regarding Aldi’s Taurus cider, which Thatchers argued copied its Cloudy Lemon variant. While a previous High Court ruling sided with the discounter, the Court of Appeal found in Thatchers’ favour, stating Aldi intended to capitalise on Thatchers’ reputation. Aldi intends to appeal this latest decision.

Dionilife to make own non-alcoholic spirits

Low- and no-alcohol startup DioniLife will launch its own non-alcoholic versions of tequila and whisky in April. Boss Damian McKinney said DioniLife was choosing the in-house route over acquiring existing non-alcoholic spirit brands after being disappointed with the quality of products already in the market. The business launched last September with the purchase of low/no craft brewer Mash Gang.

Glasgow Distillery has launched two new cask strength bottlings. Glasgow 1770 Original (ABV 59.5%) is a vatting of three barrels handpicked for their fruity characteristics. A total of 750 bottles are available, RSP £64. The rich and smoky Glasgow 1770 Peated was matured in three hogsheads and then bottled at 60.7% ABV. Retailing at £66, there are1,000 bottles available.

Our annual search for Scotland’s local retailing stars is gathering pace and the clock is ticking if you want to enter this year’s SLR Awards.

With Hogmanay and Burns Night now receding in the rear-view mirror, Valentine’s Day is the next big event on the retailing calendar.

However, the 14th of February also happens to be the last day you can enter this year’s SLR Awards, so time is running out if you want to take part.

ere’s little doubt that 2024 was a tough year for the sector and 2025 looks set to o er more of the same –not least because of the impending rises to the minimum wage and employers’ National Insurance Contributions that will kick in from April.

at’s why this year’s SLR Awards are even more pertinent and important than ever. As well as providing a platform to reward and recognise the stars of our sector, the Awards also give us a fantastic opportunity to share best practice and to learn from one another. It’s also a great night out into the bargain.

Simply head over to SLRAwards.com where you’ll be able to enter as many

categories as you like, entirely free of charge. We’ve ne-tuned our entry forms once again this year, so it’s easier than ever to enter. You’ll also nd a comprehensive guide to entering, that will help you submit your best-possible entry.

Our glittering awards ceremony at the Radisson blu in Glasgow on 4 June will pay homage to the very brightest lights in our sector and if you think you’ve got what it takes to be there, then we want to hear just how far you’ve come over the past 12 months.

A round table judging session will see a panel of industry experts help to select the very best of the entries in each category. If you make the grade, our on-the-road judges will be visiting your store, and we can’t wait to see what you’ve got to o er. Awards judging visits will again be unannounced to ensure the judging team see your stores exactly the way your customers do.

So please do get involved and we look forward to hearing from you. Best of luck – and we’ll hopefully see you in June!

Bread & Bakery Retailer of the Year

Confectionery Retailer of the Year

Food-to-Go Retailer of the Year

Forecourt Convenience Retailer of the Year

Fresh & Chilled Retailer of the Year

Newstrade Retailer of the Year

Off-Trade Retailer of the Year

Scottish Brands Retailer of the Year

Soft Drinks Retailer of the Year

Vaping Retailer of the Year

Community Retailer of the Year

New Store of The Year

Refit of the Year

Sustainability Retailer of the Year

#ThinkSmart Innovation Award Team of the Year

All category winners will be considered for the overall Scottish Local Retailer of the Year award –sponsored by

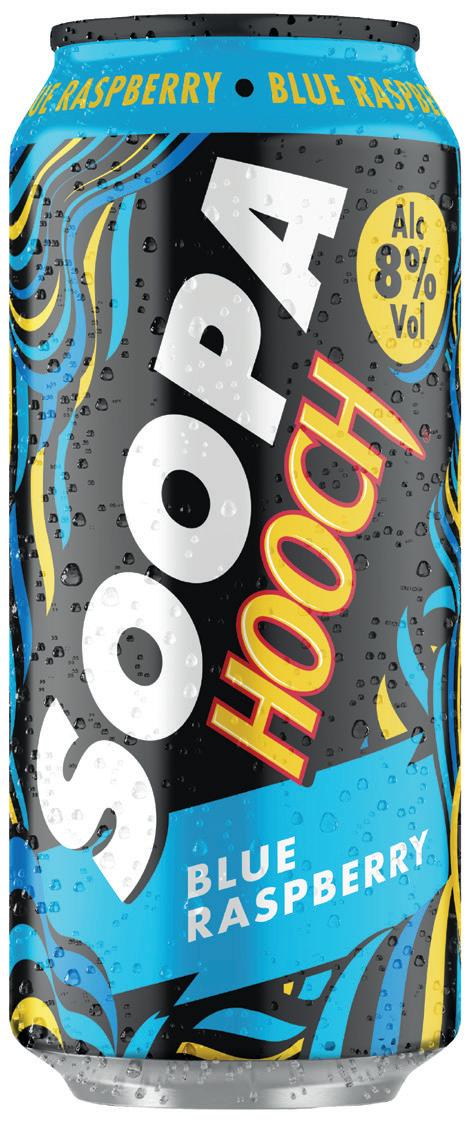

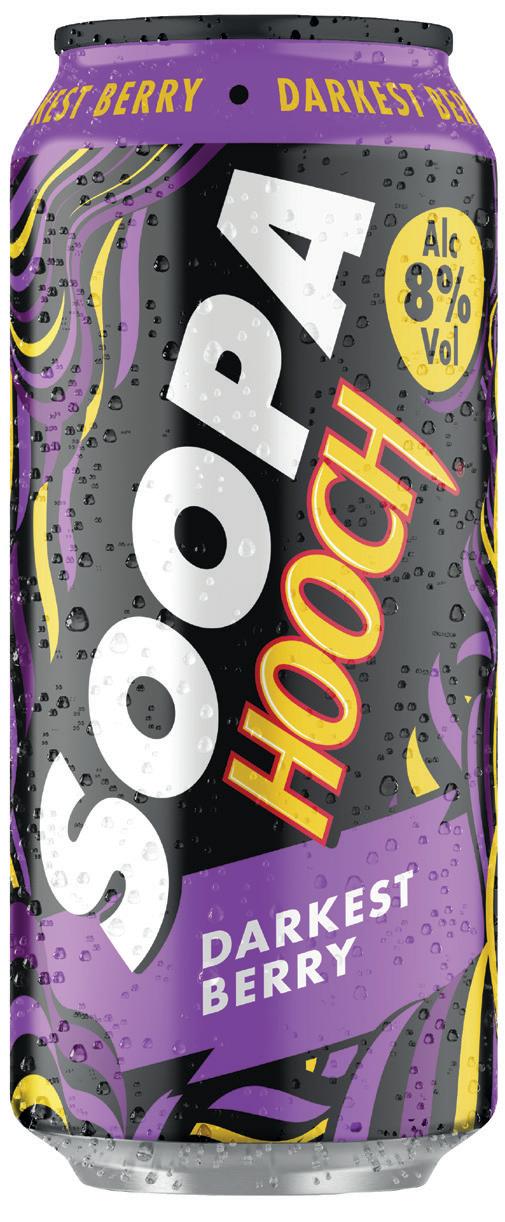

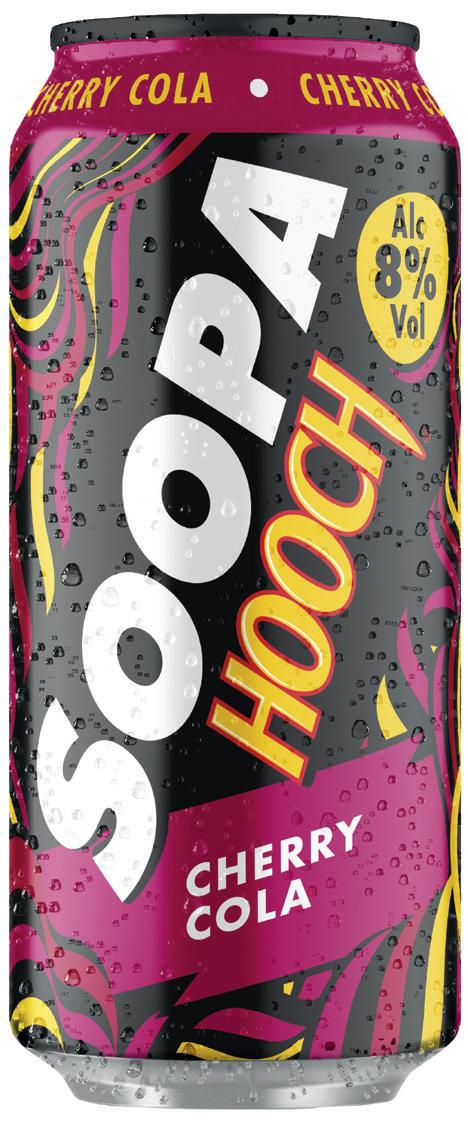

With RTDs continuing to drive sales and profits in local retailing, we caught up with Global Brands National Account Manager Daniel McPherson to find out how the category and their brands like VK, Hooch, and Shake Baby Shake are performing.

Daniel has been at Global Brands for seven years. He started off looking after the on-trade as a Regional Sales Manager, visiting pubs and clubs, securing listings and supporting venues to grow rate of sale. Then he moved over to the off-trade team and managed the company’s cash and carry wholesale accounts. This led him to his current role where he manages both off- and ontrade wholesale customers across Scotland.

HOW BIG IS THE RTD OPPORTUNITY FOR SCOTTISH LOCAL RETAILERS?

e RTD opportunity for Scottish local retailers is substantial. e value of alcoholic RTDs in the Scottish convenience market is £39.6m and is outgrowing its counterparts in England and Wales (11.1% compared to 6.6% – NIQ RTD Data 52we 02/11/24). Shoppers in Scottish c-stores are increasing the frequency of purchase faster and buying more RTDs per trip.

HOW ARE YOUR KEY BRANDS PERFORMING IN THE SCOTTISH CONVENIENCE CHANNEL?

Global Brands have experienced strong volume growth of 9.6% year on year. VK and Soopa Hooch are the standout performers with increases in ROS and distribution.

HOW HAS GLOBAL BRANDS RESPONDED TO GROWING DEMAND FOR LOW- AND NO-ALCOHOL PRODUCTS?

We recently launched VK 0.0%. e launch comes following shi ing market dynamics and consumer behaviours. e insights highlight a clear opportunity for retailers to support consumers’ changing needs and tastes, while providing greater choice when it comes to high-quality, fun, alcohol-free options.

HOW ELSE HAS THE RTD MARKET CHANGED OVER TIME AND HOW ARE YOUR BRANDS ADAPTING?

We have seen huge growth in the Enhanced RTD category, which is why we launched Soopa Hooch. Shoppers who can a ord to are trading up and adding more premium products to their repertoire in Spirit & Mixers and ready-to-serve Cocktails. at’s where our brands such as Shake Baby Shake, be. Cocktails and GATHER Gourmet Cocktails, as well as our Franklin

& Sons spirit and mixer cans, come in. However, value remains a priority for shoppers, that is why we are experiencing growth for VK and Soopa Hooch.

HOW CAN CONVENIENCE STORES CAPITALISE ON THE POPULARITY OF RTDS?

Range your top-selling products in a chiller/fridge; shoppers are 58% more likely to purchase RTDs if they are ranged in a chiller/fridge (ProQuo AI 2024). If space allows it, try to stock a diverse product range. It’s also important to o er promotions and utilise POS materials – this will help drive rate of sale.

WHAT NPD HAVE YOU LAUNCHED RECENTLY?

We relaunched Reef with great success. It is now available in 70cl PMP and a 275ml 10 pack.

GATHER Gourmet Cocktails is also brand new: a super-premium range of canned cocktails, available in ve avours. With premiumisation seeing a surge in popularity within the RTD cocktail category, GATHER’s launch is driven by the demand for bar-quality cocktails at home.

We have also extended the Soopa Hooch range with the launch of two brand-new avours: Blue Raspberry and Cherry Cola.

e future is bright for RTDs within the Scottish convenience channel. Retailers that embrace the trends, di erentiate their o erings, and engage with evolving consumer demands will thrive.

Enhanced RTDs is the biggest category in Scotland and category growth is coming from non-ca einated products. Continued growth for cocktails is highly likely as more shoppers add them to their baskets.

Scottish wholesale buyers are no stranger to the broad range and high quality of food and drink from Northern Ireland.

From exceptional everyday staples to special treats, Northern Ireland producers have products to boost your sales and inspire your customers. Flexibility, innovation and strong customer relationships are at the heart of our industry. We bring the goodies, from our families to yours.

We look forward to celebrating the success of Scottish wholesale with new and existing customers at the Scottish Wholesale Association Achievers Dinner.

IRWIN’S BAKERY GOLDEN POPCORN THOMPSON’S TEA FOREST FEAST FEEDWELL PETFOOD CLANDEBOYE YOGHURT

For more information contact Michelle Charrington E: michelle.charrington@investni.com T: +44 (0)78 1717 3514 Northern Ireland.

Judges are busy drawing up what is promising to be a spectacular shortlist for the Above And Beyond Awards 2025.

Last year’s inaugural Above And Beyond Awards were a blazing success – shining the spotlight on the courage, care and conviction displayed by so many of our industry’s invaluable employees – those bright sparks lighting up stores and communities across Scotland.

Entries for the Above and Beyond Awards 2025 are now closed and SLR’s judges are hard at work poring over the haul of incredible new submissions received.

‘Incredible’ really is the word. While it’s still early days, we’ve already been bowled over with astonishing acts of kindness, bravery and compassion. We’ve also been inundated with examples of exemplary employees whose business-boosting ideas are helping to supercharge store performance.

We’ll be announcing our shortlist of superstars in the next issue of SLR, with winners to be revealed at our celebratory lunch on 12 March, so watch this space!

Available in 120g bags and sold in cases of 12, each foam sweet is embossed with a fun message or emoji, making them ideal for sharing with a loved one. Messages include ‘KISS,’ ‘WOW,’ ‘FAB,’ and ‘LOVE,’ alongside two cheerful and romantic emojis. With an RSP of £1.15, the new product retains the colours and flavours of traditional Love Hearts, including Lime, Pineapple, Lemon, Cherry, Blackcurrant, and Orange.

The new non-HFSS flavour joins the existing Extra Flamin’ Hot line up of Walkers Max, Doritos and Wotsits Crunchy variants, and is available until the end of February. It comes in a 150g sharing pack (outers of six, RSP £1.65), a 70g PMP (outers of 15, RSP £1.25) and a 45g grab bag (outers of 32, RSP £1.10). The launch is supported by TV, social media, digital, out-of-home and PR activities.

Scandinavian Tobacco Group has added a new dual capsule cigarillo to its Signature range and extended its XQS nicotine pouch portfolio with the addition of two new flavours.

Signature Action Mix cigarillos contain two capsules, combining the flavours of Berry and Mint. It launches in 10-packs that have an RSP of £5.85.

The second variant in the Gold Billions range offers layers of crisp wafer with a chocolate and hazelnut flavour cream filling coated in golden caramel chocolate. It is available as an impulse channel exclusive until the end of June.

Packs have an 89p RSP, with 79p PMPs also available. The McVitie’s Gold Billions core range is backed with a social and PR campaign in February and March, a first for the brand, as well as in-store POS.

The launch will be a key focus for STG UK’s growing sales force, which will be targeting more than 10,000 convenience stores in the coming months to talk to retailers about the NPD, as well as offering them branded merchandise. There will also be promotions in the wholesale channel for both Action and Action Mix, as well as a significant trade marketing campaign.

Available in 465ml tubs with an RSP of £5.75, the new non-dairy SKU launches in a partnership with Queen that celebrates the 50th anniversary of the band’s most famous song, Bohemian Rhapsody. The ice cream includes fudgy brownies and raspberry swirls. Proceeds will go to the Mercury Phoenix Trust, which helps fund the global fight against AIDS.

Meanwhile, the XQS range of nicotines pouches benefits from the launch of new Black Cherry and Citrus Cooling flavours.

Black Cherry offers the rich, deep taste of dark cherries – a flavour not commonly found in other nicotine pouches. Citrus Cooling, on the other hand, combines tart citrus with minty freshness for a wellbalanced cool energising experience.

Both new flavours contain 8mg of nicotine per pouch and have an RSP of £5.50, in keeping with the rest of the XQS range.

XQS was launched in May last year in four flavours and a variety of strengths. It has become the fastestgrowing nicotine pouch brand in the second half of 2024, with one million cans already in the market.

The £2.50 price-marked packs are exclusive to the convenience channel and come in two flavours: Tropical and Bubblemint. Each bottle contains 30 soft-chew pieces. The new packs will benefit from a multi-million-pound media investment in Extra’s fruit gum range later in the year. The launch comes with fruit flavours the fastest-growing gum segment with value growth of 8.9% YOY.

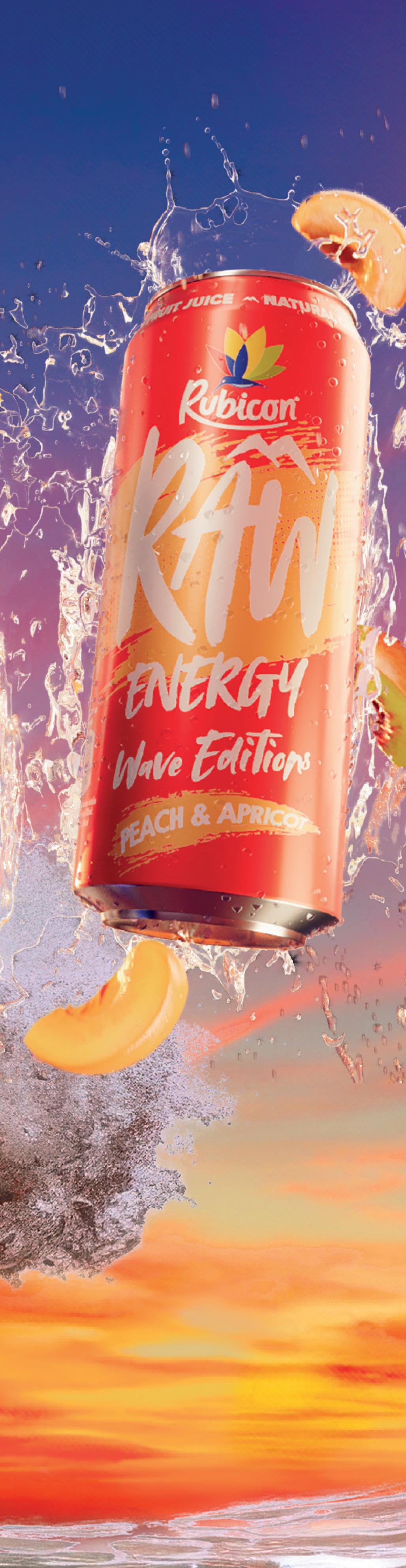

The new two-strong big can range is available until 31 January 2026 in Berry & Grape and Peach & Apricot flavours. Both come in cases of 12 x 500ml cans with an RSP of £1.25. Packs price marked at £1.19 are also available. The launch is supported by the brand’s biggest-ever marketing investment of £1.5m throughout 2025. This includes influencer, mass sampling and social media activities. Point of sale material is also available.

Coca-Cola Lime Coca-Cola EP

The zesty new flavour has a tangy, bittersweet taste and comes in the following formats: 330ml, 500ml, 1.75L, 8x330ml (Original) and 500ml, 2L, 8x330ml (Zero Sugar). Single PMPs are available. Retailers can request POS kits from My.CCEP.com. The launch will be supported by influencer partnerships, out-of-home marketing, social media and live experiences.

KP Snacks has expanded its McCoy’s range with the launch of a new Hot ‘n’ Spicy variant. Available now in a 65g £1.25 price-marked pack, the new flavour comes with Spicy being the third-largest flavour partition in CSN and the largest and fastest-growing in the PMP category. McCoy’s was recently named as the NFL’s Savoury Snacks

Partner for the UK and Ireland in a deal running until March 2027.

Samworth Brothers

Ariel has unveiled ‘The Big One,’ a campaign to promote its new laundry pods of the same name and fronted by Peter Crouch. A new TV ad see the lanky footballer-turned-podcaster enduring a variety of messy situations and has the tagline ‘Big Mess? Big Deal!’ The campaign also includes video on demand, digital, social media, in-store and PR activities.

Rowntree’s has unveiled new Jelly Tots Tangy, a sour take on the ever-popular sweet that celebrates its 60th birthday this year. The vegan-friendly sweets are made with real fruit juice and offer a “flavourful experience that combines nostalgia with tanginess”. The new product is available to retailers now in 140g sharing bags with an RSP of £1.50.

The new variant is available now in multipacks of 4 x 42g bars with an RSP of £2.25 per pack. The launch coincides with a second burst of Soreen’s masterbrand campaign and the new flavour will also receive standalone support via shopper marketing including POS, sampling and digital, both in-store and online.

Personal care brand Dove has launched ‘Unready for Anything,’ a new campaign that will run throughout 2025 across out-of-home, digital and social channels. The campaign connects with the simple joy of unwinding after a special moment, big or small, and shows consumers getting ‘unready’ after celebrating a big social event like New Year.

A new light-hearted TV ad sees Sarah Lancashire appear as Yorkshire Tea’s head of security, who is tasked with tracking down a biscuit thief at its HQ. The Happy Valley star soon nabs the culprit after grilling several suspects. The ad, part of the brand’s ‘Where Everything’s Done Proper’ campaign, runs across TV, cinema and video on demand.

This new limited-edition cherryflavoured twist on Dr Pepper’s zerosugar variant comes in 330ml, 500ml, 2L and 8x330ml packs, with 300ml (80p) and 500ml (£1.35) PMPs also available. The launch is backed with influencer, sampling and outof-home activities. POS materials and digital assets are also available.

Rubicon’s entry into the functional water category will be available from 11 March in three nonHFSS variants – Black Cherry Pomegranate, Mango Passion, and Strawberry Watermelon – in 500ml plain (RSP £1.50) and £1.29 price-marked packs. The new 15-calorie drinks are made with spring water, fruit juice, and natural flavours. The launch will be backed by £2m campaign.

Nut butter brand Pip & Nut has kicked-off a national out-of-home campaign to drive awareness and show how not all nut butters are created equal. Starring the Pip & Nut’s red squirrel mascot, the campaign emphasises the brand’s quality and taste credentials, and highlights the passion displayed by its fans on social media.

Cadbury Dairy Milk has unveiled ‘Memory,’ the latest campaign in its brand platform, ‘There’s a Glass and a Half in Everyone’. A new TV advert tells the heartwarming story of a woman visiting her father, who has dementia. Her gift of a bar of Cadbury Wholenut uncovers a long-held family secret and strengthens the bond with her dad.

We look at the growth of the forecourt sector and explore key areas of investment.

It’s full speed ahead for the UK forecourt sector, which hit value sales of £5bn in the last year, excluding fuel, according to the ACS Forecourt Report 2024.

Sector development continues at pace, with Motor Fuel Group (MFG), reporting in November that it had completed its initial £40m upgrade of Morrisons forecourts, including more than 50 sites in Scotland. e investment follows the acquisition of 337 Morrisons petrol forecourts, including outlets in and around Aberdeenshire, Inverness, Ross and Cromarty, Fort William, Ayrshire, Lanarkshire, Dumfries, Edinburgh and Glasgow, as well as more than 400 sites across the UK for ultra-rapid electric vehicle (EV) charging in April 2024.

Further a eld, Parfetts entered the arena last month with the launch of its new Shop & Go symbol group designed speci cally for forecourts

and commuter locations. Parfetts, which has depots in the Midlands and north of England, has created the new format to cater for time-sensitive shopper missions. Stores will o er a bespoke product range and tailored promotions, with a strong focus on impulse confectionery, snacks, so drinks, food to go, along with beers, wines, and spirits.

Meanwhile, Zuber Issa’s EG on e Move continues to grow, having acquired 98 sites across the UK from Applegreen. e deal achieves a wider presence across the South of England, bolstering the business’s total sites to almost 150.

As part of the deal, all 1,142 of Applegreen’s UK petrol lling station roles will be retained, bringing the EG On e Move employee headcount to a total of 4,500, according to law rm Freeths, which advised on the purchase.

e ACS’s latest forecourt report revealed that retailers invested almost £19,000 on average per store last year, compared to less than £12,000 in the previous year. Key areas for investment include refrigeration, technology and till systems, as forecourt operators strive to remain competitive amidst erce competition, reports the ACS.

For Spar Lanark Way in Belfast, Northern Ireland, investing technology has been an absolute gamechanger.

e family-owned convenience store run by father and son Karl and Ross Hunter has been operating under the Henderson umbrella for approximately eight years. Located in a transient area, the outlet attracts both local residents and visitors, particularly during busy morning and evening hours. e introduction of an alcohol licence has improved weekend trade, re ecting a shi from a high fuel volume store to a more diverse retail environment.

Ross explains that before implementing the new tech, the outlet faced several operational challenges. Sta ng issues were a primary concern, as the store struggled to hire and retain sta , especially during peak hours, leading to long queues and ine cient service. Additionally, managing cash transactions was labour intensive and time consuming, as handling cash shortages diverted sta away from customer-facing roles. ese sta ng and cash handling ine ciencies contributed to a reliance on traditional checkouts, resulting in delays that negatively impacted overall customer satisfaction.

Electronic shelf-edge labels (ESELs) have signi cantly improved operations and customer satisfaction at Ross’s store. Previously, pricing updates were labour intensive and prone to error, with sta o en struggling to identify products correctly when using paper labels. ESELs have streamlined this process, allowing sta to update prices e ciently and accurately. is shi reduces the chances of mislabelling products, minimising customer confusion and complaints about incorrect prices. Additionally, ESELs save valuable sta time, freeing employees to focus on more value-adding tasks rather than manual label replacements. ESELs

have enhanced both sta ease of use and promotional capabilities within the store.